UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | for the fiscal year ended December 31, 2006 |

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 0-32233

PEET’S COFFEE & TEA, INC.

(Exact Name of Registrant as Specified in Its Charter)

| | |

| Washington | | 91-0863396 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

1400 Park Avenue

Emeryville, California 94608-3520

(Address of Principal Executive Offices) (Zip Code)

(510) 594-2100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, no par value

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant is well-known, seasoned filer (as defined in Rule 405 under the Securities Act). Yes ¨ No x

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer (as defined in Exchange Act Rule 12b-2).

Large Accelerated Filer ¨ Accelerated Filer x Non-Accelerated Filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

The approximate aggregate market value of the voting stock held by non-affiliates of the registrant based on the closing price and shares of the Common Stock outstanding on July 2, 2006 (the registrant’s most recently completed second quarter), as reported by the Nasdaq National Market, was $417,639,433. Shares of Common Stock held by each officer, director and each person known to the Company to hold 5% or more of the outstanding Common Stock have been excluded as such persons may be deemed to be affiliates of the Company. Such determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 14, 2007, 13,516,180 shares of registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement related to the registrant’s 2006 annual meeting of shareholders, which proxy statement will be filed under the Securities Exchange Act of 1934 within 120 days of the end of the registrant’s fiscal year ended December 31, 2006, are incorporated by reference into Part III of this annual report on Form 10-K.

TABLE OF CONTENTS

References to “we”, “us”, “our”, “Peet’s”, and the “Company” in this annual report on Form 10-K refer to Peet’s Coffee & Tea, Inc.

FORWARD-LOOKING STATEMENTS

Some of the matters discussed under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” “Business” and elsewhere in this report include forward-looking statements. We have based these forward-looking statements on our current expectations and assumptions about future events, including, among other things:

| | • | | Implementing our business strategy; |

| | • | | Attracting and retaining customers; |

| | • | | Establishing and expanding our market presence in new geographic regions; |

| | • | | The availability and pricing of high quality Arabica coffee beans; |

| | • | | Consumers’ tastes and preferences; and |

| | • | | Competition in our markets. |

In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “could,” “predict,” “potential,” “continue,” “expect,” “anticipate,” “future,” “intend,” “plan,” “believe,” “estimate” and similar expressions (or the negative of such expressions). These statements are based on our current beliefs, expectations and assumptions and are subject to a number of risks and uncertainties. Actual results, levels of activity, performance, achievements and events may vary significantly from those implied by the forward-looking statements. A description of risks that could cause our results to vary appears under the caption “Risk Factors” and elsewhere in this annual report on Form 10-K (“report”). Forward-looking statements speak only as of the date of this report.

EXPLANATORY NOTE

Restatement of Consolidated Financial Results

This annual report on Form 10-K for the fiscal year ended December 31, 2006 (“Form 10-K”) includes the restatement of our consolidated financial statements and the related disclosures as of January 1, 2006 and for the two fiscals year ended January 1, 2006 resulting from the (i) previously disclosed voluntary review of historical stock option grant practices and (ii) incorrect methodology used to allocate procurement and production costs into inventory. In this Form 10-K, we have restated our consolidated balance sheet as of January 1, 2006 and the related consolidated statements of income, shareholders’ equity, and cash flows for the years ended January 1, 2006 (fiscal 2005) and January 2, 2005 (fiscal 2004) and quarterly data for fiscal years 2006 and 2005. In addition, the following items of this Form 10-K include restated financial data: (i) Part II, Item 6—Selected Financial Data; (ii) Part II, Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations; and (iii) Part II, Item 8 – Financial Statements and Supplementary Data.

We have not amended our previously-filed Annual Reports on Form 10-K or Quarterly Reports on Form 10-Q for any fiscal year or quarter affected by the restatement. Instead, the financial information that has been previously filed or otherwise reported for these periods is superseded by the information in this 2006 Form 10-K, and the financial information contained in such previously-filed reports should no longer be relied upon.

1

Stock Option Grants

As previously disclosed, on October 20, 2006, our Board of Directors appointed an Option Review Committee (the “Special Committee”) consisting of two independent directors to oversee a review of the Company’s past stock option granting practices. This voluntary review was initiated in light of the media coverage regarding stock option granting practices of other publicly traded companies. The Special Committee’s review covered the period from the Company’s 2001 initial public offering to August 2006. The Company also reviewed all options granted beginning in 1996. The review was conducted with the assistance of independent legal counsel and accounting experts (the “Review Team”).

Special Committee Findings

The Review Team reviewed the facts and circumstances surrounding stock option grants made during the review period, which included grants made on 80 dates. The Review Team conducted an extensive investigation including the review of physical and electronic documents and interviews with current and former directors, officers, employees and advisors. Documents reviewed included final versions and electronically stored drafts of board and committee meeting minutes and unanimous written consents, communication records with the Company’s Board of Directors and its Compensation Committee, grant lists and other documents. As part of its investigation, the Special Committee evaluated whether the correct measurement dates had been used under applicable accounting principles for the options granted. The measurement date as defined under Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees (“APB 25”) and related interpretations, is the first date where there is evidence of proper approval and on which all of the following are known: (1) the individual employee who is entitled to receive the option grant, (2) the number of options that an individual employee is entitled to receive, and (3) the option’s exercise price.

The Special Committee concluded its review and reported its findings to the Board of Directors on March 6, 2007. The Special Committee reported that based on their review of data and interviews, the Review Team did not find evidence that there was any deliberate attempt to manipulate the price at which any stock option was granted nor the date of the grant in order to benefit the grant recipient or Peet’s. The Review Team also reported that they did not discover evidence of intentional wrongdoing by any Peet’s employee or Board member. The Review Team did, however, discover a lack of documentation and internal controls in connection with our stock administration system, particularly in the 2001-2003 period.

Based on the work of the Special Committee and the Review Team, we have determined that we used an incorrect measurement date for financial accounting purposes for a number of stock option grants. These errors resulted primarily from misapplication of accounting standards related to the determination of certain measurement dates, as discussed below, which on a number of occasions resulted in employees receiving options with stated exercise prices higher or lower than the market prices on the revised measurement dates as determined by the applicable accounting standards. Accordingly, we sought to determine, based on the available evidence for each of the grants, when all prerequisites had been met in order to establish a revised measurement date for the granted options. In addition, we found instances in which the measurement dates for option grants were determined appropriately but the options were accounted for incorrectly. Based on these conclusions, we have restated the accompanying fiscal 2005 and 2004 consolidated financial statements to record additional non-cash stock-based compensation expense and related tax effects with regard to past stock option grants. The cumulative effect of these stock-based compensation adjustments, after tax, aggregate $1.0 million for fiscal years 1998 through 2005. The adjustments, after tax, for fiscal years 2005 and 2004 are $15,000 and $74,000, respectively.

2

The principal components of the restatement are as follows (in thousands):

| | | |

| | | Adjustments,

net of tax |

Revised Measurement Dates: | | | |

All Employee Grants | | $ | 266 |

Bonus Grants | | | 420 |

Other Grants | | | 28 |

Incorrect Accounting for Grants to Consultants, Modifications and Discounted Options | | | 265 |

Misapplication of Non-Employee Director Stock Option Plan | | | 9 |

| | | |

| | $ | 988 |

| | | |

Revised Measurement Dates.Based on available evidence, the Company applied the methodologies described below to determine the revised measurement dates under APB No. 25 for grants in the following categories: (1) annual grants to all Company employees (“All Employee Grants”); (2) bonus award option grants to directors and officers (“Bonus Grants”); and (3) grants in connection with the hiring and promotion of employees and other discretionary grants (“Other Grants”).

| | • | | All Employee Grants—Since the Company’s initial public offering in 2001, the Company has made an annual grant of stock options to all employees of the Company. These grants require approval by the Board of Directors or the Compensation Committee of the Board of Directors (“Compensation Committee”). The number of shares to be granted to each individual is based upon job level in the organization and years of service. |

We determined that the fiscal 2001 grant was not approved at a Board of Directors or Compensation Committee meeting, but instead we used a unanimous written consent (“UWC”) to obtain Board of Director approval. However, the UWC relating to the grant was not fully executed by the grant date. We have determined the appropriate measurement date of this award to be the date the final Board member signature was obtained on the UWC.

We also determined that we used the incorrect measurement date for the fiscal 2002 grant. While Board of Directors approval was received for the shares to be issued and documented in a regularly scheduled board meeting, there was no evidence that the exercise price was determined on the stated date. We have determined the revised measurement date for this grant using our judgment of when the grant details were likely finalized, based on review of available evidence, such as e-mail communications, interviews and supporting facts and circumstances.

| | • | | Bonus Grants—In 2001, the Company began to grant stock options to director-level employees and above as incentive compensation. The number of options to be granted was determined using a predefined formula that utilizes the exercise price to determine the number of shares to be granted. For the 2001 and 2002 bonus grants, we determined we used an incorrect measurement date for accounting purposes because the list containing the names of grantees, the options awarded to each grantee, and/or the grant date was not evidenced to be approved and determined with finality until a date subsequent to the measurement dates we previously used. We determined the revised measurement dates for the 2001 and 2002 bonus grants based on the date when the formula used to compute the number of options granted to each employee was approved by the Board of Directors and there was evidence that the grant price was established. |

| | • | | Other Grants—The Company also awarded options to key new hires, for promotions and in select situations to reward and retain key individuals. The Company’s general practice has been to grant stock options on the date the employee started work, was promoted or was notified of a discretionary grant. The Company would obtain approval for these grants in two different ways: (1) for grants over 10,000 shares the Company required Board of Directors or Compensation Committee approval, and (2) beginning in February 2003, the Compensation Committee delegated authority to the Chief Executive |

3

| | Officer in his capacity as a member of the Board of Directors to approve grants up to 10,000 shares, as prior to that date the delegation was implied. In certain instances, the available documentation for the grants did not support the original measurement date as all the terms of the grant were not approved and known with finality at the stated grant date. We used the methodology described below for: 1) grants requiring Board of Directors or Compensation Committee approval and 2) grants where granting authority was delegated to the Chief Executive Officer. |

Other Grants requiring Board of Directors or Compensation Committee approval—We determined the revised measurement date for each stock option grant that requires Board of Directors or Compensation Committee approval to be the Approval Date (as defined below) for the stock option, provided the criteria set forth below were met. If there was not clear documentation supporting the Approval Date, we used the evidence described below to determine the most likely measurement date.

| | • | | “Approval Date”—The Approval Date was the date of approval set forth in executed minutes or a fully-executed UWC of the Board of Directors or Compensation Committee documenting the grant of the stock option (i.e. employee, number of options, and exercise price.) When we did not have evidence of the approvals through either the minutes or signed UWC, we used other available evidence of approval by the Board of Directors or Compensation Committee, including email communications. |

| | • | | “Most Likely Measurement Date”—If the Approval Date criteria was not evidenced (i.e. all signed UWCs were not returned), we used the earlier of the following dates to determine the revised measurement date as we believe approval of the grant would have occurred prior to this date: |

| | • | | The date the employee was notified of the terms of the option grant, |

| | • | | The signature date of management approvals on the Company’s grant approval form, |

| | • | | The date the grant approval form was received by our human resources department, |

| | • | | Print date or metadata creation date on notice of grant of stock form, or |

| | • | | The date the option was entered into our stock option database application. |

Other Grants where granting authority was delegated to the Chief Executive Officer:

| | • | | New Hire Grants—The Company’s Chief Executive Officer has been directly involved in determining the stock options to be granted to new hires. Generally, the terms of these stock options were included in the employee’s offer letter. Therefore, we determined the measurement date for new hire option grants to be the employee’s start date if all of the terms of the option grant were documented in the employee’s offer letter. Where we have determined that new hire option terms had not been determined and approved with finality prior to the employee’s start date, we have used the methodology defined above under “Most Likely Measurement Date”, to determine the revised measurement date. |

| | • | | Promotion and Discretionary Grants—We did not follow a consistent practice in granting, approving or documenting promotion and discretionary grants throughout the years. In many of our promotion and discretionary grants, the available documentation for the grants did not support the original measurement date as all the terms of the grant were not approved and known with finality at the stated grant date. In such instances, we have used the methodology defined above under “Most Likely Measurement Date”, to determine the revised measurement date. |

Incorrect Accounting for Grants to Consultants, Modifications and Discounted Options.We also identified other accounting errors related to option grants. We identified one Company-wide grant from 1998, before Peet’s became a public company that was intentionally granted with an exercise price equal to 85% of fair value, consistent with the operative stock plan and the Company’s practice at the time, with respect to which we did not correctly account for the discount to fair value. We also identified two options granted to consultants that

4

were incorrectly accounted for as grants to employees. In addition, we found several instances in which we incorrectly accounted for modifications to outstanding options, including one employee option that was accelerated upon termination of employment outside the provisions of the original grant and 11 instances in which employees’ periods to exercise options were extended.

Misapplication of Non-Employee Director Stock Option Plan. The Non-Employee Director Plan provides for non-discretionary, automatic option grants to non-employee directors (including both initial grants and annual grants), requiring no independent action of the Board or any committee of the Board. The plan stipulates that each director automatically receives an initial grant and a prorated annual grant on the day of initial election or appointment to the Board of Directors and an ongoing annual grant on the day following each annual meeting of shareholders. Prior to May 2005 the plan specified that options would have an exercise price equal to the market value of the option grant, which was defined as the closing price of the stock on the day prior to the grant. The plan was amended in May 2005 to define the market value as the closing price of the stock on the day of the option grant. The Company incorrectly administered three annual grants to all directors and one initial grant by applying a measurement date that was incorrect by one day. In addition, in two instances, the Company did not record the proper prorated grant upon a new director being named to the Board. The Company intends to correct these two administrative errors on the prorated grants in accordance with the plan. Of the three annual grants to all directors, two were recorded at an exercise price higher than the market price on the revised measurement date, and therefore no additional expense has been recognized in respect to these grants.

Total Financial Impact of Stock Option Related Restatement

The total stock-based compensation expense and incremental impact, to correct these errors in our historical stock option grants is as follows, net of related income tax expenses (in thousands):

| | | | | | | | | | | | | | | |

| | | Stock-based Compensation |

| | | Adjustments | | As previously

reported, net of tax | | As restated, net of tax |

| | | pre-tax | | tax effect | | net of tax | | |

1998 | | $ | 26 | | $ | 11 | | $ | 15 | | $ | — | | $ | 15 |

1999 | | | 48 | | | 20 | | | 28 | | | 9 | | | 37 |

2000 | | | 51 | | | 21 | | | 30 | | | 143 | | | 173 |

2001 | | | 291 | | | 119 | | | 172 | | | 183 | | | 355 |

2002 | | | 953 | | | 389 | | | 564 | | | 174 | | | 738 |

2003 | | | 152 | | | 62 | | | 90 | | | 115 | | | 205 |

| | | | | | | | | | | | | | | |

1998-2003 | | | | | | | | | 899 | | | | | | |

2004 | | | 125 | | | 51 | | | 74 | | | 54 | | | 128 |

2005 | | | 26 | | | 11 | | | 15 | | | 10 | | | 25 |

| | | | | | | | | | | | | | | |

| | $ | 1,672 | | $ | 684 | | $ | 988 | | | | | | |

| | | | | | | | | | | | | | | |

As of January 2, 2006 (the first day of the Company’s 2006 fiscal year), the aggregate amount of unamortized compensation expense related to these option grants totaled approximately $57,000.

Additionally, we have restated the related pro forma expense for the years ended January 1, 2006 and January 2, 2005 under Statement of Financial Accounting Standards (“SFAS”) No. 123 in Note 1, “Summary of Significant Accounting Policies” of the “Notes to Consolidated Financial Statements” of this 2006 Form 10-K to reflect the impact of these adjustments.

With respect to the matters discussed above, it is conceivable that others viewing the same evidence might have selected different measurement dates and that a higher or lower compensation charge would have resulted. Solely for purposes of assessing the possible effect on compensation expense that using different measurement

5

dates could have had, we selected the earliest and latest measurement dates (if any) that had any substantial support, and calculated compensation expense using the highest and lowest stock price during that range of dates. Based on this data, the resulting additional pre-tax compensation expense could have been as low as $1.0 million or as high as $2.7 million instead of the $1.7 million we have recorded. However, we believe that our methodology provides for the most likely measurement date based on all available information.

We are in the process of continuing to develop more formal procedures and controls to provide reasonable assurance that the measurement date for stock option grants is appropriately determined. Effective March 26, 2007, the Compensation Committee of the Board of Directors adopted a stock option granting policy and specified Company procedures. The policy set forth policies and procedures relating to stock option granting practices, including (a) the review of stock option grant documentation prior to a grant to ensure proper support for the measurement date including the appropriate Board of Directors, Compensation Committee or Chief Executive Officer approval, (b) eliminating the use of unanimous written consents by the Board of Directors and its Compensation Committee, and (c) the use of predetermined effective dates for all grants.

Procurement and Production Costs

Subsequent to the Company’s 2006 year-end, we determined that our methodology for allocating production and procurement cost to inventory was incorrect and resulted in understating inventory balances and misstated net income. The Company’s restated consolidated balance sheet as of January 1, 2006 includes an increase to inventory balances of $0.9 million and a cumulative net effect on retained earnings of $0.6 million. The pre-tax impact on the consolidated statements of income for fiscal 2005 and 2004 is approximately a $174,000 increase and a $2,000 decrease.

Restatement Reconciliation

The reconciliation of the cumulative effect of the above adjustments to beginning retained earnings as reported is as follows (in thousands):

| | | | |

Cumulative Stock Options Adjustment | | $ | 899 | |

Cumulative Inventory Adjustment | | | (403 | ) |

| | | | |

Cumulative effect on Retained Earnings at December 28, 2003 | | $ | 496 | |

| | | | |

6

PART I

Item 1. Business

Peet’s Coffee & Tea is a specialty coffee roaster and marketer of fresh roasted whole bean coffee. We sell our coffee under strict freshness standards through multiple channels of distribution including grocery stores, home delivery, office, restaurant and food service accounts and Company-owned and operated stores in six states.

Since we believe that roasted coffee is a perishable product, we pursue distribution channels that are consistent with our strict freshness standards. For instance, our distribution to grocery stores emphasizes the use of a direct store delivery (“DSD”) system whereby our employees or agents deliver fresh goods to our grocery partners. We roast to order and ship coffee directly from our roasting facility to our home delivery customers. Our goal is to ensure that customers receive coffee within days of roasting.

We have expanded from a retailer that operates its own outlets to a premium coffee brand available through multiple channels of distribution. We signed our first office coffee distribution agreement in 1997 and have since added a number of restaurants, food service accounts and office coffee distributors in select markets. We added online ordering capability to our website in 1997 to complement our existing mail order home delivery business and have since invested in marketing programs designed to support our home delivery channel. In 1998, we initiated a strategic expansion into specialty grocery and gourmet food stores. This expansion was further developed to include distribution to mainstream grocers as we expanded our grocery accounts from 130 to 4,400 stores. We believe our expansion strategy emphasizes disciplined growth and enhancement of our brand’s image and quality reputation. We operate our business through two reportable segments: retail and specialty sales. See Note 11, “Segment Information” to the “Notes to Consolidated Financial Statements” included elsewhere in this report.

Our website is located at peets.com. Our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments or exhibits to those reports, are available free of charge through our website at peets.com as soon as reasonably practicable after we file them with, or furnish them to, the Securities and Exchange Commission (“SEC”). The Company was organized as a Washington corporation in 1971.

Company Retail Stores

At December 31, 2006 we operated 136 retail stores in six states through which we sell whole bean coffee, beverages and pastries, tea, and other related items. Our stores are designed to facilitate the sale of fresh whole bean coffee and to encourage customer trial of our coffee through coffee beverages. Each store has a dedicated staff person at the bean counter to take orders and assist customers with questions on coffee origins and on home brewing. Upon order, beans are scooped and ground to the customer’s specific requirements. At our beverage counter, we rotate and sell freshly-brewed coffees and coffee-based beverages to promote customer familiarity, sampling, and sales of whole-bean coffees. To ensure that our freshness standards are consistently met, it is our policy not to serve brewed coffee that is more than 30 minutes old and every espresso based drink is made to order using freshly pulled shots of espresso and freshly steamed milk. See “Item 2. Properties” for further discussion about our retail stores.

Specialty Sales

Grocery

In addition to sales through our retail stores, we have expanded the availability of our products through a network of grocery stores, including Safeway, Albertson’s, Ralph’s and Whole Foods Market. To support this expansion, we have developed a DSD sales and distribution system. Peet’s DSD route sales representatives

7

deliver directly to their stores anywhere between one to three times per week, properly shelve the product, resolve pricing discrepancies, rotate to ensure freshness, sell and erect free-standing displays and forge store-level selling relationships. We currently have 42 company-operated DSD route sales representatives, and approximately 100 independent distributors or multi-liners who will continue to support the expansion into new grocery accounts in the western United States and our existing grocery customers.

Home Delivery

In the home delivery channel, we have a dedicated website and customer service representatives who provide points of contact to our customers for coffee ordering and coffee knowledge. Our website features an Express Buy function for registered customers for speed and ease, special coffee and tea programs and a coffee and tea selector to assist the customer in choosing a product based upon certain characteristics. Peets.com also features a proprietary tool that allows customers to manage the timing and delivery of their recurring orders. In 2004, we implemented our Peetnik Loyalty Program to reward our most loyal home delivery customers who maintain regular, ongoing deliveries of coffee or tea. This program has proven to be successful in growing our home delivery business online by engaging our most loyal customers to establish regular deliveries of fresh roasted coffee or tea. In addition to our website, we have a team of customer service representatives who assist customers in placing customer orders, choosing a gift item, providing product information and resolving customer issues. Customer service representatives are regularly trained on Peet’s product offerings through weekly coffee and tea tastings.

Food Service and Office

In the food service and office business, we have a staff of sales and account managers who make sales calls to potential and existing accounts and manage our distributor network. Additionally, we have established relationships with office, restaurant and food service distributors to expand our account base in select markets. These distributors have their own sales and account management resources.

Our Coffee

Coffee Beans

Coffee is an agricultural crop that undergoes quality changes and price fluctuation depending on weather, economic and political conditions in coffee producing countries. We purchase only Arabica coffee beans, which are considered superior to beans traded in the commodity market. Thus, thearabicabeans purchased by us tend to trade on a negotiated basis at a substantial premium above commodity coffee prices, depending upon the supply and demand at the time of purchase. Our access to high qualityarabica beans depends on our relationships with coffee brokers, exporters and growers, with whom we have built long-term relationships to ensure a steady supply of coffee beans. We believe that, as a result of our reputation that has been built over 40 years, we have access to some of the highest quality coffee beans from the finest estates and growing regions around the world and we are occasionally presented with opportunities to purchase unique and special coffees.

Unlike roasted coffee beans, green coffee beans are not highly perishable. We generally turn our inventory of green coffee beans two to three times per year. We typically carry approximately $10 million to $14 million worth of green coffee beans in our inventory. We mitigate the risks associated with fluctuations in coffee prices by entering into fixed price commitments and in the past, hedging agreements, for a portion of our green coffee bean requirements.

Our Roasting Method

Our roasting method was first developed by Alfred Peet and further honed by our talented and skilled roasting personnel who make a long-term commitment to our artisan craft. We roast by hand in small batches, and we rely on the skills and training of each roaster to maximize the flavor and potential in our beans. Our

8

roasters undergo an extensive apprenticeship program to learn our roasting method and to gain the skills necessary to roast coffee at Peet’s.

Coffee Types and Blends

Beyond sourcing and roasting, we have developed a reputation for expert coffee blending. Our blends, such as Major Dickason’s Blend®, are well regarded by our customers for their uniqueness, consistency and special flavor characteristics. We sell approximately 32 types of coffee as regular menu items, including approximately 21 blends and 11 single origin coffees such as Colombia, Guatemala, Sumatra and Kenya. We also offer a line of high-end reserve coffees including JR Reserve Blend® and Kona, and we have also featured seasonal reserve coffees such as Jamaica Blue Mountain and Aged Sulawesi Peaberry. We are active in seeking, roasting and selling unique special lot and one-time coffees. On average, we offer four to six such coffees every year, including our Anniversary Blend and Holiday Blend.

Tea, Food and Merchandise

Peet’s offers a line of hand selected whole leaf and bagged tea. Our quality standards for tea are very high. We purchase tea directly from importers and brokers and store and pack the tea at our facility in Emeryville. We offer a limited line of specialty food items, such as jellies, jams and candies. These products are carefully selected for quality and uniqueness.

Our merchandise program consists of items such as brewing equipment for coffee and tea, paper filters and brewing accessories and branded and non-branded cups, saucers, travel mugs and serveware. We do not emphasize these items, but we carry them in retail stores and offer them through home delivery as a means to reinforce our commitment to premium home-brewed coffee and tea.

Competitive Positioning

The specialty coffee market can be characterized as highly fragmented. Our primary competitors in whole bean specialty coffee sales include Gevalia (Kraft Foods), Green Mountain Coffee, Illy Caffé, Millstone (Procter & Gamble), Seattle’s Best (Starbucks) and Starbucks. There are numerous smaller, regional brands that also compete in this category. Premium coffee brands may serve as substitutes for our whole bean coffee and we also compete indirectly against all other coffee brands on the market.

In addition to competing with other distributors of whole bean coffee, we compete with retailers of prepared beverages, including coffee house chains, particularly Starbucks, and to a lesser degree, Coffee Bean and Tea Leaf, Dunkin Donuts and Caribou Coffee, numerous convenience stores, restaurants, coffee shops and street vendors.

We believe that our customers choose among specialty coffee brands based upon quality, variety, convenience, and to a lesser extent, price. Although consumers may differentiate coffee brands based on freshness (as an element of coffee quality), to our knowledge, few significant competitors focus on product freshness and roast-dating in the same manner as Peet’s. We believe that our market share in the specialty category is based on a solidly differentiated position built on our freshness standards and artisan-roasting style. Because of the fragmented nature of the specialty coffee market, we cannot accurately estimate our market share. However, many of our existing competitors have significantly greater financial, marketing and operating resources.

Our roasted coffee is priced in tiers. Our regular menu coffees are currently priced in our retail locations within a range of $9.95 to $18.95 per pound. Our line of high-end reserve coffees introduced in 2001 is priced between $49.90 and $79.90 per pound. In the grocery channel, we sell our coffee in 12 ounce packages at prices established by the grocery store. Most grocery stores sell our product at a price between $9.99 and $11.99 for a 12 ounce bag.

9

Intellectual Property

We regard intellectual property and other proprietary rights as important to our success. We place high value on our Peet’s trade name, and we own several trademarks and service marks that have been registered with the United States Patent and Trademark Office, including Peet’s®, Peet’s Coffee & Tea®, peets.com®, Blend 101®, Espresso Forte®, Fresh Fridays®, Gaia Organic Blend®, Garuda Blend®, JR Reserve Blend®, Maduro Blend®, Major Dickason’s Blend®, Pride of the Port®, Pumphrey’s Blend®, Sierra Dorada Blend®, Summer House®, Snow Leopard®, Top Blend® and Vine Street Blend®. We also have registered trademarks on our stylized logo. In addition, we have applications pending with the United States Patent and Trademark Office for a number of additional marks including Freddo™, Blended Freddo™, eCup™ and A Cup Is Worth A Thousand Words™.

We own registered trademarks for our name and logo in Argentina, Australia, Canada, Chile, China, the European Union, Hong Kong, Japan, Paraguay, Singapore, South Korea, Taiwan and Thailand. We have filed additional applications for trademark protection in Brazil and the Philippines. In addition to peets.com and coffee.com, we own several other domain names relating to coffee, Peet’s and our roasting process.

In addition to registered and pending trademarks, we consider the packaging for our coffee beans (consisting of dark brown coloring with African-style motif and lettering with a white band running around the lower quarter of the bag) and the design of the interior of our stores (consisting of dark wood fixtures, classic lighting, granite countertops and understated color) to be strong identifiers of our brand. Although we consider our packaging and store design to be essential to our brand identity, we have not applied to register these trademarks and trade dress, and thus cannot rely on the legal protections afforded by trademark registration.

Our ability to differentiate our brand from those of our competitors depends, in part, on the strength and enforcement of our trademarks. We must constantly protect against any infringement by competitors. If a competitor infringes on our trademark rights, we may have to litigate to protect our rights, in which case, we may incur significant expenses and divert significant attention from our business operations.

Information Systems

The information systems installed at Peet’s are used to manage our operations and increase the productivity of our workforce. We believe our point-of-sale system increases store productivity, provides a higher level of service to our customers and maintains timely information for performance evaluation. Our registers have touch screen components and full point-of-sale capability. In 2002, during the rollout of our DSD system in the grocery channel, we implemented a grocery order entry and invoice system with handheld capability that allows our route sales representatives to provide service and information on the spot. In 2003, we implemented business intelligence software to better support and analyze our business in all channels. In 2004, we deployed an integrated labor and scheduling system in our retail stores to improve productivity and customer service.

Our website, peets.com, is hosted at our corporate headquarters in Emeryville, California. All website applications are built on Microsoft ASP with in-house development. We offer full-functioning e-commerce and our website is integrated with our call center for access to orders placed at both locations. Online delivery confirmation is provided by United Parcel Service and the United States Postal Service. Our website contains several customer-centered functions. Manage Deliveries is an application which enables consumers to schedule recurring deliveries including choosing specific coffees and teas to be delivered at the frequency of their choice. Other important customer functions include a coffee and tea selector, Express Buy and multiple “ship-to” capability on a single bill. Additionally, customers with Peet’s cards can check their balance as well as reload their card online. We designed our website to provide fast, easy and effective operation when navigating and shopping on our website. We have dedicated information technology employees and marketing staffers for website maintenance, improvement, development and performance.

10

Employees

As of March 14, 2007, we employed a workforce of 3,169 people, approximately 621 of whom work approximately 40 hours per week and are considered full-time employees. We consider our relationship with our employees to be good. Since 1979, we have provided full benefits to all employees who work at least 21 hours per week and have worked at least 500 total hours for the Company. We believe we offer competitive benefits packages to attract and retain valuable employees.

Government Regulation

Our coffee roasting operations and our retail stores are subject to various governmental laws, regulations, and licenses relating to customs, health and safety, building and land use, and environmental protection. Our roasting facility is subject to state and local air-quality and emissions regulations. If we encounter difficulties in obtaining any necessary licenses or complying with these laws and regulations, then:

| | • | | The opening of new retail locations could be delayed; |

| | • | | The operation of existing retail locations or our coffee roasting operations could be interrupted; or |

| | • | | Our product offerings could be limited. |

We believe that we are in compliance in all material respects with all such laws and regulations and that we have obtained all material licenses that are required for the operation of our business. We are not aware of any environmental regulations that have or that we believe will have a material adverse effect on our operations.

Executive Officers of the Registrant

Set forth below is information with respect to the names, ages, positions and offices of our executive officers as of March 14, 2007.

| | | | |

Name | | Age | | Position |

Patrick J. O’Dea | | 45 | | Chief Executive Officer, President and Director |

Thomas P. Cawley | | 46 | | Chief Financial Officer, Vice President and Secretary |

James E. Grimes | | 51 | | Vice President, Operations and Information Systems |

Patrick J. O’Deahas served as Chief Executive Officer, President and as a director since May 2002. From April 1997 to March 2001, he was CEO of Archway/Mother’s Cookies and Mother’s Cake & Cookie Company. From 1995 to 1997, Mr. O’Dea was the Vice President and General Manager of the Specialty Cheese Division of Stella Foods. From 1984 to 1995, he was with Procter & Gamble, where he marketed several of the company���s snack and beverage brands.

Thomas P. Cawley has served as Chief Financial Officer since July 2003. From August 2000 to June 2003, he was at Gap, Inc. serving as Chief Financial Officer, Gap Brand. From 1986 to August 2000, Mr. Cawley was at PepsiCo/Yum Brands (formerly Tricon Global Restaurants), holding various positions such as Director of Finance, Vice President—Controller, and Chief Financial Officer; Pizza Hut. Previous to 1986, Mr. Cawley was with The Quaker Oats Company and General Foods.

James E. Grimes has served as Vice President of Operations and Information Systems since July 2002. In August 2001, Mr. Grimes founded Supply Chain Consulting, where he provided supply chain management expertise. From 1998 to 2001, he was Senior Vice President of Operations at Archway/Mother’s Cookies. Previously, Mr. Grimes held various positions at Mother’s Cake and Cookie Company, Frito Lay and Procter & Gamble.

11

We may not be successful in the implementation of our business strategy or our business strategy may not be successful, either of which will impede our growth and operating results.

Our business strategy emphasizes expansion through multiple channels of distribution. Currently, our retail stores, which generated over 67% of our 2006 net revenue, continue to be an important element of our business. We do not know whether we will be able to successfully implement our business strategy or whether our business strategy will be successful. Our ability to implement this business strategy is dependent on our ability to:

| | • | | Market our products on a national scale and over the internet; |

| | • | | Enter into distribution and other strategic arrangements with third party retailers and other potential distributors of our coffee; |

| | • | | Increase our brand recognition on a national scale; |

| | • | | Identify and lease strategic locations suitable for new stores; and |

| | • | | Manage growth in administrative overhead and distribution costs likely to result from the planned expansion of our retail and non-retail distribution channels. |

Our revenue may be adversely affected if we fail to implement our business strategy or if we divert resources to a business strategy that ultimately proves unsuccessful.

Because our business is highly dependent on a single product, specialty coffee, if the demand for specialty coffee decreases, our business could suffer.

Sales of specialty coffee constituted nearly 84% of our 2006 net revenue. Demand for specialty coffee is affected by many factors, including:

| | • | | Consumer tastes and preferences; |

| | • | | National, regional and local economic conditions; |

| | • | | Demographic trends; and |

| | • | | Perceived or actual health benefits or risks. |

Because we are highly dependent on consumer demand for specialty coffee, a shift in consumer preferences away from specialty coffee would harm our business more than if we had more diversified product offerings. If customer demand for specialty coffee decreases, our sales would decrease accordingly.

If we fail to continue to develop and maintain our brand, our business could suffer.

We believe that maintaining and developing our brand is critical to our success and that the importance of brand recognition may increase as a result of competitors offering products similar to ours. Because the majority of our retail stores are located on the West Coast, primarily in California, our brand recognition remains largely regional. Our brand building initiative involves increasing the availability of our products and opening new stores to increase awareness of our brand and create and maintain brand loyalty. If our brand building initiative is unsuccessful, we may never recover the expenses incurred in connection with these efforts and we may be unable to increase our future revenue or implement our business strategy.

Our success in promoting and enhancing the Peet’s brand will also depend on our ability to provide customers with high quality products and customer service. Although we take measures to ensure that we sell only fresh roasted whole bean coffee and that our retail employees properly prepare our coffee beverages, we have no control over our whole bean coffee products once purchased by customers. Accordingly, customers may

12

prepare coffee from our whole bean coffee inconsistent with our standards, store our whole bean coffee for long periods of time or resell our whole bean coffee without our consent, which in each case, potentially affects the quality of the coffee prepared from our products. If customers do not perceive our products and service to be of high quality, then the value of our brand may be diminished and, consequently, our ability to implement our business strategy may be adversely affected.

Increases in the cost and decreases in availability of high quality Arabica coffee beans could impact our profitability and growth of our business.

Green coffee is our largest single cost of sales. We do not purchase coffee on the commodity markets, but price movements in the trading of coffee do impact the price we pay. Over the past two years, the commodity cost for coffee has risen above the range it was trading in for the prior three to four years. Coffee is a trade commodity and, in general, its price can fluctuate depending on:

| | • | | Weather patterns in coffee-producing countries; |

| | • | | Economic and political conditions affecting coffee-producing countries; |

| | • | | Foreign currency fluctuations; |

| | • | | The ability of coffee-producing countries to agree to export quotas; and |

| | • | | General economic conditions that make commodities more or less attractive investment options. |

If the cost of our green coffee beans increases due to any of these or other factors impacting us negatively, we many not be able to pass along those costs to our customers because of the competitive nature of the specialty coffee industry. If we are unable to pass along increased coffee costs, our margin will decrease and our profitability will suffer accordingly. If we are not able to purchase sufficient quantities of high quality Arabica beans due to any of the above factors, we many not be able to fulfill the demand for our coffee, our revenue may decrease and our ability to expand our business may also suffer.

We cannot be certain of the future effectiveness of our internal control over financial reporting or the impact of the same on our operations or the market price for our common stock.

Pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, we are required to include in our Annual Report on Form 10-K our assessment of the effectiveness of our internal control over financial reporting. Our management identified certain material weaknesses relating to our historical stock option granting practices and our methodology for allocating procurement and production costs during its assessment of the effectiveness of internal control over financial reporting as of December 31, 2006. As a result, management concluded that we did not maintain effective internal control over financial reporting as of December 31, 2006 based on the control criteria established in a report entitled “Internal Control—Integrated Framework,” issued by the Committee of Sponsoring Organizations of the Treadway Commission. Although we believe we have corrected the methodology to allocate procurement and production costs and we are in process of developing more formal procedures and controls relating to our stock option granting practices, we cannot assure you that we have or will be able to successfully remediate these material weaknesses. We cannot be certain that future material changes to our internal controls over financial reporting will be effective. If we cannot adequately maintain the effectiveness of our internal control over financial reporting, we might be subject to sanctions or investigation by regulatory authorities, such as the SEC. Any such action could adversely affect our financial results and the market price of our common stock. In addition, the inability to maintain effective internal control over financial reporting could adversely impact our operations.

13

Civil litigation relating to our stock option granting practices could have a material adverse effect on the Company.

We and certain of our directors and current and former officers are defendants in three shareholder derivative actions relating to our stock option granting practices. See Note 10, “Commitments and Contingencies, Legal Proceedings” in the “Notes to Consolidated Financial Statements” for a more detailed description of these proceedings. These actions are in their preliminary stages, and we intend to take all appropriate steps in the defense of these cases. These lawsuits could divert management time and attention from day-to-day operations, result in significant legal expenses, and result in an outcome that could have a material adverse effect on our business, financial condition, results of operations and cash flows.

As a result of the delayed filing of our Form 10-Q for the quarter ended October 1, 2006, we are ineligible to use Form S-3 to register securities with the SEC, which may adversely affect our ability to raise future capital or complete acquisitions.

As a result of our delayed filing of our Form 10-Q for the quarter ended October 1, 2006, we are ineligible to register our securities on Form S-3 for sale by us or resale by other security holders until we have timely filed all periodic reports under the Securities Exchange Act of 1934 for at least 12 full calendar months from the date our Form 10-Q for the quarter ended October 1, 2006 was due. In the meantime, we would need to use Form S-1 to register securities with the SEC, which could increase the transaction costs and adversely affect our ability to raise capital or complete acquisitions of other companies during this period.

Because our business is based primarily in California, a worsening of economic conditions, a decrease in consumer spending or a change in the competitive conditions in this market may substantially decrease our revenue and may adversely impact our ability to implement our business strategy.

Our California retail stores generated 60% of our 2006 net revenue and a substantial portion of the revenue from our other distribution channels is generated in California. We expect that our California operations will continue to generate a substantial portion of our revenue. In addition, our California retail stores provide us with means for increasing brand awareness, building customer loyalty and creating a premium specialty coffee brand. As a result, an economic downturn or other decrease in consumer spending in California may not only lead to a substantial decrease in revenue, but may also adversely impact our ability to market our brand, build customer loyalty, or otherwise implement our business strategy.

Labor conditions in the grocery business could negatively impact our grocery business.

There have been grocery strikes in the past that have negatively impacted our grocery business and it is possible that future grocery strikes in places where we have large distribution may adversely impact our grocery business.

Government mandatory healthcare requirements could adversely affect our profits.

The Company offers healthcare benefits to all employees who work at least 21 hours a week and meet service eligibility requirements. In the past, some states, including California, have unsuccessfully proposed legislation mandating that employers pay healthcare premiums into a state run fund for all employees immediately upon hiring. If legislation similar to this were to be enacted in the states we do business, it could have an adverse affect on the Company’s profits.

If we are unable to continue leasing our retail locations or obtain leases for new stores, our existing operations and our ability to expand may be adversely affected.

All of our 136 retail locations at year-end are on leased premises. If we are unable to renew these leases, our revenue and profits could suffer. In addition, we intend to lease other premises in connection with the planned

14

expansion of our retail operations. Because we compete with other retailers and restaurants for store sites and some landlords may grant exclusive locations to our competitors, we may not be able to obtain new leases or renew existing leases on acceptable terms. This could adversely impact our revenue growth and brand building initiatives.

Because we rely heavily on common carriers to ship our coffee on a daily basis, any disruption in their services or increase in shipping costs could adversely affect our business.

We rely on a number of common carriers to deliver coffee to our customers and retail stores. We consider roasted coffee a perishable product and we rely on these common carriers to deliver fresh roasted coffee on a daily basis. We have no control over these common carriers and the services provided by them may be interrupted as a result of labor shortages, contract disputes or other factors. If we experience an interruption in these services, we may be unable to ship our coffee in a timely manner. A delay in shipping could:

| | • | | Have an adverse impact on the quality of the coffee shipped, and thereby adversely affect our brand and reputation; |

| | • | | Result in the disposal of an amount of coffee that could not be shipped in a timely manner; and |

| | • | | Require us to contract with alternative, and possibly more expensive, common carriers. |

Any significant increase in shipping costs could lower our profit margins or force us to raise prices, which could cause our revenue and profits to suffer.

We depend on the expertise of key personnel. If these individuals leave or change their role within our Company without effective replacements, our operations may suffer.

The success of our business is dependent to a large degree on our management and our coffee roasters and purchasers. If members of our management leave without effective replacements, our ability to implement our business strategy could be impaired. If we lost the services of our coffee roasters and purchasers, our ability to source and purchase a sufficient supply of high quality coffee beans and roast coffee beans consistent with our quality standards could suffer. In either case, our business and operations could be adversely affected.

We may not be able to hire or retain additional management and other personnel and our recruiting and training costs may increase as a result of turnover, both of which may increase our costs and reduce our profits and may adversely impact our ability to implement our business strategy.

The success of our business depends upon our ability to attract and retain highly motivated, well-qualified management and other personnel, including technical personnel and retail employees. We face significant competition in the recruitment of qualified employees. Our ability to execute our business strategy may suffer if:

| | • | | We are unable to recruit or retain a sufficient number of qualified employees; |

| | • | | The costs of employee compensation or benefits increase substantially; or |

| | • | | The costs of outsourcing certain tasks to third party providers increase substantially. |

A significant interruption in the operation of our roasting and distribution facilities could potentially disrupt our operations.

We are currently in the process of transitioning our roasting and distribution operations to a new facility, after which we intend to convert our existing roasting and distribution facility to office space. A significant interruption in the operation of either facility during the transition process or the new facility thereafter, whether as a result of a natural disaster or other causes, could significantly impair our ability to operate our business. Since we only roast our coffee to order, we do not carry inventory of roasted coffee in our roasting plant.

15

Therefore, a disruption in service in our roasting facility would impact our sales in our retail and specialty channels almost immediately. Moreover, our roasting and distribution facilities and most of our stores are located near several major earthquake faults. The impact of a major earthquake on our facilities, infrastructure and overall operations is difficult to predict and an earthquake could seriously disrupt our entire business.

Our earthquake insurance covers net income, continuing normal operating expenses and extra expenses incurred during the period of restoration once the large deductible has been exceeded. However, in the event of a catastrophic earthquake, our coverage is limited and we would incur additional expenses.

We have a high deductible workers’ compensation insurance program and more claims and higher costs from these claims may adversely affect our profits.

Our current workers’ compensation insurance program is a modified self-insured program with a high deductible with an overall program ceiling to limit exposure. The California workers’ compensation environment has been unpredictable with continually increasing costs in the past five years. The majority of our business is in California; therefore, we are exposed to the same increased costs. Additionally, we have had to estimate our liability for existing claims whose outcome is uncertain. While we believe our reserve methodology on these claims is appropriate today, unfavorable legislative developments in this area may also affect any open claims that were filed beginning March 2002, the date we transitioned to a high deductible program. Should a greater amount of claims occur or the settlement costs increase beyond what was anticipated, our expenses could increase and our profitability may decrease.

Our roasting methods are not proprietary, so competitors may be able to duplicate them, which could harm our competitive position.

We consider our roasting methods essential to the flavor and richness of our roasted whole bean coffee and, therefore, essential to our brand. Because we do not hold any patents for our roasting methods, it may be difficult for us to prevent competitors from copying our roasting methods. If our competitors copy our roasting methods, the value of our brand may be diminished, and we may lose customers to our competitors. In addition, competitors may be able to develop roasting methods that are more advanced than our roasting methods, which may also harm our competitive position.

Competition in the specialty coffee market is intense and could affect our profits.

The specialty coffee market can be characterized as highly fragmented. Our primary competitors in whole bean specialty coffee sales include Gevalia (Kraft Foods), Green Mountain Coffee, Illy Caffé, Millstone (Procter & Gamble), Seattle’s Best (Starbucks) and Starbucks. There are numerous smaller, regional brands that also compete in this category. Premium coffee brands may serve as substitutes for our whole bean coffee and we also compete indirectly against all other coffee brands on the market. In addition to competing with other distributors of whole bean coffee, we compete with retailers of prepared beverages, including coffee house chains, particularly Starbucks, and to a lesser degree, Coffee Bean and Tea Leaf, Dunkin Donuts and Caribou Coffee, numerous convenience stores, restaurants, coffee shops and street vendors.

Despite competing in a fragmented product category, whole bean specialty coffee brands are being established across multiple distribution channels. Several competitors have been aggressive in obtaining distribution in specialty grocery and gourmet food stores, through online, and in office, restaurant and food service locations. Other competitors may have an advantage over us based on their earlier entry into these distribution channels.

Many of these new market entrants may have substantially greater financial, marketing and operating resources than we do. In addition, many of our existing competitors have substantially greater financial, marketing and operating resources than we do.

16

Adverse public or medical opinion about caffeine may harm our business.

Our specialty coffee contains significant amounts of caffeine and other active compounds, the health effects of some of which are not fully understood. A number of research studies conclude or suggest that excessive consumption of caffeine may lead to increased heart rate, nausea and vomiting, restlessness and anxiety, depression, headaches, tremors, sleeplessness and other adverse health effects. An unfavorable report on the health effects of caffeine or other compounds present in coffee could significantly reduce the demand for coffee, which could harm our business and reduce our sales and profits.

Adverse publicity regarding customer complaints may harm our business.

We may be the subject of complaints or litigation from customers alleging beverage and food-related illnesses, injuries suffered on the premises or other quality, health or operational concerns. Adverse publicity resulting from such allegations may materially adversely affect us, regardless of whether such allegations are true or whether we are ultimately held liable.

| Item 1B. | Unresolved Staff Comments |

Not Applicable.

Peet’s headquarters are located in Emeryville, California, where the Company leases approximately 103,000 square feet of office and production space in four locations. Within these facilities, we have 31,000 square feet devoted to general corporate and retail overhead and a call center for the home delivery business. Our current lease for our roasting, distribution and main office location of 72,000 square feet extends to October 2015 with two five year extension options, subject to our right to terminate early if needed before August 2007. The leases of our other office location in Emeryville expire December 31, 2007.

In December 2006 we purchased approximately 460,000 square feet of land and a 138,000 square foot building with related site improvements in Alameda for the purpose of operating a new roasting and distribution facility. The final purchase price of the facility and the land was $18.6 million. We are currently in the process of transitioning our roasting and distribution operations to this new facility, after which we intend to convert our existing roasting and distribution facility to office space. We anticipate the new facility to be at full production capability by April 2007.

In June 2006, we purchased 131,000 square feet of land for $2.3 million adjacent to the new roasting facility.

In 2006, we opened 25 new stores. Our retail locations are all company-owned and operated in leased facilities. Our stores are typically located in urban neighborhoods, suburban shopping centers (usually consisting of grocery, specialty and service stores) and on high-traffic streets.

17

The following table lists the number of retail locations as of December 31, 2006:

| | |

Location | | Number |

Northern California | | 85 |

Southern California | | 29 |

Illinois | | 2 |

Oregon | | 7 |

Massachusetts | | 6 |

Washington | | 3 |

Colorado | | 4 |

| | |

Total | | 136 |

| | |

In November 2006, a complaint styled as a shareholder derivative action was filed, purportedly on behalf of Peet’s, against certain of our present and former directors and officers. The complaint alleges that the defendants caused or allowed improprieties in connection with certain stock option grants since at least 2001 and thereby breached their fiduciary duties to Peet’s and violated specified provisions of the California Corporations Code. The complaint also alleges that certain of our present and former directors and officers were unjustly enriched as a result. Purportedly on behalf of Peet’s, the complaint seeks, among other things, damages, restitution and corporate governance reforms. This complaint and a similar one have been filed in the Superior Court for Alameda County, California and a third was filed in February 2007 in the United States District Court for the Northern District of California.

These actions could result in substantial costs and divert management’s attention and resources. These actions are at a preliminary stage, and we are not in a position to determine whether a loss is probable or estimate a range of amount of loss.

We may from time to time become involved in certain legal proceedings in the ordinary course of business. Currently, the Company is not a party to any other legal proceedings that management believes would have a material adverse effect on the financial position or results of operations of the Company.

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of our shareholders during the quarter ended December 31, 2006.

18

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market for the Registrant’s Stock

The Company’s common stock is traded on the Nasdaq National Market under the symbol “PEET”. The following table sets forth, for the periods indicated, the high and low closing prices for our common stock as reported on the Nasdaq National Market for each quarter during the last two fiscal years.

| | | | | | |

| | | High | | Low |

Fiscal Year Ended December 31, 2006 | | | | | | |

Fourth Quarter | | $ | 27.87 | | $ | 24.29 |

Third Quarter | | | 30.90 | | | 24.43 |

Second Quarter | | | 32.76 | | | 28.21 |

First Quarter | | | 31.91 | | | 28.19 |

Fiscal Year Ended January 1, 2006 | | | | | | |

Fourth Quarter | | $ | 33.27 | | $ | 28.12 |

Third Quarter | | | 36.80 | | | 29.40 |

Second Quarter | | | 34.00 | | | 25.13 |

First Quarter | | | 26.40 | | | 23.26 |

As of March 14, 2007, there were approximately 345 registered holders of record of the Company’s common stock. On March 14, 2007, the last sale price reported on the Nasdaq National Market for the common stock was $26.48 per share.

Dividend Policy

We have not declared or paid any dividends on our capital stock since 1990. We expect to retain any future earnings to fund the development and expansion of our business. Therefore, we do not anticipate paying cash dividends on our common stock in the foreseeable future.

Use of Proceeds from Sales of Registered Securities

We completed our initial public offering of our common stock in 2001. The total net proceeds from the offering of $17.8 million have since been applied to the uses described in the prospectus for the offering.

Issuer Purchases of Equity Securities

On September 6, 2006, the Company’s Board of Directors authorized the Company to purchase up to 1.0 million shares of Peet’s common stock, with no expiration, and the Company announced its plan on September 12, 2006 on Form 8-K. As of December 31, 2006, no shares had been purchased under this program. The Company expects to make purchases from time to time on the open market at prevailing market prices or in negotiated transactions off the market.

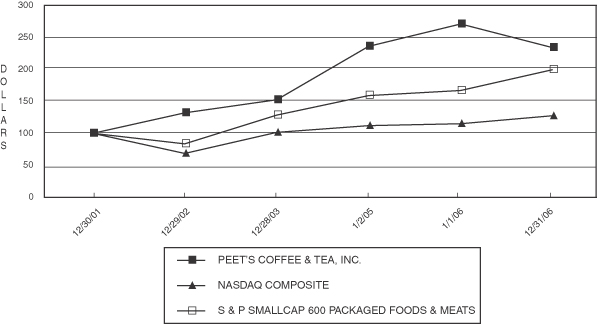

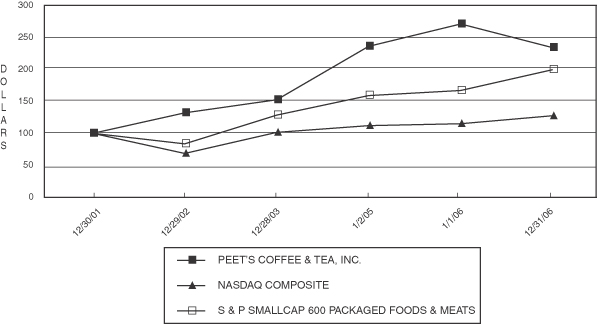

Performance Graph*

The following graph depicts the Company’s total return to shareholders from December 30, 2001 through December 31, 2006, relative to the performance of the NASDAQ Composite Index, and the Standard & Poor’s Smallcap 600 Consumer Goods Sector, Processed and Packaged Foods Industry, a peer group that includes Peet’s. All indices shown in the graph have been reset to a base of 100 as of December 30, 2001, assume an investment of $100 on that date and the reinvestment of dividends paid since that date, calculated on a monthly

19

basis. The Company has never paid cash dividends on its Common Stock. The points represent index levels based on the last trading day of the Company’s fiscal year. The chart set forth below was prepared by Research Data Group, Inc., which holds a license to provide the indices used herein. The stock price performance shown in the graph is not necessarily indicative of future price performance.

| * | This section is not “soliciting material”, is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act or the Securities Exchange Act made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

| Item 6. | Selected Financial Data |

The Company’s financial statements as of and for the year ended December 31, 2006, and its restated financial statements as of January 1, 2006 and for each of the two fiscal years in the period ended January 1, 2006 are included in Item 8, “Financial Statements and Supplementary Data” of this Form 10-K. The operating results data for the fiscal years ended December 28, 2003 and December 29, 2002 and balance sheet data as of January 2, 2005, December 28, 2003 and December 29, 2002 are derived from restated financial statements of the Company not included herein. The information set forth below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and notes thereto of the Company included elsewhere in this document. The financial statements for fiscal years 2002 through 2005 have been restated herein to reflect adjustments related to non-cash compensation expense associated with the issuance of options granted from fiscal year 1998 through fiscal 2005 and certain inventory adjustments and expense reclassifications. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Restatement of Financial Statements” and Note 2, “Restatement of Consolidated Financial Statements” in the “Notes to Consolidated Financial Statements” included in Item 8, “Financial Statements and Supplementary Data” of this Form 10-K.

20

The table below shows selected consolidated financial data for our last five fiscal years. Our fiscal year is based on a 52 or 53 week year and ends on the Sunday closest to the last day in December.

The following selected consolidated financial data should be read in conjunction with our consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this report.

Selected Consolidated Financial Data

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | Year | |

| | | 2006 (52 weeks) | | | 2005 (52 weeks) | | | 2004 (53 weeks) | | | 2003 (52 weeks) | | | 2002 (52 weeks) | |

| | | | | | As Restated | | | As Restated | | | As Restated | | | As Restated | |

Statement of Income Data: | | | | | | | | | | | | | | | | | | | | |

Net revenue | | $ | 210,493 | | | $ | 175,198 | | | $ | 145,683 | | | $ | 119,816 | | | $ | 104,073 | |

Cost of sales and related occupancy expenses | | | 98,928 | | | | 80,837 | | | | 67,806 | | | | 55,694 | | | | 48,996 | |

Operating expenses | | | 72,272 | | | | 57,879 | | | | 47,645 | | | | 37,746 | | | | 32,786 | |

General and administrative expenses | | | 20,634 | | | | 13,341 | | | | 11,439 | | | | 14,087 | | | | 12,042 | |

Depreciation and amortization expenses | | | 8,609 | | | | 7,293 | | | | 5,787 | | | | 4,883 | | | | 4,561 | |

| | | | | | | | | | | | | | | | | | | | |

Income from operations | | | 10,050 | | | | 15,848 | | | | 13,006 | | | | 7,406 | | | | 5,688 | |

Interest income, net | | | 2,456 | | | | 1,769 | | | | 922 | | | | 1,163 | | | | 540 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 12,506 | | | | 17,617 | | | | 13,928 | | | | 8,569 | | | | 6,228 | |

Income tax provision | | | (4,690 | ) | | | (6,842 | ) | | | (5,218 | ) | | | (3,444 | ) | | | (2,260 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 7,816 | | | $ | 10,775 | | | $ | 8,710 | | | $ | 5,125 | | | $ | 3,968 | |

| | | | | | | | | | | | | | | | | | | | |

Net income per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.57 | | | $ | 0.78 | | | $ | 0.65 | | | $ | 0.41 | | | $ | 0.36 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | $ | 0.55 | | | $ | 0.74 | | | $ | 0.62 | | | $ | 0.39 | | | $ | 0.34 | |

| | | | | | | | | | | | | | | | | | | | |

Shares used in calculation of net income per share: | | | | | | | | | | | | | | | | | | | | |

Basic | | | 13,733 | | | | 13,801 | | | | 13,308 | | | | 12,589 | | | | 10,919 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted | | | 14,202 | | | | 14,469 | | | | 13,949 | | | | 13,228 | | | | 11,587 | |

| | | | | | | | | | | | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 7,692 | | | $ | 20,623 | | | $ | 11,356 | | | $ | 30,263 | | | $ | 7,572 | |

Working capital | | | 37,254 | | | | 62,584 | | | | 16,726 | | | | 45,166 | | | | 23,118 | |

Total assets | | | 153,005 | | | | 148,752 | | | | 128,944 | | | | 111,319 | | | | 95,990 | |

Borrowings under line of credit | | | — | | | | — | | | | — | | | | — | | | | — | |

Current portion of long-term borrowings | | | — | | | | — | | | | — | | | | 3 | | | | 468 | |

Long-term borrowings, less current portion | | | — | | | | — | | | | — | | | | — | | | | 424 | |

Total shareholders’ equity | | | 127,439 | | | | 126,878 | | | | 109,905 | | | | 96,098 | | | | 81,349 | |

21

The table below reflects the impact of the restatement adjustments on our fiscal 2003 and 2002 consolidated statements of income and fiscal 2004, 2003 and 2002 balance sheet data.

| | | | | | | | | | | | | | | | | | |

| | | As of December 28, 2003 |

| | | As Previously Reported | | Adjustments | | | Reclassifications | | | As Restated |

| | | | Inventory | | | Stock Options | | | |

Statements of Income: | | | | | | | | | | | | | | | | | | |

Net revenue | | $ | 119,816 | | | — | | | | — | | | | — | | | $ | 119,816 |

Cost of sales and related occupancy expenses | | | 54,961 | | $ | (62 | ) | | $ | 18 | | | $ | 777 | | | | 55,694 |

Operating expenses | | | 38,751 | | | — | | | | 86 | | | | (1,091 | ) | | | 37,746 |

General and administrative expenses | | | 13,718 | | | — | | | | 48 | | | | 321 | | | | 14,087 |

Depreciation and amortization expenses | | | 4,890 | | | — | | | | — | | | | (7 | ) | | | 4,883 |

Income from operations | | | 7,496 | | | — | | | | — | | | | — | | | | 7,406 |