UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Guilfoyle, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-6036

Date of fiscal year end: December 31

Date of reporting period: June 30, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

| | | | | | | | |

| | | | | | Investing in the future | | |

| | | | | | of Asia since 1994 | | |

E-mail communications on Asia and the Funds

are available at www.matthewsfunds.com

| • | | AsiaNow Special Reports |

| • | | Occasional Fund Updates |

CONTENTS

This report has been prepared for Matthews Asian Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asian Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. You should read the prospectus carefully before investing. Additional copies of the prospectus may be obtained at www.matthewsfunds.com. Please read the prospectus carefully before you invest or send money.

The Matthews Asian Funds are distributed by:

PFPC Distributors, Inc.

760 Moore Road

King of Prussia, PA 19406

MESSAGE TO SHAREHOLDERS

FROM THE INVESTMENT ADVISOR

Dear Valued Shareholders,

The first quarter of 2008 will undoubtedly be remembered for its caustic markets, and the second quarter saw no respite. Equities around the world generally continued their descent, and shares in Asian markets suffered in tandem. Stocks retreated on concerns that the global economy might slow substantially, with U.S. financial institutions under severe pressure. These fears have weighed heavily on overseas markets, including Asia, though the U.S. credit market’s collapse has had only a limited impact on fundamentals in the region so far. Thus, cumulative losses announced by Asian banks have been relatively small, less than 10% of the $400 billion estimated to have been lost globally. Meanwhile, the Asian region is still projected to grow at a healthy, albeit moderated rate: the International Monetary Fund forecasts that the economies of the developing nations of Asia will grow at 8.4% this year, and Japan at 1.5%.

If there are greater concerns ahead for the region, they emanate from two other sources: accelerating inflation on consumer goods, and high energy prices, especially for oil. The latest readings of prices in the region generally suggest that inflation is running at the highest levels seen in the last one to two decades. As we have highlighted in recent commentaries posted on our website, this is not necessarily damaging in and of itself, provided that such inflation does not escalate to even higher levels. In our view, Asia’s greater challenge arises not from issues affecting the U.S., but rather the potential for policy errors by governments in reaction to burgeoning inflation. Many consumers in the region are expecting local governments to blunt or contain the impact of inflation on their living standards. Governments, in a bid to shore up voter support, have in turn sought to intervene in markets, typically via subsidies, price controls or trading restrictions. It is our experience that such intervention typically serves to exacerbate inflationary pressures, or makes them more structurally permanent. The region’s greatest risks are ultimately that policy overreaction may lead to greater market distortions and more permanent inflation, or may otherwise hinder the region’s growth prospects.

Oil prices have posed a second stumbling block to the region. Only a few decades ago, the region outside Japan and Australia was a relatively small consumer of oil and other natural resources. Several large markets, such as China and Indonesia, were once net exporters of oil. However, as the region’s economies have developed, local governments have done little to wean their industries off of hydrocarbon-based production and transportation systems. Worse, many governments have sought to subsidize energy prices domestically, so as to make fuels more affordable for end consumers (especially households). While this has meant that local economies have expanded smoothly in recent years, it has also meant growing distortions in the structure of the economies: many domestic consumers have not been forced to pay a market-based price for their energy consumption, and this has arguably led to excessive consumption and waste.

The bill for such subsidies, incurred by rising fiscal deficits in the region, has grown sharply in recent quarters as oil prices have surpassed $140 per barrel. Some currencies around the region have begun to swoon from such fiscal

2 MATTHEWS ASIAN FUNDS

JUNE 30, 2008

pressure. There is a small silver lining to this situation, though: during the last quarter, many Asian countries have been forced to reduce their subsidies, or depart from them entirely, as the sheer financial cost has proved too great. As market participants are forced to pay market prices for their consumption, it may induce greater conservation and efficiency in the future.

Asian markets have been decidedly weak in the first half, and we would make no predictions about their near-term course. Investors’ attention has rightly been focused on the current slump; however, to illustrate ways in which the region continues to evolve, we would like to highlight a few notable news events from the second quarter. During times such as these, it is important to cultivate an understanding of this evolution. It is this ongoing development that we, as long-term investors, remain excited about, even as the present condition of markets might be frustrating.

Perhaps the most notable of all these events was China’s growing political complexity and sophistication. During the past six months, China has been confronted with considerable challenges: severe blizzards threatened lives and crippled transport; the country’s relationship with Darfur was roundly criticized; suppression in Tibet invoked global scorn; and a tragic earthquake wrought destruction, killing more than 69,000. China’s leadership was tested on each of these occasions, and the results are safely interpreted as mixed. China’s slow movement on Darfur has come at terrible cost, and its suppression of Tibetan unrest has left even the country’s enthusiasts disappointed. Yet it would be a mistake not to acknowledge that there is also a different strain of thought emerging in the government, one characterized by a new sort of transparency, responsiveness and civic orientation.

While the affairs of Tibet remain murky, one could not help but notice that protests this spring garnered a greater level of international media coverage than in times past. Improved media access was even more apparent in May, following the earthquake that hit the Sichuan region. Journalists had nearly unrestrained access to disaster zones, as they reported on the devastation, the government’s response, and most importantly on the political unrest that ensued. Press reports included accounts from bereaved parents who decried corruption, shoddy building codes and lax enforcement as reasons that many schools in the earthquake zone collapsed. While the media presented images of prostrate officials, kneeling before wrathful parents holding photos of their lost loved ones, many stories also praised the central government for its swift and thorough response to the crisis.

In our view, this sort of openness about a national catastrophe and its causes, as well as the responsiveness that ensued, is something new to China. The earthquake even initiated a small but notable political détente: for the first time since World War II, a Japanese naval ship was allowed into a Chinese port—this time with the intent of offering assistance. This small but symbolic gesture was accompanied by a landmark agreement between Japan and China to co-develop a set of underwater gas fields in long-disputed territory in the East China Sea.

continued on page 4

800.789.ASIA [2742] www.matthewsfunds.com 3

MESSAGE TO SHAREHOLDERS

continued from page 3

A thawing of sorts also came to China’s dealings with Taiwan. More frequent dialogue has helped bridge some of the worst sources of tension between the two parties. The mood in Taiwan itself has shifted, as there appears to be increasing recognition that the country’s economic destiny (if not its political center) is forever intertwined with the mainland. Taiwan’s recent political election hints at as much, as the opposition party overturned the incumbent primarily on a platform that espoused better ties with China. Though few changes have taken place to cement such ties, direct airline flights between the two countries began on July 4—an important symbol of the growing links between the two former foes. While there is much ground still to cover, this shift in the cross-strait relations, if it should deepen and become more permanent, would alleviate one of the greatest security threats hanging over the region.

In another part of the region, there was one more important change to Asia’s security sphere: North Korea took small but deliberate steps toward defusing its own status as a hostile threat. The country destroyed a cooling tower at one of its main nuclear facilities, and then shared details of its nuclear planning framework with international inspectors. For this, the U.S. has undertaken to remove North Korea from the U.S. watch list of terrorist-sponsoring nations. These events do not, by any means, constitute an end to the North Korea problem, but they do represent one of the biggest steps forward in relations with the country in the last decade.

Thus, even as financial markets have been shaken, the landscape in Asia continues to evolve in an encouraging fashion. Fundamentals in the region, including earnings growth, will undoubtedly suffer some in the current environment, though it has been encouraging to see that export and economic activity in the region remains robust, at least thus far. Valuations, of course, have declined, particularly as multiples have fallen faster than earnings estimates. This is a glass that is at once half full and half empty. Capital has been lost as markets have declined, but valuations are beginning to look more reasonable, and arguably are healthier, than they were not long ago. Most importantly, we see Asian corporates and consumers to be in fairly healthy shape, with high savings rates, income growth and low rates of leverage. It is this sort of condition that makes us confident in the long-term prospects for the region, even as present markets are challenging.

It is our great privilege to serve as your investment advisor in Asia. We appreciate your persistence amid difficult markets, and we pledge to continue to seek out Asia’s investment potential in the years ahead.

Sincerely

|

/s/ Andrew T. Foster |

| Andrew T. Foster |

| Acting Chief Investment Officer |

| Matthews International Capital Management, LLC |

|

/s/ G. Paul Matthews |

| G. Paul Matthews |

| Chairman |

| Matthews International Capital Management, LLC |

4 MATTHEWS ASIAN FUNDS

JUNE 30, 2008

REDEMPTION FEE POLICY

Market timing can disrupt the management of a Fund’s investment portfolio and cause the targeted Fund to incur costs to accommodate frequent buying and selling of shares by the market timer. These costs are borne by the Fund’s non-redeeming shareholders. As part of their efforts to discourage market timing activity, the Funds attempt to allocate these costs, to the extent permissible, to redeeming shareholders through the assessment of a redemption fee of 2.00% of the total redemption proceeds of shareholders who sell or exchange shares within 90 calendar days after purchasing them. This fee is payable directly to the Funds. For purposes of determining whether the redemption fee applies, the shares that have been held longest will be redeemed first. The Funds may grant exemptions from the redemption fee where the Funds believe the transaction or account will not involve market timing activity. The Funds reserve the right at any time to restrict purchases or exchanges or impose conditions that are more restrictive on excessive or disruptive trading, and to modify or eliminate the redemption fee at any time, without notice to shareholders. You will receive notice of any material changes to the Funds’ redemption fee policies. For more information on this policy, please see the Funds’ prospectus. Additional restrictions may apply to shareholders who purchase shares of the Funds through a financial intermediary; please consult your intermediary.

INVESTOR DISCLOSURE

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 1-800-789-ASIA [2742] or visit www.matthewsfunds.com.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Please see the Funds’ prospectus and Statement of Additional Information for more risk disclosure.

Fund Holdings: The Fund holdings shown in this report are as of June 30, 2008. Holdings are subject to change at any time, so holdings shown in this report may not reflect current Fund holdings. The Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Form N-Q is filed with the SEC within 60 days of the end of the quarter to which it relates, and is available on the SEC’s website at www.sec.gov. It may also be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting Record: The Funds’ Statement of Additional Information containing a description of the policies and procedures that the Funds have used to vote proxies relating to portfolio securities, along with each Fund’s proxy voting record relating to portfolio securities held during the 12-month period ended June 30, 2008, is available upon request, at no charge, at the Funds’ website at www.matthewsfunds.com or by calling 1-800-789-ASIA [2742], or on the SEC’s website at www.sec.gov.

Shareholder Reports and Prospectuses: To reduce the Funds’ expenses, we try to identify related shareholders in a household and send only one copy of the Funds’ prospectus and financial reports to that address. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. At any time you may view the Funds’ current prospectus and financial reports on our website. If you prefer to receive individual copies of the Funds’ prospectus or financial reports, please call us at 1-800-789-ASIA [2742].

800.789.ASIA [2742] www.matthewsfunds.com 5

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

| | |

| FUND OBJECTIVE AND STRATEGY | | SYMBOL: MAPIX |

Objective: Total return with an emphasis on providing current income. Total return includes current income (dividends and distributions paid to shareholders) and capital gains (share price appreciation). The Fund measures total return over longer periods.

Strategy: Under normal market conditions, the Matthews Asia Pacific Equity Income Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying publicly traded common stocks, preferred stocks, convertible preferred stocks, and other equity-related instruments (including, for example, investment trusts and other financial instruments) of companies located in the Asia Pacific region, which includes Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

| | |

| PORTFOLIO MANAGERS | | |

| |

| Lead Manager: Jesper Madsen, CFA | | Co-Manager: Andrew T. Foster |

PORTFOLIO MANAGER COMMENTARY

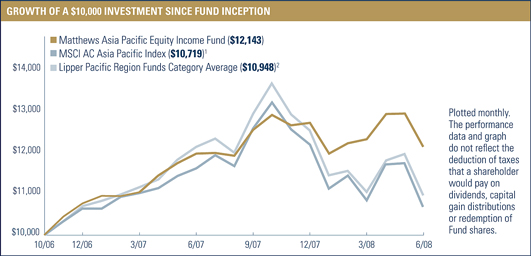

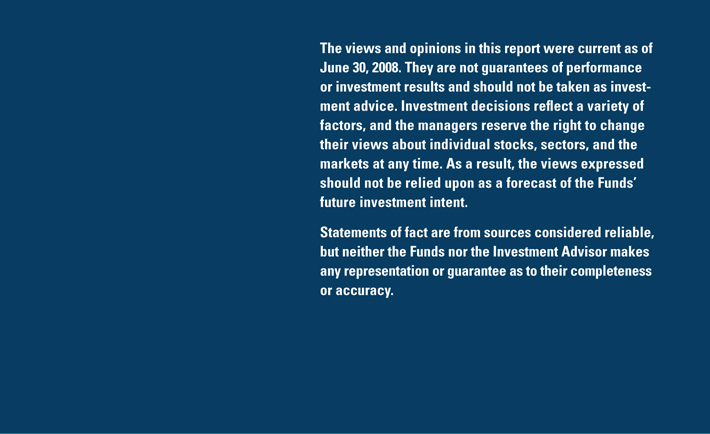

The Matthews Asia Pacific Equity Income Fund declined -4.66% during the first six months of 2008, while its benchmark, the MSCI All Country Asia Pacific Index, fell -12.18%. During the quarter ending June 30, 2008, the Fund distributed its second quarterly dividend of 7.53 cents, bringing the total year-to-date income distribution to 13.39 cents per share.

Inflation fears, driven by rising oil and food prices, as well as worries about the impact of a potential U.S. recession on corporate profits in Asia, weighed on equities across the region. Equity markets in Asia Pacific continued to exhibit a high degree of correlation with global markets. However, a short-term singular focus on the correlation in equity markets misses the point that when it comes to dividend payments, Asian companies are moving to a different beat than their U.S. counterparts. The balance sheets of companies in the region generally remain as healthy as they have been during the past decade, while earnings growth has continued to support dividend payments. This is important for long-term investors since sustainable and growing dividends can help mitigate some downside volatility during periods of pull-backs in equity markets. The Fund’s relative outperformance for the period may, in part, be reflective of this. For dividends to offer support to share prices though, they must at a minimum be “sustainable.” Once the dividend is cut or market participants suspect it cannot be maintained, share prices tend to suffer as a consequence. The financial sector in the U.S. during the past 12 months has shown evidence of this.

The Fund seeks to invest in companies we believe will grow dividends over time. Dividends may not always grow in a straight line from year to year and in some cases, may even be cut. This holds particularly true for smaller companies, with more volatile earnings, less access to capital markets and therefore, a greater need to maintain capital on the balance sheet. The attraction of successful smaller companies, though, is their potential

continued on page 9

6 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF JUNE 30, 2008, UNLESS OTHERWISE NOTED

| | | | | | | | | | | | |

PERFORMANCE AS OF JUNE 30, 2008 | |

| Fund Inception: 10/31/06 | | 3 MO | | | YTD | | | Average Annual Total Returns | |

| | | | 1 YR | | | SINCE

INCEPTION | |

Matthews Asia Pacific Equity Income Fund | | –1.60 | % | | –4.66 | % | | 1.57 | % | | 12.39 | % |

MSCI All Country Asia Pacific Index1 | | –1.37 | % | | –12.18 | % | | –8.43 | % | | 4.26 | % |

Lipper Pacific Region Funds Category Average2 | | –1.62 | % | | –12.69 | % | | –9.85 | % | | 5.50 | % |

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Unusually high returns may not be sustainable. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit www.matthewsfunds.com.

| | | | | | | | | | | | | | |

| INCOME DISTRIBUTION HISTORY | | Q1 | | | Q2 | | | Q3 | | Q4 | | | TOTAL | |

2008 | | 5.86 | ¢ | | 7.53 | ¢ | | N/A | | N/A | | | N/A | |

2007 | | — | | | 10.30 | ¢ | | — | | 17.12 | ¢ | | 27.42 | ¢ |

2006 (Fund inception: 10/31/06) | | | | | | | | | | 1.97 | ¢ | | 1.97 | ¢ |

In March 2008, the Fund began to distribute investment income dividends on a quarterly rather than semiannual basis. For additional details regarding Fund distributions, visit www.matthewsfunds.com.

| | | | | | | | |

FISCAL YEAR 2007 RATIOS | | | | | | | | |

Gross Operating Expense:3 1.41% | | | | Portfolio Turnover: | 4 | | 26.95 | % |

1 | The MSCI All Country Asia Pacific Index is a free float–adjusted market capitalization–weighted index of the stock markets of Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. The Fund invests in countries that are not included in the MSCI All Country Asia Pacific Index. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC Global Investment Servicing (“PNC”), formerly known as PFPC Inc. |

2 | Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

3 | Ratio has been restated to reflect current management and administrative and shareholder servicing fees expected to be incurred by the Funds and paid to Matthews International Capital Management (the “Advisor”). The Advisor has contractually agreed to waive fees and reimburse expenses to the extent needed to limit total annual operating expenses to 1.50% until October 31, 2009. Matthews Asian Funds do not charge 12b-1 fees. |

4 | The lesser of fiscal year 2007 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

800.789.ASIA [2742] www.matthewsfunds.com 7

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

| | | | | |

TOP TEN HOLDINGS1 | | | | | |

| | | COUNTRY | | % OF NET ASSETS | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | 4.8 | % |

Lawson, Inc. | | Japan | | 3.7 | % |

HSBC Holdings PLC | | United Kingdom | | 3.5 | % |

Singapore Press Holdings, Ltd. | | Singapore | | 3.3 | % |

Monex Group, Inc. | | Japan | | 3.2 | % |

Globe Telecom, Inc. | | Philippines | | 2.9 | % |

VTech Holdings, Ltd. | | China/Hong Kong | | 2.8 | % |

The Sumitomo Trust & Banking Co., Ltd. | | Japan | | 2.7 | % |

Ito En, Ltd., Pfd. | | Japan | | 2.6 | % |

BOC Hong Kong Holdings, Ltd. | | China/Hong Kong | | 2.6 | % |

% OF ASSETS IN TOP 10 | | | | 32.1 | % |

| | | |

COUNTRY ALLOCATION | | | |

Japan | | 22.9 | % |

China/Hong Kong | | 21.3 | % |

Taiwan | | 15.8 | % |

Singapore | | 7.4 | % |

Malaysia | | 7.4 | % |

Australia | | 7.0 | % |

United Kingdom2 | | 3.5 | % |

South Korea | | 3.4 | % |

Thailand | | 3.2 | % |

India | | 3.0 | % |

Philippines | | 3.0 | % |

Indonesia | | 1.6 | % |

Cash and other assets, less liabilities | | 0.5 | % |

| | | |

SECTOR ALLOCATION | | | |

Consumer Discretionary | | 24.4 | % |

Financials | | 22.8 | % |

Information Technology | | 16.7 | % |

Telecommunication Services | | 10.7 | % |

Consumer Staples | | 10.1 | % |

Health Care | | 5.9 | % |

Utilities | | 3.6 | % |

Industrials | | 3.4 | % |

Energy | | 1.9 | % |

Cash and other assets, less liabilities | | 0.5 | % |

| | | |

MARKET CAP EXPOSURE3 | | | |

Large cap (over $5 billion) | | 43.3 | % |

Mid cap ($1–$5 billion) | | 34.5 | % |

Small cap (under $1 billion) | | 21.7 | % |

Cash and other assets, less liabilities | | 0.5 | % |

| | | | | | | | |

NUMBER OF SECURITIES | | NAV | | FUND ASSETS | | REDEMPTION FEE | | 12b-1 FEES |

56 | | $11.29 | | $99.1 million | | 2.00% within 90 calendar days | | None |

1 | Holdings may combine more than one security from same issuer and related depositary receipts. |

2 | The United Kingdom is not included in the MSCI All Country Asia Pacific Index. |

3 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

8 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF JUNE 30, 2008, UNLESS OTHERWISE NOTED

PORTFOLIO MANAGER COMMENTARY continued from page 6

to grow the dividend at a faster rate over the longer term. To mitigate the risk of dividend cuts, the Fund is diversified across 51 companies along the market capitalization spectrum, residing in 12 countries and operating in nine different economic sectors. While five of the Fund’s holdings cut dividends during the last fiscal year, as of the end of June, 36 have raised dividends, resulting in a weighted 13% increase in the dividend per share at the portfolio level. The companies that cut their dividends were of small or medium capitalization.

Lawson, Inc., Japan’s second-largest convenience store operator with more than 8,500 stores, was the Fund’s primary contributor to performance during the first six months of 2008. Japan has been a challenging environment for retailers for years. Deflationary pressures made it difficult for retailers to increase prices and general spending was subdued due to stagnant wage growth. Retailers generally benefit from a moderate level of inflation since it allows them to pass through price increases that, in turn, underpin same-store sales growth. Furthermore, the convenience store segment in Japan has become increasingly competitive as the main convenience store operators have pursued aggressive store roll-outs. Even given these challenges, Lawson, Inc., a holding since the Fund’s inception, has done well: while same-store sales had experienced protracted declines in recent years, the company still managed to grow cash flows and dividends. The company has been at the forefront in Japan when it comes to capital management. Lawson’s estimated dividend payment for the current fiscal year represents an increase of 45% compared to the previous year. The company is also engaging in share buybacks in order to improve capital efficiency. Furthermore, should inflation take root in Japan, Lawson, Inc., could be a primary beneficiary.

The Fund’s Indian holdings were the main detractors to performance as foreign portfolio flows continued to exit the country. With wholesale inflation accelerating from 3.8% at the end of 2007 to 11.9% at the end of June, investors expect the Reserve Bank of India (RBI) to become increasingly assertive in its stance toward inflation. The RBI has already twice raised the repurchase rate, increasing it from 7.75% to 8.50% during the month of June. The higher credit costs mixed with a hike in fuel prices represented two strong headwinds for Ashok Leyland, India’s second-largest commercial vehicle manufacturer, making it the Fund’s main detractor to performance during the first six months.

The Fund continues to invest in companies we believe can sustain or grow their dividends, even during periods of rising cost pressures. We continue to find attractive investment candidates, especially in companies that enjoy a strong market position. This standing can derive from brand power or from dominant market share within their respective industries. These companies retain a greater ability to pass through costs via higher prices, thereby maintaining margins and the cash flows to fund dividend payments.

800.789.ASIA [2742] www.matthewsfunds.com 9

MATTHEWS ASIA PACIFIC EQUITY INCOME FUND

SCHEDULE OF INVESTMENTSa (UNAUDITED)

COMMON EQUITIES: 96.8%

| | | | | |

| | | SHARES | | VALUE |

CHINA/HONG KONG: 21.3% | | | | | |

VTech Holdings, Ltd. | | 452,000 | | $ | 2,727,260 |

BOC Hong Kong Holdings, Ltd. | | 966,000 | | | 2,560,602 |

CLP Holdings, Ltd. | | 289,500 | | | 2,482,694 |

Hang Seng Bank, Ltd. | | 100,100 | | | 2,113,523 |

Television Broadcasts, Ltd. | | 352,000 | | | 2,033,194 |

ASM Pacific Technology, Ltd. | | 242,000 | | | 1,829,052 |

Sa Sa International Holdings, Ltd. | | 3,800,000 | | | 1,721,450 |

Café de Coral Holdings, Ltd. | | 912,000 | | | 1,636,700 |

Pico Far East Holdings, Ltd. | | 10,696,000 | | | 1,628,208 |

Next Media, Ltd. | | 3,466,000 | | | 1,331,615 |

Huaneng Power International, Inc. H Shares | | 836,000 | | | 580,093 |

Huaneng Power International, Inc. ADR | | 17,500 | | | 483,875 |

| | | | | |

Total China/Hong Kong | | | | | 21,128,266 |

| | | | | |

JAPAN: 20.2% | | | | | |

Lawson, Inc. | | 75,700 | | | 3,685,728 |

Monex Group, Inc. | | 4,594 | | | 3,123,669 |

The Sumitomo Trust & Banking Co., Ltd. | | 383,000 | | | 2,676,329 |

Eisai Co., Ltd. | | 69,800 | | | 2,465,037 |

Benesse Corp. | | 54,800 | | | 2,219,146 |

Hitachi Koki Co., Ltd. | | 108,000 | | | 1,777,878 |

Nomura Research Institute, Ltd. | | 67,000 | | | 1,571,126 |

Tokyu REIT, Inc. | | 155 | | | 1,259,735 |

Takeda Pharmaceutical Co., Ltd. | | 24,700 | | | 1,256,110 |

| | | | | |

Total Japan | | | | | 20,034,758 |

| | | | | |

TAIWAN: 15.8% | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 1,986,298 | | | 4,253,595 |

Cyberlink Corp. | | 535,000 | | | 2,555,761 |

Chunghwa Telecom Co., Ltd. | | 857,727 | | | 2,218,284 |

Johnson Health Tech Co., Ltd. | | 1,193,000 | | | 1,918,044 |

President Chain Store Corp. | | 485,000 | | | 1,613,844 |

Giant Manufacturing Co., Ltd. | | 527,000 | | | 1,415,033 |

Taiwan Secom Co., Ltd. | | 609,000 | | | 1,157,688 |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | 50,087 | | | 546,449 |

| | | | | |

Total Taiwan | | | | | 15,678,698 |

| | | | | |

SINGAPORE: 7.4% | | | | | |

Singapore Press Holdings, Ltd. | | 1,036,000 | | | 3,236,191 |

Venture Corp., Ltd. | | 275,000 | | | 1,982,838 |

Parkway Life REIT | | 1,430,868 | | | 1,188,402 |

Singapore Post, Ltd. | | 1,142,000 | | | 923,303 |

| | | | | |

Total Singapore | | | | | 7,330,734 |

| | | | | |

MALAYSIA: 7.4% | | | | | |

Public Bank BHD | | 676,000 | | | 2,151,614 |

Top Glove Corp. BHD | | 1,637,100 | | | 2,124,347 |

Media Prima BHD | | 3,235,900 | | | 1,792,496 |

Berjaya Sports Toto BHD | | 811,200 | | | 1,206,559 |

| | | | | |

Total Malaysia | | | | | 7,275,016 |

| | | | | |

AUSTRALIA: 7.0% | | | | | |

Coca-Cola Amatil, Ltd. | | 309,730 | | | 2,081,434 |

AXA Asia Pacific Holdings, Ltd. | | 413,439 | | | 1,854,892 |

Billabong International, Ltd. | | 160,951 | | | 1,666,399 |

Insurance Australia Group, Ltd. | | 230,121 | | | 765,504 |

Tabcorp Holdings, Ltd. | | 61,523 | | | 578,586 |

| | | | | |

Total Australia | | | | | 6,946,815 |

| | | | | |

10 MATTHEWS ASIAN FUNDS

JUNE 30, 2008

| | | | | |

| | | SHARES | | VALUE |

UNITED KINGDOM: 3.5% | | | | | |

HSBC Holdings PLC ADR | | 26,900 | | $ | 2,063,230 |

HSBC Holdings PLC | | 90,800 | | | 1,399,576 |

| | | | | |

Total United Kingdom | | | | | 3,462,806 |

| | | | | |

SOUTH KOREA: 3.4% | | | | | |

Hana Financial Group, Inc. | | 37,640 | | | 1,448,315 |

SK Telecom Co., Ltd. | | 6,570 | | | 1,196,487 |

SK Telecom Co., Ltd. ADR | | 36,300 | | | 753,951 |

| | | | | |

Total South Korea | | | | | 3,398,753 |

| | | | | |

THAILAND: 3.2% | | | | | |

Advanced Info Service Public Co., Ltd. | | 710,600 | | | 1,965,919 |

PTT Public Co., Ltd. | | 136,500 | | | 1,232,930 |

| | | | | |

Total Thailand | | | | | 3,198,849 |

| | | | | |

INDIA: 3.0% | | | | | |

Ashok Leyland, Ltd. | | 1,845,000 | | | 1,224,282 |

HCL-Infosystems, Ltd. | | 340,167 | | | 1,108,854 |

Chennai Petroleum Corp., Ltd. | | 105,000 | | | 653,916 |

| | | | | |

Total India | | | | | 2,987,052 |

| | | | | |

PHILIPPINES: 3.0% | | | | | |

Globe Telecom, Inc. | | 110,560 | | | 2,905,909 |

| | | | | |

Total Philippines | | | | | 2,905,909 |

| | | | | |

INDONESIA: 1.6% | | | | | |

PT Telekomunikasi Indonesia ADR | | 35,200 | | | 1,135,200 |

PT Telekomunikasi Indonesia | | 559,000 | | | 442,592 |

| | | | | |

Total Indonesia | | | | | 1,577,792 |

| | | | | |

TOTAL COMMON EQUITIES | | | | | 95,925,448 |

(Cost $96,237,073) | | | | | |

| | | | | |

PREFERRED EQUITIES: 2.7% | | | |

JAPAN: 2.7% | | | | | |

Ito En, Ltd., Pfd. | | 246,700 | | | 2,625,333 |

| | | | | |

Total Japan | | | | | 2,625,333 |

| | | | | |

TOTAL PREFERRED EQUITIES | | | | | 2,625,333 |

(Cost $2,711,890) | | | | | |

| | | | | |

TOTAL INVESTMENTS: 99.5% | | | | | 98,550,781 |

(Cost $98,948,963b) | | | | | |

| | |

CASH AND OTHER ASSETS, LESS LIABILITIES: 0.5% | | | | | 525,524 |

| | | | | |

NET ASSETS: 100.0% | | | | | 99,076,305 |

| | | | | |

| a | Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A). |

| b | Cost of investments is $98,948,963 and net unrealized depreciation consists of: |

| | | | |

Gross unrealized appreciation | | $ | 7,768,055 | |

Gross unrealized depreciation | | | (8,166,237 | ) |

| | | | |

Net unrealized depreciation | | $ | (398,182 | ) |

| | | | |

| ADR | American Depositary Receipt |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

800.789.ASIA [2742] www.matthewsfunds.com 11

MATTHEWS ASIAN GROWTH AND INCOME FUND

(CLOSED TO MOST NEW INVESTORS)

| | |

| FUND OBJECTIVE AND STRATEGY | | SYMBOL: MACSX |

Objective: Long-term capital appreciation. The Fund also seeks to provide some current income.

Strategy: Under normal market conditions, the Matthews Asian Growth and Income Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in dividend-paying equity securities and the convertible securities, of any duration or quality, of companies located in Asia. Asia includes China, Hong Kong, India, Indonesia, Japan, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

PORTFOLIO MANAGERS

| | |

| Lead Manager: Andrew T. Foster | | Co-Manager: G. Paul Matthews |

PORTFOLIO MANAGER COMMENTARY

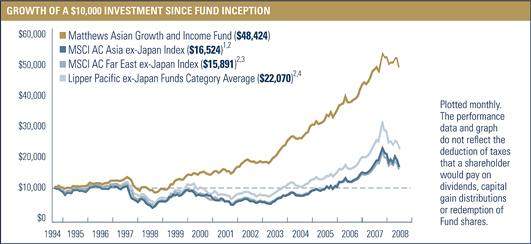

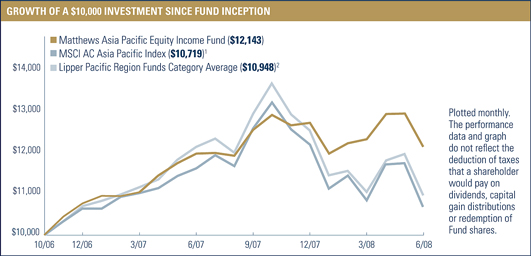

During the first half of 2008, the Matthews Asian Growth and Income Fund declined –8.04%, while its primary benchmark, the MSCI All Country Asia ex-Japan Index, fell –21.10% and the MSCI All Country Far East ex-Japan Index dropped –18.21% during the same period. On June 25, the Fund paid a semi-annual distribution of approximately 68 cents per share, of which about 25 cents represented income, and 43 cents was capital gain.

During the second quarter, markets around the world, and especially in Asia, continued the slump that commenced earlier in the year. Asian shares were hit particularly hard, by a dual set of headwinds: inflation and energy prices. Throughout the region, inflation measurements suggest that price increases for most goods and services are running at levels not seen in a decade. Meanwhile, high and rapidly rising prices for oil, coal and other resources have given markets pause. Energy prices have risen to such levels as to prove daunting for many Asian governments, several of which have been forced to abandon energy-related subsidies for consumers for fear of incurring enormous fiscal liabilities.

The twin difficulties of inflationary pressures and high oil prices put central banks in the region in an awkward spot. Most central banks have halfheartedly tried to quell inflation by raising interest rates or by other means. However, most banks have moved cautiously, as there is considerable concern that high oil prices, against the backdrop of what may be a slowing global economy, might temper Asian growth and demand. The fear that such central bankers share is that as they act to reign in inflation, they will do so at a time when the growth of their respective economies may already be drifting lower—and thus their actions could initiate or aggravate a downturn in growth.

Such fears weighed heavily on markets, as they discounted the likelihood of rising rates and the possibility of slower growth. The Fund was unable to escape such downside in markets. However, we are generally pleased that the Fund’s defensive nature is reflected in its relative outperformance for the period. We have for some time now been wary of valuations in the region: fundamental growth has been strong; but after five years of nearly uninterrupted gains in share price, very few segments of the market offered the sort of low valuations that this Fund seeks

continued on page 15

12 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF JUNE 30, 2008, UNLESS OTHERWISE NOTED

PERFORMANCE AS OF JUNE 30, 2008

| | | | | | | | | | | | | | | | | | | | | |

Fund Inception: 9/12/94 | | 3 MO | | | YTD | | | Average Annual Total Returns | |

| | | | 1 YR | | | 3 YRS | | | 5 YRS | | | 10 YRS | | | SINCE

INCEPTION | |

Matthews Asian Growth and Income Fund | | –3.96 | % | | –8.04 | % | | 0.19 | % | | 15.02 | % | | 19.54 | % | | 18.46 | % | | 12.11 | % |

MSCI All Country Asia ex-Japan Index1 | | –7.88 | % | | –21.10 | % | | –5.48 | % | | 19.89 | % | | 23.53 | % | | 13.85 | % | | 3.70 | %2 |

MSCI All Country Far East ex-Japan Index3 | | –6.40 | % | | –18.21 | % | | –4.50 | % | | 19.52 | % | | 22.81 | % | | 13.64 | % | | 3.40 | %2 |

Lipper Pacific ex-Japan Funds Category Average4 | | –6.40 | % | | –19.67 | % | | –5.93 | % | | 19.41 | % | | 22.62 | % | | 14.78 | % | | 5.72 | %2 |

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Unusually high returns may not be sustainable. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit www.matthewsfunds.com.

INCOME DISTRIBUTION HISTORY

| | | | | | | | | | | | |

| | | JUNE | | | DECEMBER | | | TOTAL | |

2008 | | | 24.82 | ¢ | | | N/A | | | | N/A | |

2007 | | | 21.51 | ¢ | | | 68.91 | ¢ | | | 90.42 | ¢ |

2006 | | | 21.89 | ¢ | | | 39.85 | ¢ | | | 61.74 | ¢ |

1994–2005 | | $ | 1.88 | | | $ | 2.07 | | | $ | 3.95 | |

For a history of the Fund’s distributions since its inception, visit www.matthewsfunds.com.

FISCAL YEAR 2007 RATIOS

| | |

Gross Operating Expense:5 1.15% | | Portfolio Turnover:6 27.93% |

1 | The MSCI All Country Asia ex-Japan Index is a free float–adjusted market capitalization–weighted index of the stock of markets of China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, and Thailand. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC. |

2 | Calculated from 8/31/94. |

3 | The MSCI All Country Far East ex-Japan Index is a free float–adjusted market capitalization–weighted index of the stock markets of China, Hong Kong, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand. The Fund invests in countries that are not included in the MSCI All Country Far East ex-Japan Index. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC. |

4 | Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

5 | Ratio has been restated to reflect current management and administrative and shareholder servicing fees expected to be incurred by the Funds and paid to the Advisor. Matthews Asian Funds do not charge 12b-1 fees. |

6 | The lesser of fiscal year 2007 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

800.789.ASIA [2742] www.matthewsfunds.com 13

MATTHEWS ASIAN GROWTH AND INCOME FUND

(CLOSED TO MOST NEW INVESTORS)

| | | | | | | |

TOP TEN HOLDINGS1 | | | | | | | |

| | | COUNTRY | | SECURITY TYPE | | % OF NET ASSETS | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | Equity | | 3.5 | % |

Singapore Press Holdings, Ltd. | | Singapore | | Equity | | 3.5 | % |

CLP Holdings, Ltd. | | China/Hong Kong | | Equity | | 3.2 | % |

HSBC Holdings PLC | | United Kingdom | | Equity | | 3.0 | % |

Hongkong Land CB 2005, Ltd., Cnv., 2.750%, 12/21/12 | | China/Hong Kong | | Convertible Bond | | 3.0 | % |

Chungwa Telecom Co., Ltd. | | Taiwan | | Equity | | 2.9 | % |

SK Telecom Co., Ltd. | | South Korea | | Equity | | 2.9 | % |

Advanced Info Service Public Co., Ltd. | | Thailand | | Equity | | 2.7 | % |

Rafflesia Capital, Ltd., Cnv., 1.250%, 10/04/11 | | Malaysia | | Convertible Bond | | 2.5 | % |

Far EasTone Telecommunications Co., Ltd. | | Taiwan | | Equity | | 2.4 | % |

% OF ASSETS IN TOP 10 | | | | | | 29.6 | % |

| | | |

COUNTRY ALLOCATION | | | |

China/Hong Kong | | 32.9 | % |

Singapore | | 14.2 | % |

Taiwan | | 12.7 | % |

South Korea | | 10.7 | % |

Malaysia | | 6.0 | % |

India | | 5.5 | % |

Thailand | | 4.7 | % |

Japan2 | | 4.0 | % |

United Kingdom2 | | 3.0 | % |

Australia2 | | 2.9 | % |

Indonesia | | 1.7 | % |

Philippines | | 1.1 | % |

Cash and other assets, less liabilities | | 0.6 | % |

| | | |

SECTOR ALLOCATION | | | |

Financials | | 25.6 | % |

Telecommunication Services | | 22.1 | % |

Consumer Discretionary | | 16.7 | % |

Industrials | | 8.1 | % |

Information Technology | | 8.0 | % |

Utilities | | 7.0 | % |

Health Care | | 5.0 | % |

Consumer Staples | | 4.8 | % |

Energy | | 2.1 | % |

Cash and other assets, less liabilities | | 0.6 | % |

| | | |

MARKET CAP EXPOSURE3 | | | |

Large cap (over $5 billion) | | 57.3 | % |

Mid cap ($1–$5 billion) | | 28.4 | % |

Small cap (under $1 billion) | | 13.7 | % |

Cash and other assets, less liabilities | | 0.6 | % |

| | | |

BREAKDOWN BY SECURITY | | | |

Common Equities | | 77.8 | % |

Convertible Bonds4 | | 19.4 | % |

Preferred Equities | | 2.2 | % |

Cash and other assets, less liabilities | | 0.6 | % |

| | | | | | | | | |

| NUMBER OF SECURITIES | | NAV | | FUND ASSETS | | REDEMPTION FEE | | 12b-1 FEES |

| 74 | | $ | 17.52 | | $2.0 billion | | 2.00% within 90 calendar days | | None |

1 | Holdings may combine more than one security from same issuer and related depositary receipts. |

2 | Australia, the United Kingdom and Japan are not included in the MSCI All Country Asia ex-Japan Index. |

3 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

4 | Convertible bonds are not included in the MSCI All Country Asia ex-Japan Index. |

14 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF JUNE 30, 2008, UNLESS OTHERWISE NOTED

PORTFOLIO MANAGER COMMENTARY continued from page 12

as a means to shelter financial storms. However, despite these general concerns, we have remained fully invested throughout the recent cycle, without retreating to cash.

We remain fully invested for two reasons. First, at Matthews we strongly believe that it is often impractical to attempt to time market cycles, and thus we adopt a discipline of being fully invested over longer horizons. Second, during market volatility such as the present, it is important to return to the original investment premise: that is, it remains an exciting time to be a long-term investor in Asia’s economic evolution. This is particularly true now when the Fund has begun to identify a handful of new opportunities emerging as a result of the market’s contraction.

One such opportunity came in the form of a convertible bond issued by a smaller company called FUJI Foods. FUJI is engaged in the industrial catering business in mainland China. In its large-scale, centralized kitchens, it has the capacity to prepare 1 million meal sets per day and deliver to canteens and cafeterias in corporate parks throughout the country. Though FUJI’s business model is relatively simple, it represented the emergence of yet another new industry in China, unique to the current landscape, but comparable to businesses overseas. Efficiency, hygiene and cost pressures are forcing the market to transition away from sub-scale “mom and pop” caterers to industrial players. FUJI is the largest such caterer in the country, and yet it has less than 1% share of the national market. Despite its small size, and the substantial competition it faces in the market, FUJI enjoys profit margins vastly superior to those of comparable caterers in Europe. In order to finance its growth, the company issued a Chinese renminbi-denominated convertible bond, a relatively rare instrument in the Asian landscape, and one in which the Fund has established a small position. Convertible bonds, such as the one issued by FUJI, illustrate the Fund’s aim: to discover investments that trace the evolution of Asia’s markets, yet offer some downside protection even amidst volatility.

The Fund’s experience has been mixed amidst the market’s decline. For several years now, the Fund’s largest exposure has been to SK Telecom, South Korea’s largest and most profitable mobile phone company. Unfortunately, the position has been one of the largest detractors to performance so far this year; its shares have stumbled due to increasing regulatory burdens at home, and some misfiring investments abroad. Yet we remain convinced of the company’s strong fundamentals, particularly its strong cash flow, which in turn underwrites an attractive dividend on the company’s shares.

Meanwhile, the Fund has taken up the largest sector exposure to technology and light manufacturing it has had in several years. A number of companies in such industries have seen their valuations depressed on perceptions of a cyclical decline in growth. Yet we have added several such companies to the portfolio, having found them to be well-run, to offer strong cash flow and to have strong balance sheets. These new positions have performed marginally to the Fund’s benefit in the short-run. More importantly, however, we believe that such companies will be well positioned to trace the rise of consumer demand in Asia, whether for electronics or manufactured goods. It is this evolution that is at the heart of the Fund’s construct, and what makes us enthusiastic long-term investors in Asia, despite what are currently rocky markets.

800.789.ASIA [2742] www.matthewsfunds.com 15

MATTHEWS ASIAN GROWTH AND INCOME FUND

SCHEDULE OF INVESTMENTSa (UNAUDITED)

COMMON EQUITIES: 77.8%

| | | | | |

| | | SHARES | | VALUE |

CHINA/HONG KONG: 25.6% | | | | | |

CLP Holdings, Ltd. | | 7,370,200 | | $ | 63,205,366 |

Hang Seng Bank, Ltd. | | 2,040,900 | | | 43,091,805 |

Television Broadcasts, Ltd. | | 6,280,000 | | | 36,274,032 |

HongKong Electric Holdings, Ltd. | | 5,858,000 | | | 35,052,368 |

PCCW, Ltd. | | 48,711,000 | | | 29,501,140 |

Hang Lung Group, Ltd. | | 6,586,000 | | | 29,373,756 |

Café de Coral Holdings, Ltd. | | 16,281,100 | | | 29,218,499 |

Next Media, Ltd. | | 75,042,000 | | | 28,830,651 |

BOC Hong Kong Holdings, Ltd. | | 10,562,000 | | | 27,996,978 |

Giordano International, Ltd. | | 66,675,000 | | | 27,342,381 |

VTech Holdings, Ltd. | | 4,331,300 | | | 26,134,034 |

Vitasoy International Holdings, Ltd. | | 50,051,000 | | | 23,759,488 |

ASM Pacific Technology, Ltd. | | 2,986,800 | | | 22,574,430 |

CITIC Pacific, Ltd. | | 6,095,000 | | | 22,541,322 |

Hong Kong & China Gas Co., Ltd. | | 8,553,490 | | | 20,353,595 |

I-CABLE Communications, Ltd.† | | 129,832,000 | | | 19,117,178 |

Hang Lung Properties, Ltd. | | 5,935,920 | | | 19,056,479 |

China-Hong Kong Photo Products Holdings, Ltd. | | 14,998,003 | | | 1,308,637 |

| | | | | |

Total China/Hong Kong | | | | | 504,732,139 |

| | | | | |

SINGAPORE: 14.2% | | | | | |

Singapore Press Holdings, Ltd. | | 22,020,500 | | | 68,786,245 |

Ascendas REIT | | 23,690,000 | | | 38,480,688 |

Parkway Holdings, Ltd. | | 19,699,093 | | | 33,590,751 |

Fraser and Neave, Ltd. | | 10,006,100 | | | 33,315,669 |

DBS Group Holdings, Ltd. | | 2,382,000 | | | 33,019,382 |

Singapore Post, Ltd. | | 29,248,000 | | | 23,646,908 |

Cerebos Pacific, Ltd. | | 8,208,000 | | | 23,105,832 |

Parkway Life REIT | | 26,137,110 | | | 21,708,084 |

Yellow Pages (Singapore), Ltd. | | 6,638,000 | | | 3,366,447 |

Hong Leong Finance, Ltd. | | 157,000 | | | 400,419 |

| | | | | |

Total Singapore | | | | | 279,420,425 |

| | | | | |

TAIWAN: 12.7% | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 31,361,352 | | | 67,159,354 |

Chunghwa Telecom Co., Ltd. ADR | | 2,009,404 | | | 50,978,580 |

Far EasTone Telecommunications Co., Ltd. | | 29,485,611 | | | 46,871,174 |

President Chain Store Corp. | | 11,192,000 | | | 37,241,525 |

Cathay Financial Holding Co., Ltd. | | 8,973,705 | | | 19,512,553 |

Cyberlink Corp. | | 2,946,000 | | | 14,073,403 |

Chunghwa Telecom Co., Ltd. | | 2,561,960 | | | 6,625,831 |

Taiwan Secom Co., Ltd. | | 3,010,779 | | | 5,723,386 |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | 200,000 | | | 2,182,000 |

| | | | | |

Total Taiwan | | | | | 250,367,806 |

| | | | | |

SOUTH KOREA: 6.8% | | | | | |

SK Telecom Co., Ltd. | | 254,760 | | | 46,395,278 |

Hana Financial Group, Inc. | | 751,889 | | | 28,931,248 |

KT Corp. | | 505,730 | | | 21,635,120 |

KT Corp. ADR | | 718,800 | | | 15,324,816 |

SK Telecom Co., Ltd. ADR | | 522,200 | | | 10,846,094 |

Daehan City Gas Co., Ltd. | | 280,300 | | | 9,057,062 |

G11R, Inc. | | 309,540 | | | 2,352,510 |

| | | | | |

Total South Korea | | | | | 134,542,128 |

| | | | | |

THAILAND: 4.7% | | | | | |

Advanced Info Service Public Co., Ltd. | | 18,935,000 | | | 52,384,851 |

BEC World Public Co., Ltd. | | 47,386,400 | | | 34,723,099 |

Thai Reinsurance Public Co., Ltd. | | 25,672,800 | | | 4,683,837 |

| | | | | |

Total Thailand | | | | | 91,791,787 |

| | | | | |

16 MATTHEWS ASIAN FUNDS

JUNE 30, 2008

| | | | | |

| | | SHARES | | VALUE |

JAPAN: 4.0% | | | | | |

Nippon Building Fund, Inc. REIT | | 2,865 | | $ | 33,726,515 |

Trend Micro, Inc. | | 749,500 | | | 24,704,525 |

Japan Real Estate Investment Corp. REIT | | 1,911 | | | 20,156,519 |

| | | | | |

Total Japan | | | | | 78,587,559 |

| | | | | |

UNITED KINGDOM: 3.0% | | | | | |

HSBC Holdings PLC ADR | | 741,600 | | | 56,880,720 |

HSBC Holdings PLC | | 196,800 | | | 3,033,441 |

| | | | | |

Total United Kingdom | | | | | 59,914,161 |

| | | | | |

AUSTRALIA: 2.9% | | | | | |

AXA Asia Pacific Holdings, Ltd. | | 6,744,925 | | | 30,261,079 |

Insurance Australia Group, Ltd. | | 7,851,267 | | | 26,117,443 |

| | | | | |

Total Australia | | | | | 56,378,522 |

| | | | | |

INDONESIA: 1.7% | | | | | |

PT Telekomunikasi Indonesia ADR | | 745,500 | | | 24,042,375 |

PT Tempo Scan Pacific | | 139,445,000 | | | 10,284,447 |

| | | | | |

Total Indonesia | | | | | 34,326,822 |

| | | | | |

PHILIPPINES: 1.1% | | | | | |

Globe Telecom, Inc. | | 856,190 | | | 22,503,713 |

| | | | | |

Total Philippines | | | | | 22,503,713 |

| | | | | |

INDIA: 1.1% | | | | | |

Sun Pharmaceutical Industries, Ltd. | | 674,811 | | | 21,972,724 |

| | | | | |

Total Philippines | | | | | 21,972,724 |

| | | | | |

TOTAL COMMON EQUITIES | | | | | 1,534,537,786 |

(Cost $1,244,293,766) | | | | | |

| | | | | |

PREFERRED EQUITIES: 2.2% | | | | | |

SOUTH KOREA: 2.2% | | | | | |

Hyundai Motor Co., Ltd., Pfd. | | 566,280 | | | 14,643,539 |

LG Household & Health Care, Ltd., Pfd. | | 177,830 | | | 10,421,088 |

Samsung Fire & Marine Insurance Co., Ltd., Pfd. | | 119,550 | | | 9,085,823 |

Hyundai Motor Co., Ltd., 2nd Pfd. | | 305,760 | | | 8,359,768 |

| | | | | |

Total South Korea | | | | | 42,510,218 |

| | | | | |

TOTAL PREFERRED EQUITIES | | | | | 42,510,218 |

(Cost $19,413,954) | | | | | |

| | | | | |

See footnotes on page 19.

800.789.ASIA [2742] www.matthewsfunds.com 17

MATTHEWS ASIAN GROWTH AND INCOME FUND

SCHEDULE OF INVESTMENTSa (UNAUDITED) (continued)

INTERNATIONAL DOLLAR BONDS: 19.4%

| | | | | | | |

| | | FACE AMOUNT | | | VALUE |

CHINA/HONG KONG: 7.3% | | | | | | | |

Hongkong Land CB 2005, Ltd., Cnv. | | | | | | | |

2.750%, 12/21/12 | | $ | 49,200,000 | | | $ | 58,671,000 |

China Petroleum & Chemical Corp., (Sinopec), Cnv. | | | | | | | |

0.000%, 04/24/14 | | | 295,950,000 | b | | | 40,377,262 |

FU JI Food and Catering Services Holdings, Ltd., Cnv. | | | | | | | |

0.000%, 10/18/10 | | | 247,500,000 | b | | | 28,933,917 |

Brilliance China Finance, Ltd., Cnv. | | | | | | | |

0.000%, 06/07/11 | | | 14,950,000 | | | | 15,376,075 |

| | | | | | | |

Total China/Hong Kong | | | | | | | 143,358,254 |

| | | | | | | |

MALAYSIA: 6.0% | | | | | | | |

Rafflesia Capital, Ltd., Cnv. | | | | | | | |

1.250%,c 10/04/11 | | | 42,100,000 | | | | 49,046,500 |

Cherating Capital, Ltd., Cnv. | | | | | | | |

2.000%, 07/05/12 | | | 44,900,000 | | | | 45,519,620 |

Prime Venture Labuan, Ltd., Cnv. | | | | | | | |

1.000%, 12/12/08 | | | 11,170,000 | | | | 12,552,287 |

YTL Power Finance Cayman, Ltd., Cnv. | | | | | | | |

0.000%, 05/09/10 | | | 9,400,000 | | | | 11,233,000 |

| | | | | | | |

Total Malaysia | | | | | | | 118,351,407 |

| | | | | | | |

INDIA: 4.4% | | | | | | | |

Ranbaxy Laboratories, Ltd., Cnv. | | | | | | | |

0.000%, 03/18/11 | | | 29,326,000 | | | | 33,175,038 |

Tata Motors, Ltd., Cnv. | | | | | | | |

1.000%, 04/27/11 | | | 27,349,000 | | | | 27,827,608 |

Reliance Communications, Ltd., Cnv. | | | | | | | |

0.000%, 05/10/11 | | | 22,290,000 | | | | 25,744,950 |

| | | | | | | |

Total India | | | | | | | 86,747,596 |

| | | | | | | |

SOUTH KOREA: 1.7% | | | | | | | |

SK Telecom Co., Ltd., Cnv. | | | | | | | |

0.000%, 05/27/09 | | | 29,430,000 | | | | 32,991,030 |

| | | | | | | |

Total South Korea | | | | | | | 32,991,030 |

| | | | | | | |

TOTAL INTERNATIONAL DOLLAR BONDS | | | | | | | 381,448,287 |

(Cost $376,384,411) | | | | | | | |

| | | | | | | |

18 MATTHEWS ASIAN FUNDS

JUNE 30, 2008

| | | |

| | | VALUE |

TOTAL INVESTMENTS: 99.4% | | $ | 1,958,496,291 |

(Cost $1,640,092,131d) | | | |

| |

CASH AND OTHER ASSETS, LESS LIABILITIES: 0.6% | | | 12,043,622 |

| | | |

NET ASSETS: 100.0% | | $ | 1,970,539,913 |

| | | |

| a | Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A). |

| b | Face amount reflects principal in local currency. |

| c | Variable rate security. The rate represents the rate in effect at June 30, 2008. |

| d | Cost of investments is $1,640,092,131 and net unrealized appreciation consists of: |

| | | | |

Gross unrealized appreciation | | $ | 368,515,768 | |

Gross unrealized depreciation | | | (50,111,608 | ) |

| | | | |

Net unrealized appreciation | | $ | 318,404,160 | |

| | | | |

| † | Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer) |

| ADR | American Depositary Receipt |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

800.789.ASIA [2742] www.matthewsfunds.com 19

MATTHEWS ASIA PACIFIC FUND

| | |

| FUND OBJECTIVE AND STRATEGY | | SYMBOL: MPACX |

Objective: Long-term capital appreciation.

Strategy: Under normal market conditions, the Matthews Asia Pacific Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in the Asia Pacific region. The Asia Pacific region includes Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. The Fund may also invest in the convertible securities, of any duration or quality, of Asia Pacific companies.

PORTFOLIO MANAGERS

| | | | |

Lead Manager: Taizo Ishida | | | | Co-Manager: Sharat Shroff, CFA |

PORTFOLIO MANAGER COMMENTARY

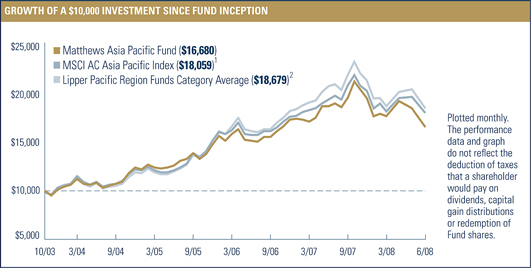

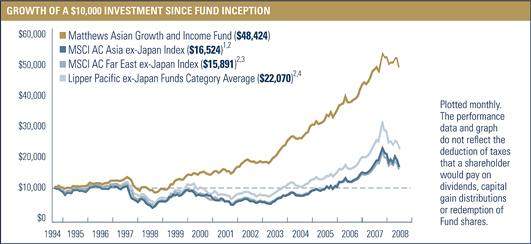

The Matthews Asia Pacific Fund declined –15.38% during the first half of 2008, compared with its benchmark, the MSCI All Country Asia Pacific Index, which fell –12.18%.

The Asia Pacific markets continued through tough times in the second quarter of 2008 as prices for food and energy jumped to record levels. Ongoing problems related to U.S. financial institutions also continued to be a drag on market sentiment. While the second quarter marked declines throughout the region, these varied widely by country and, in some cases, even among different exchanges within the same country: the domestic Chinese A share market declined another 26% in the second quarter after falling 29% in the first quarter. The MSCI China Index, however, was down just under 5% in the second quarter. The India portion of the MSCI All Country Asia Pacific Index declined 41%, while Japan was down only 5%.

We have, however, seen encouraging signs in recently passed legislation that, we believe, should help Chinese manufacturers reduce inefficiencies in the years to come. A new Chinese labor law that raises the minimum wage by an annual double-digit percentage increase, coupled with annual appreciation of China’s currency against the U.S. dollar, should prompt factories to shift manufacturing methods so they are more capital-intensive and less labor-intensive.

In addition, new regulations to battle pollution should help produce better conditions. Improved factory automation is something that has been emerging in China and some Japanese companies are big beneficiaries of this. Two of the portfolio’s holdings, FANUC and Keyence, both Japanese, are good examples of this trend in Chinese factories. FANUC is a leading supplier of industrial robots to Chinese companies and Keyence offers Chinese firms automation technology mainly through its advanced sensors.

continued on page 23

20 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF JUNE 30, 2008, UNLESS OTHERWISE NOTED

| | | | | | | | | | | | | | | |

PERFORMANCE AS OF JUNE 30, 2008 | |

Fund Inception: 10/31/03 | | 3 MO | | | YTD | | | Average Annual Total Returns | |

| | | | 1 YR | | | 3 YRS | | | SINCE

INCEPTION | |

Matthews Asia Pacific Fund | | –7.05 | % | | –15.38 | % | | –12.01 | % | | 9.32 | % | | 11.59 | % |

MSCI All Country Asia Pacific Index1 | | –1.37 | % | | –12.18 | % | | –8.43 | % | | 13.75 | % | | 13.50 | % |

Lipper Pacific Region Funds Category Average2 | | –1.62 | % | | –12.69 | % | | –9.85 | % | | 15.14 | % | | 14.23 | % |

All performance quoted is past performance and is no guarantee of future results. Assumes reinvestment of all dividends and/or distributions. Unusually high returns may not be sustainable. Investment return and principal value will fluctuate with changing market conditions so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance please call 800-789-ASIA [2742] or visit www.matthewsfunds.com.

| | | | | |

FISCAL YEAR 2007 RATIOS | | | | | |

Gross Operating Expense:3 1.20% | | Portfolio Turnover:4 | | 40.49 | % |

1 | The MSCI All Country Asia Pacific Index is a free float–adjusted market capitalization–weighted index of the stock markets of Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan and Thailand. It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International; total return calculations performed by PNC. |

2 | Lipper, Inc. fund performance does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains, for the stated periods. |

3 | Ratio has been restated to reflect current management and administrative and shareholder servicing fees expected to be incurred by the Funds and paid to the Advisor. Matthews Asian Funds do not charge 12b-1 fees. |

4 | The lesser of fiscal year 2007 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

800.789.ASIA [2742] www.matthewsfunds.com 21

MATTHEWS ASIA PACIFIC FUND

| | | | | |

TOP TEN HOLDINGS1 | | | | | |

| | | COUNTRY | | % OF NET ASSETS | |

Nintendo Co., Ltd. | | Japan | | 2.9 | % |

Funai Zaisan Consultants Co., Ltd. | | Japan | | 2.6 | % |

Unicharm Petcare Corp. | | Japan | | 2.4 | % |

Benesse Corp. | | Japan | | 2.2 | % |

Sony Corp. | | Japan | | 2.1 | % |

China Mobile, Ltd. | | China/Hong Kong | | 2.1 | % |

The Sumitomo Trust & Banking Co., Ltd. | | Japan | | 2.0 | % |

Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | 2.0 | % |

Ichiyoshi Securities Co., Ltd. | | Japan | | 1.9 | % |

Sekisui House, Ltd. | | Japan | | 1.9 | % |

% OF ASSETS IN TOP 10 | | | | 22.1 | % |

| | | |

COUNTRY ALLOCATION | | | |

Japan | | 47.0 | % |

China/Hong Kong | | 21.2 | % |

South Korea | | 8.2 | % |

India | | 6.8 | % |

Thailand | | 4.1 | % |

Taiwan | | 3.7 | % |

Australia | | 3.5 | % |

Singapore | | 3.2 | % |

Indonesia | | 2.1 | % |

Cash and other assets, less liabilities | | 0.2 | % |

| | | |

SECTOR ALLOCATION | | | |

Financials | | 32.6 | % |

Information Technology | | 20.7 | % |

Consumer Discretionary | | 16.8 | % |

Consumer Staples | | 9.7 | % |

Industrials | | 7.0 | % |

Health Care | | 6.6 | % |

Telecommunication Services | | 4.3 | % |

Materials | | 2.1 | % |

Cash and other assets, less liabilities | | 0.2 | % |

| | | |

MARKET CAP EXPOSURE2 | | | |

Large cap (over $5 billion) | | 58.2 | % |

Mid cap ($1–$5 billion) | | 23.4 | % |

Small cap (under $1 billion) | | 18.2 | % |

Cash and other assets, less liabilities | | 0.2 | % |

| | | | | | | | |

| NUMBER OF SECURITIES | | NAV | | FUND ASSETS | | REDEMPTION FEE | | 12b-1 FEES |

| 77 | | $14.63 | | $369.3 million | | 2.00% within

90 calendar days | | None |

1 | Holdings may combine more than one security from same issuer and related depositary receipts. |

2 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

22 MATTHEWS ASIAN FUNDS

ALL DATA IS AS OF JUNE 30, 2008, UNLESS OTHERWISE NOTED

PORTFOLIO MANAGER COMMENTARY continued from page 20

One of the Fund’s new holdings serves as another example of efficient manufacturing: China’s Tingyi is one of the country’s best food and beverage companies, and the country’s top instant noodle maker with dominant market share. What is so attractive about this company is its efficient manufacturing technologies, which are competitive with those of its Japanese and Korean peers. The company possesses a rare combination of both impressive factory automation and efforts to make daily improvements, which is the basic driving force behind the industry’s consolidation. These improvements are reminiscent of Toyota’s “kaizen,” a Japanese philosophy of bettering standardized activities and processes through daily activities to eliminate waste.

The Fund has traditionally avoided commodity companies where we believe forward earnings are unpredictable due to the cyclical nature of these firms. Because of this, we have typically underweighted Australia due to its large commodities and energy sectors. This hurt performance in the first half of 2008 as commodities prices rose. Our overweight in Korean stocks also hurt the Fund as Korea has faced a rapid depreciation of its currency against the U.S. dollar, which has pushed up import costs. From a valuation standpoint, China and India now appear more attractive, and the Fund has a growing list of new investment opportunities in solid companies with attractive long-term growth prospects. We also retain conviction in our current holdings.

The Fund attempts to capture the growth prospects for the entire Asia Pacific region, in which Japan is becoming more and more relevant. Japan’s domestic growth potential may not be as high as that of Asia-ex Japan, but it is our belief that more Japanese companies will benefit from growth in the region. It is important to note that we have been witnessing more regional cooperation, both economically and politically, over the last six months than we have at any time in the last decade. Looking ahead, one of the key questions facing investors is the ability of the region to withstand a global slowdown. In that context, it is encouraging to see these signs of greater integration within the Asia Pacific region, despite the current downturn in Asian equity markets.

800.789.ASIA [2742] www.matthewsfunds.com 23

MATTHEWS ASIA PACIFIC FUND

SCHEDULE OF INVESTMENTSa (UNAUDITED)

COMMON EQUITIES: 99.8%

| | | | | |

| | | SHARES | | VALUE |

JAPAN: 47.0% | | | | | |

Nintendo Co., Ltd. | | 18,800 | | $ | 10,605,264 |

Funai Zaisan Consultants Co., Ltd.† | | 7,081 | | | 9,469,341 |

Unicharm Petcare Corp. | | 299,100 | | | 8,929,199 |

Benesse Corp. | | 203,900 | | | 8,257,004 |

Sony Corp. ADR | | 180,100 | | | 7,877,574 |

The Sumitomo Trust & Banking Co., Ltd. | | 1,078,000 | | | 7,532,853 |

Ichiyoshi Securities Co., Ltd. | | 764,900 | | | 7,008,972 |

Sekisui House, Ltd. | | 738,000 | | | 6,887,583 |

Yahoo! Japan Corp. | | 17,612 | | | 6,783,734 |

Pigeon Corp. | | 334,300 | | | 6,721,576 |

Daibiru Corp. | | 598,700 | | | 6,647,524 |

Nomura Research Institute, Ltd. | | 282,800 | | | 6,631,558 |

Sysmex Corp. | | 159,800 | | | 6,290,568 |

GCA Savvian Group Corp. | | 1,776 | | | 6,171,719 |

ORIX Corp. | | 37,950 | | | 5,428,832 |

Nidec Corp. | | 79,500 | | | 5,293,262 |

Nitto Denko Corp. | | 137,700 | | | 5,290,917 |

Takeda Pharmaceutical Co., Ltd. | | 95,600 | | | 4,861,704 |

Sumitomo Realty & Development Co., Ltd. | | 234,000 | | | 4,649,809 |

Hoya Corp. | | 189,400 | | | 4,378,933 |

Toyota Motor Corp. ADR | | 45,600 | | | 4,286,400 |

Canon, Inc. ADR | | 82,650 | | | 4,232,507 |

NGK Insulators, Ltd. | | 216,000 | | | 4,200,593 |

Monex Group, Inc. | | 6,094 | | | 4,143,587 |

Takeuchi Manufacturing Co., Ltd. | | 154,500 | | | 3,790,295 |

Mitsubishi Estate Co., Ltd. | | 162,000 | | | 3,707,303 |

Fanuc, Ltd. | | 36,800 | | | 3,593,879 |

Keyence Corp. | | 14,600 | | | 3,477,271 |

Honda Motor Co., Ltd. ADR | | 81,200 | | | 2,763,236 |

Toray Industries, Inc. | | 459,000 | | | 2,459,585 |

Mori Trust Sogo REIT, Inc. | | 135 | | | 1,271,366 |

| | | | | |

Total Japan | | | | | 173,643,948 |

| | | | | |

CHINA/HONG KONG: 21.2% | | | | | |

China Mobile, Ltd. ADR | | 117,400 | | | 7,859,930 |

Hang Lung Group, Ltd. | | 1,379,000 | | | 6,150,381 |

Lenovo Group, Ltd. | | 8,928,000 | | | 6,073,731 |

Pico Far East Holdings, Ltd. | | 37,582,000 | | | 5,720,952 |

China Life Insurance Co., Ltd. H Shares | | 1,528,000 | | | 5,323,453 |

China Merchants Bank Co., Ltd. H Shares | | 1,625,000 | | | 5,117,621 |

Dairy Farm International Holdings, Ltd. | | 1,041,300 | | | 5,039,892 |

China Vanke Co., Ltd. B Shares | | 3,693,722 | | | 4,725,877 |

Shangri-La Asia, Ltd. | | 1,988,000 | | | 4,657,993 |

Ping An Insurance (Group) Co. of China, Ltd. H Shares | | 574,000 | | | 4,277,996 |

NetEase.com, Inc. ADRb | | 194,800 | | | 4,244,692 |

Kingdee International Software Group Co., Ltd. | | 19,448,000 | | | 4,002,119 |

Ctrip.com International, Ltd. ADR | | 73,900 | | | 3,383,142 |

China Merchants Holdings International Co., Ltd. | | 848,000 | | | 3,282,010 |

Tingyi (Cayman Islands) Holding Corp. | | 2,378,000 | | | 2,940,899 |

China Yurun Food Group, Ltd. | | 1,254,000 | | | 2,062,870 |

Dongfeng Motor Group Co., Ltd. H Shares | | 5,012,000 | | | 2,007,841 |

Television Broadcasts, Ltd. | | 231,000 | | | 1,334,284 |

| | | | | |

Total China/Hong Kong | | | | | 78,205,683 |

| | | | | |

SOUTH KOREA: 8.2% | | | | | |

Hanmi Pharmaceutical Co., Ltd. | | 46,114 | | | 6,788,926 |

Shinhan Financial Group Co., Ltd. | | 113,517 | | | 5,132,980 |

Amorepacific Corp. | | 8,254 | | | 5,113,134 |

Hyundai Department Store Co., Ltd. | | 45,970 | | | 3,722,249 |

Kiwoom Securities Co., Ltd. | | 100,715 | | | 3,610,547 |

NHN Corp.b | | 20,470 | | | 3,571,316 |

CDNetworks Co., Ltd.b | | 107,409 | | | 1,185,961 |

Modetour Network, Inc. | | 49,754 | | | 1,117,747 |

| | | | | |

Total South Korea | | | | | 30,242,860 |

| | | | | |

24 MATTHEWS ASIAN FUNDS

JUNE 30, 2008

| | | | | |

| | | SHARES | | VALUE |

INDIA: 6.8% | | | | | |

Sun Pharmaceutical Industries, Ltd. | | 201,218 | | $ | 6,551,920 |

HDFC Bank, Ltd. | | 221,500 | | | 5,186,266 |

Dabur India, Ltd. | | 2,788,605 | | | 5,123,515 |

Infosys Technologies, Ltd. | | 90,990 | | | 3,673,014 |

Bharti Airtel, Ltd.b | | 205,528 | | | 3,445,371 |

Financial Technologies (India), Ltd. | | 30,015 | | | 1,172,800 |

| | | | | |

Total India | | | | | 25,152,886 |

| | | | | |

THAILAND: 4.1% | | | | | |

Land & Houses Public Co., Ltd. | | 22,417,300 | | | 4,961,508 |

Advanced Info Service Public Co., Ltd. | | 1,658,600 | | | 4,588,620 |

Major Cineplex Group Public Co., Ltd. | | 7,285,400 | | | 3,181,302 |

Siam Commercial Bank Public Co., Ltd. | | 1,014,400 | | | 2,351,309 |

| | | | | |

Total Thailand | | | | | 15,082,739 |

| | | | | |

TAIWAN: 3.7% | | | | | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | 3,393,029 | | | 7,266,065 |

Taiwan Secom Co., Ltd. | | 3,348,160 | | | 6,364,736 |

| | | | | |

Total Taiwan | | | | | 13,630,801 |

| | | | | |

AUSTRALIA: 3.5% | | | | | |

AXA Asia Pacific Holdings, Ltd. | | 1,424,589 | | | 6,391,413 |

Computershare, Ltd. | | 437,302 | | | 3,861,024 |

Tabcorp Holdings, Ltd. | | 297,625 | | | 2,798,980 |

| | | | | |

Total Australia | | | | | 13,051,417 |

| | | | | |

SINGAPORE: 3.2% | | | | | |

Hyflux, Ltd. | | 2,130,812 | | | 4,682,759 |

DBS Group Holdings, Ltd. | | 269,700 | | | 3,738,592 |

Keppel Land, Ltd. | | 951,000 | | | 3,466,951 |

| | | | | |

Total Singapore | | | | | 11,888,302 |

| | | | | |

INDONESIA: 2.1% | | | | | |

Bank Rakyat Indonesia | | 6,988,500 | | | 3,865,656 |

PT Astra International | | 1,827,000 | | | 3,814,507 |

| | | | | |

Total Indonesia | | | | | 7,680,163 |

| | | | | |

TOTAL INVESTMENTS: 99.8% | | | | | 368,578,799 |

(Cost $361,846,264c) | | | | | |

| | |

CASH AND OTHER ASSETS, LESS LIABILITIES: 0.2% | | | | | 753,756 |

| | | | | |

NET ASSETS: 100.0% | | | | $ | 369,332,555 |

| | | | | |

| a | Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A). |

| b | Non–income producing security |

| c | Cost of investments is $361,846,264 and net unrealized appreciation consists of: |

| | | | |

Gross unrealized appreciation | | $ | 54,610,733 | |

Gross unrealized depreciation | | | (47,878,198 | ) |

| | | | |

Net unrealized appreciation | | $ | 6,732,535 | |

| | | | |

| † | Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer) |

| ADR | American Depositary Receipt |

See accompanying notes to financial statements.

800.789.ASIA [2742] www.matthewsfunds.com 25

MATTHEWS PACIFIC TIGER FUND (CLOSED TO MOST NEW INVESTORS)

| | |

| FUND OBJECTIVE AND STRATEGY | | SYMBOL: MAPTX |

Objective: Long-term capital appreciation.

Strategy: Under normal market conditions, the Matthews Pacific Tiger Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in the Pacific Tiger countries of China, Hong Kong, India, Indonesia, Malaysia, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

PORTFOLIO MANAGERS

| | |

| Lead Managers: Richard H. Gao and Sharat Shroff, CFA | | Co-Manager: Mark W. Headley |

PORTFOLIO MANAGER COMMENTARY

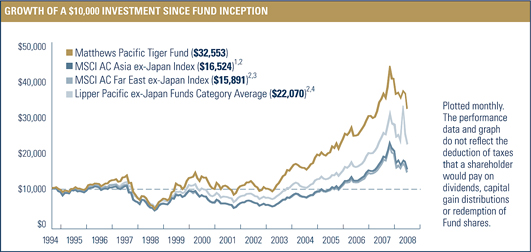

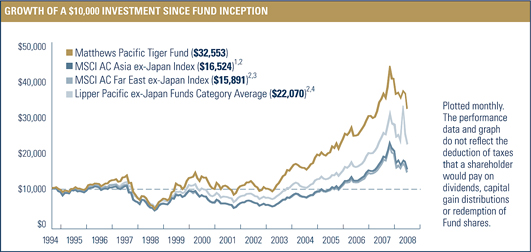

For the six months ending June 30, 2008, the Matthews Pacific Tiger Fund declined –19.20%, while its primary benchmark, the MSCI All Country Asia ex-Japan Index, fell –21.10%. During the same period, the MSCI All Country Far East ex-Japan Index was down –18.21%.

Various stocks from across the region helped the Fund’s relative performance, but were unable to offset broader weakness in the markets. Asia ex-Japan equities ended the first half of the year with one of the worst performances in recent history. The economic environment across large parts of the region worsened in the second quarter, and any partial attempts at a recovery in the markets in April proved to be short-lived.