UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08194

FINANCIAL INVESTORS TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Michael Lawlor, Esq., Secretary

Financial Investors Trust

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: April 30

Date of reporting period: April 30, 2023

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

ANNUAL REPORT

| SHAREHOLDER LETTER | 1 |

| PERFORMANCE UPDATE | 4 |

| DISCLOSURE OF FUND EXPENSES | 6 |

| PORTFOLIO OF INVESTMENTS | 7 |

| STATEMENT OF ASSETS AND LIABILITIES | 18 |

| STATEMENT OF OPERATIONS | 19 |

| STATEMENTS OF CHANGES IN NET ASSETS | 20 |

| FINANCIAL HIGHLIGHTS | 22 |

| NOTES TO FINANCIAL STATEMENTS | 24 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 32 |

| ADDITIONAL INFORMATION | 33 |

| DISCLOSURE REGARDING APPROVAL OF FUND ADVISORY AGREEMENTS | 34 |

| TRUSTEES AND OFFICERS | 36 |

| PRIVACY POLICY | 40 |

Disciplined Growth Investors’ goal is to communicate clearly and transparently with our clients and mutual fund shareholders. It is mutually beneficial when our shareholders understand how we invest, what we are currently thinking and forecasting, and the specific investment decisions we have made. Our views and opinions regarding the investment prospects of our portfolio holdings and the Fund are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for these forecasts and have confidence in our investment team’s views, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements as those including words such as “believe”, “expect”, “anticipate”, “forecast”, and similar statement. We cannot assure future performance. These forward-looking statements are made only as-of the date of this report. Following the publication of this report, we will not update any of the forward-looking statements included here.

This material must be preceded or accompanied by a prospectus. Please read the prospectus carefully before investing.

| The Disciplined Growth Investors Fund | Shareholder Letter |

April 30, 2023 (Unaudited)

April 30, 2023

The DGI Fund’s fiscal year ended on April 30, 2023. For the full year, the Fund returned +1.67%. Stocks in the Fund were up 2.13% while bonds were up 2.22%.

Since Inception (8/12/2011), the DGI Fund has returned 10.10%, in-line with our goal when we opened the Fund of a double-digit annualized growth rate over long periods of time. The stocks and bonds in the Fund have returned annualized rates of 14.01% and 2.96%, respectively, since-inception.

A positive return for the fiscal year and over 10% since inception may come as some surprise considering 2022 delivered the first bear market since the Fund opened in 2011. A strong start to 2023 has been a key component, up 7.03% year-to-date.

Calendar year 2022 was indeed a difficult year to be a shareholder in the Fund. The total return was -18.21%, the largest decline in the Fund’s history, and only the third down year in 10 full calendar years. A compounding factor was that stocks and bonds both declined for the first time since 1969.1

Since the end of 2022, much of the alarming news cycle has continued. Inflation is coming down, but remains higher than is comfortable. The Federal Reserve’s sharp interest rate increases, though likely working to lower inflation, have inflicted pain and uncertainty on the banking sector, with a few larger regional banks failing. War in Europe continues.

Despite all this, our outlook is upbeat. The bear market, though painful, was not unanticipated or irregular. Bear markets occur, on average, every six years. The most recent lasting2 bear market prior to 2022 was during the financial crisis of 2008, 14 years prior.

We have an optimistic outlook for three reasons:

| 1) | We are optimistic about the future of the Fund’s portfolio companies. |

| 2) | We believe those companies are in excellent business shape. |

| 3) | And, for the first time since the Fund opened in 2011, bonds are priced to offer fair yields. Let’s unpack each of these a little more. |

We are optimistic about the future of the Fund’s portfolio companies due to the combination of the specific growth potential they hold plus the “cheap” purchase prices offered by the bear market. We believe the stocks in the Fund have significant potential for growth in their intrinsic values over time. This is largely unchanged despite the sell off of 2022. Combining what we see as strong intrinsic value growth and the decline in stock prices last year, we entered 2023 with higher expected returns in our forecast model than we had seen at any time in the Fund’s history.3

We believe that the companies in the DGI Fund are in excellent business shape. We believe long-term earnings growth is a reasonable proxy for the increase in intrinsic value of the underlying business. Earnings growth tends to be a leading indicator of stock performance. The companies in the Fund have posted nearly uninterrupted earnings growth in excess of historical averages, and as the first quarter of earnings in 2023 has played out, nearly all companies in the Fund posted earnings in excess of what Wall Street anticipated.

Finally, bonds are offering what we believe to be fair yields for the first time in fourteen years. Currently, yields on investment-grade corporate bonds can be had in the 5-7% range. This is a result of the increase in interest rates over the last year-plus. One measure of

| Annual Report | April 30, 2023 | 1 |

| The Disciplined Growth Investors Fund | Shareholder Letter |

April 30, 2023 (Unaudited)

interest rates, the 10-year US Treasury Note yield, exceeded 4% in late 2022 for the first time since 2008. As of December 31, 2021, the Fund’s bond portfolio yield was 1.6%. As of the end of 2022, that figure was 4.9%. That’s a 300% increase in bond yields in a year. We think this is likely to be a material development in our ability to reach our goal of a double-digit growth rate over time.

In addition to these more tangible points, we pin much of this positive outlook on an increasingly critical driver of long-term value creation in the Fund’s portfolio companies, and the economy in general. That driver is innovation.

Investors often confuse innovation with invention. Invention is the development of something novel. Innovation is taking inventions and making them reliable, affordable and widely available. In this context, an example of invention would be the Wright Brothers first manned flight, while innovation would be represented by Boeing's series of technical advancements that ultimately led to the development of the 707. The 707 made commercial air travel available to the masses. Though innovation often begins with invention, the innovation process tends to be more evolutionary than revolutionary. Importantly from an investment perspective, it also demands a deep cultural commitment by innovative companies. We see this across the portfolio. The Fund owns many companies that may not be household names like Tesla or Apple but have rich histories of serial innovation.4

The economy-wide impact of innovation can be extremely beneficial over the long term. Overall, the price/performance of goods and services becomes more attractive. Importantly, innovation can be a major driver of productivity gains, which dampens inflation. Today, for example, many investors fear a return to the stagflation of the 1970’s. We think innovation is so pervasive that such a forecast is unlikely.

Innovation also creates a problem for short-term, impatient investors because it comes in slowly and is hard to quantify. For diligent investors, we believe innovation can provide a basis for superior research and portfolio decisions. But it takes careful analysis and an understanding of the power and character of innovation.

These are the times that true investors live for. The macroeconomic and political outlook is dismal. The news outlets are feasting on negative news. Yet, we believe our investment research effort is the most effective it has ever been. The Fund’s stocks are offering at significant discounts to our estimates of their future intrinsic values, the business execution of the individual portfolio companies has been robust, and bonds (for the first time in the history of the Fund) are priced to deliver reasonable yields.

Sincerely,

Frederick Martin, CFA – Portfolio Manager

Rob Nicoski, CPA* – Portfolio Manager

Nick Hansen, CFA, CAIA – Portfolio Manager

Jason Lima, CFA – Portfolio Manager

| 2 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Shareholder Letter |

April 30, 2023 (Unaudited)

| 1 | As measured by the S&P 500 Index’s calendar year returns and the Bloomberg Aggregate US Government/Credit Bond Index. |

| 2 | March of 2020 saw a 30% decline in the S&P 500 index, but that “bear market” was extremely short-lived, with the index recouping all of those losses in a matter of weeks. |

| 3 | In managing the Fund’s investment portfolio, we generally use a multi-year forecast model that results in an expected return metric. This is not a promise or guarantee of future results. This is our guidepost to help understand what we think the stock portfolio is likely to do, as well as in evaluating and potentially adjusting the allocation to each individual stock position. |

| 4 | The DGI Fund does not hold either Tesla or Apple as of April 30, 2023. |

The Barclay’s Government & Corporate Credit index includes both corporate (publicly-issued, fixed-rate, nonconvertible, investment grade, dollar-denominated, SEC-registered, corporate dept.) and government (Treasury Bond index, Agency Bond index, 1-3 Year Government index, and the 20+-Year treasury) indexes, including bonds with maturities up to ten years.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index.

Asset class-specific performance is before fees. The Fund’s single fee – the management fee – is paid from the Fund’s holding of cash. Total Fund net-of-fees performance is presented in this letter, later in this annual report, and is updated monthly on the Fund’s website, www.dgifund.com.

The views of Disciplined Growth Investors, Inc. and information discussed in this commentary are as of the date of this report, are subject to change, and may not reflect the writers’ current views.

The views expressed are those of the Fund’s adviser only, and represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the portfolios or any securities or any sectors mentioned in this letter. The subject matter contained in this letter has been derived from several sources believed to be reliable and accurate at the time of compilation. Neither Disciplined Growth Investors, Inc. nor the Fund accepts any liability for losses either direct or consequential caused by the use of this information.

The Fund is distributed by ALPS Distributors, Inc.

The Fund is subject to investment risks, including possible loss of the principal amount invested and therefore is not suitable for all investors. The Fund may not achieve its objectives.

Diversification does not eliminate the risk of experiencing investment losses.

Fred Martin is a registered representative of ALPS Distributors, Inc. CFA Institute Marks are trademarks owned by the CFA Institute.

| Annual Report | April 30, 2023 | 3 |

| The Disciplined Growth Investors Fund | Performance Update |

April 30, 2023 (Unaudited)

Annualized Total Return Performance (for the period ended April 30, 2023)

| | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception* |

| The Disciplined Growth Investors Fund | 1.67% | 9.62% | 7.55% | 8.73% | 10.10% |

| S&P 500® Total Return Index(1) | 2.66% | 14.52% | 11.45% | 12.20% | 13.59% |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. For the most current month-end performance data please call 1.855.DGI.FUND.

The table does not reflect the deductions of taxes a shareholder would pay on Fund distributions or redemptions of Fund shares.

Subject to investment risks, including possible loss of the principal amount invested.

Returns for periods less than 1 year are cumulative.

| * | Fund Inception date of August 12, 2011. |

| (1) | The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The Index is not actively managed and does not reflect any deductions for fees, expenses or taxes. An investor may not invest directly in the Index. |

| 4 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Performance Update |

April 30, 2023 (Unaudited)

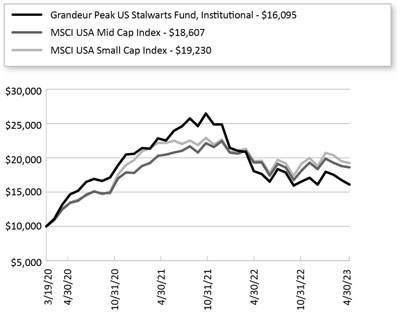

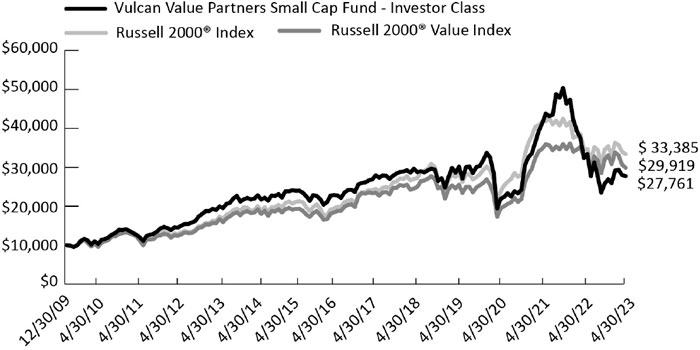

Growth of $10,000 Investment in the Fund (for the period ended April 30, 2023)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investing in the Fund is subject to investment risks, including possible loss of the principal amount invested.

Industry Sector Allocation

(as a % of Net Assets)*

| Technology | 38.89% |

| Industrials | 11.41% |

| Consumer Discretionary | 9.49% |

| Health Care | 5.82% |

| Energy | 5.02% |

| Communication | 0.36% |

| Corporate Bonds | 23.82% |

| Government & Agency Obligations | 2.90% |

| Foreign Corporate Bonds | 1.83% |

| Other Assets In Excess Of Liabilities | 0.46% |

Top Ten Holdings

(as a % of Net Assets)*

| Super Micro Computer, Inc. | 7.52% |

| Plexus Corp. | 3.38% |

| Microchip Technology, Inc. | 3.37% |

| Power Integrations, Inc. | 3.15% |

| Align Technology, Inc. | 2.82% |

| Gentex Corp. | 2.81% |

| Akamai Technologies, Inc. | 2.77% |

| Arista Networks, Inc. | 2.70% |

| Coterra Energy, Inc. | 2.64% |

| Dolby Laboratories, Inc. | 2.63% |

| Top Ten Holdings | 33.79% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. |

| Annual Report | April 30, 2023 | 5 |

| The Disciplined Growth Investors Fund | Disclosure of Fund Expenses |

April 30, 2023 (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other fund operating expenses. This example is intended to help you understand your ongoing costs (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of November 1, 2022 through April 30, 2023.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account

Value

11/1/2022 | Ending Account

Value

4/30/2023 | Expense Ratio(a) | Expenses Paid

During period

11/1/2022 - 4/30/2023(b) |

| Actual | $1,000.00 | $1,071.60 | 0.78% | $ 4.01 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,020.93 | 0.78% | $ 3.91 |

| (a) | The Fund's expense ratios have been annualized based on the Fund's most recent fiscal half-year expenses. |

| (b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181)/365 (to reflect the half-year period). |

| 6 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Shares | | | Value

(Note 2) | |

| COMMON STOCKS (70.99%) | | | | | | | | |

| COMMUNICATIONS (0.36%) | | | | | | | | |

| Media (0.36%) | | | | | | | | |

| Take-Two Interactive Software, Inc. (a) | | | 10,307 | | | $ | 1,281,057 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 1,281,057 | |

| | | | | | | | | |

| CONSUMER DISCRETIONARY (9.49%) | | | | | | | | |

| Consumer Discretionary Products (5.96%) | | | | | | | | |

| Gentex Corp. | | | 364,993 | | | | 10,070,157 | |

| Gentherm, Inc. (a) | | | 44,592 | | | | 2,659,913 | |

| LGI Homes, Inc. (a) | | | 36,608 | | | | 4,349,030 | |

| Under Armour, Inc. , Class A(a) | | | 481,185 | | | | 4,268,111 | |

| | | | | | | | 21,347,211 | |

| | | | | | | | | |

| Consumer Discretionary Services (1.97%) | | | | | | | | |

| Royal Caribbean Cruises, Ltd. (a) | | | 66,379 | | | | 4,343,178 | |

| Strategic Education, Inc. | | | 30,941 | | | | 2,722,808 | |

| | | | | | | | 7,065,986 | |

| | | | | | | | | |

| Retail & Whsle - Discretionary (1.56%) | | | | | | | | |

| Floor & Decor Holdings, Inc. , Class A(a) | | | 32,084 | | | | 3,187,225 | |

| Sleep Number Corp. (a) | | | 97,775 | | | | 2,204,826 | |

| Stitch Fix, Inc. , Class A(a) | | | 61,797 | | | | 210,728 | |

| | | | | | | | 5,602,779 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 34,015,976 | |

| | | | | | | | | |

| ENERGY (5.02%) | | | | | | | | |

| Oil & Gas (5.02%) | | | | | | | | |

| Core Laboratories NV | | | 32,086 | | | | 722,256 | |

| Coterra Energy, Inc. | | | 369,898 | | | | 9,469,388 | |

| Southwestern Energy Co. (a) | | | 1,502,120 | | | | 7,796,003 | |

| | | | | | | | 17,987,647 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 17,987,647 | |

| Annual Report | April 30, 2023 | 7 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Shares | | | Value

(Note 2) | |

| HEALTH CARE (5.82%) | | | | | | | | |

| Health Care (5.82%) | | | | | | | | |

| Align Technology, Inc. (a) | | | 31,106 | | | $ | 10,118,782 | |

| Intuitive Surgical, Inc. (a) | | | 27,198 | | | | 8,192,581 | |

| Myriad Genetics, Inc. (a) | | | 118,983 | | | | 2,533,148 | |

| | | | | | | | 20,844,511 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 20,844,511 | |

| | | | | | | | | |

| INDUSTRIALS (11.41%) | | | | | | | | |

| Industrial Products (7.16%) | | | | | | | | |

| Cognex Corp. | | | 184,842 | | | | 8,815,115 | |

| Generac Holdings, Inc. (a) | | | 14,409 | | | | 1,472,888 | |

| Graco, Inc. | | | 43,627 | | | | 3,459,185 | |

| Proto Labs, Inc. (a) | | | 114,895 | | | | 3,305,529 | |

| Snap-on, Inc. | | | 33,220 | | | | 8,617,600 | |

| | | | | | | | 25,670,317 | |

| Industrial Services (4.25%) | | | | | | | | |

| Alarm.com Holdings, Inc. (a) | | | 130,959 | | | | 6,245,435 | |

| Landstar System, Inc. | | | 38,408 | | | | 6,760,960 | |

| MSC Industrial Direct Co., Inc. , Class A | | | 24,416 | | | | 2,215,264 | |

| | | | | | | | 15,221,659 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 40,891,976 | |

| | | | | | | | | |

| TECHNOLOGY (38.89% ) | | | | | | | | |

| Software & Tech Services (7.33%) | | | | | | | | |

| Akamai Technologies, Inc. (a) | | | 120,915 | | | | 9,911,403 | |

| Autodesk, Inc. (a) | | | 36,898 | | | | 7,187,361 | |

| Intuit, Inc. | | | 19,045 | | | | 8,455,028 | |

| Paychex, Inc. | | | 6,435 | | | | 706,949 | |

| | | | | | | | 26,260,741 | |

| 8 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Shares | | | Value

(Note 2) | |

| TECHNOLOGY (continued) | | | | | | | | |

| Tech Hardware & Semiconductors (31.56%) | | | | | | | | |

| Arista Networks, Inc. (a) | | | 60,429 | | | $ | 9,678,309 | |

| Dolby Laboratories, Inc. , Class A | | | 112,722 | | | | 9,433,704 | |

| Garmin, Ltd. | | | 87,849 | | | | 8,624,136 | |

| InterDigital, Inc. | | | 44,825 | | | | 3,036,446 | |

| IPG Photonics Corp. (a) | | | 37,541 | | | | 4,316,464 | |

| Microchip Technology, Inc. | | | 165,404 | | | | 12,072,838 | |

| Plexus Corp. (a) | | | 138,441 | | | | 12,109,434 | |

| Power Integrations, Inc. | | | 155,027 | | | | 11,282,865 | |

| Pure Storage, Inc. , Class A(a) | | | 393,310 | | | | 8,979,267 | |

| Semtech Corp. (a) | | | 45,212 | | | | 881,182 | |

| Super Micro Computer, Inc. (a) | | | 255,675 | | | | 26,955,815 | |

| Viasat, Inc. (a) | | | 162,490 | | | | 5,692,025 | |

| | | | | | | | 113,062,485 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 139,323,226 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $200,606,341) | | | | | | $ | 254,344,393 | |

| | | Principal

Amount | | | Value

(Note 2) | |

| CORPORATE BONDS (23.82%) | | | | | | | | |

| COMMUNICATIONS (1.29%) | | | | | | | | |

| Cable & Satellite (0.33%) | | | | | | | | |

| Comcast Corp. | | | | | | | | |

| 4.150% 10/15/2028 | | $ | 1,181,000 | | | $ | 1,171,909 | |

| Entertainment Content (0.31%) | | | | | | | | |

| Paramount Global | | | | | | | | |

| 7.875% 07/30/2030 | | | 1,012,000 | | | | 1,116,987 | |

| | | | | | | | | |

| Wireless Telecommunications Services (0.65%) | | | | | | | | |

| AT&T, Inc. | | | | | | | | |

| 4.350% 03/01/2029 | | | 1,166,000 | | | | 1,146,569 | |

| Verizon Communications, Inc. | | | | | | | | |

| 4.329% 09/21/2028 | | | 1,191,000 | | | | 1,178,940 | |

| | | | | | | | 2,325,509 | |

| | | | | | | | | |

| TOTAL COMMUNICATIONS | | | | | | | 4,614,405 | |

| Annual Report | April 30, 2023 | 9 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal

Amount | | | Value

(Note 2) | |

| CONSUMER DISCRETIONARY (2.49%) | | | | | | | | |

| Airlines (0.33%) | | | | | | | | |

| Southwest Airlines Co. | | | | | | | | |

| 3.450% 11/16/2027 | | $ | 1,240,000 | | | $ | 1,165,457 | |

| | | | | | | | | |

| Automobiles Manufacturing (0.30%) | | | | | | | | |

| General Motors Co. | | | | | | | | |

| 5.400% 10/15/2029 | | | 1,100,000 | | | | 1,088,092 | |

| | | | | | | | | |

| Consumer Services (0.32%) | | | | | | | | |

| Cintas Corp. No 2 | | | | | | | | |

| 3.700% 04/01/2027 | | | 1,181,000 | | | | 1,157,444 | |

| | | | | | | | | |

| Restaurants (0.64%) | | | | | | | | |

| McDonald's Corp., Series MTN | | | | | | | | |

| 6.300% 03/01/2038 | | | 977,000 | | | | 1,117,125 | |

| Starbucks Corp. | | | | | | | | |

| 4.000% 11/15/2028 | | | 1,190,000 | | | | 1,176,124 | |

| | | | | | | | 2,293,249 | |

| | | | | | | | | |

| Retail - Consumer Discretionary (0.90%) | | | | | | | | |

| Advance Auto Parts, Inc. | | | | | | | | |

| 3.900% 04/15/2030 | | | 1,100,000 | | | | 1,009,768 | |

| Amazon.com, Inc. | | | | | | | | |

| 5.200% 12/03/2025 | | | 1,035,000 | | | | 1,059,262 | |

| Lowe's Cos., Inc. | | | | | | | | |

| 3.650% 04/05/2029 | | | 1,201,000 | | | | 1,145,938 | |

| | | | | | | | | |

| TOTAL CONSUMER DISCRETIONARY | | | | | | | 8,919,210 | |

| | | | | | | | | |

| CONSUMER STAPLES (0.89%) | | | | | | | | |

| Food & Beverage (0.59%) | | | | | | | | |

| Hormel Foods Corp. | | | | | | | | |

| 1.700% 06/03/2028 | | | 1,135,000 | | | | 1,012,297 | |

| Tyson Foods, Inc. | | | | | | | | |

| 3.900% 09/28/2023 | | | 1,090,000 | | | | 1,085,715 | |

| | | | | | | | | |

| Mass Merchants (0.30%) | | | | | | | | |

| Costco Wholesale Corp. | | | | | | | | |

| 1.600% 04/20/2030 | | | 1,280,000 | | | | 1,089,419 | |

| | | | | | | | | |

| TOTAL CONSUMER STAPLES | | | | | | | 3,187,431 | |

| 10 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal | | | Value | |

| | | Amount | | | (Note 2) | |

| ENERGY (2.52%) | | | | | | |

| Exploration & Production (0.30%) | | | | | | | | |

| ConocoPhillips Co. | | | | | | | | |

| 3.350% 05/15/2025 | | $ | 1,100,000 | | | $ | 1,071,320 | |

| | | | | | | | | |

| Integrated Oils (0.33%) | | | | | | | | |

| BP Capital Markets America, Inc. | | | | | | | | |

| 4.234% 11/06/2028 | | | 1,184,000 | | | | 1,188,205 | |

| | | | | | | | | |

| Pipeline (1.57%) | | | | | | | | |

| El Paso Natural Gas Co. LLC | | | | | | | | |

| 7.500% 11/15/2026 | | | 1,000,000 | | | | 1,066,716 | |

| Energy Transfer LP | | | | | | | | |

| 5.250% 04/15/2029 | | | 1,188,000 | | | | 1,192,630 | |

| Enterprise Products Operating LLC | | | | | | | | |

| 3.125% 07/31/2029 | | | 1,231,000 | | | | 1,133,997 | |

| MPLX LP | | | | | | | | |

| 2.650% 08/15/2030 | | | 1,328,000 | | | | 1,135,158 | |

| ONEOK, Inc. | | | | | | | | |

| 6.875% 09/30/2028 | | | 1,059,000 | | | | 1,110,620 | |

| | | | | | | | 5,639,121 | |

| | | | | | | | | |

| Refining & Marketing (0.32%) | | | | | | | | |

| Phillips 66 | | | | | | | | |

| 2.150% 12/15/2030 | | | 1,353,000 | | | | 1,129,827 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 9,028,473 | |

| | | | | | | | | |

| FINANCIALS (4.63%) | | | | | | | | |

| Banks (1.21%) | | | | | | | | |

| Regions Financial Corp. | | | | | | | | |

| 1.800% 08/12/2028 | | | 1,360,000 | | | | 1,131,607 | |

| Truist Financial Corp., Series MTN | | | | | | | | |

| 3.875% 03/19/2029 | | | 1,171,000 | | | | 1,060,569 | |

| US Bancorp, Series DMTN | | | | | | | | |

| 3.000% 07/30/2029 | | | 1,232,000 | | | | 1,083,956 | |

| Wachovia Corp.(b) | | | | | | | | |

| 7.574% 08/01/2026 | | | 992,000 | | | | 1,058,715 | |

| | | | | | | | 4,334,847 | |

| | | | | | | | | |

| Commercial Finance (0.32%) | | | | | | | | |

| GATX Corp. | | | | | | | | |

| 4.700% 04/01/2029 | | | 1,186,000 | | | | 1,168,397 | |

| Annual Report | April 30, 2023 | 11 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal | | | Value | |

| | | Amount | | | (Note 2) | |

| FINANCIALS (continued) | | | | | | | | |

| Consumer Finance (0.62%) | | | | | | | | |

| American Express Co. | | | | | | | | |

| 3.300% 05/03/2027 | | $ | 1,172,000 | | | $ | 1,117,197 | |

| Capital One Financial Corp. | | | | | | | | |

| 4.200% 10/29/2025 | | | 1,150,000 | | | | 1,098,601 | |

| | | | | | | | 2,215,798 | |

| | | | | | | | | |

| Diversified Banks (0.93%) | | | | | | | | |

| Bank of America Corp., Series L | | | | | | | | |

| 4.183% 11/25/2027 | | | 1,108,000 | | | | 1,069,687 | |

| Citigroup, Inc. | | | | | | | | |

| 4.125% 07/25/2028 | | | 1,230,000 | | | | 1,173,965 | |

| JPMorgan Chase & Co. | | | | | | | | |

| 4.125% 12/15/2026 | | | 1,097,000 | | | | 1,078,351 | |

| | | | | | | | 3,322,003 | |

| | | | | | | | | |

| Financial Services (0.60%) | | | | | | | | |

| Morgan Stanley | | | | | | | | |

| 5.000% 11/24/2025 | | | 1,030,000 | | | | 1,032,259 | |

| Northern Trust Corp. | | | | | | | | |

| 3M US L + 1.131% 05/08/2032 (b) | | | 1,239,000 | | | | 1,124,595 | |

| | | | | | | | 2,156,854 | |

| | | | | | | | | |

| Life Insurance (0.32%) | | | | | | | | |

| Principal Financial Group, Inc. | | | | | | | | |

| 3.100% 11/15/2026 | | | 1,197,000 | | | | 1,148,129 | |

| | | | | | | | | |

| Real Estate (0.63%) | | | | | | | | |

| Simon Property Group LP | | | | | | | | |

| 2.450% 09/13/2029 | | | 1,291,000 | | | | 1,127,214 | |

| Welltower OP LLC | | | | | | | | |

| 4.125% 03/15/2029 | | | 1,199,000 | | | | 1,125,249 | |

| | | | | | | | 2,252,463 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 16,598,491 | |

| | | | | | | | | |

| HEALTH CARE (1.56%) | | | | | | | | |

| Health Care Facilities & Services (0.31%) | | | | | | | | |

| CVS Health Corp. | | | | | | | | |

| 3.250% 08/15/2029 | | | 1,217,000 | | | | 1,121,706 | |

| 12 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal | | | Value | |

| | | Amount | | | (Note 2) | |

| HEALTH CARE (continued) | | | | | | | | |

| Managed Care (0.33%) | | | | | | | | |

| Elevance Health, Inc. | | | | | | | | |

| 3.650% 12/01/2027 | | $ | 1,205,000 | | | $ | 1,170,509 | |

| | | | | | | | | |

| Pharmaceuticals (0.92%) | | | | | | | | |

| AbbVie, Inc. | | | | | | | | |

| 4.250% 11/14/2028 | | | 1,131,000 | | | | 1,122,861 | |

| Astrazeneca Finance LLC | | | | | | | | |

| 1.750% 05/28/2028 | | | 1,228,000 | | | | 1,095,023 | |

| Bristol-Myers Squibb Co. | | | | | | | | |

| 6.800% 11/15/2026 | | | 1,000,000 | | | | 1,082,807 | |

| | | | | | | | 3,300,691 | |

| | | | | | | | | |

| TOTAL HEALTH CARE | | | | | | | 5,592,906 | |

| | | | | | | | | |

| INDUSTRIALS (2.66%) | | | | | | | | |

| Aerospace & Defense (0.62%) | | | | | | | | |

| General Dynamics Corp. | | | | | | | | |

| 3.500% 05/15/2025 | | | 1,100,000 | | | | 1,079,830 | |

| Raytheon Technologies Corp. | | | | | | | | |

| 7.500% 09/15/2029 | | | 967,000 | | | | 1,124,443 | |

| | | | | | | | 2,204,273 | |

| | | | | | | | | |

| Engineering & Construction (0.19%) | | | | | | | | |

| Fluor Corp. | | | | | | | | |

| 4.250% 09/15/2028 | | | 747,000 | | | | 692,596 | |

| | | | | | | | | |

| Railroad (0.63%) | | | | | | | | |

| CSX Corp. | | | | | | | | |

| 3.400% 08/01/2024 | | | 1,120,000 | | | | 1,096,998 | |

| Union Pacific Corp. | | | | | | | | |

| 3.950% 09/10/2028 | | | 1,184,000 | | | | 1,174,061 | |

| | | | | | | | | |

| Transportation & Logistics (0.62%) | | | | | | | | |

| FedEx Corp. | | | | | | | | |

| 2.400% 05/15/2031 | | | 1,318,000 | | | | 1,120,023 | |

| United Parcel Service, Inc. | | | | | | | | |

| 6.200% 01/15/2038 | | | 945,000 | | | | 1,086,933 | |

| | | | | | | | 2,206,956 | |

| | | | | | | | | |

| Waste & Environment Services & Equipment (0.60%) | | | | | | | | |

| Republic Services, Inc. | | | | | | | | |

| 3.375% 11/15/2027 | | | 1,135,000 | | | | 1,094,471 | |

| Annual Report | April 30, 2023 | 13 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal | | | Value | |

| | | Amount | | | (Note 2) | |

| INDUSTRIALS (continued) | | | | | | | | |

| Waste & Environment Services & Equipment (continued) | | | | | | | | |

| Waste Management, Inc. | | | | | | | | |

| 7.000% 07/15/2028 | | $ | 950,000 | | | $ | 1,066,154 | |

| | | | | | | | 2,160,625 | |

| | | | | | | | | |

| TOTAL INDUSTRIALS | | | | | | | 9,535,509 | |

| | | | | | | | | |

| MATERIALS (0.31%) | | | | | | | | |

| Chemicals (0.31%) | | | | | | | | |

| Dow Chemical Co. | | | | | | | | |

| 7.375% 11/01/2029 | | | 970,000 | | | | 1,111,493 | |

| DuPont de Nemours, Inc. | | | | | | | | |

| 4.725% 11/15/2028 | | | 14,000 | | | | 14,154 | |

| | | | | | | | 1,125,647 | |

| | | | | | | | | |

| TOTAL MATERIALS | | | | | | | 1,125,647 | |

| | | | | | | | | |

| TECHNOLOGY (0.30%) | | | | | | | | |

| Hardware (0.30%) | | | | | | | | |

| Hewlett Packard Enterprise Co. | | | | | | | | |

| 4.450% 10/02/2023 | | | 1,090,000 | | | | 1,084,590 | |

| | | | | | | | | |

| TOTAL TECHNOLOGY | | | | | | | 1,084,590 | |

| | | | | | | | | |

| UTILITIES (7.17%) | | | | | | | | |

| Utilities (7.17%) | | | | | | | | |

| Ameren Corp. | | | | | | | | |

| 1.750% 03/15/2028 | | | 1,253,000 | | | | 1,095,216 | |

| Appalachian Power Co., Series AA | | | | | | | | |

| 2.700% 04/01/2031 | | | 1,270,000 | | | | 1,084,031 | |

| Arizona Public Service Co. | | | | | | | | |

| 2.600% 08/15/2029 | | | 1,286,000 | | | | 1,131,858 | |

| Black Hills Corp. | | | | | | | | |

| 3.150% 01/15/2027 | | | 1,177,000 | | | | 1,110,551 | |

| CenterPoint Energy, Inc. | | | | | | | | |

| 4.250% 11/01/2028 | | | 1,197,000 | | | | 1,149,368 | |

| CMS Energy Corp. | | | | | | | | |

| 3.450% 08/15/2027 | | | 1,122,000 | | | | 1,077,066 | |

| Commonwealth Edison Co., Series 122 | | | | | | | | |

| 2.950% 08/15/2027 | | | 1,200,000 | | | | 1,133,728 | |

| DTE Electric Co. | | | | | | | | |

| 6.350% 10/15/2032 | | | 1,020,000 | | | | 1,111,313 | |

| 14 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal | | | Value | |

| | | Amount | | | (Note 2) | |

| UTILITIES (continued) | | | | | | | | |

| Utilities (continued) | | | | | | | | |

| Duke Energy Corp. | | | | | | | | |

| 3.400% 06/15/2029 | | $ | 1,269,000 | | | $ | 1,181,620 | |

| Eastern Energy Gas Holdings LLC, Series B | | | | | | | | |

| 3.000% 11/15/2029 | | | 936,000 | | | | 840,551 | |

| ITC Holdings Corp. | | | | | | | | |

| 4.050% 07/01/2023 | | | 1,109,000 | | | | 1,106,109 | |

| National Rural Utilities Cooperative Finance Corp. | | | | | | | | |

| 3.400% 02/07/2028 | | | 1,160,000 | | | | 1,110,517 | |

| NextEra Energy Capital Holdings, Inc. | | | | | | | | |

| 3.500% 04/01/2029 | | | 1,204,000 | | | | 1,132,328 | |

| NiSource, Inc. | | | | | | | | |

| 2.950% 09/01/2029 | | | 1,322,000 | | | | 1,192,781 | |

| Oncor Electric Delivery Co. LLC | | | | | | | | |

| 3.700% 11/15/2028 | | | 1,174,000 | | | | 1,148,809 | |

| PacifiCorp | | | | | | | | |

| 5.250% 06/15/2035 | | | 1,095,000 | | | | 1,140,388 | |

| Public Service Electric and Gas Co. | | | | | | | | |

| 3.200% 05/15/2029 | | | 1,249,000 | | | | 1,170,480 | |

| Puget Energy, Inc. | | | | | | | | |

| 4.100% 06/15/2030 | | | 1,267,000 | | | | 1,188,464 | |

| Southern Co., Series 21-B | | | | | | | | |

| 1.750% 03/15/2028 | | | 1,255,000 | | | | 1,092,790 | |

| Tampa Electric Co. | | | | | | | | |

| 3.875% 07/12/2024 | | | 1,120,000 | | | | 1,102,023 | |

| WEC Energy Group, Inc. | | | | | | | | |

| 4.750% 01/15/2028 | | | 1,100,000 | | | | 1,106,678 | |

| Wisconsin Power and Light Co. | | | | | | | | |

| 3.050% 10/15/2027 | | | 1,200,000 | | | | 1,136,459 | |

| Xcel Energy, Inc. | | | | | | | | |

| 2.600% 12/01/2029 | | | 1,275,000 | | | | 1,132,518 | |

| | | | | | | | 25,675,646 | |

| | | | | | | | | |

| TOTAL UTILITIES | | | | | | | 25,675,646 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS | | | | | | | | |

| (Cost $90,772,969) | | | | | | $ | 85,362,308 | |

| Annual Report | April 30, 2023 | 15 |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal

Amount | | | Value

(Note 2) | |

| FOREIGN CORPORATE BONDS (1.83%) | | | | | | | | |

| ENERGY (0.91%) | | | | | | | | |

| Exploration & Production (0.30%) | | | | | | | | |

| Canadian Natural Resources, Ltd. | | | | | | | | |

| 3.850% 06/01/2027 | | $ | 1,116,000 | | | $ | 1,072,420 | |

| | | | | | | | | |

| Pipeline (0.61%) | | | | | | | | |

| Enbridge, Inc. | | | | | | | | |

| 5.700% 03/08/2033 | | | 1,070,000 | | | | 1,111,640 | |

| TransCanada PipeLines, Ltd. | | | | | | | | |

| 7.250% 08/15/2038 | | | 940,000 | | | | 1,091,501 | |

| | | | | | | | 2,203,141 | |

| | | | | | | | | |

| TOTAL ENERGY | | | | | | | 3,275,561 | |

| | | | | | | | | |

| FINANCIALS (0.61% ) | | | | | | | | |

| Diversified Banks (0.61%) | | | | | | | | |

| Bank of Nova Scotia | | | | | | | | |

| 4.750% 02/02/2026 | | | 1,100,000 | | | | 1,098,142 | |

| Royal Bank of Canada, Series GMTN | | | | | | | | |

| 4.650% 01/27/2026 | | | 1,081,000 | | | | 1,070,448 | |

| | | | | | | | | |

| TOTAL FINANCIALS | | | | | | | 2,168,590 | |

| | | | | | | | | |

| MATERIALS (0.31%) | | | | | | | | |

| Metals & Mining (0.31%) | | | | | | | | |

| BHP Billiton Finance USA, Ltd. | | | | | | | | |

| 4.750% 02/28/2028 | | | 1,100,000 | | | | 1,118,869 | |

| | | | | | | | | |

| TOTAL MATERIALS | | | | | | | 1,118,869 | |

| | | | | | | | | |

| TOTAL FOREIGN CORPORATE BONDS | | | | | | | | |

| (Cost $6,858,242) | | | | | | $ | 6,563,020 | |

| | | | | | | | | |

| GOVERNMENT & AGENCY OBLIGATIONS (2.90%) | | | | | | | | |

| U.S. Treasury Bonds | | | | | | | | |

| 2.500% 08/15/2023 | | | 200,000 | | | | 198,432 | |

| 2.875% 08/15/2028 | | | 2,800,000 | | | | 2,713,375 | |

| 16 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Portfolio of Investments |

April 30, 2023

| | | Principal

Amount | | | Value

(Note 2) | |

| GOVERNMENT & AGENCY OBLIGATIONS (continued) | | | | | | | | |

| U.S. Treasury Notes | | | | | | | | |

| 0.250% 06/15/2024 | | $ | 6,500,000 | | | $ | 6,188,203 | |

| 0.375% 10/31/2023 | | | 1,070,000 | | | | 1,046,118 | |

| 2.750% 08/31/2023 | | | 240,000 | | | | 238,213 | |

| | | | | | | | | |

| TOTAL GOVERNMENT & AGENCY OBLIGATIONS | | | | | | | | |

| (Cost $10,371,453) | | | | | | $ | 10,384,341 | |

| | | | | | | | | Value | |

| | | Yield | | | Shares | | | (Note 2) | |

| SHORT TERM INVESTMENTS (0.28%) | | | | | | | | | | | | |

| MONEY MARKET FUND (0.28%) | | | | | | | | | | | | |

| First American Treasury Obligations Fund, 12/31/2049 | | | 4.740 | % (c) | | | 985,491 | | | | 985,491 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $985,491) | | | | | | | | | | $ | 985,491 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (99.82%) | | | | | | | | | | | | |

| (Cost $309,594,496) | | | | | | | | | | $ | 357,639,553 | |

| | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (0.18%) | | | | | | | | | | | 658,074 | |

| | | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | | $ | 358,297,627 | |

| (a) | Non-Income Producing Security. |

| (b) | Floating or variable rate security. The reference rate is described below. The rate in effect as of April 30, 2023 is based on the reference rate plus the displayed spread as of the securities last reset date. |

| (c) | Represents the 7-day yield. |

Common Abbreviations:

LIBOR - London Interbank Offered Rate

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

Libor Rates:

3M US L - 3 Month LIBOR as of April 30, 2023 was 5.30%

For Fund compliance purposes, the Fund's industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets.

See Notes to Financial Statements.

| Annual Report | April 30, 2023 | 17 |

| The Disciplined Growth Investors Fund | Statement of Assets and Liabilities |

April 30, 2023

| ASSETS | | | |

| Investments, at value | | $ | 357,639,553 | |

| Cash | | | 31,839 | |

| Receivable for investments sold | | | 1,160,356 | |

| Receivable for shares sold | | | 47,500 | |

| Dividends and interest receivable | | | 1,046,588 | |

| Total assets | | | 359,925,836 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for investments purchased | | | 1,117,606 | |

| Payable for shares redeemed | | | 279,109 | |

| Payable to adviser | | | 231,494 | |

| Total liabilities | | | 1,628,209 | |

| NET ASSETS | | $ | 358,297,627 | |

| | | | | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital (Note 5) | | $ | 311,557,817 | |

| Distributable Earnings | | | 46,739,810 | |

| NET ASSETS | | $ | 358,297,627 | |

| | | | | |

| INVESTMENTS, AT COST | | $ | 309,594,496 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 20.36 | |

| Shares of beneficial interest outstanding | | | 17,600,318 | |

See Notes to Financial Statements.

| 18 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Statement of Operations |

| | | For the | |

| | | Year Ended | |

| | | April 30, 2023 | |

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 2,732,972 | |

| Foreign taxes withheld | | | (11,133 | ) |

| Interest | | | 3,000,349 | |

| Other Income | | | 33,000 | |

| Total investment income | | | 5,755,188 | |

| EXPENSES | | | | |

| Investment advisory fees (Note 6) | | | 2,684,534 | |

| Total expenses | | | 2,684,534 | |

| NET INVESTMENT INCOME | | | 3,070,654 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/LOSS ON INVESTMENTS | | | | |

| Net realized loss on investments | | | (1,397,790 | ) |

| Net change in unrealized appreciation on investments | | | 4,616,078 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 3,218,288 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 6,288,942 | |

See Notes to Financial Statements.

| Annual Report | April 30, 2023 | 19 |

| The Disciplined Growth Investors Fund | Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | April 30, 2023 | | | April 30, 2022 | |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 3,070,654 | | | $ | 1,128,119 | |

| Net realized gain/(loss) | | | (1,397,790 | ) | | | 18,922,462 | |

| Net change in unrealized appreciation/(depreciation) | | | 4,616,078 | | | | (64,699,237 | ) |

| Net increase/(decrease) in net assets resulting from operations | | | 6,288,942 | | | | (44,648,656 | ) |

| | | | | | | | | |

| DISTRIBUTIONS (Note 3) | | | | | | | | |

| From distributable earnings | | | (8,142,755 | ) | | | (36,801,592 | ) |

| Net decrease in net assets from distributions | | | (8,142,755 | ) | | | (36,801,592 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS (Note 5) | | | | | | | | |

| Proceeds from sales of shares | | | 29,649,276 | | | | 60,892,430 | |

| Issued to shareholders in reinvestment of distributions | | | 8,078,561 | | | | 36,008,172 | |

| Cost of shares redeemed | | | (22,079,671 | ) | | | (16,396,837 | ) |

| Net increase from capital share transactions | | | 15,648,166 | | | | 80,503,765 | |

| Net increase/(decrease) in net assets | | | 13,794,353 | | | | (946,483 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 344,503,274 | | | | 345,449,757 | |

| End of period | | $ | 358,297,627 | | | $ | 344,503,274 | |

| | | | | | | | | |

| OTHER INFORMATION | | | | | | | | |

| Share Transactions | | | | | | | | |

| Issued | | | 1,494,874 | | | | 2,611,650 | |

| Issued to shareholders in reinvestment of distributions | | | 412,883 | | | | 1,547,140 | |

| Redeemed | | | (1,100,819 | ) | | | (681,946 | ) |

| Net increase in share transactions | | | 806,938 | | | | 3,476,844 | |

See Notes to Financial Statements.

| 20 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

Intentionally Left Blank

The Disciplined Growth Investors Fund

| |

| NET ASSET VALUE, BEGINNING OF PERIOD |

| |

| INCOME FROM OPERATIONS |

| Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from investment operations |

| |

| DISTRIBUTIONS |

| From net investment income |

| From net realized gain on investments |

| Total distributions |

| |

| INCREASE/(DECREASE) IN NET ASSET VALUE |

| NET ASSET VALUE, END OF PERIOD |

| |

| TOTAL RETURN |

| |

| RATIOS AND SUPPLEMENTAL DATA |

| Net assets, end of period (000's) |

| |

| RATIOS TO AVERAGE NET ASSETS |

| Expenses |

| Net investment income |

| |

| PORTFOLIO TURNOVER RATE |

| (a) | Per share numbers have been calculated using the average shares method. |

See Notes to Financial Statements.

| 22 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

Financial Highlights

For a share outstanding during the years presented

| For the Year | | | For the Year | | | For the Year | | | For the Year | | | For the Year | |

| Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| April 30, 2023 | | | April 30, 2022 | | | April 30, 2021 | | | April 30, 2020 | | | April 30, 2019 | |

| $ | 20.51 | | | $ | 25.94 | | | $ | 19.42 | | �� | $ | 21.15 | | | $ | 19.12 | |

| | | | | | | | | | | | | | | | | | | |

| | 0.18 | | | | 0.08 | | | | 0.09 | | | | 0.18 | | | | 0.16 | |

| | 0.14 | | | | (2.84 | ) | | | 8.83 | | | | (1.14 | ) | | | 2.55 | |

| | 0.32 | | | | (2.76 | ) | | | 8.92 | | | | (0.96 | ) | | | 2.71 | |

| | | | | | | | | | | | | | | | | | | |

| | (0.17 | ) | | | (0.08 | ) | | | (0.10 | ) | | | (0.17 | ) | | | (0.12 | ) |

| | (0.30 | ) | | | (2.59 | ) | | | (2.30 | ) | | | (0.60 | ) | | | (0.56 | ) |

| | (0.47 | ) | | | (2.67 | ) | | | (2.40 | ) | | | (0.77 | ) | | | (0.68 | ) |

| | | | | | | | | | | | | | | | | | | |

| | (0.15 | ) | | | (5.43 | ) | | | 6.52 | | | | (1.73 | ) | | | 2.03 | |

| $ | 20.36 | | | $ | 20.51 | | | $ | 25.94 | | | $ | 19.42 | | | $ | 21.15 | |

| | | | | | | | | | | | | | | | | | | |

| | 1.67 | % | | | (11.86 | %) | | | 47.00 | % | | | (4.79 | %) | | | 14.74 | % |

| | | | | | | | | | | | | | | | | | | |

| $ | 358,298 | | | $ | 344,503 | | | $ | 345,450 | | | $ | 226,591 | | | $ | 240,172 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % | | | 0.78 | % |

| | 0.89 | % | | | 0.32 | % | | | 0.39 | % | | | 0.86 | % | | | 0.80 | % |

| | | | | | | | | | | | | | | | | | | |

| | 26 | % | | | 21 | % | | | 31 | % | | | 29 | % | | | 22 | % |

| Annual Report | April 30, 2023 | 23 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

1. ORGANIZATION

Financial Investors Trust (the “Trust”), a Delaware statutory trust, is an open-end management investment company registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust consists of multiple separate portfolios or series. This annual report describes The Disciplined Growth Investors Fund (the “Fund”). The Fund seeks long-term capital growth and as a secondary objective, modest income with reasonable risk.

2. SIGNIFICANT ACCOUNTING POLICIES

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the period. Actual results could differ from those estimates. The Fund is considered an investment company for financial reporting purposes under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The following is a summary of significant accounting policies consistently followed by the Fund in preparation of its financial statements.

Investment Valuation: The Fund generally values its securities based on market prices determined at the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, on each day the NYSE is open for trading.

For equity securities and mutual funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of equity securities not traded on an exchange, or if such closing prices are not otherwise available, the securities are valued at the mean of the most recent bid and ask prices on such day. Redeemable securities issued by open-end registered investment companies are valued at the investment company’s applicable net asset value, with the exception of exchange-traded open-end investment companies, which are priced as equity securities.

The market price for debt obligations is generally the price supplied by an independent third-party pricing service, which may use a matrix, formula or other objective method that takes into consideration quotations from dealers, market transactions in comparable investments, market indices and yield curves. If vendors are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more broker–dealers that make a market in the security. Fixed-income obligations, excluding municipal securities, having a remaining maturity of greater than 60 days, are typically valued at the mean between the evaluated bid and ask prices formulated by an independent pricing service. Corporate Bonds, U.S. Government & Agency, and U.S. Treasury Bonds & Notes are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information. Publicly traded Foreign Government Debt securities and Foreign Corporate Bonds are typically traded internationally in the over-the-counter market and are

| 24 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

valued at the mean between the bid and asked prices as of the close of business of that market. Mortgage-related and asset-backed securities are valued based on models that consider trade data, prepayment and default projections, benchmark yield and spread data and estimated cash flows of each tranche of the issuer. Publicly traded foreign government debt securities are typically traded internationally in the over-the-counter market and are valued at the mean between the bid and asked prices as of the close of business of that market.

When such prices or quotations are not available, or when Disciplined Growth Investors, Inc. (the “Adviser”) believes that they are unreliable, securities may be priced using fair value procedures established by the Adviser pursuant to Rule 2a-5 under the 1940 Act and approved by and subject to the oversight of the Board of Trustees of the Trust (the “Board” or the “Trustees”).

Pursuant to Rule 2a-5 under the Investment Company Act of 1940, the Board has appointed ALPS Advisors, Inc. ("AAI", or, the “Adviser”) to serve as the Valuation Designee to perform fair value determinations for investments in the Funds. When such prices or quotations are not available, or when the Valuation Designee believes that they are unreliable, securities may be priced using fair value procedures approved by the Board. The fair valuation policies and procedures (“FV Procedures”) have been adopted by the Board for the fair valuation of portfolio assets held by the Fund(s) in the event that (1) market quotations for the current price of a portfolio security or asset are not readily available, or (2) available market quotations that would otherwise be used to value a portfolio security or asset in accordance with the Fund’s Pricing Procedures appear to be unreliable. The Pricing Procedures reflect certain pricing methodologies (or “logics”) that are not “readily available market quotations” and thus are viewed and treated as fair valuations. The Valuation Designee routinely meets to discuss fair valuations of portfolio securities and other instruments held by the Fund(s).

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 | – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| | | |

| Level 2 | – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Annual Report | April 30, 2023 | 25 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

| Level 3 | – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of each input used to value the Fund as of April 30, 2023:

| Investments in Securities at Value | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 - Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Total | |

| Common Stocks(a) | | $ | 254,344,393 | | | $ | – | | | $ | – | | | $ | 254,344,393 | |

| Corporate Bonds(a) | | | – | | | | 85,362,308 | | | | – | | | | 85,362,308 | |

| Foreign Corporate Bonds(a) | | | – | | | | 6,563,020 | | | | – | | | | 6,563,020 | |

| Government & Agency Obligations | | | – | | | | 10,384,341 | | | | – | | | | 10,384,341 | |

| Short Term Investments | | | 985,491 | | | | – | | | | – | | | | 985,491 | |

| TOTAL | | $ | 255,329,884 | | | $ | 102,309,669 | | | $ | – | | | $ | 357,639,553 | |

| (a) | For detailed descriptions of the underlying industries, see the accompanying Portfolio of Investments. |

For the year ended April 30, 2023, the Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value. There were no transfers in/out of Level 3 securities during the year ended April 30, 2023.

Investment Transactions and Investment Income: Investment transactions are accounted for on the date the investments are purchased or sold (trade date). Realized gains and losses from investment transactions are reported on an identified cost basis, which is the same basis the Fund uses for federal income tax purposes. Interest income, which includes accretion of discounts, is accrued and recorded as earned. Dividend income is recognized on the ex-dividend date or for certain foreign securities, as soon as information is available to the Fund.

Trust Expenses: Some expenses of the Trust can be directly attributed to the Fund. Expenses which cannot be directly attributed to the Fund are apportioned among all funds in the Trust based on average net assets of each fund.

Fund Expenses: Expenses that are specific to the Fund are charged directly to the Fund.

Federal Income Taxes: The Fund complies with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and intends to distribute substantially all of their net taxable income and net capital gains, if any, each year so that it will not be subject to excise tax on undistributed income and gains. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the year ended April 30, 2023, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable

| 26 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

statute of limitations, which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Distributions to Shareholders: The Fund normally pays dividends, if any, quarterly and distributes capital gains, if any, on an annual basis. Income dividend distributions are derived from dividends and other income the Fund receives from its investments, including short term capital gains. Long term capital gain distributions are derived from gains realized when the Fund sells a security it has owned for more than a year. The Fund may make additional distributions and dividends at other times if the portfolio manager believes doing so may be necessary for the Fund to avoid or reduce taxes.

Additionally, certain Funds may operate in, or have dealings with, countries subject to sanctions or embargos imposed by the U.S. government, foreign governments, or the United Nations or other international organizations. In particular, on February 24, 2022, Russian troops began a fullscale invasion of Ukraine and, as of the date hereof, the countries remain in active armed conflict. Around the same time, the U.S., the U.K., the E.U., and several other nations announced a broad array of new or expanded sanctions, export controls, and other measures against Russia, Russian backed separatist regions in Ukraine, and certain banks, companies, government officials, and other individuals in Russia and Belarus, as well as a number of Russian Oligarchs. The U.S. or other countries could also institute broader sanctions on Russia and others supporting Russia’ economy or military efforts. The ongoing conflict and the rapidly evolving measures in response could be expected to have a negative impact on the economy and business activity globally (including in the countries in which the Funds invest), and therefore are expected to result in adverse consequences to the Russian economy and could have a material adverse effect on our portfolio companies and our business, financial condition, cash flows and results of operations. The severity and duration of the conflict and its impact on global economic and market conditions are impossible to predict, and as a result, present material uncertainty and risk with respect to the Funds and their portfolio companies and operations, and the ability of the Funds to achieve their investment objectives. Similar risks will exist to the extent that any portfolio companies, service providers, vendors or certain other parties have material operations or assets in Russia, Ukraine, Belarus, or the immediate surrounding areas. Sanctions could also result in Russia taking counter measures or retaliatory actions which could adversely impact the Funds or the business of the the Funds' investments, including, but not limited to, cyberattacks targeting private companies, individuals or other infrastructure upon which the Funds and the companies in which the Funds invest rely.

Libor Risk: In March 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (“ASU”) No. 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The Fund’s investments, payment obligations, and financing terms may be based on floating rates, such as the London Interbank Offered Rate, or “LIBOR,” which is the offered rate for short-term Eurodollar deposits between major international banks. On November 30, 2020, the administrator of LIBOR announced its intention to delay the phase out of the majority of the U.S. dollar LIBOR publications until June 30, 2023. The remainder of LIBOR publications ended at the end of 2021. There remains uncertainty regarding the nature of any replacement rate and the impact of the transition from LIBOR on the Fund’s transactions and the financial markets generally. As such, the potential effect of a transition away from LIBOR on the Fund or the Fund’s investments cannot yet be determined.

| Annual Report | April 30, 2023 | 27 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

3. TAX BASIS INFORMATION

Tax Basis of Investments: As of April 30, 2023, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized appreciation for Federal tax purposes was as follows:

| | | The Disciplined

Growth Investors

Fund | |

| Gross appreciation | | | | |

| (excess of value over tax cost) | | $ | 80,244,136 | |

| Gross depreciation | | | | |

| (excess of tax cost over value) | | | (32,199,080 | ) |

| Net unrealized appreciation | | $ | 48,045,056 | |

| Cost of investments for income tax purposes | | $ | 309,594,496 | |

Components of Earnings: As of April 30, 2023, components of distributable earnings were as follows:

| Undistributed ordinary income | | $ | 195,405 | |

| Accumulated Capital losses | | | (1,454,538 | ) |

| Net unrealized appreciation on investments | | | 48,045,056 | |

| Other cumulative effect of timing differences | | | (46,113 | ) |

| Total | | $ | 46,739,810 | |

Tax Basis of Distributions to Shareholders: The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of distributions paid during the year ended April 30, 2023, were as follows:

| | | Ordinary Income | | | Long-Term Capital

Gain | |

| The Disciplined Growth Investors Fund | | $ | 2,946,749 | | | $ | 5,196,006 | |

The tax character of distributions paid during the year ended April 30, 2022, were as follows:

| | | Ordinary Income | | | Long-Term Capital

Gain | |

| The Disciplined Growth Investors Fund | | $ | 2,946,749 | | | $ | 5,196,006 | |

| 28 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

Under current law, capital losses maintain their character as short-term or long-term and are carried forward to the next year without expiration. As of April 30, 2023, the Fund elects to carry forward $84,169 in short-term capital losses to the next tax year. The fund elects to defer to the period ending April 30, 2024, capital losses recognized during the period 11/1/22 – 4/30/23 in the amount of $1,370,369.

4. SECURITIES TRANSACTIONS

The cost of purchases and proceeds from sales of securities (excluding short-term securities and U.S. Government Obligations) during the year ended April 30, 2023, were as follows:

| Fund | | Purchases of

Securities | | | Proceeds From Sales of

Securities | |

| The Disciplined Growth Investors Fund | | $ | 77,207,648 | | | $ | 53,706,359 | |

Investment transactions in U.S. Government Obligations during the year ended April 30, 2023 were as follows:

| Fund | | Purchases of

Securities | | | Proceeds From Sales of

Securities | |

| The Disciplined Growth Investors Fund | | $ | 12,985,346 | | | $ | 32,302,323 | |

The cost of purchases in kind, proceeds from sales in kind along with their realized gain/(loss) included in above transactions during the year ended April 30, 2023 were as follows:

| Fund | | Purchases | | | Proceeds | | | Net Realized

Gain/(Loss) | |

| Disciplined Growth Investors Fund | | $ | 7,683,258 | | | $ | – | | | $ | – | |

5. SHARES OF BENEFICIAL INTEREST

The capitalization of the Trust consists of an unlimited number of shares of beneficial interest with no par value per share. Holders of the shares of the Fund of the Trust have one vote for each share held and a proportionate fraction of a vote for each fractional share. All shares issued and outstanding are fully paid and are transferable and redeemable at the option of the shareholder. Purchasers of the shares do not have any obligation to make payments to the Trust or its creditors (other than the purchase price for the shares or make contributions to the Trust or its creditors solely by reason of the purchasers’ ownership of the shares. Shares have no pre-emptive rights.

6. MANAGEMENT AND RELATED-PARTY TRANSACTIONS

The Adviser, subject to the authority of the Board, is responsible for the overall management and administration of the Fund’s business affairs. The Adviser manages the investments of the Fund in accordance with the Fund’s investment objective, policies and limitations and investment guidelines established jointly by the Adviser and the Trustees. Pursuant to the Advisory Agreement, the Fund

| Annual Report | April 30, 2023 | 29 |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

pays the Adviser a unitary management fee for the services and facilities it provides payable on a monthly basis at the annual rate of 0.78% of the Fund’s average daily net assets. The management fee is paid on a monthly basis.

Out of the unitary management fee, the Adviser pays substantially all expenses of the Fund, including the cost of transfer agency, custody, fund administration, bookkeeping and pricing services, legal, audit and other services, except for interest expenses, brokerage expenses, taxes and extraordinary expenses not incurred in the ordinary course of the Fund’s business. Also included are Trustee fees which were $23,712 for the year ended April 30, 2023.

Fund Administrator Fees and Expenses

ALPS Fund Services, Inc. (“ALPS”) serves as administrator to the Fund. Pursuant to an Administration Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assists in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. The Administrator is also reimbursed for certain out-of-pocket expenses. The administrative fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Fund. ALPS receives an annual minimum fee, a fee based upon the number of shareholder accounts, and is also reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Compliance Services

ALPS provides services that assist the Trust’s chief compliance officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a-1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out-of-pocket expenses. The fee and out-of-pocket expenses are included in the unitary management fee paid to the Adviser.

Principal Financial Officer

ALPS receives an annual fee for providing principal financial officer services to the Fund. The fee is included in the unitary management fee paid to the Adviser.

Distributor

ALPS Distributors, Inc. (“ADI” or the “Distributor”) (an affiliate of ALPS) acts as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust. Shares are sold on a continuous basis by ADI as agent for the Fund, and ADI has agreed to use its best efforts to solicit orders for the sale of the Fund’s shares, although it is not obliged to sell any particular amount of shares. ADI is not entitled to any compensation for its services as Distributor. ADI is registered as a broker-dealer with the Securities and Exchange Commission.

Trustees

The fees and expenses of the Trustees of the Board are presented in the Statements of Operations

| 30 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |

| The Disciplined Growth Investors Fund | Notes to Financial Statements |

April 30, 2023

7. INDEMNIFICATIONS

Under the Trust’s organizational documents, its officers and Trustees are indemnified against certain liability arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that may contain general indemnification clauses, which may permit indemnification to the extent permissible under applicable law. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

| Annual Report | April 30, 2023 | 31 |

| | Report of Independent Registered |

| The Disciplined Growth Investors Fund | Public Accounting Firm |

To the shareholders and the Board of Trustees of Financial Investors Trust

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of The Disciplined Growth Investors Fund (the “Fund”), one of the funds constituting the Financial Investors Trust, including the portfolio of investments, as of April 30, 2023, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of The Disciplined Growth Investors Fund of Financial Investors Trust as of April 30, 2023, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. Our procedures included confirmation of securities owned as of April 30, 2023, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

DELOITTE & TOUCHE LLP

Denver, Colorado

June 29, 2023

We have served as the auditor of one or more investment companies advised by Disciplined Growth Investors, Inc. since 2012.

| 32 | 1-855-DGI-FUND (344-3863) | www.DGIfund.com |