UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08226

Templeton Global Investment Trust

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500

Date of fiscal year end: _3/31__

Date of reporting period: 3/31/14__

Item 1. Reports to Stockholders.

| | | | | | | |

| | Contents | | | | | |

| |

| Shareholder Letter | 1 | Annual Report | | Financial Statements | 51 | Tax Information | 74 |

| | | Templeton Global | | Notes to Financial | | Board Members and | |

| | | Balanced Fund | 4 | Statements | 55 | Officers | 76 |

| | | Performance Summary | 14 | Report of Independent | | Shareholder Information | 82 |

| | | | | Registered Public | | | |

| | | Your Fund’s Expenses | 21 | | | | |

| | | | | Accounting Firm | 73 | | |

| | | Financial Highlights and | | | | | |

| | | Statement of Investments | 23 | | | | |

Annual Report

Templeton Global Balanced Fund

Your Fund’s Goal and Main Investments: Templeton Global Balanced Fund seeks both income and capital appreciation. Under normal market conditions, the Fund will invest in a diversified portfolio of debt and equity securities worldwide. The Fund normally invests at least 25% of its assets in fixed income senior securities and at least 25% of its assets in equity securities. The Fund’s equity component will generally consist of stocks of companies from a variety of industries located anywhere in the world, including developing markets, that offer or could offer the opportunity to realize capital appreciation and/or attractive dividend yields. The Fund’s fixed income component will primarily consist of developed and developing country government and agency bonds and investment grade and below investment grade corporate debt securities that offer the opportunity to realize income.

We are pleased to bring you Templeton Global Balanced Fund’s annual report for the fiscal year ended March 31, 2014.

Performance Overview

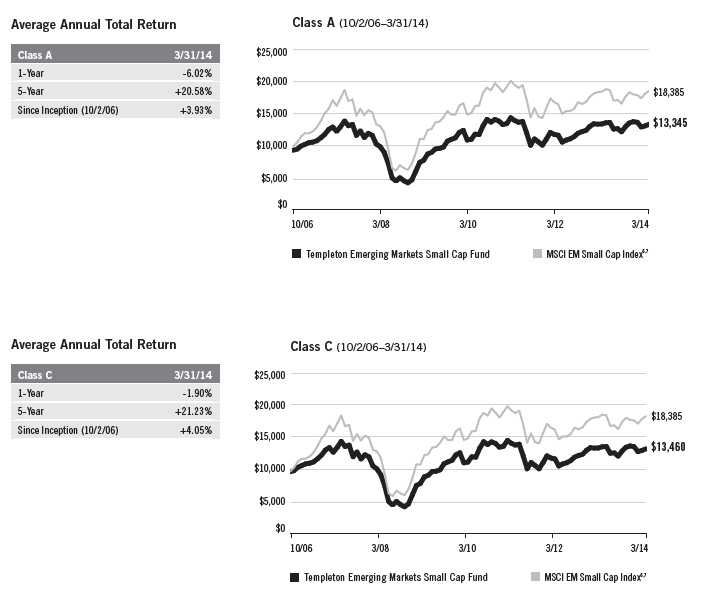

Templeton Global Balanced Fund – Class A delivered a +15.06% cumulative total return for the 12 months under review. In comparison, global equity and fixed income markets, as measured by the Fund’s benchmark, an equally

|

| Performance data represent |

| past performance, which does |

| not guarantee future results. |

| Investment return and principal |

| value will fluctuate, and you may |

| have a gain or loss when you sell |

| your shares. Current performance |

| may differ from figures shown. |

| Please visit franklintempleton.com |

| or call (800) 342-5236 for most |

| recent month-end performance. |

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the

Fund’s Statement of Investments (SOI). The SOI begins on page 30.

4 | Annual Report

weighted combination of the MSCI All Country World Index (ACWI)1, 2 and the Barclays Multiverse Index,1, 3 posted a +9.55% cumulative total return for the same period.1, 4 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 14.

Economic and Market Overview

The economic recovery was more robust in developed markets than in emerging markets during the 12 months under review. Many developed market central banks reaffirmed their accommodative monetary policies in an effort to support ongoing recovery. In contrast, several emerging markets central banks raised interest rates in an effort to control inflation and currency depreciation.

U.S. economic growth and employment trends generally exceeded expectations during the period until early 2014, when weaker economic data followed severe weather across many states. In late 2013, a budget impasse resulted in a temporary federal government shutdown. However, Congress passed a spending bill in January to fund the federal government through September 2014. Congress also approved the suspension of the debt ceiling until March 2015. The U.S. Federal Reserve Board (Fed) maintained its monthly bond purchases at $85 billion until January 2014, when it began reducing them, based on continued positive economic and employment data.

Outside the U.S., growth was strong in the U.K., supported by an easing credit environment and stronger consumer confidence. Economic activity was slower in Japan, although business sentiment and personal consumption improved. Higher Japanese exports amid a weaker yen supported the economy, and unemployment reached its lowest level since 2007. The Bank of Japan announced that it would provide additional monetary stimulus. Although technically out of recession, the eurozone experienced weak employment trends, deflationary concerns from investors and political turmoil in some peripheral economies. However, German Chancellor Angela Merkel’s reelection and the European Central Bank (ECB)’s interest rate cut to a record low helped investor confidence in the region.

In several emerging markets, including China, growth remained solid though moderating, as domestic demand, exports and commodity prices weakened. Emerging market equities declined and regional currencies depreciated sharply against the U.S. dollar amid political turmoil in certain countries and concerns over the potential impact of the Fed’s tapering its asset purchases. Uncertainty about Ukraine also weighed on markets. Central banks in several emerging market countries, including Brazil, India, Turkey and South Africa, raised interest rates during the latter half of the period in an effort to curb inflation and support their currencies.

Annual Report | 5

The stock market rally in developed markets accelerated during the period amid ongoing central bank commitments, continued strength in corporate earnings and increasing signs of an economic recovery. Emerging market stocks rebounded toward period-end, although Latin American stocks trailed their emerging market peers for the 12-month period. Gold prices experienced notable declines despite a modest rally in early 2014, and oil prices rose amid supply concerns related to political unrest.

In fixed income markets, fears of reductions in stimulative government policies contributed to periods of risk aversion, when credit spreads widened and assets perceived as risky sold off alternating with periods of heightened risk appetite, when spreads narrowed and investors again favored risk assets. Against this backdrop, extensive liquidity creation continued, in particular from the Bank of Japan’s commitment to increase inflation and the ECB’s interest rate cut. In the U.S., the 10-year Treasury yield rose from 1.87% at the beginning of the period to a high of 3.04% on December 31, 2013. However, some weakening economic data, possibly due to bad weather, and increasing political tension in Ukraine contributed to the 10-year U.S. Treasury yield’s decline to 2.73% at period-end.

Investment Strategy

We search for undervalued or out-of-favor debt and equity securities and for equity securities that offer or may offer current income. When searching for equity securities, we use a bottom-up, value-oriented, long-term approach, focusing on the market price of a security relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential, as reflected by various metrics, including the company’s price/earnings ratio, price/cash flow ratio, price/book value and discounted cash flow. Because this is a global fund, we analyze global economic trends to identify global macro trends (for example, regions with strong economic growth), and evaluate market inefficiencies to identify investment opportunities stemming from market mispricings.

When searching for debt securities, we perform an independent analysis of the securities being considered for the Fund’s portfolio, rather than relying principally on their ratings assigned by rating agencies. Among factors we consider are a company’s experience and managerial strength; responsiveness to changes in interest rates and business conditions; debt maturity schedules and borrowing requirements; a company’s changing financial condition and market recognition of the change; and a security’s relative value based on such

6 | Annual Report

|

| What is a currency forward |

| contract? |

| A currency forward contract is an |

| agreement between the Fund and a |

| counterparty to buy or sell a foreign |

| currency at a specific exchange rate |

| on a future date. |

| |

| |

| |

| What is a futures contract? |

| A futures contract is an agreement |

| between the Fund and a counterparty |

| made through a U.S. or foreign futures |

| exchange to buy or sell an asset at a |

| specific price on a future date. |

factors as anticipated cash flow, interest or dividend coverage, asset coverage and earnings prospects. With respect to sovereign debt securities, we consider market, political and economic conditions, and evaluate interest and currency exchange rate changes and credit risks. We may regularly enter into currency-related transactions involving certain derivative instruments, including currency and cross currency forward contracts, and currency and currency index futures contracts, to provide a hedge against risks associated with other securities held in the Fund or to implement a currency investment strategy.

Manager’s Discussion

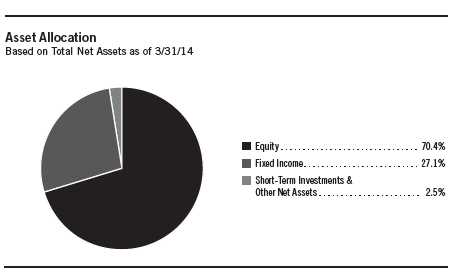

In the March 2013 shareholder report, we discussed the impact of heightened political intervention on financial markets and the corporate sector. We also described how companies used lower borrowing costs to refinance debt and fund acquisitions, share buybacks and dividend payouts while simultaneously repairing balance sheets as they sought to remain competitive in a tight business environment. As a result, in our view, many stocks offered attractive dividends, especially relative to lower yielding bonds, and fundamentals improved. At the beginning of the current report period, we raised the Fund’s target equity allocation to 70%, the highest level since the Fund’s inception, as we anticipated the recovery in corporate and economic conditions and as our analysis revealed a relative valuation disparity between equity and fixed income markets.

Equity

The Fund’s equity component delivered double-digit gains and outperformed its equity benchmark, the MSCI ACWI, for the second consecutive annual reporting period, although past performance does not guarantee future results. Encouragingly for bottom-up stock pickers, stock selection drove favorable relative performance as equities advanced and investors seemed to become more selective. All major regional and sector holdings delivered double-digit absolute gains and most outperformed their equity benchmark counterparts.

However, the Fed’s tapering of asset purchases during the period signaled to us an initial step in the long process of normalizing monetary policy, with significant implications for global financial markets. For stock markets, the Fed’s tapering impact was most pronounced in emerging market countries that had benefited from abundant U.S. dollar liquidity. As the Fed began the partial withdrawal of its sizable stimulus, intermittent capital outflows and currency losses followed in many emerging markets. Valuations for emerging market stocks declined amid the regional turmoil, but we continued to be selective, so we remained slightly underweighted compared to the benchmark’s emerging market allocation by period-end.

Annual Report | 7

To us, the story during the past 12 months was less about finding new bargains and more about investors recognizing value in some of our longer term, high-conviction holdings. The Fund’s financials and consumer discretionary sector holdings exemplified to us the merits of a long-term, contrarian, value approach.5 Our financials overweighting comprised European banks acquired at what we believed Sir John Templeton would have described as “moments of maximum pessimism.” At the market bottom, European banks were trading at 50% to 80% discounts to their tangible book values, a level that major global financial institutions had not reached since U.S. banks did during the Great Depression. As recently as 2012, the entire market capitalization of the euro-zone banking system was worth less than one U.S. stock, Apple. Encouraged by many companies’ fundamental restructuring and convinced that the euro-zone would remain intact, we began aggressively increasing exposure to European financials at these record valuation discounts. We patiently maintained the Fund’s exposure as the economic environment stabilized and banks recapitalized and restructured as they sought to improve profitability. During the review period, European financials represented many of the Fund’s top contributors to performance, including French lender BNP Paribas and Dutch financial services firm ING Groep.

We also acquired many consumer discretionary holdings at low valuations during periods of considerable pessimism. We increased the Fund’s exposure to media companies in the aftermath of the technology, media and telecommunications bubble and, more recently, to retailers as the global financial crisis clouded the outlook for consumer spending. We subsequently divested some media positions to realize gains but maintained a higher allocation than the equity benchmark to retail, where we continued to see our long-term investment theses proven. U.K. home improvement retailer Kingfisher, one of the Fund’s top contributors, is an excellent example of the values we found. Economic uncertainty and company-specific issues pressured the stock during the European sovereign debt crisis, although we remained optimistic given Kingfisher’s discounted valuation and proactive restructuring program. During the review period, Europe’s economic recovery gained pace and the company progressed with restructuring efforts aimed at strengthening its portfolio and its balance sheet and gained market share domestically and in growth markets abroad. The share price rallied during the period as Kingfisher reported better-than-expected operating results and used its improved balance sheet position to increase its dividend.

8 | Annual Report

These examples highlighted to us the strong recovery in investor sentiment for the eurozone from severely depressed levels. We recall just how desperate the situation in Europe seemed to many investors in 2010 and 2011, when the cost to insure bank debt ballooned 50-fold and many major business journals forecast the monetary union’s demise. “People are always asking me where the outlook is good, but that’s the wrong question,” wrote Sir John Templeton. “The right question is ‘Where is the outlook most miserable?’” In recent years, we believed the outlook was most miserable in Europe. We sought to take advantage of what we believed were extreme mispricings to selectively increase exposure to the region. Since then, politics and the banking system have stabilized and the economy has begun to recover. Although deflationary concerns persisted and the recovery remained fragile, from a bottom-up standpoint we continued to find many European companies with what we believed were strong global leadership positions and the potential for continued earnings recovery whose stocks traded at discounted valuations largely because of their domicile.

Sectors and regions where we found fewer values also outperformed during the period, including the consumer staples and materials sectors.6 Opportunities in consumer staples remained scarce in our view as investors continued to pay a premium for the sector’s perceived attractive combination of defensive (non-discretionary) revenue streams and cyclical emerging markets exposure. In the materials sector, years of overspending in the mining industry exacerbated the excess capacity caused by the apparent waning of the long-running commodities bull market. Although a few mining stocks in beaten-down emerging markets appeared cheap to us, we still did not find wholesale values in the sector. Among resources stocks, we found better opportunities in energy, where we believed depressed sector valuations may have understated the long-term profitability and cash flow potential of oil companies with falling capital expenditures and improving production prospects.7 In addition to finding value in certain integrated oil companies, we also found opportunities among attractively valued oil services firms that stood to benefit from the shale gas revolution and an improving supply-and-demand balance in major pressure-pumping markets. Stock selection led our positions in the high yielding energy sector to outperform the sector in the equity benchmark.

Of the major sectors and regions, information technology (IT) was the only relative detractor.8 The Fund’s IT holdings’ share prices rallied on average but marginally trailed IT in the equity benchmark, pressured by some Asia-based IT holdings. Japanese precision equipment manufacturer CANON reported

| | | |

| Top 5 Equity Holdings | | | |

| 3/31/14 | | | |

| |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Microsoft Corp., ord. & ELN | | 1.4 | % |

| Software, U.S. | | | |

| BNP Paribas SA | | 1.2 | % |

| Banks, France | | | |

| Teva Pharmaceutical Industries Ltd., ADR | 1.2 | % |

| Pharmaceuticals, Israel | | | |

| Foot Locker Inc. | | 1.1 | % |

| Specialty Retail, U.S. | | | |

| Credit Suisse Group AG | | 1.1 | % |

| Capital Markets, Switzerland | | | |

Annual Report | 9

|

| What is duration? |

| Duration is a measure of a bond’s price |

| sensitivity to interest rate changes. In |

| general, a portfolio of securities with a |

| lower duration can be expected to be |

| less sensitive to interest rate changes |

| than a portfolio with a higher duration. |

weak camera and printer sales, but we believe the firm’s strong balance sheet and healthy cash flows could support shareholder returns. Chinese IT products distributor Digital China Holdings also lost value after reporting weaker-than-expected earnings and issuing downbeat guidance as the economy pressured IT spending.9 However, structural growth trends remained strong in the Chinese enterprise technology market, and Digital China Holdings offered attractively valued exposure to the market. Although valuations appeared broadly expensive to us in IT sector segments, we continued to find companies with strong balance sheets and innovative product pipelines trading at valuations that we viewed as failing to reflect long-term catalysts, such as a renewed hardware replacement cycle and the facilities to transmit increasing quantities of data.

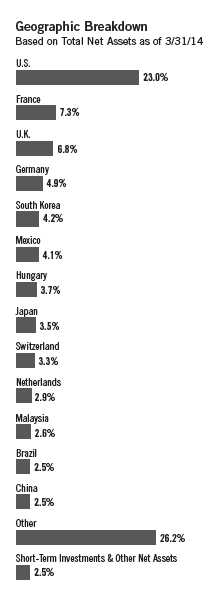

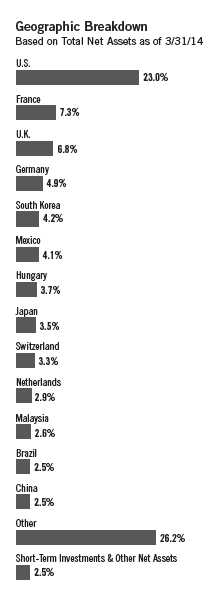

Regionally, the Fund’s European holdings performed well owing to a large regional overweighting and stock selection. Specifically, stock selection in the U.K. and an overweighting in France bolstered relative performance. Stock selection in Asia also contributed to relative performance. In contrast, an underweighted allocation to the U.S. and stock selection in Australia hampered relative results.

Although equities overall appeared to become more expensive during the period, our disciplined, bottom-up value search continued to uncover stocks trading at significant discounts to our projections of their long-term intrinsic values. Robust equity returns might be difficult to sustain in an environment of moderate economic growth and rising valuations, and in our view, the ability to pick undervalued stocks is critical in the recent, more discriminating market environment. The Fund’s favorable relative performance highlighted to us how our forward-looking, dynamic definition of value differs from a traditional, static, low-multiple approach. We remained confident in the Fund’s potential to preserve and grow capital while providing a healthy income stream over a long-term investment horizon.

Fixed Income

During the period under review, we maintained the Fund’s defensive duration posture as policymakers in the G-3 (U.S., eurozone and Japan), the U.K. and Switzerland implemented historically accommodative monetary policies. With interest rates in the U.S. and Japan at historically low levels, central banks supplying significant liquidity to the financial sector and fiscal deficits that

10 | Annual Report

| | |

| Top 5 Fixed Income Holdings* | |

| 3/31/14 | | |

| | % of Total | |

| Issue/Issuer | Net Assets | |

| Government of Mexico | 4.0 | % |

| Government of Hungary | 3.7 | % |

| Government of Malaysia | 2.6 | % |

| Government of Sri Lanka | 2.3 | % |

| Government of Ukraine | 2.0 | % |

| |

| *Excludes short-term investments. | | |

drove record funding needs, we saw what we viewed as limited value in these government bond markets and maintained underweighted duration exposure in the U.S. and limited duration exposure in Japan. Underweighted duration exposure in the U.S. contributed to performance relative to the Barclays Multiverse Index. The Fund maintained little duration exposure in emerging markets, except in select countries where rates were already quite high. Select duration exposures in Europe contributed to absolute performance.

The Fund’s diversified currency exposure detracted from performance during the period. As part of the Fund’s investment strategy, we used currency forward contracts to limit or add exposure to various currencies, which sometimes resulted in net negative positions. The U.S. dollar was broadly stronger and rose 1.32% against the currencies of major U.S. trading partners during the period.10 The Japanese yen depreciated 8.71% against the U.S. dollar during the year under review.11

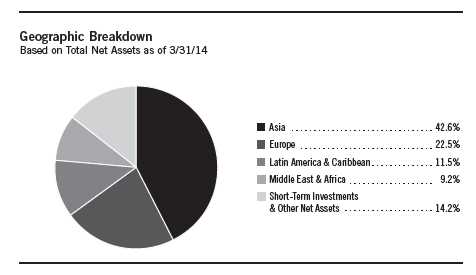

Overall, the Fund’s exposure to Asian currencies contributed to absolute performance. The Fund’s large net-negative exposure to the Japanese yen, achieved through the use of currency forward contracts, contributed to performance. Malaysia’s central bank kept its policy rate constant while central banks in Australia and South Korea cut rates during the period. Central banks in India and Indonesia increased rates during the period. During the period under review, the Malaysian ringgit fell 5.18%, the Australian dollar depreciated 11.10%, the Indian rupee shed 9.00% and the Indonesian rupiah lost 14.46% against the U.S. dollar.11 The South Korean won strengthened 4.52% against the U.S. dollar during the period.11

The euro appreciated 7.33% against the U.S. dollar during the period, and the Fund’s large underweighted position in the monetary union’s currency detracted from performance relative to the Barclays Multiverse Index.11 However, this effect was partially offset by the Fund’s exposure to some other European currencies, which appreciated against the U.S. dollar. For example, the Polish zloty appreciated 7.65% against the U.S. dollar during the period.11

Exposure to Latin American currencies detracted from Fund performance. Economic growth in much of the region continued to be supported by domestic and external demand. The Mexican and Chilean central banks cut their policy rates, while Brazil hiked rates. The Brazilian real depreciated 10.64% against the U.S. dollar, the Chilean peso depreciated 14.34% and the Mexican peso fell 5.44%.11

Annual Report | 11

In addition to purchasing global government bonds, the Fund also invested in the credit sector. As an asset class, such investments may compensate for greater credit risk by offering higher yields relative to U.S. Treasury and European benchmark bonds. Relative to the Barclays Multiverse Index, the Fund’s overall credit positioning contributed to performance. Within the credit sector, exposure to subinvestment-grade sovereign credit and high yield corporate bonds contributed to performance.

Thank you for your continued participation in Templeton Global Balanced Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

12 | Annual Report

The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

1. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

2. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

3. Source: Barclays Global Family of Indices. © 2014 Barclays Capital Inc. Used with permission.

4. The Fund’s benchmark is currently weighted 50% for the MSCI ACWI and 50% for the Barclays Multiverse Index and is rebalanced monthly. For the 12 months ended 3/31/14, the MSCI ACWI posted a +17.17% total return and the Barclays Multiverse Index posted a +2.19% total return.

5. The financials sector comprises banks, capital markets, consumer finance, diversified financial services, insurance, real estate management and development, and thrifts and mortgage finance in the equity section of the SOI. The consumer discretionary sector comprises auto components; automobiles; distributors; hotels, restaurants and leisure; household durables; media; multiline retail; and specialty retail in the equity section of the SOI.

6. The consumer staples sector comprises beverages, and food and staples retailing in the equity section of the SOI. The materials sector comprises chemicals, construction materials, metals and mining, and paper and forest products in the equity section of the SOI.

7. The energy sector comprises energy equipment and services; and oil, gas and consumable fuels in the equity section of the SOI.

8. The IT sector comprises communications equipment; IT services; semiconductors and semiconductor equipment; software; and technology hardware, storage and peripherals in the equity section of the SOI.

9. Not part of the index.

10. Source: Federal Reserve H.10 Report.

11. Source: FactSet. 2014 FactSet Research Systems Inc. All Rights Reserved. The information contained herein: (1) is proprietary to FactSet Research Systems Inc. and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither FactSet Research Systems Inc. nor its content providers are responsible for any damages or losses arising from any use of this information.

Annual Report | 13

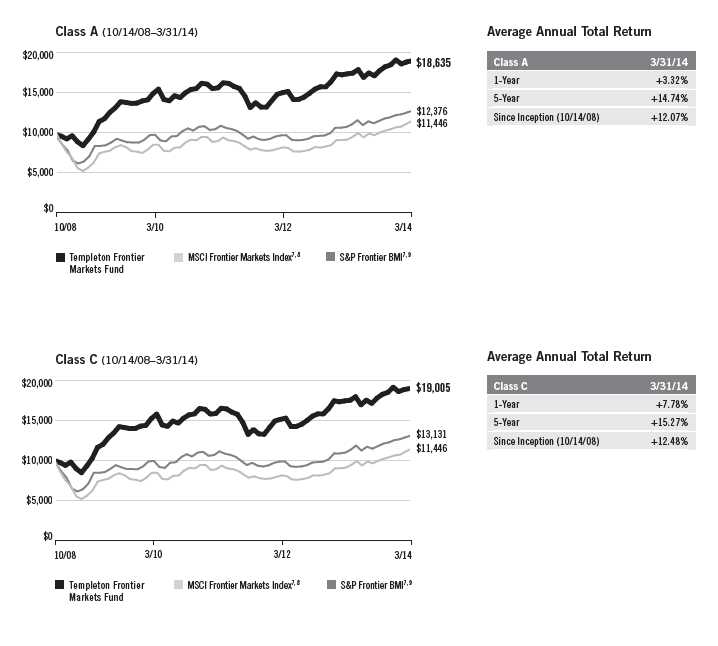

Performance Summary as of 3/31/14

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class | | 3/31/14 | | 3/31/13 | | Change |

| A (TAGBX) | $ | 3.30 | $ | 2.94 | +$ | 0.36 |

| A1 (TINCX) | $ | 3.30 | $ | 2.94 | +$ | 0.36 |

| C (FCGBX) | $ | 3.28 | $ | 2.93 | +$ | 0.35 |

| C1 (TCINX) | $ | 3.29 | $ | 2.93 | +$ | 0.36 |

| R (n/a) | $ | 3.30 | $ | 2.94 | +$ | 0.36 |

| Advisor (TZINX) | $ | 3.31 | $ | 2.95 | +$ | 0.36 |

| | | | | 5/1/13 | | |

| R6 (n/a) | $ | 3.30 | $ | 3.02 | +$ | 0.28 |

| | | |

| | Distributions | | |

| | Share Class | | Dividend Income |

| A | (4/1/13–3/31/14) | $ | 0.0766 |

| A1 | (4/1/13–3/31/14) | $ | 0.0745 |

| C | (4/1/13–3/31/14) | $ | 0.0588 |

| C1 | (4/1/13–3/31/14) | $ | 0.0622 |

| R | (4/1/13–3/31/14) | $ | 0.0670 |

| R6 | (5/1/13–3/31/14) | $ | 0.0855 |

| Advisor | (4/1/13–3/31/14) | $ | 0.0828 |

14 | Annual Report

Performance Summary (continued)

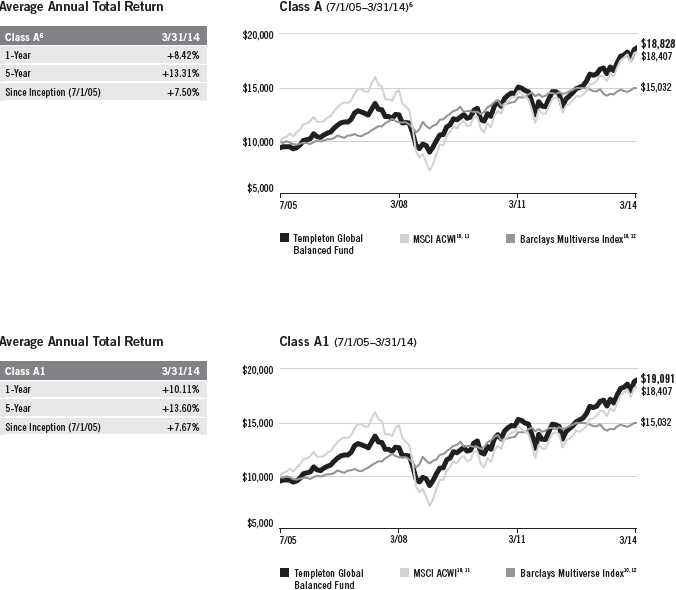

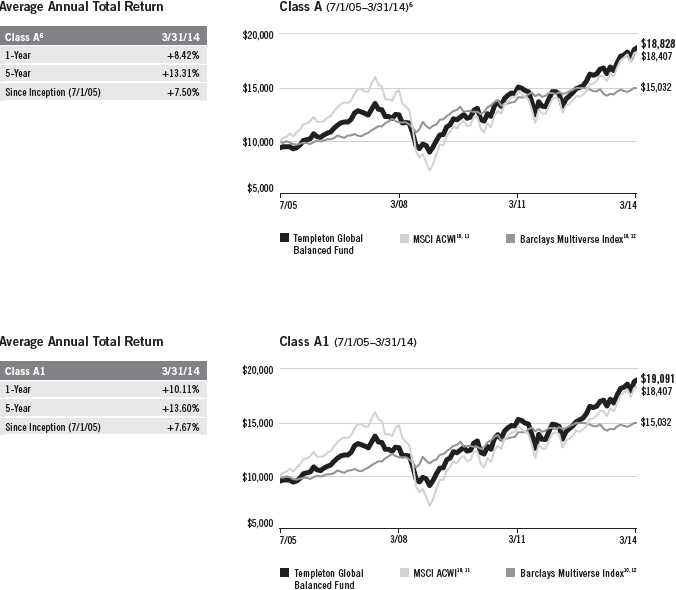

Performance as of 3/31/141

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include current maximum sales charges. Class A: 5.75% maximum initial sales charge; Class A1: 4.25% maximum initial sales charge; Class C/C1: 1% contingent deferred sales charge in first year only; Class R/R6/Advisor Class: no sales charges.

| | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | | | Value of | | Total Annual Operating Expenses5 | |

| Share Class | | Total Return2 | | | Total Return3 | | $ | 10,000 Investment4 | | (with waiver) | | (without waiver) | |

| A6 | | | | | | | | | | 1.22 | % | 1.23 | % |

| 1-Year | + | 15.06 | % | + | 8.42 | % | $ | 10,842 | | | | | |

| 5-Year | + | 97.97 | % | + | 13.31 | % | $ | 18,681 | | | | | |

| Since Inception (7/1/05) | + | 99.58 | % | + | 7.50 | % | $ | 18,828 | | | | | |

| A1 | | | | | | | | | | 1.22 | % | 1.23 | % |

| 1-Year | + | 14.98 | % | + | 10.11 | % | $ | 11,011 | | | | | |

| 5-Year | + | 97.70 | % | + | 13.60 | % | $ | 18,923 | | | | | |

| Since Inception (7/1/05) | + | 99.31 | % | + | 7.67 | % | $ | 19,091 | | | | | |

| C | | | | | | | | | | 1.97 | % | 1.98 | % |

| 1-Year | + | 14.11 | % | + | 13.11 | % | $ | 11,311 | | | | | |

| Since Inception (7/1/11) | + | 23.68 | % | + | 8.03 | % | $ | 12,368 | | | | | |

| C1 | | | | | | | | | | 1.62 | % | 1.63 | % |

| 1-Year | + | 14.57 | % | + | 13.57 | % | $ | 11,357 | | | | | |

| 5-Year | + | 93.23 | % | + | 14.08 | % | $ | 19,323 | | | | | |

| Since Inception (7/1/05) | + | 92.32 | % | + | 7.76 | % | $ | 19,232 | | | | | |

| R | | | | | | | | | | 1.47 | % | 1.48 | % |

| 1-Year | + | 14.70 | % | + | 14.70 | % | $ | 11,470 | | | | | |

| 5-Year | + | 95.24 | % | + | 14.32 | % | $ | 19,524 | | | | | |

| Since Inception (7/1/05) | + | 94.88 | % | + | 7.93 | % | $ | 19,488 | | | | | |

| R67 | | | | | | | | | | 0.86 | % | 0.87 | % |

| Since Inception (5/1/13) | + | 12.32 | % | + | 12.32 | % | $ | 11,232 | | | | | |

| Advisor | | | | | | | | | | 0.97 | % | 0.98 | % |

| 1-Year | + | 15.23 | % | + | 15.23 | % | $ | 11,523 | | | | | |

| 5-Year | + | 99.71 | % | + | 14.84 | % | $ | 19,971 | | | | | |

| Since Inception (7/1/05) | + | 103.97 | % | + | 8.49 | % | $ | 20,397 | | | | | |

| |

| |

| | | Distribution | | | 30-Day Standardized Yield9 | | | | | |

| Share Class | | Rate8 | | | (with waiver) (without waiver) | | | | | |

| A | | 1.42 | % | | 2.04 | % | | 2.04 | % | | | | |

| A1 | | 1.43 | % | | 2.02 | % | | 2.02 | % | | | | |

| C | | 1.05 | % | | 1.44 | % | | 1.44 | % | | | | |

| C1 | | 1.25 | % | | 1.72 | % | | 1.72 | % | | | | |

| R | | 1.33 | % | | 1.89 | % | | 1.87 | % | | | | |

| R6 | | 1.72 | % | | 2.49 | % | | 2.49 | % | | | | |

| Advisor | | 1.66 | % | | 2.41 | % | | 2.39 | % | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Annual Report | 15

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

16 | Annual Report

Annual Report | 17

18 | Annual Report

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing including currency fluctuations, economic instability and political developments; investments in emerging markets involve heightened risks related to the same factors. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. The risks associated with higher yielding, lower rated debt securities include higher risk of default and loss of principal. To the extent the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. The Fund’s investment in derivative securities, such as swaps, financial futures and option contracts, and use of foreign currency techniques involve special risks as such may not achieve the anticipated benefits and/or may result in losses to the Fund. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class A: The Fund began offering a new Class A share on 9/27/11. Beginning 7/1/11, the Fund’s existing Class A shares (renamed

Class A1 on 9/27/11) were available to new investors with a 5.75% maximum initial sales charge. Prior to 7/1/11, the Fund

offered Class A shares with a lower maximum initial sales charge.

Class A1

(formerly Class A): Effective 9/27/11, Class A shares were renamed Class A1. This share class is only available for shareholders who purchased

prior to 7/1/11. A new Class A share is available for investors with an initial purchase date on or after 7/1/11.

Class C: The Fund began offering a new Class C share on 7/1/11. Prior to that date, the Fund offered a Class C share (renamed

Class C1) with lower Rule 12b-1 expenses. These shares have higher annual fees and expenses than Class A shares.

Class C1

(formerly Class C): Effective 7/1/11, Class C closed to new investors and was renamed Class C1. These shares have higher annual fees and

expenses than Class A shares. A new Class C share is now available.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and

expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

Annual Report | 19

Performance Summary (continued)

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current

fiscal year-end. Fund investment results reflect the fee waiver, to the extent applicable; without this reduction, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund

operating expenses to become higher than the figure shown.

6. Total returns have been calculated based upon the returns for Class A1 shares prior to 7/1/11 and are restated to reflect the current, maximum

5.75% initial sales charge.

7. Since Class R6 shares have existed for less than one year, performance is shown for the period since inception and is not annualized.

8. Distribution rate is based on an annualization of the respective class’s most recent quarterly dividend and the maximum offering price (NAV for

Classes C, C1, R, R6 and Advisor) per share on 3/31/14.

9. The 30-day standardized yield for the 30 days ended 3/31/14 reflects an estimated yield to maturity (assuming all portfolio securities are held to

maturity). It should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution

rate (which reflects the Fund’s past dividends paid to shareholders) or the income reported in the Fund’s financial statements.

10. Source: © 2014 Morningstar. The MSCI ACWI is a free float-adjusted, market capitalization-weighted index designed to measure equity market

performance in global developed and emerging markets. The Barclays Multiverse Index provides a broad-based measure of the global fixed income

bond market. The index represents the union of the Global Aggregate Index and the Global High Yield Index and captures investment-grade and high

yield securities in all eligible currencies.

11. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI

data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products.

This report is not approved, reviewed or produced by MSCI.

12. Source: Barclays Global Family of Indices. © 2014 Barclays Capital Inc. Used with permission.

20 | Annual Report

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 21

Your Fund’s Expenses

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 10/1/13 | | Value 3/31/14 | | Period* 10/1/13–3/31/14 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,082.40 | $ | 5.76 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.40 | $ | 5.59 |

| A1 | | | | | | |

| Actual | $ | 1,000 | $ | 1,082.10 | $ | 5.71 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.45 | $ | 5.54 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,076.00 | $ | 9.58 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.71 | $ | 9.30 |

| C1 | | | | | | |

| Actual | $ | 1,000 | $ | 1,076.80 | $ | 7.82 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.40 | $ | 7.59 |

| R | | | | | | |

| Actual | $ | 1,000 | $ | 1,080.90 | $ | 7.06 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.15 | $ | 6.84 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,080.50 | $ | 3.99 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.09 | $ | 3.88 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,083.30 | $ | 4.47 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.64 | $ | 4.33 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.11%; A1: 1.10%; C: 1.85%; C1: 1.51%; R: 1.36%; R6: 0.77%; and Advisor: 0.86%), multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period.

22 | Annual Report

| | | | | | | | | |

| Templeton Global Investment Trust | | | | | | | |

| |

| Financial Highlights | | | | | | | | | |

| |

| Templeton Global Balanced Fund | | | | | | | | | |

| | | Year Ended March 31, | |

| Class A | | 2014 | | | 2013 | | | 2012 | a |

| Per share operating performance | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | |

| Net asset value, beginning of year | $ | 2.94 | | $ | 2.80 | | $ | 2.50 | |

| Income from investment operationsb: | | | | | | | | | |

| Net investment incomec | | 0.09 | d | | 0.07 | | | 0.04 | |

| Net realized and unrealized gains (losses) | | 0.35 | | | 0.23 | | | 0.33 | |

| Total from investment operations | | 0.44 | | | 0.30 | | | 0.37 | |

| Less distributions from net investment income | | (0.08 | ) | | (0.16 | ) | | (0.07 | ) |

| Net asset value, end of year | $ | 3.30 | | $ | 2.94 | | $ | 2.80 | |

| |

| Total returne | | 15.06 | % | | 11.31 | % | | 14.99 | % |

| |

| Ratios to average net assetsf | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.13 | % | | 1.21 | % | | 1.24 | % |

| Expenses net of waiver and payments by affiliates | | 1.12 | %g | | 1.20 | % | | 1.20 | % |

| Net investment income | | 2.76 | %d | | 2.84 | % | | 3.27 | % |

| |

| Supplemental data | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 1,055,121 | | $ | 238,319 | | $ | 72,962 | |

| Portfolio turnover rate | | 13.33 | % | | 30.44 | % | | 19.02 | % |

aFor the period September 27, 2011 (effective date) to March 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.02 per share received in the form of a special dividend paid in connection with certain Fund’s holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 2.24%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 23

| | | | | | | | | | | | | | | |

| Templeton Global Investment Trust | | | | | | | |

| Financial Highlights (continued) | | | | | | | | | | | | | | | |

| |

| Templeton Global Balanced Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| Class A1 | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 2.94 | | $ | 2.79 | | $ | 2.89 | | $ | 2.67 | | $ | 2.01 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.09 | c | | 0.08 | | | 0.09 | | | 0.09 | | | 0.09 | |

| Net realized and unrealized gains (losses) | | 0.34 | | | 0.23 | | | (0.08 | ) | | 0.23 | | | 0.63 | |

| Total from investment operations | | 0.43 | | | 0.31 | | | 0.01 | | | 0.32 | | | 0.72 | |

| Less distributions from net investment income | | (0.07 | ) | | (0.16 | ) | | (0.11 | ) | | (0.10 | ) | | (0.06 | ) |

| Net asset value, end of year | $ | 3.30 | | $ | 2.94 | | $ | 2.79 | | $ | 2.89 | | $ | 2.67 | |

| |

| Total returnd | | 14.98 | % | | 11.67 | % | | 0.78 | % | | 12.12 | % | | 36.26 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.13 | % | | 1.21 | % | | 1.24 | % | | 1.22 | % | | 1.20 | % |

| Expenses net of waiver and payments by affiliates | | 1.12 | %e | | 1.20 | % | | 1.20 | % | | 1.20 | % | | 1.20 | %e |

| Net investment income | | 2.76 | %c | | 2.84 | % | | 3.27 | % | | 3.48 | % | | 3.71 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 538,901 | | $ | 533,538 | | $ | 572,179 | | $ | 676,975 | | $ | 628,771 | |

| Portfolio turnover rate | | 13.33 | % | | 30.44 | % | | 19.02 | % | | 29.61 | % | | 30.16 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.02 per share received in the form of a special dividend paid in connection with certain Fund’s holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 2.24%.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of expense reduction rounds to less than 0.01%.

24 | The accompanying notes are an integral part of these financial statements. | Annual Report

| | | | | | | | | |

| Templeton Global Investment Trust | | | | | | | |

| Financial Highlights (continued) | | | | | | | | | |

| |

| Templeton Global Balanced Fund | | | | | | | | | |

| | | Year Ended March 31, | |

| Class C | | 2014 | | | 2013 | | | 2012 | a |

| Per share operating performance | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | |

| Net asset value, beginning of year | $ | 2.93 | | $ | 2.79 | | $ | 2.94 | |

| Income from investment operationsb: | | | | | | | | | |

| Net investment incomec | | 0.06 | d | | 0.05 | | | 0.04 | |

| Net realized and unrealized gains (losses) | | 0.35 | | | 0.23 | | | (0.11 | ) |

| Total from investment operations | | 0.41 | | | 0.28 | | | (0.07 | ) |

| Less distributions from net investment income | | (0.06 | ) | | (0.14 | ) | | (0.08 | ) |

| Net asset value, end of year | $ | 3.28 | | $ | 2.93 | | $ | 2.79 | |

| |

| Total returne | | 14.11 | % | | 10.66 | % | | (2.05 | )% |

| |

| Ratios to average net assetsf | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.88 | % | | 1.96 | % | | 1.99 | % |

| Expenses net of waiver and payments by affiliates | | 1.87 | %g | | 1.95 | % | | 1.95 | % |

| Net investment income | | 2.01 | %d | | 2.09 | % | | 2.52 | % |

| |

| Supplemental data | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 480,700 | | $ | 88,988 | | $ | 18,703 | |

| Portfolio turnover rate | | 13.33 | % | | 30.44 | % | | 19.02 | % |

aFor the period July 1, 2011 (effective date) to March 31, 2012.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.02 per share received in the form of a special dividend paid in connection with certain Fund’s holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 1.49%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 25

| | | | | | | | | | | | | | | |

| Templeton Global Investment Trust | | | | | | | |

| Financial Highlights (continued) | | | | | | | | | | | | | | | |

| |

| Templeton Global Balanced Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| Class C1 | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 2.93 | | $ | 2.79 | | $ | 2.89 | | $ | 2.67 | | $ | 2.01 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.07 | c | | 0.07 | | | 0.08 | | | 0.08 | | | 0.08 | |

| Net realized and unrealized gains (losses) | | 0.35 | | | 0.22 | | | (0.08 | ) | | 0.22 | | | 0.63 | |

| Total from investment operations | | 0.42 | | | 0.29 | | | — | | | 0.30 | | | 0.71 | |

| Less distributions from net investment income | | (0.06 | ) | | (0.15 | ) | | (0.10 | ) | | (0.08 | ) | | (0.05 | ) |

| Net asset value, end of year | $ | 3.29 | | $ | 2.93 | | $ | 2.79 | | $ | 2.89 | | $ | 2.67 | |

| |

| Total returnd | | 14.57 | % | | 10.86 | % | | 0.36 | % | | 11.67 | % | | 35.75 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.53 | % | | 1.61 | % | | 1.64 | % | | 1.62 | % | | 1.60 | % |

| Expenses net of waiver and payments by affiliates | | 1.52 | %e | | 1.60 | % | | 1.60 | % | | 1.60 | % | | 1.60 | %e |

| Net investment income | | 2.36 | %c | | 2.44 | % | | 2.87 | % | | 3.08 | % | | 3.31 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 341,690 | | $ | 322,243 | | $ | 342,091 | | $ | 390,187 | | $ | 383,760 | |

| Portfolio turnover rate | | 13.33 | % | | 30.44 | % | | 19.02 | % | | 29.61 | % | | 30.16 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.02 per share received in the form of a special dividend paid in connection with certain Fund’s holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 1.84%.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of expense reduction rounds to less than 0.01%.

26 | The accompanying notes are an integral part of these financial statements. | Annual Report

| | | | | | | | | | | | | | | |

| Templeton Global Investment Trust | | | | | | | |

| Financial Highlights (continued) | | | | | | | | | | | | | | | |

| |

| Templeton Global Balanced Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| Class R | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 2.94 | | $ | 2.80 | | $ | 2.90 | | $ | 2.68 | | $ | 2.01 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.08 | c | | 0.07 | | | 0.08 | | | 0.09 | | | 0.08 | |

| Net realized and unrealized gains (losses) | | 0.35 | | | 0.22 | | | (0.07 | ) | | 0.22 | | | 0.65 | |

| Total from investment operations | | 0.43 | | | 0.29 | | | 0.01 | | | 0.31 | | | 0.73 | |

| Less distributions from net investment income | | (0.07 | ) | | (0.15 | ) | | (0.11 | ) | | (0.09 | ) | | (0.06 | ) |

| Net asset value, end of year | $ | 3.30 | | $ | 2.94 | | $ | 2.80 | | $ | 2.90 | | $ | 2.68 | |

| |

| Total return | | 14.70 | % | | 10.99 | % | | 0.52 | % | | 11.80 | % | | 36.47 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.38 | % | | 1.46 | % | | 1.49 | % | | 1.47 | % | | 1.45 | % |

| Expenses net of waiver and payments by affiliates | | 1.37 | %d | | 1.45 | % | | 1.45 | % | | 1.45 | % | | 1.45 | %d |

| Net investment income | | 2.51 | %c | | 2.59 | % | | 3.02 | % | | 3.23 | % | | 3.46 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 5,757 | | $ | 3,864 | | $ | 3,426 | | $ | 2,288 | | $ | 2,199 | |

| Portfolio turnover rate | | 13.33 | % | | 30.44 | % | | 19.02 | % | | 29.61 | % | | 30.16 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.02 per share received in the form of a special dividend paid in connection with certain Fund’s holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 1.99%.

dBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 27

Templeton Global Investment Trust

Financial Highlights (continued)

Templeton Global Balanced Fund

| | | | |

| | | | Period Ended | |

| | | | March 31, | |

| | | | 2014a | |

| Class R6 | | | | |

| Per share operating performance | | | | |

| (for a share outstanding throughout the period) | | | | |

| Net asset value, beginning of period | $ | | 3.02 | |

| Income from investment operationsb: | | | | |

| Net investment incomec | | | 0.09 | d |

| Net realized and unrealized gains (losses) | | | 0.28 | |

| Total from investment operations | | | 0.37 | |

| Less distributions from net investment income | | | (0.09 | ) |

| Net asset value, end of period | $ | | 3.30 | |

| |

| Total returne | | | 12.32 | % |

| |

| Ratios to average net assetsf | | | | |

| Expenses before waiver and payments by affiliates | | | 2.31 | % |

| Expenses net of waiver and payments by affiliates | | | 0.77 | % g |

| Net investment income | | | 3.11 | %d |

| |

| Supplemental data | | | | |

| Net assets, end of period (000’s) | | $ | 5 | |

| Portfolio turnover rate | | | 13.33 | % |

aFor the period May 1, 2013 (effective date) to March 31, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.02 per share received in the form of a special dividend paid in connection with certain Fund’s holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 2.59%.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

28 | The accompanying notes are an integral part of these financial statements. | Annual Report

| | | | | | | | | | | | | | | |

| Templeton Global Investment Trust | | | | | | | |

| Financial Highlights (continued) | | | | | | | | | | | | | | | |

| |

| Templeton Global Balanced Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| Advisor Class | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 2.95 | | $ | 2.80 | | $ | 2.90 | | $ | 2.68 | | $ | 2.02 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.09 | c | | 0.08 | | | 0.10 | | | 0.10 | | | 0.09 | |

| Net realized and unrealized gains (losses) | | 0.35 | | | 0.24 | | | (0.08 | ) | | 0.22 | | | 0.64 | |

| Total from investment operations | | 0.44 | | | 0.32 | | | 0.02 | | | 0.32 | | | 0.73 | |

| Less distributions from net investment income | | (0.08 | ) | | (0.17 | ) | | (0.12 | ) | | (0.10 | ) | | (0.07 | ) |

| Net asset value, end of year | $ | 3.31 | | $ | 2.95 | | $ | 2.80 | | $ | 2.90 | | $ | 2.68 | |

| |

| Total return | | 15.23 | % | | 11.92 | % | | 1.04 | % | | 12.36 | % | | 36.40 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.88 | % | | 0.96 | % | | 0.99 | % | | 0.97 | % | | 0.95 | % |

| Expenses net of waiver and payments by affiliates | | 0.87 | %d | | 0.95 | % | | 0.95 | % | | 0.95 | % | | 0.95 | %d |

| Net investment income | | 3.01 | %c | | 3.09 | % | | 3.52 | % | | 3.73 | % | | 3.96 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 421,583 | | $ | 146,013 | | $ | 100,800 | | $ | 75,652 | | $ | 51,968 | |

| Portfolio turnover rate | | 13.33 | % | | 30.44 | % | | 19.02 | % | | 29.61 | % | | 30.16 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.02 per share received in the form of a special dividend paid in connection with certain Fund’s holdings. Excluding this

amount, the ratio of net investment income to average net assets would have been 2.49%.

dBenefit of expense reduction rounds to less than 0.01%.

Annual Report | The accompanying notes are an integral part of these financial statements. | 29

Templeton Global Investment Trust

Statement of Investments, March 31, 2014

| | | | |

| Templeton Global Balanced Fund | Industry | Shares | | Value |

| Common Stocks and Other Equity Interests 67.0% | | | |

| Austria 0.3% | | | | |

| UNIQA Insurance Group AG | Insurance | 277,980 | $ | 3,690,214 |

| aUNIQA Insurance Group AG, 144A | Insurance | 350,000 | | 4,646,286 |

| | | | | 8,336,500 |

| |

| Belgium 1.0% | | | | |

| UCB SA | Pharmaceuticals | 357,990 | | 28,667,030 |

| |

| Brazil 0.3% | | | | |

| Centrais Eletricas Brasileiras SA | Electric Utilities | 2,578,600 | | 7,502,043 |

| |

| Canada 0.4% | | | | |

| Talisman Energy Inc. | Oil, Gas & Consumable Fuels | 1,256,500 | | 12,526,352 |

| |

| China 2.5% | | | | |

| China Mobile Ltd. | Wireless Telecommunication | | | |

| | Services | 983,000 | | 8,998,060 |

| Digital China Holdings Ltd. | Electronic Equipment, | | | |

| | Instruments & Components | 8,948,000 | | 9,021,312 |

| Haier Electronics Group Co. Ltd. | Household Durables | 8,302,600 | | 22,478,660 |

| Shanghai Pharmaceuticals Holding Co. Ltd., H | Health Care | | | |

| | Providers & Services | 5,765,200 | | 13,037,099 |

| Travelsky Technology Ltd., H | IT Services | 18,506,000 | | 16,438,750 |

| | | | | 69,973,881 |

| |

| Denmark 1.0% | | | | |

| H. Lundbeck AS | Pharmaceuticals | 912,927 | | 28,136,459 |

| |

| France 7.3% | | | | |

| AXA SA | Insurance | 996,570 | | 25,903,045 |

| BNP Paribas SA | Banks | 441,920 | | 34,091,046 |

| Cie Generale des Etablissements Michelin, B | Auto Components | 174,784 | | 21,861,405 |

| Compagnie de Saint-Gobain | Building Products | 390,937 | | 23,619,059 |

| GDF Suez | Multi-Utilities | 260,970 | | 7,140,951 |

| Ipsen SA | Pharmaceuticals | 173,070 | | 7,086,908 |

| Sanofi | Pharmaceuticals | 234,950 | | 24,498,685 |

| SEB SA | Household Durables | 143,880 | | 12,417,621 |

| Technip SA | Energy Equipment & Services | 209,930 | | 21,667,086 |

| Total SA, B | Oil, Gas & Consumable Fuels | 454,830 | | 29,829,245 |

| | | | | 208,115,051 |

| |

| Germany 4.1% | | | | |

| Deutsche Boerse AG | Diversified Financial Services | 214,360 | | 17,062,094 |

| bDeutsche Lufthansa AG | Airlines | 768,570 | | 20,135,664 |

| HeidelbergCement AG | Construction Materials | 173,160 | | 14,842,053 |

| Metro AG | Food & Staples Retailing | 342,670 | | 13,986,874 |

| Muenchener Rueckversicherungs-Gesellschaft AG | Insurance | 80,320 | | 17,551,454 |

| SAP AG | Software | 132,070 | | 10,692,325 |

| Siemens AG | Industrial Conglomerates | 156,850 | | 21,113,746 |

| | | | | 115,384,210 |

30 | Annual Report

| | | | |

| Templeton Global Investment Trust | | |

| |

| Statement of Investments, March 31, 2014 (continued) | | | |

| |

| |

| Templeton Global Balanced Fund | Industry | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | |

| Hong Kong 1.6% | | | | |

| AIA Group Ltd. | Insurance | 3,921,600 | $ | 18,605,790 |

| Cheung Kong (Holdings) Ltd. | Real Estate | | | |

| | Management & Development | 406,000 | | 6,726,144 |

| Hutchison Whampoa Ltd. | Industrial Conglomerates | 1,078,000 | | 14,287,258 |

| Techtronic Industries Co. Ltd. | Household Durables | 1,741,000 | | 4,870,746 |

| | | | | 44,489,938 |

| |

| India 1.1% | | | | |

| ICICI Bank Ltd. | Banks | 480,702 | | 9,975,678 |

| LIC Housing Finance Ltd. | Thrifts & Mortgage Finance | 5,523,565 | | 21,692,981 |

| | | | | 31,668,659 |

| |

| Ireland 0.7% | | | | |

| CRH PLC | Construction Materials | 691,142 | | 19,230,800 |

| |

| Israel 1.2% | | | | |

| Teva Pharmaceutical Industries Ltd., ADR | Pharmaceuticals | 635,797 | | 33,595,513 |

| |

| Italy 1.6% | | | | |

| Eni SpA | Oil, Gas & Consumable Fuels | 1,004,000 | | 25,190,098 |

| UniCredit SpA | Banks | 2,345,176 | | 21,422,748 |

| | | | | 46,612,846 |

| |

| Japan 3.5% | | | | |

| CANON Inc. | Technology Hardware, | | | |

| | Storage & Peripherals | 536,300 | | 16,579,474 |

| ITOCHU Corp. | Trading Companies | | | |

| | & Distributors | 1,515,800 | | 17,710,277 |

| Nissan Motor Co. Ltd. | Automobiles | 3,196,300 | | 28,488,626 |

| Suntory Beverage & Food Ltd. | Beverages | 513,800 | | 17,695,786 |

| Toyota Motor Corp. | Automobiles | 329,700 | | 18,609,109 |

| | | | | 99,083,272 |

| |

| Netherlands 2.0% | | | | |

| Akzo Nobel NV | Chemicals | 251,124 | | 20,493,501 |

| Fugro NV, IDR | Energy Equipment & Services | 272,812 | | 16,777,422 |

| bING Groep NV, IDR | Diversified Financial Services | 1,491,130 | | 21,109,772 |

| | | | | 58,380,695 |

| |

| Portugal 1.3% | | | | |

| bCTT-Correios de Portugal SA | Air Freight & Logistics | 697,410 | | 7,658,306 |

| a,bCTT-Correios de Portugal SA, 144A | Air Freight & Logistics | 968,800 | | 10,638,457 |

| Galp Energia SGPS SA, B | Oil, Gas & Consumable Fuels | 1,060,750 | | 18,319,921 |

| | | | | 36,616,684 |

| |

| Russia 1.1% | | | | |

| Mining and Metallurgical Co. Norilsk | | | | |

| Nickel OJSC, ADR | Metals & Mining | 1,189,908 | | 19,782,220 |

| Mobile TeleSystems, ADR | Wireless Telecommunication | | | |

| | Services | 610,983 | | 10,686,093 |

| | | | | 30,468,313 |

| |

| | | | | Annual Report | 31 |

Templeton Global Investment Trust

Statement of Investments, March 31, 2014 (continued)

| | | | |

| Templeton Global Balanced Fund | Industry | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | |

| Singapore 1.4% | | | | |

| DBS Group Holdings Ltd. | Banks | 933,770 | $ | 12,003,865 |

| Jardine Cycle & Carriage Ltd. | Distributors | 378,000 | | 13,622,244 |

| Singapore Telecommunications Ltd. | Diversified | | | |

| | Telecommunication Services | 5,152,999 | | 14,952,853 |

| | | | | 40,578,962 |

| |

| South Korea 1.9% | | | | |

| KB Financial Group Inc. | Banks | 313,845 | | 10,978,239 |

| POSCO | Metals & Mining | 44,796 | | 12,451,513 |

| Samsung Electronics Co. Ltd. | Semiconductors & | | | |

| | Semiconductor Equipment | 23,297 | | 29,381,041 |

| | | | | 52,810,793 |

| |

| Spain 0.9% | | | | |

| Telefonica SA | Diversified | | | |

| | Telecommunication Services | 1,694,590 | | 26,815,250 |

| |

| Sweden 0.5% | | | | |

| Getinge AB, B | Health Care | | | |

| | Equipment & Supplies | 558,880 | | 15,656,377 |

| |

| Switzerland 3.3% | | | | |

| bABB Ltd. | Electrical Equipment | 814,710 | | 21,012,882 |

| bCredit Suisse Group AG | Capital Markets | 940,246 | | 30,409,087 |

| Novartis AG | Pharmaceuticals | 202,820 | | 17,207,579 |

| Roche Holding AG | Pharmaceuticals | 61,440 | | 18,418,100 |

| Vontobel Holding AG | Capital Markets | 204,817 | | 8,097,686 |

| | | | | 95,145,334 |

| |

| Taiwan 0.3% | | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | Semiconductors & | | | |

| | Semiconductor Equipment | 2,162,384 | | 8,414,498 |

| |

| Thailand 0.7% | | | | |

| Bangkok Bank PCL, fgn. | Banks | 3,384,600 | | 18,736,645 |

| |

| Turkmenistan 0.3% | | | | |

| Dragon Oil PLC | Oil, Gas & Consumable Fuels | 939,050 | | 8,841,371 |

| |

| United Kingdom 6.3% | | | | |

| Aviva PLC | Insurance | 3,403,920 | | 27,074,684 |

| bCEVA Holdings LLC | Air Freight & Logistics | 247 | | 308,388 |

| GlaxoSmithKline PLC | Pharmaceuticals | 715,913 | | 18,992,114 |

| HSBC Holdings PLC | Banks | 1,756,972 | | 17,792,953 |

| Kingfisher PLC | Specialty Retail | 3,378,502 | | 23,732,409 |

| Marks & Spencer Group PLC | Multiline Retail | 3,069,590 | | 23,110,479 |

| Royal Dutch Shell PLC, A | Oil, Gas & Consumable Fuels | 3,976 | | 145,249 |

| Royal Dutch Shell PLC, B | Oil, Gas & Consumable Fuels | 309,969 | | 12,097,463 |

| Serco Group PLC | Commercial Services | | | |

| | & Supplies | 1,178,080 | | 8,269,573 |

32 | Annual Report

| | | | |

| Templeton Global Investment Trust | | |

| |

| Statement of Investments, March 31, 2014 (continued) | | | |

| |

| |

| Templeton Global Balanced Fund | Industry | Shares | | Value |

| Common Stocks and Other Equity Interests (continued) | | | |

| United Kingdom (continued) | | | | |

| Standard Chartered PLC | Banks | 695,210 | $ | 14,534,102 |

| Tesco PLC | Food & Staples Retailing | 4,140,267 | | 20,393,275 |

| Vodafone Group PLC | Wireless Telecommunication | | | |

| | Services | 3,361,975 | | 12,346,229 |

| | | | | 178,796,918 |

| |

| United States 20.4% | | | | |

| Abercrombie & Fitch Co., A | Specialty Retail | 218,790 | | 8,423,415 |

| Accenture PLC, A | IT Services | 130,520 | | 10,405,054 |

| Allegheny Technologies Inc. | Metals & Mining | 116,849 | | 4,402,870 |

| Amgen Inc. | Biotechnology | 194,270 | | 23,961,262 |

| Applied Materials Inc. | Semiconductors & | | | |

| | Semiconductor Equipment | 764,530 | | 15,611,703 |

| Baker Hughes Inc. | Energy Equipment & Services | 398,590 | | 25,916,322 |

| Best Buy Co. Inc. | Specialty Retail | 772,370 | | 20,398,292 |

| Chesapeake Energy Corp. | Oil, Gas & Consumable Fuels | 263,620 | | 6,753,944 |

| Chevron Corp. | Oil, Gas & Consumable Fuels | 83,880 | | 9,974,171 |

| Cisco Systems Inc. | Communications Equipment | 836,800 | | 18,752,688 |

| Citigroup Inc. | Banks | 399,680 | | 19,024,768 |

| Comcast Corp., Special A | Media | 489,652 | | 23,875,432 |

| CVS Caremark Corp. | Food & Staples Retailing | 279,560 | | 20,927,862 |

| Foot Locker Inc. | Specialty Retail | 658,390 | | 30,931,162 |

| Halliburton Co. | Energy Equipment & Services | 479,295 | | 28,225,683 |

| Hewlett-Packard Co. | Technology Hardware, | | | |

| | Storage & Peripherals | 868,130 | | 28,092,687 |

| JPMorgan Chase & Co. | Banks | 426,526 | | 25,894,393 |

| LyondellBasell Industries NV, A | Chemicals | 158,280 | | 14,077,423 |

| Macy’s Inc. | Multiline Retail | 440,960 | | 26,144,518 |

| Medtronic Inc. | Health Care | | | |

| | Equipment & Supplies | 232,090 | | 14,282,819 |

| Microsoft Corp. | Software | 708,680 | | 29,048,793 |

| Morgan Stanley | Capital Markets | 662,130 | | 20,638,592 |

| bNavistar International Corp. | Machinery | 104,090 | | 3,525,528 |

| NewPage Holdings Inc. | Paper & Forest Products | 2,200 | | 198,000 |

| bNews Corp., A | Media | 1,165,360 | | 20,067,499 |

| Noble Corp. PLC | Energy Equipment & Services | 841,550 | | 27,552,347 |

| Oracle Corp. | Software | 352,618 | | 14,425,602 |

| Pfizer Inc. | Pharmaceuticals | 667,132 | | 21,428,280 |

| PG&E Corp. | Multi-Utilities | 347,180 | | 14,998,176 |

| Time Warner Cable Inc. | Media | 85,170 | | 11,683,621 |

| b,c,dTurtle Bay Resort | Hotels, Restaurants & Leisure | 1,587,888 | | 2,048,375 |

| United Parcel Service Inc., B | Air Freight & Logistics | 126,620 | | 12,330,256 |

| Verizon Communications Inc. | Diversified | | | |

| | Telecommunication Services | 162,103 | | 7,731,503 |

| Walgreen Co. | Food & Staples Retailing | 295,780 | | 19,530,353 |

| | | | | 581,283,393 |

| |

| Total Common Stocks and Other Equity | | | | |

| Interests (Cost $1,609,750,551) | | | | 1,905,867,787 |

| |

| | | | | Annual Report | 33 |

| | | | | |

| Templeton Global Investment Trust | | |

| |

| Statement of Investments, March 31, 2014 (continued) | | | |

| |

| |

| Templeton Global Balanced Fund | | Industry | Shares | | Value |

| eEquity-Linked Securities 2.6% | | | | | |

| Germany 0.3% | | | | | |

| aBarclays Bank PLC into Heidelbergcement AG, | | | | | |

| 4.00%, 144A | | Construction Materials | 118,305 | $ | 7,309,273 |

| |

| Netherlands 0.8% | | | | | |

| aBarclays Bank PLC into TNT Express NV, 4.00%, | | | | | |

| 144A | | Air Freight & Logistics | 1,724,175 | | 12,518,062 |

| aBarclays Bank PLC into TNT Express NV, 5.00%, | | | | | |

| 144A | | Air Freight & Logistics | 1,491,146 | | 11,154,055 |

| | | | | | 23,672,117 |

| |

| United Kingdom 0.4% | | | | | |

| aThe Goldman Sachs Group Inc. into Lloyds Banking | | | | | |

| Group PLC, 3.50%, 144A | | Banks | 17,497,600 | | 12,330,559 |

| |

| United States 1.1% | | | | | |

| aBank of America Corp. into Microsoft Corp., 4.00%, | | | | | |

| 144A | | Software | 300,349 | | 12,067,903 |

| aThe Goldman Sachs Group Inc. into Gilead Sciences | | | | | |

| Inc., 3.50%, 144A | | Biotechnology | 250,411 | | 17,818,245 |

| | | | | | 29,886,148 |

| |

| Total Equity-Linked Securities | | | | | |

| (Cost $63,241,974) | | | | | 73,198,097 |

| |

| Convertible Preferred Stocks 0.0%† | | | | | |

| United Kingdom 0.0%† | | | | | |

| bCEVA Holdings LLC, cvt. pfd., A-1 | | Air Freight & Logistics | 12 | | 20,040 |

| bCEVA Holdings LLC, cvt. pfd., A-2 | | Air Freight & Logistics | 534 | | 667,575 |

| |

| Total Convertible Preferred Stocks | | | | | |

| (Cost $802,629) | | | | | 687,615 |

| Preferred Stocks 0.8% | | | | | |

| Brazil 0.3% | | | | | |

| Centrais Eletricas Brasileiras SA, pfd., B | | Electric Utilities | 1,561,200 | | 7,487,539 |

| |

| Germany 0.5% | | | | | |

| Draegerwerk AG & Co. KGAA, pfd. | | Health Care Equipment & | | | |

| | | Supplies | 129,100 | | 15,859,245 |

| |

| United States 0.0%† | | | | | |

| GMAC Capital Trust I, 8.125%, pfd. | | Consumer Finance | 11,600 | | 316,680 |

| |

| Total Preferred Stocks | | | | | |

| (Cost $24,306,068) | | | | | 23,663,464 |

| |

| |

| | | | Principal Amount* | | |

| Corporate Bonds and Notes 2.8% | | | | | |

| Australia 0.0%† | | | | | |

| aFMG Resources (August 2006) Pty. Ltd., senior note, | | | | | |

| 144A, 6.875%, 2/01/18 | | Metals & Mining | 1,100,000 | | 1,161,875 |

| |

| 34 | Annual Report | | | | | |

| | | | | |

| Templeton Global Investment Trust | | | |

| |

| Statement of Investments, March 31, 2014 (continued) | | | | |

| |

| |

| Templeton Global Balanced Fund | Industry | Principal Amount* | | | Value |

| Corporate Bonds and Notes (continued) | | | | | |

| Bermuda 0.0%† | | | | | |

| aDigicel Group Ltd., senior note, 144A, 8.25%, | | | | | |

| 9/30/20 | Wireless Telecommunication | | | | |

| | Services | 600,000 | | $ | 642,141 |

| aDigicel Ltd., senior note, 144A, 6.00%, 4/15/21 | Wireless Telecommunication | | | | |

| | Services | 500,000 | | | 512,188 |

| | | | | | 1,154,329 |

| |

| Canada 0.0%† | | | | | |

| CHC Helicopter SA, senior secured note, first lien, | | | | | |

| 9.25%, 10/15/20 | Energy Equipment & Services | 990,000 | | | 1,079,100 |

| |

| Italy 0.1% | | | | | |

| aWind Acquisition Finance SA, senior secured note, | | | | | |