UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-8268

______________________________________________

FIRSTHAND FUNDS

______________________________________________________________________________

(Exact name of registrant as specified in charter)

125 SOUTH MARKET

SUITE 1200

SAN JOSE, CALIFORNIA 95113

______________________________________________________________________________

(Address of principal executive offices)(Zip code)

(Name and Address of Agent for Service) | Copy to: |

Kevin M. Landis

Firsthand Capital Management, Inc.

125 South Market, Suite 1200

San Jose, California 95113 | Kelvin K. Leung, Esq.

Firsthand Capital Management, Inc.

125 South Market, Suite 1200

San Jose, California 95113 |

| Scott M. Zoltowski, Esq.

State Street Bank and Trust Company

One Federal Street

Boston, Massachusetts 02110 |

| Steven G. Cravath, Esq.

Morrison & Foerster LLP

2000 Pennsylvania Avenue, NW

Washington, DC 20006-1888 |

Registrant's telephone number, including area code: (408) 294-2200

Date of fiscal year end: December 31

Date of reporting period: December 31, 2004

Item 1. Reports to Shareholders.

This report is provided for the general information of the shareholders of Firsthand Funds.

This report is not intended for distribution to prospective investors in the Funds,

unless preceded or accompanied by an effective prospectus. For more complete

information about Firsthand Funds, please call toll free 1.888.884.2675 or

visit www.firsthandfunds.com for a prospectus, which contains more information,

including risks, fees, and expenses. Read the prospectus carefully before

investing or sending money.

Firsthand Funds are distributed by ALPS Distributors, Inc.

| 2004 Annual Report - 1 |

PERFORMANCE SUMMARY

| Period Returns | | | | | | | | | |

| (average annual total returns as of 12/31/04) | | | | | | | | | |

| | | | | | | | | | |

| | Q4 '04 | | 1-YEAR | | 3-YEAR | | 5-YEAR | | 10-YEAR |

| FUND | TOTAL* | | | | | | | | |

|

| |

| |

| |

| |

|

| | | | | | | | | | |

| Firsthand Technology Value Fund® | 10.70% | | -6.62% | | -10.59% | | -18.47% | | 13.56% |

| Firsthand Technology Leaders Fund | 13.87% | | -2.79% | | -3.88% | | -17.81% | | • |

| Firsthand Technology Innovators Fund | 14.94% | | -12.80% | | -14.98% | | -23.01% | | • |

| Firsthand e-Commerce Fund | 16.19% | | 5.56% | | -1.01% | | -26.20% | | • |

| Firsthand Global Technology Fund | 17.91% | | -7.16% | | -5.92% | | • | | • |

| Nasdaq | 14.87% | | 9.15% | | 4.20% | | -11.42% | | 11.65% |

| DJIA | 7.59% | | 5.31% | | 4.70% | | 0.68% | | 13.09% |

| S&P 500 | 9.23% | | 10.88% | | 3.58% | | -2.30% | | 12.05% |

| * Not annualized. | | | | | | | | | |

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Each Fund may invest in small-capitalization companies and Initial Public Offerings ("IPOs"). These investments are more volatile than investments in large-capitalization companies and loss of principal could be greater. The Funds may invest in foreign securities, which are subject to greater risks than investing in domestic securities. Because the Funds are not diversified, they can take larger positions in fewer companies, increasing their risk profile. The Funds invest in several industries within the technology sector and the relative weightings of these industries in a Fund's portfolio may change at any time.

The Dow Jones Industrial Average (DJIA) is a group of 30 stocks tracked by the Dow Jones Company. The Nasdaq Composite Index (Nasdaq) is a capitalization-weighted index of all common stocks listed with Nasdaq. The Standard & Poor's 500 Index (S&P 500) is a market-weighted index of 500 stocks of well-established companies. Each index represents an unmanaged, broad-based basket of stocks. These indices are typically used as benchmarks for overall market performance. The Lipper Science and Technology Fund Index includes the largest 30 mutual funds in the group, which, by prospectus or portfolio practice, invest at least 80% of their equity portfolios in science and technology stocks.

| 2004 Annual Report - 2 |

| Returns Since Inception | | | | | | | |

| (average annual total returns as of 12/31/04) | | | | | | | |

| | AVERAGE | | | | | | |

| | ANNUAL | | | | | | |

| | TOTAL | | | | | | S&P |

| FUND (INCEPTION DATE) | RETURN | | NASDAQ | | DJIA | | 500 |

|

| |

| |

| |

|

| | | | | | | | |

| Firsthand Technology Value Fund® (5/20/94) | 15.14% | | 11.28% | | 12.68% | | 11.58% |

| Firsthand Technology Leaders Fund (12/10/97) | 7.80% | | 4.63% | | 6.20% | | 4.66% |

| Firsthand Technology Innovators Fund (5/20/98) | 4.67% | | 2.88% | | 4.63% | | 2.85% |

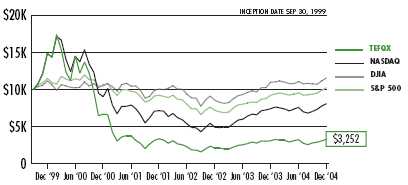

| Firsthand e-Commerce Fund (9/30/99) | -19.25% | | -3.99% | | 2.77% | | 0.43% |

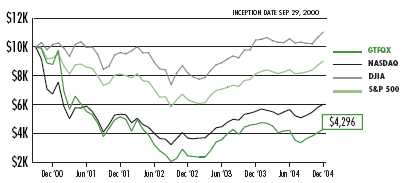

| Firsthand Global Technology Fund (9/29/00) | -18.00% | | -11.21% | | 2.35% | | -2.37% |

| 2004 Annual Report - 3 |

DEAR FELLOW SHAREHOLDERS,

DEAR FELLOW SHAREHOLDERS,

2004 was a year defined by fear: We heard that the real estate bubble was going to burst (it didn't), that China was growing too fast (then that it was growing too slowly), that interest rates were going to soar (they were up just 1%), and that there would be terrorist attacks at the Olympics in Greece and the political conventions in the United States (there weren't).

It's a testament to the steady improvement in the fundamentals of corporate profits that, despite this poor psychological backdrop, the major indices were able to eek out modest gains for the year. Unfortunately, the same can't be said for many tech stocks. I am disappointed to report that only one of our funds, Firsthand e-Commerce Fund, enjoyed a positive return this year. The other four Firsthand Funds each underperformed both the Nasdaq Composite Index and the Lipper Science & Technology Fund Index (see the Performance Summary on pages 2 and 3 and the Financial Highlights on pages 41 to 45 of this report for more information).

Within the technology sector, there was a dramatic polarization in stock performance in 2004. The Goldman Sachs Internet Index, for example, was up 23.25% for the year, while the Philadelphia Stock Exchange Semiconductor Index was down 14.47%. The Goldman Sachs Software Index was up 13.66%, while the American Stock Exchange Networking Index was up just 0.10% for the year. As these index comparisons suggest, many technology companies and industries had a great year in 2004. A host of software and Internet stocks, for example, posted tremendous gains this year as demand for certain flavors of enterprise software and Internet advertising flourished. On the flip side, however, semiconductor stocks were hammered in 2004, despite 30% revenue growth in the industry. Our funds' tendency to carry relatively heavy semiconductor weightings generally hurt performance this year. The Performance and Portfolio Discussions on the pages that follow share specific performance attribution for each fund.

Despite the sector's mixed results, we saw the strengthening of several trends in 2004 that we expect to keep delivering positive news. Shipments of cellular telephone handsets grew sharply in 2004, reaching an estimated 560 million units worldwide. Benefitting from this growth, QUAL-COMM (QCOM) was Firsthand Technology Leaders Fund's biggest single mover. This market was thought to be stalled at just over 400 million units in 2002, but is expected to exceed 600 million units in 2005-a 50% increase in only three years. More importantly, handset users seem eager to adopt new features, particularly embedded digital cameras. In 2003, cameraphones were just 16% of all cellphones sold (a total of 84 million units). In 2004, that percentage grew to more than 30%, with cameraphone shipments exploding to nearly 180 million units last year. While some investors may be scared off by projections that the handset market could plateau in 2005, we see a great deal of potential growth in a nearly 600-million-unit market, and there are a number of new features and technologies on the horizon, including GPS and digital music, poised for adoption by users hungry for more capabilities.

Digital music was another hot area in 2004, with Apple's handheld digital music player-the iPod-selling an estimated eight million units. While Apple's iPod and iTunes grabbed most of the headlines, several other providers were flourishing more quietly. One of these was Napster (NAPS), formerly Roxio, which was the leading positive contributor to Firsthand Technology Innovators Fund in 2004. Now that the music industry has jumped on board the online bandwagon, we are finally seeing digital music distribution becoming a viable, growing business. It's a business that stands to gain tremendously from the continued growth in the cellphone market: Imagine songs being downloaded onto hundreds of millions of cellphones instead of just a few million iPods.

| 2004 Annual Report - 4 |

This past year was also one of phenomenal growth for broadband wireless technologies, particularly WiFi and the rapidly emerging WiMax technology. Israel's Alvarion (ALVR) rode the WiMax trend in 2004 and was Firsthand Global Technology Fund's top performer for the year. Wireless networking continues to grow at a rapid pace, driven largely by residential consumers, and we expect to see large-scale rollouts of WiMax technology by telecommunications service providers starting in 2005.

Consumers continued to purchase more goods and services via the Internet in 2004. A recent study by Goldman Sachs, Harris Interactive, and Nielsen/NetRatings reported that U.S. online retailers reported a 25% increase in holiday sales over 2003, with total sales of more than $23 billion. Consumers are increasingly comfortable with purchasing products online, which we believe bodes well for the future of e-commerce. Furthermore, with increased Internet usage has come increased Internet advertising expenditures as marketers seek to follow consumers' migration from TV to Internet viewing. Internet leaders such as Ebay and Yahoo! enjoyed solid growth in 2004.

You've no doubt noticed that I'm talking a lot about consumer electronics. That's because we are witnessing a consumer-driven market for technology products today, quite unlike the corporate IT-focused growth in the late 1990s. That's not to say that corporate spending is not significant any more. However, much of the growth in the tech sector is coming from consumer spending, while corporate America continues to absorb the technology purchases of four and five years ago.

I would be remiss if I didn't address the Funds' Achilles heel in 2004-semiconductor stocks. As many of you know, we have long been big fans of semiconductor companies because semiconductors are at the core of all electronic products today. Furthermore, owning chip stocks is often a great way to invest in a particular trend without having to own the well-known, and often over-priced, companies with their names on the boxes that are shipped to consumers.

Despite outstanding sales and earnings growth in the industry, semiconductor stocks took a beating in 2004, with investors seemingly anticipating a tougher market environment in 2005. As long-time industry participants and observers, we know that supply/demand imbalances occur often, which can drive stock prices to dizzying heights and breathtaking lows. Our long-term investment discipline, however, tells us to stick with a trend or company if we believe the trend has legs. In the case of semiconductor stocks, we know that we are currently in the midst of some oversupply situations, but we also know that markets tend to be self-correcting. We are not buying stocks because of next quarter's or next year's earnings, but because we believe in the companies' growth over the next 3 to 5 years. And we believe that economic expansion in the U.S. is just getting started.

Overall, I am encouraged by the progress being made by our portfolio companies, and I am hopeful for continued growth in 2005. We realize this has not been an easy time to be an investor in technology stocks or technology mutual funds, but we're encouraged by the healthy growth in much of the technology sector.

I wish you a very happy and prosperous 2005.

Sincerely,

| 2004 Annual Report - 5 |

SHAREHOLDER FEE EXAMPLE (Unaudited)

Example-In general, mutual fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees, and exchange fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, non-12b-1 service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Note that Firsthand Funds does not charge transaction fees or 12b-1 distribution and service fees, though you may incur transaction fees if you purchase shares through a broker.

The example below is based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2004 to December 31, 2004.

Actual Expenses-The section of the table at right entitled "Actual" provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), and multiply the result by the number in the section entitled "Actual" under the heading "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. If your account is an IRA or other tax-qualified savings plan, your expenses may also have included a $10 annual fee. In either case, the amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

Hypothetical Example for Comparison Purposes-The section of the table at right entitled "Hypothetical" provides information about hypothetical account values and hypothetical expenses based on a Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or the expenses you paid for the period. However, you may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table at right are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher. The examples also assume all dividends and distributions have been reinvested.

| 2004 Annual Report - 6 |

Firsthand Technology Value Fund

| | Beginning | | Ending | | Expenses Paid | | |

| | Account Value | | Account Value | | During Period* | | Annualized |

| | 7/1/04 | | 12/31/04 | | 7/1/04-12/31/04 | | Expense Ratio |

| Actual | $ | 1,000 | | $ | 992.93 | | $ | 8.64 | | 1.91% |

| Hypothetical** | $ | 1,000 | | $ | 1,015.09 | | $ | 9.68 | | 1.91% |

| | | | | | | | | | | | |

| Firsthand Technology Leaders Fund | | | | | | | | |

| | | | | | | | | | | | |

| | Beginning | | | Ending | | Expenses Paid | | |

| | Account Value | | Account Value | | During Period* | | Annualized |

| | 7/1/04 | | 12/31/04 | | 7/1/04-12/31/04 | | Expense Ratio |

| Actual | $ | 1,000 | | $ | 1,016.38 | | $ | 9.05 | | 1.95% |

| Hypothetical** | $ | 1,000 | | $ | 1,014.89 | | $ | 9.88 | | 1.95% |

| | | | | | | | | | | | |

| Firsthand Technology Innovators Fund | | | | | | | |

| | | | | | | | | | | | |

| | Beginning | | | Ending | | Expenses Paid | | |

| | Account Value | | Account Value | | During Period* | | Annualized |

| | 7/1/04 | | 12/31/04 | | 7/1/04-12/31/04 | | Expense Ratio |

| Actual | $ | 1,000 | | $ | | 950.05 | | $ | 8.33 | | 1.95% |

| Hypothetical** | $ | 1,000 | | $ | 1,014.89 | | $ | 9.88 | | 1.95% |

| | | | | | | | | | | | |

| Firsthand e-Commerce Fund | | | | | | | | | |

| | | | | | | | | | | | |

| | Beginning | | | Ending | | Expenses Paid | | |

| | Account Value | | Account Value | | During Period* | | Annualized |

| | 7/1/04 | | 12/31/04 | | 7/1/04-12/31/04 | | Expense Ratio |

| Actual | $ | 1,000 | | $ | 1,006.23 | | $ | 8.67 | | 1.95% |

| Hypothetical** | $ | 1,000 | | $ | 1,014.89 | | $ | 9.88 | | 1.95% |

| | | | | | | | | | | | |

| Firsthand Global Technology Fund | | | | | | | |

| | | | | | | | | | | | |

| | Beginning | | | Ending | | Expenses Paid | | |

| | Account Value | | Account Value | | During Period* | | Annualized |

| | 7/1/04 | | 12/31/04 | | 7/1/04-12/31/04 | | Expense Ratio |

| Actual | $ | 1,000 | | $ | 1,019.05 | | $ | 8.75 | | 1.95% |

| Hypothetical** | $ | 1,000 | | $ | 1,014.89 | | $ | 9.88 | | 1.95% |

*

| Expenses are calculated by multiplying the Fund's annualized expense ratio listed above by the average account value over the period and multiplying that number by 184/366 (to reflect the one-half year period). |

**

| 5% return per year before expenses.

The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries or other financial institutions. |

| 2004 Annual Report - 7 |

Firsthand Technology Value Fund

Performance and Portfolio Discussion

How did the Fund perform in 2004?

In 2004, Firsthand Technology Value Fund (TVFQX) posted a 6.62% loss, versus a 9.15% gain for the Nasdaq Composite Index and a 4.11% gain for the Lipper Science and Technology Fund Index. For the six months ended December 31, 2004, Firsthand Technology Value Fund declined 0.71% as compared to 6.56% and 3.57% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

Despite the post-election rally in the stock market, the Fund was unable to recoup its losses and trailed its benchmarks in 2004. While the portfolio's software and defense and aerospace investments were bright spots, the Fund's large weightings in semiconductors and communications equipment significantly hurt its performance.

Which individual holdings were the largest contributors to the Fund's performance?

The Fund's largest contributor in 2004 was employee Internet management software vendor Websense (WBSN). Websense's stock performance reflected strong demand for its products, as well as the investor appeal of the company's subscription-based business model, which resulted in a steady revenue stream throughout the year.

Shares of Wind River Systems (WIND) advanced 55% in 2004 as the company continued its impressive turnaround. Wind River Systems is a leading provider of embedded operating system software, which is used in a number of different markets including defense and aerospace, automotive, consumer electronics, and communications. The primary catalyst for Wind River's turnaround was the company's decision to reduce its dependence on the beleaguered telecom sector and look to other markets for growth. Other software positions helping Fund performance in 2004 included tele-com software provider Comverse Technology (CMVT), online music provider Napster (NAPS), and VeriSign (VRSN), a provider of Internet infrastructure and communications services.

Shares of FLIR Systems (FLIR) and L-3 Communications (LLL) both fared well during the period despite worries that the defense and aerospace industry would be hurt by a cutback in goverment spending. FLIR Systems makes imaging and heat-detection systems for security and surveillance applications. Similarly, L-3 Communications is a defense electronics firm that provides intelligence, surveillance, and reconnaissance (ISR) systems; aircraft modernization; and aviation products primarily to the U.S. military.

Which holdings were the greatest detractors from the Fund's performance?

Our holdings in flash memory suppliers Lexar Media (LEXR) and SanDisk (SNDK) were among the Fund's largest detractors in 2004. Flash memory supply grew faster than demand, which led to several price cuts in an attempt to balance supply and demand. The sharp decline in average selling prices took its toll on revenue growth and profit margins. Other semiconductor stocks that hurt Fund performance included Texas Instruments (TXN), Zoran (ZRAN), PMC-Sierra (PMCS), and TriQuint Semiconductor (TQNT).

Telecom equipment provider UTStarcom (UTSI) declined 40% as investors worried about slowing growth in the Chinese market, a region that accounts for the majority of UTStarcom's sales. However, UTStarcom is working to broaden its customer base and geographic distribution of revenue. In 2004, for example, the company bought Audiovox's wireless handset business to gain exposure to the Code Division Multiple Access (CDMA) cell phone market. Other communications equipment holdings that hurt fund performance included Stratex Networks (STXN) and Powerwave Technologies (PWAV).

| 2004 Annual Report - 8 |

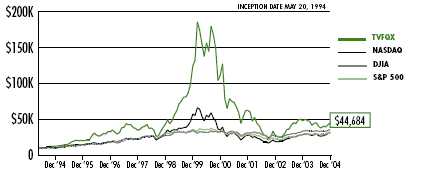

Fund Performance and Holding Information (as of December 31, 2004)

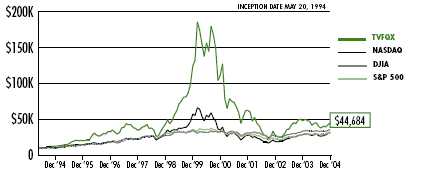

Firsthand Technology Value Fund vs. Market Indices

| | TVFQX | | NASDAQ | | DJIA | | S&P 500 |

| Since Inception (5/20/94) | 15.14% | | 11.28% | | 12.68% | | 11.58% |

| 10-Year | 13.56% | | 11.65% | | 13.09% | | 12.05% |

| 5-Year | -18.47% | | -11.42% | | 0.68% | | -2.30% |

| 3-Year | -10.59% | | 4.20% | | 4.70% | | 3.58% |

| 1-Year | -6.62% | | 9.15% | | 5.31% | | 10.88% |

| Q4 '04 Total Return (not annualized) | 10.70% | | 14.87% | | 7.59% | | 9.23% |

Growth of a Hypothetical $10,000 Investment

| Holdings by Industry* | | Top 10 Holdings** |

| | | | | |

| | % of Net Assets | | | % of Net Assets |

| Semiconductors | 35.4% | | SanDisk Corp. | 10.4% |

|

| |

|

|

| Software | 24.0% | | Comverse Technology, Inc. | 7.0% |

|

| |

|

|

| Communications Equipment | 15.5% | | Wind River Systems, Inc. | 6.1% |

|

| |

|

|

| Defense & Aerospace | 5.7% | | FLIR Systems, Inc. | 5.1% |

|

| |

|

|

| Photonics | 4.5% | | UTStarcom, Inc. | 4.8% |

|

| |

|

|

| Internet | 4.4% | | Corning, Inc. | 4.3% |

|

| |

|

|

| Other | 4.1% | | Websense, Inc. | 3.9% |

|

| |

|

|

| Peripherals | 4.0% | | Western Digital Corp. | 3.4% |

|

| |

|

|

| Services | 1.8% | | Netflix, Inc. | 3.4% |

|

| |

|

|

| Net Cash | 0.6% | | Tekelec, Inc. | 3.1% |

|

| |

|

|

| * Based on percentage of net assets as of December 31, 2004. | | ** Top 10 stock holdings total 51.5% of net assets. These holdings are current as of December 31, 2004, and may not be representative of current or future investments. |

| 2004 Annual Report - 9 |

Firsthand Technology Leaders Fund

Performance and Portfolio Discussion

How did the Fund perform in 2004?

In 2004, Firsthand Technology Leaders Fund (TLFQX) posted a 2.79% loss, versus a 9.15% gain for the Nasdaq Composite Index and a 4.11% gain for the Lipper Science and Technology Fund Index. For the six months ended December 31, 2004, Firsthand Technology Leaders Fund rose 1.64% as compared to 6.56% and 3.57% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

Firsthand Technology Leaders Fund underperformed its benchmarks in 2004, as the portfolio's exposure to the software industry was not enough to offset the poor results contributed by the Fund's semiconductor and networking positions.

Which individual holdings were the largest contributors to the Fund's performance?

For the period, the Fund's top contributor was wireless communications firm QUALCOMM (QCOM). QUALCOMM, which licenses its Code Division Multiple Access (CDMA) wireless technology and makes chips for cell phones, benefitted from record sales of cell phones in 2004 as consumers rapidly replaced older phones with new ones equipped with color screens and digital cameras. In the Internet segment, shares of eBay (EBAY) rose 80% in 2004 as business remained strong for the online auctioneer. During the year, the eBay franchise continued to grow as the company acquired several smaller firms in a bid to expand its international presence.

Among our software holdings, Adobe Systems (ADBE) enjoyed another solid year. The software giant continued to set the standard in both the professional and consumer markets with its Acrobat and Illustrator applications that enable users to create, publish, and print digital content. Growth in digital camera sales also helped promote sales of photo imaging programs like Adobe Photoshop. Also boosting Fund performance in 2004 were holdings in anti-virus software giant Symantec (SYMC) and Business Objects (BOBJ), a provider of business intelligence software that the Fund began buying in August.

Which holdings were the greatest detractors from the Fund's performance?

Technology bellwethers Cisco Systems (CSCO) and Intel (INTC) each experienced reversals of fortune in 2004. Increased competition from rival Juniper Networks (JNPR) had investors concerned that Cisco was struggling to maintain its stronghold on the networking market. Cisco is the dominant supplier of routers, switches, and software that enable computer networks to communicate over the Internet. However, a price war between the two companies put pressure on Cisco's market share in its core router business and ended up costing the company two key customers-America Online and China Telecom-in 2004.

In the case of Intel, the company suffered several uncharacteristic setbacks in 2004, including execution missteps and product delays, that contributed to the company's weak showing. Rising inventories also hurt the company by forcing it to take large inventory reserves and accept lower prices, both of which put pressure on profits. Similar inventory problems befell other semiconductor companies including flash memory provider SanDisk (SNDK), chipmaker Texas Instruments (TXN), and Altera (ALTR) and Xilinx (XLNX), makers of programmable logic devices.

| 2004 Annual Report - 10 |

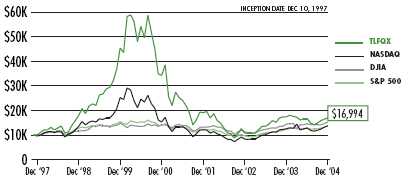

Fund Performance and Holding Information (as of December 31, 2004)

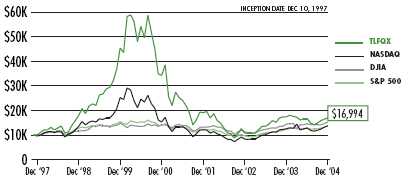

Firsthand Technology Leaders Fund vs. Market Indices

| | TLFQX | | NASDAQ | | DJIA | | S&P 500 |

| Since Inception (12/10/97) | 7.80% | | 4.63% | | 6.20% | | 4.66% |

| 5-Year | -17.81% | | -11.42% | | 0.68% | | -2.30% |

| 3-Year | -3.88% | | 4.20% | | 4.70% | | 3.58% |

| 1-Year | -2.79% | | 9.15% | | 5.31% | | 10.88% |

| Q4 '04 Total Return (not annualized) | 13.87% | | 14.87% | | 7.59% | | 9.23% |

Growth of a Hypothetical $10,000 Investment

| Holdings by Industry* | | Top 10 Holdings** |

| | % of Net Assets | | | % of Net Assets |

| Software | 33.6% | | VERITAS Software Corp. | 6.0% |

|

| |

|

|

| Semiconductors | 27.8% | | SanDisk Corp. | 5.8% |

|

| |

|

|

| Internet | 7.7% | | Business Objects SA - ADR | 5.0% |

|

| |

|

|

| Semiconductor Equipment | 7.0% | | Cisco Systems, Inc. | 4.9% |

|

| |

|

|

| Communications Equipment | 5.3% | | Amdocs Ltd. | 4.7% |

|

| |

|

|

| Networking | 4.9% | | QUALCOMM, Inc. | 4.7% |

|

| |

|

|

| Media | 4.3% | | Mercury Interactive Corp. | 4.6% |

|

| |

|

|

| Peripherals | 3.3% | | Adobe Systems, Inc. | 4.4% |

|

| |

|

|

| Other Electronics | 2.9% | | Texas Instruments, Inc. | 4.4% |

|

| |

|

|

| Photonics | 2.8% | | Taiwan Semiconductor | |

|

| | | |

| Net Cash | 0.4% | | Manufacturing Co. - ADR | 4.3% |

|

| |

|

|

| * Based on percentage of net assets as of December 31, 2004. | | ** Top 10 stock holdings total 48.8% of net assets. These holdings are current as of December 31, 2004, and may not be representative of current or future investments. |

| 2004 Annual Report - 11 |

Firsthand Technology Innovators Fund

Performance and Portfolio Discussion

How did the Fund perform in 2004?

In 2004, Firsthand Technology Innovators Fund (TIFQX) posted a 12.80% loss, versus a 9.15% gain for the Nasdaq Composite Index and a 4.11% gain for the Lipper Science and Technology Fund Index. For the six months ended December 31, 2004, Firsthand Technology Innovators Fund declined 5.00% as compared to 6.56% and 3.57% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

The Fund underperformed its benchmarks by a substantial margin primarily due to its sizable exposure to the semiconductor industry. Firsthand Technology Innovators Fund has traditionally held a large percentage of its assets in semiconductor stocks because semiconductors are the cornerstone of the electronics industry, integral to nearly every electronic device today. While most of our semiconductor holdings were a drag on Fund performance, there were a few standouts in the chip industry that managed to buck the trend.

Which individual holdings were the largest contributors to the Fund's performance?

The buzz about downloading music got louder in 2004 and Napster (NAPS) was one of the beneficiaries of this growing trend. Napster offers a subscription service that allows users to either listen to or download music over the Internet. Shares of Napster rallied toward the end of the year after the company chose to sell its software division to focus solely on its online music business.

Early in the year we realized a nice gain in shares of memory chip designer Monolithic System Technology (MOSY), after Synopsys (SNPS) announced its intention to acquire the company at a hefty premium. Closing our position in Monolithic turned out to be the right move as Synopsys subsequently walked away from the proposed deal two months later, sending Monolithic's stock price down. Other portfolio holdings that positively contributed to Fund performance included electronic design automation software maker PDF Solutions (PDFS), embedded microprocessor designer MIPS Technologies (MIPS), and Witness Systems (WITS), a provider of customer and workforce management software for call centers.

Which holdings were the greatest detractors from the Fund's performance?

The Fund's biggest money-loser during the period was flash memory supplier Lexar Media (LEXR). Removable flash memory cards have rapidly become the primary form of portable storage for various electronic devices, including digital cameras, PDAs, and MP3 players. While demand for flash memory remains strong, an industry-wide oversupply situation for flash memory in 2004 led to a sharp decline in average selling prices, which hurt Lexar's earnings and revenue growth.

The disk-drive industry also experienced similar problems with high inventory levels that resulted in the top three disk-drive manufacturers engaging in a brutal price war to clear out excess inventory. This not only negatively impacted the major drive manufacturers but also smaller component suppliers, including Intevac (IVAC). Other disappointing stocks included microdisplay manufacturer Kopin (KOPN), camera-chip maker OmniVision Technologies (OVTI), and flat-panel component suppliers Applied Films (AFCO) and Universal Display (PANL).

| 2004 Annual Report - 12 |

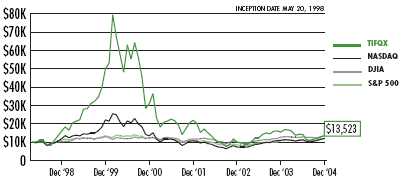

Fund Performance and Holding Information (as of December 31, 2004)

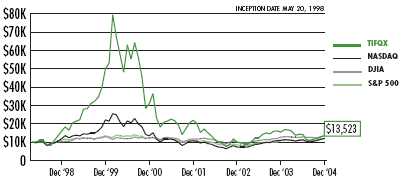

Firsthand Technology Innovators Fund vs. Market Indices

| | TIFQX | | NASDAQ | | DJIA | | S&P 500 |

| Since Inception (5/20/98) | 4.67% | | 2.88% | | 4.63% | | 2.85% |

| 5-Year | -23.01% | | -11.42% | | 0.68% | | -2.30% |

| 3-Year | -14.98% | | 4.20% | | 4.70% | | 3.58% |

| 1-Year | -12.80% | | 9.15% | | 5.31% | | 10.88% |

| Q4 '04 Total Return (not annualized) | 14.94% | | 14.87% | | 7.59% | | 9.23% |

Growth of a Hypothetical $10,000 Investment

| Holdings by Industry* | | Top 10 Holdings** |

| | % of Net Assets | | | % of Net Assets |

| Semiconductors | 28.0% | | PDF Solutions, Inc. | 9.2% |

|

| |

|

|

| Communications Equipment | 13.4% | | Napster, Inc. | 5.9% |

|

| |

|

|

| Other Electronics | 10.1% | | Avici Systems, Inc. | 4.7% |

|

| |

|

|

| Electronic Design Automation | 9.1% | | OmniVision Technologies, Inc. | 4.5% |

|

| |

|

|

| Photonics | 8.1% | | Power Integrations, Inc. | 4.3% |

|

| |

|

|

| Software | 8.0% | | Aeroflex, Inc. | 4.2% |

|

| |

|

|

| Intellectual Property | 6.9% | | Lexar Media, Inc. | 4.0% |

|

| |

|

|

| Services | 5.1% | | Vyyo, Inc. | 3.8% |

|

| |

|

|

| Networking | 3.2% | | Kopin Corp. | 3.5% |

|

| |

|

|

| Computer Storage Devices | 2.2% | | Applied Films Corp. | 3.4% |

|

| |

|

|

| Other | 1.2% | | |

|

| | | |

| Net Cash | 4.7% | | | |

|

| | | |

| * Based on percentage of net assets as of December 31, 2004. | | **Top 10 stock holdings total 47.5% of net assets. These holdings are current as of December 31, 2004, and may not be representative of current or future investments. |

| 2004 Annual Report - 13 |

Firsthand e-Commerce Fund

Performance and Portfolio Discussion

How did the Fund perform in 2004?

In 2004, Firsthand e-Commerce Fund (TEFQX) posted a 5.56% gain, versus a 9.15% gain for the Nasdaq Composite Index and a 4.11% gain for the Lipper Science and Technology Fund Index. For the six months ended December 31, 2004, Firsthand e-Commerce Fund rose 0.62% as compared to 6.56% and 3.57% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

The Fund's exposure to the software industry and Internet stocks helped the Fund finish 2004 in positive territory, ahead of its peer-group benchmark. We continue to believe that e-commerce is still in its infancy, accounting for just two percent of all U.S. retail sales, according to the U.S. Census Bureau. We believe this limited penetration underscores the vast growth potential for online commerce.

Which individual holdings were the largest contributors to the Fund's performance?

Employee Internet management software vendor Websense (WBSN) was the Fund's best performer in 2004. The company's software enables employers to monitor Internet usage by employees and to block access to inappropriate websites, thereby limiting the potential for misuse of the Internet. Despite a sluggish corporate IT spending environment, Websense's business has thrived because the company offers its customers an affordable, easy-to-implement solution to Internet management in the workplace. Other software stocks that helped Fund performance included anti-virus software maker Symantec (SYMC), online music provider Napster (NAPS), and Macromedia (MACR), a provider of Internet software development tools and applications.

With more households shifting to faster broadband connections and consumers becoming increasingly comfortable with shopping online, Internet stocks generally enjoyed another good year. Solid growth in online sales led to strong gains for many of the Fund's Internet holdings, including eBay (EBAY) and Yahoo! (YHOO). Yahoo! also benefitted from surging demand in online advertising as major brand advertisers allocated more of their budgets to the Web.

Which holdings were the greatest detractors from the Fund's performance?

One of the Fund's larger losses was in online DVD rental company Netflix (NFLX). Despite having more than 2.5 million subscribers, Netflix's business model has very few barriers to entry and has attracted several new competitors. With Wal-Mart, Blockbuster, and possibly Amazon.com entering the fray, Netflix lowered its monthly fee to attract new customers and retain current ones. However, investors were not happy about the potential revenue loss with the lower subscriber fee and, as a result, shares of Netflix plummeted more than 40% on the day of the announcement.

Chordiant Software (CHRD) was also a significant drag on Fund performance in 2004. Chordiant makes software that enables various departments within a company to share information and collaborate on projects. Shares of Chordiant dropped after the company reported disappointing license revenue growth in Q3. License revenue is often seen as a key measure of business strength at software companies. Other portfolio holdings that disappointed during 2004 included data storage management firm VERITAS Software (VRTS), BEA Systems (BEAS), and e-commerce conglomerate IAC/InterActiveCorp (IACI), parent company of popular Internet sites such as Expedia, Ticketmaster, and Hotwire.

| 2004 Annual Report - 14 |

Fund Performance and Holding Information (as of December 31, 2004)

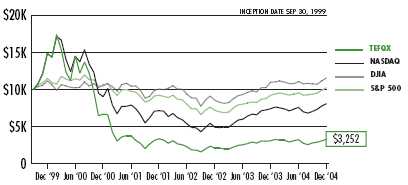

Firsthand e-Commerce Fund vs. Market Indices

| | TEFQX | | NASDAQ | | DJIA | | S&P 500 |

| Since Inception (9/30/99) | -19.25% | | -3.99% | | 2.77% | | 0.43% |

| 5-Year | -26.20% | | -11.42% | | 0.68% | | -2.30% |

| 3-Year | -1.01% | | 4.20% | | 4.70% | | 3.58% |

| 1-Year | 5.56% | | 9.15% | | 5.31% | | 10.88% |

| Q4 '04 Total Return (not annualized) | 16.19% | | 14.87% | | 7.59% | | 9.23% |

Growth of a Hypothetical $10,000 Investment

Holdings by Industry* | | Top 10 Holdings** |

| | % of Net Assets | | | % of Net Assets |

| Software | 39.0% | | Websense, Inc. | 11.0% |

|

| |

|

|

| Internet | 30.3% | | Yahoo! Inc. | 6.8% |

|

| |

|

|

| Services | 20.4% | | Macromedia, Inc. | 5.5% |

|

| |

|

|

| Financial | 2.9% | | CNET Networks, Inc. | 5.2% |

|

| |

|

|

| Other | 1.6% | | WebEx Communications, Inc. | 4.9% |

|

| |

|

|

| Net Cash | 5.8% | | IAC/InterActiveCorp | 4.3% |

|

| |

|

|

| | | | Napster, Inc. | 4.3% |

| | | |

|

|

| | | | eBay, Inc. | 3.7% |

| | | |

|

|

| | | | Netflix, Inc. | 3.6% |

| | | |

|

|

| | | | Monster Worldwide, Inc. | 3.6% |

| | | |

|

|

| * Based on percentage of net assets as of December 31, 2004. | | ** Top 10 stock holdings total 52.9% of net assets. These holdings are current as of December 31, 2004, and may not be representative of current or future investments. |

| 2004 Annual Report - 15 |

Firsthand Global Technology Fund

Performance and Portfolio Discussion

How did the Fund perform in 2004?

In 2004, Firsthand Global Technology Fund (GTFQX) posted a 7.16% loss, versus a 9.15% gain for the Nasdaq Composite Index and a 4.11% gain for the Lipper Science and Technology Fund Index. For the six months ended December 31, 2004, Firsthand Global Technology Fund rose 1.90% as compared to 6.56% and 3.57% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

The Fund underperformed its benchmarks during 2004 due to its weightings in the semiconductor and telecommunications industries. Impressive year-over-year growth in worldwide semiconductor sales reflected continued economic growth, especially in the U.S. and China. However, despite such strong sales, semiconductor stocks slipped as rising inventories squeezed profit margins and negatively impacted chipmakers' earnings.

Which holdings were the largest contributors to the Fund's performance?

Israel-based Alvarion (ALVR) saw business improve after an increase in demand for the company's wireless broadband equipment, such as base stations that are used to make voice and data transmission possible over wireless networks. Alvarion is also enjoying modest success in rolling out WiMax networks to rural and urban areas. WiMax is a technology that offers wireless data access rates of up to 75 megabits per second-compared with 11 megabits per second for a typical Wi-Fi network-over larger distances.

Standouts in the software industry included telecom software provider Comverse Technology (CMVT), customer management and billing software supplier Amdocs (DOX), and Cognos (COGN), a provider of business intelligence (BI) software. Business intelligence is a broad category of software applications and technologies for gathering, storing, and analyzing data to help corporations make better business decisions. Cognos' prospects have brightened as demand for BI software has increased over the last few years.

Which holdings were the greatest detractors from the Fund's performance?

After enjoying a robust year in 2003, UTStarcom (UTSI) reversed course and ended 2004 as the Fund's worst performer. UTStarcom provides telecom equipment for wireline and wireless networks in China and other emerging markets. Most of UTStarcom's troubles started in late July, when the company missed second-quarter estimates due to supply-chain problems that crimped the company's profit margins.

Our positions in Amkor Technology (AMKR), ASML Holding (ASML), and STMicroelectronics (STM) all declined as the outlook for continued robust growth in 2005 dimmed. Other semiconductor positions that hurt Fund performance included camera-chip maker OmniVision Technologies (OVTI), microdisplay manufacturer Kopin (KOPN), and semiconductor manufacturer Zoran (ZRAN). The Fund also realized a sizable loss after closing its position in disk-drive manufacturer Maxtor (MXO).

| 2004 Annual Report - 16 |

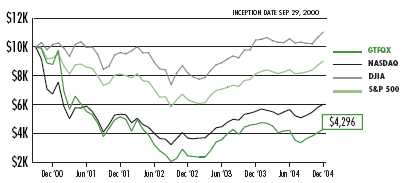

Fund Performance and Holding Information (as of December 31, 2004)

Firsthand Global Technology Fund vs. Market Indices

| | GTFQX | | NASDAQ | | DJIA | | S&P 500 |

| Since Inception (9/29/00) | -18.00% | | -11.21% | | 2.35% | | -2.37% |

| 3-Year | -5.92% | | 4.20% | | 4.70% | | 3.58% |

| 1-Year | -7.16% | | 9.15% | | 5.31% | | 10.88% |

| Q4 '04 Total Return (not annualized) | 17.91% | | 14.87% | | 7.59% | | 9.23% |

Growth of a Hypothetical $10,000 Investment

| Holdings by Industry* | | Top 10 Holdings** |

| | % of Net Assets | | | % of Net Assets |

| Communications Equipment | 21.2% | | UTStarcom, Inc. | 8.0% |

|

| |

|

|

| Software | 19.9% | | Alvarion Ltd. | 6.1% |

|

| |

|

|

| Semiconductors | 18.4% | | Samsung Electronics Co., | |

|

| | | |

| Other Electronics | 15.6% | | Ltd. - GDR | 5.9% |

|

| |

|

|

| Services | 6.9% | | Ceragon Networks Ltd. | 5.5% |

|

| |

|

|

| Semiconductor Equipment | 6.8% | | Fujitsu Ltd. | 4.5% |

|

| |

|

|

| Electronic Design Automation | 4.4% | | PDF Solutions, Inc. | 4.4% |

|

| |

|

|

| Peripherals | 3.6% | | Comverse Technology, Inc. | 4.1% |

|

| |

|

|

| Internet | 1.6% | | Amdocs Ltd. | 4.0% |

|

| |

|

|

| Other | 0.4% | | TDK Corp. | 4.0% |

|

| |

|

|

| Net Cash | 1.2% | | Western Digital Corp. | 3.6% |

|

| |

|

|

| * Based on percentage of net assets as of December 31, 2004. | | ** Top 10 stock holdings total 50.1% of net assets. These holdings are current as of December 31, 2004, and may not be representative of current or future investments. |

| 2004 Annual Report - 17 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMTo the Shareholders and Board of Trustees

Firsthand Funds

San Jose, California

We have audited the accompanying statements of assets and liabilities of Firsthand Funds comprising, respectively, Firsthand Technology Value Fund, Firsthand Technology Leaders Fund, Firsthand Technology Innovators Fund, Firsthand e-Commerce Fund, and Firsthand Global Technology Fund, including the portfolios of investments as of December 31, 2004, and the related statements of operations for the year then ended, changes in net assets for each of the two years in the period then ended, and the financial highlights for the periods indicated thereon. These financial statements and financial highlights are the responsibility of the Funds' management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2004, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Firsthand Funds as of December 31, 2004, the results of their operations, the changes in their net assets, and the financial highlights for the periods referred to above, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER

Philadelphia, Pennsylvania

January 21, 2005

| 2004 Annual Report - 18 |

Firsthand Technology Value Fund

PORTFOLIO OF INVESTMENTS

December 31, 2004

| | | | | | MARKET |

| | | | PERCENT | SHARES | VALUE |

| COMMON STOCK | 99.2% | | | $ 582,523,492 |

| | (Cost $952,866,377) | | | | |

| | | | | | | | |

| | ADVANCED MATERIALS | 0.9% | | | 5,000,000 |

| | | | | |

|

| | * | | Universal Chemical Technologies, | | | | |

| | | | Inc. - B (2) | | 500,000 | | 5,000,000 |

| | | | | | | | |

| | COMMUNICATIONS | 0.6% | | | 3,744,862 |

| | | | | |

|

| | * | | ViaSat, Inc. | | 154,300 | | 3,744,862 |

| | | | | | | | |

| | COMMUNICATIONS EQUIPMENT | 15.4% | | | 90,351,612 |

| | | | | |

|

| | * | | Anaren, Inc. (1) | | 1,111,900 | | 14,410,224 |

| | | | Harris Corp. | | 50,000 | | 3,089,500 |

| | | | Motorola, Inc. | | 690,200 | | 11,871,440 |

| | * | | REMEC, Inc. | | 240,000 | | 1,730,400 |

| | | | SpectraLink Corp. | | 180,000 | | 2,552,400 |

| | * | | Stratex Networks, Inc. | | 4,687,036 | | 10,592,701 |

| | * | | Tekelec, Inc. | | 875,800 | | 17,901,352 |

| | * | | UTStarcom, Inc. | | 1,273,300 | | 28,203,595 |

| | | | | | | | |

| | DEFENSE & AEROSPACE | 5.7% | | | 33,681,574 |

| | | | | |

|

| | * | | FLIR Systems, Inc. | | 470,600 | | 30,019,574 |

| | | | L-3 Communications Holdings, Inc. | | 50,000 | | 3,662,000 |

| | | | | | | | |

| | INTELLECTUAL PROPERTY | 0.9% | | | 5,072,515 |

| | | | | |

|

| | * | | Silicon Genesis Corp. - 1-D (1) (2) | | 850,830 | | 749,751 |

| | * | | Silicon Genesis Corp. - 1-E (1) (2) | | 4,071,226 | | 4,315,500 |

| | * | | Silicon Genesis Corp. - | | | | |

| | | | Common Stock (1) (2) | | 726,424 | | 7,264 |

| | | | | | | | |

| | INTERNET | 4.4% | | | 25,695,740 |

| | | | | |

|

| | * | | Akamai Technologies, Inc. | | 458,000 | | 5,967,740 |

| | * | | Netflix, Inc. | | 1,600,000 | | 19,728,000 |

| | | | | | | | |

| | NETWORKING | 1.0% | | | 5,983,088 |

| | | | | |

|

| | * | | Caspian Networks, Inc. - | | | | |

| | | | Common Stock (2) | | 33,781 | | 0 |

| | * | | Cisco Systems, Inc. | | 200,000 | | 3,860,000 |

| | * | | IP Unity, Inc. - C (2) | | 1,104,265 | | 1,792,863 |

| | * | | IP Unity, Inc. - E (2) | | 193,042 | | 313,307 |

| | * | | Polaris Networks, Inc. - A (2) | | 297,848 | | 16,918 |

| | | | | | | | |

| | OTHER ELECTRONICS | 0.4% | | | 2,586,350 |

| | | | | | |

|

| | * | | NanoMuscle, Inc. - A-1 (2) | | 1,250,000 | | 0 |

| | | | | |

*Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 19 |

Firsthand Technology Value Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | | | | MARKET |

| | | PERCENT | SHARES | | VALUE |

* | NanoMuscle, Inc. - Common Stock (2) | | 1,250,000 | | $ | | 0 |

| | PerkinElmer, Inc. | | 115,000 | | | 2,586,350 |

| | | | | | | | |

| PERIPHERALS | 4.0% | | | | 23,319,200 |

| | | | | |

|

| * | Electronics For Imaging, Inc. | | 200,000 | | | 3,482,000 |

| * | Western Digital Corp. | | 1,830,000 | | | 19,837,200 |

| | | | | | | | |

| PHOTONICS | 4.5% | | | | 26,427,552 |

| | | | | |

|

| * | Celox Networks, Inc. - A-1 (2) | | 1,000,000 | | | | 0 |

| * | Celox Networks, Inc. - Common | | | | | | |

| | Stock (2) | | 138,121 | | | | 0 |

| * | Corning, Inc. | | 2,150,000 | | | 25,305,500 |

| * | Luminous Networks, Inc. - D (2) | | 868,710 | | | 937,642 |

| * | Luminous Networks, Inc. - E (2) | | 434,724 | | | 184,410 |

| * | Maple Optical Systems, Inc. - | | | | | | |

| | A-1 (1) (2) | | 10,352,054 | | | | 0 |

| | | | | | | | |

| SEMICONDUCTOR EQUIPMENT | 0.2% | | | | 1,018,000 |

| | | | | |

|

| * | Asyst Technologies, Inc. | | 200,000 | | | 1,018,000 |

| | | | | | | | |

| SEMICONDUCTORS | 35.4% | | | | 208,049,947 |

| | | | | |

|

| * | Aeroflex, Inc. | | 1,250,600 | | | 15,157,272 |

| * | Applied Micro Circuits Corp. | | 1,499,900 | | | 6,314,579 |

| * | AuthenTec, Inc. - C (2) | | 1,472,495 | | | 1,179,881 |

| * | AuthenTec, Inc. - D (2) | | 290,958 | | | 232,766 |

| | Celeritek, Inc. | | 232,200 | | | 355,266 |

| * | Clarisay, Inc. - B (1) (2) | | 2,605,306 | | | | 0 |

| * | Clarisay, Inc. - C (1) (2) | | 7,194,244 | | | | 0 |

| * | Freescale Semiconductor, Inc. - B | | 76,208 | | | 1,399,179 |

| * | Global Locate, Inc. - A (1) (2) | | 6,030,896 | | | 7,794,209 |

| * | Global Locate, Inc. - C (1) (2) | | 1,111,111 | | | 1,000,000 |

| * | Global Locate, Inc. - D (1) (2) | | 555,555 | | | 500,000 |

| * | Kopin Corp. | | 299,100 | | | 1,157,517 |

| * | Lexar Media, Inc. | | 1,899,200 | | | 14,889,728 |

| * | Marvell Technology Group Ltd. | | 500,000 | | | 17,735,000 |

| * | PMC-Sierra, Inc. | | 1,155,700 | | | 13,001,625 |

| * | SanDisk Corp. | | 2,437,400 | | | 60,861,878 |

| * | Skyworks Solutions, Inc. | | 898,300 | | | 8,470,969 |

| | STMicroelectronics N.V. - ADR | | 783,400 | | | 15,135,288 |

| | Texas Instruments, Inc. | | 690,000 | | | 16,987,800 |

| * | TranSwitch Corp. | | 3,593,000 | | | 5,533,220 |

| * | TriQuint Semiconductor, Inc. | | 2,332,400 | | | 10,379,180 |

| * | Zoran Corp. | | 860,500 | | | 9,964,590 |

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 20 |

Firsthand Technology Value Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | | | | MARKET |

| | | | PERCENT | SHARES | VALUE |

| | SERVICES | 1.8% | | | $ 10,662,810 |

| | * | Anteon International Corp. | | 120,900 | | 5,060,874 |

| | * | Intrado, Inc. | | 309,100 | | 3,740,110 |

| | * | TeleCommunication Systems, Inc. - A | | 557,600 | | 1,861,826 |

| | | | | | | |

| | SOFTWARE | 24.0% | | | 140,930,242 |

| | | | | |

|

| | * | Comverse Technology, Inc. | | 1,670,900 | | 40,853,505 |

| | * | Concord Communications, Inc. (1) | | 1,089,300 | | 12,069,444 |

| | * | Napster, Inc. (1) (3) | | 1,750,000 | | 16,450,000 |

| | | SAP AG - ADR | | 100,000 | | 4,421,000 |

| | * | VERITAS Software Corp. | | 312,900 | | 8,933,295 |

| | * | Websense, Inc. | | 446,900 | | 22,666,768 |

| | * | Wind River Systems, Inc. | | 2,622,600 | | 35,536,230 |

| | | | | | | |

| WARRANTS | 0.2% | | | 929,009 |

| | | | |

|

| | (Cost $192) | | | | |

| | | | | | | |

| | ADVANCED MATERIALS | 0.0% | | | 200 |

| | | | | |

|

| | * | Universal Chemical Technologies, | | | | |

| | | Inc. - B Warrants (2) | | 200,000 | | 200 |

| | | | | | | |

| | COMMUNICATIONS EQUIPMENT | 0.1% | | | 470,734 |

| | | | | |

|

| | * | Lucent Technologies, Inc. - Warrants | | 297,933 | | 470,734 |

| | | | | | | |

| | INTELLECTUAL PROPERTY | 0.1% | | | 334,436 |

| | | | | |

|

| | * | Silicon Genesis Corp. - 1-E | | | | |

| | | Warrants (1) (2) | | 1,257,859 | | 334,339 |

| | * | Silicon Genesis Corp. - Common | | | | |

| | | Stock Warrants (1) (2) | | 59,147 | | 59 |

| | * | Silicon Genesis Corp. - Common | | | | |

| | | Stock Warrants (1) (2) | | 37,982 | | 38 |

| | | | | | | |

| | NETWORKING | 0.0% | | | 145 |

| | | | | |

|

| | * | IP Unity, Inc. - E Warrants (2) | | 69,496 | | 69 |

| | * | Polaris Networks, Inc. - Convertible | | | | |

| | | Warrants (2) | | 75,712 | | 76 |

| | | | | | | |

| | OTHER ELECTRONICS | 0.0% | | | 0 |

| | | | | | |

|

| | * | NanoMuscle, Inc. - B-1 Warrants (2) | | 306,757 | | 0 |

| | | | | | | |

| | PHOTONICS | 0.0% | | | 0 |

| | | | | |

|

| | * | Celox Networks, Inc. - A-1 | | | | |

| | | Warrants (2) | | 500,000 | | 0 |

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 21 |

Firsthand Technology Value Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | SHARES/ | | | |

| | | | | PRINCIPAL | | | | MARKET |

| | | | PERCENT | AMOUNT | | | | VALUE |

| | * | Luminous Networks, Inc. - D | | | | | | |

| | | Warrants (2) | | 144,785 | | $ | | 0 |

| | | | | | | | | |

| SEMICONDUCTORS | 0.0% | | | | 123,494 |

| | | | |

|

| | * | AuthenTec, Inc. - C Warrants (2) | | 392,665 | | | 117,835 |

| | * | Clarisay, Inc. Warrants | | | | | | |

| | | 06/03/2005- | | | | | | |

| | | 11/10/2005 (1) (2) | | 2,350,000 | | | | 0 |

| | * | Global Locate, Inc. - Board | | | | | | |

| | | Warrants (1) (2) | | 18,750 | | | | 94 |

| | * | Global Locate, Inc. - Board | | | | | | |

| | | Warrants (1) (2) | | 75,000 | | | | 375 |

| | * | Global Locate, Inc. - Board | | | | | | |

| | | Warrants (1) (2) | | 75,000 | | | | 375 |

| | * | Global Locate, Inc. - C | | | | | | |

| | | Warrants (1) (2) | | 370,370 | | | 3,704 |

| | * | Global Locate, Inc. - D | | | | | | |

| | | Warrants (1) (2) | | 111,111 | | | 1,111 |

| | | | | | | | | |

| CONVERTIBLE BONDS | 0.0% | | | | 151,435 |

| (Cost $2,900,074) | | | |

|

| | | | | | | |

| | | | | | | | | |

| NETWORKING | 0.0% | | | | 151,435 |

| | | | |

|

| | | Polaris Networks, Inc. 10.00% (2) | | 100,949 | | | 100,949 |

| | | Polaris Networks, Inc., | | | | | | |

| | | Escrow 0.56% (2) | | 50,486 | | | 50,486 |

| | | | | | | | | |

| OTHER ELECTRONICS | 0.0% | | | | | 0 |

| | | | |

|

| | * | NanoMuscle, Inc. 8.00% | | | | | | |

| | | 02/16/2005 (2) | | 398,639 | | | | 0 |

| | | | | | | | | |

| SEMICONDUCTORS | 0.0% | | | | | 0 |

| | | | |

|

| | * | Clarisay, Inc. 8.00% 06/03/2005- | | | | | | |

| | | 11/10/2005 (1) (2) | | 2,350,000 | | | | 0 |

| | | | | | | | | |

| TOTAL INVESTMENT SECURITIES | 99.4% | | | | 583,603,936 |

| (Cost $955,766,643) | | | | | | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES | 0.6% | | | | 3,326,005 |

| | | | |

|

| | | | | | | | | |

| NET ASSETS | 100.0% | | | $ | 586,929,941 |

| | | | | | |

|

| * | Non-income producing |

| (1) | Affiliated issuer |

| (2) | Restricted security |

| (3) | Napster, Inc. has the right to put a restriction of public sale on 800,000 shares of the Fund's Napster, |

| | Inc. holding. As of December 31, 2004, there are no restrictions on the Fund's shares of Napster, Inc. |

| ADR | American Depositary Receipts |

see accompanying notes to financial statements

| 2004 Annual Report - 22 |

Firsthand Technology Leaders Fund

PORTFOLIO OF INVESTMENTS

December 31, 2004

| | | | | | | MARKET |

| | | | PERCENT | | SHARES | VALUE |

| COMMON STOCK | 99.4% | | | | $ 113,258,833 |

| | (Cost $114,741,939) | | | | | |

| | | | | | | | | |

| | COMMUNICATIONS EQUIPMENT | 5.1% | | | | 5,760,698 |

| | | | | | |

|

| | | | Nokia Corp. - ADR | | | 29,400 | | 460,698 |

| | | | QUALCOMM, Inc. | | | 125,000 | | 5,300,000 |

| | | | | | | | | |

| | INTERNET | 7.7% | | | | 8,808,010 |

| | | | | | |

|

| | * | | eBay, Inc. | | | 40,000 | | 4,651,200 |

| | * | | IAC/InterActiveCorp | | | 150,500 | | 4,156,810 |

| | | | | | | | | |

| | MEDIA | | 4.3% | | | | 4,888,331 |

| | | | | | | |

|

| | * | | Pixar Animation Studios | | | 57,100 | | 4,888,331 |

| | | | | | | | | |

| | NETWORKING | 4.9% | | | | 5,575,770 |

| | | | | | |

|

| | * | | Cisco Systems, Inc. | | | 288,900 | | 5,575,770 |

| | | | | | | | | |

| | OTHER ELECTRONICS | 2.9% | | | | 3,298,230 |

| | | | | | | |

|

| | * | | Agilent Technologies, Inc. | | | 136,856 | | 3,298,230 |

| | | | | | | | | |

| | PERIPHERALS | 3.3% | | | | 3,772,519 |

| | | | | | |

|

| | * | | EMC Corp. | | | 253,700 | | 3,772,519 |

| | | | | | | | | |

| | PHOTONICS | 2.8% | | | | 3,249,697 |

| | | | | | |

|

| | * | | Corning, Inc. | | | 276,100 | | 3,249,697 |

| | | | | | | | | |

| | SEMICONDUCTOR EQUIPMENT | 7.0% | | | | 8,004,771 |

| | | | | | |

|

| | * | | Applied Materials, Inc. | | | 138,800 | | 2,373,480 |

| | * | | ASML Holding N.V. | | | 130,300 | | 2,073,073 |

| | * | | KLA-Tencor Corp. | | | 44,800 | | 2,086,784 |

| | * | | Teradyne, Inc. | | | 86,200 | | 1,471,434 |

| | | | | | | | | |

| | SEMICONDUCTORS | 27.8% | | | | 31,655,919 |

| | | | | | |

|

| | * | | Altera Corp. | | | 188,000 | | 3,891,600 |

| | | | Intel Corp. | | | 97,300 | | 2,275,847 |

| | | | Samsung Electronics | | | | | |

| | | | Co., Ltd. - GDR (144A) | | | 22,600 | | 4,917,552 |

| | * | | SanDisk Corp. | | | 264,800 | | 6,612,056 |

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 23 |

Firsthand Technology Leaders Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | | | | | MARKET |

| | | PERCENT | | SHARES | | VALUE |

| | Taiwan Semiconductor | | | | | | |

| | Manufacturing Co. - ADR | | | 580,592 | | $ | 4,929,226 |

| | Texas Instruments, Inc. | | | 201,650 | | | 4,964,623 |

| | Xilinx, Inc. | | | 137,100 | | | 4,065,015 |

| | | | | | | | |

| SOFTWARE | 33.6% | | | | | 38,244,888 |

| | | | | |

|

| | Adobe Systems, Inc. | | | 80,500 | | | 5,050,570 |

| * | Amdocs Ltd. | | | 203,600 | | | 5,344,500 |

| * | BEA Systems, Inc. | | | 276,280 | | | 2,447,841 |

| * | Business Objects SA - ADR | | | 225,100 | | | 5,704,034 |

| * | Mercury Interactive Corp. | | | 113,700 | | | 5,179,035 |

| | Microsoft Corp. | | | 78,900 | | | 2,107,419 |

| | SAP AG - ADR | | | 105,300 | | | 4,655,313 |

| * | Symantec Corp. | | | 35,100 | | | 904,176 |

| * | VERITAS Software Corp. | | | 240,000 | | | 6,852,000 |

| | | | | | | | |

| WARRANTS | 0.2% | | | | | 195,109 |

| (Cost $0) | | | | |

|

| | | | | | | |

| | | | | | | | |

| COMMUNICATIONS EQUIPMENT | 0.2% | | | | | 195,109 |

| | | | | |

|

* | Lucent Technologies, Inc. | | | 123,487 | | | 195,109 |

| | | | | | | | |

| TOTAL INVESTMENT SECURITIES | 99.6% | | | | | 113,453,942 |

| (Cost $114,741,939) | | | | | | |

| | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES | 0.4% | | | | | 460,907 |

| | | | | |

|

| | | | | | | | |

| NET ASSETS | 100.0% | | | | $ | 113,914,849 |

| | | | | |

|

* Non-income producing

ADR American Depositary Receipts

GDR Global Depositary Receipts

see accompanying notes to financial statements

| 2004 Annual Report - 24 |

Firsthand Technology Innovators Fund

PORTFOLIO OF INVESTMENTS

December 31, 2004

| | | | | | MARKET |

| | | | PERCENT | SHARES | VALUE |

| COMMON STOCK | 94.2% | | | $ 54,751,851 |

| | (Cost $78,644,705) | | | | |

| | | | | | | |

| | COMMUNICATIONS EQUIPMENT | 13.4% | | | 7,775,471 |

| | | | | |

|

| | * | Airspan Networks, Inc. | | 284,000 | | 1,542,120 |

| | * | Finisar Corp. | | 536,500 | | 1,223,220 |

| | * | Powerwave Technologies, Inc. | | 139,400 | | 1,182,112 |

| | * | Proxim Corp. - A | | 21,630 | | 88,467 |

| | | SpectraLink Corp. | | 106,700 | | 1,513,006 |

| | * | Vyyo, Inc. | | 258,600 | | 2,226,546 |

| | | | | | | |

| | COMPUTER STORAGE DEVICES | 2.2% | | | 1,281,800 |

| | | | | |

|

| | * | M-Systems Flash Disk Pioneers Ltd. | | 65,000 | | 1,281,800 |

| | | | | | | |

| | ELECTRONIC DESIGN AUTOMATION | 9.1% | | | 5,319,522 |

| | | | | |

|

| | * | PDF Solutions, Inc. | | 330,200 | | 5,319,522 |

| | | | | | | |

| | INTELLECTUAL PROPERTY | 6.9% | | | 4,003,049 |

| | | | | |

|

| | * | MIPS Technologies, Inc. | | 200,000 | | 1,970,000 |

| | * | Silicon Genesis Corp. - 1-C (1) (2) | | 82,914 | | 300,779 |

| | * | Silicon Genesis Corp. - 1-E (1) (2) | | 1,633,254 | | 1,731,249 |

| | * | Silicon Genesis Corp. - | | | | |

| | | Common Stock (1) (2) | | 102,135 | | 1,021 |

| | | | | | | |

| | NETWORKING | 3.2% | | | 1,854,975 |

| | | | | |

|

| | * | IP Unity, Inc. - C (2) | | 1,117,957 | | 1,815,093 |

| | * | Polaris Networks, Inc. - A (2) | | 702,152 | | 39,882 |

| | | | | | | |

| | OTHER ELECTRONICS | 10.1% | | | 5,870,440 |

| | | | | |

|

| | * | Applied Films Corp. | | 92,800 | | 2,000,768 |

| | * | Intevac, Inc. | | 263,700 | | 1,993,572 |

| | * | LeapFrog Enterprises, Inc. | | 40,000 | | 544,000 |

| | * | Microvision, Inc. | | 190,300 | | 1,332,100 |

| | * | NanoMuscle, Inc. - A-1 (2) | | 1,250,000 | | 0 |

| | * | NanoMuscle, Inc. - Common Stock (2) | | 1,250,000 | | 0 |

| | | | | | | |

| | PERIPHERALS | 1.2% | | | 720,000 |

| | | | | |

|

| | * | Universal Display Corp. | | 80,000 | | 720,000 |

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 25 |

Firsthand Technology Innovators Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | | | | MARKET |

| | | | PERCENT | SHARES | VALUE |

| | PHOTONICS | 8.1% | | | $ 4,681,791 |

| | * | Avici Systems, Inc. | | 300,000 | | 2,715,000 |

| | * | Luminous Networks, Inc. - D (2) | | 1,522,719 | | 1,643,547 |

| | * | Luminous Networks, Inc. - E (2) | | 762,008 | | 323,244 |

| | * | Maple Optical Systems, Inc. - | | | | |

| | | A-1 (1) (2) | | 9,647,945 | | 0 |

| | | | | | | |

| | SEMICONDUCTORS | 27.9% | | | 16,199,118 |

| | | | | |

|

| | * | Aeroflex, Inc. | | 202,700 | | 2,456,723 |

| | * | Agere Systems, Inc. - A | | 500,000 | | 685,000 |

| | * | AuthenTec, Inc. - C (2) | | 736,248 | | 589,941 |

| | * | Clarisay, Inc. - B (1) (2) | | 2,861,519 | | 0 |

| | * | Kopin Corp. | | 518,500 | | 2,006,595 |

| | * | Lexar Media, Inc. | | 296,000 | | 2,320,640 |

| | * | O2Micro International Ltd. | | 35,000 | | 400,400 |

| | * | OmniVision Technologies, Inc. | | 141,000 | | 2,587,350 |

| | * | Power Integrations, Inc. | | 127,300 | | 2,517,994 |

| | * | Silicon Optix, Inc. - B (2) | | 1,111,111 | | 1,000,000 |

| | * | Volterra Semiconductor Corp. | | 30,000 | | 664,650 |

| | * | Zoran Corp. | | 83,750 | | 969,825 |

| | | | | | | |

| | SERVICES | 4.1% | | | 2,392,549 |

| | | | | |

|

| | * | Innovion Corp. - C (1) (2) | | 1,500,000 | | 1,489,350 |

| | * | TeleCommunication Systems, Inc. - A | | 270,500 | | 903,199 |

| | | | | | | |

| | SOFTWARE | 8.0% | | | 4,653,136 |

| | | | | |

|

| | * | Napster, Inc. | | 366,700 | | 3,446,980 |

| | * | Verint Systems, Inc. | | 33,200 | | 1,206,156 |

| | | | | | | |

| WARRANTS | 0.1% | | | 60,464 |

| (Cost $0) | | | |

|

| | | | | | |

| | | | | | | |

| | INTELLECTUAL PROPERTY | 0.0% | | | 944 |

| | | | | |

|

| | * | Silicon Genesis Corp. - 1-E (1) (2) | | 94,339 | | 944 |

| | | | | | | |

| | PHOTONICS | 0.0% | | | 0 |

| | | | | |

|

| | * | Luminous Networks, Inc. - D | | | | |

| | | Warrants (2) | | 253,787 | | 0 |

| | | | | | | |

| | SEMICONDUCTORS | 0.1% | | | 58,917 |

| | | | | |

|

| | * | AuthenTec, Inc. - C Warrants (2) | | 196,333 | | 58,917 |

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 26 |

Firsthand Technology Innovators Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | SHARES/ | |

| | | | PRINCIPAL | | MARKET |

| | | PERCENT | AMOUNT | | VALUE |

* | Clarisay, Inc. Warrants | | | | |

| | 05/08/2005-12/31/2010 (1) (2) | | 1,259,290 | | $ 0 |

| | | | | | |

| SERVICES | 0.0% | | | 603 |

| | | | |

|

* | Innovion Corp. Warrants (1) (2) | | 602,577 | | 603 |

| | | | | | |

| CONVERTIBLE BONDS | 1.0% | | | 602,577 |

| | | | |

|

| (Cost $1,752,577) | | | | |

| | | | | | |

| SEMICONDUCTORS | 0.0% | | | 0 |

| | | | |

|

* | Clarisay, Inc. 8.00% 05/08/2005- | | | | |

| | 10/10/2005 (1) (2) | | 1,150,000 | | 0 |

| | | | | | |

| SERVICES | 1.0% | | | 602,577 |

| | | | |

|

* | Innovion Corp. 8.00% 03/07/2005 | | | | |

| | (1) (2) | | 602,577 | | 602,577 |

| | | | | | |

| CASH EQUIVALENTS | 4.1% | | | 2,369,786 |

| | | | |

|

| (Cost $2,369,786) | | | | |

| SSgA Prime Money Market Portfolio | | 2,340,094 | | 2,340,094 |

| State Street Bank and Trust Company | | | | |

| | Repurchase Agreement, 1.300% | | | | |

| | dated 12/31/2004, to be | | | | |

| | repurchased at $29,695 on | | | | |

| | 01/03/2005, collateralized by | | | | |

| | $30,000 U.S. Treasury Bond, | | | | |

| | 10.375% maturing 11/15/2012 | | | | |

| | (value $36,594) | | 29,692 | | 29,692 |

| | | | | | |

| TOTAL INVESTMENT SECURITIES | 99.4% | | | 57,784,678 |

| (Cost $82,767,068) | | | | |

| | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES | 0.6% | | | 371,371 |

| | | | |

|

| | | | | | |

| NET ASSETS | 100.0% | | | $ 58,156,049 |

| | | | | |

|

*

| Non-income producing

|

(1)

| Affiliated issuer

|

(2)

| Restricted security

|

see accompanying notes to financial statements

| 2004 Annual Report - 27 |

Firsthand e-Commerce Fund

PORTFOLIO OF INVESTMENTS

December 31, 2004

| | | | | | MARKET |

| | | | PERCENT | SHARES | VALUE |

| COMMON STOCK | 94.2% | | | $ 52,328,059 |

| | (Cost $ 45,614,896) | | | | |

| | | | | | | | |

| | BROADCASTING & CABLE TV | 0.6% | | | 346,725 |

| | | | | |

|

| | * | | Liberty Media International, Inc. - A | | 7,500 | | 346,725 |

| | | | | | | | |

| | FINANCIAL | 2.9% | | | 1,608,000 |

| | | | | |

|

| | * | | Ameritrade Holding Corp. | | 50,000 | | 711,000 |

| | * | | E*TRADE FINANCIAL Corp. | | 60,000 | | 897,000 |

| | | | | | | | |

| | INTERNET | 30.3% | | | 16,802,173 |

| | | | | |

|

| | * | | 1-800-FLOWERS.COM, Inc. - A | | 10,000 | | 84,100 |

| | * | | Akamai Technologies, Inc. | | 22,500 | | 293,175 |

| | * | | Amazon.com, Inc. | | 30,000 | | 1,328,700 |

| | * | | Ask Jeeves, Inc. | | 10,000 | | 267,500 |

| | * | | Autobytel, Inc. | | 60,000 | | 362,400 |

| | * | | Drugstore.com, Inc. | | 222,700 | | 757,180 |

| | * | | eBay, Inc. | | 17,600 | | 2,046,528 |

| | * | | IAC/InterActiveCorp | | 86,700 | | 2,394,654 |

| | * | | LivePerson, Inc. | | 100,000 | | 314,000 |

| | * | | Monster Worldwide, Inc. | | 58,900 | | 1,981,396 |

| | * | | Netflix, Inc. | | 161,200 | | 1,987,596 |

| | * | | Time Warner, Inc. | | 62,600 | | 1,216,944 |

| | * | | Yahoo! Inc. | | 100,000 | | 3,768,000 |

| | | | | | | | |

| | NETWORKING | 1.0% | | | 579,000 |

| | | | | |

|

| | * | | Cisco Systems, Inc. | | 30,000 | | 579,000 |

| | | | | | | | |

| | SERVICES | 20.4% | | | 11,307,020 |

| | | | | |

|

| | * | | Anteon International Corp. | | 11,700 | | 489,762 |

| | * | | CNET Networks, Inc. | | 255,400 | | 2,868,142 |

| | | | Fair, Issac Corp. | | 15,000 | | 550,200 |

| | | | First Data Corp. | | 35,000 | | 1,488,900 |

| | * | | PEC Solutions, Inc. | | 115,400 | | 1,635,218 |

| | * | | Sportsman' s Guide, Inc. | | 15,000 | | 337,500 |

| | * | | WebEx Communications, Inc. | | 114,100 | | 2,713,298 |

| | * | | WebMD Corp. | | 150,000 | | 1,224,000 |

| | | | | | | | |

| | SOFTWARE | 39.0% | | | 21,685,141 |

| | | | | |

|

| | * | | BEA Systems, Inc. | | 193,100 | | 1,710,866 |

| | * | | Chordiant Software, Inc. | | 588,285 | | 1,341,290 |

| | * | | Cognizant Technology Solutions | | | | |

| | | | Corp. - A | | 45,900 | | 1,942,947 |

| | * | | Digital Insight Corp. | | 65,000 | | 1,196,000 |

| | | | | |

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 28 |

Firsthand e-Commerce Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | SHARES/ | | |

| | | | | PRINCIPAL | | | MARKET |

| | | | PERCENT | AMOUNT | | | VALUE |

| * | Macromedia, Inc. | | 98,900 | | $ | 3,077,768 |

| * | Mercury Interactive Corp. | | 15,700 | | | 715,135 |

| * | Napster, Inc. | | 254,500 | | | 2,392,300 |

| * | Novell, Inc. | | 122,600 | | | 827,550 |

| * | Red Hat, Inc. | | 20,000 | | | 267,000 |

| * | Symantec Corp. | | 14,000 | | | 360,640 |

| * | VERITAS Software Corp. | | 61,900 | | | 1,767,245 |

| * | Websense, Inc. | | 120,000 | | | 6,086,400 |

| | | | | | | | |

| CASH EQUIVALENTS | 5.5% | | | | 3,069,709 |

| | | | |

|

| (Cost $3,069,709) | | | | | |

| SSgA Prime Money Market Portfolio | | 2,235,592 | | | 2,235,592 |

| State Street Bank and Trust Company | | | | | |

| | Repurchase Agreement, 1.300% | | | | | |

| | dated 12/31/2004, to be | | | | | |

| | repurchased at $834,207 on | | | | | |

| | 01/03/2005, collateralized by | | | | | |

| | $790,000 U.S. Treasury Note, | | | | | |

| | 5.000% maturing 08/15/2011 | | | | | |

| | (value $869,988) | | 834,117 | | | 834,117 |

| | | | | | | | |

| TOTAL INVESTMENT SECURITIES | 99.7% | | | | 55,397,768 |

| (cost $48,684,605) | | | | | |

| | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES | 0.3% | | | | 154,858 |

| | | | |

|

| | | | | | | | |

| NET ASSETS | | 100.0% | | | $ | 55,552,626 |

| | | | | |

|

| | | | | | | | |

| OPTIONS WRITTEN | | | | | |

| | | | | Number of | | | Market |

| Call Options | | Contracts | | | Value |

| Websense, Inc., expiring Jan. 2005 | | | | | |

| @ $45. | | 600 | | | (420,000) |

| Websense, Inc., expiring Jan. 2005 | | | | | |

| @ $50. | | 600 | | | (156,000) |

| | | | | | |

|

| | | | | | | | |

| Total (premiums received $187,286) | | | | | |

| (Note 2) | | | | $ | (576,000) |

| | | | | |

|

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 29 |

Firsthand Global Technology Fund

PORTFOLIO OF INVESTMENTS

December 31, 2004

| | | | | MARKET |

| | | PERCENT | SHARES | VALUE |

| COMMON STOCK | 98.8% | | | $ 32,144,565 |

| (Cost $31,511,907) | | | | |

| | | | | | | |

| COMMUNICATIONS EQUIPMENT | 21.2% | | | 6,891,491 |

| | | | |

|

| * | | Alvarion Ltd. | | 148,900 | | 1,977,392 |

| * | | Ceragon Networks Ltd. | | 265,900 | | 1,789,507 |

| | | Nokia Corp. - ADR | | 7,100 | | 111,257 |

| | | QUALCOMM, Inc. | | 10,000 | | 424,000 |

| * | | UTStarcom, Inc. | | 116,900 | | 2,589,335 |

| | | | | | | |

| ELECTRONIC DESIGN AUTOMATION | 4.4% | | | 1,417,680 |

| | | | |

|

* | | PDF Solutions, Inc. | | 88,000 | | 1,417,680 |

| | | | | | | |

| ELECTRONICS MANUFACTURING | | | | |

| SERVICES | 0.4% | | | 121,089 |

| | | | |

|

| | | Elcoteq Network Corp. - A | | 5,000 | | 121,089 |

| | | | | | | |

| INTERNET | 1.6% | | | 522,600 |

| | | | |

|

* | | RADWARE Ltd. | | 20,000 | | 522,600 |

| | | | | | | |

| OTHER ELECTRONICS | 15.6% | | | 5,082,878 |

| | | | |

|

| | | Alps Electric Co., Ltd. | | 65,000 | | 966,173 |

| | | Fujitsu Ltd. | | 223,000 | | 1,447,883 |

* | | Intevac, Inc. | | 69,000 | | 521,640 |

| | | Sharp Corp. | | 52,000 | | 846,841 |

| | | TDK Corp. | | 17,600 | | 1,300,341 |

| | | | | | | |

| PERIPHERALS | 3.6% | | | 1,183,728 |

| | | | |

|

* | | Western Digital Corp. | | 109,200 | | 1,183,728 |

| | | | | | | |

| SEMICONDUCTOR EQUIPMENT | 6.8% | | | 2,222,024 |

| | | | |

|

* | | ASML Holding N.V. | | 66,758 | | 1,062,120 |

| | | Hoya Corp. | | 1,900 | | 213,988 |

| | | Tokyo Electron Ltd. | | 15,400 | | 945,916 |

| | | | | | | |

| SEMICONDUCTORS | 18.4% | | | 5,983,356 |

| | | | |

|

| * | | Agere Systems, Inc. - A | | 200,000 | | 274,000 |

| * | | Infineon Technologies AG - ADR | | 28,700 | | 312,830 |

| * | | Kopin Corp. | | 156,000 | | 603,720 |

* Non-income producing

see accompanying notes to financial statements

| 2004 Annual Report - 30 |

Firsthand Global Technology Fund

PORTFOLIO OF INVESTMENTS (continued)

December 31, 2004

| | | | | | | MARKET |

| | | PERCENT | | SHARES | | VALUE |

* | OmniVision Technologies, Inc. | | | 55,000 | | $ | 1,009,250 |

| | Samsung Electronics Co., Ltd. - | | | | | | |

| | GDR (144A) | | | 8,800 | | | 1,914,799 |

| | STMicroelectronics N.V. - ADR | | | 32,400 | | | 625,968 |

| | Taiwan Semiconductor | | | | | | |

| | Manufacturing Co. - ADR | | | 105,464 | | | 895,389 |