UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

Robert Horrocks, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-7553

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| | (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Semi-Annual Report

June 30, 2022 | matthewsasia.com

GLOBAL EMERGING MARKETS STRATEGIES

Matthews Emerging Markets Equity Fund

Matthews Emerging Markets Small Companies Fund

ASIA GROWTH STRATEGIES

Matthews Asia Growth Fund

Matthews Pacific Tiger Fund

Matthews Asia ESG Fund

Matthews Asia Innovators Fund

Matthews China Fund

Matthews China Small Companies Fund

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Dividend Fund

Matthews China Dividend Fund

ASIA FIXED INCOME STRATEGIES

Matthews Asia Total Return Bond Fund

Matthews Asia Credit Opportunities Fund

Paper copies of the Funds’ annual and semi-annual shareholder reports are no longer being sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website matthewsasia.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive paper copies of shareholder reports and other communications from the Funds anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800.789.ASIA (2742).

Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held directly with Matthews Asia Funds.

Investor Class Performance and Expense Ratios (June 30, 2022) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Average Annual Total Return† | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense

Ratios

after Fee

Waiver

and

Expense

Reim- bursement* | |

| Investor Class | | 1 year | | | 5 years | | | 10 years | | | Since

Inception | |

GLOBAL EMERGING MARKETS STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Emerging Markets Equity Fund (MEGMX) | | | -31.53% | | | | n.a. | | | | n.a. | | | | 9.07% | | | | 4/30/20 | | | | 1.52% | | | | 1.13% | 1 |

| | | | | | | |

Emerging Markets Small Companies Fund (MSMLX) | | | -15.79% | | | | 9.48% | | | | 8.39% | | | | 10.84% | | | | 9/15/08 | | | | 1.51% | | | | 1.35% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

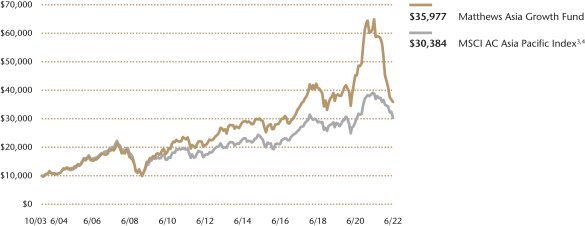

Asia Growth Fund (MPACX) | | | -44.60% | | | | 1.27% | | | | 5.60% | | | | 7.10% | | | | 10/31/03 | | | | 1.07% | | | | 1.07% | |

| | | | | | | |

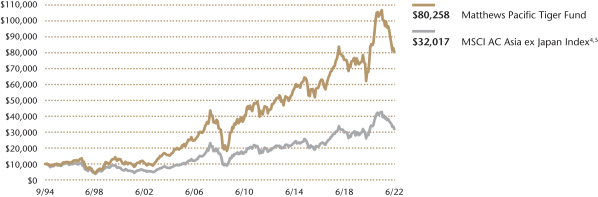

Pacific Tiger Fund (MAPTX) | | | -24.82% | | | | 3.22% | | | | 6.19% | | | | 7.78% | | | | 9/12/94 | | | | 1.06% | | | | 1.03% | 2 |

| | | | | | | |

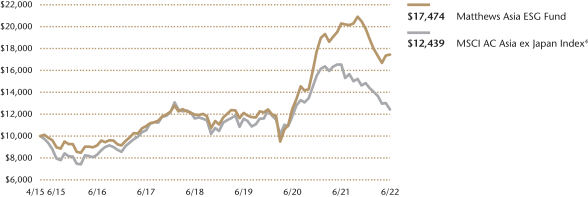

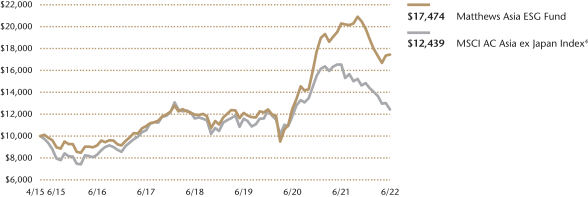

Asia ESG Fund (MASGX)§ | | | -13.98% | | | | 9.91% | | | | n.a. | | | | 8.10% | | | | 4/30/15 | | | | 1.35% | | | | 1.35% | 3,4 |

| | | | | | | |

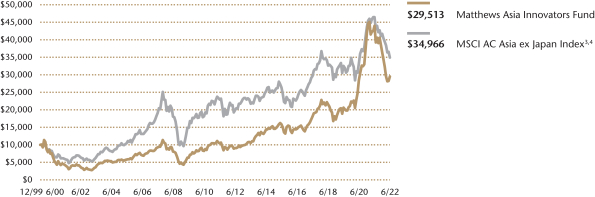

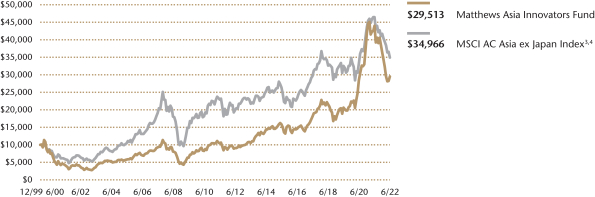

Asia Innovators Fund (MATFX) | | | -32.88% | | | | 10.28% | | | | 12.42% | | | | 4.93% | | | | 12/27/99 | | | | 1.09% | | | | 1.09% | |

| | | | | | | |

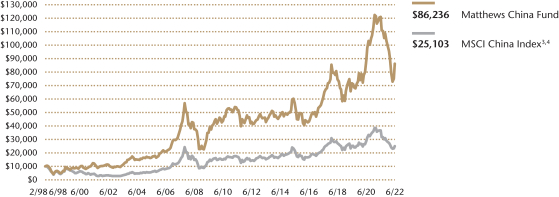

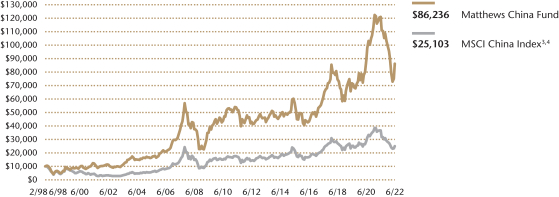

China Fund (MCHFX) | | | -28.80% | | | | 7.14% | | | | 7.17% | | | | 9.25% | | | | 2/19/98 | | | | 1.06% | | | | 1.06% | |

| | | | | | | |

China Small Companies Fund (MCSMX) | | | -32.25% | | | | 14.21% | | | | 12.78% | | | | 8.05% | | | | 5/31/11 | | | | 1.48% | | | | 1.43% | 3 |

| | | | | | | |

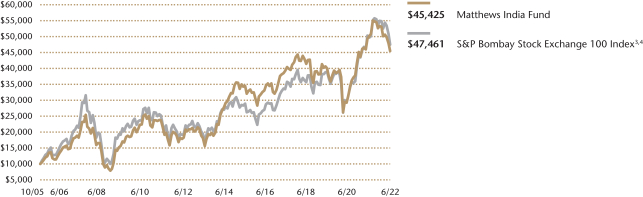

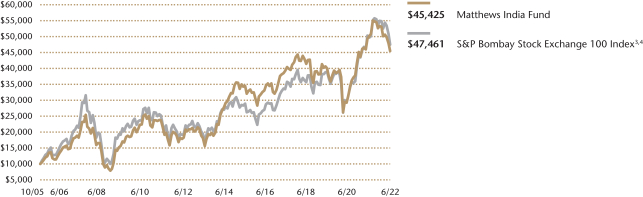

India Fund (MINDX) | | | -9.41% | | | | 3.02% | | | | 9.62% | | | | 9.51% | | | | 10/31/05 | | | | 1.10% | | | | 1.10% | |

| | | | | | | |

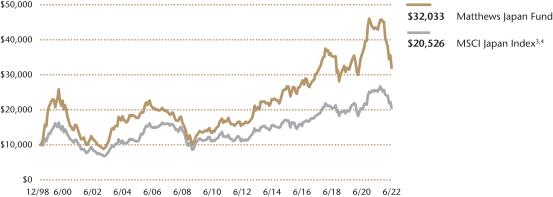

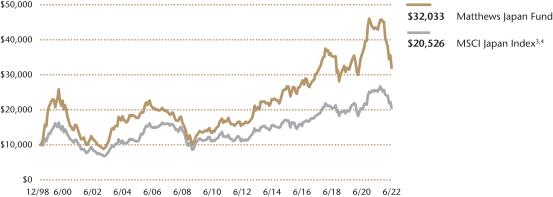

Japan Fund (MJFOX) | | | -26.32% | | | | 1.07% | | | | 7.22% | | | | 5.08% | | | | 12/31/98 | | | | 0.95% | | | | 0.95% | |

| | | | | | | |

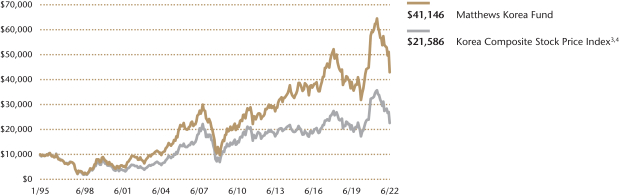

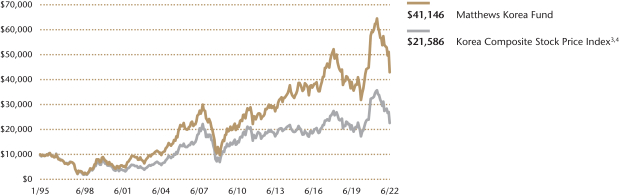

Korea Fund (MAKOX) | | | -33.39% | | | | -0.79% | | | | 5.55% | | | | 5.28% | | | | 1/3/95 | | | | 1.13% | | | | 1.13% | |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

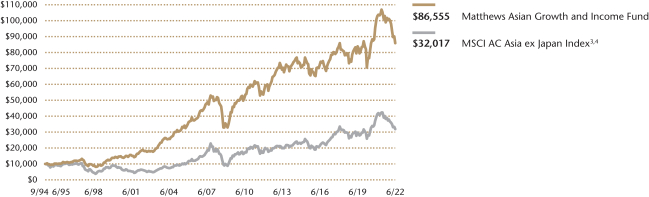

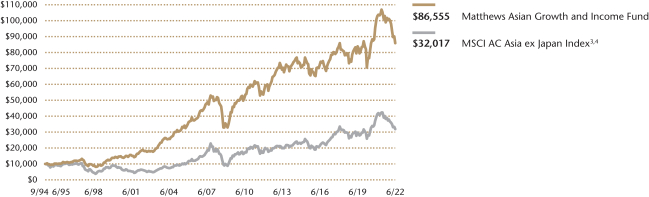

Asian Growth and Income Fund (MACSX) | | | -18.41% | | | | 1.80% | | | | 3.90% | | | | 8.07% | | | | 9/12/94 | | | | 1.07% | | | | 1.07% | |

| | | | | | | |

Asia Dividend Fund (MAPIX) | | | -27.97% | | | | 1.26% | | | | 5.45% | | | | 6.90% | | | | 10/31/06 | | | | 1.03% | | | | 1.02% | 2 |

| | | | | | | |

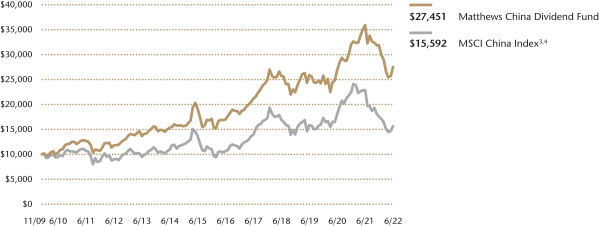

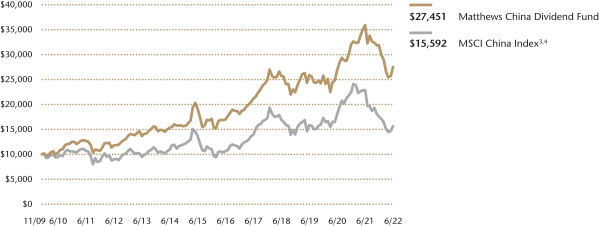

China Dividend Fund (MCDFX) | | | -23.47% | | | | 5.34% | | | | 8.84% | | | | 8.36% | | | | 11/30/09 | | | | 1.12% | | | | 1.12% | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

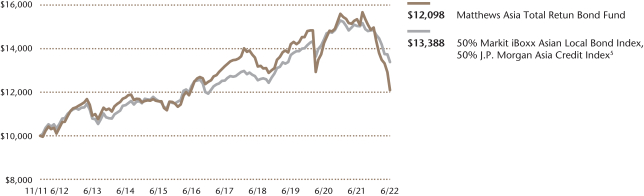

Asia Total Return Bond Fund (MAINX) | | | -21.15% | | | | -1.71% | | | | 1.56% | | | | 1.82% | | | | 11/30/11 | | | | 1.05% | | | | 1.05% | 1 |

| | | | | | | |

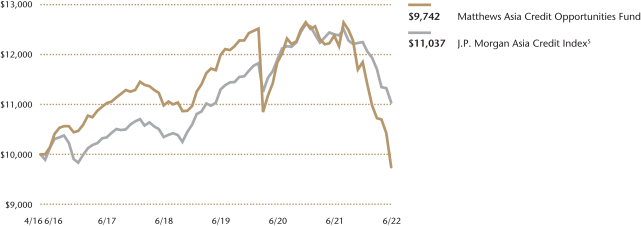

Asia Credit Opportunities Fund (MCRDX) | | | -21.29% | | | | -2.44% | | | | n.a. | | | | -0.42% | | | | 4/29/16 | | | | 1.07% | | | | 1.07% | 1 |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| * | These figures are from the Funds’ prospectus dated as of April 28, 2022, and may differ from the actual expense ratios for fiscal year 2021, as shown in the financial highlights section of this report. |

| § | The Fund’s name changed from Matthews Asia ESG Fund to Matthews Emerging Markets Sustainable Future Fund on July 29, 2022. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. Pursuant to this agreement, any amount waived for prior fiscal years with respect to the Matthews Asia Total Return Bond Fund and the Matthews Asia Credit Opportunities Fund is not subject to recoupment. For the Matthews Emerging Markets Equity Fund, if the operating expenses fall below the expense limitation within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2023 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2023 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.20% (except for the Matthews Emerging Markets Small Companies Fund, which has an expense limitation of 1.15% for the Institutional Class) first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.20% expense limitation (or 1.15% for the Matthews Emerging Markets Small Companies Fund), to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. Effective July 29, 2022, for the Matthews Emerging Markets Sustainable Future Fund (formerly the Matthews Asia ESG Fund), Matthews reduced this expense limitation to 1.15% for the Institutional Class and waived a corresponding amount (in annual percentage terms) for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.20% (or 1.15% for the Matthews Emerging Markets Small Companies Fund). If the operating expenses fall below the expense limitation within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2023 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 4 | Expense ratios are from the Fund’s prospectus dated as of July 29, 2022. |

Institutional Class Performance and Expense Ratios (June 30, 2022) (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Average Annual Total Return† | | | | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense

Ratios

after Fee

Waiver

and

Expense

Reim- bursement* | |

| Institutional Class | | 1 year | | | 5 years | | | 10 years | | | Since

Inception | | | Inception

Date | |

GLOBAL EMERGING MARKETS STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Emerging Markets Equity Fund (MIEFX) | | | -31.28% | | | | n.a. | | | | n.a. | | | | 9.35% | | | | 4/30/20 | | | | 1.38% | | | | 0.90% | 1 |

| | | | | | | |

Emerging Markets Small Companies Fund (MISMX) | | | -15.59% | | | | 9.70% | | | | n.a. | | | | 6.79% | | | | 4/30/13 | | | | 1.38% | | | | 1.15% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Growth Fund (MIAPX) | | | -44.52% | | | | 1.43% | | | | 5.78% | | | | 4.46% | | | | 10/29/10 | | | | 0.92% | | | | 0.92% | |

| | | | | | | |

Pacific Tiger Fund (MIPTX) | | | -24.73% | | | | 3.37% | | | | 6.36% | | | | 5.00% | | | | 10/29/10 | | | | 0.92% | | | | 0.90% | 2 |

| | | | | | | |

Asia ESG Fund (MISFX)§ | | | -13.74% | | | | 10.15% | | | | n.a. | | | | 8.34% | | | | 4/30/15 | | | | 1.15% | | | | 1.15% | 3,4 |

| | | | | | | |

Asia Innovators Fund (MITEX) | | | -32.76% | | | | 10.46% | | | | n.a. | | | | 11.87% | | | | 4/30/13 | | | | 0.93% | | | | 0.93% | |

| | | | | | | |

China Fund (MICFX) | | | -28.71% | | | | 7.33% | | | | 7.34% | | | | 4.42% | | | | 10/29/10 | | | | 0.91% | | | | 0.91% | |

| | | | | | | |

China Small Companies Fund (MICHX) | | | -32.08% | | | | n.a. | | | | n.a. | | | | 11.81% | | | | 11/30/17 | | | | 1.31% | | | | 1.20% | 3 |

| | | | | | | |

India Fund (MIDNX)# | | | -9.27% | | | | 3.17% | | | | 9.81% | | | | 5.25% | | | | 10/29/10 | | | | 0.96% | | | | 0.96% | |

| | | | | | | |

Japan Fund (MIJFX) | | | -26.23% | | | | 1.14% | | | | 7.32% | | | | 6.78% | | | | 10/29/10 | | | | 0.89% | | | | 0.89% | |

| | | | | | | |

Korea Fund (MIKOX) | | | -33.28% | | | | -0.67% | | | | 5.67% | | | | 5.36% | | | | 10/29/10 | | | | 0.98% | | | | 0.98% | |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asian Growth and Income Fund (MICSX) | | | -18.32% | | | | 1.93% | | | | 4.05% | | | | 3.51% | | | | 10/29/10 | | | | 0.94% | | | | 0.94% | |

| | | | | | | |

Asia Dividend Fund (MIPIX) | | | -27.86% | | | | 1.38% | | | | 5.58% | | | | 4.84% | | | | 10/29/10 | | | | 0.92% | | | | 0.91% | 2 |

| | | | | | | |

China Dividend Fund (MICDX) | | | -23.32% | | | | 5.49% | | | | 9.03% | | | | 7.53% | | | | 10/29/10 | | | | 0.97% | | | | 0.97% | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Total Return Bond Fund (MINCX) | | | -20.98% | | | | -1.50% | | | | 1.77% | | | | 2.03% | | | | 11/30/11 | | | | 0.91% | | | | 0.90% | 1 |

| | | | | | | |

Asia Credit Opportunities Fund (MICPX) | | | -21.08% | | | | -2.21% | | | | n.a. | | | | -0.19% | | | | 4/29/16 | | | | 0.93% | | | | 0.90% | 1 |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| * | These figures are from the Funds’ prospectus dated as of April 28, 2022, and may differ from the actual expense ratios for fiscal year 2021, as shown in the financial highlights section of this report. |

| § | The Fund’s name changed from Matthews Asia ESG Fund to Matthews Emerging Markets Sustainable Future Fund on July 29, 2022. |

| # | Performance results include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. |

| 1 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90%. Pursuant to this agreement, any amount waived for prior fiscal years with respect to the Matthews Asia Total Return Bond Fund and the Matthews Asia Credit Opportunities Fund is not subject to recoupment. For the Matthews Emerging Markets Equity Fund, if the operating expenses fall below the expense limitation within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2023 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2023 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.20% (except for the Matthews Emerging Markets Small Companies Fund, which has an expense limitation of 1.15% for the Institutional Class). Effective July 29, 2022, for the Matthews Emerging Markets Sustainable Future Fund (formerly the Matthews Asia ESG Fund), Matthews reduced this expense limitation to 1.15% for the Institutional Class. If the operating expenses fall below the expense limitation within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2023 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 4 | Expense ratios are from the Fund’s prospectus dated as of July 29, 2022. |

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 3 | |

Cover photo: Tea plantations in Xijian, China

This report has been prepared for Matthews International Funds (d/b/a Matthews Asia Funds) shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. Additional copies of the prospectus or summary prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of June 30, 2022. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund’s future investment intent. Current and future portfolio holdings are subject to risk.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Contents

* The Fund’s name changed from Matthews Asia ESG Fund to Matthews Emerging Markets Sustainable Future Fund on July 29, 2022.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of a concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds’ Prospectuses and Statement of Additional Information for more risk disclosure.

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 5 | |

Message to Shareholders from the

Investment Advisor

Dear Valued Shareholders,

In the end, long-term investing is not really about timing economic cycles. Why? Well, for one thing, it’s hard to do. Our macroeconomic discussions also tend to focus less on the general environment. Gross domestic product (GDP), inflation and interest-rate cycles are not front and center of our considerations.

The issues we chew over are more tied to the prospects of companies themselves. Are we investing in countries which have policies supporting markets and the promotion of high-quality businesses? Are we able to find businesses with market power? Can they raise prices when the environment allows and maintain prices when the environment moves against them? Are they in a strong bargaining position with suppliers? Do they have a good or service that their clients will prioritize over other spending? Are they free from competition in providing these goods? And, finally, can we make a decent estimate of valuation?

A lot of this is about understanding companies and their management but also having the discipline to back up the analysis with some kind of fundamental assessment and metric. We don’t invest in fads, fashions and stories. That’s speculation. Growth investing is more concrete. We try to understand the economic environment as it relates to industrial ecosystems. So it’s in this sense that the macro most often enters our calculations.

Look beyond sentiment

It’s undoubtedly been the case that there have been some significant factors playing out within the economic environments and industrial ecosystems of certain markets recently. Take the regulatory initiatives in China, which triggered such a shock on the markets. Here was a government prepared to stand up to the monopolistic power of companies in the online retail trade. That seemed like a foreign concept to many Western investors and yet, we ourselves have the same issues around market power in some industries. Our governments also espouse the same ideals of intervention in the market, rhetorically at least.

But despite the adverse sentiment these policies caused, they did not render China “uninvestable’’ as some have claimed. It simply required an understanding of the motivations behind the government’s actions and a realization that there were other companies that might benefit from having a more level playing field or open architecture in the online retail space.

Similarly, the approach to regulation in the educational and health-care sectors in China was around trying to provide broader access for lower income families. Although there may have been some missteps and misunderstanding about how the price system would react to regulation, we have emerged with a rational market where low-cost providers will grab market share and highly innovative businesses will be allowed a certain amount of time to reap quasi-monopolistic profits in order to encourage continued research and development.

Staying with Asia, while China is a managed, growth economy with developed regulatory oversight, there are other markets that are struggling with the earlier stages of development and have very different environments and ecosystems. They’re figuring out how to build the appropriate infrastructure, and how to meet the challenge of creating a strong manufacturing base and if in fact that is still the best way to raise wages and living standards. Some have been more successful than others. We’ve always been complimentary about the advances Vietnam has made, for instance. On the other hand, we’ve tended to be skeptical that India could achieve the kind of progress in these areas that other less democratic regimes have achieved—at least at the pace they have achieved them. Now, however, India appears to be moving in the right direction.

And then there are the developed economies of North Asia. They are at another level of development stage having bred their own global champions, most notably in electronics and technology hardware. Their economies are more export-led and right now

more exposed to the adverse sentiment building over slowing growth and the prospect of recession in the West.

Added value in Latin America

Looking across to Latin America, commodity price-inflation is usually seen to be a boon. It’s often a big reason for speculators to trade these markets. But while these countries are indeed resource rich, this strength can be a vulnerability and at times like these they can become caricatures. A rise in commodity prices will lift stocks but the subsequent fall in commodities will usually see these markets relegated to the sidelines once more.

But these caricatures are just that. The economies of Latin America are much more varied than this. One way to access their growth—and this apples to other areas of emerging markets too—is through investment in local banks. Their banking systems are often much more commercially run than one sees in Asia, particularly North Asia. It’s probably true that emerging market banks have benefitted perhaps even more than commodity producers in this inflationary episode and period of steepening of global yield curves.

Additionally, the opening up of Latin American economies to tourism as the pandemic subsides should be a further boost. We can access this growth directly through consumer businesses but also through travel infrastructures such as airports, which are often interesting businesses in that they are mini monopolies! And beyond the immediate beneficiaries of the return to normalcy, there are interesting franchises in the health-care sector, where we can invest for secular growth as societies both age and get wealthier.

So it would be wrong to buy into the caricature of emerging markets as inflationary trades. Even if inflation does subside quickly, there is much value to be had in Latin America, value that has only been increased by the recent strength of the U.S. dollar.

Business not inflation

If we stand back for a moment—while markets continue to fixate on the pressing problem of inflation in the U.S. economy and how the central banks will respond—we see that many emerging market economies are treading a relatively normal path. There’s no reason why these economies shouldn’t keep making advances in their own ways in terms of productivity, innovation and growth. Granted, some central banks around the world are hiking but not at the magnitude of the Fed. And those markets with large, strong domestic economies can mitigate slowing overseas consumer demand and the prospect of recession in Europe and the U.S. China’s counter-cyclical monetary stance even puts it in a position to inject stimulus and demand into its economy.

There are headwinds to be sure. China’s zero-COVID policy has hit the economy and sentiment much harder than I would have thought. And dollar strength has always been a problem for emerging markets. But at some point a strong dollar starts to make foreign purchases attractive and emerging market valuations are already relatively low compared to global peers.

We would contend that much like the magician’s sleight of hand that deceives the audience, investors in the West have been focused on inflation just as emerging markets companies have been focused on their businesses. And it is companies that we have been focused on—not rising prices. For what it is worth, I think inflation is peaking and the Fed is likely too tight than too loose. But in any case, we try to find the companies that can best navigate the future whatever the rate of increase in prices or whether or not the West enters recession.

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

| | | | | | | | |

| | | | matthewsasia.com | 800.789.ASIA | | | 7 | |

| | | | |

| PORTFOLIO MANAGERS |

| |

| John Paul Lech | | |

Lead Manager | | |

| |

| Alex Zarechnak | | |

Co-Manager | | |

|

| FUND FACTS |

| | |

| | | Investor | | Institutional |

Ticker | | MEGMX | | MIEFX |

CUSIP | | 577130651 | | 577130644 |

Inception | | 4/30/20 | | 4/30/20 |

NAV | | $10.80 | | $10.82 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.52% | | 1.38% |

After fee waiver and Reimbursement2 | | 1.13% | | 0.90% |

Portfolio Statistics |

Total # of Positions | | 57 |

Net Assets | | $38.2 million |

Weighted Average Market Cap | | $93.4 billion |

Portfolio Turnover3 | | 88.5% |

Benchmark | | |

MSCI Emerging Markets Index |

OBJECTIVE

Long-term capital appreciation.

STRATEGY

Under normal circumstances, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in emerging market countries. Emerging market countries generally include every country in the world except the United States, Australia, Canada, Hong Kong, Israel, Japan, New Zealand, Singapore and most of the countries in Western Europe.

Matthews Emerging Markets Equity Fund

Portfolio Manager Commentary (unaudited)

For the first half of 2022, the Matthews Emerging Markets Equity Fund returned –24.69% (Investor Class) and –24.55% (Institutional Class), while its benchmark, the MSCI Emerging Markets Index, returned –17.47% over the same period. For the quarter ending June 30, 2022, the Fund returned

–14.96% (Investor Class) and –14.80% (Institutional Class), while the benchmark returned –11.34%.

Market Environment:

The first half of 2022 was the weakest start for the S&P 500 since World War II with the exception of 1962 when markets were upended in the months leading up to the Cuban Missile Crisis. The NASDAQ Composite Index is down around 30% for the first half of the year. Elsewhere, bonds, crypto assets and cash provided little succor making the year thus far one of the most confounding of my career.

There have been some bright spots. Broadly, U.S.-listed Chinese American Depositary Receipts (ADRs) had their best month in June in three years after regaining from some of the underperformance of recent quarters. But while there are exceptions at the company level, index estimates indicate investors are still paying a hefty price-to-earnings ratio* (P/E) premium for U.S.-listed China exposure, with the NASDAQ Composite Index trading on 23-24x 2022 earnings and the NASDAQ Golden Dragon China Index trading on 33-34x earnings.

With U.S. Federal Reserve rates likely to move higher and little abatement in geopolitical tensions, the prospect of pandemic stocks roaring back and China internet stocks rebounding meaningfully is not a given. There is still very much a case for selectivity—and balance, ballast and income are worth considering too.

Performance Contributors and Detractors:

From a regional perspective most of our relative underperformance in the first half of the year was tied to Russia, which is nominally marked at close to zero. The pain has been taken. Geopolitical events on the magnitude of the invasion of Ukraine are rare, hard to predict ex-ante but easy to Monday morning quarterback. Our overall construction held up well in what was a major geopolitical event. That’s in stark contrast to strategies that underperformed as a result of an inability to pivot from early-stage companies with little profits that were en vogue during the pandemic and now face material headwinds in the current market backdrop. On the other hand, our allocation to Vietnam contributed the most to relative performance in the first half.

At the sector level, our overweight and stock allocation in real estate contributed the most to performance over the past six months while stock selection in materials was a positive contributor. In contrast, our stock selections in energy and financials detracted the most.

At the holdings level, real estate company CapitaLand Investment in Singapore was a top contributor in the first half, as was energy giant Petroleo Brasileiro SA in Brazil and financial services company AIA Group in Hong Kong. Two information technology (IT) stocks: Samsung Electronics Co. Ltd Pfd and Taiwan Semiconductor Manufacturing Co. (TSMC) were among the biggest detractors. The

(continued)

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2023 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | The lesser of fiscal year 2021 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | | | | | | | | | | | | | | | | | |

| |

| PERFORMANCE AS OF JUNE 30, 2022 | |

| | | 3 Months | | | YTD | | | 1 Year | | | Since

Inception | | | Inception

date | |

| Investor Class (MEGMX) | | | -14.96% | | | | -24.69% | | | | -31.53% | | | | 9.07% | | | | 04/30/20 | |

| Institutional Class (MIEFX) | | | -14.80% | | | | -24.55% | | | | -31.28% | | | | 9.35% | | | | 04/30/20 | |

| MSCI Emerging Markets Index4 | | | -11.34% | | | | -17.47% | | | | -25.00% | | | | 6.56% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

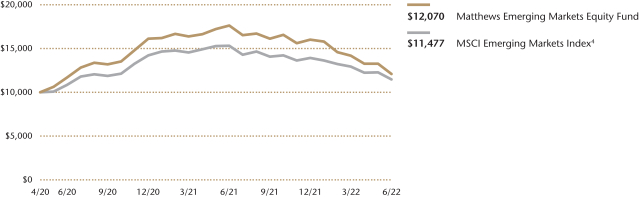

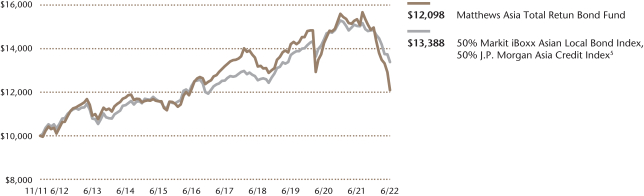

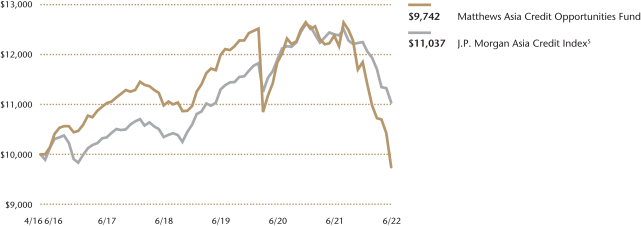

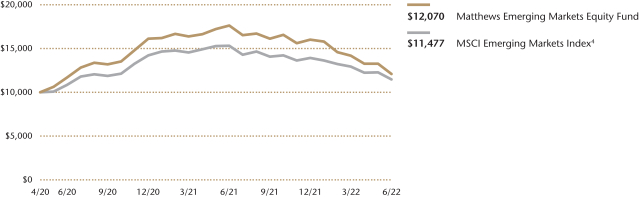

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

| | 4 | It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 84 for index definition. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS5 | | | | | | | |

Name | | Sector | | Country | | % Net Assets | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Information Technology | | Taiwan | | | 6.6% | |

| Samsung Electronics Co., Ltd., Pfd. | | Information Technology | | South Korea | | | 5.5% | |

| FPT Corp. | | Information Technology | | Vietnam | | | 4.8% | |

| Tencent Holdings, Ltd. | | Communication Services | | China/Hong Kong | | | 4.1% | |

| Capitaland Investment, Ltd. | | Real Estate | | Singapore | | | 3.5% | |

| Infosys, Ltd. | | Information Technology | | India | | | 2.9% | |

| HDFC Bank, Ltd. | | Financials | | India | | | 2.8% | |

| Woodside Energy Group, Ltd. | | Energy | | Australia | | | 2.8% | |

| First Quantum Minerals, Ltd. | | Materials | | Zambia | | | 2.8% | |

| Prologis Property Mexico SA de CV, REIT | | Real Estate | | Mexico | | | 2.7% | |

| % OF ASSETS IN TOP 10 | | | | | | | 38.5% | |

| | 5 | Holdings may combine more than one security from same issuer and related depositary receipts. |

| | | | | | | | |

| | | | matthewsasia.com | 800.789.ASIA | | | 9 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)6,7 | |

| China/Hong Kong | | | 16.5 | |

| India | | | 12.6 | |

| Mexico | | | 9.0 | |

| Brazil | | | 7.9 | |

| Taiwan | | | 7.4 | |

| South Korea | | | 7.2 | |

| Vietnam | | | 7.0 | |

| Singapore | | | 4.9 | |

| Canada | | | 3.4 | |

| Indonesia | | | 2.9 | |

| Australia | | | 2.8 | |

| Philippines | | | 2.5 | |

| United States | | | 2.5 | |

| United Kingdom | | | 2.5 | |

| France | | | 1.7 | |

| Qatar | | | 1.6 | |

| Israel | | | 1.5 | |

| Netherlands | | | 1.2 | |

| Argentina | | | 0.9 | |

| Poland | | | 0.8 | |

| Cash and Other Assets, Less Liabilities | | | 3.4 | |

| | | | |

| |

| SECTOR ALLOCATION (%)7 | |

| Information Technology | | | 25.1 | |

| Financials | | | 22.2 | |

| Consumer Discretionary | | | 10.3 | |

| Real Estate | | | 9.2 | |

| Materials | | | 8.9 | |

| Energy | | | 6.5 | |

| Industrials | | | 4.9 | |

| Consumer Staples | | | 4.5 | |

| Communication Services | | | 4.1 | |

| Health Care | | | 0.9 | |

| Cash and Other Assets, Less Liabilities | | | 3.4 | |

| | | | |

| | |

| MARKET CAP EXPOSURE (%)7 | | | |

| Mega Cap (over $25B) | | | 50.7 | |

| Large Cap ($10B-$25B) | | | 18.5 | |

| Mid Cap ($3B-10B) | | | 14.8 | |

| Small Cap (under $3B) | | | 12.6 | |

| Cash and Other Assets, Less Liabilities | | | 3.4 | |

| 6 | Not all countries where the Fund may invest are included in the benchmark index. |

| 7 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Country allocations and percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

Matthews Emerging Markets Equity Fund

Portfolio Manager Commentary (unaudited) (continued)

semiconductor space has been weak as fears of a recession or global slowdown weigh on sentiment. Samsung and TSMC fit our framework well as both have exceptional competitive positions, strong cash generation, and balance sheets that allow for funding of expansion from internal resources. These companies should continue to benefit long term from more chips in more things as well as from an expansion of semiconductor fabs in different geographies.

Notable Portfolio Changes:

Among the holdings we closed in the second quarter was our position in Alibaba Group Holding Ltd. The business is cheap, but we are unsure of the go-forward prospects in both its core e-commerce business and its capital allocation outside of it. Among the positions we added are Prudential Plc, which has a large, successful Asian life insurance business that is growing new business volumes in most of its markets now and should benefit meaningfully from re-opening in Hong Kong and China, the timing of which remains uncertain.

Outlook:

We’ve attempted to re-evaluate each of our holdings to understand resiliency against a backdrop of persistent (but perhaps peaked) inflation, geopolitical tension, and bias toward higher U.S. rates, which puts comparatively more pressure on cashless narratives compared with cash-generating ones. A strong dollar is a topic we’ve touched on in the past. The depth of asset price declines appears indiscriminate at times. When the dust settles, we believe elements of our framework including capital allocation, cash flow and capital structure, combined with solid company character, will eventually gain traction.

Good things tend to take care of themselves so investors need to ask hard questions about how companies will perform if the backdrop remains challenging. A U.S. recession or general decline in economic activity is increasingly a topic of concern. We don’t have any unique insight on the probability or depth of a slowdown, which is why the Matthews Emerging Markets Equity Fund remains more cautiously positioned than in past quarters. We believe investors need to think beyond consumer-driven trends that dominated during the height of the pandemic and embrace a broader set of companies going forward.

Definitions:

NASDAQ Composite Index: A market capitalization-weighted index of over 3,700 stocks listed on the Nasdaq stock exchange, heavily weighted toward the technology sector.

NASDAQ Golden Dragon China Index: A modified market capitalization-weighted index featuring companies whose common stock is publicly traded in the U.S. while the bulk of their business is conducted in China.

Price to earnings ratio: A valuation ratio of a company’s current share price compared to its per-share earnings.

Matthews Emerging Markets Equity Fund

June 30, 2022

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 91.1%

| | | | | | | | |

| | | Shares | | | Value | |

| | |

| CHINA/HONG KONG: 16.5% | | | | | | | | |

| | |

Tencent Holdings, Ltd. | | | 34,900 | | | | $1,579,754 | |

| | |

AIA Group, Ltd. | | | 86,400 | | | | 944,056 | |

| | |

Huazhu Group, Ltd. ADR | | | 17,400 | | | | 662,940 | |

| | |

ESR Group, Ltd.b,c,d | | | 225,800 | | | | 612,291 | |

| | |

JD.com, Inc. A Shares | | | 18,502 | | | | 596,191 | |

| | |

Yum China Holdings, Inc. | | | 11,400 | | | | 552,900 | |

| | |

Midea Group Co., Ltd. A Shares | | | 54,300 | | | | 491,472 | |

| | |

NARI Technology Co., Ltd. A Shares | | | 121,320 | | | | 491,043 | |

| | |

Techtronic Industries Co., Ltd. | | | 35,000 | | | | 365,475 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 6,296,122 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDIA: 12.6% | | | | | | | | |

| | |

Infosys, Ltd. ADR | | | 59,100 | | | | 1,093,941 | |

| | |

HDFC Bank, Ltd. ADR | | | 19,700 | | | | 1,082,712 | |

| | |

ICICI Bank, Ltd. ADR | | | 41,600 | | | | 737,984 | |

| | |

Kotak Mahindra Bank, Ltd. | | | 29,273 | | | | 619,117 | |

| | |

Restaurant Brands Asia, Ltd.c | | | 366,466 | | | | 517,320 | |

| | |

Dabur India, Ltd. | | | 73,145 | | | | 460,152 | |

| | |

Bandhan Bank, Ltd.b,d | | | 90,944 | | | | 305,140 | |

| | | | | | | | |

Total India | | | | | | | 4,816,366 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| MEXICO: 9.0% | | | | | | | | |

| | |

Prologis Property Mexico SA de CV, REIT | | | 392,998 | | | | 1,030,693 | |

| | |

Grupo Financiero Banorte SAB de CV Class O | | | 119,900 | | | | 668,797 | |

| | |

GCC SAB de CV | | | 101,400 | | | | 633,879 | |

| | |

Grupo Aeroportuario del Sureste SAB de CV ADR | | | 3,200 | | | | 628,448 | |

| | |

Becle SAB de CV | | | 218,800 | | | | 473,299 | |

| | | | | | | | |

Total Mexico | | | | | | | 3,435,116 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| BRAZIL: 7.9% | | | | | | | | |

| | |

Banco BTG Pactual SA | | | 183,200 | | | | 780,975 | |

| | |

Vale SA ADR | | | 45,400 | | | | 664,202 | |

| | |

Petroleo Brasileiro SA ADR | | | 50,200 | | | | 586,336 | |

| | |

Vinci Partners Investments, Ltd. Class A | | | 38,500 | | | | 411,950 | |

| | |

Hapvida Participacoes e Investimentos SAb,d | | | 344,100 | | | | 359,653 | |

| | |

Itau Unibanco Holding SA ADR | | | 50,400 | | | | 215,712 | |

| | | | | | | | |

Total Brazil | | | | | | | 3,018,828 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| TAIWAN: 7.3% | | | | | | | | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 157,000 | | | | 2,516,137 | |

| | |

Gogoro, Inc.c | | | 38,100 | | | | 291,465 | |

| | | | | | | | |

Total Taiwan | | | | | | | 2,807,602 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| VIETNAM: 7.0% | | | | | | | | |

| | |

FPT Corp. | | | 491,217 | | | | 1,822,163 | |

| | |

Military Commercial Joint Stock Bankc | | | 456,980 | | | | 476,082 | |

| | |

Sai Gon Cargo Service Corp. | | | 56,700 | | | | 386,613 | |

| | | | | | | | |

Total Vietnam | | | | | | | 2,684,858 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| SINGAPORE: 4.9% | | | | | | | | |

| | |

Capitaland Investment, Ltd. | | | 484,000 | | | | 1,332,123 | |

| | |

TDCX, Inc. ADRc | | | 57,800 | | | | 534,650 | |

| | | | | | | | |

Total Singapore | | | | | | | 1,866,773 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

| UNITED STATES: 3.4% | | | | | | | | |

| | |

Lam Research Corp. | | | 1,400 | | | | $596,610 | |

| | |

Globant SAc | | | 2,000 | | | | 348,000 | |

| | |

Excelerate Energy, Inc. Class Ac | | | 17,400 | | | | 346,608 | |

| | | | | | | | |

Total United States | | | | | | | 1,291,218 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDONESIA: 2.9% | | | | | | | | |

| | |

PT Bank Rakyat Indonesia Persero | | | 2,414,500 | | | | 674,287 | |

| | |

PT Avia Avian Tbk | | | 7,795,900 | | | | 426,492 | |

| | | | | | | | |

Total Indonesia | | | | | | | 1,100,779 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| AUSTRALIA: 2.8% | | | | | | | | |

| | |

Woodside Energy Group, Ltd. | | | 48,559 | | | | 1,067,255 | |

| | | | | | | | |

Total Australia | | | | | | | 1,067,255 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| ZAMBIA: 2.8% | | | | | | | | |

| | |

First Quantum Minerals, Ltd. | | | 55,500 | | | | 1,052,913 | |

| | | | | | | | |

Total Zambia | | | | | | | 1,052,913 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| UNITED KINGDOM: 2.5% | | | | | | | | |

| | |

Prudential PLC | | | 76,538 | | | | 952,074 | |

| | | | | | | | |

Total United Kingdom | | | | | | | 952,074 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| PHILIPPINES: 2.5% | | | | | | | | |

| | |

Ayala Land, Inc. | | | 1,114,400 | | | | 517,992 | |

| | |

Wilcon Depot, Inc. | | | 988,100 | | | | 427,695 | |

| | | | | | | | |

Total Philippines | | | | | | | 945,687 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| FRANCE: 1.7% | | | | | | | | |

| | |

LVMH Moet Hennessy Louis Vuitton SE | | | 615 | | | | 376,920 | |

| | |

TotalEnergies SE ADR | | | 4,900 | | | | 257,936 | |

| | | | | | | | |

Total France | | | | | | | 634,856 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| SOUTH KOREA: 1.6% | | | | | | | | |

| | |

LG Chem Ltd. | | | 1,579 | | | | 627,308 | |

| | | | | | | | |

Total South Korea | | | | | | | 627,308 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| QATAR: 1.6% | | | | | | | | |

| | |

Qatar National Bank QPSC | | | 112,729 | | | | 618,842 | |

| | | | | | | | |

Total Qatar | | | | | | | 618,842 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| ISRAEL: 1.5% | | | | | | | | |

| | |

Nice, Ltd. ADRc | | | 2,900 | | | | 558,105 | |

| | | | | | | | |

Total Israel | | | | | | | 558,105 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| NETHERLANDS: 1.2% | | | | | | | | |

| | |

Heineken NV | | | 5,168 | | | | 470,400 | |

| | | | | | | | |

Total Netherlands | | | | | | | 470,400 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| POLAND: 0.8% | | | | | | | | |

| | |

Dino Polska SAb,c,d | | | 4,353 | | | | 310,486 | |

| | | | | | | | |

Total Poland | | | | | | | 310,486 | |

| | | | | | | | |

| | | | | | | | |

| | | | matthewsasia.com | 800.789.ASIA | | | 11 | |

Matthews Emerging Markets Equity Fund

June 30, 2022

Schedule of Investmentsa (unaudited) (continued)

COMMON EQUITIES (continued)

| | | | | | | | |

| | | Shares | | | Value | |

| | |

| CANADA: 0.6% | | | | | | | | |

| | |

Parex Resources, Inc. | | | 13,400 | | | | $226,942 | |

| | | | | | | | |

Total Canada | | | | | | | 226,942 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| RUSSIA: 0.0% | | | | | | | | |

| | |

Sberbank of Russia PJSCc,e | | | 128,308 | | | | 2,333 | |

| | |

LUKOIL PJSC ADRe | | | 18,010 | | | | 360 | |

| | |

Novatek PJSC GDRd,e | | | 6,184 | | | | 124 | |

| | |

TCS Group Holding PLC GDRc,d,e | | | 3,865 | | | | 77 | |

| | | | | | | | |

Total Russia | | | | | | | 2,894 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| TOTAL COMMON EQUITIES | | | | | | | 34,785,424 | |

| | | | | | | | |

(Cost $42,383,277) | | | | | | | | |

| | | | | | | | |

| | |

PREFERRED EQUITIES: 5.5% | | | | | | | | |

| | | |

| SOUTH KOREA: 5.5% | | | | | | | | |

| | |

Samsung Electronics Co., Ltd., Pfd. | | | 52,370 | | | | 2,105,033 | |

| | | | | | | | |

Total South Korea | | | | | | | 2,105,033 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| TOTAL PREFERRED EQUITIES | | | | | | | 2,105,033 | |

| | | | | | | | |

(Cost $2,893,786) | | | | | | | | |

| | | | | | | | |

| | |

| TOTAL INVESTMENTS: 96.6% | | | | 36,890,457 | |

(Cost $45,277,063) | | | | | | | | |

| | | | | | | | |

| | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 3.4% | | | | | | | 1,281,794 | |

| | | | | | | | |

| | | | | | | | |

| |

NET ASSETS: 100.0% | | | | $38,172,251 | |

| | | | | | | | |

| a | Certain securities were fair valued under the valuation policies approved by the Board of Trustees (Note 2-A). |

| b | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The security may be resold in transactions exempt from registration normally to qualified institutional buyers. The security has been determined to be liquid in accordance with procedures adopted by the Funds’ Board of Trustees. At June 30, 2022, the aggregate value is $1,587,570, which is 4.16% of net assets. |

| c | Non-income producing security. |

| d | The securities may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| e | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. The aggregate value of Level 3 security is $2,894 and 0.01% of net assets. |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| PJSC | Public Joint Stock Co. |

| QPSC | Qatari Public Shareholding Co. |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

| | | | |

| PORTFOLIO MANAGERS |

| |

| Vivek Tanneeru | | |

| Lead Manager | | |

| |

| Jeremy Sutch, CFA | | |

Co-Manager | | |

|

| FUND FACTS |

| | |

| | | Investor | | Institutional |

Ticker | | MSMLX | | MISMX |

CUSIP | | 577125206 | | 577125867 |

Inception | | 9/15/08 | | 4/30/13 |

NAV | | $24.44 | | $24.43 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.51% | | 1.38% |

After Fee Waiver and Reimbursement2 | | 1.35% | | 1.15% |

Portfolio Statistics | | |

Total # of Positions | | 60 |

Net Assets | | $347.8 million |

Weighted Average

Market Cap | | $4.3 billion |

Portfolio Turnover3 | | 50.8% |

Benchmark | | |

MSCI Emerging Markets Small Cap Index |

OBJECTIVE

Long-term capital appreciation.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in the common and preferred stocks of Small Companies located in emerging market countries. Emerging market countries generally include every country in the world except the United States, Australia, Canada, Hong Kong, Israel, Japan, New Zealand, Singapore and most of the countries in Western Europe. The Fund defines Small Companies as companies with market capitalization no higher than the greater of $5 billion or the market capitalization of the largest company included in the Fund’s primary benchmark, the MSCI Emerging Markets Small Cap Index.

Matthews Emerging Markets Small Companies Fund

Portfolio Manager Commentary (unaudited)

For the first half of 2022, the Matthews Emerging Markets Small Companies Fund returned –18.32% (Investor Class) and –18.21% (Institutional Class), while its benchmark, the MSCI Emerging Markets Small Cap Index, returned –19.85% over the same period. For the quarter ending June 30, 2022, the Fund returned –8.09% (Investor Class) and –8.02% (Institutional Class), while the benchmark returned –16.28%.

Market Environment:

There were mixed fortunes for emerging markets in the first half of the year. Higher-than-expected inflation reads in the U.S. and European Union led the market to anticipate a steeper rate hike cycle. The Fed hiked its rate by 75 basis points (0.75%) in its June meeting, the first such move in almost three decades. Also attendant was the view that the steeper pace of tightening may lead to recession. With no end in sight to the Russian invasion of Ukraine, prices in the oil and gas markets remained elevated notwithstanding periodic pullbacks over recessionary concerns.

Still, in China, after several quarters, sentiment has turned a corner with the expectation that regulatory risk has peaked and the Chinese government is taking a more pragmatic approach to its zero COVID policy and aiding economic activity through a stimulus package. In Latin America, Colombia elected its first ever left-leaning president, solidifying gains for the left in the region following victories for left-leaning candidates in Chile and Peru.

Turkey and Kuwait were the strongest performing markets in the first six months of the year, while Egypt and Hungary were the worst. During the second quarter, Turkey and United Arab Emirates were the strongest while Hungary and Brazil were the biggest laggards.

In the second quarter, all major investable emerging market currencies weakened against a surging U.S. dollar. Currencies of commodity-exporting countries such as Chile, South Africa and Brazil that appreciated strongly in the first quarter gave up some of those gains during the second quarter. During the second quarter the Chilean peso depreciated the most followed by the Hungarian forint and the Turkish lira.

Performance Contributors and Detractors:

India, Vietnam and South Korea were major contributors to relative performance during the first half of the year. India’s contribution was driven by stock selection while the portfolio benefited from being overweight Vietnam and underweight South Korea. On the other hand, our underweight and stock selection in Taiwan was the biggest detractor.

From a sector perspective, stock selection in industrials and consumer discretionary were the biggest drivers of performance in the first half, while stock selection in information technology and financials detracted from performance.

(continued)

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.15% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.15% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.15%. If the operating expenses fall below the expense limitation within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2023 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | The lesser of fiscal year 2021 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | | | | | |

| | | | matthewsasia.com | 800.789.ASIA | | | 13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| PERFORMANCE AS OF JUNE 30, 2022 | |

| | | | | | | | | | | | Average Annual Total Returns | | | | |

| | | 3 Months | | | YTD | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | Since

Inception | | | Inception

Date | |

| Investor Class (MSMLX) | | | -8.09% | | | | -18.32% | | | | -15.79% | | | | 14.31% | | | | 9.48% | | | | 8.39% | | | | 10.84% | | | | 09/15/08 | |

| Institutional Class (MISMX) | | | -8.02% | | | | -18.21% | | | | -15.59% | | | | 14.55% | | | | 9.70% | | | | n.a. | | | | 6.79% | | | | 04/30/13 | |

| MSCI Emerging Markets Small Cap Index4 | | | -16.28% | | | | -19.85% | | | | -20.29% | | | | 6.24% | | | | 3.89% | | | | 4.67% | | | | 6.13% | 5 | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance, visit matthewsasia.com.

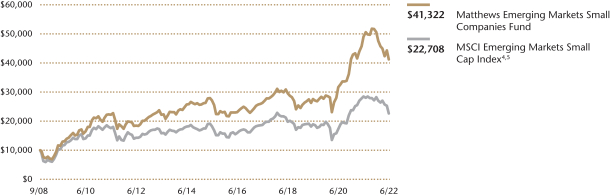

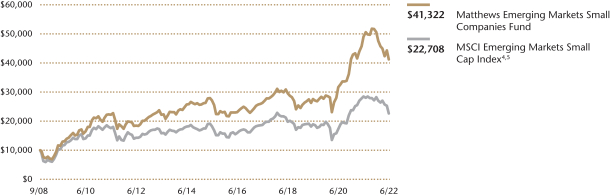

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

| | 4 | It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 84 for index definition. Effective April 30, 2021, in connection with changes to the Fund’s name and principal investment strategy, the primary benchmark changed from the MSCI All Country Asia ex Japan Small Cap Index to the MSCI Emerging Markets Small Cap Index. Before April 30, 2021, the Fund was managed with a different investment strategy and may have achieved different performance results for periods before that date with its current investment strategy. |

| | 5 | Calculated from 9/15/08. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS6 | | | | | | | |

| Name | | Sector | | Country | | % Net Assets | |

| Ginlong Technologies Co., Ltd. | | Industrials | | China/Hong Kong | | | 7.2% | |

| Shriram City Union Finance, Ltd. | | Financials | | India | | | 5.9% | |

| Ecopro BM Co., Ltd. | | Industrials | | South Korea | | | 5.1% | |

| Bandhan Bank, Ltd. | | Financials | | India | | | 4.8% | |

| Legend Biotech Corp. | | Health Care | | United States | | | 4.5% | |

| Phoenix Mills, Ltd. | | Real Estate | | India | | | 4.5% | |

| Silergy Corp. | | Information Technology | | China/Hong Kong | | | 4.2% | |

| Mobile World Investment Corp. | | Consumer Discretionary | | Vietnam | | | 3.6% | |

| Lemon Tree Hotels, Ltd. | | Consumer Discretionary | | India | | | 3.3% | |

| Vamos Locacao de Caminhoes Maquinas e Equipamentos SA | | Industrials | | Brazil | | | 2.8% | |

| % OF ASSETS IN TOP 10 | | | | | | | 45.9% | |

| | 6 | Holdings may combine more than one security from same issuer and related depositary receipts. |

Matthews Emerging Markets Small Companies Fund

Portfolio Manager Commentary (unaudited) (continued)

Turning to individual stocks, Ginlong Technologies, a Chinese solar inverter manufacturer, was the biggest contributor to the Fund’s absolute and relative performance in the first six months. Ginlong continues to benefit from the strong growth in the underlying demand for solar power globally and from distributed solar power in particular. The company’s strong performance stemmed from both domestic and overseas markets and it gained further market share. Looking ahead we see strong demand prospects for solar power on the back of reduced raw material pricing pressures in the supply chain compared to last year. This should benefit the company alongside the progress it is making in the commercial and industrial space as well as with utility projects and storage inverters. On the other hand, technology holdings such as Silergy, Formosa Sumco Technology, and Andes Technology detracted from performance due to rotation away from companies that derive a significant part of their value from growth in the long term. Such stocks face a headwind in a sharply rising interest-rate environment and near-term concerns about the semiconductor demand outlook in light of growing worries about softness in economic growth.

Notable Portfolio Changes:

During the second quarter we initiated positions including Hainan Meilan International Airport, a leading operator that serves Haikou, the capital city of Hainan island province in China. Hainan island is a major tourist destination in China and Haikou airport is a major gateway to the island. We expect the pent-up domestic tourism demand to be strong as China’s government takes a more pragmatic approach to implementing its zero COVID policy while outbound international tourism take off might be a few quarters away pending large-scale mRNA vaccination rollout in China. Meilan Airport has a strong duty-free revenue exposure given it has China’s largest duty-free store area and is expected to benefit from the opening of a new terminal that doubled the airport’s passenger handling capacity both from aeronautical and non-aeronautical revenue lines. The stock was available at very attractive valuations amid COVID-19 related lockdowns in Shanghai and Beijing during the quarter.

We exited positions such as Hua Hong Semiconductor—which was a source of cash to fund other promising ideas—and GMR Power and Urban Infra, a stub holding as a result of a de-merger from an airport operator.

Outlook:

The pace and scope of the Fed’s interest-rate hikes and quantitative tightening and the market’s expectation of its evolution remain the most important variables to watch and will have near-term implications for regional, sector and style performance. Russia’s invasion of Ukraine and its impact on energy prices also needs careful monitoring.

Overall, the impact of weak external balances and strongly depreciating currencies in addition to rampant inflation in soft and industrial commodities and energy have led to severe stress in frontier countries like Sri Lanka. But generally, larger emerging markets seem to be reasonably well placed to weather the storm. We believe there is sufficient liquidity in emerging markets in general and that there are early signs of the rate hiking cycle coming to a potential close in commodity-orientated markets like Brazil. In many parts of the emerging markets, the COVID-19 vaccination is progressing well and provides hope for economic activity normalization in the coming quarters led by a pickup in the services sector.

From a portfolio standpoint, we will look to maintain a balance between growth and value exposure while staying broadly diversified across sectors and countries. We remain watchful about the impact of input inflation and potentially slower economic growth on corporate earnings for the rest of the year and into 2023. Barring another serious pandemic wave or a major recession, we believe small companies are poised to grow and are available at attractive valuations.

| | | | |

| |

| COUNTRY ALLOCATION (%)7,8 | |

| China/Hong Kong | | | 29.2 | |

| India | | | 24.8 | |

| South Korea | | | 8.8 | |

| Vietnam | | | 7.8 | |

| Indonesia | | | 6.1 | |

| Taiwan | | | 4.9 | |

| United States | | | 4.5 | |

| Brazil | | | 4.4 | |

| Chile | | | 2.6 | |

| Philippines | | | 2.2 | |

| Mexico | | | 1.3 | |

| United Kingdom | | | 1.3 | |

| Bangladesh | | | 1.1 | |

| Canada | | | 1.1 | |

| Turkey | | | 0.5 | |

| Liabilities in Excess of Cash and Other Assets | | | -0.5 | |

| | | | |

| |

| SECTOR ALLOCATION (%)8 | |

| Industrials | | | 31.2 | |

| Financials | | | 18.9 | |

| Information Technology | | | 15.2 | |

| Consumer Discretionary | | | 12.9 | |

| Health Care | | | 10.8 | |

| Real Estate | | | 8.9 | |

| Materials | | | 1.1 | |

| Communication Services | | | 1.1 | |

| Consumer Staples | | | 0.5 | |

| Liabilities in Excess of Cash and Other Assets | | | -0.5 | |

| | | | |

| |

| MARKET CAP EXPOSURE (%)8,9 | |

| Mega Cap (over $25B) | | | 0.0 | |

| Large Cap ($10B-$25B) | | | 9.7 | |

| Mid Cap ($3B-10B) | | | 40.6 | |

| Small Cap (under $3B) | | | 50.2 | |

| Liabilities in Excess of Cash and Other Assets | | | -0.5 | |

| 7 | Not all countries where the Fund may invest are included in the benchmark index. |

| 8 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Country allocations and percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

| 9 | The Fund defines Small Companies as companies with market capitalization no higher than the greater of $5 billion or the market capitalization of the largest company included in the Fund’s primary benchmark, the MSCI Emerging Markets Small Cap Index. |

| | | | | | | | |

| | | | matthewsasia.com | 800.789.ASIA | | | 15 | |

Matthews Emerging Markets Small Companies Fund

June 30, 2022

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 99.8%

| | | | | | | | |

| | | Shares | | | Value | |

| | |

| CHINA/HONG KONG: 29.1% | | | | | | | | |

| | |

Silergy Corp. | | | 180,000 | | | | $14,554,688 | |

| | |

Ginlong Technologies Co., Ltd. A Shares | | | 441,706 | | | | 14,119,212 | |

| | |

Ginlong Technologies Co., Ltd. A Shares | | | 344,241 | | | | 11,006,413 | |

| | |

Airtac International Group | | | 285,431 | | | | 9,527,074 | |

| | |

Hainan Meilan International Airport Co., Ltd. H Sharesb | | | 1,673,000 | | | | 4,930,229 | |

| | |

SITC International Holdings Co., Ltd. | | | 1,555,000 | | | | 4,422,699 | |

| | |

Flat Glass Group Co., Ltd. H Sharesb | | | 1,229,000 | | | | 4,326,510 | |

| | |

Full Truck Alliance Co., Ltd. ADRb | | | 472,200 | | | | 4,278,132 | |

| | |

Xtep International Holdings, Ltd. | | | 2,315,500 | | | | 4,195,526 | |

| | |

Innovent Biologics, Inc.b,c,d | | | 885,500 | | | | 3,961,782 | |

| | |

Centre Testing International Group Co., Ltd. A Shares | | | 1,120,674 | | | | 3,894,530 | |

| | |

Zhihu, Inc. ADRb | | | 2,158,300 | | | | 3,863,357 | |

| | |

Medlive Technology Co., Ltd.c,d | | | 2,176,000 | | | | 3,211,041 | |

| | |

Peijia Medical, Ltd.b,c,d | | | 3,137,000 | | | | 3,104,564 | |

| | |

OPT Machine Vision Tech Co., Ltd. A Shares | | | 79,118 | | | | 3,057,047 | |

| | |

AK Medical Holdings, Ltd.c,d | | | 3,364,000 | | | | 2,519,272 | |

| | |

Morimatsu International Holdings Co., Ltd.b,d | | | 2,341,000 | | | | 2,212,436 | |

| | |

CIFI Ever Sunshine Services Group, Ltd.d | | | 1,662,000 | | | | 2,130,550 | |

| | |

Centre Testing International Group Co., Ltd. A Shares | | | 585,338 | | | | 2,033,616 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 101,348,678 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDIA: 24.8% | | | | | | | | |

| | |

Shriram City Union Finance, Ltd. | | | 975,026 | | | | 20,521,490 | |

| | |

Bandhan Bank, Ltd.c,d | | | 4,973,475 | | | | 16,687,239 | |

| | |

Phoenix Mills, Ltd. | | | 1,031,247 | | | | 15,505,999 | |

| | |

Lemon Tree Hotels, Ltd.b,c,d | | | 14,664,074 | | | | 11,408,907 | |

| | |

Ashok Leyland, Ltd. | | | 3,350,560 | | | | 6,286,808 | |

| | |

Finolex Cables, Ltd. | | | 1,112,319 | | | | 5,312,253 | |

| | |

GMR Infrastructure, Ltd.b | | | 7,823,651 | | | | 3,389,984 | |

| | |

Barbeque Nation Hospitality, Ltd.b | | | 167,508 | | | | 2,306,320 | |

| | |

HEG, Ltd. | | | 169,638 | | | | 2,153,517 | |

| | |

Marico, Ltd. | | | 264,237 | | | | 1,602,516 | |

| | |

Rainbow Children’s Medicare, Ltd.b | | | 184,518 | | | | 1,088,685 | |

| | | | | | | | |

Total India | | | | | | | 86,263,718 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| SOUTH KOREA: 8.8% | | | | | | | | |

| | |

Ecopro BM Co., Ltd. | | | 200,220 | | | | 17,644,093 | |

| | |

Hugel, Inc.b | | | 99,317 | | | | 8,053,733 | |

| | |

Solus Advanced Materials Co., Ltd. | | | 139,346 | | | | 4,879,955 | |

| | | | | | | | |

Total South Korea | | | | | | | 30,577,781 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| VIETNAM: 7.8% | | | | | | | | |

| | |

Mobile World Investment Corp. | | | 4,032,014 | | | | 12,401,827 | |

| | |

Military Commercial Joint Stock Bankb | | | 8,012,269 | | | | 8,347,192 | |

| | |

FPT Corp. | | | 1,449,888 | | | | 5,378,339 | |

| | |

Nam Long Investment Corp. | | | 698,232 | | | | 1,076,966 | |

| | | | | | | | |

Total Vietnam | | | | | | | 27,204,324 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDONESIA: 6.1% | | | | | | | | |

| | |

PT Mitra Adiperkasab | | | 136,713,400 | | | | 9,004,455 | |

| | |

PT Bank Tabungan Negara Persero | | | 66,124,500 | | | | 6,470,192 | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

PT Summarecon Agungb | | | 150,243,216 | | | | $5,763,257 | |

| | | | | | | | |

Total Indonesia | | | | | | | 21,237,904 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| TAIWAN: 4.9% | | | | | | | | |

| | |

Andes Technology Corp. | | | 568,000 | | | | 4,824,834 | |

| | |

Formosa Sumco Technology Corp. | | | 714,000 | | | | 4,256,507 | |

| | |

Yageo Corp. | | | 362,000 | | | | 3,754,270 | |

| | |

M31 Technology Corp. | | | 407,000 | | | | 3,229,450 | |

| | |

Poya International Co., Ltd. | | | 78,000 | | | | 830,275 | |

| | | | | | | | |

Total Taiwan | | | | | | | 16,895,336 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| UNITED STATES: 4.5% | | | | | | | | |

| | |

Legend Biotech Corp. ADRb | | | 284,159 | | | | 15,628,745 | |

| | | | | | | | |

Total United States | | | | | | | 15,628,745 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| CHILE: 3.7% | | | | | | | | |

| | |

Parque Arauco SA | | | 8,448,535 | | | | 6,587,399 | |

| | |

Lundin Mining Corp. | | | 589,400 | | | | 3,736,408 | |

| | |

Banco de Credito e Inversiones SA | | | 89,121 | | | | 2,608,803 | |

| | | | | | | | |

Total Chile | | | | | | | 12,932,610 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| BRAZIL: 3.7% | | | | | | | | |

| | |

Vamos Locacao de Caminhoes Maquinase | | | | | | | | |

| | |

Equipamentos SA | | | 4,335,000 | | | | 9,699,692 | |

| | |