Douglas M. Jackman

Thomas White International, Ltd.

Past performance is not a guarantee of future results.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

This report is for the information of shareholders of the Thomas White Funds, but may also be used as sales literature when preceded or accompanied by a current prospectus, which gives details about charges, expenses, investment objectives and operating policies of the funds.

Mutual fund investing involves risk. Principal loss is possible. Investing in international markets may involve additional risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. These risks are greater for emerging markets. Investing in small and mid-cap companies can involve more risk than investing in larger companies.

Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding of the Fund.

The Thomas White Funds are distributed by Quasar Distributors, LLC.

It is not possible to invest directly in an index.

An outbreak of an infectious respiratory illness caused by a novel coronavirus known as COVID-19 has negatively affected the worldwide economy, as well as the economies of individual countries, the financial health of individual companies and the market in general in significant and unforeseen ways. The future impact of COVID-19 is currently unknown, and it may exacerbate other risks that apply to a Fund. Any such impact could adversely affect a Fund’s performance, the performance of the securities in which a Fund invests and may lead to losses on your investment in a Fund.

While there are no sales charges, management fees and other expenses still apply. Please refer to the prospectus for further details.

THOMAS WHITE INTERNATIONAL FUND

| | | Deferred

Sales

Charge | Administrative

Services

Fee | 12b-1 Fees | Gross

Operating

Expenses1 | Net

Operating

Expenses1 |

| Investor Class | None | None | Up to 0.25% | None | 1.63% | 1.24% |

| Class I | None | None | None | None | 1.44% | 0.99% |

1 Thomas White International, Ltd. (“Advisor”) has agreed to defer its fees and/or reimburse the Fund to the extent that the operating expenses for Investor Class and Class I shares exceed (as a percentage of average daily net assets) 1.24% and 0.99%, respectively. The fee deferral/expense reimbursement agreement expires February 28, 2023. The Fund has agreed to repay the Advisor for amounts deferred or reimbursed by the Advisor pursuant to the agreement provided that such repayment does not cause the Fund to exceed the above limits and the repayment is made within three years after the year in which the Advisor incurred the expense. The fee deferral/expense reimbursement agreement may only be amended or terminated by the Fund’s Board of Trustees. The net expense ratio is applicable to investors.

2 Prospectus Gross Annual Operating Expense is based on the most recent prospectus and may differ from other expense ratios appearing in this report.

| | Net Asset Value

per Share

(NAV) | Net Assets | Redemption Fee* | Portfolio Turnover |

| Investor Class | $11.56 | $12.4 million | 2.00% | |

| Class I | $11.58 | $44.7 million | 2.00% | 51% |

* On shares purchased and held for less than 60 days (as a percentage of amount redeemed, if applicable).

THOMAS WHITE INTERNATIONAL FUND

Total Returns as of October 31, 2022 (Unaudited) |

Class | Sales Charge | 1 Yr | Annualized |

5 Yrs | 10 Yrs |

| Investor Class shares (TWWDX) | None | -29.82% | -2.84% | 0.91% |

| Class I shares (TWWIX) | None | -29.66% | -2.58% | 1.15% |

| MSCI All Country World ex US Index1 | N/A | -24.73% | -0.60% | 3.27% |

1 The MSCI All Country World ex US Index is a free float-adjusted market capitalization-weighted index of both developed and emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index.

Returns of each share class reflect differences in expenses applicable to each class which are primarily differences in service fees.

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impacts of trades executed on the last business day of the period that were recorded on the first business day of the next period.

Performance data is based upon past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 1-800-811-0535 to obtain performance data as of the most recent month-end. The Fund imposes a 2% redemption fee on shares held less than 60 days. Performance data does not reflect the redemption fee. If reflected, total returns would be lower. Investment performance reflects any fee waivers that were in effect. In the absence of such waivers, total return would have been reduced.

OCTOBER 31, 2022

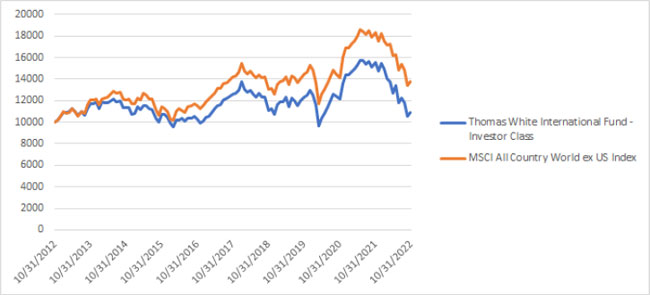

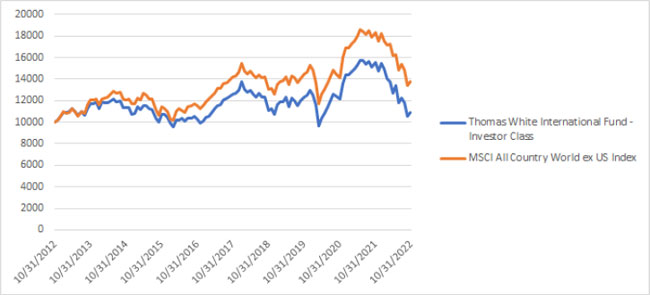

GROWTH OF A $10,000 INVESTMENT WITH DIVIDENDS REINVESTED (Unaudited)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Investor Class shares and its benchmark, the MSCI All Country World ex US Index, for the past 10 years through October 31, 2022. It assumes reinvestment of dividends and capital gains but does not reflect the effect of any applicable redemption fees. This chart does not imply future performance. Past performance does not guarantee future results. The cumulative ten-year return was 9.44% for the Fund’s Investor Class shares and 37.96% for the benchmark. The Fund’s Investor Class shares average annual total return since inception on June 28, 1994 was 5.27%. The MSCI All Country World ex US Index is a free float-adjusted market capitalization-weighted index of both developed and emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index. During the periods shown, the Fund’s manager reimbursed certain Fund expenses. Absent this reimbursement, performance would have been lower. Performance will vary from class to class based on differences in class-specific expenses.

International Fund

Performance and Portfolio Review

The Thomas White International Fund Class I shares returned -29.66% for the one-year period ended October 31, 2022, compared to -24.73% for the benchmark MSCI All Country World ex US Index.

The past twelve months have been among the most challenging equity markets in the past twenty years. The onset of the Russia/Ukraine war had a wide-ranging impact that disrupted global energy and equity markets. The Russian equity market collapsed in days while the US Dollar rose to levels not seen in two decades as investor fled to safety. Each of the 23 MSCI developed countries posted a negative return over the past twelve months. China’s stock market was among the weakest emerging market as its companies struggled due to the country’s strict Covid-19 policy, which weakened its economy dramatically. Rising geopolitical tensions between the US and China over Taiwan also contributed to China’s equity market being amongst the worst performers during the past twelve months.

The negative returns of international equities were also due to persistently high global inflationary risks, which forced most major central banks to accelerate monetary tightening. These actions led to heightened investor fears about a deeper global recession and a sharper decline in corporate earnings. Energy and commodity prices cooled off from their spring-time highs and provided relief to industrial and household consumers toward the end of the review period.

From a sector perspective, the Fund had positive stock selection in materials and communication services sectors. Glencore (Switzerland) and Vale (Brazil) benefitted from higher commodity prices in the first half of the fiscal year while Deutsche Telekom (Germany) and American Movil (Mexico) outperformed as they continued to achieve consistent cashflow and solid earnings growth despite single digit top line revenue growth. From an index perspective, only the energy sector posted a positive return over the past twelve months.

From a regional and country allocation, the Fund was hurt by weak stock selection in both developed and emerging market regions. Japan was the weakest developed market while Taiwan and Brazil detracted in emerging markets. Switzerland was a bright spot, led by mining firm Glencore, while Greek shipping company Star Bulk Carriers was among the top contributors in emerging markets.

We thank you for investing in the Thomas White International Fund.

| Portfolio Country and Industry Allocation as of October 31, 2022 |

| | | |

| Country Allocation | % of TNA | | Industry Allocation | % of TNA |

| Australia | 1.1% | | Automobiles & Components | 7.0% |

| Brazil | 5.7% | | Banks | 16.4% |

| Canada | 6.6% | | Capital Goods | 12.2% |

| China | 6.8% | | Commercial & Professional Services | 0.1% |

| France | 7.6% | | Consumer Durables & Apparel | 3.6% |

| Germany | 9.2% | | Diversified Financials | 2.0% |

| Greece | 1.9% | | Energy | 4.9% |

| Hong Kong | 0.9% | | Food, Beverage & Tobacco | 7.2% |

| India | 4.1% | | Health Care Equipment & Services | 1.3% |

| Ireland | 2.7% | | Insurance | 1.2% |

| Italy | 2.5% | | Materials | 13.1% |

| Japan | 15.6% | | Media & Entertainment | 1.6% |

| Mexico | 0.2% | | Pharmaceuticals, Biotechnology & Life Sciences | 8.1% |

| Netherlands | 7.1% | | Retailing | 3.6% |

| Singapore | 1.4% | | Semiconductors & Semiconductor Equipment | 5.4% |

| South Korea | 3.9% | | Software & Services | 0.1% |

| Spain | 1.7% | | Technology Hardware & Equipment | 1.2% |

| Sweden | 0.2% | | Telecommunication Services | 4.8% |

| Switzerland | 6.7% | | Transportation | 2.0% |

| Taiwan | 2.1% | | Utilities | 3.7% |

| United Kingdom | 11.4% | | Cash & Other | 0.6% |

| Cash & Other | 0.6% | | Total | 100.0% |

| Total | 100.0% | | |

| | | | |

TNA - Total Net Assets

Fund holdings and industry allocations are subject to change and should not be considered a recommendation to buy or sell any securities. For a complete list of Fund holdings, please refer to the Investment Portfolio section of this report.

Thomas White International Fund

| Investment Portfolio | October 31, 2022 |

| Country | | Issue | | Industry | | Shares | | | | Value (US$) | |

| COMMON STOCKS (97.2%) | | | | | | | | | |

| AUSTRALIA (1.1%) | | | | | | | | | | | |

| | | CSL Limited + | | Pharmaceuticals, Biotechnology & Life Sciences | | 3,450 | | | $ | 618,279 | |

| | | | | | | | | | | | |

| BRAZIL (4.5%) | | | | | | | | | | | |

| | | JBS SA | | Food, Beverage & Tobacco | | 283,300 | | | | 1,369,471 | |

| | | Vale SA | | Materials | | 91,400 | | | | 1,185,873 | |

| | | | | | | | | | | 2,555,344 | |

| | | | | | | | | | | | |

| CANADA (6.6%) | | | | | | | | | | | |

| | | Brookfield Asset Management, Inc. - Class A | | Diversified Financials | | 13,400 | | | | 530,649 | |

| | | Canadian Imperial Bank of Commerce USR # | | Banks | | 13,800 | | | | 626,658 | |

| | | Royal Bank of Canada | | Banks | | 7,200 | | | | 666,173 | |

| | | Suncor Energy, Inc. USR | | Energy | | 25,800 | | | | 887,262 | |

| | | West Fraser Timber Co. Ltd. | | Materials | | 14,100 | | | | 1,058,677 | |

| | | | | | | | | | | 3,769,419 | |

| | | | | | | | | | | | |

| CHINA (6.8%) | | | | | | | | | | | |

| | | | | Retailing | | | | | | | |

| | | Alibaba Group Holding Ltd. - ADR * | | | | 10,700 | | | | 680,306 | |

| | | Baidu, Inc. - Class A *+ | | Media & Entertainment | | 34,000 | | | | 326,240 | |

| | | BYD Co. Ltd. - H + | | Automobiles & Components | | 22,000 | | | | 492,828 | |

| | | China Merchants Port Holdings Co. Ltd. + | | Transportation | | 32,000 | | | | 37,403 | |

| | | JD.com, Inc. - ADR | | Retailing | | 8,200 | | | | 305,778 | |

| | | JD.com, Inc. - Class A + | | Retailing | | 776 | | | | 14,490 | |

| | | Meituan - ADR * | | Retailing | | 10,400 | | | | 333,736 | |

| | | Pinduoduo, Inc. - ADR * | | Retailing | | 12,700 | | | | 696,341 | |

| | | Tencent Holdings Ltd. + | | Media & Entertainment | | 23,300 | | | | 611,387 | |

| | | Wuxi Biologics Cayman, Inc. *+ | | Pharmaceuticals, Biotechnology & Life Sciences | | 85,000 | | | | 384,540 | |

| | | | | | | | | | | 3,883,049 | |

| | | | | | | | | | | | |

| FRANCE (7.6%) | | | | | | | | | | | |

| | | Compagnie de Saint-Gobain SA + | | Capital Goods | | 20,400 | | | | 833,414 | |

| | | Credit Agricole SA + | | Banks | | 54,500 | | | | 494,120 | |

| | | LVMH Moet Hennessy Louis Vuitton SE + | | Consumer Durables & Apparel | | 2,000 | | | | 1,261,752 | |

| | | Sanofi SA - ADR | | Pharmaceuticals, Biotechnology & Life Sciences | | 14,400 | | | | 622,512 | |

| | | Veolia Environnement SA + | | Utilities | | 49,500 | | | | 1,103,673 | |

| | | | | | | | | | | 4,315,471 | |

| | | | | | | | | | | | |

| GERMANY (8.2%) | | | | | | | | | | | |

| | | Deutsche Telekom AG + | | Telecommunication Services | | 100,100 | | | | 1,896,051 | |

| | | Mercedes-Benz Group AG + | | Automobiles & Components | | 21,200 | | | | 1,227,719 | |

| | | Siemens AG + | | Capital Goods | | 10,000 | | | | 1,093,185 | |

| | | Volkswagen AG + | | Automobiles & Components | | 2,700 | | | | 461,611 | |

| | | | | | | | | | | 4,678,566 | |

| | | | | | | | | | | | |

| GREECE (1.9%) | | | | | | | | | | | |

| | | Star Bulk Carriers Corp. # | | Transportation | | 62,400 | | | | 1,087,008 | |

| | | | | | | | | | | | |

| HONG KONG (0.9%) | | | | | | | | | | | |

| | | Techtronic Industries Co. Ltd. + | | Capital Goods | | 55,000 | | | | 518,817 | |

| | | | | | | | | | | | |

| INDIA (4.1%) | | | | | | | | | | | |

| | | HDFC Bank Ltd. - ADR # | | Banks | | 17,100 | | | | 1,065,501 | |

| | | ICICI Bank Ltd. - ADR | | Banks | | 33,200 | | | | 731,728 | |

| | | Tata Motors Ltd. - ADR *# | | Automobiles & Components | | 22,000 | | | | 550,220 | |

| | | | | | | | | | | 2,347,449 | |

| | | | | | | | | | | | |

| IRELAND (2.7%) | | | | | | | | | | | |

| | | CRH PLC + | | Materials | | 21,390 | | | | 769,608 | |

| | | Linde PLC | | Materials | | 2,600 | | | | 773,110 | |

| | | | | | | | | | | 1,542,718 | |

| | | | | | | | | | | | |

| ITALY (2.5%) | | | | | | | | | | | |

| | | Intesa Sanpaolo SpA + | | Banks | | 534,200 | | | | 1,020,026 | |

| | | Poste Italiane SpA + | | Insurance | | 6,700 | | | | 58,478 | |

| | | UniCredit SpA + | | Banks | | 27,300 | | | | 339,063 | |

| | | | | | | | | | | 1,417,567 | |

| Investment Portfolio | October 31, 2022 |

| Country | | Issue | | Industry | | Shares | | | | Value (US$) | |

| JAPAN (15.6%) | | | | | | | | | | | |

| | | Hitachi Ltd. + | | Capital Goods | | 29,600 | | | | 1,340,803 | |

| | | Hoya Corp. - ADR | | Health Care Equipment & Services | | 7,700 | | | | 715,946 | |

| | | Inpex Corp. + | | Energy | | 86,700 | | | | 885,679 | |

| | | Marubeni Corp. + | | Capital Goods | | 99,800 | | | | 873,934 | |

| | | MS&AD Insurance Group Holdings, Inc. + | | Insurance | | 22,900 | | | | 606,705 | |

| | | Murata Manufacturing Co. Ltd. + | | Technology Hardware & Equipment | | 14,200 | | | | 696,601 | |

| | | Nomura Research Institute Ltd. + | | Software & Services | | 3,000 | | | | 66,472 | |

| | | Recruit Holdings Co. Ltd. + | | Commercial & Professional Services | | 1,900 | | | | 58,315 | |

| | | Renesas Electronics Corp. *+ | | Semiconductors & Semiconductor Equipment | | 111,500 | | | | 933,748 | |

| | | Shin-Etsu Chemical Co. Ltd. + | | Materials | | 5,500 | | | | 574,310 | |

| | | SMC Corp. + | | Capital Goods | | 1,800 | | | | 724,571 | |

| | | Sony Group Corp. + | | Consumer Durables & Apparel | | 11,600 | | | | 785,467 | |

| | | Sumitomo Mitsui Financial Group, Inc. + | | Banks | | 23,800 | | | | 667,712 | |

| | | | | | | | | | | 8,930,263 | |

| | | | | | | | | | | | |

| MEXICO (0.2%) | | | | | | | | | | | |

| | | America Movil SAB de CV - Class L | | Telecommunication Services | | 135,200 | | | | 127,605 | |

| | | Sitios Latinoamerica SAB de CV *# | | Telecommunication Services | | 6,760 | | | | 2,003 | |

| | | | | | | | | | | 129,608 | |

| | | | | | | | | | | | |

| NETHERLANDS (7.1%) | | | | | | | | | | | |

| | | Airbus SE | | Capital Goods | | 7,150 | | | | 774,291 | |

| | | ArcelorMittal SA | | Materials | | 39,900 | | | | 893,313 | |

| | | ASML Holding NV + | | Semiconductors & Semiconductor Equipment | | 2,010 | | | | 947,550 | |

| | | ING Groep NV + | | Banks | | 80,000 | | | | 785,783 | |

| | | Stellantis NV USR | | Automobiles & Components | | 46,400 | | | | 627,328 | |

| | | | | | | | | | | 4,028,265 | |

| | | | | | | | | | | | |

| SINGAPORE (1.4%) | | | | | | | | | | | |

| | | DBS Group Holdings Ltd. - ADR # | | Banks | | 8,100 | | | | 787,320 | |

| | | | | | | | | | | | |

| SOUTH KOREA (3.9%) | | | | | | | | | | | |

| | | Hyundai Motor Company + | | Automobiles & Components | | 200 | | | | 23,042 | |

| | | KB Financial Group, Inc. + | | Banks | | 30,130 | | | | 1,013,561 | |

| | | Korea Zinc Co. Ltd. + | | Materials | | 180 | | | | 80,703 | |

| | | LG Chem Ltd. + | | Materials | | 125 | | | | 54,774 | |

| | | POSCO Holdings, Inc. + | | Materials | | 1,825 | | | | 318,477 | |

| | | SK Telecom Co. Ltd. + | | Telecommunication Services | | 20,538 | | | | 721,627 | |

| | | | | | | | | | | 2,212,184 | |

| | | | | | | | | | | | |

| SPAIN (1.7%) | | | | | | | | | | | |

| | | Iberdrola SA - ADR | | Utilities | | 24,400 | | | | 990,152 | |

| | | | | | | | | | | | |

| SWEDEN (0.2%) | | | | | | | | | | | |

| | | Volvo AB - Class B + | | Capital Goods | | 8,100 | | | | 132,445 | |

| | | | | | | | | | | | |

| SWITZERLAND (6.7%) | | | | | | | | | | | |

| | | Lonza Group AG + | | Pharmaceuticals, Biotechnology & Life Sciences | | 1,050 | | | | 539,793 | |

| | | Nestle SA + | | Food, Beverage & Tobacco | | 13,800 | | | | 1,502,011 | |

| | | Roche Holding AG + | | Pharmaceuticals, Biotechnology & Life Sciences | | 3,500 | | | | 1,163,229 | |

| | | UBS Group AG + | | Diversified Financials | | 39,000 | | | | 617,488 | |

| | | | | | | | | | | 3,822,521 | |

| | | | | | | | | | | | |

| TAIWAN (2.1%) | | | | | | | | | | | |

| | | Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | Semiconductors & Semiconductor Equipment | | 19,800 | | | | 1,218,690 | |

| | | | | | | | | | | | |

| UNITED KINGDOM (11.4%) | | | | | | | | | | | |

| | | Anglo American PLC | | Materials | | 21,800 | | | | 652,132 | |

| | | Ashtead Group PLC + | | Capital Goods | | 12,900 | | | | 671,328 | |

| | | AstraZeneca PLC + | | Pharmaceuticals, Biotechnology & Life Sciences | | 10,850 | | | | 1,272,930 | |

| | | Barclays PLC + | | Banks | | 334,300 | | | | 569,167 | |

| | | Diageo PLC + | | Food, Beverage & Tobacco | | 29,900 | | | | 1,232,662 | |

| | | Glencore PLC + | | Materials | | 188,100 | | | | 1,075,091 | |

| | | Shell PLC - ADR | | Energy | | 18,100 | | | | 1,006,903 | |

| | | | | | | | | | | 6,480,213 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Common Stocks | | | | (Cost $60,205,036) | | | | | | 55,465,348 | |

| Investment Portfolio | October 31, 2022 |

| Country | | Issue | | Industry | | Shares | | | | Value (US$) | |

| PREFERRED STOCKS (2.2%) | | | | | | | | | | | |

| BRAZIL (1.2%) | | | | | | | | | | | |

| | | Banco Bradesco SA - ADR (Perpetual, 4.13%) ^ |

| Banks | | 157,600 | | | | 597,304 | |

| | | Gerdau SA - ADR (Perpeptual, 16.22%) ^# | | Materials | | 12,975 | | | | 64,615 | |

| | | | | | | | | | | 661,919 | |

| | | | | | | | | | | | |

| GERMANY (1.0%) | | | | | | | | | | | |

| | | Volkswagen AG (Perpeptual, 5.47%) + ^ | | Automobiles

& Components | | 4,700 | | | | 600,754 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Preferred Stocks | | | | (Cost $1,549,945) |

| | | | | 1,262,673 | |

| | | | | | | | | | | | |

| HELD AS COLLATERAL FOR SECURITIES LENDING (2.5%) | | | | | | | | | |

| SHORT TERM INVESTMENT (2.5%) | | | | | | | | | |

| MONEY MARKET FUND (2.5%) | | | | | | | | | |

| | | Northern Institutional Liquid Assets Portfolio, 3.08% (a) | | | | 1,404,166 | | | | 1,404,166 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Held as Collateral for Securities Lending | | (Cost $1,404,166) |

| | | | | 1,404,166 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Investments | 101.9% | | | (Cost $63,159,147) |

| | | | $ | 58,132,187 | |

| Other Liabilities, Less | -1.9 | | | | | | | | | (1,060,019) | |

| Total Net Assets: | 100.0% | | | | | | | | $ | 57,072,168 | |

Percentages are stated as a percent of net assets.

| * | Non-Income Producing Securities |

| # | All or a portion of securities on loan at October 31, 2022. The market value of the securities loaned was $3,471,582. The loaned securities were secured with cash collateral of $1,404,166 and noncash collateral with a value of $2,145,915. The non-cash collateral received consists of short term investments and long term bonds, and is held for the benefit of the Fund at the Fund's custodian. The Fund cannot repledge or resell this collateral. Collateral is calculated based on prior day's prices. - See Note 1(I) to Financial Statements |

| A | Maturity Date and Preferred Dividend Rate of Preferred Stock |

| PLC | - Public Limited Company |

| ADR | - American Depositary Receipt |

The industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification

Standards (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

The accompanying notes are an integral part of these financial statements.

The following table summarizes the inputs used, as of October 31, 2022, in valuating the International Fund's assets:

| | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Australia | | $ | — | | | $ | 618,279 | | | $ | — | | | $ | 618,279 | |

| Brazil | | $ | 2,555,344 | | | $ | — | | | $ | — | | | $ | 2,555,344 | |

| Canada | | $ | 3,769,419 | | | $ | — | | | $ | — | | | $ | 3,769,419 | |

| China | | $ | 2,016,161 | | | $ | 1,866,888 | | | $ | — | | | $ | 3,883,049 | |

| France | | $ | 622,512 | | | $ | 3,692,959 | | | $ | — | | | $ | 4,315,471 | |

| Germany | | $ | — | | | $ | 4,678,566 | | | $ | — | | | $ | 4,678,566 | |

| Greece | | $ | 1,087,008 | | | $ | — | | | $ | — | | | $ | 1,087,008 | |

| Hong Kong | | $ | — | | | $ | 518,817 | | | $ | — | | | $ | 518,817 | |

| India | | $ | 2,347,449 | | | $ | — | | | $ | — | | | $ | 2,347,449 | |

| Ireland | | $ | 773,110 | | | $ | 769,608 | | | $ | — | | | $ | 1,542,718 | |

| Italy | | $ | — | | | $ | 1,417,567 | | | $ | — | | | $ | 1,417,567 | |

| Japan | | $ | 715,946 | | | $ | 8,214,317 | | | $ | — | | | $ | 8,930,263 | |

| Mexico | | $ | 129,608 | | | $ | — | | | $ | — | | | $ | 129,608 | |

| Netherlands | | $ | 2,294,932 | | | $ | 1,733,333 | | | $ | — | | | $ | 4,028,265 | |

| Singapore | | $ | 787,320 | | | $ | — | | | $ | — | | | $ | 787,320 | |

| South Korea | | $ | — | | | $ | 2,212,184 | | | $ | — | | | $ | 2,212,184 | |

| Spain | | $ | 990,152 | | | $ | — | | | $ | — | | | $ | 990,152 | |

| Sweden | | $ | — | | | $ | 132,445 | | | $ | — | | | $ | 132,445 | |

| Switzerland | | $ | — | | | $ | 3,822,521 | | | $ | — | | | $ | 3,822,521 | |

| Taiwan | | $ | 1,218,690 | | | $ | — | | | $ | — | | | $ | 1,218,690 | |

| United Kingdom | | $ | 1,659,035 | | | $ | 4,821,178 | | | $ | — | | | $ | 6,480,213 | |

| Total Common Stocks | | $ | 20,966,686 | | | $ | 34,498,662 | | | $ | — | | | $ | 55,465,348 | |

| | | | | | | | | | | | | | | | | |

| Preferred Stocks | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Brazil | | | 661,919 | | | | — | | | | — | | | | 661,919 | |

| Germany | | | — | | | | 600,754 | | | | — | | | | 600,754 | |

| Total Preferred Stocks | | | 661,919 | | | | 600,754 | | | | — | | | | 1,262,673 | |

| | | | | | | | | | | | | | | | | |

| Short Term Investments | | $ | 1,404,166 | | | $ | — | | | $ | — | | | $ | 1,404,166 | |

| Total Investments | | $ | 23,032,771 | | | $ | 35,099,416 | | | $ | — | | | $ | 58,132,187 | |

For more information on valuation inputs, please refer to Note 1(A) of the accompanying Notes to Financial Statements.

The Fund’s assets assigned to Level 2 include certain foreign securities for which a third party statistical pricing service may be employed for purposes of fair market valuation. There were no transfers into or out of Level 3 during the reporting period, as compared to their classification from the prior annual report.

The accompanying notes are an integral part of these financial statements.

THOMAS WHITE AMERICAN OPPORTUNITIES FUND

| | | Deferred

Sales

Charge | Administrative

Services

Fee | 12b-1 Fees | Gross

Operating

Expenses1 | Net

Operating

Expenses1 |

| Investor Class | None | None | Up to 0.25% | None | 1.62% | 1.34% |

1 Thomas White International, Ltd. (“Advisor”) has agreed to defer its fees and/or reimburse the Fund to the extent that the operating expenses for Investor Class shares exceed 1.34% of its average daily net assets. The fee deferral/expense reimbursement agreement expires February 28, 2023. The Fund has agreed to repay the Advisor for amounts deferred or reimbursed by the Advisor pursuant to the agreement provided that such repayment does not cause the Fund to exceed the above limits and the repayment is made within three years after the year in which the Advisor incurred the expense. The fee deferral/expense reimbursement agreement may only be amended or terminated by the Fund’s Board of Trustees. The net expense ratio is applicable to investors.

2 Prospectus Gross Annual Operating Expense is based on the most recent prospectus and may differ from other expense ratios appearing in this report.

| | Net Asset

Value per

Share (NAV) | Net Assets | Redemption Fee* | Portfolio Turnover |

| Investor Class | $16.01 | $20.8 million | 2.00% | 12% |

* On shares purchased and held for less than 60 days (as a percentage of amount redeemed, if applicable).

OCTOBER 31, 2022

Total Returns as of October 31, 2022 (Unaudited) |

Class | 1 Yr | Annualized |

5 Yrs | 10 Yrs |

| Investor Class shares (TWAOX) | -9.69% | 7.87% | 10.54% |

| Russell Midcap Total Return Index1 | -17.17% | 7.95% | 11.36% |

| Russell Midcap Value Total Return Index1 | -10.18% | 6.49% | 10.42% |

1 The Russell Midcap Total Return Index measures the performance of the 800 smallest companies in the Russell 1000 Index. These represent approximately 31% of the total market capitalization of the Russell 1000 Index. The Russell Midcap Value Total Return Index measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. Both indices are unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index.

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impacts of trades executed on the last business day of the period that were recorded on the first business day of the next period.

Performance data is based upon past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 1-800-811-0535 to obtain performance data as of the most recent month-end. The Fund imposes a 2% redemption fee on shares held less than 60 days. Performance data does not reflect the redemption fee. If reflected, total returns would be lower. Investment performance reflects any fee waivers that were in effect. In the absence of such waivers, total return would have been reduced.

THOMAS WHITE AMERICAN OPPORTUNITIES FUND

GROWTH OF A $10,000 INVESTMENT WITH DIVIDENDS REINVESTED (Unaudited)

This chart illustrates the performance of a hypothetical $ 10,000 investment made in the Fund’s Investor Class shares, its primary benchmark, the Russell Midcap Total Return Index, and its secondary benchmark, the Russell Midcap Value Total Return Index, for the past 10 years through October 31, 2022. It assumes reinvestment of dividends and capital gains but does not reflect the effect of any applicable redemption fees. This chart does not imply future performance. Past performance does not guarantee future results. The cumulative ten-year return was 172.33% for the Fund’s Investor Class shares, 193.18% for the primary benchmark, and 169.43% for the secondary benchmark. The Fund’s Investor Class shares average annual total return since inception on March 4, 1999 was 8.09%. The Fund’s primary benchmark, the Russell Midcap Total Return Index, measures the performance of the 800 smallest companies in the Russell 1000 Index, which measures the performance of the 1,000 largest U.S. companies based on total market capitalization. The Fund’s secondary benchmark, the Russell Midcap Value Index, measures the performance of the mid-cap value segment of the U.S. equity universe. It includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. Both indices are unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index. During the periods shown, the Fund’s manager reimbursed certain Fund expenses. Absent this reimbursement, performance would have been lower.

American Opportunities Fund

Performance and Portfolio Review

The Thomas White American Opportunities Fund Investor Class shares returned -9.69% during the one-year period ended October 31, 2022, while the Fund’s primary benchmark, the Russell Midcap Index, returned -17.17% and the secondary benchmark, the Russell Midcap Value Index, returned -10.18% during the same period.

The Fund’s performance over the past twelve months was led by three major energy holdings Diamondback Energy, Pioneer Natural Resources and Marathon Petroleum. These companies posted strong earnings and cashflows after crude oil and natural gas prices remained at high levels following the beginning of the Russia/Ukraine war in February 2022. The energy sector was the one bright spot in an otherwise challenging US equity market.

Increasing prices combined with above average wages led to the return of rising inflation not seen in the US over the past three decades. As consumer inflation rose systematically throughout much of 2022, the Federal Reserve was forced to turn more hawkish and raised rates five times between March and October 2022. The Fed continued to pledge tighter fiscal policy measures to cool down prices. While corporate earnings remained been solid, fears of a deeper recession that could weaken consumer spending and corporate earnings also surfaced. High prices of energy and industrial commodities persisted for most of the review period, before correcting on economic growth fears.

The Fund’s outperformance versus the primary benchmark was driven by strong stock selection in 9 of the 11 sectors led by financials, consumer staples and technology. The underweight to communication services, which was the weakest performing sector, also contributed to the Fund’s relative performance during the past twelve months. Energy, utilities and consumer staples were the only sectors within the primary index that posted positive returns over the past twelve months.

Despite the headwinds of rising inflation and the Federal Reserve’s tightening interest rate policy, the top performing companies outside of the energy sector benefited from this economic environment due to their strong pricing power, high demand for their products and solid management teams. Steel Dynamics, Corteva and Autozone each reflect these three key characteristics.

We thank you for investing in the Thomas White American Opportunities Fund.

| Portfolio Industry Allocation and Market Capitalization as of October 31, 2022 |

| Industry Allocation | % of TNA | | Portfolio Market Cap Mix | % of TNA |

| Automobiles & Components | 1.0% | | Large Cap (over $46.4 billion) | 17.9% |

| Banks | 3.5% | | Mid Cap ($3.6 - $46.4 billion) | 79.7% |

| Capital Goods | 10.2% | | Cash & Other | 2.4% |

| Commercial & Professional Services | 3.1% | | | |

| Consumer Durables & Apparel | 2.2% | | Total | 100% |

| Consumer Services | 4.2% | | | |

| Diversified Financials | 4.4% | | | |

| Energy | 5.5% | | | |

| Food, Beverage & Tobacco | 2.2% | | | |

| Health Care Equipment & Services | 8.4% | | | |

| Household & Personal Products | 1.5% | | | |

| Insurance | 5.9% | | | |

| Materials | 6.9% | | | |

| Pharmaceuticals, Biotechnology & Life Sciences | 3.4% | | | |

| Retailing | 3.9% | | | |

| Semiconductors & Semiconductor Equipment | 2.9% | | | |

| Software & Services | 8.5% | | | |

| Technology Hardware & Equipment | 5.3% | | | |

| Transportation | 1.6% | | | |

| Utilities | 5.6% | | | |

| REITs | 7.4% | | | |

| Cash & Other | 2.4% | | | |

| | | | | |

| Total | 100% | | | |

|

| | | |

TNA - Total Net Assets

Fund holdings and industry allocations are subject to change and should not be considered a recommendation to buy or sell any securities. For a complete list of Fund holdings, please refer to the Investment Portfolio section of this report.

| Thomas White American Opportunities Fund | |

| Investment Portfolio | October 31, 2022 |

| Industry | | Issue | | Shares | | | Value | |

| COMMON STOCKS (90.2%) | | | | | | |

| AUTOMOBILES & COMPONENTS (1.0%) | | | | | | | | |

| | | Ford Motor Co. | | | 15,700 | | | $ | 209,909 | |

| | | | | | | | | | | |

| BANKS (3.5%) | | | | | | | | | | |

| | | Citizens Financial Group, Inc. | | | 6,600 | | | | 269,940 | |

| | | Regions Financial Corporation | | | 20,990 | | | | 460,731 | |

| | | | | | | | | | 730,671 | |

| | | | | | | | | | | |

| CAPITAL GOODS (10.2%) | | | | | | | | | | |

| | | Carlisle Companies Incorporated | | | 1,320 | | | | 315,216 | |

| | | Cummins, Inc. | | | 1,040 | | | | 254,290 | |

| | | Huntington Ingalls Industries, Inc. | | | 800 | | | | 205,656 | |

| | | Otis Worldwide Corp. | | | 2,170 | | | | 153,289 | |

| | | Parker-Hannifin Corporation | | | 1,355 | | | | 393,790 | |

| | | The Middleby Corporation * | | | 1,300 | | | | 181,818 | |

| | | Trane Technologies PLC ^ | | | 1,900 | | | | 303,297 | |

| | | W.W. Grainger, Inc. | | | 520 | | | | 303,862 | |

| | | | | | | | | | 2,111,218 | |

| | | | | | | | | | | |

| COMMERCIAL & PROFESSIONAL SERVICES (3.1%) | | | | | | | | |

| | | Republic Services, Inc. | | | 2,290 | | | | 303,700 | |

| | | Verisk Analytics, Inc. | | | 1,875 | | | | 342,806 | |

| | | | | | | | | | 646,506 | |

| | | | | | | | | | | |

| CONSUMER DURABLES & APPAREL (2.2%) | | | | | | | | |

| | | Brunswick Corporation | | | 2,985 | | | | 210,950 | |

| | | Lennar Corporation - Class A | | | 3,150 | | | | 254,205 | |

| | | | | | | | | | 465,155 | |

| | | | | | | | | | | |

| CONSUMER SERVICES (4.2%) | | | | | | | | |

| | | Darden Restaurants, Inc. | | | 1,300 | | | | 186,082 | |

| | | Marriott International, Inc. - Class A | | | 1,990 | | | | 318,619 | |

| | | Service Corporation International | | | 3,440 | | | | 208,499 | |

| | | Vail Resorts, Inc. | | | 740 | | | | 162,156 | |

| | | | | | | | | | 875,356 | |

| | | | | | | | | | | |

| DIVERSIFIED FINANCIALS (4.4%) | | | | | | | | |

| | | Ameriprise Financial, Inc. | | | 1,380 | | | | 426,585 | |

| | | S&P Global, Inc. | | | 703 | | | | 225,839 | |

| | | State Street Corp. | | | 3,430 | | | | 253,820 | |

| | | | | | | | | | 906,244 | |

| | | | | | | | | | | |

| ENERGY (5.5%) | | | | | | | | |

| | | Diamondback Energy, Inc. | | | 2,760 | | | | 433,624 | |

| | | Marathon Petroleum Corporation | | | 2,670 | | | | 303,365 | |

| | | Pioneer Natural Resources Co. | | | 1,570 | | | | 402,564 | |

| | | | | | | | | | 1,139,553 | |

| | | | | | | | | | | |

| FOOD, BEVERAGE & TOBACCO (2.2%) | | | | | | | | |

| | | The Hershey Company | | | 1,900 | | | | 453,663 | |

| Investment Portfolio | October 31, 2022 |

| Industry | | Issue | | Shares | | | Value | |

| HEALTH CARE EQUIPMENT & SERVICES (8.4%) | | | | | | | | |

| | | AmerisourceBergen Corporation | | | 2,120 | | | | 333,307 | |

| | | Boston Scientific Corporation * | | | 5,180 | | | | 223,310 | |

| | | Centene Corporation * | | | 2,179 | | | | 185,498 | |

| | | Laboratory Corporation of America Holdings | | | 1,205 | | | | 267,341 | |

| | | Molina Healthcare, Inc. * | | | 740 | | | | 265,556 | |

| | | STERIS PLC ^ | | | 835 | | | | 144,104 | |

| | | The Cooper Companies, Inc. | | | 440 | | | | 120,292 | |

| | | Zimmer Biomet Holdings, Inc. | | | 1,810 | | | | 205,164 | |

| | | | | | | | | | 1,744,572 | |

| | | | | | | | | | | |

| HOUSEHOLD & PERSONAL PRODUCTS (1.5%) | | | | | | | | |

| | | Church & Dwight Co., Inc. | | | 4,290 | | | | 318,018 | |

| | | | | | | | | | | |

| INSURANCE (5.9%) | | | | | | | | |

| | | Arch Capital Group Ltd. *^ | | | 6,870 | | | | 395,025 | |

| | | Assurant, Inc. | | | 1,810 | | | | 245,907 | |

| | | Everest Re Group Ltd. ^ | | | 1,040 | | | | 335,566 | |

| | | The Hartford Financial Services Group, Inc. | | | 3,540 | | | | 256,331 | |

| | | | | | | | | | 1,232,829 | |

| | | | | | | | | | | |

| MATERIALS (6.9%) | | | | | | | | |

| | | Ball Corporation | | | 2,940 | | | | 145,207 | |

| | | Corteva, Inc. | | | 5,430 | | | | 354,796 | |

| | | Martin Marietta Materials, Inc. | | | 830 | | | | 278,863 | |

| | | PPG Industries, Inc. | | | 1,710 | | | | 195,248 | |

| | | Steel Dynamics, Inc. | | | 4,810 | | | | 452,380 | |

| | | | | | | | | | 1,426,494 | |

| | | | | | | | | | | |

| PHARMACEUTICALS, BIOTECHNOLOGY & LIFE SCIENCES (3.4%) | | | | | | | | |

| | | Agilent Technologies, Inc. | | | 2,970 | | | | 410,899 | |

| | | Charles River Laboratories International, Inc. * | | | 1,355 | | | | 287,599 | |

| | | | | | | | | | 698,498 | |

| | | | | | | | | | | |

| RETAILING (3.9%) | | | | | | | | |

| | | AutoZone, Inc. * | | | 254 | | | | 643,351 | |

| | | Ross Stores, Inc. | | | 1,720 | | | | 164,587 | |

| | | | | | | | | | 807,938 | |

| | | | | | | | | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT (2.9%) | | | | | | | | |

| | | KLA Corporation | | | 1,210 | | | | 382,905 | |

| | | Lam Research Corporation | | | 540 | | | | 218,581 | |

| | | | | | | | | | 601,486 | |

| | | | | | | | | | | |

| SOFTWARE & SERVICES (8.5%) | | | | | | | | |

| | | Akamai Technologies, Inc. * | | | 2,330 | | | | 205,809 | |

| | | ANSYS, Inc. * | | | 950 | | | | 210,102 | |

| | | Cadence Design Systems, Inc. * | | | 2,285 | | | | 345,926 | |

| | | Fidelity National Information Services, Inc. | | | 2,500 | | | | 207,475 | |

| | | Fortinet, Inc. * | | | 6,250 | | | | 357,250 | |

| | | Synopsys, Inc. * | | | 1,520 | | | | 444,676 | |

| | | | | | | | | | 1,771,238 | |

| Investment Portfolio | October 31, 2022 |

| Industry | | | | Issue | | Shares | | | Value | |

| TECHNOLOGY HARDWARE & EQUIPMENT (5.3%) | | | | | | | |

| | | | | Arista Networks Inc. * | | | 3,120 | | | 377,083 | |

| | | | | Keysight Technologies, Inc. * | | | 2,740 | | | 477,171 | |

| | | | | Motorola Solutions, Inc. | | | 940 | | | 234,728 | |

| | | | | | | | | | | 1,088,982 | |

| | | | | | | | | | | | |

| TRANSPORTATION (1.6%) | | | | | | | |

| | | | | GXO Logistics, Inc. * | | | 2,210 | | | 80,753 | |

| | | | | Old Dominion Freight Line, Inc. | | | 915 | | | 251,259 | |

| | | | | | | | | | | 332,012 | |

| | | | | | | | | | | | |

| UTILITIES (5.6%) | | | | | | | | | | | |

| | | | | Alliant Energy Corporation | | | 3,770 | | | 196,681 | |

| | | | | Ameren Corporation | | | 3,220 | | | 262,494 | |

| | | | | CMS Energy Corporation | | | 3,330 | | | 189,977 | |

| | | | | DTE Energy Company | | | 1,750 | | | 196,192 | |

| | | | | Xcel Energy, Inc. | | | 5,020 | | | 326,852 | |

| | | | | | | | | | | 1,172,196 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total Common Stocks | (Cost $11,352,278) | | | 18,732,538 | |

| | | | | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS (REITS) (7.4%) | | | | | | | |

| REAL ESTATE (7.4%) | | | | | | | |

| | | | | AvalonBay Communities, Inc. | | | 1,105 | | | 193,508 | |

| | | | | Digital Realty Trust, Inc. | | | 1,330 | | | 133,332 | |

| | | | | EastGroup Properties, Inc. | | | 1,225 | | | 191,945 | |

| | | | | Extra Space Storage, Inc. | | | 2,100 | | | 372,624 | |

| | | | | Prologis, Inc. | | | 3,776 | | | 418,192 | |

| | | | | SBA Communications Corp. | | | 825 | | | 222,668 | |

| | | | | | | | | | | 1,532,269 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total REITs | | | | | (Cost $1,497,919) | | | 1,532,269 | |

| | | | | | | | | | | | |

| Total Investments | | 97.6% | | | (Cost $12,850,197) | | $ | 20,264,807 | |

| Other Assets, Less | | 2.4% | | | | | | | | 505,692 | |

| Total Net Assets: | | 100.0% | | | | | | | $ | 20,770,499 | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

* Non-Income Producing Securities

^ Foreign Issued Securities

The industry classifications represented in the Schedule of Investments are in accordance with Global Industry Classification Standards (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC.

The accompanying notes are an integral part of these financial statements.

The following table summarizes the inputs used, as of October 31, 2022, in valuating the Fund’s assets:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Automobiles & Components | | $ | 209,909 | | | $ | — | | | $ | — | | | $ | 209,909 | |

| Banks | | | 730,671 | | | | — | | | | — | | | | 730,671 | |

| Capital Goods | | | 2,111,218 | | | | — | | | | — | | | | 2,111,218 | |

| Commercial & Professional Services | | | 646,506 | | | | — | | | | — | | | | 646,506 | |

| Consumer Durables & Apparel | | | 465,155 | | | | — | | | | — | | | | 465,155 | |

| Consumer Services | | | 875,356 | | | | — | | | | — | | | | 875,356 | |

| Diversified Financials | | | 906,244 | | | | — | | | | — | | | | 906,244 | |

| Energy | | | 1,139,553 | | | | — | | | | — | | | | 1,139,553 | |

| Food, Beverage & Tobacco | | | 453,663 | | | | — | | | | — | | | | 453,663 | |

| Health Care Equipment & Services | | | 1,744,572 | | | | — | | | | — | | | | 1,744,572 | |

| Household & Personal Products | | | 318,018 | | | | — | | | | — | | | | 318,018 | |

| Insurance | | | 1,232,829 | | | | — | | | | — | | | | 1,232,829 | |

| Materials | | | 1,426,494 | | | | — | | | | — | | | | 1,426,494 | |

| Pharmaceuticals, Biotechnology & Life Sciences | | | 698,498 | | | | — | | | | — | | | | 698,498 | |

| Retailing | | | 807,938 | | | | — | | | | — | | | | 807,938 | |

| Semiconductors & Semiconductor Equipment | | | 601,486 | | | | — | | | | — | | | | 601,486 | |

| Software & Services | | | 1,771,238 | | | | — | | | | — | | | | 1,771,238 | |

| Technology Hardware & Equipment | | | 1,088,982 | | | | — | | | | — | | | | 1,088,982 | |

| Transportation | | | 332,012 | | | | — | | | | — | | | | 332,012 | |

| Utilities | | | 1,172,196 | | | | — | | | | — | | | | 1,172,196 | |

| Total Common Stocks | | $ | 18,732,538 | | | $ | — | | | $ | — | | | $ | 18,732,538 | |

| REITS | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Real Estate | | $ | 1,532,269 | | | $ | — | | | $ | — | | | $ | 1,532,269 | |

| Total REITS | | $ | 1,532,269 | | | $ | — | | | $ | — | | | $ | 1,532,269 | |

| | | | | | | | | | | | | | | | | |

| Total Investments | | $ | 20,264,807 | | | $ | — | | | $ | — | | | $ | 20,264,807 | |

For more information on valuation inputs, please refer to Note 1(A) of the accompanying Notes to Financial Statements.

There were no transfers into or out of Level 3 during the reporting period, as compared to their classification from the prior annual report.

The accompanying notes are an integral part of these financial statements.

THOMAS WHITE FUNDS

Statements of Assets and Liabilities

October 31, 2022

| | | International Fund | | | American

Opportunities Fund | |

| ASSETS: | | | | | | |

| Investments in securities at market value1,2 | | $ | 58,132,187 | | | $ | 20,264,807 | |

| Cash | | | 381,720 | | | | 750,586 | |

| Foreign currency3 | | | 6,311 | | | | — | |

| Receivables: | | | | | | | | |

| Dividends | | | 119,326 | | | | 3,185 | |

| Reclaims | | | 284,626 | | | | 2,170 | |

| Fund shares sold | | | 144,236 | | | | — | |

| Prepaid expenses and other assets | | | 50,214 | | | | 6,518 | |

| Total assets | | | 59,188,620 | | | | 21,027,266 | |

| LIABILITIES: | | | | | | | | |

| Investment Payable | | | — | | | | 206,371 | |

| Management and administrative fees payable (Note 4) | | | — | | | | 1,403 | |

| Business management fees payable (Note 4) | | | 1,696 | | | | 586 | |

| Trustee fees payable | | | 19,028 | | | | 5,102 | |

| Payable for Fund shares redeemed | | | 475,109 | | | | — | |

| Collateral on loaned securities (See Note 1)2,4 | | | 1,404,166 | | | | — | |

| Accrued fund accounting and fund administration fees | | | 32,991 | | | | 6,162 | |

| Accrued custody fees | | | 20,767 | | | | 1,773 | |

| Accrued printing and mailing expenses | | | 24,521 | | | | 5,873 | |

| Accrued professional fees | | | 40,641 | | | | 23,234 | |

| Accrued shareholder servicing fees | | | 23,913 | | | | 6,158 | |

| Accrued expenses and other liabilities | | | 3,620 | | | | 105 | |

| Total liabilities | | | 2,046,452 | | | | 256,767 | |

| Net Assets | | $ | 57,072,168 | | | $ | 20,770,499 | |

| NET ASSETS | | | | | | | | |

| Source of Net Assets: | | | | | | | | |

| Net capital paid in on shares of beneficial interest | | $ | 59,719,149 | | | $ | 12,276,928 | |

| Total distributable earnings (deficit) | | $ | (2,646,981 | ) | | $ | 8,493,571 | |

| Net assets | | $ | 57,072,168 | | | $ | 20,770,499 | |

The accompanying notes are an integral part of these financial statements.

THOMAS WHITE FUNDS

Statements of Assets and Liabilities

October 31, 2022

| | | International Fund | | | American

Opportunities Fund | |

| INVESTOR CLASS SHARES | | | | | | |

| Net assets | | $ | 12,359,389 | | | $ | 20,770,499 | |

| Shares outstanding5 | | | 1,068,970 | | | | 1,297,526 | |

| Net asset value and offering price per share | | $ | 11.56 | | | $ | 16.01 | |

| CLASS I SHARES | | | | | | | | |

| Net assets | | $ | 44,712,779 | | | | | |

| Shares outstanding5 | | | 3,860,336 | | | | | |

| Net asset value and offering price per share | | $ | 11.58 | | | | | |

1 Cost Basis of Investments:

International Fund: $63,159,147 including

Securities lending collateral of $1,404,166

American Opportunities Fund: $12,850,197

2 Value of securities out on loan at 10/31/2022:

International Fund: $3,471,582

3 Cost Basis of Cash denominated in foreign currencies:

International Fund: $6,342

4 Non-cash collateral from securities on loan:

International Fund: $2,145,915

5 There are an unlimited number of $.01 par value shares of beneficial interest authorized.

The accompanying notes are an integral part of these financial statements.

THOMAS WHITE FUNDS

Statements of Operations

Year Ended October 31, 2022

| | | International Fund | | | American Opportunities Fund | |

| INVESTMENT INCOME | | | | | | | | |

| Income: | | | | | | | | |

| Dividends1 | | $ | 2,771,380 | | | $ | 326,664 | |

| Securities lending income (Note 1) | | | 21,504 | | | | — | |

| Total investment income | | | 2,792,884 | | | | 326,664 | |

| Expenses (Note 1(B)): | | | | | | | | |

| Investment management fees (Note 4) | | | 655,731 | | | | 182,716 | |

| Business management fees (Note 4) | | | 27,001 | | | | 7,524 | |

| Fund accounting and fund administration fees | | | 99,987 | | | | 34,112 | |

| Custodian fees | | | 46,686 | | | | 5,292 | |

| Shareholder servicing fees | | | 73,496 | | | | 18,826 | |

| Trustees' fees and expenses | | | 38,028 | | | | 10,102 | |

| Professional fees | | | 161,986 | | | | 54,342 | |

| Registration fees | | | 38,267 | | | | 21,916 | |

| Printing and mailing expenses | | | 32,090 | | | | 7,491 | |

| Administrative service fee (Note 4) | | | 34,195 | | | | 11,345 | |

| Other expenses | | | 86,676 | | | | 19,566 | |

| Total expenses | | | 1,294,143 | | | | 373,232 | |

| Reimbursement from Advisor (Note 4) | | | (484,073 | ) | | | (84,327 | ) |

| Net expenses | | | 810,070 | | | | 288,905 | |

| Net investment income | | | 1,982,814 | | | | 37,759 | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | | | |

| Net realized gain on investments and foreign currency translation | | | 795,350 | | | | 1,039,654 | |

| Net change in unrealized depreciation on | | | | | | | | |

| investments and foreign currency transactions | | | (30,093,546 | ) | | | (3,274,489 | ) |

| Net realized and unrealized loss | | | (29,298,196 | ) | | | (2,234,835 | ) |

| Net decrease in net assets resulting from operations | | $ | (27,315,382 | ) | | $ | (2,197,076 | ) |

1 Net of issuance fees and/or foreign tax withheld of:

International Fund: $942,294

American Opportunities: $135

The accompanying notes are an integral part of these financial statements.

THOMAS WHITE FUNDS

Statements of Changes in Net Assets

| | | International Fund | |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | |

| Change in net assets from operations: | | | | | | | | |

| Net investment income | | $ | 1,982,814 | | | $ | 1,016,915 | |

| Net realized gain on investments and foreign currency translation | | | 795,350 | | | | 11,625,622 | |

| Net changed in unrealized appreciation (depreciation) on investments and foreign | | | | | | | | |

| currency translation | | | (30,093,546 | ) | | | 8,276,792 | |

| Net increase (decrease) in net assets resulting from operations | | | (27,315,382 | ) | | | 20,919,329 | |

| Distributions: | | | | | | | | |

| Distributable earnings - Investor Class | | | (2,071,490 | ) | | | — | |

| Distributable earnings - Class I | | | (7,628,905 | ) | | | — | |

| Total distributions | | | (9,700,395 | ) | | | — | |

| Fund share transactions (Note 3) | | | 2,077,638 | | | | (4,441,015 | ) |

| Total increase (decrease) in net assets | | | (34,938,139 | ) | | | 16,478,314 | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 92,010,307 | | | | 75,531,993 | |

| End of period | | $ | 57,072,168 | | | $ | 92,010,307 | |

The accompanying notes are an integral part of these financial statements.

THOMAS WHITE FUNDS

Statements of Changes in Net Assets

| | | American Opportunities Fund | |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | |

| Change in net assets from operations: | | | | | | | | |

| Net investment income (loss) | | $ | 37,759 |

| | $ | (35,523 | ) |

| Net realized gain on investments | | | 1,039,654 | | | | 1,473,795 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (3,274,489 | ) | | | 6,387,355 | |

| Net increase (decrease) in net assets resulting from operations | | | (2,197,076 | ) | | | 7,825,627 | |

| Total distributions from distributable earnings | | | (1,450,749 | ) | | | — | |

| Fund share transactions (Note 3) | | | (823,289 | ) | | | 562,942 | |

| Total increase (decrease) in net assets | | | (4,471,114 | ) | | | 8,388,569 | |

| Net assets: | | | | | | | | |

| Beginning of period | | | 25,241,613 | | | | 16,853,044 | |

| End of period | | $ | 20,770,499 |

| | $ | 25,241,613 | |

The accompanying notes are an integral part of these financial statements.

FINANCIAL HIGHLIGHTS

| Thomas White International Fund - Investor Class | | | | | | | | | | | | | | |

| | | Year Ended October 31, |

| | | | | | | | | | | | | | | |

| | | | 2022 | | | | 2021 | | | | 2020 | | | | 2019 | | | | 2018 |

| Per share operating performance (For a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 18.51 | | | $ | 14.47 | | | $ | 14.80 | | | $ | 13.86 | | | $ | 17.88 |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | |

| Net investment income1 | | | 0.34 | | | | 0.16 | | | | 0.10 | | | | 0.32 | | | | 0.25 |

| Net realized and unrealized gains/(losses) | | | (5.31) | | | | 3.88 | | | | (0.22) | | | | 1.15 | | | | (2.44) |

| Total from investment operations | | | (4.97) | | | | 4.04 | | | | (0.12) | | | | 1.47 | | | | (2.19) |

| | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.27) | | | | — | | | | (0.21) | | | | (0.23) | | | | (0.29) |

| From net realized gains | | | (1.71) | | | | — | | | | — | | | | (0.30) | | | | (1.54) |

| Total Distributions | | | (1.98) | | | | — | | | | (0.21) | | | | (0.53) | | | | (1.83) |

| Change in net asset value for the year | | | (6.95) | | | | 4.04 | | | | (0.33) | | | | 0.94 | | | | (4.02) |

| Net asset value, end of year | | $ | 11.56 | | | $ | 18.51 | | | $ | 14.47 | | | $ | 14.80 | | | $ | 13.86 |

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (29.82)% | | | | 27.92% | | | | (0.86)% | | | | 10.59% | | | | (12.01)% |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($000) | | $ | 12,359 | | | $ | 20,300 | | | $ | 17,983 | | | $ | 26,331 | | | $ | 29,473 |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | |

| Expenses (net of reimbursement) | | | 1.24% | | | | 1.24% | | | | 1.24% | | | | 1.24% | | | | 1.24% |

| Expenses (prior to reimbursement) | | | 1.83% | | | | 1.63% | | | | 1.63% | | | | 1.63% | | | | 1.34% |

| Net investment income (net of reimbursement) | | | 2.36% | | | | 0.92% | | | | 0.71% | | | | 2.17% | | | | 1.32% |

| Net investment income (prior to reimbursement) | | | 1.77% | | | | 0.53% | | | | 0.32% | | | | 1.78% | | | | 1.22% |

| Portfolio turnover rate2 | | | 51% | | | | 49% | | | | 24% | | | | 43% | | | | 38% |

(1) Net investment income per share represents net investment income divided by the average shares outstanding throughout the year.

(2) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

The accompanying notes are an integral part of these financial statements.

FINANCIAL HIGHLIGHTS

| Thomas White International Fund - Class I | | | | | | | | | | | | | | |

| | | Year Ended October 31, |

| | | | 2022 | | | | 2021 | | | | 2020 | | | | 2019 | | | | 2018 |

| Per share operating performance (For a share outstanding throughout the year) | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 18.50 | | | $ | 14.43 | | | $ | 14.75 | | | $ | 13.81 | | | $ | 17.79 |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | |

| Net investment income1 | | | 0.37 | | | | 0.21 | | | | 0.13 | | | | 0.35 | | | | 0.27 |

| Net realized and unrealized gains/(losses) | | | (5.31) | | | | 3.86 | | | | (0.20) | | | | 1.16 | | | | (2.42) |

| Total from investment operations | | | (4.94) | | | | 4.07 | | | | (0.07) | | | | 1.51 | | | | (2.15) |

| | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.27) | | | | — | | | | (0.25) | | | | (0.27) |

| | | (0.29) |

| From net realized gains | | | (1.71) | | | | — | | | | — | | | | (0.30) |

| | | (1.54) |

| Total Distributions | | | (1.98) | | | | — | | | | (0.25) | | | | (0.57) |

| | | (1.83) |

| Change in net asset value for the year | | | (6.92) | | | | 4.07 | | | | (0.32) | | | | 0.94 | | | | (3.98) |

| Net asset value, end of year | | $ | 11.58 | | | $ | 18.50 | | | $ | 14.43 | | | $ | 14.75 | | | $ | 13.81 |

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (29.66)% | | | | 28.21% | | | | (0.54)% | | | | 10.90% | | | | (11.80)% |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period ($000) | | $ | 44,713 | | | $ | 71,710 | | | $ | 57,549 | | | $ | 92,785 | | | $ | 181,179 |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | |

| Expenses (net of reimbursement) | | | 0.99% | | | | 0.99% | | | | 0.99% | | | | 0.99% | | | | 0.99% |

| Expenses (prior to reimbursement) | | | 1.63% | | | | 1.44% | | | | 1.49% | | | | 1.40% | | | | 1.18% |

| Net investment income (net of reimbursement) | | | 2.63% | | | | 1.19% | | | | 0.88% | | | | 2.42% | | | | 1.53% |

| Net investment income (prior to reimbursement) | | | 1.99% | | | | 0.74% | | | | 0.38% | | | | 2.01% | | | | 1.34% |

| Portfolio turnover rate2 | | | 51% | | | | 49% | | | | 24% | | | | 43% | | | | 38% |

(1) Net investment income per share represents net investment income divided by the average shares outstanding throughout the year.

(2) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

The accompanying notes are an integral part of these financial statements.

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | |

| Thomas White American Opportunities Fund - Investor Class | | | | | | | | | |

| | | Year Ended October 31, |

| | | | 2022 | | | | 2021 | | | | 2020 | | | | 2019 | | | | 2018 |

| Per share operating performance (For a share outstanding throughout the year) | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 18.93 | | | $ | 12.95 | | | $ | 17.46 | | | $ | 15.81 | | | $ | 16.49 |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | |

| Net investment income1 | | | 0.03 | | | | (0.03) | | | | 0.03 | | | | 0.04 | | | | 0.06 |

| Net realized and unrealized gains/(losses) | | | (1.72) | | | | 6.01 | | | | (0.44) | | | | 2.08 | | | | — |

| Total from investment operations | | | (1.69) | | | | 5.98 | | | | (0.41) | | | | 2.12 | | | | 0.06 |

| | | | | | | | | | | | | | | | | | | | |

| Distributions: | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | — | | | | (0.03) | | | | (0.03) | | | | (0.05) |

| From net realized gains | | | (1.23) | | | | — | | | | (4.07) | | | | (0.44) | | | | (0.69) |

| Total Distributions | | | (1.23) | | | | — | | | | (4.10) | | | | (0.47) | | | | (0.74) |

| Change in net asset value for the year | | | (2.92) | | | | 5.98 | | | | (4.51) | | | | 1.65 | | | | (0.68) |

| Net asset value, end of year | | $ | 16.01 | | | $ | 18.93 | | | $ | 12.95 | | | $ | 17.46 | | | $ | 15.81 |

| | | | | | | | | | | | | | | | | | | | |

| Total Return | | | (9.69)% | | | | 46.18% | | | | (2.87)% | | | | 13.37% | | | | 0.50% |

| Ratios/supplemental data | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year ($000) | | $ | 20,770 | | | $ | 25,242 | | | $ | 16,853 | | | $ | 45,766 | | | $ | 40,969 |

| Ratio to average net assets: | | | | | | | | | | | | | | | | | | | |

| Expenses (net of reimbursement/recoupment) | | | 1.34% | | | | 1.34% | | | | 1.34% | | | | 1.34% | | | | 1.34% |

| Expenses (prior to reimbursement/recoupment) | | | 1.74% | | | | 1.62% | | | | 1.71% | | | | 1.55% | | | | 1.43% |

| Net investment income (net of reimbursement/recoupment) | | | 0.18% | | | | (0.16)% | | | | 0.19% | | | | 0.23% | | | | 0.31% |

| Net investment income/(loss) (prior to reimbursement/recoupment) | | | (0.22)% | | | | (0.44)% | | | | (0.18)% | | | | 0.02% | | | | 0.22% |

| Portfolio turnover rate | | | 12% | | | | 14% | | | | 31% | | | | 20% | | | | 21% |

(1) Net investment income per share represents net investment income divided by shares outstanding throughout the year.

The accompanying notes are an integral part of these financial statements.

Notes to Financial Statements Year Ended October 31, 2022

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Lord Asset Management Trust (the “Trust”) was organized as a Delaware business trust on February 9, 1994, as an open-end diversified management investment company. The Trust currently has two series of shares (collectively referred to as the “Funds,” and each a “Fund”) - the Thomas White International Fund (the “International Fund”), which commenced operations with the sale of Investor Class shares on June 28, 1994 and the sale of Class I shares, Class A shares and Class C shares on August 31, 2012; and the Thomas White American Opportunities Fund (the “American Opportunities Fund”), which commenced operations with the sale of Investor Class shares on March 4, 1999. Class A and Class C shares of the International Fund closed on February 28, 2017 and, effective at the close of business on that date, the outstanding Class A and Class C shares of those Funds were converted to Class I shares, as applicable. The investment objective of each Fund is to seek long-term capital growth. The International Fund primarily invests in equity securities of companies located in the world’s developed countries outside of the U.S. The American Opportunities Fund primarily invests in U.S. equity securities, with a focus on mid-size and small companies.

The following is a summary of significant accounting policies followed in the preparation of the Trust’s financial statements.

(A) VALUATION OF SECURITIES

Securities listed or traded on a recognized national or foreign stock exchange or NASDAQ are valued at the last reported sales prices on the principal exchange on which the securities are traded. NASDAQ National Market securities are valued at the NASDAQ official closing price. Over-the-counter securities and listed securities for which no closing sale price is reported are valued at the mean between the last current bid and ask price. Securities for which market quotations are not readily available are valued at fair value under the Valuation Procedures. As of October 31, 2022, all securities within each Fund’s portfolio were valued at the last reported sales price on the principal exchange on which the securities are traded and, for the International Fund, adjusted by a fair value factor when necessary and as further described below. An independent statistical fair value pricing service has been retained to assist in the fair valuation process for securities principally traded in a foreign market in order to adjust for changes in value that may occur between the close of the foreign exchange and the time at which Fund shares are priced. Short term investments are valued at original cost, which combined with accrued interest, approximates market value.

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants at the measurement date. In determining fair value, the Fund uses various valuation approaches. A three-tiered fair value hierarchy for inputs is used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by generally requiring that the most observable inputs be used when available. Observable inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent of a Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The inputs or methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The fair value hierarchy is categorized into three levels based on the inputs as follows:

Level 1 - Valuations based on unadjusted quoted prices in active markets for identical assets.

Level 2 - Valuations based on quoted prices for similar securities or in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 - Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

(B) MULTI-CLASS OPERATIONS AND ALLOCATIONS

Expenses of the International Fund that are not directly attributable to a specific class of shares are prorated among the classes based on the relative net assets of each class. Expenses directly attributable to a class of shares, which presently include administration fees, administrative services fees, printing expenses, registration fees and transfer agent fees, are recorded to the specific class.

For the year ended October 31, 2022, the multi-class fund expenses per class are as follows:

THOMAS WHITE FUNDS

Year Ended October 31, 2022

Note 1(B) & Financial Highlights support

For the year ended October 31, 2022, the multi-class fund expenses per class are as follows:

| | | | | | | | | | |

International Fund | | | | | | | | | |

| | | Investor Class | | | Class I | | | Total | |

| Total investment income | | $ | 623,603 | | | $ | 2,169,281 | | | $ | 2,792,884 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Investment management fees (Note 4) | | $ | 147,058 | | | $ | 508,673 | | | $ | 655,731 | |

| Business management fees (Note 4) | | | 6,055 | | | | 20,946 | | | | 27,001 | |

| Fund accounting and fund administration fees | | | 22,415 | | | | 77,572 | | | | 99,987 | |

| Custodian fees | | | 10,477 | | | | 36,209 | | | | 46,686 | |

| Shareholder servicing fees | | | 16,489 | | | | 57,007 | | | | 73,496 | |

| Trustees' fees and expenses | | | 8,531 | | | | 29,497 | | | | 38,028 | |

| Professional fees | | | 36,302 | | | | 125,684 | | | | 161,986 | |

| Registration fees | | | 8,585 | | | | 29,682 | | | | 38,267 | |

| Printing and mailing expenses | | | 7,190 | | | | 24,900 | | | | 32,090 | |

| Administrative service fee (Note 4) | | | 34,195 | | | | — | | | | 34,195 | |

| Other expenses | | | 19,429 | | | | 67,247 | | | | 86,676 | |

| Total expenses | | | 316,726 | | | | 977,417 | | | | 1,294,143 | |

| Reimbursement of management fees | | | (101,432 | ) | | | (350,875 | ) | | | (452,307 | ) |

| Reimbursement of class specific expenses | | | — | | | | (31,766 | ) | | | (31,766 | ) |

| Reimbursement from Advisor | | | (101,432 | ) | | | (382,641 | ) | | | (484,073 | ) |

| Net expenses | | $ | 215,294 | | | $ | 594,776 | | | $ | 810,070 | |

| Net investment income | | $ | 408,309 | | | $ | 1,574,505 | | | $ | 1,982,814 | |

Notes to Financial Statements Year Ended October 31, 2022

Income, realized and unrealized capital gains and losses of the Fund are prorated among the classes based on the relative net assets of each class within the Fund.

(C) MARKET RISK

Investing in securities of foreign companies and foreign governments involves special risks and considerations not typically associated with investing in U.S. companies and securities of the U.S. Government. These risks include revaluation of currencies and future adverse political and economic developments. Moreover, securities of many foreign companies and foreign governments and their markets may be less liquid and their prices more volatile than securities of comparable U.S. companies and securities of the U.S. Government.

(D) FOREIGN CURRENCY TRANSLATION

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of portfolio securities and income items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. When a Fund purchases or sells a foreign security, it will customarily enter into a foreign exchange contract to minimize foreign exchange risk from the trade date to the settlement date of such transaction.

The Funds do not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments.

Net realized gain (loss) on investments and foreign currency translation include those gains and losses arising from the sale of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions, the differences between the amounts of dividends, and foreign withholding taxes recorded on a Fund’s books, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized appreciation (depreciation) on investments and foreign currency translation includes changes in the value of assets and liabilities resulting from exchange rates.

(E) INCOME TAXES

Each Fund is a separate taxpayer for federal income tax purposes. Each Fund intends to distribute substantially all of its net investment income and net capital gains to its shareholders and to otherwise comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no federal income tax provision is required.

All open tax years and major jurisdictions have been reviewed for the Funds and, based on this review, there are no significant uncertain tax positions that would require recognition in the financial statements. Open tax years are those that are open for exam by taxing authorities and, as of October 31, 2022, open Federal tax years include the tax years ended October 31, 2019 through 2022. The Funds have no examinations in progress and are also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

The Funds accrue for such material foreign taxes on net realized and unrealized gains at the appropriate rate for each country. Based on rates ranging from approximately 10% to 15%, there were no material accruals at period end.

The Funds may utilize equalization accounting for tax purposes and designate earnings and profits, including net realized gains distributed to shareholders on the redemption of shares, as part of the dividends paid deduction for income tax purposes.

(F) USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the period. Actual results could differ from these estimates.

The Funds are investment companies and follow accounting and reporting guidance under the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”.

(G) SECURITY TRANSACTIONS AND INVESTMENT INCOME

Security transactions are accounted for on a trade date basis. Interest is accrued on a daily basis and dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded when the information is available to the Fund. Realized gains and losses are determined using specific identification.

(H) DISTRIBUTIONS TO SHAREHOLDERS

The Funds usually declare and pay dividends from net investment income annually but may do so more frequently to avoid excise tax. Distributions of net realized capital gains, if any, will be distributed at least annually.

(I) SECURITIES LENDING

The International Fund may lend investment securities to investors who borrow securities in order to complete certain transactions. By lending investment securities, the Fund attempts to increase its net investment income through the receipt of interest earned on loan collateral. Any increase or decline in the market price of the securities loaned that might occur and any interest earned or dividends declared during the term of the loan would be for the account of the Fund. Risks of delay in recovery of the securities or even loss of rights in the collateral may occur should the borrower of the securities fail financially. Risk may also arise to the extent that the value of the securities loaned increases above the value of the collateral received. It is the Fund’s policy to obtain additional collateral from or return excess collateral to the borrower by the end of the next business day. Therefore, the value of the collateral may be temporarily less than the value of the securities on loan.

When the Fund lends securities it receives cash, cash equivalents, or other securities as collateral. Initial collateral levels shall not be less than 102% of the market value of the borrowed securities (105% if the collateral and the borrowed securities are denominated in different currencies). Marking to market is performed every business day (subject to de minimis rules of change in market value) for the Fund and each borrower is required to deliver additional collateral when necessary so that the total collateral held in the account for all loans of the Fund to the borrower will not be less than 100% of the market value of all the borrowed securities loaned to the borrower by the Fund. Any cash, cash equivalents, or other securities received as collateral is invested by the securities lending agent, Northern Trust, in accordance with pre-established guidelines as set forth in the securities lending agreement. The cash collateral would be invested in the Northern Institutional Liquid Asset Portfolio (an open-end regulated investment company) and would be shown on the investment portfolio for the International Fund. The cash collateral, if any, is reflected in the Fund’s Statement of Assets and Liabilities in the line item labeled “Investments in securities at market value”. Non-cash collateral is not shown in the Fund’s investment portfolio nor disclosed in the Statement of Assets and Liabilities as it is held by the lending agent on behalf of the Fund, and the Fund does not have the ability to re-hypothecate those securities. A portion of the interest received on the loan collateral is retained by the Fund and the remainder is rebated to the borrower of the securities. From the interest retained by the Fund, 50% is paid to the securities lending agent for the International Fund for its services. The net amount of interest earned, after the interest rebate and the allocation to the securities lending agent, is included in the statement of operations as securities lending income. The value of loaned securities and related collateral outstanding at October 31, 2022 are as follows:

| Fund | Value of

Loaned

Securities | Value of

Cash

Collateral | Value of

Non-Cash

Collateral* | Total