EXHIBIT 99.4

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Sarasota, Florida

Audited Consolidated Financial Statements

At December 31, 2008 and 2007 and for the Years Then Ended

(Together with Independent Auditors’ Report)

HACKER, JOHNSON & SMITH PA

Certified Public Accountants

{W0019809.2}

HACKER, JOHNSON & SMITH PA

Fort Lauderdale

Fort Myers

Orlando

Tampa

Certified Public Accountants

Independent Auditors’ Report

Century Bank, A Federal Savings Bank Sarasota, Florida:

We have audited the accompanying consolidated balance sheets of Century Bank, A Federal Savings Bank and Subsidiary (the “Bank”) at December 31, 2008 and 2007 and the related consolidated statements of operations, stockholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Bank’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with generally accepted auditing standards as established by the Auditing Standards Board (United States) and in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Bank is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Bank’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of the Bank at December 31, 2008 and 2007, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

HACKER, JOHNSON & SMITH PA Tampa, Florida April 15, 2009

500 North Westshore Boulevard, Post Office Box 20368, Tampa, Florida 33622-0368, (813)2862424

A Registered Public Accounting Firm

{W0019809.2}

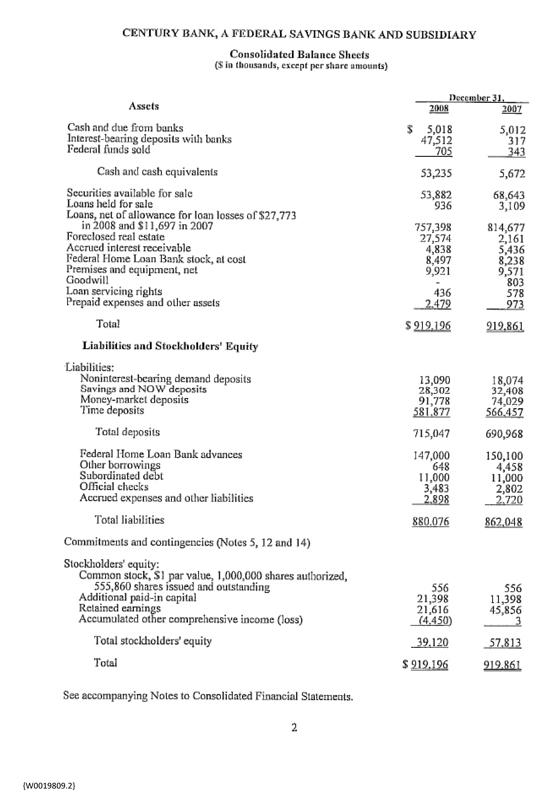

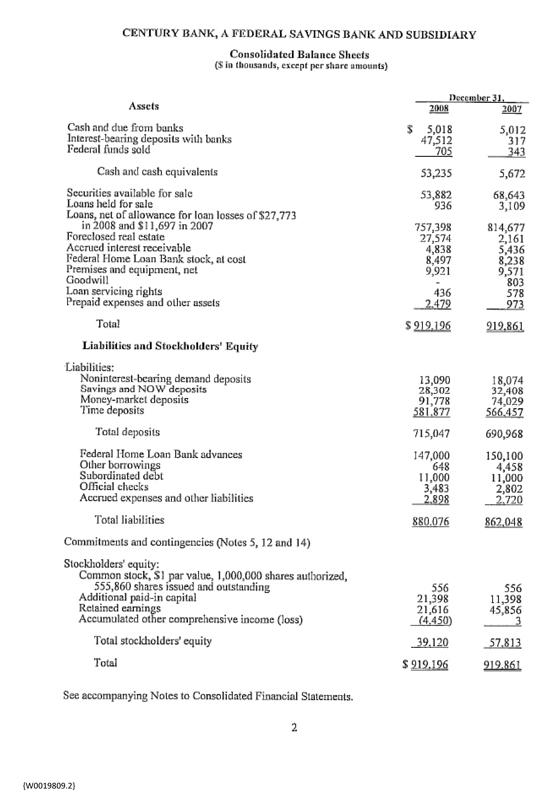

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Consolidated Balance Sheets

($ in thousands, except per share amounts)

December 31,

Assets 2008 2007

Cash and due from banks $5,018 5,012

Interest-bearing deposits with banks 47,512 317

Federal funds sold 705 343

Cash and cash equivalents 53,235 5,672

Securities available for sale 53,882 68,643

Loans held for sale 936 3,109

Loans, net of allowance for loan losses of $27,773

in 2008 and $11,697 in 2007 757,398 814,677

Foreclosed real estate 27,574 2,161

Accrued interest receivable 4,838 5,436

Federal Home Loan Bank stock, at cost 8,497 8,238

Premises and equipment, net 9,921 9,571

Goodwill - 803

Loan servicing rights 436 578

Prepaid expenses and other assets 2,479 973

Total $919,196 919,861

Liabilities and Stockholders’ Equity

Liabilities:

Noninterest-bearing demand deposits 13,090 18,074

Savings and NOW deposits 28,302 32,408

Money-market deposits 91,778 74,029

Time deposits 581,877 566,457

Total deposits 715,047 690,968

Federal Home Loan Bank advances 147,000 150,100

Other borrowings 648 4,458

Subordinated debt 11,000 11,000

Official checks 3,483 2,802

Accrued expenses and other liabilities 2,898 2,720

Total liabilities 880,076 862,048

Commitments and contingencies (Notes 5, 12 and 14)

Stockholders’ equity:

Common stock, $1 par value, 1,000,000 shares authorized,

555,860 shares issued and outstanding 556 556

Additional paid-in capital 21,398 11,398

Retained earnings 21,616 45,856

Accumulated other comprehensive income (loss) (4,450) 3

Total stockholders’ equity 39,120 57,813

Total $919,196 919,861

See accompanying Notes to Consolidated Financial Statements.

2

{W0019809.2}

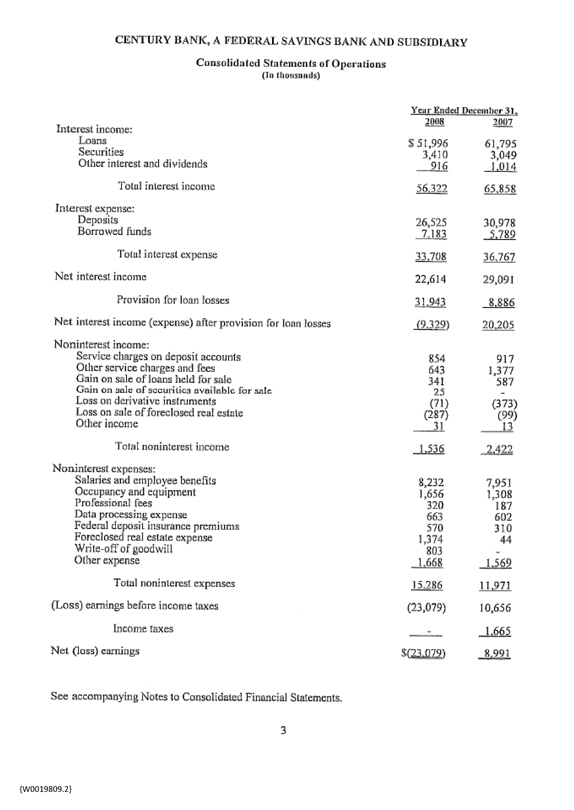

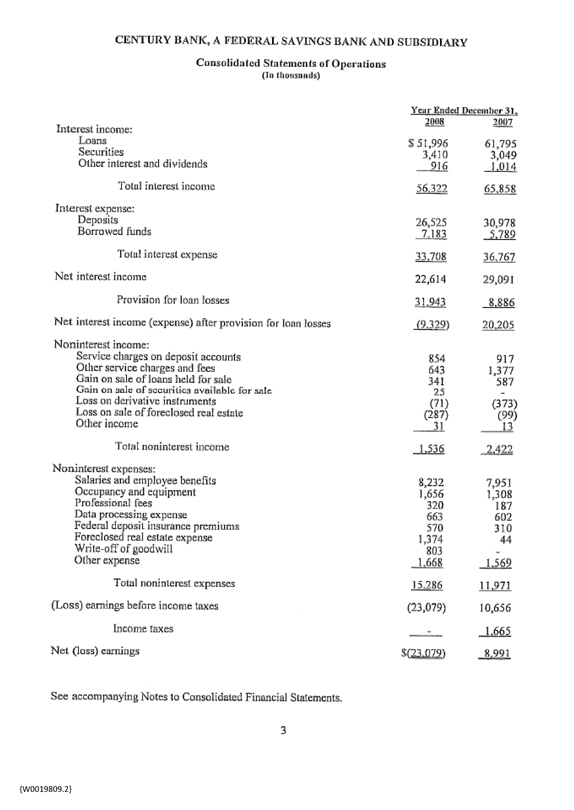

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Consolidated Statements of Operations

(In thousands)

Year Ended December 31,

2008 2007

Interest income:

Loans $51,996 61,795

Securities 3,410 3,049

Other interest and dividends 916 1,014

Total interest income 56,322 65,858

Interest expense:

Deposits 26,525 30,978

Borrowed funds 7,183 5,789

Total interest expense 33,708 36,767

Net interest income 22,614 29,091

Provision for loan losses 31,943 8,886

Net interest income (expense) after provision for loan losses (9,329) 20,205

Noninterest income:

Service charges on deposit accounts 854 917

Other service charges and fees 643 1,377

Gain on sale of loans held for sale 341 587

Gain on sale of securities available for sale 25 -

Loss on derivative instruments (71) (373)

Loss on sale of foreclosed real estate (287) (99)

Other income 31 13

Total noninterest income 1,536 2,422

Noninterest expenses:

Salaries and employee benefits 8,232 7,951

Occupancy and equipment 1,656 1,308

Professional fees 320 187

Data processing expense 663 602

Federal deposit insurance premiums 570 310

Foreclosed real estate expense 1,374 44

Write-off of goodwill 803 -

Other expense 1,668 1,569

Total noninterest expenses 15,286 11,971

(Loss) earnings before income taxes (23,079) 10,656

Income taxes - 1,665

Net (loss) earnings $(23,079) 8,991

See accompanying Notes to Consolidated Financial Statements.

3

{W0019809.2}

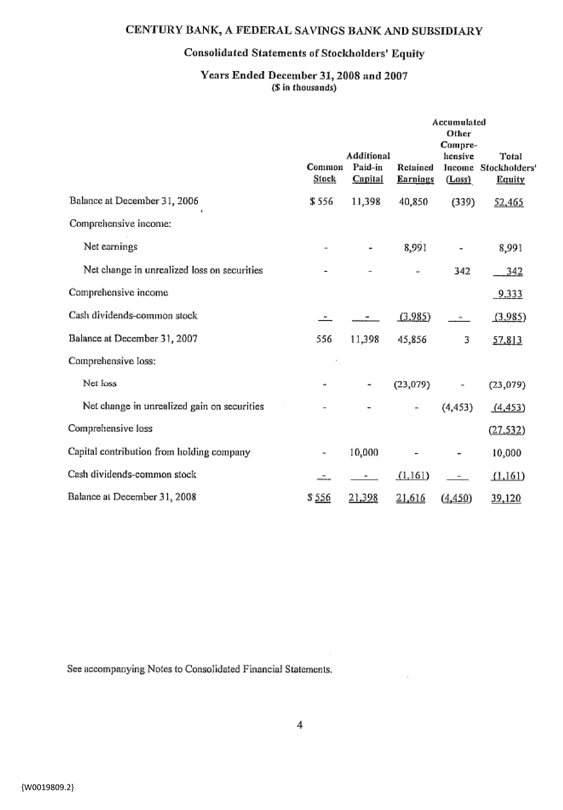

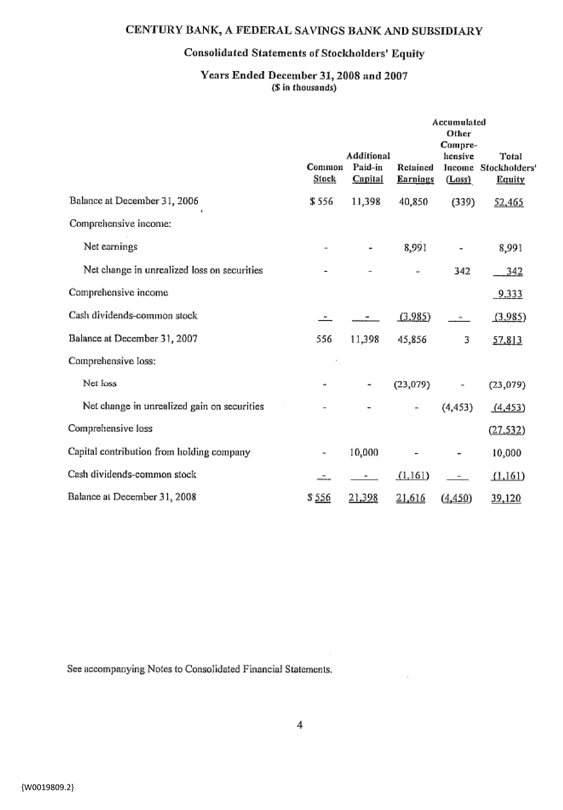

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Consolidated Statements of Stockholders’ Equity

Years Ended December 31, 2008 and 2007

($ in thousands)

Common Stock Additional Paid-in Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Total Stockholders’ Equity

Balance at December 31, 2006 $556 11,398 40,850 (339) 52,465

Comprehensive income:

Net earnings - - 8,991 - 8,991

Net change in unrealized loss on securities - - - 342 342

Comprehensive income 9,333

Cash dividends-common stock - - (3,985) - (3,985)

Balance at December 31, 2007 556 11,398 45,856 3 57,813

Comprehensive loss:

Net loss - - (23,079) - (23,079)

Net change in unrealized gain on securities - - - (4,453) (4,453)

Comprehensive loss (27,532)

Capital contribution from holding company - 10,000 - - 10,000

Cash dividends-common stock - - (1,161) - (1,161)

Balance at December 31, 2008 $556 21,398 21,616 (4,450) 39,120

See accompanying Notes to Consolidated Financial Statements.

4

{W0019809.2}

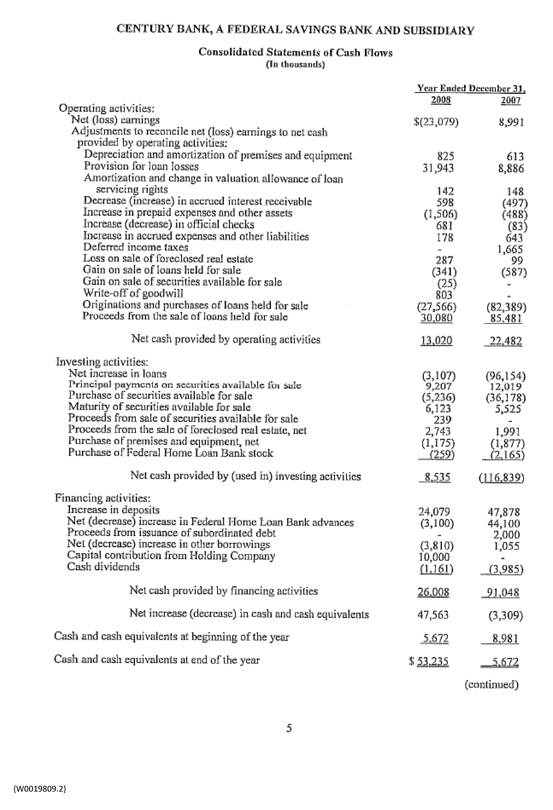

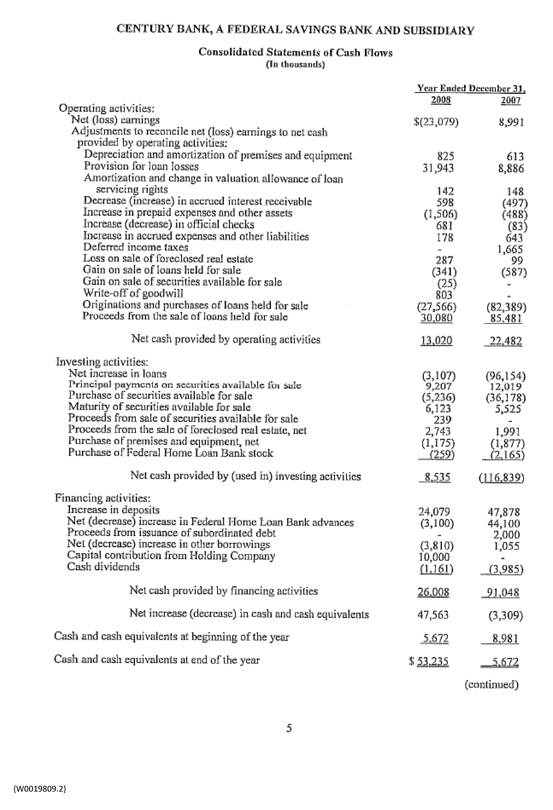

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Consolidated Statements of Cash Flows

(In thousands)

Year Ended December 31,

2008 2007

Operating activities:

Net (loss) earnings $(23,079) 8,991

Adjustments reconcile net (loss) earnings to net cash

provided by operating activities:

Depreciation and amortization of premises and equipment 825 613

Provision for loan losses 31,943 8,886

Amortization and change in valuation allowance of loan

servicing rights 142 148

Decrease (increase) in accrued interest receivable 598 (497)

Increase in prepaid expenses and other assets (1,506) (488)

Increase (decrease) in official checks 681 (83)

Increase in accrued expenses and other liabilities 178 643

Deferred income taxes - 1,665

Loss on sale of foreclosed real estate 287 99

Gain on sale of loans held for sale (341) (587)

Gain on sale of securities available for sale (25) -

Write-off of goodwill 803 -

Originations and purchases of loans held for sale (27,566) (82,389)

Proceeds from the sale of loans held for sale 30,080 85,481

Net cash provided by operating activities 13,020 22,482

Investing activities:

Net increase in loans (3,107) (96,154)

Principal payments on securities available for sale 9,207 12,019

Purchase of securities available for sale (5,236) (36,178)

Maturity of securities available for sale 6,123 5,525

Proceeds from sale of securities available for sale 239 -

Proceeds from the sale of foreclosed real estate, net 2,743 1,991

Purchase of premises and equipment, net (1,175) (1,877)

Purchase Federal Home Loan Bank stock (259) (2,165)

Net cash provided by (used in) investing activities 8,535 (116,839)

Financing activities:

Increase in deposits 24,079 47,878

Net (decrease) increase in Federal Home Loan Bank advances (3,100) 44,100

Proceeds from issuance of subordinated debt - 2,000

Net (decrease) increase in other borrowings (3,810) 1,055

Capital contribution from Holding Company 10,000 -

Cash dividends (1,161) (3,985)

Net cash provided by financing activities 26,008 91,048

Net increase (decrease) in cash and cash equivalents 47,563 (3,309)

Cash and cash equivalents at beginning of the year 5,672 8,981

Cash and cash equivalents at end of the year $53,235 5,672

(continued)

5

{W0019809.2}

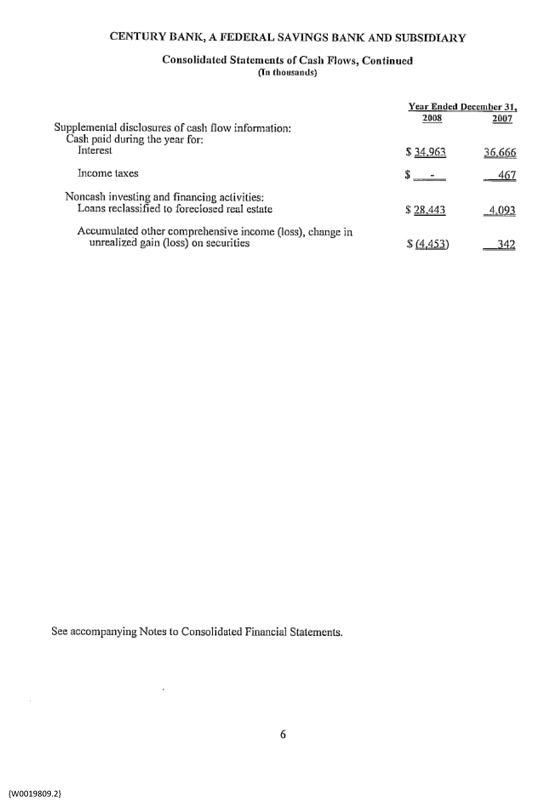

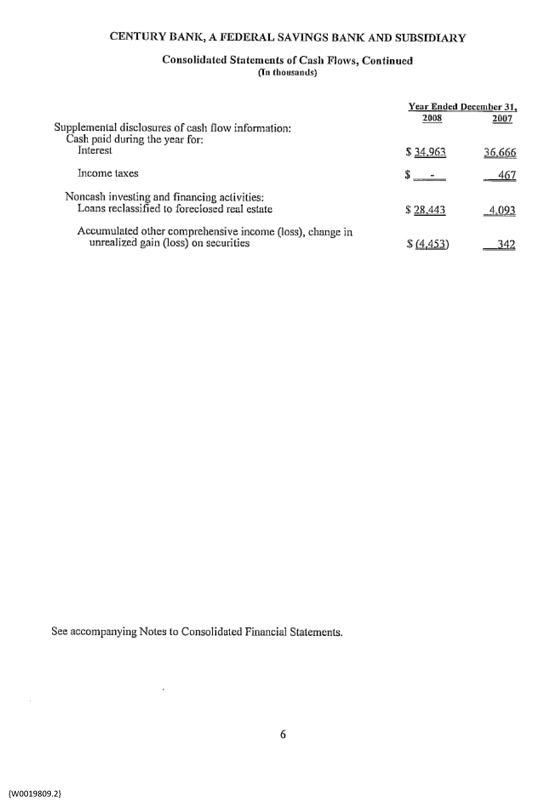

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Consolidated Statements of Cash Flows, Continued

(In thousands)

Year Ended December 31,

2008 2007

Supplemental disclosures of cash flow information:

Cash paid during the year for:

Interest $34,963 36,666

Income taxes $ - 467

Noncash investing and financing activities:

Loans reclassified to foreclosed real estate $28,443 4,093

Accumulated other comprehensive income (loss), change in

unrealized gain (loss) on securities $(4,453) 342

See accompanying Notes to Consolidated Financial Statements.

6

{W0019809.2}

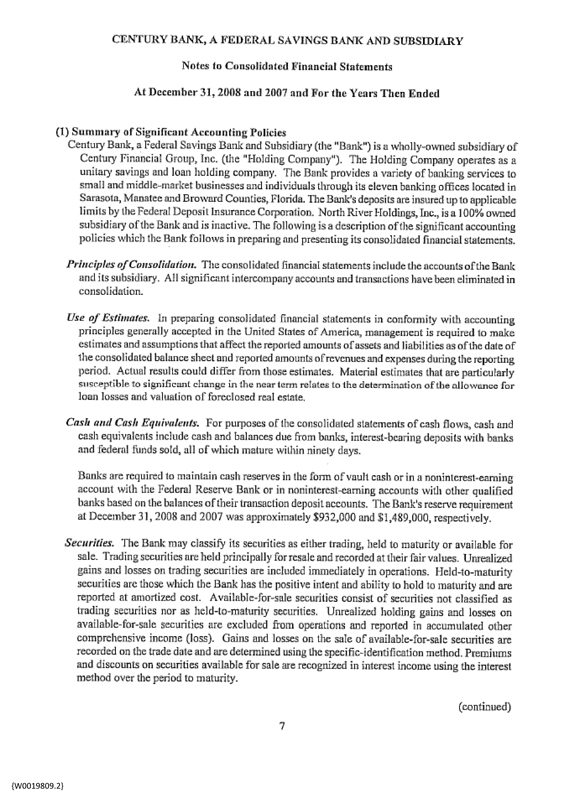

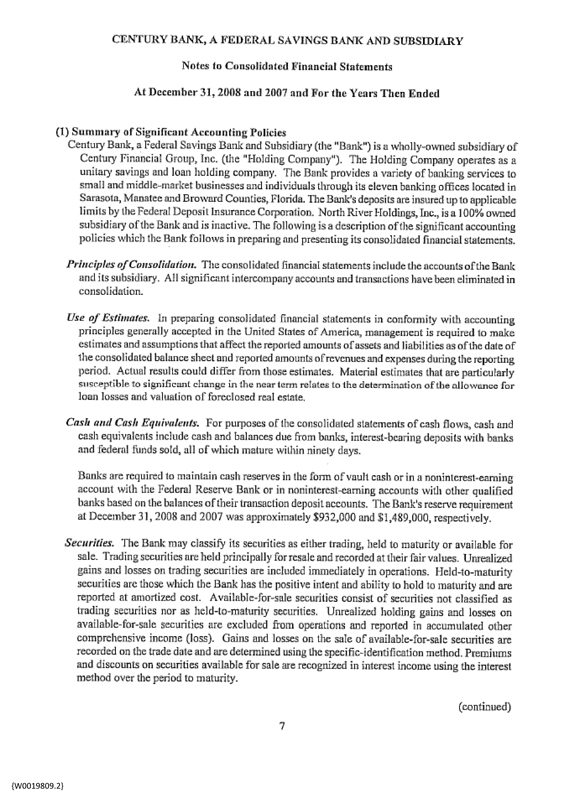

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements

At December 31, 2008 and 2007 and For the Years Then Ended

(1) Summary of Significant Accounting Policies

Century Bank, a Federal Savings Bank and Subsidiary (the “Bank”) is a wholly-owned subsidiary of Century Financial Group, Inc. (the “Holding Company”). The Holding Company operates as a unitary savings and loan holding company. The Bank provides a variety of banking services to small and middle-market businesses and individuals through its eleven banking offices located in Sarasota, Manatee and Broward Counties, Florida. The Bank’s deposits are insured up to applicable limits by the Federal Deposit Insurance Corporation. North River Holdings, Inc. is a 100% owned subsidiary of the Bank and is inactive. The following is a description of the significant accounting policies which the Bank follows in preparing and presenting its consolidated financial statements.

Principles of Consolidation. The consolidated financial statements include the accounts of the Bank and its subsidiary. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates. In preparing consolidated financial statements in conformity with accounting principles generally accepted in the United States of America, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities as of the date of the consolidated balance sheet and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change in the near term relates to the determination of the allowance for loan losses and valuation of foreclosed real estate.

Cash and Cash Equivalents. For purposes of the consolidated statements of cash flows, cash and cash equivalents include cash and balances due from banks, interest-bearing deposits with banks and federal funds sold, all of which mature within ninety days.

Banks are required to maintain cash reserves in the form of vault cash or in a noninterest-earning account with the Federal Reserve Bank or in noninterest-earning accounts with other qualified banks based on the balances of their transaction deposit accounts. The Bank’s reserve requirement at December 31, 2008 and 2007 was approximately $932,000 and $1,489,000, respectively.

Securities. The Bank may classify its securities as either trading, held to maturity or available for sale. Trading securities are held principally for resale and recorded at their fair values. Unrealized gains and losses on trading securities are included immediately in operations. Held-to-maturity securities are those which the Bank has the positive intent and ability to hold to maturity and are reported at amortized cost. Available-for-sale securities consist of securities not classified as trading securities nor as held-to-maturity securities. Unrealized holding gains and losses on available-for-sale securities are excluded from operations and reported in accumulated other comprehensive income (loss). Gains and losses on the sale of available-for-sale securities are recorded on the trade date and are determined using the specific-identification method. Premiums and discounts on securities available for sale are recognized in interest income using the interest method over the period to maturity.

(continued)

7

{W0019809.2}

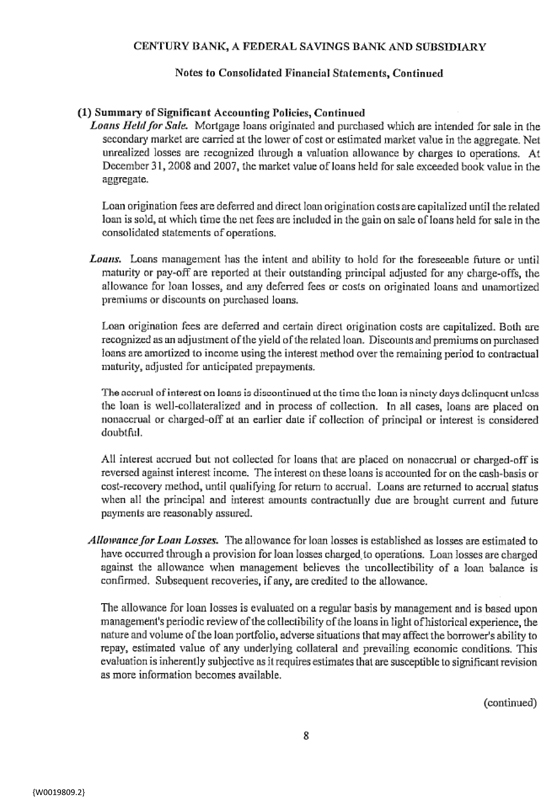

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(1) Summary of Significant Accounting Policies, Continued

Loans Held for Sale Mortgage loans originated and purchased which are intended for sale in the secondary market are carried at the lower of cost or estimated market value in the aggregate. Net unrealized losses are recognized through a valuation allowance by charges to operations. At December 31, 2008 and 2007, the market value of loans held for sale exceeded book value in the aggregate.

Loan origination fees are deferred and direct loan origination costs are capitalized until the related loan is sold, at which time the net fees are included in the gain on sale of loans held for sale in the consolidated statements of operations.

Loans. Loans management has the intent and ability to hold for the foreseeable future or until maturity or pay-off are reported at their outstanding principal adjusted for any charge-offs, the allowance for loan losses, and any deferred fees or costs on originated loans and unamortized premiums or discounts on purchased loans.

Loan origination fees are deferred and certain direct origination costs are capitalized. Both are recognized as an adjustment of the yield of the related loan. Discounts and premiums on purchased loans are amortized to income using the interest method over the remaining period to contractual maturity, adjusted for anticipated prepayments.

The accrual of interest on loans is discontinued at the time the loan is ninety days delinquent unless the loan is well-collateralized and in process of collection. In all cases, loans are placed on nonaccrual or charged-off at an earlier date if collection of principal or interest is considered doubtful.

All interest accrued but not collected for loans that are placed on nonaccrual or charged-off is reversed against interest income. The interest on these loans is accounted for on the cash-basis or cost-recovery method, until qualifying for return to accrual. Loans are returned to accrual status when all the principal and interest amounts contractually due are brought current and future payments are reasonably assured.

Allowance for Loan Losses. The allowance for loan losses is established as losses are estimated to have occurred through a provision for loan losses charged to operations. Loan losses are charged against the allowance when management believes the uncollectibility of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the allowance.

The allowance for loan losses is evaluated on a regular basis by management and is based upon management’s periodic review of the collectibility of the loans in light of historical experience, the nature and volume of the loan portfolio, adverse situations that may affect the borrower’s ability to repay, estimated value of any underlying collateral and prevailing economic conditions. This evaluation is inherently subjective as it requires estimates that are susceptible to significant revision as more information becomes available.

(continued)

8

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(1) Summary of Significant Accounting Policies, Continued

Allowance for Loan Losses, continued. The allowance consists of specific and general components. The specific component relates to loans that are classified as impaired. For such loans, an allowance is established when the discounted cash flows (or collateral value or observable market price) of the impaired loan is lower than the carrying value of that loan. The general component covers all other loans and is based on historical loss experience adjusted for qualitative factors.

A loan is considered impaired when, based on current information and events, it is probable that the Bank will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record, and the amount of the shortfall in relation to the principal and interest owed. Impairment is measured on a loan by loan basis by either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s obtainable market price, or the fair value of the collateral if the loan is collateral dependent.

Servicing. Servicing assets are recognized as separate assets when rights are acquired through purchase or through sale of financial assets. Capitalized servicing rights are amortized in proportion to, and over the period of, the estimated future net servicing income of the underlying financial assets. Servicing assets are evaluated for impairment based upon the fair value of the rights as compared to amortized cost. Impairment is determined by stratifying rights by predominant characteristics, such as interest rates and terms. Fair value is determined using prices for similar assets with similar characteristics, when available, or based upon discounted cash flows using market-based assumptions. Impairment is recognized through a valuation allowance for an individual stratum, to the extent that fair value is less than the capitalized amount for the stratum.

Foreclosed Real Estate. Real estate acquired through, or in lieu of, foreclosure, is initially recorded at the lower of fair value or the loan balance plus acquisition costs at the date of foreclosure. After foreclosure, valuations are periodically performed by management and the real estate is carried at the lower of carrying amount or fair value less cost to sell. Revenue and expenses from operations and changes in the valuation allowance are included in operations.

Premises and Equipment. Land is carried at cost. Bank premises, furniture and fixtures and leasehold improvements are carried at cost, less accumulated depreciation and amortization computed using time straight-line method over the estimated useful life of the asset or lease term, if shorter.

Advertising. The Bank expenses all media advertising as incurred.

(continued)

9

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(1) Summary of Significant Accounting Policies, Continued

Goodwill. Goodwill resulted from the initial acquisition of the Bank by the Holding Company. The Bank follows Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards (“SPAS”) No. 142, Goodwill and Other Intangible Assets (“SFAS 142”). SFAS 142 requires goodwill to be tested for impairment on an annual basis and between annual tests in certain circumstances, and written down when impaired. Based on the impairment tests performed, there was no impairment of goodwill in 2007. During 2008 the Bank determined that the goodwill was impaired and wrote off the balance of $803,000 with a charge to operations.

Transfer of Financial Assets. Transfers of financial assets are accounted for as sales, when control over the assets has been surrendered. Control over transferred assets is deemed to be surrendered when (1) the assets have been isolated from the Bank, (2) the transferee obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets, and (3) the Bank does not maintain effective control over the transferred assets through an agreement to repurchase them before their maturity.

Income Taxes. In early 2007, the Bank filed with the Internal Revenue Service an election to be treated as a “Subchapter S Corporation” for income tax purposes for years beginning January 1, 2007 and thereafter. As a Subchapter S corporation, the Bank no longer pays income taxes all the corporate level. Rather, the consolidated taxable income of the Bank is passed through to the individual stockholders of the Bank who are then responsible for paying income taxes at the individual level on that taxable income. As a result of the Subchapter S election, the net deferred income tax asset reflected on the 2006 consolidated balance sheet became unrecoverable at the corporate level due to the previously discussed elimination of future corporate income tax liabilities of the Bank. Accordingly, $1,665,000 was recorded as a charge to operations effective January 1, 2007. This amount was net of the tax effect of the unrealized losses on securities available for sale as of January 1, 2007 of $205,000.

Off-Balance-Sheet Financial Instruments. In the ordinary course of business the Bank has entered into off-balance-sheet financial instruments consisting of commitments to extend credit, unused lines of credit and standby letters of credit. Such financial instruments are recorded in the consolidated financial statements when they are funded.

Derivatives and Hedging Activities. All derivatives are reported on the consolidated balance sheet at fair value. Changes in the fair value of all derivatives are reported on the consolidated statement of operations. The Bank utilizes only exchange-traded contracts and fair value is based on quoted market prices.

The Bank uses fair value hedges to limit its exposure to changes in the fair value of certain of its fixed interest-earning assets, many of which are mortgage related, that are due to interest rate volatility. However, the Bank does not designate any of its derivative contracts as hedging for purposes of accounting treatment pursuant to SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities (“SFAS 133”) due to difficulties in meeting the requirements of SPAS 133 relative to hedge effectiveness when hedging mortgage related assets.

(continued)

10

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(1) Summary of Significant Accounting Policies, Continued

Derivatives and Hedging Activities, Continued. During 2008, the Bank ceased all hedging activities and, accordingly, no derivatives relating to these activities are reported on the consolidated balance sheet at December 31, 2008.

Fair Value Measurements. Effective January 1, 2008, the Bank adopted SFAS No. 157, Fair Value Measurements (“SFAS 157”). SFAS 157 defines fair value, establishes a framework for measuring fair value and enhances disclosures about fair value measurements.

SPAS 157 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. SFAS 157 also establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

Level 1: Observable inputs such as quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Inputs other than quoted prices that are observable for the asset or liability, either directly or indirectly. These include quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities that are not active; and model-driven valuations whose inputs are observable or whose significant value drivers are observable. Valuations may be obtained from, or corroborated by, third-party pricing services.

Level 3: Unobservable inputs to measure fair value of assets and liabilities for which there is little, if any market activity at the measurement date, using reasonable inputs and assumptions based upon the best information at the time, to the extent that inputs are available without undue cost and effort.

In February 2008, the FASB issued FASB Staff Position (“FSP”) No. FAS 157-2, Effective Date of FASB Statement No. 157. This FSP delays the effective date of FAS 157 for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value on recurring basis (at least annually) to fiscal years beginning after November 15, 2008. The impact of adoption had no effect on the Bank.

In October 2008, the FASB issued FSP 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active. This FSP clarifies the application of SPAS 157, in determining the fair value of a financial asset when the market for that financial asset is not active.

This FASB Staff Position was effective upon issuance.

(continued)

11

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(1) Summary of Significant Accounting Policies, Continued

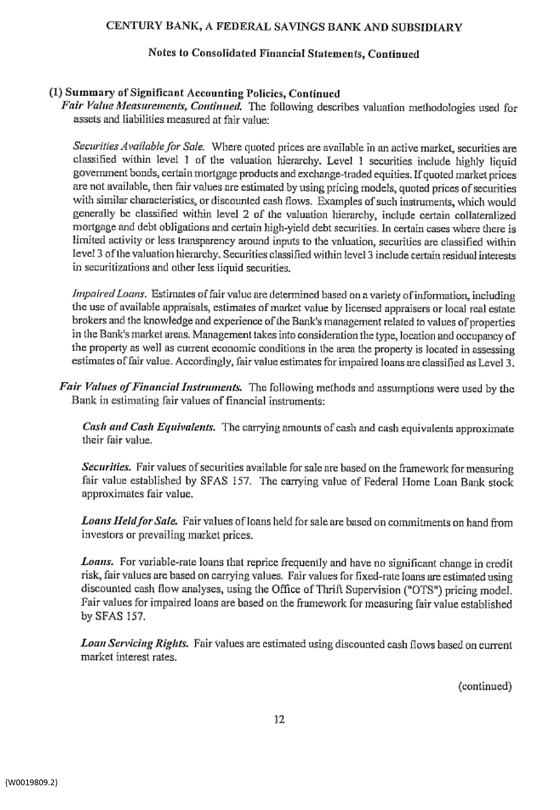

Fair Value Measurements, Continued. The following describes valuation methodologies used for assets and liabilities measured at fair value:

Securities Available for Sale. Where quoted prices are available in an active market, securities are classified within level 1 of the valuation hierarchy. Level 1 securities include highly liquid government bonds, certain mortgage products and exchange-traded equities. If quoted market prices are not available, then fair values are estimated by using pricing models, quoted prices of securities with similar characteristics, or discounted cash flows. Examples of such instruments, which would generally be classified within level 2 of the valuation hierarchy, include certain collateralized mortgage and debt obligations and certain high-yield debt securities. In certain cases where there is limited activity or less transparency around inputs to the valuation, securities are classified within level 3 of the valuation hierarchy. Securities classified within level 3 include certain residual interests in securitizations and other less liquid securities.

Impaired Loans. Estimates of fair value are determined based on a variety of information, including the use of available appraisals, estimates of market value by licensed appraisers or local real estate brokers and the knowledge and experience of the Bank’s management related to values of properties in the Bank’s market areas. Management takes into consideration the type, location and occupancy of the property as well as current economic conditions in the area the property is located in assessing estimates of fair value. Accordingly, fair value estimates for impaired loans are classified as Level 3.

Fair Values of Financial Instruments. The following methods and assumptions were used by the Bank in estimating fair values of financial instruments:

Cash and Cash Equivalents. The carrying amounts of cash and cash equivalents approximate their fair value.

Securities. Fair values of securities available for sale are based on the framework for measuring fair value established by SFAS 157. The carrying value of Federal Home Loan Bank stock approximates fair value.

Loans Held for Sale. Fair values of loans held for sale are based on commitments on hand from investors or prevailing market prices.

Loans. For variable-rate loans that reprice frequently and have no significant change in credit risk, fair values are based on carrying values. Fair values for fixed-rate loans are estimated using discounted cash flow analyses, using the Office of Thrift Supervision (“OTS”) pricing model. Fair values for impaired loans are based on the framework for measuring fair value established by SFAS 157.

Loan Servicing Rights. Fair Values are estimated using discounted cash flows based on current market interest rates.

(continued)

12

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(1) Summary of Significant Accounting Policies, Continued

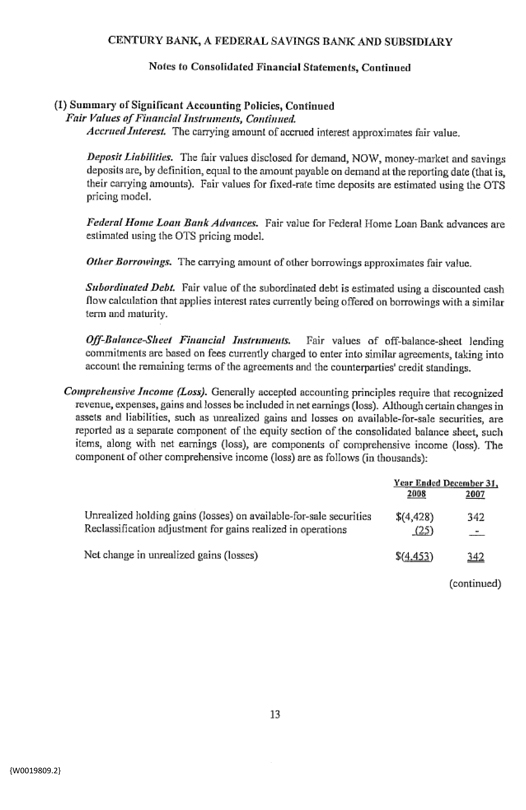

Fair Values of Financial Instruments, Continued.

Accrued Interest. The carrying amount of accrued interest approximates fair value.

Deposit Liabilities. The fair values disclosed for demand, NOW, money-market and savings deposits are, by definition, equal to the amount payable on demand at the reporting date (that is, their carrying amounts). Fair values for fixed-rate time deposits are estimated using the OTS pricing model.

Federal Home Loan Bank Advances. Fair value for Federal Home Loan Bank advances are estimated using the OTS pricing model.

Other Borrowings. The carrying amount of other borrowings approximates fair value.

Subordinated Debt. Fair value of the subordinated debt is estimated using a discounted cash flow calculation that applies interest rates currently being offered on borrowings with a similar term and maturity.

Off-Balance-Sheet Financial Instruments. Fair values of off-balance-sheet lending commitments are based on fees currently charged to enter into similar agreements, taking into account the remaining terms of the agreements and the counterparties’ credit standings.

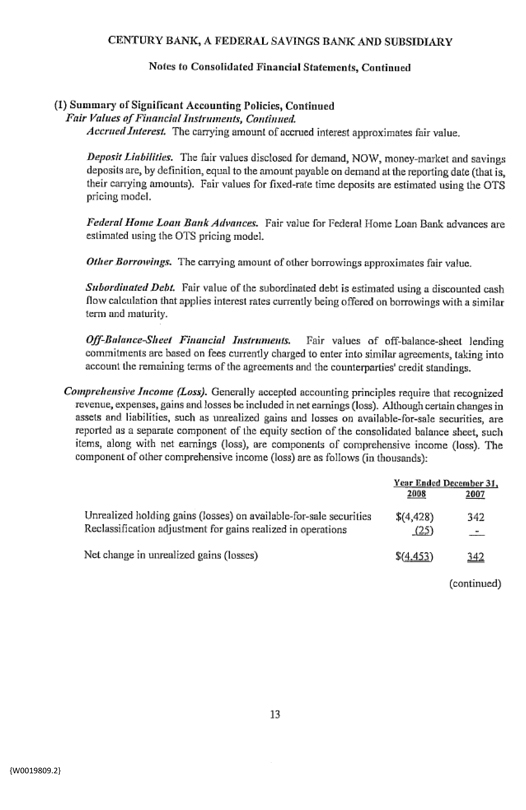

Comprehensive Income (Loss). Generally accepted accounting principles require that recognized revenue, expenses, gains and losses be included in net earnings (loss). Although certain changes in assets and liabilities, such as unrealized gains and losses on available-for-sale securities, are reported as a separate component of the equity section of the consolidated balance sheet, such items, along with net earnings (loss), are components of comprehensive income (loss). The component of other comprehensive income (loss) are as follows (in thousands):

Year Ended December 31,

2008 2007

Unrealized holding gains (losses) on available-for-sale securities $(4,428) 342

Reclassification adjustment for gains realized in operations (25) -

Net change in unrealized gains (losses) $(4,453) 342

(continued)

13

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(1) Summary of Significant Accounting Policies, Continued

Recent Pronouncements. In May 2008, the FASB issued SFAS No. 162, The Hierarchy of Generally Accepted Accounting Principles (“SFAS 162”). This statement identifies the sources of accounting principles and the framework for selecting the principles to be used in the preparation of financial statements that are presented in conformity with generally accepted accounting principles (“GAAP”) in the United States. This Statement was effective in December 2008. The adoption of SFAS 162 had no effect on the Bank.

On February 20, 2008, the FASB issued FSP No. FAS 140-3, Accounting for Transfers of Financial Assets and Repurchase Financing Transactions (“FSP 140-3”). FSP 140-3 requires that an initial transfer of a financial asset and a repurchase financing that was entered into contemporaneously with, or in contemplation of, the initial transfer be evaluated together as a linked transaction under SFAS 140, unless certain criteria are met. FSP 140-3 is effective for the Bank’s financial statements for the year beginning January 1, 2009. The adoption of FSP 140-3 had no effect on the Bank.

In December 2007, the FASB issued SFAS No. 141(R), Business Combinations (“SFAS 141(R)”). SFAS 141(R) is effective for fiscal years beginning after December 15, 2008 and early implementation is not permitted. SFAS 141(R) requires the acquiring entity in a business combination to recognize all (and only) the assets acquired and liabilities assumed in the transaction; establishes the acquisition date fair value as the measurement objective for all assets acquired and liabilities assumed; and requires the acquirer to disclose to investors and other users all of the information they need to evaluate and understand the nature and financial effect of the business combination. Acquisition related costs including finder’s fees, advisory, legal, accounting valuation and other professional and consulting fees are required to be expensed as incurred. This statement has no current effect on the Bank.

Reclassifications. Certain amounts in the 2007 consolidated financial statements have been

reclassified to conform to the 2008 presentation.

(continued)

14

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

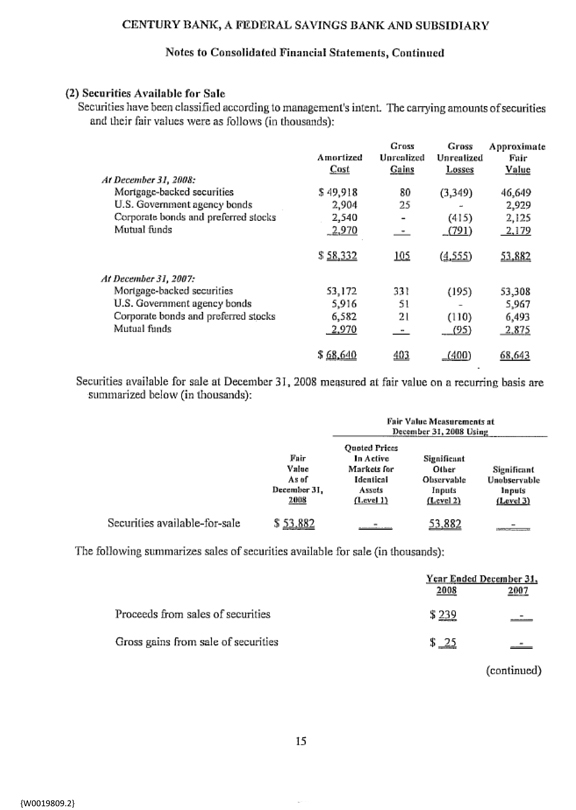

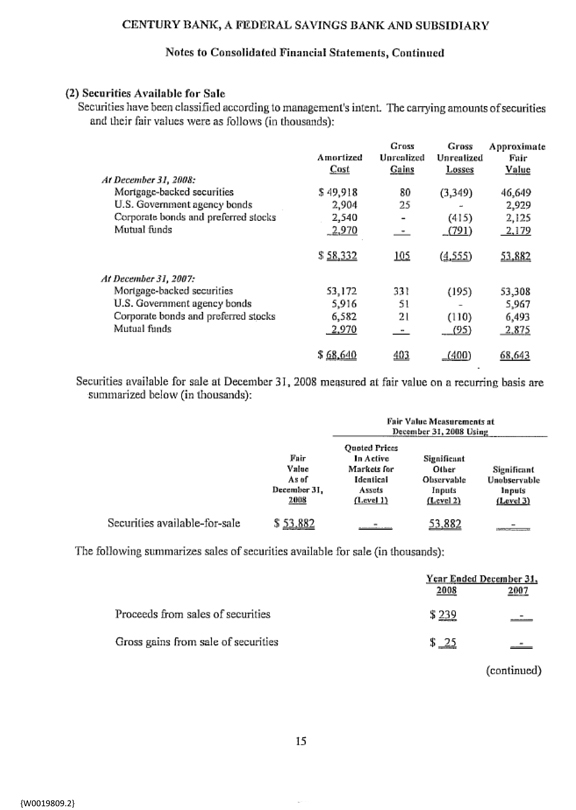

(2) Securities Available for Sale

Securities have been classified according to managements intent. The carrying amounts of securities and their fair values were as follows (in thousands):

Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Approximate Fair value

At December 31, 2008:

Mortgage-backed securities $49,918 80 (3,349) 46,649

U.S. Government agency bonds 2,904 25 - 2,929

Corporate bonds and preferred stocks 2,540 - (415) 2,125

Mutual funds 2,970 - (791) 2,179

$58,332 105 (4,555) 53,882

At December 31, 2007:

Mortgage-backed securities 53,172 331 (195) 53,308

U.S. Government agency bonds 5,916 51 - 5,967

Corporate bonds and preferred stocks 6,582 21 (110) 6,493

Mutual funds 2,970 - (95) 2,875

$68,640 403 (400) 68,643

Securities available for sale at December 31, 2008 measured at fair value on a recurring basis are summarized below (in thousands):

Fair Value Measurements December 31, 2008 Using

Fair Value As of December 31, 2008 Quoted Prices In Active Markets for Identical Assets (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3)

Securities available-for-sale $53,882 - 53,882 -

The following summarizes sales of securities available for sale (in thousands):

Year Ended December 31,

2008

2007

Proceeds from sales of Securities $239 -

Gross gains from sale of securities $25 -

(continued)

15

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

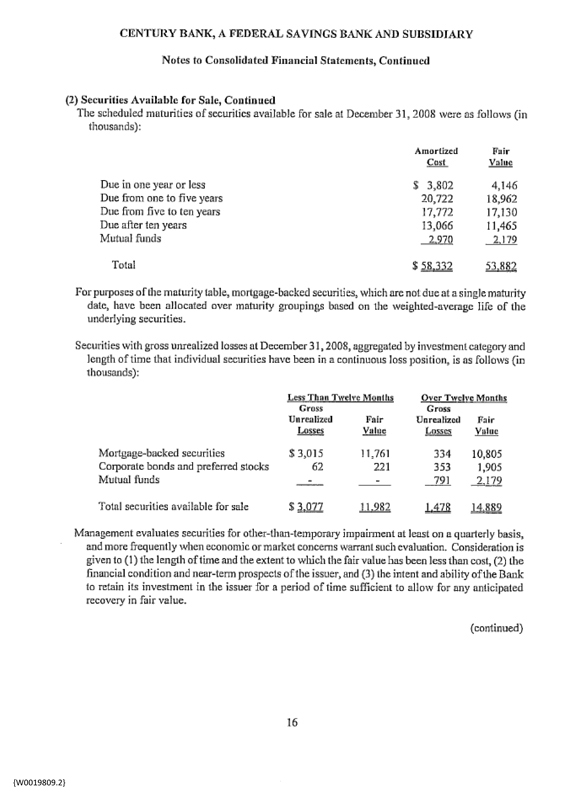

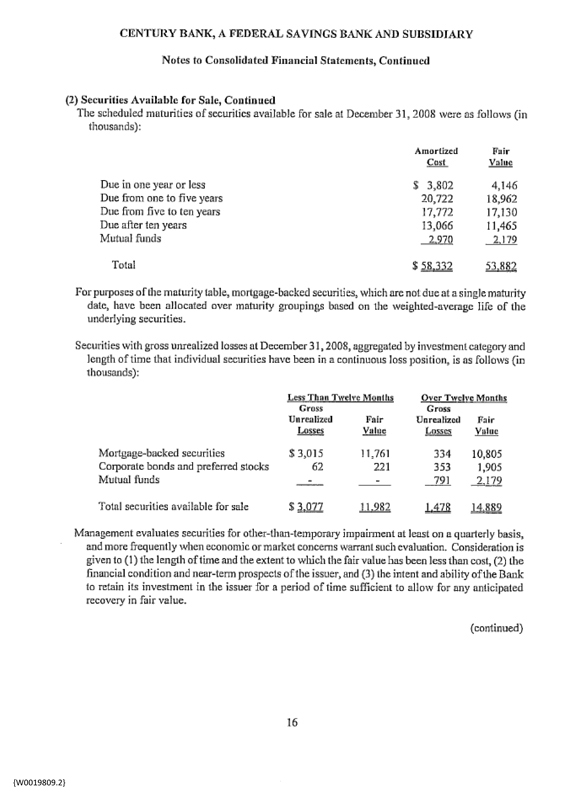

(2) Securities Available for Sale, Continued

The scheduled maturities of securities available for sale at December 31, 2008 were as follows (in thousands):

Amortized Cost Fair Value

Due in one year or less $3,802 4,146

Due from one to five years 20,722 18,962

Due from five to ten years 17,772 17,130

Due after ten years 13,066 11,465

Mutual funds 2,970 2,179

Total $58,332 53,882

For purposes of the maturity table, mortgage-backed securities, which arc not due at a single maturity date, have been allocated over maturity groupings based on the weighted-average life of the underlying securities.

Securities with gross unrealized losses at December 31,2008, aggregated by investment category and length of time that individual securities have been in a continuous loss position, is as follows (in thousands):

Less Than Twelve Months Over Twelve Months

Gross Unrealized Losses

Fair Value

Gross Unrealized Losses

Fair Value

Mortgage-backed securities $3,015 11,761 334 10,805

Corporate bonds and preferred stocks 62 221 353 1,905

Mutual funds - - 791 2,179

Total securities available for sale $3,077 11,982 1,478 14,889

Management evaluates securities for other-than-temporary impairment at least on a quarterly basis, and more frequently when economic or market concerns warrant such evaluation. Consideration is given to (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Bank to retain its investment in the issuer for a period of time sufficient to allow for any anticipated

recovery in fair value.

(continued)

16

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(2) Securities Available for Sale, Continued

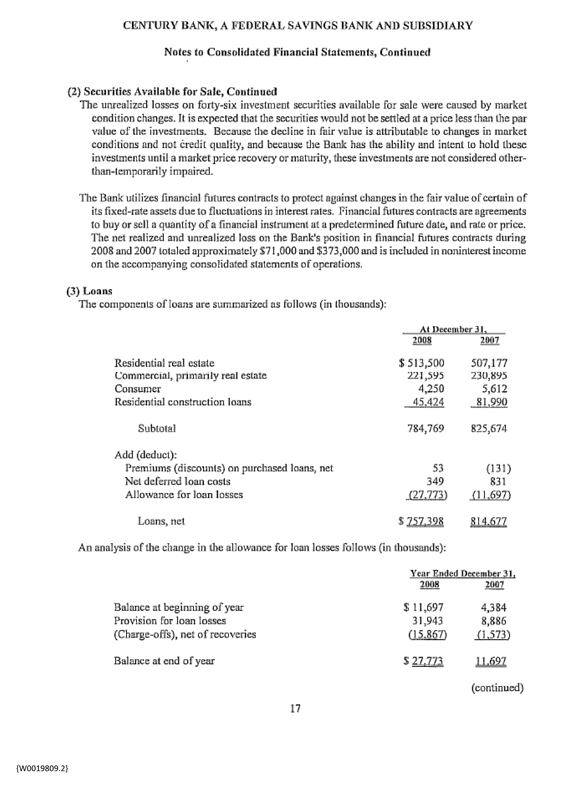

The unrealized losses on forty-six investment securities available for sale were caused by market condition changes. It is expected that the securities would not be settled at a price less than the par value of the investments. Because the decline in fair value is attributable to changes in market conditions and not credit quality, and because the Bank has the ability and intent to hold these investments until a market price recovery or maturity, these investments are not considered other-than-temporarily impaired.

The Bank utilizes financial futures contracts to protect against changes in the fair value of certain of its fixed-rate assets due to fluctuations in interest rates. Financial futures contracts are agreements to buy or sell a quantity of a financial instrument at a predetermined future date, and rate or price. The net realized and unrealized loss on the Bank’s position in financial futures contracts during 2008 and 2007 totaled approximately $71,000 and $373,000 and is included in noninterest income on the accompanying consolidated statements of operations.

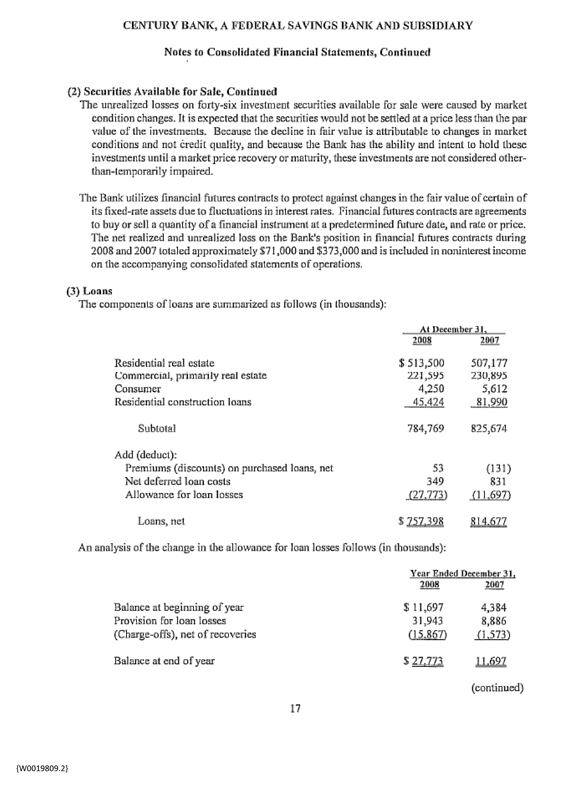

(3) Loans

The components of loans are summarized as follows (in thousands):

At December 31,

2008 2007

Residential real estate $513,500 507,177

Commercial, primarily real estate 221,595 230,895

Consumer 4,250 5,612

Residential construction loans 45,424 81,990

Subtotal 784,769 825,674

Add (deduct):

Premiums (discounts) on purchased loans, net 53 (131)

Net deferred loan costs 349 831

Allowance for loan losses (27,773) (11,697)

Loans, net $757,398 814,677

An analysis of the change in the allowance for loan losses follows (in thousands):

Year Ended December 31,

2008 2007

Balance at beginning of year $11,697 4,384

Provision for loan losses 31,943 8,886

(Charge-offs), net of recoveries (15,867) (1,573)

Balance at end of year $27,773 11,697

(continued)

17

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(3) Loans, Continued

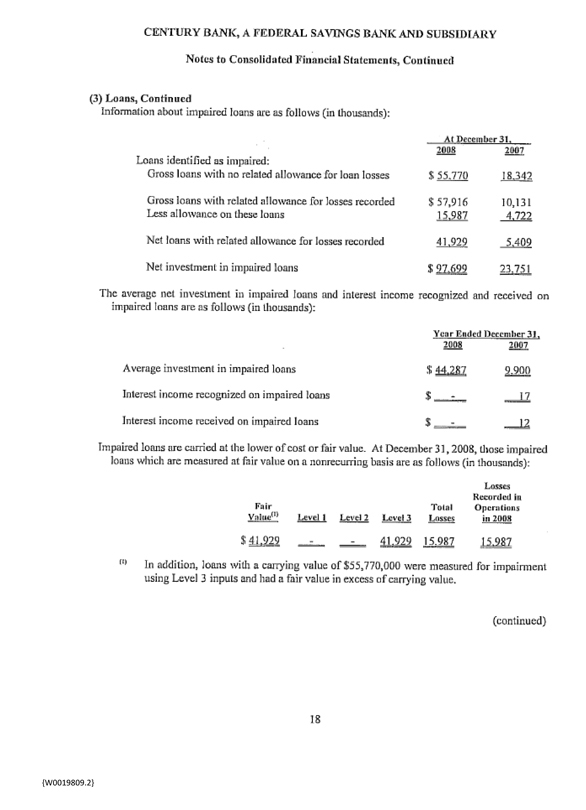

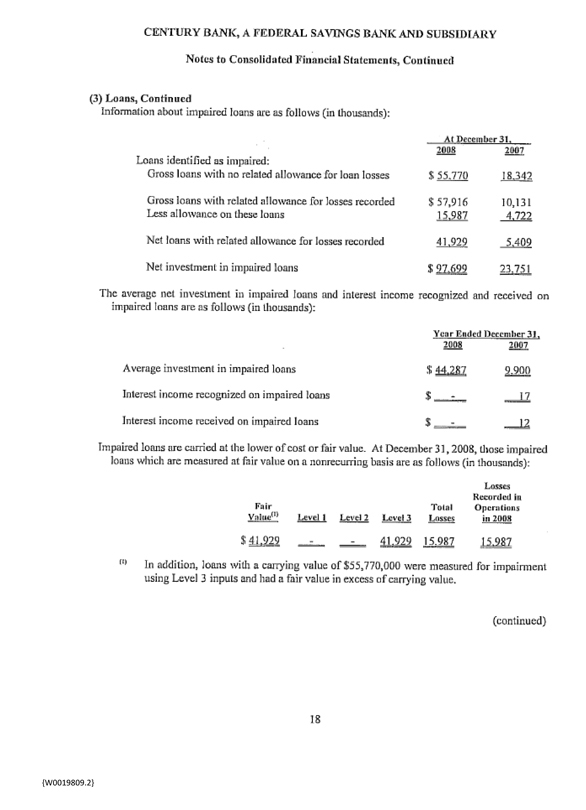

Information about impaired loans are as follows (in thousands):

At December 31,

2008 2007

Loans identified as impaired:

Gross loans with no related allowance for loan losses $55,770 18,342

Gross loans with related allowance for losses recorded $57,916 10,131

Less allowance on these loans 15,987 4,722

Net loans with related allowance for losses recorded 41,929 5,409

Net investment in impaired loans $97,699 23,751

The average net investment in impaired loans and interest income recognized and received on impaired loans are as follows (in thousands):

Year Ended December 31,

2008 2007

Average investment in impaired loans $44,287 9,900

Interest income recognized on impaired loans $ - 17

Interest income received on impaired loans $ - 12

Impaired loans carried at the lower of cost or fair value. At December 31, 2008, those impaired loans which arc measured at fair value on a nonrecurring basis are as follows (in thousands):

Fair value(1) Level 1 Level 2 Level 3 Total Losses Losses Recorded to Operations in 2008

$41,929 - - 41,929 15,987 15,987

(1) In addition, loans with a carrying value of $55,770,000 were measured for impairment using Level 3 inputs and had a fair value in excess of carrying value.

(continued)

18

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(3) Loans, Continued

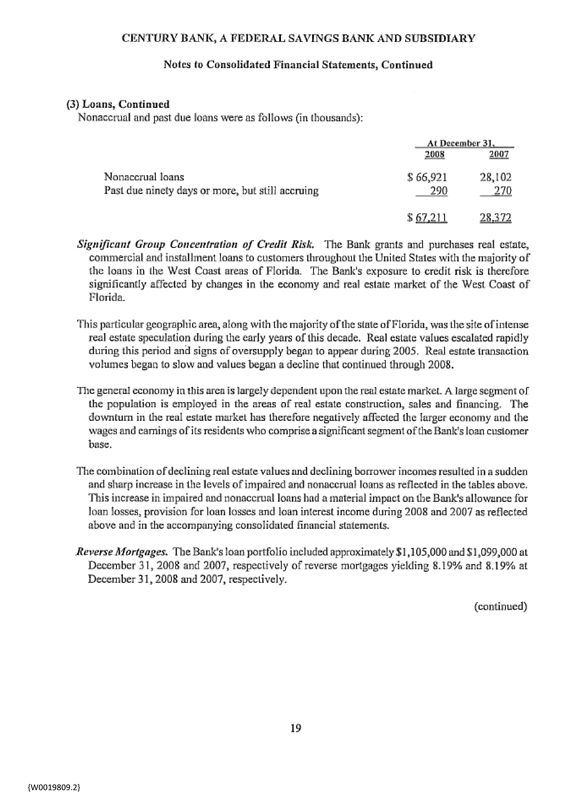

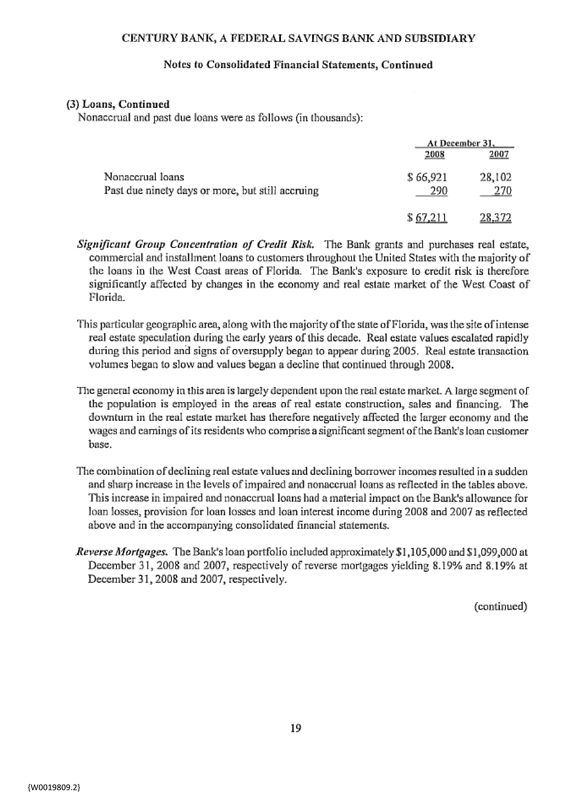

Nonaccrual and past due loans were as follows (in thousands):

At December 31,

2008 2007

Nonaccrual loans $66,921 28,102

Past due ninety days or more, but still accruing 290 270

$67,211 28,372

Significant Group Concentration of Credit Risk. The Bank grants and purchases real estate commercial and installment loans to customers throughout the United States with the majority of the loans in the West Coast areas of Florida. The Bank’s exposure to credit risk is therefore significantly affected by changes in the economy and real estate market of the West Coast of Florida.

This particular geographic area, along with the majority of the state of Florida, was the site of intense real estate speculation during the early years of this decade. Real estate values escalated rapidly during this period and signs of oversupply began to appear during 2005. Real estate transaction volumes began to slow and values began a decline that continued through 2008.

The general economy in this area is largely dependent upon the real estate market. A large segment of the population is employed in the areas of real estate construction, sales and financing. The downturn in the real estate market has therefore negatively affected the larger economy and the wages and earnings of its residents who comprise a significant segment of the Bank’s loan customer base.

The combination of declining real estate values and declining borrower incomes resulted in a sudden and sharp increase in the levels of impaired and nonaccrual loans as reflected in the tables above. This increase in impaired and nonaccrual loans had a material impact on the Bank’s allowance for loan losses, provision for loan losses and loan interest income during 2008 and 2007 as reflected above and in the accompanying consolidated financial statements.

Reverse Mortgages. The Bank’s loan portfolio included approximately $1,105,000 and $1,099,000 at December 31, 2008 and 2007, respectively of reverse mortgages yielding 8.19% and 8.19% at December 31, 2008 and 2007, respectively

(continued)

19

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

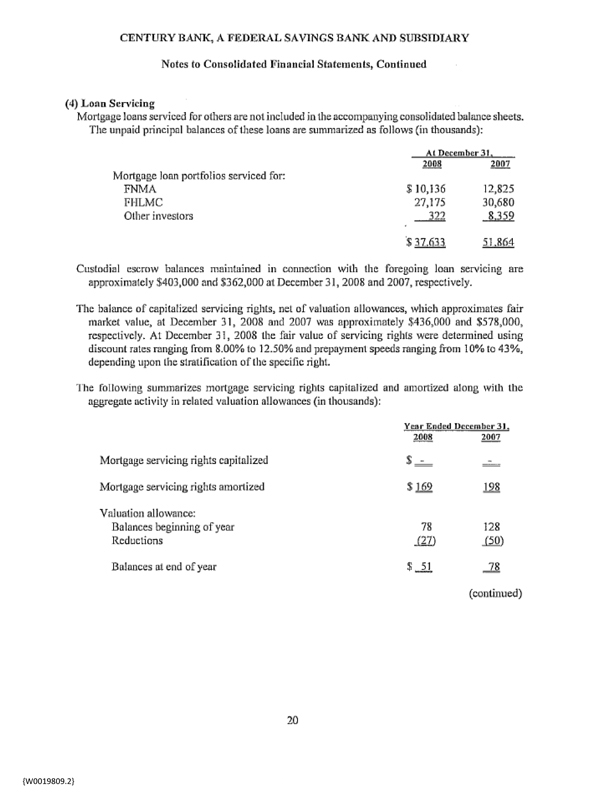

(4) Loan Servicing

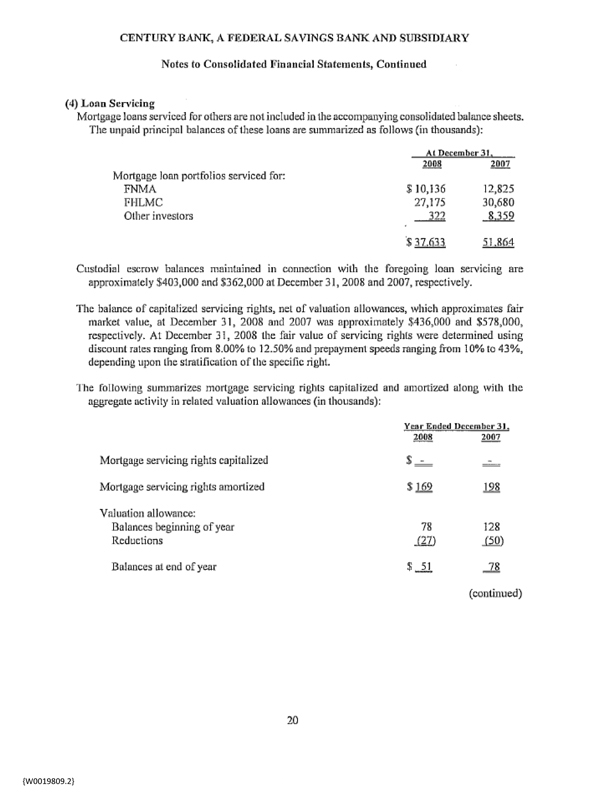

Mortgage loans serviced for others are not included in the accompanying consolidated balance sheets. The unpaid principal balances of these loans are summarized as follows (in thousands):

At December 31,

2008 2007

Mortgage loan portfolios serviced for:

FNMA $10,136 12,825

FHLMC 27,175 30,680

Other investors 322 8,359

$37,633 51,864

Custodial escrow balances maintained in connection with the foregoing loan servicing are approximately $403,000 and $362,000 at December 31, 2008 and 2007, respectively.

The balance of capitalized servicing rights, net of valuation allowances, which approximates fair market value, at December 31, 2008 and 2007 was approximately $436,000 and $578,000, respectively. At December 31, 2008 the fair value of servicing rights were determined using discount rates ranging from 8.00% to 12.50% and prepayment speeds ranging from 10% to 43%, depending upon the stratification of the specific right.

The following summarizes mortgage servicing rights capitalized and amortized along with the aggregate activity in related valuation allowances (in thousands):

Year Ended December 31,

2008 2007

Mortgage servicing rights capitalized $ - -

Mortgage servicing rights amortized $ 169 198

Valuation allowance:

Balances beginning of year 78 128

Reductions (27) (50)

Balances at end of year $51 78

(continued)

20

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

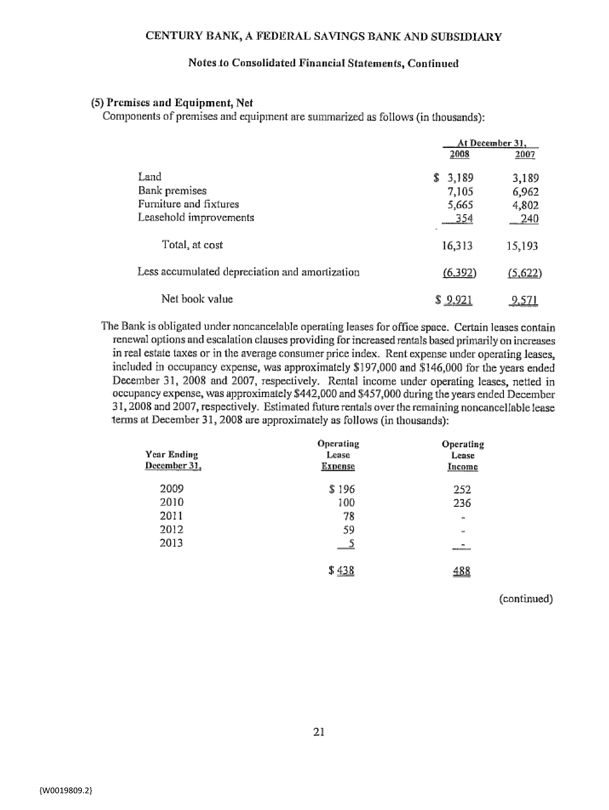

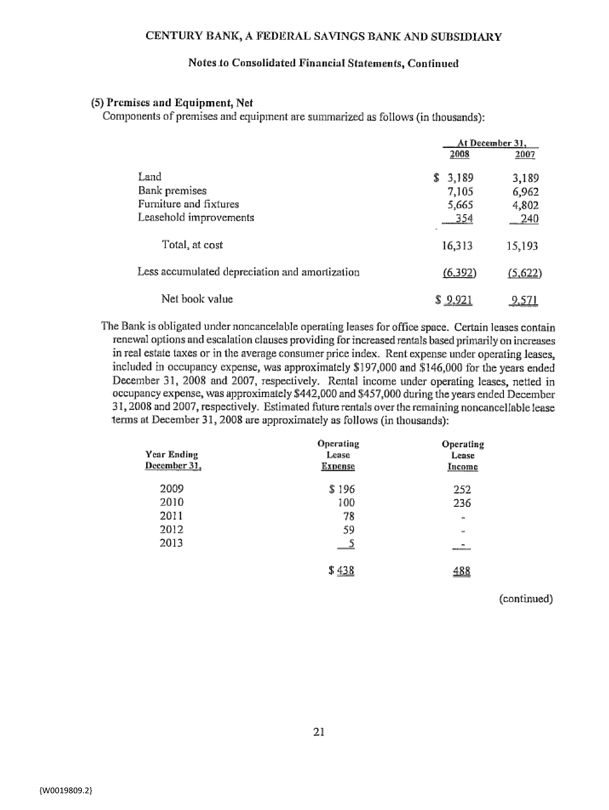

(5) Premises and Equipment, Net

Components of premises and equipment are summarized as follows (in thousands):

At December 31,

2008 2007

Land $ 3,189 3,189

Bank premises 7,105 6,962

Furniture and fixtures 5,665 4,802

Leasehold improvements 354 240

Total, at cost 16,313 15,193

Less accumulated depreciation and amortization (6,392) (5,622)

Net book value $ 9,921 9,571

The Bank is obligated under noncancelable operating leases for office space. Certain leases contain renewal options and escalation clauses providing for increased rentals based primarily on increases in real estate taxes or in the average consumer price index. Rent expense under operating leases, included in occupancy expense, was approximately $197,000 and $146,000 for the years ended December 31, 2008 and 2007, respectively. Rental income under operating leases, netted in occupancy expense, was approximately $442,000 and $457,000 during the years ended December 31, 2008 and 2007, respectively. Estimated future rentals over the remaining noncancellable lease terms at December 31, 2008 are approximately as follows (in thousands):

Year Ending December 31, Operating Lease Expense Operating lease Income

2009 $196 252

2010 100 236

2011 78 -

2012 59 -

2013 5 -

$438 488

(continued)

21

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(6) Deposits

The aggregate amount of time deposit accounts in excess of $100,000 was approximately $214.9 million and $207.3 million at December 31, 2008 and 2007, respectively.

A schedule of maturities of time deposits at December 31, 2008 follows (in thousands):

Year Ending December 31, Amount

2009

2010

2011

2012

2013

$ 489,327

49,860

12,089

15,248

15,353

$ 581877

(continued)

22

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

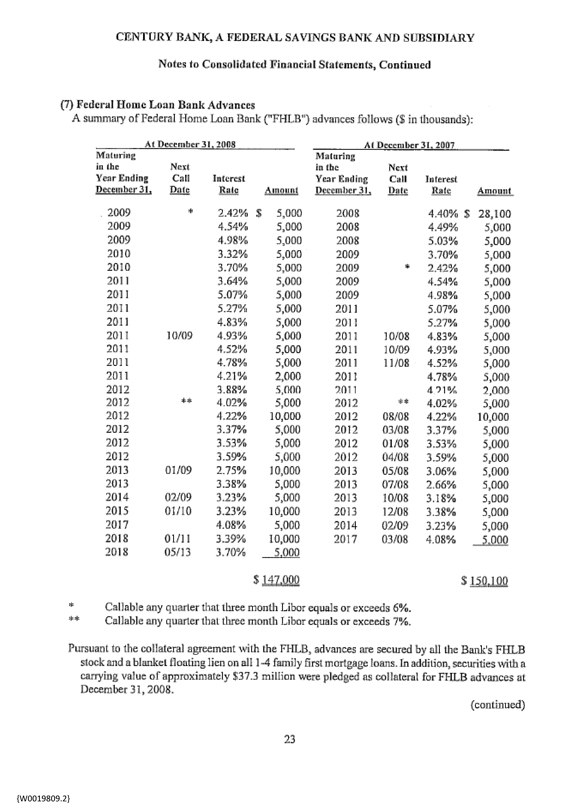

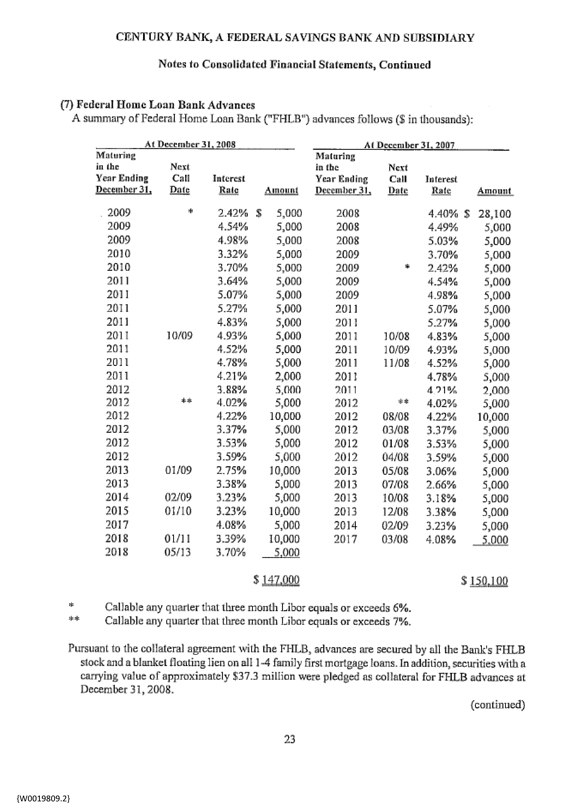

(7) Federal Home Loan Bank Advances

A summary of Federal Home Loan Bank (“FHLB”) advances follows (in thousands):

At December 31, 2008 At December 31, 2007

Maturing in the year ending December 31 Next call date Interest Rate Amount Maturing in the year ending December 31 Next call date Interest Rate Amount

2009 * 2.42% $ 5,000 2008 4.40% $ 28,100

2009 4.54% 5,000 2008 4.49% 5,000

2009 4.98% 5,000 2008 5.03% 5,000

2010 3.32% 5,000 2009 3.70% 5,000

2010 3.70% 5,000 2009 2.42% 5,000

2011 3.64% 5,000 2009 4.54% 5,000

2011 5.07% 5,000 2009 4.98% 5,000

2011 5.27% 5,000 2011 5.07% 5,000

2011 4.83% 5,000 2011 5.27% 5,000

2011 10/09 4.93% 5,000 2011 10108 4.83% 5,000

2011 4.52% 5,000 2011 10/09 4.93% 5,000

2011 4.78% 5,000 2011 11108 4.52% 5,000

2011 4.21% 2,000 2011 4.78% 5,000

2012 3.88% 5,0(10 7011 4.21 2,000

2012 ** 4.02% 5,000 2012 at 4.02% 5,000

2012 4.22% 10,000 2012 08/08 4.22% 10,000

2012 3.37% 5,000 2012 03/08 3.37% 5,000

2012 3.53% 5,000 2012 01/08 3.53% 5,000

2012 3.59% 5,000 2012 04/08 3.59% 5,000

2013 01109 2.75% 10.000 2013 05/08 3.06% 5,000

2013 3.38% 5,000 2013 07/08 2.66% 5,000

2014 02/09 3.23% 5,000 2013 10/08 3.18% 5,000

2015 01/10 3.23% 10,000 2013 12108 3.38% 5,000

2017 4.08% 5,000 2014 02109 3,23% 5,000

2018 01/11 3.39% 10,000 2017 03/08 4.08% 5.000

2018 05/13 3.70% 5.000

$147000 $ 150100

* Callable any quarter that three month Libor equals or exceeds 6%.

** Callable any quarter that three month Libor equals or exceeds 7%.

Pursuant to the collateral agreement with the FHLB, advances are secured by all the Bank’s FHLB stock and a blanket floating lien on all 1-4 family first mortgage loans. In addition, securities with a carrying value of approximately $37.3 million were pledged as collateral for FHLB advances at December 31, 2008.

(continued)

23

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

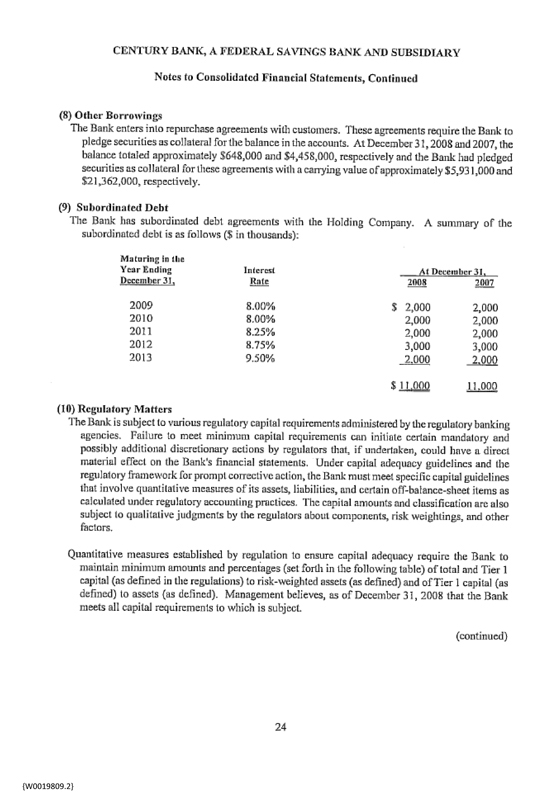

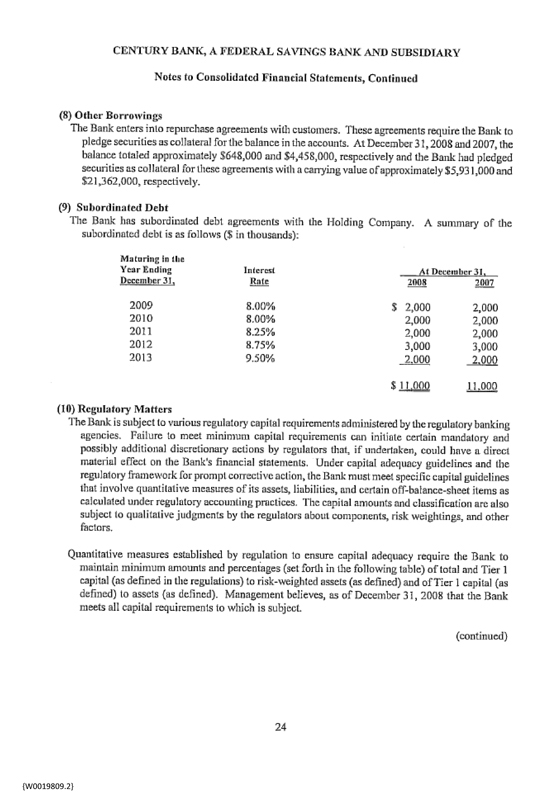

(8) Other Borrowings

The Bank enters into repurchase agreements with customers. These agreements require the Bank to pledge securities as collateral for the balance in the accounts. At December 31, 2008 and 2007, the balance totaled approximately $648,000 and $4,458,000. respectively and the Bank had pledged securities as collateral for these agreements with a carrying value of approximately $5,931,000 and $21,362,000, respectively.

(9) Subordinated Debt

The Bank has subordinated debt agreements with the Holding Company. A summary of the subordinated debt is as follows ($ in thousands):

Maturing in the year ending December 31 Interest rate At December 31

2008 2007

2009

2010

2011

2012

2013

8.00%

8.00%

8.25%

8.75%

9.50%

$ 2,000

2,000

2,000

3,000

2.000

$11,000

2,000

2,000

2,000

3,000

2.000

11,000

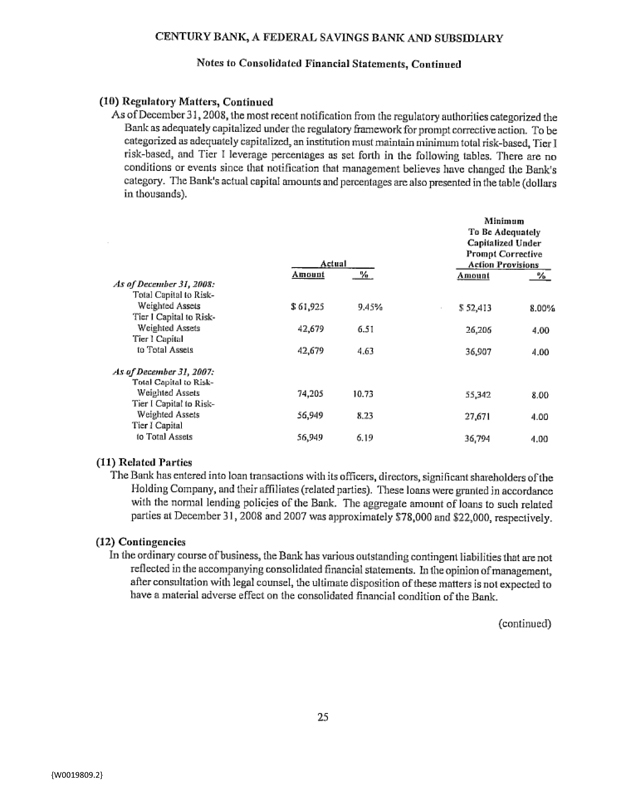

(10) Regulatory Matters

The Bank is subject to various regulatory capital requirements administered by the regulatory banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators that, if undertaken, could have a direct material effect on the Bank’s financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative measures of its assets, liabilities, and certain off-balance-sheet items as calculated under regulatory accounting practices. The capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors.

Quantitative measures established by regulation to ensure capital adequacy require the Bank to maintain minimum amounts and percentages (set forth in the following table) of total and Tier 1 capital (as defined in the regulations) to risk-weighted assets (as defined) and of Tier 1 capital (as defined) to assets (as defined). Management believes, as of December 31, 2008 that the Bank meets all capital requirements to which is subject.

(continued)

24

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(10) Regulatory Matters, Continued

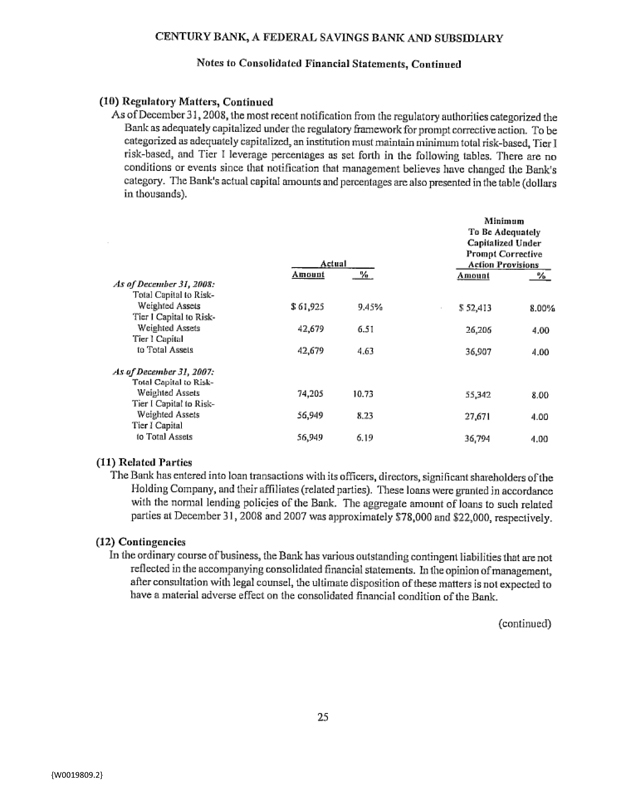

As of December 31, 2008, the most recent notification from the regulatory authorities categorized the Bank as adequately capitalized under time regulatory framework for prompt corrective action. To be categorized as adequately capitalized, an institution must maintain minimum total risk-based, Tier I risk-based, and Tier I leverage percentages as set forth in the following tables. There are no conditions or events since that notification that management believes have changed the Bank’s category. The Bank’s actual capital amounts and percentages are also presented in the table (dollars in thousands).

Actual Minimum To Be Adequately Capitalized Under Prompt Corrective Action Provisions

Amount % Amount %

As of December 31, 2008

Total Capital to Risk-Weighted Assets $ 61,925 9.45% $ 52,413 8.00%

Tier 1 Capital to Risk-Weighted Assets 42,679 6.51 26,206 4.00

Tier Capital 1

to Total Assets 42,679 4.63 36,907 4.00

As of December 31, 2007

Total Capital to Risk-Weighted Assets 74,205 10.73 55,342 8.00

Tier 1 Capital to Risk-Weighted Assets 56,949 8.23 27,671 4.00

Tier Capital 1

to Total Assets 56,949 6.19 36,794 1.00

(11) Related Parties

The Bank has entered into loan transactions with its officers, directors, significant shareholders of the Holding Company, and their affiliates (related parties). These loans were granted in accordance with the normal lending policies of the Bank. The aggregate amount of loans to such related parties at December 31, 2008 and 2007 was approximately $78,000 and $22,000, respectively.

(12) Contingencies

In the ordinary course of business, the Bank has various outstanding contingent liabilities that are not reflected in the accompanying consolidated financial statements. In the opinion of management, after consultation with legal counsel, the ultimate disposition of these matters is not expected to have a material adverse effect on the consolidated financial condition of the Bank.

(continued)

25

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

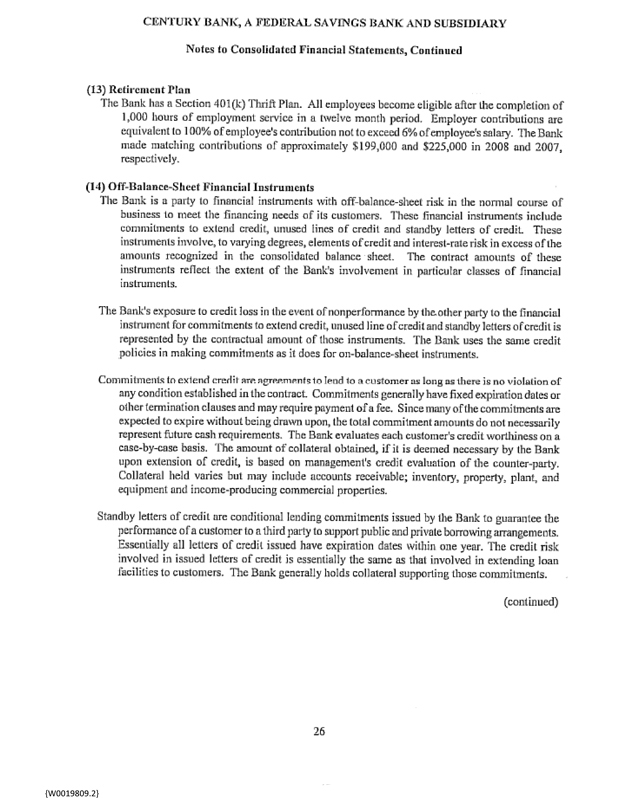

(13) Retirement Plan

The Bank has a Section 401(k) Thrift Plan. All employees become eligible after the completion of 1,000 hours of employment service in a twelve month period. Employer contributions are equivalent to 100% of employee’s contribution not to exceed 6% of employee’s salary. The Bank made matching contributions of approximately $199,000 and $225,000 in 2008 and 2007, respectively.

(14) Off-Balance-Sheet Financial Instruments

The Bank is a party to financial instruments with off-balance-sheet risk in the normal course of business to meet the financing needs of its customers. These financial instruments include commitments to extend credit, unused lines of credit and standby letters of credit. These instruments involve, to varying degrees, elements of credit and interest-rate risk in excess of the amounts recognized in the consolidated balance sheet. The contract amounts of these instruments reflect the extent of the Bank’s involvement in particular classes of financial instruments.

The Bank’s exposure to credit loss in the event of nonperformance by the other party to the financial instrument for commitments to extend credit, unused line of credit and standby letters of credit is represented by the contractual amount of those instruments. The Bank uses the same credit policies in making commitments as it does for on-balance-sheet instruments.

Commitments to extend are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. Since many of the commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. The Bank evaluates each customer’s credit worthiness on a case-by-case basis. The amount of’ collateral obtained, if it is deemed necessary by the Bank upon extension of credit, is based on management’s credit evaluation of the counter-party. Collateral held varies but may include accounts receivable; inventory, property, plant, and equipment and income-producing commercial properties.

Standby letters of credit are conditional lending commitments issued by the Bank to guarantee the performance of a customer to a third party to support public and private borrowing arrangements. Essentially all letters of credit issued have expiration dates within one year. The credit risk involved in issued letters of credit is essentially the same as that involved in extending loan facilities to customers. The Bank generally holds collateral supporting those commitments.

(continued)

26

{W0019809.2}

CENTURY BANK, A FEDERAL SAVINGS BANK AND SUBSIDIARY

Notes to Consolidated Financial Statements, Continued

(14) Off-Balance-Sheet Financial Instruments, Continued

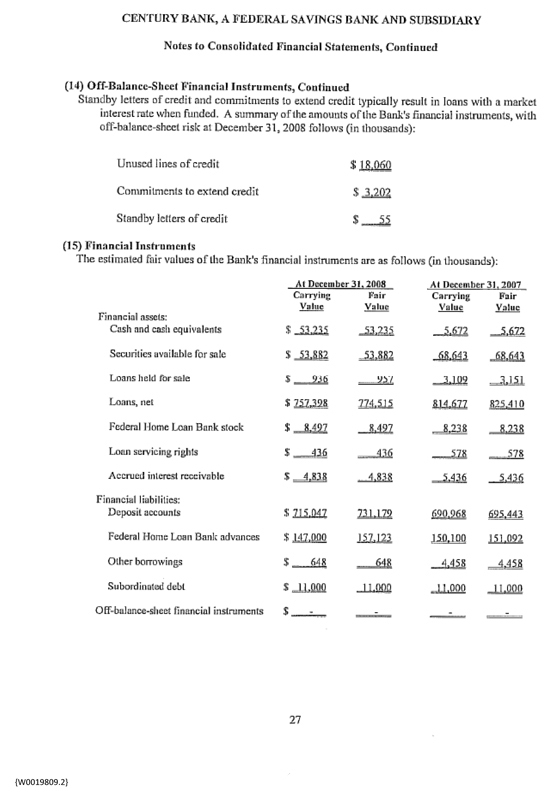

Standby letters of credit and commitments to extend credit typically result in loans with a market interest rate when funded. A summary of the amounts of the Bank’s financial instruments, with off-balance-sheet risk at December 31, 2008 follows (in thousands):

Unused lines of credit $ 18,060

Commitments to extend credit $ 3,202

Standby letters of credit $ 55

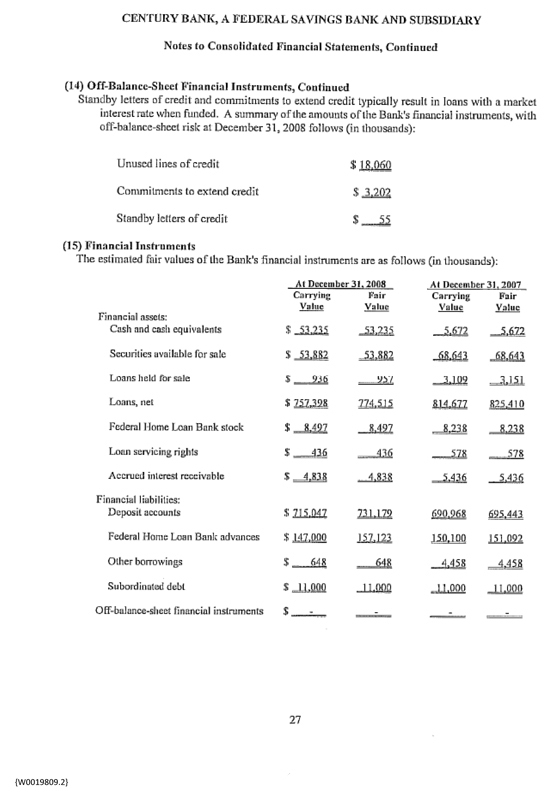

(15) Financial Instruments

The estimated fair values of the Bank’s financial instruments are as follows (in thousands):

At December 31, 2008 At December 31, 2007

Carrying Value Fair Value Carrying Value Fair Value

Financial assets:

Cash and cash equivalents $ 53,234 53,235 5,672 5,762

Securities available for sale $ 53,882 53,882 68,643 68,643

Loans held for sale $ 936 957 3,109 3,151

Loans, net $ 757,398 774,515 814,677 825,410

Federal Income Loan Bank stock $ 8,497 8,497 8,238 8,238

Loan servicing rights $ 436 436 578 578

Accrued interest receivable $ 4,838 4,838 5,436 5,436

Financial liabilities:

Deposit accounts $ 715,047 731,179 690,968 695,443

Federal Home Loan Bank advances $ 147,000 157,123 150,100 151,092

Other borrowings $ 648 648 4,458 4,458

Subordinated debt $ 11,000 11,000 11,000 11,000

Off-balance-sheet financial instruments $ - - - -

27

{W0019809.2}