UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07261 |

|

CREDIT SUISSE TRUST |

(Exact name of registrant as specified in charter) |

|

Eleven Madison Avenue, New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

J. Kevin Gao, Esq. Credit Suisse Trust Eleven Madison Avenue New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 325-2000 | |

|

Date of fiscal year end: | December 31st | |

|

Date of reporting period: | January 1, 2007 to December 31, 2007 | |

| | | | | | | |

Item 1. Reports to Stockholders.

CREDIT SUISSE FUNDS

Annual Report

December 31, 2007

CREDIT SUISSE TRUST

n INTERNATIONAL FOCUS PORTFOLIO

Credit Suisse Trust (the "Trust") shares are not available directly to individual investors, but may be offered only through certain insurance products and pension and retirement plans.

The Trust's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Trust, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-222-8977 or by writing to Credit Suisse Trust, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. The Trust is advised by Credit Suisse Asset Management, LLC.

The views of the Portfolio's management are as of the date of the letter and the Portfolio holdings described in this document are as of December 31, 2007; these views and Portfolio holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Portfolio shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Portfolio investments are subject to investment risks, including loss of your investment.

Credit Suisse Trust — International Focus Portfolio

Annual Investment Adviser's Report

December 31, 2007 (unaudited)

January 28, 2008

Dear Shareholder:

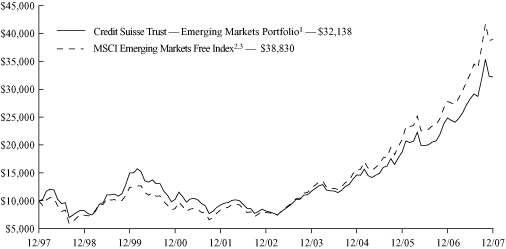

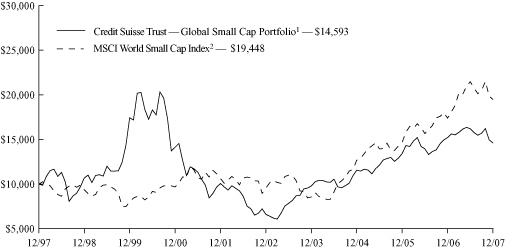

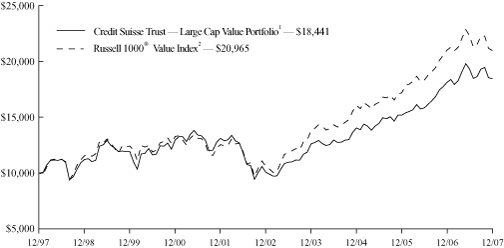

For the annual period ended December 31, 2007, Credit Suisse Trust — International Focus Portfolio (the "Portfolio")1 had a gain of 16.60%, versus an increase of 11.17% for the Morgan Stanley Capital International EAFE Index Net Dividends2 ("MSCI EAFE").

Market Review: Weakened U.S. dollar drives international returns

The year ended December 31, 2007, was a strong one for international equity markets in U.S. Dollar terms. The markets began the year very strongly with the small- and mid-cap areas performing particularly well, driven by private equity and industrial buyers.

However, in the second quarter, evidence of the sub-prime crisis began to emerge. Concerns over sub-prime exposure turned into a full-scale credit crunch, with banks becoming extremely cautious about lending to each other and to private equity funds. This lack of credit extension in private equity removed a major support from the market and caused equity markets to fall in the second half of 2007. Small- and mid-caps came under significant pressure, particularly as liquidity in these parts of the market dried up. Through all of this turmoil, however, emerging market equities remained strong.

Another important factor that drove returns for EAFE investors in 2007 was the depreciation of the U.S. dollar versus the Euro and the British Pound. A weakening U.S. dollar has a positive impact on returns for U.S. dollar based investors investing in non-U.S. dollar denominated assets. Consider that the price of oil came close to doubling in U.S. dollar terms during the year. This drove the performance of the European oil service sector in particular; the large integrated oil companies struggled to perform as, although they enjoy higher revenues from a higher oil price, they have also seen substantial cost increases and project delays.

Strategic review and market outlook: Value emerging in many global regions

Positive contributors to performance included stock selection in the capital goods and telecommunications services sectors. Leading detractors to performance came from stock selection in the technology hardware & equipment and diversified financials sectors.

Over the past year, we have had a number of themes at work in the portfolio. We were overweight the energy sector due to our strong positive view on the price of oil. Within this sector, we have been holders of oil service companies as they are benefiting from substantial price increases and volume growth.

1

Credit Suisse Trust — International Focus Portfolio

Annual Investment Adviser's Report (continued)

December 31, 2007 (unaudited)

Additionally, we have been overweight the telecommunications services sector. Toward the end of 2006, these names traded on very cheap valuations. Within the sector, we have had a greater exposure toward emerging market telecommunications companies.

We have maintained our overweight position in emerging equity markets during the year. In many instances, emerging market companies have better prospects to grow and generate high returns. And they often trade at cheaper valuations than developed market companies. However, this discrepancy did narrow substantially during 2007, as emerging equity markets outperformed developed equity markets.

In the short term, we see some risks facing equity markets: (1) whether the U.S. economy deteriorates further and descends into a full-blown recession, and the knock-on effect that this could potentially have on global economic growth; and (2) whether the credit crisis continues for longer than many market participants anticipate.

However, we have not reached the extreme of equity market overvaluation that we reached in 2001 and 2002. We therefore believe that the current sell-off in markets will be contained. We currently see value emerging in many sectors and regions of the world. And, in our opinion, the current market sell-off provides some very interesting investment opportunities.

The Credit Suisse International Equity Team

Neil Gregson

Tom Mann

International investing entails special risk considerations, including currency fluctuations, lower liquidity, economic and political risks, and differences in accounting methods. The Portfolio's fifteen largest holdings may account for 40% or more of the Portfolio's assets. As a result of this strategy, the Portfolio may be subject to greater volatility than a portfolio that invests in a larger number of issuers.

In addition to historical information, this report contains forward-looking statements, which may concern, among other things, domestic and foreign market, industry and economic trends and developments and government regulation and their potential impact on the Portfolio's investments. These statements are subject to risks and uncertainties and actual trends, developments and regulations in the future, and their impact on the Portfolio could be materially different from those projected, anticipated or implied. The Portfolio has no obligation to update or revise forward-looking statements.

2

Credit Suisse Trust — International Focus Portfolio

Annual Investment Adviser's Report (continued)

December 31, 2007 (unaudited)

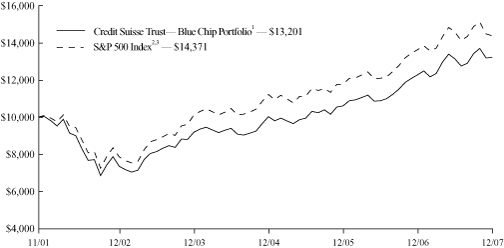

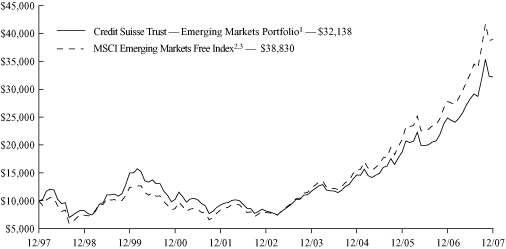

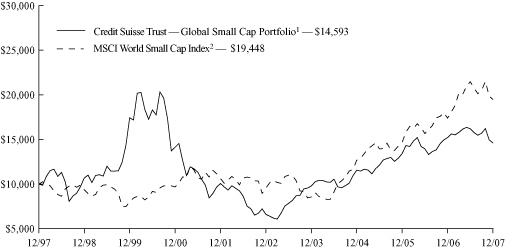

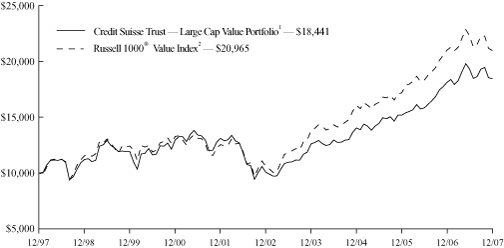

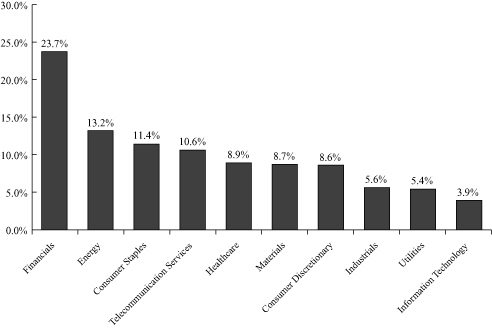

Comparison of Change in Value of $10,000 Investment in the

Credit Suisse Trust — International Focus Portfolio1

and the Morgan Stanley Capital International EAFE Index2

for Ten Years.

3

Credit Suisse Trust — International Focus Portfolio

Annual Investment Adviser's Report (continued)

December 31, 2007 (unaudited)

Average Annual Returns as of December 31, 20071

| 1 Year | | 5 Years | | 10 Years | | Since

Inception3 | |

| | 16.60 | % | | | 19.93 | % | | | 6.35 | % | | | 6.25 | % | |

Returns represent past performance and include change in share price and reinvestment of dividends and capital gains. Past performance cannot guarantee future results. The current performance of the Portfolio may be lower or higher than the figures shown. Returns and share price will fluctuate, and redemption value may be more or less than original cost. The performance results do not reflect the deduction of taxes that a shareholder would pay on portfolio distributions or the redemption of portfolio shares. Performance includes the effect of deducting expenses, but does not include charges and expenses attributable to any particular variable contract or plan. Accordingly, the Prospectus of the sponsoring Participating Insurance Company separate account or plan documents or other informational materials supplied by plan sponsors should be carefully reviewed for information on relevant charges and expenses. Excluding these charges and expenses from quotations of performance has the effect of increasing the performance quoted, and the effect of these charges should be considered when comparing performance to that of other mutual funds. Performance information current to the most recent month-end is available at www.credit-suisse.com/us.

1 Fee waivers and/or expense reimbursements may reduce expenses for the Portfolio, without which performance would be lower. Waivers and/or reimbursements may be discontinued at any time.

2 The Morgan Stanley Capital International EAFE (Europe, Australasia, Far East) Index Net Dividends is a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the U.S. and Canada. It is the exclusive property of Morgan Stanley Capital International Inc. Investors cannot invest directly in an index.

3 Inception date: 6/30/95.

4

Credit Suisse Trust — International Focus Portfolio

Annual Investment Adviser's Report (continued)

December 31, 2007 (unaudited)

Information About Your Portfolio's Expenses

As an investor of the Portfolio, you incur two types of costs: ongoing expenses and transaction costs. Ongoing expenses include management fees, distribution and service (12b-1) fees and other Portfolio expenses. Examples of transaction costs include sales charges (loads), redemption fees and account maintenance fees, which are not shown in this section and which would result in higher total expenses. The following table is intended to help you understand your ongoing expenses of investing in the Portfolio and to help you compare these expenses with the ongoing expenses of investing in other mutual funds. The table is based on an investment of $1,000 made at the beginning of the six month period ended December 31, 2007.

The table illustrates your Portfolio's expenses in two ways:

• Actual Portfolio Return. This helps you estimate the actual dollar amount of ongoing expenses paid on a $1,000 investment in the Portfolio using the Portfolio's actual return during the period. To estimate the expenses you paid over the period, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the "Expenses Paid per $1,000" line under the share class you hold.

• Hypothetical 5% Portfolio Return. This helps you to compare your Portfolio's ongoing expenses with those of other mutual funds using the Portfolio's actual expense ratio and a hypothetical rate of return of 5% per year before expenses. Examples using a 5% hypothetical fund return may be found in the shareholder reports of other mutual funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Please note that the expenses shown in these tables are meant to highlight your ongoing expenses only and do not reflect any transaction costs, such as sales charges (loads) or redemption fees. If these transaction costs had been included, your costs would have been higher. The "Expenses Paid per $1,000" line of the tables is useful in comparing ongoing expenses only and will not help you determine the relative total expenses of owning different funds.

5

Credit Suisse Trust — International Focus Portfolio

Annual Investment Adviser's Report (continued)

December 31, 2007 (unaudited)

Expenses and Value of a $1,000 Investment

for the six month period ended December 31, 2007

| Actual Portfolio Return | |

| Beginning Account Value 7/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 12/31/07 | | $ | 1,034.20 | | |

| Expenses Paid per $1,000* | | $ | 6.87 | | |

| Hypothetical 5% Portfolio Return | |

| Beginning Account Value 7/1/07 | | $ | 1,000.00 | | |

| Ending Account Value 12/31/07 | | $ | 1,018.45 | | |

| Expenses Paid per $1,000* | | $ | 6.82 | | |

| Annualized Expense Ratios* | | | 1.34 | % | |

* Expenses are equal to the Portfolio's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year period, then divided by 365.

The "Expenses Paid per $1,000" and the "Annualized Expense Ratios" in the tables are based on actual expenses paid by the Portfolio during the period, net of fee waivers and/or expense reimbursements. If those fee waivers and/or expense reimbursements had not been in effect, the Portfolio's actual expenses would have been higher. Expenses do not reflect additional charges and expenses that are, or may be, imposed under the variable contracts or plans. Such charges and expenses are described in the prospectus of the insurance company separate account or in the plan documents or other informational materials supplied by plan sponsors. The Portfolio's expenses should be considered with these charges and expenses in evaluating the overall cost of investing in the separate account.

For more information, please refer to the Portfolio's prospectus.

6

Credit Suisse Trust — International Focus Portfolio

Annual Investment Adviser's Report (continued)

December 31, 2007 (unaudited)

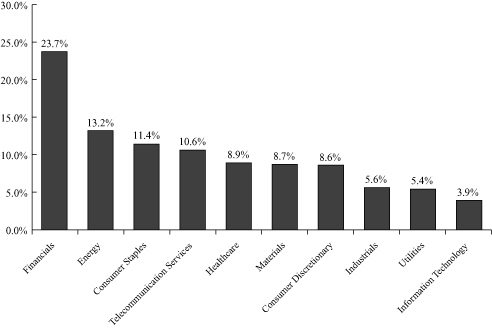

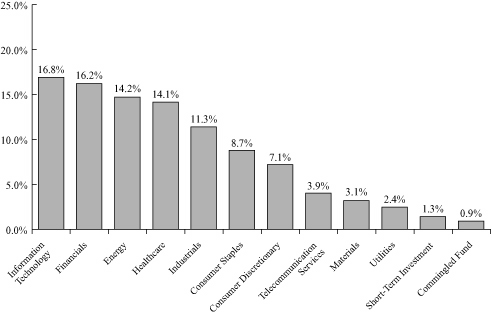

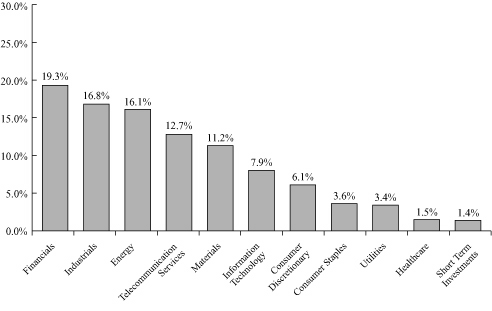

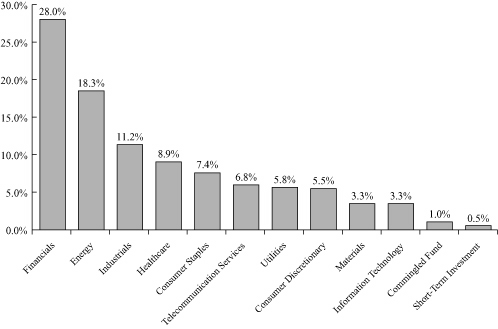

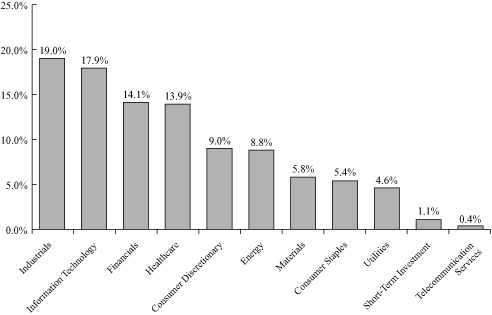

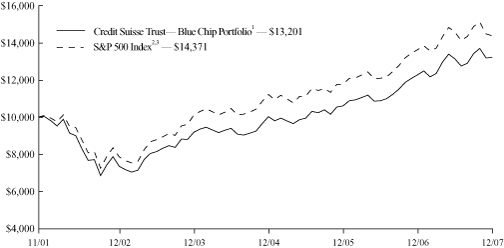

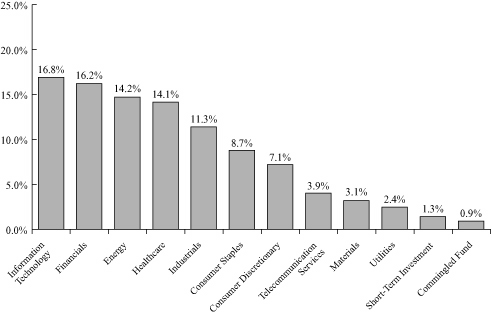

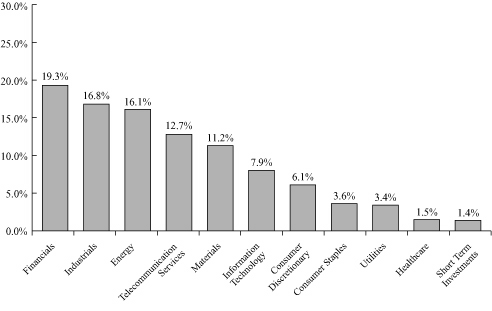

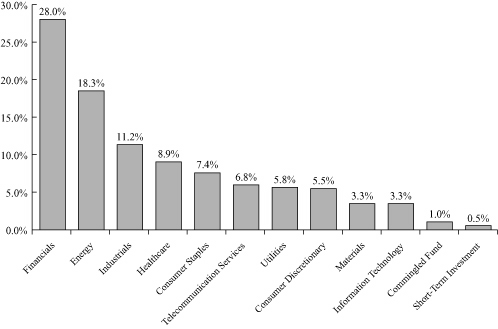

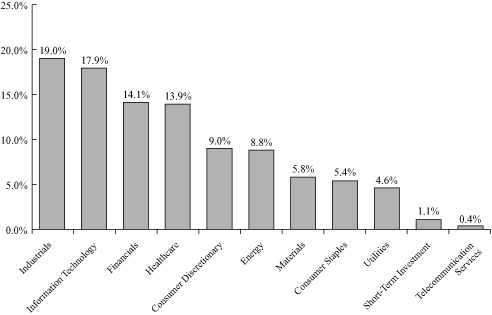

SECTOR BREAKDOWN*

* Expressed as a percentage of total investments (excluding security lending collateral) and may vary over time.

7

Credit Suisse Trust — International Focus Portfolio

Schedule of Investments

December 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS (100.0%) | |

| Austria (0.9%) | |

| Energy Equipment & Services (0.9%) | |

| C.A.T. oil AG*§ | | | 42,509 | | | $ | 934,699 | | |

| TOTAL AUSTRIA | | | 934,699 | | |

| Belgium (1.4%) | |

| Metals & Mining (1.4%) | |

| Umicore | | | 5,401 | | | | 1,338,386 | | |

| TOTAL BELGIUM | | | 1,338,386 | | |

| Brazil (2.0%) | |

| Oil & Gas (2.0%) | |

| Petroleo Brasileiro SA - Petrobras ADR | | | 20,822 | | | | 2,003,493 | | |

| TOTAL BRAZIL | | | 2,003,493 | | |

| Denmark (1.7%) | |

| Pharmaceuticals (1.7%) | |

| Novo Nordisk AS Series B | | | 25,604 | | | | 1,671,463 | | |

| TOTAL DENMARK | | | 1,671,463 | | |

| France (12.2%) | |

| Banks (3.2%) | |

| BNP Paribas§ | | | 14,081 | | | | 1,527,787 | | |

| Societe Generale | | | 11,415 | | | | 1,650,939 | | |

| | | | 3,178,726 | | |

| Beverages (1.4%) | |

| Pernod Ricard SA§ | | | 6,126 | | | | 1,413,767 | | |

| Insurance (2.3%) | |

| Axa§ | | | 57,597 | | | | 2,296,330 | | |

| Metals & Mining (1.5%) | |

| Vallourec SA | | | 5,532 | | | | 1,496,196 | | |

| Oil & Gas (1.4%) | |

| Total SA§ | | | 16,397 | | | | 1,357,677 | | |

| Pharmaceuticals (1.1%) | |

| Sanofi-Aventis | | | 11,459 | | | | 1,048,960 | | |

| Textiles & Apparel (1.3%) | |

| LVMH Moet Hennessy Louis Vuitton SA§ | | | 10,512 | | | | 1,270,366 | | |

| TOTAL FRANCE | | | 12,062,022 | | |

| Germany (9.9%) | |

| Auto Components (1.9%) | |

| Continental AG | | | 14,578 | | | | 1,907,543 | | |

| Banks (1.5%) | |

| Deutsche Bank AG | | | 10,993 | | | | 1,435,410 | | |

See Accompanying Notes to Financial Statements.

8

Credit Suisse Trust — International Focus Portfolio

Schedule of Investments (continued)

December 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Germany | |

| Electric Utilities (2.9%) | |

| E.ON AG | | | 13,527 | | | $ | 2,875,742 | | |

| Electrical Equipment (1.1%) | |

| Norddeutsche Affinerie AG§ | | | 29,053 | | | | 1,128,383 | | |

| Multi-Utilities (2.5%) | |

| RWE AG§ | | | 17,683 | | | | 2,479,336 | | |

| TOTAL GERMANY | | | 9,826,414 | | |

| Greece (1.9%) | |

| Diversified Telecommunication Services (0.9%) | |

| Hellenic Telecommunications Organization SA | | | 24,955 | | | | 912,870 | | |

| Wireless Telecommunication Services (1.0%) | |

| Cosmote Mobile Telecommunications SA | | | 24,730 | | | | 939,734 | | |

| TOTAL GREECE | | | 1,852,604 | | |

| India (2.2%) | |

| Diversified Telecommunication Services (2.2%) | |

| Bharti Airtel, Ltd.* | | | 89,087 | | | | 2,213,981 | | |

| TOTAL INDIA | | | 2,213,981 | | |

| Israel (1.8%) | |

| Pharmaceuticals (1.8%) | |

| Teva Pharmaceutical Industries, Ltd. ADR§ | | | 38,655 | | | | 1,796,684 | | |

| TOTAL ISRAEL | | | 1,796,684 | | |

| Italy (2.8%) | |

| Banks (2.8%) | |

| Intesa Sanpaolo | | | 285,652 | | | | 2,247,955 | | |

| UniCredito Italiano SpA | | | 64,599 | | | | 531,352 | | |

| TOTAL ITALY | | | 2,779,307 | | |

| Japan (15.1%) | |

| Automobiles (1.2%) | |

| Toyota Motor Corp. | | | 21,781 | | | | 1,160,027 | | |

| Banks (2.3%) | |

| Mitsubishi UFJ Financial Group, Inc. | | | 97,092 | | | | 915,571 | | |

| Mizuho Financial Group, Inc. | | | 287 | | | | 1,367,108 | | |

| | | | 2,282,679 | | |

| Chemicals (3.1%) | |

| Kuraray Company, Ltd. | | | 109,435 | | | | 1,320,259 | | |

| Shin-Etsu Chemical Company, Ltd. | | | 28,739 | | | | 1,787,312 | | |

| | | | 3,107,571 | | |

| Diversified Financials (1.4%) | |

| Daiwa Securities Group, Inc. | | | 155,701 | | | | 1,397,829 | | |

See Accompanying Notes to Financial Statements.

9

Credit Suisse Trust — International Focus Portfolio

Schedule of Investments (continued)

December 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Japan | |

| Electronic Equipment & Instruments (1.4%) | |

| Omron Corp. | | | 58,437 | | | $ | 1,375,806 | | |

| Household Products (1.7%) | |

| Uni-Charm Corp. | | | 27,041 | | | | 1,706,514 | | |

| Machinery (1.5%) | |

| Komatsu, Ltd.§ | | | 53,777 | | | | 1,442,254 | | |

| Specialty Retail (2.5%) | |

| Yamada Denki Company, Ltd.§ | | | 22,055 | | | | 2,487,917 | | |

| TOTAL JAPAN | | | 14,960,597 | | |

| Luxembourg (0.9%) | |

| Energy Equipment & Services (0.9%) | |

| Acergy SA§ | | | 39,004 | | | | 858,120 | | |

| TOTAL LUXEMBOURG | | | 858,120 | | |

| Mexico (2.0%) | |

| Wireless Telecommunication Services (2.0%) | |

| America Movil SAB de CV ADR Series L | | | 32,097 | | | | 1,970,435 | | |

| TOTAL MEXICO | | | 1,970,435 | | |

| Netherlands (6.6%) | |

| Energy Equipment & Services (1.2%) | |

| Fugro NV | | | 15,431 | | | | 1,191,779 | | |

| Household Durables (1.7%) | |

| Koninklijke (Royal) Philips Electronics NV | | | 38,407 | | | | 1,645,747 | | |

| IT Consulting & Services (2.5%) | |

| Exact Holding NV | | | 35,842 | | | | 1,297,191 | | |

| Ordina NV | | | 67,168 | | | | 1,195,219 | | |

| | | | 2,492,410 | | |

| Transportation Infrastructure (1.2%) | |

| Smit International NV | | | 11,824 | | | | 1,216,830 | | |

| TOTAL NETHERLANDS | | | 6,546,766 | | |

| Norway (5.7%) | |

| Banks (1.7%) | |

| DNB NOR ASA | | | 113,235 | | | | 1,722,529 | | |

| Energy Equipment & Services (1.3%) | |

| Sevan Marine ASA*§ | | | 88,094 | | | | 1,317,605 | | |

| Oil & Gas (2.7%) | |

| DNO ASA*§ | | | 489,775 | | | | 899,250 | | |

| Prosafe SE§ | | | 100,513 | | | | 1,738,929 | | |

| | | | 2,638,179 | | |

| TOTAL NORWAY | | | 5,678,313 | | |

See Accompanying Notes to Financial Statements.

10

Credit Suisse Trust — International Focus Portfolio

Schedule of Investments (continued)

December 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| Singapore (2.0%) | |

| Banks (2.0%) | |

| United Overseas Bank, Ltd. | | | 142,775 | | | $ | 1,955,350 | | |

| TOTAL SINGAPORE | | | 1,955,350 | | |

| Spain (4.5%) | |

| Banks (1.8%) | |

| Banco Santander SA | | | 80,547 | | | | 1,739,650 | | |

| Diversified Telecommunication Services (1.5%) | |

| Telefonica SA | | | 45,208 | | | | 1,465,474 | | |

| Tobacco (1.2%) | |

| Altadis SA | | | 16,703 | | | | 1,211,956 | | |

| TOTAL SPAIN | | | 4,417,080 | | |

| Switzerland (4.5%) | |

| Banks (1.5%) | |

| UBS AG | | | 31,376 | | | | 1,446,675 | | |

| Food Products (1.3%) | |

| Nestle SA | | | 2,925 | | | | 1,343,131 | | |

| Pharmaceuticals (1.7%) | |

| Novartis AG | | | 30,933 | | | | 1,691,643 | | |

| TOTAL SWITZERLAND | | | 4,481,449 | | |

| Taiwan (1.2%) | |

| Diversified Telecommunication Services (1.2%) | |

| Chunghwa Telecom Company, Ltd. ADR | | | 58,550 | | | | 1,235,991 | | |

| TOTAL TAIWAN | | | 1,235,991 | | |

| United Kingdom (20.7%) | |

| Aerospace & Defense (1.4%) | |

| BAE Systems PLC | | | 138,156 | | | | 1,371,044 | | |

| Banks (3.2%) | |

| Barclays PLC | | | 49,779 | | | | 502,733 | | |

| HSBC Holdings PLC§ | | | 114,085 | | | | 1,918,243 | | |

| Royal Bank of Scotland Group PLC | | | 88,953 | | | | 785,406 | | |

| | | | 3,206,382 | | |

| Beverages (2.0%) | |

| SABMiller PLC | | | 70,360 | | | | 1,974,698 | | |

| Commercial Services & Supplies (0.4%) | |

| Hays PLC | | | 179,531 | | | | 415,273 | | |

| Food & Drug Retailing (1.6%) | |

| Tesco PLC | | | 172,690 | | | | 1,642,717 | | |

| Metals & Mining (2.7%) | |

| BHP Billiton PLC | | | 87,503 | | | | 2,668,256 | | |

See Accompanying Notes to Financial Statements.

11

Credit Suisse Trust — International Focus Portfolio

Schedule of Investments (continued)

December 31, 2007

| | | Number of

Shares | | Value | |

| COMMON STOCKS | |

| United Kingdom | |

| Oil & Gas (2.8%) | |

| BP PLC | | | 108,429 | | | $ | 1,325,026 | | |

| Royal Dutch Shell PLC Class A§ | | | 34,441 | | | | 1,453,729 | | |

| | | | 2,778,755 | | |

| Pharmaceuticals (2.7%) | |

| AstraZeneca PLC | | | 19,065 | | | | 820,611 | | |

| GlaxoSmithKline PLC | | | 71,529 | | | | 1,816,587 | | |

| | | | 2,637,198 | | |

| Tobacco (2.1%) | |

| Imperial Tobacco Group PLC | | | 37,753 | | | | 2,041,939 | | |

| Wireless Telecommunication Services (1.8%) | |

| Vodafone Group PLC | | | 479,340 | | | | 1,799,399 | | |

| TOTAL UNITED KINGDOM | | | 20,535,661 | | |

| TOTAL COMMON STOCKS (Cost $74,487,318) | | | 99,118,815 | | |

| SHORT-TERM INVESTMENT (18.9%) | |

| State Street Navigator Prime Portfolio§§ (Cost $18,781,744) | | | 18,781,744 | | | | 18,781,744 | | |

| TOTAL INVESTMENTS AT VALUE (118.9%) (Cost $93,269,062) | | | 117,900,559 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-18.9%) | | | (18,754,539 | ) | |

| NET ASSETS (100.0%) | | $ | 99,146,020 | | |

INVESTMENT ABBREVIATION

ADR = American Depositary Receipt

* Non-income producing security.

§ Security or portion thereof is out on loan.

§§ Represents security purchased with cash collateral received for securities on loan.

See Accompanying Notes to Financial Statements.

12

Credit Suisse Trust — International Focus Portfolio

Statement of Assets and Liabilities

December 31, 2007

| Assets | |

Investments at value, including collateral for securities on loan of $18,781,744

(Cost $93,269,062) (Note 2) | | $ | 117,900,5591 | | |

| Foreign currency at value (cost $552,584) | | | 551,203 | | |

| Dividend and interest receivable | | | 94,395 | | |

| Receivable for portfolio shares sold | | | 5,883 | | |

| Prepaid expenses and other assets | | | 11,540 | | |

| Total Assets | | | 118,563,580 | | |

| Liabilities | |

| Advisory fee payable (Note 3) | | | 84,854 | | |

| Administrative services fee payable (Note 3) | | | 10,098 | | |

| Payable upon return of securities loaned (Note 2) | | | 18,781,744 | | |

| Due to custodian | | | 345,180 | | |

| Payable for portfolio shares redeemed | | | 92,369 | | |

| Trustees' fee payable | | | 804 | | |

| Other accrued expenses payable | | | 102,511 | | |

| Total Liabilities | | | 19,417,560 | | |

| Net Assets | |

| Capital stock, $0.001 par value (Note 6) | | | 6,257 | | |

| Paid-in capital (Note 6) | | | 160,073,394 | | |

| Undistributed net investment income | | | 1,277,977 | | |

| Accumulated net realized loss on investments and foreign currency transactions | | | (86,840,040 | ) | |

| Net unrealized appreciation from investments and foreign currency translations | | | 24,628,432 | | |

| Net Assets | | $ | 99,146,020 | | |

| Shares outstanding | | | 6,256,685 | | |

| Net asset value, offering price, and redemption price per share | | $ | 15.85 | | |

1 Including $17,924,778 of securities on loan.

See Accompanying Notes to Financial Statements.

13

Credit Suisse Trust — International Focus Portfolio

Statement of Operations

For the Year Ended December 31, 2007

| Investment Income (Note 2) | |

| Dividends | | $ | 2,599,667 | | |

| Interest | | | 52,797 | | |

| Securities lending | | | 113,359 | | |

| Foreign taxes withheld | | | (240,597 | ) | |

| Total investment income | | | 2,525,226 | | |

| Expenses | |

| Investment advisory fees (Note 3) | | | 953,530 | | |

| Administrative services fees (Note 3) | | | 114,418 | | |

| Printing fees (Note 3) | | | 58,802 | | |

| Custodian fees | | | 51,116 | | |

| Audit and tax fees | | | 28,261 | | |

| Trustees' fees | | | 19,857 | | |

| Legal fees | | | 18,387 | | |

| Interest expense (Note 4) | | | 5,095 | | |

| Transfer agent fees | | | 3,775 | | |

| Insurance expense | | | 3,710 | | |

| Commitment fees (Note 4) | | | 2,373 | | |

| Miscellaneous expense | | | 8,646 | | |

| Total expenses | | | 1,267,970 | | |

| Less: fees waived (Note 3) | | | (7,632 | ) | |

| Net expenses | | | 1,260,338 | | |

| Net investment income | | | 1,264,888 | | |

| Net Realized and Unrealized Gain (Loss) from Investments and Foreign Currency Related Items | |

| Net realized gain from investments | | | 17,664,262 | | |

| Net realized gain from foreign currency transactions | | | 16,611 | | |

| Net change in unrealized appreciation (depreciation) from investments | | | (4,533,948 | ) | |

| Net change in unrealized appreciation (depreciation) from foreign currency translations | | | 63,080 | | |

| Net realized and unrealized gain from investments and foreign currency related items | | | 13,210,005 | | |

| Net increase in net assets resulting from operations | | $ | 14,474,893 | | |

See Accompanying Notes to Financial Statements.

14

Credit Suisse Trust — International Focus Portfolio

Statements of Changes in Net Assets

| | | For the Year

Ended

December 31, 2007 | | For the Year

Ended

December 31, 2006 | |

| From Operations | |

| Net investment income | | $ | 1,264,888 | | | $ | 1,021,698 | | |

| Net realized gain from investments and foreign currency transactions | | | 17,680,873 | | | | 8,456,656 | | |

Net change in unrealized appreciation (depreciation)

from investments and foreign currency translations | | | (4,470,868 | ) | | | 6,338,235 | | |

| Net increase in net assets resulting from operations | | | 14,474,893 | | | | 15,816,589 | | |

| From Dividends | |

| Dividends from net investment income | | | (981,812 | ) | | | (967,042 | ) | |

| Net decrease in net assets resulting from dividends | | | (981,812 | ) | | | (967,042 | ) | |

| From Capital Share Transactions (Note 6) | |

| Proceeds from sale of shares | | | 15,532,378 | | | | 13,572,464 | | |

| Reinvestment of dividends | | | 981,812 | | | | 967,042 | | |

| Net asset value of shares redeemed | | | (25,667,303 | ) | | | (26,794,834 | ) | |

| Net decrease in net assets from capital share transactions | | | (9,153,113 | ) | | | (12,255,328 | ) | |

| Net increase in net assets | | | 4,339,968 | | | | 2,594,219 | | |

| Net Assets | |

| Beginning of year | | | 94,806,052 | | | | 92,211,833 | | |

| End of year | | $ | 99,146,020 | | | $ | 94,806,052 | | |

| Undistributed net investment income | | $ | 1,277,977 | | | $ | 969,893 | | |

See Accompanying Notes to Financial Statements.

15

Credit Suisse Trust — International Focus Portfolio

Financial Highlights

(For a Share of the Portfolio Outstanding Throughout Each Year)

| | | For the Year Ended December 31, | |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| Per share data | |

| Net asset value, beginning of year | | $ | 13.74 | | | $ | 11.70 | | | $ | 10.04 | | | $ | 8.85 | | | $ | 6.68 | | |

| INVESTMENT OPERATIONS | |

| Net investment income | | | 0.22 | | | | 0.15 | | | | 0.14 | | | | 0.11 | | | | 0.09 | | |

Net gain on investments and foreign currency

related items (both realized and unrealized) | | | 2.05 | | | | 2.02 | | | | 1.62 | | | | 1.17 | | | | 2.12 | | |

| Total from investment operations | | | 2.27 | | | | 2.17 | | | | 1.76 | | | | 1.28 | | | | 2.21 | | |

| LESS DIVIDENDS | |

| Dividends from net investment income | | | (0.16 | ) | | | (0.13 | ) | | | (0.10 | ) | | | (0.09 | ) | | | (0.04 | ) | |

| Net asset value, end of year | | $ | 15.85 | | | $ | 13.74 | | | $ | 11.70 | | | $ | 10.04 | | | $ | 8.85 | | |

| Total return1 | | | 16.60 | % | | | 18.65 | % | | | 17.56 | % | | | 14.63 | % | | | 33.09 | % | |

| RATIOS AND SUPPLEMENTAL DATA | |

| Net assets, end of year (000s omitted) | | $ | 99,146 | | | $ | 94,806 | | | $ | 92,212 | | | $ | 87,301 | | | $ | 90,970 | | |

| Ratio of expenses to average net assets | | | 1.32 | % | | | 1.32 | % | | | 1.42 | % | | | 1.37 | % | | | 1.41 | % | |

| Ratio of net investment income to average net assets | | | 1.33 | % | | | 1.08 | % | | | 1.17 | % | | | 0.98 | % | | | 1.01 | % | |

Decrease reflected in above operating expense

ratios due to waivers/reimbursements | | | 0.01 | % | | | 0.04 | % | | | — | | | | — | | | | — | | |

| Portfolio turnover rate | | | 41 | % | | | 37 | % | | | 47 | % | | | 90 | % | | | 131 | % | |

1 Total returns are historical and assume changes in share price and reinvestment of all dividends and distributions. Had certain expenses not been reduced during the years shown, total returns would have been lower. Total returns do not reflect charges and expenses attributable to any particular variable contract or plan.

See Accompanying Notes to Financial Statements.

16

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements

December 31, 2007

Note 1. Organization

Credit Suisse Trust (the "Trust") is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act"), and currently offers eight managed investment portfolios of which one, the International Focus Portfolio (the "Portfolio"), is included in this report. The Portfolio is a diversified investment fund that seeks long-term capital appreciation. Shares of the Portfolio are not available directly to individual investors but may be offered only through (a) variable annuity contracts and variable life insurance contracts offered by separate accounts of certain insurance companies and (b) tax-qualified pension and retirement plans. The Portfolio may not be available in connection with a particular contract or plan. The Trust was organized under the laws of The Commonwealth of Massachusetts as a business trust on March 15, 1995.

Note 2. Significant Accounting Policies

A) SECURITY VALUATION — The net asset value of the Portfolio is determined daily as of the close of regular trading on the New York Stock Exchange, Inc. (the "Exchange") on each day the Exchange is open for business. Equity investments are valued at market value, which is generally determined using the closing price on the exchange or market on which the security is primarily traded at the time of valuation (the "Valuation Time"). If no sales are reported, equity investments are generally valued at the most recent bid quotation as of the Valuation Time or at the lowest asked quotation in the case of a short sale of securities. Debt securities with a remaining maturity greater than 60 days are valued in accordance with the price supplied by a pricing service, which may use a matrix, formula or other objective method that takes into consideration market indices, yield curves and other specific adjustments. Debt obligations that will matur e in 60 days or less are valued on the basis of amortized cost, which approximates market value, unless it is determined that using this method would not represent fair value. Investments in mutual funds are valued at the mutual fund's closing net asset value per share on the day of valuation. Securities and other assets for which market quotations are not readily available, or whose values have been materially affected by events occurring before the Portfolio's Valuation Time but after the close of the securities' primary markets, are valued at fair value as determined in good faith by, or under the direction of, the Board of Trustees under procedures established by the Board of Trustees. The Portfolio may utilize a service provided by an independent third party which has been approved by the Board of Trustees to fair value certain securities. When fair-value pricing is employed, the prices of securities used by a portfolio to calculate its net asset value may differ from quoted or published prices for the same securities.

17

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements (continued)

December 31, 2007

Note 2. Significant Accounting Policies

B) FOREIGN CURRENCY TRANSACTIONS — The books and records of the Portfolio are maintained in U.S. dollars. Transactions denominated in foreign currencies are recorded at the current prevailing exchange rates. All assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the current exchange rate at the end of the period. Translation gains or losses resulting from changes in the exchange rate during the reporting period and realized gains and losses on the settlement of foreign currency transactions are reported in the results of operations for the current period. The Portfolio does not isolate that portion of realized gains and losses on investments in equity securities which is due to changes in the foreign exchange rate from that which is due to changes in market prices of equity securities. The Portfolio isolates that portion of realized gains and losses on investments in debt securities which is due to changes in the foreign exchange rate from that which is due to changes in market prices of debt securities.

C) SECURITY TRANSACTIONS AND INVESTMENT INCOME — Security transactions are accounted for on a trade date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. The cost of investments sold is determined by use of the specific identification method for both financial reporting and income tax purposes.

D) DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS — Dividends from net investment income and distributions of net realized capital gains, if any, are declared and paid at least annually. However, to the extent that a net realized capital gain can be reduced by a capital loss carryforward, such gain will not be distributed. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from accounting principles generally accepted in the United States of America ("GAAP").

E) FEDERAL INCOME TAXES — No provision is made for federal taxes as it is the Portfolio's intention to continue to qualify for and elect the tax treatment applicable to regulated investment companies under the Internal Revenue Code of 1986, as amended, and to make the requisite distributions to its shareholders, which will be sufficient to relieve it from federal income and excise taxes.

F) USE OF ESTIMATES — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from these estimates.

18

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements (continued)

December 31, 2007

Note 2. Significant Accounting Policies

G) SHORT-TERM INVESTMENTS — The Portfolio, together with other funds/portfolios advised by Credit Suisse Asset Management, LLC ("Credit Suisse"), an indirect, wholly-owned subsidiary of Credit Suisse Group, pools available cash into either a short-term variable rate time deposit issued by State Street Bank and Trust Company ("SSB"), the Portfolio's custodian, or a money market fund advised by Credit Suisse. The short-term time deposit issued by SSB is a variable rate account classified as a short-term investment.

H) FORWARD FOREIGN CURRENCY CONTRACTS — The Portfolio may enter into forward foreign currency contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date. Risks may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency. The Portfolio will enter into forward foreign currency contracts primarily for hedging purposes. Forward foreign currency contracts are adjusted by the daily forward exchange rate of the underlying currency and any gains or losses are recorded for financial statement purposes as unrealized until the contract settlement date or an offsetting position is entered into. At December 31, 2007, the Portfolio had no open forward foreign currency contracts.

I) SECURITIES LENDING — Loans of securities are required at all times to be secured by collateral at least equal to 102% of the market value of domestic securities on loan (including any accrued interest thereon) and 105% of the market value of foreign securities on loan (including any accrued interest thereon). Cash collateral received by the Portfolio in connection with securities lending activity may be pooled together with cash collateral for other funds/portfolios advised by Credit Suisse and may be invested in a variety of investments, including certain Credit Suisse-advised funds, funds advised by SSB, the Portfolio's securities lending agent, or money market instruments. However, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral may be subject to legal proceedings.

SSB has been engaged by the Portfolio to act as the Portfolio's securities lending agent. The Portfolio's securities lending arrangement provides that the Portfolio and SSB will share the net income earned from securities lending activities. During the year ended December 31, 2007, total earnings from the Portfolio's investment in cash collateral received in connection with securities lending arrangements was $1,107,565 of which $968,167 was rebated to borrowers (brokers). The Portfolio retained $113,359 in income from the cash collateral investment, and SSB, as lending agent, was paid $26,039.

19

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements (continued)

December 31, 2007

Note 2. Significant Accounting Policies

The Portfolio may also be entitled to certain minimum amounts of income from its securities lending activities. Securities lending income is accrued as earned.

J) OTHER — The Portfolio may invest in securities of foreign countries and governments which involve certain risks in addition to those inherent in domestic investments. Such risks generally include, among others, currency risk (fluctuations in currency exchange rates), information risk (key information may be inaccurate or unavailable) and political risk (expropriation, nationalization or the imposition of capital or currency controls or punitive taxes). Other risks of investing in foreign securities include liquidity and valuation risks.

The Portfolio may be subject to taxes imposed by countries in which it invests with respect to its investments in issuers existing or operating in such countries. Such taxes are generally based on income earned or repatriated and capital gains realized on the sale of such investments. The Portfolio accrues such taxes when the related income is earned or gains are realized.

The Portfolio may invest up to 15% of its net assets in non-publicly traded securities. Non-publicly traded securities may be less liquid than publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices realized from such sales could differ from the price originally paid by the Portfolio or the current carrying values, and the difference could be material.

Note 3. Transactions with Affiliates and Related Parties

Credit Suisse serves as investment adviser for the Portfolio. For its investment advisory services, Credit Suisse is entitled to receive a fee from the Portfolio at an annual rate of 1.00% of the Portfolio's average daily net assets. Effective March 1, 2006 to February 28, 2007, Credit Suisse agreed to voluntarily waive part of its investment advisory fee from 1.00% to 0.95%. For the year ended December 31, 2007, investment advisory fees earned and voluntarily waived were $953,530 and $7,632, respectively. Credit Suisse will not recapture from the Portfolio any fees it waived during the fiscal year ended December 31, 2007. Fee waivers and reimbursements are voluntary and may be discontinued by Credit Suisse at anytime.

20

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements (continued)

December 31, 2007

Note 3. Transactions with Affiliates and Related Parties

Credit Suisse Asset Management Limited ("Credit Suisse U.K.") and Credit Suisse Asset Management Limited ("Credit Suisse Australia"), each an affiliate of Credit Suisse, are sub-investment advisers to the Portfolio (the "Sub-Advisors"). Credit Suisse U.K.'s and Credit Suisse Australia's sub-investment advisory fees are paid by Credit Suisse out of Credit Suisse's net investment advisory fee and are not paid by the Portfolio.

Credit Suisse Asset Management Securities, Inc. ("CSAMSI"), an affiliate of Credit Suisse, and SSB serve as co-administrators to the Portfolio. For its co-administrative services, CSAMSI currently receives a fee calculated at an annual rate of 0.09% of the Portfolio's average daily net assets. For the year ended December 31, 2007, co-administrative services fees earned by CSAMSI were $85,818.

For its co-administrative services, SSB receives a fee, exclusive of out-of-pocket expenses, calculated in total for all the Credit Suisse funds/portfolios co-administered by SSB and allocated based upon relative average net assets of each fund/portfolio, subject to an annual minimum fee. For the year ended December 31, 2007, co-administrative services fees earned by SSB (including out-of-pocket expenses) were $28,600.

In addition to serving as the Portfolio's co-administrator, CSAMSI currently serves as distributor of the Portfolio's shares without compensation.

Merrill Corporation ("Merrill"), an affiliate of Credit Suisse, has been engaged by the Portfolio to provide certain financial printing and fulfillment services. For the year ended December 31, 2007, Merrill was paid $13,902 for its services to the Portfolio.

Note 4. Line of Credit

The Portfolio, together with other funds/portfolios advised by Credit Suisse (collectively, the "Participating Funds"), participates in a $50 million committed, unsecured line of credit facility ("Credit Facility") for temporary or emergency purposes with Deutsche Bank, A.G. as administrative agent and syndication agent and SSB as operations agent. Under the terms of the Credit Facility, the Participating Funds pay an aggregate commitment fee at a rate of 0.10% per annum on the average unused amount of the Credit Facility, which is allocated among the Participating Funds in such manner as is determined by the governing Boards of the Participating Funds. In addition, the Participating Funds pay interest on borrowings at the Federal Funds rate plus 0.50%. At December 31, 2007, the Portfolio had no loans outstanding. During the year ended

21

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements (continued)

December 31, 2007

Note 4. Line of Credit

December 31, 2007, the Portfolio had borrowings under the Credit Facility as follows:

Average Daily

Loan Balance | | Weighted Average

Interest Rate% | | Maximum Daily

Loan Outstanding | |

| $ | 1,576,727 | | | | 5.288 | % | | $ | 2,010,000 | | |

Note 5. Purchases and Sales of Securities

For the year ended December 31, 2007, purchases and sales of investment securities (excluding short-term investments) were $38,930,916 and $43,551,095, respectively.

Note 6. Capital Share Transactions

The Trust is authorized to issue an unlimited number of full and fractional shares of beneficial interest, $.001 par value per share. Transactions in capital shares of the Portfolio were as follows:

| | | For the Year Ended

December 31, 2007 | | For the Year Ended

December 31, 2006 | |

| Shares sold | | | 1,004,291 | | | | 1,061,928 | | |

| Shares issued in reinvestment of dividends | | | 64,424 | | | | 76,205 | | |

| Shares redeemed | | | (1,709,884 | ) | | | (2,120,998 | ) | |

| Net decrease | | | (641,169 | ) | | | (982,865 | ) | |

On December 31, 2007, the number of shareholders that held 5% or more of the outstanding shares of the Portfolio was as follows:

Number of

Shareholders | | Approximate Percentage

of Outstanding Shares | |

| | 5 | | | | 85 | % | |

Some of the shareholders are omnibus accounts, which hold shares on behalf of individual shareholders.

Note 7. Federal Income Taxes

Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from GAAP.

22

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements (continued)

December 31, 2007

Note 7. Federal Income Taxes

The tax character of dividends paid during the years ended December 31, 2007 and 2006, respectively, for the Portfolio were as follows:

| | | Ordinary Income | |

| | 2007 | | 2006 | |

| | $ | 981,812 | | | $ | 967,042 | | |

The tax basis of components of distributable earnings differ from the amounts reflected in the Statement of Assets and Liabilities by temporary book/tax differences. These differences are primarily due to losses deferred on wash sales and unused capital loss carryforwards. At December 31, 2007, the components of distributable earnings on a tax basis for the Portfolio were as follows:

| Undistributed net investment income | | $ | 1,277,977 | | |

| Accumulated net realized loss | | | (86,724,681 | ) | |

| Unrealized appreciation | | | 24,513,073 | | |

| | | $ | (60,933,631 | ) | |

At December 31, 2007, the Portfolio had capital loss carryforwards available to offset possible future capital gains as follows:

| | | Expires December 31, | |

| | 2009 | | 2010 | | 2011 | |

| | $ | 46,227,886 | | | $ | 37,413,453 | | | $ | 3,083,342 | | |

During the tax year ended December 31, 2007, the Portfolio utilized $17,674,651 of the capital loss carryforwards.

It is uncertain that the Portfolio will realize the full benefit of these losses prior to expiration.

At December 31, 2007, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were: $93,384,420, $27,616,882, $(3,100,743) and $24,516,139, respectively.

At December 31, 2007, the Portfolio reclassified $25,008 from accumulated net realized loss from investments to undistributed net investment income, to adjust for current period permanent book/tax differences which arose principally from differing book/tax treatments of foreign currency transactions and adjustments to income and gain/(loss) on Partnerships. Net assets were not affected by these reclassifications.

23

Credit Suisse Trust — International Focus Portfolio

Notes to Financial Statements (continued)

December 31, 2007

Note 8. Contingencies

In the normal course of business, the Portfolio may provide general indemnifications pursuant to certain contracts and organizational documents. The Portfolio's maximum exposure under these arrangements is dependent on future claims that may be made against the Portfolio and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

Note 9. Recent Accounting Pronouncements

During June 2006, the Financial Accounting Standards Board ("FASB") issued FASB Interpretation 48 ("FIN 48" or the "Interpretation"), Accounting for Uncertainty in Income Taxes — an interpretation of FASB statement 109. FIN 48 supplements FASB Statement 109, Accounting for Income Taxes, by defining the confidence level that a tax position must meet in order to be recognized in the financial statements. FIN 48 prescribes a comprehensive model for how a fund should recognize, measure, present, and disclose in its financial statements uncertain tax positions that the fund has taken or expects to take on a tax return. FIN 48 requires that the t ax effects of a position be recognized only if it is "more likely than not" to be sustained based solely on its technical merits. Management must be able to conclude that the tax law, regulations, case law, and other objective information regarding the technical merits sufficiently support the position's sustainability with a likelihood of more than 50 percent. During the period ended December 31, 2007, Management has adopted FIN 48. There was no material impact to the financial statements or disclosures thereto as a result of the adoption of this pronouncement.

On September 20, 2006, the FASB released Statement of Financial Accounting Standards No. 157 "Fair Value Measurements" ("FAS 157"). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair-value measurements. The application of FAS 157 is required for fiscal years, beginning after November 15, 2007 and interim periods within those fiscal years. As of December 31, 2007, management does not believe the adoption of FAS 157 will impact the amounts reported in the financial statements, however, additional disclosures will be required in subsequent reports.

24

Credit Suisse Trust — International Focus Portfolio

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Credit Suisse Trust and Shareholders of

Credit Suisse Trust — International Focus Portfolio:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of International Focus Portfolio (the "Portfolio"), a portfolio of the Credit Suisse Trust, at December 31, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Portfolio's management; our responsibility is to express an opinion on these financial statements based on our audits. We con ducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2007 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 25, 2008

25

Credit Suisse Trust — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited)

In approving the renewal of the current Advisory and Sub-Advisory Agreements, the Board of Trustees, including the Independent Trustees, at a meeting held on November 13 and 14, 2007, considered the following factors with respect to the International Focus Portfolio (the "Portfolio"):

Investment Advisory Fee Rates

The Board reviewed and considered the contractual advisory fee rate of 1.00% for the Portfolio ("Contractual Advisory Fee") in light of the extent and quality of the advisory services provided by Credit Suisse Asset Management, LLC ("Credit Suisse") or Credit Suisse Asset Management Limited ("Credit Suisse U.K.") and Credit Suisse Asset Management Limited ("Credit Suisse Australia"). The Board noted that Credit Suisse had voluntarily waived fees through February 28, 2007 to reduce the fee to 0.97% ("Net Advisory Fee"). The Board noted that the compensation paid to Credit Suisse U.K. and Credit Suisse Australia (collectively, the "Sub-Advisers") does not increase the fees or expenses otherwise incurred by the Portfolio's shareholders.

Additionally, the Board received and considered information comparing the Portfolio's Contractual Advisory Fee, Net Advisory Fee, the Portfolio's overall expenses with those of funds in both the relevant expense group ("Expense Group") and universe of funds ("Expense Universe") provided by Lipper Inc., an independent provider of investment company data.

Nature, Extent and Quality of the Services under the Advisory and

Sub-Advisory Agreements

The Board received and considered information regarding the nature, extent and quality of services provided to the Portfolio by Credit Suisse under the Advisory Agreement and by the Sub-Advisers under the Sub-Advisory Agreements. The Board also noted information received at regular meetings throughout the year related to the services rendered by Credit Suisse and the Sub-Advisers. The Board reviewed background information about Credit Suisse and the Sub-Advisers, including their respective Forms ADV. The Board considered the background and experience of both Credit Suisse's and the Sub-Advisers' senior management and the expertise of, and the amount of attention given to the Portfolio by, senior personnel of Credit Suisse and the Sub-Advisers. With respect to the Sub-Advisers, the Board also considered their expertise in managing the types of global investments that the Portfolio

26

Credit Suisse Trust — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited) (continued)

utilizes in its investment strategy. In addition, the Board reviewed the qualifications, backgrounds and responsibilities of the portfolio management team primarily responsible for the day-to-day portfolio management of the Portfolio and the extent of the resources devoted to research and analysis of actual and potential investments. The Board also received and considered information about the nature, extent and quality of services and fee rates offered to other Credit Suisse clients for comparable services.

In approving the Sub-Advisory Agreements, the Board also considered the benefits of retaining Credit Suisse's United Kingdom and Australian affiliates given the increased complexity of the domestic and international securities markets, specifically that retention of Credit Suisse U.K. and Credit Suisse Australia expands the universe of companies and countries from which investment opportunities could be sought and enhances the ability of the Portfolio to obtain the best price and execution on trades in international markets.

Portfolio Performance

The Board received and considered the performance results of the Portfolio over time, along with comparisons both to the relevant performance group ("Performance Group") and universe of funds ("Performance Universe") for the Portfolio. The Board was provided with a description of the methodology used to arrive at the funds included in the Performance Group and the Performance Universe.

Credit Suisse Profitability

The Board received and considered a profitability analysis of Credit Suisse based on the fees payable under the Advisory Agreement for the Portfolio, including any fee waivers or fee caps, as well as other relationships between the Portfolio on the one hand and Credit Suisse affiliates on the other. The Board received profitability information for the other funds in the Credit Suisse family of funds.

Economies of Scale

The Board considered whether economies of scale in the provision of services to the Portfolio were being passed along to the shareholders. Accordingly, the Board considered whether alternative fee structures (such as breakpoint fee structures) would be more appropriate or reasonable taking into consideration economies of scale or other efficiencies that might accrue from increases in the Portfolio's asset levels.

27

Credit Suisse Trust — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited) (continued)

Other Benefits to Credit Suisse

The Board considered other benefits received by Credit Suisse, the Sub-Advisers and their affiliates as a result of their relationships with the Portfolio. Such benefits include, among others, research arrangements with brokers who execute transactions on behalf of the Portfolio, administrative and brokerage relationships with affiliates of Credit Suisse and the Sub-Advisers and benefits potentially derived from an increase in Credit Suisse's and the Sub-Advisers' businesses as a result of their relationship with the Portfolio (such as the ability to market to shareholders other financial products offered by Credit Suisse, the Sub-Advisers and their affiliates).

The Board considered the standards applied in seeking best execution, whether and to what extent soft dollar credits are sought and how any such credits are utilized, any benefits that may be achieved by using an affiliated broker and the existence of quality controls applicable to brokerage allocation procedures. The Board also reviewed Credit Suisse's and the Sub-Advisers' method for allocating portfolio investment opportunities among their advisory clients.

Conclusions

In selecting Credit Suisse and the Sub-Advisers, and approving the Advisory Agreement and the investment advisory fee under such agreement and the Sub-Advisory Agreements, the Board concluded that:

• Although the Contractual Advisory Fee of 1.00% was higher than the median of the Portfolio's Expense Group, the Board considered the fee to be reasonable taking the relatively small size of the Portfolio into account.

• The Portfolio's performance was above most of its peers in the Performance Universe for the one- and three-year period but was below most of its peers in its Performance Universe for the other periods reviewed. The Portfolio's performance was above most of its peers in its Performance Group for the one-, two-, and three-year term periods. The Board noted that performance was improving and acknowledged the steps undertaken by Credit Suisse to improve performance. The Board stated it would continue to monitor performance.

• Aside from performance (as described above), the Board was satisfied with the nature and extent of the investment advisory services provided to the Portfolio by Credit Suisse and the Sub-Advisers and that, based on dialogue with management and counsel, the services provided by Credit Suisse under the Advisory Agreement and by the Sub-Advisers under the Sub-Advisory Agreements are typical of, and consistent with, those provided to similar mutual funds by other investment advisers.

28

Credit Suisse Trust — International Focus Portfolio

Board Approval of Advisory Agreement (unaudited) (continued)

• In light of the costs of providing investment management and other services to the Portfolio and Credit Suisse's ongoing commitment to the Portfolio, the profits and other ancillary benefits that Credit Suisse and its affiliates received were considered reasonable.

• Credit Suisse's profitability based on fees payable under the Advisory Agreement was reasonable in light of the nature, extent and quality of the services provided to the Portfolio thereunder.

• In light of the relatively small size of the Portfolio and the Portfolio's recent performance in its Performance Group, the Portfolio's current fee structure (without breakpoints) was considered reasonable.

No single factor reviewed by the Board was identified by the Board as the principal factor in determining whether to approve the Advisory Agreement and the Sub-Advisory Agreements. The Independent Trustees were advised by separate independent legal counsel throughout the process.

29

Credit Suisse Trust — International Focus Portfolio

Information Concerning Trustees and Officers (unaudited)

Name, Address

(Year of Birth) | | Position(s)

Held with

Trust | | Term

of Office1

and

Length

of Time

Served | | Principal

Occupation(s) During

Past Five Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee | | Other

Directorships

Held by Trustee | |

| Independent Trustees | | | | | | | | | | | |

|

Enrique Arzac

c/o Credit Suisse Asset

Management, LLC

Attn: General Counsel

Eleven Madison Avenue

New York, New York

10010

(1941) | | Trustee,

Nominating Committee

Member and

Audit

Committee

Chairman | | Since

2005 | | Professor of Finance and Economics, Graduate School of Business, Columbia University since 1971. | | | 35 | | | Director of Epoch

Holding Corporation

(an investment

management and investment advisory

services company);

Director of The Adams Express Company

(a closed-end investment

company); Director of

Petroleum and

Resources Corporation

(a closed-end investment company). | |

|

Jeffrey E. Garten2

Box 208200

New Haven, Connecticut

06520-8200

(1946) | | Trustee, Nominating

and Audit

Committee

Member | | Since

1998 | | The Juan Trippe Professor in the Practice of International Trade, Finance and Business from July 2005 to present; Partner and Chairman of Garten Rothkopf (consulting firm) from October 2005 to present; Dean of Yale School of Management from November 1995 to June 2005. | | | 28 | | | Director of

Aetna, Inc.

(insurance company);

Director of

CarMax Group

(used car dealers);

Director of Alcan, Inc. (smelting and refining of nonferrous metals company). | |

|

1 Each Trustee and Officer serves until his or her respective successor has been duly elected and qualified.

2 Mr. Garten was initially appointed as a Trustee of the Trust on February 6, 1998. He resigned as Trustee on February 3, 2000 and was subsequently reappointed on December 21, 2000.

30

Credit Suisse Trust — International Focus Portfolio

Information Concerning Trustees and Officers (unaudited) (continued)

Name, Address

(Year of Birth) | | Position(s)

Held with

Trust | | Term

of Office1

and

Length

of Time

Served | | Principal

Occupation(s) During

Past Five Years | | Number of

Portfolios in

Fund

Complex

Overseen by

Trustee | | Other

Directorships

Held by Trustee | |

| Independent Trustees | | | | | | | | | | | | | |

|

Peter F. Krogh

SFS/ICC 702

Georgetown University

Washington, DC 20057

(1937) | | Trustee, Nominating

and Audit Committee Member | | Since

2001 | | Dean Emeritus and

Distinguished Professor

of International Affairs

at the Edmund A.

Walsh School of

Foreign Service,

Georgetown University from June 1995 to present. | | | 28 | | | Director of

Carlisle Companies Incorporated

(diversified manufacturing company). | |

|

Steven N. Rappaport

Lehigh Court, LLC

555 Madison Avenue

29th Floor

New York, New York

10022

(1948) | | Chairman

of the Board

of Trustees, Nominating Committee Chairman

and Audit

Committee Member | | Trustee

since

1999 and

Chairman since 2005 | | Partner of Lehigh Court, LLC and RZ Capital (private investment firms) from July 2002 to present. | | | 35 | | | Director of iCAD, Inc. (surgical and medical instruments and apparatus company);

Director of Presstek, Inc.

(digital imaging technologies company); Director of Wood Resources, LLC. (plywood manufacturing company). | |

|

| Interested Trustee | | | | | | | | | | | | | |

|

Michael E. Kenneally3

c/o Credit Suisse Asset Management, LLC

Attn: General Counsel

Eleven Madison Avenue

New York, New York

10010

(1954) | | Trustee | | Since

2004 | | Chairman and Global Chief Executive Officer of Credit Suisse from March 2003 to July 2005; Chairman and Chief Investment Officer of Banc of America Capital Management from 1998 to March 2003. | | | 28 | | | None | |

|

3 Mr. Kenneally is a Trustee who is an "interested person" of the Trust as defined in the Investment Company Act of 1940, as amended, because he was an officer of Credit Suisse within the last two fiscal years.

31

Credit Suisse Trust — International Focus Portfolio

Information Concerning Trustees and Officers (unaudited) (continued)

Name, Address

(Year of Birth) | | Position(s)

Held with

Trust | | Term

of Office1

and

Length

of Time

Served | | Principal Occupation(s) During Past Five Years | |

| Officers | | | | | | | |

|

Lawrence D. Haber c/o Credit Suisse Asset Management, LLC. Attn: General Counsel Eleven Madison Avenue New York, New York 10010

(1951) | | Chief Executive Officer and President | | Since 2007 | | Managing Director and Chief Operating Officer of Credit Suisse; Member of Credit Suisse's Management Committee; Chief Financial Officer of Merrill Lynch Investment Managers from 1997 to 2003. | |

|

Michael A. Pignataro

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1959) | | Chief Financial Officer | | Since

1999 | | Director and Director of Fund Administration of Credit Suisse; Associated with Credit Suisse or its predecessor since 1984; Officer of other Credit Suisse Funds. | |

|

Emidio Morizio

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1966) | | Chief Compliance Officer | | Since

2004 | | Director and Global Head of Compliance of Credit Suisse; Associated with Credit Suisse since July 2000; Officer of other Credit Suisse Funds. | |

|

J. Kevin Gao

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1967) | | Chief Legal Officer since 2006, Vice President and Secretary since 2004 | | Since

2004 | | Director and Legal Counsel of Credit Suisse; Associated with Credit Suisse since July 2003; Associated with the law firm of Willkie Farr & Gallagher LLP from 1998 to 2003; Officer of other Credit Suisse Funds. | |

|

Robert Rizza

Credit Suisse Asset

Management, LLC

Eleven Madison Avenue

New York, New York

10010

(1965) | | Treasurer | | Since

2006 | | Vice President of Credit Suisse; Associated with Credit Suisse since 1998; Officer of other Credit Suisse Funds. | |

|

The Statement of Additional Information includes additional information about the Trustees and is available, without charge, upon request, by calling 800-222-8977.

32

Credit Suisse Trust — International Focus Portfolio

December 31, 2007 (unaudited)

Important Tax Information for Corporate Shareholders

Corporate Shareholders should note for the year ended December 31, 2007, the percentage of the Portfolio's investment income (i.e., net investment income plus short-term capital gains) that qualified for the intercorporate dividends received deduction is 0%.

33

Credit Suisse Trust — International Focus Portfolio

Proxy Voting and Portfolio Holdings Information (unaudited)

Information regarding how the Portfolio voted proxies related to its portfolio securities during the 12 month period ended June 30 of each year, as well as the policies and procedures that the Portfolio uses to determine how to vote proxies relating to its portfolio securities are available:

• By calling 1-800-222-8977

• On the Portfolio's website, www.credit-suisse.com/us

• On the website of the Securities and Exchange Commission, www.sec.gov.

The Portfolio files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Portfolio's Forms N-Q are available on the SEC's website at www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the SEC's Public Reference Room may be obtained by calling 1-202-551-8090.

34

This page intentionally left blank

This page intentionally left blank

P.O. BOX 55030, BOSTON, MA 02205-5030

800-222-8977 n www.credit-suisse.com/us

CREDIT SUISSE ASSET MANAGEMENT SECURITIES, INC., DISTRIBUTOR. TRINT-AR-1207

CREDIT SUISSE FUNDS

Annual Report

December 31, 2007

CREDIT SUISSE TRUST

n BLUE CHIP PORTFOLIO

Credit Suisse Trust (the "Trust") shares are not available directly to individual investors, but may be offered only through certain insurance products and pension and retirement plans.

The Trust's investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the Trust, are provided in the Prospectus, which should be read carefully before investing. You may obtain additional copies by calling 800-222-8977 or by writing to Credit Suisse Trust, P.O. Box 55030, Boston, MA 02205-5030.

Credit Suisse Asset Management Securities, Inc., Distributor, is located at Eleven Madison Avenue, New York, NY 10010. The Trust is advised by Credit Suisse Asset Management, LLC.

The views of the Portfolio's management are as of the date of the letter and the Portfolio holdings described in this document are as of December 31, 2007; these views and Portfolio holdings may have changed subsequent to these dates. Nothing in this document is a recommendation to purchase or sell securities.

Portfolio shares are not deposits or other obligations of Credit Suisse Asset Management, LLC ("Credit Suisse") or any affiliate, are not FDIC-insured and are not guaranteed by Credit Suisse or any affiliate. Portfolio investments are subject to investment risks, including loss of your investment.

Credit Suisse Trust — Blue Chip Portfolio

Annual Investment Adviser's Report

December 31, 2007 (unaudited)

January 25, 2008

Dear Shareholder:

For the twelve months ended December 31, 2007, Credit Suisse Trust — Blue Chip Portfolio1 (the "Portfolio") had a gain of 7.56%, versus an increase of 5.49% for the Standard & Poor's 500 Index2 (the "S&P 500").

Market Review: A challenging market on many fronts

For the year ended December 31, 2007, U.S. large-cap stocks gained in 2007 with the benchmark S&P 500 posting a 5.49% total return including dividends. Eight out of the ten economic sectors in the large-cap S&P 500 advanced in 2007. Rising global demand and elevated commodity prices boosted the energy and materials sectors to post the highest returns of 32.4% and 20%, respectively. The biggest laggard in the large-cap space was financials (-20.8%), which were negatively impacted by the credit market turmoil and housing market slowdown.

The U.S. Federal Reserve held its benchmark rate at 5.25% until September 2007 when the target federal funds rate was cut by 50 basis points to 4.75%, marking the first cut in four years. The Federal Reserve cut the target rate by another 25 basis points in October and again in December to 4.25%. The cuts were made in an effort to prevent some of the adverse effects on the overall economy from the depressed housing market and tighter lending conditions for both consumers and corporations.

The aggressive lending environment over the past few years led to a rise in mortgage defaults. U.S. home foreclosures rose 68% in November from a year earlier, according to data compiled by RealtyTrac Inc. As a result, the U.S. housing sector weakened significantly in 2007 as mortgage providers tightened their lending standards and some lenders went bankrupt. Home prices in 20 U.S. metropolitan areas dropped in October by the most in at least six years. Property values fell 6.1% from October 2006, according to the S&P/Case-Shiller home-price index.

The Chicago Board Options Exchange Volatility Index (VIX), a measure of expected stock market volatility, reached a five-year low in January 2007. However, market conditions changed rapidly in mid-2007 and the VIX reached a four-year high in November 2007 amid deteriorating conditions in the U.S. housing and credit markets.

Despite the housing market slowdown, the economy grew at a solid 4.9% annual rate in the third quarter of 2007. The personal consumption expenditures (PCE) price index, excluding food and energy, rose 2.2% year-over-year in November. The increase was the biggest since March 2007. The Fed watches the PCE price index for signs of inflation and its preferred range for this gauge is 1.0% to 2.0%.

The labor market also showed signs of weakening in 2007. Non-farm payrolls rose 1.3 million in 2007, compared with gains of 2.3 million in 2006.

1

Credit Suisse Trust — Blue Chip Portfolio

Annual Investment Adviser's Report (continued)

December 31, 2007 (unaudited)

The unemployment rate rose from 4.7% in November to 5.0% in December 2007, the highest level since November 2005. And, the Reuters/University of Michigan final index of consumer confidence dropped to 75.5 in December, the lowest since October 2005. The gauge has averaged 88 since monthly data were first compiled in 1978.

Strategic Review and Market Outlook: Potential for further rate cuts

The leading positive relative contributors to performance came from stock selection in financials, industrials, and consumer discretionary. The largest detractors to performance came primarily from stock selection within the healthcare sector, followed closely by information technology.

The U.S. Federal Reserve anticipates economic growth will be "somewhat more sluggish" than the 1.8% – 2.5% they had projected for 2008. And, Fed policy makers also expect core inflation to "trend down a bit over the next few years."

The Federal Reserve on January 22, 2008 took significant action between scheduled meetings by cutting rates 75 basis points to 3.50%. The Fed cited the weakening economic outlook and increasing downside risks to growth.

The Fed is scheduled to meet next on January 30 to discuss interest rates. Based on interest-rate futures on January 25, traders expect policy makers to further lower the target rate for overnight lending by 50 to 75 basis points.