|

Filed by Koninklijke Ahold N.V. Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Delhaize Group Commission File No.: 333-13302 Date: November 12, 2015

|

Third quarter 2015 results

November 11, 2015

Filed by Koninklijke Ahold N.V.

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Delhaize Group

Commission File No.: 333-13302

Date: November 12, 2015

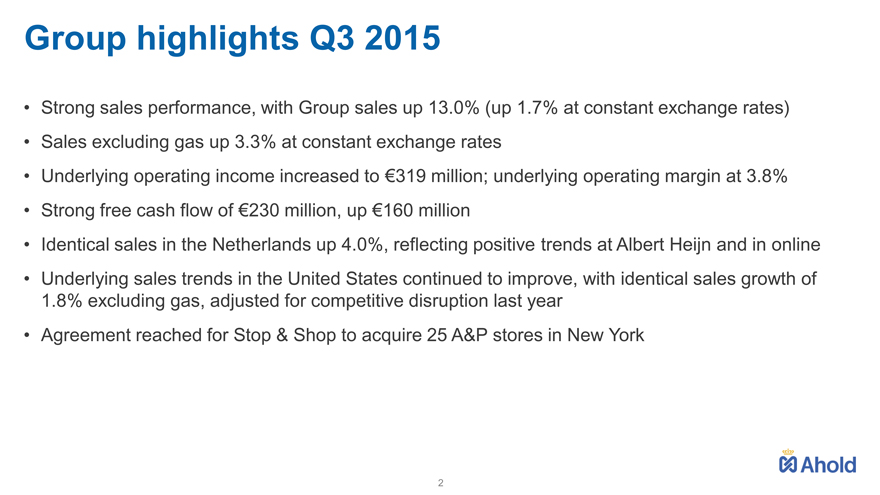

Group highlights Q3 2015

Strong sales performance, with Group sales up 13.0% (up 1.7% at constant exchange rates)

Sales excluding gas up 3.3% at constant exchange rates

Underlying operating income increased to €319 million; underlying operating margin at 3.8% Strong free cash flow of €230 million, up €160 million

Identical sales in the Netherlands up 4.0%, reflecting positive trends at Albert Heijn and in online

Underlying sales trends in the United States continued to improve, with identical sales growth of 1.8% excluding gas, adjusted for competitive disruption last year Agreement reached for Stop & Shop to acquire 25 A&P stores in New York

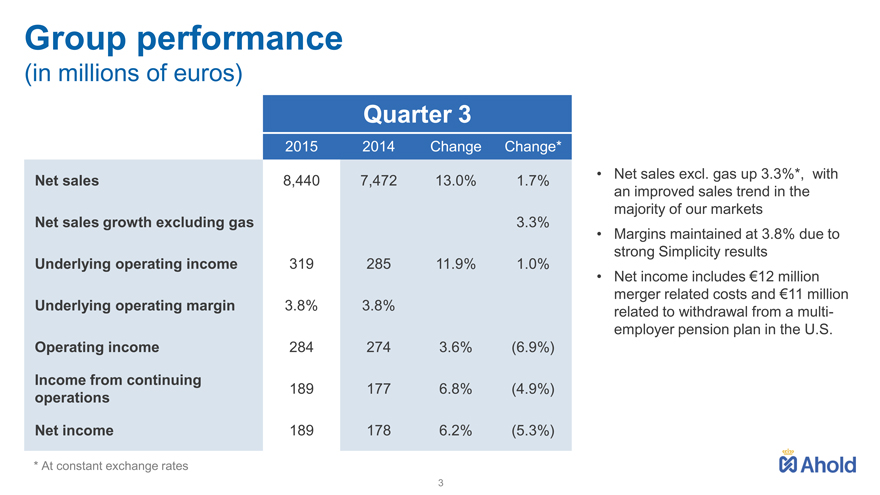

Group performance

(in millions of euros)

Net sales

Net sales growth excluding gas Underlying operating income Underlying operating margin

Operating income

Income from continuing operations

Net income

Quarter 3

2015 2014 Change Change*

8,440 7,472 13.0% 1.7%

3.3%

319 285 11.9% 1.0%

3.8% 3.8%

284 274 3.6% (6.9%)

189 177 6.8% (4.9%)

189 178 6.2% (5.3%)

Net sales excl. gas up 3.3%*, with an improved sales trend in the majority of our markets Margins maintained at 3.8% due to strong Simplicity results Net income includes €12 million merger related costs and €11 million related to withdrawal from a multi-employer pension plan in the U.S.

* | | At constant exchange rates |

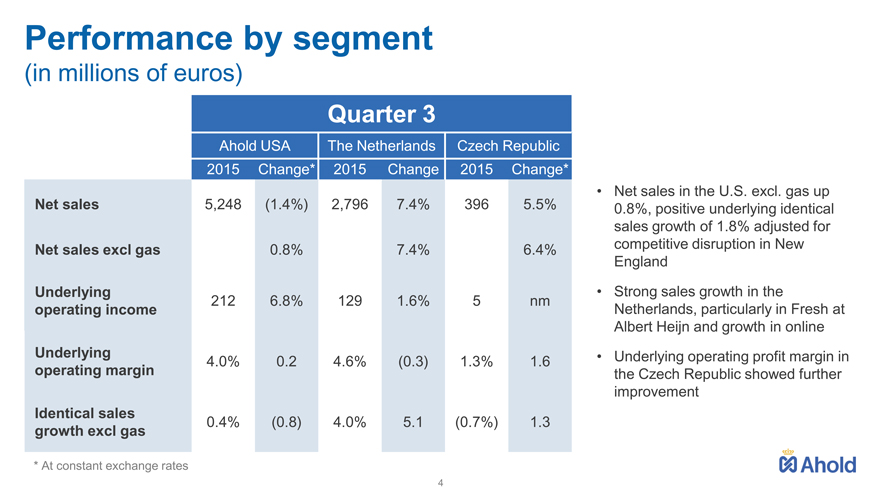

Performance by segment

(in millions of euros)

Net sales

Net sales excl gas

Underlying operating income

Underlying operating margin

Identical sales growth excl gas

Quarter 3

Ahold USA The Netherlands Czech Republic

2015 Change* 2015 Change 2015 Change*

5,248 (1.4%) 2,796 7.4% 396 5.5%

0.8% 7.4% 6.4%

212 6.8% 129 1.6% 5 nm

4.0% 0.2 4.6% (0.3) 1.3% 1.6

0.4% (0.8) 4.0% 5.1 (0.7%) 1.3

Net sales in the U.S. excl. gas up 0.8%, positive underlying identical sales growth of 1.8% adjusted for competitive disruption in New England

Strong sales growth in the

Netherlands, particularly in Fresh at Albert Heijn and growth in online

Underlying operating profit margin in the Czech Republic showed further improvement

* | | At constant exchange rates |

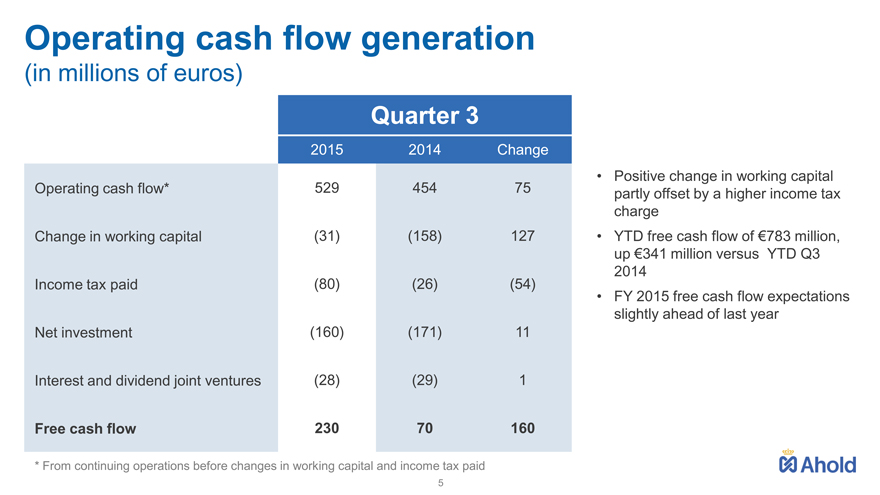

Operating cash flow generation

(in millions of euros)

Operating cash flow* Change in working capital Income tax paid Net investment

Interest and dividend joint ventures

Free cash flow

Quarter 3

2015 2014 Change

529 454 75

(31) (158) 127

(80) (26) (54)

(160) (171) 11

(28) (29) 1

230 70 160

Positive change in working capital partly offset by a higher income tax charge YTD free cash flow of €783 million, up €341 million versus YTD Q3 2014 FY 2015 free cash flow expectations slightly ahead of last year

* From continuing operations before changes in working capital and income tax paid

5

Business highlights: Ahold USA

Focused investments in quality, service and price

Super KVIs rollout to be completed in 2016

New produce departments launched in over 300 stores, showing an encouraging volume uplift. To be completed by mid-2016

New bakery pilot started in 15 stores

Second value investment with price reductions on thousands of products

New brand campaign launched helping customers “save time, save money and eat well”

New grocery shopping experience opened: bfresh™

Two stores launched at approx. 10,000 sq.ft., with focus on fresh foods, smart value and local convenience

Broad offer of natural and organic, vegan and gluten-free options, and foods from around the world

A new take on freshly prepared foods in its Little Kitchen™

A small range of daily nonperishables to offer a one-stop shop for urban shoppers

25 A&P stores converted to Stop & Shop in NYM area

Conversion of all 25 stores to be completed in November

Total acquisition costs of $150 million

Capex of $2-3 million per store falls within 2015 guidance

Sales post-conversion expected to grow to be comparable to NYM stores

First 12 months slightly dilutive on underlying margin, year two and beyond no margin impact expected

Restructuring costs of around $10 million expected in Q4 2015

6

Business highlights: the Netherlands

Innovation continues at Albert Heijn

Acceleration of new products; 1,000 skus introduced since the beginning of the year

Fully self-scan supermarket opened. Scanning done via mobile phone or handheld scanner

Over 200 stores enabled with mobile self-scanning since March

Online pilot store launched on Alibaba’s Tmall platform in China with approx. 100 skus

Continued focus on Fresh

Improved fresh deli assortment with an expanded assortment, better quality and improvements to own-brand deli products

New ready-made meals introduced that cater to customer demands for healthier and tastier prepared foods

Pilot of a “healthier checkout” in 100 stores

Rebrand of and

Etos and Gall & Gall brands refreshed, reflecting focus on quality, service and advice

Gall & Gall rolled out “Everyone an expert” strategy

Etos own-brand launched at Ahold USA offering affordable beauty care products

7

Business highlights: Czech Republic

Supermarkets drive growth in third quarter

Favorite store concept successfully rolled out to all 240 supermarkets

Positive customer reactions result in sales uplift and identical growth

New in-store communication following Albert rebranding features craftsmanship of our suppliers and quality of fresh food

Focus on improving the performance of our larger stores

After successful trial in six compact hypers, Favorite store concept rolled out to 35 large former SPAR stores

Store-centric model (SCM) introduced at Albert, with help from Stop & Shop. SCM is a modern concept used in the U.S. to improve execution of key processes by empowering store associates

Other initiatives launched to further improve performance

8

Business highlights: Online

Continuing strong growth at bol.com

Consumer sales up more than 30%

79 million visits in Q3, up 26%

Now offering an assortment of 10 million products

Plaza consumer sales up 78%, now representing over 20% of total sales

Consumer sales in Belgium up 71%

Expanding the assortment and customer base at ah.nl

Net sales up nearly 30%

High customer growth in existing markets following focus on quality of service (completeness) and improved shopping experience

Introduction of new products and solutions: Allerhande box, fresh bread, double frozen assortment, medicines and B2B improvements

Now offering an assortment of 28,500 products

Accelerating momentum at Peapod

Back to double-digit sales growth

Increasing marketing efforts after New Jersey warehouse improved capacity usage and service levels

Meal kits introduced for busy families, “Local Farm” boxes following local buying trend, and

“Fruit & Indulgence” snack box targeting B2B customers

9

Ahold Delhaize proposed merger remains on track

Integration planning progressing well

Closing still anticipated in mid-2016

Different workstreams in place to manage key topics, including: synergies, strategy and operating model

Strong focus on key milestones

Ahold F-4 (U.S. SEC)

European prospectus (AFM)

EGMs

Merger clearance in the U.S. and Belgium

Joint CEO roadshows coming up

Roadshows planned in the coming weeks with Dick Boer and Frans Muller

10

Legal notices

No offer or solicitation

This communication is being made in connection with the proposed business combination transaction between Koninklijke

Ahold N.V. also known as Royal Ahold (“Ahold”) and Delhaize Group NV/SA (“Delhaize”). This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and applicable Dutch, Belgian and other European regulations. This communication is not for release, publication or distribution, in whole or in part, in or into, directly or indirectly, any jurisdiction in which such release, publication or distribution would be unlawful.

11

Legal notices

Important additional information will be filed with the SEC

In connection with the proposed transaction, Ahold will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4 that will include a prospectus. The prospectus will be mailed to the holders of American Depositary Shares of Delhaize and holders of ordinary shares of Delhaize (other than holders of ordinary shares of Delhaize that are non-U.S. persons (as defined in the applicable rules of the SEC). INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC

CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT AHOLD, DELHAIZE, THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the prospectus and other documents filed with the SEC by Ahold and Delhaize through the website maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the prospectus and other documents filed by Ahold with the SEC by contacting Ahold Investor Relations at investor.relations@ahold.com or by calling +31 88 659 5213, and will be able to obtain free copies of the prospectus and other documents filed by Delhaize by contacting Investor Relations Delhaize Group at Investor@delhaizegroup.com or by calling +32 2 412 2151.

12

Legal notices

Forward-looking statements

This communication contains forward-looking statements, which do not refer to historical facts but refer to expectations based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those included in such statements. These statements or disclosures may discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to Ahold or Delhaize in connection with their intended merger, based on current beliefs of management as well as assumptions made by, and information currently available to, management. Forward-looking statements generally will be accompanied by words such as “anticipate,” “believe,” “plan,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “may,” “possible,” “potential,” “predict,” “project” or other similar words, phrases or expressions. Many of these risks and uncertainties relate to factors that are beyond Ahold’s or Delhaize’s control. Therefore, investors and shareholders should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the occurrence of any change, event or development that could give rise to the termination of the merger agreement; the ability to obtain the approval of the transaction by Ahold’s and Delhaize’s shareholders; the risk that the necessary regulatory approvals, including but not limited to merger clearance, may not be obtained or may be obtained subject to conditions that are not anticipated; failure to satisfy other closing conditions with respect to the transaction on the proposed terms and time frame; the possibility that the transaction does not close when expected or at all; the risks that the new businesses will not

13

Legal notices

be integrated successfully or promptly or that the combined company will not realize the expected benefits from the transaction; Ahold’s or Delhaize’s ability to successfully implement and complete its plans and strategies and to meet its targets; risks related to disruption of management time from ongoing business operations due to the proposed transaction; the benefits from Ahold’s or Delhaize’s plans and strategies being less than anticipated;

Furthermore, this communication contains Ahold forward-looking statements as to acquisition by Stop & Shop New York Metro of A&P stores, free cash flow, focus on investments in quality, service and price, new grocery shopping experience bfresh , innovation, focus on fresh, rebranding of Etos and Gall & Gall, improvement of the performance of Ahold’s larger stores in the Czech Republic and online activities. These forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by the forward-looking statements. Many of these risks and uncertainties relate to factors that are beyond Ahold’s ability to control or estimate precisely, such as the effect of general economic or political conditions, fluctuations in exchange rates or interest rates,

14

Legal notices

increases or changes in competition, Ahold’s ability to implement and successfully complete its plans and strategies, the benefits from and resources generated by Ahold’s plans and strategies being less than or different from those anticipated, changes in Ahold’s liquidity needs, the actions of competitors and third parties and other factors discussed in Ahold’s public filings and other disclosures. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this communication. Ahold does not assume any obligation to update any public information or forward-looking statements in this communication to reflect subsequent events or circumstances, except as may be required by applicable laws. Outside the Netherlands, Koninklijke Ahold N.V., being its registered name, presents itself under the name of “Royal Ahold” or simply “Ahold.”

15

Thank you