UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08274 |

|

MassMutual Select Funds |

(Exact name of registrant as specified in charter) |

|

1295 State Street, Springfield, MA | | 01111 |

(Address of principal executive offices) | | (Zip code) |

|

Frederick C. Castellani 1295 State Street, Springfield, MA 01111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 413-788-8411 | |

|

Date of fiscal year end: | 12/31/2007 | |

|

Date of reporting period: | 6/30/2007 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

MassMutual

Select Funds

Semi-annual Report

June 30, 2007

insure invest retire

Retirement Services

Table of Contents

| Letter to Shareholders | | | 1 | | |

|

| Portfolio Manager Reports | | | 3 | | |

|

| Portfolio of Investments | |

|

| MassMutual Select Strategic Bond Fund | | | 87 | | |

|

| MassMutual Select Strategic Balanced Fund | | | 96 | | |

|

| MassMutual Select Diversified Value Fund | | | 105 | | |

|

| MassMutual Select Fundamental Value Fund | | | 108 | | |

|

| MassMutual Select Value Equity Fund | | | 111 | | |

|

| MassMutual Select Large Cap Value Fund | | | 114 | | |

|

| MassMutual Select Indexed Equity Fund | | | 117 | | |

|

| MassMutual Select Core Opportunities Fund | | | 123 | | |

|

| MassMutual Select Blue Chip Growth Fund | | | 125 | | |

|

| MassMutual Select Large Cap Growth Fund | | | 128 | | |

|

| MassMutual Select Growth Equity Fund | | | 131 | | |

|

| MassMutual Select Aggressive Growth Fund | | | 135 | | |

|

| MassMutual Select OTC 100 Fund | | | 137 | | |

|

| MassMutual Select Focused Value Fund | | | 140 | | |

|

| MassMutual Select Mid-Cap Value Fund | | | 143 | | |

|

| MassMutual Select Small Cap Value Equity Fund | | | 145 | | |

|

| MassMutual Select Small Company Value Fund | | | 151 | | |

|

| MassMutual Select Small Cap Core Equity Fund | | | 156 | | |

|

| MassMutual Select Mid Cap Growth Equity Fund | | | 160 | | |

|

| MassMutual Select Mid Cap Growth Equity II Fund | | | 163 | | |

|

| MassMutual Select Small Cap Growth Equity Fund | | | 169 | | |

|

| MassMutual Select Small Company Growth Fund | | | 174 | | |

|

| MassMutual Select Emerging Growth Fund | | | 178 | | |

|

| MassMutual Select Diversified International Fund | | | 181 | | |

|

| MassMutual Select Overseas Fund | | | 184 | | |

|

| MassMutual Select Destination Retirement Income Fund | | | 187 | | |

|

| MassMutual Select Destination Retirement 2010 Fund | | | 188 | | |

|

| MassMutual Select Destination Retirement 2020 Fund | | | 189 | | |

|

| MassMutual Select Destination Retirement 2030 Fund | | | 190 | | |

|

| MassMutual Select Destination Retirement 2040 Fund | | | 191 | | |

|

| Statement of Assets and Liabilities | | | 192 | | |

|

| Statement of Operations | | | 208 | | |

|

| Statement of Changes in Net Assets | | | 216 | | |

|

| Financial Highlights | | | 232 | | |

|

| Notes to Financial Statements | | | 313 | | |

|

| Other Information (Unaudited) | | | 365 | | |

|

This material must be preceded or accompanied by a current prospectus for the MassMutual Select Funds. Investors should consider a Fund's investment objective, risks and charges and expenses carefully before investing. This and other information about the investment company is available in the prospectus. Read it carefully before investing.

MassMutual Select Funds – President's Letter to Shareholders

To Our Shareholders

June 30, 2007

Frederick C. Castellani

The stock market's impressive performance during the second quarter serves as a reminder of how difficult it can be to forecast stock market performance. Because the direction of the equity markets is constantly subject to change, MassMutual recommends that investors should generally avoid basing their investment activities on market forecasts – and instead adopt a buy-and-hold approach that employs thoughtful asset allocation.

Stocks continue to outperform bonds in first half of 2007

For the six-month period ended June 30, 2007, equities once again fared better than their fixed-income counterparts, as bonds continued to face numerous challenges. The Dow Jones Industrial AverageSM (the Dow), which tracks the progress of blue-chip stock activity, returned 7.59% for the six months ended June 30, 2007. The Nasdaq Composite® Index (Nasdaq) gained 7.78%, outpacing the S&P 500® Index, a measure of U.S. large-cap stock performance, which advanced 6.96%. Continuing the trend from 2006, a leader in worldwide equity markets for this period was once again the MSCI® EAFE® Index – a benchmark for foreign stocks that advanced 10.74%.*

The fixed-income market did not fare nearly as well in the first half of 2007, as the Lehman Brothers® Aggregate Bond Index, a broad measure of the U.S. investment-grade bond markets, gained just 0.97%.*

Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Although the Dow notched a new closing high in February, the blue-chip benchmark declined slightly for the three months ended March 31, 2007. The S&P 500 Index finished with a small advance, as did the Nasdaq Index, which barely managed to post a gain for the period. A depreciating U.S. dollar supported the returns of foreign stocks, helping the MSCI EAFE Index outperform its U.S. counterparts for the quarter.

Bond yields rose and prices fell early in 2007, reflecting expectations that the economy would achieve a "soft landing" – that is, a mild slowdown without recession. However, as concerns intensified about the weak housing market and problems with sub-prime lenders made headlines, bond yields eased and prices rallied. Overall, most Treasury securities ended the first quarter with modest price gains, and the Lehman Brothers Aggregate Bond Index closed out the period with a modest advance.

Most U.S. stock indexes advanced in the second quarter, with some setting records along the way. Stocks rode a wave of optimism over corporate earnings early in the quarter and later overcame short periods of increased volatility associated with investor concerns about soft retail sales, rising interest rates, inflation, the housing market and sub-prime mortgages. During the period, the housing market remained depressed, and long-term interest rates moved decisively higher. Crude oil surged to close the quarter near $70 per barrel.

Higher Treasury yields and widening premiums for corporate and mortgage-backed securities reflected rising interest rates in the second quarter. The Treasury yield curve, representing yields across a range of maturities, went from slightly inverted – with yields on short-term bonds higher than those of longer-term bonds – to nearly flat, with longer yields marginally higher than short ones. Also of note, the 10-year bond yield topped the 5% level in its first excursion above that mark since the summer of 2006. Performance was mixed among fixed-income groups, but investors favored shorter-term issues, such as the 13-week U.S. Treasury Bill. High-yield bonds barely managed a positive return for the quarter, despite moderately favorable corporate earnings and low default rates on corporate high-yield securities.

* Indexes are unmanaged, do not incur fees or expenses and cannot be purchased directly for investment.

(Continued)

1

MassMutual Select Funds – President's Letter to Shareholders (Continued)

Long-term interest rates jump

Interest rates have made headlines during the past few years, often in response to adjustments in short-term rates made by the Federal Reserve Board (Fed). The Fed uses short-term rates as a tool to help keep the economy on a healthy growth track while controlling inflation. Consequently, when the economy hit a rough patch earlier in this decade, the Fed cut short-term rates to stimulate growth. Over the last few years, an economic recovery and concerns about a potential resurgence of inflation prompted the Fed to boost short-term rates from 1.00% to the current level of 5.25% (reached in June 2006).

Despite the Fed's rate hikes, long-term interest rates remained relatively low for the most part. Unlike the federal funds rate – the overnight bank lending rate that the Fed controls by buying and selling securities – long-term rates fluctuate according to market forces and are very sensitive to investors' expectations for inflation. Because inflation erodes the value of fixed-income investments, investors generally demand a higher yield for investing in bonds if they believe inflation is on the rise. Typically, short- and long-term rates move in tandem, although this is not always the case.

As of the end of the second quarter, long-term rates were once again on the rise, although historically, they still were not high. So why did the increase generate so much attention? For one thing, the rise was relatively swift – for instance, the average 30-year fixed-rate mortgage (which is based on longer term interest rates) spiked to 6.74% for the week ending June 14, 2007, from 6.53% the previous week. With the housing market already reeling from a spate of sub-prime mortgage defaults, burgeoning inventories of unsold homes and soft prices, there was concern that sharply higher mortgage rates could further hamper the industry. The housing market aside, long-term rates have also risen in sectors such as Treasuries and corporate securities, suggesting that a fundamental shift in perceptions about inflation might be occurring.

Outlook

The stock market's impressive performance during the second quarter – against the challenging backdrop of tepid economic growth, a weak housing market, high energy prices and rising long-term interest rates – serves as a reminder of how difficult it can be to forecast stock market performance. Going forward, any number of scenarios could develop that would negatively affect the equity markets. Conversely, the strength of the global economy, corporate earnings and continued low interest rates may keep investors and consumers optimistic. For this reason, MassMutual recommends that investors should generally avoid basing their investment activities on market forecasts – and instead adopt a buy-and-hold approach that employs thoughtful asset allocation.

Frederick C. Castellani

President

The information provided is the opinion of MassMutual Retirement Services Investments Marketing as of 7/2/07 and is subject to change without notice. It is not to be construed as tax, legal or investment advice. Of course, past performance does not guarantee future results.

2

MassMutual Select Strategic Bond Fund – Portfolio Manager Report

What is the investment objective of the MassMutual Select Strategic Bond Fund – and who are the Fund's sub-advisers? The Fund seeks a superior total rate of return by investing in fixed-income instruments. The Fund normally invests at least 80% of its net assets in U.S. dollar-denominated, fixed-income securities and other debt instruments of domestic and foreign entities, including corporate bonds, securities issued or guaranteed by the U.S. government, its agencies or instrumentalities, mortgage-backed securities and money market instruments. The Fund's sub-advisers are Western Asset Management Company Limited (WAML) and Western Asset Management Company (Western Asset). WAML manages the non-U.S. dollar denominated investments of the Fund.

How did the Fund perform during the six months ended June 30, 2007? The Fund's Class S shares returned 0.10%, trailing the 0.97% return of the Lehman Brothers® Aggregate Bond Index, an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Lehman Brothers U.S. Government/Credit Index and the Lehman Brothers Mortgage-Backed Securities Index.

What was the investment background during the period? In the fixed-income markets, short- and intermediate-term interest rates fell in the first quarter, as the economy proved to be somewhat weaker than expected, while long-term interest rates edged higher as inflation expectations rose. The Federal Reserve ("Fed") kept its target funds rate unchanged at 5.25%, and the central banks of Australia and Canada also kept their rates steady. The Bank of England raised rates, as did the Bank of Japan and the European Central Bank. The sudden sell-off in February in the Chinese equity market rattled markets worldwide, as did the rising delinquencies and bankruptcies associated with sub-prime lending. The yield disparities ("spreads") between corporate bonds and other non-Treasuries ("credits") and U.S. Treasuries jumped during the quarter, but lower-qual ity bonds and emerging market debt generally outperformed.

Interest rates moved up significantly in the second quarter, as the economy proved stronger than anticipated and expectations of future Fed easing were largely reversed. Short-term rates rose more than long-term rates as the market recalibrated its expectations of future Fed policy, leaving the yield curve almost flat with a modestly positive slope. (The yield curve is a graphical representation of bond yields with very short maturities to the longest available, with the curve indicating whether short-term rates are higher or lower than long-term rates.)

What factors contributed to the Fund's performance? During the first quarter, the portfolio's overweight position in the mortgage-backed securities sector added to returns, as spreads stabilized and volatility subsided. The Fund's underweight exposure to investment-grade credits was also a plus, as that sector underperformed. On the other hand, an overweight to lower-quality credits hampered returns, since they underperformed as spreads widened.

Yield spreads widened significantly in the second quarter; consequently, the Fund's overweight exposure in the mortgage-backed securities sector proved to be a major drag on performance. Underweight exposure to investment-grade credits also detracted a bit, as that sector outperformed. However, spreads remained relatively stable – so the Fund's overweight exposure to lower-quality credits contributed to returns.

What is your outlook? Despite a list of concerns that includes recession, inflation, a plunging U.S. housing market, a soaring U.S. current account deficit, the collapse of sub-prime lending, and a surge in leveraged buyouts, the global financial environment has been healthy and relatively calm. Leaving headlines aside, there have been no real major threats to growth. The bottom line is that regardless of the various factors that have the potential to affect the fixed-income markets, we are confident that the Fund is positioned to navigate the variety of market conditions that may arise throughout the remainder of this year.

3

MassMutual Select Strategic Bond Fund – Portfolio Manager Report (Continued)

Select Strategic Bond Fund

Quality Structure

(% of Net Assets) on 6/30/07 | |

| U.S. Government, Aaa/AAA | | | 72.1 | % | |

| Aa/AA | | | 3.3 | % | |

| A | | | 2.8 | % | |

| Baa/BBB | | | 8.7 | % | |

| Ba/BB | | | 4.6 | % | |

| B and Below | | | 3.0 | % | |

| Equities | | | 0.1 | % | |

| Total Long-Term Investments | | | 94.6 | % | |

Short-Term Investments and

Other Assets and Liabilities | | | 5.4 | % | |

| | | | 100.0 | % | |

4

MassMutual Select Strategic Bond Fund – Portfolio Manager Report (Continued)

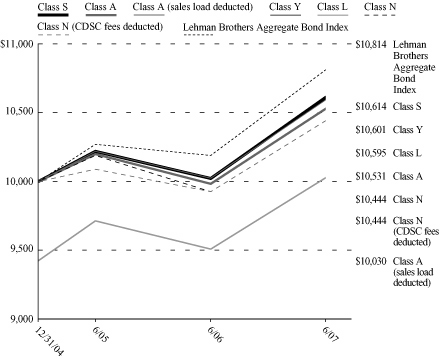

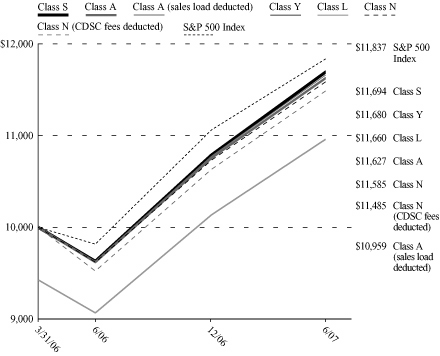

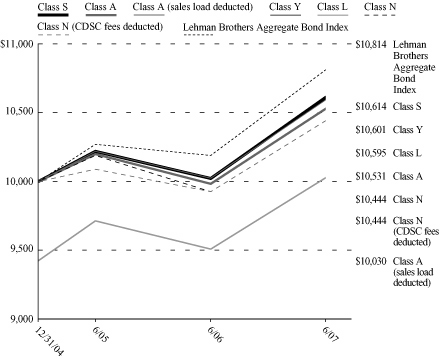

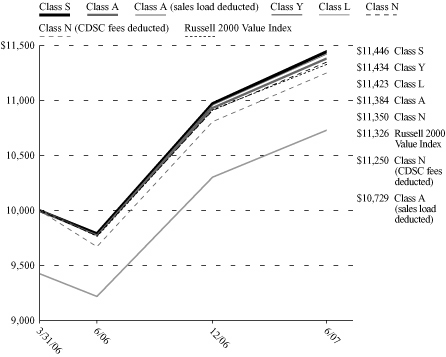

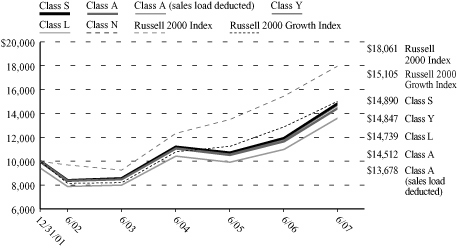

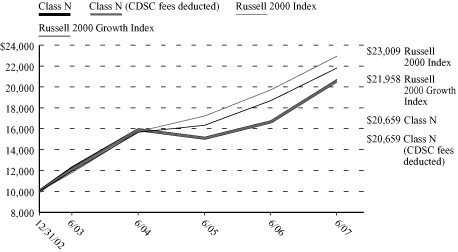

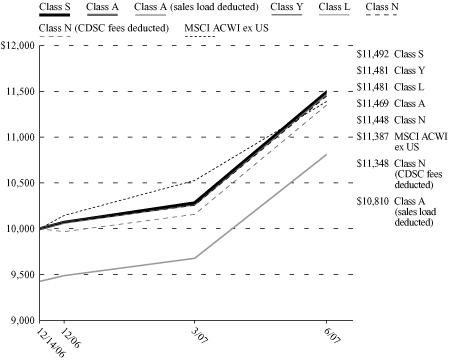

Growth of a $10,000 Investment

Hypothetical Investments in MassMutual Select Strategic Bond Fund Class S, Class A, Class A (sales load deducted), Class Y, Class L, Class N, Class N (CDSC fees deducted) and the Lehman Brothers Aggregate Bond Index.

MassMutual Select Strategic Bond Fund

Total Return

| | | Year-to-Date

1/1/07 - 6/30/07 | | One Year

7/1/06 - 6/30/07 | | Since Inception

Average Annual

12/31/04 - 6/30/07 | |

| Class S | | | 0.10 | % | | | 5.90 | % | | | 2.41 | % | |

| Class A | | | –0.10 | % | | | 5.47 | % | | | 2.09 | % | |

Class A

(sales load

deducted)* | | | –4.85 | % | | | 0.46 | % | | | 0.12 | % | |

| Class Y | | | 0.00 | % | | | 5.75 | % | | | 2.36 | % | |

| Class L | | | 0.00 | % | | | 5.69 | % | | | 2.34 | % | |

| Class N | | | –0.30 | % | | | 5.21 | % | | | 1.75 | % | |

Class N

(CDSC fees

deducted)* | | | –1.30 | % | | | 4.21 | % | | | 1.75 | % | |

Lehman Brothers

Aggregate Bond

Index | | | 0.97 | % | | | 6.11 | % | | | 3.18 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

* Class A (sales load deducted) returns include the 4.75% maximum sales charge and Class N (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 18 months shown.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should note that the Fund is a professionally managed mutual fund, while the Lehman Brothers Aggregate Bond Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

5

MassMutual Select Strategic Balanced Fund – Portfolio Manager Report

What is the investment objective of the MassMutual Select Strategic Balanced Fund – and who are the Fund's sub-advisers? The Fund seeks long-term capital growth, consistent with preservation of capital and balanced by current income. Three sub-advisers each manage their own portion of the Fund's assets. ClearBridge Advisors, LLC (ClearBridge) manages the equity component and Western Asset Management Company Limited (WAML) and Western Asset Management Company (Western Asset) manage the fixed-income component. WAML manages the non-U.S. dollar denominated investments of the Fund.

How did the Fund perform during the six months ended June 30, 2007? The Fund's Class S shares returned 3.84%, behind the 5.73% return of the Lipper Balanced Fund Index, an unmanaged, equally weighted index of the 30 largest mutual funds within the Lipper Balanced Category. Conversely, the Fund's 3.84% advance outperformed the 0.97% return of the Lehman Brothers® Aggregate Bond Index, an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Lehman Brothers U.S. Government/Credit Index and the Lehman Brothers Mortgage-Backed Securities Index – but trailed the 7.11% return of the Russell 3000® Index, which measures the performance of the 3,000 largest U.S. companies based on total market capitalization.

What was the investment background during the period? Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Although the Dow Jones Industrial AverageSM ("the Dow") notched a new closing high in February, the blue-chip benchmark declined slightly for the three months ended March 31, 2007. The S&P 500® Index finished with a small advance, as did the Nasdaq Composite® Index ("Nasdaq"), which barely managed to post a gain for the period.

In the fixed-income markets, short- and intermediate-term interest rates fell in the first quarter, as the economy proved to be somewhat weaker than expected, while long-term interest rates edged higher as inflation expectations rose. The Federal Reserve ("Fed") kept its target funds rate unchanged at 5.25%, and the central banks of Australia and Canada also kept their rates steady. The Bank of England raised rates, as did the Bank of Japan and the European Central Bank. The sudden sell-off in February in the Chinese equity market rattled markets worldwide, as did the rising delinquencies and bankruptcies associated with sub-prime lending. The yield disparities ("spreads") between corporate bonds and other non-Treasuries ("credits") and U.S. Treasuries jumped during the quarter, but lower-quality bonds and emerging market debt generally outperformed.

Most U.S. stock indexes advanced in the second quarter, with some setting records along the way. Stocks rode a wave of optimism over corporate earnings early in the quarter and later overcame short periods of increased volatility associated with investor concerns about soft retail sales, rising interest rates, inflation, the housing market and sub-prime mortgages. During the period, the housing market remained depressed, and long-term interest rates moved decisively higher. Crude oil surged to close the quarter near $70 per barrel.

Interest rates moved up significantly in the second quarter, as the economy proved stronger than anticipated and expectations of future Fed easing were largely reversed. Short-term rates rose more than long-term rates as the market recalibrated its expectations of future Fed policy, leaving the yield curve almost flat with a modestly positive slope. (The yield curve is a graphical representation of bond yields with very short maturities to the longest available, with the curve indicating whether short-term rates are higher or lower than long-term rates.)

What factors contributed to the Fund's performance with respect to its stock portfolio? Although the Fund trailed the Lipper Balanced Fund Index for the six months ended June 30, 2007, during this time frame, portfolio holdings in the energy and industrials sectors were substantial contributors to its relative performance. Conversely, the portfolio's investments in the financials and consumer discretionary sectors contributed the least to returns. On a stock-specific basis, the five best performers were Honeywell International Inc., Vodafone Group PLC (ADS), Alcoa Inc., Schlumberger Ltd. and Caterpillar Inc. The five largest detractors were Merrill Lynch & Co. Inc., Motorola Inc., Novellus Systems Inc., Bank of America Corp. and Interpublic Group of Cos.

6

MassMutual Select Strategic Balanced Fund – Portfolio Manager Report (Continued)

What factors contributed to the Fund's performance with respect to its bond portfolio? During the first quarter, the portfolio's overweight position in the mortgage-backed securities sector added to returns, as spreads stabilized and volatility subsided. The Fund's underweight exposure to investment-grade credits was also a plus, as that sector underperformed. On the other hand, an overweight to lower-quality credits hampered returns, since they underperformed as spreads widened.

Yield spreads widened significantly in the second quarter; consequently, the Fund's overweight exposure in the mortgage-backed securities sector proved to be a major drag on performance. Underweight exposure to investment-grade credits also detracted a bit, as that sector outperformed. However, spreads remained relatively stable – so the Fund's overweight exposure to lower-quality credits contributed to returns.

What is your outlook? Despite a list of concerns that includes recession, inflation, a plunging U.S. housing market, a soaring U.S. current account deficit, the collapse of sub-prime lending and a surge in leveraged buyouts, the global financial environment has been healthy and relatively calm. Leaving headlines aside, there have been no real major threats to growth. The bottom line is that regardless of the various factors that have the potential to affect the equity and fixed-income markets, we are confident that the Fund is positioned to navigate the variety of market conditions that may arise throughout the remainder of this year.

MassMutual Select Strategic

Balanced Fund

Asset Allocation

(% of Net Assets) on 6/30/07 | |

| Equities | | | 59.7 | % | |

| Bonds & Notes | | | 35.3 | % | |

| Purchased Options | | | 0.1 | % | |

Total Long-Term

Investments | | | 95.1 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 4.9 | % | |

| | | | 100.0 | % | |

MassMutual Select Strategic

Balanced Fund

Largest Stock Holdings

(% of Net Assets) on 6/30/07 | |

| News Corp., Inc. Cl. B | | | 1.8 | % | |

| JP Morgan Chase & Co. | | | 1.6 | % | |

| Pearson PLC | | | 1.5 | % | |

| Bank of America Corp. | | | 1.5 | % | |

| Raytheon Co. | | | 1.5 | % | |

| Wyeth | | | 1.4 | % | |

| Abbott Laboratories | | | 1.4 | % | |

Vodafone Group PLC Sponsored

ADR (United Kingdom) | | | 1.4 | % | |

| Merrill Lynch & Co., Inc. | | | 1.4 | % | |

| Texas Instruments, Inc. | | | 1.3 | % | |

7

MassMutual Select Strategic Balanced Fund – Portfolio Manager Report (Continued)

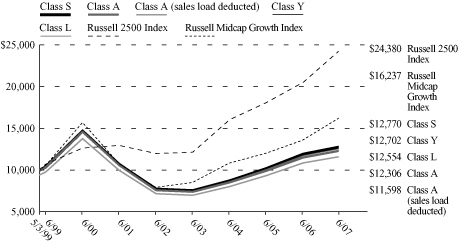

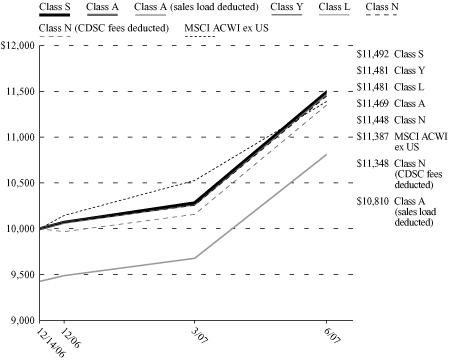

Growth of a $10,000 Investment

Hypothetical Investments in MassMutual Select Strategic Balanced Fund Class S, Class A, Class A (sales load deducted), Class Y, Class L, Class N, Class N (CDSC fees deducted), the Lipper Balanced Fund Index, the Lehman Brothers Aggregate Bond Index and the Russell 3000 Index.

MassMutual Select Strategic Balanced Fund

Total Return

| | | Year-to-Date

1/1/07 - 6/30/07 | | One Year

7/1/06 - 6/30/07 | | Since Inception

Average Annual

12/31/03 - 6/30/07 | |

| Class S | | | 3.84 | % | | | 14.01 | % | | | 7.24 | % | |

| Class A | | | 3.59 | % | | | 13.50 | % | | | 6.77 | % | |

Class A

(sales load

deducted)* | | | –2.37 | % | | | 6.98 | % | | | 4.98 | % | |

| Class Y | | | 3.84 | % | | | 14.04 | % | | | 7.18 | % | |

| Class L | | | 3.67 | % | | | 13.78 | % | | | 7.01 | % | |

| Class N | | | 3.42 | % | | | 13.18 | % | | | 6.44 | % | |

Class N

(CDSC fees

deducted)* | | | 2.42 | % | | | 12.18 | % | | | 6.44 | % | |

Lipper Balanced

Fund Index | | | 5.73 | % | | | 15.39 | % | | | 9.04 | % | |

Lehman Brothers

Aggregate Bond

Index | | | 0.97 | % | | | 6.11 | % | | | 3.48 | % | |

| Russell 3000 Index | | | 7.11 | % | | | 20.07 | % | | | 11.70 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

* Class A (sales load deducted) returns include the 5.75% maximum sales charge and Class N (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 18 months shown.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should note that the Fund is a professionally managed mutual fund, while the Lipper Balanced Fund Index, the Lehman Brothers Aggregate Bond Index and the Russell 3000 Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

8

MassMutual Select Diversified Value Fund – Portfolio Manager Report

What is the investment objective of the MassMutual Select Diversified Value Fund – and who is the Fund's sub-adviser? The Fund seeks to achieve long-term growth of capital and income by investing primarily in a diversified portfolio of equity securities of larger, well-established companies. The Fund's sub-adviser is AllianceBernstein L.P. (AllianceBernstein).

How did the Fund perform during the six months ended June 30, 2007? The Fund's Class S shares returned 6.24%, in line with the 6.23% return of the Russell 1000® Value Index, an unmanaged index representative of stocks with a greater than average value orientation among the stocks of the largest 1000 U.S. companies based on capitalization.

What was the investment background during the period? Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Equity markets around the world plunged in late February and remained volatile through most of March, rocked by events ranging from a sharp sell-off in Chinese stocks to troubles in the U.S. sub-prime mortgage market. Lulled into complacency by years of solid economic and corporate-profit growth and steadily rising stocks prices, investors were suddenly reminded that market conditions can turn on a dime – and financial markets are not without risk. By quarter-end, however, equity markets had regained their composure, reassured by statements from the U.S. Federal Reserve about the outlook for economic growth and inflation, and by the ongoing merger and acqui sition boom.

After climbing to new records through May on stronger-than-expected corporate-profit news, U.S. equities retreated in June, as investors grew nervous about rising bond yields, a deepening housing slump and losses from hedge funds invested in securities linked to sub-prime mortgages. Nevertheless, the S&P 500® Index finished the second quarter up 6.3%.

What factors contributed to the Fund's performance? The Fund's relative performance in the first quarter was hurt by our financial holdings – notably Freddie Mac, Countrywide Financial and Merrill Lynch, which underperformed amid the indiscriminate sell-off in reaction to turmoil in the sub-prime mortgage sector. Among the key contributors to the Fund's returns during the first quarter were positions in steel maker Arcelor Mittal, DaimlerChrysler and Owens-Illinois, the world's largest maker of glass bottles.

In the second quarter, the portfolio's relative returns were helped by the Fund's investments in diesel-engine maker Cummins and Owens Illinois. Conversely, relative performance was hurt by Macy's (formerly known as Federated Department Stores), Office Depot and National City.

What is your outlook? Stock valuation spreads remain compressed, limiting the value opportunity as we measure it. Since a central tenet underpinning our investment process is to keep portfolio risk proportional to the value opportunity, the portfolio's tracking error remains low versus the broad market and the Russell 1000 Value Index. Despite this environment, our extensive bottom-up research effort continues to uncover what we believe are attractive value opportunities across diverse industries.

9

MassMutual Select Diversified Value Fund – Portfolio Manager Report (Continued)

MassMutual Select Diversified Value Fund

Industry Table

(% of Net Assets) on 6/30/07 | |

| Oil & Gas | | | 12.3 | % | |

| Diversified Financial | | | 11.8 | % | |

| Insurance | | | 10.4 | % | |

| Banks | | | 8.7 | % | |

| Telecommunications | | | 8.1 | % | |

| Pharmaceuticals | | | 5.5 | % | |

| Manufacturing | | | 5.0 | % | |

| Retail | | | 4.1 | % | |

| Foods | | | 3.8 | % | |

| Media | | | 3.5 | % | |

| Electric | | | 2.8 | % | |

| Chemicals | | | 2.7 | % | |

Cosmetics & Personal

Care | | | 2.0 | % | |

| Agriculture | | | 1.9 | % | |

| Computers | | | 1.5 | % | |

| Beverages | | | 1.3 | % | |

| Automotive & Parts | | | 1.2 | % | |

| Savings & Loans | | | 1.2 | % | |

| Iron & Steel | | | 1.1 | % | |

| Household Products | | | 1.0 | % | |

| Aerospace & Defense | | | 0.9 | % | |

| Packaging & Containers | | | 0.9 | % | |

| Electronics | | | 0.9 | % | |

| Forest Products & Paper | | | 0.8 | % | |

| Apparel | | | 0.8 | % | |

| Commercial Services | | | 0.8 | % | |

| Home Builders | | | 0.7 | % | |

| Machinery — Diversified | | | 0.5 | % | |

| Health Care — Products | | | 0.5 | % | |

| Software | | | 0.4 | % | |

| Hand & Machine Tools | | | 0.4 | % | |

| Auto Manufacturers | | | 0.3 | % | |

| Housewares | | | 0.3 | % | |

| Advertising | | | 0.2 | % | |

| Toys, Games & Hobbies | | | 0.2 | % | |

| Health Care — Services | | | 0.1 | % | |

| Computers & Information | | | 0.1 | % | |

| Mining | | | 0.1 | % | |

Total Long-Term

Investments | | | 98.8 | % | |

Short-Term Investments

and Other Assets

and Liabilities | | | 1.2 | % | |

| | | | 100.0 | % | |

MassMutual Select Diversified

Value Fund

Largest Stock Holdings

(% of Net Assets) on 6/30/07 | |

| Exxon Mobil Corp. | | | 5.7 | % | |

| Citigroup, Inc. | | | 3.7 | % | |

| General Electric Co. | | | 3.5 | % | |

| Bank of America Corp. | | | 3.4 | % | |

| Pfizer, Inc. | | | 3.0 | % | |

| Chevron Corp. | | | 2.9 | % | |

| AT&T, Inc. | | | 2.9 | % | |

| JP Morgan Chase & Co. | | | 2.6 | % | |

| American International Group, Inc. | | | 2.2 | % | |

| Verizon Communications, Inc. | | | 2.1 | % | |

10

MassMutual Select Diversified Value Fund – Portfolio Manager Report (Continued)

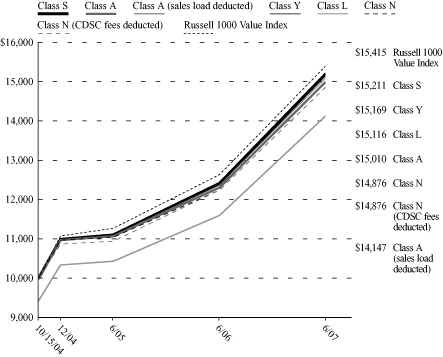

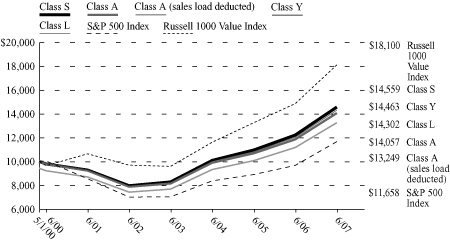

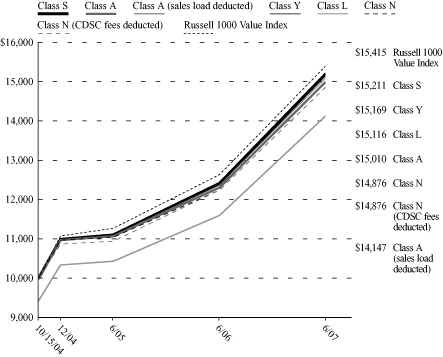

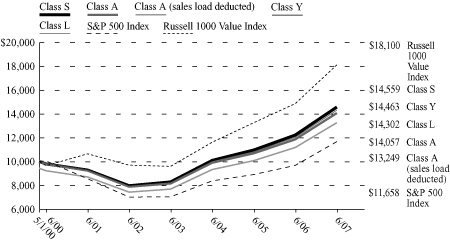

Growth of a $10,000 Investment

Hypothetical Investments in MassMutual Select Diversified Value Fund Class S, Class A, Class A (sales load deducted), Class Y, Class L, Class N, Class N (CDSC fees deducted) and the Russell 1000 Value Index.

MassMutual Select Diversified Value Fund

Total Return

| | | Year-to-Date

1/1/07 - 6/30/07 | | One Year

7/1/06 - 6/30/07 | | Since Inception

Average Annual

10/15/04 - 6/30/07 | |

| Class S | | | 6.24 | % | | | 22.43 | % | | | 16.74 | % | |

| Class A | | | 5.96 | % | | | 21.83 | % | | | 16.17 | % | |

Class A

(sales load

deducted)* | | | –0.13 | % | | | 14.83 | % | | | 13.66 | % | |

| Class Y | | | 6.17 | % | | | 22.29 | % | | | 16.62 | % | |

| Class L | | | 6.02 | % | | | 22.11 | % | | | 16.47 | % | |

| Class N | | | 5.73 | % | | | 21.37 | % | | | 15.79 | % | |

Class N

(CDSC fees

deducted)* | | | 4.73 | % | | | 20.37 | % | | | 15.79 | % | |

Russell 1000

Value Index | | | 6.23 | % | | | 21.86 | % | | | 17.32 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

* Class A (sales load deducted) returns include the 5.75% maximum sales charge and Class N (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 18 months shown.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Value Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

11

MassMutual Select Fundamental Value Fund – Portfolio Manager Report

What is the investment objective of the MassMutual Select Fundamental Value Fund – and who is the Fund's sub-adviser? The Fund seeks long-term total return by investing at least 80% of its net assets in equity securities, with a focus on companies with large capitalizations (generally having market capitalizations above $2 billion). The Fund's sub-adviser is Wellington Management Company, LLP (Wellington Management).

How did the Fund perform during the six months ended June 30, 2007? The Fund's Class S shares returned 8.66%, outpacing the 6.96% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. The Fund also outperformed the 6.23% return of the Russell 1000® Value Index, an unmanaged index representative of stocks with a greater than average value orientation among the stocks of the largest 1000 U.S. companies based on capitalization.

Going forward, the Fund's performance will be compared to the Russell 1000 Value Index rather than the S&P 500 Index because the Russell 1000 Value Index more closely represents the Fund's investment strategy.

What was the investment background during the period? Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Although the Dow Jones Industrial AverageSM ("the Dow") notched a new closing high in February, the blue-chip benchmark declined slightly for the three months ended March 31, 2007. The S&P 500 Index finished with a small advance, as did the Nasdaq Composite® Index ("Nasdaq"), which barely managed to post a gain for the period. A depreciating U.S. dollar supported the returns of foreign stocks, helping the MSCI® EAFE® Index outperform its U.S. counterparts for the quarter.

Most U.S. stock indexes advanced in the second quarter, with some setting records along the way. Stocks rode a wave of optimism over corporate earnings early in the quarter and later overcame short periods of increased volatility associated with investor concerns about soft retail sales, rising interest rates, inflation, the housing market and sub-prime mortgages. During the period, the housing market remained depressed, and long-term interest rates moved decisively higher. Crude oil surged to close the quarter near $70 per barrel.

What factors contributed to the Fund's performance? Stock selection was additive to benchmark-relative performance in seven of the 10 broad sectors in the first quarter of 2007. In aggregate, sector allocation aided performance, especially our underweight position in financials. Within consumer staples, we benefited from strong results from CVS/Caremark, Tyson Foods, Safeway and Supervalu. Within financials, Host Hotels & Resorts performed well, while the Fund benefited from avoiding Countrywide Financial, Fannie Mae and Washington Mutual, all of which were down significantly. Conversely, the Fund's holdings in the consumer discretionary sector detracted from relative performance. In addition, despite strong absolute returns, the portfolio's positioning in utilities detracted from performance.

In the second quarter, the Fund's stock selection contributed to performance in eight of the 10 broad sectors. Overall, sector allocation aided performance, especially the Fund's strategic positioning in financials and industrials. Within information technology, the Fund's positions in EMC and Nokia provided double-digit returns, as did Corning and Hewlett-Packard. Within financials, portfolio holdings in Nuveen Investments and ACE were both up significantly. Meanwhile, the Fund's positioning in the REIT (real estate investment trust) sector was a positive, as REITs were down on an absolute basis. Hampering the Fund's performance was the fact that its industrials holdings lagged the market's. In addition, in a turnaround from the first quarter, Host Hotels & Resorts lost value – as did Sun Microsystems and Macy's.

12

MassMutual Select Fundamental Value Fund – Portfolio Manager Report (Continued)

What is your outlook? In our view, economic strength is sufficient to support global corporate profit growth, although we expect a deceleration to the single digits. While commodity inflation is real and sustainable, we believe that overall inflation will remain in the 2% to 3% range. In our view, the market seems overly obsessed with capital market losses, such as in the sub-prime sector. As the market restores risk premiums toward a normalized level, these events will likely rotate through one sub-sector at a time. However, we do not expect global growth to be derailed.

MassMutual Select Fundamental Value Fund

Industry Table

(% of Net Assets) on 6/30/07 | |

| Oil & Gas | | | 13.5 | % | |

| Banks | | | 10.1 | % | |

| Telecommunications | | | 9.8 | % | |

| Diversified Financial | | | 9.5 | % | |

| Foods | | | 5.9 | % | |

| Insurance | | | 5.3 | % | |

| Retail | | | 4.9 | % | |

| Manufacturing | | | 3.9 | % | |

| Electric | | | 3.7 | % | |

| Aerospace & Defense | | | 3.6 | % | |

| Chemicals | | | 3.4 | % | |

| Pharmaceuticals | | | 3.3 | % | |

| Computers | | | 3.3 | % | |

| Media | | | 2.3 | % | |

| Health Care — Services | | | 1.9 | % | |

| Building Materials | | | 1.6 | % | |

| Health Care — Products | | | 1.6 | % | |

Real Estate Investment

Trusts (REITS) | | | 1.6 | % | |

| Machinery — Diversified | | | 1.5 | % | |

| Mining | | | 1.4 | % | |

| Beverages | | | 1.4 | % | |

| Agriculture | | | 1.2 | % | |

| Semiconductors | | | 1.0 | % | |

Cosmetics & Personal

Care | | | 0.9 | % | |

| Office Equipment/Supplies | | | 0.8 | % | |

| Household Products | | | 0.8 | % | |

| Forest Products & Paper | | | 0.3 | % | |

Total Long-Term

Investments | | | 98.5 | % | |

Short-Term Investments

and Other Assets

and Liabilities | | | 1.5 | % | |

| | | | 100.0 | % | |

MassMutual Select Fundamental

Value Fund

Largest Stock Holdings

(% of Net Assets) on 6/30/07 | |

| Exxon Mobil Corp. | | | 4.8 | % | |

| Bank of America Corp. | | | 3.7 | % | |

| AT&T, Inc. | | | 3.6 | % | |

| Citigroup, Inc. | | | 3.5 | % | |

| General Electric Co. | | | 3.0 | % | |

| Verizon Communications, Inc. | | | 2.5 | % | |

| JP Morgan Chase & Co. | | | 2.5 | % | |

| CVS Caremark Corp. | | | 2.1 | % | |

| American International Group, Inc. | | | 2.0 | % | |

| General Dynamics Corp. | | | 1.9 | % | |

13

MassMutual Select Fundamental Value Fund – Portfolio Manager Report (Continued)

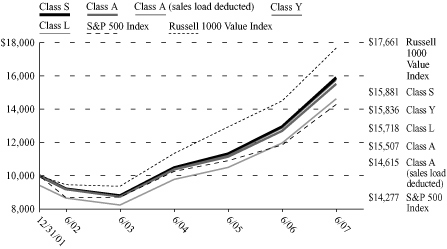

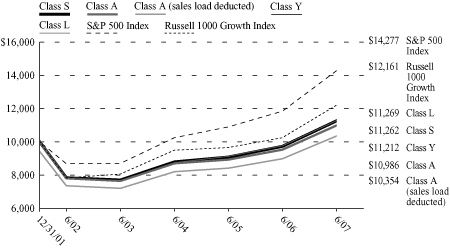

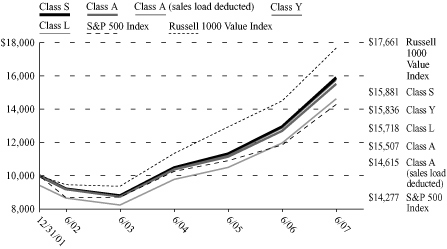

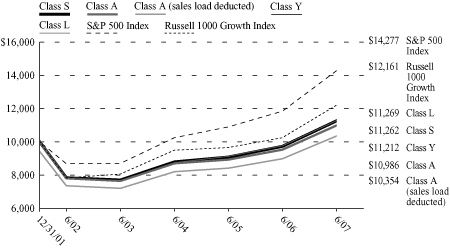

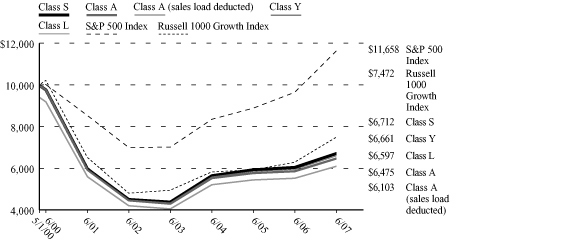

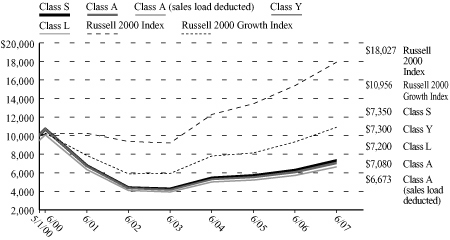

Growth of a $10,000 Investment

Hypothetical Investments in MassMutual Select Fundamental Value Fund Class S, Class A, Class A (sales load deducted), Class Y, Class L, the S&P 500 Index and the Russell 1000 Value Index.

MassMutual Select Fundamental Value Fund

Total Return

| | | Year-

to-Date

1/1/07 -

6/30/07 | | One

Year

7/1/06 -

6/30/07 | | Five

Year

Average

Annual

7/1/02 -

6/30/07 | | Since

Inception

Average

Annual

12/31/01 -

6/30/07 | |

| Class S | | | 8.66 | % | | | 22.77 | % | | | 11.54 | % | | | 8.78 | % | |

| Class A | | | 8.39 | % | | | 22.20 | % | | | 11.05 | % | | | 8.30 | % | |

Class A

(sales load

deducted)* | | | 2.16 | % | | | 15.17 | % | | | 9.75 | % | | | 7.14 | % | |

| Class Y | | | 8.58 | % | | | 22.67 | % | | | 11.50 | % | | | 8.72 | % | |

| Class L | | | 8.52 | % | | | 22.43 | % | | | 11.33 | % | | | 8.57 | % | |

| S&P 500 Index | | | 6.96 | % | | | 20.57 | % | | | 10.70 | % | | | 6.69 | % | |

Russell 1000

Value Index | | | 6.23 | % | | | 21.86 | % | | | 13.31 | % | | | 10.90 | % | |

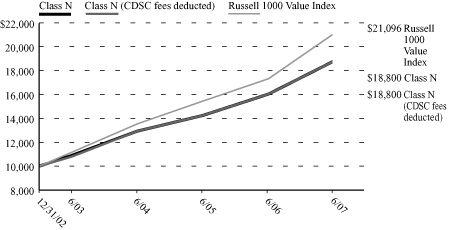

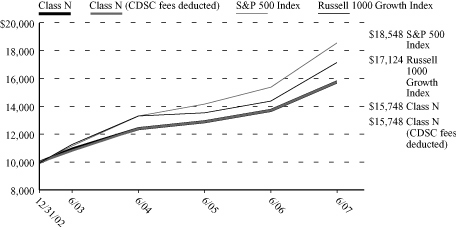

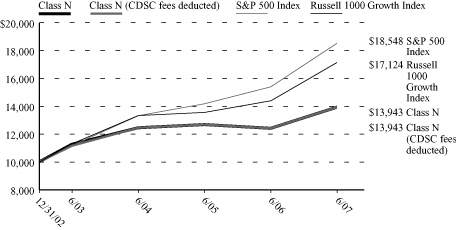

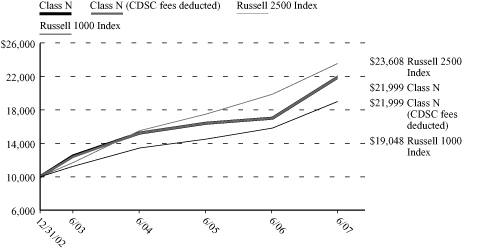

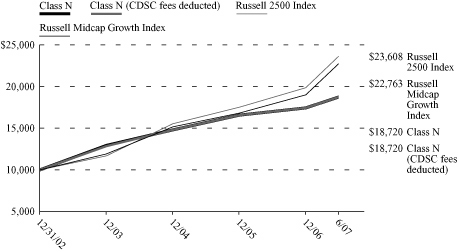

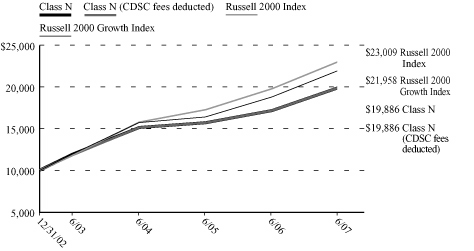

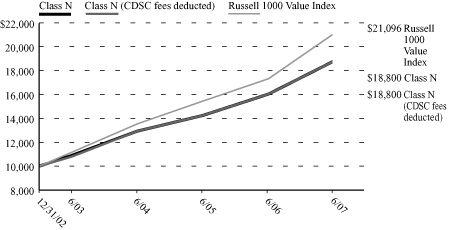

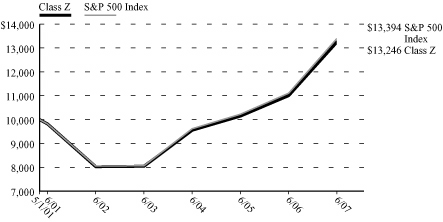

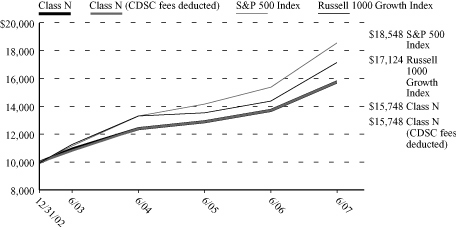

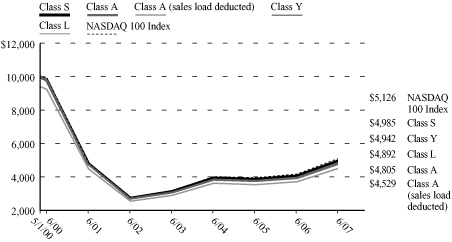

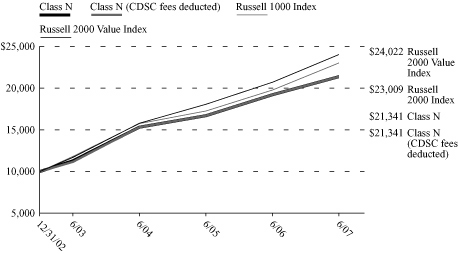

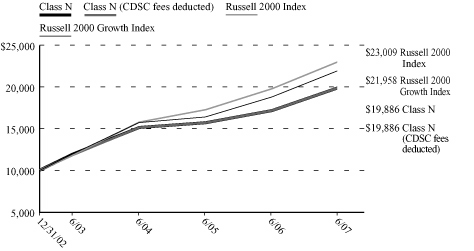

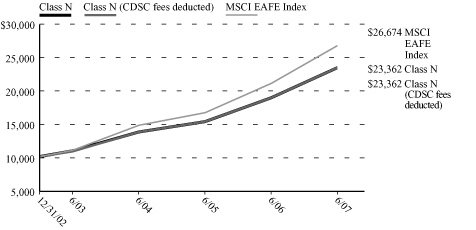

Hypothetical Investments in MassMutual Select Fundamental Value Fund Class N, Class N (CDSC fees deducted), the S&P 500 Index and the Russell 1000 Value Index.

MassMutual Select Fundamental Value Fund

Total Return

| | | Year-to-Date

1/1/07 - 6/30/07 | | One Year

7/1/06 - 6/30/07 | | Since Inception

Average Annual

12/31/02 - 6/30/07 | |

| Class N | | | 8.28 | % | | | 21.88 | % | | | 16.06 | % | |

Class N

(CDSC fees

deducted)* | | | 7.28 | % | | | 20.88 | % | | | 16.06 | % | |

| S&P 500 Index | | | 6.96 | % | | | 20.57 | % | | | 14.72 | % | |

Russell 1000

Value Index | | | 6.23 | % | | | 21.86 | % | | | 18.05 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

* Class A (sales load deducted) returns include the 5.75% maximum sales charge and Class N (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 18 months shown.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index and the Russell 1000 Value Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

14

MassMutual Select Value Equity Fund – Portfolio Manager Report

What is the investment objective of the MassMutual Select Value Equity Fund – and who is the Fund's sub-adviser? The Fund seeks long-term growth of capital by investing in securities of companies that Fund management believes are undervalued in the marketplace relative to factors such as the company's assets, sales, earnings, growth potential, or cash flow – or relative to securities of other companies in the same industry. The Fund's sub-adviser is Fidelity Management & Research Company (Fidelity).

How did the Fund perform during the six months ended June 30, 2007? The Fund's Class S shares returned 7.70%, outpacing the 6.23% return of the Russell 1000® Value Index, an unmanaged index representative of stocks with a greater-than-average value orientation among the stocks of the largest 1000 U.S. companies based on capitalization.

What was the investment background during the period? Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Markets were roiled by a mid-quarter sell-off prompted by declines in Asian markets and worries over sub-prime mortgage defaults. The broad market, as measured by the S&P 500® Index, declined nearly 6% from high levels achieved in late February, but regained ground to finish up 0.6% for the quarter. The Federal Reserve ("Fed") continued to hold short-term interest rates steady, while emphasizing that inflation remained a concern. Major commodity prices generally rose during the quarter. Existing home sales rose nearly 4% in February relative to January but remained down almost 4% from the same period in 2006, while median sales prices declined more than 1% versus the same period a year ago. In this environment, mid-cap stocks handily outperformed small- and large-cap stocks.

During the second quarter, virtually all major domestic equity indexes turned in positive returns. The Fed continued to hold short-term interest rates steady, while emphasizing that inflation remained a threat. Long-term Treasury yields spiked more than 0.30% during the quarter, as investors feared that faster economic growth and an increase in inflation could push up interest rates globally. Instead, tamer inflation readings and attempted terrorist activity in London and Scotland pushed long-term yields downward at the end of June. Major commodity price trends were mixed: oil and copper prices advanced; gold and corn prices dropped. The downturn in the housing market continued, with both existing and new home sales and median sales prices slipping again. Home sales continued to be impacted by tighter lending standards due to sub-prime mortgage market problems and a lack of buyer confidence in the housing market. In this environment, large-c ap stocks tended to outperform their small- and mid-cap counterparts.

What factors contributed to the Fund's performance? During the first quarter of 2007, the utilities, materials and telecommunications services sectors were the best performers. Also aiding results was active stock selection in the energy, consumer staples and materials sectors – which contributed the most to the Fund's performance relative to the Russell 1000 Value Index. Conversely, the Fund's holdings in the information technology sector detracted from returns.

In the second quarter of 2007, active stock selection in the financials, utilities and energy sectors contributed the most to relative performance. The portfolio's overweight position in mortgage finance firm Fannie Mae was the greatest portfolio contributor. Fannie Mae shares gained nearly 21% when the company filed its 2005 financial reports with the SEC and reinstated its dividend payment. On the other hand, the Fund's holdings in the consumer discretionary and materials sectors detracted from performance. Specifically, an overweight position in department store Macy's was the largest hindrance, as that company's shares fell 11% on weaker-than-expected first-quarter earnings.

15

MassMutual Select Value Equity Fund – Portfolio Manager Report (Continued)

What is your outlook? The portfolio comprises stocks that are trading at material discounts to our assessment of their worth. As the third quarter began, the Fund had an overweight position in insurance companies, as we believe that their valuations were attractive relative to other financials – and that insurers will be less impacted in a flat yield curve environment. (The yield curve is a graphical representation of bond yields with very short maturities to the longest available, with the curve indicating whether short-term rates are higher or lower than long-term rates.) The portfolio also held an overweight position in selected independent power producers, which we believed were trading at less than replacement cost and have been recovering from a long period of overcapacity. Lastly, within financials, the portfolio held an underweight p osition in REITs (real estate investment trusts) and commercial banks. Our belief is that this positioning makes sense for the near future, given our view of what may occur.

MassMutual Select Value Equity Fund

Industry Table

(% of Net Assets) on 6/30/07 | |

| Insurance | | | 14.7 | % | |

| Oil & Gas | | | 13.9 | % | |

| Diversified Financial | | | 13.4 | % | |

| Telecommunications | | | 6.5 | % | |

| Banks | | | 5.2 | % | |

| Electric | | | 5.0 | % | |

| Retail | | | 3.8 | % | |

| Pharmaceuticals | | | 3.4 | % | |

| Manufacturing | | | 3.0 | % | |

| Health Care — Services | | | 3.0 | % | |

| Iron & Steel | | | 3.0 | % | |

| Transportation | | | 2.6 | % | |

| Agriculture | | | 2.5 | % | |

Cosmetics & Personal

Care | | | 2.1 | % | |

| Media | | | 2.0 | % | |

| Machinery — Diversified | | | 1.8 | % | |

| Aerospace & Defense | | | 1.7 | % | |

| Computers | | | 1.6 | % | |

| Foods | | | 1.6 | % | |

| Electronics | | | 0.9 | % | |

| Semiconductors | | | 0.9 | % | |

| Home Builders | | | 0.9 | % | |

| Airlines | | | 0.8 | % | |

Metal Fabricate &

Hardware | | | 0.8 | % | |

Machinery —

Construction & Mining | | | 0.8 | % | |

| Commercial Services | | | 0.8 | % | |

| Automotive & Parts | | | 0.6 | % | |

| Savings & Loans | | | 0.6 | % | |

| Beverages | | | 0.5 | % | |

| Gas | | | 0.5 | % | |

| Computer Related Services | | | 0.0 | % | |

Total Long-Term

Investments | | | 98.9 | % | |

Short-Term Investments

and Other Assets

and Liabilities | | | 1.1 | % | |

| | | | 100.0 | % | |

MassMutual Select Value Equity Fund

Largest Stock Holdings

(% of Net Assets) on 6/30/07 | |

| AT&T, Inc. | | | 4.3 | % | |

| Exxon Mobil Corp. | | | 4.3 | % | |

| Bank of America Corp. | | | 4.1 | % | |

| Pfizer, Inc. | | | 3.4 | % | |

| General Electric Co. | | | 3.1 | % | |

| JP Morgan Chase & Co. | | | 3.0 | % | |

| Fannie Mae | | | 2.6 | % | |

| Altria Group, Inc. | | | 2.5 | % | |

| Citigroup, Inc. | | | 2.4 | % | |

| Marathon Oil Corp. | | | 2.2 | % | |

16

MassMutual Select Value Equity Fund – Portfolio Manager Report (Continued)

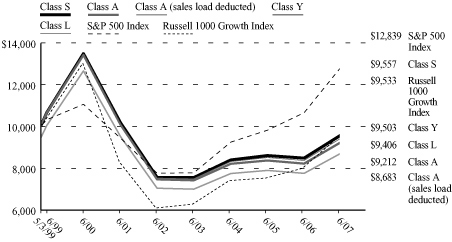

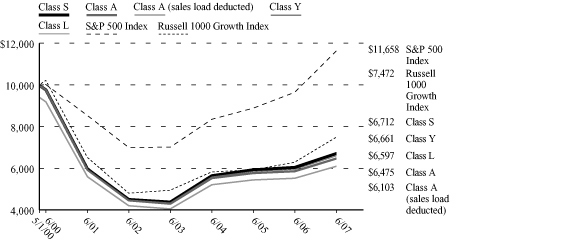

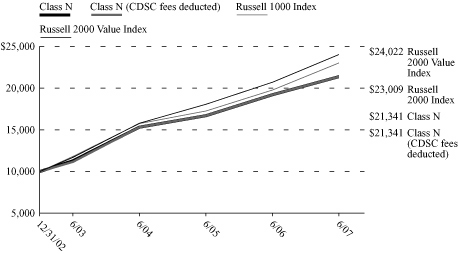

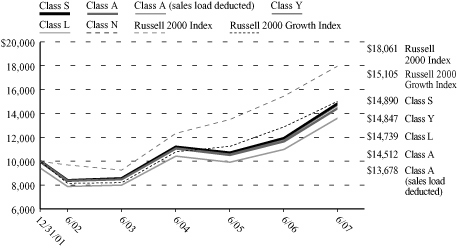

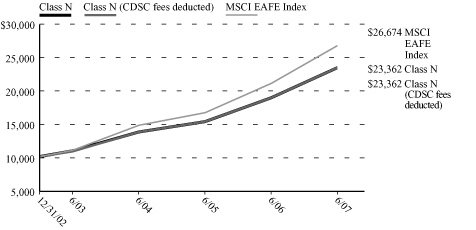

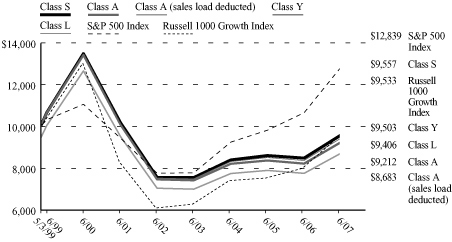

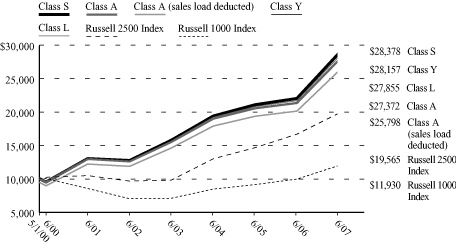

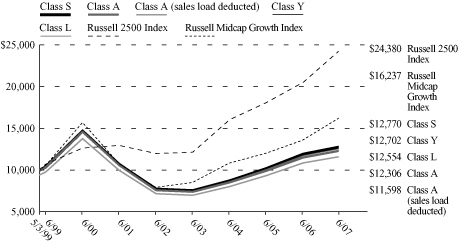

Growth of a $10,000 Investment

Hypothetical Investments in MassMutual Select Value Equity Fund Class S, Class A, Class A (sales load deducted), Class Y, Class L and the Russell 1000 Value Index.

MassMutual Select Value Equity Fund

Total Return

| | | Year-

to-Date

1/1/07 -

6/30/07 | | One

Year

7/1/06 -

6/30/07 | | Five

Year

Average

Annual

7/1/02 -

6/30/07 | | Since

Inception

Average

Annual

5/1/01 -

6/30/07 | |

| Class S | | | 7.70 | % | | | 18.21 | % | | | 11.30 | % | | | 6.96 | % | |

| Class A | | | 7.55 | % | | | 17.65 | % | | | 10.79 | % | | | 6.49 | % | |

Class A

(sales load

deducted)* | | | 1.36 | % | | | 10.88 | % | | | 9.49 | % | | | 5.47 | % | |

| Class Y | | | 7.79 | % | | | 18.13 | % | | | 11.25 | % | | | 6.92 | % | |

| Class L | | | 7.74 | % | | | 17.99 | % | | | 11.07 | % | | | 6.76 | % | |

Russell 1000

Value Index | | | 6.23 | % | | | 21.86 | % | | | 13.31 | % | | | 8.99 | % | |

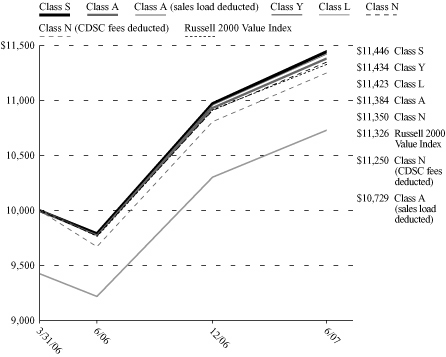

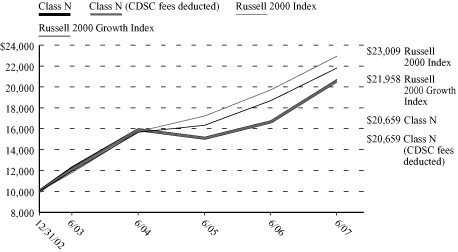

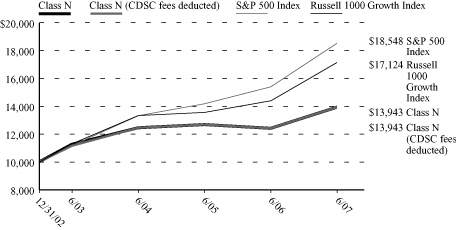

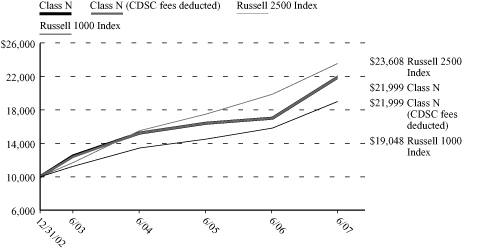

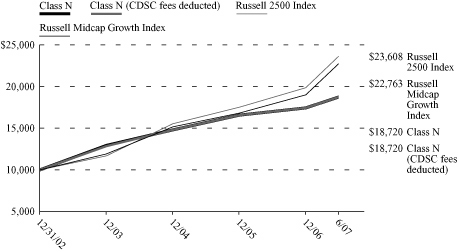

Hypothetical Investments in MassMutual Select Value Equity Fund Class N, Class N (CDSC fees deducted) and the Russell 1000 Value Index.

MassMutual Select Value Equity Fund

Total Return

| | | Year-to-Date

1/1/07 - 6/30/07 | | One Year

7/1/06 - 6/30/07 | | Since Inception

Average Annual

12/31/02 - 6/30/07 | |

| Class N | | | 7.33 | % | | | 17.27 | % | | | 15.06 | % | |

Class N

(CDSC fees

deducted)* | | | 6.33 | % | | | 16.27 | % | | | 15.06 | % | |

Russell 1000

Value Index | | | 6.23 | % | | | 21.86 | % | | | 18.05 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

* Class A (sales load deducted) returns include the 5.75% maximum sales charge and Class N (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 18 months shown.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should note that the Fund is a professionally managed mutual fund, while the Russell 1000 Value Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

17

MassMutual Select Large Cap Value Fund – Portfolio Manager Report

What is the investment objective of the MassMutual Select Large Cap Value Fund – and who is the Fund's sub-adviser? The Fund seeks both capital growth and income by selecting businesses that possess characteristics that the Fund's sub-adviser, Davis Selected Advisers, L.P. (Davis), believes foster the creation of long-term value – such as proven management, a durable franchise and business model, and sustainable competitive advantages.

How did the Fund perform during the six months ended June 30, 2007? The Fund's Class S shares returned 7.12%, outpacing the 6.96% return of the S&P 500® Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies. The Fund also outperformed the 6.23% return of the Russell 1000® Value Index, an unmanaged index representative of stocks with a greater-than-average value orientation among the stocks of the largest 1000 U.S. companies based on capitalization.

What was the investment background during the period? Domestic stocks showed little change during the first quarter of 2007, despite a significant increase in volatility across the board. Although the Dow Jones Industrial AverageSM ("the Dow") notched a new closing high in February, the blue-chip benchmark declined slightly for the three months ended March 31, 2007. The S&P 500 Index finished with a small advance, as did the Nasdaq Composite® Index ("Nasdaq"), which barely managed to post a gain for the period. A depreciating U.S. dollar supported the returns of foreign stocks, helping the MSCI® EAFE® Index outperform its U.S. counterparts for the quarter.

Most U.S. stock indexes advanced in the second quarter, with some setting records along the way. Stocks rode a wave of optimism over corporate earnings early in the quarter and later overcame short periods of increased volatility associated with investor concerns about soft retail sales, rising interest rates, inflation, the housing market and sub-prime mortgages. During the period, the housing market remained depressed, and long-term interest rates moved decisively higher. Crude oil surged to close the quarter near $70 per barrel.

What factors contributed to the Fund's performance? In the first three months of 2007, the Fund's allocations to the health care and materials sectors fueled its performance – and helped to balance the results from other sectors, which were flat to modestly negative. Individual contributors during the period included Martin Marietta, EOG Resources, Vulcan Materials, Loews Corp. and CVS/Caremark (formed out of the merger between CVS and Caremark Rx in March). Conversely, the stocks that detracted most from the Fund's return in the first quarter included Harley-Davidson, American Express, Comcast, American International Group and Progressive Corp.

In the second quarter, the Fund's allocations to the financials, energy, consumer discretionary and consumer staples sectors contributed to its performance, while detractors were largely stock specific. The top individual contributors included ConocoPhillips, Amazon, American Express, Occidental Petroleum and Costco. On the downside, News Corp, Wachovia Corp., Bed Bath & Beyond, Hershey Foods and UnitedHealth Group hampered the Fund's progress the most during this period.

What is your outlook? Whatever happens in the remainder of this year and whatever styles, industries or market capitalizations move into or out of favor, we feel that the Fund's investment approach of buying durable businesses at value prices and holding them for the long term is a perennial and sensible approach for building and preserving capital.

18

MassMutual Select Large Cap Value Fund – Portfolio Manager Report (Continued)

MassMutual Select Large Cap Value Fund

Industry Table

(% of Net Assets) on 6/30/07 | |

| Insurance | | | 15.4 | % | |

| Oil & Gas | | | 12.3 | % | |

| Diversified Financial | | | 12.2 | % | |

| Banks | | | 8.8 | % | |

| Retail | | | 8.3 | % | |

| Media | | | 6.0 | % | |

| Manufacturing | | | 4.2 | % | |

| Commercial Services | | | 3.7 | % | |

| Agriculture | | | 3.2 | % | |

| Software | | | 3.0 | % | |

| Telecommunications | | | 2.3 | % | |

| Beverages | | | 2.1 | % | |

| Packaging & Containers | | | 1.9 | % | |

| Computers | | | 1.8 | % | |

| Internet | | | 1.6 | % | |

| Leisure Time | | | 1.5 | % | |

| Mining | | | 1.4 | % | |

| Pharmaceuticals | | | 1.4 | % | |

| Cosmetics & Personal Care | | | 1.3 | % | |

| Building Materials | | | 1.2 | % | |

| Transportation | | | 1.1 | % | |

| Health Care — Services | | | 0.9 | % | |

Holding Company —

Diversified | | | 0.8 | % | |

| Coal | | | 0.6 | % | |

| Foods | | | 0.5 | % | |

| Electronics | | | 0.5 | % | |

| Advertising | | | 0.3 | % | |

| Housewares | | | 0.3 | % | |

| Real Estate | | | 0.1 | % | |

Total Long-Term

Investments | | | 98.7 | % | |

Short-Term Investments

and Other Assets

and Liabilities | | | 1.3 | % | |

| | | | 100.0 | % | |

MassMutual Select Large Cap Value Fund

Largest Stock Holdings

(% of Net Assets) on 6/30/07 | |

| American Express Co. | | | 4.5 | % | |

| ConocoPhillips Co. | | | 4.5 | % | |

| Tyco International Ltd. | | | 4.2 | % | |

| American International Group, Inc. | | | 4.1 | % | |

| Costco Wholesale Corp. | | | 3.8 | % | |

| JP Morgan Chase & Co. | | | 3.8 | % | |

| Altria Group, Inc. | | | 3.3 | % | |

| Berkshire Hathaway, Inc. Cl. A | | | 3.2 | % | |

| Comcast Corp. Special, Cl. A | | | 3.1 | % | |

| HSBC Holdings PLC | | | 2.6 | % | |

19

MassMutual Select Large Cap Value Fund – Portfolio Manager Report (Continued)

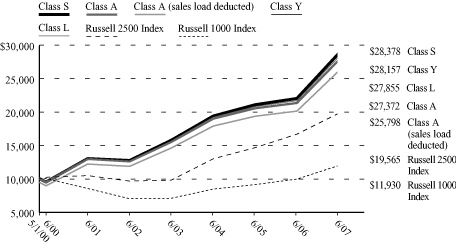

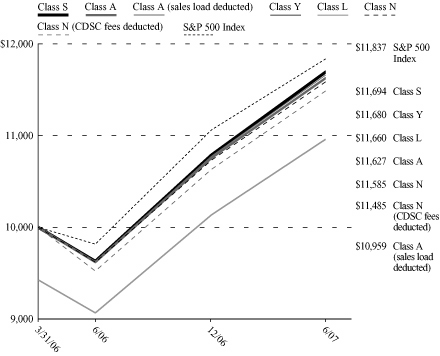

Growth of a $10,000 Investment

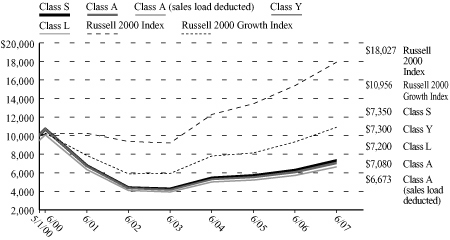

Hypothetical Investments in MassMutual Select Large Cap Value Fund Class S, Class A, Class A (sales load deducted), Class Y, Class L, the S&P 500 Index and the Russell 1000 Value Index.

MassMutual Select Large Cap Value Fund

Total Return

| | | Year-

to-Date

1/1/07 -

6/30/07 | | One

Year

7/1/06 -

6/30/07 | | Five

Year

Average

Annual

7/1/02 -

6/30/07 | | Since

Inception

Average

Annual

5/1/00 -

6/30/07 | |

| Class S | | | 7.12 | % | | | 19.20 | % | | | 12.82 | % | | | 5.38 | % | |

| Class A | | | 6.78 | % | | | 18.59 | % | | | 12.28 | % | | | 4.87 | % | |

Class A

(sales load

deducted)* | | | 0.64 | % | | | 11.77 | % | | | 10.96 | % | | | 4.00 | % | |

| Class Y | | | 7.05 | % | | | 19.05 | % | | | 12.72 | % | | | 5.28 | % | |

| Class L | | | 6.99 | % | | | 18.95 | % | | | 12.54 | % | | | 5.12 | % | |

| S&P 500 Index | | | 6.96 | % | | | 20.57 | % | | | 10.70 | % | | | 2.16 | % | |

Russell 1000

Value Index | | | 6.23 | % | | | 21.86 | % | | | 13.31 | % | | | 8.63 | % | |

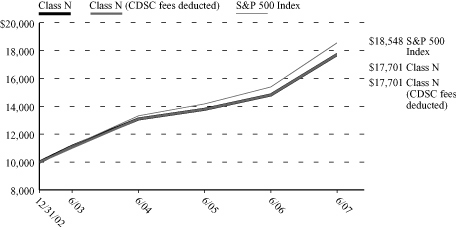

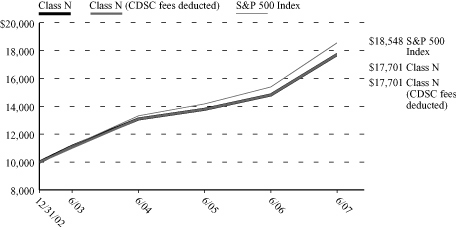

Hypothetical Investments in MassMutual Select Large Cap Value Fund Class N, Class N (CDSC fees deducted), the S&P 500 Index and the Russell 1000 Value Index.

MassMutual Select Large Cap Value Fund

Total Return

| | | Year-to-Date

1/1/07 - 6/30/07 | | One Year

7/1/06 - 6/30/07 | | Since Inception

Average Annual

12/31/02 - 6/30/07 | |

| Class N | | | 6.69 | % | | | 18.20 | % | | | 15.37 | % | |

Class N

(CDSC fees

deducted)* | | | 5.69 | % | | | 17.20 | % | | | 15.37 | % | |

| S&P 500 Index | | | 6.96 | % | | | 20.57 | % | | | 14.72 | % | |

Russell 1000

Value Index | | | 6.23 | % | | | 21.86 | % | | | 18.05 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

* Class A (sales load deducted) returns include the 5.75% maximum sales charge and Class N (CDSC fees deducted) returns include the 1.00% maximum contingent deferred sales charge for the first 18 months shown.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index and the Russell 1000 Value Index are unmanaged, do not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

20

MassMutual Select Indexed Equity Fund – Portfolio Manager Report

What is the investment objective of the MassMutual Select Indexed Equity Fund – and who is the Fund's sub-adviser?

The Fund seeks to approximate as closely as practicable (before fees and expenses) the capitalization – weighted total rate of return of that portion of the U.S. market for publicly traded common stocks composed of larger-capitalized companies. The Fund pursues this objective by investing at least 80% of its net assets in the equity securities of companies that make up the S&P 500® Index ("the Index"). The Fund's sub-adviser is Northern Trust Investments, N.A. (Northern).

How did the Fund perform during the six months ended June 30, 2007?

The Fund's Class S shares returned 6.72%, trailing the 6.96% return of the S&P 500 Index, a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

What was the investment background during the period?

Overcoming a dip in the market in February, U.S. equity markets posted positive numbers for the first half of 2007, despite negative pressures surrounding sub-prime loan defaults, rising interest rates and geopolitical conflicts in the Middle East and Asia. The S&P 500 Index closed at an all-time high in May. Ongoing merger and acquisition activity, takeover announcements and strong earnings reports also contributed to the markets' performance in the first quarter.

On January 18, 2007, crude oil prices dropped to $51 a barrel on higher-than-expected supply news. This retreat was short-lived, as oil closed higher at the end of the second quarter at around $70 per barrel. The Federal Reserve ("Fed") kept the federal funds rate unchanged at 5.25% during the second quarter. However, Federal Open Market Committee minutes pointed to inflationary pressures that have the potential to prompt the Fed to increase rates later in the year.

What factors contributed to the Fund's performance?

All but three sectors of the S&P 500 Index posted positive results for the first quarter of 2007. The utilities sector was the top performer, followed by the materials sector. The primary detractors had the heaviest weights and the lowest returns. The financials sector, which represented a significant position in the portfolio, ended the quarter in negative territory. In addition, the information technology sector, another large Index component, posted a slightly negative return. At the close of business on March 30, 2007, we incorporated into the portfolio the Index's quarterly share changes. There were 10 additions and deletions to the Index during the quarter, and we incorporated these changes into the portfolio to maintain proper tracking.

For the year-to-date period ended June 30, 2007, financials and information technology constituted the Fund's largest sector positions. During this period, the best-performing sector in the S&P 500 Index was energy, which posted a double-digit return. Conversely, the worst-performing sector, financials, ended the quarter with a slightly negative return. On June 15, 2007, quarterly share changes were incorporated into the Index. There were a total of 19 additions and deletions to the Index during the year-to-date period.

What is your outlook?

Despite the direction in which the equity markets may head throughout the remainder of the year – and the effects that certain factors, such as the price of oil, inflation, geopolitical unrest and Fed policy, may have on the markets – we believe that the Fund is positioned to strive for returns that are consistent with those of the S&P 500 Index.

21

MassMutual Select Indexed Equity Fund – Portfolio Manager Report (Continued)

MassMutual Select Indexed Equity Fund

Industry Table

(% of Net Assets) on 6/30/07 | |

| Oil & Gas | | | 8.6 | % | |

| Diversified Financial | | | 8.0 | % | |

| Telecommunications | | | 6.3 | % | |

| Banks | | | 6.3 | % | |

| Pharmaceuticals | | | 5.7 | % | |

| Retail | | | 5.5 | % | |

| Manufacturing | | | 5.3 | % | |

| Insurance | | | 4.9 | % | |

| Computers | | | 4.2 | % | |

| Software | | | 3.8 | % | |

| Electric | | | 3.2 | % | |

| Media | | | 3.2 | % | |

| Health Care — Products | | | 3.0 | % | |

| Semiconductors | | | 2.7 | % | |

| Aerospace & Defense | | | 2.2 | % | |

| Beverages | | | 2.0 | % | |

| Cosmetics & Personal Care | | | 1.8 | % | |

| Foods | | | 1.8 | % | |

| Internet | | | 1.8 | % | |

| Transportation | | | 1.7 | % | |

| Chemicals | | | 1.6 | % | |

| Oil & Gas Services | | | 1.6 | % | |

| Agriculture | | | 1.4 | % | |

| Health Care — Services | | | 1.4 | % | |

Real Estate Investment

Trusts (REITS) | | | 1.2 | % | |

| Biotechnology | | | 0.9 | % | |

| Mining | | | 0.7 | % | |

| Commercial Services | | | 0.7 | % | |

| Lodging | | | 0.5 | % | |

| Electronics | | | 0.5 | % | |

| Auto Manufacturers | | | 0.4 | % | |

| Apparel | | | 0.4 | % | |

Machinery —

Construction & Mining | | | 0.4 | % | |

| Household Products | | | 0.4 | % | |

| Pipelines | | | 0.4 | % | |

| Savings & Loans | | | 0.4 | % | |

| Machinery — Diversified | | | 0.4 | % | |

| Forest Products & Paper | | | 0.3 | % | |

Electrical Components &

Equipment | | | 0.3 | % | |

| Iron & Steel | | | 0.3 | % | |

| Leisure Time | | | 0.3 | % | |

| Automotive & Parts | | | 0.3 | % | |

| Gas | | | 0.2 | % | |

| Office Equipment/Supplies | | | 0.2 | % | |

| Environmental Controls | | | 0.2 | % | |

| Home Builders | | | 0.2 | % | |

| Advertising | | | 0.2 | % | |

| Building Materials | | | 0.2 | % | |

| Coal | | | 0.2 | % | |

| Packaging & Containers | | | 0.1 | % | |

| Metal Fabricate & Hardware | | | 0.1 | % | |

| Home Furnishing | | | 0.1 | % | |

| Toys, Games & Hobbies | | | 0.1 | % | |

| Hand & Machine Tools | | | 0.1 | % | |

| Entertainment | | | 0.1 | % | |

| Airlines | | | 0.1 | % | |

| Engineering & Construction | | | 0.1 | % | |

| Housewares | | | 0.1 | % | |

| Industrial — Distribution | | | 0.0 | % | |

| Real Estate | | | 0.0 | % | |

Total Long-Term

Investments | | | 99.1 | % | |

Short-Term Investments

and Other Assets and

Liabilities | | | 0.9 | % | |

| | | | 100.0 | % | |

MassMutual Select Indexed

Equity Fund

Largest Stock Holdings

(% of Net Assets) on 6/30/07 | |

| Exxon Mobil Corp. | | | 3.5 | % | |

| General Electric Co. | | | 2.9 | % | |

| AT&T, Inc. | | | 1.9 | % | |

| Citigroup, Inc. | | | 1.9 | % | |

| Microsoft Corp. | | | 1.8 | % | |

| Bank of America Corp. | | | 1.6 | % | |

| The Procter & Gamble Co. | | | 1.4 | % | |

| American International Group, Inc. | | | 1.3 | % | |

| Chevron Corp. | | | 1.3 | % | |

| Pfizer, Inc. | | | 1.3 | % | |

22

MassMutual Select Indexed Equity Fund – Portfolio Manager Report (Continued)

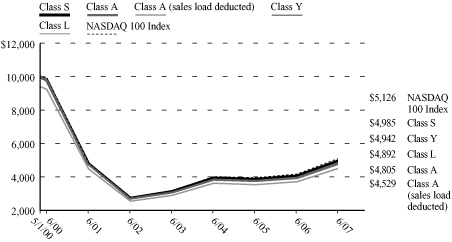

Growth of a $10,000 Investment

Hypothetical Investments in MassMutual Select Indexed Equity Fund Class S, Class A, Class A (sales load deducted), Class Y and the S&P 500 Index.

MassMutual Select Indexed Equity Fund

Total Return

| | | Year-

to-Date

1/1/07 -

6/30/07 | | One

Year

7/1/06 -

6/30/07 | | Five

Year

Average

Annual

7/1/02 -

6/30/07 | | Since

Inception

Average

Annual

3/1/98 -

6/30/07 | |

| Class S | | | 6.72 | % | | | 20.10 | % | | | 10.25 | % | | | 5.14 | % | |

| Class A | | | 6.60 | % | | | 19.72 | % | | | 9.86 | % | | | 4.70 | % | |

Class A

(sales load

deducted)* | | | 0.47 | % | | | 12.84 | % | | | 8.56 | % | | | 4.04 | % | |

| Class Y | | | 6.71 | % | | | 20.08 | % | | | 10.21 | % | | | 5.08 | % | |

| S&P 500 Index | | | 6.96 | % | | | 20.57 | % | | | 10.70 | % | | | 5.59 | % | |

Hypothetical Investments in MassMutual Select Indexed Equity Fund Class L and the S&P 500 Index.

MassMutual Select Indexed Equity Fund

Total Return

| | | Year-

to-Date

1/1/07 -

6/30/07 | | One

Year

7/1/06 -

6/30/07 | | Five

Year

Average

Annual

7/1/02 -

6/30/07 | | Since

Inception

Average

Annual

7/1/99 -

6/30/07 | |

| Class L | | | 6.81 | % | | | 20.10 | % | | | 10.15 | % | | | 2.23 | % | |

| S&P 500 Index | | | 6.96 | % | | | 20.57 | % | | | 10.70 | % | | | 2.79 | % | |

GROWTH OF $10,000 INVESTMENT SINCE INCEPTION

* Class A (sales load deducted) returns include the 5.75% maximum sales charge.

Performance data quoted represents past performance; past performance is not predictive of future results. The investment return and principal value of shares of the Fund will fluctuate with market conditions so that shares of the Fund, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-888-309-3539.

Investors should note that the Fund is a professionally managed mutual fund, while the S&P 500 Index is unmanaged, does not incur expenses, and cannot be purchased directly by investors. Investors should read the Fund's prospectus with regard to the Fund's investment objective, risks and charges and expenses in conjunction with these financial statements. Employee retirement benefit plans that invest plan assets in the Separate Investment Accounts (SIAs) may be subject to certain charges as set forth in their respective Plan Documents. Total return figures would be lower for the periods presented if they reflected these charges. The performance tables and charts do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of the Fund shares.

23

MassMutual Select Indexed Equity Fund – Portfolio Manager Report (Continued)

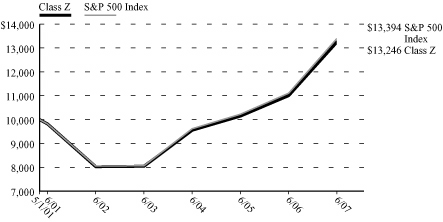

Growth of a $10,000 Investment

Hypothetical Investments in MassMutual Select Indexed Equity Fund Class Z and the S&P 500 Index.

MassMutual Select Indexed Equity Fund

Total Return

| | | Year-

to-Date

1/1/07 -

6/30/07 | | One

Year

7/1/06 -

6/30/07 | | Five

Year

Average

Annual

7/1/02 -

6/30/07 | | Since

Inception

Average

Annual

5/1/01 -

6/30/07 | |

| Class Z | | | 6.87 | % | | | 20.33 | % | | | 10.52 | % | | | 4.66 | % | |

| S&P 500 Index | | | 6.96 | % | | | 20.57 | % | | | 10.70 | % | | | 4.85 | % | |

Hypothetical Investments in MassMutual Select Indexed Equity Fund Class N, Class N (CDSC fees deducted) and the S&P 500 Index.

MassMutual Select Indexed Equity Fund

Total Return