Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of: August 2006

ADECCO SA

(Exact name of Registrant as specified in its charter)

Commission # 0-25004

Sägereistrasse 10

CH-8152 Glattbrugg

Switzerland

+41 1 878 88 88

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F]

Form 20-F x Form 40-F ¨

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934]

Yes ¨ No x

Attached:

- 2006 Half Year Report

Table of Contents

Table of Contents

2 | ||||||

3 | ||||||

8 | ||||||

9 | ||||||

10 | ||||||

11 | ||||||

12 | ||||||

1

Table of Contents

Selected financial information(unaudited)

In millions, except share and per share information

| For the six months ended (in EUR) | 2006 | 2005 | ||||

Statements of operations: | ||||||

Revenues | 9,812 | 8,626 | ||||

Gross profit | 1,696 | 1,437 | ||||

Operating income | 351 | 265 | ||||

Net income | 235 | 163 | ||||

Per share: | ||||||

Basic earnings per share data: | ||||||

Basic earnings per share | 1.26 | 0.87 | ||||

Basic weighted-average shares | 186,638,343 | 187,243,094 | ||||

Diluted earnings per share data: | ||||||

Diluted earnings per share | 1.21 | 0.85 | ||||

Diluted weighted-average shares | 196,796,667 | 195,837,960 | ||||

Cash flows: | ||||||

Cash flows from operating activities | 241 | 66 | ||||

Cash flows from/(used in) investing activities | (256 | ) | (49 | ) | ||

Cash flows from/(used in) financing activities | 97 | (258 | ) | |||

2

Table of Contents

Financial review

In millions, except share and per share information

1. Operational results 1.1 Overview Statements throughout this discussion and analysis using the term “the Company” refer to the Adecco Group, which comprises Adecco S.A., a Swiss corporation, its majority-owned subsidiaries and other affiliated entities. For the first six months of 2006 net income increased by 44% to EUR 235 compared to EUR 163 a year earlier. Revenues were up 14% to EUR 9,812 from EUR 8,626 in the same period last year. Group revenues for the first six months of 2006 were EUR 9,812, a 14% increase compared to the same period last year. In constant currency revenues were up 12%. Acquisitions added 3% to revenue growth. In the six months under review there was no material impact from differences in trading days. Gross margin improved 60 basis points (“bps”) to 17.3% versus the first six months of 2005 as a result of the growing contribution from the professional staffing and permanent placement business, improved gross margins in the temporary business as well as acquisitions. In the Office and Industrial business the Company enhanced gross margin to 15.7% (H1 2005: 15.1%), while in the professional business gross margin was raised to 25.1% (H1 2005: 24.5%). Selling, General and Administrative Expenses (SG&A) were up 14% on a reported basis and 12% in constant currency versus the first six months of 2005. SG&A as a percentage of sales increased to 13.7% (H1 2005: 13.6%). The office network grew by 11% (+650 offices) and FTEs by 11% (+3,300 FTEs) compared to the first six months last year. Acquisitions added about 5% to the office and FTE increase. Operating income for the first six months of 2006 was EUR 351, an increase of 32% on a reported basis and 31% in constant currency. Operating income margin improved to 3.6% versus 3.1% for the same period last year. Net income was up 44% to EUR 235 in the first six months of 2006 (H1 2005: EUR 163). Basic EPS was EUR 1.26 (H1 2005: EUR 0.87). Interest expense was EUR 24 for the first six months of 2006, which is EUR 4 less than in the first six months of 2005 as long-term debt has been successfully refinanced with lower interest rates and due to a lower average debt. Other income/(expenses), net, were EUR 7 for the first six months of 2006. This is a EUR 10 improvement versus the same period last year, mainly due to lower hedging expenses. The effective tax rate in the first six months was 29% compared with 30% in the same period last year.

1.2 Geographical performance In France, revenues grew 7% to EUR 3,222 in the first six months of 2006. Gross margin was up 30 bps in the period due to the acquisition of Altedia. SG&A increased by 12%. As a result operating margin declined by 20 bps to 3.3% compared to the first six months last year. Office and Industrial represented approximately 90% of France’s turnover. In the USA & Canada, revenues increased versus the first six months of 2005 by 9% or 2% in constant currency as the Company continued its focus on profitable accounts. The improved customer mix in the Office and Industrial business and lower workers compensation expenses, combined with a 23% constant currency revenue addition in the higher margin Finance & Legal business, resulted in 150 bps higher gross margins and a 24% operating profit growth in constant currency. Operating margins improved to 3.6% compared to 3.0% in the first six months last year. Office and Industrial represented approximately two-thirds of the Company’s turnover in the USA & Canada. In the first six months of 2006, UK & Ireland added 22% in revenues (also 22% in constant currency). Operating margins improved by 10 bps to 3.4% compared to the first six months of 2005. The successful expansion of the Company’s managed service business resulted in above market revenue growth in Office and Industrial as well as in Information Technology. Demand for staffing services in the engineering and finance sector also remained strong. In Japan, revenues grew 5% or 8% in constant currency versus the first six months of 2005, while operating margin expanded to 6.1% (H1 2005: 4.4%). The strong economy combined with a general shortage of human capital and good permanent placement revenues led to a better gross margin. |

3

Table of Contents

Adecco Group –

Financial review

In millions, except share and per share information

In Germany, the Company added 90% to revenues versus the first six months of 2005 driven by the acquisition of Deutscher Industrie Service AG (“DIS”), changes in the regional legislation, higher acceptance levels of temporary staffing and a generally more robust economy. Italy and Iberia grew revenues by 11% and 38% versus the first six months of 2005. In the case of Iberia revenue growth was enhanced with the acquisition of Humangroup. The following table shows revenues and operating income by geographies: |

| in EUR | H1 2006 | H1 2005 | Variance % | |||||||||

| EUR | Constant | |||||||||||

Revenues | ||||||||||||

France | 3,222 | 3,024 | 7 | % | 7 | % | ||||||

USA & Canada | 1,870 | 1,707 | 9 | % | 2 | % | ||||||

UK & Ireland | 894 | 732 | 22 | % | 22 | % | ||||||

Japan | 727 | 693 | 5 | % | 8 | % | ||||||

Italy | 571 | 514 | 11 | % | 11 | % | ||||||

Iberia | 515 | 372 | 38 | % | 38 | % | ||||||

Benelux | 453 | 395 | 15 | % | 15 | % | ||||||

Nordics | 354 | 251 | 41 | % | 40 | % | ||||||

Germany | 308 | 162 | 90 | % | 90 | % | ||||||

Australia & New Zealand | 200 | 214 | -6 | % | -7 | % | ||||||

Switzerland | 186 | 170 | 9 | % | 11 | % | ||||||

Emerging Markets | 512 | 392 | 31 | % | 23 | % | ||||||

Adecco Group | 9,812 | 8,626 | 14 | % | 12 | % | ||||||

Operating Income1 | ||||||||||||

France | 105 | 106 | -1 | % | -1 | % | ||||||

USA & Canada | 68 | 51 | 31 | % | 24 | % | ||||||

UK & Ireland | 30 | 24 | 25 | % | 24 | % | ||||||

Japan | 45 | 30 | 47 | % | 52 | % | ||||||

Italy | 34 | 32 | 5 | % | 5 | % | ||||||

Iberia | 31 | 24 | 33 | % | 33 | % | ||||||

Benelux | 17 | 10 | 60 | % | 60 | % | ||||||

Nordics | 21 | 8 | 167 | % | 164 | % | ||||||

Germany | 23 | 9 | 177 | % | 177 | % | ||||||

Australia & New Zealand | 3 | 5 | -44 | % | -44 | % | ||||||

Switzerland | 14 | 14 | 6 | % | 8 | % | ||||||

Emerging Markets | 17 | 11 | 65 | % | 58 | % | ||||||

Total Operating Units | 408 | 324 | 26 | % | 25 | % | ||||||

Corporate Expenses | (53 | ) | (58 | ) | ||||||||

Amortisation of Intangibles | (4 | ) | (1 | ) | ||||||||

Adecco Group | 351 | 265 | 32 | % | 31 | % | ||||||

| 1) | Contribution (Operating income before amortisation) on the operating unit level. |

4

Table of Contents

Adecco Group –

Financial review

In millions, except share and per share information

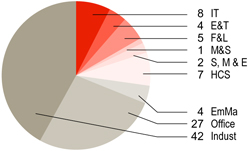

1.3 Business line performance

| H1 2006 Revenues in percent | H1 2006 Gross Profit in percent | |||||

|  | |||||

M&S: Medical&Science | ||||||

S, M&E: Sales, Marketing&Events | ||||||

E&T: Engineering&Technical | ||||||

F&L: Finance&Legal | ||||||

HCS: Human Capital Solutions | ||||||

IT: Information Technology | ||||||

EmMa: Emerging Markets | ||||||

The Company’s Office and Industrial businesses, which represented 24% and 52% of revenues in the first six months of 2006, respectively, grew 10% and 12% (9% and 11% in constant currency). In the office business, demand was strong in Japan, the UK & Ireland and the Nordics. The revenue growth acceleration in the Industrial business within the first six months of 2006 is mainly due to the recovery of the French market as well as sustained performance in Germany, the UK & Ireland and the Nordics. In Information Technology (IT), the Company increased revenues by 23% or 18% in constant currency compared to the first six months in 2005. The strong performance in the UK & Ireland more than compensated for the flat revenue development in the USA & Canada. IT reflected 7% of the Company’s revenues and 8% of the Company’s gross profit in the first six months of 2006. UK & Ireland and USA & Canada comprised approximately three-fourths of the IT business line’s revenues. The Company’s Engineering & Technical (E&T) business grew revenues by 17% or 13% in constant currency in the first six months. Continued good demand in the UK & Ireland offset the revenue decrease in the USA & Canada. UK & Ireland combined with the USA & Canada comprised approximately three-fourths of the Engineering & Technical’s revenues. In Finance & Legal (F&L), the Company achieved a revenue growth of 24% or 20% in constant currency versus the first six months of 2005. The business line contributed 3% to Company’s revenues, but 5% to Company’s gross profit. Demand for finance and legal professionals continued to be strong in the USA & Canada as well as in the UK & Ireland. The US & Canadian and UK & Irish Finance & Legal business comprised approximately three fourths of the business line’s revenues. The Company’s Human Capital Solutions (HCS) business grew revenues by 32% or 27% in constant currency in the first six months driven by the acquisition of Altedia. Sales, Marketing & Events (S,M&E) and Medical & Science (M&S) added 24% and 11% (25% and 11% in constant currency), respectively, in the first six months. The acquisition of DIS AG positively impacted all business lines, except Sales, Marketing & Events. Humangroup was consolidated in the Industrial and Sales, Marketing & Events business lines. | ||||||

5

Table of Contents

Adecco Group –

Financial review

In millions, except share and per share information

The following table illustrates the breakdown of revenues and revenue growth by business line:

| Variance % | ||||||||||||

In % of total revenues | H1 2006 | | H1 2005 | | EUR | Constant currency | | |||||

| Revenues1 | ||||||||||||

Office | 24 | % | 25 | % | 10 | % | 9 | % | ||||

Industrial | 52 | % | 53 | % | 12 | % | 11 | % | ||||

Total Office and Industrial | 76 | % | 78 | % | 11 | % | 10 | % | ||||

Information Technology | 7 | % | 7 | % | 23 | % | 18 | % | ||||

Engineering & Technical | 5 | % | 4 | % | 17 | % | 13 | % | ||||

Finance & Legal | 3 | % | 2 | % | 24 | % | 20 | % | ||||

Medical & Science | 1 | % | 1 | % | 11 | % | 11 | % | ||||

Sales, Marketing & Events | 2 | % | 2 | % | 24 | % | 25 | % | ||||

Human Capital Solutions | 1 | % | 1 | % | 32 | % | 27 | % | ||||

Total Professional Business Lines | 19 | % | 17 | % | 22 | % | 18 | % | ||||

Emerging Markets | 5 | % | 5 | % | 31 | % | 23 | % | ||||

Adecco Group | 100 | % | 100 | % | 14 | % | 12 | % | ||||

| 1) | Breakdown of revenues is based on dedicated branches. |

2. Non-U.S. GAAP information and financial measures The Company uses non-U.S. GAAP financial measures for management purposes. The principal non-U.S. GAAP financial measures discussed herein are net debt and constant currency comparisons which are used in addition to and in conjunction with results presented in accordance with U.S. GAAP. Net debt and constant currency comparisons should not be relied upon to the exclusion of U.S. GAAP financial measures, but rather reflect an additional measure of comparability and means of viewing aspects of the Company’s operations that, when viewed together with the U.S. GAAP results, provide a more complete understanding of factors and trends affecting our business. Because net debt and constant currency comparisons are not standardised, it may not be possible to compare our measures with other companies’ non-U.S. GAAP financial measures having the same or a similar name. Management encourages investors to review the Company’s financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Management monitors outstanding debt obligations by calculating net debt. Net debt comprises short-term and long-term debt (and off balance sheet debt, to the extent there is any) less cash and cash equivalents and short term investments. Constant currency comparisons are calculated by multiplying the prior year functional currency amount by the current year’s foreign currency exchange rate. Management believes that constant currency comparisons are important supplemental information for investors because these comparisons exclude the impact of changes in foreign currency exchange rates, which are outside the Company’s control, and focus on the underlying growth and performance. |

6

Table of Contents

Adecco Group –

Financial review

In millions, except share and per share information

3. Balance sheet, cash flow and net debt The Company generated EUR 241 of operating cash flow in the first six months of 2006, compared with EUR 66 in H1 2005. The main reasons for this increase are a higher net income as well as the timing of cash payments due to an additional trading week in previous periods. Net debt increased by EUR 483 to EUR 907 at the end of June 2006 compared to the year end of 2005. This increase was mainly due to the purchase of DIS AG (EUR 552 net of cash acquired) and treasury shares (EUR 43) as well as the payment of dividends (EUR 79 net of withholding tax), partially compensated by the operating cash flow. In the first six months of 2006, days sales outstanding (“DSO”) improved one day to 59 days compared to the same period last year. DIS AG was consolidated as of March 31, 2006.

4. Outlook Current trading conditions combined with the key indicators for the global staffing services market continue to point to a favourable growth for the industry. The Company therefore remains committed to its objective of revenue growth, at or above market rates, of at least 7-9% per annum on average for the coming years providing no material changes to the macroeconomic environment. At the same time management continues to be confident that the focus on professional business fields and on key regions will allow the Company to continuously improve operating income margins to over 5% by 2009. There are no impacts expected for differences in trading days for the remainder of the year. Dieter Scheiff (54) took office as the new Chief Executive Officer (CEO) of the Company as of August 1, 2006. Dieter Scheiff took over from Klaus J. Jacobs, who has been CEO of the Company since November 22, 2005. Klaus J. Jacobs remains Chairman of the Company.

5. Forward-looking statements Information in this report may involve guidance, expectations, beliefs, plans, intentions or strategies regarding the future. These forward-looking statements involve risks and uncertainties. All forward-looking statements included in this report are based on information available to the Company as of the date of this report, and we assume no duty to update any such forward-looking statements. The forward-looking statements in this report are not guarantees of future performance and actual results could differ materially from our current expectations. Numerous factors could cause or contribute to such differences. Factors that could affect the Company’s forward-looking statements include, among other things: – global GDP trends and the demand for temporary work; – changes in regulation of temporary work; – intense competition in the markets in which the Company competes; – changes in the Company’s ability to attract and retain qualified temporary personnel; – the resolution of U.S. unemployment tax reviews, the resolution of the French anti-trust investigation and the resolution of the U.S. class action; and – any adverse developments in existing commercial relationships, disputes or legal proceedings. Please refer to the Company’s Annual Report on Form 20-F for the year ended December 31, 2005, and other reports filed with or submitted to the U.S. Securities and Exchange Commission from time to time, for further discussion of the factors and risks associated with our business. |

7

Table of Contents

Consolidated balance sheets(unaudited)

In millions, except share and per share information

As of (in EUR) | 30.6.2006 | 31.12.2005 | ||||||

Assets | ||||||||

Current assets: | ||||||||

– Cash and cash equivalents | 543 | 468 | ||||||

– Short-term investments | 20 | 380 | ||||||

– Trade accounts receivable, net | 3,917 | 3,659 | ||||||

– Other current assets | 289 | 298 | ||||||

Total current assets | 4,769 | 4,805 | ||||||

Property, equipment and leasehold improvements, net | 237 | 240 | ||||||

Other assets | 299 | 312 | ||||||

Intangible assets, net | Note 2 | 171 | 48 | |||||

Goodwill | Note 2 | 1,884 | 1,434 | |||||

Total assets | 7,360 | 6,839 | ||||||

Liabilities and shareholders’ equity | ||||||||||

Liabilities | ||||||||||

Current liabilities: | ||||||||||

– Accounts payable and accrued expenses | 3,507 | 3,287 | ||||||||

– Short-term debt and current maturities of long-term debt | Note 3 | 51 | 550 | |||||||

Total current liabilities | 3,558 | 3,837 | ||||||||

Long-term debt, less current maturities | Note 3 | 1,419 | 722 | |||||||

Other liabilities | 194 | 143 | ||||||||

Total liabilities | 5,171 | 4,702 | ||||||||

Minority interests | 37 | 20 | ||||||||

Shareholders’ equity | ||||||||||

Common shares | 117 | 117 | ||||||||

Additional paid-in capital | 2,078 | 2,045 | ||||||||

Treasury stock, at cost | (102 | ) | (59 | ) | ||||||

Retained earnings / (accumulated deficit) | 90 | (25 | ) | |||||||

Accumulated other comprehensive income/(loss), net | Note 4 | (31 | ) | 39 | ||||||

Total shareholders’ equity | 2,152 | 2,117 | ||||||||

Total liabilities and shareholders’ equity | 7,360 | 6,839 | ||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

8

Table of Contents

Consolidated statements of operations(unaudited)

In millions, except share and per share information

For the six months ended (in EUR) | 2006 | 2005 | ||||||||

Revenues | Note 8 | 9,812 | 8,626 | |||||||

Direct costs of services | (8,116 | ) | (7,189 | ) | ||||||

Gross profit | 1,696 | 1,437 | ||||||||

Selling, general and administrative expenses | (1,341 | ) | (1,171 | ) | ||||||

Amortisation of intangible assets | (4 | ) | (1 | ) | ||||||

Operating income | Note 8 | 351 | 265 | |||||||

Interest expense | (24 | ) | (28 | ) | ||||||

Other income/(expenses), net | 7 | (3 | ) | |||||||

Income applicable to minority interests | (2 | ) | (1 | ) | ||||||

Income before income taxes | 332 | 233 | ||||||||

Provision for income taxes | (97 | ) | (70 | ) | ||||||

Net income | 235 | 163 | ||||||||

Basic earnings per share data: | ||||||||||

Basic earnings per share | 1.26 | 0.87 | ||||||||

Basic weighted-average shares | 186,638,343 | 187,243,094 | ||||||||

Diluted earnings per share data: | ||||||||||

Diluted earnings per share | 1.21 | 0.85 | ||||||||

Diluted weighted-average shares | 196,796,667 | 195,837,960 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

9

Table of Contents

Consolidated statements of cash flows(unaudited)

In millions, except share and per share information

| For the six months ended (in EUR) | 2006 | 2005 | ||||

Cash flows from operating activities | ||||||

Net income | 235 | 163 | ||||

Adjustments to reconcile net income to cash flows from operating activities: | ||||||

– Depreciation and amortisation | 51 | 53 | ||||

– Other charges | 28 | 30 | ||||

Changes in operating assets and liabilities, net of acquisitions: | ||||||

– Trade accounts receivable | (250 | ) | (199 | ) | ||

– Accounts payable and accrued expenses | 168 | 13 | ||||

– Other assets and liabilities | 9 | 6 | ||||

Cash flows from operating activities | 241 | 66 | ||||

Cash flows from/(used in) investing activities | ||||||

Capital expenditures, net of proceeds | (38 | ) | (32 | ) | ||

Acquisition of DIS, net of cash acquired | (552 | ) | ||||

Acquisition of Altedia, net of cash acquired | (88 | ) | ||||

Deposit for Altedia squeeze out | (8 | ) | ||||

Acquisition of Humangroup, net of cash acquired | (57 | ) | ||||

Purchase of available-for-sale securities | (24 | ) | (32 | ) | ||

Purchase of term deposits | (130 | ) | ||||

Proceeds from the sale of available-for-sale securities | 183 | 58 | ||||

Proceeds from the sale of term deposits | 195 | 246 | ||||

Cash settlements on derivative instruments | (2 | ) | ||||

Other investing activities, net | (20 | ) | (4 | ) | ||

Cash flows from/(used in) investing activities | (256 | ) | (49 | ) | ||

Cash flows from/(used in) financing activities | ||||||

Net increase/(decrease) in short-term debt | 27 | (8 | ) | |||

Borrowings of long-term debt, net of issuance costs | 694 | |||||

Repayment of long-term debt | (517 | ) | (101 | ) | ||

Dividends paid, net of withholding tax | (79 | ) | (79 | ) | ||

Purchase of treasury shares | (43 | ) | (59 | ) | ||

Cash settlement on derivative instruments | (15 | ) | (13 | ) | ||

Common stock options exercised | 33 | 1 | ||||

Other financing activities, net | (3 | ) | 1 | |||

Cash flows from/(used in) financing activities | 97 | (258 | ) | |||

Effect of exchange rate changes on cash | (7 | ) | 18 | |||

Net increase/(decrease) in cash and cash equivalents | 75 | (223 | ) | |||

Cash and cash equivalents: | ||||||

– Beginning of year | 468 | 879 | ||||

– End of period | 543 | 656 | ||||

| The accompanying notes are an integral part of these condensed consolidated financial statements. | ||||||

10

Table of Contents

Consolidated statements of changes in shareholders’ equity(unaudited)

In millions, except share and per share information

In EUR | Common Shares | Additional paid-in capital | | Treasury stock, at cost | | Retained earnings / (accumulated deficit) | | Accumulated other comprehensive income/ (loss), net | | Total shareholders’ equity | | ||||||

January 3, 2005 | 116 | 2,026 | (1 | ) | (356 | ) | (12 | ) | 1,773 | ||||||||

| �� | |||||||||||||||||

Comprehensive income: | |||||||||||||||||

Net income | 163 | 163 | |||||||||||||||

Other comprehensive income/(loss), net of tax | |||||||||||||||||

– Currency translation adjustment | 44 | 44 | |||||||||||||||

– Unrealised loss on cash flow hedging activities | (3 | ) | (3 | ) | |||||||||||||

– Minimum pension liability adjustment | 1 | 1 | |||||||||||||||

– Changes in available-for-sale securities | (3 | ) | (3 | ) | |||||||||||||

Total comprehensive income | 202 | ||||||||||||||||

Stock-based compensation | 5 | 5 | |||||||||||||||

Common stock options exercised | 1 | 1 | 2 | ||||||||||||||

Treasury stock transactions | (59 | ) | (59 | ) | |||||||||||||

Cash dividends, CHF 1.00 per share | (121 | ) | (121 | ) | |||||||||||||

July 3, 2005 | 117 | 2,032 | (60 | ) | (314 | ) | 27 | 1,802 | |||||||||

January 1, 2006 | 117 | 2,045 | (59 | ) | (25 | ) | 39 | 2,117 | |||||||||

Comprehensive income: | |||||||||||||||||

Net income | 235 | 235 | |||||||||||||||

Other comprehensive income/(loss), net of tax | |||||||||||||||||

– Currency translation adjustment | (68 | ) | (68 | ) | |||||||||||||

– Unrealised gain on cash flow hedging activities | 1 | 1 | |||||||||||||||

– Minimum pension liability adjustment | |||||||||||||||||

– Changes in available-for-sale securities | (3 | ) | (3 | ) | |||||||||||||

Total comprehensive income | 165 | ||||||||||||||||

Stock-based compensation | 5 | 5 | |||||||||||||||

Common stock options exercised | 31 | 31 | |||||||||||||||

DIS stock options exercised | (1 | ) | (1 | ) | |||||||||||||

Treasury stock transactions | (43 | ) | (43 | ) | |||||||||||||

Purchase of call options | (2 | ) | (2 | ) | |||||||||||||

Cash dividends, CHF 1.00 per share | (120 | ) | (120 | ) | |||||||||||||

June 30, 2006 | 117 | 2,078 | (102 | ) | 90 | (31 | ) | 2,152 | |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements. |

| ||||||||||||||||

11

Table of Contents

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

Note 1 - Summary of significant accounting policies Basis of presentation and principles of consolidation | ||||

The consolidated half year financial report includes Adecco S.A., a Swiss corporation, its majority-owned subsidiaries and other affiliated entities (collectively, the “Company”). The Company prepares its consolidated half year financial report using the same accounting principles and methods of computation that were applied in the audited consolidated financial statements as of December 31, 2005 and for the year then ended. | ||||

Certain information and footnote disclosures included in the audited consolidated financial statements as of December 31, 2005 have been condensed or omitted. As a result, the financial information to the condensed financial statements should be read in conjunction with the Company’s Annual Report 2005 including the Financial Review and Corporate Governance and the Annual Report on Form 20-F for the fiscal year ended December 31, 2005. | ||||

The reporting currency of the Company is the Euro, which reflects the significance of the Company’s Euro-denominated operations. Adecco S.A.’s share capital is denominated in Swiss francs, and the Company declares and pays dividends in Swiss francs. The Swiss franc is the currency of Adecco stock option grants since it is the functional currency of the parent company, Adecco S.A. | ||||

In the opinion of management, the consolidated half year financial statements reflect all adjustments necessary to present fairly the consolidated balance sheets, the consolidated statements of operations, the consolidated statements of cash flows and the consolidated statements of shareholders’ equity. Such adjustments are of a normal recurring nature. | ||||

In 2005, the Company decided to change its fiscal year end. Instead of the Company’s fiscal year ending on the Sunday nearest to December 31, the Company now has a fiscal year that coincides with the calendar year. The change also had an impact on the closing date for the half year period. Whereas, in previous years, half year periods ended on the Sunday closest to June 30, the half year period now concludes on June 30 in conjunction with the calendar month end. The change did not have a material impact on the consolidated financial statements for the half year period. | ||||

| Use of estimates | ||||

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make judgements, assumptions and estimates that affect the amounts reported in the consolidated half year financial statements and accompanying notes. The results of these estimates form the basis for making judgements about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ significantly from those estimates. | ||||

| Seasonality | ||||

Our quarterly operating results are affected by the seasonality of our customers’ businesses. Demand for staffing services historically has been lowest during the first quarter of the year. | ||||

| New accounting standards | ||||

In July 2006, the Financial Accounting Standards Board (“FASB”) issued an interpretation of FASB Statement No. 109, “Accounting for Income Taxes”. Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”) will become effective for the Company on January 1, 2007. FIN 48 prescribes the minimum recognition threshold a tax position is required to meet before being recognised in the financial statements. FIN 48 also provides guidance on de-recognition, measurement, classification, interest and penalties, accounting in interim periods, disclosure and transition. The Company has not yet determined the financial statement impact of this new interpretation. | ||||

| Note 2 – Acquisitions | ||||

In March 2006, the Company acquired approximately 84% of outstanding common shares of DIS Deutscher Industrie Service AG (“DIS”), a leading supplier of professional staffing services in Germany, for approximately EUR 580. As a result of the acquisition, the Company has strengthened its presence in the German professional services market. | ||||

The acquisition of DIS was originally financed with short-term borrowings. In April 2006, the Company issued EUR 700 unsubordinated guaranteed notes and used part of the proceeds to settle the short-term debt it had incurred as a result of the DIS acquisition. See Note 3 for details on debt instruments. | ||||

12

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

| The following table summarises the estimated fair value of the assets acquired and liabilities assumed at the date of acquisition: |

| In EUR | |||

Fair value of assets acquired and liabilities assumed | |||

Cash acquired | 28 | ||

Other current assets | 65 | ||

Tangible assets | 11 | ||

Intangible assets | |||

– Marketing related (trademarks) | 87 | ||

– Customer base | 32 | ||

Goodwill | 483 | ||

Current liabilities | (67 | ) | |

Deferred tax liability | (48 | ) | |

Minority interest | (11 | ) | |

Total fair value of assets acquired and liabilities assumed | 580 | ||

Marketing related intangible assets (trademarks) are considered to have infinite lives and are not amortised. Customer base intangible assets acquired have estimated useful lives of five years and are amortised on a straight-line basis over the useful lives. DIS was consolidated by the Company on March 31, 2006, and the results of DIS operations have been included in the financial statements since April 1, 2006. The following unaudited pro forma information shows consolidated operating results as if the DIS acquisition had occurred at the beginning of 2006 and at the beginning of 2005: |

| In EUR | 2006 | 2005 | ||

Pro forma consolidated operating results | ||||

Revenues | 9,891 | 8,770 | ||

Net income | 235 | 156 | ||

Basic income per share | 1.26 | 0.83 | ||

Diluted income per share | 1.21 | 0.81 | ||

The pro forma net income of DIS, including adjustments for depreciation of fixed assets, amortisation of intangible assets, and interest expense, reduced pro forma net income by less than EUR 1 and approximately EUR 7 for the six months ended June 30, 2006 and July 3, 2005, respectively. The pro forma results of operations do not necessarily represent operating results which would have occurred if the acquisition had taken place on the basis assumed above, nor are they indicative of future operating results of the combined companies. | ||||

| Note 3 – Financing arrangements | ||||

The Company’s total long-term and short-term debt as of June 30, 2006, amounted to EUR 1,470 compared to EUR 1,272 as of December 31, 2005. The increase was mainly due to the issuance of EUR 500 fixed rate guaranteed notes and EUR 200 floating rate guaranteed notes in April 2006. It was partly offset by the repayment of EUR 363 guaranteed notes and USD 190 guaranteed notes in March 2006. At June 30, 2006 and December 31, 2005, bank overdrafts and borrowings outstanding under lines of credit amounted to EUR 50 and EUR 26, respectively. | ||||

13

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

| In EUR | Principal at maturity | Maturity | Fixed interest rate | 30.6.2006 | 31.12.2005 | ||||||||

Long-term debt | |||||||||||||

Guaranteed zero-coupon convertible bond | CHF 1,044 | 2013 | 600 | 599 | |||||||||

Multicurrency revolving credit facility | EUR 580 | 2008 | |||||||||||

Guaranteed notes | EUR 363 | 2006 | 6.0 | % | 363 | ||||||||

USD Olsten guaranteed notes | USD 190 | 2006 | 7.0 | % | 160 | ||||||||

EUR Olsten guaranteed notes | EUR 122 | 2008 | 6.0 | % | 122 | 122 | |||||||

Fixed rate guaranteed notes | EUR 500 | 2013 | 4.5 | % | 497 | ||||||||

Floating rate guaranteed notes | EUR 200 | 2008 | 200 | ||||||||||

Other | 1 | 2 | |||||||||||

| 1,420 | 1,246 | ||||||||||||

Less current maturities | (1 | ) | (524) | ||||||||||

Long-term debt, less current maturities | 1,419 | 722 |

Multicurrency revolving credit facility On March 17, 2006, the Company agreed with the syndicate of banks an extension of EUR 577 of the existing EUR 580 multicurrency revolving credit facility through March 28, 2009.

Fixed and floating rate guaranteed notes On April 25, 2006, Adecco International Financial Services BV, a wholly-owned subsidiary of the Company, issued EUR 500 fixed rate notes guaranteed by Adecco S.A. due April 25, 2013, and EUR 200 floating rate notes guaranteed by Adecco S.A. due April 25, 2008. The proceeds were used for the refinancing of the DIS acquisition and for general corporate purposes. Interest is paid on the fixed rate notes annually in arrears at a fixed annual rate of 4.5% and on the floating rate notes quarterly in arrears at a rate determined by the three-month EURIBOR plus 23 basis points, which as of June 30, 2006 was 3.3%. |

14

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

Note 4 – Shareholders’ equity The Annual General Meeting of Shareholders of Adecco S.A. was held on May 23, 2006. The shareholders approved a dividend of CHF 1.00 per common share in respect of the fiscal year 2005. The net dividend to shareholders of EUR 79 was paid in June 2006. The withholding tax of EUR 41 was paid in July 2006. The Company had 4,889,282 and 5,822,915 common shares reserved for issuance of common shares to employees and directors upon the exercise of stock options as of June 30, 2006, and December 31, 2005, respectively. Additionally, during the six months ended June 30, 2006, the Company acquired 2,370,996 tradeable call options on its shares to cover its remaining obligations under the stock option plans. 15,400,000 common shares were reserved for issuance of financial instruments, such as convertible bonds as of June 30, 2006 and December 31, 2005. During the six months ended June 30, 2006, a total of 933,633 shares have been issued to employees and directors upon the exercise of stock options and 900,000 treasury shares were purchased by the Company for total consideration of EUR 43. Prior to the Company’s acquisition of DIS in March 2006, DIS had in place a stock incentive plan for its employees. Subsequent to the acquisition, DIS utilised a portion of its treasury stock to fulfil obligations resulting from the exercise of employee stock options under this plan. The Company treated the exercise of DIS stock options as a capital transaction in accordance with Staff Accounting Bulletin Topic 5-H (“SAB 51”) which allows for equity recognition of gains or losses on subsidiary stock transactions and requires that this accounting treatment be consistently applied for all future subsidiary stock transactions. The exercises resulted in a dilution of the Company’s ownership in DIS by less than 1%. Because the book value per share of the Company’s investment in DIS exceeded the cash proceeds from the option exercises, an after tax loss of EUR 1 has been reported as an adjustment to the Company’s additional paid-in capital. The components of accumulated other comprehensive income/(loss), net of tax, are as follows: |

| In EUR | 30.6.2006 | 31.12.2005 | ||||

Accumulated other comprehensive income/(loss), net | ||||||

Currency translation adjustment | (27 | ) | 41 | |||

Unrealised gain on cash flow hedging activities | 1 | |||||

Minimum pension liability adjustment | (5 | ) | (5 | ) | ||

Unrealised gain on available-for-sale securities | 3 | |||||

Accumulated other comprehensive income/(loss), net | (31 | ) | 39 |

15

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

Note 5 – Stock-based compensation The Company adopted Statement of Financial Accounting Standards (“SFAS”) No. 123(R) “Share-Based Payment” (“SFAS No. 123(R)”) on January 1, 2006, using the “modified prospective method”. Accordingly, compensation cost is recognised for awards granted to employees prior to January 1, 2006, and which remain unvested as of that date. Prior to adoption of SFAS No. 123(R), the Company utilised the fair value method of accounting for stock-based compensation in accordance with SFAS No. 123 “Accounting for Stock-Based Compensation” (“SFAS No. 123”) for grants in the year 2003 and subsequent years, and the intrinsic value method prescribed by Accounting Principles Board Opinion No. 25 “Accounting for Stock Issued to Employees” (“APB No. 25”) for grants prior to 2003. Adoption of SFAS No. 123(R) has not had a material impact on the accounting for option grants which were granted on or after the first day of 2003 but has resulted in expense being taken on unvested options granted prior to 2003. The prior periods are not restated. During the six months ended July 3, 2005, the Company did not record compensation expense for options granted prior to 2003. Had compensation expense for the Company’s stock-based compensation plans, which were accounted for in accordance with APB No. 25, been determined based on the fair value method at the grant dates for awards under those plans consistent with SFAS No. 123, the Company’s pro forma net income and earnings per share for the six months ended July 3, 2005 would have changed as follows: |

| In EUR | Six months ended July 3, 2005 | ||

Net income, as reported | 163 | ||

Stock-based employee compensation expense included in reported income, net of tax | 5 | ||

Total stock-based employee compensation expense determined under the fair value based method for all awards, net of tax | (14 | ) | |

Pro forma net income | 154 | ||

Basic earnings per share: | |||

– As reported | 0.87 | ||

– Pro forma | 0.82 | ||

Diluted earnings per share: | |||

– As reported | 0.85 | ||

– Pro forma | 0.80 |

These pro forma disclosures are not applicable to the six months ended June 30, 2006, since stock-based compensation expense for all stock options vesting during that period is recognised in the Company’s financial statements for that period. During the six months ended June 30, 2006 and July 3, 2005 the Company recognised total compensation expense relating to its stock option plans of EUR 7 and EUR 5, net of tax benefit of less than EUR 1 and EUR 0, respectively. The impact of adoption of SFAS No. 123(R) for the six months ended June 30, 2006, was a reduction in income before income taxes and net income of EUR 2, and a reduction in basic and diluted earnings per share of EUR 0.01. No benefits of tax deductions in excess of recognised compensation expense were recognised during the six months ended June 30, 2006. As of June 30, 2006, the Company had options and tradeable options outstanding relating to its common shares under several existing plans and plans assumed in the Olsten acquisition. Additionally, as of June 30, 2006, the Company’s newly acquired subsidiary, DIS, had options outstanding related to DIS common shares. |

16

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

Adecco and Olsten stock option plans Under the Adecco and Olsten plans, options vest and become exercisable in instalments, generally on a rateable basis up to four years beginning on the date of the grant or one year after the date of grant, and have a contractual life of three to ten years. Options are typically granted with an exercise price equal to or above fair market value on the date of grant. Certain options granted under the plans are tradeable on the SWX Swiss Exchange (virt-x). The options are granted to employees or directors of the Company and give the optionee a choice of selling the option on the public market or exercising the option to receive an Adecco S.A. share. If the option holder chooses to sell the option on the public market, the options may be held by a non-employee or non-director of the Company. As of June 30, 2006 and December 31, 2005, the number of stock options sold to the market was 2,106,778 and 1,086,662, respectively. The trading and valuation of the tradeable options is managed by a Swiss bank. The Company uses the Black-Scholes model to estimate the value of stock options granted to employees. Management believes that this model appropriately approximates the fair value of the stock option. The fair value of the option award, as calculated using the Black-Scholes model, is expensed for non-tradeable stock options on a straight-line basis and for tradeable stock options on an accelerated basis over the service period, which is consistent with the vesting period. There were no stock options granted during the six months ended June 30, 2006 and July 3, 2005. A summary of the status of the Company’s stock option plans as of June 30, 2006 and December 31, 2005, and changes during the six months are presented below. |

| In CHF | Number of shares | Exercise price per share | Weighted- average exercise price per share | Weighted- average remaining life (in years) | Aggregate intrinsic value | ||||||

Summary of stock option plans | |||||||||||

Options outstanding as of December 31, 2005 | 11,045,346 | 43-176 | 78 | 3.3 | 11 | ||||||

Exercised | (870,953 | ) | 43-65 | 53 | |||||||

Forfeited | (520,087 | ) | 43-176 | 92 | |||||||

Expired | (100,460 | ) | 75-142 | 102 | |||||||

Options outstanding as of June 30, 2006 | 9,553,846 | 43-176 | 79 | 3.0 | 40 | ||||||

Of which fully vested and exercisable | 8,892,784 | 43-176 | 79 | 2.9 | 38 |

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the Company’s closing stock price on the last trading day of the first half of 2006 and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders had all option holders exercised their options on June 30, 2006. This amount changes based on the fair market value of Adecco S.A. stock. The total intrinsic value of options exercised for the six months ended June 30, 2006 and for the six months ended July 3, 2005 was EUR 11 and less than EUR 1, respectively. As of June 30, 2006, EUR 7 of total unrecognised compensation cost related to stock options is expected to be recognised over a weighted-average period of approximately 1.1 years. No options were modified during the six months ended June 30, 2006. |

17

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

As of June 30, 2006 and December 31, 2005, 520 stock options and 63,200 stock options were exercised, for which the Adecco S.A. common shares were only issued in July 2006 and January 2006, respectively. Therefore, these shares are not included in outstanding common shares at June 30, 2006 and December 31, 2005, respectively. | ||||

| DIS stock option plan | ||||

| Under the DIS stock option plan, which was approved by its shareholders, each option has a term of up to five years and gives the option holder the right to acquire one DIS share at an exercise price originally linked to the fair market value at the date of grant. Subsequent to the date of grant, the exercise price of the share options increases 10% each year and is adjusted for dividends. While options vest immediately at time of grant, options become exercisable as follows: 1/3 two years after date of grant, 1/3 three years after date of grant and the remaining 1/3 four years after date of grant. | ||||

The fair value of each option award is estimated on the date of grant using the binomial pricing model, which uses the assumptions noted in the following table: | ||||

| 2006 | |||

Assumptions used for the estimation of the fair value of option awards | |||

Share price on grant date in EUR | 64.70 | ||

Average exercise price in EUR | 65.76 | ||

Standard deviation of expected share price gain | 38.80 | % | |

Expected option term (in months) | 60 | ||

Annual risk free rate | 3 | % |

The volatility as measured by the standard deviation of the expected share price gains is based on statistical analyses of the daily share price over the past three years. The expected term of the options is determined using historical data. The expected dividend yield is based on the expected annual dividend of EUR 0.05 per share. The risk-free rate is based on the five-year German government bonds rate in effect as of the grant date. | ||||

A summary of the status of the DIS stock option plan as of June 30, 2006 and the acquisition date, and changes during the period are presented below. |

| In EUR | Number of shares | Weighted- average exercise price per share | Weighted- average remaining life (in years) | Aggregate intrinsic value | |||||

Summary of stock option plans | |||||||||

Options outstanding and vested at acquisition | 336,810 | 30 | 2.8 | ||||||

Granted | 117,315 | 66 | 4.8 | ||||||

Exercised | (56,949 | ) | 31 | ||||||

Options outstanding and vested as of June 30, 2006 | 397,176 | 41 | 3.4 | 18 | |||||

Of which exercisable | 79,782 | 32 | 1.4 | 4 |

The weighted-average grant date fair value of options granted and vested during the six months ended June 30, 2006 was EUR 16.02. The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between DIS’ closing stock price on the last trading day of the first half of 2006 and the exercise price, multiplied by the number of in-the-money options) that would have been received by the option holders had all option holders exercised their options on June 30, 2006. This amount changes based on the fair market value of DIS stock. The total intrinsic value of options exercised for the six months ended June 30, 2006 was EUR 2. As of June 30, 2006, all options granted under the DIS stock option plan had vested. Accordingly, there is no unrecognised compensation cost related to non-vested share-based compensation arrangements under this plan. |

18

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

Note 6 – Employee benefit plans For the six months ended June 30, 2006, estimated net pension expense for the defined benefit plans is as follows: |

| In EUR | Swiss plan | Non-Swiss plans | ||||||||||

| 2006 | 2005 | 2006 | 2005 | |||||||||

Components of pension expense | ||||||||||||

Service cost | 5 | 4 | 1 | 2 | ||||||||

Interest cost | 1 | 1 | 3 | 2 | ||||||||

Expected return on plan assets | (2 | ) | (2 | ) | (2 | ) | (2 | ) | ||||

Amortisation of net gain | 1 | |||||||||||

Pension expense, net | 4 | 3 | 2 | 3 | ||||||||

Note 7 – Income taxes The Company operates in various countries with different tax laws and rates; therefore, the effective tax rate may vary from year to year due to change in the mix of taxable income among countries and special transactions. Income taxes for the first half of 2006 were provided at a rate of 29%, based on the Company’s current estimate of the annual effective tax rate. For the six months ended July 3, 2005, the tax rate was 30%. The main contributing element supporting this reduction is the change in the mix of income.

Note 8 – Segment reporting Beginning in 2006, the Company changed its organisational structure such that operations are managed through a geographical structure combined with newly introduced global business lines. The Company now reports its business on a geographical basis with seven reportable segments as disclosed below. Segment financial information has been modified for all periods in order to conform to the new structure. The Company evaluates the performance of its reportable segments based on operating income before amortisation which is defined as the amount of income from continuing operations before amortisation of intangible assets, interest expense, other income/(expenses), net, income applicable to minority interests and income taxes. Corporate items consist of certain expenses which are separately managed at the corporate level. Segment assets include current assets, property, equipment, and leasehold improvements, net, other assets, intangible assets, net, and goodwill. The accounting principles used for the segment reporting are those used by the Company. Intersegmental revenues are not material in any of the years presented. |

19

Table of Contents

Adecco Group –

Notes to the consolidated financial statements(unaudited)

In millions, except share and per share information

| In EUR | France | USA & Canada | UK & Ireland | Japan | Italy | Iberia | Germany | Other | Corporate | Total | ||||||||||||||||||||

Six months ended July 3, 2005 | ||||||||||||||||||||||||||||||

Revenues | 3.024 | 1,707 | 732 | 693 | 514 | 372 | 162 | 1,422 | 8,626 | |||||||||||||||||||||

Depreciation | (13 | ) | (11 | ) | (5 | ) | (4 | ) | (2 | ) | (1 | ) | (1 | ) | (6 | ) | (9 | ) | (52 | ) | ||||||||||

Operating income before amortisation | 106 | 51 | 24 | 30 | 32 | 24 | 9 | 48 | (58 | ) | 266 | |||||||||||||||||||

Amortisation of intangible assets | (1 | ) | ||||||||||||||||||||||||||||

Operating income | 265 | |||||||||||||||||||||||||||||

Segment assets | 2,047 | 1,391 | 521 | 345 | 294 | 293 | 110 | 863 | 826 | 6,690 | ||||||||||||||||||||

| In EUR | France | USA & Canada | UK & Ireland | Japan | Italy | Iberia | Germany | Other | Corporate | Total | ||||||||||||||||||||

Six months ended June 30, 2006 | ||||||||||||||||||||||||||||||

Revenues | 3,222 | 1,870 | 894 | 727 | 571 | 515 | 308 | 1,705 | 9,812 | |||||||||||||||||||||

Depreciation | (13 | ) | (11 | ) | (4 | ) | (3 | ) | (2 | ) | (2 | ) | (2 | ) | (6 | ) | (4 | ) | (47 | ) | ||||||||||

Operating income before amortisation | 105 | 68 | 30 | 45 | 34 | 31 | 23 | 72 | (53 | ) | 355 | |||||||||||||||||||

Amortisation of intangible assets | (4 | ) | ||||||||||||||||||||||||||||

Operating income | 351 | |||||||||||||||||||||||||||||

Segment assets | 2,225 | 1,380 | 584 | 260 | 298 | 346 | 816 | 969 | 482 | 7,360 | ||||||||||||||||||||

Note 9 – Commitments and contingencies Guarantees The Company has entered into certain guarantee contracts and standby letters of credit that total EUR 842, including those letters of credit issued under the multicurrency revolving credit facility. The guarantees primarily relate to government requirements for operating a temporary staffing business in certain countries and are generally renewed annually. Other guarantees relate to operating leases and credit lines. The standby letters of credit mainly relate to workers compensation in the U.S. If the Company is not able to obtain and maintain letters of credit and/or guarantees from third parties then the Company would be required to collateralise its obligations with cash. Due to the nature of these arrangements and historical experience, the Company does not expect to be required to collateralise its obligations with cash.

Contingencies In the ordinary course of business, the Company is involved in various legal actions and claims, including those related to social security charges, other payroll related charges, and various employment related matters. Although the outcome of the legal proceedings cannot be predicted with certainty, the Company believes it has adequately reserved for such matters.

Securities class action lawsuits Class action lawsuits in the U.S. against Adecco S.A. and certain of its current and former directors and officers, which were commenced following the Company’s January 2004 announcement of a delay in the release of its 2003 consolidated financial statements, are pending. The lawsuits, which have been consolidated, allege violations of Sections 10(b) and 20(a) of the U.S. Securities Exchange Act of 1934 in connection with public disclosures made by the Company between March 2000 and January 2004 regarding its earnings and operating results. On March 29, 2006, the U.S. District Court for the Southern District of California dismissed the plaintiffs’ amended consolidated complaint with prejudice and entered judgement in the Company’s favour. On April 25, 2006, the plaintiffs filed a notice of appeal from the dismissal of their complaint. The Company continues to believe that the decision of the District Court is correct and that there is no merit to the case and will vigorously defend the judgement in its favour. However, there can be no assurance that the resolution of this matter will not have a material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows.

U.S. state unemployment tax reviews In the U.S., the Company, like other companies, incurs costs for unemployment taxes based on taxable wages (which include the wages of its temporary staff) and tax rates notified by each state. Certain states have advised the Company that they are reviewing the unemployment tax rates applied by the Company as a result of certain past changes in structure in the U.S. As of this date, the Company has not received any assessments from these states. However, the Company anticipates that it will receive assessments from these states. It is possible that other states will initiate similar reviews. As of June 30, 2006, the Company has reserved EUR 9 for potential assessments. Liability, if any, will depend on resolution of future assessments. There can be no assurance that, when finally resolved, the total liability arising from state unemployment tax reviews will not exceed the amount of the reserve or be material to the Company’s consolidated financial position, results of operations, or cash flows. The Company intends to evaluate and, as appropriate, contest any such assessment.

French antitrust investigation In November 2004, the French competition authority (DGCCRF) commenced an investigation concerning alleged anti-competitive practices in France by Adecco Travail Temporaire SASU, a French subsidiary of the Company. Up to the date of this report, the Company has not received any statement of objections by the competent French competition authorities and is unable to predict whether the outcome of this matter will have a material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows. |

20

Table of Contents

Adresses

Registered office

Adecco S.A. (Holding)

CH 1275 Chéserex

Contact details:

Adecco Management & Consulting SA

Sägereistrasse 10

PO Box

CH 8152 Glattbrugg

T+41 44 878 88 88

F+41 44 829 88 88

Corporate Communications

T+41 44 878 88 32

F+41 44 829 88 39

press.office@adecco.com

Investor Relations

T+41 44 878 89 25

F+41 44 829 89 24

investor.relations@adecco.com

http://investor.adecco.com

Adecco on the Internet

www.adecco.com

Imprint

Publisher: Adecco Management&Consulting S.A., Glattbrugg

Design: Gottschalk+Ash Int’l

August 2006

Table of Contents

| www.adecco.com |

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ADECCO SA | ||||||||

| (Registrant) | ||||||||

| Dated: 17 August 2006 | By: | /s/ Dominik de Daniel | ||||||

| Dominik de Daniel | ||||||||

| Chief Financial Officer | ||||||||

| Dated: 17 August 2006 | By: | /s/ Hans R. Brütsch | ||||||

| Hans R. Brütsch | ||||||||

| Corporate Secretary | ||||||||