UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08282

Loomis Sayles Funds I

(Exact name of Registrant as specified in charter)

399 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Coleen Downs Dinneen, Esq.

NGAM Distribution, L.P.

399 Boylston Street

Boston, Massachusetts 02116

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 449-2810

Date of fiscal year end: September 30

Date of reporting period: March 31, 2012

Item 1. Reports to Stockholders.

The Registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Loomis Sayles Fixed Income Fund

Loomis Sayles Global Bond Fund

Loomis Sayles Inflation Protected Securities Fund

Loomis Sayles Institutional High Income Fund

Loomis Sayles Intermediate Duration Bond Fund

Loomis Sayles Investment Grade Fixed Income Fund

SEMI-ANNUAL REPORT

MARCH 31, 2012

LOOMIS SAYLES FIXED INCOME FUND

Fund and manager review

FUND FACTS

Managers:

Matthew Eagan, CFA

Daniel Fuss, CFA, CIC

Kathleen Gaffney, CFA

Elaine Stokes

Symbol:

| | |

| Institutional Class | | LSFIX |

Objective:

High total investment return through a combination of current income and capital appreciation

Strategy:

The Fund will invest primarily in fixed-income securities and may invest up to 35% of its assets in below investment-grade fixed-income securities and up to 20% of its assets in equity securities such as common stocks and preferred stocks (with up to 10% of its assets in common stocks).

Fund Inception Date:

January 17, 1995

Fund Registration Date:

March 7, 1997

Net Assets:

$1.0 Billion

Market Conditions

Market anxiety from the sovereign debt crisis in Europe eased markedly during the six-month period, as the European Central Bank took action to aid Greece and restore liquidity. In addition, the release of positive domestic macroeconomic data over successive months and a significant increase in liquidity encouraged greater risk-taking in the markets. Better-than-expected stress test results from U.S. banks bolstered general investor optimism and lifted many corporate financial names.

Performance Results

For the six months ended March 31, 2012, Institutional Class shares of Loomis Sayles Fixed Income Fund returned 9.86%. The fund outperformed its benchmark, the Barclays Capital U.S. Government/Credit Bond Index, which returned 1.26% for the period.

Explanation of Fund Performance

A particularly strong showing by non-U.S.-dollar-denominated holdings in the second half of the period, coupled with robust security selection, resulted in a strong contribution to return. Winners within the allocation included investments denominated in the New Zealand dollar, Australian dollar, Brazilian real and Canadian dollar. A rally in commodity prices and a corresponding increase in demand for these currencies buoyed these securities. The fund’s allocation to convertible securities also bolstered returns, as the sector tracked equities, which surged forward throughout much of the six-month period. In addition, high-yield securities benefited from the increase in investor risk appetite, allowing for favorable performance from the sector. In particular, high-yield industrial names outpaced high-yield financials and utilities. High-yield industrials rebounded largely because subsectors that had previously lagged, such as homebuilders and retail, improved.

Certain holdings in the traditionally defensive industries, such as natural gas, struggled due to investors favoring higher-beta (higher-risk/higher-reward potential) names. In addition, a relative underweight position in government-related securities detracted from performance, as this sector generated solid results.

Outlook

As the second quarter begins, fixed-income investors continue to face an environment filled with opportunities and pitfalls. The sovereign debt situation in Europe is a chief ongoing concern, and the market is now focusing on Spain. Investors are taking solace in the improving U.S. economic situation, but Europe’s debt problems cast a large shadow over any sustainable recovery. So far this year, investors have generally sought out higher-risk securities for yield, but the progress (or lack thereof) in the Euro Zone could greatly influence their risk tolerance. In some respects, this is very similar to 2011, when cash rushed into credit, equity and other risky markets early in the year, only to reverse when political gyrations increased uncertainty. However, a resulting period of volatility can create buying opportunities for us. We continue to add credits that we believe have long-term potential for improving fundamentals.

In the first quarter of 2012, higher U.S. interest rates reinvigorated discussions surrounding the potential threat higher rates pose to fixed-income portfolios. We continue to believe that interest rates are in a period of transition and see rising rates as the next secular trend. However, given the Federal Reserve Board’s commitment to keep short-term rates low at least through the middle of 2014, the trading range in U.S. Treasuries should persist in the near term.

U.S. economic growth has been a bright spot thus far in 2012. We believe the overall health of corporate America remains intact, largely because corporate managements remain conservative. Reductions in the ranks of the unemployed, signs of potential recovery in the housing market and increased lending from financial institutions have highlighted the underlying fundamental health of the domestic economy. We anticipate a modest recovery in the United States and little to no growth in Europe and Japan. However, many areas removed from the developed world show moderate to strong growth potential.

Above all else, our conviction in the merits of fundamental credit research has not changed. We remain steadfast in our opportunistic approach as well as our long-term outlook. Our focus continues to be on maintaining yield advantage, surveying the global marketplace for opportunities, and searching out specific risk that can lead to total return opportunities for the fund.

1 |

LOOMIS SAYLES FIXED INCOME FUND

Average Annual Total Returns

March 31, 2012

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

| | | | | |

| Institutional Class (Inception 1/17/95) | | | 9.86 | % | | | 7.12 | % | | | 8.27 | % | | | 10.94 | % |

| | | | | |

| COMPARATIVE PERFORMANCE | | | | | | | | | | | | | | | | |

| Barclays Capital U.S. Government/Credit Bond Index(b) | | | 1.26 | | | | 8.53 | | | | 6.26 | | | | 5.91 | |

| Lipper BBB-Rated Funds Index(b) | | | 4.22 | | | | 9.41 | | | | 6.37 | | | | 6.36 | |

| | |

| Gross expense ratio (before fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 0.58% | | | | | | | | | | | | | | | | |

| | |

| Net expense ratio (after fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 0.58% | | | | | | | | | | | | | | | | |

| * | | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 1/31/13. Contracts are reevaluated on an annual basis. |

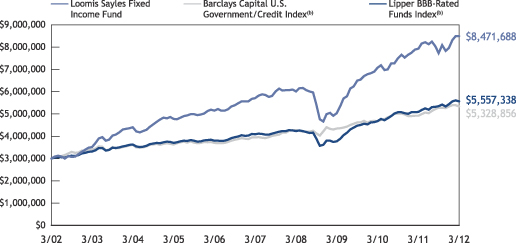

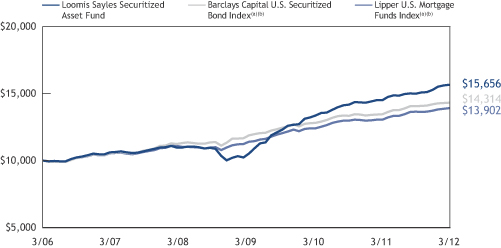

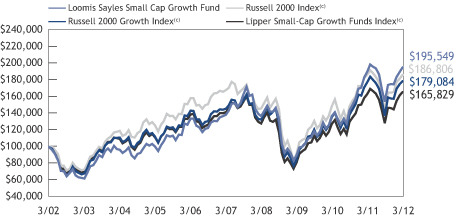

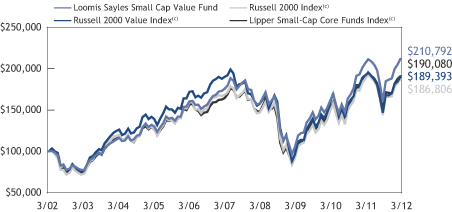

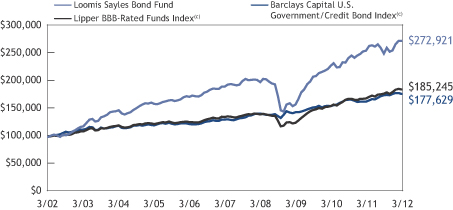

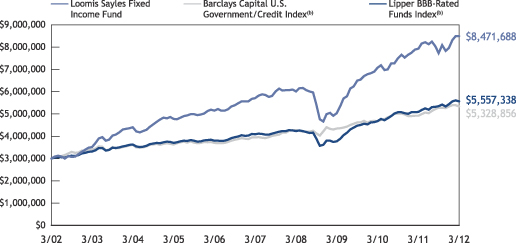

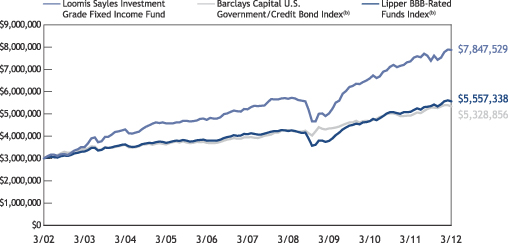

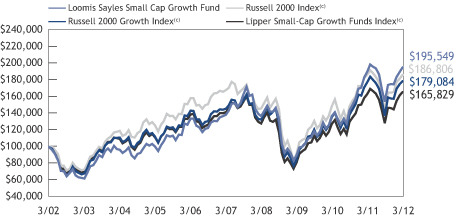

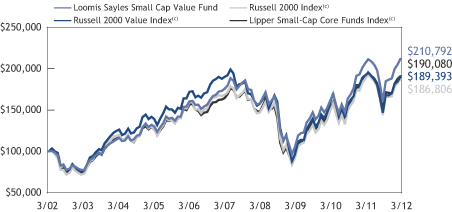

Cumulative Performance

March 31, 2002 through March 31, 2012(a)

Performance data quoted represents past performance and is no guarantee of future results.Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Performance data reflects certain fee waivers and/or expense reimbursements, if any, without which performance would be lower.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| (a) | | The mountain chart is based on the fund’s minimum initial investment of $3,000,000. |

| (b) | | See page 13 for a description of the indices. |

What you should know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 2

LOOMIS SAYLES GLOBAL BOND FUND

Fund and manager review

FUND FACTS

Managers:

Kenneth M. Buntrock, CFA, CIC

David W. Rolley, CFA

Lynda L. Schweitzer, CFA

Symbols:

| | |

| Institutional Class | | LSGBX |

| Retail Class | | LSGLX |

Objective:

High total investment return through a combination of high current income and capital appreciation

Strategy:

Invests primarily in fixed-income securities including investing primarily in investment grade fixed-income securities worldwide, although it may invest up to 20% of assets in below investment grade fixed-income securities.

Fund Inception Date:

May 10, 1991

Class Inception Date:

Institutional Class:

May 10, 1991

Retail Class:

December 31, 1996

Net Assets:

$2.2 Billion

Market Conditions

U.S. economic data appeared to strengthen and the European Central Bank’s (ECB’s) long-term refinancing operations created ample liquidity, causing market sentiment to become more optimistic. A heightened preference for risk led most markets higher during the six-month period. As a result, the quest for yield caused spreads (the yield difference between non-Treasury securities and comparable-maturity Treasuries) to tighten.

Performance Results

For the six months ended March 31, 2012, Institutional Class shares of Loomis Sayles Global Bond Fund returned 4.95%. The fund outperformed its benchmark, the Barclays Capital Global Aggregate Bond Index, which returned 1.11% for the period.

Explanation of Fund Performance

An overweight allocation to corporate bonds combined with security selection within this sector helped drive the fund’s outperformance relative to the benchmark. Our preference for lower-quality U.S. corporates over euro-area corporates and our selections in the banking, basic industry, communications and consumer non-cyclicals segments were particularly favorable. From a currency perspective, underweight positions in the yen and euro and corresponding overweight positions in emerging market and peripheral currencies contributed positively to performance. Specifically, the fund’s holdings in the Colombian peso, Mexican peso, New Zealand dollar, Norwegian krone, Singaporean dollar and South Korean won were additive to performance. In addition, the fund’s shorter-than-benchmark duration (price sensitivity to interest rate changes) for U.S.-dollar-pay corporates and Treasuries contributed to the fund’s outperformance.

The fund’s underweight in European local markets hampered returns, as the downside fears surrounding the euro calmed during the latter half of the period. The recent massive liquidity provision from the ECB decreased fears of a banking system breakdown and, as a result, sentiment rose along with liquidity.

For hedging purposes and to gain exposure to specific currencies, we traded foreign exchange forward contracts during the period. The foreign currency contracts are part of our fixed-income currency strategy. We also used interest rate futures contracts to help manage duration positioning in U.S. dollars. During the period, the use of these contracts had no material impact on performance.

Outlook

We anticipate additional volatility in the coming months, which we plan to use to assess opportunities. Currently, growth challenges from a deteriorating outlook in Spain, higher oil prices and fears of slower growth in China seem to be offsetting the positive effects of the ECB’s bank liquidity program. In response, we have sought to reduce the fund’s risk exposure without reducing its yield, mostly by selling higher-risk credits selectively and replacing them with high-quality credits, such as U.S. Treasuries, and by reducing certain out-of-benchmark currency positions and maintaining the fund’s position in corporates.

Globally, investor sentiments remain challenged by uncertain electoral and policy outcomes from the French elections, Spanish fiscal agony and doubts about the Bank of Japan truly embracing a positive inflation target and quantitative easing. Domestically, we expect the U.S. recovery to be sustained, with gross domestic product growth in the range of 2% or slightly higher in 2012. Economic data have been improving in recent months, and we believe there are more reasons to be positive than negative on the outlook. As the year progresses, we believe attention will shift from concerns in Europe to the U.S. political landscape and its fiscal ramifications. Ultimately, we expect a recovery in global growth, but currently too many near-term policy risks loom for us to aggressively add growth-correlated positions.

3 |

LOOMIS SAYLES GLOBAL BOND FUND

Average Annual Total Returns

March 31, 2012

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

| | | | | |

| Institutional Class (Inception 5/10/91) | | | 4.95 | % | | | 4.82 | % | | | 6.76 | % | | | 8.79 | % |

| | | | | |

| Retail Class (Inception 12/31/96) | | | 4.79 | | | | 4.50 | | | | 6.41 | | | | 8.48 | |

| | | | | |

| COMPARATIVE PERFORMANCE | | | | | | | | | | | | | | | | |

| Barclays Capital Global Aggregate Bond Index(c) | | | 1.11 | | | | 5.26 | | | | 6.38 | | | | 7.34 | |

| Lipper Global Income Funds Index(c) | | | 3.78 | | | | 4.86 | | | | 5.79 | | | | 6.89 | |

| |

| Gross expense ratio (before fee waivers and/or expense reimbursements)* | |

| Institutional: 0.67% Retail 0.97% | | | | | | | | | | | | | | | | |

| |

| Net expense ratio (after fee waivers and/or expense reimbursements)* | |

| Institutional: 0.67% Retail: 0.97% | | | | | | | | | | | | | | | | |

| * | | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 1/31/13. Contracts are reevaluated on an annual basis. |

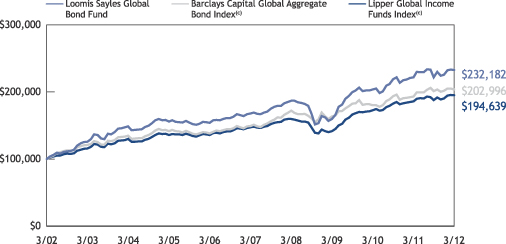

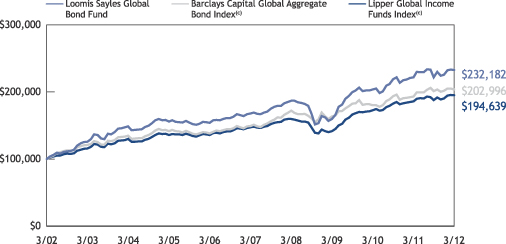

Cumulative Performance(a)

March 31, 2002 through March 31, 2012(a)(b)

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Performance data reflects certain fee waivers and/or expense reimbursements, if any, without which performance would be lower.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| (a) | | Cumulative performance is shown for the Institutional Class. Performance of the Retail Class would be lower due to higher fees. |

| (b) | | The mountain chart is based on the Institutional Class minimum initial investment of $100,000. |

| (c) | | See page 13 for a description of the indices. |

What you should know:

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 4

LOOMIS SAYLES INFLATION PROTECTED SECURITIES FUND

Fund and manager review

FUND FACTS

Managers:*

John Hyll

Clifton V. Rowe, CFA

Symbols:

| | |

| Institutional Class | | LSGSX |

| Retail Class | | LIPRX |

Objective:

High total investment return through a combination of current income and capital appreciation

Strategy:

Invests primarily in inflation-protected securities with emphasis on debt securities issued by the U.S. Treasury.

Fund Inception Date:

May 20, 1991

Class Inception Date:

Institutional Class:

May 20, 1991

Retail Class:

May 28, 2010

Net Assets:

$23.5 million

| * | | Please note that effective 4/23/12 John Hyll and Clifton Rowe are no longer managers. Elaine Kan, Kevin Kearns and Maura Murphy have replaced them. |

Market Conditions

The volatility that was present for much of the fourth quarter of 2011 dissipated in the first quarter of 2012. Riskier assets rallied on improving economic conditions and Treasury yields increased significantly. Economic data released in the United States showed signs of a strengthening labor market, while globally, fears surrounding Europe subsided after the European Central Bank’s long-term refinancing operations extended funding to banks and creditors accepted a deal to restructure Greek debt. Meanwhile, the Consumer Price Index rose during the six-month period, because energy prices climbed higher. Treasury Inflation-Protected Securities (TIPS) outperformed nominal (non-inflation-protection) Treasuries, and real yields fell during the period.

Performance Results

For the six months ended March 31, 2012, Institutional Class shares of Loomis Sayles Inflation Protected Securities Fund returned 3.29%. The fund slightly underperformed its benchmark, the Barclays Capital U.S. Treasury Inflation Protected Securities Index, which returned 3.57% for the period.

Explanation of Fund Performance

The fund’s out-of-benchmark exposure to high-yield and investment-grade corporate bonds (industrials in particular) contributed positively to performance for the six-month period. Improving liquidity and credit in the corporate bond market caused spreads (the yield difference between non-Treasury securities and comparable-maturity Treasuries) to tighten, which led to capital appreciation for bondholders. As investor optimism increased during the first quarter of 2012, investors moved out of the perceived safe-haven U.S. Treasury market in search of opportunities outside of the United States. This exodus resulted in depreciation of the U.S. dollar relative to other major currencies, and out-of-benchmark holdings denominated in the Canadian dollar and Mexican peso benefited as the dollar weakened.

The fund’s yield curve positioning (a curve that shows the relationship among bond yields across the maturity spectrum) detracted from relative performance. Overall, the fund’s average duration (price sensitivity to interest rate changes) was slightly longer than that of the benchmark. This led to relative underperformance for the fund, as Treasury yields rose during the period. While TIPS achieved strong absolute returns for the fund during the six-month period, weaker security selection relative to the benchmark also weighed on the fund’s relative return. A small allocation to non-inflation-protected Treasuries achieved positive performance but had a negative impact relative to the benchmark.

Over the past six months, the income component of the Fund has been lower relative to past years due to the very low interest rate environment. This environment is the result of low current inflation pressures, low inflation expectations, a flight to quality given the events in Europe and, more recently, Operation Twist implemented by the Federal Reserve. Current nominal and real yields are historically low; in fact, TIPS with maturities as far out as January 2026 have negative real yields. We have tried to mitigate this low yield and income environment with the use of corporate bonds in the Fund. However, even corporate debt is trading at very low yield levels.

Outlook

U.S. economic data continued to improve into the first quarter of 2012, but the uncertainty surrounding Europe still poses a problem domestically and abroad. The fund has continued to benefit from the market’s preference for quality during uncertain times. While we remain optimistic about a long-term U.S. economic recovery, the fund’s quality bias could continue to be a positive factor should volatility persist in the short term. Low rates have stifled near-term inflation concerns, but longer term, as growth eventually takes hold, we believe the Federal Reserve Board will shift toward a more hawkish stance on inflation. Expectations for higher longer-term inflation may emerge over time, causing TIPS breakeven rates (the difference between yields on nominal Treasuries and TIPS of the same maturity) to widen.

5 |

LOOMIS SAYLES INFLATION PROTECTED SECURITIES FUND

Average Annual Total Returns

March 31, 2012

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

| | | | | |

| Institutional Class (Inception 5/20/91)(e) | | | 3.29 | % | | | 11.40 | % | | | 7.11 | % | | | 6.18 | % |

| | | | | |

| Retail Class (Inception 5/28/10)(a)(e) | | | 3.11 | | | | 11.09 | | | | 6.81 | | | | 5.84 | |

| | | | | |

| COMPARATIVE PERFORMANCE | | | | | | | | | | | | | | | | |

| Barclays Capital U.S. Treasury Inflation Protected Securities Index(c) | | | 3.57 | | | | 12.20 | | | | 7.60 | | | | 7.51 | |

| Lipper Treasury Inflation Protected Securities Index(c) | | | 3.43 | | | | 10.83 | | | | 6.88 | | | | N/A | |

| | |

| Gross expense ratio (before fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 1.08% Retail: 1.31% | | | | | | | | | | | | | | | | |

| | |

| Net expense ratio (after fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 0.40% Retail: 0.65% | | | | | | | | | | | | | | | | |

| * | | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 1/31/13. Contracts are reevaluated on an annual basis. |

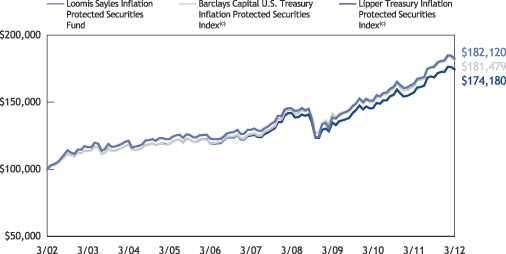

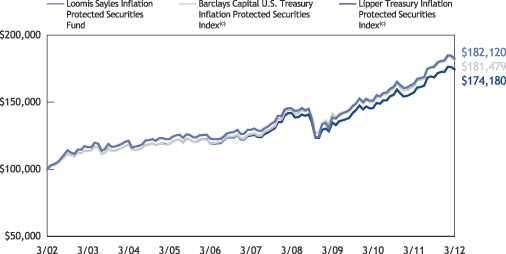

Cumulative Performance(d)(e)

March 31, 2002 through March 31, 2012(b)(d)(e)

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Performance data reflects certain fee waivers and/or expense reimbursements, if any, without which performance would be lower.

For illustrative purposes, the chart above reflects the growth of a hypothetical investment of $100,000 in the fund, for the last ten years. The chart above also reflects the growth of a hypothetical investment in the former primary benchmark of the fund, the Barclays Capital U.S. Government Bond Index (the “Former Benchmark”), compared to the performance of the fund from March 31, 2002 through December 31, 2004. On December 15, 2004, in connection with a change of the fund’s investment objective, the fund changed its primary benchmark to the Barclays Capital U.S. Treasury Inflation Protected Securities Index (the “New Benchmark”). Since index performance data is not available coincident with the date of the fund’s strategy change, comparative data for the fund’s New Benchmark begins on December 31, 2004. The chart above reflects the growth of a hypothetical investment in the New Benchmark, compared to the performance of the fund, from December 31, 2004, through March 31, 2012. The chart above also compares the performance of the fund to the Lipper Treasury Inflation Protected Securities Funds Index from December 31, 2004 through March 31, 2012. The performance of the New Benchmark and of the Lipper Treasury Inflation Protected Securities Funds Index was linked to the performance of the Former Benchmark as of December 31, 2004.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| (a) | | Prior to inception of Retail Class (5/28/10), performance is that of Institutional Class, restated to reflect the higher net expenses of Retail Class. |

| (b) | | The mountain chart is based on the fund’s initial minimum investment of $100,000 for the Institutional Class. |

| (c) | | See page 13 for a description of the indices. Return data is not available for the Lipper Treasury Inflation Protected Securities Index prior to July 1, 2003. |

| (d) | | Cumulative performance is shown for the Institutional Class. Performance of the Retail Class would be lower due to higher fees. |

| (e) | | The fund revised its investment strategies on 12/15/04; performance may have been different had the current investment strategy been in place for all periods shown. |

What you should know:

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 6

LOOMIS SAYLES INSTITUTIONAL HIGH INCOME FUND

Fund and manager review

FUND FACTS

Managers:

Matthew Eagan, CFA

Daniel Fuss, CFA, CIC

Kathleen Gaffney, CFA

Elaine Stokes

Symbol:

| | |

| Institutional Class | | LSHIX |

Objective:

High total investment return through a combination of current income and capital appreciation

Strategy:

Invests primarily in below investment grade fixed-income securities and other securities that are expected to produce a relatively high level of income, (including income-producing preferred and common stocks).

The fund may invest any portion of its assets in Canadian securities and up to 50% of assets in other foreign securities, including emerging markets securities.

Fund Inception Date:

June 5, 1996

Fund Registration Date:

March 7, 1997

Net Assets:

$599.0 million

Market Conditions

The momentum of the high-yield and equity market rallies from December 2011 continued into 2012. High-yield bonds generated strong returns in January before easing slightly in February and becoming flat in March. Actions by the European Central Bank calmed contagion fears, at least for the time being. In the United States, annualized fourth quarter gross domestic product growth of 3% pointed to a moderate but continued recovery and also helped subdue investor fears.

Performance Results

For the six months ended March 31, 2012, Loomis Sayles Institutional High Income Fund returned 12.55%. The fund outperformed its benchmark, the Barclays Capital U.S. Corporate High Yield Bond Index, which returned 12.14% for the period.

Explanation of Fund Performance

Out-of-benchmark allocations to convertible securities and common stock contributed significantly to the fund’s outperformance relative to the benchmark. In addition, an underweight position in below-investment-grade utilities had a positive effect on relative performance. An allocation to high-yield electric utilities posted the strongest gains. Investment-grade and high-yield consumer cyclical companies were also strong contributors. Similarly, investment-grade and high-yield financials made a positive contribution to performance, with brokerage and banking companies buoying the sector. Furthermore, a small, out-of-benchmark position in preferred securities contributed favorably to the fund’s return, as these equity-sensitive securities largely mirrored the upswing in the stock market.

In terms of lagging performers, consumer non-cyclical companies struggled, particularly within the healthcare and grocery store segments. In addition, an out-of-benchmark exposure to Treasuries detracted from the fund’s relative return.

OUTLOOK

As the second quarter begins, fixed-income investors continue to face an environment filled with opportunities and pitfalls. The sovereign debt situation in Europe is a chief ongoing concern, and the market is now focusing on Spain. Investors are taking solace in the improving U.S. economic situation, but Europe’s debt problems cast a large shadow over any sustainable recovery. So far this year, investors have generally sought out higher-risk securities for yield, but the progress (or lack thereof) in the Euro Zone could greatly influence their risk tolerance. In some respects, this is very similar to 2011, when cash rushed into credit, equity and other risky markets early in the year, only to reverse when political gyrations increased uncertainty. However, a resulting period of volatility can create buying opportunities for us. We continue to add credits that we believe have long-term potential for improving fundamentals.

In the first quarter of 2012, higher U.S. interest rates reinvigorated discussions surrounding the potential threat higher rates pose to fixed-income portfolios. We continue to believe that interest rates are in a period of transition and see rising rates as the next secular trend. However, given the Federal Reserve Board’s commitment to keep short-term rates low at least through the middle of 2014, the trading range in U.S. Treasuries should persist in the near term.

U.S. economic growth has been a bright spot thus far in 2012. We believe the overall health of corporate America remains intact, largely because corporate managements remain conservative. Reductions in the ranks of the unemployed, signs of potential recovery in the housing market and increased lending from financial institutions have highlighted the underlying fundamental health of the domestic economy. We anticipate a modest recovery in the United States and little to no growth in Europe and Japan. However, many areas removed from the developed world show moderate to strong growth potential.

Above all else, our conviction in the merits of fundamental credit research has not changed. We remain steadfast in our opportunistic approach as well as our long-term outlook. Our focus continues to be on maintaining yield advantage, surveying the global marketplace for opportunities, and searching out specific risk that can lead to total return opportunities for the fund.

7 |

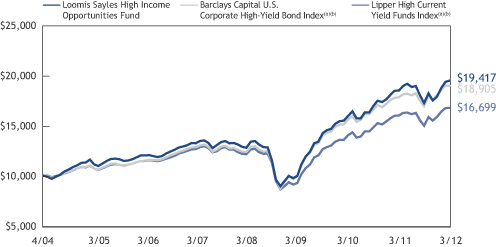

LOOMIS SAYLES INSTITUTIONAL HIGH INCOME FUND

Average Annual Total Returns

March 31, 2012

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

| | | | | |

| Institutional Class (Inception 6/5/96) | | | 12.55 | % | | | 2.26 | % | | | 7.47 | % | | | 11.77 | % |

| COMPARATIVE PERFORMANCE | | | | | | | | | | | | | | | | |

| Barclays Capital U.S. Corporate High-Yield Bond Index(b) | | | 12.14 | | | | 6.45 | | | | 8.10 | | | | 9.24 | |

| Lipper High Current Yield Funds Index(b) | | | 11.88 | | | | 4.62 | | | | 5.74 | | | | 7.64 | |

| | |

| Gross expense ratio (before fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 0.69% | | | | | | | | | | | | | | | | |

| | |

| Net expense ratio (after fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 0.69% | | | | | | | | | | | | | | | | |

| * | | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 1/31/13. Contracts are reevaluated on an annual basis. |

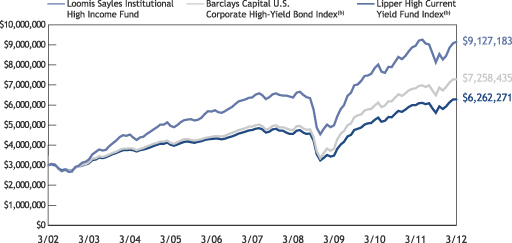

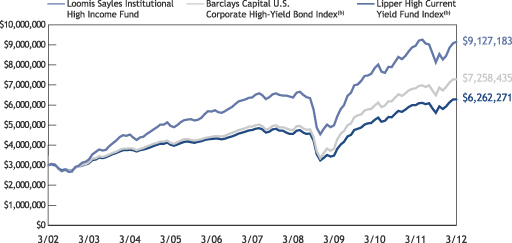

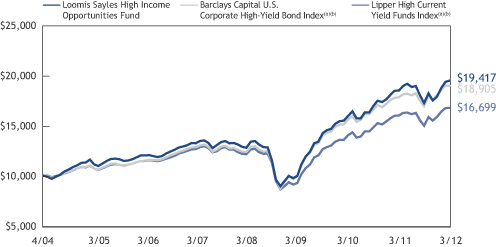

Cumulative Performance

March 31, 2002 through March 31, 2012(a)

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Performance data reflects certain fee waivers and/or expense reimbursements, if any, without which performance would be lower.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| (a) | | The mountain chart is based on the fund’s minimum initial investment of $3,000,000. |

| (b) | | See page 13 for a description of the indices. |

What you should know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 8

LOOMIS SAYLES INTERMEDIATE DURATION BOND FUND

Fund and manager review

FUND FACTS

Managers:*

Neil A. Burke

Richard Raczkowski

Clifton V. Rowe, CFA

Symbols:

| | |

| Institutional Class | | LSDIX |

| Retail Class | | LSDRX |

Objective:

Above-average total return through a combination of current income and capital appreciation

Strategy:

Invests primarily in investment-grade fixed-income securities. The fund’s weighted average duration generally is two to five years. The fund may invest any portion of its assets in U.S.-dollar-denominated Canadian securities and up to 20% of its assets in other U.S.-dollar-denominated foreign securities, including emerging market securities.

Fund Inception Date:

January 28, 1998

Class Inception Date:

Institutional Class:

January 28, 1998

Retail Class:

May 28, 2010

Net Assets:

$74.8 million

| * | | Please note that effective 4/23/12 Neil Burke and Richard Raczkowski are no longer managers. Christopher Harms and Kurt Wagner have joined Clifton Rowe as managers. |

Market Conditions

The markets generally moved higher during the six-month period, despite a selloff in November that was triggered by growing investor fears about euro zone debt, ballooning U.S. debt and Italian and Spanish bond yields finally breaking through their debt yield threshold of 7%. In December, indications that the U.S. economy might be performing better than anticipated sparked a market rally that helped erase losses experienced in November. The new year began more optimistically, due to growing sentiment that the U.S. economy seemed to be improving, particularly after February’s unemployment numbers dropped to levels not seen since 2008. The Federal Reserve Board also shared the opinion that the U.S. economy was becoming stronger. European policymakers reached a deal in early 2012 to help reduce Greece’s sovereign debt and also provided the bank system with much needed liquidity through its long-term refinancing operations. These factors combined to quell investor fears, and investor appetites for risk increased, as indicated by a shift away from the relative safety of Treasuries into riskier assets.

Performance Results

For the six months ended March 31, 2012, Institutional Class shares of Loomis Sayles Intermediate Duration Bond Fund returned 2.14%. The fund outperformed its benchmark, the Barclays Capital U.S. Intermediate Government/Credit Bond Index, which returned 1.46% for the period.

Explanation of Fund Performance

The fund’s outperformance relative to the benchmark primarily was due to favorable sector allocation and security selection. In particular, an out-of-benchmark allocation to commercial mortgage-backed securities (CMBS) generated the greatest excess returns of any individual sector, as spreads (the yield difference between non-Treasury securities and comparable-maturity Treasuries) narrowed sharply during the period. Lower-quality investment-grade holdings generated much of the performance in the CMBS sector. Earlier in 2012, we slightly pared back the fund’s CMBS allocation to lock in gains. In addition, an overweight in corporate bonds had a positive effect during the period, with the greatest contributions coming from the industrials sector. The financial industry, led by holdings in banking companies, posted the greatest overall returns within the corporate sector. Higher-beta (higher-risk/higher-reward potential) corporate securities generally outperformed lower-beta corporates, with the bulk of the returns generated from lower-quality securities since corporate spreads narrowed during the period. We also maintained a significant underweight in U.S. Treasuries, which proved beneficial. These securities were largely negative, given investor preference for riskier assets. Additionally, a small position in U.S. agencies was beneficial, as the segment outperformed the benchmark and contributed favorably to returns.

The fund’s yield curve positioning (a curve that shows the relationship among bond yields across the maturity spectrum) detracted modestly, as yields increased during the period. Also, an out-of-benchmark allocation to asset-backed securities weighed somewhat on fund performance. Finally, a small, out-of-benchmark position in 15-year mortgage-backed securities (MBS) underperformed on a relative basis.

Outlook

Recent economic data have been relatively encouraging for the U.S. growth outlook, but concerns remain about the sustainability of the recovery. We believe the sovereign debt crisis in Europe could hinder economic recovery in the U.S. While there appears to be some stability in Europe, at least in the near term, we cannot discount a possible resurgence of volatility and uncertainty from the ongoing sovereign debt issues in the region. Our current strategy remains relatively cautious toward Europe, and we have no plans to make significant additions to risk in the near term. The fund’s average duration remained mostly unchanged throughout the period, and we currently expect to keep it relatively neutral to the benchmark.

9 |

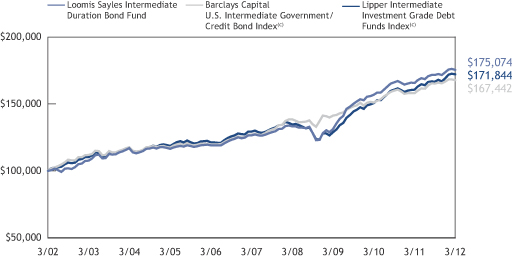

LOOMIS SAYLES INTERMEDIATE DURATION BOND FUND

Average Annual Total Returns

March 31, 2012

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

| | | | | |

| Institutional Class (Inception 1/28/98) | | | 2.14 | % | | | 5.83 | % | | | 6.73 | % | | | 5.76 | % |

| | | | | |

| Retail Class (Inception 5/28/10)(a) | | | 1.92 | | | | 5.36 | | | | 6.46 | | | | 5.45 | |

| | | | | |

| COMPARATIVE PERFORMANCE | | | | | | | | | | | | | | | | |

| Barclays Capital U.S. Intermediate Government/Credit Bond Index(c) | | | 1.46 | | | | 6.09 | | | | 5.67 | | | | 5.29 | |

| Lipper Intermediate Investment Grade Debt Funds Index(c) | | | 3.32 | | | | 7.11 | | | | 5.88 | | | | 5.56 | |

| |

| Gross expense ratio (before fee waivers and/or expense reimbursements)* | |

| Institutional: 0.57% Retail: 0.94% | | | | | | | | | | | | | | | | |

| |

| Net expense ratio (after fee waivers and/or expense reimbursements)* | |

| Institutional: 0.40% Retail: 0.65% | | | | | | | | | | | | | | | | |

| * | | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 1/31/13. Contracts are reevaluated on an annual basis. |

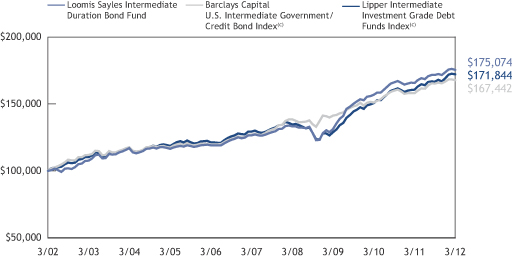

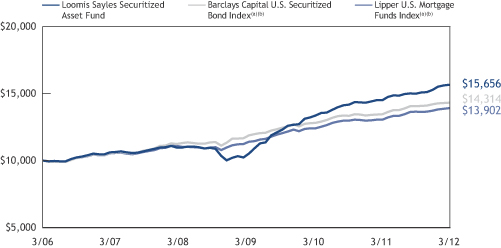

Cumulative Performance(d)

March 31, 2002 through March 31, 2012(b)(d)

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Performance data reflects certain fee waivers and/or expense reimbursements, if any, without which performance would be lower.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| (a) | | Prior to inception of Retail Class (5/28/10), performance is that of Institutional Class, restated to reflect the higher net expenses of Retail Class. |

| (b) | | The mountain chart is based on the fund’s initial minimum investment of $100,000 for the Institutional Class. |

| (c) | | See page 13 for a description of the indices. |

| (d) | | Cumulative performance is shown for the Institutional Class. Performance of the Retail Class would be lower due to higher fees. |

What you should know:

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 10

LOOMIS SAYLES INVESTMENT GRADE FIXED INCOME FUND

Fund and manager review

FUND FACTS

Managers:

Matthew Eagan, CFA

Daniel Fuss, CFA, CIC

Kathleen Gaffney, CFA

Elaine Stokes

Symbols:

| | |

| Institutional Class | | LSIGX |

Objective:

Above-average total investment return through a combination of current income and capital appreciation

Strategy:

Invests primarily in investment grade fixed-income securities. The Fund may invest up to 10% of its assets in below investment-grade fixed-income securities and up to 10% of its assets in equity securities (including preferred stocks and common stocks).

Fund Inception Date:

July 1, 1994

Fund Registration Date:

March 7, 1997

Net Assets:

$582.6 million

Market Conditions

The ongoing European sovereign debt crisis consistently moved markets higher or lower depending on headline news, causing investor preferences for risk to be intermittent. The European Central Bank’s (ECB’s) decision to cut rates and provide liquidity through its long-term refinancing operations (LTRO) helped ease market fears. During the second half of the period, investor appetite for risk returned and pushed credit-sensitive markets higher and narrowed yield spreads (the yield difference between non-Treasury securities and comparable-maturity Treasuries). In the United States, strong corporate and bank balance sheets helped markets slowly recover. For the time being, positive U.S. labor and economic data have mitigated the need for another round of quantitative easing from the Federal Reserve Board. These data indicate that economic recovery is underway, albeit at a slower pace than initially expected.

Performance Results

For the six months ended March 31, 2012, Institutional Class shares of Loomis Sayles Investment Grade Fixed Income Fund returned 6.56%. The fund outperformed its benchmark, the Barclays Capital U.S. Government/Credit Bond Index, which returned 1.26% for the period.

Explanation of Fund Performance

Significant exposure to non-U.S.-dollar-denominated holdings boosted the fund’s performance during the period. A preference for risk remained a dominant theme among investors, and commodity-linked currency holdings tended to outperform. In particular, holdings denominated in the Canadian dollar, New Zealand dollar, Australian dollar and Indonesian rupiah were among the top performers. Certain euro-denominated issues added to performance during the second half of the period, receiving a boost from the ECB’s LTRO. An overweight in investment-grade corporate credits contributed to the fund’s outperformance during the period, as specific holdings in the banking, communication, transportation, basic industry and electric utilities sectors drove performance higher. An underweight position in U.S. Treasuries contributed to performance, as a preference for risk led investors away from the perceived safe-haven sector. Furthermore, out-of-benchmark allocations to industrial high-yield corporate bonds aided returns. Certain issues within financials, consumer cyclical, transportation and capital goods sectors contributed positively. An allocation to equity-sensitive convertible holdings also aided the fund’s outperformance, as these securities mirrored the rally in equity markets. Certain names within the technology and insurance sectors were strong performers.

A small allocation to high-yield utility corporate bonds weighed on fund performance. In particular, names from the electric utility and natural gas sectors generally underperformed. An underweight allocation to government-related securities detracted from relative performance.

OUTLOOK

As the second quarter begins, fixed-income investors continue to face an environment filled with opportunities and pitfalls. The sovereign debt situation in Europe is a chief ongoing concern, and the market is now focusing on Spain. Investors are taking solace in the improving U.S. economic situation, but Europe’s debt problems cast a large shadow over any sustainable recovery. So far this year, investors have generally sought out higher-risk securities for yield, but the progress (or lack thereof) in the Euro Zone could greatly influence their risk tolerance. In some respects, this is very similar to 2011, when cash rushed into credit, equity and other risky markets early in the year, only to reverse when political gyrations increased uncertainty. However, a resulting period of volatility can create buying opportunities for us. We continue to add credits that we believe have long-term potential for improving fundamentals.

In the first quarter of 2012, higher U.S. interest rates reinvigorated discussions surrounding the potential threat higher rates pose to fixed-income portfolios. We continue to believe that interest rates are in a period of transition and see rising rates as the next secular trend. However, given the Federal Reserve Board’s continued commitment to keep short-term rates low at least through the middle of 2014, the trading range in U.S. Treasuries should persist in the near term.

U.S. economic growth has been a bright spot thus far in 2012. We believe the overall health of corporate America remains intact, largely because corporate managements remain conservative. Reductions in the ranks of the unemployed, signs of potential recovery in the housing market and increased lending from financial institutions have highlighted the underlying fundamental health of the domestic economy. We anticipate a modest recovery in the United States and little to no growth in Europe and Japan. However, many areas removed from the developed world show moderate to strong growth potential.

Above all else, our conviction in the merits of fundamental credit research has not changed. We remain steadfast in our opportunistic approach as well as our long-term outlook. Our focus continues to be on maintaining yield advantage, surveying the global marketplace for opportunities, and searching out specific risk that can lead to total return opportunities for the fund.

11 |

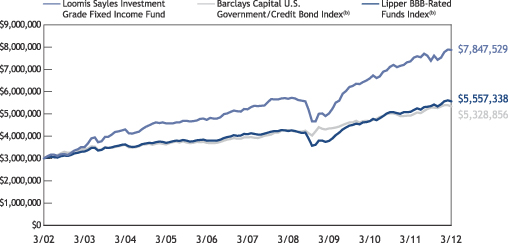

LOOMIS SAYLES INVESTMENT GRADE FIXED INCOME FUND

Average Annual Total Returns

March 31, 2012

| | | | | | | | | | | | | | | | |

| | | | | |

| | | 6 MONTHS | | | 1 YEAR | | | 5 YEARS | | | 10 YEARS | |

| | | | | |

| Institutional Class (Inception 7/1/94) | | | 6.56 | % | | | 7.01 | % | | | 8.58 | % | | | 10.09 | % |

| COMPARATIVE PERFORMANCE | | | | | | | | | | | | | | | | |

| Barclays Capital U.S. Government/Credit Bond Index(b) | | | 1.26 | | | | 8.53 | | | | 6.26 | | | | 5.91 | |

| Lipper BBB-Rated Funds Index(b) | | | 4.22 | | | | 9.41 | | | | 6.37 | | | | 6.36 | |

| | |

| Gross expense ratio (before fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 0.49% | | | | | | | | | | | | | | | | |

| | |

| Net expense ratio (after fee waivers and/or expense reimbursements)* | | | | | |

| Institutional: 0.49% | | | | | | | | | | | | | | | | |

| * | | As stated in the most recent prospectus. Waivers/reimbursements are contractual and are set to expire on 1/31/13. Contracts are reevaluated on an annual basis. |

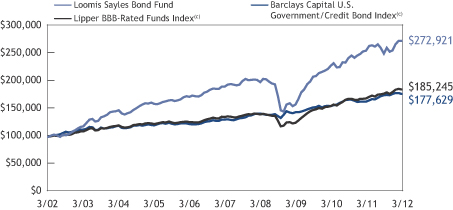

Cumulative Performance

March 31, 2002 through March 31, 2012(a)

Performance data quoted represents past performance and is no guarantee of future results. Total return and value will vary and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For most recent month-end performance, visit loomissayles.com. You may not invest directly in an index. Performance for periods less than one year is cumulative, not annualized. Returns reflect changes in share price and reinvestment of dividends and capital gains, if any. Performance data reflects certain fee waivers and/or expense reimbursements, if any, without which performance would be lower.

The table and graph do not reflect taxes shareholders might owe on any fund distributions or when they redeem their shares.

| (a) | | The mountain chart is based on the fund’s minimum initial investment of $3,000,000. |

| (b) | | See page 13 for a description of the indices. |

What you should know

Investments in the fund are subject to a number of risks. Please see the “Principal Risks” section of the fund’s prospectus. The purchase of fund shares should be seen as a long-term investment.

| 12

ADDITIONAL INFORMATION

The views expressed in this report reflect those of the portfolio managers as of the dates indicated. The managers’ views are subject to change at any time without notice based on changes in market or other conditions. References to specific securities or industries should not be regarded as investment advice. Because the funds are actively managed, there is no assurance that they will continue to invest in the securities or industries mentioned.

Index Definitions

Indexes are unmanaged and do not have expenses that affect results, unlike mutual funds. Index returns are adjusted for the reinvestment of capital gain distributions and income dividends. It is not possible to invest directly in an index.

Barclays Capital U.S. Government/Credit Bond Index is an unmanaged index that includes U.S. Treasuries, government-related issues, and investment grade U.S. corporate securities.

Barclays Capital U.S. Intermediate Government/Credit Bond Index is an unmanaged index that includes U.S. Treasuries, government-related issues, and investment grade U.S. corporate securities with remaining maturities of one to ten years.

Barclays Capital Global Aggregate Bond Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-rate debt markets.

Barclays Capital U.S. Corporate High-Yield Bond Index is an unmanaged index that covers the U.S.-dollar denominated, non-investment grade, fixed-rate, taxable corporate bond market.

Barclays Capital U.S. Treasury Inflation Protected Securities Index is an unmanaged index that tracks inflation protected securities issued by the U.S. Treasury.

Lipper BBB-Rated Funds Index is an unmanaged index that tracks the average performance of the 30 largest BBB-rated funds according to Lipper Inc.

Lipper Global Income Funds Index is an unmanaged index that tracks the average performance of the 30 largest global income funds according to Lipper Inc.

Lipper High Current Yield Funds Index is an unmanaged index that tracks the average performance of the 30 largest high current yield funds according to Lipper Inc.

Lipper Intermediate Investment Grade Debt Funds Index is an unmanaged index that tracks the average performance of the 30 largest intermediate investment grade debt funds according to Lipper Inc.

Lipper Treasury Inflation Protected Securities Funds Index is an unmanaged index that tracks the average performance of the 30 largest treasury inflation protected securities funds according to Lipper Inc.

Source: Lipper, Inc.

Proxy Voting Information

A description of the funds’ proxy voting policies and procedures is available without charge, upon request, (i) by calling Loomis, Sayles & Company, L.P. at 800-633-3330; (ii) on the funds’ website, www.loomissayles.com, and (iii) on the SEC’s website, www.sec.gov. Information about how the funds voted proxies relating to portfolio securities during the 12 months ended June 30, 2011 is available on (i) the funds’ website and (ii) the SEC’s website.

Quarterly Portfolio Schedules

The funds file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The funds’ Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

UNDERSTANDING YOUR FUND’S EXPENSES

As a mutual fund shareholder you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees, distribution fees (12b-1 fees), and other fund expenses. These costs are described in more detail in each fund’s prospectus. The examples below are intended to help you understand the ongoing costs of investing in the funds and help you compare these with the ongoing costs of investing in other mutual funds.

The first line in the table for each class of fund shares shows the actual amount of fund expenses you would have paid on a $1,000 investment in the fund from October 1, 2011 through March 31, 2012. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual fund returns and expenses. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for your Class.

The second line in the table for each class of fund shares provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid on your investment for the period. You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown reflect ongoing costs only, and do not include any transaction costs. Therefore, the second line in the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. If transaction costs were included, total costs would be higher.

13 |

Loomis Sayles Fixed Income Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

10/1/2011 | | | Ending

Account Value

3/31/2012 | | | Expenses Paid

During Period*

10/1/2011 – 3/31/2012 | |

Actual | | | $1,000.00 | | | | $1,098.60 | | | | $3.04 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,022.10 | | | | $2.93 | |

* Expenses are equal to the Fund’s annualized expense ratio: 0.58%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). | |

Loomis Sayles Global Bond Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

10/1/2011 | | | Ending

Account Value

3/31/2012 | | | Expenses Paid

During Period*

10/1/2011 – 3/31/2012 | |

Actual | | | $1,000.00 | | | | $1,049.50 | | | | $3.59 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.50 | | | | $3.54 | |

| | | |

Retail Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,047.90 | | | | $5.07 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,020.05 | | | | $5.00 | |

* Expenses are equal to the Fund’s annualized expense ratio: 0.70% and 0.99% for Institutional and Retail Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). | |

Loomis Sayles Inflation Protected Securities Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

10/1/2011 | | | Ending

Account Value

3/31/2012 | | | Expenses Paid

During Period*

10/1/2011 – 3/31/2012 | |

Actual | | | $1,000.00 | | | | $1,032.90 | | | | $2.03 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.00 | | | | $2.02 | |

| | | |

Retail Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,031.10 | | | | $3.30 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.75 | | | | $3.29 | |

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.40% and 0.65% for Institutional and Retail Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). | |

Loomis Sayles Institutional High Income Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

10/1/2011 | | | Ending

Account Value

3/31/2012 | | | Expenses Paid

During Period*

10/1/2011 – 3/31/2012 | |

Actual | | | $1,000.00 | | | | $1,125.50 | | | | $3.61 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.60 | | | | $3.44 | |

* Expenses are equal to the Fund’s annualized expense ratio: 0.68%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). | |

Loomis Sayles Intermediate Duration Bond Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

10/1/2011 | | | Ending

Account Value

3/31/2012 | | | Expenses Paid

During Period*

10/1/2011 – 3/31/2012 | |

Actual | | | $1,000.00 | | | | $1,021.40 | | | | $2.02 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,023.00 | | | | $2.02 | |

| | | |

Retail Class | | | | | | | | | |

Actual | | | $1,000.00 | | | | $1,019.20 | | | | $3.28 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,021.75 | | | | $3.29 | |

* Expenses are equal to the Fund’s annualized expense ratio (after waiver/reimbursement): 0.40% and 0.65% for Institutional and Retail Class, respectively, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). | |

| 14

Loomis Sayles Investment Grade Fixed Income Fund

| | | | | | | | | | | | |

Institutional Class | | Beginning

Account Value

10/1/2011 | | | Ending

Account Value

3/31/2012 | | | Expenses Paid

During Period*

10/1/2011 – 3/31/2012 | |

Actual | | | $1,000.00 | | | | $1,065.60 | | | | $2.53 | |

Hypothetical (5% return before expenses) | | | $1,000.00 | | | | $1,022.55 | | | | $2.48 | |

* Expenses are equal to the Fund’s annualized expense ratio: 0.49%, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, divided by 366 (to reflect the half-year period). | |

15 |

Portfolio of Investments – as of March 31, 2012 (Unaudited)

Loomis Sayles Fixed Income Fund

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | | | | | |

| |

| | Bonds and Notes – 82.9% of Net Assets | | | | |

| |

| | Non-Convertible Bonds – 73.4% | | | | |

| | |

| | | | ABS Other – 0.1% | | | | |

| $ | 725,000 | | | Community Program Loan Trust, Series 1987-A, Class A5,

4.500%, 4/01/2029 | | $ | 733,560 | |

| | | | | | | | |

| | | | Aerospace & Defense – 0.2% | | | | |

| | 175,000 | | | Bombardier, Inc.,

7.450%, 5/01/2034, 144A | | | 179,375 | |

| | 600,000 | | | Meccanica Holdings USA, Inc.,

6.250%, 7/15/2019, 144A | | | 536,162 | |

| | 400,000 | | | Meccanica Holdings USA, Inc.,

6.250%, 1/15/2040, 144A | | | 309,950 | |

| | 1,400,000 | | | Meccanica Holdings USA, Inc.,

7.375%, 7/15/2039, 144A | | | 1,170,691 | |

| | | | | | | | |

| | | | | | | 2,196,178 | |

| | | | | | | | |

| | | | Airlines – 0.5% | | | | |

| | 153,971 | | | Continental Airlines Pass Through Trust,

Series 1997-1, Class A,

7.461%, 10/01/2016 | | | 153,971 | |

| | 48,940 | | | Continental Airlines Pass Through Trust,

Series 2000-2, Class B,

8.307%, 10/02/2019 | | | 48,509 | |

| | 70,802 | | | Continental Airlines Pass Through Trust,

Series 2001-1, Class B,

7.373%, 6/15/2017 | | | 71,064 | |

| | 275,000 | | | Continental Airlines Pass Through Trust,

Series 2012-1, Class B,

6.250%, 10/22/2021 | | | 279,812 | |

| | 1,277,955 | | | Delta Air Lines Pass Through Trust, Series 2007-1, Class C,

8.954%, 8/10/2014 | | | 1,276,294 | |

| | 276,711 | | | Delta Air Lines Pass Through Trust, Series 2009-1, Series B,

9.750%, 6/17/2018 | | | 294,698 | |

| | 484,000 | | | Delta Air Lines, Inc.,

9.500%, 9/15/2014, 144A | | | 515,460 | |

| | 1,009,113 | | | UAL Pass Through Trust,

Series 2007-1, Class A,

6.636%, 1/02/2024 | | | 1,069,660 | |

| | 1,651,000 | | | US Airways Pass Through Trust,

Series 2011-1A, Class A,

7.125%, 4/22/2025 | | | 1,733,550 | |

| | | | | | | | |

| | | | | | | 5,443,018 | |

| | | | | | | | |

| | | | Automotive – 2.4% | | | | |

| | 2,200,000 | | | Chrysler Group LLC/CG Co-Issuer, Inc.,

8.250%, 6/15/2021 | | | 2,222,000 | |

| | 200,000 | | | FCE Bank PLC, EMTN,

7.125%, 1/15/2013, (EUR) | | | 276,409 | |

| | 765,000 | | | Ford Motor Co.,

6.375%, 2/01/2029 | | | 829,603 | |

| | 1,030,000 | | | Ford Motor Co.,

6.500%, 8/01/2018 | | | 1,117,550 | |

| | | | | | | | |

| | |

| | | | Automotive – continued | | | | |

| $ | 165,000 | | | Ford Motor Co.,

6.625%, 2/15/2028 | | $ | 182,740 | |

| | 4,230,000 | | | Ford Motor Co.,

6.625%, 10/01/2028 | | | 4,696,214 | |

| | 690,000 | | | Ford Motor Co.,

7.125%, 11/15/2025 | | | 752,100 | |

| | 9,250,000 | | | Ford Motor Co.,

7.450%, 7/16/2031 | | | 11,308,125 | |

| | 1,645,000 | | | Ford Motor Co.,

7.500%, 8/01/2026 | | | 1,842,400 | |

| | 645,000 | | | Ford Motor Credit Co. LLC,

7.000%, 4/15/2015 | | | 704,572 | |

| | 565,000 | | | Ford Motor Credit Co. LLC,

8.000%, 12/15/2016 | | | 655,063 | |

| | 375,000 | | | Goodyear Tire & Rubber Co. (The), 7.000%, 3/15/2028 | | | 353,437 | |

| | | | | | | | |

| | | | | | | 24,940,213 | |

| | | | | | | | |

| | | | Banking – 8.1% | | | | |

| | 1,710,000 | | | Associates Corp. of North America, 6.950%, 11/01/2018 | | | 1,935,493 | |

| | 500,000 | | | Bank of America Corp.,

4.850%, 11/15/2014 | | | 491,230 | |

| | 1,900,000 | | | Bank of America Corp.,

5.490%, 3/15/2019 | | | 1,904,499 | |

| | 1,060,000 | | | Bank of America Corp.,

5.650%, 5/01/2018 | | | 1,131,552 | |

| | 600,000 | | | Bank of America Corp.,

6.500%, 9/15/2037 | | | 578,818 | |

| | 2,247,000 | | | Bank of America Corp.,

Series L, MTN,

7.625%, 6/01/2019 | | | 2,591,052 | |

| | 2,420,000,000 | | | Barclays Bank PLC, EMTN,

3.680%, 8/20/2015, (KRW) | | | 2,153,406 | |

| | 250,000 | | | Barclays Bank PLC, EMTN, (fixed rate to 3/15/2020, variable rate thereafter),

4.750%, 3/29/2049, (EUR) | | | 185,331 | |

| | 535,000 | | | BNP Paribas Capital Trust VI, (fixed rate to 1/16/2013, variable rate thereafter),

5.868%, 1/29/2049, (EUR) | | | 665,866 | |

| | 1,300,000 | | | BNP Paribas S.A., (fixed rate to 10/23/2017, variable rate thereafter),

7.436%, 10/29/2049, (GBP) | | | 1,626,057 | |

| | 1,450,000 | | | BNP Paribas S.A., (fixed rate to 4/12/2016, variable rate thereafter),

4.730%, 4/29/2049, (EUR) | | | 1,489,172 | |

| | 550,000 | | | BNP Paribas S.A., (fixed rate to 4/13/2017, variable rate thereafter),

5.019%, 4/29/2049, (EUR) | | | 564,822 | |

| | 2,700,000 | | | BNP Paribas S.A., (fixed rate to 4/19/2016, variable rate thereafter),

5.945%, 4/29/2049, (GBP) | | | 2,915,090 | |

| | 1,000,000 | | | BNP Paribas S.A., (fixed rate to 6/25/2037, variable rate thereafter),

7.195%, 6/29/2049, 144A | | | 887,500 | |

See accompanying notes to financial statements.

| 16

Portfolio of Investments – as of March 31, 2012 (Unaudited)

Loomis Sayles Fixed Income Fund – continued

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | | | | | |

| |

| | Bonds and Notes – continued | | | | |

| | |

| | | | Banking – continued | | | | |

| $ | 1,525,000 | | | BNP Paribas S.A., (fixed rate to 6/29/2015, variable rate thereafter),

5.186%, 6/29/2049, 144A | | $ | 1,319,125 | |

| | 1,050,000 | | | BNP Paribas S.A., (fixed rate to 7/13/2016, variable rate thereafter),

5.954%, 7/29/2049, (GBP) | | | 1,242,812 | |

| | 3,830,000 | | | Citigroup, Inc.,

5.000%, 9/15/2014 | | | 3,966,459 | |

| | 300,000 | | | Citigroup, Inc.,

5.365%, 3/06/2036, (CAD)(b) | | | 241,462 | |

| | 135,000 | | | Citigroup, Inc.,

5.850%, 12/11/2034 | | | 138,015 | |

| | 3,320,000 | | | Citigroup, Inc.,

5.875%, 2/22/2033 | | | 3,115,740 | |

| | 1,215,000 | | | Citigroup, Inc.,

6.000%, 10/31/2033 | | | 1,163,562 | |

| | 795,000 | | | Citigroup, Inc.,

6.125%, 8/25/2036 | | | 764,052 | |

| | 200,000 | | | Citigroup, Inc., EMTN, (fixed rate to 11/30/2012, variable rate thereafter),

3.625%, 11/30/2017, (EUR) | | | 231,930 | |

| | 4,030,000 | | | Goldman Sachs Group, Inc. (The), 6.750%, 10/01/2037 | | | 3,937,604 | |

| | 1,955,000 | | | Goldman Sachs Group, Inc. (The), GMTN,

5.375%, 3/15/2020 | | | 1,987,408 | |

| | 2,500,000 | | | HBOS PLC, GMTN, 6.750%, 5/21/2018, 144A | | | 2,346,443 | |

| | 21,194,634,240 | | | JPMorgan Chase & Co., Zero Coupon,

4/12/2012, 144A, (IDR) | | | 2,297,708 | |

| | 1,000,000,000 | | | JPMorgan Chase & Co., EMTN,

7.070%, 3/22/2014, (IDR) | | | 108,486 | |

| | 18,000,000,000 | | | JPMorgan Chase Bank NA,

7.700%, 6/01/2016, 144A, (IDR) | | | 2,079,331 | |

| | 1,700,000 | | | Merrill Lynch & Co., Inc.,

6.050%, 5/16/2016 | | | 1,789,957 | |

| | 5,600,000 | | | Merrill Lynch & Co., Inc.,

6.110%, 1/29/2037 | | | 5,330,069 | |

| | 2,000,000 | | | Merrill Lynch & Co., Inc.,

6.220%, 9/15/2026 | | | 2,038,542 | |

| | 50,000 | | | Merrill Lynch & Co., Inc., EMTN,

1.434%, 9/14/2018, (EUR)(c) | | | 53,839 | |

| | 1,000,000 | | | Merrill Lynch & Co., Inc., EMTN,

4.625%, 9/14/2018, (EUR) | | | 1,233,520 | |

| | 300,000 | | | Merrill Lynch & Co., Inc., Series C, MTN,

6.050%, 6/01/2034 | | | 273,029 | |

| | 595,000 | | | Morgan Stanley,

4.750%, 4/01/2014 | | | 604,737 | |

| | 7,300,000 | | | Morgan Stanley,

5.500%, 7/24/2020 | | | 7,124,691 | |

| | | | | | | | |

| | | | Banking – continued | | | | |

| $ | 7,400,000 | | | Morgan Stanley,

5.750%, 1/25/2021 | | $ | 7,265,187 | |

| | 50,000 | | | Morgan Stanley, EMTN,

5.750%, 2/14/2017, (GBP) | | | 81,860 | |

| | 200,000 | | | Morgan Stanley, GMTN,

5.500%, 1/26/2020 | | | 195,056 | |

| | 4,100,000 | | | Morgan Stanley, GMTN,

7.625%, 3/03/2016, (AUD) | | | 4,310,965 | |

| | 1,600,000 | | | Morgan Stanley, MTN,

7.250%, 5/26/2015, (AUD) | | | 1,638,847 | |

| | 300,000 | | | Morgan Stanley, Series F, GMTN, 5.625%, 9/23/2019 | | | 296,526 | |

| | 625,000 | | | Morgan Stanley, Series F, MTN,

5.950%, 12/28/2017 | | | 643,494 | |

| | 300,000 | | | Morgan Stanley, Series G & H, GMTN,

5.125%, 11/30/2015, (GBP) | | | 490,137 | |

| | 185,000 | | | RBS Capital Trust A, (fixed rate to 6/30/2012, variable rate thereafter),

6.467%, 12/29/2049, (EUR)(e) | | | 143,106 | |

| | 50,000 | | | Royal Bank of Scotland PLC (The), EMTN,

4.350%, 1/23/2017, (EUR) | | | 57,649 | |

| | 300,000 | | | Royal Bank of Scotland PLC (The), EMTN,

6.934%, 4/09/2018, (EUR) | | | 372,502 | |

| | 600,000 | | | Societe Generale S.A., (fixed rate to 5/22/2013, variable rate thereafter),

7.756%, 5/29/2049, (EUR) | | | 684,268 | |

| | 5,000,000 | | | Societe Generale S.A., MTN, 5.200%, 4/15/2021, 144A | | | 4,802,150 | |

| | | | | | | | |

| | | | | | | 83,490,156 | |

| | | | | | | | |

| | | | Brokerage – 0.7% | | | | |

| | 1,495,000 | | | Jefferies Group, Inc.,

3.875%, 11/09/2015 | | | 1,476,313 | |

| | 1,245,000 | | | Jefferies Group, Inc.,

5.125%, 4/13/2018 | | | 1,207,650 | |

| | 2,395,000 | | | Jefferies Group, Inc.,

6.250%, 1/15/2036 | | | 2,161,487 | |

| | 1,580,000 | | | Jefferies Group, Inc.,

6.450%, 6/08/2027 | | | 1,556,300 | |

| | 165,000 | | | Jefferies Group, Inc.,

6.875%, 4/15/2021 | | | 167,888 | |

| | 70,000 | | | Jefferies Group, Inc.,

8.500%, 7/15/2019 | | | 77,700 | |

| | | | | | | | |

| | | | | | | 6,647,338 | |

| | | | | | | | |

| | | | Building Materials – 1.1% | | | | |

| | 860,000 | | | Masco Corp.,

4.800%, 6/15/2015 | | | 881,031 | |

| | 240,000 | | | Masco Corp.,

5.850%, 3/15/2017 | | | 245,964 | |

| | 2,600,000 | | | Masco Corp.,

6.125%, 10/03/2016 | | | 2,748,408 | |

| | 755,000 | | | Masco Corp.,

6.500%, 8/15/2032 | | | 710,925 | |

| | 1,410,000 | | | Masco Corp.,

7.125%, 3/15/2020 | | | 1,507,387 | |

See accompanying notes to financial statements.

17 |

Portfolio of Investments – as of March 31, 2012 (Unaudited)

Loomis Sayles Fixed Income Fund – continued

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | | | | | |

| |

| | Bonds and Notes – continued | | | | |

| |

| | | | Building Materials – continued | |

| $ | 815,000 | | | Masco Corp.,

7.750%, 8/01/2029 | | $ | 840,616 | |

| | 805,000 | | | Owens Corning, Inc.,

6.500%, 12/01/2016 | | | 894,331 | |

| | 2,050,000 | | | Owens Corning, Inc.,

7.000%, 12/01/2036 | | | 2,184,593 | |

| | 1,680,000 | | | USG Corp.,

6.300%, 11/15/2016 | | | 1,570,800 | |

| | | | | | | | |

| | | | | | | 11,584,055 | |

| | | | | | | | |

| | | | Chemicals – 1.2% | | | | |

| | 3,440,000 | | | Chevron Phillips Chemical Co. LLC, 8.250%, 6/15/2019, 144A | | | 4,505,176 | |

| | 275,000 | | | Hexion US Finance Corp./Hexion Nova Scotia Finance ULC, 8.875%, 2/01/2018 | | | 284,625 | |

| | 115,000 | | | ICI Wilmington, Inc.,

5.625%, 12/01/2013 | | | 122,000 | |

| | 620,000 | | | Methanex Corp.,

5.250%, 3/01/2022 | | | 631,087 | |

| | 1,565,000 | | | Methanex Corp., Senior Note, 6.000%, 8/15/2015 | | | 1,627,221 | |

| | 5,240,000 | | | Momentive Specialty Chemicals, Inc., 7.875%, 2/15/2023(b) | | | 4,244,400 | |

| | 55,000 | | | Momentive Specialty Chemicals, Inc., 8.375%, 4/15/2016(b) | | | 48,950 | |

| | 905,000 | | | Momentive Specialty Chemicals, Inc., 9.200%, 3/15/2021(b) | | | 778,300 | |

| | | | | | | | |

| | | | | | | 12,241,759 | |

| | | | | | | | |

| | | | Collateralized Mortgage Obligations – 0.1% | |

| | 1,037,035 | | | Wells Fargo Mortgage Backed Securities Trust,

Series 2005-AR4, Class 2A2, 2.689%, 4/25/2035(c) | | | 962,509 | |

| | | | | | | | |

| | | | Commercial Mortgage-Backed Securities – 0.1% | |

| | 95,000 | | | GS Mortgage Securities Corp. II, Series 2005-GG4, Class A4A,

4.751%, 7/10/2039 | | | 103,024 | |

| | 1,000,000 | | | Merrill Lynch/Countrywide Commercial Mortgage Trust, Series 2007-6, Class A4,

5.485%, 3/12/2051 | | | 1,076,751 | |

| | | | | | | | |

| | | | | | | 1,179,775 | |

| | | | | | | | |

| | | | Construction Machinery – 0.2% | |

| | 965,000 | | | Toro Co.,

6.625%, 5/01/2037(b) | | | 1,017,371 | |

| | 1,155,000 | | | UR Financing Escrow Corp., 7.625%, 4/15/2022, 144A | | | 1,186,762 | |

| | | | | | | | |

| | | | | | | 2,204,133 | |

| | | | | | | | |

| | | | Distributors – 0.1% | | | | |

| | 1,000,000 | | | ONEOK, Inc.,

6.000%, 6/15/2035 | | | 1,065,943 | |

| | | | | | | | |

| | | | Diversified Manufacturing – 0.9% | |

| | 245,000 | | | Textron, Inc.,

5.600%, 12/01/2017 | | | 265,667 | |

| | | | | | | | |

| | | | Diversified Manufacturing – continued | |

| $ | 6,855,000 | | | Textron, Inc.,

5.950%, 9/21/2021 | | $ | 7,493,550 | |

| | 1,290,000 | | | Textron, Inc.,

7.250%, 10/01/2019 | | | 1,480,968 | |

| | | | | | | | |

| | | | | | | 9,240,185 | |

| | | | | | | | |

| | | | Electric – 4.0% | | | | |

| | 730,000 | | | AES Corp. (The),

7.750%, 3/01/2014 | | | 788,400 | |

| | 2,928,050 | | | Alta Wind Holdings LLC,

7.000%, 6/30/2035, 144A | | | 3,153,452 | |

| | 4,126,072 | | | Bruce Mansfield Unit,

6.850%, 6/01/2034 | | | 4,372,316 | |

| | 380,000 | | | Dynegy Holdings, Inc.,

7.125%, 5/15/2018(d) | | | 248,900 | |

| | 810,000 | | | Dynegy Holdings, Inc.,

7.625%, 10/15/2026(d) | | | 530,550 | |

| | 7,005,000 | | | EDP Finance BV,

4.900%, 10/01/2019, 144A | | | 5,694,364 | |

| | 5,555,000 | | | EDP Finance BV,

6.000%, 2/02/2018, 144A | | | 4,909,426 | |

| | 100,000 | | | EDP Finance BV, EMTN,

4.625%, 6/13/2016, (EUR) | | | 116,699 | |

| | 1,200,000 | | | EDP Finance BV, EMTN,

8.625%, 1/04/2024, (GBP) | | | 1,724,605 | |

| | 1,589,000 | | | Endesa S.A./Cayman Islands,

7.875%, 2/01/2027 | | | 1,901,698 | |

| | 2,890,000 | | | Energy Future Holdings Corp.,

10.000%, 1/15/2020 | | | 3,135,650 | |

| | 275,000 | | | Enersis S.A.,

7.375%, 1/15/2014 | | | 298,301 | |

| | 4,000,000 | | | Enersis S.A., Cayman Islands,

7.400%, 12/01/2016 | | | 4,717,296 | |

| | 3,256,600 | | | Mackinaw Power LLC,

6.296%, 10/31/2023, 144A(b) | | | 3,314,014 | |

| | 675,000 | | | NGC Corp. Capital Trust I, Series B,

8.316%, 6/01/2027(b)(d) | | | 175,500 | |

| | 2,865,000 | | | Texas Competitive Electric Holdings Co. LLC/TCEH Finance, Inc.,

11.500%, 10/01/2020, 144A | | | 1,869,412 | |

| | 765,000 | | | TXU Corp., Series P,

5.550%, 11/15/2014 | | | 560,362 | |

| | 1,515,000 | | | TXU Corp., Series Q,

6.500%, 11/15/2024 | | | 795,375 | |

| | 1,675,000 | | | TXU Corp., Series R,

6.550%, 11/15/2034 | | | 837,500 | |

| | 450,000 | | | White Pine Hydro LLC,

6.310%, 7/10/2017(b) | | | 409,324 | |

| | 670,000 | | | White Pine Hydro LLC,

6.960%, 7/10/2037(b) | | | 563,912 | |

| | 1,280,000 | | | White Pine Hydro Portfolio LLC,

7.260%, 7/20/2015(b) | | | 1,158,221 | |

| | | | | | | | |

| | | | | | | 41,275,277 | |

| | | | | | | | |

| | |

| | | | Entertainment – 0.5% | | | | |

| | 2,065,000 | | | Time Warner, Inc.,

6.625%, 5/15/2029 | | | 2,444,309 | |

| | 730,000 | | | Time Warner, Inc.,

7.625%, 4/15/2031 | | | 934,661 | |

See accompanying notes to financial statements.

| 18

Portfolio of Investments – as of March 31, 2012 (Unaudited)

Loomis Sayles Fixed Income Fund – continued

| | | | | | | | |

Principal

Amount (‡) | | | Description | | Value (†) | |

| | | | | | | | |

| |

| | Bonds and Notes – continued | | | | |

| | |

| | | | Entertainment – continued | | | | |

| $ | 1,155,000 | | | Time Warner, Inc.,

7.700%, 5/01/2032 | | $ | 1,506,397 | |

| | | | | | | | |

| | | | | | | 4,885,367 | |

| | | | | | | | |

| | | | Food & Beverage – 0.5% | | | | |

| | 1,540,000 | | | Corn Products International, Inc., 6.625%, 4/15/2037 | | | 1,741,395 | |

| | 2,740,000 | | | Viterra, Inc.,

6.406%, 2/16/2021, 144A, (CAD) | | | 3,046,071 | |

| | | | | | | | |

| | | | | | | 4,787,466 | |

| | | | | | | | |

| | | | Gaming – 0.5% | | | | |

| | 410,000 | | | MGM Resorts International,

6.625%, 7/15/2015 | | | 421,275 | |

| | 435,000 | | | MGM Resorts International,

6.875%, 4/01/2016 | | | 439,350 | |

| | 350,000 | | | MGM Resorts International,

7.500%, 6/01/2016 | | | 360,500 | |

| | 895,000 | | | MGM Resorts International,

7.625%, 1/15/2017 | | | 924,088 | |

| | 2,525,000 | | | MGM Resorts International,

8.625%, 2/01/2019, 144A | | | 2,708,062 | |

| | | | | | | | |

| | | | | | | 4,853,275 | |

| | | | | | | | |

| | | | Government Guaranteed – 0.2% | |

| | 1,620,000 | | | Instituto de Credito Oficial, MTN,

5.500%, 10/11/2012, (AUD) | | | 1,658,765 | |

| | | | | | | | |

| | | | Government Owned – No Guarantee – 0.7% | |

| | 2,400,000 | | | DP World Ltd.,

6.850%, 7/02/2037, 144A | | | 2,316,000 | |

| | 18,000,000,000 | | | Export-Import Bank of Korea,

6.600%, 11/04/2013, 144A, (IDR) | | | 1,977,165 | |