UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-8268 |

|

Firsthand Funds |

(Exact name of registrant as specified in charter) |

|

125 South Market, Suite 1200

San Jose, CA | | 95113 |

(Address of principal executive offices) | | (Zip code) |

|

Firsthand Capital Management, Inc.

125 South Market, Suite 1200

San Jose, CA 95113 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (408) 294-2200 | |

|

Date of fiscal year end: | December 31, 2005 | |

|

Date of reporting period: | December 31, 2005 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

| | Firsthand

Funds |

| |

| |

| December 31, 2005 |

Annual Report to Shareholders

Firsthand Technology Value FundÒ

Firsthand Technology Leaders Fund

Firsthand Technology Innovators Fund

Firsthand e-Commerce Fund

Firsthand Global Technology Fund

This report is provided for the general information of the shareholders of Firsthand Funds.

This report is not intended for distribution to prospective investors in the Funds,

unless preceded or accompanied by an effective prospectus. For more complete

information about Firsthand Funds, please call toll free 1.888.884.2675, option 2, or

visit www.firsthandfunds.com for a prospectus, which contains more information,

including risks, fees, and expenses. Read the prospectus carefully before

investing or sending money.

Firsthand Funds are distributed by ALPS Distributors, Inc.

INTRODUCING FIRSTHAND HEALTH SCIENCES FUND

On January 3, 2006, Firsthand Health Sciences Fund, a health care sector fund, opened to investors. The Fund intends to invest in a broad array of health care-related companies, including biotechnology, pharmaceutical, medical device, managed care and health care service companies.

Portfolio manager | | Chen/Payer | |

Portfolio manager tenure | | Since inception | |

Inception | | 12/30/05 | |

Ticker symbol | | HSFQX | |

CUSIP | | 337941835 | |

Sales load | | None | |

Redemption fee | | None | |

For more information about the Fund, please visit www.firsthandfunds.com

or call 1.888.884.2675, option 2.

Firsthand Health Sciences Fund is subject to greater risk than more diversified funds because of its investments in fewer securities and because of its concentration of investments in certain industries in the health care sector. Specific risks associated with investments in foreign companies (as described in the Fund’s Prospectus) could cause the Fund’s share price to fluctuate dramatically. The Fund’s investments in small-cap companies present greater risk than investments in larger companies. The Fund invests in several industries within the health care sector and the relative weightings of these industries in the Fund’s portfolio may change at any time. Equity investing involves risks, including the potential loss of the principal amount invested. Firsthand Funds are subject to greater risk than more diversified funds.

This page intentionally left blank

CONTENTS

Performance Summary | | 4 |

| | |

President’s Letter | | 6 |

| | |

Shareholder Fee Example | | 8 |

| | |

Performance and Portfolio Discussion | | 10 |

| | |

Report of Independent Registered Public Accounting Firm | 20 |

| | |

Financial Statements | |

| | |

Portfolio of Investments | |

| | |

| Firsthand Technology Value Fund | 21 |

| | |

| Firsthand Technology Leaders Fund | 25 |

| | |

| Firsthand Technology Innovators Fund | 27 |

| | |

| Firsthand e-Commerce Fund | 30 |

| | |

| Firsthand Global Technology Fund | 32 |

| | |

Statements of Assets and Liabilities | 34 |

| | |

Statements of Operations | 36 |

| | |

Statements of Changes in Net Assets | 38 |

| | |

Financial Highlights | |

| | |

| Firsthand Technology Value Fund | 43 |

| | |

| Firsthand Technology Leaders Fund | 44 |

| | |

| Firsthand Technology Innovators Fund | 45 |

| | |

| Firsthand e-Commerce Fund | 46 |

| | |

| Firsthand Global Technology Fund | 47 |

| |

Notes to Financial Statements | | 48 |

| | |

Additional Information | | 64 |

| | | |

3

PERFORMANCE SUMMARY

PERIOD RETURNS

(average annual total returns as of 12/31/05)

| | JUL-DEC | | | | | | | | | |

| | 2005 | | | | | | | | | |

FUND | | TOTAL | | 1-YEAR | | 3-YEAR | | 5-YEAR | | 10-YEAR | |

Firsthand Technology Value Fund® | | 18.75 | % | 12.35 | % | 22.33 | % | -14.77 | % | 9.53 | % |

| | | | | | | | | | | |

Firsthand Technology Leaders Fund | | 16.90 | % | 13.13 | % | 21.18 | % | -10.95 | % | * | |

| | | | | | | | | | | |

Firsthand Technology Innovators Fund | | 5.59 | % | -11.90 | % | 6.17 | % | -17.43 | % | * | |

| | | | | | | | | | | |

Firsthand e-Commerce Fund | | 11.48 | % | 5.26 | % | 17.80 | % | -12.50 | % | * | |

| | | | | | | | | | | |

Firsthand Global Technology Fund | | 4.55 | % | -8.64 | % | 17.34 | % | -14.88 | % | * | |

| | | | | | | | | | | |

Nasdaq | | 7.64 | % | 2.13 | % | 18.89 | % | -1.75 | % | 8.11 | % |

| | | | | | | | | | | |

DJIA | | 5.57 | % | 1.72 | % | 11.17 | % | 2.00 | % | 9.79 | % |

| | | | | | | | | | | |

S&P 500 | | 5.77 | % | 4.91 | % | 14.38 | % | 0.54 | % | 9.06 | % |

*Not annualized.

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

The Dow Jones Industrial Average (DJIA) is a group of 30 stocks tracked by the Dow Jones Company. The Nasdaq Composite Index (Nasdaq) is a capitalization-weighted index of all common stocks listed with Nasdaq. The Standard & Poor’s 500 Index (S&P 500) is a market-weighted index of 500 stocks of well-established companies. Each index represents an unmanaged, broad-based basket of stocks. These indices are typically used as benchmarks for overall market performance. The Lipper Science and Technology Fund Index includes the largest 30 mutual funds in the group, which, by prospectus or portfolio practice, invest at least 80% of their equity portfolios in science and technology stocks. Investments cannot be made directly in an index.

4

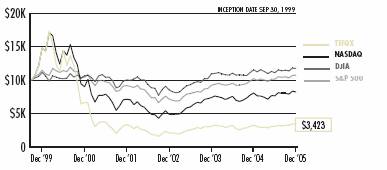

RETURNS SINCE INCEPTION

(average annual total returns as of 12/31/05)

| | AVERAGE | | | | | | | |

| | ANNUAL | | | | | | | |

| | TOTAL | | | | | | S&P | |

FUND (INCEPTION DATE) | | RETURN | | NASDAQ | | DJIA | | 500 | |

Firsthand Technology Value Fund® (5/20/94) | | 14.90 | % | 10.46 | % | 11.69 | % | 10.99 | % |

| | | | | | | | | |

Firsthand Technology Leaders Fund (12/10/97) | | 8.45 | % | 4.31 | % | 5.63 | % | 4.69 | % |

| | | | | | | | | |

Firsthand Technology Innovators Fund (5/20/98) | | 2.32 | % | 2.78 | % | 4.24 | % | 3.12 | % |

| | | | | | | | | |

Firsthand e-Commerce Fund (9/30/99) | | -15.75 | % | -3.03 | % | 2.60 | % | 1.13 | % |

| | | | | | | | | |

Firsthand Global Technology Fund (9/29/00) | | -16.30 | % | -8.82 | % | 2.23 | % | -1.03 | % |

Each Fund may invest in small-capitalization companies and Initial Public Offerings (“IPOs”). These investments may be more volatile than investments in large-capitalization companies and loss of principal could be greater. The Funds may invest in foreign securities, which may be subject to greater risks than investing in domestic securities. Because the Funds are not diversified, they can take larger positions in fewer companies, increasing their risk profile. The Funds invest in several industries within the technology sector and the relative weightings of these industries in a Fund’s portfolio may change at any time.

5

PRESIDENT’S LETTER

| FELLOW SHAREHOLDERS,

The major market indices made little progress in 2005, with the Dow Jones Industrial Average, the S&P 500 Index, and the NASDAQ Composite Index posting gains of 1.72%, 4.91%, and 2.13%, respectively. With no general market upswing, it was a stock-picker’s market. The best gains were achieved by picking the right stocks, not necessarily the right sectors or segments.

Given that environment, I am pleased to report that our three largest funds handily beat the indices, with Firsthand Technology Value Fund, Firsthand Technology Leaders Fund, and Firsthand e-Commerce Fund posting gains of |

12.35%, 13.13%, and 5.26%, respectively. Unfortunately, a few of the companies owned by Firsthand Technology Innovators Fund and Firsthand Global Technology Fund stumbled badly in 2005, causing both funds to underperform the market.

Investing while looking in the rearview mirror is almost never a good idea. As I’ve said before, technology investors should avoid falling back on the familiar names from the last bull market. In the six years since the NASDAQ peaked, the technology landscape has changed radically, and the tech “bellwethers” are not the same growth machines they once were. Our focus is growth, so these well-known technology companies of the past do not dominate our portfolios. Though it may feel unsettling to see so many new and unfamiliar names in our funds, these newcomers are often the companies leading us into the most exciting opportunities. I would like to discuss some of the most promising areas within the tech sector, highlighting those in which we have already made significant investments.

Consumer Electronics—Ten years ago, PCs and corporate networks were the major growth drivers in the technology sector. Today, that distinction belongs almost exclusively to consumer electronics, a global market that has been fueled by the emergence of middle-class consumers in developing economies such as China and India. From iPods and game consoles to flat-panel TVs and digital cameras, consumer electronics are hot. In fact, they have surpassed corporate IT gear in terms of end markets for semiconductors. Companies such as SanDisk (SNDK) and Corning (GLW) performed extremely well as consumer demand for flash memory and LCD displays surged in 2005.

The magnitude of the emerging economies of China and India and their impact on business opportunities is profound. Considering that the Chinese middle class will soon outnumber the U.S. middle class, it should soon surpass the total U.S. market for consumer electronics—at least in terms of units sold. This has already happened with cell phones and will soon happen with Internet connections. Televisions and PCs could take a while longer, but the trend is clear. For the right companies, this is very, very good news.

The Internet—The Internet is also capitalizing on a growing user base and has become a dominant force shaping both consumer behavior and business strategies. In 2005, the number of people online hit one billion. Although penetration rates in the U.S. are already nearing 70%, in Asia it is still only about 10%—a 200% increase in just five years. Our funds capitalized on this growth with solid 2005 performances from companies such as Google (GOOG), Akamai (AKAM), and Netflix (NFLX).

Note: All portfolio compositions are subject to change

6

Location, Location, Location—“Markets within markets” remain an important component of our investment strategy. We believe that great growth potential exists for companies selling a new feature or service to an already huge, established market. A good example of this is the cell phone market. Although somewhat mature in terms of total penetration rates (approximately 2 billion people worldwide already own cell phones), the cell phone market offers numerous and lucrative opportunities to businesses that offer new features and services to even a fraction of that existing user base. We believe location-based technology is poised to become one of the hottest of these new features. GPS companies like Global Locate and SiRF (SIRF) are well positioned to benefit if and when GPS-enabled phones become as popular as camera phones are today. Another company already benefiting from cell phone users’ demand for new features is QUALCOMM (QCOM), a maker of chipsets that enable multimedia capabilities on wireless phones and PDAs.

Semiconductors and Moore’s Law—Though the market for lithography equipment is relatively mature, we believe ASM Lithography (ASML) is in an excellent position to gain market share as manufacturers begin to re-tool for producing the next generation of semiconductor devices. Immersion lithography is a semiconductor manufacturing technology that enables chip makers to enhance resolution, allowing them to produce circuit features as small as 45 nanometers. As one of the leading developers of this lithography technology, we believe ASM is in a good position to capture a sizeable share of this market.

Solar Power—Cypress Semiconductor (CY) was an outstanding performer for the Funds last year, based largely on its majority ownership of solar cell manufacturer SunPower (SPWR). It may not be intuitive that solar and semiconductor technologies are interrelated, but most solar cells are made from silicon wafers—the same basic building block used to manufacture all kinds of silicon chips. While the science of collecting solar energy is fairly well understood today, we expect to see further advances in materials technology that will improve the efficiency of solar cells. Meanwhile, the market for solar equipment is expected to double by 2010.

These are just a few of what we believe to be the most promising areas of investment within the technology sector in the coming years. There are many others, such as security, RFID, web services, solid state lighting, clean technologies—and, yes, even nanotech—that we are watching closely. While I expect the U.S economy to continue to perform well in 2006, external factors, such as oil prices and international politics, will always have a considerable influence on the stock market. Nevertheless, I am encouraged by the fact that technology sector earnings are growing and innovation is alive and well.

Thank you for your investment in Firsthand Funds.

Sincerely,

Kevin Landis

President and Chief Executive Officer

7

SHAREHOLDER FEE EXAMPLE (UNAUDITED)

Example—In general, mutual fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees, and exchange fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, non-12b-1 service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Note that Firsthand Funds (“Trust”) does not charge transaction fees or 12b-1 distribution and service fees, though you may incur transaction fees if you purchase shares through a broker.

The example below is based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2005, to December 31, 2005.

Actual Expenses—The section of the table at right entitled “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), and multiply the result by the number in the section entitled “Actual” under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA or other tax-qualified savings plan, your expenses may also have included a $10 annual fee. In either case, the amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

Hypothetical Example for Comparison Purposes—The section of the table at right entitled “Hypothetical” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or the expenses you paid for the period. However, you may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table at right are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher. The examples also assume all dividends and distributions have been reinvested.

8

Firsthand Technology Value Fund

| | Beginning | | Ending | | Expenses Paid | | | |

| | Account Value | | Account Value | | During Period* | | Annualized | |

| | 7/1/05 | | 12/31/05 | | 7/1/05-12/31/05 | | Expense Ratio | |

Actual | | $ | 1,000 | | $ | 1,187.50 | | $ | 10.87 | | 1.92 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,015.08 | | $ | 9.75 | | 1.92 | % |

Firsthand Technology Leaders Fund

| | Beginning | | Ending | | Expenses Paid | | | |

| | Account Value | | Account Value | | During Period* | | Annualized | |

| | 7/1/05 | | 12/31/05 | | 7/1/05-12/31/05 | | Expense Ratio | |

Actual | | $ | 1,000 | | $ | 1,169.00 | | $ | 10.91 | | 1.95 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,014.93 | | $ | 9.90 | | 1.95 | % |

Firsthand Technology Innovators Fund

| | Beginning | | Ending | | Expenses Paid | | | |

| | Account Value | | Account Value | | During Period* | | Annualized | |

| | 7/1/05 | | 12/31/05 | | 7/1/05-12/31/05 | | Expense Ratio | |

Actual | | $ | 1,000 | | $ | 1,055.90 | | $ | 10.15 | | 1.95 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,014.93 | | $ | 9.90 | | 1.95 | % |

Firsthand e-Commerce Fund

| | Beginning | | Ending | | Expenses Paid | | | |

| | Account Value | | Account Value | | During Period* | | Annualized | |

| | 7/1/05 | | 12/31/05 | | 7/1/05-12/31/05 | | Expense Ratio | |

Actual | | $ | 1,000 | | $ | 1,114.80 | | $ | 10.45 | | 1.95 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,014.93 | | $ | 9.90 | | 1.95 | % |

Firsthand Global Technology Fund

| | Beginning | | Ending | | Expenses Paid | | | |

| | Account Value | | Account Value | | During Period* | | Annualized | |

| | 7/1/05 | | 12/31/05 | | 7/1/05-12/31/05 | | Expense Ratio | |

Actual | | $ | 1,000 | | $ | 1,045.50 | | $ | 9.96 | | 1.95 | % |

Hypothetical** | | $ | 1,000 | | $ | 1,014.93 | | $ | 9.90 | | 1.95 | % |

* Expenses are calculated by multiplying the Fund’s annualized expense ratio listed above by the average account value over the period and multiplying that number by 184/365 (to reflect the one-half year period).

** 5% return per year before expenses.

The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries, or other financial institutions.

9

Firsthand Technology Value Fund

Performance and Portfolio Discussion

How did the Fund perform in 2005?

In 2005, Firsthand Technology Value Fund (TVFQX) posted a 12.35% gain, versus a 2.13% increase for the Nasdaq Composite Index and a 5.38% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2005, Firsthand Technology Value Fund rose 18.75% as compared to 7.64% and 11.19% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund’s performance?

During 2005, Firsthand Technology Value Fund’s holdings in the semiconductor, Internet, and photonics industries helped it significantly outperform its benchmarks. Our decision to tilt the portfolio toward the consumer market paid off as robust spending on consumer electronics in 2005 benefitted the Fund’s portfolio holdings in these industries.

Which individual holdings were the largest contributors to the Fund’s performance?*

The Fund’s largest contributor in 2005 was flash memory supplier SanDisk (SNDK). SanDisk manufactures NAND flash, which is smaller, lighter, and consumes less power than a hard disk, making it the storage technology of choice for portable electronic devices such as digital cameras, MP3 players, and cell phones. Demand for flash increased when Apple Computer (AAPL) chose this type of memory over mini hard drives for use in some of its popular iPod products. After enjoying a nice run we gradually pared back our holdings as the stock price advanced, and we completely liquidated the Fund’s position by year end. Another positive contribution came from online DVD provider Netflix (NFLX), whose shares dipped briefly into the single digits early in 2005 as concerns of increased competition raised questions about the viability of the company’s business model. However, as its competitors stumbled, Netflix’s large customer base of more than four million subscribers helped it bounce back, with the stock up 119% for the year.

Once a high flier based on its leadership position in the photonics industry, Corning (GLW) successfully turned its business around by focusing on the manufacture of glass for liquid crystal display (LCD) panels found in desktop monitors, laptop computers, and LCD TVs. Increasing consumer demand for next-generation flat-panel TVs helped shares of Corning jump 67% this past year. Other holdings that helped boost performance in 2005 included Internet service provider Akamai Technologies (AKAM), employee Internet management software vendor Websense (WBSN), and semiconductor manufacturers Texas Instruments (TXN) and Zoran (ZRAN).

Which holdings were the greatest detractors from the Fund’s performance?

The Fund’s biggest money-loser during the period was telecommunications equipment provider UTStarcom (UTSI). UTStarcom struggled with declining demand for its telecom infrastructure equipment for wireline and wireless networks in its key market—China. UTStarcom’s dependence on China for the bulk of its revenues forced the company to pursue other opportunities to revitalize growth when that market started to slow. UTStarcom’s uncertain future growth prospects led many investors to abandon the stock, sending it down more than 60% in 2005.

Competition in the online music market got a bit more fierce in 2005 when Yahoo! (YHOO) announced that it would offer an online music service at significantly lower rates than Napster (NAPS)—news that sent shares of Napster down more than 25%. Other notable laggards among our portfolio holdings included communications equipment supplier Tekelec (TKLC), thermal imaging provider FLIR Systems (FLIR), and chipmakers PMC-Sierra (PMCS), Applied Micro Circuits (AMCC), and Skyworks Solutions (SWKS).

*Portfolio composition is subject to change.

10

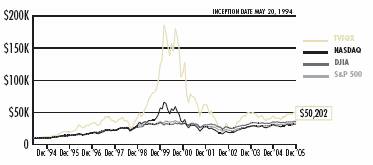

Fund Performance and Holding Information (as of December 31, 2005)

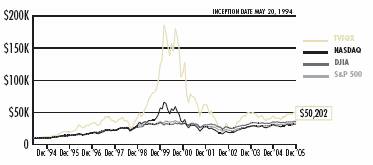

Firsthand Technology Value Fund vs. Market Indices

| | TVFQX | | NASDAQ | | DJIA | | S&P 500 | |

Since Inception (5/20/94) | | 14.90 | % | 10.46 | % | 11.69 | % | 10.99 | % |

| | | | | | | | | |

10-Year | | 9.53 | % | 8.11 | % | 9.79 | % | 9.06 | % |

| | | | | | | | | |

5-Year | | -14.77 | % | -1.75 | % | 2.00 | % | 0.54 | % |

| | | | | | | | | |

3-Year | | 22.33 | % | 18.89 | % | 11.17 | % | 14.38 | % |

| | | | | | | | | |

1-Year | | 12.35 | % | 2.13 | % | 1.72 | % | 4.91 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry*

| | % of Net Assets | |

Semiconductors | | 22.7 | % |

Software | | 18.5 | % |

Internet | | 13.6 | % |

Photonics | | 8.5 | % |

Communications Equipment | | 7.7 | % |

Semiconductor Equipment | | 6.3 | % |

Other Electronics | | 6.0 | % |

Peripherals | | 4.5 | % |

Networking | | 3.5 | % |

Intellectual Property | | 2.2 | % |

Defense & Aerospace | | 1.7 | % |

Other | | 3.0 | % |

Net Cash | | 1.8 | % |

* Based on percentage of net assets as of December 31, 2005.

Top 10 Holdings**

| | % of Net Assets | |

Netflix, Inc. | | 7.5 | % |

Corning, Inc. | | 6.8 | % |

Cypress Semiconductor Corp. | | 5.7 | % |

Comverse Technology, Inc. | | 5.5 | % |

Western Digital Corp. | | 4.5 | % |

Symbol Technologies, Inc. | | 4.4 | % |

VeriSign, Inc. | | 4.1 | % |

Applied Materials, Inc. | | 4.0 | % |

Akamai Technologies, Inc. | | 3.8 | % |

Aeroflex, Inc. | | 3.0 | % |

** Top 10 stock holdings total 49.3% of net assets. These holdings are current as of December 31, 2005, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings.

11

Firsthand Technology Leaders Fund

Performance and Portfolio Discussion

How did the Fund perform in 2005?

In 2005, Firsthand Technology Leaders Fund (TLFQX) posted a 13.13% gain, versus a 2.13% increase for the Nasdaq Composite Index and a 5.38% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2005, Firsthand Technology Leaders Fund rose 16.90% as compared to 7.64% and 11.19% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund’s performance?

Firsthand Technology Leaders Fund was able to outperform its benchmarks in 2005 due to its exposure to the semiconductor and photonics industries. Detracting from Fund performance were the portfolio’s Internet, software, and networking holdings.

Which individual holdings were the largest contributors to the Fund’s performance?*

For the period, the Fund’s top contributor was flash memory supplier SanDisk (SNDK). SanDisk manufactures NAND flash, which is smaller, lighter, and consumes less power than a hard disk, making it the storage technology of choice for portable electronic devices such as digital cameras, MP3 players, and cell phones. Demand for flash increased when Apple Computer (AAPL) chose this type of memory over mini hard drives for use in some of its popular iPod products. This news also boosted shares of Samsung Electronics (no U.S. symbol), a diversified consumer electronics giant and the world’s largest manufacturer of flash memory. Other semiconductor firms that helped Fund performance included Texas Instruments (TXN), chip foundry Taiwan Semiconductor Manufacturing Company (TSM), and semiconductor equipment provider ASML Holding N.V. (ASML).

In the photonics industry, shares of Corning (GLW) rose 67% in 2005 due in part to the success the company has experienced in its display technology division. Corning is the primary supplier of glass substrates to many of the world’s biggest television and display manufacturers and the company saw robust demand throughout 2005 as lower prices helped spark consumer interest for liquid crystal display (LCD) TVs and flat-panel monitors.

Which holdings were the greatest detractors from the Fund’s performance?

eBay (EBAY) was the Fund’s largest detractor in 2005. During the year, the online auction giant saw decelerating growth in several of its key markets and acknowledged that it would not meet Wall Street expectations. Despite moving aggressively into the Asian markets, expectations for robust growth there have not yet been realized. Investors also questioned eBay’s pricey acquisition of Skype and how easily it could be integrated into eBay’s core business. Skype allows users to make phone calls over the Internet using voice-over Internet protocol technology, or VoIP.

Cisco Systems (CSCO) finished the year down 11.4% as investors remained concerned about the company’s lackluster growth prospects. Cisco is the dominant supplier of routers, switches, and software that enable computer networks to communicate over the Internet. However, growth in Cisco’s core router and switch business has declined, forcing the company to look for other high-growth areas such as VoIP to bolster revenue.

Shares of VERITAS Software (VRTS) also lagged after Symantec (SYMC) announced that it would acquire the storage software vendor in December 2004. We elected to exit our position in VERITAS Software prior to the acquisition’s July 2005 closing. Other positions that were closed at a loss included software vendors Mercury Interactive (MERQ) and BEA Systems (BEAS).

*Portfolio composition is subject to change.

12

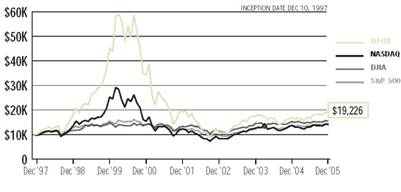

Fund Performance and Holding Information (as of December 31, 2005)

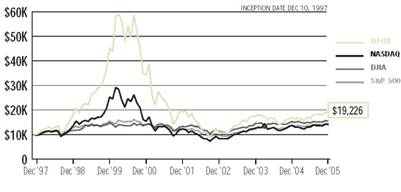

Firsthand Technology Leaders Fund vs. Market Indices

| | TLFQX | | NASDAQ | | DJIA | | S&P 500 | |

Since Inception (12/10/97) | | 8.45 | % | 4.31 | % | 5.63 | % | 4.69 | % |

5-Year | | -10.95 | % | -1.75 | % | 2.00 | % | 0.54 | % |

3-Year | | 21.18 | % | 18.89 | % | 11.17 | % | 14.38 | % |

1-Year | | 13.13 | % | 2.13 | % | 1.72 | % | 4.91 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry*

| | % of Net Assets | |

Semiconductors | | 29.5 | % |

Software | | 25.0 | % |

Semiconductor Equipment | | 9.5 | % |

Communications Equipment | | 7.4 | % |

Internet | | 5.8 | % |

Photonics | | 4.9 | % |

Media | | 3.8 | % |

Electronics Manufacturing Services | | 3.7 | % |

Other Electronics | | 3.7 | % |

Networking | | 3.6 | % |

Net Cash | | 3.1 | % |

* Based on percentage of net assets as of December 31, 2005.

Top 10 Holdings**

| | % of Net Assets | |

Taiwan Semi. Mfg. Co. - ADR | | 5.9 | % |

QUALCOMM, Inc. | | 5.5 | % |

SanDisk Corp. | | 5.4 | % |

Texas Instruments, Inc. | | 5.0 | % |

Corning, Inc. | | 4.9 | % |

VeriSign, Inc. | | 4.8 | % |

ASML Holding N.V. | | 4.7 | % |

Samsung Electronics Co., Ltd. - GDR | | 4.4 | % |

SAP AG - ADR | | 4.3 | % |

Adobe Systems, Inc. | | 4.2 | % |

** Top 10 stock holdings total 49.1% of net assets. These holdings are current as of December 31, 2005, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings.

13

Firsthand Technology Innovators Fund

Performance and Portfolio Discussion

How did the Fund perform in 2005?

In 2005, Firsthand Technology Innovators Fund (TIFQX) posted an 11.90% loss, versus a 2.13% increase for the Nasdaq Composite Index and a 5.38% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2005, Firsthand Technology Innovators Fund rose 5.59% as compared to 7.64% and 11.19% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund’s performance?

The Fund underperformed its benchmarks due to its holdings in the photonics, software, and communications equipment industries. While we are disappointed with the poor performance of the Fund, we remain committed to our style of investing in small, emerging technology companies despite the inherent volatility of this asset class.

Which individual holdings were the largest contributors to the Fund’s performance?*

During the period, the largest contributor to Fund performance was disk drive component supplier Intevac (IVAC). An increase in consumer devices that utilize portable storage, such as digital video recorders and handheld music players, drove demand for the company’s equipment as hard drive manufacturers continue to increase storage capacity. Earlier in the year, we realized a nice gain in SiRF Technology (SIRF) after the maker of global positioning navigation products posted second-quarter results that surpassed analysts’ expectations. GPS technology provides instant location information using satellite signals and is being embedded in many consumer and commercial applications, such as car navigation systems, cell phones, and PDAs.

Other portfolio holdings that positively contributed to Fund performance included Power Integrations (POWI), a supplier of high-voltage analog integrated circuits used in power conversion; Trident Microsystems (TRID), a provider of integrated circuits to the fast-growing LCD and plasma television market; and Synaptics (SYNA), a leading supplier of user interface solutions for laptop computers and portable digital music players.

Which holdings were the greatest detractors from the Fund’s performance?

The Fund’s greatest detractor during the period was Avici Systems (AVCI), a provider of optical networking equipment used by telecommunications companies and Internet service providers. The company struggled with increasing competition in the router market, which resulted in a 56% drop in Avici’s share price during 2005.

Shares of Napster (NAPS) stumbled in 2005 as well, after nearly doubling the year before. Napster offers a subscription service that allows users to either listen to or download music over the Internet. However, competition in the online music market intensified in 2005 as Yahoo! (YHOO) launched its own online music service at a significant discount to Napster’s prices. Other holdings that weighed heavily on Fund performance included wireless broadband infrastructure provider Vyyo (VYYO), software vendor Altiris (ATRS), and Microvision (MVIS), a provider of display technologies.

*Portfolio composition is subject to change.

14

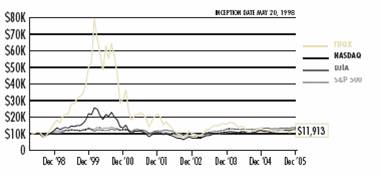

Fund Performance and Holding Information (as of December 31, 2005)

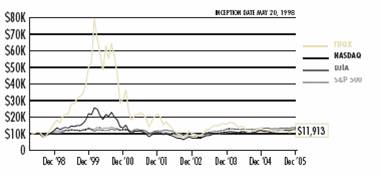

Firsthand Technology Innovators Fund vs. Market Indices

| | TIFQX | | NASDAQ | | DJIA | | S&P 500 | |

Since Inception (5/20/98) | | 2.32 | % | 2.78 | % | 4.24 | % | 3.12 | % |

5-Year | | -17.43 | % | -1.75 | % | 2.00 | % | 0.54 | % |

3-Year | | 6.17 | % | 18.89 | % | 11.17 | % | 14.38 | % |

1-Year | | -11.90 | % | 2.13 | % | 1.72 | % | 4.91 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry*

| | % of Net Assets | |

Semiconductors | | 21.5 | % |

Other Electronics | | 16.6 | % |

Intellectual Property | | 12.1 | % |

Communications Equipment | | 9.6 | % |

Networking | | 7.7 | % |

Services | | 6.4 | % |

Software | | 6.3 | % |

Internet | | 5.3 | % |

Electronic Design Automation | | 4.1 | % |

Photonics | | 2.6 | % |

Other | | 2.1 | % |

Net Cash | | 5.7 | % |

* Based on percentage of net assets as of December 31, 2005.

Top 10 Holdings**

| | % of Net Assets | |

Intevac, Inc. | | 9.5 | % |

Applied Films Corp. | | 4.1 | % |

Airspan Networks, Inc. | | 4.1 | % |

PDF Solutions, Inc. | | 4.1 | % |

Finisar Corp. | | 3.3 | % |

Synaptics, Inc. | | 3.1 | % |

Altiris, Inc. | | 2.9 | % |

Packeteer, Inc. | | 2.8 | % |

Power Integrations, Inc. | | 2.2 | % |

Microvision, Inc. | | 2.2 | % |

** Top 10 stock holdings total 38.3% of net assets. These holdings are current as of December 31, 2005, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings.

15

Firsthand e-Commerce Fund

Performance and Portfolio Discussion

How did the Fund perform in 2005?

In 2005, Firsthand e-Commerce Fund (TEFQX) posted a 5.26% gain, versus a 2.13% increase for the Nasdaq Composite Index and a 5.38% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2005, Firsthand

e-Commerce Fund rose 11.48% as compared to 7.64% and 11.19% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund’s performance?

The portfolio’s exposure to Internet stocks and the software industry helped the Fund perform well during the period. Internet stocks in general had a good year, with shoppers spending an estimated $30.1 billion online during the 2005 holiday season, up 30% from 2004.

Which individual holdings were the largest contributors to the Fund’s performance?*

For the period, the Fund’s top contributor within the Internet segment was online DVD provider Netflix (NFLX). Netflix’s stock price dipped briefly into the single digits early in 2005 as concerns about increased competition had some investors questioning the viability of the company’s business model. However, as its competitors stumbled, shares of Netflix bounced back strongly as the company added to an already large customer base of more than four million subscribers. Web content delivery firm Akamai Technologies (AKAM) also saw a nice turnaround in its business in 2005 due to increased demand for fast, reliable, and more robust multimedia content. Akamai has thousands of servers strategically placed around the world that enable companies like Yahoo! (YHOO), FedEx (FDX), and Apple (AAPL) to host their Web content physically closer to end-users, thus significantly improving download speeds.

In the software industry, the steady adoption of the Linux operating system (“OS”) helped boost shares of Novell (NOVL) and Red Hat (RHAT), two of the system’s primary suppliers. The Linux open-source OS is a powerful, low-cost alternative to proprietary operating systems such as UNIX and Microsoft Windows. Also in software, we exited our position in Macromedia for a nice gain shortly after Adobe Systems (ADBE) announced that it would acquire the company. Other holdings that positively contributed to Fund performance included Monster Worldwide (MNST), an online provider of job listings, and CNET Networks (CNET), a leading interactive media company.

Which holdings were the greatest detractors from the Fund’s performance?

During the period, Napster (NAPS) was the largest detractor from Fund performance. Increasing competition in the online music market hurt Napster as Yahoo! announced that it would offer its own online music service at a significant discount to Napster, whose shares fell more than 25% on the announcement. In the Internet industry, eBay (EBAY) struggled as the online auction giant saw decelerating growth in several of its key markets and acknowledged that the company would not meet Wall Street expectations. Despite moving aggressively into the Asian markets, eBay’s expectations for robust growth there have yet to be realized.

Other portfolio holdings that disappointed during 2005 included InfoSpace (INSP), a provider of online search and directory services, and VeriSign (VRSN), a provider of Internet infrastructure services. Earlier in the year we closed our position in Veritas Software (VRTS) at a loss after Symantec (SYMC) announced in December 2004 that it would acquire the storage software vendor.

*Portfolio composition is subject to change.

16

Fund Performance and Holding Information (as of December 31, 2005)

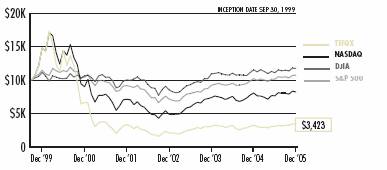

Firsthand e-Commerce Fund vs. Market Indices

| | TEFQX | | NASDAQ | | DJIA | | S&P 500 | |

Since Inception (9/30/99) | | -15.75 | % | -3.03 | % | 2.60 | % | 1.13 | % |

5-Year | | -12.50 | % | -1.75 | % | 2.00 | % | 0.54 | % |

3-Year | | 17.80 | % | 18.89 | % | 11.17 | % | 14.38 | % |

1-Year | | 5.26 | % | 2.13 | % | 1.72 | % | 4.91 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry*

| | % of Net Assets | |

Internet | | 47.6 | % |

Software | | 19.6 | % |

Services | | 15.0 | % |

Other Electronics | | 5.1 | % |

Computer | | 3.1 | % |

Communications | | 2.3 | % |

Other | | 2.0 | % |

Net Cash | | 5.3 | % |

* Based on percentage of net assets as of December 31, 2005.

Top 10 Holdings**

| | % of Net Assets | |

Akamai Technologies, Inc. | | 8.4 | % |

Netflix, Inc. | | 5.6 | % |

Microsoft Corp. | | 4.9 | % |

VeriSign, Inc. | | 4.6 | % |

Monster Worldwide, Inc. | | 4.2 | % |

Time Warner, Inc. | | 4.2 | % |

Fair Isaac Corp. | | 4.1 | % |

Novell, Inc. | | 3.8 | % |

CheckFree Corp. | | 3.7 | % |

First Data Corp. | | 3.5 | % |

** Top 10 stock holdings total 47.0% of net assets. These holdings are current as of December 31, 2005, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings.

17

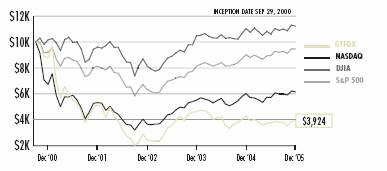

Firsthand Global Technology Fund

Performance and Portfolio Discussion

How did the Fund perform in 2005?

In 2005, Firsthand Global Technology Fund (GTFQX) posted an 8.64% loss, versus a 2.13% increase for the Nasdaq Composite Index and a 5.38% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2005, Firsthand Global Technology Fund rose 4.55% as compared to 7.64% and 11.19% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund’s performance?

The Fund underperformed its benchmarks during 2005 primarily as a result of its exposure to the communications industry. While international markets in general posted strong returns in 2005, our communications equipment holdings struggled with end-demand problems that negatively affected Fund performance. On a positive note, our holdings in the semiconductor and software industries helped offset some of those losses.

Which individual holdings were the largest contributors to the Fund’s performance?*

During the period the largest contributor to Fund performance was disk drive component supplier Intevac (IVAC). An increase in consumer devices that utilize portable storage, such as digital video recorders and handheld music players, drove demand for the company’s equipment. This trend also benefitted disk-drive manufacturer Western Digital (WDC), which the Fund sold for a gain in December 2005.

Samsung Electronics (no U.S. symbol) also enjoyed a good year in 2005 due to the company’s strong line-up of consumer electronics products. Samsung’s results were driven by continued strength in its semiconductor and liquid crystal display (LCD) business. Manufacturing memory chips remains Samsung’s largest business, and soaring demand for NAND flash memory helped boost the company’s revenues and profit margins in 2005. Other holdings that aided Fund performance during the period included semiconductor players Taiwan Semiconductor Manufacturing (TSM) and ASML Holding N.V. (ASML), and Business Objects (BOBJ), a provider of business intelligence software, which the Fund sold for a gain in September 2005.

Which holdings were the greatest detractors from the Fund’s performance?

UTStarcom (UTSI) was the largest detractor from Fund performance in 2005. UTStarcom provides telecommunications equipment for wireline and wireless networks in China and other emerging markets. As the company’s business in China has slowed, UTStarcom’s dependence on that country for the bulk of its revenues has hurt the company’s bottom line, forcing it to pursue other opportunities to revitalize growth. UTStarcom’s uncertain future growth prospects led investors to abandon the stock, sending it down more than 60% in 2005.

Another telecom holding that weighed on Fund performance was Israel-based Alvarion (ALVR). Alvarion is a provider of wireless broadband equipment, such as the base stations that are used to make wireless voice and data transmission possible. Alvarion’s stock has lagged during the company’s rollout of the next generation of broadband wireless access—WiMAX. WiMAX is a technology that offers wireless access data rates of up to 75 megabits per second—compared with 11 megabits per second for a typical Wi-Fi network—over distances as long as 30 miles. Alvarion has placed a big bet on WiMAX, which has not yet paid off for the company.

Other portfolio holdings that hurt Fund performance included broadband wireless-network equipment maker Ceragon Networks (CRNT), and Cognos (COGN), a provider of business intelligence software. The Fund also realized a loss in semiconductor outsourcer Amkor Technology (AMKR).

*Portfolio composition is subject to change.

18

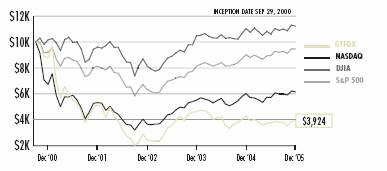

Fund Performance and Holding Information (as of December 31, 2005)

Firsthand Global Technology Fund vs. Market Indices

| | GTFQX | | NASDAQ | | DJIA | | S&P 500 | |

Since Inception (9/29/00) | | -16.30 | % | -8.82 | % | 2.23 | % | -1.03 | % |

5-Year | | -14.88 | % | -1.75 | % | 2.00 | % | 0.54 | % |

3-Year | | 17.34 | % | 18.89 | % | 11.17 | % | 14.38 | % |

1-Year | | -8.64 | % | 2.13 | % | 1.72 | % | 4.91 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry*

| | % of Net Assets | |

Other Electronics | | 17.4 | % |

Communications Equipment | | 15.2 | % |

Software | | 14.5 | % |

Semiconductors | | 11.9 | % |

Electronics Manufacturing Services | | 9.7 | % |

Services | | 9.6 | % |

Semiconductor Equipment | | 9.4 | % |

Internet | | 2.2 | % |

Other | | 1.1 | % |

Net Cash | | 9.0 | % |

* Based on percentage of net assets as of December 31, 2005.

Top 10 Holdings**

| | % of Net Assets | |

UTStarcom, Inc. | | 5.7 | % |

Intevac, Inc. | | 5.5 | % |

Alvarion Ltd. | | 5.4 | % |

Taiwan Semi. Mfg. Co. - ADR | | 5.4 | % |

Tokyo Electron Ltd. | | 5.0 | % |

Sharp Corp. | | 4.5 | % |

ASML Holding N.V. | | 4.5 | % |

Samsung Electronics Co., Ltd. - GDR | | 4.0 | % |

Lionbridge Technologies, Inc. | | 4.0 | % |

Amdocs Ltd. | | 3.6 | % |

** Top 10 stock holdings total 47.6% of net assets. These holdings are current as of December 31, 2005, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings.

19

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees

Firsthand Funds

San Jose, California

We have audited the accompanying statements of assets and liabilities of Firsthand Funds (the “Funds”) comprising, respectively, Firsthand Technology Value Fund, Firsthand Technology Leaders Fund, Firsthand Technology Innovators Fund, Firsthand

e-Commerce Fund, and Firsthand Global Technology Fund, including the portfolios of investments as of December 31, 2005, and the related statements of operations for the year then ended, statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for the periods indicated thereon. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2005, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Firsthand Funds as of December 31, 2005, the results of their operations, the changes in their net assets, and the financial highlights for the periods referred to above, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER, LLP

Philadelphia, Pennsylvania

January 20, 2006

20

Firsthand Technology Value Fund

PORTFOLIO OF INVESTMENTS

December 31, 2005

| | | | MARKET | |

| | SHARES | | VALUE | |

COMMON STOCK - 98.0% | | | | | |

| | | | | |

ADVANCED MATERIALS - 1.1% | | | | | |

UCT Coatings, Inc., Series B (2) * | | 500,000 | | $ | 5,000,000 | |

| | | | | |

ALTERNATIVE ENERGY - 0.7% | | | | | |

Solaicx, Series B (1)(2) * | | 6,000,000 | | 3,000,000 | |

| | | | | |

COMMUNICATIONS - 0.9% | | | | | |

ViaSat, Inc. * | | 154,300 | | 4,124,439 | |

| | | | | |

COMMUNICATIONS EQUIPMENT - 7.7% | | | | | |

Harris Corp. | | 100,000 | | 4,301,000 | |

Stratex Networks, Inc. * | | 2,137,036 | | 7,650,589 | |

Tekelec, Inc. * | | 875,800 | | 12,173,620 | |

UTStarcom, Inc. * | | 1,273,300 | | 10,262,798 | |

| | | | 34,388,007 | |

DEFENSE & AEROSPACE - 1.7% | | | | | |

Flir Systems, Inc. * | | 65,000 | | 1,451,450 | |

L-3 Communications Holdings, Inc. | | 80,000 | | 5,948,000 | |

| | | | 7,399,450 | |

INTELLECTUAL PROPERTY - 2.0% | | | | | |

Silicon Genesis Corp., Common (1) (2) * | | 743,077 | | 7,431 | |

Silicon Genesis Corp., Series 1-D (1) (2) * | | 850,830 | | 2,274,745 | |

Silicon Genesis Corp., Series 1-E (1) (2) * | | 4,071,226 | | 6,473,249 | |

| | | | 8,755,425 | |

INTERNET - 13.6% | | | | | |

Akamai Technologies, Inc. * | | 858,000 | | 17,099,940 | |

InfoSpace, Inc. * | | 201,000 | | 5,189,820 | |

Napster, Inc. (3) * | | 1,450,000 | | 5,104,000 | |

Netflix, Inc. * | | 1,232,800 | | 33,359,568 | |

| | | | 60,753,328 | |

NETWORKING - 3.5% | | | | | |

Caspian Networks, Inc., Common * | | 337 | | 0 | |

Cisco Systems, Inc. * | | 780,000 | | 13,353,600 | |

IP Unity, Inc., Series C (2) * | | 1,104,265 | | 1,936,660 | |

IP Unity, Inc., Series E (2) * | | 193,042 | | 342,765 | |

Polaris Networks, Inc., Series A (2) * | | 297,848 | | 0 | |

| | | | 15,633,025 | |

OTHER ELECTRONICS - 6.0% | | | | | |

Intevac, Inc. * | | 157,500 | | 2,079,000 | |

NanoMuscle, Inc., Common (2) * | | 1,250,000 | | 0 | |

NanoMuscle, Inc., Series A-1 (2) * | | 1,250,000 | | 0 | |

| | | | | | |

see accompanying notes to financial statements

21

| | | | MARKET | |

| | SHARES | | VALUE | |

Symbol Technologies, Inc. | | 1,520,000 | | $ | 19,486,400 | |

Zebra Technologies Corp., Class A * | | 124,500 | | 5,334,825 | |

| | | | 26,900,225 | |

PERIPHERALS - 4.5% | | | | | |

Western Digital Corp. * | | 1,080,000 | | 20,098,800 | |

| | | | | |

PHOTONICS - 8.5% | | | | | |

Celox Networks, Inc., Common (2) * | | 138,121 | | 0 | |

Celox Networks, Inc., Series A-1 (2) * | | 1,000,000 | | 0 | |

Corning, Inc. * | | 1,550,000 | | 30,472,999 | |

JDS Uniphase Corp. * | | 3,000,000 | | 7,080,000 | |

Luminous Networks, Inc., Common (2) * | | 28,513 | | 29 | |

Luminous Networks, Inc., Series A1 (2) * | | 129,664 | | 1,297 | |

Luminous Networks, Inc., Series B1 (2) * | | 259,236 | | 210,448 | |

Maple Optical Systems, Inc., Series A-1 (1) (2) * | | 10,352,054 | | 0 | |

| | | | 37,764,773 | |

SEMICONDUCTOR EQUIPMENT - 6.3% | | | | | |

Applied Materials, Inc. | | 1,000,000 | | 17,940,000 | |

ASML Holding N.V. * | | 500,000 | | 10,040,000 | |

| | | | 27,980,000 | |

SEMICONDUCTORS - 22.7% | | | | | |

Aeroflex, Inc. * | | 1,250,600 | | 13,443,950 | |

Applied Micro Circuits Corp. * | | 599,900 | | 1,541,743 | |

AuthenTec, Inc., Series C (2) * | | 1,472,495 | | 1,002,902 | |

AuthenTec, Inc., Series D (2) * | | 290,958 | | 197,851 | |

Clarisay, Inc., Series B (1) (2) * | | 2,605,306 | | 0 | |

Clarisay, Inc., Series C (1) (2) * | | 7,194,244 | | 0 | |

Cypress Semiconductor Corp. * | | 1,785,100 | | 25,437,675 | |

Freescale Semiconductor, Inc., Series B * | | 76,208 | | 1,918,155 | |

Global Locate, Inc., Series A (1) (2) * | | 6,030,896 | | 4,547,296 | |

Global Locate, Inc., Series C (1) (2) * | | 1,111,111 | | 837,778 | |

Global Locate, Inc., Series D (1) (2) * | | 932,835 | | 749,999 | |

Kopin Corp. * | | 299,100 | | 1,600,185 | |

PMC-Sierra, Inc. * | | 755,700 | | 5,826,447 | |

Semiconductor Manufacturing International Corp. * | | 1,000,000 | | 6,760,000 | |

Skyworks Solutions, Inc. * | | 498,300 | | 2,536,347 | |

Texas Instruments, Inc. | | 340,000 | | 10,903,800 | |

TranSwitch Corp. * | | 2,883,000 | | 5,275,890 | |

Triquint Semiconductor, Inc. * | | 1,532,400 | | 6,819,180 | |

Zoran Corp. * | | 760,500 | | 12,327,705 | |

| | | | 101,726,903 | |

SERVICES - 0.3% | | | | | |

TeleCommunication Systems, Inc., Class A * | | 557,600 | | 1,226,720 | |

| | | | | | |

see accompanying notes to financial statements

22

| | | | MARKET | |

| | SHARES | | VALUE | |

SOFTWARE - 18.5% | | | | | |

Citrix Systems, Inc. * | | 277,000 | | $ | 7,972,060 | |

Comverse Technology, Inc. * | | 920,900 | | 24,486,731 | |

Manhattan Associates, Inc. * | | 417,500 | | 8,550,400 | |

Sybase, Inc. * | | 200,000 | | 4,372,000 | |

VeriSign, Inc. * | | 840,100 | | 18,414,992 | |

Websense, Inc. * | | 96,900 | | 6,360,516 | |

Wind River Systems, Inc. * | | 852,600 | | 12,592,903 | |

| | | | 82,749,602 | |

Total COMMON STOCK | | | | 437,500,697 | |

| | | | | |

WARRANTS - 0.2% | | | | | |

| | | | | |

ADVANCED MATERIALS - 0.0% | | | | | |

UCT Coatings, Inc., B Warrant (2) * | | 200,000 | | 200 | |

| | | | | |

INTELLECTUAL PROPERTY - 0.2% | | | | | |

Silicon Genesis Corp., 1-E Warrant (1) (2) * | | 1,257,859 | | 999,998 | |

Silicon Genesis Corp., Common Warrant (1) (2) * | | 59,147 | | 59 | |

Silicon Genesis Corp., Common Warrant (1) (2) * | | 37,982 | | 38 | |

| | | | 1,000,095 | |

NETWORKING - 0.0% | | | | | |

IP Unity, Inc., E Warrant (2) * | | 69,496 | | 69 | |

Polaris Networks, Inc., Convertible Warrant (2) * | | 75,712 | | 0 | |

| | | | 69 | |

OTHER ELECTRONICS - 0.0% | | | | | |

NanoMuscle, Inc., B-1 Warrant (2) * | | 306,757 | | 0 | |

| | | | | |

PHOTONICS - 0.0% | | | | | |

Celox Networks, Inc., A-1 Warrant (2) * | | 500,000 | | 0 | |

Luminous Networks, Inc., Common Warrant (2) * | | 3,822 | | 0 | |

| | | | 0 | |

SEMICONDUCTORS - 0.0% | | | | | |

AuthenTec, Inc., C Warrant (2) * | | 392,665 | | 70,640 | |

Clarisay, Inc., Warrants (1) (2) * | | 2,350,000 | | 0 | |

Global Locate, Inc., Board Warrants (1) (2) * | | 75,000 | | 375 | |

Global Locate, Inc., Board Warrants (1) (2) * | | 75,000 | | 375 | |

Global Locate, Inc., Board Warrants (1) (2) * | | 18,750 | | 94 | |

Global Locate, Inc., Board Warrants (1) (2) * | | 75,000 | | 375 | |

Global Locate, Inc., C Warrant (1) (2) * | | 370,370 | | 3,704 | |

Global Locate, Inc., D Warrant (1) (2) * | | 233,208 | | 2,332 | |

| | | | 77,895 | |

Total WARRANTS | | | | 1,078,259 | |

| | | | | | |

see accompanying notes to financial statements

23

| | SHARES/ | | MARKET | |

| | PRINCIPAL | | VALUE | |

CONVERTIBLE BONDS - 0.0% | | | | | |

| | | | | |

NETWORKING - 0.0% | | | | | |

Polaris Networks, Inc., 10.00% (2) * | | 100,949 | | $ | 0 | |

| | | | | |

OTHER ELECTRONICS - 0.0% | | | | | |

NanoMuscle, Inc., 8.00% (2) * | | 398,639 | | 0 | |

| | | | | |

SEMICONDUCTORS - 0.0% | | | | | |

Clarisay, Inc., 8.00%, (1) (2) * | | 2,350,000 | | 0 | |

| | | | | |

Total CONVERTIBLE BONDS | | | | 0 | |

| | | | | |

CASH EQUIVALENTS - 2.7% | | | | | |

PNC Bank Money Market Portfolio | | 12,015,831 | | 12,015,831 | |

Total CASH EQUIVALENTS | | | | 12,015,831 | |

| | | | | |

Total Investments (Cost $629,024,519) - 100.9% | | | | 450,594,787 | |

Liabilities in excess of other assets - (0.9)% | | | | (3,987,702 | ) |

NET ASSETS - 100.0% | | | | $ | 446,607,085 | |

* Non-income producing security

(1) Affiliated issuer

(2) Restricted security

(3) Napster, Inc. has the right to put a restriction of public sale on 600,000 shares of the Fund’s Napster, Inc. holding. As of December 31, 2005, there are no restrictions on the Fund’s shares of Napster, Inc.

see accompanying notes to financial statements

24

Firsthand Technology Leaders Fund

PORTFOLIO OF INVESTMENTS

December 31, 2005

| | | | MARKET | |

| | SHARES | | VALUE | |

COMMON STOCK - 96.9% | | | | | |

| | | | | |

COMMUNICATIONS EQUIPMENT - 7.4% | | | | | |

Nokia Corp. - ADR | | 127,900 | | $ | 2,340,570 | |

QUALCOMM, Inc. | | 154,600 | | 6,660,168 | |

| | | | 9,000,738 | |

ELECTRONICS MANUFACTURING SERVICES - 3.7% | | | | | |

Flextronics International Ltd. * | | 428,900 | | 4,477,716 | |

| | | | | |

INTERNET - 5.8% | | | | | |

eBay, Inc. * | | 50,200 | | 2,171,150 | |

Google, Inc., Class A * | | 7,800 | | 3,235,908 | |

IAC/InterActiveCorp * | | 57,850 | | 1,637,734 | |

| | | | 7,044,792 | |

MEDIA - 3.8% | | | | | |

Pixar Animation Studios * | | 87,400 | | 4,607,728 | |

| | | | | |

NETWORKING - 3.6% | | | | | |

Cisco Systems, Inc. * | | 257,800 | | 4,413,536 | |

| | | | | |

OTHER ELECTRONICS - 3.7% | | | | | |

Agilent Technologies, Inc. * | | 134,956 | | 4,492,685 | |

| | | | | |

PHOTONICS - 4.9% | | | | | |

Corning, Inc. * | | 301,200 | | 5,921,592 | |

| | | | | |

SEMICONDUCTOR EQUIPMENT - 9.5% | | | | | |

Applied Materials, Inc. | | 241,400 | | 4,330,716 | |

ASML Holding N.V. * | | 281,600 | | 5,654,528 | |

Teradyne, Inc. * | | 106,500 | | 1,551,705 | |

| | | | 11,536,949 | |

SEMICONDUCTORS - 29.5% | | | | | |

Altera Corp. * | | 207,500 | | 3,844,975 | |

Intel Corp. | | 120,200 | | 3,000,192 | |

Samsung Electronics Co., Ltd. - GDR (1) | | 16,200 | | 5,280,605 | |

SanDisk Corp. * | | 104,300 | | 6,552,126 | |

Taiwan Semiconductor Manufacturing Co. - ADR | | 726,649 | | 7,201,091 | |

Texas Instruments, Inc. | | 187,950 | | 6,027,557 | |

Xilinx, Inc. | | 145,600 | | 3,670,576 | |

| | | | 35,577,122 | |

SOFTWARE - 25.0% | | | | | |

Adobe Systems, Inc. | | 136,700 | | 5,052,432 | |

Amdocs Ltd. * | | 170,700 | | 4,694,250 | |

Autodesk, Inc. | | 27,800 | | 1,194,010 | |

| | | | | | |

see accompanying notes to financial statements

25

| | | | MARKET | |

| | SHARES | | VALUE | |

Microsoft Corp. | | 154,800 | | $ | 4,048,020 | |

Oracle Corp. * | | 342,000 | | 4,175,820 | |

SAP AG - ADR | | 115,400 | | 5,201,078 | |

VeriSign, Inc. * | | 267,800 | | 5,870,176 | |

| | | | 30,235,786 | |

Total COMMON STOCK | | | | 117,308,644 | |

| | | | | |

CASH EQUIVALENTS - 4.6% | | | | | |

PNC Bank Money Market Portfolio | | 5,546,894 | | 5,546,894 | |

Total CASH EQUIVALENTS | | | | 5,546,894 | |

| | | | | |

Total Investments (Cost $109,842,471) - 101.5% | | | | 122,855,538 | |

Liabilities in excess of other assets - (1.5)% | | | | (1,846,645 | ) |

NET ASSETS - 100.0% | | | | $ | 121,008,893 | |

* Non-income producing security

(1) Rule 144A, Section 4(2), or other security that is restricted as to resale to institutional investors. The Investment Advisor, using Board-approved procedures has deemed these securities to be liquid.

ADR American Depositary Receipts

GDR Global Depositary Receipts

see accompanying notes to financial statements

26

Firsthand Technology Innovators Fund

PORTFOLIO OF INVESTMENTS

December 31, 2005

| | | | MARKET | |

| | SHARES | | VALUE | |

COMMON STOCK - 92.0% | | | | | |

| | | | | |

COMMUNICATIONS - 0.6% | | | | | |

Symmetricom, Inc. * | | 20,000 | | $ | 169,400 | |

| | | | | |

COMMUNICATIONS EQUIPMENT - 9.6% | | | | | |

Airspan Networks, Inc. * | | 214,000 | | 1,217,660 | |

Finisar Corp. * | | 476,500 | | 991,120 | |

Vyyo, Inc. * | | 127,900 | | 617,757 | |

| | | | 2,826,537 | |

ELECTRONIC DESIGN AUTOMATION - 4.1% | | | | | |

PDF Solutions, Inc. * | | 74,100 | | 1,204,125 | |

| | | | | |

INTELLECTUAL PROPERTY - 11.9% | | | | | |

Silicon Genesis Corp., Common (1) (2) * | | 108,815 | | 1,088 | |

Silicon Genesis Corp., Series 1-C (1) (2) * | | 82,914 | | 912,560 | |

Silicon Genesis Corp., Series 1-E (1) (2) * | | 1,633,254 | | 2,596,874 | |

| | | | 3,510,522 | |

INTERNET - 5.3% | | | | | |

JAMDAT Mobile, Inc. * | | 15,000 | | 398,700 | |

LivePerson, Inc. * | | 102,400 | | 574,464 | |

Napster, Inc. * | | 166,700 | | 586,784 | |

| | | | 1,559,948 | |

NETWORKING - 7.7% | | | | | |

IP Unity, Inc., Series C (2) * | | 827,957 | | 1,452,071 | |

Packeteer, Inc. * | | 105,300 | | 818,181 | |

| | | | 2,270,252 | |

OTHER ELECTRONICS - 16.6% | | | | | |

3D Systems Corp. * | | 11,900 | | 214,200 | |

Applied Films Corp. * | | 58,800 | | 1,221,276 | |

Intevac, Inc. * | | 213,700 | | 2,820,840 | |

Microvision, Inc. * | | 180,300 | | 649,080 | |

| | | | 4,905,396 | |

PERIPHERALS - 1.1% | | | | | |

Universal Display Corp. * | | 30,000 | | 315,300 | |

| | | | | |

PHOTONICS - 2.6% | | | | | |

Avanex Corp. * | | 200,000 | | 274,000 | |

Avici Systems, Inc. * | | 125,000 | | 488,750 | |

Luminous Networks, Inc., Common (2) * | | 49,979 | | 50 | |

Luminous Networks, Inc., Series A1 (2) * | | 227,282 | | 2,273 | |

| | | | 765,073 | |

| | | | | | |

see accompanying notes to financial statements

27

| | | | MARKET | |

| | SHARES | | VALUE | |

SEMICONDUCTOR EQUIPMENT - 0.4% | | | | | |

Therma-Wave, Inc. * | | 91,300 | | $ | 130,559 | |

| | | | | |

SEMICONDUCTORS - 21.4% | | | | | |

Aeroflex, Inc. * | | 32,000 | | 344,000 | |

AuthenTec, Inc., Series C (2) * | | 736,248 | | 501,451 | |

Hi/Fn, Inc. * | | 100,000 | | 560,300 | |

Kopin Corp. * | | 68,700 | | 367,545 | |

Microtunes, Inc. * | | 106,100 | | 442,437 | |

Power Integrations, Inc. * | | 27,300 | | 650,013 | |

PowerDsine Ltd. * | | 30,000 | | 206,100 | |

Ramtron International Corp. * | | 100,000 | | 200,000 | |

Silicon Optix, Inc., Series B (2) * | | 1,111,111 | | 700,000 | |

Synaptics, Inc. * | | 37,300 | | 922,056 | |

Trident Microsystems, Inc. * | | 30,000 | | 540,000 | |

Volterra Semiconductor Corp. * | | 40,000 | | 600,000 | |

Zygo Corp. * | | 20,000 | | 293,800 | |

| | | | 6,327,702 | |

SERVICES - 4.4% | | | | | |

Innovion Corp., Series C (1) (2) * | | 1,500,000 | | 744,675 | |

WebEx Communications, Inc. * | | 25,000 | | 540,750 | |

| | | | 1,285,425 | |

| | | | | |

SOFTWARE - 6.3% | | | | | |

Altiris, Inc. * | | 50,000 | | 844,500 | |

Verint Systems, Inc. * | | 18,200 | | 627,354 | |

Witness Systems, Inc. * | | 19,400 | | 381,598 | |

| | | | 1,853,452 | |

Total COMMON STOCK | | | | 27,123,691 | |

| | | | | |

WARRANTS - 0.3% | | | | | |

| | | | | |

INTELLECTUAL PROPERTY - 0.2% | | | | | |

Silicon Genesis Corp., 1-E Warrant (1) (2) * | | 94,339 | | 49,999 | |

| | | | | |

PHOTONICS - 0.0% | | | | | |

Luminous Networks, Inc., Common Warrant (2) * | | 6,699 | | 1 | |

| | | | | |

SEMICONDUCTORS - 0.1% | | | | | |

AuthenTec, Inc., C Warrant (2) * | | 196,333 | | 35,320 | |

| | | | | | |

see accompanying notes to financial statements

28

| | SHARES/

PRINCIPAL | | MARKET

VALUE | |

SERVICES - 0.0% | | | | | |

Innovion Corp., Warrant (1) (2) * | | 30,129 | | $ | 30 | |

Innovion Corp., Warrant (1) (2) * | | 602,577 | | 603 | |

| | | | 633 | |

Total WARRANTS | | | | 85,953 | |

| | | | | |

CONVERTIBLE BONDS - 2.0% | | | | | |

| | | | | |

SERVICES - 2.0% | | | | | |

Innovion Corp., 9.50%, 3/7/06 (1) (2) | | 602,577 | | 602,577 | |

| | | | | |

Total CONVERTIBLE BONDS | | | | 602,577 | |

| | | | | |

CASH EQUIVALENTS - 2.2% | | | | | |

PNC Bank Money Market Portfolio | | 639,265 | | 639,265 | |

Total CASH EQUIVALENTS | | | | 639,265 | |

| | | | | |

Total Investments (Cost $39,850,048) - 96.5% | | | | 28,451,486 | |

Other assets in excess of liabilities - 3.5% | | | | 1,024,038 | |

NET ASSETS - 100.0% | | | | $ | 29,475,524 | |

* Non-income producing security

(1) Affiliated issuer

(2) Restricted security

see accompanying notes to financial statements

29

Firsthand e-Commerce Fund

PORTFOLIO OF INVESTMENTS

December 31, 2005

| | SHARES | | MARKET

VALUE | |

| | | | | |

COMMON STOCK - 94.7% | | | | | |

| | | | | |

BROADCASTING & CABLE TV - 0.8% | | | | | |

Liberty Global, Inc., Class A * | | 7,500 | | $ | 168,750 | |

Liberty Global, Inc., Class C * | | 7,500 | | 159,000 | |

| | | | 327,750 | |

COMMUNICATIONS - 2.3% | | | | | |

Comcast Corp., Special Class A * | | 15,000 | | 385,350 | |

OpenTV Corp. * | | 268,300 | | 600,992 | |

| | | | 986,342 | |

COMPUTER - 3.1% | | | | | |

Dell, Inc. * | | 30,000 | | 899,700 | |

International Business Machines Corp. | | 5,000 | | 411,000 | |

| | | | 1,310,700 | |

INTERNET - 47.6% | | | | | |

Akamai Technologies, Inc. * | | 180,900 | | 3,605,337 | |

Amazon.com, Inc. * | | 10,000 | | 471,500 | |

eBay, Inc. * | | 19,200 | | 830,400 | |

Expedia, Inc. * | | 49,684 | | 1,190,429 | |

IAC/InterActiveCorp * | | 49,684 | | 1,406,554 | |

InfoSpace, Inc. * | | 36,300 | | 937,266 | |

iVillage, Inc. * | | 50,000 | | 401,000 | |

LivePerson, Inc. * | | 100,000 | | 561,000 | |

Monster Worldwide, Inc. * | | 44,600 | | 1,820,572 | |

Napster, Inc. * | | 254,500 | | 895,840 | |

Netflix, Inc. * | | 89,500 | | 2,421,870 | |

Overstock.com, Inc. * | | 28,800 | | 810,720 | |

PlanetOut, Inc. * | | 40,000 | | 347,600 | |

Priceline.com, Inc. * | | 20,000 | | 446,400 | |

Time Warner, Inc. | | 102,600 | | 1,789,344 | |

ValueClick, Inc. * | | 46,300 | | 838,493 | |

WebSideStory, Inc. * | | 20,000 | | 362,600 | |

Yahoo! Inc. * | | 34,300 | | 1,343,874 | |

| | | | 20,480,799 | |

NETWORKING - 1.2% | | | | | |

Cisco Systems, Inc. * | | 30,000 | | 513,600 | |

| | | | | |

OTHER ELECTRONICS - 5.1% | | | | | |

ActivCard Corp. * | | 255,000 | | 889,950 | |

Symbol Technologies, Inc. | | 100,000 | | 1,282,000 | |

| | | | 2,171,950 | |

| | | | | | |

see accompanying notes to financial statements

30

| | | | MARKET | |

| | SHARES | | VALUE | |

| | | | | |

SERVICES - 15.0% | | | | | |

Anteon International Corp. * | | 11,700 | | $ | 635,895 | |

CNET Networks, Inc. * | | 99,200 | | 1,457,248 | |

Emdeon Corp. * | | 130,000 | | 1,099,800 | |

Fair Isaac Corp. | | 40,000 | | 1,766,800 | |

First Data Corp. | | 35,000 | | 1,505,350 | |

| | | | 6,465,093 | |

SOFTWARE - 19.6% | | | | | |

CheckFree Corp. * | | 35,000 | | 1,606,500 | |

Microsoft Corp. | | 80,000 | | 2,092,000 | |

Novell, Inc. * | | 186,200 | | 1,644,146 | |

RSA Security, Inc. * | | 100,000 | | 1,123,000 | |

VeriSign, Inc. * | | 90,000 | | 1,972,800 | |

| | | | 8,438,446 | |

Total COMMON STOCK | | | | 40,694,680 | |

| | | | | |

CASH EQUIVALENTS - 5.8% | | | | | |

PNC Bank Money Market Portfolio | | 2,483,145 | | 2,483,145 | |

Total CASH EQUIVALENTS | | | | 2,483,145 | |

| | | | | |

Total Investments (Cost $36,591,912) - 100.5% | | | | 43,177,825 | |

Liabilities in excess of other assets - (0.5)% | | | | (234,380 | ) |

NET ASSETS - 100.0% | | | | $ | 42,943,445 | |

* Non-income producing security

see accompanying notes to financial statements

31

Firsthand Global Technology Fund

PORTFOLIO OF INVESTMENTS

December 31, 2005

| | | | MARKET | |

| | SHARES | | VALUE | |

COMMON STOCK - 91.0% | | | | | |

| | | | | |

COMMUNICATIONS - 1.1% | | | | | |

Mobile TeleSystems - ADR | | 5,000 | | $ | 175,000 | |

| | | | | |

COMMUNICATIONS EQUIPMENT - 15.2% | | | | | |

Alvarion Ltd. * | | 102,100 | | 890,312 | |

Ceragon Networks Ltd. * | | 62,100 | | 241,569 | |

QUALCOMM, Inc. | | 10,000 | | 430,800 | |

UTStarcom, Inc. * | | 116,900 | | 942,214 | |

| | | | 2,504,895 | |

ELECTRONICS MANUFACTURING SERVICES - 9.7% | | | | | |

Compal Electronics - GDR | | 56,146 | | 253,011 | |

Elcoteq Network Corp. - Class A | | 15,000 | | 356,473 | |

Flextronics International Ltd. * | | 29,800 | | 311,112 | |

Hon Hai Precision - GDR | | 42,449 | | 465,292 | |

Quanta Computer, Inc. - GDR | | 29,400 | | 206,335 | |

| | | | 1,592,223 | |

INTERNET - 2.2% | | | | | |

RADWARE Ltd. * | | 20,000 | | 363,200 | |

| | | | | |

OTHER ELECTRONICS - 17.4% | | | | | |

Alps Electric Co., Ltd. | | 28,000 | | 389,831 | |

Hoya Corp. | | 7,600 | | 273,062 | |

Intevac, Inc. * | | 69,000 | | 910,801 | |

LG. Philips LCD Co., Ltd. - ADR * | | 7,800 | | 167,388 | |

NIDEC Corp. | | 17,200 | | 372,208 | |

Sharp Corp. | | 49,000 | | 744,903 | |

| | | | 2,858,193 | |

SEMICONDUCTOR EQUIPMENT - 9.4% | | | | | |

ASML Holding N.V. * | | 36,758 | | 738,101 | |

Tokyo Electron Ltd. | | 13,200 | | 828,844 | |

| | | | 1,566,945 | |

SEMICONDUCTORS - 11.9% | | | | | |

Samsung Electronics Co., Ltd. - GDR (1) | | 2,000 | | 651,927 | |

Semiconductor Manufacturing International Corp. * | | 60,000 | | 405,600 | |

Taiwan Semiconductor Manufacturing Co. - ADR | | 89,736 | | 889,283 | |

| | | | 1,946,810 | |

SERVICES - 9.6% | | | | | |

Accenture Ltd. | | 10,000 | | 288,700 | |

Affiliated Computer Services, Inc., Class A * | | 5,000 | | 295,900 | |

| | | | | | |

see accompanying notes to financial statements

32

| | | | MARKET | |

| | SHARES | | VALUE | |

Kanbay International, Inc. * | | 7,900 | | $ | 125,531 | |

Lionbridge Technologies, Inc. * | | 92,800 | | 651,456 | |

Syntel, Inc. | | 10,000 | | 208,300 | |

| | | | 1,569,887 | |

SOFTWARE - 14.5% | | | | | |

Amdocs Ltd. * | | 21,500 | | 591,250 | |

Cognos, Inc. * | | 10,000 | | 347,100 | |

Comverse Technology, Inc. * | | 20,200 | | 537,118 | |

Dassault Systemes SA - ADR | | 5,000 | | 282,550 | |

SAP AG - ADR | | 10,000 | | 450,700 | |

Verint Systems, Inc. * | | 5,000 | | 172,350 | |

| | | | 2,381,068 | |

Total COMMON STOCK | | | | 14,958,221 | |

| | | | | |

CASH EQUIVALENTS - 9.5% | | | | | |

PNC Bank Money Market Portfolio | | 1,554,283 | | 1,554,283 | |

Total CASH EQUIVALENTS | | | | 1,554,283 | |

| | | | | |

Total Investments (Cost $15,916,774) - 100.5% | | | | 16,512,504 | |

Liabilities in excess of other assets - (0.5)% | | | | (83,797 | ) |

NET ASSETS - 100.0% | | | | $ | 16,428,707 | |

* Non-income producing security

(1) Rule 144A, Section 4(2), or other security that is restricted as to resale to institutional investors. The Investment Advisor, using Board-approved procedures has deemed these securities to be liquid.

ADR American Depositary Receipts

GDR Global Depositary Receipts

see accompanying notes to financial statements

33

STATEMENTS OF ASSETS AND LIABILITIES

December 31, 2005

| | FIRSTHAND

TECHNOLOGY

VALUE

FUND | | FIRSTHAND

TECHNOLOGY

LEADERS

FUND | | FIRSTHAND

TECHNOLOGY

INNOVATORS

FUND | |

| | | | | | | |

ASSETS | | | | | | | |

Investment securities: | | | | | | | |