UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08226

Templeton Global Investment Trust

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500

Date of fiscal year end: _3/31__

Date of reporting period: 3/31/15__

Item 1. Reports to Stockholders.

Annual Report

and Shareholder Letter

March 31, 2015

Templeton BRIC Fund

A SERIES OF TEMPLETON GLOBAL INVESTMENT TRUST

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/14. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| |

| Contents | |

| |

| Shareholder Letter | 1 |

| Annual Report | |

| Templeton BRIC Fund | 3 |

| Performance Summary | 7 |

| Your Fund’s Expenses | 10 |

| Financial Highlights and | |

| Statement of Investments | 11 |

| Financial Statements | 16 |

| Notes to Financial Statements | 20 |

| Report of Independent Registered | |

| Public Accounting Firm | 27 |

| Tax Information | 28 |

| Board Members and Officers | 29 |

| Shareholder Information | 34 |

Annual Report

Templeton BRIC Fund

This annual report for Templeton BRIC Fund covers the fiscal year ended March 31, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in securities of BRIC companies — those companies that are organized under the laws of, have a principal office in, or whose principal trading market is in Brazil, Russia, India or China (including the People’s Republic of China, Hong Kong and Taiwan); or derive 50% or more of their total revenue or profit from either goods or services produced or sales made in, or have 50% or more of their assets in, BRIC countries.

Economic and Market Overview

The global economy expanded moderately during the 12 months under review amid a generally accommodative monetary policy environment. For the 12 months ended March 31, 2015, BRIC stocks, as measured by the MSCI BRIC Index, generated a +3.93% total return.1

China was the strongest BRIC performer, as the MSCI China Index generated a +24.34% total return for the 12-month period.1 China’s economy appeared to stabilize in 2014’s second half as fiscal and monetary stimulus measures began to gain traction. First-quarter 2015’s gross domestic product (GDP) grew 7.0% year-over-year, less robust than 7.4% in 2014’s first quarter, amid solid consumption but weaker fixed-asset investment and industrial production growth.2 The services sector accounted for more than half of GDP for the first time, as the government’s market-friendly policies supported new economic drivers that could help make economic expansion more sustainable. In addition to cutting its benchmark interest rate, the People’s Bank of China (PBOC) provided short-term liquidity, extended its medium-term

lending facility and lowered the reserve requirement ratio for commercial banks. With inflationary pressures trending downward, policymakers may have the flexibility to implement additional measures to support the economy.

Indian stocks, as measured by the MSCI India Index, generated a +20.70% total return for the 12-month period.1 The new government’s pro-growth reforms, an improving economy, and the Reserve Bank of India’s interest rate cuts supported investor sentiment. India’s GDP grew 7.5% year-over-year in the December quarter, compared to the revised 8.2% growth rate in the September quarter resulting from a new methodology for calculating national accounts data.3 Key economic drivers included the manufacturing and services sectors. The Indian rupee weakened after strengthening early in the period as a result of robust foreign direct investment. The new government’s first full budget indicated efforts to keep the fiscal deficit low while prioritizing economic growth by encouraging domestic and foreign investments.

1. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

2. Source: The website of the National Bureau of Statistics of the People’s Republic of China (www.stats.gov.cn).

3. Source: India Central Statistical Organization.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 14.

franklintempleton.com

Annual Report

| 3

TEMPLETON BRIC FUND

Russia performed poorly, as measured by the MSCI Russia Index’s -24.94% total return for the 12 months under review.1 International sanctions and the Ukraine crisis led investors to withdraw from Russia, which severely pressured the equity market and the ruble. The Central Bank of Russia’s (CBR’s) efforts to defend the currency through much higher interest rates had little effect. Further hurting investor sentiment were independent credit rating agencies Standard & Poor’s (S&P’s) and Moody’s Investors Service’s downgrades of Russia’s sovereign credit rating to below investment grade. They cited deteriorating asset quality in the country’s financial system and the negative effects on the economy from the Ukraine crisis, weak oil prices and ruble depreciation. Russia’s GDP growth rate slowed from 1.3% in 2013 to 0.6% in 2014, resulting largely from lower oil prices and reduced investments.4 The CBR raised its key interest rate five times during the 12-month period, including a 6.5% increase in December to 17.0%, in an effort to curb inflation and the ruble’s devaluation. However, the CBR began easing monetary policy in 2015’s first quarter and lowered the key interest rate twice, to 14.0%, as it sought to stimulate the economy. Russia and Ukraine signed a new ceasefire agreement in February, but uncertainties still remained.

Brazil underperformed its BRIC peers, as measured by the MSCI Brazil Index’s -28.36% total return for the 12 months under review, largely due to investor concerns about currency depreciation, a weak economy, lower commodity prices and a corruption scandal affecting the state oil company.1 Brazil exited recession in the second half of 2014, as government spending helped GDP grow 0.2% quarter-over-quarter in the third quarter and consumer spending supported a 0.3% growth rate in the fourth quarter.5 The Central Bank of Brazil raised its benchmark interest rate a total of 2% during the period, to 12.75%, to curb inflation and currency depreciation. President Dilma Rousseff was reelected in a second election round. In January, the government announced measures, including fuel and import tax increases and the end of automobile tax breaks, to support the government’s fiscal position.

Investment Strategy

Our investment strategy employs a fundamental research, value-oriented, long-term approach. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term (typically five years) earnings,

asset value and cash flow potential. We also consider a company’s profit and loss outlook, balance sheet strength, cash flow trends and asset value in relation to the current price. The analysis considers the company’s corporate governance behavior as well as its position in its sector, the economic framework and political environment.

Performance Overview

The Fund’s Class A shares had a -3.89% cumulative total return for the 12 months ended March 31, 2015. In comparison, the MSCI BRIC Index generated a +3.93% total return for the same period.1 Please note index performance information is provided for reference and we do not attempt to track any index but rather undertake investments on the basis of fundamental research. In addition, the Fund’s return reflects the effect of fees and expenses for professional management, while an index does not have such costs. You can find the Fund’s long-term performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Manager’s Discussion

During the 12 months under review, key contributors to the Fund’s absolute performance included Tencent Holdings, Beijing Capital Land and China Mobile.

Tencent is one of the world’s largest and most widely used Internet service portals. Founded in 1998 to provide instant messenger services, the company grew into a provider of mass media, entertainment, and Internet and mobile phone value-added services in China and internationally. Tencent contributed significantly to Fund performance as it benefited from the general strength of Chinese Internet stocks resulting from higher demand for mobile services. Additionally, many investors recognized the strong growth potential of the company’s recent strategic investments. Substantial investment flows from mainland China through the Shanghai-Hong Kong Stock Connect program also supported share price performance.

4. Source: Federal State Statistics Service, Russia.

5. Source: Brazilian Institute of Geography and Statistics (IBGE).

4 | Annual Report

franklintempleton.com

TEMPLETON BRIC FUND

Beijing Capital Land is a real estate company developing high-end commercial and middle- to high-end residential properties in China’s capital and other regions. Most of the company’s share price appreciation occurred in 2015’s first quarter, as the PBOC’s substantial monetary easing measures and housing market stimulus programs bolstered investor sentiment. Further supporting share price performance were the company’s announcement of strong sales growth and solid gains in core profitability for 2014’s fourth quarter, China’s ongoing urbanization and middle-class consumers’ robust housing demand.

China Mobile is China’s largest mobile telecommunications company. Its stock performed well as many investors acknowledged the company’s rapid progress in launching its 4G service and anticipated its potential cost savings from merging its network infrastructure with those of its two main rivals, as well as continued strong demand for smartphones and their accompanying applications. Expectations that China Mobile would benefit from the government’s effort to foster a more market-oriented management style among state-owned enterprises also generated optimism in the company.

| | |

| Top 10 Holdings | | |

| 3/31/15 | | |

| |

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Tencent Holdings Ltd. | 6.7 | % |

| Internet Software & Services, China | | |

| ICBC (Industrial and Commercial Bank of China) Ltd., H 5.6% | |

| Banks, China | | |

| Beijing Capital Land Ltd., H | 5.0 | % |

| Real Estate Management & Development, China | | |

| China Construction Bank Corp., H | 4.8 | % |

| Banks, China | | |

| Banco Bradesco SA, ADR, pfd. | 4.4 | % |

| Banks, Brazil | | |

| Sinopec (China Petroleum and Chemical Corp.), H | 4.3 | % |

| Oil, Gas & Consumable Fuels, China | | |

| Luk Fook Holdings (International) Ltd. | 4.0 | % |

| Specialty Retail, Hong Kong | | |

| Itausa - Investimentos Itau SA, pfd. | 3.8 | % |

| Banks, Brazil | | |

| China Mobile Ltd. | 3.8 | % |

| Wireless Telecommunication Services, China | | |

| TravelSky Technology Ltd., H | 3.4 | % |

| IT Services, China | | |

In contrast, three of the largest detractors from the Fund’s absolute performance included Petrobras (Petroleo Brasileiro), Vale and Gazprom.

Investor sentiment in Brazil’s stock market was negatively affected by sluggish economic growth, interest rate increases, commodity price declines, currency devaluation and a corruption scandal affecting the state oil company, Petrobras. President Dilma Rousseff’s reelection also diminished investors’ earlier hopes for a more market-friendly political environment.

Petrobras, a new holding this period, is Brazil’s main oil and gas producer, refiner and distributor. The company’s close links with government and political figures were scrutinized amid accusations of bribery and corrupt practices. Long delays in the release of corporate results, as the company sought to quantify the impact of suspicious transactions, pressured investor sentiment. Sharply weaker oil and gas prices also led investors to worry about the group’s heavy debt burden.

Vale is a Brazil-based global mining company that owns vast reserves of iron ore and nickel, as well as transport and logistics assets. A decline in iron ore prices resulting from rising supplies and weak demand, as well as high-cost producers’ slower-than-anticipated closures of excess capacity, hurt investor sentiment.

Russia was one of the weakest performing emerging markets for the 12 months ended March 31, 2015, as commodity price declines and international sanctions in response to the crisis in Ukraine limited funding sources for Russia’s already slowing economy. Further hurting investor sentiment were S&P’s and Moody’s downgrades of Russia’s sovereign credit rating to below investment grade, citing deteriorating asset quality in the country’s financial system.

Gazprom is Russia’s main natural gas producer and distributor. The combination of weak oil prices and international sanctions in response to Russia’s activities in Ukraine, which in turn weakened the ruble and the overall economy, led the company’s share price to decline during the period.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative

| | | |

| franklintempleton.com | Annual Report | | | 5 |

TEMPLETON BRIC FUND

effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the 12 months ended March 31, 2015, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities with non-U.S. currency exposure.

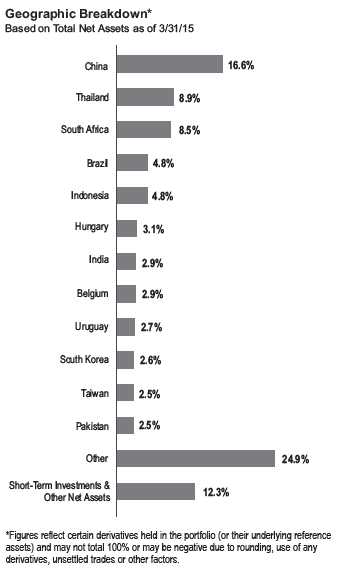

During the 12-month period, our continued search for what we considered to be undervalued companies with attractive growth prospects led us to undertake selective purchases across the BRIC countries. As a result, we increased the Fund’s holdings largely in the financials and energy sectors.6 Key purchases included new positions in major Chinese commercial banks China Construction Bank, ICBC (Industrial and Commercial Bank of China) and Bank of China; oil and gas company Cairn India; and Mail.ru Group, a leading Russian Internet communications and entertainment company.

Conversely, we conducted some sales because of share redemptions and as we sought to strategically reposition the Fund’s portfolio. As a result, we closed the Fund’s positions in the industrials sector and reduced holdings largely in the information technology (IT), telecommunication services, consumer discretionary and consumer staples sectors.7 Key sales included trimming investments in Infosys, one of India’s major IT consulting companies, and the aforementioned Tencent and China Mobile.

Thank you for your continued participation in Templeton BRIC Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6. The financials sector comprises banks, diversified financial services, and real estate management and development in the SOI. The energy sector comprises oil, gas and

consumable fuels in the SOI.

7. The IT sector comprises Internet software and services and IT services in the SOI. The telecommunication services sector comprises wireless telecommunication

services in the SOI. The consumer discretionary sector comprises automobiles, Internet and catalog retail, media and specialty retail in the SOI. The consumer staples

sector comprises beverages, food and staples retailing, and personal products in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

6 | Annual Report franklintempleton.com

TEMPLETON BRIC FUND

Performance Summary as of March 31, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 3/31/15 | | 3/31/14 | | Change |

| A (TABRX) | $ | 9.78 | $ | 10.32 | -$ | 0.54 |

| C (TPBRX) | $ | 9.64 | $ | 10.16 | -$ | 0.52 |

| Advisor (TZBRX) | $ | 9.74 | $ | 10.28 | -$ | 0.54 |

| |

| Distributions (4/1/14–3/31/15) | | | | | | |

| Share Class | | Dividend Income | | | | |

| A | $ | 0.1403 | | | | |

| C | $ | 0.0568 | | | | |

| Advisor | $ | 0.1773 | | | | |

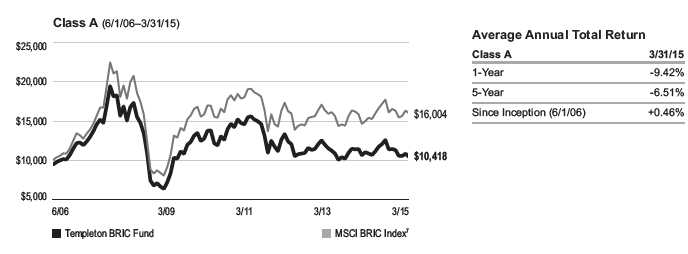

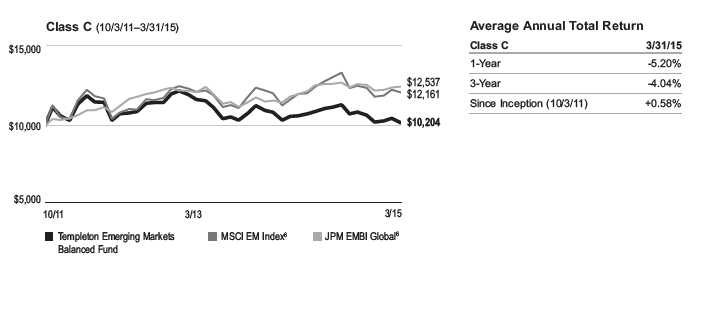

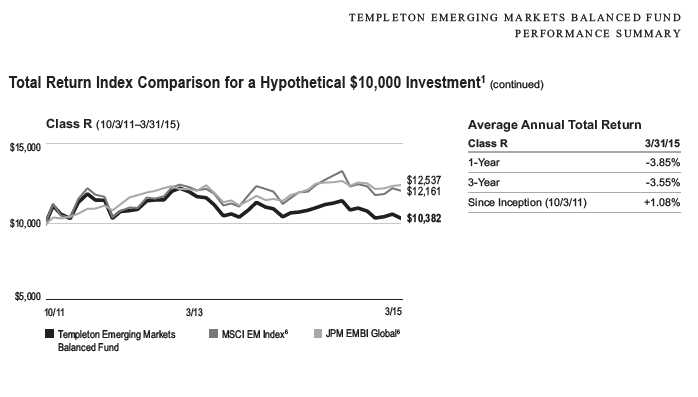

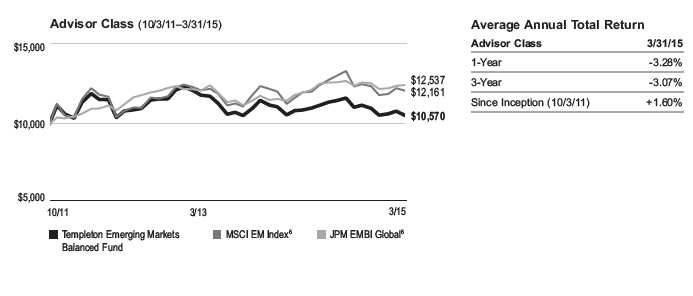

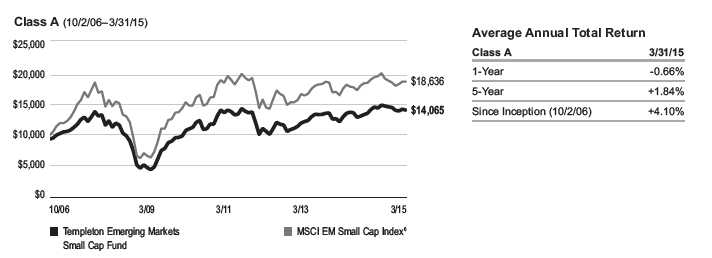

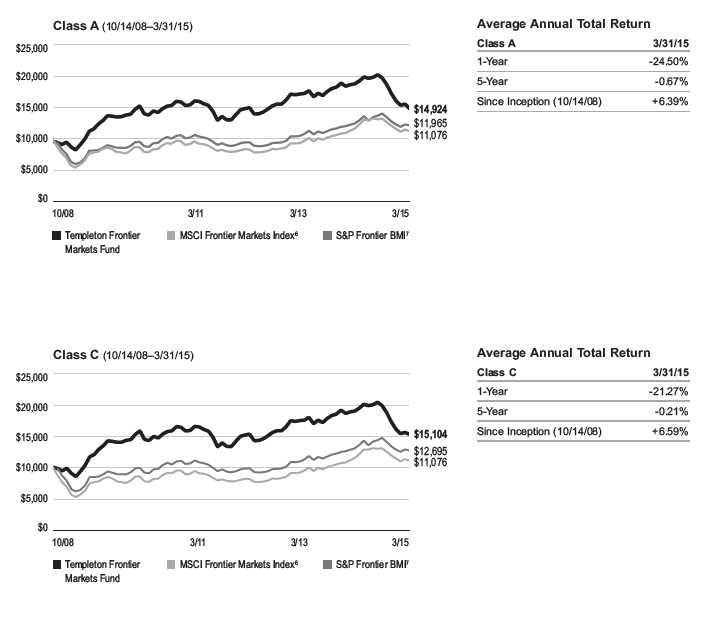

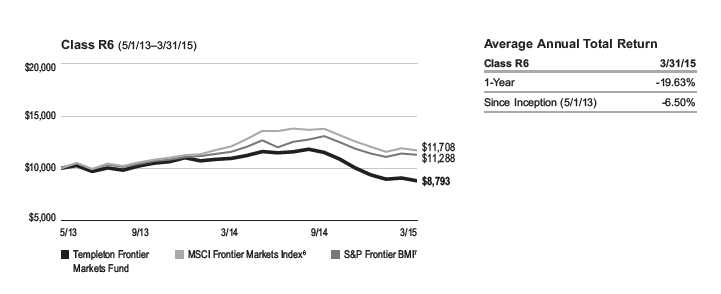

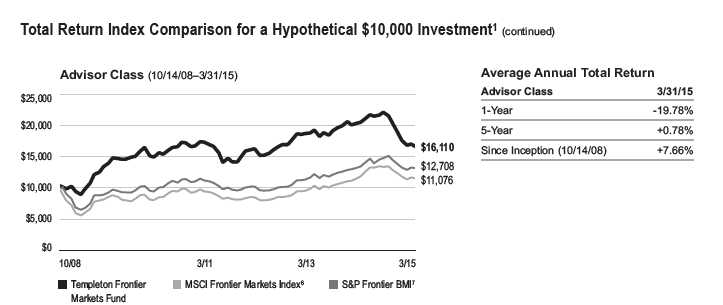

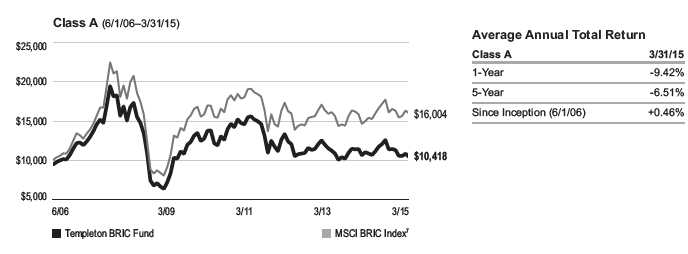

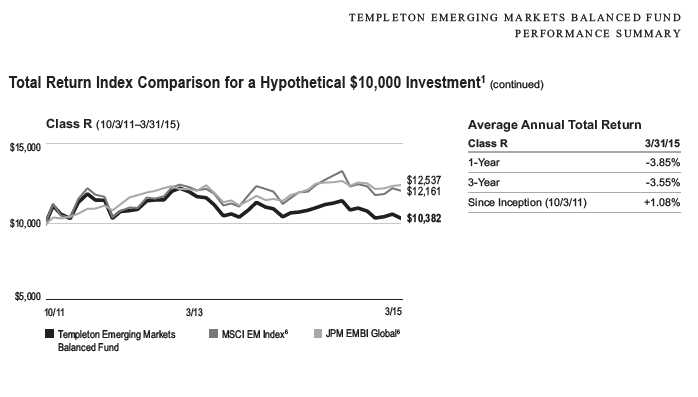

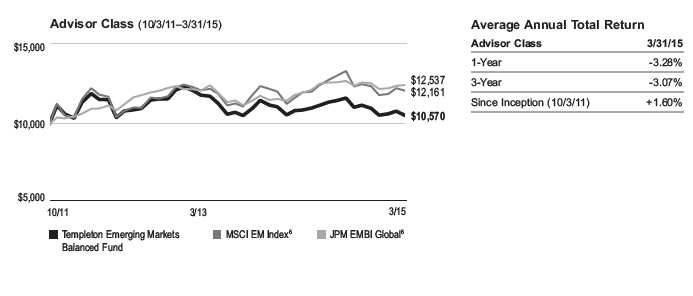

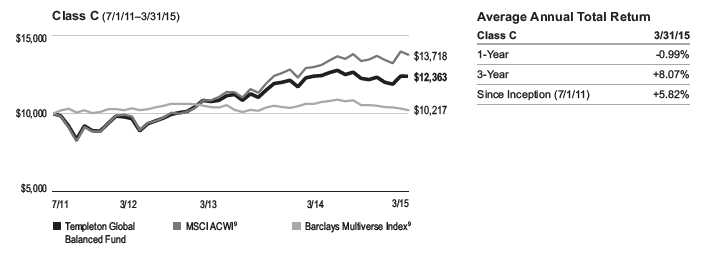

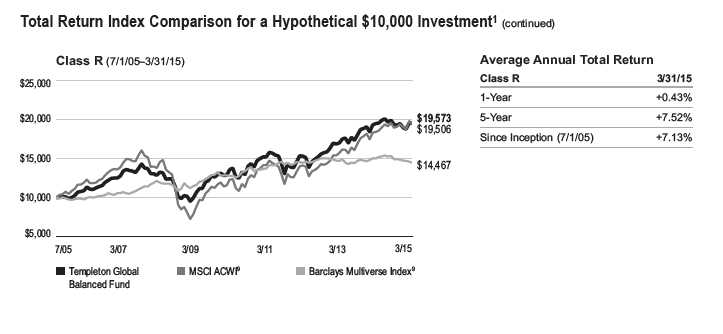

Performance1

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Advisor Class: no sales charges.

| | | | | | | | | | |

| | Cumulative | | Average Annual | | | Value of $10,000 | Total Annual Operating Expenses5 | |

| Share Class | Total Return2 | | Total Return3 | | | Investment4 | (with waiver) | | (without waiver) | |

| A | | | | | | | 2.00 | % | 2.10 | % |

| 1-Year | -3.89 | % | -9.42 | % | $ | 9,058 | | | | |

| 5-Year | -24.21 | % | -6.51 | % | $ | 7,143 | | | | |

| Since Inception (6/1/06) | +10.53 | % | +0.46 | % | $ | 10,418 | | | | |

| C | | | | | | | 2.72 | % | 2.82 | % |

| 1-Year | -4.57 | % | -5.52 | % | $ | 9,448 | | | | |

| 5-Year | -26.87 | % | -6.07 | % | $ | 7,313 | | | | |

| Since Inception (6/1/06) | +4.01 | % | +0.45 | % | $ | 10,401 | | | | |

| Advisor6 | | | | | | | 1.72 | % | 1.82 | % |

| 1-Year | -3.55 | % | -3.55 | % | $ | 9,645 | | | | |

| 5-Year | -23.14 | % | -5.13 | % | $ | 7,686 | | | | |

| Since Inception (6/1/06) | +12.72 | % | +1.37 | % | $ | 11,272 | | | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com

Annual Report

| 7

|

| TEMPLETON BRIC FUND |

| PERFORMANCE SUMMARY |

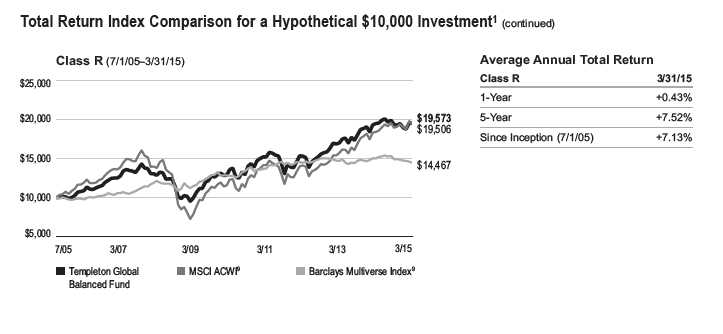

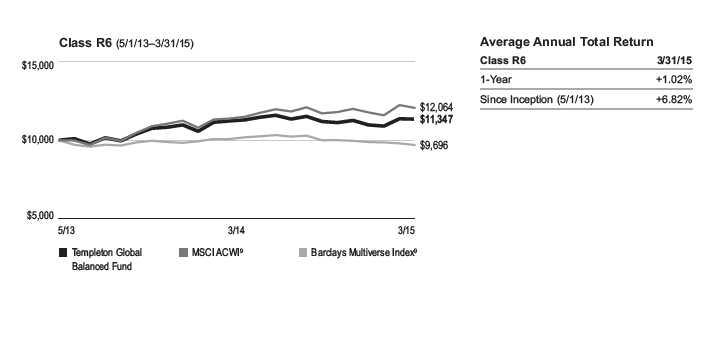

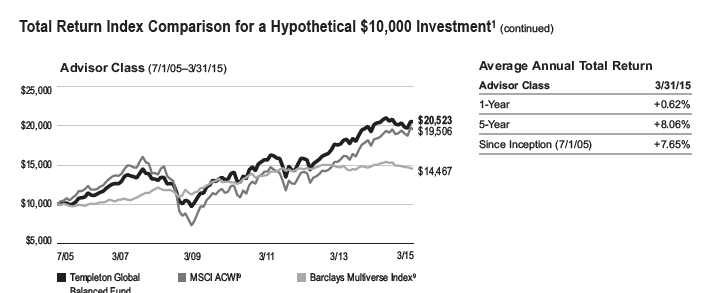

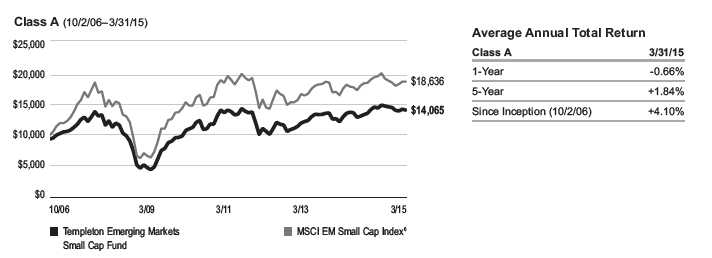

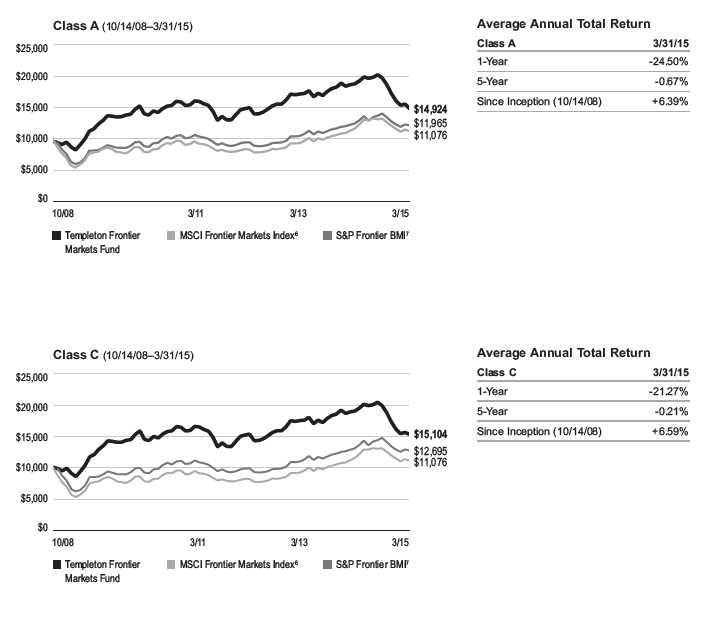

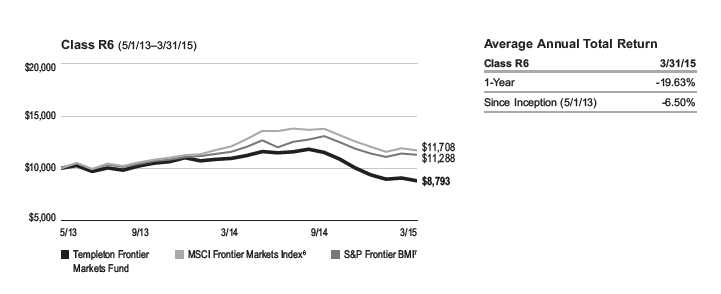

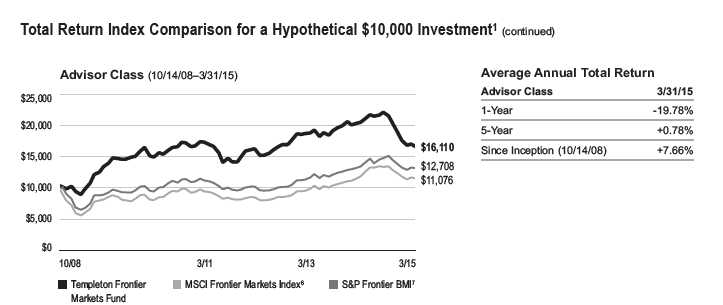

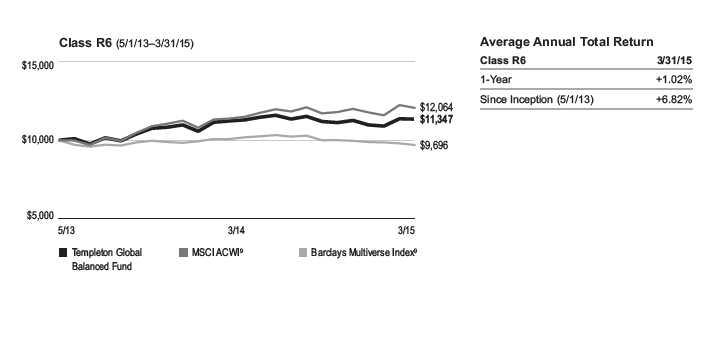

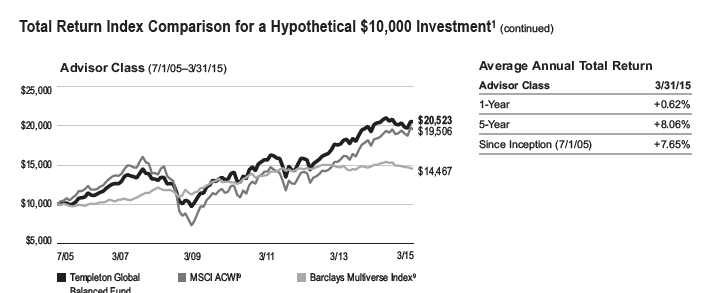

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

8 | Annual Report

franklintempleton.com

TEMPLETON BRIC FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic

instability and political developments. Investments in BRIC companies, which are located in, or operate in, emerging market countries, involve heightened risks

related to the same factors, in addition to those associated with these companies’ smaller size, lesser liquidity and the lack of established legal, political,

business and social frameworks to support securities markets in the countries in which they operate. The Fund is a nondiversified fund. It may invest a greater

portion of its assets in the securities of one issuer than a diversified fund, which may result in greater fluctuation in the value of the Fund’s shares. All invest-

ments in emerging markets should be considered long-term investments that could experience significant price volatility in any given year. The Fund is designed

for the aggressive portion of a well-diversified portfolio. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will

produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has an expense reduction contractually guaranteed through at least 7/31/15 and a fee waiver associated with its investments in a Franklin Templeton money

fund, contractually guaranteed through at least its current fiscal year-end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable;

without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

6. Effective 8/1/08, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the

following methods of calculation: (a) For periods prior to 8/1/08, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s

maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 8/1/08, actual Advisor Class performance is used reflecting all

charges and fees applicable to that class. Since 8/1/08 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were -27.49%

and -4.71%.

7. Source: Morningstar. The MSCI BRIC Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in Brazil,

Russia, India and China.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com Annual Report | 9

TEMPLETON BRIC FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| | | | | | |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 10/1/14 | | Value 3/31/15 | | Period* 10/1/14–3/31/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 917.50 | $ | 9.51 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.01 | $ | 10.00 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 914.70 | $ | 12.98 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,011.37 | $ | 13.64 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 918.90 | $ | 8.23 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.36 | $ | 8.65 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.99%; C: 2.72%; and Advisor: 1.72%), multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period.

10 | Annual Report

franklintempleton.com

| | | | | | | | | | | | | | | |

| | | | | | TEMPLETON GLOBAL INVESTMENT TRUST | |

| |

| |

| |

| Financial Highlights | | | | | | | | | | | | | | | |

| Templeton BRIC Fund | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Class A | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 10.32 | | $ | 11.28 | | $ | 12.21 | | $ | 15.44 | | $ | 13.77 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.13 | | | 0.28 | | | 0.12 | | | 0.14 | | | 0.02 | |

| Net realized and unrealized gains (losses) | | (0.53 | ) | | (0.90 | ) | | (0.99 | ) | | (3.22 | ) | | 1.68 | |

| Total from investment operations | | (0.40 | ) | | (0.62 | ) | | (0.87 | ) | | (3.08 | ) | | 1.70 | |

| Less distributions from net investment income | | (0.14 | ) | | (0.34 | ) | | (0.06 | ) | | (0.15 | ) | | (0.03 | ) |

| Net asset value, end of year | $ | 9.78 | | $ | 10.32 | | $ | 11.28 | | $ | 12.21 | | $ | 15.44 | |

| |

| Total returnc | | (3.89 | )% | | (5.69 | )% | | (7.15 | )% | | (19.93 | )% | | 12.47 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 2.07 | % | | 2.10 | % | | 2.06 | % | | 2.02 | % | | 2.11 | % |

| Expenses net of waiver and payments by affiliates | | 2.00 | % | | 2.00 | % | | 2.06 | % | | 2.02 | % | | 2.11 | % |

| Net investment income | | 1.20 | % | | 2.61 | % | | 1.02 | % | | 1.05 | % | | 0.17 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 136,298 | | $ | 182,772 | | $ | 270,172 | | $ | 398,712 | | $ | 595,870 | |

| Portfolio turnover rate | | 30.87 | % | | 19.88 | % | | 29.92 | % | | 18.48 | % | | 18.74 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases

of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 11

TEMPLETON GLOBAL INVESTMENT TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | |

| Templeton BRIC Fund (continued) | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Class C | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 10.16 | | $ | 11.10 | | $ | 12.04 | | $ | 15.20 | | $ | 13.62 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment income (loss)b | | 0.06 | | | 0.20 | | | 0.03 | | | 0.05 | | | (0.07 | ) |

| Net realized and unrealized gains (losses) | | (0.52 | ) | | (0.89 | ) | | (0.97 | ) | | (3.16 | ) | | 1.65 | |

| Total from investment operations | | (0.46 | ) | | (0.69 | ) | | (0.94 | ) | | (3.11 | ) | | 1.58 | |

| Less distributions from net investment income | | (0.06 | ) | | (0.25 | ) | | — | | | (0.05 | ) | | — | |

| Net asset value, end of year | $ | 9.64 | | $ | 10.16 | | $ | 11.10 | | $ | 12.04 | | $ | 15.20 | |

| |

| Total returnc | | (4.57 | )% | | (6.37 | )% | | (7.81 | )% | | (20.46 | )% | | 11.60 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 2.79 | % | | 2.82 | % | | 2.77 | % | | 2.72 | % | | 2.81 | % |

| Expenses net of waiver and payments by affiliates | | 2.72 | % | | 2.72 | % | | 2.77 | % | | 2.72 | % | | 2.81 | % |

| Net investment income (loss) | | 0.48 | % | | 1.89 | % | | 0.31 | % | | 0.35 | % | | (0.53 | )% |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 41,594 | | $ | 58,216 | | $ | 89,887 | | $ | 127,570 | | $ | 195,492 | |

| Portfolio turnover rate | | 30.87 | % | | 19.88 | % | | 29.92 | % | | 18.48 | % | | 18.74 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases

of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

12 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| | | | | | | | | | | | | | | |

| | | | | | TEMPLETON GLOBAL INVESTMENT TRUST | |

| | | | | | | | | FINANCIAL HIGHLIGHTS | |

| |

| |

| |

| Templeton BRIC Fund (continued) | | | | | | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Advisor Class | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 10.28 | | $ | 11.25 | | $ | 12.18 | | $ | 15.42 | | $ | 13.77 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.16 | | | 0.30 | | | 0.15 | | | 0.15 | | | 0.03 | |

| Net realized and unrealized gains (losses) | | (0.52 | ) | | (0.90 | ) | | (0.98 | ) | | (3.19 | ) | | 1.72 | |

| Total from investment operations | | (0.36 | ) | | (0.60 | ) | | (0.83 | ) | | (3.04 | ) | | 1.75 | |

| Less distributions from net investment income | | (0.18 | ) | | (0.37 | ) | | (0.10 | ) | | (0.20 | ) | | (0.10 | ) |

| Net asset value, end of year | $ | 9.74 | | $ | 10.28 | | $ | 11.25 | | $ | 12.18 | | $ | 15.42 | |

| |

| Total return | | (3.55 | )% | | (5.48 | )% | | (6.86 | )% | | (19.66 | )% | | 12.67 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.79 | % | | 1.82 | % | | 1.77 | % | | 1.72 | % | | 1.81 | % |

| Expenses net of waiver and payments by affiliates | | 1.72 | % | | 1.72 | % | | 1.77 | % | | 1.72 | % | | 1.81 | % |

| Net investment income | | 1.48 | % | | 2.89 | % | | 1.31 | % | | 1.35 | % | | 0.47 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 6,838 | | $ | 9,426 | | $ | 13,549 | | $ | 23,410 | | $ | 28,617 | |

| Portfolio turnover rate | | 30.87 | % | | 19.88 | % | | 29.92 | % | | 18.48 | % | | 18.74 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 13

| | | | |

| TEMPLETON GLOBAL INVESTMENT TRUST | | | | |

| |

| |

| |

| |

| Statement of Investments, March 31, 2015 | | | | |

| |

| Templeton BRIC Fund | | | | |

| | Industry | Shares | | Value |

| Common Stocks 81.9% | | | | |

| Brazil 3.5% | | | | |

| AES Tiete SA | Independent Power & Renewable | | | |

| | Electricity Producers | 340,600 | $ | 1,562,728 |

| Ambev SA | Beverages | 463,530 | | 2,678,399 |

| BM&F BOVESPA SA | Diversified Financial Services | 106,700 | | 372,932 |

| Cia Hering | Specialty Retail | 136,200 | | 699,555 |

| aHypermarcas SA | Personal Products | 181,565 | | 1,120,210 |

| | | | | 6,433,824 |

| China 47.8% | | | | |

| a,bBAIC Motor Corp. Ltd., 144A | Automobiles | 726,000 | | 906,488 |

| aBaidu Inc., ADR | Internet Software & Services | 14,200 | | 2,959,280 |

| Bank of China Ltd., H | Banks | 7,089,000 | | 4,087,355 |

| Beijing Capital Land Ltd., H | Real Estate Management & Development | 14,832,400 | | 9,164,247 |

| China Construction Bank Corp., H | Banks | 10,596,000 | | 8,788,257 |

| China Mobile Ltd. | Wireless Telecommunication Services | 543,359 | | 7,078,774 |

| China Petroleum and Chemical Corp., H | Oil, Gas & Consumable Fuels | 9,882,800 | | 7,865,295 |

| China Shenhua Energy Co. Ltd., H | Oil, Gas & Consumable Fuels | 1,529,500 | | 3,902,344 |

| CPMC Holdings Ltd. | Containers & Packaging | 2,570,200 | | 1,339,362 |

| Dongfeng Motor Group Co. Ltd., H | Automobiles | 1,288,000 | | 2,063,418 |

| Industrial and Commercial Bank of China Ltd., H | Banks | 14,138,000 | | 10,412,953 |

| Inner Mongolia Yitai Coal Co. Ltd., B | Oil, Gas & Consumable Fuels | 1,324,272 | | 1,950,653 |

| aJD.com Inc., ADR | Internet & Catalog Retail | 86,399 | | 2,538,403 |

| aLianhua Supermarket Holdings Co. Ltd., H | Food & Staples Retailing | 2,894,400 | | 1,489,640 |

| Mindray Medical International Ltd., ADR | Health Care Equipment & Supplies | 49,400 | | 1,351,090 |

| PetroChina Co. Ltd., H | Oil, Gas & Consumable Fuels | 3,210,000 | | 3,548,425 |

| Tencent Holdings Ltd. | Internet Software & Services | 656,095 | | 12,465,775 |

| Travelsky Technology Ltd., H | IT Services | 5,478,700 | | 6,317,785 |

| | | | | 88,229,544 |

| Hong Kong 5.0% | | | | |

| Giordano International Ltd. | Specialty Retail | 3,706,325 | | 1,792,770 |

| Luk Fook Holdings (International) Ltd. | Specialty Retail | 2,644,184 | | 7,367,078 |

| | | | | 9,159,848 |

| India 19.3% | | | | |

| Bajaj Holdings and Investment Ltd. | Diversified Financial Services | 231,042 | | 4,808,869 |

| Biocon Ltd. | Biotechnology | 264,126 | | 1,990,329 |

| Cairn India Ltd. | Oil, Gas & Consumable Fuels | 808,407 | | 2,775,892 |

| Dr. Reddy’s Laboratories Ltd. | Pharmaceuticals | 54,930 | | 3,077,108 |

| Grasim Industries Ltd. | Construction Materials | 45,935 | | 2,671,760 |

| ICICI Bank Ltd. | Banks | 332,660 | | 1,685,245 |

| Infosys Ltd. | IT Services | 116,911 | | 4,164,364 |

| Maharashtra Seamless Ltd. | Metals & Mining | 725,197 | | 2,295,705 |

| Mindtree Ltd. | IT Services | 153,236 | | 3,207,636 |

| Oil & Natural Gas Corp. Ltd. | Oil, Gas & Consumable Fuels | 325,900 | | 1,603,118 |

| Reliance Industries Ltd. | Oil, Gas & Consumable Fuels | 341,784 | | 4,533,097 |

| Tata Consultancy Services Ltd. | IT Services | 62,040 | | 2,544,178 |

| Tata Motors Ltd., A | Automobiles | 70,279 | | 374,143 |

| | | | | 35,731,444 |

14 | Annual Report

franklintempleton.com

TEMPLETON GLOBAL INVESTMENT TRUST

STATEMENT OF INVESTMENTS

| | | | | |

| Templeton BRIC Fund (continued) | | | | | |

| | Industry | Shares | | Value | |

| Common Stocks (continued) | | | | | |

| Russia 6.3% | | | | | |

| CTC Media Inc. | Media | 113,190 | $ | 448,232 | |

| Gazprom OAO, ADR | Oil, Gas & Consumable Fuels | 582,446 | | 2,768,948 | |

| cLUKOIL Holdings, ADR | Oil, Gas & Consumable Fuels | 83,250 | | 3,856,140 | |

| cLUKOIL Holdings, ADR (London Stock Exchange) | Oil, Gas & Consumable Fuels | 36,300 | | 1,681,416 | |

| a,dMail.ru Group Ltd., GDR, Reg S | Internet Software & Services | 74,435 | | 1,479,024 | |

| Mining and Metallurgical Co. Norilsk Nickel | | | | | |

| OJSC, ADR | Metals & Mining | 78,800 | | 1,399,882 | |

| | | | | 11,633,642 | |

| Total Common Stocks | | | | | |

| (Cost $130,950,133) | | | | 151,188,302 | |

| Preferred Stocks 15.4% | | | | | |

| Brazil 15.4% | | | | | |

| Banco Bradesco SA, ADR, pfd. | Banks | 870,399 | | 8,077,303 | |

| Bradespar SA, pfd. | Metals & Mining | 274,700 | | 911,078 | |

| Itau Unibanco Holding SA, ADR, pfd. | Banks | 532,693 | | 5,891,584 | |

| Itausa - Investimentos Itau SA, pfd. | Banks | 2,271,619 | | 7,100,143 | |

| Petroleo Brasileiro SA, ADR, pfd. | Oil, Gas & Consumable Fuels | 539,100 | | 3,283,119 | |

| Vale SA, ADR, pfd., A | Metals & Mining | 671,895 | | 3,258,691 | |

| Total Preferred Stocks | | | | | |

| (Cost $42,492,833) | | | | 28,521,918 | |

| Total Investments before Short | | | | | |

| Term Investments | | | | | |

| (Cost $173,442,966) | | | | 179,710,220 | |

| Short Term Investments | | | | | |

| (Cost $5,897,606) 3.2% | | | | | |

| Money Market Funds 3.2% | | | | | |

| United States 3.2% | | | | | |

| a,eInstitutional Fiduciary Trust Money | | | | | |

| Market Portfolio | | 5,897,606 | | 5,897,606 | |

| Total Investments | | | | | |

| (Cost $179,340,572) 100.5% | | | | 185,607,826 | |

| Other Assets, less Liabilities (0.5)% | | | | (878,036 | ) |

| Net Assets 100.0% | | | $ | 184,729,790 | |

See Abbreviations on page 26.

aNon-income producing.

bSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers

or in a public offering registered under the Securities Act of 1933. This security has been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At March

31, 2015, the value of this security was $906,488, representing 0.49% of net assets.

cAt March 31, 2015, pursuant to the Fund’s policies and the requirements of applicable securities law, the Fund may be restricted from trading these securities for a limited or

extended period of time.

dSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States.

Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption

from registration. This security has been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At March 31, 2015, the value of this security was

$1,479,024, representing 0.80% of net assets.

eSee Note 3(f) regarding investments in Institutional Fiduciary Trust Money Market Portfolio.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Annual Report | 15

TEMPLETON GLOBAL INVESTMENT TRUST

Financial Statements

Statement of Assets and Liabilities

March 31, 2015

| | | |

| Templeton BRIC Fund | | | |

| |

| Assets: | | | |

| Investments in securities: | | | |

| Cost - Unaffiliated issuers | $ | 173,442,966 | |

| Cost - Sweep Money Fund (Note 3f) | | 5,897,606 | |

| Total cost of investments | $ | 179,340,572 | |

| Value - Unaffiliated issuers | $ | 179,710,220 | |

| Value - Sweep Money Fund (Note 3f) | | 5,897,606 | |

| Total value of investments | | 185,607,826 | |

| Cash | | 28,862 | |

| Foreign currency, at value (cost $211,167) | | 211,167 | |

| Receivables: | | | |

| Investment securities sold | | 1,015,149 | |

| Capital shares sold | | 49,720 | |

| Dividends | | 76,811 | |

| Foreign tax | | 154,655 | |

| Other assets | | 116 | |

| Total assets | | 187,144,306 | |

| Liabilities: | | | |

| Payables: | | | |

| Investment securities purchased | | 1,263,950 | |

| Capital shares redeemed | | 521,909 | |

| Management fees | | 204,349 | |

| Distribution fees | | 131,011 | |

| Transfer agent fees | | 146,407 | |

| Accrued expenses and other liabilities | | 146,890 | |

| Total liabilities | | 2,414,516 | |

| Net assets, at value | $ | 184,729,790 | |

| Net assets consist of: | | | |

| Paid-in capital | $ | 473,230,918 | |

| Undistributed net investment income | | 313,876 | |

| Net unrealized appreciation (depreciation) | | 6,210,787 | |

| Accumulated net realized gain (loss) | | (295,025,791 | ) |

| Net assets, at value | $ | 184,729,790 | |

16 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

TEMPLETON GLOBAL INVESTMENT TRUST

FINANCIAL STATEMENTS

Statement of Assets and Liabilities (continued)

March 31, 2015

| | |

| Templeton BRIC Fund | | |

| |

| Class A: | | |

| Net assets, at value | $ | 136,297,950 |

| Shares outstanding | | 13,939,834 |

| Net asset value per sharea | $ | 9.78 |

| Maximum offering price per share (net asset value per share ÷ 94.25%) | $ | 10.38 |

| Class C: | | |

| Net assets, at value | $ | 41,593,564 |

| Shares outstanding | | 4,316,221 |

| Net asset value and maximum offering price per sharea | $ | 9.64 |

| Advisor Class: | | |

| Net assets, at value | $ | 6,838,276 |

| Shares outstanding | | 702,286 |

| Net asset value and maximum offering price per share | $ | 9.74 |

| | | |

| aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable. | | |

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | | | 17 |

TEMPLETON GLOBAL INVESTMENT TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the year ended March 31, 2015

| | | |

| Templeton BRIC Fund | | | |

| |

| Investment income: | | | |

| Dividends (net of foreign taxes of $569,607) | $ | 7,352,359 | |

| Expenses: | | | |

| Management fees (Note 3a) | | 2,984,640 | |

| Distribution fees: (Note 3c) | | | |

| Class A | | 476,958 | |

| Class C | | 525,550 | |

| Transfer agent fees: (Note 3e) | | | |

| Class A | | 599,969 | |

| Class C | | 187,529 | |

| Advisor Class | | 30,734 | |

| Custodian fees (Note 4) | | 70,493 | |

| Reports to shareholders | | 92,205 | |

| Registration and filing fees | | 58,870 | |

| Professional fees | | 51,597 | |

| Trustees’ fees and expenses | | 8,767 | |

| Other | | 19,768 | |

| Total expenses | | 5,107,080 | |

| Expenses waived/paid by affiliates (Note 3f and 3g) | | (159,843 | ) |

| Net expenses | | 4,947,237 | |

| Net investment income | | 2,405,122 | |

| Realized and unrealized gains (losses): | | | |

| Net realized gain (loss) from: | | | |

| Investments | | 8,551,269 | |

| Foreign currency transactions | | (209,065 | ) |

| Net realized gain (loss) | | 8,342,204 | |

| Net change in unrealized appreciation (depreciation) on: | | | |

| Investments | | (17,135,213 | ) |

| Translation of other assets and liabilities denominated in foreign currencies | | (21,398 | ) |

| Net change in unrealized appreciation (depreciation) | | (17,156,611 | ) |

| Net realized and unrealized gain (loss) | | (8,814,407 | ) |

| Net increase (decrease) in net assets resulting from operations | $ | (6,409,285 | ) |

18 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

TEMPLETON GLOBAL INVESTMENT TRUST

FINANCIAL STATEMENTS

| | | | | | |

| Statements of Changes in Net Assets | | | | | | |

| |

| Templeton BRIC Fund | | | | | | |

| |

| | | Year Ended March 31, | |

| | | 2015 | | | 2014 | |

| Increase (decrease) in net assets: | | | | | | |

| Operations: | | | | | | |

| Net investment income | $ | 2,405,122 | | $ | 7,371,870 | |

| Net realized gain (loss) from investments and foreign currency transactions | | 8,342,204 | | | (28,695,783 | ) |

| Net change in unrealized appreciation (depreciation) on investments and translation of other assets | | | | | | |

| and liabilities denominated in foreign currencies | | (17,156,611 | ) | | (406,215 | ) |

| Net increase (decrease) in net assets resulting from operations | | (6,409,285 | ) | | (21,730,128 | ) |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A | | (2,092,490 | ) | | (6,523,980 | ) |

| Class C | | (270,191 | ) | | (1,599,121 | ) |

| Advisor Class | | (138,571 | ) | | (378,633 | ) |

| Total distributions to shareholders | | (2,501,252 | ) | | (8,501,734 | ) |

| Capital share transactions: (Note 2) | | | | | | |

| Class A | | (39,817,856 | ) | | (65,400,617 | ) |

| Class C | | (14,770,395 | ) | | (24,570,655 | ) |

| Advisor Class | | (2,184,847 | ) | | (2,991,788 | ) |

| Total capital share transactions | | (56,773,098 | ) | | (92,963,060 | ) |

| Net increase (decrease) in net assets | | (65,683,635 | ) | | (123,194,922 | ) |

| Net assets: | | | | | | |

| Beginning of year | | 250,413,425 | | | 373,608,347 | |

| End of year | $ | 184,729,790 | | $ | 250,413,425 | |

| Undistributed net investment income (distributions in excess of net investment income) included | | | | | | |

| in net assets: | | | | | | |

| End of year | $ | 313,876 | | $ | (630,706 | ) |

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 19

TEMPLETON GLOBAL INVESTMENT TRUST

Notes to Financial Statements

Templeton BRIC Fund

1. Organization and Significant Accounting Policies

Templeton Global Investment Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end management investment company, consisting of five separate funds and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). Templeton BRIC Fund (Fund) is included in this report. The financial statements of the remaining funds in the Trust are presented separately. The Fund offers three classes of shares: Class A, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share at the close of the New York Stock Exchange (NYSE), generally at 4 p.m. Eastern time (NYSE close) on each day the NYSE is open for trading. Under compliance policies and procedures approved by the Trust’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded or as of the NYSE close, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the NYSE close on the day that the

value of the security is determined. Over-the-counter (OTC) securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing NAV.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before the daily NYSE close. In addition, trading in certain foreign markets may not take place on every NYSE business day. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded

20 | Annual Report

franklintempleton.com

TEMPLETON GLOBAL INVESTMENT TRUST

NOTES TO FINANCIAL STATEMENTS

Templeton BRIC Fund (continued)

funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

When the last day of the reporting period is a non-business day, certain foreign markets may be open on those days that the NYSE is closed, which could result in differences between the value of the Fund’s portfolio securities on the last business day and the last calendar day of the reporting period. Any significant security valuation changes due to an open foreign market are adjusted and reflected by the Fund for financial reporting purposes.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments in the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities

other than investments in securities held at the end of the reporting period.

c. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply, the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of March 31, 2015, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction’s statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except for certain dividends from foreign securities where the dividend rate is not available. In such cases, the dividend is recorded as soon as the information is received by the Fund. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with U.S. GAAP. These differences may be permanent or temporary.

franklintempleton.com

Annual Report

| 21

TEMPLETON GLOBAL INVESTMENT TRUST

NOTES TO FINANCIAL STATEMENTS

Templeton BRIC Fund (continued)

1. Organization and Significant Accounting

Policies (continued)

d. Security Transactions, Investment Income, Expenses and Distributions (continued)

Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the funds based on the ratio of net assets of each fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the fund that incurred the expense.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

2. Shares of Beneficial Interest

At March 31, 2015, there were an unlimited number of shares authorized ($0.01 par value). Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | |

| | | | | | Year Ended March 31, | | | | |

| | | | 2015 | | | | | | | 2014 | |

| | Shares | | | | Amount | | Shares | | | Amount | |

| Class A Shares: | | | | | | | | | | | |

| Shares sold | 1,663,035 | | | $ | 17,836,239 | | 2,332,736 | | $ | 24,935,368 | |

| Shares issued in reinvestment of distributions | 205,575 | | | | 2,039,325 | | 580,183 | | | 6,300,786 | |

| Shares redeemed | (5,644,625 | ) | | | (59,693,420 | ) | (9,148,404 | ) | | (96,636,771 | ) |

| Net increase (decrease) | (3,776,015 | ) | | $ | (39,817,856 | ) | (6,235,485 | ) | $ | (65,400,617 | ) |

| Class C Shares: | | | | | | | | | | | |

| Shares sold | 310,908 | | | $ | 3,239,852 | | 586,717 | | $ | 6,084,750 | |

| Shares issued in reinvestment of distributions | 25,130 | | | | 246,273 | | 134,756 | | | 1,444,586 | |

| Shares redeemed | (1,750,888 | ) | | | (18,256,520 | ) | (3,088,060 | ) | | (32,099,991 | ) |

| Net increase (decrease) | (1,414,850 | ) | | $ | (14,770,395 | ) | (2,366,587 | ) | $ | (24,570,655 | ) |

| Advisor Class Shares: | | | | | | | | | | | |

| Shares sold | 221,366 | | | $ | 2,420,582 | | 429,853 | | $ | 4,592,124 | |

| Shares issued in reinvestment of distributions | 11,621 | | | | 114,703 | | 27,951 | | | 302,435 | |

| Shares redeemed | (447,287 | ) | | | (4,720,132 | ) | (745,619 | ) | | (7,886,347 | ) |

| Net increase (decrease) | (214,300 | ) | | $ | (2,184,847 | ) | (287,815 | ) | $ | (2,991,788 | ) |

22 | Annual Report

franklintempleton.com

TEMPLETON GLOBAL INVESTMENT TRUST

NOTES TO FINANCIAL STATEMENTS

Templeton BRIC Fund (continued)

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Trust are also officers and/or directors of the following subsidiaries:

| |

| Subsidiary | Affiliation |

| Templeton Asset Management Ltd. (TAML) | Investment manager |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

a. Management Fees

The Fund pays an investment management fee to TAML based on the average daily net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 1.300 | % | Up to and including $1 billion |

| 1.250 | % | Over $1 billion, up to and including $5 billion |

| 1.200 | % | Over $5 billion, up to and including $10 billion |

| 1.150 | % | Over $10 billion, up to and including $15 billion |

| 1.100 | % | Over $15 billion, up to and including $20 billion |

| 1.050 | % | In excess of $20 billion |

b. Administrative Fees

Under an agreement with TAML, FT Services provides administrative services to the Fund. The fee is paid by TAML based on average daily net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for each share class with the exception of Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are not charged on shares held by affiliates. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods. In addition, under the Fund’s Class C compensation distribution plan, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rates for each class. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

The Board has set the current rate at 0.30% per year for Class A shares until further notice and approval by the Board.

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as

franklintempleton.com

Annual Report

| 23

TEMPLETON GLOBAL INVESTMENT TRUST

NOTES TO FINANCIAL STATEMENTS

Templeton BRIC Fund (continued)

3. Transactions with Affiliates (continued)

d. Sales Charges/Underwriting Agreements (continued)

applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

| | |

| Sales charges retained net of commissions paid to unaffiliated | | |

| broker/dealers | $ | 31,411 |

| CDSC retained | $ | 4,304 |

e. Transfer Agent Fees

Each class of shares pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations and reimburses Investor Services for out of pocket expenses incurred, including shareholding servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets.

For the year ended March 31, 2015, the Fund paid transfer agent fees of $818,232, of which $411,590 was retained by Investor Services.

f. Investments in Institutional Fiduciary Trust Money Market Portfolio

The Fund invests in Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an affiliated open-end management investment company. Management fees paid by the Fund are waived on assets invested in the Sweep Money Fund, as noted in the Statement of Operations, in an amount not to exceed the management and administrative fees paid directly or indirectly by the Sweep Money Fund. Prior to April 1, 2013, the waiver was accounted for as a reduction to management fees.

g. Waiver and Expense Reimbursements

Effective August 1, 2014, TAML has contractually agreed in advance to waive or limit its fees and to assume as its own expense certain expenses otherwise payable by the Fund so that the expenses (excluding distribution fees, and acquired fund fees and expenses) for each class of the Fund do not exceed 1.72% (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until July 31, 2015. Management agreed to extend the contractual limit on expenses currently applied to the Fund through July 31, 2016, which will be reflected in the annual prospectus update.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended March 31, 2015, there were no credits earned.

5. Income Taxes

For tax purposes, capital losses may be carried over to offset future capital gains. Capital loss carryforwards with no expiration, if any, must be fully utilized before those losses with expiration dates.

| | | |

| At March 31, 2015, capital loss carry forwards were as follows: | | | |

| |

| Capital loss carryforwards subject to expiration: | | | |

| 2017 | $ | 85,086,528 | |

| 2018 | | 170,308,709 | |

| 2019 | | 12,538,988 | |

| Capital loss carryforwards not subject to expiration: | | | |

| Short term | | 6,179,504 | |

| Long term | | 20,066,997 | |

| Total capital loss carryforwards | $ | 294,180,726 | |

| |

| 24 | Annual Report | | | franklintempleton.com |

TEMPLETON GLOBAL INVESTMENT TRUST

NOTES TO FINANCIAL STATEMENTS

Templeton BRIC Fund (continued)

During the year ended March 31, 2015, the Fund utilized $7,970,152 of capital loss carryforwards.

The tax character of distributions paid during the years ended March 31, 2015 and 2014, was as follows:

| | | | |

| | | 2015 | | 2014 |

| Distributions paid from Ordinary Income: | $ | 2,501,252 | $ | 8,501,734 |

At March 31, 2015, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income for income tax purposes were as follows:

| | | |

| Cost of investments | $ | 183,295,386 | |

| |

| Unrealized appreciation | $ | 33,554,896 | |

| Unrealized depreciation | | (31,242,456 | ) |

| Net unrealized appreciation (depreciation) | $ | 2,312,440 | |

| |

| Distributable earnings - undistributed ordinary income | $ | 3,422,592 | |

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of corporate actions and wash sales.

6. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the year ended March 31, 2015, aggregated $68,995,400 and $124,824,961, respectively.

7. Concentration of Risk

Investing in foreign securities may include certain risks and considerations not typically associated with investing in U.S. securities, such as fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, certain foreign securities may not be as liquid as U.S. securities.

The United States and other nations have imposed and could impose additional sanctions on certain issuers in Russia due to regional conflicts. These sanctions could result in the devaluation of Russia’s currency, a downgrade in Russian issuers’ credit ratings, or a decline in the value and liquidity of Russian stocks or other securities. Such sanctions could also adversely affect Russia’s economy, possibly forcing the economy into a recession. The Fund may be prohibited from investing in securities issued by companies subject to such sanctions. In addition, if the Fund holds the securities of an issuer that is subject to such sanctions, an immediate freeze of that issuer’s securities could result, impairing the ability of the Fund to buy, sell, receive or deliver those securities. There is also the risk that countermeasures could be taken by Russia’s government, which could involve the seizure of the Fund’s assets. These risks could affect the value of the Fund’s portfolio. While the Fund holds securities of certain companies impacted by the sanctions, the restrictions do not impact the existing investments in those issuers. At March 31, 2015, the Fund had 6.3% of its net assets invested in Russia.

8. Credit Facility

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which matures on February 12, 2016. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

franklintempleton.com

Annual Report

| 25

TEMPLETON GLOBAL INVESTMENT TRUST

NOTES TO FINANCIAL STATEMENTS

Templeton BRIC Fund (continued)

8. Credit Facility (continued)

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.07% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses in the Statement of Operations. During the year ended March 31, 2015, the Fund did not use the Global Credit Facility.

9. Fair Value Measurements

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical financial instruments