UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08510 |

|

Matthews International Funds |

(Exact name of registrant as specified in charter) |

|

Four Embarcadero Center, Suite 550

San Francisco, CA 94111 |

(Address of principal executive offices) (Zip code) |

|

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 415-788-7553 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2011 | |

| | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Semi-Annual Report

June 30, 2011 | matthewsasia.com

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Dividend Fund

Matthews China Dividend Fund

ASIA GROWTH STRATEGIES

Matthews Asia Growth Fund

Matthews Pacific Tiger Fund

Matthews China Fund

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA SMALL COMPANY STRATEGIES

Matthews Asia Small Companies Fund

Matthews China Small Companies Fund

ASIA SPECIALTY STRATEGY

Matthews Asia Science and Technology Fund

'11

Performance and Expenses

Through June 30, 2011

*Institutional Class Shares were first offered on October 29, 2010. For performance since that date, please see each Fund's performance table in the report. Performance for the Institutional Class Shares prior to its inception is based on the performance of the Investor Class. Performance differences between the Institutional Class and Investor Class may arise due to differences in fees charged to each class.

| | | | | | | Average Annual Total Return | | 2010 Gross | |

| | | Inception

Date | | 1 year | | 5 years | | 10 years | | Since

Inception | | Annual Operating

Expenses1 | |

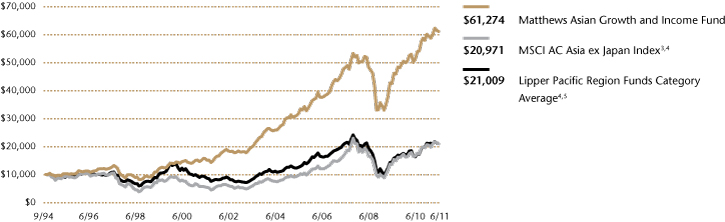

| Matthews Asian Growth & Income Fund | |

| Investor Class (MACSX) | | 9/12/94 | | | 19.32 | % | | | 10.26 | % | | | 14.60 | % | | | 11.40 | % | | | 1.13 | % | |

| Institutional Class (MICSX) | | 10/29/10* | | | 19.49 | % | | | 10.29 | % | | | 14.62 | % | | | 11.41 | % | | | 0.93 | % | |

| Matthews Asia Dividend Fund | |

| Investor Class (MAPIX) | | 10/31/06 | | | 18.60 | % | | | n.a. | | | | n.a. | | | | 12.48 | % | | | 1.14 | % | |

| After Fee Waiver, Reimbursement and Recoupment | | | | | | | | | | | | | 1.15 | %2 | |

| Institutional Class (MIPIX) | | 10/29/10* | | | 18.64 | % | | | n.a. | | | | n.a. | | | | 12.48 | % | | | 1.02 | % | |

| Matthews China Dividend Fund | |

| Investor Class (MCDFX) | | 11/30/09 | | | 22.67 | % | | | n.a. | | | | n.a. | | | | 16.23 | % | | | 1.95 | % | |

| After Fee Waiver, Reimbursement and Recoupment | | | | | | | | | | | | | 1.50 | %3 | |

| Institutional Class (MICDX) | | 10/29/10* | | | 22.79 | % | | | n.a. | | | | n.a. | | | | 16.30 | % | | | 1.24 | % | |

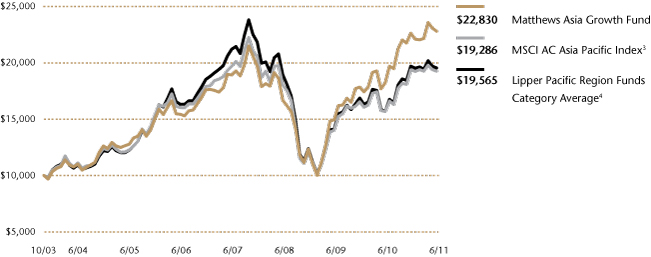

| Matthews Asia Growth Fund | |

| Investor Class (MPACX) | | 10/31/03 | | | 25.21 | % | | | 8.14 | % | | | n.a. | | | | 11.37 | % | | | 1.19 | % | |

| Institutional Class (MIAPX) | | 10/29/10* | | | 25.35 | % | | | 8.16 | % | | | n.a. | | | | 11.39 | % | | | 0.99 | % | |

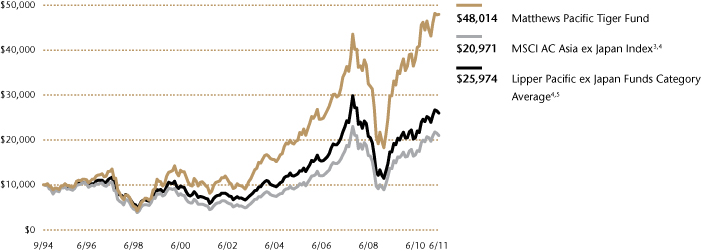

| Matthews Pacific Tiger Fund | |

| Investor Class (MAPTX) | | 9/12/94 | | | 26.44 | % | | | 14.26 | % | | | 16.60 | % | | | 9.79 | % | | | 1.09 | % | |

| Institutional Class (MIPTX) | | 10/29/10* | | | 26.59 | % | | | 14.29 | % | | | 16.61 | % | | | 9.80 | % | | | 0.95 | % | |

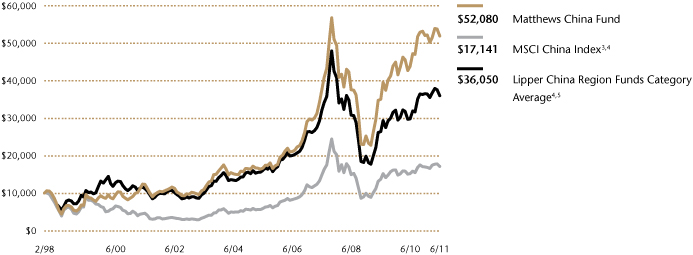

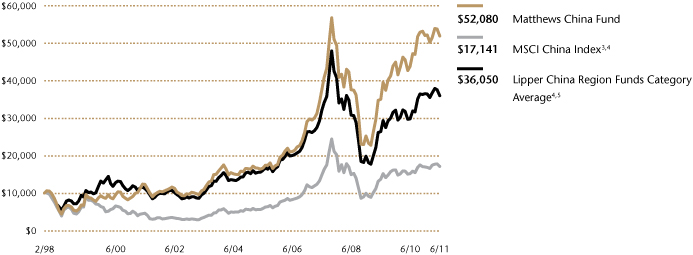

| Matthews China Fund | |

| Investor Class (MCHFX) | | 2/19/98 | | | 18.60 | % | | | 19.77 | % | | | 15.50 | % | | | 13.15 | % | | | 1.15 | % | |

| Institutional Class (MICFX) | | 10/29/10* | | | 18.73 | % | | | 19.79 | % | | | 15.51 | % | | | 13.16 | % | | | 0.97 | % | |

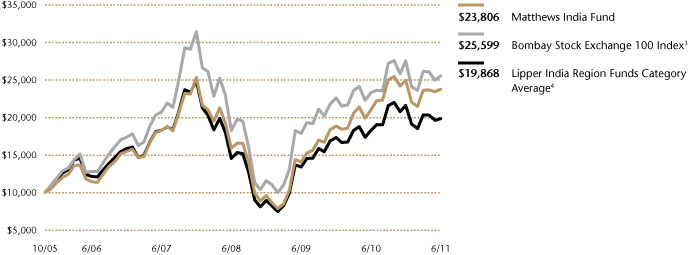

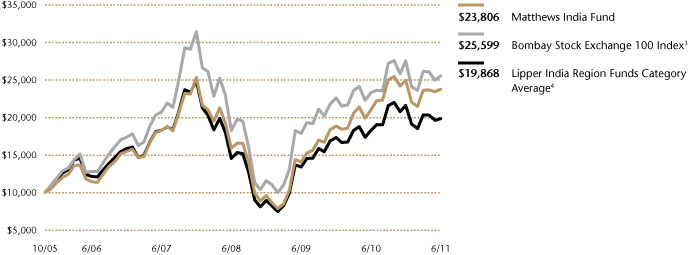

| Matthews India Fund | |

| Investor Class (MINDX) | | 10/31/05 | | | 13.36 | % | | | 15.85 | % | | | n.a. | | | | 16.55 | % | | | 1.18 | % | |

| Institutional Class (MIDNX) | | 10/29/10* | | | 13.46 | % | | | 15.87 | % | | | n.a. | | | | 16.57 | % | | | 0.99 | % | |

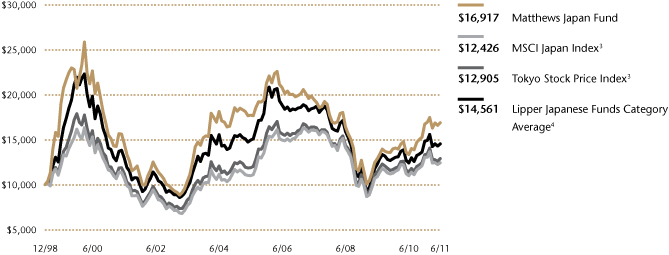

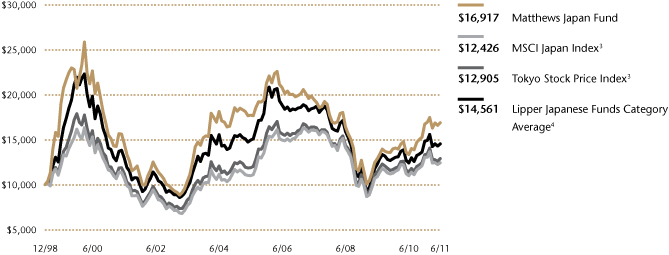

| Matthews Japan Fund | |

| Investor Class (MJFOX) | | 12/31/98 | | | 26.62 | % | | | -4.06 | % | | | 1.50 | % | | | 4.30 | % | | | 1.30 | % | |

| Institutional Class (MIJFX) | | 10/29/10* | | | 26.52 | % | | | -4.08 | % | | | 1.49 | % | | | 4.29 | % | | | 1.08 | % | |

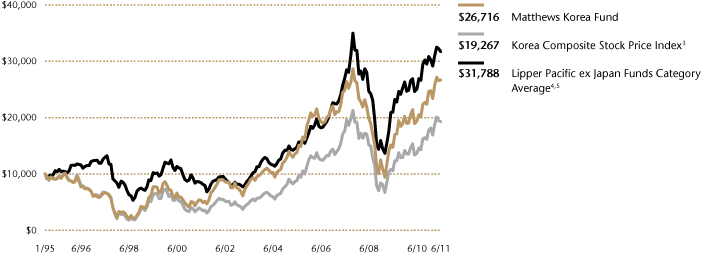

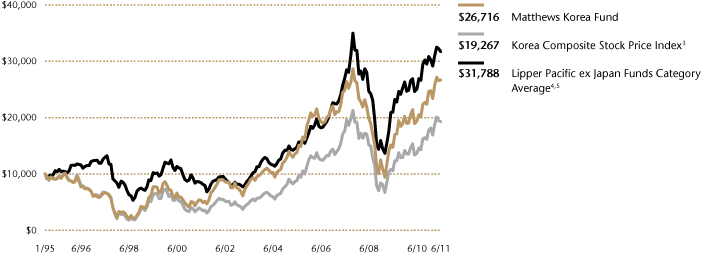

| Matthews Korea Fund | |

| Investor Class (MAKOX) | | 1/3/95 | | | 37.81 | % | | | 6.74 | % | | | 17.67 | % | | | 6.14 | % | | | 1.21 | % | |

| Institutional Class (MIKOX) | | 10/29/10* | | | 38.06 | % | | | 6.78 | % | | | 17.69 | % | | | 6.15 | % | | | 0.91 | % | |

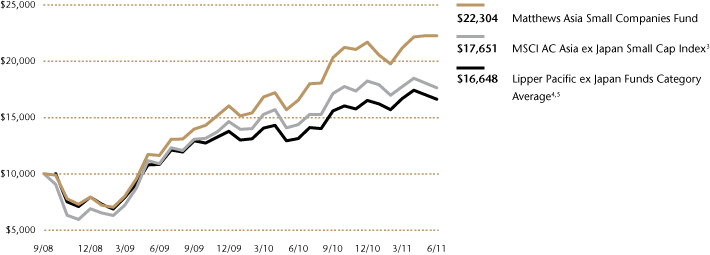

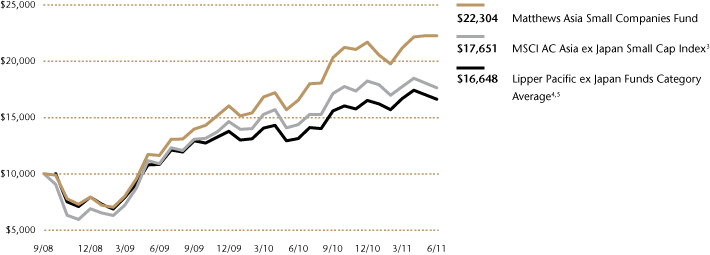

| Matthews Asia Small Companies Fund | |

| Investor Class (MSMLX) | | 9/15/08 | | | 34.69 | % | | | n.a. | | | | n.a. | | | | 33.32 | % | | | 1.59 | % | |

| After Fee Waiver, Reimbursement and Recoupment | | | | | | | | | | | | | | | | | | | | | | | 1.63 | %4 | |

| Matthews China Small Companies Fund | |

| Investor Class (MCSMX) | | 5/31/11 | | | n.a. | | | | n.a. | | | | n.a. | | | | -4.00 | %5 | | | 2.99 | % | |

| After Fee Waiver, Reimbursement and Recoupment | | | | | | | | | | | | | | | | | | | | | | | 2.00 | %6 | |

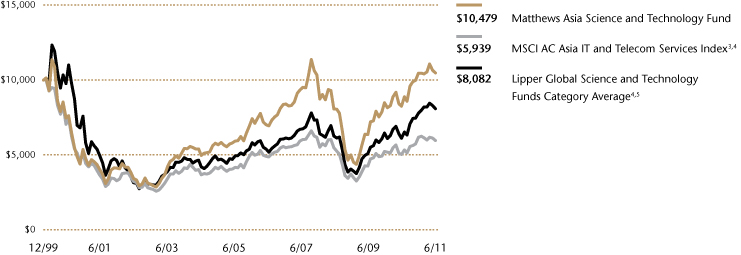

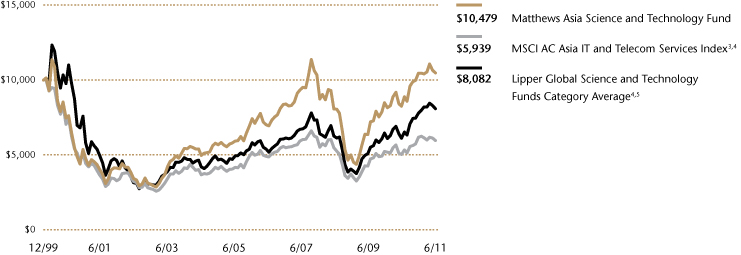

| Matthews Asia Science and Technology Fund | |

| Investor Class (MATFX) | | 12/27/99 | | | 27.03 | % | | | 8.43 | % | | | 9.25 | % | | | 0.41 | % | | | 1.26 | % | |

1 Gross annual operating expenses for Institutional Class Shares are annualized.

2 The Advisor has contractually agreed to waive the Fund's fees and reimburse expenses until at least April 30, 2012 to the extent needed to limit total annual operating expenses to 1.50%.

3 The Advisor has contractually agreed to waive the Fund's fees and reimburse expenses until at least August 31, 2013 to the extent needed to limit total annual operating expenses to 1.50%.

4 The Advisor has contractually agreed to waive the Fund's fees and reimburse expenses until at least April 30, 2012 to the extent needed to limit total annual operating expenses to 2.00%.

5 Actual return for fiscal period beginning 5/31/11 through 6/30/11, not annualized.

6 The Advisor has contractually agreed to waive the Fund's fees and reimburse expenses until at least August 31, 2014 to the extent needed to limit total annual operating expenses to 2.00%.

Investor Disclosure

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds' fees and expenses had not been waived, returns would have been lower. For the Funds' most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds' prospectus and Statement of Additional Information for more risk disclosure.

Contents

| Message to Shareholders | | | 2 | | |

|

| Manager Commentaries, Fund Characteristics and Schedules of Investments: | |

|

| ASIA GROWTH AND INCOME STRATEGIES | |

|

| Matthews Asian Growth and Income Fund | | | 4 | | |

|

| Matthews Asia Dividend Fund | | | 9 | | |

|

| Matthews China Dividend Fund | | | 14 | | |

|

| ASIA GROWTH STRATEGIES | |

|

| Matthews Asia Growth Fund | | | 19 | | |

|

| Matthews Pacific Tiger Fund | | | 24 | | |

|

| Matthews China Fund | | | 29 | | |

|

| Matthews India Fund | | | 34 | | |

|

| Matthews Japan Fund | | | 39 | | |

|

| Matthews Korea Fund | | | 44 | | |

|

| ASIA SMALL COMPANY STRATEGIES | |

|

| Matthews Asia Small Companies Fund | | | 49 | | |

|

| Matthews China Small Companies Fund | | | 54 | | |

|

| ASIA SPECIALTY STRATEGY | |

|

| Matthews Asia Science and Technology Fund | | | 59 | | |

|

| Disclosures and Index Definitions | | | 63 | | |

|

| Disclosure of Fund Expenses | | | 64 | | |

|

| Statements of Assets and Liabilities | | | 66 | | |

|

| Statements of Operations | | | 68 | | |

|

| Statements of Changes in Net Assets | | | 70 | | |

|

| Financial Highlights | | | 76 | | |

|

| Notes to Financial Statements | | | 88 | | |

|

| Approval of Investment Advisory Agreement | | | 103 | | |

|

| Trustees and Officers of the Funds | | | 105 | | |

|

Cover photo: Baha'i Lotus Temple, New Delhi, India

This report has been prepared for Matthews Asia Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds' investment objectives, risks and expenses. Additional copies of the prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of June 30, 2011. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund's future investment intent.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Matthews Asia Funds are distributed in the United States by BNY Mellon Distributors Inc., 760 Moore Road, King of Prussia, PA 19406

Matthews Asia Funds are distributed in Latin America by HMC Partners

We are likely living in a world of greater uncertainty and volatility than in the past. However, this does not necessarily mean that strategies to deal with that uncertainty are unclear.

Message to Shareholders

from the Investment Advisor

Dear Fellow Shareholders,

Sustainability has been the watchword for global economic markets so far as countries, businesses and stock prices all struggle to maintain the momentum in growth that has been built up since the financial crisis began. In addition, markets have been hit by the question: How long can this go on? These concerns have been leveled at U.S. unemployment, Chinese property markets, Asia's inflation and European debt. The question is well put. And given the context in which we are all seeing things these days—the aftermath of the greatest global financial crisis since the Great Depression—people seem naturally disposed toward extreme answers to that question. That is, people want to hear that either everything is all right or that the next crisis is imminent. I suspect that the best answer to such questions is rather ambiguous, for it is not at all clear that we have either emerged from the last crisis or already sown the seeds of the next crisis. We are likely living in a world of greater uncertainty and volatility than in the past. However, this does not necessarily mean that strategies to deal with that uncertainty are unclear.

Why is the world likely to be more volatile? One of the most powerful balancing forces in the economy is broken. Interest rates in the U.S., Japan and Europe have fallen about as far as they can go. Demand shocks will not be so easily absorbed by central bank monetary policies and low rates of nominal GDP growth, which is real growth plus inflation, are comparatively low. So smaller shocks are needed to push economies back into recession. Household debt is high in many of the large consumer-driven economies, and each shock to demand is greeted by renewed attempts to pay down debt. But one's savings are another's "spendings." This means one person's attempt to shore up his own finances may worsen another's income. In addition, each shock puts more people on the unemployed registers, hurting the development of experience and skills in the economy. Each time the economy recovers, it does so incompletely, leaving scars of idle capacity and missed opportunities. How sustainable can growth be in a world in which small random shocks to growth will lead to large policy responses that may themselves be quickly withdrawn?

This has implications for our markets in Asia, too. Given fixed exchange rates, money supply may be more volatile and cycles in prices for goods and assets could be more abrupt. Regional policymakers will need to deal with this, and we have said before that this may mean capital controls or currency appreciation. Within markets, too, however, there will be effects as sectors that are more cyclical in nature, more sensitive to money supply or more directly affected by U.S. and European demand could see shorter, more abrupt cycles. These would include the materials and export sectors. This has been the story of the past few months, and particularly of the year to date. At the start of the year, commodity stocks were rallying sharply. Many of our Funds thus underperformed during this period as this is a sector that we have tended to invest in very lightly. The sector's inherent cyclicality coupled with the difficulty for management and businesses to add value through the cycle means that success is more about timing the commodity cycle correctly rather than identifying the best businesses to own. However, as monetary policy in Western economies tightened and governments turned their attention to cutting deficits and debt burdens, the sector promptly fell back. Our Funds, on the whole, enjoyed far better relative performance during the second quarter than they did the first.

2 MATTHEWS ASIA FUNDS

If I am correct in my analysis of the macroeconomic environment, then these abrupt cycles are likely to continue. In the face of this, how will we implement our investment philosophy? By staying true to our beliefs. I think that many people will either be sucked into trying to time these cycles or tricked into mistaking short-term volatility for the start of a long-term trend. Our technique has been to focus on the sustainability of businesses. Sustainability can be due to a company's ability to raise prices; however, such ability often stems from the nature of a firm's products or services. We prefer to see products and services bought or used repeatedly by households on a regular basis, rather than during short-term fads. We also look to management teams that are trying to steer their companies on a course of steady growth funded from cash flow, in preference over businesses that rely on external financing. These companies are likely to be able to prosper even if "normal" rates of inflation rise in the future. But they are less likely to enjoy (or suffer from) the kinds of price cycles that we have witnessed in some commodities. This means that our portfolios, whilst being less volatile in absolute terms, may exhibit more volatility in performance relative to benchmarks. We have never been overly concerned with managing short-term volatility relative to an index and we are not inclined to change now.

The companies that are likely to weather inflationary cycles are those that can better manage input costs and more easily raise output prices. There are industries that find this relatively easy to do—consumer-facing businesses with brand power; monopolistic business; those with less exposure to regulators and policymakers' price controls; and those businesses that dominate hiring in any sector of the labor market. Businesses that can manage their capital commitments and are able to drive production-related efficiencies, which raise margins and competitiveness, are far better-placed to thrive. These are just some of the things we look for in identifying businesses that can achieve through-the-cycle growth, withstand acute periods of inflation and weather the downturns. It is a strategic approach to managing the cycle using stock selection rather than a tactical approach using sector allocation.

This being our approach, one should not expect an increase in cyclical volatility or a shortening of cycles to drive higher levels of turnover in our portfolios. We are neither inclined to trade the commodity cycle, nor to change the kinds of businesses we seek. It can be frustrating at times, during such cycles, and one may be tempted to try to follow the momentum of prices. However, for us to do so would be to turn our backs on our strategy. We are not expert in second guessing policymakers (known as "Fed-watching") or forecasting market sentiment. What we do enjoy doing and where we think we have a greater chance of success is in deciding which businesses and management teams are best-suited to preserve and grow clients' capital over the long run.

It is a pleasure to continue to serve as your investment advisor.

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

matthewsasia.com | 800.789.ASIA 3

ASIA GROWTH AND INCOME STRATEGIES

PORTFOLIO MANAGERS

Robert J. Horrocks, PhD

Lead Manager

Jesper O. Madsen, CFA

Lead Manager

FUND FACTS

| | | Investor Class | | Institutional Class | |

| Ticker | | MACSX | | MICSX | |

| CUSIP | | 577130206 | | 577130842 | |

| Inception | | 9/12/94 | | 10/29/10 | |

| NAV | | $18.06 | | $18.06 | |

| Initial Investment | | $2,500 | | $3 million | |

| Gross Expense Ratio1 | | 1.13% | | 0.93% | |

Portfolio Statistics

| Total # of Positions | | 82 | |

| Net Assets | | $3.8 billion | |

| Weighted Average Market Cap | | $20.5 billion | |

| Portfolio Turnover | | 19.84%2 | |

Benchmark

MSCI AC Asia ex Japan Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Long-term capital appreciation. The Fund also seeks to provide some current income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in dividend-paying equity securities and the convertible securities, of any duration or quality, of companies located in Asia.

1 Gross expense ratio for Institutional Class is annualized. Matthews Asia Funds does not charge 12b-1 fees.

2 The lesser of fiscal year 2010 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

Matthews Asian Growth and Income Fund

Portfolio Manager Commentary

For the first half of 2011, the Matthews Asian Growth and Income Fund (Investor Class) gained 1.62% and 1.72% (Institutional Class), outperforming its benchmark, the MSCI All Country Asia ex Japan Index, which returned 1.30%. For the quarter ended June 30, the Fund rose 1.51% (Investor Class) and 1.61% (Institutional Class), while its benchmark returned 0.09%. While the quarter was a rocky one, it is notable that the Fund's relative outperformance was also marked by significantly lower volatility.

During the quarter, the portfolio's sector allocations contributed significantly to its relative performance. Holdings in the consumer staples and discretionary sectors, as well as utilities and telecommunications, were the main contributors to performance. Detractors to performance were the more cyclical sectors—which are not a focus of the Fund—such as information technology, energy and materials.

Overall, the Fund's sector exposures changed little over the quarter. We made slight adjustments to provide a better risk-reward return, with a view to increasing downside protection. We increased our allocation to an Indonesian gas utility at what were judged reasonable valuations, given a relatively high growth profile for a utility. Additionally, one of the Fund's more cyclical holdings was trimmed given its recent strong performance and focus on offshore oil drilling rigs and services. These changes were very marginal in nature compared to a more significant change in the portfolio's financials holdings. We exited the Fund's position in Hang Seng Bank in favor of a more conservative and more attractively valued Singapore-focused bank, United Overseas Bank. These changes were motivated in part by investors' excitement over the reminbi (RMB) deposit business in Hong Kong and potential long-term implications for RMB convertibility, relative to what we see as the unfavorable economics of Hong Kong banks taking RMB deposits with no profitable way to lend on that RMB.

We also initiated a position in a regional investment bank, which has been out of favor for the past 18 months. While we recognize that the bank is restructuring, we feel the balance sheet risks have decreased significantly, and we have been able to purchase shares at close to book value. In addition, the company is expected to pay a sizeable dividend of 6%, offering some valuation protection while the business seeks new growth opportunities. In other changes to the portfolio's financials holdings, we have reduced our exposure to a Hong Kong property-related convertible bond and added to a Singapore-based industrial real estate investment trust (REIT). The yield on the convertible bond is negative as it is highly equity sensitive in a market that is showing some signs of overheating; on the contrary, the REIT was added in a more reasonable market environment at a yield close to 7%.

We continue to seek securities that—due to the underlying business franchise, balance sheet, valuation or income stream��provide a degree of downside mitigation with some upside participation in the growth of the region. As we have recently noted, it has become more challenging of late to find such risk-return tradeoffs via convertible bonds. While this is in part due to a limited universe, convertible bond valuations have been a greater factor. We continue to constantly monitor the convertible bond universe for potential candidates to add to the portfolio. However, at this

(continued)

Closed to most new investors as of January 7, 2011.

4 MATTHEWS ASIA FUNDS

PERFORMANCE AS OF JUNE 30, 2011

Institutional Class Shares were first offered on October 29, 2010. Performance since that date was 4.26%. Performance for the Institutional Class shares prior to its inception is based on the performance of the Investor Class. The Institutional and Investor Classes would have substantially similar returns because the shares are invested in the same portfolio of securities and the annual returns would only differ to the extent that the classes do not have the same expenses.

| | | | | Average Annual Total Returns | |

| | | Inception Date | | 3 Months | | YTD | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since

Inception | |

| Investor Class (MACSX) | | 9/12/94 | | | 1.51 | % | | | 1.62 | % | | | 19.32 | % | | | 8.16 | % | | | 10.26 | % | | | 14.60 | % | | | 11.40 | % | |

| Institutional Class (MICSX) | | 10/29/10 | | | 1.61 | % | | | 1.72 | % | | | 19.49 | % | | | 8.21 | % | | | 10.29 | % | | | 14.62 | % | | | 11.41 | % | |

| MSCI AC Asia ex Japan Index3 | | | | | 0.09 | % | | | 1.30 | % | | | 26.03 | % | | | 8.27 | % | | | 11.81 | % | | | 14.28 | % | | | 4.50 | %4 | |

| Lipper Pacific Region Funds Category Average5 | | | | | 0.76 | % | | | -0.47 | % | | | 24.86 | % | | | 1.13 | % | | | 3.63 | % | | | 8.62 | % | | | 4.13 | %4 | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | | 2011 | | 2010 | |

| | | June | | December | | Total | | June | | December | | Total | |

| Investor Class (MACSX) | | $ | 0.27 | | | n.a | | n.a | | $ | 0.19 | | | $ | 0.28 | | | $ | 0.47 | | |

| Institutional Class (MICSX) | | $ | 0.28 | | | n.a | | n.a | | | — | | | $ | 0.29 | | | $ | 0.29 | | |

Note: This table does not include capital gains distributions. Institutional Class Shares were first offered on October 29, 2010. For income distribution history, visit matthewsasia.com.

30-DAY YIELD:

1.89% (Investor Class) 2.04% (Institutional Class)

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/11, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: BNY Mellon Investment Servicing (US) Inc.

DIVIDEND YIELD: 3.59%

The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems

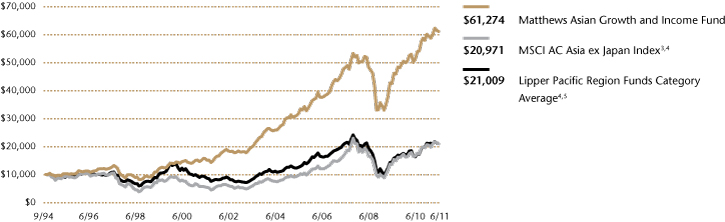

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 63 for index definition.

4 Calculated from 8/31/94.

5 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS6

| | | Country | | % of Net Assets | |

| Singapore Technologies Engineering, Ltd. | | Singapore | | | 3.5 | % | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | | 3.2 | % | |

| CLP Holdings, Ltd. | | China/Hong Kong | | | 2.9 | % | |

| Telstra Corp., Ltd. | | Australia | | | 2.9 | % | |

| Hisamitsu Pharmaceutical Co., Inc. | | Japan | | | 2.8 | % | |

| HSBC Holdings PLC | | United Kingdom | | | 2.7 | % | |

| China Petroleum & Chemical Corp. (Sinopec), Cnv., 0.000%, 04/24/2014 | | China/Hong Kong | | | 2.6 | % | |

| PTT Public Co., Ltd. | | Thailand | | | 2.6 | % | |

| Ascendas REIT | | Singapore | | | 2.4 | % | |

| AMMB Holdings BHD | | Malaysia | | | 2.3 | % | |

| % OF ASSETS IN TOP TEN | | | | | 27.9 | % | |

6 Holdings may combine more than one security from same issuer and related depositary receipts.

matthewsasia.com | 800.789.ASIA 5

COUNTRY ALLOCATION (%)7

| China/Hong Kong | | | 23.4 | | |

| Singapore | | | 16.5 | | |

| Japan | | | 9.9 | | |

| South Korea | | | 9.0 | | |

| Malaysia | | | 7.1 | | |

| India | | | 6.5 | | |

| Taiwan | | | 6.5 | | |

| Thailand | | | 5.8 | | |

| Australia | | | 5.4 | | |

| Indonesia | | | 2.8 | | |

| United Kingdom | | | 2.7 | | |

| Vietnam | | | 2.0 | | |

| Philippines | | | 1.2 | | |

Cash and Other Assets,

Less Liabilities | | | 1.2 | | |

SECTOR ALLOCATION (%)

| Financials | | | 27.5 | | |

| Telecommunication Services | | | 15.1 | | |

| Industrials | | | 12.9 | | |

| Information Technology | | | 11.4 | | |

| Consumer Discretionary | | | 8.5 | | |

| Utilities | | | 7.8 | | |

| Energy | | | 5.2 | | |

| Consumer Staples | | | 5.1 | | |

| Health Care | | | 4.6 | | |

| Materials | | | 0.7 | | |

Cash and Other Assets,

Less Liabilities | | | 1.2 | | |

MARKET CAP EXPOSURE (%)8

| Large Cap (over $5B) | | | 58.6 | | |

| Mid Cap ($1B–$5B) | | | 32.3 | | |

| Small Cap (under $1B) | | | 7.9 | | |

Cash and Other Assets,

Less Liabilities | | | 1.2 | | |

BREAKDOWN BY SECURITY TYPE (%)9

| Common Equities | | | 79.2 | | |

| Convertible Bonds | | | 14.9 | | |

| Preferred Equities | | | 3.0 | | |

| Corporate Bonds | | | 1.4 | | |

| Warrants/Rights | | | 0.3 | | |

Cash and Other Assets,

Less Liabilities | | | 1.2 | | |

7 Australia, United Kingdom and Japan are not included in the MSCI All Country Asia ex Japan Index.

8 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

9 Bonds are not included in the MSCI All Country Asia ex Japan Index.

Matthews Asian Growth and Income Fund

Portfolio Manager Commentary (continued)

point, the Fund's overall allocation to convertibles—absent better valuations and/or increased issuance—is unlikely to rise and may even decline further as some issues mature later in the year.

The other area that investors have focused on this quarter is the Chinese financial sector. It is worth restating that the Fund still remains very lightly positioned here. Despite some good dividend yields, we are avoiding altogether the Chinese banking sector as we remain skeptical about loan quality and the possibility of future capital raisings. The Fund's direct exposure to China's financial sector is largely through China Pacific Insurance, a property and casualty insurer, which has seen strong growth in the auto insurance sector and been benefiting from subdued competition from smaller competitors. During the quarter, this stock performed better than the majority of Chinese banks, and in-line with the higher-quality Chinese banks. We do, however, run the risk of underperformance relative to the benchmark should our concerns surrounding the banking sector in China prove unfounded. Nevertheless, given our understanding of the sector and how the stocks have recently behaved, we expect the portfolio to find some insulation against downside shocks. Given the long-term strategic goals we have set for the Fund, we are comfortable with that positioning. As always, we thank you for your ongoing support.

6 MATTHEWS ASIA FUNDS

Matthews Asian Growth and Income Fund June 30, 2011

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 79.2%

| | | Shares | | Value | |

| CHINA/HONG KONG: 17.4% | |

| CLP Holdings, Ltd. | | | 12,521,700 | | | $ | 111,081,039 | | |

China Pacific Insurance Group Co., Ltd.

H Shares | | | 20,355,800 | | | | 84,697,136 | | |

| Hang Lung Properties, Ltd. | | | 19,139,920 | | | | 78,696,596 | | |

Shandong Weigao Group Medical

Polymer Co., Ltd. H Shares | | | 46,680,000 | | | | 67,409,328 | | |

| Television Broadcasts, Ltd. | | | 8,897,000 | | | | 58,971,962 | | |

China Communications Services

Corp., Ltd. H Shares | | | 76,748,000 | | | | 45,444,241 | | |

| China Mobile, Ltd. ADR | | | 905,500 | | | | 42,359,290 | | |

| Vitasoy International Holdings, Ltd.† | | | 51,771,000 | | | | 41,680,009 | | |

| VTech Holdings, Ltd. | | | 3,505,300 | | | | 41,555,624 | | |

Citic Telecom International

Holdings, Ltd.† | | | 132,231,000 | | | | 36,125,587 | | |

| Cafe' de Coral Holdings, Ltd. | | | 6,726,000 | | | | 16,411,998 | | |

| Inspur International, Ltd.† | | | 286,210,000 | | | | 15,317,901 | | |

| I-CABLE Communications, Ltd.b† | | | 125,359,000 | | | | 11,921,002 | | |

| SinoCom Software Group, Ltd.† | | | 87,418,000 | | | | 8,204,915 | | |

| Total China/Hong Kong | | | | | 659,876,628 | | |

| SINGAPORE: 12.9% | |

Singapore Technologies

Engineering, Ltd. | | | 54,104,125 | | | | 132,853,619 | | |

| Ascendas REIT | | | 53,925,000 | | | | 89,691,021 | | |

| Keppel Corp., Ltd. | | | 8,415,900 | | | | 76,144,190 | | |

| United Overseas Bank, Ltd. | | | 3,590,000 | | | | 57,637,989 | | |

| Singapore Post, Ltd. | | | 38,209,000 | | | | 36,084,377 | | |

| ARA Asset Management, Ltd. | | | 28,381,100 | | | | 35,174,634 | | |

| Cerebos Pacific, Ltd. | | | 7,740,000 | | | | 31,929,847 | | |

| Hong Leong Finance, Ltd. | | | 13,650,000 | | | | 30,909,399 | | |

| Total Singapore | | | | | 490,425,076 | | |

| JAPAN: 9.9% | |

| Hisamitsu Pharmaceutical Co., Inc. | | | 2,483,600 | | | | 105,802,685 | | |

| Japan Real Estate Investment Corp., REIT | | | 8,039 | | | | 79,094,548 | | |

| Hamamatsu Photonics, K.K. | | | 1,664,700 | | | | 71,976,444 | | |

| Rohm Co., Ltd. | | | 1,229,100 | | | | 70,515,285 | | |

| Trend Micro, Inc. | | | 1,591,100 | | | | 49,431,189 | | |

| Total Japan | | | | | 376,820,151 | | |

| MALAYSIA: 6.5% | |

| AMMB Holdings BHD | | | 40,175,100 | | | | 86,765,536 | | |

| PLUS Expressways BHD | | | 44,171,359 | | | | 66,121,723 | | |

| Axiata Group BHD | | | 30,634,423 | | | | 50,908,801 | | |

| Telekom Malaysia BHD | | | 20,245,551 | | | | 26,520,673 | | |

| YTL Power International BHD | | | 25,295,218 | | | | 18,438,249 | | |

| Total Malaysia | | | | | 248,754,982 | | |

| TAIWAN: 6.5% | |

Taiwan Semiconductor

Manufacturing Co., Ltd. | | | 25,673,187 | | | | 64,703,112 | | |

Taiwan Semiconductor

Manufacturing Co., Ltd. ADR | | | 4,420,624 | | | | 55,744,069 | | |

| Chunghwa Telecom Co., Ltd. ADR | | | 1,277,525 | | | | 44,138,489 | | |

| Cathay Financial Holding Co., Ltd. | | | 22,598,902 | | | | 35,072,781 | | |

| Taiwan Hon Chuan Enterprise Co., Ltd. | | | 9,282,000 | | | | 27,985,421 | | |

| CyberLink Corp.† | | | 5,990,128 | | | | 18,091,237 | | |

| Total Taiwan | | | | | 245,735,109 | | |

| | | Shares | | Value | |

| THAILAND: 5.8% | |

| PTT Public Co., Ltd. | | | 9,111,400 | | | $ | 99,691,091 | | |

| Land & Houses Public Co., Ltd. NVDR | | | 200,090,300 | | | | 37,555,624 | | |

| Glow Energy Public Co., Ltd. | | | 21,887,400 | | | | 35,703,931 | | |

| BEC World Public Co., Ltd. | | | 30,807,800 | | | | 34,720,898 | | |

| Thai Reinsurance Public Co., Ltd. NVDR | | | 46,507,735 | | | | 10,368,690 | | |

| Thai Reinsurance Public Co., Ltd. | | | 9,336,665 | | | | 2,081,567 | | |

| Total Thailand | | | | | 220,121,801 | | |

| AUSTRALIA: 5.4% | |

| Telstra Corp., Ltd. | | | 34,977,088 | | | | 108,687,064 | | |

| Macquarie Group, Ltd. | | | 1,469,326 | | | | 49,568,258 | | |

| David Jones, Ltd. | | | 10,835,460 | | | | 47,315,090 | | |

| Total Australia | | | | | 205,570,412 | | |

| SOUTH KOREA: 5.2% | |

| S1 Corp. | | | 938,615 | | | | 48,598,058 | | |

| KT Corp. ADR | | | 2,089,505 | | | | 40,619,977 | | |

| GS Home Shopping, Inc. | | | 298,935 | | | | 38,199,979 | | |

| SK Telecom Co., Ltd. | | | 217,662 | | | | 32,875,614 | | |

| SK Telecom Co., Ltd. ADR | | | 1,534,333 | | | | 28,692,027 | | |

| Daehan City Gas Co., Ltd. | | | 368,640 | | | | 9,840,528 | | |

| Total South Korea | | | | | 198,826,183 | | |

| INDONESIA: 2.8% | |

| PT Perusahaan Gas Negara | | | 141,686,000 | | | | 66,639,561 | | |

| PT Telekomunikasi Indonesia ADR | | | 1,153,600 | | | | 39,799,200 | | |

| Total Indonesia | | | | | 106,438,761 | | |

| UNITED KINGDOM: 2.7% | |

| HSBC Holdings PLC ADR | | | 2,050,333 | | | | 101,737,523 | | |

| Total United Kingdom | | | | | 101,737,523 | | |

| VIETNAM: 2.0% | |

| Bao Viet Holdings | | | 10,333,281 | | | | 39,365,469 | | |

| Vietnam Dairy Products JSC | | | 3,861,690 | | | | 20,427,322 | | |

| Kinh Do Corp. | | | 5,165,000 | | | | 9,549,410 | | |

| FPT Corp. | | | 3,181,770 | | | | 7,411,695 | | |

| Total Vietnam | | | | | 76,753,896 | | |

| PHILIPPINES: 1.2% | |

| Globe Telecom, Inc. | | | 2,165,510 | | | | 44,735,498 | | |

| Total Philippines | | | | | 44,735,498 | | |

| INDIA: 0.9% | |

| Oriental Bank of Commerce | | | 4,603,836 | | | | 34,049,581 | | |

| Total India | | | | | 34,049,581 | | |

| TOTAL COMMON EQUITIES | | | | | 3,009,845,601 | | |

| (Cost $2,541,146,658) | | | | | |

matthewsasia.com | 800.789.ASIA 7

Matthews Asian Growth and Income Fund June 30, 2011

Schedule of Investmentsa (unaudited) (continued)

PREFERRED EQUITIES: 3.0%

| | | Shares | | Value | |

| SOUTH KOREA: 3.0% | |

| Hyundai Motor Co., Ltd., Pfd. | | | 541,280 | | | $ | 38,888,139 | | |

Samsung Fire & Marine

Insurance Co., Ltd., Pfd. | | | 515,311 | | | | 37,888,740 | | |

| Hyundai Motor Co., Ltd., 2nd Pfd. | | | 305,760 | | | | 23,641,805 | | |

| LG Household & Health Care, Ltd., Pfd. | | | 121,855 | | | | 10,880,070 | | |

| Total South Korea | | | | | 111,298,754 | | |

| TOTAL PREFERRED EQUITIES | | | | | 111,298,754 | | |

| (Cost $48,826,622) | | | | | |

WARRANTS: 0.3%

| INDIA: 0.3% | |

Housing Development Finance Corp.,

expires 08/23/12 | | | 3,875,750 | | | | 11,956,063 | | |

| Total India | | | | | 11,956,063 | | |

| TOTAL WARRANTS | | | | | 11,956,063 | | |

| (Cost $6,834,750) | | | | | |

INTERNATIONAL BONDS: 16.3%

| | | Face Amount | | | |

| CHINA/HONG KONG: 6.0% | |

China Petroleum & Chemical Corp.

(Sinopec), Cnv.

0.000%, 04/24/14 | | HKD | 676,210,000 | | | | 99,819,118 | | |

Hongkong Land CB 2005, Ltd., Cnv.

2.750%, 12/21/12 | | | 22,200,000 | | | | 41,014,500 | | |

Power Regal Group, Ltd., Cnv.

2.250%, 06/02/14 | | HKD | 234,020,000 | | | | 34,999,097 | | |

Yue Yuen Industrial Holdings, Ltd., Cnv.

0.000%, 11/17/11 | | HKD | 221,300,000 | | | | 32,242,168 | | |

PB Issuer No. 2, Ltd., Cnv.

1.750%, 04/12/16 | | | 21,820,000 | | | | 20,510,800 | | |

| Total China/Hong Kong | | | | | 228,585,683 | | |

| INDIA: 5.3% | |

Tata Power Co., Ltd., Cnv.

1.750%, 11/21/14 | | | 48,600,000 | | | | 52,852,500 | | |

Housing Development Finance Corp.

0.000%, 08/24/12 | | INR | 1,800,000,000 | | | | 45,404,172 | | |

Larsen & Toubro, Ltd., Cnv.

3.500%, 10/22/14 | | | 35,700,000 | | | | 42,536,550 | | |

Sintex Industries, Ltd., Cnv.

0.000%, 03/13/13 | | | 26,900,000 | | | | 31,338,500 | | |

Financial Technologies India, Ltd., Cnv.

0.000%, 12/21/11 | | | 20,114,000 | | | | 28,763,020 | | |

| Total India | | | | | 200,894,742 | | |

| | | Face Amount | | Value | |

| SINGAPORE: 3.6% | |

CapitaLand, Ltd., Cnv.

3.125%, 03/05/18 | | SGD | 67,000,000 | | | $ | 57,547,016 | | |

Wilmar International, Ltd., Cnv.

0.000%, 12/18/12 | | | 36,500,000 | | | | 46,601,375 | | |

Olam International, Ltd., Cnv.

6.000%, 10/15/16 | | | 24,300,000 | | | | 31,286,250 | | |

| Total Singapore | | | | | 135,434,641 | | |

| SOUTH KOREA: 0.8% | |

LG Uplus Corp., Cnv.

5.000%, 09/29/12 | | | 30,400,000 | | | | 31,692,000 | | |

| Total South Korea | | | | | 31,692,000 | | |

| MALAYSIA: 0.6% | |

Paka Capital, Ltd., Cnv.

0.000%, 03/12/13 | | | 22,300,000 | | | | 22,188,500 | | |

| Total Malaysia | | | | | 22,188,500 | | |

| TOTAL INTERNATIONAL BONDS | | | | | 618,795,566 | | |

| (Cost $583,354,038) | | | | | |

| TOTAL INVESTMENTS: 98.8% | | | | | 3,751,895,984 | | |

| (Cost $3,180,162,068c) | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 1.2% | | | | | 46,989,678 | | |

| NET ASSETS: 100.0% | | | | $ | 3,798,885,662 | | |

a Certain securities were fair valued under the discretion of the Board of Trustees (Note 2-A).

b Non-income producing security.

c Cost for federal income tax purposes is $3,184,559,782 and net unrealized appreciation consists of:

| Gross unrealized appreciation | | $ | 662,532,523 | | |

| Gross unrealized depreciation | | | (95,196,321 | ) | |

| Net unrealized appreciation | | $ | 567,336,202 | | |

† Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer)

ADR American Depositary Receipt

BHD Berhad

Cnv. Convertible

HKD Hong Kong Dollar

INR Indian Rupee

JSC Joint Stock Co.

NVDR Non-voting Depositary Receipt

Pfd. Preferred

REIT Real Estate Investment Trust

SGD Singapore Dollar

See accompanying notes to financial statements.

8 MATTHEWS ASIA FUNDS

ASIA GROWTH AND INCOME STRATEGIES

PORTFOLIO MANAGERS

Jesper O. Madsen, CFA

Lead Manager

Yu Zhang, CFA

Co-Manager

FUND FACTS

| | | Investor Class | | Institutional Class | |

| Ticker | | MAPIX | | MIPIX | |

| CUSIP | | 577125107 | | 577130750 | |

| Inception | | 10/31/06 | | 10/29/10 | |

| NAV | | $14.28 | | $14.27 | |

| Initial Investment | | $2,500 | | $3 million | |

| Gross Expense Ratio1 | | 1.14% | | 1.02% | |

After Fee Waiver,

Reimbursement and

Recoupment | | 1.15% | | n.a. | |

Portfolio Statistics

| Total # of Positions | | 75 | |

| Net Assets | | $2.6 billion | |

| Weighted Average Market Cap | | $18.9 billion | |

| Portfolio Turnover | | 10.48%2 | |

Benchmark

MSCI AC Asia Pacific Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Total return with an emphasis on providing current income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying equity securities of companies located in the Asia region.

1 Gross expense ratio for Institutional Class is annualized. The Advisor has contractually agreed to waive certain fees and reimburse certain expenses for Matthews Asia Dividend Fund. Please see page 99 for additional information. Matthews Asia Funds does not charge 12b-1 fees.

2 The lesser of fiscal year 2010 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

Matthews Asia Dividend Fund

Portfolio Manager Commentary

For the first half of 2011, the Matthews Asia Dividend Fund gained 1.20% (Investor Class) and 1.21% (Institutional Class), outperforming its benchmark, the MSCI All Country Asia Pacific Index, which declined –0.61%. For the quarter ended June 30, the Fund rose 1.60% (Investor Class) and 1.64% (Institutional Class), while its benchmark gained 0.03 %. In June, the Fund distributed a quarterly dividend of 11.32 cents per share (Investor Class) and 11.85 cents per share (Institutional Class), bringing its total year-to-date income distribution to 21.63 cents per share for the Investor Class and 22.64 cents per share for the Institutional Class.

During the past few months, investors have once again been reminded that as minority shareholders, we have to take great care in evaluating not just the growth prospects of a company, but also the integrity of management as it relates to corporate governance and financial reporting. Several companies of Chinese origin were exposed as having issues related to lapses in corporate governance, resulting in a broader sell-off in some Chinese smaller-capitalization companies.

Equity investors supply capital to companies seeking an additional source of long-term funding to supplement bank loans or bonds. In return for putting capital at risk, shareholders become the owners of the company and, as owners, should participate in the growth of the business. While this may be true in theory, competing interests among majority and minority shareholders as well as management—mixed with the asymmetry in information between insiders and outsiders—may result in minority shareholders not fully participating in the growth of the business and, therefore, not being adequately compensated for the risk taken. In Asian companies there is often a dominant majority shareholder, and management teams are often hired by or related to the majority shareholder, increasing the risk of lapses in corporate governance.

Corporate governance is one of the most challenging aspects of company analysis due to its intangible nature, but the capital lost by investing in a fraudulent company is very real and tangible. As minority investors with less-than-perfect information, it is only sensible to invest in ways that may reduce this risk. Investing in companies with track records of paying dividends is one such way. A dividend payment aligns the interests of majority and minority shareholders, since the major shareholder acknowledges the need to compensate minority shareholders in accordance with their ownership. From a financial reporting perspective, a company is more likely to have generated its reported earnings if it pays out a large proportion as dividends, and in a world of imperfect information, dividends can act as a signal of corporate governance. Of about 20 U.S.-listed reverse merger companies of Chinese origin embroiled in recent corporate governance issues, none paid a dividend. This is not to say that dividend-paying companies have not been fraudulent in the past, but history seems to indicate that it is less prevalent. The dividend payment in itself, therefore, is an important tool when assessing the strength of a company's financial reporting and corporate governance.

The Fund's Taiwanese holdings were the main contributors to performance during the first half of 2011. This was mainly a result of strong performance by Taiwan Hon Chuan Enterprise, a packaging and bottling company servicing the beverage industry in China and the rest of Asia. The company has been leveraging its dominant market share in Taiwan to

(continued)

matthewsasia.com | 800.789.ASIA 9

PERFORMANCE AS OF JUNE 30, 2011

Institutional Class Shares were first offered on October 29, 2010. Performance since that date was 4.19%. Performance for the Institutional Class shares prior to its inception is based on the performance of the Investor Class. The Institutional and Investor Classes would have substantially similar returns because the shares are invested in the same portfolio of securities and the annual returns would only differ to the extent that the classes do not have the same expenses.

| | | | | | | | | | | Average Annual Total Returns | |

| | | Inception Date | | 3 Months | | YTD | | 1 Year | | 3 Years | | Since

Inception | |

| Investor Class (MAPIX) | | 10/31/06 | | | 1.60 | % | | | 1.20 | % | | | 18.60 | % | | | 12.52 | % | | | 12.48 | % | |

| Institutional Class (MIPIX) | | 10/29/10 | | | 1.64 | % | | | 1.21 | % | | | 18.64 | % | | | 12.54 | % | | | 12.48 | % | |

| MSCI AC Asia Pacific Index3 | | | | | 0.03 | % | | | -0.61 | % | | | 22.89 | % | | | 2.22 | % | | | 2.94 | % | |

| Lipper Pacific Region Funds Category Average4 | | | | | 0.76 | % | | | -0.47 | % | | | 24.86 | % | | | 1.13 | % | | | 3.01 | % | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | | 2011 | | 2010 | |

| | | Q1 | | Q2 | | Q3 | | Q4 | | Total | | Q1 | | Q2 | | Q3 | | Q4 | | Total | |

| Investor Class (MAPIX) | | $ | 0.10 | | | $ | 0.11 | | | n.a | | n.a | | n.a | | $ | 0.05 | | | $ | 0.08 | | | $ | 0.11 | | | $ | 0.17 | | | $ | 0.41 | | |

| Institutional Class (MIPIX) | | $ | 0.11 | | | $ | 0.12 | | | n.a | | n.a | | n.a | | | — | | | | — | | | | — | | | $ | 0.17 | | | $ | 0.17 | | |

Note: This table does not include capital gains distributions. Institutional Class Shares were first offered on October 29, 2010. For income distribution history, visit matthewsasia.com.

30-DAY YIELD:

3.21% (Investor Class) 3.38% (Institutional Class)

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/2011, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: BNY Mellon Investment Servicing (US) Inc.

DIVIDEND YIELD: 4.31%

The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems.

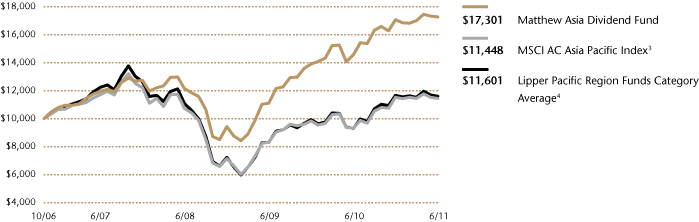

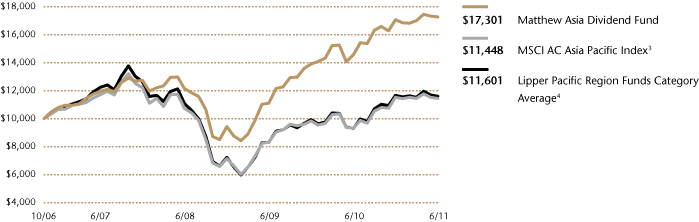

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 63 for index definition.

4 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS5

| | | Country | | % of Net Assets | |

| Metcash, Ltd. | | Australia | | | 3.6 | % | |

| HSBC Holdings PLC | | United Kingdom | | | 3.0 | % | |

| China Mobile, Ltd. | | China/Hong Kong | | | 2.8 | % | |

| SK Telecom Co., Ltd. | | South Korea | | | 2.7 | % | |

| ITOCHU Corp. | | Japan | | | 2.7 | % | |

| Japan Tobacco, Inc. | | Japan | | | 2.6 | % | |

| Cheung Kong Infrastructure Holdings, Ltd. | | China/Hong Kong | | | 2.6 | % | |

| KT&G Corp. | | South Korea | | | 2.6 | % | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | | 2.5 | % | |

| PT Perusahaan Gas Negara | | Indonesia | | | 2.5 | % | |

| % OF ASSETS IN TOP TEN | | | | | 27.6 | % | |

5 Holdings may combine more than one security from same issuer and related depositary receipts.

10 MATTHEWS ASIA FUNDS

Matthews Asia Dividend Fund

Portfolio Manager Commentary (continued)

expand its beverage packaging business in mainland China. The firm's customer base spans the major international beverage companies as well as leading domestic brands. After investing in establishing its bottling/manufacturing infrastructure on the mainland, Taiwan Hon Chuan is at the stage where it can accelerate its China expansion and improve the profitability of its operations. We believe the company is well-positioned to capture the long-term growth of beverage consumption in China, which will enable the company in turn to grow its dividends over time.

Esprit Holdings, a Hong Kong-based mid-end fashion retailer, detracted most from performance year-to-date. The underperformance became particularly pronounced during the second quarter as worries over the future of the euro and financial health of Europe in general escalated. While the company's focus has been on building out its Chinese retail footprint, it still relies on Europe for about 80% of sales. This dependency on European sales, alongside an ongoing restructuring of the business, has resulted in investors taking a dim view of the stock. As a result the share price is at levels last seen in early 2004, even though the company generated twice the earnings in 2010 compared to 2004. We continue to be invested with Esprit under the premise it will achieve further traction in China, while reinvigorating its brand and restructuring its European business.

The first half of 2011 has been a tumultuous one, ranging from natural disasters, political uprisings, concerns over debt in the U.S. and Europe and ongoing concerns of both inflationary pressures and the possibility of a severe slowdown in China's economic growth. In such a world, it seems prudent as long-term investors to decrease the risk to long-term total returns by receiving a portion of returns via dividends.

There is no guarantee that a company will pay or continue to increase dividends.

COUNTRY ALLOCATION (%)6

| China/Hong Kong | | | 26.3 | | |

| Japan | | | 21.1 | | |

| Australia | | | 10.2 | | |

| Taiwan | | | 9.9 | | |

| South Korea | | | 8.8 | | |

| Thailand | | | 6.6 | | |

| Singapore | | | 5.3 | | |

| Indonesia | | | 4.1 | | |

| United Kingdom | | | 3.0 | | |

| Philippines | | | 1.4 | | |

| Malaysia | | | 0.3 | | |

Cash and Other Assets,

Less Liabilities | | | 3.0 | | |

SECTOR ALLOCATION (%)

| Consumer Discretionary | | | 18.9 | | |

| Consumer Staples | | | 18.3 | | |

| Financials | | | 16.9 | | |

| Telecommunication Services | | | 10.7 | | |

| Information Technology | | | 7.5 | | |

| Utilities | | | 7.1 | | |

| Health Care | | | 6.2 | | |

| Industrials | | | 6.1 | | |

| Energy | | | 3.3 | | |

| Materials | | | 2.0 | | |

Cash and Other Assets,

Less Liabilities | | | 3.0 | | |

MARKET CAP EXPOSURE (%)7

| Large Cap (over $5B) | | | 41.6 | | |

| Mid Cap ($1B–$5B) | | | 32.4 | | |

| Small Cap (under $1B) | | | 23.0 | | |

Cash and Other Assets,

Less Liabilities | | | 3.0 | | |

6 The United Kingdom is not included in the MSCI All Country Asia Pacific Index.

7 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

matthewsasia.com | 800.789.ASIA 11

Matthews Asia Dividend Fund June 30, 2011

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 96.8%

| | | Shares | | Value | |

| CHINA/HONG KONG: 26.3% | |

| China Mobile, Ltd. ADR | | | 1,563,300 | | | $ | 73,131,174 | | |

Cheung Kong Infrastructure

Holdings, Ltd. | | | 12,768,000 | | | | 66,427,549 | | |

Shenzhou International Group

Holdings, Ltd. | | | 38,832,000 | | | | 52,960,367 | | |

| Television Broadcasts, Ltd. | | | 7,454,000 | | | | 49,407,329 | | |

| Esprit Holdings, Ltd. | | | 14,106,700 | | | | 44,076,437 | | |

| China Fishery Group, Ltd. | | | 30,643,000 | | | | 42,991,882 | | |

| Li Ning Co., Ltd. | | | 23,710,500 | | | | 41,141,205 | | |

| Cafe' de Coral Holdings, Ltd. | | | 16,350,000 | | | | 39,895,357 | | |

| Guangdong Investment, Ltd. | | | 73,798,000 | | | | 39,508,432 | | |

| Kingboard Laminates Holdings, Ltd. | | | 45,763,000 | | | | 36,019,545 | | |

| The Link REIT | | | 10,420,000 | | | | 35,594,589 | | |

| Yuexiu Transport Infrastructure, Ltd. | | | 59,564,000 | | | | 30,325,261 | | |

| Minth Group, Ltd. | | | 18,187,000 | | | | 29,490,336 | | |

| Sichuan Expressway Co., Ltd. H Shares† | | | 56,404,000 | | | | 29,184,926 | | |

| Jiangsu Expressway Co., Ltd. H Shares | | | 31,444,000 | | | | 29,108,872 | | |

| Yip's Chemical Holdings, Ltd. | | | 14,912,000 | | | | 17,279,226 | | |

China Communications Services

Corp., Ltd. H Shares | | | 28,242,000 | | | | 16,722,732 | | |

| VTech Holdings, Ltd. | | | 557,000 | | | | 6,603,281 | | |

| Total China/Hong Kong | | | | | 679,868,500 | | |

| JAPAN: 20.9% | |

| ITOCHU Corp. | | | 6,663,000 | | | | 69,300,892 | | |

| Japan Tobacco, Inc. | | | 17,300 | | | | 66,779,250 | | |

| ORIX Corp. | | | 643,140 | | | | 62,559,392 | | |

| Point, Inc. | | | 1,048,080 | | | | 45,642,351 | | |

| Pigeon Corp.† | | | 1,319,300 | | | | 43,364,000 | | |

| Hisamitsu Pharmaceutical Co., Inc. | | | 1,014,200 | | | | 43,205,461 | | |

| Lawson, Inc. | | | 728,100 | | | | 38,196,849 | | |

| EPS Co., Ltd.† | | | 14,556 | | | | 34,384,017 | | |

| Shinko Plantech Co., Ltd.† | | | 2,555,600 | | | | 27,623,376 | | |

| Monex Group, Inc. | | | 134,059 | | | | 26,745,764 | | |

| Miraca Holdings, Inc. | | | 618,200 | | | | 25,047,385 | | |

| Ship Healthcare Holdings, Inc. | | | 1,285,300 | | | | 23,742,039 | | |

| Hokuto Corp. | | | 972,500 | | | | 21,342,684 | | |

| Nintendo Co., Ltd. | | | 60,400 | | | | 11,342,411 | | |

| Total Japan | | | | | 539,275,871 | | |

| AUSTRALIA: 10.2% | |

| Metcash, Ltd. | | | 20,663,162 | | | | 92,215,525 | | |

| QBE Insurance Group, Ltd. | | | 3,385,000 | | | | 62,825,520 | | |

| Billabong International, Ltd. | | | 6,027,540 | | | | 39,055,981 | | |

| David Jones, Ltd. | | | 8,840,000 | | | | 38,601,536 | | |

| Coca-Cola Amatil, Ltd. | | | 2,404,730 | | | | 29,505,712 | | |

| Total Australia | | | | | 262,204,274 | | |

| | | Shares | | Value | |

| TAIWAN: 9.9% | |

Taiwan Semiconductor

Manufacturing Co., Ltd. ADR | | | 4,005,040 | | | $ | 50,503,554 | | |

| Chunghwa Telecom Co., Ltd. ADR | | | 1,285,701 | | | | 44,420,970 | | |

| TXC Corp.† | | | 21,127,000 | | | | 37,038,106 | | |

| Taiwan Hon Chuan Enterprise Co., Ltd. | | | 11,392,000 | | | | 34,347,114 | | |

| HTC Corp. | | | 764,400 | | | | 25,845,305 | | |

| St. Shine Optical Co., Ltd. | | | 1,611,000 | | | | 24,476,028 | | |

Taiwan Semiconductor

Manufacturing Co., Ltd. | | | 5,346,469 | | | | 13,474,493 | | |

| CyberLink Corp. | | | 4,313,513 | | | | 13,027,566 | | |

| Johnson Health Tech Co., Ltd. | | | 3,345,000 | | | | 7,939,953 | | |

| Chunghwa Telecom Co., Ltd. | | | 1,122,964 | | | | 3,864,254 | | |

| Total Taiwan | | | | | 254,937,343 | | |

| SOUTH KOREA: 8.8% | |

| KT&G Corp. | | | 1,067,000 | | | | 66,359,575 | | |

| SK Telecom Co., Ltd. | | | 274,414 | | | | 41,447,422 | | |

| Woongjin Thinkbig Co., Ltd.† | | | 2,079,870 | | | | 31,905,839 | | |

| MegaStudy Co., Ltd. | | | 232,984 | | | | 31,341,517 | | |

| Grand Korea Leisure Co., Ltd. | | | 1,533,580 | | | | 29,164,775 | | |

| SK Telecom Co., Ltd. ADR | | | 1,513,250 | | | | 28,297,775 | | |

| Total South Korea | | | | | 228,516,903 | | |

| THAILAND: 6.6% | |

PTT Exploration & Production

Public Co., Ltd. | | | 10,385,000 | | | | 57,999,291 | | |

| Thai Beverage Public Co., Ltd. | | | 210,795,000 | | | | 47,193,161 | | |

| Tisco Financial Group Public Co., Ltd. | | | 26,675,782 | | | | 32,700,470 | | |

| Glow Energy Public Co., Ltd. | | | 7,783,800 | | | | 12,697,363 | | |

| LPN Development Public Co., Ltd. | | | 33,126,300 | | | | 10,325,283 | | |

| Land & Houses Public Co., Ltd. NVDR | | | 38,358,200 | | | | 7,199,580 | | |

| Land & Houses Public Co., Ltd. | | | 10,267,400 | | | | 1,927,123 | | |

Tisco Financial Group

Public Co., Ltd. NVDR | | | 1,424,218 | | | | 1,745,876 | | |

| Total Thailand | | | | | 171,788,147 | | |

| SINGAPORE: 5.3% | |

| CapitaRetail China Trust, REIT† | | | 38,971,000 | | | | 38,760,138 | | |

| Ascendas India Trust† | | | 46,280,000 | | | | 35,816,342 | | |

| ARA Asset Management, Ltd. | | | 25,405,600 | | | | 31,486,894 | | |

| Super Group, Ltd. | | | 19,951,000 | | | | 23,280,038 | | |

| Parkway Life REIT | | | 4,695,868 | | | | 7,041,042 | | |

| Total Singapore | | | | | 136,384,454 | | |

| INDONESIA: 4.1% | |

| PT Perusahaan Gas Negara | | | 134,802,000 | | | | 63,401,791 | | |

| PT Telekomunikasi Indonesia ADR | | | 717,634 | | | | 24,758,373 | | |

| PT Telekomunikasi Indonesia | | | 11,036,500 | | | | 9,503,616 | | |

| PT Ramayana Lestari Sentosa | | | 87,700,000 | | | | 7,988,338 | | |

| Total Indonesia | | | | | 105,652,118 | | |

12 MATTHEWS ASIA FUNDS

Matthews Asia Dividend Fund June 30, 2011

Schedule of Investmentsa (unaudited) (continued)

COMMON EQUITIES (continued)

| | | Shares | | Value | |

| UNITED KINGDOM: 3.0% | |

| HSBC Holdings PLC ADR | | | 1,503,791 | | | $ | 74,618,110 | | |

| HSBC Holdings PLC | | | 256,133 | | | | 2,547,215 | | |

| Total United Kingdom | | | | | 77,165,325 | | |

| PHILIPPINES: 1.4% | |

| Globe Telecom, Inc. | | | 1,703,820 | | | | 35,197,822 | | |

| Total Philippines | | | | | 35,197,822 | | |

| MALAYSIA: 0.3% | |

| Top Glove Corp. BHD | | | 4,891,400 | | | | 8,512,753 | | |

| Total Malaysia | | | | | 8,512,753 | | |

| TOTAL COMMON EQUITIES | | | | | 2,499,503,510 | | |

| (Cost $2,332,527,227) | | | | | | | |

INTERNATIONAL BONDS: 0.2%

| | | Face Amount | | | |

| JAPAN: 0.2% | |

ORIX Corp., Cnv.

1.000%, 03/31/14 | | JPY | 310,000,000 | | | | 4,794,112 | | |

| Total Japan | | | | | 4,794,112 | | |

| TOTAL INTERNATIONAL BONDS | | | | | 4,794,112 | | |

| (Cost $3,378,882) | | | | | |

| TOTAL INVESTMENTS: 97.0% | | | | | 2,504,297,622 | | |

| (Cost $2,335,906,109b) | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 3.0% | | | | | 77,800,546 | | |

| NET ASSETS: 100.0% | | | | $ | 2,582,098,168 | | |

a Certain securities were fair valued under the discretion of the Board of Trustees (Note 2-A).

b Cost for federal income tax purposes is $2,337,113,197 and net unrealized appreciation consists of:

| Gross unrealized appreciation | | $ | 289,125,587 | | |

| Gross unrealized depreciation | | | (121,941,162 | ) | |

| Net unrealized appreciation | | $ | 167,184,425 | | |

† Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer)

ADR American Depositary Receipt

BHD Berhad

Cnv. Convertible

JPY Japanese Yen

NVDR Non-voting Depositary Receipt

REIT Real Estate Investment Trust

See accompanying notes to financial statements.

matthewsasia.com | 800.789.ASIA 13

ASIA GROWTH AND INCOME STRATEGIES

PORTFOLIO MANAGERS

Jesper O. Madsen, CFA

Lead Manager

Richard H. Gao

Co-Manager

FUND FACTS

| | | Investor Class | | Institutional Class | |

| Ticker | | MCDFX | | MICDX | |

| CUSIP | | 577125305 | | 577130735 | |

| Inception | | 11/30/09 | | 10/29/10 | |

| NAV | | $12.22 | | $12.21 | |

| Initial Investment | | $2,500 | | $3 million | |

| Gross Expense Ratio1 | | 1.95% | | 1.24% | |

After Fee Waiver,

Reimbursement and

Recoupment | | 1.50% | | n.a. | |

Portfolio Statistics

| Total # of Positions | | 40 | |

| Net Assets | | $43.8 million | |

| Weighted Average Market Cap | | $27.4 billion | |

| Portfolio Turnover | | 6.84%2 | |

Benchmark

MSCI China Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Total return with an emphasis on providing current income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying equity securities of companies located in China and Taiwan. China includes its administrative and other districts, such as Hong Kong.

1 Gross expense ratio for Institutional Class is annualized. The Advisor has contractually agreed to waive certain fees and reimburse certain expenses for Matthews China Dividend Fund. Please see page 99 for additional information. Matthews Asia Funds does not charge 12b-1 fees.

2 The lesser of fiscal year 2010 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

Matthews China Dividend Fund

Portfolio Manager Commentary

For the first half of 2011, the Matthews China Dividend Fund gained 1.68% (Investor Class) and 1.74% (Institutional Class), while its benchmark, the MSCI China Index, rose 1.09%. For the quarter ended June 30, the Fund gained 2.77% (Investor Class) and 2.76% (Institutional Class), and the benchmark declined –1.75%. In June, the Fund distributed a semi-annual dividend of 14.94 cents per share for the Investor Class and 16.71 cents per share for the Institutional Class.

Investors have over the years been attracted to Chinese companies because of their potential for faster earnings growth. While many Chinese companies are led by capable management teams that have delivered impressive rates of growth, there have been some that are but "stories," with little real substance. During the first half of 2011, issues related to corporate governance of certain companies were added to existing worries over the country's inflation and tightening measures implemented by the central government.

Corporate governance is one of the most challenging aspects of company analysis due to its intangible nature. However, the capital-destroying outcome of investing in companies with corporate governance issues is very tangible. Over the past few months, there were about 20 Chinese companies listed in the U.S. via reverse mergers that became embroiled in corporate governance-related issues connected to the quality of financial reporting—often ending with their delisting. In a reverse merger, a privately held firm acquires and merges with a company that is already listed. By doing so, the private company can forego the time consuming and expensive listing process. Unfortunately, they will also not be put under the scrutiny required by an initial public offering. From 2005 to 2007, many small Chinese companies underwent reverse mergers as investors clamored for exposure to China, with little regard for the quality of the underlying business. The Fund did not own any of the companies implicated in the recent issues.

Minority investors will always have less-than-perfect information. However, bottom-up analysis and investing with dividend-paying companies can improve the overall level of corporate governance of portfolio holdings. The dividend payment aligns majority shareholders with minority shareholders, since the major shareholder acknowledges the need to compensate minorities in accordance with their ownership. From a financial reporting perspective, a company is more likely to have generated the reported earnings if it pays out a significant proportion as dividends. Of the about 20 U.S.-listed reverse merger companies of Chinese origin mentioned above, none paid a dividend. While dividend-paying companies can also be fraudulent, history indicates that it is less prevalent. The dividend payment in itself, therefore, is an important tool when assessing the strength of a company's financial reporting and corporate governance.

Taiwanese companies were the main contributors to performance during the first half of 2011, mainly due to Taiwan Hon Chuan Enterprise, a packaging and bottling company servicing the beverage industry in China and the rest of Asia, and Johnson Health Tech, a manufacturer of gym equipment. Another contributor was Shenzhou International, China's largest vertically integrated knitwear manufacturer. Like other export-oriented companies in China, Shenzhou is facing headwinds from increasing labor costs, an appreciating currency and rising raw material costs. To combat those issues and

(continued)

14 MATTHEWS ASIA FUNDS

PERFORMANCE AS OF JUNE 30, 2011

Institutional Class Shares were first offered on October 29, 2010. Performance since that date was 5.72%. Performance for the Institutional Class shares prior to its inception is based on the performance of the Investor Class. The Institutional and Investor Classes would have substantially similar returns because the shares are invested in the same portfolio of securities and the annual returns would only differ to the extent that the classes do not have the same expenses.

| | | | | | | | | Average Annual

Total Returns | |

| | | Inception Date | | 3 Months | | YTD | | 1 Year | | Since

Inception | |

| Investor Class (MCDFX) | | 11/30/09 | | | 2.77 | % | | | 1.68 | % | | | 22.67 | % | | | 16.23 | % | |

| Institutional Class (MICDX) | | 10/29/10 | | | 2.76 | % | | | 1.74 | % | | | 22.79 | % | | | 16.30 | % | |

| MSCI China Index3 | | | | | | | -1.75 | % | | | 1.09 | % | | | 12.72 | % | | | 4.04 | % | |

| Lipper China Region Funds Category Average4 | | | | | | | -2.23 | % | | | -2.84 | % | | | 20.57 | % | | | 7.92 | % | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | | 2011 | | 2010 | |

| | | June | | December | | Total | | June | | December | | Total | |

| Investor Class (MCDFX) | | $ | 0.15 | | | n.a | | n.a | | $ | 0.12 | | | $ | 0.12 | | | $ | 0.24 | | |

| Institutional Class (MICDX) | | $ | 0.17 | | | n.a | | n.a | | | — | | | $ | 0.13 | | | $ | 0.13 | | |

Note: This table does not include capital gains distributions. Institutional Class Shares were first offered on October 29, 2010. For income distribution history, visit matthewsasia.com.

30-DAY YIELD:

2.62% (Investor Class) 2.39% (Institutional Class)

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/11, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: BNY Mellon Investment Servicing (US) Inc.

DIVIDEND YIELD: 4.56%

The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems.

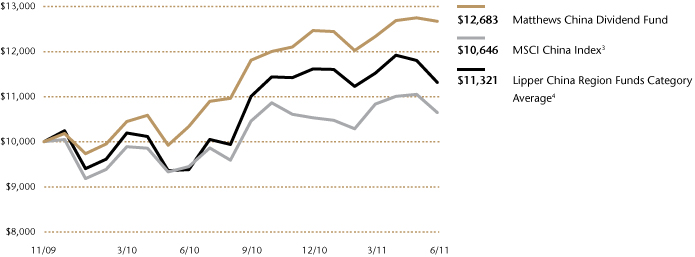

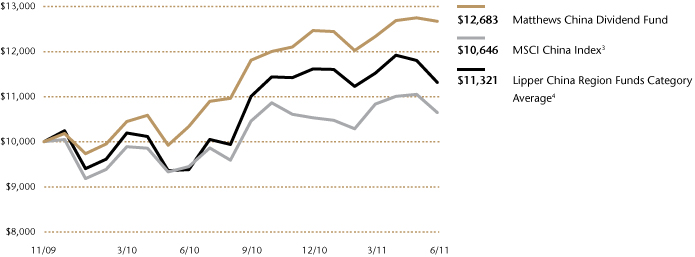

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data does not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 63 for index definition.

4 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS5

| | | Sector | | % of Net Assets | |

| China Mobile, Ltd. | | Telecommunication Services | | | 4.7 | % | |

| Cheung Kong Infrastructure Holdings, Ltd. | | Utilities | | | 4.5 | % | |

| Chunghwa Telecom Co., Ltd. | | Telecommunication Services | | | 4.4 | % | |

| The Link REIT | | Financials | | | 4.3 | % | |

| Guangdong Investment, Ltd. | | Utilities | | | 3.8 | % | |

| Shenzhou International Group Holdings, Ltd. | | Consumer Discretionary | | | 3.8 | % | |

| HSBC Holdings PLC | | Financials | | | 3.7 | % | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Information Technology | | | 3.6 | % | |

| Taiwan Hon Chuan Enterprise Co., Ltd. | | Materials | | | 3.4 | % | |

| Television Broadcasts, Ltd. | | Consumer Discretionary | | | 3.4 | % | |

| % OF ASSETS IN TOP TEN | | | | | 39.6 | % | |

5 Holdings may combine more than one security from same issuer and related depositary receipts.

matthewsasia.com | 800.789.ASIA 15

SECTOR ALLOCATION (%)

| Consumer Discretionary | | | 21.7 | | |

| Financials | | | 18.3 | | |

| Information Technology | | | 12.4 | | |

| Utilities | | | 10.8 | | |

| Telecommunication Services | | | 9.1 | | |

| Industrials | | | 8.1 | | |

| Materials | | | 6.0 | | |

| Energy | | | 5.2 | | |

| Consumer Staples | | | 4.1 | | |

| Health Care | | | 2.9 | | |

Cash and Other Assets,

Less Liabilities | | | 1.4 | | |

MARKET CAP EXPOSURE (%)6

| Large Cap (over $5B) | | | 41.9 | | |

| Mid Cap ($1B–$5B) | | | 34.5 | | |

| Small Cap (under $1B) | | | 22.2 | | |

Cash and Other Assets,

Less Liabilities | | | 1.4 | | |

6 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

Matthews China Dividend Fund

Portfolio Manager Commentary (continued)

maintain its growth, the company has pursued a diversification strategy, emphasizing higher-margin products and, importantly, is expanding its relationship with Chinese apparel brand owners. Additionally, increased automation and a relocation of its production base have helped the company mitigate labor cost pressure. However, the long-term rational for our investment is the firm's goal of increasing its sales in China, both by making products for Chinese brand owners, and eventually under its own brand.

The Fund's expressway businesses all faced challenges during the second quarter and, as a group, were the main detractors to performance year-to-date as investors feared the central government would implement universal tariff reductions. We continue to be invested in expressways on the premise that the owners of expressway assets will stand to benefit from increased car ownership and improved affordability as wages grow over time. Furthermore, these assets can be bought at a significantly higher dividend yield than other consumer-related equities. The Fund is invested in three expressways in various parts of China in an effort to diversify any specific risk facing each individual expressway.

Investing by definition entails taking risk. Due to the relative stability of dividend payments, a dividend-focused strategy may be a sensible way for long-term investors to obtain a substantial component of their long-term total return, which is comprised of income and capital appreciation, with relatively lower risk. Furthermore, being invested with dividend-paying companies may help navigate around some corporate governance pitfalls.

There is no guarantee that a company will pay or continue to increase dividends.

16 MATTHEWS ASIA FUNDS

Matthews China Dividend Fund June 30, 2011

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 96.8%