UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08544 |

|

FPA FUNDS TRUST |

(Exact name of registrant as specified in charter) |

|

11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA | | 90025 |

(Address of principal executive offices) | | (Zip code) |

| | |

(Name and address of agent for service) | | Copy to: |

| | |

J. RICHARD ATWOOD, PRESIDENT

FPA FUNDS TRUST

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025 | | MARK D. PERLOW, ESQ.

DECHERT LLP

ONE BUSH STREET, STE. 1600

SAN FRANCISCO, CA 94104 |

|

Registrant’s telephone number, including area code: | (310) 473-0225 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2018 | |

| | | | | | | | |

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Introduction

Dear Shareholders:

The second-longest bull market in the United States in the last century began its tenth year in the second quarter. Without a market correction, a new record in bull market length will be set this quarter.

The FPA Crescent Fund ("the Fund") returned 0.32% in the second quarter and declined -0.66% in the first half (1H) of 2018. In comparison, the S&P 500 produced a 3.43% return in the second quarter, while the MSCI ACWI generated a 0.53% return. Those indices have returned 2.65% and -0.43%, respectively, year-to-date during the first half of 2018.

Growth continued to outperform value year-to-date, hurting the Fund's performance relative to the broader benchmarks. The Russell 1000 Growth Index returned 7.25%, while the Russell 1000 Value Index declined -1.69% in 1H.

Portfolio Commentary

One needn't look much further than the investments that had the greatest impact on the Fund's Q2 performance to drive this point home. Three of its top five contributors are considered "growth" companies — Alphabet (Google's holding company), Facebook and Microsoft. Crescent has held Alphabet and Microsoft for much of this decade, while Facebook is a more recent position.

The holdings that hurt Q2's performance largely fall in the "value" category.

Q2 Winners and Losers1

Winners | | Performance

Contribution | | Losers | | Performance

Contribution | |

Naspers/Tencent Pair | | | 0.52 | % | | Arconic | | | -0.56 | % | |

Facebook | | | 0.29 | % | | Owens Illinois | | | -0.26 | % | |

Alphabet2 | | | 0.25 | % | | Mylan | | | -0.23 | % | |

Microsoft | | | 0.24 | % | | TE Connectivity | | | -0.22 | % | |

Kinder Morgan | | | 0.19 | % | | Nexeo Solutions2 | | | -0.20 | % | |

| | | | 1.49 | % | | | | | -1.47 | % | |

The companies we own have mostly met our expectations, with some exceeding and a few disappointing. That's always been the case, though.

Unfortunately for the Fund's recent performance, we have only owned some of the highest profile growth companies, Facebook, Apple, Amazon, Netflix, Google — or the FAANG stocks. Amazon (+45%), Apple (+10%), and Netflix (+106%) contributed 66% of the S&P 500's gains in 1H 2018. Amazon's future business model is more understandable to us than either Apple's or Netflix's, and we've written in the past that we wish we had purchased Amazon earlier this decade. But that doesn't mean we would like to own it now, given its lofty valuation. One doesn't remedy a miss in the strike zone by reaching for a ball high and outside on the next pitch.

1 Reflects the top contributors and top detractors to the Fund's performance based on contribution to return for the quarter. Contribution is presented gross of investment management fees, transactions costs and Fund operating expenses, which if included, would reduce the returns presented.

2 Multiple issues

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

In good conscience, we can only own a business whose future we believe will unfold favorably. For example, our inability to discern what Netflix will look like in ten years curbs our enthusiasm. There's no arguing its tremendous success in almost single-handedly getting the cable video subscriber to cut the cord. Yet, its unprecedented program spending for both current and future commitments, as well as new competitors like Disney, which will shortly "repatriate" its content for its own, over-the-top platform, make the future performance of Netflix unknowable to us. Perhaps that limitation is ours alone, but a limitation it nonetheless is.

Our strategy is largely to purchase equity in undervalued businesses and high-yield and distressed corporate debt. If we have correctly assessed the opportunity, we believe our investments can deliver a better than market rate of return by virtue of a discounted valuation. The market will define some of these investments as value and others as growth. We describe them as opportunities to allocate capital to idiosyncratic investments that hopefully will allow us to deliver on our oft-repeated goal of producing an equity rate of return while avoiding a permanent impairment of capital.

Fund investors like to label their managers — you're growth, you're value. You invest solely in the U.S., only offshore, or maybe all over the world. You buy stocks, or you buy bonds. Although we can't invest in everything, we have a charter broad enough to invest in most publicly traded stocks and bonds. Our broad flexibility and conservative mandate means we have never been easy to label, but we always have been (and always will be) value investors. In our mind, all sensible fundamental investing is value investing, by which we mean buying a business or asset for less than what we believe it is worth under a number of reasonable scenarios.

Buying growing businesses with an adequate margin of safety is just as much a value investment as buying, say, a financial firm at a discount to tangible book value or a holding company at a discount to readily ascertainable net asset value. We've held all three types of investments in our portfolio over the past decade.

When analyzing businesses, we focus on the key performance indicators that we believe matter. Sometimes financial statements tell the story, and in those cases, investments typically appear "cheap" based on reported financial results. In other situations, information not in the financial statements might be most relevant, for instance, data like a company's position on the cost curve, its subscribers/user base, its total addressable market, its customer acquisition cost, the lifetime value of a customer, or real asset marked-to-market. In these situations, our holding might appear "expensive" based on reported financial results, but not when one looks at these other factors. Our value approach is the same no matter what the ultimate driver of intrinsic value.

We suspect that balance sheet sources of value will prove a less fertile source of opportunities than in the past, given evolutionary changes in the economy and business models over the past 30 years. In the past few years, the team has spent much time building a base of knowledge in businesses that are capital light, demonstrate outstanding economics and are likely to offer substantial organic growth over the next decade. Some of these companies are too hard for us to underwrite and others trade at values that seem devoid of a margin of safety, but others, like Facebook, Expedia, JD.com and Baidu, have made it into our portfolio.

Admittedly, no bright line divides growth and value. Lacking a more robust methodology, index funds place some companies into both buckets. A company with a low price-to-earnings ratio but a high price-to-book may find some portion of its market capitalization allocated to a value index and the remainder in a growth index.

With active and passive funds building ever larger exposure to growth stocks, the lack of oxygen left in the room for value stocks has triggered some wilting in price. That, along with somewhat higher volatility, has allowed us to initiate new positions.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

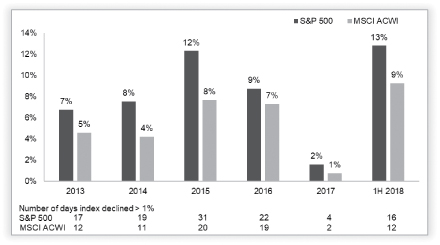

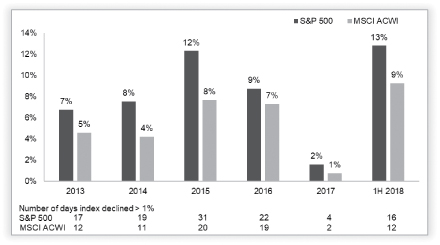

Last year the U.S. market posted the lowest volatility on record, but 2018 has seen bigger ups and downs.3 The S&P 500 has already declined more than 1% on four times as many trading days in 2018 than in all of last year; the MSCI ACWI, six times as many.

Percent of Days Per Year S&P 500 and MSCI ACWI Declined > 1%

Source: Bloomberg

When investors become fearful, we like to take advantage of indiscriminate selling. In 1H, that allowed us to establish eleven new long positions and exit seven. This is more portfolio movement than we've had in years.

The market hasn't presented a similar opportunity in corporate bonds. Low yields and a lack of appropriate discounting of risk have kept us away.

At purchase, the corporate debt in our portfolio should offer a yield well in excess of a risk-free rate like an equivalent maturity US Treasury note. The greater our expectations of interest and principal at maturity, the lower the yield we are willing to accept, yet our minimum threshold is still generally 10%. When we think a bond has a strong possibility of restructuring, we insist on a higher yield-to-maturity at purchase, usually in the mid-teens. None of those conditions exists today, which explains our negligible exposure to high-yield bonds.

Additional Portfolio Highlights

During Q2, we added to our holding in Arconic, an aerospace and value-added manufacturer that was spun out of Alcoa in late 2016. While Arconic was widely considered a "good" business within Alcoa, it was

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

poorly managed and spent the early part of its life after spinoff waging a wasteful proxy contest to protect a failed CEO and defective board. After a begrudging surrender to shareholder demands, Arconic spent 2017 with a caretaker CEO at the helm. The reconfigured board selected a new CEO who joined in January 2018, and we believe he's quite capable.

Arconic underperforms its peers from a margin perspective by anywhere from 300 to 1000 basis points, not particularly surprising given its history of poor management and governance. In Q2, reduced guidance for 2018, combined with trade concerns caused by the Trump tariffs, meant Arconic put the biggest dent in the Fund. But the stock's decline gave us an opportunity to increase our position at a price that we believe discounts the possibility of the company improving its operating performance. We believe the company's competitive position and market opportunity remain intact. While operational improvement will certainly take time, the combination of leading market positions and a capable management team leave us optimistic that Arconic will ultimately achieve its operating potential.

We also increased our position in AIG during the recent quarter at prices that represent 0.8 times tangible book value and roughly 11 times estimated 2018 earnings. We believe the shares represent good value based on current operations and are hopeful that new management will meaningfully improve the company's return on equity. For more detailed AIG thoughts, please see our AIG Investor Day slides4.

Markets and Economy

Corporate tax cuts for U.S. companies have been a big driver of recent U.S. market returns. Lower tax rates translate into higher earnings for companies with large profits in the U.S. Thanks to tax cuts, Wall Street estimates have been raised in 2018 for tax cut beneficiaries, but when it comes to projecting earnings, Wall Street analysts are usually overly optimistic. From 2010 to 2017, consensus earnings per share estimates were typically cut by 9%.

There is an expectation by many that the earnings benefits from a tax cut will not be competed away. In our view, that won't be universally true, though. Many companies manage to a return on capital (ROC). If ROC gets too high, competition comes in the form of lower prices, reinvestment in marketing, new competitors, etc. The tax cut's benefits will not all flow to the bottom line in every case.

It's no surprise that risk assets don't provide the highest margin of safety in the context of the almost decade-old bull market and economic expansion. In our recent bi-annual FPA Investor Day, we provided commentary and slides that speak to the state of the markets. Rather than repeat it all here, we refer you to our prepared remarks5 for this bigger picture perspective.

In summary, the global equity and corporate debt markets trade richly by most every measure (price-to-earnings, price-to-book, market cap to GDP, bond yields, high yield OAS).6

In this letter, I'll just focus on one valuation measure — earnings yield, or the inverse of the price-to-earnings ratio. Like a bond, the higher the earnings yield, the cheaper the security, while a lower yield means it's more expensive. Equities, unlike bonds, don't have a maturity; bankruptcy is a notable exception. Stocks have infinite duration. In a vacuum, a longer duration means additional risk, but owning a stock has the added potential of an increasing coupon via higher earnings.

4 https://fpa.com/docs/default-source/investor-day/investor-day-crescent_-website_final_wwatermark.pdf?sfvrsn=4#page=113

5 https://fpa.com/docs/default-source/funds/fpa-crescent-fund/quarterly-webcasts/crescent-prepared-remarks---investor-day-2018.pdf?sfvrsn=4#page=33

6 GDP = gross domestic product. OAS = option adjusted spread.

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

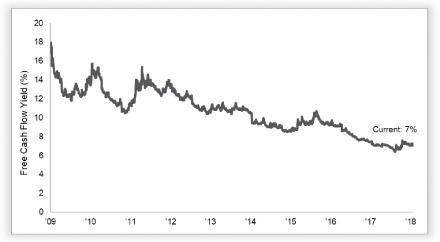

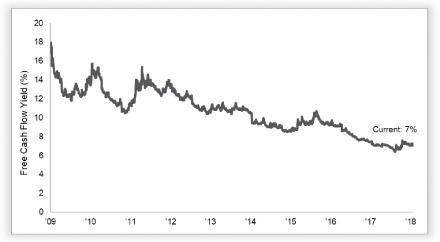

Since net income may not equal free cash flow — and all a company should ultimately be valued on its available free cash flow — it is better to consider a free cash yield. Like bonds, an investor should demand a reasonable premium to a risk-free rate when buying stocks. Reasonable people with different risk profiles demand different "equity risk premiums."

An expected yield can be calculated for corporate bonds and for stocks. The higher the expected yield, or internal rate of return, and the wider the spread to the risk-free rate, the greater the margin of safety, all else being equal. That margin of safety can expand the better the business gets and the greater the confidence in our determination of the likely outcome.

As stock prices have risen after the Great Recession, the S&P 500's free cash yield has reached cyclical lows (excluding financial stocks, whose free cash yield is calculated differently). This meager, mid-single-digit yield was last this low in 2008, the prior market peak.

S&P 500 Free Cash Yield (ex-Financials)

Source: Bloomberg

Since then, stock prices have risen along with U.S. Treasury yields (a proxy for a risk-free rate) compressing the equity risk premium. The current 417 basis point spread is less than half the average since 2009 and well below its peak, which makes a case for the cautious allocation of capital. This doesn't mean there is nothing to do, just less than we would hope.

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

S&P 500 (ex-Financials) free cash flow yield spread to 10-year U.S. Treasuries

Source: Bloomberg

Markets go up and down based on good and bad news, generally peaking when the news is most optimistic and finding their nadirs when the previous buyers seek safer havens and become sellers. Right now, the economy remains healthy; interest rates sit not far off their lows; inflation in most economies is benign; the world is mostly at peace, and markets have continued to grind upward — a daily validation that the future is bright if only because the recent past has been so.

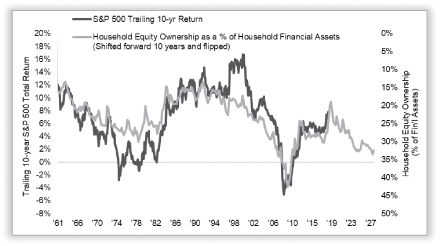

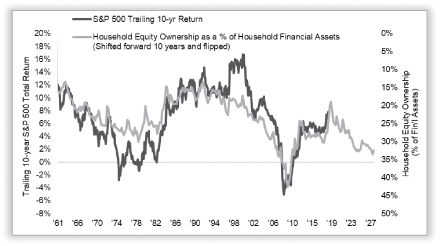

The result is that households now have a higher than normal investment in stocks. As we discussed at our Investor Day,

The blue line on this chart below shows the trailing 10-year return of the S&P 500. The green line shows household equity as a percent of household financial assets, shifted forward ten years and flipped upside-down to more clearly depict its correlation to the S&P's return.

You can see the green line reaching its nadir in 2010. That was really the peak — remember, the chart is flipped. Since it's also shifted forward ten years, that peak of about 40% really occurred 10 years earlier in 2000. In other words, household investment in stocks hit a high in 2000 and suggested that returns would be negative single digits and that's what happened.

The inverse relationship between household ownership of financial assets and future market returns has clearly been present for 56 years.

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

So what does today's household financial asset exposure suggest about the future? Current exposure suggests that the US market's projected return will converge towards the [low single digits] (the green line data point to the far right of the chart suggests that the blue line will end up there.)"

S&P 500 Trailing 10-year Return vs

Household Equity Ownership as Percent of Household Financial Assets

(shifted forward 10 years and inverted)

Source: Federal Reserve Economic Data (FRED)

Past performance does not guarantee future results.

Optimism hasn't been this high since 2000. Stocks last took a serious whopping a decade ago. The S&P 500 has just delivered 15 consecutive months of positive performance, and many investors hold the view that it's hard to lose money.

What can go wrong? Surely nothing, given that elected officials are operating with not nearly enough knowledge or discipline, and possibly self-interest. At least we have the "steady" hands of central bankers around the globe, the same ones who have been the biggest buyers of Japanese stocks (BOJ), the largest buyers of U.S. Treasuries (U.S. Federal Reserve), the largest buyers of European corporate bonds (ECB). Meanwhile, the U.S. President is losing the faith of longtime U.S. allies, igniting trade wars and pursuing ill-conceived and constantly shifting policies.

7

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

There is a view that stocks are much cheaper outside the U.S., but that's a view from 30,000 feet that doesn't hold up once you drill down and compare a U.S. company to a reasonable, albeit imprecise, analog abroad. Like-for-like-ish companies are priced similarly around the world, as we concluded when looking at the admittedly small sample size in the following table.

Large, Quality US Company Valuation vs International Peers7

Industry | | US Company | | P/E

TTM | | International

Company | | P/E

TTM | | International

Premium/

Discount | |

Consumer Durables & Apparel | | Nike | | | 33.4 | | | Adidas | | | 26.4 | | | | -21 | % | |

Distillers & Vintners | | Brown Forman | | | 32.2 | | | Diageo | | | 25.2 | | | | -22 | % | |

Food Distributors/Restaurants | | Sysco Corp | | | 24.6 | | | Compass | | | 22.6 | | | | -8 | % | |

Household/Personal Products | | Colgate-Palmolive Co | | | 22.1 | | | Unilever | | | 21.9 | | | | -1 | % | |

Household/Personal Products | | Estee Lauder | | | 32.5 | | | L'Oréal Group | | | 30.9 | | | | -5 | % | |

Household/Personal Products | | Procter & Gamble | | | 19.2 | | | Unilever | | | 21.9 | | | | 14 | % | |

Insurance Brokers | | Marsh & McLennan Cos Inc. | | | 19.5 | | | Aon | | | 23.7 | | | | 22 | % | |

Packaged Foods & Meats | | General Mills | | | 14.1 | | | Danone | | | 16.1 | | | | 14 | % | |

Pharmaceuticals | | Merck & Co Inc | | | 15.5 | | | Sanofi | | | 24.3 | | | | 57 | % | |

Specialty Chemicals | | International Flavors & Fragrances | | | 20.4 | | | Givaudan | | | 28.8 | | | | 41 | % | |

Systems/Application Software | | Oracle | | | 16.5 | | | SAP | | | 28.1 | | | | 70 | % | |

| | | | | | | | | Average | | | 15 | % | |

| | | | | | | | | Median | | | 14 | % | |

P/E TTM is the price to earnings ratio over the past trailing twelve months. International Premium/Discount refers to the premium or discount in valuation at which International companies are being traded at over their US peers.

Some observations about the above:

n On a trailing twelve-month basis, Nike trades at 33 times earnings, while Germany's Adidas trades at 26 times — even though Adidas has grown earnings slightly faster over the last decade.8

n Proctor & Gamble trades at a 12% discount to Unilever but at a substantial trailing twelve month price-to-earnings of 19.2 times, vs Unilever's 21.9 times. Unilever did grow earnings at a faster clip over the last decade, but just 2.7% faster compared to P&G's 1.9% — both rather meh, and if the future were to be in kind, poor justification for their valuations.

n SAP's trailing twelve-month price-to-earnings, at 28.1 times is 70% higher than Oracle's, which is hardly validated by SAP's earnings growth in the past decade of just 6.8%. Oracle, with its far lower price-to-earnings ratio of 16.5 times had only slightly lower earnings growth of 5.9% over the past ten years.

Stocks are no bargain anywhere, but complacency seems to be most everywhere — a potentially combustible combination. In the last 60 years, the S&P 500 has only been more expensive once, during the late 1990s tech bubble.

7 Source: Bloomber

8 For the last ten fiscal years beginning May 2008, Adidas has grown earnings per share at 10.6%, beating Nike's 9.7%.

8

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Not only is the world not on sale, but as Dr. Marc Faber notes:

"I need to bring up a few conditions that in economic history never existed before a recession: No recession ever got underway with asset prices as a percent of the economy as pricey as they are now (not just equities but also high yield bonds, international bonds, real estate, collectibles, etc.). More so, no recession ever began with the level of debts as a percentage of the global economy as high and with the quality of these debts as low as they are now. Trade globalization was never before as high as now either. Meaning, a deflationary bust cannot be ruled out, which would propel long-term Treasuries higher. [Stanley Druckenmiller: 'If I were trying to create a deflationary bust, I would do exactly what the world's central bankers have been doing the last six years.']"9

We will eventually have a recession and may end up with inflation, or perhaps even deflation. Our portfolio is set up to play the middle. Our stocks and the equity markets in general will likely perform poorly in a deflationary environment, but our cash position will likely outperform equities in such an environment and provide a source of funds for investment in what could be a period of distress. If we end up with inflation, well then, our cash will likely lag but our stocks should deliver some nominal benefit. As we have said, we manage this portfolio as if you have given us all your money (although we do not suggest that is the prudent course). But if one manages your capital as if one has it all and there's no safety net, it tends to breed prudence. Of course, there are more hardy individuals who prefer life on the high wire.

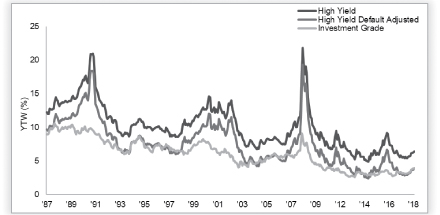

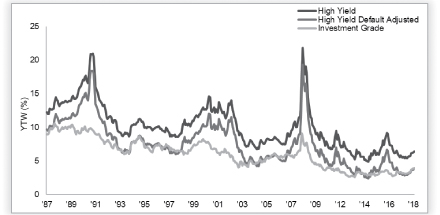

Speaking of circus acts, investing in the high-yield market right now feels a bit like sticking one's head in the lion's mouth. High-yield bonds offer a gross return of just 6.4% in the U.S. and 4% in Europe. Even such unattractive returns could only be realized if no corporate bond defaulted. But inevitably, some portion of that universe will default, delivering a lower "net" return. In the following chart, you can see that not only is the net yield low, it's no better than yields on investment grade bonds, begging the question, "Why bother?" At this point, we won't.

9 GloomBoomDoom July 2018, Dr. Marc Faber.

9

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

High Yield Bonds (adjusted for default)10 vs Investment Grade Bonds

10 Source: Bloomberg, Moody's. High Yield represented by Bloomberg Barclays U.S. High Yield Index. Investment Grade represented by Bloomberg Barclays U.S. Credit Index. Default adjustment calculated using average high yield default rate and average high yield recovery rate from 1983-2017 from Moody's. The constant default adjustment is then subtracted from high yield YTW historically to form High Yield Default Adjusted series. Investment grade default adjustment is assumed to be less than 0.1% because securities are usually downgraded to high yield prior to defaulting.

10

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

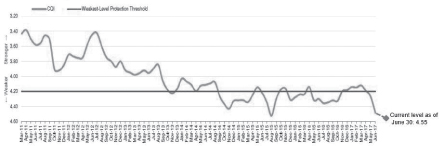

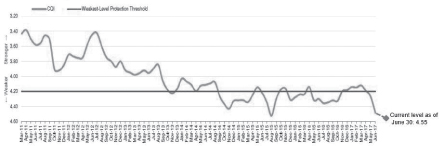

Particularly when covenant quality is lower than it has ever been...11

Moody's Covenant Quality Index

Source: Moody's High-Yield Covenant Database

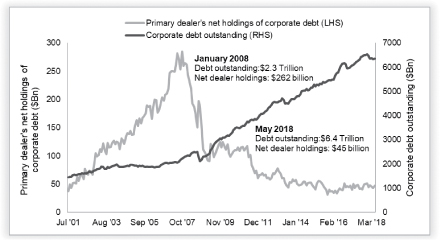

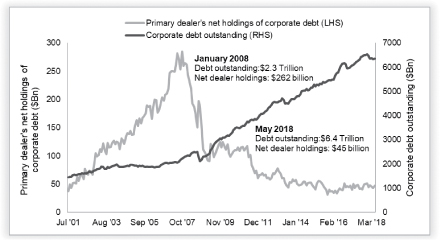

...in a high yield/levered loan market that is roughly twice as large as it was a decade ago and total corporate bonds are 2.8 times larger, even as the relative support from corporate bond desks is down by more than 90% (as a percentage of total corporate debt outstanding)! We surmise that when there is a correction, prices could get blown out. Dare we hope.

11 Note: Covenant Quality Index includes all high yield bonds, including high-yield lite. High-yield lite bonds lack a debt incurrence and/or a restricted payments covenant and automatically receive the weakest possible Covenant Quality score of 5.0.

11

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Primary Dealer's Net Holdings of Corporate Debt vs

Total Corporate Debt Outstanding

Source: New York Fed, Bloomberg

Closing

There is, of course, a price for conservatism: underperformance for a period, generally followed by a shrinking business. We are fearful of neither.

One should demand an alignment of interest between shareholder and portfolio manager, and we believe we successfully deliver that. That might be harder for a passive fund, like an index or ETF, which should invite the shareholder with a long-term buy-and-hold philosophy and the internal gumption to not head for the hills when markets turn sour — a test rarely passed amid market declines.

We believe an active value manager will likely fare better in a declining market — and hopefully scare fewer clients away and out of the market. A globally diversified value manager who invests in stocks and higher yielding corporate bonds and exhibits a willingness to hold cash should attract the independent investor less concerned about performing in line with any one index, particularly over shorter periods (and even be accepting of underperformance in the short term so long as there's an acceptable reward eventually for such loyalty and patience).

12

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

The Crowd is rarely right, and this time is unlikely to prove the exception. When stocks do decline, they tend to fall more quickly than they rise. The good times that investors think will never end morph into bad times that investors think will never end.

Respectfully submitted,

Steven Romick

Portfolio Manager

July 23, 2018

13

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

14

FPA CRESCENT FUND

PORTFOLIO SUMMARY

June 30, 2018 (Unaudited)

Common Stocks | | | | | 71.4 | % | |

Internet Media | | | 7.4 | % | | | |

Aircraft & Parts | | | 7.2 | % | | | |

Infrastructure Software | | | 5.4 | % | | | |

Diversified Banks | | | 4.6 | % | | | |

Entertainment Content | | | 4.5 | % | | | |

Banks | | | 3.7 | % | | | |

Institutional Brokerage | | | 3.4 | % | | | |

P&C Insurance | | | 3.1 | % | | | |

Semiconductor Devices | | | 3.1 | % | | | |

Cable & Satellite | | | 3.0 | % | | | |

Insurance Brokers | | | 2.5 | % | | | |

Consumer Finance | | | 2.3 | % | | | |

Electrical Components | | | 2.1 | % | | | |

Investment Companies | | | 1.8 | % | | | |

Internet Based Services | | | 1.7 | % | | | |

Generic Pharma | | | 1.6 | % | | | |

Cement & Aggregates | | | 1.6 | % | | | |

Advertising & Marketing | | | 1.5 | % | | | |

Midstream — Oil & Gas | | | 1.2 | % | | | |

Life Science Equipment | | | 1.2 | % | | | |

Packaged Food | | | 1.1 | % | | | |

Chemicals Distribution | | | 1.0 | % | | | |

Communications Equipment | | | 1.0 | % | | | |

Containers & Packaging | | | 0.9 | % | | | |

Integrated Utilities | | | 0.9 | % | | | |

Automobiles | | | 0.6 | % | | | |

Household Products | | | 0.6 | % | | | |

Specialty Chemicals | | | 0.6 | % | | | |

Integrated Oils | | | 0.5 | % | | | |

Food & Drug Stores | | | 0.5 | % | | | |

E-Commerce Discretionary | | | 0.3 | % | | | |

Base Metals | | | 0.3 | % | | | |

Marine Shipping | | | 0.2 | % | | | |

Mortgage Finance | | | 0.0 | % | | | |

Closed End Fund | | | | | 2.1 | % | |

Limited Partnerships | | | | | 0.6 | % | |

Preferred Stocks | | | | | 0.1 | % | |

Warrants | | | | | 0.0 | % | |

Convertible Preferred Stock | | | | | 0.0 | % | |

Bonds & Debentures | | | | | 7.7 | % | |

U.S. Treasuries | | | 3.4 | % | | | |

Corporate Bonds & Notes | | | 1.8 | % | | | |

Municipals | | | 1.4 | % | | | |

Asset-Backed Securities | | | 0.5 | % | | | |

Convertible Bonds | | | 0.3 | % | | | |

Corporate Bank Debt | | | 0.3 | % | | | |

Residential Mortgage-Backed Securities | | | 0.0 | % | | | |

Put Options Purchased | | | | | 0.5 | % | |

Short-term Investments | | | | | 21.3 | % | |

Securities Sold Short | | | | | (12.2 | )% | |

Other Assets And Liabilities, Net | | | | | 8.5 | % | |

Net Assets | | | | | 100.0 | % | |

15

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

June 30, 2018

(Unaudited)

COMMON STOCKS | | Shares | | Fair Value | |

INTERNET MEDIA — 7.4% | |

Alphabet, Inc. (Class A) (a) | | | 241,202 | | | $ | 272,362,886 | | |

Alphabet, Inc. (Class C) (a) | | | 242,756 | | | | 270,830,731 | | |

Baidu, Inc. (ADR) (China) (a) | | | 1,580,228 | | | | 383,995,404 | | |

Facebook, Inc. (Class A) (a) | | | 1,408,767 | | | | 273,751,604 | | |

| | | $ | 1,200,940,625 | | |

AIRCRAFT & PARTS — 7.2% | |

Arconic, Inc. | | | 19,421,962 | | | $ | 330,367,573 | | |

Esterline Technologies Corporation (a)(b) | | | 2,630,901 | | | | 194,160,494 | | |

Meggitt plc (Britain) (b) | | | 38,965,308 | | | | 253,676,976 | | |

United Technologies Corporation | | | 3,351,643 | | | | 419,055,924 | | |

| | | $ | 1,197,260,967 | | |

INFRASTRUCTURE SOFTWARE — 5.4% | |

Microsoft Corporation | | | 3,342,300 | | | $ | 329,584,203 | | |

Oracle Corporation | | | 12,869,893 | | | | 567,047,486 | | |

| | | $ | 896,631,689 | | |

DIVERSIFIED BANKS — 4.6% | |

Bank of America Corporation | | | 14,824,483 | | | $ | 417,902,176 | | |

Citigroup, Inc. | | | 5,254,757 | | | | 351,648,338 | | |

| | | $ | 769,550,514 | | |

ENTERTAINMENT CONTENT — 4.5% | |

Naspers, Ltd. (N Shares) (South Africa) | | | 2,918,607 | | | $ | 741,486,816 | | |

BANKS — 3.7% | |

CIT Group, Inc. (b) | | | 7,771,771 | | | $ | 391,774,976 | | |

Wells Fargo & Co. | | | 3,982,984 | | | | 220,816,633 | | |

| | | $ | 612,591,609 | | |

INSTITUTIONAL BROKERAGE — 3.4% | |

Jefferies Financial Group, Inc. | | | 15,780,733 | | | $ | 358,853,868 | | |

LPL Financial Holdings, Inc. | | | 3,150,845 | | | | 206,506,381 | | |

| | | $ | 565,360,249 | | |

P&C INSURANCE — 3.1% | |

American International Group, Inc. | | | 9,744,781 | | | $ | 516,668,289 | | |

SEMICONDUCTOR DEVICES — 3.1% | |

Analog Devices, Inc. | | | 3,426,243 | | | $ | 328,645,229 | | |

Broadcom, Inc. | | | 742,400 | | | | 180,135,936 | | |

| | | $ | 508,781,165 | | |

16

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

COMMON STOCKS — Continued | | Shares | | Fair Value | |

CABLE & SATELLITE — 3.0% | |

Charter Communications, Inc. (Class A) (a) | | | 779,191 | | | $ | 228,466,593 | | |

Comcast Corp. (Class A) | | | 8,058,385 | | | | 264,395,612 | | |

| | | $ | 492,862,205 | | |

INSURANCE BROKERS — 2.5% | |

Aon plc (Britain) | | | 2,984,392 | | | $ | 409,369,051 | | |

CONSUMER FINANCE — 2.3% | |

Ally Financial, Inc. | | | 8,269,555 | | | $ | 217,241,210 | | |

American Express Co. | | | 1,708,126 | | | | 167,396,348 | | |

| | | $ | 384,637,558 | | |

ELECTRICAL COMPONENTS — 2.1% | |

TE Connectivity, Ltd. (Switzerland) | | | 3,917,150 | | | $ | 352,778,529 | | |

INVESTMENT COMPANIES — 1.8% | |

Groupe Bruxelles Lambert SA (Belgium) | | | 2,851,023 | | | $ | 300,713,640 | | |

INTERNET BASED SERVICES — 1.7% | |

Expedia, Inc. | | | 2,293,166 | | | $ | 275,615,621 | | |

GENERIC PHARMA — 1.6% | |

Mylan NV (a) | | | 7,425,690 | | | $ | 268,364,437 | | |

CEMENT & AGGREGATES — 1.6% | |

HeidelbergCement AG (Germany) | | | 939,117 | | | $ | 79,050,197 | | |

LafargeHolcim Ltd. (Switzerland) | | | 3,770,860 | | | | 184,221,152 | | |

| | | $ | 263,271,349 | | |

ADVERTISING & MARKETING — 1.5% | |

WPP plc (Britain) | | | 16,089,063 | | | $ | 253,316,231 | | |

MIDSTREAM - OIL & GAS — 1.2% | |

Kinder Morgan, Inc. | | | 11,623,395 | | | $ | 205,385,390 | | |

LIFE SCIENCE EQUIPMENT — 1.2% | |

Thermo Fisher Scientific, Inc. | | | 984,150 | | | $ | 203,856,831 | | |

PACKAGED FOOD — 1.1% | |

Mondelez International, Inc. (Class A) | | | 4,290,352 | | | $ | 175,904,432 | | |

17

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

COMMON STOCKS — Continued | | Shares | | Fair Value | |

CHEMICALS DISTRIBUTION — 1.0% | |

Nexeo Solutions, Inc. (a)(b)(c) | | | 17,691,717 | | | $ | 161,525,376 | | |

Nexeo Solutions, Inc. (Founders Shares) (a)(b)(c)(d)(e) | | | 2,431,709 | | | | 10,034,627 | | |

| | | $ | 171,560,003 | | |

COMMUNICATIONS EQUIPMENT — 1.0% | |

Cisco Systems, Inc. | | | 3,869,486 | | | $ | 166,503,983 | | |

CONTAINERS & PACKAGING — 0.9% | |

Owens-Illinois, Inc. (a)(b) | | | 8,912,900 | | | $ | 149,825,849 | | |

INTEGRATED UTILITIES — 0.9% | |

PG&E Corp. (a) | | | 3,484,074 | | | $ | 148,282,189 | | |

AUTOMOBILES — 0.6% | |

Porsche Automobil Holding SE (Germany) | | | 1,562,200 | | | $ | 99,535,837 | | |

HOUSEHOLD PRODUCTS — 0.6% | |

Unilever NV (CVA) (Britain) | | | 1,756,570 | | | $ | 98,022,444 | | |

SPECIALTY CHEMICALS — 0.6% | |

Axalta Coating Systems Ltd. (a) | | | 3,060,111 | | | $ | 92,751,964 | | |

INTEGRATED OILS — 0.5% | |

Lukoil PJSC (ADR) (Russia) | | | 1,251,941 | | | $ | 85,607,726 | | |

FOOD & DRUG STORES — 0.5% | |

Jardine Strategic Holdings, Ltd. (Hong Kong) | | | 2,067,360 | | | $ | 75,417,293 | | |

E-COMMERCE DISCRETIONARY — 0.3% | |

JD.com, Inc. (ADR) (China) (a) | | | 1,328,290 | | | $ | 51,736,895 | | |

BASE METALS — 0.3% | |

Alcoa Corporation (a) | | | 914,831 | | | $ | 42,887,277 | | |

MMC Norilsk Nickel PJSC (ADR) (Russia) | | | 403,086 | | | | 7,235,394 | | |

| | | $ | 50,122,671 | | |

MARINE SHIPPING — 0.2% | |

Sound Holding FP (Luxembourg) (a)(b)(c)(d)(e) | | | 1,146,250 | | | $ | 36,370,582 | | |

18

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

COMMON STOCKS — Continued | | Shares or

Principal

Amount | | Fair Value | |

MORTGAGE FINANCE — 0.0% | |

Ditech Holding Corporation (a)(b) | | | 252,912 | | | $ | 1,320,201 | | |

| TOTAL COMMON STOCKS — 71.4% (Cost $8,453,827,935) | | $ | 11,822,404,834 | | |

CLOSED END FUND — 2.1% | |

Altaba, Inc. (a) (Cost $197,955,067) | | | 4,847,270 | | | $ | 354,868,637 | | |

LIMITED PARTNERSHIPS | |

WLRS Fund I LLC (a)(b)(c)(d)(e) | | | 968 | | | $ | 7,010,350 | | |

GACP II LP (c)(d)(e) | | | 454,995 | | | | 45,544,625 | | |

U.S. Farming Realty Trust, L.P. (c)(d)(e) | | | 350,000 | | | | 37,960,031 | | |

U.S. Farming Realty Trust II, L.P. (c)(d)(e) | | | 120,000 | | | | 12,056,403 | | |

| TOTAL LIMITED PARTNERSHIPS — 0.6% (Cost $93,162,105) | | $ | 102,571,409 | | |

PREFERRED STOCK — 0.1% | |

INTEGRATED OILS — 0.1% | |

Surgutneftegas OJSC (Preference Shares) (Russia) (Cost $27,221,319) | | | 39,322,900 | | | $ | 19,801,942 | | |

WARRANTS | |

MORTGAGE FINANCE — 0.0% | |

Ditech Holding Corporation (Class A) (a)(b)(d)(e) | | | 430,887 | | | $ | 0 | | |

Ditech Holding Corporation (Class B) (a)(b)(d)(e) | | | 341,900 | | | $ | 0 | | |

| TOTAL WARRANTS 0.0% (Cost $0) | | $ | 0 | | |

CONVERTIBLE PREFERRED STOCK — 0.0% | |

MORTGAGE FINANCE — 0.0% | |

Ditech Holding Corporation (a)(b) (Cost $16,018,470) | | | 9,950 | | | $ | 6,965,000 | | |

BONDS & DEBENTURES | |

RESIDENTIAL MORTGAGE-BACKED SECURITIES | |

NON-AGENCY COLLATERALIZED MORTGAGE OBLIGATION — 0.0% | |

Stanwich Mortgage Loan Trust Series 2010-3 A — 0.00%

7/31/2038 (d)(e)(f)(g) | | $ | 222,584 | | | $ | 111,359 | | |

Stanwich Mortgage Loan Trust Series 2012-2 A — 0.00%

3/15/2047 (d)(e)(f)(g) | | | 626,885 | | | | 266,426 | | |

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Stanwich Mortgage Loan Trust Series 2010-1 A — 0.00%

9/30/2047 (d)(e)(f)(g) | | $ | 48,015 | | | $ | 24,286 | | |

Stanwich Mortgage Loan Trust Series 2011-1 A — 0.00%

8/15/2050 (d)(e)(f)(g) | | | 1,082,862 | | | | 571,133 | | |

Stanwich Mortgage Loan Trust Series 2011-2 A — 0.00%

9/15/2050 (d)(e)(f)(g) | | | 1,859,641 | | | | 995,287 | | |

Stanwich Mortgage Loan Trust Series 2012-4 A — 0.00%

6/15/2051 (d)(e)(f)(g) | | | 209,350 | | | | 96,301 | | |

Stanwich Mortgage Loan Trust Series 2010-4 A — 1.101%

8/31/2049 (d)(e)(f)(g) | | | 819,972 | | | | 414,085 | | |

Stanwich Mortgage Loan Trust Series 2010-2 A — 1.47%

2/28/2057 (d)(e)(f)(g) | | | 1,731,122 | | | | 872,832 | | |

Sunset Mortgage Loan Co. LLC 2015-NPL1 A — 4.459%

9/18/2045 (g)(h) | | | 4,550,542 | | | | 4,550,537 | | |

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES — 0.0%

(Cost $9,015,153) | | $ | 7,902,246 | | |

ASSET-BACKED SECURITIES | |

ASSET-BACKED SECURITIES — 0.2% | |

RELP 10 — 9.75% 11/20/2018 (c)(d)(e) | | $ | 3,891,210 | | | $ | 3,891,210 | | |

RELP 11 — 10.00% 8/5/2018 (c)(d)(e) | | | 25,354,418 | | | | 25,354,418 | | |

| | | $ | 29,245,628 | | |

OTHER — 0.3% | |

Kamsarmax Shipping — 11.00% 9/4/2018 (c)(d)(e) | | $ | 7,453,766 | | | $ | 7,453,766 | | |

Northern Shipping — 7.80% 12/24/2019 (c)(d)(e) | | | 37,673,051 | | | | 37,673,051 | | |

| | | $ | 45,126,817 | | |

| TOTAL ASSET-BACKED SECURITIES — 0.5% (Cost $74,372,445) | | $ | 74,372,445 | | |

CORPORATE BONDS & NOTES | |

BASIC MATERIALS — 0.1% | |

Glencore Finance Canada, Ltd. — 4.25% 10/25/2022 (g) | | $ | 8,150,000 | | | $ | 8,206,646 | | |

Glencore Funding LLC — 2.875% 4/16/2020 (g) | | | 9,100,000 | | | | 9,028,953 | | |

Glencore Funding LLC — 4.625% 4/29/2024 (g) | | | 4,700,000 | | | | 4,730,567 | | |

| | | $ | 21,966,166 | | |

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

ENERGY — 0.5% | |

California Resources Corporation — 5.00% 1/15/2020 | | $ | 2,171,000 | | | $ | 2,092,410 | | |

California Resources Corporation — 5.50% 9/15/2021 | | | 8,984,000 | | | | 7,872,679 | | |

California Resources Corporation — 6.00% 11/15/2024 | | | 2,171,000 | | | | 1,774,793 | | |

California Resources Corporation 2nd Lien — 8.00% 12/15/2022 (g) | | | 35,750,000 | | | | 32,443,125 | | |

CONSOL Energy, Inc. — 8.00% 4/1/2023 | | | 30,845,000 | | | | 32,803,657 | | |

Southwestern Energy Co. — 4.10% 3/15/2022 | | | 3,800,000 | | | | 3,643,250 | | |

| | | $ | 80,629,914 | | |

FINANCIAL — 0.1% | |

Ditech Holding Corporation — 9.00% Cash or PIK 12/31/2024 | | $ | 25,033,174 | | | $ | 20,104,768 | | |

INDUSTRIAL — 1.1% | |

Bombardier, Inc. — 5.75% 3/15/2022 (g) | | $ | 13,800,000 | | | $ | 13,817,940 | | |

Bombardier, Inc. — 6.00% 10/15/2022 (g) | | | 12,670,000 | | | | 12,602,849 | | |

Bombardier, Inc. — 6.125% 1/15/2023 (g) | | | 29,534,000 | | | | 29,534,000 | | |

Bombardier, Inc. — 7.45% 5/1/2034 (g) | | | 5,800,000 | | | | 5,879,750 | | |

Bombardier, Inc. — 7.50% 3/15/2025 (g) | | | 82,750,000 | | | | 86,167,575 | | |

Bombardier, Inc. — 7.75% 3/15/2020 (g) | | | 28,058,000 | | | | 29,636,263 | | |

| | | $ | 177,638,377 | | |

TOTAL CORPORATE BONDS & NOTES — 1.8%

(Cost $256,692,349) | | $ | 300,339,225 | | |

CORPORATE BANK DEBT | |

Hall of Fame TL 3M LIBOR + 9.000% — 11.330%

3/20/2019 (c)(d)(e)(f) | | $ | 9,568,600 | | | $ | 9,568,600 | | |

MEC Filo TL 1M LIBOR + 9.000% — 11.090%

2/12/2021 (c)(d)(e)(f) | | | 19,202,100 | | | | 19,202,100 | | |

Walter Investment Management Corporation,

3M LIBOR + 6.000% — 8.094% 6/30/2022 (c)(f) | | | 13,661,815 | | | | 13,081,187 | | |

| TOTAL CORPORATE BANK DEBT — 0.3% (Cost $46,832,571) | | $ | 41,851,887 | | |

CONVERTIBLE BONDS | |

Navistar International Corporation — 4.50% 10/15/2018 | | $ | 22,938,000 | | | $ | 23,058,080 | | |

Navistar International Corporation — 4.75% 4/15/2019 | | | 25,220,000 | | | | 25,991,228 | | |

| TOTAL CONVERTIBLE BONDS — 0.3% (Cost $37,685,279) | | $ | 49,049,308 | | |

21

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

MUNICIPALS | |

Commonwealth of Puerto Rico GO,

Series 2014 A, (SER A), — 8.00% 7/1/2035 | | $ | 111,230,000 | | | $ | 45,048,150 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.00% 7/1/2021 | | | 7,070,000 | | | | 5,921,125 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.00% 7/1/2022 | | | 3,883,000 | | | | 3,252,013 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.00% 7/1/2033 | | | 25,194,000 | | | | 21,099,975 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.125% 7/1/2037 | | | 14,598,000 | | | | 12,225,825 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.25% 7/1/2029 | | | 9,753,000 | | | | 8,168,138 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.25% 7/1/2042 | | | 93,814,000 | | | | 78,569,225 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.75% 7/1/2037 | | | 16,607,000 | | | | 13,908,362 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 6.00% 7/1/2047 | | | 14,655,000 | | | | 12,273,562 | | |

Puerto Rico Public Buildings Auth. Rev., Series 2012 U,

(REF-GOVT FACS-SER U), — 5.25% 7/1/2042 | | | 54,920,000 | | | | 23,478,300 | | |

| TOTAL MUNICIPALS — 1.4% (Cost $161,871,179) | | $ | 223,944,675 | | |

U.S. TREASURIES | |

U.S. Treasury Notes — 0.75% 7/31/2018 | | $ | 270,000,000 | | | $ | 269,736,318 | | |

U.S. Treasury Notes — 1.50% 8/31/2018 | | | 300,000,000 | | | | 299,773,830 | | |

| TOTAL U.S. TREASURIES — 3.4% (Cost $569,948,213) | | $ | 569,510,148 | | |

| TOTAL BONDS & DEBENTURES — 7.7% (Cost $1,156,417,189) | | $ | 1,266,969,934 | | |

TOTAL PURCHASED OPTIONS (e) — 0.5%

(Premiums Paid $82,059,459) | | $ | 82,534,846 | | |

TOTAL INVESTMENT SECURITIES — 82.4%

(Cost $10,026,661,544) | | $ | 13,656,116,602 | | |

22

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

SHORT-TERM INVESTMENTS | | Principal

Amount | | Fair Value | |

Apple, Inc. | |

| — 1.90% 7/6/2018 | | $ | 35,000,000 | | | $ | 34,990,764 | | |

| — 1.92% 7/11/2018 | | | 75,000,000 | | | | 74,960,000 | | |

| — 1.92% 7/12/2018 | | | 75,000,000 | | | | 74,956,000 | | |

| — 1.92% 7/13/2018 | | | 60,000,000 | | | | 59,961,600 | | |

| — 1.92% 7/18/2018 | | | 56,500,000 | | | | 56,448,773 | | |

| — 1.92% 7/20/2018 | | | 45,000,000 | | | | 44,954,400 | | |

| — 1.92% 7/26/2018 | | | 36,284,000 | | | | 36,235,621 | | |

| — 1.93% 7/18/2018 | | | 100,000,000 | | | | 99,908,861 | | |

| — 1.93% 7/25/2018 | | | 25,000,000 | | | | 24,967,833 | | |

| — 1.93% 7/26/2018 | | | 15,000,000 | | | | 14,979,896 | | |

| — 1.93% 7/27/2018 | | | 100,000,000 | | | | 99,860,611 | | |

Chevron Corporation | |

| — 1.90% 7/17/2018 | | | 90,000,000 | | | | 89,924,000 | | |

| — 2.02% 8/21/2018 | | | 75,000,000 | | | | 74,785,375 | | |

Coca-Cola Co. (The) | |

| — 1.95% 7/31/2018 | | | 25,000,000 | | | | 24,959,375 | | |

| — 1.96% 7/31/2018 | | | 50,000,000 | | | | 49,918,333 | | |

| — 1.96% 8/3/2018 | | | 25,000,000 | | | | 24,955,083 | | |

| — 1.98% 7/30/2018 | | | 115,220,000 | | | | 115,036,224 | | |

| — 2.00% 8/10/2018 | | | 50,000,000 | | | | 49,888,889 | | |

Exxon Mobil Corp. | |

| — 1.84% 7/2/2018 | | | 50,000,000 | | | | 49,997,445 | | |

| — 1.86% 7/9/2018 | | | 50,000,000 | | | | 49,979,333 | | |

| — 1.86% 7/19/2018 | | | 100,000,000 | | | | 99,907,000 | | |

| — 1.87% 7/9/2018 | | | 100,000,000 | | | | 99,958,445 | | |

| — 1.87% 7/24/2018 | | | 29,000,000 | | | | 28,965,353 | | |

| — 1.88% 7/10/2018 | | | 50,000,000 | | | | 49,976,500 | | |

| — 1.90% 7/24/2018 | | | 100,000,000 | | | | 99,878,611 | | |

| — 1.94% 7/25/2018 | | | 67,000,000 | | | | 66,913,347 | | |

| — 1.98% 8/16/2018 | | | 75,000,000 | | | | 74,810,250 | | |

| — 1.99% 8/1/2018 | | | 100,000,000 | | | | 99,828,639 | | |

| — 2.00% 8/7/2018 | | | 118,000,000 | | | | 117,757,445 | | |

GE Capital Treasury Services US LLC | |

| — 2.03% 8/6/2018 | | | 100,000,000 | | | | 99,797,000 | | |

| — 2.03% 8/8/2018 | | | 50,000,000 | | | | 49,892,861 | | |

| — 2.06% 8/9/2018 | | | 88,000,000 | | | | 87,803,613 | | |

General Electric Co. — 2.03% 8/2/2018 | | | 141,000,000 | | | | 140,745,573 | | |

Nestle Finance International Ltd. | |

| — 2.03% 8/10/2018 | | | 100,000,000 | | | | 99,774,445 | | |

| — 2.09% 8/13/2018 | | | 100,000,000 | | | | 99,750,361 | | |

23

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

SHORT-TERM INVESTMENTS — Continued | | Shares or

Principal

Amount | | Fair Value | |

Novartis Finance Crop. | |

| — 1.88% 7/2/2018 | | $ | 33,800,000 | | | $ | 33,798,235 | | |

| — 1.90% 7/13/2018 | | | 20,000,000 | | | | 19,987,333 | | |

| — 1.91% 7/3/2018 | | | 5,000,000 | | | | 4,999,470 | | |

| — 2.00% 8/3/2018 | | | 23,000,000 | | | | 22,957,833 | | |

| — 2.02% 8/8/2018 | | | 35,000,000 | | | | 34,925,372 | | |

PepsiCo, Inc | |

| — 1.86% 7/10/2018 | | | 100,000,000 | | | | 99,953,500 | | |

| — 1.89% 7/16/2018 | | | 100,000,000 | | | | 99,921,250 | | |

| — 1.90% 7/23/2018 | | | 100,000,000 | | | | 99,883,889 | | |

| — 1.93% 7/31/2018 | | | 47,315,000 | | | | 47,238,902 | | |

| — 1.95% 7/30/2018 | | | 120,000,000 | | | | 119,811,500 | | |

Pfizer, Inc. | |

| — 2.00% 7/16/2018 | | | 53,000,000 | | | | 52,955,833 | | |

| — 2.00% 8/13/2018 | | | 30,000,000 | | | | 29,928,333 | | |

Roche Holdings, Inc. | |

| — 1.85% 7/5/2018 | | | 19,000,000 | | | | 18,996,095 | | |

| — 1.87% 7/16/2018 | | | 50,000,000 | | | | 49,961,042 | | |

| — 1.92% 7/10/2018 | | | 20,000,000 | | | | 19,990,400 | | |

| — 2.00% 8/24/2018 | | | 130,000,000 | | | | 129,610,000 | | |

The Proctor Gamble & Co. — 1.92% 7/5/2018 | | | 5,085,000 | | | | 5,083,915 | | |

Wal-Mart Stores, Inc. | |

| — 1.89% 7/9/2018 | | | 23,000,000 | | | | 22,990,340 | | |

| — 2.00% 7/17/2018 | | | 39,500,000 | | | | 39,464,889 | | |

| — 2.00% 7/20/2018 | | | 97,735,000 | | | | 97,631,835 | | |

State Street Bank Repurchase Agreement — 0.35% 7/2/2018

(Dated 06/29/2018, repurchase price of $11,618,339,

collateralized by $11,555,000 principal amount U.S. Treasury

Notes 0.125% 2024, fair value $11,853,500) | | | 11,618,000 | | | | 11,618,000 | | |

TOTAL SHORT-TERM INVESTMENTS — 21.3%

(Cost $3,529,135,825) | | $ | 3,529,135,825 | | |

| TOTAL INVESTMENTS — 103.7% (Cost $13,555,797,369) | | $ | 17,185,252,427 | | |

SECURITIES SOLD SHORT | |

COMMON STOCKS SOLD SHORT — (9.6)% | |

Alibaba Group Holding Ltd. (ADR) (China) (a) | | | (1,426,540 | ) | | $ | (264,665,966 | ) | |

iShares Russell 2000 ETF | | | (1,147,707 | ) | | | (187,959,975 | ) | |

Pennsylvania Real Estate Investment Trust | | | (600,700 | ) | | | (6,601,693 | ) | |

Tencent Holdings, Ltd. (China) | | | (17,004,856 | ) | | | (853,537,307 | ) | |

24

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

SECURITIES SOLD SHORT — Continued | | Shares | | Fair Value | |

Utilities Select Sector SPDR Fund | | | (2,862,045 | ) | | $ | (148,711,859 | ) | |

Volkswagen AG (Preference Shares) (Germany) | | | (578,602 | ) | | | (96,096,834 | ) | |

WW Grainger, Inc. | | | (96,049 | ) | | | (29,621,512 | ) | |

| | | $ | (1,587,195,146 | ) | |

OTHER COMMON STOCKS SOLD SHORT(i) — (2.6)% | | $ | (431,339,099 | ) | |

TOTAL COMMON STOCKS SOLD SHORT — (12.2)%

(Proceeds $1,293,940,812) | | $ | (2,018,534,245 | ) | |

Other Assets and Liabilities, net — 8.5% | | | 1,402,099,636 | | |

NET ASSETS — 100.0% | | $ | 16,568,817,818 | | |

(a) Non-income producing security.

(b) Affiliated Security.

(c) Restricted securities. These restricted securities constituted 2.99% of total net assets at June 30, 2018, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

(d) These securities have been valued in good faith under policies adopted by authority of the Board of Trustee in accordance with the Fund's fair value procedures. These securities constituted 1.54% of total net assets at June 30, 2018.

(e) Investments categorized as a significant unobservable input (Level 3) (See Note F of the Notes to Financial Statements).

(f) Variable/Floating Rate Security — The rate shown is based on the latest available information as of June 30, 2018. For Senior Loan Notes, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(h) Step Coupon — Coupon rate increases in increments to maturity. Rate disclosed is as of June 30, 2018.

(i) As permitted by U.S. Securities and Exchange Commission regulations, "Other" Common Stocks include holdings in their first year of acquisition that have not previously been publicly disclosed.

25

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

At June 30, 2018 the Fund, held forward foreign currency contracts, which are considered derivative instruments, as follows:

Counterparty | | Currency Bought | | Currency Sold | | Settlement

Date | | Unrealized

Appreciation/

(Depreciation) | |

Barclays Bank PLC | | USD | 104,461,266 | | | EUR | 88,725,000 | | | 9/27/2018 | | $ | 177,417 | | |

Purchased Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Value | |

Call —

CMS Cap

Swap (c)(e)

| |

Receive | | Maximum of

[0, 10-Year

— 2-Year —

USD-ISDA

Swap Rate

— 0.122] | | | 0.12 | % | |

6/24/2021 | |

Barclays

Bank

PLC | | $ | 763,000,000 | | | $ | 1,999,060 | | | $ | 1,925,049 | | |

Call —

CMS Cap

Swap (c)(e)

| |

Receive | | Maximum of

[0, 30-Year

— 2-Year —

USD-ISDA

Swap Rate

— 0.162] | | | 0.16 | % | |

6/24/2021 | |

Barclays

Bank

PLC | | | 690,000,000 | | | | 2,001,000 | | | | 2,023,770 | | |

Call —

CMS Cap

Swap (c)(e)

| |

Receive | | Maximum of

[0, 10-Year

— 2-Year —

USD-ISDA

Swap Rate

— 0.198] | | | 0.20 | % | |

6/30/2023 | |

Barclays

Bank

PLC | | | 678,000,000 | | | | 2,000,100 | | | | 2,000,100 | | |

Call —

CMS Cap

Swap (c)(e)

| |

Receive | | Maximum of

[0, 30-Year

— 2-Year —

USD-ISDA

Swap Rate

— 0.273] | | | 0.27 | % | |

6/30/2023 | |

Barclays

Bank

PLC | | | 608,000,000 | | | | 2,000,320 | | | | 2,000,320 | | |

Call —

30-Year

Interest

Rate

Agreement

(c)(e) | |

Receive | |

3-Month

USD-LIBOR | | | 0.01 | % | |

5/22/2025 | |

Barclays

Bank

PLC | | | 100,000,000 | | | | 21,930,000 | | | | 21,461,000 | | |

26

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2018

(Unaudited)

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counter-

party | | Notional

Amount | | Premium | | Value | |

Call —

30-Year

Interest

Rate

Agreement

(c)(e) | |

Receive | |

3-Month

USD-LIBOR | | | 0.01 | % | |

7/14/2025 | |

Barclays

Bank

PLC | | $ | 90,081,096 | | | $ | 18,962,071 | | | $ | 18,846,767 | | |

Call —

30-Year

Interest

Rate

Agreement

(c)(e) | |

Receive | |

3-Month

USD-LIBOR | | | 0.01 | % | |

7/13/2027 | |

Morgan

Stanley | | | 89,879,161 | | | | 18,542,071 | | | | 19,613,161 | | |

| | | $ | 67,434,622 | | | $ | 67,870,167 | | |

Description | | Exercise

Price | | Expiration

Date | |

Counterparty | | Notional

Amount | |

Premium | |

Value | |

Put — JPY FX (e) | | $ | 95.00 | | | 3/24/2022 | | Barclays Bank PLC | | $ | 194,350,000 | | | $ | 14,624,838 | | | $ | 14,664,679 | | |

See notes to financial statements.

27

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

June 30, 2018

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

CMS CAP SWAPTION 0.122

JUN21 CALL 0.122 Barclays

Bank PLC .122% 6/24/2021 | | 06/22/2018 | | $ | 1,999,060 | | | $ | 1,925,049 | | | | 0.01 | % | |

CMS CAP SWAPTION 0.162

JUN21 0.162 CALL Barclays

Bank PLC .162% 6/24/2021 | | 06/22/2018 | | | 2,001,000 | | | | 2,023,770 | | | | 0.01 | % | |

CMS CAP SWAPTION 0.198

JUN23 0.198 CALL Barclays

Bank PLC .198% 6/30/2023 | | 06/28/2018 | | | 2,000,100 | | | | 2,000,100 | | | | 0.01 | % | |

CMS CAP SWAPTION 0.273

JUN23 0.273 CALL Barclays

Bank PLC .273% 6/30/2023 | | 06/28/2018 | | | 2,000,320 | | | | 2,000,320 | | | | 0.01 | % | |

Call-Strike $0.0000.10; expires

05/22/25; $100,000,000

(Barclays Capital Counterparty)

Barclays Bank PLC 5/22/2025 | | 05/22/2017 | | | 21,930,000 | | | | 21,461,000 | | | | 0.13 | % | |

Call-Strike $0.0000.10; expires

07/13/27; $89,879,161.000

Morgan Stanley & Co.

International PLC 7/13/2027 | | 07/13/2017 | | | 18,542,071 | | | | 19,613,161 | | | | 0.12 | % | |

Call-Strike $0.0000.10; expires

07/14/25; $90,081,096.000

Barclays Bank PLC 7/14/2025 | | 07/13/2017 | | | 18,962,071 | | | | 18,846,767 | | | | 0.11 | % | |

GACP II LP

| | 01/12/2018, 02/27/2018,

04/13/2018, 05/17/2018,

6/21/2018, 6/28/2018 | | | 45,499,489 | | | | 45,544,625 | | | | 0.28 | % | |

Hall of Fame TL 3M LIBOR +

9.000% — 11.330% 3/20/2019 | | 03/20/2018 | | | 9,568,600 | | | | 9,568,600 | | | | 0.06 | % | |

Kamsarmax Shipping 11.00%

9/4/2018

| | 09/08/2015, 11/29/2016,

06/07/2017, 09/08/2017 | | | 7,453,766 | | | | 7,453,766 | | | | 0.05 | % | |

MEC Filo TL 1M LIBOR +

9.000% — 11.090% 2/12/2021 | | 06/28/2018, 06/29/2018 | | | 19,202,100 | | | | 19,202,100 | | | | 0.12 | % | |

Nexeo Solutions, Inc. | | 06/09/2016 | | | 155,231,992 | | | | 161,525,376 | | | | 0.98 | % | |

Nexeo Solutions, Inc.

(Founders Shares) | | 06/09/2016 | | | 13,179,863 | | | | 10,034,627 | | | | 0.06 | % | |

Northern Shipping 7.80%

12/24/2019 | | 12/22/2014 | | | 37,673,051 | | | | 37,673,051 | | | | 0.23 | % | |

28

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2018

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

RELP 10 9.75% 11/20/2018

| | 01/15/2016, 02/15/2016,

02/23/2016, 03/15/2016,

03/22/2016, 04/12/2016,

04/15/2016, 05/09/2016,

05/15/2016, 05/31/2016,

06/15/2016, 07/01/2016,

07/15/2016, 07/25/2016,

08/15/2016, 08/22/2016,

09/15/2016, 09/30/2016,

10/15/2016, 11/11/2016,

11/15/2016, 12/15/2016 | | $ | 3,891,210 | | | $ | 3,891,210 | | | | 0.02 | % | |

RELP 11 10.00% 8/5/2018

| | 08/03/2015, 10/01/2015,

11/01/2015, 12/01/2015,

01/01/2016, 02/01/2016,

03/01/2016, 04/01/2016,

05/01/2016, 06/01/2016,

07/01/2016, 08/01/2016,

09/01/2016, 10/01/2016,

11/01/2016, 12/01/2016

01/01/2017, 02/01/2017,

02/03/2017, 02/28/2017,

03/02/2017, 03/27/2017,

04/01/2017, 05/01/2017,

06/01/2017, 06/07/2017,

07/01/2017, 07/13/2017,

08/01/2017, 04/1/2018,

05/1/2018, 06/1/2018,

06/21/2018 | | | 25,354,418 | | | | 25,354,418 | | | | 0.15 | % | |

Sound Holding FP (Luxembourg) | | 10/07/2013 | | | 68,546,025 | | | | 36,370,582 | | | | 0.22 | % | |

U.S. Farming Realty Trust, L.P.

| | 11/26/2010, 01/31/2011,

03/09/2011, 04/15/2011,

05/10/2011, 06/27/2011,

08/15/2011, 10/17/2011,

10/28/2011, 11/28/2011,

01/03/2012, 01/26/2012,

04/05/2012, 07/13/2012,

12/07/2012, 08/01/2013 | | | 27,820,889 | | | | 37,960,031 | | | | 0.23 | % | |

29

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2018

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

U.S. Farming Realty Trust II, L.P.

| | 12/24/2012, 04/29/2013,

06/17/2013, 10/28/2013,

01/14/2014, 04/22/2014,

06/25/2014, 09/09/2014,

10/08/2014, 12/18/2014,

06/18/2015, 06/18/2015,

07/29/2015, 07/29/2015 | | $ | 11,336,412 | | | $ | 12,056,403 | | | | 0.07 | % | |

WLRS Fund I LLC | | 06/09/2016 | | | 8,505,315 | | | | 7,010,350 | | | | 0.04 | % | |

Walter Investment Management

Corporation, 3M LIBOR +

6.000% — 8.094% 6/30/2022

| | 05/12/2016, 06/09/2016,

06/15/2016, 06/20/2016,

06/21/2016 | | | 10,953,873 | | | | 13,081,187 | | | | 0.08 | % | |

TOTAL RESTRICTED

SECURITIES | | | | $ | 511,651,625 | | | $ | 494,596,493 | | | | 2.99 | % | |

See notes to financial statements.

30

FPA CRESCENT FUND

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2018

(Unaudited)

ASSETS | |

Investment securities — at fair value (identified cost $8,808,356,987) | | $ | 12,443,452,171 | | |

Investments in affiliates at fair value (identified cost $1,218,304,557) | | | 1,212,664,431 | | |

Short-term investments — at amortized cost (maturities 60 days or less) | | | 3,529,135,825 | | |

Deposits for securities sold short | | | 1,281,851,804 | | |

Cash | | | 966 | | |

Receivable for: | |

Investment securities sold | | | 239,400,704 | | |

Dividends and interest | | | 33,306,408 | | |

Capital Stock sold | | | 10,308,738 | | |

Unrealized gain on forward foreign currency contracts | | | 177,417 | | |

Unrealized gain on foreign currency contracts | | | 300,852 | | |

Total assets | | | 18,750,599,316 | | |

LIABILITIES | |

Payable for: | |

Securities sold short, at market value (proceeds $1,293,940,812) | | | 2,018,534,245 | | |

Investment securities purchased | | | 128,673,116 | | |

Capital Stock repurchased | | | 18,295,459 | | |

Advisory fees | | | 13,835,775 | | |

Accrued expenses and other liabilities | | | 2,442,903 | | |

Total liabilities | | | 2,181,781,498 | | |

NET ASSETS | | $ | 16,568,817,818 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — no par value; unlimited authorized shares;

480,851,766 outstanding shares | | $ | 13,124,282,245 | | |

Undistributed net realized gain | | | 553,262,399 | | |

Accumulated net investment loss | | | (13,523,207 | ) | |

Unrealized appreciation of investments | | | 2,904,796,381 | | |

NET ASSETS | | $ | 16,568,817,818 | | |

NET ASSET VALUE | |

Offering and redemption price per share | | $ | 34.46 | | |

See notes to financial statements.

31

FPA CRESCENT FUND

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2018

(Unaudited)

INVESTMENT INCOME | |

Dividends (net of foreign taxes withheld of $2,153,301) | | $ | 79,734,152 | | |

Interest | | | 68,828,578 | | |

Income from affiliates | | | 8,197,564 | | |

Total investment income | | | 156,760,294 | | |

EXPENSES | |

Advisory fees | | | 85,364,333 | | |

Short sale dividend expense | | | 10,795,383 | | |

Transfer agent fees and expenses | | | 3,549,886 | | |

Custodian fees | | | 722,075 | | |

Administrative services fees | | | 447,868 | | |

Professional fees | | | 404,437 | | |

Reports to shareholders | | | 310,246 | | |

Trustee fees and expenses | | | 205,846 | | |

Legal fees | | | 87,566 | | |

Filing fees | | | 65,528 | | |

Audit and tax services fees | | | 46,571 | | |

Other | | | 81,940 | | |

Total expenses | | | 102,081,679 | | |

Net expenses | | | 102,081,679 | | |

Net investment income | | | 54,678,615 | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | |

Net realized gain (loss) on: | |

Investments | | | 485,557,585 | | |

Investments in affiliates | | | 15,018,870 | | |

Investment securities sold short | | | (42,562,247 | ) | |

Investments in forward foreign currency contracts | | | 2,926,151 | | |

Foreign currency transactions | | | (446,926 | ) | |

Net change in unrealized appreciation (depreciation) of: | |

Investments | | | (594,972,333 | ) | |

Investments in affiliates | | | (72,771,358 | ) | |

Investment securities sold short | | | 46,429,549 | | |

Investments in Forward Foreign Currency Contracts | | | 1,260,699 | | |

Translation of foreign currency denominated amounts | | | (268,109 | ) | |

Net realized and unrealized loss | | | (159,828,119 | ) | |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (105,149,504 | ) | |

See notes to financial statements.

32

FPA CRESCENT FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended

June 30, 2018

(Unaudited) | | Year Ended

December 31, 2017 | |

INCREASE (DECREASE) IN NET ASSETS | |

Operations: | |

Net investment income | | $ | 54,678,615 | | | $ | 115,325,791 | | |

Net realized gain | | | 460,493,433 | | | | 401,345,100 | | |

Net change in unrealized appreciation (depreciation) | | | (620,321,552 | ) | | | 1,192,200,369 | | |

Net increase (decrease) in net assets resulting

from operations | | | (105,149,504 | ) | | | 1,708,871,260 | | |

Distributions to shareholders from: | |

Net investment income | | | — | | | | (170,034,103 | ) | |

Net realized capital gains | | | — | | | | (474,105,805 | ) | |

Total distributions | | | — | | | | (644,139,908 | ) | |

Capital Stock transactions: | |

Proceeds from Capital Stock sold | | | 1,098,645,521 | | | | 2,963,748,955 | | |

Proceeds from shares issued to shareholders upon reinvestment of

dividends and distributions | | | — | | | | 554,255,340 | | |

Cost of Capital Stock repurchased | | | (1,909,425,091 | )* | | | (3,653,023,894 | )* | |

Net decrease from Capital Stock transactions | | | (810,779,570 | ) | | | (135,019,599 | ) | |

Total change in net assets | | | (915,929,074 | ) | | | 929,711,753 | | |

NET ASSETS | |

Beginning of period | | | 17,484,746,892 | | | | 16,555,035,139 | | |

End of period | | $ | 16,568,817,818 | | | $ | 17,484,746,892 | | |

CHANGE IN CAPITAL STOCK OUTSTANDING | |

Shares of Capital Stock sold | | | 31,375,824 | | | | 86,944,211 | | |

Shares issued to shareholders upon reinvestment of

dividends and distributions | | | — | | | | 16,125,013 | | |

Shares of Capital Stock repurchased | | | (54,509,682 | ) | | | (106,749,276 | ) | |

Change in Capital Stock outstanding | | | (23,133,858 | ) | | | (3,680,052 | ) | |

* Net of redemption fees of $179,826 and $331,976 for the period ended June 30, 2018 and year ended December 31, 2017, respectively.

See notes to financial statements.

33

FPA CRESCENT FUND

FINANCIAL HIGHLIGHTS

| | | Six Months

Ended

June 30,

2018 | | Year Ended December 31, | |

| | | (Unaudited) | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

Per share operating

performance: | |

Net asset value at

beginning of period | | $ | 34.69 | | | $ | 32.61 | | | $ | 31.06 | | | $ | 33.74 | | | $ | 32.96 | | | $ | 29.29 | | |

Income from investment

operations: | |

Net investment

income* | | $ | 0.11 | | | $ | 0.23 | | | $ | 0.24 | | | $ | 0.18 | | | $ | 0.25 | | | $ | 0.14 | | |

Net realized and

unrealized gain (loss)

on investment

securities | | | (0.34 | ) | | | 3.14 | | | | 2.93 | | | | (0.89 | ) | | | 1.94 | | | | 6.02 | | |

Total from investment

operations | | $ | (0.23 | ) | | $ | 3.37 | | | $ | 3.17 | | | $ | (0.71 | ) | | $ | 2.19 | | | $ | 6.16 | | |

Less distributions: | |

Dividends from net

investment income | | | — | | | $ | (0.34 | ) | | $ | (0.29 | ) | | $ | (0.31 | ) | | $ | (0.31 | ) | | $ | (0.21 | ) | |

Distributions from net

realized capital gains | | | — | | | | (0.95 | ) | | | (1.34 | ) | | | (1.66 | ) | | | (1.10 | ) | | | (2.28 | ) | |

Total distributions | | | — | | | | (1.29 | ) | | | (1.63 | ) | | | (1.97 | ) | | | (1.41 | ) | | | (2.49 | ) | |

Redemption fees | | | — | ** | | | — | ** | | $ | 0.01 | | | | — | ** | | | — | ** | | | — | ** | |

Net asset value at end

of period | | $ | 34.46 | | | $ | 34.69 | | | $ | 32.61 | | | $ | 31.06 | | | $ | 33.74 | | | $ | 32.96 | | |

Total investment return | | | (0.66 | )% | | | 10.39 | % | | | 10.25 | % | | | (2.06 | )% | | | 6.64 | % | | | 21.95 | % | |

Ratios/supplemental data: | |

Net assets, end of

period (in $000's) | | $ | 16,568,818 | | | $ | 17,484,747 | | | $ | 16,555,035 | | | $ | 18,119,838 | | | $ | 19,983,836 | | | $ | 15,903,874 | | |

Ratio of expenses

of average net assets: | |

Expenses | | | 1.20 | %†‡ | | | 1.10 | %‡ | | | 1.09 | %‡ | | | 1.11 | %‡ | | | 1.20 | %‡ | | | 1.23 | %‡ | |

Net investment income | | | 0.64 | %† | | | 0.66 | % | | | 0.77 | % | | | 0.53 | % | | | 0.45 | % | | | 0.34 | % | |

Portfolio turnover rate | | | 42 | %† | | | 18 | % | | | 35 | % | | | 48 | % | | | 31 | % | | | 22 | % | |

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

† Annualized.

‡ For the periods ended June 30, 2018, December 31, 2017, December 31, 2016, December 31, 2015, December 31, 2014, December 31, 2013 the expense ratio includes short sale dividend expense equal to 0.13%, 0.03%, 0.02%, 0.02%, 0.05%, 0.09% of average net assets, respectively.

See notes to financial statements.

34

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS

June 30, 2018

(Unaudited)

NOTE 1 — Significant Accounting Policies

FPA Crescent Fund (the "Fund"), a series of the FPA Funds Trust, is registered under the Investment Company Act of 1940 as an open-end, diversified, management investment company. The Fund's investment objective is to seek to generate equity-like returns over the long-term, take less risk than the market and avoid permanent impairment of capital. The Fund qualifies as an investment company pursuant to Financial Accounting Standard Board (FASB) Accounting Standards Codification (ASC) No. 946, Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America, ("U.S. GAAP"). The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Disclosure of Fair Value Measurements.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis. The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities, and other assets and liabilities stated in foreign currencies, are translated using the daily spot rate; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resultant exchange gains and losses are included in net realized or net unrealized gain (loss) in the statement of operations. A detailed listing of outstanding currency transactions is included in the Portfolio of Investments, in Investment Securities in the Statement of Assets and Liabilities and in Disclosure of Fair Value Measurements.

C. Use of Estimates

The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.

Market Risk: Because the values of the Fund's investments will fluctuate with market conditions, so will the value of your investment in the Fund. You could lose money on your investment in the Fund or the Fund could underperform other investments.

Common Stocks and Other Securities (Long): The prices of common stocks and other securities held by the Fund may decline in response to certain events taking place around the world, including; those directly involving companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations.

Common Stocks and Other Securities (Short): The prices of common stocks and other securities sold short rise between the date of the short sale and the date on which the Fund replaces the borrowed security. In addition, the Fund repays the person that lent it the security for any interest or dividends that may have accrued.

35

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

(Unaudited)

Interest Rate Risk: The values of, and the income generated by, most debt securities held by the Fund may be affected by changing interest rates and by changes in the effective maturities and credit rating of these securities. For example, the value of debt securities in the Fund's portfolio generally will decline when interest rates rise and increase when interest rates fall. In addition, falling interest rates may cause an issuer to redeem, call or refinance a security before its stated maturity, which may result in the Fund having to reinvest the proceeds in lower yielding securities.

Credit Risk: The values of any of the Fund's investments may also decline in response to events affecting the issuer or its credit rating. The lower rated debt securities in which the Fund may invest are considered speculative and are generally subject to greater volatility and risk of loss than investment grade securities, particularly in deteriorating economic conditions. The Fund invests a significant portion of its assets in securities of issuers that hold mortgage-and asset-backed securities and direct investments in securities backed by commercial and residential mortgage loans and other financial assets. The value and related income of these securities is sensitive to changes in economic conditions, including delinquencies and/or defaults. Though the Fund has not been adversely impacted, continuing shifts in the market's perception of credit quality on securities backed by commercial and residential mortgage loans and other financial assets may result in increased volatility of market price and periods of illiquidity that can negatively impact the valuation of certain securities held by the Fund.