UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2023 |

Item 1.

Reports to Stockholders

Contents

Top Holdings (% of Fund's net assets) | ||

| Apple, Inc. | 6.6 | |

| Microsoft Corp. | 5.6 | |

| Merck & Co., Inc. | 2.3 | |

| Johnson & Johnson | 2.2 | |

| Visa, Inc. Class A | 2.1 | |

| AbbVie, Inc. | 2.0 | |

| Gilead Sciences, Inc. | 1.8 | |

| The Home Depot, Inc. | 1.8 | |

| Exxon Mobil Corp. | 1.8 | |

| Bristol-Myers Squibb Co. | 1.8 | |

| 28.0 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 26.2 | |

| Health Care | 14.7 | |

| Financials | 11.1 | |

| Consumer Discretionary | 11.0 | |

| Industrials | 8.9 | |

| Communication Services | 8.5 | |

| Consumer Staples | 5.9 | |

| Energy | 4.7 | |

| Real Estate | 3.1 | |

| Materials | 2.9 | |

| Utilities | 2.7 | |

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 6.9% |

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| Common Stocks - 99.7% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 8.5% | |||

| Diversified Telecommunication Services - 1.8% | |||

| AT&T, Inc. | 209,577 | 4,269,083 | |

| Lumen Technologies, Inc. (a) | 221,170 | 1,161,143 | |

| Verizon Communications, Inc. | 108,358 | 4,504,442 | |

| 9,934,668 | |||

| Entertainment - 1.5% | |||

| Activision Blizzard, Inc. | 44,422 | 3,401,393 | |

| Electronic Arts, Inc. | 23,174 | 2,982,030 | |

| Warner Music Group Corp. Class A (a) | 66,094 | 2,409,126 | |

| 8,792,549 | |||

| Media - 5.2% | |||

| Cable One, Inc. | 1,759 | 1,389,399 | |

| Comcast Corp. Class A | 118,469 | 4,661,755 | |

| Fox Corp. Class A | 70,659 | 2,398,166 | |

| Interpublic Group of Companies, Inc. (a) | 77,401 | 2,822,040 | |

| News Corp. Class A | 124,198 | 2,516,251 | |

| Nexstar Broadcasting Group, Inc. Class A | 16,028 | 3,282,054 | |

| Omnicom Group, Inc. | 36,813 | 3,165,550 | |

| Paramount Global Class B (a) | 88,085 | 2,040,049 | |

| Sirius XM Holdings, Inc. (a) | 406,299 | 2,352,471 | |

| TEGNA, Inc. | 135,126 | 2,693,061 | |

| The New York Times Co. Class A | 65,465 | 2,280,801 | |

| 29,601,597 | |||

TOTAL COMMUNICATION SERVICES | 48,328,814 | ||

| CONSUMER DISCRETIONARY - 11.0% | |||

| Hotels, Restaurants & Leisure - 3.1% | |||

| McDonald's Corp. | 33,855 | 9,052,827 | |

| Starbucks Corp. | 79,728 | 8,701,514 | |

| 17,754,341 | |||

| Household Durables - 0.6% | |||

| Persimmon PLC | 184,539 | 3,207,866 | |

| Multiline Retail - 1.1% | |||

| Target Corp. | 35,259 | 6,069,484 | |

| Specialty Retail - 4.3% | |||

| Dick's Sporting Goods, Inc. (a) | 54,737 | 7,157,410 | |

| Lowe's Companies, Inc. | 35,679 | 7,430,152 | |

| The Home Depot, Inc. | 31,700 | 10,276,189 | |

| 24,863,751 | |||

| Textiles, Apparel & Luxury Goods - 1.9% | |||

| NIKE, Inc. Class B | 59,818 | 7,616,626 | |

| VF Corp. | 99,229 | 3,070,145 | |

| 10,686,771 | |||

TOTAL CONSUMER DISCRETIONARY | 62,582,213 | ||

| CONSUMER STAPLES - 5.9% | |||

| Beverages - 1.1% | |||

| The Coca-Cola Co. | 100,745 | 6,177,683 | |

| Food & Staples Retailing - 1.0% | |||

| Costco Wholesale Corp. | 11,653 | 5,956,314 | |

| Household Products - 1.3% | |||

| Procter & Gamble Co. | 51,652 | 7,354,212 | |

| Tobacco - 2.5% | |||

| Altria Group, Inc. | 81,149 | 3,654,951 | |

| British American Tobacco PLC (United Kingdom) | 63,514 | 2,420,827 | |

| Imperial Brands PLC | 117,535 | 2,938,803 | |

| Philip Morris International, Inc. | 48,991 | 5,106,822 | |

| 14,121,403 | |||

TOTAL CONSUMER STAPLES | 33,609,612 | ||

| ENERGY - 4.7% | |||

| Oil, Gas & Consumable Fuels - 4.7% | |||

| Chevron Corp. | 43,953 | 7,648,701 | |

| Exxon Mobil Corp. | 88,231 | 10,235,678 | |

| Kinder Morgan, Inc. | 153,909 | 2,816,535 | |

| ONEOK, Inc. (a) | 41,431 | 2,837,195 | |

| The Williams Companies, Inc. | 89,192 | 2,875,550 | |

| Woodside Energy Group Ltd. | 6,778 | 173,182 | |

| 26,586,841 | |||

| FINANCIALS - 11.1% | |||

| Banks - 5.5% | |||

| Bank of America Corp. | 190,830 | 6,770,648 | |

| Citigroup, Inc. | 90,561 | 4,729,095 | |

| JPMorgan Chase & Co. | 69,763 | 9,764,029 | |

| Truist Financial Corp. | 83,118 | 4,105,198 | |

| Wells Fargo & Co. | 130,734 | 6,127,503 | |

| 31,496,473 | |||

| Capital Markets - 3.3% | |||

| Blackstone, Inc. | 40,059 | 3,844,062 | |

| Goldman Sachs Group, Inc. | 16,168 | 5,914,416 | |

| Morgan Stanley | 60,224 | 5,861,602 | |

| T. Rowe Price Group, Inc. | 30,580 | 3,561,653 | |

| 19,181,733 | |||

| Consumer Finance - 0.6% | |||

| OneMain Holdings, Inc. (a) | 79,932 | 3,448,266 | |

| Insurance - 1.1% | |||

| Progressive Corp. | 45,302 | 6,176,928 | |

| Mortgage Real Estate Investment Trusts - 0.6% | |||

| Annaly Capital Management, Inc. | 137,937 | 3,237,381 | |

TOTAL FINANCIALS | 63,540,781 | ||

| HEALTH CARE - 14.7% | |||

| Biotechnology - 5.5% | |||

| AbbVie, Inc. | 74,531 | 11,011,955 | |

| Amgen, Inc. | 38,935 | 9,827,194 | |

| Gilead Sciences, Inc. | 123,675 | 10,381,280 | |

| 31,220,429 | |||

| Health Care Equipment & Supplies - 1.3% | |||

| Medtronic PLC | 86,974 | 7,278,854 | |

| Pharmaceuticals - 7.9% | |||

| Bristol-Myers Squibb Co. | 139,746 | 10,152,547 | |

| Johnson & Johnson | 77,883 | 12,727,640 | |

| Merck & Co., Inc. | 123,784 | 13,295,639 | |

| Pfizer, Inc. | 210,193 | 9,282,123 | |

| 45,457,949 | |||

TOTAL HEALTH CARE | 83,957,232 | ||

| INDUSTRIALS - 8.9% | |||

| Aerospace & Defense - 1.1% | |||

| Lockheed Martin Corp. | 13,987 | 6,479,618 | |

| Air Freight & Logistics - 0.9% | |||

| United Parcel Service, Inc. Class B | 28,315 | 5,244,787 | |

| Electrical Equipment - 0.8% | |||

| Emerson Electric Co. | 50,784 | 4,581,732 | |

| Industrial Conglomerates - 2.5% | |||

| 3M Co. | 33,084 | 3,807,307 | |

| Honeywell International, Inc. | 31,165 | 6,497,279 | |

| Jardine Matheson Holdings Ltd. | 68,028 | 3,606,845 | |

| 13,911,431 | |||

| Machinery - 2.7% | |||

| AGCO Corp. | 36,172 | 4,996,438 | |

| Caterpillar, Inc. | 28,102 | 7,089,854 | |

| Volvo AB (B Shares) | 177,919 | 3,515,114 | |

| 15,601,406 | |||

| Road & Rail - 0.9% | |||

| Union Pacific Corp. | 25,934 | 5,295,463 | |

TOTAL INDUSTRIALS | 51,114,437 | ||

| INFORMATION TECHNOLOGY - 26.2% | |||

| Communications Equipment - 1.5% | |||

| Cisco Systems, Inc. | 176,716 | 8,600,768 | |

| IT Services - 5.5% | |||

| IBM Corp. | 59,385 | 8,000,941 | |

| The Western Union Co. | 349,062 | 4,946,209 | |

| TietoEVRY Oyj | 212,558 | 6,449,910 | |

| Visa, Inc. Class A | 51,797 | 11,924,187 | |

| 31,321,247 | |||

| Semiconductors & Semiconductor Equipment - 5.4% | |||

| Broadcom, Inc. | 16,958 | 9,920,600 | |

| Intel Corp. | 191,168 | 5,402,408 | |

| Qualcomm, Inc. | 51,875 | 6,910,269 | |

| Texas Instruments, Inc. | 49,764 | 8,818,678 | |

| 31,051,955 | |||

| Software - 7.2% | |||

| Microsoft Corp. | 129,361 | 32,056,949 | |

| Oracle Corp. | 101,363 | 8,966,571 | |

| 41,023,520 | |||

| Technology Hardware, Storage & Peripherals - 6.6% | |||

| Apple, Inc. | 261,455 | 37,725,343 | |

TOTAL INFORMATION TECHNOLOGY | 149,722,833 | ||

| MATERIALS - 2.9% | |||

| Chemicals - 1.9% | |||

| Air Products & Chemicals, Inc. | 7,675 | 2,459,914 | |

| Dow, Inc. | 31,241 | 1,854,153 | |

| Linde PLC | 11,430 | 3,782,644 | |

| LyondellBasell Industries NV Class A | 16,397 | 1,585,426 | |

| Yara International ASA | 23,669 | 1,047,401 | |

| 10,729,538 | |||

| Containers & Packaging - 0.2% | |||

| International Paper Co. | 32,078 | 1,341,502 | |

| Metals & Mining - 0.8% | |||

| BHP Group Ltd. | 37,476 | 1,304,001 | |

| Fortescue Metals Group Ltd. | 83,435 | 1,307,545 | |

| Newmont Corp. (a) | 31,880 | 1,687,408 | |

| 4,298,954 | |||

TOTAL MATERIALS | 16,369,994 | ||

| REAL ESTATE - 3.1% | |||

| Equity Real Estate Investment Trusts (REITs) - 3.0% | |||

| American Tower Corp. | 11,047 | 2,467,789 | |

| Crown Castle International Corp. | 12,417 | 1,839,082 | |

| Digital Realty Trust, Inc. | 11,746 | 1,346,327 | |

| Iron Mountain, Inc. | 28,684 | 1,565,573 | |

| Medical Properties Trust, Inc. (a) | 59,320 | 768,194 | |

| Omega Healthcare Investors, Inc. (a) | 43,042 | 1,267,156 | |

| Prologis (REIT), Inc. | 17,836 | 2,305,838 | |

| Simon Property Group, Inc. | 12,463 | 1,600,997 | |

| SL Green Realty Corp. | 16,468 | 677,658 | |

| VICI Properties, Inc. | 48,772 | 1,667,027 | |

| WP Carey, Inc. | 17,313 | 1,480,781 | |

| 16,986,422 | |||

| Real Estate Management & Development - 0.1% | |||

| Hongkong Land Holdings Ltd. | 197,500 | 961,825 | |

TOTAL REAL ESTATE | 17,948,247 | ||

| UTILITIES - 2.7% | |||

| Electric Utilities - 2.7% | |||

| American Electric Power Co., Inc. | 24,333 | 2,286,329 | |

| Duke Energy Corp. | 25,688 | 2,631,736 | |

| Edison International | 30,557 | 2,105,377 | |

| Exelon Corp. | 49,257 | 2,078,153 | |

| Pinnacle West Capital Corp. | 23,433 | 1,746,930 | |

| PPL Corp. | 62,696 | 1,855,802 | |

| Southern Co. | 37,504 | 2,538,271 | |

| 15,242,598 | |||

| TOTAL COMMON STOCKS (Cost $529,889,265) | 569,003,602 | ||

| Money Market Funds - 3.9% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 4.38% (b) | 664,162 | 664,295 | |

| Fidelity Securities Lending Cash Central Fund 4.38% (b)(c) | 21,510,924 | 21,513,075 | |

| TOTAL MONEY MARKET FUNDS (Cost $22,177,370) | 22,177,370 | ||

| TOTAL INVESTMENT IN SECURITIES - 103.6% (Cost $552,066,635) | 591,180,972 |

NET OTHER ASSETS (LIABILITIES) - (3.6)% | (20,452,624) |

| NET ASSETS - 100.0% | 570,728,348 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini S&P 500 Index Contracts (United States) | 8 | Mar 2023 | 1,636,000 | 58,134 | 58,134 |

| The notional amount of futures purchased as a percentage of Net Assets is 0.3% | |||||

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (c) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 1,664,238 | 11,572,371 | 12,572,314 | 15,911 | - | - | 664,295 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 16,551,925 | 70,646,111 | 65,684,961 | 138,608 | - | - | 21,513,075 | 0.1% |

| Total | 18,216,163 | 82,218,482 | 78,257,275 | 154,519 | - | - | 22,177,370 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 48,328,814 | 48,328,814 | - | - |

Consumer Discretionary | 62,582,213 | 62,582,213 | - | - |

Consumer Staples | 33,609,612 | 28,249,982 | 5,359,630 | - |

Energy | 26,586,841 | 26,413,659 | 173,182 | - |

Financials | 63,540,781 | 63,540,781 | - | - |

Health Care | 83,957,232 | 83,957,232 | - | - |

Industrials | 51,114,437 | 43,992,478 | 7,121,959 | - |

Information Technology | 149,722,833 | 149,722,833 | - | - |

Materials | 16,369,994 | 13,758,448 | 2,611,546 | - |

Real Estate | 17,948,247 | 16,986,422 | 961,825 | - |

Utilities | 15,242,598 | 15,242,598 | - | - |

| Money Market Funds | 22,177,370 | 22,177,370 | - | - |

| Total Investments in Securities: | 591,180,972 | 574,952,830 | 16,228,142 | - |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 58,134 | 58,134 | - | - |

| Total Assets | 58,134 | 58,134 | - | - |

| Total Derivative Instruments: | 58,134 | 58,134 | - | - |

Primary Risk Exposure / Derivative Type | Value | |

| Asset ($) | Liability ($) | |

| Equity Risk | ||

Futures Contracts (a) | 58,134 | 0 |

| Total Equity Risk | 58,134 | 0 |

| Total Value of Derivatives | 58,134 | 0 |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $21,335,884) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $529,889,265) | $ | 569,003,602 | ||

Fidelity Central Funds (cost $22,177,370) | 22,177,370 | |||

| Total Investment in Securities (cost $552,066,635) | $ | 591,180,972 | ||

| Segregated cash with brokers for derivative instruments | 84,800 | |||

| Cash | 1 | |||

| Foreign currency held at value (cost $211,759) | 221,293 | |||

| Receivable for investments sold | 4,091,154 | |||

| Dividends receivable | 878,680 | |||

| Distributions receivable from Fidelity Central Funds | 21,166 | |||

| Receivable for daily variation margin on futures contracts | 23,000 | |||

Total assets | 596,501,066 | |||

| Liabilities | ||||

| Payable for fund shares redeemed | $ | 4,119,893 | ||

| Accrued management fee | 139,750 | |||

| Collateral on securities loaned | 21,513,075 | |||

| Total Liabilities | 25,772,718 | |||

| Net Assets | $ | 570,728,348 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 561,538,406 | ||

| Total accumulated earnings (loss) | 9,189,942 | |||

| Net Assets | $ | 570,728,348 | ||

Net Asset Value , offering price and redemption price per share ($570,728,348 ÷ 13,700,000 shares) | $ | 41.66 | ||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 7,841,403 | ||

| Income from Fidelity Central Funds (including $138,608 from security lending) | 154,519 | |||

| Total Income | 7,995,922 | |||

| Expenses | ||||

| Management fee | $ | 832,051 | ||

| Independent trustees' fees and expenses | 1,011 | |||

| Total expenses before reductions | 833,062 | |||

| Expense reductions | (30) | |||

| Total expenses after reductions | 833,032 | |||

| Net Investment income (loss) | 7,162,890 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (514,897) | |||

| Redemptions in-kind | 9,319,361 | |||

| Foreign currency transactions | (48,699) | |||

| Futures contracts | (183,190) | |||

| Total net realized gain (loss) | 8,572,575 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (2,610,285) | |||

| Assets and liabilities in foreign currencies | 77,692 | |||

| Futures contracts | (17,651) | |||

| Total change in net unrealized appreciation (depreciation) | (2,550,244) | |||

| Net gain (loss) | 6,022,331 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 13,185,221 | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 7,162,890 | $ | 14,434,863 |

| Net realized gain (loss) | 8,572,575 | 16,773,810 | ||

| Change in net unrealized appreciation (depreciation) | (2,550,244) | (47,740,920) | ||

| Net increase (decrease) in net assets resulting from operations | 13,185,221 | (16,532,247) | ||

| Distributions to shareholders | (7,028,850) | (14,425,400) | ||

| Share transactions | ||||

| Proceeds from sales of shares | - | 291,688,328 | ||

| Cost of shares redeemed | (47,570,816) | (138,676,589) | ||

Net increase (decrease) in net assets resulting from share transactions | (47,570,816) | 153,011,739 | ||

| Total increase (decrease) in net assets | (41,414,445) | 122,054,092 | ||

| Net Assets | ||||

| Beginning of period | 612,142,793 | 490,088,701 | ||

| End of period | $ | 570,728,348 | $ | 612,142,793 |

| Other Information | ||||

| Shares | ||||

| Sold | - | 6,600,000 | ||

| Redeemed | (1,200,000) | (3,200,000) | ||

| Net increase (decrease) | (1,200,000) | 3,400,000 | ||

| Fidelity® Dividend ETF for Rising Rates |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 41.08 | $ | 42.62 | $ | 31.72 | $ | 32.31 | $ | 31.54 | $ | 28.50 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .50 | 1.08 | .93 | 1.01 | 1.07 | .93 | ||||||

| Net realized and unrealized gain (loss) | .56 | (1.54) | 10.85 | (.56) | .79 | 3.03 | ||||||

| Total from investment operations | 1.06 | (.46) | 11.78 | .45 | 1.86 | 3.96 | ||||||

| Distributions from net investment income | (.48) | (1.08) | (.88) | (1.04) | (1.09) | (.92) | ||||||

| Total distributions | (.48) | (1.08) | (.88) | (1.04) | (1.09) | (.92) | ||||||

| Net asset value, end of period | $ | 41.66 | $ | 41.08 | $ | 42.62 | $ | 31.72 | $ | 32.31 | $ | 31.54 |

Total Return C,D,E | 2.66% | (1.06)% | 37.57% | 1.86% | 6.09% | 14.04% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .29% H | .29% | .29% | .29% | .29% | .30% | ||||||

| Expenses net of fee waivers, if any | .29% H | .29% | .29% | .29% | .29% | .30% | ||||||

| Expenses net of all reductions | .29% H | .29% | .29% | .29% | .29% | .30% | ||||||

| Net investment income (loss) | 2.49% H | 2.54% | 2.44% | 3.15% | 3.42% | 3.08% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 570,728 | $ | 612,143 | $ | 490,089 | $ | 282,317 | $ | 360,229 | $ | 346,896 |

Portfolio turnover rate I,J | 1% H | 28% | 32% | 35% | 35% | 38% |

Top Holdings (% of Fund's net assets) | ||

| Apple, Inc. | 4.8 | |

| Exxon Mobil Corp. | 4.1 | |

| Microsoft Corp. | 4.0 | |

| Chevron Corp. | 3.4 | |

| JPMorgan Chase & Co. | 2.3 | |

| ONEOK, Inc. | 2.2 | |

| The Williams Companies, Inc. | 2.2 | |

| Kinder Morgan, Inc. | 2.2 | |

| Progressive Corp. | 1.9 | |

| Sempra Energy | 1.8 | |

| 28.9 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 19.2 | |

| Financials | 18.1 | |

| Energy | 14.2 | |

| Utilities | 11.1 | |

| Materials | 10.6 | |

| Real Estate | 10.6 | |

| Health Care | 6.8 | |

| Consumer Discretionary | 4.7 | |

| Communication Services | 2.3 | |

| Industrials | 2.0 | |

| Consumer Staples | 0.1 | |

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 7.8% |

| Common Stocks - 99.7% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 2.3% | |||

| Diversified Telecommunication Services - 0.5% | |||

| AT&T, Inc. | 140,655 | 2,865,142 | |

| Lumen Technologies, Inc. (a) | 148,027 | 777,142 | |

| Verizon Communications, Inc. | 72,702 | 3,022,222 | |

| 6,664,506 | |||

| Entertainment - 0.4% | |||

| Activision Blizzard, Inc. | 29,715 | 2,275,278 | |

| Electronic Arts, Inc. | 15,499 | 1,994,411 | |

| Warner Music Group Corp. Class A (a) | 44,211 | 1,611,491 | |

| 5,881,180 | |||

| Media - 1.4% | |||

| Cable One, Inc. | 1,176 | 928,899 | |

| Comcast Corp. Class A | 79,471 | 3,127,184 | |

| Fox Corp. Class A | 47,259 | 1,603,970 | |

| Interpublic Group of Companies, Inc. | 51,770 | 1,887,534 | |

| News Corp. Class A | 83,075 | 1,683,100 | |

| Nexstar Broadcasting Group, Inc. Class A | 10,720 | 2,195,134 | |

| Omnicom Group, Inc. | 24,623 | 2,117,332 | |

| Paramount Global Class B (a) | 58,934 | 1,364,911 | |

| Sirius XM Holdings, Inc. (a) | 271,768 | 1,573,537 | |

| TEGNA, Inc. | 90,894 | 1,811,517 | |

| The New York Times Co. Class A | 43,783 | 1,525,400 | |

| 19,818,518 | |||

TOTAL COMMUNICATION SERVICES | 32,364,204 | ||

| CONSUMER DISCRETIONARY - 4.7% | |||

| Hotels, Restaurants & Leisure - 1.8% | |||

| Darden Restaurants, Inc. | 45,872 | 6,787,680 | |

| McDonald's Corp. | 34,272 | 9,164,333 | |

| Starbucks Corp. | 80,728 | 8,810,654 | |

| 24,762,667 | |||

| Household Durables - 0.2% | |||

| Persimmon PLC | 187,149 | 3,253,236 | |

| Multiline Retail - 0.4% | |||

| Target Corp. | 35,701 | 6,145,570 | |

| Specialty Retail - 1.8% | |||

| Dick's Sporting Goods, Inc. | 55,426 | 7,247,504 | |

| Lowe's Companies, Inc. | 36,123 | 7,522,615 | |

| The Home Depot, Inc. | 32,113 | 10,410,071 | |

| 25,180,190 | |||

| Textiles, Apparel & Luxury Goods - 0.5% | |||

| NIKE, Inc. Class B | 60,640 | 7,721,291 | |

TOTAL CONSUMER DISCRETIONARY | 67,062,954 | ||

| CONSUMER STAPLES - 0.1% | |||

| Personal Products - 0.1% | |||

| Haleon PLC (b) | 373,560 | 1,491,192 | |

| ENERGY - 14.2% | |||

| Oil, Gas & Consumable Fuels - 14.2% | |||

| Chevron Corp. | 275,435 | 47,931,199 | |

| Exxon Mobil Corp. | 497,793 | 57,748,966 | |

| Kinder Morgan, Inc. | 1,692,814 | 30,978,496 | |

| ONEOK, Inc. (a) | 467,691 | 32,027,480 | |

| The Williams Companies, Inc. | 968,125 | 31,212,350 | |

| Woodside Energy Group Ltd. | 84,304 | 2,154,019 | |

| 202,052,510 | |||

| FINANCIALS - 18.1% | |||

| Banks - 6.9% | |||

| Bank of America Corp. | 665,441 | 23,609,847 | |

| Citigroup, Inc. | 365,607 | 19,091,998 | |

| JPMorgan Chase & Co. | 232,035 | 32,475,619 | |

| Wells Fargo & Co. | 488,782 | 22,909,212 | |

| 98,086,676 | |||

| Capital Markets - 5.6% | |||

| Blackstone, Inc. | 168,354 | 16,155,250 | |

| Goldman Sachs Group, Inc. | 65,746 | 24,050,544 | |

| Morgan Stanley | 239,069 | 23,268,586 | |

| T. Rowe Price Group, Inc. | 138,905 | 16,178,265 | |

| 79,652,645 | |||

| Consumer Finance - 1.2% | |||

| OneMain Holdings, Inc. (a) | 379,650 | 16,378,101 | |

| Insurance - 3.3% | |||

| Old Republic International Corp. | 749,794 | 19,787,064 | |

| Progressive Corp. | 197,016 | 26,863,132 | |

| 46,650,196 | |||

| Mortgage Real Estate Investment Trusts - 1.1% | |||

| Annaly Capital Management, Inc. (a) | 649,330 | 15,239,775 | |

TOTAL FINANCIALS | 256,007,393 | ||

| HEALTH CARE - 6.8% | |||

| Biotechnology - 2.6% | |||

| AbbVie, Inc. | 88,506 | 13,076,762 | |

| Amgen, Inc. | 46,453 | 11,724,737 | |

| Gilead Sciences, Inc. | 147,882 | 12,413,215 | |

| 37,214,714 | |||

| Pharmaceuticals - 4.2% | |||

| Bristol-Myers Squibb Co. | 166,626 | 12,105,379 | |

| GSK PLC | 299,366 | 5,245,933 | |

| Johnson & Johnson | 92,007 | 15,035,784 | |

| Merck & Co., Inc. | 147,223 | 15,813,222 | |

| Pfizer, Inc. | 249,056 | 10,998,313 | |

| 59,198,631 | |||

TOTAL HEALTH CARE | 96,413,345 | ||

| INDUSTRIALS - 2.0% | |||

| Aerospace & Defense - 0.2% | |||

| Lockheed Martin Corp. | 7,516 | 3,481,862 | |

| Air Freight & Logistics - 0.2% | |||

| United Parcel Service, Inc. Class B | 15,130 | 2,802,530 | |

| Construction & Engineering - 0.2% | |||

| ACS Actividades de Construccion y Servicios SA (a) | 84,776 | 2,498,806 | |

| Industrial Conglomerates - 0.4% | |||

| 3M Co. | 17,721 | 2,039,333 | |

| Honeywell International, Inc. | 16,713 | 3,484,326 | |

| 5,523,659 | |||

| Machinery - 0.6% | |||

| AGCO Corp. | 19,527 | 2,697,265 | |

| Caterpillar, Inc. | 15,084 | 3,805,542 | |

| Volvo AB (B Shares) | 95,791 | 1,892,526 | |

| 8,395,333 | |||

| Road & Rail - 0.4% | |||

| Aurizon Holdings Ltd. | 838,125 | 2,179,258 | |

| Union Pacific Corp. | 13,909 | 2,840,079 | |

| 5,019,337 | |||

TOTAL INDUSTRIALS | 27,721,527 | ||

| INFORMATION TECHNOLOGY - 19.2% | |||

| Communications Equipment - 1.0% | |||

| Cisco Systems, Inc. | 305,876 | 14,886,985 | |

| IT Services - 3.8% | |||

| IBM Corp. | 101,772 | 13,711,742 | |

| The Western Union Co. | 588,341 | 8,336,792 | |

| TietoEVRY Oyj | 357,819 | 10,857,745 | |

| Visa, Inc. Class A | 90,514 | 20,837,228 | |

| 53,743,507 | |||

| Semiconductors & Semiconductor Equipment - 4.5% | |||

| Broadcom, Inc. | 29,342 | 17,165,363 | |

| Intel Corp. | 330,040 | 9,326,930 | |

| NVIDIA Corp. | 110,532 | 21,594,637 | |

| Texas Instruments, Inc. | 85,610 | 15,170,948 | |

| 63,257,878 | |||

| Software - 5.1% | |||

| Microsoft Corp. | 232,537 | 57,624,994 | |

| Oracle Corp. | 173,860 | 15,379,656 | |

| 73,004,650 | |||

| Technology Hardware, Storage & Peripherals - 4.8% | |||

| Apple, Inc. | 470,775 | 67,928,119 | |

TOTAL INFORMATION TECHNOLOGY | 272,821,139 | ||

| MATERIALS - 10.6% | |||

| Chemicals - 6.3% | |||

| Air Products & Chemicals, Inc. | 63,585 | 20,379,628 | |

| Dow, Inc. | 282,330 | 16,756,286 | |

| Linde PLC | 68,039 | 22,516,827 | |

| LyondellBasell Industries NV Class A | 166,280 | 16,077,613 | |

| Yara International ASA | 295,347 | 13,069,694 | |

| 88,800,048 | |||

| Containers & Packaging - 1.0% | |||

| International Paper Co. | 344,023 | 14,387,042 | |

| Metals & Mining - 3.3% | |||

| BHP Group Ltd. | 467,553 | 16,268,795 | |

| Fortescue Metals Group Ltd. | 1,041,035 | 16,314,493 | |

| Newmont Corp. | 281,873 | 14,919,538 | |

| 47,502,826 | |||

TOTAL MATERIALS | 150,689,916 | ||

| REAL ESTATE - 10.6% | |||

| Equity Real Estate Investment Trusts (REITs) - 10.6% | |||

| American Tower Corp. | 64,287 | 14,361,073 | |

| Crown Castle International Corp. | 81,981 | 12,142,206 | |

| Digital Realty Trust, Inc. | 92,644 | 10,618,855 | |

| Gaming & Leisure Properties | 283,941 | 15,207,880 | |

| Iron Mountain, Inc. | 275,693 | 15,047,324 | |

| Medical Properties Trust, Inc. (a) | 570,921 | 7,393,427 | |

| Omega Healthcare Investors, Inc. (a) | 437,322 | 12,874,760 | |

| Prologis (REIT), Inc. | 103,356 | 13,361,864 | |

| Simon Property Group, Inc. | 95,080 | 12,213,977 | |

| SL Green Realty Corp. (a) | 170,311 | 7,008,298 | |

| VICI Properties, Inc. | 452,216 | 15,456,743 | |

| WP Carey, Inc. | 165,031 | 14,115,101 | |

| 149,801,508 | |||

| UTILITIES - 11.1% | |||

| Electric Utilities - 9.3% | |||

| American Electric Power Co., Inc. | 239,278 | 22,482,561 | |

| Duke Energy Corp. | 216,299 | 22,159,833 | |

| Edison International | 339,174 | 23,369,089 | |

| Pinnacle West Capital Corp. | 287,374 | 21,423,732 | |

| PPL Corp. | 700,323 | 20,729,561 | |

| Southern Co. | 325,496 | 22,029,569 | |

| 132,194,345 | |||

| Multi-Utilities - 1.8% | |||

| Sempra Energy | 157,066 | 25,182,392 | |

TOTAL UTILITIES | 157,376,737 | ||

| TOTAL COMMON STOCKS (Cost $1,322,379,820) | 1,413,802,425 | ||

| Money Market Funds - 2.9% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 4.38% (c) | 2,065,242 | 2,065,655 | |

| Fidelity Securities Lending Cash Central Fund 4.38% (c)(d) | 38,571,877 | 38,575,734 | |

| TOTAL MONEY MARKET FUNDS (Cost $40,641,389) | 40,641,389 | ||

| TOTAL INVESTMENT IN SECURITIES - 102.6% (Cost $1,363,021,209) | 1,454,443,814 |

NET OTHER ASSETS (LIABILITIES) - (2.6)% | (36,911,895) |

| NET ASSETS - 100.0% | 1,417,531,919 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini S&P 500 Index Contracts (United States) | 16 | Mar 2023 | 3,272,000 | 101,338 | 101,338 |

| The notional amount of futures purchased as a percentage of Net Assets is 0.2% | |||||

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Non-income producing |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 2,743,400 | 38,401,746 | 39,079,491 | 30,327 | - | - | 2,065,655 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 16,059,350 | 146,611,615 | 124,095,231 | 101,887 | - | - | 38,575,734 | 0.1% |

| Total | 18,802,750 | 185,013,361 | 163,174,722 | 132,214 | - | - | 40,641,389 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 32,364,204 | 32,364,204 | - | - |

Consumer Discretionary | 67,062,954 | 67,062,954 | - | - |

Consumer Staples | 1,491,192 | 1,491,192 | - | - |

Energy | 202,052,510 | 199,898,491 | 2,154,019 | - |

Financials | 256,007,393 | 256,007,393 | - | - |

Health Care | 96,413,345 | 91,167,412 | 5,245,933 | - |

Industrials | 27,721,527 | 23,649,743 | 4,071,784 | - |

Information Technology | 272,821,139 | 272,821,139 | - | - |

Materials | 150,689,916 | 118,106,628 | 32,583,288 | - |

Real Estate | 149,801,508 | 149,801,508 | - | - |

Utilities | 157,376,737 | 157,376,737 | - | - |

| Money Market Funds | 40,641,389 | 40,641,389 | - | - |

| Total Investments in Securities: | 1,454,443,814 | 1,410,388,790 | 44,055,024 | - |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 101,338 | 101,338 | - | - |

| Total Assets | 101,338 | 101,338 | - | - |

| Total Derivative Instruments: | 101,338 | 101,338 | - | - |

Primary Risk Exposure / Derivative Type �� | Value | |

| Asset ($) | Liability ($) | |

| Equity Risk | ||

Futures Contracts (a) | 101,338 | 0 |

| Total Equity Risk | 101,338 | 0 |

| Total Value of Derivatives | 101,338 | 0 |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $38,289,319) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $1,322,379,820) | $ | 1,413,802,425 | ||

Fidelity Central Funds (cost $40,641,389) | 40,641,389 | |||

| Total Investment in Securities (cost $1,363,021,209) | $ | 1,454,443,814 | ||

| Segregated cash with brokers for derivative instruments | 169,600 | |||

| Cash | 227,129 | |||

| Foreign currency held at value (cost $17,567) | 17,924 | |||

| Receivable for fund shares sold | 5,853,581 | |||

| Dividends receivable | 2,263,552 | |||

| Distributions receivable from Fidelity Central Funds | 25,801 | |||

| Receivable for daily variation margin on futures contracts | 46,000 | |||

Total assets | 1,463,047,401 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 6,607,150 | ||

| Accrued management fee | 332,598 | |||

| Collateral on securities loaned | 38,575,734 | |||

| Total Liabilities | 45,515,482 | |||

| Net Assets | $ | 1,417,531,919 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 1,377,645,506 | ||

| Total accumulated earnings (loss) | 39,886,413 | |||

| Net Assets | $ | 1,417,531,919 | ||

Net Asset Value , offering price and redemption price per share ($1,417,531,919 ÷ 35,850,000 shares) | $ | 39.54 | ||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 18,541,702 | ||

| Income from Fidelity Central Funds (including $101,887 from security lending) | 132,214 | |||

| Total Income | 18,673,916 | |||

| Expenses | ||||

| Management fee | $ | 1,884,830 | ||

| Independent trustees' fees and expenses | 2,227 | |||

| Total expenses before reductions | 1,887,057 | |||

| Expense reductions | (77) | |||

| Total expenses after reductions | 1,886,980 | |||

| Net Investment income (loss) | 16,786,936 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (1,078,192) | |||

| Redemptions in-kind | 5,658,309 | |||

| Foreign currency transactions | (33,023) | |||

| Futures contracts | 61,530 | |||

| Total net realized gain (loss) | 4,608,624 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 39,748,287 | |||

| Assets and liabilities in foreign currencies | (17,070) | |||

| Futures contracts | (210,573) | |||

| Total change in net unrealized appreciation (depreciation) | 39,520,644 | |||

| Net gain (loss) | 44,129,268 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 60,916,204 | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 16,786,936 | $ | 34,784,807 |

| Net realized gain (loss) | 4,608,624 | 95,057,679 | ||

| Change in net unrealized appreciation (depreciation) | 39,520,644 | (104,029,877) | ||

| Net increase (decrease) in net assets resulting from operations | 60,916,204 | 25,812,609 | ||

| Distributions to shareholders | (19,807,450) | (36,931,550) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 121,329,287 | 758,176,457 | ||

| Cost of shares redeemed | (22,960,317) | (521,124,909) | ||

Net increase (decrease) in net assets resulting from share transactions | 98,368,970 | 237,051,548 | ||

| Total increase (decrease) in net assets | 139,477,724 | 225,932,607 | ||

| Net Assets | ||||

| Beginning of period | 1,278,054,195 | 1,052,121,588 | ||

| End of period | $ | 1,417,531,919 | $ | 1,278,054,195 |

| Other Information | ||||

| Shares | ||||

| Sold | 3,200,000 | 19,000,000 | ||

| Redeemed | (600,000) | (13,400,000) | ||

| Net increase (decrease) | 2,600,000 | 5,600,000 | ||

| Fidelity® High Dividend ETF |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 38.44 | $ | 38.05 | $ | 27.56 | $ | 30.12 | $ | 30.15 | $ | 26.98 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .48 | 1.21 | 1.02 | 1.10 | 1.23 | 1.09 | ||||||

| Net realized and unrealized gain (loss) | 1.19 | .44 C | 10.48 | (2.52) | (.03) | 3.21 | ||||||

| Total from investment operations | 1.67 | 1.65 | 11.50 | (1.42) | 1.20 | 4.30 | ||||||

| Distributions from net investment income | (.57) | (1.26) | (1.01) | (1.14) | (1.23) | (1.12) | ||||||

| Distributions from net realized gain | - | - | - | - | - | (.01) | ||||||

| Total distributions | (.57) | (1.26) | (1.01) | (1.14) | (1.23) | (1.13) | ||||||

| Net asset value, end of period | $ | 39.54 | $ | 38.44 | $ | 38.05 | $ | 27.56 | $ | 30.12 | $ | 30.15 |

Total Return D,E,F | 4.47% | 4.43% | 42.42% | (4.54)% | 4.16% | 16.23% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | .29% I | .29% | .29% | .29% | .29% | .30% | ||||||

| Expenses net of fee waivers, if any | .29% I | .29% | .29% | .29% | .29% | .30% | ||||||

| Expenses net of all reductions | .29% I | .29% | .29% | .29% | .29% | .30% | ||||||

| Net investment income (loss) | 2.58% I | 3.11% | 3.04% | 3.85% | 4.15% | 3.80% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 1,417,532 | $ | 1,278,054 | $ | 1,052,122 | $ | 520,795 | $ | 362,952 | $ | 171,835 |

Portfolio turnover rate J,K | 3% I | 38% | 32% | 49% | 50% | 53% |

Top Holdings (% of Fund's net assets) | ||

| Apple, Inc. | 6.4 | |

| Microsoft Corp. | 5.5 | |

| Alphabet, Inc. Class A | 3.3 | |

| Berkshire Hathaway, Inc. Class B | 2.1 | |

| Visa, Inc. Class A | 1.8 | |

| UnitedHealth Group, Inc. | 1.8 | |

| The Home Depot, Inc. | 1.7 | |

| Johnson & Johnson | 1.7 | |

| MasterCard, Inc. Class A | 1.6 | |

| Exxon Mobil Corp. | 1.6 | |

| 27.5 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 25.5 | |

| Health Care | 14.2 | |

| Consumer Discretionary | 12.8 | |

| Financials | 11.7 | |

| Industrials | 8.5 | |

| Communication Services | 7.5 | |

| Consumer Staples | 6.0 | |

| Energy | 4.8 | |

| Real Estate | 3.1 | |

| Materials | 2.9 | |

| Utilities | 2.8 | |

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 3.2% |

| Common Stocks - 99.8% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 7.5% | |||

| Diversified Telecommunication Services - 1.6% | |||

| AT&T, Inc. | 189,434 | 3,858,771 | |

| Verizon Communications, Inc. | 93,898 | 3,903,340 | |

| 7,762,111 | |||

| Entertainment - 0.5% | |||

| Activision Blizzard, Inc. | 32,209 | 2,466,243 | |

| Interactive Media & Services - 3.3% | |||

| Alphabet, Inc. Class A (a) | 162,515 | 16,062,983 | |

| Media - 1.5% | |||

| Cable One, Inc. | 1,307 | 1,032,373 | |

| Comcast Corp. Class A | 103,056 | 4,055,254 | |

| Omnicom Group, Inc. | 28,145 | 2,420,189 | |

| 7,507,816 | |||

| Wireless Telecommunication Services - 0.6% | |||

| T-Mobile U.S., Inc. (a) | 19,986 | 2,984,110 | |

TOTAL COMMUNICATION SERVICES | 36,783,263 | ||

| CONSUMER DISCRETIONARY - 12.8% | |||

| Diversified Consumer Services - 1.0% | |||

| Service Corp. International | 64,724 | 4,799,285 | |

| Hotels, Restaurants & Leisure - 4.5% | |||

| Domino's Pizza, Inc. | 10,838 | 3,825,814 | |

| McDonald's Corp. | 25,008 | 6,687,139 | |

| Starbucks Corp. | 61,366 | 6,697,485 | |

| Yum! Brands, Inc. | 37,476 | 4,890,993 | |

| 22,101,431 | |||

| Multiline Retail - 0.9% | |||

| Dollar General Corp. | 19,080 | 4,457,088 | |

| Specialty Retail - 5.1% | |||

| AutoZone, Inc. (a) | 2,130 | 5,194,751 | |

| O'Reilly Automotive, Inc. (a) | 6,583 | 5,216,040 | |

| The Home Depot, Inc. | 26,391 | 8,555,170 | |

| TJX Companies, Inc. | 79,152 | 6,479,383 | |

| 25,445,344 | |||

| Textiles, Apparel & Luxury Goods - 1.3% | |||

| NIKE, Inc. Class B | 51,647 | 6,576,213 | |

TOTAL CONSUMER DISCRETIONARY | 63,379,361 | ||

| CONSUMER STAPLES - 6.0% | |||

| Beverages - 2.0% | |||

| PepsiCo, Inc. | 29,108 | 4,978,050 | |

| The Coca-Cola Co. | 81,451 | 4,994,575 | |

| 9,972,625 | |||

| Food Products - 1.7% | |||

| General Mills, Inc. | 34,430 | 2,697,935 | |

| Mondelez International, Inc. | 49,084 | 3,212,057 | |

| The Hershey Co. | 10,831 | 2,432,643 | |

| 8,342,635 | |||

| Household Products - 2.3% | |||

| Colgate-Palmolive Co. | 35,657 | 2,657,516 | |

| Kimberly-Clark Corp. | 19,513 | 2,536,885 | |

| Procter & Gamble Co. | 44,542 | 6,341,890 | |

| 11,536,291 | |||

TOTAL CONSUMER STAPLES | 29,851,551 | ||

| ENERGY - 4.8% | |||

| Oil, Gas & Consumable Fuels - 4.8% | |||

| Chevron Corp. | 32,016 | 5,571,424 | |

| ConocoPhillips Co. | 28,219 | 3,439,050 | |

| Coterra Energy, Inc. | 48,783 | 1,221,038 | |

| DT Midstream, Inc. | 21,145 | 1,155,786 | |

| Exxon Mobil Corp. | 65,777 | 7,630,790 | |

| Kinder Morgan, Inc. | 85,827 | 1,570,634 | |

| ONEOK, Inc. (b) | 23,999 | 1,643,452 | |

| The Williams Companies, Inc. | 48,580 | 1,566,219 | |

| 23,798,393 | |||

| FINANCIALS - 11.7% | |||

| Capital Markets - 2.9% | |||

| CME Group, Inc. | 18,794 | 3,320,148 | |

| FactSet Research Systems, Inc. | 7,176 | 3,035,017 | |

| Intercontinental Exchange, Inc. | 33,577 | 3,611,206 | |

| S&P Global, Inc. | 11,947 | 4,479,408 | |

| 14,445,779 | |||

| Diversified Financial Services - 2.1% | |||

| Berkshire Hathaway, Inc. Class B (a) | 32,760 | 10,205,395 | |

| Insurance - 6.7% | |||

| Arthur J. Gallagher & Co. (b) | 18,787 | 3,676,992 | |

| Assurant, Inc. | 18,887 | 2,504,227 | |

| Brown & Brown, Inc. | 47,197 | 2,763,856 | |

| Chubb Ltd. | 20,761 | 4,722,920 | |

| Erie Indemnity Co. Class A | 13,762 | 3,362,745 | |

| Marsh & McLennan Companies, Inc. | 23,595 | 4,127,001 | |

| Progressive Corp. | 31,800 | 4,335,930 | |

| The Travelers Companies, Inc. | 21,087 | 4,030,147 | |

| W.R. Berkley Corp. | 49,144 | 3,446,960 | |

| 32,970,778 | |||

TOTAL FINANCIALS | 57,621,952 | ||

| HEALTH CARE - 14.2% | |||

| Biotechnology - 1.9% | |||

| Amgen, Inc. | 18,752 | 4,733,005 | |

| Regeneron Pharmaceuticals, Inc. (a) | 6,174 | 4,682,794 | |

| 9,415,799 | |||

| Health Care Equipment & Supplies - 1.9% | |||

| Abbott Laboratories | 49,199 | 5,438,949 | |

| Medtronic PLC | 48,745 | 4,079,469 | |

| 9,518,418 | |||

| Health Care Providers & Services - 1.8% | |||

| UnitedHealth Group, Inc. | 17,482 | 8,726,840 | |

| Life Sciences Tools & Services - 1.2% | |||

| Thermo Fisher Scientific, Inc. | 9,988 | 5,696,456 | |

| Pharmaceuticals - 7.4% | |||

| Bristol-Myers Squibb Co. | 68,035 | 4,942,743 | |

| Eli Lilly & Co. | 19,697 | 6,778,723 | |

| Johnson & Johnson | 50,703 | 8,285,884 | |

| Merck & Co., Inc. | 66,203 | 7,110,864 | |

| Pfizer, Inc. | 130,664 | 5,770,122 | |

| Zoetis, Inc. Class A | 22,921 | 3,793,196 | |

| 36,681,532 | |||

TOTAL HEALTH CARE | 70,039,045 | ||

| INDUSTRIALS - 8.5% | |||

| Aerospace & Defense - 2.5% | |||

| General Dynamics Corp. | 12,785 | 2,979,672 | |

| L3Harris Technologies, Inc. | 11,946 | 2,566,240 | |

| Lockheed Martin Corp. | 8,289 | 3,839,962 | |

| Northrop Grumman Corp. | 6,583 | 2,949,447 | |

| 12,335,321 | |||

| Commercial Services & Supplies - 1.5% | |||

| Republic Services, Inc. | 18,601 | 2,321,777 | |

| Rollins, Inc. | 62,686 | 2,281,770 | |

| Waste Management, Inc. | 18,211 | 2,817,788 | |

| 7,421,335 | |||

| Industrial Conglomerates - 1.4% | |||

| 3M Co. | 22,487 | 2,587,804 | |

| Honeywell International, Inc. | 20,402 | 4,253,409 | |

| 6,841,213 | |||

| Machinery - 1.7% | |||

| Graco, Inc. | 35,690 | 2,438,341 | |

| Otis Worldwide Corp. | 33,775 | 2,777,318 | |

| PACCAR, Inc. | 29,263 | 3,198,739 | |

| 8,414,398 | |||

| Professional Services - 1.4% | |||

| Booz Allen Hamilton Holding Corp. Class A | 25,447 | 2,408,304 | |

| FTI Consulting, Inc. (a)(b) | 14,574 | 2,324,844 | |

| Leidos Holdings, Inc. | 24,467 | 2,418,318 | |

| 7,151,466 | |||

TOTAL INDUSTRIALS | 42,163,733 | ||

| INFORMATION TECHNOLOGY - 25.5% | |||

| IT Services - 10.4% | |||

| Akamai Technologies, Inc. (a) | 41,505 | 3,691,870 | |

| Amdocs Ltd. | 44,959 | 4,133,081 | |

| Automatic Data Processing, Inc. | 20,884 | 4,715,816 | |

| Fiserv, Inc. (a) | 43,009 | 4,588,200 | |

| IBM Corp. | 40,302 | 5,429,888 | |

| Jack Henry & Associates, Inc. | 19,152 | 3,449,084 | |

| MasterCard, Inc. Class A | 21,606 | 8,007,184 | |

| Maximus, Inc. | 59,410 | 4,446,839 | |

| Paychex, Inc. | 33,624 | 3,895,677 | |

| Visa, Inc. Class A | 38,756 | 8,922,019 | |

| 51,279,658 | |||

| Semiconductors & Semiconductor Equipment - 2.0% | |||

| Intel Corp. | 158,572 | 4,481,245 | |

| Texas Instruments, Inc. | 32,283 | 5,720,870 | |

| 10,202,115 | |||

| Software - 6.7% | |||

| Microsoft Corp. | 108,686 | 26,933,478 | |

| Oracle Corp. | 69,112 | 6,113,648 | |

| 33,047,126 | |||

| Technology Hardware, Storage & Peripherals - 6.4% | |||

| Apple, Inc. | 218,824 | 31,574,114 | |

TOTAL INFORMATION TECHNOLOGY | 126,103,013 | ||

| MATERIALS - 2.9% | |||

| Chemicals - 1.5% | |||

| Air Products & Chemicals, Inc. | 5,838 | 1,871,137 | |

| Ecolab, Inc. | 7,820 | 1,210,771 | |

| Linde PLC | 8,981 | 2,972,172 | |

| Sherwin-Williams Co. | 6,243 | 1,477,031 | |

| 7,531,111 | |||

| Construction Materials - 0.5% | |||

| Martin Marietta Materials, Inc. | 2,951 | 1,061,298 | |

| Vulcan Materials Co. | 6,248 | 1,145,446 | |

| 2,206,744 | |||

| Containers & Packaging - 0.6% | |||

| Aptargroup, Inc. | 8,128 | 939,922 | |

| Ball Corp. | 17,173 | 1,000,156 | |

| Packaging Corp. of America | 6,829 | 974,498 | |

| 2,914,576 | |||

| Metals & Mining - 0.3% | |||

| Newmont Corp. (b) | 27,257 | 1,442,713 | |

TOTAL MATERIALS | 14,095,144 | ||

| REAL ESTATE - 3.1% | |||

| Equity Real Estate Investment Trusts (REITs) - 3.1% | |||

| Agree Realty Corp. | 10,169 | 758,912 | |

| American Tower Corp. | 8,499 | 1,898,592 | |

| Crown Castle International Corp. | 9,438 | 1,397,862 | |

| CubeSmart | 18,077 | 827,746 | |

| Digital Realty Trust, Inc. | 9,031 | 1,035,133 | |

| Equinix, Inc. | 2,163 | 1,596,575 | |

| Equity Lifestyle Properties, Inc. | 11,685 | 838,749 | |

| Extra Space Storage, Inc. | 5,292 | 835,236 | |

| Prologis (REIT), Inc. | 14,780 | 1,910,758 | |

| Public Storage | 4,061 | 1,235,925 | |

| Realty Income Corp. | 17,314 | 1,174,409 | |

| Sun Communities, Inc. | 5,850 | 917,631 | |

| WP Carey, Inc. | 10,766 | 920,816 | |

| 15,348,344 | |||

| UTILITIES - 2.8% | |||

| Electric Utilities - 1.7% | |||

| American Electric Power Co., Inc. | 17,394 | 1,634,340 | |

| Duke Energy Corp. | 19,694 | 2,017,650 | |

| Eversource Energy | 16,312 | 1,342,967 | |

| Southern Co. | 27,448 | 1,857,681 | |

| Xcel Energy, Inc. | 21,485 | 1,477,523 | |

| 8,330,161 | |||

| Multi-Utilities - 1.1% | |||

| Ameren Corp. | 15,131 | 1,314,430 | |

| CMS Energy Corp. | 19,503 | 1,232,395 | |

| Consolidated Edison, Inc. | 15,646 | 1,491,220 | |

| WEC Energy Group, Inc. | 14,462 | 1,359,283 | |

| 5,397,328 | |||

TOTAL UTILITIES | 13,727,489 | ||

| TOTAL COMMON STOCKS (Cost $482,853,355) | 492,911,288 | ||

| Money Market Funds - 1.0% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 4.38% (c) | 460,111 | 460,203 | |

| Fidelity Securities Lending Cash Central Fund 4.38% (c)(d) | 4,128,136 | 4,128,549 | |

| TOTAL MONEY MARKET FUNDS (Cost $4,588,752) | 4,588,752 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.8% (Cost $487,442,107) | 497,500,040 |

NET OTHER ASSETS (LIABILITIES) - (0.8)% | (3,717,382) |

| NET ASSETS - 100.0% | 493,782,658 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME S&P 500 Index Contracts (United States) | 32 | Mar 2023 | 654,400 | 34,665 | 34,665 |

| The notional amount of futures purchased as a percentage of Net Assets is 0.1% | |||||

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 1,126,798 | 8,882,713 | 9,549,308 | 10,549 | - | - | 460,203 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 1,748,660 | 12,138,162 | 9,758,273 | 6,890 | - | - | 4,128,549 | 0.0% |

| Total | 2,875,458 | 21,020,875 | 19,307,581 | 17,439 | - | - | 4,588,752 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 36,783,263 | 36,783,263 | - | - |

Consumer Discretionary | 63,379,361 | 63,379,361 | - | - |

Consumer Staples | 29,851,551 | 29,851,551 | - | - |

Energy | 23,798,393 | 23,798,393 | - | - |

Financials | 57,621,952 | 57,621,952 | - | - |

Health Care | 70,039,045 | 70,039,045 | - | - |

Industrials | 42,163,733 | 42,163,733 | - | - |

Information Technology | 126,103,013 | 126,103,013 | - | - |

Materials | 14,095,144 | 14,095,144 | - | - |

Real Estate | 15,348,344 | 15,348,344 | - | - |

Utilities | 13,727,489 | 13,727,489 | - | - |

| Money Market Funds | 4,588,752 | 4,588,752 | - | - |

| Total Investments in Securities: | 497,500,040 | 497,500,040 | - | - |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 34,665 | 34,665 | - | - |

| Total Assets | 34,665 | 34,665 | - | - |

| Total Derivative Instruments: | 34,665 | 34,665 | - | - |

Primary Risk Exposure / Derivative Type | Value | |

| Asset ($) | Liability ($) | |

| Equity Risk | ||

Futures Contracts (a) | 34,665 | 0 |

| Total Equity Risk | 34,665 | 0 |

| Total Value of Derivatives | 34,665 | 0 |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $4,091,674) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $482,853,355) | $ | 492,911,288 | ||

Fidelity Central Funds (cost $4,588,752) | 4,588,752 | |||

| Total Investment in Securities (cost $487,442,107) | $ | 497,500,040 | ||

| Segregated cash with brokers for derivative instruments | 33,920 | |||

| Dividends receivable | 482,033 | |||

| Distributions receivable from Fidelity Central Funds | 1,654 | |||

| Receivable for daily variation margin on futures contracts | 9,200 | |||

Total assets | 498,026,847 | |||

| Liabilities | ||||

| Accrued management fee | $ | 117,744 | ||

| Collateral on securities loaned | 4,126,445 | |||

| Total Liabilities | 4,244,189 | |||

| Net Assets | $ | 493,782,658 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 517,129,480 | ||

| Total accumulated earnings (loss) | (23,346,822) | |||

| Net Assets | $ | 493,782,658 | ||

Net Asset Value , offering price and redemption price per share ($493,782,658 ÷ 10,450,000 shares) | $ | 47.25 | ||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 4,077,080 | ||

| Income from Fidelity Central Funds (including $6,890 from security lending) | 17,439 | |||

| Total Income | 4,094,519 | |||

| Expenses | ||||

| Management fee | $ | 661,725 | ||

| Independent trustees' fees and expenses | 786 | |||

| Total expenses before reductions | 662,511 | |||

| Expense reductions | (46) | |||

| Total expenses after reductions | 662,465 | |||

| Net Investment income (loss) | 3,432,054 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (9,248,607) | |||

| Redemptions in-kind | 8,746,138 | |||

| Futures contracts | 30,563 | |||

| Total net realized gain (loss) | (471,906) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (1,834,328) | |||

| Futures contracts | (80,330) | |||

| Total change in net unrealized appreciation (depreciation) | (1,914,658) | |||

| Net gain (loss) | (2,386,564) | |||

| Net increase (decrease) in net assets resulting from operations | $ | 1,045,490 | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 3,432,054 | $ | 6,029,946 |

| Net realized gain (loss) | (471,906) | 57,400,773 | ||

| Change in net unrealized appreciation (depreciation) | (1,914,658) | (66,352,118) | ||

| Net increase (decrease) in net assets resulting from operations | 1,045,490 | (2,921,399) | ||

| Distributions to shareholders | (3,518,700) | (5,937,600) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 92,467,398 | 286,611,056 | ||

| Cost of shares redeemed | (41,074,290) | (344,785,919) | ||

Net increase (decrease) in net assets resulting from share transactions | 51,393,108 | (58,174,863) | ||

| Total increase (decrease) in net assets | 48,919,898 | (67,033,862) | ||

| Net Assets | ||||

| Beginning of period | 444,862,760 | 511,896,622 | ||

| End of period | $ | 493,782,658 | $ | 444,862,760 |

| Other Information | ||||

| Shares | ||||

| Sold | 2,000,000 | 5,950,000 | ||

| Redeemed | (900,000) | (7,100,000) | ||

| Net increase (decrease) | 1,100,000 | (1,150,000) | ||

| Fidelity® Low Volatility Factor ETF |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 47.58 | $ | 48.75 | $ | 38.33 | $ | 36.37 | $ | 32.40 | $ | 28.19 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .35 | .62 | .56 | .62 | .62 | .53 | ||||||

| Net realized and unrealized gain (loss) | (.32) | (1.17) | 10.43 | 1.95 | 3.92 | 4.20 | ||||||

| Total from investment operations | .03 | (.55) | 10.99 | 2.57 | 4.54 | 4.73 | ||||||

| Distributions from net investment income | (.36) | (.62) | (.57) | (.61) | (.57) | (.52) | ||||||

| Total distributions | (.36) | (.62) | (.57) | (.61) | (.57) | (.52) | ||||||

| Net asset value, end of period | $ | 47.25 | $ | 47.58 | $ | 48.75 | $ | 38.33 | $ | 36.37 | $ | 32.40 |

Total Return C,D,E | .10% | (1.12)% | 28.90% | 7.29% | 14.20% | 16.89% | ||||||

Ratios to Average Net Assets B,F,G | ||||||||||||

| Expenses before reductions | .29% H | .29% | .29% | .29% | .29% | .30% | ||||||

| Expenses net of fee waivers, if any | .29% H | .29% | .29% | .29% | .29% | .30% | ||||||

| Expenses net of all reductions | .29% H | .29% | .29% | .29% | .29% | .30% | ||||||

| Net investment income (loss) | 1.50% H | 1.27% | 1.31% | 1.69% | 1.83% | 1.73% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 493,783 | $ | 444,863 | $ | 511,897 | $ | 350,708 | $ | 245,502 | $ | 66,420 |

Portfolio turnover rate I,J | 48% H | 28% | 46% | 31% | 36% | 31% |

Top Holdings (% of Fund's net assets) | ||

| Apple, Inc. | 6.8 | |

| Microsoft Corp. | 6.0 | |

| Alphabet, Inc. Class A | 3.6 | |

| Amazon.com, Inc. | 3.1 | |

| Berkshire Hathaway, Inc. Class B | 2.2 | |

| Visa, Inc. Class A | 1.9 | |

| UnitedHealth Group, Inc. | 1.9 | |

| Johnson & Johnson | 1.8 | |

| MasterCard, Inc. Class A | 1.7 | |

| Tesla, Inc. | 1.7 | |

| 30.7 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 25.4 | |

| Health Care | 14.3 | |

| Financials | 12.2 | |

| Consumer Discretionary | 10.3 | |

| Industrials | 8.9 | |

| Communication Services | 7.6 | |

| Consumer Staples | 6.3 | |

| Energy | 5.4 | |

| Real Estate | 3.3 | |

| Utilities | 3.1 | |

| Materials | 3.0 | |

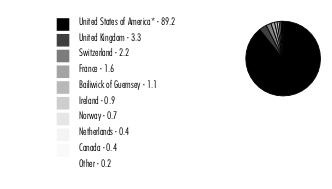

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 3.5% |

Percentages shown as 0.0% may reflect amounts less than 0.05%. |

| Common Stocks - 99.8% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 7.6% | |||

| Diversified Telecommunication Services - 1.4% | |||

| Iridium Communications, Inc. | 9,692 | 579,969 | |

| Verizon Communications, Inc. | 27,403 | 1,139,143 | |

| 1,719,112 | |||

| Entertainment - 1.0% | |||

| Activision Blizzard, Inc. | 9,035 | 691,810 | |

| Electronic Arts, Inc. | 4,638 | 596,818 | |

| 1,288,628 | |||

| Interactive Media & Services - 3.6% | |||

| Alphabet, Inc. Class A (a) | 45,561 | 4,503,249 | |

| Media - 1.0% | |||

| Nexstar Broadcasting Group, Inc. Class A | 2,994 | 613,081 | |

| Omnicom Group, Inc. | 7,322 | 629,619 | |

| 1,242,700 | |||

| Wireless Telecommunication Services - 0.6% | |||

| T-Mobile U.S., Inc. (a) | 5,286 | 789,253 | |

TOTAL COMMUNICATION SERVICES | 9,542,942 | ||

| CONSUMER DISCRETIONARY - 10.3% | |||

| Automobiles - 1.7% | |||

| Tesla, Inc. (a) | 12,191 | 2,111,725 | |

| Distributors - 0.5% | |||

| Genuine Parts Co. | 3,938 | 660,875 | |

| Diversified Consumer Services - 0.5% | |||

| H&R Block, Inc. | 16,168 | 630,229 | |

| Hotels, Restaurants & Leisure - 1.0% | |||

| McDonald's Corp. | 4,818 | 1,288,333 | |

| Internet & Direct Marketing Retail - 3.1% | |||

| Amazon.com, Inc. (a) | 37,971 | 3,915,949 | |

| Multiline Retail - 1.2% | |||

| Dollar General Corp. | 3,243 | 757,565 | |

| Dollar Tree, Inc. (a) | 4,647 | 697,886 | |

| 1,455,451 | |||

| Specialty Retail - 2.3% | |||

| AutoZone, Inc. (a) | 315 | 768,238 | |

| Murphy U.S.A., Inc. | 2,041 | 555,213 | |

| O'Reilly Automotive, Inc. (a) | 968 | 766,995 | |

| Ulta Beauty, Inc. (a) | 1,648 | 847,006 | |

| 2,937,452 | |||

TOTAL CONSUMER DISCRETIONARY | 13,000,014 | ||

| CONSUMER STAPLES - 6.3% | |||

| Beverages - 2.3% | |||

| PepsiCo, Inc. | 8,440 | 1,443,409 | |

| The Coca-Cola Co. | 24,538 | 1,504,670 | |

| 2,948,079 | |||

| Food & Staples Retailing - 0.5% | |||

| BJ's Wholesale Club Holdings, Inc. (a) | 8,693 | 629,982 | |

| Food Products - 3.5% | |||

| Archer Daniels Midland Co. | 8,600 | 712,510 | |

| Campbell Soup Co. | 13,167 | 683,762 | |

| General Mills, Inc. | 10,182 | 797,862 | |

| Kellogg Co. | 10,079 | 691,218 | |

| Lamb Weston Holdings, Inc. | 8,027 | 801,817 | |

| The Hershey Co. | 3,266 | 733,544 | |

| 4,420,713 | |||

TOTAL CONSUMER STAPLES | 7,998,774 | ||

| ENERGY - 5.4% | |||

| Oil, Gas & Consumable Fuels - 5.4% | |||

| Chesapeake Energy Corp. | 2,985 | 258,859 | |

| Chevron Corp. | 7,777 | 1,353,354 | |

| ConocoPhillips Co. | 6,434 | 784,112 | |

| Devon Energy Corp. | 6,009 | 380,009 | |

| Exxon Mobil Corp. | 17,008 | 1,973,098 | |

| Hess Corp. | 2,825 | 424,202 | |

| HF Sinclair Corp. | 4,661 | 265,211 | |

| Marathon Petroleum Corp. | 3,971 | 510,353 | |

| Occidental Petroleum Corp. (b) | 6,253 | 405,132 | |

| Valero Energy Corp. | 3,407 | 477,082 | |

| 6,831,412 | |||

| FINANCIALS - 12.2% | |||

| Banks - 1.8% | |||

| CVB Financial Corp. | 27,832 | 674,091 | |

| First Horizon National Corp. | 33,142 | 819,602 | |

| M&T Bank Corp. | 5,244 | 818,064 | |

| 2,311,757 | |||

| Capital Markets - 0.6% | |||

| LPL Financial | 3,168 | 751,196 | |

| Diversified Financial Services - 2.2% | |||

| Berkshire Hathaway, Inc. Class B (a) | 9,019 | 2,809,599 | |

| Insurance - 7.6% | |||

| AFLAC, Inc. | 13,534 | 994,749 | |

| Aon PLC | 3,489 | 1,111,875 | |

| Arthur J. Gallagher & Co. | 4,793 | 938,086 | |

| Chubb Ltd. | 5,091 | 1,158,152 | |

| Kinsale Capital Group, Inc. | 2,455 | 683,570 | |

| Marsh & McLennan Companies, Inc. | 6,530 | 1,142,162 | |

| Progressive Corp. | 8,022 | 1,093,800 | |

| The Travelers Companies, Inc. | 5,012 | 957,893 | |

| Unum Group | 17,722 | 744,856 | |

| W.R. Berkley Corp. | 10,899 | 764,456 | |

| 9,589,599 | |||

TOTAL FINANCIALS | 15,462,151 | ||

| HEALTH CARE - 14.3% | |||

| Biotechnology - 3.3% | |||

| AbbVie, Inc. | 12,050 | 1,780,388 | |

| Amgen, Inc. | 5,051 | 1,274,872 | |

| Vertex Pharmaceuticals, Inc. (a) | 3,609 | 1,166,068 | |

| 4,221,328 | |||

| Health Care Equipment & Supplies - 0.6% | |||

| Lantheus Holdings, Inc. (a) | 14,278 | 820,985 | |

| Health Care Providers & Services - 4.6% | |||

| Cigna Corp. | 3,672 | 1,162,812 | |

| Elevance Health, Inc. | 2,423 | 1,211,476 | |

| McKesson Corp. | 2,625 | 994,035 | |

| UnitedHealth Group, Inc. | 4,839 | 2,415,580 | |

| 5,783,903 | |||

| Pharmaceuticals - 5.8% | |||

| Bristol-Myers Squibb Co. | 18,244 | 1,325,427 | |

| Eli Lilly & Co. | 5,103 | 1,756,197 | |

| Johnson & Johnson | 14,178 | 2,316,969 | |

| Merck & Co., Inc. | 17,439 | 1,873,123 | |

| 7,271,716 | |||

TOTAL HEALTH CARE | 18,097,932 | ||

| INDUSTRIALS - 8.9% | |||

| Aerospace & Defense - 3.7% | |||

| General Dynamics Corp. | 3,060 | 713,164 | |

| Huntington Ingalls Industries, Inc. | 2,452 | 540,764 | |

| L3Harris Technologies, Inc. | 3,077 | 661,001 | |

| Lockheed Martin Corp. | 1,995 | 924,204 | |

| Northrop Grumman Corp. | 1,587 | 711,039 | |

| Raytheon Technologies Corp. | 11,147 | 1,113,028 | |

| 4,663,200 | |||

| Building Products - 0.5% | |||

| Carlisle Companies, Inc. | 2,661 | 667,538 | |

| Commercial Services & Supplies - 1.1% | |||

| Republic Services, Inc. | 5,008 | 625,099 | |

| Waste Management, Inc. | 4,916 | 760,653 | |

| 1,385,752 | |||

| Construction & Engineering - 1.1% | |||

| Quanta Services, Inc. | 4,414 | 671,767 | |

| Willscot Mobile Mini Holdings (a) | 13,226 | 640,932 | |

| 1,312,699 | |||

| Machinery - 0.8% | |||

| Deere & Co. | 2,412 | 1,019,890 | |

| Professional Services - 0.4% | |||

| Booz Allen Hamilton Holding Corp. Class A | 5,661 | 535,757 | |

| Road & Rail - 0.8% | |||

| Union Pacific Corp. | 5,119 | 1,045,249 | |

| Trading Companies & Distributors - 0.5% | |||

| W.W. Grainger, Inc. | 1,110 | 654,323 | |

TOTAL INDUSTRIALS | 11,284,408 | ||

| INFORMATION TECHNOLOGY - 25.4% | |||

| IT Services - 8.3% | |||

| Amdocs Ltd. | 12,049 | 1,107,665 | |

| Automatic Data Processing, Inc. | 5,425 | 1,225,019 | |

| GoDaddy, Inc. (a) | 13,435 | 1,103,417 | |

| IBM Corp. | 10,136 | 1,365,623 | |

| Jack Henry & Associates, Inc. | 5,469 | 984,912 | |

| MasterCard, Inc. Class A | 6,027 | 2,233,606 | |

| Visa, Inc. Class A | 10,553 | 2,429,406 | |

| 10,449,648 | |||

| Semiconductors & Semiconductor Equipment - 1.6% | |||

| Enphase Energy, Inc. (a) | 3,638 | 805,380 | |

| onsemi (a) | 17,338 | 1,273,476 | |

| 2,078,856 | |||

| Software - 8.0% | |||

| Cadence Design Systems, Inc. (a) | 7,516 | 1,374,150 | |

| Microsoft Corp. | 30,581 | 7,578,278 | |

| Palo Alto Networks, Inc. (a) | 7,304 | 1,158,707 | |

| 10,111,135 | |||

| Technology Hardware, Storage & Peripherals - 7.5% | |||

| Apple, Inc. | 59,834 | 8,633,446 | |

| Super Micro Computer, Inc. (a) | 11,905 | 861,089 | |

| 9,494,535 | |||

TOTAL INFORMATION TECHNOLOGY | 32,134,174 | ||

| MATERIALS - 3.0% | |||

| Chemicals - 1.8% | |||

| Albemarle Corp. | 1,132 | 318,601 | |

| CF Industries Holdings, Inc. | 2,577 | 218,272 | |

| Corteva, Inc. | 5,473 | 352,735 | |

| FMC Corp. | 2,044 | 272,118 | |

| Linde PLC | 2,415 | 799,220 | |

| The Mosaic Co. | 5,256 | 260,382 | |

| 2,221,328 | |||

| Containers & Packaging - 0.2% | |||

| Amcor PLC | 23,615 | 284,797 | |

| Metals & Mining - 1.0% | |||

| ATI, Inc. (a) | 7,682 | 279,548 | |

| Nucor Corp. | 2,453 | 414,606 | |

| Reliance Steel & Aluminum Co. | 1,202 | 273,395 | |

| Steel Dynamics, Inc. | 2,767 | 333,811 | |

| 1,301,360 | |||

TOTAL MATERIALS | 3,807,485 | ||

| REAL ESTATE - 3.3% | |||

| Equity Real Estate Investment Trusts (REITs) - 3.3% | |||

| Agree Realty Corp. (b) | 2,732 | 203,889 | |

| American Tower Corp. | 2,462 | 549,986 | |

| Crown Castle International Corp. | 2,807 | 415,745 | |

| Gaming & Leisure Properties | 4,233 | 226,719 | |

| Host Hotels & Resorts, Inc. | 12,293 | 231,723 | |

| Iron Mountain, Inc. | 4,356 | 237,750 | |

| Omega Healthcare Investors, Inc. (b) | 6,103 | 179,672 | |

| Prologis (REIT), Inc. | 4,784 | 618,476 | |

| Public Storage | 1,156 | 351,817 | |

| Realty Income Corp. | 4,867 | 330,129 | |

| SBA Communications Corp. Class A | 994 | 295,745 | |

| VICI Properties, Inc. | 8,579 | 293,230 | |

| WP Carey, Inc. | 2,944 | 251,800 | |

| 4,186,681 | |||

| UTILITIES - 3.1% | |||

| Electric Utilities - 1.5% | |||

| American Electric Power Co., Inc. | 5,074 | 476,753 | |

| Constellation Energy Corp. | 4,219 | 360,134 | |

| Southern Co. | 8,206 | 555,382 | |

| Xcel Energy, Inc. | 6,372 | 438,202 | |

| 1,830,471 | |||

| Gas Utilities - 0.3% | |||

| South Jersey Industries, Inc. | 8,903 | 321,309 | |

| Multi-Utilities - 1.3% | |||

| CenterPoint Energy, Inc. | 12,560 | 378,307 | |

| Consolidated Edison, Inc. | 4,513 | 430,134 | |

| Sempra Energy | 3,004 | 481,631 | |

| WEC Energy Group, Inc. | 4,316 | 405,661 | |

| 1,695,733 | |||

TOTAL UTILITIES | 3,847,513 | ||

| TOTAL COMMON STOCKS (Cost $123,393,681) | 126,193,486 | ||

| Money Market Funds - 0.6% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 4.38% (c) | 169,440 | 169,474 | |

| Fidelity Securities Lending Cash Central Fund 4.38% (c)(d) | 597,740 | 597,800 | |

| TOTAL MONEY MARKET FUNDS (Cost $767,274) | 767,274 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.4% (Cost $124,160,955) | 126,960,760 |

NET OTHER ASSETS (LIABILITIES) - (0.4)% | (523,220) |

| NET ASSETS - 100.0% | 126,437,540 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME S&P 500 Index Contracts (United States) | 12 | Mar 2023 | 245,400 | 7,757 | 7,757 |

| The notional amount of futures purchased as a percentage of Net Assets is 0.2% | |||||

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 180,280 | 1,882,309 | 1,893,115 | 4,326 | - | - | 169,474 | 0.0% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 1,004,850 | 4,234,987 | 4,642,037 | 1,130 | - | - | 597,800 | 0.0% |

| Total | 1,185,130 | 6,117,296 | 6,535,152 | 5,456 | - | - | 767,274 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 9,542,942 | 9,542,942 | - | - |

Consumer Discretionary | 13,000,014 | 13,000,014 | - | - |

Consumer Staples | 7,998,774 | 7,998,774 | - | - |

Energy | 6,831,412 | 6,831,412 | - | - |

Financials | 15,462,151 | 15,462,151 | - | - |

Health Care | 18,097,932 | 18,097,932 | - | - |

Industrials | 11,284,408 | 11,284,408 | - | - |

Information Technology | 32,134,174 | 32,134,174 | - | - |

Materials | 3,807,485 | 3,807,485 | - | - |

Real Estate | 4,186,681 | 4,186,681 | - | - |

Utilities | 3,847,513 | 3,847,513 | - | - |

| Money Market Funds | 767,274 | 767,274 | - | - |

| Total Investments in Securities: | 126,960,760 | 126,960,760 | - | - |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 7,757 | 7,757 | - | - |

| Total Assets | 7,757 | 7,757 | - | - |

| Total Derivative Instruments: | 7,757 | 7,757 | - | - |

Primary Risk Exposure / Derivative Type | Value | |

| Asset ($) | Liability ($) | |

| Equity Risk | ||

Futures Contracts (a) | 7,757 | 0 |

| Total Equity Risk | 7,757 | 0 |

| Total Value of Derivatives | 7,757 | 0 |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $591,304) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $123,393,681) | $ | 126,193,486 | ||

Fidelity Central Funds (cost $767,274) | 767,274 | |||

| Total Investment in Securities (cost $124,160,955) | $ | 126,960,760 | ||

| Segregated cash with brokers for derivative instruments | 12,720 | |||

| Cash | 9,001 | |||

| Dividends receivable | 77,307 | |||

| Distributions receivable from Fidelity Central Funds | 927 | |||

| Receivable for daily variation margin on futures contracts | 3,450 | |||

Total assets | 127,064,165 | |||

| Liabilities | ||||

| Accrued management fee | $ | 28,825 | ||

| Collateral on securities loaned | 597,800 | |||

| Total Liabilities | 626,625 | |||

| Net Assets | $ | 126,437,540 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 150,337,023 | ||

| Total accumulated earnings (loss) | (23,899,483) | |||

| Net Assets | $ | 126,437,540 | ||

Net Asset Value , offering price and redemption price per share ($126,437,540 ÷ 2,850,000 shares) | $ | 44.36 | ||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 851,238 | ||

| Income from Fidelity Central Funds (including $1,130 from security lending) | 5,456 | |||

| Total Income | 856,694 | |||

| Expenses | ||||

| Management fee | $ | 164,363 | ||

| Independent trustees' fees and expenses | 196 | |||

| Total expenses before reductions | 164,559 | |||

| Expense reductions | (161) | |||

| Total expenses after reductions | 164,398 | |||

| Net Investment income (loss) | 692,296 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (2,243,567) | |||

| Redemptions in-kind | 2,087,253 | |||

| Futures contracts | (12,913) | |||

| Total net realized gain (loss) | (169,227) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (4,006,950) | |||

| Futures contracts | (9,861) | |||

| Total change in net unrealized appreciation (depreciation) | (4,016,811) | |||

| Net gain (loss) | (4,186,038) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (3,493,742) | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 692,296 | $ | 1,047,146 |

| Net realized gain (loss) | (169,227) | 9,388,516 | ||

| Change in net unrealized appreciation (depreciation) | (4,016,811) | (18,448,115) | ||

| Net increase (decrease) in net assets resulting from operations | (3,493,742) | (8,012,453) | ||

| Distributions to shareholders | (733,100) | (999,550) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 31,289,503 | 86,253,555 | ||

| Cost of shares redeemed | (17,373,490) | (117,256,850) | ||

Net increase (decrease) in net assets resulting from share transactions | 13,916,013 | (31,003,295) | ||

| Total increase (decrease) in net assets | 9,689,171 | (40,015,298) | ||

| Net Assets | ||||

| Beginning of period | 116,748,369 | 156,763,667 | ||

| End of period | $ | 126,437,540 | $ | 116,748,369 |

| Other Information | ||||

| Shares | ||||

| Sold | 700,000 | 1,700,000 | ||

| Redeemed | (400,000) | (2,300,000) | ||

| Net increase (decrease) | 300,000 | (600,000) | ||

| Fidelity® Momentum Factor ETF |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 45.78 | $ | 49.77 | $ | 39.26 | $ | 35.80 | $ | 33.58 | $ | 28.60 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .27 | .43 | .25 | .42 | .40 | .36 | ||||||

| Net realized and unrealized gain (loss) | (1.41) | (4.01) | 10.54 | 3.47 | 2.22 | 4.97 | ||||||

| Total from investment operations | (1.14) | (3.58) | 10.79 | 3.89 | 2.62 | 5.33 | ||||||