UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-8416 |

|

Touchstone Variable Series Trust |

(Exact name of registrant as specified in charter) |

|

303 Broadway, Cincinnati, Ohio | | 45202 |

(Address of principal executive offices) | | (Zip code) |

|

Jill T. McGruder, 303 Broadway, Cincinnati, Ohio 45202 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (513) 878-4066 | |

|

Date of fiscal year end: | 12/31 | |

|

Date of reporting period: | 12/31/10 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

December 31, 2010

Annual Report

Touchstone Variable Series Trust

Touchstone Baron Small Cap Growth Fund

Touchstone Core Bond Fund

Touchstone High Yield Fund

Touchstone Large Cap Core Equity Fund

Touchstone Mid Cap Growth Fund

Touchstone Money Market Fund

Touchstone Third Avenue Value Fund

Touchstone Aggressive ETF Fund

Touchstone Conservative ETF Fund

Touchstone Enhanced ETF Fund

Touchstone Moderate ETF Fund

Table of Contents

| | | Page | |

| Letter from the President | | | 3 | | |

|

| Management's Discussion of Fund Performance (Unaudited) | | | 4-24 | | |

|

| Tabular Presentation of Portfolios of Investments (Unaudited) | | | 25-26 | | |

|

| Statements of Assets and Liabilities | | | 27-29 | | |

|

| Statements of Operations | | | 30-32 | | |

|

| Statements of Changes in Net Assets | | | 33-37 | | |

|

| Financial Highlights | | | 38-44 | | |

|

| Notes to Financial Statements | | | 45-57 | | |

|

| Portfolios of Investments: | |

|

| Touchstone Baron Small Cap Growth Fund | | | 58-59 | | |

|

| Touchstone Core Bond Fund | | | 60-64 | | |

|

| Touchstone High Yield Fund | | | 65-68 | | |

|

| Touchstone Large Cap Core Equity Fund | | | 69-70 | | |

|

| Touchstone Mid Cap Growth Fund | | | 71-72 | | |

|

| Touchstone Money Market Fund | | | 73-75 | | |

|

| Touchstone Third Avenue Value Fund | | | 76 | | |

|

| Touchstone Aggressive ETF Fund | | | 77 | | |

|

| Touchstone Conservative ETF Fund | | | 78 | | |

|

| Touchstone Enhanced ETF Fund | | | 79 | | |

|

| Touchstone Moderate ETF Fund | | | 80 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 81 | | |

|

| Other Items (Unaudited) | | | 82-90 | | |

|

| Management of the Trust (Unaudited) | | | 91-93 | | |

|

| Privacy Protection Policy | | | 94 | | |

|

2

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Variable Series Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the year ended December 31, 2010.

All traditional asset classes posted strong positive absolute returns regardless of style or geographic region during the year. The U.S. equity markets had a solid year, despite continued anxiety about the economy and capital markets. For the one-year period ended December 31, 2010, the U.S. stock market outperformed the international equity market. From an investment style and market capitalization perspective, U.S. growth equities outpaced their value counterparts, with mid cap leading the way. In addition, broad investment grade bonds and Treasuries exhibited solid returns.

Interest rates ended 2010 slightly lower than the beginning of the year. The expectation at the start of the year was that the economy would experience a recovery and interest rates would move higher. Interest rates did move higher in the first quarter, but then fell sharply throughout the second and third quarters on the heels of the sovereign debt crisis in Europe and concerns about the strength of the economic recovery. In the fourth quarter, the extension of the Bush-era tax cuts, as well as stronger data on the U.S. economy, increased optimism for 2011 growth and led to sharply higher interest rates.

We continue to believe that diversification is essential to balancing risk and return. We recommend that you continue to work with your financial professional to employ a sound asset allocation strategy that invests in a combination of stock, bond and money market mutual funds to help keep your financial strategy on course. It is critical to maintain a long-term approach to gain the full potential benefits of investing.

Touchstone is committed to helping investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific area of expertise. We hope that you will find the enclosed commentaries helpful.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Variable Series Trust

3

Management's Discussion of Fund Performance (Unaudited)

Touchstone Baron Small Cap Growth Fund

Sub-Advised by BAMCO, Inc.

Performance and Market Overview

The total return of the Touchstone Baron Small Cap Growth Fund was 24.93% for the year ended December 31, 2010. The total return of the Russell 2000® Growth Index was 29.09% for the same period.

During the year, the Fund maintained its investment focus in what are believed to be well-managed growth businesses that have large opportunities and significant barriers to competition.

Portfolio Review

The Fund underperformed the Russell 2000® Growth Index during the year primarily due to security selection within the Consumer Discretionary, Information Technology and Financials sectors. Within the Consumer Discretionary sector, shares of post-secondary education companies Strayer Education Inc. and DeVry Inc. weighed on the sector. The Fund's underweight position in the Information Technology sector, a key contributor to performance in the benchmark, as well as holdings in the Internet Software & Services and Application Software industries detracted from relative performance during the year. In the Financials sector, an overweight position detracted from relative performance.

The Fund's top detractors in absolute terms during the year were Strayer Education Inc., DeVry Inc. and Tetra Tech Inc. U.S. education stocks Strayer Education Inc. and DeVry Inc. languished all year as investors struggled with regulatory uncertainty facing the industry and what its impact would mean for future growth and profitability. The Fund continues to own these stocks because we are bullish on the long-term fundamentals of the industry and markets in which they operate. We believe the companies are addressing their short-term issues and have solid multi-year growth prospects. Tetra Tech Inc., a leading environmental engineering and consulting firm, also detracted from relative performance in 2010. The company's shares came under pressure on fears of slowing infrastructure spending. After a rare earnings miss during the first quarter, Tetra Tech recovered strongly during the balance of the year.

The Health Care, Energy and Materials sectors contributed positively to relative performance during the year. Edwards Lifesciences Corp., the Fund's top contributor, performed very well as transcatheter heart valve sales exceeded expectations both in the U.S. and internationally. Furthermore, the Fund's underweight position in the Health Care sector also contributed to relative performance. In the Energy sector, shares of SEACOR Holdings Inc. rose 53% for the year due to stronger than expected earnings as a result of its work for BP in assisting in the oil spill cleanup and other logistics in the Gulf of Mexico. In the Materials sector, Molycorp Inc., a producer of rare earths, saw its stock rise 117% in 2010. Tight supply of rare earths coming out of China, the world's leading producer, led prices higher.

The Fund's top performers in absolute terms for 2010 were Edwards Lifesciences Corp., Dick's Sporting Goods Inc. and Genesee & Wyoming Inc.

Edwards Lifesciences Corp. performed well for the year. Edwards is a leading manufacturer of tissue heart valves. The company has been selling transcatheter heart valves in Europe, where sales exceeded expectations throughout 2010. In the U.S., results from the company's PARTNER trial surpassed expectations and met the primary endpoint of the trial. We believe the company will receive regulatory approval to begin selling its SAPIEN transcatheter heart valve in the U.S. in 2011, which will give the company a roughly 3-year lead over its closest competitor. We continue to believe Edwards has a multi-billion dollar market opportunity in transcatheter heart valves, and we continue to have conviction in the investment thesis.

4

Management's Discussion of Fund Performance (Continued)

Dick's Sporting Goods Inc., the country's largest sporting goods retailer, saw same-store sales improve significantly during the year, led by a surge in customer traffic. Inventory per square foot finally increased in the second half of the year, indicating expectations of continued strong sales. The company has continued to grow its store base at a modest rate, but the strong new store productivity levels indicate to us that the company is significantly underpenetrated throughout the country. As a result, Dick's raised its target store count beyond investors' expectations.

Genesee & Wyoming Inc., a leading short-line railroad, performed extremely well during 2010, climbing 62% after the company reported strong double-digit growth in carload volumes, sustained price increases and a significant new acquisition. In June, the company announced that it was acquiring an Australian rail line that is poised to benefit from several mining projects with key export customers in China and India. Combined with Genesee's existing Australian business, we expect the new line will boost international revenue to roughly one-third of the company's total business, offering good diversity and leverage to secular growth drivers in emerging Asian markets.

Current Strategy and Outlook

The Fund's investment strategy is capital appreciation over the long term. It invests in small-sized U.S. growth companies that we believe have a minimum expected return of 100% within four or five years. The Fund may retain companies whose market capitalizations rise beyond their original purchase price range.

We believe the stock market continues to undervalue many publicly-traded companies relative to their prospects and relative to competitive fixed income instruments. Based upon our daily conversations with business executives, we believe the economy is now providing support for those businesses rather than serving as a headwind. Confidence is building and should translate into differentiated valuations and higher earnings multiples. Ultimately we believe investors make the most money when earnings multiples increase, not just when earnings increase. In our opinion, with current historically low interest rates, attractive stock price valuations and economic growth increasing, this could occur.

We also believe that businesses' values over the long term are determined by their growth opportunities, financial strength and earnings, sustainable competitive advantages and management talent. These analyses, valuations and comparisons are how we decide whether our fast growing, publicly-owned businesses are attractively priced, not by guessing whether stock markets will rise or fall in the near term.

5

Management's Discussion of Fund Performance (Continued)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on December 14, 1992.

6

Management's Discussion of Fund Performance (Continued)

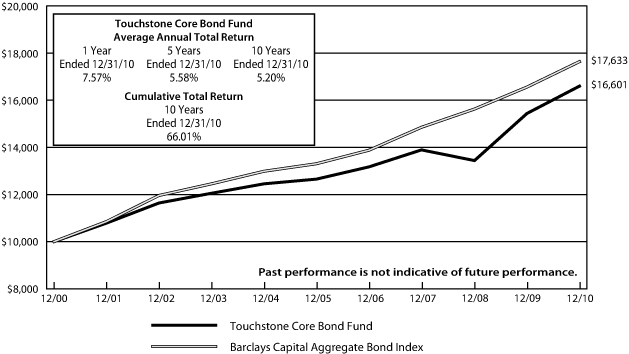

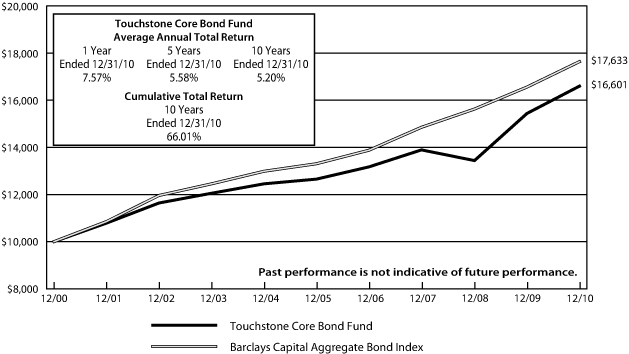

Touchstone Core Bond Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Performance and Market Overview

The total return of the Touchstone Core Bond Fund was 7.57% for the year ended December 31, 2010. The total return of the Barclays Capital Aggregate Bond Index was 6.54% for the same period.

For the year, interest rates ended 2010 slightly lower than the beginning of the year. Our expectation to start the year was that the economy would experience a recovery and interest rates would move higher. Interest rates did move higher in the first quarter, but then fell sharply throughout the second and third quarters on the heels of sovereign debt concerns in Europe and concerns about the strength of the economic recovery. In the fourth quarter, the extension of the Bush-era tax cuts as well as stronger data on the U.S. economy increased optimism on 2011 growth and led to sharply higher long-term interest rates. Long-term interest rates rose more than short-term interest rates during the fourth quarter, steepening the yield curve.

Portfolio Review

The Fund outperformed the benchmark for the year, primarily driven by improvements in the credit markets (Corporate Bonds, High Yield, and Commercial Mortgage-Backed Securities), outperformance of Treasury Inflation Protected Securities, and security selection.

The Fund was positioned with less interest rate risk during the first quarter, which detracted from relative performance. In the fourth quarter, the Fund was positioned for the yield curve to flatten which slightly detracted from relative performance. The Fund is currently structured with slightly less interest rate risk than the benchmark, as we expect interest rates to rise over the long-term, but to remain relatively low in the medium-term.

The Treasury Inflation Protected Securities (TIPS) market was quite volatile during 2010 and we tactically allocated to this sector throughout the year. For all of 2010, the Fund's allocations to TIPS contributed to performance. Inflation expectations were relatively stable for the first quarter of 2010, but declined significantly as interest rates fell in the second and third quarters. The market began to anticipate additional action by the Federal Reserve in the third quarter and inflation expectations rose throughout the balance of 2010. Toward the end of the fourth quarter, we reduced exposure to the TIPS market as we believed inflation expectations were no longer attractively priced.

Corporate bonds also contributed to performance. The Fund began the year with a significant overweight to the sector as we viewed the risk premium offered by this sector as attractive and expected fundamentals of corporations to remain solid. Risk premiums narrowed, especially on high quality issuers. In the third quarter, the Fund's position in high quality corporate bonds was reduced in favor of additional allocations to Commercial Mortgage-Backed Securities (CMBS) and High Yield.

The Fund's allocation to High Yield was a significant positive for performance for the year. The Fund had an allocation to High Yield the entire year, but was increased in the third quarter to where it remained at the end of the year.

CMBS was the best performing investment grade sector in 2010 and a significant contributor to performance. The Fund was overweight the sector for much of the year and was increased in the third quarter, which further contributed to performance. Generally, the commercial property market remains difficult, however, security specific analysis is used to manage the risks in the market and select securities that offer attractive risk/reward characteristics. The Fund had a significant overweight to this sector at the end of 2010.

7

Management's Discussion of Fund Performance (Continued)

Current Strategy and Outlook

Given our expectation of unchanged monetary policy and a continuing economic recovery, we anticipate that short- and long-term interest rates are unlikely to change materially from current levels in the near-term. We believe that long-term rates are at risk to rise later in 2011 as the economy continues to grow, the Fed completes the latest asset purchase program, and Treasury supply remains elevated. We think that economic growth will remain solid throughout 2011 and inflation is likely to remain low.

Going forward we plan to position the Fund with slightly less interest rate risk than the benchmark and to opportunistically invest in TIPS. We continue to view the U.S. Treasury and government-related sectors (Agencies, MBS) as relatively unattractive on a long-term basis. We intend to maintain a significant overweight to High Yield and CMBS to take advantage of the yield these sectors offer.

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on January 1, 1999.

8

Management's Discussion of Fund Performance (Continued)

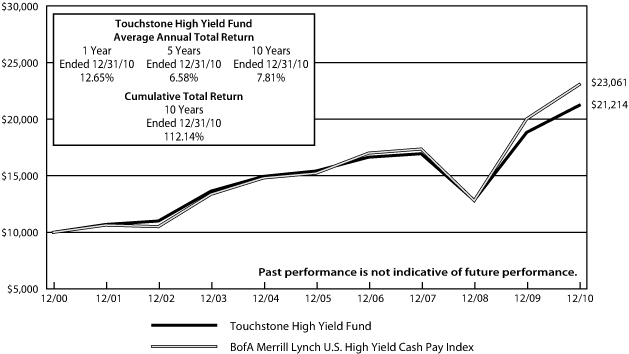

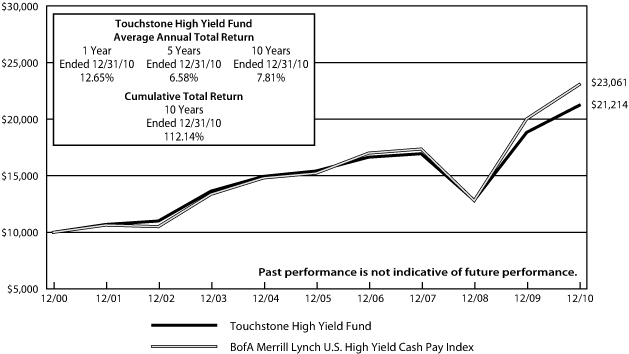

Touchstone High Yield Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Performance and Market Overview

The total return of the Touchstone High Yield Fund was 12.65% for the year ended December 31, 2010. The total return of the BofA Merrill Lynch U.S. High Yield Cash Pay Index was 15.24% for the same period.

U.S. financial markets ended calendar year 2010 with a flourish on the back of improved economic performance and surprise developments on both monetary and fiscal policy fronts. The High Yield market participated in this rally even though interest rates increased materially in the quarter. This performance partly reflects stronger economic growth in the U.S. and abroad in recent months. After averaging 2% growth in the second and third quarters, real GDP is estimated to have accelerated to about 3.5% in the fourth quarter, fueled by a pickup in consumption and an improved trade balance. Moreover, unlike the situation in the final quarter of 2009 when growth reached 5% on the back of a surge in inventories, the recent acceleration is based on a pickup in final demand. At the same time, forecasters are becoming more optimistic about the outlook for 2011 due to recent policy developments. In the run-up to the mid-term elections, most were calling for growth to be in the vicinity of 2.0-2.5%, with risks to the downside if the Bush tax cuts were not extended. Today, the consensus is nearly a full percentage point higher, and some economists are calling for growth to reach 4%.

Portfolio Review

Given the significant increase in interest rates during the fourth quarter, higher quality (BB rated) securities actually produced slightly negative returns due to their greater interest rate sensitivity. Conversely, the lowest quality securities (CCC rated) performed well. For calendar year 2010, both BB-rated securities and CCC-rated securities outperformed, while B-rated securities underperformed. With declining interest rates over the full year, BB-rated securities benefited from their longer duration and greater interest rate sensitivity, while CCC-rated securities benefited from significant spread tightening. While the Fund marginally outperformed in the fourth quarter, performance lagged over the calendar year due to its overweight allocation to B-rated securities. Additionally, lack of exposure to certain Financials sectors (generally longer-duration and higher-quality) inhibited performance. In addition, the Fund's overweight position in the Utilities sector detracted from performance.

During the last twelve months, significant value was added from security selection. Whereas the Fund's exposure to the Utilities sector generated negative attribution from sector allocation, positive attribution from security selection within this sector more than offset the impact of sector allocation. Similarly, security selection within the Energy sector contributed to performance. In fact, the Utilities and the Energy sectors were the two largest contributors to performance in 2010.

Current Strategy and Outlook

While the economy is expected to generate solid growth in the first half of 2011, some question whether it will retain momentum in the second half. Some observers, for example, contend that households will save most of the tax windfall, rather than spend it. Others note that the new Republican leadership in Congress is likely to press for significant cuts in government spending, such that the overall thrust of fiscal policy may not be as large as forecasters currently assume. In this regard, we are cautiously optimistic, mainly because of the significant adjustments households, businesses and financial institutions have made. The debt service burden that the household sector faces today, for example, has come down considerably from its pre-crisis peak, while the personal saving rate has increased to 5-6%. With personal disposable income growing at a solid pace and household net worth improving, consumer spending could reach 3% or more. Additionally, the business sector has been able to restore overall profits back to their pre-crisis peak on the back of extensive cost-cutting

9

Management's Discussion of Fund Performance (Continued)

and moderate top-line revenue growth. Businesses also have the wherewithal to boost investment spending out of retained earnings, and there are some signs that the job picture is improving. Finally, the major financial institutions have also strengthened their operating income and balance sheets considerably. Moreover, some are in a position where they will be able to resume dividend payments.

At the same time, we accept that there are still significant risks that could undermine economic expansion. The most concerning are the depressed state of residential housing and potential for further home price declines; the failure to resolve sovereign debt problems in Europe and the potential for greater spill-over if Spain comes under attack; and the reluctance of Chinese policymakers to allow the Renminbi (RMB) to appreciate more freely, which fuels inflation in China and trade frictions abroad. Because there is no resolution to these issues, we are open-minded about whether the U.S. economy will sustain solid growth in the second half of 2011.

While the risk of deflation has diminished, we do not foresee an imminent rise in inflation. The most likely outcome, in our view, is that core inflation will hover around 1% for a while longer, while headline inflation could gravitate to 2%. Headline inflation eventually could reach 2-3%, especially if commodity prices continue to rise.

Although the High Yield sector has performed exceptionally well over the last two years, we continue to be constructive on the outlook for High Yield. With increasing confidence in the economic recovery and declining default rates, valuations remain attractive. While the absolute yields in High Yield are somewhat low, the alternatives appear less compelling. Although returns this year are unlikely to exceed recent returns, we think that High Yield continues to offer attractive relative value, particularly when compared to other fixed income asset classes.

The strength of Fort Washington's High Yield strategy has historically been fundamental credit analysis with particular emphasis on avoiding problem credits. We believe this will continue to add value as negative credit events may have a material impact on returns in this lower return environment. We believe this core competency will provide considerable value to the Fund's investors. We will continue to construct the Fund to exhibit less volatility than the broad market and deliver attractive risk-adjusted returns. It is designed for performance over a full market cycle with focus on protecting principal in down markets, a style that we believe will outperform over the long-term.

10

Management's Discussion of Fund Performance (Continued)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on May 1, 1999.

11

Management's Discussion of Fund Performance (Continued)

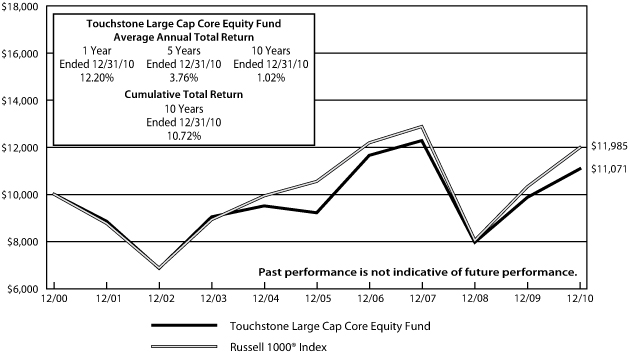

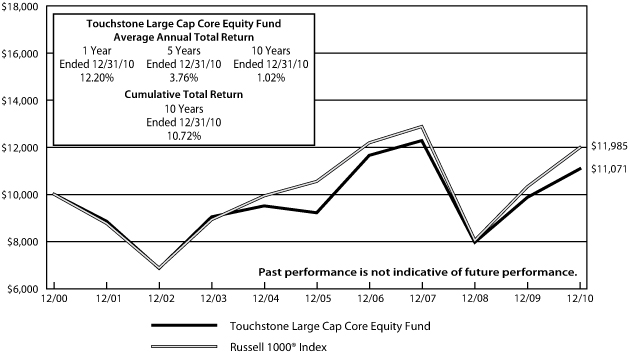

Touchstone Large Cap Core Equity Fund

Sub-Advised by Todd-Veredus Asset Management, LLC

Performance and Market Overview

The total return of the Touchstone Large Cap Core Equity Fund was 12.20% for the year ended December 31, 2010. The total return of the Russell 1000® Index was 16.10% for the same period.

This past year ended with the market breaking out to the upside; investors began to factor in a sustainable economic expansion. We think the economy and markets are in a normal expansionary period that is likely to last a few years, although we think most investors are only begrudgingly accepting that fact.

Most of the market gains for the year occurred during the fourth quarter of 2010. The good news for our style of investing is that money flows are starting to favor domestic stocks again. U.S. companies have had a strong rebound in earnings, and investors are less enamored with bonds. As this occurs, we believe more institutional money is likely to move towards active equity management. This type of development should allow for stock pickers like us to enjoy outperformance.

Portfolio Review

The Touchstone Large Cap Core Equity Fund underperformed the Russell 1000® Index during the year. We believe this is because the market favored riskier stocks of lower quality. As the economic recovery and stock market rally continue, we expect a rotation towards higher quality stocks, which should benefit the Touchstone Large Cap Core Equity Fund.

The Energy, Financials and Information Technology sectors detracted from the Fund's performance this year. Energy stocks outperformed expectations and the Fund was underweight in the sector. Most of the gains came in the fourth quarter as oil prices rose from $79 per barrel to $91 per barrel. The Financials sector overall lagged the Index, so the Fund's underweight in the sector was appropriate. The Fund's stock selection trailed the Index as investors returned to some of the downtrodden large banks. The Fund has been underweight in that portion of the Financials sector. The Fund's' Information Technology sector exposure detracted from performance as a number of the larger technology companies experienced weaker sales or management turmoil.

On the positive side, the Fund's overweight position and stock selection within the Consumer Discretionary and Industrials sectors contributed to performance. We believe that the world economy remains in a recovery and have positioned the Fund to overweight the economically sensitive sectors. Also, the Fund's stock selection within the Consumer Staples and Utilities sectors added to results.

Stocks that contributed to performance during the year included Ross Stores Inc. and Dollar Tree Inc. (both from the Consumer Discretionary sector), Union Pacific Corp. (Industrials sector), Philip Morris International Inc. (Consumer Staples sector), and AFLAC Inc. (Financials sector). Most of these guided estimates up or benefited from an improving economy. Detractors from performance included Transocean Ltd. and Chesapeake Energy Corp. (both from the Energy sector) which have been sold, and Hewlett-Packard Co., Microsoft Corp., and Cisco Systems Inc. (all from the Information Technology sector).

Current Strategy and Outlook

When we look at markets, our focus is in three driving forces; valuation, fundamentals and market sentiment. Based on these factors, we believe equities will end 2011 a fair amount higher than current levels as it becomes clearer we are in a normal recovery.

12

Management's Discussion of Fund Performance (Continued)

We believe the economy will continue to grow in 2011 and may surprise us to the upside. Consensus expectations are for 3.5% to 4.5% growth in 2011, as the tax deal and benefits extensions agreed to last year bolster the outlook. If real demand expands, growth estimates are likely to improve as well.

As we stated, we believe the market is likely to move ahead during the year, however we believe it will do so in a choppy manner. As this recovery develops, we expect later stage cyclical companies to outperform. The Fund is positioned in these types of companies which should be a benefit.

As we look forward, we expect several themes to play out in 2011. History suggests equity markets are likely to return well over 10% this year. This is because we are in the typically strong third year of the presidential cycle, the economy is recovering, investors are underinvested and sentiment remains skeptical. Bonds will probably continue their choppy moves, but longer-term rates should end the year higher than current levels. "Risk on, risk off" trading concerns will probably shift from U.S. unemployment to European sovereign debt, emerging markets slowdowns, and the potential for a new Congress to clash with the Obama Administration. Higher corporate cash balances may lead to higher dividends, share repurchases and a very strong Mergers & Acquisition market.

We like high quality companies with good balance sheets as they are likely to raise dividends, do share repurchases or make accretive acquisitions. We still think the market has the potential to move higher for the next few years, and will remain positioned in the higher quality companies that tend to be the leadership as market recoveries mature.

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on May 1, 1999.

13

Management's Discussion of Fund Performance (Continued)

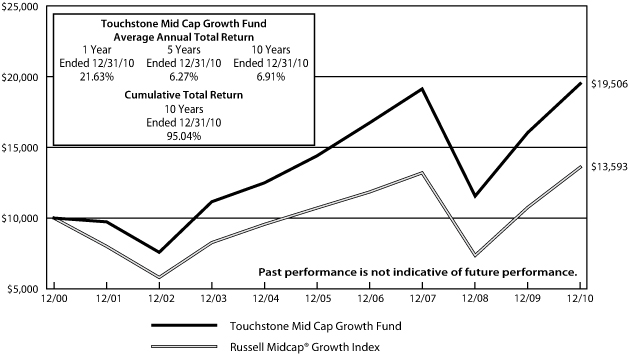

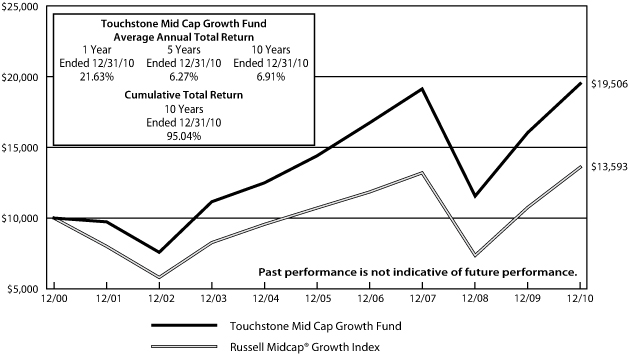

Touchstone Mid Cap Growth Fund

Sub-Advised by TCW Investment Management Company, LLC and Westfield Capital Management Company, LLC

Performance and Market Overview

The total return of the Touchstone Mid Cap Growth Fund was 21.63% for the year ended December 31, 2010. The total return of the Russell Midcap® Growth Index was 26.38% for the same period.

Although the stock market performed well in the first quarter on solid corporate earnings growth and continued momentum from the March 2009 lows, it corrected in April 2010. Investor concerns centered on a number of issues, including the European debt crisis, the oil spill in the Gulf of Mexico, uncertainty regarding the impact of new healthcare and financial reform bills, the sustainability of the housing recovery, and an inventory correction in technology.

The catalyst for the market's second half upswing looks to be Ben Bernanke's Jackson Hole speech in late August in which he outlined the case for further quantitative easing. Citing its dual mandate, the Fed determined that the risk of deflation remained high and the economy was growing too slowly. Strong earnings, attractive valuations, an improving economic outlook, and heightened Merger & Acquisition (M&A) activity also helped propel the stock market. A key event was also upheaval in Washington following the mid-term elections. President Obama's unexpected tack to the center and agreement to extend the Bush tax cuts further lifted stocks.

TCW Investment Management Company, LLC

Portfolio Review

The Industrials, Consumer Discretionary, Utilities, Materials and Information Technology sectors were the primary contributors to 2010 relative performance, while the Financials, Energy and Health Care sectors detracted from performance. The return of M&A activity to the marketplace following the financial crisis proved to be a salutary catalyst to the market and to Fund performance. Burger King Holdings Inc. (Consumer Discretionary sector) and Pactiv Corp. (Materials sector), two fund holdings, received solid take-out offers and were sold. Many pieces of the portfolio also helped performance. The rebound in the industrial economy, driven by strong emerging markets growth and restocking in the developed world helped Industrials sector stocks such as truck-parts manufacturer WABCO Holdings Inc. and mining equipment company Joy Global Inc. As U.S. consumers regained confidence, retailers such as Abercrombie & Fitch Co. and Foot Locker Inc. (both from the Consumer Discretionary sector) posted improved back-to-school and Christmas sales. Strong consumer demand for mobile telephony and increased spending by corporations to replace less efficient servers and to upgrade networks helped Information Technology stocks, such as Ciena Corp. and Avago Technologies Ltd.

The Financials sector was the largest detractor to relative performance in 2010 as results at regional banks were more mixed. While some banks reported improved loan trends, headwinds from financial regulation reform, an uneven housing rebound, little-to-no loan growth and foreclosure issues stifled the rebound. KeyCorp and New York Community Bancorp Inc. were among the better performers. Comerica Inc., a Texas-based business bank, was the first TARP recipient to raise its dividend and the stock rallied late in the year. On the other hand, Wilmington Trust Corp., which had earlier suggested that problem loans had peaked, surprised the market with additional loan losses. Subsequent pressure from regulators revealed that credit problems were more severe than management indicated, forcing the bank into a take-out with M&T Bank Corp. at lower-than-prevailing market prices.

Sector weights at year end show a sequential decrease in the Consumer Discretionary sector and an increase in the Information Technology sector. However, these snapshots miss the strong performance of Consumer

14

Management's Discussion of Fund Performance (Continued)

Discretionary stocks in the portfolio intra-quarter and subsequent trims to a number of positions. While the Information Technology sector remains volatile, we believe a multi-year upswing in tech spending continues to be driven by ongoing corporate efficiency goals and consumer bedazzlement with new mobile computing devices. The Fund remains overweight in the Financials sector. While we don't expect improvements in non-performing loans to be linear, we believe credit problems have peaked. The nuances of Dodd-Frank, such as interchange fees and mortgage issues, remain unresolved, but we believe major policy risk has diminished now that the bill has passed. In short, banks appear to be on a path, albeit choppy, towards more normalized levels of profitability, and we find the valuations compelling. We continue to like the Industrials sector stocks, believing them to be a good proxy for global demand.

Current Strategy and Outlook

We remain bullish on mid-cap value equities based on solid corporate earnings and attractive valuations. Stock movement over the past few years has been driven largely by macro-economic factors as investors put risk on or off according to their interpretation of these events. While the health of the macro-economy remains ever-important, correlations among securities are declining, and old-fashioned bottom-up stock picking appears to be regaining in importance.

The recent rise in M&A activity suggests that companies are starting to take advantage of the valuation gaps in the marketplace. With cash on balance sheets earning little return and borrowing costs low, astute corporate stewards have once again begun snapping up high-quality competitors or bolting on product lines at attractive valuations. Historically 10-20% of the portfolio gets taken out in any year, so the current uptick in M&A activity should be beneficial for Fund performance. Just as we believe many of the stocks in the portfolio are undervalued, so do strategic buyers and private equity shops.

While political factors are unlikely to go away completely, far-sweeping new regulations are likely to be fewer now that a divided Congress and Presidency will have to work together to pass any legislation. Still, passage of the budget and raising the federal debt ceiling are likely to spark contentious debate, which could provide some headline risk.

We think part of the impediment to employment growth has been the generally anti-business and confusing new laws emanating from Washington. These new regulations, including financial reform, healthcare laws, Gulf of Mexico drilling regulations and tax policy have touched significant portions of the economy. While many of the rules still need to be codified, we think businesses can start to hire knowing Washington is unlikely to create additional burdens. Market historians will point to the third year of the Presidential cycle as being salutary for stocks as Washington girds for re-election. We are also encouraged by recent cabinet appointments and job creating rhetoric coming from the White House.

A big wildcard continues to be the health of Europe, which has thus far averted full-blown crisis, but has not fully solved the debt problems in Ireland, Greece, Spain and Portugal. In addition, while inflation as measured by the Fed is not a concern, food and gasoline prices have moved significantly higher over the past year. We are keeping a close eye on China's actions to deal with escalating food and housing prices. We think China is unlikely to slam on the brakes, but its actions are worth watching closely.

These tail risks could provide opportunity to purchase high quality franchises at discounts to their intrinsic value. In the meantime, our process of bottom-up fundamentally-driven investing remains unchanged. It continues to be a stock-by-stock process. We believe the portfolio is well positioned for the current environment.

15

Management's Discussion of Fund Performance (Continued)

Westfield Capital Management Company, LLC

Portfolio Review

Investments in the Energy and Industrials sectors were the primary contributors to relative results, but they were overshadowed by weakness in the Consumer Discretionary, Health Care, Materials and Consumer Staples sectors.

Energy stocks contributed to active returns. Oil & Gas Equipment & Services and Exploration & Production industry companies were boosted by record levels of global capital investment. Spending related to deep water development was particularly robust, bolstering oil & gas equipment company National Oilwell Varco Inc. and making the stock the sector's most sizeable contributor to relative returns. National Oilwell has benefited from an acceleration in orders for premium jackups and new floating rigs. In addition, the company began to see a substantial improvement in its aftermarket parts and services segment during the year due to offshore rig fleet upgrades and higher safety standards. Denbury Resources Inc., which engages in the exploration, development and operation of oil and natural gas properties in the U.S.'s Gulf Coast region, also added to relative performance. Denbury pursued its planned sale of non-core assets and we believe the company will demonstrate a stronger organic production growth profile going forward as it has more capital to devote to its key projects. Coal mining company Massey Energy Co. benefited during the year from metallurgical coal contract prices coming in at levels above investor expectations. In November, Massey revealed that it was considering strategic opportunities and the stock surged, fueled by several competing bids. We believe that even if the buy offers are rejected, Massey's vast reserves of thermal and metallurgical coal should position the company well to achieve superior volume growth and pricing power.

Industrials contributed to relative results. The portfolio's modest overweight to the sector and holdings in the Electrical Components & Equipment sub-industry, Ametek Inc., Roper Industries Inc. and Cooper Industries PLC, drove the majority of excess returns. Like many manufacturers, these companies lowered their costs structures during the economic downturn and posted dramatic margin expansion and earnings growth as volumes recovered during 2010. Industrials was the portfolio's best performing sector, and our valuation discipline led us to sell or trim a number of positions throughout the year as they approached our internal price targets.

The Consumer Discretionary sector was the portfolio's most significant cause of underperformance. Overweight exposure to the Education Services sub-industry, which has encountered regulatory headwinds related to uncertainty around the Department of Education's proposed "gainful employment" laws, negatively impacted performance. These measures would sharply reduce the availability of government loans for students attending for-profit institutions. Strayer Education Inc. was the portfolio's biggest absolute and relative detractor, and we sold the stock in the fourth quarter after Strayer's competitor Apollo Group Inc. announced that it expects new student enrollments to decline over the next two quarters. Priceline.com Inc., an online travel company in the United States, Europe, and Asia, further eroded marginal returns, as it has trailed the market since we purchased it in early November. We expect priceline.com to generate a 20% EPS compound annual growth rate over the next few years, driven by increased airline capacity and a consequent improvement in consumer hotel and car rentals.

The Health Care sector detracted from relative returns, driven by weakness in biotechnology and pharmaceuticals holdings. Vertex Pharmaceuticals Inc., whose lead drug Telaprevir is being developed as a treatment for Hepatitis C, was one of the deficient stocks. While Vertex was pressured in the first half of the year due to fears related to its Phase III trial for Telaprevir, the trial data released in the third quarter showed Telaprevir to be more effective than Merck & Co.'s competing therapy, and we remain confident that Vertex will be able to launch Telaprevir in 2011. Dendreon Corp., which develops oncology therapies, also hurt absolute and relative returns. Its lead product, Provenge, is a novel immunotherapy that is made of a patient's own cells and helps trigger their immune system to fight cancer, which means it works like a vaccine against

16

Management's Discussion of Fund Performance (Continued)

tumors. Dendreon was purchased in early May after it received approval to launch Provenge in the U.S. as a prostate cancer therapy. The company reported lower-than-expected third quarter revenues and earnings and has remained range-bound since then. However, Provenge received a favorable review on patient survival benefit following a technology assessment, which we expect to support utilization and reimbursement trends.

The Materials sector detracted from relative results. Ecolab Inc., a manufacturer of cleaning products, traded off after reporting lower-than-expected third quarter revenues due to sluggishness in its food service and health care segments, which caused it to trail its specialty chemicals peers in the Index. We maintain our view that Ecolab can achieve double-digit earnings growth in the coming years thanks to its margin expansion potential in Europe and underlying organic growth trends. Another detractor was Yamana Gold, Inc., which acquires, explores, develops and operates gold and copper mining properties. While gold prices rose during the period, they failed to keep pace with input commodities such as oil that were propelled higher by global growth, which pressured mining company margins.

Current Strategy and Outlook

While market-wide earnings growth will likely moderate from its pace in 2010 as the cyclical recovery evolves, earnings should remain strong and ahead of Wall Street expectations. The highly-correlated, macro-driven stock price action that has dominated the markets since mid-2008 is showing signs of abating. Correlation of average equity returns appear to have peaked in the third quarter. If this trend persists, 2011 should be a stock-picker's market. Much of the margin benefit from cost-cutting efforts during the economic downturn has been achieved and increasing earnings growth should be driven by revenue growth. At this juncture, we endeavor to identify good top-line growers trading at reasonable valuations.

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on November 21, 1994.

17

Management's Discussion of Fund Performance (Continued)

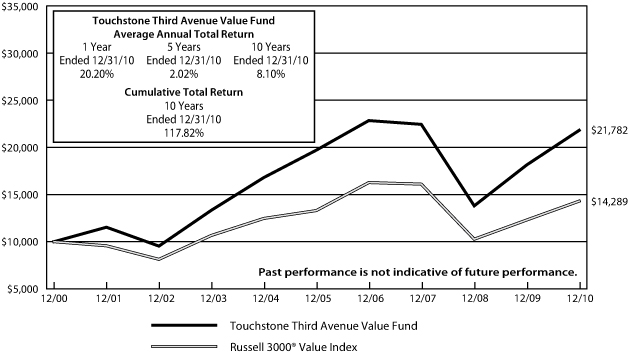

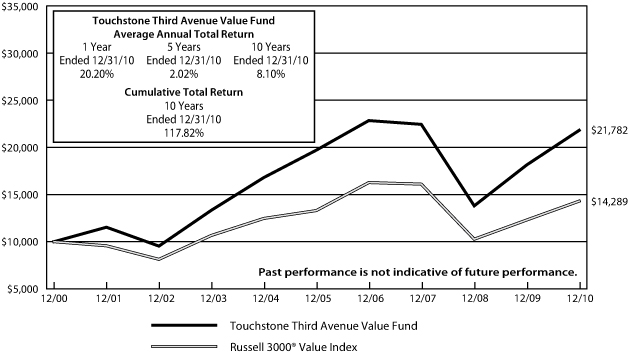

Touchstone Third Avenue Value Fund

Sub-Advised by Third Avenue Management, LLC

Performance and Market Overview

The total return of the Touchstone Third Avenue Value Fund was 20.20% for the year ended December 31, 2010. The total return of the Russell 3000® Value Index was 16.23% for the same period.

Equity markets in the U.S. "melted up" during the last quarter of 2010, as economic conditions improved generally, companies reported better than expected earnings and investors grew more comfortable owning equities. The U.S. Federal Reserve Bank continued to support the economy with its second quantitative easing program and, in an unexpectedly productive lame duck congressional session, President Barack Obama and Republicans in the House and Senate agreed to keep income tax rates low, a one year payroll tax holiday and the extension of unemployment benefits. Most of the stocks in the Fund were up for the year, as business fundamentals and operating results continued to improve.

Portfolio Review

The Fund performed well in 2010, beating relevant benchmarks and ending the year well positioned to take advantage of the improving economic climate. The strongest contributor to relative performance was Sycamore Networks Inc. Near the end of the fourth quarter 2010, Sycamore paid shareholders a $6.50 dividend. After the dividend, the company's financial position remains rock solid with cash and investment securities totaling approximately $450 million and no debt. Earlier in 2010, Sycamore announced the impending launch of IQstream, a new flexible data management product for its mobile customer base. Though the product has yet to roll out, Sycamore's management says it has received encouraging feedback from trial customers.

The second strongest contributor to relative performance was Brookfield Asset Management Inc. Brookfield is a well-financed, well-managed investment company with significant investments in real estate, power generation and infrastructure. The company has opportunistically invested a substantial amount of capital in the past year-and-a-half, having participated in the reorganization of General Growth Properties (the largest U.S. real estate-related bankruptcy in history) and leading the $1.5 billion recapitalization of Babcock & Brown Infrastructure. In addition, Brookfield has gained a lot of traction within its asset management business, having raised nearly $10 billion of external capital over the past few years. Third Avenue believes that Brookfield's management team will continue to take advantage of market dislocations to create value by investing its capital alongside its partners in opportunistic investments, which should allow them to continue to increase the company's NAV for the foreseeable future.

The third strongest contributor to relative performance was Cimarex Energy Co. Cimarex had a strong year of improving operating results and growing cash flow that management has used to strengthen the company's already solid balance sheet. Oil and gas reserves have grown more rapidly than many expected. Cimarex also has a sizable interest in the Cana-Woodford shale, an early stage resource play in western Oklahoma whose potential value is increasingly becoming apparent as one of the more attractive shale formations in the region.

The largest detractor to Fund performance during the year was South Korean steel producer POSCO. POSCO's margins suffered in 2010 due to rising materials cost. The company added debt to its balance sheet as well in order to finance its second quarter acquisition of Daewoo International Corporation. However, POSCO remains well financed and has super-attractive access to the credit markets. It recently issued $700 million in 10-year notes at an attractive borrowing rate of 4.2% for money that Third Avenue believes will be put to productive long-term use.

Hong Kong's Henderson Land Development Company Ltd. was the second largest detractor from relative performance during the year. Over the summer, Henderson took a HK$734 million charge to earnings to reflect the effect of failed condominium sales in its Conduit Road project. Though the charge represented less

18

Management's Discussion of Fund Performance (Continued)

than 1% of the company's $66 per share adjusted book value (book value + deferred tax liability), the Hong Kong government soon after announced it would investigate the Conduit Road transactions. Henderson Land re-launched sales of condos in its Conduit Road development in August and shares recovered much of their losses during the second half of the year. However, they declined again late in the fourth quarter when the Hong Kong government announced measures to reduce further price appreciation in the residential market. While Henderson Land was one of the largest detractors during the year, the company remains a core position in the Fund as the company has a strong financial position, trades at an attractive discount to Third Avenue's estimate of NAV, and has attractive prospects for future NAV growth.

During the year positions in the Alamo Group Inc., Arch Capital Group Ltd., Bel Fuse Inc., Cross Country Healthcare Inc., Electro Scientific Industries Inc., JAKKS Pacific Inc., Journal Communications Inc., Mitsui Fudosan Company Ltd., TimberWest Forest Corp. and Tokio Marine Holdings Inc. were sold from the Fund. Third Avenue initiated a position in Canfor Corp., a well-financed Canadian lumber company, and KeyCorp, a well-capitalized U.S.-based regional bank available at a discount to net asset value.

Current Strategy and Outlook

Third Avenue does not manage to a benchmark or invest using an asset allocation model; rather we analyze companies from the bottom up, focusing on business fundamentals in keeping with our time-tested "safe and cheap" investment philosophy. We invest in well-capitalized companies with competent management teams and strong long-term growth prospects. We seek to limit potential investment risk by purchasing the securities of such sound companies at a significant discount to our conservative estimate of net asset value.

Despite the recent market rally, we continue to see opportunities in select securities that meet our strict investment criteria. We believe that our focus on the merits of individual companies enables the Fund to be well positioned for the long run regardless of the macro environment.

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on December 14, 1992.

19

Management's Discussion of Fund Performance (Continued)

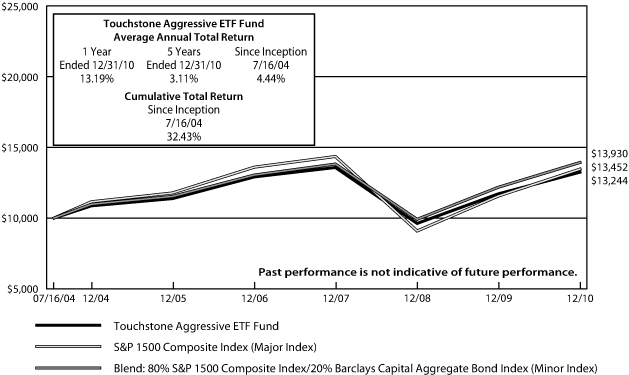

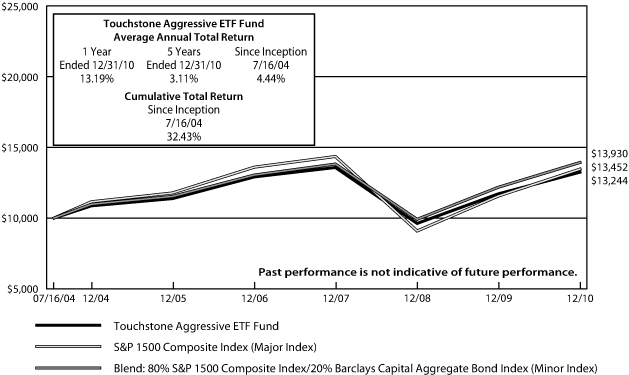

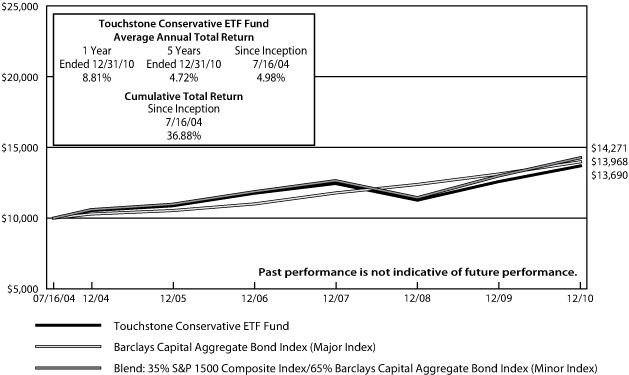

Touchstone ETF Funds

Sub-Advised by Todd-Veredus Asset Management

Touchstone Aggressive ETF Fund

Touchstone Conservative ETF Fund

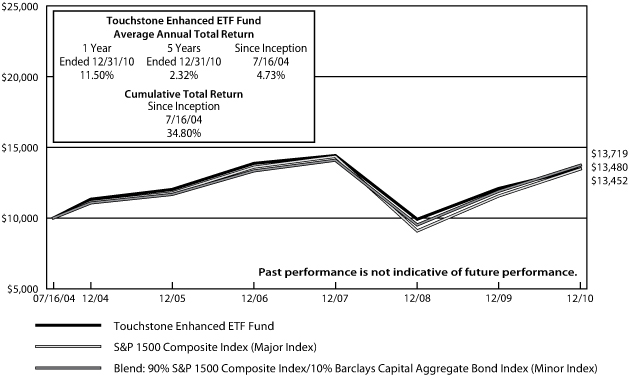

Touchstone Enhanced ETF Fund

Touchstone Moderate ETF Fund

Four Exchanged Traded Funds (ETFs) are available for investors seeking "lifestyle" products for their annuity holdings. Strategic options include the Conservative, Moderate and Aggressive ETF Funds. These funds use asset allocations of up to nine ETFs that should not change dramatically over time, with higher bond weights for the more conservative funds, and lower bond weights for the more aggressive funds. The fourth option, the Enhanced ETF Fund, uses a tactical asset allocation in an effort to generate better returns.

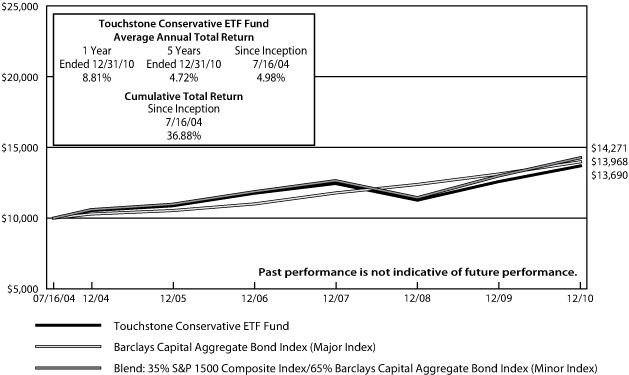

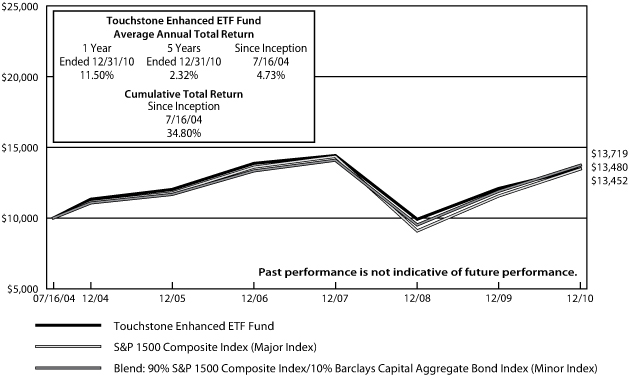

Performance and Market Overview

The Touchstone Conservative ETF Fund's total return was 8.81% for the year ended December 31, 2010. The total return of the Barclays Capital Aggregate Bond Index was 6.54% for the same period. The Touchstone Moderate ETF Fund's total return was 11.25%, the Touchstone Aggressive ETF Fund 13.19%, and the Touchstone Enhanced ETF Fund 11.50% for the year ended December 31, 2010. The total return of the S&P 1500 Composite Index was 16.38% for the same period. The specific blended benchmark returns were 9.98% for the Conservative ETF Fund, 12.44% for the Moderate ETF Fund, 14.41% for the Aggressive ETF Fund, and 15.40% for the Enhanced ETF Fund.

Portfolio Review

During the year, the strategically-oriented Conservative, Moderate and Aggressive ETF Funds, as well as the tactical Enhanced ETF Fund underperformed their blended benchmarks primarily due to sector allocation. The Fund's relatively good sector weightings in the U.S. were offset by the lower performance of the MSCI EAFE Index. International markets also suffered as concerns about sovereign debt defaults surfaced in Europe, and China began raising interest rates to slow the economy and head off inflationary pressures.

This past year, the strategically-oriented Funds favored mid- and small-cap indexes versus the large-cap. Within those sectors, Todd rebalanced the allocations in May to favor growth slightly more than value. The growth indexes generally outperformed their value counterparts during the year.

The tactically-oriented Enhanced ETF Fund was rebalanced in November to favor large- and mid-cap growth sectors, as well as the MSCI EAFE and the Barclays Capital Aggregate Bond Index. During the fourth quarter, the mid-cap and small-cap sectors outperformed, and thus the Fund underperformed its specifically-blended benchmark for the year.

Current Strategy and Outlook

As we look at the market, our focus is on three driving forces; valuation, fundamentals and market sentiment. Based on these factors, Todd believes equities will end the year a fair amount higher than current levels as it becomes clearer that the economy is in a begrudgingly normal recovery.

Valuation has become much more reasonable over the past ten years based on a normalized five-year earnings chart. Todd believes that unless we see a period where inflation expectations skyrocket, much of the correction in P/Es is probably over. Industrials have seen firm fundamentals and other neglected areas, such as Automobiles and Consumer Durables, are seeing an uptick. New home builds may not improve substantially from here, but

20

Management's Discussion of Fund Performance (Continued)

Todd believes that expectations do not call for any improvement. Real demand for many products is improving, which should lead to better margins on an already lean manufacturing base. This should allow for improved employment expectations as companies begin to bump up against production limitations. Todd expects the economy to continue to grow in 2011 with consensus expectations around 3.5-4.5%. However, it will do so in a choppy manner. Todd expects later stage cyclical companies to outperform in 2011. The Funds are already positioned well for the recovery: invested in high quality companies with good balance sheets who are likely to raise dividends, do share repurchases or make accretive acquisitions.

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

21

Management's Discussion of Fund Performance (Continued)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

22

Management's Discussion of Fund Performance (Continued)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

23

Management's Discussion of Fund Performance (Continued)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

24

Tabular Presentation of Portfolios of Investments (Unaudited)

December 31, 2010

Touchstone Baron Small Cap Growth Fund

| Sector Allocation | | (% of Net Assets) | |

| Consumer Discretionary | | | 33.3 | | |

| Financials | | | 13.3 | | |

| Health Care | | | 12.2 | | |

| Industrials | | | 10.8 | | |

| Energy | | | 8.7 | | |

| Consumer Staples | | | 6.0 | | |

| Information Technology | | | 3.2 | | |

| Materials | | | 2.9 | | |

| Utilities | | | 2.5 | | |

| Telecommunication Services | | | 2.1 | | |

| Investment Funds | | | 23.8 | | |

| Other Assets/Liabilities (Net) | | | (18.8 | ) | |

| Total | | | 100.0 | | |

Touchstone Core Bond Fund

| Credit Quality | | (% of Total Investments) | |

| U.S. Treasury | | | 27.0 | | |

| U.S. Agency | | | 12.3 | | |

| AAA/Aaa | | | 20.0 | | |

| AA/Aa | | | 1.3 | | |

| A/A | | | 7.9 | | |

| BBB/Baa | | | 11.5 | | |

| BB/Ba | | | 3.9 | | |

| B/B | | | 11.9 | | |

| CCC | | | 4.0 | | |

| CC | | | 0.2 | | |

| Total | | | 100.0 | | |

Touchstone High Yield Fund

| Credit Quality | | (% of Total Investments) | |

| BBB/Baa | | | 3.1 | | |

| BB | | | 15.9 | | |

| B | | | 73.6 | | |

| CCC | | | 5.6 | | |

| CC | | | 0.3 | | |

| NR | | | 0.2 | | |

| Cash | | | 1.3 | | |

| Total | | | 100.0 | | |

Touchstone Large Cap Core Equity Fund

| Sector Allocation | | (% of Net Assets) | |

| InformationTechnology | | | 21.9 | | |

| Industrials | | | 13.5 | | |

| Consumer Discretionary | | | 13.1 | | |

| Financials | | | 13.0 | | |

| Health Care | | | 11.3 | | |

| Energy | | | 11.0 | | |

| Consumer Staples | | | 6.4 | | |

| Materials | | | 3.5 | | |

| Telecommunication Services | | | 2.6 | | |

| Utilities | | | 2.2 | | |

| Investment Funds | | | 5.0 | | |

| Other Assets/Liabilities (Net) | | | (3.5 | ) | |

| Total | | | 100.0 | | |

25

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

Touchstone Mid Cap Growth Fund

| Sector Allocation | | (% of Net Assets) | |

| Information Technology | | | 19.0 | | |

| Financials | | | 15.6 | | |

| Industrials | | | 14.3 | | |

| Consumer Discretionary | | | 13.1 | | |

| Energy | | | 10.4 | | |

| Health Care | | | 9.9 | | |

| Materials | | | 9.1 | | |

| Consumer Staples | | | 3.5 | | |

| Utilities | | | 2.2 | | |

| Telecommunication Services | | | 1.3 | | |

| Investment Funds | | | 6.4 | | |

| Other Assets/Liabilities (Net) | | | (4.8 | ) | |

| Total | | | 100.0 | | |

Touchstone Money Market Fund

| Credit Quality | | (% of Total Investments) | |

| A-1/P-1/F-1 | | | 95.2 | | |

| FW1(NR) | | | 4.8 | | |

| Total | | | 100.0 | | |

| Portfolio Allocation | | (% of Net Assets) | |

| Variable Rate Demand Notes | | | 55.5 | | |

| U.S. Government Securities | | | 22.4 | | |

| Taxable Municipal Bonds | | | 10.4 | | |

Corporate Notes/Commercial

Paper | | | 8.8 | | |

| Adjustable Rate Put Bonds | | | 2.8 | | |

| Other Assets/Liabilities (Net) | | | 0.1 | | |

| Total | | | 100.0 | | |

Touchstone Third Avenue Value Fund

| Sector Allocation | | (% of Net Assets) | |

| Financials | | | 40.3 | | |

| Energy | | | 19.9 | | |

| Information Technology | | | 12.6 | | |

| Materials | | | 11.4 | | |

| Consumer Discretionary | | | 8.6 | | |

| Health Care | | | 0.9 | | |

| Investment Funds | | | 8.2 | | |

| Other Assets/Liabilities (Net) | | | (1.9 | ) | |

| Total | | | 100.0 | | |

Touchstone Aggressive ETF Fund

| Sector Allocation | | (% of Net Assets) | |

| Exchange Traded Funds | | | 99.2 | | |

| Investment Funds | | | 25.8 | | |

| Other Assets/Liabilities (Net) | | | (25.0 | ) | |

| Total | | | 100.0 | | |

Touchstone Conservative ETF Fund

| Sector Allocation | | (% of Net Assets) | |

| Exchange Traded Funds | | | 99.1 | | |

| Investment Funds | | | 26.1 | | |

| Other Assets/Liabilities (Net) | | | (25.2 | ) | |

| Total | | | 100.0 | | |

Touchstone Enhanced ETF Fund

| Sector Allocation | | (% of Net Assets) | |

| Exchange Traded Funds | | | 99.3 | | |

| Investment Funds | | | 28.8 | | |

| Other Assets/Liabilities (Net) | | | (28.1 | ) | |

| Total | | | 100.0 | | |

Touchstone Moderate ETF Fund

| Sector Allocation | | (% of Net Assets) | |

| Exchange Traded Funds | | | 98.9 | | |

| Investment Funds | | | 21.7 | | |

| Other Assets/Liabilities (Net) | | | (20.6 | ) | |

| Total | | | 100.0 | | |

26

Statements of Assets and Liabilities

December 31, 2010

| | | Touchstone

Baron Small

Cap Growth

Fund | | Touchstone

Core Bond

Fund | | Touchstone

High Yield

Fund | | Touchstone

Large Cap

Core Equity

Fund | |

| Assets | |

| Investments, at cost | | $ | 18,416,838 | | | $ | 42,753,767 | | | $ | 30,493,293 | | | $ | 36,597,292 | | |

| Affiliated securities, at market value | | $ | 1,443,090 | | | $ | 2,705,440 | | | $ | 416,239 | | | $ | 629,519 | | |

| Non-affiliated securities, at market value | | | 27,752,293 | | | | 40,113,463 | | | | 32,139,723 | | | | 43,987,715 | | |

Investments, at value - including $4,260,837, $106,178, $536,741,and

$1,473,535 of securities loaned for the Baron Small Cap Growth Fund,

Core Bond Fund, High Yield Fund, and Large Cap Core Equity Fund,

respectively. | | $ | 29,195,383 | | | $ | 42,818,903 | | | $ | 32,555,962 | | | $ | 44,617,234 | | |

| Cash | | | — | | | | 6 | | | | — | | | | — | | |

| Receivable for: | |

| Dividends | | | 10,404 | | | | — | | | | — | | | | 59,148 | | |

| Interest | | | — | | | | 345,280 | | | | 631,211 | | | | — | | |

| Fund shares sold | | | 34,545 | | | | — | | | | 3,727 | | | | 9,302 | | |

| Securities lending income | | | 2,270 | | | | 13 | | | | 206 | | | | 126 | | |

| Tax reclaim receivable | | | — | | | | 1,550 | | | | — | | | | — | | |

| Other assets | | | 362 | | | | 696 | | | | 529 | | | | 690 | | |

| Total Assets | | | 29,242,964 | | | | 43,166,448 | | | | 33,191,635 | | | | 44,686,500 | | |

| Liabilities | |

| Payable for: | |

| Return of collateral for securities on loan | | | 4,417,673 | | | | 111,870 | | | | 564,670 | | | | 1,505,069 | | |

| Fund shares redeemed | | | 2,845 | | | | 2,704 | | | | 346 | | | | 2,017 | | |

| Investments purchased | | | 180,433 | | | | 2,586,762 | | | | — | | | | — | | |

| Payable to Investment Advisor | | | 21,562 | | | | 18,870 | | | | 13,558 | | | | 23,587 | | |

| Payable to other affiliates | | | 20,401 | | | | 13,902 | | | | 34,769 | | | | 15,976 | | |

| Payable to Trustees | | | 2,011 | | | | 2,011 | | | | 2,011 | | | | 2,011 | | |

| Other accrued expenses | | | 17,239 | | | | 21,925 | | | | 24,442 | | | | 17,580 | | |

| Total Liabilities | | | 4,662,164 | | | | 2,758,044 | | | | 639,796 | | | | 1,566,240 | | |

| Net Assets | | $ | 24,580,800 | | | $ | 40,408,404 | | | $ | 32,551,839 | | | $ | 43,120,260 | | |

Shares of beneficial interest outstanding (unlimited number

of shares authorized, no par value) | | | 1,468,494 | | | | 3,766,091 | | | | 4,140,564 | | | | 4,770,311 | | |

| Net asset value, offering price and redemption price per share | | $ | 16.74 | | | $ | 10.73 | | | $ | 7.86 | | | $ | 9.04 | | |

| Net assets consist of: | |

| Paid-in capital | | $ | 14,207,628 | | | $ | 38,003,494 | | | $ | 31,491,941 | | | $ | 53,239,451 | | |

| Accumulated net investment income | | | 233 | | | | 1,446,554 | | | | 2,424,031 | | | | 569,185 | | |

| Accumulated net realized gains (losses) on investments | | | (405,606 | ) | | | 893,220 | | | | (3,426,802 | ) | | | (18,708,318 | ) | |

| Net unrealized appreciation on investments | | | 10,778,545 | | | | 65,136 | | | | 2,062,669 | | | | 8,019,942 | | |

| Net assets applicable to shares outstanding | | $ | 24,580,800 | | | $ | 40,408,404 | | | $ | 32,551,839 | | | $ | 43,120,260 | | |

The accompanying notes are an integral part of the financial statements.

27

Statements of Assets and Liabilities (Continued)

| | | Touchstone

Mid Cap

Growth

Fund | | Touchstone

Money

Market

Fund | | Touchstone

Third Avenue

Value

Fund | |

| Assets | |

| Investments, at cost | | $ | 23,616,053 | | | $ | 56,984,928 | | | $ | 37,887,672 | | |

| Affiliated securities, at market value | | $ | 552,764 | | | $ | — | | | $ | 3,177,555 | | |

| Non-affiliated securities, at market value | | | 28,796,398 | | | | 56,984,928 | | | | 50,397,789 | | |

Investments, at value - including $1,199,920 and $1,107,274 of securities loaned

for the Mid Cap Growth Fund and Third Avenue Value Fund, respectively. | | $ | 29,349,162 | | | $ | 56,984,928 | | | $ | 53,575,344 | | |

| Cash | | | — | | | | 484 | | | | 54 | | |

| Receivable for: | |

| Dividends | | | 21,584 | | | | — | | | | 9,795 | | |

| Interest | | | — | | | | 133,552 | | | | — | | |

| Fund shares sold | | | 63,986 | | | | — | | | | 15,453 | | |

| Investments sold | | | 1,237 | | | | — | | | | 190,239 | | |

| Securities lending income | | | 168 | | | | — | | | | 1,284 | | |

| Tax reclaim receivable | | | — | | | | — | | | | 6,874 | | |

| Other assets | | | 430 | | | | 1,047 | | | | 848 | | |

| Total Assets | | | 29,436,567 | | | | 57,120,011 | | | | 53,799,891 | | |

| Liabilities | |

| Payable for: | |

| Return of collateral for securities on loan | | | 1,230,659 | | | | — | | | | 1,128,275 | | |

| Dividends | | | — | | | | 500 | | | | — | | |

| Fund shares redeemed | | | 2,743 | | | | — | | | | 4,231 | | |

| Investments purchased | | | 140,251 | | | | — | | | | — | | |

| Payable to Investment Advisor | | | 18,596 | | | | 9,010 | | | | 34,897 | | |

| Payable to other affiliates | | | 11,081 | | | | 56,444 | | | | 20,767 | | |

| Payable to Trustees | | | 2,011 | | | | 2,011 | | | | 2,011 | | |

| Other accrued expenses | | | 18,010 | | | | 20,515 | | | | 32,057 | | |

| Total Liabilities | | | 1,423,351 | | | | 88,480 | | | | 1,222,238 | | |

| Net Assets | | $ | 28,013,216 | | | $ | 57,031,531 | | | $ | 52,577,653 | | |

Shares of beneficial interest outstanding (unlimited number

of shares authorized, no par value) | | | 2,090,026 | | | | 57,019,790 | | | | 2,975,294 | | |

| Net asset value, offering price and redemption price per share | | $ | 13.40 | | | $ | 1.00 | | | $ | 17.67 | | |

| Net assets consist of: | |

| Paid-in capital | | $ | 27,478,215 | | | $ | 57,030,355 | | | $ | 50,194,468 | | |

| Accumulated net investment income (loss) | | | 79,095 | | | | — | | | | (1,688,330 | ) | |

| Accumulated net realized gains (losses) on investments and foreign currency transactions | | | (5,277,203 | ) | | | 1,176 | | | | (11,616,254 | ) | |

| Net unrealized appreciation on investments and foreign currency transactions | | | 5,733,109 | | | | — | | | | 15,687,769 | | |

| Net assets applicable to shares outstanding | | $ | 28,013,216 | | | $ | 57,031,531 | | | $ | 52,577,653 | | |

The accompanying notes are an integral part of the financial statements.

28

Statements of Assets and Liabilities (Continued)

| | | Touchstone

Aggressive

ETF

Fund | | Touchstone

Conservative

ETF

Fund | | Touchstone

Enhanced

ETF

Fund | | Touchstone

Moderate

ETF

Fund | |

| Assets | |

| Investments, at cost | | $ | 21,318,812 | | | $ | 26,392,401 | | | $ | 16,637,628 | | | $ | 60,429,534 | | |

| Affiliated securities, at market value | | $ | 173,668 | | | $ | 255,117 | | | $ | 165,474 | | | $ | 683,798 | | |

| Non-affiliated securities, at market value | | | 24,009,886 | | | | 28,623,331 | | | | 18,160,671 | | | | 63,847,205 | | |

Investments, at value - including $4,709,884, $5,615,361, $3,839,252 and

$10,680,414 of securities loaned for the Aggressive ETF Fund,

Conservative ETF Fund, Enhanced ETF Fund and Moderate ETF Fund,

respectively. | | $ | 24,183,554 | | | $ | 28,878,448 | | | $ | 18,326,145 | | | $ | 64,531,003 | | |

| Receivable for: | |

| Dividends | | | 13,399 | | | | 41,139 | | | | 10,436 | | | | 69,567 | | |

| Fund shares sold | | | — | | | | 2,299 | | | | — | | | | 67,921 | | |

| Securities lending income | | | 866 | | | | 1,512 | | | | 564 | | | | 1,751 | | |

| Tax reclaim receivable | | | — | | | | — | | | | — | | | | 3,444 | | |

| Other assets | | | 277 | | | | 384 | | | | 154 | | | | 877 | | |

| Total Assets | | | 24,198,096 | | | | 28,923,782 | | | | 18,337,299 | | | | 64,674,563 | | |

| Liabilities | |

| Payable for: | |

| Return of collateral for securities on loan | | | 4,819,831 | | | | 5,764,771 | | | | 3,955,450 | | | | 10,938,116 | | |

| Fund shares redeemed | | | 5,500 | | | | 5,917 | | | | 3,949 | | | | 13,437 | | |

| Investments purchased | | | — | | | | 47,143 | | | | 42,813 | | | | 172,969 | | |

| Payable to Investment Advisor | | | 6,525 | | | | 7,801 | | | | 4,843 | | | | 17,940 | | |

| Payable to other affiliates | | | 2,941 | | | | 12,894 | | | | 5,242 | | | | 20,793 | | |

| Payable to Trustees | | | 2,011 | | | | 2,011 | | | | 2,011 | | | | 2,011 | | |

| Other accrued expenses | | | 19,824 | | | | 17,505 | | | | 17,524 | | | | 17,731 | | |

| Total Liabilities | | | 4,856,632 | | | | 5,858,042 | | | | 4,031,832 | | | | 11,182,997 | | |

| Net Assets | | $ | 19,341,464 | | | $ | 23,065,740 | | | $ | 14,305,467 | | | $ | 53,491,566 | | |

Shares of beneficial interest outstanding (unlimited number

of shares authorized, no par value) | | | 1,892,793 | | | | 1,989,091 | | | | 1,781,743 | | | | 4,460,700 | | |

| Net asset value, offering price and redemption price per share | | $ | 10.22 | | | $ | 11.60 | | | $ | 8.03 | | | $ | 11.99 | | |

| Net assets consist of: | |

| Paid-in capital | | $ | 19,800,913 | | | $ | 21,987,045 | | | $ | 22,613,731 | | | $ | 55,434,370 | | |

| Accumulated net investment income | | | 254,243 | | | | 439,879 | | | | 101,821 | | | | 926,794 | | |

| Accumulated net realized losses on investments | | | (3,578,434 | ) | | | (1,847,231 | ) | | | (10,098,602 | ) | | | (6,971,509 | ) | |

| Net unrealized appreciation on investments | | | 2,864,742 | | | | 2,486,047 | | | | 1,688,517 | | | | 4,101,911 | | |

| Net assets applicable to shares outstanding | | $ | 19,341,464 | | | $ | 23,065,740 | | | $ | 14,305,467 | | | $ | 53,491,566 | | |

The accompanying notes are an integral part of the financial statements.

29

Statements of Operations

For the Year Ended December 31, 2010

| | | Touchstone

Baron Small

Cap Growth

Fund | | Touchstone

Core Bond

Fund | | Touchstone

High Yield

Fund | | Touchstone

Large Cap

Core Equity

Fund | |

| Investment Income | |

| Dividends from affiliated securities | | $ | 4,032 | | | $ | 12,434 | | | $ | 1,191 | | | $ | 2,601 | | |

| Dividends from non-affiliated securities | | | 200,242 | | | | 4,732 | | | | 5,431 | | | | 1,094,136 | | |

| Interest | | | — | | | | 1,753,304 | | | | 2,751,857 | | | | — | | |

| Income from securities loaned | | | 30,203 | | | | 26 | | | | 1,836 | | | | 2,134 | | |

| Total Investment Income | | | 234,477 | | | | 1,770,496 | | | | 2,760,315 | | | | 1,098,871 | | |

| Expenses | |

| Investment advisory fees | | | 220,191 | | | | 220,441 | | | | 160,149 | | | | 344,656 | | |

| Administration fees | | | 41,941 | | | | 80,161 | | | | 64,060 | | | | 106,049 | | |

| Compliance fees and expenses | | | 1,701 | | | | 1,574 | | | | 1,792 | | | | 2,124 | | |

| Custody fees | | | 1,274 | | | | 325 | | | | 7,365 | | | | 1,180 | | |

| Professional fees | | | 16,379 | | | | 18,408 | | | | 18,013 | | | | 19,726 | | |

| Shareholder servicing fees | | | 42,665 | | | | 19,646 | | | | 60,168 | | | | 61,337 | | |

| Transfer Agent fees | | | 21 | | | | 182 | | | | 126 | | | | 215 | | |

| Trustee fees | | | 10,993 | | | | 10,993 | | | | 10,994 | | | | 10,994 | | |

| Other expenses | | | 4,171 | | | | 14,745 | | | | 13,866 | | | | 6,001 | | |

| Total Expenses | | | 339,336 | | | | 366,475 | | | | 336,533 | | | | 552,282 | | |

| Fees waived by the Administrator | | | (14,115 | ) | | | — | | | | (252 | ) | | | (22,598 | ) | |

| Net Expenses | | | 325,221 | | | | 366,475 | | | | 336,281 | | | | 529,684 | | |

| Net Investment Income (Loss) | | | (90,744 | ) | | | 1,404,021 | | | | 2,424,034 | | | | 569,187 | | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on investments | | | 1,680,660 | | | | 988,660 | | | | 1,040,770 | | | | (259,145 | ) | |

| Net change in unrealized appreciation/(depreciation) on investments | | | 3,268,043 | | | | 507,158 | | | | 286,665 | | | | 5,424,768 | | |

| Net Realized and Unrealized Gain | | | 4,948,703 | | | | 1,495,818 | | | | 1,327,435 | | | | 5,165,623 | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 4,857,959 | | | $ | 2,899,839 | | | $ | 3,751,469 | | | $ | 5,734,810 | | |

The accompanying notes are an integral part of the financial statements.

30

Statements of Operations (Continued)

| | | Touchstone

Mid Cap

Growth

Fund | | Touchstone

Money

Market

Fund | | Touchstone

Third Avenue

Value

Fund | |

| Investment Income | |

| Dividends from affiliated securities | | $ | 1,508 | | | $ | — | | | $ | 6,148 | | |

| Dividends from non-affiliated securities (A) | | | 374,387 | | | | — | | | | 1,038,277 | | |

| Interest | | | — | | | | 401,655 | | | | — | | |

| Income from securities loaned | | | 6,341 | | | | — | | | | 22,710 | | |

| Total Investment Income | | | 382,236 | | | | 401,655 | | | | 1,067,135 | | |

| Expenses | |

| Investment advisory fees | | | 205,906 | | | | 131,118 | | | | 405,802 | | |

| Administration fees | | | 51,477 | | | | 145,451 | | | | 101,451 | | |

| Compliance fees and expenses | | | 1,945 | | | | 2,127 | | | | 1,827 | | |

| Custody fees | | | 101 | | | | 1,872 | | | | 14,839 | | |

| Professional fees | | | 17,263 | | | | 21,541 | | | | 18,848 | | |

| Shareholder servicing fees | | | 32,425 | | | | 157,741 | | | | 118,956 | | |

| Transfer Agent fees | | | 1,150 | | | | 129 | | | | 126 | | |

| Trustee fees | | | 10,993 | | | | 10,352 | | | | 10,994 | | |

| Passive Foreign Investment Company tax expense | | | — | | | | — | | | | 252,316 | | |

| Other expenses | | | 5,398 | | | | 634 | | | | 22,032 | | |

| Total Expenses | | | 326,658 | | | | 470,965 | | | | 947,191 | | |

| Fees waived by the Administrator | | | (25,431 | ) | | | (81,849 | ) | | | (101,451 | ) | |

| Expenses reimbursed by the Investment Advisor | | | — | | | | — | | | | (252,387 | ) | |

| Net Expenses | | | 301,227 | | | | 389,116 | | | | 593,353 | | |

| Net Investment Income | | | 81,009 | | | | 12,539 | | | | 473,782 | | |

| Realized and Unrealized Gain | |

| Net realized gain on: | |

| Investments | | | 859,058 | | | | 103,132 | | | | 1,596,516 | | |

| Foreign currency | | | — | | | | — | | | | 9,736 | | |