Account’s existing real estate assets. This trend, which has continued for several years, was also evidenced by the net realized gains on the properties sold in 2006. During the year ended December 31, 2006, the Account sold nine properties for total net proceeds, after selling expenses, of $381.9 million, for a cumulative net gain of $76.1 million, based on the properties’ capitalized costs. The unrealized gains on the Account’s marketable securities in 2006 were primarily associated with the Account’s investments in real estate equity securities.

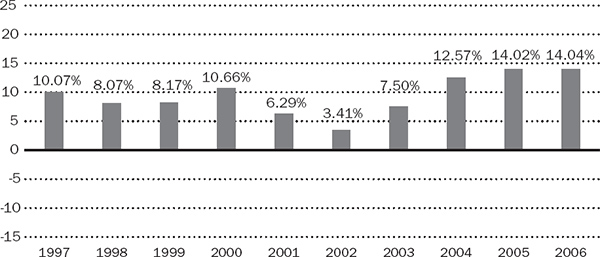

The Account’s total return was 14.02% for the year ended December 31, 2005, 145 basis points higher than the 2004 total return of 12.57%. The substantial increase in the Account’s overall performance on a year-to-year basis reflected the strong performance of the Account’s real estate properties. The market value of the Account’s real estate portfolio increased substantially in 2005 due to capital appreciation of these assets as a result of the sustained growth in capital investment in the real estate market from institutional investors as well as foreign investors.

The Account’s net investment income, after deduction of all expenses, was 41.5% higher for the year ended December 31, 2005, as compared to 2004. This increase is related to a 45.6% growth in Total Net Assets from year-end 2004 to year-end 2005. The growth in Total Net Assets was driven by a year-to-year 84.8% increase in net realized and unrealized gains on its investments and a 24.8% increase in net transfers and premiums into the Account.

The Account’s real estate holdings, including real estate joint ventures and limited partnerships, generated approximately 85.3% and 91.9% of the Account’s total investment income (before deducting Account level expenses) during 2005 and 2004, respectively. The remaining portion of the Account’s total investment income was generated by investments in marketable securities. The decline in the real estate component was due to the growth in the non-real estate assets owned by the Account as a percentage of Total Net Assets. As of year-end 2005, the Account held 89.1% of its Total Net Assets in real estate, joint ventures and limited partnership holdings, as compared to 92.2% in 2004.

Gross real estate rental income increased approximately 55.7% in the year ended December 31, 2005 as compared to 2004. This increase was primarily due to the increased number and size of properties owned by the Account. Income from the real estate joint ventures and limited partnerships was $71,826,443 for the year ended December 31, 2005 as compared with $71,390,397 for the year ended December 31, 2004. Interest and dividend income on the Account’s marketable securities increased from $27,508,560 in 2004 to $70,999,212 in 2005 due to the increase in the amount of non-real estate assets held by the Account, as well as an increase in short term rates from 2004 to 2005.

Total property level expenses for the years ended December 31, 2005 and 2004 were $278,544,030 and $157,768,776, respectively. In 2005, operating expenses and real estate taxes represented 54.0% and 31.6% of the total property level expenses, respectively, with the remaining 14.4% due to interest payments on mortgages. In comparison, operating expenses, real estate taxes, and interest expense represented 64.0%, 35.5% and 0.5% of the total property level expenses, respectively in 2004. Overall, property level expenses increased by 76.6% from 2004 to 2005, with approximately one-third of this increase attributable to interest expense in 2005. The interest expense incurred by the Account was $830,361 and $40,028,630, respectively, in 2004 and 2005. The factors influencing these year-to-year increases were an increase in the number of wholly-owned properties subject to debt, which increased from four in 2004 (all acquired in the fourth quarter of 2004) to seven in 2005, and the purchase of additional properties in 2005.

The Account also incurred expenses for the years ended December 31, 2005 and 2004 for investment advisory services ($19,603,225 and $14,393,388, respectively), administrative and distribution services ($27,130,406 and $16,372,446, respectively) and mortality, expense risk and liquidity guarantee charges ($9,366,566 and $5,962,591, respectively). The overall 52.7% increase in expenses was a result of the larger net asset base in the Account and the increased costs associated with managing and administering the Account.

Net Realized and Unrealized Gains and Losses on Investments and Mortgage Loans Payable

The Account had net realized and unrealized gains on investments and mortgage loans payable of $765,970,272 for the year ended December 31, 2005, as compared to $414,580,303 for the year ended December 31, 2004. This positive variance was primarily due to a substantial increase in net realized and unrealized gain on the Account’s real estate properties to $619,333,773 for the year ended December 31, 2005, as compared to $186,313,976 for the year ended December 31, 2004. The increase was due to the capital appreciation of real estate assets attributable to the continued inflow of capital into the real estate market from institutional and other investors, which had the effect of increasing the value of real estate. This trend, which began in 2004 and increased in 2005, is further evidenced by the net realized gain of $84.8 million on the properties sold in 2005. The net proceeds of these sales were $511.5 million. The Account also had unrealized gains on its real estate joint ventures and limited partnership holdings of $167,019,921 for the year ended December 31, 2005, as compared to $162,245,601 in 2004. The Account’s marketable securities had net realized and unrealized gains totaling $8,770,726 for the year ended December 31, 2005, as compared to $67,803,292 for the year ended December 31, 2004. The primary factor in the decline was the net effect on the Account’s real estate equity securities of the relatively weak performance of the REIT market in 2005, as compared to the strong performance of this market in 2004.

TIAA Real Estate AccountProspectus|45

LIQUIDITY AND CAPITAL RESOURCES

At year-end 2006 and 2005, the Account’s liquid assets (i.e., cash and marketable securities) had a value of $2,747,445,678 and $2,090,768,483, respectively. The increase in the Account’s liquid assets was primarily due to an increase in its net investment income and the continued net positive inflow from participant transfers and premiums into the Account, which management believes was in response to the continued strong relative performance of the Account.

In 2006, the Account received $1,085,057,614 in premiums and $1,354,697,847 in net participant transfers from TIAA, CREF Accounts and affiliated mutual funds, while, for 2005, the Account received $968,189,436 in premiums and $1,435,432,984 in net participant transfers. The Account’s net investment income increased from $426,815,008 for the year ended December 31, 2005 to $581,412,917 for the year ended December 31, 2006.

The Account’s liquid assets continue to be available to purchase additional suitable real estate properties and to meet the Account’s expense needs and participant redemption requests (i.e., cash withdrawals, benefits, or transfers). In the unlikely event that the Account’s liquid assets and its cash flow from operating activities and participant transactions are not sufficient to meet participant transfer or cash withdrawal requests, TIAA’s general account will purchase liquidity units in accordance with TIAA’s liquidity guarantee to the Account.

The Account, under certain conditions more fully described in the Account’s prospectus (as supplemented from time to time), may borrow money and assume or obtain a mortgage on a property (i.e., to make leveraged real estate investments). Also, to meet any short-term cash needs, the Account may obtain a line of credit whose terms may require that the Account secure the loan with one or more of its properties. The Account’s total borrowings may not exceed 30% of the Account’s Total Net Assets. In calculating this limit, only the Account’s actual percentage interest in any borrowings is included, and not that of any joint venture partner. Further, the Account may only borrow up to 70% of the then-current value of a property, although construction loans may be for 100% of costs incurred in developing a property.

EFFECTS OF INFLATION AND INCREASING OPERATING EXPENSES

Inflation, along with increased insurance, taxes, utilities and security costs, may increase property operating expenses in the future. These increases in operating expenses are generally billed to tenants either through contractual lease provisions in office, industrial, and retail properties or through rent increases in apartment complexes. The Account remains responsible for the expenses for unleased space in a property as well as expenses which may not be reimbursed under the terms of an existing lease.

CRITICAL ACCOUNTING POLICIES

The financial statements of the Account are prepared in conformity with accounting principles generally accepted in the United States of America.

46|ProspectusTIAA Real Estate Account

In preparing the Account’s financial statements, management is required to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses. Management bases its estimates on historical experience and assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

Management believes that the following policies related to the valuation of the Account’s assets reflected in the Account’s financial statements affect the significant judgments, estimates and assumptions used in preparing its financial statements:

Valuation of Real Estate Properties: Investments in real estate properties are stated at fair value, as determined in accordance with procedures approved by the Investment Committee of the TIAA Board of Trustees and in accordance with the responsibilities of the Board as a whole; accordingly, the Account does not record depreciation. Fair value for real estate properties is defined as the most probable price for which a property will sell in a competitive market under all conditions requisite to a fair sale. Determination of fair value involves subjective judgment because the actual market value of real estate can be determined only by negotiation between the parties in a sales transaction. Real estate properties owned by the Account are initially valued at their respective purchase prices (including acquisition costs). Subsequently, the properties are valued on a quarterly cycle, and independent appraisers value each real estate property at least once a year. TIAA’s appraisal staff performs the other quarterly valuations of each real estate property and updates the property value if it believes that the value of a property has changed since the previous valuation or appraisal. The appraisals are performed in accordance with Uniform Standards of Professional Appraisal Practices (USPAP), the real estate appraisal industry standards created by The Appraisal Foundation. Real estate appraisals are estimates of property values based on a professional’s opinion. Real estate properties subject to a mortgage are generally valued as described; the mortgage is valued independently of the property, and its fair value is reported separately.

Valuation of Real Estate Joint Ventures and Limited Partnerships: Real estate joint ventures and limited partnerships are stated at the Account’s equity in the net assets of the underlying entities, adjusted, for the joint ventures, to value their real estate holdings and mortgage notes payable at fair value.

Valuation of Marketable Securities: Equity securities listed or traded on any national market or exchange are valued at the last sale price as of the close of the principal securities exchange on which such securities are traded or, if there is no sale, at the mean of the last bid and asked prices on such exchange. Debt securities, other than money market instruments, are valued at the most recent bid price or the equivalent quoted yield for such securities (or those of comparable maturity, quality and type). Money market instruments, with maturities of one year or less, are valued in the same manner as debt securities or derived from a

TIAA Real Estate AccountProspectus|47

pricing matrix that has various types of money market instruments along one axis and various maturities along the other. Portfolio securities and limited partnership interests for which market quotations are not readily available are valued at fair value as determined in good faith under the direction of the Investment Committee of the TIAA Board of Trustees and in accordance with the responsibilities of the Board as a whole.

Mortgage Loans Receivable:Mortgage loans receivable are stated at fair value and are initially valued at the face amount of the mortgage loan funding. Subsequently, mortgage loans receivable are valued quarterly based on market factors, such as market interest rates and spreads for comparable loans, and the performance of the underlying collateral.

Mortgage Loans Payable:Estimated market values of mortgage loans payable are based on the amount at which the liability could be settled (either transferred or paid back) in a current transaction exclusive of direct transaction costs. Different assumptions or changes in future market conditions could significantly affect estimated market value. At times, the Account may assume debt in connection with the purchase of real estate. For debt assumed, the Account allocates a portion of the purchase price to the below- or above-market debt and amortizes the premium or discount over the remaining life of the debt.

Foreign currency transactions and translation:Portfolio investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rates prevailing at the end of the period. Purchases and sales of securities, income receipts and expense payments made in foreign currencies are translated into U.S. dollars at the exchange rates prevailing on the respective dates of the transactions. The effects of changes in foreign currency exchange rates on portfolio investments and mortgage loans payable are included in the net realized and unrealized gains and losses on investments and mortgage loans payable. Net realized gains and losses on foreign currency transactions include maturities of forward foreign currency contracts, disposition of foreign currencies, and currency gains and losses between the accrual and receipt dates of portfolio investment income and between the trade and settlement dates of portfolio investment transactions.

Accumulation and Annuity Fund:The Accumulation Fund represents the net assets attributable to participants in the accumulation phase of their investment. The Annuity Fund represents the net assets attributable to the participants currently receiving annuity payments. The net increase or decrease in net assets from investment operations is apportioned between the accounts based upon their relative daily net asset values. Once an Account participant begins receiving lifetime annuity income benefits, monthly payment levels cannot be reduced as a result of the Account’s adverse mortality experience. In addition, the contracts are required to stipulate the maximum expense charge that can be assessed, which is equal to 2.50% of average net assets per year. Accordingly, a small risk charge is paid by the Account to TIAA to assume these risks.

48 | ProspectusTIAA Real Estate Account

Accounting for Investments:Real estate transactions are accounted for as of the date on which the purchase or sale transactions for the real estate properties close (settlement date). The Account recognizes a gain to the extent that the contract sales price exceeds the cost-to-date of the property being sold. A loss occurs when the cost-to-date exceeds the sales price. As the Account is fair valued and all properties are appraised quarterly, any accumulated unrealized gains and losses are reversed in the calculation of realized gains and losses. Rent from real estate properties consists of all amounts earned under tenant operating leases, including base rent, recoveries of real estate taxes and other expenses and charges for miscellaneous services provided to tenants. Rental income is recognized in accordance with the billing terms of the lease agreements. The Account bears the direct expenses of the real estate properties owned. These expenses include, but are not limited to, fees to local property management companies, property taxes, utilities, maintenance, repairs, insurance and other operating and administrative costs. An estimate of the net operating income earned from each real estate property is accrued by the Account on a daily basis and such estimates are adjusted as soon as actual operating results are determined.

The Account has limited ownership interests in various real estate funds (limited partnerships and one limited liability corporation) and a private REIT (collectively, the “limited partnerships”). The Account records its contributions as increases to the investments, and distributions from the investments are treated as either income or return of capital, as determined by the management of the limited partnerships. Unrealized gains and losses are calculated and recorded quarterly when the Account’s accounting records are compared to the financial statements of the limited partnerships.

Income from joint ventures is recorded based on the Account’s proportional interest in the income earned by the joint venture.

Securities transactions are accounted for as of the date the securities are purchased or sold (trade date). Interest income is recorded as earned and includes accrual of discount and amortization of premium. Dividend income is recorded on the ex-dividend date or as soon as the Account is informed of the dividend. Realized gains and losses on securities transactions are accounted for on the specific identification method.

FORWARD-LOOKING STATEMENTS

Some statements in this prospectus which are not historical facts may be “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements about our expectations, beliefs, intentions or strategies for the future, and include the assumptions underlying these forward-looking statements. Forward-looking statements appear in this prospectus, among other places, in “Management’s Discussion and Analysis of Financial Conditions and Results of Operations.” Forward-looking statements involve risks and uncertainties, some of which are referenced in the sections of

TIAA Real Estate AccountProspectus | 49

this prospectus entitled “Risk Factors” and below in “Quantitative and Qualitative Disclosures About Market Risk,” that could cause actual results to differ materially from historical experience or management’s present expectations.

Caution should be taken not to place undue reliance on management’s forward-looking statements, which represent management’s views only as of the date of this prospectus. Neither management nor the Account undertake any obligation to update publicly or revise any forward-looking statement, whether as a result of new information, changed assumptions, future events or otherwise.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Account’s real estate holdings, including real estate joint ventures and limited partnerships, which, as of December 31, 2006 represented 81.8% of the Account’s total investments, expose the Account to a variety of risks. These risks include, but are not limited to:

| | |

| • | General Real Estate Risk — The risk that the Account’s property values or rental and occupancy rates could go down due to general economic conditions, a weak market for real estate generally, or changing supply and demand for certain types of properties; |

| | |

| • | Appraisal Risk — The risk that the sale price of an Account property (i.e., the value that would be determined by negotiations between independent parties) might differ substantially from its estimated or appraised value, leading to losses or reduced profits to the Account upon sale; |

| | |

| • | Risk Relating to Property Sales — The risk that the Account might not be able to sell a property at a particular time for its full value, particularly in a poor market. This might make it difficult to raise cash quickly and also could lead to Account losses; |

| | |

| • | Risks of Borrowing — The risk that interest rate changes may impact Account returns if the Account takes out a mortgage on a property or buys a property subject to a mortgage; and |

| | |

| • | Foreign Currency Risk — The risk that the value of the Account’s foreign investments, related debt or rental income could increase or decrease due to changes in foreign currency exchange rates or foreign currency exchange control regulations, and hedging against such changes, if undertaken by the Account, may entail additional costs and be unsuccessful. |

As of December 31, 2006, 18.2% of the Account’s total investments were in market risk sensitive instruments, comprised of marketable securities and an adjustable rate mortgage loan receivable. Marketable securities include real estate equity securities, commercial mortgage-backed securities (CMBS), and high-quality short-term debt instruments (i.e., commercial paper and government agency bonds). The Statement of Investments for the Account sets forth the general financial terms of these instruments, along with their fair values, as

50 | ProspectusTIAA Real Estate Account

determined in accordance with procedures described in Note 1 to the Account’s financial statements. Note that the Account does not currently invest in derivative financial instruments.

The Account’s investments in marketable securities and mortgage loans receivable are subject to the following general risks:

| | |

| • | Financial Risk — The risk, for debt securities, that the issuer will not be able to pay principal and interest when due and, for common or preferred stock, that the issuer’s current earnings will fall or that its overall financial soundness will decline, reducing the security’s value. |

| | |

| • | Market Risk — The risk that the Account’s investments will experience price volatility due to changing conditions in the financial markets and, particularly for debt securities, changes in overall interest rates. |

| | |

| • | Interest Rate Volatility — The risk that interest rate volatility may affect the Account’s current income from an investment. |

In addition, mortgage-backed securities are subject to prepayment risk or extension risk (i.e., the risk that borrowers will repay the loans earlier or later than anticipated). If the underlying mortgage assets experience faster than anticipated repayments of principal, the Account could fail to recoup some or all of its initial investment in these securities, since the original price paid by the Account was based in part on assumptions regarding the receipt of interest payments. If the underlying mortgage assets are repaid later than anticipated, the Account could lose the opportunity to reinvest the anticipated cash flows at a time when interest rates might be rising. The rate of prepayment depends on a variety of geographic, social and other functions, including prevailing market interest rates and general economic factors. The market value of these securities is also highly sensitive to changes in interest rates. Note that the potential for appreciation, which could otherwise be expected to result from a decline in interest rates, may be limited by any increased prepayments. These securities may be harder to sell than other securities.

In addition to these risks, real estate equity securities and mortgage-backed securities are subject to many of the same general risks inherent in real estate investing, making mortgage loans and investing in debt securities. For more information on the risks associated with all of the Account’s investments, see the Account’s most recent prospectus.

TIAA Real Estate AccountProspectus | 51

VALUING THE ACCOUNT’S ASSETS

We value the Account’s assets as of the close of each valuation day by taking the sum of:

| | |

| • | the value of the Account’s cash, cash equivalents, and short-term and other debt instruments |

| | |

| • | the value of the Account’s other securities investments and other assets |

| | |

| • | the value of the individual real properties and other real estate-related investments owned by the Account |

| | |

| • | an estimate of the net operating income accrued by the Account from its properties and other real estate-related investments and then reducing it by the Account’s liabilities, including the daily investment management fee and certain other expenses attributable to operating the Account. See “Expense Deductions” on page 54. |

VALUING REAL ESTATE INVESTMENTS

Valuing Real Property:Individual real properties will be valued initially at their purchase prices. Prices include all expenses related to purchase, such as acquisition fees, legal fees and expenses, and other closing costs. We could use a different value in appropriate circumstances.

After this initial valuation, an independent appraiser, approved by the independent fiduciary, will value properties at least once a year. The independent fiduciary can require additional appraisals if it believes that a property has changed materially or otherwise to assure that the Account is valued correctly.

Quarterly, we will conduct an internal review of each of the Account’s properties. We’ll adjust a valuation if we believe that the value of the property has changed since the previous valuation. We’ll continue to use the revised value to calculate the Account’s net asset value until the next review or appraisal. However, we can adjust the value of a property in the interim to reflect what we believe are actual changes in property value.

The Account’s net asset value will include the current value of any note receivable (an amount that someone else owes the Account) from selling a real estate-related investment. We’ll estimate the value of the note by applying a discount rate appropriate to then-current market conditions.

Development properties initially will be valued at the Account’s cost, and the value will be adjusted as additional development costs are incurred. Once a property receives a certificate of occupancy, within one year from the initial funding by the Account, or the property is substantially leased, whichever is earlier, the property will be appraised by an independent appraiser, approved by the independent fiduciary. We may also have the properties independently appraised earlier if circumstances warrant.

The Account may, at times, value properties purchased together as a portfolio as a single asset, to the extent we believe that the property will likely be sold as

52 | ProspectusTIAA Real Estate Account

one portfolio. The value assigned to the portfolio as a whole may be more or less than the valuation of each property individually.

Because of the nature of real estate assets, the Account’s net asset value won’t necessarily reflect the true or realizable value of its real estate assets (i.e., what the Account would receive if it sold them).

Valuing Real Property Encumbered by Debt:In general, when we value an Account property subject to a mortgage, the Account’s net asset value will include the value of the Account’s interest in the property (with the property valued as described above). The value of the mortgage will be recorded as a liability based on a valuation performed independently of the property.

Valuing Conventional Mortgages:Individual mortgage loans made by the Account will be valued initially at their face amount. Thereafter, quarterly, we’ll value the Account’s fixed interest mortgage loans by discounting payments of principal and interest to their present value (using a rate at which commercial lenders would make similar mortgage loans). We’ll also use this method for foreign mortgages with conventional terms. We can adjust the mortgage value more frequently if circumstances require it. Floating variable rate mortgages will generally be valued at their face amount, although we may adjust these values as market conditions dictate.

Valuing Participating Mortgages:Individual mortgages will initially be valued at their face amount. Thereafter, quarterly, we’ll estimate the values of the participating mortgages by making various assumptions about occupancy rates, rental rates, expense levels, and other things. We’ll use these assumptions to project the cash flow and anticipated sale proceeds from each investment over the term of the loan, or sometimes over a shorter period. To calculate sale proceeds, we’ll assume that the real property underlying each investment will be sold at the end of the period used in the valuation at a price based on market assumptions for the time of the projected sale. We’ll then discount the estimated cash flows and sale proceeds to their present value (using rates appropriate to then-current market conditions).

Net Operating Income:The Account usually receives operating income from its investments intermittently, not daily. In fairness to participants, we estimate the Account’s net operating income rather than applying it when we actually receive it, and assume that the Account has earned (accrued) a proportionate amount of that estimated amount daily. You bear the risk that, until we adjust the estimates when we receive actual income reports, the Account could be under- or over-valued.

Every year, we prepare a month-by-month estimate of the revenues and expenses (estimated net operating income) for each of the Account’s properties. Each day, we add the appropriate fraction of the estimated net operating income for the month to the Account’s net asset value.

Every month, the Account receives a report of the actual operating results for the prior month for each property (actual net operating income). We then recognize the actual net operating income on the accounting records of the

TIAA Real Estate AccountProspectus | 53

Account and adjust the outstanding daily accrued receivable accordingly. As the Account actually receives cash from a property, we’ll adjust the daily accrued receivable and other accounts appropriately.

Adjustments:We can adjust the value of an investment if we believe events or market conditions (such as a borrower’s or tenant’s default) have affected how much the Account could receive if it sold the investment. We may not always be aware of each event that might require a valuation adjustment, and because our evaluation is based on subjective factors, we may not in all cases make adjustments where changing conditions could affect the value of an investment.

The independent fiduciary will need to approve adjustments to any valuation of one or more properties that

| | |

| • | is made within three months of the annual independent appraisal or |

| | |

| • | results in an increase or decrease of: |

| | |

| • | more than 6 percent of the value of any of the Account’s properties since the last independent annual appraisal |

| | |

| • | more than 2 percent in the value of the Account since the prior month or |

| | |

| • | more than 4 percent in the value of the Account within any quarter. |

Right to Change Valuation Methods:If we decide that a different valuation method would reflect the value of a real estate-related investment more accurately, we may use that method if the independent fiduciary consents. Changes in TIAA’s valuation methods could change the Account’s net asset value and change the values at which participants purchase or redeem Account interests.

VALUING OTHER INVESTMENTS (INCLUDING CERTAIN REAL ESTATE-RELATED INVESTMENTS)

Debt Securities and Money Market Instruments:We value debt securities (excluding money market instruments) for which market quotations are readily available based on the most recent bid price or the equivalent quoted yield for such securities (or those of comparable maturity, quality and type). We derive these values utilizing an independent pricing service, except when we believe the prices do not accurately reflect the security’s fair value. We value money market instruments with maturities of one year or less in the same manner as debt securities, or derive them from a pricing matrix that has various types of money market instruments along one axis and various maturities along the other. All debt securities may also be valued at fair value as determined in good faith by the Investment Committee of the TIAA Board of Trustees.

Equity Securities:We value equity securities (including REITs) listed or traded on the New York Stock Exchange or the American Stock Exchange at their last sale price on the valuation day. If no sale is reported that day, we use the mean of the closing bid and asked prices. Equity securities listed or traded on any other exchange are valued in a comparable manner on the principal exchange where traded.

We value equity securities traded on the NASDAQ Stock Markets at the Nasdaq Official Closing Price on the valuation day. If no sale is reported that day,

54 | ProspectusTIAA Real Estate Account

we use the mean of the closing bid and asked prices. Other U.S. over-the-counter equity securities are valued at the mean of the closing bid and asked prices.

Mortgage-Backed Securities:We value mortgage-backed securities in the same manner in which we value debt securities, as described above.

Foreign Securities:To value investments traded on a foreign exchange or in foreign markets, we use their closing values under the generally accepted valuation method in the country where traded, as of the valuation date. We convert this to U.S. dollars at the exchange rate in effect on the valuation day.

Investments Lacking Current Market Quotations:We value securities or other assets for which current market quotations are not readily available at fair value as determined in good faith under the direction of the Investment Committee of TIAA’s Board of Trustees and in accordance with the responsibilities of TIAA’s Board as a whole. In evaluating fair value for the Account’s interest in certain commingled investment vehicles, the Account will generally look to the value periodically assigned to interests by the issuer. When possible, the Account will seek to have input in formulating the issuer’s valuation methodology.

EXPENSE DEDUCTIONS

Deductions are made each valuation day from the net assets of the Account for various services required to manage investments, administer the Account and the contracts, and to cover certain risks borne by TIAA. Services are performed at cost by TIAA and TIAA-CREF Individual & Institutional Services, LLC (“Services”), a wholly owned subsidiary of TIAA. Because services are provided at cost, we expect that expense deductions will be relatively low. TIAA guarantees that in the aggregate, the expense charges will never be more than 2.50% of average net assets per year.

The current annual estimated expense deductions are:

| | | | | | |

Type of Expense Deduction | | Estimated

Percent of

Net Assets

Annually | | Services Performed |

|

|

|

|

|

Investment Management | | | 0.190% | | For TIAA’s investment advice, portfolio accounting, custodial services, and similar services, including independent fiduciary and appraisal fees |

| | | | | | |

Administration | | | 0.275% | | For Services’ administrative services, such as allocating premiums and paying annuity income |

| | | | | | |

Distribution | | | 0.080% | | For Services’ expenses related to distributing the annuity contracts |

| | | | | | |

Mortality and Expense Risk | | | 0.050% | | For TIAA’s bearing certain mortality and expense risks |

| | | | | | |

Liquidity Guarantee | | | 0.035% | | For TIAA’s liquidity guarantee |

|

|

|

|

|

|

|

Total Annual Expense Deduction | | | 0.630% | | For total services to the Account |

|

|

|

|

|

|

TIAA Real Estate Account Prospectus | 55

After the end of every quarter, we reconcile how much we deducted as discussed above with the expenses the Account actually incurred. If there is a difference, we add it to or deduct it from the Account in equal daily installments over the remaining days in the following quarter. Since our at-cost deductions are based on projections of Account assets and overall expenses, the size of any adjusting payments will be directly affected by how different our projections are from the Account’s actual assets or expenses. While our projections of Account asset size (and resulting expense fees) are based on our best estimates, the size of the Account’s assets can be affected by many factors, including premium growth, participant transfers into or out of the Account, and any changes in the value of portfolio holdings. Historically, the adjusting payments have resulted in both upward and downward adjustments to the Account’s expense deductions for the following quarter.

TIAA’s Board of Trustees can revise the deduction rates from time to time to keep deductions as close as possible to actual expenses.

Currently there are no deductions from premiums or withdrawals, but we might change this in the future. Property expenses, brokers’ commissions, transfer taxes, and other portfolio expenses are charged directly to the Account.

EMPLOYER PLAN FEE WITHDRAWALS

Your employer may, in accordance with the terms of your plan, and with TIAA’s approval, withdraw amounts from your Real Estate Account accumulation under your Retirement Choice or Retirement Choice Plus contract, and, on a limited basis, under your GA, GSRA, GA or Keogh contract, to pay fees associated with the administration of the plan. These fees are separate from the expense deductions of the Account, and are not included for purposes of TIAA’s guarantee that the total annual expense deduction of the Account will not exceed the rate 2.50% of average net assets per year.

The amount and the effective date of an employer plan fee withdrawal will be in accordance with the terms of your plan. TIAA will determine all values as of the end of the effective date. An employer plan fee withdrawal cannot be revoked after its effective date. Each employer plan fee withdrawal will be made on a pro-rata basis from all your available TIAA and CREF accounts. An employer plan fee withdrawal reduces the accumulation from which it is paid by the amount withdrawn.

If allowed by your contract, your employer may also charge a fee on your account to pay fees associated with administering the plan.

CERTAIN RELATIONSHIPS WITH TIAA

As noted elsewhere in this prospectus, TIAA’s general account plays a significant role in operating the Real Estate Account, including providing a liquidity guarantee, and investment advisory and other services. In addition,

56 | Prospectus TIAA Real Estate Account

Services, a wholly-owned subsidiary of TIAA, provides administration and distribution services for the Account.

Liquidity Guarantee.As noted above under “Establishing and Managing the Account — The Role of TIAA — Liquidity Guarantee,” if the Account’s liquid assets and its cash flow from operating activities and participant transactions are insufficient to fund redemption requests, TIAA’s general account has agreed to purchase liquidity units. TIAA thereby guarantees that a participant can redeem accumulation units at their then-current daily net asset value. For the years ended December 31, 2006, December 31, 2005 and December 31, 2004, the Account expensed $3,905,051, $3,170,017 and $1,868,733, respectively, for this liquidity guarantee from TIAA through a daily deduction from the net assets of the Account.

Investment Advisory and Administrative Services/Certain Risks Borne by TIAA.As noted above under “Expense Deductions,” deductions are made each valuation day from the net assets of the Account for various services required to manage investments, administer the Account and distribute the contracts. These services are performed at cost by TIAA and Services. Deductions are also made each valuation day to cover mortality and expense risks borne by TIAA.

For the years ended December 31, 2006, December 31, 2005 and December 31, 2004, the Account expensed $26,899,307, $19,603,225 and $14,393,388, respectively, for investment management services and $6,931,833, $6,196,549 and $4,093,858, respectively, for mortality and expense risks provided/borne by TIAA. For the same period, the Account expensed $45,712,473, $27,130,406 and $16,372,446, respectively, for administrative and distribution services provided by Services.

THE CONTRACTS

TIAA offers the Real Estate Account as a variable option for the annuity contracts described below. Some employer plans may not offer the Real Estate Account as an option for RA, GRA, GSRA, Retirement Choice, Retirement Choice Plus, or Keogh contracts. The College Retirement Equities Fund (CREF) is a companion organization to TIAA. A companion CREF contract may have been issued to you when you received the TIAA contract offering the Account. For more information about the CREF annuity contracts, the TIAA traditional annuity, the TIAA Access variable annuity accounts, other TIAA separate accounts offered from time to time and particular mutual funds and investment options offered under the terms of your plan, please see the applicable contracts and respective prospectuses for those investment options.

Importantly, neither TIAA nor CREF guarantee the investment performance of the Account nor do they guarantee the value of your units at any time.

RA (RETIREMENT ANNUITY) AND GRA (GROUP RETIREMENT ANNUITY)

RA and GRA contracts are used mainly for employee retirement plans. RA contracts are issued directly to you. GRA contracts, which are group contracts, are issued through an agreement between your employer and TIAA.

TIAA Real Estate Account Prospectus | 57

Depending on the terms of your plan, RA and GRA premiums can be paid by your employer, you, or both. If you’re paying some of or the entire periodic premium, your contributions can be in either pre-tax dollars by salary reduction or after-tax dollars by payroll deduction. Your employer may offer you the option of making contributions in the form of after-tax Roth-style contributions, though you won’t be able to take tax deductions for these contributions. You can also transfer funds from another investment choice under your employer’s plan to your contract. Ask your employer for more information about these contracts.

SRA (SUPPLEMENTAL RETIREMENT ANNUITY) AND GSRA (GROUP SUPPLEMENTAL RETIREMENT ANNUITY)

These are for voluntary tax-deferred annuity (TDA) plans and 401(k) plans. SRA contracts are issued directly to you. GSRA contracts, which are group contracts, are issued through an agreement between your employer and TIAA. Generally, your employer pays premiums in pre-tax dollars through salary reduction. Your employer may offer you the option of making contributions in the form of after-tax Roth-style contributions, though you won’t be able to take tax deductions for these contributions. Although you can’t pay premiums directly, you can transfer amounts from other TDA plans.

RETIREMENT CHOICE/RETIREMENT CHOICE PLUS ANNUITIES

These are very similar in operation to the GRAs and GSRAs, respectively, except that they are issued directly to your employer or your plan’s trustee. Among other rights, the employer retains the right to transfer accumulations under these contracts to alternate funding vehicles.

CLASSIC IRA AND ROTH IRA

Classic IRAs are individual contracts issued directly to you. You and your spouse can each open a Classic IRA with an annual contribution of up to $4,000 or by rolling over funds from another IRA or retirement plan, if you meet our eligibility requirements. If you are age 50 or older, you may contribute up to $5,000. The combined limit for your contributions to a Classic IRA and a Roth IRA for a single year is $4,000, or $5,000 if you are age 50 or older, excluding rollovers. (The dollar limits listed are for 2007; different dollar limits may apply in future years.) We can’t issue you a joint contract.

Roth IRAs are also individual contracts issued directly to you. You or your spouse can each open a Roth IRA with an annual contribution up to $4,000 or with a rollover from another IRA or a Classic IRA issued by TIAA if you meet our eligibility requirements. If you are age 50 or older you may contribute up to $5,000. The combined limit for your contributions to a Classic IRA and a Roth IRA for a single year is $4,000, or $5,000 if you are age 50 or older, excluding rollovers. (The dollar limits listed are for 2007; different dollar limits may apply in future years.) We can’t issue you a joint contract.

58 | Prospectus TIAA Real Estate Account

Your employer may offer SEP IRAs (Simplified Employee Retirement Plans), which are subject to different rules.

Classic and Roth IRAs may together be referred to as “IRAs” in this prospectus.

GA (GROUP ANNUITY) AND INSTITUTIONALLY OWNED GSRA

These are used exclusively for employee retirement plans and are issued directly to your employer or your plan’s trustee. Your employer pays premiums directly to TIAA (you can’t pay the premiums directly to TIAA) and your employer or the plan’s trustee may control the allocation of contributions and transfers to and from these contracts including withdrawing completely from the Account. If a GA or GSRA contract is issued pursuant to your plan, the rules relating to transferring and withdrawing your money, receiving any annuity income or death benefits, and the timing of payments may be different, and are determined by your plan. Ask your employer or plan administrator for more information.

KEOGHS

TIAA also offers contracts for Keogh plans. If you are a self-employed individual who owns an unincorporated business, you can use our Keogh contracts for a Keogh plan, and cover common law employees, subject to our eligibility requirements.

ATRA (AFTER-TAX RETIREMENT ANNUITY)

The after-tax retirement annuities (ATRA) are individual non-qualified deferred annuity contracts, issued to participants who are eligible and would like to remit personal premiums under the contractual provisions of their RA contract. To be eligible, you must have an active and premium-paying or paid up RA contract.

Note that the tax rules governing these non-qualified contracts differ significantly from the treatment of qualified contracts. See “Taxes,” on page 71 for more information.

IRA AND KEOGH ELIGIBILITY

You or your spouse can set up a TIAA Classic or Roth IRA or a Keogh if you’re a current or retired employee or trustee of an eligible institution, or if you own a TIAA or CREF annuity or a TIAA individual insurance contract. To be considered a retired employee for this purpose, an individual must be at least 55 years old and have completed at least three years of service at an eligible institution. In the case of partnerships, at least half the partners must be eligible individuals and the partnership itself must be primarily engaged in education or research. Eligibility may be restricted by certain income limits on opening Roth IRA contracts.

TIAA Real Estate Account Prospectus | 59

STATE REGULATORY APPROVAL

State regulatory approval may be pending for certain of these contracts and they may not currently be available in your state.

STARTING OUT

Generally, we’ll issue you a TIAA contract when we receive your completed application or enrollment form. Your premiums will be credited to the Real Estate Account as of the business day we receive them.

If we receive premiums from your employer before your application or enrollment form, we’ll generally invest the money in the CREF Money Market Account until we receive your form. (Some employer plans may require that we send such premiums back to the employer or have a different default.) We’ll transfer the appropriate amount from the CREF Money Market Account and credit it to the Real Estate Account as of end of the business day we receive your completed form.

If the allocation instructions on your application or enrollment form are incomplete, violate plan restrictions, or total more than 100 percent, we’ll invest your premiums in the CREF Money Market Account (Some employer plans may have a different default). After we receive a complete and correct application, we’ll follow your allocation instructions for future premiums. However, any amounts that we credited to the CREF Money Market Account before we received correct instructions will be transferred to the Real Estate Account only on request, and will be credited as of the business day we receive that request.

TIAA generally doesn’t currently restrict the amount or frequency of premiums to your contract, although we may in the future. Your employer’s retirement plan may limit your premium amounts, while the Internal Revenue Code limits the total annual premiums you may invest in plans qualified for favorable tax treatment.

If you want to directly contribute personal premiums under the contractual provisions of your RA contract, you will be issued an ATRA contract. Premiums and any earnings on the ATRA contract will not subject to your employer’s retirement plan.

In most cases (subject to any restriction we may impose, as described in this prospectus), TIAA will accept premiums to a contract at any time during your accumulation period. Once your first premium has been paid, your TIAA contract can’t lapse or be forfeited for nonpayment of premiums. TIAA can stop accepting premiums to contracts at any time.

Note that we cannot accept money orders or travelers checks. In addition, we will not accept a third-party check where the relationship of the payor to the account owner cannot be identified from the face of the check.

We will not be deemed to have received any premiums sent to the addresses designated for remitting premiums until the third-party service that administers

60 | Prospectus TIAA Real Estate Account

the receipt of mail through those addresses has processed the payment on our behalf.

Important Information About Procedures for Opening a New Account

To help the U.S. government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions, including us, to obtain, verify and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, social security number and other information that will allow us to identify you, such as your home telephone number. Until you provide us with the information we need, we may not be able to open an account or effect any transactions for you.

CHOOSING AMONG INVESTMENT ACCOUNTS

You can allocate all or part of your premiums to the Real Estate Account, unless your employer’s plan precludes that choice. You can also allocate premiums to TIAA’s traditional annuity, the CREF variable investment accounts, the TIAA Access variable annuity accounts, other TIAA separate accounts offered from time to time (if available under the terms of your employer’s plan) and, in some cases, certain mutual funds if the account or fund is available under your employer’s plan.

You can change your allocation choices for future premiums

| | |

| • | by writing to our home office |

| | |

| • | using the TIAA-CREF Web Center’s account access feature at www.tiaa-cref.org or |

| | |

| • | calling our Automated Telephone Service (24 hours a day) at 800 842-2252 |

THE RIGHT TO CANCEL YOUR CONTRACT

You can generally cancel any RA, SRA or GSRA contract up to 30 days after you first receive it, unless we have begun making annuity payments from it. If you already had a TIAA contract prior to investing in the Real Estate Account, you have no 30-day right to cancel the contract. To cancel, mail or deliver the contract with a signed Notice of Cancellation (available by contacting TIAA) to our home office. We’ll cancel the contract, then send the entire current accumulation to whomever sent the premiums. You bear the investment risk during this period (although some states require us to send back your entire premium without accounting for investment results).

DETERMINING THE VALUE OF YOUR INTEREST IN THE ACCOUNT — ACCUMULATION UNITS

When you pay premiums or make transfers to the Real Estate Account, you buy accumulation units. When you take a cash withdrawal, transfer from the Account, or apply funds to begin annuity income, the number of your

TIAA Real Estate Account Prospectus | 61

accumulation units decrease. We calculate how many accumulation units to credit your account with by dividing the amount you applied to the Account by its accumulation unit value at the end of the business day when we received your premium or transfer. To determine how many accumulation units to subtract for cash withdrawals and transfers, we use the accumulation unit value for the end of the business day when we receive your transaction request and all required information and documents (unless you ask for a later date). A business day ends at 4:00 p.m. Eastern time or when trading closes on the NYSE, if earlier.

The accumulation unit value reflects the Account’s investment experience (i.e., the real estate net operating income accrued, as well as dividends, interest and other income accrued), realized and unrealized capital gains and losses, as well as Account expense charges.

Calculating Accumulation Unit Values: We calculate the Account’s accumulation unit value at the end of each valuation day. To do that, we multiply the previous day’s value by the net investment factor for the Account. The net investment factor is calculated asA divided byB, whereA andB are defined as:

| | |

| A. | The value of the Account’s net assets at the end of the current valuation period, less premiums received during the current valuation period. |

| | |

| B. | The value of the Account’s net assets at the end of the previous valuation period, plus the net effect of transactions made at the start of the current valuation period. |

HOW TO TRANSFER AND WITHDRAW YOUR MONEY

Generally, TIAA allows you to move your money to or from the Real Estate Account in the following ways:

| | |

| • | from the Real Estate Account to a CREF investment account, a TIAA Access variable account (if available) or TIAA’s traditional annuity |

| | |

| • | to the Real Estate Account from a CREF investment account, a TIAA Access variable account (if available) or TIAA’s traditional annuity (transfers from TIAA’s traditional annuity under RA, GRA or Retirement Choice contracts are subject to restrictions) |

| | |

| • | from the Real Estate Account to other companies |

| | |

| • | to the Real Estate Account from other companies/plans |

| | |

| • | by withdrawing cash |

| | |

| • | by setting up a program of automatic withdrawals or transfers |

For more information regarding the transfer policies of CREF, TIAA Access or another investment option listed above, please see the respective contract, prospectus or other governing instrument.

These transactions generally must be for at least $1,000 at a time (or your entire Account accumulation, if less). These options may be limited by the terms of your

62 | Prospectus TIAA Real Estate Account

employer’s plan, by current tax law, or by the terms of your contract, as set forth below. Transfers and cash withdrawals are currently free. TIAA can place restrictions on transfers or charge fees for transfers and/or withdrawals in the future.

Transfers and cash withdrawals are effective at the end of the business day we receive your request and all required documentation. You can also choose to have transfers and withdrawals take effect at the close of any future business day. For any transfers to TIAA’s traditional annuity, the crediting rate will be the rate in effect at the close of business of the first day that you participate in TIAA’s traditional annuity, which is the next business day after the effective date of the transfer.

To request a transfer or to withdraw cash:

| | |

| • | write to TIAA’s home office at 730 Third Avenue, New York, NY 10017-3206 |

| | |

| • | call us at 800 842-2252 or |

| | |

| • | for internal transfers, using the TIAA-CREF Web Center’s account access feature at www.tiaa-cref.org |

You may be required to complete and return certain forms to effect these transactions. We can suspend or terminate your ability to transact by telephone, over the Internet, or by fax at any time, for any reason.

Before you transfer or withdraw cash, make sure you understand the possible federal and other income tax consequences. See “Taxes” on page 71.

TRANSFERS TO AND FROM OTHER TIAA-CREF ACCOUNTS

Once every calendar quarter you can transfer some or all of your accumulation in the Real Estate Account to TIAA’s traditional annuity, to another TIAA annuity offered by your employer’s plan, to one of the CREF accounts, to a TIAA Access variable annuity account or to mutual funds offered under the terms of your plan. Transfers to CREF accounts or to certain other options may be restricted by your employer’s plan.

You can also transfer some or all of your accumulation in TIAA’s traditional annuity, in your CREF accounts, TIAA Access variable annuity accounts or in the mutual funds or TIAA annuities offered under the terms of your plan to the Real Estate Account, if your employer’s plan offers the Account. Transfers from TIAA’s traditional annuity to the Real Estate Account under RA, GRA or Retirement Choice contracts can only be effected over a period of time (up to ten years) and may be subject to other limitations, as specified in your contract. Amounts held under an ATRA contract cannot be transferred to or from any retirement plan contract.

Because excessive transfer activity can hurt Account performance and other participants, we may further limit how often you transfer or otherwise modify the transfer privilege.

TRANSFERS TO OTHER COMPANIES

Generally you may transfer funds from the Real Estate Account to a company other than TIAA or CREF, subject to certain tax restrictions. This right may be limited by your employer’s plan. If your employer participates in our special

TIAA Real Estate AccountProspectus |63

transfer services program, we can make automatic monthly transfers from your RA or GRA contract to another company, and the $1,000 minimum will not apply to these transfers. Roth amounts in a 403(b) or 401(a) plan can only be rolled over to another Roth account under such plan or to a Roth IRA, as permitted by applicable law and the terms of the plans.

Under the Retirement Choice and Retirement Choice Plus contracts, your employer could transfer monies from an Account and apply it to another Account or investment option, subject to the terms of your plan, and without your consent.

TRANSFERS FROM OTHER COMPANIES/PLANS

Subject to your employer’s plan, you can usually transfer or rollover money from another 403(b), 401(a)/403(a) or governmental 457(b) retirement plan to your qualified TIAA contract. You may also rollover before-tax amounts in a Classic IRA to 403(b) plans, 401(a)/403(a) plans or eligible governmental 457(b) plans, provided such employer plans agree to accept the rollover. Similarly, you may be able to rollover funds from 401(a), 403(a), 403(b) and governmental 457(b) plans to a TIAA Classic IRA. Roth amounts in a 403(b) or 401(a) plan can only be rolled over to another Roth account under such plan or to a Roth IRA, as permitted by applicable law and the terms of the plans. Funds in a private 457(b) plan can be transferred to another private 457(b) plan only. Accumulations in private 457(b) plans may not be rolled over to a qualified plan (e.g., a 401(a) plan), a 403(b) plan, a governmental 457(b) plan or an IRA.

WITHDRAWING CASH

You may withdraw cash from your SRA, GSRA, IRA, or Keogh Real Estate Account accumulation at any time during the accumulation period, provided federal tax law permits it (see below). Real Estate Account cash withdrawals from your RA, GRA, Retirement Choice or Retirement Choice Plus accumulation may be limited by the terms of your employer’s plan and federal tax law. Normally, you can’t withdraw money from a contract if you’ve already applied that money to begin receiving lifetime annuity income. Current federal tax law restricts your ability to make cash withdrawals from your accumulation under most voluntary salary reduction agreements. Withdrawals are generally available only if you reach age 59½, leave your job, become disabled, or die, or if your employer terminates its retirement plan. If your employer’s plan permits, you may also be able to withdraw money if you encounter hardship, as defined by the IRS, but hardship withdrawals can be from contributions only, not investment earnings. You may be subject to a 10 percent penalty tax if you make a withdrawal before you reach age 59½, unless an exception applies to your situation.

Under current federal tax law, you are not permitted to withdraw from 457(b) plans earlier than the calendar year in which you reach age 70½ or leave your job or are faced with an unforeseeable emergency (as defined by law). There are generally no early withdrawal tax penalties if you withdraw under any of these circumstances (i.e., no 10% tax on distributions prior to age 59½).

64|Prospectus TIAA Real Estate Account

Special rules and restrictions apply to Classic and Roth IRAs.

SYSTEMATIC WITHDRAWALS AND TRANSFERS

If your employer’s plan allows, you can set up a program to make cash withdrawals or transfers automatically by specifying that we withdraw or transfer from your Real Estate Account accumulation any fixed number of accumulation units, dollar amount, or percentage of accumulation until you tell us to stop or until your accumulation is exhausted. Currently, the program must be set up so that at least $100 is automatically withdrawn or transferred at a time.

WITHDRAWALS TO PAY ADVISORY FEES

You can set up a program to have monies withdrawn directly from your retirement plan or IRA accumulations to pay your financial advisor, if your employer’s plan allows. You will be required to complete and return certain forms to effect these withdrawals, including how and from which accounts you want these monies to be withdrawn. Before you set up this program, make sure you understand the possible tax consequences of these withdrawals. See the discussion under “Taxes” below.

POSSIBLE RESTRICTIONS ON PREMIUMS AND TRANSFERS TO THE ACCOUNT

From time to time we may stop accepting premiums for and/or transfers into the Account. We might do so if, for example, we can’t find enough appropriate real estate-related investment opportunities at a particular time. Whenever reasonably possible, we will notify you before we decide to restrict premiums and/or transfers. However, because we may need to respond quickly to changing market conditions, we reserve the right to stop accepting premiums and/or transfers at any time without prior notice.

If we decide to stop accepting premiums into the Account, amounts that would otherwise be allocated to the Account will be allocated to the CREF Money Market Account (or to a different default account under the terms of your employer’s plan) instead, unless you give us other allocation instructions. We will not transfer these amounts out of the CREF Money Market Account (or such different default account) when the restriction period is over, unless you request that we do so. However, we will resume allocating premiums to the Account on the date we remove the restrictions.

ADDITIONAL LIMITATIONS

Federal law requires us to obtain, verify and record information that identifies each person who opens an account. Until we receive the information we need, we may not be able to effect transactions for you. Furthermore, if we are unable to verify your identity, or that of another person authorized to act on your behalf, or if we believe that we have identified potentially criminal activity, we reserve the right to take such action as we deem appropriate, which may include closing your account.

TIAA Real Estate AccountProspectus |65

MARKET TIMING POLICY

There are participants who may try to profit from transferring money back and forth among the CREF accounts, the Real Estate Account, the TIAA Access variable accounts and mutual funds available under the terms of your plan, in an effort to “time” the market. As money is shifted in and out of these accounts, the accounts or funds incur transaction costs, including, among other things, expenses for buying and selling securities. These costs are borne by all participants, including long-term investors who do not generate the costs. In addition, market timing can interfere with efficient portfolio management and cause dilution, if timers are able to take advantage of pricing inefficiencies. To discourage market-timing activity, transfers from the Account to a CREF or TIAA account are limited to once every calendar quarter. In addition, participants who make more than three transfers out of any TIAA or CREF account or any of the TIAA-CREF mutual funds available under your plan (other than the CREF Money Market Account) in a calendar month will be advised that if this transfer frequency continues, we will suspend their ability to make telephone, fax and Internet transfers.

We have the right to modify our policy at any time without advance notice.

RECEIVING ANNUITY INCOME

THE ANNUITY PERIOD IN GENERAL

You can receive an income stream from all or part of your Real Estate Account accumulation. Unless you opt for a lifetime annuity, generally you must be at least age 59½ to begin receiving annuity income payments from your annuity contract free of a 10 percent early distribution penalty tax. Your employer’s plan may also restrict when you can begin income payments. Under the minimum distribution rules of the Internal Revenue Code, you generally must begin receiving some payments from your contract shortly after you reach the later of age 70½ or you retire. For more information, see “Minimum Distribution Requirements,” on page 73. Also, you can’t begin a one-life annuity after you reach age 90, nor may you begin a two-life annuity after either you or your annuity partner reach age 90.

Your income payments may be paid out from the Real Estate Account through a variety of income options. You can pick a different income option for different portions of your accumulation, but once you’ve started payments you usually can’t change your income option or annuity partner for that payment stream.

Usually income payments are monthly. You can choose quarterly, semi-annual, and annual payments as well. (TIAA has the right to not make payments at any interval that would cause the initial payment to be less than $100.) We’ll send your payments by mail to your home address or, on your request, by mail or electronic funds transfer to your bank.

Your initial income payments are based on the value of your accumulation on the last valuation day before the annuity starting date. Your payments change

66 | Prospectus TIAA Real Estate Account

after the initial payment based on the Account’s investment experience and the income change method you choose.

There are two income change methods for annuity payments: annual and monthly. Under the annual income change method, payments from the Account change each May 1, based on the net investment results during the prior year (April 1 through March 31). Under the monthly income change method, payments from the Account change every month, based on the net investment results during the previous month. For the formulas used to calculate the amount of annuity payments, see page 69. The total value of your annuity payments may be more or less than your total premiums.

ANNUITY STARTING DATE

Ordinarily, annuity payments begin on the date you designate as your annuity starting date, provided we have received all documentation necessary for the income option you’ve picked. If something’s missing, we’ll defer your annuity starting date until we receive it. Your first annuity check may be delayed while we process your choice of income options and calculate the amount of your initial payment. Any premiums received within 70 days after payments begin may be used to provide additional annuity income. Premiums received after 70 days will remain in your accumulating annuity contract until you give us further instructions. Ordinarily, your first annuity payment can be made on any business day between the first and twentieth of any month.

INCOME OPTIONS

Both the number of annuity units you purchase and the amount of your income payments will depend on which income option you pick. Your employer’s plan, tax law and ERISA may limit which income options you can use to receive income from an RA or GRA, GSRA, Retirement Choice, Retirement Choice Plus or Keogh contract. Ordinarily you’ll choose your income options shortly before you want payments to begin, but you can make or change your choice any time before your annuity starting date.

All Real Estate Account income options provide variable payments, and the amount of income you receive depends in part on the investment experience of the Account. The current options are:

| | |

| • | One-Life Annuity with or without Guaranteed Period: Pays income as long as you live. If you opt for a guaranteed period (10, 15 or 20 years) and you die before it’s over, income payments will continue to your beneficiary until the end of the period. If you don’t opt for a guaranteed period, all payments end at your death — so that it’s possible for you to receive only one payment if you die less than a month after payments start. (The 15-year guaranteed period is not available under all contracts.) |

| | |

| • | Annuity for a Fixed Period: Pays income for any period you choose from 5 to 30 years (2 to 30 years for RAs, SRAs and GRAs). (This option is not available under all contracts.) |

TIAA Real Estate Account Prospectus | 67

| | |

| • | Two-Life Annuities: Pays income to you as long as you live, then continues at either the same or a reduced level for the life of your annuity partner. There are three types of two-life annuity options, all available with or without a guaranteed period — Full Benefit to Survivor, Two-Thirds Benefit to Survivor, and a Half-Benefit to Annuity Partner. Under the Two-Thirds Benefit to Survivor option, payments to you will be reduced upon the death of your annuity partner. |

| | |

| • | Minimum Distribution Option (MDO) Annuity: Generally available only if you must begin annuity payments under the Internal Revenue Code minimum distribution requirements. (Some employer plans allow you to elect this option earlier — contact TIAA for more information.) The option pays an amount designed to fulfill the distribution requirements under federal tax law. (The option is not available under all contracts.) |

You must apply your entire accumulation under a contract if you want to use the MDO annuity. It is possible that income under the MDO annuity will cease during your lifetime. Prior to age 90, and subject to applicable plan and legal restrictions, you can apply any remaining part of an accumulation applied to the MDO annuity to any other income option for which you’re eligible. Using an MDO won’t affect your right to take a cash withdrawal of any accumulation not yet distributed. This pay-out annuity is not available under the Retirement Choice or Retirement Choice Plus contracts. Instead, required minimum distributions will be paid directly from these contracts pursuant to the terms of your employer’s plan.

For any of the income options described above, current federal tax law says that your guaranteed period can’t exceed the joint life expectancy of you and your beneficiary or annuity partner. Other income options may become available in the future, subject to the terms of your retirement plan and relevant federal and state laws. For more information about any annuity option, please contact us.

Receiving Lump Sum Payments (Retirement Transition Benefit):If your employer’s plan allows, you may be able to receive a single sum payment of up to 10 percent of the value of any part of an accumulation being converted to annuity income on the annuity starting date. (This does not apply to IRAs.) Of course, if your employer’s plan allows cash withdrawals, you can take a larger amount (up to 100 percent) of your Real Estate Account accumulation as a cash payment. The retirement transition benefit will be subject to current federal income tax requirements and possible early distribution penalties. See “Taxes” on page 71.

If you haven’t picked an income option when the annuity starting date arrives for your contract, TIAA usually will assume you want theone-life annuity with 10-year guaranteed periodif you’re unmarried, subject to the terms of your plan, paid from TIAA’s traditional annuity. If you’re married, we may assume for youa survivor annuity with half-benefit to annuity partner with a 10-Year guaranteed period,with your spouse as your annuity partner, paid from TIAA’s traditional annuity. If you haven’t picked an income option when the annuity starting date arrives for your IRA, we may assume you want the minimum distribution option annuity.

68 | Prospectus TIAA Real Estate Account

TRANSFERS DURING THE ANNUITY PERIOD

After you begin receiving annuity income, you can transfer all or part of the future annuity income payable once each calendar quarter (i) from the Real Estate Account into a “comparable annuity” payable from a CREF or TIAA account or TIAA’s traditional annuity, or (ii) from a CREF account into a comparable annuity payable from the Real Estate Account. Comparable annuities are those which are payable under the same income option, and have the same first and second annuitant, and remaining guaranteed period.

We’ll process your transfer on the business day we receive your request. You can also choose to have a transfer take effect at the close of any future business day. Transfers under the annual income payment method will affect your annuity payments beginning on the May 1 following the March 31 which is on or after the effective date of the transfer. Transfers under the monthly income payment method and all transfers into TIAA’s traditional annuity will affect your annuity payments beginning with the first payment due after the monthly payment valuation day that is on or after the transfer date. You can switch between the annual and monthly income change methods, and the switch will go into effect on the following March 31.

ANNUITY PAYMENTS

The amount of annuity payments we pay you or your beneficiary (annuitant) will depend upon the number and value of the annuity units payable. The number of annuity units is first determined on the day before the annuity starting date. The amount of the annuity payments will change according to the income change method chosen.

Under the annual income change method, the value of an annuity unit for payments is redetermined on March 31 of each year — the payment valuation day. Annuity payments change beginning May 1. The change reflects the net investment experience of the Real Estate Account. The net investment experience for the twelve months following each March 31 revaluation will be reflected in the following year’s value.

Under the monthly income change method, the value of an annuity unit for payments is determined on the payment valuation day, which is the 20th day of the month preceding the payment due date or, if the 20th is not a business day, the preceding business day. The monthly changes in the value of an annuity unit reflect the net investment experience of the Real Estate Account. The formulas for calculating the number and value of annuity units payable are described below.

Calculating the Number of Annuity Units Payable:When a participant or a beneficiary converts the value of all or a portion of his or her accumulation into an income-paying contract, the number of annuity units payable from the Real Estate Account under an income change method is determined by dividing the value of the Account accumulation to be applied to provide the annuity payments by the product of the annuity unit value for that income change method and an annuity factor. The annuity factor as of the annuity starting date is the value of an annuity

TIAA Real Estate Account Prospectus | 69

in the amount of $1.00 per month beginning on the first day such annuity units are payable, and continuing for as long as such annuity units are payable.

The annuity factor will reflect interest assumed at the effective annual rate of 4 percent, and the mortality assumptions for the person(s) on whose life (lives) the annuity payments will be based. Mortality assumptions will be based on the then-current settlement mortality schedules for this Account. Annuitants bear no mortality risk under their contracts — actual mortality experience will not reduce annuity payments after they have started. TIAA may change the mortality assumptions used to determine the number of annuity units payable for any future accumulations converted to provide annuity payments.