UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-7553

Date of fiscal year end: December 31

Date of reporting period: June 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Semi-Annual Report

June 30, 2018 | matthewsasia.com

ASIA FIXED INCOME STRATEGIES

Matthews Asia Strategic Income Fund

Matthews Asia Credit Opportunities Fund

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Dividend Fund

Matthews China Dividend Fund

ASIA VALUE STRATEGY

Matthews Asia Value Fund

ASIA GROWTH STRATEGIES

Matthews Asia Focus Fund

Matthews Asia Growth Fund

Matthews Pacific Tiger Fund

Matthews Asia ESG Fund

Matthews Emerging Asia Fund

Matthews Asia Innovators Fund

Matthews China Fund

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA SMALL COMPANY STRATEGIES

Matthews Asia Small Companies Fund

Matthews China Small Companies Fund

Investor Class Performance and Expenses (June 30, 2018)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Average Annual Total Return† | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement* | |

| Investor Class | | 1 year | | | 5 years | | | 10 years | | | Since

Inception | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Strategic Income Fund (MAINX) | | | -0.09% | | | | 3.83% | | | | n.a. | | | | 4.28% | | | | 11/30/11 | | | | 1.29% | | | | 1.15% | 1 |

Asia Credit Opportunities Fund (MCRDX) | | | -0.45% | | | | n.a. | | | | n.a. | | | | 4.39% | | | | 4/29/16 | | | | 1.86% | | | | 1.15% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

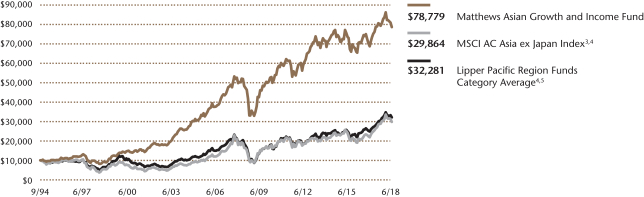

Asian Growth and Income Fund (MACSX) | | | -0.51% | | | | 2.51% | | | | 4.99% | | | | 9.06% | | | | 9/12/94 | | | | 1.07% | | | | 1.07% | |

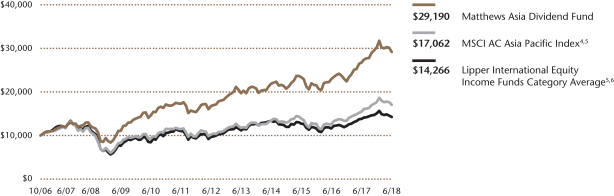

Asia Dividend Fund (MAPIX) | | | 9.27% | | | | 8.22% | | | | 9.17% | | | | 9.62% | | | | 10/31/06 | | | | 1.03% | | | | 1.02% | 2 |

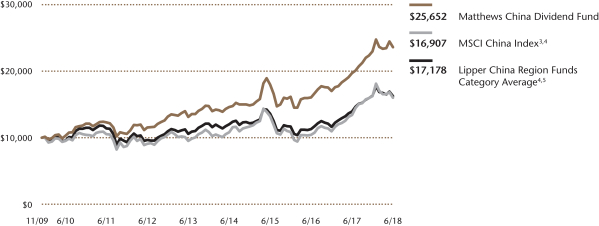

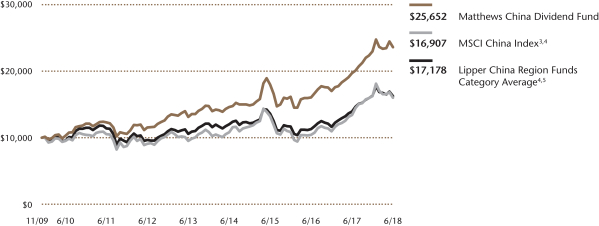

China Dividend Fund (MCDFX) | | | 21.22% | | | | 13.52% | | | | n.a. | | | | 11.60% | | | | 11/30/09 | | | | 1.19% | | | | 1.19% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

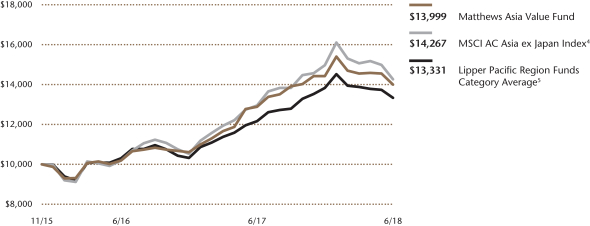

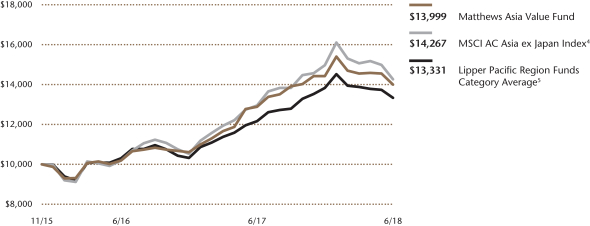

Asia Value Fund (MAVRX) | | | 8.64% | | | | n.a. | | | | n.a. | | | | 13.91% | | | | 11/30/15 | | | | 2.32% | | | | 1.50% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

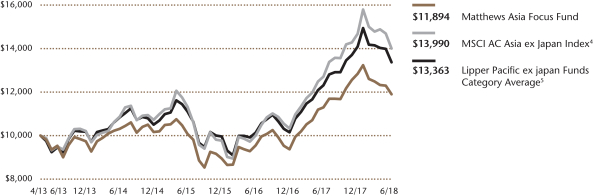

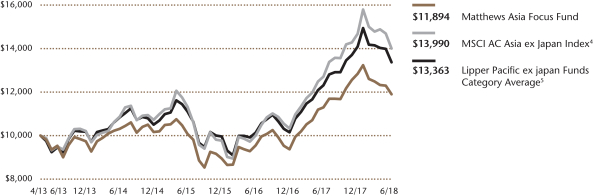

Asia Focus Fund (MAFSX) | | | 5.38% | | | | 4.93% | | | | n.a. | | | | 3.41% | | | | 4/30/13 | | | | 2.45% | | | | 1.50% | 3 |

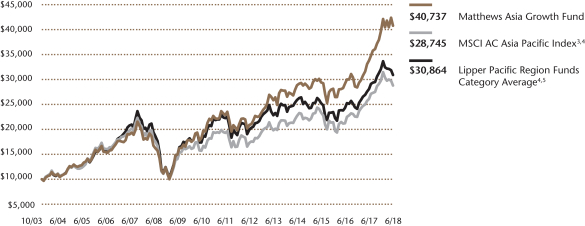

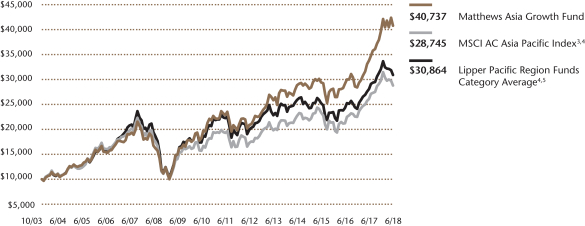

Asia Growth Fund (MPACX) | | | 20.61% | | | | 9.55% | | | | 9.34% | | | | 10.05% | | | | 10/31/03 | | | | 1.12% | | | | 1.12% | |

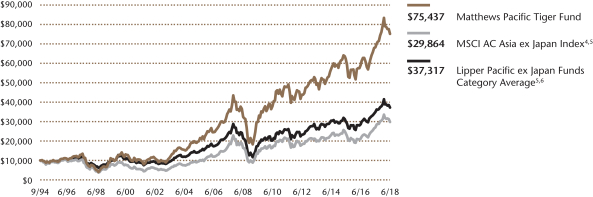

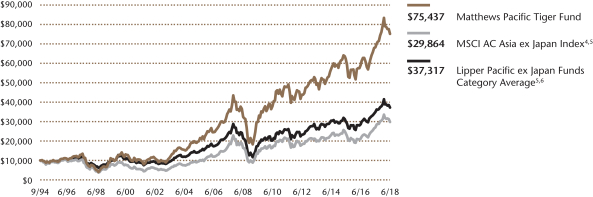

Pacific Tiger Fund (MAPTX) | | | 10.15% | | | | 8.99% | | | | 8.77% | | | | 8.86% | | | | 9/12/94 | | | | 1.08% | | | | 1.06% | 2 |

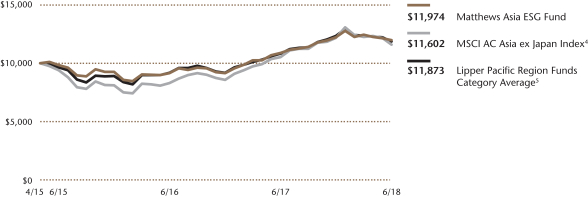

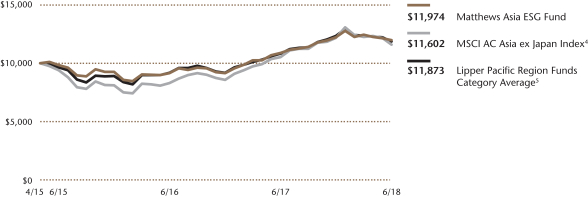

Asia ESG Fund (MASGX) | | | 9.93% | | | | n.a. | | | | n.a. | | | | 5.85% | | | | 4/30/15 | | | | 2.65% | | | | 1.50% | 3 |

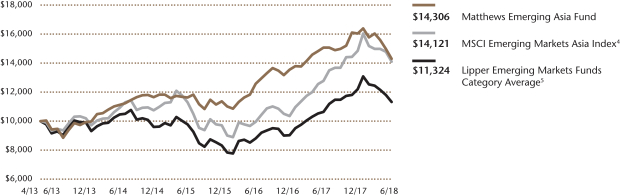

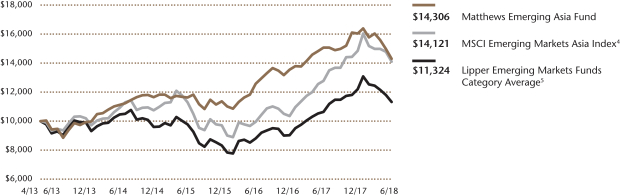

Emerging Asia Fund (MEASX) | | | -5.13% | | | | 8.67% | | | | n.a. | | | | 7.18% | | | | 4/30/13 | | | | 1.70% | | | | 1.48% | 3 |

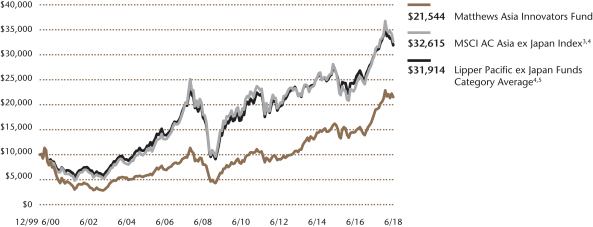

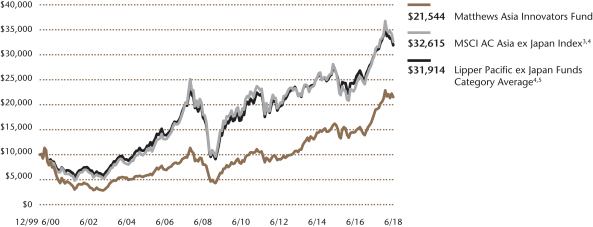

Asia Innovators Fund (MATFX) | | | 19.09% | | | | 15.36% | | | | 10.32% | | | | 4.23% | | | | 12/27/99 | | | | 1.24% | | | | 1.24% | |

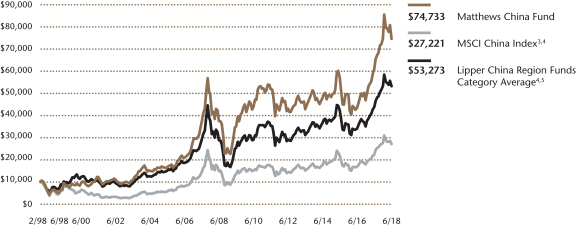

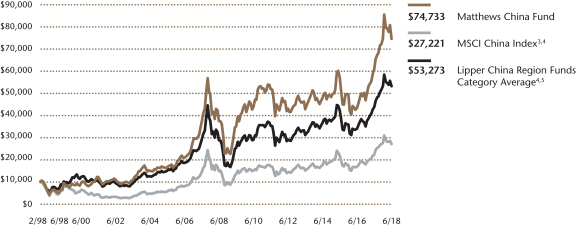

China Fund (MCHFX) | | | 22.37% | | | | 11.72% | | | | 7.10% | | | | 10.38% | | | | 2/19/98 | | | | 1.09% | | | | 1.09% | |

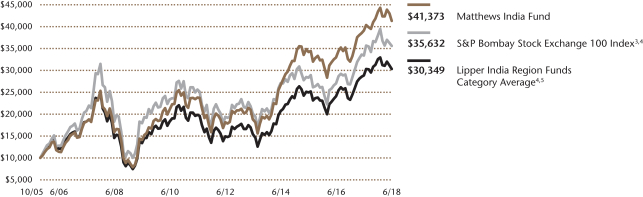

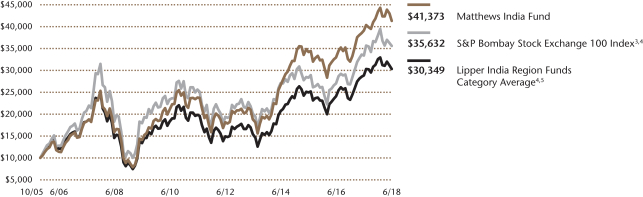

India Fund (MINDX) | | | 5.66% | | | | 17.06% | | | | 10.05% | | | | 11.87% | | | | 10/31/05 | | | | 1.09% | | | | 1.09% | |

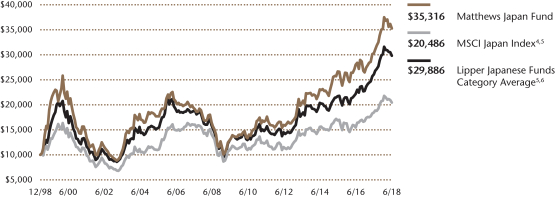

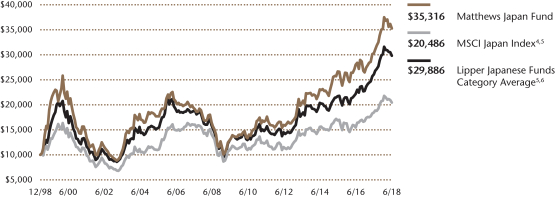

Japan Fund (MJFOX) | | | 16.27% | | | | 11.73% | | | | 7.93% | | | | 6.69% | | | | 12/31/98 | | | | 0.95% | | | | 0.94% | 2 |

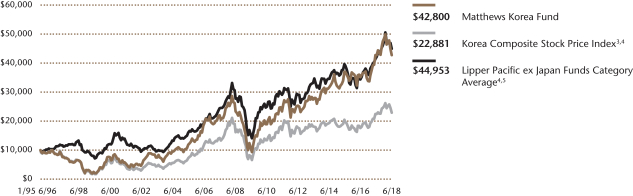

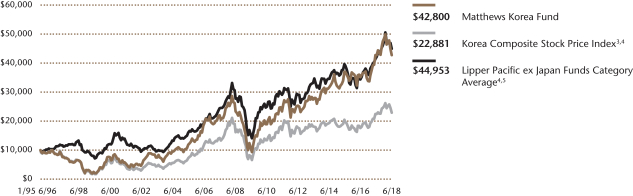

Korea Fund (MAKOX) | | | 0.00% | | | | 10.46% | | | | 7.95% | | | | 6.39% | | | | 1/3/95 | | | | 1.15% | | | | 1.15% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

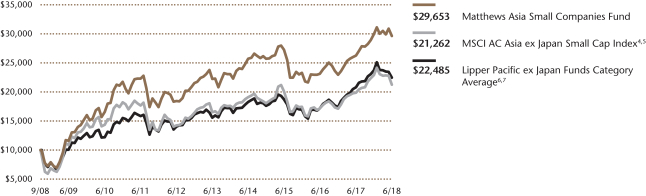

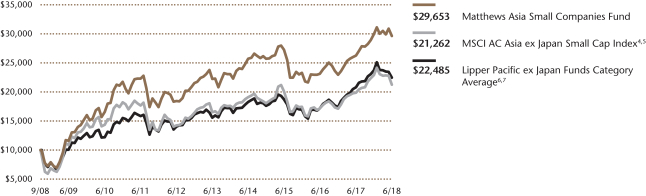

Asia Small Companies Fund (MSMLX) | | | 12.87% | | | | 5.90% | | | | n.a. | | | | 11.74% | | | | 9/15/08 | | | | 1.49% | | | | 1.46% | 3 |

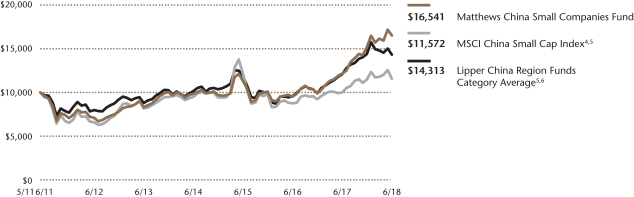

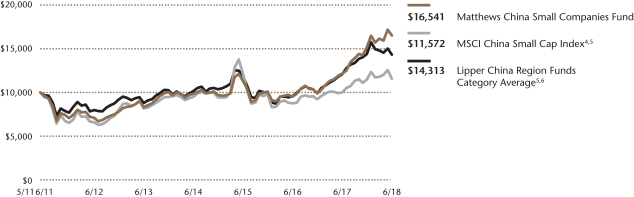

China Small Companies Fund (MCSMX) | | | 36.21% | | | | 14.78% | | | | n.a. | | | | 7.36% | | | | 5/31/11 | | | | 2.34% | | | | 1.50% | 3 |

| * | These figures are from the Funds’ prospectus dated as of April 30, 2018, and may differ from the actual expense ratios for fiscal year 2018, as shown in the financial highlights section of this report. |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of the (i) expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2019 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.25% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

Institutional Class Performance and Expenses (June 30, 2018)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | Average Annual Total Return† | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement* | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Strategic Income Fund (MINCX) | | | 0.25% | | | | 4.09% | | | | n.a. | | | | 4.51% | | | | 11/30/11 | | | | 1.08% | | | | 0.90% | 1 |

Asia Credit Opportunities Fund (MICPX) | | | -0.27% | | | | n.a. | | | | n.a. | | | | 4.60% | | | | 4/29/16 | | | | 1.62% | | | | 0.90% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asian Growth and Income Fund (MICSX) | | | -0.40% | | | | 2.67% | | | | n.a. | | | | 4.03% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | |

Asia Dividend Fund (MIPIX) | | | 9.39% | | | | 8.35% | | | | n.a. | | | | 7.75% | | | | 10/29/10 | | | | 0.92% | | | | 0.91% | 2 |

China Dividend Fund (MICDX) | | | 21.40% | | | | 13.72% | | | | n.a. | | | | 10.61% | | | | 10/29/10 | | | | 1.04% | | | | 1.04% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Value Fund (MAVAX) | | | 8.85% | | | | n.a. | | | | n.a. | | | | 14.19% | | | | 11/30/15 | | | | 2.08% | | | | 1.25% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Focus Fund (MIFSX) | | | 5.62% | | | | 5.20% | | | | n.a. | | | | 3.67% | | | | 4/30/13 | | | | 2.27% | | | | 1.25% | 3 |

Asia Growth Fund (MIAPX) | | | 20.82% | | | | 9.77% | | | | n.a. | | | | 8.53% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | |

Pacific Tiger Fund (MIPTX) | | | 10.32% | | | | 9.19% | | | | n.a. | | | | 6.77% | | | | 10/29/10 | | | | 0.91% | | | | 0.89% | 2 |

Asia ESG Fund (MISFX) | | | 10.28% | | | | n.a. | | | | n.a. | | | | 6.13% | | | | 4/30/15 | | | | 2.46% | | | | 1.25% | 3 |

Emerging Asia Fund (MIASX) | | | -4.91% | | | | 8.91% | | | | n.a. | | | | 7.41% | | | | 4/30/13 | | | | 1.52% | | | | 1.25% | 3 |

Asia Innovators Fund (MITEX) | | | 19.23% | | | | 15.57% | | | | n.a. | | | | 14.65% | | | | 4/30/13 | | | | 1.05% | | | | 1.05% | |

China Fund (MICFX) | | | 22.57% | | | | 11.88% | | | | n.a. | | | | 4.74% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | |

India Fund (MIDNX) | | | 5.84% | | | | 17.28% | | | | n.a. | | | | 6.71% | | | | 10/29/10 | | | | 0.89% | | | | 0.89% | |

Japan Fund (MIJFX) | | | 16.36% | | | | 11.85% | | | | n.a. | | | | 11.87% | | | | 10/29/10 | | | | 0.87% | | | | 0.86% | 2 |

Korea Fund (MIKOX) | | | 0.14% | | | | 10.63% | | | | n.a. | | | | 8.77% | | | | 10/29/10 | | | | 1.01% | | | | 1.01% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Small Companies Fund (MISMX) | | | 13.07% | | | | 6.13% | | | | n.a. | | | | 5.20% | | | | 4/30/13 | | | | 1.35% | | | | 1.25% | 3 |

China Small Companies Fund (MICHX)4 | | | 36.36% | | | | 14.81% | | | | n.a. | | | | 7.38% | | | | 11/30/17 | | | | 2.09% | | | | 1.25% | 3 |

| * | These figures are from the Funds’ prospectus dated as of April 30, 2018, and may differ from the actual expense ratios for fiscal year 2018, as shown in the financial highlights section of this report. |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of the (i) expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2019 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 4 | Institutional Class Shares were first offered on November 30, 2017. For performance since that date, please see the Fund’s performance table in the report. Performance for the Institutional Class Shares prior to its inception represents the performance of the Investor Class. Performance differences between the Institutional Class and Investor Class may arise due to differences in fees charged to each class. |

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 2 | |

Contents

Cover photo: Beautiful garden with Chinese architectural bridge and reflection in the lake.

This report has been prepared for Matthews International Funds (d/b/a Matthews Asia Funds) shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. Additional copies of the prospectus or summary prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of June 30, 2018. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund’s future investment intent. Current and future portfolio holdings are subject to risk.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of a concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds’ prospectus and Statement of Additional Information for more risk disclosure.

Message to Shareholders from the Investment Advisor

Dear Valued Investors,

The past two quarters have been volatile and difficult for Asia’s markets. This has led to the usual calls to try and time the market—to jump the gun on monetary cycles and to second guess the headlines. I have always found this a dangerous game. At Matthews Asia, we have found patience to be a virtue at times like this. The headline clamor has been all about trade wars and politics. These, we are told, create an atmosphere of uncertainty within which it is difficult for markets to perform. “Expect more volatility,” the pundits cry. And by this they really mean: “Markets will likely fall!” The sentiment surrounding Asia, which never really turned wholly positive, has once again swung back to one of caution and suspicion.

I’ve never really liked this way of describing market movements, which seems to border on the metaphysical. Why would the trade scuffles do much from a broad macroeconomic perspective? It makes no sense. Certain industries could surely be impacted. But what may be bad for Chinese manufacturers could be good for those in Malaysia or Vietnam. It is too complex an issue to be treated in a binary way. Is it so complex that people are just throwing their hands up in the air and standing clear until the dust settles? Maybe. But that is potentially a costly move. The actual macroeconomic impact of tariffs is small and investors can largely sidestep it by owning domestically focused businesses. So if that indecision is really driving Asia’s stock markets down, it’s a bit of a giveaway to long-term investors right now. So is it really true that a swirling uncertainty of trade and politics is causing investors to be illogically nervous about Asia and selling out at ridiculous prices?

If only it were so simple. For then, we could easily take advantage. But I suspect there is a much simpler (and more concrete) explanation for the weakness in Asia’s markets: money. Or, rather, the increasing scarcity of money. The monetary cycle has turned. The U.S. Federal Reserve is intent on raising rates, even as the spread between longer- and shorter-dated bond yields narrows (the so-called “two-ten spread,” which now stands at just 0.31%).1 Are we barely one rate rise away from an inverted yield curve and an economic slowdown in the U.S.? The other central banks are not exactly leaning against the Fed’s tightening. You can make a case that the Bank of Japan is still pursuing looser money, yes; however, the European Central Bank has stayed pat, even as the European banking system continues to teeter on the brink. The share price of Deutsche Bank—an institution large enough to cause a systemic liquidity shock should it run into trouble—continues to hit new lows. The liquidity conditions in China are tightening, too. And peripheral nations such as Indonesia and the Philippines are already raising interest rates. These are real concerns for investors, as tighter money will impact nominal growth and feed into profit growth for listed companies and therefore impact their share prices. So, it is not illogical that markets are falling, nor is it due to some unspecified funk that investors have gotten into. It’s real and it’s calculated.

But that doesn’t mean we can’t take advantage of these calculated fears. How? What do we have that the price-setters in the market lack? Patience. I do not argue that investors that are selling are doing so illogically, but they are doing so with a shorter-term time horizon than we have. It is the marginal investor who sets the price, the investor who is most emotionally driven, the investor who palpably feels Greed and Fear. These emotions are amplified when you look at the short term. I have often thought their calculations are guided by the same kind of thought process that author Douglas Adams taught us was the key to flying: “You must learn how to throw yourself at the ground and miss.... Clearly, it is the second part, the missing, which presents the difficulties.” And for the marginal investors now, they are mostly concerned with trying to miss the ground. You have to focus elsewhere.

| 1 | Federal Reserve Bank of St. Louis |

I try to remember at times like this that monetary cycles are a “fluttering veil” that can hide or disguise the underlying real forces in an economy. So long as entrepreneurialism, investment, good governance flourishes underneath that veil, it will only temporarily be hidden from view. With that in mind, I do see opportunities arising for the patient investor. For the long-run secular trends in Asia all remain in place. These include high savings, productivity growth, infrastructure spending, openness to trade, and the pursuit of institutional and market reform. The medium-term cycle of credit, profits and wages has largely been subdued in Asia, with the exception of Japan. And so there are not really any cyclical excesses built up in the economic system—not to the extent that corporates are over-indebted or that political and class tensions are awoken, or that banking systems are stretched.

The medium- to long-term cycles both look favorable. It is only the monetary cycle that has brought what I see as a temporary halt to the macroeconomic tailwinds for the region. The focus on short-term rewards has also caused a great divergence in market prices, where those companies that are able to meet short-run expectations and feed those emotional desires have been bid up. Those companies that require patience have seen their share prices languish.

In the reversal of sentiment we have seen lately, therefore, I do believe that opportunities are arising for long-term investors. Parts of Southeast Asia appear to have been unnecessarily acutely sold down. Some of the bank stocks, while always the most vulnerable in a monetary cycle, look quite cheap. There are opportunities, too, in some of the companies that will patiently accumulate returns, as their stocks seem to be trading now at outright cheap valuations. Certainly, I find in my conversations with my investment team colleagues that they see real value and opportunities in some good-quality businesses. We don’t focus our attention trying to guess where the bottom of the market is. Rather, we continue to focus on the businesses that we believe will survive through the bad times and prosper in the good, and we take our opportunities where we find them.

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 5 | |

| | | | |

| PORTFOLIO MANAGERS |

| Teresa Kong, CFA | | |

Lead Manager | | |

| Satya Patel | | Wei Zhang |

Co-Manager | | Co-Manager |

|

| FUND FACTS |

| | | Investor | | Institutional |

Ticker | | MAINX | | MINCX |

CUSIP | | 577125503 | | 577125602 |

Inception | | 11/30/11 | | 11/30/11 |

NAV | | $10.38 | | $10.38 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.29% | | 1.08% |

After Fee Waiver and Reimbursement2 | | 1.15% | | 0.90% |

Portfolio Statistics | | | | |

Total # of Positions | | 45 |

Net Assets | | $116.7 million |

Modified Duration3 | | 2.74 |

Portfolio Turnover4 | | 36.58% |

Benchmark | | |

Markit iBoxx Asian Local Bond Index* |

OBJECTIVE

Total return over the long term with an emphasis on income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in income-producing securities including, but not limited to, dividend paying equity securities, and debt and debt-related instruments issued by governments, quasi-governmental entities, supra-national institutions, and companies in Asia. Asia consists of all countries and markets in Asia, such as China and India, and includes developed, emerging, and frontier countries and markets in the Asian region. Investments may be denominated in any currency, and may represent any part of a company’s capital structure from debt to equity or with features of both.

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited)

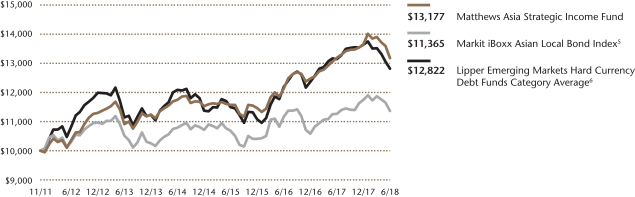

For the first half of 2018, the Matthews Asia Strategic Income Fund returned –3.49% (Investor Class) and –3.28% (Institutional Class) while its benchmark, the Markit iBoxx Asian Local Bond Index, returned –3.33%. For the quarter ending June 30, the Fund returned –5.26% (Investor Class) and –5.20% (Institutional Class) compared to the benchmark return of –4.31% over the same period.

Market Environment:

The key pillars for Asia’s strength were firmly in place as the year began, but some of these pillars looked increasingly fragile in the second quarter. Stability in the first quarter was followed by a notable return of volatility in the second quarter. While U.S. growth remains strong, European economic indicators surprised on the downside in the first quarter. Rising trade tensions between the U.S. and China also led to market swings.

On the interest rate front, volatility in rates markets led to a repricing of risk globally as investors demanded higher risk premiums. Strong economic data in the U.S. has increased rate hike expectations for the remainder of 2018 and 2019. As rates in the U.S. moved higher in the second quarter, interest rates in most Asian countries followed suit. The notable exception was China. The higher bond yields resulting from efforts by Chinese authorities to deleverage the financial system began easing earlier in the year and continued through June.

Asia high yield credit spreads are now significantly wider than historical averages. With the attractive value of Asia high yield relative to its U.S. and European counterparts, demand for Asia bonds may turn positive. It is important to put this mild depreciation in the context of the more severe sell-off in the currencies of emerging market countries such as Turkey, Brazil and South Africa—all of which experienced depreciation of more than 15% relative to the U.S. dollar in the second quarter.

After a stable first quarter, Asia high-yield credit spreads widened by 100 basis points (1.0%) in the second quarter, driven by issuers in China and Indonesia. Dispersion among dollar-denominated bonds increased, presenting an opportunity to identify attractive relative value. In this environment, security selection is paramount and we continued to move our portfolio into low duration, higher quality issuers where we believe we are well-compensated for the risk.

Performance Contributors and Detractors:

In the second quarter, among the biggest contributors to portfolio returns were our holdings in the bonds of Sprint Communications, KWG Property Holding and DFCC Bank in Sri Lanka. Sprint Communications, which is majority-owned by the Japanese firm Softbank, benefited from a renewed effort to merge the company with its rival, T-Mobile. The combined company would likely benefit from increased scale and lower leverage. The bonds of Chinese property developers have been under pressure this year as spreads have widened and credit conditions continued to be tight in onshore China. KWG is a high-quality developer with ample liquidity and solid prospects. DFCC Bank bonds mature in October this year and, given their short remaining life, we earned attractive carry with little price volatility by owning them.

The largest detractors in the second quarter were sub-investment grade Indonesian corporate bonds issued by Lippo Karawaci†, the convertible bonds of CP Foods, a

(continued)

| † | Lippo Karawaci is listed as Theta Capital Pte, Ltd. |

| * | The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2017 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| PERFORMANCE AS OF JUNE 30, 2018 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns | | | | |

| | | 3 Months | | | YTD | | | 1 Year | | | 3 Years | | | 5 Years | | | Since

Inception | | | Inception

Date | |

| Investor Class (MAINX) | | | -5.26% | | | | -3.49% | | | | -0.09% | | | | 4.41% | | | | 3.83% | | | | 4.28% | | | | 11/30/11 | |

| Institutional Class (MINCX) | | | -5.20% | | | | -3.28% | | | | 0.25% | | | | 4.70% | | | | 4.09% | | | | 4.51% | | | | 11/30/11 | |

| Markit iBoxx Asian Local Bond Index5 | | | -4.31% | | | | -3.33% | | | | 0.88% | | | | 2.09% | | | | 1.56% | | | | 1.96% | | | | | |

| Lipper Emerging Markets Hard Currency Debt Funds Category Average6 | | | -5.29% | | | | -5.74% | | | | -2.20% | | | | 3.47% | | | | 2.47% | | | | 3.76% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| INCOME DISTRIBUTION HISTORY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2018 | | | | | | 2017 | |

| | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MAINX) | | $ | 0.12 | | | $ | 0.10 | | | | n.a. | | | | n.a. | | | | n.a. | | | | | | | $ | 0.07 | | | $ | 0.08 | | | $ | 0.13 | | | $ | 0.14 | | | $ | 0.42 | |

| Inst’l (MINCX) | | $ | 0.13 | | | $ | 0.11 | | | | n.a. | | | | n.a. | | | | n.a. | | | | | | | $ | 0.08 | | | $ | 0.08 | | | $ | 0.14 | | | $ | 0.15 | | | $ | 0.45 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

30-DAY YIELD: Investor Class: 4.15% (4.06% excluding waivers) Institutional Class: 4.41% (4.29% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/2018, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 6.54% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

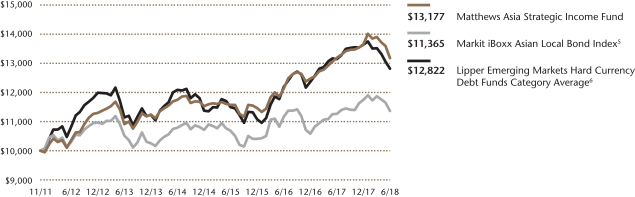

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from HSBC, Markit iBoxx and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 92 for index definitions. The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| | 6 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Ctrip.com International, Ltd., Cnv., 1.250%, 09/15/2022 | | Consumer Discretionary | | U.S. Dollar | | | 4.8% | |

| Debt and Asset Trading Corp., 1.000%, 10/10/2025 | | Financials | | U.S. Dollar | | | 4.2% | |

| Wanda Properties International Co., Ltd., 7.250%, 01/29/2024 | | Real Estate | | U.S. Dollar | | | 4.1% | |

| China Overseas Finance Investment Cayman V, Ltd., Cnv., 0.000%, 01/05/2023 | | Real Estate | | U.S. Dollar | | | 3.9% | |

| KWG Property Holding, Ltd., 6.000%, 09/15/2022 | | Real Estate | | U.S. Dollar | | | 3.6% | |

| Malaysia Government Investment Issue, 3.226%, 04/15/2020 | | Foreign Government Bonds | | Malaysian Ringgit | | | 3.5% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 3.1% | |

| LIC Housing Finance, Ltd., 7.830%, 09/25/2026 | | Financials | | Indian Rupee | | | 2.9% | |

| CIFI Holdings Group Co., Ltd., 6.875%, 04/23/2021 | | Real Estate | | U.S. Dollar | | | 2.7% | |

| Malaysia Government Investment Issue, 4.194%, 07/15/2022 | | Foreign Government Bonds | | Malaysian Ringgit | | | 2.6% | |

| % OF ASSETS IN TOP TEN | | | | | | | 35.4% | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 7 | |

| | | | |

| |

| CURRENCY ALLOCATION (%)7,8 | |

| U.S. Dollar (USD) | | | 53.9 | |

| Chinese Renminbi (CNY) | | | 14.3 | |

| Malaysian Ringgit (MYR) | | | 7.2 | |

| Indian Rupee (INR) | | | 5.9 | |

| Indonesian Rupiah (IDR) | | | 4.7 | |

| Hong Kong Dollar (HKD) | | | 3.3 | |

| Vietnamese Dong (VND) | | | 1.7 | |

| South Korean Won (KRW) | | | 0.3 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)7,8,9 | |

| China/Hong Kong | | | 50.2 | |

| Indonesia | | | 11.4 | |

| Malaysia | | | 7.2 | |

| India | | | 5.9 | |

| Vietnam | | | 5.9 | |

| Sri Lanka | | | 4.0 | |

| Thailand | | | 2.5 | |

| Japan | | | 2.4 | |

| United States | | | 1.6 | |

| South Korea | | | 0.3 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

| | | | |

| |

| SECTOR ALLOCATION (%)7,8 | |

| Real Estate | | | 21.1 | |

| Financials | | | 19.3 | |

| Foreign Government Bonds | | | 15.3 | |

| Consumer Discretionary | | | 10.4 | |

| Utilities | | | 7.3 | |

| Energy | | | 5.6 | |

| Industrials | | | 4.3 | |

| Telecommunication Services | | | 3.9 | |

| Consumer Staples | | | 2.5 | |

| Information Technology | | | 1.7 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

Please note: Foreign Government Bonds category includes Supranationals.

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)7,8 | |

| Non-Convertible Corporate Bonds | | | 53.3 | |

| Government Bonds | | | 19.4 | |

| Convertible Corporate Bonds | | | 18.7 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

| 7 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

| 8 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 9 | Not all countries where the Fund may invest are included in the benchmark index. |

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited) (continued)

Thai company, and Indonesian government bonds. Lippo Karawaci is a property developer in Indonesia. Bonds performed poorly in the quarter as high yield spreads widened and the Indonesian central bank raised interest rates to help stabilize the Indonesian rupiah, potentially dampening property purchases in the country. CP Foods’ convertible bonds performed poorly as shares of its subsidiary CP All corrected on softer growth. Indonesian government bonds performed poorly as the Indonesian rupiah depreciated versus the dollar and rates moved higher.

Notable Portfolio Changes:

In the second quarter, we started a number of positions in local currency, high yield and convertible bonds. We selectively added to our local currency bond holdings. For instance, we invested in Malaysian government bonds and the dim sum bonds of Franshion, a leading property developer. As high yield spreads widened and expectations for rate hikes from the U.S. Federal Reserve increased, we added shorter duration bonds with mid-single digit yields, which we expect will have potentially limited interest rate sensitivity while earning reasonable returns. These include the bonds of Chinese companies like KWG Property and Tsinghua Unigroup, which we added after they fell in price. We also added the convertible bonds of companies like Zhongsheng Group, a leading Chinese auto-dealership, and China Overseas Land & Investment, a high quality Chinese property developer.

We also closed a handful of positions in the quarter. Notably, we decreased both our local currency exposure and duration in Indonesia and India. Both countries have relatively high beta currencies and saw rates move higher in the second quarter, and we proactively reduced risk in each. We also exercised our put on the convertible bonds of Saratoga Investama, an Indonesian holding company with stakes in leading Indonesian companies, as we saw limited upside in continuing to hold the bonds.

Outlook:

While we anticipate that Asia’s fixed income markets may remain volatile through the second half of 2018, we do believe that current prices have corrected to account for much of the uncertainty in the global environment. We expect U.S. rates to set the tone for local rates in Asia’s developed countries as the U.S. economic cycle gathers momentum and starts to create mild inflation. Recent Federal Reserve commentary has led to somewhat higher expectations for rate hikes in 2018 and 2019. We expect inflation to remain subdued in emerging economies such as India and Indonesia, offering insulation from the rising rate environment globally. The wild card is for tariffs, which can create inflation in the U.S.

We expect Asian currencies to rebound in the second half of the year as the U.S. dollar loses the strong momentum it displayed in the second quarter. One significant driver of dollar strength has been euro weakness. Some measures of Eurozone economic sentiment hit lows experienced during the Global Financial Crisis and Greek Crisis, so we think the euro is more likely to strengthen than weaken given the amount of negativity priced in.

Finally, Asia high yield spreads are now significantly wider than historical averages, with room to fall given default rates of less than 2%. With the attractive value of Asia high yield relative to its U.S. and European counterparts, we expect greater demand for Asia bonds. On the supply side, the move by Chinese regulators to limit offshore issuance to just refinancing of existing issues might create scarcity value. The relative value of Asia combined with little net new supply should drive spreads lower. Here, too, there is potential downside in the negative headlines associated with the inevitable rise of defaults in China. While we have consistently highlighted the need for more defaults to drive a more appropriate credit risk premia onshore, some investors might conflate the Chinese onshore corporate market, which we believe is expensive, with that of the Chinese offshore market, which already has experienced a substantial correction. In sum, we see value in U.S. dollar-denominated debt of Asia corporates because the valuation can be grounded in intrinsic value. As long as we maintain a long-term investment horizon of greater than three years, and experience no defaults, the total return potential for U.S. dollar bonds offers compelling investment opportunity at current levels.

Matthews Asia Strategic Income Fund

June 30, 2018

Schedule of Investmentsa (unaudited)

NON-CONVERTIBLE CORPORATE BONDS: 53.3%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| CHINA/HONG KONG: 32.8% | |

Wanda Properties International Co., Ltd.

7.250%, 01/29/24b | | | 5,000,000 | | | | $4,787,500 | |

KWG Property Holding, Ltd.

6.000%, 09/15/22b | | | 4,500,000 | | | | 4,157,266 | |

Standard Chartered PLC

6.500%c, 04/02/20b,d | | | 3,700,000 | | | | 3,671,984 | |

CIFI Holdings Group Co., Ltd.

6.875%, 04/23/21b | | | 3,200,000 | | | | 3,159,376 | |

PetroChina Co., Ltd., Series A

3.030%, 01/19/21 | | | CNY 20,000,000 | | | | 2,900,068 | |

State Grid Corp. of China, Series B

3.150%, 11/14/21 | | | CNY 20,000,000 | | | | 2,877,681 | |

Tsinghua Unic, Ltd.

4.750%, 01/31/21b | | | 3,000,000 | | | | 2,845,389 | |

HSBC Holdings PLC

6.375%c, 03/30/25d | | | 2,500,000 | | | | 2,453,125 | |

PetroChina Co., Ltd.

3.150%, 03/03/21 | | | CNY 15,000,000 | | | | 2,163,185 | |

Unigroup International Holdings, Ltd.

6.000%, 12/10/20b | | | 2,000,000 | | | | 1,969,810 | |

China Southern Power Grid Co., Ltd.

3.140%, 03/11/21 | | | CNY 12,000,000 | | | | 1,750,838 | |

China National Petroleum Corp., Series INBK | | | | | |

4.690%, 01/11/22 | | | CNY 10,000,000 | | | | 1,518,168 | |

State Grid Corp. of China

3.750%, 11/11/20 | | | CNY 10,000,000 | | | | 1,478,387 | |

Huaneng Power International, Inc., Series A

3.480%, 06/13/21 | | | CNY 10,000,000 | | | | 1,464,322 | |

Franshion Brilliant, Ltd.

5.200%, 03/08/21b | | | CNY 7,000,000 | | | | 1,052,537 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 38,249,636 | |

| | | | | | | | |

| | | | | | | | |

| INDONESIA: 6.6% | | | | | | | | |

Theta Capital Pte, Ltd.

6.750%, 10/31/26b | | | 3,500,000 | | | | 2,462,880 | |

Modernland Overseas Pte, Ltd.

6.950%, 04/13/24b | | | 1,900,000 | | | | 1,634,800 | |

Alam Synergy Pte, Ltd.

6.950%, 03/27/20e | | | 1,500,000 | | | | 1,357,500 | |

Theta Capital Pte, Ltd.

7.000%, 04/11/22b | | | 1,200,000 | | | | 957,521 | |

Listrindo Capital BV

4.950%, 09/14/26b | | | 1,000,000 | | | | 895,000 | |

Alam Synergy Pte, Ltd.

6.950%, 03/27/20b | | | 500,000 | | | | 452,500 | |

| | | | | | | | |

Total Indonesia | | | | | | | 7,760,201 | |

| | | | | | | | |

| | | | | | | | |

| INDIA: 5.9% | | | | | | | | |

LIC Housing Finance, Ltd., Series 309

7.830%, 09/25/26 | | | INR 240,000,000 | | | | 3,430,765 | |

Housing Development Finance Corp., Ltd., Series K-24 | |

8.950%, 03/21/23 | | | INR 100,000,000 | | | | 1,480,684 | |

Power Finance Corp., Ltd., Series 151A

7.470%, 09/16/21 | | | INR 90,000,000 | | | | 1,274,309 | |

Rural Electrification Corp., Ltd., Series 122

9.020%, 06/18/19 | | | INR 50,000,000 | | | | 738,238 | |

| | | | | | | | |

Total India | | | | | | | 6,923,996 | |

| | | | | | | | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| SRI LANKA: 4.0% | | | | | | | | |

DFCC Bank PLC

9.625%, 10/31/18b | | | 2,650,000 | | | | $2,685,801 | |

National Savings Bank

5.150%, 09/10/19b | | | 2,000,000 | | | | 1,970,800 | |

| | | | | | | | |

Total Sri Lanka | | | | | | | 4,656,601 | |

| | | | | | | | |

| | | | | | | | |

| JAPAN: 2.4% | | | | | | | | |

SoftBank Group Corp.

6.000%c, 07/19/23b,d | | | 3,150,000 | | | | 2,746,882 | |

| | | | | | | | |

Total Japan | | | | | | | 2,746,882 | |

| | | | | | | | |

| | | | | | | | |

| UNITED STATES: 1.6% | | | | | | | | |

Sprint Communications, Inc.

6.000%, 11/15/22 | | | 1,863,000 | | | | 1,846,699 | |

| | | | | | | | |

Total United States | | | | | | | 1,846,699 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL NON-CONVERTIBLE CORPORATE BONDS | | | | 62,184,015 | |

| | | | | | | | |

(Cost $64,793,734) | | | | | | | | |

| | | | | | | | |

FOREIGN GOVERNMENT OBLIGATIONS: 19.4% | |

| MALAYSIA: 7.2% | | | | | | | | |

Malaysia Government Investment Issue | |

3.226%, 04/15/20 | | | MYR 16,600,000 | | | | 4,075,845 | |

Malaysia Government Investment Issue | |

4.194%, 07/15/22 | | | MYR 12,000,000 | | | | 2,993,652 | |

Malaysia Government Investment Issue | |

3.872%, 08/30/18 | | | MYR 5,500,000 | | | | 1,362,363 | |

| | | | | | | | |

Total Malaysia | | | | | | | 8,431,860 | |

| | | | | | | | |

| | | | | | | | |

| VIETNAM: 5.9% | | | | | | | | |

Debt and Asset Trading Corp.

1.000%, 10/10/25b | | | 6,969,000 | | | | 4,860,877 | |

Socialist Republic of Vietnam

5.200%, 01/12/22 | | | VND 43,000,000,000 | | | | 1,994,295 | |

| | | | | | | | |

Total Vietnam | | | | | | | 6,855,172 | |

| | | | | | | | |

| | | | | | | | |

| INDONESIA: 4.7% | | | | | | | | |

Indonesia Treasury Bond

8.375%, 03/15/24 | | | IDR 40,500,000,000 | | | | 2,887,003 | |

Indonesia Treasury Bond

7.875%, 04/15/19 | | | IDR 38,000,000,000 | | | | 2,658,409 | |

| | | | | | | | |

Total Indonesia | | | | | | | 5,545,412 | |

| | | | | | | | |

| | | | | | | | |

| CHINA/HONG KONG: 1.3% | | | | | | | | |

China Government Bond

3.550%, 12/12/21b | | | CNY 10,000,000 | | | | 1,497,682 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 1,497,682 | |

| | | | | | | | |

| | | | | | | | |

| SOUTH KOREA: 0.3% | | | | | | | | |

Korea Treasury Bond

3.500%, 03/10/24 | | | KRW 400,000,000 | | | | 378,728 | |

| | | | | | | | |

Total South Korea | | | | | | | 378,728 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL FOREIGN GOVERNMENT OBLIGATIONS | | | | 22,708,854 | |

| | | | | | | | |

(Cost $22,866,961) | | | | | | | | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 9 | |

Matthews Asia Strategic Income Fund

June 30, 2018

Schedule of Investmentsa (unaudited) (continued)

CONVERTIBLE CORPORATE BONDS: 18.7%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| CHINA/HONG KONG: 16.2% | | | | | | | | |

Ctrip.com International, Ltd., Cnv.

1.250%, 09/15/22 | | | 5,500,000 | | | | $5,644,485 | |

China Overseas Finance Investment Cayman V, Ltd., Cnv. | |

0.000%, 01/05/23b | | | 4,400,000 | | | | 4,609,000 | |

Harvest International Co., Cnv.

0.000%, 11/21/22b | | | HKD 22,000,000 | | | | 2,947,831 | |

Vipshop Holdings, Ltd., Cnv.

1.500%, 03/15/19 | | | 2,700,000 | | | | 2,659,770 | |

Johnson Electric Holdings, Ltd., Cnv.

| |

1.000%, 04/02/21b | | | 2,000,000 | | | | 2,132,500 | |

Zhongsheng Group Holdings, Ltd., Cnv. | |

0.000%, 05/23/23b | | | HKD 7,000,000 | | | | 888,874 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 18,882,460 | |

| | | | | | | | |

| | | | | | | | |

| THAILAND: 2.5% | | | | | | | | |

CP Foods Holdings, Ltd., Cnv.

0.500%, 09/22/21b | | | 2,800,000 | | | | 2,947,000 | |

| | | | | | | | |

Total Thailand | | | | | | | 2,947,000 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL CONVERTIBLE CORPORATE BONDS | | | | 21,829,460 | |

| | | | | | | | |

(Cost $22,071,504) | | | | | | | | |

| | | | | | | | |

| TOTAL INVESTMENTS: 91.4% | | | | | | | 106,722,329 | |

(Cost $109,732,199) | | | | | | | | |

| | | | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 8.6% | | | | | | | 9,979,358 | |

| | | | | | | | |

| | |

NET ASSETS: 100.0% | | | | | | | $116,701,687 | |

| | | | | | | | |

| a | Certain securities were fair valued under the valuation policies approved by the Board of Trustees (Note 2-A). |

| b | The securities may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| c | Variable rate security. Security may be issued at a fixed coupon rate, which converts to a variable rate at a specified date. Rate shown is the rate in effect as of period end. |

| d | Perpetual security with no stated maturity date. First call date is disclosed. |

| e | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The security may be resold in transactions exempt from registration normally to qualified institutional buyers. The security has been determined to be liquid in accordance with procedures adopted by the Funds’ Board of Trustees. At June 30, 2018, the aggregate value is $1,357,500, which is 1.16% of net assets. |

| * | All Values in USD unless otherwise specified |

| CNY | Chinese Renminbi (Yuan) |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

| | | | | | | | | | | | | | |

Currency

Purchased | | Currency Sold | | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| USD 7,973,612 | | | SGD 10,714,940 | | | Merrill Lynch & Co., Inc. | | | 07/18/18 | | | | $106,547 | |

| USD 1,564,334 | | | INR 103,512,000 | | | Merrill Lynch & Co., Inc. | | | 07/30/18 | | | | 58,921 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 165,468 | |

| | | | | | | | | | | | | | |

| THB 233,643,750 | | | USD 7,500,000 | | | Merrill Lynch & Co., Inc. | | | 07/11/18 | | | | (445,518 | ) |

| SGD 21,429,880 | | | USD 16,400,000 | | | Merrill Lynch & Co., Inc. | | | 07/18/18 | | | | (665,870 | ) |

| INR 103,512,000 | | | USD 1,600,000 | | | Merrill Lynch & Co., Inc. | | | 07/30/18 | | | | (94,586 | ) |

| KRW 8,146,440,000 | | | USD 7,600,000 | | | Merrill Lynch & Co., Inc. | | | 09/14/18 | | | | (267,482 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | (1,473,456 | ) |

| | | | | | | | | | | | | | |

Net Unrealized Depreciation | | | | | | | | | | | | | ($1,307,988 | ) |

| | | | | | | | | | | | | | |

See accompanying notes to financial statements.

| | | | |

| PORTFOLIO MANAGERS |

| Teresa Kong, CFA | | Satya Patel |

Lead Manager | | Lead Manager |

| | |

| FUND FACTS | | | | |

| | | Investor | | Institutional |

Ticker | | MCRDX | | MICPX |

CUSIP | | 577130677 | | 577130669 |

Inception | | 4/29/16 | | 4/29/16 |

NAV | | $9.93 | | $9.92 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.86% | | 1.62% |

After Fee Waiver and Reimbursement2 | | 1.15% | | 0.90% |

Portfolio Statistics | | |

Total # of Positions | | 36 |

Net Assets | | $43.2 million |

Modified Duration3 | | 3.15 |

Portfolio Turnover4 | | 27.86% |

Benchmark | | | | |

J.P. Morgan Asia Credit Index |

OBJECTIVE

Total return over the long term.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in debt and debt-related instruments issued by companies as well as governments, quasi-governmental entities, and supranational institutions in Asia. Debt and debt-related instruments typically include bonds, debentures, bills, securitized instruments (which are vehicles backed by pools of assets such as loans or other receivables), notes, certificates of deposit and other bank obligations, bank loans, senior secured bank debt, convertible debt securities, credit-linked notes, inflation linked instruments, repurchase agreements, payment-in-kind securities and derivative instruments with fixed income characteristics. Asia consists of all countries and markets in Asia, such as China and Indonesia, in addition to the developed, emerging, and frontier countries and markets in the Asian region.

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited)

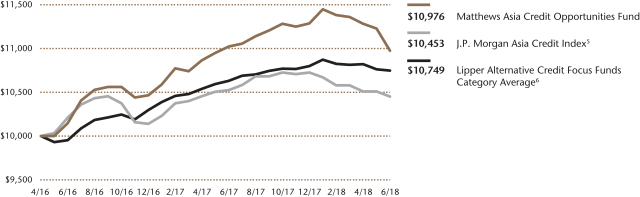

For the first half of 2018, the Matthews Asia Credit Opportunities Fund returned –2.77% (Investor Class) and –2.75% (Institutional Class), while its benchmark, the J.P. Morgan Asia Credit Index (JACI), returned –2.55% over the same period. For the quarter ending June 30, the Fund returned –3.40% (Investor Class) and –3.45% (Institutional Class) compared to the benchmark return of –1.20%.

Market Environment:

The first half of the year was notable for the volatility in financial markets across the world. U.S. Treasury yields continued to move higher as the U.S. Federal Reserve raised interest rates. Continued solid economic data in the U.S., on the margin, has increased rate hike expectations for the remainder of 2018 and 2019. Meanwhile, concerns around trade wars, the reversal of investor flows and politics in Latin America led to a sell-off across emerging markets.

Asia’s credit markets were not immune to this volatility, and in the second quarter, Asian high yield credit spreads widened by 100 basis points (1.0%). Returns were largely negatively correlated to risk, with longest duration and highest spread bonds selling off the most. By country and sector, Chinese issuers came under pressure as policymakers onshore continued to keep credit markets tight, while Indonesian issuers were weak as the Indonesian central bank raised interest rates to combat depreciation in the Indonesian rupiah. The combination of rising interest rates and widening credit spreads created a challenging market environment in the second quarter.

Performance Contributors and Detractors:

Our holdings from China and Thailand were broadly positive performance contributors for the first half of the year. In the second quarter, the biggest contributors to portfolio returns were our holdings in the bonds of Chinese property developers KWG Property Holding and CIFI Holdings Group, as well as the bonds of DFCC Bank in Sri Lanka. The bonds of Chinese property developers have been under pressure this year as spreads have widened and credit conditions continued to be tight in onshore China. Both KWG and CIFI are high quality developers with ample liquidity and solid prospects. DFCC Bank bonds mature in October, and given their short remaining life, we earned attractive carry with little price volatility by owning them.

The largest detractors in the second quarter were sub-investment grade Indonesian corporate bonds issued by Lippo Karawaci and Modernland, and the convertible bonds of CP Foods, a Thai company. Lippo Karawaci and Modernland are both property developers in Indonesia. Bonds performed poorly in the quarter as high yield spreads widened, and the Indonesian central bank raised interest rates to help stabilize the rupiah, potentially dampening property purchases in the country. CP Foods’ convertible bonds performed poorly as its subsidiary CP All’s shares corrected on softer growth.

Notable Portfolio Changes:

In the second quarter, we started a number of new positions in high yield and convertible bonds. As high yield spreads widened and expectations for rate hikes

(continued)

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2019 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2017 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 11 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

| PERFORMANCE AS OF JUNE 30, 2018 | | | | | | | | | | | | |

| | | | | | | | | Average Annual

Total Retuns | | | | |

| | | 3 Months | | | YTD | | | 1 Year | | | Since

Inception | | | Inception

Date | |

| Investor Class (MCRDX) | | | -3.40% | | | | -2.77% | | | | -0.45% | | | | 4.39% | | | | 4/29/2016 | |

| Institutional Class (MICPX) | | | -3.45% | | | | -2.75% | | | | -0.27% | | | | 4.60% | | | | 4/29/2016 | |

| J.P. Morgan Asia Credit Index5 | | | -1.20% | | | | -2.55% | | | | -0.70% | | | | 2.06% | | | | | |

| Lipper Alternative Credit Focus Funds Cateory Average6 | | | -0.67% | | | | -0.46% | | | | 1.08% | | | | 8.51% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance, visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | |

| INCOME DISTRIBUTION HISTORY | | | | | | | | | |

| | | 2018 | | | | | | 2017 | |

| | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MCRDX) | | $ | 0.09 | | | $ | 0.09 | | | | n.a. | | | | n.a. | | | | n.a. | | | | | | | $ | 0.12 | | | $ | 0.08 | | | $ | 0.14 | | | $ | 0.10 | | | $ | 0.43 | |

| Inst’l (MICPX) | | $ | 0.09 | | | $ | 0.09 | | | | n.a. | | | | n.a. | | | | n.a. | | | | | | | $ | 0.12 | | | $ | 0.08 | | | $ | 0.15 | | | $ | 0.10 | | | $ | 0.46 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

30-DAY YIELD: Investor Class: 4.07% (3.83% excluding waivers) Institutional Class: 4.33% (4.04% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/18, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 6.75% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

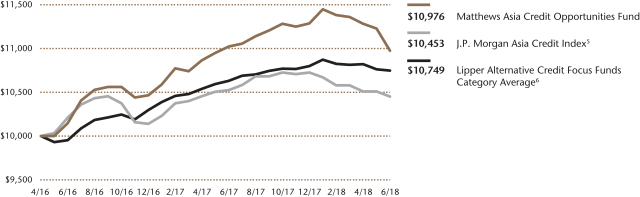

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from J.P. Morgan and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 92 for index definition. |

| | 6 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Ctrip.com International, Ltd., Cnv., 1.250%, 09/15/2022 | | Consumer Discretionary | | U.S. Dollar | | | 4.4% | |

| Debt and Asset Trading Corp., 1.000%, 10/10/2025 | | Financials | | U.S. Dollar | | | 4.4% | |

| China Overseas Finance Investment Cayman V, Ltd., Cnv., 0.000%, 01/05/2023 | | Real Estate | | U.S. Dollar | | | 3.9% | |

| Wanda Properties International Co., Ltd., 7.250%, 01/29/2024 | | Real Estate | | U.S. Dollar | | | 3.4% | |

| Huaneng Power International, Inc., 3.480%, 06/13/2021 | | Utilities | | Chinese Renminbi | | | 3.4% | |

| Socialist Republic of Vietnam, 5.500%, 03/12/2028 | | Foreign Government Bonds | | U.S. Dollar | | | 3.3% | |

| Tsinghua Unic, Ltd., 4.750%, 01/31/2021 | | Industrials | | U.S. Dollar | | | 3.3% | |

| KWG Property Holding, Ltd., 6.000%, 09/15/2022 | | Real Estate | | U.S. Dollar | | | 3.2% | |

| SoftBank Group Corp., 6.000%, 07/19/2049 | | Telecom Services | | U.S. Dollar | | | 3.0% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 3.0% | |

| % OF ASSETS IN TOP TEN | | | | | | | 35.3% | |

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited) (continued)

from the U.S. Federal Reserve increased, we added shorter duration bonds with mid-single digit yields, which we expect will have limited interest rate sensitivity while earning reasonable returns. We opportunistically added bonds of Chinese property issuers such as KWG Property Holding and CIFI Holdings after they fell in price. We also added the convertible bonds of companies, including those of Johnson Electric, one of the largest producers of micro motors in China; Zhongsheng Group, a leading Chinese auto-dealership; and China Overseas Land & Investment, a high-quality Chinese property developer.

We also closed a handful of positions during the second quarter. We exercised our put on the convertible bonds of Saratoga Investama, an Indonesian holding company with stakes in leading Indonesian companies, as we saw limited upside in continuing to hold the bonds. Our bonds of China Hongqiao Group, the largest aluminum producer in the world, matured, while we sold bonds in Bangkok Dusit Medical, a hospital chain in Thailand.

Outlook:

In our view, Asian high yield bonds appear attractively valued, while U.S. and European high yield bonds appear overvalued. Credit spreads for Asia high yield bonds are almost 100 basis points (1.0%) higher than historic averages. In contrast, spreads for U.S. and European high yield bonds are about 200 basis points (2.0%) below average. In simple terms, Asian high yield bonds are compensating investors for taking credit risk, in our view, while U.S. and European high yield bonds are not.

To be sure, risks remain on the horizon. If a further slowdown in global growth materializes, we expect investor appetite for emerging markets to diminish. Any escalation in trade shocks or further outflows stemming from policy normalization in the U.S. also could put pressure on Asian fixed income markets. Finally, the demand for Asian credit from Chinese wealth managers might fall as the wealth management channels through which buyers purchase bonds are being more closely regulated.

While these risks could increase, we believe that much of this is already being priced in. We have been expecting volatility to rise over the course of 2018, and that was certainly the case in the second quarter. Asian credit markets will likely remain volatile in the second half of 2018, but we believe it is imperative that we continue to stay the course and not sell into the volatility. Based on our solvency and liquidity analysis, we do not expect any of the securities in the portfolio will default. As such, the relatively attractive yields in Asia offer a strong base for positive returns. A bond that starts with a 5% to 8% yield and has 25 basis points (0.25%) of credit spread compression, for example, could generate attractive returns for investors over the course of the year.

| | | | |

| |

| CURRENCY ALLOCATION (%)7,8 | |

| U.S. Dollar (USD) | | | 67.0 | |

| Chinese Renminbi (CNY) | | | 11.4 | |

| Hong Kong Dollar (HKD) | | | 3.3 | |

| Cash and Other Assets, Less Liabilities | | | 18.2 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)7,8,9 | |

| China/Hong Kong | | | 47.9 | |

| Indonesia | | | 11.3 | |

| Vietnam | | | 8.6 | |

| Sri Lanka | | | 6.2 | |

| Japan | | | 3.0 | |

| Thailand | | | 1.9 | |

| Philippines | | | 1.9 | |

| United States | | | 1.0 | |

| Cash and Other Assets, Less Liabilities | | | 18.2 | |

| | | | |

| |

| SECTOR ALLOCATION (%)7,8 | |

| Real Estate | | | 21.9 | |

| Financials | | | 14.0 | |

| Consumer Discretionary | | | 10.2 | |

| Industrials | | | 9.1 | |

| Utilities | | | 8.1 | |

| Foreign Government Bonds | | | 6.2 | |

| Telecommunication Services | | | 6.0 | |

| Energy | | | 3.3 | |

| Consumer Staples | | | 1.9 | |

| Information Technology | | | 0.9 | |

| Cash and Other Assets, Less Liabilities | | | 18.2 | |

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)7,8 | |

| Non-Convertible Corporate Bonds | | | 53.3 | |

| Convertible Corporate Bonds | | | 17.9 | |

| Government Bonds | | | 10.5 | |

| Cash and Other Assets, Less Liabilities | | | 18.2 | |

| 7 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

| 8 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 9 | Not all countries where the Fund may invest are included in the benchmark index. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 13 | |

Matthews Asia Credit Opportunities Fund

June 30, 2018

Schedule of Investmentsa (unaudited)

NON-CONVERTIBLE CORPORATE BONDS: 53.3%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| CHINA/HONG KONG: 31.9% | | | | | | | | |

Wanda Properties International Co., Ltd. | | | | | | | | |

7.250%, 01/29/24b | | | 1,550,000 | | | | $1,484,125 | |

Huaneng Power International, Inc., Series A | | | | | | | | |

3.480%, 06/13/21 | | | CNY 10,000,000 | | | | 1,464,322 | |

Tsinghua Unic, Ltd. | | | | | | | | |

4.750%, 01/31/21b | | | 1,500,000 | | | | 1,422,694 | |

KWG Property Holding, Ltd. | | | | | | | | |

6.000%, 09/15/22b | | | 1,500,000 | | | | 1,385,756 | |

Standard Chartered PLC | | | | | | | | |

6.500%c, 04/02/20b,d | | | 1,300,000 | | | | 1,290,156 | |

HSBC Holdings PLC | | | | | | | | |

6.375%c, 03/30/25d | | | 1,100,000 | | | | 1,079,375 | |

CIFI Holdings Group Co., Ltd. | | | | | | | | |

6.875%, 04/23/21b | | | 1,000,000 | | | | 987,305 | |

Air China, Ltd. | | | | | | | | |

3.080%, 10/20/21 | | | CNY 6,000,000 | | | | 864,111 | |

KWG Property Holding, Ltd. | | | | | | | | |

8.975%, 01/14/19b | | | 800,000 | | | | 816,012 | |

PetroChina Co., Ltd., Series A | | | | | | | | |

3.030%, 01/19/21 | | | CNY 5,000,000 | | | | 725,017 | |

PetroChina Co., Ltd. | | | | | | | | |

3.150%, 03/03/21 | | | CNY 5,000,000 | | | | 721,062 | |

China Southern Power Grid Co., Ltd. | | | | | | | | |

3.140%, 03/11/21 | | | CNY 4,000,000 | | | | 583,613 | |

State Grid Corp. of China, Series B | | | | | | | | |

3.150%, 11/14/21 | | | CNY 4,000,000 | | | | 575,536 | |

Unigroup International Holdings, Ltd. | | | | | | | | |

6.000%, 12/10/20b | | | 400,000 | | | | 393,962 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 13,793,046 | |

| | | | | | | | |

| | | | | | | | |

| INDONESIA: 11.3% | | | | | | | | |

Modernland Overseas Pte, Ltd. | | | | | | | | |

6.950%, 04/13/24b | | | 1,400,000 | | | | 1,204,589 | |

Listrindo Capital BV | | | | | | | | |

4.950%, 09/14/26b | | | 1,000,000 | | | | 895,000 | |

TBG Global Pte, Ltd. | | | | | | | | |

5.250%, 02/10/22b | | | 900,000 | | | | 879,456 | |

Theta Capital Pte, Ltd. | | | | | | | | |

6.750%, 10/31/26b | | | 1,200,000 | | | | 844,416 | |

Alam Synergy Pte, Ltd. | | | | | | | | |

6.950%, 03/27/20b | | | 900,000 | | | | 814,500 | |

Theta Capital Pte, Ltd. | | | | | | | | |

7.000%, 04/11/22b | | | 300,000 | | | | 239,380 | |

| | | | | | | | |

Total Indonesia | | | | | | | 4,877,341 | |

| | | | | | | | |

| | | | | | | | |

| SRI LANKA: 4.2% | | | | | | | | |

DFCC Bank PLC | | | | | | | | |

9.625%, 10/31/18b | | | 1,200,000 | | | | 1,216,212 | |