Technical Report Summary, Wodgina Operation, Western Australia Albemarle Corporation Date: 10 February 2025 Exhibit 96.2 | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page i of vi | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 TABLE OF CONTENTS 1. EXECUTIVE SUMMARY .................................................................................................. 1 1.1 Summary .......................................................................................................................... 1 1.2 Report Scope .................................................................................................................... 1 1.3 Property Description and Location .................................................................................... 1 1.4 Geology and Mineralization ............................................................................................... 2 1.5 Exploration Status ............................................................................................................. 2 1.6 Development and Operations ........................................................................................... 2 1.7 Mineral Resources and Mineral Reserves ......................................................................... 4 1.8 Market Studies .................................................................................................................. 5 1.9 Environmental, Permitting, and Social Considerations ...................................................... 6 1.10 Economic Evaluation ........................................................................................................ 6 1.11 Recommendations ............................................................................................................ 8 1.12 Key Risks .......................................................................................................................... 9 2. INTRODUCTION ............................................................................................................ 10 2.1 Report Scope .................................................................................................................. 10 2.2 Site Visits ........................................................................................................................ 10 2.3 Sources of Information .................................................................................................... 11 2.4 Forward-Looking Statements .......................................................................................... 11 2.5 List of Abbreviations........................................................................................................ 11 2.6 Independence ................................................................................................................. 15 2.7 Inherent Mining Risks ..................................................................................................... 15 3. PROPERTY DESCRIPTION AND LOCATION ............................................................... 16 3.1 Location .......................................................................................................................... 16 3.2 Land Tenure ................................................................................................................... 19 3.3 Surface Rights and Easement ........................................................................................ 23 3.4 Material Government Consents....................................................................................... 23 3.5 Significant Limiting Factors ............................................................................................. 23 4. ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY .................................................................................................................... 24 4.1 Accessibility .................................................................................................................... 24 4.2 Climate ........................................................................................................................... 24 4.3 Local Resources ............................................................................................................. 24 4.4 Infrastructure................................................................................................................... 25 4.5 Physiography .................................................................................................................. 25 5. HISTORY ........................................................................................................................ 27 5.1 Exploration and Development History ............................................................................. 27 5.2 Past Production .............................................................................................................. 28 6. GEOLOGICAL SETTING, MINERALIZATION AND DEPOSIT ...................................... 30 6.1 Regional Geology ........................................................................................................... 30 6.2 Local Geology ................................................................................................................. 30 6.3 Pegmatite Geology ......................................................................................................... 32

| ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page ii of vi | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 6.4 Mineralization.................................................................................................................. 36 6.5 Deposit Types ................................................................................................................. 37 7. EXPLORATION .............................................................................................................. 38 7.1 Exploration ...................................................................................................................... 38 7.2 MRL Exploration ............................................................................................................. 38 7.3 Drilling............................................................................................................................. 40 7.4 Historical Drilling ............................................................................................................. 40 7.5 MRL and Company Drilling ............................................................................................. 41 7.6 Qualified Person Statement on Exploration Drilling ......................................................... 44 7.7 Hydrogeology.................................................................................................................. 44 7.8 Geotechnical Data, Testing, and Analysis ....................................................................... 46 8. SAMPLE PREPARATION, ANALYSES AND SECURITY ............................................. 48 8.1 Density Determinations ................................................................................................... 48 8.2 Analytical and Test Laboratories ..................................................................................... 48 8.3 Sample Preparation and Analysis ................................................................................... 49 8.4 Sample Security .............................................................................................................. 49 8.5 Quality Assurance and Quality Control............................................................................ 50 8.6 Field Duplicates .............................................................................................................. 50 8.7 Laboratory Duplicates ..................................................................................................... 50 8.8 Standard Reference Material .......................................................................................... 51 8.9 Certified Reference Materials .......................................................................................... 51 9. DATA VERIFICATION .................................................................................................... 52 10. MINERAL PROCESSING AND METALLURGICAL TESTING ....................................... 53 10.1 Mineralogy ...................................................................................................................... 53 10.2 Metallurgical Test Work .................................................................................................. 54 10.3 LOM Plan ........................................................................................................................ 55 11. MINERAL RESOURCE ESTIMATES ............................................................................. 56 11.1 Resource Areas .............................................................................................................. 56 11.2 Statement Of Mineral Resources .................................................................................... 56 11.3 Resource Initial Assessment ........................................................................................... 57 11.4 Resource Database ........................................................................................................ 58 11.5 Geological Interpretation ................................................................................................. 59 11.6 Compositing .................................................................................................................... 63 11.7 Resource Assays ............................................................................................................ 64 11.8 Block Model .................................................................................................................... 71 11.9 Classification................................................................................................................... 77 11.10 Comparison to Previous Mineral Resources Estimates ................................................... 80 11.11 Exploration Potential ....................................................................................................... 81 12. MINERAL RESERVE ESTIMATES ................................................................................ 83 12.1 Summary ........................................................................................................................ 83 12.2 Statement of Mineral Reserves ....................................................................................... 83 12.3 Approach ........................................................................................................................ 84 12.4 Planning Status ............................................................................................................... 85 | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page iii of vi | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 12.5 Modifying Factors ........................................................................................................... 85 12.6 Comparison to Previous Mineral Reserve Estimate ........................................................ 90 13. MINING METHODS ........................................................................................................ 91 13.1 Mining Method ................................................................................................................ 91 13.2 Mine Design .................................................................................................................... 91 13.3 Geotechnical Considerations .......................................................................................... 91 13.4 Hydrogeological Considerations...................................................................................... 94 13.5 Mining Strategy ............................................................................................................... 94 13.6 Life of Mine Plan ............................................................................................................. 97 13.7 Mining Equipment ........................................................................................................... 99 13.8 Equipment Estimate ........................................................................................................ 99 14. PROCESSING AND RECOVERY METHODS .............................................................. 100 14.1 Process Description ...................................................................................................... 100 14.2 Process Plant Design .................................................................................................... 109 15. INFRASTRUCTURE ..................................................................................................... 115 15.1 Site Access ................................................................................................................... 115 15.2 Airport ........................................................................................................................... 115 15.3 Port ............................................................................................................................... 115 15.4 Site Buildings ................................................................................................................ 117 15.5 Power Supply................................................................................................................ 118 15.6 Water Supply ................................................................................................................ 119 15.7 Tailings Disposal ........................................................................................................... 121 15.8 Design Responsibilities and Engineer of Record ........................................................... 123 15.9 Production Capacities and Schedule ............................................................................ 124 16. MARKET STUDIES ...................................................................................................... 126 16.1 Introduction ................................................................................................................... 126 16.2 Lithium demand ............................................................................................................ 126 16.3 Lithium Supply .............................................................................................................. 128 16.4 Lithium supply-demand balance.................................................................................... 130 16.5 Lithium prices................................................................................................................ 131 16.6 Contracts ...................................................................................................................... 134 17. ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS OR AGREEMENTS LOCAL INDIVIDUALS OR GROUP ............................................................. 135 17.1 Environmental Studies .................................................................................................. 135 17.2 Environmental Management ......................................................................................... 143 17.3 Mine Waste and Water Management ............................................................................ 143 17.4 Operation Permitting and Compliance........................................................................... 148 17.5 Social or Community Requirements .............................................................................. 153 17.6 Land Use ...................................................................................................................... 153 17.7 Mine Closure Requirements .......................................................................................... 155 18. CAPITAL AND OPERATING COSTS .......................................................................... 157 18.1 Capital Costs ................................................................................................................ 157 18.2 Mine Closure and Rehabilitation ................................................................................... 158

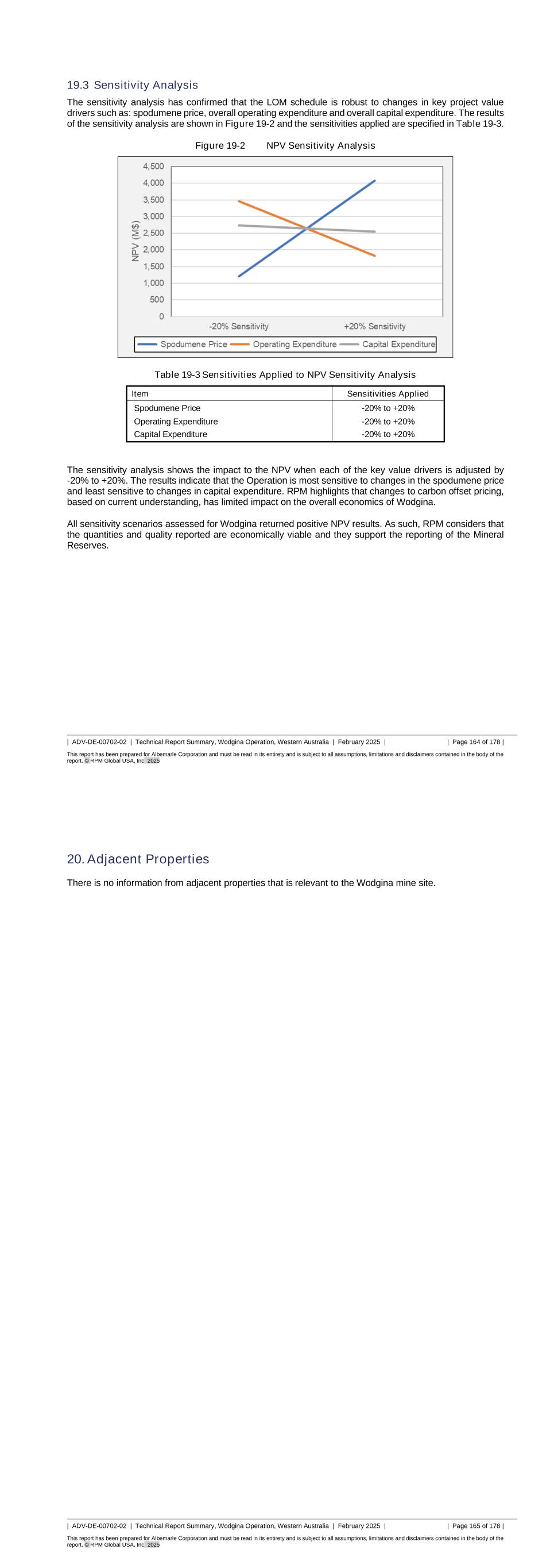

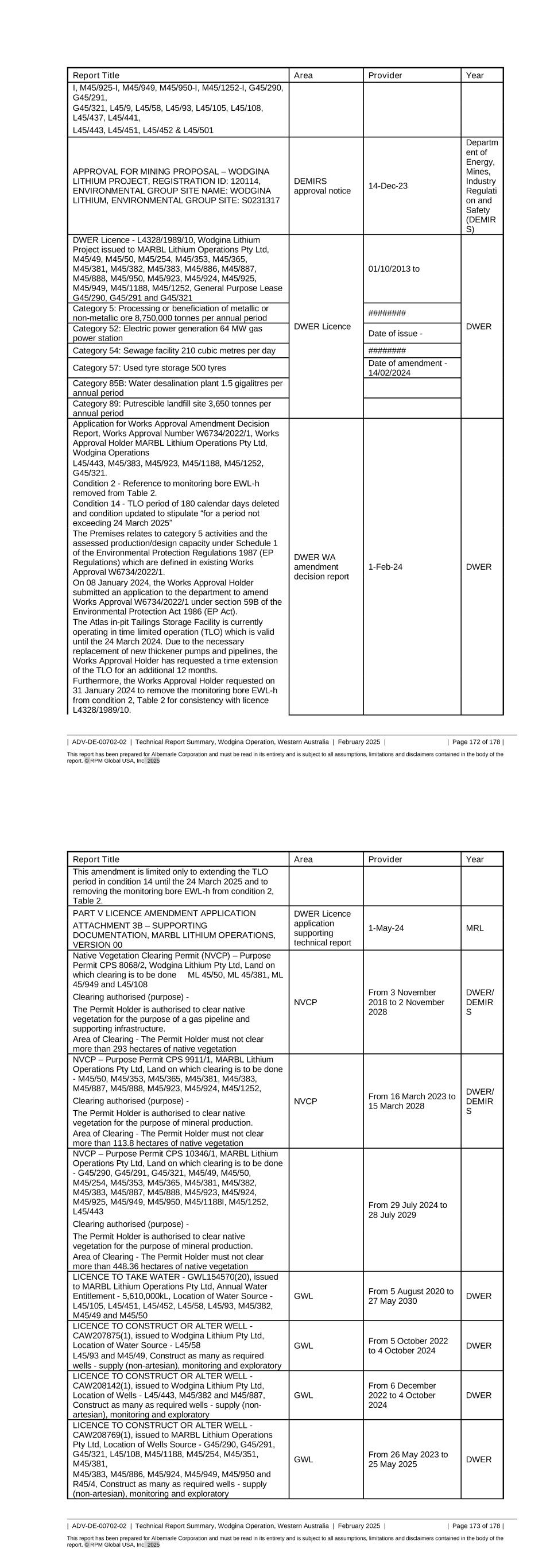

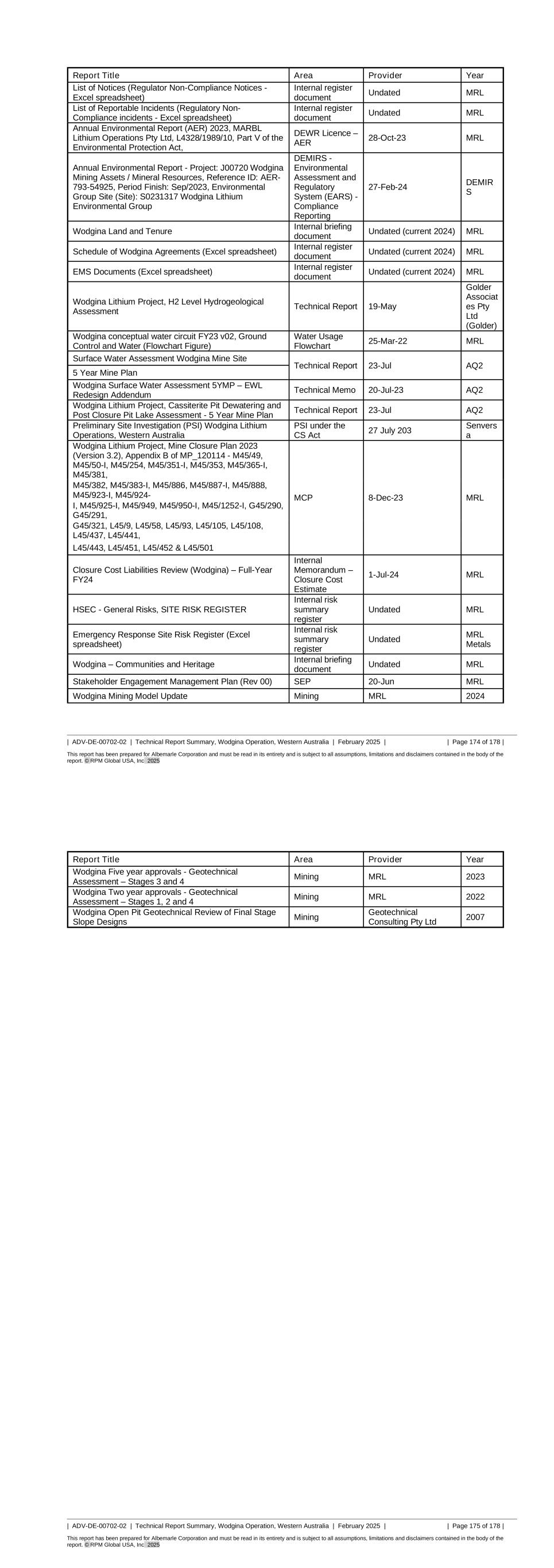

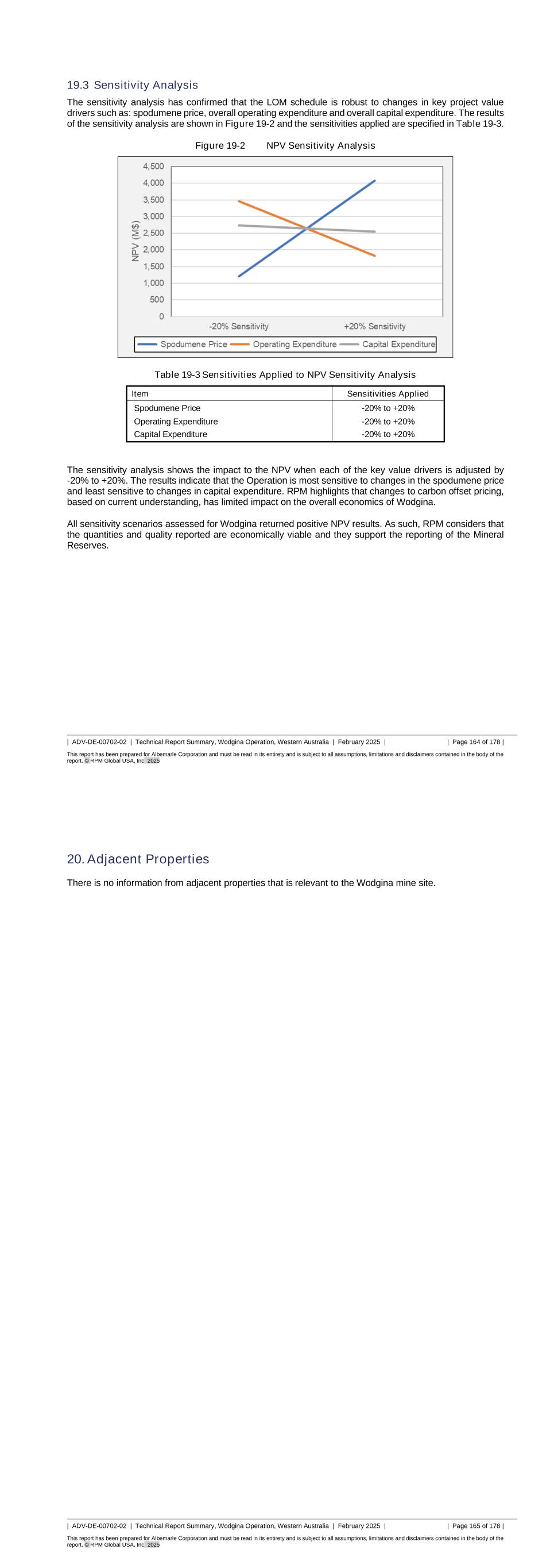

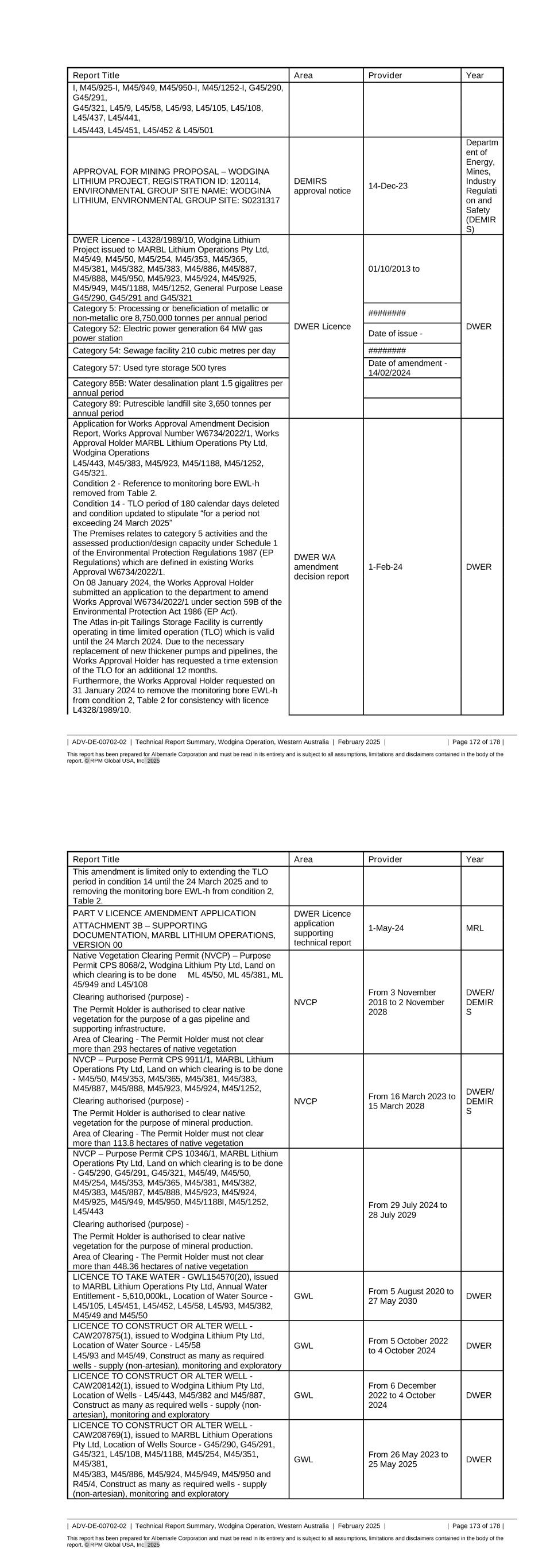

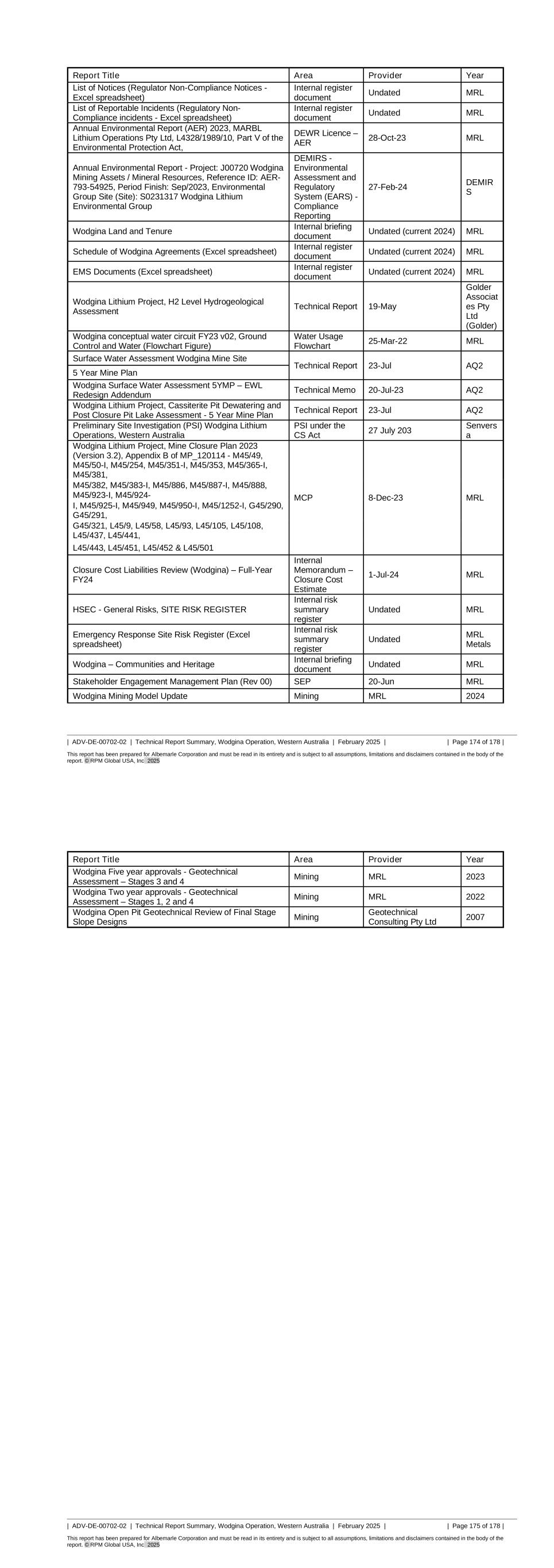

| ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page iv of vi | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 18.3 Operating Costs ............................................................................................................ 158 18.4 Safeguard Mechanism .................................................................................................. 159 19. ECONOMIC ANALYSIS ............................................................................................... 161 19.1 Economic Criteria ......................................................................................................... 161 19.2 Cash Flow Analyses ..................................................................................................... 161 19.3 Sensitivity Analysis ....................................................................................................... 164 20. ADJACENT PROPERTIES .......................................................................................... 165 21. OTHER RELEVANT DATA AND INFORMATION ........................................................ 166 22. INTERPRETATION AND CONCLUSIONS ................................................................... 167 22.1 Geology ........................................................................................................................ 167 22.2 Mining ........................................................................................................................... 167 22.3 Mineral Processing ....................................................................................................... 168 22.4 Environmental, Social, and Governance (ESG) ............................................................ 168 23. RECOMMENDATIONS ................................................................................................ 169 23.1 Geology and Mineral Resources ................................................................................... 169 23.2 Mining ........................................................................................................................... 169 23.3 Mineral Processing ....................................................................................................... 169 23.4 Environmental, Social, and Governance ....................................................................... 169 23.5 Tailings Storage ............................................................................................................ 170 24. REFERENCES ............................................................................................................. 171 25. RELIANCE ON INFORMATION PROVIDED BY REGISTRANT .................................. 176 25.1 Macroeconomic Trends ................................................................................................ 176 25.2 Marketing ...................................................................................................................... 176 25.3 Legal Matters ................................................................................................................ 176 25.4 Environmental Matters .................................................................................................. 176 25.5 Stakeholder Accommodations ...................................................................................... 176 25.6 Governmental Factors .................................................................................................. 177 26. DATE AND SIGNATURE PAGE .................................................................................. 178 | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page v of vi | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 LIST OF TABLES Table 1-1 LOM Physicals .......................................................................................................................... 3 Table 1-2 Statement of Mineral Resources at 30 June 2024 (Albemarle Share 50%) ................................ 4 Table 1-3 Statement of Mineral Reserves as at 30 June 2024 (Albemarle Share 50%) .............................. 5 Table 1-4 Summary of Economic Evaluation ............................................................................................. 7 Table 2-1 Site Visit Summary ..................................................................................................................10 Table 2-2 List of abbreviations .................................................................................................................12 Table 3-1 Land Tenure ............................................................................................................................21 Table 5-1 Production History ...................................................................................................................29 Table 5-2 Production since restart in 2022 ...............................................................................................29 Table 7-1 Drilling summary ......................................................................................................................44 Table 8-1 Density values for material types at Wodgina ...........................................................................48 Table 8-2 Density estimates for TSF's .....................................................................................................48 Table 8-3 Elements, Units and Detection Limits for Wodgina Analyses at NAGROM ................................49 Table 8-4 Comparison of CRM analysis ...................................................................................................51 Table 10-1 Mineralogical Documentation Reviewed ...............................................................................53 Table 10-2 Geometallurgy – Mineralogy Sample Texture Selection ........................................................54 Table 10-3 Metallurgical Test Work Documentation Reviewed ...............................................................54 Table 11-1 Statement of Mineral Resources at 30 June 2024.................................................................57 Table 11-2 Summary Statistics per Domain ...........................................................................................65 Table 11-3 Variogram Interpretation.......................................................................................................67 Table 11-4 Selected Optimal Parameters ...............................................................................................68 Table 11-5 Density values for material types at Wodgina .......................................................................69 Table 11-6 Density estimates for TSF's ..................................................................................................70 Table 11-7 Block Model Parameters ......................................................................................................71 Table 11-8 Search Parameters ..............................................................................................................71 Table 11-9 Comparison with Previous Mineral Resources Estimates......................................................80 Table 12-1 Statement of Mineral Reserves as at 30 June 2024 ..............................................................84 Table 12-2 MRL Pit Optimization Parameters ........................................................................................86 Table 12-3 Applied Ore Recovery Factor ...............................................................................................88 Table 12-4 Pit Design Parameters .........................................................................................................88 Table 12-5 Pit Ramp Parameters ...........................................................................................................89 Table 12-6 LOM Plant Feed Recovery ...................................................................................................89 Table 12-7 Reserves Marginal Cutoff Grade Assumptions .....................................................................90 Table 12-8 Comparison with Previous Mineral Reserves ........................................................................90 Table 13-1 LOM Physicals .....................................................................................................................97 Table 13-2 LOM Schedule as at 30 June 2024 ......................................................................................98 Table 13-3 Wodgina Major Earth Moving Fleet.......................................................................................99 Table 13-4 Major Mining Fleet Summary ................................................................................................99 Table 14-1 Process Design Criteria .....................................................................................................109 Table 14-2 Wodgina – Mass Balance ...................................................................................................113 Table 14-3 Wodgina – Mechanical Equipment List ...............................................................................114 Table 15-1 Fine Tailings Storage Capacity ...........................................................................................124 Table 17-1 Current Key Operation E&S Approvals and Licenses/Permits .............................................150 Table 17-2 Future Key Operation E&S Approvals and Licenses/Permits ..............................................151 Table 18-1 LOM Capital Cost Estimate ................................................................................................157 Table 18-2 Annual Capital Costs Summary ..........................................................................................158 Table 18-3 Annual Operating Costs Summary .....................................................................................158 Table 18-4 LOM Average Annual Cost* ...............................................................................................159 Table 19-1 Annual Discounted Cashflow..............................................................................................162 Table 19-2 Annual Cashflow ................................................................................................................163 Table 19-3 Sensitivities Applied to NPV Sensitivity Analysis .................................................................164

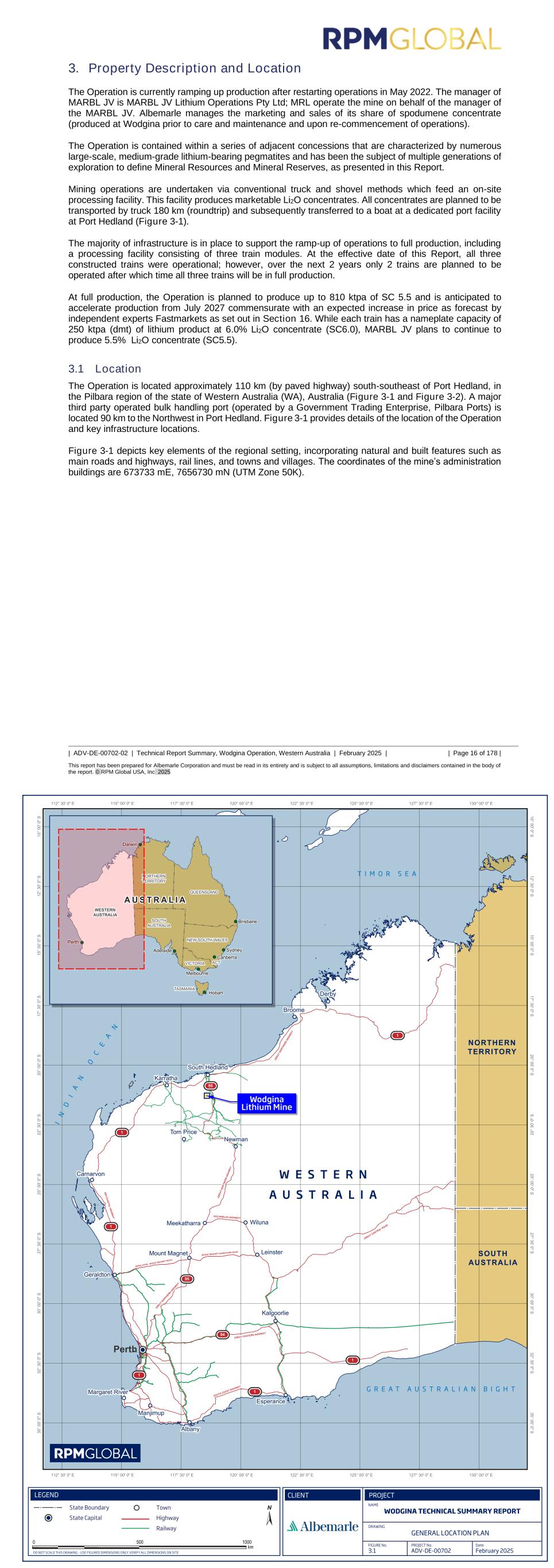

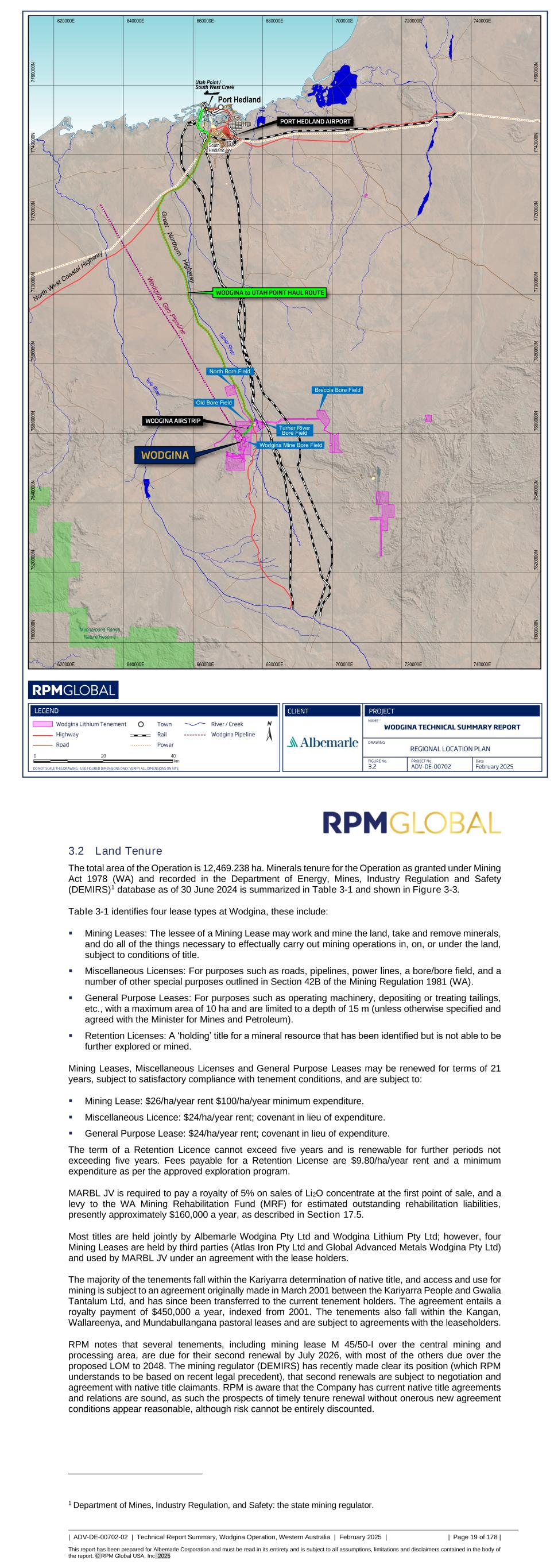

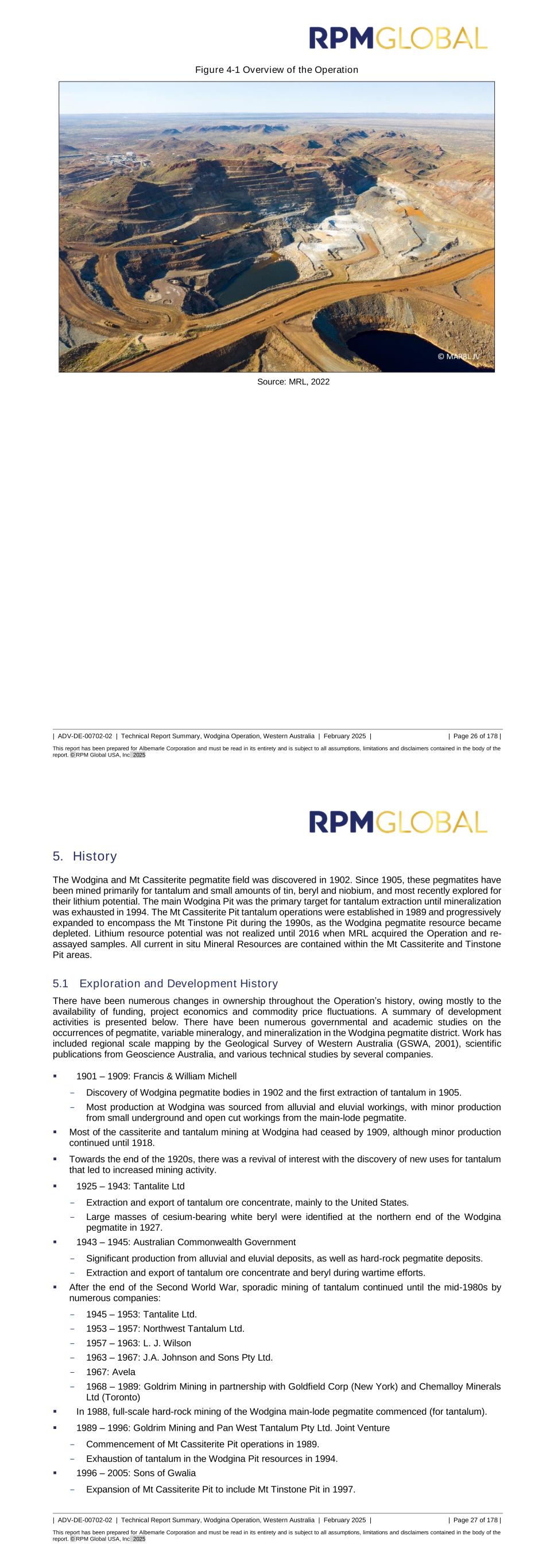

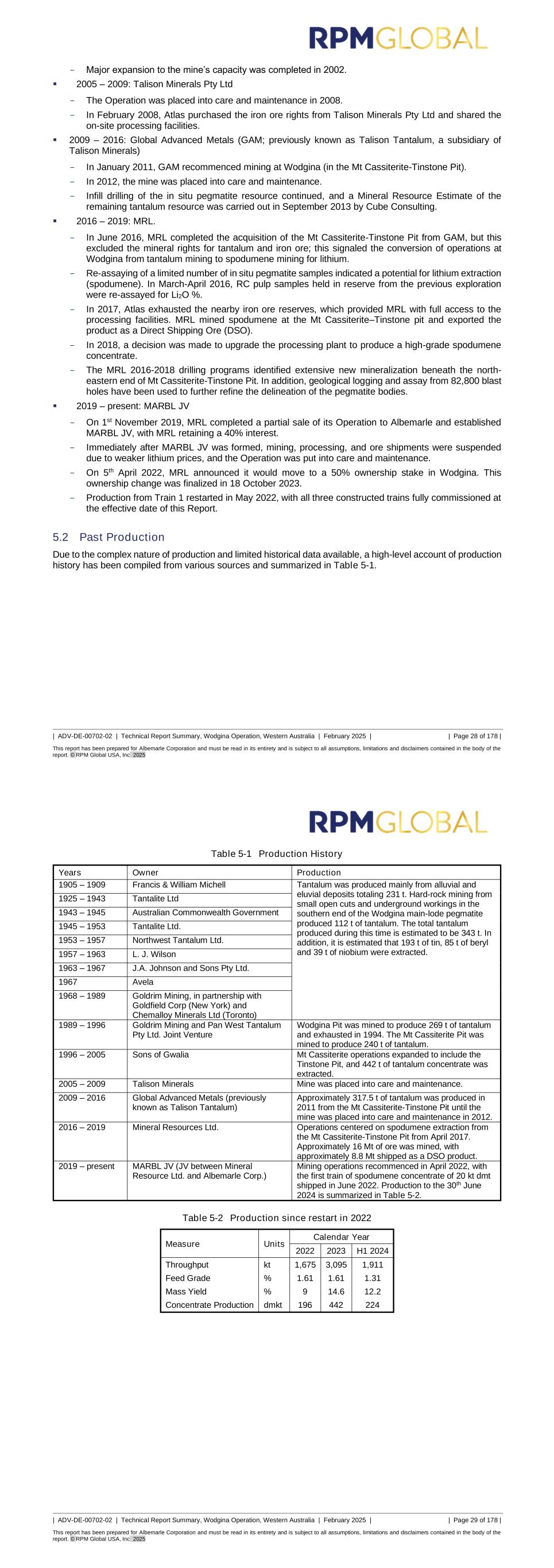

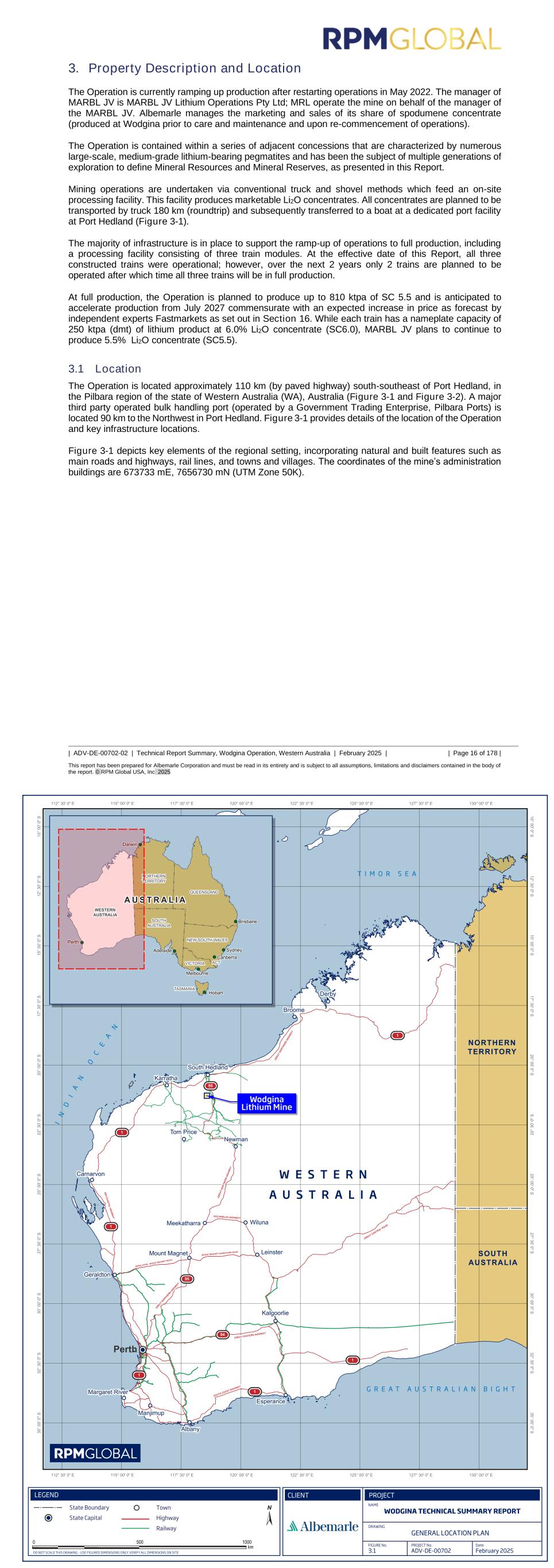

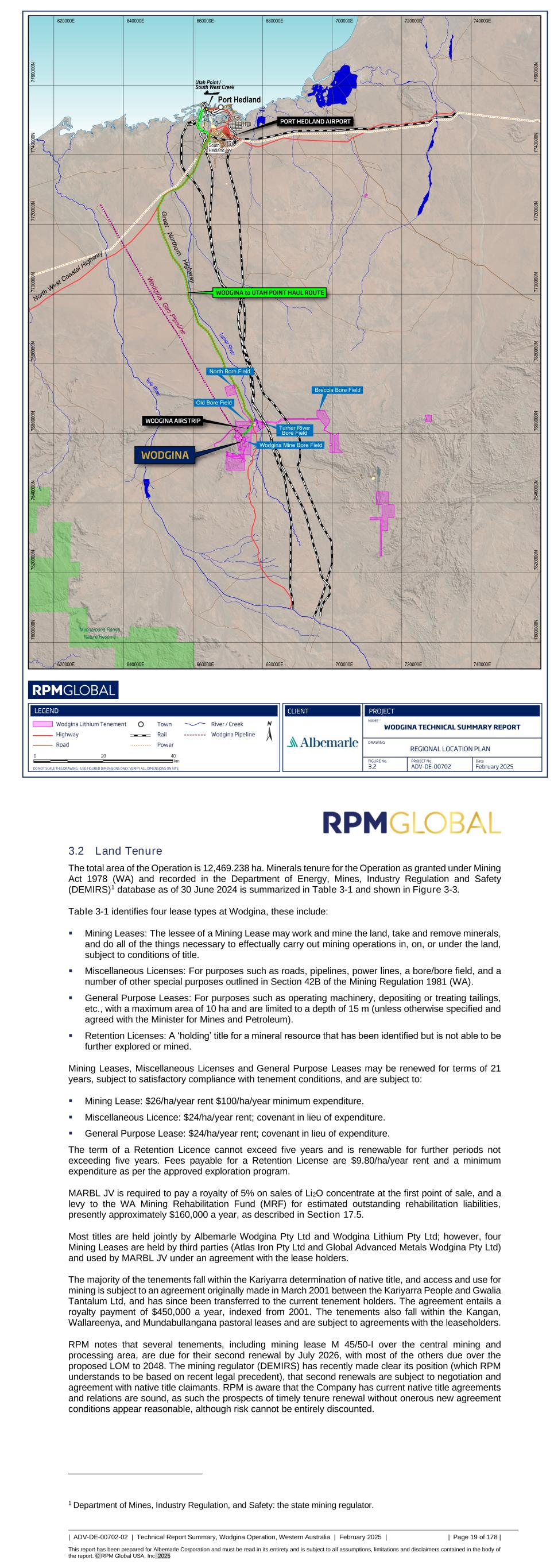

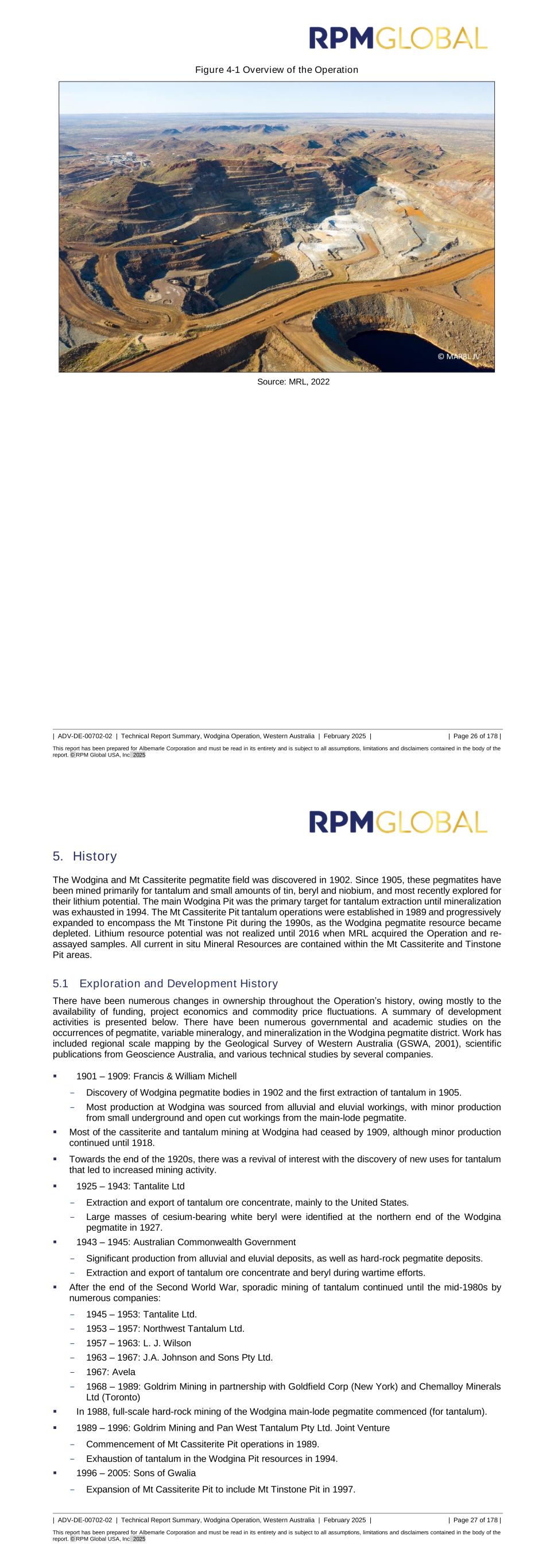

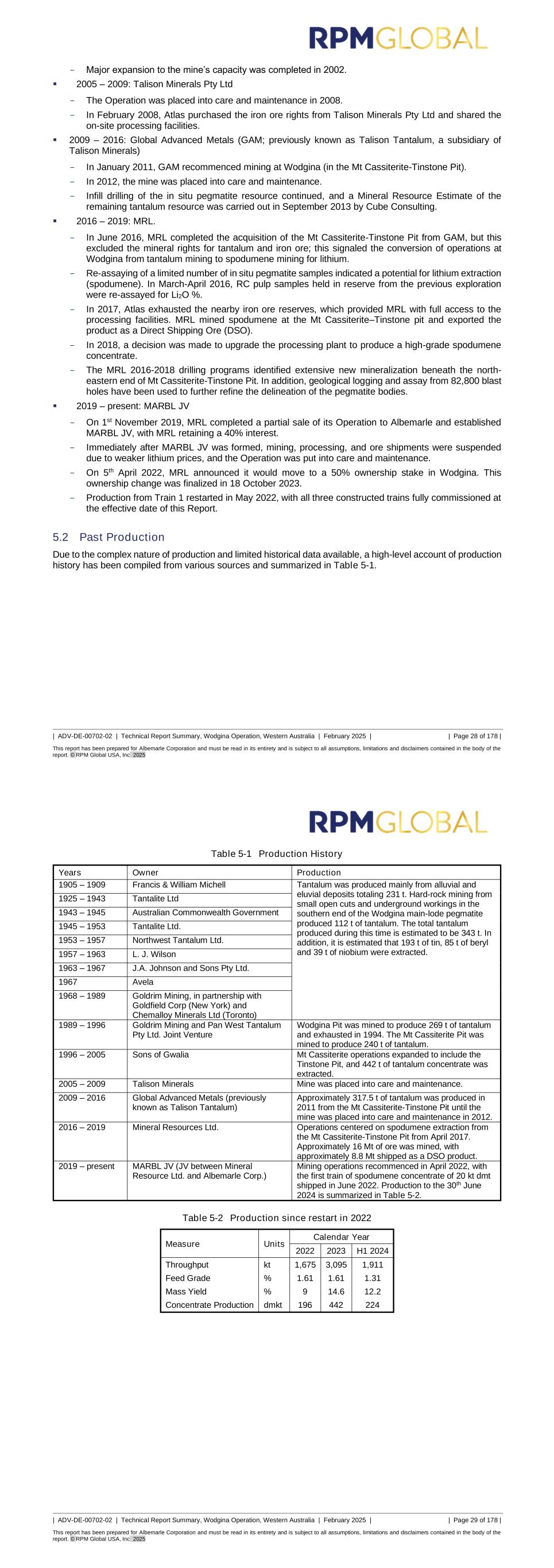

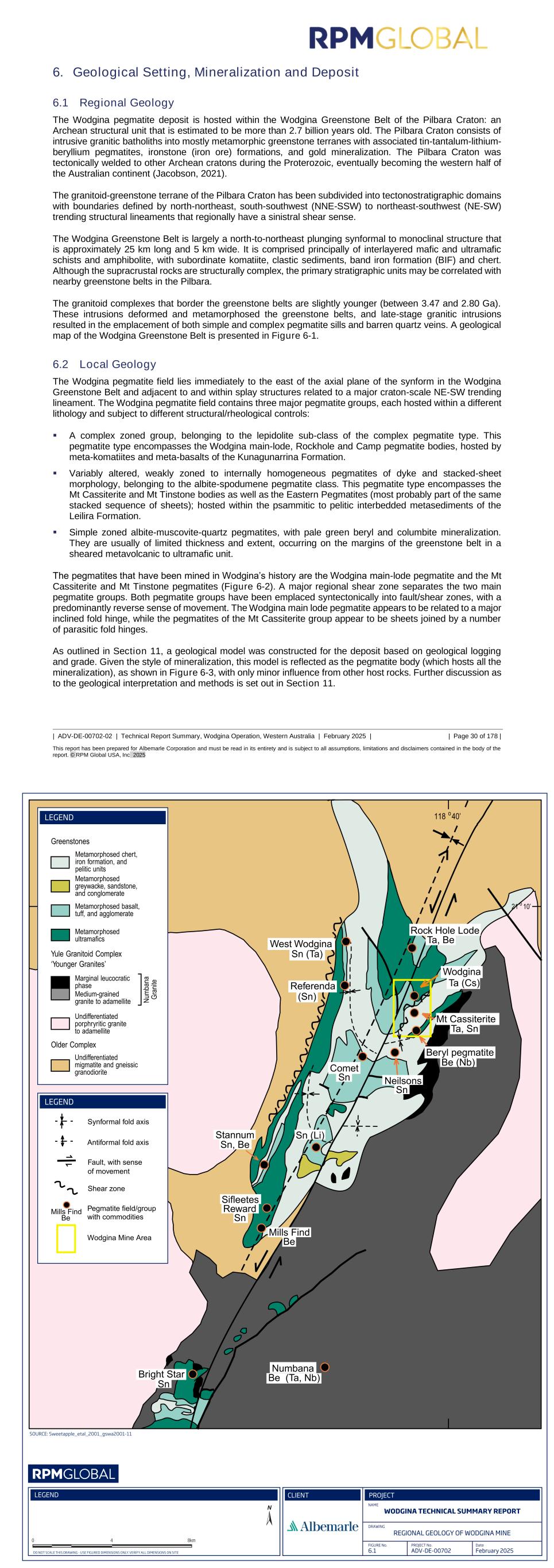

| ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page vi of vi | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 LIST OF FIGURES Figure 1-1 Lithium supply-demand balance ('000 tonnes LCE) ..................................................................... 6 Figure 3-1 Wodgina Lithium Operation General Location Plan ..................................................................17 Figure 3-2 Regional Location Plan ............................................................................................................18 Figure 3-3 Wodgina Land Tenure Layout ..................................................................................................20 Figure 4-1 Overview of the Operation .......................................................................................................26 Figure 6-1 Geological map of the Wodgina greenstone belt showing distribution of pegmatite fields ..........31 Figure 6-2 Simplified local geology map of Wodgina .................................................................................32 Figure 6-3 Generalized cross-section of the Mt Cassiterite and Mt Tinstone pegmatites ............................34 Figure 6-4 Stratigraphic Column of the Pegmatite .....................................................................................35 Figure 6-5 Upper Contact of the Basal Zone .............................................................................................37 Figure 7-1 Sample locations for re-assayed RC pulp (black) and new samples (red) from 2016 ................39 Figure 7-2 Drillhole Locations ...................................................................................................................43 Figure 7-3 Foliation controlling batter stability in the East Wall ..................................................................47 Figure 10-1 Geometallurgical Program – Metallurgical Testing Flowsheet ...............................................55 Figure 11-1 Interpreted Lithology Model ..................................................................................................60 Figure 11-2 Geological interpretation of In situ Pegmatites. .....................................................................61 Figure 11-3 Wireframe surfaces of TSF top and base .............................................................................62 Figure 11-4 Log Probability by Depth ......................................................................................................63 Figure 11-5 TSF Composite Histogram ...................................................................................................69 Figure 11-6 TSF Log Probability Plot.......................................................................................................70 Figure 11-7 Plan View of Interpreted Fault Zones ....................................................................................72 Figure 11-8 Cross Section Comparison of the Drill Holes Vs the Block Model. .........................................73 Figure 11-9 Swath Plots for Basal Pegmatites. ........................................................................................74 Figure 11-10 2024 Monthly Reconciliation.................................................................................................75 Figure 11-11 Section through the TSF rock model at 7,656,500 mN ..........................................................76 Figure 11-12 Classification of the Mineral Resources ................................................................................79 Figure 11-13 Depth Extension Beneath LOM Pit .......................................................................................82 Figure 12-1 Pit Optimization Shell ...........................................................................................................87 Figure 13-1 LOM Pit Design Shell ...........................................................................................................93 Figure 13-2 LOM Total Material Movement (ex-pit + tailings rehandle) ....................................................95 Figure 13-3 LOM Active Mining Areas .....................................................................................................95 Figure 13-4 LOM EWL Dump Sequence .................................................................................................96 Figure 13-5 LOM Stockpile Inventory ......................................................................................................97 Figure 14-1 Processing Overview – Block Flow Diagram .......................................................................100 Figure 14-2 Process Plant Overview – Aerial Image ..............................................................................101 Figure 14-3 Comminution Circuit – Block Flow Diagram ........................................................................102 Figure 14-4 Crushing Circuit – Aerial View ............................................................................................103 Figure 14-5 Processing Train Example – Block Flow Diagram ...............................................................105 Figure 14-6 Processing Trains 1 to 3 – Aerial View ...............................................................................106 Figure 15-1 Lumsden Point Port ...........................................................................................................116 Figure 15-2 Port Lumsden Product Storage ..........................................................................................117 Figure 15-3 Site Layout .........................................................................................................................118 Figure 15-4 Simplified Water Flow Sheet ..............................................................................................119 Figure 15-5 Potential Bore field locations ..............................................................................................120 Figure 15-6 Tailings Storage Facilities at Wodgina ................................................................................122 Figure 15-7 TSF3E ...............................................................................................................................123 Figure 15-8 Southern Sites 1 and 2 .......................................................................................................125 Figure 16-1 EV sales and penetration rates (‘000 vehicles, %) ..............................................................127 Figure 16-2 Lithium demand in key sectors ('000 LCE tonnes) ..............................................................127 Figure 16-3 Forecast mine supply ('000 tonnes LCE) ............................................................................130 Figure 16-4 Lithium supply-demand balance ('000 tonnes LCE) ............................................................131 Figure 16-5 Spodumene prices (6% lithia, spot, CIF China, US$/tonne) ................................................132 Figure 16-6 Spodumene long-term price forecast scenarios (6% Li2O spot, CIF China, US$/tonne, real (2024)) 134 Figure 19-1 Operation Cashflow and Pre Tax NPV Summary (100% Basis) ..........................................162 Figure 19-2 NPV Sensitivity Analysis ....................................................................................................164 | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 1 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 1. Executive Summary 1.1 Summary RPMGlobal USA, Inc. (RPM) was engaged by Albemarle Corporation (Albemarle, or the Client) to prepare a Technical Report Summary (TRS or the Report) on the Wodgina Lithium Operation (the Operation, or Wodgina), located approximately 110 km (by paved highway) south-southeast of Port Hedland, in the Pilbara region of the state of Western Australia, Australia. The Operation is owned by an unincorporated Joint Venture between Mineral Resources Limited (MRL) (50%) and Albemarle (50%), known as the MARBL JV Lithium Joint Venture (MARBL JV or the Company). MRL through various wholly owned subsidiaries, operates Wodgina on behalf of the MARBL JV including a life of mine crushing services. Each party individually manages the marketing and sales its attributable share of spodumene concentrate. RPM’s technical team (the Team) consisted of Senior, Principal and Executive level Consultants across geology, mining, processing, infrastructure and environment, health, safety & social (EHSS) with relevant experience in the styles of mineralization, mining method and regional setting of the Operation. RPM, as the QP, was responsible for compiling or supervising the compilation of this Report and the Statements of Mineral Resources and Mineral Reserves stated within. A single site visit was conducted by several of the Team members to the Operation, including the mine site and surface operations, to familiarize themselves with the Operation’s characteristics. The team also held a number of meetings with MRLs key operational staff in the areas of mining, processing and EHSS in Perth during the undertaking of the TRS. During the site visit and meetings, the Team had open discussions with MRLs operational personnel on technical aspects relating to the relevant issues. MRLs personnel were cooperative and open in facilitating RPM’s work. It should be noted that all costs and cashflow within this TRS are presented in Australian Dollars ($) (unless otherwise stated), the economics have been detailed and evaluated on a 100% equity basis (Albemarle 50%), and no adjustment has been made for inflation (real terms basis). 1.2 Report Scope The purpose of this Report is to provide a Technical Report Summary for Wodgina, which includes a statement of Mineral Resources and Mineral Reserves as at 30 June 2024 reported to reflect the 50% Albemarle ownership in the relevant holding companies that own the Operation. This TRS conforms to the United States Securities and Exchange Commission’s (SEC) Modernized Property Disclosure Requirements for Mining Registrants as described in Title 17 Subpart 229.1300 of Regulation S-K, Disclosure by Registrants Engaged in Mining Operations (S-K 1300) and Item 601 (b)(96) Technical Report Summary. The Report was prepared by RPM as a third-party firm in accordance with S-K 1300. References to the QP are references to RPM and not to any individual employed or engaged by RPM. In addition to work undertaken to generate independent Mineral Resources and Mineral Reserves estimates, the TRS relies largely on information provided by the Company, MRL or the Client, either directly from the sites and other offices or from reports by other organizations whose work is the property of the Company or the Client or its subsidiaries. The data relied upon for the Mineral Resources and Mineral Reserves estimates independently completed by RPM have been compiled primarily by the Client and Company and subsequently reviewed and verified as well as reasonably possible by RPM. The TRS is based on information made available to RPM as at 30 June 2024. Neither the Client, nor MRL has advised RPM of any material change, or event likely to cause material change, to the underlying data, designs, or forecasts since the date of asset inspections. It is noted that references to quarterly, half-yearly or annual time periods are based on a calendar year commencing 1 January each year, unless otherwise noted. 1.3 Property Description and Location Wodgina is a large-scale operating lithium mine that is contained within a series of adjacent concessions that contain numerous large-scale, medium-grade lithium-bearing pegmatites. The pegmatites have been the subject of multiple generations of exploration to define Mineral Resources and Mineral Reserves, as

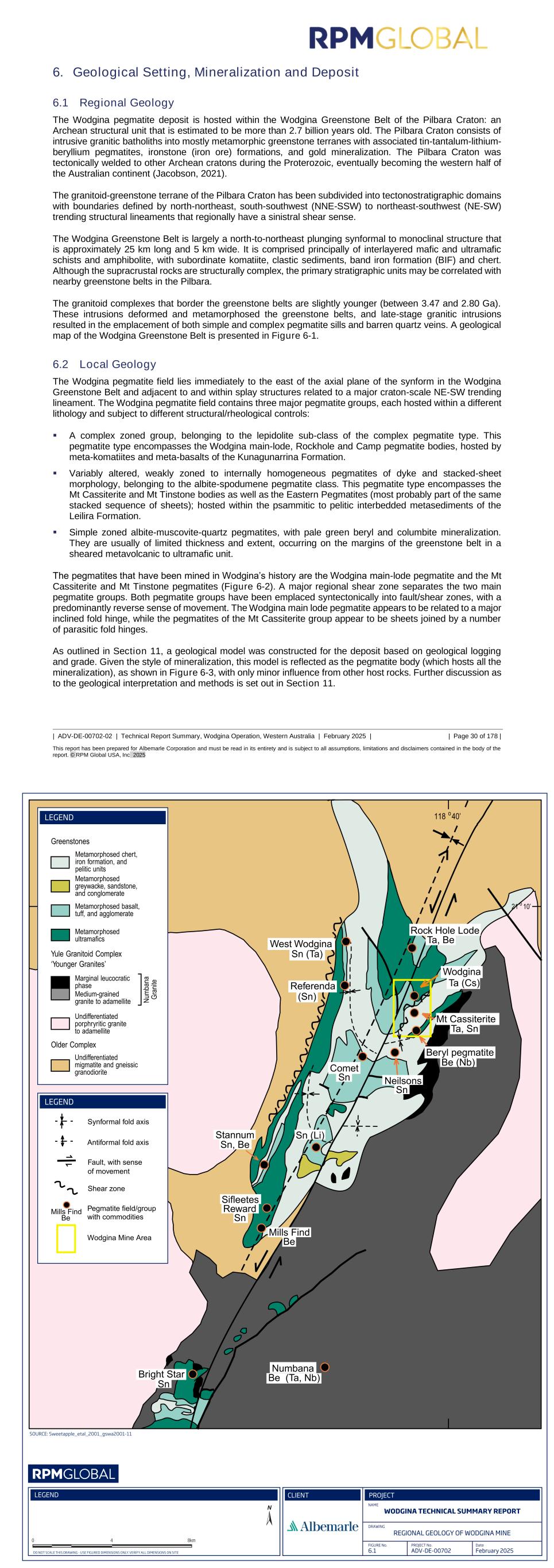

| ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 2 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 presented in this Report. Mining operations are undertaken via conventional truck and shovel methods which feed an on-site processing facility consisting of three identical train modules. This facility produces a 5.5% Li2O concentrate (SC 5.5) which is subsequently transported to a third-party port facility in Port Hedland. MRL, and subsequently the Company, has a history of operating in the Pilbara, acquiring the Operation in 2016 and commencing Direct Shipping Ore (DSO) production and sales in 2017, prior to the establishment of the MARBL JV Joint Venture in 2019. The Operation is currently ramping up production after restarting operations in May 2022. Wodgina has undergone a number of expansions to its current total nominal processing capacity of 5.6 million tonnes per annum (Mtpa) and is forecast to produce 460 kt of SC5.5 in 2025. Wodgina operates under tenure issued by the State Government of Western Australia and granted under the provisions of the Mining Act 1978. Wodgina has a combined surface extent of 12,469.238 ha with a total of 19 Mining Leases, 1 Retention Licence, 7 General Purposes Leases, and 11 Miscellaneous Licenses. Most titles are held jointly by Albemarle Wodgina Pty Ltd and Wodgina Lithium Pty Ltd; however, four Mining Leases are held by third parties (Atlas Iron Pty Ltd and Global Advanced Metals Wodgina Pty Ltd) and used by MARBL JV under an agreement with the lease holders. The Operation is accessible year-round via sealed bitumen roads, and there is sufficient road, air, and port infrastructure in place with sufficient capacity to support the planned mining operations. RPM considers there to be no limitations on mining or exploration at the site due to the climate other than cyclonic events typical for the region. 1.4 Geology and Mineralization The Wodgina pegmatite deposit is hosted within the Wodgina Greenstone Belt of the Pilbara Craton: an Archean structural unit that is estimated to be more than 2.7 billion years old. The Pilbara Craton consists of intrusive granitic batholiths into mostly metamorphic greenstone terranes with associated tin-tantalum- lithium-beryllium pegmatites, ironstone (iron ore) formations, and gold mineralization. The Pilbara Craton was tectonically welded to other Archean cratons during the Proterozoic, eventually becoming the western half of the Australian continent (Jacobson, 2021). The Mt Cassiterite-Tinstone pegmatite sheets of Wodgina Greenstone Belt are mostly zoned, which appears to increase in complexity at depth, with mineralogy dominated by phenocrysts of spodumene (10- 30 cm long) and K-feldspar in a matrix of fine- to medium-grained albite, quartz, and muscovite. Veins of quartz up to 10 cm thick are common, as are 1 mm thick veinlets of green sericite-albite. Some mineralized zoning of the pegmatites has been observed, with higher concentrations of spodumene occurring close to the upper contact, and near-perpendicular alignment of crystals to the pegmatite contact exhibiting distinctive 'pull apart' structures. In the massive basal pegmatite, the spodumene is distributed within fine- grained quartz, feldspar, spodumene, and muscovite matrix. A weak zonation is evident in the development of finer-grained border units and occasionally in areas rich in microcline crystals. However, there is no obvious zoning associated with the minor occurrences of other minerals, including lepidolite, biotite, fluorite, white beryl, and lithium phosphate minerals. 1.5 Exploration Status The Wodgina deposit is well explored and understood, with exploration drilling programs completing 2,295 holes since drilling commenced in the early 1980s. Exploration has been continuous throughout the life of the Operation, with recent exploration focused on the mining areas within the Life of Mine (LOM) pit limits. These exploration programs have gathered geology and geochemical data, with all of this data collected from surface drilling activities. Wodgina’s forward-looking exploration strategy focuses on increasing the geological confidence within current LOM pit and drilling has recently commenced to execute this. 1.6 Development and Operations The Operation utilizes conventional open-cut mining techniques optimized for the deposit's geological characteristics, with targeted extraction from the pegmatites. Mining is forecast to be sourced from a single open cut with the final pit design incorporating staged cutbacks to balance cost efficiency, recovery and safety. | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 3 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 The mining fleet is expected to remain fully owner-operated; however, managed by MRL, consisting of a mixed fleet of backhoe hydraulic excavators, 230-tonne and 140-tonne haul trucks. Contractors manage equipment supply, maintenance, replacement, and workforce logistics, and subsequently, all mining costs are based on unit rates. Wodgina is operated 24 hours a day through all seasons and is supported by infrastructure including a crushing plant, three floatation trains, laboratory, process water ponds, water bore fields, gas fired power station, natural gas pipeline, accommodation village, administration buildings, maintenance facilities, diesel storage and refueling , aviation fuel storage, access roads, dedicated airport able to service A320 jets, water storage and tailings storage facilities (TSF). The Operation features a single crushing circuit that feeds three identical flotation trains, each with a capacity of 1.85 Mtpa. Each train was designed to produce 250 ktpa of 6.0% spodumene concentrate (SC6.0), resulting in a total throughput of 5.6 Mtpa and a combined concentrate output of 750 ktpa (SC6.0); however, the Operation targets a SC5.5 concentrate for a total design capacity of approximately 810 ktpa of SC5.5. While the comminution circuit is shared, the flotation trains operate as standalone units, with a shared final concentrate destination. This provides the operation with significant flexibility and the ability to adjust processing throughput as required. The currently operating Atlas InPit TSFs, with the proposed bunding, along with the planned southern TSF have a combined storage life suitable to meeting the LOM, provided the documentation for regulatory approval is completed by MRL. There is single operating waste dump, which has a designed capacity to support the LOM. This waste dump is approved to 2030 with additional regulatory approvals required to meet the LOM. 1.6.1 Life of Mine Physicals The key physicals relevant to the LOM plan are summarized in Table 1-1. Active mining and processing in the LOM plan extend to 2048. Total annual material movement is projected to progressively ramp up in 2025 and peak at 37.7 Mt in 2027, sustaining steady production rates thereafter. The LOM as presented in this Report includes production from only two of the three trains until 2027 after which time all three trains will be in operation for the remainder of the mine life. As such, it is forecast that in 2025 440 kt of dry concentrate ramping up to 810 kt by 2029. Table 1-1 LOM Physicals Parameter Units (metric) LOM LOM Active Mine Period Years 25 LOM Plant Period Years 25 Waste Material Moved Mt 733.9 Ore Mined (ex-pit) Mt 101.0 Ore Mined (reprocessed tailings) Mt 14.8 Ore Processed (Feed total) Mt 115.8 Feed Grade (Total average) % 1.3 Strip Ratio (ROM) t:t 6.3 LOM Plant Recovery % 56.7 Concentrate Tonnes (SC5.5) dmt 16.4 The LOM plan underpinning the Mineral Reserves estimate outlined below is an independent assessment based on the estimate of Mineral Resources, and a LOM schedule and associated financial analysis completed by RPM. This LOM was based on the forecast mining sequence; however, RPM modified various aspects of the Company’s LOM plan to align with appropriate and practical modifying factors. Of note, these changes include the plant throughput during 2024 and 2026 to 2 trains only and associated capital expenditure. RPM considers the estimation methodology to align with industry standards and the achievable production in the medium to long term. RPM considers the underlying studies, as well as capital and operating cost estimates, to be of a pre-feasibility level of accuracy.

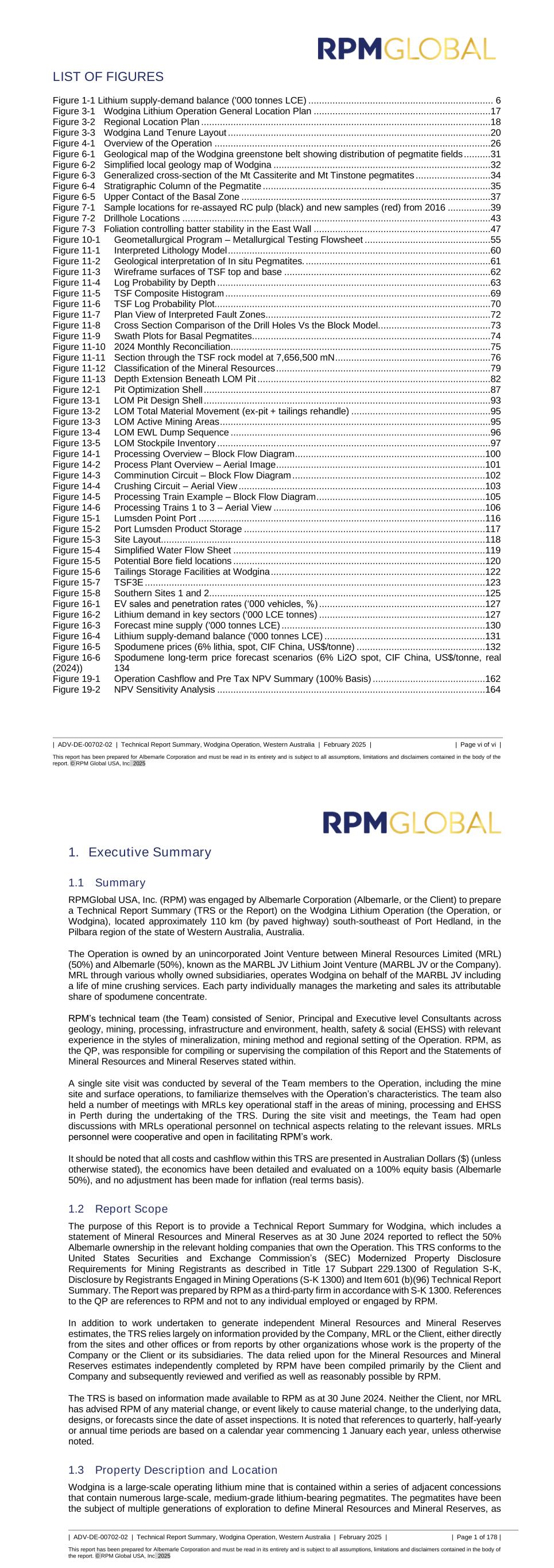

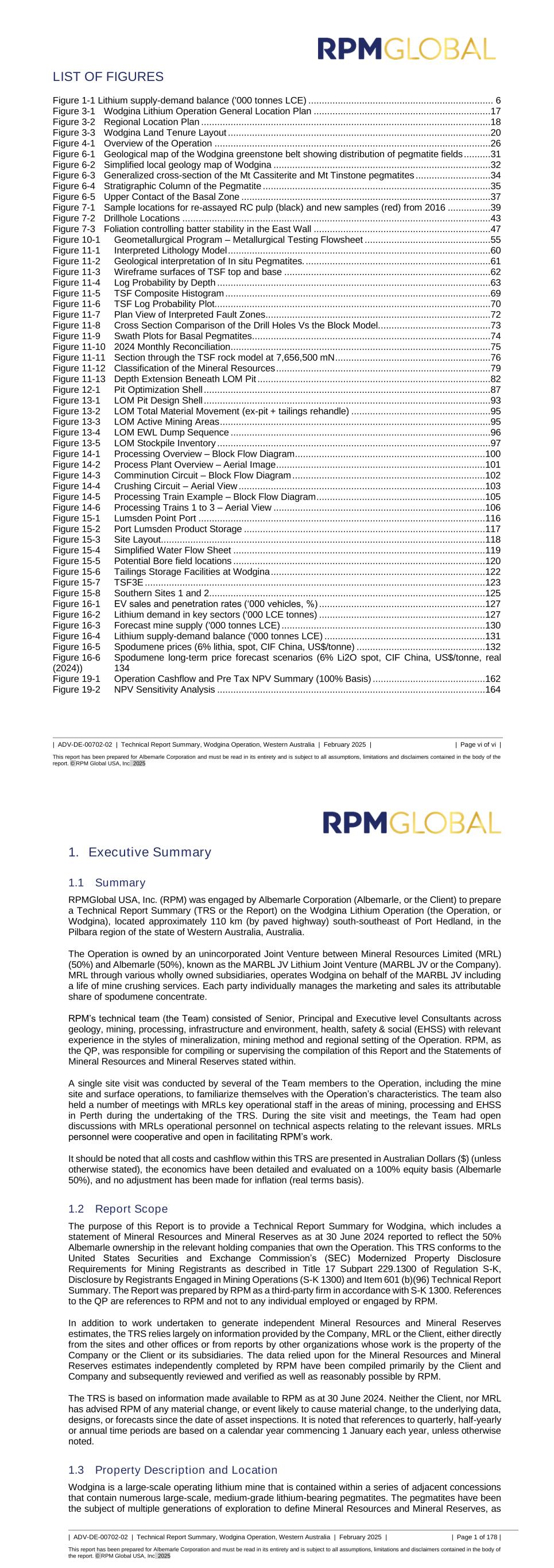

| ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 4 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 1.7 Mineral Resources and Mineral Reserves The Mineral Resources as at 30 June 2024 for the Operation have been summarized in Table 1-2. The Mineral Resources have been estimated with reference to a cut-off grade (COG) based on mining method; the open cut COG is 0.5%, while the underground COG is 0.75%. The COGs were determined based on estimated mining and processing costs, product qualities, and long-term benchmark pricing. It is highlighted that the long-term price (as discussed in Section 16) of US$1,500 tonne of product over a timeline of 7 to 10 years is above the current spot price and was selected based on the reasonable long- term prospect based on independent marketing study by Fastmarkets, rather than the short-term viability (0.5 to 2 years). RPM considers the geological model is based on adequate structural and geochemical data that has been reviewed and verified by geologists, over a long period of time, as well as RPM. Deposit modelling has been carried out using industry-standard geological modelling software and procedures. The estimation and classification of the Mineral Resource reflects the QP’s opinion of in situ material with reasonable prospects for eventual economic extraction. The COG of 0.5% Li2O for open cut Mineral Resources is based on estimated mining and processing costs and recovery factors; however, RPM notes that 0.5% Li2O is also the lowest grade to ensure a saleable product can be produced. RPM notes that the stockpiles and TSF material is included in Mineral Reserves, hence excluded from Mineral Resources. Table 1-2 Statement of Mineral Resources at 30 June 2024 (Albemarle Share 50%) Type Classification Quantity (100%) (Mt) Attributable Quantity (50%) (Mt) Li2O (%) Open Cut Indicated 36.2 18.1 0.6 Inferred 11.0 5.5 1.2 Underground Indicated 10.5 5.3 1.3 Inferred 15.5 7.8 1.2 TSF Indicated Inferred 2.4 1.2 0.4 Notes: 1. The Mineral Resources are reported exclusive of the Mineral Reserves. 2. The Mineral Resources have been compiled under the supervision of RPM as the QP. 3. All Mineral Resources figures reported in the table above represent estimates at 30 June 2024 based on a model completed in September 2024. Mineral Resource estimates are not precise calculations, dependent on the interpretation of limited information on the location, shape and continuity of the occurrence and on the available sampling results. The totals contained in the above table have been rounded to reflect the relative uncertainty of the estimate. Rounding may cause some computational discrepancies. 4. Mineral Resources are reported in accordance with S-K 1300. 5. The Mineral Resources reflect the 50% ownership in the relevant holding companies. 6. The Mineral Resources are reported above 0.5% Li2O cut-off for in situ pegmatites within the open cut, 0.75% within the underground, and above 0% for TSF as all material would be mined and recovered. The basis for the COG is provided in Section 11.3. Mineral Reserves were estimated using technical data available as of 30 June 2024 in accordance with the guidelines of Regulation S-K Subpart 1300 (“S-K 1300”), as summarized in Table 1-3. Mineral Resources are reported exclusive of Mineral Reserves (that is, Mineral Reserves are additional to Mineral Resources). Mineral Reserves are subdivided into Proven Mineral Reserves and Probable Mineral Reserves categories to reflect the confidence in the underlying Mineral Resource data and modifying factors applied during mine planning. A Proven Mineral Reserve can only be derived from a Measured Mineral Resource, while a Probable Mineral Reserve is typically derived from an Indicated Mineral Resource as well as Measured Resources dependent on the QP’s confidence in the underlying Modifying Factors. It is noted that no Measured Resources have been reported have been reported for the Operation and as such there are no Proven Reserves. The conversion of Mineral Resources to Mineral Reserves incorporated systematic mine planning and analysis, including pit optimization, detailed pit design, the application of modifying parameters, LOM | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 5 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 scheduling, and cost analysis. All reserve calculations are in metric units, with LI2O grades reported in percentage (%). Mineral Reserve quantities were estimated using a marginal cut of grade of 0.75% Li2O and a selling price of US$1,300, based on Fastmarkets independent guidance in Section 16. Table 1-3 Statement of Mineral Reserves as at 30 June 2024 (Albemarle Share 50%) Type Classification Quantity (100%) (Mt) Attributable Quantity (50%) (Mt) Li2O (%) Open Cut Proven Probable 101.0 50.5 1.4 Stockpiles Proven Probable 0.1 0.05 1.5 TSF Proven Probable 14.8 7.4 1.0 Combined Probable 115.8 57.9 1.3 Notes: 1. The Mineral Reserves are additional to the reported Mineral Resources 2. The Mineral Reserves have been estimated by RPM as the QP. 3. Mineral Reserves are reported in accordance with S-K 1300. 4. The Mineral Reserves have been reported at a 50% equity basis. 5. Mineral Reserves are reported on a dry basis and in metric tonnes. 6. The totals contained in the above table have been rounded with regard to materiality. Rounding may result in minor computational discrepancies. 7. Mineral Reserves are reported considering a nominal set of assumptions for reporting purposes: - Mineral Reserves are based on a selling price of US$1,300/t CIF CKJ of chemical grade concentrate (benchmark 6% Li2O). - Mineral Reserves assume variable mining recoveries based on grade, oxidation, thickness, and search distance, sourced from MRL as presented in Table 12-3. - The total mining recoveries are 91.1% for the open cut pit and 100% for the TSF. - Mineral Resources were converted to Mineral Reserves using plant recovery equations, sourced from MRL and based on plant data. The plant processing recovery equations depend on the material type, weathering, and in some circumstances, the Li2O% grade of the plant feed. - Costs estimated in Australian Dollars were converted to U.S. dollars based on an exchange rate of AU$1.00:US$0.68. - The economic COG calculation is based on US$2.8/t-ore incremental ore mining cost, US$33.57/t-ore processing cost, US$15.66/t-ore G&A cost, US$3.64/t-ore sustaining capital cost and US$6.80/t ore. Incremental ore mining costs are the costs associated with the ROM loader, stockpile rehandling, grade control assays and rockbreaker. - The price, cost and mass yield parameters produce a calculated economic COG of <0.75% Li2O. However, due to the internal constraints of the current operations, an elevated Mineral Reserves COG of 0.75% Li2O has been applied. The same COG was utilized for the TSF. - Waste tonnage within the Mineral Reserve pit is 733.9 Mt at a strip ratio of 6.3:1 (waste to ore – not including stockpiles) 1.8 Market Studies Fastmarkets has developed a marketing study on behalf of Albemarle to support lithium pricing assumptions utilized in this Report. This market study does not consider by- or co-products that may be produced alongside the lithium production process. Battery demand is now responsible for 85% of all lithium consumed. Looking forward, Fastmarkets expects demand from eMobility, especially battery electric vehicles (BEVs), to continue to drive lithium demand growth. Supply is still growing despite the low-price environment and some production restraint. This has coincided with a period of weaker-than-expected demand growth. Ironically, the industry is still growing healthily; Fastmarkets expects demand growth from electric vehicles (EVs) to average 25% over the next 10 years, but this is slower than >40% growth in demand from EVs the market was used to in the early post-Covid years. The high prices in 2021-2022 triggered a massive producer response with some new supply still being ramped up, while at the same time some high-cost production is being cut, mainly by non-Chinese producers.

| ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 6 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 Based on Fastmarkets view in August 2024, the combination of weaker-than-expected demand at a time when supply is still rising means the market is likely to be in a supply surplus until 2026. Based on supply restraint and investment cuts, Fastmarkets forecasts the market to swing back into a deficit in 2027. This could change relatively easily should demand exceed expectations and supply expansion disappoint to the downside. Fastmarkets recommends that a real price of US$1,300/tonne for spodumene SC6.0 CIF China should be utilized by Albemarle for Mineral Reserve estimation. Recommended prices are on the lower end of Fastmarkets' low-case scenario. Figure 1-1 Lithium supply-demand balance ('000 tonnes LCE) Source: Fastmarkets Based on the Fastmarkets report, RPM has adopted the following to support Mineral Resource and Mineral Reserve Estimation: ▪ Mineral Resources: US$1,500/t for spodumene SC6.0 CIF China ▪ Mineral Reserves: US$1,300/t for spodumene SC6.0 CIF China; and ▪ Financial Modelling: US$1,300/t for spodumene SC6.0 CIF China from 2027, increased from spot price in line with the Fastmarkets forecast. 1.9 Environmental, Permitting, and Social Considerations There are no material local environmental and social (E&S) concerns for the Operation that limit the footprint or current operations; however, several approvals are required to allow execution of the full LOM as presented in this Report. Of note are the potential biodiversity and cultural heritage limits associated with the development of the Southern Basin TSF; this potential has been included in the approvals process. The Company has plans in place to address these potential E&S heritage limits through the project assessment and approvals process. The Operation has the required Environmental and Social (E&S) approvals and the licenses/permits for current operations and is generally operating in compliance with these current E&S approvals and permits with no material compliance issues noted. The future E&S approvals required to support the LOM plan comprise approvals for a new water supply and water processing / brine disposal, waste rock landform expansions, and an expanded and new TSF. MARBL JV has a plan and schedule in place to secure these future E&S approvals. RPM consider that this plan and schedule to be appropriate and achievable based on the requirements of the LOM as presented in this Report. 1.10 Economic Evaluation RPM highlights that the capital estimates for the next 5 years, along with the sustaining capital, are based on first-principles cost build-ups and are considered to be at least to a pre-feasibility level of accuracy. The | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 7 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 remainder of the capital expenditures are built-up using typical costing methods for an operation of the scale, long mine life, and operational requirements to meet the LOM plan. In addition, various contingencies are built into the cost estimates. Operating Costs The LOM operating costs are built up from first principles with reference to historical actuals (cost and production performance), the LOM physical schedule, and forecast product estimates. The total Free on Board (FOB) operating costs are $12,790 over the LOM and the average FOB cost, excluding state royalties, is $926/t product. Mine Closure of $112M is included in addition to the operating costs and allows for the total planned closure costs, ongoing closure holding costs and workforce redundancy. As such, RPM considers the basis of costs reasonable for the Operation. Capital Costs The economic evaluation includes: ▪ $690M in expansion capital to support the LOM ▪ $660M in sustaining capital for equipment purchase and replacement, and other general sustaining capital costs, which are typical for an operating asset of this scale. RPM highlights that the majority of operating infrastructure is in place to support the 25-year mine life. 1.10.1 Economic Evaluation The economic evaluation of the asset was completed using a discounted cash flow analysis and confirmed the LOM economics of Wodgina is positive; however, the current market environment shows a material negative cashflow until the beginning of 2027. Table 1-4 provides a summary of the economic evaluation. Table 1-4 Summary of Economic Evaluation Economic Evaluation Units LOM (AUDM) LOM (USD#) LOM (USD#) 1 1 0.5 Gross Spodumene Revenue $M 28,010 19,050 9,520 Free Cashflow*** $M 7,010 4,670 2,330 Total Operating Costs* $M 12,790 8,700 4,350 Total Capital Costs $M 2,510 1,710 860 Avg. Free on Board Costs* $/Prod t 742 504 504 All-In Sustaining Costs** $/Prod t 907 616 616 Discount Rate % 10.0% 10.0% 10.0% Pre-Tax NPV*** $M 3,780 2,570 1,290 Post-Tax NPV*** $M 2,640 1,800 900 * excluding royalties ** including royalties *** rounding to nearest 2 significant figures. Rounding may cause computational discrepancies # Based on an exchage rate of 1USD:0.68AUD The economic model was tested for sensitivity regarding lithium prices and capital and operating cost estimates. The results indicate that the economics of the operation are most sensitive to changes in the spodumene price and least sensitive to changes in capital expenditure. All sensitivity scenarios assessed for Wodgina returned positive NPV results. The results of the cash flow modelling show negative cashflows in most quarterly time periods from July 2024 to June 2026 (cumulative discounted cash flows of -$209M across this time period), predominantly driven by elevated levels of capital expenditure and a weak spodumene price environment, followed by mostly cash flow positive quarterly time periods to the end of the LOM plan.

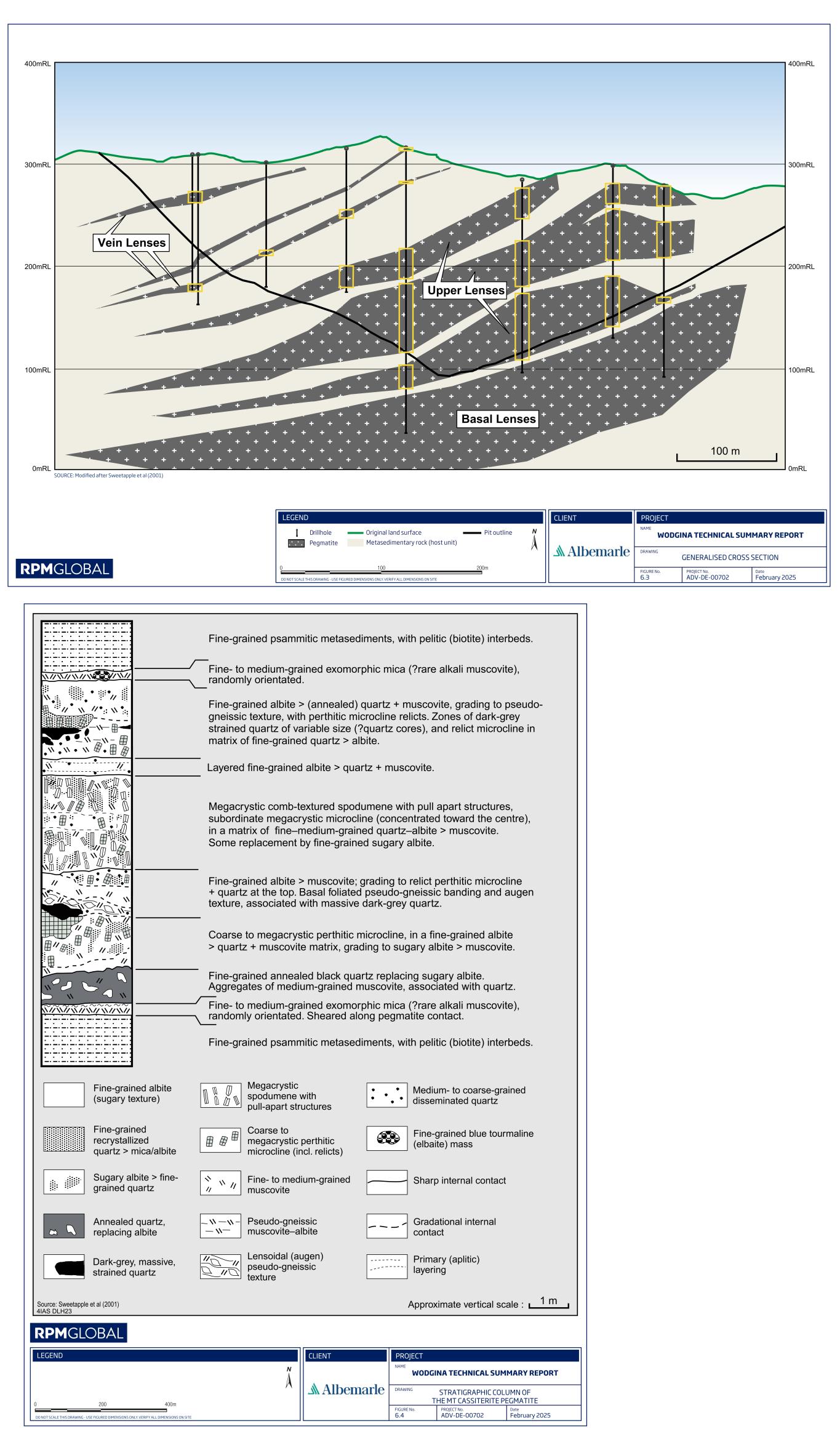

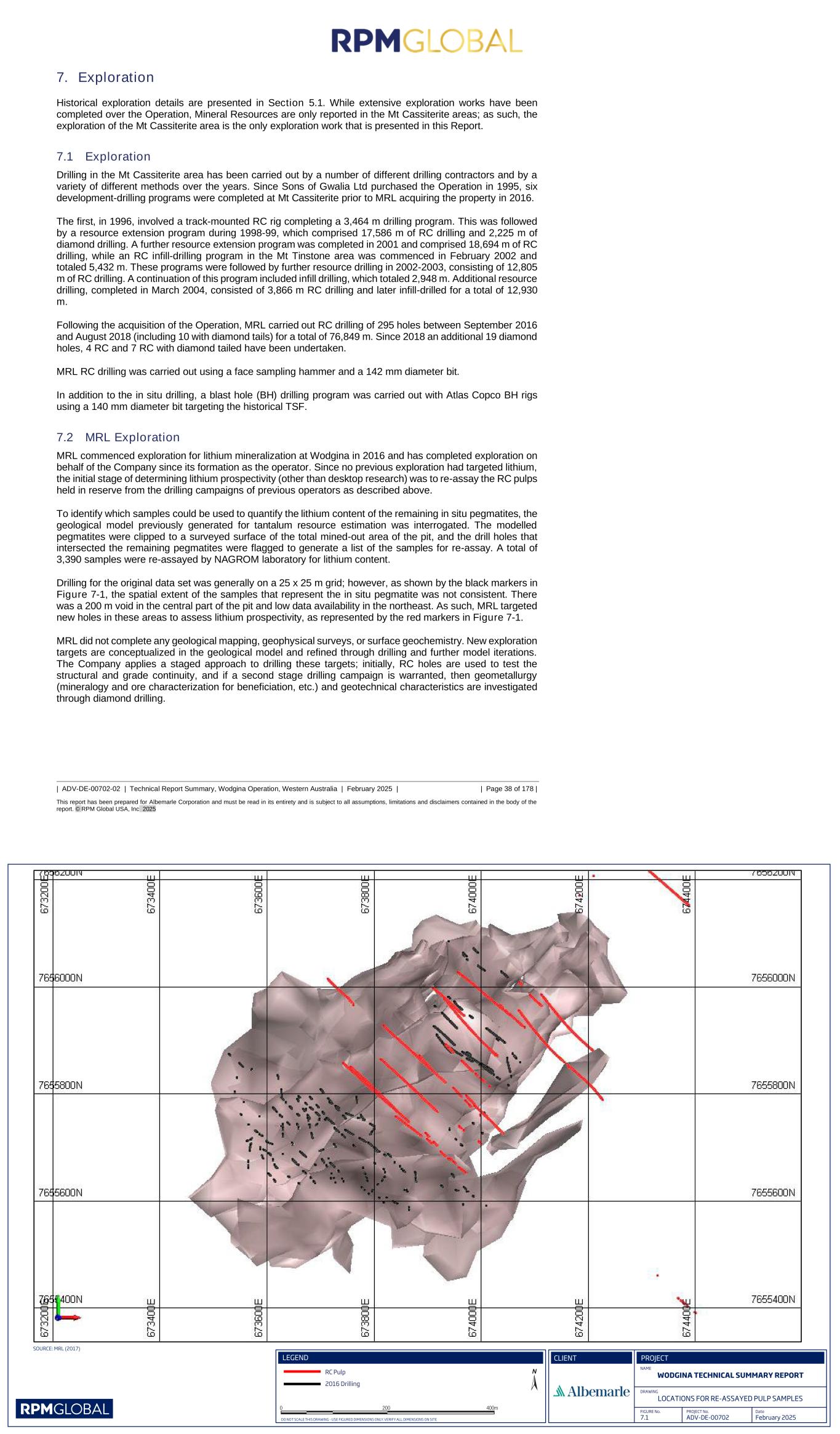

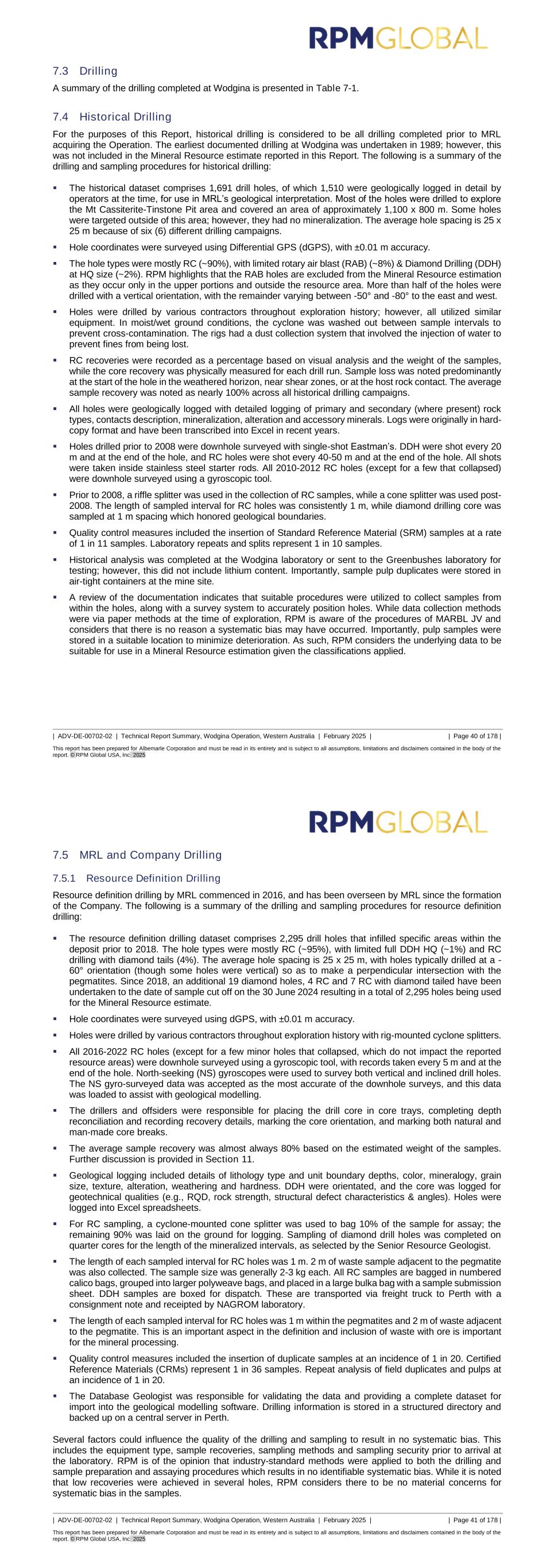

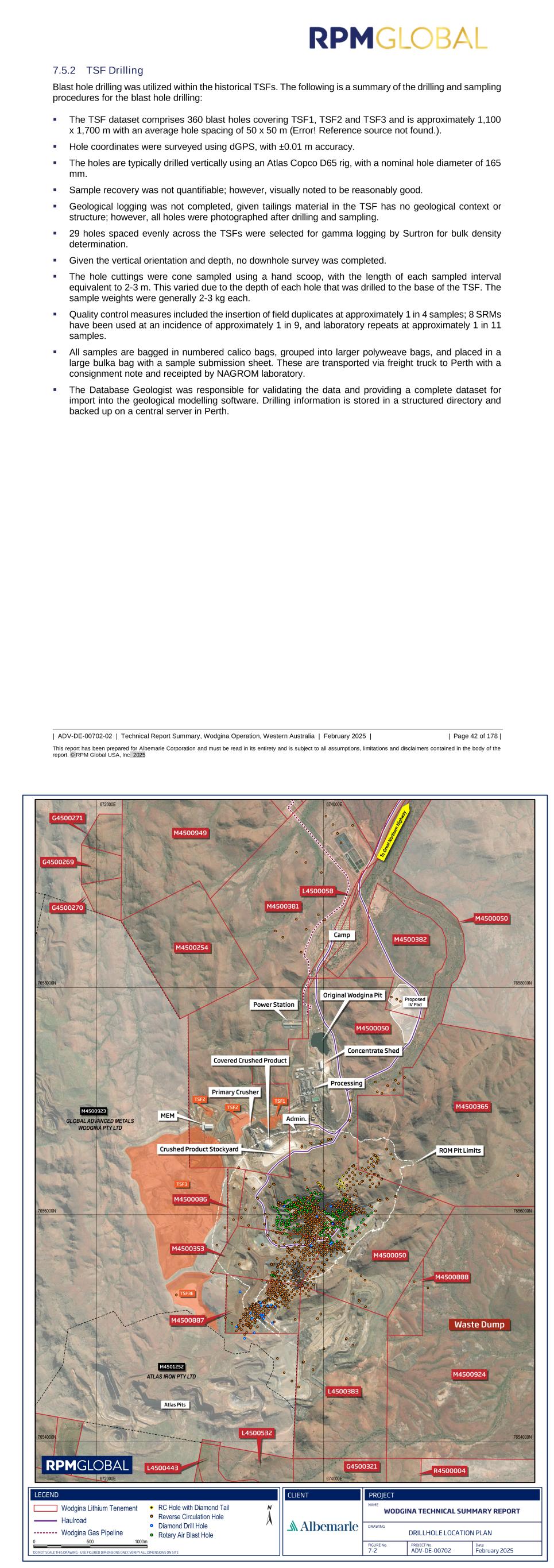

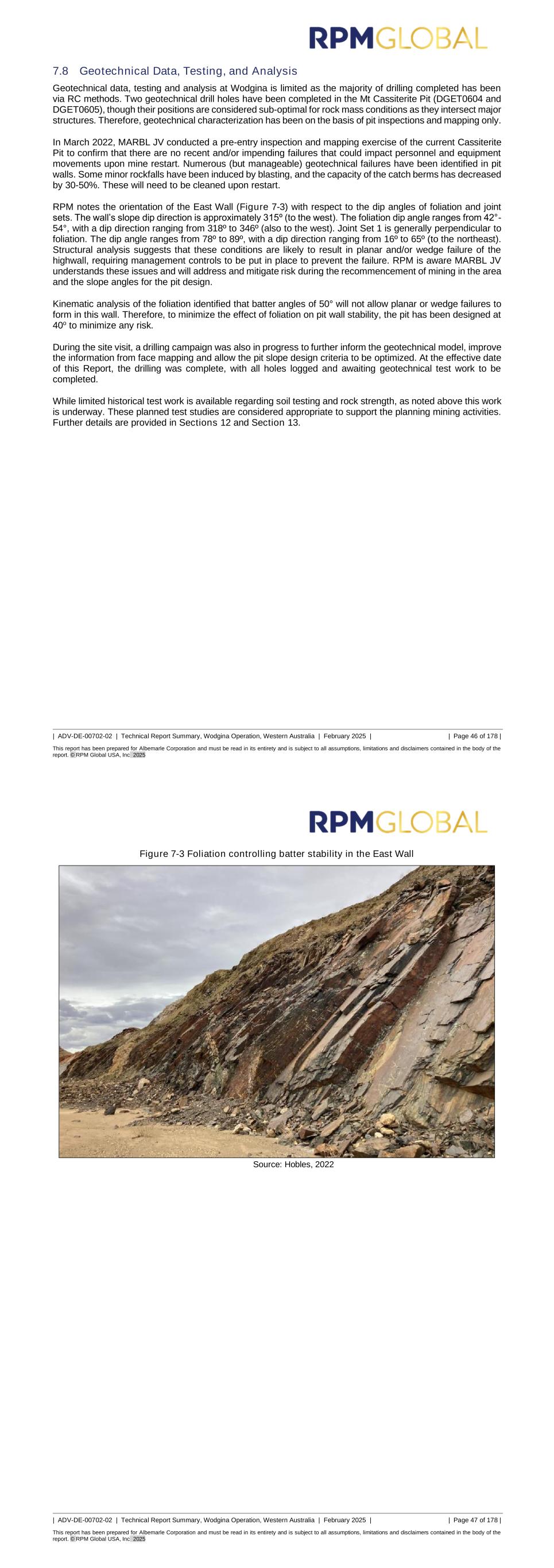

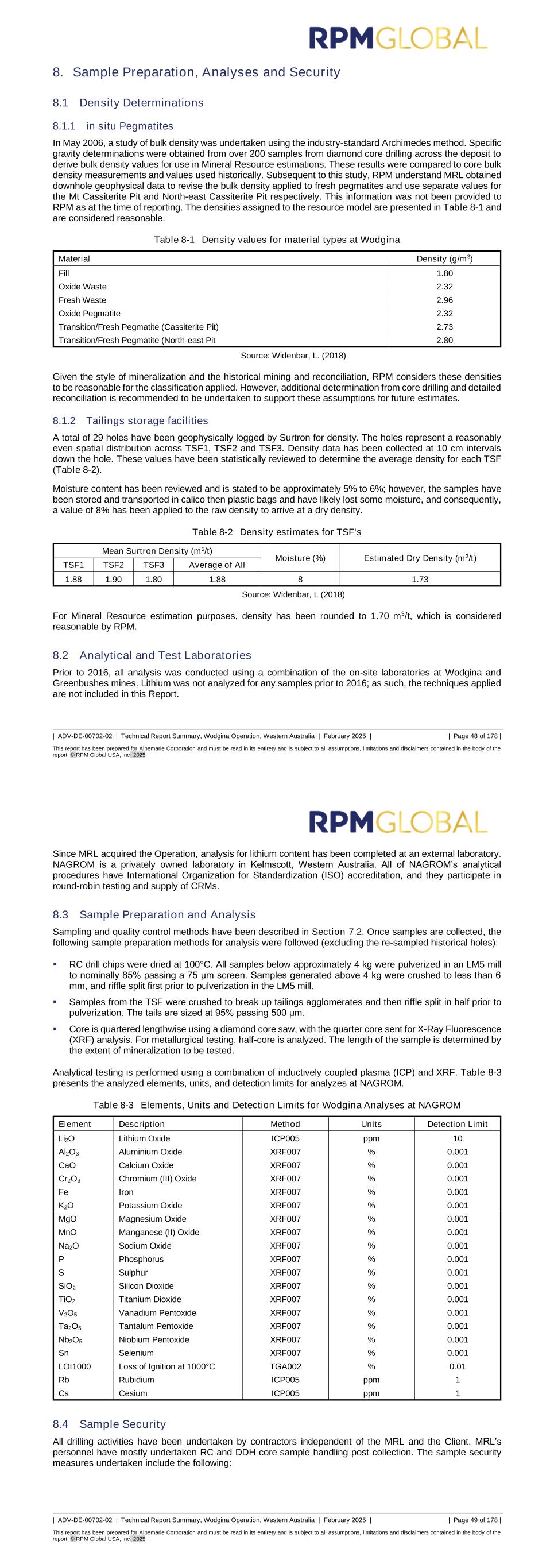

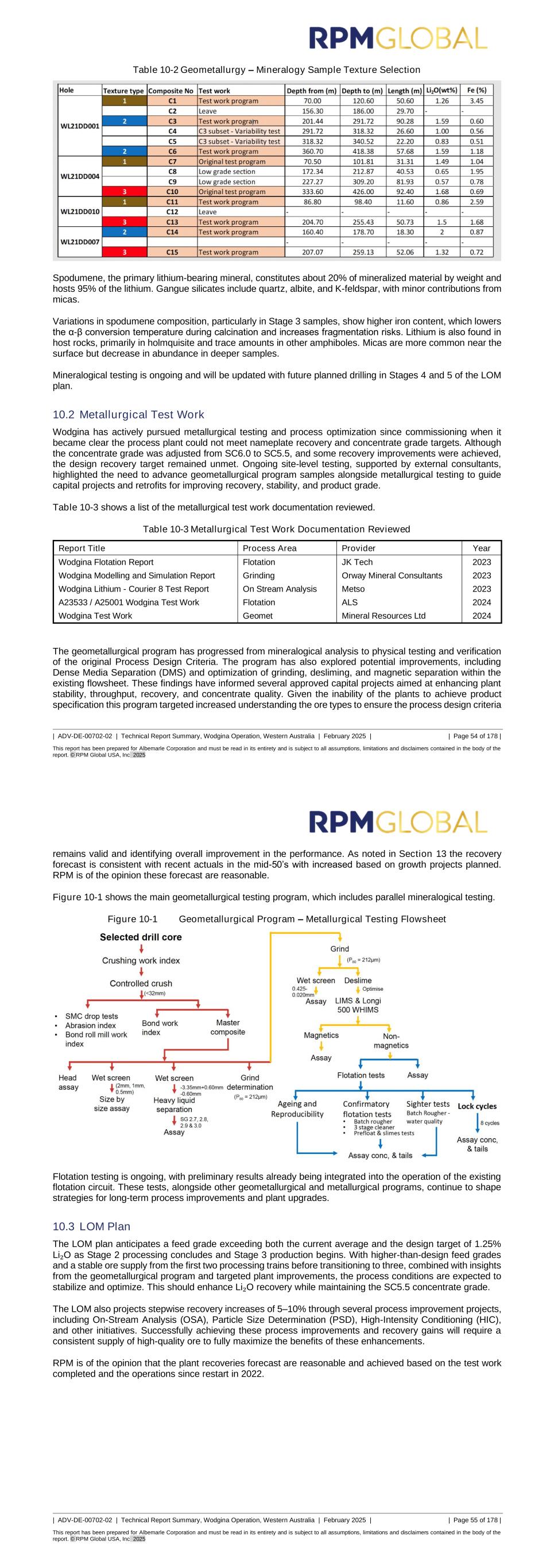

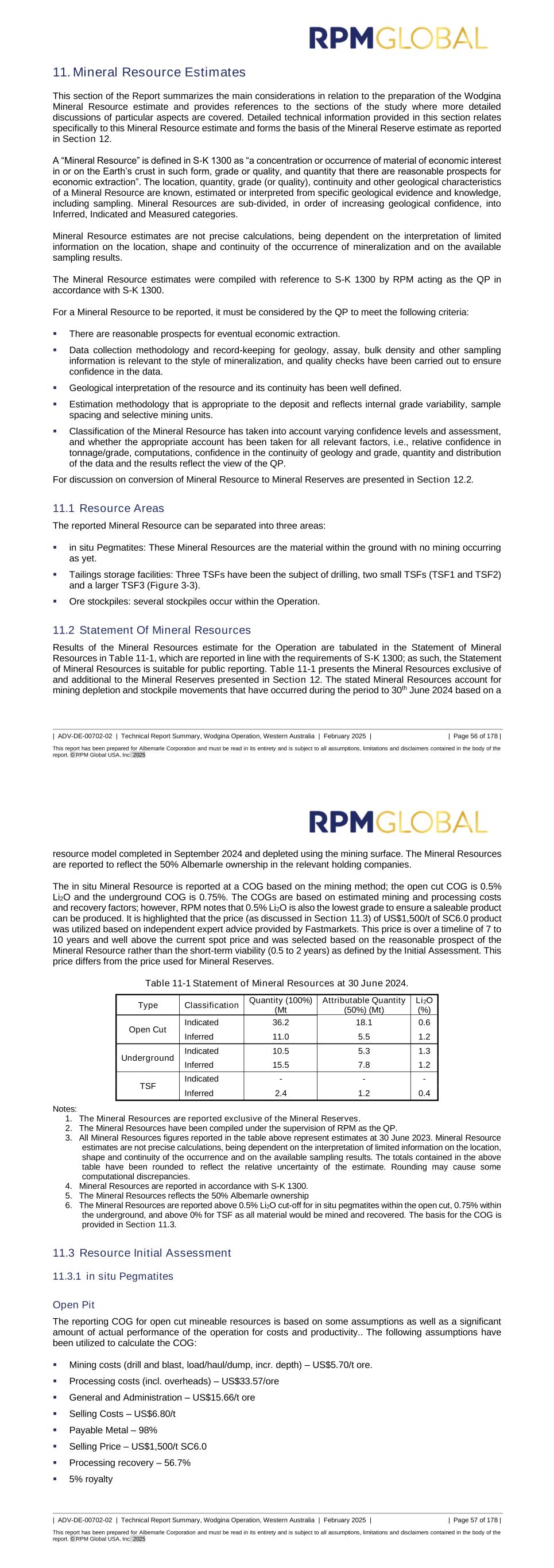

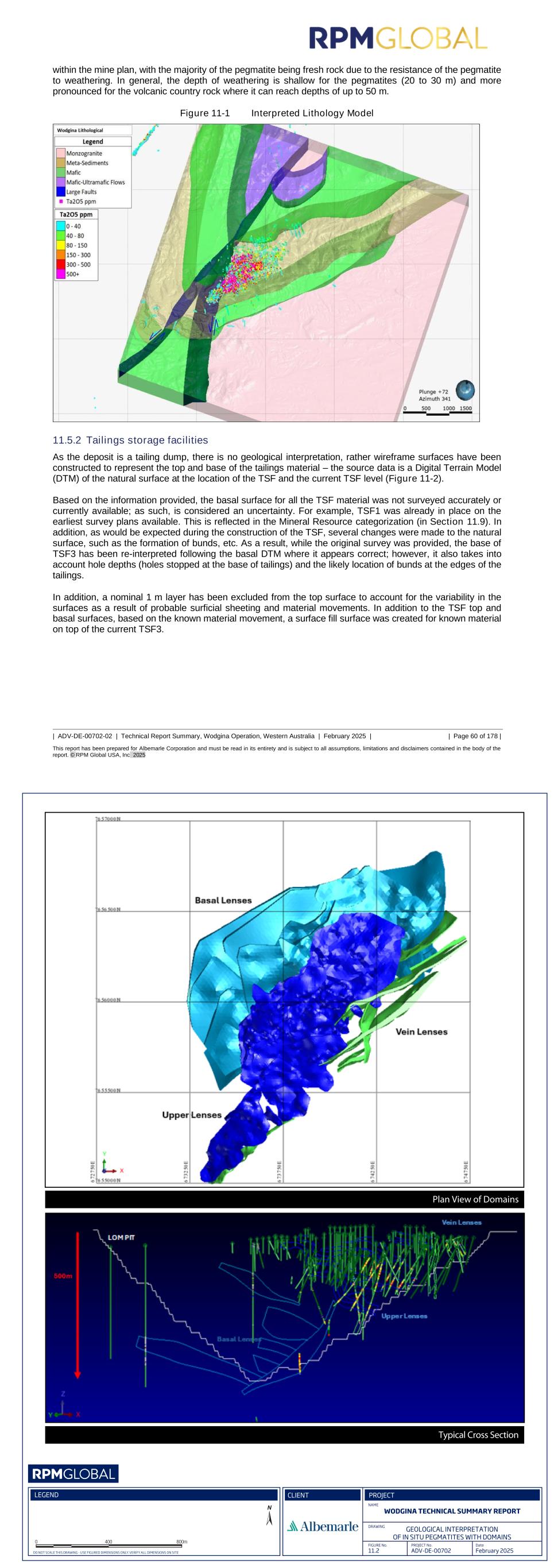

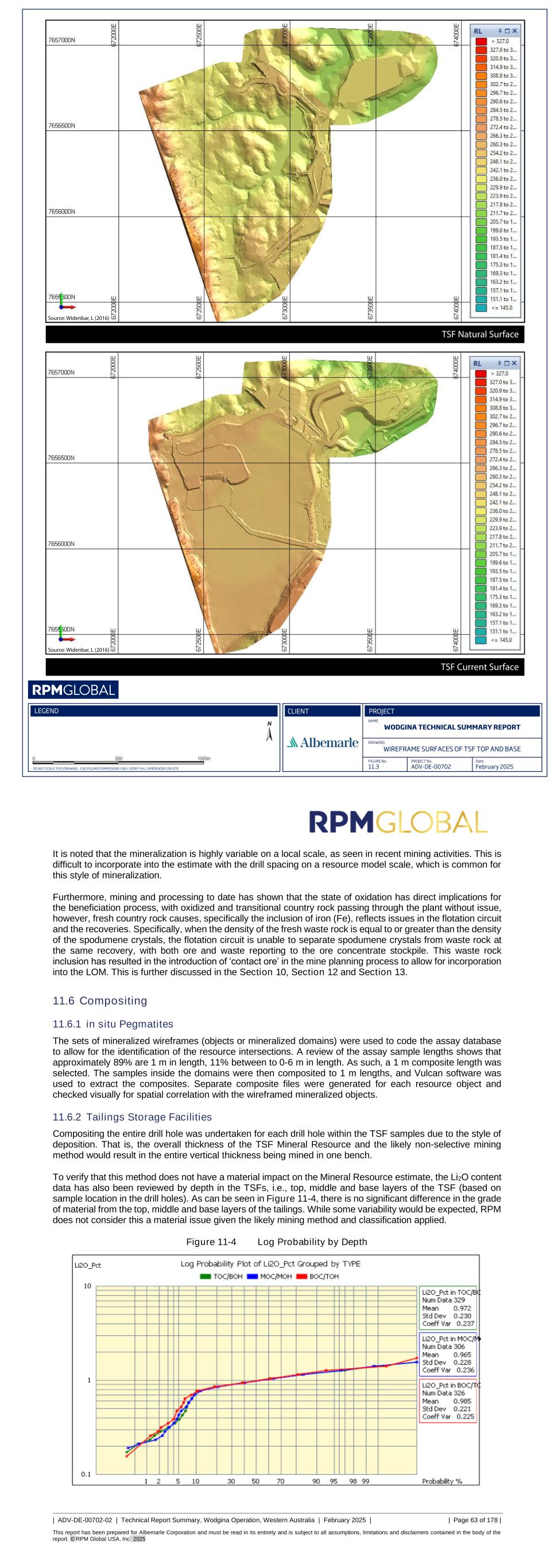

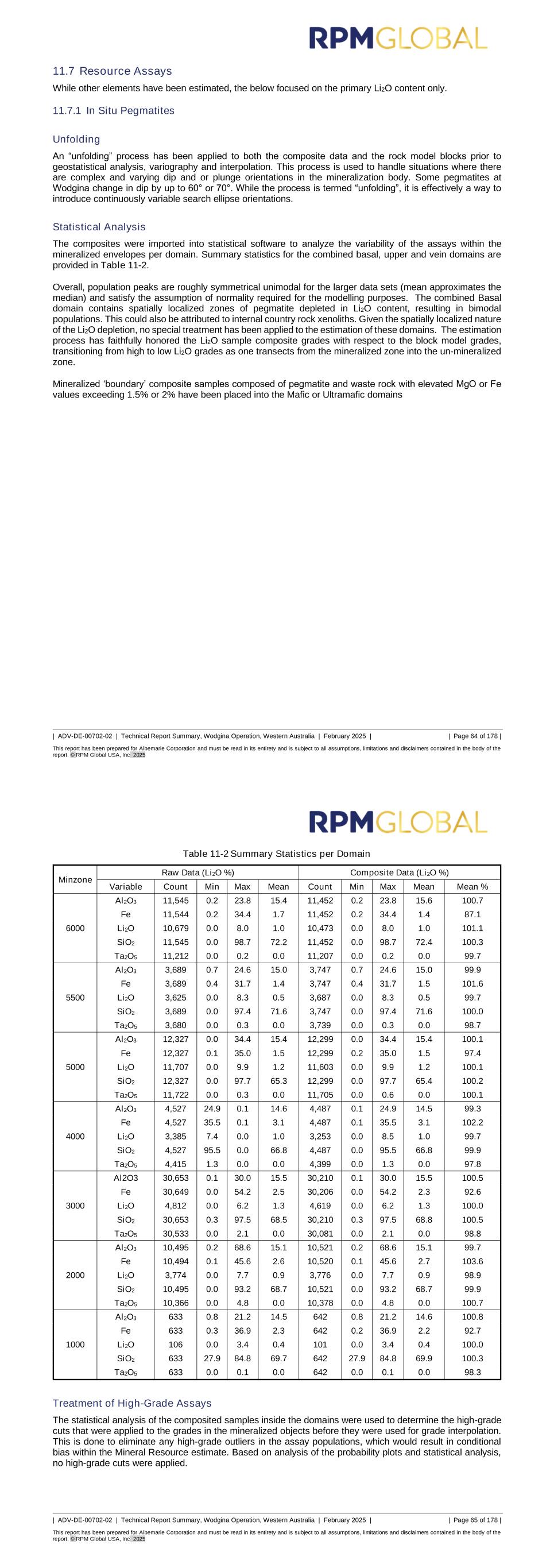

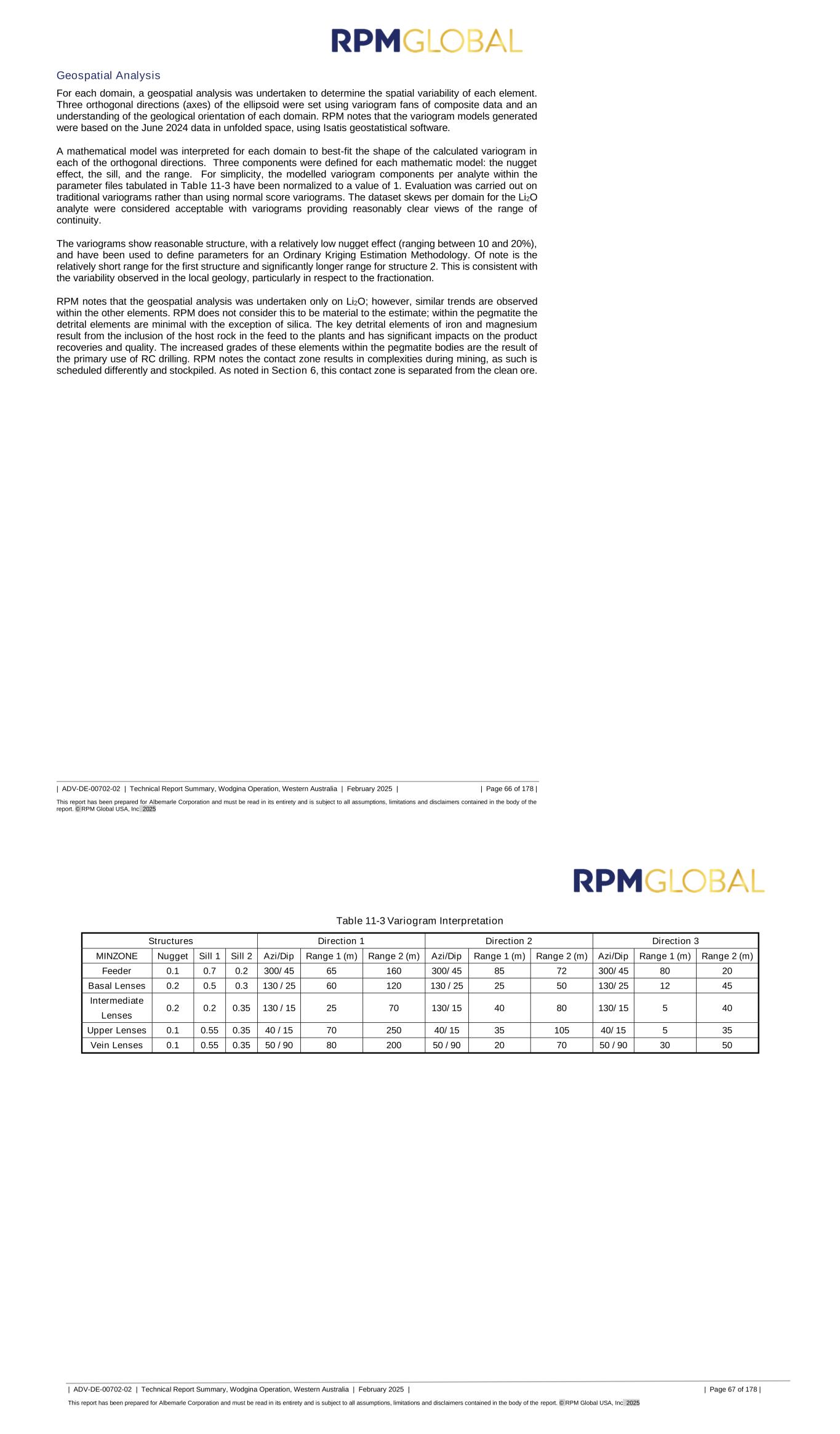

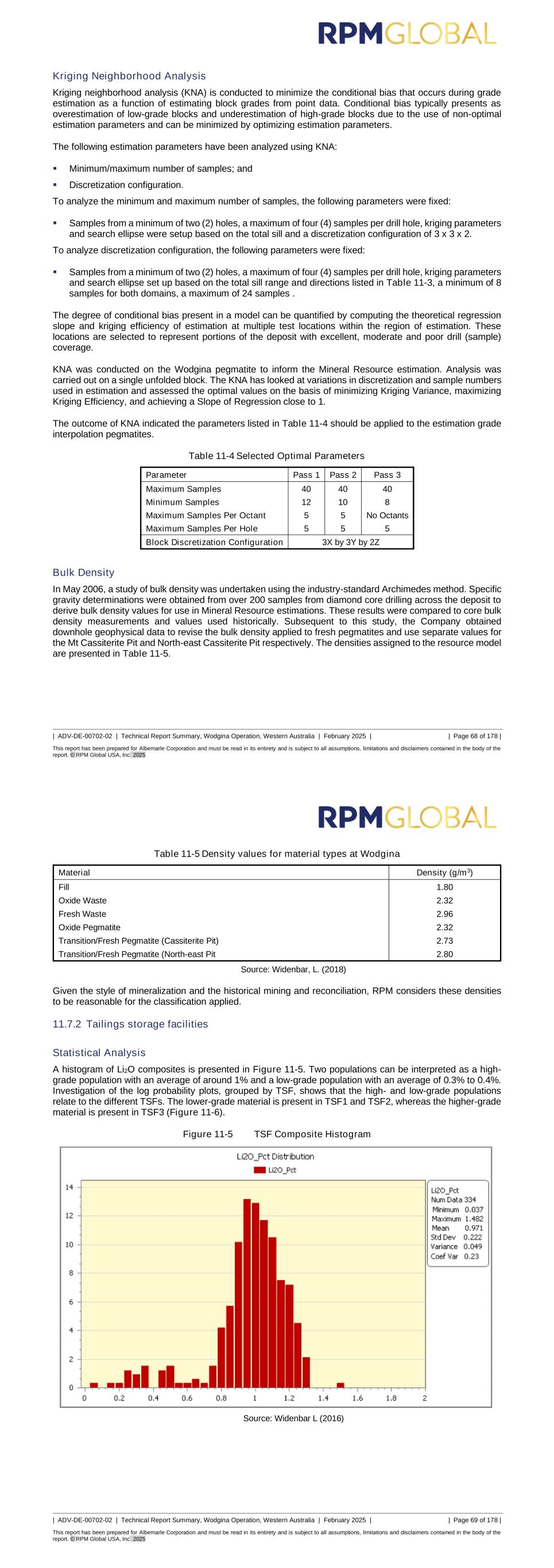

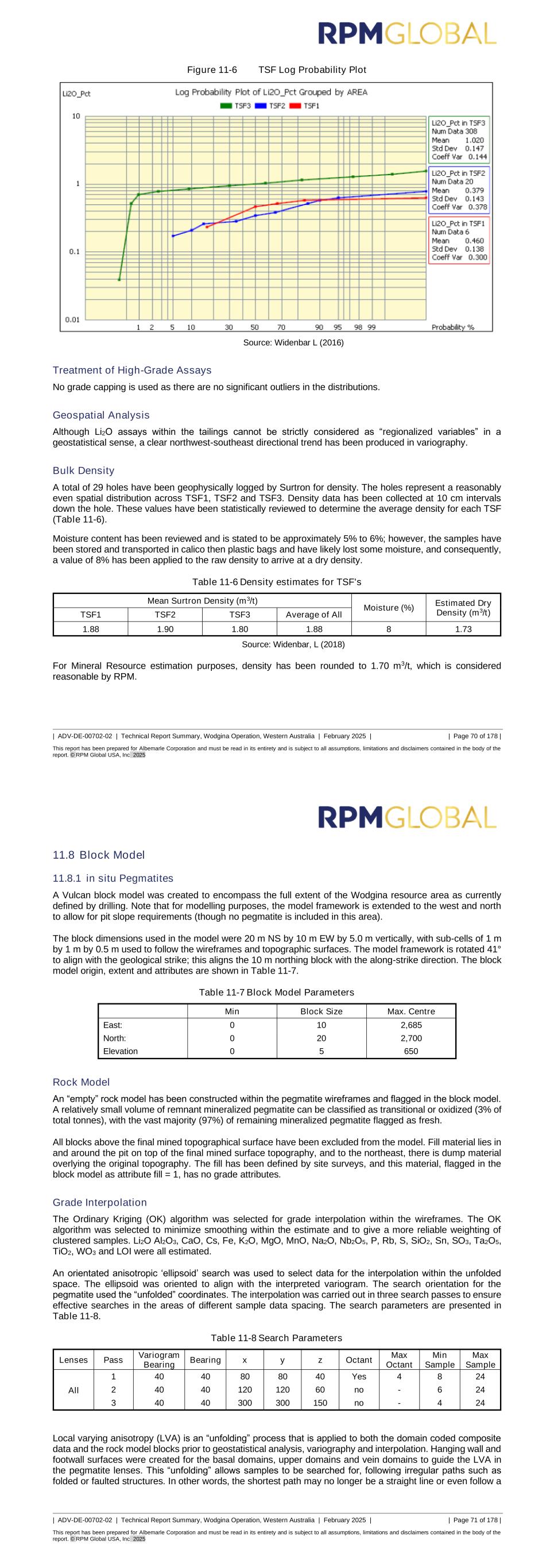

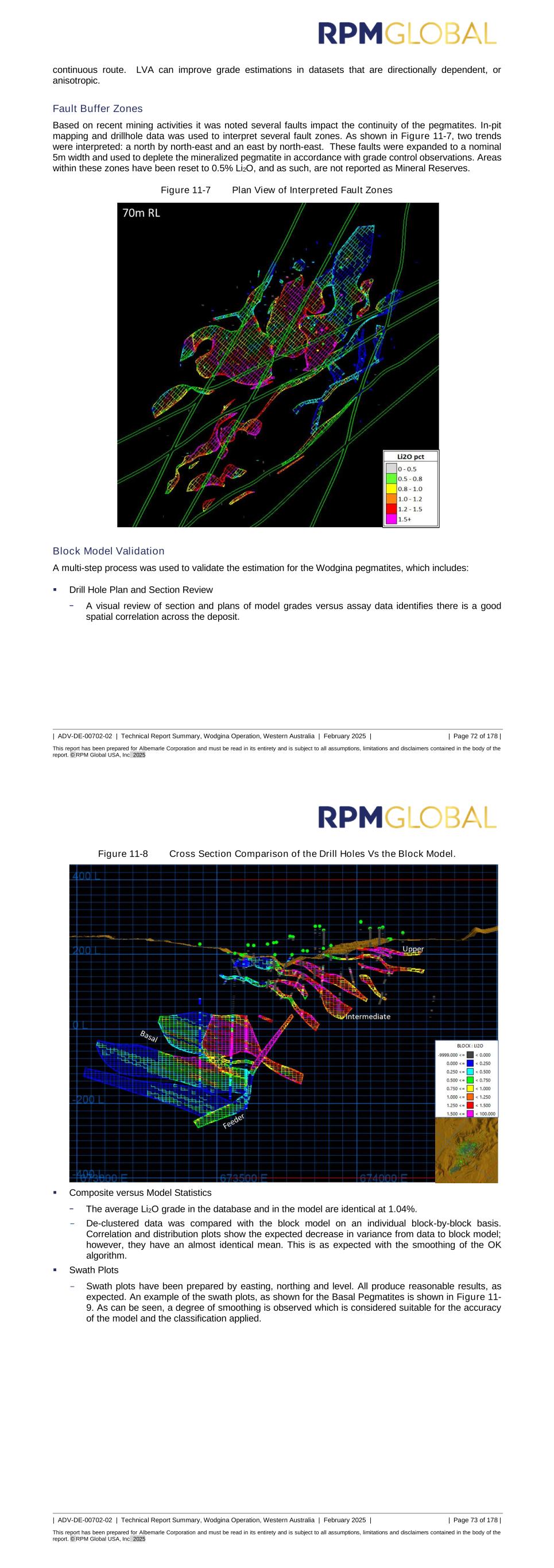

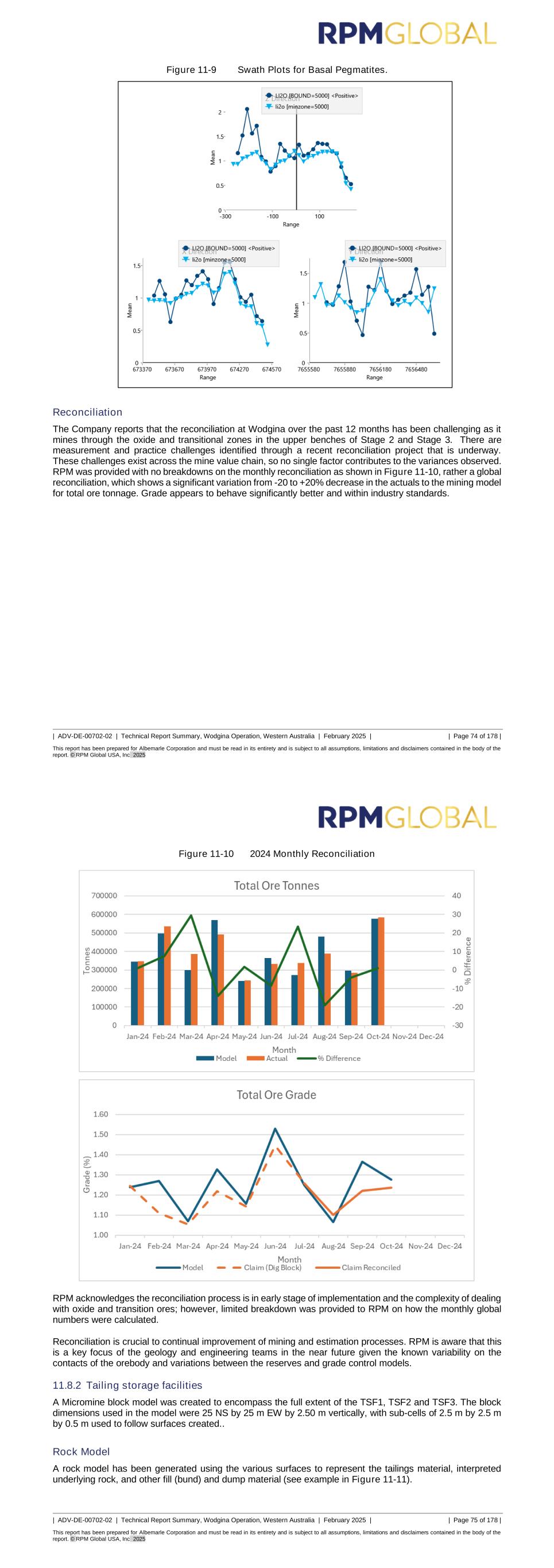

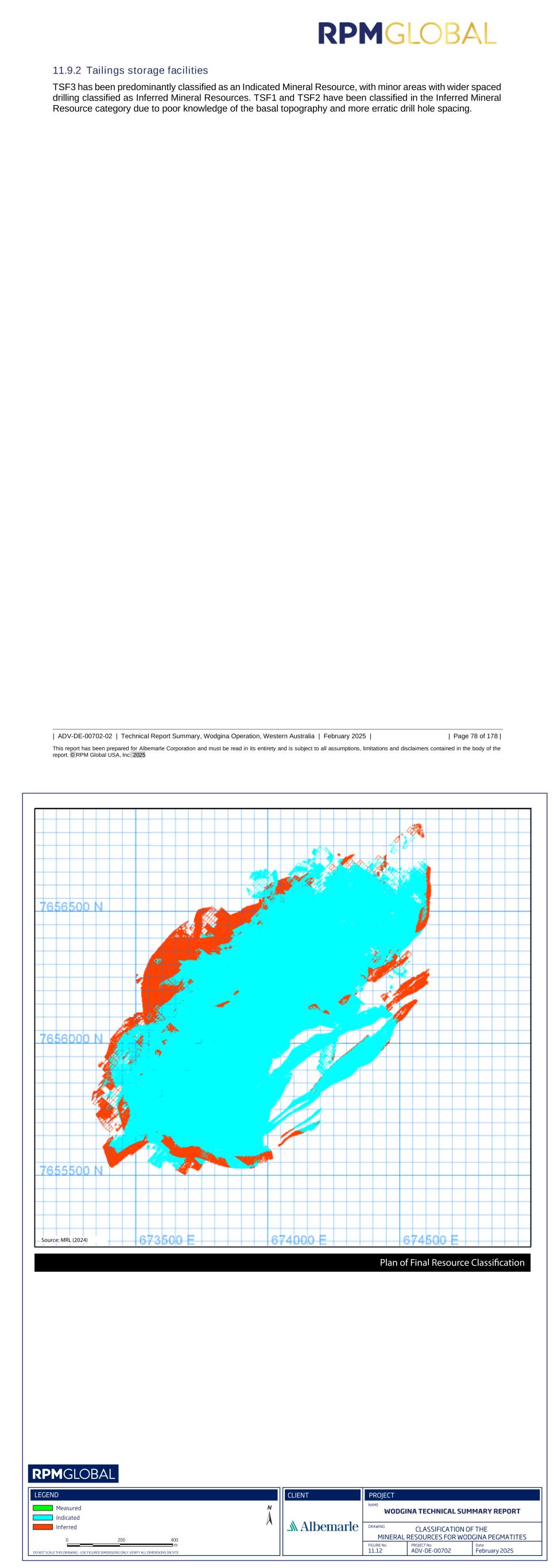

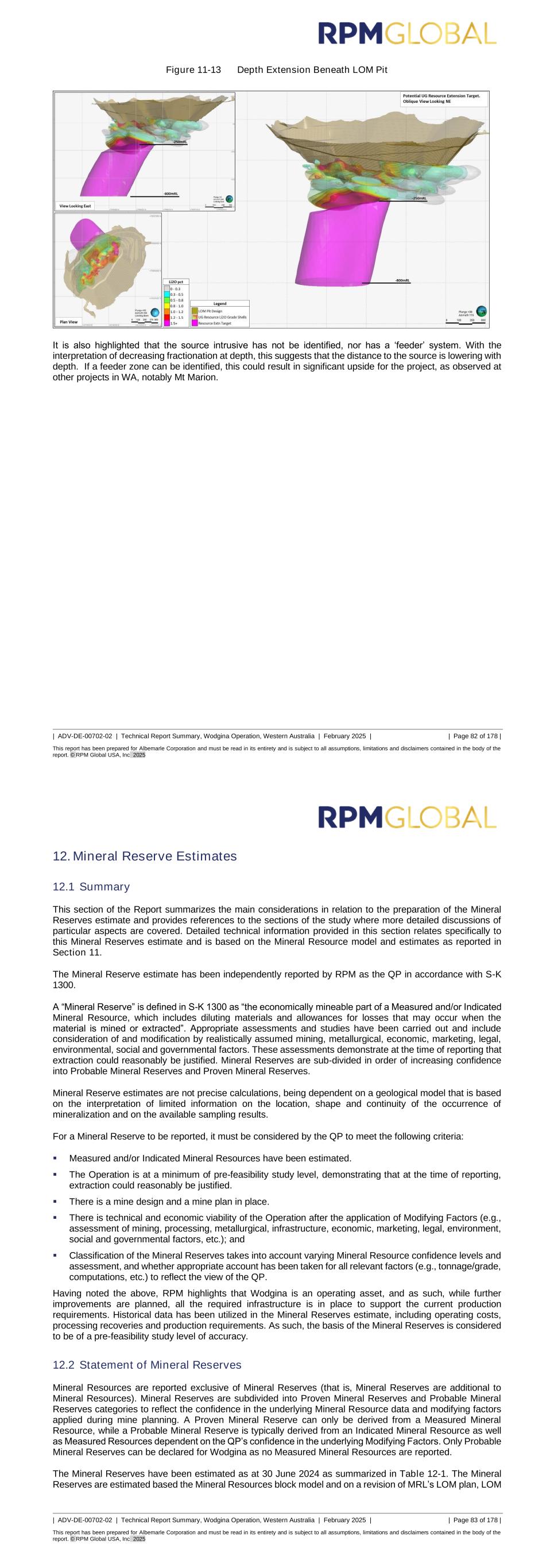

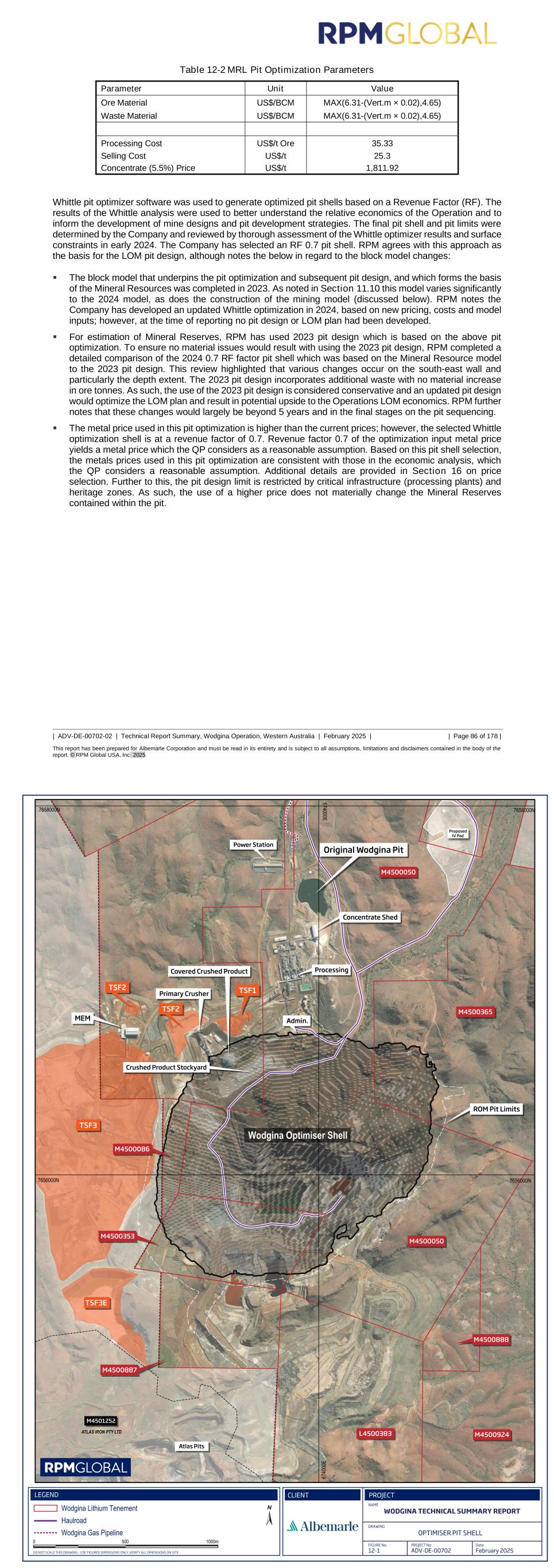

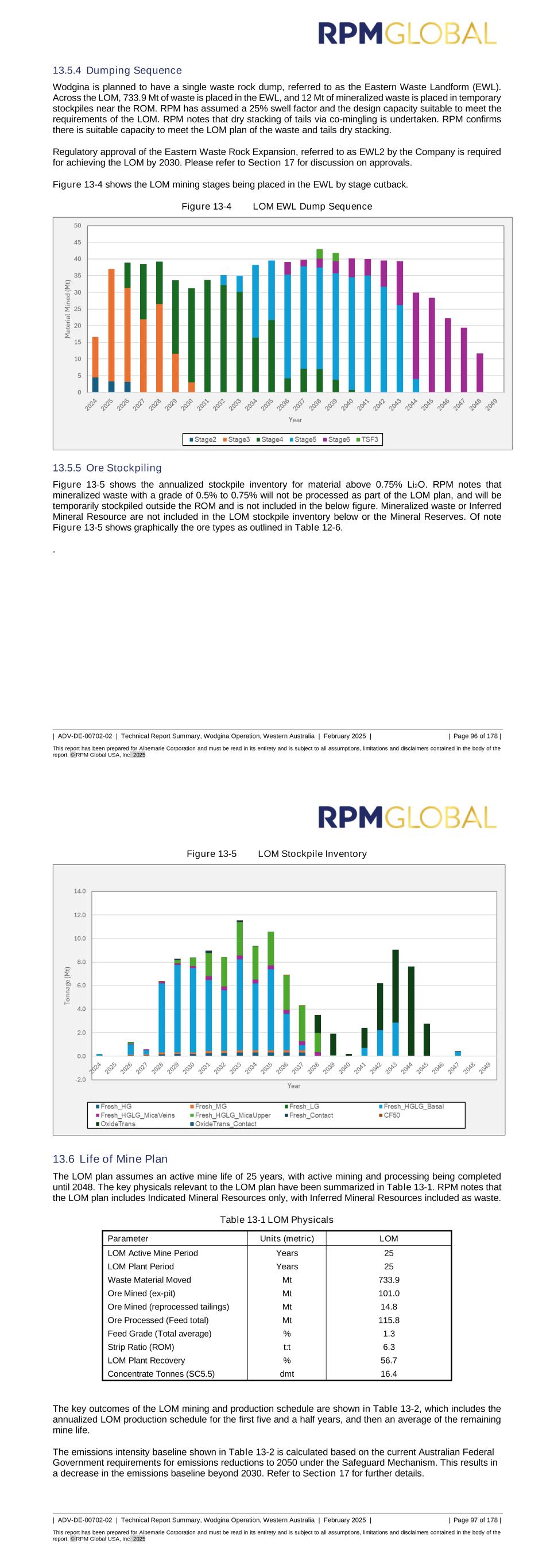

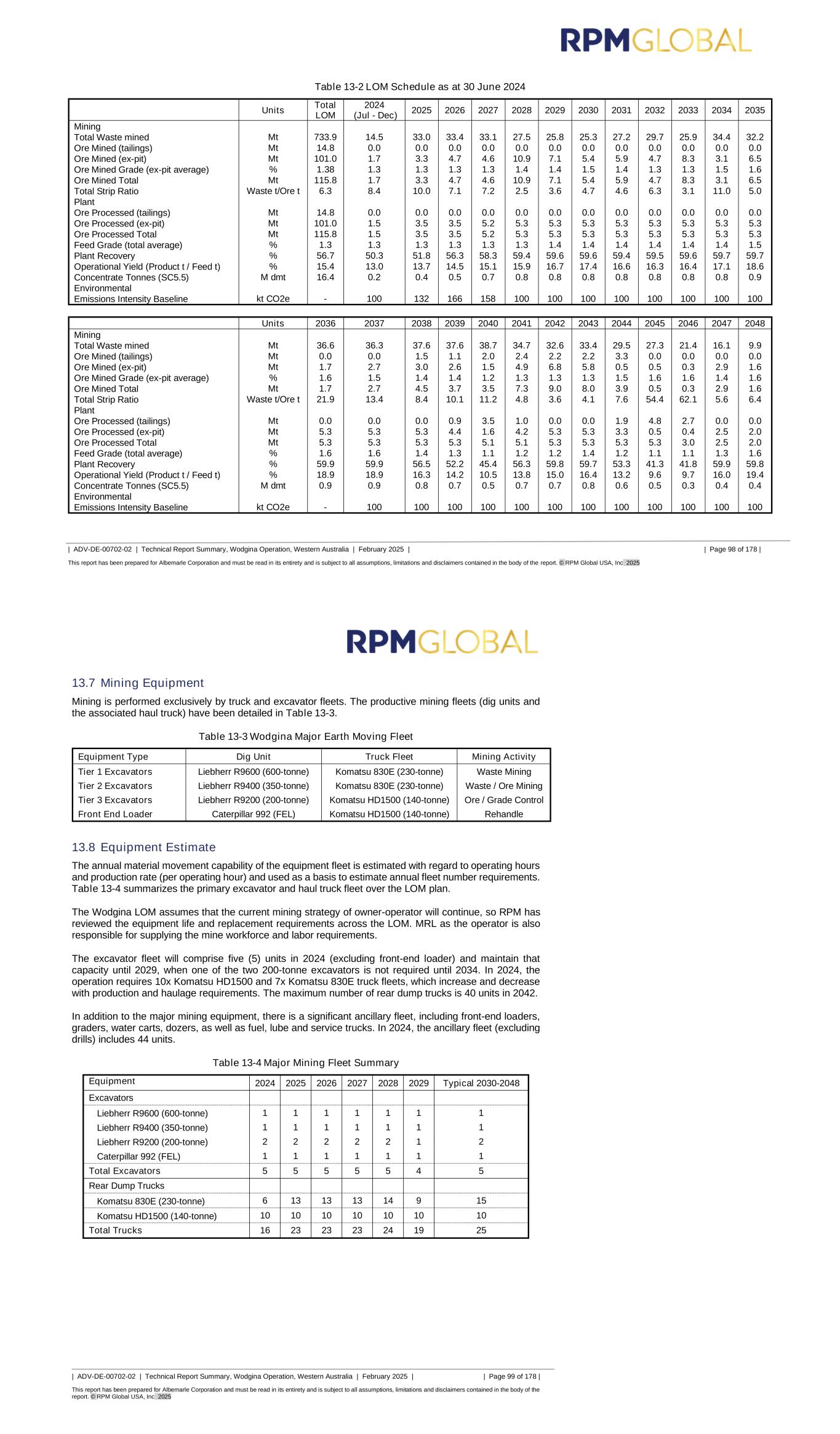

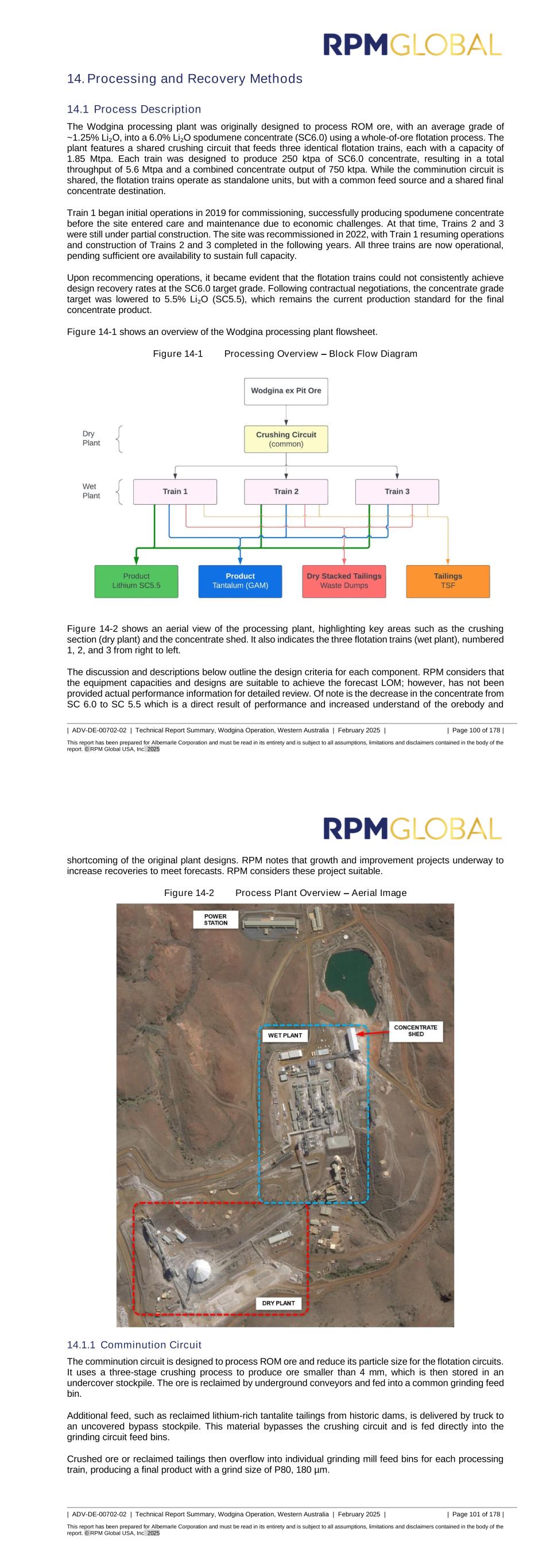

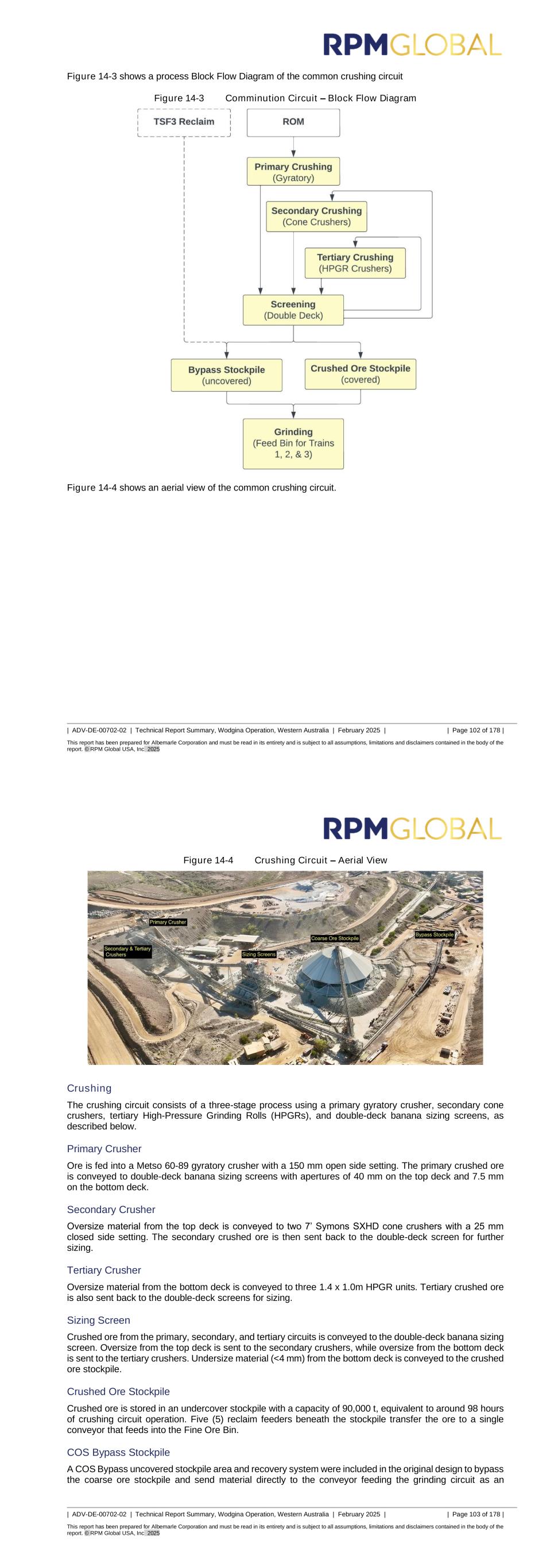

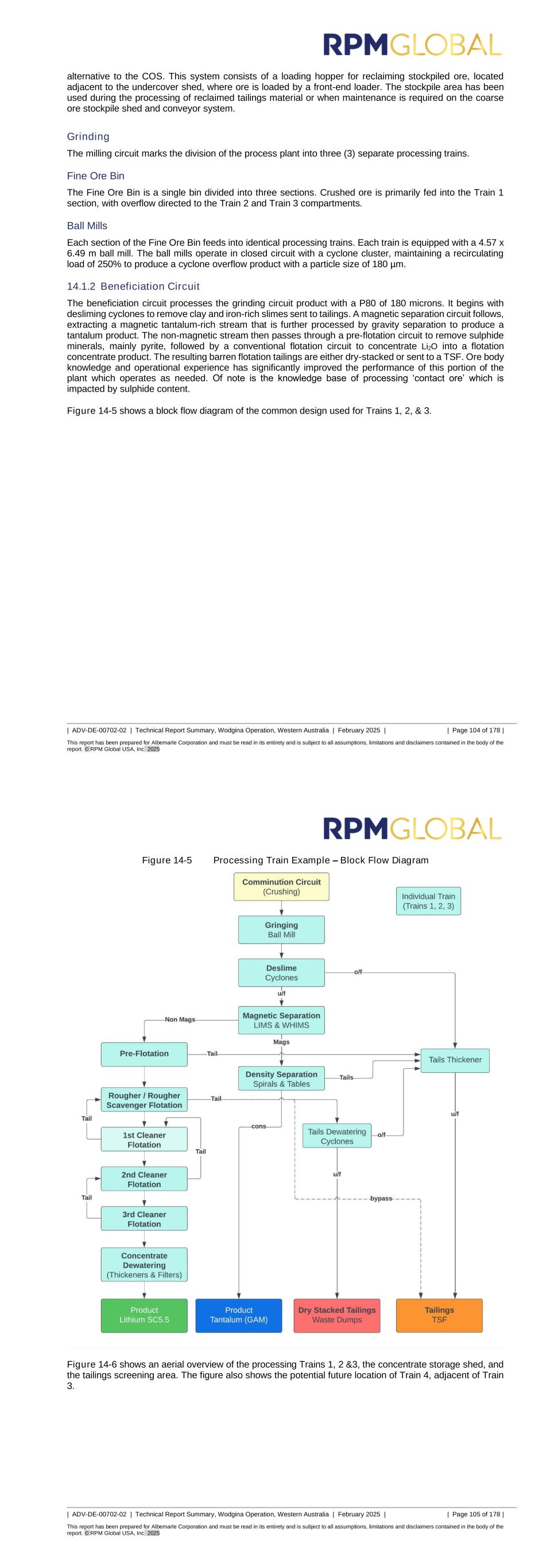

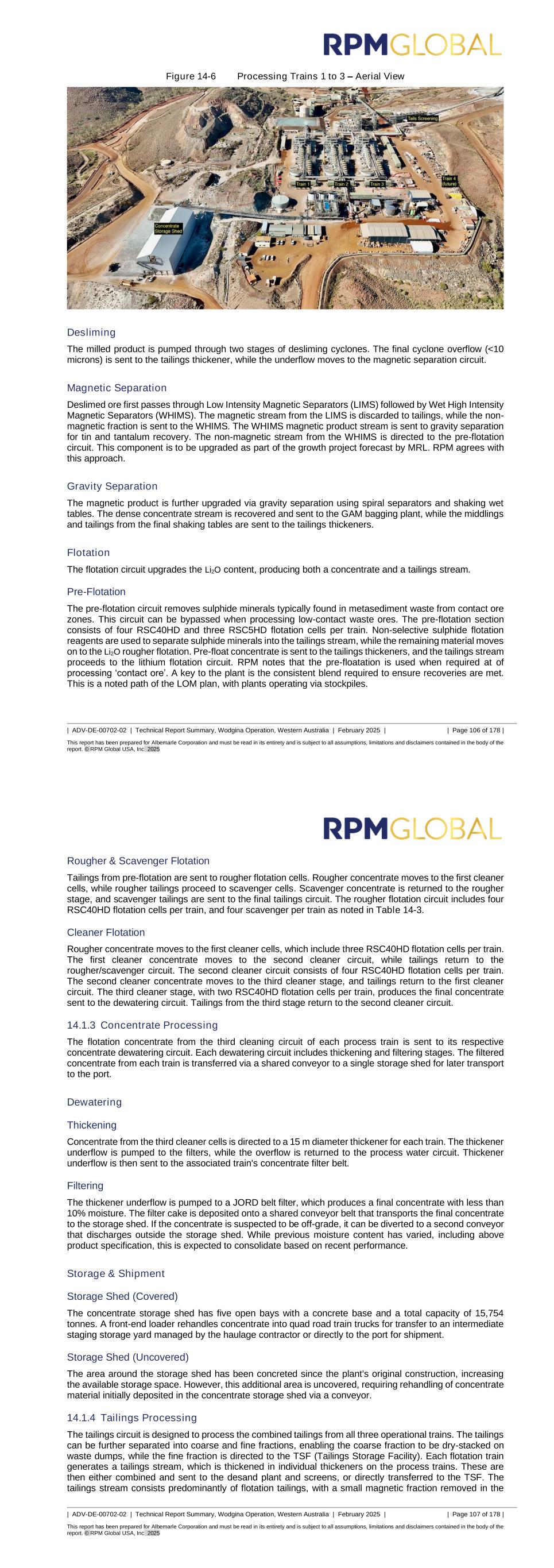

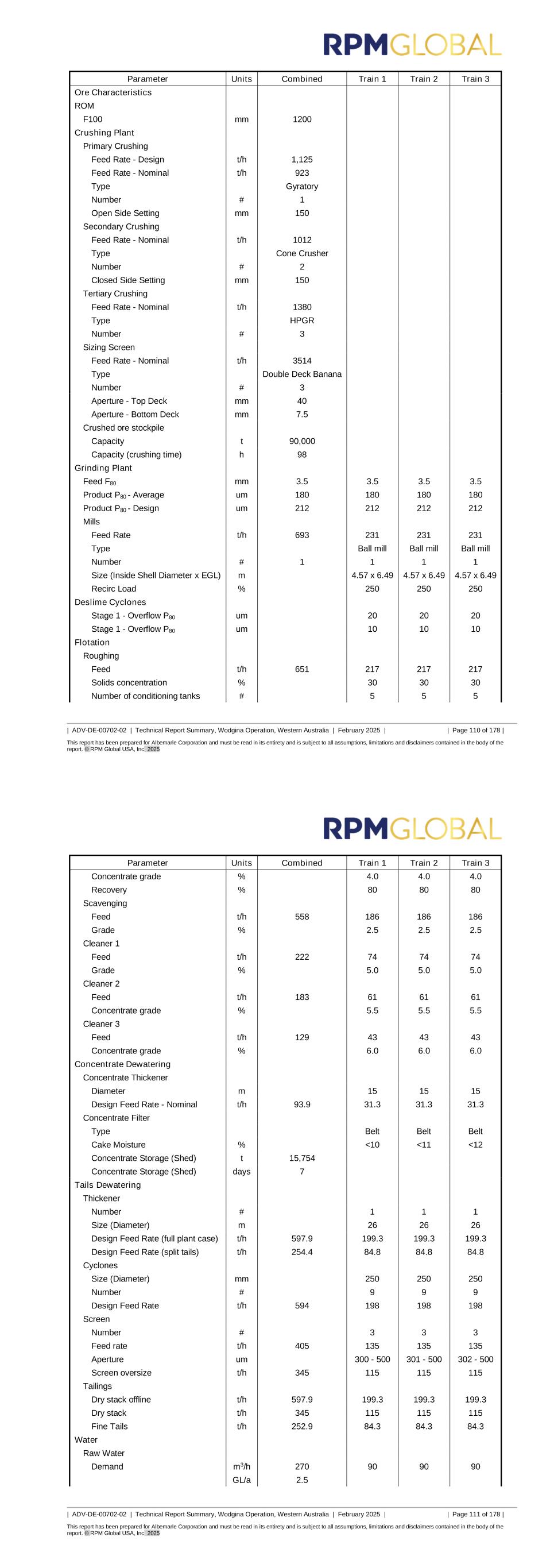

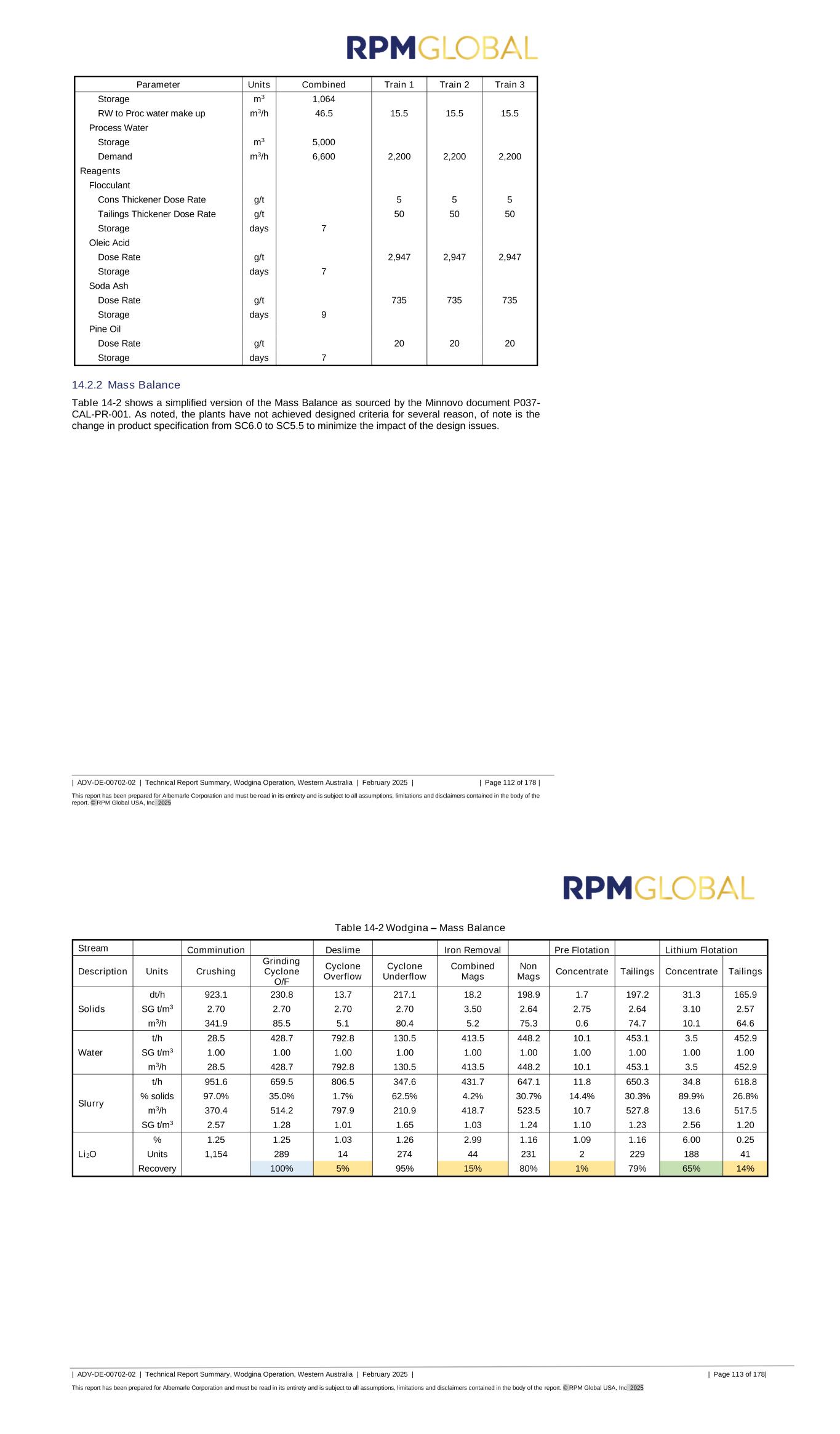

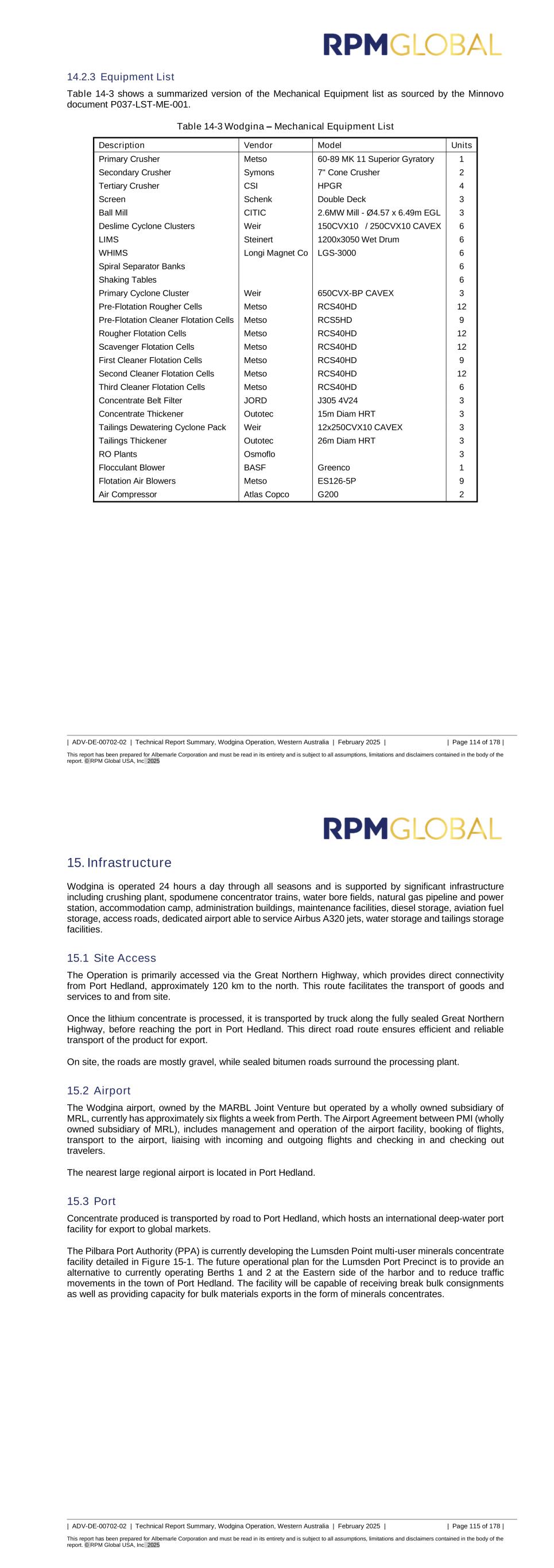

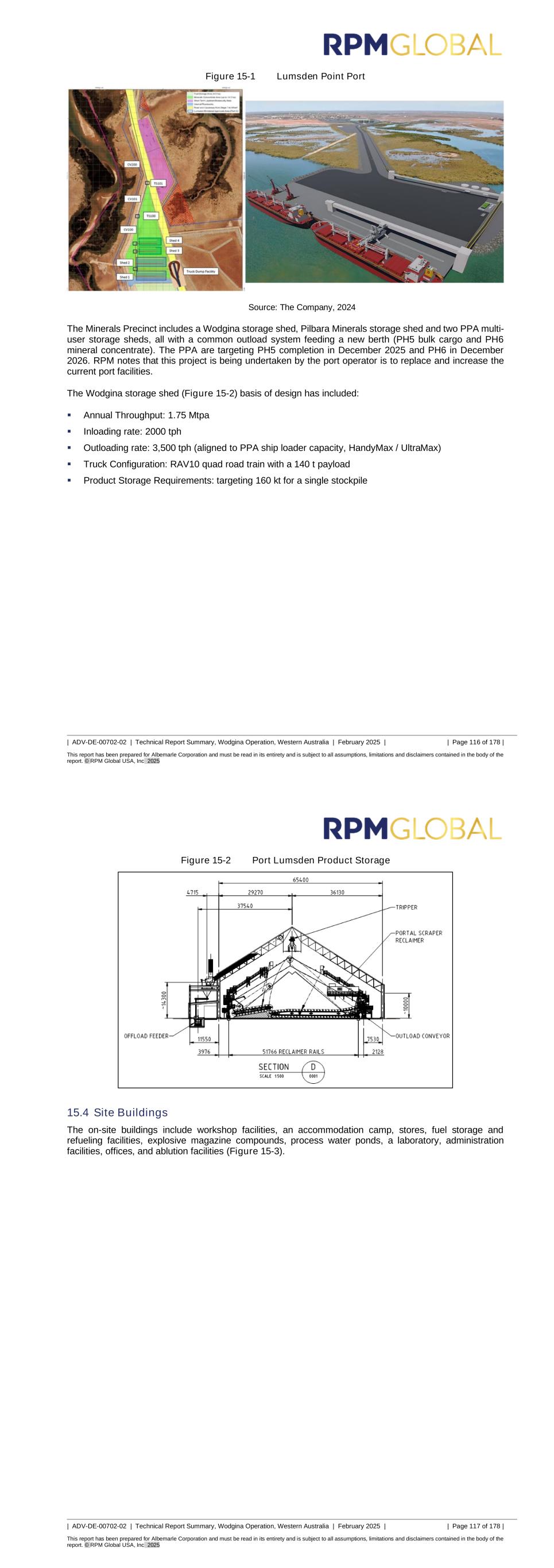

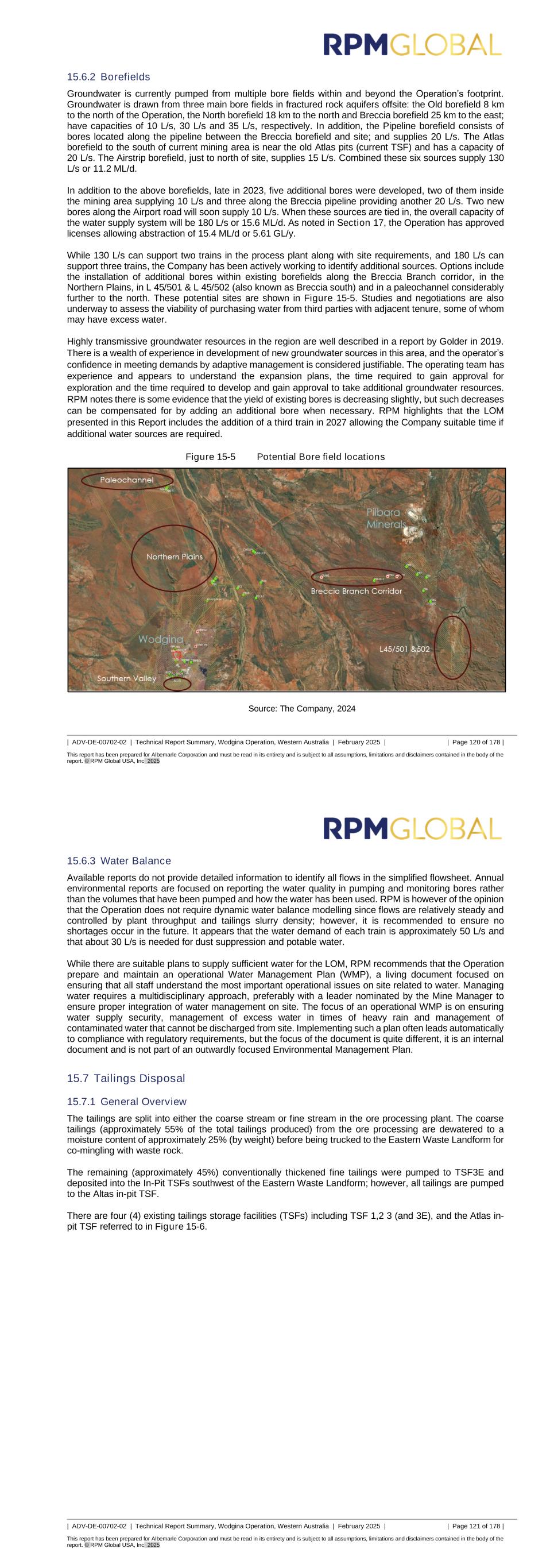

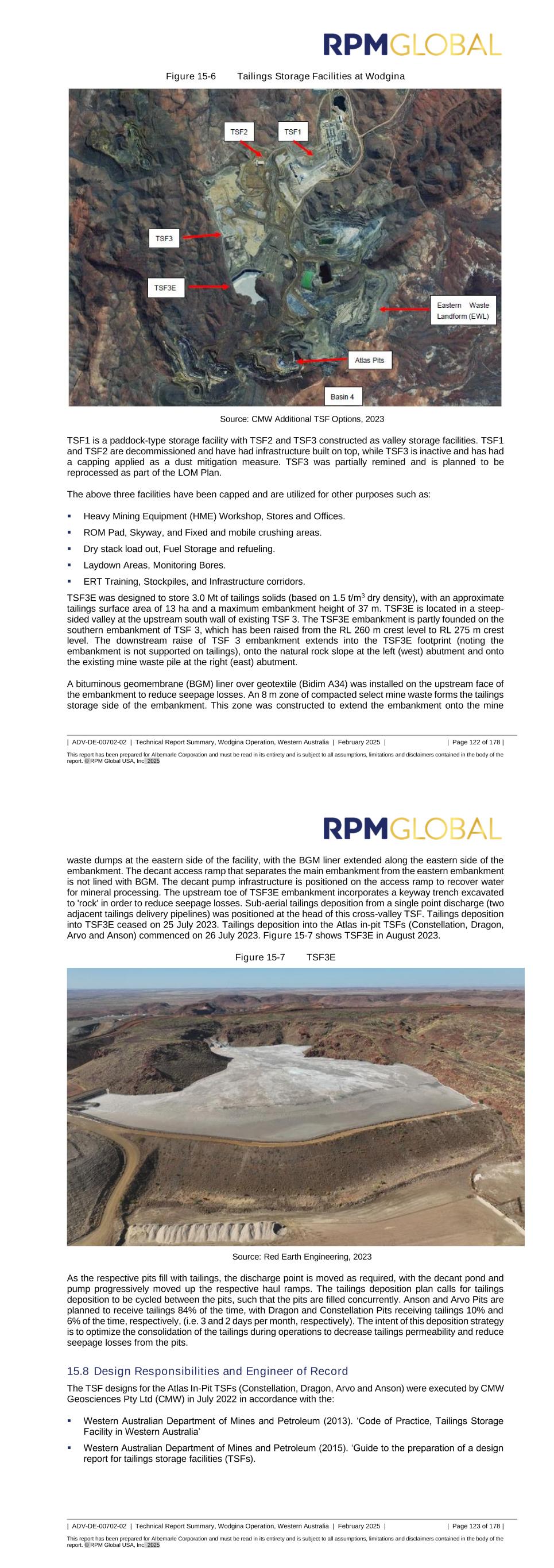

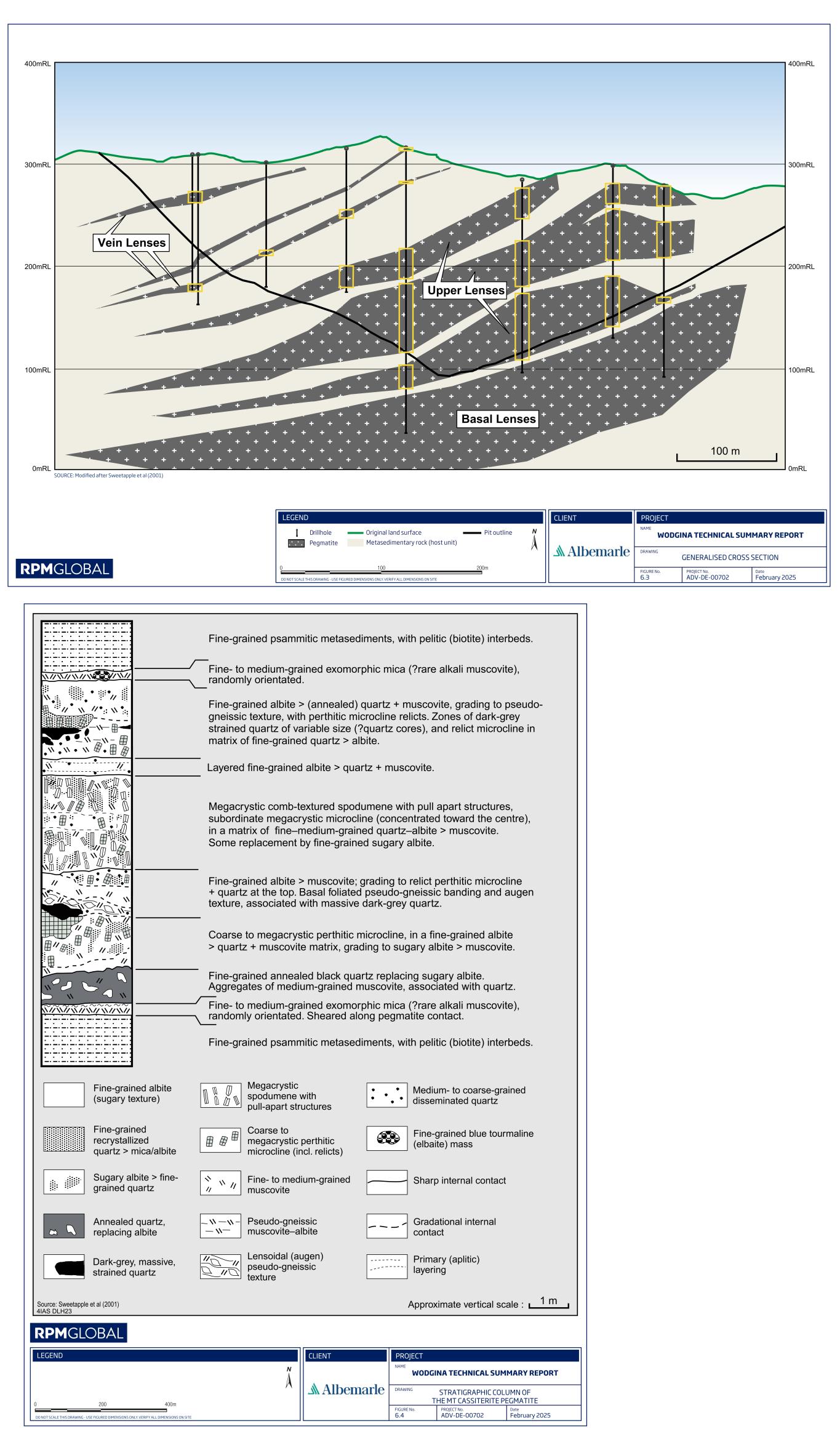

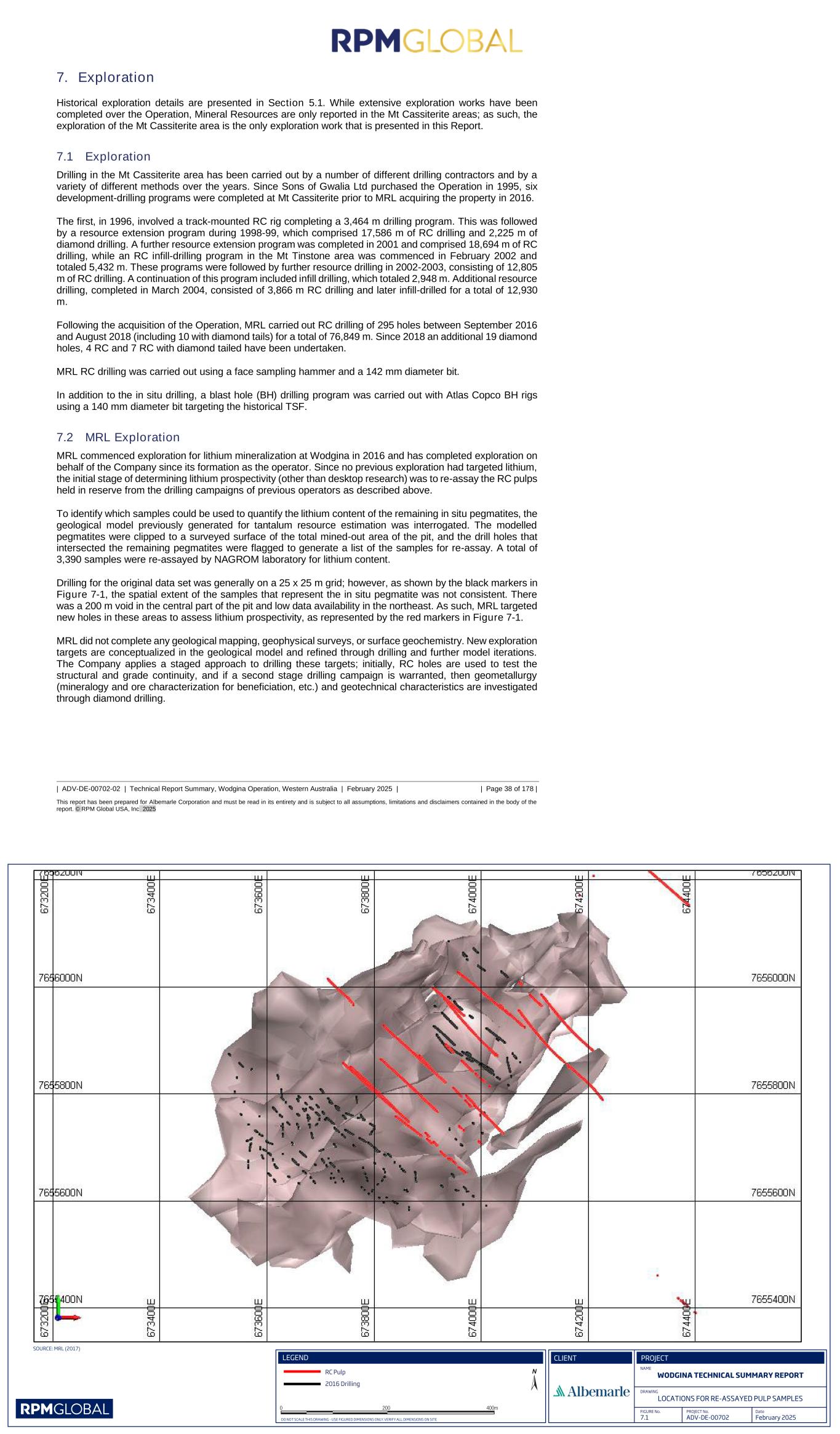

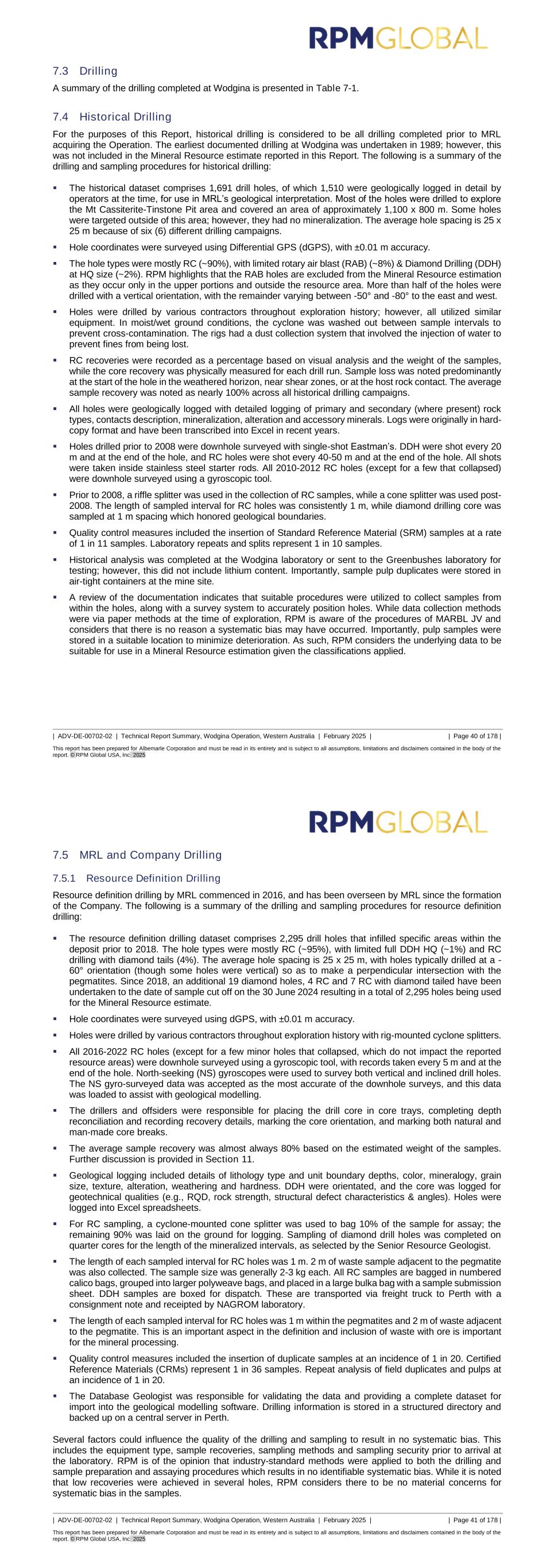

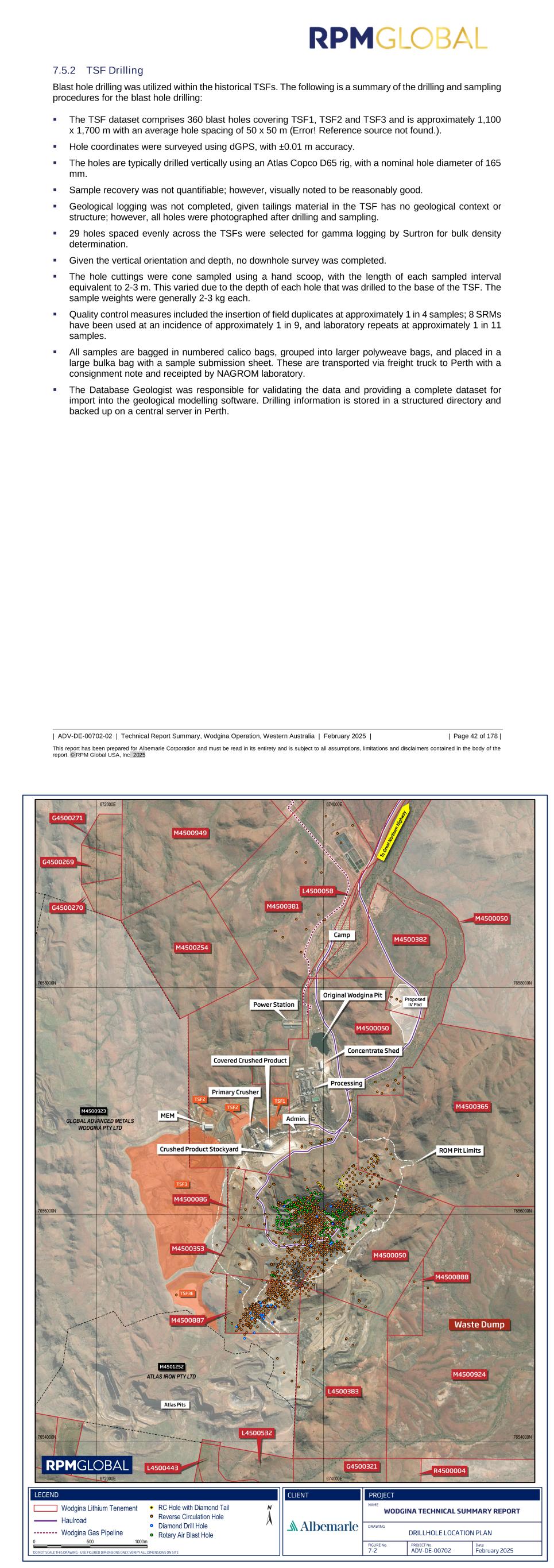

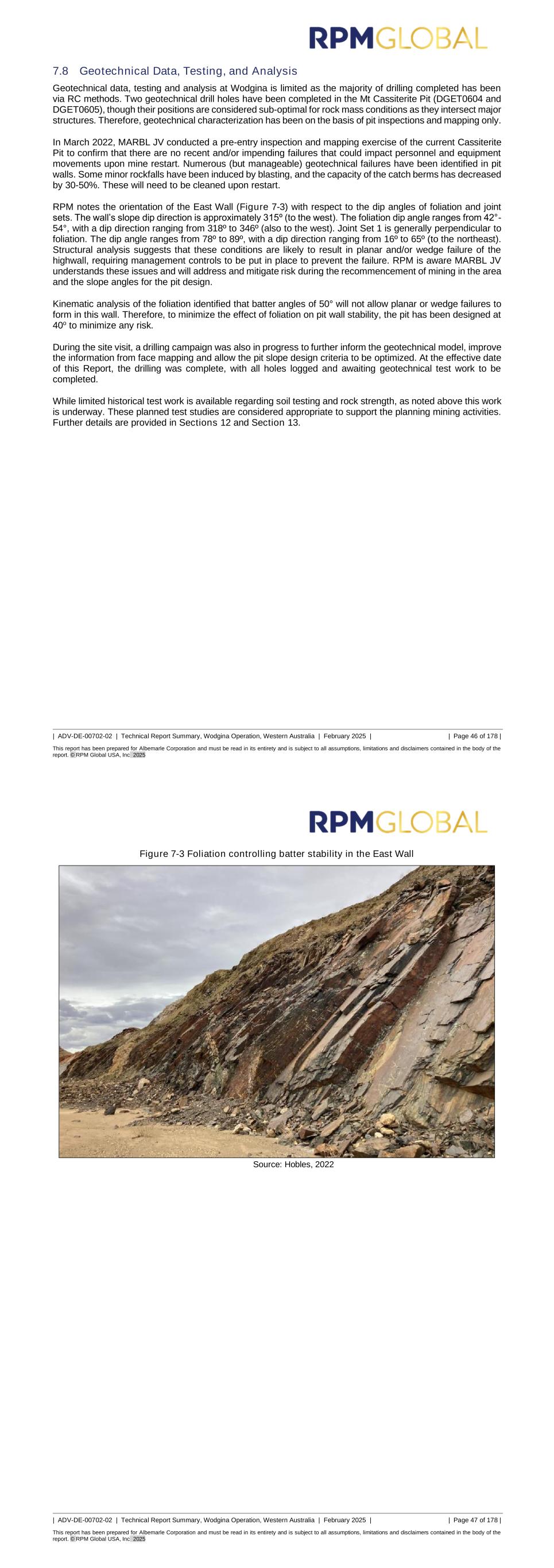

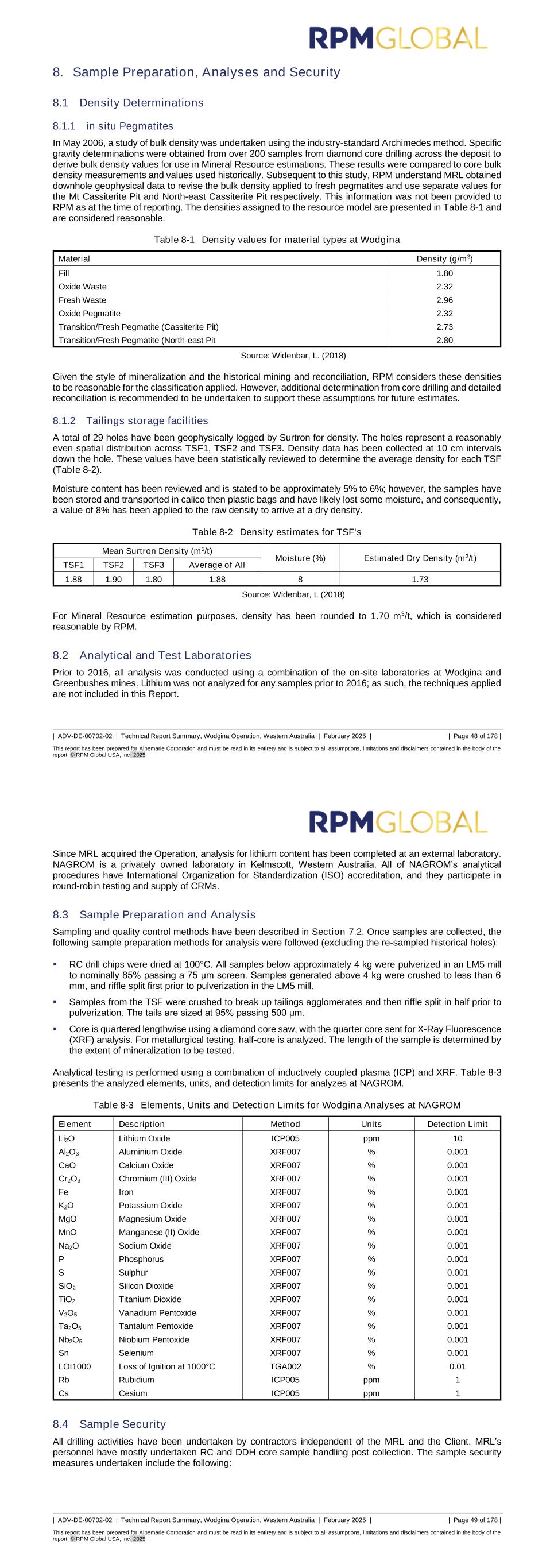

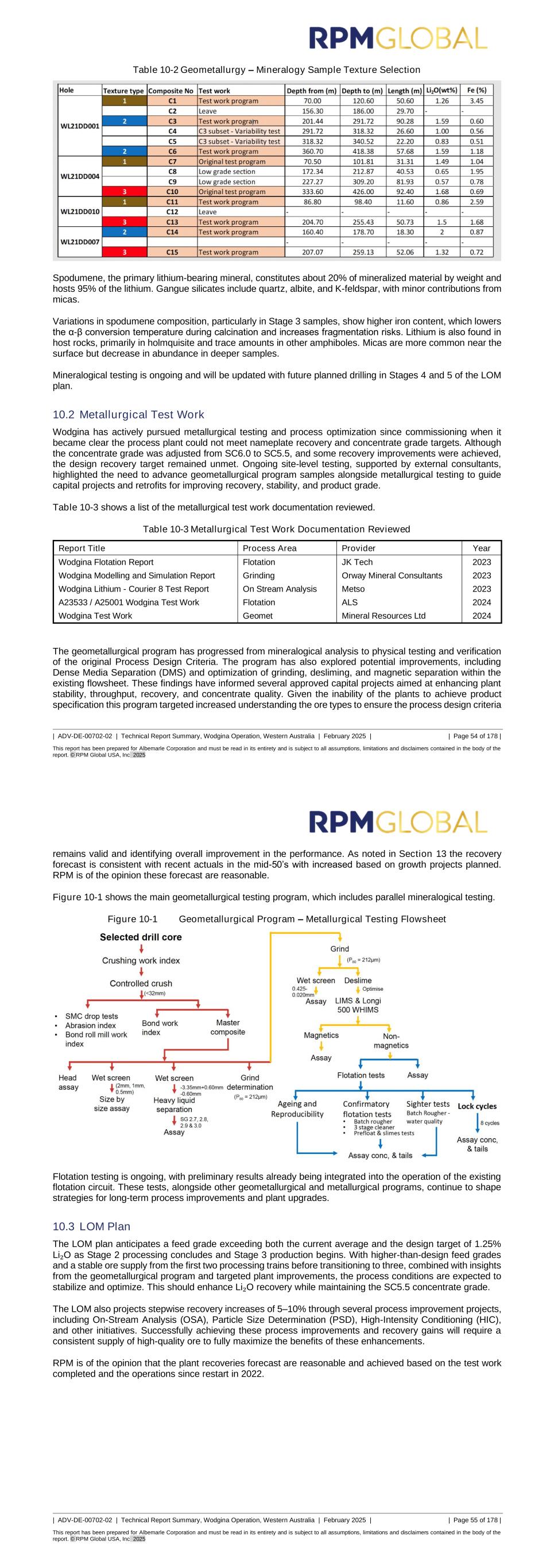

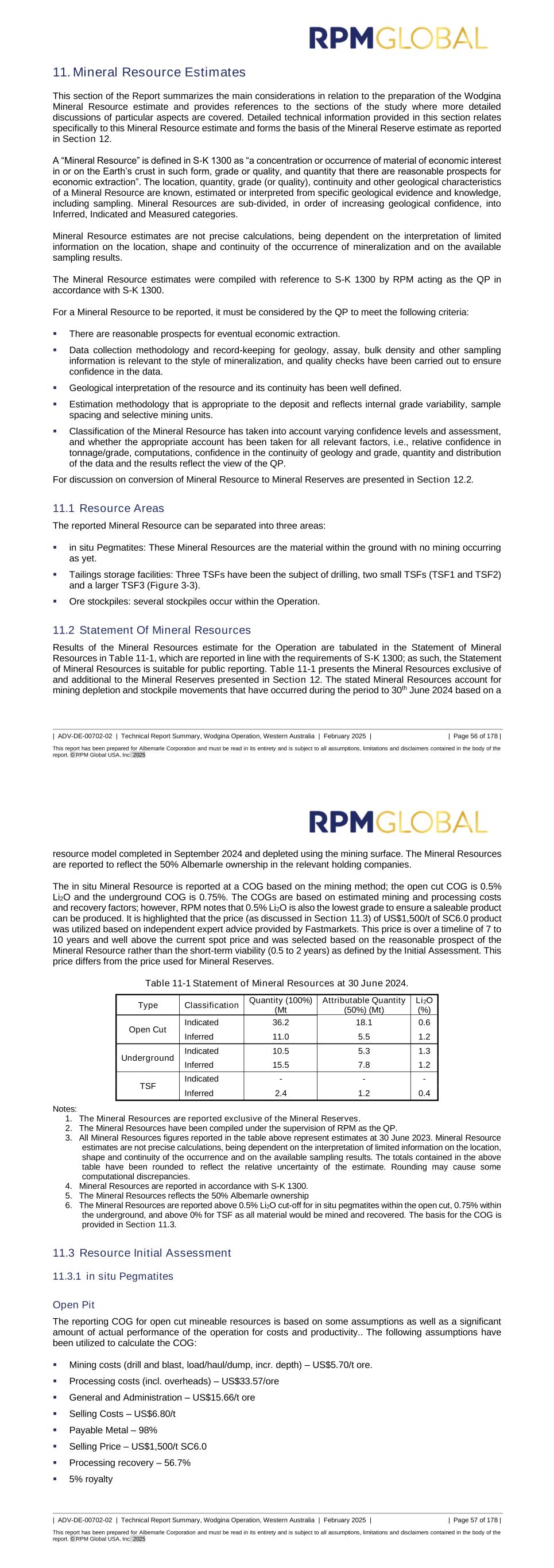

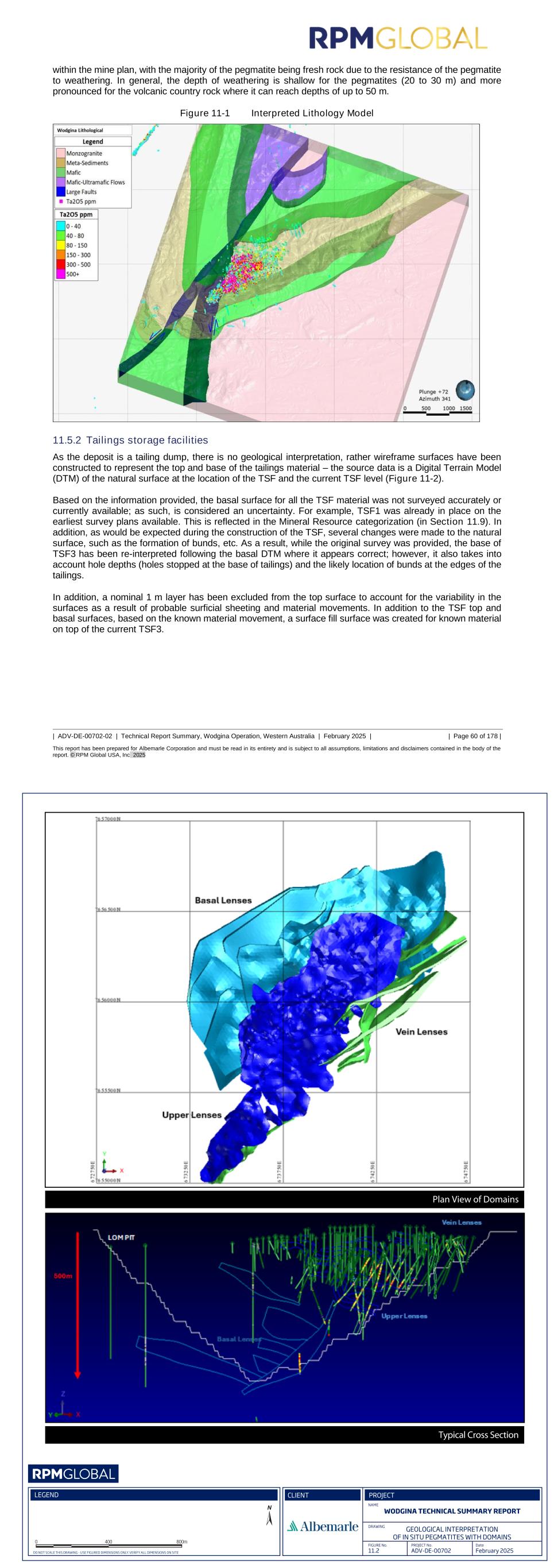

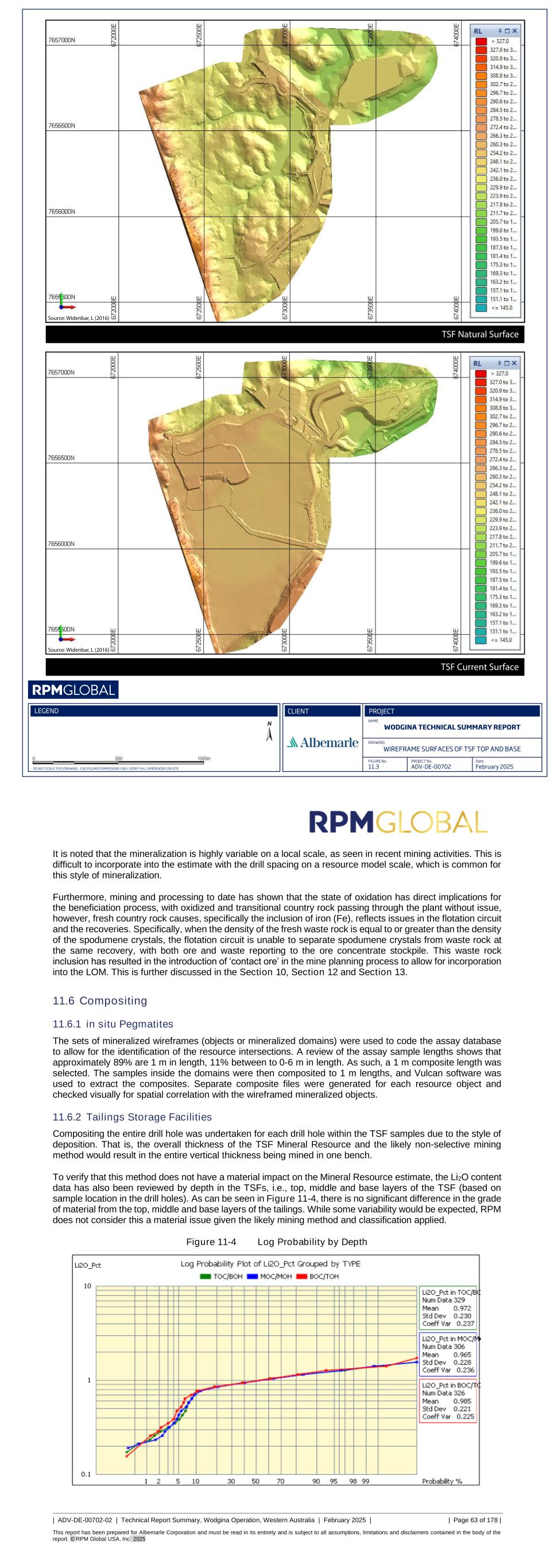

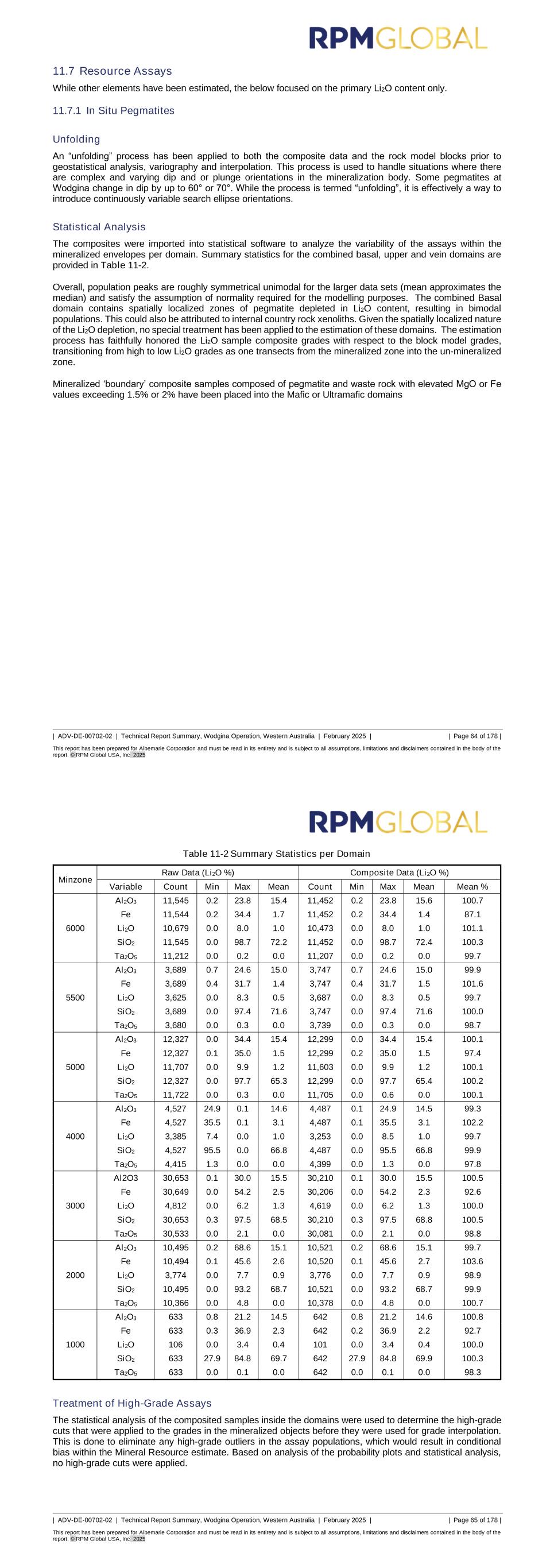

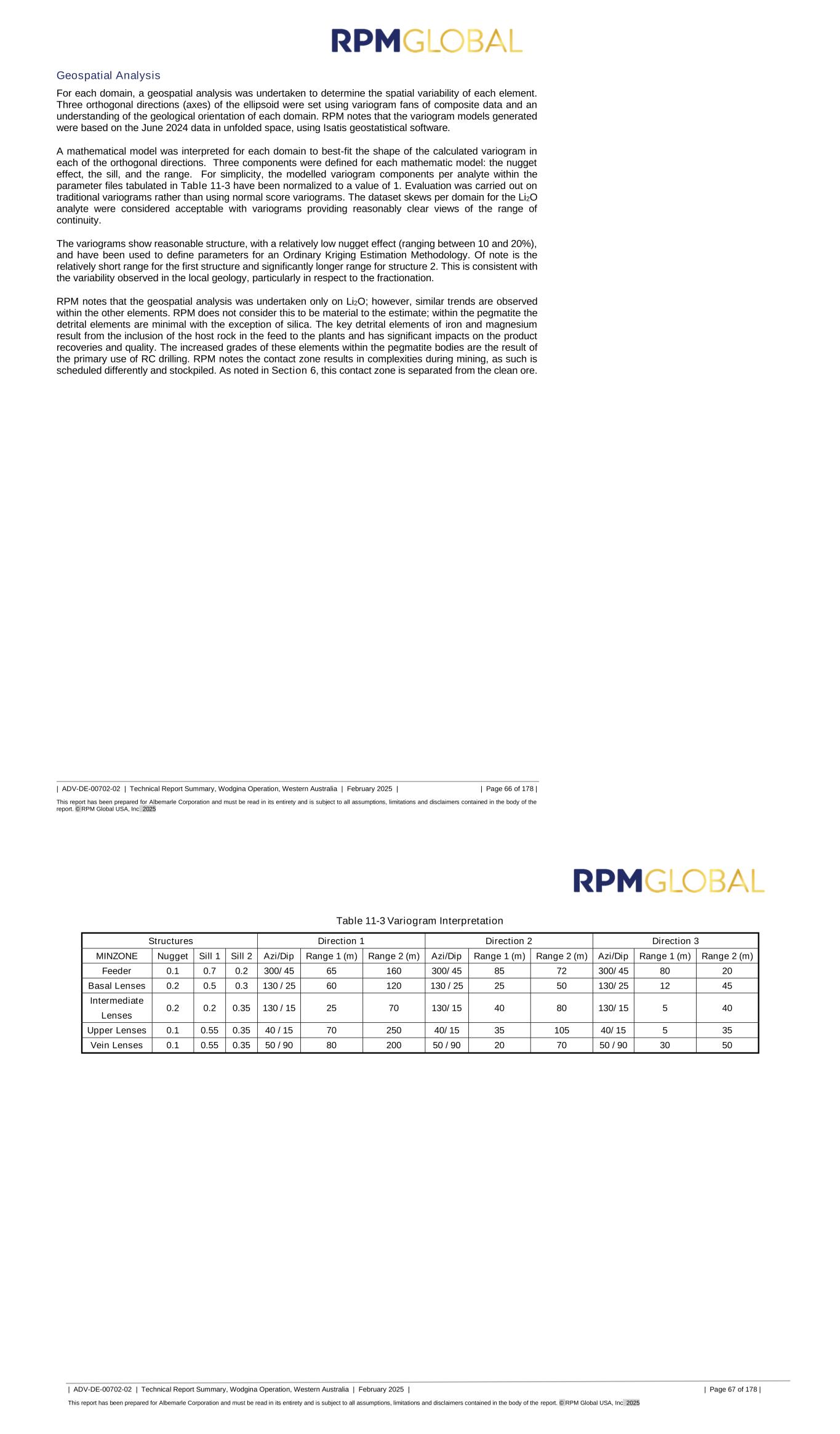

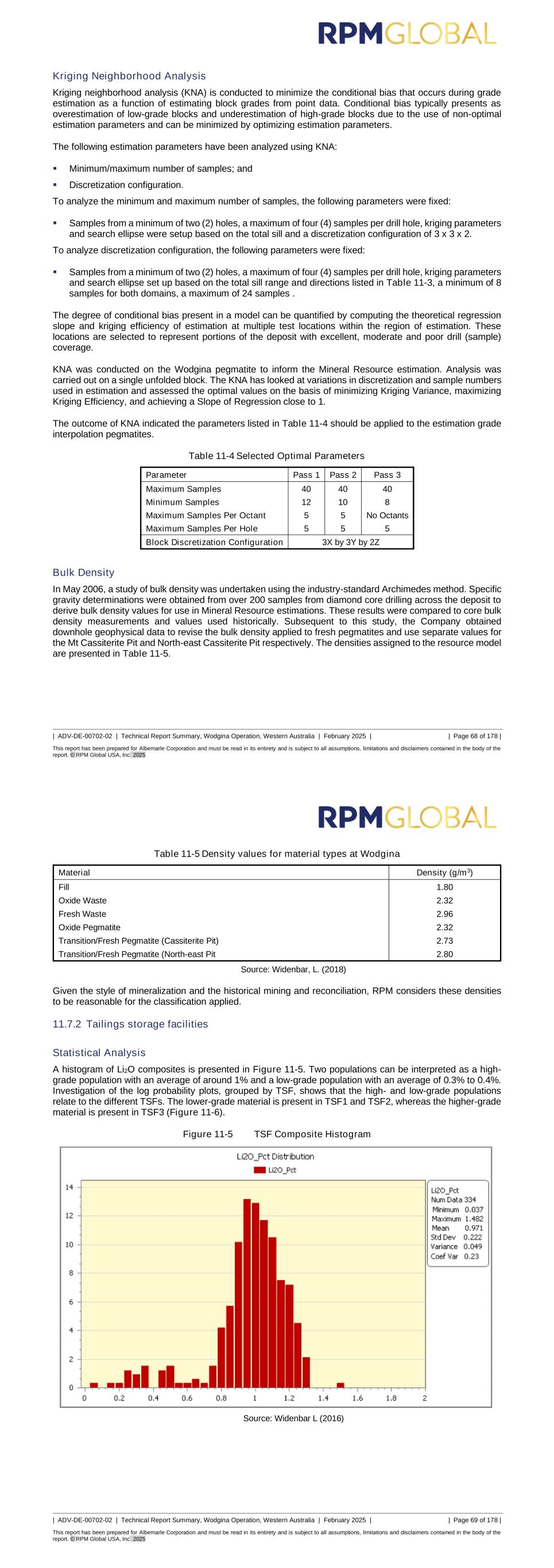

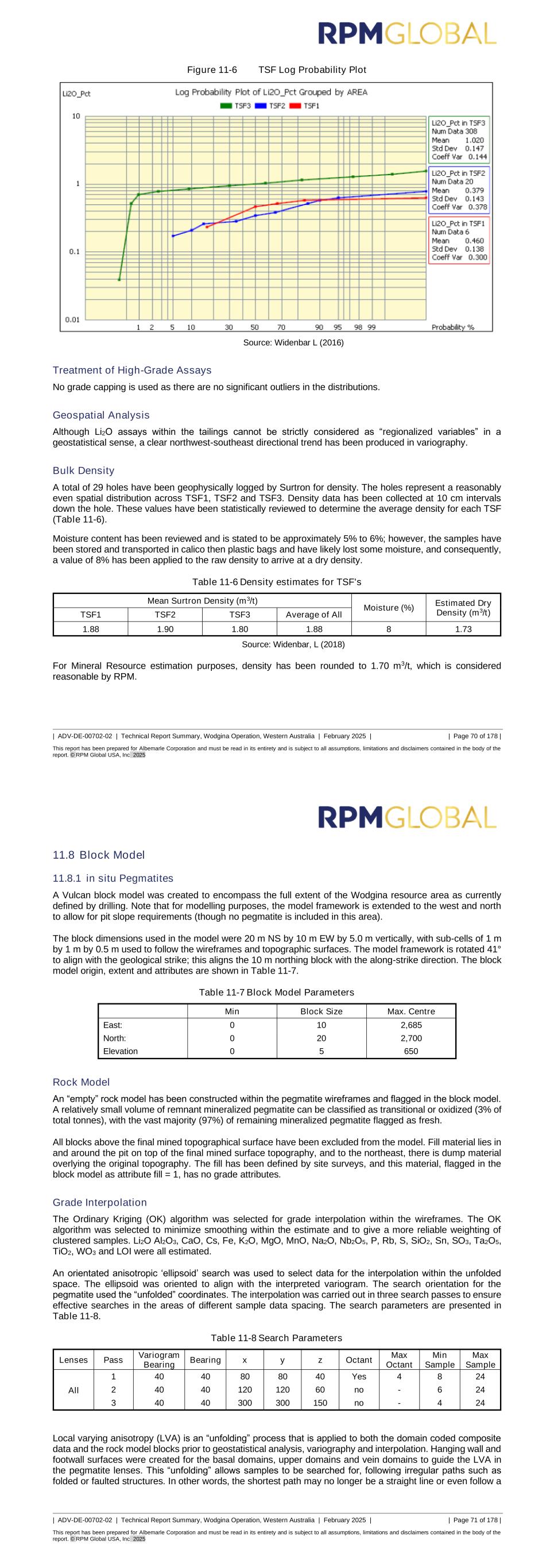

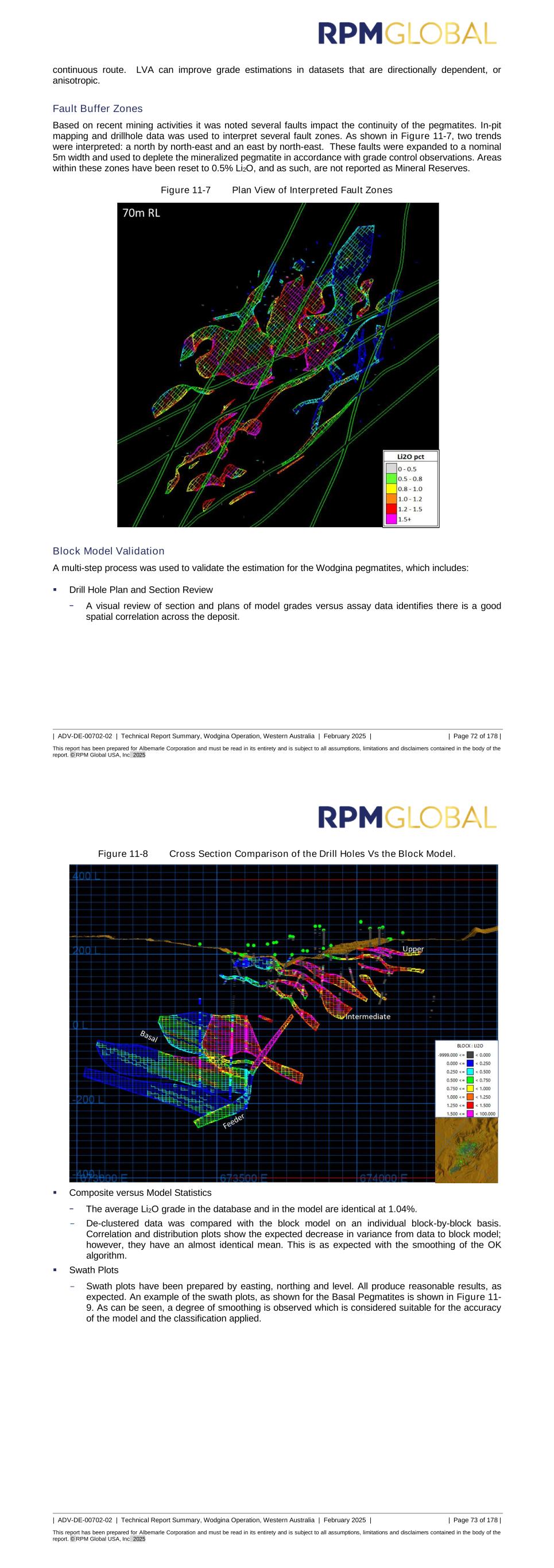

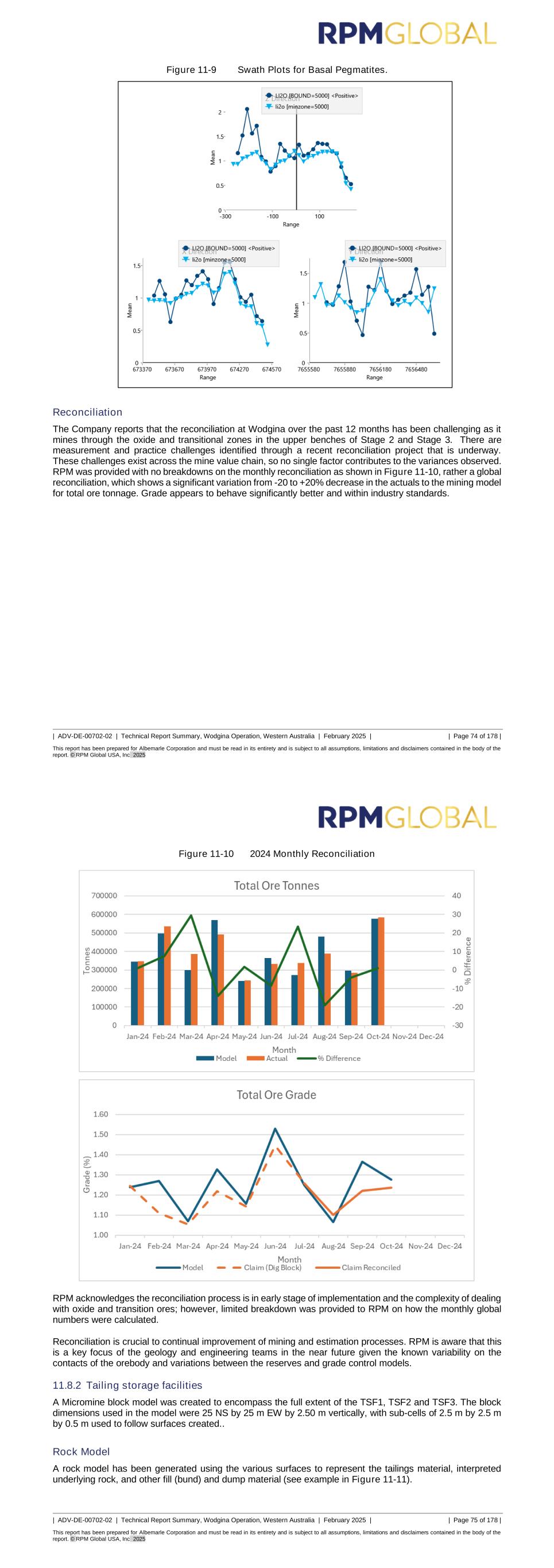

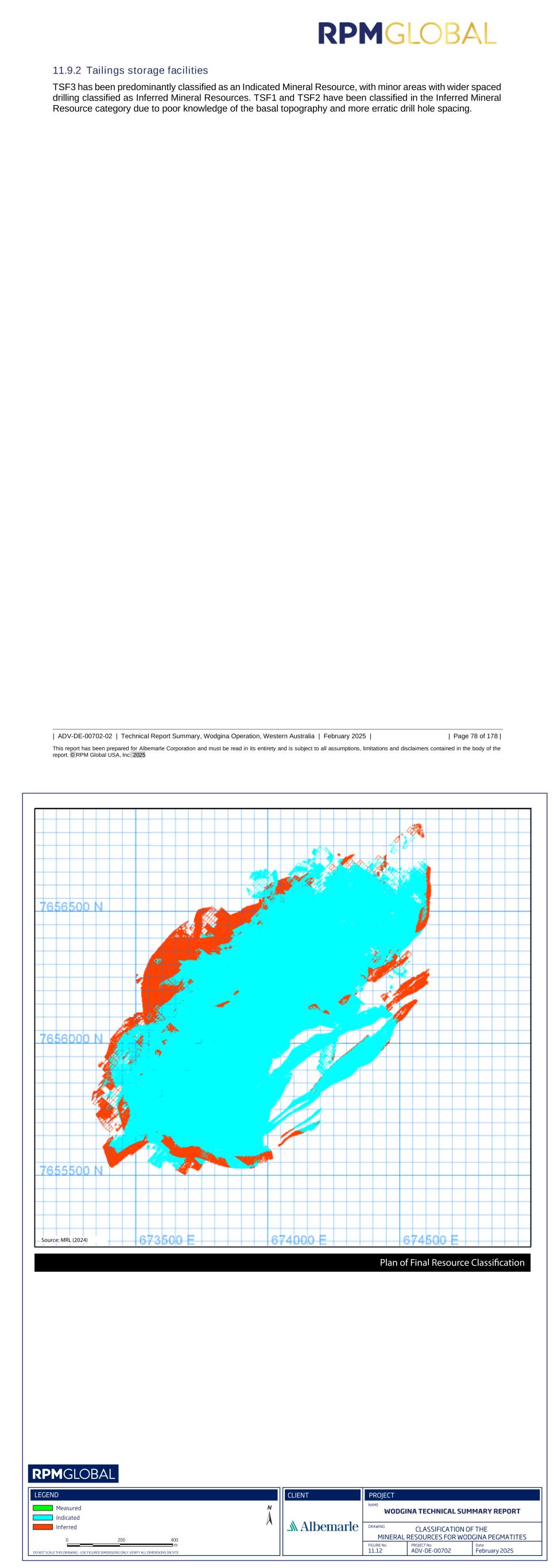

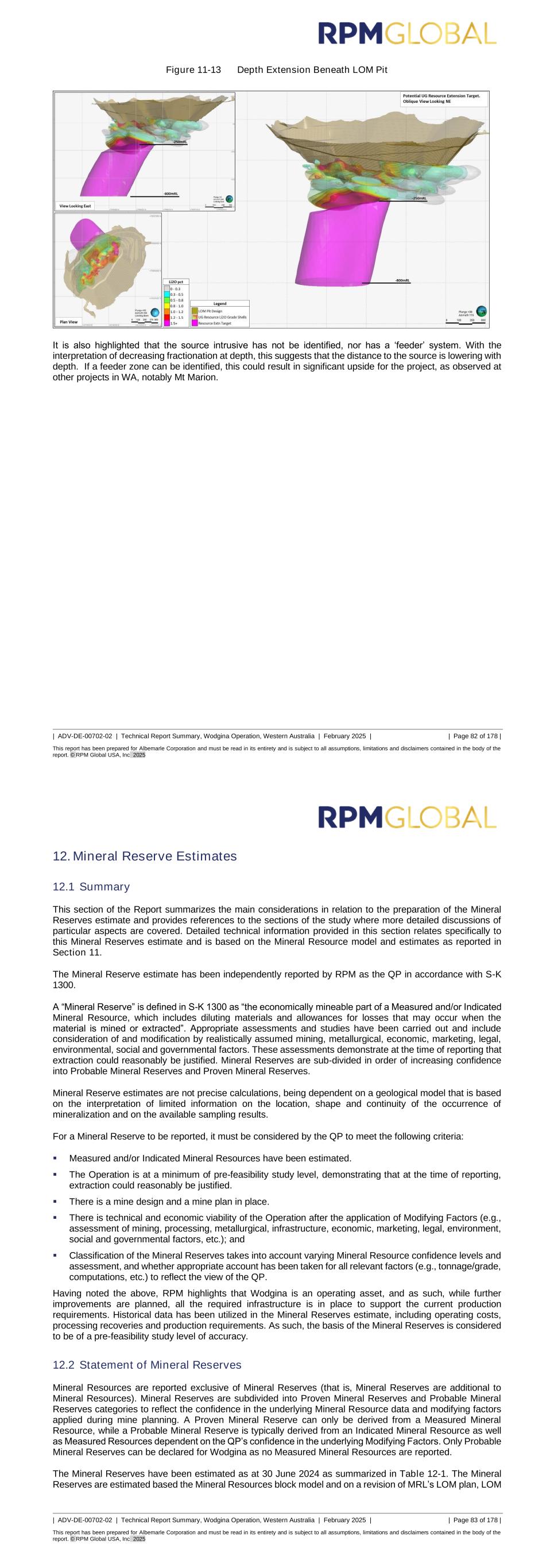

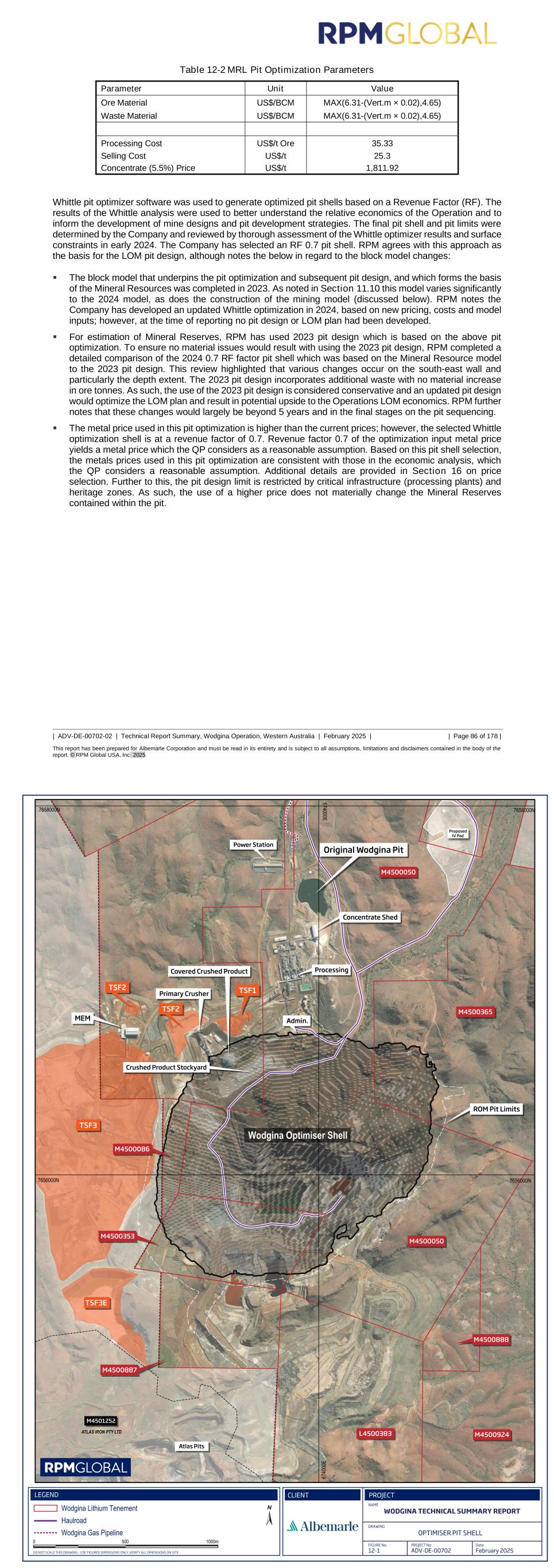

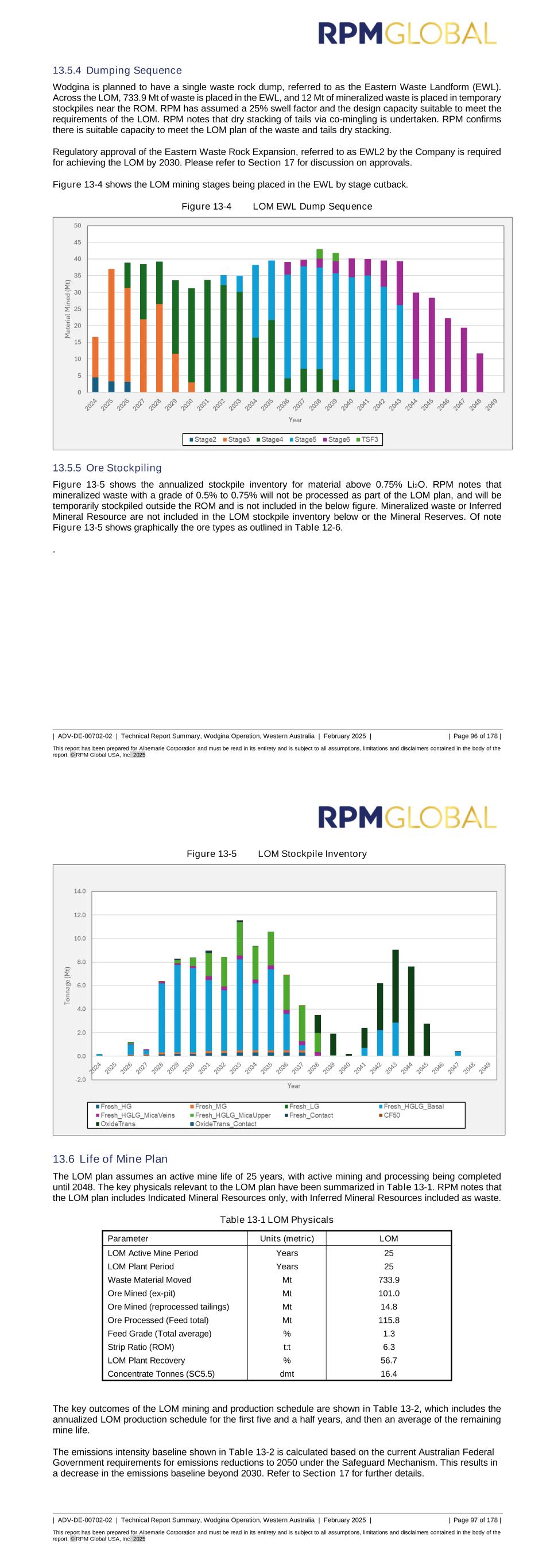

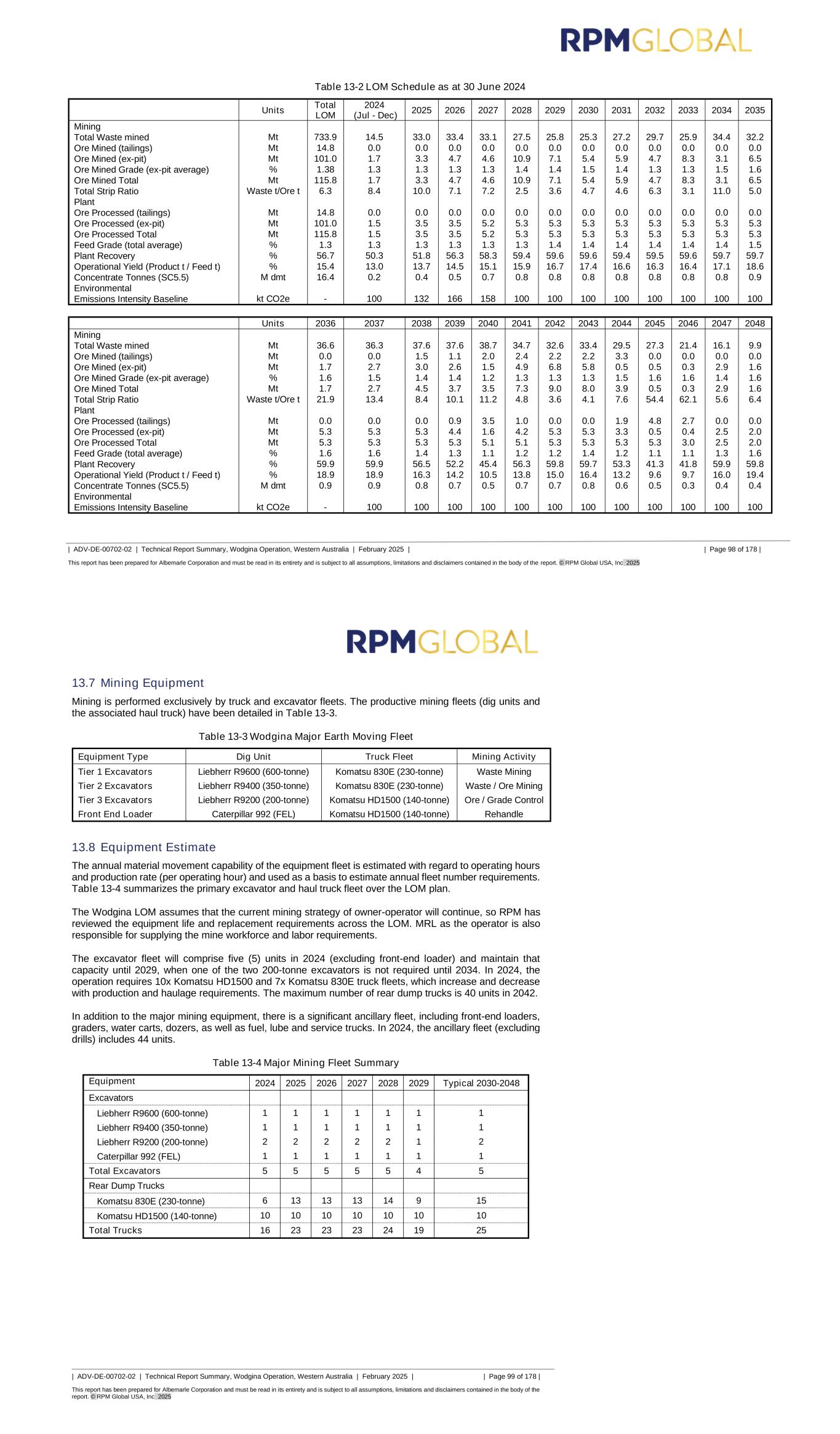

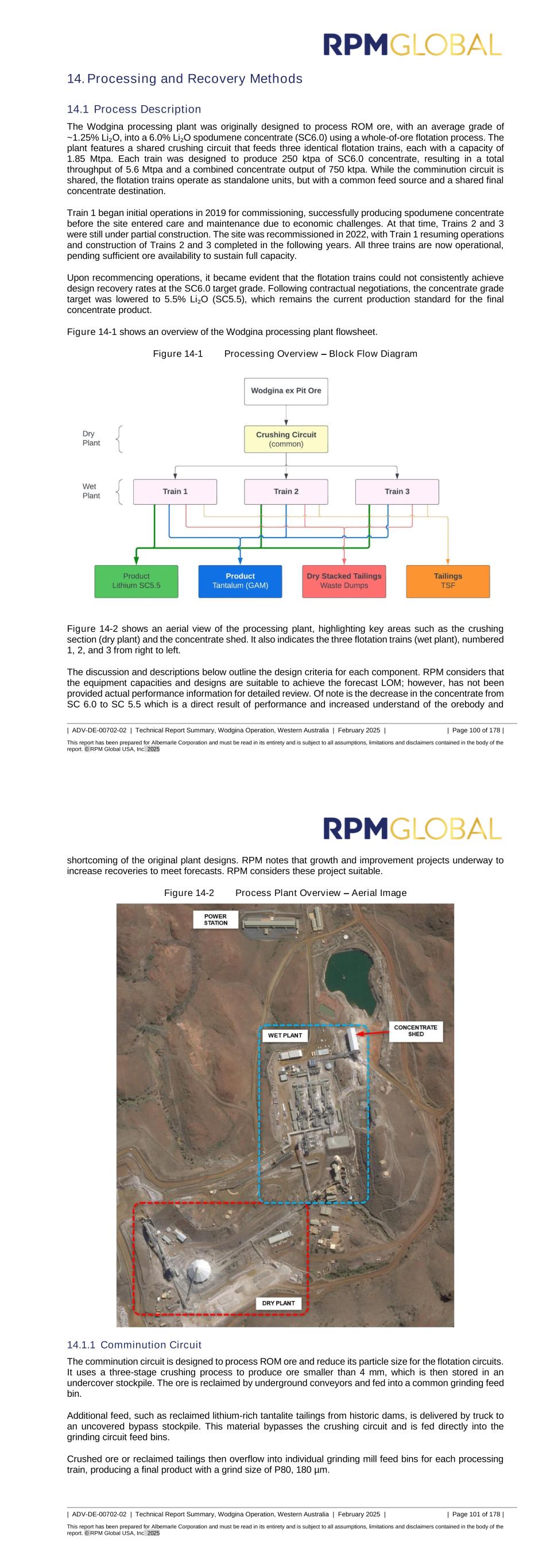

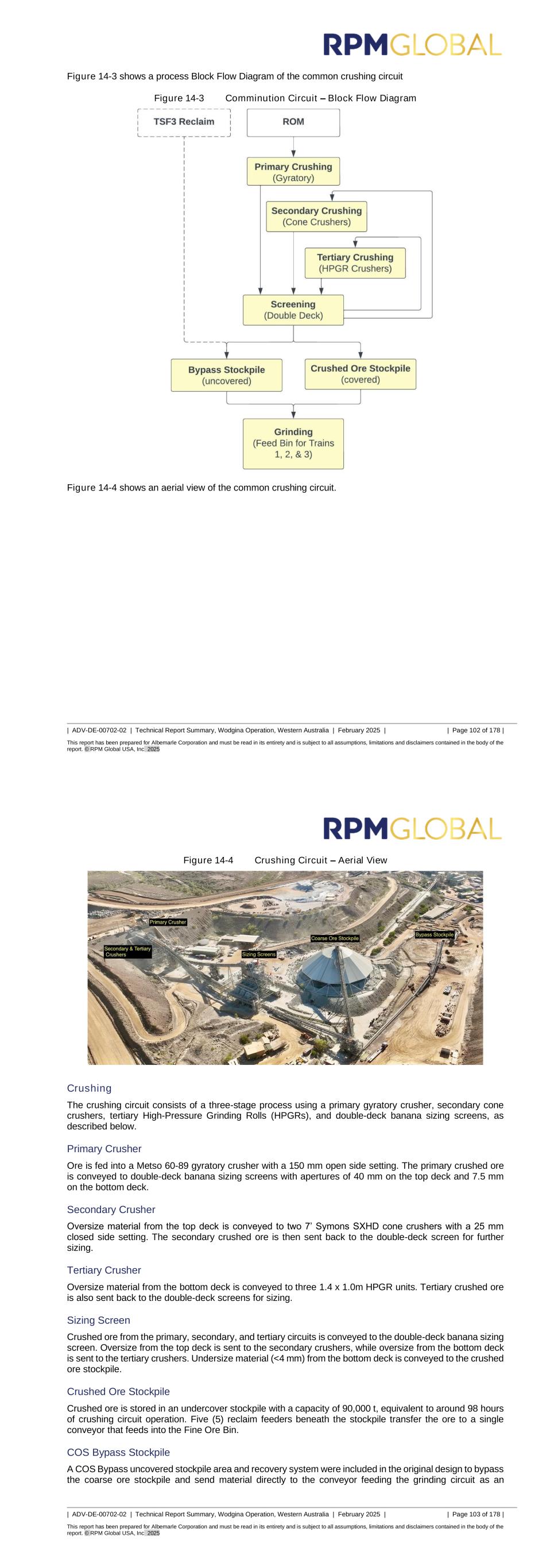

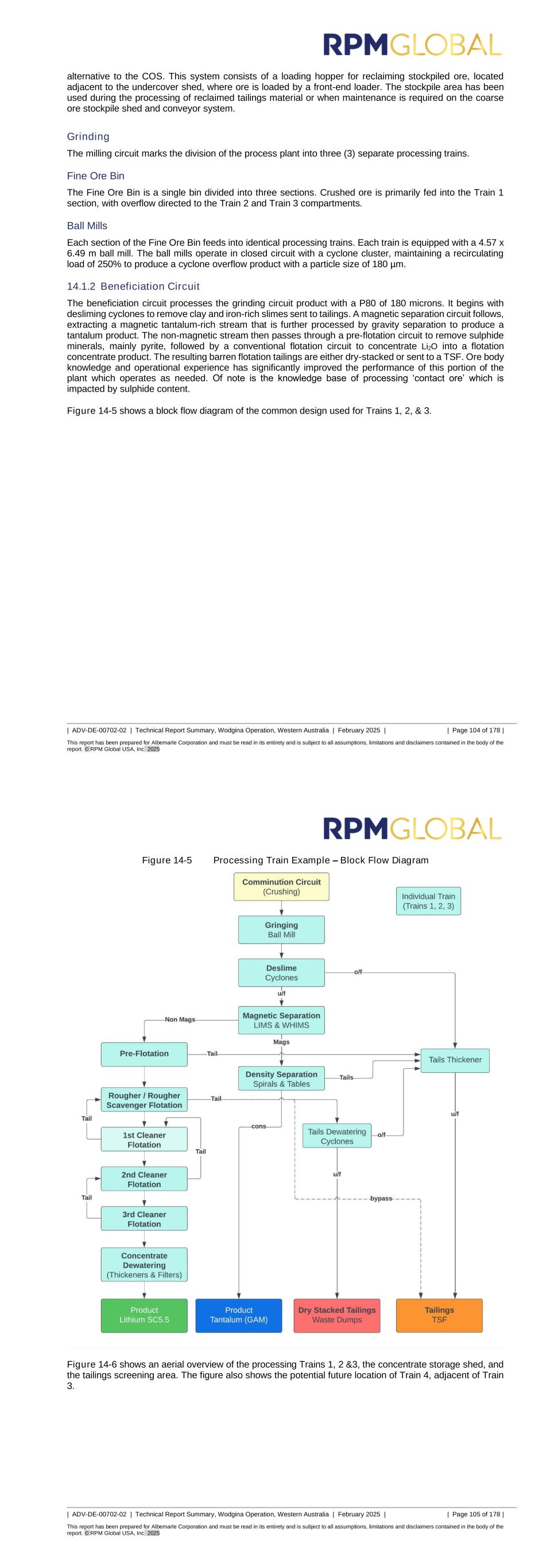

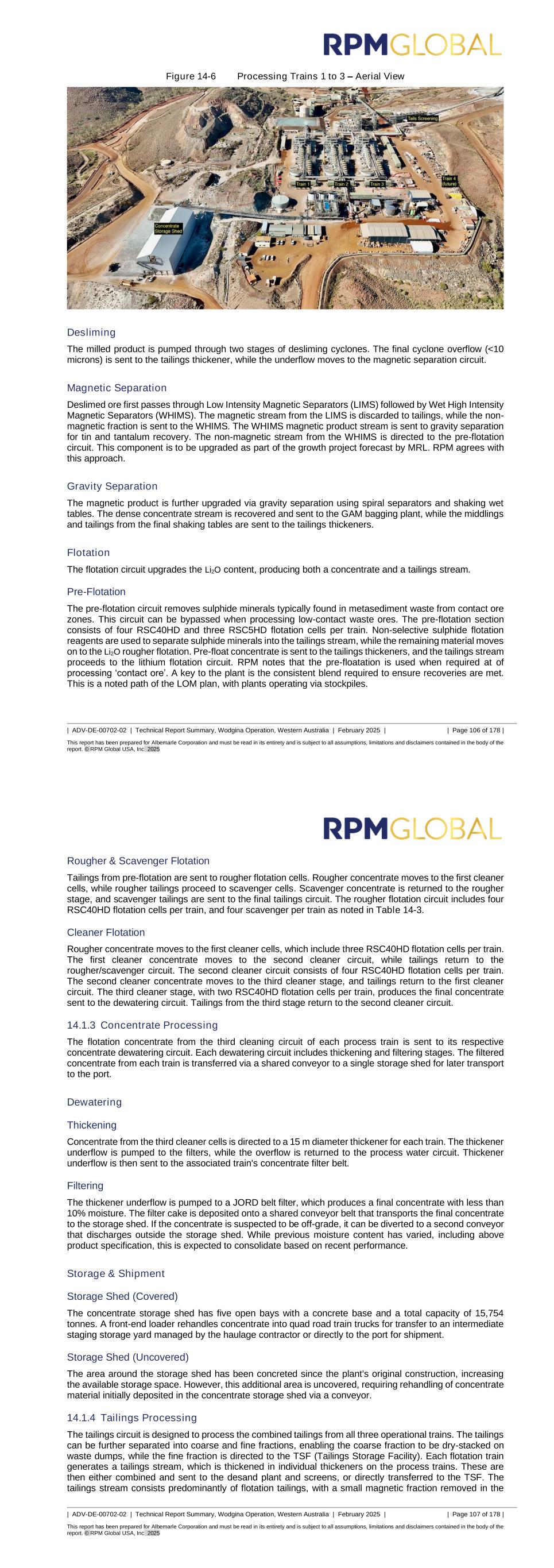

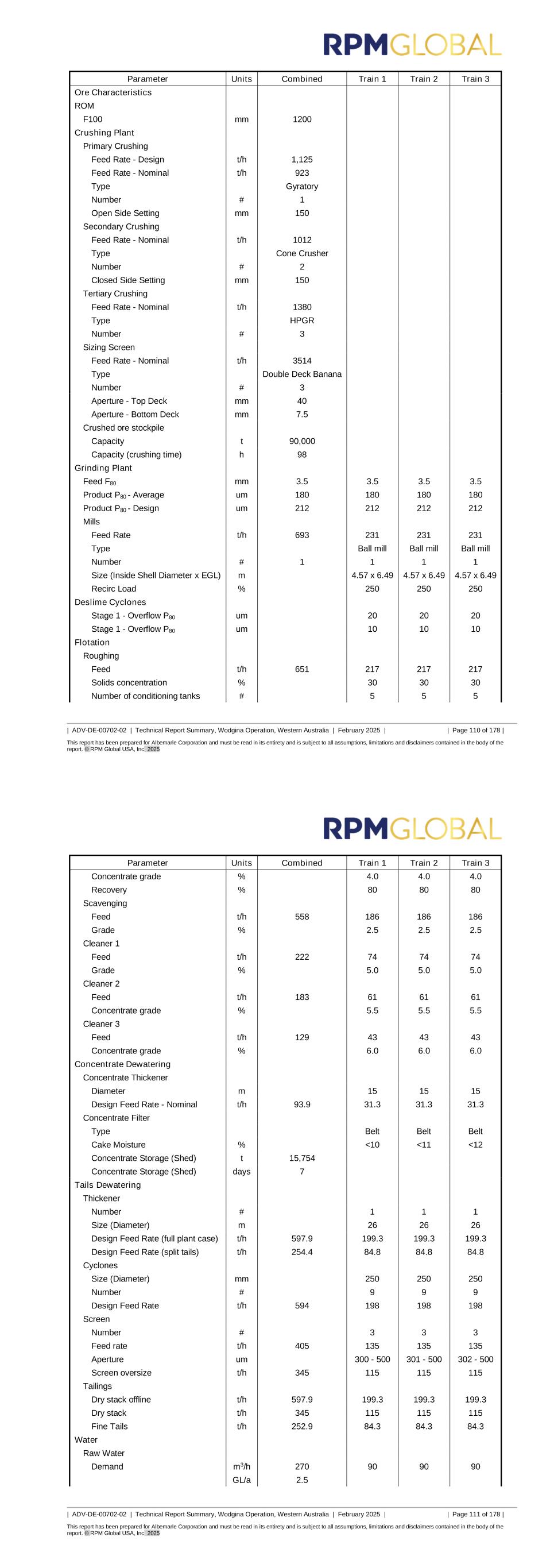

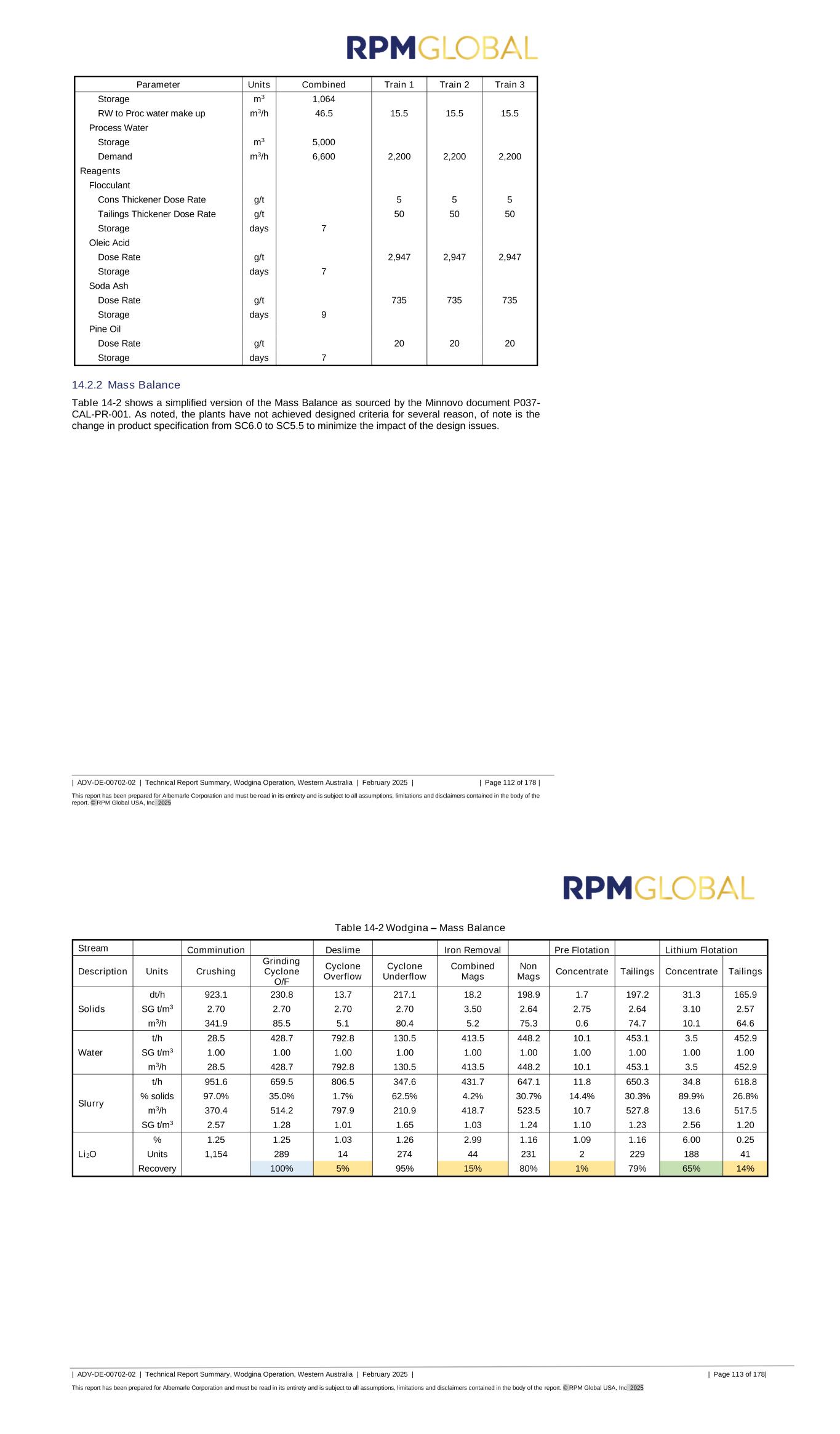

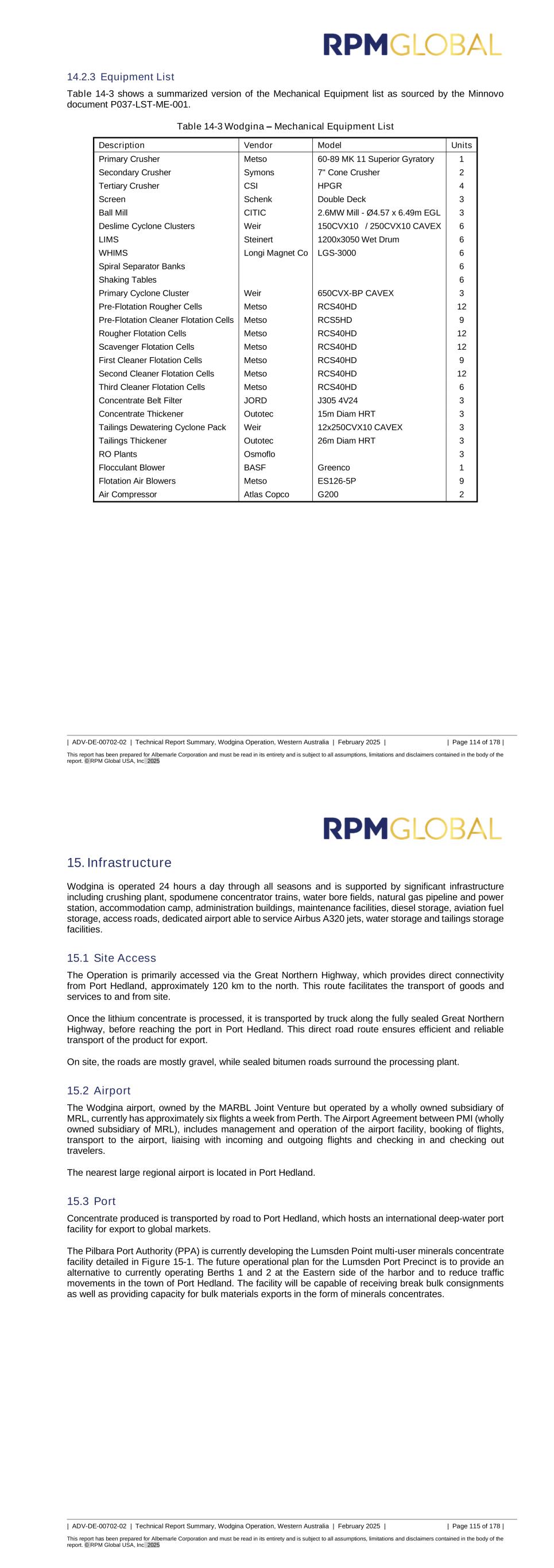

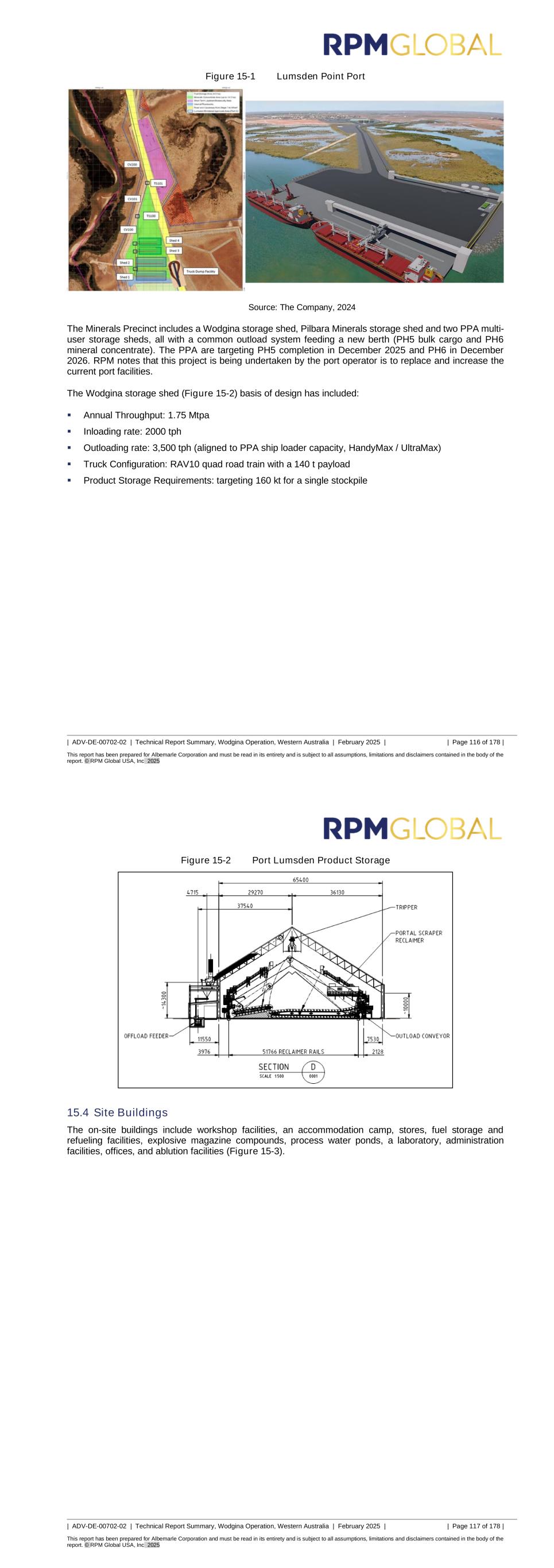

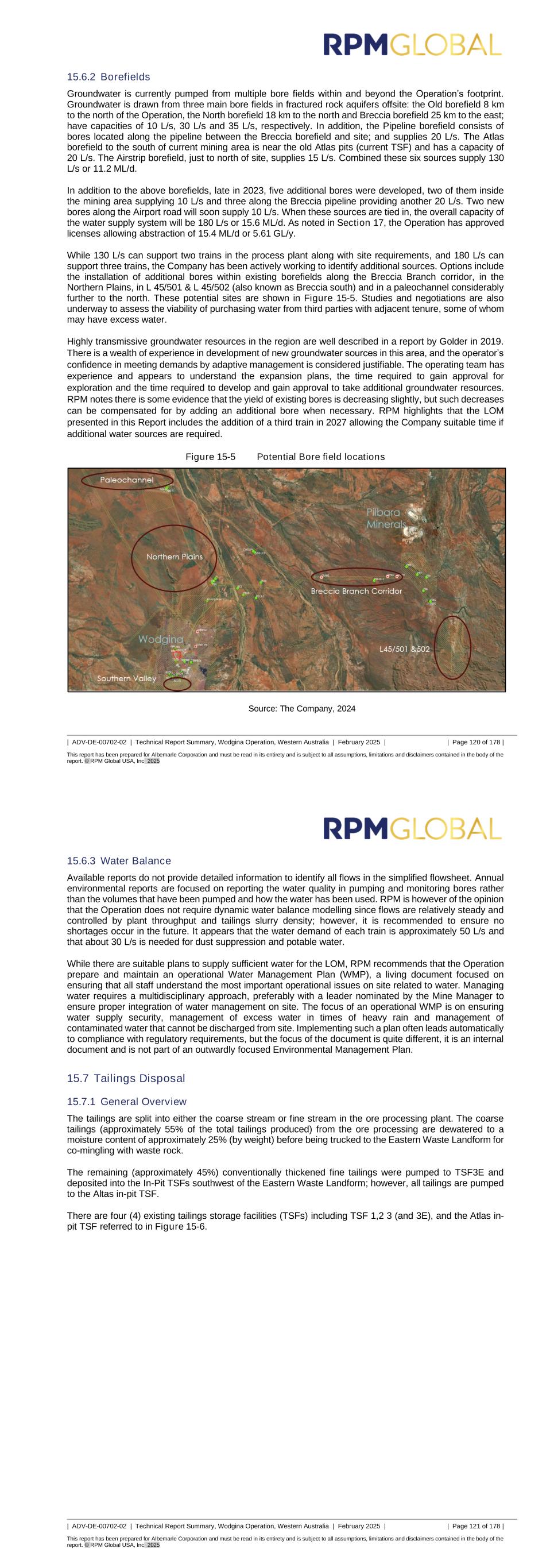

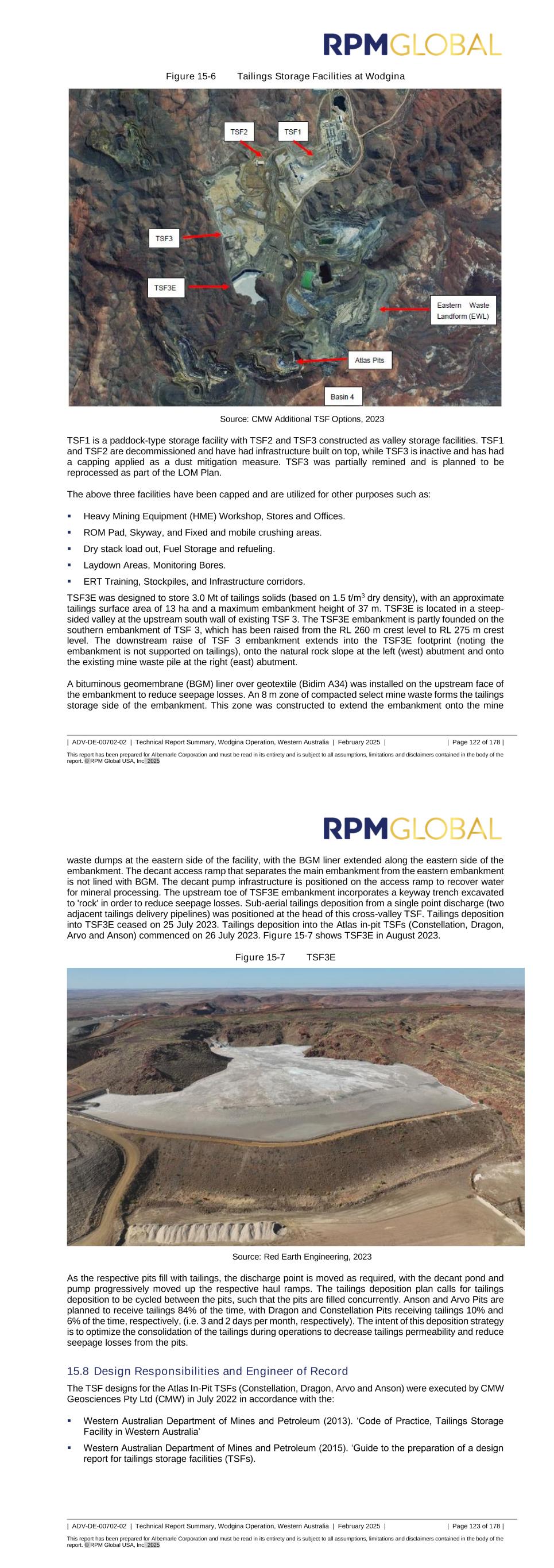

| ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 8 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 1.10.2 Conclusions The Wodgina deposit is well explored with exploration drilling programs for lithium having been conducted since 1996. RPM considers that the geological model is based on adequate geology and geochemical data and has been sufficiently reviewed and verified. RPM has determined that the estimation and classification of the Mineral Resources have reasonable prospects for eventual economic extraction in-line with an Initial Assessment. The Operation is an established open cut mine that is a conventional truck and shovel operation employing industry-standard mining methods. RPM considers the major mining fleet assumptions to be reasonable when benchmarked to industry standards and historical performance. RPM is of the opinion that the Mineral Reserves, and associated equipment fleet numbers are reasonable to achieve the forecasts and reflect an appropriate level of accuracy. The geological model, detailed mine plans, and technical studies that underpin the LOM plan are supported by historical performance, well-documented systems and processes, and reconciliation and review. Where available, RPM has reviewed this data and determined it to be adequate to support the Statements of Mineral Resources and Mineral Reserves reported in this TRS. Tenure critical to the declared Mineral Resources and Mineral Reserves, the associated infrastructure and the LOM plan are currently in good standing and are subject to routine renewal processes. However, additional approvals are required to achieve the full LOM plan. The surface area of the existing operation is almost wholly owned by the Company, and RPM is of the opinion that there are no material surface rights and easement issues, with the exception of the required additional areas for future development plans beyond 2030. All permits and approvals are in place for mining to continue until 2030. However, receipt of approvals is a key risk associated with achieving the LOM plan. Documents associated with approvals required for ongoing works beyond 2030 have been submitted, and RPM is of the opinion that these approvals have fair prospects to be granted in line with the required timeframe to allow ongoing operations. If a delay occurs in granting these approvals, the LOM plan as presented in this Report will need to be revised. 1.11 Recommendations To further support the LOM plan, RPM has the following key recommendations by area. ▪ Drilling: It is recommended to complete additional drilling targeting two main areas: − Approximately 11 Mt of Inferred material is within the final pit design in later stages of the mine life. As the pit deepens, it is recommended that this material is converted to Indicated with additional drilling. − Targeted resource and grade control drilling via diamond and reverse circulation (RC) techniques given the geology risks noted in the mining activities to date. RPM notes that all grade control is currently via blast hole sampling but recommends that RC be undertaken at least in high risk zones to minimize issues and complexities in short-term planning. Furthermore, diamond drilling will provide detailed mineralogical information to enable further understanding of the fractionation and structural complexities of the deposit. ▪ Approvals: Carefully monitor and amend as required, the implementation of the proposed future approval strategy (including waste dump and tails storage) and schedule, taking into consideration the comments that RPM has made on the proposed future approval strategy and schedule in this review. ▪ Stakeholder Engagement: Continue with the key stakeholder engagement and community development measures, to ensure ongoing good relations with the Operation’s traditional owners. ▪ Ore Sorters: Complete technical studies for the placement of ore sorters and assess the potential economic benefits of processing contaminated ore with grades between 0.5% and 0.75%. RPM notes that there is approximately 18 Mt of material between these COG’s. This material is currently stockpiled. ▪ Alternative Feed Integration: Introduce the capability to directly feed at least one processing train with alternative material, enabling isolated tailings retreatment on a single train while others process conventional ROM feed. | ADV-DE-00702-02 | Technical Report Summary, Wodgina Operation, Western Australia | February 2025 | | Page 9 of 178 | This report has been prepared for Albemarle Corporation and must be read in its entirety and is subject to all assumptions, limitations and disclaimers contained in the body of the report. © RPM Global USA, Inc 2025 ▪ Future Deposits Modelling: Conduct geometallurgical modelling for Stage 4 and Stage 5 deposits, supported by a dedicated drilling program, it is envisaged this would be undertaken during the resource and grade control drilling. ▪ Water Recovery and Chemistry: Prioritize water recovery around the processing plant and assess the impact of water chemistry on flotation performance. 1.12 Key Risks ▪ Geology uncertainty: In-pit mapping, sampling and grade control via blast holes have shown variations from the resource interpretation. While the 2024 model reflects these changes with the introduction of fault buffer zones, and ore recovery based on reconciliation factors in the Mineral Reserves, geology risk is high which reflects the classification of Inferred Mineral Resources and Indicated Mineral Resources in the estimation rather than Measured Mineral Resources. − To gain a more detailed understanding of the geology trends and performance of the resource model, a detailed end-to-end reconciliation is required to be undertaken. This will allow reviews of the interpretation, modelling practices and modifying factors applied to the Mineral Reserves. ▪ Forecast Ore Volumes: Reconciliation has shown significant variability in tonnage between the mining reserves model and actuals. While improvement has been shown in recent months following adjustments to the modifying factors, ongoing review is critical to the medium-term performance of the Operation. If ongoing variability continues and consistent feed blends are not achieved, this will impact the performance of the plants and likely decrease recoveries. ▪ Approvals: Granting of approvals is a key risk for the continued operations to achieve the LOM plan. Key milestones for achieving the LOM plan include securing regulatory approvals for the Eastern Waste Landform expansion (EWL2) dump, and the Southern Basin Tailings Storage Facility. ▪ Ore Types: While significant work has been undertaken to define the ore types within Stages 1 through to 3 of the pit sequence, additional studies and test work are required for Stages 4 to 6 to confirm no material changes are expected. RPM notes that the predominant ore type in Stage 4 to 6 are the basal lodes which are significantly thicker than with upper and vein lodes, and as such, variability in feed ore type is expected to increase on a short-term basis. Of note, the basal lode appears to have been subjected to less exploration than the upper lodes, and has only recently been exposed in the pit during mining. Recent mining indicates that reconciliation in this basal lode is reasonable; however, further work is required to confirm both the ore types and geology continuity assumed.