UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8510

Matthews International Funds

(Exact name of registrant as specified in charter)

456 Montgomery Street, Suite 1200

San Francisco, CA 94104-1245

(Address of principal executive offices) (Zip code)

G. Paul Matthews, President

456 Montgomery Street, Suite 1200

San Francisco, CA 94104-1245

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-7553

Date of fiscal year end: August 31, 2003

Date of reporting period: August 31, 2003

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Matthews Asian Funds

Matthews Asian Funds

Investing in a region as complex and diverse as Asia requires knowledge, focus and commitment.

At Matthews Asian Funds, we invest exclusively in the Asian markets. While these markets certainly can be volatile, we are strong believers in the long-term prospects for this region.

www.matthewsfunds.com

CONTENTS

Message to Shareholders 2

Morningstar Analysis 6

Manager Comments,

Performance and

Schedule of Investments:

Matthews Pacific Tiger Fund 8

Matthews Asian Growth

and Income Fund 12

Matthews Korea Fund 18

Matthews China Fund 22

Matthews Japan Fund 26

Matthews Asian

Technology Fund 30

Statement of

Assets and Liabilities 34

Statement of Operations 36

Statement of

Changes in Net Assets 38

Financial Highlights 42

Notes to Financial Statements 48

Report of Independent

Certified Public Accountants 55

Trustees and Officers 56

MESSAGE TO SHAREHOLDERS

Dear Fellow Shareholders,

It is with pleasure that we present this Annual Report for the Matthews Asian Funds for the fiscal year ended August 31, 2003. We are particularly pleased to be able to report that during this period all six of our funds, collectively comprising the Matthews Asian Funds family, achieved positive returns.

As all of you who have been long-term owners of our funds can attest, it has by no means been a smooth ride and, as always, we would caution that Asian financial markets are likely to remain more volatile than their counterparts in the Western world.

Additionally, we are able to report that the four funds in our family that have been in existence for a full five years all provided positive returns for the five-year period ended August 31.

As all of you who have been long-term owners of our funds can attest, it has by no means been a smooth ride and, as always, we would caution that Asian financial markets are likely to remain more volatile than their counterparts in the Western world. Nevertheless, we remain enthusiastic about the long-term prospects for continued economic growth in Asia, which increasingly is being driven by the emergence of China as a truly global competitor.

The two events that had the most influence on Asian market sentiment during the 12 months ended August 31 were the war in Iraq and the outbreak and subsequent containment of the deadly SARS virus. The lead-up to the war created much uncertainty in Asia and caused wide fluctuations in world oil prices, which has a particular impact on a region that is generally dependent on imported oil. The end of the war and subsequent stabilization of oil prices were therefore greeted with some relief in the region, and Asia’s markets were generally stronger following the cessation of large-scale hostilities.

Shortly after this event, however, the outbreak of SARS dealt a short-lived shock to the financial systems of the region, with many commentators suggesting that its economic impact would rival that of the

2 MATTHEWS ASIAN FUNDS

financial crisis of 1997/98. With hindsight, this has clearly not been the case, and even the worst-hit sectors of Asian industry (notably tourism) have bounced back strongly from the dark days of March and April.

A third influence on sentiment amongst investors in Asia during this period has been the ups and downs of the negotiations between North Korea, the United States, Japan, South Korea and China regarding the longstanding dispute over North Korea’s nuclear program. This issue remains extremely complex, and the outcome of current negotiations is impossible to predict. Suffice it to say that any positive progress in this respect would be well received by investors in the region, and any setbacks are likely to cause weaker markets, in South Korea in particular.

On the economic front, the major developments over the past year have been the continued strong performance of the economy in mainland China and the nascent signs of life in the long-stagnant economy of Japan.

G. Paul Matthews Chairman and Chief Investment Officer (left)

Mark W. Headley President and Portfolio Manager

On the economic front, the major developments over the past year have been the continued strong performance of the economy in mainland China and the nascent signs of life in the long-stagnant economy of Japan. The question of how these two countries in particular have managed their currency regimes is currently the topic of much debate. Whether or not the large trade deficit of the United States can be addressed by changing the way in which Asia manages its exchange rate policies is a difficult question to answer. Generally speaking, we are supportive of the idea that exchange rates should be set by market forces, but we also believe that it is critically important that China engage in large-scale

800.789.ASIA (2742) www.matthewsfunds.com 3

MESSAGE TO SHAREHOLDERS

bank sector reform as a precursor to opening its currency on the capital account. A destabilized China would threaten global economic growth, and without addressing the problem of the high level of non-performing loans in the Chinese banking system, a freely floating renminbi could lead to such instability.

We have long sought to discourage market timing and are appalled at the “late trading” activity that has apparently occurred, which we view as illegal and amounting to simple theft. We support comprehensive regulation that assists fund companies in their efforts to serve shareholders.

One of the most encouraging changes in recent months, in our opinion, has been a renewed sense of confidence among the people of Hong Kong. Sentiment has been much improved there due to the strong recovery from SARS, as well as the aftermath to the political protests that led to a half-million people marching peacefully in the streets in Hong Kong in early June. That such demonstrations can still occur in Hong Kong is testimony to China’s willingness to abide by its undertakings to the people of Hong Kong at the time of the handover in 1997. Furthermore, China has taken a number of steps to help restore economic growth by encouraging mainland visitors to Hong Kong and by introducing a series of measures to further encourage integration with the mainland economy.

We would like to emphasize that Hong Kong is increasingly becoming an integral part of China—but a part that enjoys a strong legal structure, a well-regulated market and a free media. In our opinion, Hong Kong will remain the primary market for those equity investors seeking exposure to China’s opportunities for many years to come.

On a separate subject, we are pleased to announce the addition of the seventh fund in the Matthews Asian Funds series with the October 31, 2003, launch of the Matthews Asia Pacific Fund. A number of our investors have requested a portfolio that combines Japan with the rest of Asia. We believe that the region overall is becoming increasingly integrated into an economic

4 MATTHEWS ASIAN FUNDS

whole—with long-term implications for Asia’s entire corporate community. Combining the entire universe of Asian equities, including Australia and New Zealand, is an exciting challenge for our team.

No Message to Shareholders today would be complete without a discussion of the investigation into inappropriate trading activities within the mutual fund industry. While market timing is a legal activity that we have long sought to discourage through redemption fees and the banning of abusive parties, as well as the more recent emphasis on fair-value pricing, the “late trading” activity that has apparently occurred is illegal and amounts to simple theft. We support comprehensive regulation that assists fund companies in their efforts to serve shareholders. We believe that mutual funds remain one of the best vehicles available in the financial world for the long-term savings of individuals and institutions.

As always, we encourage you to visit our website at www.matthewsfunds.com, where a wide range of regular and ongoing e-mail communications on Asia and our Funds is available to shareholders.

Our sincere thanks to you, our fellow shareholders, for your continued support.

G. Paul Matthews

Chairman and Chief Investment Officer

Mark W. Headley

President and Portfolio Manager

| | OPENING OCTOBER 31, 2003 | |

| | | |

| | THE MATTHEWS ASIA PACIFIC FUND | |

| | | |

| | For information on this new fund and its investment objectives, visit our website at www.matthewsfunds.com. | |

| | | |

800.789.ASIA (2742) www.matthewsfunds.com 5

MATTHEWS PACIFIC TIGER FUND

Overall Morningstar rating as of 8/31/03 out of 75 Pacific/Asia ex-Japan Funds.

Investors seeking a bit of Asian spice for their overseas portfolio should consider this fund.

Matthews Pacific Tiger always has plenty of pop. Managers Mark Headley and Paul Matthews pay a lot of attention to phone- and computer-related stocks as they pursue issues with robust earnings prospects and moderate valuations. The Thai mobile-phone-system operator Advanced Information Systems is their top holding at 5% of assets, while the Taiwanese computer-parts maker Hon Hai Precision Instruments is their number-two holding at 4.4% of assets. Overall, the fund has 30% of its assets in telecom and tech names, which is twice the category norm.

Moreover, Headley and Matthews don’t hesitate to search beyond the region’s biggest markets and companies for good growth opportunities. While many of its peers have limited stakes in Indonesia, the fund has a 6% weighting in that market, ranging from the moderately popular carmaker Astra to the largely ignored department store chain Ramayana. And small caps, such as the Korean health-food manufacturer Pulmuone, currently make up about one fourth of the portfolio. Thus, the fund’s holdings have less overlap with the emerging-Asian exposure of the average foreign-stock offering than the stocks of the typical Pacific/Asia ex-Japan stock fund do.

The performance is just as appealing as the portfolio here. The fund has thrived in the recent surge. Whereas its typical peer soared 24% in the three months ending July 10, it zoomed 28%, fueled by larger-cap telecom names like Advanced Information Systems, smaller-cap tech names such as Internet Auction, and its Indonesia holdings, among other picks. And the fund has also prospered in past rallies, so it has handily outpaced its average peer since opening in late 1994.

In short, while it’s volatile, this fund is a terrific choice for investors who want a zesty Asian complement to their core foreign offering.

—William Samuel Rocco

Senior Analyst, Morningstar

July 11, 2003

Investing in foreign securities may involve certain additional risks including exchange rate fluctuations, reduced liquidity, greater volatility, and less regulation. Past performance does not guarantee future results. Investment return and principal value of mutual funds will vary with market conditions, so that shares, when redeemed, may be worth more or less than their original cost. As of 6/30/03, the 1-year total return for the Matthews Asian Growth and Income Fund was 7.55%, the 5-year average annual total return was 17.39% and since inception (9/12/94) the average annual total return was 8.10%. As of August 31, 2003, the Matthews Asian Growth and Income Fund received an Overall Morningstar Rating™ of 5 stars out of 75 funds in the Pacific/Asia ex-Japan stock category, 5 stars out of 75 funds for the 3-year period, and 5 stars out of 64 funds

6 MATTHEWS ASIAN FUNDS

MATTHEWS ASIAN GROWTH AND INCOME FUND

Overall Morningstar rating as of 8/31/03 out of 75 Pacific/Asia ex-Japan Funds.

This moderate play on emerging Asia has done what it’s supposed to, and then some.

Matthews Asian Growth & Income Fund continues to sport the safest portfolio in its category. It’s still the only offering in the group that invests significantly in convertibles bonds, and these issues, which currently make up 32% of assets, are relatively resilient due to their bond features. And, manager Paul Matthews remains focused on modest valuations and ample dividends while picking stocks. He picked up a couple of cheap Japanese REITs yielding 6% early this year, for example, as well as a similarly attractive Singapore REIT this spring. Thus, the fund’s equity stake, which is now 60% of assets, is also rather buoyant, as is its small position in preferred stocks.

Moreover, the fund pays more attention to issue diversification than most of its rivals. And Matthews’ focus on price and dividends while choosing stocks, as well as the industry composition of the convertibles market, skews the portfolio toward the value sectors.

Given all the conservative aspects of the fund’s style, it’s no surprise that the fund is the least volatile member of its category by far. The fund has a five-year standard deviation of 15, while the second tamest offering in the group has a five-year standard deviation of 22, and the category average is 33.

The fund’s safety features have their drawbacks, of course. The fund has lagged markedly as emerging Asia’s markets have surged this spring, and it has disappointed during other strong rallies. But it has acquitted itself well in more-moderate upturns in the region, and it has thrived during downturns. As a result, this fund has gained 8% per year since opening in late 1994, whereas its typical rival has lost 3% per year during that period.

We continue to think that this fund is a terrific way to make a play on emerging Asia without incurring a lot of risk.

—William Samuel Rocco

Senior Analyst, Morningstar

July 11, 2003

for the 5-year period. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. A fund’s rating may change at a ny time based on new data. Ratings are historical and do not represent future performance. Past performance is no guarantee of future results. Reprinted by permission of Morningstar.

800.789.ASIA (2742) www.matthewsfunds.com 7

MATTHEWS PACIFIC TIGER FUND

| | |

| | CO-PORTFOLIO MANAGERS

G. Paul Matthews

Mark W. Headley

The Matthews Pacific Tiger Fund is an all-capitalization, core equity fund focusing on the broad range of equity markets in Asia ex-Japan. |

| | |

PORTFOLIO MANAGER COMMENTS

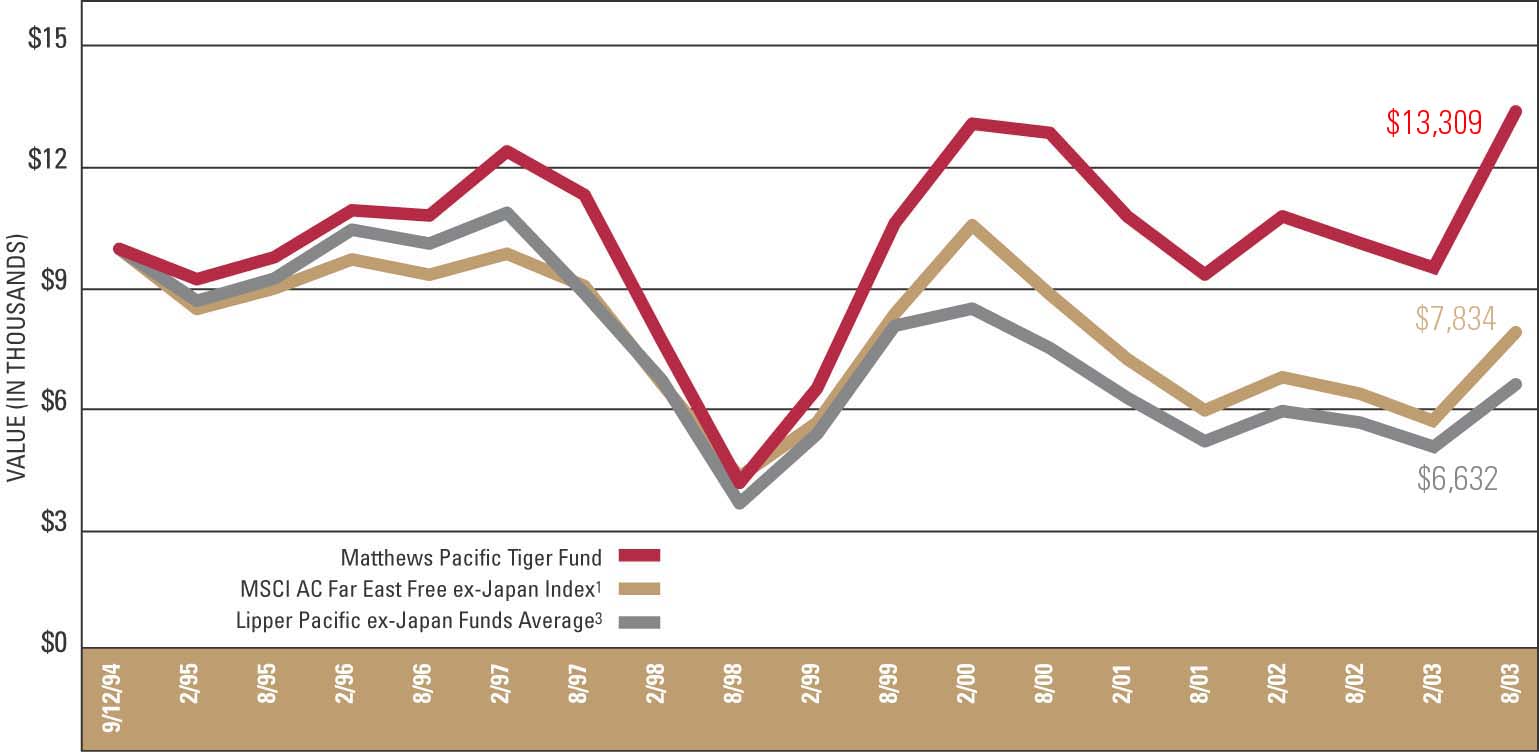

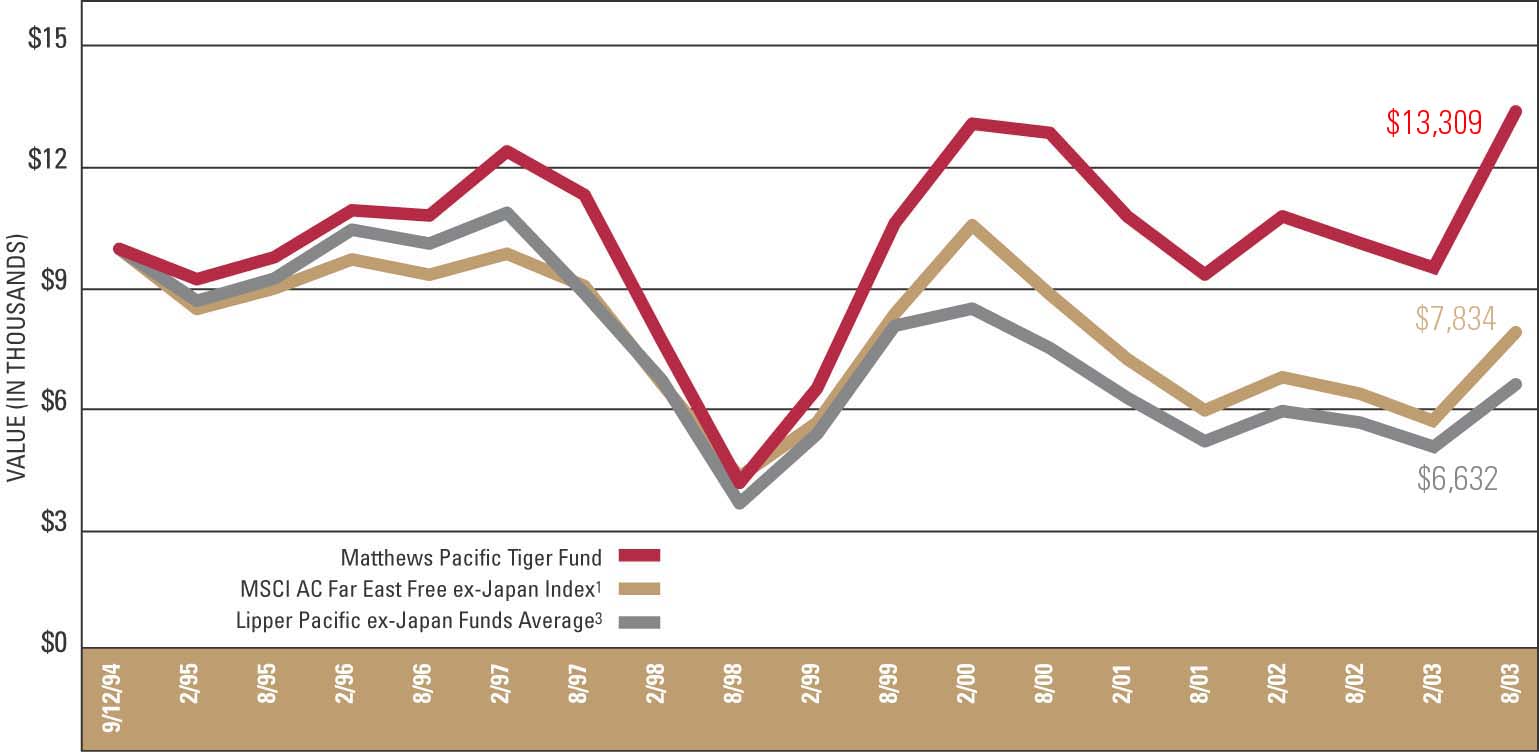

For the fiscal year ended August 31, 2003, the Matthews Pacific Tiger Fund gained 31.15%, outperforming its benchmark, the MSCI All Country Far East Free ex-Japan Index, which gained 17.23%. The peer group measured by the Lipper Pacific ex-Japan Funds Average gained 16.13%.

The Matthews Pacific Tiger Fund’s performance relative to its benchmark indices over the fiscal year benefited from overweight positions in consumer and information technology industries. By country, the primary contributors to positive returns were Hong Kong and South Korea. The Fund’s investment returns were positive in all countries with the exception of the Philippines, which produced a modest loss. The bottom-up nature of the Fund’s investment style was reflected in the fact that the top five individual contributors to performance during the year were based in different markets. The three positions with the most negative impact on performance were South Korean-listed companies, two of which were financial companies.

The Matthews Pacific Tiger Fund has now entered its tenth year of operations, and the environment in Asia has changed dramatically since its inception in September 1994. Markets that were once restricted, such as South Korea, are now largely open to foreign investment. China has taken an ever-more significant role in the Asian financial and economic universe. Hong Kong has successfully returned to Chinese sovereignty. In 1997 and 1998, the region weathered one of the most severe financial crises of the 20th century, and emerged stronger for it. The Fund’s focus on corporations that drive change in Asia helped it outperform its benchmark and peer group in all the standard time periods—one year, three years, five years and since its inception.

The Fund remains driven by “bottom-up” stock selection, with careful consideration of the local environment in which companies must operate. Diversification is achieved across nations, industries and market capitalization. A careful balance is maintained between companies that derive their earnings from domestic operations and those that compete in the global market. That balance has, for several years, been weighted toward those companies that operate primarily within their local economies or within the region. This bias is accomplished through a focus on consumer/retail companies and financials. We believe that these sectors are poorly understood by global investors and offer a purer play on Asia’s long-term progress than do export-related companies.

As we look forward, we see an Asian region that is increasingly integrated and open to trade and investment flows from neighbors as well as from other regions such as the United States and Europe. We are convinced that Asian governmental policy is slowly grasping the importance of domestically driven growth that complements the region’s export prowess. A more mature and well-balanced Asian environment is emerging, and the Matthews Pacific Tiger Fund continues to participate in this trend.

8 MATTHEWS ASIAN FUNDS

FUND PERFORMANCE

Average Annual Returns as of August 31, 2003

- ------------------------------------------------------------------------------

MSCI ALL COUNTRY

MATTHEWS PACIFIC FAR EAST FREE LIPPER PACIFIC

TIGER FUND EX-JAPAN INDEX(1) EX-JAPAN FUNDS

AVERAGE(2)

- ------------------------------------------------------------------------------

One Year 31.15% 17.23% 16.13%

- ------------------------------------------------------------------------------

Five Years 26.24% 12.77% 13.23%

- ------------------------------------------------------------------------------

Since Inception (9/12/94) 3.24% -4.48% -3.09%*

- ------------------------------------------------------------------------------

*From 8/31/94

GROWTH OF A $10,000 INVESTMENT

| | | Past performance is not indicative of future results. Before taxes on distributions or redemptions of Fund shares. |

| (1) | | The MSCI All Country Far East Free ex-Japan Index is an unmanaged capitalization-weighted index of stock markets of Hong Kong, Taiwan, Singapore, Korea, Indonesia, Malaysia, Philippines, Thailand and China that excludes securities not available to foreign investors. Taiwan is represented at only 50% of its total market cap. |

| (2) | | As of 8/31/03, the Lipper Pacific ex-Japan Funds Average consisted of 66 funds for the one-year period, 48 funds for the five-year period, and 20 funds since 8/31/94. Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| (3) | | For Lipper Pacific ex-Japan Funds Average, graph start date is 8/31/94. |

800.789.ASIA (2742) www.matthewsfunds.com 9

MATTHEWS PACIFIC TIGER FUND

SCHEDULE OF INVESTMENTS

EQUITIES: 95.82%*

SHARES VALUE

===========================================================================

CHINA/HONG KONG: 38.34%

Asia Satellite Telecommunications

Holdings, Ltd. 1,476,600 $2,357,074

China Insurance International

Holdings Co., Ltd. 6,182,000 3,388,490

China Merchants Holdings

International Co., Ltd. 3,496,000 3,899,705

China Mobile HK, Ltd. 1,552,717 3,991,606

China Mobile HK, Ltd. ADR 165,850 2,151,075

China Pharmaceutical Group, Ltd. 9,291,000 3,365,286

Dah Sing Financial Group 1,504,400 8,911,408

Giordano International, Ltd. 20,923,000 8,718,632

Hang Lung Group, Ltd. 6,015,000 6,169,737

Huaneng Power International,

Inc. ADR 100,200 5,500,980

Legend Group, Ltd. 18,124,000 7,784,664

Moulin International

Holdings, Ltd. 6,370,000 3,756,975

Sa Sa International

Holdings, Ltd. 3,410,000 699,545

Shangri-La Asia, Ltd. 6,022,000 5,018,745

Swire Pacific, Ltd. A Shares 1,647,500 9,252,105

Television Broadcasts, Ltd. 1,324,700 5,587,975

Travelsky Technology,

Ltd. H Shares 1,180,000 1,013,673

Tsingtao Brewery Co.,

Ltd. H Shares 5,032,000 4,225,936

Vitasoy International

Holdings, Ltd. 8,948,750 2,180,003

- ---------------------------------------------------------------------------

Total China/Hong Kong 87,973,614

===========================================================================

INDIA: 2.28%

Hero Honda Motors, Ltd. 469,000 2,972,686

Infosys Technologies, Ltd. 26,500 2,260,593

- ---------------------------------------------------------------------------

Total India 5,233,279

===========================================================================

INDONESIA: 4.47%

PT Astra International ** 7,261,230 3,251,935

PT Bank Central Asia 8,660,000 2,985,327

PT Ramayana Lestari Sentosa 11,554,000 4,017,006

- ---------------------------------------------------------------------------

Total Indonesia 10,254,268

===========================================================================

SHARES VALUE

===========================================================================

PHILIPPINES: 0.30%

SM Prime Holdings 7,030,000 $690,595

===========================================================================

SINGAPORE: 14.97%

DBS Group Holdings, Ltd. 1,114,750 8,012,921

Fraser & Neave, Ltd. 1,301,500 7,239,218

Great Eastern Holdings, Ltd. 767,500 4,509,812

Hyflux, Ltd. 4,343,000 4,311,039

Parkway Holdings, Ltd. 4,329,000 2,160,919

Venture Corp., Ltd. 704,800 8,121,946

- ---------------------------------------------------------------------------

Total Singapore 34,355,855

===========================================================================

SOUTH KOREA: 22.04%

Amorepacific Corp. 37,680 4,732,985

Hana Bank 573,587 8,348,837

Hite Brewery Co., Ltd. 89,977 5,108,815

Internet Auction Co., Ltd. ** 61,200 4,072,209

Kookmin Bank 103,970 3,789,952

KT Corp. ADR 66,000 1,244,100

Nong Shim Co., Ltd. 20,508 2,262,712

Pulmuone Co., Ltd. 75,970 3,339,907

Samsung Electronics Co., Ltd. 16,713 6,170,299

Samsung Securities Co., Ltd. 180,580 4,582,510

SK Telecom Co., Ltd. 25,305 4,316,830

SK Telecom Co., Ltd. ADR 136,500 2,601,690

- ---------------------------------------------------------------------------

Total South Korea 50,570,846

===========================================================================

TAIWAN: 5.24%

Hon Hai Precision Industry

Co., Ltd. 2,145,300 8,855,538

Taiwan Semiconductor

Manufacturing Co., Ltd. ** 1,614,189 3,166,190

- ---------------------------------------------------------------------------

Total Taiwan 12,021,728

===========================================================================

THAILAND: 8.18%

Advanced Info Service

Public Co., Ltd. 5,502,900 7,432,734

Bangkok Bank Public Co., Ltd. ** 4,034,800 8,297,413

Serm Suk Public Co., Ltd. 4,241,000 3,044,768

- ---------------------------------------------------------------------------

Total Thailand 18,774,915

===========================================================================

See accompanying notes to financial statements.

10 MATTHEWS ASIAN FUNDS

VALUE

===========================================================================

TOTAL INVESTMENTS: 95.82% $219,875,100

(Cost $176,309,686***)

CASH AND OTHER ASSETS,

LESS LIABILITIES: 4.18% 9,591,837

- ---------------------------------------------------------------------------

NET ASSETS: 100.00% $229,466,937

===========================================================================

* As a percentage of net assets as of August 31, 2003

** Non - income producing security.

ADR American Depositary Receipt

*** Cost for Federal income tax purposes is $176,894,084 and

net unrealized appreciation consists of:

Gross unrealized appreciation $46,968,628

Gross unrealized depreciation (3,987,612)

-----------

Net unrealized appreciation $42,981,016

===========

MARKET SECTOR DIVERSIFICATION

As a Percentage of Total Value of Investment in Securities

Consumer Discretionary 21.52%

Automobile 1.35%

Cosmetics 0.32%

Distributors 1.48%

Hotels, Restaurants & Leisure 2.28%

Internet & Catalog Retail 1.85%

Media 4.46%

Retail 9.78%

Consumer Staples 12.69%

Beverages 9.15%

Food Products 3.54%

Financials 31.05%

Banks 18.36%

Diversified Financials 6.29%

Insurance 3.59%

Real Estate 2.81%

Health Care 2.51%

Pharmaceuticals 2.51%

Information Technology 17.00%

Computer Software 1.49%

Computers & Peripherals 3.54%

Electronic Equipment & Instruments 7.72%

Semiconductor Equipment & Products 4.25%

Industrial 1.77%

Industrial Conglomerates 1.77%

Telecommunication Services 10.96%

Diversified Telecommunication Services 5.02%

Wireless Telecommunication Services 5.94%

Utilities 2.50%

Electric Utilities 2.50%

===========================================================================

TOTAL INVESTMENTS 100.00%

See accompanying notes to financial statements.

800.789.ASIA (2742) www.matthewsfunds.com 11

MATTHEWS ASIAN GROWTH AND INCOME FUND

| | |

| | PORTFOLIO MANAGER

G. Paul Matthews

The Matthews Asian Growth and Income Fund seeks long-term capital appreciation and some current income through investments in higher-yielding equities, convertible bonds, and preferred shares of Asia-based companies. |

| | |

PORTFOLIO MANAGER COMMENTS

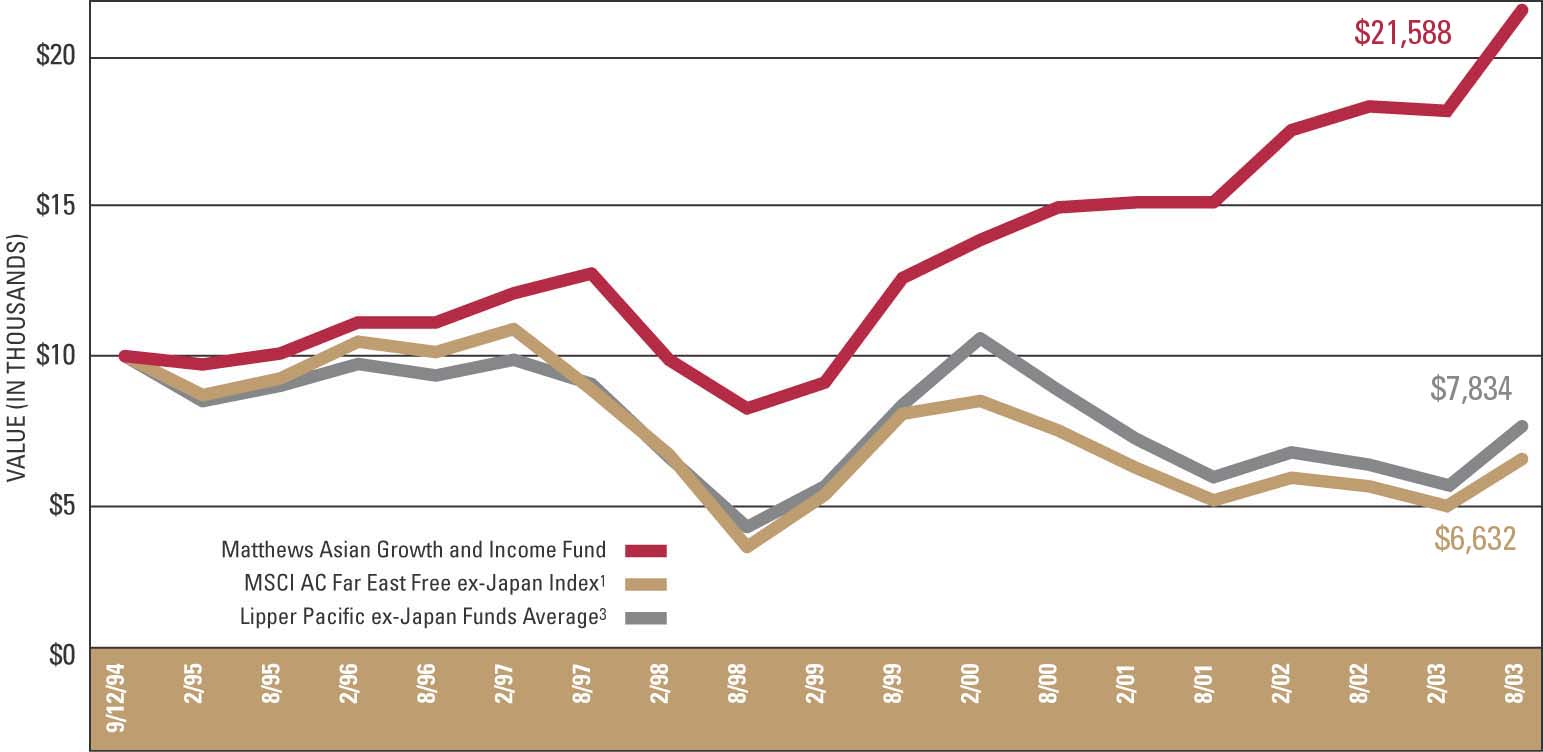

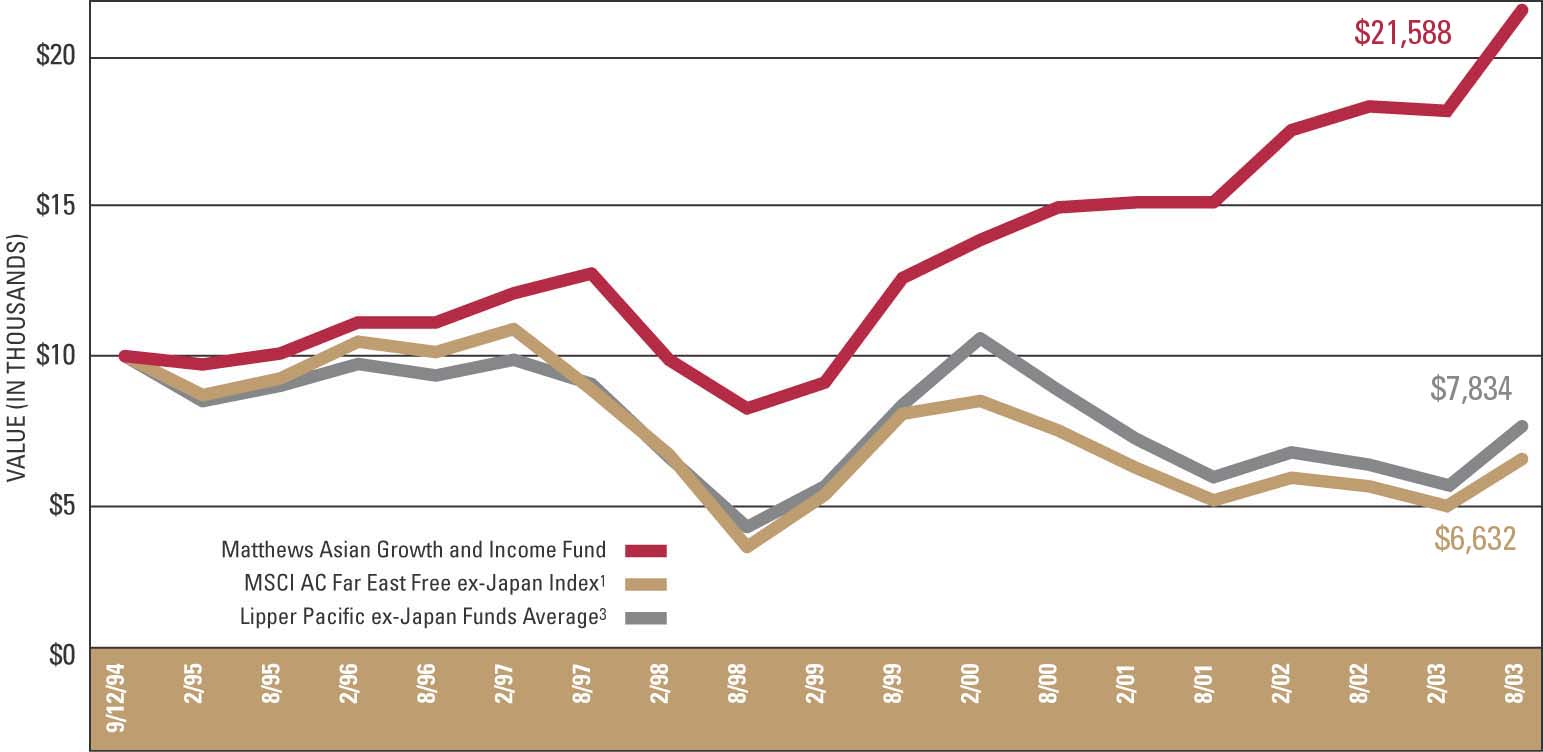

For the fiscal year ended August 31, 2003, the Matthews Asian Growth and Income Fund gained 17.81%, while its benchmark, the MSCI All Country Far East Free ex-Japan Index, gained 17.23%. Generally speaking, the Fund outperformed its benchmark in the first half of the year but lagged in the second half, ending the year almost exactly in line with its benchmark. The Fund seeks both capital gains and some income through investing in dividend-paying stocks and convertible bonds in Asia, so its performance characteristics are likely to differ over time from pure equity benchmarks.

In general, during periods of strong equity market performance the Fund is likely to rise less than the indices, but it also is intended to fall less than those indices during periods of weak equity market performance. One of our objectives over long periods of time is to generate less-volatile returns than have historically been achieved by pure equity funds in the region, although of course there can be no guarantee that this will always be the case.

During the fiscal year, the Fund reduced its exposure to convertible bonds from approximately 40% of fund assets to approximately 26%, based on our view that the environment was more positive for dividend-paying equities than for more bond-like securities. By country, the portfolio remained well diversified, although its exposure to South Korea was reduced to approximately 17%; weightings in Singapore rose to approximately 13%, and a small exposure was added in Japanese REITs.

Outside of REITs, the Fund has invested in real estate-related businesses in Hong Kong, and those positions were increased during the year and contributed positively to investment. New positions were also added during the year to energy-related companies, which also made significant positive contributions to the Fund’s performance. The investments that did least well for the Fund were the positions in convertible bonds of Asian telecommunications companies, which underperformed during the year.

It is encouraging to note that many companies in Asia are actively developing policies to increase dividend payouts. Overall, we believe that focusing on dividend-paying companies in Asia remains an appropriate strategy for less-aggressive investors in Asia.

12 MATTHEWS ASIAN FUNDS

FUND PERFORMANCE

Average Annual Returns as of August 31, 2003

- ------------------------------------------------------------------------------

MATTHEWS ASIAN MSCI ALL COUNTRY LIPPER PACIFIC

GROWTH AND FAR EAST FREE EX-JAPAN FUNDS

INCOME FUND EX-JAPAN INDEX(1) AVERAGE(2)

- ------------------------------------------------------------------------------

One Year 17.81% 17.23% 16.13%

- ------------------------------------------------------------------------------

Five Years 21.20% 12.77% 13.23%

- ------------------------------------------------------------------------------

Since Inception (9/12/94) 8.96% -4.48% -3.09%*

- ------------------------------------------------------------------------------

*From 8/31/94

GROWTH OF A $10,000 INVESTMENT

| | | Past performance is not indicative of future results. Before taxes on distributions or redemptions of Fund shares. |

| (1) | | The MSCI All Country Far East Free ex-Japan Index is an unmanaged capitalization-weighted index of stock markets of Hong Kong, Taiwan, Singapore, Korea, Indonesia, Malaysia, Philippines, Thailand and China that excludes securities not available to foreign investors. Taiwan is represented at only 50% of its total market cap. |

| (2) | | As of 8/31/03, the Lipper Pacific ex-Japan Funds Average consisted of 66 funds for the one-year period, 48 funds for the five-year period, and 20 funds since 8/31/94. Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| (3) | | For Lipper Pacific ex-Japan Funds Average, graph start date is 8/31/94. |

800.789.ASIA (2742) www.matthewsfunds.com 13

MATTHEWS ASIAN GROWTH AND INCOME FUND

SCHEDULE OF INVESTMENTS

EQUITIES: 69.62%*

SHARES VALUE

===========================================================================

CHINA/HONG KONG: 33.15%

BOC Hong Kong Holdings, Ltd. 1,937,000 $2,483,537

Cafe De Coral Holdings, Ltd. 11,275,100 9,396,688

Cheung Kong Infrastructure

Holdings, Ltd. 3,547,500 7,345,747

China Hong Kong Photo Products

Holdings, Ltd. 8,810,003 609,973

CLP Holdings, Ltd. 2,753,700 12,145,519

Giordano International, Ltd. 24,585,000 10,244,591

Hang Lung Group, Ltd. 4,156,000 4,262,914

Hang Seng Bank, Ltd. 720,000 7,985,271

Hengan International Group Co.,

Ltd. 11,018,000 4,803,112

Hong Kong and China Gas Co.,

Ltd. 6,550,000 8,818,031

Hongkong Electric Holdings, Ltd. 2,360,000 9,319,739

Hongkong Land Holdings, Ltd. 6,035,000 8,086,900

Kerry Properties, Ltd. 2,989,901 3,986,862

Lerado Group Holding Co., Ltd. 2,950,000 521,966

MTR Corp., Ltd. 4,025,000 5,057,466

PetroChina Co., Ltd. ADR 173,900 6,216,925

PetroChina Co., Ltd. H Shares 27,016,000 9,439,057

Shandong International

Power Development Co., Ltd.

H Shares 11,644,000 3,396,445

Shangri-La Asia, Ltd. 11,287,000 9,406,605

Sun Hung Kai Properties, Ltd. 2,651,000 19,119,357

Television Broadcasts, Ltd. 3,152,000 13,296,065

The Bank of East Asia, Ltd. 2,084,000 4,916,506

The Wharf Holdings, Ltd. 4,634,000 10,872,969

Vitasoy International Holdings,

Ltd. 20,765,000 5,058,556

- ---------------------------------------------------------------------------

Total China/Hong Kong 176,790,801

===========================================================================

SHARES VALUE

===========================================================================

INDONESIA: 2.20%

PT Indonesian Satellite Corp. ADR 171,000 $1,631,340

PT Ramayana Lestari Sentosa 2,747,000 955,056

PT Telekomunikasi Indonesia 880,000 474,484

PT Telekomunikasi Indonesia ADR 388,500 4,351,200

PT Tempo Scan Pacific 7,162,500 4,305,097

- ---------------------------------------------------------------------------

Total Indonesia 11,717,177

===========================================================================

JAPAN: 2.17%

Japan Retail Fund Investment

Corp. REIT 1,409 7,426,594

Nippon Building Fund, Inc. REIT 759 4,156,676

- ---------------------------------------------------------------------------

Total Japan 11,583,270

===========================================================================

SINGAPORE: 10.54%

CapitaMall Trust REIT 9,426,000 6,345,302

Fraser & Neave, Ltd. 2,999,800 16,685,521

Singapore Exchange, Ltd. 9,189,000 8,649,581

Singapore Press Holdings, Ltd. 1,137,000 12,129,557

Singapore Telecommunications,

Ltd. 12,789,000 12,403,046

- ---------------------------------------------------------------------------

Total Singapore 56,213,007

===========================================================================

See accompanying notes to financial statements.

14 MATTHEWS ASIAN FUNDS

SHARES VALUE

===========================================================================

SOUTH KOREA: 11.69%

Daehan City Gas Co., Ltd. 280,300 $3,568,428

Hyundai Motor Co., Ltd., Pfd. 721,890 10,966,969

Hyundai Motor Co., Ltd., 2nd Pfd. 173,390 2,648,861

Korea Electric Power Corp. 129,500 2,121,239

Korea Electric Power Corp. ADR 343,250 3,168,197

Korea Gas Corp. 60,870 1,358,694

Korean Reinsurance Co. 159,300 4,096,575

LG Household & Health Care,

Ltd., Pfd. 177,830 2,641,226

Samsung Electronics Co., Ltd., Pfd. 58,440 10,564,583

Samsung Fire & Marine Insurance

Co., Ltd. 56,590 3,121,876

Samsung Fire & Marine Insurance

Co., Ltd., Pfd. 142,820 3,781,866

Shinhan Financial Group Co., Ltd. 619,300 8,409,760

Sindo Ricoh Co., Ltd. 94,290 5,913,881

- ---------------------------------------------------------------------------

Total South Korea 62,362,155

===========================================================================

TAIWAN: 1.72%

Chunghwa Telecom Co., Ltd. 648,000 927,666

Chunghwa Telecom Co., Ltd. ADR 582,200 8,220,664

- ---------------------------------------------------------------------------

Total Taiwan 9,148,330

===========================================================================

SHARES VALUE

===========================================================================

THAILAND: 4.78%

Bangkok Bank Public Co., Ltd. ** 2,926,300 $6,017,825

Charoen Pokphand Foods Public

Co., Ltd. 33,805,000 4,360,344

Charoen Pokphand Foods Public

Co., Ltd., Foreign 9,260,000 1,194,403

Charoen Pokphand Foods Public

Co., Ltd., Warrants ** 638,000 106,359

PTT Public Co., Ltd. 990,000 1,758,823

PTT Public Co., Ltd., Foreign 5,199,000 9,236,483

Thai Reinsurance Public

Co., Ltd. 25,672,800 2,836,567

- ---------------------------------------------------------------------------

Total Thailand 25,510,804

===========================================================================

UNITED KINGDOM: 3.37%

HSBC Holdings PLC 329,600 4,289,378

HSBC Holdings PLC ADR 213,000 13,700,160

- ---------------------------------------------------------------------------

Total United Kingdom 17,989,538

===========================================================================

TOTAL EQUITIES 371,315,082

(Cost $316,323,157)

===========================================================================

* As a percentage of net assets as of August 31, 2003

** Non - income producing security.

See accompanying notes to financial statements.

800.789.ASIA (2742) www.matthewsfunds.com 15

MATTHEWS ASIAN GROWTH AND INCOME FUND

SCHEDULE OF INVESTMENTS (continued)

INTERNATIONAL DOLLAR BONDS: 26.26%*

FACE AMOUNT VALUE

===========================================================================

CHINA/HONG KONG: 11.47%

China Mobile Hong Kong, Ltd., Cnv.

2.250%, 11/03/05 $25,150,000 $24,929,937

Hang Lung Properties., Ltd., Cnv.

5.500%, 12/29/49 11,550,000 10,972,500

New World Capital Finance, Ltd., Cnv.

3.000%, 06/09/04 3,600,000 4,396,500

PCCW Capital II, Ltd., Cnv.

1.000%, 01/29/07 16,050,000 16,992,938

Tingyi (C.I.) Holding Corp., Cnv.

3.500%, 06/04/05 3,500,000 3,885,000

- ---------------------------------------------------------------------------

Total China/Hong Kong 61,176,875

===========================================================================

SINGAPORE: 2.48%

Finlayson Global Corp., Cnv.

0.000%, 02/19/04 10,150,000 13,080,813

Finlayson Global Corp., Cnv. ***

0.000%, 02/19/04 100,000 128,875

- ---------------------------------------------------------------------------

Total Singapore 13,209,688

===========================================================================

SOUTH KOREA: 5.97%

Korea Deposit Insurance Corp., Cnv.

2.250%, 10/11/05 8,820,000 10,837,575

Korea Telecom Corp., Cnv.

0.250%, 01/04/07 20,325,000 20,604,469

Korea Telecom Corp., Cnv.***

0.250%, 01/04/07 375,000 380,156

- ---------------------------------------------------------------------------

Total South Korea 31,822,200

===========================================================================

FACE AMOUNT VALUE

===========================================================================

TAIWAN: 5.36%

Cathay Financial Holding Co., Cnv.

0.000%, 05/20/07 $10,600,000 $11,236,000

Fubon Financial Holding Co., Ltd., Cnv.

0.000%, 07/10/04 11,000,000 11,728,750

Sinopac Holdings Co., Cnv.

0.000%, 07/12/07 5,000,000 5,631,250

- ---------------------------------------------------------------------------

Total Taiwan 28,596,000

===========================================================================

THAILAND: 0.98%

Bangkok Bank Public Co., Ltd., Cnv.

4.589%, 03/03/04 8,450,000 5,217,875

- ---------------------------------------------------------------------------

TOTAL INTERNATIONAL DOLLAR BONDS 140,022,638

(Cost $141,223,233)

- ---------------------------------------------------------------------------

TOTAL INVESTMENTS: 95.88%* 511,337,720

(Cost $457,546,390****)

CASH AND OTHER ASSETS,

LESS LIABILITIES: 4.12% 21,964,688

- ---------------------------------------------------------------------------

NET ASSETS: 100.00% $533,302,408

===========================================================================

* As a percentage of net assets as of August 31, 2003

** Non - income producing security.

*** Securities exempt from registration under rule 144A of the Securities Act

of 1933. These securities may be resold in transactions exempt from

registration, normally to qualified, institutional buyers. At August 31,

2003, the value of these securities amounted to $509,031 or 0.10% of net

assets.

ADR American Depositary Receipt

Pfd. Preferred

Cnv. Convertible

REIT Real Estate Investment Trust

**** Cost for Federal income tax purposes is $457,724,749 and

net unrealized appreciation consists of:

Gross unrealized appreciation $58,157,124

Gross unrealized depreciation (4,544,153)

-----------

Net unrealized appreciation $53,612,971

===========

See accompanying notes to financial statements.

16 MATTHEWS ASIAN FUNDS

MARKET SECTOR DIVERSIFICATION

As a Percentage of Total Value of Investment in Securities

Consumer Discretionary 16.21%

Automobiles 2.66%

Hotels, Restaurants & Leisure 7.42%

Media 2.60%

Retail 3.53%

Consumer Staples 5.52%

Beverages 3.25%

Food Products 1.75%

Household Products 0.52%

Energy 5.47%

Oil & Gas 5.47%

Financials 35.67%

Banks 11.32%

Diversified Financials 11.05%

Insurance 4.83%

Real Estate 8.47%

Health Care 1.78%

Medical & Pharmaceutical 1.78%

Industrials 6.73%

Agriculture 1.11%

Distributors 0.82%

Industrial Conglomerates 3.81%

Transportation Infrastructure 0.99%

Information Technology 3.22%

Semiconductor Equipment & Products 3.22%

Telecommunication Services 17.78%

Diversified Telecommunication Services 12.90%

Wireless Telecommunication Services 4.88%

Utilities 7.62%

Electric Utilities 5.90%

Gas Utilities 1.72%

=======================================================

TOTAL INVESTMENTS 100.00%

See accompanying notes to financial statements.

800.789.ASIA (2742) www.matthewsfunds.com 17

MATTHEWS KOREA FUND

CO-PORTFOLIO MANAGERS

G. Paul Matthews

Mark W. Headley

The Matthews Korea Fund is an all-capitalization equity fund with diversified exposure across a wide range of Korean equities.

PORTFOLIO MANAGER COMMENTS

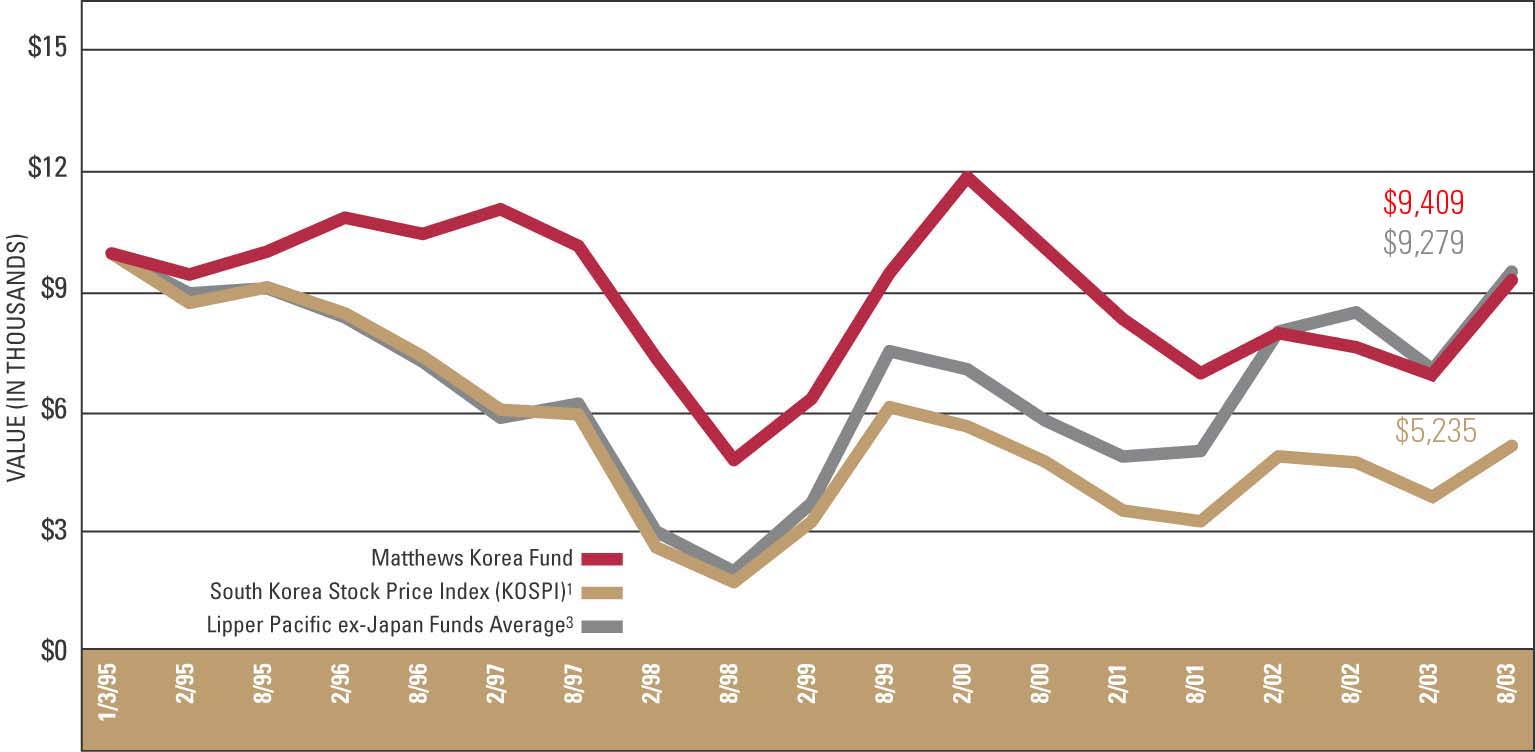

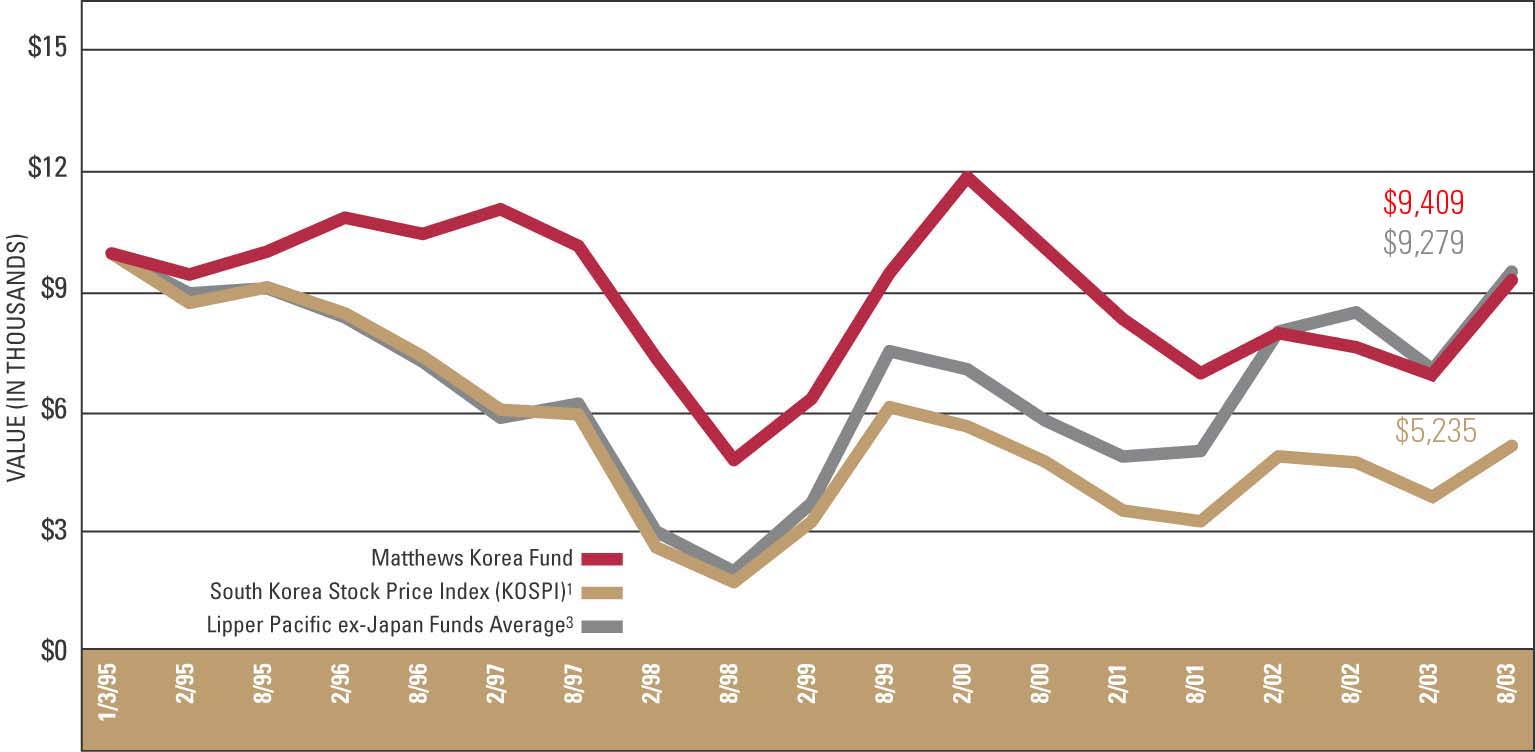

Korean equities experienced a challenging environment during the fiscal year ended August 31, 2003, clouded by the North Korean threat, the U.S. war with Iraq and weak consumer spending. However, since Korea’s market bottom in March, the expectation of a consumer-spending recovery along with the resilient performance of exporters gave investors enough confidence to pull the market out of negative territory. For the fiscal year, the Fund gained 8.80%, while the benchmark KOSPI Index gained 7.49%.

Consumer spending was the key contributor behind the Korean economy’s resilient performance during the fiscal year. However, as global uncertainties and geographical risks grew late in the second half of 2002, consumer spending slowed dramatically and turned against the market. Consumer spending remains weak, with no concrete signs of recovery yet in evidence. The asset quality for many Korean banks remains problematic despite the government buying billions of dollars worth of non-performing loans. The ongoing North Korean issue remains one of the major risks for the South Korean market and one that is difficult to quantify.

While foreign investors worried about North Korea, domestic politics have been a bigger issue for South Korean local investors. New president Roh Moo-hyun and his cabinet took office in February 2003, promising to put an end to corruption and to continue to restructure the economy; however, the latest approval rating for President Roh was the lowest ever for a newly elected president. The president’s relatively young and inexperienced cabinet members have been heavily criticized for inconsistent public policies and poor public relations—especially by the local media.

Despite these difficulties, however, the general status of the Korean economy remains healthy. South Korea has more than US$130 billion in foreign reserves and consistently registers trade surpluses. Exports remain resilient despite Korea’s strengthening currency and a slow global recovery. Korean companies are becoming more globally competitive and continue to expand market share in major markets. A key to further market progress remains the reform of the domestic asset management industry that, unlike the banking system, remains mired in past practices and discourages market participation by domestic investors. We continue to believe that the long-term growth prospects of the South Korean economy remain attractive.

18 MATTHEWS ASIAN FUNDS

FUND PERFORMANCE

Average Annual Returns as of August 31, 2003

- -----------------------------------------------------------------------------------

MATTHEWS LIPPER PACIFIC

KOREA FUND KOSPI INDEX(1) EX-JAPAN FUNDS

AVERAGE(2)

- -----------------------------------------------------------------------------------

One Year 8.80% 7.49% 16.13%

- -----------------------------------------------------------------------------------

Five Years 35.28% 24.10% 13.23%

- -----------------------------------------------------------------------------------

Since Inception (1/3/95) -0.86% -7.41% -1.37%*

- -----------------------------------------------------------------------------------

*From 12/31/94

GROWTH OF A $10,000 INVESTMENT

Past performance is not indicative of future results. Before taxes on distributions or redemptions of Fund shares.

| (1) | KOSPI: The South Korea Stock Price Index is a capitalization-weighted index of all common stocks listed on the Korean Stock Exchange. |

| (2) | As of 8/31/03, the Lipper Pacific ex-Japan Funds Average consisted of 66 funds for the one-year period, 48 funds for the five-year period, and 25 funds since 12/31/94. Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| (3) | For Lipper Pacific ex-Japan Funds Average, graph start date is 12/31/94. |

800.789.ASIA (2742) www.matthewsfunds.com 19

MATTHEWS KOREA FUND

SCHEDULE OF INVESTMENTS

EQUITIES: SOUTH KOREA: 102.85%*

SHARES VALUE

==============================================================================

BUSINESS SERVICES: 3.58%

Media: 3.58%

Cheil Communications, Inc. 24,740 $2,687,647

CJ Entertainment, Inc. 353,357 5,083,302

- ------------------------------------------------------------------------------

Total Business Services 7,770,949

==============================================================================

CONSUMER DISCRETIONARY: 11.06%

Automobiles: 4.69%

Hyundai Motor Co., Ltd. 176,361 5,867,474

Hyundai Motor Co., Ltd., Pfd. 285,320 4,334,588

- ------------------------------------------------------------------------------

10,202,062

- ------------------------------------------------------------------------------

Department Stores: 0.45%

Taegu Department Store Co., Ltd. 121,300 983,166

- ------------------------------------------------------------------------------

Internet & Catalog Retail: 3.98%

Internet Auction Co., Ltd. ** 84,197 5,602,414

LG Home Shopping, Inc. 46,483 3,037,718

- ------------------------------------------------------------------------------

8,640,132

- ------------------------------------------------------------------------------

Retail: 1.94%

Hyundai Department Store Co., Ltd. 150,610 4,218,230

- ------------------------------------------------------------------------------

Total Consumer Discretionary 24,043,590

==============================================================================

CONSUMER STAPLES: 16.24%

Beverages: 3.42%

Hite Brewery Co., Ltd. 111,001 6,302,539

Lotte Chilsung Beverage Co., Ltd. 2,330 1,137,068

- ------------------------------------------------------------------------------

7,439,607

- ------------------------------------------------------------------------------

Consumer Products: 4.75%

Amorepacific Corp. 54,200 6,808,063

Handsome Co., Ltd. 385,029 3,512,889

- ------------------------------------------------------------------------------

10,320,952

- ------------------------------------------------------------------------------

Food Products: 7.21%

CJ Corp. 81,250 3,585,826

Nong Shim Co., Ltd. 48,400 5,340,123

ORION Corp. 62,540 4,405,534

Pulmuone Co., Ltd. 53,000 2,330,066

- ------------------------------------------------------------------------------

15,661,549

- ------------------------------------------------------------------------------

Household Products / Ware: 0.86%

LG Household & Health Care, Ltd.,

Pfd. 126,050 1,872,162

- ------------------------------------------------------------------------------

Total Consumer Staples 35,294,270

==============================================================================

SHARES VALUE

==============================================================================

FINANCIALS: 23.65%

Banks: 15.79%

Hana Bank 871,854 $12,690,257

Kookmin Bank 311,933 11,370,696

Kookmin Bank ADR 93,139 3,464,771

Shinhan Financial Group Co., Ltd. 500,062 6,790,572

- ------------------------------------------------------------------------------

34,316,296

- ------------------------------------------------------------------------------

Diversified Financials: 3.89%

Kookmin Credit Card Co., Ltd. ** 144,000 2,309,866

Samsung Securities Co., Ltd. 241,885 6,138,223

- ------------------------------------------------------------------------------

8,448,089

- ------------------------------------------------------------------------------

Insurance: 3.97%

Samsung Fire & Marine Insurance

Co., Ltd. 109,303 6,029,870

Samsung Fire & Marine Insurance

Co., Ltd., Pfd. 98,000 2,595,035

- ------------------------------------------------------------------------------

8,624,905

- ------------------------------------------------------------------------------

Total Financials 51,389,290

==============================================================================

HEALTH CARE: 4.44%

Pharmaceuticals: 4.44%

Hanmi Pharm Co., Ltd. 195,000 4,418,841

Yuhan Corp. 92,767 5,219,989

- ------------------------------------------------------------------------------

Total Health Care 9,638,830

==============================================================================

INDUSTRIALS: 7.62%

Commercial Services: 2.43%

S1 Corp. 273,615 5,271,428

Construction: 2.73%

Tae Young Corp. 157,330 5,942,020

Electrical Products: 0.92%

Korea Electric Terminal Co., Ltd. 109,720 2,002,105

Manufacturing Industries: 0.44%

Daewoo International Corp. ** 264,900 951,010

Metals & Mining: 1.10%

Poongsan Corp. 303,540 2,388,131

- ------------------------------------------------------------------------------

Total Industrials 16,554,694

==============================================================================

See accompanying notes to financial statements.

20 MATTHEWS ASIAN FUNDS

SHARES VALUE

==============================================================================

INFORMATION TECHNOLOGY: 23.38%

Electrical & Electronic Equipment: 3.58%

Daeduck Electronics Co., Ltd. 489,933 $4,740,281

Daeduck GDS Co., Ltd. 282,150 3,041,209

- ------------------------------------------------------------------------------

7,781,490

- ------------------------------------------------------------------------------

Internet Software & Services: 4.21%

NCsoft Corp. ** 99,686 5,127,071

NHN Corp. 26,916 4,020,552

- ------------------------------------------------------------------------------

9,147,623

- ------------------------------------------------------------------------------

Office Electronics: 2.82%

Sindo Ricoh Co., Ltd. 97,596 6,121,234

- ------------------------------------------------------------------------------

Semiconductor Equipment

& Products: 12.77%

Samsung Electronics Co., Ltd. 60,641 22,388,147

Samsung Electronics Co., Ltd., Pfd. 29,640 5,358,218

- ------------------------------------------------------------------------------

27,746,365

- ------------------------------------------------------------------------------

Total Information Technology 50,796,712

==============================================================================

TELECOMMUNICATION SERVICES: 11.83%

Diversified Telecommunication

Services: 4.31%

KT Corp. 79,920 3,042,149

KT Corp. ADR 335,500 6,324,175

- ------------------------------------------------------------------------------

9,366,324

Wireless Telecommunication

Services: 7.52%

KT Freetel ** 183,801 3,517,685

SK Telecom Co., Ltd. 54,595 9,313,469

SK Telecom Co., Ltd. ADR 184,300 3,512,758

- ------------------------------------------------------------------------------

16,343,912

- ------------------------------------------------------------------------------

Total Telecommunication Services 25,710,236

==============================================================================

UTILITIES: 1.05%

Korea Electric Power (KEPCO) Corp. 138,610 2,270,463

==============================================================================

TOTAL EQUITIES: SOUTH KOREA 223,469,034

(Cost $172,394,546)

- ------------------------------------------------------------------------------

INTERNATIONAL DOLLAR BONDS:

SOUTH KOREA: 0.72%*

FACE AMOUNT VALUE

==============================================================================

FINANCIALS: 0.11%

Insurance: 0.11%

Korea Deposit Insurance Cnv.

2.250%, 10/11/05 $200,000 $245,750

- ------------------------------------------------------------------------------

TELECOMMUNICATION

SERVICES: 0.61%

Korea Telecom Co., Cnv.

0.250%, 01/04/07 925,000 936,719

Korea Telecom Co., Cnv.

0.250%, 01/04/07 *** 375,000 381,156

- ------------------------------------------------------------------------------

Total Telecommunication Services 1,317,875

==============================================================================

TOTAL INTERNATIONAL DOLLAR BONDS 1,563,625

(Cost $1,619,522)

- ------------------------------------------------------------------------------

TOTAL INVESTMENTS: 103.57%* 225,032,659

(Cost $174,014,068****)

LIABILITIES, LESS CASH AND

OTHER ASSETS: (3.57%) (7,765,921)

- ------------------------------------------------------------------------------

NET ASSETS: 100.00% $217,266,738

==============================================================================

* As a percentage of net assets as of August 31, 2003

** Non - income producing security.

*** Securities exempt from registration under rule 144A of the Securities Act of

1933. These securities may be resold in transactions exempt from

registration, normally to qualified, institutional buyers. At August 31,

2003, the value of these securities amounted to $381,156 or 0.18% of net

assets.

**** Cost for Federal income tax purposes is $177,075,252 and net unrealized

appreciation consists of:

Gross unrealized appreciation $57,892,618

Gross unrealized depreciation (9,935,211)

-----------

Net unrealized appreciation $47,957,407

===========

ADR American Depositary Receipt

Cnv. Convertible

Pfd. Preferred

See accompanying notes to financial statements.

800.789.ASIA (2742) www.matthewsfunds.com 21

MATTHEWS CHINA FUND

CO-PORTFOLIO MANAGERS

G. Paul Matthews

Mark W. Headley

Richard H. Gao

The Matthews China Fund is an all-capitalization equity fund that invests in a diversified portfolio of Chinese securities.

PORTFOLIO MANAGER COMMENTS

The Matthews China Fund was up 30.88% for the fiscal year ended August 31, 2003, outperforming its benchmark, the MSCI China Free Index, which was up 28.35% during the same period. The Fund also outperformed its benchmark index on a one- and five-year basis over this period. The Fund’s overweight positions in the utility, energy and consumer sectors were the major contributors to its outperformance.

During the fiscal year, China’s economy continued to expand, and it remains one of the world’s fastest-growing economies. Although its growth rate slowed a bit in the second quarter of 2003 due to the SARS virus, it recovered strongly and regained the momentum it had recorded in early 2003. Strong domestic consumption, increasing exports and growing foreign direct investment are the driving forces of the Chinese economy. With the rapid increase of average personal incomes, Chinese consumers are showing their strong purchasing power in such areas as automobiles, property and luxury goods. On the other hand, China’s weak banking system remains the biggest risk for the economy, although official numbers show a reduction in non-performing loans.

The Fund’s strategy has been in line with the development trend of China’s economy. Companies in the consumer sector have always been among the top holdings in the Fund, and our exposure is broad—from automakers and textile manufacturers to retailers and media players. Other areas in which we remain overweight are the utility and energy sectors. Companies like PetroChina and CNOOC are dominant upstream oil explorers in China, and we believe that strong domestic consumption will drive up demand for utilities and energy. The Fund also benefited from the strong performance of its H shares; historically trading at deep discounts against Hong Kong companies, these mainland Chinese companies are undergoing a re-rating in the market thanks to their improving profit picture and management capabilities.

The Fund has been increasing its investment in companies that have significant exposure to Hong Kong. With the support of the central government and the gradual recovery of the global economy, we are starting to see early signs of improvement in Hong Kong’s economy.

22 MATTHEWS ASIAN FUNDS

FUND PERFORMANCE

Average Annual Returns as of August 31, 2003

- ------------------------------------------------------------------------------------

MATTHEWS MSCI CHINA LIPPER CHINA

CHINA FUND FREE INDEX(1) REGION FUNDS

AVERAGE(2)

- ------------------------------------------------------------------------------------

One Year 30.88% 28.35% 27.75%

- ------------------------------------------------------------------------------------

Five Years 24.28% 1.00% 16.00%

- ------------------------------------------------------------------------------------

Since Inception (2/19/98) 4.76% -15.19% 2.30%*

- ------------------------------------------------------------------------------------

*From 2/28/98

GROWTH OF A $10,000 INVESTMENT

Past performance is not indicative of future results. Before taxes on distributions or redemptions of Fund shares.

| (1) | The MSCI China Free Index is an unmanaged capitalization-weighted index of Chinese equities that includes Red Chips and H shares listed on the Hong Kong exchange, and B shares listed on the Shanghai and Shenzhen exchanges. Red Chips are Chinese companies that are incorporated in Hong Kong but have at least 35% of their shares held by Chinese state-owned organizations. |

| (2) | As of 8/31/03, the Lipper China Region Funds Average consisted of 22 funds for the one-year period, 20 funds for the five-year period, and 16 funds since 2/28/98. Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| (3) | For Lipper China Region Funds Average, graph start date is 2/28/98. |

800.789.ASIA (2742) www.matthewsfunds.com 23

MATTHEWS CHINA FUND

SCHEDULE OF INVESTMENTS

EQUITIES: CHINA/HONG KONG: 96.85%*

SHARES VALUE

==============================================================================

CONSUMER DISCRETIONARY: 30.83%

Automobiles & Components: 3.21%

Denway Motors, Ltd. 6,362,600 $3,589,453

- ------------------------------------------------------------------------------

Consumer Durables & Apparel: 6.99%

Lerado Group Holding Co., Ltd. 14,052,000 2,486,327

TCL International Holdings, Ltd. 8,408,000 2,452,535

Texwinca Holdings, Ltd. 3,724,000 2,888,724

- ------------------------------------------------------------------------------

7,827,586

- ------------------------------------------------------------------------------

Distributors: 3.19%

Li & Fung, Ltd. 2,100,000 3,567,600

- ------------------------------------------------------------------------------

Hotels, Restaurants & Leisure: 7.54%

Cafe De Coral Holdings, Ltd. 1,840,100 1,533,542

Shangri-La Asia, Ltd. 3,979,000 3,316,105

Tsingtao Brewery Co., Ltd. H

Shares 4,284,000 3,597,757

- ------------------------------------------------------------------------------

8,447,404

- ------------------------------------------------------------------------------

Media: 4.58%

Clear Media, Ltd. ** 3,394,000 1,892,963

Television Broadcasts, Ltd. 767,000 3,235,432

- ------------------------------------------------------------------------------

5,128,395

- ------------------------------------------------------------------------------

Retail: 4.86%

Giordano International, Ltd. 9,118,000 3,799,478

Moulin International Holdings,

Ltd. 2,776,000 1,637,263

- ------------------------------------------------------------------------------

5,436,741

- ------------------------------------------------------------------------------

Travel & Recreation: 0.46%

China Travel International Investment

Hong Kong, Ltd. 2,702,000 516,194

- ------------------------------------------------------------------------------

Total Consumer Discretionary 34,513,373

==============================================================================

SHARES VALUE

==============================================================================

ENERGY: 12.18%

Oil & Gas: 12.18%

China Oilfield Services, Ltd. H

Shares 8,740,000 $2,409,300

CNOOC, Ltd. 2,025,500 3,791,632

Hong Kong and China Gas Co.,

Ltd. 1,706,400 2,297,265

PetroChina Co., Ltd. H Shares 7,744,000 2,705,658

Sinopec Zhenhai Refining &

Chemical Co., Ltd. 4,618,000 2,427,609

- ------------------------------------------------------------------------------

Total Energy 13,631,464

==============================================================================

FINANCIALS: 9.34%

Banks: 1.54%

BOC Hong Kong Holdings, Ltd. 1,348,500 1,728,988

Diversified Financials: 3.70%

Swire Pacific, Ltd. A Shares 737,000 4,138,878

Insurance: 2.47%

China Insurance International

Holdings Co., Ltd. 5,034,000 2,759,246

Real Estate: 1.63%

China Vanke Co., Ltd. B Shares 3,419,466 1,828,249

- ------------------------------------------------------------------------------

Total Financials 10,455,361

==============================================================================

HEALTH CARE: 2.39%

Pharmaceuticals: 2.39%

China Pharmaceutical Group, Ltd. 7,392,000 2,677,451

- ------------------------------------------------------------------------------

Total Health Care 2,677,451

==============================================================================

See accompanying notes to financial statements.

24 MATTHEWS ASIAN FUNDS

SHARES VALUE

==============================================================================

INDUSTRIALS: 21.79%

Airlines: 3.19%

Beijing Capital International

Airport Co., Ltd. H Shares 8,976,000 $2,531,900

China Southern Airlines Co., Ltd.

H Shares ** 3,138,000 1,036,027

- ------------------------------------------------------------------------------

3,567,927

- ------------------------------------------------------------------------------

Industrial Conglomerates: 11.23%

Beijing Enterprises Holdings, Ltd. 760,000 755,190

BYD Co., Ltd. H Shares 857,000 2,362,437

Cheung Kong Infrastructure

Holdings, Ltd. 1,675,500 3,469,429

China Merchants Holdings

International Co., Ltd. 3,946,000 4,401,669

Shanghai Industrial Holdings, Ltd. 948,000 1,580,130

- ------------------------------------------------------------------------------

12,568,855

- ------------------------------------------------------------------------------

Machinery: 1.04%

Shanghai Zhenhua Port Machinery

Co., Ltd. B Shares 1,341,700 1,168,621

- ------------------------------------------------------------------------------

Transportation: 6.33%

GZI Transport, Ltd. 2,396,000 611,337

Sinotrans, Ltd. H Shares ** 8,601,000 2,922,374

Zhejiang Expressway Co., Ltd. H

Shares 7,302,000 3,557,677

- ------------------------------------------------------------------------------

7,091,388

- ------------------------------------------------------------------------------

Total Industrials 24,396,791

==============================================================================

INFORMATION

TECHNOLOGY: 6.96%

Computer Software: 2.77%

Travelsky Technology, Ltd. H

Shares 3,605,000 3,096,857

- ------------------------------------------------------------------------------

Computers & Peripherals: 4.19%

Legend Group, Ltd. 10,928,000 4,693,821

- ------------------------------------------------------------------------------

Total Information Technology 7,790,678

==============================================================================

SHARES VALUE

==============================================================================

TELECOMMUNICATION

SERVICES: 4.43%

Wireless Telecommunication

Services: 4.43%

China Mobile HK, Ltd. 1,111,083 $2,856,288

China Mobile HK, Ltd. ADR 21,500 278,855

China Unicom, Ltd. 2,398,000 1,706,409

China Unicom, Ltd. ADR 16,200 116,154

- ------------------------------------------------------------------------------

Total Telecommunication Services 4,957,706

==============================================================================

UTILITIES: 8.93%

Beijing Datang Power Generation,

Co., Ltd. H Shares 6,056,000 3,280,603

Huaneng Power International,

Inc. ADR 39,400 2,163,060

Huaneng Power International,

Inc. H Shares 1,844,000 2,529,797

Shandong International Power

Development Co., Ltd. H Shares 6,940,000 2,024,333

- ------------------------------------------------------------------------------

Total Utilities 9,997,793

==============================================================================

TOTAL INVESTMENTS: 96.85%* $108,420,617

(Cost $92,460,817***)

CASH AND OTHER ASSETS,

LESS LIABILITIES: 3.15% 3,529,478

- ------------------------------------------------------------------------------

NET ASSETS: 100.00% $111,950,095

==============================================================================

* As a percentage of net assets as of August 31, 2003

** Non - income producing security.

ADR American Depositary Receipt

*** Cost for Federal income tax purposes is $92,885,392 and net unrealized

appreciation consists of:

Gross unrealized appreciation $17,963,076

Gross unrealized depreciation (2,427,851)

-----------

Net unrealized appreciation $15,535,225

===========

See accompanying notes to financial statements.

800.789.ASIA (2742) www.matthewsfunds.com 25

MATTHEWS JAPAN FUND

PORTFOLIO MANAGER

Mark W. Headley

The Matthews Japan Fund is an all-capitalization core equity fund with diversified exposure across a wide range of corporate Japan

PORTFOLIO MANAGER COMMENTS

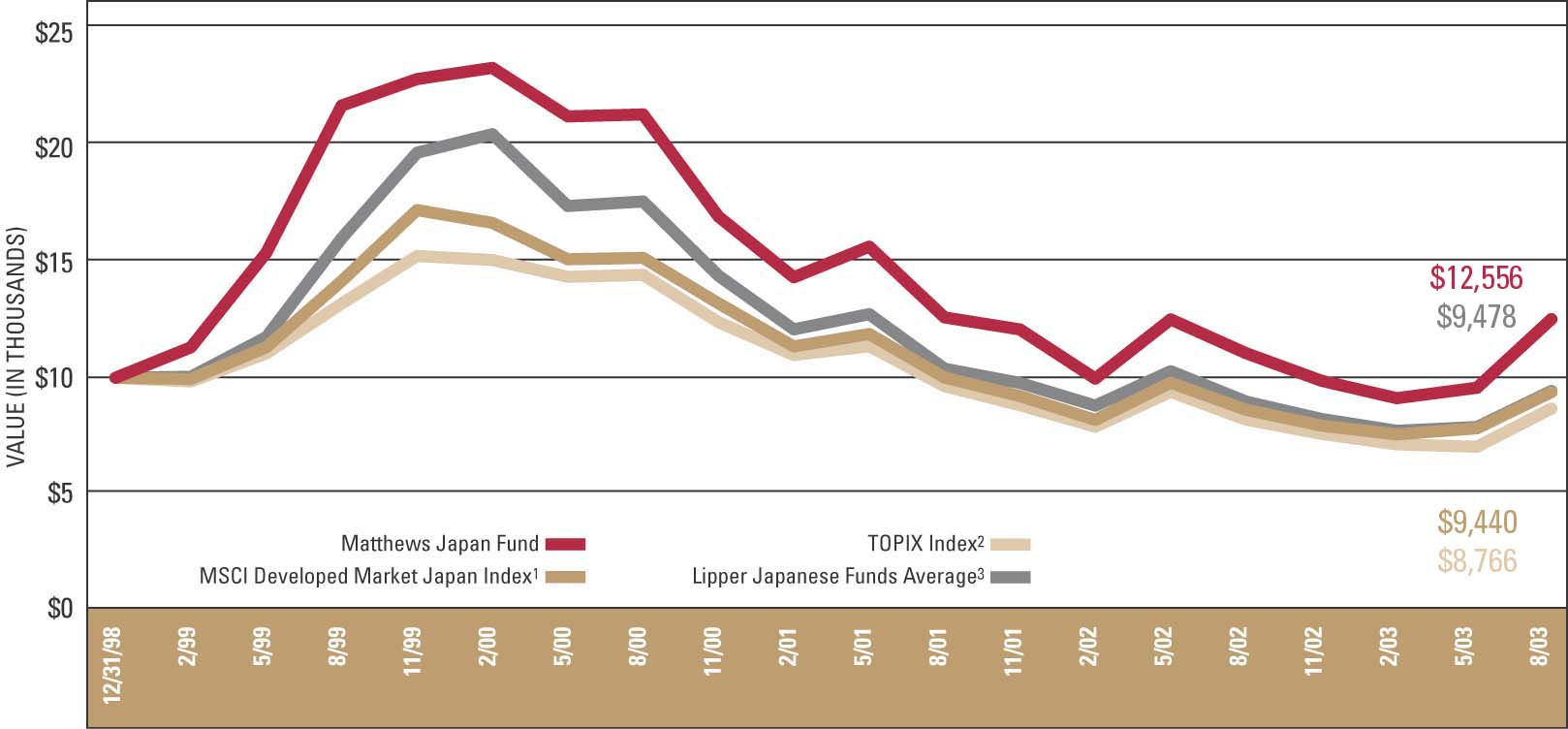

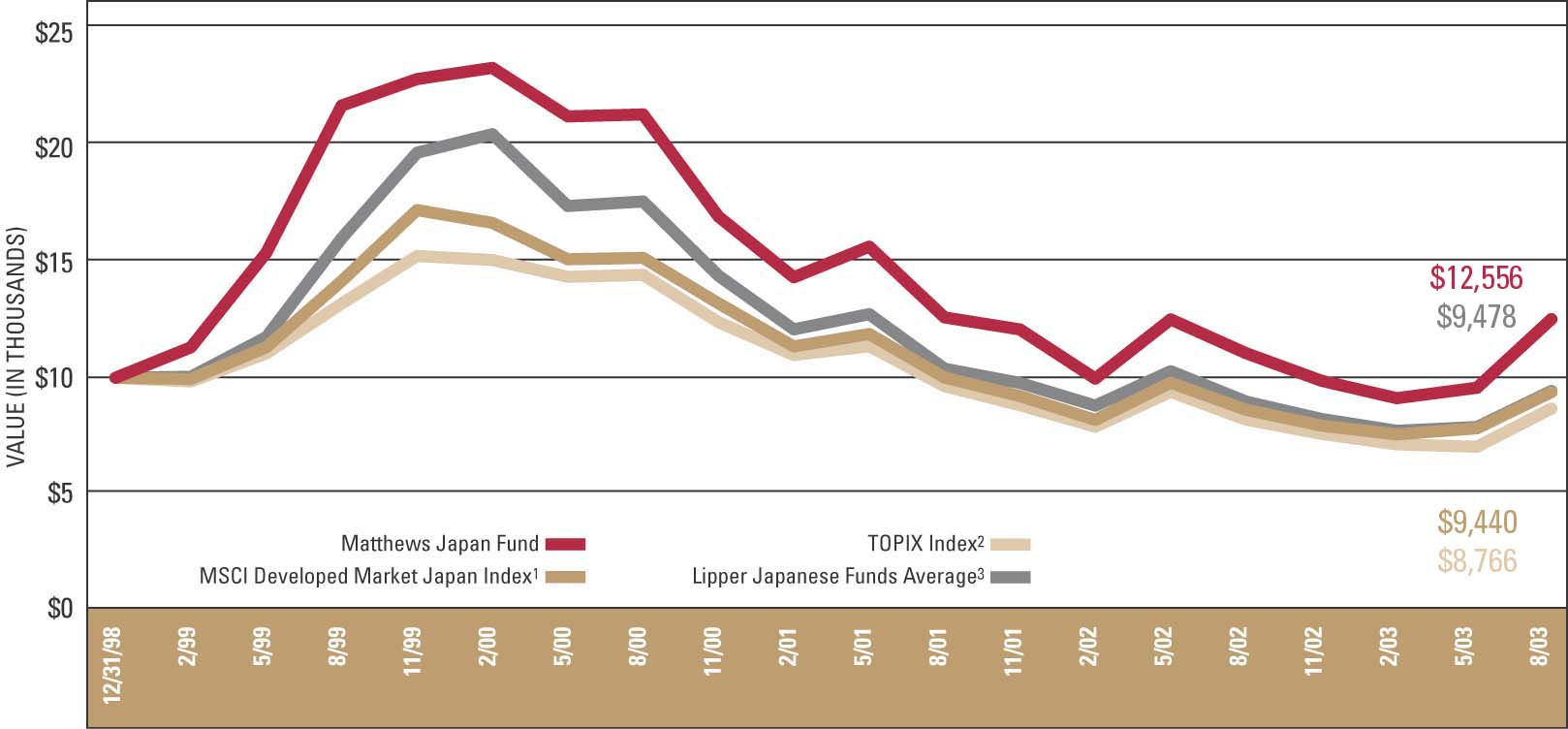

For the fiscal year ended August 31, 2003, the Matthews Japan Fund gained 13.54%, outperforming its benchmarks, the MSCI Developed Market Japan and TOPIX indices, which gained 6.92% and 9.45%, respectively. After a difficult stretch in the first quarter, the Fund enjoyed strong performance against its peers throughout the remainder of the year. In particular, the Fund benefited from its exposure to financial, technology and smaller-capitalization issues. Consumption related issues were relatively weak.

The Fund remains focused on three primary areas of the Japanese equity market: consumer, financials and technology. Our focus is founded on the belief that these areas will benefit from Japan’s ongoing transition from a manufacturing-based economy toward a service-driven one. We have tended to favor the lesser-known, more domestically oriented companies as opposed to the higher-profile exporters. We have also attempted to strike an even balance between what we would classify as “large-cap, restructuring” Japan and “small-cap, growth” Japan. We believe that both of these areas represent sound long-term opportunities, particularly in light of an increasing awareness in Japan of shareholder value and return on investment.

The outlook for the Japanese economy, while weak in comparison to its Asian neighbors, appears better than it has been over the past 14 years. Although we have yet to see a truly robust recovery in consumption, excess capacity is being reduced, labor mobility is increasing, and greater efficiency in production and distribution appears to be laying the foundation for improved economic growth. Undoubtedly, there will be setbacks along the way, but a fundamental change seems to have occurred: Japan no longer sees itself as apart from the rest of Asia. As such, Japan’s collaboration with the rest of Asia is a positive development, allowing Japan to reduce competitive overlap, focus on higher value-added areas, and participate in growth across the region, particularly in China.

The Matthews Japan Fund remains fully invested and well diversified. Over the past decade, investment in Japan has generally been a perilous undertaking. While the market will likely continue to generate its fair share of disappointments, we believe that there is plenty of room for optimism. Patience should be rewarded over the long term.

26 MATTHEWS ASIAN FUNDS

FUND PERFORMANCE

Average Annual Returns as of August 31, 2003

- --------------------------------------------------------------------------------------------------------------

MATTHEWS MSCI DEVELOPED LIPPER

JAPAN FUND MARKET JAPAN TOPIX INDEX(2) JAPANESE FUNDS

INDEX(1) AVERAGE(3)

- --------------------------------------------------------------------------------------------------------------

One Year 13.54% 6.92% 9.45% 5.89%

- --------------------------------------------------------------------------------------------------------------

Since Inception (12/31/98) 5.00% -2.78% -1.23% -1.45%

- --------------------------------------------------------------------------------------------------------------

GROWTH OF A $10,000 INVESTMENT

Past performance is not indicative of future results. Before taxes on distributions or redemptions of Fund shares.

| (1) | The MSCI Developed Market Japan Index is an unmanaged capitalization-weighted index of all Japanese equities. |

| (2) | TOPIX: The Tokyo Price Index is a capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange. |

| (3) | As of 8/31/03, the Lipper Japanese Funds Average consisted of 55 funds for the one-year period and 37 funds since 12/31/98. Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

800.789.ASIA (2742) www.matthewsfunds.com 27

MATTHEWS JAPAN FUND

SCHEDULE OF INVESTMENTS

EQUITIES: 96.76%*

SHARES VALUE

==============================================================================

CONSUMER DISCRETIONARY: 29.13%

Apparel & Textiles: 2.34%

Shiseido Co., Ltd. 53,000 $554,619

- ------------------------------------------------------------------------------

Automobiles: 7.66%

Gulliver International Co., Ltd. 24,500 1,060,379

Honda Motor Co., Ltd. ADR 36,900 751,284

- ------------------------------------------------------------------------------

1,811,663

- ------------------------------------------------------------------------------

Bicycle Manufacturing: 3.08%

Shimano, Inc. 40,100 728,591

- ------------------------------------------------------------------------------

Cosmetics: 3.36%

Dr. Ci:Labo Co., Ltd. 149 794,292

- ------------------------------------------------------------------------------

Household Durables: 3.75%

Nintendo Co., Ltd. 10,665 887,531

- ------------------------------------------------------------------------------

Media: 3.64%

Fuji Television Network, Inc. 181 860,944

- ------------------------------------------------------------------------------

Retail: 5.30%

Belluna Co., Ltd. 24 946

Belluna Co., Ltd. Warrants ** 622 3,049

Don Quijote Co., Ltd. 1,700 84,505

Kyoto Kimono Yuzen Co., Ltd. 216 431,334

Paris Miki, Inc. 58,000 733,202

- ------------------------------------------------------------------------------

1,253,036

- ------------------------------------------------------------------------------

Total Consumer Discretionary 6,890,676

==============================================================================

CONSUMER STAPLES: 4.46%

Beverages: 2.84%

ITO EN, Ltd. 18,400 670,209

- ------------------------------------------------------------------------------

Food: 1.62%

Nissin Healthcare Food Service Co.,

Ltd. 20,200 384,333

- ------------------------------------------------------------------------------

Total Consumer Staples 1,054,542

==============================================================================

SHARES VALUE

==============================================================================

FINANCIALS: 22.32%

Banks: 10.03%

Mizuho Financial Group, Inc. ** 768 $954,405

The Joyo Bank, Ltd. 177,000 482,396

The Sumitomo Trust and Banking

Co., Ltd. 208,000 937,676

- ------------------------------------------------------------------------------

2,374,477

- ------------------------------------------------------------------------------

Diversified Financials: 6.41%

Monex, Inc. ** 2,583 641,987

Nomura Holdings, Inc. 60,000 873,157

- ------------------------------------------------------------------------------

1,515,144

- ------------------------------------------------------------------------------

Insurance: 2.94%

Taiyo Life Insurance Co. ** 587 694,258

- ------------------------------------------------------------------------------

Real Estate: 2.94%

Japan Retail Fund Investment Corp.

REIT 132 695,749

- ------------------------------------------------------------------------------

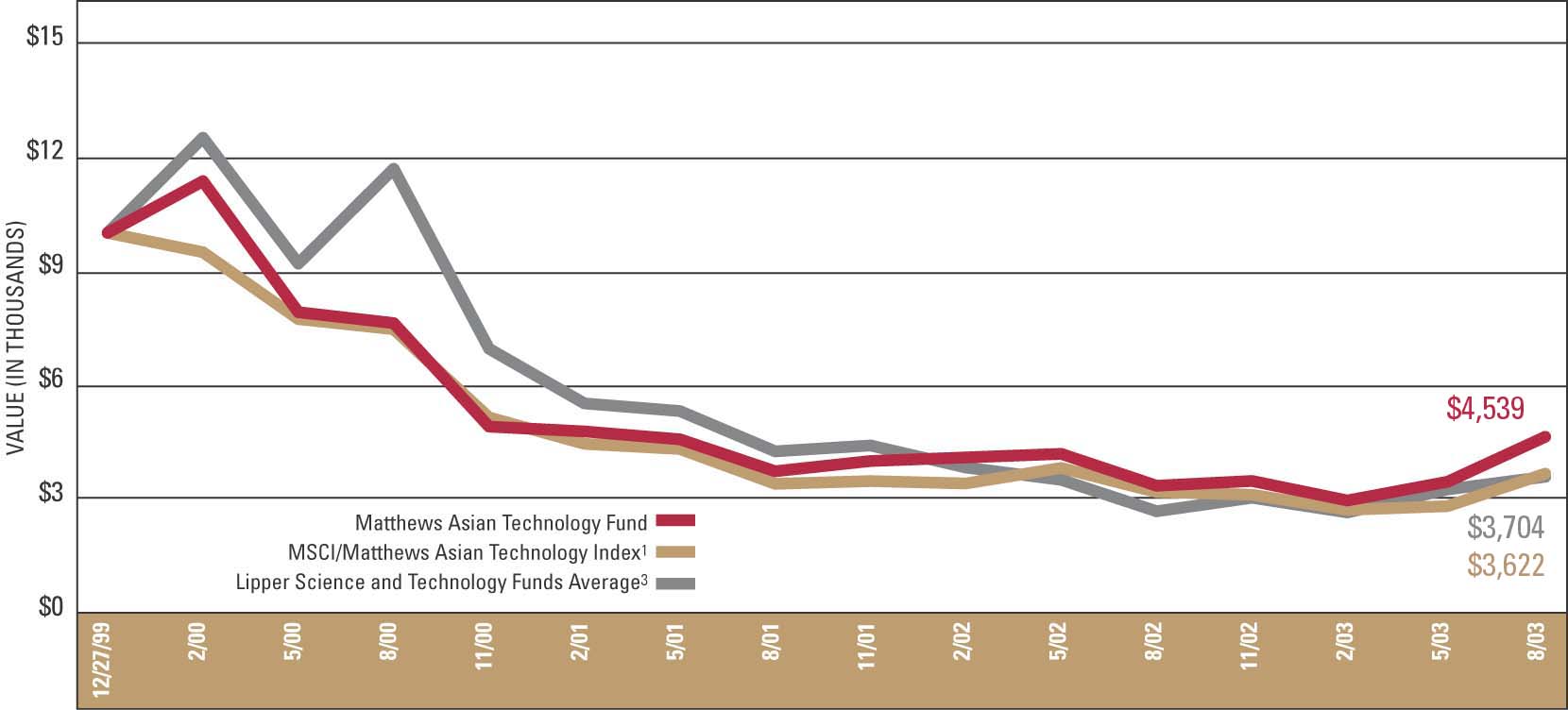

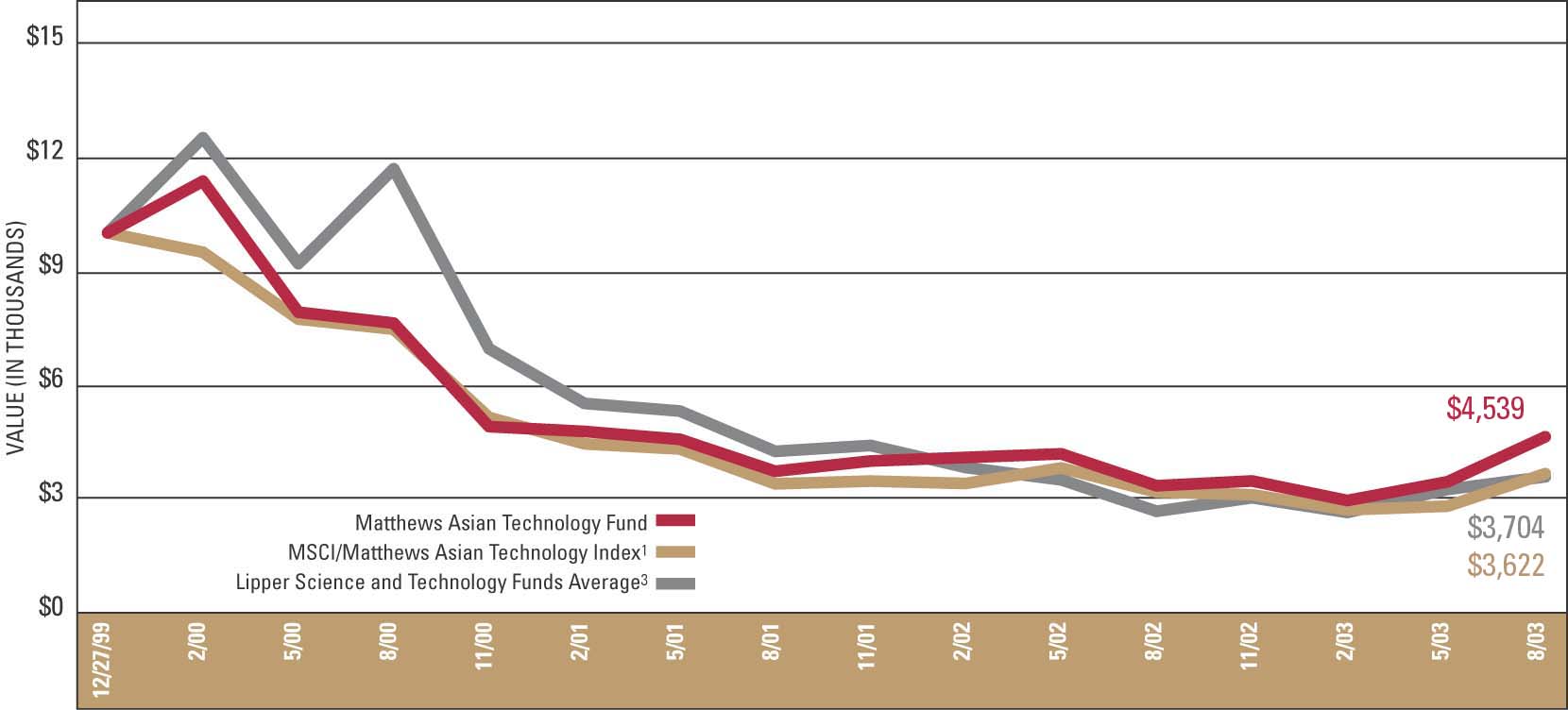

Total Financials 5,279,628