UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-8544 | ||||||||

| |||||||||

FPA FUNDS TRUST | |||||||||

(Exact name of registrant as specified in charter) | |||||||||

| |||||||||

11601 WILSHIRE BLVD., STE. 1200 |

| 90025 | |||||||

(Address of principal executive offices) |

| (Zip code) | |||||||

|

| ||||||||

(Name and Address of Agent for Service) | Copy to: | ||||||||

|

| ||||||||

J. RICHARD ATWOOD, PRESIDENT FPA FUNDS TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 | ||||||||

| |||||||||

Registrant’s telephone number, including area code: | (310) 473-0225 |

| |||||||

| |||||||||

Date of fiscal year end: | December 31 |

| |||||||

| |||||||||

Date of reporting period: | June 30, 2017 |

| |||||||

Item 1: Report to Shareholders.

FPA Crescent Fund

Semi-Annual Report

June 30, 2017

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Dear Shareholders:

Global markets had a strong performance in the second quarter of 2017. The FPA Crescent Fund ("the Fund") returned 1.84% in the second quarter. This compares to the 3.09% return of the S&P 500 and the 4.27% return of the MSCI ACWI indices in the same period. Year-to-date, the Fund has returned 5.27%, as compared to the 9.34% return of the S&P 500 and the 11.48% return of the MSCI ACWI indices.

Portfolio Commentary

The Fund's top five performing positions added 1.83% to our return, while the bottom five detracted -1.18%.1 We did not find any meaningful surprises when our companies reported prior quarter earnings. (We address the Naspers/Tencent pair trade later in this commentary.)

Q2 2017 Winners and Losers

| Winners | Losers | ||||||

| Oracle Corp | Naspers/Tencent Pair Trade | ||||||

| CIT Group | Arconic Inc | ||||||

| Citigroup | Cisco Systems | ||||||

| Aon Plc | General Electric | ||||||

| United Technologies Corp | Analog Devices | ||||||

Unusually, we did not initiate a position in any new company during the second quarter, a function of an elevated market.

In a recent speech, I shared some views that explain our current thinking about stock and corporate bond markets and our resulting current portfolio positioning. I refer you to Two Decades of Winning by not Losing (available on the Fund's website, www.fpafunds.com), where we suggest that always owning the hot stocks may not be necessary to keep up with the equity market over time.

Markets and Economy

Despite the turbulent changes to the political terrain in the United States and Europe, the global economy continues to putt-putt along, much as it did before Brexit and the U.S. elections. The U.S is now in year nine of its economic expansion — the third longest since 1900. Yet despite its long duration, the rate of GDP growth has fallen well below past expansions.2

Low interest rates and the absence of bad news have been the twin pillars underpinning stable markets worldwide. The S&P 500 is in its 99th month of a bull market — the second longest since 1926, and hasn't corrected more than 20% since 2009.3 US stocks trade at historically high valuations, which we believe is more a function of the low rates than earnings growth.

Other parts of the world are less expensive — not to be confused with inexpensive. The MSCI ACWI has a median valuation higher than the prior two market peaks. Asia and Emerging Markets are trading closer to their

1 Reflects the top contributors and top detractors to the Fund's performance based on contribution to return for the quarter.

2 Since the Great Recession (2008/09), GDP growth has averaged just 2.1%, as compared to the prior two expansions: 3.2% (1992-2007) and 4.1% (1983-1990). Average GDP growth since 1948 has been 3.2%; since this includes all recessions, the current expansion looks all the more anemic (St. Louis Federal Reserve (FRED)).

3 The longest bull market since 1926 lasted 99 months from 3/9/2009 to 6/30/17 (J.P. Morgan US Guide to the Markets (6/30/2017)).

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

median valuation. At best, one can argue that parts of the world are relatively cheap, which causes us to be less active buyers while we await better values.

Current Valuation vs Recent Market Peaks4

U.S. (S&P 500) | Global (MSCI ACWI) | ||||||||||||||||||||||||||||||||||

P/E | P/S | P/B | CAPE | P/E | P/S | P/B | CAPE | ||||||||||||||||||||||||||||

Mar 31, 2000 | 18.9 | 1.4 | 2.9 | 43.2 | 16.2 | 1.0 | 1.9 | N/A | |||||||||||||||||||||||||||

Sep 30, 2007 | 18.2 | 1.7 | 3.1 | 26.7 | 17.8 | 1.7 | 2.6 | 28.6 | |||||||||||||||||||||||||||

Jun 30, 2017 | 21.2 | 2.5 | 3.3 | 29.8 | 18.4 | 1.8 | 1.9 | 20.0 | |||||||||||||||||||||||||||

Just because we aren't actively allocating capital doesn't mean that everyone else is standing still. Given continued low interest rates, the prospect of an economic Armageddon having faded into the past with nothing looming on the horizon, and a lack of investment alternatives, stock markets seem to be one of the few games in towns, villes, stadts, cittas, ciudads,  ....From these more elevated levels, we expect to see less robust returns over the not-so-foreseeable intermediate term.

....From these more elevated levels, we expect to see less robust returns over the not-so-foreseeable intermediate term.

Part of our historical bread and butter has been finding opportunities in the high yield sector, but today we find the bread burned. The yield-to-worst of the US high yield market is a paltry 5.6%, while the EU high yield sector offers a pathetic 3.5%. Importantly, those yields are gross of some future default and recovery rates. If one were to look at the US as a proxy over the past thirty-five years, with an average default rate of 3.7% and recovery of 40.9%, the US gross yield would be reduced to a net yield of 3.4%. In Europe, the return would be approaching zero.5

High? Yield6

US | EU | ||||||||||

| Yield, gross | 5.6 | % | 3.5 | % | |||||||

| Default rate, historical | -3.7 | % | -4.6 | % | |||||||

| Recovery rate, historical | 40.9 | % | 38.4 | % | |||||||

| Net default | -2.2 | % | -2.8 | % | |||||||

| Yield, net | 3.4 | % | 0.7 | % | |||||||

We have called this set-up "return-free risk." We won't put our/your capital in the position of having to bank on interest rates remaining low — and a good economy keeping defaults at bay — in order to justify participating in the high yield sector. What we might otherwise have invested in high yield in a riper period stays on the sidelines in cash until the return justifies the risk.

4 P/E = Price/Earnings median value of underlying securities. P/S = Price/Sales median value of underlying securities. P/B = Price/Book median value of underlying securities. CAPE Ratio = value of Price/average 10-year earnings, adjusted for inflation. CAPE is not available for MSCI ACWI as the index was created in 1995 (Bloomberg, Research Affiliates).

5 Default rates have reached double digits in past and recoveries have been in the low 20% range. Most recently, 10.3% of the US high yield market defaulted in 2009 and the recovery was just 22.4% (J.P. Morgan, Moody's Investors Service, S&P LCD using data from 1982-2016).

6 US gross yield as of 6/30/17: J.P. Morgan US Guide to the Markets (6/30/2017); US default and recovery rates: J.P. Morgan, Moody's Investors Service, S&P LCD using year-end data from 1982-2016; EU gross yield as of 6/30/2017: J.P. Morgan US Guide to the Markets (6/30/2017); EU default rate: J.P. Morgan Europe Guide to the Markets (6/30/2017); EU recovery rate: Moody's Investors Service using 1985-Q3 2016 data.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Investing

The three current investments discussed below can serve as a window into our investment philosophy and process.

Naspers/Tencent Arbitrage

We have been long Naspers and short Tencent for longer (and less profitably) than we care to remember. Naspers, a South African holding company, made a prescient investment in Tencent, a technology business with a market capitalization among the top 10 globally. Naspers' $34 million investment in 2001 is now valued at $113 billion — a 63% IRR. The passion to own Tencent shares has caused it to be valued at 40x current year's earnings (36x excluding cash and investments) and dwarfs investor interest in Naspers. Its Tencent stake now exceeds its $86 billion market cap by $28 billion!7 We don't believe this should be the case. Naspers profitably operates a Pay TV business in South Africa and has made successful investments in other valuable technology investments, such as Allegro, Avito and Ibibo. Yet, the market insists on paying us to own Naspers. Unfortunately, we're being paid far more today than when we initiated the trade. The price of the Naspers 'stub' was trading then at negative $1.5 billion but is now trading at negative $27 billion.

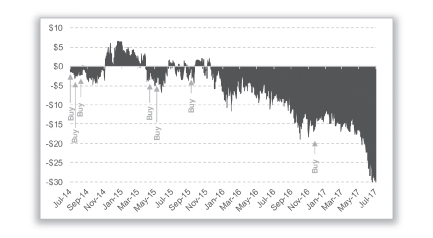

The charts below show the points in time we initiated and added to the Fund's position. Although paired trades have a long and short component, we refer to them in the following charts as Buy and Sell, reflecting when we put trades in and when we took them out of the portfolio, respectively. If nothing else, you should note that we have no ability to pick either bottoms or tops. We continue to think, however, that Naspers will not be valued so irrationally in the future.

Naspers Stub (i.e., Naspers ex-Tencent)

7 S&P Capital IQ (7/12/2017)

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

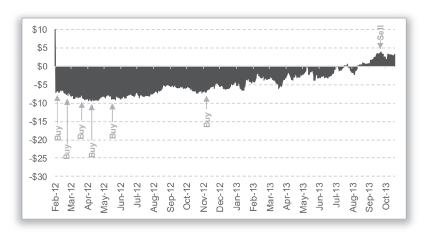

We've had experience waiting things out in the past. A similar thought process led us to invest in Renault at two different times (in 2006 and in 2012-2013), while shorting its ownership stakes in Nissan and Volvo Truck — whose combined value exceeded Renault. In the most recent instance, we established our position when their Nissan and Volvo Truck interests exceeded Renault's enterprise value. The market was paying us to own Renault, but its stock price appreciated slower than that of its equity stakes, creating unrealized losses in our portfolios. This lasted for ~1.5 years but eventually the market appreciated that Renault was worth more than zero, let alone a negative number, and we profitably unwound our trade.

Renault Stub (i.e., Renault ex-Nissan and ex-Volvo Truck)

We anticipate that the same could be true of Naspers/Tencent. Nevertheless, this trade exemplifies both the type of attractive risk/reward sought by our Contrarian Value team, and our willingness to buy down as long as the thesis remains intact.

(For more detailed attributes of the Naspers/Tencent trade, including a description of each business and our investment thesis, please see my speech to CFA Society of Chicago: Don't Be Surprised.)

Sears Canada Loans

We made a loan to Sears Canada in the second quarter, the details of which you may find in the Two Decades of Winning by Not Losing speech I referenced earlier. I suggested that its existential challenges were similar to many other brick-and-mortar retailers and that it could very well go bankrupt at some point. Well, that point came within months of the loan origination. Since we underwrote the loan predicated on liquidation value, we remain comfortable that we will be paid in full in the next couple of months. We expect that our 2% commitment fee will now be amortized over a shorter maturity, resulting in a higher-than-budgeted IRR.

We are in the process of seeking to fund the DIP (debtor-in-possession) loan that, if approved by the Canadian courts, will allow the company to conduct either its restructuring or its liquidation in an orderly manner.

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

This prospective DIP loan should afford us somewhat better asset coverage, with a higher starting yield, an additional and higher commitment fee, and a shorter expected duration, which we think should result in underwriting at a higher than expected IRR, as exhibited in the table below.8

Sears Canada Loans9

Secured Loan | Prospective DIP | ||||||||||

Terms | |||||||||||

Coupon | Libor + 9.75% | Libor +11.0% | |||||||||

Commitment fee | 2.0% | 3.5% | |||||||||

Expected term | 1-3 years | <1 year | |||||||||

Asset coverage | |||||||||||

| Loan made with liquidation in mind, not as going concern Secured by inventory, receivables, and real estate Loan-to-value <60% | |||||||||||

Return target | |||||||||||

Budgeted IRR | >11% | >17%10 | |||||||||

Financials

The Fund's investment in balance sheet intensive financials have performed well over the past year. Earnings have improved and book value has increased but the largest driver has been an increase in valuation, as seen in the table below. In that time, the Price/Tangible Book ratio of our portfolio of financials has increased from 0.73x to 1.04x.

Financials owned by Crescent11

| Q1 2016 P/TB | Q2 2017 P/TB | Q1 2017 TE/TA | 2016 ROTE | ||||||||||||||||

Citigroup | 0.67 | x | 1.01 | x | 11.3 | % | 7.6 | % | |||||||||||

Bank of America | 0.84 | x | 1.41 | x | 9.0 | % | 9.8 | % | |||||||||||

CIT Group | 0.64 | x | 1.06 | x | 15.0 | % | 7.0 | % | |||||||||||

AIG | 0.84 | x | 0.83 | x | 15.2 | % | 6.0 | % | |||||||||||

Leucadia | 0.78 | x | 1.19 | x | 19.7 | % | 1.6 | % | |||||||||||

Ally | 0.69 | x | 0.74 | x | 8.1 | % | 8.1 | % | |||||||||||

Average | 0.73 | x | 1.04 | x | 13.1 | % | 6.7 | % | |||||||||||

8 By making the prospective DIP loan on the heels of our secured loan, it is as if we will have received 5.5% in advance (2% for the Secured Loan and 33.5% for the DIP).

9 Expected term and budgeted IRR based on FPA estimates. There is no guarantee that our estimates will be correct. These estimates are subject to change based on various factors (e.g., market conditions), many of which are outside our control.

10 Return target assumes approval by Canadian bankruptcy courts of Prospective DIP financing on the terms proposed.

11 Balance sheet intensive financials only. P/TB = Price/Tangible Book. TE/TA = Tangible Equity/Tangible Assets. ROTE = Return on Tangible Equity and includes FPA adjustments. Q1 2016 P/TB = Q1 2016 Price/ Q1 2016 Tangible Book. Q2 2017 P/TB = Q2 2017 Price/ Q1 2017 Tangible Book. Q1 2017 TE/TA = Q1 2017 Tangible Equity/ Q1 2017 Tangible Assets. AIG figures are as of previous year-end except Q2 2017 which uses 6/30/2017 price divided by 12/31/2016 tangible book value (Bloomberg).

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

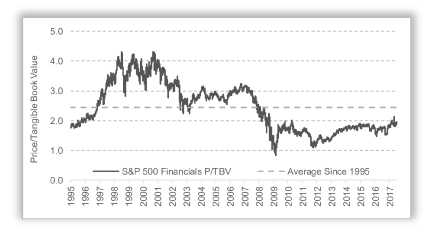

As we discussed more than a year ago, we thought it was reasonable to expect equity-like returns in all but extremely negative scenarios. Our companies still trade at a discount to historic norms based on tangible book value, as exhibited in the chart below, but can no longer be viewed as "dirt" cheap.

S&P 500 Financials Price/Tangible Book

The current investment case for these financials to continue to perform well increasingly relies on a continued favorable regulatory climate, our avoiding a recession, increasing capital return — the recent CCAR12 is a step in the right direction — and, in some cases, higher interest rates and/or a steeper yield curve.

If our portfolio companies can improve ROTE to an average of 12% (less than their historical average) and trade at 1.25x their TBV (up slightly more than current TBVs and still a sizeable discount to historical multiples as depicted in the prior graph) our positions would offer decent returns over the next three years. Note, however, that a little more than a year ago, when these institutions were trading at just 0.75x book, we believed we were well-protected on the downside (and we had more upside). We don't have that same protection today.

12 Comprehensive Capital Analysis and Review: a federally-required stress test that is held annually to determine the financial resilience of the nation's large bank holding companies.

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Financials 3-year Cumulative Return Potential13

This chart is a hypothetical illustration of mathematical principals only. It does not imply any future performance of the Fund and past performance is no guarantee of future results.

We aren't finding much of anything that's so statistically inexpensive, which explains why we maintain a significant position in these financials although we have taken some money off the table. Our exposure to balance sheet intensive financials at quarter-end stands at 14.7%.

Closing

The business of investing is harder than investing itself because one must ably manage both the capital and the high expectations of others. It is unlikely that every client's expectations mirror those of their investment counselor or fund. We write and speak so we can inform our co-investors about our philosophy and current

13 FPA estimates. TBV (tangible book value) multiples are equal-weighted between the financials owned by Crescent (first chart in section) and not representative of the TBV for the positions in the Fund. Current Return on Tangible Equity as of YE 2016. The table assumes a price to tangible book value of 1.05x and compounds returns over 3-years using a return rate of tangible equity listed in each column.

7

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

positioning, but recognize that we can only realize long-term success by remaining true to our longstanding investment philosophy, even in those periods where it might not align with the general tenor of the market.

We have enough self-awareness to know that we're not smart enough to determine the direction of either markets or economies, and appreciate that more things might happen than will happen. We therefore leave the future to either the more capable or more foolhardy. We can only speak to a present dictated by price and with that in hand, we always query: does an asset price today afford us an acceptable rate of return after taking into account the good, the bad, and the ugly? Should we find a good business (or other asset), and should winning offer a return well in excess of what might be lost in our downside case, and should chance to win be more likely than the chance to lose, then we'll be buyers. Until such time, we exercise a patience — a quantity seemingly in limited supply today. I wish I could remember where I recently read one person's clear view of the stock market, so I'll paraphrase: "Markets are only lived forwards, but only understood backwards."

Respectfully submitted,

Steven Romick

Portfolio Manager

July 28, 2017

8

FPA CRESCENT FUND

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

9

FPA CRESCENT FUND

PORTFOLIO SUMMARY

June 30, 2017

(Unaudited)

Common Stocks | 62.7 | % | |||||||||

Aircraft & Parts | 7.9 | % | |||||||||

Infrastructure Software | 6.6 | % | |||||||||

Diversified Banks | 5.7 | % | |||||||||

Internet Media | 5.1 | % | |||||||||

Investment Companies | 4.0 | % | |||||||||

Entertainment Content | 3.6 | % | |||||||||

Insurance Brokers | 2.8 | % | |||||||||

P&C Insurance | 2.8 | % | |||||||||

Commercial Finance | 2.5 | % | |||||||||

Consumer Finance | 2.4 | % | |||||||||

Semiconductor Devices | 2.1 | % | |||||||||

Electrical Components | 2.0 | % | |||||||||

Communications Equipment | 2.0 | % | |||||||||

Electrical Power Equipment | 1.8 | % | |||||||||

Specialty Pharma | 1.4 | % | |||||||||

Advertising & Marketing | 1.3 | % | |||||||||

Containers & Packaging | 1.2 | % | |||||||||

Life Science Equipment | 1.1 | % | |||||||||

Base Metals | 1.1 | % | |||||||||

Institutional Brokerage | 1.0 | % | |||||||||

Specialty Chemicals | 0.9 | % | |||||||||

Integrated Oils | 0.9 | % | |||||||||

Investment Management | 0.8 | % | |||||||||

Food & Drug Stores | 0.8 | % | |||||||||

Household Products | 0.6 | % | |||||||||

Exploration & Production | 0.2 | % | |||||||||

Marine Shipping | 0.1 | % | |||||||||

Limited Partnerships | 0.3 | % | |||||||||

Preferred Stocks | 0.1 | % | |||||||||

Bonds & Debentures | 32.2 | % | |||||||||

U.S. Treasuries | 26.6 | % | |||||||||

Corporate Bonds & Notes | 4.2 | % | |||||||||

Asset-Backed Securities | 0.5 | % | |||||||||

Convertible Bonds | 0.4 | % | |||||||||

Corporate Bank Debt | 0.3 | % | |||||||||

Residential Mortgage-Backed Securities | 0.2 | % | |||||||||

Put Options Purchased | 0.1 | % | |||||||||

Call Options Purchased | 0.1 | % | |||||||||

Short-term Investments | 7.7 | % | |||||||||

Securities Sold Short | (7.1 | )% | |||||||||

Other Assets And Liabilities, Net | 3.9 | % | |||||||||

Net Assets | 100.0 | % | |||||||||

10

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

June 30, 2017

(Unaudited)

COMMON STOCKS | Shares | Fair Value | |||||||||

AIRCRAFT & PARTS — 7.9% | |||||||||||

Arconic, Inc. | 15,228,573 | $ | 344,927,178 | ||||||||

Esterline Technologies Corporation*,§ | 2,863,871 | 271,494,971 | |||||||||

Meggitt plc (Britain)§ | 38,965,308 | 242,028,427 | |||||||||

United Technologies Corporation | 4,341,290 | 530,114,922 | |||||||||

$ | 1,388,565,498 | ||||||||||

INFRASTRUCTURE SOFTWARE — 6.6% | |||||||||||

Microsoft Corporation | 5,727,360 | $ | 394,786,925 | ||||||||

Oracle Corporation | 15,311,810 | 767,734,153 | |||||||||

$ | 1,162,521,078 | ||||||||||

DIVERSIFIED BANKS — 5.7% | |||||||||||

Bank of America Corporation | 18,801,990 | $ | 456,136,277 | ||||||||

Citigroup, Inc. | 8,308,010 | 555,639,709 | |||||||||

$ | 1,011,775,986 | ||||||||||

INTERNET MEDIA — 5.1% | |||||||||||

Alphabet, Inc. (Class A)* | 220,277 | $ | 204,787,121 | ||||||||

Alphabet, Inc. (Class C)* | 220,881 | 200,721,191 | |||||||||

Altaba, Inc.* | 4,847,270 | 264,079,270 | |||||||||

Baidu, Inc. (ADR) (China)* | 1,282,010 | 229,300,309 | |||||||||

$ | 898,887,891 | ||||||||||

INVESTMENT COMPANIES — 4.0% | |||||||||||

Groupe Bruxelles Lambert SA (Belgium) | 2,851,023 | $ | 274,473,102 | ||||||||

Leucadia National Corporation | 16,096,920 | 421,095,427 | |||||||||

$ | 695,568,529 | ||||||||||

ENTERTAINMENT CONTENT — 3.6% | |||||||||||

Naspers, Ltd. (N Shares) (South Africa) | 3,281,487 | $ | 638,363,036 | ||||||||

INSURANCE BROKERS — 2.8% | |||||||||||

Aon plc (Britain) | 3,734,880 | $ | 496,552,296 | ||||||||

P&C INSURANCE — 2.8% | |||||||||||

American International Group, Inc. | 7,840,680 | $ | 490,199,314 | ||||||||

COMMERCIAL FINANCE — 2.5% | |||||||||||

CIT Group, Inc. | 9,091,855 | $ | 442,773,339 | ||||||||

11

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2017

(Unaudited)

COMMON STOCKS — Continued | Shares | Fair Value | |||||||||

CONSUMER FINANCE — 2.4% | |||||||||||

Ally Financial, Inc. | 9,942,850 | $ | 207,805,565 | ||||||||

American Express Co. | 2,630,010 | 221,552,042 | |||||||||

$ | 429,357,607 | ||||||||||

SEMICONDUCTOR DEVICES — 2.1% | |||||||||||

Analog Devices, Inc. | 3,176,140 | $ | 247,103,692 | ||||||||

QUALCOMM, Inc. | 2,340,250 | 129,228,605 | |||||||||

$ | 376,332,297 | ||||||||||

ELECTRICAL COMPONENTS — 2.0% | |||||||||||

TE Connectivity, Ltd. (Switzerland) | 4,470,390 | $ | 351,730,285 | ||||||||

COMMUNICATIONS EQUIPMENT — 2.0% | |||||||||||

Cisco Systems, Inc. | 11,070,960 | $ | 346,521,048 | ||||||||

ELECTRICAL POWER EQUIPMENT — 1.8% | |||||||||||

General Electric Co. | 11,884,830 | $ | 321,009,258 | ||||||||

SPECIALTY PHARMA — 1.4% | |||||||||||

Mylan NV* | 6,341,690 | $ | 246,184,406 | ||||||||

ADVERTISING & MARKETING — 1.3% | |||||||||||

WPP plc (Britain) | 10,495,478 | $ | 220,631,082 | ||||||||

CONTAINERS & PACKAGING — 1.2% | |||||||||||

Owens-Illinois, Inc.*,§ | 8,912,900 | $ | 213,196,568 | ||||||||

LIFE SCIENCE EQUIPMENT — 1.1% | |||||||||||

Thermo Fisher Scientific, Inc. | 1,134,900 | $ | 198,006,003 | ||||||||

BASE METALS — 1.1% | |||||||||||

Alcoa Corporation | 3,866,740 | $ | 126,249,061 | ||||||||

MMC Norilsk Nickel PJSC (ADR) (Russia) | 4,377,920 | 60,415,296 | |||||||||

$ | 186,664,357 | ||||||||||

INSTITUTIONAL BROKERAGE — 1.0% | |||||||||||

LPL Financial Holdings, Inc. | 4,165,970 | $ | 176,887,086 | ||||||||

12

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2017

(Unaudited)

COMMON STOCKS — Continued | Shares | Fair Value | |||||||||

SPECIALTY CHEMICALS — 0.9% | |||||||||||

Nexeo Solutions, Inc.*,**,§ | 17,691,717 | $ | 146,841,251 | ||||||||

Nexeo Solutions, Inc. (Founders Shares) *,**,§,†† | 2,431,709 | 7,539,164 | |||||||||

$ | 154,380,415 | ||||||||||

INTEGRATED OILS — 0.9% | |||||||||||

Gazprom PJSC (ADR) (Russia) | 12,690,400 | $ | 50,228,603 | ||||||||

Lukoil PJSC (ADR) (Russia) | 1,455,100 | 70,863,370 | |||||||||

Rosneft Oil Co. PJSC (GDR) (Russia) | 5,711,200 | 31,040,372 | |||||||||

$ | 152,132,345 | ||||||||||

INVESTMENT MANAGEMENT — 0.8% | |||||||||||

Legg Mason, Inc. | 3,669,319 | $ | 140,021,213 | ||||||||

FOOD & DRUG STORES — 0.8% | |||||||||||

Jardine Strategic Holdings, Ltd. (Hong Kong) | 2,067,360 | $ | 86,188,238 | ||||||||

Lenta, Ltd. (GDR) (Russia)*,**,†† | 8,153,870 | 47,373,985 | |||||||||

$ | 133,562,223 | ||||||||||

HOUSEHOLD PRODUCTS — 0.6% | |||||||||||

Unilever NV (CVA) (Britain) | 1,756,570 | $ | 96,942,765 | ||||||||

EXPLORATION & PRODUCTION — 0.2% | |||||||||||

Occidental Petroleum Corporation | 620,540 | $ | 37,151,730 | ||||||||

MARINE SHIPPING — 0.1% | |||||||||||

Sound Holding FP (Luxembourg) **,§,†† | 1,146,250 | $ | 24,418,078 | ||||||||

| TOTAL COMMON STOCKS — 62.7% (Cost $7,692,276,056) | $ | 11,030,335,733 | |||||||||

LIMITED PARTNERSHIPS — 0.3% | |||||||||||

U.S. Farming Realty Trust, L.P. ** | 350,000 | $ | 40,636,190 | ||||||||

U.S. Farming Realty Trust II, L.P. ** | 120,000 | 12,926,676 | |||||||||

WLRS Fund I LLC*,**,§,†† | 968 | 5,581,434 | |||||||||

| TOTAL LIMITED PARTNERSHIPS — 0.3% (Cost $48,139,439) | $ | 59,144,300 | |||||||||

PREFERRED STOCK — 0.1% | |||||||||||

INTEGRATED OILS — 0.1% | |||||||||||

Surgutneftegas OJSC (Preference Shares) (Russia) (Cost $27,221,319) | 39,322,900 | $ | 18,996,344 | ||||||||

13

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2017

(Unaudited)

BONDS & DEBENTURES | Principal Amount | Fair Value | |||||||||

RESIDENTIAL MORTGAGE-BACKED SECURITIES | |||||||||||

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 0.2% | |||||||||||

| Stanwich Mortgage Loan Trust Series 2010-3 A — 0.00% 7/31/2038**,@,†† | $ | 2,900,713 | $ | 1,451,227 | |||||||

| Stanwich Mortgage Loan Trust Series 2012-2 A — 0.00% 3/15/2047**,@,†† | 2,508,740 | 1,066,215 | |||||||||

| Stanwich Mortgage Loan Trust Series 2011-2 A — 0.00% 9/15/2050**,@,†† | 4,473,535 | 2,394,254 | |||||||||

| Stanwich Mortgage Loan Trust Series 2011-1 A — 0.144% 8/15/2050**,@,†† | 5,195,837 | 2,740,435 | |||||||||

| Stanwich Mortgage Loan Trust Series 2010-4 A — 0.394% 8/31/2049**,@,†† | 2,793,958 | 1,410,949 | |||||||||

| Stanwich Mortgage Loan Trust Series 2009-2 A — 0.521% 2/15/2049**,@,†† | 648,831 | 290,157 | |||||||||

| Stanwich Mortgage Loan Trust Series 2010-1 A — 1.091% 9/30/2047**,@,†† | 1,034,208 | 523,102 | |||||||||

| Stanwich Mortgage Loan Trust Series 2010-2 A — 1.702% 2/28/2057**,@,†† | 5,663,619 | 2,855,597 | |||||||||

| Stanwich Mortgage Loan Trust Series 2012-4 A — 12.318% 6/15/2051**,@,†† | 4,860,762 | 2,235,950 | |||||||||

| Sunset Mortgage Loan Co. LLC 2015-NPL1 A — 4.459% 9/18/2045**,@@ | 17,873,152 | 18,056,398 | |||||||||

| TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES — 0.2% (Cost $32,672,428) | $ | 33,024,284 | |||||||||

ASSET-BACKED SECURITIES — 0.2% | |||||||||||

RELP 8 — 10.00% 10/17/2017**,†† | $ | 10,620,434 | $ | 10,620,434 | |||||||

RELP 10 — 9.50% 11/20/2017**,†† | 3,891,210 | 3,891,210 | |||||||||

RELP 11 — 10.75% 8/5/2018**,†† | 22,852,610 | 22,852,610 | |||||||||

$ | 37,364,254 | ||||||||||

OTHER — 0.3% | |||||||||||

Ship Loan Participation — 7.80% 12/24/2019**,†† | $ | 43,054,347 | $ | 43,054,347 | |||||||

Ship Loan Participation II — 11.00% 9/4/2018**,†† | 7,826,858 | 7,826,858 | |||||||||

$ | 50,881,205 | ||||||||||

| TOTAL ASSET-BACKED SECURITIES — 0.5% (Cost $88,245,459) | $ | 88,245,459 | |||||||||

14

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2017

(Unaudited)

BONDS & DEBENTURES — Continued | Principal Amount | Fair Value | |||||||||

CORPORATE BONDS & NOTES | |||||||||||

BASIC MATERIALS — 0.1% | |||||||||||

Glencore Funding LLC — 4.625% 4/29/2024** | $ | 4,700,000 | $ | 4,898,488 | |||||||

Glencore Funding LLC — 2.875% 4/16/2020** | 9,100,000 | 9,151,522 | |||||||||

Glencore Finance Canada, Ltd. — 4.25% 10/25/2022** | 8,150,000 | 8,415,754 | |||||||||

$ | 22,465,764 | ||||||||||

CONSUMER, CYCLICAL — 0.8% | |||||||||||

Navistar International Corporation — 8.25% 11/1/2021 | $ | 143,177,000 | $ | 144,071,856 | |||||||

ENERGY — 1.9% | |||||||||||

CONSOL Energy, Inc. — 8.25% 4/1/2020 | $ | 5,650,000 | $ | 5,727,970 | |||||||

CONSOL Energy, Inc. — 8.00% 4/1/2023 | 77,110,000 | 80,579,950 | |||||||||

Southwestern Energy Co. — 4.10% 3/15/2022 | 3,800,000 | 3,538,940 | |||||||||

California Resources Corporation — 5.00% 1/15/2020 | 2,171,000 | 1,389,440 | |||||||||

California Resources Corporation — 5.50% 9/15/2021 | 8,984,000 | 4,671,680 | |||||||||

California Resources Corporation — 6.00% 11/15/2024 | 2,171,000 | 1,042,080 | |||||||||

CONSOL Energy, Inc. — 5.875% 4/15/2022 | 196,666,000 | 193,716,010 | |||||||||

California Resources Corporation 2nd Lien — 8.00% 12/15/2022** | 35,750,000 | 22,611,875 | |||||||||

Rice Energy, Inc. — 6.25% 5/1/2022 | 16,731,000 | 17,483,895 | |||||||||

$ | 330,761,840 | ||||||||||

FINANCIAL — 0.3% | |||||||||||

Springleaf Finance Corporation — 6.90% 12/15/2017 | $ | 15,366,000 | $ | 15,596,490 | |||||||

Springleaf Finance Corporation — 6.50% 9/15/2017 | 8,980,000 | 9,058,575 | |||||||||

Walter Investment Management Corporation — 7.875% 12/15/2021 | 53,600,000 | 33,701,000 | |||||||||

$ | 58,356,065 | ||||||||||

INDUSTRIAL — 1.1% | |||||||||||

Bombardier, Inc. — 7.75% 3/15/2020** | $ | 28,058,000 | $ | 30,144,814 | |||||||

Bombardier, Inc. — 4.75% 4/15/2019** | 4,893,000 | 4,978,627 | |||||||||

Bombardier, Inc. — 5.75% 3/15/2022** | 13,800,000 | 13,800,000 | |||||||||

Bombardier, Inc. — 6.125% 1/15/2023** | 29,534,000 | 29,607,835 | |||||||||

Bombardier, Inc. — 6.00% 10/15/2022** | 12,670,000 | 12,701,675 | |||||||||

Bombardier, Inc. — 7.50% 3/15/2025** | 82,750,000 | 85,853,125 | |||||||||

Bombardier, Inc. — 7.45% 5/1/2034** | 5,800,000 | 5,814,500 | |||||||||

$ | 182,900,576 | ||||||||||

| TOTAL CORPORATE BONDS & NOTES — 4.2% (Cost $574,960,134) | $ | 738,556,101 | |||||||||

15

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2017

(Unaudited)

BONDS & DEBENTURES — Continued | Principal Amount | Fair Value | |||||||||

CORPORATE BANK DEBT | |||||||||||

Sears Canada Term Loan — 10.66% 3/20/2022** | $ | 23,416,667 | $ | 23,406,832 | |||||||

Walter Investment Management Corporation — 0.00% 12/18/2020** | 27,914,215 | 25,320,426 | |||||||||

| TOTAL CORPORATE BANK DEBT — 0.3% (Cost $45,283,576) | $ | 48,727,258 | |||||||||

CONVERTIBLE BONDS | |||||||||||

Navistar International Corporation — 4.50% 10/15/2018 | $ | 22,938,000 | $ | 22,894,991 | |||||||

Navistar International Corporation — 4.75% 4/15/2019 | 34,244,000 | 33,366,498 | |||||||||

Walter Investment Management Corporation — 4.50% 11/1/2019 | 28,841,000 | 9,805,940 | |||||||||

| TOTAL CONVERTIBLE BONDS — 0.4% (Cost $65,775,219) | $ | 66,067,429 | |||||||||

U.S. TREASURIES — 26.6% | |||||||||||

U.S. Treasury Notes — 0.625% 8/31/2017 | $ | 200,000,000 | $ | 199,860,360 | |||||||

U.S. Treasury Notes — 0.625% 9/30/2017 | 274,000,000 | 273,679,365 | |||||||||

U.S. Treasury Notes — 0.625% 11/30/2017 | 200,000,000 | 199,579,400 | |||||||||

U.S. Treasury Notes — 0.625% 4/30/2018 | 300,000,000 | 298,403,310 | |||||||||

U.S. Treasury Notes — 0.75% 1/31/2018 | 275,000,000 | 274,315,800 | |||||||||

U.S. Treasury Notes — 0.75% 2/28/2018 | 230,000,000 | 229,293,601 | |||||||||

U.S. Treasury Notes — 0.75% 3/31/2018 | 325,000,000 | 323,801,887 | |||||||||

U.S. Treasury Notes — 0.75% 4/15/2018 | 150,000,000 | 149,408,940 | |||||||||

U.S. Treasury Notes — 0.875% 8/15/2017 | 108,000,000 | 107,983,120 | |||||||||

U.S. Treasury Notes — 0.875% 10/15/2017 | 280,000,000 | 279,818,980 | |||||||||

U.S. Treasury Notes — 0.875% 11/15/2017 | 290,000,000 | 289,762,113 | |||||||||

U.S. Treasury Notes — 0.875% 1/15/2018 | 259,000,000 | 258,588,786 | |||||||||

U.S. Treasury Notes — 0.875% 5/31/2018 | 330,000,000 | 328,801,176 | |||||||||

U.S. Treasury Notes — 1.00% 9/15/2017 | 270,000,000 | 269,972,784 | |||||||||

U.S. Treasury Notes — 1.00% 12/15/2017 | 250,000,000 | 249,880,375 | |||||||||

U.S. Treasury Notes — 1.00% 3/15/2018 | 325,000,000 | 324,466,805 | |||||||||

U.S. Treasury Notes — 1.875% 10/31/2017 | 291,000,000 | 291,685,916 | |||||||||

U.S. Treasury Notes — 2.25% 11/30/2017 | 75,000,000 | 75,331,673 | |||||||||

U.S. Treasury Notes — 3.50% 2/15/2018 | 260,000,000 | 263,616,912 | |||||||||

| TOTAL U.S. TREASURIES (Cost $4,703,386,896) | $ | 4,688,251,303 | |||||||||

| TOTAL BONDS & DEBENTURES — 32.2% (Cost $5,510,323,712) | $ | 5,662,871,834 | |||||||||

16

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2017

(Unaudited)

| Principal Amount | Fair Value | ||||||||||

PUT OPTIONS PURCHASED — 0.1% | |||||||||||

| JPY Put-Strike $95; expires 03/24/22; $194,350,000* (Barclays Capital Counterparty)†† (Cost $14,624,838) | $ | 194,350,000 | $ | 20,848,119 | |||||||

CALL OPTION PURCHASED — 0.1% | |||||||||||

| Call-Strike $0.0000.10; expires 05/22/25; $100,000,000* (Barclays Capital Counterparty) (Barclays Bank PLC)†† (Cost $21,930,000) | $ | 100,000,000 | $ | 21,930,000 | |||||||

| TOTAL PURCHASED OPTIONS — 0.2% (Cost $36,554,838) | $ | 42,778,119 | |||||||||

| TOTAL INVESTMENT SECURITIES — 95.5% (Cost $13,314,515,364) | $ | 16,814,126,330 | |||||||||

SHORT-TERM INVESTMENTS | |||||||||||

Apple, Inc. | |||||||||||

| — 0.87% 7/13/2017 | $ | 100,000,000 | $ | 99,971,000 | |||||||

| — 0.00% 7/11/2017 | 200,000,000 | 199,940,460 | |||||||||

| — 0.89% 7/20/2017 | 50,000,000 | 49,976,514 | |||||||||

| — 0.94% 8/3/2017 | 78,200,000 | 78,132,618 | |||||||||

The Coca-Cola Co. — 1.13% 8/24/2017 | 125,000,000 | 124,788,125 | |||||||||

General Electric Co. — 0.00% 7/5/2017 | 65,000,000 | 64,990,614 | |||||||||

Exxon Mobil Corp. — 0.83% 7/14/2017 | 119,000,000 | 118,964,333 | |||||||||

Microsoft Corp. | |||||||||||

| — 0.84% 7/10/2017 | 147,000,000 | 146,969,130 | |||||||||

| — 0.92% 7/20/2017 | 41,000,000 | 40,980,092 | |||||||||

| — 0.92% 7/27/2017 | 49,000,000 | 48,967,442 | |||||||||

| — 1.04% 8/7/2017 | 100,000,000 | 99,893,111 | |||||||||

Wal-Mart Stores, Inc. | |||||||||||

| — 0.93% 7/12/2017 | 100,000,000 | 99,971,583 | |||||||||

| — 1.11% 7/19/2017 | 123,000,000 | 122,931,735 | |||||||||

| State Street Bank Repurchase Agreement — 0.12% 7/3/2017 (Dated 06/30/2017, repurchase price of $51,488,515, collateralized by $52,915,000 principal amount U.S. Treasury Notes — 2.00% 2024, fair value $52,518,138) | 51,488,000 | 51,488,000 | |||||||||

| TOTAL SHORT-TERM INVESTMENTS — 7.7% (Cost $1,347,978,992) | $ | 1,347,964,757 | |||||||||

| TOTAL INVESTMENTS — 103.2% (Cost $14,662,494,356) | $ | 18,162,091,087 | |||||||||

17

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2017

(Unaudited)

SECURITIES SOLD SHORT | Shares | Fair Value | |||||||||

COMMON STOCKS SOLD SHORT | |||||||||||

Alibaba Group Holding Ltd. (ADR) (China) | (1,426,540 | ) | $ | (200,999,486 | ) | ||||||

WW Grainger, Inc. | (96,049 | ) | (17,339,726 | ) | |||||||

Yahoo Japan Corporation (Japan) | (7,538,000 | ) | (32,772,456 | ) | |||||||

Pennsylvania Real Estate Investment Trust | (600,700 | ) | (6,799,924 | ) | |||||||

Pitney Bowes, Inc. | (401,000 | ) | (6,055,100 | ) | |||||||

Ventas, Inc. | (61,800 | ) | (4,293,864 | ) | |||||||

Tencent Holdings, Ltd. (China) | (23,897,100 | ) | (854,577,400 | ) | |||||||

iShares Russell 2000 ETF | (944,720 | ) | (133,129,942 | ) | |||||||

Care Capital Properties, Inc. | (15,450 | ) | (412,515 | ) | |||||||

| TOTAL COMMON STOCKS SOLD SHORT — (7.1)% (Proceeds $747,174,551) | $ | (1,256,380,413 | ) | ||||||||

Other Assets and Liabilities, net — 3.9% | 691,990,405 | ||||||||||

NET ASSETS — 100.0% | $ | 17,597,701,079 | |||||||||

* Non-income producing security.

§ Affiliated Security.

†† These securities have been valued in good faith under policies adopted by authority of the Board of Trustee in accordance with the Fund's fair value procedures. These securities constituted 1.31% of total net assets at June 30, 2017.

** Restricted securities. These restricted securities constituted 3.88% of total net assets at June 30, 2017, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

@ Variable/Floating Rate Security — Interest rate changes on these instruments are based on changes in a designated base rate. The rates shown are those in effect on June 30, 2017.

@@ Step Coupon — Coupon rate increases in increments to maturity. Rate disclosed is as of June 30, 2017.

See notes to financial statements.

18

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

June 30, 2017

(Unaudited)

Issuer | Acquisition Date (s) | Cost | Fair Value | Fair Value as a % of Net Assets | |||||||||||||||

| Bombardier, Inc. 7.50% 3/15/2025 | 09/25/2015, 09/28/2015, 09/29/2015, 12/10/2015, 12/11/2015, 12/21/2015, 01/07/2016, 01/21/2016, 01/29/2016, 02/01/2016, 02/02/2016, 02/08/2016, 02/16/2016 | $ | 58,190,692 | $ | 85,853,125 | 0.50 | % | ||||||||||||

| Bombardier, Inc. 7.75% 3/15/2020 | 08/19/2015, 08/20/2015, 08/24/2015 | 21,931,518 | 30,144,814 | 0.17 | % | ||||||||||||||

| Bombardier, Inc. 6.125% 1/15/2023 | 09/28/2015, 09/29/2015, 01/05/2016, 02/01/2016 | 20,798,655 | 29,607,835 | 0.17 | % | ||||||||||||||

| Bombardier, Inc. 5.75% 3/15/2022 | 09/28/2015, 12/28/2015, 01/29/2016 | 9,843,000 | 13,800,000 | 0.08 | % | ||||||||||||||

| Bombardier, Inc. 6.00% 10/15/2022 | 09/28/2015, 09/29/2015, 01/20/2016, 02/03/2016, 02/16/2016 | 8,504,562 | 12,701,675 | 0.07 | % | ||||||||||||||

Bombardier, Inc. 7.45% 5/1/2034 | 11/10/2015, 12/01/2015 | 4,087,750 | 5,814,500 | 0.03 | % | ||||||||||||||

Bombardier, Inc. 4.75% 4/15/2019 | 08/19/2015 | 3,816,540 | 4,978,627 | 0.03 | % | ||||||||||||||

| California Resources Corporation 2nd Lien 8.00% 01/07/2015, 01/12/2015, 12/15/2022 | 01/15/2015, 08/28/2015 | 36,124,329 | 22,611,875 | 0.13 | % | ||||||||||||||

| Glencore Finance Canada, 09/28/2015, 01/21/2016, Ltd. 4.25% 10/25/2022 | 02/03/2016 | 5,555,033 | 8,415,754 | 0.05 | % | ||||||||||||||

| Glencore Funding LLC 2.875% 4/16/2020 | 09/28/2015, 01/20/2016 | 6,415,500 | 9,151,522 | 0.05 | % | ||||||||||||||

| Glencore Funding LLC 4.625% 4/29/2024 | 09/28/2015, 01/13/2016 | 3,078,500 | 4,898,488 | 0.03 | % | ||||||||||||||

Lenta, Ltd. GDR | 10/21/2015 | 57,892,477 | 47,373,985 | 0.27 | % | ||||||||||||||

Nexeo Solutions, Inc. | 155,231,992 | 146,841,251 | 0.84 | % | |||||||||||||||

| Nexeo Solutions, Inc. (Founders Shares) | 13,179,863 | 7,539,164 | 0.04% | ||||||||||||||||

| RELP 8 10.00% 10/17/2017 | 02/03/2016, 03/01/2016, 03/23/2016, 04/01/2016, 05/01/2016, 06/01/2016, 07/01/2016, 08/01/2016, 09/01/2016, 09/23/2016, 10/03/2016, 10/19/2016 | 10,620,434 | 10,620,434 | 0.06 | % | ||||||||||||||

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2017

(Unaudited)

Issuer | Acquisition Date (s) | Cost | Fair Value | Fair Value as a % of Net Assets | |||||||||||||||

| RELP 10 9.50% 11/20/2017 | 01/15/2016, 02/15/2016, 02/23/2016, 03/15/2016, 03/22/2016, 04/12/16, 04/15/2016, 05/09/2016, 05/15/2016, 05/31/2016, 06/15/2016, 07/01/2016, 07/15/2016, 07/25/2016, 08/22/2016, 09/15/2016, 09/30/2016, 10/15/2016, 11/11/2016 | $ | 3,891,210 | $ | 3,891,210 | 0.02 | % | ||||||||||||

| RELP 11 10.75% 8/5/2018 | 04/01/2016, 05/01/2016, 06/01/2016, 07/01/2016, 08/01/2016, 09/01/2016, 10/01/2016, 11/01/2016, 12/01/2016 | 22,852,610 | 22,852,610 | 0.13 | % | ||||||||||||||

| Sears Canada Term Loan — 10.66% 3/20/2022 | 22,856,507 | 23,406,832 | 0.13% | ||||||||||||||||

| Ship Loan Participation 7.80% 12/24/2019 | 12/22/2014 | 43,054,347 | 43,054,347 | 0.24% | |||||||||||||||

| Ship Loan Participation II 11.00% 9/4/2018 | 11/29/2016 | 7,826,858 | 7,826,858 | 0.04% | |||||||||||||||

Sound Holding FP (Luxembourg) | 68,431,400 | 24,418,078 | 0.14 | % | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2010-2 A 1.702% 2/28/2057 | 05/21/2010 | 3,045,527 | 2,855,597 | 0.02% | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2011-1 A .144% 8/15/2050 | 05/11/2011, 10/03/2013 | 2,739,577 | 2,740,435 | 0.02% | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2011-2 A 9/15/2050 | 06/10/2011 | 2,392,951 | 2,394,254 | 0.01% | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2012-4 A 12.318% 6/15/2051 | 05/10/2012 | 2,157,532 | 2,235,950 | 0.01% | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2010-3 A 7/31/2038 | 06/02/2010 | 1,386,873 | 1,451,227 | 0.01% | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2010-4 A .394% 8/31/2049 | 08/04/2010 | 1,300,728 | 1,410,949 | 0.01% | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2012-2 A 3/15/2047 | 02/10/2012 | 965,964 | 1,066,215 | 0.01% | |||||||||||||||

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2017

(Unaudited)

Issuer | Acquisition Date (s) | Cost | Fair Value | Fair Value as a % of Net Assets | |||||||||||||||

| Stanwich Mortgage Loan Trust Series 2010-1 A 1.091% 9/30/2047 | 04/22/2010 | $ | 542,407 | $ | 523,102 | 0.00 | % | ||||||||||||

| Stanwich Mortgage Loan Trust Series 2009-2 A .521% 2/15/2049 | 11/30/2009, 01/21/2010 | 267,951 | 290,157 | 0.00 | % | ||||||||||||||

| Sunset Mortgage Loan Co. LLC 2015-NPL1 A 4.459% 9/18/2045 | 10/02/2015 | 17,872,918 | 18,056,398 | 0.10 | % | ||||||||||||||

U.S. Farming Realty Trust II, L.P. | 11,431,585 | 12,926,676 | 0.07 | % | |||||||||||||||

U.S. Farming Realty Trust, L.P. | 28,202,539 | 40,636,190 | 0.23 | % | |||||||||||||||

| Walter Investment Management Corporation | 22,427,069 | 25,320,426 | 0.14% | ||||||||||||||||

WLRS Fund I LLC | 06/09/2016 | 8,505,315 | 5,581,434 | 0.03 | % | ||||||||||||||

| TOTAL RESTRICTED SECURITIES | $ | 687,422,713 | $ | 683,291,994 | 3.88 | % | |||||||||||||

See notes to financial statements.

21

FPA CRESCENT FUND

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2017

(Unaudited)

ASSETS | |||||||

Investment securities — at fair value (identified cost $13,314,515,364) | $ | 16,814,126,330 | |||||

Short-term investments — at amortized cost (maturities 60 days or less) | 1,347,964,757 | ||||||

Cash | 248 | ||||||

Deposits for securities sold short | 755,827,183 | ||||||

Receivable for: | |||||||

Dividends and interest | 45,641,382 | ||||||

Capital Stock sold | 20,038,907 | ||||||

Prepaid expenses and other assets | 689,718 | ||||||

| Total assets | 18,984,288,525 | ||||||

LIABILITIES | |||||||

Payable for: | |||||||

Securities sold short, at market value (proceeds $747,174,551) | 1,256,380,413 | ||||||

Investment securities purchased | 65,969,047 | ||||||

Capital Stock repurchased | 43,363,534 | ||||||

Advisory fees | 14,483,899 | ||||||

Accrued expenses and other liabilities | 3,383,014 | ||||||

Unrealized loss on forward foreign currency contracts | 3,007,539 | ||||||

Total liabilities | 1,386,587,446 | ||||||

NET ASSETS | $ | 17,597,701,079 | |||||

SUMMARY OF SHAREHOLDERS' EQUITY | |||||||

| Capital Stock — no par value; unlimited authorized shares; 512,572,212 outstanding shares | $ | 14,235,912,028 | |||||

Undistributed net realized gain | 337,374,547 | ||||||

Undistributed net investment income | 53,766,018 | ||||||

| Unrealized appreciation of investments | 2,970,648,486 | ||||||

NET ASSETS | $ | 17,597,701,079 | |||||

NET ASSET VALUE | |||||||

Offering and redemption price per share | $ | 34.33 | |||||

See notes to financial statements.

22

FPA CRESCENT FUND

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2017

(Unaudited)

INVESTMENT INCOME | |||||||

Dividends (net of foreign taxes withheld of $2,624,337) | $ | 84,610,508 | |||||

Interest | 67,590,628 | ||||||

Total investment income | 152,201,136 | ||||||

EXPENSES | |||||||

Advisory fees | 85,687,413 | ||||||

Short sale dividend expense | 3,348,792 | ||||||

Transfer agent fees and expenses | 3,115,326 | ||||||

Custodian fees | 689,385 | ||||||

Reports to shareholders | 593,964 | ||||||

Administrative services fees | 426,665 | ||||||

Professional fees | 385,750 | ||||||

Trustee fees and expenses | 210,760 | ||||||

Legal fees | 124,978 | ||||||

Filing fees | 72,755 | ||||||

Audit and tax services fees | 43,160 | ||||||

Other | 27,677 | ||||||

Total expenses | 94,726,625 | ||||||

Net expenses | 94,726,625 | ||||||

Net investment income | 57,474,511 | ||||||

NET REALIZED AND UNREALIZED GAIN (LOSS) | |||||||

Net realized gain (loss) on: | |||||||

Investments | 189,090,151 | ||||||

Foreign currency transactions | (7,335,304 | ) | |||||

Net change in unrealized appreciation (depreciation) of: | |||||||

| Investments | 1,005,825,891 | ||||||

Investment securities sold short | (350,159,354 | ) | |||||

Translation of foreign currency denominated amounts | (17,935,615 | ) | |||||

| Net realized and unrealized gain | 819,485,769 | ||||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 876,960,280 | |||||

See notes to financial statements.

23

FPA CRESCENT FUND

STATEMENTS OF CHANGES IN NET ASSETS

| Six Months Ended June 30, 2017 (Unaudited) | Year Ended December 31, 2016 | ||||||||||

INCREASE (DECREASE) IN NET ASSETS | |||||||||||

Operations: | |||||||||||

Net investment income | $ | 57,474,511 | $ | 128,861,961 | |||||||

Net realized gain | 181,754,847 | 723,447,334 | |||||||||

| Net change in unrealized appreciation | 637,730,922 | 701,692,687 | |||||||||

| Net increase in net assets resulting from operations | 876,960,280 | 1,554,001,982 | |||||||||

Distributions to shareholders from: | |||||||||||

Net investment income | — | (141,761,297 | ) | ||||||||

Net realized capital gains | — | (660,533,612 | ) | ||||||||

Total distributions | — | (802,294,909 | ) | ||||||||

Capital Stock transactions: | |||||||||||

Proceeds from Capital Stock sold | 1,738,747,950 | 2,320,886,124 | |||||||||

| Proceeds from shares issued to shareholders upon reinvestment of dividends and distributions | — | 702,052,272 | |||||||||

Cost of Capital Stock repurchased | (1,573,042,290 | )* | (5,339,447,889 | )* | |||||||

Net increase (decrease) from Capital Stock transactions | 165,705,660 | (2,316,509,493 | ) | ||||||||

| Total change in net assets | 1,042,665,940 | (1,564,802,420 | ) | ||||||||

NET ASSETS | |||||||||||

Beginning of period | 16,555,035,139 | 18,119,837,559 | |||||||||

End of period | $ | 17,597,701,079 | $ | 16,555,035,139 | |||||||

CHANGE IN CAPITAL STOCK OUTSTANDING | |||||||||||

Shares of Capital Stock sold | 51,517,106 | 73,991,731 | |||||||||

| Shares issued to shareholders upon reinvestment of dividends and distributions | — | 21,525,181 | |||||||||

Shares of Capital Stock repurchased | (46,610,570 | ) | (171,324,508 | ) | |||||||

Change in Capital Stock outstanding | 4,906,536 | (75,807,596 | ) | ||||||||

* Net of redemption fees of $200,230 and $7,860,248 for the period ended June 30, 2017 and year ended December 31, 2016, respectively.

See notes to financial statements.

24

FPA CRESCENT FUND

FINANCIAL HIGHLIGHTS

Selected Data for Each Share of Capital Stock Outstanding Throughout Each Period

| Six Months Ended June 30, 2017 | Year Ended December 31 | ||||||||||||||||||||||||||

(unaudited) | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||

| Per share operating performance: | |||||||||||||||||||||||||||

| Net asset value at beginning of period | $ | 32.61 | $ | 31.06 | $ | 33.74 | $ | 32.96 | $ | 29.29 | $ | 26.78 | |||||||||||||||

| Income from investment operations: | |||||||||||||||||||||||||||

| Net investment income* | $ | 0.11 | $ | 0.24 | $ | 0.18 | $ | 0.25 | $ | 0.14 | $ | 0.12 | |||||||||||||||

| Net realized and unrealized gain (loss) on investment securities | $ | 1.61 | 2.93 | (0.89 | ) | 1.94 | 6.02 | 2.63 | |||||||||||||||||||

| Total from investment operations | $ | 1.72 | $ | 3.17 | $ | (0.71 | ) | $ | 2.19 | $ | 6.16 | $ | 2.75 | ||||||||||||||

Less distributions: | |||||||||||||||||||||||||||

| Dividends from net investment income | — | $ | (0.29 | ) | $ | (0.31 | ) | $ | (0.31 | ) | $ | (0.21 | ) | $ | (0.12 | ) | |||||||||||

| Distributions from net realized capital gains | — | (1.34 | ) | (1.66 | ) | (1.10 | ) | (2.28 | ) | (0.12 | ) | ||||||||||||||||

Total distributions | — | $ | (1.63 | ) | $ | (1.97 | ) | $ | (1.41 | ) | $ | (2.49 | ) | $ | (0.24 | ) | |||||||||||

Redemption fees | — | ** | $ | 0.01 | — | ** | — | ** | — | ** | — | ** | |||||||||||||||

| Net asset value at end of period | $ | 34.33 | $ | 32.61 | $ | 31.06 | $ | 33.74 | $ | 32.96 | $ | 29.29 | |||||||||||||||

Total investment return | 5.27 | % | 10.25 | % | (2.06 | )% | 6.64 | % | 21.95 | % | 10.33 | % | |||||||||||||||

Ratios/supplemental data: | |||||||||||||||||||||||||||

| Net assets, end of period (in $000's) | $ | 17,597,701 | $ | 16,555,035 | $ | 18,119,838 | $ | 19,983,836 | $ | 15,903,874 | $ | 9,916,697 | |||||||||||||||

| Ratio of expenses to average net assets | 1.11 | %‡† | 1.09 | %‡ | 1.11 | %‡ | 1.20 | %‡ | 1.23 | %‡ | 1.26 | %‡ | |||||||||||||||

| Ratio of net investment income (loss) to average net assets | 0.67 | %† | 0.77 | % | 0.53 | % | 0.45 | % | 0.34 | % | 0.62 | % | |||||||||||||||

Portfolio turnover rate | 23 | %† | 35 | % | 48 | % | 31 | % | 22 | % | 26 | % | |||||||||||||||

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

† Annualized.

‡ For the periods ended June 30, 2017, December 31, 2016, December 31, 2015, December 31, 2014, December 31, 2013, December 31, 2012, the expense ratio includes short sale dividend expense equal to 0.04%, 0.02%, 0.02%, 0.05%, 0.09%, 0.10%, of average net assets, respectively.

See notes to financial statements.

25

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS

June 30, 2017

(Unaudited)

NOTE 1 — Significant Accounting Policies

FPA Crescent Fund (the "Fund"), a series of the FPA Funds Trust, is registered under the Investment Company Act of 1940 as an open-end, diversified, management investment company. The Fund's investment objective is to seek to generate equity-like returns over the long-term, take less risk than the market and avoid permanent impairment of capital. The Fund qualifies as an investment company pursuant to Financial Accounting Standard Board (FASB) Accounting Standards Codification (ASC) No. 946, Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America, ("U.S. GAAP"). The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Disclosure of Fair Value Measurements.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis. The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities, and other assets and liabilities stated in foreign currencies, are translated using the daily spot rate; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resultant exchange gains and losses are included in net realized or net unrealized gain (loss) in the statement of operations. A detailed listing of outstanding currency transactions is included in the Portfolio of Investments, in Investment Securities in the Statement of Assets and Liabilities and in Disclosure of Fair Value Measurements.

C. Use of Estimates

The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

Common Stocks and Other Securities (Long): The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including; those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations.

Common Stocks and Other Securities (Short): The prices of common stocks and other securities sold short rise between the date of the short sale and the date on which the Fund replaces the borrowed security. In addition, the Fund repays the person that lent it the security for any interest or dividends that may have accrued.

26

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2017

(Unaudited)

Interest Rate Risk: The values of, and the income generated by, most debt securities held by the Fund may be affected by changing interest rates and by changes in the effective maturities and credit rating of these securities. For example, the value of debt securities in the Fund's portfolio generally will decline when interest rates rise and increase when interest rates fall. In addition, falling interest rates may cause an issuer to redeem, call or refinance a security before its stated maturity, which may result in the Fund having to reinvest the proceeds in lower yielding securities.

Credit Risk: The values of any of the Fund's investments may also decline in response to events affecting the issuer or its credit rating. The lower rated debt securities in which the Fund may invest are considered speculative and are generally subject to greater volatility and risk of loss than investment grade securities, particularly in deteriorating economic conditions. The Fund invests a significant portion of its assets in securities of issuers that hold mortgage-and asset-backed securities and direct investments in securities backed by commercial and residential mortgage loans and other financial assets. The value and related income of these securities is sensitive to changes in economic conditions, including delinquencies and/or defaults. Though the Fund has not been adversely impacted, continuing shifts in the market's perception of credit quality on securities backed by commercial and residential mortgage loans and other financial assets may result in increased volatility of market price and periods of illiquidity that can negatively impact the valuation of certain securities held by the Fund.

Repurchase Agreements: Repurchase agreements permit the Fund to maintain liquidity and earn income over periods of time as short as overnight. Repurchase agreements held by the Fund are fully collateralized by U.S. Government securities, or securities issued by U.S. Government agencies, or securities that are within the three highest credit categories assigned by established rating agencies (Aaa, Aa, or A by Moody's or AAA, AA or A by Standard & Poor's) or, if not rated by Moody's or Standard & Poor's, are of equivalent investment quality as determined by the Adviser. Such collateral is in the possession of the Fund's custodian. The collateral is evaluated daily to ensure its market value equals or exceeds the current market value of the repurchase agreements including accrued interest. In the event of default on the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation.

The Fund may enter into repurchase agreements, under the terms of a Master Repurchase Agreement ("MRA"). The MRA permits the Fund, under certain circumstances including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due to or from the Fund. However, bankruptcy or insolvency laws of a particular jurisdiction may impose restrictions on or prohibitions against such a right of offset in the event of a MRA counterparty's bankruptcy or insolvency. Pursuant to the terms of the MRA, the Fund receives securities as collateral with a market value in excess of the repurchase price to be received by the Fund upon the maturity of the repurchase transaction. Upon a bankruptcy or insolvency of the MRA counterparty, the Fund recognizes a liability with respect to such excess collateral to reflect the Fund's obligation under bankruptcy law to return the excess to the counterparty. Repurchase agreements outstanding at the end of the period are listed in the Fund's Portfolio of Investments.

NOTE 3 — Purchases and Sales of Investment Securities

Cost of purchases of investment securities (excluding short-term investments) aggregated $1,836,918,596 for the period ended June 30, 2017. The proceeds and cost of securities sold resulting in net realized gains of $189,090,151 aggregated $1,706,538,417 and $1,517,448,266, respectively, for the period ended June 30, 2017. Realized gains or losses are based on the specific identification method.

27

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2017

(Unaudited)

NOTE 4 — Federal Income Tax

No provision for federal income tax is required because the Fund has elected to be taxed as a "regulated investment company" under the Internal Revenue Code (the "Code") and intends to maintain this qualification and to distribute each year to its shareholders, in accordance with the minimum distribution requirements of the Code, its taxable net investment income and taxable net realized gains on investments.

The cost of investment securities held at June 30, 2017, was $13,579,460,673 for federal income tax purposes. Gross unrealized appreciation and depreciation for all investments (excluding short-term investments) at June 30, 2017, for federal income tax purposes was $3,742,065,645 and $241,663,100, respectively resulting in net unrealized appreciation of $3,500,402,545. As of and during the period ended June 30, 2017, the Fund did not have any liability for unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any interest or penalties. The Fund is not subject to examination by U.S. federal tax authorities for years ended on or before December 31, 2013 or by state tax authorities for years ended on or before December 31, 2012.

NOTE 5 — Advisory Fees and Other Affiliated Transactions

Pursuant to an Investment Advisory Agreement (the "Agreement"), advisory fees were paid by the Fund to First Pacific Advisors, LLC (the "Adviser"). Under the terms of this Agreement, the Fund pays the Adviser a monthly fee calculated at the annual rate of 1.00% of the Fund's average daily net assets.

For the period ended June 30, 2017, the Fund paid aggregate fees and expenses of $210,760 to all Trustees who are not affiliated persons of the Adviser. Certain officers of the Fund are also officers of the Adviser.

NOTE 6 — Securities Sold Short

The Fund maintains cash deposits and segregates marketable securities in amounts equal to the current market value of the securities sold short or the market value of the securities at the time they were sold short, whichever is greater. Possible losses from short sales may be unlimited, whereas losses from purchases cannot exceed the total amount invested. The dividends on securities sold short are reflected as short sale dividend expense.

NOTE 7 — Redemption Fees

A redemption fee of 2% applies to redemptions within 90 days of purchase. For the period ended June 30, 2017, the Fund collected $200,230 in redemption fees. The impact of these fees is less than $0.01 per share.

NOTE 8 — Disclosure of Fair Value Measurements

The Fund uses the following methods and inputs to establish the fair value of its assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued each day at the official closing price of, or the last reported sale price on, the exchange or market on which such securities principally are traded, as of the close of business on that day. If there have been no sales that day, equity securities are generally valued at the last available bid price. Securities that are unlisted and fixed-income and convertible securities listed on a national securities exchange for which the over-the-counter ("OTC") market more accurately reflects the securities' value in the judgment of the Fund's officers, are valued at the most recent bid price. Events occurring after the close of trading on non-U.S. exchanges may result in adjustments to the valuation of foreign securities to reflect their fair value as of the close of regular

28

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2017

(Unaudited)

trading on the NYSE. The Fund may utilize an independent fair valuation service in adjusting the valuations of foreign securities. However, most fixed income securities are generally valued at prices obtained from pricing vendors and brokers. Vendors value such securities based on one or more of the following inputs: transactions, bids, offers quotations from dealers and trading systems, spreads and other relationships observed in the markets among comparable securities, benchmarks, underlying equity of the issuer, and proprietary pricing models such as cash flows, financial or collateral performance and other reference data (includes prepayments, defaults, collateral, credit enhancements, and interest rate volatility). Currency forwards are valued at the closing currency exchange rate which is not materially different from the forward rate. Short-term corporate notes with maturities of 60 days or less at the time of purchase are valued at amortized cost.

Securities for which representative market quotations are not readily available or are considered unreliable by the Adviser are valued as determined in good faith under procedures adopted by the authority of the Fund's Board of Trustees. Various inputs may be reviewed in order to make a good faith determination of a security's value. These inputs include, but are not limited to, the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. Investments in limited partnerships are valued, as a practical expedient, utilizing the net asset valuations provided by the underlying limited partnerships in a manner consistent with U.S. GAAP for investment companies. The Fund applies the practical expedient to its investments in limited partnerships on an investment-by-investment basis, and consistently with the Fund's entire position in a particular investment, unless it is probable that the Fund will sell a portion of an investment at an amount different from the net asset valuation. Investments in limited partnerships are included in Level 3 of the fair value hierarchy based on the limited rights of withdrawal by the Fund as specified in the respective agreements. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations of investments that would have been used had greater market activity occurred.

The Fund classifies its assets based on three valuation methodologies. Level 1 values are based on quoted market prices in active markets for identical assets. Level 2 values are based on significant observable market inputs, such as quoted prices for similar assets and quoted prices in inactive markets or other market observable inputs as noted above including spreads, cash flows, financial performance, prepayments, defaults, collateral, credit enhancements, and interest rate volatility. Level 3 values are based on significant unobservable inputs that reflect the Fund's determination of assumptions that market participants might reasonably use in valuing the assets. These assumptions consider inputs such as proprietary pricing models, cash flows, prepayments, defaults, and collateral. The valuation levels are not necessarily an indication of the risk associated with investing in those securities. The following table presents the valuation levels of the Fund's investments as of June 30, 2017: (see Portfolio of Investments for industry categories):

Investments | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||

Common Stocks | |||||||||||||||||||

Aircraft & Parts | $ | 1,388,565,498 | — | — | $ | 1,388,565,498 | |||||||||||||

Infrastructure Software | 1,162,521,078 | — | — | 1,162,521,078 | |||||||||||||||

Diversified Banks | 1,011,775,986 | — | — | 1,011,775,986 | |||||||||||||||

Internet Media | 898,887,891 | — | — | 898,887,891 | |||||||||||||||

Investment Companies | 695,568,529 | — | — | 695,568,529 | |||||||||||||||

29

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2017

(Unaudited)

Investments | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||

Common Stocks | |||||||||||||||||||

Entertainment Content | $ | 638,363,036 | — | — | $ | 638,363,036 | |||||||||||||

Insurance Brokers | 496,552,296 | — | — | 496,552,296 | |||||||||||||||

P&C Insurance | 490,199,314 | — | — | 490,199,314 | |||||||||||||||

Commercial Finance | 442,773,339 | — | — | 442,773,339 | |||||||||||||||

Consumer Finance | 429,357,607 | — | — | 429,357,607 | |||||||||||||||

Semiconductor Devices | 376,332,297 | — | — | 376,332,297 | |||||||||||||||

Electrical Components | 351,730,285 | — | — | 351,730,285 | |||||||||||||||

Communications Equipment | 346,521,048 | — | — | 346,521,048 | |||||||||||||||

Electrical Power Equipment | 321,009,258 | — | — | 321,009,258 | |||||||||||||||

Specialty Pharma | 246,184,406 | — | — | 246,184,406 | |||||||||||||||

Advertising & Marketing | 220,631,082 | — | — | 220,631,082 | |||||||||||||||

Containers & Packaging | 213,196,568 | — | — | 213,196,568 | |||||||||||||||

Life Science Equipment | 198,006,003 | — | — | 198,006,003 | |||||||||||||||

Base Metals | 186,664,357 | — | — | 186,664,357 | |||||||||||||||

Institutional Brokerage | 176,887,086 | — | — | 176,887,086 | |||||||||||||||

Specialty Chemicals | 146,841,251 | — | $ | 7,539,164 | 154,380,415 | ||||||||||||||

Integrated Oils | 152,132,345 | — | — | 152,132,345 | |||||||||||||||

Investment Management | 140,021,213 | — | — | 140,021,213 | |||||||||||||||

Food & Drug Stores | 86,188,238 | — | 47,373,985 | 133,562,223 | |||||||||||||||

Household Products | 96,942,765 | — | — | 96,942,765 | |||||||||||||||

Exploration & Production | 37,151,730 | — | — | 37,151,730 | |||||||||||||||

Marine Shipping | — | — | 24,418,078 | 24,418,078 | |||||||||||||||

Limited Partnerships | — | — | 5,581,434 | 5,581,434 | |||||||||||||||

| Limited Partnerships — valued at NAV as a practical expedient | — | — | — | 53,562,866 | |||||||||||||||

Preferred Stock | |||||||||||||||||||

Integrated Oils | 18,996,344 | — | — | 18,996,344 | |||||||||||||||

Residential Mortgage-Backed Securities | |||||||||||||||||||

| Non-Agency Collateralized Mortgage Obligation | — | $ | 18,056,398 | 14,967,886 | 33,024,284 | ||||||||||||||

Asset-Backed Securities | |||||||||||||||||||

Asset-Backed Securities | — | — | 37,364,254 | 37,364,254 | |||||||||||||||

Other | — | — | 50,881,205 | 50,881,205 | |||||||||||||||

Corporate Bonds & Notes | — | 738,556,101 | — | 738,556,101 | |||||||||||||||

Corporate Bank Debt | — | 48,727,258 | — | 48,727,258 | |||||||||||||||

Convertible Bonds | — | 66,067,429 | — | 66,067,429 | |||||||||||||||

U.S. Treasuries | — | 4,688,251,303 | — | 4,688,251,303 | |||||||||||||||

Short-Term Investments | — | 1,347,964,757 | — | 1,347,964,757 | |||||||||||||||

$ | 10,970,000,850 | $ | 6,907,623,246 | $ | 188,126,006 | $ | 18,119,312,968 | ||||||||||||

30

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2017

(Unaudited)

Investments | Level 1 | Level 2 | Level 3 | Total | |||||||||||||||

Currency Options (currency risk) | — | — | $ | 20,848,119 | $ | 20,848,119 | |||||||||||||

Call Options Purchased | — | — | 21,930,000 | 21,930,000 | |||||||||||||||

| Forward Foreign Currency Contracts (currency risk) | — | $ | (3,007,539 | ) | — | (3,007,539 | ) | ||||||||||||

— | $ | (3,007,539 | ) | $ | 42,778,119 | $ | 39,770,580 | ||||||||||||

Common Stock Sold Short | $ | (1,256,380,413 | ) | — | — | $ | (1,256,380,413 | ) | |||||||||||

The following table summarizes the Fund's Level 3 investment securities and related transactions during the period ended June 30, 2017:

Investments | Beginning Value at December 31, 2016 | Net Realized and Unrealized Gains (Losses)* | Purchases | (Sales) | Transfers Out | Transfers In | Ending Value at June 30, 2017 | Net Change in Unrealized Appreciation (Depreciation) related to Investments held at June 30, 2017 | |||||||||||||||||||||||||||

| Asset-Backed Securities | $ | 44,696,707 | — | $ | 4,918,355 | $ | (12,250,808 | ) | — | — | $ | 37,364,254 | — | ||||||||||||||||||||||

| Asset-Backed Securities — Other | 65,298,046 | — | 410,953 | (14,827,794 | ) | — | — | 50,881,205 | — | ||||||||||||||||||||||||||

| Common Stocks | 102,065,979 | $ | (22,734,752 | ) | — | — | — | — | 79,331,227 | $ | (22,734,751 | ) | |||||||||||||||||||||||

| Currency Options | 24,962,703 | (4,114,584 | ) | — | — | — | — | 20,848,119 | (4,114,584 | ) | |||||||||||||||||||||||||

| Call Option Purchased | — | — | 21,930,000 | — | — | — | 21,930,000 | — | |||||||||||||||||||||||||||

| Limited Partnerships | 7,352,285 | (1,770,851 | ) | — | — | — | — | 5,581,434 | (1,770,851 | ) | |||||||||||||||||||||||||

| Residential Mortgage- Backed Securities Non-Agency Collateralized Mortgage Obligation | 22,175,492 | 678,088 | — | (7,885,694 | ) | — | — | 14,967,886 | (134,875 | ) | |||||||||||||||||||||||||

$ | 266,551,212 | $ | (27,942,099 | ) | $ | 27,259,308 | $ | (34,964,296 | ) | — | — | $ | 230,904,125 | $ | (28,755,061 | ) | |||||||||||||||||||

31

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

June 30, 2017

(Unaudited)

Level 3 Valuation Process: Investments classified within Level 3 of the fair value hierarchy are valued by the Adviser in good faith under procedures adopted by authority of the Fund's Board of Trustees. The Adviser employs various methods to determine fair valuations including regular review of key inputs and assumptions, and review of related market activity, if any. However, there are generally no observable trade activities in these securities. The Adviser reports to the Board of Trustees at their regularly scheduled quarterly meetings, or more often if warranted. The report includes a summary of the results of the process, the key inputs and assumptions noted, and any changes to the inputs and assumptions used. When appropriate, the Adviser will recommend changes to the procedures and process employed. The value determined for an investment using the fair value procedures may differ significantly from the value realized upon the sale of such investment. Transfers of investments between different levels of the fair value hierarchy are recorded at market value as of the end of the reporting period. There were no transfers from Level 2 to Level 1 during the period ended June 30, 2017.

Financial Assets | Fair Value at | Valuation Technique(s) | Unobservable | Price/Range | |||||||||||||||

Asset-Backed Securities | $ | 37,364,254 | Most Recent Capitlization (Funding)***** | Private Financing | $100.00 | ||||||||||||||

Call Option Purchased | $ | 21,930,000 | Third-Party Broker Quote***** | Quotes/Prices | $0.22 | ||||||||||||||

Common Stocks- Long | $ | 7,539,164 | Restricted Assets* | N/A | $3.10 | ||||||||||||||