Item 1: Report to Shareholders| Equity Index 500 Portfolio | June 30, 2005 |

The views and opinions in this report were current as of June 30, 2005. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act of 2002, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Dear Investor

Large-cap U.S. stocks generally declined in the first half of 2005, as modest second-quarter gains were not enough to offset first-quarter losses. The market’s attempts to advance were hindered by concerns about the pace of economic growth amid surging oil prices—which reached $60 per barrel in late June—and rising short-term interest rates.

| Periods Ended 6/30/05 | 6 Months | 12 Months |

| Equity Index 500 Portfolio | -0.86% | 6.02% |

| S&P 500 Stock Index | -0.81 | 6.32 |

Your portfolio returned -0.86% in the last six months and 6.02% for the 12-month period ended June 30, 2005. As shown in the table, it closely tracked the performance of its benchmark, the S&P 500 Stock Index, in both periods. The portfolio usually lags slightly due to annual operating and management expenses.

MARKET ENVIRONMENT

Economic conditions were mostly favorable in the first half of 2005. Although the manufacturing sector decelerated somewhat, the economy continued to expand at a steady pace. New job growth continued at a reasonable rate, unemployment hovered slightly above 5%, and inflation remained contained, despite surging oil prices.

Relatively low interest rates continued to provide a helpful stimulus to the economy. Although money market and short-term bond yields increased as the Federal Reserve continued to raise the fed funds target rate, long-term interest rates unexpectedly declined. The result was a flattening of the Treasury yield curve, which currently indicates that long-term Treasury yields are not much higher than short-term yields.

Large-cap U.S. stocks generally struggled through April amid fears of slower economic growth accompanied by higher inflation. However, Federal Reserve officials assuaged investor worries by asserting that the economy was on a “reasonably firm footing” and that “underlying inflation remains contained.” Brisk merger activity and generally favorable corporate earnings news helped lift stocks in the second quarter, though a late-June spike in oil prices and prospects for the central bank to continue raising the overnight federal funds target rate—which has already risen from 1.00% to 3.25% over the last 12 months—capped the market’s advance.

SECTOR PERFORMANCE

In the U.S. stock market, as measured by the S&P 500, energy stocks and utilities produced vigorous gains and far surpassed other sectors in the last six months. Health care was also modestly higher. The materials and consumer discretionary sectors fared worst, but stocks in the information technology and industrials and business services sectors also struggled.

| Percent of Equities | 6/30/04 | 12/31/04 | 6/30/05 |

| Financials | 20.1% | 20.6% | 19.6% |

| Information | | | |

| Technology | 17.1 | 15.9 | 14.3 |

| Health Care | 13.2 | 12.8 | 13.4 |

| Consumer | | | |

| Discretionary | 11.2 | 12.3 | 11.1 |

| Industrials and | | | |

| Business Services | 11.1 | 11.6 | 10.9 |

| Consumer Staples | 11.1 | 10.2 | 9.8 |

| Energy | 6.5 | 7.0 | 8.7 |

| Trusts and Mutual | | | |

| Funds | 0.5 | 0.2 | 3.4 |

| Utilities | 2.7 | 2.9 | 3.1 |

| Telecommunication | | | |

| Services | 3.4 | 3.4 | 3.0 |

| Materials | 3.1 | 3.1 | 2.7 |

| Total | 100.0% | 100.0% | 100.0% |

| Historical weightings reflect current industry/sector classifications. The 6/30/05 data may not match the sector percentages in the portfolio of investments, which are calculated as a percentage of net assets. |

PORTFOLIO REVIEW

Energy stocks (8.7% of equities as of June 30) produced outstanding results as oil prices continued their ascent in the last six months. Nearly every energy holding appreciated in value, and many were among our largest contributors to performance. The largest was ExxonMobil, which gained 13%, aided by rising oil prices and better-than-expected earnings in the fourth quarter of 2004. (Please refer to the portfolio of investments for a complete listing of holdings and the amount each represents in the portfolio.)

Utility stocks (3.1% of equities) also extended last year’s brisk performance, led by electric utilities. A top contributor in this segment was Exelon, which advanced 18%. Independent power producers also performed well, especially TXU, whose shares surged 30% as its energy division benefited from rising natural gas prices. Gas utility companies trailed.

In the health care sector (13.4% of equities), gains were driven by providers and service companies. UnitedHealth Group, a high-quality, diversified, national managed care provider, was the best holding in the sector. Shares of WellPoint, HCA, and Aetna also performed very well. Pharmaceutical stocks were mixed, as weakness in Merck and Schering-Plough offset gains in Pfizer and Johnson & Johnson. Biotechnology and health care equipment and supply companies generally declined, though Gilead Sciences and Medtronic contributed to results.

| Portfolio Characteristics |

| | Equity Index |

| As of 6/30/05 | 500 Portfolio |

| Market Cap | |

| (Investment-Weighted Median) | $50.46 billion |

| Earnings Growth | |

| Rate Estimated | |

| Next 5 Years* | 11.2% |

| P/E Ratio (Based | |

| on Next 12 Months’ | |

| Estimated Earnings)* | 15.4X |

| * | Source for data: IBES. Forecasts are in no way indicative of future investment returns. |

On the downside, information technology shares (14.3% of equities) detracted the most in the last six months. Nearly every underlying industry declined, but semiconductor-related stocks produced gains, thanks primarily to strength in Intel and Texas Instruments. Software stocks were dragged lower by weakness in industry giant Microsoft, but makers of computers and peripherals fared worst, led by IBM, which reported lower-than-expected first-quarter earnings and tumbled more than 24% in the first half. Hewlett-Packard, however, bucked the negative trend as the company replaced CEO Carly Fiorina and began focusing on increasing its profitability.

Consumer discretionary stocks (11.1% of equities) generally fell, though multiline retailers J.C. Penney, May Department Stores, and Nordstrom performed very well. Media stocks continued to struggle across the board, especially Time Warner and Viacom, while automobile stocks Ford Motor and GM suffered from weakening sales and credit rating downgrades. Specialty retailers were mixed, as gains in Best Buy and Office Depot were offset by weak performance of Home Depot. Toys “R” Us performed well, however, after the company received a buyout offer from two private equity firms and a real estate developer.

Most major underlying industries in the financials sector (19.6% of equities) declined in the last six months. Real estate-related companies outperformed, however, especially Simon Property Group and Equity Office Properties, which continued to benefit from a booming real estate market. Insurance stocks also held up well, with Prudential and Allstate producing good returns, though shares of American International Group suffered amid regulatory scrutiny of its accounting practices. Commercial banks fared worst, led by Bank of America and Wachovia. Brokerage stocks and asset managers also struggled, though Lehman Brothers and Franklin Resources traded higher.

The industrials and business services sector (10.9% of equities) also detracted substantially from the S&P 500’s performance. Industrial conglomerates GE, 3M, and Tyco International were responsible for a large portion of the sector’s weakness. Machinery stocks also struggled amid fears that slower economic growth would hurt the earnings of these cyclical companies. On the plus side, aerospace and defense firms gained altitude, led by Boeing and Lockheed Martin.

Standard & Poor’s authorized only three changes to the composition of the S&P 500 in the last six months, two of which stemmed from mergers. Adolph Coors, which was acquired by Canadian brewer Molson, was replaced by Molson Coors Brewing; Sears, Roebuck & Co., which merged with K-Mart, was replaced by Sears Holdings; and Power-One was supplanted by National Oilwell Varco.

OUTLOOK

The economy is likely to continue expanding this year, despite elevated oil prices, and short-term interest rates are likely to keep rising. Fundamentals in corporate America are generally sound, but unless profit growth remains vigorous, stocks could have difficulty making progress until the Fed signals that rates are at or near a neutral level that neither stimulates nor stifles economic growth.

Although macroeconomic factors are a major influence on the stock market, we are not preoccupied with discerning how individual stocks, sectors, or the market as a whole will react to the latest economic data, interest rate trends, or corporate developments. Our goal is to closely track the broad-based S&P 500 Stock Index with the assets you have entrusted to us. Thank you for your support in this endeavor.

Respectfully submitted,

E. Frederick Bair

Chairman of the portfolio’s Investment Advisory Committee

July 18, 2005

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the portfolio’s investment program.

As with all stock mutual funds, the portfolio’s share price can fall because of weakness in the stock market, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment.

Fed funds target rate: An overnight lending rate set by the Federal Reserve and used by banks to meet reserve requirements. Banks also use the fed funds rate as a benchmark for their prime lending rates.S&P 500 Stock Index: Tracks the stocks of 500 mostly large U.S. companies.

Portfolio Highlights

| The Evolving S&P 500 Stock Index |

|

| Changes in the index in 2005 | |

| ADDITIONS | DELETIONS |

| Sears Holdings | Sears, Roebuck & Co. |

| National Oilwell Varco | Power-One |

| Molson Coors Brewing | Adolph Coors |

| Twenty-Five Largest Holdings |

| |

| | Percent of |

| | Net Assets |

| Equity Index 500 Portfolio | 6/30/05 |

| GE | 3.3% |

| ExxonMobil | 3.2 |

| Microsoft | 2.2 |

| Citigroup | 2.1 |

| Pfizer | 1.8 |

| Johnson & Johnson | 1.8 |

| Bank of America | 1.6 |

| Wal-Mart | 1.4 |

| Intel | 1.4 |

| American International Group | 1.3 |

| Altria Group | 1.2 |

| Procter & Gamble | 1.2 |

| J.P. Morgan Chase | 1.1 |

| Cisco Systems | 1.1 |

| Chevron | 1.0 |

| IBM | 1.0 |

| Wells Fargo | 0.9 |

| Verizon Communications | 0.8 |

| Coca-Cola | 0.8 |

| Dell | 0.8 |

| PepsiCo | 0.8 |

| Home Depot | 0.8 |

| ConocoPhillips | 0.7 |

| UnitedHealth Group | 0.7 |

| Time Warner | 0.7 |

| Total | 33.7% |

| Note: Table excludes investments in the T. Rowe Price Reserve Investment Fund. |

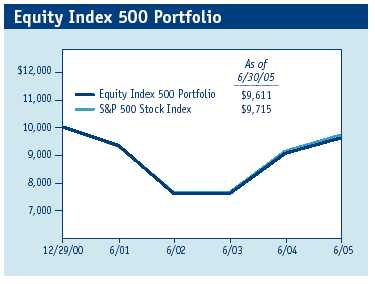

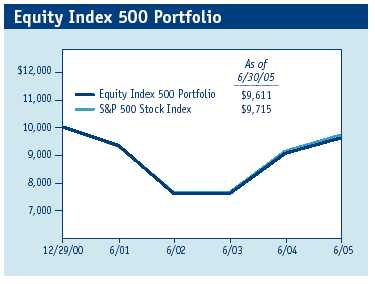

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| Average Annual Compound Total Return |

| | | Since |

| | | Inception |

| Periods Ended 6/30/05 | 1 Year | 12/29/00 |

| Equity Index 500 Portfolio | 6.02% | -0.88% |

| S&P 500 Stock Index | 6.32 | -0.64 |

| |

Current performance may be higher or lower than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will vary, and you may have a gain or loss when you sell your shares. For the most recent month-end performance information, please visit our Web site (troweprice.com) or contact a T. Rowe Price representative at 1-800-469-5304. Total returns do not include charges imposed by your insurance company’s separate account. If these were included, performance would have been lower.

This table shows how the portfolio would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. When assessing performance, investors should consider both short- and long-term returns. |

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs such as redemption fees or sales loads and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

| T. Rowe Price Equity Index 500 Portfolio |

| | | | Expenses |

| | Beginning | Ending | Paid During |

| | Account | Account | Period* |

| | Value | Value | 1/1/05 to |

| | 1/1/05 | 6/30/05 | 6/30/05 |

| Actual | $1,000.00 | $991.40 | $1.98 |

| Hypothetical | | | |

| (assumes 5% return | | | |

| before expenses) | 1,000.00 | 1,022.81 | 2.01 |

| * | Expenses are equal to the fund’s annualized expense ratio for the six-month period (0.40%), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181) divided by the days in the year (365) to reflect the half-year period. |

| Financial Highlights |

| T. Rowe Price Equity Index 500 Portfolio |

| (Unaudited) |

| |

| For a share outstanding throughout each period |

| |

| | 6 Months | | Year | | | | | 12/29/00 |

| | | Ended | | Ended | | | | | Through |

| | | 6/30/05** | 12/31/04 | 12/31/03 | 12/31/02 | 12/31/01 |

| NET ASSET VALUE | | | | | | | | | | |

| Beginning of period | $ | 9.20 | $ | 8.47 | $ | 6.70 | $ | 8.73 | $ | 10.00 |

|

|

| Investment activities | | | | | | | | | | |

| Net investment income (loss) | | 0.07 | | 0.14 | | 0.10 | | 0.09 | | 0.08 |

| Net realized and | | | | | | | | | | |

| unrealized gain (loss) | | (0.15) | | 0.73 | | 1.78 | | (2.03) | | (1.27) |

|

|

| Total from | | | | | | | | | | |

| investment activities | | (0.08) | | 0.87 | | 1.88 | | (1.94) | | (1.19) |

|

|

| Distributions | | | | | | | | | | |

| Net investment income | | (0.06) | | (0.14) | | (0.11) | | (0.09) | | (0.08) |

|

|

| NET ASSET VALUE | | | | | | | | | | |

| End of period | $ | 9.06 | $ | 9.20 | $ | 8.47 | $ | 6.70 | $ | 8.73 |

|

|

| | |

| Ratios/Supplemental Data | | | | | | | | | | |

| Total return^ | | (0.86)% | | 10.36% | | 28.27% | | (22.29)% | | (11.82)% |

| Ratio of total expenses to | | | | | | | | | | |

| average net assets | | 0.40%† | | 0.40% | | 0.40% | | 0.40% | | 0.40% |

| Ratio of net investment | | | | | | | | | | |

| income (loss) to average | | | | | | | | | | |

| net assets | | 1.46%† | | 1.65% | | 1.37% | | 1.21% | | 0.98% |

| Portfolio turnover rate | | 8.1%† | | 25.5% | | 40.8% | | 43.7% | | 32.6% |

| Net assets, end of period | | | | | | | | | | |

| (in thousands) | $ | 5,937 | $ | 5,449 | $ | 3,887 | $ | 4,475 | $ | 5,011 |

| ^ | Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions. |

| † | Annualized |

| ** | Per share amounts calculated using average shares outstanding method. |

The accompanying notes are an integral part of these financial statements.

Portfolio of Investments (1)

(Unaudited)

| Shares/$ Par | Value |

| (Cost and value in $ 000s) | | |

| |

| COMMON STOCKS 99.0% | | |

| |

| CONSUMER DISCRETIONARY 10.9% | |

| Auto Components 0.2% | | |

| Cooper Tire | 40 | 1 |

| Dana | 70 | 1 |

| Delphi | 270 | 1 |

| Goodyear Tire & Rubber * | 70 | 1 |

| Johnson Controls | 80 | 5 |

| Visteon | 50 | 0 |

| | | 9 |

| Automobiles 0.4% | | |

| Ford Motor | 910 | 9 |

| GM | 270 | 9 |

| Harley-Davidson | 140 | 7 |

| | | 25 |

| Distributors 0.0% | | |

| Genuine Parts | 70 | 3 |

| | | 3 |

| Diversified Consumer Services 0.2% | | |

| Apollo Group, Class A * | 100 | 8 |

| H&R Block | 90 | 5 |

| | | 13 |

| Hotels, Restaurants & Leisure 1.5% | | |

| Carnival | 300 | 16 |

| Darden Restaurants | 75 | 3 |

| Harrah’s Entertainment | 160 | 12 |

| Hilton | 170 | 4 |

| International Game Technology | 140 | 4 |

| Marriott, Class A | 120 | 8 |

| McDonald’s | 640 | 18 |

| Starbucks * | 180 | 9 |

| Starwood Hotels & Resorts | | |

| Worldwide, Equity Units | 90 | 5 |

| Wendy’s | 50 | 3 |

| Yum! Brands | 140 | 7 |

| | | 89 |

| Household Durables 0.6% | | |

| Black & Decker | 50 | 5 |

| Centex | 50 | 4 |

| Fortune Brands | 80 | 7 |

| KB Home | 40 | 3 |

| Leggett & Platt | 80 | 2 |

| Maytag | 40 | 1 |

| Newell Rubbermaid | 120 | 3 |

| Pulte | 60 | 5 |

| Snap-On | 40 | 1 |

| Stanley Works | 50 | 2 |

| Whirlpool | 30 | 2 |

| | | 35 |

| Internet & Catalog Retail 0.3% | | |

| eBay * | 620 | 20 |

| | | 20 |

| Leisure Equipment & Products 0.2% | | |

| Brunswick | 40 | 2 |

| Eastman Kodak | 130 | 4 |

| Hasbro | 90 | 2 |

| Mattel | 190 | 3 |

| | | 11 |

| Media 3.5% | | |

| Clear Channel Communications | 300 | 9 |

| Comcast, Class A * | 1,143 | 35 |

| Disney | 1,080 | 27 |

| Dow Jones | 40 | 1 |

| Gannett | 120 | 9 |

| Interpublic Group * | 210 | 3 |

| Knight-Ridder | 40 | 2 |

| McGraw-Hill | 180 | 8 |

| Meredith | 30 | 2 |

| New York Times, Class A | 80 | 3 |

| News Corp., Class A | 1,500 | 24 |

| Omnicom | 90 | 7 |

| Time Warner * | 2,525 | 42 |

| Tribune | 140 | 5 |

| Univision Communications | | |

| Class A * | 150 | 4 |

| Viacom, Class B | 850 | 27 |

| | | 208 |

| Multiline Retail 1.2% | | |

| Big Lots * | 40 | 1 |

| Dillards, Class A | 30 | 1 |

| Dollar General | 150 | 3 |

| Family Dollar Stores | 70 | 2 |

| Federated Department Stores | 90 | 7 |

| J.C. Penney | 140 | 7 |

| Kohl’s * | 170 | 9 |

| May Department Stores | 150 | 6 |

| Nordstrom | 60 | 4 |

| Sears Holding * | 50 | 7 |

| Target | 480 | 26 |

| | | 73 |

| Specialty Retail 2.3% | | |

| Autonation * | 100 | 2 |

| AutoZone * | 50 | 5 |

| Bed Bath & Beyond * | 130 | 5 |

| Best Buy | 140 | 9 |

| Circuit City | 100 | 2 |

| GAP | 430 | 8 |

| Home Depot | 1,160 | 45 |

| Lowes | 460 | 27 |

| Office Depot * | 160 | 4 |

| OfficeMax | 30 | 1 |

| RadioShack | 80 | 2 |

| Sherwin-Williams | 80 | 4 |

| Staples | 375 | 8 |

| The Limited | 220 | 5 |

| Tiffany | 60 | 2 |

| TJX | 230 | 5 |

| Toys “R” Us * | 100 | 3 |

| | | 137 |

| Textiles, Apparel, & Luxury Goods 0.5% | |

| Coach * | 200 | 7 |

| Jones Apparel Group | 50 | 2 |

| Liz Claiborne | 60 | 2 |

| Nike, Class B | 130 | 11 |

| Reebok | 40 | 2 |

| V. F. | 60 | 3 |

| | | 27 |

| Total Consumer Discretionary | | 650 |

| |

| CONSUMER STAPLES 9.7% | | |

| Beverages 2.1% | | |

| Anheuser-Busch | 420 | 19 |

| Brown-Forman, Class B | 60 | 4 |

| Coca-Cola | 1,170 | 49 |

| Coca-Cola Enterprises | 210 | 4 |

| Molson Coors Brewing, Class B | 30 | 2 |

| Pepsi Bottling Group | 120 | 3 |

| PepsiCo | 852 | 46 |

| | | 127 |

| Food & Staples Retailing 2.7% | | |

| Albertsons | 160 | 3 |

| Costco Wholesale | 300 | 13 |

| CVS | 400 | 12 |

| Kroger * | 340 | 6 |

| Safeway | 210 | 5 |

| Supervalu | 50 | 2 |

| Sysco | 290 | 11 |

| Wal-Mart | 1,770 | 85 |

| Walgreen | 520 | 24 |

| | | 161 |

| Food Products 1.0% | | |

| Archer-Daniels-Midland | 303 | 6 |

| Campbell Soup | 180 | 6 |

| ConAgra | 250 | 6 |

| General Mills | 170 | 8 |

| Heinz | 170 | 6 |

| Hershey Foods | 100 | 6 |

| Kellogg | 180 | 8 |

| McCormick | 60 | 2 |

| Sara Lee | 360 | 7 |

| Wrigley | 100 | 7 |

| | | 62 |

| Household Products 1.8% | | |

| Clorox | 70 | 4 |

| Colgate-Palmolive | 330 | 16 |

| Kimberly-Clark | 250 | 16 |

| Procter & Gamble | 1,310 | 69 |

| | | 105 |

| Personal Products 0.7% | | |

| Alberto Culver, Class B | 45 | 2 |

| Avon | 220 | 8 |

| Gillette | 560 | 29 |

| | | 39 |

| Tobacco 1.4% | | |

| Altria Group | 1,110 | 72 |

| Reynolds American | 60 | 5 |

| UST | 90 | 4 |

| | | 81 |

| Total Consumer Staples | | 575 |

| |

| ENERGY 8.7% | | |

| Energy Equipment & Services 1.3% | | |

| Baker Hughes | 170 | 9 |

| BJ Services | 80 | 4 |

| Halliburton | 300 | 14 |

| Nabors Industries * | 80 | 5 |

| National Oilwell Varco * | 100 | 5 |

| Noble Drilling | 60 | 4 |

| Rowan | 40 | 1 |

| Schlumberger | 330 | 25 |

| Transocean * | 160 | 8 |

| | | 75 |

| Oil, Gas & Consumable Fuels 7.4% | | |

| Amerada Hess | 40 | 4 |

| Anadarko Petroleum | 130 | 11 |

| Apache | 178 | 11 |

| Ashland | 40 | 3 |

| Burlington Resources | 180 | 10 |

| Chevron | 1,114 | 62 |

| ConocoPhillips | 760 | 44 |

| Devon Energy | 300 | 15 |

| El Paso Corporation | 361 | 4 |

| EOG Resources | 140 | 8 |

| ExxonMobil | 3,350 | 193 |

| Kerr-McGee | 46 | 4 |

| Kinder Morgan | 50 | 4 |

| Marathon Oil | 160 | 9 |

| Occidental Petroleum | 270 | 21 |

| Sunoco | 40 | 5 |

| Unocal | 130 | 8 |

| Valero Energy | 140 | 11 |

| Williams Companies | 330 | 6 |

| XTO Energy | 186 | 6 |

| | | 439 |

| Total Energy | | 514 |

| |

| FINANCIALS 19.4% | | |

| Capital Markets 2.6% | | |

| Bank of New York | 380 | 11 |

| Bear Stearns | 50 | 5 |

| Charles Schwab | 630 | 7 |

| E*TRADE Financial * | 170 | 2 |

| Federated Investors, Class B | 60 | 2 |

| Franklin Resources | 110 | 8 |

| Goldman Sachs | 250 | 26 |

| Janus Capital Group | 100 | 1 |

| Lehman Brothers | 140 | 14 |

| Mellon Financial | 210 | 6 |

| Merrill Lynch | 550 | 30 |

| Morgan Stanley | 620 | 33 |

| Northern Trust | 90 | 4 |

| State Street | 160 | 8 |

| | | 157 |

| Commercial Banks 5.6% | | |

| AmSouth | 170 | 4 |

| Bank of America | 2,114 | 96 |

| BB&T | 270 | 11 |

| Comerica | 90 | 5 |

| Compass Bancshares | 100 | 5 |

| Fifth Third Bancorp | 267 | 11 |

| First Horizon National | 60 | 3 |

| Huntington Bancshares | 120 | 3 |

| KeyCorp | 200 | 7 |

| M & T Bank | 50 | 5 |

| Marshall & Ilsley | 110 | 5 |

| National City | 310 | 11 |

| North Fork Bancorporation | 255 | 7 |

| PNC Financial Services Group | 170 | 9 |

| Regions Financial | 235 | 8 |

| SunTrust | 170 | 12 |

| Synovus Financial | 140 | 4 |

| U.S. Bancorp | 967 | 28 |

| Wachovia | 793 | 39 |

| Wells Fargo | 910 | 56 |

| Zions Bancorp | 40 | 3 |

| | | 332 |

| Consumer Finance 1.2% | | |

| American Express | 650 | 35 |

| Capital One Financial | 120 | 10 |

| MBNA | 595 | 15 |

| Providian Financial * | 140 | 2 |

| SLM Corporation | 210 | 11 |

| | | 73 |

| Diversified Financial Services 3.6% | | |

| CIT Group | 100 | 4 |

| Citigroup | 2,760 | 128 |

| J.P. Morgan Chase | 1,883 | 67 |

| Moody’s | 140 | 6 |

| Principal Financial Group | 150 | 6 |

| | | 211 |

| Insurance 4.1% | | |

| ACE Limited | 130 | 6 |

| AFLAC | 230 | 10 |

| Allstate | 370 | 22 |

| Ambac | 50 | 3 |

| American International Group | 1,371 | 80 |

| Aon | 150 | 4 |

| Chubb | 100 | 8 |

| Cincinnati Financial | 97 | 4 |

| Hartford Financial Services | 180 | 13 |

| Jefferson Pilot | 65 | 3 |

| Lincoln National | 80 | 4 |

| Loews | 90 | 7 |

| Marsh & McLennan | 250 | 7 |

| MBIA | 65 | 4 |

| MetLife | 360 | 16 |

| Progressive Corporation | 100 | 10 |

| Prudential | 260 | 17 |

| SAFECO | 70 | 4 |

| St. Paul Companies | 318 | 13 |

| Torchmark | 40 | 2 |

| UnumProvident | 150 | 3 |

| XL Capital | 80 | 6 |

| | | 246 |

| Real Estate 0.5% | | |

| Apartment Investment & Management | |

| Class A, REIT | 50 | 2 |

| Archstone-Smith Trust, REIT | 100 | 4 |

| Equity Office Properties, REIT | 190 | 6 |

| Equity Residential, REIT | 120 | 4 |

| Plum Creek Timber, REIT | 70 | 3 |

| ProLogis, REIT | 100 | 4 |

| Simon Property Group, REIT | 100 | 7 |

| | | 30 |

| Thrifts & Mortgage Finance 1.8% | | |

| Countrywide Credit | 278 | 11 |

| Fannie Mae | 490 | 29 |

| Freddie Mac | 420 | 27 |

| Golden West Financial | 140 | 9 |

| MGIC Investment | 50 | 3 |

| Sovereign Bancorp | 200 | 5 |

| Washington Mutual | 515 | 21 |

| | | 105 |

| Total Financials | | 1,154 |

| |

| HEALTH CARE 13.3% | | |

| Biotechnology 1.3% | | |

| Amgen * | 633 | 38 |

| Applera | 80 | 1 |

| Biogen Idec * | 163 | 6 |

| Chiron * | 90 | 3 |

| Genzyme * | 200 | 12 |

| Gilead Sciences * | 250 | 11 |

| MedImmune * | 110 | 3 |

| | | 74 |

| Health Care Equipment & Supplies 2.1% | |

| Bausch & Lomb | 30 | 3 |

| Baxter International | 290 | 11 |

| Becton, Dickinson | 130 | 7 |

| Biomet | 120 | 4 |

| Boston Scientific * | 380 | 10 |

| C R Bard | 40 | 3 |

| Fisher Scientific * | 60 | 4 |

| Guidant | 160 | 11 |

| Hospira * | 69 | 3 |

| Medtronic | 660 | 34 |

| Millipore * | 30 | 2 |

| PerkinElmer | 70 | 1 |

| St. Jude Medical * | 180 | 8 |

| Stryker | 190 | 9 |

| Thermo Electron * | 80 | 2 |

| Waters Corporation * | 40 | 1 |

| Zimmer Holdings * | 203 | 15 |

| | | 128 |

| Health Care Providers & Services 2.9% | | |

| Aetna | 180 | 15 |

| AmerisourceBergen | 40 | 3 |

| Cardinal Health | 210 | 12 |

| Caremark RX * | 230 | 10 |

| CIGNA | 70 | 7 |

| Express Scripts * | 60 | 3 |

| HCA | 220 | 12 |

| Health Management, Class A | 100 | 3 |

| Humana * | 90 | 4 |

| IMS Health | 130 | 3 |

| Laboratory Corporation of America * | 100 | 5 |

| Manor Care | 30 | 1 |

| McKesson | 150 | 7 |

| Medco * | 165 | 9 |

| Quest Diagnostics | 100 | 5 |

| Tenet Healthcare * | 215 | 3 |

| UnitedHealth Group | 820 | 43 |

| WellPoint * | 380 | 26 |

| | | 171 |

| Pharmaceuticals 7.0% | | |

| Abbott Laboratories | 860 | 42 |

| Allergan | 60 | 5 |

| Bristol Myers Squibb | 1,040 | 26 |

| Eli Lilly | 620 | 35 |

| Forest Laboratories * | 160 | 6 |

| Johnson & Johnson | 1,618 | 105 |

| King Pharmaceuticals * | 123 | 1 |

| Merck | 1,200 | 37 |

| Mylan Laboratories | 100 | 2 |

| Pfizer | 3,874 | 107 |

| Schering-Plough | 740 | 14 |

| Watson Pharmaceuticals * | 50 | 2 |

| Wyeth | 720 | 32 |

| | | 414 |

| Total Health Care | | 787 |

| |

| INDUSTRIALS & BUSINESS SERVICES 10.7% | |

| Aerospace & Defense 2.3% | | |

| Boeing | 490 | 33 |

| General Dynamics | 100 | 11 |

| Goodrich | 70 | 3 |

| Honeywell International | 470 | 17 |

| L-3 Communication | 100 | 8 |

| Lockheed Martin | 210 | 14 |

| Northrop Grumman | 184 | 10 |

| Raytheon | 210 | 8 |

| Rockwell Collins | 90 | 4 |

| United Technologies | 550 | 28 |

| | | 136 |

| Air Freight & Logistics 0.9% | | |

| Fedex | 160 | 13 |

| Ryder System | 40 | 2 |

| UPS, Class B | 570 | 39 |

| | | 54 |

| Airlines 0.1% | | |

| Delta * | 50 | 0 |

| Southwest Airlines | 380 | 5 |

| | | 5 |

| Building Products 0.1% | | |

| American Standard | 90 | 4 |

| Masco | 200 | 6 |

| | | 10 |

| Commercial Services & Supplies 0.7% | |

| Allied Waste Industries * | 150 | 1 |

| Avery Dennison | 50 | 3 |

| Cendant | 480 | 11 |

| Cintas | 90 | 3 |

| Deluxe | 30 | 1 |

| Equifax | 70 | 3 |

| PHH * | 24 | 1 |

| Pitney Bowes | 120 | 5 |

| R.R. Donnelley | 100 | 3 |

| Robert Half International | 70 | 2 |

| Waste Management | 250 | 7 |

| | | 40 |

| Construction & Engineering 0.0% | | |

| Fluor | 40 | 2 |

| | | 2 |

| Electrical Equipment 0.4% | | |

| American Power Conversion | 80 | 2 |

| Cooper Industries, Class A | 50 | 3 |

| Emerson Electric | 200 | 13 |

| Power-One * | 50 | 0 |

| Rockwell Automation | 90 | 4 |

| Thomas & Betts * | 20 | 1 |

| | | 23 |

| Industrial Conglomerates 4.4% | | |

| 3M | 410 | 30 |

| GE | 5,600 | 194 |

| Textron | 60 | 5 |

| Tyco International | 1,075 | 31 |

| | | 260 |

| Machinery 1.3% | | |

| Caterpillar | 170 | 16 |

| Crane | 20 | 1 |

| Cummins Engine | 20 | 1 |

| Danaher | 140 | 7 |

| Deere | 120 | 8 |

| Dover | 90 | 3 |

| Eaton | 60 | 4 |

| Illinois Tool Works | 160 | 13 |

| Ingersoll-Rand, Class A | 90 | 6 |

| ITT Industries | 40 | 4 |

| Navistar * | 20 | 1 |

| PACCAR | 97 | 7 |

| Pall | 60 | 2 |

| Parker Hannifin | 70 | 4 |

| | | 77 |

| Road & Rail 0.5% | | |

| Burlington Northern Santa Fe | 180 | 9 |

| CSX | 90 | 4 |

| Norfolk Southern | 200 | 6 |

| Union Pacific | 160 | 10 |

| | | 29 |

| Trading Companies & Distributors 0.0% | |

| W. W. Grainger | 40 | 2 |

| | | 2 |

| Total Industrials & Business Services | 638 |

| |

| INFORMATION TECHNOLOGY 14.2% |

| Communications Equipment 2.5% | | |

| ADC Telecommunications * | 62 | 1 |

| Andrew * | 90 | 1 |

| Avaya * | 220 | 2 |

| CIENA * | 410 | 1 |

| Cisco Systems * | 3,340 | 64 |

| Comverse Technology * | 100 | 2 |

| Corning * | 760 | 13 |

| JDS Uniphase * | 840 | 1 |

| Lucent Technologies * | 2,340 | 7 |

| Motorola | 1,290 | 24 |

| QUALCOMM | 870 | 29 |

| Scientific-Atlanta | 70 | 2 |

| Tellabs * | 210 | 2 |

| | | 149 |

| Computers & Peripherals 3.3% | | |

| Apple Computer * | 480 | 18 |

| Dell * | 1,230 | 49 |

| EMC * | 1,160 | 16 |

| Gateway * | 160 | 0 |

| Hewlett-Packard | 1,457 | 34 |

| IBM | 830 | 62 |

| Lexmark International * | 50 | 3 |

| NCR * | 100 | 3 |

| Network Appliance * | 170 | 5 |

| QLogic * | 40 | 1 |

| Sun Microsystems * | 1,600 | 6 |

| | | 197 |

| Electronic Equipment & Instruments 0.3% | |

| Agilent Technologies * | 220 | 5 |

| Jabil Circuit * | 80 | 3 |

| Molex | 80 | 2 |

| Sanmina-SCI * | 260 | 1 |

| Solectron * | 560 | 2 |

| Symbol Technologies | 120 | 1 |

| Tektronix | 30 | 1 |

| | | 15 |

| Internet Software & Services 0.4% | | |

| Monster Worldwide * | 70 | 2 |

| Yahoo! * | 650 | 23 |

| | | 25 |

| IT Services 1.0% | | |

| Affiliated Computer Services | | |

| Class A * | 70 | 4 |

| Automatic Data Processing | 290 | 12 |

| Computer Sciences * | 90 | 4 |

| Convergys * | 60 | 1 |

| Electronic Data Systems | 220 | 4 |

| First Data | 405 | 16 |

| Fiserv * | 90 | 4 |

| Paychex | 170 | 5 |

| Sabre Holdings, Class A | 60 | 1 |

| SunGard Data Systems * | 130 | 5 |

| Unisys * | 160 | 1 |

| | | 57 |

| Office Electronics 0.1% | | |

| Xerox * | 450 | 6 |

| | | 6 |

| Semiconductor & Semiconductor Equipment 3.0% | |

| Advanced Micro Devices * | 160 | 3 |

| Altera * | 180 | 4 |

| Analog Devices | 170 | 6 |

| Applied Materials | 790 | 13 |

| Applied Micro Circuits * | 130 | 0 |

| Broadcom, Class A * | 140 | 5 |

| Freescale Semiconductor, Class B * | 320 | 7 |

| Intel | 3,220 | 84 |

| KLA-Tencor | 90 | 4 |

| Linear Technology | 160 | 6 |

| LSI Logic * | 170 | 1 |

| Maxim Integrated Products | 140 | 5 |

| Micron Technology * | 270 | 3 |

| National Semiconductor | 200 | 4 |

| Novellus Systems * | 60 | 2 |

| NVIDIA * | 80 | 2 |

| PMC-Sierra * | 90 | 1 |

| Teradyne * | 100 | 1 |

| Texas Instruments | 850 | 24 |

| Xilinx | 160 | 4 |

| | | 179 |

| Software 3.6% | | |

| Adobe Systems | 240 | 7 |

| Autodesk | 100 | 3 |

| BMC Software * | 100 | 2 |

| Citrix Systems * | 70 | 1 |

| Computer Associates | 290 | 8 |

| Compuware * | 170 | 1 |

| Electronic Arts * | 140 | 8 |

| Intuit * | 100 | 4 |

| Mercury Interactive * | 40 | 2 |

| Microsoft | 5,270 | 131 |

| Novell * | 170 | 1 |

| Oracle * | 2,190 | 29 |

| Parametric Technology * | 140 | 1 |

| Siebel Systems | 240 | 2 |

| Symantec * | 360 | 8 |

| VERITAS Software * | 190 | 5 |

| | | 213 |

| Total Information Technology | | 841 |

| |

| MATERIALS 2.7% | | |

| Chemicals 1.5% | | |

| Air Products and Chemicals | 100 | 6 |

| Dow Chemical | 528 | 23 |

| DuPont | 570 | 24 |

| Eastman Chemical | 30 | 2 |

| Ecolab | 110 | 3 |

| Engelhard | 60 | 2 |

| Great Lakes Chemical | 20 | 1 |

| Hercules * | 40 | 1 |

| International Flavors & Fragrances | 30 | 1 |

| Monsanto | 140 | 9 |

| PPG Industries | 90 | 6 |

| Praxair | 140 | 6 |

| Rohm & Haas | 100 | 5 |

| Sigma Aldrich | 30 | 2 |

| | | 91 |

| Construction Materials 0.1% | | |

| Vulcan Materials | 40 | 3 |

| | | 3 |

| Containers & Packaging 0.1% | | |

| Ball | 40 | 1 |

| Bemis | 60 | 2 |

| Pactiv * | 60 | 1 |

| Sealed Air * | 40 | 2 |

| Temple-Inland | 40 | 2 |

| | | 8 |

| Metals & Mining 0.6% | | |

| Alcoa | 410 | 11 |

| Allegheny Technologies | 30 | 1 |

| Freeport McMoRan Copper Gold | | |

| Class B | 90 | 3 |

| Newmont Mining | 200 | 8 |

| Nucor | 60 | 3 |

| Phelps Dodge | 50 | 4 |

| USX-U.S. Steel Group | 60 | 2 |

| Worthington Industries | 30 | 0 |

| | | 32 |

| Paper & Forest Products 0.4% | | |

| Georgia-Pacific | 120 | 4 |

| International Paper | 220 | 7 |

| Louisiana Pacific | 50 | 1 |

| MeadWestvaco | 108 | 3 |

| Neenah Paper | 7 | 0 |

| Weyerhaeuser | 150 | 9 |

| | | 24 |

| Total Materials | | 158 |

| |

| TELECOMMUNICATION SERVICES 3.0% | |

| Diversified Telecommunication Services 2.6% | |

| Alltel | 160 | 10 |

| AT&T | 384 | 7 |

| BellSouth | 910 | 24 |

| Centurytel | 50 | 2 |

| Citizens Communications | 140 | 2 |

| Qwest Communications | | |

| International * | 930 | 3 |

| SBC Communications | 1,680 | 40 |

| Sprint | 715 | 18 |

| Verizon Communications | 1,440 | 50 |

| | | 156 |

| Wireless Telecommunication Services 0.4% | |

| Nextel Communications, Class A * | 630 | 20 |

| | | 20 |

| Total Telecommunication Services | 176 |

| |

| TRUSTS & MUTUAL FUNDS 3.3% | |

| Trusts & Mutual Funds 3.3% | | |

| S&P Depository Receipts Trust | 1,670 | 199 |

| Total Trusts & Mutual Funds | | 199 |

| UTILITIES 3.1% | | |

| Electric Utilities 2.0% | | |

| Allegheny Energy * | 70 | 2 |

| Ameren | 90 | 5 |

| American Electric Power | 160 | 6 |

| CenterPoint Energy | 150 | 2 |

| CINergy | 70 | 3 |

| Consolidated Edison | 100 | 5 |

| DTE Energy | 90 | 4 |

| Edison International | 140 | 6 |

| Entergy | 100 | 8 |

| Exelon | 410 | 21 |

| FirstEnergy | 153 | 7 |

| FPL Group | 200 | 8 |

| PG&E | 210 | 8 |

| Pinnacle West Capital | 50 | 2 |

| PPL | 90 | 5 |

| Progress Energy | 120 | 5 |

| Southern Company | 350 | 12 |

| Teco Energy | 90 | 2 |

| XCEL Energy | 200 | 4 |

| | | 115 |

| Gas Utilities 0.1% | | |

| KeySpan | 70 | 3 |

| NICOR | 20 | 1 |

| NiSource | 100 | 2 |

| Peoples Energy | 20 | 1 |

| | | 7 |

| Independent Power Producers & Energy Traders 0.6% |

| AES * | 290 | 5 |

| Calpine * | 190 | 1 |

| Constellation Energy Group | 70 | 4 |

| Duke Energy | 440 | 13 |

| Dynegy, Class A * | 280 | 1 |

| TXU | 140 | 12 |

| | | 36 |

| Multi-Utilities 0.4% | | |

| CMS Energy * | 70 | 1 |

| Dominion Resources | 160 | 12 |

| Public Service Enterprise | 120 | 7 |

| Sempra Energy | 110 | 5 |

| | | 25 |

| Total Utilities | | 183 |

| Total Common Stocks (Cost $5,265) | 5,875 |

| SHORT-TERM INVESTMENTS 1.5% | | | |

| Money Market Fund 1.3% | | | |

| T. Rowe Price Reserve | | | |

| Investment Fund, 3.14% #† | 79,362 | | 79 |

| | | | 79 |

| U.S. Treasury Obligations 0.2% | | | |

| U.S. Treasury Bills | | | |

| 2.602%, 7/7/05 ++ | 10,000 | | 10 |

| | | | 10 |

| Total Short-Term Investments (Cost $89) | | 89 |

| |

| FUTURES CONTRACTS 0.0% | | | |

| Variation margin receivable (payable) | | |

| on open futures contracts (2) | | | – |

| Total Futures Contracts | | | – |

| |

| Total Investments in Securities | | | |

| 100.5% of Net Assets (Cost $5,354) | $ | 5,964 |

| (1) | Denominated in U.S dollars unless otherwise noted |

| # | Seven-day yield |

| * | Non-income producing |

| ++ | All or a portion of this security is pledged to cover margin |

| | requirements on futures contracts at June 30, 2005 |

| † | Affiliated company – See Note 4 |

| REIT | Real Estate Investment Trust |

| (2) Open Futures Contracts at June 30, 2005 were as follows: |

| ($ 000s) |

| | | Contract | Unrealized |

| | Expiration | Value | Gain (Loss) |

| Long, 1 S&P 500 E-Mini contracts, | | | | | |

| $10 par of 2,602% U.S. Treasury Bills | | | | | |

| pledged as initial margin | 9/05 | $ | 60 | $ | – |

| Net payments (receipts) of variation | | | | | |

| margin to date | | | | | – |

| Variation margin receivable (payable) | | | | | |

| on open futures contracts | | | | $ | – |

The accompanying notes are an integral part of these financial statements.

| Statement of Assets and Liabilities |

| (Unaudited) |

| (In thousands except shares and per share amounts) | | |

| |

| Assets | | |

| Investments in securities, at value | | |

| Affiliated companies (cost $79) | $ | 79 |

| Non-affiliated companies (cost $5,275) | | 5,885 |

|

|

| Total investments in securities | | 5,964 |

| Dividends and interest receivable | | 8 |

|

|

| Total assets | | 5,972 |

|

|

| |

| Liabilities | | |

| Payable for investment securities purchased | | 24 |

| Due to affiliates | | 11 |

|

|

| Total liabilities | | 35 |

|

|

| |

| NET ASSETS | $ | 5,937 |

|

|

| Net Assets Consist of: | | |

| Undistributed net investment income (loss) | $ | 2 |

| Undistributed net realized gain (loss) | | (1,009) |

| Net unrealized gain (loss) | | 610 |

| Paid-in-capital applicable to 655,642 shares of | | |

| $0.0001 par value capital stock outstanding; | | |

| 1,000,000,000 shares of the Corporation authorized | | 6,334 |

|

|

| |

| NET ASSETS | $ | 5,937 |

|

|

| NET ASSET VALUE PER SHARE | $ | 9.06 |

|

|

The accompanying notes are an integral part of these financial statements.

| Statement of Operations |

| (Unaudited) |

| ($ 000s) |

| |

| | | 6 Months |

| | | Ended |

| | | 6/30/05 |

| Investment Income (Loss) | | |

| Dividend income | $ | 51 |

| Investment management and administrative expense | | 11 |

|

|

| Net investment income (loss) | | 40 |

|

|

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain (loss) | | |

| Securities | | 6 |

| Futures | | (2) |

|

|

| Net realized gain (loss) | | 4 |

| Change in net unrealized gain (loss) on securities | | (92) |

|

|

| Net realized and unrealized gain (loss) | | (88) |

|

|

| |

| INCREASE (DECREASE) IN NET | | |

| ASSETS FROM OPERATIONS | $ | (48) |

|

|

The accompanying notes are an integral part of these financial statements.

| Statement of Changes in Net Assets |

| (Unaudited) |

| ($ 000s) |

| |

| | | 6 Months | | Year |

| | | Ended | | Ended |

| | | 6/30/05 | | 12/31/04 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income (loss) | $ | 40 | $ | 81 |

| Net realized gain (loss) | | 4 | | 20 |

| Change in net unrealized gain (loss) | | (92) | | 428 |

|

|

| Increase (decrease) in net assets from operations | | (48) | | 529 |

|

|

| Distributions to shareholders | | | | |

| Net investment income | | (38) | | (83) |

|

|

| Capital share transactions * | | | | |

| Shares sold | | 853 | | 2,699 |

| Distributions reinvested | | 38 | | 83 |

| Shares redeemed | | (317) | | (1,666) |

|

|

| Increase (decrease) in net assets from capital | | | | |

| share transactions | | 574 | | 1,116 |

|

|

| |

| Net Assets | | | | |

| Increase (decrease) during period | | 488 | | 1,562 |

| Beginning of period | | 5,449 | | 3,887 |

|

|

| End of period | $ | 5,937 | $ | 5,449 |

|

|

| (Including undistributed net investment income | | | | |

| of $2 at 6/30/05 and $0 at 12/31/04) | | | | |

| |

| *Share information | | | | |

| Shares sold | | 94 | | 316 |

| Distributions reinvested | | 5 | | 9 |

| Shares redeemed | | (35) | | (192) |

|

|

| Increase (decrease) in shares outstanding | | 64 | | 133 |

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements

(Unaudited)

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

T. Rowe Price Equity Series, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Equity Index 500 Portfolio (the fund), a diversified, open-end management investment company, is one portfolio established by the corporation. The fund commenced operations on December 29, 2000. The fund seeks to match the performance of the Standard & Poor’s 500 Stock Index®. Shares of the fund are currently offered only through certain insurance companies as an investment medium for both variable annuity contracts and variable life insurance policies.

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund receives upon sale of the securities.

Valuation The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business. Equity securities listed or regularly traded on a securities exchange or in the over-the-counter market are valued at the last quoted sale price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices. Debt securities with original maturities of less than one year are valued at amortized cost in local currency, which approximates fair value when combined with accrued interest.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Financial futures contracts are valued at closing settlement prices.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Payments (“variation margin”) made or received to settle the daily fluctuations in the value of futures contracts are recorded as unrealized gains or losses until the contracts are closed. Unsettled variation margin on futures contracts is included in investments in securities, and unrealized gains and losses on futures contracts are included in the change in net unrealized gain or loss in the accompanying financial statements. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid on a quarterly basis. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

NOTE 2 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Futures Contracts During the six months ended June 30, 2005, the fund was a party to futures contracts, which provide for the future sale by one party and purchase by another of a specified amount of a specific financial instrument at an agreed upon price, date, time, and place. Risks arise from possible illiquidity of the futures market and from movements in security values.

Other Purchases and sales of portfolio securities, other than short-term securities, aggregated $855,000 and $225,000, respectively, for the six months ended June 30, 2005.

NOTE 3 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Federal income tax regulations differ from generally accepted accounting principles; therefore, distributions determined in accordance with tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial records are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of June 30, 2005.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. As of December 31, 2004, the fund had $1,011,000 of unused capital loss carryforwards, of which $9,000 expire in 2009, $183,000 expire in 2010, and $819,000 expire in 2011.

At June 30, 2005, the cost of investments for federal income tax purposes was $5,354,000. Net unrealized gain aggregated $610,000 at period-end, of which $949,000 related to appreciated investments and $339,000 related to depreciated investments.

NOTE 4 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management and administrative agreement between the fund and the manager provides for an all-inclusive annual fee equal to 0.40% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The agreement provides that investment management, shareholder servicing, transfer agency, accounting, and custody services are provided to the fund, and interest, taxes, brokerage commissions, directors’ fees and expenses, and extraordinary expenses are paid directly by the fund.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the Reserve Funds), open-end management investment companies managed by Price Associates and affiliates of the fund. The Reserve Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates, and are not available for direct purchase by members of the public. The Reserve Funds pay no investment management fees. During the six months ended June 30, 2005, dividend income from the Reserve Funds totaled $1,000, and the value of shares of the Reserve Funds held at June 30, 2005 and December 31, 2004 was $79,000 and $109,000, respectively.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Company Info” at the top of our homepage for individual investors. Then, in the window that appears, click on the “Proxy Voting Policy” navigation button in the top left corner.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Record” at the bottom of the Proxy Voting Policy page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| Approval of Investment Management Agreement |

On March 2, 2005, the fund’s Board of Directors unanimously approved the investment advisory contract (“Contract”) between the fund and its investment manager, T. Rowe Price Associates, Inc. (“Manager”). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Manager during the course of the year, as discussed below:

Services Provided by the Manager

The Board considered the nature, quality, and extent of the services provided to the fund by the Manager. These services included, but were not limited to, management of the fund’s portfolio and a variety of activities related to portfolio management. The Board also reviewed the background and experience of the Manager’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Manager.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total return over the 1- and 3-year periods as well as the fund’s year-by-year returns and compared these returns to previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Manager under the Contract and other benefits that the Manager (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements. The Board also received information on the estimated costs incurred and profits realized by the Manager and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Manager’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Manager. The Board noted that, under the Contract, the fund pays the Manager a single fee based on the fund’s assets and the Manager, in turn, pays all expenses of the fund, with certain exceptions. The Board concluded that, based on the profitability data it reviewed and consistent with this single fee structure, the Contract provided for a reasonable sharing of benefits from any economies of scale with the fund.

Fees

The Board reviewed the fund’s single-fee structure and compared the rate to fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s single fee rate was generally below the median management fee rate and expense ratio for comparable funds. The Board also reviewed the fee schedules for comparable privately managed accounts of the Manager and its affiliates. Management informed the Board that the Manager’s responsibilities for privately managed accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Equity Series, Inc. |

| |

| By | /s/ James S. Riepe |

| | James S. Riepe |

| | Principal Executive Officer |

| |

| Date | August 18, 2005 |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ James S. Riepe |

| | James S. Riepe |

| | Principal Executive Officer |

| |

| Date | August 18, 2005 |

| |

| |

| |

| By | /s/ Joseph A. Carrier |

| | Joseph A. Carrier |

| | Principal Financial Officer |

| |

| Date | August 18, 2005 |