SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: May 2006

ADECCO SA

(Exact name of Registrant as specified in its charter)

Commission # 0-25004

Sägereistrasse 10

CH-8152 Glattbrugg

Switzerland

+41 1 878 88 88

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F]

Form 20-F X Form 40-F

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934]

Yes No X

Attached:

| - | Adecco increases net income by 59% in Q1 2006 |

| ||

| Press Relase |

Adecco increases net income by 59% in Q1 2006

Q1 HIGHLIGHTS (Q1 06 vs. Q1 05)

| • | Revenues of EUR 4.7 billion, up 15% (9% organically1) |

| • | Professional2 revenues grew 24% (13% organically), Office and Industrial 11% (7% organically) |

| • | Gross margin improvement of 80 bps to 17.4% |

| • | Operating income of EUR 149 million up 37% (30% organically) |

| • | Net income of EUR 100 million, up 59% |

Chéserex, Switzerland – May 10, 2006:The Adecco Group, the worldwide leader in Human Resource services, announced today results for the first quarter 2006. For the first three months of 2006 net income increased by 59% to EUR 100 million compared to EUR 63 million a year earlier. Revenues were up 15% to EUR 4.7 billion from EUR 4.1 billion in the same period last year.

Klaus J. Jacobs, Adecco Group Chairman and Chief Executive Officer, said: “We are well on track with the plan we initiated last year. The implementation of our six global business lines and the completion of our management team give us comfort that we are on course to reach our long-term goals. 2006 started well, with 9% organic revenue growth and encouraging initial profitability improvements. I am particularly pleased with the superior performance of our professional business. Although not yet contributing to this quarter’s results, I am very satisfied with the development of our recent acquisition of DIS AG, which doubled operating profits in the first quarter compared to 2005.”

| 1 | Organic growth is a non US GAAP measure and excludes the impact of currency and acquisitions. |

| 2 | Professional business refers to Adecco’s Information Technology, Engineering & Technical, Finance & Legal, Medical & Science, Sales, Marketing & Events and Human Capital Solutions business. |

Adecco SA – Q1 2006 Results | Page 1 of 10 | 10/5/2006 |

| ||

| Press Relase |

Q1 2006 FINANCIAL PERFORMANCE

Sales

Group sales for the first quarter of 2006 were EUR 4.7 billion, a 15% increase compared to the same quarter last year. Organically, excluding the impact of currency and acquisitions, revenues were up 9%. In the quarter there was a positive impact of 1% from additional trading days.

Gross Profit

Gross margin improved 80 bps to 17.4% versus the first quarter of 2005 as a result of the growing contribution from the professional staffing business and improved gross margins in the temporary business. In the Office and Industrial business Adecco enhanced gross margins to 15.8% (Q1 2005: 15.1%), while in the professional business gross margins were raised to 24.9% (Q1 2005: 24.0%). The permanent placement business and acquisitions each contributed a 30 bps enhancement to the Group’s gross margin.

Selling, General and Administrative Expenses (SG&A)

SG&A were up 16% for the quarter on a reported basis. SG&A as a percentage of sales increased to 14.2% (Q1 2005: 13.9%) and remained stable when excluding the impact of foreign currency and acquisitions. Organically costs grew 8%, the office network by 7% (+400 offices) and FTEs by 8% (+2,300 FTEs) compared to the same quarter last year.

Operating Income

Operating income for the first quarter 2006 was EUR 149 million, an increase of 37% (30% organically). Operating income margin improved to 3.2% versus 2.7% for the same period last year.

Interest Expenses and Other Income / (Expenses), net

Interest expenses were EUR 12 million in the period, which is EUR 3 million less than in the first quarter 2005 due to the Group’s reduced gross debt position versus the first quarter 2005. Interest expenses are expected to be approximately EUR 55 million for the full year 2006. Other Income / (Expenses), net were EUR 4 million. Realization of investment gains is the main reason for the increase.

Provision for Income Taxes

The effective tax rate in the first quarter was 29.0% compared with 32.5% in the same period last year. The main contributing elements supporting this reduction are the change in the mix of income and the successful resolution of a number of prior years’ tax audits as well as changes in tax legislation in several jurisdictions. For the full year 2006 Adecco expects an effective tax rate of approximately 29%.

Net Income and EPS

Net income was up 59% to EUR 100 million in the first quarter of the year (Q1 2005: EUR 63 million). Basic EPS was EUR 0.53 (Q1 2005: EUR 0.33).

Balance Sheet, Cash-flow, and Net Debt1

The Group generated EUR 255 million of operating cash flow in the first quarter of 2006, compared with EUR 68 million in Q1 2005. The main reason for this increase is the timing of cash payments due to an additional trading week in previous periods. Net debt increased by EUR 292 million to EUR 716 million at the end of the first quarter of 2006 compared to the year end of 2005. This increase was mainly due to the purchase of DIS AG (EUR 547 million net of cash acquired). DIS AG was consolidated as of March 31, 2006.

| 1 | Net debt is a non-US GAAP measure and comprises short-term and long-term debt less cash and cash equivalents and short-term investments. |

Adecco SA – Q1 2006 Results | Page 2 of 10 | 10/5/2006 |

| ||

| Press Relase |

Currency Impact

Currency fluctuations had a positive impact on the first quarter’s revenues and operating income. Mainly the stronger US dollar improved the Group’s results by approximately 4%.

Litigation matters

On March 29, 2006, the United States District Court for the Southern District of California dismissed the securities class action complaint filed against Adecco S.A. and certain of its current and former directors and officers with prejudice and entered judgment in the Company’s favour. The plaintiffs, who had 30 days to appeal, have recently filed a notice of appeal from the dismissal of their complaint. The Company continues to believe that the decision of the District Court is correct and that there is no merit to the case and will vigorously defend the judgment in its favour.

GEOGRAPHICAL PERFORMANCE

InFrance revenues grew 5% (organically 3%) to EUR 1.5 billion in the first quarter of 2006, which is slightly below the French staffing market and a reflection of the weak automotive sector. Gross margin was up 90 bps in the quarter due to the acquisition of Altedia. Excluding the impact of the acquisition, gross margin declined by 20 bps. On an organic basis SG&A increased by 7%, ahead of revenue growth. As a result operating margin declined by 30 bps to 3.0% compared to the same quarter last year. Office and Industrial represented approximately 90% of France’s turnover.

In theUS & Canada Adecco continued its focus on profitable accounts, which resulted in 2% revenue growth in constant currency. The improved customer mix in the Office and Industrial business, combined with a 17% revenue addition in the higher margin Finance & Legal business, resulted in 120 bps higher gross margins and a 39% operating profit growth in constant currency. Operating margins improved to 3.1% compared to 2.3% in the first quarter last year. Office and Industrial represented approximately two-thirds of Adecco’s US & Canada’s turnover.

In the first quarter of 2006UK & Ireland added 24% in revenues in constant currency. Operating margins improved by 60 bps to 3.6% compared to the first quarter of 2005. The successful expansion of Adecco’s managed service business resulted in above market revenue growth in Office and Industrial as well as in Information Technology. Demand for staffing services in the engineering and finance sector have also remained strong.

InJapanrevenues grew 7% in constant currency, while operating margins expanded to 5.9% (Q1 2005: 3.8%). The strong economy combined with a general shortage of human capital led to a healthy pricing environment and thus better gross margins.

Good revenue additions of 11%, 38% and 43% inIberia,Germany and theNordics in constant currency and adjusted for acquisitions are partially driven by changes in the regional legislation and higher acceptance levels of temporary staffing, but also mirror a generally more robust economy.

Adecco SA – Q1 2006 Results | Page 3 of 10 | 10/5/2006 |

| ||

| Press Relase |

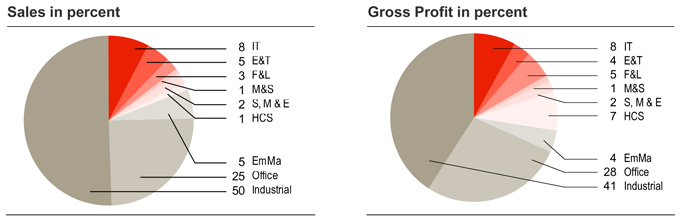

BUSINESS LINE PERFORMANCE

Adecco’sOffice and Industrial businesses, which represented 25% and 50% of revenues in the quarter respectively, both grew 9% in constant currency. Demand was strong in the UK & Ireland, Iberia, Italy, the Nordics and Germany. France and US & Canada comprised approximately half of Office and Industrial’s revenues.

InInformation Technology (IT) Adecco increased revenues by 20% in constant currency compared to the first three months in 2005. The strong performance in the UK & Ireland more than compensated for weaker revenue growth in the US & Canada. IT reflected 8% of revenues and gross profit in the first quarter of 2006. UK and US & Canada comprised approximately three-fourths of the IT business line’s revenues.

Adecco’sEngineering & Technical (E&T) business grew 7% in constant currency in the first quarter. Continued good demand in the UK & Ireland offset the sales decrease in the US & Canada. UK & Ireland combined with the US & Canada comprised approximately three-fourths of the Engineering & Technical’s revenues.

InFinance & Legal (F&L) Adecco achieved a revenue growth of 13% in constant currency. The business line contributed 3% to Group’s revenues, but 5% to Group’s gross profit. Demand for finance and legal professionals continued to be strong in the US & Canada as well as in the UK & Ireland. The US and UK Finance & Legal business comprised approximately three fourths of the business line’s revenues.

Adecco’sHuman Capital Solutions (HCS) business grew revenues by 42% in constant currency and decreased 6% when excluding the impact of acquisitions.Sales, Marketing & Events (S,M&E) andMedical & Science (M&S)added in constant currency 32% (11% organically) and 7% respectively.

MANAGEMENT OUTLOOK

Additional trading days had a positive impact of 1% in the first quarter. This impact is expected to be 2% negative in the second quarter. Current trading conditions combined with the key indicators for the global staffing services market continue to point to a favourable growth for the industry. The Group therefore remains committed to its objective of revenue growth, at or above market rates, of at least 7-9% per annum on average for the coming years providing no material changes to the macroeconomic environment. At the same time management continues to be confident that the focus on professional business fields and on key regions will allow Adecco to continuously improve operating income margins to over 5% by 2009.

Adecco SA – Q1 2006 Results | Page 4 of 10 | 10/5/2006 |

| ||

| Press Relase |

Subsequent events

On April 25, 2006, Adecco Group issued Eurobonds in the amount of EUR 700 million in part to refinance the acquisition of DIS announced on January 9, 2006. Adecco has purchased approximately 83% of the outstanding shares of DIS at a cost of approximately EUR 580 million.

Financial Agenda 2006

| Annual General Meeting | May 23, 2006 | |

| Q2 2006 results | August 11, 2006 | |

| Q3 2006 results | November 3, 2006 |

Forward-looking statements

Information in this release may involve guidance, expectations, beliefs, plans, intentions or strategies regarding the future. These forward-looking statements involve risks and uncertainties. All forward-looking statements included in this release are based on information available to Adecco S.A. as of the date of this release, and we assume no duty to update any such forward-looking statements. The forward-looking statements in this release are not guarantees of future performance and actual results could differ materially from our current expectations. Numerous factors could cause or contribute to such differences. Factors that could affect the Company’s forward-looking statements include, among other things: global GDP trends and the demand for temporary work; changes in regulation of temporary work; intense competition in the markets in which the Company competes; changes in the Company’s ability to attract and retain qualified temporary personnel; the resolution of US unemployment tax reviews, the resolution of the French anti-trust investigation and the resolution of the US class action; and any adverse developments in existing commercial relationships, disputes or legal and tax proceedings.

Please refer to the Company’s most recent Annual Report on Form 20-F and other reports filed with or submitted to the US Securities and Exchange Commission from time to time, for further discussion of the factors and risks associated with our business.

About Adecco

Adecco S.A. is a Fortune Global 500 company and the global leader in HR services. The Adecco Group network connects over 700,000 associates with business clients each day through its network of over33,000 employees and6,600 offices in over70 countries and territories around the world. Registered in Switzerland, and managed by a multinational team with expertise in markets spanning the globe, the Adecco Group delivers an unparalleled range of flexible staffing and career resources to corporate clients and qualified associates.

Adecco S.A. is registered in Switzerland (ISIN: CH001213860) and listed on the Swiss Stock Exchange with trading on Virt-x (SWX/VIRT-X:ADEN), the New York Stock Exchange (NYSE:ADO) and Euronext Paris—Premier Marché (EURONEXT: ADE).

Contacts:

Adecco Corporate Investor Relations

Investor.relations@adecco.com or +41 (0) 44 878 8925

| Adecco | Corporate Press Office |

| Press.office@adecco.com | or +41 (0) 44 878 8832 |

There will be an audio webcast of the analyst presentation at 11 am CET, details of which can be found at our Investor Relations section athttp://webcast.adecco.com.

Adecco SA – Q1 2006 Results | Page 5 of 10 | 10/5/2006 |

| ||

Press Relase Annexes |

Consolidated statements of operations

EUR millions, | Q1 2006 | Q1 2005 | Variance % | |||||||||

except share and per share amounts | EUR | Constant | ||||||||||

Revenues | 4,679 | 4,086 | 15 | % | 11 | % | ||||||

Direct costs of services | (3,867 | ) | (3,409 | ) | ||||||||

Gross profit | 812 | 677 | 20 | % | 16 | % | ||||||

Gross margin | 17.4 | % | 16.6 | % | ||||||||

Selling, general and administrative expenses | (662 | ) | (569 | ) | 16 | % | 12 | % | ||||

As a percentage of revenues | 14.2 | % | 13.9 | % | ||||||||

Amortisation of intangible assets | (1 | ) | — | |||||||||

Operating income | 149 | 108 | 37 | % | 33 | % | ||||||

Operating income margin | 3.2 | % | 2.7 | % | ||||||||

Interest expense | (12 | ) | (15 | ) | ||||||||

Other income/(expenses), net | 4 | — | ||||||||||

Income applicable to minority interests | — | — | ||||||||||

Income before income taxes | 141 | 93 | 51 | % | ||||||||

Provision for income taxes | (41 | ) | (30 | ) | ||||||||

Net income | 100 | 63 | 59 | % | ||||||||

Net income margin | 2.1 | % | 1.5 | % | ||||||||

Basic earnings per share data: | ||||||||||||

Basic earnings per share | 0.53 | 0.33 | ||||||||||

Basic weighted-average shares | 186,537,922 | 187,332,372 | ||||||||||

Diluted earnings per share data: | ||||||||||||

Diluted earnings per share | 0.52 | 0.33 | ||||||||||

Diluted weighted-average shares | 196,675,125 | 197,418,787 | ||||||||||

Adecco SA - Q1 2006 Results | Page 6 of 10 | 10/5/2006 |

| ||

Press Relase Annexes |

Revenues and operating income by geographies

EUR millions | Q1 2006 | Q1 2005 | Variance % | |||||||||

| EUR | Constant | |||||||||||

Revenues | ||||||||||||

France1 | 1,481 | 1,414 | 5 | % | 5 | % | ||||||

USA & Canada | 948 | 832 | 14 | % | 2 | % | ||||||

UK & Ireland | 446 | 352 | 26 | % | 24 | % | ||||||

Japan | 362 | 342 | 6 | % | 7 | % | ||||||

Italy | 268 | 243 | 10 | % | 10 | % | ||||||

Iberia2 | 247 | 163 | 51 | % | 51 | % | ||||||

Benelux | 221 | 188 | 18 | % | 18 | % | ||||||

Nordics | 160 | 112 | 43 | % | 43 | % | ||||||

Germany | 106 | 77 | 38 | % | 38 | % | ||||||

Australia & New Zealand | 103 | 104 | -1 | % | -6 | % | ||||||

Switzerland | 83 | 73 | 13 | % | 14 | % | ||||||

Emerging Markets | 254 | 186 | 37 | % | 24 | % | ||||||

Adecco Group | 4,679 | 4,086 | 15 | % | 11 | % | ||||||

Operating Income3 | ||||||||||||

France | 45 | 47 | -5 | % | -5 | % | ||||||

USA & Canada | 29 | 18 | 55 | % | 39 | % | ||||||

UK & Ireland | 16 | 10 | 51 | % | 49 | % | ||||||

Japan | 21 | 13 | 65 | % | 67 | % | ||||||

Italy | 17 | 14 | 17 | % | 17 | % | ||||||

Iberia | 14 | 9 | 48 | % | 48 | % | ||||||

Benelux | 9 | 4 | 144 | % | 144 | % | ||||||

Nordics | 10 | 1 | n.m | n.m | ||||||||

Germany | 9 | 4 | 131 | % | 131 | % | ||||||

Australia & New Zealand | — | 3 | -86 | % | -86 | % | ||||||

Switzerland | 6 | 6 | 5 | % | 6 | % | ||||||

Emerging Markets | 4 | 6 | -32 | % | -39 | % | ||||||

Total Operating Units | 180 | 135 | 33 | % | 30 | % | ||||||

Corporate Expenses | (30 | ) | (27 | ) | ||||||||

Amortisation of Intangibles | (1 | ) | — | |||||||||

Adecco Group | 149 | 108 | 37 | % | 33 | % | ||||||

| 1) | Organic revenue growth of 3 % |

| 2) | Organic revenue growth of 11 % |

| 3) | Contribution (Operating income before amortisation) on the operating unit level |

Adecco SA - Q1 2006 Results | Page 7 of 10 | 10/5/2006 |

| ||

Press Relase Annexes |

Revenues breakdown and revenue growth by business line

in % of total revenues | Q1 2006 | Q1 2005 | Variance % | |||||||||

| EUR | Constant | |||||||||||

Revenues1 | ||||||||||||

Office | 25 | % | 26 | % | 12 | % | 9 | % | ||||

Industrial | 50 | % | 52 | % | 11 | % | 9 | % | ||||

Total Office and Industrial | 75 | % | 78 | % | 11 | % | 9 | % | ||||

Information Technology | 8 | % | 7 | % | 28 | % | 20 | % | ||||

Engineering & Technical | 5 | % | 4 | % | 14 | % | 7 | % | ||||

Finance & Legal | 3 | % | 2 | % | 21 | % | 13 | % | ||||

Medical & Science | 1 | % | 1 | % | 7 | % | 7 | % | ||||

Sales, Marketing & Events | 2 | % | 2 | % | 32 | % | 32 | % | ||||

Human Capital Solutions | 1 | % | 1 | % | 53 | % | 42 | % | ||||

Total Global Business Lines | 20 | % | 17 | % | 24 | % | 18 | % | ||||

Emerging Markets | 5 | % | 5 | % | 37 | % | 24 | % | ||||

Adecco Group | 100 | % | 100 | % | 15 | % | 11 | % | ||||

| 1) | Breakdown of revenues is based on dedicated branches. |

Adecco SA - Q1 2006 Results | Page 8 of 10 | 10/5/2006 |

| ||

Press Relase Annexes |

Consolidated balance sheets

EUR millions | Mar 31, 2006 | Dec31, 2005 | ||||

Assets | ||||||

Current assets: | ||||||

– Cash and cash equivalents | 422 | 468 | ||||

– Short-term investments | 26 | 380 | ||||

– Trade accounts receivable, net | 3,540 | 3,659 | ||||

– Other current assets | 294 | 298 | ||||

Total current assets | 4,282 | 4,805 | ||||

Property, equipment, and leasehold improvements, net | 243 | 240 | ||||

Other assets | 307 | 312 | ||||

Intangible assets, net | 165 | 48 | ||||

Goodwill | 1,903 | 1,434 | ||||

Total assets | 6,900 | 6,839 | ||||

Liabilities and shareholders’ equity | ||||||

Liabilities | ||||||

Current liabilities: | ||||||

– Accounts payable and accrued expenses | 3,288 | 3,287 | ||||

– Short-term debt and current maturities of long-term debt | 448 | 550 | ||||

Total current liabilities | 3,736 | 3,837 | ||||

Long-term debt, less current maturities | 716 | 722 | ||||

Other liabilities | 191 | 143 | ||||

Total liabilities | 4,643 | 4,702 | ||||

Minority interests | 34 | 20 | ||||

Shareholders’ equity | ||||||

Common shares | 117 | 117 | ||||

Additional paid-in capital | 2,076 | 2,045 | ||||

Treasury stock, at cost | (59 | ) | (59 | ) | ||

Retained earnings / accumulated deficit | 75 | (25 | ) | |||

Accumulated other comprehensive income/(loss), net | 14 | 39 | ||||

Total shareholders’ equity | 2,223 | 2,117 | ||||

Total liabilities and shareholders’ equity | 6,900 | 6,839 | ||||

Adecco SA - Q1 2006 Results | Page 9 of 10 | 10/5/2006 |

| ||

Press Relase Annexes |

Consolidated statements of cash flows

EUR millions | 2006 Q1 | 2005 Q1 | ||||

Cash flows from operating activities | ||||||

Net income | 100 | 63 | ||||

Adjustments to reconcile net income to cash flows from operating activities | ||||||

– Depreciation and amortisation | 25 | 26 | ||||

– Other charges | 17 | 16 | ||||

Changes in operating assets and liabilities, net of acquisitions: | ||||||

– Trade accounts receivable | 148 | 116 | ||||

– Accounts payable and accrued expenses | (40 | ) | (154 | ) | ||

– Other assets and liabilities | 5 | 1 | ||||

Cash flows from operating activities | 255 | 68 | ||||

Cash flows from/(used in) investing activities | ||||||

Capital expenditures, net of proceeds | (19 | ) | (14 | ) | ||

Acquisition (83% in DIS net of cash acquired) | (547 | ) | — | |||

Acquisition (49% in Altedia) | — | (40 | ) | |||

Increase of restricted cash (tender offer for remaining 51% in Altedia) | — | (63 | ) | |||

Purchase of short-term investments | (10 | ) | (280 | ) | ||

Proceeds from sale of short-term investments | 358 | 85 | ||||

Cash settlements on derivative instruments | 1 | — | ||||

Other acquisition and investing activities, net | (4 | ) | (4 | ) | ||

Cash flows from/(used in) investing activities | (221 | ) | (316 | ) | ||

Cash flows from/(used in) financing activities | ||||||

Net increase in short-term debt | 422 | 10 | ||||

Repayment of long-term debt | (516 | ) | (65 | ) | ||

Cash settlements on derivative instruments | (8 | ) | (10 | ) | ||

Common stock options exercised | 26 | — | ||||

Other financing activities | (1 | ) | — | |||

Cash flows from/(used in) financing activities | (77 | ) | (65 | ) | ||

Effect of exchange rate changes on cash | (3 | ) | 8 | |||

Net increase/(decrease) in cash and cash equivalents | (46 | ) | (305 | ) | ||

Cash and cash equivalents: | ||||||

– Beginning of year | 468 | 879 | ||||

– End of period | 422 | 574 | ||||

Adecco SA - Q1 2006 Results | Page 10 of 10 | 10/5/2006 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ADECCO SA | ||||||

| (Registrant) | ||||||

| Dated: 10 May 2006 | By: | /s/ Dominik de Daniel | ||||

| Dominik de Daniel | ||||||

| Chief Financial Officer | ||||||

| Dated: 10 May 2006 | By: | /s/ Hans R. Brütsch | ||||

| Hans R. Brütsch | ||||||

| Corporate Secretary | ||||||