Item 1: Report to Shareholders| Personal Strategy Balanced Portfolio | June 30, 2005 |

The views and opinions in this report were current as of June 30, 2005. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act of 2002, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Fellow Shareholders

Stronger stock markets during the first half of the Personal Strategy Balanced Portfolio’s fiscal year more than offset weakness over the second half, producing favorable returns for the 12-month period ended June 30, 2005. Even though the Federal Reserve raised short-term interest rates nine times since mid-2004, investment-grade bonds, particularly long-term issues, produced unexpectedly good returns in both periods. Non-U.S. equities in developed countries performed on par with their domestic counterparts in the last six months primarily because the U.S. dollar rebounded from multiyear lows, but they strongly outperformed for the 12-month period. Your portfolio, aided by higher exposure to stocks, registered solid gains for the 12 months but posted a slight gain for the six-month period.

Market Environment

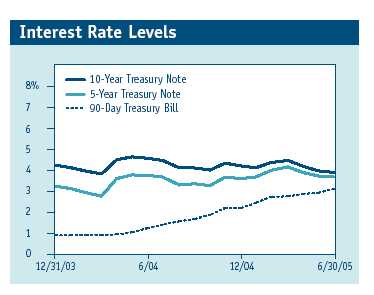

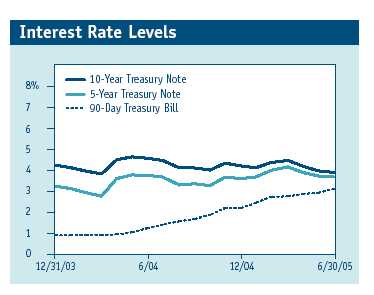

Twelve months ago, strong U.S. economic growth and signs of rising inflation prompted the Federal Reserve to warn investors that it would soon begin raising rates from the low levels that had prevailed for several years. From June 2004 through June 2005, the central bank gradually lifted the federal funds target rate—an overnight intrabank lending rate—from a 46-year low of 1.00% to 3.25% in nine quarter-point increments. Despite these rate increases and higher oil prices, the economy expanded—albeit with some “soft patches.”

Money market yields, which closely track the fed funds rate, rose substantially during the last 12 months. In contrast, long-term interest rates declined, an unexpected development that Federal Reserve Chairman Alan Greenspan called a “conundrum.” As a result, the difference between short- and long-term interest rates significantly narrowed during our fiscal year, generating a flattened Treasury yield curve (a graphic depiction of the relationship between short- and longer-term yields).

Despite rising short-term rates in the U.S., bond returns were generally favorable in the last six months. Treasuries, investment-grade corporates, mortgage-backed securities, and high-yield securities (below investment-grade) posted positive returns. For the 12-month period, bond returns were more robust. High-yield securities strongly outperformed, followed by investment-grade corporate bonds and Treasuries. Mortgage-backed securities trailed but still performed well.

U.S. stocks advanced over the last 12 months, overcoming concerns about high oil prices, rising interest rates, and periodic reports of slowing growth and job creation. Large-cap shares fared better than their small-cap counterparts in the last six months, but the reverse was true for the one-year period. Among large-cap stocks, value stocks outpaced growth for the 6- and 12-month periods.

| Major Index Returns |

| Periods Ended 6/30/05 | 6 Months | 12 Months |

| S&P 500 Stock Index | -0.81% | 6.32% |

| Dow Jones Wilshire 4500 Index | 2.19 | 14.49 |

| MSCI EAFE Index | -0.85 | 14.13 |

Non-U.S. stocks in developed markets produced solid returns in local currency over the last six months. However, a stronger dollar during this period eroded returns to U.S. investors. Returns for the full year were strong in local currency and for U.S. investors. European shares fared better than Japanese stocks in both periods.

Performance Review

The Personal Strategy Balanced Portfolio’s investment objective is to generate the highest total return consistent with an equal emphasis on income and capital appreciation. The typical asset mix of securities is 60% stocks, 30% bonds, and 10% cash, although allocations can vary by as much as 10 percentage points above or below these levels.

| Performance Comparison |

| Periods Ended 6/30/05 | 6 Months | 12 Months |

| Personal Strategy | | |

| Balanced Portfolio | 0.46% | 9.51% |

| Combined Index Portfolio* | 0.86 | 7.91 |

| Merrill Lynch-Wilshire Capital | |

| Market Index | 0.82 | 7.79 |

| * An unmanaged portfolio composed of 60% stocks (51% |

| Wilshire 5000, 9% MSCI EAFE Index), 30% bonds (Lehman |

| Brothers U.S. Aggregate Index), and 10% money market |

| securities (Citigroup 3-Month Treasury Bill Index). |

The Personal Strategy Balanced Portfolio posted gains for the six and 12 months ended June 30, 2005, as shown in the table. The portfolio outpaced the Combined Index Portfolio benchmark and the Merrill Lynch-Wilshire Capital Market Index for the 12-month period, aided by our heavier exposure to stocks relative to bonds and the strong performance of our non-U.S. equities. For the most recent six months, the portfolio lagged slightly behind the two indices. The non-U.S. equity holdings helped performance, but the allocations to large-cap growth stocks and high-yield bonds modestly hurt results relative to the benchmark.

Reflecting our decision to reduce fixed-income exposure, the portfolio’s bond allocation of 27.2% was significantly lower than 12 months ago. The fund’s cash position was increased to 6.0%, a healthy increase from the end of June 2004. During the year, as mentioned in the Portfolio Review section, we reallocated our stock holdings, reducing small-cap, large-cap value, and non-U.S. equity positions and supplementing our large-cap growth holdings.

Portfolio Review

The portfolio’s investment committee meets on a monthly basis during the year to adjust the weightings of stocks, bonds, and money market securities within the appropriate ranges for each fund. Economic fundamentals and market conditions drive these allocation changes.

In the spring of 2004, the economy was showing signs of sustained recovery. We anticipated that the Fed would begin a tightening process, so we continued decreasing our allocation to bonds and increasing our holdings of stocks and cash. With stocks outperforming bonds for the 12-month period, the increased allocation to stocks was beneficial. In addition, by adding to our cash position, we were able to capture rising short-term yields.

Within our stock holdings, we reduced our allocation to small-caps and increased our large-cap allocation. We believed the strong multiyear rally in small-caps was losing its momentum and that small-cap valuations were no longer compelling. Our underweight in this sector was beneficial over the last six months as small-caps posted negative returns, although this underweight was a slightly negative contributor over the full 12 months. We redirected assets from small-cap to our large-cap holdings, particularly large-cap growth stocks. With the economic recovery and corporate profit growth leveling off, we believed that investors would follow historical precedents and pay a premium for those high-quality large-cap companies whose earnings grow faster than the market. Our overweighting in large-cap growth holdings detracted slightly from the portfolios’ performance relative to their weighted benchmarks for the fiscal year.

Strong returns in non-U.S. markets in 2004 boosted the fund’s performance for the fiscal year. However, given several years of solid performance by non-U.S. equities and the prospects of formidable profit growth in U.S. companies, we reduced our allocation to non-U.S. equities in early 2005 and increased our purchases of U.S. equities, continuing a trend we began in 2004.

In anticipation of higher interest rates, we embarked on a defensive strategy with our fixed-income allocation. Over the past 12 months, we reduced the overall allocation of bonds, shortened maturities within the bond portfolio, and reduced our high-yield bond allocation in favor of investment-grade issues.

Among our major equity holdings, Microsoft, which maintains a large cash hoard even after distributing a $32 billion special dividend in late 2004, generates solid revenue and earnings and maintains its 60% operating margins. Nevertheless, it continues to trade at a discount relative to its peers. The company is no longer solely a software company. Microsoft has expanded into home entertainment with its Xbox video game console and is likely to solidify its presence with the 2007 release of its next generation operating systems software. Through its recent acquisitions, UnitedHealth Group has gained market share while maintaining a strong balance sheet. The company has diversified its revenue base and improved its operating margins. Although American International Group shares tumbled after it disclosed there had been improper accounting of certain transactions, it finished the quarter with much improved results and stock performance. We believe the company has a strong business and will overcome its current difficulties. Citigroup is benefiting from increased investment banking activity, continued credit improvements, below-average interest rate sensitivity, and prudent capital management. The economy’s recovery is improving fundamentals across General Electric’s business lines. The company’s largest businesses, power and aerospace, are poised to generate double-digit earnings per share growth during the next two years. Also, the health care division is introducing new products, and NBC/Universal is improving despite the loss of some key programs. (Please refer to our portfolio of investments for a complete listing of its holdings and the amount each represents in the portfolio.)

Outlook

The Federal Reserve has not given any sign that it is about to change its policy and stop the measured, upward climb in short-term interest rates, and, therefore, it is quite likely that short-term rates will continue to rise. Determining when long-term rates begin to move in the same direction as short-term rates is the enigma that even Mr. Greenspan can’t seem to answer. We are not certain that the equity markets will outperform bonds or cash in the next three to six months, but we believe that equities will outperform bonds over the intermediate and longer terms, hence our current overweighting in equities. The portfolio also maintains solid allocations in fixed income and cash to dampen overall portfolio volatility and moderate risk. Investors should be well served by this fundamental commitment to diversification across asset classes.

Respectfully submitted,

Edmund M. Notzon III

Chairman of the portfolio’s Investment Advisory Committee

July 22, 2005

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the portfolio’s investment program.

As with all stock and bond mutual funds, each fund’s share price can fall because of weakness in the stock or bond markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

Bonds are subject to interest rate risk, the decline in bond prices that usually accompanies a rise in interest rates, and credit risk, the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default (fail to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. High-yield corporate bonds could have greater price declines than funds that invest primarily in high-quality bonds. Companies issuing high-yield bonds are not as strong financially as those with higher credit ratings, so the bonds are usually considered speculative investments.

Funds that invest overseas may carry more risk than funds that invest strictly in U.S. assets. Risks can result from varying stages of economic and political development; differing regulatory environments, trading days, and accounting standards; and higher transaction costs of non-U.S. markets. Non-U.S. investments are also subject to currency risk, or a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Citigroup 3-Month Treasury Bill Index: An unmanaged index that tracks short-term U.S. government debt instruments.

CS First Boston High Yield Index: An unmanaged index constructed to mirror the high-yield debt market.

Dow Jones Wilshire 4500 Index: An unmanaged index that tracks the performance of all stocks in the Wilshire 5000 Equity Index, excluding those found in the S&P 500 Stock Index.

Dow Jones Wilshire 5000 Index: An unmanaged index that tracks the performance of the most active stocks in the broad U.S. market.

Duration: The average time (expressed in years) it takes investors to receive the present value of the future cash flows on their investment. It is used to measure the sensitivity of bond prices to interest rate changes (the shorter the duration, the less the bond’s price will rise or fall in value when interest rates change). Duration is affected by maturity, the coupon, and the time interval between payments. Other things being equal, a bond with a higher coupon will have a shorter duration, while zero-coupon bonds have the longest.

Lehman Brothers U.S. Aggregate Index: An unmanaged index that tracks investment-grade corporate and government bonds.

Merrill Lynch-Wilshire Capital Market Index: A market capitalization-weighted index including the Wilshire 5000 and Merrill Lynch High Yield II and Domestic Master indexes.

MSCI EAFE Index: An unmanaged index that tracks the stocks of about 1,000 companies in Europe, Australasia, and the Far East (EAFE).

S&P 500 Stock Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

Portfolio Highlights

| | Percent of |

| | Net Assets |

| | 6/30/05 |

| Reserves | 6.0% |

| Money Market Funds | 6.8 |

| Other Assets Less Liabilities | -0.8 |

| Bonds | 27.2% |

| Stocks | 66.8% |

| Largest Holdings | |

| Microsoft | 1.7% |

| UnitedHealth Group | 1.1 |

| American International Group | 1.0 |

| Citigroup | 1.0 |

| First Data | 0.9 |

| GE | 0.9 |

| Tyco International | 0.9 |

| Intel | 0.8 |

| Home Depot | 0.8 |

| Baker Hughes | 0.7 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| Average Annual Compound Total Return |

| Periods Ended 6/30/05 | 1 Year | 5 Years | 10 Years |

| Personal Strategy Balanced Portfolio | 9.51% | 5.53% | 9.55% |

| Combined Index Portfolio* | 7.91 | 2.14 | 8.37 |

| Merrill Lynch-Wilshire Capital | | | |

| Market Index | 7.79 | 1.32 | 8.61 |

| * | An unmanaged portfolio composed of 60% stocks (51% Wilshire 5000, 9% |

| | MSCI EAFE Index), 30% bonds (Lehman Brothers U.S. Aggregate Index), and |

| | 10% money market securities (Citigroup 3-Month Treasury Bill Index). |

Current performance may be higher or lower than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will vary, and you may have a gain or loss when you sell your shares. For the most recent month-end performance information, please visit our Web site (troweprice.com) or contact a T. Rowe Price representative at 1-800-469-5304.

This table shows how the portfolio would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate. Average annual total return figures include changes in principal value, reinvested dividends, and capital gain distributions. Total returns do not include charges imposed by your insurance company’s separate account. If these were included, performance would have been lower. When assessing performance, investors should consider both short- and long-term returns.

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs such as redemption fees or sales loads and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and actual expenses. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

T. Rowe Price Personal Strategy

Balanced Portfolio |

|

| | | | Expenses |

| | Beginning | Ending | Paid During |

| | Account | Account | Period* |

| | Value | Value | 1/1/05 to |

| | 1/1/05 | 6/30/05 | 6/30/05 |

| Actual | $1,000.00 | $1,004.60 | $4.37 |

| Hypothetical | | | |

| (assumes 5% return | | | |

| before expenses) | 1,000.00 | 1,020.43 | 4.41 |

| * Expenses are equal to the fund’s annualized expense ratio for the six-month |

| period (0.88%), multiplied by the average account value over the period, mul- |

| tiplied by the number of days in the most recent fiscal half year (181) divided |

| by the days in the year (365) to reflect the half-year period. |

Financial Highlights

T. Rowe Price Personal Strategy Balanced Portfolio

(Unaudited)

| | For a share outstanding throughout each period |

|

|

| |

| | | 6 Months | | Year | | | | | | | | |

| | | Ended | | Ended | | | | | | | | |

| | | 6/30/05** | | 12/31/04 | | 12/31/03 | | 12/31/02 | | 12/31/01 | | 12/31/00 |

| NET ASSET VALUE | | | | | | | | | | | | |

| Beginning of period | $ | 17.76 | $ | 16.13 | $ | 13.22 | $ | 14.72 | $ | 15.54 | $ | 16.00 |

|

|

| Investment activities | | | | | | | | | | | | |

| Net investment income (loss) | | 0.17* | | 0.34* | | 0.32* | | 0.36 | | 0.43 | | 0.49 |

| Net realized and | | | | | | | | | | | | |

| unrealized gain (loss) | | (0.09) | | 1.70 | | 2.92 | | (1.50) | | (0.82) | | 0.35 |

|

|

| Total from | | | | | | | | | | | | |

| investment activities | | 0.08 | | 2.04 | | 3.24 | | (1.14) | | (0.39) | | 0.84 |

|

|

| Distributions | | | | | | | | | | | | |

| Net investment income | | (0.16) | | (0.34) | | (0.32) | | (0.36) | | (0.43) | | (0.48) |

| Net realized gain | | – | | (0.07) | | (0.01) | | – | | – | | (0.82) |

|

|

| Total distributions | | (0.16) | | (0.41) | | (0.33) | | (0.36) | | (0.43) | | (1.30) |

|

|

| NET ASSET VALUE | | | | | | | | | | | | |

| End of period | $ | 17.68 | $ | 17.76 | $ | 16.13 | $ | 13.22 | $ | 14.72 | $ | 15.54 |

|

|

| |

| Ratios/Supplemental Data | | | | | | | | | | | | |

| Total return^ | | 0.46%* | | 12.80%* | | 24.80%* | | (7.80)% | | (2.41)% | | 5.41% |

| Ratio of total expenses to | | | | | | | | | | | | |

| average net assets | | 0.88%*† | | 0.87%* | | 0.88%* | | 0.90% | | 0.90% | | 0.90% |

| Ratio of net investment | | | | | | | | | | | | |

| income (loss) to average | | | | | | | | | | | | |

| net assets | | 1.92%*† | | 2.03%*+ | | 2.19%* | | 2.57% | | 2.91% | | 3.08% |

| Portfolio turnover rate | | 65.3%¤† | | 72.5% | | 73.8% | | 100.9% | | 81.5% | | 55.4% |

| Net assets, end of period | | | | | | | | | | | | |

| (in thousands) | $ | 130,570 | $ | 125,949 | $ | 106,206 | $ | 89,690 | $ | 103,413 | $ | 109,713 |

| ^ | Total return reflects the rate that an investor would have earned on an investment in the fund during |

| | each period, assuming reinvestment of all distributions. |

| * | See Note 4. Excludes expenses permanently waived of 0.02%, 0.03%, and 0.02% of average net assets for |

| the periods ended 6/30/05, 12/31/04, and 12/31/03 respectively, related to investments in TRP mutual funds. |

| + | Includes the effect of a one-time special dividend (0.14% of average net assets) that is not expected to recur. |

| ** | Per share amounts calculated using average shares outstanding method. |

| ¤ | The portfolio turnover rate calculation includes purchases and sales from mortgage dollar roll transactions |

| | (see Note 2); had these transactions been excluded from the calculation, the portfolio turnover for the year |

| ended June 30, 2005, would have been 62.5%. |

| † | Annualized |

The accompanying notes are an integral part of these financial statements.Portfolio of Investments (1)

T. Rowe Price Personal Strategy Balanced Portfolio

June 30, 2005 (Unaudited)

| Shares/$ Par | Value |

| (Cost and value in $000s) | | |

| |

| COMMON STOCKS 66.8% | | |

| |

| CONSUMER DISCRETIONARY 9.5% | |

| Auto Components 0.2% | | |

| Autoliv GDR (SEK) § | 1,700 | 74 |

| Bridgestone (JPY) § | 1,000 | 19 |

| GKN (GBP) | 6,613 | 31 |

| Keystone Automotive *§ | 700 | 17 |

| Koito Manufacturing (JPY) | 3,800 | 40 |

| Strattec Security * | 300 | 16 |

| TRW * | 700 | 17 |

| | | 214 |

| Automobiles 0.4% | | |

| Bayerische Motoren Werke (EUR) | 1,417 | 65 |

| Ford Motor § | 21,600 | 221 |

| Honda (JPY) | 900 | 44 |

| Renault (EUR) § | 706 | 62 |

| Toyota Motor (JPY) | 3,800 | 136 |

| Winnebago § | 100 | 3 |

| | | 531 |

| Distributors 0.0% | | |

| Cycle & Carriage (SGD) | 501 | 4 |

| Pacific Brands (AUD) | 11,153 | 19 |

| | | 23 |

| Diversified Consumer Services 0.3% | | |

| Apollo Group, Class A * | 4,250 | 332 |

| Corinthian Colleges * | 700 | 9 |

| Education Management * | 400 | 14 |

| Matthews International, Class A | 1,500 | 58 |

| | | 413 |

| Hotels, Restaurants & Leisure 1.6% | | |

| Applebee’s | 662 | 18 |

| BJ’s Restaurants *§ | 800 | 16 |

| Carnival | 10,200 | 556 |

| CEC Entertainment * | 550 | 23 |

| Great Wolf Resorts *§ | 400 | 8 |

| Harrah’s Entertainment | 3,000 | 216 |

| International Game Technology | 9,500 | 267 |

| Marriott, Class A | 3,000 | 205 |

| McDonald’s | 4,400 | 122 |

| Mitchells & Butlers (GBP) | 6,028 | 36 |

| Panera Bread, Class A *§ | 600 | 37 |

| PF Chang’s China Bistro *§ | 500 | 30 |

| Red Robin Gourmet Burgers *§ | 300 | 19 |

| Ruby Tuesday § | 500 | 13 |

| Sonic *§ | 1,437 | 44 |

| Starbucks * | 600 | 31 |

| Starwood Hotels & Resorts | | |

| Worldwide, Equity Units | 4,900 | 287 |

| Texas Roadhouse, Class A *§ | 100 | 3 |

| The Cheesecake Factory * | 1,300 | 45 |

| Wynn Resorts *§ | 2,300 | 109 |

| | | 2,085 |

| Household Durables 0.8% | | |

| Fortune Brands | 1,500 | 133 |

| Goldcrest Company (JPY) § | 600 | 34 |

| Jarden *§ | 950 | 51 |

| Newell Rubbermaid § | 23,200 | 553 |

| Persimmon (GBP) | 3,321 | 47 |

| Philips Electronics (EUR) | 1,550 | 39 |

| Pioneer (JPY) § | 2,000 | 30 |

| Sony (JPY) | 2,500 | 86 |

| THOMSON Multimedia (EUR) § | 3,164 | 75 |

| | | 1,048 |

| Internet & Catalog Retail 0.3% | | |

| Amazon.com *§ | 4,700 | 155 |

| eBay * | 6,200 | 205 |

| J. Jill Group *§ | 1,200 | 16 |

| priceline.com *§ | 600 | 14 |

| | | 390 |

| Leisure Equipment & Products 0.3% | |

| Brunswick | 1,300 | 56 |

| Eastman Kodak | 8,200 | 220 |

| MarineMax *§ | 800 | 25 |

| Nikon (JPY) | 2,000 | 23 |

| Polaris Industries § | 200 | 11 |

| SCP Pool | 737 | 26 |

| | | 361 |

| Media 2.8% | | |

| Aegis Group (GBP) | 27,094 | 48 |

| Comcast | | |

| Class A * | 17,116 | 526 |

| Special Class A * | 11,200 | 335 |

| Disney | 13,200 | 332 |

| Emmis Communications *§ | 800 | 14 |

| Entercom Communications * | 500 | 17 |

| Gestevision Telecino (EUR) | 1,139 | 27 |

| Getty Images *§ | 200 | 15 |

| Liberty Media, Class A * | 15,600 | 159 |

| McGraw-Hill | 1,700 | 75 |

| New York Times, Class A § | 14,700 | 458 |

| News Corp., Class A | 16,300 | 264 |

| Omnicom | 1,100 | 88 |

| Publicis (EUR) § | 2,220 | 65 |

| Rogers Communications | | |

| Class B § | 2,600 | 85 |

| Scholastic * | 1,500 | 58 |

| Scripps, Class A | 4,300 | 210 |

| Singapore Press (SGD) | 7,500 | 19 |

| Time Warner * | 25,400 | 424 |

| Viacom, Class B | 10,490 | 336 |

| WPP Group (GBP) | 5,021 | 52 |

| WPP Group ADR | 450 | 23 |

| Young Broadcasting *§ | 500 | 2 |

| | | 3,632 |

| Multiline Retail 1.1% | | |

| Big Lots * | 900 | 12 |

| Kohl’s * | 6,900 | 386 |

| Nordstrom | 6,300 | 428 |

| Target | 11,300 | 615 |

| | | 1,441 |

| Specialty Retail 1.6% | | |

| AC Moore Arts & Crafts *§ | 400 | 13 |

| AnnTaylor Stores * | 2,200 | 53 |

| Aoyama Trading (JPY) | 700 | 17 |

| Best Buy | 4,400 | 302 |

| Charles Voegele (CHF) | 410 | 26 |

| Christopher & Banks § | 1,075 | 20 |

| Dixons Group (GBP) | 11,503 | 32 |

| DSW, Class A * | 100 | 2 |

| Esprit Holdings (HKD) | 4,600 | 33 |

| Gymboree * | 1,200 | 16 |

| Home Depot | 27,500 | 1,070 |

| Hot Topic *§ | 1,500 | 29 |

| Kesa Electricals (GBP) | 2,784 | 14 |

| Linens ‘n Things * | 800 | 19 |

| Monro Muffler Brake *§ | 800 | 24 |

| Nobia (SEK) | 1,898 | 28 |

| RadioShack | 17,000 | 394 |

| Select Comfort *§ | 700 | 15 |

| The Finish Line, Class A | 600 | 11 |

| Zumiez *§ | 200 | 6 |

| | | 2,124 |

| Textiles, Apparel, & Luxury Goods 0.1% | |

| Adidas-Salomon (EUR) | 243 | 41 |

| Columbia Sportswear *§ | 600 | 30 |

| Culp *§ | 100 | 0 |

| Warnaco Group * | 1,800 | 42 |

| World (JPY) § | 500 | 17 |

| | | 130 |

| Total Consumer Discretionary | | 12,392 |

| |

| CONSUMER STAPLES 5.1% | | |

| Beverages 1.0% | | |

| Allied Domecq (GBP) | 5,168 | 63 |

| Asahi Breweries (JPY) § | 2,600 | 31 |

| Coca-Cola | 20,300 | 848 |

| Kirin Brewery (JPY) | 5,000 | 48 |

| Lion Nathan (NZD) | 5,125 | 29 |

| PepsiCo | 5,850 | 315 |

| | | 1,334 |

| Food & Staples Retailing 1.8% | | |

| Casey’s General Stores | 2,400 | 48 |

| Casino Guichard-Perrachon (EUR) § | 799 | 56 |

| Coles Myer (AUD) § | 6,501 | 46 |

| CVS | 33,200 | 965 |

| J Sainsbury (GBP) | 6,275 | 32 |

| Matsumotokiyoshi (JPY) | 1,000 | 27 |

| METRO (EUR) | 2,271 | 112 |

| Organizacion Soriana, | | |

| Series B (MXN) * | 10,600 | 44 |

| Performance Food Group * | 1,600 | 48 |

| Sysco | 4,600 | 166 |

| Tesco (GBP) | 10,470 | 60 |

| Wal-Mart | 15,000 | 723 |

| Wal-Mart de Mexico, | | |

| Series V (MXN) | 16,100 | 65 |

| Wild Oats Markets *§ | 1,100 | 13 |

| York-Benimaru (JPY) § | 800 | 22 |

| | | 2,427 |

| Food Products 0.7% | | |

| American Italian Pasta, Class A § | 400 | 8 |

| Associated British Foods (GBP) | 3,692 | 55 |

| Campbell Soup | 7,700 | 237 |

| General Mills | 7,860 | 368 |

| Koninklijke Wessanen GDS (EUR) | 2,609 | 37 |

| Nestle (CHF) | 462 | 118 |

| Seneca Foods | | |

| Class A * | 300 | 5 |

| Class B * | 100 | 1 |

| Unilever (GBP) | 9,788 | 94 |

| | | 923 |

| Household Products 0.5% | | |

| Colgate-Palmolive | 9,160 | 457 |

| Procter & Gamble | 3,000 | 159 |

| | | 616 |

| Personal Products 0.3% | | |

| Chattem *§ | 300 | 12 |

| Gillette | 6,800 | 344 |

| L’Oreal (EUR) | 257 | 19 |

| | | 375 |

| Tobacco 0.8% | | |

| Altria Group | 12,680 | 820 |

| UST | 4,630 | 211 |

| | | 1,031 |

| Total Consumer Staples | | 6,706 |

| |

| ENERGY 4.9% | | |

| Energy Equipment & Services 1.9% | | |

| Baker Hughes | 18,900 | 967 |

| BJ Services | 1,700 | 89 |

| FMC Technologies * | 1,900 | 61 |

| Grant Prideco * | 3,500 | 92 |

| Hanover Compressor *§ | 1,800 | 21 |

| Hydril * | 400 | 22 |

| Key Energy Services * | 800 | 9 |

| Lone Star Technologies * | 500 | 23 |

| Saipem (EUR) | 2,116 | 28 |

| Schlumberger | 7,700 | 585 |

| Seacor Holdings *§ | 1,000 | 64 |

| Smith International | 6,200 | 395 |

| Transocean * | 2,000 | 108 |

| W-H Energy Services * | 600 | 15 |

| | | 2,479 |

| Oil, Gas & Consumable Fuels 3.0% | | |

| Bill Barrett *§ | 1,200 | 36 |

| BP (GBP) | 11,862 | 123 |

| BP ADR | 9,138 | 570 |

| Chevron | 6,548 | 366 |

| China Shenhua Energy (HKD) * | 29,000 | 28 |

| Eni S.p.A. (EUR) | 6,478 | 166 |

| ExxonMobil | 13,726 | 789 |

| Forest Oil * | 1,600 | 67 |

| INPEX (JPY) | 3 | 17 |

| Marathon Oil | 5,560 | 297 |

| Murphy Oil | 2,600 | 136 |

| Neste Oil (EUR) * | 800 | 21 |

| Noble Energy | 300 | 23 |

| Oil Search (AUD) | 24,410 | 57 |

| OMV (EUR) | 72 | 31 |

| Petroleo Brasileiro (Petrobras) ADR | |

| (1 ADR represents | | |

| 1 preference share) | 3,200 | 147 |

| Shell Transport & Trading (GBP) | 18,310 | 178 |

| Shell Transport & Trading ADR § | 400 | 23 |

| Statoil ASA (NOK) | 6,226 | 126 |

| TonenGeneral Sekiyu (JPY) § | 2,000 | 22 |

| Total (EUR) | 883 | 207 |

| Total ADR § | 200 | 23 |

| Unocal | 6,630 | 431 |

| | | 3,884 |

| Total Energy | | 6,363 |

| |

| FINANCIALS 13.9% | | |

| Capital Markets 3.4% | | |

| Affiliated Managers Group *§ | 600 | 41 |

| AmeriTrade * | 16,700 | 310 |

| Bank of New York | 1,900 | 55 |

| Charles Schwab | 21,450 | 242 |

| Credit Suisse Group (CHF) | 2,379 | 93 |

| Franklin Resources | 6,700 | 516 |

| Goldman Sachs | 3,200 | 326 |

| Investors Financial Services § | 800 | 30 |

| Legg Mason | 5,250 | 547 |

| Macquarie Bank (AUD) | 2,332 | 106 |

| Mellon Financial | 18,580 | 533 |

| Merrill Lynch | 6,600 | 363 |

| Morgan Stanley | 2,700 | 142 |

| National Financial Partners | 400 | 16 |

| Northern Trust | 7,300 | 333 |

| Piper Jaffray * | 1,000 | 30 |

| State Street | 14,700 | 709 |

| | | 4,392 |

| Commercial Banks 3.1% | | |

| ABN AMRO (EUR) | 2,982 | 73 |

| Alliance & Leicester (GBP) | 3,398 | 53 |

| Allied Irish Banks (EUR) | 1,893 | 40 |

| Amegy Bancorp § | 2,500 | 56 |

| Australia & New Zealand | | |

| Banking (AUD) | 7,621 | 126 |

| Australia & New Zealand | | |

| Banking ADR | 100 | 8 |

| Banca Intesa (EUR) | 12,839 | 59 |

| Banco Santander Central | | |

| Hispano (EUR) | 6,959 | 80 |

| Bank Austria Creditanstalt (EUR) § | 819 | 85 |

| Bank of America | 16,800 | 766 |

| Bank of Fukuoka (JPY) | 6,000 | 35 |

| Bank of Ireland (EUR) | 3,661 | 59 |

| Barclays (GBP) | 18,900 | 188 |

| BNP Paribas (EUR) § | 1,858 | 127 |

| Boston Private Financial § | 700 | 18 |

| Cascade Bancorp § | 600 | 13 |

| Chittenden | 2,143 | 58 |

| Citizens Banking | 1,700 | 51 |

| DBS Group (SGD) | 7,789 | 66 |

| Dexia (EUR) | 1,994 | 44 |

| Glacier Bancorp | 1,165 | 30 |

| Grupo Financiero Banorte (MXN) | 23,297 | 154 |

| HBOS (GBP) | 6,268 | 96 |

| HSBC (GBP) | 4,167 | 66 |

| Joyo (JPY) | 9,000 | 44 |

| Mitsubishi Tokyo Financial (JPY) § | 8 | 67 |

| National Australia Bank (AUD) § | 4,816 | 113 |

| NORDEA (SEK) | 12,040 | 109 |

| Pinnacle Financial Partners *§ | 200 | 5 |

| Provident Bankshares | 900 | 29 |

| Royal Bank of Scotland (GBP) | 6,029 | 182 |

| S-E-Banken (SEK) | 2,499 | 41 |

| Sandy Spring Bancorp § | 1,000 | 35 |

| Signature Bank *§ | 100 | 2 |

| Sumitomo Trust & Banking (JPY) | 10,000 | 61 |

| Svenska Handelsbanken, | | |

| Series A (SEK) | 4,344 | 89 |

| Texas Capital Bancshares *§ | 1,100 | 22 |

| The Bank of Yokohama (JPY) | 10,600 | 61 |

| U.S. Bancorp | 14,000 | 409 |

| UniCredito (EUR) § | 10,034 | 53 |

| Valley National Bancorp § | 1,594 | 37 |

| Wells Fargo | 5,000 | 308 |

| WestAmerica | 1,300 | 69 |

| | | 4,087 |

| Consumer Finance 1.0% | | |

| AIFUL (JPY) | 800 | 59 |

| American Express | 16,450 | 876 |

| SLM Corporation | 6,000 | 305 |

| | | 1,240 |

| Diversified Financial Services 1.5% | | |

| Aktiv Kapital (NOK) | 2,900 | 44 |

| Babcock & Brown (AUD) * | 5,958 | 62 |

| Citigroup | 28,650 | 1,325 |

| ING Groep GDS (EUR) | 2,570 | 72 |

| J.P. Morgan Chase | 13,414 | 474 |

| | | 1,977 |

| Insurance 3.7% | | |

| AFLAC | 500 | 22 |

| Aioi Insurance (JPY) § | 6,000 | 31 |

| American International Group | 23,098 | 1,342 |

| Aspen Insurance Holdings | 1,400 | 39 |

| Assured Guaranty | 2,000 | 47 |

| Aviva (GBP) | 3,830 | 43 |

| AXA (EUR) | 4,628 | 115 |

| Bristol West Holdings § | 1,300 | 24 |

| Brown & Brown | 100 | 4 |

| CNP Assurances (EUR) § | 1,101 | 70 |

| Friends Provident (GBP) | 9,734 | 32 |

| Genworth Financial, Class A | 9,900 | 299 |

| Hannover Rueckversicherung (EUR) | 795 | 30 |

| Harleysville Group | 200 | 4 |

| Hartford Financial Services | 5,400 | 404 |

| Horace Mann Educators | 1,900 | 36 |

| Infinity Property & Casualty | 1,100 | 38 |

| Insurance Australia (AUD) | 5,764 | 26 |

| Markel * | 130 | 44 |

| Marsh & McLennan | 30,500 | 845 |

| Mitsui Sumitomo Insurance (JPY) | 4,300 | 38 |

| Ohio Casualty | 2,700 | 65 |

| PartnerRe | 700 | 45 |

| QBE Insurance (AUD) | 3,607 | 44 |

| SAFECO | 8,000 | 435 |

| Selective Insurance § | 700 | 35 |

| St. Paul Companies | 10,000 | 395 |

| Unipol (EUR) § | 11,812 | 45 |

| W. R. Berkley | 337 | 12 |

| Willis Group Holdings § | 400 | 13 |

| XL Capital | 2,500 | 186 |

| | | 4,808 |

| Real Estate 0.8% | | |

| Arden Realty, REIT | 800 | 29 |

| China Overseas Land & | | |

| Investment (HKD) § | 120,000 | 22 |

| EastGroup Properties, REIT § | 900 | 38 |

| Equity Lifestyle Properties, REIT | 400 | 16 |

| Essex Property Trust, REIT | 100 | 8 |

| Federal Realty Investment Trust, | | |

| REIT | 5,200 | 307 |

| Gables Residential Trust, REIT | 900 | 39 |

| GPT Group, Equity Units (AUD) * | 20,980 | 58 |

| LaSalle Hotel Properties, REIT | 500 | 16 |

| Mirvac Group (AUD) | 6,894 | 19 |

| Parkway Properties, REIT | 300 | 15 |

| Reckson Associates Realty, REIT | 326 | 11 |

| Simon Property Group, REIT | 5,096 | 370 |

| Sun Hung Kai Properties (HKD) | 4,200 | 41 |

| Washington SBI, REIT | 1,000 | 31 |

| Wheelock (HKD) | 8,600 | 14 |

| | | 1,034 |

| Thrifts & Mortgage Finance 0.4% | | |

| Bradford Bingley (GBP) | 9,953 | 58 |

| Fannie Mae | 6,120 | 357 |

| First Niagra Financial | 1,000 | 15 |

| Harbor Florida Bancshares § | 1,300 | 49 |

| Hypo Real Estate Holding (EUR) | 1,961 | 74 |

| Triad Guaranty *§ | 300 | 15 |

| | | 568 |

| Total Financials | | 18,106 |

| |

| HEALTH CARE 8.5% | | |

| Biotechnology 1.3% | | |

| Abgenix *§ | 200 | 2 |

| Alexion Pharmaceutical *§ | 400 | 9 |

| Alkermes *§ | 1,100 | 15 |

| Amgen * | 9,700 | 586 |

| Amylin Pharmaceuticals *§ | 700 | 15 |

| Anadys Pharmaceuticals *§ | 600 | 5 |

| Biogen Idec * | 2,400 | 83 |

| Cephalon *§ | 376 | 15 |

| CSL Limited (AUD) | 1,166 | 30 |

| Cubist Pharmaceuticals *§ | 1,200 | 16 |

| CV Therapeutics *§ | 200 | 4 |

| Cytogen *§ | 400 | 2 |

| Cytokinetics *§ | 100 | 1 |

| deCode genetics *§ | 1,000 | 9 |

| Exelixis * | 1,100 | 8 |

| Genentech * | 4,900 | 393 |

| Gilead Sciences * | 8,200 | 361 |

| InterMune *§ | 1,100 | 14 |

| Martek Biosciences *§ | 700 | 27 |

| Memory Pharmaceuticals * | 400 | 1 |

| Myriad Genetics *§ | 900 | 14 |

| Neurocrine Biosciences *§ | 500 | 21 |

| NPS Pharmaceuticals *§ | 300 | 3 |

| ONYX Pharmaceuticals *§ | 300 | 7 |

| Rigel Pharmaceuticals *§ | 500 | 10 |

| Trimeris *§ | 600 | 6 |

| Vertex Pharmaceuticals *§ | 1,648 | 28 |

| | | 1,685 |

| Health Care Equipment & Supplies 1.5% | |

| Advanced Neuromodulation | | |

| Systems *§ | 1,200 | 47 |

| Analogic § | 500 | 25 |

| Baxter International | 14,600 | 542 |

| Biomet | 4,500 | 156 |

| Boston Scientific * | 2,700 | 73 |

| DJ Orthopedics * | 900 | 25 |

| Edwards Lifesciences * | 600 | 26 |

| Elekta, Series B (SEK) * | 1,083 | 45 |

| Greatbatch *§ | 600 | 14 |

| Integra LifeSciences *§ | 1,300 | 38 |

| Medtronic | 9,500 | 492 |

| NuVasive *§ | 700 | 11 |

| ResMed *§ | 1,300 | 86 |

| St. Jude Medical * | 3,600 | 157 |

| Steris | 1,000 | 26 |

| Stryker | 4,000 | 190 |

| Thoratec *§ | 700 | 11 |

| Wright Medical Group *§ | 500 | 13 |

| | | 1,977 |

| Health Care Providers & Services 2.6% | |

| Accredo Health * | 1,300 | 59 |

| Alliance UniChem (GBP) | 1,973 | 30 |

| AmerisourceBergen § | 6,600 | 456 |

| Caremark RX * | 2,200 | 98 |

| Celesio (EUR) | 658 | 52 |

| Henry Schein * | 1,400 | 58 |

| LabOne *§ | 400 | 16 |

| LCA-Vision § | 300 | 15 |

| Lifeline Systems *§ | 800 | 26 |

| LifePoint Hospitals * | 200 | 10 |

| Odyssey Healthcare *§ | 800 | 12 |

| Sunrise Senior Living *§ | 1,500 | 81 |

| Symbion *§ | 1,000 | 24 |

| United Surgical Partners | | |

| International *§ | 1,100 | 57 |

| UnitedHealth Group | 27,800 | 1,449 |

| VistaCare, Class A *§ | 100 | 2 |

| WellChoice * | 500 | 35 |

| WellPoint * | 12,800 | 891 |

| | | 3,371 |

| Pharmaceuticals 3.1% | | |

| Abbott Laboratories | 2,200 | 108 |

| AstraZeneca ADR | 1,700 | 70 |

| Atherogenics *§ | 800 | 13 |

| Dainippon Pharma (JPY) § | 2,000 | 19 |

| Eisai (JPY) § | 1,100 | 37 |

| Eli Lilly | 900 | 50 |

| Eon Labs * | 500 | 15 |

| GlaxoSmithKline (GBP) | 5,940 | 143 |

| GlaxoSmithKline ADR | 900 | 44 |

| Hisamitsu Pharmaceutical (JPY) § | 1,400 | 37 |

| Inspire Pharmaceuticals *§ | 1,300 | 11 |

| IVAX * | 900 | 19 |

| Johnson & Johnson | 7,460 | 485 |

| Kobayashi Pharmaceutical (JPY) § | 1,000 | 27 |

| Medicines Company * | 300 | 7 |

| Merck | 23,000 | 708 |

| Nektar Therapeutics *§ | 300 | 5 |

| Novartis (CHF) | 3,619 | 172 |

| Noven Pharmaceuticals *§ | 1,200 | 21 |

| Pfizer | 13,400 | 370 |

| Sanofi-Aventis (EUR) | 1,516 | 124 |

| Schering-Plough | 18,400 | 351 |

| Sepracor * | 500 | 30 |

| Takeda Chemical Industries (JPY) | 900 | 45 |

| Teva Pharmaceutical ADR § | 6,600 | 206 |

| Theravance *§ | 200 | 3 |

| UCB (EUR) | 1,095 | 53 |

| Wyeth | 21,380 | 951 |

| | | 4,124 |

| Total Health Care | | 11,157 |

| |

| INDUSTRIALS & BUSINESS SERVICES 7.0% | |

| Aerospace & Defense 1.1% | | |

| Armor Holdings *§ | 1,600 | 63 |

| BAE Systems (GBP) | 8,367 | 43 |

| General Dynamics | 1,200 | 131 |

| Honeywell International | 7,700 | 282 |

| Lockheed Martin | 13,100 | 850 |

| Mercury Computer Systems * | 500 | 14 |

| Rockwell Collins | 1,300 | 62 |

| Rolls-Royce (GBP) * | 4,580 | 24 |

| | | 1,469 |

| Air Freight & Logistics 0.1% | | |

| EGL *§ | 1,200 | 24 |

| Exel (GBP) | 1,644 | 25 |

| Pacer International * | 600 | 13 |

| Ryder System | 300 | 11 |

| UPS, Class B | 600 | 41 |

| UTi Worldwide § | 400 | 28 |

| Yamato Transport (JPY) | 2,000 | 28 |

| | | 170 |

| Airlines 0.0% | | |

| Frontier Airlines *§ | 900 | 9 |

| Midwest Express Holdings *§ | 900 | 2 |

| Qantas Airways (AUD) | 8,810 | 23 |

| | | 34 |

| Building Products 0.1% | | |

| Pilkington (GBP) | 21,311 | 46 |

| Quixote § | 300 | 6 |

| Trex *§ | 600 | 15 |

| | | 67 |

| Commercial Services & Supplies 1.0% | |

| Angelica § | 700 | 17 |

| Cendant | 5,300 | 119 |

| Central Parking § | 500 | 7 |

| ChoicePoint * | 1,300 | 52 |

| Consolidated Graphics * | 1,100 | 45 |

| Downer EDI (AUD) | 6,504 | 26 |

| First Advantage, Class A * | 200 | 5 |

| G & K Services, Class A | 1,000 | 38 |

| Herman Miller | 1,800 | 55 |

| Intersections *§ | 200 | 2 |

| Kforce * | 1,600 | 14 |

| LECG *§ | 1,000 | 21 |

| R.R. Donnelley | 11,600 | 400 |

| Resources Global Professionals *§ | 1,600 | 37 |

| Ritchie Bros Auctioneers | 700 | 27 |

| Synagro Technologies *§ | 2,200 | 11 |

| Tetra Tech * | 1,590 | 22 |

| Waste Connections * | 700 | 26 |

| Waste Management | 15,022 | 426 |

| West Corporation * | 400 | 15 |

| | | 1,365 |

| Construction & Engineering 0.2% | | |

| Acciona (EUR) | 1,160 | 115 |

| China State Construction (HKD) * | 6,666 | 0 |

| Insituform Technologies *§ | 800 | 13 |

| JGC (JPY) § | 4,000 | 49 |

| NCC AB, Series B (SEK) | 4,045 | 60 |

| | | 237 |

| Electrical Equipment 0.1% | | |

| A.O. Smith § | 1,800 | 48 |

| Artesyn Technologies *§ | 1,400 | 12 |

| Baldor Electric § | 1,400 | 34 |

| Sumitomo | | |

| Electric Industries (JPY) § | 3,000 | 31 |

| Woodward Governor | 100 | 8 |

| | | 133 |

| Industrial Conglomerates 2.0% | | |

| DCC (EUR) | 3,830 | 76 |

| GE | 35,200 | 1,220 |

| Hutchison Whampoa (HKD) | 7,000 | 63 |

| Sembcorp (SGD) | 41,360 | 65 |

| Siemens (EUR) | 1,368 | 100 |

| Tyco International | 39,252 | 1,146 |

| | | 2,670 |

| Machinery 1.5% | | |

| 3-D Systems *§ | 100 | 2 |

| Accuride * | 600 | 6 |

| Actuant, Class A *§ | 940 | 45 |

| Cargotec (EUR) * | 920 | 26 |

| Cascade § | 600 | 26 |

| Danaher | 15,400 | 806 |

| Deere | 11,800 | 773 |

| Fanuc (JPY) | 800 | 51 |

| Graco | 1,050 | 36 |

| Harsco | 1,200 | 65 |

| IDEX | 450 | 17 |

| Lindsay Manufacturing § | 1,200 | 28 |

| SKF AB (Redemption shares) | | |

| Series B (SEK) | 2,700 | 28 |

| Toro | 1,700 | 66 |

| | | 1,975 |

| Marine 0.1% | | |

| Nippon Yusen (JPY) | 12,000 | 69 |

| | | 69 |

| Road & Rail 0.7% | | |

| Arriva (GBP) | 5,657 | 55 |

| Burlington Northern Santa Fe | 8,000 | 377 |

| Genesee & Wyoming, Class A *§ | 200 | 5 |

| Heartland Express | 776 | 15 |

| Knight Transportation § | 1,450 | 35 |

| Nippon Express (JPY) § | 4,000 | 17 |

| Norfolk Southern | 11,400 | 353 |

| Union Pacific | 100 | 7 |

| | | 864 |

| Trading Companies & Distributors 0.1% | |

| Electro Rent *§ | 600 | 9 |

| Interline Brands * | 600 | 12 |

| Mitsubishi (JPY) § | 4,900 | 66 |

| Sumitomo (JPY) | 4,000 | 32 |

| | | 119 |

| Total Industrials & Business Services | 9,172 |

| |

| INFORMATION TECHNOLOGY 11.6% | |

| Communications Equipment 2.1% | | |

| ADTRAN | 1,900 | 47 |

| Belden CDT § | 1,400 | 30 |

| Cisco Systems * | 28,400 | 543 |

| Corning * | 56,300 | 936 |

| F5 Networks * | 200 | 9 |

| Juniper Networks * | 7,400 | 186 |

| Lucent Technologies *§ | 65,500 | 190 |

| Nokia ADR | 19,600 | 326 |

| Nokia OYJ (EUR) | 7,715 | 128 |

| Packeteer *§ | 400 | 6 |

| QUALCOMM | 7,000 | 231 |

| Research In Motion * | 1,500 | 111 |

| Riverstone Networks * | 2,000 | 1 |

| Tekelec *§ | 400 | 7 |

| | | 2,751 |

| Computers & Peripherals 0.9% | | |

| Creative Technology (SGD) | 1,200 | 8 |

| Dell * | 20,300 | 802 |

| EMC * | 16,500 | 226 |

| Emulex * | 1,200 | 22 |

| Gateway *§ | 6,700 | 22 |

| Synaptics *§ | 600 | 13 |

| Toshiba (JPY) | 8,000 | 32 |

| | | 1,125 |

| Electronic Equipment & Instruments 0.2% | |

| Cogent *§ | 300 | 9 |

| DTS *§ | 700 | 12 |

| Global Imaging Systems * | 900 | 29 |

| Hamamatsu Photonics (JPY) | 1,100 | 24 |

| KEMET *§ | 2,200 | 14 |

| Kyocera (JPY) | 300 | 23 |

| Littelfuse *§ | 900 | 25 |

| Methode Electronics | 1,200 | 14 |

| National Instruments § | 600 | 13 |

| Newport * | 900 | 12 |

| Orbotech * | 500 | 11 |

| Plexus * | 2,200 | 31 |

| Shimadzu (JPY) § | 8,000 | 50 |

| TDK (JPY) | 300 | 20 |

| Woodhead Industries | 1,200 | 15 |

| | | 302 |

| Internet Software & Services 0.9% | | |

| Digital Insight * | 1,200 | 29 |

| Digital River *§ | 300 | 10 |

| Google, Class A * | 1,600 | 471 |

| IAC/InterActiveCorp *§ | 6,000 | 144 |

| MatrixOne *§ | 1,900 | 9 |

| Yahoo! * | 13,600 | 471 |

| | | 1,134 |

| IT Services 1.8% | | |

| Accenture, Class A * | 6,600 | 150 |

| Affiliated Computer | | |

| Services, Class A * | 400 | 21 |

| Automatic Data Processing | 6,600 | 277 |

| BISYS Group * | 1,300 | 19 |

| CACI International, Class A *§ | 800 | 51 |

| First Data | 30,668 | 1,231 |

| Fiserv * | 3,900 | 168 |

| Global Payments § | 900 | 61 |

| Indra Sistemas (EUR) | 3,566 | 70 |

| Iron Mountain * | 1,825 | 57 |

| Logica (GBP) | 3,673 | 11 |

| Maximus | 1,200 | 42 |

| MPS Group * | 2,800 | 26 |

| Paychex | 2,500 | 81 |

| RightNow Technologies *§ | 1,200 | 14 |

| Trans Cosmos (JPY) | 800 | 32 |

| | | 2,311 |

| Office Electronics 0.1% | | |

| Canon (JPY) | 1,400 | 73 |

| Neopost (EUR) | 472 | 42 |

| | | 115 |

| Semiconductor & Semiconductor | | |

| Equipment 2.8% | | |

| AMIS Holdings * | 900 | 12 |

| Analog Devices | 9,300 | 347 |

| Atheros Communications *§ | 200 | 2 |

| ATMI *§ | 1,000 | 29 |

| Brooks-Pri Automation * | 1,200 | 18 |

| Cabot Microelectronics *§ | 500 | 14 |

| Credence Systems *§ | 1,500 | 14 |

| Cymer *§ | 1,300 | 34 |

| Cypress Semiconductor *§ | 600 | 8 |

| Entegris * | 1,700 | 17 |

| Exar * | 1,400 | 21 |

| FEI *§ | 700 | 16 |

| Intel | 42,300 | 1,102 |

| KLA-Tencor | 1,200 | 52 |

| Lattice Semiconductor * | 2,500 | 11 |

| Linear Technology | 2,800 | 103 |

| Marvell Technology Group * | 3,900 | 148 |

| Maxim Integrated Products | 11,300 | 432 |

| Microchip Technology | 3,200 | 95 |

| Microsemi *§ | 300 | 6 |

| MKS Instruments * | 1,800 | 30 |

| Mykrolis *§ | 1,600 | 23 |

| PDF Solutions *§ | 1,400 | 18 |

| Power Integrations *§ | 700 | 15 |

| Rohm Company (JPY) | 100 | 10 |

| Samsung Electronics (KRW) | 100 | 47 |

| Semiconductor | | |

| Manufacturing ADR *§ | 900 | 9 |

| Semtech * | 1,900 | 32 |

| Silicon Laboratories *§ | 700 | 18 |

| Texas Instruments | 24,600 | 690 |

| Virage Logic *§ | 200 | 2 |

| Xilinx | 10,300 | 263 |

| | | 3,638 |

| Software 2.8% | | |

| Adobe Systems | 6,600 | 189 |

| Altiris *§ | 800 | 12 |

| Blackbaud § | 100 | 1 |

| Catapult Communications *§ | 500 | 9 |

| CCC Information Services *§ | 800 | 19 |

| FactSet Research Systems § | 1,350 | 48 |

| FileNet * | 1,600 | 40 |

| Hyperion Solutions * | 500 | 20 |

| Internet Security Systems * | 900 | 18 |

| Intuit * | 5,300 | 239 |

| Jack Henry & Associates | 3,200 | 59 |

| Kronos * | 1,000 | 40 |

| Mercury Interactive * | 300 | 12 |

| Microsoft | 89,480 | 2,223 |

| Motive * | 900 | 9 |

| NetIQ * | 1,584 | 18 |

| Open Solutions *§ | 400 | 8 |

| Oracle * | 26,100 | 345 |

| Progress Software * | 1,000 | 30 |

| Quest Software * | 1,500 | 20 |

| Red Hat *§ | 1,000 | 13 |

| RSA Security * | 1,200 | 14 |

| SAP (EUR) | 460 | 80 |

| SPSS * | 400 | 8 |

| Trend Micro (JPY) § | 500 | 18 |

| VERITAS Software * | 8,175 | 199 |

| Verity *§ | 1,500 | 13 |

| | | 3,704 |

| Total Information Technology | | 15,080 |

| |

| MATERIALS 3.0% | | |

| Chemicals 1.3% | | |

| Airgas | 3,000 | 74 |

| Arch Chemicals § | 1,200 | 30 |

| BASF (EUR) | 1,096 | 73 |

| Dow Chemical | 8,800 | 392 |

| DSM (EUR) | 538 | 37 |

| DuPont | 7,184 | 309 |

| Ferro | 2,000 | 40 |

| Kaneka (JPY) | 4,000 | 45 |

| MacDermid | 700 | 22 |

| Material Sciences * | 800 | 12 |

| Minerals Technologies | 700 | 43 |

| Mitsubishi Gas Chemical (JPY) | 6,000 | 30 |

| Mitsui Chemicals (JPY) § | 4,000 | 23 |

| Monsanto | 2,700 | 170 |

| Potash Corp./Saskatchewan | 4,000 | 382 |

| Symyx Technologies *§ | 800 | 22 |

| Yara International (NOK) | 2,742 | 43 |

| | | 1,747 |

| Construction Materials 0.2% | | |

| Boral (AUD) | 18,744 | 92 |

| Cemex (MXN) | 19,516 | 83 |

| Holcim (CHF) | 558 | 34 |

| | | 209 |

| Containers & Packaging 0.0% | | |

| Chesapeake Corp. | 700 | 15 |

| DS Smith (GBP) | 15,467 | 40 |

| Smurfit-Stone Container * | 300 | 3 |

| | | 58 |

| Metals & Mining 1.2% | | |

| Alcoa | 5,868 | 153 |

| Anglo American (GBP) | 2,776 | 65 |

| BHP Billiton (AUD) § | 2,800 | 38 |

| BlueScope Steel (AUD) § | 17,233 | 107 |

| Corus Group (GBP) * | 56,812 | 42 |

| Gibraltar Industries § | 450 | 8 |

| Lihir Gold (AUD) * | 8,500 | 8 |

| Meridian Gold * | 1,900 | 34 |

| Nippon Steel (JPY) § | 34,000 | 79 |

| Nucor § | 6,300 | 288 |

| Phelps Dodge | 6,200 | 574 |

| SSAB Svenskt Stal, Series A (SEK) | 3,215 | 74 |

| Voestalpine (EUR) § | 717 | 50 |

| | | 1,520 |

| Paper & Forest Products 0.3% | | |

| Buckeye Technologies * | 1,900 | 15 |

| MeadWestvaco | 5,700 | 160 |

| UPM-Kymmene (EUR) | 703 | 13 |

| Weyerhaeuser | 3,800 | 242 |

| | | 430 |

| Total Materials | | 3,964 |

| |

| TELECOMMUNICATION SERVICES 1.7% | |

| Diversified Telecommunication Services 0.7% | |

| China Telecom (HKD) | 93,000 | 33 |

| Compania de Telecomunics | | |

| Chile ADR § | 2,700 | 27 |

| Eircom Group (EUR) | 24,733 | 55 |

| Sprint | 13,300 | 334 |

| Tele Danmark (DKK) | 2,312 | 99 |

| Tele Norte Leste ADR § | 2,900 | 48 |

| Telenor ASA (NOK) | 13,393 | 106 |

| Telus (Non-voting shares) | 4,400 | 150 |

| | | 852 |

| Wireless Telecommunication Services 1.0% | |

| America Movil ADR, Series L § | 4,400 | 262 |

| Bouygues (EUR) | 2,185 | 91 |

| China Unicom (HKD) | 17,000 | 14 |

| KDDI (JPY) | 13 | 60 |

| MobilCom AG (EUR) | 2,872 | 62 |

| Nextel Communications | | |

| Class A * | 14,100 | 456 |

| Nextel Partners, Class A * | 1,500 | 38 |

| SBA Communications *§ | 100 | 1 |

| SpectraSite * | 900 | 67 |

| Starhub (SGD) * | 24,000 | 26 |

| Vodafone ADR | 9,200 | 224 |

| | | 1,301 |

| Total Telecommunication Services | 2,153 |

| |

| UTILITIES 1.6% | | |

| Electric Utilities 0.8% | | |

| Cleco | 800 | 17 |

| E.ON AG (EUR) | 2,507 | 223 |

| El Paso Electric * | 600 | 12 |

| Exelon | 5,550 | 285 |

| FirstEnergy | 6,087 | 293 |

| Hong Kong Electric (HKD) | 4,600 | 21 |

| Iberdrola, (EUR) | 2,976 | 78 |

| TEPCO (JPY) | 2,500 | 60 |

| Unisource Energy | 1,300 | 40 |

| | | 1,029 |

| Gas Utilities 0.1% | | |

| Australian Gas Light (AUD) | 2,475 | 27 |

| Centrica (GBP) | 17,767 | 74 |

| Southwest Gas | 300 | 8 |

| Toho Gas (JPY) | 16,000 | 66 |

| | | 175 |

| Independent Power Producers & Energy Traders 0.7% | |

| Black Hills | 400 | 15 |

| Constellation Energy Group | 3,900 | 225 |

| TXU | 7,240 | 601 |

| | | 841 |

| Multi-Utilities 0.0% | | |

| United Utilities (GBP) | 3,754 | 44 |

| | | 44 |

| Total Utilities | | 2,089 |

| Total Common Stocks (Cost $65,979) | 87,182 |

| |

| PREFERRED STOCKS 0.0% | | |

| Fresenius (EUR) | 393 | 45 |

| Total Preferred Stocks (Cost $19) | 45 |

| |

| CORPORATE BONDS 4.0% | | |

| ABN Amro Bank (Chicago) | | |

| 7.125%, 6/18/07 | 40,000 | 42 |

| ACE INA Holdings | | |

| 5.875%, 6/15/14 | 35,000 | 37 |

| AIG Sunamerica Global | | |

| Financing XII | | |

| 144A, 5.30%, 5/30/07 | 100,000 | 102 |

| Alabama Power | | |

| VR, 3.484%, 8/25/09 | 35,000 | 35 |

| Allstate Financial Global Funding | |

| 144A, 5.25%, 2/1/07 | 35,000 | 36 |

| Amerada Hess, 7.875%, 10/1/29 | 30,000 | 38 |

| America Movil, 5.50%, 3/1/14 | 30,000 | 30 |

| Amgen, 4.00%, 11/18/09 | 30,000 | 30 |

| AOL Time Warner | | |

| 7.625%, 4/15/31 | 45,000 | 56 |

| AT&T Broadband | | |

| 8.375%, 3/15/13 | 50,000 | 61 |

| AT&T Wireless, 8.75%, 3/1/31 | 40,000 | 56 |

| Atmos Energy, 4.00%, 10/15/09 | 50,000 | 49 |

| Baker Hughes, 6.875%, 1/15/29 | 65,000 | 81 |

| Bank of America Capital Trust | | |

| 5.625%, 3/8/35 | 50,000 | 53 |

| Bank One, 5.25%, 1/30/13 | 85,000 | 88 |

| BB&T, 6.50%, 8/1/11 | 20,000 | 22 |

| Belo, 8.00%, 11/1/08 | 5,000 | 5 |

| Black Hills, 6.50%, 5/15/13 | 40,000 | 43 |

| Bunge Limited Finance | | |

| 4.375%, 12/15/08 | 45,000 | 45 |

| Canadian National Railway | | |

| 6.25%, 8/1/34 | 50,000 | 59 |

| Capital One Bank | | |

| 6.50%, 6/13/13 | 30,000 | 33 |

| CE Electric UK Funding | | |

| 144A, 6.995%, 12/30/07 | 35,000 | 36 |

| Celulosa Arauco y Constitucion | | |

| 5.125%, 7/9/13 | 40,000 | 40 |

| Centerpoint Energy | | |

| 7.25%, 9/1/10 | 30,000 | 33 |

| CIT Group, 5.00%, 2/1/15 | 80,000 | 81 |

| Comcast, 5.65%, 6/15/35 | 30,000 | 30 |

| ConocoPhillips | | |

| 5.90%, 10/15/32 | 45,000 | 50 |

| Countrywide Home Loans | | |

| 4.125%, 9/15/09 | 50,000 | 49 |

| CVS, 4.00%, 9/15/05 | 25,000 | 25 |

| DaimlerChrysler | | |

| 6.50%, 11/15/13 | 50,000 | 54 |

| Deutsche Telekom International | | |

| Finance | | |

| VR, STEP, 8.75%, 6/15/30 | 35,000 | 47 |

| Developers Diversified Realty | | |

| 3.875%, 1/30/09 | 35,000 | 34 |

| Devon Financing | | |

| 7.875%, 9/30/31 | 40,000 | 52 |

| Diamond Offshore Drilling | | |

| 5.15%, 9/1/14 | 30,000 | 31 |

| 144A, 4.875%, 7/1/15 | 35,000 | 35 |

| Dow Chemical, 6.125%, 2/1/11 | 30,000 | 33 |

| Duke Capital | | |

| 4.302%, 5/18/06 | 25,000 | 25 |

| 6.25%, 2/15/13 | 40,000 | 43 |

| Encana Holdings Finance | | |

| 5.80%, 5/1/14 | 50,000 | 54 |

| EOP Operating, 4.65%, 10/1/10 | 35,000 | 35 |

| ERAC USA Finance Company | | |

| 144A, 5.60%, 5/1/15 | 40,000 | 41 |

| Exelon Generation | | |

| 5.35%, 1/15/14 | 35,000 | 36 |

| Ford Motor Credit | | |

| 5.80%, 1/12/09 | 140,000 | 134 |

| VR, 4.218%, 11/16/06 | 25,000 | 25 |

| France Telecom, VR, STEP | | |

| 8.50%, 3/1/11 | 40,000 | 46 |

| Franklin Resources | | |

| 3.70%, 4/15/08 | 15,000 | 15 |

| Fund American Companies | | |

| 5.875%, 5/15/13 | 45,000 | 47 |

| General Electric Capital | | |

| 6.00%, 6/15/12 | 60,000 | 65 |

| General Motors Acceptance Corp. | | |

| 8.00%, 11/1/31 | 35,000 | 31 |

| Genworth Financial | | |

| 5.75%, 6/15/14 | 45,000 | 48 |

| GlaxoSmithKline Capital | | |

| 5.375%, 4/15/34 | 30,000 | 32 |

| Goldman Sachs Capital I | | |

| 6.345%, 2/15/34 | 90,000 | 98 |

| GTECH Holdings | | |

| 4.50%, 12/1/09 | 25,000 | 25 |

| Harrah’s Operating | | |

| 5.50%, 7/1/10 | 25,000 | 26 |

| HBOS, 144A, 6.00%, 11/1/33 | 40,000 | 45 |

| Hearst-Argyle, 7.00%, 1/15/18 | 5,000 | 5 |

| Highmark, 144A, 6.80%, 8/15/13 | 35,000 | 39 |

| Hospira, 4.95%, 6/15/09 | 45,000 | 46 |

| HSBC Finance, 5.00%, 6/30/15 | 60,000 | 61 |

| Huntington National Bank | | |

| 4.375%, 1/15/10 | 50,000 | 50 |

| International Lease Finance | | |

| 6.375%, 3/15/09 | 45,000 | 48 |

| International Speedway | | |

| 4.20%, 4/15/09 | 20,000 | 20 |

| iStar Financial, 5.125%, 4/1/11 | 45,000 | 45 |

| John Deere Capital | | |

| 7.00%, 3/15/12 | 55,000 | 63 |

| Kaneb Pipe Line Operations | | |

| 7.75%, 2/15/12 | 25,000 | 28 |

| Kraft Foods, 5.625%, 11/1/11 | 45,000 | 48 |

| Kroger, 8.05%, 2/1/10 | 45,000 | 51 |

| Legg Mason, 6.75%, 7/2/08 | 25,000 | 27 |

| Lehman Brothers Holdings | | |

| 3.50%, 8/7/08 | 70,000 | 69 |

| Lennar, 144A, 5.60%, 5/31/15 | 40,000 | 41 |

| MBNA America Bank | | |

| 4.625%, 8/3/09 | 50,000 | 51 |

| McCormick, 6.40%, 2/1/06 | 125,000 | 127 |

| MDC Holdings, 5.50%, 5/15/13 | 60,000 | 61 |

| Motorola, 5.80%, 10/15/08 | 45,000 | 47 |

| Nationwide Financial Services | | |

| 5.90%, 7/1/12 | 55,000 | 59 |

| Nationwide Mutual Insurance | | |

| 144A, 6.60%, 4/15/34 | 25,000 | 27 |

| Newmont Mining | | |

| 5.875%, 4/1/35 | 55,000 | 56 |

| News America, 6.20%, 12/15/34 | 30,000 | 32 |

| NLV Financial | | |

| 144A, 7.50%, 8/15/33 | 30,000 | 35 |

| Norfolk Southern | | |

| 6.00%, 4/30/08 | 60,000 | 62 |

| Northern Trust, 4.60%, 2/1/13 | 30,000 | 30 |

| NVR, 5.00%, 6/15/10 | 35,000 | 35 |

| Panhandle Eastern Pipeline | | |

| 4.80%, 8/15/08 | 20,000 | 20 |

| Pemex Project Funding Master Trust | |

| 7.375%, 12/15/14 | 30,000 | 34 |

| 144A, VR, 4.71%, 6/15/10 | 45,000 | 46 |

| PG&E | | |

| 6.05%, 3/1/34 | 35,000 | 39 |

| VR, 3.82%, 4/3/06 | 3,000 | 3 |

| Pinnacle West Capital | | |

| 6.40%, 4/1/06 | 45,000 | 46 |

| PPL Capital Funding | | |

| 4.33%, 3/1/09 | 45,000 | 44 |

| Principal Life Global Funding | | |

| 144A, 5.125%, 10/15/13 | 45,000 | 46 |

| Principal Mutual Life Insurance | | |

| 144A, 8.00%, 3/1/44 | 45,000 | 54 |

| Progress Energy, 6.75%, 3/1/06 | 30,000 | 30 |

| Prudential Financial | | |

| 3.75%, 5/1/08 | 40,000 | 40 |

| Public Service of New Mexico | | |

| 4.40%, 9/15/08 | 35,000 | 35 |

| Pulte Homes, 7.875%, 8/1/11 | 35,000 | 40 |

| Residential Capital | | |

| 144A, 6.375%, 6/30/10 | 15,000 | 15 |

| Rogers Cable, 5.50%, 3/15/14 | 40,000 | 38 |

| Ryland Group, 5.375%, 7/15/05 | 20,000 | 20 |

| Sealed Air | | |

| 144A, 5.375%, 4/15/08 | 40,000 | 41 |

| Security Benefit Life Insurance | | |

| 144A, 7.45%, 10/1/33 | 20,000 | 23 |

| Simon Property Group | | |

| 3.75%, 1/30/09 | 45,000 | 44 |

| SLM Corporation | | |

| VR, 3.361%, 1/26/09 | 50,000 | 50 |

| VR, 4.13%, 4/1/09 | 35,000 | 35 |

| Sprint Capital, 7.625%, 1/30/11 | 55,000 | 63 |

| Telecom Italia Capital | | |

| 5.25%, 11/15/13 | 45,000 | 46 |

| Telefonos de Mexico | | |

| 144A, 5.50%, 1/27/15 | 35,000 | 35 |

| Telus, 8.00%, 6/1/11 | 30,000 | 35 |

| TGT Pipeline | | |

| 144A, 5.50%, 2/1/17 | 15,000 | 15 |

| Transamerica Capital | | |

| 144A, 7.65%, 12/1/26 | 25,000 | 30 |

| Transocean, 7.50%, 4/15/31 | 30,000 | 39 |

| TXU Energy, VR, 3.92%, 1/17/06 | 10,000 | 10 |

| U.S. Bank, 2.87%, 2/1/07 | 40,000 | 39 |

| United Technologies | | |

| 5.40%, 5/1/35 | 40,000 | 42 |

| Verizon Global Funding | | |

| 7.75%, 12/1/30 | 45,000 | 58 |

| Wachovia, 6.40%, 4/1/08 | 20,000 | 21 |

| Webster Financial | | |

| 5.125%, 4/15/14 | 45,000 | 46 |

| Wells Fargo, VR, 3.512%, 3/23/07 | 55,000 | 55 |

| Westar Energy, 5.10%, 7/15/20 | 25,000 | 25 |

| Western Power Distribution Holdings | |

| 144A, 6.875%, 12/15/07 | 25,000 | 26 |

| Western Resources, 7.875%, | | |

| 5/1/07 | 25,000 | 27 |

| XTO Energy, 6.25%, 4/15/13 | 30,000 | 32 |

| Yum! Brands, 7.70%, 7/1/12 | 45,000 | 53 |

| Total Corporate Bonds (Cost $5,026) | 5,205 |

| |

| ASSET-BACKED SECURITIES 0.5% | | |

| BankBoston Home Equity Loan Trust | |

| Series 1998-1, Class A6 | | |

| 6.35%, 2/25/13 | 56,375 | 58 |

| Chase Funding Mortgage Loan | | |

| Series 2002-2, Class 1M1 | | |

| 5.599%, 9/25/31 | 20,000 | 20 |

| Chase Manhattan Auto Owner Trust | |

| Series 2001-B, Class CTFS | | |

| 3.75%, 5/15/08 | 13,694 | 14 |

| Series 2003-A, Class A4 | | |

| 2.06%, 12/15/09 | 80,000 | 78 |

| Countrywide Asset-Backed Certificates | |

| Series 2003-5, Class AF3 | | |

| 3.613%, 4/25/30 | 58,807 | 59 |

| New Century Home Equity Loan Trust | |

| Series 2005-A, Class A6 | | |

| VR, 4.954%, 8/25/35 | 135,000 | 136 |

| Series 2005-A, Class M2 | | |

| VR, 5.344%, 8/25/35 | 50,000 | 50 |

| Peco Energy Transition Trust | | |

| Series 2001-A, Class A1 | | |

| 6.52%, 12/31/10 | 110,000 | 121 |

| Reliant Energy Transition Bond | | |

| Series 2001-1, Class A4 | | |

| 5.63%, 9/15/15 | 100,000 | 108 |

| Total Asset-Backed Securities | | |

| (Cost $635) | | 644 |

| |

| FOREIGN GOVERNMENT OBLIGATIONS | |

| & MUNICIPALITIES 0.9% | | |

| Asian Development Bank | | |

| 6.25%, 6/15/11 (AUD) | 295,000 | 234 |

| European Investment Bank | | |

| 5.75%, 9/15/09 (AUD) | 100,000 | 77 |

| Federal Republic of Germany | | |

| 3.25%, 4/9/10 (EUR) | 280,000 | 351 |

| Government of Canada | | |

| 5.25%, 6/1/12 (CAD) | 365,000 | 327 |

| Republic of South Africa | | |

| 6.50%, 6/2/14 § | 70,000 | 78 |

| United Mexican States | | |

| 6.375%, 1/16/13 § | 55,000 | 59 |

| Total Foreign Government Obligations & | |

| Municipalities (Cost $1,018) | | 1,126 |

| |

| NON-U.S. GOVERNMENT MORTGAGE-BACKED | |

| SECURITIES 1.5% | | |

| Banc of America Commercial Mortgage | |

| Series 2003-1, Class A2 | | |

| CMO, 4.648%, 9/11/36 | 100,000 | 101 |

| Series 2004-6, Class A1 | | |

| CMO, 3.801%, 12/10/42 | 23,099 | 23 |

| Bank of America Mortgage Securities | |

| Series 2003-L, Class 2A2 | | |

| CMO, VR, 4.276% | | |

| 1/24/34 | 122,138 | 123 |

| Series 2004-1, Class 3A2 | | |

| CMO, VR, 4.971% | | |

| 10/25/34 | 45,894 | 46 |

| Series 2004-A, Class 2A2 | | |

| CMO, VR, 4.133%, | | |

| 2/25/34 | 65,177 | 65 |

| Series 2004-D, Class 2A2 | | |

| CMO, VR, 4.51%, 5/25/34 | 49,284 | 49 |

| Series 2004-H, Class 2A2 | | |

| CMO, VR, 4.79%, 9/25/34 | 42,331 | 43 |

| Bear Stearns Commercial Mortgage Securities | |

| Series 2004-PWR6, Class A1 | | |

| CMO, 3.688%, 11/11/41 | 16,114 | 16 |

| Series 2004-T14, Class A2 | | |

| CMO, 4.17%, 1/12/41 | 225,000 | 224 |

| Series 2005-PWR8, Class A4 | | |

| CMO, 4.674%, 6/11/41 | 140,000 | 141 |

| Series 2005-T18, Class A1 | | |

| CMO, 4.274%, 2/13/42 | 97,837 | 98 |

| Citigroup Commercial Mortgage Trust | |

| Series 2004-C2, Class A1 | | |

| CMO, 3.787%, 10/15/41 | 13,938 | 14 |

| Commercial Mortgage | | |

| Series 2005-LP5, Class A1 | | |

| CMO, 4.235%, 5/10/43 | 97,520 | 98 |

| DLJ Commercial Mortgage | | |

| Series 1999-CG2, Class A1B | | |

| CMO, 7.30%, 6/10/32 | 75,000 | 82 |

| GE Capital Commercial Mortgage | |

| Series 2001-1, Class A2 | | |

| CMO, 6.531%, 5/15/33 | 100,000 | 110 |

| GMAC Commercial Mortgage Securities | |

| Series 2001-C2, Class A1 | | |

| CMO, 6.25%, 4/15/34 | 102,044 | 106 |

| Greenwich Capital Commercial Funding | |

| Series 2004-GG1A, Class A2 | | |

| CMO, 3.835%, 6/10/36 | 84,887 | 84 |

| Series 2005-GG3, Class AAB | | |

| CMO, VR, 4.619% | | |

| 8/10/42 | 35,000 | 35 |

| J.P. Morgan Chase Commercial Mortgage Securities | |

| Series 2001-CIB2, Class A2 | | |

| CMO, 6.244%, 4/15/35 | 100,000 | 105 |

| Series 2001-CIBC, Class A3 | | |

| CMO, 6.26%, 3/15/33 | 100,000 | 109 |

| LB-UBS Commercial Mortgage Trust | |

| Series 2004-C2, Class A2 | | |

| CMO, 3.246%, 3/15/29 | 125,000 | 121 |

| Series 2004-C4, Class A2 | | |

| CMO, VR, 4.567%, | | |

| 5/15/29 | 125,000 | 126 |

| Washington Mutual | | |

| Series 2004-AR1, Class A, CMO | |

| VR, 4.229%, 3/25/34 | 42,229 | 41 |

| Total Non-U.S. Government | | |

| Mortgage-Backed Securities (Cost $1,972) | 1,960 |

| |

| U.S. GOVERNMENT & AGENCY MORTGAGE-BACKED | |

| SECURITIES 7.3% | | |

| U.S. Government Agency Obligations ± 6.1% | |

| Federal Home Loan Mortgage | | |

| 4.50%, 11/1/18 - 5/1/19 | 260,084 | 259 |

| 5.00%, 12/1/08 - 11/1/18 | 280,870 | 284 |

| 5.50%, 9/1 - 12/1/33 | 59,845 | 61 |

| 6.00%, 10/1/16 - 3/1/33 | 422,231 | 434 |

| 7.00%, 6/1/32 | 32,810 | 35 |

| ARM, 4.573%, 9/1/32 | 28,497 | 29 |

| CMO | | |

| 4.50%, 3/15/16 | 175,000 | 174 |

| 5.00%, 10/15 - 11/15/27 | 225,000 | 227 |

| 5.50%, 4/15/28 | 200,000 | 205 |

| CMO, IO | | |

| 4.50%, 7/15/11 - 5/15/16 | 257,000 | 25 |

| TBA, 5.00%, 1/1/35 | 255,000 | 255 |

| Federal National Mortgage Assn. | | |

| 4.50%, 5/1/18 - 1/1/19 | 501,554 | 501 |

| 5.50%, 1/1/17 - 1/1/35 | 2,175,567 | 2,217 |

| 6.00%, | | |

| 10/1/13 - 11/1/34 | 1,428,228 | 1,467 |

| 6.50%, 5/1/17 - 12/1/32 | 290,236 | 301 |

| 7.00%, 4/1/32 | 10,371 | 11 |

| CMO | | |

| 2.91%, 11/25/33 | 27,713 | 27 |

| 3.50%, 4/25/13 | 75,000 | 74 |

| 5.00%, 3/25/15 | 125,000 | 126 |

| CMO, IO | | |

| 5.50%, 11/25/28 | 44,333 | 3 |

| 6.50%, 2/1/32 | 26,487 | 4 |

| TBA | | |

| 4.50%, 1/1/35 | 25,000 | 24 |

| 5.00%, 1/1/33 | 896,000 | 894 |

| 6.00%, 1/1/34 | 300,000 | 308 |

| | | 7,945 |

| U.S. Government Obligations 1.2% | |

| Government National Mortgage Assn. | |

| 5.00%, 7/15/33 - 3/20/34 | 855,391 | 864 |

| 5.50%, 1/20 - 5/20/34 | 392,722 | 401 |

| 6.00%, 4/15/26 - 2/20/34 | 106,176 | 110 |

| 6.50%, 3/15/26 - 12/20/33 | 91,107 | 95 |

| 7.00%, 9/20/27 | 58,636 | 62 |

| 8.00%, 10/15/25 - 6/15/26 | 24,114 | 26 |

| 8.50%, 12/15/24 | 6,977 | 8 |

| 11.50%, 11/15/19 | 7,675 | 9 |

| CMO, 2.946%, 3/16/19 | 60,000 | 58 |

| | | 1,633 |

| Total U.S. Government & | | |

| Agency Mortgage-Backed | | |

| Securities (Cost $9,556) | | 9,578 |

| |

| U.S. GOVERNMENT AGENCY OBLIGATIONS | |

| (EXCLUDING MORTGAGE-BACKED) 10.1% | |

| U.S. Government Agency Obligations ± 1.6% | |

| Federal Home Loan Bank | | |

| 5.75%, 5/15/12 | 330,000 | 362 |

| Federal Home Loan Mortgage | | |

| 2.75%, 3/15/08 | 87,000 | 85 |

| 4.625%, 2/15/07 (EUR) | 315,000 | 396 |

| 5.125%, 7/15/12 | 135,000 | 144 |

| Federal National Mortgage Assn. | | |

| 3.25%, 8/15/08 | 160,000 | 157 |

| 4.375%, 9/15/12 | 100,000 | 102 |

| 6.00%, 5/15/11 | 310,000 | 341 |

| 7.125%, 6/15/10 - 1/15/30 | 360,000 | 465 |

| | | 2,052 |

| U.S. Treasury Obligations 8.5% | | |

| U.S. Treasury Bonds | | |

| 5.375%, 2/15/31 | 35,000 | 41 |

| 6.00%, 2/15/26 | 590,000 | 728 |

| 6.25%, 8/15/23 - 5/15/30 | 380,000 | 481 |

| 6.375%, 8/15/27 | 140,000 | 182 |

| 7.50%, 11/15/16 | 95,000 | 125 |

| 7.625%, 2/15/25 | 30,000 | 43 |

| 8.50%, 2/15/20 | 185,000 | 271 |

| U.S. Treasury Inflation-Indexed Bonds | |

| 2.375%, 1/15/25 | 268,359 | 294 |

| U.S. Treasury Inflation-Indexed Notes | |

| 2.00%, 7/15/14 | 273,520 | 282 |

| 3.625%, 1/15/08 | 150,535 | 159 |

| U.S. Treasury Notes | | |

| 1.50%, 3/31/06 | 465,000 | 458 |

| 1.875%, 11/30/05 ++ | 1,895,000 | 1,884 |

| 3.375%, 2/28/07 - | | |

| 12/15/08 | 2,180,000 | 2,164 |

| 3.50%, 11/15/06 - | | |

| 2/15/10 | 1,085,000 | 1,084 |

| 4.00%, 6/15/09 | 105,000 | 106 |

| 4.25%, 11/15/13 | 890,000 | 913 |

| 4.75%, 5/15/14 | 20,000 | 21 |

| 5.00%, 8/15/11 | 400,000 | 427 |

| 5.75%, 8/15/10 | 1,280,000 | 1,399 |

| | | 11,062 |

| Total U.S. Government Agency Obligations | |

| (excluding Mortgage-Backed) | | |

| (Cost $12,628) | | 13,114 |

| |

| MUNICIPAL BONDS 0.5% | | |

| Atlanta Airport | | |

| 5.00%, 1/1/33 | | |

| (FSA Insured) | 95,000 | 100 |

| California, GO | | |

| 5.25%, 4/1/34 | 20,000 | 22 |

| Economic Recovery | | |

| 5.00%, 7/1/16 | 25,000 | 27 |

| Clark County School Dist., GO | | |

| 5.00%, 6/15/18 | | |

| (MBIA Insured) | 50,000 | 55 |

| District of Columbia, GO | | |

| 5.00%, 6/1/16 | | |

| (MBIA Insured) | 65,000 | 71 |

| Houston Water & Sewer | | |

| 5.25%, 5/15/16 | | |

| (MBIA Insured) | 80,000 | 89 |

| Kansas Dev. Fin. Auth. | | |

| Public Employee Retirement | | |

| 5.501%, 5/1/34 | | |

| (FSA Insured) | 30,000 | 33 |

| New York City, GO | | |

| 5.00%, 8/1/15 | 60,000 | 65 |

| New York State Urban Dev. Corp. | |

| Corrections & Youth Fac. | |

| 5.25%, 1/1/21 | | |

| (Tender 1/1/09) | 50,000 | 53 |

| North Carolina, GO | | |

| 5.25%, 3/1/13 | 145,000 | 164 |

| Oregon, Taxable Pension, GO | |

| 5.892%, 6/1/27 | 15,000 | 17 |

| Total Municipal Bonds (Cost $685) | 696 |

| |

| SHORT-TERM INVESTMENTS 6.8% | |

| Money Market Fund 6.8% | |

| T. Rowe Price Reserve Investment Fund | |

| 3.14% #† | 8,859,076 | 8,859 |

| Total Short-Term Investments | |

| (Cost $8,859) | | 8,859 |

| |

| DOMESTIC BOND MUTUAL FUNDS 2.4% | |

| T. Rowe Price Institutional High Yield Fund | |

| 7.31% p† | 297,172 | 3,141 |

| Total Domestic Bond Mutual Funds | |

| (Cost $3,117) | | 3,141 |

| |

| SECURITIES LENDING COLLATERAL 5.7% | |

| Money Market Pooled Account 1.1% | |

| Investment in money market pooled | |

| account managed by JP Morgan | |

| Chase Bank, London, | |

| 3.198% # | 1,517,950 | 1,518 |

| Money Market Trust 4.6% | |

| State Street Bank and Trust Company | |

| of New Hampshire N.A. Securities | |

| Lending Quality Trust units, | |

| 3.194% # | 5,959,808 | 5,960 |

| Total Securities Lending Collateral | |

| (Cost $7,478) | | 7,478 |

| |

| FUTURES CONTRACTS 0.0% | |

| Variation margin receivable (payable) | |

| on open futures contracts (2) | (1) |

| Total Futures Contracts | (1) |

| Total Investments in Securities | | |

| 106.5% of Net Assets (Cost $116,972) | | $ 139,027 |

| (1) | Denominated in U.S. dollars unless otherwise noted |

| # | Seven-day yield |

| * | Non-income producing |

| § | All or a portion of this security is on loan at June 30, 2005— |

| | See Note 2 |

| ± | The issuer operates under a congressional charter; its securi- |

| | ties are neither issued nor guaranteed by the U.S. government |

| ++ | All or a portion of this security is pledged to cover margin |

| | requirements on futures contracts at June 30, 2005 |

| † | Affiliated company—See Note 4 |

| p | SEC Yield |

| 144A | Security was purchased pursuant to Rule 144A under the |

| | Securities Act of 1933 and may be resold in transactions |

| | exempt from registration only to qualified institutional |

| | buyers—total value of such securities at period-end |

| | amounts to $768 and represents 0.6% of net assets |

| ADR | American Depository Receipts |

| ARM | Adjustable Rate Mortgage |

| AUD | Australian dollar |

| CAD | Canadian dollar |

| CHF | Swiss franc |

| CMO | Collateralized Mortgage Obligation |

| DKK | Danish krone |

| EUR | Euro |

| FSA | Financial Security Assurance Inc. |

| GBP | British pound |

| GDR | Global Depository Receipts |

| GDS | Global Depository Shares |

| GO | General Obligation |

| HKD | Hong Kong dollar |

| IO | Interest Only security for which the fund receives interest |

| | on notional principal (par) |

| JPY | Japanese yen |

| KRW | South Korean yen |

| MBIA | MBIA Insurance Corp. |

| MXN | Mexican peso |

| NOK | Norwegian krone |

| NZD | New Zealand dollar |

| REIT | Real Estate Investment Trust |

| SEK | Swedish krona |

| SGD | Singapore dollar |

| STEP | Stepped coupon bond for which the coupon rate of interest |

| | will adjust on specified future date(s) |

| TBA | To Be Announced security was purchased on a forward |

| | commitment basis |

| VR | Variable Rate; rate shown is effective rate at period-end |

| (2) Open Futures Contracts at June 30, 2005, were as follows: |

| ($ 000s) | | | | | |

| | | Contract | Unrealized |

| | Expiration | Value | Gain (Loss) |

| Short, 8 U.S. Treasury five year contracts, | | | | | |

| $15 par of 1.875% U.S. Treasury Notes | | | | | |

| pledged as initial margin | 9/05 | $ | (871) | $ | (3) |

| Net payments (receipts) of variation | | | | | |

| margin to date | | | | | 2 |

| Variation margin receivable (payable) | | | | | |

| on open futures contracts | | | | $ | (1) |

The accompanying notes are an integral part of these financial statements.

Statement of Assets and Liabilities

T. Rowe Price Personal Strategy Balanced Portfolio

June 30, 2005 (Unaudited)

(In thousands except shares and per share amounts)

| Assets | | |

| Investments in securities, at value | | |

| Affiliated companies (cost $11,976) | $ | 12,000 |

| Non-affiliated companies (cost $104,996) | | 127,027 |

|

|

| Total investments in securities | | 139,027 |

| Dividends and interest receivable | | 444 |

| Receivable for investment securities sold | | 1,208 |

| Receivable for shares sold | | 213 |

| Other assets | | 4 |

|

|

| Total assets | | 140,896 |

|

|

| |

| Liabilities | | |