Filed by Delhaize Group

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Delhaize Group

Commission File No.: 333-13302

Date: October 29, 2015

The following information was provided during an investor conference call held on October 29, 2015 discussing the third quarter 2015 results of Delhaize Group:

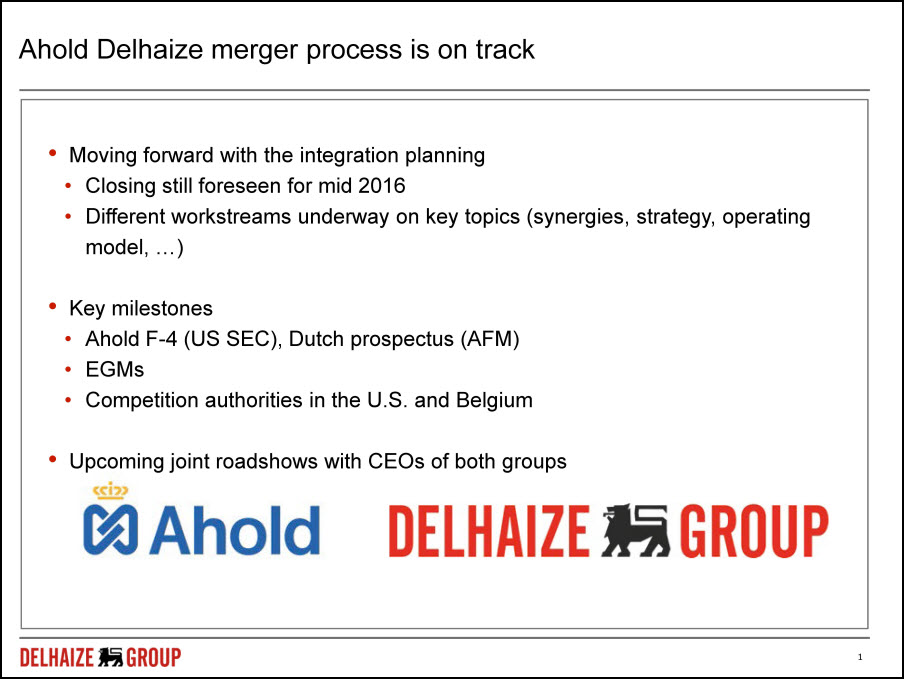

Ahold Delhaize merger process is on track Moving forward with the integration planningClosing still foreseen for mid 2016Different workstreams underway on key topics (synergies, strategy, operating model, …)Key milestonesAhold F-4 (US SEC), Dutch prospectus (AFM)EGMsCompetition authorities in the U.S. and BelgiumUpcoming joint roadshows with CEOs of both groups

Important Information for Investors and Shareholders

The transaction will be submitted to the shareholders of Delhaize Group (“Delhaize”) for their consideration. In connection with the transaction, Delhaize and Koninklijke Ahold N.V. also known as Royal Ahold (“Ahold”) will prepare a prospectus for Delhaize’s shareholders to be filed with the Securities and Exchange Commission (the “SEC”) and Delhaize will mail the prospectus to its shareholders and file other documents regarding the proposed transaction with the SEC. Investors and shareholders are urged to read the prospectus and the registration statement of which it forms a part when it becomes available, as well as other documents filed with the SEC, because they will contain important information. Investors and shareholders of Delhaize will be able to receive the prospectus and other documents free of charge at the SEC’s web site, http://www.sec.gov and from Delhaize by contacting Investor Relations Delhaize Group at Investor@delhaizegroup.com or by calling +32 2 412 2151.

Forward-Looking Statements

This communication contains forward-looking statements with respect to the financial condition, results of operations and business of Delhaize and Ahold and the merger of Delhaize and Ahold, including the expected effects of any proposed transaction. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors which are beyond the control of Delhaize and Ahold, including, among other things, the possibility that the expected synergies and value creation from the transaction will not be realized, or will not be realized within the expected time period; the risk that the businesses will not be integrated successfully; the possibility that the transaction will not receive the necessary approvals, that the expected timing of such approvals will be delayed or will require actions that adversely impact the benefits expected to be realized in the transaction; and the possibility that the transaction does not close. Neither Delhaize nor Ahold, nor any of their respective directors, officers, employees and advisors nor any other person is therefore in a position to make any representation as to the accuracy of the forward-looking statements included in this communication, such as economic projections and predictions or their impact on the financial condition, credit rating, financial profile, distribution policy or share buyback program of Delhaize, Ahold or the combined company, or the market for the shares of Delhaize, Ahold or the combined company. The actual performance, the success and the development over time of the business activities of Delhaize, Ahold and the combined company may differ materially from the performance, the success and the development over time expressed in or implied from the forward-looking statements contained in this presentation.