UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-07123 |

| | |

| | BNY Mellon Advantage Funds, Inc. | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 10/31 | |

| Date of reporting period: | 10/31/22 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Dynamic Total Return Fund

BNY Mellon Global Dynamic Bond Income Fund

BNY Mellon Global Real Return Fund

BNY Mellon Sustainable Balanced Fund

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Dynamic Total Return Fund

| |

ANNUAL REPORT October 31, 2022 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from November 1, 2021, through October 31, 2022, as provided by portfolio managers James Stavena, Torrey Zaches, Roberto Croce and Dimitri Curtil of Newton Investment Management North America LLC, sub-adviser.

Market and Fund Performance Overview

For the 12-month period from November 1, 2021 to October 31, 2022, the BNY Mellon Dynamic Total Return Fund’s (the “fund”) Class A shares produced a total return of −10.75%, Class C shares returned −11.44%, Class I shares returned −10.53%, and Class Y shares returned −10.54%.1 In comparison, the FTSE Three-Month U.S. Treasury Bill Index, the MSCI World Index, FTSE World Government Bond Index, and an index comprised of 60% MSCI World Index and 40% FTSE World Government Bond Index (the “Hybrid Index”) returned .88%, -18.48%, -22.23%, and -19.78%, respectively.2,3,4,5

The fund delivered a negative total return over the reporting period but outperformed the Hybrid Index. High inflation, slowing economic growth, the war in Ukraine, and a continuation of disruptions from the ongoing COVID-19 pandemic all contributed to a broad sell-off in risky assets.

The Fund’s Investment Approach

The fund seeks total return. To pursue its goal, the fund normally invests in instruments that provide investment exposure to global equity, bond, currency and commodity markets, and in fixed-income securities. The fund may invest in instruments that provide economic exposure to developed and, to a limited extent, emerging market issuers.

The fund will seek to achieve investment exposure primarily through long and short positions in futures, options, forward contracts, swap agreements, or exchange-traded funds (ETFs), and normally will use economic leverage as part of its investment strategy. The fund also may invest in fixed-income securities, such as bonds, notes (including structured notes) and money market instruments including foreign government obligations and securities of supranational entities, to provide exposure to bond markets and for liquidity and income, as well as hold cash.

The fund’s portfolio managers apply a systematic investment approach designed to identify and exploit relative misvaluations across and within global capital markets. The portfolio managers update, monitor and follow buy or sell recommendations using proprietary investment models of the fund’s sub-adviser. Among equity markets, the portfolio managers employ a bottom-up valuation approach using proprietary models to derive market-level expected returns. For bond markets, the portfolio managers use proprietary models to identify temporary mispricing among global bond markets. For currency markets, the portfolio managers evaluate currencies on a relative valuation basis and overweight exposure to currencies that are undervalued. For commodities, the portfolio managers seek to identify opportunities in commodity markets by measuring and evaluating inventory and term structure, hedging and speculative activity, as well as momentum.

Bonds React to Higher Rates to Deliver Negative Returns

Investors were subjected to a challenging investment backdrop during the period due to the emergence and persistence of high inflation, slowing economic growth, the war in Ukraine,

2

and a continuation of disruptions from the ongoing COVID-19 pandemic, all of which likely contributed to a broad sell-off in risky assets. For the 12-month period ending October 31, 2022, the MSCI World Index returned -18.5%, FTSE World Government Bond Index -22.2%, and Bloomberg Commodity Index -9.8%. Cash outperformed risky assets over the period, with the FTSE Three-Month U.S. Treasury Bill Index returning .9%.

Inflation in the U.S.—as measured by the U.S. Consumer Price Index (CPI)—was above 6.0% year-over-year for the entire reporting period, peaking at 9.1% in June. To combat high inflation, central banks turned decidedly hawkish. The Federal Reserve (the “Fed”) began reversing quantitative easing measures and tightening its target policy rate. Since the beginning of 2022, the Fed increased its target federal rate on five occasions by a total of 300 basis points. This spurred a meaningful and prolonged sell-off in bonds. U.S. 10-year Treasury yields rose from 1.5% to 4.0%, and U.S. 30-year Treasury yields rose from 1.9% to 4.2% during the reporting period.

Equity fundamentals were stronger than the nearly 20% sell-off in the MSCI World Index would imply. Over the reporting period, earnings growth was 6.6% for the S&P 500® Index and 9.8% for the MSCI World Index. The sell-off in stocks was largely driven by worsening consumer sentiment, rising interest rates and growing concerns around an economic “hard landing” scenario emerging from much stricter monetary policy.

Opportunistic Strategies and Real Assets Added to Relative Performance

The fund pursues diversified long-term exposures to global risk premia to maximize risk-adjusted total return. Exposures span four broad categories: growth, defensive, real assets and opportunistic strategies.

Exposures to opportunistic strategies and real assets were the primary positive contributors to performance. Opportunistic strategies, including active currency and active volatility, were the main drivers of relative returns. The fund’s position in real assets helped hedge against inflation, enhancing performance. In the fixed-income arena, relative value positions were also beneficial.

On a less positive note, exposures to the growth and defensive strategies detracted from performance. In the growth category, long exposure to global equities, which varied between approximately 32% and 72% during the period, hampered performance as the MSCI World Index declined -18.5%. Relative-value decisions within growth assets also slightly detracted from performance. Long exposure to global bonds, which varied between 31% and 63% during the reporting period, was also detrimental as the FTSE World Government Bond Index fell 22%.

Anticipating Slow Growth and Continued High Inflation

Newton Multi-Asset Solutions team expects below-average growth, higher-than-average inflation and flat corporate earnings growth in the U.S. over the next 12 months. While a soft economic landing is possible, our confidence in such an outcome has declined as of late. Our estimate of U.S. GDP growth has declined (but is still positive), while inflation has not shown meaningful signs yet of rolling over. While CPI and Core CPI may have peaked, median CPI remains on an unbroken upward trajectory and has surpassed Core CPI. Accordingly, we expect the Fed to continue its tightening campaign even if it comes at the

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

expense of economic activity and growth. At the same time, analyst consensus earnings estimates still seem too rosy given the level of uncertainty in the economic outlook.

At the end of the reporting period, the fund’s allocation to stocks was 40.5%, 36.5% to bonds, and 9.9% to commodities. Within growth assets, the UK continues to be the largest long allocation. The fund eliminated its exposure to emerging markets while taking on a small position in high yield bonds. Within bonds/defensive assets, U.S. Treasury bonds continue to be the largest weight in the portfolio. The largest short positions remain in Canadian government bonds and UK gilts. The fund continues to hold exposure to real assets given the persistently high inflationary

environment. Within opportunistic strategies, the U.S. dollar continues to be the largest long position, while the euro is the largest short position.

We believe the fund will continue to play an important role in investor portfolios, as a core allocation that is flexible, diverse and able to access additional liquid strategies and asset classes. As both equities and bonds continue to experience challenges, we believe the fund’s expanded toolkit will continue to serve investors well.

November 15, 2022

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Share price, yield, and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. Past performance is no guarantee of future results. The fund’s returns reflect the absorption of certain fund expenses by BNY Mellon Investment Adviser pursuant to an agreement in effect through March 1, 2023, at which time it may be extended, terminated, or modified.

The fund’s investment adviser, BNY Mellon Investment Adviser, Inc., has contractually agreed, for so long as the fund invests in the subsidiary, to waive the management fee it receives from the fund in the amount equal to the management fee paid to BNY Mellon Investment Adviser, Inc., by the subsidiary.

2 Source: Lipper Inc. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. Investors cannot invest directly in any index.

3 Source: Lipper Inc. — The FTSE Three-Month U.S. Treasury Bill Index consists of the last three-month Treasury bill month-end rates. The FTSE Three-Month U.S. Treasury Bill Index measures return equivalents of yield averages. The instruments are not marked to market. Investors cannot invest directly in any index.

4 Source: Lipper Inc. — The FTSE World Government Bond Index (the “WGB Index”) measures the performance of fixed-rate, local-currency, investment-grade sovereign bonds. The WGB Index is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGB Index provides a broad benchmark for the global sovereign, fixed-income market. Investors cannot invest directly in any index.

5 Source: FactSet —The Hybrid Index is an unmanaged hybrid index composed of 60% MSCI World Index and 40% WGB Index. Investors cannot invest directly in any index.

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Bonds are subject generally to interest-rate, credit, liquidity, call, sector, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus.

Investing internationally involves special risks, including changes in currency exchange rates, political, economic, and social instability, a lack of comprehensive company information, differing auditing and legal standards, and less market liquidity. These risks generally are greater with emerging market countries than with more economically and politically established foreign countries.

Emerging markets tend to be more volatile than the markets of more mature economies and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. The securities of companies located in emerging markets are often subject to rapid and large changes in price. An investment in this fund should be considered only as a supplement to a complete investment program for those investors willing to accept the greater risks associated with investing in emerging-market countries.

Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors. Derivatives and commodity-linked derivatives involve risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

4

High yield bonds involve increased credit and liquidity risk than higher rated bonds and are considered speculative in terms of the issuer’s ability to pay interest and repay principal on a timely basis.

Short sales involve selling a security the portfolio does not own in anticipation that the security’s price will decline. Short sales may involve risk and leverage, and expose the portfolio to the risk that it will be required to buy the security sold short at a time when the security has appreciated in value, thus resulting in a loss.

Recent market risks include pandemic risks related to COVID-19. The effects of COVID-19 have contributed to increased volatility in global markets and will likely affect certain countries, companies, industries and market sectors more dramatically than others. To the extent the fund may overweight its investments in certain countries, companies, industries or market sectors, such positions will increase the fund’s exposure to risk of loss from adverse developments affecting those countries, companies, industries or sectors.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

5

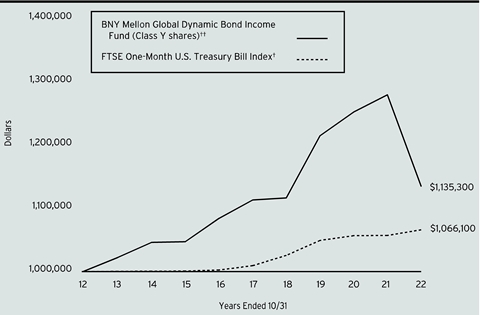

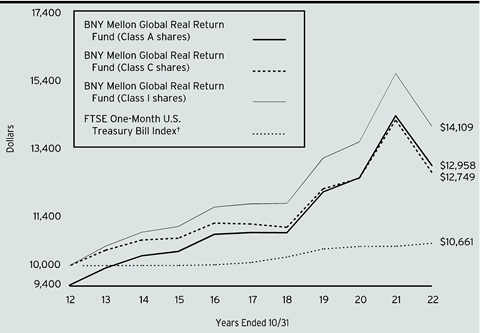

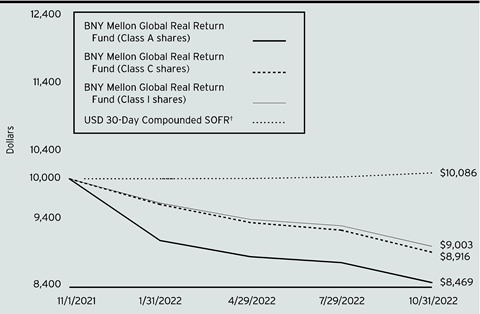

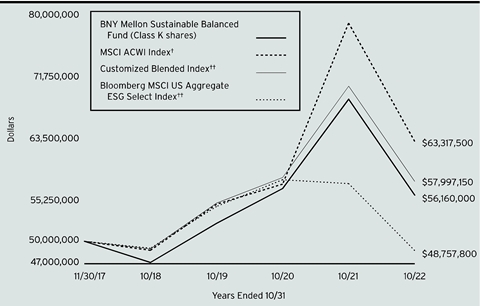

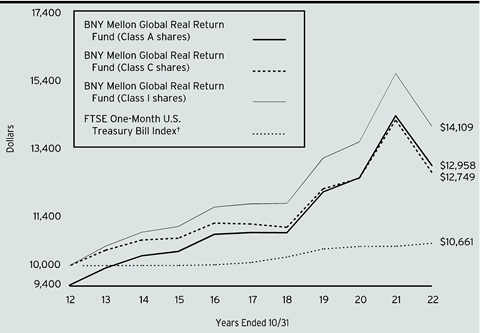

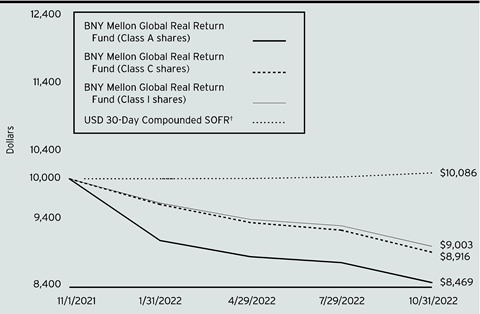

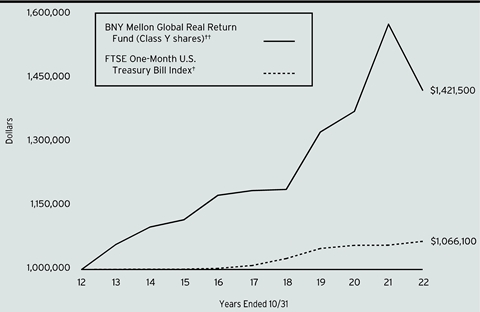

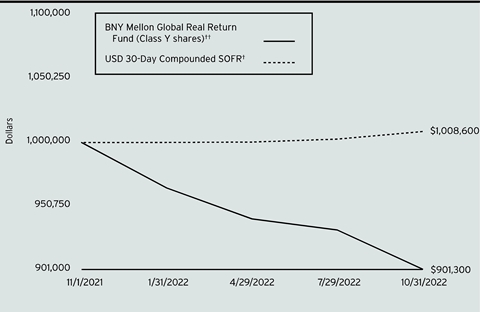

FUND PERFORMANCE (Unaudited)

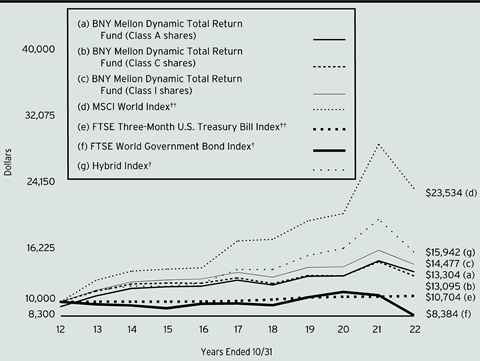

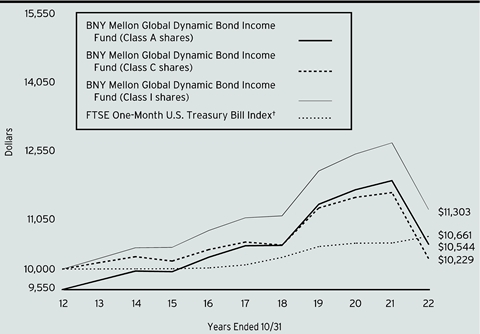

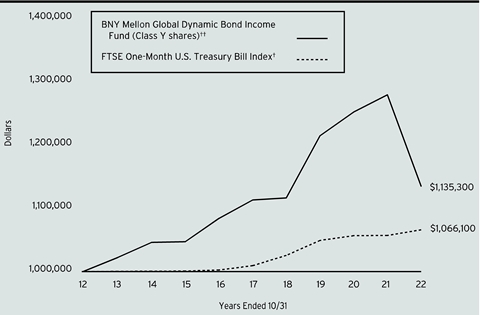

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares and Class I shares of BNY Mellon Dynamic Total Return Fund with a hypothetical investment of $10,000 in the MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, FTSE World Government Bond Index (the “WGB Index”) and an index comprised of 60% MSCI World Index and 40% the WGB Index (the “Hybrid Index”).

† Source: FactSet

†† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $10,000 made in each of the Class A shares, Class C shares and Class I shares of BNY Mellon Dynamic Total Return Fund on 10/31/12 to a hypothetical investment of $10,000 made on that date in each of the following: MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, the WGB Index and the Hybrid Index. Returns assume all dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. The FTSE Three-Month U.S. Treasury Bill Index consists of the last three-month Treasury bill month-end rates. The FTSE Three-Month U.S. Treasury Bill Index measures returns equivalent of yield averages. The instruments are not marked to market. The WGB Index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGB Index is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGB Index provides a broad benchmark for the global sovereign fixed income market. Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

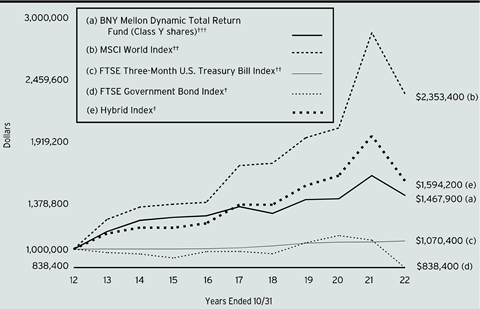

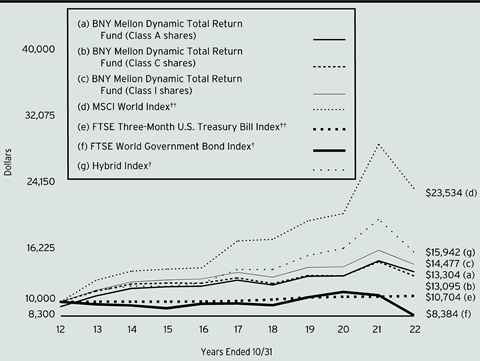

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Dynamic Total Return Fund with a hypothetical investment of $1,000,000 in the MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, FTSE World Government Bond Index (the “WGB Index”) and an index comprised of 60% MSCI World Index and 40% the WGB Index (the “Hybrid Index”).

† Source: FactSet

†† Source: Lipper Inc.

††† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a hypothetical investment of $1,000,000 made in Class Y shares of BNY Mellon Dynamic Total Return Fund on 10/31/12 to a hypothetical investment of $1,000,000 made on that date in each of the following: MSCI World Index, FTSE Three-Month U.S. Treasury Bill Index, the WGB Index and the Hybrid Index. Returns assume all dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses of the fund’s Class Y shares. The MSCI World Index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets. The FTSE Three-Month U.S. Treasury Bill Index consists of the last three-month Treasury bill month-end rates. The FTSE Three-Month U.S. Treasury Bill Index measures returns equivalent of yield averages. The instruments are not marked to market. The WGB Index measures the performance of fixed-rate, local currency, investment-grade sovereign bonds. The WGB Index is a widely used benchmark that currently comprises sovereign debt from over 20 countries, denominated in a variety of currencies, and has more than 25 years of history available. The WGB Index provides a broad benchmark for the global sovereign fixed income market. Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

7

FUND PERFORMANCE (Unaudited) (continued)

| | | | | |

Average Annual Total Returns as of 10/31/2022 |

| | Inception | | | |

| | Date | 1 Year | 5 Years | 10 Years |

Class A shares | | | | |

with maximum sales charge (5.75%) | 5/2/06 | -15.89% | -.07% | 2.90% |

without sales charge | 5/2/06 | -10.75% | 1.12% | 3.51% |

Class C shares | | | | |

with applicable redemption charge † | 5/2/06 | -12.18% | .36% | 2.73% |

without redemption | 5/2/06 | -11.44% | .36% | 2.73% |

Class I shares | 5/2/06 | -10.53% | 1.36% | 3.77% |

Class Y shares | 7/1/13 | -10.54% | 1.39% | 3.91%†† |

MSCI World Index | | -18.48% | 6.37% | 8.94% |

FTSE Three-Month U.S. Treasury Bill Index | .88% | 1.16% | .68% |

FTSE World Government Bond Index | | -22.23% | -3.07% | -1.75% |

Hybrid Index | | -19.78% | 2.83% | 4.77% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (inception date for Class Y shares), not reflecting the applicable sales charges for class A shares.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

8

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Dynamic Total Return Fund from May 1, 2022 to October 31, 2022. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended October 31, 2022 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $6.96 | $10.66 | $5.72 | $5.72 | |

Ending value (after expenses) | $971.30 | $967.40 | $972.30 | $972.90 | |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended October 31, 2022 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $7.12 | $10.92 | $5.85 | $5.85 | |

Ending value (after expenses) | $1,018.15 | $1,014.37 | $1,019.41 | $1,019.41 | |

† | Expenses are equal to the fund’s annualized expense ratio of 1.40% for Class A, 2.15% for Class C, 1.15% for Class I and 1.15% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

9

CONSOLIDATED STATEMENT OF INVESTMENTS

October 31, 2022

| | | | | | | | | | |

| |

Description | Coupon

Rate (%) | | Maturity Date | | Principal Amount ($) | | Value ($) | |

Options Purchased - 1.0% | | | | | |

Call Options - 1.0% | | | | | |

Standard & Poor's 500 E-mini December Future, Contracts 154 | | 3,890 | | 12/16/2022 | | 29,953,000 | | 1,014,475 | |

Standard & Poor's 500 E-mini December Future, Contracts 120 | | 4,150 | | 12/16/2022 | | 24,900,000 | | 216,000 | |

Standard & Poor's 500 E-mini January Future, Contracts 77 | | 4,150 | | 1/20/2023 | | 15,977,500 | | 283,938 | |

Total Options Purchased

(cost $1,099,949) | | 1,514,413 | |

| | Annualized

Yield (%) | | | | | | | |

Short-Term Investments - 81.7% | | | | | |

U.S. Government Securities | | | | | |

U.S. Treasury Bills | | 9.71 | | 12/15/2022 | | 9,415,000 | a | 9,374,811 | |

U.S. Treasury Bills | | 8.01 | | 11/17/2022 | | 41,741,400 | a | 41,688,719 | |

U.S. Treasury Bills | | 4.26 | | 12/1/2022 | | 78,579,000 | a | 78,353,903 | |

Total Short-Term Investments

(cost $129,558,794) | | 129,417,433 | |

| | 1-Day

Yield (%) | | | | Shares | | | |

Investment Companies - 13.9% | | | | | |

Registered Investment Companies - 13.9% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $21,984,479) | | 3.23 | | | | 21,984,479 | b | 21,984,479 | |

Total Investments (cost $152,643,222) | | 96.6% | 152,916,325 | |

Cash and Receivables (Net) | | 3.4% | 5,412,731 | |

Net Assets | | 100.0% | 158,329,056 | |

a Security is a discount security. Income is recognized through the accretion of discount.

b Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Government | 81.7 |

Investment Companies | 13.9 |

Options Purchased | 1.0 |

| | 96.6 |

† Based on net assets.

See notes to consolidated financial statements.

10

| | | | | | | |

Affiliated Issuers | | | |

Description | Value ($) 10/31/2021 | Purchases ($)† | Sales ($) | Value ($) 10/31/2022 | Dividends/

Distributions ($) | |

Registered Investment Companies - 13.9% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - 13.9% | 39,021,299 | 316,914,038 | (333,950,858) | 21,984,479 | 274,175 | |

† Includes reinvested dividends/distributions.

See notes to financial statements.

| | | | | | | |

Futures | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation (Depreciation) ($) | |

Futures Long | | |

Australian 10 Year Bond | 207 | 12/15/2022 | 15,603,878a | 15,687,862 | 83,984 | |

Brent Crude | 12 | 2/28/2023 | 1,017,803b | 1,057,560 | 39,757 | |

CAC 40 10 Euro | 309 | 11/18/2022 | 18,682,641a | 19,142,071 | 459,430 | |

Coffee "C" | 6 | 3/21/2023 | 467,891b | 391,613 | (76,278) | |

Copper | 12 | 12/28/2022 | 1,058,286b | 1,012,500 | (45,786) | |

Corn No.2 Yellow | 27 | 3/14/2023 | 928,217b | 940,613 | 12,396 | |

Cotton No.2 | 10 | 3/9/2023 | 435,384b | 358,200 | (77,184) | |

Crude Oil | 14 | 2/21/2023 | 1,193,546b | 1,160,320 | (33,226) | |

Crude Soybean Oil | 25 | 3/14/2023 | 964,807b | 1,021,950 | 57,143 | |

DAX | 5 | 12/16/2022 | 1,546,621a | 1,641,607 | 94,986 | |

E-mini Russell 2000 | 76 | 12/16/2022 | 7,269,732 | 7,041,400 | (228,332) | |

Euro-Bond | 94 | 12/8/2022 | 12,808,052a | 12,860,453 | 52,401 | |

FTSE 100 | 445 | 12/16/2022 | 37,521,347a | 36,271,420 | (1,249,927) | |

FTSE/MIB Index | 25 | 12/16/2022 | 2,650,546a | 2,784,765 | 134,219 | |

Gasoline | 14 | 2/28/2023 | 1,398,678b | 1,437,190 | 38,512 | |

Gold 100 oz | 6 | 12/28/2022 | 1,039,375b | 984,420 | (54,955) | |

Hang Seng | 101 | 11/29/2022 | 9,739,179a | 9,416,579 | (322,600) | |

Hard Red Winter Wheat | 7 | 3/14/2023 | 343,797b | 340,988 | (2,809) | |

IBEX 35 Index | 12 | 11/18/2022 | 901,831a | 942,791 | 40,960 | |

Japanese 10 Year Bond | 24 | 12/13/2022 | 23,951,048a | 24,012,105 | 61,057 | |

Japanese 10 Year Mini Bond | 5 | 12/12/2022 | 498,810a | 499,781 | 971 | |

Lean Hog | 13 | 2/14/2023 | 478,059b | 459,940 | (18,119) | |

11

CONSOLIDATED STATEMENT OF INVESTMENTS (continued)

| | | | | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation (Depreciation) ($) | |

Futures Long(continued) | | |

Live Cattle | 13 | 2/28/2023 | 788,508b | 810,290 | 21,782 | |

LME Primary Aluminum | 12 | 12/21/2022 | 737,111b | 667,800 | (69,311) | |

LME Primary Aluminum | 9 | 3/15/2023 | 529,191b | 502,144 | (27,047) | |

LME Primary Nickel | 4 | 12/21/2022 | 521,100b | 522,048 | 948 | |

LME Primary Nickel | 3 | 3/15/2023 | 410,859b | 394,002 | (16,857) | |

LME Refined Pig Lead | 2 | 12/21/2022 | 98,394b | 98,729 | 335 | |

LME Refined Pig Lead | 1 | 3/15/2023 | 51,647b | 49,277 | (2,370) | |

LME Zinc | 7 | 12/21/2022 | 558,296b | 475,125 | (83,171) | |

LME Zinc | 6 | 3/15/2023 | 462,918b | 402,000 | (60,918) | |

Low Sulphur Gas oil | 10 | 3/10/2023 | 934,170b | 930,250 | (3,920) | |

Natural Gas | 30 | 2/24/2023 | 1,743,951b | 1,715,100 | (28,851) | |

NY Harbor ULSD | 9 | 2/28/2023 | 1,228,820b | 1,233,679 | 4,859 | |

Platinum | 13 | 1/27/2023 | 575,547b | 604,565 | 29,018 | |

S&P/Toronto Stock Exchange 60 Index | 6 | 12/15/2022 | 1,039,149a | 1,037,266 | (1,883) | |

Silver | 5 | 12/28/2022 | 511,694b | 477,975 | (33,719) | |

Soybean Meal | 58 | 3/14/2023 | 2,276,972b | 2,373,940 | 96,968 | |

Sugar No.11 | 43 | 2/28/2023 | 880,913b | 865,435 | (15,478) | |

U.S. Treasury 10 Year Notes | 114 | 12/20/2022 | 12,547,777 | 12,607,688 | 59,911 | |

U.S. Treasury Long Bond | 95 | 12/20/2022 | 11,629,438 | 11,447,500 | (181,938) | |

Futures Short | | |

Amsterdam Exchange Index | 23 | 11/18/2022 | 2,937,770a | 3,040,741 | (102,971) | |

ASX SPI 200 | 15 | 12/15/2022 | 1,641,719a | 1,644,540 | (2,821) | |

Canadian 10 Year Bond | 197 | 12/19/2022 | 17,884,229a | 17,790,516 | 93,713 | |

Chicago SRW Wheat | 7 | 3/14/2023 | 312,829b | 314,738 | (1,909) | |

Cocoa | 12 | 3/16/2023 | 280,840b | 281,160 | (320) | |

LME Primary Aluminum | 12 | 12/21/2022 | 693,305b | 667,800 | 25,505 | |

LME Primary Aluminum | 3 | 3/15/2023 | 166,156b | 167,381 | (1,225) | |

LME Primary Nickel | 4 | 12/21/2022 | 537,618b | 522,048 | 15,570 | |

LME Refined Pig Lead | 2 | 12/21/2022 | 101,438b | 98,729 | 2,709 | |

LME Zinc | 7 | 12/21/2022 | 559,448b | 475,125 | 84,323 | |

Long Gilt | 65 | 12/28/2022 | 7,396,391a | 7,612,974 | (216,583) | |

Soybean | 1 | 3/14/2023 | 70,432b | 71,375 | (943) | |

Standard & Poor's 500 E-mini | 48 | 12/16/2022 | 8,882,404 | 9,319,200 | (436,796) | |

12

| | | | | | | |

Description | Number of

Contracts | Expiration | Notional

Value ($) | Market

Value ($) | Unrealized Appreciation (Depreciation) ($) | |

Futures Short(continued) | | |

Swiss Market Index | 150 | 12/16/2022 | 15,585,299a | 16,206,621 | (621,322) | |

Topix | 65 | 12/8/2022 | 8,252,066a | 8,419,247 | (167,181) | |

Gross Unrealized Appreciation | | 1,511,457 | |

Gross Unrealized Depreciation | | (4,186,750) | |

a Notional amounts in foreign currency have been converted to USD using relevant foreign exchange rates.

b These securities are wholly-owned by the Subsidiary referenced in Note 1.

See notes to consolidated financial statements.

| | | | | | |

Forward Foreign Currency Exchange Contracts | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Bank of Montreal |

Australian Dollar | 10,434,126 | United States Dollar | 7,128,741 | 12/21/2022 | (443,242) |

Japanese Yen | 1,293,196,015 | United States Dollar | 9,042,623 | 12/21/2022 | (286,876) |

United States Dollar | 1,807,441 | Swedish Krona | 19,073,915 | 12/21/2022 | 72,210 |

Citigroup Global Markets Inc. |

Japanese Yen | 241,106,000 | United States Dollar | 1,700,769 | 12/21/2022 | (68,330) |

Swedish Krona | 7,224,000 | United States Dollar | 647,083 | 12/21/2022 | 10,113 |

New Zealand Dollar | 542,000 | United States Dollar | 301,522 | 12/21/2022 | 13,847 |

Euro | 2,904,000 | United States Dollar | 2,915,746 | 12/21/2022 | (33,344) |

Canadian Dollar | 1,780,000 | United States Dollar | 1,316,030 | 12/21/2022 | (8,651) |

United States Dollar | 4,643,587 | Canadian Dollar | 6,070,013 | 12/21/2022 | 185,270 |

Swiss Franc | 301,000 | United States Dollar | 315,017 | 12/21/2022 | (12,500) |

British Pound | 618,000 | United States Dollar | 713,945 | 12/21/2022 | (3,922) |

Danish Krone | 1,164,000 | United States Dollar | 157,191 | 12/21/2022 | (1,983) |

Australian Dollar | 488,000 | United States Dollar | 329,339 | 12/21/2022 | (16,661) |

United States Dollar | 1,438,033 | Australian Dollar | 2,281,000 | 12/21/2022 | (23,481) |

Goldman Sachs & Co. LLC |

New Zealand Dollar | 1,939,000 | United States Dollar | 1,110,332 | 12/21/2022 | 17,899 |

13

CONSOLIDATED STATEMENT OF INVESTMENTS (continued)

| | | | | | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

Goldman Sachs & Co. LLC(continued) |

United States Dollar | 1,146,396 | New Zealand Dollar | 2,009,000 | 12/21/2022 | (22,565) |

United States Dollar | 1,704,091 | Norwegian Krone | 18,077,000 | 12/21/2022 | (37,884) |

United States Dollar | 4,252,213 | Swiss Franc | 4,197,000 | 12/21/2022 | 34,066 |

British Pound | 11,521,000 | United States Dollar | 12,514,547 | 12/21/2022 | 721,975 |

Canadian Dollar | 481,000 | United States Dollar | 350,633 | 12/21/2022 | 2,653 |

United States Dollar | 2,936,192 | Canadian Dollar | 4,009,000 | 12/21/2022 | (8,348) |

Japanese Yen | 432,481,000 | United States Dollar | 2,923,650 | 12/21/2022 | 4,517 |

United States Dollar | 338,519 | Japanese Yen | 48,442,000 | 12/21/2022 | 10,536 |

United States Dollar | 4,470,318 | Australian Dollar | 6,922,000 | 12/21/2022 | 35,157 |

Swedish Krona | 9,526,000 | United States Dollar | 852,867 | 12/21/2022 | 13,751 |

United States Dollar | 1,131,442 | Swedish Krona | 12,744,000 | 12/21/2022 | (27,931) |

HSBC Securities (USA) Inc. |

Norwegian Krone | 84,866,218 | United States Dollar | 8,333,330 | 12/21/2022 | (155,267) |

Japanese Yen | 63,189,000 | United States Dollar | 446,177 | 12/21/2022 | (18,348) |

United States Dollar | 1,641,216 | Japanese Yen | 237,308,000 | 12/21/2022 | 34,492 |

British Pound | 1,610,000 | United States Dollar | 1,800,270 | 12/21/2022 | 49,465 |

United States Dollar | 1,219,239 | British Pound | 1,064,000 | 12/21/2022 | (3,195) |

United States Dollar | 4,090,721 | Swedish Krona | 45,546,000 | 12/21/2022 | (52,781) |

Swiss Franc | 870,000 | United States Dollar | 872,964 | 12/21/2022 | 1,420 |

United States Dollar | 2,981,943 | Swiss Franc | 2,902,000 | 12/21/2022 | 65,321 |

Canadian Dollar | 311,000 | United States Dollar | 225,815 | 12/21/2022 | 2,609 |

United States Dollar | 1,211,040 | Canadian Dollar | 1,650,000 | 12/21/2022 | (856) |

Euro | 1,300,000 | United States Dollar | 1,282,776 | 12/21/2022 | 7,556 |

Australian Dollar | 1,613,000 | United States Dollar | 1,045,622 | 12/21/2022 | (12,118) |

14

| | | | | | |

Counterparty/ Purchased

Currency | Purchased Currency

Amounts | Currency

Sold | Sold

Currency

Amounts | Settlement Date | Unrealized Appreciation (Depreciation) ($) |

HSBC Securities (USA) Inc.(continued) |

United States Dollar | 5,481,026 | Australian Dollar | 8,664,000 | 12/21/2022 | (70,293) |

New Zealand Dollar | 3,507,000 | United States Dollar | 1,995,901 | 12/21/2022 | 44,689 |

Morgan Stanley & Co. LLC |

New Zealand Dollar | 9,688,817 | United States Dollar | 5,844,246 | 12/21/2022 | (206,691) |

Swiss Franc | 554,000 | United States Dollar | 563,758 | 12/21/2022 | (6,967) |

United States Dollar | 1,126,790 | Australian Dollar | 1,749,000 | 12/21/2022 | 6,146 |

Euro | 639,000 | United States Dollar | 631,715 | 12/21/2022 | 2,533 |

British Pound | 2,074,000 | United States Dollar | 2,345,829 | 12/21/2022 | 36,998 |

United States Dollar | 16,051,802 | British Pound | 13,851,349 | 12/21/2022 | 137,933 |

Canadian Dollar | 829,000 | United States Dollar | 604,338 | 12/21/2022 | 4,548 |

United States Dollar | 2,156,937 | Japanese Yen | 319,656,000 | 12/21/2022 | (7,334) |

RBC Capital Markets, LLC |

Swiss Franc | 10,247,059 | United States Dollar | 10,725,615 | 12/21/2022 | (426,925) |

Standard Chartered Securities |

United States Dollar | 29,137,022 | Euro | 28,795,365 | 12/21/2022 | 555,815 |

Gross Unrealized Appreciation | | | 2,071,519 |

Gross Unrealized Depreciation | | | (1,956,493) |

See notes to consolidated financial statements.

15

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

October 31, 2022

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Consolidated Statement of Investments | | | |

Unaffiliated issuers | 130,658,743 | | 130,931,846 | |

Affiliated issuers | | 21,984,479 | | 21,984,479 | |

Cash | | | | | 2,055,833 | |

Cash denominated in foreign currency | | | 398,635 | | 394,638 | |

Cash collateral held by broker—Note 4 | | 3,084,523 | |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | 2,071,519 | |

Receivable for investment securities sold | | 283,748 | |

Receivable for shares of Common Stock subscribed | | 129,650 | |

Dividends receivable | | 57,909 | |

Prepaid expenses | | | | | 40,862 | |

| | | | | 161,035,007 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 148,171 | |

Unrealized depreciation on forward foreign

currency exchange contracts—Note 4 | | 1,956,493 | |

Payable for shares of Common Stock redeemed | | 319,651 | |

Payable for futures variation margin—Note 4 | | 118,844 | |

Directors’ fees and expenses payable | | 16,950 | |

Other accrued expenses | | | | | 145,842 | |

| | | | | 2,705,951 | |

Net Assets ($) | | | 158,329,056 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 200,038,437 | |

Total distributable earnings (loss) | | | | | (41,709,381) | |

Net Assets ($) | | | 158,329,056 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 30,234,057 | 7,899,040 | 91,927,633 | 28,268,326 | |

Shares Outstanding | 2,235,031 | 648,524 | 6,556,784 | 2,020,815 | |

Net Asset Value Per Share ($) | 13.53 | 12.18 | 14.02 | 13.99 | |

| | | | | |

See notes to consolidated financial statements. | | | | | |

16

CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended October 31, 2022

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Interest | | | 1,182,795 | |

Dividends from affiliated issuers | | | 274,175 | |

Total Income | | | 1,456,970 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 2,503,369 | |

Shareholder servicing costs—Note 3(c) | | | 273,318 | |

Subsidiary management fees—Note 3(a) | | | 265,640 | |

Professional fees | | | 148,382 | |

Distribution fees—Note 3(b) | | | 85,615 | |

Registration fees | | | 68,156 | |

Directors’ fees and expenses—Note 3(d) | | | 28,900 | |

Prospectus and shareholders’ reports | | | 22,654 | |

Chief Compliance Officer fees—Note 3(c) | | | 17,405 | |

Custodian fees—Note 3(c) | | | 5,162 | |

Loan commitment fees—Note 2 | | | 3,678 | |

Miscellaneous | | | 33,146 | |

Total Expenses | | | 3,455,425 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (634,241) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (261) | |

Net Expenses | | | 2,820,923 | |

Net Investment (Loss) | | | (1,363,953) | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | (123,232) | |

Net realized gain (loss) on futures | (25,417,152) | |

Net realized gain (loss) on options transactions | (767,697) | |

Net realized gain (loss) on forward foreign currency exchange contracts | 2,056,098 | |

Net Realized Gain (Loss) | | | (24,251,983) | |

Net change in unrealized appreciation (depreciation) on investments

and foreign currency transactions | (134,097) | |

Net change in unrealized appreciation (depreciation) on futures | (2,892,982) | |

Net change in unrealized appreciation (depreciation) on

options transactions | 952,497 | |

Net change in unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | 656,932 | |

Net Change in Unrealized Appreciation (Depreciation) | | | (1,417,650) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (25,669,633) | |

Net (Decrease) in Net Assets Resulting from Operations | | (27,033,586) | |

| | | | | | |

See notes to consolidated financial statements. | | | | | |

17

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2022 | | 2021 | |

Operations ($): | | | | | | | | |

Net investment (loss) | | | (1,363,953) | | | | (3,538,678) | |

Net realized gain (loss) on investments | | (24,251,983) | | | | 48,779,603 | |

Net change in unrealized appreciation

(depreciation) on investments | | (1,417,650) | | | | 6,080,913 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | (27,033,586) | | | | 51,321,838 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (6,080,213) | | | | - | |

Class C | | | (2,393,723) | | | | - | |

Class I | | | (21,247,593) | | | | - | |

Class Y | | | (15,888,539) | | | | - | |

Total Distributions | | | (45,610,068) | | | | - | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 8,873,859 | | | | 5,745,871 | |

Class C | | | 188,357 | | | | 266,084 | |

Class I | | | 31,639,933 | | | | 34,565,477 | |

Class Y | | | 770,180 | | | | 5,109,784 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 4,789,734 | | | | - | |

Class C | | | 2,362,765 | | | | - | |

Class I | | | 17,048,947 | | | | - | |

Class Y | | | 8,564,294 | | | | - | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (11,798,075) | | | | (7,102,212) | |

Class C | | | (7,225,560) | | | | (8,965,935) | |

Class I | | | (63,286,554) | | | | (83,483,341) | |

Class Y | | | (78,878,396) | | | | (145,730,889) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (86,950,516) | | | | (199,595,161) | |

Total Increase (Decrease) in Net Assets | (159,594,170) | | | | (148,273,323) | |

Net Assets ($): | |

Beginning of Period | | | 317,923,226 | | | | 466,196,549 | |

End of Period | | | 158,329,056 | | | | 317,923,226 | |

18

| | | | | | | | | | |

| | | | Year Ended October 31, |

| | | | 2022 | | 2021 | |

Capital Share Transactions (Shares): | |

Class Aa,b | | | | | | | | |

Shares sold | | | 593,238 | | | | 334,928 | |

Shares issued for distributions reinvested | | | 317,411 | | | | - | |

Shares redeemed | | | (808,361) | | | | (418,968) | |

Net Increase (Decrease) in Shares Outstanding | 102,288 | | | | (84,040) | |

Class Ca | | | | | | | | |

Shares sold | | | 14,643 | | | | 16,641 | |

Shares issued for distributions reinvested | | | 172,717 | | | | - | |

Shares redeemed | | | (528,548) | | | | (568,980) | |

Net Increase (Decrease) in Shares Outstanding | (341,188) | | | | (552,339) | |

Class Ib | | | | | | | | |

Shares sold | | | 2,078,847 | | | | 1,965,293 | |

Shares issued for distributions reinvested | | | 1,092,181 | | | | - | |

Shares redeemed | | | (4,241,028) | | | | (4,761,687) | |

Net Increase (Decrease) in Shares Outstanding | (1,070,000) | | | | (2,796,394) | |

Class Yb | | | | | | | | |

Shares sold | | | 44,781 | | | | 292,371 | |

Shares issued for distributions reinvested | | | 550,051 | | | | - | |

Shares redeemed | | | (5,159,107) | | | | (8,443,227) | |

Net Increase (Decrease) in Shares Outstanding | (4,564,275) | | | | (8,150,856) | |

| | | | | | | | | |

a | During the period ended October 31, 2021, 31 Class C shares representing $482 were automatically converted to 29 Class A shares. | |

b | During the period ended Octoberl 31, 2022, 39,868 Class Y shares representing $617,930 were exchanged for 39,787 Class I share and 3 Class I shares representing $45 were exchanged for 3 Class A share. During the period ended October 31, 2021, 180,047 Class Y shares representing $3,164,338 were exchanged for 179,705 Class I share and 396 Class Y shares representing $6,706 were exchanged for 406 Class A share. | |

See notes to consolidated financial statements. | | | | | | | | |

19

CONSOLIDATED FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s consolidated financial statements.

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class A Shares | | 2022 | 2021 | 2020 | 2019 | 2018 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 17.98 | 15.82 | 16.26 | 15.08 | 16.63 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | (.11) | (.19) | (.02) | .15 | .08 |

Net realized and unrealized

gain (loss) on investments | | (1.52) | 2.35 | .08 | 1.16 | (.81) |

Total from

Investment Operations | | (1.63) | 2.16 | .06 | 1.31 | (.73) |

Distributions: | | | | | | |

Dividends from

net investment income | | (.08) | - | (.17) | (.13) | - |

Dividends from

net realized gain on investments | | (2.74) | - | (.33) | - | (.82) |

Total Distributions | | (2.82) | - | (.50) | (.13) | (.82) |

Net asset value, end of period | | 13.53 | 17.98 | 15.82 | 16.26 | 15.08 |

Total Return (%)b | | (10.75) | 13.79 | .28 | 8.82 | (4.63) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.72 | 1.60 | 1.58 | 1.55 | 1.59 |

Ratio of net expenses

to average net assets c | | 1.40 | 1.42 | 1.44 | 1.44 | 1.44 |

Ratio of net investment income (loss) to average net assets | | (.76) | (1.12) | (.14) | .96 | .48 |

Portfolio Turnover Rate | | - | 82.12 | 176.12 | 26.17 | 17.55 |

Net Assets,

end of period ($ x 1,000) | | 30,234 | 38,354 | 35,061 | 38,100 | 47,280 |

a Based on average shares outstanding.

b Exclusive of sales charge

c Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

20

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class C Shares | | 2022 | 2021 | 2020 | 2019 | 2018 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 16.50 | 14.62 | 15.06 | 13.96 | 15.56 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | (.20) | (.29) | (.13) | .03 | (.04) |

Net realized and unrealized

gain (loss) on investments | | (1.38) | 2.17 | .06 | 1.09 | (.74) |

Total from

Investment Operations | | (1.58) | 1.88 | (.07) | 1.12 | (.78) |

Distributions: | | | | | | |

Dividends from

net investment income | | - | - | (.04) | (.02) | - |

Dividends from

net realized gain on investments | | (2.74) | - | (.33) | - | (.82) |

Total Distributions | | (2.74) | - | (.37) | (.02) | (.82) |

Net asset value, end of period | | 12.18 | 16.50 | 14.62 | 15.06 | 13.96 |

Total Return (%)b | | (11.44) | 12.93 | (.50) | 8.01 | (5.30) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 2.48 | 2.36 | 2.33 | 2.29 | 2.31 |

Ratio of net expenses

to average net assetsc | | 2.15 | 2.17 | 2.19 | 2.19 | 2.19 |

Ratio of net investment income (loss) to average net assets | | (1.51) | (1.87) | (.87) | .22 | (.27) |

Portfolio Turnover Rate | | - | 82.12 | 176.12 | 26.17 | 17.55 |

Net Assets,

end of period ($ x 1,000) | | 7,899 | 16,334 | 22,548 | 31,771 | 46,681 |

a Based on average shares outstanding.

b Exclusive of sales charge

c Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

21

CONSOLIDATED FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class I Shares | | 2022 | 2021 | 2020 | 2019 | 2018 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 18.54 | 16.26 | 16.71 | 15.51 | 17.04 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | (.08) | (.15) | .02 | .19 | .12 |

Net realized and unrealized

gain (loss) on investments | | (1.58) | 2.43 | .08 | 1.20 | (.83) |

Total from

Investment Operations | | (1.66) | 2.28 | .10 | 1.39 | (.71) |

Distributions: | | | | | | |

Dividends from

net investment income | | (.12) | - | (.22) | (.19) | - |

Dividends from

net realized gain on investments | | (2.74) | - | (.33) | - | (.82) |

Total Distributions | | (2.86) | - | (.55) | (.19) | (.82) |

Net asset value, end of period | | 14.02 | 18.54 | 16.26 | 16.71 | 15.51 |

Total Return (%) | | (10.53) | 14.02 | .53 | 9.04 | (4.33) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.46 | 1.34 | 1.31 | 1.29 | 1.31 |

Ratio of net expenses

to average net assetsb | | 1.15 | 1.17 | 1.19 | 1.19 | 1.19 |

Ratio of net investment income (loss) to average net assets | | (.51) | (.88) | .13 | 1.20 | .73 |

Portfolio Turnover Rate | | - | 82.12 | 176.12 | 26.17 | 17.55 |

Net Assets,

end of period ($ x 1,000) | | 91,928 | 141,384 | 169,485 | 324,848 | 472,940 |

a Based on average shares outstanding.

b Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

22

| | | | | | | |

| | | |

| | | Year Ended October 31, |

Class Y Shares | | 2022 | 2021 | 2020 | 2019 | 2018 |

Per Share Data ($): | | | | | | |

Net asset value,

beginning of period | | 18.50 | 16.23 | 16.69 | 15.53 | 17.04 |

Investment Operations: | | | | | | |

Net investment income (loss)a | | (.08) | (.15) | .03 | .20 | .13 |

Net realized and unrealized

gain (loss) on investments | | (1.57) | 2.42 | .07 | 1.19 | (.82) |

Total from

Investment Operations | | (1.65) | 2.27 | .10 | 1.39 | (.69) |

Distributions: | | | | | | |

Dividends from

net investment income | | (.12) | - | (.23) | (.23) | - |

Dividends from

net realized gain on investments | | (2.74) | - | (.33) | - | (.82) |

Total Distributions | | (2.86) | - | (.56) | (.23) | (.82) |

Net asset value, end of period | | 13.99 | 18.50 | 16.23 | 16.69 | 15.53 |

Total Return (%) | | (10.54) | 14.05 | .54 | 9.13 | (4.27) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | | 1.35 | 1.26 | 1.22 | 1.22 | 1.21 |

Ratio of net expenses

to average net assetsb | | 1.15 | 1.17 | 1.17 | 1.15 | 1.14 |

Ratio of net investment income (loss) to average net assets | | (.51) | (.86) | .18 | 1.25 | .78 |

Portfolio Turnover Rate | | - | 82.12 | 176.12 | 26.17 | 17.55 |

Net Assets,

end of period ($ x 1,000) | | 28,268 | 121,851 | 239,102 | 564,884 | 733,373 |

a Based on average shares outstanding.

b Reflected is the waiver of the Subsidiary management fee.

See notes to consolidated financial statements.

23

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Dynamic Total Return Fund (the “fund”) is a separate diversified series of BNY Mellon Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering eight series, including the fund. The fund’s investment objective is to seek total return. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Newton Investment Management North America, LLC (the “Sub-Adviser”), a wholly-owned subsidiary of BNY Mellon and an affiliate of the Adviser, serves as the fund’s sub-adviser.

The fund may gain investment exposure to global commodity markets through investments in DTR Commodity Fund Ltd., (the “Subsidiary”), a wholly-owned and controlled subsidiary of the fund organized under the laws of the Cayman Islands. The Subsidiary has the ability to invest in commodities and securities consistent with the investment objective of the fund. The Adviser serves as investment adviser for the Subsidiary, the Sub-Adviser serves as the Subsidiary’s sub-investment advisor and Citibank N.A. serves as the Subsidiary’s custodian. The financial statements have been consolidated and include the accounts of the fund and the Subsidiary. Accordingly, all inter-company transactions and balances have been eliminated. A subscription agreement was entered into between the fund and the Subsidiary, comprising the entire issued share capital of the Subsidiary, with the intent that the fund will remain the sole shareholder and retain all rights. Under the Amended and Restated Memorandum and Articles of Association, shares issued by the Subsidiary confer upon a shareholder the right to receive notice of, to attend and to vote at general meetings of the Subsidiary and shall confer upon the shareholder rights in a winding-up or repayment of capital and the right to participate in the profits or assets of the Subsidiary. The following summarizes the structure and relationship of the Subsidiary at October 31, 2022:

24

| | | | |

| | Subsidiary Activity |

Consolidated fund Net Assets ($) | | 158,329,056 | |

Subsidiary Percentage of fund Net Assets | | 9.93% | |

Subsidiary Financial Statement Information ($) | | | |

Total Assets | | 15,797,539 | |

Total Liabilities | | 82,843 | |

Net Assets | | 15,714,696 | |

Total Income | | 123,814 | |

Total Expenses | | 313,877 | |

Net Investment (Loss) | | (190,063) | |

Net Realized Gain (Loss) | | 3,254,757 | |

Net Change in Unrealized Appreciation (Depreciation) | | (265,167) | |

Net Increase in Net Assets Resulting from Operations | | 2,799,527 | |

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 600 million shares of $.001 par value Common Stock. The fund currently has authorized four classes of shares: Class A (200 million shares authorized), Class C (100 million shares authorized), Class I (150 million shares authorized) and Class Y (150 million shares authorized). Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY Mellon and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to

25

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s consolidated financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

26

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

The Company’s Board of Directors (the “Board”) has designated the Adviser as the fund’s valuation designee, effective September 8, 2022, to make all fair value determinations with respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under the Act.

Registered investment companies that are not traded on an exchange are valued at their net asset value and are generally categorized within Level 1 of the fair value hierarchy.

Investments in debt securities, excluding short-term investments (other than U.S. Treasury Bills), futures, options and forward foreign currency exchange contracts (“forward contracts”) are valued each business day by one or more independent pricing services (each, a “Service”) approved by the Board. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of a Service are valued at the mean between the quoted bid prices (as obtained by a Service from dealers in such securities) and asked prices (as calculated by a Service based upon its evaluation of the market for such securities). Securities are valued as determined by a Service, based on methods which include consideration of the following: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. The Services are engaged under the general supervision of the Board. These securities are generally categorized within Level 2 of the fair value hierarchy. U.S. Treasury Bills are valued at the mean price between quoted bid prices and asked prices by a Service. These securities are generally categorized within Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair

27

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward contracts are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy. Futures and options, which are traded on an exchange, are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day and are generally categorized within Level 1 of the fair value hierarchy. Options traded over-the-counter (“OTC”) are valued at the mean between the bid and asked price and are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of October 31, 2022 in valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Investment Companies | 21,984,479 | - | | - | 21,984,479 | |

U.S. Treasury Securities | - | 129,417,433 | | - | 129,417,433 | |

Other Financial Instruments: | | |

Forward Foreign Currency Exchange Contracts†† | - | 2,071,519 | | - | 2,071,519 | |

Futures†† | 1,511,457 | - | | - | 1,511,457 | |

Options Purchased | 1,514,413 | - | | - | 1,514,413 | |

| | | |

28

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Liabilities ($) | | |

Other Financial Instruments: | | |

Forward Foreign Currency Exchange Contracts†† | - | (1,956,493) | | - | (1,956,493) | |

Futures†† | (4,186,750) | - | | - | (4,186,750) | |

† See Consolidated Statement of Investments for additional detailed categorizations, if any.

†† Amount shown represents unrealized appreciation (depreciation) at period end, but only variation margin on exchange-traded and centrally cleared derivatives, if any, are reported in the Consolidated Statement of Assets and Liabilities.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(e) Market Risk: The value of the securities in which fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or

29

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

segments of the market. The value of a security may also decline due to general market conditions that are not specifically related to a particular company or industry, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, changes to inflation, adverse changes to credit markets or adverse investor sentiment generally. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide. Recent examples include pandemic risks related to COVID-19 and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and reducing staff.

Subsidiary Risk: To the extent the fund invests in the subsidiary, the fund will be indirectly exposed to the risks associated with the subsidiary’s investments. The subsidiary principally invests in commodity-related instruments, including futures and options contracts, swap agreements and pooled investment vehicles that invest in commodities, and the fund’s investment in the subsidiary is subject to the same risks that apply to similar investments if held directly by the fund. Changes in applicable laws governing the subsidiary could prevent the fund or the subsidiary from operating as described in the prospectus and could negatively affect the fund and its shareholders. There also may be federal income tax risks associated with the fund’s investment in the subsidiary.

Commodity Risk: The fund’s investments in commodity-linked financial derivatives instruments may subject the fund to greater market price volatility than investments in traditional securities. The value of commodity-linked financial derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from net investment income and dividends from net realized capital gains, if any, are

30

normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

The Subsidiary is classified as a controlled foreign corporation under Subchapter N of the Code. Therefore, the fund is required to increase its taxable income by its share of the Subsidiary’s income. Net investment losses of the Subsidiary cannot be deducted by the fund in the current period nor carried forward to offset taxable income in future periods.

As of and during the period ended October 31, 2022, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Consolidated Statement of Operations. During the period ended October 31, 2022, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended October 31, 2022 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2022, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $1,714,462, accumulated capital losses $31,661,157 and unrealized depreciation $11,762,686.

The fund is permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as either short-term or long-term capital losses.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to October 31, 2022. The fund has $18,411,364 of short-term capital losses and $13,249,793 of long-term capital losses which can be carried forward for an unlimited period.

31

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The tax character of distributions paid to shareholders during the fiscal years ended October 31, 2022 and October 31, 2021 were as follows: ordinary income $20,372,070 and $0, and long-term capital gains $25,237,998 and $0, respectively.

During the period ended October 31, 2022, as a result of permanent book to tax differences, primarily due to the tax treatment for Subpart F income from subsidiary, the fund decreased total distributable earnings (loss) by $3,064,695 and increased paid-in capital by the same amount. Net assets and net asset value per share were not affected by this reclassification.

(h) New accounting pronouncements: In March 2020, the FASB issued Accounting Standards Update 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), and in January 2021, the FASB issued Accounting Standards Update 2021-01, Reference Rate Reform (Topic 848): Scope (“ASU 2021-01”), which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (“LIBOR”) and other interbank offered rates as of the end of 2021. The temporary relief provided by ASU 2020-04 and ASU 2021-01 is effective for certain reference rate-related contract modifications that occur during the period from March 12, 2020 through December 31, 2022 (“FASB Effective Date”). Management had evaluated the impact of ASU 2020-04 and ASU 2021-01 on the fund’s investments, derivatives, debt and other contracts that will undergo reference rate-related modifications as a result of the Reference Rate Reform. Management will be adopting ASU 2020-04 and ASU 2021-01 on FASB Effective Date or if amended ASU 2020-04 new extended FASB Effective Date, if any. Management will continue to work with other financial institutions and counterparties to modify contracts as required by applicable regulation and within the regulatory deadlines. As of October 31, 2022, management believes these accounting standards have no impact on the fund and does not have any concerns of adopting the regulations by FASB Effective Date.

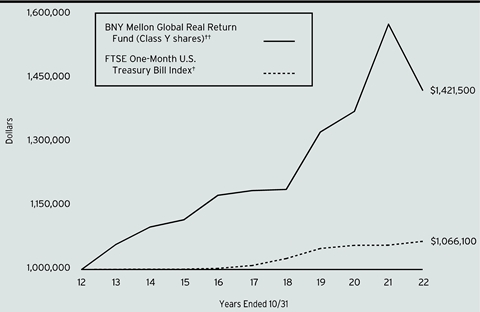

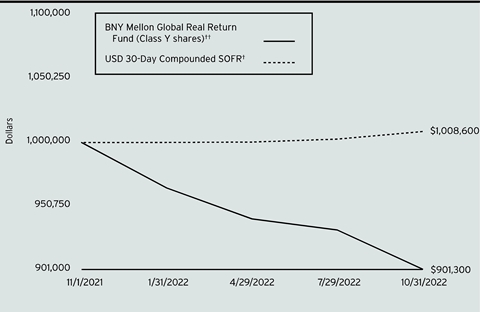

NOTE 2—Bank Lines of Credit: