UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | Investment Company Act file number: 811-08544 | |

fpa FUNDS TRUST

(Exact name of registrant as specified in charter)

11601 WILSHIRE BLVD., STE. 1200

LOS ANGELES, CALIFORNIA 90025

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

| | |

J. RICHARD ATWOOD, PRESIDENT FPA FUNDS TRUST 11601 WILSHIRE BLVD., STE. 1200 LOS ANGELES, CALIFORNIA 90025 | MARK D. PERLOW, ESQ. DECHERT LLP ONE BUSH STREET, STE. 1600 SAN FRANCISCO, CA 94104 |

Registrant’s telephone number, including area code: (310) 473-0225

Date of fiscal year end: December 31

Date of reporting period: June 30, 2020

Item 1: Report to Shareholders.

Distributor:

UMB DISTRIBUTION SERVICES, LLC

235 West Galena Street

Milwaukee, Wisconsin 53212

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of the Fund's shareholder reports, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the FPA Funds website (fpa.com/funds), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you prefer to receive shareholder reports and other communications electronically, you may update your mailing preferences with your financial intermediary, or enroll in e-delivery at fpa.com (for accounts held directly with the Fund).

You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you may inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting us at (800) 638-3060. Your election to receive reports in paper will apply to all funds held with the FPA Funds or through your financial intermediary.

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

Dear Shareholders:

Overview

We closed our first quarter letter with the observation that economies were worse than stock indices might suggest. What we thought true then is only more true today, yet in the second quarter, the market made one of its larger quarterly moves.

The global MSCI ACWI Index advanced 19.22% in the second quarter, while the domestic S&P 500 Index increased 20.54%, erasing the majority of the year-to-date decline to March's trough. The FPA Crescent Fund ("Fund" or "Crescent") increased 15.00% over the same period.

Long equities held by the Fund returned 22.29% and -13.11% in the second quarter and six months, respectively, performing better than the MSCI ACWI and S&P 500 indices for the quarter.1 Including a small amount of other risk assets and cash it held, the Fund generated 75.5% of the market's return in the second quarter (where "market" is the average of the 2020 second quarter returns for the MSCI ACWI and S&P 500 indices) but slightly underperformed its own risk exposure of 76.7%, on average, during the quarter.2

We would have thought that a global pandemic, social disturbances, extreme political polarity, and all that has accompanied those trends would have created more fear — or at least caution — in global markets. Yet stock markets and debt markets are up around the world, and in many cases, way up. Koyantsqatsi, a word used by the Hopi Native American tribe to describe a life out of balance, is as apt a description for this disconnect as any.

At the beginning of the year, the global economy was expected to grow 2.5% this year, but thanks to COVID-19, that outlook has darkened significantly and the consensus view now looks for a -5.2% contraction.3 Although you wouldn't know it from the popular indexes, this darkened outlook has pushed the average stock down 10.92%.4 Economic data suggest we won't return to normal in the near future (see Exhibit A).

1 For illustrative purposes only. The performance of the long equity segment of the Fund is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. Long equity holdings exclude paired trades, short-sales, limited partnerships, derivatives/futures, corporate bonds, mortgage backed securities, and cash and cash equivalents. The long equity segment average weight in the Fund was 70.2% and 69.2% for Q2 2020 and YTD through 6/30/20, respectively. Please refer to the first page for overall net performance of the Fund since inception. The long equity performance information shown is for illustrative purposes only and may not reflect the impact of material economic or market factors. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Long equity performance does not represent the return an investor can or should expect to receive. Fund shareholders may only invest or redeem their shares at net asset value.

2 Risk assets are any assets that are not risk free and generally refers to any financial security or instrument, such as equities, commodities, high-yield bonds, and other financial products that are likely to fluctuate in price. Risk exposure refers to the Fund's exposure to risk assets as a percent of total assets. The Fund's net risk exposure as of June 30, 2020 was 79.4%.

3 Source: The World Bank, Global Economic Prospects, June 2020.

4 As of June 30, 2020. This reflects the average year-to-date performance of the S&P 500 Index constituents.

Past performance is no guarantee, nor is it indicative, of future results. Comparison to any index is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. Please see end of Commentary for important disclosures and definitions.

1

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit A: Select Economic Data/Indicators

| | 12/31/2019

unless indicated | | 6/30/2020

unless indicated | |

GDP Growth (Estimated 2020) | |

U.S. | | | 1.8 | % | | | -6.1 | % | |

Global | | | 2.5 | % | | | -5.2 | % | |

U.S. Unemployment (%) | | | 3.6 | % | | | 11.1 | %5 | |

Oil (WTI $/barrel) | | $ | 61 | | | $ | 39 | | |

Hotel Occupancy6 | |

Asia Pacific | | | 66.6 | % | | | 35.8 | % | |

Europe | | | 66.9 | % | | | 31.9 | % | |

Americas | | | 80.7 | % | | | 30.6 | % | |

Middle East and Africa | | | 64.4 | % | | | 13.3 | % | |

Residential Mortgages in Forbearance | | | 0.25 | %7 | | | 8.5 | %8 | |

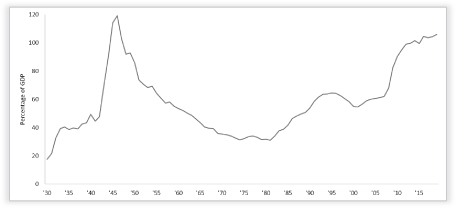

U.S. Budget Deficit (Estimated 2020)9 | | $ | 1.0 | tn | | $ | 3.7 | tn | |

U.S. National Debt (Estimated 2020)10 | | $ | 24.2 | tn | | $ | 26.9 | tn | |

In March, we were particularly concerned with the high COVID-19 transmission and fatality rates and what a "closed" global economy might look like. Rightly or wrongly, that influenced our judgment. Securities were on sale and we went shopping, but we could have bought even more. There is no lesson here; as presented with the same facts, we would do the same thing again. This coronavirus has delivered less death than initially anticipated, but we are far from done with it, hitting new highs in daily infections almost every day.

We never believed COVID-19 posed existential risk to the global economy, confident that we will eventually reach the other side as we always do. But we still do not know how bad things might get along the way. The world remains, as always, uncertain, though uncertainty has narrowed for now. The left tail of the probability distribution has flattened from what we expected.

Although stocks are still expensive, the portfolio was cheaper to assemble, and we believe the companies in it have more growth and better balance sheets than the stock market overall. In an uncertain world, this gives us some margin of safety, particularly since governments seem willing to do anything to resolve the crisis, including keeping interest rates low or even negative, printing money, giving money away, and making loans that can be forgiven.

5 Source: The Bureau of Labor Statistics, as of June 1, 2020.

6 Source: Statista.com. Data as of September 2019 (pre-COVID) and May 2020. https://www.statista.com/statistics/206825/hotel-occupancy-rate-by-region/.

7 Source: MBA.org. Data as of March 2, 2020. https://www.mba.org/2020-press-releases/april/mba-survey-shows-spike-in-loans-in-forbearance-service-call-volume.

8 Source: MBA.org. Data as of June 29, 2020. https://www.mba.org/2020-press-releases/june/share-of-mortgage-loans-in-forbearance-decreases-slightly-to-847.

9 Source: Congressional Budget Office April 2020. https://www.cbo.gov/publication/56020; https://www.cbo.gov/ publication/56335.Most recent 2020 estimate as of April 2020.

10 Federal Reserve Bank of St. Louis, U.S. Office of Management and Budget. 2019 year-end total debt including estimated deficit.

2

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

In our last letter, we commented on the six headwinds faced over the last market cycle and our belief that they could become tailwinds in the near future. They are worth repeating here, though the details can be found in our first quarter commentary.

1. Value vs growth

2. Low volatility vs high volatility (or business quality perception differential)

3. United States vs. international

4. High-yield window of opportunity

5. Cash

6. Interest rates

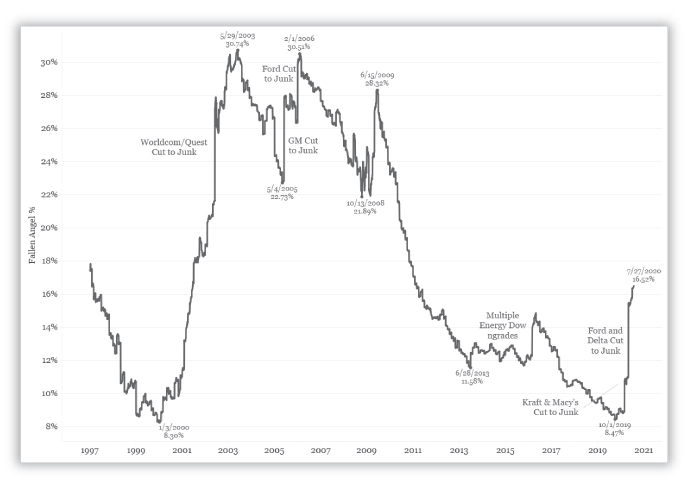

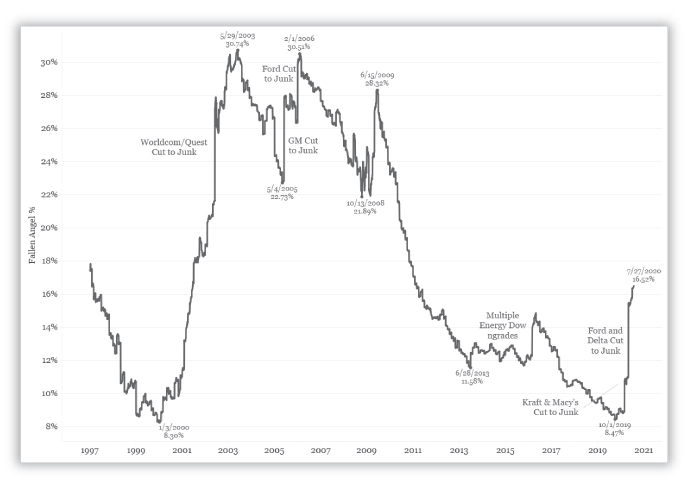

Whether the stock market buying spree is driven by need (given the lack of an alternative) or greed, the result is the same. Investors are showing a willingness to look across a deep chasm and accept a sanguine view of the future for many businesses, particularly those in the tech space. However, prices for high quality businesses have not fallen to levels we might have hoped. And thanks to unprecedented U.S. government involvement in the country's corporate debt markets, high-yield bonds also have not presented the opportunity that one might have expected. This story, however, is far from written.

Portfolio discussion

Contributors to and detractors from the Fund's trailing 12-month returns are listed below.

Exhibit B: Trailing Twelve Month Contributors and Detractors11

Contributors | | Perf. Cont. | | Avg. % of Port. | | Detractors | | Perf. Cont. | | Avg. % of Port. | |

TTM | |

Alphabet | | | 1.31 | % | | | 4.7 | % | | American International Group | | | -1.33 | % | | | 3.4 | % | |

Microsoft | | | 0.89 | % | | | 1.9 | % | | Howmet Aerospace | | | -1.24 | % | | | 2.9 | % | |

Broadcom | | | 0.73 | % | | | 2.6 | % | | Wells Fargo & Company | | | -0.82 | % | | | 1.6 | % | |

Charter Communications | | | 0.70 | % | | | 2.2 | % | | Ally Financial | | | -0.74 | % | | | 0.8 | % | |

Naspers, Prosus/Tencent | | | 0.59 | % | | | 2.4 | % | | O-I Glass | | | -0.71 | % | | | 0.6 | % | |

| | | 4.22 | % | | | 13.8 | % | | | | | -4.85 | % | | | 9.3 | % | |

As is clear from the above, the Fund's investments in the tech sector have continued to outperform its more traditional value investments. While we own a number of high-quality growing businesses that trade at reasonable valuations, it seems no price is too high for some "quality" stock, and no price is too low for lower quality ones. Similarly, growth can't be expensive enough, nor value cheap enough.

11 Reflects the top five contributors and detractors to the Fund's performance based on contribution to return for the trailing twelve months ("TTM"). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the TTM is available by contacting FPA Client Service at crm@fpa.com. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

3

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

We have come across a number of references made to work done by Empirical Research that identified 75 large-cap stocks with great growth characteristics. Looking back to the 1950s, that firm has not seen a period as expensive as the current — at 66 times forward price-to-earnings ("P/E") estimates, and the highest relative P/E multiple for these 75 names when compared to the rest of the large cap market. This is not to suggest that these companies are bad (although, approximately 30 percent of them do lose money).12

A lot must go right in the future for such companies to justify their current valuation. Conversely, a lot would have to go incredibly wrong for many of the value stocks that have been left behind in this bull run to prove to be unreasonable investments in the future.

Investors have found comfort in those businesses that have a less volatile earnings stream, for instance, consumer products companies selling staple goods, and have recent and seemingly great future prospects, such as a Netflix or Tesla. We believe there is better opportunity in the uncomfortable, where the short-term is more challenged but with respectable long-term prospects, like industrial, travel and leisure and hospitality, and foreign-based companies. Given the Fund's avoidance of more richly priced companies, we believe this dichotomy should position the Fund well for the future.

It is not the first time that our style of investing has been so out of favor. As shown in Exhibit C below and based on consensus earnings projections at that time, Crescent's equity portfolio has remained attractive relative to the market over the past year.13 Crescent's equity portfolio had better earnings-per-share ("EPS") and book value than the indices, while achieving higher historic and forecasted EPS growth. Over time we would expect the relationship between valuation and growth to support improved performance, but, of course, we can make no guarantees and the disconnect may continue to try our patience. Relative to the indices, Crescent's equity holdings continue to trade at a significant discount on forward P/E and Price/Book. One might suggest that the growth rate of the companies held by the Fund is lower, but as you can see in Exhibit C, both the trailing and forecasted consensus 3-year EPS growth is higher than the market. There are a number of puts and takes that make these Wall Street consensus numbers far from precise, but directionally, suggests that Crescent's equity portfolio is (and has been) less expensive than the market and the earnings growth potential of its underlying companies is at least as good if not better than the market as one looks through the economic cycle.

12 Source: Empirical Research Partners ("ERP"), National Bureau of Economic Research. ERP categorized a group of 75 U.S. large-capitalization ("cap") stocks that have faster and stronger growth credentials than the rest of the U.S. large-cap universe (830 companies) as 'Big Growers'. Their analysis covered the period January 1, 1952 through June 8, 2020. Trailing P/E analysis showed the Big Growers, as an equally weighted group, currently trade at a relative (to the universe) trailing P/E ratio higher than anything seen since 1952. Forward P/E is the average of the Forward P/E's for the 75 firms as of July 22, 2020. Forward P/E's are estimates and subject to change.

13 References to Crescent's "equity portfolio" refers to the Fund's long equity holdings. Please refer to Footnote 1 for definition of long equity holdings. The long equity segment average weight in the Fund was 70.2% and 69.2% for Q2 2020 and YTD through 6/30/20, respectively. Long equity portfolio statistics noted herein do not represent the results that the Fund or an investor can or should expect to receive.

Past performance is no guarantee, nor is it indicative, of future results.

4

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Exhibit C: FPA Crescent Long Equity Holding Valuation and Earnings Growth vs Stock Market14

| | Price/Earnings

1 Year Forward | | Price/Book | |

| | 6/30/2019 | | 6/30/2020 | | 6/30/2019 | | 6/30/2020 | |

FPA Crescent — Equity

Portfolio | | | 12.7 | | | | 19.3 | | | | 1.5 | | | | 1.3 | | |

S&P 500 | | | 18.1 | | | | 24.9 | | | | 3.3 | | | | 3.5 | | |

MSCI ACWI | | | 16.2 | | | | 21.9 | | | | 2.3 | | | | 2.3 | | |

| | | 3-Year Historic

EPS Growth | | 3-Year Forecasted

EPS Growth | |

| | 6/30/2019 | | 6/30/2020 | | 6/30/2019 | | 6/30/2020 | |

FPA Crescent — Equity

Portfolio | | | 22.3 | % | | | 13.6 | % | | | 14.0 | % | | | 18.9 | % | |

S&P 500 | | | 11.8 | % | | | 6.5 | % | | | 9.8 | % | | | 10.6 | % | |

MSCI ACWI | | | 11.2 | % | | | 3.5 | % | | | 9.7 | % | | | 11.1 | % | |

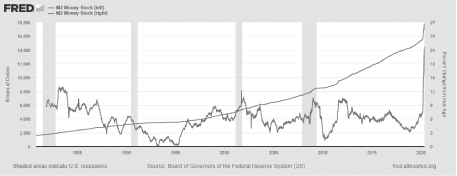

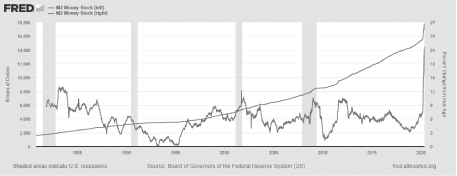

We remain intent on preserving capital and purchasing power over time, though we acknowledge that the Fund's current risk exposure represents a greater concern for the former. We can understand why price volatility and increased equity exposure may feel incompatible with this goal, but we think that it makes sense to increase the Fund's exposure to an equity portfolio with the characteristics of Crescent as depicted above. We continue to like the optionality of cash, but given the increase of the global money supply and an expressed commitment by central bankers to hold rates near zero, we are reluctant to hold too much dry powder.

If we consider the equity portfolio as depicted in Exhibit C, it trades at a 5.2% earnings yield (earnings/price) on depressed COVID numbers. Assuming the consensus earnings growth of 18.9% over the next three years, then the prospective earnings yield will have increased to 8.8%.15 If we then assume a more pedestrian 4% growth for the rest of the decade, our equity portfolio would trade at 11.5% yield in Year 10, and we will have earned a 2.2% dividend along the way, or approximately 20% of your capital, assuming no increase in dividends. If instead one were to buy a 10-year bond at 0.66% yield, in 10 years you'd have collected 6.6% of your capital pre-tax and have the option to reinvest in whatever the opportunity set might be at the time. Framed over the

14 Source: CapIQ, Factset, Bloomberg, FPA calculations. 3-Year Forecasted EPS Growth is based on FPA calculations using consensus data from CapIQ, Factset and Bloomberg. Comparison to the S&P 500 and MSCI ACWI Indices is being used as a representation of the "market" and is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. Long equity statistics noted herein do not represent the results that the Fund or an investor can or should expect to receive. Forward looking statistics are estimates and subject to change.

15 Source: CapIQ, Factset, Bloomberg, FPA calculations. As of June 30, 2020. The earnings yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share.

Past performance is no guarantee, nor is it indicative, of future results.

5

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

long-term, the Crescent equity portfolio's earnings and dividend yields appear superior to the bond and cash markets. So we have chosen to accept a bit more volatility in exchange for the opportunity for a better longer-term return on capital. We believe when global economies recover, investors will appreciate the merits of many of these unloved companies with deeply discounted valuations compared to the market. People will again stay in hotels, and Marriott will be there to accommodate them. The cruise industry will not disappear, as vacationers will once again set sail (though the industry could suffer more than the hotel business). During the downturn we therefore established a position in Marriott stock but opted to retain our perch atop the capital structure in the cruise industry, purchasing senior secured loans of Carnival Cruises and Royal Caribbean at close to 12 percent yields.

For the most part, our more significant 2020 purchases were in companies hurt in this economic downturn, in many cases quite severely. Expectations have changed, but prices sank much more than those expectations changed. Looking toward an eventual economic recovery, we believe these recent investments — LG Corp, Swire Pacific, Booking Holdings, Marriott International, NXP Semiconductors, Compagnie Financiere Richemont and Wabtec (formerly Westinghouse Brake Technologies), complemented by additions to many of the Fund's existing holdings — will fare quite well and once again return to investor's favor.

Whenever possible, we have traded lower quality businesses for higher quality ones for which growth, even if cyclical, should hopefully ensure a prosperous future. Owning higher quality businesses gives us the comfort to invest more over this next decade than previously.

30,000' View

We believe that irrational behavior has once again entered pockets of the market. We also believe that the Fund owns good businesses at good prices, though their stock prices appear dwarfed at the moment by the unnaturally levitating shares of businesses with unproven operating models.

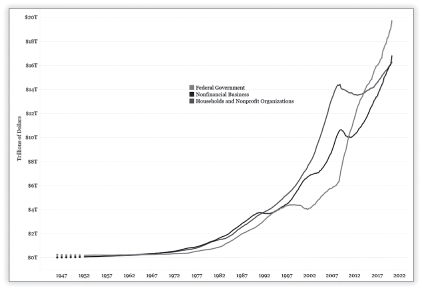

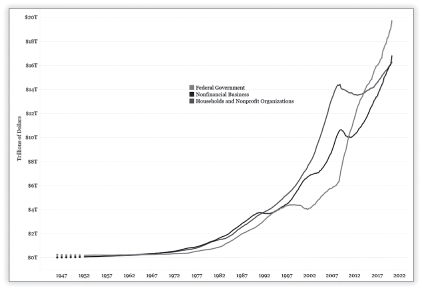

Faith-based investing has a checkered history, whether it be blind faith in a charismatic CEO or in central bankers around the world. Having set zero-bound interest rates in most parts, central banks have successfully forced the move into riskier assets — but that has failed to translate into real economic growth. Those who started with an investment portfolio are generally wealthier, while those who did not are generally worse off. Central bankers have spiked the Kool-Aid punch bowl, widening by fiat the gap between the Haves and Have Nots.

Negative interest rates take money away from savers and lenders and give it to borrowers and investors, including speculators. In one shocking example, LVMH Moët Hennessy — Louis Vuitton SE ("LVMH") acquired Tiffany for $16 billion, selling $10 billion of bonds to finance its purchase. Even the longest maturity of the bonds it sold, a tranche with an 11-year maturity, promised a yield of just 0.43%. As if that wasn't stunning enough, the European Central Bank has snapped up about 20 percent of European bond issues that meet certain qualifications, which this new LVMH debt appears to meet. Two of the five LVMH tranches denominated in Euros were even sold with negative yields — in other words, the holders of these bonds are literally paying Berrnard Arnault, LVMH's largest shareholder and the richest man in a country with historically left liberal leanings, to buy into a foreign-based luxury brand at a time when Covid-19 has vastly diminished consumer appetites. It's no wonder we have found so few high yield bonds to put into our portfolio.

When money costs almost nothing, or even less than nothing, it perverts price discovery. If there is no cost of capital, then one theoretically can pay an infinite price for assets, which creates a difficult backdrop for investors such as ourselves who insist on a margin of safety.

6

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

The U.S. Federal Reserve and European Central Bank are doing their best to inhibit what should have been (and might hopefully still be) a historic opportunity to buy high-yield debt. But investors thirsty for yield, coupled with central bank purchase of high-yielding corporate bonds, has propped prices up at higher levels than they otherwise would be.

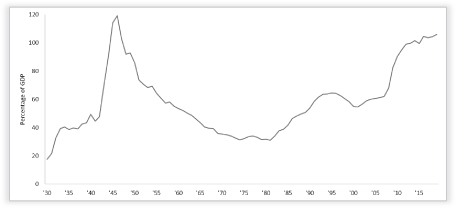

The pandemic has brought the global economy to its knees. How long it will take the economy to reopen and what the world might look like when the economy does revive remains in question. We believe there will be no high interest rates in the years to come. Governments have an imperative to keep rates low, if for no other reason than minimizing budget damage. As a result, a portfolio light on risk assets might be disadvantageous.

Crisis foments change, and a new economic order can translate into a new social order. Currently, there is movement in the United States to establish greater equality, racially and financially. The coming U.S. elections are a cipher at this point. It's impossible to know which presidential candidate will win or what the ramifications might be if one were to remain in office or the other were to take over. We think the more significant variable could be the Senate races. If the Senate were to flip to the Democrats, we can expect higher personal and corporate taxes together with more generous and costly social programs — and an attendant increase in Federal deficits and the U.S. national debt. This would likely put an even more significant crimp in our economy, and we don't think the markets yet appreciate that. That, along with more attractive valuations outside the United States, further supports our continuing investment overseas.

Summary

We believe what one pays for a business shall guide returns. We will continue to prudently manage your portfolio.

None of us have seen anything like this, with so many businesses closed, people afraid to leave their homes, necessary socialization hijacked, and the loss of life. As Frodo said in J.R.R. Tolkien's The Fellowship of the Ring, "I wish it need not have happened in my time."

"So do I," replied Gandalf, "and so do all who live to see such times. But that is not for them to decide. All we have to decide is what to do with the time that is given us."

We wish everyone as well as can be during these extraordinary times.

Respectfully submitted,

Steven Romick

Co-Portfolio Manager

July 30, 2020

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale with respect to any securities, products or services discussed, and neither does it provide investment advice. Any such offer or solicitation shall only be

7

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

made pursuant to the Fund's Prospectus, which supersedes the information contained herein in its entirety. This presentation does not constitute an investment management agreement or offering circular.

The views expressed herein and any forward-looking statements are as of the date of the publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data have been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

Portfolio composition will change due to ongoing management of the Fund. References to individual securities are for informational purposes only and should not be construed as recommendations by the Fund, the portfolio managers, the Adviser, or the distributor. It should not be assumed that future investments will be profitable or will equal the performance of the security examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

Investments, including investments in mutual funds, carry risks and investors may lose principal value. Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be heightened when investing in emerging markets. Foreign investments, especially those of companies in emerging markets, can be riskier, less liquid, harder to value, and more volatile than investments in the United States. Adverse political and economic developments or changes in the value of foreign currency can make it more difficult for the Fund to value the securities. Differences in tax and accounting standards, difficulties in obtaining information about foreign companies, restrictions on receiving investment proceeds from a foreign country, confiscatory foreign tax laws, and potential difficulties in enforcing contractual obligations, can all add to the risk and volatility of foreign investments.

Small and mid-cap stocks involve greater risks and may fluctuate in price more than larger company stocks. Short-selling involves increased risks and transaction costs. You risk paying more for a security than you received from its sale.

The return of principal in a bond investment is not guaranteed. Bonds have issuer, interest rate, inflation and credit risks. Interest rate risk is the risk that when interest rates go up, the value of fixed income securities, such as bonds, typically go down and investors may lose principal value. Credit risk is the risk of loss of principal due to the issuer's failure to repay a loan. Generally, the lower the quality rating of a security, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults the security may lose some or all of its value. Lower rated bonds, callable bonds and other types of debt obligations involve greater risks. Mortgage-backed securities and asset-backed securities are subject to prepayment risk and the risk of default on the underlying mortgages or other assets. High yield securities can be volatile and subject to much higher instances of default. Derivatives may increase volatility.

Value securities, including those selected by the Fund's portfolio managers, are subject to the risk that their intrinsic value may never be realized by the market because the market fails to recognize what the portfolio managers consider to be their true business value or because the portfolio managers have misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

Please refer to the Fund's Prospectus for a complete overview of the primary risks associated with the Fund.

8

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

In making any investment decision, you must rely on your own examination of the Fund, including the risks involved in an investment. Investments mentioned herein may not be suitable for all recipients and in each case, potential investors are advised not to make any investment decision unless they have taken independent advice from an appropriately authorized advisor. An investment in any security mentioned herein does not guarantee a positive return as securities are subject to market risks, including the potential loss of principal. You should not construe the contents of this document as legal, tax, investment or other advice or recommendations.

Index Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund may be less diversified than the indices noted herein, and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The Fund does not include outperformance of any index in its investment objectives.

The S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy. The Index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 26 emerging markets. As of December 2019, it covers more than 3,000 constituents across 11 sectors and approximately 85% of the free float-adjusted market capitalization in each market.

The Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. The CPI is presented to illustrate the Fund's purchasing power against changes in the prices of goods as opposed to a benchmark, which is used to compare the Fund's performance. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time.

60% S&P500/ 40% Bloomberg Barclays U.S. Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index.

Other Definitions

Dividend Yield, expressed as a percentage, is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price.

Earnings Per Share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company's profitability.

Earnings Per Share Growth is defined as the percentage change in normalized earnings per share over the previous 12-month period to the latest year end.

Earnings Yield refers to the earnings per share for the most recent 12-month period divided by the current market price per share. The earnings yield (which is the inverse of the P/E ratio) shows the percentage of how much a company earned per share.

9

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

Forward Price to Earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation.

Long Equity Performance represents the performance of stocks that the Fund owned over the given time periods and excludes the long equity portion of a pair trade, short-sales, limited partnerships, derivatives/futures, corporate bonds, mortgage backed securities, and cash and cash equivalents.

Market Cycles, also known as stock market cycles, is a wide term referring to trends or patterns that emerge during different markets or business environments.

Net Risk Exposure is a measure of the extent to which a fund's trading book is exposed to market fluctuations. In regards to the Fund, it is the percent of the portfolio exposed to Risk Assets.

Price to Book is used to compare a firm's market capitalization to its book value. It's calculated by dividing the company's stock price per share by its book value per share (BVPS). An asset's book value is equal to its carrying value on the balance sheet, and companies calculate it netting the asset against its accumulated depreciation.

Price to Earnings is the ratio for valuing a company that measures its current share price relative to its EPS. The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

Return on Capital measures the return an investment generates for capital contributors, i.e. bondholders/stockholders. It indicates how effective a company is at turning capital into profits.

Risk Assets is any asset that carries a degree of risk. Risk asset generally refers to assets that have a significant degree of price volatility, such as equities, commodities, high-yield bonds, real estate and currencies, but does not include cash and cash equivalents.

Standard Deviation is a measure of the dispersion of a set of data from its mean.

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In most cases, the higher the volatility, the riskier the security. Volatility is often measured as either the standard deviation or variance between returns from that same security or market index.

The FPA Funds are distributed by UMB Distribution Services, LLC, 235 W. Galena Street, Milwaukee, WI, 53212.

10

FPA CRESCENT FUND

LETTER TO SHAREHOLDERS

(Continued)

The discussions of Fund investments represent the views of the Fund's managers at the time of this report and are subject to change without notice. These views may not be relied upon as investment advice or as an indication of trading intent on behalf of any First Pacific Advisors portfolio. Security examples featured are samples for presentation purposes and are intended to illustrate our investment philosophy and its application. It should not be assumed that most recommendations made in the future will be profitable or will equal the performance of the securities. This information and data has been prepared from sources believed reliable. The accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

FORWARD LOOKING STATEMENT DISCLOSURE

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. Insofar as some of our opinions and comments in our letters to shareholders are based on our current expectations, they are considered "forward-looking statements" which may or may not prove to be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be construed as a recommendation to purchase or sell any particular security.

11

FPA CRESCENT FUND

PORTFOLIO SUMMARY

June 30, 2020 (Unaudited)

Common Stocks | | | | | 70.8 | % | |

Internet Media | | | 13.0 | % | | | |

Semiconductor Devices | | | 6.6 | % | | | |

Cable & Satellite | | | 5.8 | % | | | |

Cement & Aggregates | | | 3.5 | % | | | |

Banks | | | 3.3 | % | | | |

Industrial Distribution & Rental | | | 3.1 | % | | | |

P&C Insurance | | | 3.1 | % | | | |

Diversified Banks | | | 3.0 | % | | | |

Electrical Components | | | 2.5 | % | | | |

Investment Companies | | | 2.4 | % | | | |

Institutional Brokerage | | | 2.4 | % | | | |

Infrastructure Software | | | 1.9 | % | | | |

Internet Based Services | | | 1.7 | % | | | |

Midstream — Oil & Gas | | | 1.6 | % | | | |

Base Metals | | | 1.5 | % | | | |

Computer Hardware & Storage | | | 1.5 | % | | | |

Insurance Brokers | | | 1.3 | % | | | |

Commercial & Residential Building

Equipment & Systems | | | 1.3 | % | | | |

Application Software | | | 1.3 | % | | | |

Specialty Chemicals | | | 1.3 | % | | | |

Railroad Rolling Stock | | | 1.3 | % | | | |

Medical Equipment | | | 1.1 | % | | | |

Wealth Management | | | 1.0 | % | | | |

Apparel, Footwear & Accessory Design | | | 0.8 | % | | | |

Hotels, Restaurants & Leisure | | | 0.8 | % | | | |

Telecom Carriers | | | 0.8 | % | | | |

E-Commerce Discretionary | | | 0.7 | % | | | |

Aircraft & Parts | | | 0.7 | % | | | |

Real Estate Owners & Developers | | | 0.5 | % | | | |

Food & Drug Stores | | | 0.5 | % | | | |

Integrated Utilities | | | 0.3 | % | | | |

Marine Shipping | | | 0.2 | % | | | |

Closed End Fund | | | | | 1.0 | % | |

Limited Partnerships | | | | | 1.5 | % | |

Preferred Stocks | | | | | 1.1 | % | |

Bonds & Debentures | | | | | 22.0 | % | |

U.S. Treasuries | | | 15.4 | % | | | |

Municipals | | | 2.8 | % | | | |

Corporate Bank Debt | | | 2.0 | % | | | |

Corporate Bonds & Notes | | | 1.7 | % | | | |

Asset-Backed Securities | | | 0.1 | % | | | |

Short-term Investments | | | | | 3.9 | % | |

Securities Sold Short | | | | | (2.9 | )% | |

Other Assets And Liabilities, Net | | | | | 2.6 | % | |

Net Assets | | | | | 100.0 | % | |

12

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS

June 30, 2020

(Unaudited)

COMMON STOCKS | | Shares | | Fair Value | |

INTERNET MEDIA — 13.0% | |

Alphabet, Inc. (Class A)(a) | | | 201,028 | | | $ | 285,067,755 | | |

Alphabet, Inc. (Class C)(a) | | | 176,922 | | | | 250,098,709 | | |

Baidu, Inc. (ADR) (China)(a) | | | 1,507,799 | | | | 180,770,022 | | |

Facebook, Inc. (Class A)(a)(b) | | | 1,133,000 | | | | 257,270,310 | | |

Naspers, Ltd. (N Shares) (South Africa) | | | 1,150,335 | | | | 211,408,901 | | |

Prosus NV (Netherlands)(a) | | | 1,160,627 | | | | 107,889,976 | | |

| | | $ | 1,292,505,673 | | |

SEMICONDUCTOR DEVICES — 6.6% | |

Analog Devices, Inc. | | | 2,322,564 | | | $ | 284,839,249 | | |

Broadcom, Inc. | | | 978,635 | | | | 308,866,992 | | |

NXP Semiconductors NV (Netherlands) | | | 568,891 | | | | 64,876,330 | | |

| | | $ | 658,582,571 | | |

CABLE & SATELLITE — 5.8% | |

Charter Communications, Inc. (Class A)(a)(b) | | | 486,346 | | | $ | 248,055,914 | | |

Comcast Corp. (Class A)(b) | | | 8,462,115 | | | | 329,853,243 | | |

| | | $ | 577,909,157 | | |

CEMENT & AGGREGATES — 3.5% | |

HeidelbergCement AG (Germany) | | | 1,863,006 | | | $ | 99,729,911 | | |

LafargeHolcim Ltd. (Switzerland)(a) | | | 5,751,110 | | | | 253,371,028 | | |

| | | $ | 353,100,939 | | |

BANKS — 3.3% | |

CIT Group, Inc.(b)(c) | | | 5,226,101 | | | $ | 108,337,074 | | |

Signature Bank | | | 731,980 | | | | 78,263,302 | | |

Wells Fargo & Co. | | | 5,531,767 | | | | 141,613,235 | | |

| | | $ | 328,213,611 | | |

INDUSTRIAL DISTRIBUTION & RENTAL — 3.1% | |

Bureau Veritas SA (France)(a) | | | 1,069,830 | | | $ | 22,690,493 | | |

GEA Group AG (Germany) | | | 1,017,395 | | | | 32,290,335 | | |

Howmet Aerospace, Inc. | | | 9,476,102 | | | | 150,196,217 | | |

LG Corp. (South Korea) | | | 1,772,486 | | | | 105,784,108 | | |

| | | $ | 310,961,153 | | |

P&C INSURANCE — 3.1% | |

American International Group, Inc.(b) | | | 9,755,406 | | | $ | 304,173,559 | | |

DIVERSIFIED BANKS — 3.0% | |

Bank of America Corp. | | | 4,008,111 | | | $ | 95,192,636 | | |

Citigroup, Inc. | | | 4,033,295 | | | | 206,101,375 | | |

| | | $ | 301,294,011 | | |

13

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

COMMON STOCKS — Continued | | Shares | | Fair Value | |

ELECTRICAL COMPONENTS — 2.5% | |

TE Connectivity, Ltd. (Switzerland) | | | 2,995,470 | | | $ | 244,280,578 | | |

INVESTMENT COMPANIES — 2.4% | |

Groupe Bruxelles Lambert SA (Belgium) | | | 2,830,088 | | | $ | 237,048,340 | | |

INSTITUTIONAL BROKERAGE — 2.4% | |

Jefferies Financial Group, Inc.(b)(c) | | | 15,093,320 | | | $ | 234,701,126 | | |

INFRASTRUCTURE SOFTWARE — 1.9% | |

Microsoft Corp. | | | 944,218 | | | $ | 192,157,805 | | |

INTERNET BASED SERVICES — 1.7% | |

Booking Holdings, Inc.(a) | | | 106,096 | | | $ | 168,940,905 | | |

MIDSTREAM — OIL & GAS — 1.6% | |

Kinder Morgan, Inc.(b) | | | 10,664,948 | | | $ | 161,787,261 | | |

BASE METALS — 1.5% | |

Glencore plc (Switzerland)(a) | | | 71,849,910 | | | $ | 153,055,015 | | |

COMPUTER HARDWARE & STORAGE — 1.5% | |

Dell Technologies (C Shares)(a) | | | 2,722,000 | | | $ | 149,546,680 | | |

INSURANCE BROKERS — 1.3% | |

Aon plc (Class A) (Britain) | | | 696,227 | | | $ | 134,093,320 | | |

COMMERCIAL & RESIDENTIAL BUILDING EQUIPMENT &

SYSTEMS — 1.3% | |

Otis Worldwide Corp. | | | 870,269 | | | $ | 49,483,495 | | |

Samsung C&T Corp. (South Korea) | | | 859,404 | | | | 83,600,261 | | |

| | | $ | 133,083,756 | | |

APPLICATION SOFTWARE — 1.3% | |

Epic Games, Inc.(a)(d)(e)(f) | | | 33,130 | | | $ | 19,049,750 | | |

Nexon Co. Ltd. (Japan) | | | 4,952,100 | | | | 111,701,695 | | |

| | | $ | 130,751,445 | | |

SPECIALTY CHEMICALS — 1.3% | |

Univar Solutions, Inc.(a) | | | 7,632,838 | | | $ | 128,689,649 | | |

14

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

COMMON STOCKS — Continued | | Shares | | Fair Value | |

RAILROAD ROLLING STOCK — 1.3% | |

Westinghouse Air Brake Technologies Corp. | | | 2,162,605 | | | $ | 124,501,170 | | |

MEDICAL EQUIPMENT — 1.1% | |

Olympus Corp. (Japan) | | | 5,794,100 | | | $ | 111,550,851 | | |

WEALTH MANAGEMENT — 1.0% | |

LPL Financial Holdings, Inc. | | | 1,252,149 | | | $ | 98,168,482 | | |

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 0.8% | |

Cie Financiere Richemont SA (Switzerland) | | | 1,260,768 | | | $ | 81,319,933 | | |

HOTELS, RESTAURANTS & LEISURE — 0.8% | |

Marriott International, Inc. (Class A) | | | 921,818 | | | $ | 79,027,457 | | |

TELECOM CARRIERS — 0.8% | |

SoftBank Group Corp. (Japan) | | | 1,522,000 | | | $ | 76,750,891 | | |

E-COMMERCE DISCRETIONARY — 0.7% | |

Alibaba Group Holding Ltd. (ADR) (China)(a) | | | 328,555 | | | $ | 70,869,313 | | |

AIRCRAFT & PARTS — 0.7% | |

Meggitt plc (Britain) | | | 19,162,851 | | | $ | 69,797,971 | | |

REAL ESTATE OWNERS & DEVELOPERS — 0.5% | |

Swire Pacific Ltd. (Class A) (Hong Kong) | | | 10,152,602 | | | $ | 53,958,772 | | |

FOOD & DRUG STORES — 0.5% | |

Jardine Strategic Holdings, Ltd. (Hong Kong) | | | 2,452,760 | | | $ | 52,908,724 | | |

INTEGRATED UTILITIES — 0.3% | |

PG&E Corp.(a) | | | 3,585,220 | | | $ | 31,800,901 | | |

MARINE SHIPPING — 0.2% | |

Sound Holding FP (Luxembourg)(a)(c)(d)(e)(f)(g) | | | 1,146,250 | | | $ | 20,466,414 | | |

| TOTAL COMMON STOCKS — 70.8% (Cost $6,024,074,122) | | $ | 7,065,997,433 | | |

15

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

CLOSED END FUND — 1.0% | | Shares or

Principal

Amount | | Fair Value | |

Altaba Escrow(d)(e)(f)(Cost $0) | | | 4,756,180 | | | $ | 97,501,690 | | |

LIMITED PARTNERSHIPS | |

FPS LLC (Marine Shipping)(c)(d)(e)(f)(g) | | | 1,057,447 | | | $ | 57,628,801 | | |

FPS Shelby Holding I LLC(c)(d)(e)(f)(g) | | | 102,899 | | | | 8,746,444 | | |

GACP II LP (Credit)(d)(e)(f) | | | 958,312 | | | | 45,984,593 | | |

U.S. Farming Realty Trust, L.P. (Real Estate)(c)(d)(e)(f) | | | 350,000 | | | | 27,657,099 | | |

U.S. Farming Realty Trust II, L.P. (Real Estate)(d)(e)(f) | | | 120,000 | | | | 8,270,156 | | |

| TOTAL LIMITED PARTNERSHIPS — 1.5% (Cost $188,553,240) | | $ | 148,287,093 | | |

PREFERRED STOCKS | |

AUTOMOBILES — 0.9% | |

Porsche Automobil Holding SE (Germany) | | | 1,539,070 | | | $ | 89,140,923 | | |

INDUSTRIALS — 0.2% | |

General Electric Co., 5.00% 12/29/2049(h) | | | 28,026,000 | | | $ | 22,002,291 | | |

| TOTAL PREFERRED STOCKS — 1.1% (Cost $110,217,470) | | $ | 111,143,214 | | |

BONDS & DEBENTURES | |

ASSET-BACKED SECURITY — 0.1% | |

MARINE SHIPPING — 0.1% | |

Kamsarmax Shipping — 11.000% 7/31/2020(d)(e)(f)(Cost $6,847,314) | | $ | 6,847,314 | | | $ | 6,847,314 | | |

CORPORATE BONDS & NOTES | |

COMMUNICATIONS — 0.1% | |

Uber Technologies, Inc. — 8.000% 11/1/2026(i) | | $ | 7,066,000 | | | $ | 7,171,990 | | |

CONSUMER, CYCLICAL — 0.9% | |

Carnival Corp. — 11.500% 4/1/2023(i) | | $ | 30,383,000 | | | $ | 32,813,640 | | |

Royal Caribbean Cruises Ltd. — 11.500% 6/1/2025(i) | | | 61,108,000 | | | | 63,552,320 | | |

| | | $ | 96,365,960 | | |

ENERGY — 0.2% | |

California Resources Corp. — 6.000% 11/15/2024 | | $ | 2,171,000 | | | $ | 21,710 | | |

California Resources Corp. 2nd Lien — 8.000% 12/15/2022(i) | | | 30,851,000 | | | | 1,234,040 | | |

Gulfport Energy Corp. — 6.000% 10/15/2024 | | | 18,209,000 | | | | 9,468,680 | | |

16

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

BONDS & DEBENTURES — Continued | | Principal

Amount | | Fair Value | |

Gulfport Energy Corp. — 6.375% 5/15/2025 | | $ | 8,822,000 | | | $ | 4,368,258 | | |

Gulfport Energy Corp. — 6.375% 1/15/2026 | | | 9,128,000 | | | | 4,392,850 | | |

Gulfport Energy Corp. — 6.625% 5/1/2023 | | | 9,417,000 | | | | 5,556,030 | | |

| | | $ | 25,041,568 | | |

INDUSTRIAL — 0.5% | |

Bombardier, Inc. — 7.450% 5/1/2034(i) | | $ | 5,800,000 | | | $ | 3,538,000 | | |

Bombardier, Inc. — 7.500% 3/15/2025(i) | | | 66,677,000 | | | | 43,513,410 | | |

| | | $ | 47,051,410 | | |

TOTAL CORPORATE BONDS & NOTES — 1.7%

(Cost $194,500,970) | | $ | 175,630,928 | | |

CORPORATE BANK DEBT | |

Dell International LLC Term Loan B, 1M USD

LIBOR + 2.000% — 2.750% 9/19/2025(e)(h) | | $ | 17,242,393 | | | $ | 16,811,334 | | |

Gray Television, Inc. Term Loan, 1M USD

LIBOR + 2.250% — 2.421% 2/7/2024(e)(h) | | | 21,837,000 | | | | 21,018,112 | | |

Gray Television, Inc. Term Loan C, 1M USD

LIBOR + 2.500% — 2.671% 1/2/2026(e)(h) | | | 14,242,000 | | | | 13,779,135 | | |

Hall of Fame TL, 11.000% — 12.000% 10/31/2020(d)(e)(f) | | | 9,568,600 | | | | 8,133,310 | | |

McDermott International Inc. 1M USD

LIBOR + 9.000% — 9.794% 10/21/2020(e)(h) | | | 20,989,296 | | | | 20,779,403 | | |

McDermott International, Inc., 1M USD

LIBOR + 0.000% — 6.335% 5/10/2023(e)(h) | | | 10,089,206 | | | | 250,562 | | |

McDermott Technolgy Americas, Inc., 3M USD

LIBOR + 9.000% — 10.000% 10/21/2020(e)(h) | | | 7,744,573 | | | | 7,667,127 | | |

McDermott Technology Americas, Inc., 1M USD

LIBOR + 0.5000% PIK — 6.350% 5/4/2023(e)(h) | | | 64,586,000 | | | | 15,187,012 | | |

McDermott Technology Americas, Inc., 1M USD

LIBOR + 6.000% PIK — 6.350% 5/9/2025(e)(h) | | | 144,246,534 | | | | 48,322,589 | | |

McDermott Technology Americas, Inc. — 3M USD

LIBOR + 0.000% + 10.627% 10/23/2020(e)(h) | | | 45,270,878 | | | | (452,709 | ) | |

MEC Filo TL 1, 9.500% — 11.500% 2/12/2021(d)(e)(f) | | | 24,383,430 | | | | 20,725,915 | | |

Steenbok LUX Financial 2 SARL, PIK — 10.750%

12/31/2021(e)(h) | | | 1,000,000 | | | | 617,925 | | |

Western Digital Corp. Term Loan B 4, 1M USD

LIBOR + 1.750% — 1.924% 4/29/2023(e)(h) | | | 33,325,000 | | | | 32,491,875 | | |

| TOTAL CORPORATE BANK DEBT — 2.0% (Cost $264,719,643) | | $ | 205,331,590 | | |

17

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

MUNICIPALS | | Principal

Amount | | Fair Value | |

Commonwealth of Puerto Rico GO, Series 2014 A,

(SER A), — 8.000% 7/1/2035 | | $ | 111,230,000 | | | $ | 66,738,000 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.125% 7/1/2037 | | | 14,598,000 | | | | 14,889,960 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 5.250% 7/1/2029 | | | 5,198,000 | | | | 5,405,920 | | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority Rev.,

Series 2012 A, (SR LIEN-SER A), — 6.000% 7/1/2047 | | | 14,655,000 | | | | 15,204,562 | | |

Puerto Rico Public Buildings Authority Rev., Series 2012 U,

(REF-GOVT FACS-SER U), — 5.250% 7/1/2042 | | | 54,920,000 | | | | 38,032,100 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(CABS-RESTRUCTURED-SER A-1), — 0.000% 7/1/2024(j) | | | 2,175,000 | | | | 1,959,718 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(CABS-RESTRUCTURED-SER A-1), — 0.000% 7/1/2027(j) | | | 4,153,000 | | | | 3,418,127 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(CABS-RESTRUCTURED-SER A-1), — 0.00% 7/1/2029(j) | | | 4,047,000 | | | | 3,089,358 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(CABS-RESTRUCTURED-SER A-1), — 0.0000% 7/1/2031(j) | | | 5,216,000 | | | | 3,672,325 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(CABS-RESTRUCTURED-SER A-1), — 0.000% 7/1/2033(j) | | | 5,871,000 | | | | 3,795,191 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(CABS-RESTRUCTURED-SER A-1), — 0.000% 7/1/2046(j) | | | 55,871,000 | | | | 15,758,416 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(CABS-RESTRUCTURED-SER A-1), — 0.000% 7/1/2051(j) | | | 45,515,000 | | | | 9,239,090 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(RESTRUCTURED-SER A-2), — 4.3290% 7/1/2040 | | | 22,112,000 | | | | 22,214,379 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(RESTRUCTURED-SER A-1), — 4.500% 7/1/2034 | | | 4,298,000 | | | | 4,476,668 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(RESTRUCTURED-SER A-2), — 4.536% 7/1/2053 | | | 662,000 | | | | 670,824 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(RESTRUCTURED-SER A-1), — 4.550% 7/1/2040 | | | 2,177,000 | | | | 2,219,451 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(RESTRUCTURED-SER A-1), — 4.750% 7/1/2053 | | | 15,968,000 | | | | 16,409,675 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(RESTRUCTURED-SER A-2), — 4.784% 7/1/2058 | | | 8,865,000 | | | | 9,140,258 | | |

Puerto Rico Sales Tax Financing Corp. Sales Tax Rev.,

(RESTRUCTURED-SER A-1), — 5.000% 7/1/2058 | | | 40,380,000 | | | | 42,219,309 | | |

| TOTAL MUNICIPALS — 2.8% (Cost $181,604,303) | | $ | 278,553,331 | | |

18

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

U.S. TREASURIES | | Principal

Amount | | Fair Value | |

U.S. Treasury Bills — 0.091% 7/2/2020(j) | | $ | 110,000,000 | | | $ | 109,999,285 | | |

U.S. Treasury Bills — 0.238% 7/9/2020(j) | | | 35,000,000 | | | | 34,998,982 | | |

U.S. Treasury Bills — 0.112% 7/14/2020(j) | | | 50,000,000 | | | | 49,997,360 | | |

U.S. Treasury Bills — 0.078% 7/16/2020(j) | | | 50,000,000 | | | | 49,996,915 | | |

U.S. Treasury Bills — 0.079% 7/21/2020(j) | | | 70,000,000 | | | | 69,994,309 | | |

U.S. Treasury Bills — 0.096% 7/23/2020(j) | | | 70,000,000 | | | | 69,994,057 | | |

U.S. Treasury Bills — 0.106% 7/28/2020(j) | | | 70,000,000 | | | | 69,993,049 | | |

U.S. Treasury Bills — 0.110% 8/4/2020(j) | | | 70,000,000 | | | | 69,990,263 | | |

U.S. Treasury Bills — 0.111% 8/6/2020(j) | | | 50,000,000 | | | | 49,993,010 | | |

U.S. Treasury Bills — 0.122% 8/11/2020(j) | | | 90,000,000 | | | | 89,986,104 | | |

U.S. Treasury Bills — 0.143% 8/13/2020(j) | | | 95,000,000 | | | | 94,984,268 | | |

U.S. Treasury Bills — 0.120% 8/18/2020(j) | | | 54,000,000 | | | | 53,990,275 | | |

U.S. Treasury Bills — 0.155% 8/20/2020(j) | | | 54,000,000 | | | | 53,989,659 | | |

U.S. Treasury Bills — 0.131% 8/25/2020(j) | | | 54,000,000 | | | | 53,988,433 | | |

U.S. Treasury Bills — 0.110% 8/27/2020(j) | | | 125,000,000 | | | | 124,972,712 | | |

U.S. Treasury Bills — 0.148% 9/1/2020(j) | | | 50,000,000 | | | | 49,980,170 | | |

U.S. Treasury Bills — 0.158% 9/3/2020(j) | | | 50,000,000 | | | | 49,986,280 | | |

U.S. Treasury Bills — 0.132% 9/8/2020(j) | | | 65,000,000 | | | | 64,981,735 | | |

U.S. Treasury Bills — 0.139% 9/10/2020(j) | | | 65,000,000 | | | | 64,982,229 | | |

U.S. Treasury Bills — 0.127% 9/24/2020(j)(k) | | | 50,000,000 | | | | 49,983,190 | | |

U.S. Treasury Bills — 0.128% 10/15/2020(j) | | | 110,000,000 | | | | 109,948,388 | | |

U.S. Treasury Notes — 2.625% 7/31/2020(j) | | | 100,000,000 | | | | 100,209,650 | | |

| TOTAL U.S. TREASURIES — 15.4% (Cost $1,536,857,603) | | $ | 1,536,940,323 | | |

| TOTAL BONDS & DEBENTURES — 22.0% (Cost $2,184,529,833) | | $ | 2,203,303,486 | | |

TOTAL INVESTMENT SECURITIES — 96.4%

(Cost $8,507,374,665) | | $ | 9,626,232,916 | | |

SHORT-TERM INVESTMENTS | |

Apple, Inc. — 0.101% 7/20/2020 | | $ | 40,000,000 | | | $ | 39,997,889 | | |

Exxon Mobil Corp. — 0.132% 7/31/2020 | | | 75,000,000 | | | | 74,991,875 | | |

General Electric Co. | |

| — 0.274% 7/7/2020 | | | 40,000,000 | | | | 39,998,200 | | |

| — 0.274% 7/15/2020 | | | 40,000,000 | | | | 39,995,800 | | |

| — 0.284% 7/17/2020 | | | 30,000,000 | | | | 29,996,267 | | |

| — 0.284% 7/24/2020 | | | 10,000,000 | | | | 9,998,211 | | |

Johnson & Johnson — 0.101% 8/7/2020 | | | 40,000,000 | | | | 39,995,889 | | |

19

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

SHORT-TERM INVESTMENTS — Continued | | Shares or

Principal

Amount | | Fair Value | |

Nestle Cap Corp. | |

| — 0.071% 7/22/2020(i) | | $ | 40,000,000 | | | $ | 39,998,367 | | |

| — 0.081% 7/6/2020(i) | | | 25,000,000 | | | | 24,999,722 | | |

Roche Holding, Inc. | |

| — 0.091% 7/1/2020(i) | | | 25,000,000 | | | | 25,000,000 | | |

| — 0.101% 7/17/2020(i) | | | 20,000,000 | | | | 19,999,111 | | |

State Street Bank Repurchase Agreement — 0.00% 7/1/2020

(Dated 06/30/2020, repurchase price of $6,556,000,

collateralized by $6,164,400 principal amount

U.S. Treasury Notes — 2.63% 2023, fair value $6,687,172)(k) | | | 6,556,000 | | | | 6,556,000 | | |

| TOTAL SHORT-TERM INVESTMENTS — 3.9% (Cost $391,527,331) | | $ | 391,527,331 | | |

| TOTAL INVESTMENTS — 100.3% (Cost $8,898,901,996) | | $ | 10,017,760,247 | | |

SECURITIES SOLD SHORT — (2.9)% | |

COMMON STOCKS SOLD SHORT — (2.0)% | |

Financial Select Sector SPDR Fund | | | (5,206,957 | ) | | | (120,488,985 | ) | |

Softbank Corp. (Japan) | | | (1,443,159 | ) | | | (18,394,843 | ) | |

Volkswagen AG (Preference Shares) (Germany) | | | (408,519 | ) | | | (62,094,872 | ) | |

WW Grainger, Inc. | | | (13,425 | ) | | | (4,217,598 | ) | |

TOTAL COMMON STOCKS SOLD SHORT

(Proceeds $(185,133,002)) | | $ | (205,196,298 | ) | |

CORPORATE BONDS & NOTES SOLD SHORT — (0.9)% | |

Dell International LLC / EMC Corp. — 7.125% 6/15/2024(i) | | $ | (17,417,000 | ) | | $ | (18,021,152 | ) | |

Gray Television, Inc. — 5.125% 10/15/2024(i) | | | (21,837,000 | ) | | | (21,624,089 | ) | |

Gray Television, Inc. — 5.875% 7/15/2026(i) | | | (14,242,000 | ) | | | (14,170,790 | ) | |

Western Digital Corp. — 4.750% 2/15/2026 | | | (33,325,000 | ) | | | (34,408,063 | ) | |

TOTAL CORPORATE BONDS & NOTES SOLD SHORT

(Proceeds $(87,979,733)) | | $ | (88,224,094 | ) | |

| TOTAL SECURITIES SOLD SHORT (Proceeds $(273,112,735)) | | $ | (293,420,392 | ) | |

Other Assets and Liabilities, net — 2.6% | | | 260,735,081 | | |

NET ASSETS — 100.0% | | $ | 9,985,074,936 | | |

20

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

(a) Non-income producing security.

(b) As of June 30, 2020, investments with a value of $1,298,193,000 were fully or partially segregated with the broker(s)/custodian as collateral for short option contracts.

(c) Affiliated Security.

(d) Investments categorized as a significant unobservable input (Level 3) (See Note 6 of the Notes to Financial Statements).

(e) Restricted securities. These restricted securities constituted 5.07% of total net assets at June 30, 2020, most of which are considered liquid by the Adviser. These securities are not registered and may not be sold to the public. There are legal and/or contractual restrictions on resale. The Fund does not have the right to demand that such securities be registered. The values of these securities are determined by valuations provided by pricing services, brokers, dealers, market makers, or in good faith under policies adopted by authority of the Fund's Board of Trustees.

(f) These securities have been valued in good faith under policies adopted by authority of the Board of Trustees in accordance with the Fund's fair value procedures. These securities constituted 3.21% of total net assets at June 30, 2020.

(g) Controlled company.

(h) Variable/Floating Rate Security — The rate shown is based on the latest available information as of June 30, 2020. For Corporate Bank Debt, the rate shown may represent a weighted average interest rate. Certain variable rate securities are not based on a published rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description.

(i) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid.

(j) Zero coupon bond. Coupon amount represents effective yield to maturity.

(k) Security pledged as collateral (See Note 9 of the Notes to Financial Statements).

21

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

Purchased Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate Index | | Exercise

Rate | | Expiration

Date | | Counterparty | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 2/15/2023 | | Barclays

Bank PLC | | $ | 4,776,000,000 | | | $ | 1,265,640 | | | $ | 1,241,760 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 2/22/2023 | | Barclays

Bank PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,241,760 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 3/01/2023 | | Barclays

Bank PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,289,520 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 3/08/2023 | | Barclays

Bank PLC | | | 4,776,000,000 | | | | 1,265,640 | | | | 1,289,520 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 2/15/2023 | | Goldman

Sachs

International | | | 9,204,500,000 | | | | 2,531,237 | | | | 2,669,305 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 2/22/2023 | | Goldman

Sachs

International | | | 9,204,500,000 | | | | 2,531,238 | | | | 2,761,350 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 3/01/2023 | | Goldman

Sachs

International | | | 9,204,500,000 | | | | 2,531,237 | | | | 2,761,350 | | |

22

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate Index | | Exercise

Rate | | Expiration

Date | | Counterparty | | Notional

Amount | | Premium | | Fair Value | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 3/08/2023 | | Goldman

Sachs

International | | $ | 9,204,500,000 | | | | $ 2,531,238 | | | $ | 2,761,350 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 2/15/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 810,000 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 2/22/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 810,000 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 3/01/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 860,625 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | Maximum of

0, 30-Year —

3-Year —

USD-ISDA

Swap Rate — 0.04 | | 0.04% | | 3/08/2023 | | Morgan

Stanley | | | 5,062,500,000 | | | | 1,265,625 | | | | 860,625 | | |

Call —

CMS Cap

Swap(d)(e) | | Receive | | 3-Month

USD-LIBOR | | 2.89% | | 1/11/2029 | | Morgan

Stanley | | | 72,866,628 | | | | 3,563,250 | | | | 415,194 | | |

| | | $ | 23,813,260 | | | $ | 19,772,359 | | |

Written Options

Description | | Pay/

Receive

Floating

Rate | | Floating

Rate

Index | | Exercise

Rate | | Expiration

Date | | Counterparty | | Notional

Amount | | Premium | | Fair Value | |

Put —

CMS

Floor

Swap

(d)(e) | | Pay | | |

3-Month

USD-LIBOR | | | | 2.55 | % | | 1/11/2029 | | Morgan

Stanley | | $ | (72,866,628 | ) | | $ | (3,563,250 | ) | | $ | (13,358,347 | ) | |

23

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2020

(Unaudited)

Equity Options

Description | | Exercise

Price | | Expiration

Date | | Counterparty | | Number of

Contracts | | Notional

Amount | | Premium | | Fair Value | |

Put —

VMware, Inc.

(d)(e) | | $ | 105 | | | 01/21/2022 | | JP Morgan | | | 12,527 | | | $ | 1,252,700 | | | $ | 16,731,876 | | | $ | 12,965,445 | | |

Call —

VMware, Inc.

(d)(e) | | | 200 | | | 01/21/2022 | | JP Morgan | | | (9,173 | ) | | | (917,300 | ) | | | (12,141,641 | ) | | | (11,512,115 | ) | |

| | | $ | 4,590,235 | | | $ | 1,453,330 | | |

Swap Agreements outstanding as of June 30, 2020 were as follows:

Credit Default Swaps on Credit Indices — Buy Protection (1)

Description | | Payment

Frequency | | Fixed Deal

Pay Rate | | Expiration

Date | | Counterparty | | Notional

Amount (2) | | Value (3) | | Upfront

Payments

Paid

(Received) | | Unrealized

Appreciation

(Depreciation) | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 6/20/2024 | | Barclays

Bank PLC | | $ | 7,682,605 | | | $ | 171,187 | | | $ | 231,562 | | | $ | (60,375 | ) | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 6/20/2024 | | Goldman Sachs

International | | | 29,846,904 | | | | 642,113 | | | | 898,556 | | | | (256,443 | ) | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 12/20/2024 | | Goldman Sachs

International | | | 4,801,628 | | | | 157,718 | | | | 136,609 | | | | 21,109 | | |

Dell Inc. 7.1% Bonds

due 4/15/2028(d)(e) | | | Q | | | | 1.00 | % | | 6/20/2024 | | Morgan

Stanley | | | 17,362,671 | | | | 312,781 | | | | 485,979 | | | | (173,198 | ) | |

| | | | | | | | | | | | | $ | 1,283,799 | | | $ | 1,752,706 | | | $ | (468,907 | ) | |

(1) If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and deliver the referenced obligation or underlying investments comprising the referenced index or (ii) receive a net settlement amount in the form of cash or investments equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying investments comprising the referenced index.

(2) The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement.

(3) The quoted market prices and resulting values for credit default swap agreements on credit indices serve as an indicator of the current status of the payment/performance risk and represent the expected amount paid or received for the credit derivative had the notional amount of the swap agreement been closed/sold as of year-end. Increasing values (buy protection) or decreasing values (sell protection), when compared to the notional amount of the swap, represent a deterioration of the referenced entity's credit soundness and a greater likelihood of risk of default or other credit event occurring as defined under the terms of the agreement.

24

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES

June 30, 2020

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

Altaba Escrow

| | 09/26/2014, 09/29/2014,

09/30/2014, 10/03/2014,

10/06/2014, 10/07/2014,

08/28/2015, 11/01/2016,

11/02/2016, 11/03/2016 | | $ | — | | | $ | 97,501,690 | | | | 0.97 | % | |

CDS USD R V 03MEVENT | | 09/12/2019, 10/10/2019 | | | 231,562 | | | | 171,187 | | | | 0.00 | % | |

0DS USD R V 03MEVENT

| | 09/09/2019, 09/10/2019,

09/17/2019, 10/01/2019,

10/10/2019, 10/11/2019,

10/15/2019 | | | 898,556 | | | | 642,113 | | | | 0.01 | % | |

CDS USD R V 03MEVENT | | 11/01/2019 | | | 136,609 | | | | 157,718 | | | | 0.00 | % | |

CDS USD R V 03MEVENT | | 09/05/2019, 10/15/2019,

10/17/2019 | | | 485,979 | | | | 312,781 | | | | 0.00 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL

Barclays Bank PLC 4.000%

2/15/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,241,760 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL

Barclays Bank PLC 4.000%

2/22/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,241,760 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL

Barclays Bank PLC 4.000%

3/1/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,289,520 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL

Barclays Bank PLC 4.000%

3/8/2023 | | 02/26/2020 | | | 1,265,640 | | | | 1,289,520 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL

Goldman Sachs International

4.000% 2/15/2023 | | 02/26/2020 | | | 2,531,238 | | | | 2,669,305 | | | | 0.03 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL

Goldman Sachs International

4.000% 2/22/2023 | | 02/26/2020 | | | 2,531,238 | | | | 2,761,350 | | | | 0.03 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL

Goldman Sachs International

4.000% 3/1/2023 | | 02/26/2020 | | | 2,531,237 | | | | 2,761,350 | | | | 0.03 | % | |

25

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2020

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL

Goldman Sachs International

4.000% 3/8/2023 | | 02/26/2020 | | $ | 2,531,237 | | | $ | 2,761,350 | | | | 0.03 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 2/15/2023 | | 02/26/2020 | | | 1,265,625 | | | | 810,000 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

FEB23 4.000 CALL Morgan

Stanley 4.000% 2/22/2023 | | 02/26/2020 | | | 1,265,625 | | | | 810,000 | | | | 0.01 | % | |

CMS CAP SWAPTION 4.000

MAR23 4.000 CALL Morgan

Stanley 4.000% 3/1/2023 | | 02/26/2020 | | | 1,265,625 | | | | 860,625 | | | | 0.01 | % | |

CMS CAP SWAPTION 2.550

MAR23 2.550 CALL Morgan

Stanley 2.550% 3/8/2023 | | 02/26/2020 | | | 1,265,625 | | | | 860,625 | | | | 0.01 | % | |

CMS CAP SWAPTION 2.890

JAN29 2.890 CALL Morgan

Stanley 2.890% 1/11/029 | | 01/09/2019 | | | 3,563,250 | | | | 415,194 | | | | 0.00 | % | |

CMS FLOOR SWAPTION 2.550

JAN29 2.550 PUT Morgan

Stanley 2.550% 1/11/2029 | | 01/09/2019 | | | (3,563,250 | ) | | | (13,358,347 | ) | | | (0.13 | )% | |

Dell International LLC

Term Loan B, 1M USD

LIBOR + 2.000% —

2.750% 9/19/2025

| | 09/23/2019, 09/27/2019,

10/03/2019, 10/04/2019,

02/19/2020 | | | 17,322,047 | | | | 16,811,334 | | | | 0.17 | % | |

Epic Games, Inc.. | | 06/25/2020 | | | 19,049,750 | | | | 19,049,750 | | | | 0.19 | % | |

FPS LLC

| | 10/17/2018, 12/10/2018,

12/17/2018, 01/28/2019,

02/28/2019, 03/22/2019,

03/26/2019, 04/08/2019,

04/24/2019, 05/03/2019,

05/15/2019, 06/28/2019,

07/27/2019, 10/18/2019,

02/03/2020, 03/02/2020,

03/09/2020, 04/09/2020,

05/29/2020 | | | 95,713,502 | | | | 57,628,801 | | | | 0.57 | % | |

26

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2020

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

FPS Shelby Holding I LLC | | 02/04/2020, 03/26/2020 | | $ | 10,289,934 | | | $ | 8,746,444 | | | | 0.09 | % | |

GACP II LP

| | 01/12/2018, 02/27/2018,

04/13/2018, 05/17/2018,

06/21/2018, 06/28/2018,

11/27/2018, 02/01/2019,

07/22/2019, 09/30/2019,

01/17/2020 | | | 45,751,331 | | | | 45,984,593 | | | | 0.46 | % | |

Gray Television, Inc.

Term Loan, 1M USD

LIBOR + 2.250% —

2.421% 2/7/2024

| | 06/13/2019, 06/14/2019,

06/18/2019, 06/21/2019,

07/19/2019 | | | 21,837,928 | | | | 21,018,112 | | | | 0.21 | % | |

Gray Television, Inc.

Term Loan C, 1M USD

LIBOR + 2.500% —

2.671% 1/2/2026

| | 06/18/2019, 06/20/2019,

08/23/2019, 02/24/2020 | | | 14,269,481 | | | | 13,779,135 | | | | 0.14 | % | |

Hall of Fame TL, Fixed

11.000% — 12.000%

10/31/2020 | | 03/20/2018 | | | 9,568,600 | | | | 8,133,310 | | | | 0.08 | % | |

Kamsarmax Shipping —

11.00% 6/30/2020

| | 09/08/2015, 6/07/2017,

09/08/2017 | | | 6,847,315 | | | | 6,847,315 | | | | 0.07 | % | |

McDermott International, Inc.,

1M USD LIBOR + 0.000% —

6.335% 5/10/2023 | | 11/12/2019 | | | 973,079 | | | | 250,562 | | | | 0.00 | % | |

McDermott International Inc.

1M USD LIBOR + 9.000% —

9.794% 10/21/2020

| | 04/16/2020, 04/22/2020,

10/31/2019 | | | 20,989,296 | | | | 20,779,403 | | | | 0.21 | % | |

McDermott Technology

Americas, Inc. — 3M USD

LIBOR + 0.000% + 10.627%

10/23/2020 | | 02/28/2020 | | | (1,265,474 | ) | | | (452,709 | ) | | | 0.00 | % | |

27

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2020

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

McDermott Technology

Americas, Inc., 1M USD

LIBOR + 6.000% PIK —

6.350% 5/9/2025

| | 09/19/2019, 09/23/2019,

09/25/2019, 09/26/2019,

10/24/2019, 10/29/2019,

10/31/2019, 11/01/2019,

11/04/2019, 11/05/2019,

11/13/2019, 11/14/2019,

11/15/2019, 11/22/2019,

11/26/2019 | | $ | 87,471,295 | | | $ | 48,322,589 | | | | 0.48 | % | |

McDermott Technolgy

Americas, Inc., 3M USD

LIBOR + 9.000% —

10.000% 10/21/2020

| | 10/31/2020, 02/03/2020,

04/22/2020, 06/30/2020 | | | 7,563,535 | | | | 7,667,127 | | | | 0.08 | % | |

McDermott Technology

Americas, Inc., 1M USD

LIBOR + 0.5000% PIK —

6.350% 5/4/2023

| | 09/27/2019, 09/30/3019,

10/04/2019, 11/12/2019 | | | 27,825,587 | | | | 15,187,012 | | | | 0.15 | % | |

MEC Filo TL 1, 9.500% —

11.500% 2/12/2021

| | 06/29/2018, 10/31/2019,

11/07/2019 | | | 24,333,430 | | | | 20,725,915 | | | | 0.21 | % | |

Sound Holding FP | | 10/07/2013 | | | 68,546,025 | | | | 20,466,414 | | | | 0.20 | % | |

Steenbok LUX Financial

2 SARL, PIK — 10.750%

12/31/2021 | | 03/04/2020 | | | 824,138 | | | | 617,925 | | | | 0.01 | % | |

U.S. Farming Realty Trust, L.P.

| | 11/26/2010, 01/31/2011,

03/09/2011, 04/15/2011,

05/10/2011, 06/27/2011,

08/15/2011, 10/17/2011,

10/28/2011, 11/28/2011,

01/03/2012, 01/26/2012,

04/05/2012, 07/13/2012,

12/07/2012, 08/01/2013 | | | 26,888,976 | | | | 27,657,099 | | | | 0.28 | % | |

28

FPA CRESCENT FUND

PORTFOLIO OF INVESTMENTS — RESTRICTED SECURITIES (Continued)

June 30, 2020

(Unaudited)

Issuer | | Acquisition

Date(s) | | Cost | | Fair Value | | Fair

Value as a %

of Net Assets | |

U.S. Farming Realty Trust II, L.P.

| | 12/24/2012, 04/29/2013,