UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | | 811-08416 | |

| Touchstone Variable Series Trust |

| (Exact name of registrant as specified in charter) |

303 Broadway, Suite 1100

| Cincinnati, Ohio 45202-4203 |

| (Address of principal executive offices) (Zip code) |

Jill T. McGruder

303 Broadway, Suite 1100

| Cincinnati, Ohio 45202-4203 |

| (Name and address of agent for service) |

Registrant's telephone number, including area code: 800-638-8194

Date of fiscal year end: December 31

Date of reporting period: December 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

December 31, 2014

Annual Report

Touchstone Variable Series Trust

Touchstone Active Bond Fund

Touchstone Baron Small Cap Growth Fund

Touchstone High Yield Fund

Touchstone Large Cap Core Equity Fund

Touchstone Mid Cap Growth Fund

Touchstone Money Market Fund

Touchstone Third Avenue Value Fund

Touchstone Aggressive ETF Fund

Touchstone Conservative ETF Fund

Touchstone Moderate ETF Fund

Table of Contents

| | Page | |

| Letter from the President | 3 | |

| Management’s Discussion of Fund Performance (Unaudited) | 4 - 27 | |

| Tabular Presentation of Portfolios of Investments (Unaudited) | 28 - 29 | |

| Portfolio of Investments | | |

| Touchstone Active Bond Fund | 30 | |

| Touchstone Baron Small Cap Growth Fund | 35 | |

| Touchstone High Yield Fund | 37 | |

| Touchstone Large Cap Core Equity Fund | 42 | |

| Touchstone Mid Cap Growth Fund | 44 | |

| Touchstone Money Market Fund | 46 | |

| Touchstone Third Avenue Value Fund | 49 | |

| Touchstone Aggressive ETF Fund | 51 | |

| Touchstone Conservative ETF Fund | 52 | |

| Touchstone Moderate ETF Fund | 53 | |

| Statements of Assets and Liabilities | 54 - 55 | |

| Statements of Operations | 56 - 57 | |

| Statements of Changes in Net Assets | 58 - 61 | |

| Financial Highlights | 62 - 66 | |

| Notes to Financial Statements | 67 - 80 | |

| Report of Independent Registered Public Accounting Firm | 81 | |

| Other Items (Unaudited) | 82 - 90 | |

| Management of the Trust (Unaudited) | 91 - 93 | |

| Privacy Protection Policy | 95 | |

This report identifies the Funds’ investments on December 31, 2014. These holdings are subject to change. Not all investments in each Fund performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

Letter from the President

Dear Shareholder:

We are pleased to provide you with the Touchstone Variable Series Trust Annual Report. Inside you will find key financial information, as well as manager commentaries for the Funds, for the twelve months ended December 31, 2014.

After struggling through an unusually harsh winter, the U.S. economy generated strong growth during 2014. This economic growth and an improving labor market supported the U.S. Federal Reserve Board’s actions to discontinue its Quantitative Easing program. Globally, economic weakness and lower-than-expected inflation pushed central banks outside the U.S. to further loosen monetary policy in an effort to stimulate their economies. This divergence in economic growth, monetary policy, and expected interest rate paths led to a significant appreciation of the dollar.

Equity markets posted solid gains in 2014. Looking across the market capitalization spectrum, smaller- and mid-capitalization company stocks experienced greater volatility and lower returns than their large capitalization counterparts. Outside the U.S., developed and emerging market equities suffered losses as a result of the strong appreciation in the U.S. dollar.

The bond market also performed well in 2014. As yields on intermediate and long-term U.S. Treasuries declined, investment grade corporate bonds benefited from the tailwind of falling interest rates. While high yield securities also generated positive returns, the gains were limited after a lengthy period of strong performance. Non-U.S. fixed income securities faced the same currency headwinds as non-U.S. equities and recorded moderate losses during the year.

After more than five years of robust performance from U.S. stocks and bonds, we continue to believe that diversification is essential to balancing risk and return. We recommend that you work with your financial professional to employ a sound asset allocation strategy to help keep your financial strategy on course. We also believe that it is important to maintain a long-term approach to gain the full potential benefits of investing.

Touchstone is committed to helping investors achieve their financial goals by providing access to a distinctive selection of institutional asset managers who are known and respected for proficiency in their specific areas of expertise.

We greatly appreciate your continued support. Thank you for including Touchstone as part of your investment plan.

Sincerely,

Jill T. McGruder

President

Touchstone Variable Series Trust

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Active Bond Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone Active Bond Fund seeks to provide as high a level of current income as is consistent with the preservation of capital. Capital appreciation is a secondary goal. In deciding what securities to buy and sell for the Fund, the overall investment opportunities and risks in different sectors of the debt securities market are analyzed by focusing on maximizing total return and reducing volatility of the Fund’s portfolio. A disciplined sector allocation process is followed in order to build a broadly diversified portfolio of bonds.

Fund Performance

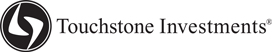

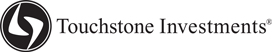

The Touchstone Active Bond Fund underperformed its benchmark, the Barclays U.S. Aggregate Bond Index, for the 12-month period ending December 31, 2014. The Fund’s total return was 3.82 percent, while the total return of the benchmark was 5.97 percent.

Market Environment

Over the past year, financial markets were influenced by a divergence in economic performance between the U.S., which registered solid growth, and the eurozone and Japan which were weak. This reinforced expectations that policymakers in the U.S. could begin tightening monetary policies by mid-2015, while the European Central Bank and Bank of Japan would keep monetary policies accommodative for the foreseeable future. Late in 2014, energy commodities fell by nearly 50%, creating significant uncertainty as to the strength of the global economy and further exposing persistent disinflationary forces.

Portfolio Review

The Fund’s underperformance for the year was driven partly by its defensive position in terms of interest rate risk, primarily by under weighting longer-maturity bonds. The Treasury yield curve flattened over the past year, with short-term yields rising modestly and long-term yields falling while prices increased. At a security level, the Fund’s allocations to Treasury Inflation Protected Securities (“TIPS”), High Yield securities and other risk sectors detracted from performance.

TIPS detracted from performance during the year as inflation expectations declined significantly, which accelerated in the fourth quarter due to falling energy prices and renewed global economic concerns. Credit sectors, investment grade and high yield, underperformed Treasuries in 2014, with the majority of the weakness occurring in the fourth quarter. The Fund was generally overweight credit during the year and these allocations modestly detracted from performance. The Fund’s High Yield allocation remained relatively unchanged.

An allocation to preferred stock was added to the Fund. The securities were primarily focused in financial institutions. We believe that Bank/Finance credit quality continued to improve.

Outlook

In our view, the greatest potential will likely be a result of the global factors that have been driving markets over the past few months. The sharp decline in the price of energy commodities has created uncertainty in the markets and will likely continue to drive volatility in spread sectors. Additionally, central bank policy will be on divergent paths in 2015, with the U.S. Federal Reserve Board (“Fed”) expected to begin raising interest rates, while central banks in Europe, Japan and China are expected to add stimulus in 2015. We believe this could likely create volatility and investment opportunities.

Uncertain global economic growth and disinflationary forces represent the greatest concern going forward, in our view. As noted above, there is divergence between the U.S. economy and many other global economies,

Management’s Discussion of Fund Performance (Unaudited) (Continued)

resulting in differing central bank policies. Many economies are experiencing significant disinflationary forces, which declining energy prices may magnify. If central banks are not able to overcome these forces and significantly reduce the probability of persistent low inflation or deflation, the resulting market impact could represent a significant risk. Given our outlook for rising interest rates, returns in the fixed income market, including the Fund, will continue to be challenging over the near- and medium-term. The return of the Fund will largely be contained to the yield of the Fund over the next several quarters.

Interest rates are at risk to rise if labor market conditions and economic growth continue along recent trends and inflation moves closer to the Fed’s two percent target. If these conditions are met, we expect the Fed will begin raising interest rates in mid-2015 which will put upward pressure on interest rates.

Recent inflation data has been somewhat lower than expected and market-based inflation expectations have declined materially. If sustained, these factors may cause the Fed to delay rate hikes. Moreover, increases in long-term interest rates may be contained if inflation or inflation expectations do not rise. Generally, continued strong economic growth and supportive financial conditions should support risk assets into 2015. We have positioned the Fund to maintain a modestly defensive bias in terms of interest rate exposure relative to the benchmark, but will actively trade securities to capture short-term opportunities. We will maintain an overweight to the TIPS sector as we believe it offers long-term value at current valuations as well as an overweight to risk assets, including investment grade corporate bonds and high yield corporate bonds.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Active Bond Fund and the Barclays U.S. Aggregate Bond Index

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was January 1, 1999.

Note to Chart

The Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Baron Small Cap Growth Fund

Sub-Advised by BAMCO, Inc.

Investment Philosophy

The Touchstone Baron Small Cap Growth Fund primarily invests in common stocks of small-sized growth companies. The Fund’s sub-advisor, BAMCO, Inc. (“BAMCO”), seeks securities that it believes have (1) favorable price to value characteristics, are well managed, have significant long-term growth prospects and have significant barriers to competition; and (2) the potential to increase in value at least 100 percent over the next four or five years. Securities are selected for their capital appreciation potential and investment income is not a consideration in BAMCO’s stock selection process.

Fund Performance

The Touchstone Baron Small Cap Growth Fund underperformed its benchmark, the Russell 2000® Growth Index, for the 12-month period ended December 31, 2014. The Fund’s total return was 3.85 percent while the total return of the benchmark was 5.60 percent.

Market Environment

Domestic economic news in 2014 was largely positive for the market. After a weak first quarter, in part due to an unusually harsh winter, the U.S. gross domestic product (“GDP”) picked up speed over the rest of the year. Corporate earnings reports were generally positive, U.S. manufacturing maintained its growth path, the housing market showed further signs of recovery and unemployment continued to fall.

While the domestic economy grew steadily stronger over the course of the year, the European economy stalled. Investors fretted over whether the European Central Bank (“ECB”) would undertake full-blown quantitative easing (“QE”) to head off eurozone-wide deflation. Elsewhere, slower-than-expected growth in China and Brazil pressured emerging markets. Russia’s economy also stagnated, weighed down by Western sanctions and lower oil prices later in the year. Though market volatility in 2014 was exacerbated by a series of geopolitical crises, the market quickly recovered the losses generated by investor reaction to each of these events.

The freefall in oil prices dominated business headlines in the last months of the year. Oil prices fell almost 25 percent on average in the fourth quarter, driven down by slower global demand growth and rising oversupply. The price of crude oil dropped to $54 per barrel as of year-end, down 50 percent from its June high and the lowest level since September 2009.

Portfolio Review

Positions in the Energy, Utilities and Materials sectors contributed to the Fund’s relative returns in 2014, while the Health Care, Industrials and Information Technology sectors detracted from relative performance.

The Fund benefited from its exposure within the Energy sector, which is primarily concentrated in Storage & Transportation companies, an industry that is less sensitive to oil price fluctuations. Despite the challenging second half of the year for the Energy sector overall, the Fund holdings managed a modest gain and contributed to relative performance. The largest relative individual contributors in the Energy sector were Sunoco LP and Targa Resources Corp. Sunoco LP (formerly Susser Petroleum Partners LP), a wholesale distributor of motor fuels in Texas, rose after Energy Transfer Partners LP, bought a Sunoco affiliate and announced plans to make Sunoco its home for its retail and gas distribution assets. Targa Resources Corp. benefited from the company’s continued execution on its growth projects and increases to its quarterly and annual guidance.

ITC Holdings Corp. contributed to performance in the Utilities sector. ITC Holdings Corp. is the nation’s largest independent transmission company and benefited from low interest rates and investor demand for the

Management’s Discussion of Fund Performance (Unaudited) (Continued)

comparative safety of Utilities stocks. The key components of our investment thesis – reliability and connection of new electricity generation (including renewables) – remained intact, and we believe ITC is well positioned to benefit.

The Fund had minimal exposure to the Materials sector during the year, which contributed to relative returns as the benchmark generated negative returns in that sector. Outperformance of the only Materials holding, quartz countertop manufacturer CaesarStone Sdot-Yam Ltd., helped relative performance within the sector. CaesarStone outperformed on reports of better-than-expected results and raises in full-year earnings guidance.

Though the Fund’s Health Care holdings produced positive returns during 2014, the Fund was underweight the sector. This lack of exposure to the strong performance of the Health Care sector detracted from returns. The Fund’s performance within the sector was buoyed by the strong performance of Community Health Systems, Inc. (“CHS”) and CFR Pharmaceuticals SA. Shares of the U.S. hospital operator Community Health Systems benefited from higher utilization, an improved payer mix stemming from health care reform and the improving domestic economy. Additionally, CHS acquired Health Management Associates (“HMA”) during 2014. The integration with HMA is going well, and we believe synergies will ultimately exceed management’s initial guidance. Latin American generic drug company CFR Pharmaceuticals experienced gains in May on news that Abbott Laboratories was acquiring CFR.

Performance of the Fund’s Industrials sector holdings was mixed, but poor performance from several investments, including Generac Holdings, Inc. and Colfax Corporation, outweighed gains from other Industrials holdings. Generac, a standby generator manufacturer, fell in 2014 over investor concerns that the current performance of the residential business was not sustainable. Weak spending by telecom customers and below-normal storm activity caused Generac to cut earnings guidance toward year-end. However, our investment thesis remains intact, as we believe the market for standby generators is underpenetrated (only 3 percent of U.S. homes) and Generac will be able to leverage its significant market share to grow its business. Industrial machinery company Colfax fell in 2014 as the company missed earnings and lowered guidance due to execution issues in its fluid handling segment. We believe Colfax will use its solid business system to improve operations at acquired companies, generating shareholder value over time.

Outlook

We think oil prices may remain relatively low for an extended period and, in our view, the steep decline in oil prices is a positive for the U.S. economy. The decrease in oil prices is saving the U.S. economy roughly $365 billion per year, a figure that translates to $1,000 savings per household, per year. Money not spent on oil and gas can be spent elsewhere. We believe energy-intensive manufacturers and other businesses will have lower energy costs, resulting in higher cash flow, and consumers will have more disposable income to spend on goods and services.

Energy investments represent less than five percent of the Fund’s portfolio, and we are not making significant changes to our overall investment approach in this new environment of cheap oil. We take a long-term view to our investments, investing in companies with significant growth opportunities, exceptional management and a strong balance sheet, at what we believe are attractive valuations. We have employed this approach with great success for more than 30 years, by looking through oil price and market fluctuations that can impact stock prices in the near-term in order to see the long-term opportunities a business presents.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Baron Small Cap Growth Fund and the Russell 2000® Growth Index

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was December 14, 1992.

Note to Chart

The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone High Yield Fund

Sub-Advised by Fort Washington Investment Advisors, Inc.

Investment Philosophy

The Touchstone High Yield Fund seeks high current income and capital appreciation by primarily investing in non-investment grade securities. The Fund emphasizes the higher-quality segment of the high yield market. It utilizes a research process designed to maximize risk-adjusted returns by avoiding lower-rated securities.

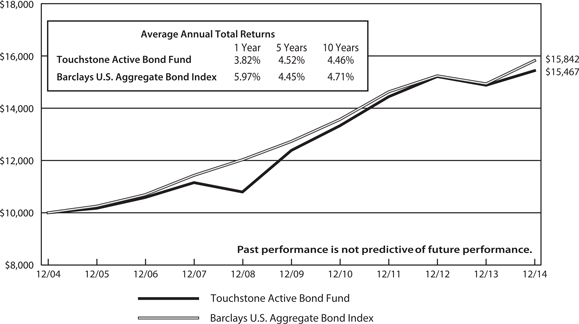

Fund Performance

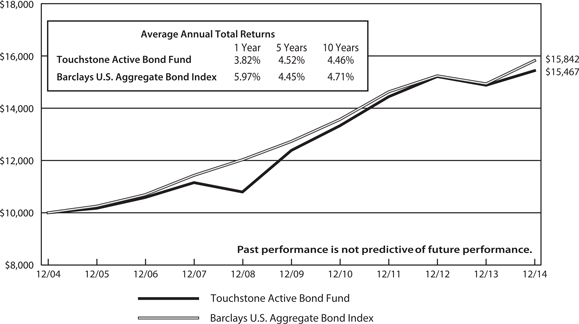

The Touchstone High Yield Fund underperformed its benchmark, the BofA Merrill Lynch U.S. High Yield Cash Pay Index, for the 12-month period ended December 31, 2014. The Fund’s total return was 0.62 percent while the benchmark’s total return was 2.45 percent.

Market Environment

For calendar year 2014, High Yield reported its worst performance since 2008. The primary reason was a sharp drop in the price of crude oil, which ended 2014 at approximately $53 a barrel, down 50 percent from its mid-year high. The impact on the High Yield market was meaningful in both direct and indirect ways. Nearly 15 percent of the High Yield market is comprised of Energy issuers, many of which we believe will experience reduced cash flow prospects while oil prices remain low. Indirectly, there are concerns about slowing global growth that may be manifest in the declining price of oil.

Portfolio Review

The Fund was negatively impacted by an overweight allocation to the Energy sector and poor security selection within the sector. Energy has historically exhibited defensive qualities in volatile markets and relatively solid risk-adjusted returns. However, the rather sharp drop in the price of crude oil caused declines in Energy bonds.

Among the Energy issuers that detracted from performance were Key Energy Services Inc., Sandridge Energy Inc. and Bill Barrett Corp. We believe each of these companies has the operational flexibility to withstand low oil prices for some amount of time. However, a prolonged period of low oil prices will present challenges to many Energy issuers.

Contributors to performance included an underweight allocation to Gaming and an overweight allocation to Diversified Media. Within Gaming, security selection contributed positively, due to an underweight position to Caesar’s Entertainment Corp. Additionally, security selection within Diversified Media and Metals & Mining also contributed. Within Metals & Mining the Fund benefitted from a lack of exposure to lower quality coal producers such as Arch Coal Inc., Alpha Natural Resources Inc. and Cliffs Natural Resources Inc.

Within the healthcare industry the Fund’s exposure to HCA Holdings Inc. (“HCA”) was reduced and we added to Tenet Healthcare Corp. While we remain comfortable with HCA we think the value is less attractive. We also added to Community Health Systems Inc. In the Telecommunication Services sector the Fund was underweight Sprint Corp. in favor of an overweight to T-Mobile USA Inc. due operational weakness at Sprint and market share gains at T-Mobile. We consider T-Mobile to be a better operator. We reduced the Fund’s Broadcast Media exposure to Sirius XM Holdings Inc., whose senior notes were upgraded to investment grade, and we added to Sinclair Television Group Inc. We prefer television broadcasters to radio broadcasters and think that Sinclair is a stronger operator within the Media Broadcasting subsector. Lastly, exposure to Sabine Pass LNG LP (Energy sector) was reduced significantly.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Outlook

Historically, steep declines in oil prices have been associated with above average global growth and favorable performance of risk assets. Conversely, oil price spikes have been associated with global recessions and stock market sell-offs. In the near term, we believe that swings in oil prices may drive the volatility in the High Yield market. While we accept the challenges that $50 oil provides, the Fund is overweight Energy as we think there is relative value within this sector.

We believe that the steep drop in oil prices will give the global economy a much needed boost, as discretionary household income increases. We expect to see increased market volatility in the coming year, considering that the adverse impact on energy producers and their creditors is more concentrated than the favorable impact on consumers and businesses.

We find considerable relative value in High Yield and think that the market appears to be pricing in a higher default rate than we think likely. We believe the Fund is positioned properly within the construct of our philosophy and process.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone High Yield Fund and the BofA Merrill Lynch U.S. High Yield Cash Pay Index

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was May 1, 1999.

Note to Chart

The BofA Merrill Lynch U.S. High Yield Cash Pay Index is an unmanaged index used as a general measure of market performance consisting of fixed-rate, coupon-bearing bonds with an outstanding par which is greater than or equal to $50 million, a maturity range greater than or equal to one year and must be less than BBB/Baa3 rated but not in default.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Large Cap Core Equity Fund

Sub-Advised by Todd Asset Management LLC

Investment Philosophy

The Touchstone Large Cap Core Equity Fund primarily invests in common stocks of large capitalization companies. The Fund’s sub-advisor, Todd Asset Management LLC, (“Todd”) selects stocks that it believes are attractively valued with active catalysts in place. Todd uses a database of 4,000 stocks from which to choose the companies that will be selected for the Fund’s portfolio. As a result, the portfolio generally consists of 40-60 positions. Todd’s selection process is expected to cause the Fund’s portfolio to have some of the following characteristics: attractive relative value, unrecognized earnings potential, above-average market capitalization, seasoned management and dominant industry.

Fund Performance

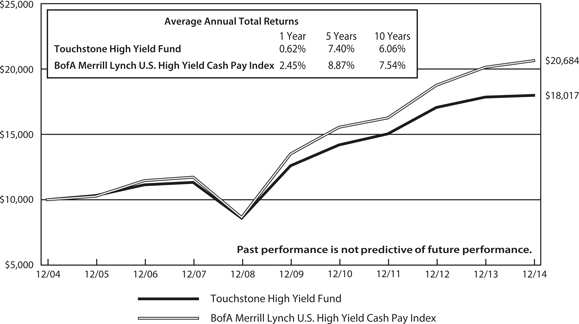

The Touchstone Large Cap Core Equity Fund outperformed its benchmark, the Russell 1000® Index, for the 12-month period ended December 31, 2014. The Fund’s total return was 14.93 percent while the total return of the benchmark was 13.24 percent.

Market Environment

The capital markets produced solid returns during 2014 despite concerning headlines about geopolitical tensions and slowing global economic growth. This was reflected in the relative sector performance. The more defensive Utilities, Health Care, and Consumer Staples sectors were among the best performing sectors, while the more economically sensitive Energy, Materials, Consumer Discretionary, and Industrials sectors were among the worst performers. The second half of the year provided evidence of the variation in the performance of the world’s largest economies. Growth in Europe, Japan, and China slowed, while indicators in the U.S. provided further evidence of a strengthening economic recovery and labor market domestically. This divergence in growth rates globally supported a strong appreciation in the U.S. dollar. The diminishing prospects for global economic growth, in combination with increased oil supplies from North America, led to a rapid decline in oil prices and a major sell-off in the Energy sector late in 2014.

Portfolio Review

The Fund’s outperformance relative to the benchmark was driven by positive stock selection during 2014, particularly within the Consumer Discretionary, Industrials, and Information Technology sectors.

Within the Consumer Discretionary sector, the Fund emphasized companies that benefitted from the positive trends in the automotive, home improvement, retailing and media industries. This positioning contributed to performance, as stocks such as TRW Automotive Holdings Corp., Home Depot Inc., Macy’s Inc., and DirecTV outperformed the broader Consumer Discretionary sector. We believed that the improving U.S. economy and the strengthening labor market would lead to greater spending in these industries after years of deferred spending and pent up demand during and following the recession.

The Information Technology sector was also an area of strength for the Fund, driven by holdings that were focused on consumers as well. With new product cycles underway, and consumers and corporations in better financial shape, companies in the consumer electronic and desktop hardware business benefitted. This trend was reflected in the contributions from positions in Apple Inc., Hewlett Packard Co., and Intel Corp.

Within the Industrials sector, the Fund generated positive relative performance, in part through its positions in railroad and construction companies. The railroads outperformed from a secular move for several years, and 2014 was no exception. Union Pacific Corp. and Norfolk Southern Corp. were among the top performers

Management’s Discussion of Fund Performance (Unaudited) (Continued)

for both the Industrials sector and the Fund overall. United Rentals Inc., a company focused on the rental of construction equipment, also generated positive returns during the year, outperforming the broader Industrials sector.

Stock selection in the Financials and Energy sectors detracted from relative performance during the year. The Energy sector experienced significant declines late in the year as oil prices plunged, with companies most directly exposed to oil price levels experiencing the largest losses. The Fund’s holdings in offshore drilling (Seadrill Ltd. and Atwood Oceanics Inc.) and oil services companies such as Halliburton Co. experienced significant decreases that ultimately detracted from the Fund’s relative performance in the Energy sector. Within the Financials sector, the Fund’s overweight to non-banks caused it to lag the sector during a year in which banks generally outperformed.

Over the past year, we trimmed the Fund’s Financials sector exposure and added to the Information Technology sector. If, as we believe, capital spending picks up and a new product cycle gains traction, we may look to bolster the Fund’s Information Technology sector weight even more. The Fund held overweight positions in the Consumer Discretionary, Financials, Health Care and Industrials sectors. We believe the U.S. economy is in a recovery phase, and we have not seen signs of excess valuations in these sectors. We see unrecognized growth potential at good value within the Health Care sector.

The Fund was underweight the Energy, Consumer Staples, Materials,Telecommunication Services and Utilities sectors, as value has been difficult to find. The Materials and Energy sectors also faced headwinds after overinvestment in new production.

Outlook

Supported by employment growth, high corporate profitability, and the impact of lower energy prices on consumer spending, we believe that the U.S. economic recovery will continue in 2015, offering the potential for further gains in the U.S. equity markets. The end of the Federal Reserve’s policy of quantitative easing, the effects of lower energy prices, and geopolitical instability could lead to greater volatility in stock prices. While this warrants caution, we maintain our long-term investment horizon and believe that our philosophy of investing in companies with attractive valuations, improving fundamentals, and market recognition of those factors is suitably positioned for the year ahead.

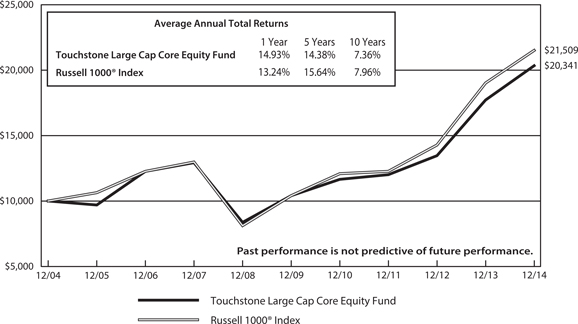

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Large Cap Core Equity Fund and the Russell 1000® Index

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was May 1, 1999.

Note to Chart

The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000® Index. The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Mid Cap Growth Fund

Sub-Advised by Westfield Capital Management Company, L.P.

Investment Philosophy

The Touchstone Mid Cap Growth Fund invests primarily in stocks of domestic mid-cap companies that are believed to have a demonstrated record of achievement with excellent prospects for earnings growth over a 1 to 3 year period. Fund management believes that companies that exhibit faster earnings growth offer the best opportunity for superior real rates of return and that reasonably priced stocks of companies with high forecasted earnings potential are best identified through in-depth, fundamental research and first-hand knowledge of company operations derived through on-site visits and meetings with management.

Fund Performance

The Touchstone Mid Cap Growth Fund outperformed its benchmark, the Russell Midcap® Growth Index, for the 12-month period ended December 31, 2014. The Fund’s total return was 13.10 percent while the total return of the benchmark was 11.90 percent.

Market Environment

U.S. equity indices provided positive returns in 2014. This performance came despite the modest expectations from Wall Street’s top strategists at the start of the year and deteriorating economic conditions in the rest of the world. As the year progressed, we saw a significant divergence in sector performance, with commodity-sensitive Energy, Materials, and Industrials sectors underperforming companies within the Health Care and Information Technology sectors. The year ended with a dramatic decline of crude oil prices, which reverberated through the currency markets and the economies of commodity producing nations. After several years of low volatility, we would not be surprised to see increased stock market volatility going forward, driven by investor concerns about the global economy and the U.S. Federal Reserve Board’s monetary policy tightening.

Portfolio Review

The Fund particularly benefitted from investments in the Information Technology, Health Care, Energy, and Consumer Staples sectors. The Consumer Discretionary and Materials sectors were the biggest detractors from returns.

The Information Technology sector contributed positively to relative returns. Stock selection within semi-conductors, communications equipment, and software substantially impacted returns during the year. Skyworks Solutions, Inc., which designs, manufactures, and markets semiconductor products to multimedia platforms and smart phones, was one of the performance highlights within the sector. The company supplies the robust smartphone market and has been gaining market share on leading customer platforms, such as the iPhone and Samsung Galaxy. In addition, the company’s radio frequency semiconductor business is nicely complemented by strong growth in non-mobile Internet-of-Things applications. NXP Semiconductors NV, a broad-based, global IT company specializing in high performance, mixed signal semiconductors, also contributed meaningfully to relative returns. NXP continues to deliver solid quarterly earnings, powered by growth related to automotive, identification, and wireless applications. The company’s robust product cycle, coupled with management’s focus on cost control and profit margins, translates into double-digit organic revenue and earnings growth. Although the Fund was underweight the sector relative to the benchmark, we continued to be active in the space, particularly focusing on areas of secular growth such as Internet, cloud, and security software, as well as segments with stable and predictable growth such as data processing.

Positioning within the Health Care sector also generated positive relative returns during the year. The Fund maintained its long-standing overweight in Health Care. Cubist Pharmaceuticals, Inc. surged in the beginning

Management’s Discussion of Fund Performance (Unaudited) (Continued)

of December, following news that Merck would purchase it. Actavis PLC, a pharmaceutical firm focused on manufacturing generic and over-the-counter products, also contributed to returns. The firm’s acquisitions of Forest Laboratories earlier in the year and Warner Chilcott last year expanded the earnings growth of the company, which is domiciled in Ireland. In November, the company announced it would acquire Allergan Inc., a global multi-specialty health care company. We believe that the acquisition will provide meaningful tax and cost savings, as well as geographic and sales channel revenue synergies. Allergan has a book of products that is diversified across neurology, ophthalmology, and medical aesthetics, and represents a high-visibility cash flow generation machine.

The Fund’s Energy sector stocks added comparative returns. The performance of financial markets overall, and the Energy sector in particular, was dominated by the dramatic decline of crude oil prices in the fourth quarter. The Fund’s largest exposure to Energy is through oil & gas refining companies, which benefitted from falling crude oil prices. Refiners have generally struggled for 30 years in the U.S., but we saw a fundamental shift in the industry driven by shale oil production and management commitment to change. The Fund’s largest Energy holding was the West Coast refiner Tesoro Corporation, which produced the top absolute and relative performance within the sector.

The Consumer Staples sector was also a source of relative strength through positive stock selection within the Packaged Foods and Household Products sub-industries. The food category has become a challenging place to invest given aggressive competition, increased promotional activity, and lower unit volumes. Food and beverage producer WhiteWave Foods Company appreciated during the period and was the sector’s top relative and absolute performer. We believe WhiteWave, which owns well-recognized brands such as Horizon Organic, Silk, and International Delight, represents one of the best growth stories in its category. Though the company trades at a premium to its peer universe, we believe that the robust valuation is justified – WhiteWave delivered a double-digit organic net sales growth in fiscal 2014. Although we remain underweight the sector, we have been constructive in the space. We continue to seek investments that present a growth opportunity in excess of the average growth rate of 2 percent to 3 percent for Consumer Staples companies. As an example of this philosophy, the Fund holds Church & Dwight Co., Inc., which develops, manufactures, and markets a range of household and personal care products. Church & Dwight matched earnings expectations during each quarter of 2014 through a combination of strategic acquisitions and a diversified product range. The company generated double digit earnings per share (“EPS”) growth. Relative returns were also enhanced by Mead Johnson Nutrition Company, a manufacturer of infant and children’s nutrition products. The nutritional market has secular tailwinds from an improving outlook for the U.S. consumer, including job growth and rising incomes. We believe that the company should also benefit from its exposure to rapidly-growing emerging markets.

The Consumer Discretionary sector was the only meaningful detractor from relative returns during 2014. Urban Outfitters, Inc., which operates brand-name clothing stores including Free People and Anthropologie, retreated in the second half of the year, after lowering sales projections for the fourth quarter. Although we still like the company for its long-term positioning, we felt that the merchandise inventory buildup will take several months to resolve and thus, it was sold from the Fund’s portfolio. The Fund also exited an underperforming investment in GameStop Corp., which sells new and used specialty electronic games and PC entertainment software. Shares of the company fell under pressure following an announcement from Sony Corp. that it was planning to launch PlayStation Now, a cloud-based subscription streaming service that would allow gamers to play PlayStation 3 titles across multiple Sony devices. Our concern for GameStop was that this lower cost gaming option could threaten GameStop’s highly profitable used game business. Offsetting the declines in these stocks, the Fund benefitted from gains within Leisure Products and Homebuilding. The recreational vehicle manufacturer Polaris Industries Inc. increased after the company reported earnings results that highlighted acceleration in North American retail sales, as well as market share gains. The company’s motorcycle shipments were up 107% year-over-year,

Management’s Discussion of Fund Performance (Unaudited) (Continued)

driven by the ongoing rollout of its Indian motorcycle brand. Year-over-year revenue growth of the parts, garments, and accessories segment and from its international business also helped the stock’s price during the year.

Outlook

We think the U.S. economy is on solid ground and growing. The housing market has recovered, the employment picture is much improved, and the drop in oil prices is a large stimulus for the U.S. consumer. The U.S. is a consumer-led economy, and the U.S. consumer is benefiting from low interest rates, lower gas prices at the pump, and more disposable income due to an improvement in wages. Global growth has slowed, and we are closely monitoring business activity in Europe and the emerging economies. The U.S. is currently the driver of global growth. We believe that the U.S. dollar will remain strong and 2015 will be another year of positive returns for the U.S. equity markets. Therefore, we are cautious about the market’s near-term prospects. The recent precipitous drop in oil prices raises important questions, particularly for commodity-based economies outside of the U.S. How low is too low for oil? Unprecedented low oil prices for a prolonged period of time, deflation in Europe and Japan, or an economic slowdown in China could easily trigger a growth scare and a stock market pullback. These factors introduce near-term caution into our otherwise constructive outlook on domestic equities this year. From a portfolio positioning standpoint, the current macroeconomic and financial backdrop reinforces our belief in the importance of a bottom-up driven investment process.

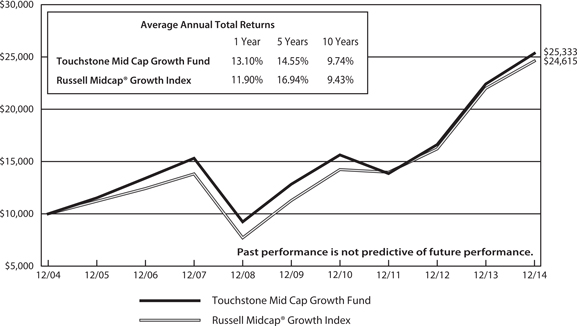

Management’s Discussion of Fund Performance (Unaudited) (Continued)

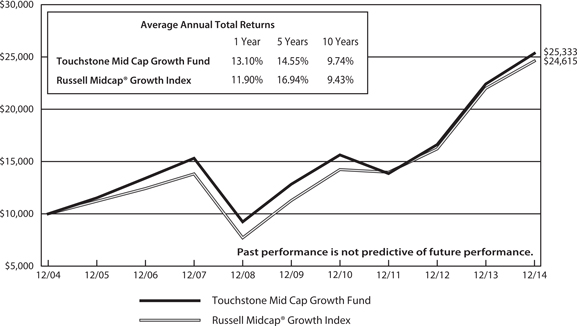

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Mid Cap Growth Fund and the Russell Midcap® Growth Index

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was November 21, 1994.

Note to Chart

The Russell Midcap® Growth Index measures the performance of those Russell Midcap® companies with higher price-to-book ratios and higher forecasted growth values.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone Third Avenue Value Fund

Sub-Advised by Third Avenue Management LLC

Investment Philosophy

The Touchstone Third Avenue Value Fund primarily invests in common stocks of well-financed companies (meaning companies believed to have high quality assets and a relative absence of liabilities) at a discount to what the Fund’s sub-advisor, Third Avenue Management LLC (“TAM”), believes is their intrinsic value. TAM analyzes companies from the bottom up, focusing on business fundamentals such as competent management teams and strong long-term growth prospects.

Fund Performance

The Touchstone Third Avenue Value Fund underperformed its benchmark, the Russell 3000® Value Index, for the 12-month period ended December 31, 2014. The Fund’s total return was -2.89 percent while the total return of the benchmark was 12.70 percent.

Market Environment

Market volatility returned to financial markets during the second half of the year. Most financial markets exhibited large swings in prices. U.S. Treasuries and the U.S. dollar continued to appreciate while oil and commodity prices fell. Contrary to consensus expectations at the beginning of the year, the yield on the 10-year U.S. Treasury Bond dropped over the course of the year. Also, during the year, the U.S. dollar appreciated significantly relative to most major currencies, and the price of Brent crude oil fell from over $100 to below $50 a barrel. In spite of increased volatility in the second half of the year, global equity markets had a positive year in local currency terms, with U.S. stocks handily outperforming other developed and emerging equity markets. Due to the strength of the U.S. dollar, non-U.S. market returns, when translated into U.S. dollars, were negative.

Portfolio Review

Most of the Fund’s underperformance can be attributed to its holdings in the Materials, Industrials and Financials sectors. Stock selection within these sectors was negative for the year. Capstone Mining Corp. and POSCO were the largest detractors within the Materials sector. Stock prices declined as a result of these companies’ exposure to commodities. POSCO is the largest steel maker in South Korea and the sixth largest producer in the world. It is also one of the lowest cost integrated steel makers in the world. Capstone Mining is a mid-cap copper mining company headquartered in Vancouver.

Within the Financials sector holdings, Comerica Inc. and Leucadia National Corp. were detractors to relative performance. Comerica, Texas’ largest commercial bank, is a conservative lender and has shown exemplary credit history over many cycles. Comerica’s stock price declined in the last quarter of the year mainly as a result of the drop in oil prices, as the bank is based in Texas, the country’s “energy capital.” Leucadia is an investment holding company whose long term, eclectic investment style has compounded returns for shareholders greatly in excess of the market.

Nexans SA (Industrials sector) and Apache Corp. (Energy sector) are two individual names that also detracted from performance as a result of their exposure to oil. Nexans is a Paris-based global leader in the business of manufacturing cables for specific applications in a number of industries including energy, telecommunications, oil and gas, mining as well as for building applications and local area networks. Apache, an independent energy company, explores for, develops, and produces natural gas, crude oil and natural gas liquids. Despite the impact of what we deem is a short-term demand and supply imbalance in oil, we remain supportive of the Fund’s positions.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Among the top contributors to performance were: Weyerhaeuser Co. (Financials sector), Cheung Kong Holdings Ltd. (Financials sector), Symantec Corp. (Information Technology sector), Bank of New York Mellon Corp. (Financials sector) and Toyota Industries Corp. (Industrials sector). Weyerhaeuser is a Real Estate Investment Trust (“REIT”) with wood products and wood fiber businesses, and the second largest owner of timberlands in the US. This company is well positioned to benefit from a recovery in the U.S. housing market, albeit slow, continues to expand at a healthy pace. Earlier in the year, Weyerhaeuser merged its home building business, WRECO, with TRI Pointe Homes, obtaining significant value for what had been an underperforming asset. Cheung Kong is a Hong Kong based property owner and developer of real estate in Hong Kong and mainland China, and is the controlling shareholder of Hutchison Whampoa. Symantec is a provider of security and back-up solutions to protect people and content in a digital environment. Bank of New York Mellon is a global financial services company with a focus on investment management and investment services. Toyota Industries is a Japanese conglomerate serving varied industries including textile machinery, automobiles, materials handling, electronics and providing logistics solutions.

New purchases included CBS Corp. and General Motors Co. (both Consumer Discretionary sector). CBS Corp. is a national broadcaster and content creator. CBS is currently trading at a discount to its peers and our conservative estimate of net asset value (“NAV”). Our research suggests it is very likely to continue to grow NAV as it is well positioned to capitalize on a new phase of industry transformation where boundaries between distribution and content are being redefined and likely favor content owners over distributors.

General Motors (“GM”), one of the largest automotive companies in the world, has struggled in the last few years: high profile bankruptcy, pension woes and recalls. Negative sentiment around GM’s stock corresponds to a dated perception of GM. Today, the century old automaker has a clean and strong balance sheet, significantly streamlined operations and is one of the most attractively valued large caps in the U.S.

Outlook

We continue to believe that a recovery of the U.S. economy offers the most opportunity going forward. This would be an environment characterized by rising interest rates and inflation. The expectation is that U.S. interest rates will be higher in the next one to three years and that inflation will be more significant going forward, subject to how the Fed decides to monetize its balance sheet. In this environment, we see less macro-focused and less correlated market movements with renewed investor attention to fundamentals. We would welcome this trend.

We believe the Fund is positioned to benefit from interest rate increases, as illustrated by the holdings in asset sensitive Financials, as well as exposure to Real Estate, particularly the U.S. housing market, and commodities, including timber and steel. In addition, we believe a significant number of positions in the Fund will benefit dramatically from corporate improvements. Conversely, a slowdown in the U.S. could provide a headwind for the Fund by slowing growth in many of the companies held in the Fund and refocusing investor attention on the potential for central bank easing actions.

From a new idea generation standpoint, we continue to evaluate companies and industries that are under stress. As such, we are taking a closer look at some of the Energy names that appear to be oversold and are beginning to look attractive on a three to five-year time horizon. We believe the Fund is positioned to benefit from global economic recovery and, despite generally high valuations across global markets, we continue to find opportunities.

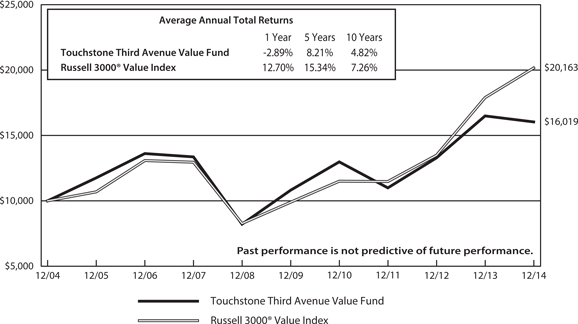

Management’s Discussion of Fund Performance (Unaudited) (Continued)

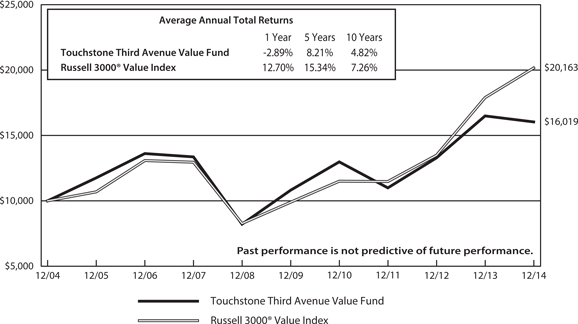

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Third Avenue Value Fund and the Russell 3000® Value Index

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was December 14, 1992.

Note to Chart

The Russell 3000® Value Index measures the performance for those Russell 3000® companies with lower price-to book ratios and lower forecasted growth values.

Management’s Discussion of Fund Performance (Unaudited)

Touchstone ETF Funds

Sub-Advised by Todd Asset Management LLC

Touchstone Aggressive ETF Fund

Touchstone Conservative ETF Fund

Touchstone Moderate ETF Fund

Investment Philosophy

Three Funds which invest in Exchanged Traded Funds (ETFs) are available for investors seeking “lifestyle” products for their annuity holdings. The three strategic options include: the Conservative, Moderate, and Aggressive ETF Funds. These funds allocate their assets among up to nine ETFs. These nine ETF selections generally do not change dramatically over time. The more conservative fund has a higher bond weighting and the more aggressive fund has a lower bond weighting.

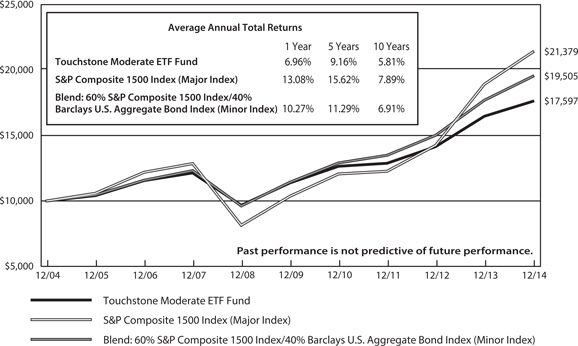

Fund Performance

The Touchstone Conservative ETF Fund’s total return was 5.23 percent for the 12-month period ended December 31, 2014. The Fund underperformed its benchmark. The total return of its benchmark, the Barclays U.S. Aggregate Bond Index, was 5.97 percent. The Touchstone Moderate ETF Fund’s total return was 6.96 percent, and the Touchstone Aggressive ETF Fund’s total return was 7.49 percent. Both of these Funds underperformed their benchmark, the S&P Composite 1500 Index. The total return of their benchmark was 13.08 percent for the 12-month period ended December 31, 2014. The specific blended benchmark returns were 8.48 percent for the Conservative ETF Fund, 10.27 percent for the Moderate ETF Fund and 11.68 percent for the Aggressive ETF Fund.

Market Environment

The capital markets produced solid returns during 2014 despite concerning headlines about geopolitical tensions and slowing global economic growth. This was reflected in the relative sector weights. The more defensive Utilities, Health Care, and Consumer Staples sectors were among the top performing sectors, while the more economically sensitive Energy, Materials, Consumer Discretionary, and Industrials sectors were among the worst performers. The second half of the year provided evidence of the variation in the performance of the world’s largest economies. Growth in Europe, Japan, and China slowed, while indicators in the U.S. provided further evidence of a strengthening economic recovery and labor market. This divergence in growth rates globally supported a strong appreciation in the U.S. dollar. The diminishing prospects for global economic growth, in combination with increased oil supplies from North America, led to a rapid decline in oil prices and a major sell-off in the Energy sector.

Portfolio Review

Each of the Conservative, Moderate, and Aggressive ETF Funds lagged their respective benchmarks during 2014. The Treasury yield curve flattened, with short-term rates increasing and long-term rates declining. This resulted in the underperformance for the Conservative ETF Fund, as its allocation to the shorter duration Barclays 1-3 Year Treasury underperformed relative to the Barclays Aggregate Bond Index which represents the benchmark’s bond position. The more equity-oriented Moderate and Aggressive ETF Funds also underperformed due to a non-benchmark allocation to international equities. The rapidly appreciating U.S. dollar drove international equities to negative absolute returns and underperformance relative to the benchmark’s allocation to the domestically-focused S&P 1500 Index.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

Outlook

We believe the stock market continues to offer upside potential. Small and mid-caps historically have outperformed large caps during bull markets, therefore we have positioned the Funds to have a modest overweight in these asset classes. While exposure to international equities has detracted from the Funds’ performance in recent periods, we believe that the diversification benefits of these stocks have the potential to enhance risk-adjusted returns.

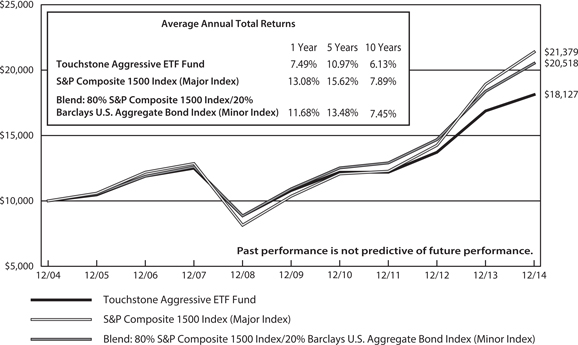

Management’s Discussion of Fund Performance (Unaudited) (Continued)

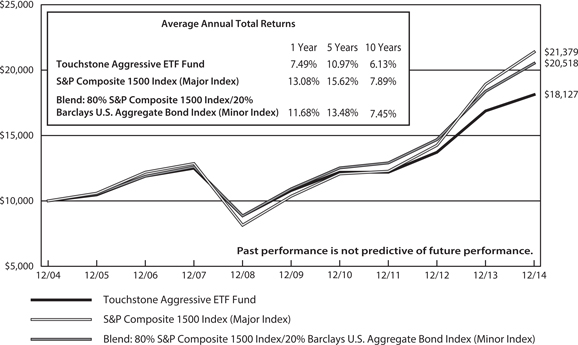

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Aggressive ETF Fund, the S&P Composite 1500 Index (Major Index)

and the Blend: 80% S&P Composite 1500 Index/20% Barclays U.S. Aggregate Bond Index

(Minor Index)

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was July 16, 2004.

Notes to Chart

S&P Composite 1500 Index is an unmanaged, broad market index representing the large-cap, mid-cap, and small-cap segments of the U.S. equity market.

The Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

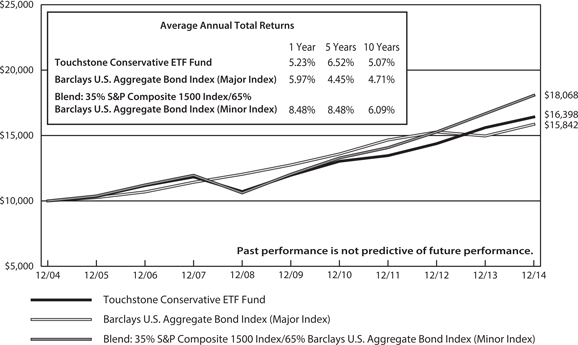

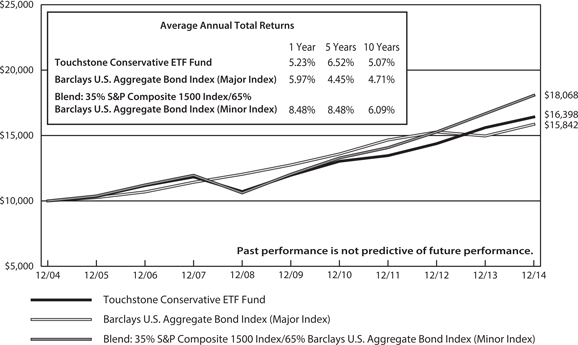

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Conservative ETF Fund, the Barclays U.S. Aggregate Bond Index (Major Index)

and the Blend: 35% S&P Composite 1500 Index /65% Barclays U.S. Aggregate Bond Index

(Minor Index)

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was July 16, 2004.

Notes to Chart

The Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

S&P Composite 1500 Index is an unmanaged, broad market index representing the large-cap, mid-cap, and small-cap segments of the U.S. equity market.

Management’s Discussion of Fund Performance (Unaudited) (Continued)

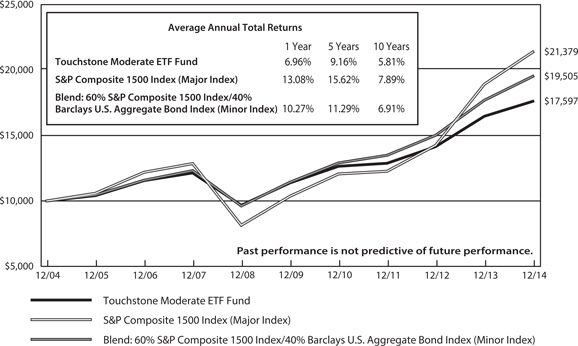

Comparison of the Change in Value of a $10,000 Investment in the

Touchstone Moderate ETF Fund, the S&P Composite 1500 Index (Major Index)

and the Blend: 60% S&P Composite 1500 Index/40% Barclays U.S. Aggregate Bond Index

(Minor Index)

Performance information does not reflect fees that are paid by the separate accounts through which shares of the Fund are sold. Inclusion of those fees would reduce figures for all periods.

The inception date of the Fund was July 16, 2004.

Notes to Chart

S&P Composite 1500 Index is an unmanaged, broad market index representing the large-cap, mid-cap, and small-cap segments of the U.S. equity market.

The Barclays U.S. Aggregate Bond Index is an unmanaged index comprised of U.S. investment grade, fixed rate bond market securities, including government, government agency, corporate and mortgage-backed securities between one and ten years.

Tabular Presentation of Portfolios of Investments (Unaudited)

December 31, 2014

The illustrations below provide each Fund’s credit quality, sector allocation or geographic allocation. We hope it will be useful to shareholders as it summarizes key information about each Fund’s investments.

| Touchstone Active Bond Fund | | | |

| Credit Quality* | | (% of Investment Securities) | |

| AAA/Aaa | | | 49.4 | % |

| AA/Aa | | | 3.7 | |

| A | | | 9.3 | |

| BBB/Baa | | | 18.3 | |

| BB/Ba | | | 8.8 | |

| B | | | 6.8 | |

| CC | | | 0.4 | |

| C or Lower | | | 0.8 | |

| Other Assets/Liabilities (Net) | | | 2.5 | |

| Total | | | 100.0 | % |

| Touchstone Baron Small Cap Growth Fund |

| Sector Allocation** | | (% of Net Assets) | |

| Consumer Discretionary | | | 26.4 | % |

| Financials | | | 22.1 | |

| Industrials | | | 14.7 | |

| Information Technology | | | 13.2 | |

| Consumer Staples | | | 7.1 | |

| Utilities | | | 4.1 | |

| Health Care | | | 3.0 | |

| Energy | | | 2.2 | |

| Telecommunication Services | | | 1.0 | |

| Materials | | | 0.9 | |

| Investment Funds | | | 20.1 | |

| Other Assets/Liabilities (Net) | | | (14.8 | ) |

| Total | | | 100.0 | % |

| Touchstone High Yield Fund | | | |

| Credit Quality* | | (% of Investment Securities) | |

| BBB/Baa | | | 0.9 | % |

| BB/Ba | | | 46.6 | |

| B/B | | | 41.9 | |

| CCC | | | 1.0 | |

| Other Assets/Liabilities (Net) | | | 9.6 | |

| Total | | | 100.0 | % |

| Touchstone Large Cap Core Equity Fund | | | |

| Sector Allocation** | | (% of Net Assets) | |

| Financials | | | 21.0 | % |

| Information Technology | | | 19.4 | |

| Health Care | | | 15.8 | |

| Consumer Discretionary | | | 14.0 | |

| Industrials | | | 13.6 | |

| Energy | | | 6.3 | |

| Consumer Staples | | | 4.9 | |

| Utilities | | | 1.1 | |

| Materials | | | 1.0 | |

| Telecommunication Services | | | 0.5 | |

| Other Assets/Liabilities (Net) | | | 2.4 | |

| Total | | | 100.0 | % |

| * | Credit quality may be rated by Standard & Poor’s, Moody’s and Fitch. If all three agencies rate the bond, the middle or common rating is used; if two of the agencies rate the bond, the lower rating is used; if one agency rates the bond, that rating is used; if none of the agencies rate the bond, the bond will be classified as non-rated. |

| ** | Sector Classifications are based upon the Global Industry Classification Standard (GICS®). |

Tabular Presentation of Portfolios of Investments (Unaudited) (Continued)

| Touchstone Mid Cap Growth Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Consumer Discretionary | | | 20.2 | % |

| Health Care | | | 18.5 | |

| Information Technology | | | 16.8 | |

| Industrials | | | 13.8 | |

| Financials | | | 9.2 | |

| Consumer Staples | | | 6.8 | |

| Materials | | | 6.4 | |

| Energy | | | 6.0 | |

| Investment Funds | | | 7.3 | |

| Other Assets/Liabilities (Net) | | | (5.0 | ) |

| Total | | | 100.0 | % |

| Touchstone Money Market Fund |

| Credit Quality | | (% of Investment Securities) |

| A-1/P-1/MIG1/SP1 | | | 99.4 | % |

| FW1(NR)** | | | 0.6 | |

| Total | | | 100.0 | % |

| Portfolio Allocation* | | (% of Net Assets) | |

| Variable Rate Demand Notes | | | 48.1 | % |

| U.S. Government Agency Obligations | | | 24.9 | |

| Corporate Bonds | | | 12.6 | |

| Commercial Paper | | | 9.7 | |

| Certificate of Deposit | | | 3.5 | |

| Municipal Bonds | | | 1.1 | |

| Other Assets/Liabilities (Net) | | | 0.1 | |

| Total | | | 100.0 | % |

| Touchstone Third Avenue Value Fund | | | |

| Geographic Allocation | | (% of Net Assets) | |

| Common Stocks | | | | |

| United States | | | 72.5 | % |

| France | | | 6.8 | |

| Canada | | | 6.2 | |

| Hong Kong | | | 5.9 | |

| Korea | | | 2.8 | |

| China | | | 1.5 | |

| Investment Funds | | | 8.4 | |

| Other Assets/Liabilities (Net) | | | (4.1 | ) |

| Total | | | 100.0 | % |

| Touchstone Aggressive ETF Fund |

| Sector Allocation* | | (% of Net Assets) | |

| Exchange Traded Funds | | | 98.8 | % |

| Investment Funds | | | 13.5 | |

| Other Assets/Liabilities (Net) | | | (12.3 | ) |

| Total | | | 100.0 | % |

| Touchstone Conservative ETF Fund | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Exchange Traded Funds | | | 98.8 | % |

| Investment Funds | | | 19.3 | |

| Other Assets/Liabilities (Net) | | | (18.1 | ) |

| Total | | | 100.0 | % |

| Touchstone Moderate ETF | | | |

| Sector Allocation* | | (% of Net Assets) | |

| Exchange Traded Funds | | | 98.8 | % |

| Investment Funds | | | 17.7 | |

| Other Assets/Liabilities (Net) | | | (16.5 | ) |

| Total | | | 100.0 | % |

| * | Sector Classifications are based upon the Global Industry Classification Standard (GICS®). |

| ** | Equivalent to Standard & Poor’s and Moody’s highest short-term ratings of A-1 and P-1, respectively, based upon independent research conducted by Fort Washington Investment Advisors, Inc. |

NR - Not Rated

Portfolio of Investments

Touchstone Active Bond Fund – December 31, 2014

| Principal | | | | | Market | |

| Amount | | | | | Value | |

| | | | | | | |

| | | | | Corporate Bonds — 42.7% | | | | |

| | | | | | | | | |

| | | | | Financials — 11.6% | | | | |

| $ | 233,000 | | | AerCap Ireland Capital Ltd. / AerCap | | | | |

| | | | | Global Aviation Trust (Ireland), 144a, | | | | |

| | | | | 4.500%, 5/15/21 | | $ | 235,912 | |

| | 134,000 | | | Ally Financial, Inc., 8.000%, 11/1/31 | | | 170,515 | |

| | 175,000 | | | American Express Credit Corp. MTN, | | | | |

| | | | | 2.375%, 3/24/17 | | | 178,963 | |

| | 300,000 | | | Bank of America Corp., | | | | |

| | | | | 5.200%, 12/29/49(A) | | | 277,125 | |

| | 100,000 | | | Bank of America Corp. MTN, | | | | |

| | | | | 5.000%, 5/13/21 | | | 111,585 | |

| | 155,000 | | | Boston Properties LP, REIT, | | | | |

| | | | | 3.850%, 2/1/23 | | | 160,902 | |

| | 290,000 | | | Caterpillar Financial Services Corp. | | | | |

| | | | | MTN, 5.450%, 4/15/18 | | | 323,672 | |

| | 125,000 | | | Citigroup, Inc., 3.375%, 3/1/23 | | | 126,118 | |

| | 300,000 | | | Citigroup, Inc., 5.350%, 4/29/49(A) | | | 276,750 | |

| | 300,000 | | | Fifth Third Bancorp, | | | | |

| | | | | 4.900%, 12/29/49(A) | | | 290,250 | |

| | 265,000 | | | Ford Motor Credit Co. LLC, | | | | |

| | | | | 2.375%, 1/16/18 | | | 266,536 | |

| | 300,000 | | | General Electric Capital Corp., | | | | |

| | | | | 6.250%, 12/29/49(A) | | | 326,625 | |

| | 155,000 | | | General Electric Capital Corp. MTN | | | | |

| | | | | MTN, 4.650%, 10/17/21 | | | 174,705 | |

| | 115,000 | | | Goldman Sachs Group, Inc. (The), | | | | |

| | | | | 5.250%, 7/27/21 | | | 129,796 | |

| | 300,000 | | | Goldman Sachs Group, Inc. (The), | | | | |

| | | | | 5.700%, 12/29/49(A) | | | 303,450 | |

| | 180,000 | | | Health Care REIT, Inc., 6.125%, 4/15/20 | | | 206,916 | |

| | 160,000 | | | HSBC Bank PLC (United Kingdom), | | | | |

| | | | | 144a, 4.125%, 8/12/20 | | | 173,196 | |

| | 145,000 | | | JPMorgan Chase & Co., | | | | |

| | | | | 3.250%, 9/23/22 | | | 145,845 | |

| | 300,000 | | | JPMorgan Chase & Co., | | | | |

| | | | | 5.150%, 12/29/49(A) | | | 282,600 | |

| | 300,000 | | | Morgan Stanley, 5.450%, 7/29/49(A) | | | 300,540 | |

| | 166,000 | | | Navient LLC MTN, 6.125%, 3/25/24 | | | 163,095 | |

| | 160,000 | | | Omega Healthcare Investors, Inc. REIT, | | | | |

| | | | | 4.950%, 4/1/24 | | | 166,502 | |

| | 231,000 | | | PHH Corp., 6.375%, 8/15/21 | | | 211,654 | |

| | 160,000 | | | PNC Bank NA, 2.700%, 11/1/22 | | | 153,226 | |

| | 250,000 | | | Simon Property Group LP, REIT, | | | | |

| | | | | 2.750%, 2/1/23 | | | 244,776 | |

| | 275,000 | | | Wells Fargo & Co., 5.900%, 12/29/49(A) | | | 277,062 | |

| | | | | | | | 5,678,316 | |

| | | | | | | | | |

| | | | | Consumer Discretionary — 7.4% | | | | |

| | 230,000 | | | AutoNation, Inc., 5.500%, 2/1/20 | | | 252,244 | |

| | 215,000 | | | CBS Corp., 4.900%, 8/15/44 | | | 218,325 | |

| | 233,000 | | | CCO Holdings LLC / CCO Holdings | | | | |

| | | | | Capital Corp., 6.625%, 1/31/22 | | | 247,562 | |

| | 233,000 | | | Cequel Communications Holdings I | | | | |

| | | | | LLC / Cequel Capital Corp., 144a, | | | | |

| | | | | 6.375%, 9/15/20 | | | 241,155 | |

| | 275,000 | | | Comcast Corp., 4.650%, 7/15/42 | | | 300,991 | |

| | 195,000 | | | DIRECTV Holdings LLC / DIRECTV | | | | |

| | | | | Financing Co., Inc., 2.400%, 3/15/17 | | | 198,679 | |

| | 233,000 | | | DISH DBS Corp., 6.750%, 6/1/21 | | | 250,475 | |

| | 205,000 | | | Forest Laboratories, Inc., 144a, | | | | |

| | | | | 5.000%, 12/15/21 | | | 221,979 | |

| | 150,000 | | | Home Depot, Inc., 5.950%, 4/1/41 | | | 195,911 | |

| | 116,000 | | | MGM Resorts International, | | | | |

| | | | | 6.750%, 10/1/20 | | | 121,800 | |

| | 290,000 | | | Mondelez International, Inc., | | | | |

| | | | | 4.125%, 2/9/16 | | | 300,774 | |

| | 175,000 | | | News America, Inc., 6.900%, 3/1/19 | | | 206,352 | |

| | 240,000 | | | Scripps Networks Interactive, Inc., | | | | |

| | | | | 2.750%, 11/15/19 | | | 241,004 | |

| | 214,000 | | | Sirius XM Radio, Inc., 144a, | | | | |

| | | | | 5.250%, 8/15/22 | | | 224,700 | |

| | 175,000 | | | Time Warner Cable, Inc., | | | | |

| | | | | 4.125%, 2/15/21 | | | 187,283 | |

| | 175,000 | | | Viacom, Inc., 6.250%, 4/30/16 | | | 186,953 | |

| | | | | | | | 3,596,187 | |

| | | | | | | | | |

| | | | | Energy — 6.7% | | | | |

| | 185,000 | | | Access Midstream Partners LP / ACMP | | | | |

| | | | | Finance Corp., 5.875%, 4/15/21 | | | 192,862 | |

| | 375,000 | | | Boardwalk Pipelines LP, 3.375%, 2/1/23 | | | 341,614 | |

| | 250,000 | | | BP Capital Markets PLC (United | | | | |

| | | | | Kingdom), 3.994%, 9/26/23 | | | 257,234 | |

| | 150,000 | | | Cenovus Energy, Inc. (Canada), | | | | |

| | | | | 6.750%, 11/15/39 | | | 170,881 | |

| | 115,000 | | | Chesapeake Energy Corp., | | | | |

| | | | | 5.375%, 6/15/21 | | | 114,928 | |

| | 265,000 | | | CNOOC Finance 2012 Ltd. (Virgin | | | | |

| | | | | Islands), 144a, 3.875%, 5/2/22 | | | 269,578 | |

| | 285,000 | | | ConocoPhillips Co., 3.350%, 11/15/24 | | | 287,949 | |

| | 245,000 | | | Continental Resources, Inc./OK, | | | | |

| | | | | 7.125%, 4/1/21 | | | 263,375 | |

| | 215,000 | | | DCP Midstream LLC, 144a, | | | | |

| | | | | 5.350%, 3/15/20 | | | 225,028 | |

| | 231,000 | | | FTS International, Inc., 144a, | | | | |

| | | | | 6.250%, 5/1/22 | | | 168,630 | |

| | 260,000 | | | Kinder Morgan Energy Partners LP, | | | | |

| | | | | 3.500%, 9/1/23 | | | 246,831 | |

| | 233,000 | | | Linn Energy LLC / Linn Energy Finance | | | | |

| | | | | Corp., 8.625%, 4/15/20 | | | 202,710 | |

| | 125,000 | | | Petrobras International Finance Co. - | | | | |

| | | | | Pifco (Cayman Islands), | | | | |

| | | | | 5.375%, 1/27/21 | | | 115,821 | |

| | 156,000 | | | Plains Exploration & Production Co., | | | | |

| | | | | 6.875%, 2/15/23 | | | 173,550 | |

| | 265,000 | | | Suncor Energy, Inc. (Canada), | | | | |

| | | | | 3.600%, 12/1/24 | | | 261,861 | |

| | | | | | | | 3,292,852 | |

| | | | | | | | | |

| | | | | Telecommunication Services — 3.7% | | | | |

| | 113,000 | | | Frontier Communications Corp., | | | | |

| | | | | 6.875%, 1/15/25 | | | 113,000 | |

| | 220,000 | | | Orange SA (France), 2.750%, 2/6/19 | | | 224,086 | |

Touchstone Active Bond Fund (Continued)

| Principal | | | | | Market | |

| Amount | | | | | Value | |

| | | | | | | | | |

| | | | | Corporate Bonds — 42.7% (Continued) | | | | |

| | | | | | | | | |

| | | | | Telecommunication Services — (Continued) | | | | |

| $ | 240,000 | | | SBA Tower Trust, 144a, | | | | |

| | | | | 2.898%, 10/15/44 | | $ | 240,629 | |

| | 161,000 | | | Sprint Nextel Corp., 6.000%, 11/15/22 | | | 148,120 | |

| | 233,000 | | | T-Mobile USA, Inc., 6.731%, 4/28/22 | | | 239,990 | |

| | 233,000 | | | UPCB Finance III Ltd. (Cayman Islands), | | | | |

| | | | | 144a, 6.625%, 7/1/20 | | | 244,650 | |

| | 275,000 | | | Verizon Communications, Inc., | | | | |

| | | | | 6.250%, 4/1/37 | | | 337,492 | |

| | 254,000 | | | Windstream Corp., 6.375%, 8/1/23 | | | 237,490 | |

| | | | | | | | 1,785,457 | |

| | | | | | | | | |

| | | | | Industrials — 3.0% | | | | |

| | 200,000 | | | Air Lease Corp., 5.625%, 4/1/17 | | | 215,500 | |

| | 265,000 | | | Burlington Northern Santa Fe LLC, | | | | |

| | | | | 5.750%, 5/1/40 | | | 326,947 | |

| | 175,000 | | | FedEx Corp., 5.100%, 1/15/44 | | | 202,067 | |

| | 116,000 | | | Navios Maritime Holdings, Inc. / | | | | |

| | | | | Navios Maritime Finance II US Inc. | | | | |

| | | | | (Marshall Islands), 144a, | | | | |

| | | | | 7.375%, 1/15/22 | | | 106,140 | |

| | 200,000 | | | Republic Services, Inc., 3.550%, 6/1/22 | | | 205,323 | |

| | 235,000 | | | Rexel SA (France), 144a, | | | | |

| | | | | 5.250%, 6/15/20 | | | 236,762 | |

| | 175,000 | | | United Rentals North America, Inc., | | | | |

| | | | | 7.625%, 4/15/22 | | | 192,412 | |

| | | | | | | | 1,485,151 | |

| | | | | | | | | |

| | | | | Utilities — 2.5% | | | | |

| | 65,000 | | | CenterPoint Energy, Inc., | | | | |

| | | | | 5.950%, 2/1/17 | | | 70,873 | |

| | 275,000 | | | Dominion Resources, Inc., | | | | |

| | | | | 5.750%, 10/1/54(A) | | | 286,939 | |

| | 145,000 | | | Dynegy, Inc., 5.875%, 6/1/23 | | | 137,750 | |

| | 145,000 | | | Iberdrola International BV, | | | | |

| | | | | 6.750%, 7/15/36 | | | 184,847 | |

| | 145,000 | | | NextEra Energy Capital Holdings, Inc., | | | | |

| | | | | 6.350%, 10/1/66(A) | | | 144,094 | |

| | 230,000 | | | NRG Energy, Inc., 6.625%, 3/15/23 | | | 239,200 | |

| | 165,000 | | | PPL Energy Supply LLC, | | | | |

| | | | | 6.500%, 5/1/18 | | | 173,293 | |

| | | | | | | | 1,236,996 | |

| | | | | | | | | |

| | | | | Consumer Staples — 2.5% | | | | |

| | 190,000 | | | Anheuser-Busch InBev Worldwide, | | | | |

| | | | | Inc., 8.200%, 1/15/39 | | | 293,326 | |

| | 295,000 | | | Cargill, Inc., 144a, 1.900%, 3/1/17 | | | 298,078 | |

| | 155,000 | | | Kraft Foods Group, Inc., | | | | |

| | | | | 6.875%, 1/26/39 | | | 204,872 | |

| | 233,000 | | | Post Holdings, Inc., 7.375%, 2/15/22 | | | 233,000 | |

| | 200,000 | | | Walgreens Boots Alliance, Inc., | | | | |

| | | | | 2.700%, 11/18/19 | | | 201,018 | |

| | | | | | | | 1,230,294 | |

| | | | | | | | | |

| | | | | Materials — 2.0% | | | | |

| | 233,000 | | | ArcelorMittal (Luxembourg), | | | | |

| | | | | 6.000%, 3/1/21 | | | 242,320 | |

| | 155,000 | | | Domtar Corp., 10.750%, 6/1/17 | | | 184,229 | |

| | 175,000 | | | First Quantum Minerals Ltd. (Canada), | | | | |

| | | | | 144a, 7.250%, 10/15/19 | | | 161,875 | |

| | 175,000 | | | Glencore Funding LLC, 144a, | | | | |

| | | | | 2.500%, 1/15/19 | | | 172,318 | |

| | 175,000 | | | LyondellBasell Industries N.V. | | | | |

| | | | | (Netherlands), 6.000%, 11/15/21 | | | 201,418 | |

| | | | | | | | 962,160 | |

| | | | | | | | | |

| | | | | Health Care — 1.9% | | | | |

| | 233,000 | | | CHS / Community Health Systems, | | | | |

| | | | | Inc., 7.125%, 7/15/20 | | | 248,436 | |

| | 186,000 | | | HCA, Inc., 6.500%, 2/15/20 | | | 208,413 | |

| | 31,000 | | | Select Medical Corp., 6.375%, 6/1/21 | | | 31,465 | |

| | 265,000 | | | Valeant Pharmaceuticals International, | | | | |

| | | | | 144a, 6.750%, 8/15/21 | | | 276,925 | |

| | 185,000 | | | Ventas Realty LP, 1.550%, 9/26/16 | | | 185,741 | |

| | | | | | | | 950,980 | |

| | | | | | | | | |

| | | | | Information Technology — 1.4% | | | | |

| | 450,000 | | | Apple, Inc., 1.000%, 5/3/18 | | | 443,322 | |

| | 100,000 | | | Intel Corp., 3.300%, 10/1/21 | | | 104,863 | |

| | 125,000 | | | Oracle Corp., 3.875%, 7/15/20 | | | 134,316 | |

| | | | | | | | 682,501 | |

| | | | | Total Corporate Bonds | | $ | 20,900,894 | |

| | | | | | | | | |

| | | | | U.S. Government Mortgage-Backed Obligations — 21.1% | | | | |

| | 58,705 | | | FHLMC, Pool #A56988, 5.500%, 2/1/37 | | | 65,570 | |

| | 237,519 | | | FHLMC, Pool #A95946, 4.000%, 1/1/41 | | | 253,521 | |

| | 254,772 | | | FHLMC, Pool #A96485, 4.500%, 1/1/41 | | | 277,740 | |

| | 80,905 | | | FHLMC, Pool #G03217, 5.500%, 9/1/37 | | | 90,234 | |

| | 45,992 | | | FHLMC, Pool #G03781, 6.000%, 1/1/38 | | | 51,986 | |

| | 107,246 | | | FHLMC, Pool #G06031, 5.500%, 3/1/40 | | | 119,812 | |

| | 22,484 | | | FNMA, Pool #254759, 4.500%, 6/1/18 | | | 23,621 | |

| | 12,807 | | | FNMA, Pool #535290, 8.000%, 5/1/30 | | | 15,604 | |

| | 9,856 | | | FNMA, Pool #561741, 7.500%, 1/1/31 | | | 11,679 | |

| | 27,593 | | | FNMA, Pool #889734, 5.500%, 6/1/37 | | | 30,833 | |

| | 94,563 | | | FNMA, Pool #899079, 5.000%, 3/1/37 | | | 104,401 | |

| | 40,129 | | | FNMA, Pool #933806, 5.000%, 5/1/38 | | | 44,304 | |

| | 19,429 | | | FNMA, Pool #974401, 4.500%, 4/1/23 | | | 20,892 | |

| | 29,645 | | | FNMA, Pool #974403, 4.500%, 4/1/23 | | | 31,860 | |

| | 51,116 | | | FNMA, Pool #984256, 5.000%, 6/1/23 | | | 55,226 | |

| | 37,454 | | | FNMA, Pool #995220, 6.000%, 11/1/23 | | | 40,937 | |

| | 36,312 | | | FNMA, Pool #995472, 5.000%, 11/1/23 | | | 39,652 | |

| | 158,466 | | | FNMA, Pool #AB1149, 5.000%, 6/1/40 | | | 175,369 | |

| | 115,993 | | | FNMA, Pool #AB1800, 4.000%, 11/1/40 | | | 124,619 | |

| | 584,560 | | | FNMA, Pool #AB5910, 3.000%, 8/1/32 | | | 604,474 | |

| | 95,962 | | | FNMA, Pool #AB5989, 2.500%, 8/1/27 | | | 97,964 | |

| | 222,338 | | | FNMA, Pool #AD3795, 4.500%, 4/1/40 | | | 241,569 | |

| | 345,325 | | | FNMA, Pool #AD9150, 5.000%, 8/1/40 | | | 383,292 | |

| | 526,583 | | | FNMA, Pool #AE0548, 4.500%, 11/1/40 | | | 572,423 | |

| | 62,799 | | | FNMA, Pool #AE0831, 6.000%, 9/1/39 | | | 71,262 | |