UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-8268 |

Firsthand Funds

(Exact name of registrant as specified in charter)

125 South Market, Suite 1200

San Jose, CA 95113

(Address of principal executive offices) (Zip code)

Firsthand Capital Management, Inc.

125 South Market, Suite 1200

San Jose, CA 95113

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | (408) 294-2200 |

| | |

| Date of fiscal year end: | December 31, 2007 |

| | |

| Date of reporting period: | December 31, 2007 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

Firsthand Funds

ANNUAL REPORT TO SHAREHOLDERS

Firsthand Technology Value Fund®

Firsthand Technology Leaders Fund

Firsthand Technology Innovators Fund

Firsthand e-Commerce Fund

Firsthand Global Technology Fund

Firsthand Alternative Energy Fund

December 31, 2007

CONTENTS

| Performance Summary | 2 |

| President’s Letter | 4 |

| Shareholder Fee Example | 6 |

| Performance and Portfolio Discussion | 8 |

| Audit Letter | 20 |

| Portfolio of Investments | 21 |

| Statements of Assets and Liabilities | 28 |

| Statements of Operations | 29 |

| Statements of Changes in Net Assets | 30 |

| Financial Highlights | 32 |

| Notes to Financial Statements | 35 |

| Additional Information | 46 |

PERFORMANCE SUMMARY

PERIOD RETURNS (average annual total returns as of 12/31/07)

| Fund | | 1-Year | | | 3-Year | | | 5-Year | | | 10-Year | | | Exp. Ratio | |

| Firsthand Technology Value Fund | | | 23.39 | % | | | 14.74 | % | | | 19.74 | % | | | 6.94 | % | | | 1.93 | % |

| Firsthand Technology Leaders Fund | | | 13.99 | % | | | 11.25 | % | | | 16.71 | % | | | 8.80 | % | | | 1.95 | % |

| Firsthand Technology Innovators Fund | | | 17.13 | % | | | 5.27 | % | | | 9.65 | % | | | • | | | | 1.95 | % |

| Firsthand e-Commerce Fund | | | 15.31 | % | | | 13.08 | % | | | 17.56 | % | | | • | | | | 1.95 | % |

| Firsthand Global Technology Fund | | | 16.93 | % | | | 7.05 | % | | | 16.75 | % | | | • | | | | 1.95 | % |

| Firsthand Alternative Energy Fund | | | • | | | | • | | | | • | | | | • | | | | 2.10 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Lipper Science and Technology Fund Index | | | 16.76 | % | | | 9.51 | % | | | 15.65 | % | | | 5.67 | % | | | • | |

| NASDAQ Composite Index | | | 10.66 | % | | | 7.65 | % | | | 15.46 | % | | | 5.90 | % | | | • | |

| S&P 500 Index | | | 5.49 | % | | | 8.61 | % | | | 12.81 | % | | | 5.90 | % | | | • | |

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

The Nasdaq Composite Index (NASDAQ) is a capitalization-weighted index of all common stocks listed with Nasdaq. The Standard & Poor’s 500 Index (S&P 500) is a market-weighted index of 500 stocks of well-established companies. Each index represents an unmanaged, broad-based basket of stocks. These indices are typically used as benchmarks for overall market performance. The Lipper Science and Technology Fund Index includes the largest 30 mutual funds in the group, which, by prospectus or portfolio practice, invest at least 80% of their equity portfolios in science and technology stocks. The Wilder Hill Clean Energy Index is a market-weighted index of 40 companies in the cleaner fuel, energy conversion, energy storage, greener utilities, power delivery and conservation, and renewable energy harvesting sectors.

RETURNS SINCE INCEPTION (average annual total returns as of 12/31/07)

| Fund (Inception Date) | | Avg Annual Total Return | | | NASDAQ | | | S&P 500 | |

| Firsthand Technology Value Fund (5/20/94) | | | 15.05 | % | | | 10.47 | % | | | 10.92 | % |

| Firsthand Technology Leaders Fund (12/10/97) | | | 8.82 | % | | | 5.52 | % | | | 5.83 | % |

| Firsthand Technology Innovators Fund (5/20/98) | | | 4.85 | % | | | 4.35 | % | | | 4.62 | % |

| Firsthand e-Commerce Fund (9/30/99) | | | -8.74 | % | | | 0.09 | % | | | 3.33 | % |

| Firsthand Global Technology Fund (9/29/00) | | | -8.45 | % | | | -3.85 | % | | | 2.03 | % |

| Firsthand Alternative Energy Fund (10/29/07)* | | | 8.90 | % | | | -5.71 | % | | | -4.32 | % |

Each Fund may invest in small-capitalization companies and Initial Public Offerings (“IPOs”). These investments will be more volatile than investments in large-capitalization companies and loss of principal could be greater. The Funds may invest in foreign securities, which will be subject to greater risks than investing in domestic securities. Because the Funds are not diversified, they can take larger positions in fewer companies, increasing their risk profile. The Funds invest in several industries within the technology sector and the relative weightings of these industries in a Fund’s portfolio may change at any time.

HOLDINGS BY INDUSTRY - % of net assets (as of 12/31/07)

| Industry | | TVFQX | | | TLFQX | | | TIFQX | | | TEFQX | | | GTFQX | | | ALTEX | |

| Advanced Materials | | | 3.1 | % | | | • | | | | • | | | | • | | | | • | | | | • | |

| Alternative Energy | | | 11.1 | % | | | • | | | | 2.4 | % | | | • | | | | 10.9 | % | | | 37.3 | % |

| Communications | | | 2.6 | % | | | 5.3 | % | | | 1.9 | % | | | 7.9 | % | | | 7.5 | % | | | • | |

| Communications Equipment | | | 1.1 | % | | | 6.1 | % | | | 2.3 | % | | | • | | | | 5.9 | % | | | • | |

| Computer | | | 1.2 | % | | | 7.2 | % | | | • | | | | 4.5 | % | | | 4.6 | % | | | • | |

| Electronic Entertainment | | | 7.2 | % | | | • | | | | • | | | | • | | | | 4.0 | % | | | • | |

| Electronic Manufacturing Services | | | • | | | | • | | | | • | | | | • | | | | 4.4 | % | | | • | |

Intellectual Property | | | 5.9 | % | | | • | | | | 32.5 | % | | | • | | | | • | | | | • | |

| Internet | | | 6.3 | % | | | 10.5 | % | | | 1.4 | % | | | 39.5 | % | | | 6.0 | % | | | • | |

| Media | | | • | | | | • | | | | • | | | | 2.9 | % | | | • | | | | • | |

| Networking | | | 8.0 | % | | | 5.6 | % | | | 5.6 | % | | | 3.5 | % | | | • | | | | 4.0 | % |

| Other Electronics | | | 3.8 | % | | | 9.8 | % | | | 7.5 | % | | | 6.5 | % | | | 16.6 | % | | | 14.1 | % |

| Peripherals | | | 4.9 | % | | | 9.6 | % | | | • | | | | • | | | | • | | | | • | |

| Photonics | | | 6.2 | % | | | 5.8 | % | | | • | | | | • | | | | • | | | | 3.3 | % |

Semiconductors | | | 32.2 | % | | | 20.6 | % | | | 31.4 | % | | | 4.2 | % | | | 14.3 | % | | | 11.5 | % |

| Semiconductor Equipment | | | 3.5 | % | | | 4.8 | % | | | • | | | | • | | | | 6.4 | % | | | 3.5 | % |

| Services | | | • | | | | • | | | | 4.2 | % | | | • | | | | 6.9 | % | | | • | |

| Software | | | 1.3 | % | | | 13.8 | % | | | 10.1 | % | | | 23.7 | % | | | 8.5 | % | | | • | |

| Net Cash | | | 1.6 | % | | | 0.9 | % | | | 0.7 | % | | | 7.3 | % | | | 4.0 | % | | | 26.3 | % |

TVFQX: Firsthand Technology Value Fund, TLFQX: Firsthand Technology Leaders Fund, TIFQX: Firsthand Technology Innovators Fund, TEFQX: Firsthand e-Commerce Fund, GTFQX: Firsthand Global Technology Fund, ALTEX: Firsthand Alternative Energy Fund.

PRESIDENT’S LETTER

Dear Fellow Shareholders,

2007 was a good year for technology investors. While the broad market, as measured by the S&P 500, was up a modest 5.49%, the NASDAQ Composite gained 10.66%. Technology benchmarks fared better still: The Russell 1000 Technology Index appreciated 16.66%, while the Lipper index of technology mutual funds gained 16.76%. The lone disappointment was the Russell 2000 Technology Index, which returned just 4.61%—reflecting the struggles of many small-cap technology companies.

I am pleased to report that each of the Firsthand technology funds outperformed the NASDAQ, and that three of the five beat the Lipper peer-group benchmark. Our two laggards, Firsthand Technology Leaders Fund and Firsthand e-Commerce Fund, beat the market but modestly underperformed the peer-group benchmark. The fund discussions in the following pages detail each fund’s relative performance against those benchmarks for the period ended December 31, 2007. The bottom line: Firsthand had a good 2007. Our broad investment themes still seem to be on the mark, and our fundamental approach to selecting individual stocks is working well.

Globalization

Technology investing has become a worldwide exercise. This was demonstrated by the strong performance of our investments in Nintendo, Lenovo, China Mobile, Nokia, and Suntech Power Holdings. Although these firms are all based far from San Jose, they have strong Silicon Valley connections. Similarly, some of the most successful U.S. companies, such as Apple, Hewlett Packard, Cisco, and Intel, have been case studies in successful globalization: Each company has established operations around the world, taking advantage of the growth in overseas markets.

At Firsthand, adaptation has meant taking a much more global view in our research process. Paradoxically, Silicon Valley has become a great place to get that global view, as our industry contacts offer us insights from their own far-flung networks. I still cannot imagine a better vantage point from which to follow technology than here.

Alternative Energy

Growing prosperity in China, India, and other developing nations has put tremendous strains on the world’s supply of basic resources. Prices for copper, nickel, cement, lumber, and many other basic materials have surged in recent years as hundreds of millions of people race for “first-world” status. But no other resource seems to pack the psychological punch that energy does. Personally, I can recall dozens of headlines about the price of oil in 2007. I did not see any headlines about zinc.

Combine anxieties over an energy shortage with increasing concerns about climate change, and it’s understandable that alternative energy is suddenly the hot (and seemingly inescapable) topic. At Firsthand, we’ve noticed that a steadily increasing portion of our top-performing investments have come from the alternative energy sector, and our investments in solar, wind, and efficiency technologies comprise an increasing portion of our technology portfolios.

This fall we launched Firsthand Alternative Energy Fund (ALTEX), specifically dedicated to renewable energy and clean technologies. Because we recognize that investing in alternative energy companies is only part of the long-term solution, Firsthand has pledged to donate a portion of our management fee* for the Fund to several non-profit organizations that support renewable energy, based on the expressed preferences of our shareholders. The current list of organizations we support includes Audubon, Defenders of Wildlife, National Wildlife Federation, Sierra Club, and World Resources Institute.

Looking Ahead

As I write this in early 2008, the markets are again in the midst of a sharp decline. To make sense of the current situation, it helps to look back a bit: Five years ago, things looked pretty bleak. We were worried about terrorism, recession, and an impending war. Investor confidence was undermined by a weakening dollar, the offshore migration of American jobs, and waves of corporate scandals. We fretted over the price of oil at $40 per barrel, then $50, then $60…

And in the face of so much bad news and anxiety the market went…up! Not spectacularly, but steadily and impressively. Over the past five years the S&P 500 returned more than 10% annually, on average, while the various technology indices posted returns in the mid-teens. Why? We think it’s because human behavior is adaptable, and that adaptability makes economies resilient.

Today we are facing a new set of fears, mostly centered around the oft-predicted yet not-adequately-prepared-for bursting of the housing bubble. In an admirable display of consistency, pessimists continue to predict a recession—as they have every year since we emerged from the last one. 2008 may indeed be the year in which they are correct. After all, predicting a recession is a bit like predicting rain: Eventually, it will happen.

But whether we are in for a deep recession, a mild recession, or simply a brief pause in growth, we believe that the equity markets have a good deal of bad news priced into them already. It is also worth noting that over the past two decades our recessions have been shallow and short, according to the U.S. Department of Commerce. In any case, we can count on this: Recessions end. I believe there is an excellent chance that a year from now the discussion will have moved on to the timing and nature of the recovery.

At Firsthand, our focus will continue to be on finding the best-positioned companies associated with the most powerful technology trends, and on making solid long-term investments. Difficult markets can provide excellent opportunities for investors willing to look beyond short-term market turbulence.

Sincerely,

Kevin Landis

President and Chief Executive Officer

| * | Firsthand will donate a portion of its management fee for the Fund, equal to 0.20% of average daily net assets, to these organizations in proportion to an asset-weighted tally of shareholder votes. |

SHAREHOLDER FEE EXAMPLE (unaudited)

Example—In general, mutual fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees, and exchange fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, non-12b-1 service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Note that Firsthand Funds (“Trust”) does not charge transaction fees for 12b-1 distribution and service fees, though you may incur transaction fees if you purchase shares through a broker.

The example on the following page is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2007 through December 31, 2007.

Actual Expenses—The section of the table at right entitled “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the section entitled “Actual” under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA or other tax-qualified savings plan, your expenses may also have included a $10 annual fee. In either case, the amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

Hypothetical Example for Comparison Purposes—The section of the table at right entitled “Hypothetical” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or the expenses you paid for the period. However, you may use this information to compare the ongoing costs of investing in the Trust to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table at right are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The examples also assume all dividends and distributions have been reinvested.

Firsthand Technology Value Fund

| | Beginning Account Value 7/1/07 | Ending Account Value 12/31/07 | Expenses Paid During Period *7/1/07 - 12/31/07 | Annualized Expense Ratio |

| Actual | $1,000 | $1,085.04 | $10.32 | 1.93% |

| Hypothetical** | $1,000 | $1,015.03 | $9.80 | 1.93% |

Firsthand Technology Leaders Fund

| | Beginning Account Value 7/1/07 | Ending Account Value 12/31/07 | Expenses Paid During Period *7/1/07 - 12/31/07 | Annualized Expense Ratio |

| Actual | $1,000 | $1,027.63 | $10.24 | 1.95% |

| Hypothetical** | $1,000 | $1,014.93 | $9.90 | 1.95% |

Firsthand Technology Innovators Fund

| | Beginning Account Value 7/1/07 | Ending Account Value 12/31/07 | Expenses Paid During Period *7/1/07 - 12/31/07 | Annualized Expense Ratio |

| Actual | $1,000 | $1,072.99 | $9.97 | 1.95% |

| Hypothetical** | $1,000 | $1,014.93 | $9.90 | 1.95% |

Firsthand e-Commerce Fund

| | Beginning Account Value 7/1/07 | Ending Account Value 12/31/07 | Expenses Paid During Period *7/1/07 - 12/31/07 | Annualized Expense Ratio |

| Actual | $1,000 | $1,017.43 | $10.03 | 1.95% |

| Hypothetical** | $1,000 | $1,014.93 | $9.90 | 1.95% |

Firsthand Global Technology Fund

| | Beginning Account Value 7/1/07 | Ending Account Value 12/31/07 | Expenses Paid During Period *7/1/07 - 12/31/07 | Annualized Expense Ratio |

| Actual | $1,000 | $1,045.82 | $10.11 | 1.95% |

| Hypothetical** | $1,000 | $1,014.93 | $9.90 | 1.95% |

Firsthand Alternative Energy Fund

| | Beginning Account Value 7/1/07 | Ending Account Value 12/31/07 | Expenses Paid During Period *7/1/07 - 12/31/07 | Annualized Expense Ratio |

| Actual*** | $1,000 | $1,089.00 | $3.73 | 2.10% |

| Hypothetical** | $1,000 | $1,014.17 | $10.66 | 2.10% |

| * | Expenses are calculated by multiplying the Fund’s annualized expense ratio listed above by the average account value over the period and multiplying that number by 184/365 (to reflect the one-half year period). |

| ** | 5% return per year before expenses. |

| *** | Because Firsthand Alternative Energy Fund commenced operations on 10/29/07, expenses shown here reflect only 64 days of activity, compared with 184 days for the other funds. |

The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries, or other financial institutions.

FIRSTHAND TECHNOLOGY VALUE FUND

Performance and Portfolio Discussion

How did the Fund perform in 2007?

In 2007, Firsthand Technology Value Fund (TVFQX) posted a 23.39% gain, versus a 10.66% increase for the NASDAQ Composite Index and a 16.76% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2007, Firsthand Technology Value Fund rose 8.50% as compared to 2.29% and 5.81% gains for the NASDAQ and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

For the period ending December 31, 2007, semiconductor and alternative energy stocks represented the portfolio's largest weightings, followed by networking and electronic entertainment holdings. The portfolio's exposure to the semiconductor and electronic entertainment industries contributed most to the Fund's strong performance versus its benchmarks in 2007. In particular, semiconductor stocks that had exposure to the solar industry benefited greatly from the blossoming demand for solar panels.

Which individual holdings were the largest contributors to the Fund's performance?

Cypress Semiconductor (CY) was the Fund's top contributor during 2007. Despite weakness in chip demand, the company managed to increase its revenue above analysts' estimates because of strong sales from its SunPower division, which makes solar cells and panels. Similarly, MEMC Electronic Materials (WFR) was also a profitable investment for the Fund. MEMC, which supplies polysilicon wafers to the semiconductor and solar cell industries, benefited from robust solar panel sales. We liquidated our position in MEMC for a nice gain mid-year, after it hit our price target.

Shares of Nintendo (NTDOY) rose sharply during the year as the videogame maker saw brisk sales of its popular DS portable handheld complemented by strong demand for its Wii game console. The Wii continued to be in short supply throughout the year as it consistently outsold Sony's PlayStation3 and Microsoft's Xbox 360 game systems in 2007 helping drive Nintendo shares higher by more than 125% during the period.

The Fund received a nice boost in performance from aQuantive (AQNT). Shares of the online advertising firm rocketed after Microsoft (MSFT) announced that it would buy the company for approximately $6 billion in May 2007. The all-cash deal represented a sizable premium over aQuantive's closing price and was the largest acquisition in Microsoft's history.

We are also pleased to report that one of the private companies in which we invested in 2003 had its initial public offering in June. AuthenTec (AUTH) manufactures chips that provide fingerprint identification for PCs and wireless devices and finished the period among the top contributors to the Fund's performance. After going public at $11.00 per share, the stock closed 2007 at $14.53, a 32% gain in just over six months.

Which holdings were the greatest detractors from the Fund's performance?

For the period, the portfolio's largest detractor was disk drive manufacturing equipment maker Intevac (IVAC). Shares fell after one of Intevac's key customers revealed that weak demand and price declines for hard drives hurt its profit margins and earnings. These concerns weighed heavily on the industry and affected all hard drive component suppliers, including Intevac, which provides equipment used to deposit specialized materials onto hard disks.

Despite growing demand for robust multimedia online content, such as video, music, and software downloads, shares of Web content delivery firm Akamai Technologies (AKAM) declined more than 34% during the period as investors worried that increasing competition in the content delivery segment would result in lower prices and shrinking profit margins.

SanDisk (SNDK) lost nearly 40% of its market cap during Q4 over concerns that a larger-than-expected decline in the average selling price for NAND flash would crimp future profits for the flash memory manufacturer.

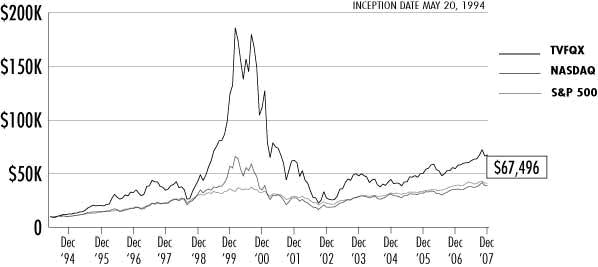

Fund Performance and Holdings (as of 12/31/07)

Firsthand Technology Value Fund vs. Market Indices

| | | TVFQX | | | NASDAQ | | | S&P 500 | |

| Since Inception (5/20/94) | | | 15.05 | % | | | 10.47 | % | | | 10.92 | % |

| 10-Year | | | 6.94 | % | | | 5.90 | % | | | 5.90 | % |

| 5 -Year | | | 19.74 | % | | | 15.46 | % | | | 12.81 | % |

| 3 -Year | | | 14.74 | % | | | 7.65 | % | | | 8.61 | % |

| 1 -Year | | | 23.39 | % | | | 10.66 | % | | | 5.49 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worrth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

| Holdings by Industry* | % Net Assets |

| Semiconductors | 32.2% |

| Alternative Energy | 11.1% |

| Networking | 8.0% |

| Electronic Entertainment | 7.2% |

| Internet | 6.3% |

| Photonics | 6.2% |

| Intellectual Property | 5.9% |

| Peripherals | 4.9% |

| Other Electronics | 3.8% |

| Other | 3.6% |

| Semiconductor Equipment | 3.5% |

| Advanced Materials | 3.1% |

| Communications | 2.6% |

| Net Cash | 1.6% |

| * | Based on percentage of net assets as of 12/31/07. |

| Top 10 Holdings** | % Net Assets |

| Cypresss Semiconductor Corp. | 8.7% |

| Nintendo Co. Ltd. - ADR | 7.2% |

| Cisco Systems, Inc. | 6.2% |

| Corning, Inc. | 6.2% |

| Rambus, Inc. | 5.4% |

| SiRF Technology Holdings, Inc. | 4.9% |

| AuthenTec, Inc. | 2.8% |

| Seagate Technology, Inc. | 2.6% |

| Netflix, Inc. | 2.4% |

| Zoran Corp. | 2.4% |

| ** | Top 10 stock holdings total 48.8% of net assets. These holdings are current as of 12/31/07, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings. |

FIRSTHAND TECHNOLOGY LEADERS FUND

Performance and Portfolio Discussion

How did the Fund perform in 2007?

In 2007, Firsthand Technology Leaders Fund (TLFQX) posted a 13.99% gain, versus a 10.66% increase for the NASDAQ Composite Index and a 16.76% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2007, Firsthand Technology Leaders Fund rose 2.76% as compared to 2.29% and 5.81% gains for the NASDAQ and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

For the period ending December 31, 2007, semiconductor and software stocks represented the portfolio's largest weightings, followed by Internet and electronics holdings. The portfolio's exposure to the computer, communications, and Internet industries contributed most to the Fund's performance, while the net contribution of our semiconductor holdings was essentially flat for the year.

Which individual holdings were the largest contributors to the Fund's performance?

Apple (AAPL) was the top contributor to Fund performance in 2007. Shares of the consumer electronics company hit an all-time high toward the end of the year on strong holiday sales of notebook computers, iPods, and its popular new iPhone handset. The success of the iPod has helped revitalize sales of Mac computers, pushing Apple into third place in market share in the U.S. personal computer market.

China Mobile (CHL) was also a very profitable investment for the Fund. Shares of the world's largest cell phone carrier nearly doubled in 2007, as the service provider continued to enjoy robust business by adding more than five million new customers each month, ending the year with more than 360 million subscribers.

Google (GOOG) continued its dominance in the Internet search market in 2007, keeping the company well ahead of rivals Yahoo! (YHOO) and Microsoft (MSFT). Google also said that it may target the cell phone market to get a piece of the rapidly growing mobile ad market. The stock responded by finishing the year higher by more than 48%.

Nokia (NOK) widened its lead in the global handset market by selling aggressively in emerging markets like China and India and enjoying strong demand for its high-end smartphones. Nokia also made a bid for digital mapmaker Navteq (NVT) for approximately $8 billion in October 2007. This acquisition will give Nokia a foothold in the highly competitive GPS navigation business.

Which holdings were the greatest detractors from the Fund's performance?

The Fund's largest detractor in 2007 was Broadcom (BRCM). Shares of the chipmaker tumbled following a disappointing third-quarter earnings report. Although revenues met Wall Street's estimates, research and development expenses unexpectedly rose. Broadcom management explained that higher R&D spending was necessary to strengthen its presence in the lucrative handset chip market.

VeriFone Holdings (PAY) announced in early December that it would restate some of its financial results due to errors in accounting related to inventory, and said that it would also delay reporting of its upcoming quarterly numbers. News of accounting discrepancies sent shares of the payment processing equipment maker down more than 40% during the fourth quarter.

SanDisk (SNDK) lost nearly 40% of its market cap in Q4 over concerns that a larger-than-expected decline in the average selling price for NAND flash would potentially crimp future profits for the flash memory manufacturer.

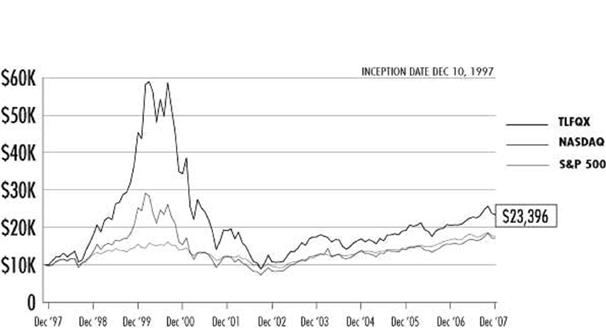

Fund Performance and Holdings (as of 12/31/07)

Firsthand Technology Leaders Fund vs. Market Indices

| | | TLFQX | | | NASDAQ | | | S&P 500 | |

| Since Inception (12/10/97) | | | 8.82 | % | | | 5.52 | % | | | 5.83 | % |

| 10-Year | | | 8.80 | % | | | 5.90 | % | | | 5.90 | % |

| 5 -Year | | | 16.71 | % | | | 15.46 | % | | | 12.81 | % |

| 3 -Year | | | 11.25 | % | | | 7.65 | % | | | 8.61 | % |

| 1 -Year | | | 13.99 | % | | | 10.66 | % | | | 5.49 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worrth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

| Holdings by Industry* | % Net Assets |

| Semiconductors | 20.6% |

| Software | 13.8% |

| Internet | 10.5% |

| Other Electronics | 9.8% |

| Peripherals | 9.6% |

| Computer | 7.2% |

| Communications Equipment | 6.1% |

| Photonics | 5.8% |

| Networking | 5.6% |

| Communications | 5.3% |

| Semiconductor Equipment | 4.8% |

| Net Cash | 0.9% |

| | |

| * | Based on percentage of net assets as of 12/31/07. |

| Top 10 Holdings** | % Net Assets |

| Corning, Inc. | 5.8% |

| Cisco Systems, Inc. | 5.6% |

| eBay, Inc. | 5.4% |

| China Mobile Hong Kong Ltd. | 5.3% |

| L-1 Identity Solutions, Inc. | 5.2% |

| Google, Inc. | 5.1% |

| Microsoft Corp. | 5.0% |

| EMC Corp. | 4.8% |

| Intel Corp. | 4.8% |

| Seagate Technology, Inc. | 4.8% |

| ** | Top 10 stock holdings total 51.8% of net assets. These holdings are current as of 12/31/07, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings. |

FIRSTHAND TECHNOLOGY INNOVATORS FUND

Performance and Portfolio Discussion

How did the Fund perform in 2007?

In 2007, Firsthand Technology Innovators Fund (TIFQX) posted a 17.13% gain, versus a 10.66% increase for the Nasdaq Composite Index and a 16.76% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2007, Firsthand Technology Innovators Fund rose 7.30% as compared to 2.29% and 5.81% gains for the Nasdaq and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

For the period ending December 31, 2007, intellectual property (IP) represented the portfolio's largest weighting, followed by our semiconductor and software holdings. The Fund outperformed its benchmarks due to its holdings in the semiconductor, IP, networking, and software industries.

Which individual holdings were the largest contributors to the Fund's performance?

Our position in Echelon (ELON) more than doubled in value during 2007 as rising energy costs helped boost interest in energy efficiency. Echelon provides automation technologies that help businesses reduce energy usage by more effectively controlling lighting, HVACs, and other energy-intensive appliances.

Improving financial results for database management software vendor Versant (VSNT) helped shares more than double in 2007. The company experienced a pickup in demand in its core business from the telecommunications sector, helping drive growth in licensing revenue.

We are pleased to report that one of the private companies in which we invested in 2003 had its initial public offering in June. AuthenTec (AUTH) manufactures chips that provide fingerprint identification for PCs and wireless devices and finished the period as the number one contributor to Fund performance. After going public at $11.00 per share, the stock closed 2007 at $14.53, a 32% gain in just over six months.

The value of the Fund's position in Silicon Genesis appreciated significantly after the company received a large contract from a key customer. Silicon Genesis is a privately held company that licenses its layer transfer technology to companies manufacturing silicon wafers for the semiconductor and solar industries. The company's technology helps minimize the amount of silicon that is wasted during the wafer manufacturing process.

Which holdings were the greatest detractors from the Fund's performance?

For the period, the portfolio's largest detractor was disk drive manufacturing equipment maker Intevac (IVAC). Shares fell after one of Intevac's key customers revealed that weak demand and price declines for hard drives hurt its profit margins and earnings. These concerns weighed heavily on the industry and affected all hard drive component suppliers, including Intevac, which provides equipment used to deposit specialized materials onto hard disks.

2007 started out on an ominous note for Verint Systems (VRNT.PK) with the NASDAQ delisting the security and analytics software company for not filing the required financial reports with the Securities and Exchange Commission for more than a year. Shares drifted down further in Q4 after the company said that the completion of an internal audit would be delayed, which has kept potential investors away from the stock.

We liquidated our position in PDF Solutions (PDFS) after the software company lowered its guidance due to a softer sales environment that was projected to remain weak for the rest of the year.

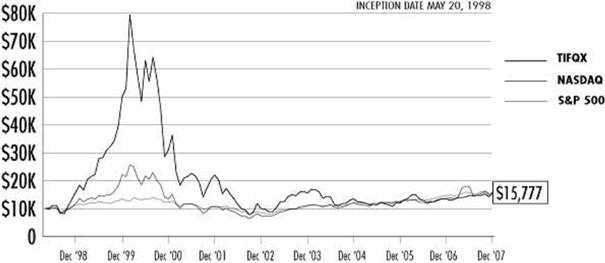

Fund Performance and Holdings (as of 12/31/07)

Firsthand Technology Innovators Fund vs. Market Indices

| | | TIFQX | | | NASDAQ | | | S&P 500 | |

| Since Inception (5/20/98) | | | 4.85 | % | | | 4.35 | % | | | 4.62 | % |

| 5 -Year | | | 9.65 | % | | | 15.46 | % | | | 12.81 | % |

| 3 -Year | | | 5.27 | % | | | 7.65 | % | | | 8.61 | % |

| 1 -Year | | | 17.13 | % | | | 10.66 | % | | | 5.49 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worrth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

| Holdings by Industry* | % Net Assets |

| Intellectual Property | 32.5% |

| Semiconductors | 31.4% |

| Software | 10.1% |

| Other Electronics | 7.5% |

| Networking | 5.6% |

| Services | 4.2% |

| Alternative Energy | 2.4% |

| Communications Equipment | 2.3% |

| Communications | 1.9% |

| Internet | 1.4% |

| Net Cash | 0.7% |

| * | Based on percentage of net assets as of 12/31/07. |

| Top 10 Holdings** | % Net Assets |

| AuthenTec, Inc. | 16.5% |

| Echelon Corp. | 5.6% |

| Intevac, Inc. | 4.9% |

| Versant Corp. | 3.7% |

| Synaptics, Inc. | 2.8% |

| Akeena Solar, Inc. | 2.5% |

| Concur Technologies, Inc. | 2.3% |

| Verint Systems, Inc. | 2.1% |

| EMCORE Corp. | 1.9% |

| MIPS Technologies, Inc. | 1.8% |

| | |

| ** | Top 10 stock holdings total 44.1% of net assets. These holdings are current as of 12/31/07, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings. |

FIRSTHAND E-COMMERCE FUND

Performance and Portfolio Discussion

How did the Fund perform in 2007?

In 2007, Firsthand e-Commerce Fund (TEFQX) posted a 15.31% gain, versus a10.66% increase for the NASDAQ Composite Index and a 16.76% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2007, Firsthand e-Commerce Fund rose 1.74% as compared to 2.29% and 5.81% gains for the NASDAQ and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

For the period ending December 31, 2007, Internet and software stocks represented the portfolio's largest weightings, followed by communications and electronics holdings. The portfolio's exposure to the Internet, software and computer industries contributed most to the Fund's performance in 2007.

Which individual holdings were the largest contributors to the Fund's performance?

Chinese search engine Baidu (BIDU) was one of the best-performing stocks in 2007 and was also the top contributor to Fund performance during the period. Baidu, which is considered to be the Chinese equivalent of Google (GOOG), is benefiting from being the dominant search engine in a large market that is regarded by many to still be in the early stages of growth. Baidu also expanded its presence by entering the Japanese market in March 2007 and by creating a search engine for users that offers e-commerce opportunities.

Shares of Apple (AAPL) hit an all-time high toward the end of the year on strong holiday sales of notebook computers, iPods, and its popular new iPhone device. The success of the iPod has helped revitalize sales of Mac computers, pushing Apple into third place in market share in the U.S. personal computer market.

Google (GOOG) continued its dominance in the Internet search market in 2007, keeping the company well ahead of rivals Yahoo! (YHOO) and Microsoft (MSFT). Google also said that it may target the cell phone market to get a piece of the rapidly growing mobile ad market. The stock responded by finishing the year higher by more than 48%.

The Fund also got a nice boost in performance from Visual Sciences (VSCN) in October 2007. Shares of the online advertising company jumped after Omniture (OMTR) said it planned to buy the company in a stock and cash deal valued at approximately $372 million.

Which holdings were the greatest detractors from the Fund's performance?

Despite growing demand for robust multimedia online content, such as video, music, and software downloads, Web content delivery firm Akamai Technologies (AKAM) was the Fund's largest detractor in 2007. Shares declined more than 34% during the period as investors worried that increasing competition in the content delivery segment would result in lower prices and shrinking profit margins.

VeriFone Holdings (PAY) announced in early December that it would restate some of its financial results due to errors in accounting related to inventory, and said that it would also delay reporting of its upcoming quarterly numbers. News of accounting discrepancies sent shares of the payment processing equipment maker down more than 40% during the fourth quarter.

Monster Worldwide (MNST) experienced a pair of negative events in 2007 that negatively impacted its share price. The parent company of the online job search site Monster.com said it would cut 15% of its workforce after reporting disappointing quarterly results. Monster also suffered a hacker attack that resulted in the theft of personal user data, further damaging the company's reputation.

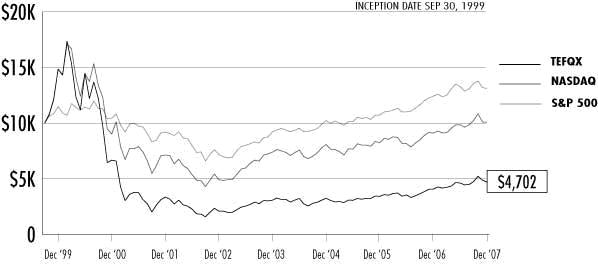

Fund Performance and Holdings (as of 12/31/07)

Firsthand e-Commerce Fund vs. Market Indices

| | | TEFQX | | | NASDAQ | | | S&P 500 | |

| Since Inception (9/30/99) | | | -8.74 | % | | | 0.09 | % | | | 3.33 | % |

| 5 -Year | | | 17.56 | % | | | 15.46 | % | | | 12.81 | % |

| 3 -Year | | | 13.08 | % | | | 7.65 | % | | | 8.61 | % |

| 1 -Year | | | 15.31 | % | | | 10.66 | % | | | 5.49 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worrth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

| Holdings by Industry* | % Net Assets |

| Internet | 39.5% |

| Software | 23.7% |

| Communications | 7.9% |

| Other Electronics | 6.5% |

| Computer | 4.5% |

| Semiconductors | 4.2% |

| Networking | 3.5% |

| Media | 2.9% |

| Net Cash | 7.3% |

| * | Based on percentage of net assets as of 12/31/07. |

| Top 10 Holdings** | % Net Assets |

| Microsoft Corp. | 6.1% |

| Oracle Corp. | 5.1% |

| Adobe Systems, Inc. | 5.1% |

| eBay, Inc. | 4.9% |

| Google, Inc. | 4.6% |

| Yahoo! Inc. | 4.4% |

| Akamai Technologies, Inc. | 4.3% |

| Baidu.com, Inc. | 3.9% |

| L-1 Identity Solutions, Inc. | 3.7% |

| Equinix, Inc. | 3.7% |

| ** | Top 10 stock holdings total 45.8% of net assets. These holdings are current as of 12/31/07, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings. |

FIRSTHAND GLOBAL TECHNOLOGY FUND

Performance and Portfolio Discussion

How did the Fund perform in 2007?

In 2007, Firsthand Global Technology Fund (GTFQX) posted a 16.93% gain, versus a 10.66% increase for the NASDAQ Composite Index and a 16.76% gain for the Lipper Science and Technology Fund Index. For the six months ending December 31, 2007, Firsthand Global Technology Fund rose 4.58% as compared to 2.29% and 5.81% gains for the NASDAQ and the Lipper peer group benchmarks, respectively.

Which industries had the greatest impact on the Fund's performance?

For the period ending December 31, 2007, other electronics, semiconductors and alternative energy stocks together represented the portfolio's largest weighting, followed by software and communications. The Fund’s positive performance was due to its holdings in alternative energy, computer, electronics, and communications equipment. One trend in particular that the Fund benefited from was the surge in demand for global positioning system (GPS) devices and digital mapping services.

Which holdings were the largest contributors to the Fund's performance?

Suntech Power Holdings (STP) was the Fund's top contributor to performance during 2007. China-based Suntech manufactures photovoltaic cells and modules for use in solar panels. The company enjoyed strong demand for its products due to rising energy prices and ongoing government incentives in Europe and the United States.

Lenovo Group (no U.S. symbol) was another Chinese company that performed well in 2007. The computer maker returned to profitability by showing strong gains in market share, revenue, and profit in both its laptop and desktop divisions. Lenovo has benefited from several key acquisitions and by expanding its existing businesses in emerging markets.

Fears about a possible slowdown in the hot flat-panel TV market proved to be a bit premature as LG.Philips LCD (LPL) reported its best quarterly profit in more than three years. Results for the liquid crystal display manufacturer were driven by strong sales for larger-size flat-screen televisions and moderate price declines.

GPS devices were one of the "must have" gifts during the recent holiday season and companies that had exposure to this trend enjoyed nice stock gains in 2007. Portfolio holdings including Tele Atlas (no U.S. symbol), Navteq (NVT), and TomTom (no U.S. symbol) all contributed positively to Fund performance. We liquidated our position in Navteq shortly after the digital mapping company received a bid from Nokia (NOK) to buy the company for approximately $8 billion in cash.

Which holdings were the greatest detractors from the Fund's performance?

For the period, the portfolio's largest detractor from Fund performance was disk drive manufacturing equipment maker Intevac (IVAC). Shares fell after one of Intevac's key customers revealed that weak demand and price declines for hard drives hurt its profit margins and earnings. These concerns weighed heavily on the industry and impacted all hard drive component suppliers, including Intevac, which provides equipment used to deposit specialized materials onto hard disks.

2007 started out on an ominous note for Verint Systems (VRNT.PK) with the NASDAQ delisting the security and analytics software company for not filing the required financial reports with the Securities and Exchange Commission for more than a year. Shares drifted down further in Q4 after the company said that the completion of an internal audit would be delayed, which has kept potential investors away from the stock.

Despite receiving a large capital infusion from Electronic Arts (ERTS) in May 2007, shares of The9 Limited (NCTY) slumped after the Chinese online gaming company reported higher operating expenses due mainly to higher sales and marketing costs that dampened its quarterly earnings results.

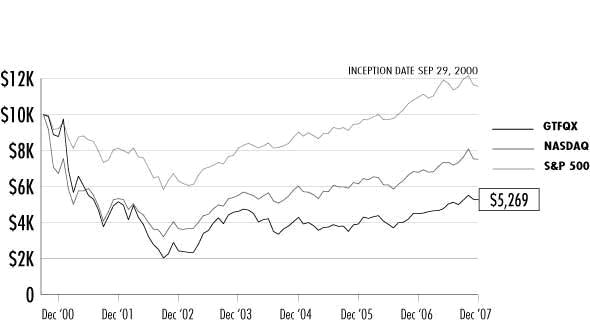

Fund Performance and Holdings (as of 12/31/07)

Firsthand Global Technology Fund vs. Market Indices

| | | GTFQX | | | NASDAQ | | | S&P 500 | |

| Since Inception (9/29/00) | | | -8.45 | % | | | -3.85 | % | | | 2.03 | % |

| 5 -Year | | | 16.75 | % | | | 15.46 | % | | | 12.81 | % |

| 3 -Year | | | 7.05 | % | | | 7.65 | % | | | 8.61 | % |

| 1 -Year | | | 16.93 | % | | | 10.66 | % | | | 5.49 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worrth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

| Holdings by Industry* | % Net Assets |

| Other Electronics | 16.6% |

| Semiconductors | 14.3% |

| Alternative Energy | 10.9% |

| Software | 8.5% |

| Communications | 7.5% |

| Services | 6.9% |

| Semiconductor Equipment | 6.4% |

| Internet | 6.0% |

| Communications Equipment | 5.9% |

| Computer | 4.6% |

| Electronics Manufacturing Services | 4.4% |

| Electronic Entertainment | 4.0% |

| Net Cash | 4.0% |

| * | Based on percentage of net assets as of 12/31/07. |

| Top 10 Holdings** | % Net Assets |

| Suntech Power Holdings Co., Ltd - ADR | 7.0% |

| Tele Atlas NV | 5.6% |

| Sharp Corp. | 4.7% |

| Lenovo Group Ltd ADR | 4.6% |

| Applied Materials, Inc. | 4.4% |

| Samsung Electronics Co., Ltd. - GDR | 4.3% |

| Nintendo Co Ltd. ADR | 4.0% |

| Koninklijke (Royal) Philips Electronics N.V. | 4.0% |

| Alvarion Ltd. | 3.4% |

| Singapore Telecom - ADR | 3.4% |

| | |

| ** | Top 10 stock holdings total 45.4% of net assets. These holdings are current as of 12/31/07, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings. |

FIRSTHAND ALTERNATIVE ENERGY FUND

Performance and Portfolio Discussion

How did the Fund perform in 2007?

Firsthand Alternative Energy Fund (ALTEX) began operations on October 29, 2007. Since inception of the Fund, Firsthand Alternative Energy Fund posted a 8.90% gain, versus a 4.32% decrease for the S&P 500 Index and an 8.84% gain for the WilderHill Clean Energy Index.

Which industries had the greatest impact on the Fund's performance?

For the period ending December 31, 2007, solar and energy efficiency stocks represented the portfolio's largest weightings. The portfolio's exposure to solar and energy efficiency technologies contributed most to the Fund's outperformance versus its benchmarks in 2007. Solar was a particularly profitable area to have exposure to with many stocks ending the year with significant gains.

Which individual holdings were the largest contributors to the Fund's performance?

Akeena Solar (AKNS) was the Fund's top contributor during the period. The Fund’s position in this solar system manufacturer resulted in significant gains after the company received a vote of confidence from a lender by increasing its existing credit line to $25 million from $7.5 million. Akeena plans to use the additional borrowing capacity to further expand upon its growth opportunities in the solar market.

Shares of EMCORE (EMKR) rose more than 40% during the period after an agreement was made to supply solar power systems to Canada over the next three years. EMCORE is a manufacturer that uses compound semiconductor materials, such as gallium arsenide, to develop highly efficient solar cells. This reduces the risk of being dependent on silicon, which is a key component used in manufacturing solar cells.

The Fund also got a nice boost in performance from China-based Suntech Power Holdings (STP). Suntech manufactures photovoltaic cells and modules for use in solar panels. The company enjoyed strong demand for its products due to rising energy prices and ongoing government incentives in Europe and the United States.

Our position in Echelon (ELON) also contributed to Fund performance as higher energy costs helped boost interest in energy efficiency. Echelon provides automation technologies that help businesses reduce energy usage by more effectively controlling lighting, HVACs, and other energy-intensive appliances.

Which holdings were the greatest detractors from the Fund's performance?

Due to the recent launch of the Fund (October 29, 2007), and the strong relative returns in the alternative energy sector, there were only a few stocks that hurt Fund performance during the period. Included among the detractors were German solar panel manufacturer Conergy (no U.S. symbol), lithium-ion rechargeable battery maker Valence Technology (VLNC), Spanish wind turbine supplier Gamesa (no U.S. symbol), and manufacturing equipment maker Applied Materials (AMAT).

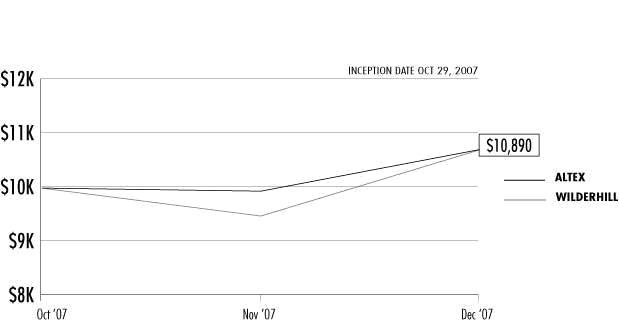

Fund Performance and Holdings (as of 12/31/07)

Firsthand Alternative Energy Fund vs. Market Indices

| | | ALTEX | | | WilderHill Clean Energy | | | S&P 500 | |

| Since Inception (10/29/07) | | | 8.90 | % | | | 8.84 | % | | | -4.32 | % |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worrth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

| Holdings by Industry* | % Net Assets |

| Alternative Energy | 37.3% |

| Other Electronics | 14.1% |

| Semiconductors | 11.5% |

| Networking | 4.0% |

| Semiconductor Equipment | 3.5% |

| Photonics | 3.3% |

| Net Cash | 26.3% |

| * | Based on percentage of net assets as of 12/31/07. |

| Top 10 Holdings** | % Net Assets |

| Suntech Power Holdings Co., Ltd - ADR | 4.9% |

| Koninklijke (Royal) Philips Electronics N.V. | 4.0% |

| Echelon Corp. | 4.0% |

| Honeywell International, Inc. | 3.9% |

| Akeena Solar, Inc. | 3.8% |

| Itron, Inc. | 3.7% |

| Aixtron AG - ADR | 3.7% |

| Applied Materials, Inc. | 3.5% |

| Valence Technology, Inc. | 3.4% |

| Power Integrations, Inc. | 3.4% |

| ** | Top 10 stock holdings total 38.3% of net assets. These holdings are current as of 12/31/07, and may not be representative of current or future investments. Firsthand includes only public companies in top 10 holdings. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees

Firsthand Funds

San Jose, California

We have audited the accompanying statements of assets and liabilities of Firsthand Funds (the “Funds”) comprising, respectively, Firsthand Technology Value Fund, Firsthand Technology Leaders Fund, Firsthand Technology Innovators Fund, Firsthand e-Commerce Fund, Firsthand Global Technology Fund, and Firsthand Alternative Energy Fund, including the portfolios of investments as of December 31, 2007, and the related statements of operations for the year then ended and for the period then ended for Firsthand Alternative Energy Fund, statements of changes in net assets and the financial highlights for the periods indicated thereon. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of the Funds’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2007, by correspondence with the custodian, brokers, and by other auditing procedures as deemed necessary. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Firsthand Funds as of December 31, 2007, the results of their operations, the changes in their net assets, and the financial highlights for the periods referred to above, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER, LLP

Philadelphia, Pennsylvania

February 22, 2008

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Technology Value Fund

| | | SHARES | | | MARKET VALUE | |

COMMON STOCKS- 96.7% ($370,279,826) | | | | | | |

Advanced Materials- 2.9% ($11,250,000) | | | | | | |

| UCT Coatings, Inc., Series B* (1) | | | 500,000 | | | $ | 11,250,000 | |

Alternative Energy- 10.3% ($39,301,065) | | | | | | | | |

| Honeywell International, Inc. | | | 71,300 | | | | 4,389,942 | |

| Itron, Inc.* | | | 80,000 | | | | 7,677,600 | |

| Solaicx, Series B* (1)(2) | | | 7,396,238 | | | | 4,137,752 | |

| Solaicx, Series C* (1)(2) | | | 2,916,581 | | | | 2,915,210 | |

| SoloPower, Series A* (1)(2) | | | 2,721,088 | | | | 10,726,529 | |

| SoloPower, Series B* (1)(2) | | | 228,779 | | | | 1,002,052 | |

| Trina Solar Ltd. - ADR* | | | 157,100 | | | | 8,451,980 | |

Communications- 2.6% ($10,117,249) | | | | | | | | |

| Clearwire Corp.* | | | 250,000 | | | | 3,427,500 | |

| ViaSat, Inc.* | | | 194,300 | | | | 6,689,749 | |

Communications Equipment- 1.1% ($4,324,400) | | | | | | | | |

| Alvarion Ltd.* | | | 455,200 | | | | 4,324,400 | |

| Computer- 1.2% ($4,532,500) | | | | | | | | |

| Sun Microsystems, Inc.* | | | 250,000 | | | | 4,532,500 | |

Electronic Entertainment- 7.2% ($27,650,788) | | | | | | | | |

| Nintendo Co. Ltd. - ADR | | | 373,407 | | | | 27,650,788 | |

Intellectual Property- 5.2% ($19,720,379) | | | | | | | | |

Silicon Genesis Corp., Common* (1)(2) | | | 743,077 | | | | 1,505,036 | |

Silicon Genesis Corp., Series 1-D* (1)(2) | | | 850,830 | | | | 3,881,027 | |

Silicon Genesis Corp., Series 1-E* (1)(2) | | | 4,071,226 | | | | 11,482,526 | |

Silicon Genesis Corp., Series 1-F* (1)(2) | | | 912,453 | | | | 2,851,790 | |

| Internet- 6.3% ($24,182,956) | | | | | | | | |

| Akamai Technologies, Inc.* | | | 145,800 | | | | 5,044,680 | |

| Napster, Inc.* (3) | | | 600,000 | | | | 1,182,000 | |

| Netflix, Inc.* | | | 350,000 | | | | 9,317,000 | |

| Yahoo! Inc.* | | | 371,422 | | | | 8,639,276 | |

| Networking- 8.0% ($30,612,162) | | | | | | | | |

| Cisco Systems, Inc.* | | | 882,900 | | | | 23,900,103 | |

| Echelon Corp.* | | | 311,000 | | | | 6,419,040 | |

| IP Unity, Inc., Series C* (1) | | | 1,104,265 | | | | 11,043 | |

| IP Unity, Inc., Series E* (1) | | | 193,042 | | | | 281,976 | |

| Polaris Networks, Inc., Series A* (1) | | | 297,848 | | | | 0 | |

Other Electronics- 3.8% ($14,358,741) | | | | | | | | |

| Intevac, Inc.* | | | 626,400 | | | | 9,107,856 | |

| Microvision, Inc.* | | | 50,000 | | | | 195,000 | |

| NCR Corp.* | | | 117,600 | | | | 2,951,760 | |

| VeriFone Holdings, Inc.* | | | 90,500 | | | | 2,104,125 | |

| Peripherals- 4.9% ($18,922,700) | | | | | | | | |

| EMC Corp.* | | | 490,000 | | | | 9,079,700 | |

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Technology Value Fund (continued)

| | | SHARES/

PRINCIPAL | | | MARKET VALUE | |

| Seagate Technology, Inc. | | | 386,000 | | | $ | 9,843,000 | |

| Photonics- 6.2% ($23,678,130) | | | | | | | | |

| Celox Networks, Inc., Common* (1) | | | 138,121 | | | | 0 | |

| Celox Networks, Inc., Series A-1* (1) | | | 1,000,000 | | | | 0 | |

| Corning, Inc. | | | 987,000 | | | | 23,678,130 | |

Luminous Networks, Inc., Common* (1) | | | 28,513 | | | | 0 | |

Luminous Networks, Inc., Series A1* (1) | | | 129,664 | | | | 0 | |

Luminous Networks, Inc., Series B1* (1) | | | 259,236 | | | | 0 | |

Semiconductor Equipment- 3.5% ($13,545,061) | | | | | | | | |

| Applied Materials, Inc. | | | 400,000 | | | | 7,104,000 | |

| FormFactor, Inc.* | | | 194,594 | | | | 6,441,061 | |

Semiconductors- 32.2% ($123,256,425) | | | | | | | | |

| AuthenTec, Inc.* (4) | | | 743,930 | | | | 10,666,660 | |

Chartered Semiconductor Manufacturing Ltd. - ADR* | | | 1,126,100 | | | | 7,556,131 | |

| Clarisay, Inc., Series B* (1)(2) | | | 2,605,306 | | | | 0 | |

| Clarisay, Inc., Series C* (1)(2) | | | 7,194,244 | | | | 0 | |

| Cypress Semiconductor Corp.* | | | 923,000 | | | | 33,255,690 | |

| Intel Corp. | | | 296,500 | | | | 7,904,690 | |

| Qimonda AG - ADR* | | | 312,600 | | | | 2,235,090 | |

| Rambus, Inc.* | | | 991,500 | | | | 20,762,010 | |

| SanDisk Corp.* | | | 250,000 | | | | 8,292,500 | |

Semiconductor Manufacturing International Corp.* | | | 700,000 | | | | 3,633,000 | |

| SiRF Technology Holdings, Inc.* | | | 749,000 | | | | 18,822,370 | |

| Soitec S.A.* | | | 72,740 | | | | 887,929 | |

| Zoran Corp.* | | | 410,500 | | | | 9,240,355 | |

| Software- 1.3% ($4,827,270) | | | | | | | | |

| Citrix Systems, Inc.* | | | 127,000 | | | | 4,827,270 | |

| WARRANTS- 1.1% ($4,269,100) | | | | | | | | |

Advanced Materials- 0.2% ($1,000,002) | | | | | | | | |

| UCT Coatings, Inc., B Warrant* (1) | | | 600,000 | | | | 1,000,002 | |

Alternative Energy- 0.2% ($663,791) | | | | | | | | |

| Solaicx, Series C Warrant* (1)(2) | | | 670,814 | | | | 663,791 | |

Intellectual Property- 0.7% ($2,605,238) | | | | | | | | |

Silicon Genesis Corp., 1-E Warrant* (1)(2) | | | 1,257,859 | | | | 2,547,680 | |

Silicon Genesis Corp., Common Warrant* (1)(2) | | | 37,982 | | | | 57,558 | |

| Networking- 0.0% ($69) | | | | | | | | |

| IP Unity, Inc., E Warrant* (1) | | | 69,496 | | | | 69 | |

Polaris Networks, Inc., Convertible Warrant* (1) | | | 75,712 | | | | 0 | |

| Photonics- 0.0% ($0) | | | | | | | | |

Celox Networks, Inc., A-1 Warrant* (1) | | | 500,000 | | | | 0 | |

Luminous Networks, Inc., Common Warrant* (1) | | | 3,822 | | | | 0 | |

| Semiconductors- 0.0% ($0) | | | | | | | | |

| Clarisay, Inc., D Warrant* (1)(2) | | | 2,350,000 | | | | 0 | |

CONVERTIBLE BONDS- 0.0% ($0) | | | | | | | | |

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Technology Value Fund (continued)

| | | SHARES/

PRINCIPAL | | | MARKET VALUE | |

| Networking- 0.0% ($0) | | | | | | |

| Polaris Networks, Inc., 10.00%* (1) | | | 100,949 | | | $ | 0 | |

| Semiconductors- 0.0% ($0) | | | | | | | | |

| Clarisay, Inc., 8.00%* (1)(2) | | | 2,350,000 | | | | 0 | |

PARTICIPATION NOTE- 0.6% ($2,250,612) | | | | | | | | |

Alternative Energy- 0.6% ($2,250,612) | | | | | | | | |

Suzlon Energy Ltd., 0.00%, 09/16/10* | | | 45,800 | | | | 2,250,612 | |

CASH EQUIVALENTS- 1.6% ($5,894,880) | | | | | | | | |

| PNC Bank Money Market Portfolio | | | 5,894,880 | | | | 5,894,880 | |

Total Investments (Cost $363,052,423) - 100.0% | | | | | | | 382,694,418 | |

Other assets in excess of liabilities - 0.0% | | | | | | | 84,013 | |

| | | | | | | | | |

| NET ASSETS - 100.0% | | | | | | $ | 382,778,431 | |

| (3) | Napster, Inc. has the right to put a restriction of public sale on 600,000 shares of the Fund's Napster, Inc. holding. As of December 31, 2007 there are no restrictions on the Fund's shares of Napster, Inc. |

| (4) | AuthenTec, Inc. issued an initial public offering on June 27, 2007, as a result 98,166 of the fund's shares may be restricted from resale for an agreed upon period of time. |

| * | Non-income producing security. |

| ADR | American Depositary Receipt |

see accompanying notes to financial statements

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Technology Leaders Fund

| | | SHARES | | | MARKET VALUE | |

COMMON STOCKS- 99.1% ($62,960,952) | | | | | | |

Communications- 5.3% ($3,360,392) | | | | | | |

| China Mobile Hong Kong Ltd. - ADR | | | 38,683 | | | $ | 3,360,392 | |

Communications Equipment- 6.1% ($3,894,227) | | | | | | | | |

| Nokia Corp. - ADR | | | 68,090 | | | | 2,613,975 | |

| QUALCOMM, Inc. | | | 32,535 | | | | 1,280,252 | |

| Computer- 7.2% ($4,585,680) | | | | | | | | |

| Apple Computer, Inc.* | | | 12,600 | | | | 2,495,808 | |

| Hewlett-Packard Co. | | | 41,400 | | | | 2,089,872 | |

| Internet- 10.5% ($6,660,477) | | | | | | | | |

| eBay, Inc.* | | | 103,695 | | | | 3,441,637 | |

| Google, Inc., Class A* | | | 4,655 | | | | 3,218,840 | |

| Networking- 5.6% ($3,583,256) | | | | | | | | |

| Cisco Systems, Inc.* | | | 132,370 | | | | 3,583,256 | |

Other Electronics- 9.8% ($6,194,007) | | | | | | | | |

Koninklijke (Royal) Philips Electronics N.V. | | | 31,700 | | | | 1,355,175 | |

| L-1 Identity Solutions, Inc.* | | | 184,100 | | | | 3,304,595 | |

| Sharp Corp. | | | 35,000 | | | | 629,812 | |

| VeriFone Holdings, Inc.* | | | 38,900 | | | | 904,425 | |

| Peripherals- 9.6% ($6,098,266) | | | | | | | | |

| EMC Corp.* | | | 165,400 | | | | 3,064,862 | |

| Seagate Technology, Inc. | | | 118,957 | | | | 3,033,404 | |

| Photonics- 5.8% ($3,687,911) | | | | | | | | |

| Corning, Inc. | | | 153,727 | | | | 3,687,911 | |

Semiconductor Equipment- 4.8% ($3,055,901) | | | | | | | | |

| Applied Materials, Inc. | | | 99,800 | | | | 1,772,448 | |

| ASML Holding N.V., NY Shares | | | 41,018 | | | | 1,283,453 | |

Semiconductors- 20.6% ($13,083,340) | | | | | | | | |

| Broadcom Corp., Class A* | | | 98,025 | | | | 2,562,373 | |

| Intel Corp. | | | 114,000 | | | | 3,039,240 | |

Samsung Electronics Co. Ltd. - GDR (1) | | | 6,900 | | | | 2,049,250 | |

| SanDisk Corp.* | | | 47,300 | | | | 1,568,941 | |

Taiwan Semiconductor Manufacturing Co. - ADR | | | 193,035 | | | | 1,922,629 | |

| Texas Instruments, Inc. | | | 58,111 | | | | 1,940,907 | |

Software- 13.8% ($8,757,495) | | | | | | | | |

| Adobe Systems, Inc.* | | | 33,130 | | | | 1,415,645 | |

| Amdocs Ltd.* | | | 76,809 | | | | 2,647,606 | |

| Microsoft Corp. | | | 89,250 | | | | 3,177,300 | |

| NICE-Systems Ltd. - ADR* | | | 44,200 | | | | 1,516,944 | |

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Technology Leaders Fund (continued)

| | | SHARES/ PRINCIPAL | | | MARKET VALUE | |

CASH EQUIVALENTS- 0.4% ($278,370) | | | | | | |

| PNC Bank Money Market Portfolio | | | 278,370 | | | $ | 278,370 | |

| | | | | | | | | |

Total Investments (Cost $50,387,978) - 99.5% | | | | | | | 63,239,322 | |

| | | | | | | | | |

Other assets in excess of liabilities - 0.5% | | | | | | | 302,189 | |

| | | | | | | | | |

| NET ASSETS - 100.0% | | | | | | $ | 63,541,511 | |

| (1) | Rule 144A, Section 4(2), or other security that is restricted as to resale to institutional investors. The Investment Advisor, using Board-approved procedures has deemed these securities to be liquid. |

| * | Non-income producing security. |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

see accompanying notes to financial statements

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Technology Innovators Fund

| | | SHARES | | MARKET VALUE | |

COMMON STOCKS- 97.0% ($18,905,020) | | | | | | |

Alternative Energy- 2.4% ($477,600) | | | | | | |

| Akeena Solar, Inc* | | | 60,000 | | | $ | 477,600 | |

Communications- 1.9% ($362,884) | | | | | | | | |

| Acme Packet, Inc.* | | | 17,600 | | | | 221,584 | |

| Symmetricom, Inc.* | | | 30,000 | | | | 141,300 | |

Communications Equipment- 2.3% ($444,690) | | | | | | | | |

| Finisar Corp.* | | | 101,855 | | | | 147,690 | |

| Sierra Wireless, Inc.* | | | 20,000 | | | | 297,000 | |

Intellectual Property- 31.6% ($6,152,545) | | | | | | | | |

| MIPS Technologies, Inc.* | | | 70,000 | | | | 347,200 | |

Silicon Genesis Corp., Common* (1)(2) | | | 108,815 | | | | 220,395 | |

Silicon Genesis Corp., Series 1-C* (1)(2) | | | 82,914 | | | | 978,504 | |

Silicon Genesis Corp., Series 1-E* (1)(2) | | | 1,633,254 | | | | 4,606,446 | |

| Internet- 1.4% ($279,816) | | | | | | | | |

| LivePerson, Inc.* | | | 52,400 | | | | 279,816 | |

| Networking- 5.6% ($1,093,944) | | | | | | | | |

| Echelon Corp.* | | | 52,600 | | | | 1,085,664 | |

| IP Unity, Inc., Series C* (1) | | | 827,957 | | | | 8,280 | |

Other Electronics- 7.5% ($1,455,696) | | | | | | | | |

| Intevac, Inc.* | | | 65,300 | | | | 949,462 | |

| iRobot Corp.* | | | 11,800 | | | | 213,344 | |

| Microvision, Inc.* | | | 75,100 | | | | 292,890 | |

| Photonics- 0.0% ($0) | | | | | | | | |

Luminous Networks, Inc., Common* (1) | | | 49,979 | | | | 0 | |

Luminous Networks, Inc., Series A1* (1) | | | 227,282 | | | | 0 | |

Semiconductors- 31.4% ($6,124,089) | | | | | | | | |

| AuthenTec, Inc.* (3) | | | 225,945 | | | | 3,211,666 | |

| EMCORE Corp.* | | | 24,100 | | | | 368,730 | |

| Netlogic Microsystems, Inc.* | | | 8,000 | | | | 257,600 | |

| Nextest Systems Corp.* | | | 10,200 | | | | 202,878 | |

| PLX Technology, Inc.* | | | 10,000 | | | | 93,000 | |

| Power Integrations, Inc.* | | | 9,000 | | | | 309,870 | |

| Ramtron International Corp.* | | | 60,000 | | | | 258,000 | |

| SigmaTel, Inc.* | | | 122,500 | | | | 258,475 | |

| Silicon Optix, Inc., Series B* (1) | | | 1,111,111 | | | | 350,000 | |

| Synaptics, Inc.* | | | 13,300 | | | | 547,428 | |

| Techwell, Inc* | | | 24,200 | | | | 266,442 | |

| Services- 2.8% ($554,737) | | | | | | | | |

| iGATE Corp.* | | | 12,000 | | | | 101,640 | |

| Innovion Corp., Series C* (1)(2) | | | 1,575,322 | | | | 147,753 | |

| Net 1 UEPS Technologies, Inc.* | | | 10,400 | | | | 305,344 | |

| Software- 10.1% ($1,959,019) | | | | | | | | |

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Technology Innovators Fund (continued)

| | | SHARES/ PRINCIPAL | | | MARKET VALUE | |

| Concur Technologies, Inc* | | | 12,300 | | | $ | 445,383 | |

| Saba Software, Inc* | | | 30,300 | | | | 155,742 | |

| Synchronoss Technologies, Inc.* | | | 6,100 | | | | 216,184 | |

| Verint Systems, Inc.* | | | 21,200 | | | | 414,460 | |

| Versant Corp.* | | | 25,000 | | | | 727,250 | |

| WARRANTS- 0.9% ($166,708) | | | | | | | | |

Intellectual Property- 0.9% ($166,075) | | | | | | | | |

Silicon Genesis Corp., 1-E Warrant* (1)(2) | | | 94,339 | | | | 166,075 | |

| Photonics- 0.0% ($0) | | | | | | | | |

Luminous Networks, Inc., Common Warrant* (1) | | | 6,699 | | | | 0 | |

| Services- 0.0% ($633) | | | | | | | | |

| Innovion Corp., Warrant* (1)(2) | | | 602,577 | | | | 603 | |

| Innovion Corp., Warrant* (1)(2) | | | 30,129 | | | | 30 | |

CONVERTIBLE BOND- 1.4% ($271,751) | | | | | | | | |

| Services- 1.4% ($271,751) | | | | | | | | |

| Innovion Corp., 9.50%* (1)(2) | | | 543,502 | | | | 271,751 | |

CASH EQUIVALENTS- 0.5% ($103,186) | | | | | | | | |

| PNC Bank Money Market Portfolio | | | 103,186 | | | | 103,186 | |

Total Investments (Cost $23,780,863) - 99.8% | | | | | | | 19,446,665 | |

Other assets in excess of liabilities - 0.2% | | | | | | | 43,756 | |

| | | | | | | | | |

| NET ASSETS - 100.0% | | | | | | $ | 19,490,421 | |

| (3) | AuthenTec, Inc. issued an initial public offering on June 27, 2007, as a result a portion or all of the fund's shares may be restricted from resale for an agreed upon period of time. |

| * | Non-income producing security. |

see accompanying notes to financial statements

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand e-Commerce Fund

| | | SHARES | | | MARKET VALUE | |

COMMON STOCKS- 92.7% ($37,705,401) | | | | | | |

Communications- 7.9% ($3,222,608) | | | | | | |

| Comcast Corp., Special Class A* | | | 22,500 | | | $ | 407,700 | |

| Equinix, Inc.* | | | 15,000 | | | | 1,516,050 | |

| Internap Network Services Corp.* | | | 23,715 | | | | 197,546 | |

| NeuStar, Inc.* | | | 38,400 | | | | 1,101,312 | |

| Computer- 4.5% ($1,831,697) | | | | | | | | |

| Apple Computer, Inc.* | | | 3,400 | | | | 673,472 | |

| Dell, Inc.* | | | 15,500 | | | | 379,905 | |

| International Business Machines Corp. | | | 7,200 | | | | 778,320 | |

| Internet- 39.5% ($16,053,912) | | | | | | | | |

| 51job, Inc. - ADR* | | | 17,368 | | | | 312,971 | |

| Akamai Technologies, Inc.* | | | 50,800 | | | | 1,757,680 | |

| Baidu.com, Inc. - ADR* | | | 4,100 | | | | 1,600,599 | |

| Ctrip.com International Ltd. - ADR | | | 23,000 | | | | 1,321,810 | |

| CyberSource Corp.* | | | 41,814 | | | | 743,035 | |

| eBay, Inc.* | | | 60,000 | | | | 1,991,400 | |

| Gmarket, Inc. - ADR* | | | 22,100 | | | | 550,290 | |

| Google, Inc., Class A* | | | 2,700 | | | | 1,866,996 | |

| LivePerson, Inc.* | | | 140,000 | | | | 747,600 | |

| Monster Worldwide, Inc.* | | | 34,900 | | | | 1,130,760 | |

| Napster, Inc.* | | | 64,400 | | | | 126,868 | |

| ValueClick, Inc.* | | | 46,300 | | | | 1,013,970 | |

| Visual Sciences, Inc.* | | | 58,667 | | | | 1,084,166 | |

| Yahoo! Inc.* | | | 77,634 | | | | 1,805,767 | |

| Media- 2.9% ($1,178,525) | | | | | | | | |

| News Corp., Class B | | | 55,460 | | | | 1,178,525 | |

Networking- 3.5% ($1,426,589) | | | | | | | | |

| Cisco Systems, Inc.* | | | 52,700 | | | $ | 1,426,589 | |

Other Electronics- 6.5% ($2,623,126) | | | | | | | | |

| L-1 Identity Solutions, Inc.* | | | 84,500 | | | | 1,516,775 | |

| VeriFone Holdings, Inc.* | | | 47,585 | | | | 1,106,351 | |

Semiconductors- 4.2% ($1,727,992) | | | | | | | | |

| AuthenTec, Inc.* | | | 82,400 | | | | 1,197,272 | |

| SanDisk Corp.* | | | 16,000 | | | | 530,720 | |

Software- 23.7% ($9,640,952) | | | | | | | | |

| Adobe Systems, Inc.* | | | 48,069 | | | | 2,053,989 | |

| Amdocs Ltd.* | | | 16,000 | | | | 551,520 | |

| Microsoft Corp. | | | 70,000 | | | | 2,492,000 | |

| Omniture, Inc.* | | | 41,700 | | | | 1,388,193 | |

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand e-Commerce Fund (continued)

| | | SHARES/ PRINCIPAL | | | MARKET VALUE | |

| Oracle Corp.* | | | 91,100 | | | $ | 2,057,038 | |

| VeriSign, Inc.* | | | 29,200 | | | | 1,098,212 | |

CASH EQUIVALENTS- 7.8% ($3,161,900) | | | | | | | | |

| PNC Bank Money Market Portfolio | | | 3,161,900 | | | | 3,161,900 | |

Total Investments (Cost $32,668,160) – 100.5% | | | | | | | 40,867,301 | |

Liabilities in excess of other assets - (0.5)% | | | | | | | (199,372 | ) |

| NET ASSETS - 100.0% | | | | | | $ | 40,667,929 | |

| * | Non-income producing security. |

| ADR | American Depositary Receipt |

see accompanying notes to financial statements

PORTFOLIO OF INVESTMENTS, December 31, 2007

Firsthand Global Technology Fund

| | | SHARES | | | MARKET VALUE | |

COMMON STOCKS- 93.6% ($10,865,978) | | | | | | |

Alternative Energy- 8.5% ($984,705) | | | | | | |

| Renewable Energy Corp. A.S.* | | | 3,500 | | | $ | 177,969 | |

Suntech Power Holdings Co., Ltd. - ADR* | | | 9,800 | | | | 806,736 | |

Communications- 7.5% ($869,003) | | | | | | | | |

America Movil SAB de C.V., Series L - ADR | | | 3,700 | | | | 227,143 | |

Singapore Telecommunications Ltd. - ADR | | | 14,100 | | | | 391,816 | |

| Vodafone Group PLC - ADR | | | 6,700 | | | | 250,044 | |

Communications Equipment-5.9% ($684,369) | | | | | | | | |

| Alvarion Ltd.* | | | 42,135 | | | | 400,283 | |

| Nokia Corp. - ADR | | | 7,400 | | | | 284,086 | |

| Computer- 4.6% ($539,412) | | | | | | | | |

| Lenovo Group Ltd. - ADR | | | 30,000 | | | | 539,412 | |

Electronic Entertainment- 4.0% ($466,515) | | | | | | | | |

| Nintendo Co. Ltd. - ADR | | | 6,300 | | | | 466,515 | |

Electronics Manufacturing Services - 4.4% ($508,125) | | | | | | | | |

| Hon Hai Precision - GDR | | | 23,364 | | | | 291,019 | |

| Quanta Computer, Inc. - GDR | | | 30,583 | | | | 217,106 | |

| Internet- 6.0% ($697,304) | | | | | | | | |

| 51job, Inc. - ADR* | | | 8,880 | | | | 160,018 | |

| The9 Ltd. - ADR* | | | 12,000 | | | | 255,840 | |

| Yahoo! Inc.* | | | 12,100 | | | | 281,446 | |

Other Electronics - 16.6% ($1,923,377) | | | | | | | | |