UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | Investment Company Act file number: 811-08544 | |

fpa FUNDS TRUST

(Exact name of registrant as specified in charter)

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

J. RICHARD ATWOOD, PRESIDENT FPA FUNDS TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: (310) 473-0225

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

Item 1: Report to Shareholders.

| (a) | The Reports to Shareholders are attached herewith. |

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Dear Shareholder:

Overview

The FPA Crescent Fund — Institutional Class ("Fund" or "Crescent") gained 3.26% in 2021's second quarter and 39.00% for the trailing twelve months.1 The Fund generated 97.4% of the average of the S&P 500 and MSCI ACWI's return in the trailing twelve months, outperforming its own 77.8% average net risk exposure.2 Crescent's performance and that of its underlying equity exposure are captured in the following table:

Exhibit A: Performance versus Illustrative Indices3

| | | Q2 2021 | | Trailing 12-month | |

Crescent | | | 3.26 | % | | | 39.00 | % | |

Crescent — Long Equity | | | 6.02 | % | | | 54.09 | % | |

MSCI ACWI | | | 7.39 | % | | | 39.27 | % | |

S&P 500 | | | 8.55 | % | | | 40.79 | % | |

60% MSCI ACWI / 40% BBgBarc U.S. Agg | | | 5.15 | % | | | 22.19 | % | |

60% S&P 500 / 40% BBgBarc U.S. Agg | | | 5.84 | % | | | 23.02 | % | |

Portfolio discussion

As stewards of your capital, we presently find ourselves feeling uncomfortably comfortable, which we find an odd sensation. We don't mean to imply that we feel complacent; however, the Fund's cash levels are significantly lower than in recent years. With a relatively modest amount of dry powder, we no longer wake each morning hoping for a market pullback that offers a flood of potential bargains. Instead, we would now be happy with a sale in just one section of the store, allowing us to pick up a few discounted securities to go along with a shopping cart that is already relatively full — and we may have tempted fate and invited such an opportunity with our opening line.

But just because we do not currently welcome a large drawdown for the markets, it does not mean that it will not happen. In fact, we are virtually certain at some point it will, but we just can't tell you when. Though the portfolio will not be immune to the next selloff, whenever it may arrive, we remain committed to seeking equity-like returns over the long-term while avoiding permanent impairment of capital.

1 Effective September 4, 2020, the current single class of shares of the Fund was renamed the Institutional Class shares. Unless otherwise noted, all data herein is representative of the Institutional Share Class.

2 Risk assets are any assets that are not risk free and generally refers to any financial security or instrument, such as equities, commodities, high-yield bonds, and other financial products that are likely to fluctuate in price. Risk exposure refers to the Fund's exposure to risk assets as a percent of total assets. The Fund's net risk exposure as of June 30, 2021 was 76.9%.

3 Comparison to the indices is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index. The long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Long equity holdings only includes equity securities excluding paired trades, short-sales, and preferred securities. The long equity performance information shown herein is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor in the Fund can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value.

Past performance is no guarantee, nor is it indicative, of future results.

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Consistent with the above philosophy, back in Q3 2019 the Fund began reporting contributors and detractors on a trailing twelve-month basis rather than the most recent quarter. At the time we wrote "Quarterly price movements, however, are generally not much more than "noise," frequently reversing in the coming months or quarters. It is therefore more informative to focus on what has happened in the most recent year."4

The top contributors to and detractors from the Fund's trailing 12-month returns are listed below.

Exhibit B: Trailing Twelve-Month Contributors and Detractors as of June 30, 20215

Contributors | | Perf. Cont. | | Avg. % of Port. | | Detractors | | Perf. Cont. | | Avg. % of Port. | |

Alphabet | | | 3.63 | % | | | 5.4 | % | | McDermott (multiple issues) | | | -0.52 | % | | | 0.6 | % | |

Jefferies Financial Group | | | 2.61 | % | | | 2.4 | % | | Financials Select Sector SPDR | | | -0.11 | % | | | -0.3 | % | |

AIG | | | 1.75 | % | | | 3.0 | % | | Just Eat Takeaway.com | | | -0.04 | % | | | 0.1 | % | |

TE Connectivity | | | 1.72 | % | | | 2.7 | % | | Jardine Strategic Holdings | | | -0.04 | % | | | 0.1 | % | |

Comcast | | | 1.69 | % | | | 3.4 | % | | Western Digital TL/Corp (pair) | | | -0.03 | % | | | 0.0 | % | |

| | | 11.40 | % | | | 16.9 | % | | | | | -0.74 | % | | | 0.5 | % | |

Truth be told, even one year does not align with how we view the world. While many equity-oriented mutual funds have an average holding period of less than one year, Crescent walks the walk with lower turnover than two thirds of the broad equity-oriented and allocation mutual funds.6 Of course a longer than average holding period does not guarantee higher than average returns, but it reflects how we are willing to manage your capital (with ours alongside) in a differentiated manner in our quest for differentiated after-tax returns.

With the above in mind, we thought it would be interesting to look at the historical performance of the ten largest holdings which the Fund has held for at least the past three years. Though the returns for all fell broadly into the range of the targeted equity-like returns we aim to deliver, each name went through a period of at least two quarters for which performance was at best flat. However, what we find particularly interesting is that some of the better performing names required significant patience, with 30% of the observations compounding at 20%+ per year from our first purchase despite multi-year periods of flat performance during our ownership.

4 The Q3 2019 Commentary can be found at: https://fpa.com/docs/default-source/funds/fpa-crescent-fund/literature/quarterly-commentaries/fpa-crescent-fund-commentary-2019-q3b0f6f4531b0367849d6cff0000f7084a.pdf?sfvrsn=2de9939d_6.

5 Reflects the top five contributors and detractors to the Fund's performance based on contribution to return for the trailing twelve months ("TTM"). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the TTM is available by contacting FPA Client Service at crm@fpa.com. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

6 Source: Morningstar Direct. Broad equity-oriented mutual funds are represented by the "Equity" Morningstar Global Broad Category Group and equity-oriented allocation mutual funds are represented by the "Allocation" Global Broad Category Group. As of 12/31/2020, the average turnover for the funds in these categories is 73.5%. The Fund's turnover rate as of the year-ended 12/31/2020 was 29%.

Past performance is no guarantee, nor is it indicative, of future results.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit C: Top Ten Holdings as of June 30, 20217

| Portfolio Holding | | Portfolio

Ending

Weight | | First

Purchase

Date | | Flat

Performance

Period Start | | Flat

Performance

Period End | | Flat

Performance

(Years) | | Annualized

Return Since

First Purchase* | |

Alphabet | | | 5.7 | % | | 8/22/2011 | | 4/4/2014 | | 6/24/2016 | | | 2.2 | | | | 26.03 | % | |

Comcast Corporation | | | 3.5 | % | | 5/7/2018 | | 5/31/2019 | | 2/26/2020 | | | 0.7 | | | | 22.08 | % | |

Facebook | | | 3.1 | % | | 2/8/2018 | | 7/25/2018 | | 2/18/2020 | | | 1.6 | | | | 23.15 | % | |

Holcim Ltd | | | 2.9 | % | | 6/1/2018 | | 6/1/2018 | | 12/3/2019 | | | 1.5 | | | | 8.75 | % | |

Analog Devices | | | 2.9 | % | | 8/18/2011 | | 3/9/2012 | | 10/13/2014 | | | 2.6 | | | | 22.04 | % | |

Broadcom | | | 2.9 | % | | 4/16/2018 | | 4/30/2019 | | 2/13/2020 | | | 0.8 | | | | 27.17 | % | |

Groupe Bruxelles Lambert | | | 2.8 | % | | 5/19/2010 | | 7/2/2010 | | 8/29/2012 | | | 2.2 | | | | 7.70 | % | |

Charter Communications | | | 2.8 | % | | 4/30/2018 | | 4/30/2018 | | 12/24/2018 | | | 0.7 | | | | 36.15 | % | |

TE Connectivty | | | 2.7 | % | | 10/26/2012 | | 4/30/2015 | | 12/25/2018 | | | 3.7 | | | | 20.37 | % | |

American International Group | | | 2.7 | % | | 6/2/2011 | | 12/24/2013 | | 5/30/2019 | | | 5.4 | | | | 7.24 | % | |

While it certainly would have aided Fund returns if we had been able to enter, exit, and ultimately re-enter each name to avoid the periods of fallow results, such ambidexterity is easier said than done. We say this with experience, having previously sold shares in high quality equities assured in the belief we would be able to repurchase them in the future at a lower price. Oddly, even when the shares did subsequently trade off, we demonstrated an uncanny consistency for proclaiming the right price for re-entry to be some 5-10% lower than where the shares ultimately bottomed. This has led us to conclude that when it comes to investing in quality equities, one of the keys to generating attractive compound returns is to not interfere with the process of compounding.

So, while at times it may look like we are sitting on names that are stuck in the mud, it is fair to assume we are not overly perturbed by short-term underperformance provided we remain confident that such securities are simply building kinetic energy ahead of delivering future gains. In this manner you can think of us coming into the office each day and not eating the marshmallow lying on our desk, confident that our delayed gratification will be rewarded in the form of a much larger marshmallow at a future date.

We believe this approach has served us well over time at the portfolio level. Looking at rolling five-year periods since the inception of the Fund, we would argue the Fund has done a respectable job of consistently delivering equity-like rates of return over extended periods. The kink of course is that one could only realize these returns by holding the Fund through periods of underperformance and resisting the urge to look for a tastier marshmallow elsewhere. We realize this style of investing with a multi-year outlook is not for everyone, but if you are reading this commentary, we thank you for partnering with us on the journey.

7 Source: FPA, Bloomberg. For illustrative purposes only.

* Annualized Return shown is the total return of each security since the first date of purchase in the Fund through June 30, 2021. It is not the contribution to return for the portfolio. The Annualized Return for each holding may not equate with the performance of the holding in the Fund and does not take into account Fund fees and expenses. An investor in the Fund cannot achieve these returns and can only purchase and redeem shares at net asset value. Additional academic research: 'Patient Capital Outperformance — The Investment Skill of High Active Share Managers Who Trade Infrequently', Martjin Cremers and Ankur Pareek. December 2015.

Past performance is no guarantee, nor is it indicative, of future results.

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

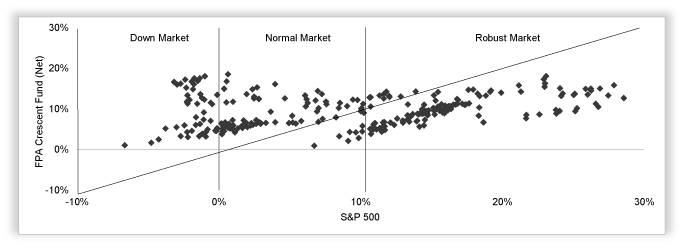

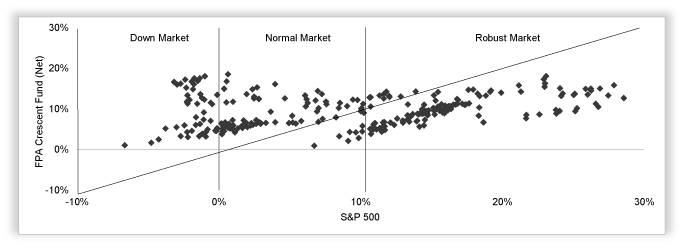

Exhibit D: 5-year Rolling Returns by Market Type since Inception8

| | Down Market

S&P 500 5yr Average

Return Below 0% | | Normal Market

S&P 5yr 500 Average

Return 0-10% | | Robust Market

S&P 500 5yr Average

Return Above 10% | |

FPA Crescent Fund

(average net return) | | | 9.54 | % | | | 8.30 | % | | | 10.10 | % | |

S&P 500 (average return) | | | -1.81 | % | | | 3.69 | % | | | 16.18 | % | |

Periods in Which FPA Crescent

Fund Outperformed | | | 100 | % | | | 91 | % | | | 9 | % | |

| | | 49 of 49 | | | | 77 of 85 | | | | 13 of 143 | | |

But past aside, the matter at hand is how the Fund is currently positioned and what prospective returns will be in the coming years. Unfortunately, we still do not have a crystal ball to tell us what the future holds for inflation, variants, or GDP growth. We can tell you with confidence that we like what we own in terms of quality and value and are comfortable with our current level of net exposure. Though we do not view the market at large

8 Source: Morningstar Direct. The chart illustrates the monthly five-year rolling average returns for the FPA Crescent Fund-Institutional Class ('Fund") from July 1, 1993 (the first full month of performance since inception) through June 30, 2021 compared to the S&P 500 Index ("Index"). The horizontal axis represents the five-year rolling average returns for the Index, and the vertical axis represents the Fund's five-year rolling average returns. The diagonal line illustrates the relative performance of the Fund vs. the Index. Points above the diagonal line indicate the Fund outperformed in that period, while points below the line indicate the Fund underperformed in that period. The table categorizes returns for three distinct market environments: a "down market" is defined as any period where the five-year rolling average return for the Index was less than 0%; a "normal market" is defined as any period where the five-year rolling average return for the Index was between 0-10%; and a "robust market" is defined as any period where the five-year rolling average return for the Index was greater than 10%. There were 277 five-year rolling average monthly periods between July 1, 1993 and June 30, 2021. Comparison to the S&P 500 index is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives.

Past performance is no guarantee, nor is it indicative, of future results.

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

as particularly inexpensive at present — as we called out in our Q1 2021 letter, we are not overly concerned with where the market may trade, as we don't own the market. As for what we do own, as illustrated in Exhibit E, the Fund's long equity holdings are cheaper than the market as measured by 1-year forward price to earnings and current price to book despite not making any sacrifices as it relates to historical or perspective earnings growth.

Exhibit E: FPA Crescent Long Equity Holding Valuation and Earnings Growth vs Stock Market9

| | Price/Earnings

1 Year Forward | | Price/Book | | 3-Year Trailing

EPS Growth | | 3-Year Forward

Estimated

EPS Growth | |

| | 6/30/2020 | | 6/30/2021 | | 6/30/2020 | | 6/30/2021 | | 6/30/2020 | | 6/30/2021 | | 6/30/2020 | | 6/30/2021 | |

FPA Crescent —

Long Equity

Portfolio | | | 19.3 | x | | | 17.2 | x | | | 1.3 | x | | | 1.9 | x | | | 14 | % | | | 9 | % | | | 19 | % | | | 32 | % | |

vs. S&P 500 | | | -23 | % | | | -23 | % | | | -64 | % | | | -58 | % | | | | | | | | | | | 78 | % | | | 26 | % | |

vs. MSCI ACWI | | | -12 | % | | | -11 | % | | | -46 | % | | | -8 | % | | | | | | | | | | | 71 | % | | | 37 | % | |

S&P 500 | | | 24.9 | x | | | 22.3 | x | | | 3.5 | x | | | 4.6 | x | | | 7 | % | | | -1 | % | | | 11 | % | | | 25 | % | |

MSCI ACWI | | | 21.9 | x | | | 19.4 | x | | | 2.3 | x | | | 2.1 | x | | | 4 | % | | | -6 | % | | | 11 | % | | | 23 | % | |

Stepping back for a moment, many managers start with an index benchmark when constructing their portfolio and then play a game of over- or underweighting various names or sectors. In sharp contrast, we start with a completely blank page and have a portfolio that looks nothing like any index we have ever observed. So, while we own many well-known companies, such as three of the FAANG constituents, which we believe are reasonably valued, we also round out our holdings with a collection of names that either remain starkly out of favor or are largely absent from the major indices.10 Examples of such securities include our Asian holding companies such as LG Corp, Samsung C&T, Softbank, and Swire Pacific, as well as our "Chinternet"-focused positions in Alibaba, Naspers/Prosus, and Baidu.11

9 Source: CapIQ, Factset, Bloomberg, FPA calculations. 3-Year Forward Estimated EPS Growth is based on FPA calculations using consensus data from CapIQ, Factset and Bloomberg. Forward looking statistics are estimates and subject to change. Comparison to the S&P 500 and MSCI ACWI Indices is being used as a representation of the "market" and is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. Please refer to Footnote 3 for the definition of the long equity holdings and other important information, and refer to Page 1 for net returns of the Fund. The long equity holdings average weight in the Fund was 75.0% and 74.6% for Q2 2021 and TTM through 6/30/21, respectively. The long equity holdings average weight in the Fund was 70.2% and 69.3% for Q2 2020 and TTM through 6/30/20, respectively. The long equity statistics shown herein are for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve results similar to those shown. Long equity statistics noted herein do not represent the results that the Fund or an investor can or should expect to receive. Fund shareholders can only purchase and redeem shares at net asset value.

10 The FAANG constituents include: Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOG).

11 Portfolio composition will change due to ongoing management of the Fund. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed. This is not a recommendation for a specific security and these securities may not be in the Fund at the time you receive this commentary. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

Past performance is no guarantee, nor is it indicative, of future results.

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Though we have discussed the Chinese internet conglomerates regularly in prior commentaries and conference calls, LG Corp, Samsung C&T, and Softbank are names that were purchased in 2020, and we have yet to publicly profile. Interestingly, LG Corp and Samsung C&T trade at discounts to our estimates of intrinsic value greater than 50% based exclusively on publicly traded marks, while also trading at a single digit multiple to our estimates of look through after-tax earnings for 2021. As for Softbank, look through earnings are challenging to calculate due to limited disclosure for many of the private holdings, but the discount to intrinsic value estimates based on private and public marks is similarly wide to the other two names. Regardless, in all instances we are afforded the privilege of investing alongside the controlling family or founder, and moreover, we believe the underlying asset quality of each conglomerate has significant appeal, as we will briefly review in this quarter's public conference call.

As for Alibaba, Tencent and Baidu, we believe they trade at very wide discounts to intrinsic value estimates based on the "sum of the parts" — a four word phrase analogous to a four letter curse word for investors with time horizons shorter than our own. While we readily acknowledge many of these "parts" may not contribute to earnings for several years, as genuine long-term oriented investors, we relish the opportunity pick up cheap or even free options, as we believe exists in the form of autonomous driving within Baidu or the cloud business within Alibaba. This is no different to how we viewed asymmetric optionality in past years in the form of Waymo/Youtube within Alphabet, and Occulus/Whatsapp within Facebook.

Speaking of free options, we have also spent the past quarter assembling a portfolio of special purpose acquisition companies or "SPACs", for which we see a positively skewed potential for returns versus the commensurate risk. For those not familiar, a SPAC is a non-operating corporate shell set up by a sponsor to pursue an acquisition of an unknown business on unknown terms. Mechanically, a SPAC's IPO proceeds are placed into an interest bearing trust, and the money in trust can only be used to complete an acquisition or it will be returned to investors if the sponsor fails to complete a deal (typically a two-year window from the SPAC IPO).

In each case, we seek to acquire the SPACs at roughly equal to or slightly less than the trust value per share, mitigating the long-term risk of a permanent loss of capital. The upside occurs if the market takes a favorable view on a potential deal, which would result in the shares trading at a premium to trust value and provide the option to exit the holdings with a capital gain. Alternatively, should investors take a dim view of an announced transaction, we could simply exercise our redemption rights to receive the trust value of the shares in cash.

Quite often we are also buying a share in a SPAC with a unit for warrants attached. In this instance, we have the opportunity to retain the warrants and participate in the future upside of the SPAC even if we choose to sell or redeem the shares prior to the closing of the actual acquisition. In summary, we view our SPAC basket as a case of "heads we win, tails we don't lose."12

As for other activity in the portfolio, our valuation discipline has made it challenging to put capital to work in this market that has largely been up and to the right. Nonetheless we have used the occasional pullback to opportunistically establish toehold positions in a handful of new names. Of the roughly 600bps of current exposure attributed to new purchases in 2021, half has been towards SPACs, and the balance largely towards digitally focused firms. Though our recent digital investments are not necessarily bleeding edge tech companies, we believe the purchase of each is an additional step towards the never-ending goal of further future-proofing the portfolio.

12 SPACs involve risks. There is no guarantee that the Fund's investments in SPACs will be profitable. Please see Important Disclosures for more information about the risks of investing in SPACs.

Past performance is no guarantee, nor is it indicative, of future results.

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Closing

In order to optimize the likelihood of future success, we operate in a perpetual state of adaptation. We tackle each day in the hopes that we learn something new that helps us to be better prepared to face the inevitable challenges and act on new opportunities.

Al Osborne, a long-time investor in Crescent and one of the FPA Fund's valued independent board members, offered us this observation from the novelist, playwright, essayist, poet, and activist James Baldwin, "Not everything that is faced can be changed, but nothing can be changed until it is faced." We can't bend the world to our will, but we can always improve.

Thank you for entrusting us with your capital.

Respectfully submitted,

FPA Crescent Portfolio Management Team

July 27, 2021

7

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

8

FPA CRESCENT FUND

PORTFOLIO SUMMARY

June 30, 2021 (Unaudited)

Common Stocks | | | | | 73.7 | % | |

Internet Media | | | 12.4 | % | | | |

Semiconductor Devices | | | 6.7 | % | | | |

Cable & Satellite | | | 6.2 | % | | | |

Diversified Banks | | | 2.9 | % | | | |

Cement & Aggregates | | | 3.7 | % | | | |

Industrial Distribution & Rental | | | 2.9 | % | | | |

Investment Companies | | | 2.8 | % | | | |

Electrical Components | | | 2.7 | % | | | |

Application Software | | | 2.7 | % | | | |

P&C Insurance | | | 2.7 | % | | | |

Banks | | | 2.6 | % | | | |

Base Metals | | | 2.3 | % | | | |

Insurance Brokers | | | 2.1 | % | | | |

Institutional Brokerage | | | 1.9 | % | | | |

E-Commerce Discretionary | | | 1.4 | % | | | |

Railroad Rolling Stock | | | 1.4 | % | | | |

Medical Equipment | | | 0.6 | % | | | |

Chemicals | | | 1.2 | % | | | |

Apparel, Footwear & Accessory Design | | | 1.2 | % | | | |

Food Services | | | 1.2 | % | | | |

Computer Hardware & Storage | | | 1.1 | % | | | |

Telecom Carriers | | | 1.1 | % | | | |

Aircraft & Parts | | | 1.0 | % | | | |

Infrastructure Software | | | 1.0 | % | | | |

Commercial & Residential Building

Equipment & Systems | | | 1.0 | % | | | |

Hotels, Restaurants & Leisure | | | 0.9 | % | | | |

Midstream — Oil & Gas | | | 0.9 | % | | | |

Wealth Management | | | 0.9 | % | | | |

Specialty Chemicals | | | 0.8 | % | | | |

Household Products | | | 0.8 | % | | | |

Internet Based Services | | | 0.8 | % | | | |

Real Estate Owners & Developers | | | 0.6 | % | | | |

Entertainment Content | | | 0.4 | % | | | |

Integrated Utilities | | | 0.3 | % | | | |

Marine Shipping | | | 0.3 | % | | | |

Oil & Gas Services & Equipment | | | 0.2 | % | | | |

Closed End Fund | | | | | 0.6 | % | |

Limited Partnerships | | | | | 1.3 | % | |

Preferred Stocks | | | | | 0.1 | % | |

Special Purpose Acquisition Companies | | | | | 2.8 | % | |

Bonds & Debentures | | | | | 13.6 | % | |

U.S. Treasuries | | | 12.4 | % | | | |

Corporate Bonds & Notes | | | 0.7 | % | | | |

Corporate Bank Debt | | | 0.5 | % | | | |

Short-term Investments | | | | | 8.8 | % | |

Securities Sold Short | | | | | (3.2 | )% | |

Other Assets And Liabilities, Net | | | | | 2.3 | % | |

Net Assets | | | | | 100.0 | % | |

9

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

June 30, 2021

(Unaudited)

COMMON STOCKS | | Shares | | Fair Value | |

INTERNET MEDIA — 12.4% | |

Alphabet, Inc. (Class A)(a) | | | 122,518 | | | $ | 299,163,231 | | |

Alphabet, Inc. (Class C)(a) | | | 122,045 | | | | 305,883,824 | | |

Baidu, Inc. (ADR) (China)(a) | | | 445,804 | | | | 90,899,436 | | |

Facebook, Inc. (Class A)(a) | | | 943,178 | | | | 327,952,422 | | |

Naspers, Ltd. (N Shares) (South Africa) | | | 961,057 | | | | 201,780,917 | | |

Prosus NV (Netherlands) | | | 970,500 | | | | 94,904,043 | | |

| | | $ | 1,320,583,873 | | |

SEMICONDUCTOR DEVICES — 6.7% | |

Analog Devices, Inc. | | | 1,801,707 | | | $ | 310,181,877 | | |

Broadcom, Inc. | | | 640,699 | | | | 305,510,911 | | |

NXP Semiconductors NV (Netherlands) | | | 490,109 | | | | 100,825,224 | | |

| | | $ | 716,518,012 | | |

CABLE & SATELLITE — 6.2% | |

Charter Communications, Inc. (Class A)(a)(b) | | | 407,280 | | | $ | 293,832,156 | | |

Comcast Corp. (Class A)(b) | | | 6,450,030 | | | | 367,780,711 | | |

| | | $ | 661,612,867 | | |

CEMENT & AGGREGATES — 3.7% | |

HeidelbergCement AG (Germany) | | | 1,012,913 | | | $ | 86,884,805 | | |

LafargeHolcim Ltd. (Switzerland) | | | 5,189,042 | | | | 311,258,396 | | |

| | | $ | 398,143,201 | | |

DIVERSIFIED BANKS — 2.9% | |

Citigroup, Inc. | | | 3,571,897 | | | $ | 252,711,713 | | |

Flutter Entertainment plc (Ireland)(a) | | | 104,039 | | | | 18,917,909 | | |

Gulfport Energy Corp.(a) | | | 503,402 | | | | 32,570,109 | | |

LX Holdings Corp. (South Korea)(a) | | | 345,750 | | | | 3,453,969 | | |

| | | $ | 307,653,700 | | |

INDUSTRIAL DISTRIBUTION & RENTAL — 2.9% | |

Howmet Aerospace, Inc.(a) | | | 4,577,152 | | | $ | 157,774,430 | | |

LG Corp. (South Korea) | | | 1,610,766 | | | | 146,608,813 | | |

| | | $ | 304,383,243 | | |

INVESTMENT COMPANIES — 2.8% | |

Groupe Bruxelles Lambert SA (Belgium) | | | 2,631,560 | | | $ | 294,375,952 | | |

ELECTRICAL COMPONENTS — 2.7% | |

TE Connectivity, Ltd. (Switzerland) | | | 2,124,600 | | | $ | 287,267,166 | | |

10

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

COMMON STOCKS — Continued | | Shares | | Fair Value | |

APPLICATION SOFTWARE — 2.7% | |

Alteryx, Inc. (Class A)(a) | | | 147,315 | | | $ | 12,672,036 | | |

Entain plc (Isle of Man)(a) | | | 3,205,123 | | | | 77,389,301 | | |

Epic Games, Inc.(c)(d)(e) | | | 33,130 | | | | 29,320,050 | | |

Nexon Co. Ltd. (Japan) | | | 3,654,463 | | | | 81,447,864 | | |

Open Text Corp. (Canada) | | | 572,669 | | | | 29,091,585 | | |

Ubisoft Entertainment SA (France)(a) | | | 766,684 | | | | 53,673,007 | | |

| | | $ | 283,593,843 | | |

P&C INSURANCE — 2.7% | |

American International Group, Inc.(b) | | | 5,948,177 | | | $ | 283,133,225 | | |

BANKS — 2.6% | |

Signature Bank | | | 193,444 | | | $ | 47,519,519 | | |

Wells Fargo & Co. | | | 5,029,984 | | | | 227,807,975 | | |

| | | $ | 275,327,494 | | |

BASE METALS — 2.3% | |

Glencore plc (Switzerland)(a) | | | 57,208,380 | | | $ | 244,887,437 | | |

INSURANCE BROKERS — 2.1% | |

Aon plc (Class A) (Britain) | | | 910,807 | | | $ | 217,464,279 | | |

Willis Towers Watson plc (Britain) | | | 38,137 | | | | 8,772,273 | | |

| | | $ | 226,236,552 | | |

INSTITUTIONAL BROKERAGE — 1.9% | |

Jefferies Financial Group, Inc.(b) | | | 5,858,352 | | | $ | 200,355,638 | | |

E-COMMERCE DISCRETIONARY — 1.4% | |

Alibaba Group Holding Ltd. (ADR) (China)(a) | | | 673,113 | | | $ | 152,648,566 | | |

RAILROAD ROLLING STOCK — 1.4% | |

Westinghouse Air Brake Technologies Corp. | | | 1,774,158 | | | $ | 146,013,203 | | |

CHEMICALS — 1.2% | |

International Flavors & Fragrances, Inc. | | | 868,051 | | | $ | 129,686,819 | | |

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 1.2% | |

Cie Financiere Richemont SA (Switzerland) | | | 1,041,770 | | | $ | 126,048,259 | | |

11

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

COMMON STOCKS — Continued | | Shares | | Fair Value | |

FOOD SERVICES — 1.2% | |

JDE Peet S NV (Netherlands)(a) | | | 2,023,638 | | | $ | 73,425,588 | | |

Just Eat Takeaway.com NV (Netherlands)(a)(f) | | | 524,837 | | | | 48,460,490 | | |

| | | $ | 121,886,078 | | |

COMPUTER HARDWARE & STORAGE — 1.1% | |

Dell Technologies (C Shares)(a) | | | 1,192,689 | | | $ | 118,875,313 | | |

TELECOM CARRIERS — 1.1% | |

SoftBank Group Corp. (Japan) | | | 1,605,074 | | | $ | 112,331,341 | | |

AIRCRAFT & PARTS — 1.0% | |

Meggitt plc (Britain)(a) | | | 16,289,061 | | | $ | 103,920,617 | | |

INFRASTRUCTURE SOFTWARE — 1.0% | |

FirstEnergy Corp. | | | 2,789,666 | | | $ | 103,803,472 | | |

COMMERCIAL & RESIDENTIAL BUILDING EQUIPMENT &

SYSTEMS — 1.0% | |

Samsung C&T Corp. (South Korea) | | | 835,452 | | | $ | 101,264,661 | | |

HOTELS, RESTAURANTS & LEISURE — 0.9% | |

Marriott International, Inc. (Class A)(a) | | | 724,959 | | | $ | 98,971,403 | | |

MIDSTREAM — OIL & GAS — 0.9% | |

Kinder Morgan, Inc.(b) | | | 5,262,897 | | | $ | 95,942,612 | | |

WEALTH MANAGEMENT — 0.9% | |

LPL Financial Holdings, Inc. | | | 704,429 | | | $ | 95,083,826 | | |

SPECIALTY CHEMICALS — 0.8% | |

Univar Solutions, Inc.(a) | | | 3,690,211 | | | $ | 89,967,344 | | |

HOUSEHOLD PRODUCTS — 0.8% | |

Unilever plc (Britain) | | | 1,451,639 | | | $ | 84,971,043 | | |

INTERNET BASED SERVICES — 0.8% | |

Booking Holdings, Inc.(a) | | | 37,488 | | | $ | 82,027,118 | | |

12

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

COMMON STOCKS — Continued | | Shares | | Fair Value | |

REAL ESTATE OWNERS & DEVELOPERS — 0.6% | |

Swire Pacific Ltd. (Class A) (Hong Kong) | | | 10,136,602 | | | $ | 68,736,666 | | |

MEDICAL EQUIPMENT — 0.6% | |

Olympus Corp. (Japan) | | | 3,218,401 | | | $ | 63,965,340 | | |

ENTERTAINMENT CONTENT — 0.4% | |

Netflix, Inc.(a) | | | 72,931 | | | $ | 38,522,883 | | |

INTEGRATED UTILITIES — 0.3% | |

PG&E Corp.(a) | | | 3,597,611 | | | $ | 36,587,704 | | |

MARINE SHIPPING — 0.3% | |

Sound Holding FP (Luxembourg)(c)(d)(e)(g)(h) | | | 1,146,250 | | | $ | 30,985,861 | | |

OIL & GAS SERVICES & EQUIPMENT — 0.2% | |

McDermott International Ltd.(a)(g) | | | 14,118,980 | | | $ | 6,918,300 | | |

McDermott International Ltd.(a) | | | 31,866,698 | | | | 15,614,682 | | |

| | | $ | 22,532,982 | | |

| TOTAL COMMON STOCKS — 73.7% (Cost $4,580,687,765) | | $ | 7,828,845,314 | | |

CLOSED END FUND — 0.6% | |

Altaba Escrow(c)(Cost $0) | | | 4,756,180 | | | $ | 68,488,992 | | |

LIMITED PARTNERSHIPS | |

FPS LLC (Marine Shipping)(c)(d)(e)(g)(h) | | | 1,162,447 | | | $ | 74,281,258 | | |

FPS Shelby Holding I LLC (Marine Shipping)(c)(d)(e)(g)(h) | | | 107,799 | | | | 8,876,468 | | |

GACP II L.P. (Credit)(c)(d)(e) | | | 958,312 | | | | 32,012,429 | | |

U.S. Farming Realty Trust, L.P. (Real Estate)(c)(d)(e)(g) | | | 350,000 | | | | 14,442,711 | | |

U.S. Farming Realty Trust II, L.P. (Real Estate)(c)(d)(e)(g) | | | 120,000 | | | | 8,400,319 | | |

| TOTAL LIMITED PARTNERSHIPS — 1.3% (Cost $158,227,567) | | $ | 138,013,185 | | |

PREFERRED STOCKS | |

ENGINEERING SERVICES — 0.1% | |

McDermott International, Inc.(c)(d)(e) | | | 22,591 | | | $ | 13,554,380 | | |

13

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

PREFERRED STOCKS — Continued | | Shares | | Fair Value | |

ENERGY — 0.0% | |

Gulfport Energy Corp.(d)(e) | | | 1,298 | | | $ | 600,273 | | |

| TOTAL PREFERRED STOCKS — 0.1% (Cost $1,274,000) | | $ | 14,154,653 | | |

WARRANTS — 0.0% | |

ENERGY — 0.0% | |

Cie Financiere Richemont SA 11/22/2023(a) (Cost $0) | | | 2,521,536 | | | $ | 1,689,654 | | |

SPECIAL PURPOSE ACQUISITION COMPANIES(a) | |

DIVERSIFIED BANKS — 2.8% | |

Accelerate Acquisition Corp. | | | 1,824 | | | $ | 18,404 | | |

African Gold Acquisition Corp. | | | 175,509 | | | | 1,774,396 | | |

Agile Growth Corp. | | | 972,411 | | | | 9,694,938 | | |

Alkuri Global Acquisition Corp. (Class A) | | | 62,046 | | | | 509,523 | | |

Angel Pond Holdings Corp. | | | 618,627 | | | | 6,186,270 | | |

Ares Acquisition Corp. | | | 287,111 | | | | 2,871,110 | | |

Athena Technology Acquisition Corp. | | | 296,505 | | | | 2,956,155 | | |

Atlantic Coastal Acquisition Corp. | | | 1,238,597 | | | | 12,311,654 | | |

Broadscale Acquisition Corp. | | | 691,757 | | | | 6,910,652 | | |

Churchill Capital Corp. VII | | | 477,902 | | | | 4,783,799 | | |

Colonnade Acquisition Corp. II | | | 1,032,132 | | | | 10,259,392 | | |

COVA Acquisition Corp. | | | 334,885 | | | | 3,378,990 | | |

DHC Acquisition Corp. | | | 520,584 | | | | 5,226,663 | | |

Digital Transformation Opportunities Corp. | | | 72,255 | | | | 715,325 | | |

Disruptive Acquisition Corp. I | | | 1,032,135 | | | | 10,290,386 | | |

ESM Acquisition Corp. | | | 157 | | | | 1,570 | | |

Flame Acquisition Corp. | | | 1,032,145 | | | | 10,476,272 | | |

Forest Road Acquisition Corp. II | | | 646,625 | | | | 6,488,882 | | |

Fortress Value Acquisition Corp. IV | | | 75,327 | | | | 753,270 | | |

FTAC Hera Acquisition Corp. | | | 124,395 | | | | 1,249,548 | | |

Fusion Acquisition Corp. II | | | 173,927 | | | | 1,737,531 | | |

GigCapital4, Inc. | | | 1,067,809 | | | | 8,192,766 | | |

Glenfarne Merger Corp. | | | 1,033,214 | | | | 10,239,151 | | |

Global Partner Acquisition Corp. II | | | 355,596 | | | | 3,520,400 | | |

Golden Arrow Merger Corp. | | | 1,032,132 | | | | 10,259,392 | | |

Gores Holdings VII, Inc. | | | 2,391 | | | | 24,101 | | |

Gores Holdings VIII, Inc. | | | 71,754 | | | | 716,105 | | |

Gores Technology Partners II, Inc. | | | 6,490 | | | | 65,874 | | |

14

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

SPECIAL PURPOSE ACQUISITION COMPANIES — Continued | | Shares | | Fair Value | |

GX Acquisition Corp. II | | | 648,196 | | | $ | 6,468,996 | | |

Haymaker Acquisition Corp. III | | | 7,337 | | | | 73,590 | | |

Hudson Executive Investment Corp. III | | | 1,243,215 | | | | 12,419,718 | | |

InterPrivate IV InfraTech Partners, Inc. | | | 848,174 | | | | 8,439,331 | | |

ION Acquisition Corp. 3 Ltd. (Class A) (Israel) | | | 593,375 | | | | 5,821,009 | | |

Kismet Acquisition Three Corp. | | | 1,032,132 | | | | 10,310,999 | | |

Landcadia Holdings IV, Inc. | | | 1,243,001 | | | | 12,367,860 | | |

Lazard Growth Acquisition Corp. I | | | 20,722 | | | | 207,220 | | |

Lead Edge Growth Opportunities Ltd. | | | 111,893 | | | | 1,118,930 | | |

Mason Industrial Technology, Inc. | | | 759,575 | | | | 7,648,920 | | |

Mission Advancement Corp. | | | 613,037 | | | | 6,124,240 | | |

Monument Circle Acquisition Corp. | | | 69,903 | | | | 701,826 | | |

NextGen Acquisition Corp. II | | | 472,799 | | | | 5,115,685 | | |

Northern Star Investment Corp. III | | | 550,747 | | | | 5,507,470 | | |

Northern Star Investment Corp. IV | | | 420,679 | | | | 4,206,790 | | |

Orion Acquisition Corp. | | | 204,096 | | | | 2,024,632 | | |

Pathfinder Acquisition Corp. | | | 25 | | | | 249 | | |

Peridot Acquisition Corp. II | | | 582,407 | | | | 5,818,246 | | |

Pine Technology Acquisition Corp. | | | 964,170 | | | | 9,612,775 | | |

Plum Acquisition Corp. I | | | 964,270 | | | | 9,546,273 | | |

Queen's Gambit Growth Capital | | | 82,401 | | | | 821,538 | | |

Reinvent Technology Partners Y | | | 251 | | | | 452 | | |

Reinvent Technology Partners Y (Class A) | | | 2,008 | | | | 19,839 | | |

Ross Acquisition Corp. II | | | 231,224 | | | | 2,305,303 | | |

RXR Acquisition Corp. | | | 9,883 | | | | 98,435 | | |

Silver Spike Acquisition Corp. II | | | 93,554 | | | | 942,089 | | |

Slam Corp. | | | 714,153 | | | | 7,127,247 | | |

Stratim Cloud Acquisition Corp. | | | 575,747 | | | | 5,757,470 | | |

TCW Special Purpose Acquisition Corp. | | | 114,519 | | | | 1,141,754 | | |

Tio Tech A (Germany) | | | 296,636 | | | | 2,966,360 | | |

TLG Acquisition One Corp. | | | 1,242,983 | | | | 12,330,391 | | |

Twelve Seas Investment Co. II | | | 979,931 | | | | 9,760,113 | | |

Viking Acquisitions LLC (Norway)(c)(d)(e) | | | 9,562,500 | | | | 7,404,052 | | |

| | | $ | 295,822,321 | | |

TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES — 2.8%

(Cost $295,258,495) | | $ | 295,822,321 | | |

15

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

BONDS & DEBENTURES | | Principal

Amount | | Fair Value | |

CORPORATE BONDS & NOTES | |

CONSUMER, CYCLICAL — 0.7% | |

Royal Caribbean Cruises Ltd. — 11.500% 6/1/2025(f) | | $ | 61,108,000 | | | $ | 70,292,532 | | |

ENERGY — 0.0% | |

Gulfport Energy Corp. — 6.000% 10/15/2024(d)(e) | | $ | 18,209,000 | | | $ | — | | |

Gulfport Energy Corp. — 6.375% 5/15/2025(d)(e) | | | 8,822,000 | | | | — | | |

Gulfport Energy Corp. — 6.375% 1/15/2026(d)(e) | | | 9,128,000 | | | | — | | |

Gulfport Energy Corp. — 6.625% 5/1/2023(d)(e) | | | 9,417,000 | | | | — | | |

Gulfport Energy Corp. — 8.000% 5/17/2026 | | | 4,221,128 | | | | 4,537,713 | | |

| | | $ | 4,537,713 | | |

TOTAL CORPORATE BONDS & NOTES — 0.7%

(Cost $60,539,858) | | $ | 74,830,245 | | |

CORPORATE BANK DEBT | |

McDermott LC, 1M USD LIBOR — 6.335% 12/31/2021(c)(d)(e)(j) | | $ | 28,718,370 | | | $ | 23,296,034 | | |

McDermott Technology Americas, Inc., | |

1M USD LIBOR + 1.000% — 1.113% 6/30/2025(c)(i) | | | 32,664,489 | | | | 14,535,698 | | |

McDermott Technology Americas, Inc., | |

1M USD LIBOR + 3.000% — 3.093% 6/30/2024(c)(i) | | | 1,074,102 | | | | 644,461 | | |

Steenbok LUX Financial 2 SARL, PIK — 10.750% 12/31/2021(c) | | | 703,343 | | | | 718,273 | | |

Western Digital Corp. Term Loan B 4, | |

1M USD LIBOR + 1.750% — 1.843% 4/29/2023(c)(i) | | | 17,010,786 | | | | 16,982,378 | | |

| TOTAL CORPORATE BANK DEBT — 0.5% (Cost $127,979,879) | | $ | 56,176,844 | | |

U.S. TREASURIES | |

U.S. Treasury Bills — 0.002% 8/24/2021(k) | | $ | 80,000,000 | | | $ | 79,994,440 | | |

U.S. Treasury Bills — 0.003% 10/21/2021(k) | | | 120,000,000 | | | | 119,979,876 | | |

U.S. Treasury Bills — 0.005% 8/5/2021(k) | | | 50,000,000 | | | | 49,997,620 | | |

U.S. Treasury Bills — 0.005% 8/26/2021(k) | | | 35,000,000 | | | | 34,997,162 | | |

U.S. Treasury Bills — 0.008% 7/15/2021(k) | | | 42,000,000 | | | | 41,999,181 | | |

U.S. Treasury Bills — 0.008% 8/12/2021(k) | | | 110,000,000 | | | | 109,992,916 | | |

U.S. Treasury Bills — 0.010% 7/1/2021(k) | | | 40,000,000 | | | | 39,999,980 | | |

U.S. Treasury Bills — 0.010% 8/10/2021(k) | | | 50,000,000 | | | | 49,997,345 | | |

U.S. Treasury Bills — 0.012% 11/4/2021(k) | | | 130,000,000 | | | | 129,976,145 | | |

U.S. Treasury Bills — 0.013% 8/19/2021(k) | | | 100,000,000 | | | | 99,993,170 | | |

U.S. Treasury Bills — 0.018% 9/2/2021(k) | | | 71,000,000 | | | | 70,993,120 | | |

16

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

U.S. Treasury Bills — 0.018% 11/12/2021(k) | | $ | 47,000,000 | | | $ | 46,990,389 | | |

U.S. Treasury Bills — 0.032% 7/27/2021(k) | | | 65,000,000 | | | | 64,997,575 | | |

U.S. Treasury Bills — 0.034% 7/22/2021(k) | | | 97,000,000 | | | | 96,997,022 | | |

U.S. Treasury Bills — 0.042% 8/3/2021(k) | | | 70,000,000 | | | | 69,996,878 | | |

U.S. Treasury Bills — 0.042% 9/9/2021(k) | | | 45,000,000 | | | | 44,995,086 | | |

U.S. Treasury Bills — 0.046% 9/23/2021(k) | | | 75,000,000 | | | | 74,991,045 | | |

U.S. Treasury Cash Management Bills — 0.011% 9/14/2021(k) | | | 48,000,000 | | | | 47,995,056 | | |

U.S. Treasury Cash Management Bills — 0.018% 9/7/2021(k) | | | 42,000,000 | | | | 41,996,094 | | |

| TOTAL U.S. TREASURIES — 12.4% (Cost $1,316,962,179) | | $ | 1,316,880,100 | | |

| TOTAL BONDS & DEBENTURES — 13.6% (Cost $1,505,481,916) | | $ | 1,447,887,189 | | |

TOTAL INVESTMENT SECURITIES — 92.1%

(Cost $6,540,929,743) | | $ | 9,794,901,308 | | |

SHORT-TERM INVESTMENTS | |

Apple, Inc. | |

| — 0.041% 7/29/2021 | | $ | 75,000,000 | | | $ | 74,997,667 | | |

| — 0.041% 7/30/2021 | | | 20,000,000 | | | | 19,999,355 | | |

| — 0.051% 8/10/2021 | | | 52,000,000 | | | | 51,997,111 | | |

| — 0.051% 8/11/2021 | | | 20,000,000 | | | | 19,998,861 | | |

Chevron Corp. | |

| — 0.02% 7/20/2021 | | | 60,000,000 | | | | 59,999,367 | | |

| — 0.03% 7/6/2021 | | | 25,000,000 | | | | 24,999,896 | | |

| — 0.03% 7/7/2021 | | | 50,000,000 | | | | 49,999,750 | | |

| — 0.020% 7/21/2021 | | | 47,000,000 | | | | 46,999,478 | | |

| — 0.041% 7/8/2021 | | | 30,000,000 | | | | 29,999,767 | | |

| — 0.041% 7/9/2021 | | | 60,000,000 | | | | 59,999,467 | | |

| — 0.041% 7/12/2021 | | | 70,000,000 | | | | 69,999,144 | | |

| — 0.041% 7/13/2021 | | | 30,000,000 | | | | 29,999,600 | | |

| — 0.041% 7/14/2021 | | | 60,000,000 | | | | 59,999,133 | | |

Exxon Mobil Corp. | |

| — 0.041% 7/27/2021 | | | 56,000,000 | | | | 55,998,382 | | |

| — 0.061% 8/2/2021 | | | 55,000,000 | | | | 54,997,067 | | |

| — 0.061% 8/17/2021 | | | 100,000,000 | | | | 99,992,167 | | |

| — 0.061% 8/23/2021 | | | 60,000,000 | | | | 59,994,700 | | |

Johnson & Johnson — 0.010% 7/8/2021 | | | 43,700,000 | | | | 43,699,915 | | |

17

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

SHORT-TERM INVESTMENTS — Continued | | Shares or

Principal

Amount | | Fair Value | |

State Street Bank Repurchase Agreement — 0.00% 7/1/2021 | |

(Dated 06/30/2021, repurchase price of $18,333,000, collateralized by

$18,747,300 principal amount U.S. Treasury Notes — 0.125% 2023,

fair value $18,699,701)(l) | | $ | 18,333,000 | | | $ | 18,333,000 | | |

TOTAL SHORT-TERM INVESTMENTS — 8.8%

(Cost $932,003,827) | | $ | 932,003,827 | | |

| TOTAL INVESTMENTS — 100.9% (Cost $7,472,933,570) | | $ | 10,726,905,135 | | |

SECURITIES SOLD SHORT — (3.2)% | |

COMMON STOCKS SOLD SHORT — (0.2)% | |

Softbank Corp. (Japan) | | | (1,166,548 | ) | | $ | (15,262,411 | ) | |

| OTHER COMMON STOCKS SOLD SHORT(m) | | $ | (301,045,203 | ) | |

| TOTAL COMMON STOCKS SOLD SHORT (Proceeds $264,992,977) | | $ | (316,307,614 | ) | |

CORPORATE BONDS & NOTES_SOLD SHORT — (0.2)% | |

Western Digital Corp. — 4.750% 2/15/2026 | | $ | (19,366,000 | ) | | $ | (21,484,330 | ) | |

TOTAL CORPORATE BONDS & NOTES SOLD SHORT

(Proceeds $19,392,859) | | $ | (21,484,330 | ) | |

| TOTAL SECURITIES SOLD SHORT (Proceeds $284,385,836) | | $ | (337,791,944 | ) | |

Other assets and liabilities, net — 2.3% | | $ | 237,530,665 | | |

NET ASSETS — 100.0% | | $ | 10,626,643,856 | | |

(a) Non-income producing security.

(b) As of June 30, 2021, investments with a value of $1,039,592,500 were fully or partially segregated with the broker(s)/custodian as collateral for short option contracts.

(c) Restricted securities. These restricted securities constituted 3.49% of total net assets at June 30, 2021, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

18

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

(d) These securities have been valued in good faith under policies adopted by authority of the Board of Trustees in accordance with the Fund's fair value procedures. These securities constituted 2.29% of total net assets at June 30, 2021.

(e) Investments categorized as a significant unobservable input (Level 3) (See Note 8 of the Notes to Financial Statements).

(f) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(g) Affiliated Security.

(h) Controlled company.

(i) Variable/Floating Rate Security — The rate shown is based on the latest available information as of June 30, 2021. For Corporate Bank Debt, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

(j) All or a portion of this holding is subject to unfunded loan commitments. The stated interest rate reflects the weighted average of the reference rate and spread for the funded portion, if any, and the commitment fees on the portion of the loan that is unfunded. See Note 11.

(k) Zero coupon bond. Coupon amount represents effective yield to maturity.

(l) Security pledged as collateral (See Note 10 of the Notes to Financial Statements).

(m) As permitted by U.S. Securities and Exchange Commission regulations, "Other" Common Stocks include holdings in their first year of acquisition that have not previously been publicly disclosed.

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

Purchased Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate Index | | Exercise

Rate | | Expiration

Date | | Counterparty | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(c)(e)

| | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Barclays

Bank

PLC | | $ | 4,776,000,000 | | | $ | 1,265,640 | | | $ | 1,289,520 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,289,520 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,337,280 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Barclays

Bank

PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,337,280 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Goldman

Sachs

International | | | 9,204,500,000 | | | | 2,531,237 | | | | 1,840,900 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Goldman

Sachs

International | | | 9,204,500,000 | | | | 2,531,238 | | | | 1,932,945 | | |

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate Index | | Exercise

Rate | | Expiration

Date | | Counterparty | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Goldman

Sachs

International | | $ | 9,204,500,000 | | | $ | 2,531,237 | | | $ | 1,932,945 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Goldman

Sachs

International | | | 9,204,500,000 | | | | 2,531,238 | | | | 2,024,990 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/15/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 860,625 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 2/22/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 860,625 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/01/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 911,250 | | |

Call —

CMS Cap

Swap(c)(e) | | Receive | | Maximum of

[0, 30-Year —

3-Year —

USD-ISDA

Swap Rate —

0.04] | | | 0.04 | % | | 3/08/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 911,250 | | |

Call —

OIS Cap

Swap(c)(e) | |

Receive | |

3-Month

USD-LIBOR | | | 0.68 | % | |

1/11/2029 | |

Morgan

Stanley | | | 260,061,813 | | | | 7,038,227 | | | | 14,594,669 | | |

| | | $ | 27,288,237 | | | $ | 31,123,799 | | |

21

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2021

(Unaudited)

Written Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counterparty | | Notional

Amount | | Premium | | Fair Value | |

Put — OIS

Floor Swap

(c)(e) | |

Pay | | |

3-Month

USD-LIBOR | | | |

0.35% | | |

1/11/2029 | |

Morgan

Stanley | | $ | (260,061,813 | ) | | $ | (7,038,227 | ) | | $ | (4,348,234 | ) | |

22

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

June 30, 2021

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

Altaba Escrow

| | 09/26/2014, 09/29/2014,

09/30/2014, 10/03/2014,

10/06/2014, 10/07/2014,

08/28/2015, 11/01/2016,

11/02/2016, 11/03/2016 | | $ | — | | | $ | 68,488,992 | | | | 0.64 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Barclays

Bank PLC 4.000% 02/15/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,289,520 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Barclays

Bank PLC 4.000% 02/22/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,289,520 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Barclays

Bank PLC 4.000% 03/01/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,337,280 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Barclays

Bank PLC 4.000% 03/08/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,337,280 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Goldman

Sachs International 4.000%

02/15/2023 | | 02/26/2020 | | | 2,531,237 | | | | 1,840,900 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Goldman

Sachs International 4.000%

02/22/2023 | | 02/26/2020 | | | 2,531,238 | | | | 1,932,945 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Goldman

Sachs International 4.000%

03/01/2023 | | 02/26/2020 | | | 2,531,237 | | | | 1,932,945 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Goldman

Sachs International 4.000%

03/08/2023 | | 02/26/2020 | | | 2,531,238 | | | | 2,024,990 | | | | 0.02 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 02/15/2023 | | 02/26/2020 | | | 1,265,625 | | | | 860,625 | | | | 0.01 | % | |

23

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2021

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 02/22/2023 | |

02/26/2020 | | $ | 1,265,625 | | | $ | 860,625 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Morgan

Stanley 4.000% 03/01/2023 | | 02/26/2020 | | | 1,265,625 | | | | 911,250 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Morgan

Stanley 4.000% 03/08/2023 | | 02/26/2020 | | | 1,265,625 | | | | 911,250 | | | | 0.01 | % | |

Epic Games, Inc. | | 06/25/2020 | | | 19,049,750 | | | | 29,320,050 | | | | 0.27 | % | |

FPS LLC (Marine Shipping) | | 01/11/2021, 04/13/2021 | | | 106,213,517 | | | | 74,281,258 | | | | 0.70 | % | |

FPS Shelby Holding I LLC | | 02/04/2020, 03/26/2020,

04/29/2020, 07/24/2020 | | | 10,191,934 | | | | 8,876,468 | | | | 0.08 | % | |

GACP II L.P. (Credit) | | 01/17/2020 | | | 21,832,680 | | | | 32,012,429 | | | | 0.30 | % | |

McDermott International, Inc. | | 12/31/2020 | | | — | | | | 13,554,380 | | | | 0.13 | % | |

MCDERMOTT LC —

6.335% 12/31/2021 | | 03/04/2021, 03/05/2021 | | | 28,718,370 | | | | 23,296,034 | | | | 0.22 | % | |

McDermott Technology

Americas, Inc., 1M USD

LIBOR + 1.000% — 1.113%

6/30/2025

| | 07/20/2020, 07/29/2020,

08/03/2020, 09/01/2020,

11/02/2020, 11/30/2020,

12/31/2020, 01/05/2021 | | | 73,548,626 | | | | 14,535,698 | | | | 0.14 | % | |

McDermott Technology

Americas, Inc., 1M USD

LIBOR + 3.000% —

3.093% 6/30/2024 | | 07/01/2020 | | | 1,096,603 | | | | 644,461 | | | | 0.01 | % | |

OIS CAP SWAPTION 0.680

JAN29 0.680 CALL Morgan

Stanley 0.680% 01/11/2029 | | 10/19/2020 | | | 7,038,227 | | | | 14,594,669 | | | | 0.14 | % | |

OIS FLOOR SWAPTION 0.350

JAN29 0.350 PUT Morgan

Stanley 0.350% 01/11/2029 | | 10/19/2020 | | | (7,038,227 | ) | | | (4,348,234 | ) | | | (0.04 | )% | |

Sound Holding FP | | 10/07/2013 | | | 68,546,025 | | | | 30,985,861 | | | | 0.29 | % | |

Steenbok LUX Financial

2 SARL, PIK — 10.750%

12/31/2021 | | 06/30/2021 | | | 739,257 | | | | 718,273 | | | | 0.01 | % | |

24

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2021

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

U.S. Farming Realty Trust II,

L.P. (Real Estate)

| | 12/24/2012, 04/29/2013,

06/17/2013, 10/28/2013,

01/14/2014, 04/22/2014,

06/25/2014, 09/09/2014,

10/08/2014, 12/18/2014,

06/18/2015, 07/29/2015 | | $ | 9,498,194 | | | $ | 8,400,319 | | | | 0.08 | % | |

U.S. Farming Realty Trust,

L.P. (Real Estate)

| | 11/26/2010, 01/31/2011,

03/09/2011, 04/15/2011,

05/10/2011, 06/27/2011,

08/15/2011, 10/17/2011,

10/28/2011, 11/28/2011,

01/03/2012, 01/26/2012,

04/05/2012, 07/13/2012,

12/07/2012, 08/01/2013 | | | 10,491,242 | | | | 14,442,711 | | | | 0.13 | % | |

Viking Acquisitions LLC | | 06/03/2021 | | | 7,607,534 | | | | 7,404,052 | | | | 0.07 | % | |

Western Digital Corp.

Term Loan B 4, 1M USD

LIBOR + 1.750% — 1.843%

4/29/2023

| | 04/05/2021, 04/07/2021,

04/22/2021 | | | 16,817,748 | | | | 16,982,378 | | | | 0.16 | % | |

TOTAL RESTRICTED

SECURITIES | | | | $ | 394,601,490 | | | $ | 370,718,929 | | | | 3.49 | % | |

See accompanying Notes to Financial Statements.

25

FPA CRESCENT FUND

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2021

(Unaudited)

ASSETS | |

Investment securities — at fair value (identified cost $6,299,272,369) | | $ | 9,650,996,391 | | |

Investments in affiliates — at fair value (identified cost $241,657,374) | | | 143,904,917 | | |

Short-term investments — at amortized cost (maturities 60 days or less) | | | 932,003,827 | | |

Purchased options, at value (premiums paid $27,288,237) | | | 31,123,799 | | |

Deposits for securities sold short | | | 284,667,071 | | |

Cash | | | 2,104,341 | | |

Foreign currencies at value (identified cost $451,614) | | | 451,685 | | |

Receivable for: | |

Investment securities sold | | | 46,899,217 | | |

Dividends and interest | | | 14,777,415 | | |

Capital Stock sold | | | 2,496,669 | | |

Total assets | | | 11,109,425,332 | | |

LIABILITIES | |

Securities sold short, at fair value (proceeds $284,385,836) | | | 337,791,944 | | |

Written options, at value (premiums received $7,038,227) | | | 4,348,234 | | |

Payable for: | |

Due to broker — OTC derivatives collateral | | | 20,284,124 | | |

Advisory fees | | | 8,688,520 | | |

Investment securities purchased | | | 7,999,934 | | |

Capital Stock repurchased | | | 5,508,215 | | |

Accrued expenses and other liabilities | | | 98,160,505 | | |

Total liabilities | | | 482,781,476 | | |

NET ASSETS | | $ | 10,626,643,856 | | |

SUMMARY OF SHAREHOLDERS' EQUITY | |

Capital Stock — no par value; unlimited authorized shares;

267,779,152 outstanding shares | | $ | 6,850,014,719 | | |

Distributable earnings | | | 3,776,629,137 | | |

NET ASSETS | | $ | 10,626,643,856 | | |

Institutional Class | |

Net Assets | | $ | 8,854,668,577 | | |

Shares outstanding, no par value; unlimited authorized shares | | | 223,124,084 | | |

Offering and redemption price per share | | $ | 39.68 | | |

Supra Institutional Class: | |

Net Assets | | $ | 1,771,975,279 | | |

Shares outstanding, no par value; unlimited authorized shares | | | 44,655,068 | | |

Offering and redemption price per share | | $ | 39.68 | | |

See accompanying Notes to Financial Statements.

26

FPA CRESCENT FUND

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2021

(Unaudited)

INVESTMENT INCOME | |

Dividends (net of foreign taxes withheld of $3,207,107) | | $ | 67,934,467 | | |

Interest | | | 8,252,618 | | |

| Total investment income | | | 76,187,085 | | |

EXPENSES | |

Advisory fees | | | 48,931,026 | | |

Short sale dividend expense | | | 1,760,588 | | |

Transfer agent fees and expenses | | | 1,892,859 | | |

Reports to shareholders | | | 255,940 | | |

Custodian fees | | | 252,225 | | |

Administrative services fees — Institutional Class | | | 3,350,389 | | |

Other professional fees | | | 231,998 | | |

Administrative services fees — Supra Institutional Class | | | 115,760 | | |

Trustee fees and expenses | | | 191,374 | | |

Legal fees | | | 133,328 | | |

Filing fees | | | 82,157 | | |

Audit and tax services fees | | | 24,049 | | |

Redemption liquidity service | | | 521,788 | | |

Other | | | 56,412 | | |

Total expenses | | | 57,799,893 | | |

Reimbursement from Adviser | | | (1,032,335 | ) | |

Net expenses | | | 56,767,558 | | |

Net investment income | | | 19,043,076 | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) | |

Net realized gain (loss) on: | |

Investments | | | 456,049,079 | | |

In-kind redemptions | | | 263,101,467 | | |

Swap contracts | | | (3,273,435 | ) | |

Investments in foreign currency transactions | | | (74,715 | ) | |

Net change in unrealized appreciation (depreciation) of: | |

Investments | | | 596,440,668 | | |

Investments in affiliates | | | (13,314,409 | ) | |

Investment securities sold short | | | (20,184,922 | ) | |

Written options | | | 2,005,076 | | |

Purchased options | | | 7,277,714 | | |

Swap contracts | | | 1,591,624 | | |

Translation of foreign currency denominated amounts | | | (306,128 | ) | |

Net realized and unrealized gain | | | 1,289,312,019 | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,308,355,095 | | |

See accompanying Notes to Financial Statements.

27

FPA CRESCENT FUND

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended

June 30, 2021

(Unaudited) | | Year Ended

December 31, 2020 | |

INCREASE (DECREASE) IN NET ASSETS | |

Operations: | |

Net investment income | | $ | 19,043,076 | | | $ | 59,992,476 | | |

Net realized gain | | | 715,802,396 | | | | 816,651,617 | | |

Net change in unrealized appreciation (depreciation) | | | 573,509,623 | | | | (296,372,002 | ) | |

Net increase in net assets resulting from operations | | | 1,308,355,095 | | | | 580,272,091 | | |

Distributions to shareholders — Institutional Class | | | (235,847,396 | ) | | | (510,592,905 | ) | |

Distributions to shareholders — Supra Institutional Class | | | (47,701,409 | ) | | | (12,461,447 | )(a) | |

Total distributions to shareholders | | | (283,548,805 | ) | | | (523,054,352 | ) | |

Capital Stock transactions:(b) | |

Proceeds from Capital Stock sold | | | 1,315,160,238 | | | | 2,408,393,979 | | |

Proceeds from shares issued to shareholders upon reinvestment of

dividends and distributions | | | 239,510,133 | | | | 458,862,950 | | |

Cost of Capital Stock repurchased(c) | | | (2,035,468,361 | ) | | | (6,850,927,376 | ) | |

Net decrease from Capital Stock transactions | | | (480,797,990 | ) | | | (3,983,670,447 | ) | |

Total change in net assets | | | 544,008,300 | | | | (3,926,452,708 | ) | |

NET ASSETS | |

Beginning of period | | | 10,082,635,556 | | | | 14,009,088,264 | | |

End of period | | $ | 10,626,643,856 | | | $ | 10,082,635,556 | | |

(a) Period from September 4, 2020, date operations commenced, through December 31, 2020.

(b) See Note 9, Capital Stock, in the Notes to Financial Statements.

(c) Net of redemption fees of $205,419 and $444,210 for the period ended June 30, 2021 and year ended December 31, 2020, respectively, see Note 7.

See accompanying Notes to Financial Statements.

28

FPA CRESCENT FUND

FINANCIAL HIGHLIGHTS

| | | Six

Months

Ended

June 30,

2021 | | Year Ended December 31, | |

| | | (Unaudited) | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | |

Institutional Class | |

Per share operating

performance: | |

Net asset value at

beginning of period | | $ | 35.97 | | | $ | 33.83 | | | $ | 29.53 | | | $ | 34.69 | | | $ | 32.61 | | | $ | 31.06 | | |

Income from investment

operations: | |

Net investment income* | | | 0.07 | | | | 0.18 | | | | 0.62 | | | | 0.24 | | | | 0.23 | | | | 0.24 | | |

Net realized and

unrealized gain (loss)

on investment

securities | | | 4.72 | | | | 3.69 | | | | 5.25 | | | | (2.78 | ) | | | 3.14 | | | | 2.93 | | |

Total from investment

operations | | | 4.79 | | | | 3.87 | | | | 5.87 | | | | (2.54 | ) | | | 3.37 | | | | 3.17 | | |

Less distributions: | |

Dividends from net

investment income | | | (0.22 | ) | | | (0.11 | ) | | | (0.80 | ) | | | (0.21 | ) | | | (0.34 | ) | | | (0.29 | ) | |

Distributions from net

realized capital gains | | | (0.86 | ) | | | (1.62 | ) | | | (0.77 | ) | | | (2.41 | ) | | | (0.95 | ) | | | (1.34 | ) | |

Total distributions | | | (1.08 | ) | | | (1.73 | ) | | | (1.57 | ) | | | (2.62 | ) | | | (1.29 | ) | | | (1.63 | ) | |

Redemption fees | | | — | ** | | | — | ** | | | — | ** | | | — | ** | | | — | ** | | | 0.01 | | |

Net asset value at

end of period | | $ | 39.68 | | | $ | 35.97 | | | $ | 33.83 | | | $ | 29.53 | | | $ | 34.69 | | | $ | 32.61 | | |

Total investment return | | | 13.34 | % | | | 12.11 | % | | | 20.02 | % | | | (7.43 | )% | | | 10.39 | % | | | 10.25 | % | |

Ratios/supplemental data: | |

Net assets, end of

period (in 000's) | | $ | 8,854,669 | | | $ | 8,903,455 | | | $ | 14,009,883 | | | $ | 13,707,240 | | | $ | 17,484,747 | | | $ | 16,555,035 | | |

Ratio of expenses

to average net assets: | |

Before reimbursement

from Adviser | | | 1.11 | %†‡ | | | 1.15 | %‡ | | | 1.23 | %‡ | | | 1.18 | %‡ | | | 1.10 | %‡ | | | 1.09 | %‡ | |

After reimbursement

from Adviser | | | 1.09 | %†‡ | | | 1.13 | %‡ | | | 1.23 | %‡ | | | 1.18 | %‡ | | | 1.10 | %‡ | | | 1.09 | %‡ | |

Net investment income: | |

Before reimbursement

from Adviser | | | 0.33 | %† | | | 0.54 | % | | | 1.90 | % | | | 0.70 | % | | | 0.66 | % | | | 0.77 | % | |

After reimbursement

from Adviser | | | 0.35 | %† | | | 0.56 | % | | | 1.90 | % | | | 0.70 | % | | | 0.66 | % | | | 0.77 | % | |

Portfolio turnover rate | | | 23 | %† | | | 29 | % | | | 23 | % | | | 64 | % | | | 18 | % | | | 35 | % | |

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

† Annualized

‡ For the periods ended June 30, 2021, December 31, 2020, December 31, 2019, December 31, 2018, December 31, 2017 and December 31, 2016, the expense ratio includes short sale dividend expense equal to 0.03%, 0.07%, 0.16%, 0.11%, 0.03% and 0.02% of average net assets, respectively.

See accompanying Notes to Financial Statements.

29

FPA CRESCENT FUND

FINANCIAL HIGHLIGHTS

| | | Six Months Ended

June 30, 2021

(Unaudited) | | Period from

September 4,

through

December 31, 2020 | |

Supra Institutional Class | |

Per share operating performance: | |

Net asset value at beginning of period | | $ | 35.98 | | | $ | 31.96 | | |

Income from investment operations: | |

Net investment income* | | | 0.09 | | | | 0.01 | | |

Net realized and unrealized gain on investment securities | | | 4.70 | | | | 4.81 | | |

Total from investment operations | | | 4.79 | | | | 4.82 | | |

Less distributions: | |

Dividends from net investment income | | | (0.23 | ) | | | — | | |

Distributions from net realized capital gains | | | (0.86 | ) | | | (0.80 | ) | |

Total distributions | | | (1.09 | ) | | | (0.80 | ) | |

Redemption fees | | | — | ** | | | — | ** | |

Net asset value at end of period | | $ | 39.68 | | | $ | 35.98 | | |

Total investment return | | | 13.34 | % | | | 15.08 | % | |

Ratios/supplemental data: | |

Net assets, end of period (in $000's) | | $ | 1,771,975 | | | $ | 1,179,180 | | |

Ratio of expenses to average net assets: | |

Before reimbursement from Adviser | | | 1.05 | %†‡ | | | 1.14 | %†‡ | |

After reimbursement from Adviser | | | 1.03 | %†‡ | | | 1.11 | %†‡ | |

Net investment income: | |

Before reimbursement from Adviser | | | 0.45 | %† | | | 0.07 | %† | |

After reimbursement from Adviser | | | 0.47 | %† | | | 0.10 | %† | |

Portfolio turnover rate | | | 23 | %† | | | 29 | % | |

* Per share amount is based on average shares outstanding.

** Rounds to less than $0.01 per share.

† Annualized.

‡ For the periods ended June 30, 2021 and December 31, 2020, the expense ratio includes short sale dividend expense equal to 0.03% and 0.13% of average net assets, respectively.

See accompanying Notes to Financial Statements.

30

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS

June 30, 2021

(Unaudited)

NOTE 1 — Significant Accounting Policies

FPA Crescent Fund (the "Fund"), a series of the FPA Funds Trust, is registered under the Investment Company Act of 1940 as an open-end, diversified, management investment company. The Fund's investment objective is to seek to generate equity-like returns over the long-term, take less risk than the market and avoid permanent impairment of capital. The Fund qualifies as an investment company pursuant to Financial Accounting Standard Board (FASB) Accounting Standards Codification (ASC) No. 946, Financial Services — Investment Companies.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

A. Security Valuation

The Fund's investments are reported at fair value as defined by accounting principles generally accepted in the United States of America, ("U.S. GAAP"). The Fund generally determines its net asset value as of approximately 4:00 p.m. New York time each day the New York Stock Exchange is open. Further discussion of valuation methods, inputs and classifications can be found under Disclosure of Fair Value Measurements.

B. Securities Transactions and Related Investment Income

Securities transactions are accounted for on the date the securities are purchased or sold. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest income and expenses are recorded on an accrual basis. Market discounts and premiums on fixed income securities are amortized over the expected life of the securities. Realized gains or losses are based on the specific identification method. The books and records of the Fund are maintained in U.S. dollars as follows: (1) the foreign currency fair value of investment securities, and other assets and liabilities stated in foreign currencies, are translated using the daily spot rate; and (2) purchases, sales, income and expenses are translated at the rate of exchange prevailing on the respective dates of such transactions. The resultant exchange gains and losses are included in net realized or net unrealized gain (loss) in the statement of operations.

C. Use of Estimates

The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported. Actual results could differ from those estimates. Actual results could differ from those estimates.

D. Recent Accounting Pronouncements

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2018-13, Fair Value Measurement (Topic 820) — Disclosure Framework — Changes to the Disclosure Requirements for Fair Value Measurement. The amendments eliminate certain disclosure requirements for fair value measurements for all entities, requires public entities to disclose certain new information and modifies some disclosure requirements. The new guidance is effective for all entities for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. The Fund has adopted the standard for the current fiscal year and the changes are incorporated into the financial statements.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848) Facilitation of the Effects of Reference Rate Reform on Financial Reporting, which provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transaction to ease the potential burden in accounting for (or recognizing the effects of) reference rate reform on financial reporting if certain criteria

31

FPA CRESCENT FUND

NOTES TO FINANCIAL STATEMENTS (Continued)

(Unaudited)

are met. The guidance is effective from March 12, 2020 through December 31, 2022. As of June 30, 2021, the guidance did not have a material impact on the Financial Statements.

NOTE 2 — Risk Considerations

Investing in the Fund may involve certain risks including, but not limited to, those described below.