Washington, D.C. 20549

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

CONTENTS

| Performance Summary | 2 |

| President’s Letter | 4 |

| Shareholder Fee Example | 6 |

| Performance and Portfolio Discussion | 8 |

| Audit Letter | 16 |

| Portfolio of Investments | 17 |

| Statements of Assets and Liabilities | 23 |

| Statements of Operations | 24 |

| Statements of Changes in Net Assets | 25 |

| Statement of Cash Flows | 27 |

| Financial Highlights | 28 |

| Notes to Financial Statements | 30 |

| Additional Information | 47 |

PERFORMANCE SUMMARY

Period Returns (Average Annual Total Returns as of 12/31/09)

| | | | | | Expense |

| Fund | 1-Year | 3-Year | 5-Year | 10-Year | Ratio |

Firsthand Technology Value Fund® | 29.52% | -5.64% | 0.56% | -9.45% | 1.85% |

| Firsthand Technology Leaders Fund | 55.62% | -1.88% | 2.67% | -8.14% | 1.85% |

| Firsthand e-Commerce Fund | 73.98% | 4.94% | 7.70% | -10.85% | 1.85% |

| Firsthand Alternative Energy Fund | 41.02% | • | • | • | 1.98% |

| | | | | | |

| NASDAQ Composite Index | 45.36% | -1.14% | 1.70% | -5.08% | • |

| S&P 500 Index | 26.47% | -5.52% | 0.43% | -0.95% | • |

| WilderHill Clean Energy Index | 29.78% | • | • | • | • |

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

The NASDAQ Composite Index (NASDAQ) is a capitalization-weighted index of all common stocks listed with NASDAQ. The Standard & Poor’s 500 Index (S&P 500) is a market-weighted index of 500 stocks of well-established companies. Each index represents an unmanaged, broad-based basket of stocks. These indices are typically used as benchmarks for overall market performance. The WilderHill Clean Energy Index is a market-weighted index of 40 companies in the cleaner fuel, energy conversion, energy storage, greener utilities, power delivery and conservation, and renewable energy harvesting sectors. You cannot invest directly in an index.

Returns Since Inception (Average Annual Total Returns as of 12/31/09)

| | Average | | | WilderHill |

| | Annual | NASDAQ | | Clean |

| | Total | Composite | S&P 500 | Energy |

| Fund | Returns | Index | Index | Index |

| Firsthand Technology Value Fund® (5/20/94) | 10.26% | 8.12% | 7.88% | • |

| Firsthand Technology Leaders Fund (12/10/97) | 5.64% | 3.41% | 2.88% | • |

| Firsthand e-Commerce Fund (9/30/99) | -7.07% | -1.25% | 0.42% | • |

| Firshand Alternative Energy Fund (10/29/07) | -9.70% | • | -11.73% | -32.49% |

Each Fund may invest in small-capitalization companies and Initial Public Offerings (“IPOs”). These investments may be more volatile than investments in large-capitalization companies and loss of principal could be greater. The Funds may invest in foreign securities, which may be subject to greater risks than investing in domestic securities. Because the Funds are not diversified, they can take larger positions in fewer companies, increasing their risk profile. The Funds invest in several industries within the technology sector and the relative weightings of these industries in a Fund’s portfolio may change at any time.

Holdings by Industry - % of Net Assets (as of 12/31/09)

| | Firsthand | Firsthand | Firsthand | Firsthand |

| | Technology | Technology | e-Commerce | Alternative |

| Industry | Value Fund | Leaders Fund | Fund | Energy Fund |

| Advanced Materials | 5.8% | 5.4% | • | 4.9% |

| Basic Materials | • | • | • | 0.8% |

| Building Automation | • | • | • | 3.4% |

| Communications | 3.0% | 4.7% | 7.4% | • |

| Communications Equipment | 6.9% | 9.1% | 1.6% | • |

| Computer | • | 3.7% | 6.5% | • |

| Consumer Electronics | • | • | 2.5% | • |

| Defense & Aerospace | 2.5% | • | • | • |

| Electronic Manufacturing Services | 0.2% | • | • | • |

| Energy Efficiency | 3.1% | • | • | 9.1% |

| Environmental Services | • | • | • | 0.8% |

| Industrials | • | • | • | 4.0% |

| Intellectual Property | 13.4% | • | • | 4.3% |

| Internet | 8.9% | 6.0% | 42.6% | • |

| Networking | 0.1% | 3.2% | 4.4% | • |

| Other Electronics | 9.7% | 11.8% | 7.5% | 8.1% |

| Peripherals | 2.7% | 7.0% | • | • |

| Photonics | 1.5% | • | • | • |

| Renewable Energy | 11.0% | 2.0% | • | 46.9% |

| Semiconductors | 18.2% | 14.7% | • | 5.3% |

| Services | 1.3% | • | • | • |

| Software | 8.0% | 17.3% | 10.0% | • |

| Net Other Assets and Liabilities | 3.7% | 15.1% | 17.5% | 12.4% |

PRESIDENT’S LETTER

| Fellow Shareholders,

2009 represented a dramatic turnaround from the dismal performance of 2008. Anticipating the beginning of the economic recovery, equity markets began a remarkable bull run late in the first quarter and the major indices clawed back more than half of their prior year losses. Although growth has returned to the overall economy, we still have a long way to go, and many people will feel the effects of the recession for some time. The open question now is whether this is an anemic recovery, analogous to Japan’s “lost decade” or whether it will gather momentum over time - reminiscent of the US recovery circa 1992. By and large, it was a very good year for Firsthand Funds. The technology sector led the recovery in 2009 and was the best-performing sector in the S&P 500 Index. We saw strong returns in most segments of the tech sector as investors emerged from beneath their desks and began to add risk to their portfolios again. Three of our four funds handily beat their respective benchmarks. Firsthand e-commerce Fund led the way, posting a return of nearly 74% for the year. The laggard, Firsthand Technology Value Fund, still beat the S&P 500 Index, although it trailed the Nasdaq Composite Index. For more details on the funds’ performance, please see the performance tables that begin on page 2, and the individual fund discussions that follow. |

Despite the recession — some might say because of it — a number of consumer trends demonstrated their ability to thrive in any climate. Several of our portfolio companies benefited from this. Netflix was a prime example, adding subscribers and gaining market share as cost-conscious consumers were more willing to try their service. Like many industry leaders, Netflix emerged from the recession in a stronger position than before.

Apple continued to write its own success story. Amidst a stagnant economy and brutal competition, with consumers as price sensitive as ever, the iPhone continued to gain market share while charging a premium price. It’s a stunning example of the power of innovation, and it renews one’s confidence in the future of Silicon Valley.

The alternative energy sector appears to be back on the growth track after a rough 2009. Dramatic declines in the price of polysilicon, the feedstock for most solar cells, brought overall costs down considerably — but not fast enough to offset price declines in solar panels. On the other side of the vise, project financing all but disappeared in the wake of the banking crisis, stunting demand. The silver lining: Solar power today is more cost competitive than ever before, and the ultimate goal of “grid parity”— the point at which the cost of solar power equals the cost of grid power — is drawing much closer.

Our thesis here remains unchanged: Alternative energy cannot burst into the mainstream until it can stand on its own — without subsidies. Our focus is on the companies and technological innovation that will drive down costs.

Overall, we are pleased with the performance of our stocks in 2009. But after such a strong market rebound, and with the economic recovery still weak and uneven, we are mindful that there is plenty of opportunity for disappointment. Even if the economy continues to expand, 2010 could be a volatile year.

As ever, change creates uncertainties, anxieties, and opportunities. Looking ahead, we see innovation as the key. The creative application of technology is what solves today’s problems and opens tomorrow’s new markets. That is what drives our efforts and shapes our portfolios as we navigate these changing times. Thank you for your investment in Firsthand Funds.

Sincerely,

Kevin Landis

President, Firsthand Funds

SHAREHOLDER FEE EXAMPLE

Example — In general, mutual fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads), redemption fees, and exchange fees; and (2) ongoing costs, including management fees, 12b-1 distribution and service fees, non-12b-1 service fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. Note that Firsthand Funds (“Trust”) does not charge transaction fees for 12b-1 distribution and service fees, though you may incur transaction fees if you purchase shares through a broker.

The example on the following page is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2009 through December 31, 2009.

Actual Expenses — The section of the table at right entitled “Actual” provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the section entitled “Actual” under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. If your account is an IRA or other tax-qualified savings plan, your expenses may also have included a $10 annual fee. In either case, the amount of any fee paid through your account would increase the estimate of expenses you paid during the period and decrease your ending account value.

Hypothetical Example for Comparison Purposes — The section of the table at right entitled “Hypothetical” provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate your actual ending account balance or the expenses you paid for the period. However, you may use this information to compare the ongoing costs of investing in the Trust to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. As in the case of the actual expense example, if your account is subject to an IRA fee, the amount of the fee paid through your account would increase the hypothetical expenses you would have paid during the period and decrease the hypothetical ending account value.

Please note that the expenses shown in the table at right are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The examples also assume all dividends and distributions have been reinvested.

Firsthand Technology Value Fund

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 7/1/09 | 12/31/09 | 7/1/09-12/31/09 | Expense Ratio |

| | | | | |

| Actual | $1,000 | $1,181.20 | $10.61 | 1.93% |

Hypothetical** | $1,000 | $1,015.48 | $9.80 | 1.93% |

Firsthand Technology Leaders Fund

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 7/1/09 | 12/31/09 | 7/1/09-12/31/09 | Expense Ratio |

| | | | | |

| Actual | $1,000 | $1,237.70 | $10.55 | 1.87% |

Hypothetical** | $1,000 | $1,015.78 | $9.50 | 1.87% |

Firsthand e-Commerce Fund

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 7/1/09 | 12/31/09 | 7/1/09-12/31/09 | Expense Ratio |

| | | | | |

| Actual | $1,000 | $1,285.70 | $10.77 | 1.87% |

Hypothetical** | $1,000 | $1,015.78 | $9.50 | 1.87% |

Firsthand Alternative Energy Fund

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 7/1/09 | 12/31/09 | 7/1/09-12/31/09 | Expense Ratio |

| | | | | |

| Actual | $1,000 | $1,219.20 | $11.36 | 2.03% |

Hypothetical** | $1,000 | $1,014.97 | $10.31 | 2.03% |

| * | Expenses are calculated by multiplying the Fund’s annualized expense ratio listed above by the average account value over the period and multiplying that number by 184/365 (to reflect the one-half year period). |

| ** | 5% return per year before expenses. |

The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries, or other financial institutions.

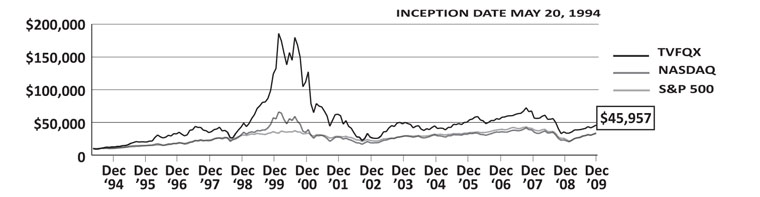

FIRSTHAND TECHNOLOGY VALUE FUND

Performance and Portfolio Discussion

How did the Fund perform in 2009?

Firsthand Technology Value Fund (TVFQX) posted a gain of 29.52%, versus a 45.36% increase for the NASDAQ Composite Index and a 26.47% gain for the S&P 500 Index. For the six months ended December 31, 2009, Firsthand Technology Value Fund rose 18.11% as compared to 24.26% and 22.59% increases for the NASDAQ and the S&P 500 indices, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the period ended December 31, 2009, semiconductor and intellectual property stocks represented the portfolio’s largest weightings, followed by renewable energy and software holdings. The Fund’s underperformance during the past 12 months reflects poor performance of our holdings in the semiconductor, renewable energy, and intellectual property industries.

Which individual holdings were the largest contributors to the Fund’s performance?

The Fund’s top contributor in 2009 was Corning (GLW), a diversified manufacturer of glass products, including fiber optic equipment and glass substrates for LCD panels. The company’s shares rebounded strongly during the year as the global economic situation improved, boosting consumer confidence and providing a lift to the LCD television market.

VeriFone (PAY), a provider of electronic payment systems, was another top performer for the Fund. The company’s stock posted a gain of over 200% during the year as it returned to profitability. VeriFone has been aggressively rolling out its products and services to retailers, restaurants, and taxi cab companies worldwide.

Shares of Netflix (NFLX) returned to their growth trajectory in 2009 as the company continued to defy its detractors by growing revenues, earnings, and subscribers. Netflix has been active in partnering with DVD and game console vendors to offer streaming video services to its 11-million-plus subscribers. Late in the year, rumors of a potential acquisition by Amazon also helped boost the stock.

Which holdings were the greatest detractors from the Fund’s performance?

The Fund’s top detractors were both privately held companies in the alternative energy industry. The largest detractor was SoloPower, a thin-film solar company in which the Fund initially invested in 2006. During 2009, the value of our SoloPower investment declined, reflecting changing economics in the solar business, as well as certain fundamental developments at the company.

Solaicx was another private company whose performance hurt the Fund in 2009. The company, which makes equipment for manufacturing silicon ingots intended for use in silicon solar cells, suffered from extreme pricing pressure caused by the global economic decline and required a dilutive round of financing, in which the Fund did not participate.

Shares of Rambus (RMBS) took a big hit early in the year after a U.S. District Court ruled that its patent suit against Micron Technology was “unenforceable.” Though the Fund liquidated its position immediately following the announcement, it was unable to avoid the stock’s rapid decline.

Fund Performance and Holdings Information (as of 12/31/09)

Firsthand Technology Value Fund vs. Market Indices

| | Firsthand | NASDAQ | |

| | Technology | Composite | S&P 500 |

| | Value Fund | Index | Index |

| Since Inception (5/20/94) | 10.26% | 8.12% | 7.88% |

| 10-Year | -9.45% | -5.08% | -0.95% |

| 5-Year | 0.56% | 1.70% | 0.43% |

| 3-Year | -5.64% | -1.14% | -5.52% |

| 1-Year | 29.52% | 45.36% | 26.47% |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry* | | Top 10 Holdings** | |

| | % Net Assets | | % Net Assets |

| Semiconductors | 18.2% | SoloPower, Series A | 9.6% |

| Intellectual Property | 13.4% | Silicon Genesis Corp., Series 1-E | 7.6% |

| Renewable Energy | 11.0% | Netflix, Inc. | 5.6% |

| Other Electronics | 9.7% | VeriFone Holdings, Inc. | 4.9% |

| Internet | 8.9% | Intevac, Inc. | 4.7% |

| Software | 8.0% | Broadcom Corp., Class A | 4.6% |

| Communications Equipment | 6.9% | Intel Corp. | 4.0% |

| Advanced Materials | 5.8% | Microsoft Corp. | 3.9% |

| Energy Efficiency | 3.1% | Techwell, Inc. | 3.4% |

| Communications | 3.0% | Echelon Corp. | 3.1% |

| Peripherals | 2.7% | | |

| Defense & Aerospace | 2.5% | | |

| Photonics | 1.5% | | |

| Services | 1.3% | | |

| Electronics Manufacturing Services | 0.2% | | |

| Networking | 0.1% | | |

| Net Other Assets and Liabilities | 3.7% | | |

| * | Based on percentage of net assets as of 12/31/09. |

| ** | Top 10 stock holdings total 51.4% of net assets. These holdings are current as of 12/31/09, and may not be representative of current or future investments. |

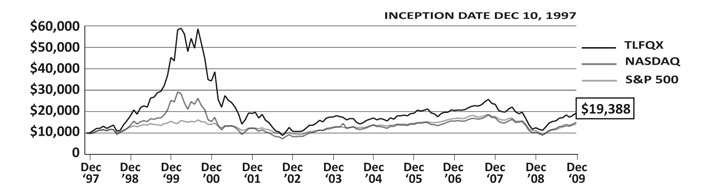

FIRSTHAND TECHNOLOGY LEADERS FUND

Performance and Portfolio Discussion

How did the Fund perform in 2009?

Firsthand Technology Leaders Fund (TVFQX) posted a gain of 55.62%, versus a 45.36% increase for the NASDAQ Composite Index and a 26.47% gain for the S&P 500 Index. For the six months ended December 31, 2009, Firsthand Technology Leaders Fund rose 23.77% as compared to 24.26% and 22.59% increases for the NASDAQ and the S&P 500 indices, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the period ended December 31, 2009, software and semiconductor stocks represented the portfolio’s largest weightings, followed by holdings in the “other electronics” and communications equipment industries. The portfolio’s exposure to the peripherals, Internet, advanced materials, and semiconductor industries contributed most to the Fund’s outperformance versus its benchmarks in 2009.

Which individual holdings were the largest contributors to the Fund’s performance?

The Fund’s top contributor in 2009 was Seagate (STX), the world’s largest manufacturer of disk drives. Seagate’s stock steadily gained ground throughout 2009 as the company‘s restructuring began yielding positive results. After struggling through the economic downturn, the company returned to profitability in the third quarter of 2009.

The Fund’s investment in Google (GOOG) was another significant contributor to performance. The stock doubled in 2009, with the resurgence in growth of the paid Internet search business. The company entered several new markets this year, notably the cell phone market with its Android operating system.

VeriFone (PAY), a provider of electronic payment systems, was another top performer for the Fund. The company’s stock posted a gain of over 200% during the year as it returned to profitability. VeriFone has been aggressively rolling out its products and services to retailers, restaurants, and taxi cab companies worldwide.

Corning (GLW) was another top performer in 2009. The company is a diversified manufacturer of glass products, including fiber optic equipment and glass substrates for LCD panels. Corning’s shares rebounded strongly during the year as the global economic situation improved, boosting consumer confidence and providing a lift to the LCD television market.

Which holdings were the greatest detractors from the Fund’s performance?

Owing to the broad market recovery in 2009, only a handful of portfolio companies posted negative returns for the year. Increased competition and slowing growth altered the market dynamics in the solar panel industry in 2009, causing shares of SunPower (SPWRB) to decline modestly.

First Solar (FSLR), another solar panel manufacturer, also suffered in the changing landscape of the global solar market. The Fund liquidated its position in the stock mid-year as business fundamentals deteriorated. Demand expectations have been curbed considerably, thanks to the global recession and cutbacks in solar subsidies, particularly in Europe. Furthermore, First Solar’s competitive cost advantage has eroded substantially as silicon prices have fallen, bringing the cost of silicon-based photovoltaic panels more in line with the company’s thin-film cadmium telluride solution.

Nokia (NOK) was another underperformer in 2009. Though it remains the largest handset manufacturer in the world by a wide margin, the company continues to struggle in the high-margin smartphone segment. As a result, Nokia’s growth has not kept pace with competitors during the economic recovery, causing its stock to wane.

Despite increasing revenue, China Mobile (CHL) suffered a small decline in its stock price in 2009 as investors fled telecom carrier stocks in search of higher growth rates as the market rebounded.

Fund Performance and Holdings Information (as of 12/31/09)

Firsthand Technology Leaders Fund vs. Market Indices

| | Firsthand | NASDAQ | |

| | Technology | Composite | S&P 500 |

| | Leaders Fund | Index | Index |

| Since Inception (12/10/97) | 5.64% | 3.41% | 2.88% |

| 10-Year | -8.14% | -5.08% | -0.95% |

| 5-Year | 2.67% | 1.70% | 0.43% |

| 3-Year | -1.88% | -1.14% | -5.52% |

| 1-Year | 55.62% | 45.36% | 26.47% |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry* | | Top 10 Holdings** | |

| | % Net Assets | | % Net Assets |

| Software | 17.3% | Google, Inc., Class A | 6.0% |

| Semiconductors | 14.7% | VeriFone Holdings, Inc. | 5.7% |

| Other Electronics | 11.8% | QUALCOMM, Inc. | 5.6% |

| Communications Equipment | 9.1% | Intel Corp. | 5.5% |

| Peripherals | 7.0% | Corning, Inc. | 5.4% |

| Internet | 6.0% | Adobe Systems, Inc. | 5.2% |

| Advanced Materials | 5.4% | China Mobile Hong Kong Ltd. - ADR | 4.7% |

| Communications | 4.7% | Broadcom Corp., Class A | 4.6% |

| Computer | 3.7% | Samsung Electronics Co., Ltd. - GDR | 4.5% |

| Networking | 3.2% | NICE Systems Ltd. - ADR | 3.9% |

| Renewable Energy | 2.0% | | |

| Net Other Assets and Liabilities | 15.1% | | |

| * | Based on percentage of net assets as of 12/31/09. |

| ** | Top 10 stock holdings total 51.1% of net assets. These holdings are current as of 12/31/09, and may not be representative of current or future investments. |

FIRSTHAND E-COMMERCE FUND

Performance and Portfolio Discussion

How did the Fund perform in 2009?

Firsthand e-Commerce Fund (TEFQX) posted a gain of 73.98%, versus a 45.36% increase for the NASDAQ Composite Index and a 26.47% gain for the S&P 500 Index. For the six months ended December 31, 2009, Firsthand e-Commerce Fund rose 28.57% as compared to 24.26% and 22.59% increases for the NASDAQ and the S&P 500 indices, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the period ended December 31, 2009, Internet and software stocks represented the portfolio’s largest weightings, followed by holdings in the “other electronics” and communications industries. The Fund’s Internet stocks were largely responsible for the Fund’s outperformance during the year.

Which individual holdings were the largest contributors to the Fund’s performance?

The Fund’s top contributor in 2009 was Baidu (BIDU), the leading Chinese-language Internet search provider. The company’s stock was up over 200% in 2009, propelled by its status as the dominant search franchise in arguably the fastest-growing economy in the world. Although growth slowed somewhat during the year, Baidu continues to take share in the Chinese market and its revenue ramp remains healthy.

LivePerson (LPSN) was another standout performer for the Fund this past year. The company, whose stock rose nearly 300% in 2009, provides online sales support and customer service functions for small and medium-sized businesses, as well as large companies including The Home Depot and Hewlett-Packard. Despite the sluggish economy, company sales continued to grow, due in part to its ability to help clients cut costs.

The Fund’s investment in Google (GOOG) was another significant contributor to performance. The stock doubled in 2009, with the resurgence in growth of the paid Internet search business. The company entered several new markets this year, notably the cell phone market with its Android operating system.

VeriFone (PAY), a provider of electronic payment systems, was another top performer for the Fund. The company’s stock posted a gain of more than 200% during the year as it returned to profitability. VeriFone has been aggressively rolling out its products and services to retailers, restaurants, and taxi cab companies worldwide.

Which holdings were the greatest detractors from the Fund’s performance?

Owing to the broad market recovery in 2009, only a handful of portfolio companies posted negative returns for Fund during the year.

Although it posted a small positive return for calendar year 2009, we sold Comcast (CMCSK) mid-year, at a time when it was down moderately on a year-to-date basis. “Carrier” stocks like Comcast tend to trade more like utilities than technology stocks. They are often a relatively safe haven during economic downturns, but tend to lag in a bull market. The position was liquidated in order to better position the Fund for a market recovery.

The Fund began purchasing the stock of telecom supplier Ericsson (ERIC) late in the third quarter of 2009. The stock slid during the fourth quarter, however, as a string of disappointments from the company rattled investors. Despite improving its competitive position by acquiring the North American GSM operations from Nortel in November, the stock sold off following lower-than-expected Q3 earnings, a widely publicized staffing reduction, and declining prospects for profitability of its Sony-Ericsson and ST-Ericsson subsidiaries.

Shares of Activision Blizzard (ATVI), another third-quarter acquisition of the Fund, dropped sharply in late October as industry-wide sales of video games lagged expectations. Despite blockbuster sales of its latest hit, “Call of Duty: Modern Warfare 2,” the company’s stock continues to struggle in the face of declining industry revenues.

Fund Performance and Holdings Information (as of 12/31/09)

Firsthand e-Commerce Fund vs. Market Indices

| | Firsthand | NASDAQ | |

| | e-Commerce | Composite | S&P 500 |

| | Fund | Index | Index |

| Since Inception (9/30/99) | -7.07% | -1.25% | 0.42% |

| 10-Year | -10.85% | -5.08% | -0.95% |

| 5-Year | 7.70% | 1.70% | 0.43% |

| 3-Year | 4.94% | -1.14% | -5.52% |

| 1-Year | 73.98% | 45.36% | 26.47% |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry* | | Top 10 Holdings** | |

| | % Net Assets | | % Net Assets |

| Internet | 42.6% | Google, Inc., Class A | 9.1% |

| Software | 10.0% | Baidu, Inc. - ADR | 6.7% |

| Other Electronics | 7.5% | VeriFone Holdings, Inc. | 5.7% |

| Communications | 7.4% | Shanda Interactive | |

| Computer | 6.5% | Entertainment Ltd. - ADR | 5.2% |

| Networking | 4.4% | Equinix, Inc. | 4.6% |

| Consumer Electronics | 2.5% | Microsoft Corp. | 4.6% |

| Communications Equipment | 1.6% | Cisco Systems, Inc. | 4.4% |

| Net Other Assets and Liabilities | 17.5% | VeriSign, Inc. | 3.9% |

| | | International Business Machines Corp. | 3.5% |

| | | Akamai Technologies, Inc. | 3.4% |

| * | Based on percentage of net assets as of 12/31/09. |

| ** | Top 10 stock holdings total 51.1% of net assets. These holdings are current as of 12/31/09, and may not be representative of current or future investments. |

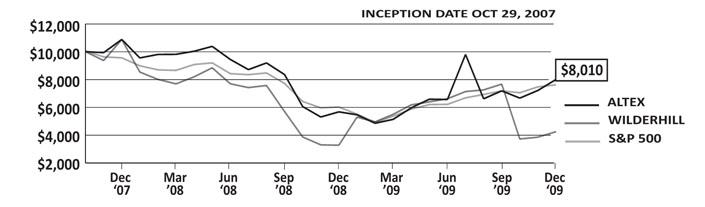

FIRSTHAND ALTERNATIVE ENERGY FUND

Performance and Portfolio Discussion

How did the Fund perform in 2009?

Firsthand Alternative Energy Fund (ALTEX) posted a gain of 41.02%, versus a 29.78% increase for the WilderHill Clean Energy Index and a 26.47% gain for the S&P 500 Index. For the six months ended December 31, 2009, Firsthand Alternative Energy Fund rose 21.92% as compared to 10.36% and 22.59% increases for the WilderHill and the S&P 500 benchmarks, respectively.

Which industries had the greatest impact on the Fund’s performance?

For the period ended December 31, 2009, renewable energy and energy efficiency stocks represented the portfolio’s largest weightings, followed by holdings in the “other electronics” and semiconductor industries. The Fund was buoyed by strong performance during the year across all the industries in which the Fund invests.

Which individual holdings were the largest contributors to the Fund’s performance?

The Fund’s top contributor in 2009 was Aixtron (AIXG), a provider of deposition equipment to the LED industry. The stock posted knock-out performance in 2009, gaining nearly 400%, as demand for high-brightness LEDs continued to rise, particularly in backlighting for LCD TVs. This demand has resulted in explosive growth in new equipment orders for the company.

Power Integrations (POWI) was another strong contributor to the Fund’s performance this past year. The company exhibited solid revenue and earnings growth as demand increased for its energy-efficient power conversion chips.

Chinese-based Trina Solar (TSL) thrived in a difficult environment in 2009, as its industry-leading manufacturing costs enabled it to increase market share while improving its margins. The vertically integrated photovoltaic manufacturer currently sells most of its volume in Europe, but the local Chinese market is expected to comprise an increasing portion of its total sales in the future.

The stock of Motech Industries (no U.S. symbol), a Taiwanese solar cell manufacturer, rose 73.12% following the return of top-line revenue growth in Q3 and an optimistic fourth quarter outlook.

Which holdings were the greatest detractors from the Fund’s performance?

Owing to the broad market recovery in 2009, only a handful of portfolio companies posted negative returns for the Fund during the year. Among them was Orion Energy Systems (OESX), a provider of energy-efficient lighting systems, which saw its shares post a modest loss in 2009. After struggling in the difficult economy for much of the year, the company appeared to turn the corner in Q3, and its stock price surged in the fourth quarter.

Shares of Norwegian integrated solar manufacturer Renewable Energy Corp. (no U.S. symbol) struggled in 2009 as declining prices, sluggish demand, low capacity utilization, and write-offs conspired to weaken the company’s financial condition. Among the myriad problems faced by the company during the year was the termination of fixed-price contracts for silicon wafers, precipitated by the dramatic price declines in the market.

The Fund also realized a loss on Energy Conversion Devices (ENER), which it sold late in the third quarter. Revenues for the maker of so-called “building-integrated solar” modules declined throughout 2009 as new construction and re-roofing projects remained sluggish worldwide.

Fund Performance and Holdings Information (as of 12/31/09)

Firsthand Alternative Energy Fund vs. Market Indices

| | Firsthand | WilderHill | |

| | Alternative | Clean Energy | S&P 500 |

| | Energy Fund | Index | Index |

| Since Inception (10/29/07) | -9.70% | -32.49% | -11.73% |

| 1-Year | 41.02% | 29.78% | 26.47% |

Growth of a Hypothetical $10,000 Investment

Returns assume reinvestment of all dividends and distributions but do not reflect the impact of taxes. The performance data quoted represent past performance. Past performance cannot guarantee future results, and current performance may be lower or higher than the performance quoted. Both the return from and the principal value of an investment in the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. To obtain performance as of the most recent month-end, please contact Firsthand Funds by calling 1.888.884.2675 or go to www.firsthandfunds.com.

Holdings by Industry* | | Top 10 Holdings** | |

| | % Net Assets | | % Net Assets |

| Renewable Energy | 46.9% | Amtech Systems, Inc. | 7.8% |

| Energy Efficiency | 9.1% | Silicon Genesis Corp., Common | 4.2% |

| Other Electronics | 8.1% | Echelon Corp. | 3.8% |

| Semiconductors | 5.3% | Solarfun Power Holdings Co., Ltd. - ADR | 3.5% |

| Advanced Materials | 4.9% | Meyer Burger Technology AG | 3.4% |

| Intellectual Property | 4.3% | Johnson Controls, Inc. | 3.4% |

| Industrials | 4.0% | Power Integrations, Inc. | 3.3% |

| Building Automation | 3.4% | Canadian Solar, Inc. | 3.3% |

| Basic Materials | 0.8% | Itron, Inc. | 3.2% |

| Environmental Services | 0.8% | Motech Industries, Inc. | 3.2% |

| Net Other Assets and Liabilities | 12.4% | | |

| * | Based on percentage of net assets as of 12/31/09. |

| ** | Top 10 stock holdings total 39.1% of net assets. These holdings are current as of 12/31/09, and may not be representative of current or future investments. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees

Firsthand Funds

Santa Clara, California

We have audited the accompanying statements of assets and liabilities of Firsthand Funds (the “Funds”), comprising respectively, the Firsthand Technology Value Fund, Firsthand Technology Leaders Fund, e- Commerce Fund and Firsthand Alternative Energy Fund, including the portfolios of investments as of December 31, 2009, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the statement of cash flows (with respect to the Firsthand Technology Value Fund) for the year then ended and the financial highlights for the periods indicated thereon. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on those fin ancial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2009 by correspondence with the custodian and brokers or by other appropriate auditing procedures when replies from brokers were not received. As described in Note 5, Firsthand Technology Value Fund has restricted securities, representing 26.8% of the Fund’s net assets, that do not have market quotations readily available and are valued at their fair value as determined in good faith using procedures established by the Board of Trustees. Amounts ultimately realized from the disposal of such restricted securities may vary significantly from the fair values presented. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basi s for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Firsthand Funds as of December 31, 2009, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, the statement of cash flows (with respect to the Firsthand Technology Value Fund) for the year then ended and the financial highlights for the periods indicated thereon, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER, LLP

Philadelphia, Pennsylvania

The Fund will incur a loss if the market price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund will realize a gain if the security declines in value between those dates.

All short sales must be fully collateralized. The Fund maintains the collateral in a segregated account consisting of cash, cash equivalents and/or liquid securities sufficient to collateralize the market value of its short positions. Typically, the segregated cash with brokers and other financial institutions exceeds the minimum required. Deposits with brokers for securities sold short are invested in money market instruments.

These reclassifications, related to different treatment of net investment losses, short-term capital gains, and expiration of capital loss carryforwards, have no effect on net asset value per share.

The difference between the acquisition cost and the federal income tax cost of portfolio investments is due to certain timing differences in the recognition of capital losses under accounting principles generally accepted in the United States and income tax regulations. As of December 31, 2009, the Funds had capital loss carryforwards for federal income tax purposes as follows: