UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-7553

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Semi-Annual Report

June 30, 2020 | matthewsasia.com

GLOBAL EMERGING MARKETS STRATEGY

Matthews Emerging Markets Equity Fund

ASIA FIXED INCOME STRATEGIES

Matthews Asia Total Return Bond Fund

Matthews Asia Credit Opportunities Fund

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Dividend Fund

Matthews China Dividend Fund

ASIA VALUE STRATEGY

Matthews Asia Value Fund

ASIA GROWTH STRATEGIES

Matthews Asia Growth Fund

Matthews Pacific Tiger Fund

Matthews Asia ESG Fund

Matthews Emerging Asia Fund

Matthews Asia Innovators Fund

Matthews China Fund

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA SMALL COMPANY STRATEGIES

Matthews Asia Small Companies Fund

Matthews China Small Companies Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website matthewsasia.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800.789.ASIA (2742).

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 800.789.ASIA (2742) to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held directly with Matthews Asia Funds.

Investor Class Performance and Expenses (June 30, 2020)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | | | | | Average Annual Total Return† | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver and Expense

Reimbursement* | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | |

GLOBAL EMERGING MARKETS STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Emerging Markets Equity Fund (MEGMX) | | | n.a. | | | | n.a. | | | | n.a. | | | | 16.70% | | | | 4/30/20 | | | | 2.77% | | | | 1.15% | 1 |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Total Return Bond Fund (MAINX)** | | | 0.45% | | | | 4.26% | | | | n.a. | | | | 4.22% | | | | 11/30/11 | | | | 1.08% | | | | 1.07% | 1 |

| | | | | | | |

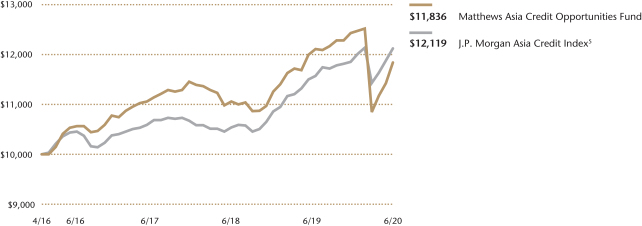

Asia Credit Opportunities Fund (MCRDX) | | | -1.30% | | | | n.a. | | | | n.a. | | | | 4.13% | | | | 4/29/16 | | | | 1.24% | | | | 1.12% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

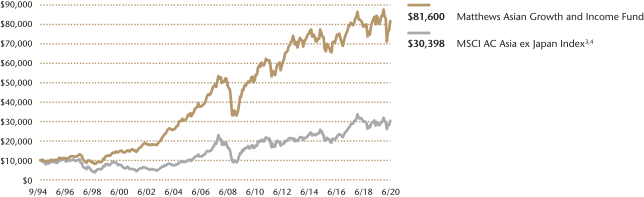

Asian Growth and Income Fund (MACSX) | | | -3.38% | | | | 2.06% | | | | 4.74% | | | | 8.48% | | | | 9/12/94 | | | | 1.08% | | | | 1.08% | |

| | | | | | | |

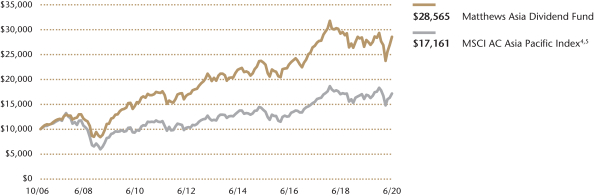

Asia Dividend Fund (MAPIX) | | | 2.31% | | | | 4.09% | | | | 6.95% | | | | 7.98% | | | | 10/31/06 | | | | 1.03% | | | | 1.02% | 2 |

| | | | | | | |

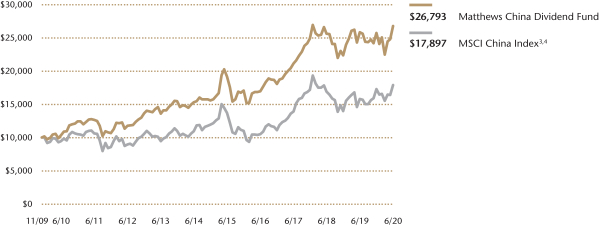

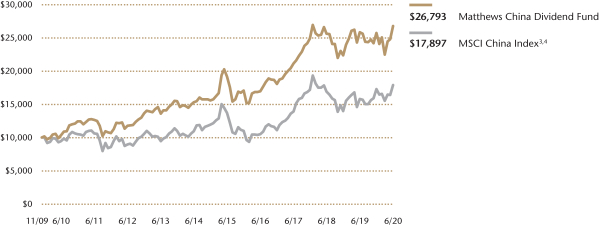

China Dividend Fund (MCDFX) | | | 3.56% | | | | 6.94% | | | | 9.99% | | | | 9.76% | | | | 11/30/09 | | | | 1.15% | | | | 1.15% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

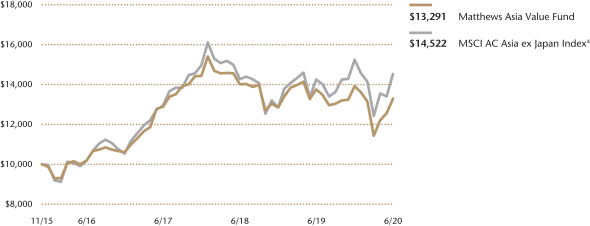

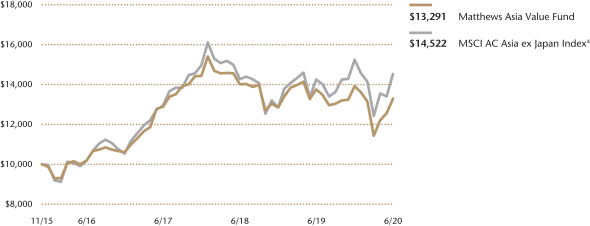

Asia Value Fund (MAVRX) | | | -3.33% | | | | n.a. | | | | n.a. | | | | 6.40% | | | | 11/30/15 | | | | 1.85% | | | | 1.37% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

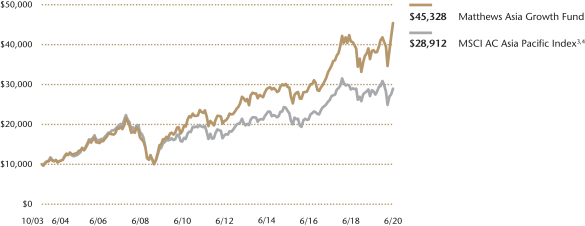

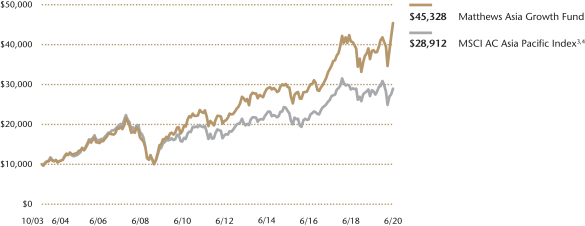

Asia Growth Fund (MPACX) | | | 18.17% | | | | 9.04% | | | | 9.53% | | | | 9.49% | | | | 10/31/03 | | | | 1.09% | | | | 1.09% | |

| | | | | | | |

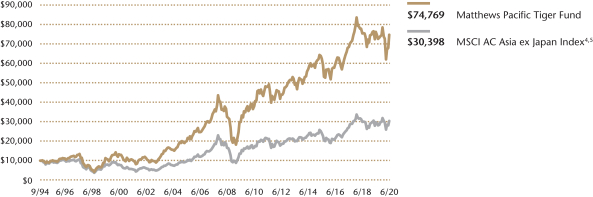

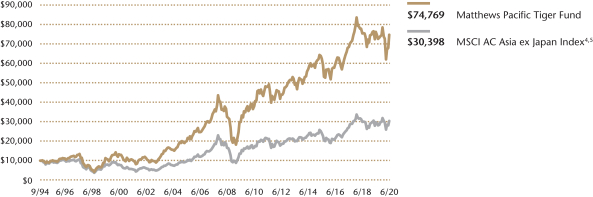

Pacific Tiger Fund (MAPTX) | | | -2.00% | | | | 3.64% | | | | 7.01% | | | | 8.11% | | | | 9/12/94 | | | | 1.08% | | | | 1.05% | 2 |

| | | | | | | |

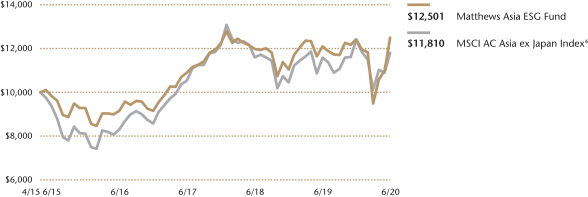

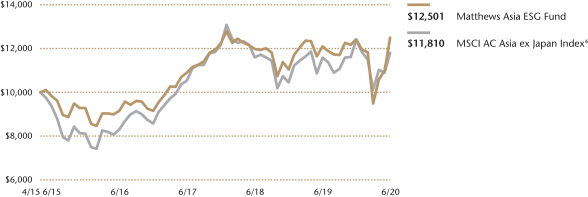

Asia ESG Fund (MASGX) | | | 3.32% | | | | 4.90% | | | | n.a. | | | | 4.42% | | | | 4/30/15 | | | | 1.54% | | | | 1.38% | 3 |

| | | | | | | |

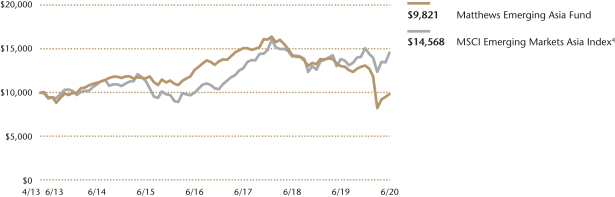

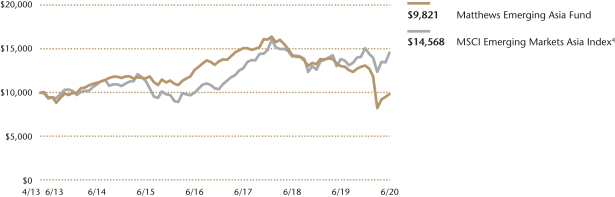

Emerging Asia Fund (MEASX) | | | -24.51% | | | | -3.34% | | | | n.a. | | | | -0.25% | | | | 4/30/13 | | | | 1.65% | | | | 1.42% | 3 |

| | | | | | | |

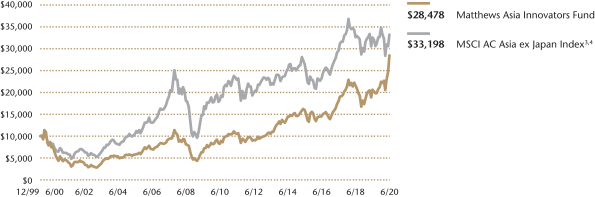

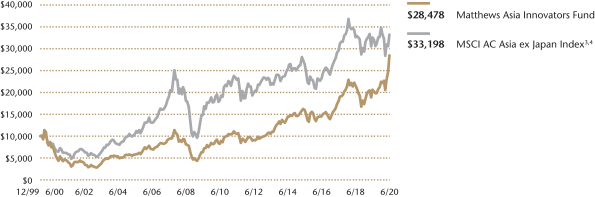

Asia Innovators Fund (MATFX) | | | 38.22% | | | | 12.33% | | | | 13.19% | | | | 5.24% | | | | 12/27/99 | | | | 1.19% | | | | 1.19% | |

| | | | | | | |

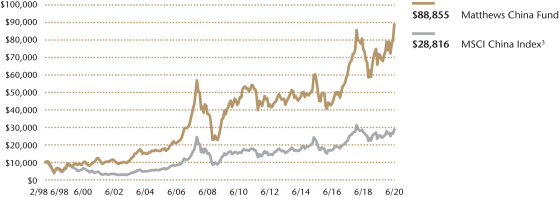

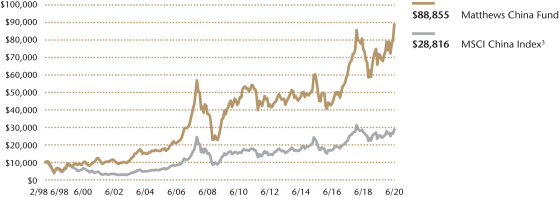

China Fund (MCHFX) | | | 23.58% | | | | 9.21% | | | | 7.30% | | | | 10.26% | | | | 2/19/98 | | | | 1.09% | | | | 1.09% | |

| | | | | | | |

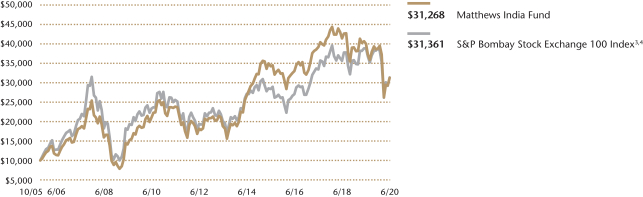

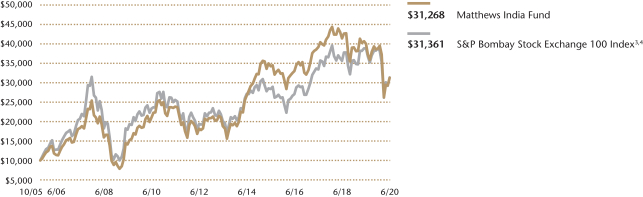

India Fund (MINDX) | | | -21.86% | | | | -1.80% | | | | 4.06% | | | | 8.08% | | | | 10/31/05 | | | | 1.11% | | | | 1.11% | |

| | | | | | | |

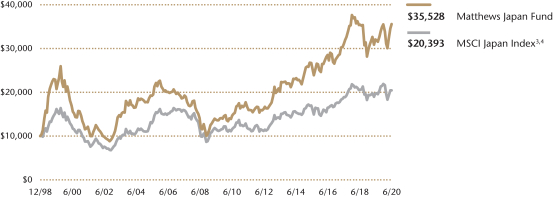

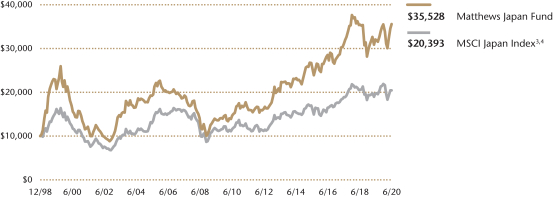

Japan Fund (MJFOX) | | | 10.88% | | | | 5.86% | | | | 10.27% | | | | 6.07% | | | | 12/31/98 | | | | 0.93% | | | | 0.93% | |

| | | | | | | |

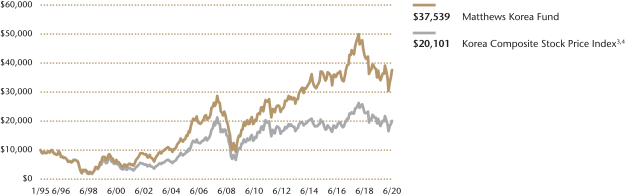

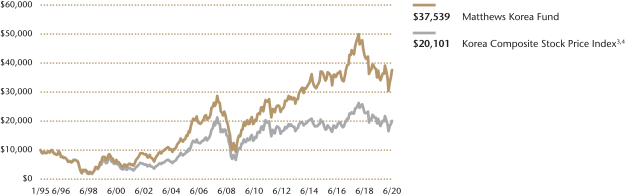

Korea Fund (MAKOX) | | | 0.41% | | | | 0.73% | | | | 6.83% | | | | 5.33% | | | | 1/3/95 | | | | 1.15% | | | | 1.15% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

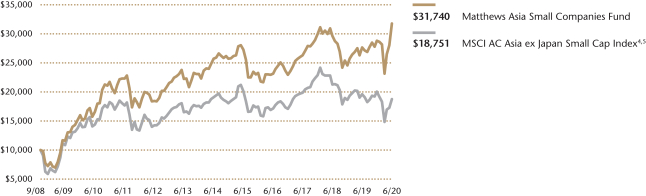

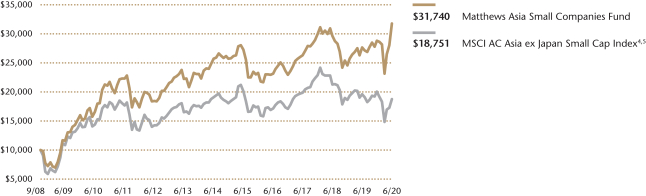

Asia Small Companies Fund (MSMLX) | | | 14.74% | | | | 3.10% | | | | 6.72% | | | | 10.29% | | | | 9/15/08 | | | | 1.60% | | | | 1.41% | 3 |

| | | | | | | |

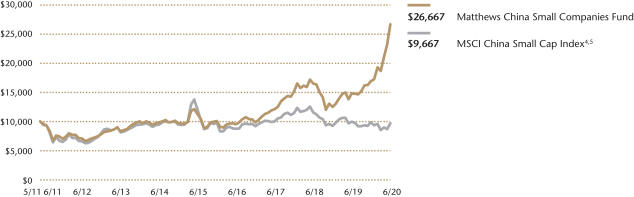

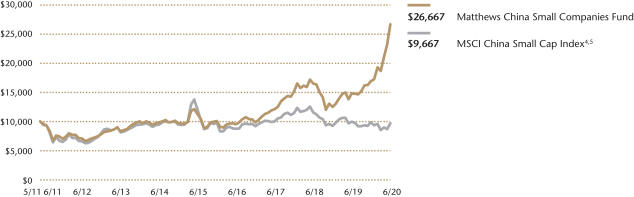

China Small Companies Fund (MCSMX) | | | 79.85% | | | | 18.72% | | | | n.a. | | | | 11.40% | | | | 5/31/11 | | | | 1.62% | | | | 1.38% | 3 |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| * | These figures are from the Funds’ prospectus dated as of April 29, 2020, and may differ from the actual expense ratios for fiscal year 2020, as shown in the financial highlights section of this report. |

| ** | The Fund’s name changed from Matthews Asia Strategic Income Fund to Matthews Asia Total Return Bond Fund on January 31, 2020. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. Pursuant to this agreement, any amount waived for prior fiscal years with respect to the Matthews Asia Total Return Bond Fund and the Matthews Asia Credit Opportunities Fund is not subject to recoupment. For the Matthews Emerging Markets Equity Fund, if the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2021 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2021 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.20% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.20% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.20%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2021 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

Institutional Class Performance and Expenses (June 30, 2020)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | Average Annual Total Return† | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement* | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | |

GLOBAL EMERGING MARKETS STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Emerging Markets Equity Fund (MIEFX) | | | n.a. | | | | n.a. | | | | n.a. | | | | 16.70% | | | | 4/30/20 | | | | 2.57% | | | | 0.90% | 1 |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Total Return Bond Fund (MINCX)** | | | 0.51% | | | | 4.51% | | | | n.a. | | | | 4.44% | | | | 11/30/11 | | | | 0.97% | | | | 0.90% | 1 |

| | | | | | | |

Asia Credit Opportunities Fund (MICPX) | | | -1.09% | | | | n.a. | | | | n.a. | | | | 4.37% | | | | 4/29/16 | | | | 1.07% | | | | 0.90% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asian Growth and Income Fund (MICSX) | | | -3.17% | | | | 2.22% | | | | n.a. | | | | 3.60% | | | | 10/29/10 | | | | 0.94% | | | | 0.94% | |

| | | | | | | |

Asia Dividend Fund (MIPIX) | | | 2.48% | | | | 4.21% | | | | n.a. | | | | 5.89% | | | | 10/29/10 | | | | 0.93% | | | | 0.92% | 2 |

| | | | | | | |

China Dividend Fund (MICDX) | | | 3.72% | | | | 7.12% | | | | n.a. | | | | 8.85% | | | | 10/29/10 | | | | 1.01% | | | | 1.01% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Value Fund (MAVAX) | | | -3.21% | | | | n.a. | | | | n.a. | | | | 6.65% | | | | 11/30/15 | | | | 1.74% | | | | 1.20% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Growth Fund (MIAPX) | | | 18.29% | | | | 9.23% | | | | n.a. | | | | 7.92% | | | | 10/29/10 | | | | 0.94% | | | | 0.94% | |

| | | | | | | |

Pacific Tiger Fund (MIPTX) | | | -1.88% | | | | 3.82% | | | | n.a. | | | | 5.26% | | | | 10/29/10 | | | | 0.93% | | | | 0.91% | 2 |

| | | | | | | |

Asia ESG Fund (MISFX) | | | 3.48% | | | | 5.15% | | | | n.a. | | | | 4.65% | | | | 4/30/15 | | | | 1.41% | | | | 1.20% | 3 |

| | | | | | | |

Emerging Asia Fund (MIASX) | | | -24.39% | | | | -3.12% | | | | n.a. | | | | -0.03% | | | | 4/30/13 | | | | 1.51% | | | | 1.20% | 3 |

| | | | | | | |

Asia Innovators Fund (MITEX) | | | 38.36% | | | | 12.53% | | | | n.a. | | | | 14.80% | | | | 4/30/13 | | | | 1.05% | | | | 1.05% | |

| | | | | | | |

China Fund (MICFX) | | | 23.83% | | | | 9.40% | | | | n.a. | | | | 5.66% | | | | 10/29/10 | | | | 0.91% | | | | 0.91% | |

| | | | | | | |

India Fund (MIDNX) | | | -21.76% | | | | -1.62% | | | | n.a. | | | | 2.31% | | | | 10/29/10 | | | | 0.94% | | | | 0.94% | |

| | | | | | | |

Japan Fund (MIJFX) | | | 10.92% | | | | 5.94% | | | | n.a. | | | | 9.38% | | | | 10/29/10 | | | | 0.88% | | | | 0.88% | |

| | | | | | | |

Korea Fund (MIKOX) | | | 0.19% | | | | 0.81% | | | | n.a. | | | | 5.45% | | | | 10/29/10 | | | | 1.05% | | | | 1.05% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Small Companies Fund (MISMX) | | | 14.99% | | | | 3.33% | | | | n.a. | | | | 4.77% | | | | 4/30/13 | | | | 1.46% | | | | 1.20% | 3 |

| | | | | | | |

China Small Companies Fund (MICHX) | | | 79.99% | | | | n.a. | | | | n.a. | | | | 27.58% | | | | 11/30/17 | | | | 1.51% | | | | 1.20% | 3 |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| * | These figures are from the Funds’ prospectus dated as of April 29, 2020, and may differ from the actual expense ratios for fiscal year 2020, as shown in the financial highlights section of this report. |

| ** | The Fund’s name changed from Matthews Asia Strategic Income Fund to Matthews Asia Total Return Bond Fund on January 31, 2020. |

| 1 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90%. Pursuant to this agreement, any amount waived for prior fiscal years with respect to the Matthews Asia Total Return Bond Fund and the Matthews Asia Credit Opportunities Fund is not subject to recoupment. For the Matthews Emerging Markets Equity Fund, if the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2021 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2021 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.20%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2021 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

| | | | |

| matthewsasia.com | 800.789.ASIA | | | | |

Cover photo: Asian Palace

This report has been prepared for Matthews International Funds (d/b/a Matthews Asia Funds) shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. Additional copies of the prospectus or summary prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of June 30, 2020. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund’s future investment intent. Current and future portfolio holdings are subject to risk.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Contents

*The Fund’s name changed from Matthews Asia Strategic Income Fund to Matthews Asia Total Return Bond Fund on January 31, 2020.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of a concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds’ Prospectuses and Statement of Additional Information for more risk disclosure.

Message to Shareholders from the

Investment Advisor

Dear Valued Investors,

I feel like saying something like “It’s a funny old world.” That’s the kind of cliché that the editors normally strike out of the first draft. But not this time. For the developments in the fight against COVID-19, the increased tensions between the U.S. and China and the performance of the markets appear to be completely out of step. It is, after all, a funny old world.

The virus seems to be spiking again—the hopes that warm weather would slow its progress appear to be unfounded. The rhetoric between the Trump administration and China has picked up—“The China virus” is a common catchphrase. Changes in visa processing in the U.S. and potentially more stringent moves on both the movement of people and goods, as well as measures that may harm Hong Kong’s special treatment by the U.S. would all seem to argue for caution. And yet the markets have been climbing ever higher—for Asia ex Japan, we are very close to the high point for the year. It has also been gratifying to see the performance of many of the Matthews Asia portfolios outperforming their benchmarks and even in positive territory for the year. The portfolio managers and analysts have been able to keep in close contact with holdings as well as keep up the steady flow of new ideas to which we are accustomed during more normal times.

However, it is undeniably strange to me that markets should have reacted this strongly. Clearly investors believe that governments have done enough to battle the virus and to support the economies for the moment. They also appear to believe that governments stand prepared and able to deliver the necessary economic medicine for a long-term recovery. I can understand this kind of optimism when it comes to the Chinese market—where China’s authorities have the will to close down the economy and its citizens will cooperate with a strict enforcement. The mildness of the second wave also gives some hope; earnings reports and economic data suggest China is functioning quite like normal.

In the U.S., I am less sure of the response to the virus—the second wave seems more acute. And I am troubled by some of the Trump administration’s moves on trade and visas. Although one can concoct short-term arguments for protectionism at times like this, my suspicion is the moves are meant to be for the foreseeable future. However, the Federal Reserve has shown itself capable and willing to do what is necessary not only for the U.S. economy but also for the global financial system. In that sense they are worthy of the market’s optimism. Europe, on the other hand, may be most at odds with the market’s optimism about recovery and the authorities’ willingness and ability to stimulate economies and support business. For the initial European stimulus has been small relative to other parts of the world and the European Central Bank (ECB) has not been as successful as other central banks in creating accelerated growth in monetary aggregates.

Should we worry too much about Europe? In one sense, no. Our portfolios are built around the growth in Asia’s domestic demand and other emerging economies. On the other hand, Europe is a significant part of the world economy, and how successful it is in reflating will have an impact on the world and the attractiveness of various markets. My main concern is that if the U.S. is able to successfully support its own economy while Europe continues to be weak, this may raise U.S. yields relative to Europe. The U.S. long bond would re-emerge as an attractive investment for Europeans trying to shelter from domestic weakness. In so doing, they are likely to prevent the dollar from weakening and may even push it higher—something that is likely to be a headwind for Asia stock markets and particularly for the non-Asia parts of the emerging market asset class. In such an atmosphere, it is likely to be the economies of North Asia, with their

significant current account surpluses that are best placed to perform. However, there is one aspect where Europe does seem increasingly better placed than the U.S.: Europe still seems (for the moment) to be reaching out to Asia, both central and eastern Asia, in terms of building trade routes. This is all part of China’s One Belt One Road initiative, of course, which will have the added benefit of some potential infrastructure and stimulus spending in Europe. In this sense, Europe seems committed to the ideas of global economic cooperation that the U.S. finds so troubling.

It is in this relationship that I see the best prospects for the continued growth in world trade. It would be a realignment of diplomatic influence away from the U.S. and towards China. A world split between two poles. In this scenario, China’s attempts to build trust in its capital markets, and its bond markets in particular, start to play a very significant role. Are we moving to a stage where China enjoys perpetual current account deficits financed by foreign purchases of its government bonds and the increased internationalization of its currency? That seems an increasingly likely scenario and one that is likely to raise the profile of Chinese assets in the minds of international asset allocators. Just as China increases its significance in the global economy and global politics, so, too it is increasing its significance in global benchmarks. But there is one caveat—the Chinese have made some missteps. The new security law in Hong Kong raises questions about their ability to manage an international financial center and creates mistrust between China and Europe and may yet get in the way of improved economic relations. Certainly, there have been increased signs of nervousness towards China in parts of core Europe.

At Matthews Asia, we stand in the middle of this, trying to monitor the developments that seem to be occurring on a daily basis. Yet, we remain mindful of the longer-term trends and committed to helping our shareholders protect and grow their investments in countries that seemed destined to still have the fastest-growing economies and growing domestic markets that will be the breeding ground for their own corporate champions. Ultimately, it is those businesses that we try to identify and to hold for many years.

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 5 | |

| | | | |

| PORTFOLIO MANAGERS* |

| |

| John Paul Lech | | |

Lead Manager | | |

* As of August 31, 2020 | | |

|

| FUND FACTS |

| | |

| | | Investor | | Institutional |

Ticker | | MEGMX | | MIEFX |

CUSIP | | 577130651 | | 577130644 |

Inception | | 4/30/20 | | 4/30/20 |

NAV | | $11.67 | | $11.67 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 2.77% | | 2.57% |

After fee waiver and Reimbursement2 | | 1.15% | | 0.90% |

Portfolio Statistics |

Total # of Positions | | | | 53 |

Net Assets | | | | $9.2 million |

Weighted Average Market Cap | | $125.8 billion |

Portfolio Turnover3 | | | | N/A |

Benchmark | | |

MSCI Emerging Markets Index |

OBJECTIVE

Long-term capital appreciation.

STRATEGY

Under normal circumstances, the Matthews Emerging Markets Equity Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in emerging market countries. Emerging market countries generally include every country in the world except the United States, Australia, Canada, Hong Kong, Israel, Japan, New Zealand, Singapore and most of the countries in Western Europe. Certain emerging market countries may also be classified as “frontier” market countries, which are a subset of emerging market countries with newer or even less developed economies and markets, such as Sri Lanka and Vietnam. The list of emerging market countries and frontier market countries may change from time to time. The Fund may also invest in companies located in developed countries; however, the Fund may not invest in any company located in a developed country if, at the time of purchase, more than 20% of the Fund’s assets are invested in developed market companies.

Matthews Emerging Markets Equity Fund

Portfolio Manager Commentary (unaudited)

The Matthews Emerging Markets Equity Fund was launched on April 30, 2020. Since inception, the Fund returned 16.70% (Investor Class) and 16.70% (Institutional Class), while its benchmark, the MSCI Emerging Markets Index, returned 8.25% over the same period. This is the first commentary for the Matthews Emerging Markets Equity Fund.

Market Environment:

The first half of 2020 has been like no other. The expansion of the COVID-19 around the world led to a dramatic selloff across most asset classes in March and a dash into USD cash. Market volatility exceeded the levels seen during the 2008 Global Financial Crisis. Emerging markets were no different as many currencies, country indices and individual company stock prices moved up over the course of the second quarter. As investors gained confidence that the plumbing would not break, the selloff abated and markets began to recover from their March lows. Within emerging markets, the first part of the year saw very strong relative performance from China, but the rebound since the bottom has been led by other markets that were particularly hard hit. While volatility—as measured by the Chicago Board Options Exchange’s CBOE Volatility Index—has come down, we remain quite cautious as asset prices remain high and the duration and economic damage of the pandemic remain hard to dimension.

Year-to-date, the Shanghai Composite Index led most major emerging market country indices, followed by Taiwan. While the aforementioned were slightly negative year-to-date, the return was roughly in line with the S&P 500 Index. Russia, Mexico, Brazil, India and much of Southeast Asia remain down more than 10% in U.S. dollar terms year-to-date.

Market dislocations allowed us to invest in high conviction companies at what we believe are compelling valuations as we built the portfolio. We believe constructing an emerging markets portfolio designed for sustainable growth requires identifying companies that have higher growth metrics, as well as higher quality metrics, than the broader market. Good companies worldwide share common traits. They require a strong competitive position and the ability to allocate capital well. We tend to focus on companies that can serve the needs of domestic consumer within their markets, although we may invest in commodities and companies that serve a global marketplace. We also tend to look for companies that can withstand economic cycles. In addition, the Fund’s portfolio management team takes an all-cap approach, believing that smaller cap companies may offer attractive potential for generating alpha.

Contributors and Detractors:

The Fund outperformed its benchmark since its inception on April 30, 2020 through June 30, 2020 driven by strong stock selection. During the reporting period, our largest positive attribution came from China/HK, followed by Brazil and Russia.

From a sector standpoint, consumer staples and discretionary sectors were contributors to absolute performance but slight detractors from relative performance.

(continued)

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2021 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | The Fund commenced operations on April 30, 2020. |

| | | | | | | | |

| | | |

| PERFORMANCE AS OF JUNE 30, 2020 | | | | | | |

| | | Actual Return, Not Annualized | |

| | | Since

Inception | | | Inception

Date | |

| Investor Class (MEGMX) | | | 16.70% | | | | 4/30/20 | |

| Institutional Class (MIEFX) | | | 16.70% | | | | 4/30/20 | |

| MSCI Emerging Markets Index4 | | | 8.25% | | | | | |

| | 4 | It is not possible to invest directly in an index. Source: Index data from Morgan Stanley Capital International and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 90 for index definition. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS5 | | | | | | | |

| | | Sector | | Country | | % of Net Assets | |

| Alibaba Group Holding, Ltd. | | Consumer Discretionary | | China/Hong Kong | | | 6.8% | |

| Taiwan Semiconductor Manufacturing Co., Ltd. | | Information Technology | | Taiwan | | | 4.6% | |

| Tencent Holdings, Ltd. | | Communication Services | | China/Hong Kong | | | 4.3% | |

| Samsung Electronics Co., Ltd., Pfd. | | Information Technology | | South Korea | | | 3.6% | |

| AIA Group, Ltd. | | Financials | | China/Hong Kong | | | 3.3% | |

| Wuxi Biologics Cayman, Inc. | | Health Care | | China/Hong Kong | | | 2.2% | |

| LVMH Moet Hennessy Louis Vuitton SE | | Consumer Discretionary | | France | | | 2.2% | |

| NAVER Corp. | | Communication Services | | South Korea | | | 2.2% | |

| Kotak Mahindra Bank, Ltd. | | Financials | | India | | | 2.2% | |

| Banco BTG Pactual SA | | Financials | | Brazil | | | 2.2% | |

| Total | | | | | | | 33.6% | |

| | 5 | Holdings may combine more than one security from same issuer and related depositary receipts. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 7 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)6,7 | |

| China/Hong Kong | | | 32.2 | |

| South Korea | | | 9.9 | |

| India | | | 7.7 | |

| Brazil | | | 7.1 | |

| Russia | | | 7.0 | |

| Taiwan | | | 5.9 | |

| Mexico | | | 3.9 | |

| France | | | 3.8 | |

| Singapore | | | 3.1 | |

| Philippines | | | 3.0 | |

| Poland | | | 2.0 | |

| United Kingdom | | | 1.7 | |

| Indonesia | | | 1.6 | |

| Argentina | | | 1.6 | |

| United States | | | 1.3 | |

| Canada | | | 1.1 | |

| Vietnam | | | 1.0 | |

| | | | |

| |

| SECTOR ALLOCATION (%)7 | |

| Information Technology | | | 17.5 | |

| Consumer Discretionary | | | 15.0 | |

| Financials | | | 13.9 | |

| Communication Services | | | 13.5 | |

| Health Care | | | 9.0 | |

| Consumer Staples | | | 8.8 | |

| Energy | | | 5.9 | |

| Materials | | | 3.7 | |

| Real Estate | | | 3.4 | |

| Industrials | | | 3.2 | |

| Cash and Other Assets, Less Lliabilities | | | 6.1 | |

| Total | | | 100.0 | |

| | | | |

| |

| MARKET CAP EXPOSURE (%)7 | |

| Mega Cap (over $25B) | | | 49.4 | |

| Large Cap ($10B–$25B) | | | 18.6 | |

| Mid Cap ($3B–$10B) | | | 17.7 | |

| Small Cap (under $3B) | | | 8.2 | |

| Cash and Other Assets, Less Lliabilities | | | 6.1 | |

| Total | | | 100.0 | |

| 6 | Not all countries where the Fund may invest are included in the benchmark index. |

| 7 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

Matthews Emerging Markets Equity Fund

Portfolio Manager Commentary (unaudited) (continued)

However, this was more than offset by very strong relative attribution in other consumer facing sectors like communication services, where our holdings tend to be concentrated in media and entertainment. The Fund takes a holistic approach to considering consumer behavior and increasingly digitally driven behavior. Companies that do similar things can often be classified differently. Alibaba and Sea Ltd, for example, are both e-commerce companies yet one is classified as consumer discretionary and the other as communication services. We focus less on classifications and more on how and where companies make money. Our holdings are the natural outcome of our bottom-up stock selection process.

Notable Portfolio Changes:

The Fund added to its overweight in software over the reporting period by increasing position sizes in existing holdings and starting a position in Livechat, a Polish software company. Health care has been an increasing focus for the Fund, and we currently maintain seven positions in the sector—three in China/HK, one in South Korea, one in India, one in Brazil and a company listed in the U.S. whose largest market is China. While we are (or have been) cautious in the financials sector, we have increased our exposure during the reporting period.

Outlook:

Media coverage of the ongoing health pandemic of COVID-19 has been intense. Very few people alive have lived through something similar, and the scope of every economy being impacted is without recent precedent. All companies, too, have been impacted. For some, this has been an acceleration of trends that were in place and the pandemic appears to have improved their long term business prospects. For others, the pandemic has decreased line of sight on strategy or end demand. It is far too early to predict with certainty the near-term or long term impacts of a global event like the one we’re all living through.

Experiences both at the company and country level have been highly heterodox. In China, the disease hit before the economic lockdown and we’re seeing some green shoots. In much of emerging markets, the lockdown hit before the disease. Some, like South Korea, appear to have managed the pandemic well. Others, like Brazil, are still seeing increases in cases. Similarly, fiscal budgets and monetary responses have varying amounts of firepower across emerging markets. Many of the EM geographies are quite constrained versus the G3 (U.S., Europe, and Japan) in terms of the fiscal or monetary expansions that they can proffer without detrimental impact to currencies or local market conditions. Political tensions, too, remain elevated. China’s relationship with the U.S. is a focus for many investors, as is China’s engagement with other emerging markets geographies like India.

We do not pretend to have more clarity on such macro events. For the Matthews Emerging Markets Equity Fund, our philosophy starts at the company level and we believe the attributes of great companies are similar across geographies. The heightened uncertainty of the pandemic has accentuated our focus on quality balance sheets and business model. We remain cautious on banks in a world of low rates and loose government balance sheets. History has often shown that the best time to pick up great assets may be in times of great stress. While we are very concerned about the global pandemic and its social and economic impacts, we are optimistic about the long-term prospects of our holdings.

Matthews Emerging Markets Equity Fund

June 30, 2020

Schedule of Investmentsa (unaudited)

COMMON EQUITIES: 90.3%

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | |

| CHINA/HONG KONG: 32.2% | | | | | | | | |

Alibaba Group Holding, Ltd. ADRb | | | 2,900 | | | | $625,530 | |

| | |

Tencent Holdings, Ltd. | | | 6,200 | | | | 397,283 | |

| | |

AIA Group, Ltd. | | | 32,600 | | | | 305,058 | |

| | |

Wuxi Biologics Cayman, Inc.b,c,d | | | 11,000 | | | | 201,912 | |

| | |

Midea Group Co., Ltd. A Shares | | | 21,400 | | | | 181,421 | |

| | |

Bilibili, Inc. ADRb | | | 3,600 | | | | 166,752 | |

| | |

Wuliangye Yibin Co., Ltd. A Shares | | | 6,100 | | | | 148,284 | |

| | |

Yum China Holdings, Inc. | | | 3,000 | | | | 144,210 | |

| | |

Techtronic Industries Co., Ltd. | | | 13,500 | | | | 133,576 | |

| | |

Ping An Insurance Group Co. of China, Ltd. A Shares | | | 12,800 | | | | 129,612 | |

| | |

Anhui Conch Cement Co., Ltd. A Shares | | | 16,500 | | | | 124,172 | |

| | |

China East Education Holdings, Ltd.c,d | | | 62,500 | | | | 113,613 | |

| | |

Shandong Weigao Group Medical Polymer Co., Ltd. H Shares | | | 44,000 | | | | 98,245 | |

| | |

Lepu Medical Technology Beijing Co., Ltd. A Shares | | | 18,500 | | | | 95,630 | |

| | |

China International Capital Corp., Ltd. H Sharesb,c,d | | | 46,800 | | | | 92,596 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 2,957,894 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDIA: 7.7% | | | | | | | | |

| | |

Kotak Mahindra Bank, Ltd. | | | 11,004 | | | | 198,622 | |

| | |

Reliance Industries, Ltd. | | | 7,368 | | | | 167,596 | |

| | |

Colgate-Palmolive India, Ltd. | | | 6,830 | | | | 127,407 | |

| | |

HDFC Bank, Ltd. ADR | | | 2,400 | | | | 109,104 | |

| | |

Dr. Reddy’s Laboratories, Ltd. ADR | | | 2,000 | | | | 106,020 | |

| | | | | | | | |

Total India | | | | | | | 708,749 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| BRAZIL: 7.1% | | | | | | | | |

| | |

Banco BTG Pactual SA | | | 11,400 | | | | 160,368 | |

| | |

Pagseguro Digital, Ltd. Class Ab | | | 4,200 | | | | 148,428 | |

| | |

Vale SA ADR | | | 11,200 | | | | 115,472 | |

| | |

Hapvida Participacoes e Investimentos SAc,d | | | 8,500 | | | | 98,316 | |

| | |

Raia Drogasil SA | | | 4,600 | | | | 94,451 | |

| | |

Banco BTG Pactual SAb | | | 2,700 | | | | 37,982 | |

| | | | | | | | |

Total Brazil | | | | | | | 655,017 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| RUSSIA: 7.0% | | | | | | | | |

| | |

LUKOIL PJSC ADR | | | 2,556 | | | | 189,998 | |

| | |

Novatek PJSC GDRd | | | 1,310 | | | | 185,683 | |

| | |

Yandex N.V. Class Ab | | | 3,100 | | | | 155,062 | |

| | |

Mail.Ru Group, Ltd. GDRb,d | | | 5,058 | | | | 114,091 | |

| | | | | | | | |

Total Russia | | | | | | | 644,834 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| SOUTH KOREA: 6.2% | | | | | | | | |

| | |

NAVER Corp. | | | 888 | | | | 199,785 | |

| | |

LG Household & Health Care, Ltd. | | | 150 | | | | 168,122 | |

| | |

Hugel, Inc.b | | | 271 | | | | 106,668 | |

| | |

Macquarie Korea Infrastructure Fund | | | 10,283 | | | | 97,774 | |

| | | | | | | | |

Total South Korea | | | | | | | 572,349 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| TAIWAN: 5.9% | | | | | | | | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | | 7,400 | | | | 420,098 | |

| | |

Advantech Co., Ltd. | | | 12,000 | | | | 120,765 | |

| | | | | | | | |

Total Taiwan | | | | | | | 540,863 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| | |

| MEXICO: 3.9% | | | | | | | | |

| | |

Prologis Property Mexico SA de CV, REIT | | | 77,300 | | | | $138,259 | |

| | |

Fomento Economico Mexicano SAB de CV ADR | | | 1,900 | | | | 117,819 | |

| | |

America Movil SAB de CV ADR | | | 7,900 | | | | 100,251 | |

| | | | | | | | |

Total Mexico | | | | | | | 356,329 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| FRANCE: 3.8% | | | | | | | | |

| | |

LVMH Moet Hennessy Louis Vuitton SE | | | 455 | | | | 200,880 | |

| | |

Pernod Ricard SA | | | 956 | | | | 150,537 | |

| | | | | | | | |

Total France | | | | | | | 351,417 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| SINGAPORE: 3.1% | | | | | | | | |

| | |

CapitaLand, Ltd.b | | | 82,300 | | | | 173,871 | |

| | |

Sea, Ltd. ADRb | | | 1,000 | | | | 107,240 | |

| | | | | | | | |

Total Singapore | | | | | | | 281,111 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| PHILIPPINES: 3.0% | | | | | | | | |

| | |

Ayala Corp. | | | 10,070 | | | | 158,064 | |

| | |

Wilcon Depot, Inc. | | | 373,600 | | | | 116,083 | |

| | | | | | | | |

Total Philippines | | | | | | | 274,147 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| POLAND: 2.0% | | | | | | | | |

| | |

LiveChat Software SA | | | 11,545 | | | | 186,318 | |

| | | | | | | | |

Total Poland | | | | | | | 186,318 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| UNITED KINGDOM: 1.8% | | | | | | | | |

| | |

Avast PLCc,d | | | 24,354 | | | | 159,174 | |

| | | | | | | | |

Total United Kingdom | | | | | | | 159,174 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| ARGENTINA: 1.6% | | | | | | | | |

| | |

Globant SAb | | | 1,000 | | | | 149,850 | |

| | | | | | | | |

Total Argentina | | | | | | | 149,850 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDONESIA: 1.6% | | | | | | | | |

| | |

PT Bank Rakyat Indonesia Persero | | | 690,600 | | | | 147,404 | |

| | | | | | | | |

Total Indonesia | | | | | | | 147,404 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| UNITED STATES: 1.3% | | | | | | | | |

| | |

STAAR Surgical Co.b | | | 1,900 | | | | 116,926 | |

| | | | | | | | |

Total United States | | | | | | | 116,926 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| ZAMBIA: 1.1% | | | | | | | | |

| | |

First Quantum Minerals, Ltd. | | | 12,500 | | | | 99,624 | |

| | | | | | | | |

Total Zambia | | | | | | | 99,624 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| VIETNAM: 1.0% | | | | | | | | |

| | |

FPT Corp. | | | 46,044 | | | | 91,213 | |

| | | | | | | | |

Total Vietnam | | | | | | | 91,213 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| TOTAL COMMON EQUITIES | | | | | | | 8,293,219 | |

| | | | | | | | |

(Cost $7,327,711) | | | | | | | | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 9 | |

Matthews Emerging Markets Equity Fund

June 30, 2020

Schedule of Investmentsa (unaudited) (continued)

PREFERRED EQUITIES: 3.6%

| | | | | | | | |

| | | Shares | | | Value | |

| | | | | | | | |

| |

| SOUTH KOREA: 3.6% | | | | | |

Samsung Electronics Co., Ltd., Pfd. | | | 8,594 | | | | $334,773 | |

| | | | | | | | |

Total South Korea | | | | 334,773 | |

| | | | | | | | |

| | | | | | | | |

| | |

| TOTAL PREFERRED EQUITIES | | | | 334,773 | |

| | | | | | | | |

(Cost $306,070) | | | | | |

| | | | | | | | |

| | |

| TOTAL INVESTMENTS: 93.9% | | | | 8,627,992 | |

(Cost $7,633,781) | | | | | |

| | | | | | | | |

| |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 6.1% | | | | 556,390 | |

| | | | | | | | |

| |

NET ASSETS: 100.0% | | | | $9,184,382 | |

| | | | | | | | |

| a | Certain securities were fair valued under the valuation policies approved by the Board of Trustees (Note 2-A). |

| b | Non-income producing security. |

| c | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The security may be resold in transactions exempt from registration normally to qualified institutional buyers. The security has been determined to be liquid in accordance with procedures adopted by the Funds’ Board of Trustees. At June 30, 2020, the aggregate value is $665,611, which is 7.25% of net assets. |

| d | The securities may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

| | | | |

| PORTFOLIO MANAGERS |

| |

| Teresa Kong, CFA | | |

Lead Manager | | |

| |

| Satya Patel | | Wei Zhang |

Co-Manager | | Co-Manager |

|

| FUND FACTS |

| | |

| | | Investor | | Institutional |

Ticker | | MAINX | | MINCX |

CUSIP | | 577125503 | | 577125602 |

Inception | | 11/30/11 | | 11/30/11 |

NAV | | $10.54 | | $10.54 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.08% | | 0.97% |

After Fee Waiver and Reimbursement2 | | 1.07% | | 0.90% |

Portfolio Statistics | | | | |

Total # of Positions | | 41 | | |

Net Assets | | $102.1

million | |

|

Modified Duration3 | | 5.0 | | |

Portfolio Turnover4 | | 84.38% | | |

Benchmark | | |

| 50% Markit iBoxx Asian Local Bond Index, 50% J.P. Morgan Asia Credit Index* |

OBJECTIVE

Total return over the long term with an emphasis on income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in debt and debt-related instruments issued by governments, quasi-governmental entities, supra-national institutions, and companies in Asia. Asia consists of all countries and markets in Asia, such as China and India, and includes developed, emerging, and frontier countries and markets in the Asian region. The Fund’s investments in debt securities may be denominated in any currency, may be of any quality or may be unrated, and may have no stated maturity or duration target.

Matthews Asia Total Return Bond Fund†

Portfolio Manager Commentary (unaudited)

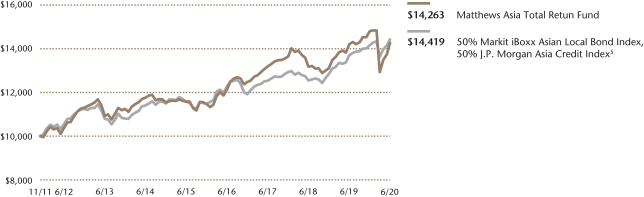

For the first half of 2020, the Matthews Asia Total Return Bond Fund returned –3.65% (Investor Class) and –3.55% (Institutional Class) while its benchmark, the 50% Markit iBoxx Asian Local Bond Index/50% J.P. Morgan Asia Credit Index (JACI), returned 1.87%. For the quarter ending June 30, 2020, the Fund returned 10.32% (Investor Class) and 10.39% (Institutional Class) compared to the benchmark return of 5.75%.

Market Environment:

Just as the recovery from Covid-19 has been uneven globally, the recovery in markets has also been uneven. For some asset classes, it’s as if the virus never happened, posting positive gains for the year. These are generally the less risky parts of the market, such as developed market government bonds, investment grade corporates and gold. The riskier parts of the market have also rebounded from March lows but given the lingering uncertainty to economic activity and corporate fundamentals due to the coronavirus, these markets still faced losses year to date.

For Asia fixed income, this means that investment-grade corporates and rates performed the best in the first half of the year, followed by high yield. Within credit, issuers from more developed countries such as China have outperformed issuers from emerging countries such as Indonesia and India. Within Asian currencies, the most punished in the first quarter rebounded the most in the second quarter, including the Indonesian rupiah and the Thai baht.

Global central banks continue to provide ample liquidity, which we believe undergirds a lot of the markets’ return to normalcy. The U.S. Federal Reserve continues to signal it will do “whatever it takes” to remain accommodative and to support the smooth functioning of financial markets. Meanwhile, the European Central Bank increased the size of its bond buying program by 600 billion euros in June. Many Asian countries are also in the enviable position of having ample fiscal flexibility to boost spending. For instance, Thailand and Singapore have already started disbursing fiscal stimulus packages.

We also see increased experimentation with support from emerging markets central banks. For instance, the Indonesian central bank has announced a program to buy government bonds in both the primary and secondary markets. For now, it looks like the Indonesian central bank’s goal is to act as a buyer of last resort and cap government bond yields, rather than monetizing the debt. As such, this alleviates pressure on the government without debasing the currency. However, we are watching carefully as emerging market countries tread the narrow path between fiscal prudence to provide the needed social support for a health crisis and fiscal largess that could lead to a financial crisis.

Performance Contributors and Detractors:

A key driver of positive performance was the Fund’s exposure to U.S. dollar high yield issuers, which recouped much of their first quarter losses. In general, lower-rated bonds outperformed higher-rated bonds. The top contributors were our positions in Chinese property developer Dalian Wanda, Tata Steel, a top three global steel producer, and Bharti Airtel, one the three largest wireless companies in India. These large blue chip companies recovered most quickly as their probability of survival, even in a protracted economic downturn, is materially higher than their peers. Top detractors were Modernland Reality, Franshion Brilliant and Sino-Ocean. As a real estate developer in Indonesia, Modernland faced both a revenue shortfall as well as potential liquidity issues due to the economic lockdown in response to Covid-19. Both Franshion Brilliant and Sino-Ocean are fundamentally sound, with their long-dated perpetual bonds slower to recover than their shorter dated ones.

(continued)

| † | The Fund’s name changed from Matthews Asia Strategic Income Fund to Matthews Asia Total Return Bond Fund on January 31, 2020. |

| * | Effective January 31, 2020, the Fund changed its benchmark to a blended benchmark comprised of 50% Markit iBoxx Asian Local Bond Index and 50% J.P. Morgan Asia Credit Index. Prior to January 31, 2020, the Fund’s benchmark was the Markit iBoxx Asian Local Bond Index. Matthews believes that the blended benchmark is more appropriate in light of the Fund’s current investment strategy. The Markit iBoxx Local Bond Index performance reflects the returns of the discontinued predecessor HSBC Asia Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Local Bond Index thereafter. |

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g. custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. Pursuant to this agreement, any amount waived for prior fiscal years with respect to the Fund is not subject to recoupment. This agreement will remain in place until April 30, 2021 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2019 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 11 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| PERFORMANCE AS OF JUNE 30, 2020 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns | | | | |

| | | 3 Months | | | YTD | | | 1 Year | | | 3 Years | | | 5 Years | | | Since

Inception | | | Inception

Date | |

| Investor Class (MAINX) | | | 10.32% | | | | -3.65% | | | | 0.45% | | | | 2.64% | | | | 4.26% | | | | 4.22% | | | | 11/30/11 | |

| Institutional Class (MINCX) | | | 10.39% | | | | -3.55% | | | | 0.51% | | | | 2.88% | | | | 4.51% | | | | 4.44% | | | | 11/30/11 | |

| 50% Markit iBoxx Asian Local Bond Index, 50% J.P. Morgan Asia Credit Index5 | | | 5.75% | | | | 1.87% | | | | 5.22% | | | | 4.79% | | | | 4.77% | | | | 4.36% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| INCOME DISTRIBUTION HISTORY | |

| | | 2020 | | | | | | 2019 | |

| | Jan. | | | Feb. | | | Mar. | | | Apr. | | | May | | | June | | | July | | | Aug. | | | Sept. | | | Oct. | | | Nov. | | | Dec. | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MAINX) | | | n.a. | | | $ | 0.06 | | | $ | 0.04 | | | $ | 0.00 | | | $ | 0.03 | | | $ | 0.04 | | | | n.a. | | | | n.a. | | | | n.a. | | | | n.a. | | | | n.a. | | | | n.a. | | | $ | 0.17 | | | | | | | $ | 0.08 | | | $ | 0.10 | | | $ | 0.14 | | | $ | 0.12 | | | $ | 0.44 | |

| Inst’l (MINCX) | | | n.a. | | | $ | 0.07 | | | $ | 0.04 | | | $ | 0.01 | | | $ | 0.03 | | | $ | 0.04 | | | | n.a. | | | | n.a. | | | | n.a. | | | | n.a. | | | | n.a. | | | | n.a. | | | $ | 0.19 | | | | | | | $ | 0.09 | | | $ | 0.11 | | | $ | 0.14 | | | $ | 0.12 | | | $ | 0.46 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

| | | |

30-DAY YIELD: Investor Class: 5.65% (5.63% excluding waivers) Institutional Class: 5.89% (5.80% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/20, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 6.24% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

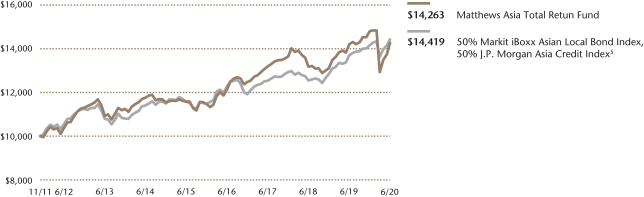

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from HSBC, Markit iBoxx and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 90 for index definitions. Effective January 31, 2020, the Fund changed its benchmark to a blended benchmark comprised of 50% Markit iBoxx Asian Local Bond Index and 50% J.P. Morgan Asia Credit Index. Prior to January 31, 2020, the Fund’s benchmark was the Markit iBoxx Asian Local Bond Index. Matthews believes that the blended benchmark is more appropriate in light of the Fund’s current investment strategy. The Markit iBoxx Asian Local Bond Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Wanda Properties International Co., Ltd., 7.250%, 01/29/2024 | | Real Estate | | U.S. Dollar | | | 4.9% | |

| Network i2i, Ltd., 5.650%, 04/15/2068 | | Communication Services | | U.S. Dollar | | | 4.7% | |

| Viet Nam Debt & Asset Trading Corp., 1.000%, 10/10/2025 | | Financials | | U.S. Dollar | | | 4.6% | |

| CIFI Holdings Group Co., Ltd., 6.550%, 03/28/2024 | | Real Estate | | U.S. Dollar | | | 4.5% | |

| Luye Pharma Group, Ltd., Cnv., 1.500%, 07/09/2024 | | Health Care | | U.S. Dollar | | | 4.4% | |

| PB International BV, 7.625%, 01/26/2022 | | Consumer Discretionary | | U.S. Dollar | | | 4.4% | |

| Bosideng International Holdings, Ltd., Cnv., 1.000%, 12/17/2024 | | Consumer Discretionary | | U.S. Dollar | | | 4.1% | |

| ABJA Investment Co. Pte, Ltd., 5.450%, 01/24/2028 | | Materials | | U.S. Dollar | | | 4.0% | |

| Logan Group Co., Ltd., 5.250%, 02/23/2023 | | Real Estate | | U.S. Dollar | | | 3.8% | |

| Malaysia Government Bond, 4.642%, 11/07/2033 | | Foreign Government Bonds | | Malaysian Ringgit | | | 3.4% | |

| % OF ASSETS IN TOP TEN | | | | | | | 42.8% | |

Matthews Asia Total Return Bond Fund

Portfolio Manager Commentary (unaudited) (continued)

Local currency bond exposures also added to performance as most Asian currencies appreciated relative to the U.S. dollar, and interest rates across Asia fell in the quarter. Relative to our benchmark, overweights to Indonesia, Malaysia and Thailand were the top rate contributors while underweights to the Philippines and Singapore detracted, even though these positions still posted positive total returns. Our exposure to local currency-denominated bonds of Indonesia contributed most in our local currency positions as the rupiah was one of the best performing currencies globally, appreciating 14% in the second quarter.

Notable Portfolio Changes:

During the second quarter, we exited our position in Sri Lanka sovereign bonds. We believe these bonds have limited upside after the pandemic-driven sell-off. We expect developing countries across the world to seek external assistance in the coming quarters and think that will weigh on performance in Sri Lanka. We also exited Chinese auto manufacture Geely perpetual bonds, and Huaneng, a state owned Chinese utility company. Both of these bonds carry investment-grade level risk and had reached our price targets after the pandemic-induced sell-off. We decided to take profit and re-deploy into bonds with more upside. Finally, we exited the bonds of Modernland Realty as the company seemed less willing and able to refinance its maturities.

In the second quarter, we initiated new positions in a handful of high-quality bonds where we see the potential for upside. These include the bonds of JD.com, a Chinese e-commerce company, and Sygenta, a global chemicals company headquartered in Switzerland and wholly owned by ChemChina, a state owned enterprise.

In terms of currencies, we slightly reduced our overweight to the Indonesian rupiah after its strong performance in the quarter via a currency hedge.

Outlook:

We expect the Asia credit, currency and interest rate markets to continue to be driven by policy makers’ response to the coronavirus in the coming quarters. Countries that have been the most effective in stopping the spread of the coronavirus have also had the fastest economic rebounds. Given this view, we remain most concerned about the spread of coronavirus in the U.S. and emerging market countries. While the U.S. remains behind the curve in terms of curtailing the spread of the coronavirus, it has been ahead of the curve in terms of stimulus, which has been supportive for its asset prices. Emerging markets are in a tough spot since many countries lack the resources to control the virus as well as the monetary and fiscal space to stimulate their markets.

Our strategy is to hold issuers that we believe have the best fundamentals to survive the coronavirus and its related economic challenges. Taken altogether, we believe Asia to be well positioned in this crisis, given their early control of the virus and space for economic stimulus. We continue to be overweight to Asia high yield, especially to credits which have a positive skew in price. In terms of Asia currencies, we have positioned the portfolio to be slightly long U.S. dollar given our expectations of continued volatility which still favors safe haven currencies such as the U.S. dollar. Among rates, we continue to be overweight countries like Thailand, Malaysia and Indonesia where we think rates are stable and provide attractive carry. Our biggest overweight in interest rates remains in the U.S., where the U.S. Fed has effectively signaled structurally lower rates for the coming quarters to buoy the markets. As the market recovers, we expect the credit spread compression to more than compensate for a mild rise and steepening of the U.S. yield curve.

| | | | |

| |

| CURRENCY ALLOCATION (%)6,7 | |

| US Dollar | | | 53.5 | |

South Korean Won | | | 9.7 | |

China Renminbi | | | 7.0 | |

Thailand Baht | | | 5.9 | |

Malaysian Ringgit | | | 5.8 | |

Singapore Dollar | | | 5.7 | |

Indonesian Rupiah | | | 5.5 | |

| Philippines Peso | | | 4.2 | |

China Renminbi Offshore | | | 2.7 | |

Total | | | 100.0 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)6,7,8 | |

| China/Hong Kong | | | 48.8 | |

| Indonesia | | | 13.8 | |

| India | | | 11.1 | |

| Philippines | | | 6.7 | |

| Malaysia | | | 5.6 | |

| Vietnam | | | 4.6 | |

| Switzerland | | | 3.1 | |

| Thailand | | | 2.4 | |

| Cash and Other Assets, Less Liabilities | | | 4.0 | |

| Total | | | 100.1 | |

| | | | |

| |

| SECTOR ALLOCATION (%)6,7 | |

| Real Estate | | | 24.1 | |

| Foreign Government Bonds | | | 18.7 | |

Consumer Discretionary | | | 14.2 | |

Financials | | | 14.0 | |

Communication Services | | | 8.7 | |

| Materials | | | 7.1 | |

Health Care | | | 4.4 | |

Energy | | | 3.9 | |

| Industrials | | | 1.0 | |

| Cash and Other Assets, Less Liabilities | | | 4.0 | |

| Total | | | 100.1 | |

Please note: Foreign Government Bonds category includes Supranationals.

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)6,7 | |

| Non-Convertible Corporate Bonds | | | 61.3 | |

Government Bonds | | | 23.3 | |

Convertible Corporate Bonds | | | 11.5 | |

Cash and Other Assets, Less Liabilities | | | 4.0 | |

| 6 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

| 7 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 8 | Not all countries where the Fund may invest are included in the benchmark index. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 13 | |

Matthews Asia Total Return Bond Fund

June 30, 2020

Schedule of Investmentsa (unaudited)

NON-CONVERTIBLE CORPORATE BONDS: 61.3%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| | | | | | | | |

|

| CHINA/HONG KONG: 37.2% | |

Wanda Properties International Co., Ltd.

7.250%, 01/29/24b | | | 5,300,000 | | | | $4,975,375 | |

| | |

CIFI Holdings Group Co., Ltd.

6.550%, 03/28/24b | | | 4,500,000 | | | | 4,611,977 | |

| | |

Logan Group Co., Ltd.

5.250%, 02/23/23b | | | 3,900,000 | | | | 3,870,521 | |

| | |

KWG Group Holdings, Ltd.

5.875%, 11/10/24b | | | 3,400,000 | | | | 3,238,003 | |

| | |

King Talent Management, Ltd.

5.600%c, 12/04/22b,d | | | 3,500,000 | | | | 3,011,641 | |

| | |

Franshion Brilliant, Ltd.

5.750%c, 01/17/22b,d | | | 3,400,000 | | | | 2,928,420 | |

| | |

JD.com, Inc.

4.125%, 01/14/50 | | | 2,200,000 | | | | 2,327,291 | |

| | |

KWG Group Holdings, Ltd.

7.875%, 09/01/23b | | | 2,050,000 | | | | 2,121,724 | |

| | |

HSBC Holdings PLC

6.375%c, 03/30/25d | | | 2,000,000 | | | | 2,053,760 | |

| | |

CIFI Holdings Group Co., Ltd.

7.750%, 09/20/20b | | | CNY 12,000,000 | | | | 1,715,963 | |

| | |

CITIC Telecom International Finance, Ltd.

6.100%, 03/05/25b | | | 1,631,000 | | | | 1,687,784 | |

| | |

China Cinda Asset Management Co., Ltd.

5.500%, 03/14/28 | | | CNY 10,000,000 | | | | 1,555,585 | |

| | |

Agricultural Bank of China, Ltd.

4.300%, 04/11/29b | | | CNY 10,000,000 | | | | 1,445,405 | |

| | |

Sino-Ocean Land Treasure III, Ltd.

4.900%c, 09/21/22b,d | | | 1,400,000 | | | | 1,162,658 | |

| | |

Honghua Group, Ltd.

6.375%, 08/01/22b | | | 1,100,000 | | | | 1,075,208 | |

| | |

Deutsche Bank AG

3.670%c, 04/10/25b,e | | | CNY 2,000,000 | | | | 256,695 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 38,038,010 | |

| | | | | | | | |

| | | | | | | | |

| |

| INDIA: 11.1% | |

Network i2i, Ltd.

5.650%c, 01/15/25d,f | | | 5,000,000 | | | | 4,840,000 | |

| | |

ABJA Investment Co. Pte, Ltd.

5.450%, 01/24/28b | | | 4,440,000 | | | | 4,098,079 | |

| | |

ICICI Bank UK PLC

5.375%c, 09/26/28b | | | SGD 1,750,000 | | | | 1,248,219 | |

| | |

Network i2i, Ltd.

5.650%c, 01/15/25b,d | | | 1,200,000 | | | | 1,161,600 | |

| | | | | | | | |

Total India | | | | | | | 11,347,898 | |

| | | | | | | | |

| | | | | | | | |

| |

| INDONESIA: 7.3% | |

PB International BV

7.625%, 01/26/22b | | | 5,100,000 | | | | 4,475,154 | |

| | |

Indika Energy Capital III Pte, Ltd.

5.875%, 11/09/24b | | | 3,300,000 | | | | 2,938,487 | |

| | | | | | | | |

Total Indonesia | | | | | | | 7,413,641 | |

| | | | | | | | |

| | | | | | | | |

| |

| SWITZERLAND: 3.1% | |

Syngenta Finance N.V.

5.182%, 04/24/28b | | | 2,400,000 | | | | 2,560,072 | |

| | |

Syngenta Finance N.V.

4.892%, 04/24/25f | | | 300,000 | | | | 315,394 | |

| | |

Syngenta Finance N.V.

5.676%, 04/24/48b | | | 300,000 | | | | 303,709 | |

| | | | | | | | |

Total Switzerland | | | | | | | 3,179,175 | |

| | | | | | | | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| | | | | | | | |

|

| PHILIPPINES: 2.6% | |

Jollibee Worldwide Pte, Ltd.

3.900%c, 01/23/25b,d | | | 1,729,000 | | | | $1,613,157 | |

| | |

Royal Capital BV

4.875%c, 05/05/24b,d | | | 1,041,000 | | | | 1,014,975 | |

| | | | | | | | |

Total Philippines | | | | | | | 2,628,132 | |

| | | | | | | | |

| | | | | | | | |

| | |

| TOTAL NON-CONVERTIBLE CORPORATE BONDS | | | | 62,606,856 | |

| | | | | | | | |

(Cost $63,336,665) | | | | | | | | |

| | | | | | | | |

| |

FOREIGN GOVERNMENT OBLIGATIONS: 23.2% | | | | | |

| |

| INDONESIA: 6.5% | |

Indonesia Government Bond

9.000%, 03/15/29 | | | IDR 38,000,000,000 | | | | 2,945,299 | |

| | |