As filed with the U.S. Securities and Exchange Commission on January 10, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08348

LORD ASSET MANAGEMENT TRUST

(Exact name of registrant as specified in charter)

440 South LaSalle Street

Chicago, Illinois 60605-1028

(Address of principal executive offices) (Zip code)

Thomas S. White, Jr.

Thomas White International, Ltd.

440 South LaSalle Street

Chicago, Illinois 60605-1028

(Name and address of agent for service)

(312) 663-8300

Registrant’s telephone number, including area code

Date of fiscal year end: 10/31

Date of reporting period: 11/1/2016 – 10/31/2017

Item 1. Reports to Stockholders.

ANNUAL REPORT

OCTOBER 31, 2017

THE INTERNATIONAL FUND

THE EMERGING MARKETS FUND

THE AMERICAN OPPORTUNITIES FUND

The world economy is continuously evolving in ways we could have hardly imagined even a few years earlier. At Thomas White, we always ask ourselves “What is the big picture?” In other words, we always try to analyze local or regional trends from a broader global context.

We invite you to visit our websites as well as our YouTube channel for added insights into the transformative changes that make global investing more complex, but at the same time open up fascinating prospects for those who have the ability to spot them, and the discipline to focus on long-term trends.

President, Thomas White Funds

| | |

| |

| | thomaswhite.com The Thomas White website offers a panorama of the trends, economic indicators and policy changes occurring in the world economy that are of interest to global investors. |

| |

| | thomaswhitefunds.com The Thomas White Funds website provides important information on our three fund offerings, including performance, rankings, and commentaries. |

| |

| | thenewglobal.com Our New Global website is a highly informative resource for investors and their advisors, offering an in-depth understanding of the dramatic changes and trends in the world economy from a broader global context. |

| |

| | youtube.com/user/ThomasWhiteIntl Our YouTube channel features videos with Thomas White spokeswoman Stathy White, reporting on our investment team’s take on evolving global market trends. |

Thomas White: Empowering the InvestorSM

(This page is not part of the Annual Report.)

CONTENTS

Message to Shareholders

Dear Shareholders and Friends,

It has been a positive year for equity investors, especially for those who have international exposure. After a period of highly unexpected political events and heightened geopolitical risks, the global economic environment has become more favorable for businesses. Most global corporations are now benefiting from this positive setting, and I believe are well placed to reward their investors.

Global Economy Radiant in Synchronized Growth

Over the last five years, the global economy has struggled to achieve a steady and sustainable growth pace. Short spurts of acceleration proved to be false-starts and did not endure, hemmed in by wide regional disparities. Even the deep correction in energy and commodity prices after 2014 did not deliver the widely expected growth push, as capital investments slumped. Startling political developments such as the Brexit vote and the 2016 U.S. presidential elections only made the environment more uncertain.

This year marked the much-needed positive change as most major economies across the globe are expanding at a healthy pace. Global trade volumes have seen an appreciable recovery this year, filling a major gap in the growth puzzle. Energy and commodity prices now reflect the buoyant demand outlook, and appear more

sustainable. Consumers remain optimistic across the world, confident that more jobs are available, and wages are rising, even if at a modest rate. Global industrial activity is at its highest level in several years, and the services sector is also expanding at a robust pace. Low inflation risks make this environment even better, allowing interest rates to remain relatively low for longer.

The synchronized global growth is not an accident, but partly the result of persistent policy measures implemented over the last several years, especially by the central banks in the developed world. While there has been much skepticism over the scale of quantitative easing, and the lasting effects it could have on consumer and investor behavior, there is no doubt that the global economy is now better off because of these programs. This policy support provided enough time for the global economy to heal the deep wounds sustained during the 2008 financial crisis.

Policymakers Should Do More to Sustain This Recovery

The only major missing piece in the ongoing global growth story is capital investments. Despite record high cash holdings, low interest rates and remunerative commodity prices, businesses remain reluctant to invest in new capacity. This could be due to lack of confidence in the sustainability of consumer demand in major markets. Supportive fiscal policies could encourage more business

| | | | |

| www.thomaswhitefunds.com | | | 1 | |

investments. Governments that have enough fiscal flexibility might also consider more public spending, to kick start the investment cycle.

Higher debt levels at consumer and corporate levels are the most significant risk to the global economy. The risk is relatively benign in the near term, and masked by higher revenue and income growth. However, if unattended, this debt burden has the potential to deepen and prolong the next downturn.

Central banks in the developed countries should use extra caution as they contemplate and communicate the plans to scale down their balance sheets. Any misstep may cause unwanted volatility in the financial markets and potentially exacerbate the risks from higher consumer and corporate leverage.

We Expect Emerging Markets to Continue to Do Well

Barring a short period of turbulence soon after the U.S. presidential elections, emerging markets have largely been in favor over the last eighteen months. The combination of faster economic growth, lower political risks, higher commodity prices and relatively lower equity valuations should continue to attract investors to emerging markets. The emerging economies tend to do well when the rest of the world economy is robust. They also benefit disproportionately when global trade is expanding and commodity prices are elevated. All these factors now favor further growth in the emerging economies.

The structural changes in emerging economies have the potential to sustain their growth rates for longer periods.

Governments in several countries have tried to improve productivity and efficiency by investing in infrastructure and reducing regulatory bottlenecks. The sharp decline in average inflation levels in emerging countries is one of the major gains from the past reform initiatives. We expect the emerging economies to maintain their wide growth differential over the developed countries for the next several years.

Political risks in emerging markets are a persistent worry for investors. Compared to recent years, the domestic political environment appears to have calmed down in Russia and Turkey. In Brazil, though challenged by corruption allegations, the government is trying to implement necessary reforms. Elections are scheduled over the next two years in several countries across Latin America and Asia. It is possible that leadership changes in some of these countries could bring more responsive governments and transparency.

Our Portfolio Strategy

To benefit from the strengthening global economy, we have increased the Funds’ exposure to more cyclical sectors over the last year. Our research team believes cash flow expansion and potential reduction in leverage justifies current valuations in the energy and materials sectors. We remain hopeful of a recovery in demand for industrial goods and services, while the healthcare sector could potentially benefit from less stringent regulatory regimes. Despite elevated valuations, we expect segments of the technology sector to expand into newer markets and sustain rapid revenue growth rates. Our research places much

| | |

| 2 | | www.thomaswhitefunds.com |

emphasis on identifying management teams that are transparent and have the foresight and ability to identify and navigate long-term structural changes.

Please visit our websites www.thomaswhitefunds.com, www.thomaswhite.com, and www.thenewglobal.com, for our updated market commentaries and sector reviews.

I thank all Fund shareholders for the trust you continue to have in us. I would also like to welcome our new shareholders and thank you for selecting the Thomas White Funds. I assure you that all professionals at Thomas White are steadfastly committed to helping you achieve your investment goals.

Thomas S. White, Jr.

Chairman

Thomas White Funds

Chief Investment Officer

Thomas White International

| | | | |

| www.thomaswhitefunds.com | | | 3 | |

Past performance is not a guarantee of future results.

Opinions expressed are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. Investing in international markets may involve additional risks such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. These risks are greater for emerging markets. Investing in small and mid-cap companies can involve more risk than investing in larger companies.

Diversification does not assure a profit nor protect against loss in a declining market.

Earnings growth for a Fund holding does not guarantee a corresponding increase in the market value of the holding of the Fund.

The Thomas White Funds are distributed by Quasar Distributors, LLC.

It is not possible to invest directly in an index.

Cash Flow: Measures the cash generating capability of a company by adding non-cash charges (i.e. depreciation) and interest expense to pretax income.

| | |

| 4 | | www.thomaswhitefunds.com |

THE WORLD HAS CHANGED

The number of stocks in the world has surged 134% since the end of the Cold War in 1989. As of October 2017, America’s 5,223 exchange-traded stocks now only represent 10.04% of the 50,343 stocks on the world’s 78 exchanges.1

| | | | | | | | | | | | |

| The Growth of World Stock Markets: Regional Weights |

| 1960 to October 31, 20172 | | 1960 | | 1970 | | 1980 | | 1990 | | 2000 | | 2017 |

| Developed Markets | | 99.9% | | 99.8% | | 99.2% | | 97% | | 96% | | 88% |

| | | | | | | |

United States | | 72% | | 66% | | 57% | | 43% | | 51% | | 52% |

| | | | | | | |

Canada | | 3% | | 3% | | 3% | | 2% | | 2% | | 3% |

| | | | | | | |

Europe | | 22% | | 23% | | 23% | | 25% | | 28% | | 21% |

| | | | | | | |

Asia Pacific | | 3% | | 8% | | 16% | | 27% | | 15% | | 12% |

| | | | | | | |

| Emerging Markets | | 0.1% | | 0.2% | | 0.8% | | 3% | | 4% | | 12% |

| The World Market | | 100% | | 100% | | 100% | | 100% | | 100% | | 100% |

Market Value

($ trillions) | | $0.5 | | $2.0 | | $4.1 | | $8.2 | | $26.9 | | $54.6 |

1World Federation of Exchanges, Focus-October 2017

2Source: Thomas White International (Data for 1960-2000); MSCI (Data for 2017)

Globalization has spurred growth in every region of the world. International stocks now represent over half of the total world stock market value, including, for example, Sony, Nokia, Toyota, BMW, L’Oreal, Unilever, Heineken, Volvo, Nestle, UBS, Volkswagen, Honda and Royal Dutch Shell. Emerging market companies include Samsung, LG and Hyundai.

Given their quality, diversity and long- term growth potential, it only makes common sense that investors search for opportunities worldwide. The Thomas

White American Opportunities, International and Emerging Markets Funds are managed by the same portfolio managers and analysts who adhere to an identical valuation-oriented investment style. The three portfolios complement one another in that, when combined, they seek to have similar geographical and industry allocations to that of the MSCI All Country World Index.

Shareholders who want to adopt a global investment strategy for their savings and investment program should consider owning all three Thomas White Funds.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any securities. For a complete list of Fund holdings, please refer to the Investment Portfolio section of this report.

| | | | |

| www.thomaswhitefunds.com | | | 5 | |

THOMAS WHITE INTERNATIONAL FUND

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Unaudited

Sales

Charge | | Deferred

Sales

Charge | | Administrative

Services

Fee | | 12b-1 Fees | | Operating

Expenses1,3 | | Prospectus

Gross

Annual

Operating

Expense2 | | Prospectus

Net

Annual

Operating

Expense2,3 |

| Investor Class | | None | | None | | Up to 0.25% | | None | | 1.24% | | 1.33% | | 1.24% |

| Class I | | None | | None | | None | | None | | 0.99% | | 1.10% | | 0.99% |

1 In the absence of the fee deferral/expense reimbursement arrangement for the International Fund, the ratio of expenses to average net assets would have been 1.36% for Investor Class shares and 1.14% for Class I shares.

2 Gross Annual Operating Expense and Net Annual Operating Expense are based on the most recent prospectus and may differ from other expense ratios appearing in this report.

3 Thomas White International, Ltd. (“Advisor”) has agreed to defer its fees and/or reimburse the Fund to the extent that the operating expenses for Investor Class and Class I shares exceed (as a percentage of average daily net assets) 1.24% and 0.99%, respectively. The fee deferral/expense reimbursement agreement expires February 28, 2018. The Fund has agreed to repay the Advisor for amounts deferred or reimbursed by the Advisor pursuant to the agreement provided that such repayment does not cause the Fund to exceed the above limits and the repayment is made within three years after the year in which the Advisor incurred the expense. The fee deferral/expense reimbursement agreement may only be amended or terminated by the Fund’s Board of Trustees.

| | | | | | | | |

| | | | | |

| | | NAV | | Net Assets | | Redemption Fee | | Portfolio Turnover |

| Investor Class | | $17.88 | | $43.8 million | | 2.00% on shares held less than 60 days | | 48% |

| Class I | | $17.79 | | $277.3 million | | |

| | |

| 6 | | www.thomaswhitefunds.com |

OCTOBER 31, 2017

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Average Annual Returns as of October 31, 2017 (Unaudited) | |

| Class | | Sales Charge | | 6 month | | | Calendar

YTD | | | 1 Yr | | | 3 Yrs | | | 5 Yrs | | | 10 Yrs | | | Since

Inception

(6/28/1994)* | |

| Investor Class shares (TWWDX) | | None | | | 12.25% | | | | 25.24% | | | | 23.06% | | | | 3.59% | | | | 4.79% | | | | 0.09% | | | | 7.09% | |

| Class I shares1 (TWWIX) | | None | | | 12.35% | | | | 25.32% | | | | 23.23% | | | | 3.83% | | | | 5.03% | | | | 0.21% | | | | 7.15% | |

| MSCI All Country World ex US Index2 | | N/A | | | 12.02% | | | | 23.41% | | | | 23.64% | | | | 5.71% | | | | 7.29% | | | | 0.92% | | | | 5.53% | |

* The inception date of the Investor Class shares.

1 Performance figures for Class I shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

2 The MSCI All Country World ex US Index is a free float-adjusted market capitalization-weighted index of both developed and emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index.

Returns of each share class reflect differences in expenses applicable to each class which are primarily differences in service fees.

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impacts of trades executed on the last business day of the period that were recorded on the first business day of the next period.

Performance data is based upon past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 1-800-811-0535 to obtain performance data as of the most recent month-end. The Fund imposes a 2% redemption fee on shares held less than 60 days. Performance data does not reflect the redemption fee. If reflected, total returns would be lower. Investment performance reflects any fee waivers that were in effect. In the absence of such waivers, total return would have been reduced. The Gross Expense Ratios, based on the most recent prospectus, are 1.33% (Investor Class) and 1.10% (Class I).

| | | | |

| www.thomaswhitefunds.com | | | 7 | |

THOMAS WHITE INTERNATIONAL FUND

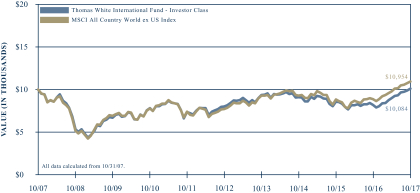

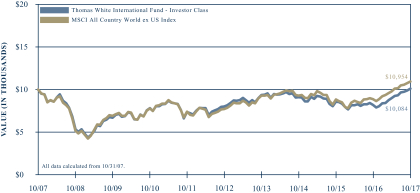

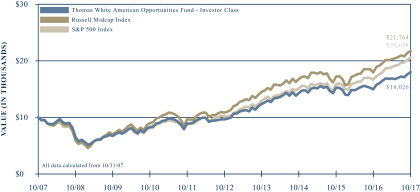

GROWTH OF A $10,000 INVESTMENT WITH DIVIDENDS REINVESTED (Unaudited)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Investor Class shares and its benchmark, the MSCI All Country World ex US Index, for the past 10 years through October 31, 2017. It assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable redemption fees. This chart does not imply future performance. Past performance does not guarantee future results. The cumulative ten year return was +0.84% for the Fund’s Investor Class shares and +9.54% for the benchmark. The Fund’s Investor Class shares average annual total return since inception on June 28, 1994 was +7.09%. The MSCI All Country World ex US Index is a free float-adjusted market capitalization-weighted index of both developed and emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index. During the periods shown, the Fund’s manager reimbursed certain Fund expenses. Absent this reimbursement, performance would have been lower. Performance will vary from class to class based on differences in class-specific expenses.

| | |

| 8 | | www.thomaswhitefunds.com |

OCTOBER 31, 2017

The Thomas White International Fund primarily invests in equity securities of companies located in the world’s developed countries outside of the U.S. There may also be a portion of the Fund’s assets invested in companies located in emerging market countries.

Portfolio Managers

Thomas S. White, Jr.

Jinwen Zhang, Ph.D., CFA

Douglas M. Jackman, CFA

Wei Li, Ph.D., CFA

John Wu, Ph.D., CFA

Rex Mathew, CFA, CM

Ramkumar Venkatramani, CFA

Performance Review

The Thomas White International Fund’s Class I shares returned +23.23% for the one-year period ended October 31, 2017, compared to +23.64% for the benchmark MSCI All Country World ex US Index. Since the Fund’s inception on June 28, 1994, the Fund’s Class I shares have returned +7.15%* annualized while the benchmark index returned +5.53% for the same period.

Faster Growth and Supportive Monetary Policy Help Equities

International equity prices declined at the beginning of the review period as investors shifted their attention to U.S. domestic assets that were expected to benefit from the policy changes promised by the incoming Trump administration. The economic recovery in the Eurozone appeared fragile while the Japanese economy seemed to have slowed

after the consumption tax increases. Several of the emerging economies, most notably China and Mexico, were expected to face tighter trade policies from the Trump administration. Finally, the strength of the U.S. Dollar against other currencies was unfavorable for international assets.

The investor sentiment started turning during the first half of 2017 as the U.S. administration struggled to implement several of the promised changes. At the same time, economic trends in the Eurozone and Japan started improving, while several of the emerging economies appeared to be accelerating. Global demand recovered and lifted export volumes for most Asian countries. During the third quarter, higher energy and commodity prices brightened the outlook for resource exporting countries as well.

Despite the more robust economic signals, the European Central Bank (ECB) and the Bank of Japan are continuing their bond purchases. The ECB will scale back its program early in 2018 but has promised to expand it again if growth falters. Inflation remains well below targets in the Eurozone and Japan, which makes rate increases unlikely before 2019.

Emerging markets outperformed the developed world during the review period, helped by healthy economic growth and favorable fiscal as well as monetary policies. Most emerging markets have seen a healthy recovery in corporate earnings, while relatively inexpensive valuations compared to the developed markets continue to attract investors.

* Performance for Class I shares include the historical performance of Investor Class shares through August 30, 2012.

| | | | |

| www.thomaswhitefunds.com | | | 9 | |

THOMAS WHITE INTERNATIONAL FUND

Portfolio Review

The Fund’s industrial holdings benefited from early signs of a revival in the investment cycle, especially in the developed economies. The financials sector gained as central banks in Europe and Japan are expected to keep interest rates low for longer than previously expected. The technology sector outperformed by a wide margin during the review period as companies gained market share and reported revenues and earnings that exceeded expectations. The sales platforms built by the leading e-commerce companies have proven to be very scalable, and continue to attract more users. Defensive sectors such as consumer staples and healthcare did not attract much investor attention during the period. These sectors are also facing business risks from disruptive online competitors as well as potential regulatory restrictions on pricing, in the case of drug makers. The telecom sector was subdued as erosion of pricing power has offset the gains from data demand growth.

Samsung Electronics, a leading electronic component and semiconductor manufacturer, was the biggest contributor to Fund returns during the review period, helped by the better than expected earnings in recent quarters and the company’s recent efforts to improve corporate governance. Ping An Insurance, one of the leading insurers in China, gained on robust earnings and business growth reported for the most recent quarter. Alibaba Group, the largest e-commerce player in Asia, advanced as it continued to expand into new market segments and repeatedly raised its revenue and earnings guidance. Dutch banking and financial services group ING Groep

benefited from the improved demand outlook for credit and services. Higher oil prices and signs of a recovery in energy demand helped integrated energy group Royal Dutch Shell outperform during the review period.

British lender Provident Financial detracted the most from Fund returns for the one-year review period after it sharply lowered earnings estimates on unexpected weakness in credit demand and higher credit costs. Belgium-based IWG, a leading provider of flexible workspaces across the globe, declined after it said earnings will be much lower than earlier estimates. Japanese telecom group Nippon Telegraph and Telephone as well as cigarette manufacturer Japan Tobacco were hurt as investor interest shifted to export-oriented Japanese corporations. Nevertheless, we believe Japanese domestic demand could recover as the government expands fiscal spending. Royal Ahold underperformed as revenue growth in its grocery stores continues to be threatened by growing competition from online retailers.

Economic Growth Outlook Remains Bright

The economic growth outlook for the Eurozone continues to brighten, and the International Monetary Fund (IMF) has lifted its GDP growth estimates for the region to 2.1% for this year. The ECB is more confident and expects the pace of expansion to reach 2.2%. While the region is now benefiting from the recovery in global trade volumes, the main driver of the Eurozone economy in recent years has been domestic demand. Though some countries such as Spain in the common currency area still have high unemployment,

| | |

| 10 | | www.thomaswhitefunds.com |

OCTOBER 31, 2017

the average jobless rates have steadily come down. Wages have started increasing at a faster pace, most notably in Germany where unions are demanding pay hikes of 5% or more. The healthier economic conditions have encouraged the ECB to scale down its bond purchases beginning in January 2018. However, lingering political risks such as the separatist movements in Spain are likely to prevent the ECB from increasing its benchmark rate anytime soon.

The Japanese economy is also gaining speed, and the IMF expects growth of 1.3% this year, helped by exports and investments. Domestic consumption could strengthen in Japan and boost growth in the coming quarters. The government has been re-elected and is now expected to expand the fiscal policies initiated in 2014. As in the Eurozone, inflation remains stubbornly low in Japan, and the central bank is expected to continue its bond purchases. Australia and Canada, as well as select European countries such as Norway, are benefiting from higher energy and commodity prices. If higher commodity prices prevail for longer, these

countries could also see a more robust recovery in capital spending.

The synchronized global economic recovery has brightened the growth prospects of emerging economies as well, most notably in Asia. The Chinese economy expanded at an annualized pace of 6.8% during the third quarter of 2017, very close to the pace set during the first half of the year. If the rate of expansion is sustained during the last three months of this year, aggregate growth for the year will exceed the Chinese government’s target of 6.5%. Korea and Taiwan, which rely more on exports, continue to see strong expansion in shipment volumes. Growth in India has fallen short of expectations in recent quarters, largely due to disruptions caused by major structural policy changes implemented by the government. The Latin American economies should benefit from higher energy and industrial commodity prices, though the outlook for Mexico remains clouded by the trade policy frictions with the U.S.

Thank you for your confidence in the Thomas White International Fund.

| | | | |

| www.thomaswhitefunds.com | | | 11 | |

THOMAS WHITE INTERNATIONAL FUND

Portfolio Country and Industry Allocation as of October 31, 2017 (Unaudited)

| | | | |

| | |

| Country Allocation | | % of TNA | |

| Australia | | | 6.6% | |

| Belgium | | | 1.5% | |

| Brazil | | | 2.0% | |

| Canada | | | 4.3% | |

| China | | | 6.6% | |

| Finland | | | 1.2% | |

| France | | | 2.8% | |

| Germany | | | 4.3% | |

| Hong Kong | | | 2.0% | |

| India | | | 3.3% | |

| Indonesia | | | 2.2% | |

| Ireland | | | 1.0% | |

| Israel | | | 1.0% | |

| Japan | | | 15.2% | |

| Mexico | | | 1.0% | |

| Netherlands | | | 6.1% | |

| Peru | | | 1.5% | |

| Russia | | | 2.3% | |

| South Africa | | | 2.6% | |

| South Korea | | | 6.5% | |

| Spain | | | 2.9% | |

| Sweden | | | 5.5% | |

| Switzerland | | | 1.7% | |

| Taiwan | | | 2.4% | |

| Thailand | | | 2.3% | |

| Turkey | | | 0.7% | |

| United Kingdom | | | 9.0% | |

| Cash & Other | | | 1.5% | |

| | | | |

| | |

| Industry Allocation | | % of TNA | |

| Automobiles & Components | | | 4.4% | |

| Banks | | | 18.4% | |

| Capital Goods | | | 9.9% | |

| Commercial & Professional Services | | | 1.3% | |

| Consumer Durables & Apparel | | | 2.0% | |

| Diversified Financials | | | 1.3% | |

| Energy | | | 6.3% | |

| Food & Staples Retailing | | | 1.1% | |

| Food, Beverage & Tobacco | | | 1.8% | |

| Health Care Equipment & Services | | | 1.0% | |

| Household & Personal Products | | | 2.9% | |

| Insurance | | | 5.6% | |

| Materials | | | 13.8% | |

| Media | | | 3.4% | |

| Pharmaceuticals, Biotechnology & Life Sciences | | | 2.1% | |

| Real Estate | | | 1.0% | |

| Retailing | | | 2.8% | |

| Semiconductors & Semiconductor Equipment | | | 3.7% | |

| Software & Services | | | 6.2% | |

| Technology Hardware & Equipment | | | 3.7% | |

| Telecommunication Services | | | 2.6% | |

| Transportation | | | 3.2% | |

| Cash & Other | | | 1.5% | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

TNA - Total Net Assets

Fund holdings and industry allocations are subject to change and should not be considered a recommendation to buy or sell any securities. For a complete list of Fund holdings, please refer to the Investment Portfolio section of this report.

| | |

| 12 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2017 |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

COMMON

STOCKS (95.5%) | | | | | | | | | | |

|

| |

| AUSTRALIA (6.6%) | | | | | | | | |

| | BHP Billiton Ltd + | | Materials | | | 238,600 | | | | $4,878,442 | |

| | CSL Limited + | | Pharmaceuticals, Biotechnology & Life Sciences | | | 42,800 | | | | 4,564,759 | |

| | Iluka Resources Ltd + | | Materials | | | 565,800 | | | | 4,097,104 | |

| | Newcrest Mining Limited + | | Materials | | | 188,800 | | | | 3,220,898 | |

| | Orica Limited + | | Materials | | | 280,600 | | | | 4,494,440 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 21,255,643 | |

|

| |

| BELGIUM (1.5%) | | | | | | | | |

| | KBC Group NV + | | Banks | | | 60,400 | | | | 5,017,984 | |

|

| |

| CANADA (4.3%) | | | | | | | | | | |

| | Canadian National Railway Company * | | Transportation | | | 44,600 | | | | 3,588,812 | |

| | Open Text Corporation * | | Software & Services | | | 98,600 | | | | 3,447,675 | |

| | Potash Corporation of Saskatchewan Inc. * | | Materials | | | 180,000 | | | | 3,503,449 | |

| | Suncor Energy, Inc. * | | Energy | | | 92,800 | | | | 3,150,640 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 13,690,576 | |

|

| |

| CHINA (6.6%) | | | | | | | | |

| | Alibaba Group Holding Ltd. ADR * # | | Software & Services | | | 37,800 | | | | 6,988,842 | |

| | Anhui Conch Cement Company Limited - H Shares + | | Materials | | | 723,500 | | | | 3,093,283 | |

| | Baidu, Inc. ADR * | | Software & Services | | | 20,800 | | | | 5,073,952 | |

| | Ping An Insurance (Group) Company of China Limited - H Shares + | | Insurance | | | 685,500 | | | | 6,020,418 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 21,176,495 | |

|

| |

| FINLAND (1.2%) | | | | | | | | |

| | Sampo Oyj - A Shares + | | Insurance | | | 75,300 | | | | 3,944,821 | |

|

| |

| FRANCE (2.8%) | | | | | | | | |

| | Eiffage + | | Capital Goods | | | 21,900 | | | | 2,289,040 | |

| | Safran SA + | | Capital Goods | | | 30,900 | | | | 3,255,871 | |

| | Total SA + | | Energy | | | 60,000 | | | | 3,346,668 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,891,579 | |

|

| |

| GERMANY (3.3%) | | | | | | | | |

| | Bayerische Motoren Werke Aktiengesellschaft + | | Automobiles & Components | | | 31,400 | | | | 3,200,459 | |

| | Continental Aktiengesellschaft + | | Automobiles & Components | | | 10,400 | | | | 2,639,751 | |

| | Muenchener Rueckversicherungs-Gesellschaft AG + | | Insurance | | | 20,900 | | | | 4,675,530 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,515,740 | |

|

| |

| HONG KONG (2.0%) | | | | | | | | |

| | Hang Lung Properties Ltd. + | | Real Estate | | | 1,405,000 | | | | 3,232,947 | |

| | Techtronic Industries Company Limited + | | Consumer Durables & Apparel | | | 559,000 | | | | 3,278,509 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,511,456 | |

|

| |

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 13 | |

| | |

| Thomas White International Fund | | |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| INDIA (3.3%) | | | | | | | | |

| | Axis Bank Limited + | | Banks | | | 456,800 | | | | $3,692,543 | |

| | Exide Industries Ltd. | | Automobiles & Components | | | 781,000 | | | | 2,517,070 | |

| | Infosys Limited ADR # | | Software & Services | | | 292,700 | | | | 4,346,595 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,556,208 | |

|

| |

| INDONESIA (2.2%) | | | | | | | | |

| | PT Bank Central Asia Tbk + | | Banks | | | 3,106,000 | | | | 4,797,900 | |

| | PT Telekomunikasi Indonesia Persero Tbk + | | Telecommunication Services | | | 7,493,600 | | | | 2,238,022 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,035,922 | |

|

| |

| IRELAND (1.0%) | | | | | | | | |

| | CRH PLC + | | Materials | | | 88,400 | | | | 3,336,546 | |

|

| |

| ISRAEL (1.0%) | | | | | | | | |

| | Elbit Systems Ltd. + | | Capital Goods | | | 21,200 | | | | 3,141,575 | |

|

| |

| JAPAN (15.2%) | | | | | | | | |

| | DAIKIN INDUSTRIES, LTD. + | | Capital Goods | | | 31,300 | | | | 3,466,812 | |

| | FANUC Corporation + | | Capital Goods | | | 15,200 | | | | 3,563,535 | |

| | HONDA MOTOR CO., LTD. + | | Automobiles & Components | | | 114,800 | | | | 3,590,401 | |

| | Hoya Corp + | | Technology Hardware & Equipment | | | 76,600 | | | | 4,140,146 | |

| | Japan Tobacco Inc. + | | Food, Beverage & Tobacco | | | 79,400 | | | | 2,625,909 | |

| | Kansai Paint Co., Ltd. + | | Materials | | | 160,600 | | | | 4,141,692 | |

| | Nitori Holdings Co., Ltd. + | | Retailing | | | 20,100 | | | | 2,910,674 | |

| | ORIX Corporation + | | Diversified Financials | | | 195,700 | | | | 3,371,744 | |

| | Rakuten Inc + | | Retailing | | | 244,200 | | | | 2,599,344 | |

| | SMC Corp/Japan + | | Capital Goods | | | 14,000 | | | | 5,371,932 | |

| | SoftBank Corp. + | | Telecommunication Services | | | 67,600 | | | | 5,982,529 | |

| | Sundrug Co., Ltd. + | | Food & Staples Retailing | | | 84,500 | | | | 3,676,726 | |

| | Tokio Marine Holdings, Inc. + | | Insurance | | | 78,400 | | | | 3,379,214 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 48,820,658 | |

|

| |

| MEXICO (1.0%) | | | | | | | | |

| | Cemex SAB de CV * | | Materials | | | 3,874,324 | | | | 3,150,506 | |

|

| |

| NETHERLANDS (6.1%) | | | | | | | | |

| | ING Groep N.V. + | | Banks | | | 359,800 | | | | 6,644,976 | |

| | Koninklijke DSM N.V. + | | Materials | | | 31,900 | | | | 2,720,496 | |

| | Koninklijke Philips NV + | | Capital Goods | | | 111,800 | | | | 4,549,951 | |

| | Royal Dutch Shell PLC - B Shares + | | Energy | | | 173,700 | | | | 5,590,549 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 19,505,972 | |

|

| |

| PERU (1.5%) | | | | | | | | |

| | Credicorp Ltd. | | Banks | | | 22,500 | | | | 4,712,400 | |

|

| |

The accompanying notes are an integral part of these financial statements

| | |

| 14 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2017 |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| RUSSIA (2.3%) | | | | | | | | |

| | LUKOIL PJSC ADR + | | Energy | | | 58,000 | | | | $3,081,017 | |

| | Sberbank of Russia PJSC ADR + | | Banks | | | 302,700 | | | | 4,342,889 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,423,906 | |

|

| |

| SOUTH AFRICA (2.6%) | | | | | | | | |

| | Mondi Ltd + | | Materials | | | 98,700 | | | | 2,375,517 | |

| | Naspers Limited - N Shares + | | Media | | | 13,800 | | | | 3,409,569 | |

| | Sibanye Gold Limited # + | | Materials | | | 1,935,070 | | | | 2,499,349 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,284,435 | |

|

| |

| SOUTH KOREA (6.5%) | | | | | | | | |

| | KB Financial Group Inc. + | | Banks | | | 90,000 | | | | 4,699,202 | |

| | KT&G Corporation + | | Food, Beverage & Tobacco | | | 33,500 | | | | 3,168,721 | |

| | LG Household & Health Care Ltd. + | | Household & Personal Products | | | 2,500 | | | | 2,625,605 | |

| | POSCO + | | Materials | | | 9,200 | | | | 2,679,041 | |

| | Samsung Electronics Co., Ltd. + | | Semiconductors & Semiconductor Equipment | | | 3,095 | | | | 7,618,879 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 20,791,448 | |

|

| |

| SPAIN (2.9%) | | | | | | | | |

| | Aena SME, S.A. + | | Transportation | | | 18,000 | | | | 3,303,302 | |

| | Banco Bilbao Vizcaya Argentaria, S.A. + | | Banks | | | 684,500 | | | | 5,987,944 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,291,246 | |

|

| |

| SWEDEN (5.5%) | | | | | | | | |

| | Hennes & Mauritz AB - B Shares # + | | Retailing | | | 143,900 | | | | 3,608,828 | |

| | Hexagon AB - B Shares + | | Technology Hardware & Equipment | | | 82,000 | | | | 4,206,916 | |

| | Nordea Bank AB + | | Banks | | | 322,300 | | | | 3,896,903 | |

| | SKF AB - B Shares + | | Capital Goods | | | 262,100 | | | | 6,082,193 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 17,794,840 | |

|

| |

| SWITZERLAND (1.7%) | | | | | | | | |

| | IWG PLC + | | Commercial & Professional Services | | | 800,000 | | | | 2,289,153 | |

| | The Swatch Group AG + | | Consumer Durables & Apparel | | | 8,300 | | | | 3,255,680 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,544,833 | |

|

| |

| TAIWAN (2.4%) | | | | | | | | |

| | Pegatron Corporation + | | Technology Hardware & Equipment | | | 1,299,000 | | | | 3,376,138 | |

| | Taiwan Semiconductor Manufacturing Company Ltd. ADR | | Semiconductors & Semiconductor Equipment | | | 104,000 | | | | 4,402,320 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,778,458 | |

|

| |

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 15 | |

| | |

| Thomas White International Fund | | |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| THAILAND (2.3%) | | | | | | | | |

| | Airports of Thailand Public Company Ltd. | | Transportation | | | 1,853,000 | | | | $3,322,062 | |

| | Kasikornbank Public Company Limited + | | Banks | | | 611,000 | | | | 4,201,822 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 7,523,884 | |

|

| |

| TURKEY (0.7%) | | | | | | | | |

| | Tofas Turk Otomobil Fabrikasi A.S. + | | Automobiles & Components | | | 277,700 | | | | 2,260,517 | |

|

| |

| UNITED KINGDOM (9.0%) | | | | | | | | |

| | BP p.l.c. + | | Energy | | | 756,300 | | | | 5,126,389 | |

| | Experian PLC + | | Commercial & Professional Services | | | 90,100 | | | | 1,896,494 | |

| | Lloyds Banking Group PLC + | | Banks | | | 4,941,000 | | | | 4,480,525 | |

| | Provident Financial plc + | | Diversified Financials | | | 69,000 | | | | 854,235 | |

| | RELX NV + | | Media | | | 181,604 | | | | 4,099,904 | |

| | Shire + | | Pharmaceuticals, Biotechnology & Life Sciences | | | 44,600 | | | | 2,195,140 | |

| | Smith & Nephew PLC + | | Health Care Equipment & Services | | | 171,100 | | | | 3,230,322 | |

| | Unilever NV + | | Household & Personal Products | | | 64,000 | | | | 3,718,732 | |

| | WPP PLC + | | Media | | | 186,200 | | | | 3,290,801 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 28,892,542 | |

|

| |

| Total Common Stocks | | | | (Cost $246,418,886) | | | | | | | 306,850,190 | |

| | | | | | | | | | | | |

|

| |

| PREFERRED STOCKS (3.0%) | | | | | | | | | | | | |

|

| |

| BRAZIL (2.0%) | | | | | | | | |

| | Itau Unibanco Holding S.A. (2/7/18, 0.44%)^ | | Banks | | | 499,060 | | | | 6,439,435 | |

|

| |

| GERMANY (1.0%) | | | | | | | | |

| | Henkel AG & Co. KGaA + (2/22/18, 1.47%)^ | | Household & Personal Products | | | 21,900 | | | | 3,073,927 | |

|

| |

| Total Preferred Stocks | | | | (Cost $6,525,743) | | | | | | | 9,513,362 | |

| | | | | | | | | | | | |

|

| |

| Total Investments | | 98.5% | | (Cost $252,944,629) | | | | | | | $316,363,552 | |

Other Assets,

Less Liabilities | | 1.5% | | | | | | | | | 4,735,325 | |

| Total Net Assets: | | 100.0% | | | | | | | | | $321,098,877 | |

|

| |

| * | Non-Income Producing Securities |

| # | All or a portion of securities on loan at October 31, 2017. The market value of the securities loaned was $11,822,118. The loaned securities were secured with non-cash collateral with a value of $12,529,046. The non-cash collateral received consists of short term investments and long term bonds, and is held for the benefit of the Fund at the Fund’s custodian. The Fund cannot repledge or resell this collateral. Collateral is calculated based on prior day’s prices. - See Note 1(I) to Financial Statements |

| ^ | Maturity Date and Preferred Dividend Rate of Preferred Stock. |

| ADR | - American Depositary Receipt |

Industry classifications shown in the Investment Portfolio are based off of the Global Industry Classification Standard (GICS®). GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements

| | |

| 16 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2017 |

The following table summarizes the inputs used, as of October 31, 2017, in valuating the Fund’s assets:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Australia | | | $------- | | | | $21,255,643 | | | | $------- | | | | $21,255,643 | |

| Belgium | | | ------- | | | | 5,017,984 | | | | ------- | | | | 5,017,984 | |

| Canada | | | 13,690,576 | | | | ------- | | | | ------- | | | | 13,690,576 | |

| China | | | 12,062,794 | | | | 9,113,701 | | | | ------- | | | | 21,176,495 | |

| Finland | | | ------- | | | | 3,944,821 | | | | ------- | | | | 3,944,821 | |

| France | | | ------- | | | | 8,891,579 | | | | ------- | | | | 8,891,579 | |

| Germany | | | ------- | | | | 10,515,740 | | | | ------- | | | | 10,515,740 | |

| Hong Kong | | | ------- | | | | 6,511,456 | | | | ------- | | | | 6,511,456 | |

| India | | | 6,863,665 | | | | 3,692,543 | | | | ------- | | | | 10,556,208 | |

| Indonesia | | | ------- | | | | 7,035,922 | | | | ------- | | | | 7,035,922 | |

| Ireland | | | ------- | | | | 3,336,546 | | | | ------- | | | | 3,336,546 | |

| Israel | | | ------- | | | | 3,141,575 | | | | ------- | | | | 3,141,575 | |

| Japan | | | ------- | | | | 48,820,658 | | | | ------- | | | | 48,820,658 | |

| Mexico | | | 3,150,506 | | | | ------- | | | | ------- | | | | 3,150,506 | |

| Netherlands | | | ------- | | | | 19,505,972 | | | | ------- | | | | 19,505,972 | |

| Peru | | | 4,712,400 | | | | ------- | | | | ------- | | | | 4,712,400 | |

| Russia | | | ------- | | | | 7,423,906 | | | | ------- | | | | 7,423,906 | |

| South Africa | | | ------- | | | | 8,284,435 | | | | ------- | | | | 8,284,435 | |

| South Korea | | | ------- | | | | 20,791,448 | | | | ------- | | | | 20,791,448 | |

| Spain | | | ------- | | | | 9,291,246 | | | | ------- | | | | 9,291,246 | |

| Sweden | | | ------- | | | | 17,794,840 | | | | ------- | | | | 17,794,840 | |

| Switzerland | | | ------- | | | | 5,544,833 | | | | ------- | | | | 5,544,833 | |

| Taiwan | | | 4,402,320 | | | | 3,376,138 | | | | ------- | | | | 7,778,458 | |

| Thailand | | | ------- | | | | 7,523,884 | | | | ------- | | | | 7,523,884 | |

| Turkey | | | ------- | | | | 2,260,517 | | | | ------- | | | | 2,260,517 | |

| United Kingdom | | | ------- | | | | 28,892,542 | | | | ------- | | | | 28,892,542 | |

| Total Common Stocks | | | $44,882,261 | | | | $261,967,929 | | | | $------- | | | | $306,850,190 | |

| Preferred Stocks | | | | | | | | | | | | | | | | |

| Brazil | | | $6,439,435 | | | | $------- | | | | $------- | | | | $6,439,435 | |

| Germany | | | ------- | | | | 3,073,927 | | | | ------- | | | | 3,073,927 | |

| Total Preferred Stocks | | | $6,439,435 | | | | $3,073,927 | | | | $------- | | | | $9,513,362 | |

| Total Investments | | | $51,321,696 | | | | $265,041,856 | | | | $------- | | | | $316,363,552 | |

For more information on valuation inputs, please refer to Note 1(A) of the accompanying Notes to Financial Statements.

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 17 | |

| | |

| Thomas White International Fund | | |

The Fund’s assets assigned to Level 2 include certain foreign securities for which a third party statistical pricing service may be employed for purposes of fair market valuation. In addition, no transfers in and/or out between Levels 1, 2 or 3 were observed during the reporting period, as compared to their classification from the prior annual report.

The accompanying notes are an integral part of these financial statements

| | |

| 18 | | www.thomaswhitefunds.com |

THOMAS WHITE EMERGING MARKETS FUND

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Unaudited

Sales

Charge | | Deferred

Sales

Charge | | Administrative

Services

Fee | | 12b-1 Fees | | Operating

Expenses1,3 | | Prospectus

Gross

Annual

Operating

Expense2 | | Prospectus

Net Annual

Operating

Expense2,3 |

| Investor Class | | None | | None | | Up to 0.25% | | None | | 1.32% | | 1.32% | | 1.35% |

| Class I | | None | | None | | None | | None | | 1.09% | | 1.30% | | 1.10% |

1 In the absence of the fee deferral/expense reimbursement arrangement for the Emerging Markets Fund, the ratio of expenses to average net assets would have been 1.48% for Investor Class shares and 1.42% for Class I shares.

2 Gross Annual Operating Expense and Net Annual Operating Expense are based on the most recent prospectus and may differ from other expense ratios appearing in this report.

3 Thomas White International, Ltd. (“Advisor”) has agreed to defer its fees and/or reimburse the Fund to the extent that the operating expenses for Investor Class and Class I shares exceed (as a percentage of average daily net assets) 1.34% and 1.09%, respectively. The fee deferral/expense reimbursement agreement expires February 28, 2018. The Fund has agreed to repay the Advisor for amounts deferred or reimbursed by the Advisor pursuant to the agreement provided that such repayment does not cause the Fund to exceed the above limits and the repayment is made within three years after the year in which the Advisor incurred the expense. The fee deferral/expense reimbursement agreement may only be amended or terminated by the Fund’s Board of Trustees.

| | | | | | | | |

| | | | | |

| | | NAV | | Net Assets | | Redemption Fee | | Portfolio Turnover |

| Investor Class | | $11.30 | | $2.0 million | | 2.00% on shares held less than 60 days | | 67% |

| Class I | | $11.38 | | $45.4 million | | |

| | | | |

| www.thomaswhitefunds.com | | | 19 | |

THOMAS WHITE EMERGING MARKETS FUND

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Average Annual Returns as of October 31, 2017 (Unaudited) | |

| Class | | Sales Charge | | 6 month | | | Calendar

YTD | | | 1 Yr | | | 3 Yrs | | | 5 Yrs | | | Since

Inception

(6/28/2010)* | |

| Investor Class shares (TWEMX) | | None | | | 11.39% | | | | 23.85% | | | | 17.02% | | | | 0.36% | | | | 1.19% | | | | 2.88% | |

| Class I shares1 (TWIIX) | | None | | | 11.55% | | | | 23.94% | | | | 17.29% | | | | 0.61% | | | | 1.42% | | | | 3.05% | |

| MSCI Emerging Markets Index2 | | N/A | | | 16.14% | | | | 32.26% | | | | 26.45% | | | | 5.70% | | | | 4.83% | | | | 4.74% | |

* The inception date of the Investor Class shares.

1 Performance figures for Class I shares, first offered on August 31, 2012, include the historical performance of Investor Class shares through August 30, 2012.

2 The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index.

Returns of each share class reflect differences in expenses applicable to each class which are primarily differences in service fees.

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impacts of trades executed on the last business day of the period that were recorded on the first business day of the next period.

Performance data is based upon past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Please call 1-800-811-0535 to obtain performance data as of the most recent month-end. The Fund imposes a 2% redemption fee on shares held less than 60 days. Performance data does not reflect the redemption fee. If reflected, total returns would be lower. Investment performance reflects any fee waivers that were in effect. In the absence of such waivers, total return would have been reduced. The Gross Expense Ratios, based on the most recent prospectus, are 1.32% (Investor Class) and 1.30% (Class I).

| | |

| 20 | | www.thomaswhitefunds.com |

OCTOBER 31, 2017

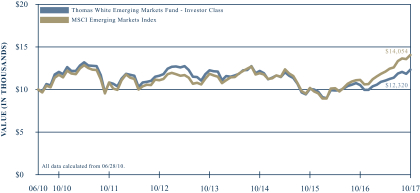

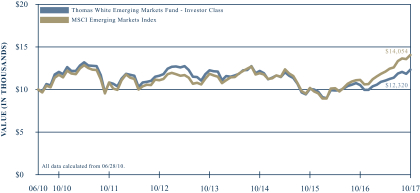

GROWTH OF A $10,000 INVESTMENT WITH DIVIDENDS REINVESTED (Unaudited)

This chart illustrates the performance of a hypothetical $10,000 investment made in the Fund’s Investor Class shares and its benchmark, the MSCI Emerging Markets Index, since inception on June 28, 2010 through October 31, 2017. It assumes reinvestment of dividends and capital gains, but does not reflect the effect of any applicable redemption fees. This chart does not imply future performance. Past performance does not guarantee future results. The cumulative return since inception was +23.20% for the Fund’s Investor Class shares and +40.54% for the benchmark. The Fund’s Investor Class shares average annual total return since inception on June 28, 2010 was +2.88%. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index is unmanaged and returns assume the reinvestment of dividends. It is not possible to invest directly in an index. During the periods shown, the Fund’s manager reimbursed certain Fund expenses. Absent this reimbursement, performance would have been lower. Performance will vary from class to class based on differences in class-specific expenses.

| | | | |

| www.thomaswhitefunds.com | | | 21 | |

THOMAS WHITE EMERGING MARKETS FUND

The Thomas White Emerging Markets Fund invests primarily in securities of companies located in or whose businesses are closely associated with the world’s emerging markets countries.

Portfolio Managers

Thomas S. White, Jr.

Jinwen Zhang, Ph.D., CFA

Douglas M. Jackman, CFA

Wei Li, Ph.D., CFA

John Wu, Ph.D., CFA

Rex Mathew, CFA, CM

Ramkumar Venkatramani, CFA

Performance Review

During the one-year period ended October 31, 2017, the Thomas White Emerging Markets Fund’s Class I shares returned +17.29%, compared to +26.45% for its benchmark MSCI Emerging Markets Index. Since the Fund’s inception on June 28, 2010, the Fund’s Class I shares have returned +3.05%* annualized, against +4.74% for the benchmark index.

Emerging Markets Seeing Renewed Investor Interest

Emerging market equity prices declined at the beginning of the review period as investor attention shifted to the potential boost to U.S. assets from the proposed tax and fiscal policy changes by the incoming Trump administration. It was feared that restrictive trade policies proposed by the new administration could hurt overseas markets, especially emerging markets that are relatively more dependent on trade.

Additionally, the U.S. Dollar’s gains against international currencies also made overseas assets less attractive for investors.

The sentiment started to turn early in 2017 as the global economy gathered pace. Data from Europe and Japan indicated that economic trends are healthier than forecast. This helped brighten the outlook for global demand, as expanding export volumes in subsequent months confirmed. Domestic demand in major emerging markets continued to expand as expected. Other than in India where economic activity was hurt by key policy changes that are considered essential in the long run, most major emerging economies have met or exceeded growth expectations during the first three quarters of 2017.

Stronger economic data encouraged the International Monetary Fund (IMF) to lift its estimates for emerging markets economic growth for the current year as well as for 2018. After the subdued trends during the first half of 2017, energy and commodity prices trended higher during the third quarter. This led to renewed optimism about the recovery in resource exporting countries such as Russia, Brazil and South Africa. At the same time, the commodity price gains have not appreciably dampened consumer spending or widened current account deficits in importing countries. Inflation remains well under control in most emerging markets, except Mexico where the central bank has hiked interest rates. Brazil saw meaningful cuts to its benchmark interest rates this year while central banks in other large emerging countries have left rates unchanged in recent months.

| | |

| 22 | | www.thomaswhitefunds.com |

* Performance for Class I shares include the historical performance of Investor Class shares through August 30, 2012.

OCTOBER 31, 2017

Portfolio Review

The Fund’s technology holdings outperformed by a wide margin during the review period as companies gained market share and reported revenues and earnings that exceeded expectations. The sales platforms built by the leading e-commerce companies have proven to be very scalable and continue to attract more users. The materials sector benefited from the uptrend in industrial commodity prices, supported by signs of healthier demand. The telecom sector also outperformed as the rapid growth in popularity of handheld devices boosted demand for data services. Defensive sectors such as consumer staples and healthcare did not attract much investor attention during the period. The industrials sector also lagged as capital investments for new projects and capacity expansions remain subdued.

Four of the top five contributors to Fund returns for the one-year review period were from the technology sector. Alibaba Group, the largest e-commerce player in Asia, contributed the most to returns as it continued to expand into new market segments, and repeatedly raised its revenue and earnings guidance. Samsung Electronics, one of the largest electronic component and semiconductor manufacturers, gained on strong earnings growth as well as initiatives to improve corporate governance. Tencent Holdings, a market leader in mobile-based instant communication services in Asia with fast growing e-commerce businesses, advanced on better than expected revenue growth. Taiwan Semiconductor Manufacturing, the leading manufacturer of chipsets used in smartphones and other devices, gained on

expectations of further demand growth coming from new devices and technologies. Ping An Insurance, one of the leading insurers in China, benefited from robust earnings and business growth reported in recent quarters.

Indonesian department store operator Matahari Department Store detracted the most from Fund returns, and was sold, as it struggled to revive revenue growth on growing completion and weaker than expected consumer spending. Gentera, a Mexican lender that focuses on small loans, was hurt by the weak economic trends in the country and higher lending rates. Oil field services provider Gulf International, based in the Middle East, declined as the anticipated recovery in capital investment did not yet happen. China Biologic, a manufacturer of blood plasma products, was negatively affected by lower than expected revenue growth and the risk of government controls. Automaker Tata Motors underperformed as currency volatility reduced profit margins and offset the gains from volume growth in China and other major markets.

Emerging Economies Could Continue to Outpace the Developed World

After the growth slowdown that lasted nearly five years, emerging economies started recovering during the first half of 2016. This was triggered by a sharp rebound in prices of energy and industrial commodities from multi-year lows at the beginning of last year. Higher commodity prices were expected to help Brazil, Russia and other resource exporters to move out of severe recessions. The optimism faded as oil and commodity

| | | | |

| www.thomaswhitefunds.com | | | 23 | |

THOMAS WHITE EMERGING MARKETS FUND

prices moderated and a new U.S. administration that called for restrictive trade policies came to power during the first quarter of 2017.

However, the synchronous global economic growth this year has exceeded most forecasts and has brightened the outlook for emerging markets. Export volume growth for manufactured goods, the missing piece for emerging economies for most of last year, has seen a robust revival in recent quarters. Several of the Asian economies such as Korea and Taiwan have reported double digit growth in export volumes this year. Shipments from China have expanded while India is now seeing an export recovery after lagging other Asian countries earlier this year. Higher export earnings should continue to support aggregate growth in emerging markets, as the global economy is expected to sustain the current pace in 2018 as well.

Domestic demand in most emerging economies was stable, even during the multi-year slowdown after 2011. Measured fiscal stimulus and lower interest rates helped support domestic consumption during that period. As these economies expand at a faster pace, consumer spending could also see moderate acceleration in the coming quarters, especially in Asia and Latin America. Though no major country is expected to significantly expand public spending, most of them are likely to sustain the current spending levels. Relatively benign inflation levels should help central banks to avoid sharp rate increases, even if the growth outlook brightens further.

We thank you for investing in the Thomas White Emerging Markets Fund.

| | |

| 24 | | www.thomaswhitefunds.com |

OCTOBER 31, 2017

Portfolio Country and Industry Allocation as of October 31, 2017 (Unaudited)

| | | | |

| | |

| Country Allocation | | % of TNA | |

| Brazil | | | 7.8% | |

| Canada | | | 0.8% | |

| Chile | | | 1.7% | |

| China | | | 34.6% | |

| Hong Kong | | | 2.0% | |

| India | | | 7.1% | |

| Indonesia | | | 2.7% | |

| Malaysia | | | 1.1% | |

| Mexico | | | 3.7% | |

| Philippines | | | 1.2% | |

| Russia | | | 6.3% | |

| South Africa | | | 6.0% | |

| South Korea | | | 12.3% | |

| Taiwan | | | 7.1% | |

| Thailand | | | 1.2% | |

| Turkey | | | 2.5% | |

| United Arab Emirates | | | 1.0% | |

| Cash & Other | | | 0.9% | |

| | | | | |

| | | | |

| | | | |

| | |

| Industry Allocation | | % of TNA | |

| Automobiles & Components | | | 2.1% | |

| Banks | | | 19.9% | |

| Capital Goods | | | 4.8% | |

| Commercial & Professional Services | | | 0.0% | |

| Consumer Durables & Apparel | | | 3.8% | |

| Energy | | | 7.0% | |

| Food & Staples Retailing | | | 0.8% | |

| Health Care Equipment & Services | | | 1.4% | |

| Household & Personal Products | | | 1.9% | |

| Insurance | | | 4.5% | |

| Materials | | | 8.4% | |

| Media | | | 2.8% | |

| Real Estate | | | 2.1% | |

| Retailing | | | 1.1% | |

| Semiconductors & Semiconductor Equipment | | | 11.0% | |

| Software & Services | | | 17.6% | |

| Technology Hardware & Equipment | | | 3.1% | |

| Telecommunication Services | | | 3.3% | |

| Transportation | | | 2.6% | |

| Utilities | | | 0.9% | |

| Cash & Other | | | 0.9% | |

TNA - Total Net Assets

Fund holdings and industry allocations are subject to change and should not be considered a recommendation to buy or sell any securities. For a complete list of Fund holdings, please refer to the Investment Portfolio section of this report.

| | | | |

| www.thomaswhitefunds.com | | | 25 | |

| | |

| Thomas White Emerging Markets Fund | | |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

COMMON

STOCKS (93.0%) | | | | | | | | | | |

|

| |

| BRAZIL (2.8%) | | | | | | | | |

| | BB Seguridade Participacoes S.A. | | Insurance | | | 42,500 | | | | $358,703 | |

| | Hypermarcas S.A. | | Household & Personal Products | | | 36,900 | | | | 387,014 | |

| | Petroleo Brasileiro SA Petrobras * | | Energy | | | 110,200 | | | | 565,940 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,311,657 | |

|

| |

| CANADA (0.8%) | | | | | | | | |

| | Gran Tierra Energy, Inc. * # | | Energy | | | 175,700 | | | | 381,269 | |

|

| |

| CHILE (1.7%) | | | | | | | | |

| | Itau CorpBanca | | Banks | | | 84,233,650 | | | | 785,228 | |

|

| |

| CHINA (34.6%) | | | | | | | | |

| | Alibaba Group Holding Ltd. ADR * # | | Software & Services | | | 13,400 | | | | 2,477,526 | |

| | Anhui Conch Cement Company Limited - H Shares + | | Materials | | | 188,000 | | | | 803,783 | |

| | Baidu, Inc. ADR * | | Software & Services | | | 3,000 | | | | 731,820 | |

| | Beijing Enterprises Holdings Limited + | | Capital Goods | | | 131,400 | | | | 780,887 | |

| | China Construction Bank Corp. - H Shares + | | Banks | | | 1,242,000 | | | | 1,108,298 | |

| | China Overseas Land & Investment Limited + | | Real Estate | | | 154,000 | | | | 499,559 | |

| | China Petroleum and Chemical Corporation (Sinopec) - H Shares + | | Energy | | | 576,000 | | | | 422,787 | |

| | China Railway Signal & Communication Corporation Ltd. - H Shares + | | Technology Hardware & Equipment | | | 580,000 | | | | 456,501 | |

| | China State Construction International Holdings Limited # + | | Capital Goods | | | 537,300 | | | | 756,721 | |

| | Chongqing Rural Commercial Bank Co., Ltd. - H Shares + | | Banks | | | 973,600 | | | | 662,144 | |

| | Ctrip.com International, Ltd. ADR * | | Retailing | | | 11,400 | | | | 545,946 | |

| | Haier Electronics Group Co., Ltd. + | | Consumer Durables & Apparel | | | 115,000 | | | | 305,867 | |

| | Momo Inc. ADR * | | Software & Services | | | 15,900 | | | | 484,473 | |

| | NetEase, Inc. ADR | | Software & Services | | | 3,600 | | | | 1,014,912 | |

| | Ping An Insurance (Group) Company of China Limited - H Shares + | | Insurance | | | 135,700 | | | | 1,191,788 | |

| | Sinopharm Group Co. Ltd. - H Shares + | | Health Care Equipment & Services | | | 150,000 | | | | 671,584 | |

| | Tencent Holdings Limited + | | Software & Services | | | 59,300 | | | | 2,670,995 | |

| | ZTO Express Cayman, Inc ADR * # | | Transportation | | | 50,100 | | | | 801,099 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 16,386,690 | |

|

| |

| HONG KONG (2.0%) | | | | | | | | |

| | Techtronic Industries Company Limited + | | Consumer Durables & Apparel | | | 165,900 | | | | 972,996 | |

|

| |

| INDIA (7.1%) | | | | | | | | |

| | Infosys Limited | | Software & Services | | | 39,300 | | | | 559,333 | |

| | Mahindra & Mahindra Ltd. GDR + | | Automobiles & Components | | | 24,949 | | | | 520,436 | |

| | NTPC Limited + | | Utilities | | | 151,500 | | | | 424,628 | |

| | Reliance Industries Ltd. | | Energy | | | 33,900 | | | | 492,422 | |

The accompanying notes are an integral part of these financial statements

| | |

| 26 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2017 |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| INDIA (CONT.) | | | | | | | | |

| | Tata Motors Limited * | | Automobiles & Components | | | 74,968 | | | | $495,842 | |

| | WNS (Holdings) Ltd. ADR * | | Software & Services | | | 10,500 | | | | 398,160 | |

| | YES BANK Limited + | | Banks | | | 95,200 | | | | 461,653 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,352,474 | |

|

| |

| INDONESIA (2.7%) | | | | | | | | |

| | Pembangunan Perumahan Persero + | | Capital Goods | | | 2,096,700 | | | | 440,624 | |

| | PT Bank Negara Indonesia (Persero) Tbk + | | Banks | | | 1,013,600 | | | | 568,292 | |

| | Wijaya Karya Persero Tbk PT + | | Capital Goods | | | 1,934,100 | | | | 280,948 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,289,864 | |

|

| |

| MALAYSIA (1.1%) | | | | | | | | |

| | CIMB Group Holdings Berhad + | | Banks | | | 354,300 | | | | 513,860 | |

|

| |

| MEXICO (3.7%) | | | | | | | | |

| | Cemex SAB de CV * | | Materials | | | 534,720 | | | | 434,821 | |

| | Grupo Financiero Banorte, S.A.B. de C.V. | | Banks | | | 151,800 | | | | 899,474 | |

| | Mexichem, S.A.B. de C.V. | | Materials | | | 168,650 | | | | 434,386 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,768,681 | |

|

| |

| PHILIPPINES (1.2%) | | | | | | | | |

| | Metropolitan Bank & Trust Company + | | Banks | | | 334,800 | | | | 561,539 | |

|

| |

| RUSSIA (6.3%) | | | | | | | | |

| | LUKOIL PJSC ADR + | | Energy | | | 16,600 | | | | 881,808 | |

| | Mobile TeleSystems PJSC ADR | | Telecommunication Services | | | 64,000 | | | | 679,040 | |

| | Sberbank of Russia PJSC ADR + | | Banks | | | 100,450 | | | | 1,441,174 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,002,022 | |

|

| |

| SOUTH AFRICA (6.0%) | | | | | | | | |

| | Capitec Bank Holdings Limited + | | Banks | | | 7,200 | | | | 478,615 | |

| | Naspers Limited - N Shares + | | Media | | | 5,425 | | | | 1,340,356 | |

| | Novus Holdings Limited + | | Commercial & Professional Services | | | 1 | | | | 0 | |

| | Sibanye Gold Limited + | | Materials | | | 375,111 | | | | 484,495 | |

| | Steinhoff International Holdings N.V. + | | Consumer Durables & Apparel | | | 121,077 | | | | 526,768 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,830,234 | |

|

| |

| SOUTH KOREA (11.2%) | | | | | | | | |

| | KB Financial Group Inc. + | | Banks | | | 13,400 | | | | 699,659 | |

| | Korea Zinc Co Ltd + | | Materials | | | 1,350 | | | | 617,714 | |

| | LG Household & Health Care Ltd. + | | Household & Personal Products | | | 480 | | | | 504,116 | |

| | POSCO + | | Materials | | | 1,850 | | | | 538,720 | |

| | Samsung Electronics Co., Ltd. + | | Semiconductors & Semiconductor Equipment | | | 970 | | | | 2,387,823 | |

| | Samsung Life Insurance Co., Ltd. + | | Insurance | | | 4,800 | | | | 578,841 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,326,873 | |

|

| |

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 27 | |

| | |

| Thomas White Emerging Markets Fund | | |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

| TAIWAN (7.1%) | | | | | | | | |

| | Catcher Technology Co., Ltd + | | Technology Hardware & Equipment | | | 46,000 | | | | $491,150 | |

| | Pegatron Corporation + | | Technology Hardware & Equipment | | | 205,000 | | | | 532,801 | |

| | Taiwan Semiconductor Manufacturing Company Ltd. + | | Semiconductors & Semiconductor Equipment | | | 289,400 | | | | 2,337,535 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,361,486 | |

|

| |

| THAILAND (1.2%) | | | | | | | | |

| | PTT Exploration and Production Public Company Limited + | | Energy | | | 212,900 | | | | 553,955 | |

|

| |

| TURKEY (2.5%) | | | | | | | | |

| | TAV Havalimanlari Holding AS + | | Transportation | | | 84,400 | | | | 420,259 | |

| | Turkcell Iletisim Hizmetleri AS + | | Telecommunication Services | | | 109,500 | | | | 409,441 | |

| | Turkiye Garanti Bankasi A.S. + | | Banks | | | 127,200 | | | | 349,682 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,179,382 | |

|

| |

| UNITED ARAB EMIRATES (1.0%) | | | | | | | | |

| | Emaar Properties PJSC + | | Real Estate | | | 219,400 | | | | 496,584 | |

|

| |

| Total Common Stocks | | | | (Cost $33,560,379) | | | | | | | 44,074,794 | |

| | | | | | | | | | | | |

|

| |

PREFERRED

STOCKS (6.1%) | | | | | | | | | | |

|

| |

| BRAZIL (5.0%) | | | | | | | | |

| | Cia Brasileira de Distribuicao * (2/23/18, N/A)^ | | Food & Staples Retailing | | | 15,600 | | | | 363,760 | |

| | Itau Unibanco Holding S.A. (2/7/18, 0.44%)^ | | Banks | | | 69,049 | | | | 890,948 | |

| | Telefonica Brasil S.A. (2/21/18, 2.33%)^ | | Telecommunication Services | | | 29,600 | | | | 456,763 | |

| | Vale S.A. (2/28/18, N/A)^ | | Materials | | | 72,600 | | | | 665,124 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,376,595 | |

|

| |

| SOUTH KOREA (1.1%) | | | | | | | | |

| | Samsung Electronics Co., Ltd. + (1/8/18, 1.43%)^ | | Semiconductors & Semiconductor Equipment | | | 250 | | | | 500,394 | |

|

| |

| Total Preferred Stocks | | | | (Cost $2,629,691) | | | | | | | 2,876,989 | |

| | | | | | | | | | | | |

|

| |

| RIGHTS (-%) | | | | | | | | | | |

|

| |

| CHINA (-%) | | | | | | | | |

| | Tencent Holdings Limited + | | Software & Services | | | 48 | | | | 0 | |

|

| |

| Total Rights | | | | (Cost $0) | | | | | | | 0 | |

| | | | | | | | | | | | |

|

| |

The accompanying notes are an integral part of these financial statements

| | |

| 28 | | www.thomaswhitefunds.com |

| | |

| Investment Portfolio | | October 31, 2017 |

| | | | | | | | | | | | |

| Country | | Issue | | Industry | | Shares | | | Value (US$) | |

| | | | | | | | | | | |

SHORT TERM

INVESTMENTS (1.6%) | | | | | | | | |

|

| |

| MONEY MARKET FUND (1.6%) | | | | | | | | |

| | Northern Institutional Treasury Portfolio - Shares Class, 0.93% (a) | | | | | 777,559 | | | | $777,559 | |

|

| |

| Total Short Term Investments | | | | (Cost $777,559) | | | | | | | 777,559 | |

| | | | | | | | | | | | |

|

| |

| | | | |

HELD AS COLLATERAL

FOR SECURITIES

LENDING (1.7%) | | | | | | | | | | | | |

|

| |

SHORT TERM

INVESTMENTS (1.7%) | | | | | | | | | | |

|

| |

| MONEY MARKET FUND (1.7%) | | | | | | | | |

| | Northern Institutional Liquid Assets Portfolio, 1.10% (a) | | | | | 814,125 | | | | 814,125 | |

|

| |

| Total held as collateral for securities lending | | | | (Cost $814,125) | | | | | | | 814,125 | |

| | | | | | | | | | | | |

|

| |

| Total Investments | | 102.4% | | (Cost $37,781,754) | | | | | | | $48,543,467 | |

| Liabilities in excess of other assets | | (2.4)% | | | | | | | | | (1,149,007 | ) |

| Total Net Assets: | | 100.0% | | | | | | | | | $47,394,460 | |

|

| |

| * | Non-Income Producing Securities |

| # | All or a portion of securities on loan at October 31, 2017. The market value of the securities loaned was $3,450,207. The loaned securities were secured with cash collateral of $814,125 and non-cash collateral with a value of $2,657,326. The non-cash collateral received consists of short term investments and long term bonds, and is held for the benefit of the Fund at the Fund’s custodian. The Fund cannot repledge or resell this collateral. Collateral is calculated based on prior day’s prices. - See Note 1(I) to Financial Statements |

| ^ | Maturity Date and Preferred Dividend rate of Preferred Stock |

| ADR | - American Depositary Receipt |

| GDR | - Global Depositary Receipt |

Industry classifications shown in the Investment Portfolio are based off of the Global Industry Classification Standard (GICS®). GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements

| | | | |

| www.thomaswhitefunds.com | | | 29 | |

| | |

| Thomas White Emerging Markets Fund | | |

The following table summarizes the inputs used, as of October 31, 2017, in valuating the Fund’s assets:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Brazil | | | $1,311,657 | | | | $------- | | | | $------- | | | | $1,311,657 | |

| Canada | | | 381,269 | | | | ------- | | | | ------- | | | | 381,269 | |

| Chile | | | 785,228 | | | | ------- | | | | ------- | | | | 785,228 | |

| China | | | 6,055,776 | | | | 10,330,914 | | | | ------- | | | | 16,386,690 | |

| Hong Kong | | | ------- | | | | 972,996 | | | | ------- | | | | 972,996 | |

| India | | | 1,945,757 | | | | 1,406,717 | | | | ------- | | | | 3,352,474 | |

| Indonesia | | | ------- | | | | 1,289,864 | | | | ------- | | | | 1,289,864 | |

| Malaysia | | | ------- | | | | 513,860 | | | | ------- | | | | 513,860 | |

| Mexico | | | 1,768,681 | | | | ------- | | | | ------- | | | | 1,768,681 | |

| Philippines | | | ------- | | | | 561,539 | | | | ------- | | | | 561,539 | |

| Russia | | | 679,040 | | | | 2,322,982 | | | | ------- | | | | 3,002,022 | |

| South Africa | | | ------- | | | | 2,830,234 | | | | ------- | | | | 2,830,234 | |

| South Korea | | | ------- | | | | 5,326,873 | | | | ------- | | | | 5,326,873 | |

| Taiwan | | | ------- | | | | 3,361,486 | | | | ------- | | | | 3,361,486 | |

| Thailand | | | ------- | | | | 553,955 | | | | ------- | | | | 553,955 | |

| Turkey | | | ------- | | | | 1,179,382 | | | | ------- | | | | 1,179,382 | |

| United Arab Emirates | | | ------- | | | | 496,584 | | | | ------- | | | | 496,584 | |

| Total Common Stocks | | | $12,927,408 | | | | $31,147,386 | | | | $------- | | | | $44,074,794 | |

| Preferred Stocks | | | | | | | | | | | | | | | | |

| Brazil | | | $2,376,595 | | | | $------- | | | | $------- | | | | $2,376,595 | |

| South Korea | | | ------- | | | | 500,394 | | | | ------- | | | | 500,394 | |

| Total Preferred Stocks | | | $2,376,595 | | | | $500,394 | | | | $------- | | | | $2,876,989 | |

| Rights | | | | | | | | | | | | | | | | |

| China | | | $------- | | | | $------- | | | | $------- | | | | $------- | |

| Total Rights | | | $------- | | | | $------- | | | | $------- | | | | $------- | |

| Short Term Investments | | | $1,591,684 | | | | $------- | | | | $------- | | | | $1,591,684 | |