UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-8544 | |||||||

| ||||||||

FPA FUNDS TRUST | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

11400 WEST OLYMPIC BLVD., SUITE 1200, LOS ANGELES, CALIFORNIA |

| 90064 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

J. RICHARD ATWOOD, | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | 310-473-0225 |

| ||||||

| ||||||||

Date of fiscal year end: | MARCH 31 |

| ||||||

| ||||||||

Date of reporting period: | SEPTEMBER 30, 2009 |

| ||||||

Item 1. Report to Stockholders.

FPA Crescent Fund

Semi-Annual Report

September 30, 2009

Distributor:

FPA FUND DISTRIBUTORS, INC.

11400 West Olympic Boulevard, Suite 1200

Los Angeles, California 90064

52510

LETTER TO SHAREHOLDERS

Dear Shareholders:

Overview

Continued strength in the equity and corporate bond markets has buoyed Crescent, which increased 8.8% for the third quarter, and 22.0% year-to-date ended September 30, 2009. We are proud (and relieved) to report that, as of this writing, your portfolio is approximately break-even since the start of 2008, as compared to the broader market's loss of 21.9%.1 More detailed returns of both the Fund and the comparative indices can be found at the end of this commentary.

It is strange to us, though, that the global economic dysfunction of 2008 and early 2009 seems forgotten, made all the more apparent by the S&P 500's 61% rally from the March low. We cannot help but admit we felt some fear as the market continually made new lows last fall/winter, but our more objective selves saw opportunity and we happily committed capital during that time of great bargains. Sadly, the market move now leaves us with less obvious investment opportunities. Whereas before, we found haystacks, we now find ourselves combing for needles.

If all the turbulent water lies behind and the economic sea remains calm, we will likely lag the market as your portfolio remains postured to protect capital.

Economy

It's not easy to sit here and write about numbers without recognizing the tremendous financial and emotional distress inflicted on those who have lost their jobs. We clearly see an economic recovery, but how much and for how long remain the key. The economy is so strung out on easy money, fiscal stimuli, guarantees, tax credits, etc. that we find understanding this heavily medicated economy unusually challenging — not that it's ever easy. It's difficult to determine vitals and make a diagnosis when the patient is all doped up. The U.S government's prescription has been to try to boost consumption, which will likely continue for the foreseeable future through such means as jobless benefits and extended/expanded homeownership tax credits. We question how our economy will perform as we are weaned from the medication (the transient stimuli). If your baby girl has the flu, administering children's Tylenol has proven effective at lowering the fever; however, that does not mean she's recovered. Skip a dose and you'll find out. What happens when Dr. Bernanke packs up his medicine bag and goes home?

One can only hope that stimulus programs will prove successful but we have our doubts. We only just witnessed the frivolity of the Cash for Clunkers program, which merely pulled car sales forward with the unintended consequence of adding around $12 billion in debt on consumers' balance sheets.2,3,4 The following is a rough calculation of politically desirous, yet useless spending.

| Total program payments | $ | 2,877,000,000 | |||||

| Program participants | 690,000 | ||||||

| Average cost of auto | $ | 22,500 | |||||

| Average rebate | ($ | 4,170 | ) | ||||

| Net cost of auto | $ | 18,330 | |||||

| 5% down payment (typical) | $ | 917 | |||||

| Amount borrowed per car | $ | 17,414 | |||||

| Estimated amount borrowed | $ | 12,015,660,000 | |||||

1 Cumulative return with dividends reinvested from December 31, 2007 through October 19, 2009 equals -0.03%. S&P 500 used in broader market calculation.

2 United States Department of Transportation, 26 August 2009, <http://www.dot.gov/affairs/2009/dot13309.htm>.

3 We realize that some cars were purchased for cash, albeit a very small number. The average car is purchased with just 5% down. Some cars were leased but the present value of the future lease liability would approximate a ratable share of the $12 billion debt burden.

4 "Bankrate.com," Web, 25 Oct 2009, <http://www.bankrate.com/finance/auto/sizing-up-your-down-payment.aspx.

1

The Top Chefs of the Fed and Treasury have mixed in their cauldron a witch's brew of fiscal and monetary policy, tax credits, guarantees, etc. that kept our economy from a depression death spiral. We thought we'd be able to take a breath and properly assess the economic and investing landscape but the market, with its recent meteoric rise, seems to have already voted on a fairly typical recovery. We suspect, however, that GDP growth will not justify valuations of many securities — both equity and debt.

It's easy to stimulate an economy with government spending. The more you spend, the more you grow. It's like this.... Joe Spender earns and spends $125,000 after taxes. He wants a new something or another and so he borrows and then spends another $25,000. He will eventually have to repay his debt, but in the interim the economy has received a fleeting boost. It takes more spending than originally thought to put people back to work. At the time of the American Recovery and Reinvestment Act of 2009's passage last February, "Administration economists cited Keynesian models that predicted that the $787 billion stimulus package would increase GDP by enough to create 3.6 million jobs... but the data available so far tell us that the government transfers and rebates have not stimulated consumption at all, and that the resilience of the private sector (e.g., business investment) following the fall 2008 panic, not the fiscal stimulus program, deserve s the lion's share of the credit."5

We aren't the first to try to boost economic activity through the issuance of paper money that lacks all but the guarantee of its issuer. Such experiments go back at least as far as the early 18th century when John Law, King Louis XV's regent and economic adviser, tried to do just that but failed, breaking what would be the French equivalent of our U.S. Treasury and wreaking economic havoc across Europe.6

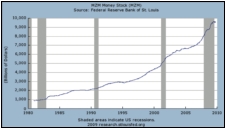

Money supply continues to expand as can be seen in the chart below.7 As long as politicians seek public support for reelection, and without much needed campaign reform policies, we expect the political will for stimulus retrenchment to be found wanting. We believe the result will, at a point, be inflation and the longer-term degradation of the U.S. dollar.

5 Cogan, John F., John B. Taylor, and Volker Wieland, "The Stimulus Didn't Work," Wall Street Journal, 17 September 2009.

6 "Quantitative Easing," Economist, 15 August 2009.

7 Economic Research Federal Reserve Bank of St. Louis, Web, 25 October 2009,

<http://research.stlouisfed.org/fred2/data/MZM_Max_630_378.png.>.

2

The government needs to foster creativity in ways other than with its balance sheet because all we seem to be getting is bigger and bigger government. We now have the highest amount of government spending since WWII, as a percent of GDP; Fannie and Freddie now buy or guarantee two-thirds of all U.S. mortgages; the FHA now guarantees 23% of all mortgages (up from 2%); the world's largest auto company and what was once the largest insurer have effectively become majority-owned subsidiaries of the U.S. government, not to mention an increasing number of banks either assisted through the TARP or taken over by the FDIC....8

The focus needs to become less political and more sensible. Rather than demonizing for-profit health insurance companies, whose aggregate after-tax profits account for less than 1% of total U.S. healthcare spending, healthcare reform needs to address the healthcare delivery system and the misaligned incentives of our third-party payer system.9 Rather than applying tariffs on goods imported from China, let's provide incentives to make our manufacturing more competitive. Rather than making labor markets more rigid through benefit mandates and union card check legislation, let's provide job retraining and continuing education programs. And, rather than give wintery Duluth, Minnesota $6 million in requested Federal stimulus money for snow making machines, let's do just about anything else.

The securities markets appear to have priced in economic stability. We don't buy it. Besides the aforementioned, a number of considerations could easily inhibit a sustained economic recovery:

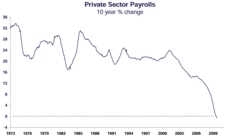

• Employment. Job losses continue. The Labor Department calculates employment by estimating the number of businesses that have shuttered and the number of businesses that have been created (the birth/death model) in a given period, but this approach has dreadfully understated job losses. Note from the chart below that the private sector has failed to create any net new jobs in the last ten years!10

8 Fannie = Fannie Mae. Freddie = Freddie Mac. TARP = Troubled Asset Relief Program. FHA = Federal Housing Association. FDIC = Federal Deposit Insurance Corporation.

9 Total U.S. healthcare spending in 2008 was $2.4 trillion according to the Center for Medicare and Medicaid Services. Aggregate net income of for-profit publicly traded managed care companies was $10 billion in 2008 (Compustat).

10 MacroMavens, 23 October 2009.

3

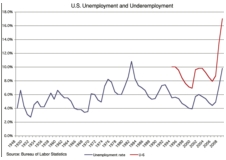

We now stand at the highest levels of unemployment and underemployment we have seen since the 1930s, and they are still rising.11

• Cost containment. Labor and raw material costs have been coming down but pricing has held relatively firm, thereby providing a margin boost to many corporations (and to a degree greater than we admittedly expected). The optimists argue that this cost containment will result in higher operating leverage when revenues uptick. We expect that at least a portion of the current margin expansion will be competed away.

• Residential Housing.

m Defaulted home mortgages are just inching their way through the foreclosure process. Numbers are distorted by a ton of all cash deals by people who are looking to become landlords so as to receive rent that is greater than the paltry bank interest they would otherwise be receiving.

m 88% of Option ARM loans have yet to reprice. "Of these loans that have not yet recast, 94% have utilized the minimum monthly payment to allow their loans to negatively amortize.....Option ARMs either 90 days or more delinquent, in foreclosure or real estate-owned proceedings, which have increased from 16% to 37%. Total 30+ delinquencies are now 46%, despite the fact that only 12% have recast and experienced an associated payment shock."12

n One estimate has this overhang on existing home sales to be 7.1 million units, not inconsequential on a current base of 5.57 million. As Alan Abelson points out in a recent Barron's article, "Amherst (Securities) estimates...(t)hat's the equivalent of 135% of a full year's existing-home sales and chillingly greater than the 1.27 million units that made up the overhang in early 2005, when the housing bubble had just begun its dizzying and more than a little lunatic ascent."

11 Bureau Labor Statistics. Unemployment rate = Total unemployed, as a percent of the civilian labor force (official unemployment rate). U6 = Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers. Note: Marginally attached workers are persons who currently are neither working nor looking for work but indicate that they want and are available for a job and have looked for work sometime in the recent past.

12 "Recast — Fitch: $134B of U.S. Option ARM RMBS To Recast by 2011," trading-house.Net, Web, 25 Oct 2009, <http://www.direktbroker.de/news-kurse/details/International-News/Nachricht/20499863>.

4

• Commercial Mortgages. As we have addressed in prior commentaries, there are $2 trillion of commercial mortgages outstanding, with the unfortunate majority coming due in the next three to four years as can be seen in the chart below — the effects of which will be problematic for many banks, particularly the smaller, undercapitalized regional banks.13,14

• Consumer spending. A sustainable rise in consumer spending is necessary for a commensurately sustained economic recovery. For that, we'll need to see a fall-off in consumer bankruptcies that have continued to rise while U.S. households struggle under high unemployment and pressing debt burdens.

• Wage growth. Wage growth continues to be negative — net of transfer payments. A strong economic recovery will need to see net wage growth turn positive.

This is just a partial list and not intended to be unduly negative but hopefully serve as a reminder that we are not out of the woods yet. We still predict an "uh-oh" moment in 2010 when one or more of the above become headlines.

Investments

We are left with the unsettling feeling that the stock market seems to have greater expectations for the economy than we do. Somebody's wrong. At best, we are shocked with how quickly complacency has returned. In the same span where we saw the stock market increase more than 60%, we also have shed more than 2.5 million jobs. As David Rosenberg, Chief Economist and Strategist at Gluskin Sheff, points out, "Never before have we seen the stock market rise so much off a low over such a short time period, and usually at this stage, the economy has already created over one million jobs."15 We thought Mr. Rosenberg had thrown in his bear towel when we saw his recent commentary headlining a V-shaped recovery; however, as we subsequently read, he interpreted the "V" as valuation, not a quick and su stained snapback of GDP growth.

With the market having exhibited such rarely paralleled strength, we have naturally had many successes. We are not claiming to be particularly smart of late, as it has been virtually impossible for long investors to lose money. Your portfolio has performed well despite its conservative posture, thanks to our team's strong security selection, particularly in high yield and distressed credits with particular appreciation for the stalwart efforts of our associates Brian Selmo and John Peetz. Meanwhile, our net market exposure still provides us reasonable protection should market trends reverse.

Healthcare remains one of the few parts of the market experiencing duress and, as is in our nature, we have increased investments in that sector. We do not like the degree of government proposed involvement, recognizing,

13 Deutsche Bank, "The Future Refinancing Crisis in Commercial Real Estate," 23 April 2009.

14 Excludes $600 billion of construction loans and $200 billion of multi-family loans.

15 Gluskin Sheff, "Market Musings & Data Deciphering, Breakfast with Dave," 17 September 2009.

5

as Arthur Laffer pointed out in the New York Times, "that when the government spends money on health care, the patient does not"16 and are therefore treading cautiously. We have owned Covidien (medical equipment provider) and WellPoint (largest owner of Blue Cross/Blue Shield health insurance programs) and are working on or building positions in other companies in the space. We expect further opportunities to materialize as Congress finalizes healthcare reform.

We recently initiated a position in PetSmart, Inc., thanks to another of our associates, Greg Nathan. PetSmart, a pet supplies and services retailer, has the largest market share in the U.S. Its competitive advantages include superior selection of products and services, the lowest prices, purchasing power, and 1,145 convenient locations. Consumer frugality has hurt both sales and margins, but once the economy recovers, and certain operating improvements are made, we believe that at our low $20s average cost, we own a great company in a growing industry at what could prove to be less than 10x after-tax free cash flow. We believe the future drivers of higher cash flow per share will likely be: excess depreciation resulting from an only just completed storewide remodel; better marketing and merchandising; savings resulting from distribution center rationalization; an increase in private label from the current 19% of merchandise sales to a 4-yea r target of 28%; inflation beneficiary should agricultural commodity prices rise; and a shareholder friendly management that has committed to repurchase up to $350 million of shares over the next couple of years.

We purchased CIT bonds based on analysis that suggests that the position should do well in the event CIT were to file for bankruptcy. We believed that we would make money in our investment across a range of outcomes that included both bankruptcy and restructuring. Please refer to our 2nd quarter commentary for the details of that discussion. Since then, CIT ran out of money and was forced to seek temporary "rescue" financing to prevent a disorderly free-fall bankruptcy and the situation bears revisiting now.

Thanks to our existing position and understanding of CIT, we were able to take advantage of the company's July liquidity crisis by increasing our position at highly attractive levels (mid 50s) and help fund the company's rescue facility (on terms that seem extremely favorable to the new lenders). CIT proposed an exchange offer and bankruptcy plan to existing unsecured bondholders in October. The proposal and plan were largely in line with our expectations for a restructuring of CIT. The principal of the exchange and plan are consistent with the rule of absolute priority. Under either the exchange or proposal, unsecured bondholders will receive over 95% of CIT's economic value and functional control of the company's board/strategy. We believe that the exchange is unlikely to succeed, but that the pre-packaged bankruptcy plan will succeed. Under that plan, we estimate that bondholders should realize more than 90 cents on the dollar (over time) through a combination of new notes and new common stock.

We purchased the debt of a number of distressed companies with the belief that some of these companies would ultimately fall into bankruptcy and we would be required to participate in the restructurings. So far, only one investment has required us to actively participate on a creditor committee, with John Peetz ably taking that seat on our behalf. Our work on this creditor committee is nearing an end as we are currently negotiating a final restructuring agreement that we hope will be completed by year end. The time we have invested on the creditor committee has paid off as the market price of our bonds has more than doubled in value. We had anticipated making additional investments with the prospect of influencing the debt restructuring process in favor of our shareholders, but have been surprised at the dearth of opportunities as many troubled companies have been able to raise fresh capital to fix their balance-sheet problems.

As past owners of TIPS (Treasury Inflation Protected Notes), investors have asked us why we have not been buyers as a means to protect against our government's profligate use of ink and paper. Although quite concerned

16 Arthur Laffer, "How to Fix the Health-Care 'Wedge'," Wall Street Journal, 5 August 2009.

6

about inflation, we do not know when it will rear its head. We have heard some reference conclusions drawn from Peter Bernholz's book Monetary Regimes and Inflation, which lays out the argument for hyperinflation as has been the case over time in those countries where government deficits exceed 40% of government expenditures — something the U.S. unfortunately exceeds today. We certainly don't argue with Mr. Bernholz's conclusions but we lack the capability to address timing. In the meantime, we see high unemployment and low capacity utilization, not to mention a flawed CPI index. We would rather seek inflation protection elsewhere. We also believe that interest rates have every possibility of rising even without a commensurate increase in the rate of inflation due to, as we have addressed in detail in past commentaries, the continued need to convince people to buy our government-issued treasuries (more than half of whom have been foreigners).

Closing

According to the securities markets, things don't seem so bad. The frog wasn't squished in the road but it did not become a prince. Is it really possible that the gut wrenching movement of the economic tectonic plates have settled for the duration? Perhaps, but we would rather act protectively over your capital entrusted to us. A drinking binge is generally followed by sickness, and then by a hangover. We believe that we are in the latter stage. When the fear of not being in the game is replaced by the fear of losing, expect us to be committing additional capital.

Respectfully submitted,

Steven Romick

President

October 20, 2009

7

The discussion of Fund investments represents the views of the Fund's managers at the time of this report and are subject to change without notice. References to individual securities are for informational purposes only and should not be construed as recommendations to purchase or sell individual securities. While the Fund's managers believe that the Fund's holdings are value stocks, there can be no assurance that others will consider them as such. Further, investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on current management expectations, they are considered "forward-looking statements" which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in t his report should not be construed as a recommendation to purchase or sell any particular security.

8

PORTFOLIO CHARACTERISTICS AND PERFORMANCE

September 30, 2009

Portfolio Characteristics

| FPA Crescent | Russell 2500 | S&P 500 | Barclays Capital Gov't/Credit | ||||||||||||||||

| Stocks | |||||||||||||||||||

| Price/Earnings TTM | 11.2 | x | 152.0 | x | 23.5 | x | |||||||||||||

| Price/Earnings 2009 est. | 13.6 | x | 117.9 | x | 21.3 | x | |||||||||||||

| Price/Book | 1.3 | x | 1.8 | x | 2.2 | x | |||||||||||||

| Dividend Yield | 1.8 | % | 1.4 | % | 2.0 | % | |||||||||||||

| Average Weighted Market Cap (billion) | $ | 37.5 | $ | 2.1 | $ | 77.1 | |||||||||||||

| Median Market Cap (billion) | $ | 2.9 | $ | 0.5 | $ | 8.2 | |||||||||||||

| Bonds | |||||||||||||||||||

| Duration (years) | 1.7 | 5.3 | |||||||||||||||||

| Maturity (years) | 2.1 | 7.6 | |||||||||||||||||

| Yield-to-Worst | 6.8 | % | 3.1 | % | |||||||||||||||

| Yield-to-Worst (corporate only) | 12.3 | % | |||||||||||||||||

Portfolio Analysis

10 Largest Holdings (excluding U.S. Treasuries)

| Ensco International | 4.0 | % | |||||

| Covidien LTD | 3.5 | % | |||||

| CIT Group Bonds* | 3.1 | % | |||||

| American General Finance Bonds* | 2.9 | % | |||||

| Chevron | 2.9 | % | |||||

| Total S.A. | 2.7 | % | |||||

| PetSmart | 2.0 | % | |||||

| Ford Credit Europe Bonds* | 2.0 | % | |||||

| ConocoPhillips | 1.9 | % | |||||

| American Capital 8.6% 08/2012 | 1.8 | % | |||||

| Total | 26.8 | % | |||||

* Various issues

Portfolio Composition

| Asset Class | |||||||

| Common Stocks, Long | 38.0 | % | |||||

| Common Stocks, Short | -6.7 | % | |||||

| Corporate Fixed Income | 27.8 | % | |||||

| Net Liquidity (Cash Ex-Short Rebate) | 27.5 | % | |||||

| Geographic | |||||||

| U.S. | 50.7 | % | |||||

| Europe | 11.6 | % | |||||

| Other | 0.9 | % | |||||

Performance Statistics

| FPA Crescent | 60% R2500/ 40% BCGC | Russell 2500 | S&P 500 | ||||||||||||||||

| Statistics | |||||||||||||||||||

| Gain in Up Months - Cumulative | 333.9 | % | 323.4 | % | 494.6 | % | 410.8 | % | |||||||||||

| Upside Participation | 103.2 | % | 67.5 | % | 81.3 | % | |||||||||||||

| Loss in Down Months - Cumulative | -153.9 | % | -181.4 | % | -321.3 | % | -274.4 | % | |||||||||||

| Downside Participation | 84.8 | % | 47.9 | % | 56.1 | % | |||||||||||||

| Up Month - Average | 2.6 | % | 2.5 | % | 4.0 | % | 3.3 | % | |||||||||||

| Down Month - Average | -2.2 | % | -2.7 | % | -4.4 | % | -3.9 | % | |||||||||||

| Delta between Up/Down months | 4.8 | % | 5.2 | % | 8.4 | % | 7.2 | % | |||||||||||

| Worst Month | -13.9 | % | -13.9 | % | -21.5 | % | -16.8 | % | |||||||||||

| Best Month | 12.6 | % | 9.3 | % | 14.4 | % | 9.8 | % | |||||||||||

| Standard Deviation | 10.82 | 11.20 | 18.46 | 15.32 | |||||||||||||||

| Sharpe Ratio (using 5% risk-free rate) | 0.55 | 0.30 | 0.22 | 0.16 | |||||||||||||||

| Performance | |||||||||||||||||||

| Quarter | 8.8 | % | 13.5 | % | 20.1 | % | 15.6 | % | |||||||||||

| Calendar YTD | 22.0 | % | 18.8 | % | 27.9 | % | 19.3 | % | |||||||||||

| 1 Year - Trailing | 2.3 | % | 2.4 | % | -5.7 | % | -6.9 | % | |||||||||||

| 3 Years - Trailing | 2.7 | % | 0.8 | % | -3.8 | % | -5.4 | % | |||||||||||

| 5 Years - Trailing | 6.0 | % | 4.5 | % | 3.3 | % | 1.0 | % | |||||||||||

| 10 Years - Trailing | 9.8 | % | 6.9 | % | 6.3 | % | -0.2 | % | |||||||||||

| 15 Years - Trailing | 11.0 | % | 8.6 | % | 9.0 | % | 7.6 | % | |||||||||||

| From Inceptiona | 10.9 | % | 8.4 | % | 9.0 | % | 7.4 | % | |||||||||||

9

PORTFOLIO CHARACTERISTICS AND PERFORMANCE

September 30, 2009

HISTORICAL PERFORMANCE

| Calendar Year-End | FPA Crescent | 60% R2500/ 40% BCGC | Russell 2500 | S&P 500 | |||||||||||||||

| 2008 | -20.6 | % | -21.4 | % | -36.8 | % | -37.0 | % | |||||||||||

| 2007 | 6.8 | % | 3.9 | % | 1.4 | % | 5.5 | % | |||||||||||

| 2006 | 12.4 | % | 11.2 | % | 16.2 | % | 15.8 | % | |||||||||||

| 2005 | 10.8 | % | 6.0 | % | 8.1 | % | 4.9 | % | |||||||||||

| 2004 | 10.2 | % | 12.7 | % | 18.3 | % | 10.9 | % | |||||||||||

| 2003 | 26.2 | % | 28.1 | % | 45.5 | % | 28.7 | % | |||||||||||

| 2002 | 3.7 | % | -6.6 | % | -17.8 | % | -22.1 | % | |||||||||||

| 2001 | 36.1 | % | 4.8 | % | 1.2 | % | -11.9 | % | |||||||||||

| 2000 | 3.6 | % | 7.9 | % | 4.3 | % | -9.1 | % | |||||||||||

| 1999 | -6.3 | % | 13.3 | % | 24.2 | % | 21.0 | % | |||||||||||

| 1998 | 2.8 | % | 4.9 | % | 0.4 | % | 28.6 | % | |||||||||||

| 1997 | 22.0 | % | 18.5 | % | 24.4 | % | 33.4 | % | |||||||||||

| 1996 | 22.9 | % | 12.6 | % | 19.0 | % | 23.0 | % | |||||||||||

| 1995 | 26.0 | % | 26.7 | % | 31.7 | % | 37.6 | % | |||||||||||

| 1994 | 4.3 | % | -2.0 | % | -1.1 | % | 1.3 | % | |||||||||||

| 1993(a) | 9.6 | % | 8.2 | % | 10.1 | % | 5.3 | % | |||||||||||

Objective, Strategy and Rankings

Objective

The Fund's investment objective is to provide a total return consistent with reasonable investment risk through a combination of income and capital appreciation. We employ a strategy of selectively investing across a company's capital structure (i.e., a combination of equity and debt securities) that we believe have the potential to increase in market value, in order to achieve rates of return with less risk than the broad U.S. equity indices.

Strategy

To invest across a company's capital structure to meet our objective. This includes investing in Common and Preferred Stocks, Convertible Bonds, High-Yield Bonds, and Bank Debt. There is an occasional use of Government Bonds.

Downside Protection

FPA Crescent's ratio of positive to negative monthly performance is, on average from inception,a 7% better than the equity indexes. FPA Crescent has, on average from inception, captured 74% of the upside monthly performance but just 52% of the downside when compared to the equity indexes.

Volatility

FPA Crescent has exhibited much less volatility as measured by its Standard Deviation from inception.a On average, the Fund's Standard Deviation is 36% lower than the equity indexes. FPA Crescent has a much lower delta in its average monthly performance, i.e., the difference between the average positive and negative month when compared to the equity indexes.

FPA Crescent has had only two years of negative performance since inception,a the worst a loss of 21%. FPA Crescent's maximum drawdown is 37% better than its benchmarks.

| Crescent | 60% R2500/40% BCGC | R2500 | S&P 500 | ||||||||||||||||

| Number loss years since inceptiona | 2 | 3 | 3 | 4 | |||||||||||||||

| Maximum Drawdownb | -29 | % | -33 | % | -53 | % | -51 | % | |||||||||||

Performance

FPA Crescent has beaten the stock indexes for the inception-to-date time period.a

Conclusion

FPA Crescent has met its objective since inception, having achieved higher absolute rates of return than the indexes and a dramatically higher Sharpe Ratio.a

NOTES

a Inception date is June 2, 1993. Returns from inception are annualized. The annualized performance of the Russell 2500 and Barclays Capital Government/Credit Indexes begins 6/1/93.

b Maximum Drawdown is the largest percentage peak to trough decline in value that has occurred since inception.

Past performance is not necessarily indicative of future results. All returns assume the reinvestment of dividends and distributions. There are no assurances that the Fund will meet its stated objectives. The Fund's holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities. Distributed by FPA Fund Distributors, Inc., a subsidiary of First Pacific Advisors, LLC.

Balanced Benchmark is a hypothetical combination of unmanaged indices comprised of 60% Russell 2500 Index and 40% Barclays Capital Government/Credit Index, reflecting the Fund's neutral mix of 60% stocks and 40% bonds.

Russell 2500 Index is an unmanaged index comprised of 2,500 stocks of U.S. companies with small market capitalizations.

Barclays Capital Government/Credit Index is an unmanaged index of investment grade bonds, including U.S. Government Treasury bonds, corporate bonds, and yankee bonds.

S&P 500 Index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. The index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

10

MAJOR PORTFOLIO CHANGES

For the Six Months Ended September 30, 2009

| Shares or Principal Amount | |||||||

| NET PURCHASES | |||||||

| Common Stocks | |||||||

| AGCO Corporation | 331,500 | ||||||

| Chevron Corporation | 583,400 | ||||||

| Covidien plc | 374,200 | ||||||

| ENSCO International Incorporated | 509,700 | ||||||

| Health Net, Inc. (1) | 1,836,179 | ||||||

| Lowe's Companies, Inc. | 423,100 | ||||||

| Omnicare, Inc. | 915,500 | ||||||

| PetSmart, Inc. (1) | 1,993,700 | ||||||

| Total S.A. (ADR) | 740,100 | ||||||

| Transatlantic Holdings Inc. (1) | 290,000 | ||||||

| Non-Convertible Bonds & Debentures | |||||||

| Capital Automotive L.P. — 2.02% 2010 (Floating) | $ | 13,611,273 | |||||

| CIT Group Inc. — 0.41969% 2010 (Floating) (1) | $ | 9,568,000 | |||||

| CIT Group Inc. — 5.125% 2014 (1) | $ | 10,153,000 | |||||

| CIT Group Inc. — 13% 2012 (Floating) (1) | $ | 7,500,000 | |||||

| Leucadia National Corporation — 7.125% 2017 (1) | $ | 15,967,000 | |||||

| Residential Capital, LLC — 8.5% 2010 (1) | $ | 11,802,000 | |||||

| The Rouse Company — 7.2% 2012 (1) | $ | 26,512,000 | |||||

| Convertible Debenture | |||||||

| Prologis — 2.625% 2038 (1) | $ | 10,536,000 | |||||

| NET SALES | |||||||

| Common Stocks | |||||||

| eBay Inc. | 444,900 | ||||||

| Patterson-UTI Energy, Inc. (2) | 989,776 | ||||||

| Reliant Energy, Inc. (2) | 1,393,165 | ||||||

| Non-Convertible Bonds & Debentures | |||||||

| Alliance One International, Inc. — 11% 2012 (2) | $ | 5,871,000 | |||||

| The Interpublic Group of Companies, Inc. — 7.25% 2011 (2) | $ | 23,806,000 | |||||

| Michaels Stores, Inc. — 2.5625% 2013 (Floating) | $ | 11,656,404 | |||||

| Newfield Exploration Company — 7.625% 2011 (2) | $ | 7,300,000 | |||||

| SLM Corporation — 3.675% 2009 (Floating) (2) | $ | 5,281,000 | |||||

| Tenet Healthcare Corporation — 9.875% 2014 (2) | $ | 8,000,000 | |||||

(1) Indicates new commitment to portfolio

(2) Indicates elimination from portfolio

11

PORTFOLIO OF INVESTMENTS

September 30, 2009

| COMMON STOCKS — LONG | Shares | Value | |||||||||

| ENERGY — 13.5% | |||||||||||

| Arkema S.A. | 806,000 | $ | 28,411,500 | ||||||||

| Chevron Corporation | 900,000 | 63,387,000 | |||||||||

| ConocoPhillips | 891,500 | 40,260,140 | |||||||||

| ENSCO International Incorporated† | 2,039,900 | 86,777,346 | |||||||||

| Rowan Companies, Inc. | 744,600 | 17,177,922 | |||||||||

| Total S.A. (ADR) | 980,000 | 58,074,800 | |||||||||

| $ | 294,088,708 | ||||||||||

| HEALTH CARE — 8.1% | |||||||||||

| Amgen Inc.* | 328,600 | $ | 19,791,578 | ||||||||

| Covidien plc | 1,749,200 | 75,670,392 | |||||||||

| Health Net, Inc.* | 1,836,179 | 28,277,157 | |||||||||

| Omnicare, Inc. | 1,133,000 | 25,515,160 | |||||||||

| WellPoint, Inc.* | 598,000 | 28,321,280 | |||||||||

| $ | 177,575,567 | ||||||||||

| RETAILING — 5.7% | |||||||||||

| eBay Inc.* | 1,143,700 | $ | 27,002,757 | ||||||||

| Lowe's Companies, Inc. | 1,358,000 | 28,436,520 | |||||||||

| PetSmart, Inc. | 1,993,700 | 43,362,975 | |||||||||

| Wal-Mart Stores, Inc. | 525,000 | 25,772,250 | |||||||||

| $ | 124,574,502 | ||||||||||

| INDUSTRIAL PRODUCTS — 3.2% | |||||||||||

| AGCO Corporation* | 675,000 | $ | 18,650,250 | ||||||||

| Cookson Group plc | 3,582,030 | 23,541,101 | |||||||||

| Cymer, Inc.* | 402,400 | 15,637,264 | |||||||||

| Trinity Industries, Inc. | 714,900 | 12,289,131 | |||||||||

| $ | 70,117,746 | ||||||||||

| FINANCIAL SERVICES — 3.0% | |||||||||||

| Assurant, Inc.† | 770,000 | $ | 24,686,200 | ||||||||

| Countrywide Holdings, Ltd. — A*,** | 3,092,167 | 7,415,326 | |||||||||

| Countrywide Holdings, Ltd. — B*,**,†† | 3,092,167 | 49,474 | |||||||||

| Discover Financial Services | 1,145,700 | 18,594,711 | |||||||||

| Transatlantic Holdings Inc. | 290,000 | 14,549,300 | |||||||||

| $ | 65,295,011 | ||||||||||

| SERVICE — 1.4% | |||||||||||

| Brink's Company, The | 443,500 | $ | 11,934,585 | ||||||||

| Brink's Home Security Holdings, Inc.* | 257,500 | 7,928,425 | |||||||||

| G&K Services, Inc. | 458,502 | 10,160,404 | |||||||||

| $ | 30,023,414 | ||||||||||

12

PORTFOLIO OF INVESTMENTS

September 30, 2009

| COMMON STOCKS — LONG — Continued | Shares or Principal Amount | Value | |||||||||

| CONSUMER NON-DURABLE GOODS — 1.2% | |||||||||||

| Koninklijke Philips Electronics N.V. | 982,600 | $ | 23,936,136 | ||||||||

| WestPoint International, Inc.*,**,†† | 167,161 | 1,653,222 | |||||||||

| WestPoint International, Inc. — rights*,**,†† | 149,230 | 165,646 | |||||||||

| $ | 25,755,004 | ||||||||||

| AUTOMOTIVE — 0.6% | |||||||||||

| Group 1 Automotive, Inc. | 502,200 | $ | 13,484,070 | ||||||||

| MULTI-INDUSTRY — 0.5% | |||||||||||

| Onex Corporation | 441,400 | $ | 10,827,542 | ||||||||

| INVESTMENT COMPANIES — 0.5% | |||||||||||

| Ares Capital Corporation | 925,209 | $ | 10,195,803 | ||||||||

| UTILITIES — 0.3% | |||||||||||

| PG&E Corporation | 160,000 | $ | 6,478,400 | ||||||||

| TOTAL COMMON STOCKS — 38.0% (Cost $736,815,581) | $ | 828,415,767 | |||||||||

| CONVERTIBLE BONDS & DEBENTURES REAL ESTATE — 2.1% | |||||||||||

| Forest City Enterprises, Inc. — 3.625% 2011 | $ | 3,886,000 | $ | 3,521,687 | |||||||

| General Growth Properties, Inc. — 3.98% 2027** | 7,060,000 | 4,950,825 | |||||||||

| Hospitality Properties Trust — 3.8% 2027 | 9,565,000 | 8,943,275 | |||||||||

| Prologis — 2.625% 2038 | 10,536,000 | 9,021,450 | |||||||||

| SL Green Realty Corp. — 3% 2027** | 22,001,000 | 19,800,900 | |||||||||

| $ | 46,238,137 | ||||||||||

| TECHNOLOGY — 0.5% | |||||||||||

| Lucent Technologies Inc. — 2.875% 2023 | $ | 11,097,000 | $ | 10,916,674 | |||||||

| FINANCIAL SERVICES — 0.4% | |||||||||||

| National Financial Partners Corp. — 0.75% 2012 | $ | 11,325,000 | $ | 8,479,594 | |||||||

| ADVERTISING — 0.3% | |||||||||||

| The Interpublic Group of Companies, Inc. — 4.25% 2023 | $ | 7,584,000 | $ | 7,384,920 | |||||||

| AUTOMOTIVE — 0.2% | |||||||||||

| Group 1 Automotive, Inc. — 2.25% 2036 | $ | 7,000,000 | $ | 4,830,000 | |||||||

| TOTAL CONVERTIBLE BONDS & DEBENTURES — 3.5% (Cost $56,781,522) | $ | 77,849,325 | |||||||||

13

PORTFOLIO OF INVESTMENTS

September 30, 2009

| NON-CONVERTIBLE BONDS & DEBENTURES | Principal Amount | Value | |||||||||

| CORPORATE BONDS & DEBENTURES FINANCIAL SERVICES — 14.4% | |||||||||||

| American Capital, Ltd. — 6.85% 2012 | $ | 46,824,000 | $ | 38,388,188 | |||||||

| American General Finance | |||||||||||

| —4% 2011 | 1,900,000 | 1,633,886 | |||||||||

| —4.625% 2010 | 5,111,000 | 4,677,843 | |||||||||

| —4.875% 2012 | 8,141,000 | 6,308,868 | |||||||||

| —5.375% 2012 | 18,011,000 | 14,071,454 | |||||||||

| —5.625% 2011 | 26,430,000 | 23,386,321 | |||||||||

| —5.85% 2013 | 3,486,000 | 2,689,100 | |||||||||

| —5.9% 2012 | 357,000 | 280,602 | |||||||||

| —6.9% 2017 | 15,366,000 | 10,901,255 | |||||||||

| CIT Group Inc. | |||||||||||

| —0.41969% 2010 (Floating) | 9,568,000 | 6,936,800 | |||||||||

| —0.69188% 2012 (Floating) | 4,853,000 | 3,257,819 | |||||||||

| —0.7731% 2010 (Floating) | 5,000,000 | 3,500,000 | |||||||||

| —1.117% 2012 (Floating) | 1,823,000 | 1,213,407 | |||||||||

| —5% 2014 | 3,803,000 | 2,445,025 | |||||||||

| —5% 2015 | 1,951,000 | 1,219,355 | |||||||||

| —5.125% 2014 | 10,153,000 | 6,598,333 | |||||||||

| —5.4% 2012 | 5,101,000 | 3,371,251 | |||||||||

| —5.6% 2011 | 16,141,000 | 11,557,763 | |||||||||

| —5.6% 2011 | 13,696,000 | 10,854,080 | |||||||||

| —5.8% 2011 | 12,042,000 | 8,201,084 | |||||||||

| —7.75% 2012 | 401,000 | 254,005 | |||||||||

| —13% 2012 (Floating)** | 7,500,000 | 7,687,500 | |||||||||

| Delta Air Lines, Inc. | |||||||||||

| —7.57% 2010 | 3,952,000 | 3,912,875 | |||||||||

| —7.111% 2013 | 9,971,000 | 9,630,490 | |||||||||

| Ford Credit Europe (Series F) | |||||||||||

| —7.875% 2011 | £ | 7,950,000 | 12,360,150 | ||||||||

| —7.125% 2012 | € | 14,800,000 | 20,532,602 | ||||||||

| —7.125% 2013 | € | 7,500,000 | 10,131,542 | ||||||||

| International Lease Finance Corporation | |||||||||||

| —0.90938% 2010 (Floating) | $ | 1,502,000 | 1,460,605 | ||||||||

| —4.75% 2012 | 2,150,000 | 1,829,801 | |||||||||

| —4.875% 2010 | 942,000 | 880,977 | |||||||||

| —5% 2010 | 10,604,000 | 10,353,640 | |||||||||

| —5.125% 2010 | 6,625,000 | 6,307,133 | |||||||||

| —5.3% 2012 | 3,000,000 | 2,402,310 | |||||||||

| —5.35% 2012 | 3,297,000 | 2,812,506 | |||||||||

| —5.625% 2010 | 3,150,000 | 2,962,323 | |||||||||

14

PORTFOLIO OF INVESTMENTS

September 30, 2009

| NON-CONVERTIBLE BONDS & DEBENTURES — Continued | Principal Amount | Value | |||||||||

| —5.75% 2011 | $ | 5,638,000 | $ | 5,105,942 | |||||||

| —5.875% 2013 | 2,051,000 | 1,601,175 | |||||||||

| —6.625% 2013 | 1,612,000 | 1,335,203 | |||||||||

| iStar Financial Inc. | |||||||||||

| —5.125% 2011 | 2,272,000 | 1,533,873 | |||||||||

| —10% 2014** | 6,185,000 | 4,952,577 | |||||||||

| Northwest Airlines Corporation — 6.841% 2011 | 1,579,000 | 1,529,498 | |||||||||

| Residental Capital, LLC — 8.5% 2010 | 11,802,000 | 10,746,665 | |||||||||

| SLM Corporation | |||||||||||

| —4% 2010 | 5,280,000 | 5,266,853 | |||||||||

| —5.45% 2011 | 6,280,000 | 5,955,136 | |||||||||

| Willis North America | |||||||||||

| —5.125% 2010 | 11,760,000 | 12,083,400 | |||||||||

| —5.625% 2015 | 9,038,000 | 8,912,281 | |||||||||

| $ | 314,033,496 | ||||||||||

| REAL ESTATE — 3.2% | |||||||||||

| Capital Automotive L.P. — 2.02% 2010 (Floating)** | $ | 25,263,216 | $ | 21,789,523 | |||||||

| Countrywide Holdings, Ltd. — 10% 2018** | £ | 8,273,712 | 12,962,425 | ||||||||

| HCP, Inc. | |||||||||||

| —4.875% 2010 | $ | 5,914,000 | 5,976,511 | ||||||||

| —6.3% 2016 | 3,120,000 | 3,017,789 | |||||||||

| —7.072% 2015 | 3,076,000 | 3,058,867 | |||||||||

| The Rouse Company — 7.2% 2012* | 26,512,000 | 23,131,720 | |||||||||

| $ | 69,936,835 | ||||||||||

| RETAILING — 2.8% | |||||||||||

| The Home Depot, Inc. — 0.42% 2009 (Floating) | $ | 5,975,000 | $ | 5,964,663 | |||||||

| Michaels Stores, Inc. — 2.5625% 2013 (Floating)** | 18,921,125 | 17,029,013 | |||||||||

| Sally Holdings LLC — 10.5% 2016 | 21,104,000 | 21,578,840 | |||||||||

| Sears Roebuck Acceptance Corp. — 6.7% 2012 | 6,748,000 | 6,487,122 | |||||||||

| Toys "R" Us — 4.49625% 2012 (Floating)** | 9,861,000 | 9,417,255 | |||||||||

| $ | 60,476,893 | ||||||||||

| INDUSTRIAL PRODUCTS — 0.8% | |||||||||||

| Navistar International Corporation — 3.49625% 2012 (Floating)** | $ | 12,521,000 | $ | 12,145,370 | |||||||

| Thermadyne Holdings Corporation — 10.5% 2014 | 5,000,000 | 4,262,500 | |||||||||

| Trinity Industries, Inc — 6.5% 2014 | 987,000 | 977,130 | |||||||||

| $ | 17,385,000 | ||||||||||

| UTILITIES — 0.7% | |||||||||||

| Dynegy-Roseton Danskamme — 7.27% 2010 | $ | 475,124 | $ | 473,955 | |||||||

| RRI Energy, Inc. — 7.625% 2014 | 15,230,000 | 15,019,065 | |||||||||

| $ | 15,493,020 | ||||||||||

15

PORTFOLIO OF INVESTMENTS

September 30, 2009

| NON-CONVERTIBLE BONDS & DEBENTURES — Continued | Principal Amount | Value | |||||||||

| MULTI-INDUSTRY — 0.7% | |||||||||||

| Leucadia National Corporation — 7.125% 2017 | $ | 15,967,000 | $ | 15,354,346 | |||||||

| AUTOMOTIVE — 0.7% | |||||||||||

| Penske Automotive Group — 7.75% 2016 | $ | 16,390,000 | $ | 15,010,454 | |||||||

| ADVERTISING — 0.4% | |||||||||||

| Valassis Communications, Inc. — 8.25% 2015 | $ | 9,990,000 | $ | 8,941,050 | |||||||

| CONSUMER NON-DURABLES — 0.3% | |||||||||||

| Abitibi Consolidated Of Canada — 13.75% 2011*,** | $ | 2,965,000 | $ | 2,906,085 | |||||||

| B&G Foods, Inc. — 12% 2016†† | 3,645,000 | 4,093,698 | |||||||||

| $ | 6,999,783 | ||||||||||

| BUSINESS SERVICES — 0.2% | |||||||||||

| First Data Corporation — 3.03563% 2014 (Floating)** | $ | 4,912,500 | $ | 4,230,891 | |||||||

| TOTAL CORPORATE BONDS & DEBENTURES — 24.2% | $ | 527,861,768 | |||||||||

| SHORT-TERM U.S. GOVERNMENT — 19.1% | |||||||||||

| U.S. Treasury Bills | |||||||||||

| —0.1775% 10/22/09 | $ | 50,000,000 | $ | 49,998,950 | |||||||

| —0.27% 11/19/09 | 40,000,000 | 39,996,516 | |||||||||

| —0.235% 04/01/10 | 50,000,000 | 49,955,510 | |||||||||

| —0.305% 06/17/10 | 50,000,000 | 49,897,480 | |||||||||

| —0.425% 07/01/10† | 60,000,000 | 59,879,424 | |||||||||

| —0.325% 07/15/10 | 100,000,000 | 99,750,470 | |||||||||

| —0.35% 08/26/10 | 67,000,000 | 66,796,106 | |||||||||

| TOTAL SHORT-TERM U.S. GOVERNMENT | $ | 416,274,456 | |||||||||

| U.S. GOVERNMENT & AGENCIES — 4.2% | |||||||||||

| Federal Home Loan Mortgage Corporation — 1.5% 2011 | $ | 20,000,000 | $ | 20,092,000 | |||||||

| Federal Home Loan Mortgage Corporation — 5% 2018 | 7,440,607 | 7,656,384 | |||||||||

| Federal National Mortgage Association — 7.5% 2028 | 73,136 | 80,572 | |||||||||

| U.S. Treasury Note — 3.875% 2010† | 15,000,000 | 15,417,187 | |||||||||

| U.S. Treasury Note — 4.375%% 2010† | 40,000,000 | 41,875,000 | |||||||||

| U.S. Treasury Inflation-Indexed Notes — 3.375% 2012† | 5,457,915 | 5,802,446 | |||||||||

| TOTAL U.S. GOVERNMENT & AGENCIES | $ | 90,923,589 | |||||||||

| TOTAL NON-CONVERTIBLE BONDS & DEBENTURES — 47.5% (Cost $912,104,156) | $ | 1,035,059,813 | |||||||||

| TOTAL INVESTMENT SECURITIES — 89.0% (Cost $1,705,701,259) | $ | 1,941,324,905 | |||||||||

16

PORTFOLIO OF INVESTMENTS

September 30, 2009

| Shares or Principal Amount | Value | ||||||||||

| SHORT-TERM INVESTMENTS — 13.5% | |||||||||||

| Toyota Motor Credit Corporation — 0.01% 10/01/09 | $ | 36,084,000 | $ | 36,084,000 | |||||||

| Chevron Funding Corporation — 0.14% 10/05/09 | 35,000,000 | 34,999,456 | |||||||||

| Federal Home Loan Bank Discount Notes — 0.12% 10/06/09 | 55,000,000 | 54,999,083 | |||||||||

| Federal Home Loan Bank Discount Notes — 0.10% 10/09/09 | 50,000,000 | 49,998,889 | |||||||||

| Federal Home Loan Bank Discount Notes — 0.12% 10/14/09 | 47,125,000 | 47,122,958 | |||||||||

| Federal Home Loan Bank Discount Notes — 0.11% 10/19/09 | 41,000,000 | 40,997,745 | |||||||||

| Federal Home Loan Bank Discount Notes — 0.05% 11/09/09 | 30,000,000 | 29,998,375 | |||||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $294,200,506) | $ | 294,200,506 | |||||||||

| TOTAL INVESTMENTS — 102.5% (Cost $1,999,901,765) | $ | 2,235,525,411 | |||||||||

| COMMON STOCKS — SHORT | |||||||||||

| AMB Property Corporation | (21,400 | ) | $ | (491,130 | ) | ||||||

| American Greetings Corporation (Class A) | (166,200 | ) | (3,706,260 | ) | |||||||

| Apollo Group, Inc.* | (23,600 | ) | (1,738,612 | ) | |||||||

| Apollo Investment Corporation | (490,075 | ) | (4,680,216 | ) | |||||||

| AutoNation, Inc.* | (375,100 | ) | (6,781,808 | ) | |||||||

| Banco Bilbao Vizcaya Argentaria, S.A. | (197,683 | ) | (3,526,665 | ) | |||||||

| Banco Popular Espanol, S.A. | (276,522 | ) | (2,773,516 | ) | |||||||

| BJ's Wholsale Club, Inc.* | (71,000 | ) | (2,571,620 | ) | |||||||

| Boston Properties, Inc. | (79,100 | ) | (5,185,005 | ) | |||||||

| Capital One Financial Corporation | (173,300 | ) | (6,192,009 | ) | |||||||

| Coach, Inc. | (85,100 | ) | (2,801,492 | ) | |||||||

| Deutsche Bank A.G. | (49,300 | ) | (3,784,761 | ) | |||||||

| Eclipsys Corporation* | (145,400 | ) | (2,806,220 | ) | |||||||

| Frontier Oil Corporation | (235,000 | ) | (3,271,200 | ) | |||||||

| Granite Construction Incorporated | (77,000 | ) | (2,382,380 | ) | |||||||

| Guess?, Inc. | (73,249 | ) | (2,713,143 | ) | |||||||

| HCP, Inc. | (225,600 | ) | (6,483,744 | ) | |||||||

| The Home Depot, Inc. | (561,800 | ) | (14,966,352 | ) | |||||||

| Hospitality Properties Trust | (182,300 | ) | (3,713,451 | ) | |||||||

| HSBC Holdings plc | (103,983 | ) | (5,963,425 | ) | |||||||

| Intuitive Surgical, Inc.* | (9,900 | ) | (2,596,275 | ) | |||||||

| Jarden Corporation* | (102,900 | ) | (2,888,403 | ) | |||||||

| Kingfisher plc | (975,000 | ) | (3,315,000 | ) | |||||||

| PharMerica Corporation* | (351,800 | ) | (6,532,926 | ) | |||||||

| Principal Financial Group, Inc. | (27,100 | ) | (742,269 | ) | |||||||

| Regis Corporation | (60,995 | ) | (945,422 | ) | |||||||

| Sally Beauty Holdings, Inc.* | (239,126 | ) | (1,700,186 | ) | |||||||

| Scientific Games Corporation* | (25,500 | ) | (403,665 | ) | |||||||

17

PORTFOLIO OF INVESTMENTS

September 30, 2009

| COMMON STOCKS — SHORT — Continued | Shares | Value | |||||||||

| Simon Property Group, Inc. | (172,802 | ) | $ | (11,997,643 | ) | ||||||

| Snap-on Incorporated | (8,600 | ) | (298,936 | ) | |||||||

| TCF Financial Corporation | (156,900 | ) | (2,045,976 | ) | |||||||

| Tesoro Corporation | (220,000 | ) | (3,295,600 | ) | |||||||

| Texas Roadhouse, Inc. — (Class A)* | (297,000 | ) | (3,154,140 | ) | |||||||

| Treehouse Foods Inc.* | (40,700 | ) | (1,451,769 | ) | |||||||

| Urban Outfitters, Inc.* | (130,900 | ) | (3,949,253 | ) | |||||||

| V.F. Corporation | (47,200 | ) | (3,418,696 | ) | |||||||

| Ventas Inc. | (61,800 | ) | (2,379,300 | ) | |||||||

| VistaPrint Limited* | (91,900 | ) | (4,663,925 | ) | |||||||

| Washington Federal, Inc. | (184,700 | ) | (3,114,042 | ) | |||||||

| West Marine, Inc.* | (115,000 | ) | (903,900 | ) | |||||||

| TOTAL COMMON STOCKS — SHORT — (6.7%) (Proceeds $135,276,052) | $ | (146,330,335 | ) | ||||||||

| Other assets less liabilities, net — 4.2% | $ | 92,055,769 | |||||||||

| TOTAL NET ASSETS — 100.0% | $ | 2,181,250,845 | |||||||||

* Non-income producing security.

** Restricted securities. These restricted securities constituted 4.8% of total net assets at September 30, 2009.

† Security segregated as collateral for common stocks sold short.

†† These securities have been valued by Board of Trustees in accordance with the Fund's fair value procedures.

See notes to financial statements.

18

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2009

| ASSETS | |||||||||||

| Investments at value: | |||||||||||

| Investment securities — at market value (identified cost $1,705,701,259) | $ | 1,941,324,905 | |||||||||

| Short-term investments — at amortized cost (maturities 60 days or less) | 294,200,506 | $ | 2,235,525,411 | ||||||||

| Cash | 186 | ||||||||||

| Deposits for securities sold short | 82,103,766 | ||||||||||

| Receivable for: | |||||||||||

| Dividends and accrued interest | $ | 11,588,665 | |||||||||

| Capital stock sold | 9,532,586 | ||||||||||

| Investment securities sold | 45,195 | 21,166,446 | |||||||||

| $ | 2,338,795,809 | ||||||||||

| LIABILITIES | |||||||||||

| Payable for: | |||||||||||

| Securities sold short, at market value (proceeds $135,276,052) | $ | 146,330,335 | |||||||||

| Investment securities purchased | 7,838,679 | ||||||||||

| Advisory fees and financial services | 1,932,152 | ||||||||||

| Accrued expenses and other liabilities | 595,791 | ||||||||||

| Capital stock repurchased | 569,815 | ||||||||||

| Dividends on securities sold short | 278,192 | 157,544,964 | |||||||||

| NET ASSETS | $ | 2,181,250,845 | |||||||||

| SUMMARY OF SHAREHOLDERS' EQUITY | |||||||||||

| Capital Stock — no par value; unlimited authorized shares; 92,005,324 outstanding shares | $ | 1,984,759,258 | |||||||||

| Accumulated net realized loss on investments | (37,512,370 | ) | |||||||||

| Undistributed net investment income | 9,434,594 | ||||||||||

| Unrealized appreciation of investments | 224,569,363 | ||||||||||

| NET ASSETS | $ | 2,181,250,845 | |||||||||

| NET ASSET VALUE | |||||||||||

| Offering and redemption price per share | $ | 23.71 | |||||||||

See notes to financial statements.

19

STATEMENT OF OPERATIONS

For the Six Months Ended September 30, 2009

| INVESTMENT INCOME | |||||||||||

| Interest | $ | 20,907,258 | |||||||||

| Dividends | 5,549,097 | ||||||||||

| $ | 26,456,355 | ||||||||||

| EXPENSES: — Note 4 | |||||||||||

| Advisory fees | $ | 8,569,408 | |||||||||

| Short sale dividend expense | 1,718,320 | ||||||||||

| Financial services | 856,941 | ||||||||||

| Transfer agent fees and expenses | 813,160 | ||||||||||

| Custodian fees and expenses | 57,256 | ||||||||||

| Reports to shareholders | 53,975 | ||||||||||

| Trustees' fees and expenses | 37,009 | ||||||||||

| Registration fees | 33,041 | ||||||||||

| Legal fees | 27,558 | ||||||||||

| Audit and tax fees | 24,170 | ||||||||||

| Other expenses | 92,853 | 12,283,691 | |||||||||

| Net investment income | $ | 14,172,664 | |||||||||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | |||||||||||

| Net realized loss on investments: | |||||||||||

| Net realized gain on sale of investment securities | $ | 3,145,956 | |||||||||

| Net realized loss on sale of investment securities sold short | (5,567,288 | ) | |||||||||

| Net realized loss on investments | $ | (2,421,332 | ) | ||||||||

| Change in unrealized appreciation of investments: | |||||||||||

| Investment securities | $ | 389,971,790 | |||||||||

| Investment securities sold short | (44,049,393 | ) | |||||||||

| Change in unrealized appreciation of investments | 345,922,397 | ||||||||||

| Net realized and unrealized gain on investments | $ | 343,501,065 | |||||||||

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 357,673,729 | |||||||||

See notes to financial statements.

20

STATEMENT OF CHANGES IN NET ASSETS

| Six Months Ended September 30, 2009 | Year Ended March 31, 2009 | ||||||||||||||||||

| CHANGES IN NET ASSETS | |||||||||||||||||||

| Operations: | |||||||||||||||||||

| Net investment income | $ | 14,172,664 | $ | 20,659,256 | |||||||||||||||

| Net realized loss on investments | (2,421,332 | ) | (33,776,344 | ) | |||||||||||||||

| Change in unrealized appreciation of investments | 345,922,397 | (283,001,604 | ) | ||||||||||||||||

| Change in net assets resulting from operations | $ | 357,673,729 | $ | (296,118,692 | ) | ||||||||||||||

| Distributions to shareholders from: | |||||||||||||||||||

| Net investment income | $ | (13,111,552 | ) | $ | (20,024,527 | ) | |||||||||||||

| Net realized capital gains | — | (13,111,552 | ) | (11,733,860 | ) | (31,758,387 | ) | ||||||||||||

| Capital Stock transactions: | |||||||||||||||||||

| Proceeds from Capital Stock sold | $ | 696,991,705 | $ | 645,622,363 | |||||||||||||||

| Proceeds from shares issued to shareholders upon reinvestment of dividends and distributions | 11,160,370 | 27,828,280 | |||||||||||||||||

| Cost of Capital Stock repurchased* | (134,524,013 | ) | 573,628,062 | (328,678,398 | ) | 344,772,245 | |||||||||||||

| Total change in net assets | $ | 918,190,239 | $ | 16,895,166 | |||||||||||||||

| NET ASSETS | |||||||||||||||||||

| Beginning of period | 1,263,060,606 | 1,246,165,440 | |||||||||||||||||

| End of period | $ | 2,181,250,845 | $ | 1,263,060,606 | |||||||||||||||

| CHANGE IN CAPITAL STOCK OUTSTANDING | |||||||||||||||||||

| Shares of Capital Stock sold | 31,464,967 | 30,850,653 | |||||||||||||||||

| Shares issued to shareholders upon reinvestment of dividends and distributions | 511,240 | 1,191,555 | |||||||||||||||||

| Shares of Capital Stock repurchased | (6,066,977 | ) | (15,819,280 | ) | |||||||||||||||

| Change in Capital Stock outstanding | 25,909,230 | 16,222,928 | |||||||||||||||||

* Net of redemption fees of $227,079 and $281,213 for the periods ended September 30, 2009 and March 31, 2009, respectively.

See notes to financial statements.

21

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Period

| Six Months Ended September 30, | Year Ended March 31, | ||||||||||||||||||||||||||

| 2009 | 2009 | 2008 | 2007 | 2006 | 2005 | ||||||||||||||||||||||

| Per share operating performance: | |||||||||||||||||||||||||||

| Net asset value at beginning of period | $ | 19.11 | $ | 24.99 | $ | 26.98 | $ | 26.47 | $ | 24.18 | $ | 22.74 | |||||||||||||||

| Income from investment operations: | |||||||||||||||||||||||||||

| Net investment income | $ | 0.15 | $ | 0.31 | $ | 0.59 | $ | 0.72 | $ | 0.39 | $ | 0.11 | |||||||||||||||

| Net realized and unrealized gain (loss) on investment securities | 4.62 | (5.59 | ) | 0.33 | 1.66 | 2.82 | 1.78 | ||||||||||||||||||||

| Total from investment operations | $ | 4.77 | $ | (5.28 | ) | $ | 0.92 | $ | 2.38 | $ | 3.21 | $ | 1.89 | ||||||||||||||

| Less distributions: | |||||||||||||||||||||||||||

| Dividends from net investment income | $ | (0.17 | ) | $ | (0.37 | ) | $ | (0.75 | ) | $ | (0.53 | ) | $ | (0.33 | ) | $ | (0.08 | ) | |||||||||

| Distributions from net realized capital gains | — | (0.23 | ) | (2.16 | ) | (1.34 | ) | (0.59 | ) | (0.37 | ) | ||||||||||||||||

| Total distributions | $ | (0.17 | ) | $ | (0.60 | ) | $ | (2.91 | ) | $ | (1.87 | ) | $ | (0.92 | ) | $ | (0.45 | ) | |||||||||

| Redemption fees | — | * | — | * | — | * | — | * | — | * | — | * | |||||||||||||||

| Net asset value at end of period | $ | 23.71 | $ | 19.11 | $ | 24.99 | $ | 26.98 | $ | 26.47 | $ | 24.18 | |||||||||||||||

| Total investment return** | 25.04 | % | (21.57 | )% | 3.30 | % | 9.26 | % | 13.52 | % | 8.43 | % | |||||||||||||||

| Ratios/supplemental data: | |||||||||||||||||||||||||||

| Net assets at end of period (in $000's) | $ | 2,181,251 | $ | 1,263,061 | $ | 1,246,165 | $ | 1,407,249 | $ | 1,374,055 | $ | 1,102,149 | |||||||||||||||

| Ratio of expenses to average net assets | 1.38 | %†‡ | 1.50 | %‡ | 1.34 | %‡ | 1.35 | %‡ | 1.39 | %‡ | 1.40 | %‡ | |||||||||||||||

| Ratio of net investment income to average net assets | 1.59 | %† | 1.47 | % | 2.06 | % | 2.68 | % | 1.45 | % | 0.57 | % | |||||||||||||||

| Portfolio turnover rate | 24 | %† | 32 | % | 29 | % | 29 | % | 24 | % | 17 | % | |||||||||||||||

* Rounds to less than $0.01 per share

** Return is based on net asset value per share, adjusted for reinvestment of distributions. The return for the six months ended September 30, 2009 is not annualized.

† Annualized

‡ For the periods ended September 30, 2009, March 31, 2009, March 31, 2008, March 31, 2007, March 31, 2006, and March 31, 2005, the expense ratio includes short sale dividend expense equal to 0.19%, 0.27%, 0.12%, 0.10%, 0.11%, and 0.12% of average net assets, respectively.

See notes to financial statements.

22

NOTES TO FINANCIAL STATEMENTS

September 30, 2009

NOTE 1 — Significant Accounting Policies

The FPA Funds Trust is registered under the Investment Company Act of 1940, as amended. FPA Crescent Fund (the "Fund") is an open-end, diversified, management investment company. At September 30, 2009, the FPA Funds Trust was comprised of only the Fund. The Fund's investment objective is to provide a total return consistent with reasonable risk through a combination of income and capital appreciation by investing in a combination of equity securities and fixed income obligations. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund values securities pursuant to policies and procedures approved by the Board of Directors. Securities listed or traded on a national securities exchange are valued at the last sale price on the last business day of the period, or if there was not a sale that day, at the last bid price. Securities traded on the NASDAQ National Market System are valued at the NASDAQ Official Closing Price on the last business day of the period, or if there was not a sale that day, at the last bid price. Unlisted securities and securities listed on a national securities exchange for which the over-the-counter market more accurately reflects the securities' value in the judgement of the Fund's officers, are valued at the most recent bid price or other ascertainable market value. The Fund receives additional pricing information from independent pricing vendors that also use information provided by market makers or estimates of values obtained from data re lating to securities with similar characteristics. Short-term investments with maturities of 60 days or less at the time of purchase are valued at amortized cost which approximates market value. Securities for which market quotations are not readily available from the sources above are valued at fair value as determined in good faith by, or under the direction of, the Board of Trustees.

B. Federal Income Tax

No provision for federal income tax is required because the Fund has elected to be taxed as a "regulated investment company" under the Internal Revenue Code and intends to maintain this qualification and to distribute each year to its shareholders, in accordance with the minimum distribution requirements of the Code, all of its taxable net investment income and taxable net realized gains on investments.

C. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis.

D. Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

Common Stocks and Other Securities: The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations.

23

NOTES TO FINANCIAL STATEMENTS

Continued

Credit Risk: The values of any of the Fund's investments may also decline in response to events affecting the issuer or its credit rating. The lower rated debt securities in which the Fund may invest are considered speculative and are generally subject to greater volatility and risk of loss than investment grade securities, particularly in deteriorating economic conditions. The Fund invests a significant portion of its assets in securities of issuers that hold mortgage- and asset-backed securities and direct investments in securities backed by commercial and residential mortgage loans and other financial assets. The value and related income of these securities is sensitive to changes in economic conditions, including delinquencies and/or defaults. Though the Fund has not been adversely impacted, continuing shifts in the market's perception of credit quality on securities backed by commercial and residential mortgage loans and other financial assets may result in increased volatility of market price and periods of illiquidity that can negatively impact the valuation of certain securities held by the Fund.

NOTE 3 — Purchases and Sales of Investment Securities

Cost of purchases of investment securities (excluding securities sold short and short-term investments with maturities of 60 days or less at the time of purchase) aggregated $398,686,154 for the period ended September 30, 2009. The proceeds and cost of securities sold resulting in net realized losses of $2,421,332 aggregated $163,508,982 and $165,930,314, respectively, for the period ended September 30, 2009. Realized gains or losses are based on the specific identification method. The cost of investment securities (excluding securities sold short) held at September 30, 2009 for federal tax purposes was $1,703,557,251. Gross unrealized appreciation and depreciation for all investment securities (excluding securities sold short) at September 30, 2009 for federal income tax purposes was $287,916,133 and $50,148,480, respectively, resulting in net unrealized appreciation of $237,767,653.

As of and during the period ended September 30, 2009, the Fund did not have any liability for unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. federal tax authorities for years ended before March 31, 2005 or by state tax authorities for years ended before March 31, 2004.

NOTE 4 — Advisory Fees and Other Affiliated Transactions

Pursuant to an Investment Advisory Agreement, advisory fees were paid by the Fund to First Pacific Advisors, LLC (the "Adviser"). Under the terms of this Agreement, the Fund pays the Adviser a monthly fee calculated at the annual rate of 1.00% of the Fund's average daily net assets. In addition, the Fund pays the Adviser an amount equal to 0.10% of the average daily net assets for each fiscal year for the provision of financial services to the Fund. The Adviser has agreed to voluntarily reduce its fees for any annual expenses (exclusive of short sale dividends, interest, taxes, the cost of any supplemental statistical and research information, and extraordinary expenses such as litigation) in excess of 1.85% of the average net assets of the Fund for the year. The Adviser is not obligated to continue this fee reduction policy indefinitely.

For the six months ended September 30, 2009, the Fund paid aggregate fees of $36,848 to all Trustees who are not interested persons of the Adviser. Certain officers of the Fund are also officers of the Adviser and FPA Fund Distributors. Inc.

NOTE 5 — Securities Sold Short

The Fund maintains cash deposits and segregates marketable securities in amounts equal to the current market value of the securities sold short or the market value of the securities at the time they were sold short, whichever is greater. Possible losses from short sales may be unlimited, whereas losses from purchases cannot exceed the total amount invested. The dividends on securities sold short are reflected as short sale dividend expense.

24

NOTES TO FINANCIAL STATEMENTS

Continued

NOTE 6 — Redemption Fees

A redemption fee of 2% applies to redemptions within 90 days of purchase. For the six months ended September 30, 2009, the Fund collected $227,079 in redemption fees, which amounts to less than $0.01 per share.

NOTE 7 — Distributor

FPA Fund Distributors, Inc. ("Distributor"), a wholly owned subsidiary of the Adviser, received no fees for distribution services during the year. The distributor pays its own overhead and general administrative expenses, the cost of supplemental sales literature, promotion and advertising.

NOTE 8 — Disclosure of Fair Value Measurements

The Fund classifies its assets based on three valuation methodologies. Level 1 investment securities are valued based on quoted market prices in active markets for identical assets. Level 2 investment securities are valued based on significant observable market inputs, such as quoted prices for similar assets and quoted prices in inactive markets or other market observable inputs. Level 3 investment securities are valued using significant unobservable inputs that reflect the Fund's determination of assumptions that market participants might reasonably use in valuing the assets. The valuation levels are not necessarily an indication of the risk associated with investing in those securities. The following table presents the valuation levels of the Fund's investments as of September 30, 2009:

| Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||

| Common Stocks – Long | $ | 826,547,424 | — | $ | 1,868,343 | $ | 828,415,767 | ||||||||||||

| Convertible Bonds & Debentures | 19,800,900 | $ | 58,048,425 | — | 77,849,325 | ||||||||||||||

| Non-Convertible Bonds & Debentures | 12,962,425 | 510,805,645 | 4,093,698 | 527,861,768 | |||||||||||||||

| Short-Term U.S. Government | 416,274,456 | — | — | 416,274,456 | |||||||||||||||

| U.S. Government & Agencies | 63,094,634 | 27,828,955 | — | 90,923,589 | |||||||||||||||

| Short-Term Investments | — | 294,200,506 | — | 294,200,506 | |||||||||||||||

| $ | 1,338,679,839 | $ | 890,883,531 | $ | 5,962,041 | $ | 2,235,525,411 | ||||||||||||

| Common Stocks – Short | $ | (146,330,335 | ) | — | — | $ | (146,330,335 | ) | |||||||||||

The following table summarizes the Fund's Level 3 investment securities and related transactions during the six months ended September 30, 2009:

| Beginning value at April 1, 2009 | $ | 4,718,500 | |||||

| Net change in unrealized appreciation | 5,169,357 | ||||||

| Transfers into Level 3 | 3,803,365 | ||||||

| Transfers out of Level 3 | (7,729,181 | ) | |||||

| Ending value at September 30, 2009 | $ | 5,962,041 | |||||

25

RENEWAL OF INVESTMENT ADVISORY AGREEMENT

Approval of the Advisory Agreement

At a meeting of the Board of Trustees held on August 4, 2009, the Trustees approved the continuation of the advisory agreement between the Fund and the Adviser on the recommendation of the Independent Trustees. Additionally, the Independent Trustees met in executive sessions on April 21 and April 23, 2009, and at meeting of the Board of Trustees held on April 23, 2009, to review and discuss the results of a report prepared by an independent consultant engaged by the Independent Trustees to assist them with items relating to the approval of the continuation of the advisory agreement. The agreement was continued for one year through September 30, 2010. The following paragraphs summarize the material information and factors considered by the Independent Trustees as well as their conclusions relative to such factors.

Nature, Extent and Quality of Services. The Independent Trustees considered information regarding the Adviser and its staffing in connection with the Fund, including the Fund's portfolio manager, the increased number and quality of analysts the Adviser has hired who are under the direct supervision of the Fund's portfolio manager, the scope of accounting, administrative, shareholder and other services supervised and provided by the Adviser, and the absence of any significant service problems reported to the Board. The Independent Trustees especially noted the experience, length of service and the outstanding reputation of the Fund's President, Chief Investment Officer and portfolio manager, Steven Romick, who has managed the Fund since its inception in 1993. The Independent Trustees concluded that the nature, extent and quality of services provided by the Adviser have benefited and should continue to benefit the Fund and its shareholders.

Investment Performance. The Independent Trustees reviewed the overall investment performance of the Fund. They also received information from an independent consultant, Lipper Analytical Services, Inc. ("Lipper"), regarding the Fund's performance relative to a peer group of flexible portfolio funds selected by Lipper (the "Peer Group"). The Independent Trustees were told by the Adviser that the Fund's investment strategy is significantly different from other funds in the Peer Group in that the Fund has a much broader universe of investment possibilities, which requires a greater degree of portfolio management skill on the part of the Adviser. The Adviser also maintained and the research contained in a report prepared by another independent consultant concluded that no other Lipper category ade quately represents the breadth and style of investing performed by the Fund's portfolio manager on behalf of the Fund. The Independent Trustees noted the Fund's outstanding long-term investment performance and low volatility of returns when compared to the Peer Group and concluded that the Fund's investment performance has been strong. They further concluded that the Adviser's continued management of the Fund should benefit the Fund and its shareholders.

Advisory Fees and Fund Expenses; Adviser Profitability; Economies of Scale and Sharing of Economies of Scale. The Independent Trustees were provided information by the Adviser to enable consideration of the Fund's advisory fees and total expense levels, as well as the overall profitability of the Adviser, the benefits to the Adviser from its relationship to the Fund, (including the Financial Services Agreement), the extent to which economies of scale with respect to the management of the Fund, if any, would be realized, and whether the Fund is sharing, or will share, in those economies.

The Independent Trustees reviewed comparative information relative to fees and expenses for the mutual fund industry generally and for the Peer Group, as well as aspects of the independent consultant's report relating to such matters. While the Independent Trustees acknowledged that the Fund's fees and expenses were at the highest end of the range for the Peer Group, they noted that the Fund's broader investment strategy made comparisons to the fees and expenses of the funds in the Peer Group less relevant. The Independent Trustees noted that the overall expense ratio of the Fund is within the range of the overall equity and hybrid fund universe. Specifically with respect to the advisory fee charged by the Adviser to the Fund, the Independent Trustees noted that many equity and hybrid funds have advisory fees that are the same or higher at similar or greater asset levels. In addition, the Independent Trustees noted that the fee rate charged to the Fund is the same fee rate charged by the Adviser on the other products managed in a similar

26

RENEWAL OF INVESTMENT ADVISORY AGREEMENT

Continued

style by the portfolio manager. The Independent Trustees concluded that the overall fee rate was reasonable and fair to the Fund and its shareholders in light of the nature and quality of the services provided by the Adviser.

The Independent Trustees considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether the fee rate is reasonable in relation to the Fund's assets and any economies of scale that may exist. The Independent Trustees expressed concern that the fee rate does not have any breakpoints. The mutual fund industry has trended toward funds having breakpoints in the advisory fee structure as a means by which to share in economies of scale as a fund's assets grow; however, not all funds have breakpoints in their fee structures. The Adviser indicated its belief that breakpoints currently were not appropriate for the Fund and that no meaningful income and expense forecasts for its business could be prepared given uncertainties regarding the direction of the economy, rising inflation, increasing costs for personnel and systems, and grow th (or not) in the Fund's assets, all of which could negatively impact the Adviser. The Independent Trustees noted that the Adviser had not increased the fee rate charged to the Fund despite the Adviser's claims of increases in the Adviser's internal costs of providing investment management services to the Fund, in part due to administrative burdens and expenses resulting from recent legislative and regulatory actions such as Sarbanes-Oxley. According to the Adviser, such increased costs have included significant investments in financial analysts who assist with the management of the Fund, additions to administrative personnel and systems that enhance the quality of services provided to the Fund and the establishment of a full-time Chief Compliance Officer and his assistant. The Independent Trustees also noted that during the past three years, the Fund has been at least partially closed to new investors. They further noted that the Adviser has continued to make investments in personnel servicing the Fund irrespective of the Fund's open or closed status. The Independent Trustees also observed that the Fund's expense ratio has continued to decline over time, albeit slightly.