UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07185 | |||||||

| ||||||||

Morgan Stanley Select Dimensions Investment Series | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

522 Fifth Avenue, New York, New York |

| 10036 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Ronald E. Robison 522 Fifth Avenue, New York, New York 10036 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | 212-296-6990 |

| ||||||

| ||||||||

Date of fiscal year end: | December 31, 2007 |

| ||||||

| ||||||||

Date of reporting period: | December 31, 2007 |

| ||||||

Item 1 - Report to Shareholders

MORGAN STANLEY

SELECT DIMENSIONS INVESTMENT SERIES

Annual Report

DECEMBER 31, 2007

Morgan Stanley Select Dimensions Investment Series

Table of Contents

| Letter to the Shareholders | 1 | ||||||

| Expense Example | 22 | ||||||

| Portfolio of Investments: | |||||||

| Money Market | 27 | ||||||

| Flexible Income | 30 | ||||||

| Balanced | 50 | ||||||

| Utilities | 65 | ||||||

| Dividend Growth | 67 | ||||||

| Equally-Weighted S&P 500 | 71 | ||||||

| Growth | 84 | ||||||

| Focus Growth | 88 | ||||||

| Capital Opportunities | 91 | ||||||

| Global Equity | 94 | ||||||

| Developing Growth | 98 | ||||||

| Financial Statements: | |||||||

| Statements of Assets and Liabilities | 102 | ||||||

| Statements of Operations | 104 | ||||||

| Statements of Changes in Net Assets | 106 | ||||||

| Notes to Financial Statements | 114 | ||||||

| Financial Highlights | 128 | ||||||

| Report of Independent Registered Public Accounting Firm | 136 | ||||||

| Results of Special Shareholder Meeting | 137 | ||||||

| Trustee and Officer Information | 138 | ||||||

| Federal Tax Notice | 145 | ||||||

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007

Dear Shareholders,

Financial markets encountered a difficult environment in 2007. With many signs pointing to deceleration in the U.S. economy — and a recession looking more possible as the year drew to a close — investors struggled to gauge the length and severity of an economic downturn on the financial markets both at home and abroad. Market volatility increased dramatically for stocks and bonds, particularly in the second half of the year, hastened by the subprime mortgage market collapse and ensuing liquidity crisis. Overall, international equity markets generally performed the best, with the broad domestic equity and fixed income markets producing moderate gains for the year.

Domestic Equity Overview

The S&P 500® Index returned 5.49 percent for the year ended December 31, 2007. The year began on a rather positive note for investors, fuelled by strong corporate earnings growth, robust merger and acquisition activity, and a generally positive outlook for the U.S. and global economies. The Federal Open Market Committee (the "Fed") had kept its target federal funds rate on hold since August 2006, giving confidence to investors that inflation was under control. However, pockets of turbulence erupted at several points throughout the first half of the year, notably in late February and again in June, as investors responded to volatility in China's stock markets, concerns about a slowing U.S. economy, rising oil prices, and initial signs of distress in the subprime mortgage market.

While price volatility turned out to be short-lived in those occurrences, the underlying pressures continued to build. In the second half of 2007, the subprime market's woes spread across the economy, causing the credit markets to significantly tighten. The Fed acted quickly to attempt to stabilize the financial markets in August, and also delivered a positive surprise to investors in the form of a larger-than-expected federal funds target rate cut in September. However, a host of other troubling signs, including higher oil prices, a weak housing market and declines in consumer spending, dampened investors' economic outlooks going into year end. Moreover, in the third quarter, year-over-year corporate earnings growth turned negative for the first time since 2002, and expectations for the fourth quarter were even lower.

Within the S&P 500 Index, eight of the ten sectors had positive absolute performance during the period, led by energy. Energy companies commanded enormous profits as energy prices continued to rise in 2007. The utilities sector, which was the third best performing sector, also benefited from this environment because of utility companies' ability to capture pricing power from high energy prices. Strong global economic growth and robust demand for materials, particularly in China and India, supported the performance of the materials sector.

1

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

The two negative returning sectors in the S&P 500 Index were consumer discretionary and financials. Consumer-related stocks suffered from a waning outlook for consumer spending. The effects of a weakening housing market, high energy prices and tightening credit standards began to materialize, as declining consumer confidence and disappointing retail sales data reported in the second half of 2007 reflected a slowdown in consumer spending. The financial sector faced a crisis of confidence as subprime troubles spilled into the credit market and the broader economy. A tightening in credit standards, mortgage lender bankruptcies, hedge fund implosions and multi-billion dollar losses reported at several large financial institutions contributed to major volatility in the share prices of financials stocks.

Another notable performance trend during the year was the outperformance of large-capitalization stocks and growth-oriented stocks. Investors generally favored growth stocks in their belief that these companies have greater potential to deliver earnings growth in a slower economic environment. This helped growth stocks outpace value stocks during the period. Similarly, large-cap stocks outperformed the other capitalization segments for the year overall. These large companies typically have greater earnings stability, more established positions within their business markets and the ability to tap into international markets for growth — characteristics that better position them to withstand an economic downturn in the U.S.

Fixed Income Overview

Worries surrounding the residential housing downturn persisted throughout the 12-month period. Confronted with increasing delinquency rates on subprime loans, high-profile hedge fund collapses, and a series of subprime mortgage related credit downgrades, the markets responded severely beginning in the second quarter of the year. The impact was exacerbated by an influx of forced sellers looking to liquidate assets to help meet margin calls and capital withdrawals. The result was a considerable contraction in credit and liquidity.

As the subprime mortgage crisis worsened, investors grew increasingly concerned about the impact on financial markets, the financial system and the broader economy, and demanded additional compensation for owning riskier investments. As a result, a flight to quality ensued and credit spreads widened sharply. The subprime debacle severely impacted many major banks and Wall Street firms, which took significant losses on their subprime mortgage loans and related securities in their portfolios. Some sold stakes to sovereign wealth funds in exchange for cash infusions needed to bolster their balance sheets.

The Fed took steps to ease the liquidity crisis, reducing the target federal funds rate 50 basis points in September, with additional reductions of 25 basis points in both October and December. Seeking to further improve credit market liquidity, the Fed announced in December the creation of a Term Auction Facility (TAF) whereby term funds would be auctioned to depository institutions against a wide variety of collateral.

2

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

These Fed actions, coupled with the flight to quality, caused yields across the yield curve to decline, but more so on the short end. As a result, the shape of the yield curve ended the year steeper. Overall, U.S. Treasury securities outperformed all other areas of the fixed income market.

The mortgage market was hit by the turmoil surrounding residential housing, most notably in the non-agency mortgage area, as investors avoided mortgage-backed securities lacking agency backing. The result was a further reduction in mortgage market liquidity, which in turn reduced the availability of non-conforming mortgage loans to the general public.

Within the investment-grade corporate sector, higher-rated (AAA) issues outpaced the middle investment grade issues. Industrials and utilities handily outpaced financials, which were hit most by the recent liquidity crisis. Overall, short-term issues outperformed intermediate- and long-dated issues for the year.

Various fundamental factors supported the high-yield market throughout the year, including low default rates, moderate economic growth, favorable earnings trends, and relatively low U.S. Treasury yields. At the end of May, spreads were at the tightest levels in over 20 years. However, over the balance of the year spreads widened considerably as the growing probability of recession, concerns of higher default rates in 2008, the liquidity crunch, and the inability to finance many of the leveraged buyouts (LBOs) that occurred early in the year weighted heavily on the market. Overall, intermediate-term and higher-quality issues posted the best returns within the high-yield sector.

International Equity Overview

The past year was difficult for global equity markets. Financial institutions were hit by significant credit losses from their subprime mortgage exposure, leading to increasingly tight liquidity and accelerating the decline in the U.S. housing market. Outperformance in global equity markets was largely concentrated in stocks connected to strength in commodity markets and China, as investors sought refuge from a deteriorating outlook for the U.S. financial and consumer segments.

From a regional view, performance was mixed. Japan remained the weakest performer among all global markets. While global equity markets recovered after the correction sparked by China in February, volatility continued to increase in the Japanese market as investors awaited the fiscal year 2006 results announcement season beginning in late April. By early July, the market began rising again, but subsequently declined sharply in late July due to growing concerns over credit risks triggered by U.S. subprime mortgage problems. With the sudden resignation of Prime Minister Shinzo Abe in September, political uncertainty further roiled the markets until a higher-than-expected interest rate cut by the Fed, a high approval rating for the new Fukuda administration and robust Asian stock markets helped Japan's market recover. In late October, the

3

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

market fell again in reaction to a rising yen and a correction in the U.S. market triggered by concerns over the U.S. economic outlook. Finally, the market rebounded toward year end, as fears of a credit crunch and pressure on the U.S. dollar abated.

Europe on the whole did not experience the same extremes of the U.S. housing mania, although areas where the real estate markets were particularly active, principally the U.K. and Spain, have been affected to some degree by credit concerns. Inflation remained contained but rising energy prices in 2007 were a persistent threat to that stability. European markets appeared fairly resilient during the year, although projections are for economic growth in this region to slow in 2008. The strong euro, the impact of rising oil prices on consumer spending power and the turmoil in financial markets are likely to put pressure on growth in the near term.

Meanwhile, Asia ex-Japan and the emerging markets continued to show impressive growth rates, as robust demand from China and other emerging markets fuelled ongoing demand for raw materials. Investors have sought both direct and indirect exposure to China through commodities and energy stocks, on the rather questionable assumption that China has effectively decoupled from the U.S. economy, and that economic growth in China will continue to remain strong. Against this backdrop, emerging market equities posted their fifth consecutive calendar year of double-digit returns in 2007. Moreover, the emerging markets continued their outperformance over the developed markets for the seventh consecutive year. Although growing concern about a U.S. credit crisis and increased risk aversion continued to cause volatility in the emerging markets, on the whole, the markets weathered these conditions fairly well, owing to healthier economic fundam entals and favorable reforms.

4

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

Balanced Portfolio

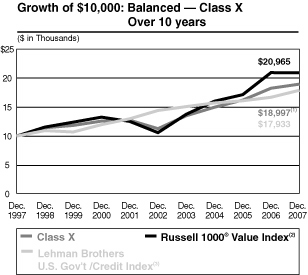

For the 12-month period ended December 31, 2007, Balanced Portfolio Class X shares produced a total return of 3.86 percent, outperforming the Russell 1000® Value Index, which returned -0.17 percent and underperforming the Lehman Brothers U.S. Government/Credit Index, which returned 7.23 percent. For the same period, the Portfolio's Class Y shares returned 3.60 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Relative to the Russell 1000 Value Index, the Portfolio's stock allocation benefited primarily from an underweight to the financial sector (although we note that all sector weights are a result of our bottom-up stock selection process and are not intentional top-down allocations). Limited exposures to regional banks and diversified financial companies, and no holdings in real estate investment trusts, helped minimize the Portfolio's exposure to the damage caused by the subprime mortgage collapse. The materials sector also bolstered relative performance, but this was primarily due to a single holding which generates a larger share of its business in the health care sector than in the materials sector. An overweight in the consumer staples sector contributed positively to relative returns as well.

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

| Average Annual Total Returns as of December 31, 2007 | |||||||||||||||||||

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 3.86 | % | 10.98 | % | 6.63 | % | 9.10 | % | |||||||||||

| Class Y | 3.60 | % | 10.69 | % | — | 6.85 | % | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell 1000® Value Index measures the performance of those companies in the Russell 1000® Index with lower price -to-book ratios and lower forecasted growth values. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(3) The Lehman Brothers U.S. Government/Credit Index tracks the performance of government and corporate obligations, including U.S. government agency and Treasury securities and corporate and Yankee bonds. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

5

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

Detractors from the stock allocation's relative performance included an underweight in the energy sector. Stock selection in the technology sector was another area of weakness, due to holdings in hardware and equipment, software and services, and semiconductor companies.

The Portfolio's fixed income allocation was additive to overall performance. We kept a defensive credit sector allocation, focusing on selected high quality issues. The position benefited relative performance, particularly in later months of the year as credit spreads widened. We continued to look for opportunities to take advantage of recent credit spread widening where they offered the potential to add value to the Portfolio.

Throughout the year, we employed a defensive interest rate strategy by keeping the Portfolio's duration* shorter than that of the Lehman Brothers U.S. Government/Credit Index. Although this strategy was beneficial early in the period when interest rates were rising, it detracted from performance for the overall reporting year as Federal Reserve easing in the latter months caused rates to decline significantly.

In March of this year, the Portfolio's yield curve positioning was adjusted to underweight longer dated issues and overweight intermediate dated issues. This was particularly additive to performance as the spread between intermediate- and long-dated yields widened and the curve steepened during the summer.

We hold an underweight position to agency mortgage-backed securities, with a focus on high-coupon, slow-prepaying agency issues, and an overweight to non-agency mortgages issued to high quality borrowers. Overall, the recent turmoil in the mortgage market and the drying up of liquidity hurt price performance. As a result, although the underweight to agency mortgage-backed securities benefited performance, the positive influence was more than offset by the poor price performance of the non-agency position.

As of the end of the reporting period, the Portfolio held 66 percent in stocks and 34 percent in bonds.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

* A measure of the sensitivity of a bond's price to changes in interest rates, expressed in years. Each year of duration represents an expected 1 percent change in the price of a bond for every 1 percent change in interest rates. The longer a bond's duration, the greater the effect of interest-rate movements on its price. Typically, portfolios with shorter durations perform better in rising interest-rate environments, while portfolios with longer durations perform better when rates decline.

6

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

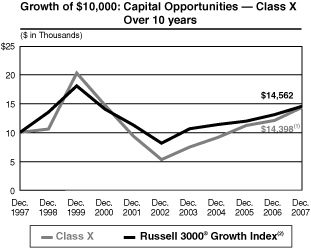

Capital Opportunities Portfolio

For the 12-month period ended December 31, 2007, Capital Opportunities Portfolio Class X shares produced a total return of 19.32 percent, outperforming the Russell 3000® Growth Index, which returned 11.40 percent. For the same period, the Portfolio's Class Y shares returned 19.08 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

The top contributing sector to the Portfolio relative to the Russell 3000 Growth Index was the consumer discretionary sector. Security selection in the retail, consumer electronics, and hotel/motel segments greatly added to relative returns and helped to offset the negative effect of a large overweight allocation in the sector overall. In the materials and processing sector, a single holding within the agriculture fishing and ranching segment along with an overweight allocation significantly bolstered relative returns. Additionally, investment in medical and dental instruments and an underweight allocation in the health care sector were advantageous to performance.

In contrast, the financial services sector was an area of weakness for the Portfolio's performance during the period. Here, stock selection in financial information services companies significantly detracted from relative returns, despite the

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 19.32 | % | 22.33 | % | 3.71 | % | 4.79 | % | |||||||||||

| Class Y | 19.08 | % | 22.05 | % | — | (6.47 | )% | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell 3000® Growth Index measures the performance of those companies in the Russell 3000® Index with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of January 21, 1997 for Class X and July 24, 2000 for Class Y.

7

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

beneficial effect of an underweight allocation within the financial services sector. The Portfolio's lack of exposure to the consumer staples sector further diminished performance. Lastly, an overweight allocation in the multi-industry sector (which includes conglomerates) also hindered relative returns, which unfortunately overshadowed gains made through positive stock selection in this sector.

At the end of the period, consumer discretionary represented the largest sector weight and overweight in the Portfolio, followed by the materials and processing and financial services sectors. The materials and processing sector was overweight relative to the Russell 3000 Growth Index, and the financial services sector was underweight versus the Index.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

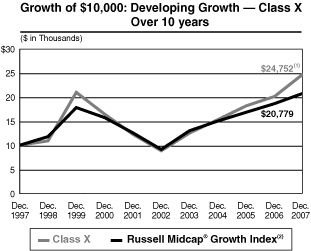

Developing Growth Portfolio

For the 12-month period ended December 31, 2007, Developing Growth Portfolio Class X shares produced a total return of 22.94 percent, outperforming the Russell Midcap® Growth Index, which returned 11.43 percent. For the same period, the Portfolio's Class Y shares returned 22.65 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 22.94 | % | 22.81 | % | 9.49 | % | 12.83 | % | |||||||||||

| Class Y | 22.65 | % | 22.52 | % | — | 3.43 | % | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell Midcap® Growth Index measures the performance of those Russell Midcap® companies with higher price-to-book ratios and higher forecasted growth values. The stocks are also members of the Russell 1000® Growth Index. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to in vest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

8

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

The top contributing sectors to the Portfolio relative to the Russell Midcap Growth Index were technology, consumer discretionary and health care. In the technology sector, an underweight allocation in the sector and stock selection within the computer services software and systems segment contributed most significantly to performance. In the consumer discretionary sector, stock picking in the retail, education services, commercial services, consumer electronics, and communications and media areas also benefitted relative returns, and helped to offset the negative influence of an overweight allocation. Additionally, investment in medical and dental instruments within the health care sector was advantageous to performance.

The bottom contributing sectors were materials and processing, other energy and multi-industry. A modest underweight allocation in the materials and processing sector, together with investments in real estate companies and an engineering and contracting services firm, and an avoidance of the metal fabricating industry all detracted from performance. In the other energy sector, an underweight allocation as well as a lack of exposure to oil well equipment firms and coal and offshore drilling companies offset the gains made through stock selection in crude oil producers. Finally, stock selection and an underweight allocation in the multi-industry (which includes conglomerates) further dampened relative returns.

At the end of the period, consumer discretionary represented the largest sector weight and overweight in the Portfolio, followed by the financial services and technology sectors. The financial services and technology sectors were both underweight versus the Russell Midcap Growth Index.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

9

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

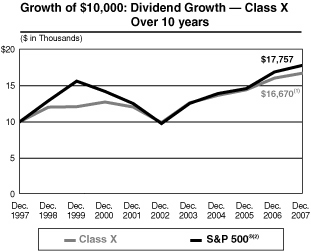

Dividend Growth Portfolio

For the 12-month period ended December 31, 2007, Dividend Growth Portfolio Class X shares produced a total return of 4.27 percent, underperforming the S&P 500® Index, which returned 5.49 percent. For the same period, the Portfolio's Class Y shares returned 3.95 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

The main detractors from relative performance included stock selection in the health care sector, in which several pharmaceutical holdings exhibited declining performance during the period. Stock selection in the technology sector also had a negative effect on relative results, largely because of stocks not held in the Portfolio. The S&P 500 Index included several strong performing technology stocks that bolstered the Index's return, while the Portfolio had little to no exposure to these stocks. Although an underweight position in the consumer discretionary sector benefited relative performance, the negative influence of our stock selection in the sector offset those gains. In particular, the Portfolio's holdings in media and retailing stocks had a detrimental effect on relative performance.

However, other areas of investment did well for the Portfolio relative to the S&P 500 Index. Stock selection in the financials sector contributed

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 4.27 | % | 11.12 | % | 5.24 | % | 10.39 | % | |||||||||||

| Class Y | 3.95 | % | 10.84 | % | — | 5.22 | % | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Standard & Poor's 500® Index (S&P 500®) is a broad-based index, the performance of which is based on the performance of 500 widely-held common stocks chosen for market size, liquidity and industry group representation. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

10

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

positively due to the double-digit returns of a number of capital markets holdings and an underweight to the banking group (which includes thrifts and mortgage finance companies). The consumer staples sector added value through an overweight position and our stock selection. Here, holdings across a number of industries benefited the Portfolio, including beverages, tobacco, staples retailing, and household products. Stock selection in the materials sector was another area of strength for the Portfolio on a relative basis, although the contribution came entirely from one holding in an agribusiness company that performed very strongly during the period.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

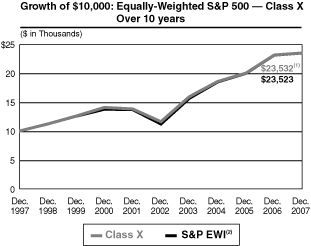

Equally-Weighted S&P 500 Portfolio

For the 12-month period ended December 31, 2007, Equally-Weighted S&P Portfolio Class X shares produced a total return of 1.47 percent, underperforming the Standard & Poor's Equal Weight Index, which returned 1.53 percent. For the same period, the Portfolio's Class Y shares returned 1.23 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 1.47 | % | 15.15 | % | 8.93 | % | 11.95 | % | |||||||||||

| Class Y | 1.23 | % | 14.87 | % | — | 8.35 | % | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Standard & Poor's Equal Weight Index (S&P EWI) is the equal-weighted version of the widely regarded S&P 500® Index, which measures 500 leading companies in leading U.S. industries. The S&P EWI has the same constituents as the capitalization-weighted S&P 500® Index, but each company in the S&P EWI is allocated a fixed weight, rebalancing quarterly. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance . It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

11

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

The best performing sectors in the Portfolio and Standard & Poor's Equal Weight Index for the 12-month period were energy, industrials and utilities. Energy prices continued to soar in 2007, supporting huge profits for many energy companies, which in turn commanded significant investor attention for energy stocks. The industrials sector was led by strong performance in capital goods stocks. The utilities sector also benefited from the rising energy price environment because utility companies generally pass through higher energy costs to their customers. On an individual stock basis, the highest returning holdings in the overall portfolio were dominated by technology and energy stocks.

In contrast, the financials sector had the lowest return during the period. Financials stocks were hit hard in the second half of the year as the subprime mortgage market crisis undermined investors' confidence for stocks in the sector. Mortgage lender bankruptcies, imploding hedge funds, staggering asset losses at a number of large financial institutions and tightening credit standards contributed to significant volatility in the sector. The consumer discretionary sector was another bottom performing sector. Languishing consumer spending data, the weakening housing market, and concerns about the overall financial health of the U.S. consumer led investors to rotate out of consumer discretionary stocks. For the overall portfolio, the individual stocks with the largest declines during the period were primarily those of companies with exposure to mortgage lending, mortgage insurance, and homebuilding.

Other performance trends within the Portfolio and the Index during the period included the outperformance of stocks within the largest capitalization segments, as investors had a more favorable outlook for the larger, more established companies in an environment of slowing economic growth. Similarly, growth stocks bested value stocks because investors believed growth stocks had better earnings prospects in a slower-growing economy.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

12

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

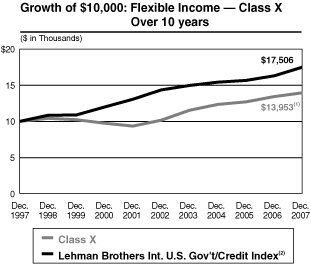

Flexible Income Portfolio

For the 12-month period ended December 31, 2007, Flexible Income Portfolio Class X shares produced a total return of 3.89 percent, underperforming the Lehman Brothers Intermediate U.S. Government/Credit Index, which returned 7.39 percent. For the same period, the Portfolio's Class Y shares returned 3.64 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

We maintained an underweight to corporate credits, which was additive to performance as credit spreads widened considerably in the latter months of the year. We also maintained an underweight to high-yield securities, and the lower-rated segment of that sector in particular, which was also beneficial as higher-quality issues generally outperformed lower-rated issues. While we are looking for areas to add to our corporate position to take advantage of the recent credit spread widening, we are cautious as we believe the credit market remains vulnerable to potential credit downgrades and/or an economic downturn.

Throughout the year, we employed a defensive interest rate strategy by keeping the Portfolio's duration* shorter than that of the Lehman Brothers Intermediate U.S. Government/Credit Index. Although this strategy was beneficial early in the period when interest rates were rising, it detracted

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 3.89 | % | 6.55 | % | 3.39 | % | 4.50 | % | |||||||||||

| Class Y | 3.64 | % | 6.28 | % | — | 4.03 | % | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Lehman Brothers Intermediate U.S. Government/Credit Index tracks the performance of U.S. government and corporate obligations, including U.S. government agency and Treasury securities, and corporate and Yankee bonds with maturities of 1 to 10 years. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

13

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

from performance for the overall reporting year as the Federal Open Market Committee's (the "Fed") monetary easing in the latter months caused rates to decline significantly.

In March of this year, the Portfolio's yield curve positioning was adjusted to underweight longer dated issues and overweight intermediate dated issues. This was particularly additive to performance as the spread between intermediate- and long-dated yields widened and the curve steepened during the summer.

The Portfolio held an underweight position to agency mortgage-backed securities for most of the year, with a focus on high-coupon, slow-prepaying agency issues, and an overweight to non-agency mortgages issued to high quality borrowers. Although the underweight to agency mortgage-backed securities benefited performance, this was more than offset by the poor price performance of holdings in non-agency mortgages, which were overweighted versus the benchmark index. During the fourth quarter, the agency mortgage-backed position was increased to a neutral position versus the benchmark index.

Our emerging market debt activities had a favorable impact on performance. Overall, the strategy favored local-currency denominated securities in Argentina, Brazil, Mexico, Turkey, and a few other smaller countries.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

* A measure of the sensitivity of a bond's price to changes in interest rates, expressed in years. Each year of duration represents an expected 1 percent change in the price of a bond for every 1 percent change in interest rates. The longer a bond's duration, the greater the effect of interest-rate movements on its price. Typically, portfolios with shorter durations perform better in rising interest-rate environments, while portfolios with longer durations perform better when rates decline.

14

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

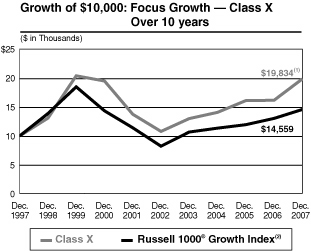

Focus Growth Portfolio

For the 12-month period ended December 31, 2007, Focus Growth Portfolio Class X shares produced a total return of 22.78 percent, outperforming the Russell 1000® Growth Index, which returned 11.81 percent. For the same period, the Portfolio's Class Y shares returned 22.49 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

The technology sector was the most significant contributor to overall performance for the period. Stock selection in the communications technology and computer technology sectors greatly bolstered relative returns, offsetting the negative influence of an underweight allocation in the sector overall. Stock selection in the consumer discretionary sector also benefitted relative returns, and helped to mitigate the damaging effects caused by a large overweight allocation. Here, investments in the retail, consumer electronics, and hotel/motel segments were particularly advantageous. Additionally, in the materials and processing sector, a sector overweight and a single holding in the agriculture fishing and ranching segment made a positive impact on the Portfolio's relative performance.

In contrast, the financial services sector had the largest negative impact on the Portfolio's relative performance for the period. Security selection,

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 22.78 | % | 12.98 | % | 7.09 | % | 11.41 | % | |||||||||||

| Class Y | 22.49 | % | 12.69 | % | — | (0.61 | )% | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell 1000® Growth Index measures the performance of those companies in the Russell 1000® Index with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

15

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

particularly in the financial information services companies, was a significant source of weak returns. Furthermore, the Portfolio's zero exposure in the consumer staples sector, and an underweight allocation within the producer durables sectors, also considerably diminished performance.

At the close of the period, consumer discretionary represented the largest sector weight and overweight in the Portfolio, followed by multi-industry and financial services sectors. The multi-industry sector (which includes conglomerates) was overweight relative to the Russell 1000 Growth Index, and the financial services sector was weighted in-line with the Index.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

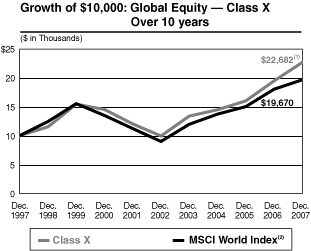

Global Equity Portfolio

For the 12-month period ended December 31, 2007, Global Equity Portfolio Class X shares produced a total return of 16.45 percent, outperforming the MSCI World Index, which returned 9.04 percent. For the same period, the Portfolio's Class Y shares returned 16.15 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

The Portfolio employs a bottom-up investment process that seeks opportunities on a stock-by-stock

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 16.45 | % | 17.95 | % | 8.53 | % | 9.03 | % | |||||||||||

| Class Y | 16.15 | % | 17.65 | % | — | 4.67 | % | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Morgan Stanley Capital International (MSCI) World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance. The term "free float" represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index .

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

16

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

basis; therefore, all broad country and sector weightings are a result of these individual bottom-up stock selections and not active top-down allocations. However, the Portfolio benefited from certain country allocations including a relative underweight in Japan, which was one of the worst performing markets in the MSCI World Index, and overweight allocations in Hong Kong and Spain, which were among the best performing markets during the period. In contrast, sector allocations were a detractor from relative performance, mainly due to underweight positions in the strong performing energy and materials sectors.

Nevertheless, we seek to add the most value through individual security selection, and stock selection was a major positive contributor to the Portfolio's relative performance during the period. In particular, the strongly positive influence of stock selection in the U.S. and Singapore offset weakness in our stock selection in Australia and Germany. From a sector view, stock selection decisions in the industrials, financials and information technology sectors were significantly additive to relative results.

Additionally, the Portfolio's performance was driven by other notable factors during the period. The Portfolio's growth-oriented investment strategy benefited in an environment in which growth stocks outperformed value stocks. Further, a modest position in emerging markets stocks also enhanced gains, as emerging markets outpaced developed markets during the period. However, the Portfolio's exposure to small cap stocks turned out to be a negative influence. A flight to quality during the period bolstered the performance of large cap stocks over small cap stocks. This development was negative for the Portfolio, which was overweight in small caps and underweight in large caps relative to the MSCI World Index.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

17

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

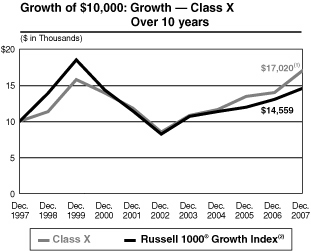

Growth Portfolio

For the 12-month period ended December 31, 2007, Growth Portfolio Class X shares produced a total return of 21.92 percent, outperforming the Russell 1000® Growth Index, which returned 11.81 percent. For the same period, the Portfolio's Class Y shares returned 21.58 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

For the period, the technology sector had the most significant positive impact on the Portfolio's performance. Security selection within the communications technology and the computer technology segments were particularly advantageous to relative returns, and helped to offset the negative influence of an underweight allocation in the technology sector overall. Another leading contributor to performance was the materials and processing sector, where a single holding in the agriculture fishing and ranching segment along with an overweight allocation within the sector helped relative returns. Additionally, stock selection in the retail, consumer electronics and hotel/motel segments within the consumer dictionary sector further bolstered performance, and mitigated the less favorable effect of the sector's overweight position.

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 21.92 | % | 14.87 | % | 5.46 | % | 8.58 | % | |||||||||||

| Class Y | 21.58 | % | 14.58 | % | — | (0.33 | )% | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Russell 1000® Growth Index measures the performance of those companies in the Russell 1000® Index with higher price-to-book ratios and higher forecasted growth values. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

18

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

Among the area of weakness for the Portfolio during the period was the financial services sector. Here, stock selection in financial information services companies detracted from performance. Further diminishing relative returns was Portfolio's underweight allocation in the consumer staples sector, which unfortunately overshadowed the benefits of strong security selection in this sector. The Portfolio's lack of exposure to the integrated oils sector also hindered performance.

At the close of the period, consumer discretionary represented the largest sector weight and overweight in the Portfolio, followed by financial services and the materials and processing sectors. The financial services sector was modestly underweighted versus the Russell 1000 Growth Index, while the materials and processing sector was overweight relative to the Index.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

Money Market Portfolio

An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of an investment at $1.00 per share, it is possible to lose money by investing in such funds.

As of December 31, 2007, Money Market Portfolio had net assets of approximately $123 million and an average portfolio maturity of 38 days. For the seven-day period ended December 31, 2007, the Portfolio's Class X shares provided an effective annualized yield of 4.92 percent and a current yield of 4.81 percent, while its 30-day moving average yield for December was 4.74 percent. For the 12-month period ended December 31, 2007 the Class X shares provided a total return of 4.93 percent. Past performance is no guarantee of future results.

For the seven-day period ended December 31, 2007 the Portfolio's Class Y shares provided an effective annualized yield of 4.67 percent and a current yield of 4.56 percent, while its 30-day moving average yield for December was 4.49 percent. For the 12-month period ended December 31, 2007 the Class Y shares provided a total return of 4.67 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

Our strategy in managing the Portfolio remained consistent with our long-term focus on maintaining preservation of capital and liquidity. We attempted to manage the Portfolio conservatively by emphasizing the purchase of high-quality money market obligations. We continued to invest in deposit

19

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

liabilities and senior obligations of strong financial institutions and two month and shorter traditional asset backed commercial paper. Given attractive levels available in short-dated asset backed commercial paper over year end, we maintained the Portfolio's weighted average maturity somewhat on the short end.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

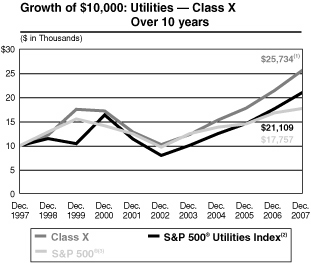

Utilities Portfolio

For the 12-month period ended December 31, 2007, Utilities Portfolio Class X shares produced a total return of 19.86 percent outperforming the S&P 500® Utilities Index and the S&P 500® Index which returned 19.38 percent and 5.49 percent, respectively. For the same period, the Portfolio's Class Y shares returned 19.59 percent. Past performance is no guarantee of future results.

The performance of the Portfolio's two share classes varies because each has different expenses. The Portfolio's total returns assume the reinvestment of all distributions but do not reflect the deduction of any charges by your insurance company. Such costs would lower performance.

The Portfolio outperformed the S&P 500 Utilities Index for the period primarily due to our exposure to the telecommunications services segment. Since the S&P 500 Utilities Index does not hold any telecommunications services securities, the gains the Portfolio achieved in this area helped to bolster its overall return relative to the Index's return.

Performance data quoted represents past performance and is not predictive of future returns. Current performance may be lower or higher than the performance shown. Investment return and principal value will fluctuate. When you sell Portfolio shares, they may be worth less than their original cost. Total returns do not reflect the deduction of taxes that a shareholder would pay on Portfolio distributions or the redemption of Portfolio shares. Performance for Class Y shares will vary from the performance of Class X shares due to differences in expenses. Performance assumes reinvestment of all distributions for the underlying portfolio based on net asset value (NAV). It does not reflect the deduction of insurance expenses, an annual contract maintenance fee, or surrender charges. If performance information included the effect of these additional charges, the total returns would be lower.

Average Annual Total Returns as of December 31, 2007

| 1 Year | 5 Years | 10 Years | Since Inception* | ||||||||||||||||

| Class X | 19.86 | % | 20.28 | % | 9.91 | % | 12.22 | % | |||||||||||

| Class Y | 19.59 | % | 19.99 | % | — | 4.24 | % | ||||||||||||

(1) Ending value on December 31, 2007 for the underlying portfolio. This figure does not reflect the deduction of any account fees or sales charges.

(2) The Standard & Poor's 500® Utilities Index (S&P 500® Utilities Index) is an unmanaged, market capitalization weighted index consisting of utilities companies in the S&P 500® Index and is designed to measure the performance of the utilities sector. It includes reinvested dividends. The Index is unmanaged and it s returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

(3) The Standard & Poor's 500® Index (S&P 500®) is a broad-based index, the performance of which is based on the performance of 500 widely-held common stocks chosen for market size, liquidity and industry group representation. The Index is unmanaged and its returns do not include any sales charges or fees. Such costs would lower performance. It is not possible to invest directly in an index.

* Inception dates of November 9, 1994 for Class X and July 24, 2000 for Class Y.

20

Morgan Stanley Select Dimensions Investment Series

Letter to the Shareholders n December 31, 2007 continued

(Conversely, any losses from these holdings would have detracted from the Portfolio's overall relative return.) The Portfolio's investment in wireless companies with coverage in Canada, Europe and Latin America significantly helped relative returns. In addition, stock selection in companies that own, operate and lease towers for wireless communications boosted relative performance, as the demand for multiple services continues to grow among existing wireless customers. Furthermore, the Portfolio's selection of independent electrical power providers yielded strong results, given that these providers were able to sell power at high prices on the open market.

In contrast, the Portfolio's allocation within the gas utility segment weakened overall performance. While the Portfolio's holdings in this sector all performed strongly on a absolute basis, our decision to have a smaller exposure to companies engaged in exploration and production of gasoline (as compared to the S&P 500 Utilities Index) in favor of firms that solely dedicated to distributing gas products to commercial and residential consumers somewhat diminished relative returns. Also detracting from the Portfolio's performance was a single holding in an electric utility company, which declined following a change in the regulatory environment.

We believe that the U.S. markets will remain volatile in the near term as investors brace for the widely anticipated economic slowdown. Defensive sectors, such as utilities, position the Portfolio well in the current environment.

There is no guarantee that any sectors mentioned will continue to perform as discussed herein or that securities in such sectors will be held by the Portfolio in the future.

We appreciate your ongoing support of Morgan Stanley Select Dimensions Investment Series and look forward to continuing to serve your investment needs.

Very truly yours,

Ronald E. Robison

President and Principal Executive Officer

21

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2007

As a shareholder of the Portfolio, you incur two types of costs: (1) insurance company charges; and (2) ongoing costs, including advisory fees; distribution and service (12b-1) fees; and other Portfolio expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 07/01/07–12/31/07.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical expenses based on the Portfolio's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any insurance company charges. Therefore, the second line of the table is useful in comparing ongoing costs, and will not help you determine the relative total cost of owning different funds. In addition, if these insurance company charges were included, your costs would have been higher.

22

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2007 continued

Money Market

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (2.46% return) | $ | 1,000.00 | $ | 1,024.60 | $ | 2.96 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.28 | $ | 2.96 | |||||||||

| Class Y | |||||||||||||||

| Actual (2.33% return) | $ | 1,000.00 | $ | 1,023.30 | $ | 4.23 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.02 | $ | 4.23 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.58% and 0.83% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 185**/365 (to reflect the one-half year period).

** Adjusted to reflect non-business days accruals.

Flexible Income

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (2.10% return) | $ | 1,000.00 | $ | 1,021.00 | $ | 3.01 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.23 | $ | 3.01 | |||||||||

| Class Y | |||||||||||||||

| Actual (1.98% return) | $ | 1,000.00 | $ | 1,019.80 | $ | 4.28 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.97 | $ | 4.28 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.59% and 0.84% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). If the Portfolio had borne all its expenses, the annualized expense ratios would have been 0.60% and 0.85% for Class X and Class Y, respectively.

Balanced

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (-1.62% return) | $ | 1,000.00 | $ | 983.80 | $ | 3.95 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.22 | $ | 4.02 | |||||||||

| Class Y | |||||||||||||||

| Actual (-1.81% return) | $ | 1,000.00 | $ | 981.90 | $ | 5.20 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.96 | $ | 5.30 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.79% and 1.04% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). If the Portfolio had borne all its expenses, the annualized expense ratios would have been 0.80% and 1.05% for Class X and Class Y, respectively.

23

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2007 continued

Utilities

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (6.75% return) | $ | 1,000.00 | $ | 1,067.50 | $ | 3.86 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.48 | $ | 3.77 | |||||||||

| Class Y | |||||||||||||||

| Actual (6.63% return) | $ | 1,000.00 | $ | 1,066.30 | $ | 5.16 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.21 | $ | 5.04 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.74% and 0.99% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). If the Portfolio had borne all its expenses, the annualized expense ratios would have been 0.75% and 1.00% for Class X and Class Y, respectively.

Dividend Growth

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (-2.16% return) | $ | 1,000.00 | $ | 978.40 | $ | 3.34 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.83 | $ | 3.41 | |||||||||

| Class Y | |||||||||||||||

| Actual (-2.28% return) | $ | 1,000.00 | $ | 977.20 | $ | 4.58 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.57 | $ | 4.69 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.67% and 0.92% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). If the Portfolio had borne all its expenses, the annualized expense ratios would have been 0.68% and 0.93% for Class X and Class Y, respectively.

Equally-Weighted S&P 500

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (-6.62% return) | $ | 1,000.00 | $ | 933.80 | $ | 1.36 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,023.79 | $ | 1.43 | |||||||||

| Class Y | |||||||||||||||

| Actual (-6.73% return) | $ | 1,000.00 | $ | 932.70 | $ | 2.58 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,022.53 | $ | 2.70 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.28% and 0.53% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

24

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2007 continued

Growth

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (10.84% return) | $ | 1,000.00 | $ | 1,108.40 | $ | 3.77 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.63 | $ | 3.62 | |||||||||

| Class Y | |||||||||||||||

| Actual (10.74% return) | $ | 1,000.00 | $ | 1,107.40 | $ | 5.10 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.37 | $ | 4.89 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.71% and 0.96% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Focus Growth

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (10.72% return) | $ | 1,000.00 | $ | 1,107.20 | $ | 3.88 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,021.53 | $ | 3.72 | |||||||||

| Class Y | |||||||||||||||

| Actual (10.60% return) | $ | 1,000.00 | $ | 1,106.00 | $ | 5.20 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.27 | $ | 4.99 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.73% and 0.98% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Capital Opportunities

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (9.04% return) | $ | 1,000.00 | $ | 1,090.40 | $ | 4.90 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.52 | $ | 4.74 | |||||||||

| Class Y | |||||||||||||||

| Actual (8.91% return) | $ | 1,000.00 | $ | 1,089.10 | $ | 6.21 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,019.26 | $ | 6.01 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 0.93% and 1.18% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). If the Portfolio had borne all its expenses, the annualized expense ratios would have been 0.94% and 1.19% for Class X and Class Y, respectively.

25

Morgan Stanley Select Dimensions Investment Series

Expense Example n December 31, 2007 continued

Global Equity

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (5.46% return) | $ | 1,000.00 | $ | 1,054.60 | $ | 5.18 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,020.16 | $ | 5.09 | |||||||||

| Class Y | |||||||||||||||

| Actual (5.33% return) | $ | 1,000.00 | $ | 1,053.30 | $ | 6.47 | |||||||||

| Hypothetical (5% annual return before expenses) | $ | 1,000.00 | $ | 1,018.90 | $ | 6.36 | |||||||||

* Expenses are equal to the Portfolio's annualized expense ratios of 1.00% and 1.25% for Class X and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Developing Growth

| Beginning Account Value | Ending Account Value | Expenses Paid During Period* | |||||||||||||

| 07/01/07 | 12/31/07 | 07/01/07 – 12/31/07 | |||||||||||||

| Class X | |||||||||||||||

| Actual (9.38% return) | $ | 1,000.00 | $ | 1,093.80 | $ | 3.48 | |||||||||