UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08510 |

|

Matthews International Funds |

(Exact name of registrant as specified in charter) |

|

Four Embarcadero Center, Suite 550

San Francisco, CA 94111 |

(Address of principal executive offices) (Zip code) |

|

William J. Hackett, President Four Embarcadero Center, Suite 550 San Francisco, CA 94111 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 415-788-6036 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2009 | |

| | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Semi-Annual Report

June 30, 2009 | matthewsasia.com

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Pacific Equity Income Fund

ASIA GROWTH STRATEGIES

Matthews Asia Pacific Fund

Matthews Pacific Tiger Fund

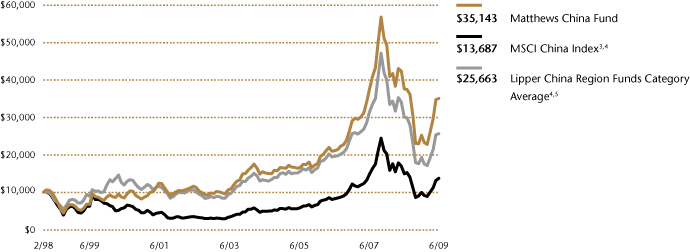

Matthews China Fund

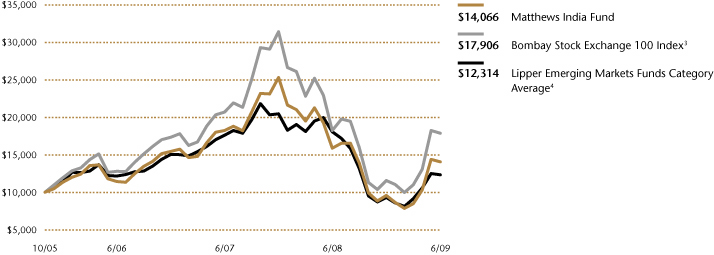

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA SMALL COMPANY STRATEGY

Matthews Asia Small Companies Fund

ASIA SPECIALTY STRATEGY

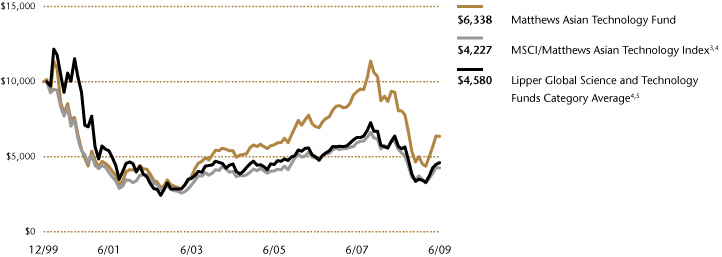

Matthews Asian Technology Fund

Performance and Expenses

Through June 30, 2009

| | | Average Annual Total Returns | | | | 2008 Gross

Annual | |

| | | 1 year | | 5 years | | 10 years | | Since

Inception | | Inception

Date | | Operating

Expenses | |

| ASIA GROWTH AND INCOME STRATEGIES | |

| Matthews Asian Growth and Income Fund | | | -11.99 | % | | | 10.43 | % | | | 13.53 | % | | | 10.29 | % | | 9/12/94 | | | 1.16 | % | |

| Matthews Asia Pacific Equity Income Fund | | | -8.51 | % | | | n.a. | | | | n.a. | | | | 4.03 | % | | 10/31/06 | | | 1.35 | % | |

| After Contractual Fee Waiver | | | | | | | | | | | | | | | | | | | | | 1.32 | %1 | |

| ASIA GROWTH STRATEGIES | |

| Matthews Asia Pacific Fund | | | -10.44 | % | | | 6.31 | % | | | n.a. | | | | 7.34 | % | | 10/31/03 | | | 1.23 | % | |

| Matthews Pacific Tiger Fund | | | -8.26 | % | | | 13.87 | % | | | 10.29 | % | | | 7.67 | % | | 9/12/94 | | | 1.12 | % | |

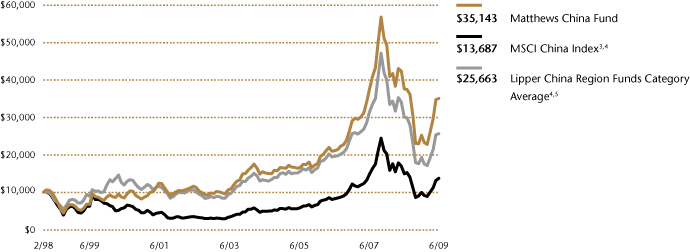

| Matthews China Fund | | | -6.61 | % | | | 18.41 | % | | | 13.84 | % | | | 11.70 | % | | 2/19/98 | | | 1.23 | % | |

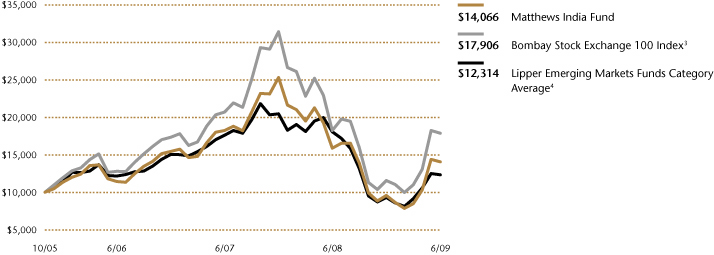

| Matthews India Fund | | | -11.45 | % | | | n.a. | | | | n.a. | | | | 9.76 | % | | 10/31/05 | | | 1.29 | % | |

| Matthews Japan Fund | | | -21.77 | % | | | -6.63 | % | | | -3.80 | % | | | 2.44 | % | | 12/31/98 | | | 1.23 | % | |

| Matthews Korea Fund | | | -26.07 | % | | | 7.56 | % | | | 6.78 | % | | | 2.71 | % | | 1/3/95 | | | 1.27 | % | |

| ASIA SMALL COMPANY STRATEGY | |

| Matthews Asia Small Companies Fund | | | n.a. | | | | n.a. | | | | n.a. | | | | 16.25 | %2 | | 9/15/08 | | | 14.31 | %3 | |

| After Contractual Fee Waiver | | | | | | | | | | | | | | | | | | | | | 2.00 | %3 | |

| ASIA SPECIALTY STRATEGY | |

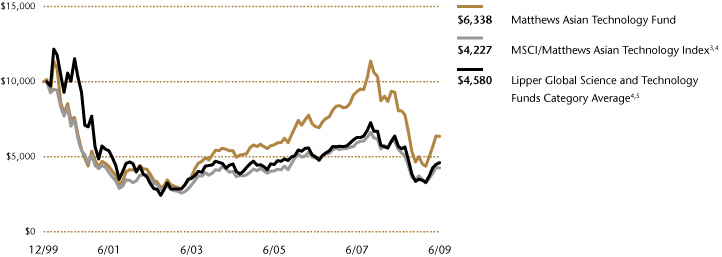

| Matthews Asian Technology Fund | | | -21.47 | % | | | 3.30 | % | | | n.a. | | | | -4.68 | % | | 12/27/99 | | | 1.33 | % | |

1 The Advisor has contractually agreed to waive certain fees and reimburse certain expenses for Matthews Asia Pacific Equity Income Fund. Please see page 81 for additional information.

2 Actual Return, Not Annualized.

3 The Advisor has contractually agreed to waive Matthews Asia Small Companies Fund's fees and reimburse expenses until August 31, 2010 to the extent needed to limit total annual operating expenses to 2.00%.

Investor Disclosure

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds' fees and expenses had not been waived, returns would have been lower. For the Funds' most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds' prospectus and Statement of Additional Information for more risk disclosure.

Redemption Fee Policy

The Funds assess a redemption fee of 2.00% on the total redemption proceeds on most sales or exchanges of shares that take place within 90 calendar days after their purchase as part of the Funds' efforts to discourage market timing activity. This fee is payable directly to the Funds. For purposes of determining whether the redemption fee applies, the shares that have been held longest will be redeemed first. The Funds may grant exemptions from the redemption fee in certain circumstances. For more information on this policy, please see the Funds' prospectus.

Cover photo: River by the Esplanade, Singapore

Contents

| Message to Shareholders | | | 2 | | |

|

| Manager Commentaries, Fund Characteristics and Schedules of Investments: | |

|

| ASIA GROWTH AND INCOME STRATEGIES | |

|

| Matthews Asian Growth and Income Fund | | | 6 | | |

|

| Matthews Asia Pacific Equity Income Fund | | | 11 | | |

|

| ASIA GROWTH STRATEGIES | |

|

| Matthews Asia Pacific Fund | | | 16 | | |

|

| Matthews Pacific Tiger Fund | | | 21 | | |

|

| Matthews China Fund | | | 26 | | |

|

| Matthews India Fund | | | 31 | | |

|

| Matthews Japan Fund | | | 36 | | |

|

| Matthews Korea Fund | | | 41 | | |

|

| ASIA SMALL COMPANY STRATEGY | |

|

| Matthews Asia Small Companies Fund | | | 46 | | |

|

| ASIA SPECIALTY STRATEGY | |

|

| Matthews Asian Technology Fund | | | 50 | | |

|

| Disclosure of Fund Expenses | | | 54 | | |

|

| Statements of Assets and Liabilities | | | 56 | | |

|

| Statements of Operations | | | 58 | | |

|

| Statements of Changes in Net Assets | | | 60 | | |

|

| Financial Highlights | | | 65 | | |

|

| Notes to Financial Statements | | | 75 | | |

|

| Disclosures and Index Definitions | | | 84 | | |

|

| Trustees and Officers of the Funds | | | 85 | | |

|

This report has been prepared for Matthews Asia Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds' investment objectives, risks and expenses. Additional copies of the prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of June 30, 2009. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund's future investment intent.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Matthews Asia Funds are distributed by:

PFPC Distributors, Inc. | 760 Moore Road | King of Prussia, PA 19406

"To deal with uncertainty, it is useful to focus on one fixed point. For us, it is our confidence in the secular growth of the Asian household..."

Message to Shareholders

from the Investment Advisor

Dear Fellow Shareholders,

To some investors it may appear that everything is back to normal. Long-term treasuries are yielding pretty much what they did before the crisis. Credit spreads on investment grade corporate debt are back to pre-Lehman levels. Core inflation is back down to the 2% level that is assumed to be the U.S. Federal Reserve's target. The Fed Funds rate is still close to zero, but conditions in the interbank money markets have improved and futures markets are anticipating an "exit strategy" from extreme monetary policy measures. Equity markets, too, are trading close to long-term average valuations.

However, the normality in the financial markets hides much of the uncertainty in the real global economy. Unemployment in the U.S. and Europe is high and rising. Financial systems in the West have stabilized but borrowing and lending are subdued and their stimulus programs are finding it hard to gain traction. China's economy is growing quickly again but investors worry about non-performing loans and the loss of the U.S. export market and what, if anything, might replace it. Fears of protectionism and changing political relationships cloud the horizon.

Amid the recovery in capital markets that took place in the first half of 2009, the Matthews Asia Funds have on the whole performed well, but did not fully participate in the acute rally in the most risky and distressed securities. Our Funds tend not to hold large positions in such equities as we try to avoid the allure and risks of short-term returns and cyclical stocks. Rather, we seek companies that we believe will benefit from the long-term economic evolution of the region.

One Fixed Point

To deal with uncertainty, it is useful to focus on one fixed point. For us, it is our confidence in the secular growth of the Asian household—in terms of both its rising average wealth and increasing sophistication. Incomes have grown steadily throughout the past three decades—even through the Asian financial crisis. We have seen, for example, wages in East Asian economies (excluding Japan) increase from just 8% of U.S. levels in 1975 to 39% in 2007.

China is a prime example. Twenty years ago, life there was an uninspiring struggle. When I was studying in Beijing, my university professor's compensation consisted of a tiny university room and the equivalent of about US$20 a month—enough for a couple of meals a day. As a result, many academics turned into street vendors at night—I can remember buying lamb kebabs from a university lecturer on the streets of Taiyuan. My Chinese classmates waited for the government to allocate similarly low-paying jobs to them as teachers or in state publishing houses. Years later—as reforms rolled on—I learned my own roommate had quit his job at the publishing house, joined an insurance company and launched an internet start up. Colloquially, he had "taken the plunge" into China's new capitalist markets. Now, the Chinese government

2 MATTHEWS ASIA FUNDS

wants to start the process of privatizing the publishing houses that my former roommate found so uninspiring. What changes in 20 years! Changes I would not have dared imagine. And yet in the 1990s it did seem clear, in a general sense, that economic growth would transform Chinese lives. The particular ways may not be predictable year to year, but the trend, direction and even pace seem set.

Superficially, China has changed a lot. The new China has brought nearly 300 million people from rural to urban life since the 1990s; adding to the urban population at a rate of 1.5 million people each month—roughly the population of Philadelphia. This shift has been significant and obvious to the naked eye. In fact, much of the quaintness of the old Beijing I knew is now gone; replaced by functional, modern buildings. But its quaintness obscured great poverty and now the new buildings incubate great prosperity. As the example of the kebab-selling academic shows, China's growth has been through the hard work and ingenuity of the Chinese people and not just some abstract offshoot of an "export-driven" economic model. Indeed, net exports only directly contributed 2-3% to China's 10% growth rate, even as the trade surplus expanded massively during the past decade. The real motor behind Chinese and Asian growth has always been entrepreneurialism—seeking out opportunities and profits wherever they lie.

As China continues to develop and enrich the lives of its citizens we believe that issues related to the environment, health care, pension provision, and saving and investment decisions will move to the forefront. This is the infrastructure spending that will drive the productivity of the Asian household—not just the roads, buildings, railways and new cities that are popping up but the unseen infrastructure: the abstract, virtual, legal and financial infrastructure that surrounds new media, better banking services, home and car loans, health and property insurance, and financial services. These industries have changed dramatically and promise continued change.

Buy and Hold

The severe disruptions in the global economy appeared to sound the death knell of an investment icon of the last two decades—the buy and hold strategy. Indeed, some of the voices sounding its death knell have been prominent. We disagree—we continue to embrace buy and hold.

On a fundamental level, the alternative to a buy and hold strategy is extremely unattractive, i.e., "sell and give it all away." After all, you have to hold something—even if it is cash or gold or consumer goods. Any asset will have a return relative to anything else—cash is only safe if inflation does not erode its value and bonds are safe only if the credit is good. Each asset has a risk associated with it. Balancing out those risks is the job of intelligent strategic asset allocation or tactical buying and selling. The latter is hard to do successfully and incurs high transaction costs. The former at least affords some kind of protection against risk—be it volatility or risk of the kind that we have seen recently. Anyone who rejects buy and hold implies that they consistently know more than the market—that they can make frequent correct decisions regarding when to dip in and out of and switch to and from the multitude of available assets, and that they are capable of foreseeing all the

"While we cannot predict every development in the markets, we do anticipate an upward trajectory in Asia's growth that we want to participate in on behalf of our shareholders."

matthewsasia.com | 800.789.ASIA 3

twists and turns that lie ahead. We do not claim this ability for ourselves—and I don't think I have ever met anyone who has reliably demonstrated it.

We don't expect to be able to see the future perfectly. That is not how we approach stock selection. We seek only to find good companies that, through a mixture of the economics of their industry or business and the reliability and savvy of their management, could have the flexibility and strength to withstand the inevitable vagaries of the market. We also look to find the right type of security associated with the company—equity, debt or convertible—and the right price that may help us navigate the ever changing conditions in as secure and profitable a way as possible.

From our point of view, to pursue a buy and hold strategy is not to ignore the uncertain future, but to accept it. It is not a suggestion that we know or see the future clearly, but the secure recognition that we cannot. While we cannot predict every development in the markets, we do anticipate an upward trajectory in Asia's growth that we want to participate in on behalf of our shareholders. All we can do then is use our judgment to benefit from this growth in a manner in which we are cognizant of the risks involved.

A Personal Note

On a personal note, it is an exciting time to be named Chief Investment Officer at Matthews. I can't help but think that many of Asia's best years still lie ahead. I am enthusiastic about the opportunity to participate in Asia's future through the implementation of a style and strategy of investing in which I firmly believe. I am privileged to work with a team of talented investment professionals, who inspire me to develop the investment solutions to grow wealth by investing in, what are for me, the world's most exciting markets.

As always, we are honored to serve as your Asia investment specialists and thank you for your investment in the Matthews Asia Funds.

Robert J. Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

4 MATTHEWS ASIA FUNDS

Chairman's Message to Shareholders

Dear Fellow Shareholders,

I would like to inform you of some recent changes at Matthews International Capital Management, LLC ("Matthews").

Paul Matthews and I have worked long and hard to build a team with depth and diversity to cover an Asia that has changed and evolved since we started working on these markets. As part of the ongoing evolution of the firm, I recently assumed the role of Chairman of the Board of Directors of Matthews and will continue to serve as a Co-Manager of the Matthews Pacific Tiger and Matthews Korea Funds. William J. Hackett has succeeded me as the firm's Chief Executive Officer and Robert J. Horrocks, PhD, has been appointed Chief Investment Officer.

Bill has served as President of Matthews since 2007, and now as Chief Executive Officer will oversee all areas of the firm, with the exception of investment management. Robert joined Matthews in August 2008 as our Director of Research. As Chief Investment Officer, he will oversee the firm's investment process and investment professionals and set the research agenda for the investment team. Robert is also Co-Manager of the Matthews Asian Growth and Income Fund.

Both Bill and Robert bring extensive experience in Asian markets and proven leadership skills to their roles. I look forward to continuing to work with them to develop and enhance Matthews' position as a leader in Asian asset management.

Since January 2008, Andrew Foster served as Matthews' acting Chief Investment Officer. Robert's appointment as Chief Investment Officer enables Andrew to focus on his primary role as Portfolio Manager. Andrew is Lead Manager of the Matthews Asian Growth and Income Fund and Co-Manager of the Matthews Asia Pacific Equity Income, Matthews China and Matthews India Funds. During his tenure as acting Chief Investment Officer, Andrew helped navigate Matthews and our investment team through some of modern history's most challenging financial conditions. We are grateful to Andrew for stepping in to fill this role when needed and his ongoing contributions to Matthews.

Paul and I will continue to be closely involved with the strategic direction of Matthews and mentor, support and work with the members of the investment team. Paul remains a Director of Matthews and a Trustee of the Matthews Asia Funds. We continue to remain optimistic about the long-term growth prospects in Asia, and are confident in the team of professionals that we have brought together at Matthews. As always, we appreciate the opportunity to serve you.

Yours truly,

Mark W. Headley

Chairman

Matthews International Capital Management, LLC

matthewsasia.com | 800.789.ASIA 5

ASIA GROWTH AND INCOME STRATEGIES

PORTFOLIO MANAGERS

Andrew T. Foster

Lead Manager

Robert J. Horrocks, PhD

Co-Manager

Note: Managers shown reflect changes effective April 29, 2009.

FUND FACTS

| Ticker | | MACSX | |

| Inception Date | | 9/12/94 | |

| Assets | | $1.6 billion | |

| NAV | | $ | 13.47 | | |

| Total # of Positions | | | 80 | | |

Fiscal Year 2008 Ratios

| Portfolio Turnover | | | 25.16 | %1 | |

| Gross Expense Ratio | | | 1.16 | %2 | |

Benchmarks

MSCI AC Asia ex Japan Index

MSCI AC Far East ex Japan Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Long-term capital appreciation.

The Fund also seeks to provide some current income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in dividend-paying equity securities and the convertible securities, of any duration or quality, of companies located in Asia.

1 The lesser of fiscal year 2008 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

2 Matthews Asia Funds does not charge 12b-1 fees.

Matthews Asian Growth and Income Fund

Portfolio Manager Commentary

During the first half of 2009, the Matthews Asian Growth and Income Fund rose 19.14% while its benchmark, the MSCI All Country Asia ex Japan Index, gained 35.87%. For the second quarter ended June 30, the Fund gained 21.57%, while its benchmark increased 34.98%.

Capital markets in Asia have been characterized by pronounced volatility thus far this year. The first three months saw sharp declines, such that valuations on equities fell to some of the lowest levels on record. As most stock markets in the region are relatively young—with the notable exceptions of Japan, Australia and India—the notion of "lowest levels on record" should be taken with a grain of salt. Yet in March, equities began a fierce rally, and valuations on broader market indices rose approximately 50% within the span of six weeks. Shares in China and India lead the way.

Amid this recovery, the Fund's performance lagged its benchmark due to its relatively defensive orientation. The Fund's low exposure to energy stocks—especially to Chinese coal, gas and oil companies—was the main reason for its relative underperformance during the second quarter. Historically, we have not made extensive investments in such industries given the cyclicality that tends to prevail in energy markets. Instead we preferred to invest in more stable sources of growth—particularly companies that derive their economic value in tandem with rising consumption and living standards for households in Asia.

After such a dramatic rally in valuations, we believe some of the "easiest" gains have been achieved. In particular, yields on Asian bonds have dropped substantially in recent months, as the securities' underlying market values have appreciated sharply. Yields that were well into the double digits, often over 20%, have now generally declined to a range in the mid-single digits. Also, the gross valuation disparities that prevailed among Chinese and Indian equities during late 2008 (and which led us to raise the Fund's allocation to those markets) have generally dissipated.

Still, we remain confident that opportunities in the region persist. In particular, the Fund has found attractive investment candidates among mid- and larger-sized industrial companies where valuations have lagged. The common hallmarks of these new holdings are secure balance sheets—with little or no debt, and large cash reserves—combined with reasonable returns on capital and increasing returns to scale (or "operating leverage"). While the economic environment may pose challenges to such companies in the short term, their strong financial condition should facilitate their survival; and their returns to scale should enhance profitability if and when the business cycle recovers.

During the past several years, the Fund has maintained a large position in "traditional" media stocks (publications, radio and broadcast television), with the portfolio's weighting typically ranging between 5% and 7%, while its benchmark has been well below 1%. The fundamentals for the industry (revenues and profits) have generally grown to expectation, but stock performance has been mixed.

(continued)

6 MATTHEWS ASIA FUNDS

PERFORMANCE AS OF JUNE 30, 2009

| | | | | Average Annual Total Return | |

| | | 3 Months | | YTD | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Inception

9/12/94 | |

| Matthews Asian Growth and Income Fund | | | 21.57 | % | | | 19.14 | % | | | -11.99 | % | | | 4.26 | % | | | 10.43 | % | | | 13.53 | % | | | 10.29 | % | |

| MSCI AC Asia ex Japan Index3 | | | 34.98 | % | | | 35.87 | % | | | -17.74 | % | | | 4.24 | % | | | 12.61 | % | | | 5.39 | % | | | 2.09 | %4 | |

| MSCI AC Far East ex Japan Index3 | | | 32.47 | % | | | 33.64 | % | | | -18.94 | % | | | 3.74 | % | | | 11.69 | % | | | 4.52 | % | | | 1.72 | %4 | |

| Lipper Pacific ex Japan Funds Category Average5 | | | 35.80 | % | | | 34.55 | % | | | -16.24 | % | | | 3.66 | % | | | 12.05 | % | | | 6.61 | % | | | 3.71 | %4 | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | | June | | December | | Total | |

| 2009 | | | 21.94 | ¢ | | | N/A | | | | N/A | | |

| 2008 | | | 24.82 | ¢ | | | 16.66 | ¢ | | | 41.48 | ¢ | |

| 2007 | | | 21.51 | ¢ | | | 68.91 | ¢ | | | 90.42 | ¢ | |

| 2006 | | | 21.89 | ¢ | | | 39.85 | ¢ | | | 61.74 | ¢ | |

| 1994-2005 | | $ | 1.88 | | | $ | 2.07 | | | $ | 3.95 | | |

Note: This table does not include capital gains distributions.

30-DAY YIELD: 3.41%

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/09, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: PNC Global Investment Servicing (U.S.) Inc.

DIVIDEND YIELD: 4.58%

The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems

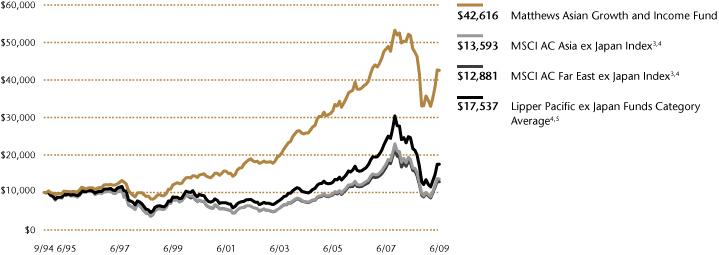

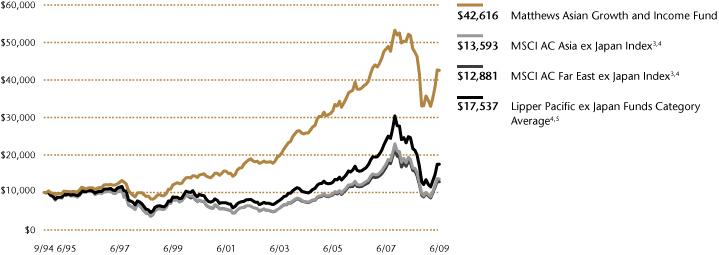

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital Management; total return calculations performed by PNC Global Investment Servicing (U.S.) Inc. Please see page 84 for index definitions.

4 Calculated from 8/31/94.

5 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS6

| | | Security Type | | Country | | % of Net Assets | |

| Hongkong Land CB 2005, Ltd., Cnv., 2.750%, 12/21/12 | | Convertible Bond | | China/Hong Kong | | | 3.1 | % | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Equity | | Taiwan | | | 2.7 | % | |

| HSBC Holdings PLC | | Equity | | United Kingdom | | | 2.6 | % | |

| China Petroleum & Chemical Corp. (Sinopec), Cnv., 0.000%, 04/24/14 | | Convertible Bond | | China/Hong Kong | | | 2.3 | % | |

| Hang Lung Properties, Ltd. | | Equity | | China/Hong Kong | | | 2.3 | % | |

| CLP Holdings, Ltd. | | Equity | | China/Hong Kong | | | 2.3 | % | |

| Nippon Building Fund, Inc., REIT | | Equity | | Japan | | | 2.2 | % | |

| Rafflesia Capital, Ltd., Cnv., 1.250%, 10/04/11 | | Convertible Bond | | Malaysia | | | 2.2 | % | |

| Reliance Communications, Ltd., Cnv., 0.000%, 05/10/11 | | Convertible Bond | | India | | | 2.1 | % | |

| Cherating Capital, Ltd., Cnv., 2.000%, 07/05/12 | | Convertible Bond | | Malaysia | | | 2.1 | % | |

| % OF ASSETS IN TOP TEN | | | | | | | 23.9 | % | |

6 Holdings may combine more than one security from same issuer and related depositary receipts.

matthewsasia.com | 800.789.ASIA 7

COUNTRY ALLOCATION (%)7

| China/Hong Kong | | | 34.6 | | |

| Singapore | | | 13.1 | | |

| South Korea | | | 8.4 | | |

| India | | | 8.2 | | |

| Taiwan | | | 7.2 | | |

| Japan | | | 7.0 | | |

| Malaysia | | | 6.3 | | |

| Thailand | | | 2.8 | | |

| United Kingdom | | | 2.6 | | |

| Indonesia | | | 2.6 | | |

| Australia | | | 1.5 | | |

| Philippines | | | 1.2 | | |

| Vietnam | | | 1.0 | | |

Cash and Other Assets,

Less Liabilities | | | 3.5 | | |

SECTOR ALLOCATION (%)

| Financials | | | 25.7 | | |

| Industrials | | | 13.8 | | |

| Information Technology | | | 13.3 | | |

| Consumer Discretionary | | | 12.1 | | |

| Telecommunication Services | | | 12.0 | | |

| Consumer Staples | | | 6.6 | | |

| Utilities | | | 5.1 | | |

| Health Care | | | 2.8 | | |

| Energy | | | 2.3 | | |

| Non-Classified | | | 1.9 | | |

| Materials | | | 0.9 | | |

Cash and Other Assets,

Less Liabilities | | | 3.5 | | |

MARKET CAP EXPOSURE (%)8

| Large Cap (Over $5B) | | | 38.7 | | |

| Mid Cap ($1B-$5B) | | | 41.9 | | |

| Small Cap (Under $1B) | | | 13.9 | | |

| Non-Classified | | | 1.9 | | |

Cash and Other Assets,

Less Liabilities | | | 3.5 | | |

BREAKDOWN BY SECURITY TYPE (%)

| Common Equities | | | 63.9 | | |

| Convertible Bonds9 | | | 27.5 | | |

| Preferred Equities | | | 2.3 | | |

| Government Bonds | | | 1.9 | | |

| Corporate Bonds | | | 0.9 | | |

Cash and Other Assets,

Less Liabilities | | | 3.5 | | |

7 Australia, The United Kingdom and Japan are not included in the MSCI All Country Asia ex Japan Index.

8 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

9 Convertible bonds are not included in the MSCI All Country Asia ex Japan Index.

Matthews Asian Growth and Income Fund

Portfolio Manager Commentary (continued)

There are several reasons for the Fund's ongoing investment in media. The bulk of the industry has a secure balance sheet—little debt, with substantial holdings in cash. Meanwhile, the Fund's holdings have generated relatively stable revenue growth (typically near 9% or 10% annually), while enjoying healthy margins, such that profits have generally followed the expansion in revenues. This condition has allowed the Fund's holdings to pay meaningful dividends—historically, such companies have paid yields above the average available in the Asian markets (and even above long-term U.S. treasury yields). Admittedly, the expansion of the industry has lagged behind faster-growing industries in Asia, but it has still been respectable in absolute terms, while the dividends have provided some buffer for share prices during market downturns.

In our view, there is another compelling reason for the investment. To invest in media in Asia is also to invest in a "long-term call option" on greater freedom of speech within the region; it is to invest in the Asia you cannot readily see but which is already emerging. We can illustrate this notion with an example from the past: just over a decade ago, the Fund's benchmark gave China short shrift—its weighting in the benchmark was approximately 1%. China's capital markets were then relatively small and difficult to access; the benchmark index could not "see" the growing depth and breadth of China's economy. The small weighting may have seemed reasonable, but it was the wrong premise upon which to invest for the next decade.

In similar fashion, Asia's media industry today is relatively difficult to "see" within the benchmark index, as the underlying market capitalization is relatively small. Yet this overlooks an industry that we believe is substantial and poised for more growth. Currently the advertising industry in the U.S. spends the equivalent of $450 per person on media each year, similar figures in China and India run at $21 and $4, respectively. Even Taiwan—a relatively wealthy and developed country within the region—generates only $58 in advertising expenditure per capita per annum.1

Media markets in Asia are relatively small: government regulations and strictures on free expression have tended to stunt their growth. It is difficult to develop a robust and valuable media market without freedom of speech! We would argue that even as freedoms within Asia lag behind our own, change is happening. Public discourse, even on sensitive political topics, is far more prevalent than it was one decade ago. We believe that in time, such discourse will grow—and with it, the value of the region's media markets. Thus the Fund continues to invest patiently in this underappreciated "long-term call option" on Asia's freedom of speech; in the process, the Fund is investing in the Asia that is not yet readily visible, but which is already there and growing.

1 In US$. Sources: CIA World Factbook, Nielson Company, China State Administration of Industry and Commerce, Madison World and Pitch.

8 MATTHEWS ASIA FUNDS

Matthews Asian Growth and Income Fund June 30, 2009

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 63.9%

| | | Shares | | Value | |

| CHINA/HONG KONG: 23.5% | |

| Hang Lung Properties, Ltd. | | | 11,388,920 | | | $ | 37,504,074 | | |

| CLP Holdings, Ltd. | | | 5,602,700 | | | | 37,124,469 | | |

| VTech Holdings, Ltd. | | | 4,535,300 | | | | 30,887,506 | | |

| Television Broadcasts, Ltd. | | | 7,647,000 | | | | 30,625,722 | | |

Shandong Weigao Group Medical

Polymer Co., Ltd. H Shares | | | 11,760,000 | | | | 30,134,761 | | |

Bank of Communications Co., Ltd.

H Shares | | | 26,020,000 | | | | 28,948,205 | | |

| Hang Seng Bank, Ltd. | | | 1,694,400 | | | | 23,715,095 | | |

| Vitasoy International Holdings, Ltd. | | | 43,697,000 | | | | 22,937,755 | | |

| Hang Lung Group, Ltd. | | | 4,683,000 | | | | 21,913,534 | | |

| ASM Pacific Technology, Ltd. | | | 4,199,800 | | | | 21,476,761 | | |

| Lenovo Group, Ltd. | | | 47,626,000 | | | | 17,772,028 | | |

| HongKong Electric Holdings, Ltd. | | | 2,577,500 | | | | 14,318,337 | | |

| PCCW, Ltd. | | | 49,380,000 | | | | 12,858,240 | | |

| Hong Kong & China Gas Co., Ltd. | | | 5,971,490 | | | | 12,535,246 | | |

| I-CABLE Communications, Ltd.b† | | | 129,832,000 | | | | 12,061,734 | | |

| Café de Coral Holdings, Ltd. | | | 5,757,100 | | | | 11,472,126 | | |

| Next Media, Ltd. | | | 67,392,000 | | | | 9,096,157 | | |

| China Green Holdings, Ltd. | | | 4,740,000 | | | | 4,925,009 | | |

| Hengan International Group Co., Ltd. | | | 669,460 | | | | 3,128,368 | | |

| Giordano International, Ltd. | | | 9,109,000 | | | | 1,909,349 | | |

| Total China/Hong Kong | | | | | | | 385,344,476 | | |

| SINGAPORE: 11.2% | |

| Ascendas REIT | | | 29,117,000 | | | | 31,744,486 | | |

| Keppel Corp., Ltd. | | | 6,590,000 | | | | 31,237,405 | | |

Singapore Technologies

Engineering, Ltd. | | | 14,429,000 | | | | 24,312,755 | | |

| Fraser and Neave, Ltd.c | | | 7,766,100 | | | | 20,808,430 | | |

| Singapore Post, Ltd. | | | 26,322,000 | | | | 16,241,423 | | |

| Parkway Holdings, Ltd. | | | 13,793,093 | | | | 15,819,156 | | |

| Cerebos Pacific, Ltd. | | | 7,640,000 | | | | 15,597,848 | | |

| Hong Leong Finance, Ltd. | | | 8,184,000 | | | | 14,876,330 | | |

| Parkway Life REIT | | | 10,233,110 | | | | 6,519,913 | | |

| Singapore Press Holdings, Ltd. | | | 2,984,500 | | | | 6,494,516 | | |

| Total Singapore | | | | | | | 183,652,262 | | |

| TAIWAN: 7.2% | |

Taiwan Semiconductor Manufacturing

Co., Ltd. | | | 24,944,469 | | | | 40,938,885 | | |

| Cathay Financial Holding Co., Ltd. | | | 17,962,240 | | | | 26,406,638 | | |

| Cyberlink Corp. | | | 4,912,889 | | | | 18,267,646 | | |

| Chunghwa Telecom Co., Ltd. ADR | | | 804,044 | | | | 15,944,192 | | |

| President Chain Store Corp. | | | 5,263,000 | | | | 13,454,176 | | |

Taiwan Semiconductor Manufacturing

Co., Ltd. ADR | | | 391,708 | | | | 3,685,972 | | |

| Total Taiwan | | | | | | | 118,697,509 | | |

| JAPAN: 7.0% | |

| Nippon Building Fund, Inc., REIT | | | 4,208 | | | | 35,969,859 | | |

| Japan Real Estate Investment Corp., REIT | | | 3,912 | | | | 32,449,741 | | |

| Trend Micro, Inc. | | | 806,500 | | | | 25,752,834 | | |

| Hamamatsu Photonics, K.K. | | | 1,065,700 | | | | 20,437,838 | | |

| Total Japan | | | | | | | 114,610,272 | | |

| | | Shares | | Value | |

| SOUTH KOREA: 5.2% | |

| Hana Financial Group, Inc. | | | 986,639 | | | $ | 21,019,167 | | |

| SK Telecom Co., Ltd. ADR | | | 1,166,733 | | | | 17,676,005 | | |

| S1 Korea Corp. | | | 401,150 | | | | 17,034,484 | | |

| GS Home Shopping, Inc. | | | 272,258 | | | | 13,855,498 | | |

| SK Telecom Co., Ltd. | | | 68,216 | | | | 9,298,830 | | |

| Daehan City Gas Co., Ltd. | | | 280,300 | | | | 5,971,015 | | |

| Total South Korea | | | | | | | 84,854,999 | | |

| THAILAND: 2.8% | |

| Advanced Info Service Public Co., Ltd. | | | 8,633,000 | | | | 22,860,707 | | |

| BEC World Public Co., Ltd. | | | 33,152,500 | | | | 20,286,896 | | |

| Thai Reinsurance Public Co., Ltd. NVDR | | | 25,672,800 | | | | 3,409,961 | | |

| Total Thailand | | | | | | | 46,557,564 | | |

| UNITED KINGDOM: 2.6% | |

| HSBC Holdings PLC ADR | | | 1,011,733 | | | | 42,260,087 | | |

| Total United Kingdom | | | | | | | 42,260,087 | | |

| INDONESIA: 1.7% | |

| PT Telekomunikasi Indonesia ADR | | | 903,200 | | | | 27,077,936 | | |

| Total Indonesia | | | | | | | 27,077,936 | | |

| AUSTRALIA: 1.5% | |

| AXA Asia Pacific Holdings, Ltd. | | | 7,737,372 | | | | 24,168,851 | | |

| Total Australia | | | | | | | 24,168,851 | | |

| PHILIPPINES: 1.2% | |

| Globe Telecom, Inc. | | | 1,036,040 | | | | 20,413,618 | | |

| Total Philippines | | | | | | | 20,413,618 | | |

| TOTAL COMMON EQUITIES | | | | | | | 1,047,637,574 | | |

| (Cost $1,036,587,820) | | | | | | | | | |

PREFERRED EQUITIES: 2.3%

| SOUTH KOREA: 2.3% | |

| Hyundai Motor Co., Ltd., Pfd. | | | 566,280 | | | | 12,448,608 | | |

| LG Household & Health Care, Ltd., Pfd. | | | 200,290 | | | | 9,450,263 | | |

Samsung Fire & Marine Insurance Co.,

Ltd., Pfd. | | | 135,056 | | | | 8,609,141 | | |

| Hyundai Motor Co., Ltd., 2nd Pfd. | | | 305,760 | | | | 7,204,397 | | |

| Total South Korea | | | | | | | 37,712,409 | | |

| TOTAL PREFERRED EQUITIES | | | | | | | 37,712,409 | | |

| (Cost $20,704,275) | | | | | | | | | |

matthewsasia.com | 800.789.ASIA 9

Matthews Asian Growth and Income Fund June 30, 2009

Schedule of Investmentsa (unaudited) (continued)

INTERNATIONAL BONDS: 30.3%

| | | Face Amount | | Value | |

| CHINA/HONG KONG: 11.1% | |

Hongkong Land CB 2005, Ltd., Cnv.

2.750%, 12/21/12 | | $ | 46,700,000 | | | $ | 51,486,750 | | |

China Petroleum & Chemical Corp.

(Sinopec), Cnv. 0.000%, 04/24/14 | | | 282,470,000 | d | | | 38,278,994 | | |

Yue Yuen Industrial Holdings, Ltd., Cnv.

0.000%, 11/17/11 | | | 226,300,000 | d | | | 31,316,798 | | |

China High Speed Transmission

Equipment Group Co., Ltd., Cnv.

0.000%, 05/14/11 | | | 132,000,000 | d | | | 20,918,793 | | |

PB Issuer, Ltd., Cnv.

3.300%, 02/01/13 | | | 19,750,000 | | | | 17,972,500 | | |

FU JI Food and Catering Services

Holdings, Ltd., Cnv.

0.000%, 10/18/10 | | | 141,500,000 | d | | | 15,536,475 | | |

China Green Holdings, Ltd., Cnv.

0.000%, 10/29/10 | | | 55,000,000 | d | | | 7,249,111 | | |

| Total China/Hong Kong | | | | | | | 182,759,421 | | |

| INDIA: 8.2% | |

Reliance Communications, Ltd., Cnv.

0.000%, 05/10/11 | | | 32,915,000 | | | | 35,219,050 | | |

Tata Motors, Ltd., Cnv.

1.000%, 04/27/11 | | | 25,149,000 | | | | 24,205,912 | | |

Financial Technologies India, Ltd., Cnv.

0.000%, 12/21/11 | | | 19,314,000 | | | | 20,134,845 | | |

Rolta India, Ltd., Cnv.

0.000%, 06/29/12 | | | 23,116,000 | | | | 19,417,440 | | |

Sintex Industries, Ltd., Cnv.

0.000%, 03/13/13 | | | 25,400,000 | | | | 19,304,000 | | |

Housing Development Finance

Corp., Cnv.

0.000%, 09/27/10 | | | 6,400,000 | | | | 9,856,000 | | |

Educomp Solutions, Ltd., Cnv.

0.000%, 07/26/12 | | | 5,915,000 | | | | 6,920,550 | | |

| Total India | | | | | | | 135,057,797 | | |

| MALAYSIA: 6.3% | |

Rafflesia Capital, Ltd., Cnv.

1.250%e, 10/04/11 | | | 32,700,000 | | | | 35,765,625 | | |

Cherating Capital, Ltd., Cnv.

2.000%e, 07/05/12 | | | 34,000,000 | | | | 34,680,000 | | |

Paka Capital, Ltd., Cnv.

0.000%, 03/12/13 | | | 20,300,000 | | | | 19,056,625 | | |

YTL Power Finance Cayman, Ltd., Cnv.

0.000%, 05/09/10 | | | 11,000,000 | | | | 13,007,500 | | |

| Total Malaysia | | | | | | | 102,509,750 | | |

| SINGAPORE: 1.9% | |

Wilmar International, Ltd., Cnv.

0.000%, 12/18/12 | | | 18,600,000 | | | | 20,506,500 | | |

Olam International, Ltd., Cnv.

1.2821%, 07/03/13 | | | 6,630,000 | | | | 10,740,600 | | |

| Total Singapore | | | | | | | 31,247,100 | | |

| VIETNAM: 1.0% | |

Socialist Republic of Vietnam

6.875%, 01/15/16 | | | 15,711,000 | | | | 15,868,110 | | |

| Total Vietnam | | | | | | | 15,868,110 | | |

| | | Face Amount | | Value | |

| SOUTH KOREA: 0.9% | |

POSCO

8.750%, 03/26/14 | | $ | 13,500,000 | | | $ | 14,986,215 | | |

| Total South Korea | | | | | 14,986,215 | | |

| INDONESIA: 0.9% | |

Republic of Indonesia

10.375%, 05/04/14 | | | 12,700,000 | | | | 14,668,500 | | |

| Total Indonesia | | | | | 14,668,500 | | |

| TOTAL INTERNATIONAL BONDS | | | | | 497,096,893 | | |

| (Cost $498,984,349) | | | | | | | |

| TOTAL INVESTMENTS: 96.5% | | | | | 1,582,446,876 | | |

| (Cost $1,556,276,444f) | | | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 3.5% | | | | | 58,101,572 | | |

| NET ASSETS: 100.0% | | | | $ | 1,640,548,448 | | |

a Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A).

b Non-income producing security.

c Security was suspended from trading on June 30, 2009.

d Face amount reflects principal in local currency.

e Variable rate security. The rate reflects the rate in effect at June 30, 2009.

f Cost of investments is $1,556,276,444 and net unrealized appreciation consists of:

| Gross unrealized appreciation | | $ | 169,818,960 | | |

| Gross unrealized depreciation | | | (143,648,528 | ) | |

| Net unrealized appreciation | | $ | 26,170,432 | | |

† Affiliated Issuer, as defined under the Investment Company Act of 1940 (ownership of 5% or more of the outstanding voting securities of this issuer)

ADR American Depositary Receipt

NVDR Non-voting Depositary Receipt

Cnv. Convertible

Pfd. Preferred

REIT Real Estate Investment Trust

See accompanying notes to financial statements.

10 MATTHEWS ASIA FUNDS

ASIA GROWTH AND INCOME STRATEGIES

PORTFOLIO MANAGERS

Jesper O. Madsen, CFA

Lead Manager

Andrew T. Foster

Co-Manager

FUND FACTS

| Ticker | | MAPIX | |

| Inception Date | | 10/31/06 | |

| Assets | | $157.4 million | |

| NAV | | $ | 9.88 | | |

| Total # of Positions | | | 58 | | |

Fiscal Year 2008 Ratios

| Portfolio Turnover | | | 25.07 | %1 | |

| Gross Expense Ratio | | | 1.35 | % | |

After Contractual

Fee Waiver | | | 1.32 | %2 | |

Benchmark

MSCI AC Asia Pacific Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Total return with an emphasis on providing current income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in income-paying publicly traded common stock, preferred stocks, convertible preferred stock and other equity-related instruments of companies located in the Asia Pacific region.

1 The lesser of fiscal year 2008 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

2 The Advisor has contractually agreed to waive certain fees and expenses to the extent needed to limit total annual operating expenses to 1.50% until October 31, 2009. Matthews Asia Funds does not charge 12b-1 fees.

Matthews Asia Pacific Equity Income Fund

Portfolio Manager Commentary

For the first half of 2009, the Matthews Asia Pacific Equity Income Fund gained 17.82%, while its benchmark, the MSCI All Country Asia Pacific Index, rose 16.83%. For the quarter ended June 30, the Fund gained 25.07% and the benchmark increased 28.20%. In June, the Fund distributed 13.86 cents per share, bringing its total year-to-date income distribution to 23.93 cents per share.

Capital markets took investors on a roller-coaster ride during the first six months of 2009—an illustration of the inherent volatility of Asian investing. Sentiment swung from an extremely pessimistic outlook on economic growth and the viability of the global financial system, to one of snapping up beaten-down "risky assets" as risk aversion subsided. The performance of the Fund's holdings within the financial sector illustrated this sharp change in sentiment. This sector, which spans not just banks and insurance companies but also real estate-related companies, was the Fund's worst-performing sector during the first quarter. However, the sector delivered strong returns in the second quarter making it the largest positive contributor to performance year-to-date. The Fund maintained a substantial weight within financials, acquiring shares in real estate-related companies and investment trusts, while trimming some exposure to banks.

The Fund's Japanese holdings were the main detractors to performance during the first six months of the year as Japanese equities did not fully participate in the rally during the second quarter. The Fund's holdings in China and Hong Kong accounted for the bulk of positive performance as investors perceived China as one of the few countries with both the fiscal and monetary firepower to support economic growth. Chinese macro economic data indicated resilient domestic consumption, with retail sales growing about 15% year-on-year. Additionally, Chinese banks embraced the government's call for greater access to financing to help spur domestic investments and economic expansion by extending US$1.1 trillion of new loans in the first half of 2009, an almost three-fold increase compared to last year.

Investors seeking the benefits of dividend-paying companies, such as lower downside volatility, recognize that it is important that those companies maintain the absolute value of their dividend payments—especially during periods of earnings contractions. Oftentimes a company will tie its dividend payment to earnings via the "payout ratio"—or the percentage of earnings paid out as dividends. However, while this results in higher dividends during periods of earnings expansion, it leaves investors with little safety when earnings contract. As a consequence, when earnings decline, investors are hit with the double impact of falling share prices and eroding dividend income.

The Matthews Asia Pacific Equity Income Fund aims to focus on companies that can grow dividends in a stable fashion over time. As a result, even during this challenging business environment, the majority of the Fund's holdings that declared and paid dividends year-to-date either raised or maintained their dividends compared to last year. Companies that pay stable and/or growing dividends often exhibit at least

(continued)

matthewsasia.com | 800.789.ASIA 11

PERFORMANCE AS OF JUNE 30, 2009

| | | | | | | Average Annual Total Return | |

| | | 3 Months | | YTD | | 1 Year | | Inception

10/31/06 | |

| Matthews Asia Pacific Equity Income Fund | | | 25.07 | % | | | 17.82 | % | | | -8.51 | % | | | 4.03 | % | |

| MSCI AC Asia Pacific Index3 | | | 28.20 | % | | | 16.83 | % | | | -22.33 | % | | | -6.64 | % | |

| Lipper Pacific Region Funds Category Average4 | | | 28.56 | % | | | 16.01 | % | | | -25.57 | % | | | -7.37 | % | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance visit matthewsasia.com.

INCOME DISTRIBUTION HISTORY

| | | Q1 | | Q2 | | Q3 | | Q4 | | Total | |

| 2009 | | | 10.07 | ¢ | | | 13.86 | ¢ | | N/A | | | N/A | | | | N/A | | |

| 2008 | | | 5.86 | ¢ | | | 7.53 | ¢ | | | 11.43 | ¢ | | | 5.55 | ¢ | | | 30.37 | ¢ | |

| 2007 | | | — | | | | 10.30 | ¢ | | | — | | | | 17.12 | ¢ | | | 27.42 | ¢ | |

| 2006 (Fund inception: 10/31/06) | | | | | | | | | | | | | 1.97 | ¢ | | | 1.97 | ¢ | |

Note: This table does not include capital gains distributions. In March 2008, the Fund began to distribute investment income dividends on a quarterly rather than semi-annual basis. For additional details regarding Fund distributions, visit matthewsasia.com.

30-DAY YIELD: 3.01%

The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/09, expressed as an annual percentage rate based on the Fund's share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund's rate of investment income, and it may not equal the Fund's actual income distribution rate.

Source: PNC Global Investment Servicing (U.S.) Inc.

DIVIDEND YIELD: 4.79%

The dividend yield (trailing) for the portfolio is the weighted average sum of the dividend paid per share during the last 12 months divided by the current price. The annualized dividend yield for the Fund is for the equity-only portion of the portfolio. Please note that this is based on gross portfolio holdings and does not reflect the actual yield an investor in the Fund would receive. Past yields are no guarantee of future yields.

Source: FactSet Research Systems.

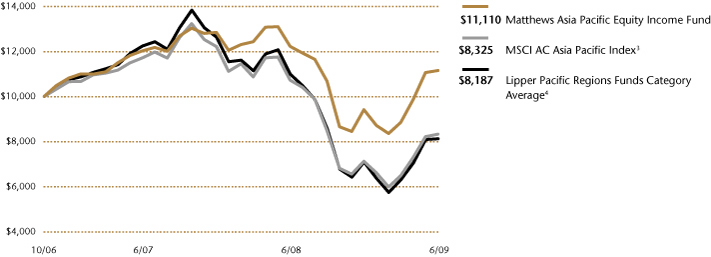

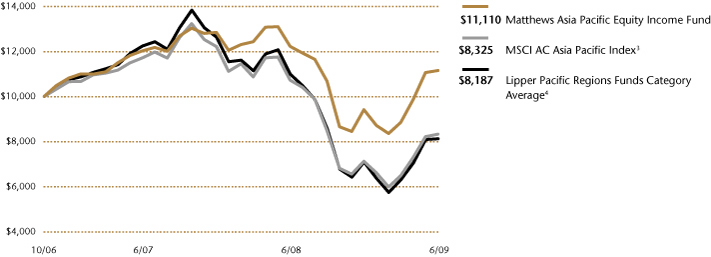

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital Management; total return calculations performed by PNC Global Investment Servicing (U.S.) Inc. Please see page 84 for index definitions.

4 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS5

| | | Country | | % of Net Assets | |

| Globe Telecom, Inc. | | Philippines | | | 3.8 | % | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Taiwan | | | 3.5 | % | |

| Top Glove Corp. BHD | | Malaysia | | | 3.4 | % | |

| SK Telecom Co., Ltd. | | South Korea | | | 3.4 | % | |

| Monex Group, Inc. | | Japan | | | 3.2 | % | |

| HSBC Holdings PLC | | United Kingdom | | | 3.2 | % | |

| PT Telekomunikasi Indonesia | | Indonesia | | | 3.1 | % | |

| Minth Group, Ltd. | | China/Hong Kong | | | 3.0 | % | |

| Chunghwa Telecom Co., Ltd. | | Taiwan | | | 3.0 | % | |

| VTech Holdings, Ltd. | | China/Hong Kong | | | 2.4 | % | |

| % OF ASSETS IN TOP TEN | | | | | 32.0 | % | |

5 Holdings may combine more than one security from same issuer and related depositary receipts.

12 MATTHEWS ASIA FUNDS

Matthews Asia Pacific Equity Income Fund

Portfolio Manager Commentary (continued)

one of the following characteristics: they generate stable earnings that allow for the ongoing funding of the dividend; they pay out a smaller proportion of earnings as a dividend and as a result have more capacity to maintain the dividend-per-share even when earnings fall, by temporarily increasing the ratio of earnings paid out; and third, while the financial ability to pay a dividend is essential for longer-term dividend payments, a company's commitment to maintain its dividend acts as an additional layer of insurance.

One of the Fund's main contributors to performance year-to-date, Top Glove Corp. Bhd, exhibits all of these attributes. This Malaysian company is the world's largest manufacturer of latex rubber gloves, mainly for medical use. Awareness of basic health and hygiene tends to increase as households become wealthier, while medical spending generally tends to be less impacted by the business cycle. Geographically, Top Glove derives approximately one-third of its sales from emerging markets where household incomes have been on the rise, while the health care sector accounts for the majority of sales. As a result of its customer mix, the company has been able to grow its sales even during the economic downturn. Top Glove has grown its dividend-per-share by an average of 30% annually for the past five years but still only pays out 30% of earnings. During a meeting with the founder and chairman at one of Top Glove's production facilities in Malaysia, we found that the management team exhibits the strict focus on operational efficiency one would expect from a company that produces 31.5 billion pieces annually, as well as the commitment to and track record of increasing its dividend.

The recent rally in equity markets across the region has resulted in higher share prices and, consequently, lower dividend yields. However, we believe that dividend-paying companies in Asia continue to offer the potential for long-term growth at attractive dividend yields, while allowing investors to diversify their sources of investment income.

COUNTRY ALLOCATION (%)6

| China/Hong Kong | | | 21.0 | | |

| Japan | | | 18.3 | | |

| Taiwan | | | 9.9 | | |

| Singapore | | | 8.9 | | |

| Thailand | | | 8.6 | | |

| Malaysia | | | 7.3 | | |

| Australia | | | 6.1 | | |

| South Korea | | | 5.4 | | |

| Indonesia | | | 4.9 | | |

| Philippines | | | 3.8 | | |

| United Kingdom | | | 3.2 | | |

| India | | | 0.8 | | |

Cash and Other Assets,

Less Liabilities | | | 1.8 | | |

SECTOR ALLOCATION (%)

| Financials | | | 24.1 | | |

| Consumer Discretionary | | | 20.9 | | |

| Information Technology | | | 14.0 | | |

| Telecommunication Services | | | 13.2 | | |

| Consumer Staples | | | 11.5 | | |

| Utilities | | | 5.1 | | |

| Health Care | | | 5.1 | | |

| Industrials | | | 4.3 | | |

Cash and Other Assets,

Less Liabilities | | | 1.8 | | |

MARKET CAP EXPOSURE (%)7

| Large Cap (Over $5B) | | | 34.3 | | |

| Mid Cap ($1B-$5B) | | | 37.2 | | |

| Small Cap (Under $1B) | | | 26.7 | | |

Cash and Other Assets,

Less Liabilities | | | 1.8 | | |

| Source: FactSet Research Systems | |

6 The United Kingdom is not included in the MSCI All Country Asia Pacific Index.

7 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

matthewsasia.com | 800.789.ASIA 13

Matthews Asia Pacific Equity Income Fund June 30, 2009

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 94.4%

| | | Shares | | Value | |

| CHINA/HONG KONG: 21.0% | |

| Minth Group, Ltd. | | | 5,683,000 | | | $ | 4,689,112 | | |

| VTech Holdings, Ltd. | | | 557,000 | | | | 3,793,429 | | |

| CLP Holdings, Ltd. | | | 529,500 | | | | 3,508,559 | | |

| Television Broadcasts, Ltd. | | | 772,000 | | | | 3,091,808 | | |

| Yantai Changyu Pioneer Wine Co., Class B | | | 469,896 | | | | 2,894,511 | | |

| ASM Pacific Technology, Ltd. | | | 560,100 | | | | 2,864,216 | | |

| Xinao Gas Holdings, Ltd. | | | 1,582,000 | | | | 2,692,551 | | |

| Café de Coral Holdings, Ltd. | | | 1,312,000 | | | | 2,614,412 | | |

| China Resources Enterprise, Ltd. | | | 1,218,000 | | | | 2,430,002 | | |

| Sa Sa International Holdings, Ltd. | | | 6,080,000 | | | | 2,276,157 | | |

| Hang Lung Properties, Ltd. | | | 458,000 | | | | 1,508,208 | | |

| Shenzhen International Holdings | | | 9,642,500 | | | | 644,176 | | |

| Total China/Hong Kong | | | | | | | 33,007,141 | | |

| JAPAN: 17.2% | |

| Monex Group, Inc. | | | 11,294 | | | | 5,013,286 | | |

| Nintendo Co., Ltd. | | | 12,200 | | | | 3,376,410 | | |

| Lawson, Inc. | | | 73,200 | | | | 3,221,971 | | |

| Fanuc, Ltd. | | | 40,100 | | | | 3,213,467 | | |

| Shiseido Co., Ltd. | | | 180,000 | | | | 2,944,738 | | |

| Sysmex Corp. | | | 73,000 | | | | 2,646,252 | | |

| MID REIT, Inc. | | | 1,124 | | | | 2,504,151 | | |

| United Urban Investment Corp., REIT | | | 470 | | | | 2,012,830 | | |

| Benesse Corp. | | | 40,800 | | | | 1,636,006 | | |

| ORIX Corp. | | | 10,000 | | | | 595,202 | | |

| Total Japan | | | | | | | 27,164,313 | | |

| TAIWAN: 9.9% | |

Taiwan Semiconductor Manufacturing

Co., Ltd. | | | 3,031,313 | | | | 4,974,994 | | |

| Cyberlink Corp. | | | 778,343 | | | | 2,894,121 | | |

| Chunghwa Telecom Co., Ltd. | | | 1,403,706 | | | | 2,799,905 | | |

| Taiwan Secom Co., Ltd. | | | 1,627,000 | | | | 2,507,105 | | |

| Chunghwa Telecom Co., Ltd. ADR | | | 95,179 | | | | 1,887,400 | | |

Taiwan Semiconductor Manufacturing

Co., Ltd. ADR | | | 50,339 | | | | 473,690 | | |

| Total Taiwan | | | | | | | 15,537,215 | | |

| THAILAND: 8.6% | |

| Land & Houses Public Co., Ltd. NVDR | | | 23,358,200 | | | | 3,477,812 | | |

| Thai Beverage Public Co., Ltd. | | | 22,461,000 | | | | 3,331,699 | | |

| Major Cineplex Group Public Co., Ltd. | | | 12,000,000 | | | | 2,406,007 | | |

| Siam Makro Public Co., Ltd. | | | 1,130,000 | | | | 2,401,744 | | |

| Thai Tap Water Supply Public Co., Ltd. | | | 15,646,200 | | | | 1,888,705 | | |

| Total Thailand | | | | | | | 13,505,967 | | |

| MALAYSIA: 7.3% | |

| Top Glove Corp. BHD | | | 2,820,700 | | | | 5,371,795 | | |

| Astro All Asia Networks PLC | | | 3,170,000 | | | | 2,912,531 | | |

| Media Prima BHD | | | 4,931,200 | | | | 1,696,995 | | |

| Public Bank BHD | | | 599,600 | | | | 1,542,436 | | |

| Total Malaysia | | | | | | | 11,523,757 | | |

| | | Shares | | Value | |

| SINGAPORE: 6.2% | |

| Venture Corp., Ltd. | | | 767,000 | | | $ | 3,680,204 | | |

| CapitaRetail China Trust, REIT | | | 3,329,000 | | | | 2,447,727 | | |

| Parkway Life REIT | | | 3,395,868 | | | | 2,163,640 | | |

| CapitaLand, Ltd. | | | 555,000 | | | | 1,411,113 | | |

| Total Singapore | | | | | | | 9,702,684 | | |

| AUSTRALIA: 6.1% | |

| AXA Asia Pacific Holdings, Ltd. | | | 1,097,112 | | | | 3,426,995 | | |

| Coca-Cola Amatil, Ltd. | | | 469,730 | | | | 3,255,408 | | |

| Billabong International, Ltd. | | | 421,631 | | | | 2,963,354 | | |

| Total Australia | | | | | | | 9,645,757 | | |

| SOUTH KOREA: 5.4% | |

| Cheil Worldwide, Inc. | | | 17,658 | | | | 3,236,827 | | |

| SK Telecom Co., Ltd. | | | 20,816 | | | | 2,837,523 | | |

| SK Telecom Co., Ltd. ADR | | | 161,300 | | | | 2,443,695 | | |

| Total South Korea | | | | | | | 8,518,045 | | |

| INDONESIA: 4.9% | |

| PT Ramayana Lestari Sentosa | | | 57,354,000 | | | | 2,857,508 | | |

| PT Telekomunikasi Indonesia ADR | | | 92,900 | | | | 2,785,142 | | |

| PT Telekomunikasi Indonesia | | | 2,766,000 | | | | 2,047,665 | | |

| Total Indonesia | | | | | | | 7,690,315 | | |

| PHILIPPINES: 3.8% | |

| Globe Telecom, Inc. | | | 303,560 | | | | 5,981,195 | | |

| Total Philippines | | | | | | | 5,981,195 | | |

| UNITED KINGDOM: 3.2% | |

| HSBC Holdings PLC ADR | | | 68,691 | | | | 2,869,223 | | |

| HSBC Holdings PLC | | | 256,133 | | | | 2,137,118 | | |

| Total United Kingdom | | | | | | | 5,006,341 | | |

| INDIA: 0.8% | |

| Shriram Transport Finance Co., Ltd. | | | 150,000 | | | | 944,606 | | |

| Thermax, Ltd. | | | 37,951 | | | | 318,952 | | |

| Total India | | | | | | | 1,263,558 | | |

| TOTAL COMMON EQUITIES | | | | | | | 148,546,288 | | |

| (Cost $130,550,067) | | | | | | | | | |

14 MATTHEWS ASIA FUNDS

Matthews Asia Pacific Equity Income Fund June 30, 2009

Schedule of Investmentsa (unaudited) (continued)

INTERNATIONAL BONDS: 3.8%

| | | Face Amount | | Value | |

| SINGAPORE: 2.7% | |

CapitaLand, Ltd., Cnv.

3.125%, 03/05/18 | | | 3,500,000 | b | | $ | 2,159,711 | | |

CapitaCommerical Trust, Cnv.

2.000%, 05/06/13 | | | 3,000,000 | b | | | 2,045,360 | | |

| Total Singapore | | | | | | | 4,205,071 | | |

| JAPAN: 1.1% | |

ORIX Corp., Cnv.

1.000%, 03/31/14 | | | 170,000,000 | b | | | 1,742,617 | | |

| Total Japan | | | | | | | 1,742,617 | | |

| TOTAL INTERNATIONAL BONDS | | | | | | | 5,947,688 | | |

| (Cost $5,349,637) | | | | | | | | | |

| TOTAL INVESTMENTS: 98.2% | | | | | | | 154,493,976 | | |

| (Cost $135,899,704c) | | | | | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 1.8% | | | | | | | 2,930,783 | | |

| NET ASSETS: 100.0% | | | | | | $ | 157,424,759 | | |

a Certain securities were fair valued under the discretion of the Board of Trustees (Note 1-A).

b Face amount reflects principal in local currency.

c Cost of investments is $135,899,704 and net unrealized appreciation consists of:

| Gross unrealized appreciation | | $ | 23,886,218 | | |

| Gross unrealized depreciation | | | (5,291,946 | ) | |

| Net unrealized appreciation | | $ | 18,594,272 | | |

ADR American Depositary Receipt

BHD Berhad

NVDR Non-voting Depositary Receipt

REIT Real Estate Investment Trust

Cnv. Convertible

See accompanying notes to financial statements.

matthewsasia.com | 800.789.ASIA 15

ASIA GROWTH STRATEGIES

PORTFOLIO MANAGERS

Taizo Ishida

Lead Manager

Sharat Shroff, CFA

Co-Manager

FUND FACTS

| Ticker | | MPACX | |

| Inception Date | | 10/31/03 | |

| Assets | | $161.6 million | |

| NAV | | $ | 12.15 | | |

| Total # of Positions | | | 53 | | |

Fiscal Year 2008 Ratios

| Portfolio Turnover | | | 37.10 | %1 | |

| Gross Expense Ratio | | | 1.23 | %2 | |

Benchmark

MSCI AC Asia Pacific Index

Redemption Fee

2% within first 90 calendar days of purchase

OBJECTIVE

Long-term capital appreciation.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its total net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in the Asia Pacific region. The Fund may also invest in the convertible securities, of any duration or quality, of Asia Pacific companies.

1 The lesser of fiscal year 2008 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities.

2 Matthews Asia Funds does not charge 12b-1 fees.

Matthews Asia Pacific Fund

Portfolio Manager Commentary

For the first half the year, the Matthews Asia Pacific Fund returned 21.14%, outperforming its benchmark, the MSCI All Country Asia Pacific Index, which gained 16.83%. For the quarter ended June 30, the Fund rose 33.81%, while its benchmark increased 28.20%.

The market rally that began in Asia Pacific in early March continued through the second quarter. Global cyclicals were the clear leaders of the rally—companies in the financial, industrial, energy and materials sectors made major upward moves. The health care, telecom and utilities sectors were relatively weak as investors tended to avoid these more defensive stocks and instead demonstrated an increased appetite for risk. By country, India, Indonesia and Thailand led the way—each posting returns of more than 50% for the second quarter. They were followed by Singapore, China and Hong Kong, all of which gained more than 30%. Taiwan, Korea and Japan also performed reasonably well—advancing more than 20%.

For the first half of 2009, the largest positive contributors to Fund performance were the portfolio's consumer discretionary holdings in China. Chinese domestic demand was resilient during the first half of the year, and the portfolio was positioned to benefit from this. Ctrip, the Fund's largest holding and one of China's leading online (and offline) travel agencies, is a beneficiary of growing domestic travel. The company is growing much faster than the rest of the industry by focusing on corporate businesses and offering superior services. Despite the global slowdown in travel, demand for domestic travel within China has fared relatively well. Air traffic volume actually rose 17% in the first half of the year. Although occupancy rates at high-end hotels were down mainly due to the decline in the number of foreign travelers, mid- to low-end hotels frequented by domestic travelers weathered the storm. The industry as a whole i s very fragmented as most travel agencies in China are "mom and pop" shops. We believe that Ctrip is well-positioned to benefit from China's growing middle class.

During the second quarter, the Fund benefited from strong stock selection across the region. The portfolio's overweight positions in financials—especially its real estate holdings in China, Japan and Singapore—performed well. Additionally, the investments we initiated late last year in depressed auto companies in China, Korea and Indonesia contributed to Fund performance. Despite generally weak performance in the telecom sector, the Fund's positions in Softbank of Japan and Bharti Airtel of India added value. Conversely, the Fund's overweight positions in health care and information technology detracted from performance in the second quarter.

Some of the portfolio's holdings, particularly those in China and Hong Kong, have risen to almost pre-global crisis levels and as a result are becoming less attractive. After the markets' sharp rally, we believe that it will be increasingly challenging to find companies trading at attractive valuations in Asia Pacific, with the exception of Japan. The Fund's weighting in Japan is currently at the low end of its historical range; this is primarily the result of the massive stock price appreciation that

(continued)

16 MATTHEWS ASIA FUNDS

PERFORMANCE AS OF JUNE 30, 2009

| | | | | Average Annual Total Return | |

| | | 3 Months | | YTD | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | Inception

10/31/03 | |

| Matthews Asia Pacific Fund | | | 33.81 | % | | | 21.14 | % | | | -10.44 | % | | | -1.09 | % | | | 6.31 | % | | N/A | | | 7.34 | % | |

| MSCI AC Asia Pacific Index3 | | | 28.20 | % | | | 16.83 | % | | | -22.33 | % | | | -4.37 | % | | | 4.79 | % | | N/A | | | 6.15 | % | |

| Lipper Pacific Regions Fund Category Average4 | | | 28.56 | % | | | 16.01 | % | | | -25.57 | % | | | -5.34 | % | | | 4.75 | % | | | 3.60 | % | | | 5.86 | % | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund's fees and expenses had not been waived. For the Fund's most recent month-end performance visit matthewsasia.com.

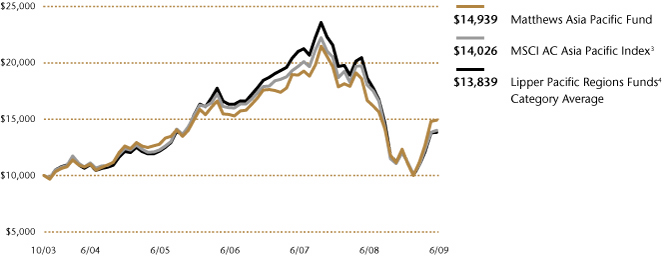

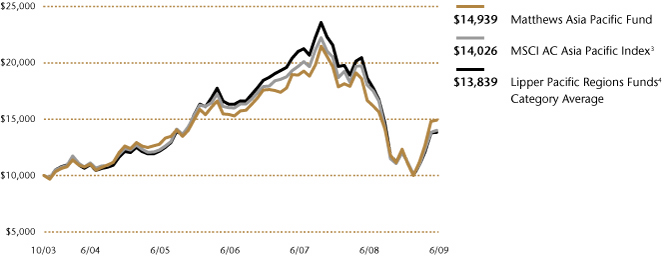

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gain distributions or redemption of Fund shares. Values are in US$.

3 It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital Management; total return calculations performed by PNC Global Investment Servicing (U.S.) Inc. Please see page 84 for index definition.

4 The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods.

TOP TEN HOLDINGS5

| | | Country | | % of Net Assets | |

| Ctrip.com International, Ltd. | | China/Hong Kong | | | 4.3 | % | |

| China Vanke Co., Ltd. | | China/Hong Kong | | | 3.7 | % | |

| Sysmex Corp. | | Japan | | | 3.0 | % | |

| HDFC Bank, Ltd. | | India | | | 3.0 | % | |

| Softbank Corp. | | Japan | | | 2.7 | % | |

| Monex Group, Inc. | | Japan | | | 2.5 | % | |

| China South Locomotive and Rolling Stock Corp. | | China/Hong Kong | | | 2.5 | % | |

| MID REIT, Inc. | | Japan | | | 2.5 | % | |

| Oil Search, Ltd. | | Australia | | | 2.4 | % | |

| PT Bank Rakyat Indonesia | | Indonesia | | | 2.4 | % | |

| % OF ASSETS IN TOP TEN | | | | | 29.0 | % | |

5 Holdings may combine more than one security from same issuer and related depositary receipts.

matthewsasia.com | 800.789.ASIA 17

COUNTRY ALLOCATION (%)

| Japan | | | 33.5 | | |

| China/Hong Kong | | | 29.2 | | |

| India | | | 7.9 | | |

| South Korea | | | 7.2 | | |

| Australia | | | 6.6 | | |

| Indonesia | | | 5.9 | | |

| Taiwan | | | 4.2 | | |

| Singapore | | | 2.9 | | |

| Thailand | | | 1.7 | | |

| Malaysia | | | 1.0 | | |

Liabilities in Excess of

Cash and Other Assets | | | -0.1 | | |

SECTOR ALLOCATION (%)

| Financials | | | 35.9 | | |

| Consumer Discretionary | | | 16.4 | | |

| Industrials | | | 13.3 | | |

| Information Technology | | | 10.2 | | |

| Consumer Staples | | | 8.4 | | |

| Health Care | | | 6.5 | | |

| Telecommunication Services | | | 5.6 | | |

| Energy | | | 2.4 | | |

| Materials | | | 1.4 | | |

Liabilities in Excess of

Cash and Other Assets | | | -0.1 | | |

MARKET CAP EXPOSURE (%)6

| Large Cap (Over $5B) | | | 50.9 | | |

| Mid Cap ($1B-$5B) | | | 31.2 | | |

| Small Cap (Under $1B) | | | 18.0 | | |

Liabilities in Excess of

Cash and Other Assets | | | -0.1 | | |

6 Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding.

Matthews Asia Pacific Fund

Portfolio Manager Commentary (continued)

occurred in other parts of Asia Pacific during the first half of the year. We believe that there are many great investment opportunities in Japan and the country's upcoming elections later this summer will be critical in determining the direction Japan will take over the next few years.

The Fund continues to seek investment opportunities that are beneficiaries of Asia's continuing integration. The direct investment by a mainland Chinese company in Taiwan earlier this year may be a precursor to greater integration between the two countries. In our view, there is also a link quietly developing between Japan and Taiwan. For many years, Taiwan has been the center for outsourced electronic products, mainly semiconductor chips and PCs. Unlike U.S. companies, Japanese companies did not participate in the trend to outsource to Taiwanese electronic manufacturing services (EMS) companies; rather they opted to use their own domestic manufacturing facilities. The current lack of global demand is now leading to a consolidation of the semiconductor industry in Japan with leading Japanese chip makers now opting to outsource to Taiwanese companies in a significant way for the first time. We think that this development is posit ive for both Japan and Taiwan: Taiwanese companies acquire more business from Japan, and Japanese companies can focus on design rather than draining investment capital and human resources on manufacturing. While this may be a small step toward regional reconfiguration of industries, it is certainly an important symbolic step that integration is moving in the right direction.

18 MATTHEWS ASIA FUNDS

Matthews Asia Pacific Fund June 30, 2009

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 98.8%

| | | Shares | | Value | |

| JAPAN: 33.5% | |

| Sysmex Corp. | | | 134,700 | | | $ | 4,882,879 | | |

| Softbank Corp. | | | 224,100 | | | | 4,365,678 | | |

| Monex Group, Inc. | | | 9,218 | | | | 4,091,772 | | |

| MID REIT, Inc. | | | 1,832 | | | | 4,081,499 | | |

| Benesse Corp. | | | 94,400 | | | | 3,785,268 | | |

| Pigeon Corp. | | | 110,800 | | | | 3,531,254 | | |

| Toshiba Machine Co., Ltd. | | | 918,000 | | | | 3,388,249 | | |

| The Japan Steel Works, Ltd. | | | 252,000 | | | | 3,105,647 | | |

| Keyence Corp. | | | 14,930 | | | | 3,041,671 | | |

| Unicharm Petcare Corp. | | | 100,400 | | | | 2,996,560 | | |

| The Furukawa Electric Co., Ltd. | | | 628,000 | | | | 2,825,161 | | |

| ORIX Corp. | | | 45,190 | | | | 2,689,716 | | |

| Fanuc, Ltd. | | | 33,100 | | | | 2,652,512 | | |

| Mori Trust Sogo REIT, Inc. | | | 364 | | | | 2,592,765 | | |

| Komatsu, Ltd. | | | 160,200 | | | | 2,473,416 | | |

| GCA Savvian Group Corp. | | | 1,603 | | | | 1,984,142 | | |

| Nintendo Co., Ltd. | | | 6,100 | | | | 1,688,205 | | |

| Total Japan | | | | | | | 54,176,394 | | |

| CHINA/HONG KONG: 29.2% | |

| Ctrip.com International, Ltd. ADRb | | | 149,400 | | | | 6,917,220 | | |

| China Vanke Co., Ltd. B Shares | | | 4,178,387 | | | | 6,022,261 | | |

China South Locomotive and Rolling

Stock Corp., H Shares | | | 7,006,900 | | | | 4,084,552 | | |

| Tingyi (Cayman Islands) Holding Corp. | | | 2,370,000 | | | | 3,901,483 | | |

| China Life Insurance Co., Ltd. H Shares | | | 1,049,000 | | | | 3,855,287 | | |

| Hang Lung Group, Ltd. | | | 782,000 | | | | 3,659,275 | | |

| China Merchants Bank Co., Ltd. H Shares | | | 1,594,450 | | | | 3,618,597 | | |

| Hong Kong Exchanges and Clearing, Ltd. | | | 228,900 | | | | 3,537,992 | | |

| Shangri-La Asia, Ltd. | | | 2,096,000 | | | | 3,095,729 | | |

| Dairy Farm International Holdings, Ltd. | | | 477,354 | | | | 3,080,331 | | |

Kingdee International Software Group

Co., Ltd. | | | 14,118,000 | | | | 2,431,299 | | |

Dongfeng Motor Group Co., Ltd.

H Shares | | | 2,460,000 | | | | 2,063,352 | | |

New Oriental Education & Technology

Group, Inc. ADRb | | | 14,100 | | | | 949,776 | | |

| Total China/Hong Kong | | | | | | | 47,217,154 | | |

| INDIA: 7.9% | |

| HDFC Bank, Ltd. | | | 126,958 | | | | 3,933,780 | | |

| Jain Irrigation Systems, Ltd. | | | 231,623 | | | | 3,034,428 | | |

| Bharti Airtel, Ltd.b | | | 173,242 | | | | 2,895,979 | | |

| Sun Pharmaceutical Industries, Ltd. | | | 83,845 | | | | 1,902,640 | | |

| HDFC Bank, Ltd. ADR | | | 9,000 | | | | 928,170 | | |

| Total India | | | | | | | 12,694,997 | | |

| | | Shares | | Value | |