UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Guilfoyle, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-6036

Date of fiscal year end: December 31

Date of reporting period: December 31, 2007

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

The views and opinions in this report were current as of December 31, 2007. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the Funds’ future investment intent.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

CONTENTS

MESSAGE TO SHAREHOLDERS

FROM THE INVESTMENT ADVISOR

Dear Fellow Shareholders,

At first glance, 2007 mirrored much of what transpired in 2006. Once again, the year was generally a very positive one for the Asia Pacific region, marked by continued economic expansion and substantial returns for stocks. China and India again dominated the regional landscape. Both countries sustained their recent high rates of growth, and stock indices associated with the two countries were the best performing by a wide margin. As in 2006, Japan was the exception to the rule—it was the only major market in the region to experience tepid growth and declining equity markets. Even the major challenges confronting the region were familiar ones: political disruptions hampered stability and progress; Japan’s stagnation saw little respite; and China’s reforms, though impressive, were still underpinned by a fragile financial system and an autocratic government.

While the broad contours of 2007 followed those of 2006, the year was in fact distinct from the past. Most notably, globally induced volatility was far more prevalent in Asia Pacific, precipitated by the collapse of “subprime” mortgage markets in the U.S. A decade after the region experienced its own financial crisis, Asian markets were impacted again, but this time by instability that originated from overseas. Though the U.S. was the epicenter of the mortgage-related woes, the ramifications were global. Markets in the region experienced sharp volatility throughout the year, as the appetite for risk waxed and then waned. However,

Asia’s direct exposure to the subprime crisis has thus far been limited. Ironically, the financial crisis that swamped the region in 1997 left many banks chastened, and therefore less prone to pursue the sort of business models that gave rise to the current crisis. That said, some Asian banks have exposure related to subprime mortgages due to their purchase of dollar-denominated assets—losses in the region may exceed $50 billion. Yet during a period of sustained growth, liquidity and profitability, a loss of this magnitude will only dent profitability among Asian banks, not destroy it. For Asia, the subprime crisis has only posed a temporary threat to current earnings. There is no reason yet to believe that it will level balance sheets in the region, as it has done elsewhere in the world.

Amid this volatile environment, the celebrated notion of “decoupling” was sorely tested. Many financial market observers have speculated that Asia’s fundamentals were evolving in a fashion that could move independently from the global marketplace. If true, this would fulfill an elusive promise for many investors—namely, that the region’s financial markets might hold up better even as others were deteriorating. We have previously stated that decoupling is, for the most part, a myth. Over the last several decades, Asian economies have grown much more closely integrated with other markets around the world, and this has been to their tremendous benefit. Enhanced trade flows, deregulation and more open markets have unlocked new and meaningful growth opportunities in

2 MATTHEWS ASIAN FUNDS

DECEMBER 31, 2007

Asia’s largest markets, such as China, India and Japan. Ironically, this has meant Asia has grown more coupled with the rest of the world, not less.

Though external risks generally dominated Asia Pacific’s markets, a number of internal events also drove performance. China’s markets continued their remarkable ascent, catalyzed by the major reforms in the banking sector and stock market that began five years ago. China has been under intense scrutiny for its currency policies; yet 2007 saw China’s authorities introduce a number of important reforms to liberalize its currency. Perhaps most significant of these was a tentative plan known as the “through-train,” which was announced in August. Under this plan, Chinese individuals would be able to invest directly in Hong Kong (and in the process, sell their own currency, the renminbi). The “through-train” is currently in limbo. Nevertheless, the boldness of this plan was immediately evident upon its announcement, which came even as global markets were slumping sharply from mortgage-related losses. News of the plan sent stocks in Hong Kong to record levels during the ensuing weeks.

Chinese stocks have backed off their late-October highs. Since then, a familiar risk has resurfaced: inflation. Toward the end of 2007, price increases escalated to levels not seen in a decade. In response, authorities have attempted to “cool off” the market by increasing interest rates and curtailing loan growth. This environment has created a headwind

for Chinese equities; however, China is not alone in its battle against surging prices. Most countries in Asia Pacific are also experiencing higher levels of inflation. Inflation of this sort is a relatively predictable result of the region’s currency policies—and is not entirely detrimental, provided it does not reach excessive levels. It may even spur growth in certain domestic sectors across Asia, as they discover newfound pricing power. However, inflation also means that countries throughout the region may not have much room to cut interest rates, even as the outlook for the global economy is softening.

Against this backdrop, the nine Matthews Asian Funds recorded varying performances for the year. During a year notable for its volatility, most of the Funds delivered relatively steady performance. This was particularly true during the final quarter of the year when almost every Fund outperformed its respective benchmark, holding their ground, or even gaining, despite slumping markets.

More importantly, we remain very pleased with the Funds’ longer-term performance records outlined in this report. In fact, the Matthews Asian Growth and Income Fund was recognized by The Street.com as one of only two Funds in the country to beat the S&P 500 each of the last 10 years, and simultaneously generate positive returns during each of the last 10 years. While an achievement of this magnitude may not be repeated, this record illustrates the

continued on page 4

800.789.ASIA [2742] www.matthewsfunds.com 3

MESSAGE TO SHAREHOLDERS

continued from page 3

core performance goal of the Fund family. Rather than seek to outperform a narrow set of peers or benchmarks in a given year, the Funds aim to provide investors with a viable means to participate in some of the very best long-term growth opportunities that Asia Pacific offers.

We would like to bring to your attention some recent changes to the management of the Funds. Effective January 1, 2008, Mark Headley, Chief Investment Officer of Matthews International Capital Management, LLC, the investment advisor to the Matthews Asian Funds, temporarily stepped down from most day-to-day business activities to focus on his health. Mark was recently diagnosed with a form of non-Hodgkin’s lymphoma known as Burkitt’s lymphoma. He is undergoing treatment and his doctors are optimistic that he will make a full recovery. During Mark’s absence Andrew Foster is serving as acting Chief Investment Officer.

Mark has also stepped down from his role as lead portfolio manager of the Matthews Pacific Tiger and Matthews Korea Funds. Richard Gao and Sharat Shroff are now co-lead managers of the Matthews Pacific Tiger Fund. Richard has been a co-manager on the Fund for the last two years, and has almost a decade of experience managing Asian equities. Sharat has served as co-manager on the Matthews India Fund for nearly two years. With regard to the Matthews Korea Fund, Michael Oh, who shared lead portfolio management responsibility with Mark, will continue as lead manager.

Michael joined Matthews in 2000, and became co-manager of the Matthews Korea Fund in 2006. Mark remains a co-manager of the Matthews Pacific Tiger, Matthews Korea, Matthews China and Matthews Asian Technology Funds. Mark’s dedication and contributions go beyond his duties and titles and we wish him a speedy recovery.

Effective February 1, 2008, Andrew Foster is lead manager of the Matthews Asian Growth and Income Fund. Andrew served as co-manager of this Fund since January 2005. Paul Matthews will remain as co-manager, and will continue to research individual investment ideas and contribute to the portfolio’s overall strategy. In addition, Jesper Madsen, CFA, who has been co-manager of the Matthews Asia Pacific Equity Income Fund since its inception, has been named that Fund’s lead manager. Andrew Foster remains co-manager of the Fund.

Thank you for your investment in the Matthews Asian Funds. We are honored to serve as your investment advisors.

|

| G. Paul Matthews |

| Chairman |

| Matthews International Capital Management, LLC |

|

| Andrew T. Foster |

| Acting Chief Investment Officer |

| Matthews International Capital Management, LLC |

4 MATTHEWS ASIAN FUNDS

DECEMBER 31, 2007

REDEMPTION FEE POLICY

The Funds assess a redemption fee of 2.00% of the total redemption proceeds if you sell or exchange your shares within 90 calendar days after purchasing them. The redemption fee is paid directly to the Funds and is designed to discourage frequent short-term trading and to offset transaction costs associated with such trading of Fund shares. For purposes of determining whether the redemption fee applies, the shares that have been held longest will be redeemed first. The redemption fee does not apply to redemptions of shares held in certain omnibus accounts and retirement plans that cannot currently implement the redemption fee. While these exceptions exist, the Funds are not accepting any new accounts that cannot implement the redemption fee or provide adequate alternative controls. For more information on this policy, please see the Funds’ prospectus.

INVESTOR DISCLOSURE

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 1-800-789-ASIA [2742] or visit www.matthewsfunds.com.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Please see the Funds’ prospectus and Statement of Additional Information for more risk disclosure.

Fund Holdings: The Fund holdings shown in this report are as of December 31, 2007. Holdings are subject to change at any time, so holdings shown in this report may not reflect current Fund holdings. The Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is filed with the SEC within 60 days of the end of the quarter to which it relates, and is available on the SEC’s website at www.sec.gov. It may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting Record: The Funds’ Statement of Additional Information containing a description of the policies and procedures that the Funds have used to vote proxies relating to portfolio securities, along with each Fund’s proxy voting record relating to portfolio securities held during the 12-month period ended June 30, 2007, is available upon request, at no charge, at the Funds’ website at www.matthewsfunds.com or by calling 1-800-789-ASIA [2742], or on the SEC’s website at www.sec.gov.

Shareholder Reports and Prospectuses: To reduce the Funds’ expenses, we try to identify related shareholders in a household and send only one copy of the Funds’ prospectus and financial reports to that address. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. At any time you may view the Funds’ current prospectus and financial reports on our website. If you prefer to receive individual copies of the Funds’ prospectus or financial reports, please call us at 1-800-789-ASIA [2742].

This report has been prepared for Matthews Asian Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asian Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. You should read the prospectus carefully before investing. Additional copies of the prospectus may be obtained by visiting www.matthewsfunds.com. Please read the prospectus carefully before you invest or send money.

The Matthews Asian Funds are distributed by PFPC Distributors, Inc., 760 Moore Road, King of Prussia, PA 19406.

800.789.ASIA [2742] www.matthewsfunds.com 5

MATTHEWS ASIA PACIFIC FUND

| | |

| FUND DESCRIPTION | | SYMBOL: MPACX |

Under normal market conditions, the Matthews Asia Pacific Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in the Asia Pacific region. The Asia Pacific region includes Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. The Fund may also invest in the convertible securities, of any duration or quality, of Asia Pacific companies. |

| | |

| PORTFOLIO MANAGERS |

Lead Manager: Taizo Ishida | | Co-Manager: Sharat Shroff, CFA |

PORTFOLIO MANAGER COMMENTARY

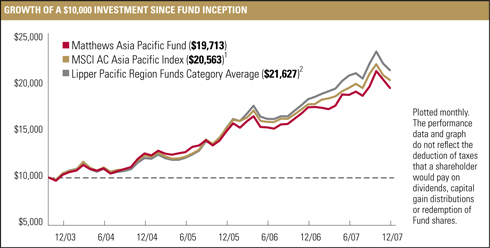

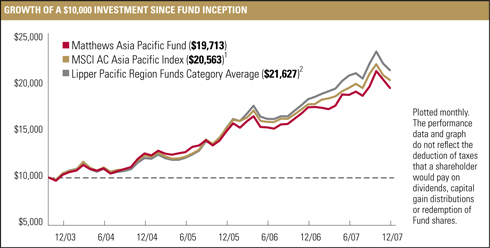

For the year ended December 31, 2007, the Matthews Asia Pacific Fund returned 11.92%, lagging its benchmark, the MSCI All Country Asia Pacific Index, which posted a 14.64% gain. Although the Fund trailed the benchmark for the first three quarters, strong performance amidst the market’s volatility in the fourth quarter helped the portfolio end the year with a double-digit return. For the quarter ended December 31, 2007, the Fund declined - -0.70%, while the benchmark, fell -3.11%.

2007 saw more strong growth in emerging Asian countries, particularly in China and India, as well as rising commodity prices ranging from energy to agricultural products. Equity markets across the globe greatly benefited from ample liquidity, albeit some contraction was evident after U.S. subprime mortgage problems arose in the summer. In general, Asian markets performed well as a result of continued strong demand from within the region, rather than external demand from the U.S. and Europe. Even Japan, which lacked much domestic consumption, benefited more from trading with its neighboring Asian countries than it did from the U.S. Another contributing factor to growth in 2007 was the rise in Asian currency valuations. Japan’s yen

appreciated 6.2% against the dollar, and the Indian rupee and China’s renminbi moved along with the mighty Euro.

On a country basis, the Fund’s overweight positions in China and India had the most significant positive contribution to performance in 2007. The Fund’s considerable underweight position in Australia hurt performance throughout the year, while its underweight in Japan helped. However, the portfolio’s holdings in Japan’s financial sector detracted from performance. By sector, the portfolio’s emphasis on consumer-related areas such as health care, information technology, consumer discretionary and consumer staples strongly contributed to the Fund’s returns, but our continued avoidance of energy and materials did not fare as well.

By company, Korean online brokerage Kiwoom Securities, which was added to the portfolio following a research trip to Korea last January, was the largest contributor to Fund performance for the year. Japan’s Nintendo maintained strong earnings momentum with its popular “Wii” game console that debuted in 2006. Although there is some skepticism in the market, we believe the company’s valuation

continued on page 8

6 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF DECEMBER 31, 2007, UNLESS OTHERWISE NOTED

| | | | | | | | |

| PERFORMANCE AS OF DECEMBER 31, 2007 |

| Fund Inception: 10/31/03 | | 3 MO | | Average Annual Total Returns |

| | | | 1 YR | | 3 YRS | | SINCE INCEPTION |

Matthews Asia Pacific Fund | | –0.70% | | 11.92% | | 16.01% | | 17.69% |

MSCI All Country Asia Pacific Index1 | | –3.11% | | 14.64% | | 18.35% | | 18.87% |

Lipper Pacific Region Funds Category Average2 | | –3.14% | | 15.35% | | 21.10% | | 20.15% |

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Unusually high returns may not be sustainable. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit www.matthewsfunds.com.

| | | |

| OPERATING EXPENSES | |

Net Ratio: Fiscal Year 20073 | | 1.20 | % |

Gross Ratio: Fiscal Year 2007 | | 1.20 | % |

Gross Ratio: Fiscal Year 2006 | | 1.26 | % |

| | | |

| PORTFOLIO TURNOVER4 | |

Fiscal Year 2007 | | 40.49 | % |

1 | The MSCI All Country Asia Pacific Index is a free float-adjusted market capitalization–weighted index of the stock markets of Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PFPC Inc. |

2 | Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

3 | Includes management fee, administration and shareholder services fees after reimbursement, waiver or recapture of expenses by Matthews International Capital Management, LLC, the Funds’ advisor (the “Advisor”). Matthews Asian Funds do not charge 12b-1 fees. |

4 | The lesser of fiscal year-to-date long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

800.789.ASIA [2742] www.matthewsfunds.com 7

MATTHEWS ASIA PACIFIC FUND

| | | | |

| TOP TEN HOLDINGS1 | | | | |

| | | COUNTRY | | % OF NET ASSETS |

Benesse Corp. | | Japan | | 2.6% |

Sun Pharmaceutical Industries, Ltd. | | India | | 2.5% |

Sony Corp. | | Japan | | 2.4% |

HDFC Bank, Ltd. | | India | | 2.4% |

Nintendo Co., Ltd. | | Japan | | 2.3% |

Hana Financial Group, Inc. | | South Korea | | 2.3% |

China Mobile, Ltd. | | China/Hong Kong | | 2.3% |

Unicharm Petcare Corp. | | Japan | | 2.1% |

Hanmi Pharmaceutical Co., Ltd. | | South Korea | | 2.1% |

Amorepacific Corp. | | South Korea | | 2.0% |

% OF ASSETS IN TOP 10 | | | | 23.0% |

| | | |

| COUNTRY ALLOCATION | | | |

Japan | | 41.0 | % |

China/Hong Kong | | 19.1 | % |

South Korea | | 14.7 | % |

India | | 7.9 | % |

Thailand | | 4.8 | % |

Singapore | | 3.8 | % |

Australia | | 3.2 | % |

Indonesia | | 3.1 | % |

Taiwan | | 2.5 | % |

| Liabilities in excess of cash and other assets | | –0.1 | % |

| | | |

| SECTOR ALLOCATION | | | |

Financials | | 30.6 | % |

Consumer Discretionary | | 21.8 | % |

Information Technology | | 20.6 | % |

Consumer Staples | | 8.3 | % |

Health Care | | 7.6 | % |

Industrials | | 4.7 | % |

| Telecommunication Services | | 4.0 | % |

Materials | | 2.5 | % |

| Liabilities in excess of cash and other assets | | –0.1 | % |

| | | |

| MARKET CAP EXPOSURE | | | |

Large cap (over $5 billion) | | 62.3 | % |

Mid cap ($1–$5 billion) | | 20.8 | % |

Small cap (under $1 billion) | | 17.0 | % |

| Liabilities in excess of cash and other assets | | –0.1 | % |

| | | | | | | | |

| NUMBER OF SECURITIES | | NAV | | FUND ASSETS | | REDEMPTION FEE | | 12b-1 FEES |

71 | | $17.29 | | $471.1 million | | 2.00% within 90 calendar days | | None |

1 | Holdings may combine more than one security from same issuer and related depositary receipts. |

PORTFOLIO MANAGER COMMENTARY continued from page 6

is still compelling. Meanwhile, Lenovo, one of the largest PC makers in the world, finally broke free of the slump it had been in for the last few years, and showed the world that it had been undervalued compared to its global peers and the local stock market.

In 2007, many of the region’s energy and material stocks performed very well with the continuing commodity boom. The portfolio’s

lack of emphasis on this sector was a drag on performance. Though the Fund has historically minimized commodities and energy companies as they tend to be highly cyclical, we will continue to monitor for opportunities that demonstrate the long-term growth we require.

Two companies that illustrate the type of stocks in which the Fund seeks to invest are China Mobile, China’s leading wireless

8 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF DECEMBER 31, 2007, UNLESS OTHERWISE NOTED

telecom service provider, and India’s HDFC Bank. China Mobile has more than 65% market share among the subscriber base, and one of the company’s more attractive aspects is its reach in rural China. Rural income levels began accelerating about eight years ago and are now growing at levels comparable to, or even faster than, urban income. Rising food prices in urban centers may affect the city consumer, but they are actually benefiting the rural farmer. As rural consumption rises, China Mobile appears to be well-placed to benefit.

HDFC Bank is India’s second-largest private sector bank. Led by a strong management team, it has grown consistently at over 30% for the past few years. The bank’s executives have focused on generating quality growth, rather than simply growing the size of its balance sheet. HDFC, a leader in wholesale banking and transaction services to corporate clients, has the potential to grow the company’s retail banking services to employees of those clients. The bank has been innovative in utilizing technology to launch new products and has built a base of 10 million retail customers through multiple channels such as ATMs, phone banking and Internet banking. Despite its rapid growth, the bank has been able to contain non-performing assets. HDFC is also in a strong position to capitalize on the opportunities for offering wealth management services to India’s growing middle class.

On the political front, we saw some progress this year with the promise of change from the region’s newly elected leaders. Japanese Prime Minister Yasuo Fukuda’s visit to Beijing at the end of the year demonstrated signs of better cooperation between the two nations. South Korea also experienced newfound optimism with the landslide victory of President-elect Lee Myung-bak. His pro-business stance—a departure from

the position of his more socialistic predecessor, President Roh Moo-hyun—is anticipated to be good for the Korean economy. Down under, Australia’s newly elected Prime Minister Kevin Rudd also pledged to usher in a new era. After ratifying the Kyoto Protocol in a reversal of the policy of former Liberal Prime Minister John Howard, Rudd may make strides with environmental concerns.

Meanwhile, in Southeast Asia, Myanmar continued to isolate itself from the region but Thailand appeared to be emerging from an economic funk that came after the September 2006 coup. Furthermore, North Korea also appeared more willing to engage peacefully with the U.S. over its nuclear weapon research and development program.

The Fund is geared toward providing investors with exposure to “Asian growth” mainly from within the region. As such, we are optimistic about the trend toward increasing intra-regional travel. Japan, for example, is rapidly attracting Asian travelers who seek products that are “Made in Japan” at very affordable prices. At the same time, a growing number of retired Japanese are spending more time in Southeast Asia. Particularly popular are countries like the Philippines and Malaysia, which have good quality assisted living services that are hard to get or very expensive in Japan. Intra-regional trade has continued to grow strongly each year, and China and India are becoming integral to business activities across Asia. We expect to see more economic activity within the region, including mergers and acquisitions: low-priced Japanese companies that own superior brand names and technologies should be natural targets for lesser-known Asian companies full of ambition and management acumen.

800.789.ASIA [2742] www.matthewsfunds.com 9

MATTHEWS ASIA PACIFIC FUND

SCHEDULE OF INVESTMENTSa

COMMON EQUITIES: 100.1%

| | | | |

| | | SHARES | | VALUE |

| |

JAPAN: 41.0% | | | | |

Benesse Corp. | | 291,500 | | $12,334,854 |

Sony Corp. ADR | | 209,300 | | 11,364,990 |

Nintendo Co., Ltd. | | 18,800 | | 11,038,457 |

Unicharm Petcare Corp. | | 194,100 | | 10,028,788 |

Funai Zaisan Consultants Co., Ltd.† | | 5,310 | | 8,654,278 |

Sysmex Corp. | | 198,500 | | 8,398,874 |

Nomura Research Institute, Ltd. | | 254,000 | | 8,309,704 |

Nitto Denko Corp. | | 157,200 | | 8,261,942 |

Sekisui House, Ltd. | | 738,000 | | 7,888,015 |

Yahoo! Japan Corp. | | 17,612 | | 7,854,040 |

Ichiyoshi Securities Co., Ltd. | | 764,900 | | 6,894,971 |

Daibiru Corp. | | 598,700 | | 6,400,080 |

Point, Inc. | | 126,150 | | 6,380,113 |

Mitsubishi Estate Co., Ltd. | | 264,000 | | 6,289,786 |

Hoya Corp. | | 189,400 | | 5,992,458 |

The Sumitomo Trust & Banking Co., Ltd. | | 907,000 | | 5,977,807 |

Sumitomo Realty & Development Co., Ltd. | | 244,000 | | 5,967,282 |

Canon, Inc. ADR | | 126,650 | | 5,804,369 |

Nidec Corp. | | 79,500 | | 5,744,049 |

GCA Holdings Corp. | | 1,297 | | 5,669,813 |

Pigeon Corp. | | 334,300 | | 5,599,942 |

Takeda Pharmaceutical Co., Ltd. | | 95,600 | | 5,585,033 |

Nitori Co., Ltd. | | 111,900 | | 5,362,770 |

Keyence Corp. | | 21,400 | | 5,255,189 |

Toyota Motor Corp. ADR | | 48,500 | | 5,149,245 |

ORIX Corp. | | 23,490 | | 3,950,718 |

Taiheiyo Cement Corp. | | 1,482,000 | | 3,500,804 |

Takeuchi Manufacturing Co., Ltd. | | 84,200 | | 3,300,391 |

| | | | |

| | |

Total Japan | | | | 192,958,762 |

| |

| | | | |

| | | SHARES | | VALUE |

| |

CHINA/HONG KONG: 19.1% |

China Mobile, Ltd. ADR | | 124,800 | | $10,841,376 |

China Life Insurance Co., Ltd. H Shares | | 1,689,000 | | 8,633,267 |

Pico Far East Holdings, Ltd. | | 31,028,000 | | 8,562,067 |

Lenovo Group, Ltd. | | 9,610,000 | | 8,438,033 |

China Merchants Bank Co., Ltd. H Shares | | 2,062,000 | | 8,295,955 |

Hang Lung Group, Ltd. | | 1,379,000 | | 7,451,392 |

China Vanke Co., Ltd. B Shares | | 2,689,214 | | 6,930,353 |

Shangri-La Asia, Ltd. | | 1,988,000 | | 6,182,876 |

NetEase.com, Inc. ADRb | | 301,000 | | 5,706,960 |

Dairy Farm International Holdings, Ltd. | | 1,256,400 | | 5,460,882 |

The9, Ltd. ADRb | | 224,300 | | 4,782,076 |

Television Broadcasts, Ltd. | | 788,000 | | 4,710,118 |

China Merchants Holdings International Co., Ltd. | | 448,000 | | 2,742,991 |

Ctrip.com International, Ltd. ADR | | 22,100 | | 1,270,087 |

Alibaba.com, Ltd.b | | 3,000 | | 10,638 |

| | | | |

| | |

Total China/Hong Kong | | | | 90,019,071 |

| |

| | |

SOUTH KOREA: 14.7% | | | | |

Hana Financial Group, Inc. | | 205,120 | | 11,013,099 |

Hanmi Pharmaceutical Co., Ltd. | | 56,073 | | 9,810,624 |

Amorepacific Corp. | | 12,565 | | 9,476,428 |

Kiwoom.com Securities Co., Ltd. | | 100,715 | | 6,804,719 |

Shinhan Financial Group Co., Ltd. | | 113,517 | | 6,439,229 |

NHN Corp.b | | 24,868 | | 5,929,939 |

Hyundai Department Store Co., Ltd. | | 45,970 | | 5,793,443 |

ON*Media Corp.b | | 714,300 | | 5,286,546 |

CDNetworks Co., Ltd.b | | 306,865 | | 5,210,886 |

Samsung Electronics Co., Ltd. | | 5,465 | | 3,216,141 |

| | | | |

| | |

Total South Korea | | | | 68,981,054 |

| |

10 MATTHEWS ASIAN FUNDS

DECEMBER 31, 2007

| | | | |

| | | SHARES | | VALUE |

| |

INDIA: 7.9% | | | | |

Sun Pharmaceutical Industries, Ltd. | | 394,073 | | $11,942,818 |

HDFC Bank, Ltd. | | 260,636 | | 11,261,535 |

Dabur India, Ltd. | | 2,973,060 | | 8,541,322 |

Infosys Technologies, Ltd. | | 125,678 | | 5,605,635 |

| | | | |

| | |

Total India | | | | 37,351,310 |

| |

| | |

THAILAND: 4.8% | | | | |

Advanced Info Service Public Co., Ltd. | | 2,847,700 | | 8,116,434 |

Land & Houses Public Co., Ltd. | | 22,417,300 | | 5,937,042 |

Bangkok Bank Public Co., Ltd. | | 1,323,300 | | 4,673,586 |

Major Cineplex Group Public Co., Ltd. | | 7,285,400 | | 4,086,615 |

| | | | |

| | |

Total Thailand | | | | 22,813,677 |

| |

| | |

SINGAPORE: 3.8% | | | | |

DBS Group Holdings, Ltd. | | 519,700 | | 7,376,092 |

Fraser and Neave, Ltd. | | 1,462,000 | | 5,922,871 |

Hyflux, Ltd. | | 2,130,812 | | 4,691,290 |

| | | | |

| | |

Total Singapore | | | | 17,990,253 |

| |

| | |

AUSTRALIA: 3.2% | | | | |

AXA Asia Pacific Holdings, Ltd. | | 1,424,589 | | 9,164,603 |

Tabcorp Holdings, Ltd. | | 297,625 | | 3,847,971 |

Computershare, Ltd. | | 212,463 | | 1,832,809 |

| | | | |

| | |

Total Australia | | | | 14,845,383 |

| |

| | |

INDONESIA: 3.1% | | | | |

PT Astra International | | 3,000,500 | | 8,602,591 |

Bank Rakyat Indonesia | | 7,889,500 | | 6,133,026 |

| | | | |

| | |

Total Indonesia | | | | 14,735,617 |

| |

| | |

TAIWAN: 2.5% | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 3,393,029 | | 6,433,142 |

Taiwan Secom Co., Ltd. | | 3,579,160 | | 5,548,197 |

| | | | |

| | |

Total Taiwan | | | | 11,981,339 |

| |

| | | |

| | | VALUE | |

| | |

TOTAL INVESTMENTS: 100.1% | | $471,676,466 | |

(Cost $388,012,855c) | | | |

| |

LIABILITIES IN EXCESS OF CASH AND OTHER ASSETS: –0.1% | | (622,000 | ) |

| | | |

| |

NET ASSETS: 100.0% | | $471,054,466 | |

| | |

a | Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A). |

b | Non–income producing security |

c | Cost for Federal income tax purposes is $388,116,770 and net unrealized appreciation consists of: |

| | | |

Gross unrealized appreciation | | $117,661,287 | |

Gross unrealized depreciation | | (34,101,591 | ) |

| | | |

Net unrealized appreciation | | $83,559,696 | |

| | | |

† | Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer) |

| | |

| ADR | | American Depositary Receipt |

See accompanying notes to financial statements.

800.789.ASIA [2742] www.matthewsfunds.com 11

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

| | |

| FUND DESCRIPTION | | SYMBOL: MAPIX |

Under normal market conditions, the Matthews Asia Pacific Equity Income Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying publicly traded common stocks, preferred stocks, convertible preferred stocks, and other equity-related instruments (including, for example, investment trusts and other financial instruments) of companies located in the Asia Pacific region, which includes Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. |

| | |

| PORTFOLIO MANAGERS | | Note: Managers shown reflect changes effective February 1, 2008. |

Lead Manager: Jesper Madsen, CFA | | Co-Manager: Andrew T. Foster |

PORTFOLIO MANAGER COMMENTARY

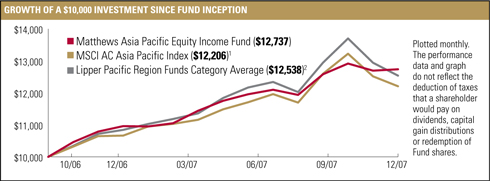

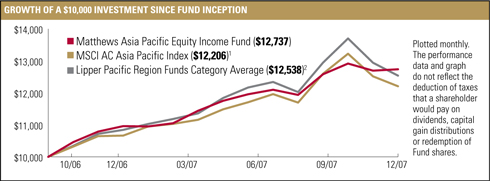

During the fourth quarter of 2007, the Matthews Asia Pacific Equity Income Fund returned 1.23%, while the benchmark MSCI All Country Asia Pacific Index fell –3.11%. For the year, the Fund and the index rose 18.05% and 14.64%, respectively. During the year, the Fund paid two distributions to its shareholders, one in June and the other in December. The Fund began 2007 with a share price of $10.77, and shareholders who were invested in the Fund throughout the year would have received income distributions totaling approximately 27 cents or 2.5% of that initial amount.

2007 was a year marked by volatility in both global and Asian markets. Except for Japan, most major Asian markets posted gains for the year; however, they did so only after several sharp swings. Weakness in stocks was prompted in no small part by the concerns gathering around the U.S. housing market and mortgage industry, and the fears of what a U.S. recession might mean for Asia. In this context, the Fund performed as intended—producing steady gains amid the year’s notable volatility. Japan was a particularly important market in this regard: Though Japanese shares dropped on average about 6% during the year in dollar

terms, the Fund’s holdings held steady, particularly during the fourth quarter, when the gyrations of global markets were most pronounced.

Despite the twin headwinds of deflation and demographic decline that continue to buffet the Japanese economy, the Fund maintained consistent exposure to this market, as we continued to find attractive candidates for investment. What is often lost amid Japan’s prolonged slump is that there are a number of small- to medium-sized companies that have maintained healthy balance sheets throughout the economic downturn; many of these same companies produce healthy, albeit moderate, rates of growth.

Though the rights of minority investors in Japan suffered setbacks in the last year, we are most intrigued by the improved outlook for dividends. While dividend yields in Japan remain paltry in comparison to other global markets, they still exceed yen-based fixed income yields. Furthermore, Japanese companies as a group appear to have grown their dividends at a rate during the year that exceeded all other countries in the region, as represented by the Fund’s benchmark.

12 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF DECEMBER 31, 2007, UNLESS OTHERWISE NOTED

| | | | | | |

| PERFORMANCE AS OF DECEMBER 31, 2007 | | | | | | |

| Fund Inception: 10/31/06 | | | | Average Annual Total Returns |

| | | 3 MO | | 1 YR | | SINCE INCEPTION |

Matthews Asia Pacific Equity Income Fund | | 1.23% | | 18.05% | | 23.04% |

MSCI All Country Asia Pacific Index1 | | –3.11% | | 14.64% | | 18.62% |

Lipper Pacific Region Funds Category Average2 | | –3.14% | | 15.35% | | 21.35% |

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Unusually high returns may not be sustainable. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit www.matthewsfunds.com.

| | | |

| OPERATING EXPENSES | | | |

Net Ratio: Fiscal Year 20075 | | 1.39 | % |

Gross Ratio: Fiscal Year 2007 | | 1.42 | % |

Gross Ratio: Fiscal Year 2006 | | 2.93 | % |

|

| INCOME DISTRIBUTION YIELD4 |

2.28% |

| | | |

| PORTFOLIO TURNOVER6 | | | |

Fiscal Year 2007 | | 26.95 | % |

1 | The MSCI All Country Asia Pacific Index is a free float-adjusted market capitalization–weighted index of the stock markets of Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. The Matthews Asia Pacific Equity Income Fund invests in countries that are not included in the MSCI All Country Asia Pacific Index. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PFPC Inc. |

2 | Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

3 | The 30-day SEC Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/07, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The SEC Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate, the income paid to a shareholder’s account, or the income reported in the Fund’s financial statements. Past yields are no guarantee of future yields. |

4 | The Income Distribution Yield represents the past two dividends (does not include capital gains) paid by the Fund for the period ended 12/31/07, expressed as an annual percentage rate based on the Fund’s share price on 12/31/07. Generally, the Fund has made distributions of net investment income twice each year and of capital gains, if any, annually. Past Income Distribution Yields are no guarantee of future yields or that any distributions will continue to be paid twice each year. |

5 | Includes management fee, administration and shareholder services fees after reimbursement, waiver or recapture of expenses by Advisor. The Advisor has contractually agreed to waive fees and reimburse expenses to the extent needed to limit total annual operating expenses to 1.50% until October 31, 2009. Matthews Asian Funds do not charge 12b-1 fees. |

6 | The lesser of fiscal year-to-date long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

800.789.ASIA [2742] www.matthewsfunds.com 13

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

| | | | |

| TOP TEN HOLDINGS1 | | | | |

| | | COUNTRY | | % OF NET ASSETS |

Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | 5.0% |

HSBC Holdings PLC | | United Kingdom | | 4.1% |

Lawson, Inc. | | Japan | | 3.3% |

BOC Hong Kong Holdings, Ltd. | | China/Hong Kong | | 3.3% |

Hang Seng Bank, Ltd. | | China/Hong Kong | | 3.1% |

Ashok Leyland, Ltd. | | India | | 3.0% |

Benesse Corp. | | Japan | | 2.8% |

Globe Telecom, Inc. | | Philippines | | 2.8% |

The Sumitomo Trust & Banking Co., Ltd. | | Japan | | 2.8% |

SK Telecom Co., Ltd. | | South Korea | | 2.8% |

% OF ASSETS IN TOP 10 | | | | 33.0% |

| | | |

| COUNTRY ALLOCATION | | | |

Japan | | 19.3 | % |

China/Hong Kong | | 17.6 | % |

Taiwan | | 15.0 | % |

Singapore | | 8.1 | % |

Malaysia | | 7.0 | % |

India | | 6.4 | % |

Australia | | 5.5 | % |

South Korea | | 5.3 | % |

United Kingdom2 | | 4.1 | % |

Thailand | | 3.7 | % |

Philippines | | 2.8 | % |

Indonesia | | 1.3 | % |

New Zealand | | 1.1 | % |

Cash and other assets, less liabilities | | 2.8 | % |

| | | |

| SECTOR ALLOCATION | | | |

Financials | | 27.2 | % |

Consumer Discretionary | | 21.1 | % |

Information Technology | | 13.5 | % |

Telecommunication Services | | 11.4 | % |

Consumer Staples | | 6.8 | % |

Industrials | | 5.5 | % |

Health Care | | 5.0 | % |

Utilities | | 3.5 | % |

Energy | | 3.2 | % |

Cash and other assets, less liabilities | | 2.8 | % |

| | | |

| MARKET CAP EXPOSURE | | | |

Large cap (over $5 billion) | | 52.1 | % |

Mid cap ($1–$5 billion) | | 30.2 | % |

Small cap (under $1 billion) | | 14.9 | % |

Cash and other assets, less liabilities | | 2.8 | % |

| | | | | | | | |

| NUMBER OF SECURITIES | | NAV | | FUND ASSETS | | REDEMPTION FEE | | 12b-1 FEES |

51 | | $12.00 | | $81.6 million | | 2.00% within 90 calendar days | | None |

1 | Holdings may combine more than one security from same issuer and related depositary receipts. |

2 | The United Kingdom is not included in the MSCI All Country Asia Pacific Index. |

PORTFOLIO MANAGER COMMENTARY continued from page 12

Thus while the country plays host to a number of “value trap” investments, Japan offers the focused, bottom-up investor opportunities to invest in growing dividends and reasonable yields.

The Fund’s latest addition in the country, Hitachi Koki, illustrates this point: One of Japan’s leading manufacturers of power tools, the company has undertaken some of the more difficult steps to improve cost efficiency,

14 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF DECEMBER 31, 2007, UNLESS OTHERWISE NOTED

relocating the majority of its production to China. In the process, the company has remained lean and efficient—over the last four years, the company has boosted sales by over 40%, but has grown operating profits more than four-fold. Hitachi Koki has grown its dividend in a roughly corresponding fashion. Dividends are paid on a quarterly basis, with an eye to attracting retail shareholders that would otherwise park their funds in a basic savings account yielding less than 0.25%; assuming the company simply maintains its dividends from last year, the yield on its shares will be several times higher.

Yet even as Japan provides fruitful ground at present, China and India still figure largely in the Fund’s future. As stocks in both of these countries have risen dramatically in recent years, it has been difficult for the Fund to find companies that offer reasonable current dividend yields. Nevertheless, we remain convinced that some of Asia’s largest dividend growing companies—the companies that will ultimately pay the largest absolute dividends in the long run—will emerge from markets like India, and especially China. Many of China’s recently-listed companies are relatively new to paying dividends, and thus they do not have a long-term history of dividend growth. Still, China’s track record with dividends has been impressive to date, and speaks volumes of companies’ intentions to maintain higher governance standards, allowing minority investors to participate in their growth. It is for reasons like these that we intend to maintain exposure to China and India, even as valuations in those markets might otherwise compromise the Fund’s dividend orientation.

The Fund’s one distinct area of weakness came from its financial services holdings. Markets in Asia have retreated from this sector based on concerns regarding exposure

to U.S. subprime securities and collateralized debt obligations; the sector has also suffered from fears over what a U.S. recession might mean for global growth. We remain quite positive about their outlook, in part because none of the Fund’s financial holdings have cut their dividends (most have in fact grown them). On a global basis, this sector has undermined investors’ trust; yet in Asia we remain for the most part pleased with the growth and yield prospects for the Fund’s holdings in the banking sector. These companies have suffered from the exposure they bear to dollar-denominated securities; but none has engaged in the sort of full-scale securitization business model that led their U.S. counterparts to such woes.

Looking forward, the portfolio’s construction will emphasize companies that can offer growth in dividends, rather than a simplistic focus on high current yields or larger dividend payers. We believe that Asian companies are gradually shifting towards an emphasis on paying cash dividends; and if we are correct, this should be of particular benefit to investors who are seeking a combination of yield, relative stability and some growth in their investments. Recent history bears this point out. Asian companies, as represented by the MSCI AC Asia Pacific Index, have outpaced the S&P 500. Asian companies have offered greater capital appreciation, and also higher dividend yields, versus their U.S. counterparts in each of the last five years.3 While there can be no guarantee that this relationship will hold in the future, it nevertheless illustrates the core objective of the Fund—to provide total returns over the long term, with an emphasis on providing current income.

800.789.ASIA [2742] www.matthewsfunds.com 15

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

SCHEDULE OF INVESTMENTSa

COMMON EQUITIES: 97.2%

| | | | |

| | | SHARES | | VALUE |

| |

JAPAN: 19.3% | | | | |

Lawson, Inc. | | 75,700 | | $2,681,992 |

Benesse Corp. | | 54,800 | | 2,318,868 |

The Sumitomo Trust & Banking Co., Ltd. | | 348,000 | | 2,293,580 |

Monex Beans Holdings, Inc. | | 2,784 | | 1,830,419 |

Eisai Co., Ltd. | | 38,700 | | 1,514,634 |

Tokyu REIT, Inc. | | 155 | | 1,448,517 |

Takeda Pharmaceutical Co., Ltd. | | 24,700 | | 1,442,995 |

Hitachi Koki Co., Ltd. | | 75,000 | | 1,164,277 |

Hisamitsu Pharmaceutical Co., Inc. | | 36,000 | | 1,091,715 |

| | | | |

| | |

Total Japan | | | | 15,786,997 |

| |

| | |

CHINA/HONG KONG: 17.6% | | | | |

BOC Hong Kong Holdings, Ltd. | | 966,000 | | 2,678,453 |

Hang Seng Bank, Ltd. | | 124,900 | | 2,556,665 |

Café de Coral Holdings, Ltd. | | 912,000 | | 2,237,238 |

CLP Holdings, Ltd. | | 289,500 | | 1,966,869 |

Sa Sa International Holdings, Ltd. | | 4,500,000 | | 1,827,807 |

ASM Pacific Technology, Ltd. | | 212,000 | | 1,540,979 |

Huaneng Power International, Inc. H Shares | | 836,000 | | 865,428 |

Next Media, Ltd. | | 1,890,000 | | 667,911 |

| | | | |

| | |

Total China/Hong Kong | | | | 14,341,350 |

| |

| | |

TAIWAN: 15.0% | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 1,876,298 | | 3,557,438 |

Chunghwa Telecom Co., Ltd.b | | 957,727 | | 2,115,979 |

Cyberlink Corp. | | 535,000 | | 2,112,407 |

Giant Manufacturing Co., Ltd. | | 647,000 | | 1,437,244 |

President Chain Store Corp. | | 537,000 | | 1,406,389 |

Taiwan Secom Co., Ltd. | | 721,000 | | 1,117,651 |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | 50,087 | | 498,867 |

| | | | |

| | |

Total Taiwan | | | | 12,245,975 |

| |

| | | | |

| | | SHARES | | VALUE |

| |

SINGAPORE: 8.1% | | | | |

Singapore Press Holdings, Ltd. | | 645,000 | | $2,002,597 |

Venture Corp., Ltd. | | 190,000 | | 1,666,412 |

Parkway Life REITc | | 1,657,868 | | 1,301,463 |

Singapore Post, Ltd. | | 1,142,000 | | 881,484 |

Yellow Pages (Singapore), Ltd. | | 1,067,000 | | 752,955 |

| | | | |

| | |

Total Singapore | | | | 6,604,911 |

| |

| | |

MALAYSIA: 7.0% | | | | |

Media Prima BHD | | 2,435,800 | | 2,059,671 |

Public Bank BHD | | 412,800 | | 1,366,164 |

Malayan Banking BHD | | 345,300 | | 1,193,656 |

Berjaya Sports Toto BHD | | 691,200 | | 1,050,564 |

| | | | |

| | |

Total Malaysia | | | | 5,670,055 |

| |

| | |

INDIA: 6.4% | | | | |

Ashok Leyland, Ltd. | | 1,895,000 | | 2,473,848 |

HCL-Infosystems, Ltd. | | 230,167 | | 1,637,741 |

Chennai Petroleum Corp., Ltd. | | 105,000 | | 1,137,166 |

| | | | |

| | |

Total India | | | | 5,248,755 |

| |

| | |

AUSTRALIA: 5.5% | | | | |

Coca-Cola Amatil, Ltd. | | 179,498 | | 1,484,279 |

Insurance Australia Group, Ltd. | | 365,121 | | 1,314,126 |

St. George Bank, Ltd. | | 31,464 | | 865,754 |

Tabcorp Holdings, Ltd. | | 61,523 | | 795,426 |

| | | | |

| | |

Total Australia | | | | 4,459,585 |

| |

| | |

SOUTH KOREA: 5.3% | | | | |

Hana Financial Group, Inc. | | 37,640 | | 2,020,929 |

SK Telecom Co., Ltd. | | 4,488 | | 1,183,508 |

SK Telecom Co., Ltd. ADR | | 36,300 | | 1,083,192 |

| | | | |

| | |

Total South Korea | | | | 4,287,629 |

| |

16 MATTHEWS ASIAN FUNDS

DECEMBER 31, 2007

| | | | |

| | | SHARES | | VALUE |

| |

UNITED KINGDOM: 4.1% | | | | |

HSBC Holdings PLC ADR | | 21,900 | | $1,833,249 |

HSBC Holdings PLC | | 90,800 | | 1,526,726 |

| | | | |

| | |

Total United Kingdom | | | | 3,359,975 |

| |

| | |

THAILAND: 3.7% | | | | |

Advanced Info Service Public Co., Ltd. | | 540,600 | | 1,540,803 |

PTT Public Co., Ltd. | | 136,500 | | 1,516,133 |

| | | | |

| | |

Total Thailand | | | | 3,056,936 |

| |

| | |

PHILIPPINES: 2.8% | | | | |

Globe Telecom, Inc. | | 60,950 | | 2,305,849 |

| | | | |

| | |

Total Philippines | | | | 2,305,849 |

| |

| | |

INDONESIA: 1.3% | | | | |

PT Telekomunikasi Indonesia | | 559,000 | | 591,780 |

PT Telekomunikasi Indonesia ADR | | 11,700 | | 491,517 |

| | | | |

| | |

Total Indonesia | | | | 1,083,297 |

| |

| | |

NEW ZEALAND: 1.1% | | | | |

Fisher & Paykel Appliances Holdings, Ltd. | | 345,798 | | 910,860 |

| | | | |

| | |

Total New Zealand | | | | 910,860 |

| |

| | |

| | | VALUE |

| |

TOTAL INVESTMENTS: 97.2% | | $79,362,174 |

(Cost $74,230,040d) | | |

| |

CASH AND OTHER ASSETS, LESS LIABILITIES: 2.8% | | 2,261,881 |

| | |

| |

NET ASSETS: 100.0% | | $81,624,055 |

| |

a | Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A). |

c | Non–income producing security |

d | Cost for Federal income tax purposes is $74,332,664 and net unrealized appreciation consists of: |

| | | |

Gross unrealized appreciation | | $8,722,751 | |

Gross unrealized depreciation | | (3,693,241 | ) |

| | | |

Net unrealized appreciation | | $5,029,510 | |

| | | |

| | |

| ADR | | American Depositary Receipt |

| REIT | | Real Estate Investment Trust |

See accompanying notes to financial statements.

800.789.ASIA [2742] www.matthewsfunds.com 17

MATTHEWS PACIFIC TIGER FUND (CLOSED TO MOST NEW INVESTORS)

| | |

| FUND DESCRIPTION | | SYMBOL: MAPTX |

Under normal market conditions, the Matthews Pacific Tiger Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in the Pacific Tiger countries of China, Hong Kong, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. |

| | |

| PORTFOLIO MANAGERS | | Note: Managers shown reflect changes effective January 1, 2008. |

Lead Managers: Richard H. Gao and Sharat Shroff | | Co-Manager: Mark W. Headley |

PORTFOLIO MANAGER COMMENTARY

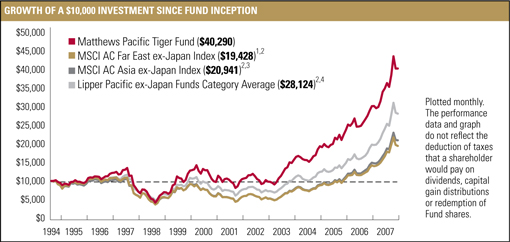

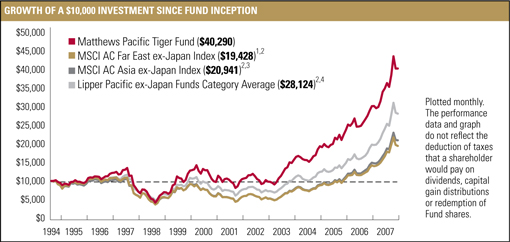

In 2007, the Matthews Pacific Tiger Fund returned 33.66%, while the benchmark MSCI All Country Far East ex-Japan Index returned 36.92%, and the MSCI All Country Asia ex-Japan Index returned 40.52%. The Fund finished the year with solid gains compared to its benchmark as many markets in Asia turned volatile. For the quarter ended December 31, 2007, the Fund advanced 4.56%, while the MSCI All Country Far East ex-Japan Index fell –1.67%. For the last 12 to 18 months, the Fund has pursued an approach of staying a bit more cautious with valuations. Over much of the last year, this tactic held the Fund back as expensive stocks got even pricier, and gains seemed more concentrated within larger market capitalization stocks. However, the Fund’s performance in the fourth quarter highlights this approach.

For the second year running, the equity markets in China and India generated strong returns, reflecting an environment of solid corporate earnings growth and inflationary trends that were generally benign up until the middle of 2007. At the same time, it is also evident that these markets are awash with investors who are chasing news and events such as the valuation arbitrage between China’s domestic A-shares and Hong Kong-listed H-shares (the Fund

does not own A shares), or the potential market capitalization that could be created through spin-offs in India. In addition, the money raised through initial public offerings set records in both countries last year. On the one hand, it is encouraging to see such strong capital flows, especially to India where entrepreneurs have long been starved of resources. Nonetheless, the expectations reflected in the prices of many of the portfolio’s Chinese holdings appeared too demanding, leading us to trim or even eliminate positions. For the first time in at least the past five years, the Fund ended the year with a slight underweight in China/Hong Kong securities relative to the benchmark.

By contrast, we have selectively added to the Fund’s holdings in Indonesia and Malaysia, including PT Telekomunikasi Indonesia (PT Telkom), the largest integrated telecommunications company in Indonesia. PT Telkom’s main attraction is its investment in Telkomsel—the dominant wireless operator in a market that is growing at 25-30% per year. On a relative basis, cell phone subscription charges in Indonesia are high but have started to decline in recent months, sparking some concern over the outlook for the company. However, we believe falling subscriber rates should aide

continued on page 20

18 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF DECEMBER 31, 2007, UNLESS OTHERWISE NOTED

| | | | | | | | | | | | |

| PERFORMANCE AS OF DECEMBER 31, 2007 | | | | | | | | | | | | |

| Fund Inception: 9/12/94 | | | | Average Annual Total Returns |

| | | 3 MO | | 1 YR | | 3 YRS | | 5 YRS | | 10 YRS | | SINCE INCEPTION |

Matthews Pacific Tiger Fund | | 4.56% | | 33.66% | | 27.71% | | 32.70% | | 18.82% | | 11.05% |

MSCI All Country Far East ex-Japan Index1 | | –1.67% | | 36.92% | | 30.16% | | 30.32% | | 12.54% | | 5.10%2 |

MSCI All Country Asia ex-Japan Index3 | | 0.83% | | 40.52% | | 32.28% | | 31.98% | | 13.26% | | 5.70%2 |

Lipper Pacific ex-Japan Funds Category Average4 | | 0.93% | | 37.67% | | 30.31% | | 30.16% | | 14.25% | | 7.89%2 |

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Unusually high returns may not be sustainable. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit www.matthewsfunds.com.

| | | |

| OPERATING EXPENSES | | | |

Net Ratio: Fiscal Year 20075 | | 1.10 | % |

Gross Ratio: Fiscal Year 2007 | | 1.11 | % |

Gross Ratio: Fiscal Year 2006 | | 1.18 | % |

| | | |

| PORTFOLIO TURNOVER6 | | | |

Fiscal Year 2007 | | 24.09 | % |

1 | The MSCI All Country Far East ex-Japan Index is a free float–adjusted market capitalization–weighted index of the stock markets of China, Hong Kong, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand. The Matthews Pacific Tiger Fund invests in countries that are not included in the MSCI All Country Far East ex-Japan Index. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PFPC Inc. |

2 | Calculated from 8/31/94. |

3 | The MSCI All Country Asia ex-Japan Index is a free float–adjusted market capitalization–weighted index of the stock of markets of China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, and Thailand. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PFPC Inc. |

4 | Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

5 | Includes management fee, administration and shareholder services fees after reimbursement, waiver or recapture of expenses by Advisor. Matthews Asian Funds do not charge 12b-1 fees. |

6 | The lesser of fiscal year-to-date long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

800.789.ASIA [2742] www.matthewsfunds.com 19

MATTHEWS PACIFIC TIGER FUND (CLOSED TO MOST NEW INVESTORS)

| | | | |

| TOP TEN HOLDINGS1 | | | | |

| | | COUNTRY | | % OF NET ASSETS |

Lenovo Group, Ltd. | | China/Hong Kong | | 3.8% |

Hana Financial Group, Inc. | | South Korea | | 3.2% |

Swire Pacific, Ltd. | | China/Hong Kong | | 3.2% |

Advanced Info Service Public Co., Ltd. | | Thailand | | 3.1% |

Amorepacific Corp. | | South Korea | | 2.7% |

Dah Sing Financial Holdings, Ltd. | | China/Hong Kong | | 2.7% |

Hang Lung Group, Ltd. | | China/Hong Kong | | 2.6% |

Cipla, Ltd. | | India | | 2.5% |

NHN Corp. | | South Korea | | 2.5% |

DBS Group Holdings, Ltd. | | Singapore | | 2.5% |

% OF ASSETS IN TOP 10 | | | | 28.8% |

| | | |

| COUNTRY ALLOCATION | |

China/Hong Kong | | 33.7 | % |

South Korea | | 19.1 | % |

India2 | | 15.9 | % |

Singapore | | 9.7 | % |

Thailand | | 7.8 | % |

Indonesia | | 5.8 | % |

Malaysia | | 3.8 | % |

Taiwan | | 3.5 | % |

Philippines | | 0.4 | % |

Cash and other assets, less liabilities | | 0.3 | % |

| | | |

| SECTOR ALLOCATION | |

Financials | | 32.2 | % |

Consumer Discretionary | | 14.3 | % |

Information Technology | | 14.1 | % |

Health Care | | 11.6 | % |

Industrials | | 10.2 | % |

Consumer Staples | | 9.8 | % |

Telecommunication Services | | 6.8 | % |

Utilities | | 0.7 | % |

Cash and other assets, less liabilities | | 0.3 | % |

| | | |

| MARKET CAP EXPOSURE | |

Large cap (over $5 billion) | | 55.9 | % |

Mid cap ($1–$5 billion) | | 36.2 | % |

Small cap (under $1 billion) | | 7.6 | % |

Cash and other assets, less liabilities | | 0.3 | % |

| | | | | | | | |

| NUMBER OF SECURITIES | | NAV | | FUND ASSETS | | REDEMPTION FEE | | 12b-1 FEES |

71 | | $27.86 | | $3.8 billion | | 2.00% within 90 calendar days | | None |

1 | Holdings may combine more than one security from same issuer and related depositary receipts. |

2 | India is not included in the MSCI All Country Far East ex-Japan Index. |

PORTFOLIO MANAGER COMMENTARY continued from page 18

management’s efforts in increasing penetration throughout Indonesia, especially in areas beyond greater Jakarta where rural income levels are being driven by the boom in commodities. Furthermore, management has an opportunity to bolster shareholder returns through buybacks and dividends. In our view, PT Telkom is a good example of a growth story that is still accessible at reasonable valuations.

In the coming years, it is our belief that a company’s country of origin will matter less in deciding its fortune. Rather, company and sector specific risks are going to be a greater source of investment returns. The Fund’s exposure to the consumer, financial and technology sectors has been relatively steady over the years. One notable change has been the portfolio’s steady increase to its health care allocation. While this

20 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF DECEMBER 31, 2007, UNLESS OTHERWISE NOTED

change did not help relative performance last year, we believe the Fund stands to benefit from its holdings in the health care sector over the long term. In many parts of Asia, consumers appear to be devoting an increasingly large part of their personal incomes to spending on health care. It is our belief that Asians will continue to seek better quality treatment and this trend will continue to gain momentum with rising income levels and changing lifestyles. Conversely, the portfolio’s lack of exposure to the energy and commodities sectors was a considerable detriment to relative performance in 2007. Many stocks in the energy and commodities sectors are enjoying valuation multiples that seem to extrapolate strong cyclical earnings into perpetuity—a trend we believe is likely to end in some disappointment. Throughout its history, the Fund has generally avoided commodity-oriented companies where we believe forward earnings are unpredictable.

At its very core, the portfolio aims to identify companies and management teams that are capable of generating sustainable, long-term organic growth by driving their own destiny. We have been attracted to companies focused on taking advantage of the growth in domestic consumption. Some of the Fund’s best successes have stemmed from identifying such companies early in their evolution, which is why the portfolio carries a heavier weight (relative to the benchmark) in mid-sized companies. It is our belief that small- to mid-sized companies can be more entrepreneurial, and often thrive in a sector, such as services, where there is greater need for business acumen over capital and contacts. At times, the outcomes of this strategy can be slow to unfold but we are patient and willing to focus on these factors rather than trying to predict the price of oil.

On the surface, the Fund’s allocation to small- and mid-capitalization stocks appears to be less than it was last year. However, many of the portfolio’s small- and mid-cap stocks actually became larger capitalization stocks helped by price appreciation and strengthening currencies. One example is Hang Lung Group, a well-established Hong Kong-based property developer. When the Fund first initiated its position in Hang Lung, the company’s management was still in the early stages of forming its China strategy. Leveraging its experience in Hong Kong, it successfully developed large-scale, commercial property projects in Shanghai, and is now expanding aggressively into other major cities in China. Hang Lung’s near-term outlook may be clouded by the Chinese government’s initiatives to cool the property sector; however, having followed Hang Lung’s progress for the last several years, we are confident in the ability of the management team to navigate through the regulatory hurdles.

As we look ahead, Asia’s ability to overcome a slowdown in the U.S. has improved but it is not fully ready to escape unscathed. The Matthews Pacific Tiger Fund has historically maintained a bias toward domestically oriented companies, and business models that are able to survive changes in macro cycles. We are encouraged by the improvement in corporate balance sheets since the Asian crisis, and the prospect for greater integration between the various economies in the region. In the coming years, the pace of change is likely to remain hectic—and we believe generally in the right direction. The portfolio was built on the principles of harnessing that change to generate superior long-term returns for investors.

800.789.ASIA [2742] www.matthewsfunds.com 21

MATTHEWS PACIFIC TIGER FUND

SCHEDULE OF INVESTMENTSa

COMMON EQUITIES: 99.7%

| | | | |

| | | SHARES | | VALUE |

| |

CHINA/HONG KONG: 33.7% |

Lenovo Group, Ltd. | | 162,664,000 | | $142,826,665 |

Swire Pacific, Ltd. A Shares | | 8,775,000 | | 120,244,869 |

Dah Sing Financial Holdings, Ltd. | | 10,262,400 | | 101,001,108 |

Hang Lung Group, Ltd. | | 18,041,000 | | 97,484,095 |

NWS Holdings, Ltd. | | 23,023,636 | | 73,018,764 |

NetEase.com, Inc. ADRb | | 3,480,800 | | 65,995,968 |

Television Broadcasts, Ltd. | | 11,020,700 | | 65,874,114 |

Tencent Holdings, Ltd. | | 8,362,000 | | 62,454,697 |

Shangri-La Asia, Ltd. | | 19,672,000 | | 61,181,855 |

Agile Property Holdings, Ltd. | | 33,518,000 | | 60,173,115 |

Ping An Insurance (Group) Co. of China, Ltd. H Shares | | 5,301,000 | | 56,119,890 |

Dairy Farm International Holdings, Ltd. | | 10,937,300 | | 47,538,450 |

China Merchants Bank Co., Ltd. H Shares | | 11,316,500 | | 45,529,183 |

China Mobile, Ltd. ADR | | 506,250 | | 43,977,938 |

Travelsky Technology, Ltd. H Shares† | | 40,812,000 | | 43,049,987 |

Dynasty Fine Wines Group, Ltd.† | | 89,260,000 | | 34,888,567 |

Integrated Distribution Services Group, Ltd. | | 10,711,000 | | 32,762,421 |

China Vanke Co., Ltd. B Shares | | 11,782,993 | | 30,365,861 |

Dickson Concepts International, Ltd.† | | 32,715,400 | | 29,888,262 |

Towngas China Co., Ltd.b | | 50,564,000 | | 26,760,271 |

Glorious Sun Enterprises, Ltd. | | 41,262,000 | | 25,002,277 |

Dongfeng Motor Group Co., Ltd. H Shares | | 26,100,000 | | 18,204,698 |

Alibaba.com, Ltd.b | | 8,500 | | 30,141 |

| | | | |

| |

Total China/Hong Kong | | 1,284,373,196 |

| |

| | | | |

| | | SHARES | | VALUE |

| |

SOUTH KOREA: 19.1% | | | | |

Hana Financial Group, Inc. | | 2,271,603 | | $121,964,645 |

Amorepacific Corp. | | 133,948 | | 101,022,550 |

NHN Corp.b | | 402,280 | | 95,926,330 |

Hanmi Pharmaceutical Co., Ltd.† | | 462,747 | | 80,962,975 |

S1 Corp. | | 926,932 | | 55,549,811 |

Hyundai Development Co. | | 532,704 | | 51,497,179 |

Samsung Securities Co., Ltd. | | 525,760 | | 50,134,588 |

Yuhan Corp. | | 223,067 | | 48,144,324 |

MegaStudy Co., Ltd. | | 159,301 | | 45,297,701 |

ON*Media Corp.b | | 4,834,370 | | 35,779,254 |

Nong Shim Co., Ltd. | | 147,466 | | 30,461,876 |

GS Home Shopping, Inc. | | 120,294 | | 8,581,092 |

| | | | |

| | |

Total South Korea | | | | 725,322,325 |

| |

| | |

INDIA: 15.9% | | | | |

Cipla, Ltd. | | 18,066,792 | | 96,755,871 |

HDFC Bank, Ltd. | | 1,952,568 | | 84,366,370 |

Dabur India, Ltd. | | 28,958,736 | | 83,195,728 |

Sun Pharmaceutical Industries, Ltd. | | 2,679,886 | | 81,216,911 |

Infosys Technologies, Ltd. | | 1,585,051 | | 70,698,275 |

Titan Industries, Ltd. | | 1,436,318 | | 56,269,994 |

Bank of Baroda | | 4,547,022 | | 52,463,065 |

Bharti Airtel, Ltd.b | | 1,585,402 | | 39,654,966 |

Sintex Industries, Ltd. | | 2,227,839 | | 31,896,892 |

Sun Pharma Advanced Research Co., Ltd.b | | 2,296,352 | | 9,240,814 |

| | | | |

| | |

Total India | | | | 605,758,886 |

| |

| | |

SINGAPORE: 9.7% | | | | |

DBS Group Holdings, Ltd. | | 6,585,750 | | 93,471,422 |

Fraser and Neave, Ltd. | | 19,892,750 | | 80,589,732 |

Hyflux, Ltd.† | | 33,427,187 | | 73,594,778 |

Keppel Land, Ltd. | | 10,416,000 | | 52,115,718 |

Parkway Holdings, Ltd. | | 18,091,050 | | 49,163,454 |

Tat Hong Holdings, Ltd. | | 8,947,000 | | 21,077,621 |

Parkway Life REITb | | 961,302 | | 754,643 |

| | | | |

| | |

Total Singapore | | | | 370,767,368 |

| |

22 MATTHEWS ASIAN FUNDS

DECEMBER 31, 2007

| | | | |

| | | SHARES | | VALUE |

| |

THAILAND: 7.8% | | | | |

Advanced Info Service Public Co., Ltd. | | 40,925,800 | | $116,645,552 |

Bangkok Bank Public Co., Ltd. | | 16,438,300 | | 58,056,232 |

Bank of Ayudhya Public Co., Ltd. NVDR | | 61,539,600 | | 47,665,571 |

Land & Houses Public Co., Ltd. | | 156,102,800 | | 41,342,574 |

Amata Corp. Public Co., Ltd.† | | 59,894,900 | | 31,205,447 |

| | | | |

| | |

Total Thailand | | | | 294,915,376 |

| |

| | |

INDONESIA: 5.8% | | | | |

PT Bank Central Asia | | 69,945,500 | | 53,598,553 |

PT Telekomunikasi Indonesia | | 45,799,000 | | 48,484,662 |

PT Kalbe Farma | | 341,674,000 | | 45,206,670 |

PT Astra International | | 13,289,730 | | 38,102,354 |

PT Ramayana Lestari Sentosa | | 277,326,000 | | 24,802,298 |

PT Telekomunikasi Indonesia ADR | | 265,000 | | 11,132,650 |

| | | | |

| | |

Total Indonesia | | | | 221,327,187 |

| |

| | |

MALAYSIA: 3.8% | | | | |

Resorts World BHD | | 52,087,200 | | 60,704,269 |

Public Bank BHD | | 16,107,900 | | 53,309,205 |

Top Glove Corp. BHD† | | 15,609,880 | | 30,459,525 |

| | | | |

| | |

Total Malaysia | | | | 144,472,999 |

| |

| | |

TAIWAN: 3.5% | | | | |

President Chain Store Corp. | | 29,591,000 | | 77,498,055 |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 24,767,053 | | 46,958,032 |

Hon Hai Precision Industry Co., Ltd. | | 867,000 | | 5,343,738 |

MediaTek, Inc. | | 249,000 | | 3,191,645 |

| | | | |

| | |

Total Taiwan | | | | 132,991,470 |

| |

| | |

PHILIPPINES: 0.4% | | | | |

SM Prime Holdings, Inc. | | 70,208,117 | | 17,083,638 |

| | | | |

| | |

Total Philippines | | | | 17,083,638 |

| |

| | |

| | | VALUE |

| |

TOTAL INVESTMENTS: 99.7% | | $3,797,012,445 |

(Cost $2,410,744,272c) | | |

| |

CASH AND OTHER ASSETS, LESS LIABILITIES: 0.3% | | 9,702,026 |

| | |

| |

NET ASSETS: 100.0% | | $3,806,714,471 |

| |

a | Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A). |

b | Non–income producing security |

c | Cost for Federal income tax purposes is $2,410,744,272 and net unrealized appreciation consists of: |

| | | |

Gross unrealized appreciation | | $1,440,054,557 | |

Gross unrealized depreciation | | (53,786,384 | ) |

| | | |

Net unrealized appreciation | | $1,386,268,173 | |

| | | |

† | Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer) |

| | |

| |

| ADR | | American Depositary Receipt |

| NVDR | | Non-voting Depositary Receipt |

| REIT | | Real Estate Investment Trust |

See accompanying notes to financial statements.

800.789.ASIA [2742] www.matthewsfunds.com 23

MATTHEWS ASIAN GROWTH AND INCOME FUND

(CLOSED TO MOST NEW INVESTORS)

| | |

| FUND DESCRIPTION | | SYMBOL: MACSX |

Under normal market conditions, the Matthews Asian Growth and Income Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in dividend-paying equity securities and the convertible securities, of any duration or quality, of companies located in Asia. Asia includes China, Hong Kong, India, Indonesia, Japan, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. |

| | |

| PORTFOLIO MANAGERS | | Note: Managers shown reflect changes effective February 1, 2008. |

Lead Manager: Andrew T. Foster | | Co-Manager: G. Paul Matthews |

PORTFOLIO MANAGER COMMENTARY

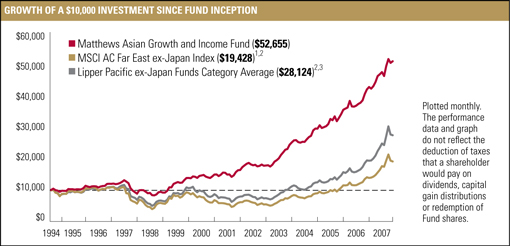

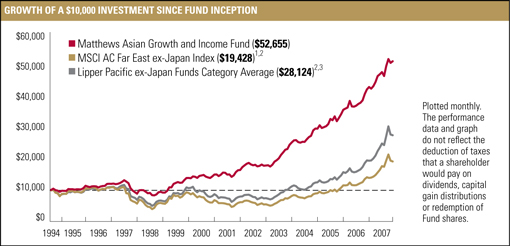

The Matthews Asian Growth and Income Fund gained 21.54% in 2007. While this return was lower than the 36.92% gained by the MSCI All Country Far East ex-Japan Index during the year, in an absolute sense, it ranks among the best individual years since the inception of the Fund in 1994. It is also above the Fund’s average annual return since inception and over the last ten years. In addition, the Fund outperformed the index for the fourth quarter, returning 3.10% against the index’s –1.67%. Toward the end of the year, the portfolio’s more conservative holdings (convertible bonds and high-yielding stocks) provided downside protection when market volatility increased.

Over longer periods, the Fund has outperformed both its benchmarks and peers, while experiencing significantly lower volatility. The Fund’s performance and volatility is entirely in keeping with its investment objectives. By retaining a portion of its assets in convertible bonds and the majority of its equity investments in securities that have historically paid above average dividends, the Fund has consistently pursued a strategy that seeks to provide its investors with long-term returns that benefit from the region’s growth, while earning some income, and mitigating some of the short-term volatility that has been a feature of Asian markets. While the range and breadth of Asia’s

24 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF DECEMBER 31, 2007, UNLESS OTHERWISE NOTED

markets have grown significantly in recent years and the regulatory environment is substantially improved, we continue to believe that these markets will likely remain more volatile than their counterparts in more developed regions.

During the year, the best performing (in absolute return terms) equity markets in the region were those of India and China. These markets are benefitting from particularly strong underlying economic growth starting from a relatively low base. Incomes per capita in China and India remain substantially below levels

that have been achieved in many other Asian economies. In that sense, the growth opportunities in these two countries remain particularly attractive. On the other hand, both countries have greater limitations on the free flow of capital than much of the rest of Asia, and less developed regulatory systems. For these reasons, we believe that the more developed markets of Asia (such as Hong Kong and Singapore) offer a number of advantages, particularly for more risk-conscious investors. While the Fund will continue to have direct exposure to both China

continued on page 26

| | | | | | | | | | | | |

| PERFORMANCE AS OF DECEMBER 31, 2007 | | | | | | | | | | | | |

| Fund Inception: 9/12/94 | | | | Average Annual Total Returns |

| | | 3 MO | | 1 YR | | 3 YRS | | 5 YRS | | 10 YRS | | SINCE

INCEPTION |

Matthews Asian Growth and Income Fund | | 3.10% | | 21.54% | | 20.19% | | 23.92% | | 19.00% | | 13.30% |

MSCI All Country Far East ex-Japan Index1 | | –1.67% | | 36.92% | | 30.16% | | 30.32% | | 12.54% | | 5.10%2 |

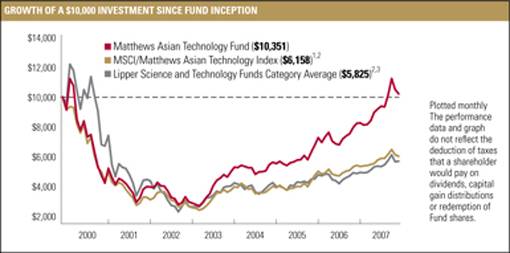

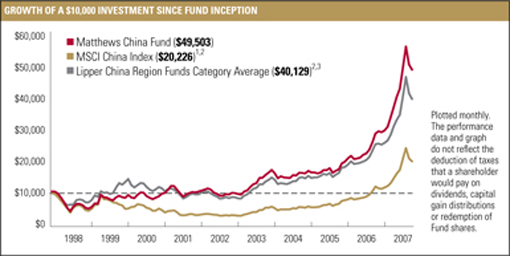

Lipper Pacific ex-Japan Funds Category Average3 | | 0.93% | | 37.67% | | 30.31% | | 30.16% | | 14.25% | | 7.89%2 |