UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08188

ALLIANCEBERNSTEIN HIGH INCOME FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: October 31, 2011

Date of reporting period: October 31, 2011

ITEM 1. REPORTS TO STOCKHOLDERS.

ANNUAL REPORT

AllianceBernstein

High Income Fund

Annual Report

Investment Products Offered

| | • | | Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.alliancebernstein.com or contact your AllianceBernstein Investments representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AllianceBernstein’s website at www.alliancebernstein.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AllianceBernstein at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AllianceBernstein publishes full portfolio holdings for the Fund monthly at www.alliancebernstein.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AllianceBernstein family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the manager of the funds.

AllianceBernstein® and the AB Logo are registered trademarks and service marks used by permission of the owner, AllianceBernstein L.P.

December 19, 2011

Annual Report

This report provides management’s discussion of fund performance for AllianceBernstein High Income Fund (the “Fund”) for the annual reporting period ended October 31, 2011.

Investment Objectives and Policies

The Fund’s investment objective is to seek to maximize total returns from price appreciation and income.

The Fund pursues income opportunities from government, corporate, emerging market and high yield sources. It has the flexibility to invest in a broad range of fixed income securities in both developed and emerging market countries. The Fund’s investments may include U.S. and non-U.S. corporate debt securities and sovereign debt securities. The Fund may invest, without limitation, in either U.S. dollar-denominated or non-U.S. dollar-denominated fixed income securities.

The Fund may invest in debt securities with a range of maturities from short- to long-term. Substantially all of the Fund’s assets may be invested in lower-rated securities, which may include securities having the lowest rating for non-subordinated debt instruments (i.e., rated C by Moody’s Investors Service or CCC+ or lower by Standard & Poor’s Rating Service and Fitch Ratings, Ltd.) and unrated securities of equivalent investment quality. The Fund also may invest in investment-grade securities and unrated securities. The Fund may also make short sales of securities or maintain a short position. The Fund is non-diversified, meaning it may invest more of its assets in a fewer number of issuers.

The Fund may invest in mortgage-related and other asset-backed securities, loan participations, inflation-protected securities, structured securities, variable, floating, and inverse floating rate instruments and preferred stock, and may use other investment techniques. The Fund may use borrowings or other leverage for investment purposes. The Fund intends, among other things, to enter into transactions such as reverse repurchase agreements and dollar rolls. The Fund may invest, without limit, in derivatives, such as options, futures, forwards, or swap agreements.

Investment Results

The table on page 6 shows the Fund’s performance compared with its composite benchmark, which is composed of equal weightings of the J.P. Morgan Emerging Markets Bond Index Global (“JPM EMBI Global”), the J.P. Morgan Government Bond Index-Emerging Markets (“JPM GBI-EM”) (local-currency-denominated) and the Barclays Capital (“BC”) U.S. Corporate High Yield (“HY”) 2% Issuer Capped Index for the six- and 12-month periods ended October 31, 2011. Individual performance for each of these indices is also included for both time periods. The Fund is also compared to its broad-based benchmark, the JPM EMBI Global, which tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities.

The Fund’s Class A shares outperformed the composite benchmark for the 12-month period and declined and underperformed for the six-month

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 1 | |

period, before sales charges. The Fund’s significant overweight to U.S. corporate high yield securities contributed positively for the 12-month period, as these securities outperformed. The Fund’s corporate high yield industry allocation, specifically an overweight to subordinated financials (banks and insurance) within the capital structure, detracted for both periods.

The Fund’s underweight to U.S. dollar-denominated emerging market debt, which outperformed the composite benchmark for both periods, detracted. The Fund’s underweight to local emerging market debt (which performed poorly) contributed positively during both periods.

The Fund’s use of leverage was a positive contributor for both periods. The Fund utilized leverage through repurchase agreements at favorable rates and was able to reinvest the proceeds into higher-yielding securities. Within the Fund’s derivative positions, credit default swap (“CDS”) index and CDS credit derivative exposure was a slight detractor for both periods. The Fund also utilized interest rate swaps to manage overall duration and interest rate risk within the Fund. These positions had no material impact on performance.

Market Review and Investment Strategy

The global economic recovery that was underway slowed early in the year, resulting from a myriad of global events. Social unrest in North Africa and the Middle East, supply disruptions from the natural disaster in

Japan and a spike in commodity prices, particularly oil, all provided headwinds for the global economy early in the year. During the six-month period ended October 31, 2011, renewed fears of a double-dip recession roiled the global capital markets, driving up risk aversion, sending equities sharply lower and widening credit spreads. Fiscal challenges—ranging from the contentious debate over the U.S. debt ceiling to the ongoing sovereign debt woes of Greece and the peripheral European nations—were at the forefront of investors’ worries. The mounting fear and uncertainty led to a spike in financial market volatility.

U.S. fixed income securities generally posted positive returns for the annual period, led by U.S. high yield corporates, as measured by the BC U.S. Corporate HY 2% Issuer Capped Index. By industry, energy, utilities and technology outperformed while basics, communications, transportation and financials underperformed. Financials were dragged down by both banks and insurance, which underperformed for the year. U.S. high yield spreads widened 93 basis points to end the period at 670 basis points over duration-matched Treasuries. The yield on the index rose to 8.23%.

U.S. dollar-denominated emerging market debt posted positive returns for the annual period, as measured by the JPM EMBI Global, with Latin countries outperforming non-Latin countries. The Ivory Coast, which faced political issues, underperformed, as did Belize, Argentina and Belarus.

| | |

| 2 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Outperforming countries for the year included Venezuela and Ecuador. During the period, U.S. dollar-denominated emerging market debt spreads widened 109 basis points to end the annual period at 392 basis points over duration-matched Treasuries. Local currency emerging market bonds fell -2.53% in U.S. dollar unhedged terms, as measured by the JPM GBI-EMI, with much of the loss in the local index stemming from weaker emerging market country currencies. In local currency terms, Brazil outperformed for the year with Turkey underperforming.

The Fund continued to overweight corporate high yield and underweight emerging market debt. The Fund’s

Global Fixed Income Investment Team and the Global Credit Investment Team (collectively, the “Team”) continue to believe that corporate high yield bonds present the best risk/return opportunity in the global high-yield space, and find current risk premiums attractive given non-financial corporation cash positions, balance sheets and reduced medium-term refinancing needs of borrowers. However, continued uncertainty around global growth, particularly risks emanating from Europe, leaves tail risk magnified and volatility elevated. Within this environment, the Team has reduced risk, and will continue to monitor and adjust positions as necessary to balance exposures with market conditions and developments.

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 3 | |

HISTORICAL PERFORMANCE

An Important Note About Historical Performance

The investment return and principal value of an investment in the Fund will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown on the following pages represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.alliancebernstein.com.

All fees and expenses related to the operation of the Fund have been deducted. NAV returns do not reflect sales charges; if sales charges were reflected, the Fund’s quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 4.25% maximum front-end sales charge for Class A shares; the applicable contingent deferred sales charge for Class B shares (3% year 1, 2% year 2, 1% year 3); a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

Benchmark Disclosure

The unmanaged JPM® EMBI Global, the JPM® GBI-EM and the BC U.S. Corporate HY 2% Issuer Capped Index do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The unmanaged JPM EMBI Global (market-capitalization weighted) represents the performance of U.S. dollar-denominated Brady bonds, Eurobonds, and trade loans issued by sovereign and quasi-sovereign entities. The JPM GBI-EM represents the performance of local currency government bonds issued by emerging markets. The BC U.S. Corporate HY 2% Issuer Capped Index is the 2% Issuer Capped component of the U.S. Corporate HY Index. The BC U.S. Corporate HY Index represents the performance of fixed income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 and at least 1 year to maturity. An investor cannot invest directly in an index or average, and their results are not indicative of the performance for any specific investment, including the Fund.

A Word About Risk

Derivatives Risk: Investing in derivative instruments such as options, futures, forwards or swaps can be riskier than traditional investments, and may be more volatile, especially in a down market. Non-U.S. securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets.

Leverage Risk: Trying to enhance investment returns by borrowing money or using other leverage tools—magnify both gains and losses, resulting in greater volatility.

Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments.

Foreign (Non-U.S.) Risk: Non-U.S. securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets.

(Historical Performance continued on next page)

| | |

| 4 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered and the bond’s value may decline.

Interest Rate Risk (with Prepayment Risk): As interest rates rise, bond prices fall and vice versa—long-term securities tend to rise and fall more than short-term securities. The values of mortgage-related and asset-backed securities are particularly sensitive to changes in interest rates due to prepayment risk.

Below Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

Diversification/Focused Portfolio Risk: Portfolios that hold a smaller number of securities may be more volatile than more diversified portfolios, since gains or losses from each security will have a greater impact on the portfolio’s overall value.

These risks are fully discussed in the Fund’s prospectus.

(Historical Performance continued on next page)

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 5 | |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | |

| | | | | | | | | | |

THE FUND VS. ITS BENCHMARK

PERIODS ENDED OCTOBER 31, 2011 | | NAV Returns | | | |

| | 6 Months | | | 12 Months | | | |

AllianceBernstein High Income Fund† | | | | | | | | | | |

Class A | | | -2.51% | | | | 2.48% | | | |

|

Class B* | | | -2.93% | | | | 1.75% | | | |

|

Class C | | | -2.93% | | | | 1.73% | | | |

|

Advisor Class** | | | -2.36% | | | | 2.79% | | | |

|

Class R** | | | -2.59% | | | | 2.29% | | | |

|

Class K** | | | -2.46% | | | | 2.55% | | | |

|

Class I** | | | -2.33% | | | | 2.81% | | | |

|

Composite Benchmark: 33% JPM EMBI Global/33% JPM GBI-EM/33% BC US Corporate HY 2% Issuer Capped Index | | | -1.15% | | | | 2.34% | | | |

|

JPM EMBI Global | | | 5.28% | | | | 4.05% | | | |

|

JPM GBI-EM | | | -7.68% | | | | -2.53% | | | |

|

BC US Corporate HY 2% Issuer Capped Index | | | -0.95% | | | | 5.16% | | | |

|

† Includes the impact of proceeds received and credited to the Fund resulting from class action settlements, which enhanced the Fund’s performance for the six- and 12-month periods ended October 31, 2011, by 0.01% and 0.03%, respectively, for all share classes. * Effective January 31, 2009, Class B shares are no longer available for sale to new investors. Please see Note A for additional information. ** Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Funds. |

| | | | | | | | | | |

See Historical Performance and Benchmark disclosures on pages 4-5.

(Historical Performance continued on next page)

| | |

| 6 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

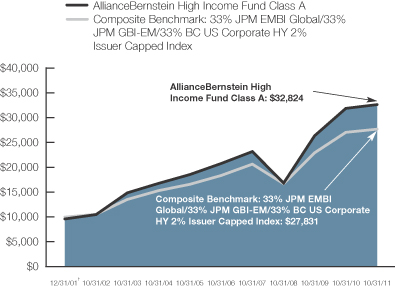

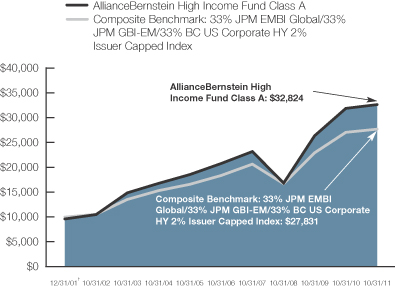

GROWTH OF A $10,000 INVESTMENT IN THE FUND 12/31/01† TO 10/31/11

| † | | Prior to 12/31/01, data was not available for the JPM GBI-EM. |

This chart illustrates the total value of an assumed $10,000 investment in AllianceBernstein High Income Fund Class A shares (from 12/31/01† to 10/31/11) as compared to the performance of the Fund’s composite benchmark. The chart reflects the deduction of the maximum 4.25% sales charge from the initial $10,000 investment in the Fund and assumes the reinvestment of dividends and capital gains distributions.

See Historical Performance and Benchmark disclosures on pages 4-5.

(Historical Performance continued on next page)

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 7 | |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF OCTOBER 31, 2011 | |

| | | NAV Returns | | | SEC Returns | | | SEC Yields* | |

| | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | | |

1 Year | | | 2.48 | % | | | -1.90 | % | | | 7.67 | % |

5 Years | | | 9.5 | % | | | 8.55 | % | | | | |

10 Years | | | 14.11 | % | | | 13.61 | % | | | | |

| | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | | |

1 Year | | | 1.75 | % | | | -1.10 | % | | | 7.26 | % |

5 Years | | | 8.63 | % | | | 8.63 | % | | | | |

10 Years(a) | | | 13.56 | % | | | 13.56 | % | | | | |

| | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | | |

1 Year | | | 1.73 | % | | | 0.78 | % | | | 7.29 | % |

5 Years | | | 8.62 | % | | | 8.62 | % | | | | |

10 Years | | | 13.21 | % | | | 13.21 | % | | | | |

| | | | | | | | | | | | |

| Advisor Class Shares‡ | | | | | | | | | | | | |

1 Year | | | 2.79 | % | | | 2.79 | % | | | 8.31 | % |

Since Inception† | | | 10.15 | % | | | 10.15 | % | | | | |

| | | | | | | | | | | | |

| Class R Shares‡ | | | | | | | | | | | | |

1 Year | | | 2.29 | % | | | 2.29 | % | | | 7.79 | % |

Since Inception† | | | 9.59 | % | | | 9.59 | % | | | | |

| | | | | | | | | | | | |

| Class K Shares‡ | | | | | | | | | | | | |

1 Year | | | 2.55 | % | | | 2.55 | % | | | 8.10 | % |

Since Inception† | | | 9.88 | % | | | 9.88 | % | | | | |

| | | | | | | | | | | | |

| Class I Shares‡ | | | | | | | | | | | | |

1 Year | | | 2.81 | % | | | 2.81 | % | | | 8.25 | % |

Since Inception† | | | 10.17 | % | | | 10.17 | % | | | | |

The Fund’s current prospectus fee table shows the Fund’s total annual operating expense ratios as 1.04%, 1.78%, 1.73%, 0.73%, 1.37%, 1.08% and 0.72% for Class A, Class B, Class C, Advisor Class, Class R, Class K and Class I shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Fund’s annual operating expense ratios (exclusive of interest expense) to 0.95%, 1.65%, 1.65%, 0.65%, 1.15%, 0.90% and 0.65% for Class A, Class B, Class C, Advisor Class, Class R, Class K and Class I shares, respectively. These waivers/reimbursements expire on January 31, 2012. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights sections since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended October 31, 2011. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

| † | | Inception date: 1/28/08. |

| ‡ | | These share classes are offered at net asset value (NAV) to eligible investors and their SEC returns are the same as the NAV returns. Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of and certain other persons associated with, the Adviser and its affiliates or the Funds. The inception date for these share classes is listed above. |

See Historical Performance disclosures on pages 4-5.

(Historical Performance continued on next page)

| | |

| 8 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | |

SEC AVERAGE ANNUAL RETURNS (WITH ANY APPLICABLE SALES CHARGES) AS OF THE MOST RECENT CALENDAR QUARTER-END (SEPTEMBER 30, 2011) | |

| | | SEC Returns | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -4.82 | % |

5 Years | | | 7.85 | % |

10 Years | | | 13.02 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -4.16 | % |

5 Years | | | 7.92 | % |

10 Years(a) | | | 12.97 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -2.33 | % |

5 Years | | | 7.89 | % |

10 Years | | | 12.60 | % |

| | | | |

| Advisor Class Shares‡ | | | | |

1 Year | | | -0.29 | % |

Since Inception† | | | 8.77 | % |

| | | | |

| Class R Shares‡ | | | | |

1 Year | | | -0.80 | % |

Since Inception† | | | 8.22 | % |

| | | | |

| Class K Shares‡ | | | | |

1 Year | | | -0.54 | % |

Since Inception† | | | 8.50 | % |

| | | | |

| Class I Shares‡ | | | | |

1 Year | | | -0.28 | % |

Since Inception† | | | 8.79 | % |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

| † | | Inception date: 1/28/08. |

| ‡ | | Please note that these share classes are for investors purchasing shares through accounts established under certain fee-based programs sponsored and maintained by certain broker-dealers and financial intermediaries, institutional pension plans and/or investment advisory clients of, and certain other persons associated with, the Adviser and its affiliates or the Funds. The inception date for these share classes is listed above. |

See Historical Performance disclosures on pages 4-5.

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 9 | |

Historical Performance

FUND EXPENSES

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

May 1, 2011 | | | Ending

Account Value

October 31, 2011 | | | Expenses Paid

During Period* | |

| | | Actual | | | Hypothetical | | | Actual | | | Hypothetical** | | | Actual | | | Hypothetical | |

| Class A | | $ | 1,000 | | | $ | 1,000 | | | $ | 974.90 | | | $ | 1,020.21 | | | $ | 4.93 | | | $ | 5.04 | |

| Class B | | $ | 1,000 | | | $ | 1,000 | | | $ | 970.70 | | | $ | 1,016.89 | | | $ | 8.20 | | | $ | 8.39 | |

| Class C | | $ | 1,000 | | | $ | 1,000 | | | $ | 970.70 | | | $ | 1,016.69 | | | $ | 8.39 | | | $ | 8.59 | |

| Advisor Class | | $ | 1,000 | | | $ | 1,000 | | | $ | 976.40 | | | $ | 1,021.78 | | | $ | 3.39 | | | $ | 3.47 | |

| Class R | | $ | 1,000 | | | $ | 1,000 | | | $ | 974.10 | | | $ | 1,019.41 | | | $ | 5.72 | | | $ | 5.85 | |

| Class K | | $ | 1,000 | | | $ | 1,000 | | | $ | 975.40 | | | $ | 1,020.67 | | | $ | 4.48 | | | $ | 4.58 | |

| Class I | | $ | 1,000 | | | $ | 1,000 | | | $ | 976.70 | | | $ | 1,022.13 | | | $ | 3.04 | | | $ | 3.11 | |

| * | | Expenses are equal to the classes’ annualized expense ratios of 0.99%, 1.65%, 1.69%, 0.68%, 1.15%, 0.90% and 0.61%, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| ** | | Assumes 5% return before expenses. |

| | |

| 10 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Fund Expenses

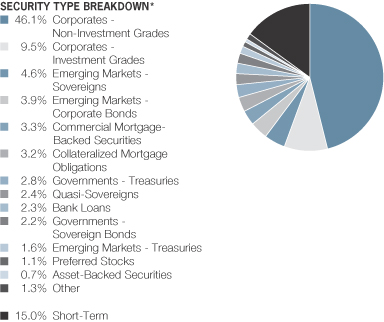

PORTFOLIO SUMMARY

October 31, 2011 (unaudited)

PORTFOLIO STATISTICS

Net Assets ($mil): $3,202.6

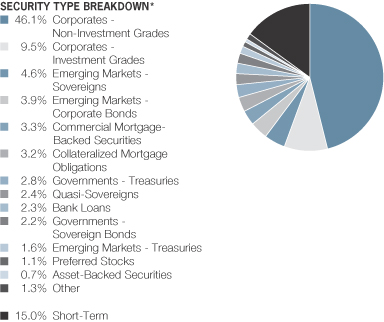

| * | | All data are as of October 31, 2011. The Fund’s security type breakdowns are expressed as a percentage of total investments and may vary over time. The Fund may also enter into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” securities type weightings represents 0.5% or less in the following security types: Common Stocks, Governments—Sovereign Agencies, Inflation-Linked Securities, Local Governments—Municipal Bonds, Local Governments—Regional Bonds, Options Purchased—Puts, Supranationals and Warrants. |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 11 | |

Portfolio Summary

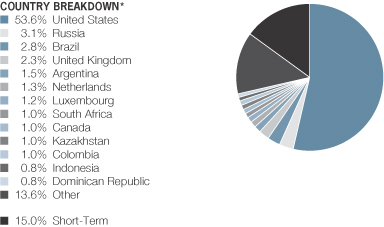

PORTFOLIO SUMMARY

October 31, 2011 (unaudited)

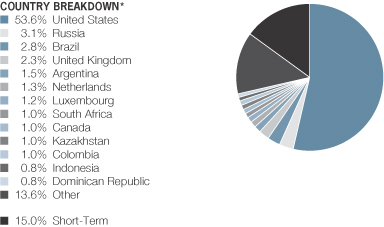

| * | | All data are as of October 31, 2011. The Fund’s country breakdowns are expressed as a percentage of total investments and may vary over time. The Fund may also enter into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). “Other” country weightings represent 0.8% or less in the following countries: Australia, Austria, Barbados, Belgium, Bermuda, Cayman Islands, Chile, China, Cote D’Ivoire, Croatia, Czech Republic, Denmark, Egypt, El Salvador, Euro Zone, France, Gabon, Germany, Ghana, Hong Kong, Hungary, Iceland, India, Ireland, Israel, Italy, Jamaica, Japan, Lithuania, New Zealand, Norway, Panama, Peru, Philippines, Poland, Serbia & Montenegro, Singapore, Spain, Supranational, Sweden, Switzerland, Trinidad & Tobago, Turkey, Ukraine, United Arab Emirates, Uruguay and Venezuela. |

| | |

| 12 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio Summary

PORTFOLIO OF INVESTMENTS

October 31, 2011

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

CORPORATES - NON-INVESTMENT GRADES – 47.3% | | | | | | | | | | |

Industrial – 41.0% | | | | | | | | | | |

Basic – 3.8% | | | | | | | | | | |

AK Steel Corp.

7.625%, 5/15/20(a) | | U.S.$ | | | 3,564 | | | $ | 3,332,340 | |

Aleris International, Inc.

7.625%, 2/15/18 | | | | | 6,500 | | | | 6,256,250 | |

Appleton Papers, Inc.

10.50%, 6/15/15(b) | | | | | 2,150 | | | | 2,150,000 | |

Arch Coal, Inc.

7.00%, 6/15/19(b) | | | | | 1,500 | | | | 1,552,500 | |

7.25%, 6/15/21(b) | | | | | 2,502 | | | | 2,577,060 | |

8.75%, 8/01/16 | | | | | 1,675 | | | | 1,829,937 | |

Arch Western Finance LLC

6.75%, 7/01/13 | | | | | 304 | | | | 307,040 | |

Boise Paper Holdings LLC/Boise Finance Co.

9.00%, 11/01/17 | | | | | 2,410 | | | | 2,578,700 | |

Calcipar SA

6.875%, 5/01/18(b) | | | | | 1,301 | | | | 1,209,930 | |

Celanese US Holdings LLC

6.625%, 10/15/18 | | | | | 644 | | | | 695,520 | |

CF Industries, Inc.

6.875%, 5/01/18 | | | | | 1,100 | | | | 1,254,000 | |

7.125%, 5/01/20 | | | | | 1,100 | | | | 1,280,125 | |

Consol Energy, Inc.

8.00%, 4/01/17 | | | | | 2,000 | | | | 2,190,000 | |

8.25%, 4/01/20 | | | | | 3,000 | | | | 3,285,000 | |

Graphic Packaging International, Inc.

7.875%, 10/01/18 | | | | | 2,000 | | | | 2,140,000 | |

9.50%, 6/15/17 | | | | | 480 | | | | 524,400 | |

Hexion US Finance Corp./Hexion Nova Scotia Finance ULC

4.786%, 11/15/14(c) | | | | | 1,390 | | | | 1,184,975 | |

Huntsman International LLC

8.625%, 3/15/21 | | | | | 3,900 | | | | 4,007,250 | |

Ineos Group Holdings Ltd.

8.50%, 2/15/16(b) | | | | | 9,341 | | | | 7,893,145 | |

James River Coal Co.

7.875%, 4/01/19 | | | | | 600 | | | | 510,000 | |

JMC Steel Group

8.25%, 3/15/18(b) | | | | | 1,620 | | | | 1,603,800 | |

Kerling PLC

10.625%, 2/01/17(b) | | EUR | | | 4,082 | | | | 5,252,885 | |

Kinove German Bondco GmbH

9.625%, 6/15/18(b) | | U.S.$ | | | 2,426 | | | | 2,341,090 | |

Lyondell Chemical Co.

8.00%, 11/01/17 | | | | | 566 | | | | 636,750 | |

11.00%, 5/01/18 | | | | | 2,500 | | | | 2,784,375 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 13 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

MacDermid, Inc.

9.50%, 4/15/17(b) | | U.S.$ | | | 3,315 | | | $ | 3,149,250 | |

Momentive Performance Materials, Inc.

11.50%, 12/01/16 | | | | | 1,300 | | | | 1,092,000 | |

NewMarket Corp.

7.125%, 12/15/16 | | | | | 1,074 | | | | 1,106,220 | |

NewPage Corp.

10.00%, 5/01/12(a)(d) | | | | | 1,120 | | | | 128,800 | |

11.375%, 12/31/14(d) | | | | | 1,400 | | | | 1,046,500 | |

Norske Skogindustrier ASA

7.00%, 6/26/17 | | EUR | | | 1,720 | | | | 928,186 | |

Nova Chemicals Corp.

8.625%, 11/01/19 | | U.S.$ | | | 2,383 | | | | 2,680,875 | |

Omnova Solutions, Inc.

7.875%, 11/01/18 | | | | | 5,538 | | | | 4,776,525 | |

Peabody Energy Corp.

7.875%, 11/01/26 | | | | | 50 | | | | 55,125 | |

Polymer Group, Inc.

7.75%, 2/01/19(b) | | | | | 7,300 | | | | 7,573,750 | |

Polypore International, Inc.

7.50%, 11/15/17 | | | | | 1,635 | | | | 1,667,700 | |

Rain CII Carbon LLC/CII Carbon Corp.

8.00%, 12/01/18(b) | | | | | 2,500 | | | | 2,487,500 | |

Smurfit Kappa Acquisitions

7.75%, 11/15/19(b) | | EUR | | | 3,440 | | | | 4,902,726 | |

Solutia, Inc.

7.875%, 3/15/20 | | U.S.$ | | | 2,115 | | | | 2,263,050 | |

Steel Dynamics, Inc.

6.75%, 4/01/15 | | | | | 675 | | | | 686,812 | |

7.625%, 3/15/20 | | | | | 2,500 | | | | 2,650,000 | |

7.75%, 4/15/16 | | | | | 1,910 | | | | 2,010,275 | |

TPC Group LLC

8.25%, 10/01/17 | | | | | 5,374 | | | | 5,441,175 | |

Tube City IMS Corp.

9.75%, 2/01/15 | | | | | 2,000 | | | | 1,990,000 | |

United States Steel Corp.

6.65%, 6/01/37 | | | | | 4,900 | | | | 3,675,000 | |

7.375%, 4/01/20(a) | | | | | 1,000 | | | | 940,000 | |

Verso Paper Holdings LLC/Verso Paper, Inc.

8.75%, 2/01/19 | | | | | 2,250 | | | | 1,620,000 | |

Series B

11.375%, 8/01/16(a) | | | | | 2,215 | | | | 1,639,100 | |

Westvaco Corp.

8.20%, 1/15/30 | | | | | 2,940 | | | | 3,241,153 | |

Weyerhaeuser Co.

7.375%, 3/15/32 | | | | | 3,308 | | | | 3,305,496 | |

8.50%, 1/15/25 | | | | | 1,000 | | | | 1,120,789 | |

| | | | | | | | | | |

| | | | | | | | | 121,555,079 | |

| | | | | | | | | | |

| | |

| 14 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Capital Goods – 4.8% | | | | | | | | | | |

Alion Science and Technology Corp.

12.00%, 11/01/14(e) | | U.S.$ | | | 1,083 | | | $ | 996,198 | |

Alliant Techsystems, Inc.

6.875%, 9/15/20 | | | | | 2,120 | | | | 2,178,300 | |

Ardagh Glass Finance PLC

8.75%, 2/01/20(b) | | EUR | | | 2,144 | | | | 2,714,487 | |

Ardagh Packaging Finance PLC

7.375%, 10/15/17(b) | | U.S.$ | | | 350 | | | | 360,500 | |

9.25%, 10/15/20(a)(b) | | EUR | | | 1,198 | | | | 1,558,212 | |

BE Aerospace, Inc.

6.875%, 10/01/20 | | U.S.$ | | | 2,480 | | | | 2,672,200 | |

Berry Plastics Corp.

9.75%, 1/15/21 | | | | | 5,000 | | | | 5,000,000 | |

10.25%, 3/01/16 | | | | | 302 | | | | 295,960 | |

Bombardier, Inc.

7.75%, 3/15/20(b) | | | | | 2,558 | | | | 2,813,800 | |

Building Materials Corp. of America

6.875%, 8/15/18(b) | | | | | 1,540 | | | | 1,601,600 | |

7.00%, 2/15/20(b) | | | | | 985 | | | | 1,044,100 | |

7.50%, 3/15/20(b) | | | | | 1,898 | | | | 2,021,370 | |

Case New Holland, Inc.

7.875%, 12/01/17 | | | | | 2,558 | | | | 2,884,145 | |

Clondalkin Industries BV

8.00%, 3/15/14(b) | | EUR | | | 3,449 | | | | 3,817,905 | |

CNH America LLC

7.25%, 1/15/16 | | U.S.$ | | | 997 | | | | 1,071,775 | |

Crown European Holdings SA

7.125%, 8/15/18(b) | | EUR | | | 1,295 | | | | 1,845,648 | |

Griffon Corp.

7.125%, 4/01/18 | | U.S.$ | | | 1,604 | | | | 1,527,810 | |

Grohe Holding GmbH

8.625%, 10/01/14(a)(b) | | EUR | | | 3,505 | | | | 4,534,627 | |

HeidelbergCement Finance BV

8.50%, 10/31/19 | | | | | 2,420 | | | | 3,574,581 | |

Huntington Ingalls Industries, Inc.

6.875%, 3/15/18(b) | | U.S.$ | | | 1,511 | | | | 1,522,333 | |

7.125%, 3/15/21(b) | | | | | 1,493 | | | | 1,511,663 | |

KUKA AG

8.75%, 11/15/17(b) | | EUR | | | 2,358 | | | | 3,262,837 | |

Lafarge SA

7.125%, 7/15/36 | | U.S.$ | | | 2,640 | | | | 2,308,268 | |

Manitowoc Co., Inc. (The)

8.50%, 11/01/20 | | | | | 5,474 | | | | 5,692,960 | |

9.50%, 2/15/18 | | | | | 216 | | | | 231,120 | |

Masco Corp.

6.125%, 10/03/16 | | | | | 2,315 | | | | 2,335,078 | |

Nordenia Holdings AG

9.75%, 7/15/17 | | EUR | | | 1,652 | | | | 2,188,723 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 15 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Nortek, Inc.

8.50%, 4/15/21(b) | | U.S.$ | | | 7,538 | | | $ | 6,689,975 | |

Obrascon Huarte Lain SA

7.375%, 4/28/15 | | EUR | | | 2,550 | | | | 3,528,435 | |

OI European Group BV

6.75%, 9/15/20(b) | | | | | 1,500 | | | | 2,054,794 | |

6.875%, 3/31/17(b) | | | | | 1,000 | | | | 1,390,618 | |

Plastipak Holdings, Inc.

8.50%, 12/15/15(b) | | U.S.$ | | | 3,733 | | | | 3,788,995 | |

Ply Gem Industries, Inc.

8.25%, 2/15/18(a) | | | | | 6,550 | | | | 6,173,375 | |

Pregis Corp.

6.572%, 4/15/13(c) | | EUR | | | 3,000 | | | | 4,026,566 | |

RBS Global, Inc./Rexnord LLC

8.50%, 5/01/18 | | U.S.$ | | | 3,000 | | | | 3,075,000 | |

11.75%, 8/01/16(a) | | | | | 1,324 | | | | 1,396,820 | |

Rexam PLC

6.75%, 6/29/67 | | EUR | | | 2,660 | | | | 3,386,191 | |

Reynolds Group Issuer, Inc./Reynolds Group Issuer LLC/Reynolds Group Issuer Lu

7.125%, 4/15/19(b) | | U.S.$ | | | 712 | | | | 726,240 | |

7.875%, 8/15/19(b) | | | | | 4,653 | | | | 4,862,385 | |

9.00%, 5/15/18-4/15/19(b) | | | | | 6,688 | | | | 6,464,045 | |

9.875%, 8/15/19(b) | | | | | 4,304 | | | | 4,304,000 | |

RSC Equipment Rental, Inc./RSC Holdings III LLC

8.25%, 2/01/21 | | | | | 4,500 | | | | 4,567,500 | |

10.25%, 11/15/19 | | | | | 2,000 | | | | 2,190,000 | |

Sealed Air Corp.

8.125%, 9/15/19(b) | | | | | 1,729 | | | | 1,875,965 | |

8.375%, 9/15/21(b) | | | | | 1,773 | | | | 1,919,273 | |

Sequa Corp.

11.75%, 12/01/15(b) | | | | | 5,545 | | | | 5,863,838 | |

Sterling Merger, Inc.

11.00%, 10/01/19(b) | | | | | 5,184 | | | | 5,132,160 | |

Terex Corp.

8.00%, 11/15/17 | | | | | 2,356 | | | | 2,314,770 | |

Textron Financial Corp.

6.00%, 2/15/67(b) | | | | | 125 | | | | 93,750 | |

TransDigm, Inc.

7.75%, 12/15/18 | | | | | 4,800 | | | | 5,208,000 | |

United Rentals North America, Inc.

8.375%, 9/15/20(a) | | | | | 6,300 | | | | 6,536,250 | |

10.875%, 6/15/16 | | | | | 1,000 | | | | 1,130,000 | |

USG Corp.

6.30%, 11/15/16 | | | | | 1,911 | | | | 1,476,248 | |

| | |

| 16 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Wienerberger AG

6.50%, 2/09/17 | | EUR | | | 2,900 | | | $ | 3,029,611 | |

| | | | | | | | | | |

| | | | | | | | | 154,771,004 | |

| | | | | | | | | | |

Communications - Media – 4.4% | | | | | | | | | | |

Allbritton Communications Co.

8.00%, 5/15/18 | | U.S.$ | | | 5,115 | | | | 5,140,575 | |

Cablevision Systems Corp.

8.00%, 4/15/20 | | | | | 1,700 | | | | 1,793,500 | |

CCH II LLC/CCH II Capital Corp.

13.50%, 11/30/16 | | | | | 2,000 | | | | 2,305,000 | |

CCO Holdings LLC/CCO Holdings Capital Corp.

7.00%, 1/15/19 | | | | | 2,000 | | | | 2,075,000 | |

7.25%, 10/30/17 | | | | | 2,250 | | | | 2,351,250 | |

Cengage Learning Acquisitions, Inc.

10.50%, 1/15/15(b) | | | | | 3,885 | | | | 3,069,150 | |

Cequel Communications Holdings I LLC and Cequel Capital Corp.

8.625%, 11/15/17(b) | | | | | 4,615 | | | | 4,822,675 | |

Charter Communications Operating LLC/Charter Communications Operating Capital

8.00%, 4/30/12(b) | | | | | 1,275 | | | | 1,303,688 | |

Clear Channel Communications, Inc.

5.75%, 1/15/13 | | | | | 2,388 | | | | 2,256,660 | |

9.00%, 3/01/21 | | | | | 2,916 | | | | 2,595,240 | |

10.75%, 8/01/16 | | | | | 3,104 | | | | 2,265,920 | |

Clear Channel Worldwide Holdings, Inc.

9.25%, 12/15/17 | | | | | 65 | | | | 70,200 | |

Series B

9.25%, 12/15/17 | | | | | 4,258 | | | | 4,619,930 | |

Crown Media Holdings, Inc.

10.50%, 7/15/19(b) | | | | | 3,405 | | | | 3,541,200 | |

CSC Holdings LLC

6.75%, 4/15/12 | | | | | 190 | | | | 192,850 | |

7.875%, 2/15/18(a) | | | | | 2,212 | | | | 2,427,670 | |

Cumulus Media, Inc.

7.75%, 5/01/19(a)(b) | | | | | 3,988 | | | | 3,668,960 | |

Dex One Corp.

12.00%, 1/29/17(e) | | | | | 4,048 | | | | 910,881 | |

DISH DBS Corp.

6.75%, 6/01/21 | | | | | 1,500 | | | | 1,548,750 | |

7.125%, 2/01/16 | | | | | 1,250 | | | | 1,328,125 | |

EH Holding Corp.

7.625%, 6/15/21(b) | | | | | 5,725 | | | | 5,925,375 | |

Houghton Mifflin Harcourt Publishing Co.

10.50%, 6/01/19(b) | | | | | 2,400 | | | | 1,776,000 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 17 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Intelsat Jackson Holdings SA

7.25%, 10/15/20(b) | | U.S.$ | | | 2,125 | | | $ | 2,135,625 | |

11.25%, 6/15/16 | | | | | 2,472 | | | | 2,607,960 | |

Intelsat Luxembourg SA

11.25%, 2/04/17 | | | | | 3,200 | | | | 3,176,000 | |

11.50%, 2/04/17(b)(e) | | | | | 1,500 | | | | 1,500,000 | |

11.50%, 2/04/17(e) | | | | | 1,750 | | | | 1,750,000 | |

Kabel BW Erste Beteiligungs GmbH/Kabel Baden-Wurttemberg GmbH & Co. KG

7.50%, 3/15/19(b) | | | | | 1,029 | | | | 1,070,160 | |

7.50%, 3/15/19(b) | | EUR | | | 1,263 | | | | 1,795,672 | |

Lamar Media Corp.

6.625%, 8/15/15 | | U.S.$ | | | 3,941 | | | | 3,960,705 | |

7.875%, 4/15/18 | | | | | 1,000 | | | | 1,047,500 | |

Liberty Interactive LLC

5.70%, 5/15/13 | | | | | 1,145 | | | | 1,160,744 | |

LIN Television Corp.

6.50%, 5/15/13 | | | | | 3,050 | | | | 3,050,000 | |

8.375%, 4/15/18 | | | | | 2,750 | | | | 2,832,500 | |

Local TV Finance LLC

9.25%, 6/15/15(b)(e) | | | | | 3,360 | | | | 3,124,800 | |

McClatchy Co. (The)

11.50%, 2/15/17 | | | | | 3,600 | | | | 3,555,000 | |

New York Times Co. (The)

6.625%, 12/15/16 | | | | | 2,200 | | | | 2,200,000 | |

Nexstar Broadcasting, Inc./Mission Broadcasting, Inc.

8.875%, 4/15/17 | | | | | 2,021 | | | | 2,051,315 | |

Quebecor Media, Inc.

7.75%, 3/15/16 | | | | | 5,952 | | | | 6,145,440 | |

RR Donnelley & Sons Co.

4.95%, 4/01/14 | | | | | 2,400 | | | | 2,352,000 | |

7.25%, 5/15/18 | | | | | 3,401 | | | | 3,315,975 | |

Sinclair Television Group, Inc.

8.375%, 10/15/18 | | | | | 1,710 | | | | 1,761,300 | |

9.25%, 11/01/17(b) | | | | | 3,430 | | | | 3,738,700 | |

Sirius XM Radio, Inc.

8.75%, 4/01/15(b) | | | | | 3,500 | | | | 3,876,250 | |

Telesat Canada/Telesat LLC

11.00%, 11/01/15 | | | | | 1,600 | | | | 1,740,000 | |

Thomson Corp.

5.75%, 9/25/15(d)(f) | | EUR | | | 925 | | | | 1,280 | |

Univision Communications, Inc.

6.875%, 5/15/19(b) | | U.S.$ | | | 4,700 | | | | 4,582,500 | |

8.50%, 5/15/21(b) | | | | | 3,600 | | | | 3,240,000 | |

UPC Holding BV

8.375%, 8/15/20(b) | | EUR | | | 3,000 | | | | 4,088,833 | |

UPCB Finance III Ltd.

6.625%, 7/01/20(b) | | U.S.$ | | | 2,615 | | | | 2,601,925 | |

| | |

| 18 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

UPCB Finance Ltd.

7.625%, 1/15/20(b) | | EUR | | | 1,600 | | | $ | 2,230,524 | |

Valassis Communications, Inc.

6.625%, 2/01/21(a) | | U.S.$ | | | 1,325 | | | | 1,258,750 | |

Virgin Media Finance PLC

8.375%, 10/15/19 | | | | | 4,650 | | | | 5,173,125 | |

XM Satellite Radio, Inc.

7.625%, 11/01/18(b) | | | | | 1,345 | | | | 1,445,875 | |

| | | | | | | | | | |

| | | | | | | | | 140,559,057 | |

| | | | | | | | | | |

Communications - Telecommunications – 2.7% | | | | | | | | | | |

Cincinnati Bell, Inc.

8.25%, 10/15/17 | | | | | 750 | | | | 755,625 | |

8.75%, 3/15/18 | | | | | 4,650 | | | | 4,464,000 | |

Cricket Communications, Inc.

7.75%, 10/15/20(a) | | | | | 3,770 | | | | 3,223,350 | |

Crown Castle International Corp.

7.125%, 11/01/19 | | | | | 2,500 | | | | 2,706,250 | |

Data & Audio Visual Enterprise

9.50%, 4/29/18 | | CAD | | | 2,500 | | | | 2,279,339 | |

Digicel Group Ltd.

10.50%, 4/15/18(b) | | U.S.$ | | | 4,241 | | | | 4,368,230 | |

Digicel Ltd.

12.00%, 4/01/14(b) | | | | | 660 | | | | 745,800 | |

eAccess Ltd.

8.25%, 4/01/18(b) | | | | | 3,648 | | | | 3,506,640 | |

ERC Ireland Finance Ltd.

6.535%, 8/15/16(b)(c) | | EUR | | | 1,000 | | | | 55,348 | |

Fairpoint Communications, Inc./Old Series 1

13.125%, 4/02/18(d) | | U.S.$ | | | 1,048 | | | | 10,482 | |

Frontier Communications Corp.

6.25%, 1/15/13 | | | | | 1,222 | | | | 1,249,495 | |

8.125%, 10/01/18 | | | | | 1,600 | | | | 1,708,000 | |

9.00%, 8/15/31 | | | | | 1,600 | | | | 1,568,000 | |

Level 3 Financing, Inc.

8.75%, 2/15/17 | | | | | 3,220 | | | | 3,292,450 | |

9.25%, 11/01/14 | | | | | 567 | | | | 579,049 | |

9.375%, 4/01/19 | | | | | 2,200 | | | | 2,299,000 | |

10.00%, 2/01/18 | | | | | 2,200 | | | | 2,332,000 | |

MetroPCS Wireless, Inc.

6.625%, 11/15/20 | | | | | 2,650 | | | | 2,491,000 | |

7.875%, 9/01/18 | | | | | 3,000 | | | | 3,052,500 | |

NII Capital Corp.

7.625%, 4/01/21 | | | | | 2,861 | | | | 2,946,830 | |

PAETEC Holding Corp.

9.50%, 7/15/15 | | | | | 1,250 | | | | 1,303,125 | |

9.875%, 12/01/18 | | | | | 2,675 | | | | 2,942,500 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 19 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Phones4u Finance PLC

9.50%, 4/01/18(b) | | GBP | | | 4,000 | | | $ | 5,338,228 | |

Sprint Capital Corp.

6.875%, 11/15/28 | | U.S.$ | | | 4,250 | | | | 3,102,500 | |

Sunrise Communications Holdings SA

8.50%, 12/31/18(b) | | EUR | | | 2,500 | | | | 3,407,361 | |

Telenet Finance Luxembourg SCA

6.375%, 11/15/20(a)(b) | | | | | 2,500 | | | | 3,346,824 | |

tw telecom holdings, Inc.

8.00%, 3/01/18 | | U.S.$ | | | 4,824 | | | | 5,113,440 | |

Wind Acquisition Finance SA

7.25%, 2/15/18(b) | | | | | 2,325 | | | | 2,255,250 | |

11.75%, 7/15/17(b) | | | | | 4,400 | | | | 4,356,000 | |

Windstream Corp.

7.50%, 4/01/23 | | | | | 1,750 | | | | 1,776,250 | |

7.75%, 10/15/20-10/01/21 | | | | | 4,580 | | | | 4,779,150 | |

8.125%, 8/01/13-9/01/18 | | | | | 3,652 | | | | 3,907,640 | |

| | | | | | | | | | |

| | | | | | | | | 85,261,656 | |

| | | | | | | | | | |

Consumer Cyclical - Automotive – 2.2% | | | | | | | | |

Affinia Group, Inc.

9.00%, 11/30/14 | | | | | 4,100 | | | | 4,059,000 | |

Allison Transmission, Inc.

7.125%, 5/15/19(b) | | | | | 5,699 | | | | 5,528,030 | |

11.00%, 11/01/15(b) | | | | | 3,700 | | | | 3,894,250 | |

American Axle & Manufacturing Holdings, Inc.

9.25%, 1/15/17(b) | | | | | 2,876 | | | | 3,134,840 | |

Chrysler Group LLC/CG Co-Issuer, Inc.

8.00%, 6/15/19(b) | | | | | 6,800 | | | | 6,256,000 | |

Commercial Vehicle Group, Inc.

7.875%, 4/15/19(b) | | | | | 2,500 | | | | 2,437,500 | |

Cooper Tire & Rubber Co.

8.00%, 12/15/19 | | | | | 3,000 | | | | 3,105,000 | |

Dana Holding Corp.

6.50%, 2/15/19 | | | | | 675 | | | | 680,063 | |

6.75%, 2/15/21 | | | | | 638 | | | | 647,570 | |

Delphi Corp.

5.875%, 5/15/19(b) | | | | | 1,278 | | | | 1,297,170 | |

6.125%, 5/15/21(b) | | | | | 957 | | | | 976,140 | |

Exide Technologies

8.625%, 2/01/18 | | | | | 1,991 | | | | 1,991,000 | |

Ford Motor Co.

7.45%, 7/16/31(a) | | | | | 5,000 | | | | 5,950,001 | |

Ford Motor Credit Co. LLC

3.148%, 1/13/12(a)(c) | | | | | 640 | | | | 640,960 | |

7.00%, 10/01/13 | | | | | 974 | | | | 1,047,461 | |

8.00%, 12/15/16 | | | | | 2,650 | | | | 3,059,875 | |

| | |

| 20 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Goodyear Dunlop Tires Europe BV

6.75%, 4/15/19(b) | | EUR | | | 2,100 | | | $ | 2,775,010 | |

Goodyear Tire & Rubber Co. (The)

7.00%, 3/15/28 | | U.S.$ | | | 700 | | | | 644,000 | |

8.25%, 8/15/20(a) | | | | | 1,619 | | | | 1,732,330 | |

8.75%, 8/15/20 | | | | | 2,679 | | | | 2,879,925 | |

Lear Corp.

7.875%, 3/15/18 | | | | | 1,500 | | | | 1,616,250 | |

8.125%, 3/15/20 | | | | | 2,000 | | | | 2,190,000 | |

Navistar International Corp.

8.25%, 11/01/21 | | | | | 4,880 | | | | 5,307,000 | |

Tenneco, Inc.

6.875%, 12/15/20 | | | | | 3,700 | | | | 3,792,500 | |

7.75%, 8/15/18 | | | | | 1,143 | | | | 1,200,150 | |

UCI International, Inc.

8.625%, 2/15/19 | | | | | 2,685 | | | | 2,644,725 | |

| | | | | | | | | | |

| | | | | | | | | 69,486,750 | |

| | | | | | | | | | |

Consumer Cyclical - Entertainment – 0.7% | | | | | | | | | | |

AMC Entertainment, Inc.

8.00%, 3/01/14 | | | | | 1,000 | | | | 990,000 | |

9.75%, 12/01/20 | | | | | 3,040 | | | | 2,948,800 | |

ClubCorp Club Operations, Inc.

10.00%, 12/01/18 | | | | | 3,500 | | | | 3,307,500 | |

Greektown Holdings LLC

10.75%, 12/01/13(d)(f) | | | | | 715 | | | | – 0 | – |

NAI Entertainment Holdings LLC

8.25%, 12/15/17(b) | | | | | 4,639 | | | | 4,882,548 | |

Pinnacle Entertainment, Inc.

7.50%, 6/15/15 | | | | | 4,050 | | | | 3,979,125 | |

8.625%, 8/01/17 | | | | | 260 | | | | 277,550 | |

8.75%, 5/15/20 | | | | | 271 | | | | 273,710 | |

Regal Entertainment Group

9.125%, 8/15/18(a) | | | | | 5,805 | | | | 6,211,350 | |

| | | | | | | | | | |

| | | | | | | | | 22,870,583 | |

| | | | | | | | | | |

Consumer Cyclical - Other – 3.8% | | | | | | | | | | |

Beazer Homes USA, Inc.

6.875%, 7/15/15 | | | | | 1,000 | | | | 823,750 | |

12.00%, 10/15/17 | | | | | 1,860 | | | | 1,992,525 | |

Boyd Gaming Corp.

6.75%, 4/15/14 | | | | | 925 | | | | 878,750 | |

9.125%, 12/01/18(a) | | | | | 2,700 | | | | 2,639,250 | |

Broder Brothers Co.

12.00%, 10/15/13(b)(e) | | | | | 331 | | | | 329,068 | |

Caesars Entertainment Operating Co., Inc.

10.00%, 12/15/18 | | | | | 1,935 | | | | 1,458,506 | |

11.25%, 6/01/17 | | | | | 1,350 | | | | 1,444,500 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 21 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Chukchansi Economic Development Authority

8.00%, 11/15/13(b) | | U.S.$ | | | 2,075 | | | $ | 1,353,938 | |

DR Horton, Inc.

6.50%, 4/15/16 | | | | | 1,000 | | | | 1,022,500 | |

GWR Operating Partnership LLP

10.875%, 4/01/17 | | | | | 3,500 | | | | 3,727,500 | |

Host Hotels & Resorts LP

6.875%, 11/01/14 | | | | | 481 | | | | 487,614 | |

9.00%, 5/15/17(a) | | | | | 1,000 | | | | 1,117,500 | |

Series Q

6.75%, 6/01/16 | | | | | 2,558 | | | | 2,647,530 | |

Isle of Capri Casinos, Inc.

7.00%, 3/01/14(a) | | | | | 3,570 | | | | 3,427,200 | |

7.75%, 3/15/19 | | | | | 2,950 | | | | 2,861,500 | |

K Hovnanian Enterprises, Inc.

10.625%, 10/15/16(a) | | | | | 5,380 | | | | 4,613,350 | |

KB Home

5.875%, 1/15/15 | | | | | 1,995 | | | | 1,765,575 | |

7.25%, 6/15/18 | | | | | 1,000 | | | | 847,500 | |

9.10%, 9/15/17 | | | | | 2,300 | | | | 2,104,500 | |

Lennar Corp.

6.95%, 6/01/18 | | | | | 2,780 | | | | 2,717,450 | |

Series B

6.50%, 4/15/16 | | | | | 3,200 | | | | 3,088,000 | |

Levi Strauss & Co.

7.625%, 5/15/20(a) | | | | | 1,000 | | | | 1,022,500 | |

8.875%, 4/01/16 | | | | | 3,000 | | | | 3,142,500 | |

M/I Homes, Inc.

8.625%, 11/15/18 | | | | | 5,325 | | | | 4,792,500 | |

Marina District Finance Co., Inc.

9.50%, 10/15/15(a) | | | | | 1,200 | | | | 1,188,000 | |

9.875%, 8/15/18(a) | | | | | 5,220 | | | | 5,154,750 | |

Meritage Homes Corp.

6.25%, 3/15/15 | | | | | 1,350 | | | | 1,296,000 | |

7.15%, 4/15/20 | | | | | 2,500 | | | | 2,306,250 | |

MGM Resorts International

6.625%, 7/15/15(a) | | | | | 2,000 | | | | 1,900,000 | |

7.625%, 1/15/17 | | | | | 4,965 | | | | 4,617,450 | |

NCL Corp. Ltd.

9.50%, 11/15/18(b) | | | | | 3,500 | | | | 3,640,000 | |

11.75%, 11/15/16 | | | | | 2,000 | | | | 2,300,000 | |

Penn National Gaming, Inc.

8.75%, 8/15/19 | | | | | 2,775 | | | | 2,997,000 | |

Pulte Group, Inc.

7.875%, 6/15/32 | | | | | 2,600 | | | | 2,164,500 | |

PVH Corp.

7.375%, 5/15/20 | | | | | 2,340 | | | | 2,538,900 | |

| | |

| 22 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Quiksilver, Inc.

6.875%, 4/15/15 | | U.S.$ | | | 5,000 | | | $ | 4,712,500 | |

Royal Caribbean Cruises Ltd.

7.25%, 6/15/16-3/15/18 | | | | | 3,850 | | | | 4,061,000 | |

7.50%, 10/15/27 | | | | | 1,000 | | | | 967,500 | |

Ryland Group, Inc.

6.625%, 5/01/20 | | | | | 4,500 | | | | 3,982,500 | |

Seminole Indian Tribe of Florida

6.535%, 10/01/20(b) | | | | | 390 | | | | 376,389 | |

7.75%, 10/01/17(b) | | | | | 2,835 | | | | 2,948,400 | |

Shea Homes LP/Shea Homes Funding Corp.

8.625%, 5/15/19(b) | | | | | 3,886 | | | | 3,361,390 | |

Sheraton Holding Corp.

7.375%, 11/15/15 | | | | | 2,035 | | | | 2,243,587 | |

Standard Pacific Corp.

8.375%, 5/15/18 | | | | | 3,250 | | | | 3,136,250 | |

10.75%, 9/15/16 | | | | | 1,667 | | | | 1,725,345 | |

Starwood Hotels & Resorts Worldwide, Inc.

7.875%, 5/01/12 | | | | | 2,500 | | | | 2,568,750 | |

Station Casinos, Inc.

6.625%, 3/15/18(d)(f) | | | | | 1,755 | | | | – 0 | – |

6.875%, 3/01/16(d)(f) | | | | | 1,500 | | | | – 0 | – |

Sugarhouse HSP Gaming Prop Mezz LP/Sugarhouse HSP Gaming Finance Corp.

8.625%, 4/15/16(b) | | | | | 2,016 | | | | 2,056,320 | |

Toll Brothers Finance Corp.

5.15%, 5/15/15 | | | | | 1,900 | | | | 1,945,507 | |

Tropicana Entertainment LLC/Tropicana Finance Corp.

9.625%, 12/15/14(d)(f) | | | | | 750 | | | | – 0 | – |

WCI Communities, Inc.

6.625%, 3/15/15(d)(f)(g) | | | | | 750 | | | | – 0 | – |

Wynn Las Vegas LLC/Wynn Las Vegas Capital Corp.

7.75%, 8/15/20 | | | | | 5,400 | | | | 5,940,000 | |

| | | | | | | | | | |

| | | | | | | | | 120,433,794 | |

| | | | | | | | | | |

Consumer Cyclical - Restaurants – 0.4% | | | | | | | | |

Burger King Corp.

9.875%, 10/15/18(a) | | | | | 4,666 | | | | 5,004,285 | |

CKE Restaurants, Inc.

11.375%, 7/15/18 | | | | | 3,966 | | | | 4,263,450 | |

Landry’s Restaurants, Inc.

11.625%, 12/01/15(b) | | | | | 825 | | | | 874,500 | |

11.625%, 12/01/15 | | | | | 3,580 | | | | 3,794,800 | |

| | | | | | | | | | |

| | | | | | | | | 13,937,035 | |

| | | | | | | | | | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 23 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Consumer Cyclical - Retailers – 1.3% | | | | | | | | | | |

Asbury Automotive Group, Inc.

8.375%, 11/15/20 | | U.S.$ | | | 1,555 | | | $ | 1,539,450 | |

AutoNation, Inc.

6.75%, 4/15/18 | | | | | 349 | | | | 362,088 | |

Bon-Ton Department Stores, Inc. (The)

10.25%, 3/15/14 | | | | | 4,930 | | | | 4,375,375 | |

Burlington Coat Factory Warehouse Corp.

10.00%, 2/15/19(b) | | | | | 601 | | | | 594,990 | |

GameStop Corp./GameStop, Inc.

8.00%, 10/01/12 | | | | | 671 | | | | 671,067 | |

Gymboree Corp.

9.125%, 12/01/18(a) | | | | | 4,800 | | | | 4,296,000 | |

Hines Nurseries, Inc.

10.25%, 10/01/11(d)(f)(g) | | | | | 1,000 | | | | – 0 | – |

JC Penney Corp., Inc.

7.40%, 4/01/37 | | | | | 4,100 | | | | 3,823,250 | |

Limited Brands, Inc.

5.25%, 11/01/14 | | | | | 3,194 | | | | 3,305,790 | |

6.625%, 4/01/21 | | | | | 1,000 | | | | 1,050,000 | |

6.90%, 7/15/17 | | | | | 3,710 | | | | 3,960,425 | |

Michaels Stores, Inc.

7.75%, 11/01/18 | | | | | 3,100 | | | | 3,146,500 | |

11.375%, 11/01/16 | | | | | 1,000 | | | | 1,042,510 | |

Neiman Marcus Group, Inc. (The)

10.375%, 10/15/15 | | | | | 500 | | | | 520,000 | |

Penske Automotive Group, Inc.

7.75%, 12/15/16 | | | | | 1,250 | | | | 1,281,250 | |

Rite Aid Corp.

6.875%, 8/15/13 | | | | | 470 | | | | 460,600 | |

8.00%, 8/15/20(a) | | | | | 2,300 | | | | 2,527,125 | |

9.50%, 6/15/17 | | | | | 1,500 | | | | 1,365,000 | |

10.25%, 10/15/19 | | | | | 2,000 | | | | 2,175,000 | |

Toys R US, Inc.

7.375%, 10/15/18 | | | | | 4,900 | | | | 4,508,000 | |

YCC Holdings LLC/Yankee Finance, Inc.

10.25%, 2/15/16(e) | | | | | 625 | | | | 575,000 | |

| | | | | | | | | | |

| | | | | | | | | 41,579,420 | |

| | | | | | | | | | |

Consumer Non-Cyclical – 6.2% | | | | | | | | | | |

ACCO Brands Corp.

7.625%, 8/15/15(a) | | | | | 3,550 | | | | 3,523,375 | |

10.625%, 3/15/15 | | | | | 1,587 | | | | 1,749,668 | |

Alere, Inc.

8.625%, 10/01/18 | | | | | 6,195 | | | | 6,187,256 | |

AMGH Merger Sub, Inc.

9.25%, 11/01/18(b) | | | | | 3,765 | | | | 3,915,600 | |

ARAMARK Corp.

8.50%, 2/01/15 | | | | | 5,942 | | | | 6,164,825 | |

| | |

| 24 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Aurora Diagnostics Holdings/Aurora Diagnostics Financing, Inc.

10.75%, 1/15/18(b) | | U.S.$ | | | 3,750 | | | $ | 3,750,000 | |

Bakkavor Finance 2 PLC

8.25%, 2/15/18(b) | | GBP | | | 2,500 | | | | 3,055,010 | |

Bausch & Lomb, Inc.

9.875%, 11/01/15 | | U.S.$ | | | 4,855 | | | | 5,097,750 | |

Biomet, Inc.

11.625%, 10/15/17 | | | | | 5,550 | | | | 6,049,500 | |

BioScrip, Inc.

10.25%, 10/01/15 | | | | | 4,005 | | | | 4,035,037 | |

Boparan Holdings Ltd.

9.875%, 4/30/18(b) | | GBP | | | 3,500 | | | | 4,952,332 | |

Capsugel FinanceCo SCA

9.875%, 8/01/19(b) | | EUR | | | 4,550 | | | | 6,484,710 | |

Care UK Health & Social Care PLC

9.75%, 8/01/17 | | GBP | | | 2,900 | | | | 4,196,619 | |

Catalent Pharma Solutions, Inc.

9.50%, 4/15/15(e) | | U.S.$ | | | 4,534 | | | | 4,511,031 | |

CHS/Community Health Systems, Inc.

8.875%, 7/15/15 | | | | | 5,495 | | | | 5,625,506 | |

CityCenter Holdings LLC/CityCenter Finance Corp.

7.625%, 1/15/16(b) | | | | | 5,907 | | | | 6,143,280 | |

ConvaTec Healthcare E SA

10.50%, 12/15/18(b) | | | | | 2,961 | | | | 2,849,963 | |

Cott Beverages, Inc.

8.125%, 9/01/18 | | | | | 1,390 | | | | 1,483,825 | |

8.375%, 11/15/17 | | | | | 1,400 | | | | 1,505,000 | |

Del Monte Foods Co.

7.625%, 2/15/19(b) | | | | | 1,300 | | | | 1,235,000 | |

DJO Finance LLC/DJO Finance Corp.

7.75%, 4/15/18 | | | | | 720 | | | | 608,400 | |

10.875%, 11/15/14 | | | | | 3,030 | | | | 3,037,575 | |

Dole Food Co., Inc.

8.00%, 10/01/16(b) | | | | | 4,350 | | | | 4,589,250 | |

Elan Finance PLC/Elan Finance Corp.

8.75%, 10/15/16 | | | | | 3,050 | | | | 3,248,250 | |

Elizabeth Arden, Inc.

7.375%, 3/15/21 | | | | | 4,400 | | | | 4,455,000 | |

Emergency Medical Services Corp.

8.125%, 6/01/19(b) | | | | | 6,342 | | | | 6,342,000 | |

Endo Pharmaceuticals Holdings, Inc.

7.00%, 7/15/19(b) | | | | | 1,160 | | | | 1,252,800 | |

7.25%, 1/15/22(b) | | | | | 1,555 | | | | 1,675,513 | |

Gentiva Health Services, Inc.

11.50%, 9/01/18 | | | | | 1,560 | | | | 1,248,000 | |

Giant Funding Corp.

8.25%, 2/01/18(b) | | | | | 3,575 | | | | 3,762,687 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 25 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

HCA Holdings, Inc.

7.75%, 5/15/21(a)(b) | | U.S.$ | | | 3,500 | | | $ | 3,500,000 | |

HCA, Inc.

6.375%, 1/15/15 | | | | | 3,017 | | | | 3,099,968 | |

6.50%, 2/15/16-2/15/20 | | | | | 3,482 | | | | 3,630,289 | |

Healthsouth Corp.

7.75%, 9/15/22 | | | | | 435 | | | | 435,000 | |

8.125%, 2/15/20 | | | | | 1,455 | | | | 1,476,825 | |

Jarden Corp.

7.50%, 1/15/20 | | | | | 3,750 | | | | 4,012,500 | |

Kindred Healthcare, Inc.

8.25%, 6/01/19(b) | | | | | 2,980 | | | | 2,637,300 | |

Kinetic Concepts, Inc./KCI USA, Inc.

10.50%, 11/01/18(b) | | | | | 3,500 | | | | 3,539,375 | |

LifePoint Hospitals, Inc.

6.625%, 10/01/20 | | | | | 2,150 | | | | 2,241,375 | |

Mylan Inc.

7.625%, 7/15/17(b) | | | | | 330 | | | | 365,475 | |

7.875%, 7/15/20(b) | | | | | 335 | | | | 375,200 | |

New Albertsons, Inc.

7.45%, 8/01/29 | | | | | 4,110 | | | | 3,216,075 | |

8.00%, 5/01/31 | | | | | 2,600 | | | | 2,184,000 | |

Picard Bondco SA

9.00%, 10/01/18(b) | | EUR | | | 2,300 | | | | 3,214,335 | |

Pilgrim’s Pride Corp.

7.875%, 12/15/18(a)(b) | | U.S.$ | | | 6,250 | | | | 5,187,500 | |

Pinnacle Foods Finance LLC/Pinnacle Foods Finance Corp.

8.25%, 9/01/17 | | | | | 2,500 | | | | 2,537,500 | |

10.625%, 4/01/17(a) | | | | | 3,000 | | | | 3,105,000 | |

R&R Ice Cream PLC

8.375%, 11/15/17(b) | | EUR | | | 3,450 | | | | 4,463,470 | |

Select Medical Corp.

7.625%, 2/01/15 | | U.S.$ | | | 2,554 | | | | 2,375,220 | |

Select Medical Holdings Corp.

6.267%, 9/15/15(c) | | | | | 2,900 | | | | 2,479,500 | |

Smithfield Foods, Inc.

7.75%, 7/01/17 | | | | | 5,250 | | | | 5,670,000 | |

Stater Bros Holdings, Inc.

7.375%, 11/15/18 | | | | | 2,275 | | | | 2,411,500 | |

STHI Holding Corp.

8.00%, 3/15/18(b) | | | | | 930 | | | | 948,600 | |

SUPERVALU, Inc.

8.00%, 5/01/16(a) | | | | | 2,500 | | | | 2,625,000 | |

Tenet Healthcare Corp.

6.875%, 11/15/31 | | | | | 4,000 | | | | 3,320,000 | |

9.25%, 2/01/15 | | | | | 2,000 | | | | 2,135,000 | |

Tops Holding Corp./Tops Markets LLC

10.125%, 10/15/15 | | | | | 2,555 | | | | 2,606,100 | |

| | |

| 26 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Universal Hospital Services, Inc.

3.778%, 6/01/15(c) | | U.S.$ | | | 500 | | | $ | 462,500 | |

Valeant Pharmaceuticals International

7.00%, 10/01/20(b) | | | | | 2,043 | | | | 2,022,570 | |

Vanguard Health Holding Co. II LLC/Vanguard Holding Co. II, Inc.

8.00%, 2/01/18 | | | | | 4,060 | | | | 4,151,350 | |

Vanguard Health Systems, Inc.

Zero Coupon, 2/01/16 | | | | | 26 | | | | 17,030 | |

Visant Corp.

10.00%, 10/01/17 | | | | | 2,798 | | | | 2,714,060 | |

Voyager Learning Exchange

8.375%, 12/01/14(d)(f)(g) | | | | | 1,283 | | | | – 0 | – |

Warner Chilcott

7.75%, 9/15/18 | | | | | 3,500 | | | | 3,648,750 | |

| | | | | | | | | | |

| | | | | | | | | 199,543,129 | |

| | | | | | | | | | |

Energy – 4.4% | | | | | | | | | | |

Antero Resources Finance Corp.

7.25%, 8/01/19(b) | | | | | 1,680 | | | | 1,730,400 | |

9.375%, 12/01/17 | | | | | 4,838 | | | | 5,345,990 | |

ATP Oil & Gas Corp./United States

11.875%, 5/01/15 | | | | | 5,200 | | | | 4,316,000 | |

Basic Energy Services, Inc.

7.75%, 2/15/19(b) | | | | | 2,960 | | | | 2,960,000 | |

Bill Barrett Corp.

7.625%, 10/01/19 | | | | | 2,500 | | | | 2,643,750 | |

Bluewater Holding BV

3.403%, 7/17/14(b)(c) | | | | | 4,400 | | | | 3,344,000 | |

Chaparral Energy, Inc.

8.875%, 2/01/17 | | | | | 5,505 | | | | 5,670,150 | |

Chesapeake Energy Corp.

6.625%, 8/15/20 | | | | | 1,746 | | | | 1,892,227 | |

6.875%, 11/15/20 | | | | | 1,910 | | | | 2,096,225 | |

Cie Generale de Geophysique-Veritas

6.50%, 6/01/21(b) | | | | | 1,600 | | | | 1,592,000 | |

9.50%, 5/15/16 | | | | | 2,307 | | | | 2,497,327 | |

Citgo Petroleum Corp.

11.50%, 7/01/17(b) | | | | | 4,527 | | | | 5,183,415 | |

Complete Production Services, Inc.

8.00%, 12/15/16 | | | | | 2,360 | | | | 2,454,400 | |

Continental Resources, Inc./OK

7.125%, 4/01/21 | | | | | 1,567 | | | | 1,692,360 | |

Denbury Resources, Inc.

6.375%, 8/15/21 | | | | | 3,001 | | | | 3,091,030 | |

8.25%, 2/15/20 | | | | | 1,536 | | | | 1,697,280 | |

Edgen Murray Corp.

12.25%, 1/15/15 | | | | | 3,034 | | | | 2,867,130 | |

Energy XXI Gulf Coast, Inc.

7.75%, 6/15/19 | | | | | 3,500 | | | | 3,535,000 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 27 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

9.25%, 12/15/17 | | U.S.$ | | | 3,600 | | | $ | 3,834,000 | |

Expro Finance Luxembourg SCA

8.50%, 12/15/16(b) | | | | | 2,547 | | | | 2,457,855 | |

Forest Oil Corp.

7.25%, 6/15/19 | | | | | 5,240 | | | | 5,371,000 | |

Helix Energy Solutions Group, Inc.

9.50%, 1/15/16(b) | | | | | 2,900 | | | | 3,045,000 | |

Hercules Offshore, Inc.

10.50%, 10/15/17(b) | | | | | 1,379 | | | | 1,379,000 | |

Hilcorp Energy I LP/Hilcorp Finance Co.

7.75%, 11/01/15(b) | | | | | 3,509 | | | | 3,599,883 | |

8.00%, 2/15/20(b) | | | | | 1,000 | | | | 1,075,000 | |

Key Energy Services, Inc.

6.75%, 3/01/21 | | | | | 2,666 | | | | 2,725,985 | |

Linn Energy LLC/Linn Energy Finance Corp.

8.625%, 4/15/20 | | | | | 4,190 | | | | 4,619,475 | |

McJunkin Red Man Corp.

9.50%, 12/15/16 | | | | | 6,250 | | | | 6,375,000 | |

Nalco Co.

6.625%, 1/15/19(b) | | | | | 1,350 | | | | 1,505,250 | |

Newfield Exploration Co.

6.625%, 9/01/14-4/15/16 | | | | | 1,475 | | | | 1,508,500 | |

Oasis Petroleum, Inc.

6.50%, 11/01/21 | | | | | 1,790 | | | | 1,798,950 | |

Offshore Group Investments Ltd.

11.50%, 8/01/15 | | | | | 4,250 | | | | 4,632,500 | |

11.50%, 8/01/15(b) | | | | | 875 | | | | 953,750 | |

Oil States International, Inc.

6.50%, 6/01/19 | | | | | 3,394 | | | | 3,555,215 | |

OPTI Canada, Inc.

8.25%, 12/15/14(d) | | | | | 2,505 | | | | 1,628,250 | |

Parker Drilling Co.

9.125%, 4/01/18 | | | | | 1,389 | | | | 1,454,978 | |

Perpetual Energy, Inc.

8.75%, 3/15/18(b) | | CAD | | | 4,250 | | | | 3,880,110 | |

PHI, Inc.

8.625%, 10/15/18 | | U.S.$ | | | 2,910 | | | | 2,924,550 | |

Pioneer Drilling Co.

9.875%, 3/15/18 | | | | | 2,000 | | | | 2,080,000 | |

Pioneer Natural Resources Co.

5.875%, 7/15/16 | | | | | 500 | | | | 530,751 | |

Plains Exploration & Production Co.

6.625%, 5/01/21 | | | | | 1,000 | | | | 1,040,000 | |

7.00%, 3/15/17 | | | | | 509 | | | | 528,088 | |

7.625%, 4/01/20 | | | | | 1,000 | | | | 1,080,000 | |

7.75%, 6/15/15 | | | | | 541 | | | | 561,288 | |

8.625%, 10/15/19 | | | | | 2,300 | | | | 2,553,000 | |

| | |

| 28 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Precision Drilling Corp.

6.50%, 12/15/21(b) | | U.S.$ | | | 1,870 | | | $ | 1,972,850 | |

QEP Resources, Inc.

6.875%, 3/01/21 | | | | | 1,453 | | | | 1,569,240 | |

SandRidge Energy, Inc.

7.50%, 3/15/21(b) | | | | | 933 | | | | 900,345 | |

8.75%, 1/15/20 | | | | | 3,673 | | | | 3,792,372 | |

SESI LLC

6.375%, 5/01/19(b) | | | | | 771 | | | | 786,420 | |

Tesoro Corp.

6.25%, 11/01/12 | | | | | 2,070 | | | | 2,157,975 | |

9.75%, 6/01/19 | | | | | 3,518 | | | | 3,957,750 | |

W&T Offshore, Inc.

8.50%, 6/15/19(b) | | | | | 3,500 | | | | 3,570,000 | |

| | | | | | | | | | |

| | | | | | | | | 140,013,014 | |

| | | | | | | | | | |

Other Industrial – 1.0% | | | | | | | | | | |

Briggs & Stratton Corp.

6.875%, 12/15/20 | | | | | 737 | | | | 751,740 | |

Brightstar Corp.

9.50%, 12/01/16(b) | | | | | 4,301 | | | | 4,344,010 | |

Education Management LLC/Education Management Finance Corp.

8.75%, 6/01/14 | | | | | 1,025 | | | | 1,014,750 | |

Exova Ltd.

10.50%, 10/15/18(b) | | GBP | | | 2,000 | | | | 2,667,188 | |

Interline Brands, Inc.

7.00%, 11/15/18 | | U.S.$ | | | 4,065 | | | | 4,146,300 | |

Lecta SA

5.535%, 2/15/14(b)(c) | | EUR | | | 1,903 | | | | 2,396,195 | |

Liberty Tire Recycling

11.00%, 10/01/16(b) | | U.S.$ | | | 4,400 | | | | 4,444,000 | |

Mueller Water Products, Inc.

7.375%, 6/01/17 | | | | | 1,700 | | | | 1,496,000 | |

8.75%, 9/01/20 | | | | | 900 | | | | 958,500 | |

Neenah Foundry Co.

15.00%, 7/29/15(e)(f) | | | | | 282 | | | | 274,704 | |

New Enterprise Stone & Lime Co.

11.00%, 9/01/18 | | | | | 5,850 | | | | 4,943,250 | |

Pipe Holdings PLC

9.50%, 11/01/15(b) | | GBP | | | 2,745 | | | | 3,795,769 | |

Wendel SA

4.375%, 8/09/17 | | EUR | | | 1,750 | | | | 2,040,093 | |

| | | | | | | | | | |

| | | | | | | | | 33,272,499 | |

| | | | | | | | | | |

Services – 1.2% | | | | | | | | | | |

Ceridian Corp.

11.25%, 11/15/15 | | U.S.$ | | | 4,650 | | | | 3,952,500 | |

Goodman Networks, Inc.

12.125%, 7/01/18(b) | | | | | 3,000 | | | | 2,850,000 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 29 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

ISS Holdings A/S

8.875%, 5/15/16(a)(b) | | EUR | | | 2,000 | | | $ | 2,656,704 | |

Live Nation Entertainment, Inc.

8.125%, 5/15/18(b) | | U.S.$ | | | 2,370 | | | | 2,275,200 | |

Lottomatica SpA

8.25%, 3/31/66(b) | | EUR | | | 3,585 | | | | 4,365,297 | |

Mobile Mini, Inc.

7.875%, 12/01/20 | | U.S.$ | | | 2,320 | | | | 2,320,000 | |

Realogy Corp.

Series A

11.00%, 4/15/18(b) | | | | | 2,732 | | | | 1,748,480 | |

Series C

11.00%, 4/15/18(a)(b) | | | | | 1,450 | | | | 899,000 | |

Service Corp. International/US

6.75%, 4/01/15-4/01/16 | | | | | 4,400 | | | | 4,686,000 | |

7.50%, 4/01/27 | | | | | 1,575 | | | | 1,575,000 | |

ServiceMaster Co. (The)

10.75%, 7/15/15(b)(e) | | | | | 4,325 | | | | 4,427,612 | |

Ticketmaster Entertainment LLC/Ticketmaster Noteco, Inc.

10.75%, 8/01/16 | | | | | 2,110 | | | | 2,204,950 | |

West Corp.

7.875%, 1/15/19 | | | | | 1,250 | | | | 1,268,750 | |

8.625%, 10/01/18 | | | | | 1,535 | | | | 1,588,725 | |

11.00%, 10/15/16 | | | | | 2,100 | | | | 2,226,000 | |

| | | | | | | | | | |

| | | | | | | | | 39,044,218 | |

| | | | | | | | | | |

Technology – 2.9% | | | | | | | | | | |

Advanced Micro Devices, Inc.

7.75%, 8/01/20 | | | | | 973 | | | | 987,595 | |

8.125%, 12/15/17 | | | | | 2,180 | | | | 2,245,400 | |

Amkor Technology, Inc.

6.625%, 6/01/21(b) | | | | | 3,000 | | | | 2,850,000 | |

Aspect Software, Inc.

10.625%, 5/15/17 | | | | | 4,211 | | | | 4,253,110 | |

CDW LLC/CDW Finance Corp.

8.25%, 12/15/18(b) | | | | | 3,282 | | | | 3,380,460 | |

8.50%, 4/01/19(b) | | | | | 7,125 | | | | 6,911,250 | |

11.50%, 10/12/15(e) | | | | | 362 | | | | 372,643 | |

CommScope, Inc.

8.25%, 1/15/19(b) | | | | | 6,500 | | | | 6,402,500 | |

CoreLogic, Inc./United States

7.25%, 6/01/21(b) | | | | | 3,750 | | | | 3,562,500 | |

CPI International, Inc.

8.00%, 2/15/18 | | | | | 3,977 | | | | 3,549,472 | |

DCP LLC/DCP Corp.

10.75%, 8/15/15(b) | | | | | 2,385 | | | | 1,991,475 | |

Eagle Parent, Inc.

8.625%, 5/01/19(b) | | | | | 5,997 | | | | 5,607,195 | |

| | |

| 30 | | • ALLIANCEBERNSTEIN HIGH INCOME FUND |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Eastman Kodak Co.

7.25%, 11/15/13 | | U.S.$ | | | 315 | | | $ | 138,600 | |

First Data Corp.

7.375%, 6/15/19(b) | | | | | 3,320 | | | | 3,295,100 | |

11.25%, 3/31/16(a) | | | | | 3,950 | | | | 3,515,500 | |

Freescale Semiconductor, Inc. | | | | | | | | | | |

8.875%, 12/15/14(a) | | | | | 2,233 | | | | 2,283,243 | |

9.25%, 4/15/18(b) | | | | | 1,726 | | | | 1,868,395 | |

10.125%, 12/15/16(a) | | | | | 2,429 | | | | 2,526,160 | |

Interactive Data Corp.

10.25%, 8/01/18 | | | | | 4,700 | | | | 5,052,500 | |

Iron Mountain, Inc.

6.625%, 1/01/16 | | | | | 1,393 | | | | 1,393,000 | |

8.375%, 8/15/21 | | | | | 3,000 | | | | 3,142,500 | |

8.75%, 7/15/18 | | | | | 1,000 | | | | 1,045,000 | |

MagnaChip Semiconductor SA/MagnaChip Semiconductor Finance Co.

10.50%, 4/15/18 | | | | | 2,800 | | | | 2,863,000 | |

NXP BV/NXP Funding LLC

3.153%, 10/15/13(c) | | | | | 539 | | | | 528,220 | |

9.50%, 10/15/15(a) | | | | | 700 | | | | 731,500 | |

Sanmina-SCI Corp.

7.00%, 5/15/19(b) | | | | | 1,550 | | | | 1,488,000 | |

8.125%, 3/01/16 | | | | | 4,059 | | | | 4,140,180 | |

Seagate HDD Cayman

6.875%, 5/01/20 | | | | | 2,951 | | | | 2,891,980 | |

Sensata Technologies BV

6.50%, 5/15/19(b) | | | | | 5,000 | | | | 4,906,250 | |

Serena Software, Inc.

10.375%, 3/15/16 | | | | | 419 | | | | 429,475 | |

SunGard Data Systems, Inc.

7.625%, 11/15/20 | | | | | 4,000 | | | | 4,100,000 | |

10.25%, 8/15/15 | | | | | 974 | | | | 1,010,525 | |

Syniverse Holdings, Inc.

9.125%, 1/15/19 | | | | | 1,598 | | | | 1,661,920 | |

| | | | | | | | | | |

| | | | | | | | | 91,124,648 | |

| | | | | | | | | | |

Transportation - Airlines – 0.3% | | | | | | | | | | |

Air Canada

12.00%, 2/01/16(b) | | | | | 2,850 | | | | 2,693,250 | |

American Airlines, Inc.

10.50%, 10/15/12 | | | | | 1,909 | | | | 1,870,820 | |

AMR Corp.

9.00%, 8/01/12 | | | | | 849 | | | | 766,222 | |

Continental Airlines, Inc.

8.75%, 12/01/11 | | | | | 703 | | | | 703,879 | |

Delta Air Lines, Inc.

9.50%, 9/15/14(b) | | | | | 1,164 | | | | 1,233,840 | |

| | | | |

| ALLIANCEBERNSTEIN HIGH INCOME FUND • | | | 31 | |

Portfolio of Investments

| | | | | | | | | | |

| | | | | Principal

Amount

(000) | | | U.S. $ Value | |

| | | | | |

| | | | | | | | | | |

Northwest Airlines 2000-1 Class G Pass Through Trust

7.15%, 10/01/19 | | U.S.$ | | | 1,007 | | | $ | 971,590 | |

UAL 2007-1 Pass Through Trust Series 071A

6.636%, 7/02/22 | | | | | 2,162 | | | | 2,151,160 | |

| | | | | | | | | | |

| | | | | | | | | 10,390,761 | |

| | | | | | | | | | |

Transportation - Railroads – 0.0% | | | | | | | | | | |

Florida East Coast Railway Corp.

8.125%, 2/01/17 | | | | | 813 | | | | 813,000 | |

| | | | | | | | | | |

| | | |

Transportation - Services – 0.9% | | | | | | | | | | |

America West Airlines 1999-1 Pass

Through Trust

Series 991G

7.93%, 1/02/19 | | | | | 1,889 | | | | 1,823,338 | |

Avis Budget Car Rental LLC/Avis Budget Finance, Inc.

7.625%, 5/15/14 | | | | | 267 | | | | 269,002 | |

7.75%, 5/15/16 | | | | | 5,088 | | | | 5,138,880 | |

EC Finance PLC

9.75%, 8/01/17(b) | | EUR | | | 148 | | | | 182,261 | |

Hapag-Lloyd AG

9.75%, 10/15/17(b) | | U.S.$ | | | 2,250 | | | | 1,777,500 | |

Hertz Corp. (The)

6.75%, 4/15/19 | | | | | 3,288 | | | | 3,353,760 | |

7.375%, 1/15/21 | | | | | 2,950 | | | | 3,031,125 | |

7.50%, 10/15/18 | | | | | 1,900 | | | | 1,980,750 | |