UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant’s telephone number, including area code: 617-563-7000

Date of fiscal year end: August 31

Date of reporting period: February 28, 2021

| Item 1. | Reports to Stockholders |

| Semi-Annual Report | 3 |

| 4 | Semi-Annual Report |

| (by issuer, excluding cash equivalents) | % of fund’s net assets |

| Occidental Petroleum Corp. | 2.2 |

| SBA Communications Corp. | 2.1 |

| TransDigm, Inc. | 2.0 |

| Kraft Heinz Foods Co. | 1.4 |

| TriNet Group Inc. | 1.6 |

| 9.3 |

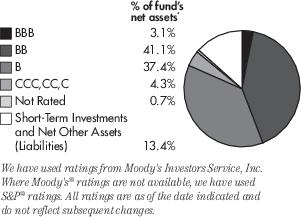

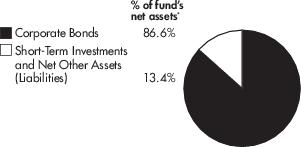

| % of fund's net assets | ||

| Energy | 13.5 | |

| Industrials | 11.7 | |

| Consumer Discretionary | 11.0 | |

| Communication Services | 10.2 | |

| Materials | 10.2 | |

| Semi-Annual Report | 5 |

| Nonconvertible Bonds – 86.6% | ||

| Principal Amount | Value | |

| COMMUNICATION SERVICES – 10.2% | ||

| Diversified Telecommunication Services – 1.2% | ||

| Frontier Communications Corp. 5.00% 5/1/28 (a) | $ 407,000 | $ 419,088 |

| Level 3 Financing, Inc. 3.75% 7/15/29 (a) | 290,000 | 289,275 |

| Lumen Technologies, Inc.: | ||

4.50% 1/15/29 (a) | 1,140,000 | 1,138,575 |

5.625% 4/1/25 | 37,000 | 39,634 |

5.80% 3/15/22 | 36,000 | 37,319 |

| Telecom Italia Capital SA 7.721% 6/4/38 | 458,000 | 613,171 |

| 2,537,062 | ||

| Entertainment – 0.7% | ||

| Live Nation Entertainment, Inc. 4.875% 11/1/24 (a) | 1,414,000 | 1,430,091 |

| Interactive Media & Services – 1.5% | ||

| Match Group, Inc.: | ||

4.125% 8/1/30 (a) | 270,000 | 279,112 |

4.625% 6/1/28 (a) | 1,309,000 | 1,358,978 |

| TripAdvisor, Inc. 7.00% 7/15/25 (a) | 1,437,000 | 1,546,571 |

| 3,184,661 | ||

| Media – 5.8% | ||

| Cable One, Inc. 4.00% 11/15/30 (a) | 2,003,000 | 2,003,000 |

| CCO Holdings LLC / CCO Holdings Capital Corp. 4.50% 5/1/32 (a) | 2,645,000 | 2,716,944 |

| Cimpress PLC 7.00% 6/15/26 (a) | 650,000 | 685,555 |

| Diamond Sports Group LLC / Diamond Sports Finance Co.: | ||

5.375% 8/15/26 (a) | 400,000 | 282,880 |

6.625% 8/15/27 (a) | 40,000 | 20,600 |

12.75% 12/1/26 (a) | 140,000 | 121,800 |

| DISH DBS Corp.: | ||

5.875% 11/15/24 | 441,000 | 461,983 |

7.375% 7/1/28 | 1,106,000 | 1,159,226 |

| Lamar Media Corp.: | ||

3.625% 1/15/31 (a) | 2,000,000 | 1,976,260 |

4.875% 1/15/29 | 128,000 | 134,721 |

| Liberty Interactive LLC 8.25% 2/1/30 | 124,000 | 144,615 |

| Nexstar Broadcasting, Inc. 4.75% 11/1/28 (a) | 1,924,000 | 1,964,885 |

| Scripps Escrow II, Inc. 3.875% 1/15/29 (a) | 145,000 | 142,408 |

| | ||

| Principal Amount | Value | |

| Virgin Media Vendor Financing Notes IV DAC 5.00% 7/15/28 (a) | $ 250,000 | $256,028 |

| Windstream Escrow LLC / Windstream Escrow Finance Corp. 7.75% 8/15/28 (a) | 251,000 | 256,961 |

| 12,327,866 | ||

| Wireless Telecommunication Services – 1.0% | ||

| Sprint Corp.: | ||

7.125% 6/15/24 | 396,000 | 455,974 |

7.625% 3/1/26 | 940,000 | 1,154,207 |

7.875% 9/15/23 | 333,000 | 384,465 |

| T-Mobile USA, Inc. 6.50% 1/15/26 | 41,000 | 42,282 |

| Vodafone Group PLC 7.00% 4/4/79 (b) | 134,000 | 160,604 |

| 2,197,532 | ||

| TOTAL COMMUNICATION SERVICES | 21,677,212 | |

| CONSUMER DISCRETIONARY – 11.0% | ||

| Auto Components – 0.0% | ||

| The Goodyear Tire & Rubber Co. 9.50% 5/31/25 | 57,000 | 64,048 |

| Automobiles – 1.2% | ||

| Ford Motor Co.: | ||

4.75% 1/15/43 | 35,000 | 35,403 |

6.375% 2/1/29 | 300,000 | 341,625 |

7.45% 7/16/31 | 59,000 | 76,479 |

8.50% 4/21/23 | 86,000 | 96,213 |

9.625% 4/22/30 | 713,000 | 1,008,681 |

| Ford Motor Credit Co. LLC: | ||

2.90% 2/16/28 | 170,000 | 168,300 |

2.979% 8/3/22 | 150,000 | 151,516 |

3.664% 9/8/24 | 164,000 | 168,859 |

4.00% 11/13/30 | 115,000 | 117,587 |

4.25% 9/20/22 | 267,000 | 275,010 |

| Winnebago Industries, Inc. 6.25% 7/15/28 (a) | 128,000 | 138,240 |

| 2,577,913 | ||

| Diversified Consumer Services – 0.7% | ||

| Adtalem Global Education, Inc. 5.50% 3/1/28 (a)(c) | 1,500,000 | 1,492,950 |

| Hotels, Restaurants & Leisure – 4.6% | ||

| 1011778 BC ULC / New Red Finance, Inc. 4.00% 10/15/30 (a) | 645,000 | 627,263 |

| Affinity Gaming 6.875% 12/15/27 (a) | 60,000 | 63,600 |

| Bally's Corp. 6.75% 6/1/27 (a) | 650,000 | 695,858 |

| 6 | Semi-Annual Report |

| Nonconvertible Bonds – continued | ||

| Principal Amount | Value | |

| CONSUMER DISCRETIONARY – continued | ||

| Hotels, Restaurants & Leisure – continued | ||

| Caesars Entertainment, Inc. 6.25% 7/1/25 (a) | $ 571,000 | $ 604,543 |

| Carnival Corp. 5.75% 3/1/27 (a) | 1,000,000 | 1,015,000 |

| Churchill Downs, Inc. 4.75% 1/15/28 (a) | 1,437,000 | 1,491,707 |

| Full House Resorts, Inc. 8.25% 2/15/28 (a) | 300,000 | 318,000 |

| Hilton Domestic Operating Co., Inc. 3.75% 5/1/29 (a) | 1,085,000 | 1,103,770 |

| MGM Resorts International 4.75% 10/15/28 | 51,000 | 53,081 |

| NCL Corp. Ltd.: | ||

5.875% 3/15/26 (a) | 90,000 | 90,432 |

10.25% 2/1/26 (a) | 276,000 | 320,850 |

| Royal Caribbean Cruises Ltd.: | ||

9.125% 6/15/23 (a) | 222,000 | 243,645 |

11.50% 6/1/25 (a) | 281,000 | 329,121 |

| SeaWorld Parks & Entertainment, Inc. 9.50% 8/1/25 (a) | 128,000 | 138,565 |

| Travel + Leisure Co.: | ||

3.90% 3/1/23 | 65,000 | 66,300 |

6.60% 10/1/25 | 114,000 | 127,965 |

| Vail Resorts, Inc. 6.25% 5/15/25 (a) | 1,540,000 | 1,644,566 |

| Viking Ocean Cruises Ship VII Ltd. 5.625% 2/15/29 (a) | 70,000 | 70,455 |

| Wyndham Hotels & Resorts, Inc. 4.375% 8/15/28 (a) | 433,000 | 441,660 |

| Wynn Las Vegas LLC / Wynn Las Vegas Capital Corp. 5.50% 3/1/25 (a) | 75,000 | 79,500 |

| Wynn Resorts Finance LLC / Wynn Resorts Capital Corp. 7.75% 4/15/25 (a) | 34,000 | 36,897 |

| Yum! Brands, Inc.: | ||

4.75% 1/15/30 (a) | 100,000 | 104,340 |

7.75% 4/1/25 (a) | 40,000 | 43,892 |

| 9,711,010 | ||

| Internet & Direct Marketing Retail – 0.1% | ||

| Netflix, Inc.: | ||

4.875% 4/15/28 | 60,000 | 68,223 |

5.875% 2/15/25 | 136,000 | 155,964 |

| 224,187 | ||

| Leisure Products – 0.4% | ||

| Vista Outdoor, Inc. 4.50% 3/15/29 (a)(c) | 800,000 | 793,120 |

| | ||

| Principal Amount | Value | |

| Multiline Retail – 0.1% | ||

| Nordstrom, Inc. 5.00% 1/15/44 | $ 200,000 | $ 192,054 |

| Specialty Retail – 3.2% | ||

| Asbury Automotive Group, Inc. 4.75% 3/1/30 | 1,414,000 | 1,481,165 |

| Burlington Coat Factory Warehouse Corp. 6.25% 4/15/25 (a) | 35,000 | 37,100 |

| Carvana Co.: | ||

5.625% 10/1/25 (a) | 650,000 | 677,625 |

5.875% 10/1/28 (a) | 690,000 | 726,225 |

| Foundation Building Materials, Inc. 6.00% 3/1/29 (a) | 120,000 | 119,700 |

| L Brands, Inc.: | ||

7.50% 6/15/29 | 1,503,000 | 1,698,390 |

9.375% 7/1/25 (a) | 510,000 | 631,125 |

| LSF9 Atlantis Holdings LLC / Victra Finance Corp. 7.75% 2/15/26 (a) | 300,000 | 306,711 |

| Macy's Retail Holdings LLC 3.625% 6/1/24 | 475,000 | 471,437 |

| Murphy Oil USA, Inc.: | ||

3.75% 2/15/31 (a) | 75,000 | 74,906 |

4.75% 9/15/29 | 40,000 | 42,900 |

| Party City Holdings, Inc. 8.75% 2/15/26 (a) | 90,000 | 91,800 |

| PetSmart, Inc. / PetSmart Finance Corp. 4.75% 2/15/28 (a) | 145,000 | 149,953 |

| QVC, Inc. 5.95% 3/15/43 | 93,000 | 95,790 |

| Specialty Building Products Holdings LLC / SBP Finance Corp. 6.375% 9/30/26 (a) | 85,000 | 88,188 |

| 6,693,015 | ||

| Textiles, Apparel & Luxury Goods – 0.7% | ||

| The William Carter Co. 5.50% 5/15/25 (a) | 1,437,000 | 1,516,035 |

| TOTAL CONSUMER DISCRETIONARY | 23,264,332 | |

| CONSUMER STAPLES – 3.6% | ||

| Food Products – 2.4% | ||

| Albertsons Cos., Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC 3.50% 3/15/29 (a) | 115,000 | 110,486 |

| C&S Group Enterprises LLC 5.00% 12/15/28 (a) | 110,000 | 108,075 |

| Kraft Heinz Foods Co.: | ||

3.00% 6/1/26 | 83,000 | 88,085 |

3.75% 4/1/30 | 247,000 | 269,935 |

| Semi-Annual Report | 7 |

| Nonconvertible Bonds – continued | ||

| Principal Amount | Value | |

| CONSUMER STAPLES – continued | ||

| Food Products – continued | ||

3.875% 5/15/27 | $ 25,000 | $ 27,327 |

3.95% 7/15/25 | 452,000 | 502,721 |

4.25% 3/1/31 | 38,000 | 42,663 |

4.375% 6/1/46 | 439,000 | 478,278 |

4.625% 1/30/29 | 740,000 | 857,333 |

4.875% 10/1/49 | 960,000 | 1,120,334 |

| Post Holdings, Inc.: | ||

4.50% 9/15/31 (a)(c) | 505,000 | 503,737 |

4.625% 4/15/30 (a) | 520,000 | 527,800 |

5.00% 8/15/26 (a) | 134,000 | 139,829 |

| Simmons Foods, Inc. / Simmons Prepared Foods, Inc. / Simmons Pet Food, Inc. / Simmons Feed 4.625% 3/1/29 (a)(c) | 130,000 | 131,677 |

| US Foods, Inc. 4.75% 2/15/29 (a) | 240,000 | 243,394 |

| 5,151,674 | ||

| Household Products – 0.1% | ||

| Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.: | ||

5.00% 12/31/26 (a) | 35,000 | 36,039 |

7.00% 12/31/27 (a) | 45,000 | 44,539 |

| Spectrum Brands, Inc. 3.875% 3/15/31 (a)(c) | 130,000 | 128,504 |

| 209,082 | ||

| Personal Products – 0.1% | ||

| Prestige Brands, Inc. 3.75% 4/1/31 (a)(c) | 255,000 | 248,676 |

| Tobacco – 1.0% | ||

| Turning Point Brands, Inc. 5.625% 2/15/26 (a) | 2,000,000 | 2,070,000 |

| TOTAL CONSUMER STAPLES | 7,679,432 | |

| ENERGY – 13.5% | ||

| Energy Equipment & Services – 0.6% | ||

| Bristow Group, Inc. 6.875% 3/1/28 (a) | 300,000 | 302,625 |

| DCP Midstream Operating LP 5.125% 5/15/29 | 256,000 | 271,288 |

| TechnipFMC PLC 6.50% 2/1/26 (a) | 600,000 | 627,031 |

| Tervita Corp. 11.00% 12/1/25 (a) | 18,000 | 19,440 |

| USA Compression Partners LP / USA Compression Finance Corp. 6.875% 4/1/26 | 49,000 | 50,593 |

| 1,270,977 | ||

| | ||

| Principal Amount | Value | |

| Oil, Gas & Consumable Fuels – 12.9% | ||

| Aethon United BR LP / Aethon United Finance Corp. 8.25% 2/15/26 (a) | $ 85,000 | $ 88,400 |

| Aker BP ASA 4.75% 6/15/24 (a) | 500,000 | 516,510 |

| Antero Midstream Partners LP / Antero Midstream Finance Corp. 5.375% 9/15/24 | 650,000 | 654,875 |

| Antero Resources Corp. 8.375% 7/15/26 (a) | 400,000 | 437,500 |

| Apache Corp.: | ||

4.375% 10/15/28 | 50,000 | 50,750 |

4.875% 11/15/27 | 1,305,000 | 1,367,888 |

| Ascent Resources Utica Holdings LLC / ARU Finance Corp. 8.25% 12/31/28 (a) | 400,000 | 416,000 |

| Buckeye Partners LP: | ||

3.95% 12/1/26 | 156,000 | 154,833 |

4.125% 3/1/25 (a) | 100,000 | 101,813 |

4.50% 3/1/28 (a) | 230,000 | 232,875 |

5.85% 11/15/43 | 100,000 | 100,311 |

| California Resources Corp. 7.125% 2/1/26 (a) | 290,000 | 290,181 |

| Cenovus Energy, Inc. 5.375% 7/15/25 | 1,437,000 | 1,627,039 |

| Cheniere Energy Partners Co. 4.00% 3/1/31 (c) | 300,000 | 302,349 |

| Cheniere Energy Partners LP 5.25% 10/1/25 | 327,000 | 336,091 |

| Chesapeake Energy Corp. 5.875% 2/1/29 (a) | 180,000 | 192,154 |

| CITGO Petroleum Corp.: | ||

6.375% 6/15/26 (a) | 215,000 | 218,225 |

7.00% 6/15/25 (a) | 374,000 | 385,609 |

| CNX Resources Corp. 6.00% 1/15/29 (a) | 70,000 | 73,238 |

| Colgate Energy Partners III LLC 7.75% 2/15/26 (a) | 300,000 | 292,875 |

| Comstock Resources, Inc.: | ||

6.75% 3/1/29 (a)(c) | 250,000 | 259,375 |

9.75% 8/15/26 | 501,000 | 544,837 |

| Continental Resources, Inc. 5.75% 1/15/31 (a) | 347,000 | 391,142 |

| Crestwood Midstream Partners LP / Crestwood Midstream Finance Corp. 6.00% 2/1/29 (a) | 275,000 | 272,079 |

| CVR Energy, Inc. 5.75% 2/15/28 (a) | 366,000 | 362,646 |

| DCP Midstream LP 7.375% (b)(d) | 153,000 | 133,110 |

| 8 | Semi-Annual Report |

| Nonconvertible Bonds – continued | ||

| Principal Amount | Value | |

| ENERGY – continued | ||

| Oil, Gas & Consumable Fuels – continued | ||

| EnLink Midstream LLC 5.625% 1/15/28 (a) | $ 70,000 | $ 70,613 |

| EnLink Midstream Partners LP 5.45% 6/1/47 | 315,000 | 260,662 |

| Enviva Partners LP / Enviva Partners Finance Corp. 6.50% 1/15/26 (a) | 222,000 | 232,268 |

| EQM Midstream Partners LP: | ||

4.50% 1/15/29 (a) | 400,000 | 387,750 |

4.75% 1/15/31 (a) | 400,000 | 385,500 |

6.50% 7/15/48 | 25,000 | 23,625 |

| EQT Corp.: | ||

5.00% 1/15/29 | 240,000 | 262,800 |

8.50% 2/1/30 | 171,000 | 223,658 |

| Genesis Energy LP / Genesis Energy Finance Corp. 8.00% 1/15/27 | 170,000 | 172,550 |

| Hess Midstream Operations LP 5.125% 6/15/28 (a) | 146,000 | 150,380 |

| Hilcorp Energy I LP / Hilcorp Finance Co. 6.00% 2/1/31 (a) | 500,000 | 508,140 |

| Holly Energy Partners LP / Holly Energy Finance Corp. 5.00% 2/1/28 (a) | 65,000 | 65,485 |

| MEG Energy Corp. 5.875% 2/1/29 (a) | 330,000 | 335,049 |

| Murphy Oil Corp.: | ||

5.75% 8/15/25 | 200,000 | 198,000 |

5.875% 12/1/27 | 110,000 | 108,350 |

| New Fortress Energy, Inc. 6.75% 9/15/25 (a) | 1,308,000 | 1,357,312 |

| NGL Energy Operating LLC / NGL Energy Finance Corp. 7.50% 2/1/26 (a) | 300,000 | 309,304 |

| Northern Oil and Gas, Inc. 8.125% 3/1/28 (a) | 200,000 | 197,190 |

| NuStar Logistics LP 6.375% 10/1/30 | 225,000 | 248,672 |

| Occidental Petroleum Corp.: | ||

6.125% 1/1/31 | 770,000 | 860,244 |

6.625% 9/1/30 | 2,001,000 | 2,276,137 |

8.50% 7/15/27 | 1,161,000 | 1,389,955 |

| Ovintiv, Inc. 6.50% 8/15/34 | 540,000 | 673,643 |

| Parkland Fuel Corp. 5.875% 7/15/27 (a) | 512,000 | 544,000 |

| | ||

| Principal Amount | Value | |

| PBF Holding Co. LLC / PBF Finance Corp.: | ||

6.00% 2/15/28 | $ 315,000 | $ 200,025 |

9.25% 5/15/25 (a) | 170,000 | 165,699 |

| PBF Logistics LP / PBF Logistics Finance Corp. 6.875% 5/15/23 | 872,000 | 848,020 |

| PDC Energy, Inc. 6.125% 9/15/24 | 866,000 | 884,801 |

| Range Resources Corp.: | ||

5.00% 3/15/23 | 211,000 | 212,055 |

8.25% 1/15/29 (a) | 400,000 | 429,880 |

| Rockies Express Pipeline LLC 4.80% 5/15/30 (a) | 45,000 | 46,580 |

| Southwestern Energy Co. 7.75% 10/1/27 | 300,000 | 321,000 |

| Sunoco LP / Sunoco Finance Corp. 4.50% 5/15/29 (a) | 301,000 | 301,000 |

| Tallgrass Energy Partners LP / Tallgrass Energy Finance Corp. 6.00% 12/31/30 (a) | 600,000 | 596,760 |

| Talos Production, Inc. 12.00% 1/15/26 (a) | 400,000 | 378,000 |

| Targa Resources Partners LP / Targa Resources Partners Finance Corp. 4.00% 1/15/32 (a) | 340,000 | 333,268 |

| Warrior Met Coal, Inc. 8.00% 11/1/24 (a) | 1,183,000 | 1,218,490 |

| Western Midstream Operating LP 6.50% 2/1/50 | 365,000 | 420,009 |

| 27,399,579 | ||

| TOTAL ENERGY | 28,670,556 | |

| FINANCIALS – 6.2% | ||

| Capital Markets – 1.1% | ||

| LPL Holdings, Inc. 4.625% 11/15/27 (a) | 2,226,000 | 2,276,753 |

| Consumer Finance – 2.2% | ||

| Credit Acceptance Corp. 6.625% 3/15/26 | 371,000 | 387,695 |

| Enova International, Inc. 8.50% 9/15/25 (a) | 50,000 | 51,250 |

| FirstCash, Inc. 4.625% 9/1/28 (a) | 350,000 | 363,622 |

| Ford Motor Credit Co. LLC: | ||

3.087% 1/9/23 | 325,000 | 329,777 |

5.125% 6/16/25 | 190,000 | 205,200 |

| goeasy Ltd. 5.375% 12/1/24 (a) | 582,000 | 602,370 |

| Navient Corp. 4.875% 3/15/28 | 500,000 | 481,785 |

| Semi-Annual Report | 9 |

| Nonconvertible Bonds – continued | ||

| Principal Amount | Value | |

| FINANCIALS – continued | ||

| Consumer Finance – continued | ||

| OneMain Finance Corp. 4.00% 9/15/30 | $ 1,000,000 | $ 970,710 |

| PennyMac Financial Services, Inc. 5.375% 10/15/25 (a) | 30,000 | 31,350 |

| PRA Group, Inc. 7.375% 9/1/25 (a) | 1,161,000 | 1,238,253 |

| 4,662,012 | ||

| Diversified Financial Services – 2.1% | ||

| Deutsche Bank AG: | ||

3.729% 1/14/32 (b) | 100,000 | 99,489 |

4.296% 5/24/28 (b) | 65,000 | 66,759 |

4.875% 12/1/32 (b) | 134,000 | 142,576 |

| Global Aircraft Leasing Co. Ltd. 6.50% 9/15/24 (a) | 92,000 | 85,385 |

| Icahn Enterprises LP / Icahn Enterprises Finance Corp.: | ||

4.375% 2/1/29 (a) | 190,000 | 189,943 |

4.75% 9/15/24 | 1,012,000 | 1,063,865 |

6.25% 5/15/26 | 857,000 | 900,673 |

| PHH Mortgage Corp. 7.875% 3/15/26 | 300,000 | 306,000 |

| StoneX Group, Inc. 8.625% 6/15/25 (a) | 1,351,000 | 1,435,438 |

| UniCredit SpA 7.296% 4/2/34 (a)(b) | 228,000 | 270,841 |

| 4,560,969 | ||

| Thrifts & Mortgage Finance – 0.8% | ||

| NMI Holdings, Inc. 7.375% 6/1/25 (a) | 1,437,000 | 1,623,810 |

| TOTAL FINANCIALS | 13,123,544 | |

| HEALTH CARE – 8.7% | ||

| Biotechnology – 0.0% | ||

| Emergent BioSolutions, Inc. 3.875% 8/15/28 (a) | 70,000 | 70,984 |

| Health Care Providers & Services – 6.1% | ||

| Akumin, Inc. 7.00% 11/1/25 (a) | 1,000,000 | 1,045,000 |

| AMN Healthcare, Inc. 4.00% 4/15/29 (a) | 1,315,000 | 1,337,618 |

| Centene Corp. 2.50% 3/1/31 | 800,000 | 776,016 |

| CHS / Community Health Systems, Inc.: | ||

4.75% 2/15/31 (a) | 225,000 | 220,642 |

6.875% 4/15/29 (a) | 220,000 | 225,819 |

| DaVita, Inc. 3.75% 2/15/31 (a) | 819,000 | 780,462 |

| | ||

| Principal Amount | Value | |

| Encompass Health Corp. 4.75% 2/1/30 | $ 1,501,000 | $ 1,587,863 |

| HCA, Inc.: | ||

3.50% 9/1/30 | 520,000 | 541,046 |

5.375% 2/1/25 | 155,000 | 173,987 |

5.875% 2/15/26 | 239,000 | 276,272 |

| ModivCare, Inc 5.875% 11/15/25 (a) | 935,000 | 991,100 |

| Molina Healthcare, Inc.: | ||

4.375% 6/15/28 (a) | 3,079,000 | 3,202,160 |

5.375% 11/15/22 | 44,000 | 46,475 |

| Tenet Healthcare Corp. 6.125% 10/1/28 (a) | 1,660,000 | 1,747,482 |

| 12,951,942 | ||

| Life Sciences Tools & Services – 0.1% | ||

| IQVIA, Inc. 5.00% 5/15/27 (a) | 200,000 | 209,250 |

| Pharmaceuticals – 2.5% | ||

| Bausch Health Cos., Inc. 5.00% 2/15/29 (a) | 630,000 | 637,088 |

| Catalent Pharma Solutions, Inc. 3.125% 2/15/29 (a) | 2,000,000 | 1,975,960 |

| Syneos Health, Inc. 3.625% 1/15/29 (a) | 2,175,000 | 2,131,500 |

| US Acute Care Solutions LLC 6.375% 3/1/26 (a) | 500,000 | 516,250 |

| 5,260,798 | ||

| TOTAL HEALTH CARE | 18,492,974 | |

| INDUSTRIALS – 11.7% | ||

| Aerospace & Defense – 2.3% | ||

| Howmet Aerospace, Inc. 6.75% 1/15/28 | 238,000 | 282,625 |

| Spirit AeroSystems, Inc. 5.50% 1/15/25 (a) | 39,000 | 40,549 |

| TransDigm, Inc.: | ||

4.625% 1/15/29 (a) | 280,000 | 275,450 |

6.25% 3/15/26 (a) | 3,682,000 | 3,880,423 |

8.00% 12/15/25 (a) | 315,000 | 342,956 |

| 4,822,003 | ||

| Airlines – 0.3% | ||

| American Airlines, Inc. 11.75% 7/15/25 (a) | 314,000 | 374,052 |

| Delta Air Lines, Inc. 7.375% 1/15/26 | 143,000 | 167,484 |

| United Airlines Holdings, Inc. 4.875% 1/15/25 | 25,000 | 25,614 |

| 567,150 | ||

| 10 | Semi-Annual Report |

| Nonconvertible Bonds – continued | ||

| Principal Amount | Value | |

| INDUSTRIALS – continued | ||

| Building Products – 0.5% | ||

| PGT Innovations, Inc. 6.75% 8/1/26 (a) | $ 1,000,000 | $ 1,060,000 |

| Commercial Services & Supplies – 2.0% | ||

| Avis Budget Car Rental LLC / Avis Budget Finance, Inc. 5.75% 7/15/27 (a) | 276,000 | 284,970 |

| GFL Environmental, Inc. 3.75% 8/1/25 (a) | 2,893,000 | 2,947,244 |

| Legends Hospitality Holding Co. LLC / Legends Hospitality Co-Issuer, Inc. 5.00% 2/1/26 (a) | 100,000 | 101,750 |

| Nielsen Finance LLC / Nielsen Finance Co. 5.00% 4/15/22 (a) | 150,000 | 150,390 |

| Rent-A-Center, Inc. 6.375% 2/15/29 (a) | 55,000 | 57,206 |

| Ritchie Bros Auctioneers, Inc. 5.375% 1/15/25 (a) | 153,000 | 157,207 |

| Shift4 Payments LLC / Shift4 Payments Finance Sub, Inc. 4.625% 11/1/26 (a) | 510,000 | 533,358 |

| 4,232,125 | ||

| Construction & Engineering – 1.6% | ||

| Fluor Corp. 4.25% 9/15/28 | 208,000 | 212,160 |

| MasTec, Inc. 4.50% 8/15/28 (a) | 110,000 | 114,972 |

| PowerTeam Services LLC 9.033% 12/4/25 (a) | 105,000 | 116,288 |

| TopBuild Corp. 3.625% 3/15/29 (a)(c) | 3,000,000 | 3,011,250 |

| 3,454,670 | ||

| Electrical Equipment – 0.7% | ||

| EnerSys 4.375% 12/15/27 (a) | 1,437,000 | 1,516,035 |

| Machinery – 0.6% | ||

| ATS Automation Tooling Systems, Inc. 4.125% 12/15/28 (a) | 140,000 | 141,582 |

| Meritor, Inc. 6.25% 6/1/25 (a) | 391,000 | 416,415 |

| RBS Global, Inc. / Rexnord LLC 4.875% 12/15/25 (a) | 281,000 | 288,376 |

| United Rentals North America, Inc. 5.875% 9/15/26 | 442,000 | 464,516 |

| 1,310,889 | ||

| Marine – 0.1% | ||

| Danaos Corp. 8.50% 3/1/28 (a) | 300,000 | 308,250 |

| | ||

| Principal Amount | Value | |

| Professional Services – 1.7% | ||

| ASGN, Inc. 4.625% 5/15/28 (a) | $ 270,000 | $281,475 |

| TriNet Group, Inc. 3.50% 3/1/29 (a) | 3,325,000 | 3,295,906 |

| 3,577,381 | ||

| Road & Rail – 0.8% | ||

| Uber Technologies, Inc.: | ||

6.25% 1/15/28 (a) | 131,000 | 140,039 |

7.50% 5/15/25 (a) | 1,437,000 | 1,544,790 |

| 1,684,829 | ||

| Trading Companies & Distributors – 1.1% | ||

| Fortress Transportation and Infrastructure Investors LLC: | ||

6.50% 10/1/25 (a) | 1,500,000 | 1,560,608 |

9.75% 8/1/27 (a) | 709,000 | 808,756 |

| H&E Equipment Services Co. 3.875% 12/15/28 (a) | 24,000 | 23,100 |

| 2,392,464 | ||

| TOTAL INDUSTRIALS | 24,925,796 | |

| INFORMATION TECHNOLOGY – 7.4% | ||

| Electronic Equipment, Instruments & Components – 0.1% | ||

| TTM Technologies, Inc. 4.00% 3/1/29 (a)(c) | 255,000 | 257,869 |

| IT Services – 2.3% | ||

| Arches Buyer, Inc. 4.25% 6/1/28 (a) | 95,000 | 95,791 |

| Booz Allen Hamilton, Inc. 3.875% 9/1/28 (a) | 363,000 | 371,805 |

| Gartner, Inc. 4.50% 7/1/28 (a) | 516,000 | 541,800 |

| Go Daddy Operating Co. LLC / GD Finance Co., Inc. 3.50% 3/1/29 (a) | 500,000 | 496,875 |

| Northwest Fiber LLC / Northwest Fiber Finance Sub, Inc. 6.00% 2/15/28 (a) | 65,000 | 65,406 |

| Science Applications International Corp. 4.875% 4/1/28 (a) | 2,165,000 | 2,257,012 |

| Unisys Corp. 6.875% 11/1/27 (a) | 885,000 | 973,500 |

| 4,802,189 | ||

| Semiconductors & Semiconductor Equipment – 0.7% | ||

| Microchip Technology, Inc. 4.25% 9/1/25 (a) | 1,437,000 | 1,507,824 |

| Software – 3.2% | ||

| Fair Isaac Corp. 4.00% 6/15/28 (a) | 3,018,000 | 3,122,725 |

| Semi-Annual Report | 11 |

| Nonconvertible Bonds – continued | ||

| Principal Amount | Value | |

| INFORMATION TECHNOLOGY – continued | ||

| Software – continued | ||

| J2 Global, Inc. 4.625% 10/15/30 (a) | $ 845,000 | $ 876,772 |

| Open Text Corp. 3.875% 2/15/28 (a) | 256,000 | 260,160 |

| PTC, Inc.: | ||

3.625% 2/15/25 (a) | 325,000 | 332,719 |

4.00% 2/15/28 (a) | 55,000 | 56,581 |

| Rackspace Technology Global, Inc. 3.50% 2/15/28 (a) | 500,000 | 490,315 |

| SS&C Technologies, Inc. 5.50% 9/30/27 (a) | 872,000 | 921,155 |

| Veritas US Inc. / Veritas Bermuda Ltd. 7.50% 9/1/25 (a) | 630,000 | 652,995 |

| ZoomInfo Technologies LLC / ZoomInfo Finance Corp. 3.875% 2/1/29 (a) | 115,000 | 114,137 |

| 6,827,559 | ||

| Technology Hardware, Storage & Peripherals – 1.1% | ||

| EMC Corp. 3.375% 6/1/23 | 50,000 | 51,537 |

| NCR Corp.: | ||

5.25% 10/1/30 (a) | 110,000 | 114,400 |

8.125% 4/15/25 (a) | 117,000 | 127,371 |

| Seagate HDD Cayman: | ||

3.125% 7/15/29 (a) | 1,051,000 | 1,007,236 |

3.375% 7/15/31 (a) | 1,051,000 | 1,022,728 |

| 2,323,272 | ||

| TOTAL INFORMATION TECHNOLOGY | 15,718,713 | |

| MATERIALS – 10.2% | ||

| Chemicals – 3.5% | ||

| Axalta Coating Systems LLC 3.375% 2/15/29 (a) | 600,000 | 582,000 |

| GPD Cos., Inc. 10.125% 4/1/26 (a) | 200,000 | 220,750 |

| INEOS Quattro Finance 2 PLC 3.375% 1/15/26 (a) | 500,000 | 498,750 |

| Ingevity Corp. 3.875% 11/1/28 (a) | 955,000 | 945,455 |

| Methanex Corp. 5.65% 12/1/44 | 134,000 | 138,020 |

| Minerals Technologies, Inc. 5.00% 7/1/28 (a) | 260,000 | 271,089 |

| Olin Corp. 5.125% 9/15/27 | 89,000 | 92,286 |

| SBA Communications Corp. 3.875% 2/15/27 | 4,349,000 | 4,507,869 |

| | ||

| Principal Amount | Value | |

| The Scotts Miracle-Gro Co. 4.50% 10/15/29 | $ 135,000 | $ 143,147 |

| 7,399,366 | ||

| Construction Materials – 0.4% | ||

| Forterra Finance LLC / FRTA Finance Corp. 6.50% 7/15/25 (a) | 709,000 | 762,175 |

| Containers & Packaging – 0.5% | ||

| Ardagh Metal Packaging 4.00% 9/1/29 (c) | 500,000 | 501,875 |

| Intertape Polymer Group, Inc. 7.00% 10/15/26 (a) | 642,000 | 675,705 |

| 1,177,580 | ||

| Metals & Mining – 4.5% | ||

| Arconic Corp. 6.125% 2/15/28 (a) | 500,000 | 527,665 |

| Cleveland-Cliffs, Inc. 4.625% 3/1/29 (a) | 500,000 | 489,375 |

| Coeur Mining, Inc. 5.125% 2/15/29 (a) | 500,000 | 486,563 |

| Compass Minerals International, Inc. 6.75% 12/1/27 (a) | 271,000 | 291,325 |

| Constellium SE 3.75% 4/15/29 (a) | 1,000,000 | 992,700 |

| First Quantum Minerals Ltd. 6.875% 10/15/27 (a) | 500,000 | 541,875 |

| FMG Resources August 2006 Pty Ltd.: | ||

4.50% 9/15/27 (a) | 842,000 | 925,147 |

| 5.125% 3/15/23 to 5/15/24 (a) | 776,000 | 822,807 |

| Freeport-McMoRan, Inc.: | ||

3.55% 3/1/22 | 77,000 | 78,155 |

4.125% 3/1/28 | 125,000 | 131,250 |

| Hudbay Minerals, Inc. 4.50% 4/1/26 (a)(c) | 110,000 | 111,444 |

| Infrabuild Australia Pty Ltd. 12.00% 10/1/24 (a) | 281,000 | 302,075 |

| Kaiser Aluminum Corp. 4.625% 3/1/28 (a) | 510,000 | 532,404 |

| Mineral Resources Ltd. 8.125% 5/1/27 (a) | 883,000 | 977,349 |

| New Gold, Inc. 7.50% 7/15/27 (a) | 1,104,000 | 1,163,384 |

| Perenti Finance Pty Ltd. 6.50% 10/7/25 (a) | 800,000 | 850,792 |

| United States Steel Corp.: | ||

6.875% 8/15/25 | 75,000 | 73,922 |

12.00% 6/1/25 (a) | 276,000 | 331,497 |

| 9,629,729 | ||

| Paper & Forest Products – 1.3% | ||

| Boise Cascade Co. 4.875% 7/1/30 (a) | 100,000 | 106,595 |

| 12 | Semi-Annual Report |

| Nonconvertible Bonds – continued | ||

| Principal Amount | Value | |

| MATERIALS – continued | ||

| Paper & Forest Products – continued | ||

| Louisiana Pacific Corp. 3.625% 3/15/29 (c) | $ 500,000 | $ 499,000 |

| Mercer International, Inc. 5.125% 2/1/29 (a) | 215,000 | 217,997 |

| Norbord, Inc. 5.75% 7/15/27 (a) | 1,183,000 | 1,270,246 |

| Resolute Forest Products, Inc. 4.875% 3/1/26 (a) | 600,000 | 597,000 |

| 2,690,838 | ||

| TOTAL MATERIALS | 21,659,688 | |

| REAL ESTATE – 3.0% | ||

| Equity Real Estate Investment Trusts (REITs) – 2.4% | ||

| Diversified Healthcare Trust 4.375% 3/1/31 | 400,000 | 396,000 |

| EPR Properties 4.75% 12/15/26 | 196,000 | 203,612 |

| HAT Holdings I LLC / HAT Holdings II LLC 6.00% 4/15/25 (a) | 1,240,000 | 1,302,000 |

| Iron Mountain, Inc. 4.50% 2/15/31 (a) | 270,000 | 268,029 |

| iStar, Inc. 4.25% 8/1/25 | 365,000 | 366,369 |

| MGM Growth Properties Operating Partnership LP / MGP Finance Co-Issuer, Inc. 3.875% 2/15/29 (a) | 540,000 | 546,750 |

| RHP Hotel Properties LP / RHP Finance Corp. 4.50% 2/15/29 (a) | 700,000 | 691,250 |

| Service Properties Trust: | ||

4.65% 3/15/24 | 275,000 | 277,750 |

4.95% 2/15/27 | 250,000 | 247,587 |

5.25% 2/15/26 | 240,000 | 241,200 |

| The GEO Group, Inc. 6.00% 4/15/26 | 742,000 | 541,660 |

| 5,082,207 | ||

| Real Estate Management & Development – 0.6% | ||

| Realogy Group LLC / Realogy Co-Issuer Corp. 5.75% 1/15/29 (a) | 185,000 | 186,387 |

| The Howard Hughes Corp. 4.125% 2/1/29 (a) | 1,000,000 | 992,650 |

| 1,179,037 | ||

| TOTAL REAL ESTATE | 6,261,244 | |

| | ||

| Principal Amount | Value | |

| UTILITIES – 1.1% | ||

| Electric Utilities – 0.3% | ||

| FirstEnergy Corp.: | ||

1.60% 1/15/26 | $ 280,000 | $275,100 |

2.25% 9/1/30 | 360,000 | 338,292 |

| 613,392 | ||

| Multi-Utilities – 0.8% | ||

| Calpine Corp. 3.75% 3/1/31 (a) | 1,051,000 | 1,014,435 |

| FirstEnergy Corp. 5.35% 7/15/47 | 248,000 | 295,120 |

| FirstEnergy Transmission LLC 4.35% 1/15/25 (a) | 170,000 | 184,750 |

| Talen Energy Supply LLC 6.50% 6/1/25 | 200,000 | 174,750 |

| 1,669,055 | ||

| TOTAL UTILITIES | 2,282,447 | |

| TOTAL NONCONVERTIBLE BONDS (Cost $180,528,266) | 183,755,938 | |

| Money Market Fund – 18.3% | ||

| Shares | ||

| Fidelity Cash Central Fund, 0.07% (e) (Cost $38,809,425) | 38,801,665 | 38,809,425 |

| TOTAL INVESTMENT IN SECURITIES – 104.9% (Cost $219,337,691) | 222,565,363 | |

| NET OTHER ASSETS (LIABILITIES) – (4.9%) | (10,444,158) | |

| NET ASSETS – 100.0% | $ 212,121,205 | |

| Legend | ||

| (a) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $134,362,813 or 63.3 of net assets. | |

| (b) | Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. | |

| (c) | Security or a portion of the security purchased on a delayed delivery or when-issued basis. | |

| (d) | Security is perpetual in nature with no stated maturity date. | |

| (e) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. | |

| Semi-Annual Report | 13 |

| Fund | Income earned |

| Fidelity Cash Central Fund | $6,603 |

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||||||

| Corporate Bonds | $ 183,755,938 | $ — | $ 183,755,938 | $ — | ||||

| Money Market Funds | 38,809,425 | 38,809,425 | — | — | ||||

| Total Investments in Securities: | $ 222,565,363 | $ 38,809,425 | $ 183,755,938 | $ — |

| United States of America | 92.6 |

| Canada | 6.1 |

| Australia | 1.8 |

| Cayman Islands | 1.0 |

| Others (Individually Less Than 1%) | 3.4 |

| 104.9% |

| 14 | Semi-Annual Report |

| Assets | |

| Investments in securities, at value – See accompanying schedule: | |

| Unaffiliated issuers | $183,755,938 |

| Fidelity Central Funds | 38,809,425 |

| Total Investments in Securities | $222,565,363 |

| Receivable for investments sold | |

| Regular delivery | 2,056,563 |

| Distributions receivable from Fidelity Central Funds | 1,736 |

| Interest receivable | 2,289,446 |

| Total assets | 226,913,108 |

| Liabilities | |

| Payable for investments purchased | |

| Regular delivery | 4,838,739 |

| Delayed delivery | 9,235,000 |

| Distributions payable | 642,950 |

| Accrued management fees | 75,214 |

| Total liabilities | 14,791,903 |

| Net Assets | $212,121,205 |

| Net Assets consist of: | |

| Paid in capital | 205,636,713 |

| Total accumulated earnings (loss) | 6,484,492 |

| Net Assets | $212,121,205 |

| Shares outstanding | 3,850,000 |

| Net Asset Value per share | $ 55.10 |

| Investments at cost – Unaffiliated issuers | $180,528,266 |

| Investments at cost – Fidelity Central Funds | 38,809,425 |

| Investments at cost | $219,337,691 |

| Semi-Annual Report | 15 |

| Investment Income | |

| Interest | $ 3,671,960 |

| Income from Fidelity Central Funds | 6,603 |

| Total income | 3,678,563 |

| Expenses | |

| Management fees | 352,338 |

| Independent trustees' fees and expenses | 323 |

| Total expenses before reductions | 352,661 |

| Expense reductions | (45) |

| Total expenses | 352,616 |

| Net investment income (loss) | 3,325,947 |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on investment securities | 4,106,045 |

| Net realized gain (loss) on Fidelity Central Funds | (241) |

| Total net realized gain (loss) | 4,105,804 |

| Change in net unrealized appreciation (depreciation) on investment securities | (387,693) |

| Net gain (loss) | 3,718,111 |

| Net increase (decrease) in net assets resulting from operations | $ 7,044,058 |

| 16 | Semi-Annual Report |

| Six months ended February 28, 2021 (Unaudited) | Year ended August 31, 2020 | ||

| Increase (Decrease) in Net Assets | |||

| Operations | |||

| Net investment income (loss) | $ 3,325,947 | $ 4,815,932 | |

| Net realized gain (loss) | 4,105,804 | 1,618,162 | |

| Change in net unrealized appreciation (depreciation) | (387,693) | 2,199,562 | |

| Net increase (decrease) in net assets resulting from operations | 7,044,058 | 8,633,656 | |

| Distributions to shareholders | (5,657,850) | (5,165,200) | |

| Share transactions | |||

| Proceeds from sales of shares | 96,313,776 | 52,988,374 | |

| Cost of shares redeemed | — | (10,051,764) | |

| Net increase (decrease) in net assets resulting from share transactions | 96,313,776 | 42,936,610 | |

| Total increase (decrease) in net assets | 97,699,984 | 46,405,066 | |

| Net Assets | |||

| Beginning of period | 114,421,221 | 68,016,155 | |

| End of period | $212,121,205 | $114,421,221 | |

| Other Information | |||

| Shares | |||

| Sold | 1,750,000 | 1,000,000 | |

| Redeemed | — | (200,000) | |

| Net increase (decrease) | 1,750,000 | 800,000 |

| Semi-Annual Report | 17 |

| Six months ended February 28, 2021 (Unaudited) | Year ended August 31, 2020 | Year ended August 31, 2019 | Year ended August 31, 2018A | ||||

| Selected Per-Share Data | |||||||

| Net asset value, beginning of period | $ 54.49 | $ 52.32 | $ 50.21 | $ 50.00 | |||

| Income from Investment Operations | |||||||

| Net investment income (loss)B | 1.169 | 2.518 | 2.589 | 0.578 | |||

| Net realized and unrealized gain (loss) | 1.379 | 2.323 | 2.006 | 0.209 | |||

| Total from investment operations | 2.548 | 4.841 | 4.595 | 0.787 | |||

| Distributions from net investment income | (1.128) | (2.429) | (2.485) | (0.577) | |||

| Distributions from net realized gain | (0.808) | (0.242) | — | — | |||

| Total distributions | (1.936) | (2.671) | (2.485) | (0.577) | |||

| Net asset value, end of period | $ 55.10 | $ 54.49 | $ 52.32 | $ 50.21 | |||

| Total ReturnC,D,E | 4.75% | 9.61% | 9.48% | 1.59% | |||

| Ratios to Average Net AssetsF,G | |||||||

| Expenses before reductions | .46% H,I | .45% | .44% I | .45% H | |||

| Expenses net of fee waivers, if any | .46% H,I | .45% | .44% I | .45% H | |||

| Expenses net of all reductions | .46% H,I | .45% | .44% I | .45% H | |||

| Net investment income (loss) | 4.32% H,I | 4.84% | 5.03% | 5.21% H | |||

| Supplemental Data | |||||||

| Net assets, end of period (000 omitted) | $212,121 | $114,421 | $68,016 | $12,553 | |||

| Portfolio turnover rateJ | 98% K,L | 179% L | 76% | 8% K |

| A | For the period June 12, 2018 (commencement of operations) to August 31, 2018. |

| B | Calculated based on average shares outstanding during the period. |

| C | Based on net asset value. |

| D | Total returns for periods of less than one year are not annualized. |

| E | Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown. |

| F | Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur. |

| G | Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund’s expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report. |

| H | Annualized. |

| I | The size and fluctuation of net assets and expense amounts may cause ratios to differ from contractual rates. |

| J | Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs). |

| K | Amount not annualized. |

| L | Portfolio turnover rate excludes securities received or delivered in-kind. |

| 18 | Semi-Annual Report |

For the period ended February 28, 2021 (Unaudited)

| Semi-Annual Report | 19 |

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business (normally 4:00 p.m. Eastern time) of NYSE Arca and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds received from litigation. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. Debt obligations may be placed on non-accrual status and related interest income may be reduced by ceasing current accruals and writing off interest receivables when the collection of all or a portion of interest has become doubtful based on consistently applied procedures. A debt obligation is removed from non-accrual status when the issuer resumes interest payments or when collectability of interest is reasonably assured.

| Tax cost | Gross unrealized appreciation | Gross unrealized depreciation | Net unrealized appreciation (depreciation) on securities and other investments | |

| Fidelity High Yield Factor ETF | $ 219,343,477 | $ 4,396,278 | $ (1,174,392) | $ 3,221,886 |

| 20 | Semi-Annual Report |

| Purchases | Sales | |

| Fidelity High Yield Factor ETF | $ 142,334,535 | $ 157,674,309 |

| In-kind Subscriptions | In-kind Redemptions | |

| Fidelity High Yield Factor ETF | $ 87,784,193 | $ — |

| Semi-Annual Report | 21 |

| Annualized Expense RatioA | Beginning Account Value September 1, 2020 | Ending Account Value February 28, 2021 | Expenses Paid During PeriodB September 1, 2020 to February 28, 2021 | |

| Fidelity High Yield Factor ETF | 0.46% | |||

| Actual | $ 1,000.00 | $ 1,047.50 | $ 2.34 | |

| Hypothetical C | $ 1,000.00 | $ 1,022.51 | $ 2.31 |

| A | Annualized expense ratio reflects expenses net of applicable fee waivers. |

| B | Expenses are equal to the annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The fees and expenses of any Underlying Funds are not included in each annualized expense ratio. |

| C | 5% return per year before expenses. |

| 22 | Semi-Annual Report |

| Semi-Annual Report | 23 |

| 24 | Semi-Annual Report |

| Item 2. | Code of Ethics |

Not applicable.

| Item 3. | Audit Committee Financial Expert |

Not applicable.

| Item 4. | Principal Accountant Fees and Services |

Not applicable.

| Item 5. | Audit Committee of Listed Registrants |

Not applicable.

| Item 6. | Investments |

| (a) | Not applicable. |

| (b) | Not applicable |

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies |

Not applicable.

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies |

Not applicable.

| Item 9. | Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers |

Not applicable.

| Item 10. | Submission of Matters to a Vote of Security Holders |

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Covington Trust’s Board of Trustees.

| Item 11. | Controls and Procedures |

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Covington Trust’s (the “Trust”) disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable

assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

| Item 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies |

Not applicable.

| Item 13. | Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Covington Trust

| By: | /s/ Stacie M. Smith | |

| Stacie M. Smith | ||

| President and Treasurer | ||

| Date: | April 21, 2021 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Stacie M. Smith | |

| Stacie M. Smith | ||

| President and Treasurer | ||

| Date: | April 21, 2021 | |

| By: | /s/ John J. Burke III | |

| John J. Burke III | ||

| Chief Financial Officer | ||

| Date: | April 21, 2021 | |