UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-08510

Matthews International Funds

(Exact name of registrant as specified in charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of principal executive offices) (Zip code)

William J. Hackett, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and address of agent for service)

Registrant’s telephone number, including area code:415-788-7553

Date of fiscal year end: December 31

Date of reporting period: June 30, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Matthews Asia Funds | Semi-Annual Report

June 30, 2019 | matthewsasia.com

ASIA FIXED INCOME STRATEGIES

Matthews Asia Strategic Income Fund

Matthews Asia Credit Opportunities Fund

ASIA GROWTH AND INCOME STRATEGIES

Matthews Asian Growth and Income Fund

Matthews Asia Dividend Fund

Matthews China Dividend Fund

ASIA VALUE STRATEGY

Matthews Asia Value Fund

ASIA GROWTH STRATEGIES

Matthews Asia Growth Fund

Matthews Pacific Tiger Fund

Matthews Asia ESG Fund

Matthews Emerging Asia Fund

Matthews Asia Innovators Fund

Matthews China Fund

Matthews India Fund

Matthews Japan Fund

Matthews Korea Fund

ASIA SMALL COMPANY STRATEGIES

Matthews Asia Small Companies Fund

Matthews China Small Companies Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual andsemi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website matthewsasia.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 800.789.ASIA (2742).

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with a Fund, you can call 800.789.ASIA (2742) to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held directly with Matthews Asia Funds.

Investor Class Performance and Expenses(June 30, 2019)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Investor Class | | | | | Average Annual Total Return† | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement* | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Strategic Income Fund (MAINX) | | | 7.76% | | | | 3.85% | | | | n.a. | | | | 4.73% | | | | 11/30/11 | | | | 1.15% | | | | 1.15% | 1 |

| | | | | | | |

Asia Credit Opportunities Fund (MCRDX) | | | 9.26% | | | | n.a. | | | | n.a. | | | | 5.90% | | | | 4/29/16 | | | | 1.37% | | | | 1.15% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

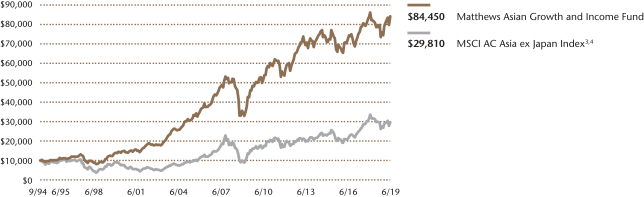

Asian Growth and Income Fund (MACSX) | | | 7.20% | | | | 2.34% | | | | 7.08% | | | | 8.99% | | | | 9/12/94 | | | | 1.08% | | | | 1.08% | |

| | | | | | | |

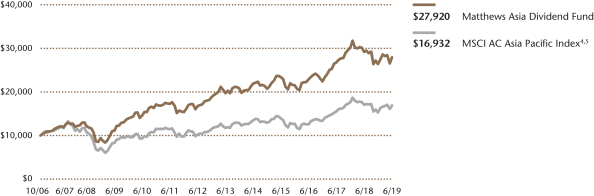

Asia Dividend Fund (MAPIX) | | | -4.35% | | | | 4.96% | | | | 9.65% | | | | 8.45% | | | | 10/31/06 | | | | 1.02% | | | | 1.01% | 2 |

| | | | | | | |

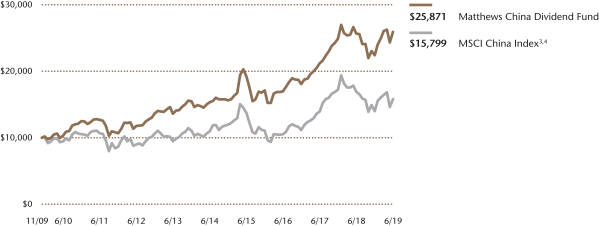

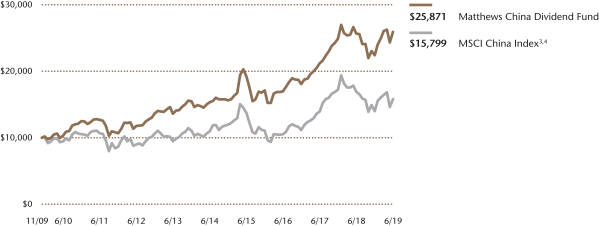

China Dividend Fund (MCDFX) | | | 0.86% | | | | 11.07% | | | | n.a. | | | | 10.43% | | | | 11/30/09 | | | | 1.15% | | | | 1.15% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

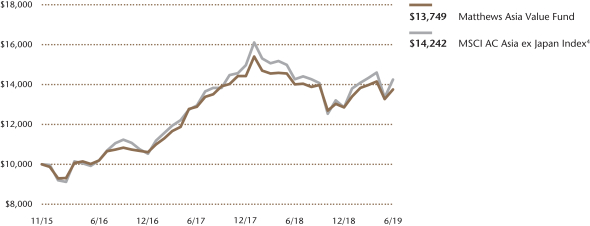

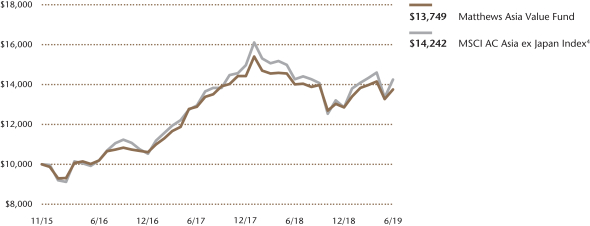

Asia Value Fund (MAVRX) | | | -1.78% | | | | n.a. | | | | n.a. | | | | 9.29% | | | | 11/30/15 | | | | 1.77% | | | | 1.50% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

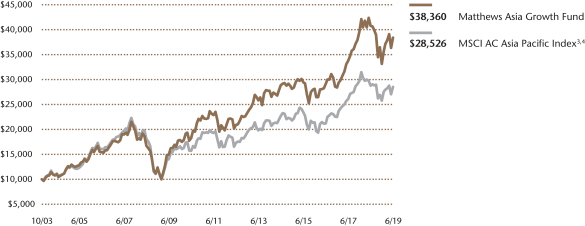

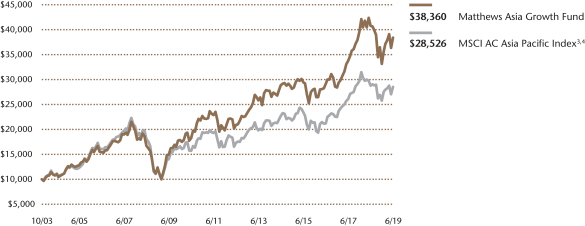

Asia Growth Fund (MPACX) | | | -5.84% | | | | 5.91% | | | | 9.89% | | | | 8.96% | | | | 10/31/03 | | | | 1.10% | | | | 1.10% | |

| | | | | | | |

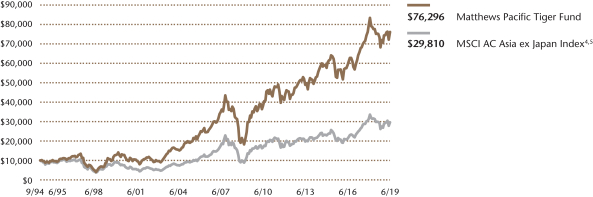

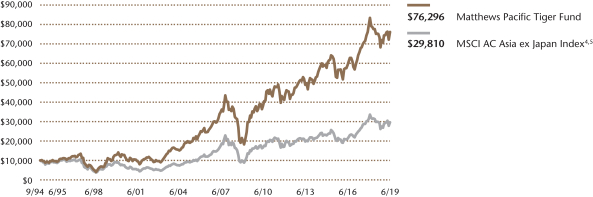

Pacific Tiger Fund (MAPTX) | | | 1.14% | | | | 5.95% | | | | 9.83% | | | | 8.54% | | | | 9/12/94 | | | | 1.07% | | | | 1.04% | 2 |

| | | | | | | |

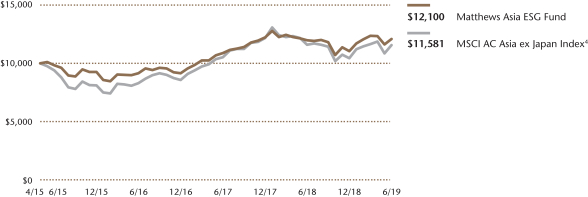

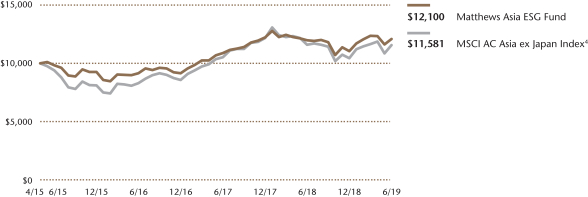

Asia ESG Fund (MASGX) | | | 1.05% | | | | n.a. | | | | n.a. | | | | 4.68% | | | | 4/30/15 | | | | 2.20% | | | | 1.50% | 3 |

| | | | | | | |

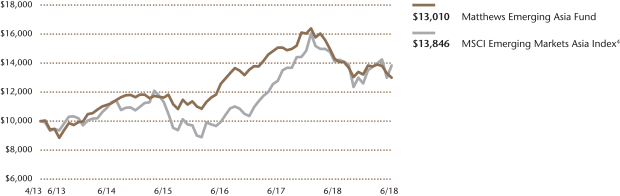

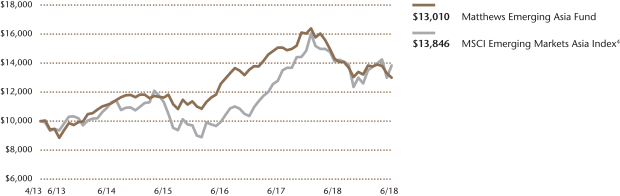

Emerging Asia Fund (MEASX) | | | -9.06% | | | | 3.17% | | | | n.a. | | | | 4.36% | | | | 4/30/13 | | | | 1.66% | | | | 1.48% | 3 |

| | | | | | | |

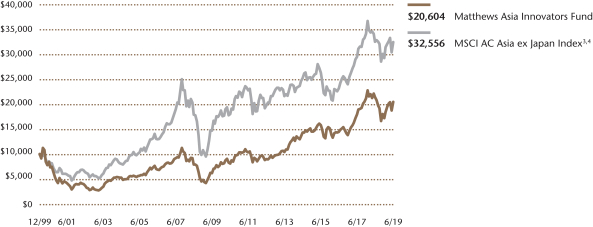

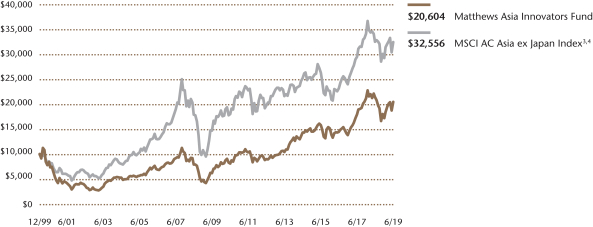

Asia Innovators Fund (MATFX) | | | -4.36% | | | | 7.34% | | | | 12.51% | | | | 3.77% | | | | 12/27/99 | | | | 1.19% | | | | 1.19% | |

| | | | | | | |

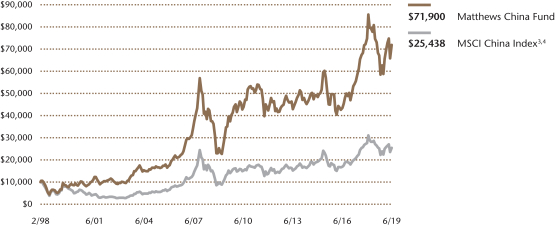

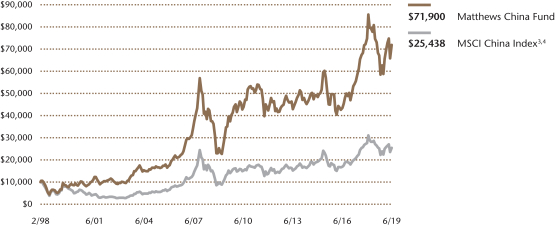

China Fund (MCHFX) | | | -3.79% | | | | 8.43% | | | | 7.42% | | | | 9.68% | | | | 2/19/98 | | | | 1.10% | | | | 1.10% | |

| | | | | | | |

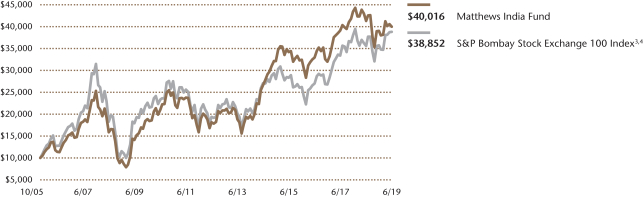

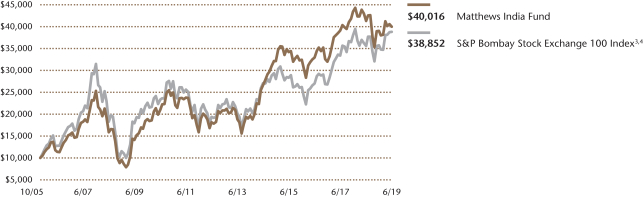

India Fund (MINDX) | | | -3.28% | | | | 8.43% | | | | 11.02% | | | | 10.68% | | | | 10/31/05 | | | | 1.09% | | | | 1.09% | |

| | | | | | | |

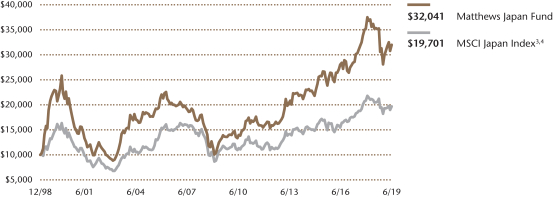

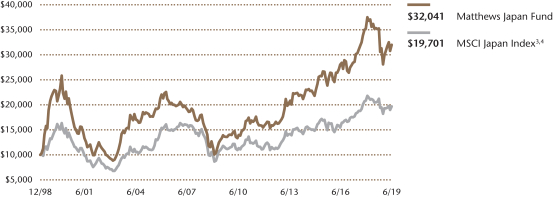

Japan Fund (MJFOX) | | | -9.27% | | | | 6.77% | | | | 9.54% | | | | 5.85% | | | | 12/31/98 | | | | 0.91% | | | | 0.91% | |

| | | | | | | |

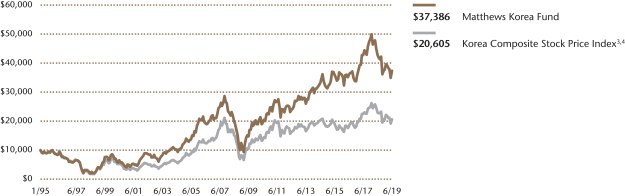

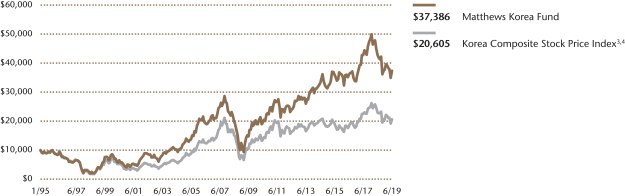

Korea Fund (MAKOX) | | | -12.65% | | | | 2.41% | | | | 9.77% | | | | 5.53% | | | | 1/3/95 | | | | 1.14% | | | | 1.14% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

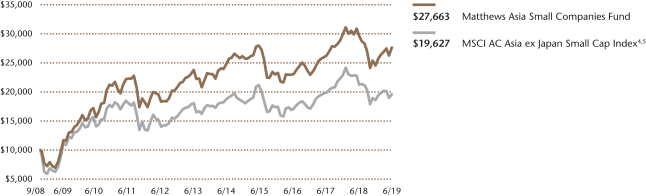

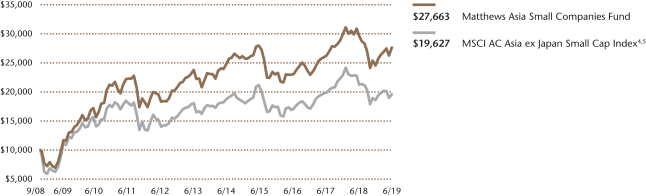

Asia Small Companies Fund (MSMLX) | | | -6.71% | | | | 1.45% | | | | 9.06% | | | | 9.89% | | | | 9/15/08 | | | | 1.51% | | | | 1.46% | 3 |

| | | | | | | |

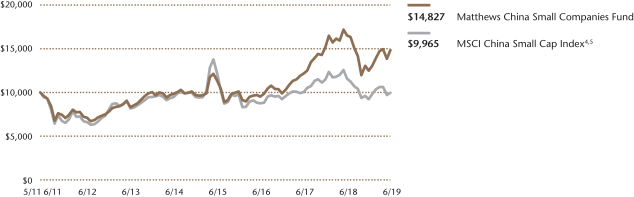

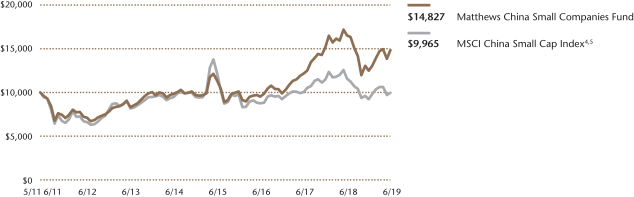

China Small Companies Fund (MCSMX) | | | -10.36% | | | | 8.51% | | | | n.a. | | | | 4.99% | | | | 5/31/11 | | | | 1.97% | | | | 1.50% | 3 |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| * | These figures are from the Funds’ prospectus dated as of April 30, 2019, and may differ from the actual expense ratios for fiscal year 2019, as shown in the financial highlights section of this report. |

| 1 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. Any amount waived with respect to the Fund pursuant to this agreement is not subject to recoupment. This agreement will remain in place until April 30, 2020 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2020 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 1.25% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2020 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

Institutional Class Performance and Expenses(June 30, 2019)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Institutional Class | | | | | Average Annual Total Return† | | | Inception

Date | | | Prospectus

Expense

Ratios* | | | Prospectus

Expense Ratios

after Fee Waiver

and Expense

Reimbursement* | |

| | 1 year | | | 5 years | | | 10 years | | | Since

Inception | |

ASIA FIXED INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Strategic Income Fund (MINCX) | | | 8.06% | | | | 4.12% | | | | n.a. | | | | 4.97% | | | | 11/30/11 | | | | 0.96% | | | | 0.90% | 1 |

| | | | | | | |

Asia Credit Opportunities Fund (MICPX) | | | 9.64% | | | | n.a. | | | | n.a. | | | | 6.16% | | | | 4/29/16 | | | | 1.18% | | | | 0.90% | 1 |

ASIA GROWTH AND INCOME STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asian Growth and Income Fund (MICSX) | | | 7.34% | | | | 2.49% | | | | n.a. | | | | 4.41% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | |

| | | | | | | |

Asia Dividend Fund (MIPIX) | | | -4.25% | | | | 5.07% | | | | n.a. | | | | 6.29% | | | | 10/29/10 | | | | 0.91% | | | | 0.90% | 2 |

| | | | | | | |

China Dividend Fund (MICDX) | | | 0.99% | | | | 11.24% | | | | n.a. | | | | 9.46% | | | | 10/29/10 | | | | 1.01% | | | | 1.01% | |

ASIA VALUE STRATEGY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Value Fund (MAVAX) | | | -1.48% | | | | n.a. | | | | n.a. | | | | 9.58% | | | | 11/30/15 | | | | 1.54% | | | | 1.25% | 3 |

ASIA GROWTH STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Growth Fund (MIAPX) | | | -5.65% | | | | 6.11% | | | | n.a. | | | | 6.79% | | | | 10/29/10 | | | | 0.93% | | | | 0.93% | |

| | | | | | | |

Pacific Tiger Fund (MIPTX) | | | 1.31% | | | | 6.13% | | | | n.a. | | | | 6.12% | | | | 10/29/10 | | | | 0.90% | | | | 0.88% | 2 |

| | | | | | | |

Asia ESG Fund (MISFX) | | | 1.23% | | | | n.a. | | | | n.a. | | | | 4.93% | | | | 4/30/15 | | | | 2.01% | | | | 1.25% | 3 |

| | | | | | | |

Emerging Asia Fund (MIASX) | | | -8.76% | | | | 3.42% | | | | n.a. | | | | 4.61% | | | | 4/30/13 | | | | 1.50% | | | | 1.25% | 3 |

| | | | | | | |

Asia Innovators Fund (MITEX) | | | -4.11% | | | | 7.55% | | | | n.a. | | | | 11.38% | | | | 4/30/13 | | | | 1.02% | | | | 1.02% | |

| | | | | | | |

China Fund (MICFX) | | | -3.55% | | | | 8.60% | | | | n.a. | | | | 3.75% | | | | 10/29/10 | | | | 0.91% | | | | 0.91% | |

| | | | | | | |

India Fund (MIDNX) | | | -3.13% | | | | 8.64% | | | | n.a. | | | | 5.53% | | | | 10/29/10 | | | | 0.90% | | | | 0.90% | |

| | | | | | | |

Japan Fund (MIJFX) | | | -9.22% | | | | 6.86% | | | | n.a. | | | | 9.21% | | | | 10/29/10 | | | | 0.85% | | | | 0.85% | |

| | | | | | | |

Korea Fund (MIKOX) | | | -12.46% | | | | 2.59% | | | | n.a. | | | | 6.08% | | | | 10/29/10 | | | | 1.02% | | | | 1.02% | |

ASIA SMALL COMPANY STRATEGIES | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Asia Small Companies Fund (MISMX) | | | -6.54% | | | | 1.67% | | | | n.a. | | | | 3.20% | | | | 4/30/13 | | | | 1.37% | | | | 1.25% | 3 |

| | | | | | | |

China Small Companies Fund (MICHX) | | | -10.08% | | | | n.a. | | | | n.a. | | | | 2.62% | | | | 11/30/17 | | | | 1.79% | | | | 1.25% | 3 |

| † | Annualized performance for periods of at least one year, otherwise cumulative. |

| * | These figures are from the Funds’ prospectus dated as of April 30, 2019, and may differ from the actual expense ratios for fiscal year 2019, as shown in the financial highlights section of this report. |

| 1 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90%. Any amount waived with respect to the Fund pursuant to this agreement is not subject to recoupment. This agreement will remain in place until April 30, 2020 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 2 | Matthews has contractually agreed to waive a portion of its advisory fee and administrative and shareholder services fee if the Fund’s average daily net assets are over $3 billion, as follows: for every $2.5 billion average daily net assets of the Fund that are over $3 billion, the advisory fee rate and the administrative and shareholder services fee rate for the Fund with respect to such excess average daily net assets will be each reduced by 0.01%, in each case without reducing such fee rate below 0.00%. Any amount waived by Matthews pursuant to this agreement may not be recouped by Matthews. This agreement will remain in place until April 30, 2020 and may be terminated (i) at any time by the Board of Trustees upon 60 days’ prior written notice to Matthews; or (ii) by Matthews at the annual expiration date of the agreement upon 60 days’ prior written notice to the Trust, in each case without payment of any penalty. |

| 3 | Matthews has contractually agreed to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 1.25%. If the operating expenses fall below the expense limitation in a year within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2020 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

Past Performance: All performance quoted in this report is past performance and is no guarantee of future results. Investment return and principal value will fluctuate with changing market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the returns quoted. If certain of the Funds’ fees and expenses had not been waived, returns would have been lower. For the Funds’ most recent month-end performance, please call 800.789.ASIA (2742) or visit matthewsasia.com.

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 2 | |

Contents

Cover photo: Chinese New Year lantern and gold coin decorations along the Hong Kong harbor.

This report has been prepared for Matthews International Funds (d/b/a Matthews Asia Funds) shareholders. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current Matthews Asia Funds prospectus, which contains more complete information about the Funds’ investment objectives, risks and expenses. Additional copies of the prospectus or summary prospectus may be obtained at matthewsasia.com. Please read the prospectus carefully before you invest or send money.

The views and opinions in this report were current as of June 30, 2019. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of a Fund’s future investment intent. Current and future portfolio holdings are subject to risk.

Statements of fact are from sources considered reliable, but neither the Funds nor the Investment Advisor makes any representation or guarantee as to their completeness or accuracy.

Investment Risk: Mutual fund shares are not deposits or obligations of, or guaranteed by, any depositary institution. Shares are not insured by the FDIC, Federal Reserve Board or any government agency and are subject to investment risks, including possible loss of principal amount invested. Investing in international and emerging markets may involve additional risks, such as social and political instability, market illiquidity, exchange-rate fluctuations, a high level of volatility and limited regulation. Fixed income investments are subject to additional risks, including, but not limited to, interest rate, credit and inflation risks. In addition, single-country and sector funds may be subject to a higher degree of market risk than diversified funds because of a concentration in a specific industry, sector or geographic location. Investing in small and mid-size companies is more risky than investing in large companies as they may be more volatile and less liquid than larger companies. Please see the Funds’ Prospectuses and Statement of Additional Information for more risk disclosure.

Message to Shareholders from the Investment Advisor

Dear Valued Investors,

In many respects, the environment for investment has not really improved markedly since the start of the year. Trade tensions linger. Global indicators have weakened. Political tensions have intensified. Only the U.S. remains a bright spot—that perfect mix of good economic growth numbers, low inflation and (hurrah!) potential interest rate cuts to boot.

All of this just drains the appetite of investors for Asia’s equity and bond markets. Everywhere I go, at every conference around the world it seems, Asia remains a top “intended” destination for new funds. And yet for the most part, industry flows suggest that few people are actually acting on their plans.

That is hardly surprising—Asia’s reputation for volatility, the conventional wisdom that it is an export economy, the reticence of Asia’s policymakers to stimulate in a strong dollar environment, and the supercharged (by tax breaks and low wage growth) earnings growth in the U.S. all inveigh against asset allocators making the courageous decision to move funds across the Pacific. After all, who wants to be courageous in this atmosphere? As one client with a flair for humorous exposition told me recently: “It neverfeels good to buy China.”

I think he was right. What we are up against is primarily sentiment. I don’t want to downplay the trade war, the earnings issue, or the growth environment. However, market reactions to tweets on trade are out of proportion to the actual effect on GDP and earnings. Valuations suggest that the current pro-capitalist/anti-labor policies can persist in the U.S. without an economic or political backlash, and a belief that Asia’s policymakers will remain tight-fisted on fiscal and monetary policy assumes a strong dollar regime will continue, which is at odds with the stated intention of the administration to reduce the trade deficit. It seems to me to just be a case of the market justifying “more of the same” and to follow the momentum trade.

That is fine. However, perhaps because of our focus on Asia, we see things slightly differently. We see the steady creep of China’s economic influence through ASEAN and Central Europe, even now, bringing in Italy and Greece into the fold. We see the adjustments being made at the corporate level to circumvent the tariffs imposed by the U.S., and we see the acceleration of the buildout of the manufacturing base in the region. We see a region, in short, adapting to circumstance: fluid, and dynamic. We see a region where borders are being broken down by closer economic cooperation, not built up by economic protectionism.

It’s hard to argue with momentum in the markets—the S&P 500 Index is making new highs as I write this. But it does increasingly feel to me as if pressures are building up to force an inflection in world markets. I doubt a severe recession is in the offing (though I worry about a long stagnation in Europe), but I do think that markets are going to be shaken out of their complacency. It has been a long expansion, after all, and there is little room for policy error. I guess I am not the only one to feel this way and hence, the reticence of people to buy.

For us, the trade issues have offered up opportunities. This is not because we believe there will be a rapid and total resolution—tension will rumble on between the U.S. and China for many a year—but because of the lack of proportion in market movements relative to actual effects of policy. These opportunities are predominantly in China and mostly, though not exclusively, in domestic-demand stocks that were somewhat inexplicably caught up in the weak market sentiment. Indeed, despite the breathless headlines at times and the gladiatorial nature of some of the language, we retain a cool posture.

One thing is clear in the data. The effects of tariffs so far have been: 1) to reduce the trade deficit between the U.S. and China; 2) to increase the trade deficit between the

U.S. and the rest of Asia (plus Mexico); and to raise the prices of tariffed goods versus non-tariffed goods in the U.S. My interpretation of this is that Chinese manufacturers with factories in ASEAN and Mexico have been running their factories there on extra shifts and the corresponding increase in costs and inefficiencies has been largely borne by the U.S. consumer. The longer-term effects are likely to be simply to accelerate Chinese investment in these areas. And thus, trade wars, far from being easy to win, are complex and unpredictable events with winners and losers that are very different from what the protagonists might expect.

We remain, therefore, wedded to our cause. We are aware of the global macroeconomic risks but we are not paralyzed by them. Indeed, for such complex issues as this, there is perhaps more insight to be gained by talking to the companies who are “at the coal face” rather than trying to divine big trends from newspaper headlines. We will continue to follow where the pursuit of profit opportunity leads us, to be guided by the decisions of entrepreneurs, not by the pronouncements of politicians, and to respect the price signals of the market.

There remains ample scope for corporates to grow profitably by meeting the needs of the domestic consumer. There is plenty of opportunity in economic and political cooperation with neighbors to drive down costs and ramp up efficiency in production and to improve the region’s living standards together. A few years ago, it might have seemed crazy that the U.S. would turn its back on globalization and that China would eagerly take up the role of champion of cross-border economic cooperation. But that is where we now are—the leadership of the global economy may already have passed from one superpower to the other.

With this strategic focus, the future of Asia looks bright beyond the headlines of the day—we continue to target investments in the domestic companies that are driving and profiting from the region’s creation of wealth.

Robert Horrocks, PhD

Chief Investment Officer

Matthews International Capital Management, LLC

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 5 | |

| | | | |

| PORTFOLIO MANAGERS |

| |

| Teresa Kong, CFA | | |

Lead Manager | | |

| |

| Satya Patel | | Wei Zhang |

Co-Manager | | Co-Manager |

|

| FUND FACTS |

| | |

| | | Investor | | Institutional |

Ticker | | MAINX | | MINCX |

CUSIP | | 577125503 | | 577125602 |

Inception | | 11/30/11 | | 11/30/11 |

NAV | | $10.92 | | $10.93 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.15% | | 0.96% |

After Fee Waiver and Reimbursement2 | | 1.15% | | 0.90% |

Portfolio Statistics | | | | |

Total # of Positions | | 36 |

Net Assets | | $113.6 million |

Modified Duration3 | | 5.2 |

Portfolio Turnover4 | | 82.32% |

Benchmark | | |

Markit iBoxx Asian Local Bond Index* |

OBJECTIVE

Total return over the long term with an emphasis on income.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in income-producing securities including, but not limited to, dividend paying equity securities, and debt and debt-related instruments issued by governments, quasi-governmental entities, supra-national institutions, and companies in Asia. Asia consists of all countries and markets in Asia, such as China and India, and includes developed, emerging, and frontier countries and markets in the Asian region. Investments may be denominated in any currency, and may represent any part of a company’s capital structure from debt to equity or with features of both.

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited)

For the first half of 2019, the Matthews Asia Strategic Income Fund returned 8.39% (Investor Class) and 8.63% (Institutional Class), while its benchmark, the Markit iBoxx Asian Local Bond Index, returned 5.27%. For the quarter ending June 30, the Fund returned 2.56% (Investor Class) and 2.72% (Institutional Class) compared to the benchmark return of 2.11% over the same period.

Market Environment:

The combination of supportive central banks and positive trade news led to a constructive environment for Asian fixed income over the second quarter, with Asian credit, currencies and rates all performing positively. The U.S. Federal Reserve, the European Central Bank and emerging market central banks all moved in a dovish direction during the quarter, seemingly ending the momentum for higher rates around the world. Meanwhile, the G-20 Summit ended without an escalation in the U.S.–China trade war, at least temporarily removing the risk of a further tariff shock from the global economy.

While the quarter was positive overall, geopolitics led to unexpected volatility. The quarter began with a positive tone as data from the U.S. and China implied that fears of a synchronized growth slowdown may have been overdone. Optimism evaporated in early May, however, when President Trump threatened to raise tariffs on all Chinese imports, including consumer-related goods, and attempted to limit U.S. companies from doing business with Chinese tech giant Huawei. By the end of May, equities markets had relinquished most of their year-to-date gains.

For Asia credit, this caused high-yield spreads to widen by about 40 basis points during May and 35 basis points over the quarter. The rally in U.S. rates more than offset this modest spread widening, so total return from credit bonds was positive for the quarter.

Asian local rates generally followed U.S. rates lower over the quarter, albeit to a lesser degree. Asia currency returns were mixed, with some currencies such as the Thai baht, the Philippine peso and the Indonesian rupiah outperforming the U.S. dollar, while others, notably the Chinese renminbi, the Korean won, and the Malaysian ringgit underperforming the U.S. dollar.

Performance Contributors and Detractors:

During the first half and the second quarter, the biggest contributor to Fund performance was the portfolio’s overweight in Asian USD high-yield corporate bonds, which delivered positive performance. Within high-yield corporate bonds, the strongest contributors over the quarter included PT Perusahaan Listrik Negara, a government-owned Indonesian utility, Tata Steel (ABJA Investment Co.) and Indika Energy Capital III bonds. Our exposures to convertible bonds, including CP Foods Holdings, Weibo and Zhongsheng Group Holdings, also contributed strongly within corporate exposures. In addition, our exposure to the Vietnam government-backed Debt & Asset Trading Corp. contributed to outperformance.

The biggest detractors to our performance were our currency forward positions in the Korean won and the Chinese renminbi (RMB), both currencies that underperformed the U.S. dollar over the quarter. Other detractors to performance

(continued)

| * | The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. Any amount waived with respect to the Fund pursuant to this agreement is not subject to recoupment. This agreement will remain in place until April 30, 2020 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2018 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| PERFORMANCE AS OF JUNE 30, 2019 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns | | | | |

| | | 3 Months | | | YTD | | | 1 Year | | | 3 Years | | | 5 Years | | | Since

Inception | | | Inception

Date | |

| Investor Class (MAINX) | | | 2.56% | | | | 8.39% | | | | 7.76% | | | | 5.38% | | | | 3.85% | | | | 4.73% | | | | 11/30/11 | |

| Institutional Class (MINCX) | | | 2.72% | | | | 8.63% | | | | 8.06% | | | | 5.69% | | | | 4.12% | | | | 4.97% | | | | 11/30/11 | |

| Markit iBoxx Asian Local Bond Index5 | | | 2.11% | | | | 5.27% | | | | 8.42% | | | | 3.33% | | | | 2.67% | | | | 2.79% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth more or less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-end performance visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| INCOME DISTRIBUTION HISTORY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2019 | | | | | | 2018 | |

| | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MAINX) | | $ | 0.08 | | | $ | 0.10 | | | | n.a. | | | | n.a. | | | $ | 0.19 | | | | | | | $ | 0.12 | | | $ | 0.10 | | | $ | 0.07 | | | $ | 0.00 | | | $ | 0.29 | |

| Inst’l (MINCX) | | $ | 0.09 | | | $ | 0.11 | | | | n.a. | | | | n.a. | | | $ | 0.20 | | | | | | | $ | 0.13 | | | $ | 0.11 | | | $ | 0.08 | | | $ | 0.00 | | | $ | 0.31 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

| | | |

30-DAY YIELD: Investor Class: 4.38% (4.35% excluding waivers) Institutional Class: 4.63% (4.54% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/19, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 5.08% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

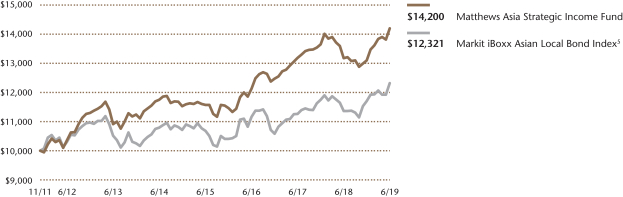

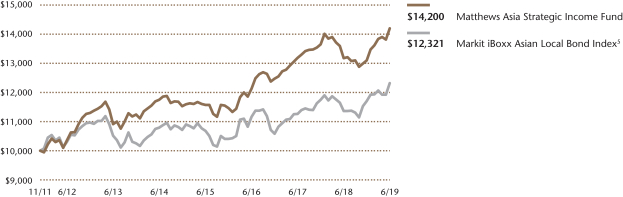

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from HSBC, Markit iBoxx and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 88 for index definitions. The Index performance reflects the returns of the discontinued predecessor HSBC Asian Local Bond Index up to December 31, 2012 and the returns of the successor Markit iBoxx Asian Local Bond Index thereafter. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Debt and Asset Trading Corp., 1.000%, 10/10/2025 | | Financials | | U.S. Dollar | | | 4.6% | |

| HSBC Holdings PLC, 6.375%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.5% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.4% | |

| Wanda Properties International Co., Ltd., 7.250%, 01/29/2024 | | Real Estate | | U.S. Dollar | | | 4.4% | |

| Sri Lanka Government Bond, 7.850%, 03/14/2029 | | Foreign Government Bonds | | U.S. Dollar | | | 4.1% | |

| SoftBank Group Corp., 6.000%, 07/19/2049 | | Communication Services | | U.S. Dollar | | | 4.1% | |

| Shriram Transport Finance Co., Ltd., 5.700%, 02/27/2022 | | Financials | | U.S. Dollar | | | 3.9% | |

| PB International BV, 7.625%, 01/26/2022 | | Consumer Discretionary | | U.S. Dollar | | | 3.9% | |

| CIFI Holdings Group Co., Ltd., 6.550%, 03/28/2024 | | Real Estate | | U.S. Dollar | | | 3.9% | |

| ABJA Investment Co. Pte, Ltd., 5.450%, 01/24/2028 | | Materials | | U.S. Dollar | | | 3.7% | |

| % OF ASSETS IN TOP TEN | | | | | | | 41.5% | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 7 | |

| | | | |

| |

| CURRENCY ALLOCATION (%)6,7 | |

| US Dollar | | | 62.1 | |

| Singapore Dollar | | | 5.9 | |

| China Reminbi | | | 5.9 | |

| South Korean Won | | | 5.4 | |

| Indonesian Rupiah | | | 5.0 | |

| Thai Baht | | | 4.3 | |

| Indian Rupee | | | 4.1 | |

| Phillipines Peso | | | 3.5 | |

| Malaysian Ringgit | | | 2.1 | |

| Vietnam Dong | | | 1.7 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)6,7,8 | |

| China/Hong Kong | | | 36.0 | |

| Indonesia | | | 18.8 | |

| India | | | 13.3 | |

| Vietnam | | | 6.3 | |

| Philippines | | | 5.9 | |

| Sri Lanka | | | 4.1 | |

| Japan | | | 4.1 | |

| Thailand | | | 3.1 | |

| Malaysia | | | 2.1 | |

| United States | | | 1.7 | |

| South Korea | | | 0.3 | |

| Cash and Other Assets, Less Liabilities | | | 4.5 | |

| | | | |

| |

| SECTOR ALLOCATION (%)6,7 | |

| Financials | | | 24.3 | |

| Real Estate | | | 20.7 | |

| Foreign Government Bonds | | | 16.5 | |

| Communication Services | | | 9.9 | |

| Utilities | | | 8.1 | |

| Consumer Discretionary | | | 3.9 | |

| Materials | | | 3.7 | |

| Consumer Staples | | | 3.1 | |

| Energy | | | 2.8 | |

| Industrials | | | 2.4 | |

| Cash and Other Assets, Less Liabilities | | | 4.5 | |

Please note: Foreign Government Bonds category includes Supranationals.

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)6,7 | |

| Non-Convertible Corporate Bonds | | | 69.4 | |

| Government Bonds | | | 21.1 | |

| Convertible Corporate Bonds | | | 5.1 | |

| Cash and Other Assets, Less Liabilities | | | 4.5 | |

| 6 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

| 7 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 8 | Not all countries where the Fund may invest are included in the benchmark index. |

Matthews Asia Strategic Income Fund

Portfolio Manager Commentary (unaudited) (continued)

included our convertible bond position in Ctrip.com International, Ltd., a Chinese online travel agency, as well as our holding in the RMB-denominated bonds of China Jinmao (Franshion Brilliant), a Chinese property developer.

Notable Portfolio Changes:

We made a number of changes to the portfolio in the second quarter, rotating out of shorter-duration bonds and bonds with higher equity beta, and adding longer-duration bonds and issues with asymmetric risk profiles.

Within corporate bonds, we initiated positions in two Indian issuers: Shriram Transport Finance, an Indian non-bank finance company that issued a U.S.-dollar bond with an attractive spread premium given the recent non-banking financial companies sector (NBFC) funding crisis; and Tata Steel (ABJA Investment), one of the world’s largest steel producers, where we gained exposure through a long-duration issue. We also initiated positions in two Chinese issuers: Logan Property Holdings, a top 20 developer that offered an attractive spread premium given its exposure to China’s Greater Bay Area, and to the technology firm Weibo via convertible bonds that were trading close to their lowest possible level, and which we saw as offering an asymmetric risk profile.

We increased overall duration in the portfolio to 4.5 years from 3.7 years by rotating out of short-duration bonds, including Aluminum Corporation of China (Chinalco Capital Holdings), Olam International and Krung Thai Bank Public, and also by adding longer-duration exposures. We also exited two bond holdings: Huaneng Hong Kong Capital and China Minmetals. Despite being perpetual bonds, they did not offer material duration due to the embedded fixed-to-floating coupon resets.

Outside of corporate bonds, we added to Indian duration via interest-rate swaps to take advantage of lower-than-expected growth and inflation in the country, which we expect to bring about rate cuts. We also added Malaysian government bond exposure given the country’s weak economy, attractive carry profile and as we believe the current market is underpricing the likelihood of rate cuts.

Finally on currency, we increased exposure to the U.S. dollar by cutting exposure to most Asian local currencies, with the Indian rupee and Malaysian ringgit being notable exceptions.

Outlook:

The U.S. and global economies both look to be late cycle, characterized by falling inflation and moderating GDP growth. Fed funds futures are pricing in two interest rate cuts by the Fed before the end of this year. Despite lackluster growth in the U.S., its equities continue to rally.

How is it possible that the bond markets are pricing such negativity while equities are so bullish? Our best explanation for this is that equity markets are pricing in perfect execution by the Fed. In other words, equities are expecting the Fed and other central banks to deliver sufficient rate cuts and loosen monetary policies to extend the current expansion.

Because few Asia government bond curves have fully priced in the dovish G-3 central banks, we maintain a long exposure to interest rate duration in Asia, where the bond markets have more room to rally. We expect that over the coming quarters, Asian central banks will become increasingly dovish, with their respective yield curves falling to price in more rate cuts. This means that even those central banks that may have been reluctant to cut should likely follow suit. We place the more-developed, lower-yielding countries like Thailand, South Korea and Malaysia solidly in that camp. Even the emerging Asian economies of India and Indonesia will have more room to cut rates given subdued domestic inflation.

Given our outlook, the biggest risk is that the equities markets are wrong. This would mean potential credit spread widening. However, in our base case, lower rates globally bodes well for credit spreads to remain stable.

Matthews Asia Strategic Income Fund

June 30, 2019

Schedule of Investmentsa(unaudited)

| | |

| NON-CONVERTIBLE CORPORATE BONDS: 69.4% | | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| | |

| CHINA/HONG KONG: 33.9% | | | | | | | | |

HSBC Holdings PLC 6.375%b, 03/30/25c | | | 4,900,000 | | | | $5,152,350 | |

| | |

Standard Chartered PLC

6.500%b, 04/02/20c,d | | | 4,950,000 | | | | 5,017,073 | |

| | |

Wanda Properties International Co., Ltd.

7.250%, 01/29/24d | | | 5,000,000 | | | | 4,981,250 | |

| | |

CIFI Holdings Group Co., Ltd.

6.550%, 03/28/24d | | | 4,500,000 | | | | 4,400,035 | |

| | |

Franshion Brilliant, Ltd.

5.750%b, 01/17/22c,d | | | 3,400,000 | | | | 3,231,578 | |

| | |

China Huaneng Group Co., Ltd.

3.950%, 04/21/26 | | | CNY 20,000,000 | | | | 2,862,712 | |

| | |

Logan Property Holdings Co., Ltd.

5.250%, 02/23/23d | | | 3,000,000 | | | | 2,862,354 | |

| | |

CITIC Telecom International Finance, Ltd.

6.100%, 03/05/25d | | | 2,300,000 | | | | 2,387,868 | |

| | |

KWG Group Holdings, Ltd.

5.875%, 11/10/24d | | | 2,600,000 | | | | 2,361,388 | |

| | |

KWG Group Holdings, Ltd.

7.875%, 09/01/23d | | | 2,050,000 | | | | 2,061,760 | |

| | |

CIFI Holdings Group Co., Ltd.

7.750%, 09/20/20d | | | CNY 12,000,000 | | | | 1,804,583 | |

| | |

Agricultural Bank of China, Ltd.

4.300%, 04/11/29d | | | CNY 10,000,000 | | | | 1,445,324 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 38,568,275 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDONESIA: 13.9% | | | | | | | | |

PB International BV 7.625%, 01/26/22d | | | 4,300,000 | | | | 4,452,483 | |

| | |

Listrindo Capital BV 4.950%, 09/14/26d | | | 3,500,000 | | | | 3,452,750 | |

| | |

Indika Energy Capital III Pte, Ltd.

5.875%, 11/09/24d | | | 3,300,000 | | | | 3,222,352 | |

| | |

PT Perusahaan Listrik Negara

5.250%, 05/15/47d | | | 2,700,000 | | | | 2,849,128 | |

| | |

Modernland Overseas Pte, Ltd.

6.950%, 04/13/24d | | | 1,900,000 | | | | 1,854,649 | |

| | | | | | | | |

Total Indonesia | | | | | | | 15,831,362 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDIA: 13.3% | | | | | | | | |

Shriram Transport Finance Co., Ltd.

5.700%, 02/27/22d | | | 4,400,000 | | | | 4,457,030 | |

| | |

ABJA Investment Co. Pte, Ltd.

5.450%, 01/24/28d | | | 4,440,000 | | | | 4,249,860 | |

| | |

Housing Development Finance Corp., Ltd.

9.000%, 11/29/28 | | | INR 190,000,000 | | | | 2,872,557 | |

| | |

ICICI Bank UK PLC 5.375%b, 09/26/28d | | | SGD 2,750,000 | | | | 2,054,532 | |

| | |

Bajaj Finance, Ltd., Series 246

8.538%, 06/07/22 | | | INR 100,000,000 | | | | 1,461,039 | |

| | | | | | | | |

Total India | | | | | | | 15,095,018 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| JAPAN: 4.1% | | | | | | | | |

SoftBank Group Corp.

6.000%b, 07/19/23c,d | | | 4,850,000 | | | | 4,631,750 | |

| | | | | | | | |

Total Japan | | | | | | | 4,631,750 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| PHILIPPINES: 2.5% | | | | | | | | |

Royal Capital BV 4.875%b, 05/05/24c,d | | | 2,800,000 | | | | 2,775,500 | |

| | | | | | | | |

Total Philippines | | | | | | | 2,775,500 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| | |

| UNITED STATES: 1.7% | | | | | | | | |

Sprint Communications, Inc.

6.000%, 11/15/22 | | | 1,863,000 | | | | $1,942,178 | |

| | | | | | | | |

Total United States | | | | | | | 1,942,178 | |

| | | | | | | | |

| | | | | | | | |

| | |

| TOTALNON-CONVERTIBLE CORPORATE BONDS | | | | 78,844,083 | |

| | | | | | | | |

(Cost $76,847,011) | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| FOREIGN GOVERNMENT OBLIGATIONS: 21.1% | |

| | | |

| VIETNAM: 6.3% | | | | | | | | |

Debt and Asset Trading Corp.

1.000%, 10/10/25d | | | 6,969,000 | | | | 5,209,328 | |

| | |

Vietnam Government Bond

5.200%, 01/12/22 | | | VND 43,000,000,000 | | | | 1,917,081 | |

| | | | | | | | |

Total Vietnam | | | | | | | 7,126,409 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDONESIA: 4.9% | | | | | | | | |

Indonesia Government Bond

9.000%, 03/15/29 | | | IDR 38,000,000,000 | | | | 2,963,212 | |

| | |

Indonesia Government Bond

8.250%, 05/15/29 | | | IDR 34,550,000,000 | | | | 2,592,320 | |

| | | | | | | | |

Total Indonesia | | | | | | | 5,555,532 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| SRI LANKA: 4.1% | | | | | | | | |

Sri Lanka Government Bond

7.850%, 03/14/29d | | | 4,500,000 | | | | 4,639,870 | |

| | | | | | | | |

Total Sri Lanka | | | | | | | 4,639,870 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| PHILIPPINES: 3.4% | | | | | | | | |

Republic of Philippines

3.900%, 11/26/22 | | | PHP 123,000,000 | | | | 2,344,475 | |

| | |

Republic of Philippines

6.250%, 01/14/36 | | | PHP 70,000,000 | | | | 1,547,282 | |

| | | | | | | | |

Total Philippines | | | | | | | 3,891,757 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| MALAYSIA: 2.1% | | | | | | | | |

Malaysia Government Bond

4.642%, 11/07/33 | | | MYR 9,000,000 | | | | 2,342,875 | |

| | | | | | | | |

Total Malaysia | | | | | | | 2,342,875 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| SOUTH KOREA: 0.3% | | | | | | | | |

Korea Treasury Bond

3.500%, 03/10/24 | | | KRW 400,000,000 | | | | 377,298 | |

| | | | | | | | |

Total South Korea | | | | | | | 377,298 | |

| | | | | | | | |

| | | | | | | | |

| | |

| TOTAL FOREIGN GOVERNMENT OBLIGATIONS | | | | 23,933,741 | |

| | | | | | | | |

(Cost $23,021,276) | | | | | | | | |

| | | | | | | | |

|

CONVERTIBLE CORPORATE BONDS: 5.0% | |

| | | |

| THAILAND: 3.0% | | | | | | | | |

CP Foods Holdings, Ltd., Cnv.

0.500%, 09/22/21d | | | 2,800,000 | | | | 3,476,918 | |

| | | | | | | | |

Total Thailand | | | | | | | 3,476,918 | |

| | | | | | | | |

| | | | | | | | |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 9 | |

Matthews Asia Strategic Income Fund

June 30, 2019

Schedule of Investmentsa(unaudited) (continued)

CONVERTIBLE CORPORATE BONDS(continued)

| | | | | | | | |

| | | Face Amount* | | | Value | |

| | |

| CHINA/HONG KONG: 2.0% | | | | | | | | |

Weibo Corp., Cnv.

1.250%, 11/15/22 | | | 2,400,000 | | | | $2,265,666 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 2,265,666 | |

| | | | | | | | |

| | | | | | | | |

| | |

| TOTAL CONVERTIBLE CORPORATE BONDS | | | | 5,742,584 | |

| | | | | | | | |

(Cost $ 5,067,936) | | | | | | | | |

| | | | | | | | |

| | | |

| TOTAL INVESTMENTS: 95.5% | | | | | | | 108,520,408 | |

(Cost $ 104,936,223) | | | | | | | | |

| | | | | | | | |

| | |

CASH AND OTHER ASSETS,

LESS LIABILITIES: 4.5% | | | | | | | 5,108,081 | |

| | | | | | | | |

| | |

NET ASSETS: 100.0% | | | | | | | $113,628,489 | |

| | | | | | | | |

| a | Certain securities were fair valued under the valuation policies approved by the Board of Trustees (Note2-A). |

| b | Security is afix-to-float security, which carries a fixed coupon until a certain date, upon which it switches to a floating rate. Reference rate and spread are provided if the rate is currently floating. |

| c | Perpetual security with no stated maturity date. First call date is disclosed. |

| d | The securities may be resold to qualified foreign investors and foreign institutional buyers under Regulation S of the Securities Act of 1933. |

| * | All Values in USD unless otherwise specified |

| CNY | Chinese Renminbi (Yuan) |

| 3M MYR-KLIBOR | Three Month Kuala Lumpur Interbank Offered Rate |

| 6M INR-MIBOR | Six Month Mumbai Inter-Bank Offered Rate |

| 6M THB-THBFIX | Six Month Thai Baht Interest Rate Fixing |

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

| | | | | | | | | | | | |

Currency Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

| CNY 33,648,300 | | USD 4,900,000 | | Merrill Lynch & Co., Inc. | | | 07/10/19 | | | | $1,014 | |

| IDR 36,000,000,000 | | USD 2,500,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | 36,733 | |

| KRW 1,174,350,000 | | USD 1,000,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | 15,835 | |

| THB 149,433,600 | | USD 4,800,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | 77,304 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 130,886 | |

| | | | | | | | | | | | |

| USD 2,904,866 | | CNY 20,000,000 | | Merrill Lynch & Co., Inc. | | | 07/10/19 | | | | (8,217 | ) |

| USD 1,446,759 | | CNY 10,000,000 | | Merrill Lynch & Co., Inc. | | | 07/10/19 | | | | (9,782 | ) |

| SGD 8,509,410 | | USD 6,300,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | (6,387 | ) |

| KRW 10,075,320,000 | | USD 9,000,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | (284,654 | ) |

| USD 1,670,904 | | SGD 2,300,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | (30,190 | ) |

| USD 2,436,548 | | IDR 36,000,000,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | (100,184 | ) |

| USD 2,852,660 | | KRW 3,400,000,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | (88,406 | ) |

| USD 986,683 | | KRW 1,174,350,000 | | Merrill Lynch & Co., Inc. | | | 08/05/19 | | | | (29,152 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | (556,972 | ) |

| | | | | | | | | | | | |

Net Unrealized Depreciation | | | | | | | | | | | ($426,086 | ) |

| | | | | | | | | | | | |

OTC INTEREST RATE SWAPS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Floating Rate Paid by Fund | | Fixed Rate Received by Fund | | Counterparty | | Termination Date | | | Notional

Amount (000) | | | Value | | | Upfront

Premium

Paid

(Received) | | | Unrealized

Depreciation | |

| Rate | | Frequency | | Rate | | Frequency |

6M INR-MIBOR, (0.31)% | | Semi-annual | | 5.46% | | Semi-annual | | Bank of America, N.A. | | | 06/19/2024 | | | | INR 204,000 | | | | ($9,867 | ) | | | — | | | | ($9,867 | ) |

3M MYR-KLIBOR, 3.46% | | Quarterly | | 3.30% | | Quarterly | | Bank of America, N.A. | | | 06/19/2024 | | | | MYR 13,000 | | | | (9,076 | ) | | | — | | | | (9,076 | ) |

6M THB-THBFIX, 1.48% | | Semi-annual | | 1.61% | | Semi-annual | | Bank of America, N.A. | | | 06/21/2024 | | | | THB 281,000 | | | | (35,226 | ) | | | — | | | | (35,226 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total | | | | | | | | | | | | | | | | | | | ($54,169 | ) | | | — | | | | ($54,169 | ) |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes to financial statements.

| | | | |

| PORTFOLIO MANAGERS |

| |

| Teresa Kong, CFA | | Satya Patel |

Lead Manager | | Lead Manager |

| | |

| FUND FACTS | | | | |

| | |

| | | Investor | | Institutional |

Ticker | | MCRDX | | MICPX |

CUSIP | | 577130677 | | 577130669 |

Inception | | 4/29/16 | | 4/29/16 |

NAV | | $10.47 | | $10.47 |

Initial Investment | | $2,500 | | $100,000 |

Gross Expense Ratio1 | | 1.37% | | 1.18% |

After Fee Waiver and Reimbursement2 | | 1.15% | | 0.90% |

Portfolio Statistics | | |

Total # of Positions | | 29 |

Net Assets | | $57.4 million |

Modified Duration3 | | 5.0 |

Portfolio Turnover4 | | 49.06% |

Benchmark | | | | |

J.P. Morgan Asia Credit Index |

OBJECTIVE

Total return over the long term.

STRATEGY

Under normal market conditions, the Fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in debt and debt-related instruments issued by companies as well as governments, quasi-governmental entities, and supra-national institutions in Asia. Debt and debt-related instruments typically include bonds, debentures, bills, securitized instruments (which are vehicles backed by pools of assets such as loans or other receivables), notes, certificates of deposit and other bank obligations, bank loans, senior secured bank debt, convertible debt securities, exchangeable bonds, credit-linked notes, inflation-linked instruments, repurchase agreements, payment-in-kind securities and derivative instruments with fixed income characteristics. Asia consists of all countries and markets in Asia, such as China and Indonesia, in addition to the developed, emerging, and frontier countries and markets in the Asian region.

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited)

For the first half of 2019, the Matthews Asia Credit Opportunities Fund returned 9.39% (Investor Class) and 9.63% (Institutional Class) while its benchmark, the J.P. Morgan Asia Credit Index (JACI), returned 8.04%. For the quarter ending June 30, the Fund returned 3.16% (Investor Class) and 3.23% (Institutional Class) compared to the benchmark return of 3.00% over the same period.

Market Environment:

Asian credit markets enjoyed a positive first half, with high yield credit spreads peaking at 622 basis points (6.22%) in early January and ending June at 539 basis points (5.39%). The first quarter was characterized by a strong risk-on environment and spread tightening. Despite spreads widening modestly in the second quarter, the combination of falling U.S. interest rates and coupon income resulted in positive total returns for investors in the asset class.

The constructive environment for Asian credit over the period was largely due to supportive central banks around the world. The U.S. Federal Reserve, the European Central Bank and emerging market central banks all moved in a dovish direction, seemingly ending the momentum for higher rates around the world. Meanwhile, the G-20 Summit ended without an escalation of the U.S.–China trade war, at least temporarily removing the risk of a further tariff shock from the global economy.

While the second quarter was positive overall, geopolitics led to unexpected volatility in credit spreads. The quarter began with a continuation of the positive tone in risk markets from the first quarter, as data from the U.S. and China implied that fears of a synchronized growth slowdown may have been overdone. As the U.S.–China trade war flared up, however, spreads widened in May, before gradually tightening as the late-June G-20 summit approached.

Performance Contributors and Detractors:

During the first half and the second quarter, the biggest contributor to performance was the portfolio’s overweight allocation to Asian high yield bonds, which as a group outperformed in the risk-on environment. Within high yield corporate bonds, the strongest contributors over the quarter included Tata Steel (ABJA Investment), Lippo Karawaci (Theta Capital) and the Vietnam government-backed Debt and Asset Trading. Tata Steel performed well as it has moved toward a deleveraging plan following an unsuccessful merger of its European operations. Lippo Karawaci continues to execute on its turnaround plan, which includes raising new capital and increasing discipline around capital expenditures. Our exposure to convertible bonds, including Weibo and CP Foods Holdings as well as our positions in SoftBank Group and HSBC Holdings perpetual bonds, were also contributors.

The biggest detractors to performance were our positions in Indika (Indo Energy Finance II BV), our convertible bond positions in China Mengniu Dairy and Ctrip.com International, a Chinese online travel agency. The Indika bonds were sold during the quarter to buy longer-dated bonds of the same issuer, allowing us to extend our duration. The longer-dated Indika bonds were in fact among our highest contributors to returns in the quarter.

(continued)

| 1 | Prospectus expense ratios. |

| 2 | Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class to 0.90% first by waiving class specific expenses (i.e., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class may vary from year to year and will in some years exceed 0.90%. Any amount waived with respect to the Fund pursuant to this agreement is not subject to recoupment. This agreement will remain in place until April 30, 2020 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date. |

| 3 | Modified duration measures the percent change in value of the fixed income portion of the portfolio in response to a 1% change in interest rates. In a multi-currency denominated portfolio with sensitivities to different interest rate regimes, modified duration will not accurately reflect the change in value of the overall portfolio from a change in any one interest rate regime. |

| 4 | The lesser of fiscal year 2018 long-term purchase costs or sales proceeds divided by the average monthly market value of long-term securities. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 11 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| PERFORMANCE AS OF JUNE 30, 2019 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Retuns | | | | |

| | | 3 Months | | | YTD | | | 1 Year | | | 3 Years | | | Since Inception | | | Inception Date | |

| Investor Class (MCRDX) | | | 3.16% | | | | 9.39% | | | | 9.26% | | | | 5.73% | | | | 5.90% | | | | 4/29/2016 | |

| Institutional Class (MICPX) | | | 3.23% | | | | 9.63% | | | | 9.64% | | | | 6.02% | | | | 6.16% | | | | 4/29/2016 | |

| J.P. Morgan Asia Credit Index5 | | | 3.00% | | | | 8.04% | | | | 10.01% | | | | 4.04% | | | | 4.51% | | | | | |

Performance assumes reinvestment of all dividends and/or distributions before taxes. All performance quoted represents past performance and is no guarantee of future results.Investment return and principal value will fluctuate with market conditions so that when redeemed, shares may be worth moreor less than their original cost. Current performance may be lower or higher than the return figures quoted. Returns would have been lower if certain of the Fund’s fees and expenses had not been waived. For the Fund’s most recent month-endperformance, visit matthewsasia.com.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| INCOME DISTRIBUTION HISTORY | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2019 | | | | | | 2018 | |

| | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | | | | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Total | |

| Investor (MCRDX) | | $ | 0.10 | | | $ | 0.10 | | | | n.a. | | | | n.a. | | | $ | 0.20 | | | | | | | $ | 0.09 | | | $ | 0.09 | | | $ | 0.06 | | | $ | 0.10 | | | $ | 0.33 | |

| Inst’l (MICPX) | | $ | 0.10 | | | $ | 0.11 | | | | n.a. | | | | n.a. | | | $ | 0.21 | | | | | | | $ | 0.09 | | | $ | 0.09 | | | $ | 0.06 | | | $ | 0.11 | | | $ | 0.36 | |

Note: This table does not include capital gains distributions. Totals may differ by $0.02 due to rounding. For income distribution history, visit matthewsasia.com.

| | | | |

| | | |

30-DAY YIELD: Investor Class: 4.85% (4.69% excluding waivers) Institutional Class: 5.10% (4.89% excluding waivers) The 30-Day Yield represents net investment income earned by the Fund over the 30-day period ended 6/30/19, expressed as an annual percentage rate based on the Fund’s share price at the end of the 30-day period. The 30-Day Yield should be regarded as an estimate of the Fund’s rate of investment income, and it may not equal the Fund’s actual income distribution rate. Source: BNY Mellon Investment Servicing (US) Inc. | | | | YIELD TO WORST: 5.93% Yield to worst is the lowest yield that can be received on a bond assuming that the issuer does not default. It is calculated by utilizing the worst case assumptions for a bond with respect to certain income-reducing factors, including prepayment, call or sinking fund provisions. It does not represent the yield that an investor should expect to receive. Past yields are no guarantee of future yields. Source: FactSet Research Systems |

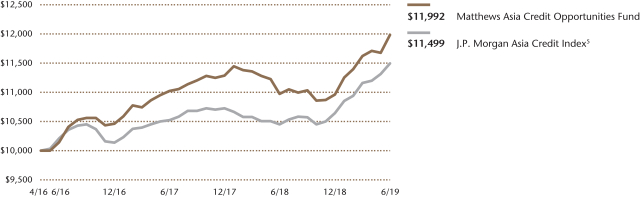

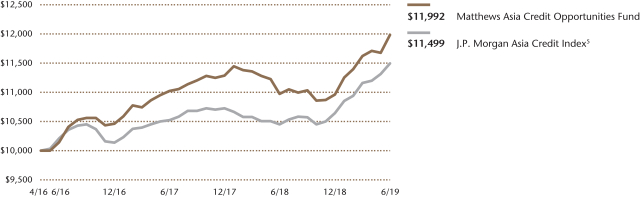

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT SINCE INCEPTION—INVESTOR CLASS

Plotted monthly. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. Values are in US$.

| | 5 | It is not possible to invest directly in an index. Source: Index data from J.P. Morgan and Bloomberg; total return calculations performed by BNY Mellon Investment Servicing (US) Inc. Please see page 88 for index definition. |

| | | | | | | | |

| | | | |

| TOP TEN HOLDINGS | | | | | | | |

| | | Sector | | Currency | | % of Net Assets | |

| Franshion Brilliant, Ltd., 5.750%, 07/17/2067 | | Real Estate | | U.S. Dollar | | | 5.0% | |

| Debt and Asset Trading Corp., 1.000%, 10/10/2025 | | Financials | | U.S. Dollar | | | 4.9% | |

| Indika Energy Capital III Pte, Ltd., 5.875%, 11/09/2024 | | Energy | | U.S. Dollar | | | 4.9% | |

| Shriram Transport Finance Co., Ltd., 5.700%, 02/27/2022 | | Financials | | U.S. Dollar | | | 4.4% | |

| Pakistan Government Bond, 6.875%, 12/05/2027 | | Foreign Government Bonds | | U.S. Dollar | | | 4.4% | |

| HSBC Holdings PLC, 6.375%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.4% | |

| ABJA Investment Co. Pte, Ltd., 5.450%, 01/24/2028 | | Materials | | U.S. Dollar | | | 4.3% | |

| PB International BV, 7.625%, 01/26/2022 | | Consumer Discretionary | | U.S. Dollar | | | 4.3% | |

| Wanda Properties International Co., Ltd., 7.250%, 01/29/2024 | | Real Estate | | U.S. Dollar | | | 4.2% | |

| Standard Chartered PLC, 6.500%, 12/29/2049 | | Financials | | U.S. Dollar | | | 4.1% | |

| % OF ASSETS IN TOP TEN | | | | | | | 44.9% | |

Matthews Asia Credit Opportunities Fund

Portfolio Manager Commentary (unaudited) (continued)

Notable Portfolio Changes:

With weaker-than-expected economic data released in the U.S. leading to speculation about rate cuts by the Fed, we increased duration in the portfolio to 4.6 years from 3.5 years over the quarter. We achieved this both by rotating into longer duration issues of companies we already owned, such as CIFI Holdings Group and KWG Group Holdings, as well as by adding exposure to longer duration securities of other issuers, including the Indonesian state-owned enterprises INALUM (PT Indonesia Asahan Aluminium Perser) and PLN (PT Perusahaan Listrik Negara), both of which are investment grade-rated, thereby allowing us to add duration without taking on excessive spread duration.

New bonds added to the portfolio included Shriram Transport Finance, an Indian non-bank finance company that issued a USD bond with an attractive spread premium given the recent NBFCs funding crisis, and Pakistan Government Bonds, which are long-duration bonds of a high yield country under an IMF-led turnaround program.

In China, we initiated positions in two companies: China Jinmao (Franshion Brilliant, Ltd.) perpetual bonds, higher yielding bonds of a central SOE-backed property developer, and the technology firm Weibo, via convertible bonds trading close to their lowest possible level, which we see as offering an asymmetric risk profile.

We sold a number of bonds that had reached their price target and had limited upside for the portfolio. These included India’s Bharti Airtel, Krung Thai Bank Public in Thailand, Indonesia’s Tower Bersama (TBG Global), and in China, Chinalco Capital Holdings and China Minmetals. In addition, we sold several convertible bond holdings that were short duration and/or had reached our price target. These included China Mengniu Dairy, CP Foods Holdings, Ctrip.com International and Johnson Electric Holdings.

Outlook:

In our view, Asian high yield bonds continue to offer attractive value for long-term investors. Asian high yield credit spreads are 86 basis points (0.86%) above their historic averages and are about 132 basis points (1.32%) above U.S. high yield spreads at the index level. We think there is room for this relationship to tighten back closer to historical levels. Default rates in Asia have remained low and we believe could stay low in the medium term as interest costs and recession risks remain low. For many of the riskiest borrowers, refinancing has become easier in 2019 as investor risk appetite has returned. We believe this continues to be a key risk to monitor, and we prefer to invest in holdings that have taken steps to refinance upcoming maturities or improve their balance sheets in other ways to be resilient to further turmoil.

We continue to see value in Chinese property, particularly given the magnitude of the sell-off last year. Policymakers are incrementally easing restrictions on developers, pointing to an improving business environment in the second half of the year. We also see value in a number of sectors in Indonesia, including manufacturing and mining. With the momentum among developed and emerging market central banks shifting toward synchronized easing, we expect domestic business environments in Asia to be supportive in an environment of slowing global growth and trade.

To be sure, there continue to be risks on the horizon. If a further slowdown in global growth materializes, we expect investor appetite for emerging markets to diminish. Any re-escalation in trade shocks could also put pressure on Asian fixed income markets. If the Chinese economy deteriorates, corporate defaults will likely rise, and Asian credit could come under pressure. Our base case, however, remains a benign one, with most of the key global macro tail risks fading, with supportive central banks and Chinese economic growth to rebound.

| | | | |

| |

| CURRENCY ALLOCATION (%)6,7 | |

| US Dollar | | | 100.0 | |

| | | | |

| |

| COUNTRY ALLOCATION (%)6,7,8 | |

| China/Hong Kong | | | 31.6 | |

| Indonesia | | | 25.7 | |

| India | | | 8.7 | |

| Vietnam | | | 7.4 | |

| Sri Lanka | | | 4.8 | |

| Pakistan | | | 4.4 | |

| Australia | | | 3.8 | |

| Philippines | | | 3.6 | |

| Japan | | | 3.3 | |

| United States | | | 0.8 | |

| Cash and Other Assets, Less Liabilities | | | 5.9 | |

| | | | |

| |

| SECTOR ALLOCATION (%)6,7 | |

| Real Estate | | | 24.3 | |

| Financials | | | 21.7 | |

| Foreign Government Bonds | | | 11.6 | |

| Materials | | | 8.4 | |

| Communication Services | | | 7.6 | |

| Utilities | | | 7.6 | |

| Energy | | | 4.9 | |

| Consumer Discretionary | | | 4.3 | |

| Industrials | | | 3.6 | |

| Cash and Other Assets, Less Liabilities | | | 5.9 | |

| | | | |

| |

| ASSET TYPE BREAKDOWN (%)6,7 | |

| Non-Convertible Corporate Bonds | | | 74.9 | |

| Government Bonds | | | 16.6 | |

| Convertible Corporate Bonds | | | 2.6 | |

| Cash and Other Assets, Less Liabilities | | | 5.9 | |

| 6 | Source: FactSet Research Systems. Percentage values in data are rounded to the nearest tenth of one percent, so the values may not sum to 100% due to rounding. Percentage values may be derived from different data sources and may not be consistent with other Fund literature. |

| 7 | Cash and other assets may include forward currency exchange contracts and certain derivative instruments that have been marked-to-market. |

| 8 | Not all countries where the Fund may invest are included in the benchmark index. |

| | | | |

| matthewsasia.com | 800.789.ASIA | | | 13 | |

Matthews Asia Credit Opportunities Fund

June 30, 2019

Schedule of Investmentsa(unaudited)

| | |

| NON-CONVERTIBLE CORPORATE BONDS: 74.9% | | FOREIGN GOVERNMENT OBLIGATIONS: 16.6% |

| | | | | | | | |

| | | Face Amount* | | | Value | |

| | |

| CHINA/HONG KONG: 28.9% | | | | | | | | |

Franshion Brilliant, Ltd. 5.750%b, 01/17/22c,d | | | 3,000,000 | | | | $2,851,392 | |

| | |

HSBC Holdings PLC 6.375%b, 03/30/25c | | | 2,400,000 | | | | 2,523,600 | |

| | |

Wanda Properties International Co., Ltd.

7.250%, 01/29/24d | | | 2,400,000 | | | | 2,391,000 | |

| | |

Standard Chartered PLC 6.500%b, 04/02/20c,d | | | 2,350,000 | | | | 2,381,842 | |

| | |

CIFI Holdings Group Co., Ltd.

6.550%, 03/28/24d | | | 2,300,000 | | | | 2,248,907 | |

| | |

Logan Property Holdings Co., Ltd.

5.250%, 02/23/23d | | | 1,500,000 | | | | 1,431,177 | |

| | |

KWG Group Holdings, Ltd. 7.875%, 09/01/23d | | | 1,300,000 | | | | 1,307,458 | |

| | |

KWG Group Holdings, Ltd. 5.875%, 11/10/24d | | | 1,100,000 | | | | 999,049 | |

| | |

CITIC Telecom International Finance, Ltd.

6.100%, 03/05/25d | | | 462,000 | | | | 479,650 | |

| | | | | | | | |

Total China/Hong Kong | | | | | | | 16,614,075 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDONESIA: 25.7% | | | | | | | | |

Indika Energy Capital III Pte, Ltd.

5.875%, 11/09/24d | | | 2,900,000 | | | | 2,831,764 | |

| | |

PB International BV 7.625%, 01/26/22d | | | 2,400,000 | | | | 2,485,107 | |

| | |

PT Indonesia Asahan Aluminium Perser

6.757%, 11/15/48d | | | 1,900,000 | | | | 2,334,443 | |

| | |

PT Perusahaan Listrik Negara

5.250%, 05/15/47d | | | 2,100,000 | | | | 2,215,988 | |

| | |

Listrindo Capital BV 4.950%, 09/14/26d | | | 2,200,000 | | | | 2,170,300 | |

| | |

Theta Capital Pte, Ltd. 6.750%, 10/31/26d | | | 1,500,000 | | | | 1,373,815 | |

| | |

Modernland Overseas Pte, Ltd.

6.950%, 04/13/24d | | | 1,400,000 | | | | 1,366,584 | |

| | | | | | | | |

Total Indonesia | | | | | | | 14,778,001 | |

| | | | | | | | |

| | | | | | | | |

| | | |

| INDIA: 8.7% | | | | | | | | |

Shriram Transport Finance Co., Ltd.