UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08352

LKCM Funds

(Exact name of Registrant as specified in charter)

c/o Luther King Capital Management Corporation

301 Commerce Street, Suite 1600

Fort Worth, TX 76102

(Address of principal executive offices) (Zip code)

K&L Gates LLP

1601 K Street, NW

Washington, DC 20006

(Name and address of agent for service)

1-800-688-LKCM and 1-800-423-6369

Registrant’s telephone number, including area code

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

| | (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

LKCM

FUNDS

LKCM Small Cap Equity Fund

LKCM Small-Mid Cap Equity Fund

LKCM Equity Fund

LKCM Balanced Fund

LKCM Fixed Income Fund

LKCM International Equity Fund

Annual Report

December 31, 2023

Dear Fellow Shareholders:

We report the following performance information for the LKCM Funds for indicated periods ended December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Funds | | Inception

Date | | NAV @

12/31/23 | | Net

Expense

Ratio*,** | | Gross

Expense

Ratio** | | One Year

Total

Return

Ended

12/31/23 | | Five Year

Average

Annualized

Return

Ended

12/31/23 | | Ten Year

Average

Annualized

Return

Ended

12/31/23 | | Avg.

Annual

Total

Return

Since

Incept. |

LKCM Small Cap Equity Fund | | | | 07/14/1994 | | | | $ | 19.53 | | | | | 1.01% | | | | | 1.08% | | | | | 22.57% | | | | | 12.57% | | | | | 7.15% | | | | | 10.23% | |

Russell 2000® Index(1) | | | | | | | | | | | | | | | | | | | | | | | | 16.93% | | | | | 9.97% | | | | | 7.16% | | | | | 8.89% | |

LKCM Small-Mid Cap Equity Fund | | | | 05/02/2011 | | | | $ | 9.91 | | | | | 1.01% | | | | | 1.81% | | | | | 25.76% | | | | | 14.11% | | | | | 7.63% | | | | | 8.17% | |

Russell 2500® Index(2) | | | | | | | | | | | | | | | | | | | | | | | | 17.42% | | | | | 11.67% | | | | | 8.36% | | | | | 9.44% | |

LKCM Equity Fund | | | | 01/03/1996 | | | | $ | 34.41 | | | | | 0.81% | | | | | 0.98% | | | | | 12.65% | | | | | 13.22% | | | | | 9.64% | | | | | 9.00% | |

S&P 500® Index®(3) | | | | | | | | | | | | | | | | | | | | | | | | 26.29% | | | | | 15.69% | | | | | 12.03% | | | | | 9.57% | |

LKCM Balanced Fund | | | | 12/30/1997 | | | | $ | 26.00 | | | | | 0.80% | | | | | 0.99% | | | | | 10.84% | | | | | 8.87% | | | | | 7.08% | | | | | 6.71% | |

S&P 500® Index(3) | | | | | | | | | | | | | | | | | | | | | | | | 26.29% | | | | | 15.69% | | | | | 12.03% | | | | | 8.30% | |

Bloomberg U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index(4) | | | | | | | | | | | | | | | | | | | | | | | | 5.24% | | | | | 1.59% | | | | | 1.72% | | | | | 3.83% | |

LKCM Fixed Income Fund | | | | 12/30/1997 | | | | $ | 10.36 | | | | | 0.50% | | | | | 0.79% | | | | | 4.98% | | | | | 1.65% | | | | | 1.59% | | | | | 3.66% | |

Bloomberg U.S. Intermediate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Government/Credit Bond Index(4) | | | | | | | | | | | | | | | | | | | | | | | | 5.24% | | | | | 1.59% | | | | | 1.72% | | | | | 3.83% | |

LKCM International Equity Fund | | | | 05/01/2019 | | | | $ | 12.68 | | | | | 1.01% | | | | | 1.46% | | | | | 16.09% | | | | | NA | | | | | NA | | | | | 6.77% | |

MSCI/EAFE® Index(5) | | | | | | | | | | | | | | | | | | | | | | | | 18.85% | | | | | NA | | | | | NA | | | | | 6.40% | |

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if Luther King Capital Management Corporation, the Funds’ investment adviser, had not waived a portion of its management fee and/or reimbursed certain expenses of the Funds. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Funds. The Funds impose a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

| * | Luther King Capital Management Corporation, the Funds’ investment adviser, has contractually agreed to waive all or a portion of its management fee and/or reimburse expenses of each Fund to maintain the expense ratios designated in the Funds’ prospectus through May 1, 2024. This expense limitation excludes interest, taxes, brokerage commissions, indirect fees and expenses related to investments in other investment companies, including money market funds, and extraordinary expenses. Investment performance, which is based on the net expense ratio, reflects fee waivers, if any, in effect during the relevant period. In the absence of such waivers, total return would be reduced. LKCM waived management fees and/or reimbursed expenses for each Fund during the fiscal year ended December 31, 2023. |

| ** | Expense ratios above are as reported in the Funds’ current prospectus dated May 1, 2023. Expense ratios reported for other periods in the financial highlights of this report may differ. |

| (1) | The Russell 2000® Index is an unmanaged index which measures the performance of the 2,000 smallest companies in the Russell 3000® Index. |

| (2) | The Russell 2500® Index is an unmanaged index which measures the performance of the 2,500 smallest companies in the Russell 3000® Index. |

| (3) | The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market. |

| (4) | The Bloomberg U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued. |

| (5) | The Morgan Stanley Capital International Europe, Australia, Far East Index (“MSCI/EAFE® Index”) is an unmanaged index composed of large-cap and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East. The MSCI/EAFE® Index is a recognized international index and is weighted by market capitalization. |

Note: The indices defined above are not available for direct investment and the index performance therefore does not include fees, expenses or taxes.

2023 Review

Entering 2023, headline U.S. inflation was running at a rate of approximately 6.5% and the U.S. unemployment rate was at a half-century low of approximately 3.5%. At that time, approximately ninety-eight percent of CEOs were preparing for a recession in 2023, according to the Conference Board’s CEO Confidence Survey. This pessimism appeared well founded at the time by the historical economic assumption that there is supposed to be a short-term tradeoff between inflation and unemployment. The cost of lowering inflation has historically been resulting higher unemployment. When people lose their jobs—or worry about losing their jobs—they typically rein in spending, which historically leads to reduced demand and, ultimately, lower prices. This is how the U.S. economy operated the last time the Federal Reserve battled high inflation in the 1970s. Fifty years ago, the result was a deep recession, an extended period of muted economic growth, and higher prices aptly labeled stagflation.

2

We believe the critical factor that helped the U.S. economy avoid a recession in 2023 was the resilience of consumers. Despite ongoing challenges, such as the Russia-Ukraine War and conflict in the Middle East, significant bank failures in the spring of 2023, and the persistent pressure of higher interest rates and tighter financial conditions, U.S. economic growth continued to accelerate through the third quarter of 2023. According to the latest data, the U.S. economy grew at an annualized rate of approximately 4.9% in the third quarter of 2023 before inflation. The strength was driven primarily by consumer spending, which grew at a seasonally adjusted annual rate of approximately 3.6%, contributing approximately 2.5% to real growth in Gross Domestic Product (GDP). The recovery in consumption following the pandemic recession was notably strong, surpassing the performance after recent recessions. We believe a resilient labor market, increasing incomes, the surplus of savings from pandemic-related government transfers, and low debt service ratios all played a role in sustaining this resilient spending trend.

We believe the exceptionally robust labor market has been a key driver of robust consumer spending. The pandemic recession witnessed an unprecedented loss of approximately 22 million jobs in the U.S., surpassing any previous economic downturn. However, the recovery appeared to be remarkably swift. In contrast to the prolonged jobless recoveries of the 2001 and 2007 recessions, which took nearly four and six years to regain lost jobs, respectively, the pandemic recession saw a full recovery within just approximately 2.5 years. Notably, approximately five million additional jobs have been created beyond pre-recession levels. The U.S. unemployment rate has consistently stayed below 4% for a record 21 months, marking the lengthiest sub-4% unemployment streak since the 1960s.

The buoyant labor market appears to have generally contributed to an upswing in incomes post-pandemic. Real per capita incomes have ascended since 2022, reaching a year-over-year growth rate not witnessed since early 2015. Increased real income and stimulus payments during the pandemic bolstered consumer wallets. As of October 2023, total consumer bank deposits reached a peak of approximately $17.4 trillion, which we believe have corresponded to diminishing debt service ratios and elevated net worth. Debt service ratios, having stayed below 10% since 2012, were pushed to historical lows primarily as a result of U.S. government transfer payments during the pandemic.

2024 Outlook

We believe the U.S. economy has witnessed three critical peaks: inflation, economic growth, and the Federal Reserve’s policy interest rate. Historically, these dynamics have typically aligned with a broad peak in interest rates and a subsequent steepening of the yield curve. If inflation continues to subside and economic growth softens, we believe central banks will begin to signal interest rate cuts, which should cause U.S. Treasury yields to drift lower.

We believe inflation should continue its decline in 2024, pulled lower by falling shelter costs. The Zillow Rent Index, which measures the changes in new leases, currently reflects an approximate 3.3% increase in shelter costs over the prior year. This figure compares favorably to an approximate 6.5% rise in shelter costs embedded in the latest Consumer Price Index (CPI) reading, which is designed to reflect all existing leases rather than new leases. The shelter component of CPI is important in our view as it comprises roughly one-third of the index. Though inflation should trend lower during 2024 in our view, we believe the era in which inflation tended to undershoot the Federal Reserve’s 2% target and deflation risks occasionally emerged is likely over.

We believe economic growth proved higher than expected during 2023 as government spending and the drawdown of pandemic-era excess savings offset the impact of meaningfully tighter monetary policy. Despite inflation falling, the Federal Reserve continued to tighten monetary policy during 2023. We believe we are unlikely to see a repeat of the 2023 economic tailwind, consisting of a doubling of the U.S. fiscal deficit—unprecedented outside of wartime—and broadly depleted excess consumer savings—particularly by lower income groups. Therefore, we believe economic growth will likely slow in 2024 due to falling consumer savings, plateauing wage gains, lower savings rates, a softening labor market, less fiscal stimulus, and the lagged effects of high interest rates. We believe a critical risk to the year ahead is that the Federal Reserve must precisely calibrate monetary policy when the economy reaches full employment. If the Federal Reserve cuts interest rates too slowly, unemployment could rise; if it cuts interest rates too fast, inflation could rise. Monetary policy decisions will likely hold the key between tepid economic growth and a slight economic contraction over the next twelve to eighteen months. History also suggests that it is difficult to accelerate growth once the economy has reached full employment.

We believe that interest rates are poised to fall around the world. Central banks rapidly increased interest rates to combat surging inflation in many countries. Domestically, the CPI has fallen by nearly two-thirds since its approximate 9.1% peak in June 2022. With the Federal Reserve holding the upper end of its benchmark rate at 5.50% since July of 2023, any further decline in the inflation rate in our view, will likely result in further monetary tightening in real terms. Monetary policy’s real—or inflation-adjusted—stance has the most significant impact on the economy in our view. We believe that any tightening of real monetary policy into softening economic growth will likely hinder further economic expansion. Accordingly, we believe that central banks in most developed economies will likely loosen interest rates in the year ahead.

We believe that politics will most likely feature prominently in the headlines at home and abroad in the coming year. While the U.S. Presidential election will garner significant attention, there will also be critical elections in India, Indonesia, Mexico, and perhaps the U.K. While the outcome of these elections creates the opportunity for significant policy shifts, we believe markets tend to overestimate the influence of policy shifts on long-term economic trends. Often, the effect of most policy shifts is uncertain and frequently overwhelmed by factors outside the control of governments. In our view, the most significant concern is that the world is passing through a period of peak globalization. The 1990s were a remarkable era of pro-market globalization bookended by the fall of the Berlin Wall in

3

1989 and the acceptance of China into the World Trade Organization in 2001. While it is impossible to know what the future holds, we believe we are witnessing the fracturing of the old order into two primary trading blocs—one anchored by the U.S. and the other by China. We believe this global fracturing into a multipolar world will affect trade and global economic growth.

We anticipate corporate earnings for the S&P 500® Index for 2023 will be essentially unchanged from 2022 once fourth quarter 2023 earnings are reported. If so, this would suggest that the 26.29% return for the S&P 500® Index in 2023 was largely due to the expansion of the Price/Earnings ratio. In our view, the Price/Earnings ratio expanded during 2023 primarily in response to investors reducing both the odds of a recession and interest rates staying “higher for longer.” We believe corporate earnings are forecasted to grow around 11% in 2024, which may prove optimistic in our view. We believe an economy can grow above potential if it is force-fed rapid credit growth or, as it turns out, massive fiscal stimulus. As the tailwind from excessive fiscal stimulus fades, we believe it will be important for corporate profits to drive the equity markets higher in 2024. Most economic soft landings have historically been derailed by an external shock, such as Iraq’s invasion of Kuwait in 1990, which resulted in sharply higher energy prices. While the U.S. economy currently appears to be coming in for a soft landing, we believe it will not take much of a wobble or external shock, such as the escalating turmoil in the Middle East, to tilt the economy into recession as economic growth likely slows in 2024.

LKCM Small Cap Equity Fund

The LKCM Small Cap Equity Fund returned 22.57% for the year ended December 31, 2023, as compared to the 16.93% return for the Russell 2000® Index, the Fund’s benchmark. The Fund’s relative performance benefited from sector allocation decisions, particularly being underweight the Utilities sector and being overweight the Industrials sector relative to the benchmark, which were partially offset by the Fund’s overweight position in the Energy sector. Stock selection decisions in the Consumer Staples, Energy, Industrials, Healthcare and Financials sectors were the largest contributors to the Fund’s relative performance, which were partially offset by stock selection in the Consumer Discretionary, Information Technology and Communication Services sectors – the only three underperforming sectors during the year ended December 31, 2023. Overall, both sector allocation and stock selection decisions contributed positively to the Fund’s performance relative to the benchmark during 2023. The Fund’s bias towards high quality companies and growth-oriented companies benefited the Fund during the first three quarters of 2023, while giving back some of that performance during the frenetic rally during the fourth quarter of 2023 that focused on lower quality companies and value-oriented companies. We continue to focus the Fund’s investment program on companies that we believe have solid fundamentals and attractive entry points for long term capital appreciation.

LKCM Small-Mid Cap Equity Fund

The LKCM Small-Mid Cap Equity Fund returned 25.76% for the year ended December 31, 2023, as compared to the 17.42% return for the Russell 2500® Index, the Fund’s benchmark. During the year, both stock selection and sector allocation decisions were positive contributors to the Fund’s performance relative to the benchmark. Stock selection was the largest positive contributor to the Fund’s relative performance with particularly strong selection in the Industrials, Consumer Staples and Healthcare sectors, which was partially offset by stock selection in the Consumer Discretionary and Communication Services sectors. The Fund’s relative performance also benefited from an overweight position in the Industrials sector and underweight positions in the Utilities and Healthcare sectors, which was partially offset by an overweight position in the Energy sector, which underperformed the market after two strong prior years. In addition, the Fund’s focus on companies that we believe are higher quality benefited the Fund’s relative performance during the year, as higher quality companies generally outperformed lower quality companies during the year. The Fund continues to implement an investment strategy that focuses on companies that we believe are higher quality, and we believe the Fund is well-positioned for 2024.

LKCM Equity Fund

The LKCM Equity Fund returned 12.65% for the year ended December 31, 2023, as compared to the 26.29% return for the S&P 500® Index, the Fund’s benchmark. The Fund’s underweight position in the Utilities and Financials sectors contributed positively to the Fund’s relative performance, which was offset by the Fund’s underweight position in the Communications Services sector and overweight position in the Industrials sector. Stock selection decisions in the Healthcare sector benefited the Fund’s relative performance, which was offset by stock selection decisions in the Information Technology, Materials and Financials sectors. The strong returns for the S&P 500® Index during the past year were predominantly driven by a small number of technology-related companies. While the Fund was invested in some of those companies, our investment strategy focuses on diversification of the Fund’s investments in an effort to minimize portfolio concentration risk. We believe that the Fund’s focus on portfolio diversification as well as investments in higher quality companies have the Fund well-positioned for a potentially volatile election year.

LKCM Balanced Fund

The LKCM Balanced Fund returned 10.84% for the year ended December 31, 2023 versus the 26.29% return for the S&P 500® Index and the 5.24% return for the Bloomberg Intermediate Government/Credit Bond Index, the Fund’s benchmark indices. The Fund’s equity portfolio benefited from being underweight the Utilities, Financials and Healthcare sectors and from stock selection in the Healthcare sector relative to the S&P 500® Index, which was offset by an underweight position and stock selection in the Information Technology sector. The strong returns for the S&P 500® Index during the past year were predominantly driven by a small number of technology-related companies. While the Fund was invested in some of those companies, our investment strategy focuses on diversification of the

4

Fund’s investments in an effort to minimize portfolio concentration risk. The Fund’s fixed income portfolio benefited from its relative short duration during the first part of the year, but lagged the Bloomberg Intermediate Government/Credit Bond Index during the fourth quarter of 2023 as the Federal Reserve pivoted to a less aggressive monetary policy stance. The Fund’s fixed income portfolio slightly outperformed its benchmark for the year and was additive to the Fund’s returns. The Fund’s investment strategy focuses on investments in higher quality companies and portfolio diversification, which we believe have the Fund well-positioned for the future.

LKCM Fixed Income Fund

The LKCM Fixed Income Fund returned 4.98% for the year ended December 31, 2023 compared to its benchmark, the Bloomberg Intermediate Government/Credit Bond Index, which returned 5.24% for the year ended December 31, 2023. During the first three quarters of 2023, the Fund’s shorter duration of approximately 3.2 years was additive to the Fund’s performance, relative to the approximate 3.8 year duration of the benchmark, as the Federal Reserve continued to tighten monetary policy. However, during the fourth quarter of 2023, the Federal Reserve signaled the end of monetary policy tightening for this cycle, and the U.S. Treasury reversed their policy of increasing issuance of longer-term debt that had put upward pressure on longer duration issues earlier in the year. These actions by the Federal Reserve and the U.S. Treasury led the markets to rally sharply into the end of the year as longer duration fixed income securities outperformed their shorter duration counterparts. Despite the substantial volatility throughout the year as a result of the regional banking turmoil, the massive increase in U.S. Treasury issuance to fund the increasing U.S. federal deficit, and 100 basis points of additional monetary policy tightening by the Federal Reserve, the 10-year U.S. Treasury ended 2023 where it began, at approximately 3.88%. In this environment, the Fund’s overweight in corporate bonds relative to government bonds was additive to relative performance as credit spreads tightened during the year. The Fund remains largely focused in the short-to-intermediate duration sector that has continued to help limit price volatility as well as in investment-grade corporate bonds with strong underlying fundamentals to mitigate credit risk and achieve a sustainable cash flow stream.

LKCM International Equity Fund

The LKCM International Equity Fund returned 16.09% for the year ended December 31, 2023, as compared to the 18.85% return for the MSCI/EAFE Index, the Fund’s benchmark. During this period, the Fund’s relative performance benefited from being overweight in the Industrials and Information Technology sectors. The only two sectors weights that detracted from the Fund’s relative performance were the Fund’s underweight position in the Financials sector and overweight position in the Energy sectors. Stock selection decisions in the Materials, Communication Services, and Consumer Discretionary sectors were the largest contributors to positive security selection relative to the benchmark, which were offset by security selection decisions in the Healthcare, Financials, and Energy sectors. Overall, security selection detracted from the Fund’s performance relative to the benchmark, whereas sector allocation offset much of this negative attribution. The Fund’s tilt toward growth-oriented companies weighed on relative performance, particularly, during the latter part of the year when value-oriented companies tended to outperform, and the Financials sector, more specifically, rebounded.

During the past year, we saw deterioration of economic activity in many international markets versus our domestic market with year-over-year growth in real GDP declining as the year progressed for Germany, Japan, Australia, and the United Kingdom. Inflation continues to be persistent in many of these markets, though they have started to experience decelerating inflation. Japan remains an exception as inflation continued to accelerate into the end of the year. Japan also has maintained a much more accommodative rate policy, despite the acceleration in pricing, but the core CPI, excluding food and energy, still remains relatively benign at approximately 2.6%. Other markets have been more aggressive on restrictive monetary policy in order to curb inflationary pressures. Fiscal programs in these markets were much more conservative than in the United States in our view, where the fiscal impulse from legislative policy provided support and liquidity remained high despite restrictive monetary policy. We expect further economic strain during the first portion of 2024 with a possibility for improving economic prospects for these markets as the year progresses.

J. Luther King, Jr., CFA, CIC

January 16, 2024

5

The information provided herein represents the opinion of J. Luther King, Jr., CFA, CIC and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Please refer to the Schedule of Investments found on pages 15-29 of the report for more information on Fund holdings. Fund holdings and sector allocations are subject to change and are not recommendations to buy or sell any securities.

Mutual fund investing involves risk. Principal loss is possible. Past performance is not a guarantee of future results. Investments in equity securities are subject to market risks and significant fluctuations in value. Small and medium capitalization funds typically carry additional risks, since smaller companies generally have a higher risk of failure, and, historically, their equity securities have experienced a greater degree of market volatility than equity securities on average. Investments in debt securities typically decrease in value when interest rates rise. This risk is greater for longer-term debt securities. Investments in mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. These and other risks are discussed in the Funds’ summary and statutory prospectuses.

Earnings growth is not a measure of future performance.

Price-earnings ratio is the ratio of a company’s share price to the company’s earnings per share.

Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Bond ratings are grades given to bonds that indicate their credit quality as determined by a private independent rating service such as S&P Global. The firm evaluates a bond issuer’s financial strength, or its ability to pay a bond’s principal and interest in a timely fashion. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as nonrated.

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Yield curve is a line that plots yields (interest rates) of fixed income securities having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity. An inverted yield curve signals that interest rates associated with fixed income securities with shorter maturities are higher than interest rates associated with fixed income securities with longer maturities.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

Must be preceded or accompanied by a current prospectus.

Investors should consider the investment objective, risks and charges and expenses of a Fund carefully before reinvesting. A Fund’s summary prospectus and the prospectus contain this and other information about a Fund. Investors can obtain a summary prospectus and the prospectus by calling 1-800-688-LKCM. The summary prospectus and the prospectus should be read carefully before investing in a Fund.

Quasar Distributors, LLC, distributor.

6

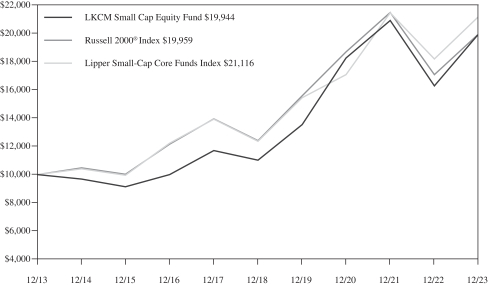

PERFORMANCE:

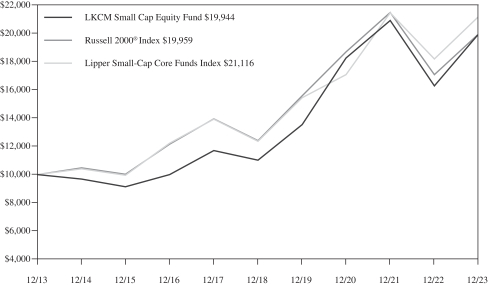

The following information illustrates the historical performance of the LKCM Small Cap Equity Fund as of December 31, 2023 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund. The Fund imposes a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Small-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2023)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Small Cap Equity Fund | | | | 22.57% | | | | | 12.57% | | | | | 7.15% | | | | | 10.23% | |

Russell 2000® Index | | | | 16.93% | | | | | 9.97% | | | | | 7.16% | | | | | 8.89% | |

Lipper Small-Cap Core Funds Index | | | | 16.15% | | | | | 11.30% | | | | | 7.76% | | | | | 9.69% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM SMALL CAP EQUITY FUND

(for the ten years ended December 31, 2023)

The Russell 2000® Index is an unmanaged index consisting of the 2,000 smallest companies in the Russell 3000® Index.

The Lipper Small-Cap Core Funds Index is an unmanaged index generally considered representative of small cap core mutual funds tracked by Lipper, Inc.

7

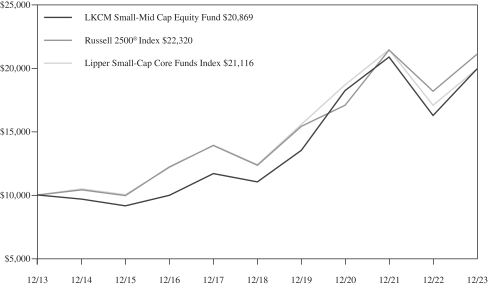

PERFORMANCE:

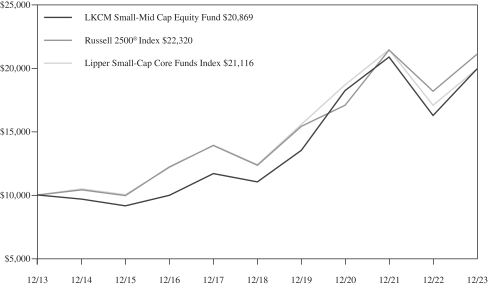

The following information illustrates the historical performance of the LKCM Small-Mid Cap Equity Fund as of December 31, 2023 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund. The Fund imposes a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Small-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2023)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Small-Mid Cap Equity Fund | | | | 25.76% | | | | | 14.11% | | | | | 7.63% | | | | | 8.17% | |

Russell 2500® Index | | | | 17.42% | | | | | 11.67% | | | | | 8.36% | | | | | 9.44% | |

Lipper Small-Cap Core Funds Index | | | | 16.15% | | | | | 11.30% | | | | | 7.76% | | | | | 8.78% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM SMALL-MID CAP EQUITY FUND

(for the ten years ended December 31, 2023)

The Russell 2500® Index is an unmanaged index consisting of the 2,500 smallest companies in the Russell 3000® Index.

The Lipper Small-Cap Core Funds Index is an unmanaged index generally considered representative of small cap core mutual funds tracked by Lipper, Inc.

8

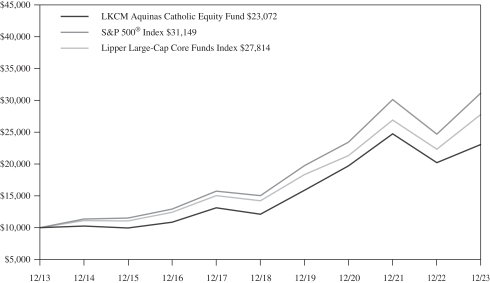

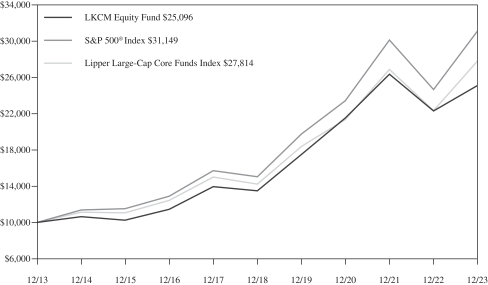

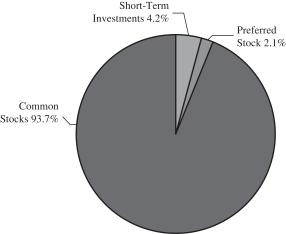

PERFORMANCE:

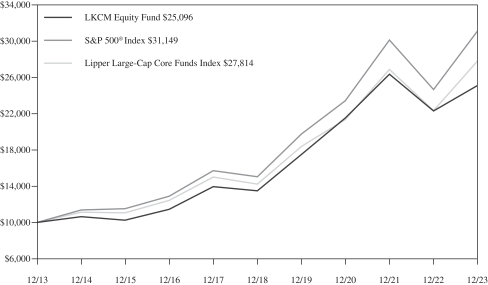

The following information illustrates the historical performance of the LKCM Equity Fund as of December 31, 2023 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund. The Fund imposes a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Large-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2023)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Equity Fund | | | | 12.65% | | | | | 13.22% | | | | | 9.64% | | | | | 9.00% | |

S&P 500® Index | | | | 26.29% | | | | | 15.69% | | | | | 12.03% | | | | | 9.57% | |

Lipper Large-Cap Core Funds Index | | | | 24.65% | | | | | 14.32% | | | | | 10.77% | | | | | 8.52% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM EQUITY FUND

(for the ten years ended December 31, 2023)

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market.

The Lipper Large-Cap Core Funds Index is an unmanaged index generally considered representative of large cap core mutual funds tracked by Lipper, Inc.

9

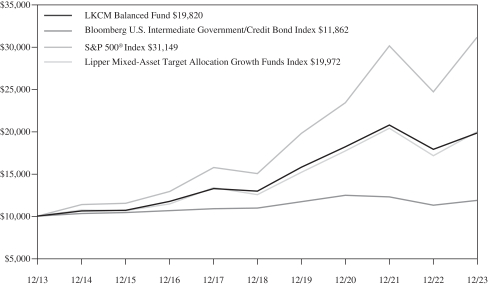

PERFORMANCE:

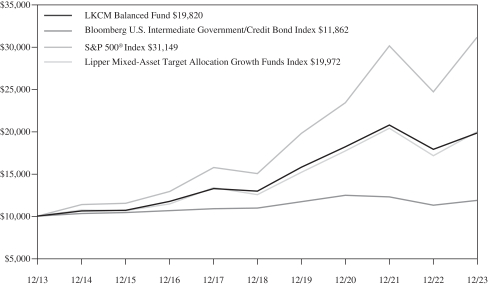

The following information illustrates the historical performance of the LKCM Balanced Fund as of December 31, 2023 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund. The Fund imposes a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Mixed-Asset Target Allocation Growth Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2023)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Balanced Fund | | | | 10.84% | | | | | 8.87% | | | | | 7.08% | | | | | 6.71% | |

S&P 500® Index | | | | 26.29% | | | | | 15.69% | | | | | 12.03% | | | | | 8.30% | |

Bloomberg U.S. Intermediate Government/Credit Bond Index | | | | 5.24% | | | | | 1.59% | | | | | 1.72% | | | | | 3.83% | |

Lipper Mixed-Asset Target Allocation Growth Funds Index | | | | 16.54% | | | | | 9.75% | | | | | 7.16% | | | | | 6.56% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM BALANCED FUND

(for the ten years ended December 31, 2023)

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 selected stocks that is generally considered representative of the performance of large capitalization companies in the U.S. stock market.

The Bloomberg U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria; fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued.

The Lipper Mixed-Asset Target Allocation Growth Funds Index is an unmanaged index generally considered representative of mutual funds tracked by Lipper, Inc. that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash and cash equivalents.

10

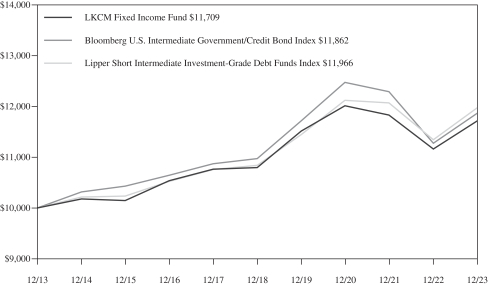

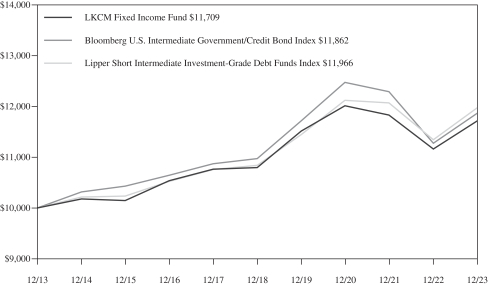

PERFORMANCE:

The following information illustrates the historical performance of the LKCM Fixed Income Fund as of December 31, 2023 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund. The Fund imposes a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper Short Intermediate Investment-Grade Debt Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2023)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM Fixed Income Fund | | | | 4.98% | | | | | 1.65% | | | | | 1.59% | | | | | 3.66% | |

Bloomberg U.S. Intermediate Government/Credit Bond Index | | | | 5.24% | | | | | 1.59% | | | | | 1.72% | | | | | 3.83% | |

Lipper Short Intermediate Investment-Grade Debt Funds Index | | | | 5.56% | | | | | 2.01% | | | | | 1.81% | | | | | 3.47% | |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM FIXED INCOME FUND

(for the ten years ended December 31, 2023)

The Bloomberg U.S. Intermediate Government/Credit Bond Index is an unmanaged market value weighted index measuring both the principal price changes of, and income provided by, the underlying universe of securities that comprise the index. Securities included in the index must meet the following criteria: fixed as opposed to variable rate; remaining maturity of one to ten years; minimum outstanding par value of $250 million; rated investment grade or higher by Moody’s Investors Service or equivalent; must be dollar denominated and non-convertible; and must be publicly issued.

The Lipper Short Intermediate Investment-Grade Debt Funds Index is an unmanaged index generally considered representative of short intermediate investment grade mutual funds tracked by Lipper, Inc.

11

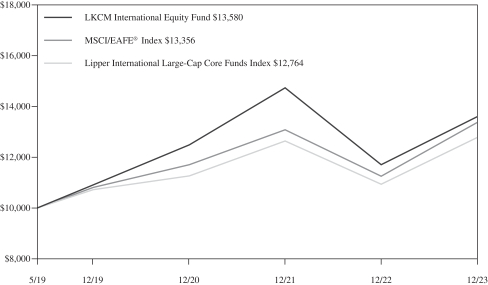

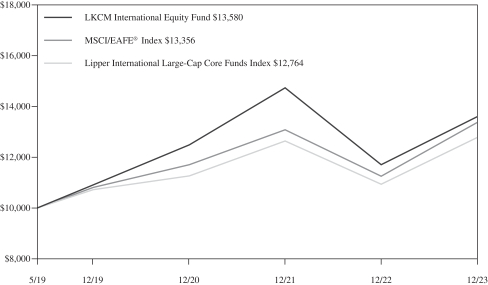

PERFORMANCE:

The following information illustrates the historical performance of the LKCM International Equity Fund as of December 31, 2023 compared to the Fund’s representative benchmark and peer group indices.

Performance data quoted represents past performance; past performance does not guarantee future results. The graph and table reflect the reinvestment of dividends and other distributions, if any, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-688-LKCM. Returns would have been lower if LKCM had not waived a portion of its management fee and/or reimbursed certain expenses of the Fund. Please see Note B to the Notes to the Financial Statements for specific information regarding management fee waiver and/or expense reimbursement arrangements for the Fund. The Fund imposes a 1.00% redemption fee on shares held less than 30 days. If reflected, the fee would reduce performance shown.

An index is an unmanaged portfolio and does not trade or incur any expenses. The Lipper International Large-Cap Core Funds Index, however, does reflect the fees and expenses borne by the funds included in that index. One can not invest in an unmanaged index.

AVERAGE ANNUAL TOTAL RETURN (Periods Ended December 31, 2023)

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Past

1 Year | | Past

5 Years(1) | | Past

10 Years(1) | | Since

Inception(1)(2) |

LKCM International Equity Fund | | | | 16.09 | % | | | | NA | | | | | NA | | | | | 6.77 | % |

MSCI/EAFE® Index | | | | 18.85 | % | | | | NA | | | | | NA | | | | | 6.40 | % |

Lipper International Large-Cap Core Funds Index | | | | 16.82 | % | | | | NA | | | | | NA | | | | | 5.37 | % |

A HYPOTHETICAL $10,000 INVESTMENT IN LKCM INTERNATIONAL EQUITY FUND

(for the period from May 1, 2019 (inception date) to December 31, 2023)

The Morgan Stanley Capital International Europe, Australia, Far East Index (“MSCI/EAFE® Index”) is an unmanaged index composed of large-cap and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East. The MSCI/EAFE® Index is a recognized international index and is weighted by market capitalization.

The Lipper International Large-Cap Core Funds Index is an unmanaged index generally considered representative of large cap core mutual funds tracked by Lipper Inc.

12

LKCM Funds Expense Example — December 31, 2023 (Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (07/01/2023-12/31/2023).

ACTUAL EXPENSES

The third and fourth columns of the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the fourth column under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC (doing business as U.S. Bank Global Fund Services), the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem your shares of the LKCM Small Cap Equity, Small-Mid Cap Equity, Equity, Balanced, Fixed Income, and International Equity Funds within 30 days of purchase, unless otherwise determined by the Funds in their discretion. To the extent the Funds invest in shares of other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes management fees, registration fees and other expenses. However, the example below does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles.

HYPOTHETICAL EXAMPLES FOR COMPARISON PURPOSES

The fifth and sixth columns of the table below provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the fifth and sixth columns of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical (5% return

before expenses) |

| | | Fund’s

Annualized

Expense

Ratio(1) | | Beginning

Account Value

07/01/2023 | | Ending

Account Value

12/31/2023 | | Expenses

Paid

During

Period(1) | | Ending

Account Value

12/31/2023 | | Expenses

Paid

During

Period(1) |

LKCM Small Cap Equity Fund | | | | 1.00 | % | | | $ | 1,000.00 | | | | $ | 1,081.70 | | | | $ | 5.25 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

LKCM Small-Mid Cap Equity Fund | | | | 1.00 | % | | | $ | 1,000.00 | | | | $ | 1,111.00 | | | | $ | 5.32 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

LKCM Equity Fund | | | | 0.80 | % | | | $ | 1,000.00 | | | | $ | 1,040.50 | | | | $ | 4.11 | | | | $ | 1,021.17 | | | | $ | 4.08 | |

LKCM Balanced Fund | | | | 0.80 | % | | | $ | 1,000.00 | | | | $ | 1,046.80 | | | | $ | 4.13 | | | | $ | 1,021.17 | | | | $ | 4.08 | |

LKCM Fixed Income Fund | | | | 0.50 | % | | | $ | 1,000.00 | | | | $ | 1,036.00 | | | | $ | 2.57 | | | | $ | 1,022.68 | | | | $ | 2.55 | |

LKCM International Equity Fund | | | | 1.00 | % | | | $ | 1,000.00 | | | | $ | 1,016.00 | | | | $ | 5.08 | | | | $ | 1,020.16 | | | | $ | 5.09 | |

| (1) | Expenses are equal to the annualized net expense ratio for the Fund, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

13

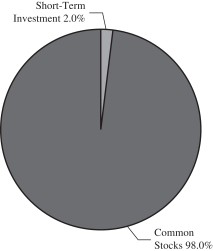

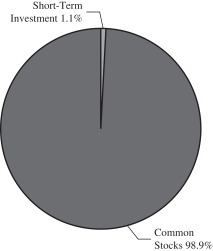

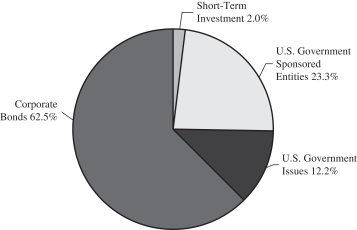

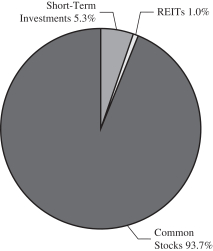

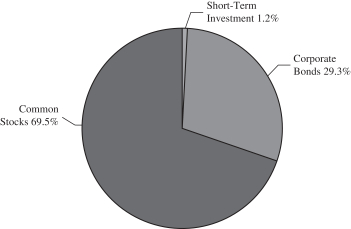

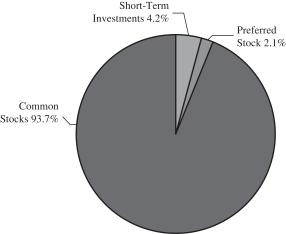

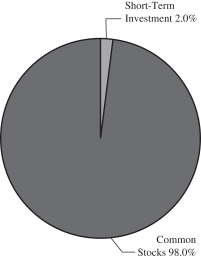

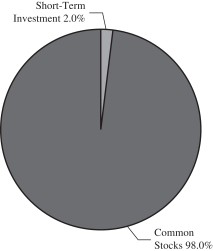

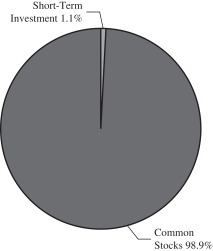

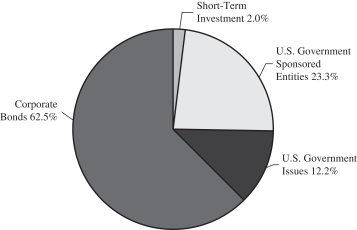

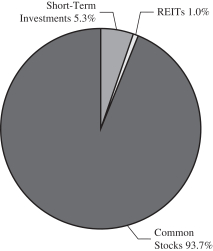

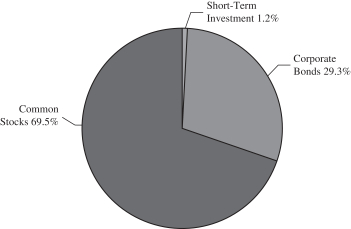

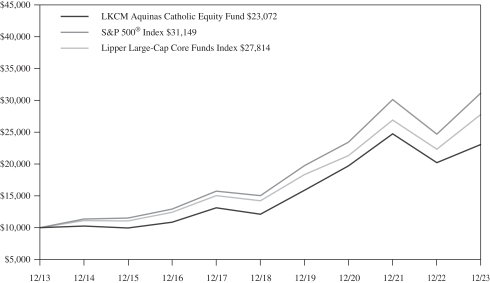

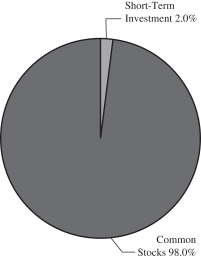

ALLOCATION OF PORTFOLIO HOLDINGS — LKCM Funds — December 31, 2023

Percentages represent market value as a percentage of total investments.

LKCM Small Cap Equity Fund

LKCM Equity Fund

LKCM Fixed Income Fund

LKCM Small-Mid Cap Equity Fund

LKCM Balanced Fund

LKCM International Equity Fund

14

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| as of December 31, 2023 |

| | | | | | | | | | |

| COMMON STOCKS - 98.3% | | Shares | | Value |

| Aerospace & Defense - 2.0% | | |

Hexcel Corp. | | | | 39,900 | | | | $ | 2,942,625 | |

Mercury Systems, Inc. (a) | | | | 46,949 | | | | | 1,716,925 | |

| | | | | | | | | | |

| | | | | | | | | 4,659,550 | |

| | | | | | | | | | |

| Banks - 7.4% | | |

Cadence Bank | | | | 99,352 | | | | | 2,939,826 | |

Cullen/Frost Bankers, Inc. | | | | 21,375 | | | | | 2,318,974 | |

Hilltop Holdings, Inc. | | | | 32,874 | | | | | 1,157,494 | |

Home BancShares Inc./AR | | | | 141,973 | | | | | 3,596,176 | |

Pinnacle Financial Partners, Inc. | | | | 46,057 | | | | | 4,017,091 | |

Webster Financial Corp. | | | | 61,844 | | | | | 3,139,201 | |

| | | | | | | | | | |

| | | | | | | | | 17,168,762 | |

| | | | | | | | | | |

| Beverages - 1.3% | | |

Primo Water Corp. (b) | | | | 202,743 | | | | | 3,051,282 | |

| | | | | | | | | | |

| Broadline Retail - 0.9% | | |

Ollie’s Bargain Outlet Holdings, Inc. (a) | | | | 28,293 | | | | | 2,147,156 | |

| | | | | | | | | | |

| Building Products - 5.3% | | |

CSW Industrials, Inc. | | | | 20,048 | | | | | 4,158,156 | |

PGT Innovations, Inc. (a) | | | | 114,297 | | | | | 4,651,887 | |

Zurn Elkay Water Solutions Corp. | | | | 115,319 | | | | | 3,391,532 | |

| | | | | | | | | | |

| | | | | | | | | 12,201,575 | |

| | | | | | | | | | |

| Chemicals - 4.1% | | |

Ecovyst, Inc. (a) | | | | 367,120 | | | | | 3,586,763 | |

Ferroglobe Representation & Warranty Insurance Trust (a)(c) | | | | 302,970 | | | | | 0 | |

Hawkins, Inc. | | | | 39,493 | | | | | 2,781,097 | |

Quaker Chemical Corp. | | | | 14,941 | | | | | 3,188,708 | |

| | | | | | | | | | |

| | | | | | | | | 9,556,568 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 0.8% | | |

Driven Brands Holdings Inc. (a) | | | | 124,781 | | | | | 1,779,377 | |

| | | | | | | | | | |

| Communications Equipment - 0.8% | | |

Lumentum Holdings, Inc. (a) | | | | 34,025 | | | | | 1,783,591 | |

| | | | | | | | | | |

| Construction Materials - 1.2% | | |

Eagle Materials, Inc. | | | | 13,412 | | | | | 2,720,490 | |

| | | | | | | | | | |

| Consumer Finance - 1.0% | | |

FirstCash Holdings, Inc. | | | | 20,481 | | | | | 2,219,936 | |

| | | | | | | | | | |

| Electrical Equipment - 0.8% | | |

Generac Holdings, Inc. (a) | | | | 15,144 | | | | | 1,957,211 | |

| | | | | | | | | | |

| Energy Equipment & Services - 2.3% | | |

Weatherford International PLC (a)(b) | | | | 55,184 | | | | | 5,398,652 | |

| | | | | | | | | | |

| Financial Services - 4.1% | | |

AvidXchange Holdings, Inc. (a) | | | | 339,404 | | | | | 4,205,215 | |

Euronet Worldwide, Inc. (a) | | | | 28,100 | | | | | 2,851,869 | |

Repay Holdings Corp. (a) | | | | 279,840 | | | | | 2,389,834 | |

| | | | | | | | | | |

| | | | | | | | | 9,446,918 | |

| | | | | | | | | | |

| Food Products - 1.0% | | |

Utz Brands, Inc. | | | | 139,223 | | | | | 2,260,982 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Health Care Equipment & Supplies - 3.7% | | |

Alphatec Holdings, Inc. (a) | | | | 195,847 | | | | $ | 2,959,248 | |

Enovis Corp. (a) | | | | 54,242 | | | | | 3,038,637 | |

Neogen Corp. (a) | | | | 125,934 | | | | | 2,532,533 | |

| | | | | | | | | | |

| | | | | | | | | 8,530,418 | |

| | | | | | | | | | |

| Health Care Providers & Services - 3.9% | | |

Ensign Group, Inc. | | | | 7,851 | | | | | 880,961 | |

HealthEquity, Inc. (a) | | | | 37,029 | | | | | 2,455,023 | |

Progyny, Inc. (a) | | | | 79,386 | | | | | 2,951,570 | |

R1 RCM Inc. (a) | | | | 257,880 | | | | | 2,725,792 | |

| | | | | | | | | | |

| | | | | | | | | 9,013,346 | |

| | | | | | | | | | |

| Hotels, Restaurants & Leisure - 6.1% | | |

Bowlero Corp. (a) | | | | 189,190 | | | | | 2,678,930 | |

Everi Holdings, Inc. (a) | | | | 181,945 | | | | | 2,050,520 | |

Playa Hotels & Resorts NV (a)(b) | | | | 350,322 | | | | | 3,030,285 | |

Red Rock Resorts, Inc. - Class A | | | | 51,909 | | | | | 2,768,307 | |

Wingstop, Inc. | | | | 14,088 | | | | | 3,614,700 | |

| | | | | | | | | | |

| | | | | | | | | 14,142,742 | |

| | | | | | | | | | |

| Insurance - 3.3% | | |

Goosehead Insurance, Inc. - Class A (a) | | | | 63,278 | | | | | 4,796,472 | |

Palomar Holdings, Inc. (a) | | | | 52,983 | | | | | 2,940,557 | |

| | | | | | | | | | |

| | | | | | | | | 7,737,029 | |

| | | | | | | | | | |

| IT Services - 0.7% | | |

Perficient Inc. (a) | | | | 25,450 | | | | | 1,675,119 | |

| | | | | | | | | | |

| Leisure Products - 0.6% | | |

YETI Holdings, Inc. (a) | | | | 28,454 | | | | | 1,473,348 | |

| | | | | | | | | | |

| Life Sciences Tools & Services - 2.9% | | |

Medpace Holdings, Inc. (a) | | | | 13,349 | | | | | 4,091,869 | |

Stevanato Group SpA (b) | | | | 96,142 | | | | | 2,623,715 | |

| | | | | | | | | | |

| | | | | | | | | 6,715,584 | |

| | | | | | | | | | |

| Machinery - 9.6% | | |

Alamo Group, Inc. | | | | 19,357 | | | | | 4,068,648 | |

Chart Industries, Inc. (a) | | | | 19,311 | | | | | 2,632,669 | |

ESAB Corp. | | | | 52,221 | | | | | 4,523,382 | |

Franklin Electric Co., Inc. | | | | 18,534 | | | | | 1,791,311 | |

Helios Technologies, Inc. | | | | 51,458 | | | | | 2,333,620 | |

ITT, Inc. | | | | 30,360 | | | | | 3,622,555 | |

Watts Water Technologies, Inc. - Class A | | | | 15,324 | | | | | 3,192,602 | |

| | | | | | | | | | |

| | | | | | | | | 22,164,787 | |

| | | | | | | | | | |

| Marine Transportation - 1.8% | | |

Kirby Corp. (a) | | | | 52,376 | | | | | 4,110,468 | |

| | | | | | | | | | |

| Media - 2.4% | | |

Magnite, Inc. (a) | | | | 279,296 | | | | | 2,608,625 | |

Nexstar Media Group, Inc. - Class A | | | | 18,077 | | | | | 2,833,569 | |

| | | | | | | | | | |

| | | | | | | | | 5,442,194 | |

| | | | | | | | | | |

| Oil, Gas & Consumable Fuels - 6.6% | | |

CNX Resources Corp. (a) | | | | 164,454 | | | | | 3,289,080 | |

HF Sinclair Corp. | | | | 48,714 | | | | | 2,707,037 | |

Magnolia Oil & Gas Corp. - Class A | | | | 159,066 | | | | | 3,386,515 | |

The accompanying notes are an integral part of these financial statements.

15

|

| LKCM SMALL CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| as of December 31, 2023 |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Oil, Gas & Consumable Fuels - 6.6%, Continued | | |

Northern Oil and Gas, Inc. | | | | 76,508 | | | | $ | 2,836,152 | |

Permian Resources Corp. | | | | 216,937 | | | | | 2,950,343 | |

| | | | | | | | | | |

| | | | | | | | | 15,169,127 | |

| | | | | | | | | | |

| Personal Care Products - 2.3% | | |

BellRing Brands, Inc. (a) | | | | 98,013 | | | | | 5,432,861 | |

| | | | | | | | | | |

| Professional Services - 3.2% | | |

CBIZ, Inc. (a) | | | | 43,369 | | | | | 2,714,466 | |

NV5 Global, Inc. (a) | | | | 24,215 | | | | | 2,690,771 | |

Upwork, Inc. (a) | | | | 142,058 | | | | | 2,112,402 | |

| | | | | | | | | | |

| | | | | | | | | 7,517,639 | |

| | | | | | | | | | |

| Real Estate Management & Development - 1.0% | | |

FirstService Corp. (b) | | | | 14,470 | | | | | 2,345,442 | |

| | | | | | | | | | |

| Semiconductors & Semiconductor Equipment - 0.8% | | |

Tower Semiconductor Ltd. (a)(b) | | | | 63,302 | | | | | 1,931,977 | |

| | | | | | | | | | |

| Software - 11.2% | | |

Altair Engineering, Inc. - Class A (a) | | | | 47,450 | | | | | 3,992,918 | |

Appian Corp. - Class A (a) | | | | 48,326 | | | | | 1,819,957 | |

LiveRamp Holdings, Inc. (a) | | | | 92,415 | | | | | 3,500,680 | |

Model N, Inc. (a) | | | | 71,897 | | | | | 1,936,186 | |

Nutanix, Inc. - Class A (a) | | | | 109,644 | | | | | 5,228,921 | |

Q2 Holdings, Inc. (a) | | | | 79,392 | | | | | 3,446,407 | |

Sprout Social, Inc. - Class A (a) | | | | 41,388 | | | | | 2,542,879 | |

Workiva Inc. (a) | | | | 33,777 | | | | | 3,429,379 | |

| | | | | | | | | | |

| | | | | | | | | 25,897,327 | |

| | | | | | | | | | |

| Specialty Retail - 1.7% | | |

Academy Sports & Outdoors, Inc. | | | | 59,874 | | | | | 3,951,684 | |

| | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 1.2% | | |

Crocs, Inc. (a) | | | | 29,199 | | | | | 2,727,479 | |

| | | | | | | | | | |

| Trading Companies & Distributors - 2.3% | | |

Global Industrial Co. | | | | 73,726 | | | | | 2,863,517 | |

SiteOne Landscape Supply, Inc. (a) | | | | 15,657 | | | | | 2,544,263 | |

| | | | | | | | | | |

| | | | | | | | | 5,407,780 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $156,878,404) | | 227,738,401 |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 2.0% | | Shares | | Value |

| Money Market Fund - 2.0% | | | | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 5.27% (d) | | | | 4,545,035 | | | | $ | 4,545,035 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENT

(Cost $4,545,035) | | 4,545,035 |

| | | | | | | | | | |

TOTAL INVESTMENTS - 100.3%

(Cost $161,423,439) | | 232,283,436 |

Liabilities in Excess of Other Assets - (0.3)% | | | | | (733,339 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 231,550,097 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting through its Valuation Committee. These securities represented $0 or 0.0% of net assets as of December 31, 2023. |

| (d) | The rate shown represents the 7-day effective yield as of December 31, 2023. |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

16

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| as of December 31, 2023 |

| | | | | | | | | | |

| COMMON STOCKS - 93.8% | | Shares | | Value |

| Aerospace & Defense - 2.6% | | |

Axon Enterprise, Inc. (a) | | | | 2,851 | | | | $ | 736,499 | |

| | | | | | | | | | |

| Banks - 3.2% | | |

Cullen/Frost Bankers, Inc. | | | | 2,742 | | | | | 297,480 | |

Pinnacle Financial Partners, Inc. | | | | 3,652 | | | | | 318,527 | |

Webster Financial Corp. | | | | 5,677 | | | | | 288,165 | |

| | | | | | | | | | |

| | | | | | | | | 904,172 | |

| | | | | | | | | | |

| Beverages - 1.2% | | |

Celsius Holdings, Inc. (a) | | | | 6,398 | | | | | 348,819 | |

| | | | | | | | | | |

| Biotechnology - 1.5% | | |

Natera, Inc. (a) | | | | 6,951 | | | | | 435,411 | |

| | | | | | | | | | |

| Building Products - 5.8% | | |

Builders FirstSource, Inc. (a) | | | | 4,213 | | | | | 703,319 | |

CSW Industrials, Inc. | | | | 2,963 | | | | | 614,556 | |

Zurn Elkay Water Solutions Corp. | | | | 11,306 | | | | | 332,509 | |

| | | | | | | | | | |

| | | | | | | | | 1,650,384 | |

| | | | | | | | | | |

| Capital Markets - 1.6% | | |

LPL Financial Holdings, Inc. | | | | 2,030 | | | | | 462,069 | |

| | | | | | | | | | |

| Chemicals - 1.8% | | |

Quaker Chemical Corp. | | | | 2,440 | | | | | 520,745 | |

| | | | | | | | | | |

| Construction & Engineering - 3.9% | | |

AECOM | | | | 6,066 | | | | | 560,680 | |

WillScot Mobile Mini Holdings Corp. (a) | | | | 12,143 | | | | | 540,364 | |

| | | | | | | | | | |

| | | | | | | | | 1,101,044 | |

| | | | | | | | | | |

| Construction Materials - 1.9% | | |

Eagle Materials, Inc. | | | | 2,647 | | | | | 536,917 | |

| | | | | | | | | | |

| Distributors - 2.0% | | |

Pool Corp. | | | | 1,462 | | | | | 582,914 | |

| | | | | | | | | | |

| Electronic Equipment, Instruments & Components - 1.2% |

Trimble, Inc. (a) | | | | 6,379 | | | | | 339,363 | |

| | | | | | | | | | |

| Energy Equipment & Services - 1.2% | | |

Weatherford International PLC (a)(b) | | | | 3,496 | | | | | 342,014 | |

| | | | | | | | | | |

| Financial Services - 5.6% | | |

AvidXchange Holdings, Inc. (a) | | | | 34,705 | | | | | 429,995 | |

Euronet Worldwide, Inc. (a) | | | | 5,362 | | | | | 544,189 | |

FleetCor Technologies, Inc. (a) | | | | 2,188 | | | | | 618,351 | |

| | | | | | | | | | |

| | | | | | | | | 1,592,535 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 3.5% | | |

Enovis Corp. (a) | | | | 9,418 | | | | | 527,596 | |

Neogen Corp. (a) | | | | 23,383 | | | | | 470,232 | |

| | | | | | | | | | |

| | | | | | | | | 997,828 | |

| | | | | | | | | | |

| Health Care Providers & Services - 2.2% | | |

Ensign Group, Inc. | | | | 1,932 | | | | | 216,790 | |

Progyny, Inc. (a) | | | | 10,958 | | | | | 407,418 | |

| | | | | | | | | | |

| | | | | | | | | 624,208 | |

| | | | | | | | | | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Hotels, Restaurants & Leisure - 3.4% | | |

Bowlero Corp. (a) | | | | 27,702 | | | | $ | 392,260 | |

Wingstop, Inc. | | | | 2,204 | | | | | 565,503 | |

| | | | | | | | | | |

| | | | | | | | | 957,763 | |

| | | | | | | | | | |

| Insurance - 4.7% | | |

Globe Life, Inc. | | | | 3,165 | | | | | 385,244 | |

Goosehead Insurance, Inc. - Class A (a) | | | | 6,677 | | | | | 506,116 | |

Palomar Holdings, Inc. (a) | | | | 7,982 | | | | | 443,001 | |

| | | | | | | | | | |

| | | | | | | | | 1,334,361 | |

| | | | | | | | | | |

| IT Services - 1.5% | | |

Twilio Inc. - Class A (a) | | | | 5,498 | | | | | 417,133 | |

| | | | | | | | | | |

| Life Sciences Tools & Services - 2.3% | | |

Charles River Laboratories International, Inc. (a) | | | | 1,742 | | | | | 411,809 | |

Stevanato Group SpA (b) | | | | 9,329 | | | | | 254,588 | |

| | | | | | | | | | |

| | | | | | | | | 666,397 | |

| | | | | | | | | | |

| Machinery - 5.3% | | |

ITT, Inc. | | | | 4,462 | | | | | 532,406 | |

Kadant, Inc. | | | | 2,383 | | | | | 667,978 | |

Toro Co. | | | | 3,250 | | | | | 311,968 | |

| | | | | | | | | | |

| | | | | | | | | 1,512,352 | |

| | | | | | | | | | |

| Media - 1.4% | | |

Nexstar Media Group, Inc. - Class A | | | | 2,635 | | | | | 413,036 | |

| | | | | | | | | | |

| Metals & Mining - 2.1% | | |

Reliance Steel & Aluminum Co. | | | | 2,154 | | | | | 602,431 | |

| | | | | | | | | | |

| Oil, Gas & Consumable Fuels - 4.5% | | |

Diamondback Energy Inc. | | | | 2,334 | | | | | 361,957 | |

HF Sinclair Corp. | | | | 3,381 | | | | | 187,882 | |

Northern Oil and Gas, Inc. | | | | 9,202 | | | | | 341,118 | |

Permian Resources Corp. | | | | 28,184 | | | | | 383,302 | |

| | | | | | | | | | |

| | | | | | | | | 1,274,259 | |

| | | | | | | | | | |

| Personal Care Products - 2.1% | | |

BellRing Brands, Inc. (a) | | | | 10,538 | | | | | 584,121 | |

| | | | | | | | | | |

| Professional Services - 6.5% | | |

Broadridge Financial Solutions, Inc. | | | | 3,601 | | | | | 740,906 | |

CBIZ, Inc. (a) | | | | 8,018 | | | | | 501,847 | |

Paylocity Holding Corp. (a) | | | | 3,618 | | | | | 596,427 | |

| | | | | | | | | | |

| | | | | | | | | 1,839,180 | |

| | | | | | | | | | |

| Real Estate Management & Development - 5.2% | | |

Colliers International Group, Inc. (b) | | | | 4,756 | | | | | 601,729 | |

DigitalBridge Group, Inc. | | | | 22,165 | | | | | 388,774 | |

FirstService Corp. (b) | | | | 3,043 | | | | | 493,240 | |

| | | | | | | | | | |

| | | | | | | | | 1,483,743 | |

| | | | | | | | | | |

| Software - 7.6% | | |

Altair Engineering, Inc. - Class A (a) | | | | 5,360 | | | | | 451,044 | |

Q2 Holdings, Inc. (a) | | | | 15,817 | | | | | 686,616 | |

Sprout Social, Inc. - Class A (a) | | | | 9,257 | | | | | 568,750 | |

Workiva Inc. (a) | | | | 4,648 | | | | | 471,911 | |

| | | | | | | | | | |

| | | | | | | | | 2,178,321 | |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

17

|

| LKCM SMALL-MID CAP EQUITY FUND |

| SCHEDULEOF INVESTMENTS, CONTINUED |

| as of December 31, 2023 |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Specialty Retail - 4.3% | | |

Academy Sports & Outdoors, Inc. | | | | 7,532 | | | | $ | 497,112 | |

Five Below, Inc. (a) | | | | 1,497 | | | | | 319,101 | |

Floor & Decor Holdings, Inc. - Class A (a) | | | | 3,611 | | | | | 402,843 | |

| | | | | | | | | | |

| | | | | | | | | 1,219,056 | |

| | | | | | | | | | |

| Trading Companies & Distributors - 3.7% | | |

SiteOne Landscape Supply, Inc. (a) | | | | 2,722 | | | | | 442,325 | |

Watsco, Inc. | | | | 1,438 | | | | | 616,140 | |

| | | | | | | | | | |

| | | | | | | | | 1,058,465 | |

| | | | | | | | | | |

TOTAL COMMON STOCKS

(Cost $21,045,694) | | 26,715,540 |

| | | | | | | | | | |

| | | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS - 1.0% |

| Residential REITs - 1.0% | | |

Camden Property Trust | | | | 2,902 | | | | | 288,140 | |

| | | | | | | | | | |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $392,385) | | 288,140 |

| | | | | | | | | | |

| | | | | | | | | | |

| SHORT-TERM INVESTMENTS - 5.3% | | | | |

| Money Market Funds - 5.3% | | | | |

Invesco Short-Term Investments Trust - Government & Agency Portfolio - Institutional Shares, 5.27% (c) | | | | 854,360 | | | | | 854,360 | |

MSILF Government Portfolio, 5.27% (c) | | | | 666,157 | | | | | 666,157 | |

| | | | | | | | | | |

| | | | | | | | | 1,520,517 | |

| | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $1,520,517) | | 1,520,517 |

| | | | | | | | | | |

TOTAL INVESTMENTS - 100.1%

(Cost $22,958,596) | | 28,524,197 |

Liabilities in Excess of Other Assets - (0.1)% | | | | | (30,426 | ) |

| | | | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | | | $ | 28,493,771 | |

| | | | | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued by non-U.S. incorporated company. |

| (c) | The rate shown represents the 7-day effective yield as of December 31, 2023. |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

18

|

| LKCM EQUITY FUND |

| SCHEDULEOF INVESTMENTS |

| as of December 31, 2023 |

| | | | | | | | | | |

| COMMON STOCKS - 99.1% | | Shares | | Value |

| Banks - 5.3% | | |

Bank of America Corp. | | | | 160,000 | | | | $ | 5,387,200 | |

Cullen/Frost Bankers, Inc. | | | | 65,000 | | | | | 7,051,850 | |

Glacier Bancorp, Inc. | | | | 50,000 | | | | | 2,066,000 | |

JPMorgan Chase & Co. | | | | 68,000 | | | | | 11,566,800 | |

| | | | | | | | | | |

| | | | | | | | | 26,071,850 | |

| | | | | | | | | | |

| Beverages - 2.7% | | |

Coca-Cola Co. | | | | 95,000 | | | | | 5,598,350 | |

PepsiCo, Inc. | | | | 45,000 | | | | | 7,642,800 | |

| | | | | | | | | | |

| | | | | | | | | 13,241,150 | |

| | | | | | | | | | |

| Biotechnology - 1.6% | | |

Amgen, Inc. | | | | 28,000 | | | | | 8,064,560 | |

| | | | | | | | | | |

| Chemicals - 6.4% | | |

Air Products & Chemicals, Inc. | | | | 25,000 | | | | | 6,845,000 | |

Albemarle Corp. | | | | 26,000 | | | | | 3,756,480 | |

DuPont de Nemours, Inc. | | | | 85,000 | | | | | 6,539,050 | |

Ecolab, Inc. | | | | 47,000 | | | | | 9,322,450 | |

FMC Corp. | | | | 80,000 | | | | | 5,044,000 | |

| | | | | | | | | | |

| | | | | | | | | 31,506,980 | |

| | | | | | | | | | |

| Commercial Services & Supplies - 4.9% | | |

Cintas Corp. | | | | 16,000 | | | | | 9,642,560 | |

Veralto Corp. | | | | 11,916 | | | | | 980,210 | |

Waste Connections, Inc. (a) | | | | 90,000 | | | | | 13,434,300 | |

| | | | | | | | | | |

| | | | | | | | | 24,057,070 | |

| | | | | | | | | | |

| Construction & Engineering - 2.6% | | |

Fluor Corp. (b) | | | | 125,000 | | | | | 4,896,250 | |

Valmont Industries, Inc. | | | | 35,000 | | | | | 8,172,850 | |

| | | | | | | | | | |

| | | | | | | | | 13,069,100 | |

| | | | | | | | | | |

| Construction Materials - 1.8% | | |

Martin Marietta Materials, Inc. | | | | 18,000 | | | | | 8,980,380 | |

| | | | | | | | | | |

| Electrical Equipment - 3.5% | | |

Emerson Electric Co. | | | | 50,000 | | | | | 4,866,500 | |

Generac Holdings, Inc. (b) | | | | 35,000 | | | | | 4,523,400 | |

Rockwell Automation, Inc. | | | | 25,000 | | | | | 7,762,000 | |

| | | | | | | | | | |

| | | | | | | | | 17,151,900 | |

| | | | | | | | | | |

Electronic Equipment, Instruments & Components -

4.0% | | |

Teledyne Technologies, Inc. (b) | | | | 25,000 | | | | | 11,157,250 | |

Trimble, Inc. (b) | | | | 160,000 | | | | | 8,512,000 | |

| | | | | | | | | | |

| | | | | | | | | 19,669,250 | |

| | | | | | | | | | |

| Financial Services - 1.0% | | |

PayPal Holdings, Inc. (b) | | | | 85,000 | | | | | 5,219,850 | |

| | | | | | | | | | |

| Food Products - 0.9% | | |

Kraft Heinz Co. | | | | 120,000 | | | | | 4,437,600 | |

| | | | | | | | | | |

| Ground Transportation - 1.2% | | |

Union Pacific Corp. | | | | 24,000 | | | | | 5,894,880 | |

| | | | | | | | | | |

| Health Care Equipment & Supplies - 4.0% | | |

Alcon, Inc. (a) | | | | 60,000 | | | | | 4,687,200 | |

Neogen Corp. (b) | | | | 450,000 | | | | | 9,049,500 | |

| | | | | | | | | | |

| COMMON STOCKS | | Shares | | Value |

| Health Care Equipment & Supplies - 4.0%, Continued | | |

Stryker Corp. | | | | 20,000 | | | | $ | 5,989,200 | |

| | | | | | | | | | |

| | | | | | | | | 19,725,900 | |

| | | | | | | | | | |

| Household Durables - 0.9% | | |

Newell Brands, Inc. | | | | 500,000 | | | | | 4,340,000 | |

| | | | | | | | | | |

| Household Products - 2.1% | | |

Kimberly-Clark Corp. | | | | 50,000 | | | | | 6,075,500 | |

Procter & Gamble Co. | | | | 30,000 | | | | | 4,396,200 | |

| | | | | | | | | | |

| | | | | | | | | 10,471,700 | |

| | | | | | | | | | |

| Industrial Conglomerates - 2.1% | | |

Honeywell International Inc. | | | | 50,000 | | | | | 10,485,500 | |

| | | | | | | | | | |

| Interactive Media & Services - 3.1% | | |

Alphabet, Inc. - Class A (b) | | | | 110,000 | | | | | 15,365,900 | |

| | | | | | | | | | |

| IT Services - 2.2% | | |

Akamai Technologies, Inc. (b) | | | | 90,000 | | | | | 10,651,500 | |

| | | | | | | | | | |

| Life Sciences Tools & Services - 3.1% | | |

Danaher Corp. | | | | 35,750 | | | | | 8,270,405 | |

Thermo Fisher Scientific, Inc. | | | | 13,000 | | | | | 6,900,270 | |

| | | | | | | | | | |

| | | | | | | | | 15,170,675 | |

| | | | | | | | | | |

| Machinery - 6.3% | | |

Chart Industries, Inc. (b) | | | | 30,000 | | | | | 4,089,900 | |

Franklin Electric Co., Inc. | | | | 85,000 | | | | | 8,215,250 | |

IDEX Corp. | | | | 20,000 | | | | | 4,342,200 | |

Toro Co. | | | | 80,000 | | | | | 7,679,200 | |

Xylem, Inc. | | | | 60,000 | | | | | 6,861,600 | |

| | | | | | | | | | |

| | | | | | | | | 31,188,150 | |

| | | | | | | | | | |

| Marine Transportation - 1.7% | | |

Kirby Corp. (b) | | | | 110,000 | | | | | 8,632,800 | |

| | | | | | | | | | |

| Oil, Gas & Consumable Fuels - 6.1% | | |

Chevron Corp. | | | | 42,500 | | | | | 6,339,300 | |

ConocoPhillips | | | | 100,000 | | | | | 11,607,000 | |

Coterra Energy, Inc. | | | | 384,000 | | | | | 9,799,680 | |