UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-07123 |

| | |

| | BNY Mellon Advantage Funds, Inc. | |

| | (Exact name of Registrant as specified in charter) | |

| | | |

| | c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 | |

| | (Name and address of agent for service) | |

| |

| Registrant's telephone number, including area code: | (212) 922-6400 |

| | |

Date of fiscal year end: | 08/31 | |

| Date of reporting period: | 08/31/23 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Dynamic Value Fund

BNY Mellon Opportunistic Midcap Value Fund

BNY Mellon Opportunistic Small Cap Fund

BNY Mellon Technology Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Dynamic Value Fund

| |

ANNUAL REPORT August 31, 2023 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from September 1, 2022, through August 31, 2023, as provided by Brian C. Ferguson, John C. Bailer, CFA and Keith Howell, CFA portfolio managers of Newton Investment Management North America, LLC, sub-adviser.

Market and Fund Performance Overview

For the 12-month period ended August 31, 2023, BNY Mellon Dynamic Value Fund’s (the “fund”) Class A shares produced a total return of 14.27%, Class C shares returned 13.40%, Class I shares returned 14.56% and Class Y shares returned 14.60%.1 The fund’s benchmark, the Russell 1000® Value Index (the “Index”), produced a total return of 8.59% for the same period.2

Stocks posted gains as investors began to anticipate an easing of tighter monetary policy that has occurred over the past year. The fund outperformed the Index, primarily due to stock selection in the health care, energy, utilities and communication services sectors.

The Fund’s Investment Approach

The fund seeks capital appreciation. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in stocks. The fund may invest up to 30% of its assets in foreign securities. We identify potential investments through extensive quantitative and fundamental research. We focus on individual stock selection (a “bottom-up” approach), emphasizing three key factors: value, sound business fundamentals and positive business momentum.

Market Supported by Easing Inflation, Economic Resilience

The reporting period was marked by a range of factors that affected returns. Early in the period, the dominant theme was the Federal Reserve’s (the “Fed”) continued monetary tightening policies aimed at curbing inflation. Added to this was the banking crisis that emerged early in 2023. Uncertainty about the outcome of the debt ceiling standoff in the Congress also weighed on markets, as did some weaker-than-expected performance of China’s economy. Easing inflation, continued economic growth, the anticipated end to the Fed’s rate hikes and the emergence of the artificial intelligence (“AI”) theme provided markets with support.

The Fed raised the federal funds rate seven times during the period but reduced the size of the increase from 75 basis points to just 25 basis points for the last four hikes. The smaller rate hikes late in the period disappointed markets somewhat, as many investors were hoping for an end to the hiking cycle, given some signs of economic slowing.

Economic data showed that as pricing pressures continued to weaken from their peak in June 2022, the labor market also began to soften. Though unemployment remained relatively low, some large technology companies announced layoffs or paused hiring amid a more cautious macroeconomic outlook.

The banking crisis that emerged early in 2023 gave investors another reason to believe the Fed’s tightening policy would not continue. Three regional banks—Silicon Valley Bank, Signature Bank and First Republic Bank—faced mounting losses in their long-dated bond holdings as interest rates rose. Uninsured depositors were spooked by the headlines and lost confidence, choosing to move their money into larger money center banks.

In May 2023, the debate in Congress over the federal debt ceiling reached an apparent standoff, resulting in some market volatility. While an agreement was eventually reached, providing the

2

market with some relief, the run-up caused some turmoil as the prospect of a default was threatened.

In addition to easing inflation and investors’ growing anticipation of the end to the Fed’s tightening cycle, the possibility the economy could avoid recession also provided some support as a widely expected recession failed to arrive. China’s weaker-than-expected rebound from its Zero-COVID-19 policies, however, disappointed investors somewhat.

The market was also supported by the launch of ChatGPT by Open AI, which drew investors’ attention to the promise of artificial intelligence and its likely enhancement of productivity and economic growth. While the most immediate beneficiaries of this news were large-cap growth stocks in the information technology sector, their performance provided support to the market as a whole.

Performance Helped by Health Care, Energy, Utilities and Communication Services

The fund’s outperformance versus the Index was driven primarily by stock selections in the health care, energy, utilities and communication services sectors. In the health care sector, stock performance was driven by a decision to avoid pharmaceutical company Pfizer was beneficial as the company continued to be hurt by the end of the COVID-19 pandemic. In addition, shares of Eli Lilly & Co. gained on strong results from Mounjaro, a diabetes drug, which also holds promise as a weight loss treatment. The company also has an abundance of products in its pipeline, including an Alzheimer’s drug that is likely to receive FDA approval. A decision to avoid shares of CVS Health Corp. also supported performance. The company has experienced some turnover in management and has performed poorly in capital allocation decisions. In addition, the retail operation has been hurt by inventory shrinkage due to rampant shoplifting. In the health care equipment and supplies industry, medical device companies, especially Medtronic PLC and Boston Scientific Corp., also contributed to performance. In the energy sector, performance benefited from decisions by oil and gas companies to focus more on investor returns in the form of dividends and share buybacks. The fund’s positions in Hess Corp., Marathon Petroleum Corp. and Schlumberger NV, an oilfield services company, were especially advantageous. In the utilities sector, the fund’s position in Constellation Energy Corp. was the primary contributor. The company is the largest owner and operator of nuclear power plants, which are receiving financial incentives passed in 2022 as part of the Inflation Reduction Act. In the communication services sector, the fund’s position in Meta Platforms, Inc., parent company of Facebook, was beneficial. Shares rose more than 100% due to investor interest in the advent of artificial intelligence.

On a less positive note, the materials sector was the primary detractor from relative returns. It was the only sector that posted a negative performance during the reporting period, and much of this was a result of the poor performance of Alcoa Corp. This aluminum-maker was hurt primarily by weak economic performance in China despite the lifting of its Zero-COVID-19 policy. Another major detractor came from the financial sector, where shares of The Allstate Corp. were a drag on the fund’s performance. The property and casualty insurance company has struggled with pricing that has been weak relative to the cost of covering losses.

An Increased Focus on Fundamentals

While it is always important to focus on company fundamentals, we believe that in the current environment this focus is critical. Given that borrowing costs have risen dramatically, many companies will increasingly come under pressure as interest expenses increase. This is especially true of companies whose business models may have been built on an assumption of low funding

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

costs. Given this new environment, we are focused on companies that self-fund or have access to low-cost capital, and whose balance sheets are suited to these new economic conditions.

We are currently finding value in the financials sector, especially in the insurance and reinsurance industry. We are underweight in banking, however, as most of this industry will come under pressure due to higher funding costs.

We are also seeing opportunities in the health care sector, particularly among medical device companies. We are overweight in the energy sector as well because balance sheets in this sector are the strongest in decades, and the new focus on generating investor returns should prove beneficial.

In contrast, we are underweight the consumer staples and real estate sectors. Real estate investment trusts in particular are likely to remain under pressure, given their heavy reliance on debt.

September 15, 2023

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charges imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s returns reflect the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement in effect through December 30, 2023, at which time it may be extended, terminated or modified. Had these expenses not been absorbed, the fund’s returns would have been lower.

2 Source: Lipper Inc. — The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies that are considered more value-oriented relative to the overall market, as defined by Russell’s leading style methodology. The Russell 1000® Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included, and that the represented companies continue to reflect value characteristics. Investors cannot invest directly in any index.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund’s performance will be influenced by political, social and economic factors affecting investments in foreign companies. Special risks associated with investments in foreign companies include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards. These risks are enhanced in emerging market countries. Please read the prospectus for further discussion of these risks.

4

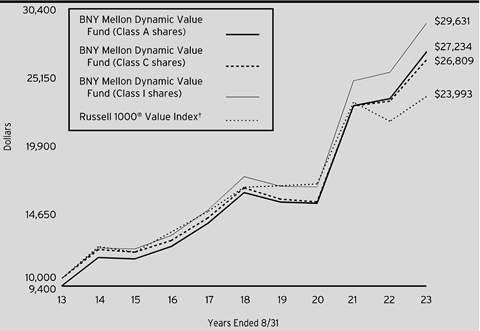

FUND PERFORMANCE (Unaudited)

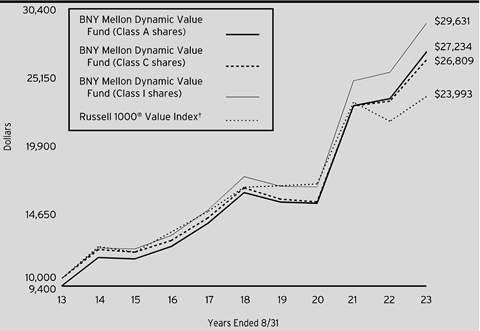

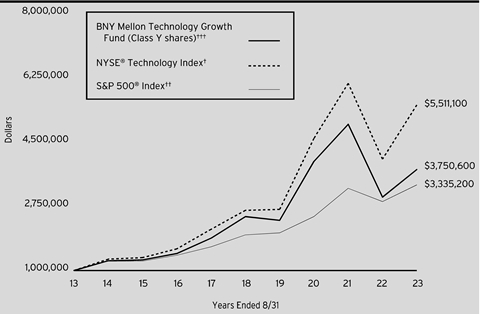

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares and Class I shares of BNY Mellon Dynamic Value Fund with a hypothetical investment of $10,000 in the Russell 1000® Value Index (the “Index”).

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in each of the Class A shares, Class C shares and Class I shares of BNY Mellon Dynamic Value Fund on 8/31/13 to a hypothetical investment of $10,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on Class A shares, Class C shares and Class I shares. The Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies that are considered more value-oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 1000® Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (Unaudited) (continued)

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Dynamic Value Fund with a hypothetical investment of $1,000,000 in the Russell 1000® Value Index (the “Index”).

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon Dynamic Value Fund on 8/31/13 to a hypothetical investment of $1,000,000 made in the Index on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account all applicable fees and expenses on Class Y shares. The Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies that are considered more value-oriented relative to the overall market as defined by Russell’s leading style methodology. The Russell 1000® Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | | | | |

Average Annual Total Returns as of 8/31/2023 | | |

| | | | | | |

| | | 1 Year | 5 Years | 10 Years |

| | | | | | |

Class A shares | | | | |

with maximum sales charge (5.75%) without sales charge | | 7.68% | 9.12% | 10.57% |

| | 14.27% | 10.41% | 11.19% |

Class C shares | | | | |

with applicable redemption charge † | | 12.40% | 9.59% | 10.36% |

without redemption | | 13.40% | 9.59% | 10.36% |

Class I shares | | 14.56% | 10.69% | 11.47% |

Class Y shares | | 14.60% | 10.74% | 11.50% |

Russell 1000® Value Index | | 8.59% | 7.11% | 9.15% |

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Dynamic Value Fund from March 1, 2023 to August 31, 2023. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assume actual returns for the six months ended August 31, 2023 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $4.79 | $8.68 | $3.49 | $3.28 | |

Ending value (after expenses) | $1,065.30 | $1,061.50 | $1,066.70 | $1,066.90 | |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

Expenses and Value of a $1,000 Investment | |

Assuming a hypothetical 5% annualized return for the six months ended August 31, 2023 | |

| | | | | | |

| | Class A | Class C | Class I | Class Y | |

Expenses paid per $1,000† | $4.69 | $8.49 | $3.41 | $3.21 | |

Ending value (after expenses) | $1,020.57 | $1,016.79 | $1,021.83 | $1,022.03 | |

† | Expenses are equal to the fund’s annualized expense ratio of .92% for Class A, 1.67% for Class C, .67% for Class I and .63% for Class Y, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

8

STATEMENT OF INVESTMENTS

August 31, 2023

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 98.5% | | | | | |

Automobiles & Components - .7% | | | | | |

General Motors Co. | | | | 667,265 | | 22,360,050 | |

Banks - 3.8% | | | | | |

JPMorgan Chase & Co. | | | | 831,605 | | 121,688,760 | |

Capital Goods - 5.9% | | | | | |

Eaton Corp. PLC | | | | 203,530 | | 46,887,206 | |

Howmet Aerospace, Inc. | | | | 522,354 | | 25,840,852 | |

Hubbell, Inc. | | | | 53,699 | | 17,508,559 | |

Northrop Grumman Corp. | | | | 113,853 | | 49,308,596 | |

The Boeing Company | | | | 216,314 | a | 48,460,825 | |

| | | | | 188,006,038 | |

Commercial & Professional Services - 1.0% | | | | | |

CACI International, Inc., Cl. A | | | | 92,942 | a | 30,485,905 | |

Consumer Durables & Apparel - .5% | | | | | |

Hasbro, Inc. | | | | 229,637 | | 16,533,864 | |

Consumer Services - 2.8% | | | | | |

International Game Technology PLC | | | | 997,050 | | 31,925,541 | |

Las Vegas Sands Corp. | | | | 1,054,163 | | 57,831,382 | |

| | | | | 89,756,923 | |

Energy - 13.8% | | | | | |

ConocoPhillips | | | | 462,213 | | 55,017,213 | |

EQT Corp. | | | | 1,500,313 | b | 64,843,528 | |

Hess Corp. | | | | 431,018 | | 66,592,281 | |

Marathon Petroleum Corp. | | | | 502,915 | | 71,801,175 | |

Occidental Petroleum Corp. | | | | 1,204,573 | | 75,635,139 | |

Schlumberger NV | | | | 779,704 | | 45,971,348 | |

Shell PLC, ADR | | | | 980,109 | | 60,854,968 | |

| | | | | 440,715,652 | |

Financial Services - 15.0% | | | | | |

Ameriprise Financial, Inc. | | | | 92,784 | | 31,322,023 | |

Ares Management Corp., Cl. A | | | | 305,868 | | 31,638,986 | |

Berkshire Hathaway, Inc., Cl. B | | | | 419,758 | a | 151,196,832 | |

CME Group, Inc. | | | | 360,200 | | 73,005,336 | |

LPL Financial Holdings, Inc. | | | | 168,625 | | 38,883,239 | |

Morgan Stanley | | | | 355,232 | | 30,248,005 | |

The Charles Schwab Corp. | | | | 776,316 | | 45,919,091 | |

The Goldman Sachs Group, Inc. | | | | 75,847 | | 24,855,820 | |

Voya Financial, Inc. | | | | 736,739 | | 51,335,973 | |

| | | | | 478,405,305 | |

Food, Beverage & Tobacco - 1.9% | | | | | |

Bunge Ltd. | | | | 299,072 | | 34,189,911 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 98.5% (continued) | | | | | |

Food, Beverage & Tobacco - 1.9% (continued) | | | | | |

Philip Morris International, Inc. | | | | 257,782 | | 24,762,539 | |

| | | | | 58,952,450 | |

Health Care Equipment & Services - 12.0% | | | | | |

Alcon, Inc. | | | | 278,282 | | 23,094,623 | |

Baxter International, Inc. | | | | 392,676 | | 15,942,646 | |

Becton, Dickinson & Co. | | | | 320,659 | | 89,608,158 | |

Boston Scientific Corp. | | | | 821,566 | a | 44,315,270 | |

Centene Corp. | | | | 528,665 | a | 32,592,197 | |

GE HealthCare Technologies, Inc. | | | | 321,498 | | 22,649,534 | |

Globus Medical, Inc., Cl. A | | | | 262,664 | a | 14,210,122 | |

McKesson Corp. | | | | 67,055 | | 27,648,118 | |

Medtronic PLC | | | | 1,049,664 | | 85,547,616 | |

The Cooper Companies, Inc. | | | | 71,573 | | 26,481,294 | |

| | | | | 382,089,578 | |

Household & Personal Products - 1.7% | | | | | |

Kenvue, Inc. | | | | 2,288,977 | | 52,760,920 | |

Insurance - 9.5% | | | | | |

American International Group, Inc. | | | | 622,703 | | 36,440,580 | |

Aon PLC, Cl. A | | | | 127,152 | | 42,391,205 | |

Assurant, Inc. | | | | 396,508 | | 55,245,460 | |

Everest Group Ltd. | | | | 100,484 | | 36,242,569 | |

RenaissanceRe Holdings Ltd. | | | | 246,819 | | 46,374,822 | |

The Allstate Corp. | | | | 323,096 | | 34,832,980 | |

The Progressive Corp. | | | | 385,710 | | 51,480,714 | |

| | | | | 303,008,330 | |

Materials - 2.1% | | | | | |

Freeport-McMoRan, Inc. | | | | 1,710,860 | | 68,280,423 | |

Media & Entertainment - 3.3% | | | | | |

Alphabet, Inc., Cl. A | | | | 289,849 | a | 39,468,738 | |

Meta Platforms, Inc., Cl. A | | | | 49,245 | a | 14,571,103 | |

Omnicom Group, Inc. | | | | 311,943 | | 25,270,502 | |

The Interpublic Group of Companies, Inc. | | | | 770,187 | b | 25,115,798 | |

| | | | | 104,426,141 | |

Pharmaceuticals, Biotechnology & Life Sciences - 10.4% | | | | | |

AbbVie, Inc. | | | | 404,265 | | 59,410,784 | |

Alnylam Pharmaceuticals, Inc. | | | | 89,573 | a | 17,719,331 | |

Biogen, Inc. | | | | 74,964 | a | 20,042,375 | |

BioMarin Pharmaceutical, Inc. | | | | 281,955 | a | 25,765,048 | |

Danaher Corp. | | | | 361,039 | | 95,675,335 | |

Gilead Sciences, Inc. | | | | 511,605 | | 39,127,550 | |

Regeneron Pharmaceuticals, Inc. | | | | 53,672 | a | 44,359,371 | |

Sanofi, ADR | | | | 579,235 | | 30,803,717 | |

| | | | | 332,903,511 | |

10

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 98.5% (continued) | | | | | |

Semiconductors & Semiconductor Equipment - 4.8% | | | | | |

Applied Materials, Inc. | | | | 390,145 | | 59,598,550 | |

Intel Corp. | | | | 901,411 | | 31,675,582 | |

Lam Research Corp. | | | | 23,187 | | 16,286,549 | |

Micron Technology, Inc. | | | | 664,001 | | 46,440,230 | |

| | | | | 154,000,911 | |

Software & Services - 3.3% | | | | | |

Akamai Technologies, Inc. | | | | 325,525 | a | 34,209,422 | |

Check Point Software Technologies Ltd. | | | | 178,825 | a | 24,068,057 | |

Dolby Laboratories, Inc., Cl. A | | | | 273,793 | | 23,127,295 | |

International Business Machines Corp. | | | | 163,772 | | 24,046,643 | |

| | | | | 105,451,417 | |

Technology Hardware & Equipment - 2.5% | | | | | |

Cisco Systems, Inc. | | | | 1,363,606 | | 78,202,804 | |

Transportation - 1.5% | | | | | |

FedEx Corp. | | | | 188,933 | | 49,315,292 | |

Utilities - 2.0% | | | | | |

Constellation Energy Corp. | | | | 626,708 | | 65,277,905 | |

Total Common Stocks (cost $2,793,694,703) | | | | 3,142,622,179 | |

| | | 1-Day

Yield (%) | | | | | |

Investment Companies - 1.4% | | | | | |

Registered Investment Companies - 1.4% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $44,146,863) | | 5.41 | | 44,146,863 | c | 44,146,863 | |

Total Investments (cost $2,837,841,566) | | 99.9% | | 3,186,769,042 | |

Cash and Receivables (Net) | | .1% | | 2,322,668 | |

Net Assets | | 100.0% | | 3,189,091,710 | |

ADR—American Depositary Receipt

a Non-income producing security.

b Security, or portion thereof, on loan. At August 31, 2023, the value of the fund’s securities on loan was $53,351,877 and the value of the collateral was $54,550,391, consisting of U.S. Government & Agency securities. In addition, the value of collateral may include pending sales that are also on loan.

c Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

11

STATEMENT OF INVESTMENTS (continued)

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Financials | 28.3 |

Health Care | 22.4 |

Energy | 13.8 |

Information Technology | 10.6 |

Industrials | 8.4 |

Consumer Discretionary | 4.0 |

Consumer Staples | 3.5 |

Communication Services | 3.3 |

Materials | 2.1 |

Utilities | 2.1 |

Investment Companies | 1.4 |

| | 99.9 |

† Based on net assets.

See notes to financial statements.

| | | | | | | |

Affiliated Issuers | | | |

Description | Value ($) 8/31/2022 | Purchases ($)† | Sales ($) | Value ($) 8/31/2023 | Dividends/

Distributions ($) | |

Registered Investment Companies - 1.4% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - 1.4% | 15,035,152 | 889,458,681 | (860,346,970) | 44,146,863 | 896,298 | |

Investment of Cash Collateral for Securities Loaned - .0%†† | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .0% | - | 94,012,056 | (94,012,056) | - | 502,734 | ††† |

12

| | | | | | | |

Affiliated Issuers (continued) | | | |

Description | Value ($) 8/31/2022 | Purchases ($)† | Sales ($) | Value ($) 8/31/2023 | Dividends/

Distributions ($) | |

Investment of Cash Collateral for Securities Loaned - .0%†† (continued) | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares - .0% | 187,600 | 195,515,985 | (195,703,585) | - | 13,704 | ††† |

Total - 1.4% | 15,222,752 | 1,178,986,722 | (1,150,062,611) | 44,146,863 | 1,412,736 | |

† Includes reinvested dividends/distributions.

†† Effective July 3, 2023, cash collateral for securities lending was transferred from Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares to Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares.

††† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

13

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2023

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $53,351,877)—Note 1(c): | | | |

Unaffiliated issuers | 2,793,694,703 | | 3,142,622,179 | |

Affiliated issuers | | 44,146,863 | | 44,146,863 | |

Receivable for investment securities sold | | 29,944,085 | |

Receivable for shares of Common Stock subscribed | | 16,583,190 | |

Dividends and securities lending income receivable | | 4,785,301 | |

Tax reclaim receivable—Note 1(b) | | 226,741 | |

Prepaid expenses | | | | | 160,121 | |

| | | | | 3,238,468,480 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 1,812,141 | |

Payable for investment securities purchased | | 43,993,290 | |

Payable for shares of Common Stock redeemed | | 3,064,252 | |

Directors’ fees and expenses payable | | 42,521 | |

Other accrued expenses | | | | | 464,566 | |

| | | | | 49,376,770 | |

Net Assets ($) | | | 3,189,091,710 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 2,718,203,762 | |

Total distributable earnings (loss) | | | | | 470,887,948 | |

Net Assets ($) | | | 3,189,091,710 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 1,021,796,796 | 33,012,533 | 1,856,783,846 | 277,498,535 | |

Shares Outstanding | 24,764,672 | 906,328 | 44,649,495 | 6,688,854 | |

Net Asset Value Per Share ($) | 41.26 | 36.42 | 41.59 | 41.49 | |

| | | | | |

See notes to financial statements. | | | | | |

14

STATEMENT OF OPERATIONS

Year Ended August 31, 2023

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $301,063 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 48,020,789 | |

Affiliated issuers | | | 896,298 | |

Income from securities lending—Note 1(c) | | | 516,438 | |

Total Income | | | 49,433,525 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 15,624,262 | |

Shareholder servicing costs—Note 3(c) | | | 4,158,871 | |

Registration fees | | | 368,817 | |

Directors’ fees and expenses—Note 3(d) | | | 213,172 | |

Distribution fees—Note 3(b) | | | 184,668 | |

Prospectus and shareholders’ reports | | | 97,450 | |

Professional fees | | | 93,241 | |

Loan commitment fees—Note 2 | | | 66,367 | |

Custodian fees—Note 3(c) | | | 65,514 | |

Interest expense—Note 2 | | | 24,143 | |

Chief Compliance Officer fees—Note 3(c) | | | 21,224 | |

Miscellaneous | | | 86,419 | |

Total Expenses | | | 21,004,148 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (639,847) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (142,557) | |

Net Expenses | | | 20,221,744 | |

Net Investment Income | | | 29,211,781 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | 124,493,258 | |

Net change in unrealized appreciation (depreciation) on investments

and foreign currency transactions | 197,353,064 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 321,846,322 | |

Net Increase in Net Assets Resulting from Operations | | 351,058,103 | |

| | | | | | |

See notes to financial statements. | | | | | |

15

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2023 | | 2022 | |

Operations ($): | | | | | | | | |

Net investment income | | | 29,211,781 | | | | 15,424,531 | |

Net realized gain (loss) on investments | | 124,493,258 | | | | 255,088,410 | |

Net change in unrealized appreciation

(depreciation) on investments | | 197,353,064 | | | | (234,045,533) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 351,058,103 | | | | 36,467,408 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (82,406,100) | | | | (172,945,161) | |

Class C | | | (1,747,344) | | | | (1,451,936) | |

Class I | | | (94,067,152) | | | | (97,232,481) | |

Class Y | | | (20,632,403) | | | | (66,006,827) | |

Total Distributions | | | (198,852,999) | | | | (337,636,405) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 160,101,228 | | | | 97,741,023 | |

Class C | | | 25,244,240 | | | | 7,564,168 | |

Class I | | | 1,503,418,033 | | | | 434,795,690 | |

Class Y | | | 116,795,687 | | | | 85,318,056 | |

Distributions reinvested: | | | | | | | | |

Class A | | | 77,017,420 | | | | 161,208,223 | |

Class C | | | 1,656,007 | | | | 1,256,179 | |

Class I | | | 88,854,229 | | | | 91,981,560 | |

Class Y | | | 16,158,925 | | | | 33,442,482 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (158,170,478) | | | | (91,470,743) | |

Class C | | | (6,781,231) | | | | (2,668,266) | |

Class I | | | (583,867,642) | | | | (154,340,139) | |

Class Y | | | (109,842,575) | | | | (161,056,793) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | 1,130,583,843 | | | | 503,771,440 | |

Total Increase (Decrease) in Net Assets | 1,282,788,947 | | | | 202,602,443 | |

Net Assets ($): | |

Beginning of Period | | | 1,906,302,763 | | | | 1,703,700,320 | |

End of Period | | | 3,189,091,710 | | | | 1,906,302,763 | |

16

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2023 | | 2022 | |

Capital Share Transactions (Shares): | |

Class Aa,b | | | | | | | | |

Shares sold | | | 4,061,975 | | | | 2,415,677 | |

Shares issued for distributions reinvested | | | 2,001,492 | | | | 4,062,707 | |

Shares redeemed | | | (4,027,566) | | | | (2,180,376) | |

Net Increase (Decrease) in Shares Outstanding | 2,035,901 | | | | 4,298,008 | |

Class Ca | | | | | | | | |

Shares sold | | | 722,248 | | | | 205,774 | |

Shares issued for distributions reinvested | | | 48,478 | | | | 35,138 | |

Shares redeemed | | | (196,062) | | | | (69,322) | |

Net Increase (Decrease) in Shares Outstanding | 574,664 | | | | 171,590 | |

Class Ib | | | | | | | | |

Shares sold | | | 38,041,141 | | | | 10,622,754 | |

Shares issued for distributions reinvested | | | 2,295,382 | | | | 2,305,302 | |

Shares redeemed | | | (14,758,742) | | | | (3,757,002) | |

Net Increase (Decrease) in Shares Outstanding | 25,577,781 | | | | 9,171,054 | |

Class Yb | | | | | | | | |

Shares sold | | | 2,954,760 | | | | 2,061,074 | |

Shares issued for distributions reinvested | | | 418,517 | | | | 840,475 | |

Shares redeemed | | | (2,758,559) | | | | (3,870,709) | |

Net Increase (Decrease) in Shares Outstanding | 614,718 | | | | (969,160) | |

| | | | | | | | | |

a | During the period ended August 31, 2023, 1,627 Class C shares representing $56,584 were automatically converted to 1,455 Class A shares and during the period ended August 31, 2022, 1,056 Class C shares representing $39,636 were automatically converted to 951 Class A shares. | |

b | During the period ended August 31, 2023, 44,051 Class Y shares representing $1,754,656 were exchanged for 43,942 Class I shares, 5,457 Class A shares representing $225,051 were exchanged for 5,415 Class I shares and during the period ended August 31, 2022, 87,969 Class Y shares representing $3,670,947 were exchanged for 87,775 Class I shares, 439 Class A shares representing $17,582 were exchanged for 437 Class I shares. | |

See notes to financial statements. | | | | | | | | |

17

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. These figures have been derived from the fund’s financial statements.

| | | | | | | | |

| | Year Ended August 31, |

| |

Class A Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 39.43 | 47.84 | 33.28 | 34.61 | 42.18 |

Investment Operations: | | | | | | |

Net investment incomea | | .38 | .32 | .36 | .47 | .57 |

Net realized and unrealized gain

(loss) on investments | | 4.99 | .86 | 15.20 | (.56) | (2.67) |

Total from Investment Operations | | 5.37 | 1.18 | 15.56 | (.09) | (2.10) |

Distributions: | | | | | | |

Dividends from net investment

income | | (.28) | (.46) | (.22) | (.57) | (.63) |

Dividends from net realized gain

on investments | | (3.26) | (9.13) | (.78) | (.67) | (4.84) |

Total Distributions | | (3.54) | (9.59) | (1.00) | (1.24) | (5.47) |

Net asset value, end of period | | 41.26 | 39.43 | 47.84 | 33.28 | 34.61 |

Total Return (%)b | | 14.27 | 2.34 | 47.60 | (.55) | (4.40) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | | .94 | .94 | .95 | .97 | .96 |

Ratio of net expenses to

average net assets | | .93 | .93 | .93 | .93 | .93 |

Ratio of net investment income to

average net assets | | .97 | .76 | .88 | 1.42 | 1.58 |

Portfolio Turnover Rate | | 106.44 | 115.23 | 108.10 | 103.12 | 97.03 |

Net Assets, end of period ($ x 1,000) | | 1,021,797 | 896,291 | 881,741 | 648,545 | 728,146 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

18

| | | | | | | | | | | |

| | | | | | |

| | Year Ended August 31, |

Class C Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 35.34 | 43.80 | 30.58 | 31.84 | 39.20 |

Investment Operations: | | | | | | |

Net investment incomea | | .08 | .01 | .04 | .20 | .27 |

Net realized and unrealized gain

(loss) on investments | | 4.42 | .79 | 13.96 | (.53) | (2.48) |

Total from Investment Operations | | 4.50 | .80 | 14.00 | (.33) | (2.21) |

Distributions: | | | | | | |

Dividends from net investment

income | | (.16) | (.13) | - | (.26) | (.31) |

Dividends from net realized gain

on investments | | (3.26) | (9.13) | (.78) | (.67) | (4.84) |

Total Distributions | | (3.42) | (9.26) | (.78) | (.93) | (5.15) |

Net asset value, end of period | | 36.42 | 35.34 | 43.80 | 30.58 | 31.84 |

Total Return (%)b | | 13.40 | 1.59 | 46.48 | (1.29) | (5.12) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | | 1.73 | 1.72 | 1.73 | 1.73 | 1.71 |

Ratio of net expenses to

average net assets | | 1.68 | 1.68 | 1.68 | 1.68 | 1.68 |

Ratio of net investment income to

average net assets | | .23 | .02 | .11 | .66 | .83 |

Portfolio Turnover Rate | | 106.44 | 115.23 | 108.10 | 103.12 | 97.03 |

Net Assets, end of period ($ x 1,000) | | 33,013 | 11,719 | 7,011 | 9,372 | 16,615 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

19

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | | |

| | Year Ended August 31, |

Class I Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 39.72 | 48.13 | 33.47 | 34.80 | 42.33 |

Investment Operations: | | | | | | |

Net investment incomea | | .49 | .43 | .47 | .56 | .66 |

Net realized and unrealized gain

(loss) on investments | | 5.02 | .86 | 15.28 | (.56) | (2.68) |

Total from Investment Operations | | 5.51 | 1.29 | 15.75 | (.00)b | (2.02) |

Distributions: | | | | | | |

Dividends from net investment

income | | (.38) | (.57) | (.31) | (.66) | (.67) |

Dividends from net realized gain

on investments | | (3.26) | (9.13) | (.78) | (.67) | (4.84) |

Total Distributions | | (3.64) | (9.70) | (1.09) | (1.33) | (5.51) |

Net asset value, end of period | | 41.59 | 39.72 | 48.13 | 33.47 | 34.80 |

Total Return (%) | | 14.56 | 2.60 | 47.97 | (.30) | (4.16) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | | .72 | .69 | .70 | .71 | .71 |

Ratio of net expenses to

average net assets | | .68 | .68 | .68 | .68 | .68 |

Ratio of net investment income to

average net assets | | 1.22 | 1.02 | 1.13 | 1.67 | 1.83 |

Portfolio Turnover Rate | | 106.44 | 115.23 | 108.10 | 103.12 | 97.03 |

Net Assets, end of period ($ x 1,000) | | 1,856,784 | 757,567 | 476,540 | 342,508 | 452,432 |

a Based on average shares outstanding.

b Amount represents less than $.01 per share.

See notes to financial statements.

20

| | | | | | | | | | |

| | | | |

| | Year Ended August 31, |

Class Y Shares | | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 39.63 | 48.05 | 33.41 | 34.74 | 42.35 |

Investment Operations: | | | | | | |

Net investment incomea | | .50 | .45 | .49 | .57 | .67 |

Net realized and unrealized gain

(loss) on investments | | 5.01 | .85 | 15.25 | (.56) | (2.68) |

Total from Investment Operations | | 5.51 | 1.30 | 15.74 | .01 | (2.01) |

Distributions: | | | | | | |

Dividends from net investment

income | | (.39) | (.59) | (.32) | (.67) | (.76) |

Dividends from net realized gain

on investments | | (3.26) | (9.13) | (.78) | (.67) | (4.84) |

Total Distributions | | (3.65) | (9.72) | (1.10) | (1.34) | (5.60) |

Net asset value, end of period | | 41.49 | 39.63 | 48.05 | 33.41 | 34.74 |

Total Return (%) | | 14.60 | 2.64 | 48.06 | (.27) | (4.13) |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | | .64 | .63 | .64 | .65 | .65 |

Ratio of net expenses to

average net assets | | .63 | .63 | .64 | .65 | .65 |

Ratio of net investment income to

average net assets | | 1.26 | 1.04 | 1.18 | 1.70 | 1.84 |

Portfolio Turnover Rate | | 106.44 | 115.23 | 108.10 | 103.12 | 97.03 |

Net Assets, end of period ($ x 1,000) | | 277,499 | 240,726 | 338,408 | 204,901 | 240,163 |

a Based on average shares outstanding.

See notes to financial statements.

21

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

BNY Mellon Dynamic Value Fund (the “fund”) is a separate diversified series of BNY Mellon Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering seven series, including the fund. The fund’s investment objective is to seek capital appreciation. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Newton Investment Management North America, LLC (the “Sub-Adviser”), an indirect wholly-owned subsidiary of BNY Mellon and an affiliate of the Adviser, serves as the fund’s sub-adviser.

Effective March 31, 2023, the Sub-Adviser, entered into a sub-sub-investment advisory agreement with its affiliate, Newton Investment Management Limited (“NIM”), to enable NIM to provide certain advisory services to the Sub-Adviser for the benefit of the fund, including, but not limited to, portfolio management services. NIM is subject to the supervision of the Sub-Adviser and the Adviser. NIM is also an affiliate of the Adviser. NIM, located at 160 Queen Victoria Street, London, EC4V, 4LA, England, was formed in 1978. NIM is an indirect subsidiary of BNY Mellon.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 800 million shares of $.001 par value Common Stock. The fund currently has authorized four classes of shares: Class A (300 million shares authorized), Class C (100 million shares authorized), Class I (250 million shares authorized), and Class Y (150 million shares authorized). Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY Mellon and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such

22

institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly.

23

NOTES TO FINANCIAL STATEMENTS (continued)

GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

The Company’s Board of Directors (the “Board”) has designated the Adviser as the fund’s valuation designee, effective September 8, 2022, to make all fair value determinations with respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under the Act.

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities

24

and other appropriate indicators, such as prices of relevant ADRs and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

The following is a summary of the inputs used as of August 31, 2023 in valuing the fund’s investments:

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Equity Securities - Common Stocks | 3,142,622,179 | - | | - | 3,142,622,179 | |

Investment Companies | 44,146,863 | - | | - | 44,146,863 | |

† See Statement of Investments for additional detailed categorizations, if any.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

25

NOTES TO FINANCIAL STATEMENTS (continued)

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

Foreign taxes: The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the fund invests. These foreign taxes, if any, are paid by the fund and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred or those subject to reclaims as of August 31, 2023, if any, are disclosed in the fund’s Statement of Assets and Liabilities.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with BNY Mellon, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, BNY Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending

26

transactions are on an overnight and continuous basis. During the period ended August 31, 2023, BNY Mellon earned $70,423 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

(e) Market Risk: The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. The value of a security may also decline due to general market conditions that are not specifically related to a particular company or industry, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, changes to inflation, adverse changes to credit markets or adverse investor sentiment generally. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed-income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide.

Foreign Investment Risk: To the extent the fund invests in foreign securities, the fund’s performance will be influenced by political, social and economic factors affecting investments in foreign issuers. Special risks associated with investments in foreign issuers include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political and economic instability and differing auditing and legal standards.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from net investment income and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

27

NOTES TO FINANCIAL STATEMENTS (continued)

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended August 31, 2023, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended August 31, 2023, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended August 31, 2023 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At August 31, 2023, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $22,773,285, undistributed capital gains $125,265,653 and unrealized appreciation $322,849,010.

The tax character of distributions paid to shareholders during the fiscal years ended August 31, 2023 and August 31, 2022 were as follows: ordinary income $41,551,859 and $102,630,678, and long-term capital gains $157,301,140 and $235,005,727, respectively.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $823.5 million unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by BNY Mellon (the “BNYM Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $688.5 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is an amount equal to $135 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNYM Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

28

During the period ended August 31, 2023, the fund was charged $24,143 for interest expense. These fees are included in Interest expense in the Statement of Operations. The average amount of borrowings outstanding under the Facilities during the period ended August 31, 2023 was approximately $423,288 with a related weighted average annualized interest rate of 5.70%.

NOTE 3—Management Fee, Sub-Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Adviser the management fee is computed at the annual rate of .60% of the value of the fund’s average daily net assets and is payable monthly. The Adviser has contractually agreed, from September 1, 2022 through December 30, 2023, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 Distribution plan fees, Shareholder Services plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .68% of the value of the fund’s average daily net assets. On or after December 30, 2023, the Adviser may terminate this expense limitation agreement at any time. The reduction in expenses, pursuant to the undertaking amounted to $639,847 during the period ended August 31, 2023.

Pursuant to a sub-investment advisory agreement between the Adviser and the Sub-Adviser, the Adviser pays the Sub-Adviser a monthly fee at an annual rate of .288% of the value of the fund’s average daily net assets.

During the period ended August 31, 2023, the Distributor retained $84,385 from commissions earned on sales of the fund’s Class A shares, $2,963 and $17,433 from CDSC fees on redemptions of the fund’s Class A and Class C shares, respectively.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. The Distributor may pay one or more Service Agents in respect of advertising, marketing and other distribution services, and determines the amounts, if any, to be paid to Service Agents and the basis on which such payments are made. During the period ended August 31, 2023, Class C shares were charged $184,668 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as

29

NOTES TO FINANCIAL STATEMENTS (continued)

answering shareholder inquiries regarding the fund, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended August 31, 2023, Class A and Class C shares were charged $2,442,860 and $61,556, respectively, pursuant to the Shareholder Services Plan.

The fund has an arrangement with BNY Mellon Transfer, Inc., (the “Transfer Agent”), a subsidiary of BNY Mellon and an affiliate of the Adviser, whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset Transfer Agent fees. For financial reporting purposes, the fund includes transfer agent net earnings credits, if any, as an expense offset in the Statement of Operations.

The fund has an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY Mellon and an affiliate of the Adviser, whereby the fund will receive interest income or be charged overdraft fees when cash balances are maintained. For financial reporting purposes, the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates the Transfer Agent, under a transfer agency agreement, for providing transfer agency and cash management services for the fund. The majority of Transfer Agent fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended August 31, 2023, the fund was charged $164,425 for transfer agency services. These fees are included in Shareholder servicing costs in the Statement of Operations. These fees were partially offset by earnings credits of $142,557.

The fund compensates the Custodian, under a custody agreement, for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended August 31, 2023, the fund was charged $65,514 pursuant to the custody agreement.

During the period ended August 31, 2023, the fund was charged $21,224 for services performed by the fund’s Chief Compliance Officer and his staff. These fees are included in Chief Compliance Officer fees in the Statement of Operations.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: management

30

fee of $1,600,768, Distribution Plan fees of $20,770, Shareholder Services plan fees of $223,691, Custodian fees of $16,800 and Chief Compliance Officer fees of $3,833, which are offset against an expense reimbursement currently in effect in the amount of $53,721.

(d) Each board member also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended August 31, 2023, amounted to $3,695,554,743 and $2,748,676,968, respectively.

At August 31, 2023, the cost of investments for federal income tax purposes was $2,863,921,440; accordingly, accumulated net unrealized appreciation on investments was $322,847,602, consisting of $382,610,410 gross unrealized appreciation and $59,762,808 gross unrealized depreciation.

31

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Directors of BNY Mellon Dynamic Value Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of BNY Mellon Dynamic Value Fund (the “Fund”) (one of the funds constituting BNY Mellon Advantage Funds, Inc. (the “Company”)), including the statement of investments, as of August 31, 2023, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the funds constituting BNY Mellon Advantage Funds, Inc.) at August 31, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of the Company’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2023, by correspondence with the custodian, brokers and others; when replies were not received from brokers and others, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies in the BNY Mellon Family of Funds since at least 1957, but we are unable to determine the specific year.

New York, New York

October 23, 2023

32

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby reports 65.79% of the ordinary dividends paid during the fiscal year ended August 31, 2023 as qualifying for the corporate dividends received deduction. Also certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $29,169,517 represents the maximum amount that may be considered qualified dividend income. The fund also hereby reports $.417 per share as a short-term capital gain distribution and $2.8456 per share as a long-term capital gain distribution paid on December 6, 2022. Shareholders will receive notification in early 2024 of the percentage applicable to the preparation of their 2023 income tax returns.

33

INFORMATION ABOUT THE RENEWAL OF THE FUND’S MANAGEMENT AND SUB-INVESTMENT ADVISORY AGREEMENTS AND THE APPROVAL OF THE FUND’S SUB- SUB-INVESTMENT ADVISORY AGREEMENT (Unaudited)

At a meeting of the fund’s Board of Directors held on March 14-15, 2023, the Board considered the renewal of the fund’s Management Agreement, pursuant to which the Adviser provides the fund with investment advisory and administrative services, and the Sub-Investment Advisory Agreement (together with the Management Agreement, the “Agreements”), pursuant to which Newton Investment Management North America, LLC (the “Sub-Adviser” or “NIMNA”) provides day-to-day management of the fund’s investments. The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Adviser and the Sub-Adviser. In considering the renewal of the Agreements, the Board considered several factors that it believed to be relevant, including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund. The Board considered information provided to it at the meeting and in previous presentations from representatives of the Adviser regarding the nature, extent, and quality of the services provided to funds in the BNY Mellon fund complex, including the fund. The Adviser provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. The Adviser also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the BNY Mellon fund complex (such as retail direct or intermediary, in which intermediaries typically are paid by the fund and/or the Adviser) and the Adviser’s corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that the Adviser also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board also considered the Adviser’s extensive administrative, accounting and compliance infrastructures, as well as the Adviser’s supervisory activities over the Sub-Adviser. The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board reviewed reports prepared by Broadridge Financial Solutions, Inc. (“Broadridge”), an independent provider of investment company data based on classifications provided by Thomson Reuters Lipper (“Lipper”), which included information comparing (1) the performance of the fund’s Class I shares with the

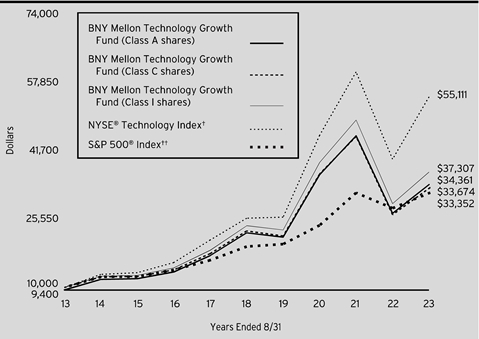

34