UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 415-788-7553

Date of fiscal year end: December 31

Date of reporting period: June 30, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Semi-Annual Report

June 30, 2016 | matthewsasia.com

ASIA FIXED INCOME STRATEGIES

Matthews Asia Strategic Income Fund

Matthews Asia Credit Opportunities Fund

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Dividend Fund

Matthews China Dividend Fund

ASIA VALUE STRATEGY

Matthews Asia Value Fund

ASIA GROWTH STRATEGIES

Matthews Asia Focus Fund

Matthews Asia Growth Fund

Matthews Pacific Tiger Fund

Matthews Asia ESG Fund

Matthews Emerging Asia Fund

Matthews Asia Innovators Fund

Matthews China Fund

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA SMALL COMPANY STRATEGIES

Matthews Asia Small Companies Fund

Matthews China Small Companies Fund

'16

Contents

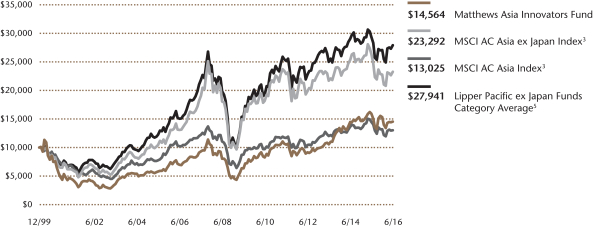

*The Fund’s name changed from Matthews Asia Science and Technology Fund to Matthews Asia Innovators Fund on April 29, 2016.

Cover photo: Karaweik palace in Yangon, Myanmar

This report has been prepared for Matthews Asia Funds shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. Additional copies of the prospectus or summary prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of June 30, 2016. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund’s future investment intent. Current and future portfolio holdings are subject to risk.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds’ prospectus and Statement of Additional Information for more risk disclosure.

Investor Class Performance and Expenses (June 30, 2016)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investor Class | | | | | Average Annual Total Return | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement* | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | | | | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Strategic Income Fund (MAINX) | | | 4.82% | | | | n.a. | | | | n.a. | | | | 4.31% | | | | 11/30/11 | | | | 1.28% | | | | 1.12% | 1 |

Asia Credit Opportunities Fund (MCRDX) | | | n.a. | | | | n.a. | | | | n.a. | | | | 1.46% | | | | 4/29/16 | | | | 2.10% | | | | 1.10% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

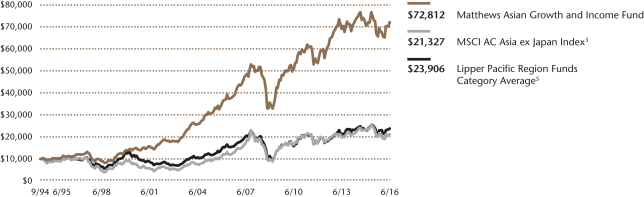

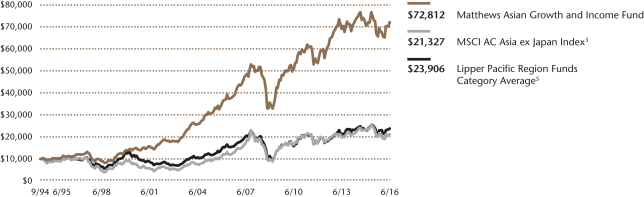

Asian Growth and Income Fund (MACSX) | | | -1.18% | | | | 3.51% | | | | 6.83% | | | | 9.54% | | | | 9/12/94 | | | | 1.09% | | | | n.a. | |

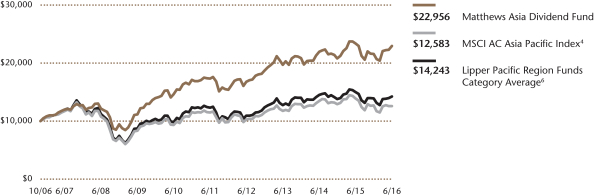

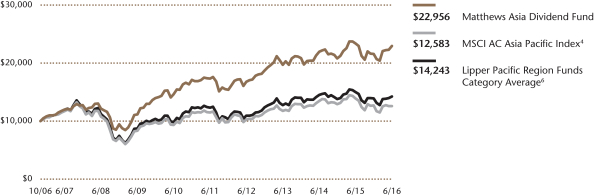

Asia Dividend Fund (MAPIX) | | | -1.81% | | | | 5.82% | | | | n.a. | | | | 8.98% | | | | 10/31/06 | | | | 1.06% | | | | 1.05% | 2 |

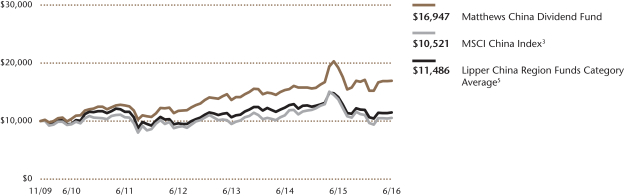

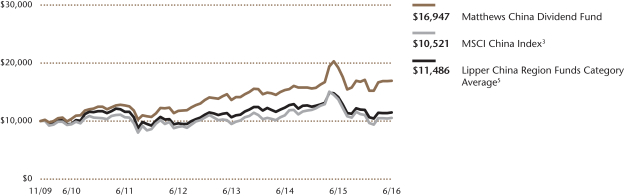

China Dividend Fund (MCDFX) | | | -11.53% | | | | 5.97% | | | | n.a. | | | | 8.35% | | | | 11/30/09 | | | | 1.19% | | | | n.a. | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

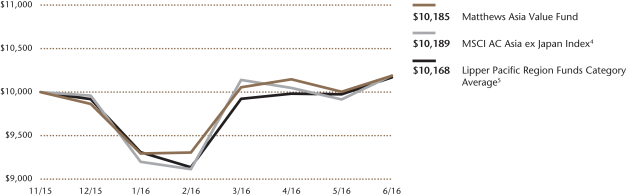

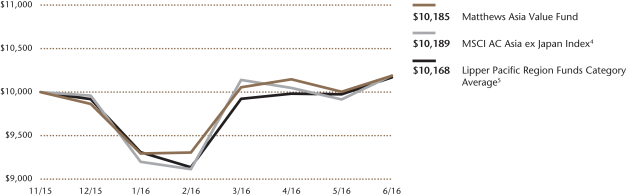

Asia Value Fund (MAVRX) | | | n.a. | | | | n.a. | | | | n.a. | | | | 1.85% | | | | 11/30/15 | | | | 36.42% | | | | 1.50% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

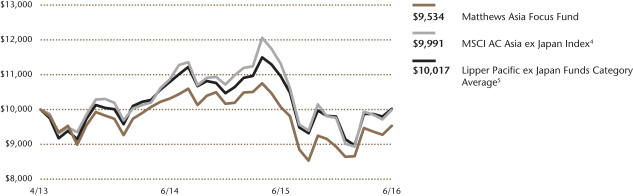

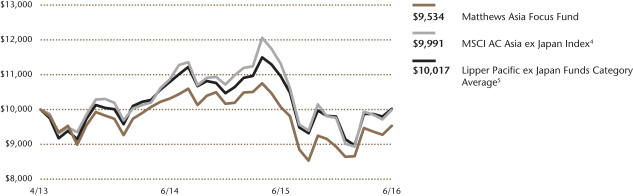

Asia Focus Fund (MAFSX) | | | -5.35% | | | | n.a. | | | | n.a. | | | | -1.50% | | | | 4/30/13 | | | | 2.07% | | | | 1.50% | 3 |

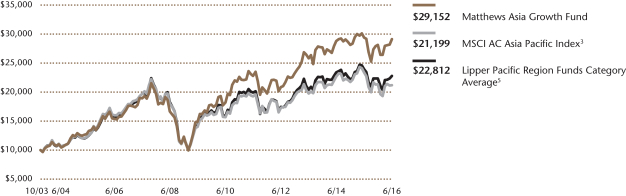

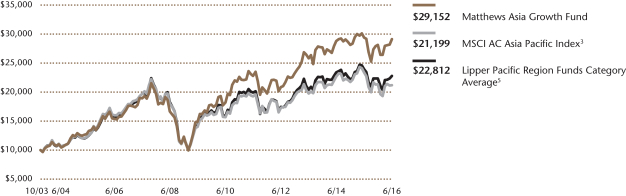

Asia Growth Fund (MPACX) | | | -0.86% | | | | 5.01% | | | | 6.56% | | | | 8.81% | | | | 10/31/03 | | | | 1.11% | | | | n.a. | |

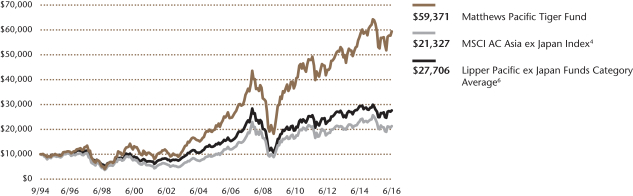

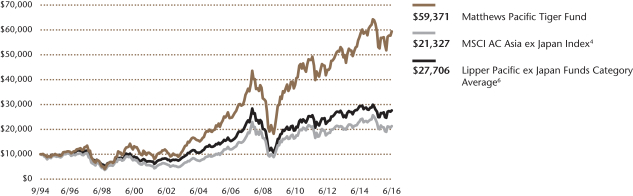

Pacific Tiger Fund (MAPTX) | | | -5.04% | | | | 4.34% | | | | 9.19% | | | | 8.51% | | | | 9/12/94 | | | | 1.09% | | | | 1.07% | 2 |

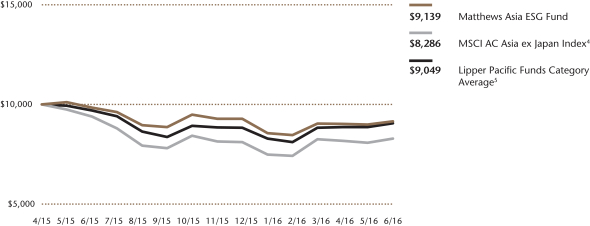

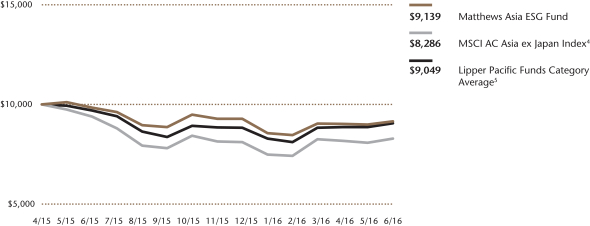

Asia ESG Fund (MASGX) | | | -7.12% | | | | n.a. | | | | n.a. | | | | -7.42% | | | | 4/30/15 | | | | 9.09% | | | | 1.44% | 3 |

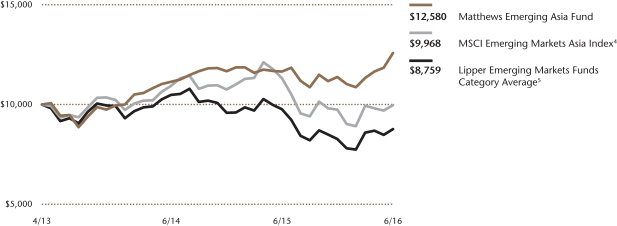

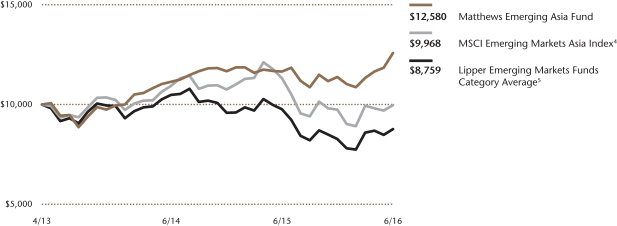

Emerging Asia Fund (MEASX) | | | 8.10% | | | | n.a. | | | | n.a. | | | | 7.51% | | | | 4/30/13 | | | | 1.75% | | | | 1.50% | 3 |

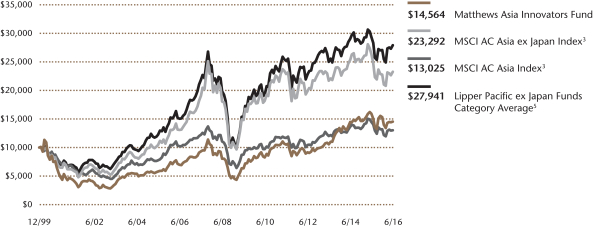

Asia Innovators Fund (MATFX) | | | -8.52% | | | | 6.80% | | | | 7.61% | | | | 2.30% | | | | 12/27/99 | | | | 1.18% | | | | n.a. | |

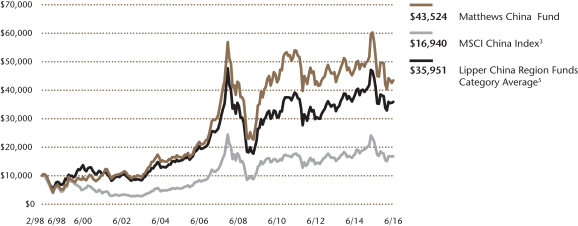

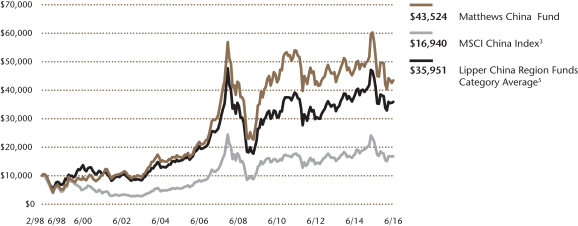

China Fund (MCHFX) | | | -23.89% | | | | -3.53% | | | | 7.49% | | | | 8.34% | | | | 2/19/98 | | | | 1.14% | | | | n.a. | |

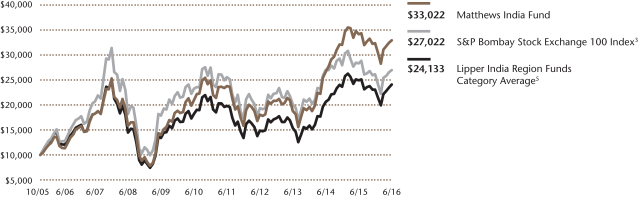

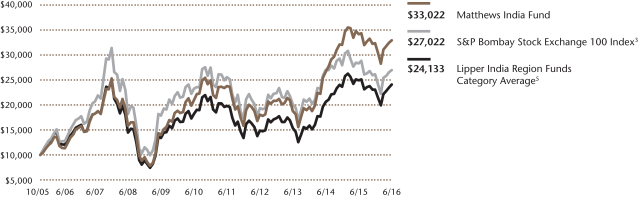

India Fund (MINDX) | | | -3.54% | | | | 6.76% | | | | 11.21% | | | | 11.85% | | | | 10/31/05 | | | | 1.11% | | | | n.a. | |

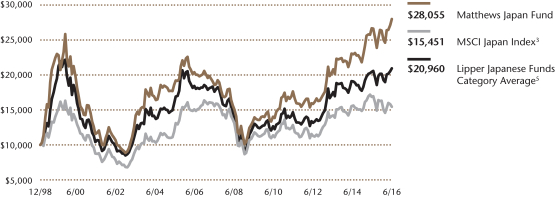

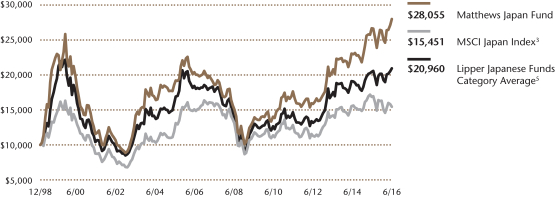

Japan Fund (MJFOX) | | | 5.00% | | | | 10.65% | | | | 3.03% | | | | 6.07% | | | | 12/31/98 | | | | 0.99% | | | | n.a. | |

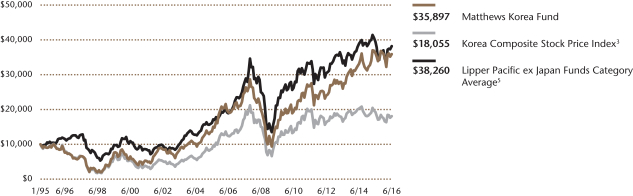

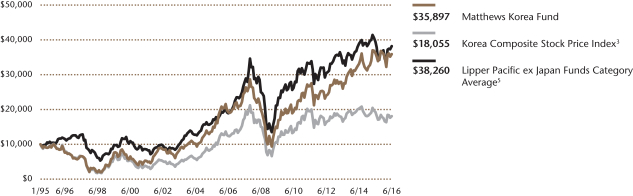

Korea Fund (MAKOX) | | | -0.83% | | | | 6.09% | | | | 6.41% | | | | 6.13% | | | | 1/3/95 | | | | 1.10% | | | | n.a. | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Small Companies Fund (MSMLX) | | | -15.10% | | | | 0.73% | | | | n.a. | | | | 11.36% | | | | 9/15/08 | | | | 1.48% | | | | 1.47% | 3 |

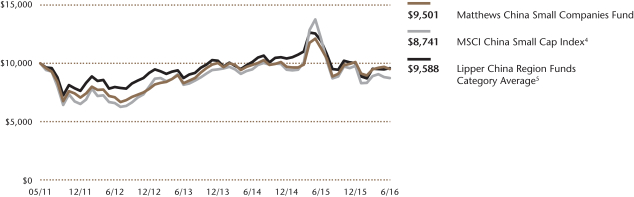

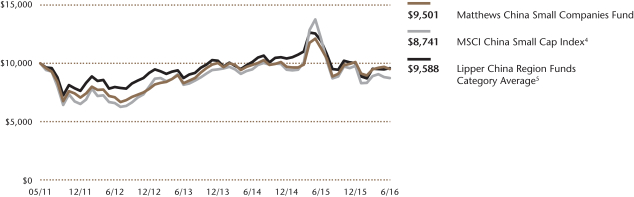

China Small Companies Fund (MCSMX) | | | -15.96% | | | | -0.21% | | | | n.a. | | | | -1.00% | | | | 5/31/11 | | | | 2.10% | | | | 1.50% | 4 |

| * | These figures are from the fund’s prospectus dated as of April 29, 2016, and may differ from the actual expense ratios for fiscal year 2016, as shown in the financial highlights section of this report. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of the (i) expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2017 for the Asia Strategic Income Fund and until April 30, 2018 for the Asia Credit Opportunities Fund and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2017 and may be terminated at any time (i) by the Trust on behalf of the Fund or by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.25% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2017 for the Asia Focus Fund, Emerging Asia Fund, Asia Small Companies Fund and Asia ESG Fund, and until April 30, 2018 for the Asia Value Fund and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. |

| 4 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) to 1.50%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2017 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. |

Institutional Class Performance and Expenses (June 30, 2016)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | Average Annual Total Return | | | Inception

Date | | | Prospectus Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver and Expense

Reimbursement* | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | | | | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Strategic Income Fund (MINCX) | | | 5.07% | | | | n.a. | | | | n.a. | | | | 4.51% | | | | 11/30/11 | | | | 1.09% | | | | 0.90% | 1 |

Asia Credit Opportunities Fund (MICPX) | | | n.a. | | | | n.a. | | | | n.a. | | | | 1.41% | | | | 4/29/16 | | | | 1.94% | | | | 0.90% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asian Growth and Income Fund (MICSX) | | | -1.06% | | | | 3.66% | | | | n.a. | | | | 3.98% | | | | 10/29/10 | | | | 0.92% | | | | n.a. | |

Asia Dividend Fund (MIPIX) | | | -1.66% | | | | 5.96% | | | | n.a. | | | | 6.00% | | | | 10/29/10 | | | | 0.93% | | | | 0.92% | 3 |

China Dividend Fund (MICDX) | | | -11.33% | | | | 6.19% | | | | n.a. | | | | 6.48% | | | | 10/29/10 | | | | 1.00% | | | | n.a. | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Value Fund (MAVAX) | | | n.a. | | | | n.a. | | | | n.a. | | | | 2.02% | | | | 11/30/15 | | | | 36.17% | | | | 1.25% | 2 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Focus Fund (MIFSX) | | | -5.03% | | | | n.a. | | | | n.a. | | | | -1.23% | | | | 4/30/13 | | | | 1.91% | | | | 1.25% | 2 |

Asia Growth Fund (MIAPX) | | | -0.63% | | | | 5.21% | | | | n.a. | | | | 5.24% | | | | 10/29/10 | | | | 0.91% | | | | n.a. | |

Pacific Tiger Fund (MIPTX) | | | -4.85% | | | | 4.51% | | | | n.a. | | | | 4.68% | | | | 10/29/10 | | | | 0.91% | | | | 0.89% | 3 |

Asia ESG Fund (MISFX) | | | -6.86% | | | | n.a. | | | | n.a. | | | | -7.20% | | | | 4/30/15 | | | | 8.90% | | | | 1.25% | 2 |

Emerging Asia Fund (MIASX) | | | 8.32% | | | | n.a. | | | | n.a. | | | | 7.75% | | | | 4/30/13 | | | | 1.57% | | | | 1.25% | 2 |

Asia Innovators Fund (MITEX) | | | -8.37% | | | | n.a. | | | | n.a. | | | | 10.33% | | | | 4/30/13 | | | | 0.97% | | | | n.a. | |

China Fund (MICFX) | | | -23.83% | | | | -3.37% | | | | n.a. | | | | -3.28% | | | | 10/29/10 | | | | 0.99% | | | | n.a. | |

India Fund (MIDNX) | | | -3.32% | | | | 6.95% | | | | n.a. | | | | 4.85% | | | | 10/29/10 | | | | 0.90% | | | | n.a. | |

Japan Fund (MIJFX) | | | 5.10% | | | | 10.79% | | | | n.a. | | | | 11.72% | | | | 10/29/10 | | | | 0.87% | | | | n.a. | |

Korea Fund (MIKOX) | | | -0.65% | | | | 6.24% | | | | n.a. | | | | 8.58% | | | | 10/29/10 | | | | 0.93% | | | | n.a. | |

ASIA SMALL COMPANY STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Asia Small Companies Fund (MISMX) | | | -14.89% | | | | n.a. | | | | n.a. | | | | 0.28% | | | | 4/30/13 | | | | 1.30% | | | | 1.25% | 2 |

| * | These figures are from the fund’s prospectus dated as of April 29, 2016, and may differ from the actual expense ratios for fiscal year 2016, as shown in the financial highlights section of this report. |

| 1 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2017 for the Asia Strategic Income Fund and until April 30, 2018 for the Asia Credit Opportunities Fund and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. |

| 2 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2017 for the Asia Focus Fund, Emerging Asia Fund, Asia Small Companies Fund and Asia ESG Fund, and until April 30, 2018 for the Asia Value Fund and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. |

| 3 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2017 and may be terminated at any time (i) by the Trust on behalf of the Fund or by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 3 | |

Message to Shareholders from the Investment Advisor

Dear Valued Investors,

As an Englishman, it’s hard for me not to get sucked into the whole Brexit chaos. Let me say two things about it—first, the initial reaction was quite extreme; second, there has been a temptation for people to look again at Asia in light of the concerns around Europe. I’d like to pause for a breath a bit and examine whether Brexit really is a reason to reallocate to Asia.

The initial reaction to the Brexit vote was one of real concern—lower GDP in Britain over the long term, a hit to investment in the short term, and worries that political turmoil in Europe might hold back spending there too. Well, some of this was perhaps overdone. The sterling’s fall on the Brexit news has probably provided something of a boost to the U.K. economy. The likelihood that the U.S. Federal Reserve will now be much slower to raise rates, too, has also calmed stock markets and allowed them to bounce back. So, the initial shock seems to have been excessive and everything is back on an even keel, economically speaking. Or so it might seem.

Politics is a different matter. Who would be leader of the U.K.’s governing Conservative Party now? Dumb question. There is always someone ambitious enough to step up. But they would probably face a short premiership before having to call a general election; the possibility of having to implement a tight budget; and the difficulty of getting votes through Parliament to actually execute the separation from Europe—most members of Parliament are probably in favor of remaining. All this is complicated by the fact that it seems very difficult to me to meet the desires of the British electorate as expressed in the last two referenda—most recently Brexit, and what seems just a moment ago, the referendum on whether Scotland should remain part of the United Kingdom. For, if one thing seems sure in this mess, it is that if the U.K. does leave Europe, Scotland will want to remain a part of the E.U. and that means splitting from the U.K. So, a Great British “muddle-through” is called for. All of which will take a lot of negotiating as they muddle. In the meantime, populist and separatist movements in France, Spain and Greece may gain traction. Other nations, probably the Netherlands and France, might want to join in any separation Britain wins from European immigration policy (a key cause of the leave campaign). So, the political mess will likely churn on in Europe for some time. This could depress investment. It might depress stock market sentiment, so it is not to be ignored.

But is that, in and of itself, a reason to turn to Asia? I would say not. Asia has to build its own case for investment, outside of what is happening in Europe. It’s not good enough just to be a less bad choice. There are reasons to be cautious about Asia, to be sure. Credit cycles seem to be worsening everywhere—from China, to Thailand, to India, and everywhere in between. This leaves us somewhat concerned about the ability of the financial systems to support near-term growth and for those companies reliant on borrowing to continue to grow. Consequently, our portfolios are relatively light on banking stocks and we have a natural bias toward self-funding companies with secular, if not always spectacular, growth trajectories. These qualities do not come cheaply in today’s markets. But nor is Asia expensive relative to the rest of the world. There does appear to be a valuation argument in favor of Asia—the U.S. trades at 17x forward Earnings Per Share*; Europe at 14.0x; and Asia at 13.5x. It is true that such valuation differences disappear if we look at a sector like consumer staples where Europe, the U.S. and Asia seem to be trading at similar levels. But here, the chance of Asia producing better future growth relative to these two areas seems reasonably strong.

After all, productivity levels are still low, but still growing. Governments have a keen eye on increasing both the efficiency of financial systems (China and Vietnam being cases in point); as well as legal systems (again China and India); corporate governance systems (Japan and Korea); and overhauling government investment in infrastructure, such as in Indonesia. Everywhere one looks, governments are at least trying to do the right things. And the record pace and levels of Asian countries—in terms of savings, manufacturing exposure, openness to trade, productivity growth, and increasing political stability—continue to be prominent in a world where the political trends in other regions seem to be challenging this openness. Even as immigration and trade treaties become political controversies in the U.S. and Europe, China is looking to deal with its demographic issues by opening up vast new trade routes and stepping up its foreign direct investment into the rest of the Asia region. These are multi-year, even multi-decade plans that show a long-term commitment to embrace the forces of growth. And despite many Doomsday headlines about China’s growth and its currency, it still achieves rates of growth that are the envy of much of the world and an increasing share of global exports. Asia is not perfect by any means, but it seems to me to still be on the right track.

But no, Brexit itself is not a reason to turn your attention to Asia. There is a danger in trying to respond to short-term political events. Rather, we try to take a long-term view of the region. This remains a view centered on the growth in productivity of Asia’s workforce, the emergence of domestic corporate champions, and the improving institutions of investment—markets, legal infrastructure and corporate governance. Our portfolios at the moment express some skepticism about the credit cycle, but we can still find good value in companies that are seeking to protect themselves from industry competition, allocating capital efficiently, and sometimes even paying out dividends that, despite their superior growth, are at higher yields than you find on average in the U.S. and that are comparable to Europe.

Since 2008, the world has become dominated by breathless hyperbole and shock headlines. Better, I think, to put them to the side of your mind and focus on the fundamentals of growing businesses and macroeconomic reform. In these areas, despite all its problems, Asia is doing quite well. And that is reason enough to consider it as an investment opportunity—but no, not just because my fellow Brits threw a hissy fit.

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

| * | Forward earnings are calculated by dividing market price per share by expected earnings per share. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 5 | |

| | | | |

| PORTFOLIO MANAGERS |

| Teresa Kong, CFA | | |

Lead Manager | | |

| Gerald M. Hwang, CFA | | Satya Patel |

Co-Manager | | Co-Manager |

| | | | |

|

| FUND FACTS |

| | | Investor | | Institutional |

Ticker | | MAINX | | MINCX |

CUSIP | | 577125503 | | 577125602 |

Inception | | 11/30/11 | | 11/30/11 |

NAV | | $10.37 | | $10.36 |

Initial Investment | | $2,500 | | $3 million |

Gross Expense Ratio1 | | 1.28% | | 1.09% |

After Fee Waiver and Reimbursement2 | | 1.12% | | 0.90% |

Portfolio Statistics | | | | |

Total # of Positions | | 39 |

Net Assets | | $63.3 million |

Modified Duration3 | | 4.4 |

Portfolio Turnover4 | | 50.09% |

Benchmark | | |

Markit iBoxx Asian Local Bond Index* |

OBJECTIVE

Total return over the long term with an emphasis on income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in income-producing securities including, but not limited to, dividend paying equity securities, and debt and debt-related instruments issued by governments, quasi-governmental entities, supra-national institutions, and companies in Asia. Asia consists of all countries and markets in Asia, such as China and India, and includes developed, emerging, and frontier countries and markets in the Asian region. Investments may be denominated in any currency, and may represent any part of a company’s capital structure from debt to equity or with features of both.

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited)

For the first half of 2016, the Matthews Asia Strategic Income Fund returned 5.83% (Investor Class) and 5.86% (Institutional Class), while its benchmark, the Markit iBoxx Asian Local Bond Index*, returned 7.29%. For the quarter ending June 30, the Fund returned 2.47% (Investor Class) and 2.53% (Institutional Class) while its benchmark returned 0.88%.

Market Environment:

The second quarter of 2016 was dominated by two overarching forces for Asian Fixed Income: Federal Reserve rate hike probabilities and Brexit. For the majority of the second quarter, uncertainty about the timing of U.S. rate hikes by the Federal Reserve dominated market sentiment. Fed officials repeatedly suggested a rate hike was probable if economic data did not disappoint, yet Fed Chair Janet Yellen continued to delay rate hikes, citing external risks. This caused currency and rates markets in Asia to flip flop due to the continued repricing in the path for rate hikes expected from the Federal Reserve. While currencies and rates were somewhat volatile for most of the second quarter, significantly higher volatility affected the region following the surprise Brexit vote. Asia credit, however, was relatively insulated from Brexit effects as the trade exposure to the U.K. among Asian companies is limited. Despite the severe sell-off in almost all markets post-Brexit, Asia currencies, rates and credit markets quickly recovered in the following week. As of the end of the second quarter, Asia markets had largely returned to pre-Brexit levels.

Performance Contributors and Detractors:

The biggest contributors to Fund performance for the second quarter were our holdings in U.S. dollar-denominated bonds. Within U.S. dollar-denominated debt, bonds from Indonesian companies and our holdings of contingent convertible bonds of banks performed particularly well. As macroeconomic concerns around Indonesia’s growth, inflation and currency stability subsided, risk aversion faded, resulting in strong performance of our bonds. Our contingent convertibles performed well despite some volatility around Brexit.

The biggest detractors to Fund performance in the second quarter were our currency forward positions in the Indonesian rupiah, Malaysian ringgit and South Korean won. The U.S. dollar remained volatile but overall strengthened from the previous quarter.

Notable Portfolio Changes:

Given markets were pricing in a much lower probability of a Brexit vote than polls suggested, we pared back our exposure to higher beta currencies with limited appreciation potential. Notably, we increased our weight to the U.S. dollar and the Malaysian ringgit while reducing our exposure to the Chinese renminbi, the South Korean won, and the Singaporean dollar. We increased exposure to U.S. interest rates on the expectation that long-dated U.S. rates were well-anchored despite the potential for shorter rates to rise. We did not increase interest rate exposure to most Asian local markets as we believed that potential currency depreciation would likely more than offset any fall in interest rates. As spreads tightened, we

(continued)

| * | The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2017 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2015 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

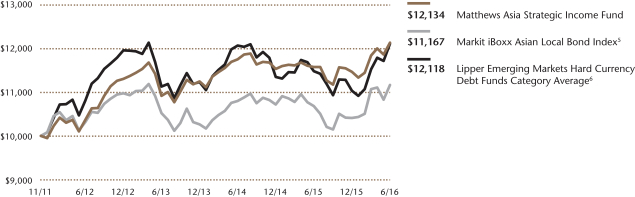

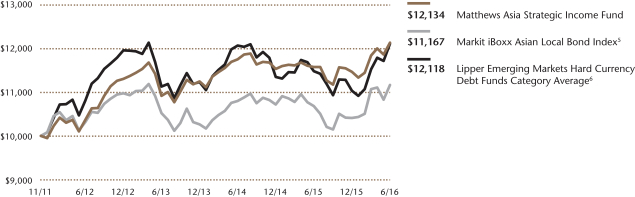

| PERFORMANCE AS OF JUNE 30, 2016 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | Average Annual

Total Returns | | | | |

| | | 3 Months | | | YTD | | | 1 Year | | | 3 Years | | | Since

Inception | | | Inception

Date | |

| Investor Class (MAINX) | | | 2.47% | | | | 5.83% | | | | 4.82% | | | | 3.59% | | | | 4.31% | | | | 11/30/11 | |

| Institutional Class (MINCX) | | | 2.53% | | | | 5.86% | | | | 5.07% | | | | 3.81% | | | | 4.51% | | | | 11/30/11 | |

| Markit iBoxx Asian Local Bond Index5 | | | 0.88% | | | | 7.29% | | | | 4.55% | | | | 2.01% | | | | 2.44% | | | | | |

| Lipper Emerging Markets Hard Currency Debt Funds Category Average6 | | | 4.68% | | | | 9.43% | | | | 4.98% | | | | 2.61% | | | | 4.19% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| INCOME DISTRIBUTION HISTORY | | | | | | | | | | | | | | | | | | | |

| | | 2016 | | | | | | 2015 | |

| | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MAINX) | | $ | 0.06 | | | $ | 0.11 | | | | n.a. | | | | n.a. | | | | n.a. | | | | | | | $ | 0.00 | | | $ | 0.10 | | | $ | 0.08 | | | $ | 0.11 | | | $ | 0.29 | |

| Inst’l (MINCX) | | $ | 0.06 | | | $ | 0.12 | | | | n.a. | | | | n.a. | | | | n.a. | | | | | | | $ | 0.01 | | | $ | 0.10 | | | $ | 0.09 | | | $ | 0.11 | | | $ | 0.31 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

30-DAY YIELD: Investor Class: 4.82% (4.72% excluding expense waiver) Inst’l Class: 5.08% (4.94% excluding expense waiver) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/16, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 6.38% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

GROWTH OF A $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from HSBC, Markit iBoxx and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 91 for index definitions. The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| | 6 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Indonesia Treasury Bond, 8.375%, 03/15/2034 | | Foreign Government Bonds | | Indonesian Rupiah | | | 5.3% | |

| Ctrip.com International, Ltd., Cnv., 1.000%, 07/01/2020 | | Consumer Discretionary | | U.S. Dollar | | | 5.0% | |

| DFCC Bank PLC, 9.625%, 10/31/2018 | | Financials | | U.S. Dollar | | | 4.4% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.2% | |

| PT Perusahaan Listrik Negara, 5.250%, 10/24/2042 | | Utilities | | U.S. Dollar | | | 3.8% | |

| HSBC Holdings PLC, 6.375%, 12/29/2049 | | Financials | | U.S. Dollar | | | 3.8% | |

| Sri Lanka Government Bond, 6.125%, 06/03/2025 | | Foreign Government Bonds | | U.S. Dollar | | | 3.5% | |

| Shimao Property Holdings, Ltd., 6.625%, 01/14/2020 | | Financials | | U.S. Dollar | | | 3.3% | |

| TML Holdings Pte, Ltd., 5.750%, 05/07/2021 | | Consumer Discretionary | | U.S. Dollar | | | 3.3% | |

| China Hongqiao Group, Ltd., 6.875%, 05/03/2018 | | Materials | | U.S. Dollar | | | 3.2% | |

| % OF ASSETS IN TOP TEN | | | | | | | 39.8% | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 7 | |

| | | | |

| |

| CURRENCY ALLOCATION (%)7,8 | |

| U.S. Dollar (USD) | | | 71.5 | |

| Indian Rupee (INR) | | | 9.8 | |

| Indonesian Rupiah (IDR) | | | 8.3 | |

| Hong Kong Dollar (HKD) | | | 3.0 | |

| Sri Lankan Rupee (LKR) | | | 2.7 | |

| South Korean Won (KRW) | | | 2.0 | |

| Cash and Other Assets, Less Liabilities | | | 2.6 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)7,8,9,10 | |

| China/Hong Kong | | | 36.5 | |

| Indonesia | | | 25.5 | |

| Sri Lanka | | | 14.5 | |

| India | | | 13.5 | |

| Pakistan | | | 2.5 | |

| South Korea | | | 2.0 | |

| Vietnam | | | 1.7 | |

| Supranational | | | 1.2 | |

| Cash and Other Assets, Less Liabilities | | | 2.6 | |

| | | | |

| |

| SECTOR ALLOCATION (%)7,8 | |

| Financials | | | 39.6 | |

| Foreign Government Bonds | | | 24.2 | |

| Consumer Discretionary | | | 15.5 | |

| Utilities | | | 5.1 | |

| Information Technology | | | 4.3 | |

| Materials | | | 3.2 | |

| Consumer Staples | | | 3.0 | |

| Telecommunication Services | | | 2.6 | |

| Cash and Other Assets, Less Liabilities | | | 2.6 | |

Please note: Foreign Government Bonds category includes Supranationals.

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)7,8 | |

| Non-Convertible Corporate Bonds | | | 56.2 | |

| Government Bonds | | | 24.2 | |

| Convertible Corporate Bonds | | | 17.0 | |

| Cash and Other Assets, Less Liabilities | | | 2.6 | |

| 7 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

| 8 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 9 | Not all countries where the Fund may invest are included in the benchmark index. |

| 10 | Supranational is an international organization in which member states transcend national boundaries (ex. IMF). |

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited) (continued)

replaced several credits, which have reached our spread targets, with new companies that offered relatively higher spreads. The exposure to relatively higher credit spreads despite falling interest rates resulted in relatively constant yields through the quarter.

We rebuilt a position in Sri Lankan rupee-denominated bonds after both the currency and rates sold off over the last several quarters. At current levels, we see returns skewed positively as fiscal and monetary policies will likely abide by International Monetary Fund (IMF)-prescribed guidelines. We believe the US$1.5 billion Extended Fund Facility from the IMF will help stabilize the macro economy in Sri Lanka, as well as help the country implement economic reforms. In addition to Sri Lanka, we also initiated a small position in Pakistan. Pakistan’s economy has seen steady improvement over the last several years with the help of the IMF. The fiscal deficit has declined and the government is working on improving infrastructure with the help of Chinese direct investment. Lastly, we have increased our exposure to long-dated Indonesian rates as we believe the central bank will cut interest rates further to support the economy. We funded these purchases by selling low-yielding bonds from companies in the Philippines, Indonesia, China, and Malaysia.

Outlook:

Brexit has injected uncertainty in the markets. Unlike risks that are identifiable and quantifiable, uncertainties are unknown and not measurable. In the absence of known near-term catalysts, markets will be very volatile. The silver lining is that Brexit is not likely to pose systematic risk, but instead more idiosyncratic risks to countries and sectors most exposed to the U.K. and Europe. As such, we believe Asia fixed income provides a relative safe haven to most other developed and emerging markets.

On interest rates, we believe chances of rate hikes in the U.S. have diminished following Brexit. We believe Asian countries will continue to have lower to stable rates as most countries have seen moderating inflation with slow growth, providing room for policymakers to continue easing. We believe Indonesia and India both have room for more interest rate cuts, which should support their local currency bond prices.

On currencies, we expect substantial uncertainties concerning the Brexit situation will continue to drive volatility in currencies in the coming quarters. Despite Asia’s relatively small trade exposure to the U.K., we believe concerns over the viability of the E.U. and general uncertainties regarding the framework under which Brexit will happen will continue to weigh on risk sentiment. Asian currencies will remain volatile, and we expect greater dispersion amongst returns. Higher yielding, high volatility currencies that have experienced the greatest depreciation in the last few years, like the Indonesian rupiah and the Malaysian ringgit, will continue to have the greatest likelihood of appreciating in 2016.

The easing bias of central banks will mitigate risks of rising defaults. Prudent carry strategies, such as Asia high yield, continue to be attractive. Entering at current levels has historically resulted in gains as long as investors have an investment horizon greater than two years.

Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets.

Matthews Asia Strategic Income Fund

June 30, 2016

Schedule of Investmentsa (unaudited)

NON-CONVERTIBLE CORPORATE BONDS: 56.2%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| CHINA/HONG KONG: 22.1% | |

Standard Chartered PLC

6.500%b, 12/29/49 | | | 2,900,000 | | | | $2,660,750 | |

HSBC Holdings PLC

6.375%b, 12/29/49 | | | 2,500,000 | | | | 2,381,250 | |

Shimao Property Holdings, Ltd.

6.625%, 01/14/20 | | | 2,000,000 | | | | 2,100,704 | |

China Hongqiao Group, Ltd.

6.875%, 05/03/18 | | | 2,000,000 | | | | 2,032,396 | |

MCE Finance, Ltd.

5.000%, 02/15/21 | | | 2,000,000 | | | | 1,979,050 | |

Yum! Brands, Inc.

5.350%, 11/01/43 | | | 2,000,000 | | | | 1,610,000 | |

Unigroup International Holdings, Ltd.

6.000%, 12/10/20 | | | 1,200,000 | | | | 1,253,432 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 14,017,582 | |

| | | | | | | | |

| | | | | | | | |

| INDIA: 13.5% | | | | | |

TML Holdings Pte, Ltd.

5.750%, 05/07/21 | | | 2,000,000 | | | | 2,063,962 | |

Housing Development Finance Corp., Ltd. | | | | | |

9.240%, 06/24/24 | | | INR 100,000,000 | | | | 1,550,900 | |

Housing Development Finance Corp., Ltd. | | | | | |

8.950%, 03/21/23 | | | INR 100,000,000 | | | | 1,515,653 | |

Axis Bank, Ltd.

7.250%b, 08/12/21 | | | 1,000,000 | | | | 1,001,790 | |

Rural Electrification Corp., Ltd.

9.340%, 08/25/24 | | | INR 52,000,000 | | | | 823,763 | |

Power Grid Corp. of India, Ltd., Series B | | | | | |

9.300%, 09/04/24 | | | INR 52,000,000 | | | | 821,914 | |

Rural Electrification Corp., Ltd.

9.020%, 06/18/19 | | | INR 50,000,000 | | | | 762,533 | |

| | | | | | | | |

Total India | | | | | | | 8,540,515 | |

| | | | | | | | |

| | | | | | | | |

| INDONESIA: 12.3% | | | | | |

PT Perusahaan Listrik Negara

5.250%, 10/24/42 | | | 2,500,000 | | | | 2,399,025 | |

Theta Capital Pte, Ltd.

7.000%, 05/16/19 | | | 1,500,000 | | | | 1,555,831 | |

Alam Synergy Pte, Ltd.

6.950%, 03/27/20c | | | 1,500,000 | | | | 1,466,250 | |

Jababeka International BV

7.500%, 09/24/19 | | | 1,400,000 | | | | 1,466,046 | |

Alam Synergy Pte, Ltd.

6.950%, 03/27/20 | | | 500,000 | | | | 488,750 | |

PT Astra Sedaya Finance

8.600%, 02/21/17 | | | IDR 5,000,000,000 | | | | 380,738 | |

| | | | | | | | |

Total Indonesia | | | | | | | 7,756,640 | |

| | | | | | | | |

| | | | | | | | |

| SRI LANKA: 8.3% | | | | | |

DFCC Bank PLC

9.625%, 10/31/18 | | | 2,650,000 | | | | 2,781,096 | |

National Savings Bank

5.150%, 09/10/19 | | | 2,000,000 | | | | 1,946,160 | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

National Savings Bank

8.875%, 09/18/18 | | | 500,000 | | | | $532,790 | |

| | | | | | | | |

Total Sri Lanka | | | | | | | 5,260,046 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL NON-CONVERTIBLE CORPORATE BONDS | | | | 35,574,783 | |

| | | | | | | | |

(Cost $36,540,762) | | | | | | | | |

| | | | | | | | |

FOREIGN GOVERNMENT OBLIGATIONS: 24.2% | | | | | |

| INDONESIA: 10.6% | | | | | | | | |

Indonesia Treasury Bond

8.375%, 03/15/34 | | | IDR 42,000,000,000 | | | | 3,369,536 | |

Indonesia Government Bond

5.950%, 01/08/46 | | | 1,500,000 | | | | 1,767,498 | |

Indonesia Treasury Bond

7.875%, 04/15/19 | | | IDR 20,000,000,000 | | | | 1,535,667 | |

| | | | | | | | |

Total Indonesia | | | | | | | 6,672,701 | |

| | | | | | | | |

| | | | | | | | |

| SRI LANKA: 6.2% | | | | | |

Sri Lanka Government Bond

6.125%, 06/03/25 | | | 2,400,000 | | | | 2,241,941 | |

Sri Lanka Government Bond

8.500%, 07/15/18 | | | LKR 257,000,000 | | | | 1,682,252 | |

| | | | | | | | |

Total Sri Lanka | | | | | | | 3,924,193 | |

| | | | | | | | |

| | | | | | | | |

| PAKISTAN: 2.5% | | | | | |

Pakistan Government Bond

8.250%, 04/15/24 | | | 1,500,000 | | | | 1,577,603 | |

| | | | | | | | |

Total Pakistan | | | | | | | 1,577,603 | |

| | | | | | | | |

| | | | | | | | |

| SOUTH KOREA: 2.0% | | | | | |

Korea Treasury Bond

3.500%, 09/10/16 | | | KRW 1,000,000,000 | | | | 871,890 | |

Korea Treasury Bond

3.500%, 03/10/24 | | | KRW 400,000,000 | | | | 399,435 | |

| | | | | | | | |

Total South Korea | | | | | | | 1,271,325 | |

| | | | | | | | |

| | | | | | | | |

| VIETNAM: 1.7% | | | | | |

Socialist Republic of Vietnam

4.800%, 11/19/24 | | | 1,055,000 | | | | 1,085,607 | |

| | | | | | | | |

Total Vietnam | | | | | | | 1,085,607 | |

| | | | | | | | |

| | | | | | | | |

| SUPRANATIONAL: 1.2% | | | | | |

International Finance Corp.

7.750%, 12/03/16 | | | INR 50,000,000 | | | | 743,444 | |

| | | | | | | | |

Total Supranational | | | | | | | 743,444 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL FOREIGN GOVERNMENT OBLIGATIONS | | | | 15,274,873 | |

| | | | | | | | |

(Cost $15,032,252) | | | | | | | | |

| | | | | | | | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 9 | |

Matthews Asia Strategic Income Fund

June 30, 2016

Schedule of Investmentsa (unaudited) (continued)

CONVERTIBLE CORPORATE BONDS: 17.0%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| CHINA/HONG KONG: 14.4% | | | | | |

Ctrip.com International, Ltd., Cnv.

1.000%, 07/01/20 | | | 3,000,000 | | | | $3,157,500 | |

E-House China Holdings, Ltd., Cnv.

2.750%, 12/15/18c | | | 2,010,000 | | | | 1,984,875 | |

Biostime International Holdings, Ltd., Cnv. | | | | | |

0.000%, 02/20/19 | | | HKD 14,000,000 | | | | 1,917,351 | |

Qihoo 360 Technology Co., Ltd., Cnv.

1.750%, 08/15/21 | | | 1,500,000 | | | | 1,459,688 | |

Vipshop Holdings Ltd., Cnv.

1.500%, 03/15/19 | | | 600,000 | | | | 589,500 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 9,108,914 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| INDONESIA: 2.6% | | | | | |

Delta Investment Horizon International, Ltd., Cnv. | | | | | |

3.000%, 05/26/20 | | | 1,800,000 | | | | $1,638,000 | |

| | | | | | | | |

Total Indonesia | | | | | | | 1,638,000 | |

| | | | | | | | |

| | | | | | | | |

| TOTAL CONVERTIBLE CORPORATE BONDS | | | | 10,746,914 | |

| | | | | | | | |

(Cost $10,266,289) | | | | | | | | |

| | | | | | | | |

| TOTAL INVESTMENTS: 97.4% | | | | | | | 61,596,570 | |

(Cost $61,839,303d) | | | | | | | | |

| | | | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 2.6% | | | | | | | 1,665,563 | |

| | | | | | | | |

| | |

NET ASSETS: 100.0% | | | | | | | $63,262,133 | |

| | | | | | | | |

| a | Certain securities were fair valued under the valuation polices approved by the Board of Trustees (Note 2-A). |

| b | Variable rate security. The rate represents the rate in effect at June 30, 2016. |

| c | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The security may be resold in transactions exempt from registration normally to qualified institutional buyers. The security has been determined to be liquid in accordance with procedures adopted by the Fund’s Board of Directors. |

| d | Cost for federal income tax purposes is $61,839,303 and net unrealized depreciation consists of: |

| * | All values are in USD unless otherwise noted. |

| | | | | | | | |

Gross unrealized appreciation | | | $1,512,041 | |

Gross unrealized depreciation | | | (1,754,774 | ) |

| | | | | | | | |

Net unrealized depreciation | | | ($242,733 | ) |

| | | | | | | | |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS:

| | | | | | | | | | | | |

| | | Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation | |

LONG | | MYR 24,615,000 | | USD 6,000,000 | | JP Morgan | | 09/21/16 | | | $164,393 | |

| | THB 105,870,000 | | USD 3,000,000 | | JP Morgan | | 09/21/16 | | | 8,735 | |

| | | | | | | | | | | | |

| | | | | | | | | | | $173,128 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

| | | | |

| PORTFOLIO MANAGERS |

| Teresa Kong, CFA | | Satya Patel |

Lead Manager | | Lead Manager |

| | |

| FUND FACTS | | | | |

| | | Investor | | Institutional |

Ticker | | MCRDX | | MICPX |

CUSIP | | 577130677 | | 577130669 |

Inception | | 4/29/16 | | 4/29/16 |

NAV | | $10.09 | | $10.08 |

Initial Investment | | $2,500 | | $3 million |

Gross Expense Ratio1 | | 2.10% | | 1.94% |

After Fee Waiver and Reimbursement2 | | 1.10% | | 0.90% |

Portfolio Statistics | | |

Total # of Positions | | 25 |

Net Assets | | $12.8 million |

Modified Duration | | 4.03 |

Portfolio Turnover | | N/A4 |

Benchmark | | | | |

J.P. Morgan Asia Credit Index |

OBJECTIVE

Total return over the long term.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in debt and debt-related instruments issued by companies as well as governments, quasi-governmental entities, and supranational institutions in Asia. Debt and debt-related instruments typically include bonds, debentures, bills, securitized instruments (which are vehicles backed by pools of assets such as loans or other receivables), notes, certificates of deposit and other bank obligations, bank loans, senior secured bank debt, convertible debt securities, credit-linked notes, inflation linked instruments, repurchase agreements, payment-in-kind securities and derivative instruments with fixed income characteristics. Asia consists of all countries and markets in Asia, such as China and Indonesia, in addition to the developed, emerging, and frontier countries and markets in the Asian region.

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited)

From inception to the quarter ending June 30, 2016, the Matthews Asia Credit Opportunities Fund returned 1.46% (Investor Class) and 1.41% (Institutional Class), while its benchmark, the J.P. Morgan Asia Credit Index (JACI) returned 2.10%.

At Matthews Asia, we aim to launch new strategies when we identify compelling investment opportunities in the region, and as such, our second dedicated fixed income investment strategy, the Matthews Asia Credit Opportunities Fund, was launched on April 29, 2016. The Fund is intended as a higher risk, higher return strategy than our Matthews Asia Strategic Income Fund, and offers investors the potential for attractive yield, exposure to the U.S. dollar, and diversification benefits from the lower correlation between Asian credit and developed Western fixed income markets. The Fund may be a complement to an emerging market fixed income or high yield strategy as a way to increase allocation to Asia.

Asia has two distinct bond markets—local currency-denominated and U.S. dollar-denominated bonds. The Matthews Asia Credit Opportunities Fund seeks total return over the long term and focuses more on investing in the sub-investment grade segment of the U.S. dollar-denominated bond market. This market is dominated by corporate borrowers, and allows investors to isolate the credit risk of issuers in Asia. The U.S. dollar-denominated bond market has grown in size to about US$623 billion and often offers the opportunity for attractive yields relative to its U.S. counterparts.

Because the strategy seeks to derive most of its returns from credit, exposure to currencies and interest rates of Asian countries will be minimized via holding majority of bonds denominated in U.S. dollar. Thus, the strategy may be appropriate for those investors seeking enhanced yield without foreign currency and interest rate exposure. We aim to add value through individual security selection based on the security’s credit worthiness, with an emphasis on companies with strong balance sheets, stable cash flows and business models that will thrive across various cycles.

Market Environment:

The second quarter of 2016 was a rollercoaster ride for Asian credit spreads, amid global, rather than Asia-specific, developments that drove spreads. Credit spreads gradually tightened from the beginning of quarter until the end of May, when risk aversion took over with Federal Reserve officials indicating that a rate hike was imminent in June. However, the Fed held rates steady, citing risks from overseas as well as continued low productivity gains in U.S., paving the way for a strong credit environment leading into the Brexit vote. Markets were pricing in a “remain” outcome for Britain, and the surprise result led to a sharp repricing of risk assets globally. Asian credit also sold off but then quickly recovered as the trade exposure to the U.K. for Asian corporate is relatively small. Overall, for the quarter, credit spreads ended slightly tighter than where they began.

Performance Contributors and Detractors:

The biggest contributors to Fund performance since inception were bonds issued by companies in Indonesia, Macau and Sri Lanka. Following a period of concern in

(continued)

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2018 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The Fund commenced operations on April 29, 2016. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 11 | |

| | | | | | | | |

| | | |

| PERFORMANCE AS OF JUNE 30, 2016 | | | | | | |

| | | Actual Return,

Not Annualized | | | | |

| | | Since Inception | | | Inception Date | |

| Investor Class (MCRDX) | | | 1.46% | | | | 4/29/2016 | |

| Institutional Class (MICPX) | | | 1.41% | | | | 4/29/2016 | |

| J.P. Morgan Asia Credit Index5 | | | 2.10% | | | | | |

| Lipper Alternative Credit Focus Funds Category Average6 | | | 0.41% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance, visit matthewsasia.com.

| | 5 | It is not possible to invest directly in an index. Source: Index data from J.P. Morgan and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 91 for index definition. |

| | 6 | The Lipper Category Average does not reflect sales charges and is based on total return, including reinvestment of dividends and capital gains for the stated periods. |

| | | | | | | | | | | | | | | | |

| | | |

| INCOME DISTRIBUTION HISTORY | | | | | | |

| | | 2016 | |

| | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MCRDX) | | $ | 0.06 | | | | n.a. | | | | n.a | | | | n.a | |

| Inst’l (MICPX) | | $ | 0.06 | | | | n.a. | | | | n.a | | | | n.a | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

30-DAY YIELD: Investor Class: 4.04% (3.50% excluding waivers) Institutional Class: 4.27% (3.74% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/16, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 5.79% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| National Savings Bank, 8.875%, 09/18/2018 | | Financials | | U.S. Dollar | | | 5.0% | |

| Delta Investment Horizon International, Ltd., Cnv., 3.000%, 05/26/2020 | | Telecommunication Services | | U.S. Dollar | | | 5.0% | |

| Pakistan Government Bond, 8.250%, 04/15/2024 | | Foreign Government Bonds | | U.S. Dollar | | | 4.9% | |

| MPM Global Pte, Ltd., 6.750%, 09/19/2019 | | Consumer Discretionary | | U.S. Dollar | | | 4.8% | |

| China Hongqiao Group, Ltd., 6.875%, 05/03/2018 | | Materials | | U.S. Dollar | | | 4.8% | |

| HSBC Holdings PLC, 6.375%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.5% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.3% | |

| Biostime International Holdings, Ltd., Cnv., 0.000%, 02/20/2019 | | Consumer Staples | | Hong Kong Dollar | | | 4.3% | |

| Sri Lanka Government Bond, 6.125%, 06/03/2025 | | Foreign Government Bonds | | U.S. Dollar | | | 3.6% | |

| Shimao Property Holdings, Ltd., 8.125%, 01/22/2021 | | Financials | | U.S. Dollar | | | 3.4% | |

| % OF ASSETS IN TOP TEN | | | | | | | 44.6% | |

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited) (continued)

Indonesia around slowing growth, high inflation, and currency volatility, risk aversion faded and the rupiah stabilized, resulting in strong performance of our Indonesian corporate bonds. Issuers in Macau also performed well as signs pointed to stabilization in the mass segment of its casinos. Sri Lankan corporates also recovered as the country is on track to secure a US$1.5 billion loan from the International Monetary Fund (IMF). We believe this Facility will help stabilize the macro economic situation in Sri Lanka and provide for a more supportive environment for companies operating in the country, as well as help the country push further for economic reforms.

The biggest detractor to Fund performance during the period was our holding in a Ctrip.com International convertible bond. Despite the recent weakness in Ctrip shares, we remain convinced that online travel will continue to experience higher-than-average growth in China, and we believe Ctrip, with its overwhelming majority market share, will be the main beneficiary of this secular trend.

Outlook:

Brexit has injected uncertainty in the markets. Unlike risks that are identifiable and quantifiable, uncertainties are unknown and not measurable. In the absence of known near- term catalysts, markets will be very volatile. The silver lining is that Brexit is not likely to pose systematic risk, but instead more idiosyncratic risks to countries and sectors most exposed to the U.K. and Europe. As such, we believe Asia fixed income provides a relative safe haven to most other developed and emerging markets.

The easing bias of central banks will help mitigate risks of rising defaults. Prudent carry strategies such as Asia high yield continue to be attractive. Entering at current levels has historically resulted in gains as long as investors have an investment horizon greater than two years.

Historically, credit cycles have lasted eight to nine years, and with just over seven years having passed since the Global Financial Crisis-driven peak in corporate defaults, we expect that, over the medium term, the credit cycle is likely to turn. With this in mind, fundamental credit analysis is key as we believe the market will continue to reward prudent capital structures that are consistent with a company’s industry and strategy, and punish poor ones, driving increased dispersion in the credit market. As such, we seek to limit exposure to issuers with near-term financing needs as tight liquidity conditions may shut some issuers completely out of the market. Based on history, we believe current spread levels compensate investors who have a minimum two-year holding period for the risk that the credit cycle turns.

No doubt we are in a period of heightened volatility, driven by uncertainty in the path of U.S. rate hikes, Europe’s large dispersion in growth prospects, the extraordinary easing policies of the Bank of Japan, and, last but not least, China’s slowing growth, which has negatively impacted commodities. Despite that, we believe much of the downside risks have been priced in, and think Asian bonds may offer better value than they have in the last few years. It takes a lot of intestinal fortitude to buy when most are selling. But at today’s prices, we believe there is more room for upside potential than downside for investors with a long-term investment horizon.

Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. Investing in emerging markets involves different and greater risks, as these countries are substantially smaller, less liquid and more volatile than securities markets in more developed markets.

| | | | |

| |

| CURRENCY ALLOCATION (%)7,8 | |

| U.S. Dollar (USD) | | | 87.2 | |

| Hong Kong Dollar (HKD) | | | 4.3 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)7,8,9 | |

| China/Hong Kong | | | 42.6 | |

| Indonesia | | | 28.7 | |

| Sri Lanka | | | 8.7 | |

| Pakistan | | | 4.9 | |

| Philippines | | | 3.3 | |

| Vietnam | | | 3.2 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

| | | | |

| |

| SECTOR ALLOCATION (%)7,8 | |

| Financials | | | 30.0 | |

| Consumer Discretionary | | | 16.5 | |

| Foreign Government Bonds | | | 15.1 | |

| Telecommunication Services | | | 8.1 | |

| Information Technology | | | 6.3 | |

| Materials | | | 4.8 | |

| Consumer Staples | | | 4.3 | |

| Industrials | | | 3.3 | |

| Utilities | | | 3.0 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)7,8 | |

| Non-Convertible Corporate Bonds | | | 58.5 | |

| Convertible Corporate Bonds | | | 17.8 | |

| Government Bonds | | | 15.1 | |

| Cash and Other Assets, Less Liabilities | | | 8.6 | |

| 7 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent; the values may not sum to 100% due to rounding. |

| 8 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 9 | Not all countries where the Fund may invest are included in the benchmark index. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 13 | |

Matthews Asia Credit Opportunities Fund

June 30, 2016

Schedule of Investmentsa (unaudited)

NON-CONVERTIBLE CORPORATE BONDS: 58.5%

| | | | | | | | |

| | | Face Amount* | | | Value | |

| CHINA/HONG KONG: 29.7% | | | | | | | | |

China Hongqiao Group, Ltd.

6.875%, 05/03/18 | | | 600,000 | | | | $609,719 | |

HSBC Holdings PLCb

6.375%, 12/29/49 | | | 600,000 | | | | 571,500 | |

Standard Chartered PLCb

6.500%, 12/29/49 | | | 600,000 | | | | 550,500 | |

Shimao Property Holdings, Ltd.

8.125%, 01/22/21 | | | 400,000 | | | | 441,968 | |

KWG Property Holding, Ltd.

8.975%, 01/14/19 | | | 400,000 | | | | 426,377 | |

Unigroup International Holdings, Ltd.

6.000%, 12/10/20 | | | 400,000 | | | | 417,811 | |

MCE Finance, Ltd.

5.000%, 02/15/21 | | | 400,000 | | | | 395,810 | |

Wynn Macau, Ltd.

5.250%, 10/15/21 | | | 400,000 | | | | 389,120 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 3,802,805 | |

| | | | | | | | |

| | | | | | | | |

| INDONESIA: 20.5% | | | | | | | | |

MPM Global Pte, Ltd.

6.750%, 09/19/19 | | | 600,000 | | | | 620,242 | |

Jababeka International BV

7.500%, 09/24/19 | | | 400,000 | | | | 418,870 | |

Theta Capital Pte, Ltd.

7.000%, 05/16/19 | | | 400,000 | | | | 414,889 | |

TBG Global Pte, Ltd.

5.250%, 02/10/22 | | | 400,000 | | | | 406,273 | |

Alam Synergy Pte, Ltd.

6.950%, 03/27/20 | | | 400,000 | | | | 391,000 | |

PT Perusahaan Listrik Negara

5.250%, 10/24/42 | | | 400,000 | | | | 383,844 | |

| | | | | | | | |

Total Indonesia | | | | | | | 2,635,118 | |

| | | | | | | | |

| | | | | | | | |

| SRI LANKA: 5.0% | | | | | | | | |

National Savings Bank

8.875%, 09/18/18 | | | 600,000 | | | | 639,348 | |

| | | | | | | | |

Total Sri Lanka | | | | | | | 639,348 | |

| | | | | | | | |

| | | | | | | | |

| PHILIPPINES: 3.3% | | | | | | | | |

ICTSI Treasury BV

5.875%, 09/17/25 | | | 400,000 | | | | 427,000 | |

| | | | | | | | |

Total Philippines | | | | | | | 427,000 | |

| | | | | | | | |

| | | | | | | | |

TOTAL NON-CONVERTIBLE CORPORATE BONDS | | | | 7,504,271 | |

| | | | | | | | |

(Cost $7,403,146) | | | | | | | | |

| | | | | | | | |

CONVERTIBLE CORPORATE BONDS: 17.8% | |

| CHINA/HONG KONG: 12.9% | | | | | | | | |

Biostime International Holdings, Ltd., Cnv. | | | | | |

0.000%, 02/20/19 | | | HKD 4,000,000 | | | | 547,815 | |

Ctrip.com International, Ltd., Cnv.

1.000%, 07/01/20 | | | 400,000 | | | | 421,000 | |

SouFun Holdings, Ltd., Cnv.

2.000%, 12/15/18 | | | 400,000 | | | | 392,500 | |

Vipshop Holdings Ltd., Cnv.

1.500%, 03/15/19 | | | 300,000 | | | | 294,750 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 1,656,065 | |

| | | | | | | | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| INDONESIA: 4.9% | | | | | | | | |

Delta Investment Horizon International, Ltd., Cnv. | | | | | |

3.000%, 05/26/20 | | | 700,000 | | | | $637,000 | |

| | | | | | | | |

Total Indonesia | | | | | | | 637,000 | |

| | | | | | | | |

| | | | | | | | |

TOTAL CONVERTIBLE CORPORATE BONDS | | | | 2,293,065 | |

| | | | | | | | |

(Cost $2,295,758) | | | | | | | | |

| | | | | | | | |

FOREIGN GOVERNMENT OBLIGATIONS: 15.1% | | | | | |

| PAKISTAN: 4.9% | | | | | | | | |

Pakistan Government Bond

8.250%, 04/15/24 | | | 600,000 | | | | 631,041 | |

| | | | | | | | |

Total Pakistan | | | | | | | 631,041 | |

| | | | | | | | |

| | | | | | | | |

| SRI LANKA: 3.7% | | | | | | | | |

Sri Lanka Government Bond

6.125%, 06/03/25 | | | 500,000 | | | | 467,071 | |

| | | | | | | | |

Total Sri Lanka | | | | | | | 467,071 | |

| | | | | | | | |

| | | | | | | | |

| INDONESIA: 3.3% | | | | | | | | |

Republic of Indonesia

5.125%, 01/15/45 | | | 400,000 | | | | 424,375 | |

| | | | | | | | |

Total Indonesia | | | | | | | 424,375 | |

| | | | | | | | |

| | | | | | | | |

| VIETNAM: 3.2% | | | | | | | | |

Socialist Republic of Vietnam

4.800%, 11/19/24 | | | 400,000 | | | | 411,604 | |

| | | | | | | | |

Total Vietnam | | | | | | | 411,604 | |

| | | | | | | | |

| | | | | | | | |

TOTAL FOREIGN GOVERNMENT OBLIGATIONS | | | | 1,934,091 | |

| | | | | | | | |

(Cost $1,917,752) | | | | | | | | |

| | | | | | | | |

| TOTAL INVESTMENTS: 91.4% | | | | | | | 11,731,427 | |

(Cost $11,616,656c) | | | | | | | | |

| | | | | | | | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 8.6% | | | | | | | 1,096,959 | |

| | | | | | | | |

| | |

NET ASSETS: 100.0% | | | | | | | $12,828,386 | |

| | | | | | | | |

| a | Certain securities were fair valued under the valuation polices approved by the Board of Trustees (Note 2-A). |

| b | Variable rate security. The rate represents the rate in effect at June 30, 2016. |

| c | Cost for federal income tax purposes is $11,616,656 and net unrealized appreciation consists of: |

| | | | |

Gross unrealized appreciation | | | $161,991 | |

Gross unrealized depreciation | | | (47,220 | ) |

| | | | |

Net unrealized appreciation | | | $114,771 | |

| | | | |

| * | All values are in USD unless otherwise noted. |

See accompanying notes to financial statements.

| | | | |

| PORTFOLIO MANAGERS |

| Robert J. Horrocks, PhD | | |

Lead Manager | | |

| Kenneth Lowe, CFA | | |

Lead Manager | | | | |

|

| FUND FACTS |

| | | Investor | | Institutional |

Ticker | | MACSX | | MICSX |

CUSIP | | 577130206 | | 577130842 |

Inception | | 9/12/94 | | 10/29/10 |

NAV | | $17.01 | | $16.99 |

Initial Investment | | $2,500 | | $3 million |

Gross Expense Ratio1 | | 1.09% | | 0.92% |

Portfolio Statistics | | | | |

Total # of Positions | | 58 |

Net Assets | | $3.0 billion |

Weighted Average Market Cap | | $33.5 billion |

Portfolio Turnover2 | | 16.48% |