UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-8416

| Touchstone Variable Series Trust |

| (Exact name of registrant as specified in charter) |

| |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202- 4203 |

| (Address of principal executive offices) (Zip code) |

| |

| Jill T. McGruder |

| 303 Broadway, Suite 1100 |

| Cincinnati, Ohio 45202- 4203 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: December 31

Date of reporting period: December 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

December 31, 2011

Annual Report

Touchstone Variable Series Trust

Touchstone Baron Small Cap Growth Fund

Touchstone Core Bond Fund

Touchstone High Yield Fund

Touchstone Large Cap Core Equity Fund

Touchstone Mid Cap Growth Fund

Touchstone Money Market Fund

Touchstone Third Avenue Value Fund

Touchstone Aggressive ETF Fund

Touchstone Conservative ETF Fund

Touchstone Enhanced ETF Fund

Touchstone Moderate ETF Fund

Table of Contents

| | Page |

| Letter from the President | 3 |

| Management's Discussion of Fund Performance (Unaudited) | 4 - 24 |

| Tabular Presentation of Portfolios of Investments (Unaudited) | 26 - 27 |

| Portfolio Investments: | |

| Touchstone Baron Small Cap Growth Fund | 28 |

| Touchstone Core Bond Fund | 30 |

| Touchstone High Yield Fund | 36 |

| Touchstone Large Cap Core Equity Fund | 40 |

| Touchstone Mid Cap Growth Fund | 42 |

| Touchstone Money Market Fund | 43 |

| Touchstone Third Avenue Value Fund | 46 |

| Touchstone Aggressive ETF Fund | 47 |

| Touchstone Conservative ETF Fund | 48 |

| Touchstone Enhanced ETF Fund | 49 |

| Touchstone Moderate ETF Fund | 50 |

| Statement of Assets and Liabilities | 52 - 53 |

| Statement of Operations | 54 - 55 |

| Statement of Changes in Net Assets | 56 - 59 |

| Financial Highlights | 60 - 65 |

| Notes to Financial Statements | 66 - 78 |

| Report of Independent Registered Public Accounting Firm | 79 |

| Other Items (Unaudited) | 80 - 88 |

| Management of the Trust (Unaudited) | 89 - 92 |

| Privacy Protection Policy | 93 |

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Variable Series Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the twelve months ended December 31, 2011.

2011 was a challenging environment for investors. From a market capitalization and style perspective, large cap outpaced both small and mid-cap stocks, while growth outperformed across most asset classes. The U.S. equity markets outperformed both the developed and emerging international markets for the year. Interest rates remain low, and are forecasted to stay low throughout the next two years.

In the third quarter, U.S. and world equity markets suffered their worst losses since the 2008-09 financial crisis, while treasury yields fell to their lowest levels since that period. For many investors, the key issues impacting markets were whether the U.S. economy is headed for a “double dip” recession, what can policymakers do to avert one, and whether the financial crisis in Europe can be contained.

It is thought that the U.S. economy is not on the brink of recession. The equity market is pricing in a mild recession already but certainly not a severe recession along the lines of 2008-2009. It is generally believed, however, that risks have increased and the outcome will be dictated by policy responses in the U.S. and Europe. The myriad of forces at play, which have been building throughout this year, could reach a climax soon depending on the outcome of U.S. budget deliberations and actions European policymakers take to halt financial contagion.

We continue to believe that diversification is essential to balancing risk and return. We recommend that you continue to work with your financial professional to employ a sound asset allocation strategy that invests in a combination of stock, bond and money market mutual funds to help keep your financial strategy on course. It is critical to maintain a long-term approach to gain the full potential benefits of investing.

Touchstone is committed to helping investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific areas of expertise. We hope that you will find the enclosed commentaries helpful.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Variable Series Trust

Management's Discussion of Fund Performance (Unaudited)

Touchstone Baron Small Cap Growth Fund

Sub-Advised by BAMCO, Inc.

Investment Philosophy and Process

The Touchstone Baron Small Cap Growth Fund primarily invests in common stocks of small-sized growth companies. The Fund’s sub-advisor, BAMCO, Inc. (“BAMCO”), seeks securities that it believes have (1) favorable price to value characteristics, are well managed, have significant long term growth prospects and have significant barriers to competition; and (2) the potential to increase in value at least 100% over the next four or five years. Securities are selected for their capital appreciation potential and investment income is not a consideration in BAMCO’s stock selection process.

Fund Performance and Market Review

The total return of the Touchstone Baron Small Cap Growth Fund was 4.84% for the year ended December 31, 2011. The total return of the Russell 2000 Growth Index was -2.91% for the same period.

The U.S. stock markets ended 2011 at almost the point at which they began.The U.S. stock markets rebounded in the fourth quarter following a sharp correction in the third quarter.The markets benefited from generally positive economic data and strong reported business results. We believe the primary reason for the rebound was that a number of economic indicators provided reassurance that a recession was not imminent, as had been feared in the fall.The markets, however, remain dominated by macro concerns. Daily headlines concerning developments in Europe have led to continued volatility.

Portfolio Review

During the year, the Fund’s favorable stock selection effect, and to a lesser extent, sector weightings, contributed to relative performance.

The Fund’s investments in Energy, Consumer Discretionary, and Industrials were the largest contributors to relative results for the year. Within Energy, strength in crude prices and opportunistic acquisition sled to outperformance of the majority of the Fund’s energy holdings, which contributed to positive stock selection effect. Among the largest contributors to relative performance within the sector were Southern Union Co. and Brigham Exploration. Within Consumer Discretionary, positive stock selection effect was largely the result of outperformance of Panera Bread Co. and Peet’s Coffee & Tea, Inc. Shares of Panera, a fast, casual restaurant concept, rose for the year on strong earnings and operating margin. Positive relative performance in apparel accessories, and luxury goods was the result of our focus on businesses with outstanding management and unique value-priced products with meaningful unit-growth potential, and that are benefiting from increasing global demand for luxury goods. Ralph Lauren Corp. and Under Armour, Inc. fared well during the year and significantly contributed to the Fund’s relative results. In Industrials, positive stock selection effect was mostly driven by outperformance of Generac Holdings, Inc. Genesee & Wyoming, Inc. was also a contributor to relative results. Genesee & Wyoming share prices increased during 2011 after the company reported double-digit growth and announced two large new acquisitions.

Industrial stocks rallied in the fourth quarter after pulling back sharply in the third quarter due to weak economic data. Industrial stock prices are highly sensitive to the macro outlook, yet not always indicative of the fundamentals of each company. We see pockets of strength in energy-oriented companies while industrial companies that are more geared towards government spending have a bit of a tougher outlook. We are invested in several high-quality companies that have been laying the groundwork so that they can capture growth by expanding marketing, sales, and product distribution. For example, Generac Holdings, Inc. a leading manufacturer of standby and portable generators for the residential, industrial, and commercial markets, performed well for the year as the company had strong second-half sales driven by severe power outages caused by seasonal storms. With 70%

Management's Discussion of Fund Performance (Continued)

market share in the residential standby generator market and only 2% market penetration, we believe that Generac has significant room to grow. Another absolute contributor was Colfax Corp., a supplier of industrial fluid-handling products. Its shares advanced as investors reacted favorably to its strong third-quarter earnings results and the potential earnings accretion from its pending acquisition of Charter International plc. Due to U.K. takeover rules, management has been unable to update yearly guidance for Colfax or comment on expectations for earnings accretion from the Charter deal. We continue to hold Colfax as we believe the stock remains undervalued relative to the substantial operational improvements expected at Charter. In addition, we are excited about and have confidence in management’s vision to create a multi-platform industrial company.

While the near-term macro backdrop is uncertain, over the long term we believe that global economic growth will generate higher demand in energy and that the industry will still be challenged to meet growing demand with new supply. We continue to see four trends in energy: 1) unconventional resource development, 2) increasing service intensity of finding, developing, and producing oil and gas, 3) deepwater and frontier exploration and development, and 4) global natural gas demand spurring additional development of gas resources around the world. The two largest absolute contributors within the Energy sector are Southern Union Co. and Brigham Exploration. Shares of Southern Union rose sharply on news of rival bids from Energy Transfer Equity L.P. and Williams Cos., and the company was ultimately sold to Energy Transfer Equity. Brigham Exploration, one of the largest operators in the Williston Basin, was also acquired this year by Statoil ASA, the Norwegian national oil company, driving the share prices higher.

The Fund’s investments in Health Care were the only meaningful detractors from relative performance during the year. Weakness in the sector was mainly attributable to underperformance of the Fund’s health care facilities holdings, led by hospital operator Community Health Systems, Inc. The company’s shares dropped in 2011 as a result of the company’s failed attempt to acquire Tenet Healthcare and the government’s investigation of its Medicare billing and hospital admissions practices.

Health Care performance for the year was weak due to continued high unemployment and low consumer confidence. For people with health insurance, employers are shifting more of the cost burden to employees, resulting in higher deductibles, co-payments and co-insurance. As a result, people are consuming less healthcare. We believe the winners will be healthcare companies that can reduce costs and enhance efficiency while improving patient outcomes and benefit from the aging of the population. For example, Edwards Lifesciences Corp. is a leading manufacturer of heart valves used in surgical and transcatheter heart-valve replacement. In early November, the company received regulatory approval for its transcatheter heart valve. The shares lost ground for the year, as it became clear that close government and medical association scrutiny, intended to ensure that physicians and medical centers are properly trained, will slow the introduction of these valves into surgical practice. We continue to have a positive view about the long-term global market potential for transcatheter valves and believe that Edwards will be a leader in the field for many years. The best performer in the sector was AMERIGROUP Corp., an HMO focused on people in government-sponsored programs. It increased significantly in 2011 as revenue is expected to grow more than 40% in 2012 on new business and an increased presence in New York, the result of a $1 billion Medicaid plan acquisition. We think AMERIGROUP has a significant growth opportunity in managed Medicaid as states seek ways to control their spending and budgets.

Strategy and Outlook

Although there are still U.S. fiscal issues and a somewhat dysfunctional government, we think the U.S. consumer has remained resilient and corporate America has remained strong. We think the balance sheets for the companies we own are solid, and businesses are equipped with ample capital to fund growth opportunities, make acquisitions, and/or return capital to shareholders. Though there is momentum at present, we think we are in for a period of modest general economic growth. Even in this environment, we believe the businesses in which we have

Management's Discussion of Fund Performance (Continued)

invested can grow earnings and accrete value. We do not believe this growth is reflected in the trading multiples, so we expect multiple expansions in the future when the focus of the markets returns to fundamentals.

We believe that current stock market valuations are compelling. U.S. interest rates remain near historically low levels, and the fixed income markets offer limited inflation-adjusted returns. There are important trends occurring in several industries that we believe offer growth opportunities over the next few years independent of normal business cycles. In our search for new companies, we seek businesses with visionary leaders that are separating themselves from competitors through efficient operations, strong balance sheets, unique assets or properties and, in many cases, innovative and game-changing technology.

Management's Discussion of Fund Performance (Continued)

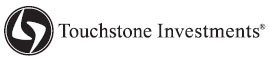

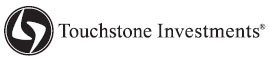

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Baron Small Cap Growth Fund and the Russell 2000® Growth Index

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on December 14, 1992.

Management's Discussion of Fund Performance (Continued)

Touchstone Core Bond Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy and Process

The Touchstone Core Bond Fund seeks to provide as high a level of current income as is consistent with the preservation of capital. Capital appreciation is a secondary goal. In deciding what securities to buy and sell for the Fund, the overall investment opportunities and risks in different sectors of the debt securities market are analyzed by focusing on maximizing total return and reducing volatility of the Fund’s portfolio. A disciplined sector allocation process is followed in order to build a broadly diversified portfolio of bonds.

Fund Performance and Market Overview

The total return of the Touchstone Core Bond Fund was 8.45% for the year ended December 31, 2011. The total return of the Barclays Capital U.S. Aggregate Bond Index was 7.84% for the same period.

Performance was primarily driven by a lower and flatter yield curve and volatility in the non-Treasury markets. Interest rates fell and the yield curve flattened during the past year, with long-term rates falling more than short-term. Economic growth disappointed expectations in early 2011 as many temporary factors negatively impacted the U.S. and sovereign concerns in the eurozone intensified. The Federal Reserve (the Fed) contributed to this drop in rates as it refined guidance by indicating it would keep short-term interest rates low for the next two years. In addition, near the end of the third quarter, the Fed announced the sale of short-term Treasuries and the purchase of long-term Treasuries in an effort to reduce long-term rates (or keep long-term rates low). The change in interest rates was a positive for the Fund’s performance, with the largest impact coming from the holdings of long-term Treasuries during the third quarter, while the flattening of the yield curve had a negative impact on performance. Opportunistic use of Treasury inflation protected securities (TIPS) also made a positive contribution to performance over the year.

Portfolio Review

Residential mortgage-backed securities (RMBS) underperformed in 2011, and the Fund’s underweight position in this sector was a slight positive for performance. Commercial mortgage-backed securities (CMBS) fared better, outperforming for the year. The Fund was overweight this sector during the entire year, which was a positive factor for performance. In addition, the security selection within the CMBS sector had a positive impact on performance.

Corporate bonds underperformed significantly in 2011 as risk aversion increased as the eurozone crisis intensified and added significant uncertainty to the economic outlook. The Financial sector performed the worst as the market feared that further weakness in the eurozone could negatively impact access to markets for U.S. and European financial institutions. The Fund’s weighting to the sector was neutral for much of the year; however, it was underweight the banking industry, which positively impacted performance. The High Yield sector underperformed during 2011, but the Fund’s allocation to High Yield was a positive factor due to tactical shifts made throughout the year and a positive impact from security selection. The allocation was reduced in the first quarter of 2011, and was increased slightly in the fourth quarter. The Fund continues to hold a position in the High Yield sector given the high level of defaults built in to High Yield prices and our outlook for modest economic growth.

Strategy and Outlook

In positioning the Fund for the coming year, we are mindful that one year ago investors were optimistic about the U.S. and global economy, but have since turned cautious in the wake of all that has transpired. In our opinion, markets are now priced for subdued U.S. growth, a mild recession in Europe, and a soft landing in

Management's Discussion of Fund Performance (Continued)

China. We believe these are reasonable expectations and they constitute the base case of our economic outlook. We are also cognizant of events that could alter the outlook materially, including the possibility of a financial crisis in Europe, a more protracted slowdown in China, and the threat of oil-supply disruptions in the Middle East. These developments are not priced into markets, and undoubtedly would provoke a flight to quality. On the positive side, we see increased signs that the U.S. economy has made steady progress adjusting to the 2008-09 financial crisis. While we are uncertain when the U.S. economy will accelerate, we suspect a sustained upturn may be closer than market participants currently anticipate, in which case risk assets would likely rally and long-term bond yields would surge. Given this outlook, we anticipate that short- and long-term interest rates are unlikely to change materially from current levels over the next several months, economic growth will continue at a sub-par pace (+2 percent), core inflation will remain low (1-2 percent) and economic conditions will be supportive of an overall overweight to non-Treasury sectors. On our part, we plan to position the Fund with interest rate risk close to that of the benchmark and continue to opportunistically invest in TIPS. We continue to view the U.S. Treasury and government-related sectors (including Agencies) as relatively unattractive on a long-term basis. We intend to maintain a neutral position versus the benchmark in investment-grade corporate bonds and maintain a significant overweight to the CMBS and High Yield sectors to take advantage of the yield these sectors offer.

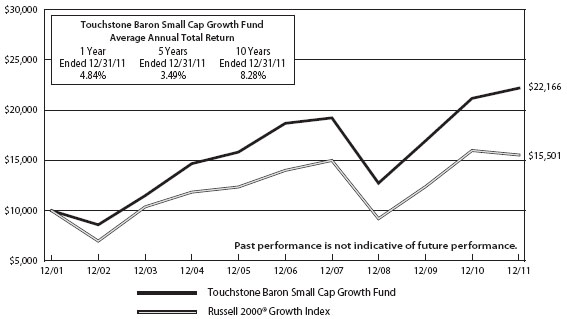

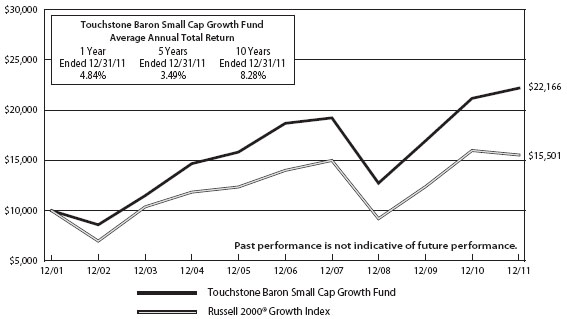

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Core Bond Fund and the Barclays Capital U.S. Aggregate Bond Index

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on January 1, 1999.

Management's Discussion of Fund Performance (Continued)

Touchstone High Yield Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy and Process

The Touchstone High Yield Fund seeks high current income and capital appreciation by primarily investing in non-investment grade securities. The Fund emphasizes the higher-quality segment of the high yield market. It utilizes a research process designed to maximize risk-adjusted returns by avoiding lower-rated securities.

Fund Performance and Market Overview

The total return of the Touchstone High Yield Fund was 6.08% for the year ended December 31, 2011. The total return of the BofA Merrill Lynch U.S. High Yield Cash Pay Index was 4.50% for the same period.

After a very volatile third calendar quarter with materially negative returns, the High Yield market rallied in the fourth calendar quarter.The difference in yield between Treasury securities and comparable high yield securities was 708 basis points at the end of the year, increasing over 170 basis points throughout the year. The Fund’s higher quality bias coupled with strong security selection allowed it to outperform the market.

Portfolio Review

Although the year began with a continuation of the two-year High Yield rally, significant volatility returned to the market mid-year. Concerns that the U.S. was going to fall back into a recession, the potential for higher default rates and considerable uncertainty surrounding developments in Europe all resulted in a significant increase in risk premiums in all risky asset classes. In this environment, higher quality BB-rated securities performed best while the lower quality CCC-rated securities had the worst performance. In fact, the total return of CCC-rated securities was actually negative, more than 580 basis points below the whole market. The Fund had significant contribution within the Energy sector, including considerable outperformance from Petrohawk Energy Corp., which was purchased by BHP Billiton Ltd. Additionally, Helix Energy Solutions Group Inc. was upgraded by the credit rating agencies and outperformed accordingly. Performance contributors also included Insight Communications Co. Inc., which announced its intent to be purchased by Time Warner Cable Inc. The Fund continues to benefit from the lack of exposure to Bank & Thrifts and Diversified Financials. Conversely, it was hurt by the lack of exposure to Ford Motor Company which began to attract interest from Investment Grade bond managers anticipating an upgrade by the rating agencies.

Strategy and Outlook

Looking back on the events of 2011, financial markets were dominated by two major developments: an end to the bull rally in global equities in spring that was followed by a period of market turbulence and a downward shift in the treasury yield curve that sent interest rates to new lows. These market moves, in turn, reflected a loss of confidence in economic and political leadership on both sides of the Atlantic. Problems in the U.S. were compounded by the spreading crisis in the eurozone, as yields on government debt surged not only for small countries in the periphery such as Greece and Portugal, but also for larger ones such as Italy and Spain. Just when it appeared the authorities had bought time by negotiating a 50 percent haircut on Greek debt, the European game-plan unraveled when the Greek government announced it would seek a political referendum. The upshot was that European officials for the first time acknowledged it was possible for a member of the eurozone to opt out, which raised new questions about the viability of the European Union (EU).

While some confidence in U.S. capital markets certainly returned in the fourth calendar quarter, considerable uncertainty remains. Market participants are now concerned with a variety of considerations including the ability of the U.S. to avoid a recession and the ability of political leaders on both sides of the Atlantic to avoid deadlock and resolve long-term fiscal problems. We feel that the United States can avoid a recession because

Management's Discussion of Fund Performance (Continued)

we do not see many of the typical excesses in the economy that tend to lead to a recession. Consumer spending is growing moderately and debt service burdens have been eased by record low interest rates. Spending on housing and autos – the most cyclically sensitive areas of the economy – continues to be abnormally low and do not appear to be near a bubble. While business investment spending has accelerated, it is far from excessive even though companies are enjoying record profits with very clean balance sheets. Finally, while unemployment does remain high, the trend in weekly jobless claims is decidedly lower. However, while the U.S. economy has regained momentum, conditions outside the U.S. (most notably in Europe and China) have deteriorated.

As for the ability of politicians to overcome deadlock and resolve long-term fiscal problems, we are less confident. With no prospect for growth on the horizon, it is difficult to be optimistic about Europe’s prospects, although we continue to believe European leaders will do what it takes to avoid a break-up of the eurozone. The most encouraging development is that the European Central Bank has stepped up its financing to the banking system, including initiating an unprecedented three-year refinancing operation at very low interest rates. As for the United States, there is no solution in sight due to gridlock between the two political parties. This already has resulted in a downgrade of U.S. Treasury debt by Standard and Poor’s, and the rating agencies could embark on a new round of downgrades if the impasse is not broken after the 2012 elections. In the meantime, failure to resolve the political dispute in the U.S. and the sovereign debt problems in the eurozone will continue to weigh on markets and contribute to unusually high volatility. In our opinion, markets are now priced for subdued U.S. growth, a mild recession in Europe, and a soft landing in China. We believe these are reasonable expectations, and they constitute the base case of our economic outlook.

While this outlook is hardly robust, it appears adequate to support the High Yield market. Even if economic growth turns negative, we expect any contraction to be shallow and short-lived. More importantly, default rates continue to decline and are expected to remain low, around 2 percent, throughout 2012. This level is down from 3.3 percent at year-end 2010 and significantly lower than 2009 peak of 13 percent. Strong corporate earnings, healthy balance sheets, considerable access to capital and reduced debt amortization all support this accommodative default forecast. Valuations are currently attractive in High Yield and the yields of comparable High Yield securities versus U.S. Treasury are comfortably above the long-term average. Additionally, current spreads are pricing in a default rate of 5 percent to 6 percent, a level that we do not think is in the cards.

The strength of Fort Washington’s High Yield strategy has historically been fundamental credit analysis with particular emphasis on avoiding problem credits. We believe this will continue to add value as negative credit events may have a material impact on returns in this challenging investment environment. We believe this core competency will provide considerable value to the Fund’s shareholders. We will continue to construct the Fund to be designed to exhibit less volatility than the broad market and seek to deliver attractive risk-adjusted returns. The Fund’s style is designed for performance over a full market cycle with focus on protecting principal in down markets, a style that we believe will outperform over the long-term.

Management's Discussion of Fund Performance (Continued)

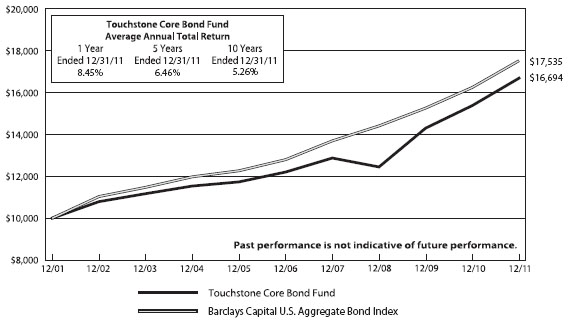

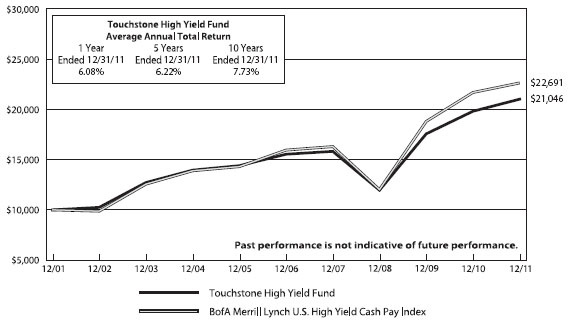

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone High Yield Fund and the BofA Merrill Lynch U.S. High Yield Cash Pay Index

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on May 1, 1999.

Management's Discussion of Fund Performance (Continued)

Touchstone Large Cap Core Equity Fund

Sub-Advised by Todd-Veredus Asset Management LLC.

Investment Philosophy and Process

TheTouchstone Large Cap Core Equity Fund primarily invests in common stocks of large capitalization companies. The Fund’s sub-advisor, Todd-Veredus Asset Management LLC (“Todd-Veredus”), selects stocks that it believes are attractively valued with active catalysts in place. Todd-Veredus uses a database of 4,000 stocks from which to choose the companies that will be selected for the Fund’s portfolio. As a result, the portfolio generally consists of 40-60 positions. Todd-Veredus’s selection process is expected to cause the Fund’s portfolio to have some of the following characteristics: attractive relative value, unrecognized earnings potential, above-average market capitalization, seasoned management and dominant industry position.

Fund Performance and Market Overview

The total return of the Touchstone Large Cap Core Equity Fund was 3.02% for the year ended December 31, 2011. The total return of the Russell 1000 Index was 1.50% for the same period.

For the full year, market return characteristics were very different than either the fourth quarter or almost any other quarter we have seen. The worst characteristics for the year were among the best for the fourth quarter. We believe this illustrates the volatile nature of 2011. Sentiment in the beginning of the year was that an economic recovery was at hand, and that feeling evaporated in the third quarter as uncertainty surrounding developments in Europe prompted a 20% decline during August. Late in the year, there was renewed optimism among investors that the economy was recovering, but unlike in the first part of the year, this optimism was more tempered, focusing on valuations instead of other economic indicators. For the full year, the higher quality, “show me” stocks with cash to distribute to shareholders, good profitability and visibility of earnings were the winners. Our style tends to emphasize stocks that possess these qualities.

Portfolio Review

The Fund’s emphasis on quality and valuation, as well as our economically sensitive emphasis during the August bear market, helped the Fund’s performance. Stock selection drove almost all of the Fund’s performance. Stock selection and an underweight in Financials as well as stock selection in Energy and Consumer Discretionary contributed to performance. The Fund’s stock selection in Information Technology, Industrials and Health Care detracted from performance.

The top five contributors to Fund performance during the year were Philip Morris International Inc., Ross Stores Inc., McDonalds Corp., United Health and Marathon Oil Corp. The Fund continues to hold all of these stocks. The five stocks detractors were AFLAC Inc., MetLife Inc.,Target Corp., Oracle Corp. and Broadcom Corp. The Fund’s leaders and laggards are from various sectors and are held by the Fund for many different reasons. It is difficult to pick one theme that caused either leadership or underperformance. We find this encouraging as it indicates to us we are in a stock-pickers market.

Economic statistics lead us to conclude that the recovery is likely to be durable and sustainable. To capitalize on this, the Fund is overweight the Consumer Discretionary and Industrials sectors. The Fund is underweight the Financials and Consumer Staples sectors. Regulations are likely to remain an issue for banks, although when investors become less concerned about European defaults, a strong rally could occur. We are looking within the Financials Sector for a potential increase in the sector’s weight. The Fund is not likely to increase the weight of Consumer Staples, as input costs remain an issue. We are examining Health Care for an increase it its weight, as the group consistently ranks among the best in our multi-factor ranking models.

Management's Discussion of Fund Performance (Continued)

Strategy and Outlook

We believe the U.S. equity market is setting the stage for better performance for the next two years. Other important trends that we see include a reinvigoration of the industrial base, a continuation in the growth of net exports, and a frugal consumer who is busy getting his or her fiscal house in order. All of these trends make a case for increased competition of U.S. businesses and consumers. On the negative side, there is still excess spending at the government level that will need to be addressed, though we suspect that some progress will be made on that front in the coming years. Investors are still somewhat cautious in their moves and only willing to buy where valuation looks good. We think that this will remain the case for the next few quarters as investors appear reluctant to fully embrace the idea that an economic recovery is sustainable. In summary, worldwide economies suffered headwinds last year. Markets have been volatile as a result of this, and that volatility may persist.

We believe that economies worldwide have decoupled. Emerging Markets should see renewed growth, especially as they focus on the consumption side of their economies. The U.S. should continue to see economic growth, but Europe is likely to suffer a self-imposed recession. We believe that markets worldwide will have a better year in 2012 than in 2011 if European problems do not migrate abroad and low rates force investors to consider income alternatives aside from traditional bonds.

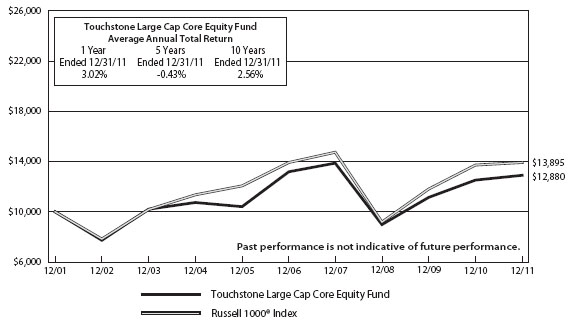

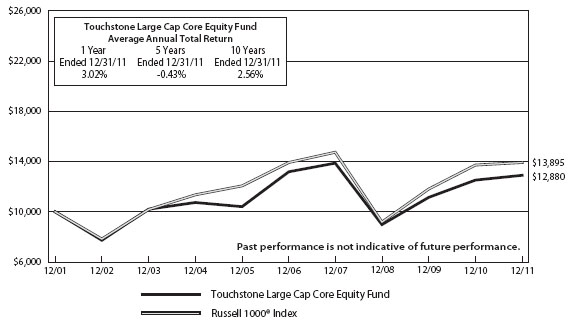

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Large Cap Core Equity Fund and the Russell 1000® Index

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on May 1, 1999.

Management's Discussion of Fund Performance (Continued)

Touchstone Mid Cap Growth Fund

Sub-Advised by TCW Investment Management Company, LLC (through February 22, 2011) and Westfield Capital Management Company, L.P.

Investment Philosophy and Process

The Touchstone Mid Cap Growth Fund seeks capital appreciation by investing primarily in stocks of domestic mid-cap companies that are believed to have a demonstrated record of achievement with excellent prospects for earnings growth over a 1- to 3-year period. Securities are chosen that are believed to be reasonably priced with high forecasted earnings potential after in-depth fundamental analysis of a company’s financial statements, interviews with management, assessment of a company’s operations and product development as well as consideration of the company’s industry category.

Fund Performance and Market Overview

The total return of the Touchstone Mid Cap Growth Fund was -11.33% for the year ended December 31, 2011. The total return of the Russell Midcap® Growth Index was -1.65% for the same period.

We found that companies demonstrating relative certainty and predictability performed the best during 2011. We, as a firm, tend to gravitate toward companies with improving operating margins and misunderstood franchises where we project meaningful improvement in free cash flow growth. In general terms, the stocks that worked best in 2011 were either income or expensive. Investors were willing to pay high price-to-earnings multiples for visible, protected growth. We generally do not buy slow, predictable growers with the highest multiple of earnings. These stocks led in 2011 and made new highs, while less expensive companies with prospective growth potential were punished due to fears of collapse of the European Union and uncertainty about the pace of global economic growth. We had little to no exposure to the best performing parts of the market in 2011 –like Consumer Staples, Utilities and REITs – because in most cases the leadership stocks would not meet Westfield’s growth-at-a-reasonable-price style. Additionally, we underestimated the strength of the U.S. consumer. In the face of market and media fear that the 2008 stock market decline was repeating itself, we held the contrarian belief that growth was merely moderating and that the domestic economy would reaccelerate, albeit modestly. While this was an accurate view, we miscalculated the impact on investor psychology and the degree of aversion to any uncertainty or risk.

The Fund’s portfolio generated relative gains within the Industrials, Consumer Staples, and Financials sectors; however, these sectors’positive impact was offset by stock-specific weakness in the Health Care, Energy, Materials, and Information Technology sectors.

Portfolio Review

The Industrials sector contributed to relative results. Particular strength was evident in the aerospace and defense and industrial machinery sub-industries.The Fund’s portfolio is now equal weight Industrials, with investments in some early-cycle areas like trucking and construction-related stocks. J.B. Hunt Transport Services Inc. and Stanley Black & Decker Inc., for example, were purchased in the last quarter of the year. J.B. Hunt is the premier intermodal (truck and rail combination) freight carrier in the U.S. In our opinion, this is the secular growth segment of the trucking market and the company’s early entry into the intermodal freight market has allowed it to lock in favorable contracts with its railroad partners. Stanley manufactures industrial tools, and one of the reasons why we like the company is its significant leverage to improving U.S. construction. Stanley’s 2010 merger with Black & Decker was wildly accretive and the company’s future revenues should benefit from the merger synergies, a strong pipeline of new products, and pricing offsetting inflation.

The Consumer Staples sector contributed to relative results, helped by investments within packaged foods and meats. Ralcorp Holdings Inc., a leading player in the private label food industry, surged in April after packaged

Management's Discussion of Fund Performance (Continued)

foods manufacturer ConAgra Foods, Inc. made a bid to acquire the company. Green Mountain Coffee Roasters Inc., which manufactures Keurig coffee brewers and single-serve ‘K-Cups’ coffee pods, was one of the top contributors to the Fund portfolio’s return. We continue to think that the company represents a unique, open-ended growth story; however, we exited our position in December, as we were concerned that the heightened investor scrutiny of this high-expectations stock would put pressure on its near-term returns.

The Health Care sector detracted from active results. Dendreon Corp., which developed and markets the first cancer vaccine, Provenge, was one major detractor. Our investment thesis was based on the commercialization of Provenge, which has been approved by the FDA for the treatment of prostate cancer and is shown to significantly increase survival in patients who have failed existing therapies. While the summer selloff was harsh for many biotechnology stocks, Dendreon was hit particularly hard after releasing weak data around the time of the August “risk-off” trade. Investors were disappointed by evidence of lingering insurance reimbursement concerns, the company’s difficulty identifying suitable patients, and supply chain issues. While we still believe Provenge has potential, investor sentiment is likely to be a headwind, and we consequently sold our shares.

The Information Technology sector was a source of relative underperformance. While there were quite a few strong performers in the sector, including Alliance Data Systems Corp., Alcatel-Lucent ADS, Brocade Communications Systems Inc. and F5 Networks Inc., one investment in the application software sub-industry, Longtop Financial Technologies Ltd., contributed to the majority of the performance shortfall. Longtop is a provider of software and IT services in China. A position was established in the stock in September 2010 after meeting with the CEO and CFO, based on our belief that Longtop would play a critical role in the financial modernization of Chinese banks. The company had the leading market position in China, relationships with four top Chinese banks, and was rapidly growing in the smaller bank and insurance markets. In May of 2011, the company announced the resignation of its auditor and the CFO as the result of identified falsity of the company’s financial records and other associated transgressions. Trading of the stock was halted, and the stock was eventually sold out of the Fund’s portfolio in August, when trading in the shares resumed.

Stocks within the Energy sector had a negative impact on relative returns. In 2011, we witnessed extreme volatility in the Energy space. Unrest in the Middle East in the early part of the year was a key factor, as Libya’s civil war alone decreased world oil production by 1.3 million barrels a day in an already tight capacity market. Brent Crude oil prices shot up to $125 a barrel in April, making three-year highs. As oil prices rose, Energy stocks were hit with market trepidations about multiple macro risks including the effect of commodity inflation on the economy. Weatherford International Ltd., in particular, was a disappointing holding for the Fund’s portfolio over the past year. Weatherford provides oilfield-related services globally, and its growth is correlated with a rising global Gross Domestic Product (GDP), particularly in emerging economies. Middle East and North Africa dislocations and weather across several regions had a significant negative impact onWeatherford’s international revenues and margins. The Fund portfolio’s holdings within the coal and consumable fuels sub-industry, which drastically lagged the index sector overall, also negatively impacted relative performance. Alpha Natural Resources Inc. underperformed due in part to the perceived risk associated with Alpha finalizing its Massey Energy Co. acquisition. While we remain bullish on the prospects for secular demand growth for coal given its importance to power generation in emerging markets, we sold our shares in the stock.

The Materials sector detracted from comparative performance. In general, late 2011 was a difficult time for the Materials sector. Slowing global demand and sovereign debt risks drove investors out of this high beta sector. We continue to like the group, focusing on companies facing structural shifts and long-term growth opportunities. Importantly, many of the portfolio’s holdings in the sector have been trading below the replacement value of their assets, providing an attractive risk/reward combination. Rare earth mineral company Molycorp Inc. was the portfolio’s weakest holding in the sector. The company reported disappointing second quarter production and lowered forward guidance. Focusing on the company-specific competitive advantages, we also underestimated

Management's Discussion of Fund Performance (Continued)

the pace and severity of price declines for rare earth oxides due to global growth deceleration and customer inventory drawdowns. As a result, we sold our shares.

Strategy and Outlook

Looking forward, we are likely to be in a slow growth, de-leveraging environment for some time where the best stewards of capital will prove to be the biggest winners. The best performing stocks in 2011 were high dividend payers. However, we do not intend to buy stocks just because of a dividend yield. We will focus on identifying leadership companies that are growing organically, buying back stock, and raising their returns on invested capital, because we are convinced these kinds of companies will outperform for the foreseeable future. Sustainable growth comes with accelerating free cash flow and Return on Invested Capital (ROIC) – factors that have gained greater importance in our analysis and in the current market. We have also developed a major new growth theme related to domestically-oriented replacement cycles in transportation, repair and maintenance, and housing. While we agree that rising middle classes in emerging markets will continue to drive demand for energy and high value manufactured goods, we think that companies benefiting from the domestic economy will generate better returns in the near-term.

Beta is a measure of the volatility of a portfolio relative to its benchmark.

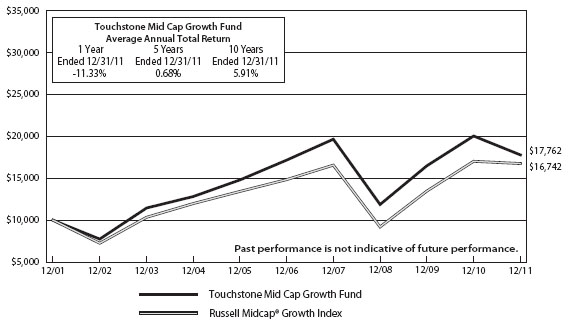

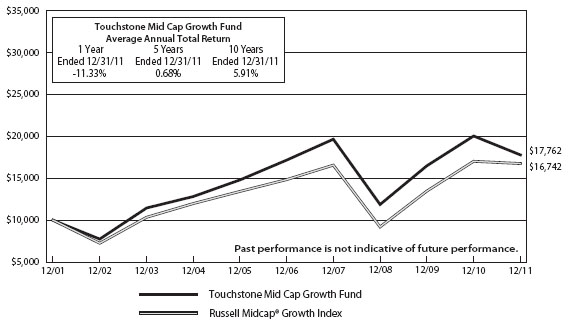

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Mid Cap Growth Fund and the Russell Midcap® Growth Index

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on November 21, 1994.

Management's Discussion of Fund Performance (Continued)

Touchstone Third Avenue Value Fund

Sub-Advised by Third Avenue Management, LLC

Investment Philosophy and Process

The Touchstone Third Avenue Value Fund primarily invests in common stocks of common stocks of well-financed companies (meaning companies believed to have high quality assets and a relative absence of liabilities) at a discount to what the Fund’s sub-advisor, Third Avenue Management LLC (“TAM”), believes is their intrinsic value. Third Avenue analyzes companies from the bottom up, focusing on business fundamentals such as competent management teams and strong long-term growth prospects.

Fund Performance and Market Overview

The total return of the Touchstone Third Avenue Value Fund was -15.31% for the year ended December 31, 2011. The total return of the Russell 3000 Value Index was -0.10% for same period.

In 2011, markets exhibited high instances of volatility and a high degree of correlation between stocks in various industries and geographies, as well as between asset classes. Both appear to have been the result of “fear trading” around several global and macroeconomic issues. At the start of the year, investors were confronted with the earthquake, tsunami and subsequent nuclear disaster in Japan. Concurrently, and picking up speed soon after, global markets were rocked by uncertainties resulting from the “Arab Spring” protests. At the start of August, Standard and Poor’s took the unprecedented step of downgrading U.S. Treasury debt. The Euro zone sovereign debt issues, which were years in the making, reached a series of pivotal, end of the year moments. Meanwhile, inflation-fighting tight monetary policies in India and China dampened some investor’s optimism about continued growing demand from the emerging markets.

Portfolio Review

2011 was marked by a massive divergence between the business performance and the stock performance of the companies in whose common stocks the Fund is invested. This has been most notable among its Hong Kong-based Real Estate and Investment Companies. 2011 would seem like a terrible year, if measured only by the common stock performance of these companies. However, the underlying businesses have actually performed well. Despite headwinds from government measures to curb residential housing prices in both Hong Kong and China, the companies have generated strong property development operating margins and continued net asset value (“NAV”) growth. These investments are Wheelock & Company Ltd., Henderson Land Development Ltd. and Cheung Kong Holdings Ltd. Each delivered strong business performance in 2011 and we believe that the stocks were victims of a macro trade away from China, which should reverse itself as the market takes notice of fundamentals.

The largest performance detractor was Wheelock & Co., a Hong Kong-based Real Estate and Investment Company. The stock price decline during the quarter appears to have been driven by tightening measures being imposed on the residential property markets in both Hong Kong and China. Nevertheless,Wheelock’s business fundamentals seem to remain healthy, particularly considering their larger exposure to the Hong Kong commercial real estate market, which remains strong.

Another significant detractor for the year was Henderson Land Development. Henderson delivered strong operating results this year and has a business that is quite diverse (it has a 40% ownership stake in Hong Kong & China Gas), although its market price did not reflect these strenghts.

The strongest performance contributors came from companies in the Energy sector, Bronco Drilling and Cimarex Energy Co. Bronco Drilling was sold to Chesapeake Energy Corp. for $315 million in June, at an attractive price. We sold Cimarex Energy as the stock had reached its full valuation. In all, we sold five positions during

Management's Discussion of Fund Performance (Continued)

the year, either on valuation or to allocate capital to higher conviction ideas. We added Consumer Discretionary clothing retailer American Eagle Outfitters Inc., Information Technology financial services firm Broadridge Financial Solutions, Inc. and Consumer Discretionary sports, media and entertainment company The Madison Square Garden Company.

Strategy and Outlook

The global economy appears to have entered another period of turbulence in late 2011 driven primarily by sovereign debt issues in Europe. Despite this challenging macro environment, the Fund’s holdings appear likely to continue generating attractive NAV growth over the next three to seven years, particularly if they can use their strong financial positions to make opportunistic investments as they have in the past. With discounts to NAV at historically wide levels, we believe that stock prices should, at a minimum, appreciate along with NAV growth over this period.

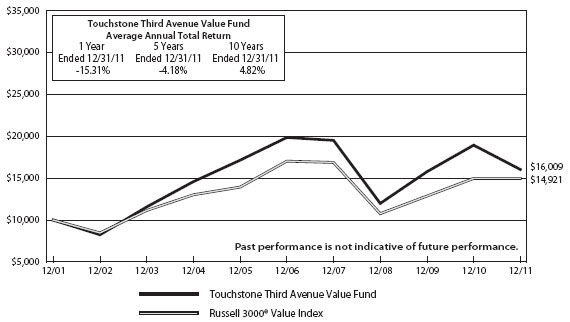

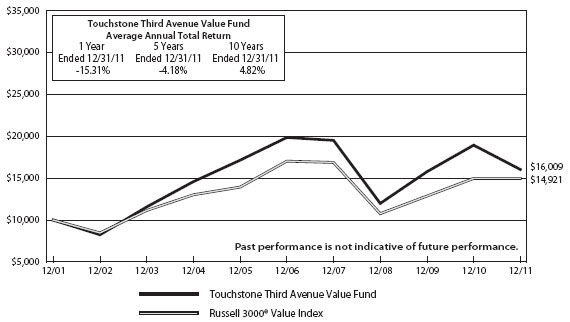

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Third Avenue Value Fund and the Russell 3000® Value Index

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on December 14, 1992.

Management's Discussion of Fund Performance (Continued)

Touchstone ETF Funds

Sub-Advised by Todd-Veredus Asset Management LLC.

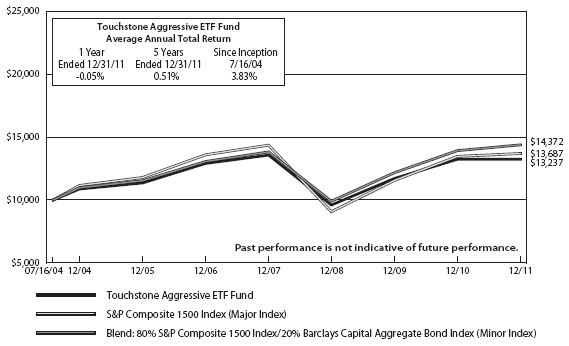

Touchstone Aggressive ETF Fund

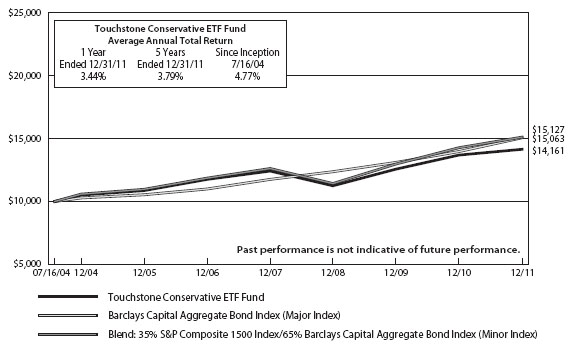

Touchstone Conservative ETF Fund

Touchstone Enhanced ETF Fund

Touchstone Moderate ETF Fund

Investment Philosophy and Process

Four Exchanged Traded Funds (ETFs) are available for investors seeking “lifestyle” products for their annuity holdings. Strategic options include the Conservative, Moderate and Aggressive ETF Funds. These funds use asset allocations of up to nine ETFs that should not change dramatically over time, with higher bond weights for the more conservative funds, and lower bond weights for the more aggressive funds. The fourth option, the Enhanced ETF Fund, employs tactical asset allocation in an effort to generate better returns.

Performance and Market Overview

Each of the Touchstone ETF Funds underperformed their respective benchmarks during the trailing twelve month period ended December 31, 2011 against a difficult backdrop with volatile markets. The Touchstone Conservative ETF Fund’s total return was 3.44% for the year ended December 31, 2011. The total return of the Barclays Capital U.S. Aggregate Bond Index was 7.84% for the same period. The Touchstone Moderate ETF Fund’s total return was 1.84%, the Touchstone Aggressive ETF Fund -0.05%, and the Touchstone Enhanced ETF Fund’s total return was -4.01% for the year ended December 31, 2011. The total return of the S&P Composite 1500 Index was 1.75% for the same period. The specific blended benchmark returns were 6.00% for the Conservative ETF Fund, 4.49% for the Moderate ETF Fund, 3.17% for the Aggressive ETF Fund, and 2.47% for the Enhanced ETF Fund.

The fourth quarter news was highlighted by the politics of the sovereign debt crisis in Europe. Lack of leadership by politicians and European central bankers caused uncertainty creating volatility. Last year was economically sound for the U.S. and Emerging Markets, though somewhat less so for Europe. Annual equity returns were poor across all markets as the fear of European financial contagion kept a lid on stocks. We suspect that 2012 will be a better year as Emerging Markets are starting to stimulate their economies. Emerging Markets tend to be leading indicators for developed markets, and lower rates generally lead to better stock markets.

Portfolio Review

The strategically-oriented Conservative, Moderate and Aggressive Funds’ asset allocations have favored mid-and smaller-capitalization indexes versus the larger ones. The Funds also maintained exposure to international stocks, though it was lowered slightly when the Fund’s portfolio allocations were rebalanced last May. Within the U.S. styles, the Funds favored value slightly more than growth. International indexes underperformed domestic indexes by a wide margin. The growth indexes generally outperformed their value counterparts for the full year. International weakness was the primary reason for the underperformance of the strategically-oriented funds versus their benchmarks for the year.

The Enhanced ETF Fund uses a formula to determine which areas to overweight or underweight. We recently rebalanced this account, and the areas the model overweighted were the growth and fixed income sectors. For the year, we have found that the relative strength methodology that the Fund uses has fallen out of favor. We believe this is a short-term phenomenon and should return to a normal pattern in the future.

Management's Discussion of Fund Performance (Continued)

Strategy and Outlook

There are a number of themes to be aware of that should play out over the coming year. Worldwide economies suffered headwinds last year. Markets have been volatile as a result of this, and that volatility may persist. We believe that economies worldwide have decoupled. Emerging Markets should see renewed growth, especially as they focus on the consumption side of their economies. The U.S. should continue to see economic growth, but Europe is likely to suffer a self-imposed recession. European financial problems may only slowly improve, as politicians try to avoid relinquishing fiscal control to the European Union. Small progress will be grudgingly achieved. Politics remains at the forefront, as countries representing 45% of worldwide GDP are slated to have elections this year.

We believe that markets worldwide will probably have a better year in 2012 than in 2011 if European problems do not migrate abroad, and if low rates force investors to consider income alternatives aside from traditional bonds.

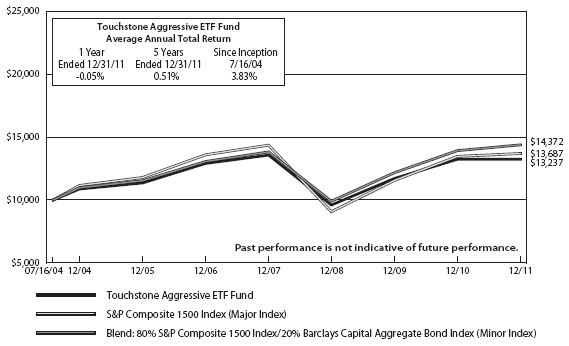

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Aggressive ETF Fund, the S&P Composite 1500 Index (Major Index)

and the Blend: 80% S&P Composite 1500 Index/20% Barclays Capital Aggregate Bond Index

(Minor Index)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

Management's Discussion of Fund Performance (Continued)

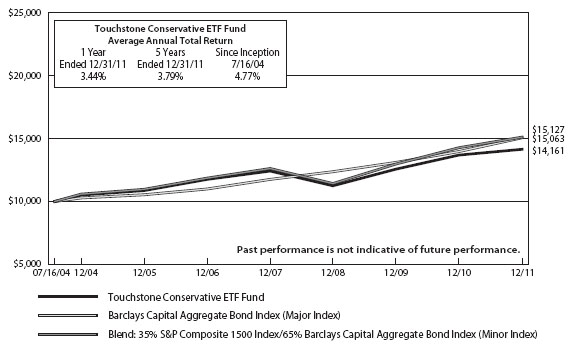

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Conservative ETF Fund, the Barclays Capital Aggregate Bond Index (Major Index)

and the Blend: 35% S&P Composite 1500 Index (Minor Index)/65% Barclays Capital Aggregate

Bond Index

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

Management's Discussion of Fund Performance (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Enhanced ETF Fund, the S&P Composite 1500 Index (Major Index)

and the Blend: 90% S&P Composite 1500 Index/10% Barclays Capital Aggregate Bond Index

(Minor Index)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

Management's Discussion of Fund Performance (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Moderate ETF Fund, the S&P Composite 1500 Index (Major Index)

and the Blend: 60% S&P Composite 1500 Index/40% Barclays Capital Aggregate Bond Index

(Minor Index)

Past performance is not indicative of future performance.

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The Fund commenced operations on July 16, 2004.

This page intentionally left blank.

Tabular Presentation of Portfolios of Investments (Unaudited)

December 31, 2011

| Touchstone Baron Small Cap Growth Fund | | |

| Sector Allocation | (% of Net Assets) | |

| Consumer Discretionary | 32.9 | % |

| Industrials | 14.6 | |

| Financials | 14.6 | |

| Health Care | 7.8 | |

| Information Technology | 7.5 | |

| Energy | 7.1 | |

| Consumer Staples | 4.9 | |

| Utilities | 3.9 | |

| Telecommunication Services | 1.6 | |

| Materials | 0.5 | |

| Investment Funds | 11.9 | |

| Other Assets/Liabilities (Net) | (7.3 | ) |

| Total | 100.0 | % |

| Touchstone High Yield Fund | | |

| Credit Quality* | (% of Net Assets) | |

| BBB | 0.6 | % |

| BB | 28.4 | |

| B | 64.7 | |

| CCC | 5.0 | |

| NR | 0.3 | |

| Other Assets/Liabilities (Net) | 1.0 | |

| Total | 100.0 | % |

| Touchstone Core Bond Fund | | |

| Credit Quality* | (% of Total Investments) | |

| AAA | 61.3 | % |

| AA | 3.3 | |

| A | 6.9 | |

| BBB | 12.3 | |

| BB | 4.8 | |

| B | 8.5 | |

| CCC | 2.1 | |

| CC | 0.4 | |

| C or Lower | 0.4 | |

| Total | 100.0 | % |

| Touchstone Large Cap Core Equity Fund | | |

| Sector Allocation | (% of Net Assets) | |

| Information Technology | 19.2 | % |

| Industrials | 13.5 | |

| Consumer Discretionary | 12.9 | |

| Financials | 12.6 | |

| Health Care | 11.6 | |

| Energy | 11.6 | |

| Consumer Staples | 7.3 | |

| Materials | 4.6 | |

| Utilities | 2.7 | |

| Telecommunication Services | 2.6 | |

| Investment Funds | 2.9 | |

| Other Assets/Liabilities (Net) | (1.5 | ) |

| Total | 100.0 | % |

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone Mid Cap Growth Fund | | |

| Sector Allocation | (% of Net Assets) | |

| Information Technology | 24.5 | % |

| Industrials | 15.3 | |

| Consumer Discretionary | 14.6 | |

| Energy | 13.6 | |

| Health Care | 11.0 | |

| Materials | 8.9 | |

| Financials | 7.0 | |

| Consumer Staples | 2.9 | |

| Telecommunication Services | 1.2 | |

| Other Assets/Liabilities (Net) | 1.0 | |

| Total | 100.0 | % |

| Touchstone Third Avenue Value Fund | | |

| Sector Allocation | (% of Net Assets) | |

| Financials | 43.3 | % |

| Energy | 14.7 | |

| Materials | 13.1 | |

| Consumer Discretionary | 11.7 | |

| Information Technology | 11.5 | |

| Health Care | 1.8 | |

| Investment Funds | 12.5 | |

| Other Assets/Liabilities (Net) | (8.6 | ) |

| Total | 100.0 | % |

| Touchstone Conservative ETF Fund | | |

| Sector Allocation | (% of Net Assets) | |

| Exchange Traded Funds | 98.6 | % |

| Investment Funds | 4.4 | |

| Other Assets/Liabilities (Net) | (3.0 | ) |

| Total | 100.0 | % |

| Touchstone Moderate ETF | | |

| Sector Allocation | (% of Net Assets) | |

| Exchange Traded Funds | 98.7 | % |

| Investment Funds | 6.0 | |

| Other Assets/Liabilities (Net) | (4.7 | ) |

| Total | 100.0 | % |

| Touchstone Money Market Fund | | |

| Credit Quality | (% of Total Investments) | |

| A-1/P-1/F-1 | 94.6 | % |

| FW1(NR) | 5.4 | |

| Total | 100.0 | % |

| Portfolio Allocation | (% of Net Assets) | |

| Variable Rate Demand Notes | 57.4 | % |

| Corporate Bonds | 12.7 | |

| Municipal Bonds | 11.8 | |

| U.S. Government Agency | | |

| Obligations | 11.6 | |

| Time Deposits | 2.2 | |

| Repurchase Agreement | 4.4 | |

| Other Assets/Liabiliaties (Net) | (0.1 | ) |

| Total | 100.0 | % |

| Touchstone Aggressive ETF Fund | | |

| Sector Allocation | (% of Net Assets) | |

| Exchange Traded Funds | 98.8 | % |

| Investment Funds | 12.8 | |

| Other Assets/Liabilities (Net) | (11.6 | ) |

| Total | 100.0 | % |

| Touchstone Enhanced ETF Fund | | |

| Sector Allocation | (% of Net Assets) | |

| Exchange Traded Funds | 98.9 | % |

| Investment Funds | 20.3 | |

| Other Assets/Liabilities (Net) | (19.2 | ) |

| Total | 100.0 | % |

* Source: Standard and Poors

Portfolio of Investments

Touchstone Baron Small Cap Growth Fund – December 31, 2011

| | | Shares | | | Market

Value | |

| | | | | | | | | |

| Common Stocks — 95.4% | | | | | | | | |

| | | | | | | | | |

| Consumer Discretionary — 32.9% | | | | | | | | |

| Ameristar Casinos, Inc. | | | 1,120 | | | $ | 19,365 | |

| Blue Nile, Inc.†* | | | 2,400 | | | | 98,112 | |

| Choice Hotels International, Inc. | | | 14,500 | | | | 551,725 | |

| DeVry, Inc. | | | 16,500 | | | | 634,590 | |

| Dick's Sporting Goods, Inc. | | | 23,000 | | | | 848,240 | |

| LKQ Corp.* | | | 16,000 | | | | 481,280 | |

| Lumber Liquidators Holdings, Inc.†* | | | 5,000 | | | | 88,300 | |

| Morningstar, Inc. | | | 6,500 | | | | 386,425 | |

| Panera Bread Co. - Class A* | | | 3,000 | | | | 424,350 | |

| Peet's Coffee & Tea, Inc.* | | | 9,000 | | | | 564,120 | |

| Penn National Gaming, Inc.* | | | 10,000 | | | | 380,700 | |

| Ralph Lauren Corp. | | | 4,500 | | | | 621,360 | |

| Strayer Education, Inc.† | | | 3,500 | | | | 340,165 | |

| Under Armour, Inc. - Class A* | | | 5,800 | | | | 416,382 | |

| Vail Resorts, Inc. | | | 11,500 | | | | 487,140 | |

| Wynn Resorts Ltd. | | | 1,359 | | | | 150,156 | |

| | | | | | | | 6,492,410 | |

| | | | | | | | | |

| Industrials — 14.6% | | | | | | | | |

| Aecom Technology Corp.* | | | 5,500 | | | | 113,135 | |

| Air Lease Corp.* | | | 2,922 | | | | 69,281 | |

| Colfax Corp.†* | | | 6,900 | | | | 196,512 | |

| Copart, Inc.* | | | 7,500 | | | | 359,175 | |

| CoStar Group, Inc.* | | | 5,700 | | | | 380,361 | |

| Generac Holdings, Inc.* | | | 15,000 | | | | 420,450 | |

| Genesee & Wyoming, Inc. - Class A* | | | 12,000 | | | | 726,960 | |

| Middleby Corp.* | | | 3,000 | | | | 282,120 | |

| Tetra Tech, Inc.* | | | 9,500 | | | | 205,105 | |

| Valmont Industries, Inc. | | | 1,500 | | | | 136,185 | |

| | | | | | | | 2,889,284 | |

| | | | | | | | | |

| Financials — 14.6% | | | | | | | | |

| Alexander's, Inc. REIT | | | 900 | | | | 333,027 | |

| Alexandria Real Estate Equities, Inc. REIT | | | 2,500 | | | | 172,425 | |

| Arch Capital Group Ltd. | | | 28,000 | | | | 1,042,440 | |

| Cohen & Steers, Inc.† | | | 7,423 | | | | 214,525 | |

| Douglas Emmett, Inc. REIT | | | 16,000 | | | | 291,840 | |

| Eaton Vance Corp. | | | 8,000 | | | | 189,120 | |

| Financial Engines, Inc.* | | | 1,490 | | | | 33,272 | |

| Green Dot Corp. - Class A†* | | | 990 | | | | 30,908 | |

| Jefferies Group, Inc.† | | | 5,500 | | | | 75,625 | |

| LaSalle Hotel Properties REIT | | | 3,500 | | | | 84,735 | |

| Manning & Napier, Inc.* | | | 8,120 | | | | 101,419 | |

| Primerica, Inc. | | | 13,000 | | | | 302,120 | |

| | | | | | | | 2,871,456 | |

| | | | | | | | | |

| Health Care — 7.8% | | | | | | | | |

| AMERIGROUP Corp.* | | | 10,500 | | | | 620,340 | |

| athenahealth, Inc.* | | | 1,200 | | | | 58,944 | |

| CFR Pharmaceuticals SA 144a ADR | | | 4,172 | | | | 98,065 | |

| Chemed Corp. | | | 1,477 | | | | 75,637 | |

| Community Health Systems, Inc.* | | | 12,205 | | | | 212,977 | |

| Edwards Lifesciences Corp* | | | 3,500 | | | | 247,450 | |

| Gen-Probe, Inc.* | | | 2,800 | | | | 165,536 | |

| IDEXX Laboratories, Inc.* | | | 800 | | | | 61,568 | |

| | | | | | | | 1,540,517 | |

| | | | | | | | | |

| Information Technology — 7.5% | | | | | | | | |

| Advent Software, Inc.* | | | 7,500 | | | | 182,700 | |

| Booz Allen-Hamilton Holding Corp.* | | | 8,649 | | | | 149,195 | |

| Cymer, Inc.* | | | 1,197 | | | | 59,563 | |

| MAXIMUS, Inc. | | | 6,000 | | | | 248,100 | |

| Pegasystems, Inc.† | | | 7,000 | | | | 205,800 | |

| RealPage, Inc.* | | | 8,500 | | | | 214,795 | |

| SS&C Technologies Holdings, Inc.* | | | 12,215 | | | | 220,603 | |

| Synchronoss Technologies, Inc.* | | | 2,500 | | | | 75,525 | |

| WebMD Health Corp.* | | | 3,500 | | | | 131,425 | |

| | | | | | | | 1,487,706 | |

| | | | | | | | | |

| Energy — 7.1% | | | | | | | | |

| CARBO Ceramics, Inc. | | | 3,800 | | | | 468,654 | |

| Denbury Resources, Inc.* | | | 5,700 | | | | 86,070 | |

| SEACOR Holdings, Inc.* | | | 2,500 | | | | 222,400 | |

| SM Energy Co. | | | 5,400 | | | | 394,740 | |

| Targa Resources Corp. | | | 5,500 | | | | 223,795 | |

| | | | | | | | 1,395,659 | |

| | | | | | | | | |

| Consumer Staples — 4.9% | | | | | | | | |

| Church & Dwight Co., Inc. | | | 8,000 | | | | 366,080 | |

| TreeHouse Foods, Inc.* | | | 6,000 | | | | 392,280 | |

| United Natural Foods, Inc.* | | | 5,000 | | | | 200,050 | |

| | | | | | | | 958,410 | |

| | | | | | | | | |

| Utilities — 3.9% | | | | | | | | |

| ITC Holdings Corp. | | | 10,000 | | | | 758,800 | |

| | | | | | | | | |

| Telecommunication Services — 1.6% | | | | | | | | |

| SBA Communications Corp. - Class A* | | | 7,513 | | | | 322,758 | |

| | | | | | | | | |

| Materials — 0.5% | | | | | | | | |

| Intrepid Potash, Inc.* | | | 4,500 | | | | 101,835 | |

| Total Common Stocks | | | | | | $ | 18,818,835 | |

| | | | | | | | | |

| Investment Funds — 11.9% | | | | | | | | |

| Invesco Liquid Assets Portfolio** | | | 1,353,441 | | | | 1,353,441 | |

| Touchstone Institutional Money Market | | | | | | | | |

| Fund^ | | | 995,365 | | | | 995,365 | |

| Total Investment Funds | | | | | | $ | 2,348,806 | |

| | | | | | | | | |

Total Investment Securities — 107.3% (Cost $13,078,815) | | | | | | $ | 21,167,641 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (7.3%) | | | | | | | (1,434,464 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 19,733,177 | |

| † | All or a portion of the security is on loan. The total value of the securites on loan as of December 31, 2011 was $1,326,521. |

| * | Non-income producing security. |

| ** | Represents collateral for securities loaned. |

Touchstone Baron Small Cap Growth Fund (Continued)

| ^ | Affiliated Fund, sub-advised by Fort Washington Investment Advisors, Inc. See Note 4 in Notes to Financial Statements. |

Portfolio Abbreviations:

ADR - American Depositary Receipt REIT - Real Estate Investment Trust

144a - This is a restricted security that was sold in a transaction exempt from Rule 144a of the Securities Act of 1933. This security may be sold in transactions exempt from registration, normally to qualified institutional buyers. At December 31, 2011, these securities were valued at $98,065 or 0.5% of net assets. These securities were deemed liquid pursuant to procedures approved by the Board of Trustees.

Other Information:

The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the security valuation section in the accompanying notes to financial statements.

Valuation inputs at Reporting Date:

| Description | | Level 1 | | | Level 2 | | | Level 3 | | | Total |

| Common Stocks | | $ | 18,818,835 | | | $ | — | | | $ | — | | | $ | 18,818,835 |

| Investment Funds | | | 2,348,806 | | | | — | | | | — | | | | 2,348,806 |

| | | | | | | | | | | | | | | $ | 21,167,641 |

See accompanying notes to financial statements.

Portfolio of Investments

Touchstone Core Bond Fund – December 31, 2011

Principal

Amount | | | | | Market

Value | |

| | | | | | | | | |

| | | | | Corporate Bonds — 31.8% | | | | |

| | | | | | | | | |

| | | | | Financials — 7.3% | | | | |

| $ | 250,000 | | | Bank of America Corp. MTN,

5.000%, 5/13/21 | | $ | 227,709 | |

| | 200,000 | | | Brandywine Operating Partnership LP,

5.400%, 11/1/14 | | | 206,361 | |

| | 290,000 | | | Caterpillar Financial Services Corp.

MTN, 5.450%, 4/15/18 | | | 339,005 | |

| | 120,000 | | | CIT Group, Inc., 144a, 7.000%, 5/2/16 | | | 119,850 | |

| | 10,000 | | | CIT Group, Inc., 144a, 7.000%, 5/2/17 | | | 9,988 | |

| | 170,000 | | | Citigroup, Inc., 5.500%, 4/11/13 | | | 173,557 | |

| | 250,000 | | | Credit Suisse New York MTN,

4.375%, 8/5/20 | | | 245,118 | |

| | 75,000 | | | EDP Finance BV, 144a, 6.000%, 2/2/18 | | | 63,089 | |

| | 100,000 | | | Ford Motor Credit Co. LLC,

5.875%, 8/2/21 | | | 104,221 | |

| | 350,000 | | | General Electric Capital Corp. MTN,

5.625%, 5/1/18 | | | 392,001 | |

| | 200,000 | | | Goldman Sachs Group, Inc.,

7.500%, 2/15/19 | | | 220,882 | |

| | 305,000 | | | Health Care REIT, Inc., 6.125%, 4/15/20 | | | 316,015 | |

| | 260,000 | | | HSBC Bank PLC, 144a, 3.100%, 5/24/16 | | | 260,015 | |

| | 300,000 | | | JPMorgan Chase & Co.,

4.250%, 10/15/20 | | | 302,107 | |

| | 16,000 | | | Liberty Mutual Group, Inc., 144a, 10.750%, 6/15/58(A) | | | 20,080 | |

| | 40,000 | | | MetLife, Inc., 10.750%, 8/1/39 | | | 52,800 | |

| | 250,000 | | | Morgan Stanley MTN, 4.100%, 1/26/15 | | | 237,302 | |

| | 26,000 | | | MPT Operating Partnership LP/MPT

Finance Corp., 6.875%, 5/1/21 | | | 25,772 | |

| | 43,000 | | | Omega Healthcare Investors, Inc.,

6.750%, 10/15/22 | | | 43,215 | |

| | 26,000 | | | PHH Corp., 9.250%, 3/1/16 | | | 24,700 | |

| | 245,000 | | | Teachers Insurance & Annuity

Association of America, 144a,

6.850%, 12/16/39 | | | 314,433 | |

| | 275,000 | | | WCI Finance LLC / WEA Finance LLC,

144a, 5.700%, 10/1/16 | | | 294,525 | |

| | | | | | | | 3,992,745 | |

| | | | | | | | | |

| | | | | Consumer Discretionary — 5.8% | | | | |

| | 40,000 | | | ACE Hardware Corp., 144a,

9.125%, 6/1/16 | | | 42,400 | |

| | 19,000 | | | AMC Networks, Inc., 144a,

7.750%, 7/15/21 | | | 20,662 | |

| | 37,000 | | | CCO Holdings LLC / CCO Holdings

Capital Corp., 7.000%, 1/15/19 | | | 38,572 | |

| | 15,000 | | | CCO Holdings LLC / CCO Holdings

Capital Corp., 7.875%, 4/30/18 | | | 15,994 | |

| | 60,000 | | | Cequel Communications Holdings I

LLC and Cequel Capital Corp., 144a,

8.625%, 11/15/17 | | | 63,600 | |

| | 32,000 | | | Chrysler Group LLC/CG Co-Issuer, Inc.,

144a, 8.250%, 6/15/21 | | | 29,120 | |

| | 5,000 | | | Clear Channel Worldwide Holdings,

Inc., 9.250%, 12/15/17 | | | 5,400 | |

| | 295,000 | | | Comcast Corp., 5.700%, 7/1/19 | | | 342,227 | |

| | 24,000 | | | Cooper-Standard Automotive, Inc.,

8.500%, 5/1/18 | | | 25,110 | |

| | 50,000 | | | CSC Holdings LLC, 8.625%, 2/15/19 | | | 57,625 | |

| | 18,000 | | | DISH DBS Corp., 7.875%, 9/1/19 | | | 20,340 | |

| | 40,000 | | | Entravision Communications Corp.,

8.750%, 8/1/17 | | | 39,200 | |

| | 100,000 | | | Equinox Holdings, Inc., 144a,

9.500%, 2/1/16 | | | 102,750 | |

| | 19,000 | | | Exide Technologies, 8.625%, 2/1/18 | | | 14,630 | |

| | 24,000 | | | Fisher Communications, Inc.,

8.625%, 9/15/14 | | | 24,420 | |

| | 23,000 | | | Goodyear Tire & Rubber Co.,

8.750%, 8/15/20 | | | 25,358 | |

| | 290,000 | | | Home Depot, Inc., 5.950%, 4/1/41 | | | 374,156 | |

| | 27,000 | | | Icon Health & Fitness, 144a,

11.875%, 10/15/16 | | | 21,938 | |

| | 30,000 | | | Insight Communications Co., Inc.,

144a, 9.375%, 7/15/18 | | | 34,275 | |

| | 28,000 | | | Intelsat Jackson Holdings SA, 144a,

7.250%, 4/1/19 | | | 28,420 | |

| | 18,000 | | | International Automotive

Components Group SL, 144a,

9.125%, 6/1/18 | | | 16,110 | |

| | 125,000 | | | Jarden Corp., 7.500%, 5/1/17 | | | 132,500 | |

| | 51,000 | | | JBS USA LLC / JBS USA Finance, Inc.,

144a, 7.250%, 6/1/21 | | | 47,558 | |

| | 57,000 | | | Libbey Glass, Inc., 10.000%, 2/15/15 | | | 60,990 | |

| | 140,000 | | | Macy's Retail Holdings, Inc.,

5.350%, 3/15/12 | | | 140,960 | |

| | 41,000 | | | Meritage Homes Corp.,

7.150%, 4/15/20 | | | 39,360 | |

| | 275,000 | | | News America, Inc., 6.900%, 3/1/19 | | | 323,206 | |

| | 6,000 | | | Pulte Group, Inc., 6.375%, 5/15/33 | | | 4,155 | |

| | 80,000 | | | Service Corp. International/US,

8.000%, 11/15/21 | | | 89,200 | |

| | 61,000 | | | Simmons Bedding Co., 144a,

11.250%, 7/15/15 | | | 62,982 | |

| | 40,000 | | | Stonemor Operating LLC /

Cornerstone Family Services of WV

/ Osiris Holding, 10.250%, 12/1/17 | | | 37,300 | |

| | 12,000 | | | Tenneco, Inc., 6.875%, 12/15/20 | | | 12,300 | |

| | 31,000 | | | Tenneco., Inc., 7.750%, 8/15/18 | | | 32,860 | |

| | 300,000 | | | Time Warner Cable, Inc.,

4.125%, 2/15/21 | | | 308,070 | |

| | 19,000 | | | Tomkins LLC / Tomkins, Inc.,

9.000%, 10/1/18 | | | 21,066 | |

| | 24,000 | | | Tower Automotive Holdings USA LLC

/ TA Holdings Finance, Inc., 144a,

10.625%, 9/1/17 | | | 24,120 | |

| | 225,000 | | | Viacom, Inc., 6.250%, 4/30/16 | | | 261,177 | |

| | 110,000 | | | Visteon Corp., 144a, 6.750%, 4/15/19 | | | 109,725 | |

| | 100,000 | | | Wyndham Worldwide Corp.,

7.375%, 3/1/20 | | | 114,137 | |

| | | | | | | | 3,163,973 | |

Touchstone Core Bond Fund (Continued)

Principal

Amount | | | | | Market

Value | |

| | | | | | | | | |

| | | | | Corporate Bonds — 31.8% (Continued) | | | | |

| | | | | | | | | |

| | | | | Energy — 4.8% | | | | |

$

| 50,000 | | | Atlas Pipeline Partners LP,

8.750%, 6/15/18 | | $ | 52,500 | |

| | 18,000 | | | Basic Energy Services, Inc.,

7.125%, 4/15/16 | | | 18,045 | |

| | 217,000 | | | Basic Energy Services, Inc.,

7.750%, 2/15/19 | | | 218,628 | |

| | 112,000 | | | Chesapeake Energy Corp.,

6.625%, 8/15/20 | | | 120,120 | |

| | 10,000 | | | Chesapeake Energy Corp.,

7.250%, 12/15/18 | | | 11,050 | |

| | 30,000 | | | Cloud Peak Energy Resources LLC /