UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-08614

Brandes Investment Trust

(Exact name of registrant as specified in charter)

4275 Executive Square, Suite 500

La Jolla, California 92037

(Address of principal executive offices) (Zip code)

Lea Anne Copenhefer

Morgan, Lewis & Bockius LLP

One Federal Street

Boston, MA 02110-1726

(Name and address of agent for service)

(800) 331-2979

Registrant’s telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

Item 1. Reports to Stockholders.

(a) The following are copies of the reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “Act”) (17 CFR 270.30e-1):

GLOBAL EQUITY FUND

| • | Consideration of qualitative factors related to individual businesses and their industries. We spend a great deal of time analyzing and debating issues such as network effects, switching costs, R&D (research and development) productivity, and the persistence of earnings. Reversion to the mean has long been a tenet of value investing and while it may still be alive and well in many instances, its gravitational pull may not be as dependable as it once was for many industries. By analyzing companies one at a time, we’re able to consider whether reversion is likely in each specific case. For example, when Microsoft makes significant investments in R&D, we generally feel confident that they are skilled and scaled to likely earn an adequate return on that investment. In such cases, we may capitalize that R&D as an asset on the balance sheet and amortize it in the income statement to better match those investments with their potential future benefit. On the other hand, a company that is not on the leading edge, |

| • | Recognition of the speed and intensity of disruption. Technological and competitive disruption has always been a part of value investing but the speed and intensity has grown over the recent past. A research driven approach can be in tune with whether the future is likely to look like the past. When disruption is anticipated, the market often reacts, and we can make a business-like assessment about whether the market has over or under reacted. As a hypothetical example, Amazon may make a declaration that it will enter a new industry and this will likely have market moving effects on incumbent industry participants. However, our experienced industry analysts and investment committees will thoughtfully evaluate whether the market’s reaction was appropriate or whether an opportunity exists. |

| • | Ability to be nuanced when the market is indiscriminate. A recent example of this was at the beginning of the pandemic. The market was indiscriminate in selling economically sensitive companies and those with leveraged balance sheets. And while it’s true that there were many that did not have a strong enough financial position going into an economic downturn, a more careful analysis uncovered that some had been sold off despite their strong – and in some cases improving - competitive positions. |

| • | Capacity to deal with cyclical businesses. Cyclical businesses often represent attractive opportunities for longer-term investors, as the market’s increasingly short-term orientation tends to extrapolate the current environment – good or bad. At Brandes, we evaluate cyclical businesses via “normalized” or mid-cycle earnings. We appreciate the best time to invest in a cyclical business may be when its P/E is optically elevated due to cyclically depressed earnings, and that it can be quite risky to invest in low P/E cyclical companies if those earnings are inflated due to a cyclical peak. The events over the past year have offered up both conditions, with traditional economically sensitive companies experiencing depressed earnings, while ‘work from home’ beneficiaries have been experiencing a surge in profitability due to the pandemic. |

| • | a possible increase in inflation and interest rates, which has historically benefited value stocks and the Fund; and |

| • | a likely pickup in economic growth, which should benefit the earnings growth of our holdings. |

| Average Annual Total Return Periods Ended September 30, 2021 | |||||||||

| One Year | Three Years | Five Years | Ten Years | Since Inception(1) | |||||

| Brandes International Equity Fund | |||||||||

Class A* | 37.55% | 3.82% | 5.83% | 6.62% | 7.27% | ||||

Class A *(with maximum sales charge) | 29.69% | 1.79% | 4.58% | 6.00% | 7.02% | ||||

Class C* | 36.90% | 3.15% | 5.10% | 5.86% | 6.47% | ||||

Class C *(with maximum sales charge) | 35.90% | 3.15% | 5.10% | 5.86% | 6.47% | ||||

Class I | 37.87% | 4.10% | 6.08% | 6.85% | 7.51% | ||||

Class R6* | 38.03% | 4.20% | 6.21% | 6.96% | 7.59% | ||||

MSCI EAFE (Europe, Australasia and Far East) Index | 25.73% | 7.62% | 8.81% | 8.10% | 5.21% | ||||

| (1) | The inception date is January 2, 1997. |

| * | Performance shown prior to January 31, 2011 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Performance shown prior to February 1, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

| • | Merchant acceptance—provides merchants with a wide range of products and services, including the means to accept payments through equipment, underwriting and transaction processing. |

| • | Financial technology—provides financial institutions with technology solutions, such as back-end payment processing, to run their businesses. |

| • | Payments and network—provides products and services, such as outsourced information technology (IT) software to process digital payment transactions. |

| • | a possible increase in inflation and interest rates, which has historically benefitted value stocks and our Fund; and |

| • | a pickup in economic growth, which will likely benefit the earnings growth of our holdings. |

| Average Annual Total Return Periods Ended September 30, 2021 | |||||||||

| One Year | Three Years | Five Years | Ten Years | Since Inception(1) | |||||

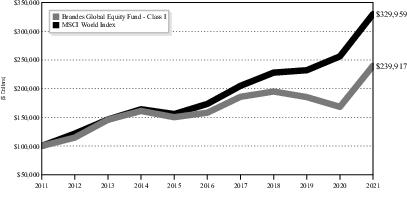

| Brandes Global Equity Fund | |||||||||

Class A* | 42.30% | 6.91% | 8.43% | 8.87% | 7.14% | ||||

Class A *(with maximum sales charge) | 34.10% | 4.82% | 7.16% | 8.23% | 6.66% | ||||

Class C* | 41.21% | 6.11% | 7.62% | 8.07% | 6.33% | ||||

Class C *(with maximum sales charge) | 40.22% | 6.11% | 7.62% | 8.07% | 6.33% | ||||

Class I | 42.67% | 7.16% | 8.71% | 9.15% | 7.39% | ||||

MSCI World Index | 28.82% | 13.14% | 13.74% | 12.68% | 10.43% | ||||

| (1) | The inception date is October 6, 2008. |

| * | Performance shown prior to January 31, 2011 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. |

| • | Equal access to education (e.g., new rules for after-school tutoring), lowering cost burden for parents to facilitate the three-child policy (with an emphasis on social equality); |

| • | Worker and labor protection (e.g., delivery employees); |

| • | Anti-monopoly (e.g., regulations for internet companies); |

| • | Data security (e.g., increased scrutiny of overseas listings; and |

| • | Containing financial risks (e.g., limiting leverage among real estate developers). |

| • | A potential for a multi-year upcycle for cyclical companies (e.g., those in energy and financials) led by both supply constraints and increased demand (not just sentiment-driven as in the early stage of the value stocks’ recovery); and |

| • | Normalization of economic activity in select emerging countries where the Fund has meaningful exposure, including Latin America and Southeast Asia. |

| Average Annual Total Return Periods Ended September 30, 2021* | |||||||||

| One Year | Three Years | Five Years | Ten Years | Since Inception(1) | |||||

| Brandes Emerging Markets Value Fund | |||||||||

Class A | 24.41% | 2.47% | 3.58% | 3.47% | 6.51% | ||||

Class A (with maximum sales charge) | 17.25% | 0.47% | 2.36% | 2.86% | 6.27% | ||||

Class C** | 24.01% | 1.87% | 2.90% | 2.75% | 5.71% | ||||

Class C **(with maximum sales charge) | 23.01% | 1.87% | 2.90% | 2.75% | 5.71% | ||||

Class I | 24.71% | 2.72% | 3.80% | 3.71% | 6.74% | ||||

Class R6** | 24.74% | 2.83% | 3.99% | 3.83% | 6.82% | ||||

MSCI Emerging Markets Index | 18.20% | 8.86% | 9.23% | 6.09% | 6.42% | ||||

| (1) | The inception date is August 20, 1996. |

| * | Prior to January 31, 2011, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes Emerging Markets Value Fund. The performance information shown for the Class I shares for periods before January 31, 2011 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to January 31, 2011 is based on a calculation method that is different from the standardized calculation method prescribed by the SEC. |

| The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. | |

| ** | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Performance shown prior to July 11, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

| Average Annual Total Return Periods Ended September 30, 2021* | |||||||||

| One Year | Three Years | Five Years | Ten Years | Since Inception(1) | |||||

| Brandes International Small Cap Equity Fund | |||||||||

Class A | 51.91% | 7.14% | 4.52% | 8.08% | 8.82% | ||||

Class A (with maximum sales charge) | 43.18% | 5.05% | 3.29% | 7.44% | 8.57% | ||||

Class C** | 51.52% | 6.52% | 3.86% | 7.33% | 8.03% | ||||

Class C **(with maximum sales charge) | 50.52% | 6.52% | 3.86% | 7.33% | 8.03% | ||||

Class I | 52.15% | 7.34% | 4.73% | 8.30% | 9.08% | ||||

Class R6** | 52.39% | 7.48% | 4.84% | 8.39% | 9.14% | ||||

S&P Developed Ex-U.S. SmallCap Index | 29.46% | 8.87% | 9.93% | 10.06% | 7.23% | ||||

| (1) | The inception date is August 19, 1996. |

| * | Prior to February 1, 2012, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes International Small Cap Fund. The performance information shown for the Class I shares for periods before February 1, 2012 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to February 1, 2012 is based on |

| a calculation method that is different from the standardized calculation method prescribed by the SEC. The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. | |

| ** | Performance shown prior to January 31, 2013 for Class C shares reflects the performance of Class I shares adjusted to reflect Class C expenses. Performance shown prior to June 27, 2016 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

| Average Annual Total Return Periods Ended September 30, 2021* | |||||||||

| One Year | Three Years | Five Years | Ten Years | Since Inception(1) | |||||

| Brandes Small Cap Value Fund | |||||||||

Class A | 57.55% | 12.90% | 11.88% | 15.52% | 7.77% | ||||

Class A (with maximum sales charge) | 48.49% | 10.69% | 10.55% | 14.85% | 7.50% | ||||

Class I | 58.09% | 13.28% | 12.22% | 15.82% | 8.05% | ||||

Class R6** | 59.25% | 10.87% | 10.90% | 15.14% | 7.78% | ||||

Russell 2000 Total Return Index | 47.68% | 10.54% | 13.45% | 14.63% | 8.22% | ||||

Russell 2000 Value Total Return Index | 63.92% | 8.59% | 1.03% | 13.22% | 8.63% | ||||

| (1) | The inception date is September 30, 1997. |

| * | Prior to January 2, 2018, the Advisor managed a private investment fund with an investment objective, investment policies and strategies that were, in all material respects, equivalent to those of the Brandes Small Cap Value Fund. The performance information shown for the Class I shares for periods before January 2, 2018 is that of the private investment fund and reflects the net expenses of the private investment fund. The performance of the private investment fund prior to January 2, 2018 is based on a calculation method that is different from the standardized calculation method prescribed by the SEC. |

| The performance information shown for the Class A shares has been adjusted to reflect the differences in the net expense ratios between the Class I and A shares. | |

| ** | Performance shown prior to January 2, 2018 for Class R6 shares reflects the performance of Class I shares. The private investment fund was not registered under the Investment Company Act of 1940 (“1940 Act”) and was not subject to certain investment limitations, diversification requirements, and other restrictions imposed by the 1940 Act and the Internal Revenue Code of 1986, which, if applicable, may have adversely affected its performance. |

| Average Annual Total Return Periods Ended September 30, 2021 | |||||||||

| One Year | Three Years | Five Years | Ten Years | Since Inception(1) | |||||

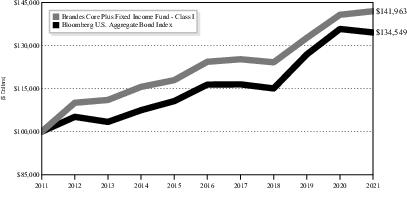

| Brandes Core Plus Fixed Income Fund | |||||||||

Class A* | 0.67% | 4.34% | 2.42% | 3.25% | 3.48% | ||||

Class A *(with maximum sales charge) | -3.10% | 3.04% | 1.63% | 2.86% | 3.19% | ||||

Class I | 0.89% | 4.57% | 2.69% | 3.57% | 3.78% | ||||

Class R6* | 2.23% | 5.48% | 3.43% | 3.97% | 4.08% | ||||

Bloomberg U.S. Aggregate Bond Index | -0.90% | 5.36% | 2.94% | 3.01% | 3.98% | ||||

| (1) | The inception date is December 28, 2007. |

| * | Performance shown prior to January 31, 2013 for Class A shares reflects the performance of Class I shares adjusted to reflect Class A expenses. Performance shown prior to October 10, 2017 for Class R6 shares reflects the performance of Class I shares adjusted to reflect Class R6 expenses. |

| Class A | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,036.00 | 1.09% | $5.57 | ||||

Global Equity Fund | $1,000.00 | $1,035.30 | 1.25% | $6.38 | ||||

Emerging Markets Value Fund | $1,000.00 | $ 987.40 | 1.29% | $6.44 | ||||

International Small Cap Fund | $1,000.00 | $1,100.10 | 1.31% | $6.92 | ||||

Small Cap Value Fund | $1,000.00 | $1,066.00 | 1.15% | $5.96 | ||||

Core Plus Fixed Income Fund | $1,000.00 | $1,018.90 | 0.50% | $2.53 | ||||

| Class C | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,034.90 | 1.26% | $ 6.42 | ||||

Global Equity Fund | $1,000.00 | $1,031.70 | 2.00% | $10.19 | ||||

Emerging Markets Value Fund | $1,000.00 | $ 987.80 | 1.10% | $ 5.50 | ||||

International Small Cap Fund | $1,000.00 | $1,101.80 | 0.95% | $ 5.00 | ||||

| Class I | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,036.70 | 0.85% | $4.34 | ||||

Global Equity Fund | $1,000.00 | $1,036.70 | 1.00% | $5.11 | ||||

Emerging Markets Value Fund | $1,000.00 | $ 987.30 | 1.12% | $5.58 | ||||

International Small Cap Fund | $1,000.00 | $1,101.00 | 1.11% | $5.87 | ||||

Small Cap Value Fund | $1,000.00 | $1,068.20 | 0.90% | $4.67 | ||||

Core Plus Fixed Income Fund | $1,000.00 | $1,019.80 | 0.30% | $1.52 | ||||

| Class R6 | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,037.40 | 0.75% | $3.83 | ||||

Emerging Markets Value Fund | $1,000.00 | $ 987.70 | 0.97% | $4.83 | ||||

International Small Cap Fund | $1,000.00 | $1,101.40 | 1.00% | $5.27 | ||||

Small Cap Value Fund | $1,000.00 | $1,072.00 | 0.72% | $3.74 | ||||

Core Plus Fixed Income Fund | $1,000.00 | $1,025.70 | 0.30% | $1.52 | ||||

| * | The Fund’s expenses are equal to the Fund’s expense ratio for the period, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one half-year period). |

| Class A | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,019.59 | 1.09% | $5.53 | ||||

Global Equity Fund | $1,000.00 | $1,018.80 | 1.25% | $6.33 | ||||

Emerging Markets Value Fund | $1,000.00 | $1,018.59 | 1.29% | $6.54 | ||||

International Small Cap Fund | $1,000.00 | $1,018.48 | 1.31% | $6.65 | ||||

Small Cap Value Fund | $1,000.00 | $1,019.30 | 1.15% | $5.82 | ||||

Core Plus Fixed Income Fund | $1,000.00 | $1,022.56 | 0.50% | $2.54 | ||||

| Class C | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,018.76 | 1.26% | $ 6.37 | ||||

Global Equity Fund | $1,000.00 | $1,015.04 | 2.00% | $10.10 | ||||

Emerging Markets Value Fund | $1,000.00 | $1,019.54 | 1.10% | $ 5.59 | ||||

International Small Cap Fund | $1,000.00 | $1,020.31 | 0.95% | $ 4.81 | ||||

| Class I | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,020.81 | 0.85% | $4.31 | ||||

Global Equity Fund | $1,000.00 | $1,020.05 | 1.00% | $5.06 | ||||

Emerging Markets Value Fund | $1,000.00 | $1,019.45 | 1.12% | $5.67 | ||||

International Small Cap Fund | $1,000.00 | $1,019.48 | 1.11% | $5.64 | ||||

Small Cap Value Fund | $1,000.00 | $1,020.56 | 0.90% | $4.56 | ||||

Core Plus Fixed Income Fund | $1,000.00 | $1,023.56 | 0.30% | $1.52 | ||||

| Class R6 | ||||||||

| Fund | Beginning Account Value | Ending Account Value | Annualized Expense Ratio | Expenses Paid During the Period* | ||||

International Equity Fund | $1,000.00 | $1,021.31 | 0.75% | $3.80 | ||||

Emerging Markets Value Fund | $1,000.00 | $1,020.21 | 0.97% | $4.91 | ||||

International Small Cap Fund | $1,000.00 | $1,020.05 | 1.00% | $5.06 | ||||

Small Cap Value Fund | $1,000.00 | $1,021.46 | 0.72% | $3.65 | ||||

Core Plus Fixed Income Fund | $1,000.00 | $1,023.56 | 0.30% | $1.52 | ||||

| * | The Fund’s expenses are equal to the Fund’s expense ratio for the period, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one half-year period). |

| Shares | Value | |

| COMMON STOCKS – 91.59% | ||

| Belgium – 1.18% | ||

| 136,828 | Anheuser-Busch InBev SA/NV | $ 7,760,530 |

| Brazil – 4.76% | ||

| 1,780,200 | Ambev SA | 5,001,526 |

| 868,979 | Embraer SA Sponsored – ADR(a) | 14,772,643 |

| 1,466,700 | Telefonica Brasil SA | 11,546,147 |

| 31,320,316 | ||

| Canada – 0.45% | ||

| 137,140 | Cameco Corp. | 2,980,052 |

| China – 1.76% | ||

| 627,200 | Alibaba Group Holding Ltd.(a) | 11,611,944 |

| France – 18.78% | ||

| 170,605 | BNP Paribas SA(b) | 10,915,428 |

| 852,822 | Carrefour SA | 15,283,800 |

| 209,852 | Danone SA | 14,307,280 |

| 992,123 | Engie SA | 12,980,143 |

| 1,082,792 | Orange SA | 11,710,250 |

| 272,138 | Publicis Groupe SA | 18,281,636 |

| 109,350 | Renault SA(a) | 3,879,401 |

| 180,384 | Sanofi | 17,364,495 |

| 109,119 | Societe BIC SA | 6,433,658 |

| 259,809 | TotalEnergies SE | 12,418,340 |

| 123,574,431 | ||

| Germany – 5.91% | ||

| 88,582 | BASF SE | 6,715,427 |

| 206,106 | Fresenius & Co. KGaA | 9,865,301 |

| 146,984 | HeidelbergCement AG | 10,965,505 |

| 131,661 | Henkel AG & Co. KGaA | 11,326,159 |

| 38,872,392 | ||

| Hong Kong – 0.65% | ||

| 11,842,000 | First Pacific Co. Ltd. | 4,259,356 |

| Ireland – 0.21% | ||

| 28,889 | CRH Plc | 1,355,644 |

| Italy – 6.09% | ||

| 225,294 | Buzzi Unicem SpA | 5,117,404 |

| 990,848 | Eni SpA | 13,213,163 |

| 4,158,760 | Intesa Sanpaolo SpA | 11,773,395 |

| Shares | Value | |

| 20,990,411 | Telecom Italia Rsp | $ 8,470,407 |

| 3,778,498 | Telecom Italia SpA | 1,477,435 |

| 40,051,804 | ||

| Japan – 13.81% | ||

| 243,700 | Dai Nippon Printing Co. Ltd. | 5,871,389 |

| 311,800 | Honda Motor Co. Ltd. | 9,585,921 |

| 2,132,500 | Mitsubishi UFJ Financial Group, Inc. | 12,605,920 |

| 400,799 | MS&AD Insurance Group Holdings, Inc. | 13,405,419 |

| 983,300 | Nissan Motor Co. Ltd.(a) | 4,914,011 |

| 299,200 | Sumitomo Mitsui Trust Holdings, Inc. | 10,304,460 |

| 154,400 | Taisho Pharmaceutical Holdings Co. Ltd. | 8,999,774 |

| 764,483 | Takeda Pharmaceutical Co. Ltd. | 25,214,774 |

| 90,901,668 | ||

| Mexico – 4.87% | ||

| 1,001,846 | Cemex SAB de CV Sponsored – ADR(a) | 7,183,236 |

| 14,129,438 | Fibra Uno Administracion SA de CV | 16,017,675 |

| 101,742 | Fomento Economico Mexicano SAB de CV – ADR | 8,823,066 |

| 32,023,977 | ||

| Netherlands – 1.01% | ||

| 1,283,691 | Aegon NV | 6,626,223 |

| South Korea – 4.25% | ||

| 150,417 | Hana Financial Group, Inc. | 5,846,984 |

| 39,208 | Hyundai Mobis Co. Ltd. | 8,273,599 |

| 115,220 | KT&G Corp. | 7,882,601 |

| 21,704 | POSCO | 5,976,385 |

| 27,979,569 | ||

| Spain – 1.44% | ||

| 727,871 | Repsol SA | 9,501,303 |

| Shares | Value | |

| Switzerland – 9.81% | ||

| 1,372,275 | Credit Suisse Group AG Registered | $ 13,552,948 |

| 184,979 | Novartis AG Registered | 15,168,132 |

| 16,342 | Swatch Group AG Bearer | 4,263,329 |

| 136,225 | Swatch Group AG Registered | 7,009,359 |

| 107,656 | Swiss Re AG | 9,188,461 |

| 964,218 | UBS Group AG Registered | 15,390,477 |

| 64,572,706 | ||

| United Kingdom – 16.61% | ||

| 2,632,376 | Barclays Plc | 6,688,813 |

| 3,059,491 | BP Plc | 13,935,537 |

| 1,074,306 | GlaxoSmithKline Plc | 20,275,560 |

| 400,385 | Imperial Brands Plc | 8,374,712 |

| 2,836,837 | J Sainsbury Plc | 10,872,980 |

| 1,310,844 | Kingfisher Plc | 5,916,987 |

| 2,661,252 | Marks & Spencer Group Plc(a) | 6,532,369 |

| Shares | Value | |

| 110,136 | Reckitt Benckiser Group Plc | $ 8,652,308 |

| 3,517,984 | Tesco Plc | 11,980,965 |

| 1,202,417 | WPP Plc | 16,109,465 |

| 109,339,696 | ||

| TOTAL COMMON STOCKS (Cost $628,186,488) | $602,731,611 | |

| PREFERRED STOCKS – 5.65% | ||

| Brazil – 1.70% | ||

| 2,233,200 | Petroleo Brasileiro SA, 2.82%(c) | $ 11,166,513 |

| Russia – 1.62% | ||

| 19,333,252 | Surgutneftegas PJSC, 16.67%(c) | 10,703,622 |

| Spain – 2.33% | ||

| 1,042,685 | Grifols SA – Class B, 5.59%(c) | 15,320,856 |

| TOTAL PREFERRED STOCKS (Cost $34,465,545) | $ 37,190,991 | |

| Shares | Value | |

| SHORT-TERM INVESTMENTS – 3.16% | ||

| Money Market Funds — 3.16% | ||

Northern Institutional Funds - Treasury Portfolio (Premier), 0.01%(d) | 20,773,725 | $ 20,773,725 |

TOTAL SHORT-TERM INVESTMENTS (Cost $20,773,725) | $ 20,773,725 | |

Total Investments (Cost $683,425,758) – 100.40% | $660,696,327 | |

Liabilities in Excess of Other Assets – (0.40)% | (2,612,304) | |

TOTAL NET ASSETS – 100.00% | $658,084,023 | |

| Percentages are stated as a percent of net assets. | ||

| ADR American Depositary Receipt | ||

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is on loan. See Note 2 in the Notes to Financial Statements. |

| (c) | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| (d) | The rate shown is the annualized seven day yield as of September 30, 2021. |

| COMMON STOCKS | |

Aerospace & Defense | 2.25% |

Auto Components | 1.25% |

Automobiles | 2.80% |

Banks | 8.83% |

Beverages | 3.28% |

Capital Markets | 4.40% |

Chemicals | 1.02% |

Commercial Services & Supplies | 1.87% |

Construction Materials | 3.75% |

Diversified Telecommunication Services | 5.04% |

Equity Real Estate Investment Trusts | 2.44% |

Food & Staples Retailing | 5.79% |

Food Products | 2.82% |

Health Care Providers & Services | 1.50% |

Household Products | 3.03% |

Insurance | 4.45% |

Internet & Direct Marketing Retail | 1.76% |

Media | 5.23% |

Metals & Mining | 0.91% |

Multiline Retail | 0.99% |

Multi-Utilities | 1.97% |

Oil, Gas & Consumable Fuels | 7.91% |

Pharmaceuticals | 13.22% |

Specialty Retail | 0.90% |

Textiles, Apparel & Luxury Goods | 1.71% |

Tobacco | 2.47% |

TOTAL COMMON STOCKS | 91.59% |

| PREFERRED STOCKS | |

Biotechnology | 2.33% |

Oil, Gas & Consumable Fuels | 3.32% |

TOTAL PREFERRED STOCKS | 5.65% |

SHORT-TERM INVESTMENTS | 3.16% |

TOTAL INVESTMENTS | 100.40% |

Liabilities in Excess of Other Assets | (0.40)% |

TOTAL NET ASSETS | 100.00% |

| Shares | Value | |

| COMMON STOCKS – 96.51% | ||

| Austria – 2.74% | ||

| 29,448 | Erste Group Bank AG | $ 1,293,039 |

| Brazil – 1.98% | ||

| 168,020 | Embraer SA(a) | 713,640 |

| 12,908 | Embraer SA Sponsored – ADR(a) | 219,436 |

| 933,076 | ||

| Chile – 0.56% | ||

| 5,632,734 | Enel Chile SA | 267,256 |

| China – 2.80% | ||

| 42,200 | Alibaba Group Holding Ltd.(a) | 781,288 |

| 90,399 | Gree Electric Appliances, Inc. of Zhuhai – Class A | 540,979 |

| 1,322,267 | ||

| France – 10.47% | ||

| 28,449 | Carrefour SA | 509,847 |

| 28,638 | Engie SA | 374,677 |

| 31,200 | Engie SA (Prime Fidelite 2019)(a) | 408,196 |

| 15,034 | Publicis Groupe SA | 1,009,951 |

| 12,685 | Sanofi | 1,221,109 |

| 2,650 | Schneider Electric SE | 441,368 |

| 20,488 | TotalEnergies SE(b) | 979,285 |

| 4,944,433 | ||

| Germany – 1.95% | ||

| 12,322 | HeidelbergCement AG | 919,263 |

| Ireland – 0.95% | ||

| 9,567 | CRH Plc | 448,940 |

| Italy – 1.16% | ||

| 41,240 | Eni SpA(b) | 549,944 |

| Japan – 1.17% | ||

| 18,000 | Honda Motor Co. Ltd. | 553,389 |

| Malaysia – 1.53% | ||

| 600,000 | Genting Berhad | 722,322 |

| Shares | Value | |

| Mexico – 2.33% | ||

| 668,608 | Fibra Uno Administracion SA de CV | $ 757,960 |

| 3,936 | Fomento Economico Mexicano SAB de CV – ADR | 341,330 |

| 1,099,290 | ||

| South Korea – 5.94% | ||

| 2,433 | Hyundai Mobis Co. Ltd. | 513,407 |

| 3,846 | Hyundai Motor Co. | 640,226 |

| 5,067 | KT&G Corp. | 346,651 |

| 13,607 | Samsung Electronics Co. Ltd. | 843,561 |

| 5,365 | SK Hynix, Inc. | 459,278 |

| 2,803,123 | ||

| Spain – 1.25% | ||

| 45,360 | Repsol SA | 592,109 |

| Switzerland – 2.71% | ||

| 80,146 | UBS Group AG Registered | 1,279,260 |

| United Kingdom – 14.92% | ||

| 156,540 | Barclays Plc | 397,765 |

| 215,586 | BP Plc | 981,963 |

| 61,223 | GlaxoSmithKline Plc | 1,155,472 |

| 40,460 | Imperial Brands Plc | 846,288 |

| 164,745 | J Sainsbury Plc | 631,432 |

| 164,394 | Kingfisher Plc | 742,054 |

| 14,819 | Royal Dutch Shell Plc – ADR – Class B | 656,037 |

| 217,768 | Tesco Plc | 741,638 |

| 66,573 | WPP Plc | 891,916 |

| 7,044,565 | ||

| United States – 44.05% | ||

| 1,866 | Amdocs Ltd. | 141,275 |

| 14,017 | American International Group, Inc. | 769,393 |

| 31,895 | Bank of America Corp. | 1,353,943 |

| 14,504 | Bank of New York Mellon Corp. | 751,887 |

| 12,799 | Cardinal Health, Inc. | 633,039 |

| 15,020 | Change Healthcare, Inc.(a) | 314,519 |

| 3,994 | Cigna Corp. | 799,439 |

| 18,575 | Citigroup, Inc. | 1,303,593 |

| 13,243 | Comcast Corp. – Class A | 740,681 |

| Shares | Value | |

| 8,977 | CVS Health Corp. | $ 761,788 |

| 4,807 | Emerson Electric Co. | 452,819 |

| 3,158 | FedEx Corp. | 692,518 |

| 4,092 | Fiserv, Inc.(a) | 443,982 |

| 3,110 | General Dynamics Corp. | 609,653 |

| 20,471 | Halliburton Co. | 442,583 |

| 2,822 | HCA Healthcare, Inc. | 684,956 |

| 4,845 | Ingredion, Inc. | 431,253 |

| 3,238 | JPMorgan Chase & Co. | 530,028 |

| 2,337 | Laboratory Corp. of America Holdings(a) | 657,725 |

| 4,426 | McKesson Corp. | 882,456 |

| 14,370 | Merck & Co., Inc. | 1,079,331 |

| 2,460 | Mohawk Industries, Inc.(a) | 436,404 |

| 22,147 | Old Republic International Corp. | 512,260 |

| 12,560 | OneMain Holdings, Inc. | 694,945 |

| 1,294 | Organon & Co. | 42,430 |

| 22,954 | Pfizer, Inc. | 987,252 |

| Shares | Value | |

| 2,517 | PNC Financial Services Group, Inc. | $ 492,426 |

| 7,801 | State Street Corp. | 660,901 |

| 9,998 | Textron, Inc. | 697,960 |

| 10,604 | Truist Financial Corp. | 621,925 |

| 25,275 | Wells Fargo & Co. | 1,173,013 |

| 20,796,377 | ||

| TOTAL COMMON STOCKS (Cost $37,124,560) | $45,568,653 | |

| PREFERRED STOCKS – 1.43% | ||

| South Korea – 0.38% | ||

| 3,072 | Samsung Electronics Co. Ltd., 2.104%(c) | $ 179,216 |

| Spain – 1.05% | ||

| 33,952 | Grifols SA – ADR, 5.980%(c) | 496,039 |

| TOTAL PREFERRED STOCKS (Cost $652,660) | $ 675,255 | |

| Shares | Value | |

| SHORT-TERM INVESTMENTS – 2.52% | ||

| Money Market Funds — 2.52% | ||

Northern Institutional Funds - Treasury Portfolio (Premier), 0.01%(d) | 1,190,091 | $ 1,190,091 |

TOTAL SHORT-TERM INVESTMENTS (Cost $1,190,091) | $ 1,190,091 | |

Total Investments (Cost $38,967,311) – 100.46% | $47,433,999 | |

Liabilities in Excess of Other Assets – (0.46)% | (219,518) | |

TOTAL NET ASSETS – 100.00% | $47,214,481 | |

| Percentages are stated as a percent of net assets. | ||

| ADR American Depositary Receipt | ||

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is on loan. See Note 2 in the Notes to Financial Statements. |

| (c) | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| (d) | The rate shown is the annualized seven day yield as of September 30, 2021. |

| COMMON STOCKS | |

Aerospace & Defense | 4.75% |

Air Freight & Logistics | 1.47% |

Auto Components | 1.09% |

Automobiles | 2.53% |

Banks | 15.18% |

Beverages | 0.72% |

Capital Markets | 5.70% |

Construction Materials | 2.90% |

Consumer Finance | 1.47% |

Electric Utilities | 0.56% |

Electrical Equipment | 1.90% |

Energy Equipment & Services | 0.94% |

Equity Real Estate Investment Trusts | 1.61% |

Food & Staples Retailing | 3.99% |

Food Products | 0.91% |

Health Care Providers & Services | 9.35% |

Health Care Technology | 0.67% |

Hotels, Restaurants & Leisure | 1.53% |

Household Durables | 2.07% |

Insurance | 2.72% |

Internet & Direct Marketing Retail | 1.65% |

IT Services | 1.24% |

Media | 5.60% |

Multi-Utilities | 1.65% |

Oil, Gas & Consumable Fuels | 7.95% |

Pharmaceuticals | 9.51% |

Semiconductors & Semiconductor Equipment | 0.97% |

Specialty Retail | 1.57% |

Technology Hardware, Storage & Peripherals | 1.79% |

Tobacco | 2.52% |

TOTAL COMMON STOCKS | 96.51% |

| PREFERRED STOCKS | |

Biotechnology | 1.05% |

Technology Hardware, Storage & Peripherals | 0.38% |

TOTAL PREFERRED STOCKS | 1.43% |

SHORT-TERM INVESTMENTS | 2.52% |

TOTAL INVESTMENTS | 100.46% |

Liabilities in Excess of Other Assets | (0.46)% |

TOTAL NET ASSETS | 100.00% |

| Shares | Value | |

| COMMON STOCKS – 96.06% | ||

| Argentina – 0.87% | ||

| 2,415,979 | YPF SA Sponsored – ADR(a) | $ 11,258,462 |

| Brazil – 7.07% | ||

| 2,653,919 | Embraer SA Sponsored – ADR(a) | 45,116,623 |

| 5,694,500 | Sendas Distribuidora SA | 19,909,706 |

| 1,125,300 | Telefonica Brasil SA | 8,858,580 |

| 630,648 | Telefonica Brasil SA – ADR | 4,893,828 |

| 6,051,000 | TIM SA(a) | 13,055,915 |

| 91,834,652 | ||

| Chile – 1.40% | ||

| 2,336,679 | Empresa Nacional de Telecomunicaciones SA | 9,626,841 |

| 102,629,673 | Enel Chile SA | 4,869,470 |

| 1,509,388 | Enel Chile SA Sponsored – ADR | 3,637,625 |

| 18,133,936 | ||

| China – 22.63% | ||

| 2,787,300 | Alibaba Group Holding Ltd.(a) | 51,603,907 |

| 11,775,000 | China Education Group Holdings Ltd. | 20,310,926 |

| 4,432,991 | China South Publishing & Media Group Co. Ltd. – Class A | 6,160,739 |

| 4,900,000 | Galaxy Entertainment Group Ltd.(a) | 25,142,054 |

| 21,333,500 | Genertec Universal Medical Group Co. Ltd.(b) | 16,678,920 |

| 3,599,996 | Gree Electric Appliances, Inc. of Zhuhai – Class A | 21,543,620 |

| 1,926,946 | Midea Group Co. Ltd. – Class A | 20,765,383 |

| Shares | Value | |

| 3,596,500 | Ping An Insurance Group Co. of China Ltd. – Class H | $ 24,597,822 |

| 11,240,200 | Shanghai Pharmaceuticals Holding Co. Ltd. – Class H | 21,785,740 |

| 15,603,000 | TravelSky Technology Ltd. – Class H | 30,094,312 |

| 1,600,000 | Weichai Power Co. Ltd. – Class H | 3,311,537 |

| 10,402,538 | Wens Foodstuffs Group Co. Ltd. – Class A | 23,305,638 |

| 10,355,400 | Wynn Macau Ltd.(a) | 8,714,031 |

| 645,248 | ZTO Express Cayman, Inc. – ADR | 19,783,304 |

| 293,797,933 | ||

| Czech Republic – 0.48% | ||

| 521,469 | O2 Czech Republic AS | 6,269,146 |

| Greece – 1.18% | ||

| 815,182 | Hellenic Telecommunications Organization SA | 15,301,974 |

| Hong Kong – 4.09% | ||

| 2,104,000 | AIA Group Ltd. | 24,205,272 |

| 28,461,920 | First Pacific Co. Ltd. | 10,237,246 |

| 10,597,500 | Lifestyle International Holdings Ltd.(a) | 5,752,137 |

| 5,041,200 | Luk Fook Holdings International Ltd. | 12,913,037 |

| 53,107,692 | ||

| India – 4.96% | ||

| 1,087,855 | HDFC Bank Ltd. | 23,256,445 |

| 6,401,487 | Indus Towers Ltd. | 26,462,122 |

| 3,608,486 | Zee Entertainment Enterprises Ltd. | 14,658,355 |

| 64,376,922 | ||

| Shares | Value | |

| Indonesia – 6.06% | ||

| 96,895,011 | Bank Rakyat Indonesia Persero Tbk PT | $ 25,827,053 |

| 6,759,412 | Gudang Garam Tbk PT | 15,322,239 |

| 37,711,800 | Indofood Sukses Makmur Tbk PT | 16,684,247 |

| 99,025,715 | XL Axiata Tbk PT | 20,876,016 |

| 78,709,555 | ||

| Malaysia – 1.95% | ||

| 21,002,200 | Genting Berhad | 25,283,910 |

| Mexico – 8.08% | ||

| 6,906,858 | America Movil SAB de CV | 6,109,984 |

| 4,076,770 | Cemex SAB de CV Sponsored – ADR(a) | 29,230,441 |

| 30,944,403 | Fibra Uno Administracion SA de CV | 35,079,768 |

| 107,399 | Fomento Economico Mexicano SAB de CV – ADR | 9,313,641 |

| 4,099,700 | Macquarie Mexico Real Estate Management SA de CV(b) | 4,895,846 |

| 13,730,184 | PLA Administradora Industrial S de RL de CV | 20,074,944 |

| 512,122 | Urbi Desarrollos Urbanos SAB de CV(a) | 229,495 |

| 104,934,119 | ||

| Panama – 2.15% | ||

| 644,836 | Banco Latinoamericano de Comercio Exterior SA – Class E | 11,310,424 |

| 203,802 | Copa Holdings SA – Class A(a) | 16,585,407 |

| 27,895,831 | ||

| Shares | Value | |

| Philippines – 1.51% | ||

| 12,309,934 | Bank of the Philippine Islands | $ 19,655,835 |

| Russia – 7.04% | ||

| 1,893,891 | Detsky Mir PJSC | 3,393,282 |

| 175,358 | Lukoil PJSC Sponsored – ADR | 16,700,991 |

| 4,445,561 | Mobile TeleSystems PJSC | 20,129,575 |

| 8,476,466 | Sberbank of Russia PJSC | 39,685,809 |

| 1,571,174 | Sistema PJSFC Sponsored – GDR | 11,557,392 |

| 91,467,049 | ||

| South Korea – 11.18% | ||

| 468,867 | KT&G Corp. | 32,076,821 |

| 110,930 | POSCO | 30,545,539 |

| 671,938 | Samsung Electronics Co. Ltd. | 41,656,528 |

| 636,890 | Shinhan Financial Group Co. Ltd. | 21,513,881 |

| 225,760 | SK Hynix, Inc. | 19,326,487 |

| 145,119,256 | ||

| Spain – 0.63% | ||

| 10,196,879 | Prosegur Cash SA(b) | 8,220,842 |

| Taiwan – 9.87% | ||

| 2,031,000 | Accton Technology Corp. | 19,141,294 |

| 267,000 | Largan Precision Co. Ltd. | 20,802,001 |

| 2,738,000 | Taiwan Semiconductor Manufacturng Co. Ltd. | 56,627,555 |

| 1,022,000 | Wiwynn Corp. | 31,647,049 |

| 128,217,899 | ||

| Thailand – 3.76% | ||

| 2,505,800 | Bangkok Bank PCL – Class F | 8,552,081 |

| 1,578,500 | Bangkok Bank PCL – NVDR | 5,387,286 |

| Shares | Value | |

| 92,422,081 | Jasmine Broadband Internet Infrastructure Fund – Class F | $ 27,315,526 |

| 2,106,600 | Siam Commercial Bank PCL – Class F | 7,542,130 |

| 48,797,023 | ||

| United Kingdom – 1.15% | ||

| 10,376,419 | Vivo Energy Plc(b) | 14,959,870 |

| TOTAL COMMON STOCKS (Cost $1,360,429,360) | $1,247,341,906 | |

| Shares | Value | |

| PREFERRED STOCKS – 2.73% | ||

| Brazil – 1.90% | ||

| 4,920,700 | Petroleo Brasileiro SA, 2.823%(c) | $ 24,604,629 |

| Russia – 0.83% | ||

| 19,459,575 | Surgutneftegas PJSC, 16.675%(c) | 10,773,560 |

| TOTAL PREFERRED STOCKS (Cost $32,041,544) | $ 35,378,189 | |

| Shares | Value | |

| SHORT-TERM INVESTMENTS – 1.15% | ||

| Money Market Funds — 1.15% | ||

Northern Institutional Funds - Treasury Portfolio (Premier), 0.01%(d) | 14,942,030 | $ 14,942,030 |

TOTAL SHORT-TERM INVESTMENTS (Cost $14,942,030) | $ 14,942,030 | |

Total Investments (Cost $1,407,412,934) – 99.94% | $1,297,662,125 | |

Other Assets in Excess of Liabilities – 0.06% | 832,352 | |

TOTAL NET ASSETS – 100.00% | $1,298,494,477 | |

| Percentages are stated as a percent of net assets. | ||

| ADR American Depositary Receipt | ||

| GDR Global Depositary Receipt | ||

| NVDR Non-Voting Depositary Receipt | ||

| (a) | Non-income producing security. |

| (b) | Acquired in a transaction exempt from registration under Rule 144A or Section 4(a)(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $44,755,478 which represented 3.45% of the net assets of the Fund. |

| (c) | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| (d) | The rate shown is the annualized seven day yield as of September 30, 2021. |

| COMMON STOCKS | |

Aerospace & Defense | 3.47% |

Air Freight & Logistics | 1.52% |

Airlines | 1.28% |

Banks | 11.67% |

Beverages | 0.72% |

Commercial Services & Supplies | 0.63% |

Communications Equipment | 1.47% |

Construction Materials | 2.25% |

Diversified Consumer Services | 1.56% |

Diversified Financial Services | 0.87% |

Diversified Telecommunication Services | 6.86% |

Electric Utilities | 0.66% |

Electronic Equipment, Instruments & Components | 1.60% |

Equity Real Estate Investment Trusts | 4.62% |

Food & Staples Retailing | 1.53% |

Food Products | 3.87% |

Health Care Providers & Services | 2.97% |

Hotels, Restaurants & Leisure | 4.56% |

Household Durables | 3.28% |

Insurance | 3.75% |

Internet & Direct Marketing Retail | 3.97% |

IT Services | 2.32% |

Machinery | 0.26% |

Media | 1.60% |

Metals & Mining | 2.35% |

Multiline Retail | 0.44% |

Oil, Gas & Consumable Fuels | 2.15% |

Semiconductors & Semiconductor Equipment | 5.85% |

Specialty Retail | 2.41% |

Technology Hardware, Storage & Peripherals | 5.65% |

Tobacco | 3.65% |

Wireless Telecommunication Services | 6.27% |

TOTAL COMMON STOCKS | 96.06% |

| PREFERRED STOCKS | |

Oil, Gas & Consumable Fuels | 2.73% |

TOTAL PREFERRED STOCKS | 2.73% |

SHORT-TERM INVESTMENTS | 1.15% |

TOTAL INVESTMENTS | 99.94% |

Other Assets in Excess of Liabilities | 0.06% |

TOTAL NET ASSETS | 100.00% |

| Shares | Value | |

| COMMON STOCKS – 95.88% | ||

| Austria – 0.92% | ||

| 236,282 | Addiko Bank AG | $ 3,722,283 |

| Belgium – 0.14% | ||

| 53,601 | Ontex Group NV(a) | 572,291 |

| Brazil – 6.30% | ||

| 6,005,740 | Embraer SA(a) | 25,508,473 |

| Canada – 5.73% | ||

| 300,490 | Cameco Corp. | 6,529,648 |

| 265,929 | Corby Spirit and Wine Ltd. | 3,793,887 |

| 683,724 | Dorel Industries, Inc. – Class B(a) | 5,894,731 |

| 2,718 | E-L Financial Corp. Ltd. | 2,006,397 |

| 321,037 | Sierra Wireless, Inc.(a) | 4,976,073 |

| 23,200,736 | ||

| Chile – 1.30% | ||

| 111,035,163 | Enel Chile SA | 5,268,285 |

| China – 2.09% | ||

| 12,512,900 | Boyaa Interactive International Ltd.(a) | 779,580 |

| 312,769 | China Yuchai International Ltd. | 4,250,530 |

| 9,469,000 | Weiqiao Textile Co. – Class H | 3,442,322 |

| 8,472,432 | ||

| France – 5.10% | ||

| 597,292 | Elior Group SA(a),(b) | 4,743,976 |

| 61,201 | Savencia SA | 4,452,029 |

| 123,079 | Societe BIC SA | 7,256,740 |

| 94,617 | Vicat SA | 4,206,387 |

| 20,659,132 | ||

| Germany – 1.01% | ||

| 52,362 | Draegerwerk AG & Co. KGaA | 4,070,923 |

| Greece – 0.60% | ||

| 236,992 | Sarantis SA | 2,437,735 |

| Hong Kong – 6.01% | ||

| 4,180,050 | APT Satellite Holdings Ltd. | 1,234,551 |

| 2,059,500 | Dickson Concepts International Ltd. | 1,079,401 |

| Shares | Value | |

| 70,600,000 | Emperor Watch & Jewellery Ltd. | $ 1,610,563 |

| 19,583,000 | First Pacific Co. Ltd. | 7,043,657 |

| 8,127,000 | PAX Global Technology Ltd. | 10,200,210 |

| 20,492,000 | Pico Far East Holdings Ltd. | 3,178,607 |

| 24,346,989 | ||

| Hungary – 2.17% | ||

| 6,437,565 | Magyar Telekom Telecommunications Plc | 8,786,920 |

| Ireland – 5.76% | ||

| 3,218,376 | AIB Group Plc(a) | 8,760,306 |

| 500,253 | Avadel Pharmaceuticals Plc – ADR(a) | 4,902,479 |

| 3,044,085 | C&C Group Plc(a) | 9,655,167 |

| 23,317,952 | ||

| Israel – 1.00% | ||

| 63,898 | Taro Pharmaceutical Industries Ltd.(a) | 4,065,830 |

| Italy – 1.89% | ||

| 148,403 | Buzzi Unicem SpA | 3,370,876 |

| 612,302 | Credito Emiliano SpA | 4,270,620 |

| 7,641,496 | ||

| Japan – 20.68% | ||

| 1,349,900 | Concordia Financial Group Ltd.(c) | 5,313,911 |

| 489,700 | Fuji Media Holdings, Inc. | 5,182,014 |

| 27,000 | Fukuda Denshi Co. Ltd. | 2,359,544 |

| 160,500 | Futaba Corp. | 1,134,986 |

| 1,875,100 | Hachijuni Bank Ltd. | 6,679,174 |

| 1,406,600 | Hyakugo Bank Ltd. | 4,089,463 |

| 373,600 | Japan Petroleum Exploration Co. Ltd. | 6,994,787 |

| 91,100 | Kaken Pharmaceutical Co. Ltd. | 3,748,628 |

| 336,100 | Kissei Pharmaceutical Co. Ltd. | 7,233,553 |

| Shares | Value | |

| 176,200 | Koatsu Gas Kogyo Co. Ltd. | $ 1,201,186 |

| 1,111,444 | Komori Corp. | 8,677,527 |

| 542,700 | Kyushu Financial Group, Inc. | 1,943,486 |

| 240,500 | Mitsubishi Shokuhin Co. Ltd. | 6,271,751 |

| 187,300 | Nichiban Co. Ltd. | 3,081,368 |

| 197,000 | Oita Bank Ltd. | 3,319,107 |

| 126,700 | Sankyo Co. Ltd. | 3,149,708 |

| 226,600 | Tachi-S Co. Ltd. | 2,568,367 |

| 110,500 | Taisho Pharmaceutical Holdings Co. Ltd. | 6,440,901 |

| 197,900 | Yodogawa Steel Works Ltd.(c) | 4,314,457 |

| 83,703,918 | ||

| Malaysia – 1.39% | ||

| 4,663,800 | Genting Berhad | 5,614,607 |

| Mexico – 6.97% | ||

| 357,715 | Cemex SAB de CV Sponsored – ADR(a) | 2,564,816 |

| 24,958,198 | Consorcio ARA SAB de CV | 5,199,247 |

| 279,501,983 | Desarrolladora Homex SAB de CV(a),(d) | 934,314 |

| 11,461,007 | Fibra Uno Administracion SA de CV | 12,992,639 |

| 5,145,255 | Macquarie Mexico Real Estate Management SA de CV(b) | 6,144,444 |

| 806,929 | Urbi Desarrollos Urbanos SAB de CV(a),(d) | 361,606 |

| 28,197,066 | ||

| Panama – 1.70% | ||

| 391,129 | Banco Latinoamericano de Comercio Exterior SA – Class E | 6,860,403 |

| Philippines – 0.47% | ||

| 1,314,612 | First Philippines Holdings Corp. | 1,921,277 |

| Shares | Value | |

| Slovenia – 2.14% | ||

| 474,148 | Nova Ljubljanska Banka – GDR(b) | $ 8,018,748 |

| 38,576 | Nova Ljubljanska Banka dd Registered – GDR | 652,394 |

| 8,671,142 | ||

| South Korea – 3.10% | ||

| 102,650 | Binggrae Co. Ltd. | 4,880,376 |

| 12,624 | Lotte Confectionery Co. Ltd. | 1,342,010 |

| 6,429 | Namyang Dairy Products Co. Ltd. | 2,326,712 |

| 49,142 | Samchully Co. Ltd. | 4,017,690 |

| 12,566,788 | ||

| Spain – 4.97% | ||

| 1,141,650 | Atresmedia Corp de Medios de Comunicacion SA(a) | 4,903,571 |

| 460,824 | Bankinter SA(c) | 2,696,346 |

| 910,066 | CaixaBank SA | 2,822,139 |

| 1,355,921 | Lar Espana Real Estate Socimi SA | 8,434,289 |

| 637,445 | Linea Directa Aseguradora SA Cia de Seguros y Reaseguros | 1,257,469 |

| 20,113,814 | ||

| Turkey – 1.04% | ||

| 1,949,432 | Ulker Biskuvi Sanayi AS | 4,191,290 |

| United Kingdom – 13.40% | ||

| 1,340,972 | Balfour Beatty Plc | 4,869,201 |

| 2,212,384 | De La Rue Plc(a) | 5,484,978 |

| 3,058,281 | J Sainsbury Plc | 11,721,726 |

| 1,060,472 | LSL Property Services Plc | 6,229,917 |

| 2,181,474 | Marks & Spencer Group Plc(a) | 5,354,695 |

| 12,083,967 | Mitie Group Plc(a) | 11,560,176 |

| 2,714,323 | Premier Foods Plc | 4,264,387 |

| 1,083,829 | Yellow Cake Plc(a),(b) | 4,775,348 |

| 54,260,428 | ||

| TOTAL COMMON STOCKS (Cost $358,507,655) | $388,172,210 | |

| Shares | Value | |

| PREFERRED STOCKS – 1.54% | ||

| Germany – 1.54% | ||

| 76,013 | Draegerwerk AG & Co. KGaA, 0.28%(e) | $ 6,229,514 |

| TOTAL PREFERRED STOCKS (Cost $4,889,447) | $ 6,229,514 | |

| INVESTMENT COMPANIES – 0.61% | ||

| Canada – 0.61% | ||

| 221,306 | Sprott Physical Uranium Trust(a) | $ 2,481,087 |

| TOTAL INVESTMENT COMPANIES (Cost $2,053,750) | $ 2,481,087 | |

| Shares | Value | |

| SHORT-TERM INVESTMENTS – 1.54% | ||

| Money Market Funds — 1.54% | ||

Northern Institutional Funds - Treasury Portfolio (Premier), 0.01%(f) | 6,218,660 | $ 6,218,660 |

TOTAL SHORT-TERM INVESTMENTS (Cost $6,218,660) | $ 6,218,660 | |

Total Investments (Cost $371,669,512) – 99.57% | $403,101,471 | |

Other Assets in Excess of Liabilities – 0.43% | 1,732,458 | |

TOTAL NET ASSETS – 100.00% | $404,833,929 | |

| Percentages are stated as a percent of net assets. | ||

| ADR American Depositary Receipt | ||

| GDR Global Depositary Receipt | ||

| (a) | Non-income producing security. |

| (b) | Acquired in a transaction exempt from registration under Rule 144A or Section 4(a)(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $23,682,516 which represented 5.85% of the net assets of the Fund. |

| (c) | All or a portion of this security is on loan. See Note 2 in the Notes to Financial Statements. |

| (d) | Affiliated issuer. See Note 8 in the Notes to Financial Statements. |

| (e) | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| (f) | The rate shown is the annualized seven day yield as of September 30, 2021. |

| COMMON STOCKS | |

Aerospace & Defense | 6.30% |

Auto Components | 0.63% |

Banks | 12.92% |

Beverages | 3.33% |

Chemicals | 0.30% |

Commercial Services & Supplies | 6.76% |

Communications Equipment | 1.23% |

Construction & Engineering | 1.20% |

Construction Materials | 2.50% |

Diversified Financial Services | 1.70% |

Diversified Telecommunication Services | 2.47% |

Electric Utilities | 1.77% |

Electrical Equipment | 0.28% |

Electronic Equipment, Instruments & Components | 2.52% |

Entertainment | 0.19% |

Equity Real Estate Investment Trusts | 6.81% |

Food & Staples Retailing | 4.45% |

Food Products | 7.04% |

Gas Utilities | 0.99% |

Health Care Equipment & Supplies | 1.59% |

Hotels, Restaurants & Leisure | 2.56% |

Household Durables | 3.07% |

Insurance | 0.80% |

Leisure Products | 0.78% |

Machinery | 3.19% |

Media | 3.27% |

Metals & Mining | 1.07% |

Multiline Retail | 1.32% |

Oil, Gas & Consumable Fuels | 3.34% |

Personal Products | 0.74% |

Pharmaceuticals | 6.52% |

Real Estate Management & Development | 1.54% |

Specialty Retail | 0.67% |

Textiles, Apparel & Luxury Goods | 0.85% |

Trading Companies & Distributors | 1.18% |

TOTAL COMMON STOCKS | 95.88% |

| PREFERRED STOCKS | |

Health Care Equipment & Supplies | 1.54% |

TOTAL PREFERRED STOCKS | 1.54% |

| INVESTMENT COMPANIES | |

Financial | 0.61% |

TOTAL INVESTMENT COMPANIES | 0.61% |

SHORT-TERM INVESTMENTS | 1.54% |

TOTAL INVESTMENTS | 99.57% |

Other Assets in Excess of Liabilities | 0.43% |

TOTAL NET ASSETS | 100.00% |

| Shares | Value | |

| COMMON STOCKS – 89.53% | ||

| Aerospace & Defense – 11.39% | ||

| 4,268 | Embraer SA Sponsored – ADR(a) | $ 72,556 |

| 680 | Moog, Inc. – Class A | 51,836 |

| 649 | National Presto Industries, Inc. | 53,270 |

| 4,739 | Park Aerospace Corp. | 64,830 |

| 242,492 | ||

| Banks – 2.79% | ||

| 575 | ACNB Corp. | 16,100 |

| 492 | Eagle Bancorp Montana, Inc. | 11,006 |

| 892 | National Bankshares, Inc. | 32,389 |

| 59,495 | ||

| Biotechnology – 6.87% | ||

| 1,376 | Eagle Pharmaceuticals, Inc.(a) | 76,753 |

| 11,508 | PDL BioPharma, Inc.(a),(b) | 28,425 |

| 223 | United Therapeutics Corp.(a) | 41,161 |

| 146,339 | ||

| Communications Equipment – 4.82% | ||

| 2,258 | NETGEAR, Inc.(a) | 72,053 |

| 1,972 | Sierra Wireless, Inc.(a) | 30,566 |

| 102,619 | ||

| Construction & Engineering – 2.64% | ||

| 10,334 | Orion Group Holdings, Inc.(a) | 56,217 |

| Electric Utilities – 1.00% | ||

| 357 | ALLETE, Inc. | 21,249 |

| Electronic Equipment, Instruments & Components – 3.05% | ||

| 3,568 | Arlo Technologies, Inc.(a) | 22,871 |

| 1,139 | Avnet, Inc. | 42,109 |

| 64,980 | ||

| Energy Equipment & Services – 4.77% | ||

| 2,254 | Dril-Quip, Inc.(a) | 56,756 |

| 1,331 | Halliburton Co. | 28,776 |

| 586 | Helmerich & Payne, Inc. | 16,062 |

| 101,594 | ||

| Equity Real Estate Investment Trusts – 3.01% | ||

| 2,467 | Equity Commonwealth | 64,093 |

| Shares | Value | |

| Food & Staples Retailing – 1.51% | ||

| 486 | Ingles Markets, Inc. – Class A | $ 32,091 |

| Food Products – 1.56% | ||

| 919 | Cal-Maine Foods, Inc. | 33,231 |

| Health Care Equipment & Supplies – 4.58% | ||

| 1,416 | Invacare Corp.(a) | 6,740 |

| 1,508 | LENSAR, Inc.(a) | 11,868 |

| 625 | Utah Medical Products, Inc. | 58,025 |

| 738 | Varex Imaging Corp.(a) | 20,812 |

| 97,445 | ||

| Health Care Providers & Services – 4.07% | ||

| 1,129 | MEDNAX, Inc.(a) | 32,097 |

| 560 | Premier, Inc. – Class A | 21,706 |

| 927 | Triple-S Management Corp. – Class B(a) | 32,788 |

| 86,591 | ||

| Household Durables – 3.13% | ||

| 2,397 | Dorel Industries, Inc. – Class B(a) | 20,666 |

| 1,784 | Taylor Morrison Home Corp.(a) | 45,991 |

| 66,657 | ||

| Insurance – 7.07% | ||

| 323 | American National Group, Inc. | 61,057 |

| 3,598 | Crawford & Co. – Class A | 32,274 |

| 272 | National Western Life Group, Inc. – Class A | 57,280 |

| 150,611 | ||

| IT Services – 0.52% | ||

| 658 | SolarWinds Corp. | 11,000 |

| Machinery – 6.48% | ||

| 5,904 | Graham Corp. | 73,209 |

| 1,007 | Hurco Companies, Inc. | 32,486 |

| 2,090 | L.B. Foster Co. – Class A(a) | 32,374 |

| 138,069 | ||

| Multi-Utilities – 0.99% | ||

| 540 | Avista Corp. | 21,125 |

| Oil, Gas & Consumable Fuels – 6.86% | ||

| 1,665 | Chesapeake Energy Corp. | 102,547 |

| 1,295 | World Fuel Services Corp. | 43,538 |

| 146,085 | ||

| Shares | Value | |

| Personal Products – 3.55% | ||

| 2,085 | Edgewell Personal Care Co. | $ 75,685 |

| Pharmaceuticals – 5.69% | ||

| 2,206 | Avadel Pharmaceuticals Plc – ADR(a) | 21,619 |

| 2,021 | Phibro Animal Health Corp. – Class A | 43,532 |

| 999 | Prestige Consumer Healthcare, Inc.(a) | 56,054 |

| 121,205 | ||

| Professional Services – 2.04% | ||

| 2,750 | Resources Connection, Inc. | 43,395 |

| Software – 0.38% | ||

| 657 | N-Able, Inc.(a) | 8,153 |

| Shares | Value | |

| Thrifts & Mortgage Finance – 0.76% | ||

| 638 | Territorial Bancorp, Inc. | $ 16,192 |

| TOTAL COMMON STOCKS (Cost $1,642,545) | $1,906,613 | |

| INVESTMENT COMPANIES – 1.75% | ||

| Financial – 1.75% | ||

| 3,328 | Sprott Physical Uranium Trust | $ 37,311 |

| TOTAL INVESTMENT COMPANIES (Cost $30,515) | $ 37,311 | |

| Principal Amount | Value | |

| CORPORATE BONDS – 0.62% | ||

| Multi-Utilities – 0.62% | ||

Avista Corp. 5.125%, 4/1/2022 | $ 13,000 | $ 13,300 |

TOTAL CORPORATE BONDS (Cost $13,308) | $ 13,300 | |

| Shares | Value | |

| SHORT-TERM INVESTMENTS – 10.14% | ||

Northern Institutional Funds - Treasury Portfolio (Premier), 0.010%(c) | 215,828 | $ 215,828 |

TOTAL SHORT-TERM INVESTMENTS (Cost $215,829) | $ 215,828 | |

Total Investments (Cost $1,902,197) – 102.04% | $ 2,173,052 | |

Liabilities in Excess of Other Assets – (2.04)% | (43,521) | |

TOTAL NET ASSETS – 100.00% | $ 2,129,531 | |

| Percentages are stated as a percent of net assets. | ||

| ADR American Depositary Receipt | ||

| (a) | Non-income producing security. |

| (b) | The price for this security was derived from an estimate of fair market value using methods approved by the Fund’s Board of Trustees. This security represents $28,425 or 1.33% of the Fund’s net assets and is classified as a Level 3 security. See Note 2 in the Notes to Financial Statements. |

| (c) | The rate shown is the annualized seven day yield as of September 30, 2021. |

| COMMON STOCKS | |

Brazil | 3.41% |

Canada | 2.41% |

Ireland | 1.02% |

United States | 82.69% |

TOTAL COMMON STOCKS | 89.53% |

| CORPORATE BONDS | |

United States | 0.62% |

TOTAL CORPORATE BONDS | 0.62% |

| INVESTMENT COMPANIES | |

Canada | 1.75% |

TOTAL INVESTMENT COMPANIES | 1.75% |

SHORT-TERM INVESTMENTS | 10.14% |

TOTAL INVESTMENTS | 102.04% |

Liabilities in Excess of Other Assets | (2.04)% |

TOTAL NET ASSETS | 100.00% |

| Shares | Value | |

| COMMON STOCKS – 0.00% | ||

| Household Durables – 0.00% | ||

Urbi Desarrollos Urbanos SAB de CV (a) | 1,564 | $ 701 |

TOTAL COMMON STOCKS (Cost $292,050) | $ 701 | |

| Principal Amount | Value | |

| FEDERAL AND FEDERALLY SPONSORED CREDITS – 5.59% | ||

| Federal Home Loan Mortgage Corporation – 1.84% | ||

Pool A9-3505 4.500%, 8/1/2040 | $ 52,195 | $ 58,328 |

Pool G0-6018 6.500%, 4/1/2039 | 16,832 | 19,446 |

Pool G1-8578 3.000%, 12/1/2030 | 722,938 | 762,780 |

Pool SD-8001 3.500%, 7/1/2049 | 261,292 | 276,147 |

Pool SD-8003 4.000%, 7/1/2049 | 318,367 | 340,827 |

| 1,457,528 | ||

| Federal National Mortgage Association – 3.75% | ||

Pool 934124 5.500%, 7/1/2038 | 37,795 | 44,029 |

Pool AL9865 3.000%, 2/1/2047 | 829,672 | 877,756 |

Pool AS6201 3.500%, 11/1/2045 | 266,616 | 285,914 |

Pool BJ2553 3.500%, 12/1/2047 | 254,378 | 270,951 |

Pool BN6683 3.500%, 6/1/2049 | 509,680 | 539,081 |

Pool CA1624 3.000%, 4/1/2033 | 546,734 | 579,233 |

Pool MA0918 4.000%, 12/1/2041 | 119,743 | 131,828 |

Pool MA3687 4.000%, 6/1/2049 | 222,092 | 237,725 |

| 2,966,517 | ||

TOTAL FEDERAL AND FEDERALLY SPONSORED CREDITS (Cost $4,180,565) | $ 4,424,045 | |

| OTHER MORTGAGE RELATED SECURITIES – 0.00% | ||

| Collateralized Mortgage Obligations – 0.00% | ||

Wells Fargo Mortgage Backed Securities Trust Series 2006-AR14 2.919%, 10/25/2036(b) | $ 505 | $ 487 |

TOTAL OTHER MORTGAGE RELATED SECURITIES (Cost $497) | $ 487 | |

| US GOVERNMENTS – 56.63% | ||

| Sovereign – 56.63% | ||

United States Treasury Note | ||

2.375%, 8/15/2024 | $ 6,360,000 | $ 6,701,602 |

2.250%, 2/15/2027 | 10,075,000 | 10,701,539 |

2.375%, 5/15/2029 | 15,900,000 | 17,067,656 |

United States Treasury Bond | ||

4.750%, 2/15/2037 | 5,775,000 | 8,150,194 |

3.500%, 2/15/2039 | 1,750,000 | 2,181,758 |

| Principal Amount | Value | |

TOTAL US GOVERNMENTS (Cost $43,148,147) | $ 44,802,749 | |

| CORPORATE BONDS – 33.46% | ||

| Automobiles – 0.93% | ||

Ford Motor Credit Co. LLC | ||

3.350%, 11/1/2022 | $ 370,000 | $ 376,516 |

3.375%, 11/13/2025 | 350,000 | 359,625 |

| 736,141 | ||

| Banks – 5.08% | ||

Fifth Third Bancorp 8.250%, 3/1/2038 | 175,000 | 290,227 |

Goldman Sachs Group, Inc. 3.800% (U.S. Treasury Yield Curve Rate CMT 5Y + 2.969%), Perpetual(c) | 585,000 | 598,894 |

JPMorgan Chase & Co. 3.598% (3M LIBOR + 3.470%), Perpetual(c) | 1,317,000 | 1,324,207 |

USB Capital IX 3.500% (3M LIBOR + 1.020%, minimum of 3.500%), Perpetual(c) | 1,830,000 | 1,805,417 |

| 4,018,745 | ||

| Commercial Services & Supplies – 3.02% | ||

Iron Mountain, Inc. 4.875%, 9/15/2027(d) | 645,000 | 669,626 |

Prime Security Services Borrower LLC | ||

5.750%, 4/15/2026(d) | 715,000 | 773,459 |

6.250%, 1/15/2028(d) | 915,000 | 945,909 |

| 2,388,994 | ||

| Consumer Products – 3.14% | ||

Avon Products, Inc. 6.500%, 3/15/2023 | 1,625,000 | 1,719,266 |

Travel + Leisure Co. 6.625%, 7/31/2026(d) | 670,000 | 762,976 |

| 2,482,242 | ||

| Containers & Packaging – 0.58% | ||

Sealed Air Corp. 4.000%, 12/1/2027(d) | 430,000 | 457,907 |

| Electric Utilities – 0.72% | ||

Commonwealth Edison Co. 5.900%, 3/15/2036 | 175,000 | 244,493 |

FirstEnergy Corp. 7.375%, 11/15/2031 | 240,000 | 327,854 |

| 572,347 | ||

| Principal Amount | Value | |

| Equipment – 0.02% | ||

Continental Airlines Pass Through Trust Series 2007-1 5.983%, 4/19/2022 | $ 14,355 | $ 14,542 |

| Food, Beverage & Tobacco – 1.13% | ||

Pilgrim's Pride Corp. | ||

5.875%, 9/30/2027(d) | 210,000 | 223,283 |

4.250%, 4/15/2031(d) | 625,000 | 671,562 |

| 894,845 | ||

| Health Care Facilities & Services – 1.35% | ||

Tenet Healthcare Corp. 4.875%, 1/1/2026(d) | 1,030,000 | 1,065,968 |

| Homebuilders – 2.49% | ||

PulteGroup, Inc. 5.500%, 3/1/2026 | 980,000 | 1,135,879 |

Toll Brothers Finance Corp. 4.875%, 11/15/2025 | 745,000 | 834,400 |

| 1,970,279 | ||

| Media – 0.88% | ||

Charter Communications Operating LLC 4.908%, 7/23/2025 | 295,000 | 331,764 |

Netflix, Inc. 4.375%, 11/15/2026 | 330,000 | 368,775 |

| 700,539 | ||

| Oil, Gas & Consumable Fuels – 6.56% | ||

BP Capital Markets Plc 3.506%, 3/17/2025 | 810,000 | 876,933 |

Continental Resources, Inc. | ||

4.500%, 4/15/2023 | 355,000 | 367,869 |

4.375%, 1/15/2028 | 215,000 | 237,844 |

Exxon Mobil Corp. 2.397%, 3/6/2022 | 945,000 | 950,349 |

Kinder Morgan, Inc. 4.300%, 6/1/2025 | 1,054,000 | 1,164,031 |

Occidental Petroleum Corp. 3.500%, 6/15/2025 | 555,000 | 576,867 |

Range Resources Corp. 4.875%, 5/15/2025 | 960,000 | 1,013,568 |

| 5,187,461 | ||

| Technology – 3.57% | ||

Microsoft Corp. 2.400%, 2/6/2022 | 1,000,000 | 1,005,589 |

| Principal Amount | Value | |

MicroStrategy, Inc. 0.000%, 2/15/2027(d),(e) | $ 640,000 | $ 471,156 |

VMware, Inc. | ||

4.500%, 5/15/2025 | 215,000 | 239,472 |

3.900%, 8/21/2027 | 995,000 | 1,108,788 |

| 2,825,005 | ||

| Telecommunications – 3.80% | ||

AT&T, Inc. 3.000%, 6/30/2022 | 1,630,000 | 1,654,511 |

Sprint Spectrum Co. LLC 5.152%, 3/20/2028(d) | 415,000 | 474,138 |

Telecom Italia Capital SA 6.375%, 11/15/2033 | 480,000 | 558,576 |

T-Mobile USA, Inc. 4.750%, 2/1/2028 | 300,000 | 318,750 |

| 3,005,975 | ||

| Transportation & Logistics – 0.19% | ||

Allison Transmission, Inc. 4.750%, 10/1/2027(d) | 145,000 | 150,800 |

TOTAL CORPORATE BONDS (Cost $24,847,881) | $ 26,471,790 | |

| ASSET BACKED SECURITIES – 1.67% | ||

| Student Loan – 1.67% | ||

SLM Private Credit Student Loan Trust Series 2007-A, 0.356%, (3M LIBOR + 0.240%), 12/16/2041(c) | $ 201,144 | $ 198,446 |

SLM Private Credit Student Loan Trust Series 2004-B, 0.546%, (3M LIBOR + 0.430%), 9/15/2033(c) | 300,000 | 296,313 |

SLM Private Credit Student Loan Trust Series 2005-A, 0.426%, (3M LIBOR + 0.310%), 12/15/2038(c) | 324,989 | 320,284 |

SLM Private Credit Student Loan Trust Series 2006-A, 0.406%, (3M LIBOR + 0.290%), 6/15/2039(c) | 519,427 | 510,443 |

TOTAL ASSET BACKED SECURITIES (Cost $1,245,959) | $ 1,325,486 | |

| FOREIGN ISSUER BONDS – 0.26% | ||

| Telecommunications – 0.26% | ||

SoftBank Group Corp., 4.750%, 9/19/2024 | $ 200,000 | $ 205,811 |

TOTAL FOREIGN ISSUER BONDS (Cost $207,762) | $ 205,811 | |

| Shares | Value | |

| SHORT-TERM INVESTMENTS – 4.80% | ||

| Money Market Funds – 4.80% | ||

Northern Institutional Funds - Treasury Portfolio (Premier), 0.01%(f) | 3,794,442 | $ 3,794,442 |

TOTAL SHORT-TERM INVESTMENTS (Cost $3,794,442) | $ 3,794,442 | |

Total Investments (Cost $77,717,303) – 102.41% | $81,025,511 | |

Liabilities in Excess of Other Assets – (2.41)% | (1,909,080) | |

Total Net Assets – 100.00% | $79,116,431 | |

| Percentages are stated as a percent of net assets. | ||

| LIBOR London Interbank Offered Rate | ||

| (a) | Non-income producing security. |

| (b) | Variable rate security. The coupon is based on an underlying pool of loans. |

| (c) | Variable rate security. The coupon is based on a reference index and spread index. |

| (d) | Acquired in a transaction exempt from registration under Rule 144A or Section 4(a)(2) of the Securities Act of 1933. May be resold in the U.S. in transactions exempt from registration, normally to qualified institutional buyers. The total value of all such securities was $6,666,784 which represented 8.43% of the net assets of the Fund. |

| (e) | Zero coupon bond. |

| (f) | The rate shown is the annualized seven day yield as of September 30, 2021. |

| Brandes International Equity Fund | Brandes Global Equity Fund | ||

| ASSETS | |||

| Investment in securities, at value(1), (2) | |||

Unaffiliated issuers | $660,696,327 | $47,433,999 | |

Affiliated issuers | — | — | |

Foreign Currency(1) | 373,993 | 11,504 | |

| Receivables: | |||

Securities sold | 1,189,158 | — | |

Fund shares sold | 379,129 | — | |

Dividends and interest | 2,293,851 | 99,624 | |

Tax reclaims | 1,522,069 | 43,175 | |

Securities lending | 6,169 | 326 | |

Receivable from service providers | 16,987 | 849 | |

Prepaid expenses and other assets | 35,889 | 33,346 | |

Due from Advisor | — | — | |

Total Assets | 666,513,572 | 47,622,823 | |

| LIABILITIES | |||

| Payables: | |||

Securities purchased | 6,454,407 | 141,444 | |

Fund shares redeemed | 1,294,993 | 147,695 | |

12b-1 Fee | 13,605 | 731 | |

Trustee Fees | 17,806 | 1,269 | |

Custodian Fee | 13,002 | 1,166 | |

Foreign capital gains taxes | — | — | |

Dividends payable | 59,033 | 1,456 | |

Accrued expenses | 189,882 | 88,709 | |

Due to Advisor | 386,821 | 25,872 | |

Total Liabilities | 8,429,549 | 408,342 | |

NET ASSETS | $658,084,023 | $47,214,481 | |

| COMPONENTS OF NET ASSETS | |||

Paid in Capital | $751,775,768 | $37,517,803 | |

Total distributable earnings (loss) | (93,691,745) | 9,696,678 | |

Total Net Assets | $658,084,023 | $47,214,481 | |

| Net asset value, offering price and redemption proceeds per share | |||

| Class A Shares | |||

Net Assets | $ 38,232,483 | $ 824,098 | |

Shares outstanding (unlimited shares authorized without par value) | 2,109,773 | 31,060 | |

Offering and redemption price | $ 18.12 | $ 26.53 | |

Maximum offering price per share* | $ 19.23 | $ 28.15 | |

| Class C Shares | |||

Net Assets | $ 8,826,454 | $ 899,546 | |

Shares outstanding (unlimited shares authorized without par value) | 496,373 | 34,266 | |

Offering and redemption price | $ 17.78 | $ 26.25 | |

| Class I Shares | |||

Net Assets | $552,182,798 | $45,490,837 | |

Shares outstanding (unlimited shares authorized without par value) | 30,315,510 | 1,698,581 | |

Offering and redemption price | $ 18.21 | $ 26.78 | |

| Class R6 Shares | |||

Net Assets | $ 58,842,288 | $ N/A | |

Shares outstanding (unlimited shares authorized without par value) | 3,211,309 | N/A | |

Offering and redemption price | $ 18.32 | $ N/A | |

| (1)Cost of: | |||

| Investments in securities | |||

Unaffiliated issuers | $683,425,758 | $38,967,311 | |

Affiliated issuers | — | — | |

Foreign currency | 373,993 | 11,504 | |

(2)Market value of securities loaned of: | $ 10,852,067 | $1,459,724 |

| * | Includes a sales load of 5.75% for the International, Global, Emerging Markets, International Small Cap, and Small Cap Value Funds and 3.75% for the Core Plus Fund. (see Note 7 of the Notes to Financial Statements) |

| Brandes Emerging Markets Value Fund | Brandes International Small Cap Equity Fund | Brandes Small Cap Value Fund | Brandes Core Plus Fixed Income Fund | ||||

| $1,297,662,125 | $ 401,805,551 | $2,173,052 | $81,025,511 | ||||

| — | 1,295,920 | — | — | ||||

| 69,393 | 33,526 | — | — | ||||

| 15,379,890 | 4,193,825 | 2,177 | — | ||||

| 890,317 | 146,898 | — | 3,090 | ||||

| 1,997,310 | 1,055,196 | 1,727 | 473,748 | ||||

| 183,657 | 352,498 | — | — | ||||

| — | 560 | — | — | ||||

| 34,161 | 8,476 | 12 | 1,873 | ||||

| 59,071 | 45,282 | 18,328 | 24,053 | ||||

| — | — | 4,309 | — | ||||

| 1,316,275,924 | 408,937,732 | 2,199,605 | 81,528,275 | ||||

| 7,267,861 | 1,525,104 | 29,622 | 2,244,988 | ||||

| 4,424,221 | 1,956,805 | 174 | 38,142 | ||||

| 51,745 | 17,679 | 143 | 208 | ||||

| 34,909 | 11,053 | 69 | 2,143 | ||||

| 37,442 | 11,329 | 558 | 600 | ||||

| 3,960,746 | — | — | — | ||||

| 639,533 | 1,810 | 1 | — | ||||

| 336,480 | 253,439 | 39,507 | 122,398 | ||||

| 1,028,510 | 326,584 | — | 3,365 | ||||

| 17,781,447 | 4,103,803 | 70,074 | 2,411,844 | ||||

| $1,298,494,477 | $ 404,833,929 | $2,129,531 | $79,116,431 | ||||

| $1,534,384,976 | $ 531,263,765 | $1,819,591 | $77,341,187 | ||||

| (235,890,499) | (126,429,836) | 309,940 | 1,775,244 | ||||

| $1,298,494,477 | $ 404,833,929 | $2,129,531 | $79,116,431 | ||||

| $ 216,221,077 | $ 68,002,373 | $ 510,132 | $ 1,003,896 | ||||

| 24,980,158 | 4,853,710 | 38,589 | 107,372 | ||||

| $ 8.66 | $ 14.01 | $ 13.22 | $ 9.35 | ||||

| $ 9.19 | $ 14.86 | $ 14.03 | $ 9.71 | ||||

| $ 10,331,294 | $ 5,322,866 | $ N/A | $ N/A | ||||

| 1,202,853 | 394,459 | N/A | N/A | ||||

| $ 8.59 | $ 13.49 | $ N/A | $ N/A | ||||

| $1,003,836,647 | $ 318,004,709 | $1,619,243 | $78,112,432 | ||||

| 115,254,129 | 22,564,820 | 121,423 | 8,284,708 | ||||

| $ 8.71 | $ 14.09 | $ 13.34 | $ 9.43 | ||||

| $ 68,105,459 | $ 13,503,981 | $ 156 | $ 103 | ||||

| 7,772,271 | 955,087 | 12 | 11 | ||||

| $ 8.76 | $ 14.14 | $ 12.53 | $ 9.43 | ||||

| $1,407,412,934 | $ 340,786,638 | $1,902,197 | $77,717,303 | ||||

| — | 30,882,874 | — | — | ||||

| 70,437 | 33,287 | — | — | ||||

| $ — | $ 5,110,655 | $ — | $— |

| Brandes International Equity Fund | Brandes Global Equity Fund | ||

| INVESTMENT INCOME | |||

| Income | |||

| Dividend income | |||

Unaffiliated issuers | $ 26,149,164 | $ 1,498,825 | |

Non Cash Dividends | — | — | |

Less: Foreign taxes withheld | (1,644,362) | (62,551) | |

Interest income | — | — | |

Income from securities lending | 202,923 | 5,726 | |

Total Income | 24,707,725 | 1,442,000 | |

| Expenses | |||

Advisory fees (Note 3) | 4,522,555 | 327,750 | |

Custody fees | 69,329 | 4,646 | |

Administration fees (Note 3) | 138,898 | 20,609 | |

Insurance expense | 18,743 | 1,198 | |

Legal fees | 38,633 | 2,642 | |

Printing fees | 36,895 | 4,321 | |

Miscellaneous | 41,120 | 5,703 | |

Registration expense | 68,504 | 46,023 | |

Trustees fees | 65,776 | 4,464 | |

Transfer agent fees | 126,910 | 8,621 | |

12b-1 Fees – Class A | 76,143 | 1,821 | |

12b-1 Fees – Class C | 67,855 | 6,528 | |

Shareholder Service Fees – Class C | 22,618 | 2,176 | |

Sub-Transfer Agency Fees – Class I | 253,642 | 19,685 | |

Auditing fees | 40,258 | 43,313 | |

Total expenses | 5,587,879 | 499,500 | |

Expenses waived by Advisor | (311,474) | (78,902) | |

Expenses recouped | — | 3,166 | |

Expenses waived by Service Providers | (67,623) | (3,394) | |

Total net expenses | 5,208,782 | 420,370 | |

Net investment income | 19,498,943 | 1,021,630 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |||

| Net realized gain (loss) on: | |||

Unaffiliated investments | (474,713) | 1,871,263 | |

Affiliated investments | — | — | |

Foreign currency transactions | (131,250) | (4,557) | |

Net realized gain (loss) | (605,963) | 1,866,706 | |

| Net change in unrealized appreciation (depreciation) on: | |||

Unaffiliated investments (net of increase in estimated foreign capital gains taxes of $3,797,746 for the Emerging Markets Fund) | 154,701,750 | 9,678,417 | |

Affiliated investments | — | — | |

Foreign currency transactions | (29,853) | (3,044) | |

Net change in unrealized appreciation (depreciation) | 154,671,897 | 9,675,373 | |

Net realized and unrealized gain (loss) on investments and foreign currency transactions | 154,065,934 | 11,542,079 | |

Net increase (decrease) in net assets resulting from operations | $173,564,877 | $12,563,709 |

| Brandes Emerging Markets Value Fund | Brandes International Small Cap Equity Fund | Brandes Small Cap Value Fund | Brandes Core Plus Fixed Income Fund | |||

| $ 50,303,265 | $ 10,206,130 | $ 24,730 | $ 247 | |||

| — | — | 3,038 | — | |||

| (6,750,188) | (977,197) | — | (31) | |||

| — | — | 411 | 2,038,588 | |||

| — | 15,382 | — | — | |||

| 43,553,077 | 9,244,315 | 28,179 | 2,038,804 | |||

| 12,402,979 | 3,713,667 | 12,689 | 282,166 | |||

| 204,559 | 59,037 | 3,658 | 2,832 | |||

| 286,829 | 94,278 | 12,368 | 28,967 | |||

| 41,907 | 12,301 | 4 | 3,087 | |||

| 84,627 | 25,467 | 206 | 5,214 | |||

| 99,938 | 31,680 | 2,988 | 13,537 | |||

| 106,975 | 27,265 | 4,138 | 13,617 | |||

| 81,934 | 50,498 | 40,584 | 47,885 | |||

| 141,476 | 42,780 | 193 | 8,809 | |||

| 274,841 | 82,290 | 381 | 16,979 | |||

| 534,078 | 156,006 | 831 | 2,902 | |||

| 89,028 | 39,045 | — | — | |||

| 29,676 | 13,015 | — | — | |||

| 504,225 | 155,312 | 740 | 39,730 | |||

| 45,602 | 44,495 | 39,185 | 42,602 | |||

| 14,928,674 | 4,547,136 | 117,965 | 508,327 | |||

| (56,334) | (8,859) | (100,743) | (216,372) | |||

| 216,384 | 14,808 | — | — | |||

| (136,245) | (33,888) | (48) | (47,829) | |||

| 14,952,479 | 4,519,197 | 17,174 | 244,126 | |||

| 28,600,598 | 4,725,118 | 11,005 | 1,794,678 | |||

| 3,896,861 | 23,490,222 | 217,309 | 2,224,588 | |||

| — | (1,198) | — | — | |||

| (265,591) | (86,203) | (305) | — | |||

| 3,631,270 | 23,402,821 | 217,004 | 2,224,588 | |||

| 224,737,828 | 129,923,590 | 300,796 | (3,279,513) | |||

| — | 286,344 | — | — | |||

| 73,348 | (27,266) | (15) | — | |||

| 224,811,176 | 130,182,668 | 300,781 | (3,279,513) | |||

| 228,442,446 | 153,585,489 | 517,785 | (1,054,925) | |||

| $257,043,044 | $158,310,607 | $ 528,790 | $ 739,753 |

| Brandes International Equity Fund | Brandes Global Equity Fund | ||||||

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | Year Ended September 30, 2021 | Year Ended September 30, 2020 | ||||

| INCREASE (DECREASE) IN NET ASSETS FROM: | |||||||

| OPERATIONS | |||||||

Net investment income | $ 19,498,943 | $ 11,973,556 | $ 1,021,630 | $ 582,146 | |||

| Net realized gain (loss) on: | |||||||

Investments | (474,713) | (61,359,277) | 1,871,263 | 982,919 | |||

Foreign currency transactions | (131,250) | (151,301) | (4,557) | (7,480) | |||

| Net unrealized appreciation (depreciation) on: | |||||||

Investments | 154,701,750 | (53,936,184) | 9,678,417 | (4,789,985) | |||

Foreign currency transactions | (29,853) | 130,348 | (3,044) | 4,758 | |||

Net increase (decrease) in net assets resulting from operations | 173,564,877 | (103,342,858) | 12,563,709 | (3,227,642) | |||

| DISTRIBUTIONS TO SHAREHOLDERS | |||||||

| Distributions to shareholders | |||||||

Class A | (867,045) | (633,619) | (24,398) | (23,271) | |||

Class C | (203,047) | (193,760) | (26,196) | (11,406) | |||

Class I | (14,614,616) | (13,239,310) | (1,407,084) | (643,170) | |||

Class R6 | (1,576,599) | (1,236,134) | N/A | N/A | |||

Decrease in net assets from distributions | (17,261,307) | (15,302,823) | (1,457,678) | (677,847) | |||

| CAPITAL SHARE TRANSACTIONS | |||||||

Proceeds from shares sold | 181,449,754 | 238,453,291 | 9,162,908 | 902,634 | |||

Net asset value of shares issued on reinvestment of distributions | 16,741,706 | 14,391,141 | 1,446,229 | 670,579 | |||

Cost of shares redeemed | (175,603,810) | (358,370,424) | (4,707,060) | (3,533,160) | |||

Net increase (decrease) in net assets from capital share transactions | 22,587,650 | (105,525,992) | 5,902,077 | (1,959,947) | |||

Total increase (decrease) in net assets | 178,891,220 | (224,171,673) | 17,008,108 | (5,865,436) | |||

| NET ASSETS | |||||||

Beginning of the Period | 479,192,803 | 703,364,476 | 30,206,373 | 36,071,809 | |||

End of the Period | $ 658,084,023 | $ 479,192,803 | $47,214,481 | $30,206,373 | |||

| Brandes Emerging Markets Value Fund | Brandes International Small Cap Equity Fund | ||||||

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | Year Ended September 30, 2021 | Year Ended September 30, 2020 | ||||

| INCREASE (DECREASE) IN NET ASSETS FROM: | |||||||

| OPERATIONS | |||||||

Net investment income | $ 28,600,598 | $ 22,914,468 | $ 4,725,118 | $ 3,010,129 | |||

| Net realized gain (loss) on: | |||||||

Investments | 3,896,861 | (108,076,408) | 23,489,024 | (45,423,208) | |||

Foreign currency transactions | (265,591) | (910,849) | (86,203) | 44,369 | |||

| Net unrealized appreciation (depreciation) on: | |||||||

Investments | 224,737,828 | (154,143,873) | 130,209,934 | 15,180,645 | |||