UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-6036

Date of fiscal year end: December 31

Date of reporting period: December 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Performance and Expenses

Through December 31, 2008

| | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | Inception

Date | | 2008 Gross

Annual

Operating

Expenses | | | 2007 Gross

Annual

Operating

Expenses1 | |

| | | 1 year | | | 5 years | | | 10 years | | | Since

Inception | | | | |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | |

Matthews Asian Growth and Income Fund | | -32.07 | % | | 7.45 | % | | 14.34 | % | | 9.32 | % | | 9/12/94 | | 1.16 | % | | 1.15 | % |

Matthews Asia Pacific Equity Income Fund | | -25.97 | % | | n.a. | | | n.a. | | | -2.67 | % | | 10/31/06 | | 1.35 | % | | 1.41 | % |

After Contractual Fee Waiver | | | | | | | | | | | | | | | | 1.32 | %2 | | | |

| | | | | | | |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | |

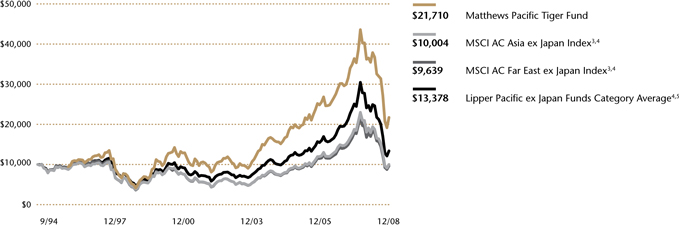

Matthews Asia Pacific Fund | | -37.44 | % | | 3.63 | % | | n.a. | | | 4.14 | % | | 10/31/03 | | 1.23 | % | | 1.20 | % |

Matthews Pacific Tiger Fund | | -46.12 | % | | 6.72 | % | | 12.02 | % | | 5.57 | % | | 9/12/94 | | 1.12 | % | | 1.10 | % |

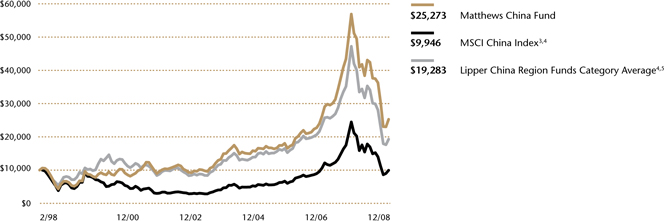

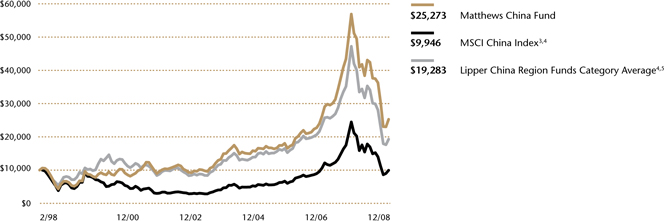

Matthews China Fund | | -48.95 | % | | 9.71 | % | | 14.95 | % | | 8.91 | % | | 2/19/98 | | 1.23 | % | | 1.17 | % |

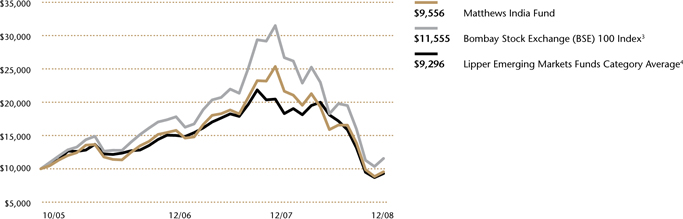

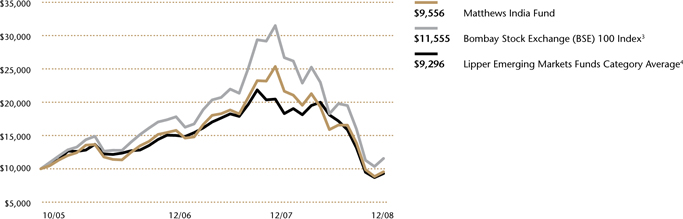

Matthews India Fund | | -62.32 | % | | n.a. | | | n.a. | | | -1.42 | % | | 10/31/05 | | 1.29 | % | | 1.28 | % |

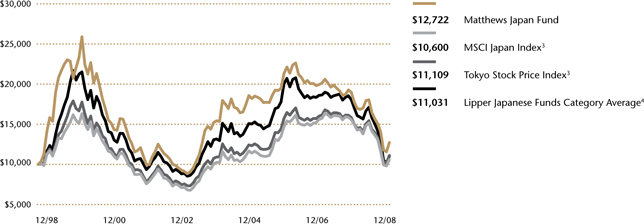

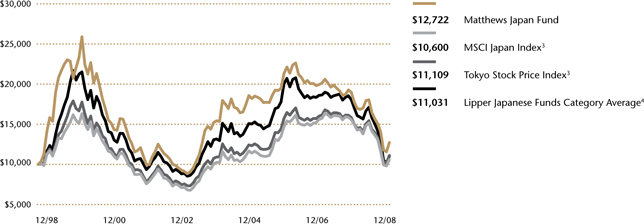

Matthews Japan Fund | | -28.38 | % | | -3.52 | % | | 2.44 | % | | 2.44 | % | | 12/31/98 | | 1.23 | % | | 1.23 | % |

Matthews Korea Fund | | -52.66 | % | | 4.51 | % | | 11.68 | % | | 1.56 | % | | 1/3/95 | | 1.27 | % | | 1.21 | % |

| | | | | | | |

ASIA SMALL COMPANY STRATEGY | | | | | | | | | | | | | | | | | | | | |

Matthews Asia Small Companies Fund | | n.a. | | | n.a. | | | n.a. | | | -21.03 | %3 | | 9/15/08 | | 14.31 | %4 | | n.a. | |

After Contractual Fee Waiver | | | | | | | | | | | | | | | | 2.00 | %4 | | n.a. | |

| | | | | | | |

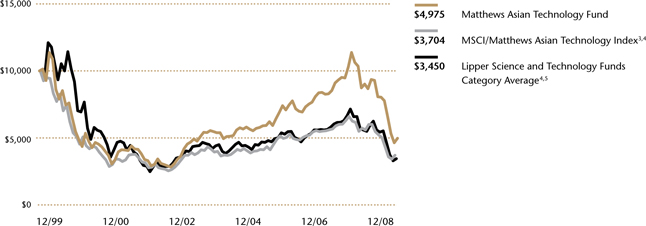

ASIA SPECIALTY STRATEGY | | | | | | | | | | | | | | | | | | | | |

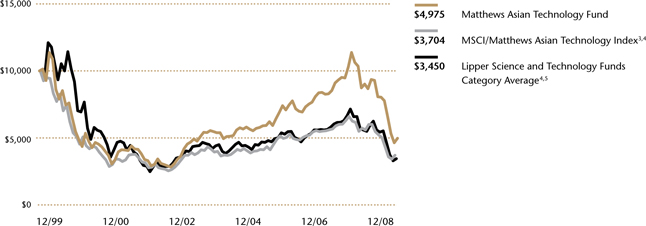

Matthews Asian Technology Fund | | -51.94 | % | | -0.50 | % | | n.a. | | | -7.46 | % | | 12/27/99 | | 1.33 | % | | 1.25 | % |

| 1 | Ratio has been restated to reflect current management and administrative and shareholder servicing fees expected to be incurred by the Funds and paid to the Advisor. |

| 2 | The Advisor has contractually agreed to waive certain fees and reimburse certain expenses for Matthews Asia Pacific Equity Income Fund. Please see page 77 for additional information. |

| 3 | Actual Return, Not Annualized. |

| 4 | The Advisor has contractually agreed to waive Matthews Asia Small Companies Fund’s fees and reimburse expenses until August 31, 2010 to the extent needed to limit total annual operating expenses to 2.00%. |

Investor Disclosure

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds’ prospectus and Statement of Additional Information for more risk disclosure.

Redemption Fee Policy

The Funds assess a redemption fee of 2.00% on the total redemption proceeds on most sales or exchanges of shares that take place within 90 calendar days after their purchase as part of the Funds’ efforts to discourage market timing activity. This fee is payable directly to the Funds. For purposes of determining whether the redemption fee applies, the shares that have been held longest will be redeemed first. The Funds may grant exemptions from the redemption fee in certain circumstances. For more information on this policy, please see the Funds’ prospectus.

Cover photo: River by the Esplanade, Singapore

Contents

This report has been prepared for Matthews Asia Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. Additional copies of the prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of December 31, 2008. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund’s future investment intent.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Matthews Asia Funds are distributed by:

PFPC Distributors, Inc. | 760 Moore Road | King of Prussia, PA 19406

| | |

“the notion that markets can be classified as either “developed” or “emerging” in a binary fashion has always been questionable. The present crisis has rendered the distinction obsolete.” | | Message to Shareholders from the Investment Advisor Dear Fellow Shareholders, 2008 was a year of extremes. The extent and breadth of collapse of the global financial order exceeded all but the direst prediction. Everyone was left wondering: How did this happen? What does it all mean? We would not pretend to be able to answer such complex questions. However, as wrenching as markets have been, their recent convulsions are unfortunately not outside the scope of expectation. The history of markets is a long one, and it is replete with fantastic booms and devastating busts. As we at Matthews know from experience, crisis is a constant interloper in the marketplace. Volatility, and the swings in fortune that accompany it, are inevitable and immutable qualities of financial markets. Amid the current environment, one might be tempted to discontinue investment. Yet yielding to such temptation would be shortsighted. Investors have recently experienced the downside of risk; but having done so, they cannot lose sight of the potential upside: namely, that their portfolios might capture some small share of the world’s march toward growth and progress. Our experience at Matthews suggests that the market’s collapse belies material gains made over the past two decades. During that time, productivity has risen in almost every corner of the globe; scientific achievement has leapt forward; trade has flourished; and markets have been deregulated and opened to greater competition. Most importantly, hundreds of millions of people in East and Central Asia have clawed their way out of abject poverty. Asian incomes have grown, and households enjoy improved living standards. This is no small feat given where the region began, and it represents growth of the most authentic kind. It is this same progress that investors should try to harvest in their portfolios, especially as some share of it is ultimately reflected in financial terms. Faulty Premises and Artificial Labels Many would expect that as a regulated, modern and developed market, the U.S. would have been the last sort of place where catastrophic risk might manifest itself. It was only five years ago that some prominent strategists warned of an imminent demise of the Chinese banking system, calling it a “house of cards.” Chinese banks have indeed suffered amid the current correction, but the fundamentals have held relatively stable during the downturn. Thus, events have confounded those who would predict that the next world crisis would arise from the “emerging” world, rather than the “developed” one. In our view, this disconnected logic arises from a faulty premise—that the labels “developed market” and “emerging market” have much meaning for investors. To be sure, countries around the world are in various stages of development; yet even as substantial differences exist, the notion that markets can be classified as either “developed” or “emerging” in a binary fashion has always been questionable. The present crisis has rendered the distinction obsolete. Regulatory and financial systems are subject to failure even in the world’s most advanced countries. Meanwhile, the capital markets and financial systems of the so-called emerging world may not be as precarious as believed. Investors must anticipate material risk in every investment, regardless of its origin or pedigree. |

| |

2 MATTHEWS ASIA FUNDS

| | |

A Measure of Progress So what did the year hold for China, Asia’s central economic power? Its experience is emblematic of the region’s struggle to advance from emerging to developed status. During the year, China was tested on many fronts: it saw deadly blizzards; a devastating earthquake that killed tens of thousands; food price inflation that threatened social stability; a deadly consumer scandal from tainted milk formula; and a domestic economy that faced headwinds arising from the downturn of the U.S. economy. Except for the Olympic Games, most external observers would struggle to find much about the year that was positive. However, a closer reading of events would suggest that China made a fair measure of progress. Not in recent memory has China’s media had such freedom to report on scandals and civil unrest; nor has the nation engaged in such open dialogue over its hardships. The country’s leadership does not allow for free debate in the country; yet high-ranking officials were repeatedly and publicly brought to task for corruption or failure to address the nation’s woes. This suggests that a new sort of social structure has begun to emerge in China—one characterized by a higher degree of openness. Still, China will face further tests in the year ahead. The domestic banking system has largely avoided the collapse of global financial markets. This is no small feat, given that less than a decade ago most of the country’s banking sector was technically insolvent. However, growth in the country is slowing, and banks will likely face pressure from the central government to stimulate credit markets. How the banks respond will test their independence, as well as the health of the industry as a whole. Meanwhile, the government will face challenges of its own, as slower growth will strain the social compact that has underwritten the ruling party’s status. The country’s social safety net likely needs expansion. In 2008, China’s leadership demonstrated that it was responsive and adaptive—and if it can do so again in 2009, it may fend off the threat of stagnation. What Worked, and What Did Not 2008 was a difficult year for China, and so too for the Matthews Asia Funds. We were pleased to note that nearly all of the Funds fared better in their performance than their peers and benchmarks. Nevertheless, it is the absolute performance of the Funds that was the obvious casualty during the year. The steep decline in shareholders’ assets was reminiscent of previous crises, and we found it every bit as painful. As a firm, we managed to avoid some of the worst-hit areas during the downturn by de-emphasizing investment in commodity-driven and cyclical industries. We also attempted to shun steep valuations on high-growth | | stocks, particularly because we were skeptical as to whether the popular notion of “decoupling” would persist. When it did not, some stocks saw their premium valuations falter. Yet even as such actions avoided the worst of the financial fallout, the Funds still suffered steep losses in absolute terms. In hindsight, we underestimated the severity of the dislocation in markets. As a firm, we tended to “trust in the fundamentals,” believing that strong underlying balance sheets and steady growth prospects would allow individual companies to avoid the worst of the downturn. Instead, 2008 was characterized by bouts of distressed selling that we have not seen since the Asian financial crisis of just over a decade ago. As a consequence, the quality of a company’s fundamentals mattered little as large swathes of assets were sold off quickly and indiscriminately. We are confident that as markets stabilize, long-term fundamentals will assert themselves again, but for the time being the market appears unwilling to extend its forecast horizon beyond the next two quarters. In an environment such as this, the only practical step to avoid losses would have been to make greater use of cash and cash-like instruments within the Funds. However, such a move would run counter to Matthews’ philosophy. In all our portfolios, we strive to maintain near-full investment, rather than attempt to time markets. Our goal is to maximize long-term performance. We believe that the best way to pursue that goal efficiently is by adhering to an investment discipline that emphasizes fundamentals and avoids excessive, costly turnover. Of course, after declines of such magnitude, we are all looking in the mirror to see how we can modify and improve our investment approach without abandoning this core discipline. A New Notion of Decoupling Though the concept of “decoupling” was popularly bandied about a year ago, we did not subscribe to the theory. Much of the growth in East and Central Asia over the past two decades has come about precisely because of greater economic coupling and “globalization,” and not the opposite. True “decoupling” is not a desirable state—witness Pakistan and Thailand, where severe political disorder has strained these countries’ linkages to the rest of the world, to their detriment. However, as 2009 dawns there is a new notion of decoupling that is beginning to emerge in Asia. Even though economic growth may be slowing, Asia enjoys a relatively strong “balance sheet,” which should allow it to have less reliance on the rest of the world. Asia’s economies enjoy high rates of saving, both among households and governments. Higher savings means a stronger financial position, which in turn will give Asia’s economies more room to maneuver. Specifically, |

matthewsasia.com | 800.789.ASIA 3

| | |

| “Asia’s economies enjoy high rates of saving, both among households and governments. Higher savings means a stronger financial position, which in turn will give Asia’s economies more room to maneuver.” | | households have the flexibility to dip into savings to consume—or, as is more likely the case, Asian governments will engage in expansionary deficit spending. Late in 2008, China announced a massive fiscal package, committing to spend nearly half a trillion dollars on physical infrastructure over two years. Meanwhile, Asia’s tight credit conditions gave Asian central banks more room for monetary stimulus, especially by further dropping rates. In the past, Asian central bankers looked to the U.S. Federal Reserve for cues on rates; but amid the current environment, Asia’s monetary conditions may take a different course. This may not constitute decoupling, but it does mean that Asia can contemplate fiscal and monetary measures separately from the rest of the world. Where do the challenges lie in the year ahead? There are many, and obviously most are tied to the contraction in global credit markets and the decline in consumer demand. However, there are two challenges that are particularly acute within Asia. First, credit markets within the region have been disrupted for an extended period because of ongoing financial instability. Even relatively secure, short-term financing options (e.g., letters of credit) have been less available to Asian companies. As a consequence, normal commercial and trade flows in the region have been hampered, even where end demand has been relatively resilient. Until order is restored in short-term financial markets, Asia’s growth will remain vulnerable. The second and more subtle challenge for the region is the propensity for “backsliding”: that is the risk that Asian policy makers, having witnessed the frailties of capitalism, will shun further market reforms. Asia has grown over the past two decades because it has deregulated and liberalized, and opened its markets. If Asia turns its back on this progress in a concerted fashion, it will stultify the growth that we associate with the region. However, to believe that is to go against the trends of past decades. As always, we remain confident that Asia will continue to give rise to new opportunities for further growth. We thank you for your investment in the Matthews Asia Funds, and we are honored to serve as your Asia investment specialists. |

| |

| |  |

| | Andrew T. Foster |

| | Acting Chief Investment Officer |

| | Matthews International Capital Management, LLC |

| |

| |  |

| | Robert J. Horrocks, PhD |

| | Director of Research |

| | Matthews International Capital Management, LLC |

4 MATTHEWS ASIA FUNDS

| | |

Message to Shareholders from Mark W. Headley Dear Fellow Shareholders, As many of you know, at the end of 2007, I was diagnosed with an aggressive Large B-Cell Lymphoma. I spent most of the winter in the hospital going through intensive rounds of chemotherapy, followed by radiation in the spring. Although recovery from the treatment has been long and sometimes painful, at this time I am very thankfully cancer free. The support that my family and I received was nothing short of amazing. I need to take a moment to thank all the friends, even friends I have not met, who sent their wishes and prayers. Many of the letters written were very personal and meaningful, and I deeply appreciate them. I also need to acknowledge the tremendous efforts of the team at Matthews that filled the gap in a time of great challenge. For many years, Paul Matthews and I have striven to build a team that did not overly rely on any one individual, and 2008 was the year that effort was put to the test. I am proud of how the individuals at Matthews, acting as a team, not only held the company together but drove it to new levels of effectiveness in both managing assets in Asia and serving our shareholders in the Matthews Asia Funds. It was a job well done and an exceptional demonstration of leadership in some of modern history’s most dangerous financial conditions. Global conditions remain uniquely uncertain and the damage to Asian economies and markets is significant, but I am profoundly optimistic about the future of Asia. In a world of debtors, the tired old line about Asian savers takes on new meaning. 2009 will most likely be another wild year, but when fear reigns, long-term investors act. Great change is in the wind, yet the potential of Asia is undiminished. With Much Gratitude,

Mark W. Headley Chief Executive Officer and Portfolio Manager Matthews International Capital Management, LLC | | Matthews Asia Shareholder Conference Call 2009 marks the 15th anniversary of the Matthews Asia Funds. This milestone falls amidst a period of unprecedented global market volatility. With that in mind, we wanted to thank you for your continued support of our long-term investment philosophy and invite you to join us for a conference call for clients and shareholders of the Matthews Asia Funds. During the call, you will hear from members of our investment team who will provide their thoughts on the current market environment. But perhaps most importantly, there will be ample opportunity for you to pose questions to Matthews’ Portfolio Managers. EVENT DETAILS: Wednesday, April 8 4 p.m. Eastern Time 1 p.m. Pacific Time TO PARTICIPATE: matthewsasia.com/call The conference call will be broadcast over the Internet. For information on how to participate in the call or submit your questions in advance, please visit matthewsasia.com/call. If you have questions regarding the call, or if you require additional information, please call us at 800.789.ASIA (2742). We hope that you will be able to attend; however, if you are unable join us, a transcript and audio replay of the call will be available on our website. The conference call will be conducted by Matthews Asia Funds. The Funds’ distributor is not involved with the event. |

| |

| |  |

matthewsasia.com | 800.789.ASIA 5

| | | | |

PORTFOLIO MANAGERS Andrew T. Foster Lead Manager G. Paul Matthews Co-Manager FUND FACTS | | Matthews Asian Growth and Income Fund Portfolio Manager Commentary For the year ending December 31, 2008, the Matthews Asian Growth and Income Fund fell –32.07%, while its benchmark, the MSCI All Country Asia ex Japan Index, declined –52.23%. During the fourth quarter of 2008, the Fund declined –14.41%, versus a –21.48% drop in its benchmark. 2008 was a difficult year for the Fund. Unfortunately, the fourth quarter was no exception, particularly as the Asian convertible bond market came under stress. It has always been the Fund’s aim to participate in a portion of the long-term growth of the Asian region; along the way, the Fund has also attempted to mitigate some of the volatility that has been inherent to the region’s financial markets. In order to do this, the portfolio has made use of different types of securities, such as equities, preferred equities, fixed income and convertible bonds. The common denominator has been the search for relatively high and secure income yields. In the past, convertible bonds have been of particular interest to the Fund, given that such instruments typically provide a degree of equity participation in conjunction with some bond-like security. Despite such features, convertible bonds have played a relatively small role in the Fund over the past five years. The portfolio has typically carried less than a 25% weight in such bonds, largely because the Asian markets saw relatively scant issuance during that period, mostly from lower-quality issuers. Issuance picked up again in 2006 and 2007; however, strong demand for bonds—particularly from hedge fund investors—meant that few convertibles were available to the Fund at attractive valuations. However, 2008 brought marked change to Asia’s bond markets. As conditions in financial markets worsened throughout the world, convertible markets in the region slumped in the summer, and collapsed in the autumn. Over a handful of months spanning the third and fourth quarters, the markets were under heavy duress, apparently subject to some distressed selling; reportedly, a number of arbitrage portfolios were liquidated during the period. Unfortunately for the Fund, this meant that convertibles were not the safe haven that they had been in the past. However, we believe this represented an attractive opportunity for the Fund to rebuild its position in such bonds, particularly as yields quickly rose to levels not seen for roughly one decade. Convertibles now make up 33.8% of the portfolio, offering shareholders exposure to a number of geographies and industries. Another notable shift in the Fund’s construction has been to place greater weight on technology shares within the portfolio. Historically, the portfolio had little exposure to the semiconductor industry, given its sharp cyclicality and its heavy capital requirements (meaning there was rarely much cash left over for shareholder dividends). However, the technology industry in Asia has matured to a degree, leading to a smoother business cycle and less capital expenditure. Meanwhile, the industry’s expansion has slowed from its headiest levels, but over the long term, growth should remain respectable. Ultimately, this has allowed companies to enjoy steadier cash flow margins, which in turn have translated to a higher propensity to pay dividends. The Fund has also found a degree of success with two newer holdings in the software sector: Taiwan-listed Cyberlink and Japan-listed Trend Micro. Though both companies have revenue streams closely linked to the personal computer industry—and thus are subject to its swings—the two companies nonetheless enjoy substantial free cash flow, good top-line growth and secure balance (continued) |

Ticker | | MACSX | |

Inception Date | | 9/12/94 | |

Assets | | $1.1 billion | |

NAV | | $11.50 | |

| Total # of Positions | | 72 | |

Fiscal Year 2008 Ratios | |

| Portfolio Turnover | | 25.16%1 | |

| Gross Expense Ratio | | 1.16%2 | |

Benchmarks | |

| MSCI AC Asia ex Japan Index | |

| MSCI AC Far East ex Japan Index | |

Redemption Fee | |

| 2% within first 90 calendar days of purchase | |

OBJECTIVE | |

| Long-term capital appreciation. The Fund also seeks to provide some current income. | |

STRATEGY | |

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in dividend-paying equity securities and the convertible securities, of any duration or quality, of companies located in Asia. | |

1 The lesser of fiscal year 2008 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. 2 Matthews Asia Funds does not charge 12b-1 fees. | |

6 MATTHEWS ASIA FUNDS

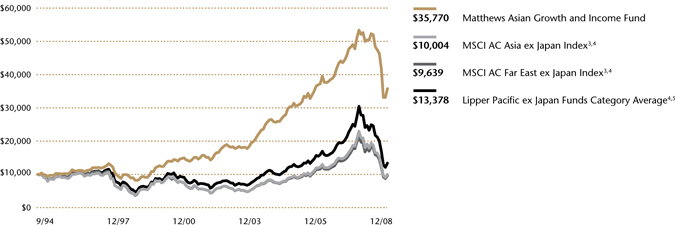

PERFORMANCE AS OF DECEMBER 31, 2008

| | | | | | | | | | | | | | | | | | |

| | | 3 Months | | | Average Annual Total Returns | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Inception

9/12/94 | |

Matthews Asian Growth and Income Fund | | -14.41 | % | | -32.07 | % | | 0.62 | % | | 7.45 | % | | 14.34 | % | | 9.32 | % |

MSCI AC Asia ex Japan Index3 | | -21.48 | % | | -52.23 | % | | -3.53 | % | | 5.42 | % | | 6.05 | % | | 0.00 | %4 |

MSCI AC Far East ex Japan Index3 | | -20.42 | % | | -50.39 | % | | -3.52 | % | | 5.17 | % | | 5.44 | % | | -0.26 | %4 |

Lipper Pacific ex Japan Funds Category Average5 | | -20.73 | % | | -50.11 | % | | -3.02 | % | | 5.36 | % | | 7.59 | % | | 1.86 | %4 |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | | | | | |

| | | June | | December | | Total |

2008 | | 24.82¢ | | 16.66¢ | | 41.48¢ |

2007 | | 21.51¢ | | 68.91¢ | | 90.42¢ |

2006 | | 21.89¢ | | 39.85¢ | | 61.74¢ |

1994–2005 | | $1.88 | | $2.07 | | $3.95 |

Note: This table does not include capital gains distributions.

| | |

| 30-DAY YIELD: 7.00% | | DIVIDEND Y IELD: 6.55% |

| |

| The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/08, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. | | The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields. |

Source: PNC Global Investment Servicing (U.S.) Inc. | | Source: FactSet Research Systems |

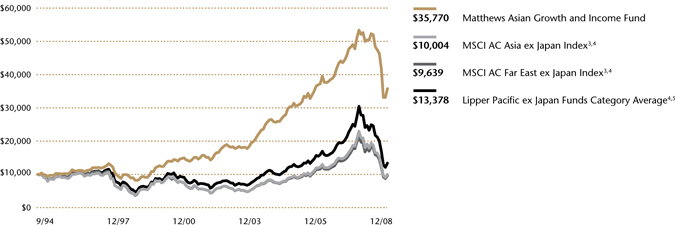

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

| 3 | It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital Management; total return calculations performed by PNC Global Investment Servicing (U.S.) Inc. Please see page 87 for index definitions. |

| 4 | Calculated from 8/31/94. |

| 5 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

TOP TEN HOLDINGS6

| | | | | | | |

| | | Security Type | | Country | | % of Net Assets | |

| Hongkong Land CB 2005, Ltd., Cnv., 2.750%, 12/21/12 | | Convertible Bond | | China/Hong Kong | | 3.9 | % |

| Cherating Capital, Ltd., Cnv., 2.000%, 07/05/12 | | Convertible Bond | | Malaysia | | 3.3 | % |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Equity | | Taiwan | | 3.2 | % |

| Rafflesia Capital, Ltd., Cnv., 1.250%, 10/04/11 | | Convertible Bond | | Malaysia | | 3.2 | % |

| China Petroleum & Chemical Corp. (Sinopec), Cnv., 0.000%, 04/24/14 | | Convertible Bond | | China/Hong Kong | | 2.8 | % |

| SK Telecom Co., Ltd., Cnv., 0.000%, 05/27/09 | | Convertible Bond | | South Korea | | 2.7 | % |

| Yue Yuen Industrial Holdings, Ltd., Cnv., 0.000%, 11/17/11 | | Convertible Bond | | China/Hong Kong | | 2.5 | % |

| Reliance Communications, Ltd., Cnv., 0.000%, 05/10/11 | | Convertible Bond | | India | | 2.5 | % |

| Nippon Building Fund, Inc., REIT | | Equity | | Japan | | 2.3 | % |

| Advanced Info Service Public Co., Ltd. | | Equity | | Thailand | | 2.1 | % |

% OF ASSETS IN TOP TEN | | | | | | 28.5 | % |

| 6 | Holdings may combine more than one security from same issuer and related depositary receipts. |

matthewsasia.com | 800.789.ASIA 7

COUNTRY ALLOCATION (%) 7

| | | | |

China/Hong Kong | | 37.7 | | Matthews Asian Growth and Income Fund Portfolio Manager Commentary (continued) sheets. This has translated to the ability to pay attractive, growing dividend streams, very much in keeping with the Fund’s strategy, even as the software industry is a relatively new addition to the Fund. Unfortunately, the Fund had no shortage of disappointments during the year as a number of securities with seemingly defensive characteristics slumped nevertheless. However, the biggest single tactical error for the Fund arose from its exposure to the media sector. We have historically favored the industry because we believe its long-term growth prospects have been underappreci-ated, especially given the low penetration of media in Asian households. This, in turn, has allowed us to purchase media shares at relatively low valuations. Meanwhile, such companies have generated stable cash flows and steadily growing dividends, with yields that were attractive relative to other alternatives. However, as markets around the world worsened, media shares in Asia suffered a substantial sell-off on the perception that discretionary expenditures, especially in advertising, would be quickly cut. We remain constructive on the fundamentals of the sector: so far the industry’s growth has remained fairly stable, somewhat contrasting the dramatic decline in share prices. As we look forward, we have reason to be a bit more positive about valuations for securities held in the portfolio. This optimism arises from the behavior of issuers in the region: a number of them have made tenders to repurchase their securities, often at what is now a steeply discounted price versus par value. During the latter half of the year, four of the Fund’s positions were subject to general tender offers from the original issuer. These issuers sought to acquire a large portion of their outstanding securities with the intent to either privatize or retire those issues from the market. Typically, issuers do this when they feel their securities are undervalued. We would note that we have not seen such conditions in quite some time. We appreciate your support of the Fund amid a difficult year and look forward to serving your interests in the year to come. |

Singapore | | 10.0 | |

Malaysia | | 8.7 | |

Taiwan | | 8.5 | |

India | | 8.4 | |

South Korea | | 8.1 | |

Japan | | 5.9 | |

Thailand | | 4.1 | |

United Kingdom | | 1.9 | |

Indonesia | | 1.7 | |

Australia | | 1.5 | |

Philippines | | 1.3 | |

Cash and Other Assets, | | | |

Less Liabilities | | 2.2 | |

SECTOR ALLOCATION (%) | |

Financials | | 24.9 | |

Telecom Services | | 18.2 | |

Consumer Discretionary | | 17.0 | |

Information Technology | | 11.7 | |

Industrials | | 9.5 | |

Consumer Staples | | 5.8 | |

Utilities | | 5.5 | |

Energy | | 2.8 | |

Health Care | | 2.4 | |

Cash and Other Assets, | | | |

Less Liabilities | | 2.2 | |

MARKET CAP EXPOSURE (%) 8 | |

Large Cap (over $5B) | | 28.2 | |

Mid Cap ($1B–$5B) | | 32.9 | |

Small Cap (under $1B) | | 36.7 | |

Cash and Other Assets, | | | |

Less Liabilities | | 2.2 | |

BREAKDOWN BY SECURITY TYPE (%) | | |

Common Equities | | 61.7 | | |

Convertible Bonds9 | | 33.8 | | |

Preferred Equities | | 2.2 | | |

Rights | | 0.1 | | |

Cash and Other Assets, | | | | |

Less Liabilities | | 2.2 | | |

7 Australia, The United Kingdom and Japan are not included in the MSCI All Country Asia ex Japan Index. 8 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. 9 Convertible bonds are not included in the MSCI All Country Asia ex Japan Index. | | | | |

8 MATTHEWS ASIA FUNDS

| | | | |

| Matthews Asian Growth and Income Fund | | December 31, 2008 |

Schedule of Investmentsa

COMMON EQUITIES: 61.7%

| | | | |

| | | Shares | | Value |

CHINA/HONG KONG: 24.2% | | | | |

PCCW, Ltd. | | 46,799,000 | | $22,468,526 |

CLP Holdings, Ltd. | | 3,292,700 | | 22,386,170 |

Television Broadcasts, Ltd. | | 6,642,000 | | 21,774,257 |

Hang Lung Properties, Ltd. | | 8,903,920 | | 19,549,162 |

VTech Holdings, Ltd. | | 4,596,300 | | 19,471,863 |

Vitasoy International Holdings, Ltd. | | 41,197,000 | | 18,378,517 |

Café de Coral Holdings, Ltd. | | 7,943,100 | | 16,115,306 |

Hang Seng Bank, Ltd. | | 1,164,700 | | 15,377,079 |

Hang Lung Group, Ltd. | | 4,976,000 | | 15,200,922 |

Bank of Communications Co., Ltd. H Shares | | 20,083,000 | | 14,596,909 |

Shandong Weigao Group Medical Polymer Co., Ltd. H Shares | | 9,076,000 | | 13,814,530 |

Giordano International, Ltd. | | 52,249,000 | | 13,182,514 |

HongKong Electric Holdings, Ltd. | | 2,243,000 | | 12,628,070 |

ASM Pacific Technology, Ltd. | | 3,163,500 | | 10,426,611 |

Next Media, Ltd. | | 88,398,000 | | 10,320,217 |

I-CABLE Communications, Ltd.† | | 129,832,000 | | 9,716,209 |

Hong Kong & China Gas Co., Ltd. | | 5,321,490 | | 8,069,862 |

China-Hong Kong Photo Products | | | | |

Holdings, Ltd. | | 14,998,003 | | 707,448 |

| | | | |

Total China/Hong Kong | | | | 264,184,172 |

| | | | |

| | | | | |

SINGAPORE: 9.4% | | | | |

Ascendas REIT | | 20,987,000 | | 20,190,171 |

Cerebos Pacific, Ltd. | | 7,920,000 | | 16,787,492 |

Fraser and Neave, Ltd. | | 6,908,100 | | 14,283,117 |

Parkway Holdings, Ltd. | | 14,326,093 | | 12,415,599 |

Singapore Press Holdings, Ltd. | | 4,735,500 | | 10,268,086 |

Parkway Life REIT | | 17,661,110 | | 9,356,521 |

Hong Leong Finance, Ltd. | | 5,421,000 | | 7,773,562 |

Singapore Post, Ltd. | | 11,567,000 | | 6,400,086 |

DBS Group Holdings, Ltd. | | 721,000 | | 4,246,964 |

Yellow Pages Singapore, Ltd. | | 6,423,000 | | 900,397 |

| | | | |

Total Singapore | | | | 102,621,995 |

| | | | |

| | | | | |

TAIWAN: 8.5% | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 23,359,469 | | 31,873,529 |

Cathay Financial Holding Co., Ltd. | | 16,893,240 | | 19,032,956 |

President Chain Store Corp. | | 5,968,000 | | 14,333,400 |

Cyberlink Corp. | | 3,873,889 | | 13,813,370 |

Chunghwa Telecom Co., Ltd. ADR | | 677,510 | | 10,569,156 |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | 391,708 | | 3,094,493 |

| | | | |

Total Taiwan | | | | 92,716,904 |

| | | | |

| | | | | |

JAPAN: 5.9% | | | | |

Nippon Building Fund, Inc., REIT | | 2,260 | | 24,841,389 |

Trend Micro, Inc.b | | 603,000 | | 21,179,142 |

Japan Real Estate Investment Corp., REIT | | 1,991 | | 17,785,886 |

| | | | |

Total Japan | | | | 63,806,417 |

| | | | |

| | | | |

| | | Shares | | Value |

| THAILAND: 4.1% | | | | |

Advanced Info Service Public Co., Ltd. | | 9,791,300 | | 22,754,581 |

| BEC World Public Co., Ltd. | | 31,595,500 | | 18,155,067 |

| Thai Reinsurance Public Co., Ltd. | | 25,672,800 | | 3,665,092 |

| | | | |

Total Thailand | | | | 44,574,740 |

| | | | |

| | | | | |

SOUTH KOREA: 3.2% | | | | |

| SK Telecom Co., Ltd. ADR | | 742,540 | | $13,499,377 |

| Hana Financial Group, Inc. | | 747,039 | | 11,900,034 |

| Daehan City Gas Co., Ltd. | | 280,300 | | 5,331,471 |

| SK Telecom Co., Ltd. | | 26,443 | | 4,395,276 |

| | | | |

Total South Korea | | | | 35,126,158 |

| | | | |

| | | | | |

UNITED KINGDOM: 1.9% | | | | |

| HSBC Holdings PLC ADR | | 573,300 | | 20,246,720 |

| | | | |

Total United Kingdom | | | | 20,246,720 |

| | | | |

| | | | | |

INDONESIA: 1.7% | | | | |

| PT Telekomunikasi Indonesia ADR | | 733,200 | | 18,381,324 |

| | | | |

Total Indonesia | | | | 18,381,324 |

| | | | |

| | | | | |

| AUSTRALIA: 1.5% | | | | |

| AXA Asia Pacific Holdings, Ltd. | | 4,744,880 | | 16,492,482 |

| | | | |

| Total Australia | | | | 16,492,482 |

| | | | |

| | | | | |

PHILIPPINES: 1.3% | | | | |

| Globe Telecom, Inc. | | 900,840 | | 14,688,196 |

| | | | |

Total Philippines | | | | 14,688,196 |

| | | | |

| | | | | |

TOTAL COMMON EQUITIES | | | | 672,839,108 |

| | | | |

| (Cost $809,603,031) | | | | |

| | | | |

| | | | |

| PREFERRED EQUITIES: 2.2% | | | | |

| | | | | |

SOUTH KOREA: 2.2% | | | | |

Samsung Fire & Marine Insurance Co., Ltd., Pfd. | | 130,056 | | 7,812,154 |

LG Household & Health Care, Ltd., Pfd. | | 191,850 | | 6,408,240 |

| Hyundai Motor Co., Ltd., Pfd. | | 566,280 | | 5,865,696 |

Hyundai Motor Co., Ltd., 2nd Pfd. | | 305,760 | | 3,376,349 |

| | | | |

Total South Korea | | | | 23,462,439 |

| | | | |

| | | | | |

TOTAL PREFERRED EQUITIES | | | | 23,462,439 |

| | | | |

| (Cost $20,157,373) | | | | |

| | | | |

RIGHTS: 0.1% | | | | |

| | | | | |

SINGAPORE: 0.1% | | | | |

DBS Group Holdings, Ltd., expires 01/20/09 | | 360,500 | | 767,306 |

| Total Singapore | | | | 767,306 |

| | | | |

| | | | | |

| TOTAL RIGHTS | | | | 767,306 |

| | | | |

| (Cost $0) | | | | |

matthewsasia.com | 800.789.ASIA 9

| | | | |

| Matthews Asian Growth and Income Fund | | December 31, 2008 |

Schedule of Investmentsa (continued)

INTERNATIONAL DOLLAR BONDS: 33.8%

| | | | | |

| | | Face Value | | | Value |

CHINA/HONG KONG: 13.5% | | | | | |

Hongkong Land CB 2005, Ltd., Cnv. | | | | | |

2.750%, 12/21/12 | | $46,500,000 | | | $41,966,250 |

China Petroleum & Chemical Corp., | | | | | |

(Sinopec), Cnv. 0.000%, 04/24/14 | | 247,470,000 | c | | 30,998,410 |

Yue Yuen Industrial Holdings, Ltd., Cnv. | | | | | |

0.000%, 11/17/11 | | 210,800,000 | c | | 27,267,296 |

FU JI Food and Catering Services Holdings, Ltd., Cnv. | | | | | |

0.000%, 10/18/10 | | 191,500,000c | | | 17,471,603 |

Brilliance China Financial, Ltd., Cnv. | | | | | |

0.000%, 06/07/11 | | 13,600,000 | | | 14,076,000 |

PB Issuer, Ltd., Cnv. | | | | | |

3.300%, 02/01/13 | | 17,750,000 | | | 13,667,500 |

Hengan International Group Co., Ltd., | | | | | |

Cnv. 0.000%, 05/16/11 | | 12,780,000 | c | | 2,151,932 |

| | | | | |

Total China/Hong Kong | | | | | 147,598,991 |

| | | | | |

| | | | | | |

MALAYSIA: 8.7% | | | | | |

Cherating Capital, Ltd., Cnv. | | | | | |

2.000%d, 07/05/12 | | 39,400,000 | | | 35,806,720 |

Rafflesia Capital, Ltd., Cnv. | | | | | |

1.250%d, 10/04/11 | | 37,200,000 | | | 34,968,000 |

YTL Power Finance Cayman, Ltd., Cnv. | | | | | |

0.000%, 05/09/10 | | 11,000,000 | | | 12,116,500 |

Paka Capital, Ltd., Cnv. | | | | | |

0.000%, 03/12/13 | | 13,900,000 | | | 11,971,375 |

| | | | | |

Total Malaysia | | | | | 94,862,595 |

| | | | | |

| | | | | | |

INDIA: 8.4% | | | | | |

Reliance Communications, Ltd., Cnv. | | | | | |

0.000%, 05/10/11 | | 32,915,000 | | | 26,908,013 |

Tata Motors, Ltd., Cnv. | | | | | |

1.000%, 04/27/11 | | 27,349,000 | | | 17,811,035 |

Sintex Industries, Ltd., Cnv. | | | | | |

0.000%, 03/13/13 | | 25,400,000 | | | 14,605,000 |

Financial Technologies India, Ltd., Cnv. | | | | | |

0.000%, 12/21/11 | | 18,814,000 | | | 14,392,710 |

Rolta India, Ltd., Cnv. | | | | | |

0.000%, 06/29/12 | | 22,116,000 | | | 12,716,700 |

Educomp Solutions, Ltd., Cnv. | | | | | |

0.000%, 07/26/12 | | 5,915,000 | | | 5,116,475 |

| | | | | |

Total India | | | | | 91,549,933 |

| | | | | |

| | | | | | |

SOUTH KOREA: 2.7% | | | | | |

SK Telecom Co., Ltd. Cnv. | | | | | |

0.000%, 05/27/2009 | | 27,430,000 | | | 29,212,950 |

| | | | | |

Total South Korea | | | | | 29,212,950 |

| | | | | |

| | | | | | |

SINGAPORE: 0.5% | | | | | |

Olam International, Ltd., Cnv. | | | | | |

1.000%, 07/03/2013 | | 8,500,000 | | | 5,683,950 |

| | | | | |

Total Singapore | | | | | 5,683,950 |

| | | | | |

| | | | | |

| | | Value | |

TOTAL INTERNATIONAL | | | |

DOLLAR BONDS | | $368,908,419 | |

| | | | | |

| (Cost $444,191,313) | | | |

| | | | |

| TOTAL INVESTMENTS: 97.8% | | 1,065,977,272 | |

| (Cost $1,273,951,717e) | | | |

| CASH AND OTHER ASSETS, | | | |

| LESS LIABILITIES: 2.2% | | 23,736,806 | |

| | | | | |

NET ASSETS: 100.0% | | $1,089,714,078 | |

| | | | | |

| a | | Certain securities were fair valued under the discretion of the Board of Trustees | |

| | (Note 1-A). | |

| b | | Non–income producing security. | |

| c | | Face amount reflects principal in local currency. | |

| d | | Variable rate security. The rate reflects the rate in effect at December 31,2008. | |

| e | | Cost for Federal income tax purposes is $1,284,350,623 and net unrealized depreciation consists of: | |

| | Gross unrealized appreciation | | $65,762,512 | |

| | Gross unrealized depreciation | | (284,135,863 | ) |

| | | | | |

| | Net unrealized depreciation. | | ($218,373,351 | ) |

| | | | | |

| † | | Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer) | |

| ADR | | American Depositary Receipt | |

| Cnv. | | Convertible | |

| Pfd. | | Preferred | |

| REIT | | Real Estate Investment Trust | |

See accompanying notes to financial statements. | |

10 MATTHEWS ASIA FUNDS

| | | | |

| | Matthews Asia Pacific Equity Income Fund Portfolio Manager Commentary For the year ending December 31, 2008, the Matthews Asia Pacific Equity Income Fund fell –25.97%, ahead of its benchmark, the MSCI All Country Asia Pacific Index, which declined –41.62%. During the fourth quarter, the Fund declined –11.46%, while the benchmark declined –16.01%. The Fund began 2008 with a share price of $12.00, and shareholders who were invested in the Fund throughout the year would have received income distributions totaling approximately 30 cents, or 2.5% of that initial amount. While the sell-off throughout the year may have appeared indiscriminate at times, the relative outperformance of the Fund’s holdings compared with the benchmark suggested an increased and welcome focus on the quality and sustainability of company earnings. Dividend payments often act as one of the better indicators of earnings quality and corporate health, especially if a company has a history of maintaining or growing dividends even through difficult economic periods. In effect, information imbedded in the dividend history of a company may have greater relevance when assessing the ongoing health of a company than both quarterly earnings and share prices. Juxtaposed against the daily noise generated by the media and stock prices, the dividend becomes a useful tool to steer the focus away from the chatter. Instead, one can refocus on what matters—the long-term sustainability and growth of companies in Asia Pacific. Dividend payments have also historically exhibited less volatility than earnings. During the Asian crisis, earnings per share (EPS) fell by 73% for companies in the MSCI Asia Pacific ex Japan Index, while dividends per share (DPS) fell by 20% in comparison, according to Morgan Stanley. During the 2001–02 economic contraction in the region, EPS dropped by 37% while DPS fell just 1%. Though history may not necessarily be a guide for the future, it is worth noting that the ability of Asian companies to fund dividend payments, even if earnings should decline, has improved greatly compared to previous recessionary periods. With net debt-to-equity at a little less than 30% for companies in Asia excluding Japan, according to Citigroup, leverage in the region remains close to its lowest level of the past 25 years. Debt holders have a higher claim to the cash of a company than shareholders, and lower levels of debt therefore leave a greater portion of current earnings for dividend payments, even if earnings should contract. Less debt puts fewer constraints on dividend growth, and it is one of the rationales behind our ongoing belief that Asia will continue to be an attractive place to invest for both current income and growing dividends over the long term. Among the Fund’s holdings at year end, dividends increased for 38 companies relative to 2007, while four companies cut their dividends in 2008. The Fund’s focus on companies that marry the ability to pay sustainable and growing dividends with the willingness to do so underpins our stock selection process. However, we remain flexible in the implementation of this process depending on market conditions. For example, we consider how much the Fund has to pay today for the potential for future growth in the dividend. During the first three quarters of 2008, the Fund focused mainly on companies that offered higher dividend yields and greater assurance of a dividend payment, sometimes at the expense of growth in the DPS. This was mainly due to general market valuations that remained too demanding for income-oriented investors, especially for companies with the potential to offer solid growth in earnings and dividends. However, as markets sold off sharply in the fourth quarter, the Fund was able to initiate positions in some of these (continued) |

PORTFOLIO MANAGERS | |

Jesper O. Madsen, CFA | |

Lead Manager | |

Andrew T. Foster | |

Co-Manager | |

FUND FACTS | |

Ticker | | MAPIX | |

Inception Date | | 10/31/06 | |

Assets | | $142.0 million | |

NAV | | $8.61 | |

Total # of Positions | | 58 | |

Fiscal Year 2008 Ratios | | | |

Portfolio Turnover | | 25.07%1 | |

Gross Expense Ratio | | 1.35% | |

After Contractual | | | |

Fee Waiver | | 1.32%2 | |

Benchmark | |

MSCI AC Asia Pacific Index | |

Redemption Fee | |

2% within first 90 calendar days of purchase | |

OBJECTIVE | |

| Total return with an emphasis on providing current income. | |

STRATEGY | |

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying publicly traded common stock, preferred stocks, convertible preferred stock and other equity-related instruments of compa- nies located in the Asia Pacific region. | |

1 The lesser of fiscal year 2008 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. 2 The Advisor has contractually agreed to waive certain fees and reimburse certain expenses for Matthews Asia Pacific Equity Fund. Please see page 77 for additional information. Matthews Asia Funds does not charge 12b-1 fees. | |

matthewsasia.com | 800.789.ASIA 11

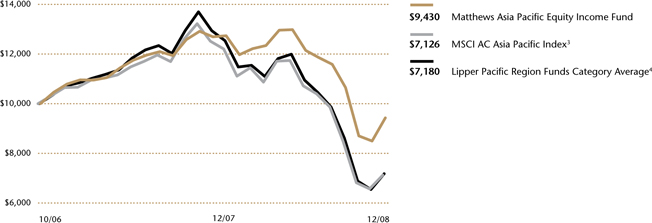

PERFORMANCE AS OF DECEMBER 31, 2008

| | | | | | | | | |

| | | 3 Months | | | Average Annual Total Returns | |

| | | 1 Year | | | Inception 10/31/06 | |

Matthews Asia Pacific Equity Income Fund | | -11.46 | % | | -25.97 | % | | -2.67 | % |

MSCI AC Asia Pacific Index3 | | -16.01 | % | | -41.62 | % | | -14.46 | % |

Lipper Pacific Region Funds Category Average4 | | -18.17 | % | | -42.92 | % | | -14.39 | % |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | | | | | | | | | | | | | | |

| | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

2008 | | 5.86 | ¢ | | 7.53 | ¢ | | 11.43 | ¢ | | 5.55 | ¢ | | 30.37 | ¢ |

2007 | | — | | | 10.30 | ¢ | | — | | | 17.12 | ¢ | | 27.42 | ¢ |

2006 (Fund inception: 10/31/06) | | | | | | | | | | | 1.97 | ¢ | | 1.97 | ¢ |

Note: This table does not include capital gains distributions. In March 2008, the Fund began to distribute investment income dividends on a quarterly rather than semi-annual basis. For additional details regarding Fund distributions, visit matthewsasia.com.

| | |

| 30-DAY YIELD: 3.35% | | DIVIDEND YIELD: 6.08% |

| |

| The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 12/31/08, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. | | The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields. |

Source: PNC Global Investment Servicing (U.S.) Inc. | | Source: FactSet Research Systems. |

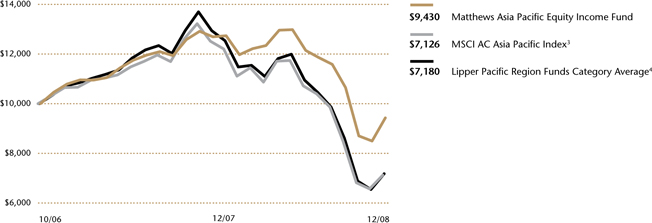

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

| 3 | It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital Management; total return calculations performed by PNC Global Investment Servicing (U.S.) Inc. Please see page 87 for index definitions. |

| 4 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

TOP TEN HOLDINGS5

| | | | | |

| | | Country | | % of Net Assets | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | 4.8 | % |

SK Telecom Co., Ltd. | | South Korea | | 4.0 | % |

PT Telekomunikasi Indonesia | | Indonesia | | 3.6 | % |

Globe Telecom, Inc. | | Philippines | | 3.4 | % |

Lawson, Inc. | | Japan | | 3.1 | % |

Chunghwa Telecom Co., Ltd. | | Taiwan | | 2.8 | % |

HSBC Holdings PLC | | United Kingdom | | 2.6 | % |

AXA Asia Pacific Holdings, Ltd. | | Australia | | 2.5 | % |

CLP Holdings, Ltd. | | China/Hong Kong | | 2.4 | % |

Fanuc, Ltd. | | Japan | | 2.4 | % |

% OF ASSETS IN TOP TEN | | | | 31.6 | % |

| 5 | Holdings may combine more than one security from same issuer and related depositary receipts. |

12 MATTHEWS ASIA FUNDS

| | | | |

| Matthews Asia Pacific Equity Income Fund | | COUNTRY ALLOCATION (%) 6 |

Portfolio Manager Commentary (continued) previously richly valued companies, particularly in China. As we approached year end, the Fund’s focus tilted increasingly toward growth in DPS, even when this often meant investing in companies with lower dividend yields. Valuations had become more attractive relative to the dividend growth we believed could be offered. This reflects the Fund’s attention not just to current dividend yield, but to total return, which is often generated by the share price appreciation of companies that can deliver sustained dividend growth. Japanese convenience store operator Lawson Inc., which we wrote about in our Semi-Annual Report, has been at the forefront of capital management in Japan. During 2008, it was the primary contributor to Fund performance. In the fourth quarter, the Fund’s Chinese additions all delivered positive performance. China Resources Enterprises, one such addition, represents a broad proxy for growth in Chinese consumption. The firm generates about half of its revenues from its retail business that operates about 2,500 stores of various formats, from hypermarkets to convenience stores. The company also partners with and operates stores for international fashion brands seeking access to the Chinese market. About a third of its revenues are generated by its beverage business, through a joint venture with SABMiller Plc. The company sells about one-fifth of the beer consumed in China, mainly under the “Snow” brand. This makes it the number one selling beer in China and measured by volume sold, the largest stand-alone beer brand globally, according to some industry statistics. During the year, the Fund’s holdings in the consumer discretionary and financial sectors were the main detractors from performance. While the woes of financial institutions in Asia were less severe than their counterparts in Europe and the U.S., the sector sold off in sympathy. As we enter 2009, financial institutions worldwide have reported US$1 trillion in write-offs related to the financial crisis, US$30.5 billion of which were from institutions residing in Asia (US$63.5 billion including HSBC). Financial institutions across the region felt the dual impacts of write-offs on impaired investments and the global credit contraction, particularly of dollar-based liquidity. However, we believe the sector remains attractive for the longer term. A thriving financial sector, acting as an intermediary for capital allocation, will be a necessary cornerstone in the region’s ongoing economic development. This may come from basic banking services in China or wealth management services in Japan. The Fund, therefore, continues to be invested in the region’s banks, brokerages, insurance companies and Real Estate Investment Trusts (REITs). With equity markets facing severe losses in 2008, many market participants held a renewed focus and appreciation for the stability offered by dividends. However, investors still tend to overlook Asia when thinking of dividend investing. This is an unfortunate oversight since Asia offers a substantial and growing pool of dividends. Dividends in the MSCI All Country Asia Pacific Index have grown 18% on average annually since 2002, compared with 7% for the S&P 500 Index, if the constituents of both indices were equally weighted. In spite of the higher historical dividend growth, Asia has offered a positive dividend yield spread, with estimated 2008 dividend yields for the MSCI U.S. and MSCI All Country Asia Pacific Indices standing at 3.2% and 3.6%, respectively. It remains to be seen how long the worldwide economic slowdown will continue. Nonetheless, we believe that every crisis brings with it opportunity for those willing to look for it. And as such, we continue to strongly believe in Asia’s dividend payers. | | Japan | | 23.2 |

| | China/Hong Kong | | 21.2 |

| | Taiwan | | 12.9 |

| | Singapore | | 8.1 |

| | Australia | | 6.4 |

| | Thailand | | 5.8 |

| | Malaysia | | 4.7 |

| | South Korea | | 4.4 |

| | Indonesia | | 3.6 |

| | Philippines | | 3.4 |

| | United Kingdom | | 2.6 |

| | India | | 0.7 |

| | Cash and Other Assets, Less Liabilities | | 3.0 |

| | SECTOR ALLOCATION (%) |

| | Financials | | 20.2 |

| | Consumer Discretionary | | 15.6 |

| | Information Technology | | 15.6 |

| | Telecom Services | | 15.4 |

| | Consumer Staples | | 13.1 |

| | Industrials | | 6.3 |

| | Utilities | | 5.5 |

| | Health Care | | 5.1 |

| | Energy | | 0.2 |

| | Cash and Other Assets, | | |

| | Less Liabilities | | 3.0 |

| | MARKET CAP EXPOSURE (%)7 |

| | Large Cap (over $5B) | | 34.1 |

| | Mid Cap ($1B–$5B) | | 30.5 |

| | Small Cap (under $1B) | | 32.4 |

| | Cash and Other Assets, Less Liabilities | | 3.0 |

| | Source: FactSet Research Systems |

| | 6 The United Kingdom is not included in the MSCI All Country Asia Pacific Index. |

| | 7 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

| | | | |

| | | | |

matthewsasia.com | 800.789.ASIA 13

| | | | |

| Matthews Asia Pacific Equity Income Fund | | December 31, 2008 |

Schedule of Investmentsa

COMMON EQUITIES: 93.1%

| | | | |

| | | Shares | | Value |

JAPAN: 21.3% | | | | |

Lawson, Inc. | | 75,700 | | $4,365,720 |

Fanuc, Ltd. | | 46,600 | | 3,339,905 |

Shiseido Co., Ltd. | | 160,000 | | 3,290,381 |

Monex Group, Inc. | | 9,794 | | 3,185,120 |

Nintendo Co., Ltd. | | 8,100 | | 3,095,429 |

Eisai Co., Ltd. | | 69,800 | | 2,912,726 |

MID REIT, Inc. | | 1,224 | | 2,351,835 |

The Sumitomo Trust & Banking Co., Ltd. | | 383,000 | | 2,264,007 |

United Urban Investment Corp., REIT | | 540 | | 2,135,230 |

Benesse Corp. | | 45,800 | | 2,004,261 |

Tokyu REIT, Inc. | | 155 | | 962,202 |

Takeda Pharmaceutical Co., Ltd. | | 7,700 | | 401,342 |

| | | | |

Total Japan | | | | 30,308,158 |

| | | | |

| | | | | |

CHINA/HONG KONG: 21.2% | | | | |

CLP Holdings, Ltd. | | 494,500 | | 3,361,971 |

Café de Coral Holdings, Ltd. | | 1,542,000 | | 3,128,476 |

VTech Holdings, Ltd. | | 732,000 | | 3,101,060 |

China Resources Enterprise, Ltd. | | 1,742,000 | | 3,063,407 |

Television Broadcasts, Ltd. | | 862,000 | | 2,825,867 |

Shenzhen International Holdings | | 59,682,500 | | 2,596,591 |

Xinao Gas Holdings, Ltd. | | 2,334,000 | | 2,475,902 |

ASM Pacific Technology, Ltd. | | 705,100 | | 2,323,946 |

Sa Sa International Holdings, Ltd. | | 9,400,000 | | 2,321,219 |

Minth Group, Ltd. | | 5,471,000 | | 2,200,410 |

BOC Hong Kong Holdings, Ltd. | | 1,486,000 | | 1,700,859 |

Shandong Weigao Group Medical | | | | |

Polymer Co., Ltd. H Shares | | 424,000 | | 645,367 |

Next Media, Ltd. | | 3,284,000 | | 383,398 |

| | | | |

Total China/Hong Kong | | | | 30,128,473 |

| | | | |

| | | | | |

TAIWAN: 12.9% | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 4,731,313 | | 6,455,782 |

Cyberlink Corp. | | 923,343 | | 3,292,422 |

Taiwan Secom Co., Ltd. | | 2,097,000 | | 3,050,303 |

Chunghwa Telecom Co., Ltd. | | 1,769,849 | | 2,850,878 |

President Chain Store Corp. | | 485,000 | | 1,164,829 |

Chunghwa Telecom Co., Ltd. ADR | | 70,000 | | 1,092,000 |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | 50,339 | | 397,678 |

| | | | |

Total Taiwan | | | | 18,303,892 |

| | | | |

| | | | | |

AUSTRALIA: 6.4% | | | | |

AXA Asia Pacific Holdings, Ltd. | | 1,008,439 | | 3,505,181 |

Coca-Cola Amatil, Ltd. | | 504,730 | | 3,243,444 |

Billabong International, Ltd. | | 435,951 | | 2,394,092 |

| | | | |

Total Australia | | | | 9,142,717 |

| | | | |

| | | | |

| | | Shares | | Value |

| SINGAPORE: 6.1% | | | | |

| Venture Corp., Ltd. | | 895,000 | | $2,737,380 |

Singapore Press Holdings, Ltd. | | 1,156,000 | | 2,506,579 |

CapitaRetail China Trust REIT | | 4,479,000 | | 1,872,292 |

| Parkway Life REIT | | 2,905,868 | | 1,539,474 |

| | | | |

Total Singapore | | | | 8,655,725 |

| | | | |

| | | | | |

THAILAND: 5.8% | | | | |

Advanced Info Service Public Co., Ltd. | | 1,030,600 | | 2,395,072 |

| Siam Makro Public Co., Ltd. | | 1,030,000 | | 2,036,113 |

Thai Tap Water Supply Public Co., Ltd. | | 16,629,500 | | 2,016,434 |

Thai Beverage Public Co., Ltd. | | 13,200,000 | | 1,788,961 |

| | | | |

Total Thailand | | | | 8,236,580 |

| | | | |

| | | | | |

MALAYSIA: 4.7% | | | | |

| Top Glove Corp. BHD | | 3,229,100 | | 3,273,330 |

| Public Bank BHD | | 826,000 | | 2,117,021 |

| Media Prima BHD | | 3,948,800 | | 1,274,280 |

| | | | |

Total Malaysia | | | | 6,664,631 |

| | | | |

| | | | | |

SOUTH KOREA: 4.4% | | | | |

SK Telecom Co., Ltd. ADR | | 161,300 | | 2,932,434 |

| SK Telecom Co., Ltd. | | 16,370 | | 2,720,972 |

| Hana Financial Group, Inc. | | 37,640 | | 599,590 |

| | | | |

Total South Korea | | | | 6,252,996 |

| | | | |

| | | | | |

INDONESIA: 3.6% | | | | |

PT Telekomunikasi Indonesia ADR | | 103,800 | | 2,602,266 |

| PT Telekomunikasi Indonesia | | 3,859,000 | | 2,466,373 |

| | | | |

Total Indonesia | | | | 5,068,639 |

| | | | |

| | | | | |

PHILIPPINES: 3.4% | | | | |

| Globe Telecom, Inc. | | 292,560 | | 4,770,191 |

| | | | |

Total Philippines | | | | 4,770,191 |

| | | | |

| | | | | |

UNITED KINGDOM: 2.6% | | | | |

| HSBC Holdings PLC ADR | | 37,900 | | 1,844,593 |

| HSBC Holdings PLC | | 180,800 | | 1,794,293 |

| | | | |

Total United Kingdom | | | | 3,638,886 |

| | | | |

| | | | | |

INDIA: 0.7% | | | | |

| HCL-Infosystems, Ltd. | | 340,167 | | 650,234 |

Chennai Petroleum Corp., Ltd. | | 105,000 | | 278,571 |

| | | | |

| Total India | | | | 928,805 |

| | | | |

| | | | | |

TOTAL COMMON EQUITIES | | | | 132,099,693 |

| | | | |

| (Cost $148,175,599) | | | | |

14 MATTHEWS ASIA FUNDS

| | | | |

| Matthews Asia Pacific Equity Income Fund | | December 31, 2008 |

Schedule of Investmentsa (continued)

| | | | |

PREFERRED EQUITIES: 1.9% |

| | | Shares | | Value |

JAPAN: 1.9% | | | | |

Ito En, Ltd., Pfd. | | 273,300 | | $2,729,906 |

| | | | |

Total Japan | | | | 2,729,906 |

| | | | |

| | | | | |

TOTAL PREFERRED EQ UITIES | | | | 2,729,906 |

| | | | |

(Cost $2,978,421) | | | | |

| | | | | | | |

INTERNATIONAL DOLLAR BONDS: 2.0% | |

| | | Face Amount | | Value | |

| SINGAPORE: 2.0% | | | | | |

| CapitaCommerical Trust, Cnv. | | | | | |

2.000%, 05/06/13 | | $4,500,000 | | $2,803,227 | |

| | | | | | | |

| Total Singapore | | | | 2,803,227 | |

| | | | | | | |

| | | | | | |

TOTAL INTERNATIONAL | | | | | |

| DOLLAR BONDS | | | | 2,803,227 | |

| | | | | | | |

| (Cost $2,315,186) | | | | | |

| | | | | |

| TOTAL INVESTMENTS: 97.0% | | | | 137,632,826 | |

| (Cost $153,469,206b) | | | | | |

| CASH AND OTHER ASSETS, LESS LIABILITIES: 3.0% | | | | 4,318,653 | |

| | | | | | | |

| NET ASSETS: 100.0% | | | | $141,951,479 | |

| | | | | | | |

| |

| a | | Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A). | |

| b | | Cost for Federal income tax purposes is $154,865,317 and net unrealized depreciation consists of: | |

| | Gross unrealized appreciation | | $7,119,011 | |

| | Gross unrealized depreciation | | (24,351,502 | ) |

| | | | | | | |

| | Net unrealized depreciation. | | ($17,232,491 | ) |

| | | | | | | |

| ADR | | American Depositary Receipt | |

| BHD | | Berhad | |

| Cnv. | | Convertible | |

| Pfd. | | Preferred | |

| REIT | | Real Estate Investment Trust | |

See accompanying notes to financial statements. | |

matthewsasia.com | 800.789.ASIA 15

| | | | |

| | Matthews Asia Pacific Fund Portfolio Manager Commentary For the year ending December 31, 2008, the Matthews Asia Pacific Fund fell –37.44%, while its benchmark, the MSCI All Country Asia Pacific Index declined –41.62%. For the fourth quarter, the Fund fell –12.98%, compared to a –16.01% drop for the benchmark. Throughout the year, our holdings in the consumer staples sector were the largest contributors to the Fund, with positive absolute returns. 2008 was truly difficult for Asian investors: though the year began calmly, it ended up as one of the most challenging years we have seen in Asia Pacific equity markets. Fears over inflation were quickly replaced with concerns over a deflationary climate as oil and other major commodity prices collapsed. Meanwhile, the U.S. government was busy pumping money into its financial sector with a fiscal stimulus plan. The size and scope of the rescue has been reminiscent of what Japan underwent in the late 1990s. As harsh as it was for all investors in 2008, one could argue that a benefit to come from the turmoil is a gigantic shake-up across industries throughout the region. If we learned anything from the Asian financial crisis of 1997–98, it is that better and stronger companies will likely emerge—just as electronics giant Samsung did after Korea’s GDP contracted 6.9% in 1998. We are positioning the portfolio to generate value for shareholders by pursuing faster-than-average earnings growth. It is our belief that the current environment will test the acumen of management teams and lay the groundwork for the sustained outperformance of a few companies. These companies will have the potential to become a much bigger part of the economic landscape in years to come. During the course of the year, we consolidated the portfolio into what we believe to be such companies. As a consequence, we had 49 holdings at the end of 2008, compared to 71 positions at the end of 2007. We terminated positions in such blue chip firms as Toyota, Sony, Honda, China Mobile, Infosys, Dabur and Lenovo, preferring instead to focus on finding Asia’s next titans. By design, these companies should offer a higher growth profile than that of today’s blue chips. Although the Fund’s Japan weighting increased over the previous year, this increase was the result of the relative strength of the yen, rather than a strategic decision. Invariably, we have been drawn to mid-size companies, which we believe are likely to emerge and grow in stature within their respective industries. For example, we have invested in leading enterprise resource planning software provider Kingdee, based in China. We believe the company has substantial room to grow, as it currently has 500,000 clients among an estimated 42 million firms in the SME (small and medium enterprise) segment it serves. With annual sales of US$100 million, Kingdee is in the same space as global players Oracle and SAP. The company has the competitive advantage of a quick system installation with low operating costs. While Kingdee did not perform as well as expected in 2008, we believe the company has the potential to become the next SAP of China, if not the world. One detractor to Fund performance during the year was the portfolio’s lack of exposure to utilities. We have traditionally avoided utilities, in part, because we believe the sector does not offer the growth potential our strategy seeks. However, as markets worsened during the year, utility stocks performed well as investors turned to these defensive stocks. The Fund’s two key holdings in the Japanese consumer staples sector continued to be big positive contributors to performance: Pigeon and Unicharm (continued) |

PORTFOLIO MANAGERS | |

Taizo Ishida Lead Manager | |

Sharat Shroff, CFA Co-Manager | |

FUND FACTS | | | |

Ticker | | MPACX | |

| Inception Date | | 10/31/03 | |

| Assets | | $168.0 million | |

| NAV | | $10.03 | |

| Total # of Positions | | 49 | |

Fiscal Year 2008 Ratios | |

| Portfolio Turnover | | 37.10%1 | |

| Gross Expense Ratio | | 1.23%2 | |

Benchmark | | | |

| MSCI AC Asia Pacific Index | |

Redemption Fee | | | |

| 2% within first 90 calendar days of purchase | |

OBJECTIVE | |

| Long-term capital appreciation. | |

STRATEGY | |

| Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in the Asia Pacific region. The Fund may also invest in the convertible securities, of any duration or quality, of Asia Pacific companies. | |

1 The lesser of fiscal year 2008 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. | |

2 Matthews Asia Funds does not charge 12b-1 fees. | |

16 MATTHEWS ASIA FUNDS

PERFORMANCE AS OF DECEMBER 31, 2008

| | | | | | | | | | | | | | | |

| | | 3 Months | | | Average Annual Total Returns | |

| | | | 1 Year | | | 3 Years | | | 5 Years | | | Inception

10/31/03 | |

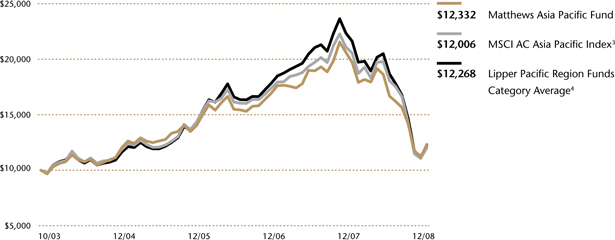

Matthews Asia Pacific Fund | | -12.98 | % | | -37.44 | % | | -6.33 | % | | 3.63 | % | | 4.14 | % |

MSCI AC Asia Pacific Index3 | | -16.01 | % | | -41.62 | % | | -7.87 | % | | 2.79 | % | | 3.60 | % |

Lipper Pacific Region Funds Category Average4 | | -18.17 | % | | -42.92 | % | | -7.47 | % | | 3.06 | % | | 3.88 | % |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

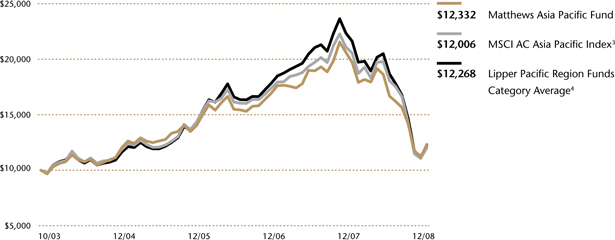

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

| 3 | It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital Management; total return calculations performed by PNC Global Investment Servicing (U.S.) Inc. Please see page 87 for index definition. |

| 4 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

TOP TEN HOLDINGS5

| | | | | |

| | | Country | | % of Net Assets | |

Yahoo! Japan Corp. | | Japan | | 4.3 | % |

Nintendo Co., Ltd. | | Japan | | 4.3 | % |

Tingyi (Cayman Islands) Holding Corp. | | China/Hong Kong | | 3.8 | % |

Sysmex Corp. | | Japan | | 3.5 | % |

Benesse Corp. | �� | Japan | | 3.4 | % |

Pigeon Corp. | | Japan | | 3.2 | % |

Unicharm Petcare Corp. | | Japan | | 3.1 | % |

Kingdee International Software Group Co., Ltd. | | China/Hong Kong | | 2.9 | % |

Daibiru Corp. | | Japan | | 2.9 | % |

GCA Savvian Group Corp. | | Japan | | 2.9 | % |

% OF ASSETS IN TOP TEN | | | | 34.3 | % |

| 5 | Holdings may combine more than one security from same issuer and related depositary receipts. |

matthewsasia.com | 800.789.ASIA 17

| | | | |

| COUNTRY ALLOCATION (%) | | Matthews Asia Pacific Fund Portfolio Manager Commentary (continued) Petcare. In a very difficult environment, both companies continued to grow in their respective niche markets. Overall, our overweight positions in high conviction names were the single-largest differentiating factor from the bench-mark during the year. Our notable avoidance of the materials and energy sectors also helped Fund performance. China South Locomotive, one of the largest manufacturers of rail trains in China, was one of the few bright stars in the declining markets of 2008 and positively contributed to Fund performance. The company has a dominant market share in China’s growing high-speed electric train market, with a substantial backlog of orders. Railway infrastructure has been one of the main focuses of the Chinese government’s 11th five-year plan, which will end in 2010. New government fiscal spending of some US$588 billion, announced in November 2008, should further enhance the company’s growth potential. We like this company not only for its natural growth potential, but also because the company has adopted Toyota’s zero-inventory management system and has already acquired technology from world-leading bullet train companies in Japan, France and Germany. Company management is also cost-conscious and efficient with its staffing needs. The Fund initiated positions in two Japanese Real Estate Investment Trusts (J-REITs) in the second half of 2008: Mori Trust Sogo REIT and MID REIT. The entire J-REIT sector was under enormous distress due to a perceived credit crunch and apparent economic slowdown in Japan; thus, the sector was yielding more than a 9% dividend. We felt this sector was one that was simply oversold due to short-term fears over difficult re-financing and eventual bankruptcies. Mori Trust Sogo REIT is one of the largest J-REITs, with a very conservative management and a strong sponsor in Mori Trust. We believe that MID REIT, a mid-sized Osaka-based REIT, was greatly discounted at the time of our purchase. It has offered a double-digit dividend yield with a fairly stable rent outlook for its Class-A office buildings. As of October 31, 2008, the Fund marked its five-year anniversary. We appreciate your continued support over the long term. |

Japan | | 46.7 | |

China/Hong Kong | | 27.6 | |

India | | 7.6 | |

South Korea | | 4.6 | |

Australia | | 4.5 | |

Indonesia | | 3.4 | |

Taiwan | | 3.2 | |

Singapore | | 1.2 | |

Thailand | | 1.1 | |