UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07205

Variable Insurance Products Fund III

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | December 31 |

Date of reporting period: | June 30, 2024 |

Item 1.

Reports to Stockholders

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Value Strategies Portfolio VIP Value Strategies Portfolio Investor Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Investor Class | $ 34 | 0.67% |

KEY FACTS | ||

| Fund Size | $715,953,051 | |

| Number of Holdings | 125 | |

| Portfolio Turnover | 71% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Financials | 19.4 | |

| Industrials | 18.8 | |

| Consumer Discretionary | 9.9 | |

| Energy | 8.4 | |

| Materials | 8.3 | |

| Utilities | 7.0 | |

| Health Care | 6.0 | |

| Consumer Staples | 5.9 | |

| Real Estate | 5.7 | |

| Information Technology | 5.4 | |

| Communication Services | 2.9 | |

| Common Stocks | 97.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

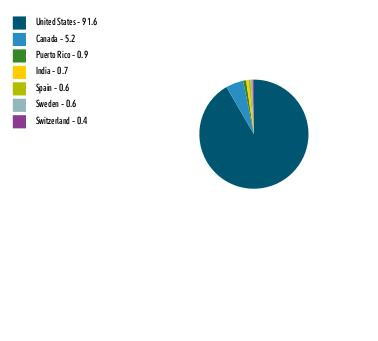

| United States | 91.6 |

| Canada | 5.2 |

| Puerto Rico | 0.9 |

| India | 0.7 |

| Spain | 0.6 |

| Sweden | 0.6 |

| Switzerland | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Canadian Natural Resources Ltd | 1.9 | |

| Expro Group Holdings NV | 1.8 | |

| Global Payments Inc | 1.7 | |

| CVS Health Corp | 1.6 | |

| First Citizens BancShares Inc/NC Class A | 1.6 | |

| East West Bancorp Inc | 1.5 | |

| PG&E Corp | 1.5 | |

| Cigna Group/The | 1.5 | |

| Flex Ltd | 1.5 | |

| Apollo Global Management Inc | 1.4 | |

| 16.0 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916046.100 1467-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Value Strategies Portfolio VIP Value Strategies Portfolio Service Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class | $ 35 | 0.70% |

KEY FACTS | ||

| Fund Size | $715,953,051 | |

| Number of Holdings | 125 | |

| Portfolio Turnover | 71% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Financials | 19.4 | |

| Industrials | 18.8 | |

| Consumer Discretionary | 9.9 | |

| Energy | 8.4 | |

| Materials | 8.3 | |

| Utilities | 7.0 | |

| Health Care | 6.0 | |

| Consumer Staples | 5.9 | |

| Real Estate | 5.7 | |

| Information Technology | 5.4 | |

| Communication Services | 2.9 | |

| Common Stocks | 97.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.6 |

| Canada | 5.2 |

| Puerto Rico | 0.9 |

| India | 0.7 |

| Spain | 0.6 |

| Sweden | 0.6 |

| Switzerland | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Canadian Natural Resources Ltd | 1.9 | |

| Expro Group Holdings NV | 1.8 | |

| Global Payments Inc | 1.7 | |

| CVS Health Corp | 1.6 | |

| First Citizens BancShares Inc/NC Class A | 1.6 | |

| East West Bancorp Inc | 1.5 | |

| PG&E Corp | 1.5 | |

| Cigna Group/The | 1.5 | |

| Flex Ltd | 1.5 | |

| Apollo Global Management Inc | 1.4 | |

| 16.0 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916044.100 1025-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Mid Cap Portfolio VIP Mid Cap Portfolio Initial Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Initial Class | $ 31 | 0.59% |

KEY FACTS | ||

| Fund Size | $7,239,760,022 | |

| Number of Holdings | 191 | |

| Portfolio Turnover | 35% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 23.3 | |

| Financials | 14.9 | |

| Consumer Discretionary | 12.8 | |

| Information Technology | 11.9 | |

| Health Care | 7.3 | |

| Real Estate | 7.1 | |

| Materials | 6.1 | |

| Energy | 4.8 | |

| Consumer Staples | 4.6 | |

| Utilities | 3.9 | |

| Communication Services | 2.7 | |

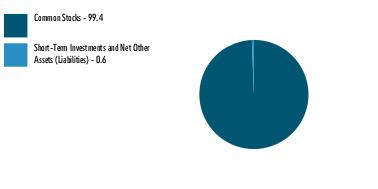

| Common Stocks | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

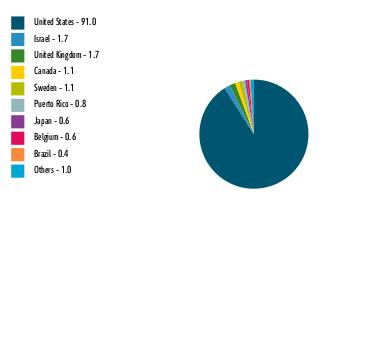

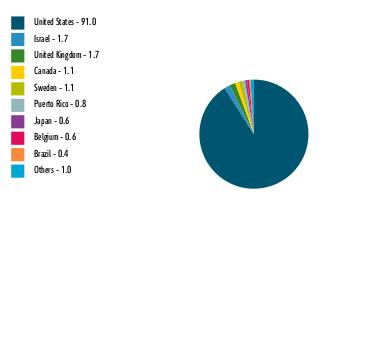

| United States | 91.0 |

| Israel | 1.7 |

| United Kingdom | 1.7 |

| Canada | 1.1 |

| Sweden | 1.1 |

| Puerto Rico | 0.8 |

| Japan | 0.6 |

| Belgium | 0.6 |

| Brazil | 0.4 |

| Others | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| ITT Inc | 1.8 | |

| Williams-Sonoma Inc | 1.6 | |

| nVent Electric PLC | 1.5 | |

| Reinsurance Group of America Inc | 1.5 | |

| US Foods Holding Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| KBR Inc | 1.2 | |

| Primerica Inc | 1.1 | |

| AptarGroup Inc | 1.1 | |

| Bj's Wholesale Club Holdings Inc | 1.1 | |

| 13.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916041.100 772-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Value Strategies Portfolio VIP Value Strategies Portfolio Service Class 2 true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class 2 | $ 43 | 0.85% |

KEY FACTS | ||

| Fund Size | $715,953,051 | |

| Number of Holdings | 125 | |

| Portfolio Turnover | 71% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Financials | 19.4 | |

| Industrials | 18.8 | |

| Consumer Discretionary | 9.9 | |

| Energy | 8.4 | |

| Materials | 8.3 | |

| Utilities | 7.0 | |

| Health Care | 6.0 | |

| Consumer Staples | 5.9 | |

| Real Estate | 5.7 | |

| Information Technology | 5.4 | |

| Communication Services | 2.9 | |

| Common Stocks | 97.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.6 |

| Canada | 5.2 |

| Puerto Rico | 0.9 |

| India | 0.7 |

| Spain | 0.6 |

| Sweden | 0.6 |

| Switzerland | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Canadian Natural Resources Ltd | 1.9 | |

| Expro Group Holdings NV | 1.8 | |

| Global Payments Inc | 1.7 | |

| CVS Health Corp | 1.6 | |

| First Citizens BancShares Inc/NC Class A | 1.6 | |

| East West Bancorp Inc | 1.5 | |

| PG&E Corp | 1.5 | |

| Cigna Group/The | 1.5 | |

| Flex Ltd | 1.5 | |

| Apollo Global Management Inc | 1.4 | |

| 16.0 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916045.100 1026-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Balanced Portfolio VIP Balanced Portfolio Investor Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Investor Class | $ 26 | 0.50% |

KEY FACTS | ||

| Fund Size | $7,359,579,841 | |

| Number of Holdings | 320 | |

| Portfolio Turnover | 25% |

(as of June 30, 2024)

| U.S. Government and U.S. Government Agency Obligations | 23.5 |

| AAA | 3.0 |

| AA | 0.0 |

| A | 3.1 |

| BBB | 4.7 |

| BB | 1.2 |

| B | 0.3 |

| Not Rated | 0.2 |

| Equities | 63.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 19.7 | |

| Financials | 8.1 | |

| Health Care | 7.7 | |

| Consumer Discretionary | 6.5 | |

| Communication Services | 6.2 | |

| Industrials | 5.4 | |

| Consumer Staples | 3.6 | |

| Energy | 2.4 | |

| Utilities | 1.4 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 63.5 |

| Bonds | 36.0 |

| Preferred Stocks | 0.2 |

| Other Investments | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| US Treasury Notes | 11.8 | |

| Microsoft Corp | 5.7 | |

| NVIDIA Corp | 4.8 | |

| US Treasury Bonds | 3.9 | |

| Uniform Mortgage Backed Securities | 3.6 | |

| Apple Inc | 3.1 | |

| Amazon.com Inc | 3.1 | |

| Alphabet Inc Class A | 2.2 | |

| Meta Platforms Inc Class A | 2.1 | |

| Fannie Mae Mortgage pass-thru certificates | 0.4 | |

| 40.7 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916017.100 1462-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth & Income Portfolio VIP Growth & Income Portfolio Initial Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Initial Class | $ 27 | 0.50% |

KEY FACTS | ||

| Fund Size | $2,358,057,803 | |

| Number of Holdings | 180 | |

| Portfolio Turnover | 16% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 25.8 | |

| Financials | 18.4 | |

| Industrials | 15.8 | |

| Health Care | 11.9 | |

| Energy | 9.8 | |

| Consumer Staples | 5.7 | |

| Communication Services | 4.1 | |

| Utilities | 2.2 | |

| Consumer Discretionary | 1.9 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 98.3 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.8 |

| Canada | 1.5 |

| Germany | 1.4 |

| United Kingdom | 1.2 |

| Netherlands | 1.0 |

| France | 0.7 |

| Belgium | 0.7 |

| Zambia | 0.6 |

| China | 0.6 |

| Others | 1.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 9.3 | |

| Exxon Mobil Corp | 7.1 | |

| Wells Fargo & Co | 5.8 | |

| General Electric Co | 5.0 | |

| NVIDIA Corp | 4.7 | |

| Apple Inc | 3.0 | |

| Bank of America Corp | 2.9 | |

| Unitedhealth Group Inc | 1.9 | |

| Visa Inc Class A | 1.9 | |

| Boeing Co | 1.8 | |

| 43.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915948.100 147-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Balanced Portfolio VIP Balanced Portfolio Initial Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Initial Class | $ 22 | 0.43% |

KEY FACTS | ||

| Fund Size | $7,359,579,841 | |

| Number of Holdings | 320 | |

| Portfolio Turnover | 25% |

(as of June 30, 2024)

| U.S. Government and U.S. Government Agency Obligations | 23.5 |

| AAA | 3.0 |

| AA | 0.0 |

| A | 3.1 |

| BBB | 4.7 |

| BB | 1.2 |

| B | 0.3 |

| Not Rated | 0.2 |

| Equities | 63.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 19.7 | |

| Financials | 8.1 | |

| Health Care | 7.7 | |

| Consumer Discretionary | 6.5 | |

| Communication Services | 6.2 | |

| Industrials | 5.4 | |

| Consumer Staples | 3.6 | |

| Energy | 2.4 | |

| Utilities | 1.4 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 63.5 |

| Bonds | 36.0 |

| Preferred Stocks | 0.2 |

| Other Investments | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| US Treasury Notes | 11.8 | |

| Microsoft Corp | 5.7 | |

| NVIDIA Corp | 4.8 | |

| US Treasury Bonds | 3.9 | |

| Uniform Mortgage Backed Securities | 3.6 | |

| Apple Inc | 3.1 | |

| Amazon.com Inc | 3.1 | |

| Alphabet Inc Class A | 2.2 | |

| Meta Platforms Inc Class A | 2.1 | |

| Fannie Mae Mortgage pass-thru certificates | 0.4 | |

| 40.7 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916020.100 616-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Mid Cap Portfolio VIP Mid Cap Portfolio Service Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class | $ 36 | 0.69% |

KEY FACTS | ||

| Fund Size | $7,239,760,022 | |

| Number of Holdings | 191 | |

| Portfolio Turnover | 35% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 23.3 | |

| Financials | 14.9 | |

| Consumer Discretionary | 12.8 | |

| Information Technology | 11.9 | |

| Health Care | 7.3 | |

| Real Estate | 7.1 | |

| Materials | 6.1 | |

| Energy | 4.8 | |

| Consumer Staples | 4.6 | |

| Utilities | 3.9 | |

| Communication Services | 2.7 | |

| Common Stocks | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.0 |

| Israel | 1.7 |

| United Kingdom | 1.7 |

| Canada | 1.1 |

| Sweden | 1.1 |

| Puerto Rico | 0.8 |

| Japan | 0.6 |

| Belgium | 0.6 |

| Brazil | 0.4 |

| Others | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| ITT Inc | 1.8 | |

| Williams-Sonoma Inc | 1.6 | |

| nVent Electric PLC | 1.5 | |

| Reinsurance Group of America Inc | 1.5 | |

| US Foods Holding Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| KBR Inc | 1.2 | |

| Primerica Inc | 1.1 | |

| AptarGroup Inc | 1.1 | |

| Bj's Wholesale Club Holdings Inc | 1.1 | |

| 13.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916042.100 773-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Mid Cap Portfolio VIP Mid Cap Portfolio Investor Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Investor Class | $ 35 | 0.66% |

KEY FACTS | ||

| Fund Size | $7,239,760,022 | |

| Number of Holdings | 191 | |

| Portfolio Turnover | 35% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 23.3 | |

| Financials | 14.9 | |

| Consumer Discretionary | 12.8 | |

| Information Technology | 11.9 | |

| Health Care | 7.3 | |

| Real Estate | 7.1 | |

| Materials | 6.1 | |

| Energy | 4.8 | |

| Consumer Staples | 4.6 | |

| Utilities | 3.9 | |

| Communication Services | 2.7 | |

| Common Stocks | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.0 |

| Israel | 1.7 |

| United Kingdom | 1.7 |

| Canada | 1.1 |

| Sweden | 1.1 |

| Puerto Rico | 0.8 |

| Japan | 0.6 |

| Belgium | 0.6 |

| Brazil | 0.4 |

| Others | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| ITT Inc | 1.8 | |

| Williams-Sonoma Inc | 1.6 | |

| nVent Electric PLC | 1.5 | |

| Reinsurance Group of America Inc | 1.5 | |

| US Foods Holding Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| KBR Inc | 1.2 | |

| Primerica Inc | 1.1 | |

| AptarGroup Inc | 1.1 | |

| Bj's Wholesale Club Holdings Inc | 1.1 | |

| 13.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916039.100 1466-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth Opportunities Portfolio VIP Growth Opportunities Portfolio Service Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class | $ 38 | 0.68% |

KEY FACTS | ||

| Fund Size | $3,545,837,106 | |

| Number of Holdings | 192 | |

| Portfolio Turnover | 62% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 47.0 | |

| Communication Services | 21.2 | |

| Consumer Discretionary | 10.3 | |

| Health Care | 9.3 | |

| Industrials | 6.5 | |

| Financials | 3.3 | |

| Utilities | 0.6 | |

| Consumer Staples | 0.4 | |

| Energy | 0.1 | |

| Materials | 0.1 | |

| Common Stocks | 97.0 |

| Preferred Stocks | 1.8 |

| Domestic Equity Funds | 0.9 |

| Bonds | 0.1 |

| Preferred Securities | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 92.5 |

| Singapore | 1.9 |

| China | 1.8 |

| Taiwan | 1.5 |

| France | 0.7 |

| United Kingdom | 0.3 |

| Netherlands | 0.3 |

| India | 0.3 |

| Canada | 0.2 |

| Others | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| NVIDIA Corp | 14.0 | |

| Microsoft Corp | 9.5 | |

| Meta Platforms Inc Class A | 5.9 | |

| Apple Inc | 5.3 | |

| Amazon.com Inc | 5.1 | |

| Alphabet Inc Class C | 4.6 | |

| Uber Technologies Inc | 3.1 | |

| Roku Inc Class A | 2.4 | |

| Eli Lilly & Co | 2.3 | |

| Broadcom Inc | 2.3 | |

| 54.5 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916023.100 491-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth Opportunities Portfolio VIP Growth Opportunities Portfolio Initial Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Initial Class | $ 33 | 0.59% |

KEY FACTS | ||

| Fund Size | $3,545,837,106 | |

| Number of Holdings | 192 | |

| Portfolio Turnover | 62% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 47.0 | |

| Communication Services | 21.2 | |

| Consumer Discretionary | 10.3 | |

| Health Care | 9.3 | |

| Industrials | 6.5 | |

| Financials | 3.3 | |

| Utilities | 0.6 | |

| Consumer Staples | 0.4 | |

| Energy | 0.1 | |

| Materials | 0.1 | |

| Common Stocks | 97.0 |

| Preferred Stocks | 1.8 |

| Domestic Equity Funds | 0.9 |

| Bonds | 0.1 |

| Preferred Securities | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 92.5 |

| Singapore | 1.9 |

| China | 1.8 |

| Taiwan | 1.5 |

| France | 0.7 |

| United Kingdom | 0.3 |

| Netherlands | 0.3 |

| India | 0.3 |

| Canada | 0.2 |

| Others | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| NVIDIA Corp | 14.0 | |

| Microsoft Corp | 9.5 | |

| Meta Platforms Inc Class A | 5.9 | |

| Apple Inc | 5.3 | |

| Amazon.com Inc | 5.1 | |

| Alphabet Inc Class C | 4.6 | |

| Uber Technologies Inc | 3.1 | |

| Roku Inc Class A | 2.4 | |

| Eli Lilly & Co | 2.3 | |

| Broadcom Inc | 2.3 | |

| 54.5 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916024.100 617-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth & Income Portfolio VIP Growth & Income Portfolio Service Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class | $ 32 | 0.60% |

KEY FACTS | ||

| Fund Size | $2,358,057,803 | |

| Number of Holdings | 180 | |

| Portfolio Turnover | 16% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 25.8 | |

| Financials | 18.4 | |

| Industrials | 15.8 | |

| Health Care | 11.9 | |

| Energy | 9.8 | |

| Consumer Staples | 5.7 | |

| Communication Services | 4.1 | |

| Utilities | 2.2 | |

| Consumer Discretionary | 1.9 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 98.3 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.8 |

| Canada | 1.5 |

| Germany | 1.4 |

| United Kingdom | 1.2 |

| Netherlands | 1.0 |

| France | 0.7 |

| Belgium | 0.7 |

| Zambia | 0.6 |

| China | 0.6 |

| Others | 1.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 9.3 | |

| Exxon Mobil Corp | 7.1 | |

| Wells Fargo & Co | 5.8 | |

| General Electric Co | 5.0 | |

| NVIDIA Corp | 4.7 | |

| Apple Inc | 3.0 | |

| Bank of America Corp | 2.9 | |

| Unitedhealth Group Inc | 1.9 | |

| Visa Inc Class A | 1.9 | |

| Boeing Co | 1.8 | |

| 43.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915950.100 473-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth Opportunities Portfolio VIP Growth Opportunities Portfolio Investor Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Investor Class | $ 37 | 0.66% |

KEY FACTS | ||

| Fund Size | $3,545,837,106 | |

| Number of Holdings | 192 | |

| Portfolio Turnover | 62% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 47.0 | |

| Communication Services | 21.2 | |

| Consumer Discretionary | 10.3 | |

| Health Care | 9.3 | |

| Industrials | 6.5 | |

| Financials | 3.3 | |

| Utilities | 0.6 | |

| Consumer Staples | 0.4 | |

| Energy | 0.1 | |

| Materials | 0.1 | |

| Common Stocks | 97.0 |

| Preferred Stocks | 1.8 |

| Domestic Equity Funds | 0.9 |

| Bonds | 0.1 |

| Preferred Securities | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 92.5 |

| Singapore | 1.9 |

| China | 1.8 |

| Taiwan | 1.5 |

| France | 0.7 |

| United Kingdom | 0.3 |

| Netherlands | 0.3 |

| India | 0.3 |

| Canada | 0.2 |

| Others | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| NVIDIA Corp | 14.0 | |

| Microsoft Corp | 9.5 | |

| Meta Platforms Inc Class A | 5.9 | |

| Apple Inc | 5.3 | |

| Amazon.com Inc | 5.1 | |

| Alphabet Inc Class C | 4.6 | |

| Uber Technologies Inc | 3.1 | |

| Roku Inc Class A | 2.4 | |

| Eli Lilly & Co | 2.3 | |

| Broadcom Inc | 2.3 | |

| 54.5 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916021.100 1465-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Balanced Portfolio VIP Balanced Portfolio Service Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class | $ 28 | 0.53% |

KEY FACTS | ||

| Fund Size | $7,359,579,841 | |

| Number of Holdings | 320 | |

| Portfolio Turnover | 25% |

(as of June 30, 2024)

| U.S. Government and U.S. Government Agency Obligations | 23.5 |

| AAA | 3.0 |

| AA | 0.0 |

| A | 3.1 |

| BBB | 4.7 |

| BB | 1.2 |

| B | 0.3 |

| Not Rated | 0.2 |

| Equities | 63.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 19.7 | |

| Financials | 8.1 | |

| Health Care | 7.7 | |

| Consumer Discretionary | 6.5 | |

| Communication Services | 6.2 | |

| Industrials | 5.4 | |

| Consumer Staples | 3.6 | |

| Energy | 2.4 | |

| Utilities | 1.4 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 63.5 |

| Bonds | 36.0 |

| Preferred Stocks | 0.2 |

| Other Investments | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| US Treasury Notes | 11.8 | |

| Microsoft Corp | 5.7 | |

| NVIDIA Corp | 4.8 | |

| US Treasury Bonds | 3.9 | |

| Uniform Mortgage Backed Securities | 3.6 | |

| Apple Inc | 3.1 | |

| Amazon.com Inc | 3.1 | |

| Alphabet Inc Class A | 2.2 | |

| Meta Platforms Inc Class A | 2.1 | |

| Fannie Mae Mortgage pass-thru certificates | 0.4 | |

| 40.7 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916019.100 469-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Dynamic Capital Appreciation Portfolio VIP Dynamic Capital Appreciation Portfolio Service Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class | $ 40 | 0.73% |

KEY FACTS | ||

| Fund Size | $270,413,995 | |

| Number of Holdings | 157 | |

| Portfolio Turnover | 51% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 37.6 | |

| Health Care | 14.5 | |

| Industrials | 13.9 | |

| Financials | 10.2 | |

| Consumer Discretionary | 8.9 | |

| Communication Services | 8.6 | |

| Energy | 2.8 | |

| Materials | 1.6 | |

| Consumer Staples | 1.2 | |

| Common Stocks | 99.1 |

| Preferred Stocks | 0.2 |

| Preferred Securities | 0.0 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 87.8 |

| Netherlands | 3.5 |

| Canada | 1.5 |

| China | 1.4 |

| Taiwan | 1.2 |

| Israel | 1.0 |

| Brazil | 0.9 |

| France | 0.8 |

| Japan | 0.6 |

| Others | 1.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 10.0 | |

| Apple Inc | 8.9 | |

| NVIDIA Corp | 5.8 | |

| Amazon.com Inc | 4.2 | |

| Uber Technologies Inc | 3.1 | |

| Boston Scientific Corp | 2.9 | |

| Mastercard Inc Class A | 2.3 | |

| Alphabet Inc Class A | 1.9 | |

| Ingersoll Rand Inc | 1.8 | |

| Netflix Inc | 1.7 | |

| 42.6 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916008.100 853-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Balanced Portfolio VIP Balanced Portfolio Service Class 2 true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class 2 | $ 36 | 0.68% |

KEY FACTS | ||

| Fund Size | $7,359,579,841 | |

| Number of Holdings | 320 | |

| Portfolio Turnover | 25% |

(as of June 30, 2024)

| U.S. Government and U.S. Government Agency Obligations | 23.5 |

| AAA | 3.0 |

| AA | 0.0 |

| A | 3.1 |

| BBB | 4.7 |

| BB | 1.2 |

| B | 0.3 |

| Not Rated | 0.2 |

| Equities | 63.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

QUALITY DIVERSIFICATION (% of Fund's net assets) |

|

| We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes. |

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 19.7 | |

| Financials | 8.1 | |

| Health Care | 7.7 | |

| Consumer Discretionary | 6.5 | |

| Communication Services | 6.2 | |

| Industrials | 5.4 | |

| Consumer Staples | 3.6 | |

| Energy | 2.4 | |

| Utilities | 1.4 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 63.5 |

| Bonds | 36.0 |

| Preferred Stocks | 0.2 |

| Other Investments | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| US Treasury Notes | 11.8 | |

| Microsoft Corp | 5.7 | |

| NVIDIA Corp | 4.8 | |

| US Treasury Bonds | 3.9 | |

| Uniform Mortgage Backed Securities | 3.6 | |

| Apple Inc | 3.1 | |

| Amazon.com Inc | 3.1 | |

| Alphabet Inc Class A | 2.2 | |

| Meta Platforms Inc Class A | 2.1 | |

| Fannie Mae Mortgage pass-thru certificates | 0.4 | |

| 40.7 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916018.100 380-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Dynamic Capital Appreciation Portfolio VIP Dynamic Capital Appreciation Portfolio Service Class 2 true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class 2 | $ 47 | 0.88% |

KEY FACTS | ||

| Fund Size | $270,413,995 | |

| Number of Holdings | 157 | |

| Portfolio Turnover | 51% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 37.6 | |

| Health Care | 14.5 | |

| Industrials | 13.9 | |

| Financials | 10.2 | |

| Consumer Discretionary | 8.9 | |

| Communication Services | 8.6 | |

| Energy | 2.8 | |

| Materials | 1.6 | |

| Consumer Staples | 1.2 | |

| Common Stocks | 99.1 |

| Preferred Stocks | 0.2 |

| Preferred Securities | 0.0 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 87.8 |

| Netherlands | 3.5 |

| Canada | 1.5 |

| China | 1.4 |

| Taiwan | 1.2 |

| Israel | 1.0 |

| Brazil | 0.9 |

| France | 0.8 |

| Japan | 0.6 |

| Others | 1.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 10.0 | |

| Apple Inc | 8.9 | |

| NVIDIA Corp | 5.8 | |

| Amazon.com Inc | 4.2 | |

| Uber Technologies Inc | 3.1 | |

| Boston Scientific Corp | 2.9 | |

| Mastercard Inc Class A | 2.3 | |

| Alphabet Inc Class A | 1.9 | |

| Ingersoll Rand Inc | 1.8 | |

| Netflix Inc | 1.7 | |

| 42.6 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916009.100 971-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth Opportunities Portfolio VIP Growth Opportunities Portfolio Service Class 2 true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class 2 | $ 46 | 0.83% |

KEY FACTS | ||

| Fund Size | $3,545,837,106 | |

| Number of Holdings | 192 | |

| Portfolio Turnover | 62% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 47.0 | |

| Communication Services | 21.2 | |

| Consumer Discretionary | 10.3 | |

| Health Care | 9.3 | |

| Industrials | 6.5 | |

| Financials | 3.3 | |

| Utilities | 0.6 | |

| Consumer Staples | 0.4 | |

| Energy | 0.1 | |

| Materials | 0.1 | |

| Common Stocks | 97.0 |

| Preferred Stocks | 1.8 |

| Domestic Equity Funds | 0.9 |

| Bonds | 0.1 |

| Preferred Securities | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 92.5 |

| Singapore | 1.9 |

| China | 1.8 |

| Taiwan | 1.5 |

| France | 0.7 |

| United Kingdom | 0.3 |

| Netherlands | 0.3 |

| India | 0.3 |

| Canada | 0.2 |

| Others | 0.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| NVIDIA Corp | 14.0 | |

| Microsoft Corp | 9.5 | |

| Meta Platforms Inc Class A | 5.9 | |

| Apple Inc | 5.3 | |

| Amazon.com Inc | 5.1 | |

| Alphabet Inc Class C | 4.6 | |

| Uber Technologies Inc | 3.1 | |

| Roku Inc Class A | 2.4 | |

| Eli Lilly & Co | 2.3 | |

| Broadcom Inc | 2.3 | |

| 54.5 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916022.100 385-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Dynamic Capital Appreciation Portfolio VIP Dynamic Capital Appreciation Portfolio Initial Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Initial Class | $ 34 | 0.63% |

KEY FACTS | ||

| Fund Size | $270,413,995 | |

| Number of Holdings | 157 | |

| Portfolio Turnover | 51% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 37.6 | |

| Health Care | 14.5 | |

| Industrials | 13.9 | |

| Financials | 10.2 | |

| Consumer Discretionary | 8.9 | |

| Communication Services | 8.6 | |

| Energy | 2.8 | |

| Materials | 1.6 | |

| Consumer Staples | 1.2 | |

| Common Stocks | 99.1 |

| Preferred Stocks | 0.2 |

| Preferred Securities | 0.0 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 87.8 |

| Netherlands | 3.5 |

| Canada | 1.5 |

| China | 1.4 |

| Taiwan | 1.2 |

| Israel | 1.0 |

| Brazil | 0.9 |

| France | 0.8 |

| Japan | 0.6 |

| Others | 1.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 10.0 | |

| Apple Inc | 8.9 | |

| NVIDIA Corp | 5.8 | |

| Amazon.com Inc | 4.2 | |

| Uber Technologies Inc | 3.1 | |

| Boston Scientific Corp | 2.9 | |

| Mastercard Inc Class A | 2.3 | |

| Alphabet Inc Class A | 1.9 | |

| Ingersoll Rand Inc | 1.8 | |

| Netflix Inc | 1.7 | |

| 42.6 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916007.100 786-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Mid Cap Portfolio VIP Mid Cap Portfolio Service Class 2 true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class 2 | $ 44 | 0.84% |

KEY FACTS | ||

| Fund Size | $7,239,760,022 | |

| Number of Holdings | 191 | |

| Portfolio Turnover | 35% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Industrials | 23.3 | |

| Financials | 14.9 | |

| Consumer Discretionary | 12.8 | |

| Information Technology | 11.9 | |

| Health Care | 7.3 | |

| Real Estate | 7.1 | |

| Materials | 6.1 | |

| Energy | 4.8 | |

| Consumer Staples | 4.6 | |

| Utilities | 3.9 | |

| Communication Services | 2.7 | |

| Common Stocks | 99.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.0 |

| Israel | 1.7 |

| United Kingdom | 1.7 |

| Canada | 1.1 |

| Sweden | 1.1 |

| Puerto Rico | 0.8 |

| Japan | 0.6 |

| Belgium | 0.6 |

| Brazil | 0.4 |

| Others | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| ITT Inc | 1.8 | |

| Williams-Sonoma Inc | 1.6 | |

| nVent Electric PLC | 1.5 | |

| Reinsurance Group of America Inc | 1.5 | |

| US Foods Holding Corp | 1.3 | |

| Performance Food Group Co | 1.2 | |

| KBR Inc | 1.2 | |

| Primerica Inc | 1.1 | |

| AptarGroup Inc | 1.1 | |

| Bj's Wholesale Club Holdings Inc | 1.1 | |

| 13.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916040.100 387-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth & Income Portfolio VIP Growth & Income Portfolio Investor Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Investor Class | $ 31 | 0.58% |

KEY FACTS | ||

| Fund Size | $2,358,057,803 | |

| Number of Holdings | 180 | |

| Portfolio Turnover | 16% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 25.8 | |

| Financials | 18.4 | |

| Industrials | 15.8 | |

| Health Care | 11.9 | |

| Energy | 9.8 | |

| Consumer Staples | 5.7 | |

| Communication Services | 4.1 | |

| Utilities | 2.2 | |

| Consumer Discretionary | 1.9 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 98.3 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.8 |

| Canada | 1.5 |

| Germany | 1.4 |

| United Kingdom | 1.2 |

| Netherlands | 1.0 |

| France | 0.7 |

| Belgium | 0.7 |

| Zambia | 0.6 |

| China | 0.6 |

| Others | 1.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 9.3 | |

| Exxon Mobil Corp | 7.1 | |

| Wells Fargo & Co | 5.8 | |

| General Electric Co | 5.0 | |

| NVIDIA Corp | 4.7 | |

| Apple Inc | 3.0 | |

| Bank of America Corp | 2.9 | |

| Unitedhealth Group Inc | 1.9 | |

| Visa Inc Class A | 1.9 | |

| Boeing Co | 1.8 | |

| 43.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915947.100 1464-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Dynamic Capital Appreciation Portfolio VIP Dynamic Capital Appreciation Portfolio Investor Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Investor Class | $ 38 | 0.71% |

KEY FACTS | ||

| Fund Size | $270,413,995 | |

| Number of Holdings | 157 | |

| Portfolio Turnover | 51% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 37.6 | |

| Health Care | 14.5 | |

| Industrials | 13.9 | |

| Financials | 10.2 | |

| Consumer Discretionary | 8.9 | |

| Communication Services | 8.6 | |

| Energy | 2.8 | |

| Materials | 1.6 | |

| Consumer Staples | 1.2 | |

| Common Stocks | 99.1 |

| Preferred Stocks | 0.2 |

| Preferred Securities | 0.0 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 87.8 |

| Netherlands | 3.5 |

| Canada | 1.5 |

| China | 1.4 |

| Taiwan | 1.2 |

| Israel | 1.0 |

| Brazil | 0.9 |

| France | 0.8 |

| Japan | 0.6 |

| Others | 1.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 10.0 | |

| Apple Inc | 8.9 | |

| NVIDIA Corp | 5.8 | |

| Amazon.com Inc | 4.2 | |

| Uber Technologies Inc | 3.1 | |

| Boston Scientific Corp | 2.9 | |

| Mastercard Inc Class A | 2.3 | |

| Alphabet Inc Class A | 1.9 | |

| Ingersoll Rand Inc | 1.8 | |

| Netflix Inc | 1.7 | |

| 42.6 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916006.100 1463-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Value Strategies Portfolio VIP Value Strategies Portfolio Initial Class true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Initial Class | $ 30 | 0.60% |

KEY FACTS | ||

| Fund Size | $715,953,051 | |

| Number of Holdings | 125 | |

| Portfolio Turnover | 71% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Financials | 19.4 | |

| Industrials | 18.8 | |

| Consumer Discretionary | 9.9 | |

| Energy | 8.4 | |

| Materials | 8.3 | |

| Utilities | 7.0 | |

| Health Care | 6.0 | |

| Consumer Staples | 5.9 | |

| Real Estate | 5.7 | |

| Information Technology | 5.4 | |

| Communication Services | 2.9 | |

| Common Stocks | 97.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 91.6 |

| Canada | 5.2 |

| Puerto Rico | 0.9 |

| India | 0.7 |

| Spain | 0.6 |

| Sweden | 0.6 |

| Switzerland | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Canadian Natural Resources Ltd | 1.9 | |

| Expro Group Holdings NV | 1.8 | |

| Global Payments Inc | 1.7 | |

| CVS Health Corp | 1.6 | |

| First Citizens BancShares Inc/NC Class A | 1.6 | |

| East West Bancorp Inc | 1.5 | |

| PG&E Corp | 1.5 | |

| Cigna Group/The | 1.5 | |

| Flex Ltd | 1.5 | |

| Apollo Global Management Inc | 1.4 | |

| 16.0 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9916043.100 1024-TSRS-0824 | |

SEMI-ANNUAL SHAREHOLDER REPORT | AS OF JUNE 30, 2024 | ||

| | VIP Growth & Income Portfolio VIP Growth & Income Portfolio Service Class 2 true | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | ||

| Service Class 2 | $ 40 | 0.75% |

KEY FACTS | ||

| Fund Size | $2,358,057,803 | |

| Number of Holdings | 180 | |

| Portfolio Turnover | 16% |

(as of June 30, 2024)

MARKET SECTORS (% of Fund's net assets) | ||

| Information Technology | 25.8 | |

| Financials | 18.4 | |

| Industrials | 15.8 | |

| Health Care | 11.9 | |

| Energy | 9.8 | |

| Consumer Staples | 5.7 | |

| Communication Services | 4.1 | |

| Utilities | 2.2 | |

| Consumer Discretionary | 1.9 | |

| Materials | 1.4 | |

| Real Estate | 1.3 | |

| Common Stocks | 98.3 |

| Bonds | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

| United States | 90.8 |

| Canada | 1.5 |

| Germany | 1.4 |

| United Kingdom | 1.2 |

| Netherlands | 1.0 |

| France | 0.7 |

| Belgium | 0.7 |

| Zambia | 0.6 |

| China | 0.6 |

| Others | 1.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

TOP HOLDINGS (% of Fund's net assets) | ||

| Microsoft Corp | 9.3 | |

| Exxon Mobil Corp | 7.1 | |

| Wells Fargo & Co | 5.8 | |

| General Electric Co | 5.0 | |

| NVIDIA Corp | 4.7 | |

| Apple Inc | 3.0 | |

| Bank of America Corp | 2.9 | |

| Unitedhealth Group Inc | 1.9 | |

| Visa Inc Class A | 1.9 | |

| Boeing Co | 1.8 | |

| 43.4 | ||

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. | ||

| For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9915949.100 382-TSRS-0824 | |

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Financial Statements and Financial Highlights for Open-End Management Investment Companies

Contents

| Common Stocks - 97.7% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 3.0% | |||

| Diversified Telecommunication Services - 0.6% | |||

| Cellnex Telecom SA (a) | 139,600 | 4,540,416 | |

| Interactive Media & Services - 0.8% | |||

| Zoominfo Technologies, Inc. (b) | 449,900 | 5,745,223 | |

| Media - 1.6% | |||

| Interpublic Group of Companies, Inc. | 272,200 | 7,918,298 | |

| Nexstar Media Group, Inc. | 19,500 | 3,237,195 | |

| 11,155,493 | |||

TOTAL COMMUNICATION SERVICES | 21,441,132 | ||

| CONSUMER DISCRETIONARY - 9.9% | |||

| Automobile Components - 1.6% | |||

| Aptiv PLC (b) | 107,996 | 7,605,078 | |

| Autoliv, Inc. | 37,900 | 4,054,921 | |

| 11,659,999 | |||

| Automobiles - 0.7% | |||

| Harley-Davidson, Inc. | 147,200 | 4,937,088 | |

| Distributors - 0.2% | |||

| LKQ Corp. | 39,400 | 1,638,646 | |

| Hotels, Restaurants & Leisure - 1.3% | |||

| Hilton Grand Vacations, Inc. (b)(c) | 95,400 | 3,857,022 | |

| Marriott Vacations Worldwide Corp. | 40,060 | 3,498,039 | |

| Red Rock Resorts, Inc. | 37,200 | 2,043,396 | |

| 9,398,457 | |||

| Household Durables - 0.9% | |||

| Tempur Sealy International, Inc. | 127,700 | 6,045,318 | |

| Leisure Products - 1.6% | |||

| BRP, Inc. (c) | 71,300 | 4,568,141 | |

| Brunswick Corp. | 49,500 | 3,602,115 | |

| Topgolf Callaway Brands Corp. (b) | 228,700 | 3,499,110 | |

| 11,669,366 | |||

| Specialty Retail - 2.0% | |||

| Lithia Motors, Inc. Class A (sub. vtg.) | 19,900 | 5,023,755 | |

| Signet Jewelers Ltd. (c) | 48,200 | 4,317,756 | |

| Upbound Group, Inc. | 150,400 | 4,617,280 | |

| Victoria's Secret & Co. (b) | 17,799 | 314,508 | |

| 14,273,299 | |||

| Textiles, Apparel & Luxury Goods - 1.6% | |||

| Gildan Activewear, Inc. | 206,400 | 7,828,731 | |

| PVH Corp. | 32,200 | 3,409,014 | |

| 11,237,745 | |||

TOTAL CONSUMER DISCRETIONARY | 70,859,918 | ||

| CONSUMER STAPLES - 5.9% | |||

| Beverages - 0.8% | |||

| Keurig Dr. Pepper, Inc. | 164,800 | 5,504,320 | |

| Consumer Staples Distribution & Retail - 1.1% | |||

| U.S. Foods Holding Corp. (b) | 152,100 | 8,058,258 | |

| Food Products - 3.0% | |||

| Bunge Global SA | 71,700 | 7,655,409 | |

| Darling Ingredients, Inc. (b) | 155,563 | 5,716,940 | |

| Lamb Weston Holdings, Inc. | 96,900 | 8,147,352 | |

| 21,519,701 | |||

| Personal Care Products - 1.0% | |||

| Kenvue, Inc. | 381,700 | 6,939,306 | |

TOTAL CONSUMER STAPLES | 42,021,585 | ||

| ENERGY - 8.4% | |||

| Energy Equipment & Services - 3.2% | |||

| Expro Group Holdings NV (b)(c) | 552,100 | 12,654,132 | |

| Tidewater, Inc. (b) | 34,900 | 3,322,829 | |

| Valaris Ltd. (b) | 91,500 | 6,816,750 | |

| 22,793,711 | |||

| Oil, Gas & Consumable Fuels - 5.2% | |||

| Antero Resources Corp. (b) | 192,500 | 6,281,275 | |

| Canadian Natural Resources Ltd. | 384,500 | 13,695,907 | |

| Cheniere Energy, Inc. | 22,100 | 3,863,743 | |

| Targa Resources Corp. | 70,400 | 9,066,112 | |

| Tourmaline Oil Corp. | 98,700 | 4,476,689 | |

| 37,383,726 | |||

TOTAL ENERGY | 60,177,437 | ||

| FINANCIALS - 19.4% | |||

| Banks - 4.4% | |||

| East West Bancorp, Inc. | 148,893 | 10,903,434 | |

| First Citizens Bancshares, Inc. | 6,700 | 11,280,187 | |

| Popular, Inc. | 69,300 | 6,128,199 | |

| U.S. Bancorp | 74,766 | 2,968,210 | |

| 31,280,030 | |||

| Capital Markets - 3.6% | |||

| Ameriprise Financial, Inc. | 21,100 | 9,013,709 | |

| LPL Financial | 28,000 | 7,820,400 | |

| Raymond James Financial, Inc. | 42,700 | 5,278,147 | |

| UBS Group AG | 118,950 | 3,501,839 | |

| 25,614,095 | |||

| Consumer Finance - 2.4% | |||

| OneMain Holdings, Inc. | 158,200 | 7,671,118 | |

| PROG Holdings, Inc. | 119,771 | 4,153,658 | |

| SLM Corp. | 278,597 | 5,792,032 | |

| 17,616,808 | |||

| Financial Services - 4.9% | |||

| Apollo Global Management, Inc. | 86,400 | 10,201,248 | |

| Global Payments, Inc. | 118,600 | 11,468,620 | |

| NCR Atleos Corp. | 222,500 | 6,011,950 | |

| WEX, Inc. (b) | 40,288 | 7,136,616 | |

| 34,818,434 | |||

| Insurance - 4.1% | |||

| American Financial Group, Inc. | 59,602 | 7,332,238 | |

| Assurant, Inc. | 25,200 | 4,189,500 | |

| First American Financial Corp. | 92,803 | 5,006,722 | |

| Reinsurance Group of America, Inc. | 31,505 | 6,467,031 | |

| The Travelers Companies, Inc. | 32,300 | 6,567,882 | |

| 29,563,373 | |||

TOTAL FINANCIALS | 138,892,740 | ||

| HEALTH CARE - 6.0% | |||

| Health Care Equipment & Supplies - 0.6% | |||

| Baxter International, Inc. | 83,339 | 2,787,690 | |

| Teleflex, Inc. | 6,300 | 1,325,079 | |

| 4,112,769 | |||

| Health Care Providers & Services - 4.8% | |||

| AdaptHealth Corp. (b) | 366,900 | 3,669,000 | |

| Centene Corp. (b) | 130,400 | 8,645,520 | |

| Cigna Group | 32,100 | 10,611,297 | |

| CVS Health Corp. | 198,800 | 11,741,128 | |

| 34,666,945 | |||

| Life Sciences Tools & Services - 0.1% | |||

| Fortrea Holdings, Inc. | 24,200 | 564,828 | |

| Pharmaceuticals - 0.5% | |||

| Jazz Pharmaceuticals PLC (b) | 35,900 | 3,831,607 | |

TOTAL HEALTH CARE | 43,176,149 | ||

| INDUSTRIALS - 18.7% | |||

| Air Freight & Logistics - 0.8% | |||

| FedEx Corp. | 20,200 | 6,056,768 | |

| Building Products - 2.0% | |||

| AZZ, Inc. | 48,200 | 3,723,450 | |

| Builders FirstSource, Inc. (b) | 53,600 | 7,418,776 | |

| Johnson Controls International PLC | 52,500 | 3,489,675 | |

| 14,631,901 | |||

| Commercial Services & Supplies - 1.5% | |||

| The Brink's Co. | 56,851 | 5,821,542 | |

| Vestis Corp. | 377,000 | 4,610,710 | |

| 10,432,252 | |||

| Construction & Engineering - 1.8% | |||

| Fluor Corp. (b) | 147,000 | 6,401,850 | |

| MDU Resources Group, Inc. | 240,400 | 6,034,040 | |

| Willscot Mobile Mini Holdings (b) | 6,199 | 233,330 | |

| 12,669,220 | |||

| Electrical Equipment - 1.7% | |||

| Regal Rexnord Corp. | 51,500 | 6,963,830 | |

| Sensata Technologies PLC | 144,790 | 5,413,698 | |

| 12,377,528 | |||

| Ground Transportation - 2.3% | |||

| TFI International, Inc. (Canada) | 37,300 | 5,415,937 | |

| U-Haul Holding Co. (non-vtg.) | 101,700 | 6,104,034 | |

| XPO, Inc. (b) | 47,700 | 5,063,355 | |

| 16,583,326 | |||

| Machinery - 5.1% | |||

| Allison Transmission Holdings, Inc. | 80,200 | 6,087,180 | |

| Atmus Filtration Technologies, Inc. (b) | 196,000 | 5,640,880 | |

| Barnes Group, Inc. | 86,871 | 3,597,328 | |

| Chart Industries, Inc. (b)(c) | 29,400 | 4,243,596 | |

| CNH Industrial NV | 458,289 | 4,642,468 | |

| Gates Industrial Corp. PLC (b) | 337,775 | 5,340,223 | |

| Timken Co. | 84,900 | 6,803,037 | |

| 36,354,712 | |||

| Professional Services - 1.2% | |||

| ManpowerGroup, Inc. | 51,900 | 3,622,620 | |

| WNS Holdings Ltd. | 90,400 | 4,746,000 | |

| 8,368,620 | |||

| Trading Companies & Distributors - 2.3% | |||

| GMS, Inc. (b) | 70,500 | 5,683,005 | |

| Herc Holdings, Inc. | 26,500 | 3,532,185 | |

| WESCO International, Inc. | 44,400 | 7,038,288 | |

| 16,253,478 | |||

TOTAL INDUSTRIALS | 133,727,805 | ||

| INFORMATION TECHNOLOGY - 5.4% | |||

| Communications Equipment - 2.0% | |||

| Ciena Corp. (b) | 96,000 | 4,625,280 | |

| Lumentum Holdings, Inc. (b) | 187,500 | 9,547,500 | |

| 14,172,780 | |||

| Electronic Equipment, Instruments & Components - 1.9% | |||

| Flex Ltd. (b) | 354,300 | 10,448,307 | |

| Jabil, Inc. | 32,600 | 3,546,554 | |

| 13,994,861 | |||

| IT Services - 0.8% | |||

| GoDaddy, Inc. (b) | 40,100 | 5,602,371 | |

| Software - 0.7% | |||

| NCR Voyix Corp. (b) | 427,600 | 5,280,860 | |

TOTAL INFORMATION TECHNOLOGY | 39,050,872 | ||

| MATERIALS - 8.3% | |||

| Chemicals - 3.8% | |||

| Axalta Coating Systems Ltd. (b) | 115,200 | 3,936,384 | |

| Methanex Corp. | 117,500 | 5,670,550 | |

| Olin Corp. | 129,101 | 6,087,112 | |

| The Chemours Co. LLC | 289,200 | 6,527,244 | |

| Tronox Holdings PLC | 1,272 | 19,958 | |

| Westlake Corp. | 35,400 | 5,126,628 | |

| 27,367,876 | |||

| Containers & Packaging - 3.0% | |||

| Berry Global Group, Inc. | 68,100 | 4,007,685 | |

| Graphic Packaging Holding Co. | 158,600 | 4,156,906 | |

| International Paper Co. | 113,800 | 4,910,470 | |

| O-I Glass, Inc. (b) | 306,670 | 3,413,237 | |

| WestRock Co. | 99,000 | 4,975,740 | |

| 21,464,038 | |||

| Metals & Mining - 1.0% | |||

| Compass Minerals International, Inc. (c) | 79,892 | 825,284 | |

| Constellium NV (b) | 315,800 | 5,952,830 | |

| 6,778,114 | |||

| Paper & Forest Products - 0.5% | |||

| Louisiana-Pacific Corp. | 42,900 | 3,531,957 | |

TOTAL MATERIALS | 59,141,985 | ||

| REAL ESTATE - 5.7% | |||

| Equity Real Estate Investment Trusts (REITs) - 5.7% | |||

| Camden Property Trust (SBI) | 41,700 | 4,549,887 | |

| EastGroup Properties, Inc. | 4,600 | 782,460 | |

| Extra Space Storage, Inc. | 42,900 | 6,667,089 | |

| Prologis, Inc. | 69,447 | 7,799,593 | |

| Sun Communities, Inc. | 32,800 | 3,947,152 | |

| Ventas, Inc. | 193,800 | 9,934,188 | |

| Welltower, Inc. | 68,000 | 7,089,000 | |

| 40,769,369 | |||

| UTILITIES - 7.0% | |||

| Electric Utilities - 4.0% | |||

| American Electric Power Co., Inc. | 34,617 | 3,037,296 | |

| Constellation Energy Corp. | 29,233 | 5,854,493 | |

| Edison International | 131,000 | 9,407,110 | |

| PG&E Corp. | 611,900 | 10,683,774 | |

| 28,982,673 | |||

| Independent Power and Renewable Electricity Producers - 2.4% | |||

| The AES Corp. | 496,300 | 8,719,991 | |

| Vistra Corp. | 96,700 | 8,314,266 | |

| 17,034,257 | |||

| Multi-Utilities - 0.6% | |||

| Sempra | 55,600 | 4,228,936 | |

TOTAL UTILITIES | 50,245,866 | ||

| TOTAL COMMON STOCKS (Cost $564,321,446) | 699,504,858 | ||

| Money Market Funds - 3.5% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 5.38% (d) | 6,839,101 | 6,840,469 | |

| Fidelity Securities Lending Cash Central Fund 5.38% (d)(e) | 18,002,033 | 18,003,834 | |

| TOTAL MONEY MARKET FUNDS (Cost $24,844,303) | 24,844,303 | ||

| TOTAL INVESTMENT IN SECURITIES - 101.2% (Cost $589,165,749) | 724,349,161 |

NET OTHER ASSETS (LIABILITIES) - (1.2)% | (8,396,110) |

| NET ASSETS - 100.0% | 715,953,051 |

| (a) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $4,540,416 or 0.6% of net assets. |

| (b) | Non-income producing |

| (c) | Security or a portion of the security is on loan at period end. |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (e) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.38% | 2,784,486 | 81,366,948 | 77,310,699 | 123,664 | (266) | - | 6,840,469 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 5.38% | 16,579,892 | 127,762,372 | 126,338,430 | 155,703 | - | - | 18,003,834 | 0.1% |

| Total | 19,364,378 | 209,129,320 | 203,649,129 | 279,367 | (266) | - | 24,844,303 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 21,441,132 | 16,900,716 | 4,540,416 | - |

Consumer Discretionary | 70,859,918 | 70,859,918 | - | - |

Consumer Staples | 42,021,585 | 42,021,585 | - | - |

Energy | 60,177,437 | 60,177,437 | - | - |

Financials | 138,892,740 | 138,892,740 | - | - |

Health Care | 43,176,149 | 43,176,149 | - | - |

Industrials | 133,727,805 | 133,727,805 | - | - |

Information Technology | 39,050,872 | 39,050,872 | - | - |

Materials | 59,141,985 | 59,141,985 | - | - |

Real Estate | 40,769,369 | 40,769,369 | - | - |

Utilities | 50,245,866 | 50,245,866 | - | - |

| Money Market Funds | 24,844,303 | 24,844,303 | - | - |

| Total Investments in Securities: | 724,349,161 | 719,808,745 | 4,540,416 | - |

| Statement of Assets and Liabilities | ||||

June 30, 2024 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $17,457,467) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $564,321,446) | $ | 699,504,858 | ||

Fidelity Central Funds (cost $24,844,303) | 24,844,303 | |||

| Total Investment in Securities (cost $589,165,749) | $ | 724,349,161 | ||

| Foreign currency held at value (cost $35,928) | 35,928 | |||

| Receivable for investments sold | 68,416,542 | |||

| Receivable for fund shares sold | 2,864,929 | |||

| Dividends receivable | 671,213 | |||

| Distributions receivable from Fidelity Central Funds | 22,523 | |||

Total assets | 796,360,296 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 61,730,548 | ||

| Payable for fund shares redeemed | 182,436 | |||

| Accrued management fee | 361,374 | |||

| Distribution and service plan fees payable | 76,851 | |||

| Other payables and accrued expenses | 52,244 | |||

| Collateral on securities loaned | 18,003,792 | |||

| Total liabilities | 80,407,245 | |||

| Net Assets | $ | 715,953,051 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 520,666,367 | ||

| Total accumulated earnings (loss) | 195,286,684 | |||

| Net Assets | $ | 715,953,051 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Initial Class : | ||||

Net Asset Value, offering price and redemption price per share ($105,703,676 ÷ 6,297,707 shares) | $ | 16.78 | ||

| Service Class : | ||||

Net Asset Value, offering price and redemption price per share ($32,930,052 ÷ 1,971,366 shares) | $ | 16.70 | ||

| Service Class 2 : | ||||

Net Asset Value, offering price and redemption price per share ($352,923,841 ÷ 20,796,858 shares) | $ | 16.97 | ||

| Investor Class : | ||||

Net Asset Value, offering price and redemption price per share ($224,395,482 ÷ 13,512,323 shares) | $ | 16.61 | ||

| Statement of Operations | ||||

Six months ended June 30, 2024 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 6,049,019 | ||

| Interest | 69 | |||

| Income from Fidelity Central Funds (including $155,703 from security lending) | 279,367 | |||

| Total income | 6,328,455 | |||

| Expenses | ||||

| Management fee | $ | 2,066,268 | ||

| Transfer agent fees | 101,566 | |||

| Distribution and service plan fees | 455,957 | |||

| Accounting fees | 37,649 | |||

| Custodian fees and expenses | 9,722 | |||

| Independent trustees' fees and expenses | 1,526 | |||

| Audit | 31,001 | |||

| Legal | 1,713 | |||

| Interest | 1,504 | |||

| Miscellaneous | 17,091 | |||

| Total expenses before reductions | 2,723,997 | |||

| Expense reductions | (30,926) | |||

| Total expenses after reductions | 2,693,071 | |||

| Net Investment income (loss) | 3,635,384 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 58,533,817 | |||

| Fidelity Central Funds | (266) | |||

| Foreign currency transactions | (3,714) | |||

| Total net realized gain (loss) | 58,529,837 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (42,461,255) | |||

| Assets and liabilities in foreign currencies | (4,198) | |||

| Total change in net unrealized appreciation (depreciation) | (42,465,453) | |||

| Net gain (loss) | 16,064,384 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 19,699,768 | ||

| Statement of Changes in Net Assets | ||||

Six months ended June 30, 2024 (Unaudited) | Year ended December 31, 2023 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 3,635,384 | $ | 6,366,845 |

| Net realized gain (loss) | 58,529,837 | 33,188,883 | ||

| Change in net unrealized appreciation (depreciation) | (42,465,453) | 81,781,351 | ||

| Net increase (decrease) in net assets resulting from operations | 19,699,768 | 121,337,079 | ||

| Distributions to shareholders | (9,471,708) | (31,624,855) | ||

| Share transactions - net increase (decrease) | 4,604,062 | (35,709,156) | ||

| Total increase (decrease) in net assets | 14,832,122 | 54,003,068 | ||

| Net Assets | ||||

| Beginning of period | 701,120,929 | 647,117,861 | ||

| End of period | $ | 715,953,051 | $ | 701,120,929 |

VIP Value Strategies Portfolio Initial Class |

Six months ended (Unaudited) June 30, 2024 | Years ended December 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 16.55 | $ | 14.38 | $ | 16.40 | $ | 13.55 | $ | 13.31 | $ | 11.11 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .10 | .17 | .16 | .24 C | .14 | .20 D | ||||||

| Net realized and unrealized gain (loss) | .35 | 2.80 | (1.29) | 4.26 | .88 | 3.39 | ||||||

| Total from investment operations | .45 | 2.97 | (1.13) | 4.50 | 1.02 | 3.59 | ||||||

| Distributions from net investment income | - | (.19) | (.16) E | (.26) | (.15) | (.21) | ||||||

| Distributions from net realized gain | (.22) | (.61) | (.73) E | (1.39) | (.63) | (1.18) | ||||||

| Total distributions | (.22) | (.80) | (.89) | (1.65) | (.78) | (1.39) | ||||||

| Net asset value, end of period | $ | 16.78 | $ | 16.55 | $ | 14.38 | $ | 16.40 | $ | 13.55 | $ | 13.31 |

Total Return F,G,H | 2.79 % | 20.85% | (7.03)% | 33.60% | 8.26% | 34.53% | ||||||

Ratios to Average Net Assets B,I,J | ||||||||||||

| Expenses before reductions | .61% K | .64% | .64% | .64% | .66% | .66% | ||||||

| Expenses net of fee waivers, if any | .60 % K | .63% | .63% | .63% | .66% | .66% | ||||||

| Expenses net of all reductions | .60% K | .63% | .63% | .63% | .65% | .66% | ||||||

| Net investment income (loss) | 1.16% K | 1.12% | 1.02% | 1.47% C | 1.32% | 1.64% D | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 105,704 | $ | 101,102 | $ | 92,162 | $ | 125,050 | $ | 95,708 | $ | 83,357 |

Portfolio turnover rate L | 71 % K | 57% | 59% | 62% | 85% | 68% |

VIP Value Strategies Portfolio Service Class |

Six months ended (Unaudited) June 30, 2024 | Years ended December 31, 2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 16.48 | $ | 14.32 | $ | 16.35 | $ | 13.51 | $ | 13.27 | $ | 11.09 |

| Income from Investment Operations | ||||||||||||